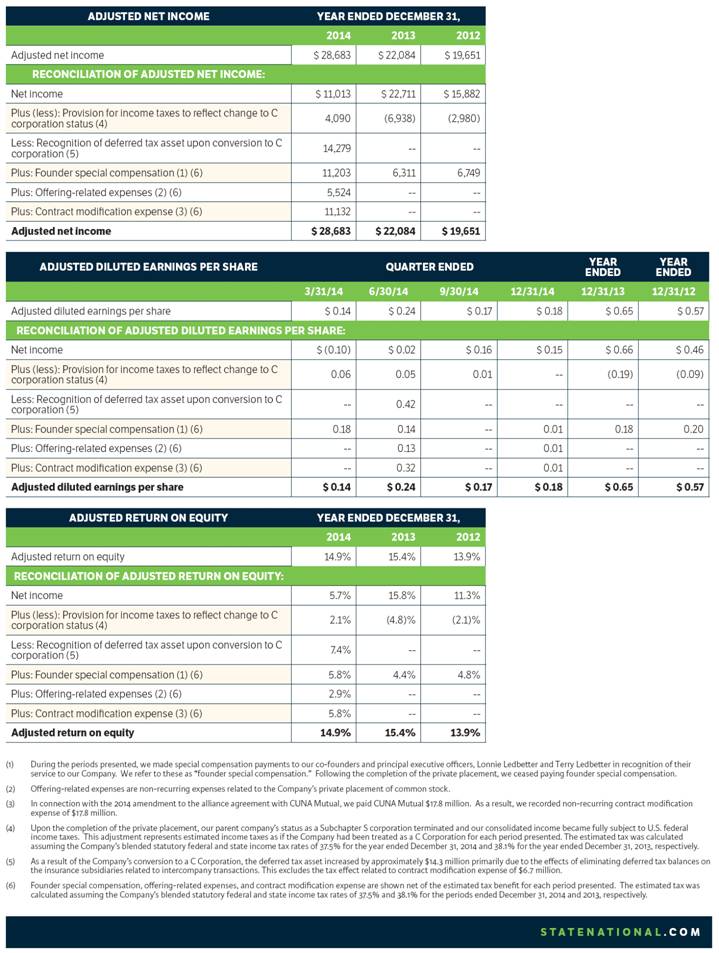

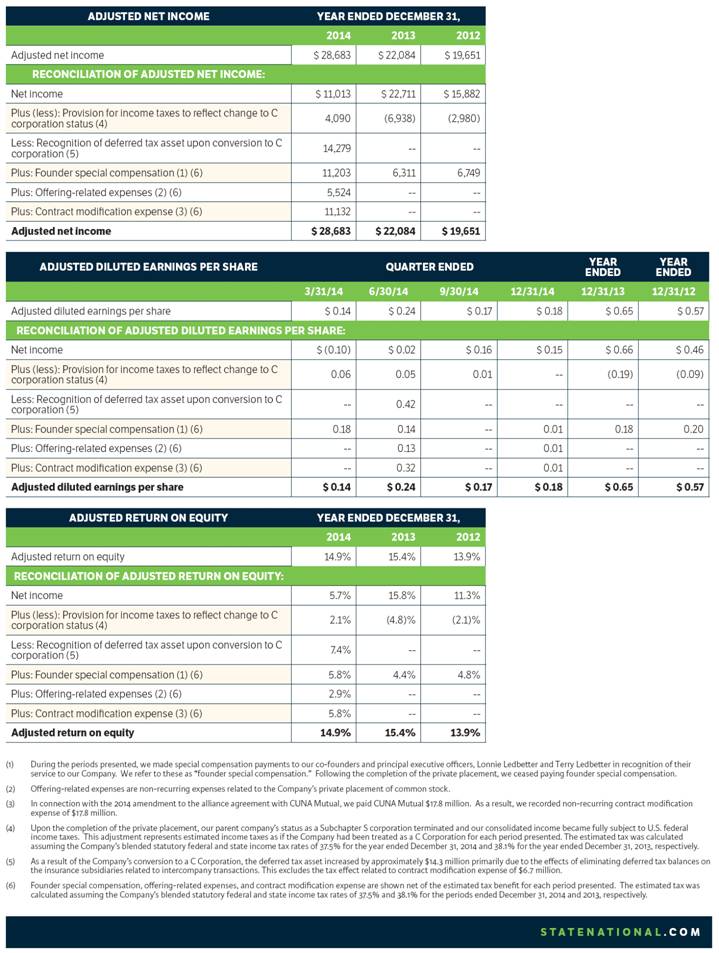

| ADJUSTED NET INCOME YEAR ENDED DECEMBER 31, 2014 2013 2012 Adjusted net income $ 28,683 $ 22,084 $ 19,651 RECONCILIATION OF ADJUSTED NET INCOME: Net income $ 11,013 $ 22,711 $ 15,882 Plus (less): Provision for income taxes to reflect change to C corporation status (4) 4,090 (6,938) (2,980) Less: Recognition of deferred tax asset upon conversion to C corporation (5) 14,279 -- -- Plus: Founder special compensation (1) (6) 11,203 6,311 6,749 Plus: Offering-related expenses (2) (6) 5,524 -- -- Plus: Contract modification expense (3) (6) 11,132 -- -- Adjusted net income $ 28,683 $ 22,084 $ 19,651 ADJUSTED DILUTED EARNINGS PER SHARE QUARTER ENDED YEAR ENDED YEAR ENDED 3/31/14 6/30/14 9/30/14 12/31/14 12/31/13 12/31/12 Adjusted diluted earnings per share $ 0.14 $ 0.24 $ 0.17 $ 0.18 $ 0.65 $ 0.57 RECONCILIATION OF ADJUSTED DILUTED EARNINGS PER SHARE: Net income $ (0.10) $ 0.02 $ 0.16 $ 0.15 $ 0.66 $ 0.46 Plus (less): Provision for income taxes to reflect change to C corporation status (4) 0.06 0.05 0.01 -- (0.19) (0.09) Less: Recognition of deferred tax asset upon conversion to C corporation (5) -- 0.42 -- -- -- -- Plus: Founder special compensation (1) (6) 0.18 0.14 -- 0.01 0.18 0.20 Plus: Offering-related expenses (2) (6) -- 0.13 -- 0.01 -- -- Plus: Contract modification expense (3) (6) -- 0.32 -- 0.01 -- -- Adjusted diluted earnings per share $ 0.14 $ 0.24 $ 0.17 $ 0.18 $ 0.65 $ 0.57 ADJUSTED RETURN ON EQUITY YEAR ENDED DECEMBER 31, 2014 2013 2012 Adjusted return on equity 14.9% 15.4% 13.9% RECONCILIATION OF ADJUSTED RETURN ON EQUITY: Net income 5.7% 15.8% 11.3% Plus (less): Provision for income taxes to reflect change to C corporation status (4) 2.1% (4.8)% (2.1)% Less: Recognition of deferred tax asset upon conversion to C corporation (5) 7.4% -- -- Plus: Founder special compensation (1) (6) 5.8% 4.4% 4.8% Plus: Offering-related expenses (2) (6) 2.9% -- -- Plus: Contract modification expense (3) (6) 5.8% -- -- Adjusted return on equity 14.9% 15.4% 13.9% (1) During the periods presented, we made special compensation payments to our co-founders and principal executive officers, Lonnie Ledbetter and Terry Ledbetter in recognition of their service to our Company. We refer to these as “founder special compensation.” Following the completion of the private placement, we ceased paying founder special compensation. (2) Offering-related expenses are non-recurring expenses related to the Company’s private placement of common stock. (3) In connection with the 2014 amendment to the alliance agreement with CUNA Mutual, we paid CUNA Mutual $17.8 million. As a result, we recorded non-recurring contract modification expense of $17.8 million. (4) Upon the completion of the private placement, our parent company’s status as a Subchapter S corporation terminated and our consolidated income became fully subject to U.S. federal income taxes. This adjustment represents estimated income taxes as if the Company had been treated as a C Corporation for each period presented. The estimated tax was calculated assuming the Company’s blended statutory federal and state income tax rates of 37.5% for the year ended December 31, 2014 and 38.1% for the year ended December 31, 2013, respectively. (5) As a result of the Company’s conversion to a C Corporation, the deferred tax asset increased by approximately $14.3 million primarily due to the effects of eliminating deferred tax balances on the insurance subsidiaries related to intercompany transactions. This excludes the tax effect related to contract modification expense of $6.7 million. (6) Founder special compensation, offering-related expenses, and contract modification expense are shown net of the estimated tax benefit for each period presented. The estimated tax was calculated assuming the Company’s blended statutory federal and state income tax rates of 37.5% and 38.1% for the periods ended December 31, 2014 and 2013, respectively. STATENATIONAL.COM |