UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | |

| ☐ | | Preliminary Proxy Statement |

| |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ☐ | | Definitive Proxy Statement |

| |

| ☐ | | Definitive Additional Materials |

| |

| ☒ | | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 |

INC RESEARCH HOLDINGS, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| ☒ | | No fee required. |

| |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ☐ | | Fee paid previously with preliminary materials. |

| |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

INC Research Holdings, Inc. held a Town Hall on May 11, 2017 regarding the proposed merger of INC Research Holdings, Inc. and Double Eagle Parent, Inc., a Delaware corporation and the indirect parent company of inVentiv Group Holdings, Inc. Below is a copy of the transcript of the Town Hall and a slide deck that was displayed during the Town Hall. The transcript has been edited to correct erroneous transcriptions and garbled statements.

INC Research Holdings, Inc.

May 11, 2017

| | |

| Alistair Macdonald: | | Welcome to the PNC Arena here in Raleigh. I guess that’s a real great testimony to our growth; the only place we fit in now in Raleigh is, what is it? Nineteen-thousand-seat arena? (LAUGHTER) And even then, it’s great to not have to put the chairs away afterwards now, so. (LAUGHTER) We have moved on. So welcome to the Town Hall. Obviously we had a big event yesterday, a big announcement yesterday and something, I think, will help us secure a great future for INC and inVentiv, so congratulations to everybody on the team who got us to that and also to everybody here, everybody around the world from INC who helped to drive the company to the point where we could do a transaction such as that and we’ll talk about that today. We’ll talk about our Q1 today and some other updates and I’ll open up for a Q&A session at the end. People will have the opportunity to send questions in remotely and we’ll get those here up on the stage and also there’s going to be mics roaming through the audience here, but also a fixed mic at the front, if people want to ask questions here. And do ask questions. We want to be as transparent as we can be at this point. We want to make sure you get the opportunity to hear about the future of the Company that we have for it. So let’s move on — and there’s a video of me coming up there. I’m going to have to put headphones on, while you listen to it, because I can’t stand to see myself on video. So let’s head down to the first slide. So I’m actually not going to read that to you. Suffice it to say, there’s going to be some forward-looking statements and we’ll read something to you in a moment. Okay, next slide, please. So we’re in the PNC Arena. Those of you who live in the U.S. and those of you who follow ice hockey globally, we support the Carolina Hurricanes here. (APPLAUSE) I won’t say they need all the support they can get, but, you know. (LAUGHTER) But I think they’re a great team, great, they do a lot of great work in the community. We’ve had a great relationship with them and the management team here at the PNC Arena and you know, we’ve been able to have many guests here to watch sporting events, concerts and that kind of thing. I think that’s a great thing for us to do in the community and good luck to the Canes next season. I’m sure they’ll be even better. |

| | |

| | One of the great advantages of it, we see our logo in the ice and you wouldn’t believe how many customers that I go and see, bankers in New York, Boston area, who, the first thing that comes out of their mouths is, you’re the guys with the, with the logo in the ice at the Carolina Hurricanes, right? So, it is great advertising for us and obviously brings us to another level and apparently one of our old competitors used to advertise down on the ice, but they’ve, they don’t do it anymore and we’ve taken over. Hopefully… hopefully an omen of things to come. So. Next slide, please. So today we are going to talk about this combination that we’re creating. Obviously yesterday was a big day for us. It’s the culmination of a lot of work by the team behind me, but also many of you in the audience today, here in Raleigh, but also people right around the world who have helped us do a very strong due diligence over inVentiv’s backlog and their processes, procedures, how they structured the culture and that’s something that we’ve seen that we’re very happy with. We feel like there’s a good strategic fit. Obviously there’s very little revenue dissenergy between us, so we don’t, we don’t work in the same spaces. And we see that as a great combination for us to get into. We will talk about our Q1. We were very happy with the ability to announce a very strong Q1. We talked about we are accelerating our growth some months ago and we’re to thank you on with, with, we crossed all the T’s and dotted all the I’s and we drove sales and drove all of our metrics to beat all the targets that we’d set. And then we’ll have, like I said before, a Q&A session at the end. Okay. So let’s get into the content. Next slide. Now… that’s Mike Bell on the right, who is the CEO of inVentiv and will become our executive chair. That’s me on the left. We were actually both happy to be there, although it’s hard to see that. But we were sitting on the world’s most uncomfortable stools you’ve ever seen. So it wasn’t all good. And you’ll see that we were both quite nervous in the beginning of this video. It’s quite daunting, actually, to try and remember all the content you’re supposed to do and you have to look in a certain and you know, smile and that kind of thing. But you’ll see in the video, I’m going to go and cringe in the corner and you guys can watch the video. So let’s play the video. (VIDEO PLAYS) |

| |

| Unknown Male Speaker: | | I would like to remind you that this discussion will include forward-looking statements and that actual plans and results could differ materially from those expressed or implied in forward-looking statements. The factors that could cause actual results to differ are discussed in filings INC Research has made and will make with the SEC. INC Research will be filing a proxy statement with the SEC that will contain important information about INC Research, inVentiv Health, the transaction and related matters. |

| |

| Alistair Macdonald: | | Today we’re announcing the combination of INC Research and inVentiv Health to create the world’s biggest global biopharmaceutical outsourcing organization. |

| |

| Michael A. Bell: | | For our clients this means unique capabilities for making each of our businesses stronger by making sure we share across all the businesses. For the people, I think this is a unique opportunity for great career development in an industry that has real moral purpose and a real important part of role in society going forward. INC represents a unique opportunity for us to gain access to a very large market where we’re typically not penetrated well, which is small and mid. |

| | |

| Alistair Macdonald: | | The combination with inVentiv brings a lot of pluses to INC Research in terms of increasing our scale,right-sizing our scale inAsia-Pac, enabling us to deliver FSP and hybrid models. |

| |

| Michael A. Bell: | | It also gives us access to a world-class reputation and skill set associated with delivering a process for clinical trials that has been proven to be both profitable and advantageous to clients. |

| |

| Alistair Macdonald: | | This enables us to have a bigger scope of commercial assets, to be able to deliver better than anybody else, more consistently than anybody else and to ensure that we meet the expectations of our customers, both large and small. |

| |

| Michael A. Bell: | | With your expertise in actually executing trials for a variety of different types of clients, access to this commercial capability will not only allow everybody to sound a little bit smarter, but we’ll be able to do things for clients that heretofore they haven’t really been able to do for themselves. |

| |

| Alistair Macdonald: | | This combination brings us a much bigger global presence. |

| |

| Michael A. Bell: | | We will be invited and asked and appropriately want to go to bids and clients that historically we haven’t been able to go to. |

| |

| Alistair Macdonald: | | Strategically, combining with inVentiv brings us our ability to flex models, to deliver any scale that we need to, whether that’s on a small scale, all the way up to the huge, global, Phase 3 programs. |

| |

| Michael A. Bell: | | For both companies we’re going to be much bigger, much more profitable and therefore have a lot more opportunities. |

| |

| Alistair Macdonald: | | You can see more capability, more opportunity in this integration and in this combination than I’ve ever seen before. |

| |

| Michael A. Bell: | | This is a chance for us to be proud. |

| |

| Alistair Macdonald: | | Very important that we get this right, it’s very important that we deliver on current commitments. It’s very important that we deliver current projects, that we keep talking to customers, that we bring them accurate information. |

| |

| Michael A. Bell: | | Keep doing what you’re doing. Keep providing client value and remember, that’s how we got here, so we don’t want to let anything get in the way of that. |

| |

| Alistair Macdonald: | | We have a lot of regulatory approval hurdles to get through, but when we’re starting to look at how we integrate these two great organizations, to create a new, fantastic organization. (VIDEO ENDS) So you saw my hand start going towards the end of the video, because I got a little bit more familiar with the environment that we were planning to do that. There are some great concepts in that video about what we’re actually creating. If you think about the scale and the scope and the reach that we’ve always had, we’re basically doubling that up in the CRO side and bringing in a whole new set of capabilities therapeutically, as well as scale. And different models. You know, we’ve talked to our investors and we’ve talked to the street and we’ve talked to you guys about the strategy to be able to move models and we’ve often lost our positions with big customers when |

| | |

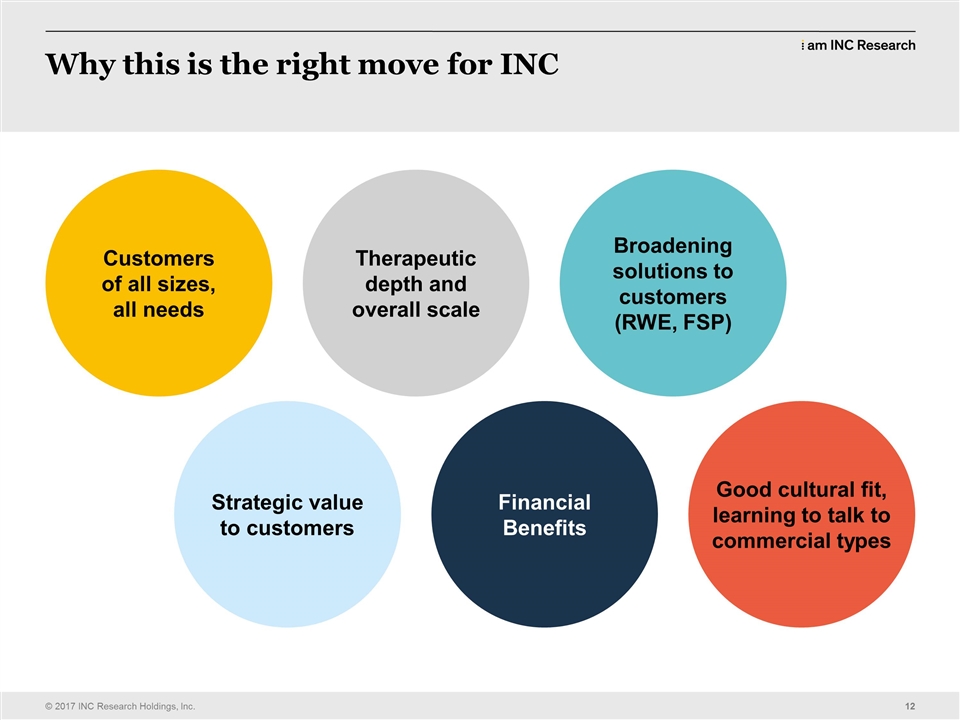

| | they’ve decided to move from a full service program or a delivery style into either an FSP or a hybrid of the two and INC was never really seen as big enough to do that. We never had enough of a reputation on the FSP side. Now we have been working on that and we’ve had some great successes in that area and we’ve built that part of the business up. But continuing to do that organically is a challenge, continuing to expand those capabilities, it takes investment and to do that, to continually push on all those fronts is very difficult to do organically. This combination brings a lot of that to us instantly. We talked yesterday with analysts and investors and you know, we had a great day yesterday on many counts and obviously you saw the market’s response to the news was very, very positive and we were very pleased to see that. But this creates an organization that has the capability, globally, to deliver for any customer at any scale and in any delivery model they want, but also gives us much deeper penetration through the therapeutic lines that we’ve always been known for, famous for, almost and I’m really excited about the fact that we can combine all of these different, really first-class assets to create a delivery engine and a delivery model, just on the CRO side that’s going to be as good as, if not better, it will be better than anybody else has. What we also get from this transaction is commercial and many of us and myself included, don’t have a lot of commercial experience, but we’ve been continually asked over the last 18 months by customers, what can you do for us in real world evidence? We’ve been setting up and hiring people with the true expertise in our area, to come into INC and work with therapeutic units, to work out how we put that data together while we were executing a clinical trial. It’s been very successful. We’ve had some great early wins. There’s been a great collaboration around that, with the therapeutic units as well as the functional units and real evidence team. That’s key for us in connecting commercial and clinical together and to be able to offer a suite of services to customers in one go. So the goal of that will be to bring some of those revenue synergies in and we, as you saw, that takes us up to 22,000 people globally. It’s the toss of a coin whether we’re the second largest CRO or the third largest CRO. So we’re going to say we’re in the top three and then we’ll shoot to make ourselves the second best, second biggest as we go through the next couple of years, or the next month. Depending on how quick I was. Right? You get it. I knew it. You get it. So let’s go onto the next slide and get my picture off there. Next. So (CLEARS THROAT) you know, not many people saw this coming. Which is great. We were totally laughing over there because I like to deliver surprises. I don’t like to be surprised. You know, anybody who’s ever worked for me knows the Golden Rule is, let him know early so there’s no surprises. But I’m really pleased about that because we executed a very thorough, strategic assessment on what we wanted to do, where we wanted to end up and this, this fit was way and above any other that we looked at. |

| | |

| | Because of our complementary nature, we’ve dominated that mid to, small andmid-size marketplace, we’re the biggest provider in that marketplace and inVentiv has always had a very strong position from relationships they’ve had for decades, really and from great execution with Big Pharma. So when we brought these two organizations together, we have no revenue dissenergy, what we call “revenue dissenergy” so we’re not working for a customer that they’re working for and therefore that customer of mine will want to work with both of us afterwards. So it’s a very appetizing, very intriguing combination and then plus layer of that, the commercial operations and you have an organization that’s different. The changes that we’re seeing globally in the healthcare market are all around paying, so what’s become the easy part of our… you may not all agree with this, what’s become the easy part of what we do is actually getting people to approval. Getting drugs to that stage, getting drugs approved, we’re in great control of the clinical trials, great control of that clinical space. We execute them better than anybody else and that’s a fact. The difficulty for our customers has been getting it beyond that stage. They say the economics around a drug launch is now and they say and I’m not, I’m not 100 percent convinced of this yet, but that 70 percent of the drugs that launch don’t return the ROI that they are projected to. Because there’s not enough evidence that they work, there’s not enough evidence that they are, have an economic benefit to the patient. So the whole industry is moving to kind of a double approval; regulator approval to show the drug’s safe and effective, but also who’s going to pay for that drug? What’s the economic approval for that? Which insurers are going to carry it? Who’s going to pay it? What’s the price going to be and what’s the evidence to support the medical benefit versus the price? That’s an area where the industry’s moving. inVentiv are the world’s leader in commercializing products to support that process. But it’s not just salesmen in gray suits. I do have a gray suit on today. It’s not just salesmen in gray suits showing off and handing out samples. Their commercial effort is very broad. It looks at advertising, P.R., marketing, so a lot of the ads you see on the television, a lot of the brand names that they use for drugs come from inVentiv. They’re a huge group that does that work. They have the selling solutions, but they also have a very strong consulting group and a very strong marketing presence. So it’s a very different business, it’s a very coordinated business, very integrated and we’re going to reap the benefits of that by taking that into the mid market, taking that to our customers, who we’re having conversations with about commercialization, but we’ve never had anything to use before that we could capitalize on that. And what they’ve been doing as organizations is partnering that drug out with major pharma and then they lose control of the drug and they don’t get as much value back for their investment as they could if they were able to commercialize it themselves. So that’s the big strategic fit for that. We received some nice notes from our competitors yesterday. I |

| | |

| | think we gave a few of our competition a big headache yesterday and I’m, I like that. We’ve got… (LAUGHTER) (CLEARS THROAT) we’ve got the upper hand, but we have to maintain it; we have to deliver and one of the things that Mike mentioned in the video and it’s something that we really need to reiterate globally is we have to carry on doing what we’ve doing. We have to deliver the work that we’ve got. We have to go out there and work with customers and close the sales. Again, we’ve got to keep accelerating our growth. First and foremost we have to deliver our commitments to customers. It’s what we’ve always been good at. We’ve never had to change from that before and we won’t change from that now. So the commitments we’ve made to customers must be concluded and we must drive the whole organization to ensure that we maintain that commitment, maintain those, that delivery we’ve always been known for. So next slide, please. (CLEARS THROAT) So these are the, some of the reactions from our customers yesterday. I think we’re… a majority of us were on the phone yesterday. Greg was even talking to a customer I think yesterday. So hopefully several customers today. (LAUGHTER) (CLEARS THROAT) We told him, no jokes, not accounting jokes. Just tell them… (LAUGHTER) So you know, this is great feedback from the customers. I think where every single customer we spoke to yesterday was hugely positive on this, gets the strategic rationale. It’s pretty obvious what we’re trying to achieve and the customers responded very, very positively to it. So can see the value of this merger. Could be a plus for small biotech to have additional commercial options. Fantastic. You never know whether these strategic imperatives going to be underlined and seen as obviously by our customers as you see them, but I think the feedback that we had yesterday was instantaneous, that they see it as well. Exciting news indeed, I’m sure INC and inVentiv will complement one another. I’m absolutely sure of that. My best personal congratulations to you and INC for this great strive forward and congratulations. This is huge, let’s chat. And none of us need more of an invitation to get on a plane and go towards somebody than that. So you know, we’ll be out with customers over the next few months, explaining what we’re doing, explaining why it’s so net positive for them, explaining how we can bring a broader service catalogue to them and how we’re going to work with them to change the dynamic. We really are starting to look at changing our dynamic from being a CRO to being this, you know, biopharmaceutical outsourcing supplier that is able to go all the way from those first clinical steps with a customer, all the way through the clinical development, get in the right place for approval, have all their real world evidence packaged and pay our packagers, market access strategists together and then execute that for them as well, on the back end in the commercial sector. So it’s a really exciting expansion of our service catalogue and our, the fact that we can play along a much broader kind of landscape with our customers than we have been before. Okay, next slide, please. |

| | |

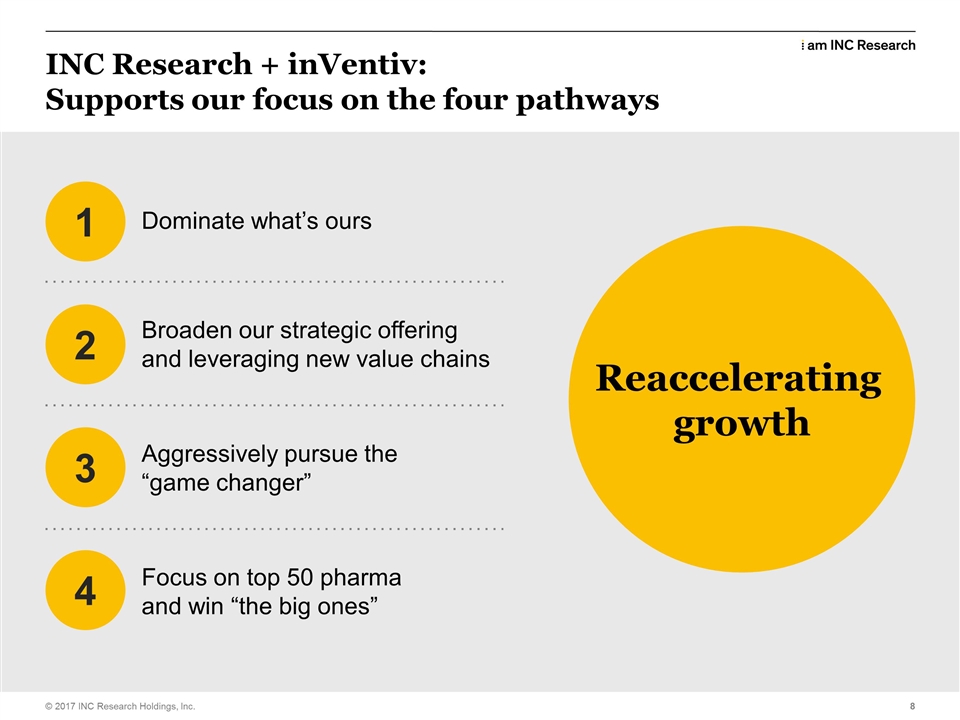

| | So. One of the discussions we had earlier in the year was reaccelerating our growth. We looked at the mechanisms, we looked at four mechanisms by which we needed to get back to where we were before in terms of sales execution and get our group back on the right curve. We had a disappointing Q4. We’ve come out of that very strongly with our Q1 results and a lot of that is just… some of it is timing, but a lot of it is attitude and a lot of it is the willingness to do, you know, the old INC, I can do it, I own it; it’s a great coin to phrase for those who are the GLM. It was somebody’s quote, apparently. But you know, you get out there and do an INC on people and doing an INC on people is going out and telling the customers things that they don’t know about their upcoming trials. Facts, concerns, the ability to go out and show them that we have the expertise that they need to run their clinical trial. So dominating what’s ours; how does this help? Well, we’ve had a great relationship in the small to mid market. We are probably the biggest provider in that market. We know from the conversations with customers that they need help commercializing their products. They also see INC as getting stretched, in terms of resources. So this, this transaction, this merger brings two ends to that. So we double up the amount of capacity that we have in the CRO, to allay any resource fears and we also bring to them a full suite of real world evidence and commercialization capabilities, plus on the CRO side, if they are looking at different areas that basically where we haven’t been as strong, we now have strengthened all those as well. So this checks a lot of those boxes. I’ve talked about value chains since somebody taught me the phrase about four years ago and it seems to always be the first thing that comes out of my mouth. But what this helps us do is broaden out what we do; enables us to be stronger in those new value chain areas that we put together last year, real world evidence in the late phase. But also we bring a whole new value chain with 6,400 people working in it, in and around commercial. Being able to take that to our customer base and have, and work, introducing our new colleagues to them and have the ability to work across that broader landscape. Aggressively pursue the game changer. I challenged everybody in the GLM and afterwards to go out and think about how we change up what we do with customers. How do we get, how do we sell them more? How do we become a preferred provider? How do we become a sole provider? The response I got in queue, almost phenomenal and from all, all levels within the organization. So you know, when I see a challenge and say, when I stand onto that stage next time and ask for a game changer, you can rest assured that I’m working on one, too. So, and I think this will be a huge game changer for our organization, for inVentiv as well and also for our combined customers and I think for the industry. Because we’re going to have a service profile that nobody else can match up to, and that’s very exciting, from a strategic perspective, but also from what we’re going to do over the next few years. Focus on the top 50 and win the big ones. Well, we kind of get that from inVentiv. We have increased our penetration in the top 50 in Q1, very, very nicely. I think we did as good a job as we possibly could in Q1 in that sense. But this is where inVentiv have played traditionally. I think six of their top customers are actually the top 10 pharma, so it’s a whole new customer segment for us and we’ve, we’ve worked with these pharmas, but not in a substantial way. They do. |

| | |

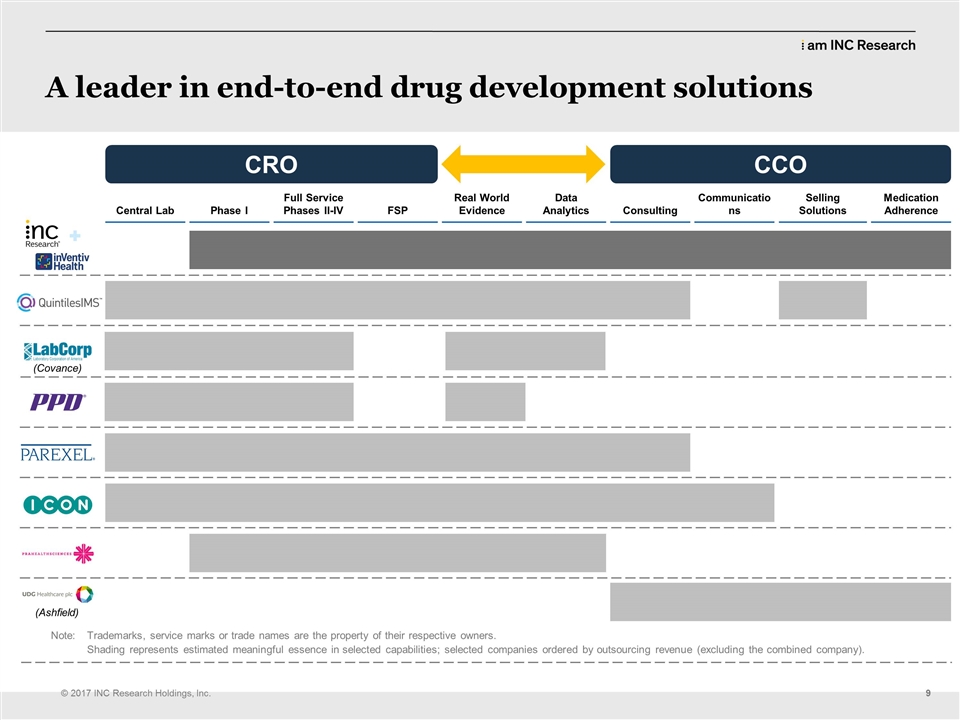

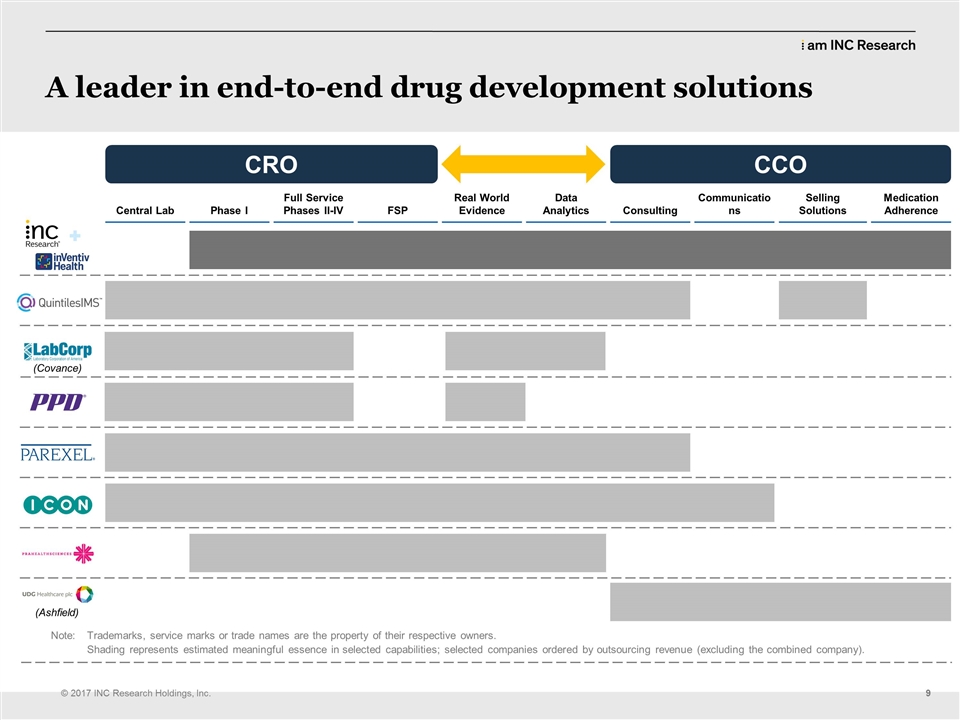

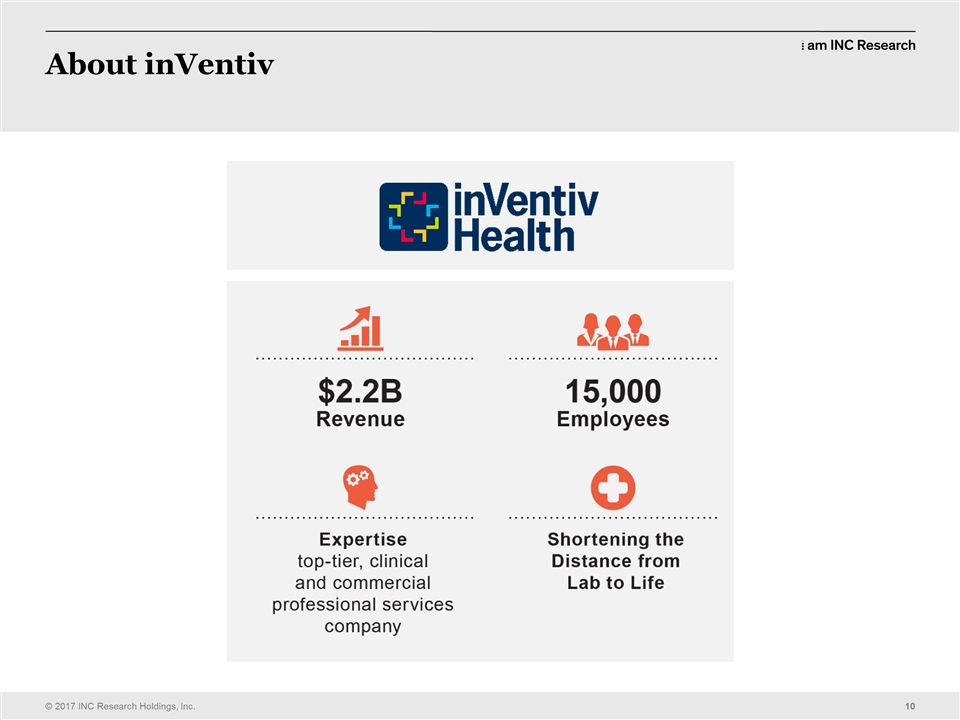

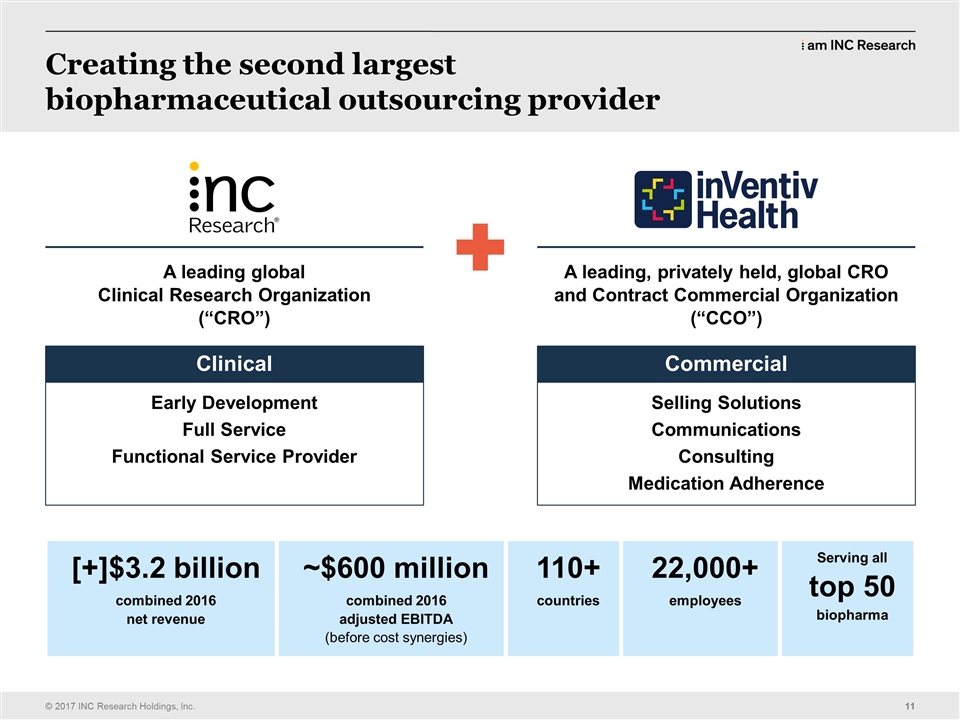

| | They have huge amounts of backlog with the Big Pharmas. The delivery style is slightly different. The requirements from those customers are slightly different and we’ll have to learn that and we’ll bring all that together as we go through the integration of how we’re going to cope with that and how we’re going to deliver that. But I think… When we explained this to investors yesterday and we explained it to analysts yesterday and when we explained it to our board back in February and March, they understood immediately how this transaction, how this merger feeds into the strategic comparatives we sat around accelerating the growth of INC and making sure that we hit these points. Okay, next slide, please. (CLEARS THROAT) So this is the service profile of our combination and you see underneath that the service profiles of all of our competitors. I think you’ll notice quite quickly there that we’re the only people that can help customers right across that spectrum. The other exciting thing about this is, there’s no weakness in that chain. So going from early phase all the way through its commercialization, we have a substantial business presences in each of those, each of those verticals. You’ll see another, we’ve added two companies at the bottom; UDG and Ashfield. Actually that’s one company, isn’t it? UDG Ashfield? They are somebody new that we’ll have to think about. They’re a competitor now of ours on the commercial side. So that’s a new name. You’ll hear them; they’re bigger in Europe than they are in the U.S., but a new competitor that we’ll, we’ll lock horns with as we, as we go through the next few years. But you can see that the breadth of that profile now, we really just became the company that can take people from, from the beginning of their development, all the way through to putting… putting commercial products on the market. Okay. Next slide, please. So this a little brief about inVentiv Health. They have gone through multiple rounds of integration, like we did after the Kendle Acquisition. They are a15,000-person global business. I think 6,400 in the commercial group and the rest in, my math is not quick enough, (LAUGHS) but the rest of them are in the clinical side and corporate; $2.2 billion in annual revenues, that’s double our revenue right now. So you can see that the combination will be in greater than three billion in revenue. Their expertise really based around clinical trial delivery, obviously, but also on that commercial side, working with payers, working with commercial efforts in… delivering drugs to the market. Now, the other thing to think about, about that market; we look at our market as about $60 billion in total, on the clinical side. I’m looking at Jean, because she knows the numbers. About $60 billion in total on the clinical side, of which $25 billion or so is the CRO market, so the rest is labs, you know, doctors’ fees, that kind of thing. So the CRO market is about $25 billion. Projected to be at about $35 billion by 2020. The commercial market is, and our market is 50 percent penetrated. So of all the work that gets done in the clinical space, 50 percent of it gets outsourced. In the commercial market, it’s only 15 percent penetrated, so it’s like the CRO market was 10, 12 years ago, in terms of penetration. |

| | |

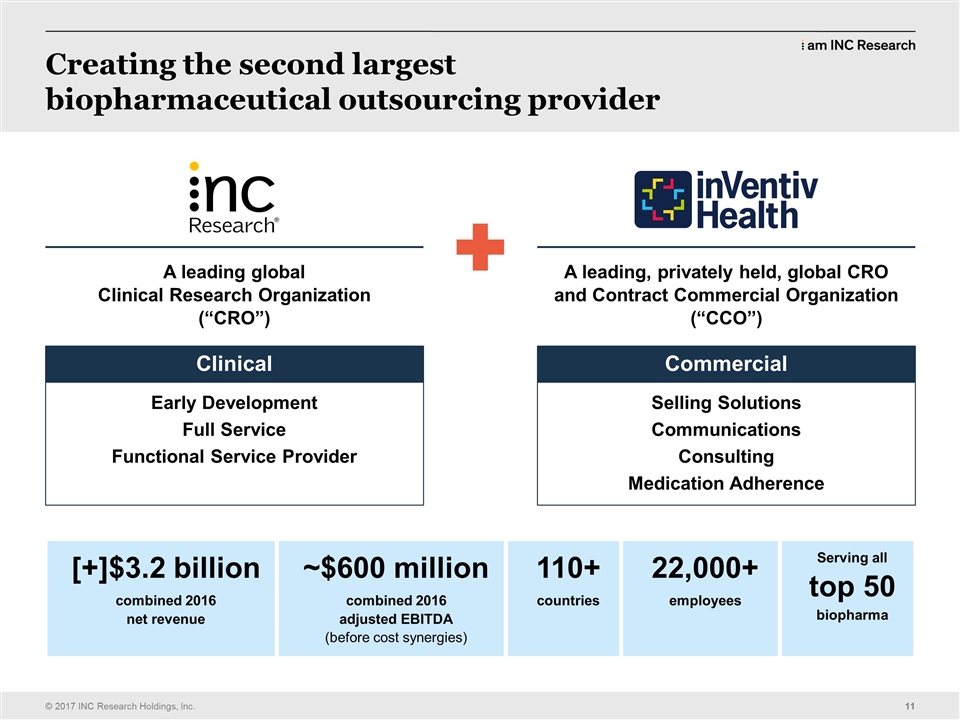

| | The commercial market is, is projected to be $150 billion. So nearly three times bigger than the market we play in. It’s only 15 percent penetrated, so it’s only 15 percent of that gets outsourced. These guys inVentiv are the number one company in that space right now. So when you do the market projections, by 2020 we’ll be the dominant player in a market that will also be $34…$35 billion in scale. So what we think we’re doing here is beefing up the CRO, making sure we’re thinking beyond that side, but taking a position and I’m going to use a hockey analogy, as we’re standing in the middle of a hockey rink, (LAUGHS) we’ve moved the organization to where the puck’s going to be, not where it is right now. There was a good hockey player apparently called Mr. Gretzky who said he was great because he skates to and was where the puck was going to be. That’s what we’re trying to do here. That’s our strategic comparative. To position the organization to be strong, to be competitive and have a market advantage and I think that’s what we’ve done. Their tag line, shortening from… shortening the… be good if I could read. Their tag line is “shortening the distance from lab to life,” and if you think about the spectrum they play across, taking products out of the lab, into the clinic, all the way to putting it into somebody who’s going to have a life-changing impact from that medicine or from that drug. Okay, next slide. [SFX] …good for me. No, it’s not. So the combination creates the second largest biopharmaceutical outsourcing provider. We’ve always been seen as the leading global CRO, early development, full service. We have had the capability to do FSP. We boost all those things now with this. inVentiv Health brings the commercial, selling solutions, communications, consulting, medication adherence and a big data asset. They have a lot of information, a lot of script information. We like that. We’ve got to work at how to handle that and how to get the benefits out of that; how we’re going to use that information to target customers… target customers… target patients in commercial, as well as how we’re going to target, use that same information to know where to look for patients in clinical. So we’ll have our own (CLEARS THROAT) data strategy around that. We’ll be working on that. Some of you will be involved in that. inVentiv is privately held right now. Obviously, though, they’ll become a public company and we’ll take them public when we do the closing. Combined 2016 revenue; so last year… $3.2 billion, combined a bit there, $600 million. Now after the Kendle integration, our revenue was $600 million. So now the combined EBITDA would be $600 million. So that will be the growth that you’ll see in the organization. Presently in 110 countries, 22,000 employees and we serve every single customer in the top 50 biopharma. That protects us from variations in customer outsourcing. It protects us from fluctuations in their fortunes and it gives us a great obviously market to play in. Next slide, please. Oh, that was my last slide. But I will be back. So I think I’m handing over to Neil. Thank you, Neil. |

| | |

| Neil Ferguson | | Thank you, Alistair. (APPLAUSE) So this next section is relatively brief, but we’ve been asked as a management team just to give some personal thoughts against some of these elements, just put some perspective from our own viewpoint. Personally, I’m really excited by this opportunity. This is truly transformational for INC. And I’m going to, no surprise, touch on it I think more as Alistair, we talk about from the customer’s perspective, too. One of the pluses I see from this is that really combined, between the two organizations, there’s not a great deal of overlap when we look at the competitive nature of where we’re targeting customers and compounds and so, you know, that really complements how we can look at adding greater value going forward. We all should be acutely aware that one of our key strategies for growth is to target Big Pharma and yet, as a company in the last few years, we’ve had a bit of challenge to be successful there, partly because these Big Pharma customers perceive that we don’t have the scale to meet their needs. We certainly don’t have the level of customer intimacy, especially at the higher level, those customer relationships that we really do need to leverage. And a lot of these customers also look for variations of service offerings; particularly a broader scale of FSP solutions that really, we’re not geared up yet to provide. inVentiv, on the other hand, have a much stronger footprint with Big Pharma, with these kind of services. So this really will enable us to leverage that capability and accelerate our growth in Big Pharma and really kind of address their concerns around scale and breadth of services that they’re looking for. I think another element of this is that we’ll be in a very unique position to potentially offer certain really interesting, strategic partnerships across the clinical and commercial landscape, that perhaps none of our competitors can offer. So that will, again, will help us to really take our relationships to a new era. But let’s not forget our core customers, too, where I think that this merger will also add real value. When we talk core customers, we’re talking emerging biotech tomid-size pharma and we’re going to be in a position to really offer a much greater portfolio across clinical and commercial solutions to service their needs. And I think one of the elements there and Alistair touched on it, is that we are potentially going to be able to enable them to derive greater value into their own organizations. Because now they’ve got an alternative solution to, rather than giving some of that value away, to Big Pharma through royalty payments to commercialize their products, they’ve got an alternative solution. So this is, I think, really exciting for how we go forward as a company, but also how we can now look forward to our customers and truly offer them a real breadth of solutions across clinical and commercial as we go forward. So with that I’ll hand over to Jean. |

| | |

| Jean Chitwood | | Thank you. When we’ve talked a lot over the last years about good strategy, what makes good strategy; we’ve talked about the fact that it’s all about having a cohesive response to what’s happening in the environment, the external world. And as Alistair mentioned, one of the things that is increasing, continues to increase is the pressure that there is on pharmaceutical drug pricing and the fact that it’s not enough to get a drug approved, to prove safety and efficacy, but you have to be able to put together a package that shows cost effectiveness and understand how it will affect the overall cost of disease, whether that’s in a country where there’s a lot of private healthcare payer or whether the government’s paying for healthcare, no matter who’s paying, they want to understand really the value, particularly for new products, because of the way that they’re usually priced. So this is really an exciting area to be able to offer across the spectrum to customers. I think the whole idea of being able to take clinical insights to things that we understand from having been a part of the clinical trial and allow them to flow into the commercialization of a product. And then in the other direction, of if it’s a kind of a virtuous circle, the types of data that inVentiv have about the preferences, perceptions of positions and patients in terms of the therapies that they’re on; how they view the disease, living with their disease state every day and how that might help us in the clinical side, both better designed trials as well as do a better job of placing them in locations where we know that there is a patient population that really matches. So as we’ve looked over the years at our strategy and our strategic options, it’s always about the thought that there’s really not a silver bullet or kind of one magic approach, but we’ve started thinking of it more as a secret sauce. So I think what happened yesterday is we got a lot more ingredients to add to the sauce (LAUGHTER) and the challenge will be to keep the taste in balance, be able to move it forward, but I think that it not only serves us well in 2017, but for a lot of years to come. Michael? |

| |

| Michael Gilbertini | | Thanks. (CLEARS THROAT) So I’m excited by this… this event and reflecting on our, our core business for a second, you’ve heard a lot about the extensions that will happen. But when we look to our full service work in… phase one through four trials, you know, we can see that (CLEARS THROAT) inVentiv has a similar vision. I mean, we are different companies, but we have a number of complementarities that can be built upon and among those and really importantly among those are the therapeutic expertise. They have a similar organizational structure in that they have therapeutic business units. In fact, they, their names are the same as ours, so Oncology, CNS and General Medicine. And a similar focus there in that their therapeutic leaders and project management are part of those business units. When we (CLEARS THROAT) are able to merge the therapeutic business units then we’ll have just tremendously new expertise, new indications. They are, in some areas we aren’t. And so we will, we’ll have a greater breadth of therapeutic experience and expertise and depth, as well and so that’s really exciting; strengthens our hand tremendously. |

| | |

| | Secondly, they have a product management culture and focus, not as explicit as ours and when they got to hear about Trusted Process, they were quite excited, jumping around, can’t wait to get focused on that and I think that that will be a tremendous value as we bring forward, you know, that particular way of doing trials. inVentiv understands that is a superior method and are eager to embrace it. So we’ll have an opportunity to bring that to more, more customers as well. (CLEARS THROAT) And then finally, you know, I think that the… the added… breadth and depth of therapeutic expertise, but also global presence, gives us new reach and we’ll be able to really field expert teams, which has always been our… our focus, part of our secret sauce in any indication that customers want to do trials and everywhere in world, I mean, we’ll be able to say that explicitly and without fear of contradiction. So it’s really quite a big, big transformative event and I’m very excited about it. |

| |

| Alistair Macdonald: | | Next one. Be nice. |

| |

| Tara Fitzgerald | | So I think Alistair alluded to this before, but another area of synergy is in FSP space. We’ve done very well growing organically over the years in specific functions, but now we’re actually jump starting into being one of the frontrunners in FSP space. We’re looking at approximately $500 million in revenue annually and $200 million of that is actually coming from clinical monitoring and project management, two functions that we’ve not grown to a great extent historically. So we have a lot more to work with moving forward. And of course in the real world evidence space we’re going to start see more and more opportunities with the merger. |

| |

| Greg Rush: | | One of the things that we’ve done here at INC and inVentiv has also done over the last three or four years is really improve our margins and that’s not from cost management as much as it is through operational excellence. If you think back to Kendle I wasn’t here at that time, but that was in sales in 2011 and they did not have the therapeutic focus and model that we have. They didn’t have the trusted process and it takes time to fully integrate that and by the time I arrived in 2013 I didn’t see any evidence of two different companies. It was a well done and all of the margin enhancement opportunities that we were looking at started to be realized in 2013, 2014 and 2015 from implementing those processes. Advent has done the same thing over the last three or four years within their integration and their margins have been improving and I think they would agree they still have a little bit further to go than we do. That’s one of the things that Michael mentioned. They are looking forward to embracing the trusted process. They are looking forward to embracing our therapeutic model which is slightly deeper than theirs and getting the benefits of that and look forward to working together to improve our combined profitability after the merger. Chris. |

| |

| Chris Gaenzle: | | If we could go to the next slide please. So I wanted to talk a little bit about what this means from a, you know, colleague perspective. Certainly that’s something that I’m sure is on everyone’s mind. And I wanted to kind of walk through it in a couple of different buckets. You know I recognize from a cultural perspective that both companies are different and while the management teams have had a lot of conversation and we think there’s a huge opportunity to take advantage of both cultures and the strengths for both of them, there is a good fit between the organizations particularly on the CRO side. We recognize and you’ve heard from Alistair and the team about the kind of fit there. |

| | |

| | There is also quite a lot of strength in the commercial side and talent in that commercial side that we’ve never had access to. And so that’s something that we feel really good about and we’re really excited about. Probably the better question is, at least from the INC perspective is, you know, how do we preserve our own culture. We are pretty proud of what we’ve done over the last you know three, four, five years and even before that with regard to embedding a culture, can do I own it, accountability and authority and autonomy for people in their own roles and a level of transparency and what I think of as kind of a low ego company with a couple of exceptions. (LAUGHS) Okay, I had to get a joke in. But all kidding aside we do have a great culture and it is something that this management team is exceedingly proud of and that goes all the way up to our Board of Directors. It is something that we will pay attention to. It’s something we will protect, but I also think that as we go forward it’s something we need to be open to allowing to change and morph as the companies ultimately combine because there is quite a bit of strength on the inVentiv side as well and they have their own cultural strengths that we will want to take advantage of. So you know we don’t know how that will look culturally I don’t think yet, but we’re pretty excited about what it will bring to all of us as colleagues at the company. You’ve heard a lot about making the company stronger. Obviously from a colleague perspective, an employee perspective the ability to grow the company substantially, to broaden the offering is something that will matter to us as employees, the opportunities for growth and development I think are frankly enhanced and expanded down to the individual level. There will be things that we will see and want to do as a combined company that even we don’t see yet and I think we’ll need key talent throughout the organization to make that happen and a key to that is growing and developing as an employee of INC Research and then the combined companies. It is I think important to note that the companies have not yet been combined. This is an announcement and we are here at day one. And there is a process for – there’s a formal legal process, but there is also an integration process that needs to occur before the companies actually combine. So from that perspective, you know, and I think you’ll hear this more from Alistair as well and the team, it is business as usual. There will be integration planning. There will be a level of activity, particularly for the deal making team to make sure that we get ourselves to closing the transaction, but for almost all of us it is business as usual. We recognize that this can be a distraction, but we need to deliver, you know, our commitments to the company. And those commitments are, you know, what we took advantage of and did in the first quarter. You heard about it yesterday, but you know we need to be able to announce great quarters and that requires you know strong business development efforts, strong operational delivery and then strong support. So you know I think that’s an important message from, you know, I think you can hear that from all of us. Integration will be on everyone’s mind. Again we’re on day one so there will be integration planning. One of the things that, you know, Greg and Alistair spoke about yesterday with you know in the earnings call and the |

| | |

| | follow ups from that is the level of strength on both sides with regard to running integrations. We’ve got great experience having done the MDS and Kendle transaction. It is something that we discussed quite a bit as we contemplated the transaction because getting it right is critical. And so we feel really good about how the integration will be structured, but there is a lot of planning to do. |

| |

| Unknown Male Speaker: | | Next slide. |

| |

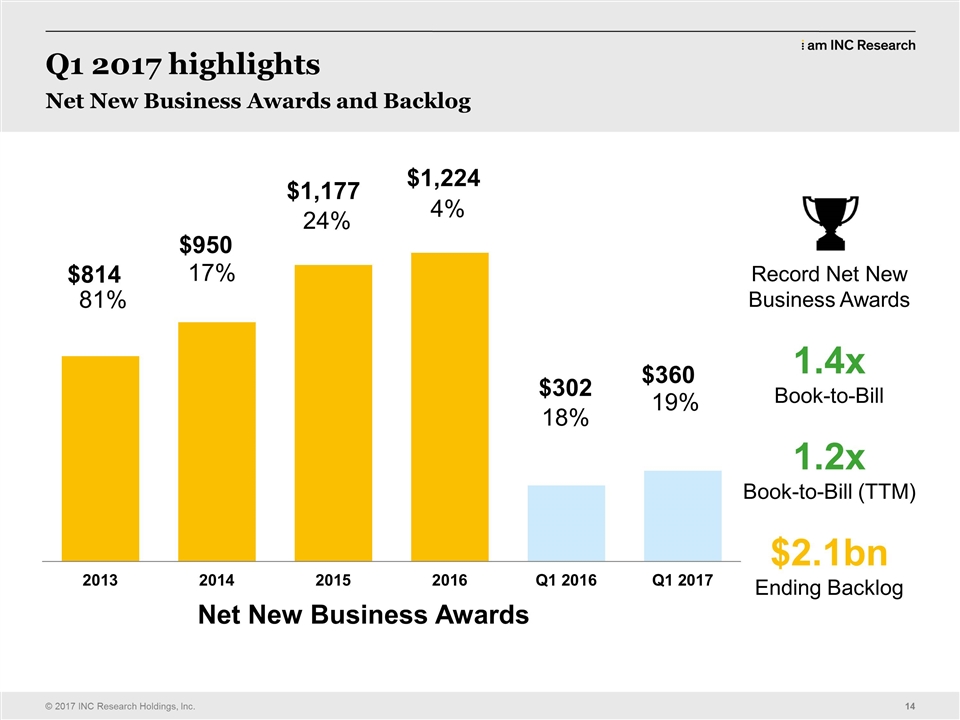

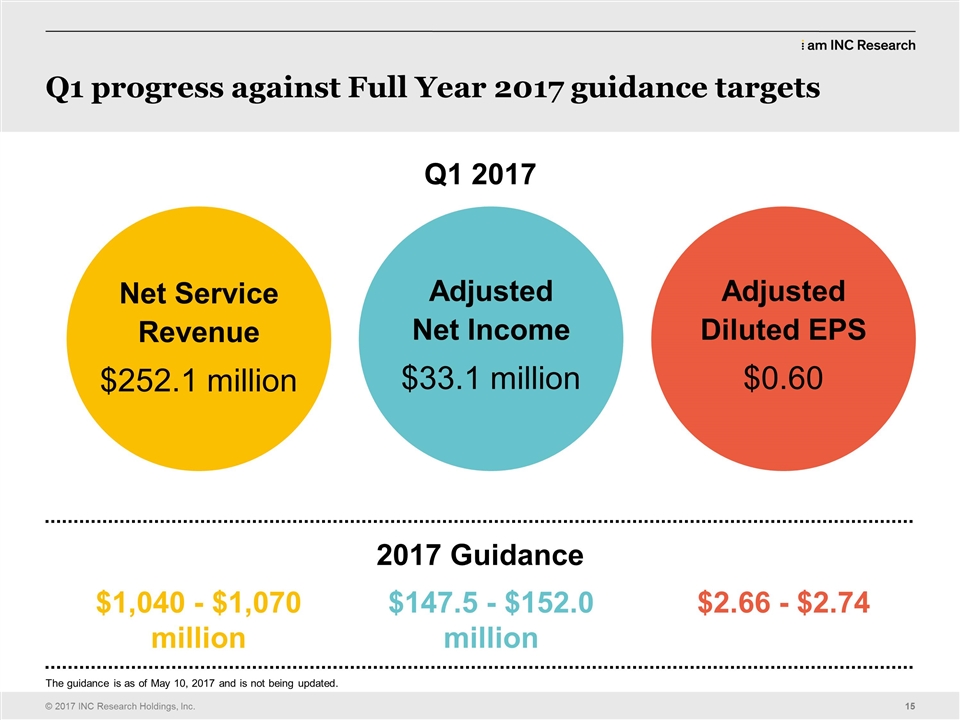

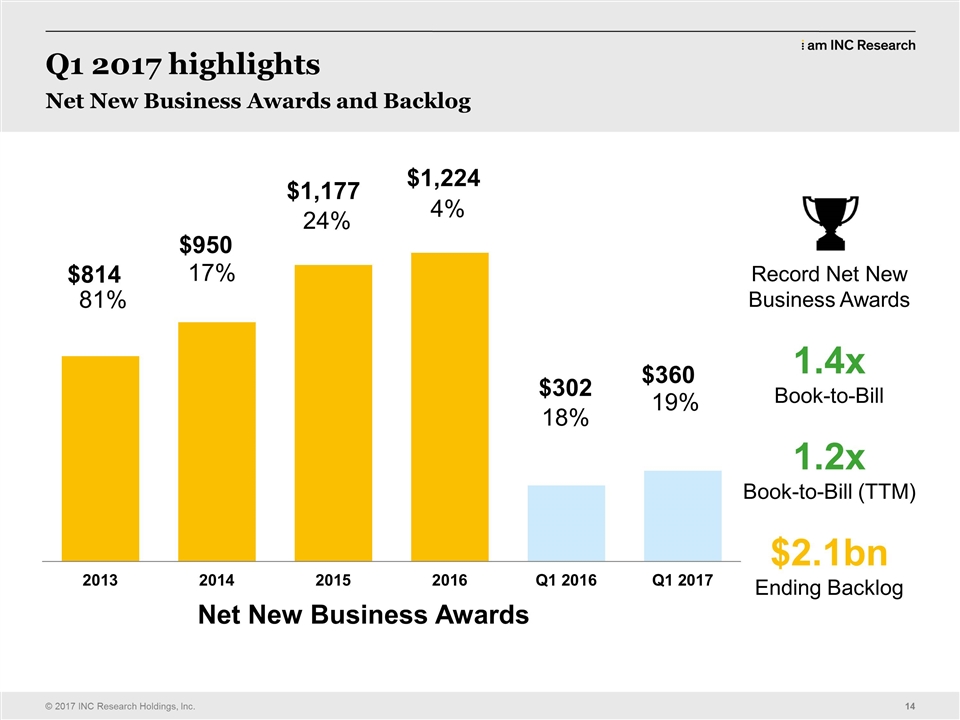

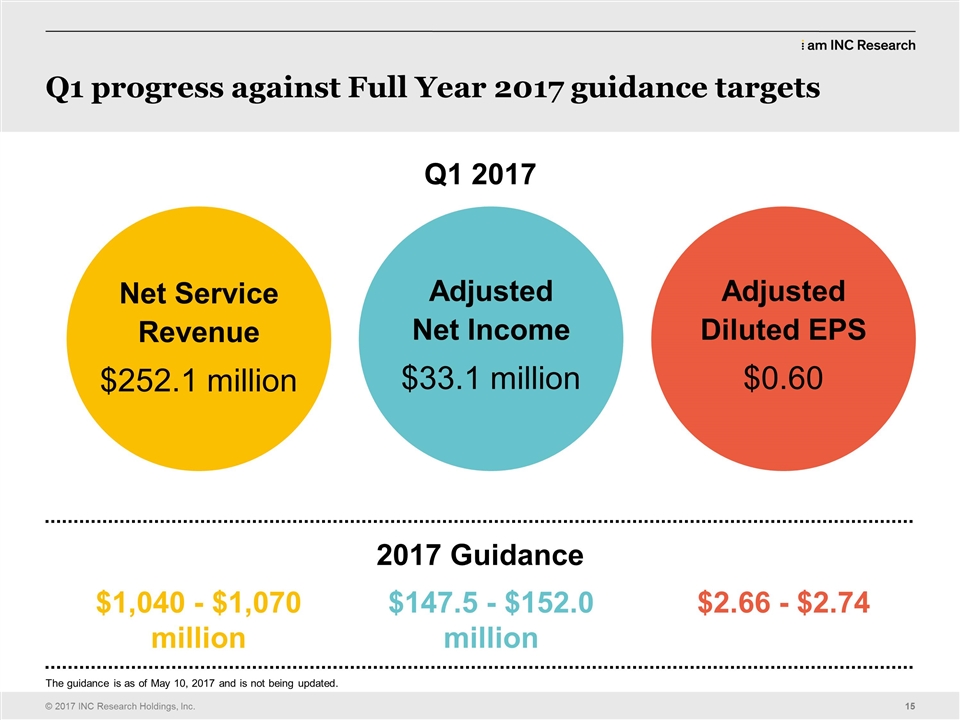

| Greg Rush: | | All right I’m going to stand up. They made me sign papers that I cannot tell jokes and they’ve been up here doing these jokes. (LAUGHS) And I think that is a violation of the contract and the guy can tear it up right now. So now I get to tell my jokes. The other thing is this is going to be filed with the SEC and I tell my kids all the time how funny I am and how all of you laughed and they were going to rob me of the opportunity with this script and I do want the editor of the script to please insert laughing hilariously and all of those things so that my kids could see it and they do remind me that you all are sort of paid to laugh so it is what it is. I think the results yesterday were balanced. We didn’t hit our guidance, but our guidance was not as what we would like it to be on revenue so we have work to do. The good news is, is the reason our work – results from revenue were not quite as strong as we would like because our awards were not – did not end Q4 as like we would want to. Look at this for Q1. $1.4 book to bill, $360 million net awards, we broke records both on gross awards and net new business awards and that is a result of everything that you have done in this room and doing the next big deal. We ended up with $2.1 billion. Yeah, you deserve a hand. (APPLAUSE) And as big as the announcement of the transaction was yesterday every one of the analysts talked about one metric in our quarterly results and that was the new business awards and how we really drove performance. Another thing that we have done really well we’ve talked about dominating what is ours. Each of the last three or four years we have grown our new business awards from small to mid market by over 20% and we continue to be very successful on that and our customers like our performance and they do that with awarding new business. Next slide. Just to touch on the numbers. We did $252 million. That’s about one or two percent higher than what we did last year. Obviously we’ve been historically growing around 10%. These new business awards are a good start to get us back into those double digit levels which is what we are all targeting and so we want to do that. We did the guidance thing. Most people had us around $250 million. I will go to adjusted EPS. We did 60 cents, a little bit above our midpoint of guidance and a little bit better than Wall Street expected. For the full year we’ve given the following guidance; a midpoint of about a billion fifty-five. Again one of the things we do at INC is we try to over perform and so our goal is to exceed that at midpoint. All of you need to help us do that. Q2 in particular, I’d really appreciate people getting out there monitoring business data on site. It’s very important. We have about 45 days so let’s make sure that we continue the great results from Q1, EPS and the midpoint of $2.70. Wall Street had expected about $2.69 so a slight increase from what they expected. Let’s go deliver to our shareholders what they deserve and do better than these results. And I will turn it over, next slide. I think this is back to Alistair. |

| | |

| Alistair Macdonald: | | So these are some of the awards we got in Q1. You know one of the critical things is not actually a financial reward, but again winning – we’re the top CRO to work with besides amongst the global top ten CROs is a huge achievement. Not only to winning in 2017, but the fact that you guys won it in 2015, 2013 and I think we are the only CRO to finish in the top three – now it’s 14 years running. So again you should give yourselves a huge round of applause for that. (APPLAUSE) We have said this before and we will continue to say it, the sites are one of the people that the customers check with before they award a contract, particularly if we’re the first – it’s the first time they’ve worked with us. The sites are a huge advocate for the CRO that they want to work with and their advocacy leads to patient enrollment, leads to success in the trials, leads to the next business. So it’s a critical part in the chain. In Q1 we secured two new preferred provider relationships. One of them where we’re seeing a much bigger relationship with now. In fact I’m going to say both of them we’re discussing a much bigger relationship with now. Because of our performance, delivering their trials historically as well as currently they are prepared to commit more work to us and more work to INC which creates more opportunity and more value for all our stakeholders. That’s not just shareholders, that’s all of our stakeholders. It keeps us all busy, active, moving forward, creates opportunities for us to advance. And in Q1 we had our biggest single award in company history I believe in a single contract. It’s a three year renewal of an FSP in the safety group. And that safety group turned itself around about two and a half years ago, declining revenues, it turned around and now it’s our fastest – I think it’s actually our fastest growing business unit and it’s not because it’s got a small amount of revenue. It’s just super competitive, incredibly high quality, super commitment from the teams. One of Tara’s groups and one of the things we haven’t done today is recognize the fact that Tara won an award recently for a very prestigious (APPLAUSE) leadership award. She will kill me later ‘cause I know I’ve embarrassed the heck out of her, but that’s what I’m here for as well. So this is great. This is Q1. It’s behind us. We need to do the same in Q2. We absolutely killed it in Q1. The sales teams, operational teams, we were kind of busy with something as well, but everybody was out there delivering the INC, doing the INC, taking our message to customers, being aggressive, not taking no for an answer, performing on the delivery side. It’s a great result. We gotta do it again in Q2. We’re gonna do it again in Q3. We’re gonna do it again in Q4. You see the pattern there? So it’s very important that we do that and it’s very important that we carry on delivering what we’ve always been known for, high quality delivery, commitment, I can do it, I own it. Let’s make sure that we keep that effort up all the way through this integration. It’s the key to us and it will be a key after the integration as well except that there will be 22,000 of us doing it instead of 7,000. So and I’m really, really looking forward to seeing those really kick on from here and become the CRO of choice which you guys are helping to create every single day. |

| | |

| | Okay, next slide. I think we’re at Q&A, okay, perfect. So we have some questions that have come in while we’ve been talking from around the world and we will start with a couple of those and then we will come – if any guys in the live here in the audience want to ask a question there’s a microphone right down here. And I think there’s a roving mic in the crowd so if you’ve got a question put your hand up and we’ll try and find you, but I will start on here. I think I’m going to go straight to Chris since he made a joke. Greg is up here too, that’s appropriate. I did too. So the question has come in what are the next steps in a merger or in the merger and what should employees expect and what are the next steps in integration planning? So three nice questions for Chris to start off. |

| |

| Greg Rush: | | Perfect. (LAUGHS) So a couple things. First we are committed to transparent communications with employees with regard to updating on the process and so that’s something that, you know, Jean and the team will work on and make sure that we’ve got that in place. Yesterday was merely an announcement of a definitive agreement to come together and so and what we said is that the companies will combine sometime in the second half of the year. So there are a number of steps that have to take place between now and actually closing the transaction and so until that time the companies will actually have to operate separately. It’s not just a combination that occurs right now. And so you will receive some communications with regard to, you know, whether you can interact with your, you know, a counterpart on the other side for example. There are really strict rules about that and those are for competitive reasons. So the companies will not operate as a whole until the agreement is approved by regulatory authorities and then we actually close the transaction. There are a couple of exceptions to that. The question about integration planning. There will be a level of integration planning that goes on between the two companies. Both companies will have integration teams that do a lot of planning work between now and the close and the success of that and the plan that goes into that really frankly I think plays into the success of the overall combined organizations. So there will be a lot of activity on that, but it will be contained. It won’t involve all or even most employees because to Alistair’s point and Greg’s point we need to continue to deliver the quarters. I think that covers it. |

| |

| Alistair Macdonald: | | And there is a follow up question that says what have we learned from previous integrations that we’re applying to this integration? Well both inVentiv and INC have used the same kind of process to drive in successful integrations. We set up the transition management office so that we have a team that’s dedicated to integrating. It’s very important. This comes in to support the fact that we have to continue to deliver for customers. We have to act business as usual. To do that you can’t be doing your day job and integrating a company as well. So we set up a transition management office. We have a lot of people still with the |

| | |

| | organization who are in those teams from both the Kendle and MDS integration. I am actually one of them. So although I don’t think I’ll be on the transition management team because nobody believes I focus on detail anymore which is probably true, the least of all my wife and children, but anyway. So we will be pulling the transition management team together and it will be staffed by teams from both INC and from inVentiv to look at what we have in terms of process procedures, structures, how we work, how we combine both CROs, but also how we drive those revenue synergies by being able to offer commercial services to customers. Obviously we’ll be integrating RT systems and that kind of thing. And with the mantra in mind we’ve always looked at – if you think about easy to do business with, easy to work for – those two things will be some of the guiding principles in the integration that we do. We want to continue to make INC’s culture and environment one that’s very positive to work in, that enables you to be successful. Another question on here that I will cover as well. We just got accredited with the silver level with IAOCR; it’s the International Academy of Clinical Research. We will still be working towards gold as a combined company. I can tell you absolutely we will be. The whole point behind the IAOCR effort is to bring accreditation to you, to bring skill sets to you that enable you to master the position that you’re in and move on to the next one. For us as a business that makes a ton of sense to have the best trained, the best knowledge, the people with the most knowledge and the people that are the most motivated in the industry. We want you to enjoy your experience at INC, get benefit out of it, learn the trade if you like and be successful in those accreditations. I was amazed actually with some of the response for those. I didn’t realize when I set that process up that you get university credit points I think for a lot of that. And they are substantial. So you can get a lot of credits from that training and I’m very proud to be a part of that and I’m very proud of the fact that not only were we the first company to get the bronze award, we’re the first and only company to get a silver award. So and I intend to make it a hat trick by INC being the first and only company to get the gold award as well and it means a lot to our customers. There’s tons of pharma companies jumping on to that because they see it as a way to get their training into an accredited program globally and have great consistency and we’re way ahead of them. So yes that will also be something that we continue with. Let me see. When will you be announcing leadership for the new company? Great question. You know like Chris said this is day one. There is a lot of planning to do. There’s a lot of things to be considered. We will start the cascade of information coming out probably next week where we start to announce leadership and we start to announce structures and that will start come from us over the next few, probably middle of next week we’ll start some of that. I think a question from Italy. Let’s just reiterate that again. Should we be operating immediately as if we are a merged company, i.e. bids, etc. What are the parameters for acting as a combined company? This is important so I want Chris to just cover that again. |

| | |

| Chris Gaenzle: | | Yeah, so the answer should we be – the question is should we be operating immediately as if we are a merged company. The answer to that is emphatically no. There are strict rules about operating together before the regulatory approvals are made and the company closes the transaction. So we will reiterate that in our communication to all employees, but you should not be, you know, working with “a counterpart on the other side” or interacting with inVentiv as if we were a combined organization. |

| |

| Alistair Macdonald | | Thanks Chris. Do we see that as an advantage or disadvantage that a combined company this big does not have a central lab? Neil. |

| |

| Neil Ferguson: | | The short answer is no we don’t. You know a part of our business model is to make sure that we focus on where our expertise is and then partner with the best partners out there that can provide additional services. And certainly from a central lab perspective that’s definitely one of the areas that we feel we get better value serving our customers by having flexibility to go to the labs that make the best sense. So certainly as we look forward we have no intention of looking at that. |

| |

| Alistair Macdonald: | | Okay, one more for you Neil that just came in. Are you a speaker? Everybody keep typing questions for Neil while he’s talking. (LAUGHS) When will sponsors be notified of the transition? |

| |

| Neil Ferguson: | | So as of yesterday morning and we notified every customer in SalesForce.com with a communication from Alistair. In addition to that the recordings of the leadership, the sounds and the new leadership identified a number of key customers and began yesterday morning reaching out to them with personal contacts to not only inform them, but also reassure them that it’s business as usual, that we’re very much focused on their delivery and the excitement of what the potential, you know, merger can offer in the future, but pretty much that we’re here for them. That will continue as we go forward, but that has already begun and we’re covering all key customers. |

| |

| Alistair Macdonald: | | Okay, a great question just came in. Will our name change? Jean. |

| |

| Jean Chitwood: | | One of the areas that we talked about the marketing PR portion of inVentiv’s business, they have a number of really top tier marquee name PR agencies, advertising agencies and part of what they do for our combined customers are product names, company names, that type of thing. So we will actually be using what is – will be our own internal expertise to work through a process. I’ve actually done this before on the product side and there is a combination of I’ll say art and science. There is a creative part of it. There will be a short list of names that will be developed and then very importantly although I’m sure we all have an opinion about a name, we need to take the new offering to our customers and bounce that offering against names and see what really makes sense. So you will hear more about this. Actually the group is located here locally in North Carolina so hopefully they’ll be an opportunity for some folks to be involved in the process or at least we will keep you updated on what that looks like. Our goal is to have a name by the time we close the transaction so that we don’t have to dig through the ice here at PNC and put a new name down. So much like any of you who have children and you went through that process of what are you going to name your child, there’s a lot of complexity to it, but again I think it’ll be – it’s very important for the new combined company going forward. |

| |

| Alistair Macdonald: | | Thanks Jean. We won’t take Prince as an example. We won’t be the CRO formerly known as INC Research. (LAUGHS) Well maybe, I kind of like it actually. (LAUGHS) Another question that I think Jean can help with. What happens to our business strategy and strategic business initiatives? Does this change our strategy for 2016 to ’18? Let me answer a little bit first. |

| | |

| | I think the strategy that we have, the main title of CRO of choice is what we still want to shoot to be, probably always. Obviously or change, it couldn’t just be a CRO, but we want to be a company that people choose to work for and choose to work with and that’s really critical for what we want to do in the future. We’re laying out a whole new service platform for customers and we want them to work with us. We want to be easy to do business with and we want to be easy to work for, systems, processes, the culture, the environment that we have; we want to continue that. So I think rest assured we’ll never come away from that. That’s key to my kind of mentality, but the individual business initiatives. Jean. |

| |

| Jean Chitwood: | | The individual strategic business initiatives have to continue. Actually they’re probably more important than ever because now we are a CRO twice the size. So many of those initiatives were about transparency to data analytics and information. They were about our efforts with the new ICH addendum, new financial guidelines, etc., etc. So those will continue. The strategy obviously will need to evolve. It will need to broaden so hang on to those mouse mats or those mouse pads with the strategy map on it because I don’t want to see those running around on EBay because they’re going to be valuable one day. (LAUGHS) Probably another one for Chris actually. Do we expect changes to holidays, benefits, compensation, etc.? Am I gonna get more holiday, Chris? |

| |

| Chris Gaenzle: | | You’re gonna get more holiday. (LAUGHS) I think it’s a fair question. Look, again we’re day one and so these are things that the company will certainly look at. We recognize that the company will be much larger and will have different types of offerings and so certainly that’s a consideration as you kind of look at the detail regarding compensation benefits and holidays. So I don’t know if I can answer specifically what that might look like, but certainly that’s something that we would – we will take a look at. |

| |

| Alistair Macdonald: | | Thanks Chris. I think we’ve nearly exhausted all the questions on here, certainly the ones we want to answer anyway. (LAUGHS) There is one I’ll come back to because I want to close with that sentiment. Any questions from the crowd here in Raleigh? Is there a question down there? Do you have a microphone? There’s a fixed mic, just it might be hard to get to |

| |

| Unknown Speaker: | | [INDISCERNIBLE QUESTION] |

| |

| Alistair Macdonald: | | Okay, thank you. So the question is INC is the company that develops the drug and then inVentiv is the company that can market and help sell the drug. Is there a conflict of interest in that? And so good question. inVentiv is also CRO as it stands so they are already in that situation. And obviously we’re – I think in similar industries, absolutely. I think testing and then selling, you know, or supporting the sales of a drug could be a conflict of interest. I think because of the industry that we work in; you think about the regulatory hurdles that we have to go through to prove the drug is safe, to prove that it’s efficacious. The FDA audits everything that you’ve done. We actually have the FDA in Camberley right now auditing for a customer to look at their projects that we supported. So you know you have to prove the drug works statistically. You have to show that everything that was done during the clinical trial was as per ICH GCP. So that gives us a lot of assurance |

| | |

| | and it gives the customer a lot of assurance and it would give the patients a lot of assurance that this drug hasn’t been jammed through. In fact one of the advantages that pharmaceutical companies get from outsourcing their work so imagine one of our customers does this all themselves and there are customers out there that do all their own clinical trials and market. They’re the ones who stand to gain financially from the success of that drug. So those regulations are in place partly to prove because the burden of proof is on the pharmaceutical company, but they’ve done all the development work correctly, through all GROP and then GCP that the drug was manufactured through good manufacturing practices or GMP, all those standards are there to safeguard the customer, so to safeguard the patient. Then there are a lot of SEC rules and regulatory rules on the commercial side that we see. Chris would know, but you know you can’t take a doctor out to dinner that you’re trying to get to sell new drugs. You can’t treat them in any – you can’t do anything with them. They have to – you have to prove that this is a very clean and a very safe environment for that transaction to take place. So it’s a great question. We will find out. We will bring those kinds of answers to you guys as we go through this, but thank you for the question, good question. Neil is going to add some more. Neil is actually – when we recruited Neil he came from the commercial side. I was going to make a joke, but one wouldn’t come, so. (LAUGHS) |

| |

| Neil Ferguson: | | I think the other thing to remember is that we don’t own the compound and we’re not driving the revenue from the sales of that compound. And I think that’s a very clear differentiation too. We are a service providing company and we will be reimbursed through revenue for provision of services to support that compound in development and in commercialization and that should be, you know, the key thing to reflect here. There isn’t a conflict provided that we subscribe to all the requirements clinically and commercially, but also recognizing that our revenue stream comes from provision of services. It can be creative deals that are different to that, but then there are additional requirements that are put around it for the protection of everybody. |

| |

| Alistair Macdonald: | | Thanks Neil. |

| |

| | If sponsors have questions where should we refer them? |

| |

| | If you are feeling uncomfortable to answer, I mean I think most people that are customer facing and the general organization has been sent FAQs, but I would say that if you’re posed with a question that you do not feel comfortable to answer to reach out to BU leadership or BD leadership as your priming point and they will then, you know, they’re perfectly equipped to be able to handle those concerns and if necessary bring in legal for additional support. So I’ve got two more questions I think. Michael, will we stay therapeutically inclined? Will therapeutic or career paths change? |

| |

| Michael Gilbertini: | | Therapeutic alignment and structure is part of our success and, you know, inVentiv has a similar structure so my anticipation is yes we will be therapeutically aligned going forward. It is a question that we ask ourselves even before this all the time. Is it still the correct operating model for INC and through all of our growth over the last ten years we have always come to the answer as yes it is the correct operating model. We will continue to ask that question independent of this, but also because of it, but my anticipation is we will be therapeutically aligned. |

| | |

| Alistair Macdonald: | | Thanks Michael. One for Neil, a quick one and then I’m gonna finish. Am I allowed to mention this at a Bid Defense next week? |

| |

| Neil Ferguson: | | Absolutely not. (LAUGHS) If it’s brought up obviously handler is being directed, but again to emphasize that until this closes we are independent companies and we have our own job to do and so we are very much INC. We are in a competitive nature and it’s business as usual. |

| |

| Alistair Macdonald: | | I think it’s – I remember from my time here when we merged with MDS, when we acquired MDS I was running sales at that time and it came up all the time. Let the sponsor bring it up and you we can’t sell the combination, but we can say you know we’re excited about it and I think we drew a line under that and then we moved on to wowing them and doing an INC on them on what their materials are that we’ve got. I will ask one more quick question. Will we still be a public company? The answer to that is easy, that’s yes. inVentiv will be going effectively private to public as part of this transaction with us. So I think we’re at the end of the time. There is one more question that I’m going to use to close out and that has come from multiple people and it says what can I do as an individual to make sure that the merger is a success? Thank you for that question, the people that sent that in because it’s critical that it is a success. It’s critical for all of us. For all of our stakeholders, employees being the most important in that. It’s critical that we get this done. It’s going to be on a big scale. The number one thing that you can do as an individual within INC is just carry on work as normal. It’s business as usual. Get out there, let’s continue wowing the customers, let’s do in Q2 what we did in Q1 from a business development perspective, from a delivery perspective. The collaboration that we have, the maturity that we show as a business, they’re all key points for us making this successful. If we can carry on hitting our numbers, if we can carry on delighting customers with the delivery and performing at a level we have that will set the right tone and that helps us continue the culture that sets us up for a great success with the integration. So collaborate, communicate, we will bring you as much information as we can. There are some regulatory constraints on us as we go through this process from now as the announcement date until we close. We will bring you information as transparently as we can and as quickly as we can and we will continue to try and make INC a CRO of choice. So thank you very much for everything you’ve done so far. I’m looking forward to a fantastic future with this organization for all of us and I’m really excited about what this transaction brings to us and what we can do with it as we take on the real big CROs as we become the CRO of choice. So thank you very much. (APPLAUSE) |

Q2 2017 Town Hall May 11, 2017