OPC ENERGY LTD.

Report of the Board of Directors regarding the Company’s Matters

for the six‑month and three‑month periods ended June 30, 2024

The Board of Directors of OPC Energy Ltd. (hereinafter – “the Company”) is pleased to present herein the Report of the Board of Directors regarding the activities of the Company and its investee companies (hereinafter together – “the Group”), as at June 30, 2024 and for the six‑month and three‑month periods then ended (the Period of the Report”).

Except for the data reviewed in the Company’s interim consolidated financial statements as at June 30, 2024 (hereinafter – “the Interim Statements”) that is included in this report below, the data appearing in the Report of the Board of Directors has not been audited or reviewed by the Company’s auditing CPAs.

This Report of the Board of Directors is submitted on the assumption that the interim reports and all parts of the Company’s Periodic Report for 2023, which was published on March 12, 2024 (Reference No.: 2024‑01‑021301) (“the Periodic Report for 2023”), are before the reader and references to the Company’s reports include the information presented therein by means of reference.

OPC Energy Ltd.

Report of the Board of Directors

Main financial parameters (in millions of shekels)

| | | | For the | | | For the | |

| | | | Six Months Ended | | | Three Months Ended | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Consolidated | Adjusted EBITDA after | | | | | | | | | | | | | | | | | | |

| proportionate consolidation | | | 583 | | | | 434 | | | | 34 | % | | | 238 | | | | 159 | | | | 50 | % |

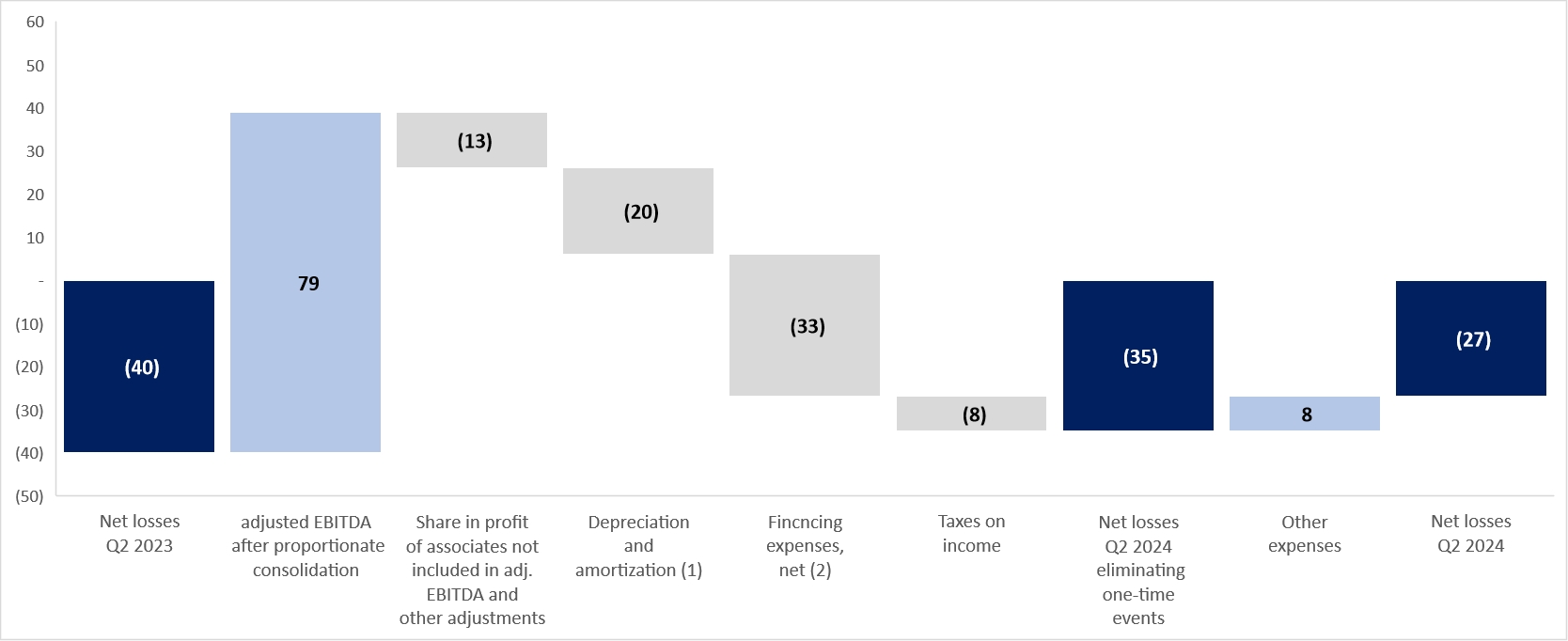

| Net income (loss) | | | (12 | ) | | | 39 | | | | (131 | )% | | | (27 | ) | | | (40 | ) | | | 33 | % |

| Adjusted net income (loss) | | | (4 | ) | | | 66 | | | | (106 | )% | | | (30 | ) | | | (37 | ) | | | 19 | % |

| FFO | | | 307 | | | | 278 | | | | 10 | % | | | 37 | | | | 81 | | | | (54) | % |

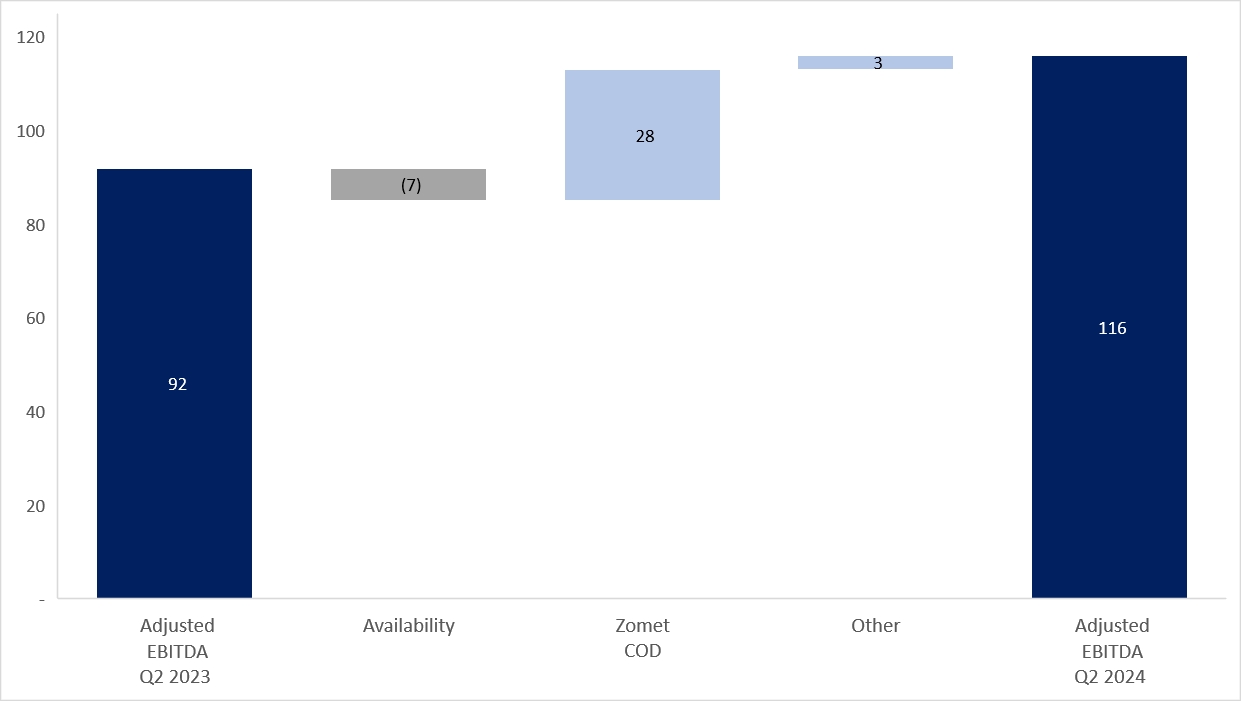

Israel | Adjusted EBITDA | | | 286 | | | | 210 | | | | 36 | % | | | 116 | | | | 92 | | | | 26 | % |

| | FFO | | | 218 | | | | 169 | | | | 29 | % | | | 9 | | | | 28 | | | | (68 | )% |

U.S. | Adjusted EBITDA after | | | | | | | | | | | | | | | | | | | | | | | | |

| proportionate consolidation | | | 305 | | | | 237 | | | | 29 | % | | | 127 | | | | 73 | | | | 74 | % |

| FFO | | | 144 | | | | 156 | | | | (8 | )% | | | 54 | | | | 49 | | | | 10 | % |

| Adjusted EBITDA after | | | | | | | | | | | | | | | | | | | | | | | | |

| proportionate consolidation – | | | | | | | | | | | | | | | | | | | | | | | | |

| energy transition | | | 288 | | | | 268 | | | | 7 | % | | | 109 | | | | 87 | | | | 25 | % |

| Adjusted EBITDA – | | | | | | | | | | | | | | | | | | | | | | | | |

| renewable energies | | | 63 | | | | 19 | | | | 232 | % | | | 35 | | | | 12 | | | | 192 | % |

| * | Adjusted EBITDA, adjusted EBITDA after proportionate consolidation, adjusted net income and FFO are not recognized in accordance with IFRS – for definitions and the manner of their calculation – see Sections 4A and 4B to the Report of the Board of Directors for 2023 and Section 4A below. |

| 1 | The Executive Summary below is presented solely for convenience and it is not a substitute for reading the full detail (including with reference to the matters referred to in the Summary) as stated in this report with all its parts (including warnings relating to “forward‑looking” information as it is defined in the Securities Law, 1968 (“the Securities Law”) definitions or explanations with respect to the indices for measurement of the results and including the information included by means of reference, as applicable). This Summary includes estimates, plans and assessment of the Company, which constitute “forward‑looking” information regarding which there is no certainty it will materialize and the readers are directed to the detail presented in this report below. |

| 1. | Executive Summary (Cont.) |

Main developments in the second quarter and thereafter

| Israel | Increase of 26% in the adjusted EBITDA compared with the corresponding quarter last year Win in the Ramat Beka 2 tender – in June 2024, the Group won an additional tender of Israel Lands Authority for two sites located adjacent to the sites of the first Ramat Beka project, for an aggregate consideration of about NIS 890 million. As at the approval date of the report, if the win is realized, the Company intends to advance a consolidated project that will amount to about 505 megawatts, plus storage capability with an estimated cumulative capacity of about 2,760 megawatts per hour on the sites of the prior tender and the present tender. See also Section 6A(1) of the report. Refinancing in Israel – in August 2024, OPC Holdings Israel signed two bank financing agreements, with an aggregate scope of NIS 1.65 billion, which were used mainly for purposes of early repayment of the project financing of the Zomet and Gat power plants. See also Note 7A(2) to the interim statements. Government Decision with respect to Hadera 2 project – in April 2024, the government of Israel rejected for plan for construction of a power plant in land located adjacent to the Hadera power plant. The Group has submitted a petition to the High Court of Justice, which as at the approval date of the report is pending. |

| | |

| U.S. | Increase of about 74% in adjusted EBITDA after proportionate consolidation compared with the corresponding quarter last year. Signing of an investment agreement in the area of renewable energy in the U.S. – in August 2024, an investment agreement was signed with Harrison Street, a U.S. private equity fund in the area of infrastructures, whereby the fund will invest an aggregate amount $300 million in exchange for 33.3% of the ordinary rights in CPV’s renewable‑energy activities. The transaction reflects a value for the said activities “before the money” of $600 million. Completion of the transaction is expected to take place within about 3 months. See also Note 10J to the interim statements. Undertaking in acquisition agreement and a memorandum of understanding regarding increase in the holdings in the Shore and Maryland power plants in the area of Energy Transition in the U.S. – in July 2024, the CPV Group signed a non‑binding memorandum of understanding and a binding agreement for acquisition, cumulatively, of significant holdings in the Shore and Maryland power plants. The total amount required in connection with the transactions, including as a result of their closing (if closed) is expected to amount to about $210 million – $240 million1. As at the approval date of the report, completion of the transactions is expected to take place in the second half of 2024. See also Section 10C below. Availability tenders in the PJM market for the period July 2025 through June 2026 – in July 2024, the results of tenders for availability prices in PJM were published, with a significant increase in the prices to about $270 per megawatt per day. In CPV’s estimation, the additional to its revenues from availability of the power plants active in the PJM market is estimated at about $54 million for the period of the tender. See also Section 3.3J below. |

2 | Including the expected amount in connection with reduction of the leverage in respect of the holdings being acquired in one of the projects. |

| 1. | Executive Summary (Cont.) |

| U.S. (Cont.) | Start of construction of the Rogue’s Wind project (wind‑energy power plant with a capacity of 114 megawatts located in Pennsylvania) – in August 2024 a Work Commencement Order was issued for construction of the Rogue’s Wind project. See also Section 6A(2) below. |

| | |

| | Refinancing of Towantic – in June 2024, Towantic signed a refinancing agreement. See also Section 9 below. |

| | |

| | Refinancing Fairview – in August 2024, Fairview completed a refinancing transaction. See also Section 9 below. |

| | |

| Group headquarters | Raising of capital – in July 2024, the Company completed raising of capital, in the amount of about NIS 800 million. |

| | |

| Credit rating – in July 2024, S&P Maalot reconfirmed the credit rating of the Company and its debentures at the level of ilA– and updated the rating outlook from negative to stable. |

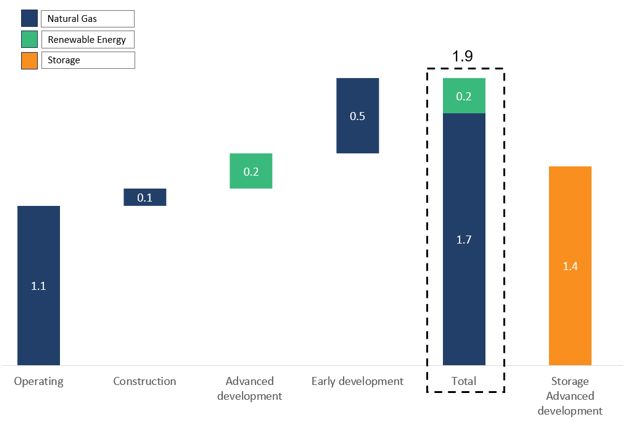

Portfolio of about 10 GW and about 1.4 GWh of storage (for details – see Section 6 below)

United States (*)

| (*) | The above chart does not include increase in the holdings in the Shore and Maryland power plants and the investment agreement in the renewable‑energy area, which as at the approval date of the report had not yet been signed and/or completed.

In addition, the CPV Group has additional projects in the area of carbon capture potential with a scope about 5GW in initial development stages. |

Israel

| (**) | The early development does not include the Hadera 2 project, with a capacity of above‑mentioned 850 megawatts, in light of the Government’s decision to reject the plan, as stated in Section 10A below. In addition, the development backlog does not include the Ramat Beka 2 project, since as at the approval date of the report the win in tender had not yet occurred, as stated in Section 6 below. |

That stated with respect to the development stages, capacities and expectations regarding construction of the development projects constitutes “forward‑looking” information as it is defined in the Securities Law, which is based on the Company’s estimates at the date of the report and regarding which there is no certainty they will be realized. Ultimately, there could be changes in the characteristics of the projects and/or delays due to regulatory and/or operating factors and/or realization of one or more of the risk factors to which the Company is exposed, as stated in Part A of the Periodic Report for 2023. Advancement of the development projects is subject to the discretion of the Company’s competent organs and existence (fulfillment) of additional conditions, as stated in Part A of the Periodic Report for 2023.

| 2. | Brief description of the areas of activity |

The Company is a public company the securities of which are listed for trade on the Tel Aviv Stock Exchange Ltd. (hereinafter – “the Stock Exchange”).

For details regarding the Group’s activity segments in the period of the report – see Part 2 of the Report of the Board of Directors that is included in the Periodic Report for 2023 (“Report of the Board of Directors for 2023”) and Note 27 to the annual financial statements.

| 3. | Main Developments in the Business Environment |

| A. | Macro‑economic environment (particularly inflation and interest) – for details regarding the business environment and the macro‑economic situation in which the Group companies operate, significant changes that occurred in 2022–2023 and the impact thereof on the Group’s activities – see Section 3.1A of the Report of the Board of Directors for 2023. |

In the first half of 2024, the interest rate in the U.S. remained unchanged. In addition, in the interest‑rate decision made in July 2024 the interest rate once again remain unchanged at the level of 5.5%, where based on the estimates published by the U.S. Federal Reserve Bank during 2024, one rate reduction of 0.25% is expected. In Israel, in the January 2024 interest decision Bank of Israel decided to reduce the interest rate to 4.5% while in the other interest‑rate decisions there was no change, where according to the forecasts published by Bank of Israel, the interest rate will gradually decline in 2024 and will stabilize in the second quarter of 2025 in the range of 4% to 4.25%.

Set forth below is data with reference to the currency exchange rate, Consumer Price Index (CPI) in Israel and in the U.S. the interest rates of Bank of Israel and the interest rates of the Fed in U.S.:

| | | | | | | | | | |

| | | | | | | | | | |

| Dollar/shekel exchange rate* | | | | | | | | | |

| At the end of the prior year | | | 3.627 | | | | 3.519 | | | | 3.1 | % |

| At June 30 | | | 3.759 | | | | 3.700 | | | | 1.6 | % |

| At March 31 | | | 3.681 | | | | 3.615 | | | | 1.8 | % |

| Average January– June | | | 3.694 | | | | 3.590 | | | | 2.9 | % |

| Average April– June | | | 3.725 | | | | 3.649 | | | | 2.1 | % |

| * | The dollar/shekel exchange rate shortly before the approval date of the report (on August 16, 2024, is 3.683. |

| | | | | | | | | Bank of | | | | |

| | | | | | | | | Israel | | | Federal | |

| | | Israeli | | | U.S. | | | interest | | | interest | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| At August 14, 2024 | | | 114.2 | | | | 314.5 | | | | 4.5 | % | | | 5.25%–5.50 | % |

| At June 30, 2024 | | | 113.4 | | | | 314.1 | | | | 4.5 | % | | | 5.25%–5.50 | % |

| At March 31, 2024 | | | 111.6 | | | | 310.3 | | | | 4.5 | % | | | 5.25%–5.50 | % |

| At December 31, 2023 | | | 111.3 | | | | 307.1 | | | | 4.75 | % | | | 5.25%–5.50 | % |

| At June 30, 2023 | | | 110.3 | | | | 304.1 | | | | 4.75 | % | | | 5.00%–5.25 | % |

| At March 31, 2023 | | | 108.9 | | | | 300.84 | | | | 4.25 | % | | | 4.75%-5.00 | % |

| At December 31, 2022 | | | 107.7 | | | | 297.7 | | | | 3.25 | % | | | 4.25%–4.50 | % |

| Change in the first half of 2024 | | | 1.9 | % | | | 2.3 | % | | | (0.25 | )% | | | 0 | % |

| Change in the first half of 2023 | | | 2.5 | % | | | 2.1 | % | | | 1.5 | % | | | 0.75 | % |

| Change in the second quarter of 2024 | | | 1.6 | % | | | 1.2 | % | | | 0 | % | | | 0 | % |

| Change in the second quarter of 2023 | | | 1.4 | % | | | 1.1 | % | | | 0.5 | % | | | 0.25 | % |

| | | | | | | | | | | | | | | | | |

For details regarding credit linked to the CPI or to prime – see Section 9B of the Report of the Board of Directors for 2023, and that stated in Note 7A(2) to the interim statements. For additional details regarding impacts of the changes in the macro‑economic environment on the results of the Group’s activities – see Section 11 of the Report of the Board of Directors for 2023

| 3. | Main Developments in the Business Environment (Cont.) |

| B. | Domestic and geopolitical instability in the defense (security) situation in Israel – 2023 was characterized by significant instability against the background of internal domestic events and geopolitical defense (security) matters as stated in the Report of the Board of Directors for 2023. As at the approval date of this report, the war that broke out on October 7, 2023 is still ongoing, including increased combat activities and defense (security) tension in additional areas. In this regard, it is noted that against the background of the War and the geo‑political defense (security) instability, in April 2024, the State of Israel withstood an air strike of missiles from Iran. The war and the security situation led to impacts and restrictions on the Israeli economy that include, among other things and based on the actual situation, reduction of economic activities, a large call for military reserves duty (soldiers), limitations on gatherings in work places and public areas, restrictions on carrying on classes in the educational system, temporary closing of air traffic routs, etc. As at the approval date of the report, most of the said restrictions had been gradually relaxed, according to the security situation existing in the State and the relevant combat areas |

In addition, as at the approval date of the report the War has had external (consequential) impacts including, among others, interruptions in the marine routes to Israel due to attacks on commercial and supply ships and a significant cutback of the activities of the foreign airline companies in Israel. These impacts could have an adverse impact on the arrival of equipment and foreign teams to Israel (including equipment and teams required for purposes of maintenance and construction of the Group’s activity sites in Israel) and the time schedules for their arrival.

Furthermore, as at the approval date of the report the War could impact Israel’s foreign relations which, in turn, could also impact the State’s economic situation. The said events involve significant uncertainty and could impact the macro‑economic environment, including a negative impact on the strength of the Israeli economy and the financial position of the State of Israel, including possible unfavorable changes in Israel’s credit rating (as at the approval date of the report, certain rating companies reduced the credit rating of Israel) and of the Israeli financial institutions, particularly the Israeli banking system (as at the approval date of the report, certain rating companies reduced the credit rating of some of the Israeli banks), adversely affect investments in the Israeli economy and trigger a removal of money and investments from Israel, increase the costs of the financing sources in Israel, cause a weakening of the exchange rate of the shekel against the other currencies (particularly the dollar), harm the activities of the business sector and create instability in the Israeli capital market (including increased volatility, falling prices of traded securities, and limited liquidity and accessibility). Also, the possible impacts of the War, including events such as the Iranian attack, could impact the possibility of acquiring insurance policies covering war and terrorist risks to the Group’s assets in Israel or a significant worsening of the terms of these policies. As at the approval date of the report, the Company had renewed the said insurance policies in Israel up to May 31, 2025. To the extent the above estimates materialize, wholly or partly, or in a case of a worsening of the security situation, this could negatively impact the Company’s activities and the activities of the Company’s customers and suppliers in Israel (including physical harm or curtailment of activities) and could also negatively impact the results of the Company’s activities and the availability and cost of the capital and financing sources that are required by the Company, mainly for purposes of supporting its continued business growth. As at the approval date of the report, there is no certainty regarding the duration or extent of the impact of these items. For details regarding the significance of the War on the Group’s business activities and results – see Section 13, below.

| C. | Global events and broad impacts on raw‑material prices and the supply chain – for details – see Section 3.1C of the Report of the Board of Directors for 2023. |

| 3. | Main Developments in the Business Environment (Cont.) |

| D. | Update of the electricity tariffs – on February 1, 2024, the annual update to the tariff for 2024 for electricity consumers of Israel Electric Company entered into effect. Pursuant to the decision, the generation component was updated to NIS 0.3007 per kilowatt hour, a decrease of 1.1% compared with the generation component at the end of 2023 – this being mainly due to the surplus receipts expected from sale of the Eshkol power plant, which led to a reduction in the generation sector. In addition, as part of the said tariff update decision, it was noted that pursuant to the decision designation of the receipts from sale of Eshkol was determined – the surplus receipts from the sale will first be used to cover expenses incurred during the war, including costs of diesel oil, and only thereafter will the surplus receipts be used to cover non‑recurring past expenses. |

Set forth below is data regarding the annual weighted‑average generation component (the prices are denominated in agurot per kilowatt hours):

| | | | | | | | | |

| | | | | | | | | | |

| January–June average | | | 30.12 | | | | 30.66 | | | | (1.8 | )% |

| April–June average | | | 30.07 | | | | 30.39 | | | | (1.1 | )% |

It is noted that the results of the Group’s activities in Israel are materially impacted by changes in the electricity generation component tariff, in such a manner that an increase in the electricity generation component has a positive impact on the Group’s result, and vice‑versa.

| E. | Supplementary arrangements and granting of a supply license to Rotem – further to that stated in Section 3.2E of the Report of the Board of Directors for 2023 regarding a proposed decision regarding the matter of supplementary arrangements and imposition of certain covenants on Rotem (“the Hearing”), on March 13, 2024 a decision of the Electricity Authority was announced further to the Hearing (“the Decision”). In general, the arrangements in the Decision are not significantly different than the arrangements included in the Hearing, which include, among other things, imposition of certain covenants on Rotem, including with respect to the matter of deviations from the consumption plans and the market model, along with provision of a supply license to Rotem, this being against the background of the intention of the Electricity Authority to consolidate in many respects the regulation applicable to Rotem with that of other bilateral electricity generators, and thus, to permit Rotem to operate in the energy market in a manner similar and equal to the said generators. The Decision entered into effect on July 1, 2024 and for the period covering Rotem’s generation license. For additional details – see Section 7.3.18.5 of Part A of the Periodic Report for 2023. |

| F. | Decision regarding the matter of “smart meters” – pursuant to the decision of the Electricity Authority, which entered into effect on July 1, 2024 with respect to virtual suppliers (which do not have means of generation) and will enter into effect on November 1, 2024 with respect to conventional suppliers (which have means of generation, such as the Company) it will be possible to assign household consumers with no smart meter to private transactions based on a normative consumption model of a household consumer. The Decision permits the Company to increase the diversity of its customers by means of selling electricity directly and/or indirectly to all households. |

| 3. | Main Developments in the Business Environment (Cont.) |

| 3.2 | Activities in Israel (Cont.) |

| G. | Public call regarding bilateral market regulation for generation facilities in the transmission network – on April 17, 2024, the Electricity Authority published a public call with respect to principles for a bilateral market regulation for generation facilities in the transmission network. Pursuant to the public call, the Electricity Authority is considering determination of a regulation whereby facilities for generation of renewable energy and storage facilities that are connected to the transmission network will be permitted to sell the electricity generated in bilateral transactions pursuant to a mechanism whereby the generator will sign a deal with a virtual supplier for sale of availability, which will convey the supplier a right to acquire energy from the network at the market price, in a capacity that will conform to the facility’s technology through use of a “conformance coefficient”, as detailed in the public call, in every year up to the amount of the capacity stated in the availability certificate it acquired from the generator, and the generator will commit to operate in accordance with the market model. In addition, the supplier and the generator will sign a financial hedging transaction covering the energy generated in the facility. According to the public call, in the first stage it will apply solely to generation facilities using renewable energy, including with integrated storage, and to independent storage facilities that are connected to the transmission network, provided that certain conditions specified in the public call have been met. It is noted that the Ramat Beka solar project that is being developed by the Company (including in connection with the additional win if realized), might operate under this regulation, to the extent it is actually advanced and subject to the final regulations that will be determined (if any). |

| H. | Additional information regarding the renewable energy activities in Israel – as part of the Company’s strategy to expand its activities in the generation and supply sector utilizing renewable sources in Israel, as stated in Section 7.9 of Part A of the Annual Report for 2023, the Company engages in and/or attempts to engage in transactions for acquisition of rights in renewable energy projects in Israel (particularly solar and/or storage) and/or acquisition of rights in lands designated for projects as stated, including as part of projects in the framework of joint ventures with holders of rights in projects or lands as stated. |

As at the approval date of the report, there is no certainty regarding the scope of the Company’s undertakings in transactions as stated and/or execution of projects as stated if they are advanced by the Company based on its said activities (the completion of which is subject to fulfillment of various conditions, including completion of development, planning, licensing and financing processes similar to projects of this type that are in the development stages).

For additional details regarding developments of the Group’s activities in Israel – see Section 6 below.

| 3. | Main Developments in the Business Environment (Cont.) |

| 3.3 | Activities in the U.S. |

| I. | Electricity and natural gas prices |

The results of the activities of the CPV Group are impacted to a significant extent by the electricity prices in effect in the areas in which the Group’s power plants operate. The main factors impacting the electricity prices are demand for electricity, available generation capacity (supply) and the natural gas price in the area in which the power plant operates.

With respect to the area of “energy transition” activities, in general, the natural gas price is significant in determination of the price of the electricity in most of the regions in which the power plants of the CPV Group operate that are powered by natural gas. For the most part, in the existing production mix, over time, to the extent the natural‑gas prices are higher, the marginal energy prices will also be higher, and will have a positive impact on the energy margins of the CPV Group due to the high efficiency of the power plants it owns compared with other power plants operating in the relevant activity markets (the impact could be different between the projects taking into account their characteristics and the area (region) in which they are located).

Electricity prices

The following table summarizes the average electricity prices in each of the main regions in which the power plants in the area of energy transition activities of the CPV Group are active (the prices are denominated in dollars per megawatt hour)*:

| | | For the | | | For the | |

| | | Six Months Ended | | | Three Months Ended | |

| Region | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| PJM West (Shore, Maryland) | | | 31.72 | | | | 31.29 | | | | 1 | % | | | 30.83 | | | | 29.47 | | | | 5 | % |

| PJM AEP Dayton (Fairview) | | | 29.10 | | | | 30.04 | | | | (3 | )% | | | 28.63 | | | | 29.04 | | | | (1 | )% |

| New York Zone G (Valley) | | | 34.43 | | | | 34.57 | | | | 0 | % | | | 28.64 | | | | 27.13 | | | | 6 | % |

| Mass Hub (Towantic) | | | 36.60 | | | | 39.76 | | | | (8 | )% | | | 29.28 | | | | 29.07 | | | | 1 | % |

| PJM ComEd (Three Rivers) | | | 24.29 | | | | N/A | | | | N/A | | | | 22.42 | | | | N/A | | | | N/A | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| * | Based on Day‑Ahead prices as published by the relevant ISO. |

It is noted that the actual electricity prices of the power plants of the CPV Group could be higher or lower than the regional price shown in the above table due to the existence of a Power Basis (the difference between the power plant’s specific electricity price and the regional price). The Power Basis is a function of transport pressures, local cost of electricity generation, local demand for electricity, losses in the transmission lines and additional factors. For details regarding the Power Basis data for 2021–2023 – see Section 3.3H to the Report of the Board of Directors for 2023.

| 3. | Main Developments in the Business Environment (Cont.) |

| 3.3 | Activities in the U.S. (Cont.) |

| I. | Electricity and natural gas prices (Cont.) |

The moderate changes in the electricity prices in the period of the report and in the second quarter compared with the corresponding periods last year stem mainly from relatively moderate changes the decline in the natural gas prices in the activity regions of the CPV Group (except with respect to the Maryland and Towantic power plants), as detailed below. In addition, the said electricity prices are impacted by supply and demand trends in the activity areas of the CPV Group: an increase in the demand for electricity as a result of electrification in the transportation, real estate and industry sectors, and due to the increase in the demand for electricity in the data‑center sector, as a result of the transition to “cloud” and growth in the Artificial Intelligence activities. At the same time, there was a decline in the available capacity as a result of closing of old, inefficient and polluting conventional power plants (mainly coal‑powered power plants), on the one hand, and limited new supply of power plants due to a relatively slow entry rate of renewable energies and a lack of construction of new conventional power plants, on the other hand. For details regarding the EPA regulations relating to carbon emissions – see Section 3K(2), below.

Natural gas prices

Set forth below are the average natural gas in each of the main markets in which the power plants of the CPV Group operate (the prices are denominated in dollars per MMBtu)*:

| | | For the | | | For the | |

| | | Six Months Ended | | | Three Months Ended | |

| Region | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Texas Eastern M‑3 (Shore, Valley – 70%) | | | 2.21 | | | | 2.21 | | | | 0 | % | | | 1.53 | | | | 1.50 | | | | 2 | % |

| Transco Zone 5 North (Maryland) | | | 2.94 | | | | 2.67 | | | | 10 | % | | | 2.27 | | | | 2.17 | | | | 5 | % |

| Texas Eastern M‑2 (Fairview) | | | 1.72 | | | | 1.82 | | | | (5 | )% | | | 1.42 | | | | 1.40 | | | | 1 | % |

| Dominion South Pt (Valley – 30%) | | | 1.66 | | | | 1.82 | | | | (9 | )% | | | 1.45 | | | | 1.43 | | | | 1 | % |

| Algonquin City Gate (Towantic) | | | 2.97 | | | | 3.57 | | | | (17 | )% | | | 1.68 | | | | 2.02 | | | | (17 | )% |

| Chicago City Gate (Three Rivers) | | | 2.25 | | | | N/A | | | | N/A | | | | 1.65 | | | | N/A | | | | N/A | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

* Source: The Day‑Ahead prices at gas Midpoints as reported in Platt’s Gas Daily. It is clarified that the actual gas prices of the power plants of the CPV Group could be significantly different.

In general, in the period of the report and in the second quarter of 2024, there were no significant changes in the natural gas prices compared with the corresponding periods last year. Regarding the Maryland power plant, which is located in the Transco Zone 5 region, which was more resilient with respect to the demand for natural gas in the period of the report, the natural gas prices increased compared with the corresponding period last year.

With respect to the Towantic power plant, the natural gas price remained at relatively low levels due to lower transport costs between Zone 2 Iroquois and the Algonquin City Gate Zone (the area in which the Towantic power plant operates) which strengthened the competition and created downward pressure on the price.

Electricity margin in the operating markets of the CPV Group (Spark Spread)

Spark Spread is the difference between the price of the electricity in the relevant area (zone) and the price of the natural gas (used for generation of the electricity) in the relevant area (zone). The Spark Spread is calculated based on the following formula:

Spark Spread ($/MWh) = price of the electricity ($/MWh) – [the gas price ($/MMBtu) x thermal conversion ratio (MMBtu/MWh)]

| 3. | Main Developments in the Business Environment (Cont.) |

| 3.3 | Activities in the U.S. (Cont.) |

| I. | Electricity and natural gas prices (Cont.) |

Electricity margin in the operating markets of the CPV Group (Spark Spread) (Cont.)

Set forth below are the average Spark Spread margins for each of the main markets in the power plants of the CPV Group are operating (the prices are denominated in dollars per megawatt/hour)*:

| | | For the | | | For the | |

| | | Six Months Ended | | | Three Months Ended | |

| Region | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Shore | | | | | | | | | | | | | | | | | | | | | | | | |

| Maryland | | | | | | | | | | | | | | | | | | | | | | | | |

| Valley | | | | | | | | | | | | | | | | | | | | | | | | |

| Towantic | | | | | | | | | | | | | | | | | | | | | | | | |

| Fairview | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Rivers | | | | | | | | | | | | | | | | | | | | | | | | |

| * | Based on electricity prices as shown in the above table, with a discount for the thermal conversion ratio (heat rate) of 6.9 MMBtu/MWh for Maryland, Shore and Valley, and a thermal conversion ratio of 6.5 MMBtu/MWh for Three Rivers, Towantic and Fairview. It is clarified that the actual energy margins of the power plants of the CPV Group could be significantly different due to, among other things, the existence of Power Basis and a different breakdown in the scope of the electricity sold in the peak and off‑peak hours in CPV’s power plants and that shown above (which was calculated based on the assumption of generation in all the hours of the 24‑hour period). |

In the period of the report and in the second quarter of 2024, generally, there was no significant change in the electricity margins (Spark Spread) compared with the corresponding periods last year. Regarding the Maryland power plant, most the decline in the electricity margin in the period of the report stems from a challenging price environment in the first quarter of 2024, along with the increase in the natural‑gas price and a moderate decline in the electricity price.

Regarding the Towantic power plant, most of the increase in the electricity margin in the period of the report and in the second quarter of 2024, stems from a decline in the natural‑gas prices, as detailed above.

It is noted that the hedging plans of the electricity margins in the power plants of the CPV Group that are powered by natural gas is intended to reduce the fluctuations of the CPV Group’s electricity margin resulting from changes in the natural gas and electricity prices in the energy market (for details regarding agreements hedging of the electricity margin of the CPV Group – see Section 4E below).

For details regarding a forecast of the EOX company of electricity and natural gas prices at the end of the second quarter of 2024 in the activity regions of the CPV Group up to the end of 2024 and for 2025–2026 – see Appendix A below.

3 | For additional details regarding the energy margin of the CPV Group – see Section 4E below. |

| 3. | Main Developments in the Business Environment (Cont.) |

| 3.3 | Activities in the U.S. (Cont.) |

Capacity is a component that is paid by regulatory bodies that manage demand and loads (system operators) for electricity generators, with respect to their ability to generate energy at the required times for purposes of reliability of the system. This revenue component is an additional component, separate and apart from the component based on the energy prices (which is paid in respect of sale of the electricity). Definition of the capacity component, as stated, including entitlement to revenue for seeing to availability of the electricity, including provisions regarding bonus or penalty payments, are governed by the tariffs determined by the FERC of every market. Accordingly, NY‑ISO, PJM and ISO‑NE publish mandatory public tenders for determination of the capacity tariffs. It is noted that, in the nature of things, an increase in the capacity prices favorably impacts CPV’s results, and vice‑versa. The extent of the impact on the overall results changes as a function of the energy margins, which is the most significant component of the gross profit (margin for generation of the electricity and the sale thereof) – this being taking into account that the weight of the capacity component is usually lower than the weight of the energy margin component.

PJM market

In the PJM market, the capacity payments vary between the market’s sub‑regions, as a function of local supply and demand and transmission capabilities.

Set forth below are the capacity tariffs in the sub‑regions that are relevant to the CPV Group’s power plants and in the general market (the prices are denominated in dollars per megawatt per day). It can be seen in the following table that in prior years, generally, the capacity prices have declined from period to period up to a significant reversal in the trend in the last tender for the period from July 2025 through June 2026.

| | | | | |

| | | | | |

| | | | | |

| Fairview, Maryland, Maple Hill | | | | |

| | | | | |

Source: PJM

4 | The Three Rivers power plant, which commenced commercial operation in July 2023, is entitled to capacity payments, from this date. |

| 3. | Main Developments in the Business Environment (Cont.) |

| 3.3 | Activities in the U.S. (Cont.) |

| J. | Capacity revenues (Cont.) |

Results of availability tender in the PJM market for the period from July 2025 through June 2026

In July 2024, PJM published the results of tenders on availability prices for the period from July 2025 through June 2026 – this being after in October 2023, PJM submitted to FERC changes in the format for the availability (capacity) market that entered into effect commencing from the present tender (at this stage for a one‑year period starting from the middle of 2025). The changes include, among others, adjustments to the scope of availability permitted to be sold, examination requirements for generators and adjustment of planning parameters with an increase in the weight of the winter reliability risk parameter.

The significant increase in the availability tariff in the tender, as shown in the above table, relates to, among other things, the forecast of an increase in demand, an increase in the reserves required and a decline in the total supply as a result of demands and a change in the manner of calculating capacities and load capability of the generation sources by PJM. The change in the manner of calculating availability capacities of the power plants caused a decrease in the availability capacity that is provided for sale in most of the power plants operating in the PJM market. The impact of the said change on the power plants of the CPV Group operating in the energy transition area is a decline in the availability capacity provided for sale from about 96% to about 79%. In the estimation of the CPV Group as at the date of the report, the addition to its revenues from availability from all its power plants in the PJM market as at the date of the report, without taking into account the increase in the rates of holdings in the Shore and Maryland power plants, if completed (for details – see Section 10C below), is expected to amount to about $54 million for the period from July 2025 through June 2026 compared with the period from July 2024 through June 20251. The next availability tenders for the period from July 2026 through June 2027 are planned to be held in December 2024.

| 5 | That stated in this Section regarding the estimate of the CPV Group constitutes “forward‑looking” information as it is defined in the Securities Law, regarding which there is no certainty it will be realized. Ultimately, the revenues of the CPV Group from availability could be different (even significantly) as a result of, among other things, regulatory changes (including appeal processes or other processes in the PJM market or as part of other municipal authorities), operating factors, changes in the business environment and/or the occurrence of one or more of the risk factors to which the CPV Group is exposed. |

| 3. | Main Developments in the Business Environment (Cont.) |

| 3.3 | Activities in the U.S. (Cont.) |

| J. | Capacity revenues (Cont.) |

NYISO market

Similar to the PJM market, in the NYISO market capacity payments are made in the framework of a central mechanism for acquisition of capacity. In the NYISO market, there are a number of submarkets, wherein there could be various capacity demands as a function of local supply and demand and transmission capability. NYISO makes seasonal tenders in every spring for the upcoming summer (the months of May through October) and in the fall for the upcoming winter (the months of November through April). In addition, there are supplemental monthly tenders for the balance of the capacity not sold in the seasonal tenders. The power plants are permitted to assure the capacity tariffs in the seasonal tender, the monthly tender or through bilateral sales.

Set forth below are the capacity prices determined in the seasonal tenders in NYISO market, the capacity prices rose compared with prior periods – this being mainly due to exit from the system of power plants and an anticipated increase in demand (the prices are denominated in dollars per megawatt per day):

| Sub-Area | | Summer 2024 | | Summer 2023 |

| | | | |

| | | | |

Source: NYISO – the Company’s processing in order to convert from dollars for kilowatt per month to dollars for megawatt per day.

It is noted that the Valley power plant is located in Area G (Lower Hudson Valley) and the actual capacity prices for the Valley power plants are impacted by the seasonal tenders, the monthly tenders and the SPOT prices, with variable capacity prices every month, as well as bilateral agreements with energy suppliers in the market.

| 3. | Main Developments in the Business Environment (Cont.) |

| 3.3 | Activities in the U.S. (Cont.) |

| J. | Capacity revenues (Cont.) |

ISO‑NE market

The Towantic power plant, which operates in this market, participated for the first time in a capacity tender for 2018–2019 at a price of $313.97 MW/day and determination of the tariff for seven years in respect of 725 megawatts linked to the Handy Whtiman Price Index, which will apply up to May 2025.

Similar to the PJM market, in the ISO‑NE market capacity payments are made as part of a central mechanism for acquisition of capacity. In the ISO‑NE market, there are a number of submarkets, in which there should be capacity requirements that differ as a function of local supply and demand and transport capacity. ISO‑NE executes forward tenders for a period of one year, commencing from June 1, three years from the year of the tender. In addition, there are supplementary monthly and annual tenders for the balance of the capacity not sold in the forward tenders. The power plants are permitted to guarantee the capacity payments in the forward tenders, the supplementary tenders or through bilateral sales.

Set forth below are the capacity payments determined in the sub‑regions that are relevant to the Towantic power plant (the prices are denominated in dollars per megawatt per day):

Source: NE‑ISO – the Company’s processing in order to convert from dollars for kilowatt per month to dollars for megawatt per day.

It is noted that the actual availability prices for the Towantic power plant are impacted by forward tenders, supplementary annual tenders, monthly tenders with capacity prices that change every month and bilaterial agreements with energy suppliers in the market.

| K. | Additional information regarding the activities in the U.S. |

| 1. | Further to that stated in Section 17.1 of Part A of the Periodic Report for 2023, as part of the activities of the CPV Group to strengthen its position as a significant player in the energy transition area through, among other things, holding and managing effective and reliable conventional means (natural gas), which will support the rising demand for electricity in the U.S., the CPV Group is examining business possibilities/opportunities with respect to increasing its holdings in certain of the power plants it holds, subject to formulation of appropriate terms with the other holders in the said power plants. For details regarding undertakings of the CPV Group signed in July 2024 for acquisition of additional rights in the Shore and Maryland power plants – see Section 10C below. As at the date of the report, there is no certainty that these activities and/or additional similar activities will be executed and/or will come to fruition. |

| 3. | Main Developments in the Business Environment (Cont.) |

| 3.3 | Activities in the U.S. (Cont.) |

| K. | Additional information regarding the activities in the U.S. (Cont.) |

| 2. | Further to that stated in Section 8.1.4 of Part A of the Periodic Report for 2023, in April 2024 the U.S. EPA (Environmental Protection Agency) published final emissions’ regulations in the framework of the Clean Air Act. Pursuant to the new rules, up to January 1, 2032, a reduction of emissions will be required at a carbon‑capture rate of 90% for coal‑fired generation facilities that are expected to operate after 2039 and new baseload natural gas-fired power plants (that were not under construction as at May 2023). Less stringent requirements were provided for, among other things, existing coal‑fired generation facilities that integrate natural‑gas fired generation that are expected to discontinue their operations prior to 2039. For new gas turbines, the regulations require that full baseload (as defined) generation through use of natural gas combustion will be executed with maximum utilization of efficient technologies in order to limit emissions to no more than 800 lbs. CO2/MWh-gross until January 1, 2032 and thereafter a reduction to 100 lbs. CO2/MWh-gross via 90% carbon capture or co-firing with hydrogen. Efficiency requirements and reduced emission restrictions were provided with respect to gas turbines that generate at a partial baseload or a low baseload. The various states have two years to develop compliance plans for the existing coal plants but compliance for new natural gas plants (the construction of which started after 2023) is immediate. In July 2024, the U.S. Appeals Court rejected a request for an injunctive order filed by several state Attorneys General with respect to the new regulations, which is intended to stay their enforcement. |

The development portfolio of the CPV Group, which includes wind energy and solar projects, with a scope of more than 4.6 gigawatts, and natural gas projects with carbon capture potential with a scope of about 6.3 gigawatts, is expected to benefit from a significant tailwind due the regulation, to the extent it is implemented in the manner it was published (or at all). In addition, in the estimation of the CPV Group its active natural‑gas powered power plants are expected to have a significant competitive advantage under the said regulation in light of their high level of efficiency along with entry barriers that are expected to be created in the market for construction of new natural‑gas powered power plants.

As at the approval date of the report, there is no certainty regarding the actual impacts of the said new regulation on the market and on the CPV Group, and the matter depends on, among other things, the policies and the manner of implementation of the rules (in whole or in part) by the relevant electricity authorities and entities, as they will be from time to time, and/or on legal proceedings in connection therewith.

For additional details regarding developments of the Group’s activities in the U.S. – see Section 6.

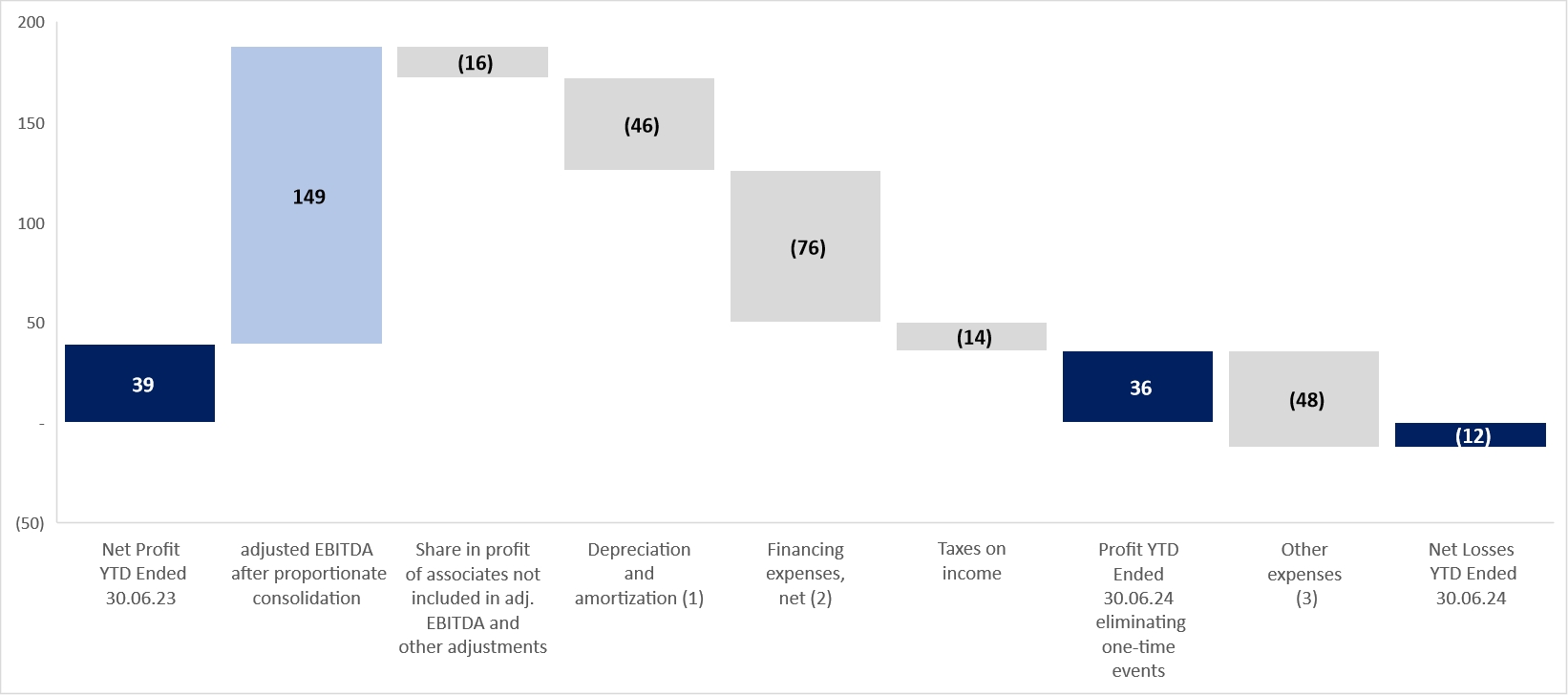

| 4. | Analysis of the results of operations for the Six Months Ended June 30, 2024 (in millions of NIS) |

The Group’s activities in Israel and the United States are subject to seasonal fluctuations.

In Israel, the TAOZ tariffs are supervised (controlled) and published by the Electricity Authority. Generally, the electricity tariffs in Israel in the summer and the winter are higher than those in the transition seasons. It is noted that acquisition of the gas, which constitutes the main cost in this activity area, is not impacted by seasonality of the TAOZ (or the demand hours’ brackets).

In the United States, the electricity tariffs are not supervised (controlled) and are impacted by the demand for electricity, which is generally high in periods in which the weather is cold or hot compared with the average (generally in the summer and the winter seasons) and they are materially impacted by the natural gas prices, which are usually higher in the winter compared with the annual average and depending on the weather. In addition, in connection with renewable energy projects, in wind projects the wind speeds tend to be higher in the winter and lower in the summer, whereas in solar projects the radiation from the sun tends to be higher in the spring and summer months and lower in the fall and winter months.

| 4. | Analysis of the results of operations for the Six Months Ended June 30, 2024 (in millions of NIS) (Cont.) |

| | | For the Six Months Ended | |

| | | |

| | | | | | | |

| | | | | | | |

| Revenues from sales and provision of services (1) | | | 1,311 | | | | 1,120 | |

| Cost of sales and provision of services (without depreciation and amortization) (2) | | | (911 | ) | | | (834 | ) |

| Depreciation and amortization | | | (155 | ) | | | (110 | ) |

| Gross profit | | | 245 | | | | 176 | |

| Administrative and general expenses | | | (119 | ) | | | (117 | ) |

| Share in earnings of associated companies | | | 86 | | | | 100 | |

| Business development expenses | | | (22 | ) | | | (30 | ) |

| Compensation for lost revenues | | | 26 | | | | – | |

| Other expenses, net | | | (52 | ) | | | (5 | ) |

| Operating income | | | 164 | | | | 124 | |

| Financing expenses, net | | | (149 | ) | | | (73 | ) |

| Income before taxes on income | | | 15 | | | | 51 | |

| Taxes on income expenses | | | (27 | ) | | | (12 | ) |

| Net income (loss) for the period | | | (12 | ) | | | 39 | |

| Adjustments | | | 8 | | | | 27 | |

Adjusted net income (loss) for the period7 | | | (4 | ) | | | 66 | |

| | | | | | | | | |

Attributable to: | | | | | | | | |

| The Company’s shareholders | | | 7 | | | | 58 | |

| Holders of non‑controlling interests | | | (11 | ) | | | 8 | |

| 6 | The results of the associated companies in the U.S. (mainly in the Energy Transition segment) are presented in the category “Company’s share in earnings of associated companies”. |

7 | Adjusted net income or loss – net income or loss in accordance with IFRS plus or minus the adjustments detailed in Section G below. It is emphasized that “adjusted income or loss” as stated in this report is not a recognized data item that is recognized under IFRS or under any other set of generally accepted accounting principles as an index for measuring financial performance and should not be considered as a substitute for income or loss or other terms provided in accordance with IFRS. It is possible that the Company’s definitions of “adjusted income or loss” are different than those used by other companies. Nonetheless, the Company believes that the “adjusted income or loss” provides information that is useful to management and investors by means of eliminating certain line items (categories) that do not constitute an indication of the Company’s ongoing business activities. |

| 4. | Analysis of the results of operations for the Six Months Ended June 30, 2024 (in millions of NIS) (Cont.) |

| A. | Statement of income (Cont.) |

| | For the Six | | |

| | | Months Ended | | |

| | | | | |

| | | | | | | | |

Revenues in Israel | | | | | | | |

| Revenues from sale of energy to private customers | | | 605 | | | | 624 | | |

| Revenues from sale of energy to the System Operator and to other suppliers | | | 96 | | | | 45 | | Most of the increase, in the amount of about NIS 64 million, stems from the commercial operation of Zomet at the end of the second quarter of 2023. |

| Revenues in respect of capacity payments | | | 88 | | | | – | | Most of the increase stems from the commercial operation of Zomet at the end of the second quarter of 2023. |

| Revenues from sale of energy at cogeneration tariff | | | 25 | | | | 20 | | |

| Revenues from sale of steam | | | 30 | | | | 31 | | |

| Other revenues | | | 23 | | | | 43 | | Most of the decline derives from sales of electricity recognized in the corresponding period last year, in the amount of about NIS 26 million, from the Zomet power plant prior to the commercial operation at the end of June 2023. |

| Total revenues from sale of energy and others in Israel (without infrastructure services) | | | 867 | | | | 763 | | |

| Revenues from private customers in respect of infrastructure services | | | 207 | | | | 235 | | |

| Total revenues in Israel | | | 1,074 | | | | 998 | | |

| | | | | | | | | | |

Revenues in the U.S. | | | | | | | | | |

| Revenues from sale of electricity from renewable energy | | | 125 | | | | 60 | | The increase derives mainly from the first‑time consolidation of the Mountain Wind project starting from the second quarter of 2023 and the commercial operation of the Maple Hill and Stagecoach projects starting from the fourth quarter of 2023 and the second quarter of 2024, respectively. |

| Revenues from provision of services (as part of the other segment) and other revenues | | | 112 | | | | 62 | | The increase stems mainly from an increase in the scope of sale of electricity from renewable sources (retail) to commercial customers. |

| Total revenues in the U.S. | | | 237 | | | | 122 | | |

| | | | | | | | | | |

| Total revenues | | | 1,311 | | | | 1,120 | | |

| 4. | Analysis of the results of operations for the Six Months Ended June 30, 2024 (in millions of NIS) (Cont.) |

| A. | Statement of income (Cont.) |

| (2) | Changes in the cost of sales and provision of services (not including depreciation and amortization): |

Cost of Sales and Provision of Services | | For the Six Months Ended | | |

| | | | | |

| | | | | | | | |

Cost of sales in Israel | | | | | | | |

| Natural gas and diesel oil | | | 331 | | | | 286 | | The increase stems mainly from the first‑time consolidation of Gat starting from the second quarter of 2023 and the commercial operation of Zomet starting from the end of the second quarter of 2023, in the aggregate amount of about NIS 72 million, and an increase in the natural gas tariff as a result of an increase in the shekel/dollar exchange rate, in the amount of about NIS 8 million. In addition, there was an increase of about NIS 18 million, as described in Note 28C(3) to the annual financial statements. On the other hand, there was a decrease of about NIS 27 million, deriving from a decrease in the quantity of the gas consumed against the background of maintenance work at the Rotem power plant in the first quarter of 2024 and a decrease, in the amount of about NIS 29 million, due to entry of the Energean agreement into effect commencing from the second quarter of 2023, and a decrease in the gas tariff deriving from a decline in the generation tariff. |

| Expenses in respect of acquisition of energy | | | 117 | | | | 126 | | |

| Cost of transmission of gas | | | 28 | | | | 16 | | The increase stems mainly from the first‑time consolidation of Gat, starting from the second quarter of 2023 and the commercial operation of Zomet starting from the end of the second quarter of 2023. |

| Salaries and related expenses | | | 21 | | | | 14 | | |

| Operating expenses | | | 57 | | | | 30 | | The increase stems mainly from the first‑time consolidation of Gat commencing from the second quarter of 2023 and the commercial operation of Zomet starting from the end second quarter of 2023. |

| Other expenses | | | 18 | | | | 56 | | Most of the decrease stems from the fact that in the corresponding period last year, pre‑commercial operation natural gas and other expenses were recorded in the Zomet power plant at the end of June 2023. |

| Total cost of sales in Israel without infrastructure services | | | 572 | | | | 528 | | |

| Expenses in respect of infrastructure services | | | 207 | | | | 235 | | |

| Total cost of sales in Israel | | | 779 | | | | 763 | | |

| 4. | Analysis of the results of operations for the Six Months Ended June 30, 2024 (in millions of NIS) (Cont.) |

| A. | Statement of income (Cont.) |

| (2) | Changes in the cost of sales and provision of services (not including depreciation and amortization): (Cont.) |

Cost of sales and services in the U.S. | | | | | | | |

| Cost of sales in respect of sale of electricity from renewable energy | | | 42 | | | | 20 | | The increase stems mainly from the commercial operation of the Maple Hill and Stagecoach projects and the first‑time consolidation of the Mountain Wind project. |

| Cost in respect provision of services (as part of the “others” segment) and other costs | | | 90 | | | | 51 | | The increase stems mainly from an increase in the scope of sale of electricity from renewable sources (retail) to commercial customers. |

| Total cost of sales and provision of services in the U.S. | | | 132 | | | | 71 | | |

| Total cost of sales and provision of services | | | 911 | | | | 834 | | |

| 4. | Analysis of the results of operations for the Six Months Ended June 30, 2024 (in millions of NIS) (Cont.) |

| B. | EBITDA, FFO and net cash flows after service of the project debt |

For details regarding “EBITDA indices”, “EBITDA after adjusted proportionate consolidation”, “FFO” and “net cash flows after service of the project debt” – see Section 4B to the Report of the Board of Directors for 2023.

The said indices are not recognized in accordance with International Financial Reporting Standards (IFRS) as indices for measurement of financial performances and are not intended to be considered a replacement for gross profit or loss and operating income, cash flows from operation activities or other terms relating to operating performances or liquidity indices in accordance with IFRS.

EBITDA calculations, including adjusted EBITDA after proportionate consolidation (in millions of NIS):

| | | For the | |

| | | Six Months Ended | |

| | | | |

| | | | | | | |

| | | | | | | |

| Revenues from sales and provision of services | | | 1,311 | | | | 1,120 | |

| Cost of sales (without depreciation and amortization) | | | (911 | ) | | | (834 | ) |

| Administrative and general expenses (without depreciation and amortization) | | | (112 | ) | | | (110 | ) |

| Business development expenses | | | (22 | ) | | | (30 | ) |

| Share in income of associated companies | | | 86 | | | | 100 | |

| Compensation for lost revenues | | | 26 | | | | – | |

| Consolidated EBITDA | | | 378 | | | | 246 | |

| Elimination of the share in income of associated companies | | | (86 | ) | | | (100 | ) |

Addition of the share of Group in proportionate EBITDA of associated companies (1) | | | 281 | | | | 254 | |

| EBITDA after proportionate consolidation | | | 573 | | | | 400 | |

| Adjustments for consolidated companies (see detail in Section G below) | | | – | | | | 18 | |

| Adjustments for associated companies (see detail in Section G below) (1) | | | 10 | | | | 16 | |

| Adjusted EBITDA after proportionate consolidation | | | 583 | | | | 434 | |

| 4. | Analysis of the results of operations for the Six Months Ended June 30, 2024 (in millions of NIS) (Cont.) |

| B. | EBITDA, FFO and net cash flows after service of the project debt (Cont.) |

| (1) | Calculation of the Group’s share in the proportionate EBITDA of associated companies (in millions of NIS): |

For the six months ended June 30, 2024 | | | | | | | | | | | | | | | | | Three | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| Revenues from sales of energy | | | 102 | | | | 93 | | | | 67 | | | | 76 | | | | 168 | | | | 26 | | | | 532 | |

| Cost of natural gas | | | 47 | | | | 46 | | | | 36 | | | | 43 | | | | 69 | | | | 18 | | | | 259 | |

| Carbon emissions tax (RGGI)** | | | – | | | | 16 | | | | 11 | | | | 22 | | | | 35 | | | | – | | | | 84 | |

Cost of sales – other expenses (without depreciation and amortization) | | | 1 | | | | 2 | | | | 3 | | | | 3 | | | | 3 | | | | 1 | | | | 13 | |

Gain on realization of transactions hedging the electricity margins | | | 15 | | | | 3 | | | | 8 | | | | 8 | | | | 39 | | | | 11 | | | | 84 | |

| Net energy margin | | | 69 | | | | 32 | | | | 25 | | | | 16 | | | | 100 | | | | 18 | | | | 260 | |

| Revenues from capacity payments | | | 8 | | | | 56 | | | | 6 | | | | 9 | | | | 29 | | | | 2 | | | | 110 | |

| Other income | | | 2 | | | | 4 | | | | 3 | | | | 3 | | | | 1 | | | | 1 | | | | 14 | |

| Gross profit | | | 79 | | | | 92 | | | | 34 | | | | 28 | | | | 130 | | | | 21 | | | | 384 | |

| Fixed costs (without depreciation and amortization) | | | 5 | | | | 10 | | | | 9 | | | | 15 | | | | 34 | | | | 6 | | | | 79 | |

Administrative and general expenses (without depreciation and amortization) | | | 2 | | | | 2 | | | | 2 | | | | 3 | | | | 4 | | | | 1 | | | | 14 | |

Group’s share in proportionate adjusted EBITDA of associated companies | | | 72 | | | | 80 | | | | 23 | | | | 10 | | | | 92 | | | | 14 | | | | 291 | |

For the six months ended June 30, 2023 | | | | | | | | | | | | | | | | | Three | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| Revenues from sales of energy | | | 107 | | | | 95 | | | | 72 | | | | 53 | | | | 124 | | | | – | | | | 451 | |

| Cost of natural gas | | | 50 | | | | 58 | | | | 40 | | | | 32 | | | | 56 | | | | – | | | | 236 | |

| Carbon emissions tax (RGGI)** | | | – | | | | 12 | | | | 10 | | | | 9 | | | | 18 | | | | – | | | | 49 | |

Cost of sales – other expenses (without depreciation and amortization) | | | 1 | | | | 2 | | | | 4 | | | | 3 | | | | 3 | | | | – | | | | 13 | |

Gain on realization of transactions hedging the electricity margins | | | 24 | | | | (2 | ) | | | 3 | | | | 1 | | | | 52 | | | | – | | | | 78 | |

| Net energy margin | | | 80 | | | | 21 | | | | 21 | | | | 10 | | | | 99 | | | | – | | | | 231 | |

| Revenues from capacity payments | | | 15 | | | | 49 | | | | 10 | | | | 16 | | | | 25 | | | | – | | | | 115 | |

| Other income | | | 2 | | | | 4 | | | | 2 | | | | 2 | | | | 1 | | | | – | | | | 11 | |

| Gross profit | | | 97 | | | | 74 | | | | 33 | | | | 28 | | | | 125 | | | | – | | | | 357 | |

Fixed costs (without depreciation and amortization) | | | 5 | | | | 9 | | | | 9 | | | | 16 | | | | 36 | | | | – | | | | 75 | |

Administrative and general expenses (without depreciation and amortization) | | | 2 | | | | 2 | | | | 2 | | | | 2 | | | | 4 | | | | – | | | | 12 | |

Group’s share in proportionate adjusted EBITDA of associated companies | | | 90 | | | | 63 | | | | 22 | | | | 10 | | | | 85 | | | | – | | | | 270 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| * | At the Shore power plant – gas transport costs (totaling in the first quarter of 2024 and 2023 about NIS 11 million) that are classified in accordance with IFRS 16 as depreciation expenses and, accordingly, are not included in the adjusted EBITDA. |

| ** | It is noted that as at the approval date of the report, in Pennsylvania RGGI is not imposed. For details regarding a legal proceeding underway regarding the matter and possible implications of imposition of RGGI on costs of the Fairview power plant and the electricity prices throughout the PJM – see Section 8.1.5B of Part A of the Periodic Report for 2023. In the period of the report, there was an increase of 48% in the average RGGI tariff compared with the corresponding period last year. |

| 4. | Analysis of the results of operations for the Six Months Ended June 30, 2024 (in millions of NIS) (Cont.) |

| B. | EBITDA, FFO and net cash flows after service of the project debt (Cont.) |

| (2) | Set forth below is a breakdown of the adjusted EBITDA after proportionate consolidation data broken down by the subsidiaries (on a consolidated basis) and the associated companies (on a proportionate basis, based on the rate of the holdings of the CPV Group therein) (in NIS millions): |

| | | | For the | | | For the | |

| | | | Six months ended | | | Six months ended | |

| Basis of | | | | | | |

| presentation | | Adjusted | | | | | | Adjusted | | | | |

| in the | | EBITDA | | | | | | EBITDA | | | | |

| Company’s | | after | | | | | | after | | | | |

| financial | | proportionate | | | | | | proportionate | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Total operating projects and | | | | | | | | | | | | | |

| accompanying business activities* ** | Consolidated | | | 299 | | | | 231 | | | | 224 | | | | 183 | |

| Business development costs, | | | | | | | | | | | | | | | | | |

| headquarters in Israel | Consolidated | | | (13 | ) | | | (13 | ) | | | (14 | ) | | | (14 | ) |

| Total Israel | | | | 286 | | | | 218 | | | | 210 | | | | 169 | |

| | | | | | | | | | | | | | | | | | |

| Total operating projects* | Associated | | | 291 | | | | 175 | | | | 270 | | | | 190 | |

| Other costs | Consolidated | | | (3 | ) | | | (9 | ) | | | (2 | ) | | | (3 | ) |

| Total energy transition in the U.S. | | | | 288 | | | | 166 | | | | 268 | | | | 187 | |

| Total operating projects* | Consolidated | | | 77 | | | | 58 | | | | 36 | | | | 41 | |

| Business development and other costs | Consolidated | | | (14 | ) | | | (29 | ) | | | (17 | ) | | | (21 | ) |

| Total renewable energy in the U.S. | | | | 63 | | | | 29 | | | | 19 | | | | 20 | |

| Total activities as part of the “others” | | | | | | | | | | | | | | | | | |

| segment | Consolidated | | | (3 | ) | | | (3 | ) | | | (3 | ) | | | (3 | ) |

Headquarters in the United States8 | Consolidated | | | (43 | ) | | | (48 | ) | | | (47 | ) | | | (48 | ) |

| Total United States | | | | 305 | | | | 144 | | | | 237 | | | | 156 | |

| | | | | | | | | | | | | | | | | | |

| Company headquarters (not allocated | | | | | | | | | | | | | | | | | |

| to the segments) | Consolidated | | | (8 | ) | | | (55 | ) | | | (13 | ) | | | (47 | ) |

| | | | | | | | | | | | | | | | | | |

| Total consolidated | | | | 583 | | | | 307 | | | | 434 | | | | 278 | |

| | | | | | | | | | | | | | | | | | |

| ** | The accompanying business activities in Israel include mainly virtual supply activities through OPC Israel, sale of electricity from facilities for generation of energy on the customer’s premises through OPC Power Plants and commerce in natural gas, including with third parties through OPC Natural Gas. |

8 | After elimination of management fees between the CPV Group and the Company, in the amounts of about NIS 15 million and about NIS 13 million for the six months ended June 30, 2024 and 2023, respectively. |

| 4. | Analysis of the results of operations for the Six Months Ended June 30, 2024 (in millions of NIS) (Cont.) |

| B. | EBITDA, FFO and net cash flows after service of the project debt (Cont.) |

| (3) | Set forth below is additional information regarding the revenues, net (in Israel net of infrastructure services and in the U.S. – revenues from sale of energy, availability and other), adjusted EBITDA after proportionate consolidation, FFO and net cash flows after service of the project debt of the Group’s active power plants broken down by activity segments and subsidiaries (on a consolidated basis) and the associated companies (on a proportionate basis, based on the rate of the holdings of the CPV Group therein) (in NIS millions): |

| | | | For the Six Months Ended June 30, 2024 | | | For the Six Months Ended June 30, 2023 | |

| | Basis of | | | | | Adjusted | | | | | | Net cash | | | | | | Adjusted | | | | | | Net cash | |

| | presentation | | | | | EBITDA | | | | | | flows | | | | | | EBITDA | | | | | | flows | |

| | in the | | | | | after | | | | | | after | | | | | | after | | | | | | after | |

| Main | | Company’s | | | | | proportionate | | | | | | service of | | | | | | proportionate | | | | | | service of | |

| projects in | | financial | | Net | | | consol- | | | | | | project | | | Net | | | consol- | | | | | | project | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Rotem9 | | Consolidated | | | 417 | | | | 147 | | | | 114 | | | | 114 | | | | 428 | | | | 174 | | | | 149 | | | | 149 | |

Hadera10 | | Consolidated | | | 153 | | | | 38 | | | | 15 | | | | (33 | ) | | | 148 | | | | 42 | | | | 24 | | | | 3 | |

Zomet11, 12 | | Consolidated | | | 153 | | | | 87 | | | | 65 | | | | 48 | | | | 4 | | | | 2 | | | | – | | | | – | |

Gat11 | | Consolidated | | | 68 | | | | 28 | | | | 9 | | | | 7 | | | | 37 | | | | 10 | | | | (1 | ) | | | (1 | ) |

| Accompanying | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| business activities | | Consolidated | | | 53 | | | | (1 | ) | | | 28 | | | | 28 | | | | 103 | | | | (4 | ) | | | 11 | | | | 11 | |

| Total operating | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| projects in Israel and | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| accompanying | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| business activities | | | | | 844 | | | | 299 | | | | 231 | | | | 164 | | | | 720 | | | | 224 | | | | 183 | | | | 162 | |

| Fairview | | Associated (25%) | | | 112 | | | | 72 | | | | 63 | | | | 27 | | | | 124 | | | | 90 | | | | 88 | | | | 8 | |

| Towantic | | Associated (26%) | | | 153 | | | | 80 | | | | 66 | | | | 10 | | | | 148 | | | | 63 | | | | 38 | | | | (30 | ) |

Maryland13 | | Associated (25%) | | | 76 | | | | 23 | | | | (5 | ) | | | (2 | ) | | | 84 | | | | 22 | | | | 8 | | | | 5 | |

Shore14 | | Associated (37.5%) | | | 88 | | | | 10 | | | | (5 | ) | | | (5 | ) | | | 71 | | | | 10 | | | | (9 | ) | | | (9 | ) |

| Valley | | Associated (50%) | | | 198 | | | | 92 | | | | 50 | | | | 11 | | | | 150 | | | | 85 | | | | 65 | | | | 11 | |

Three Rivers11 | | Associated (10%) | | | 29 | | | | 14 | | | | 6 | | | | 9 | | | | – | | | | – | | | | – | | | | – | |

| Total energy | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

transition in the U.S.15 | | | | | 656 | | | | 291 | | | | 175 | | | | 50 | | | | 577 | | | | 270 | | | | 190 | | | | (15 | ) |

| Keenan | | Consolidated | | | 48 | | | | 31 | | | | 28 | | | | 1 | | | | 43 | | | | 27 | | | | 27 | | | | 3 | |

Mountain Wind11 | | Consolidated | | | 40 | | | | 22 | | | | 16 | | | | 7 | | | | 17 | | | | 9 | | | | 14 | | | | 11 | |

Maple Hill11 | | Consolidated | | | 23 | | | | 18 | | | | 10 | | | | 10 | | | | – | | | | – | | | | – | | | | – | |

Stagecoach16 | | Consolidated | | | 14 | | | | 6 | | | | 4 | | | | 4 | | | | – | | | | – | | | | – | | | | – | |

| Total renewable | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| energy in the U.S. | | | | | 125 | | | | 77 | | | | 58 | | | | 22 | | | | 60 | | | | 36 | | | | 41 | | | | 14 | |

9 | Not including a deduction of repayment of loans to shareholders of Rotem before the Veridis transaction and payments of intercompany taxes in the consolidated tax reconciliation statement. In the first quarter of 2024, planned maintenance was performed at the Rotem power plant. For details – see Section 4C(2) of the report. |

10 | In the period of the report, the net cash flows after service of the Hadera project debt includes early repayment of the long‑term loans, in the amount of about NIS 25 million, further to receipt of compensation from the construction contractor at the end of 2023, as detailed in Note 28A(4) to the annual financial statements. |

11 | The financial results of the projects were included starting from the initial consolidation or the commercial operation dates, as applicable, which occurred in 2023. For details regarding the capacity tariffs in the Zomet power plant, particularly in 2023, see Section 7.13 of Part A of the Periodic Report for 2023. |

12 | In the first quarter of 2024, the financial results of the Zomet power plant include compensation, in the amount of about NIS 26 million, in respect of lost revenues caused due to delay in the commercial operation date. For additional details – see Note 8A(3) to the interim statements. |

13 | The FFO in the period of the report includes a payment for upgrading of the facilities at the Maryland power plant, in the amount of about NIS 8 million. |

14 | The FFO in the first quarter of 2023 includes a payment, in the amount of about NIS 9 million, in respect of significant planned maintenance work performed. |

15 | It is noted that the financing agreements of the CPV Group including mechanisms of the “cash sweep” type in the framework of which all or part of the free cash flows from the project is designated for repayment of the loan principal on a current basis in addition to the predetermined minimum repayment schedule with respect to every long‑term loan. Accordingly, there could be an acceleration of execution of repayments upon occurrence of certain events and there are limitations on distributions to the owners. |

16 | The financial results of the Stagecoach project Maple Hill were included starting from the commercial operation date, in the second quarter of 2024. |

| 4. | Analysis of the results of operations for the Six Months Ended June 30, 2024 (in millions of NIS) (Cont.) |

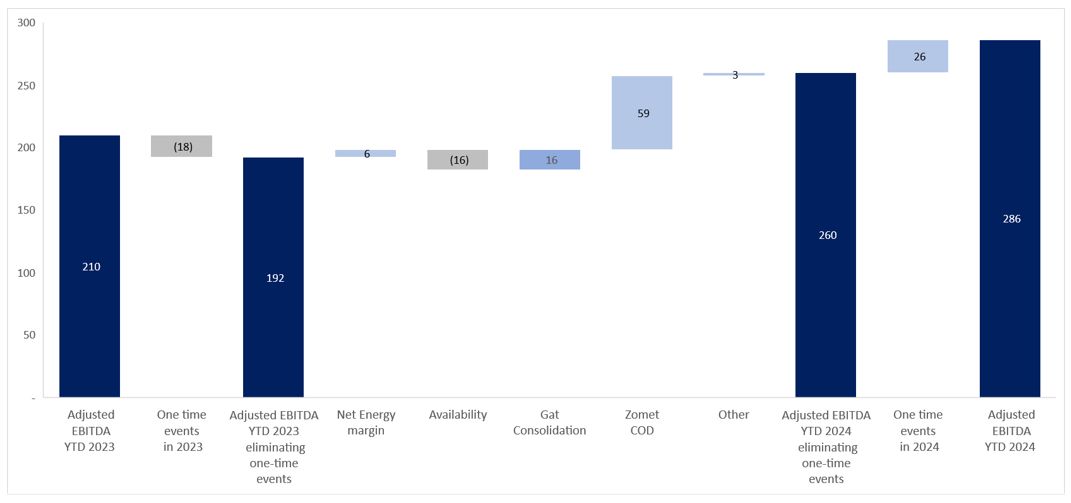

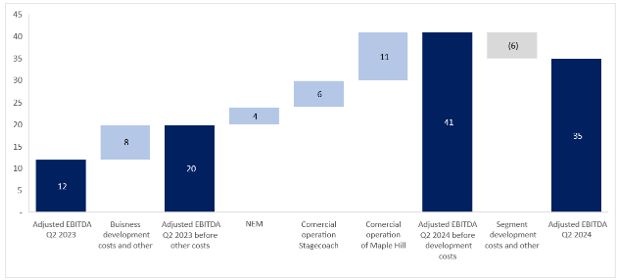

| C. | Analysis of the change in adjusted EBITDA – Israel segment |

Set forth below is an analysis of the change in adjusted EBITDA in Israel in the period of the report compared with the corresponding period last year (in NIS millions):

| 1. | Energy margin – the increase stems mainly from a decrease in the natural gas prices, in the amount of about NIS 23 million, as a result of the entry into effect of the Energean agreement commencing from the end of the first quarter of 2023. On the other hand, there was a decrease of about NIS 10 million as a result of a decline in customer consumption and a drop in the generation tariff along with an increase in the natural gas price due to the strengthening of the dollar against the shekel, in the amount of about NIS 8 million. |

| 2. | Availability (operational) – as stated in Section 7.11.1 of Part A of the Periodic Report for 2023, in the period of the report, the Rotem and Hadera power plants were shut down for various time periods for purposes of maintenance work, which had a negative impact on their results in the period of the report, including compared with the corresponding period last year. |

The activities of the Rotem power plant were suspended in March 2024 for purposes of planned maintenance work, which lasted for 17 days and activities of the Hadera power plant were partially suspended in the second quarter of 2024.

It is noted that during above‑mentioned maintenance, sale of electricity to customers continued, and the companies purchased electricity from the System Operator in order to supply the full demand of their customers during the shutdown.

| 4. | Analysis of the results of operations for the Six Months Ended June 30, 2024 (in millions of NIS) (Cont.) |

| C. | Analysis of the change in adjusted EBITDA – Israel segment (Cont.) |

| 3. | Commercial operation of Zomet and acquisition of Gat – in the period of the report, planned maintenance was performed a number of times at the Zomet power plant which had a negative impact on the power plant’s availability (for details – see Section 4H) and on its results accordingly. It is noted that maintenance in a similar format in Zomet is planned for the second half of 2024. |

It is further noted that as at the approval date of the report the Gat power plant is undergoing unplanned maintenance due to a breakdown that caused a shutdown of the plant’s activities. As at the approval date of the report, the Company estimates that subject to completion of the maintenance as planned the said maintenance is expected to continue for about two months and is not expected to have a significant impact on the Group’s activities17.

| 4. | One‑time events – for details regarding events in the first quarter of 2023 – see Note 28C(3) to the annual financial statements. |

In addition, in the first quarter of 2024, an amendment to the agreement was signed with Zomet’s construction contractor, in the framework of which the construction contractor paid Zomet compensation, in the amount of about NIS 26 million (about $7 million) in respect of a loss of revenues caused to Zomet due to delay in the commercial operation date of the power plant. For additional details – see Note 8A(3) to the interim financial statements.