OCTOBER 2017 INVESTOR PRESENTATION

2 FOWARD-LOOKING STATEMENTS AND NON-GAAP FINANCIAL MEASURES Certain statements contained in this Presentation constitute forward-looking statements as such term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are not guarantees of future performance. They represent our intentions, plans, expectations and beliefs and are subject to numerous assumptions, risks and uncertainties. Our future results, financial condition and business may differ materially from those expressed in these forward-looking statements. You can find many of these statements by looking for words such as “approximates,” “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “would,” “may” or other similar expressions in this Presentation. Many of the factors that will determine the outcome of these and our other forward-looking statements are beyond our ability to control or predict; these factors include, among others, appropriate project and corporate-level cap rates, the Company's ability to (i) complete its development, redevelopment and anchor repositioning projects, (ii) achieve the estimated unleveraged returns for such projects, (iii) pursue, finance and complete acquisition opportunities, and (iv) execute the planned refinancing described herein. For further discussion of factors that could materially affect the outcome of our forward-looking statements, see “Risk Factors” involved in our Annual Report on Form 10-K for the year ended December 31, 2016 and the other documents filed by the company with the SEC. This presentation also contains non-GAAP financial measures, including but not limited to Funds from Operations ("FFO"), FFO as Adjusted, Cash NOI, Same Property Cash NOI and Adjusted EBITDA. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP measures can be found in our quarterly supplemental disclosure package and in filings made with the SEC which are available on our website at www.uedge.com.

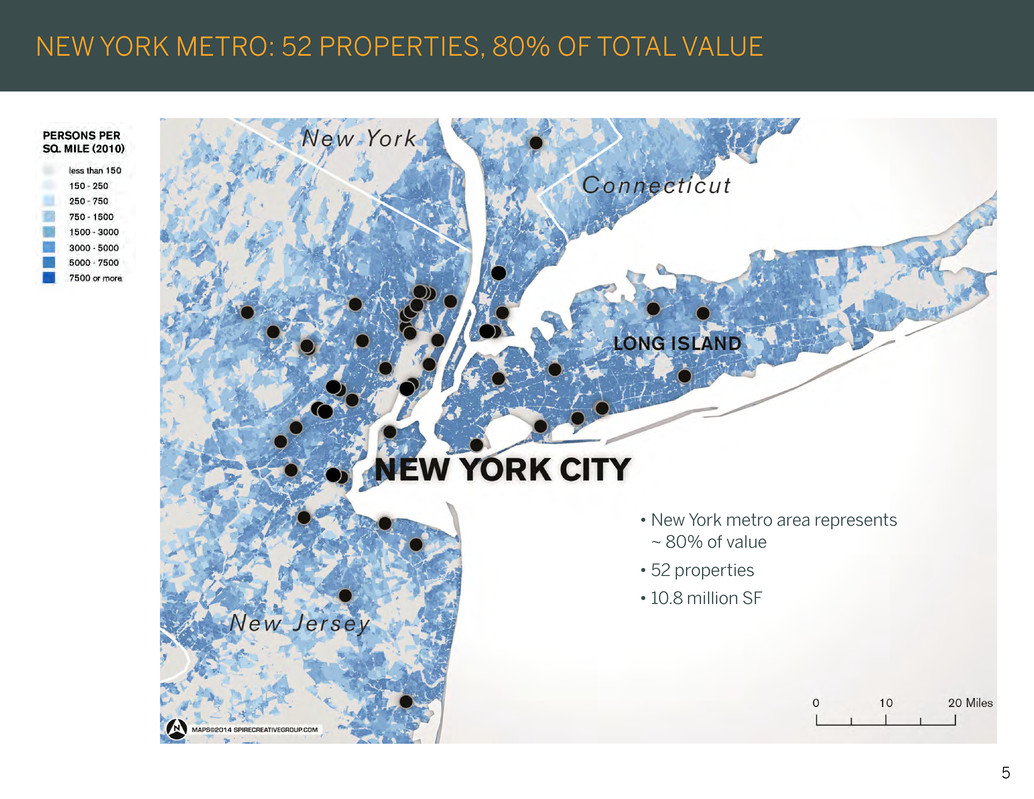

3 HOW ARE WE DIFFERENT? 1. Our real estate is concentrated in the NY metropolitan area • 52 properties valued at $3.3 billion, representing ~ 80% of our total assets(1) • Impossible to replicate as comparable assets rarely trade • Highest population density in the country • Anchored by high-volume value and necessity retailers - Average supermarket generates $774 PSF in sales(2) - Top six tenants: Home Depot, Walmart, TJX, Lowe's, Royal Ahold and Best Buy(3) • Older, historically under-managed portfolio with high land values 2. Significant growth expected from redeveloping existing assets • Recently completed five projects creating $65 million of value • $250 million of projects expected to generate a 9% return • $500+ million of future projects 3. Acquisitions will provide additional growth • Recently acquired ~$500 million of property, predominately in the NY metro area • FFO & NAV accretive with embedded redevelopment opportunities 4. Strong, liquid balance sheet positions us for opportunistic growth • Net debt to total market capitalization of 24%(4) • Cash balance of $400 million(4) • No corporate debt, only non-recourse mortgages 5. We have a proven track record and highly motivated board and management team. Since the date of our spin, UE has: • Generated a 15% total return compared to -13% for peers, outperformance of 2,800 basis points(5) • Increased quarterly same property cash NOI by 4.3% on average 6. UE is well prepared to take advantage of future disruption due to our acquisition, redevelopment, leasing and financial expertise (1) Based upon management estimates as of June 30, 2017 (2) Based on the 11 reporting supermarkets with at least one full year of operations as of June 30, 2017 (3) Based on annualized base rent as of June 30, 2017 (4) Proforma metrics incorporating results as of June 30, 2017 (including $155M of equity raised August 9, 2017) (5) Based on total return from January 15, 2015 through October 9, 2017

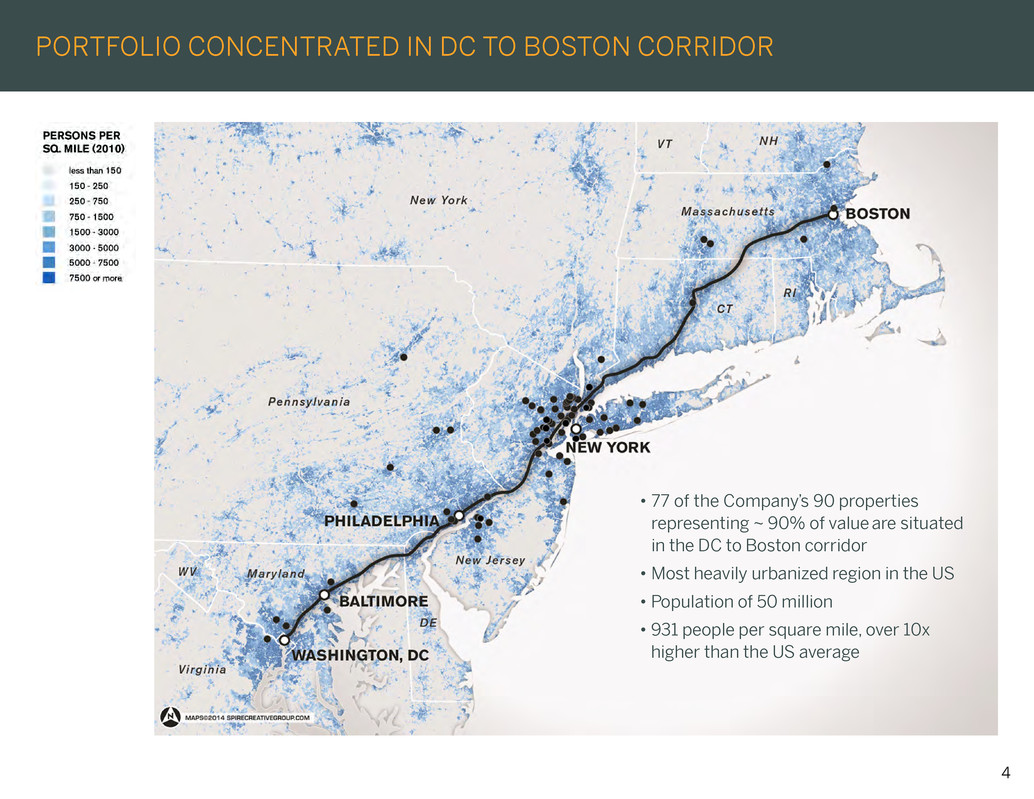

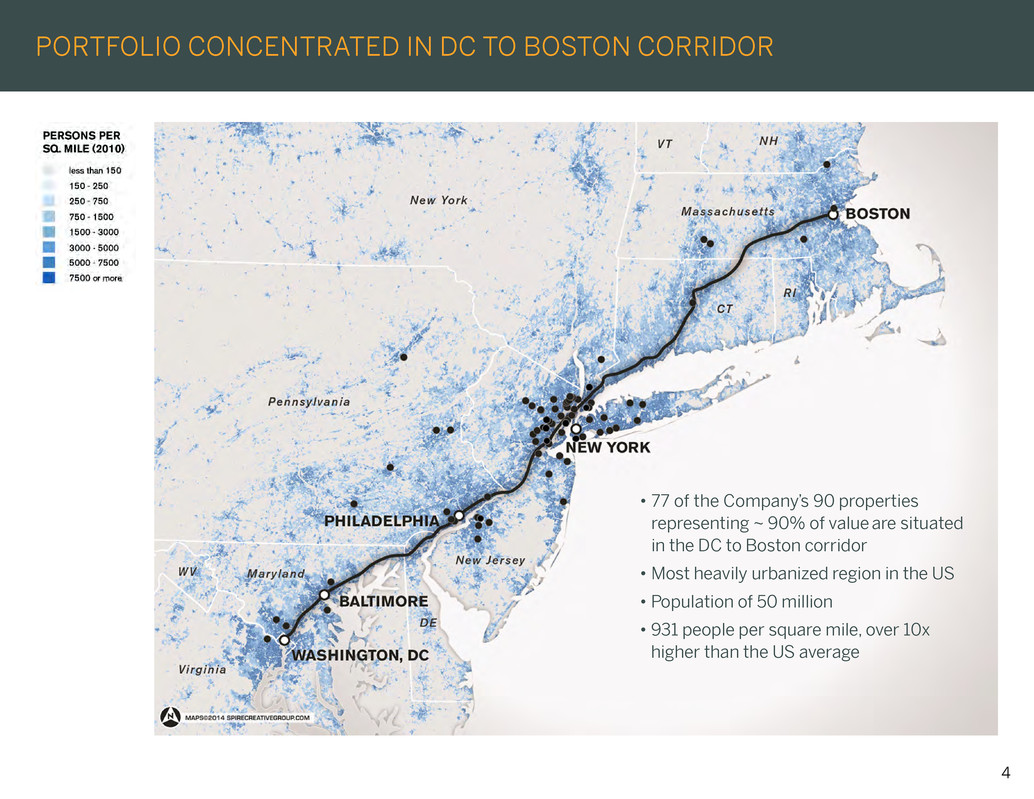

4 • 77 of the Company’s 90 properties representing ~ 90% of value are situated in the DC to Boston corridor • Most heavily urbanized region in the US • Population of 50 million • 931 people per square mile, over 10x higher than the US average PORTFOLIO CONCENTRATED IN DC TO BOSTON CORRIDOR

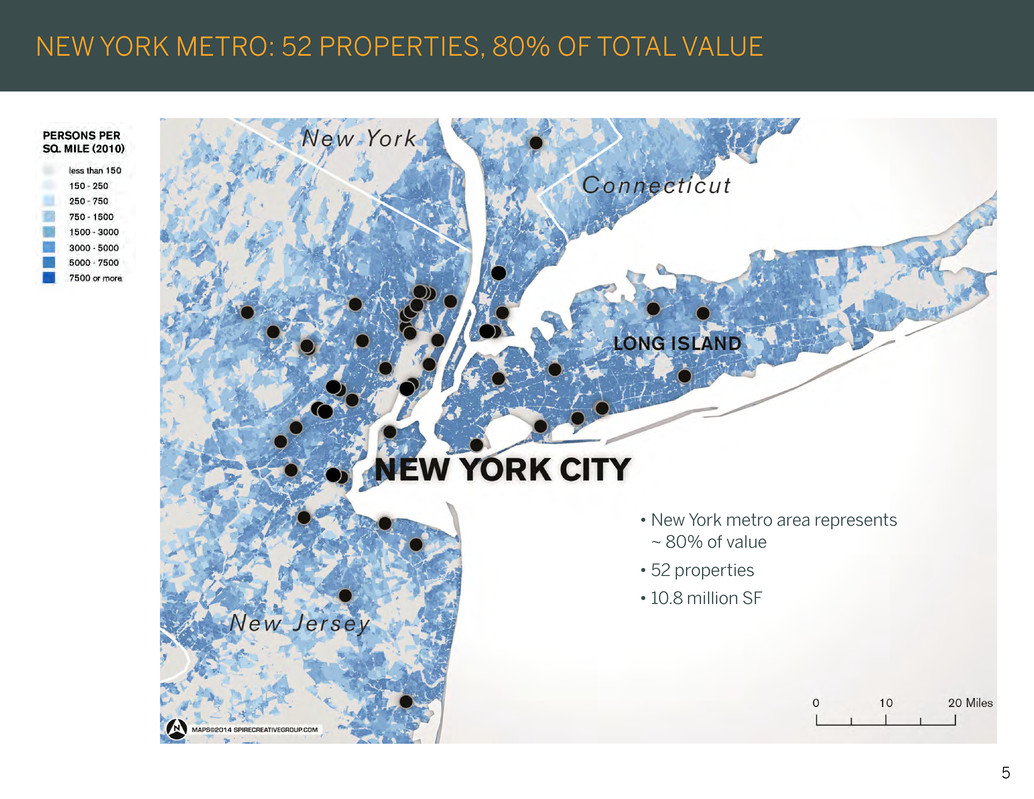

5 • New York metro area represents ~ 80% of value • 52 properties • 10.8 million SF NEW YORK METRO: 52 PROPERTIES, 80% OF TOTAL VALUE

6 RECENTLY COMPLETED FIVE PROJECTS CREATING $65 MILLION OF VALUE East Hanover Warehouses, East Hanover, NJ Complete renovation; increased occupancy from 45% to 92% $26M value creation Walnut Creek (Olympic), Walnut Creek, CA Anthropologie replaced Barnes & Noble $15M value creation Freeport Commons, Freeport, NY Home Depot expanded into former Cablevision $17M value creation Walnut Creek (Mt. Diablo), Walnut Creek, CA Z Gallerie replaced Anthropologie $5M value creation Panera Bread, East Hanover, NJ Developed outparcel for Panera Bread $2M value creation

7 CREATING ~$200M OF ADDITIONAL VALUE FROM 21 PROJECTS Bruckner Commons, Bronx, NY Expansion & Redevelopment Before After Before After Anchor Repositioning Before After Before After Before After Before After Garfield Commons, Garfield, NJ Goucher Commons, Towson, MD Hanover Commons, East Hanover, NJ Verizon, Turnersville, NJ Marlton Commons, Marlton, NJ Outparcel Developments/Redevelopments

8 REDEVELOPMENT PROJECTS Est. Gross Est. Value Target Property Cost(1) Yield(1) Creation(2) Stabilization(1) Project Description Bergen Town Center $79,500 8% $57,700 2018-2020 Add Best Buy, a national discounter and 4 restaurants Hackensack Commons 4,700 46% 32,700 1Q18 Retenant former Pathmark with 99 Ranch Market West End Commons 7,200 18% 14,800 4Q17 Added La-Z-Boy, Petco and 7k +/- sf of shops Bruckner Commons 56,500 7% 13,200 3Q18 Renovate and remerchandise; add ShopRite and Burlington Outlets at Montehiedra 28,200 12% 13,200 2Q18/2019 Converted to value/outlet hybrid mall and add 20k +/- sf Garfield Commons 21,600 9% 10,200 4Q17/2019 Added Burlington, PetSmart, Ulta and 7k +/- sf of shops Hanover Commons 5,100 16% 8,700 4Q17 Saks Fifth Avenue OFF 5th replaced former Loehmann's Goucher Commons 11,600 9% 6,800 2Q18/2019 Replaced weaker tenants with Ulta, Five Below & Kirkland's Rockaway River Commons 900 36% 4,700 4Q17/2018 Expand ShopRite & develop new Popeye's outparcel Hubbards Commons 3,300 11% 2,800 2018 Add 10k +/- sf of shops Marlton Commons 3,300 9% 2,300 2Q18 Construct new outparcel building for Shake Shack and honeygrow Kearny Commons 7,000 8% 2,000 2018 Expand by 20k +/- sf and add new Starbucks outparcel Woodbridge Commons 2,500 10% 1,800 2019 Redevelop existing vacant building or convert site to pads Huntington Commons 2,800 9% 1,300 2018 Convert 11k +/- sf of basement into street-front retail space Turnersville 2,100 14% 1,100 3Q17 Replaced vacant Friendly's with Verizon Mt. Kisco Commons 2,100 8% 1,000 2019 Convert former Applebee's into quick service restaurants Lawnside Commons 2,100 9% 900 3Q18 Add 6k sf building on excess land Governors Commons 1,300 10% 200 4Q18 Develop restaurant pad for Bubba's 33 Cherry Hill Commons 1,000 11% 700 2018 Develop outparcel approved for 3k +/- sf Gun Hill Commons 1,000 9% 600 2019 Expand Aldi supermarket Briarcliff Commons 3,500 0% (3,500) 2018 Replace vacant anchor and reposition center Total Redevelopment $247,300 9% $173,200 Dollars in thousands (1) As of June 30, 2017. Estimated Gross Cost. Estimated Yield and Target Stabilization are subject to change resulting from uncertainties inherent in the development process and not wholly under the Company’s control (2) Estimates the impact on net asset value by dividing the incremental NOI from the projects by management's estimated capitalization rate to apply upon completion of the project and subtracting all project costs necessary to achieve the projected NOI

9 FUTURE REDEVELOPMENT PROJECTS - $500M+ OF POTENTIAL INVESTMENT Bruckner Commons, Bronx, NY Huntington Commons, Huntington, NY The Plaza at Woodbridge, Woodbridge, NJ Hudson Mall, Jersey City, NJ Tonnelle Commons, North Bergen, NJ Hazlet, NJ Yonkers Gateway, Yonkers, NY Brunswick Commons, East Brunswick, NJ The Plaza at Cherry Hill, Cherry Hill, NJ 9

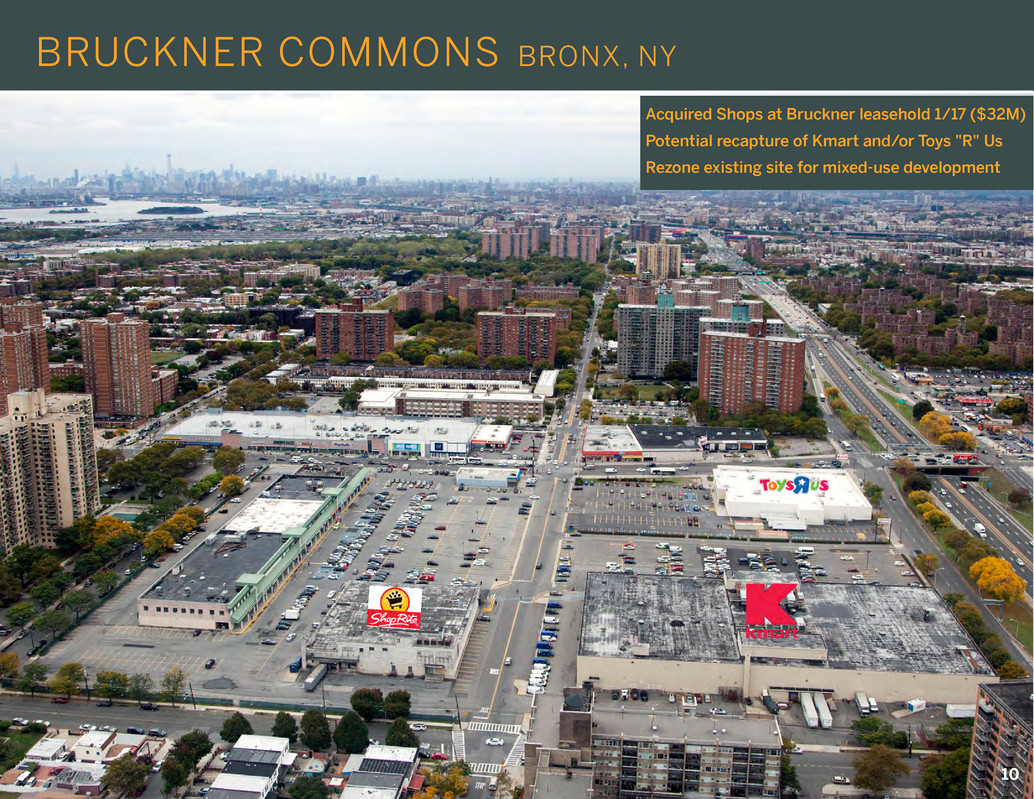

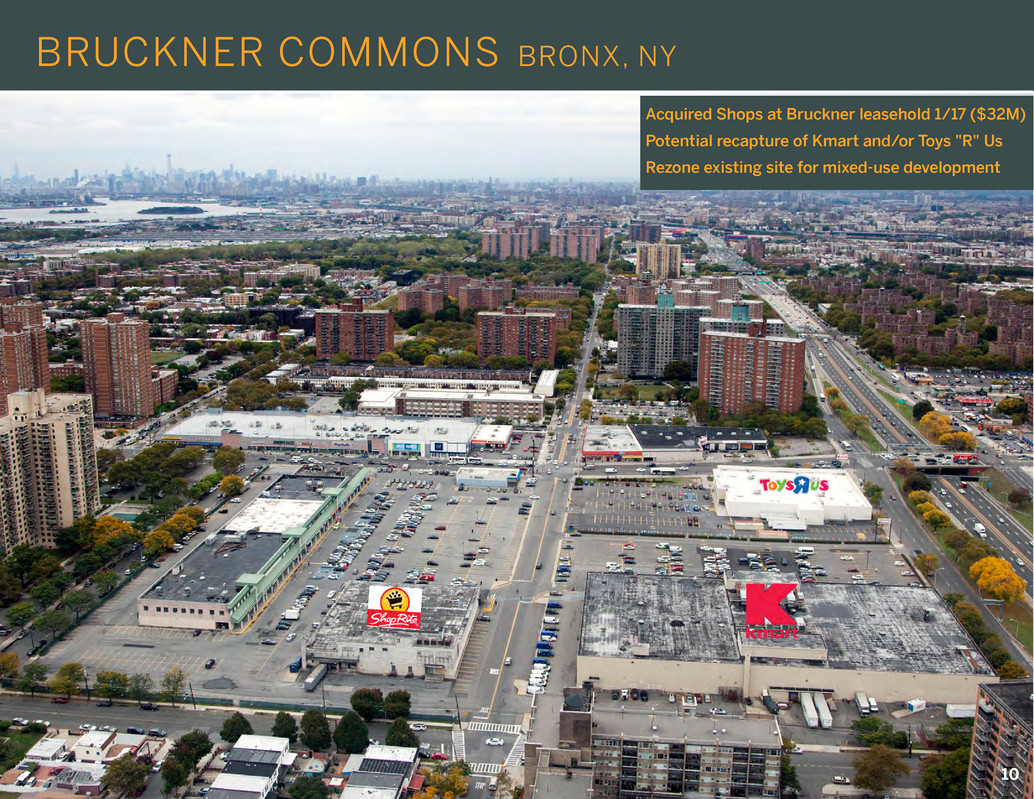

10 BRUCKNER COMMONS BRONX, NY Acquired Shops at Bruckner leasehold 1/17 ($32M) Potential recapture of Kmart and/or Toys "R" Us Rezone existing site for mixed-use development 10

11 YONKERS GATEWAY YONKERS, NY Former Completed acquisition in May 2017 ($152M) Plan to renovate, remerchandise and densify 60k sf vacant Pathmark Burlington/Bob's Furniture (196k sf) pay ~ $5 psf 11

12 HUDSON MALL JERSEY CITY, NJ Acquired Hudson Mall in February 2017 ($44M) Adjacent to Hudson Commons Combined 48 acres & 1,800 linear feet on Rte. 440 Plan to renovate, redevelop and remerchandise Toys "R" Us (39k sf) pays $0.43 psf Planned Bayfront development includes estimated 8,000 + residential units, office and retail space 12

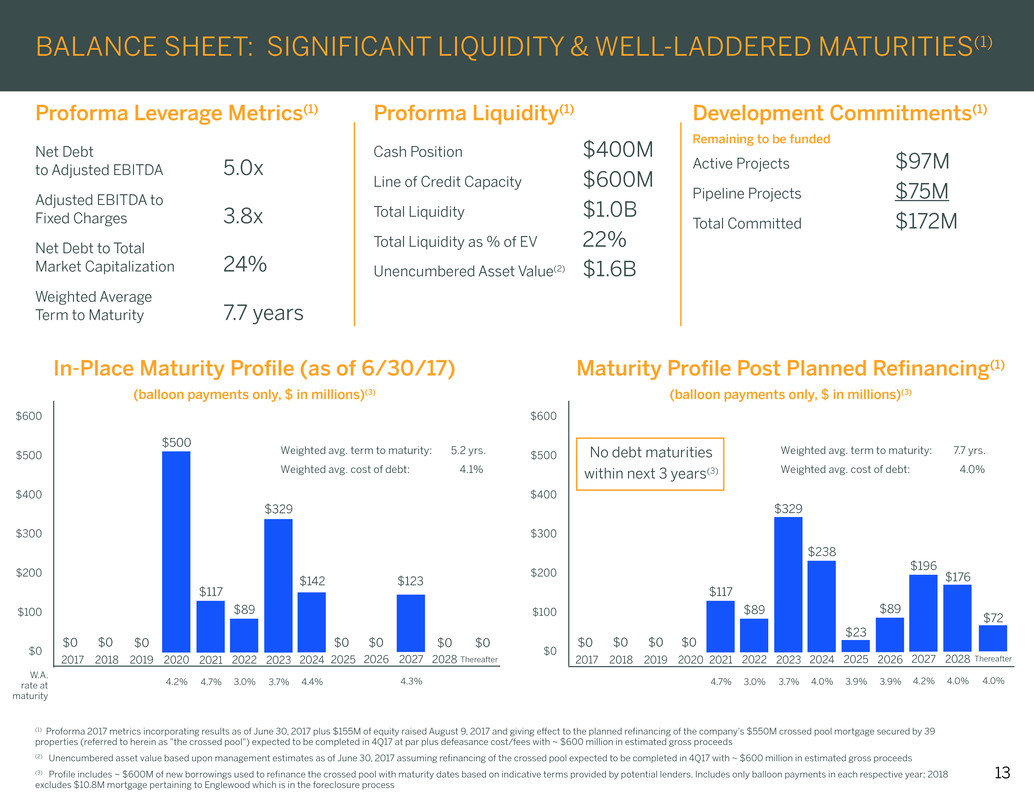

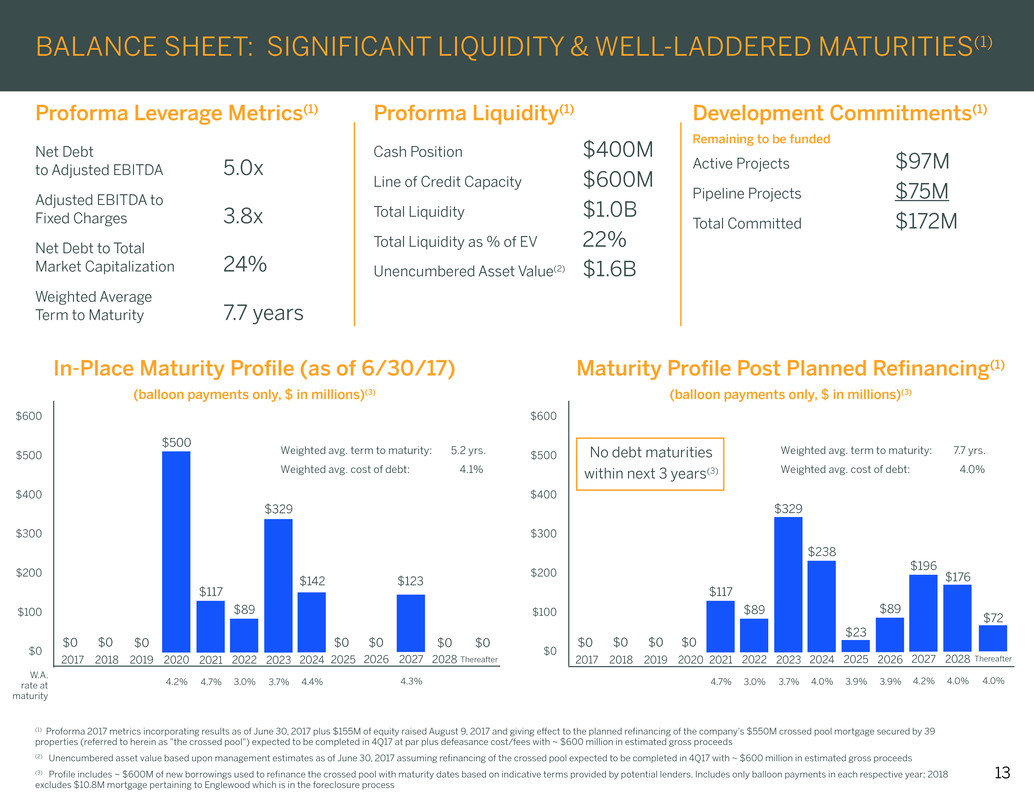

13 $600 $500 $400 $300 $200 $100 $0 2017 $0 W.A. rate at maturity BALANCE SHEET: SIGNIFICANT LIQUIDITY & WELL-LADDERED MATURITIES(1) Proforma Leverage Metrics(1) Net Debt to Adjusted EBITDA 5.0x Adjusted EBITDA to Fixed Charges 3.8x Net Debt to Total Market Capitalization 24% Weighted Average Term to Maturity 7.7 years In-Place Maturity Profile (as of 6/30/17) (balloon payments only, $ in millions)(3) Proforma Liquidity(1) Cash Position $400M Line of Credit Capacity $600M Total Liquidity $1.0B Total Liquidity as % of EV 22% (1) Proforma 2017 metrics incorporating results as of June 30, 2017 plus $155M of equity raised August 9, 2017 and giving effect to the planned refinancing of the company's $550M crossed pool mortgage secured by 39 properties (referred to herein as "the crossed pool") expected to be completed in 4Q17 at par plus defeasance cost/fees with ~ $600 million in estimated gross proceeds (2) Unencumbered asset value based upon management estimates as of June 30, 2017 assuming refinancing of the crossed pool expected to be completed in 4Q17 with ~ $600 million in estimated gross proceeds (3) Profile includes ~ $600M of new borrowings used to refinance the crossed pool with maturity dates based on indicative terms provided by potential lenders. Includes only balloon payments in each respective year; 2018 excludes $10.8M mortgage pertaining to Englewood which is in the foreclosure process Development Commitments(1) Remaining to be funded Active Projects $97M Pipeline Projects $75M Total Committed $172M Maturity Profile Post Planned Refinancing(1) (balloon payments only, $ in millions)(3) 2018 $0 2022 $89 3.0% 2021 $117 4.7% 2020 $500 4.2% 2019 $0 2023 3.7% Thereafter2025 $0 2024 $142 4.4% 2017 $0 2018 $0 2022 $89 3.0% 2021 $117 4.7% 2020 $0 2019 $0 2023 $329 3.7% 2026 $89 3.9% 2025 $23 3.9% 2024 $238 4.0% $329 $600 $500 $400 $300 $200 $100 $0 2026 20282027 $123 4.3% 2028 $176 4.0% 2027 $196 4.2% Thereafter $72 4.0% $0 $0 $0 Weighted avg. term to maturity: 5.2 yrs. Weighted avg. cost of debt: 4.1% Weighted avg. term to maturity: 7.7 yrs. Weighted avg. cost of debt: 4.0% No debt maturities within next 3 years(3) Unencumbered Asset Value(2) $1.6B

14 BOARD AND MANAGEMENT TEAM Jeffrey Olson Chairman and CEO, Urban Edge Properties Steven Roth Chairman and CEO, Vornado Realty Trust Michael Gould Former Chairman and CEO, Bloomingdale's Steven Grapstein Former Chairman, Tesoro Corporation Former Chairman, Armani Exchange Steven Guttman Founder and Principal, Storage Deluxe Former Chairman and CEO, Federal Realty Amy Lane Director, The TJX Companies Inc. GNC Holdings, Inc. and NextEra Energy Kevin O’Shea CFO, AvalonBay Communities Jeffrey Olson CEO of Equity One (2006-2014) Chairman and CEO Robert Minutoli EVP - Retail at Vornado Realty Trust (2009-2015) EVP - Chief Operating Officer Mark Langer CFO & CAO of Equity One (2009-2015) EVP - Chief Financial Officer Herbert Eilberg SVP Acquisitions at Acadia Realty (2011-2015) Chief Investment Officer Michael Zucker SVP Leasing at Vornado Realty Trust (2004-2015) EVP - Leasing Bernie Schachter SVP Real Estate at Staples (2003-2016) EVP - Asset Management Robert Milton General Counsel at CIFC Corp. (2008-2015) EVP - General Counsel Jennifer Holmes Senior Manager at Deloitte & Touche (2010-2014) Chief Accounting Officer BOARD OF TRUSTEES MANAGEMENT TEAM TRUSTEE BACKGROUND NAME BACKGROUND

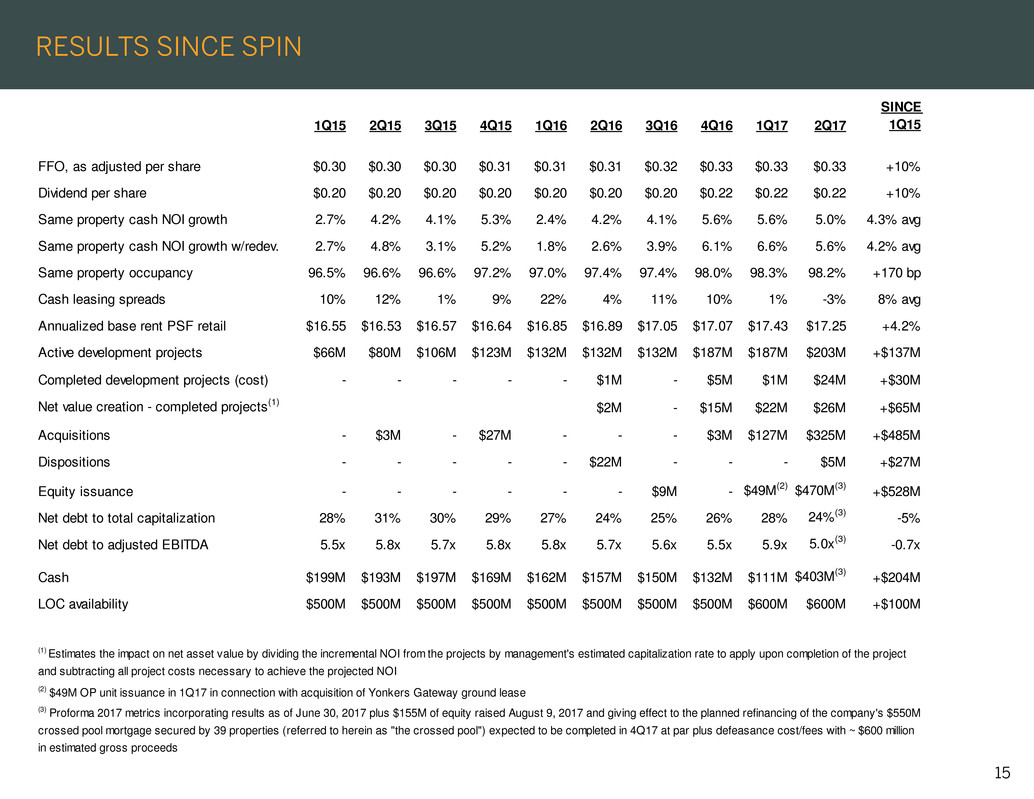

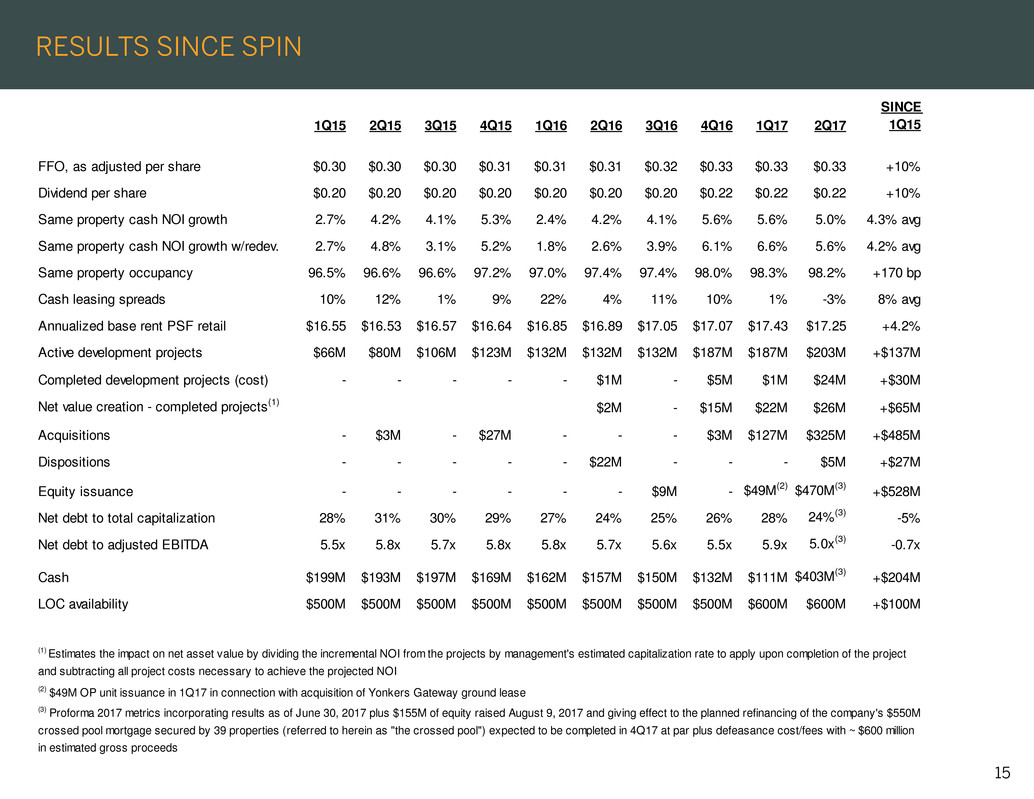

15 RESULTS SINCE SPIN 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 SINCE 1Q15 FFO, as adjusted per share $0.30 $0.30 $0.30 $0.31 $0.31 $0.31 $0.32 $0.33 $0.33 $0.33 +10% Dividend per share $0.20 $0.20 $0.20 $0.20 $0.20 $0.20 $0.20 $0.22 $0.22 $0.22 +10% Same property cash NOI growth 2.7% 4.2% 4.1% 5.3% 2.4% 4.2% 4.1% 5.6% 5.6% 5.0% 4.3% avg Same property cash NOI growth w/redev. 2.7% 4.8% 3.1% 5.2% 1.8% 2.6% 3.9% 6.1% 6.6% 5.6% 4.2% avg Same property occupancy 96.5% 96.6% 96.6% 97.2% 97.0% 97.4% 97.4% 98.0% 98.3% 98.2% +170 bp Cash leasing spreads 10% 12% 1% 9% 22% 4% 11% 10% 1% -3% 8% avg Annualized base rent PSF retail $16.55 $16.53 $16.57 $16.64 $16.85 $16.89 $17.05 $17.07 $17.43 $17.25 +4.2% Active development projects $66M $80M $106M $123M $132M $132M $132M $187M $187M $203M +$137M Completed development projects (cost) - - - - - $1M - $5M $1M $24M +$30M Net value creation - completed projects(1) $2M - $15M $22M $26M +$65M Acquisitions - $3M - $27M - - - $3M $127M $325M +$485M Dispositions - - - - - $22M - - - $5M +$27M Equity issuance - - - - - - $9M - $49M(2) $470M(3) +$528M Net debt to total capitalization 28% 31% 30% 29% 27% 24% 25% 26% 28% 24%(3) -5% Net debt to adjusted EBITDA 5.5x 5.8x 5.7x 5.8x 5.8x 5.7x 5.6x 5.5x 5.9x 5.0x(3) -0.7x Cash $199M $193M $197M $169M $162M $157M $150M $132M $111M $403M(3) +$204M LOC availability $500M $500M $500M $500M $500M $500M $500M $500M $600M $600M +$100M (2) $49M OP unit issuance in 1Q17 in connection with acquisition of Yonkers Gateway ground lease (3) Proforma 2017 metrics incorporating results as of June 30, 2017 plus $155M of equity raised August 9, 2017 and giving effect to the planned refinancing of the company's $550M crossed pool mortgage secured by 39 properties (referred to herein as "the crossed pool") expected to be completed in 4Q17 at par plus defeasance cost/fees with ~ $600 million in estimated gross proceeds (1) Estimates the impact on net asset value by dividing the incremental NOI from the projects by management's estimated capitalization rate to apply upon completion of the project and subtracting all project costs necessary to achieve the projected NOI

16 POSITIONED FOR GROWTH IN A CHANGING RETAIL ENVIRONMENT 1. Strengthening our balance sheet • Increased liquidity to $1.0 billion ($400M of cash and $600M LOC)(1) • Raised ~$520M of equity YTD in four separate transactions • Extended LOC maturity to 2021 and increased capacity from $500M to $600M • Proactively refinancing existing $550M crossed pool mortgage using single asset mortgages 2. Redeveloping, renovating and remerchandising existing assets • Increased active development project spend by $137M since spin • Acquired properties with redevelopment opportunities: Yonkers, Hudson Mall, Woodbridge and Cherry Hill 3. Expanding strong anchors and extending leases prior to expiration • Rockaway - ShopRite extended for 20 years and expanded by 10k sf • Freeport - Home Depot extended for 20 years and expanded by 55k sf 4. Opportunistically buying out or otherwise replacing underperforming tenants • Towson - bought out underperforming tenants (Shopper's & hhgregg) and improved tenancy along with increased rents • Negotiating several buyout agreements with tenants at properties with development/redevelopment potential 5. Selling non-core assets • Sold Waterbury, CT and Eatontown, NJ for combined proceeds of $27M • Marketing ~ $150M of assets in secondary markets 6. Evaluating opportunities throughout portfolio for non-retail uses including residential, storage, office and industrial • Densification potential at multiple sites • Residential at several assets including Hazlet and self storage at North Bergen and Woodbridge 7. Opportunistically acquiring assets • Significant liquidity in-place to act as opportunities arise • Intense focus on New York metro leverages management relationships and team expertise • Targeting land parcels adjacent to existing assets (1) Proforma metrics incorporating results as of June 30, 2017 and all equity raised in 2017 (including $155M raised August 9, 2017)

17 A P P E N D I X

Project Description Value Creation Incremental NOI $ Estimated Cap Rate % Incremental Value $ Cost $ Value Creation $Estimated Stabilization Year: 2Q17 18 BERGEN TOWN CENTER PARAMUS, NJ Project Description Expanding and remerchandising Bergen Town Center, our largest property and one of the most productive outlet/value-oriented centers in the country. We are replacing underperforming retailers with successful, sought after merchants, expanding food offerings and adding approximately 100,000 square feet (sf) of new space. Our five-year plan is to grow net operating income by 6% annually, expand in-line sales productivity from $600 per sf to $800 per sf and increase NAV by $100M+. Estimated Gross Cost $79.5M Estimated Yield 8% Est. Value Creation $57.7M Target Stabilization 2018-20

19 Estimated Gross Cost $4.7M Estimated Yield 46% Est. Value Creation $32.7M Target Stabilization 1Q18 Project Description Replacing 59k sf, former Pathmark with 99 Ranch Market (opening 1Q18), a 43 unit, California-based, Asian grocer; leased shop space to Chipotle, Orangetheory Fitness and Eastern Dental. HACKENSACK COMMONS HACKENSACK, NJ

20 Estimated Gross Cost $7.2M Estimated Yield 18% Est. Value Creation $14.8M Target Stabilization 4Q17 Project Description Expanded center by 33k sf; La-Z-Boy open; Petco opening in October 2017; 8k sf available; prior projects added Costco, Tile Shop, Texas Roadhouse and Aroogas. WEST END COMMONS NORTH PLAINFIELD, NJ

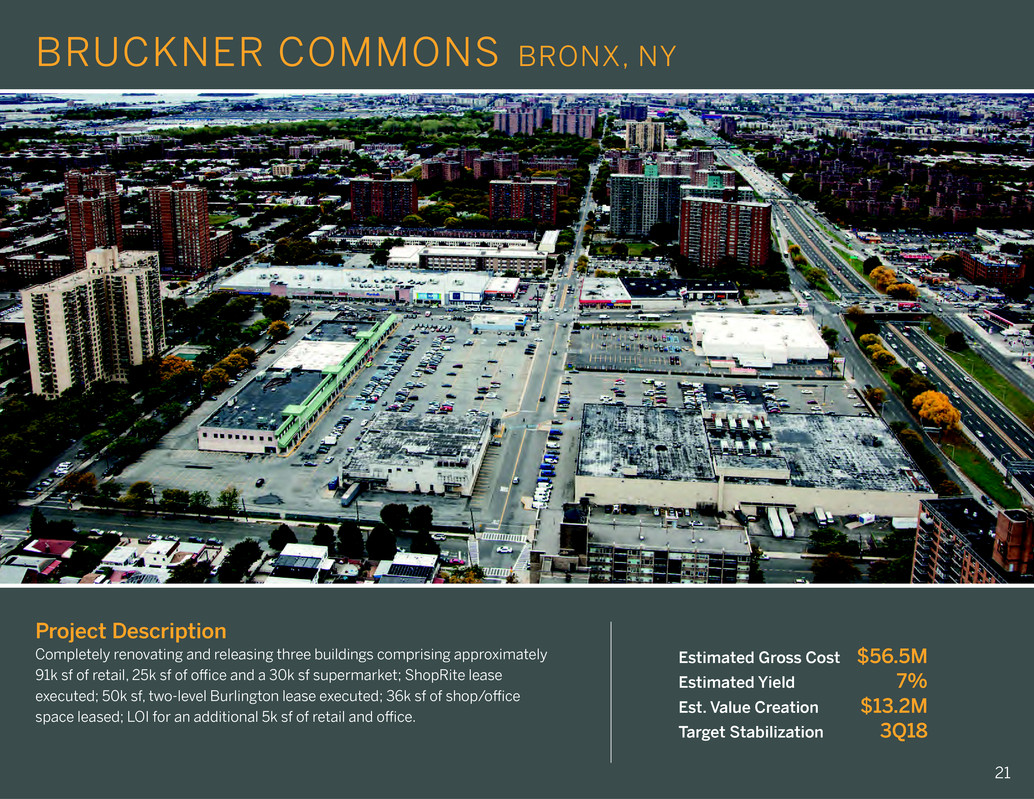

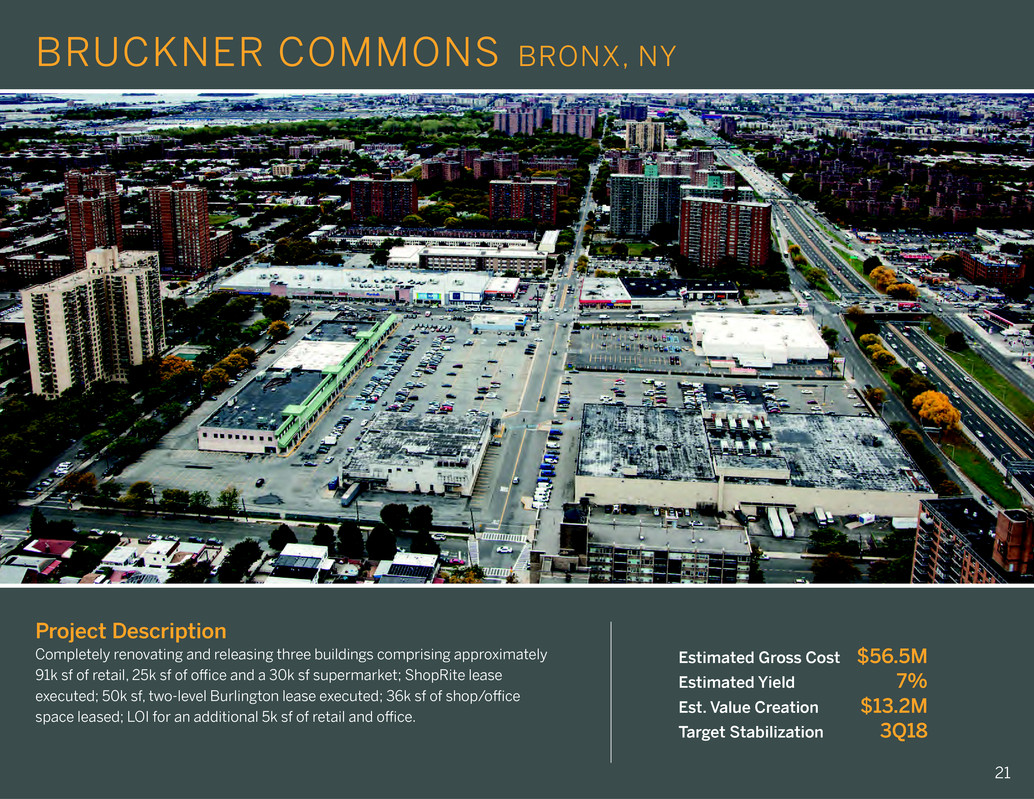

21 Estimated Gross Cost $56.5M Estimated Yield 7% Est. Value Creation $13.2M Target Stabilization 3Q18 Project Description Completely renovating and releasing three buildings comprising approximately 91k sf of retail, 25k sf of office and a 30k sf supermarket; ShopRite lease executed; 50k sf, two-level Burlington lease executed; 36k sf of shop/office space leased; LOI for an additional 5k sf of retail and office. BRUCKNER COMMONS BRONX, NY

22 Estimated Gross Cost $28.2M Estimated Yield 12% Est. Value Creation $13.2M Target Stabilization 2Q18/2019 Project Description Completely renovated enclosed regional mall built in 1994 and converted it into a hybrid offering outlets, off price, entertainment and food uses; 57% of the total 117k sf leasing plan is complete; Caribbean Cinemas (renovated and opened with new IMAX and 4DX); Nike, Polo Ralph Lauren Factory Store, Gap, Puma and Skechers are open. Marketing outparcel with 20k +/- sf of development potential; strong restaurant and service interest. OUTLETS AT MONTEHIEDRA SAN JUAN, PR

23 Estimated Gross Cost $21.6M Estimated Yield 9% Est. Value Creation $10.2M Target Stabilization 4Q17/2019 Project Description Expanded center by 85k sf; Burlington, PetSmart and Ulta open; remaining 7k sf in lease. Adding 15k - 20k sf of small shops adjacent to Walmart or in the adjacent parking lot. GARFIELD COMMONS GARFIELD, NJ

Project Description Value Creation Incremental NOI $ Estimated Cap Rate % Incremental Value $ Cost $ Value Creation $Estimated Stabilization Year: 2Q17 24 HANOVER COMMONS EAST HANOVER, NJ Estimated Gross Cost $5.1M ed Yield 16% Est. Value Creation $8.7M Target Stabilization 4Q17 cription Replaced former Loehmann's with Saks Fifth Avenue OFF 5th (open). Facade renovation completed in 3Q17.

Project Description Value Creation Incremental NOI $ Estimated Cap Rate % Incremental Value $ Cost $ Value Creation $Estimated Stabilization Year: 2Q17 25 Estimated Gross Cost $11.6M ted Yield 9% Est. Value Creation 6.8M Target Stabilization 2Q18/2019 Recaptured underperforming 39k sf grocery store and redemised it with Ulta, Tuesday Morning, Five Below and Kirklands (all open). Retenanting former hhgregg space (in lease). GOUCHER COMMONS TOWSON, MD

26 Estimated Gross Cost $0.9M Estimated Yield 36% Est. Value Creation $4.7M Target Stabilization 4Q17/2018 Project Description Leased approved pad to Popeyes (open). Renewed and expanding existing ShopRite (under construction). ROCKAWAY RIVER COMMONS ROCKAWAY, NJ

Project Description Value Creation Incremental NOI $ Estimated Cap Rate % Incremental Value $ Cost $ Value Creation $Estimated Stabilization Year: 2Q17 27 Adding 10k sf building on adjacent parcel. HUBBARDS COMMONS WEST BABYLON, NY Estimated Gross Cost $3.3M Estimated Yield 11% Est. Value Creation $2.8M Target Stabilization 2018

Project Description Value Creation Incremental NOI $ Estimated Cap Rate % Incremental Value $ Cost $ Value Creation $Estimated Stabilization Year: 2Q17 28 MARLTON COMMONS MARLTON, NJ Estimated Gross Cost $3.3M ed Yield 9% Est. Value Creation $2.3M Target Stabilization 2Q18 roject cription Creating a new pad for Shake Shack and honeygrow (both under construction).

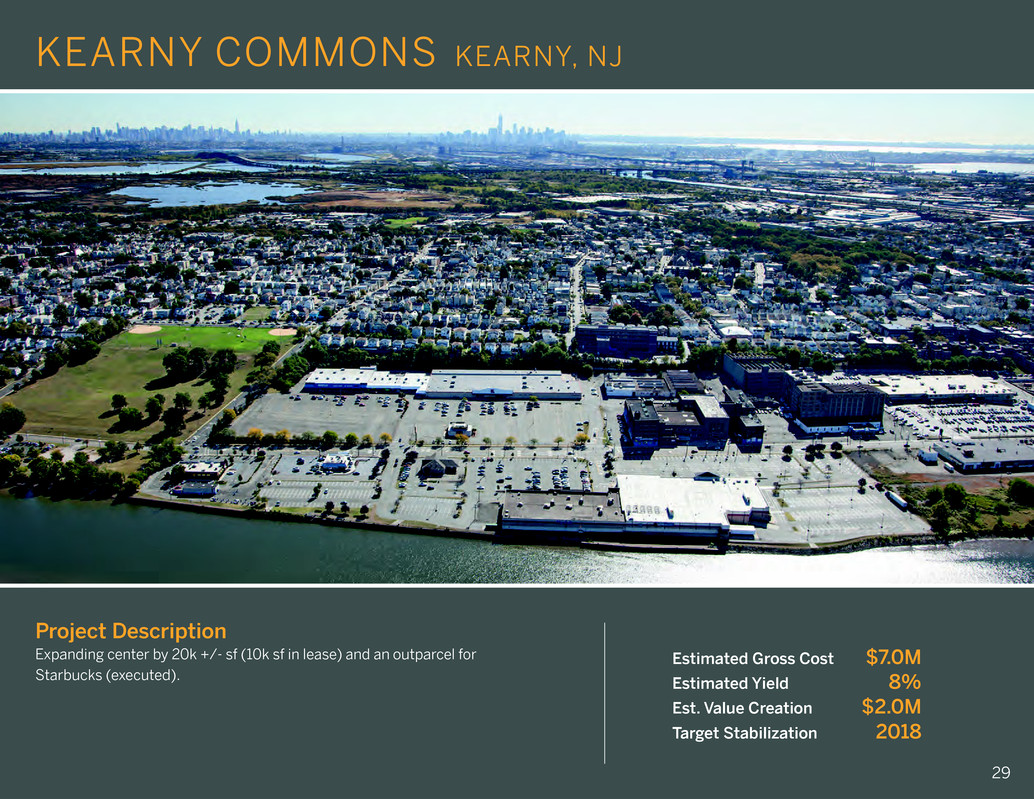

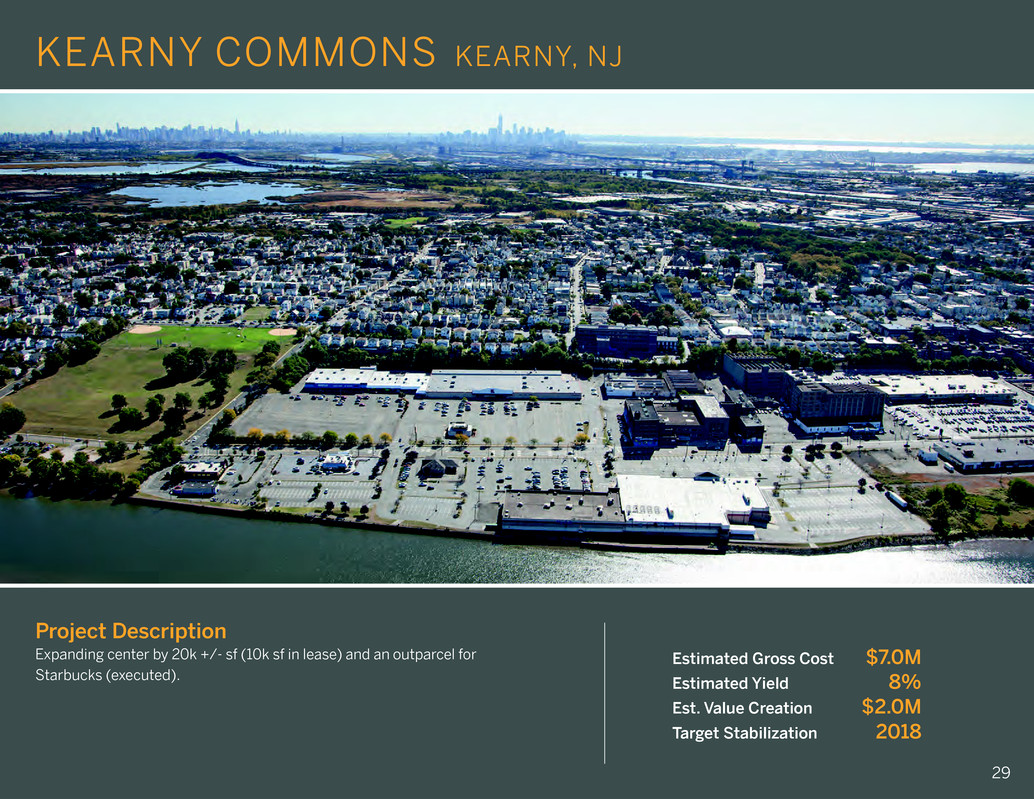

Project Description Value Creation Incremental NOI $ Estimated Cap Rate % Incremental Value $ Cost $ Value Creation $Estimated Stabilization Year: 2Q17 29 Expanding center by 20k +/- sf (10k sf in lease) and an outparcel for Starbucks (executed). KEARNY COMMONS KEARNY, NJ Estimated Gross Cost $7.0M Estimated Yield 8% Est. Value Creation $2.0M Target Stabilization 2018

Project Description Value Creation Incremental NOI $ Estimated Cap Rate % Incremental Value $ Cost $ Value Creation $Estimated Stabilization Year: 2Q17 30 Redeveloping former Syms building (36k sf); options include releasing, downsizing or demolishing for pads. WOODBRIDGE COMMONS WOODBRIDGE, NJ Estimated Gross Cost $2.5M Estimated Yield 10% Est. Value Creation $1.8M Target Stabilization 2019

Project Description Value Creation Incremental NOI $ Estimated Cap Rate % Incremental Value $ Cost $ Value Creation $Estimated Stabilization Year: 2Q17 31 Converting an 11k sf, unusable basement into retail space fronting Route 110. HUNTINGTON COMMONS HUNTINGTON, NY Estimated Gross Cost $2.8M Estimated Yield 9% Est. Value Creation $1.3M Target Stabilization 2018

Project Description Value Creation Incremental NOI $ Estimated Cap Rate % Incremental Value $ Cost $ Value Creation $Estimated Stabilization Year: 2Q17 32 Estimated Gross Cost $2.1M ed Yield 14% Est. Value Creation $1.1M Target Stabilization 3Q17 Demolished 4k sf, former Friendly’s restaurant and constructed a new, 6k sf Verizon store (open). TURNERSVILLE TURNERSVILLE, NJ

Estimated Cost Gross Cost $46.7M Target Stabilization 2Q19 Project Description Value Creation Incremental NOI $ Estimated Cap Rate % Incremental Value $ Cost $ Value Creation $Estimated Stabilization Year: 2Q17 33 Reconfiguring existing Applebee’s restaurant into two quick service restaurants. MT. KISCO COMMONS MOUNT KISCO, NY Estimated Gross Cost $2.1M Estimated Yield 8% Est. Value Creation $1.0M Target Stabilization 2019

Project Description Value Creation Incremental NOI $ Estimated Cap Rate % Incremental Value $ Cost $ Value Creation $Estimated Stabilization Year: 2Q17 34 LAWNSIDE COMMONS LAWNSIDE, NJ Estimated Gross Cost $2.1M ed Yield 9% Est. Value Creation $0.9M Target Stabilization 3Q18 Project Description Adding 6k sf of shop space; 100% in lease.

35 Estimated Gross Cost $1.3M Estimated Yield 10% Est. Value Creation $0.2M Target Stabilization 4Q18 Project Description Creating a pad for Bubba’s 33, a new restaurant concept from Texas Roadhouse (executed). GOVERNORS COMMONS GLEN BURNIE, MD

Project Description Value Creation Incremental NOI $ Estimated Cap Rate % Incremental Value $ Cost $ Value Creation $Estimated Stabilization Year: 2Q17 36 CHERRY HILL COMMONS CHERRY HILL, NJ Leasing approved pad to a fast casual restaurant (in lease). Estimated Gross Cost $1.0M Estimated Yield 11% Est. Value Creation $0.7M Target Stabilization 2018

Project Description Value Creation Incremental NOI $ Estimated Cap Rate % Incremental Value $ Cost $ Value Creation $Estimated Stabilization Year: 2Q17 37 Rezoning property to permit 4k sf expansion of Aldi (executed). GUN HILL COMMONS BRONX, NY Estimated Gross Cost $1.0M Estimated Yield 9% Est. Value Creation $0.6M Target Stabilization 2019

Project Description Value Creation Incremental NOI $ Estimated Cap Rate % Incremental Value $ Cost $ Value Creation $Estimated Stabilization Year: 2Q17 38 Renovating, reconfiguring and remerchandising; replacing vacant grocer; adding restaurant pad. BRIARCLIFF COMMONS MORRIS PLAINS, NJ Estimated Gross Cost $3.5M Estimated Yield 0% Est. Value Creation ($3.5M) Target Stabilization 2018

F U T U R E P ROJ ECTS

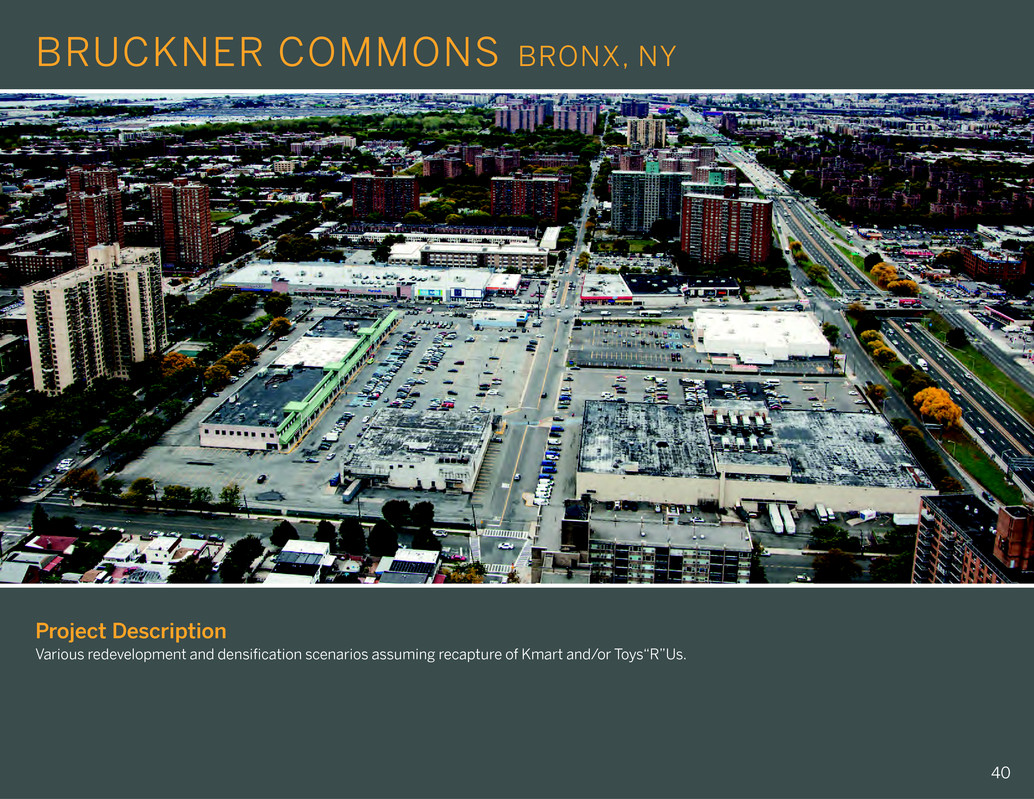

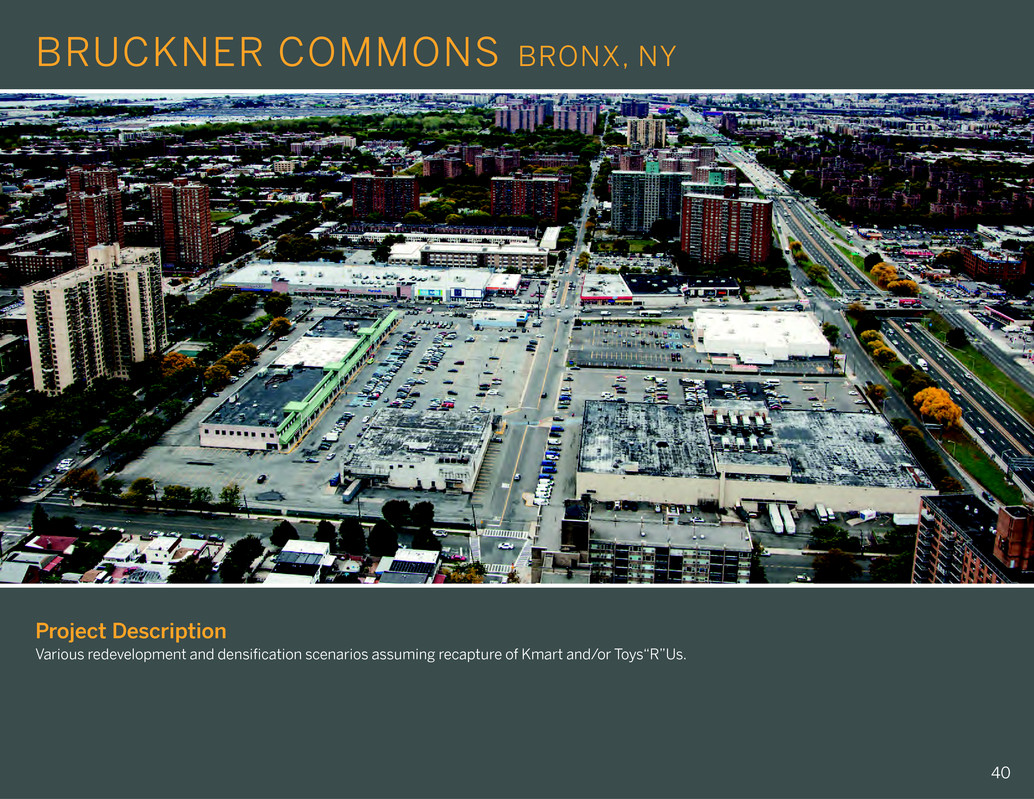

Project Description Various redevelopment and densification scenarios assuming recapture of Kmart and/or Toys“R”Us. BRUCKNER COMMONS BRONX, NY 40

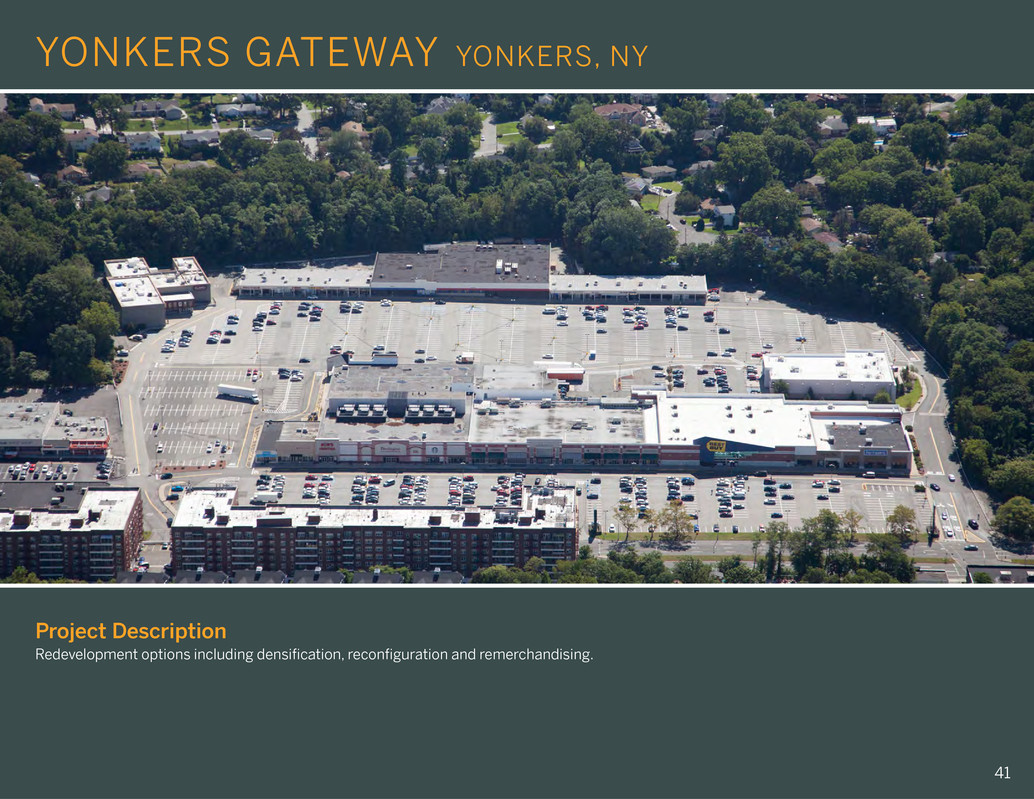

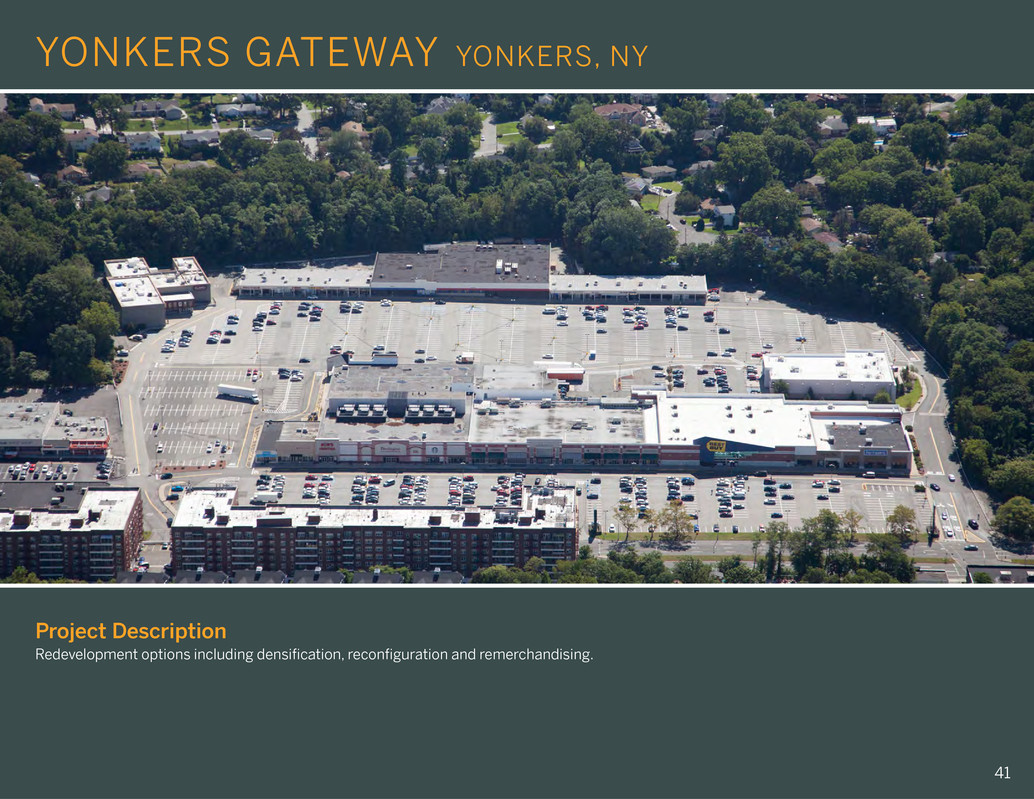

Project Description Redevelopment options including densification, reconfiguration and remerchandising. YONKERS GATEWAY YONKERS, NY 41

Project Description Redevelopment options including densification, reconfiguration and retenanting. HUDSON MALL JERSEY CITY, NJ 42

Project Description Reposition 102k sf Kmart box. HUNTINGTON COMMONS HUNTINGTON, NY 43

Project Description Possible 10k sf expansion between Kohl’s and L.A. Fitness. BRUNSWICK COMMONS EAST BRUNSWICK, NJ 44

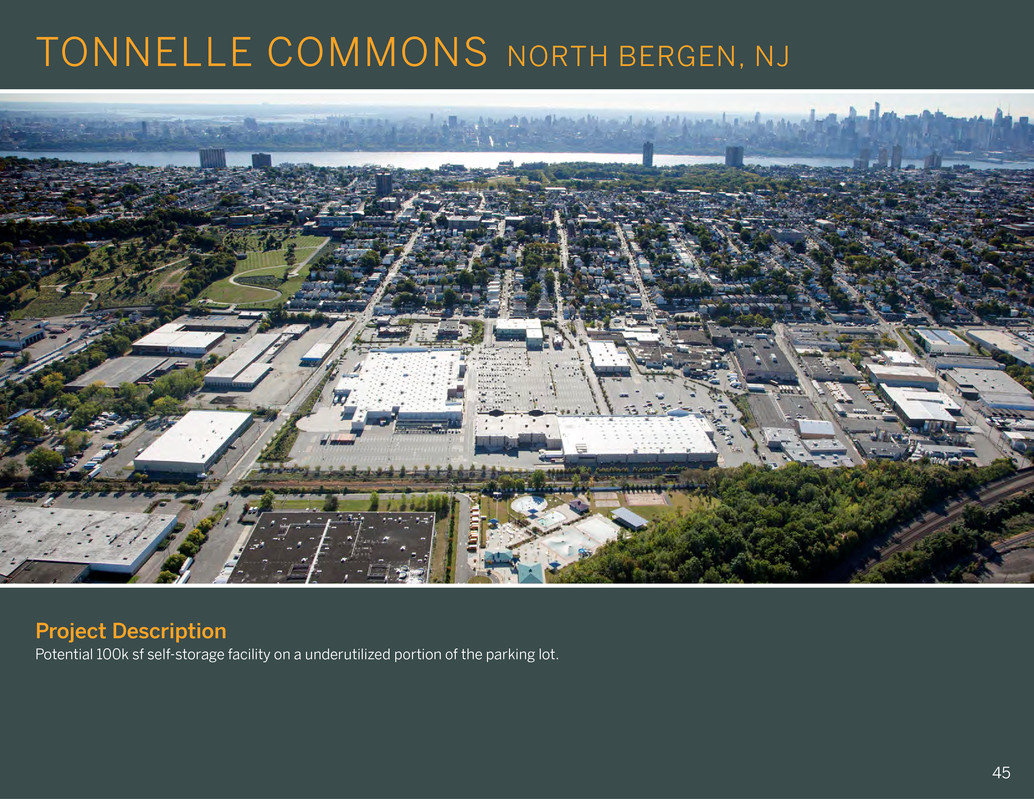

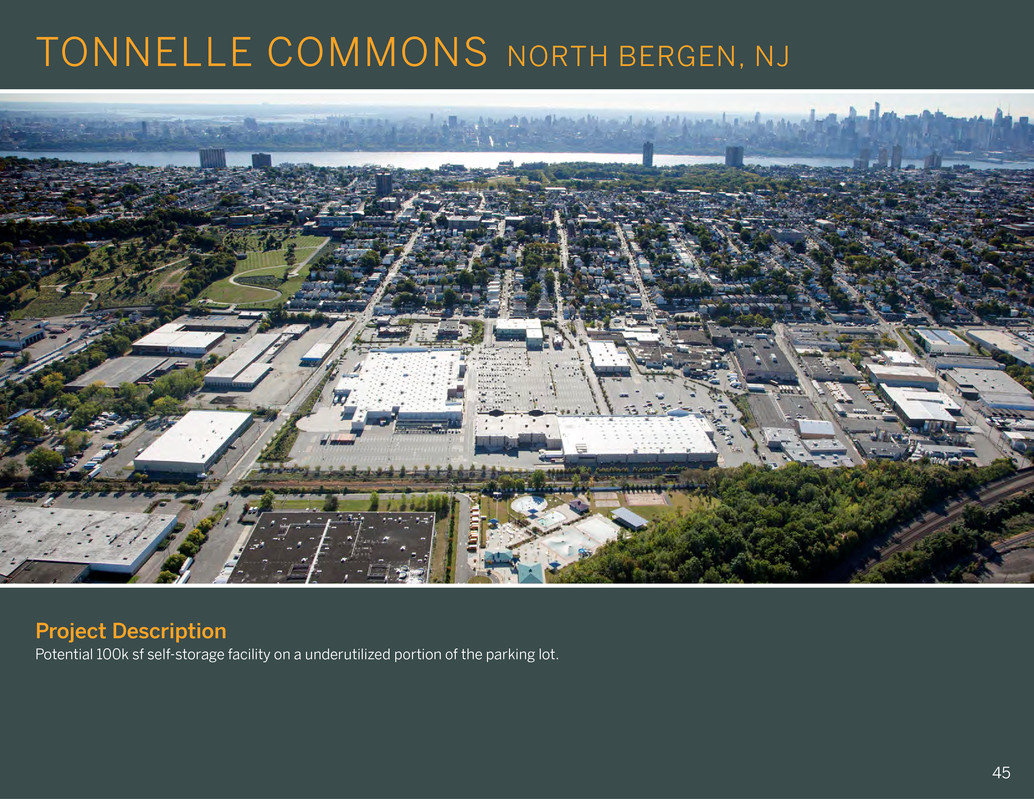

Project Description Potential 100k sf self-storage facility on a underutilized portion of the parking lot. TONNELLE COMMONS NORTH BERGEN, NJ 45

Project Description Potential 60k sf self-storage facility in unused basement space. THE PLAZA AT WOODBRIDGE WOODBRIDGE, NJ 46

Project Description Repositioning and remerchandising. THE PLAZA AT CHERRY HILL CHERRY HILL, NJ 47

Project Description Potential rental apartment project. HAZLET HAZLET, NJ 48

888 Seventh Avenue New York, NY 10019 212.956.2556 www.uedge.com