NOVEMBER 2022 INVESTOR PRESENTATION

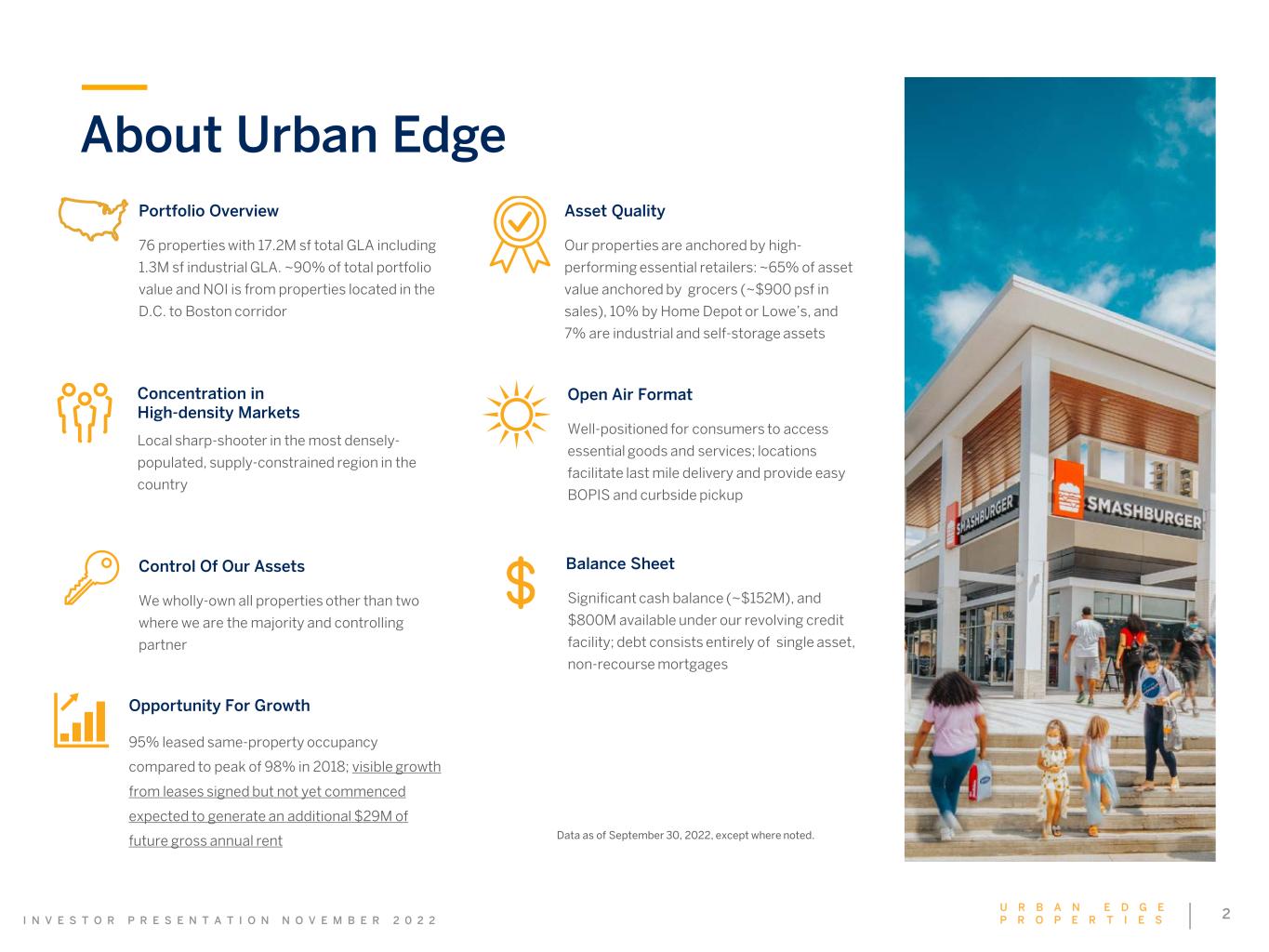

2U R B A N E D G E P R O P E R T I E SI N V E S T O R P R E S E N T A T I O N N O V E M B E R 2 0 2 2 About Urban Edge Data as of September 30, 2022, except where noted. Portfolio Overview 76 properties with 17.2M sf total GLA including 1.3M sf industrial GLA. ~90% of total portfolio value and NOI is from properties located in the D.C. to Boston corridor Concentration in High-density Markets Local sharp-shooter in the most densely- populated, supply-constrained region in the country Control Of Our Assets We wholly-own all properties other than two where we are the majority and controlling partner Asset Quality Our properties are anchored by high- performing essential retailers: ~65% of asset value anchored by grocers (~$900 psf in sales), 10% by Home Depot or Lowe’s, and 7% are industrial and self-storage assets Open Air Format Well-positioned for consumers to access essential goods and services; locations facilitate last mile delivery and provide easy BOPIS and curbside pickup Balance Sheet Significant cash balance (~$152M), and $800M available under our revolving credit facility; debt consists entirely of single asset, non-recourse mortgages Opportunity For Growth 95% leased same-property occupancy compared to peak of 98% in 2018; visible growth from leases signed but not yet commenced expected to generate an additional $29M of future gross annual rent

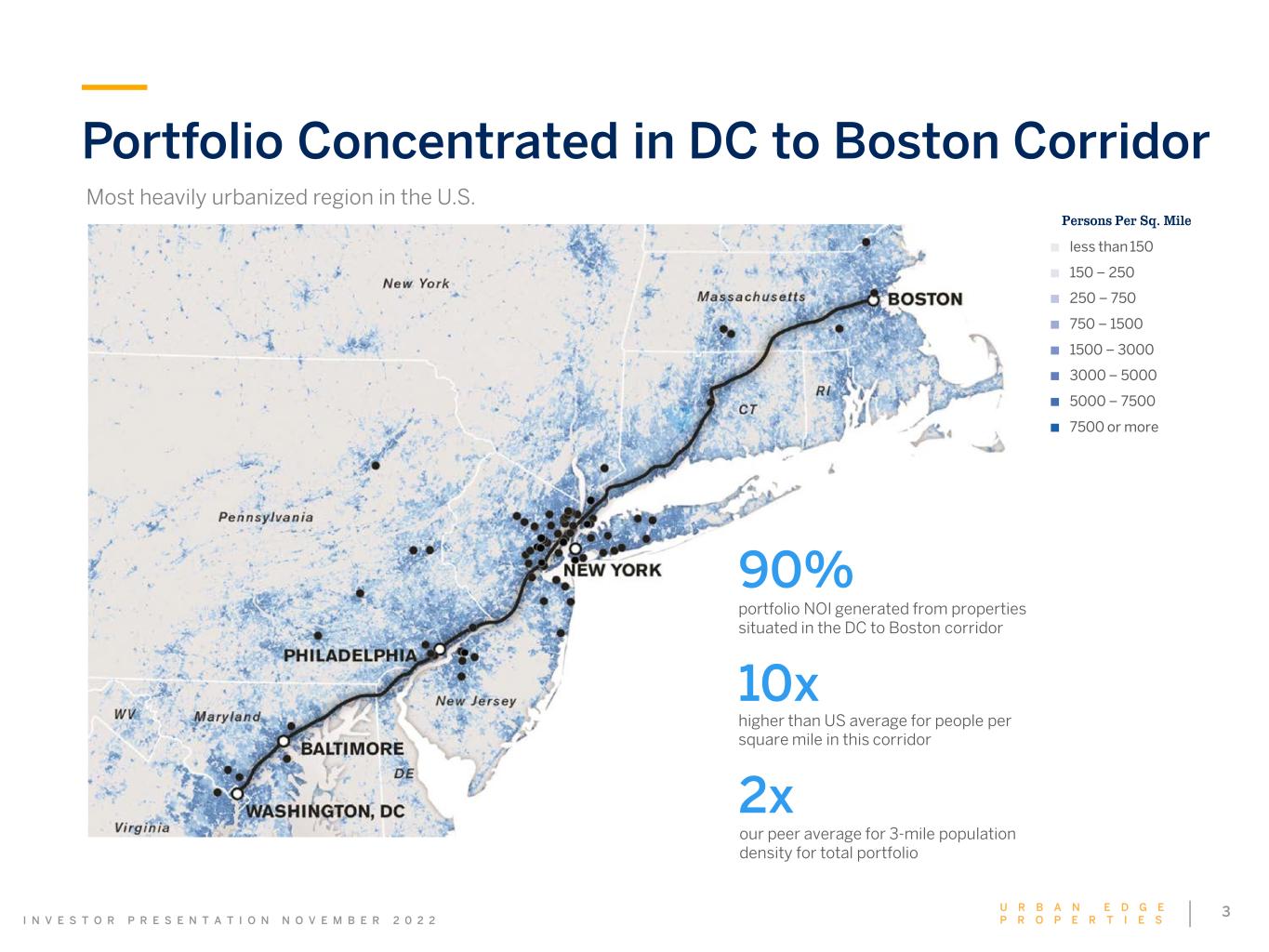

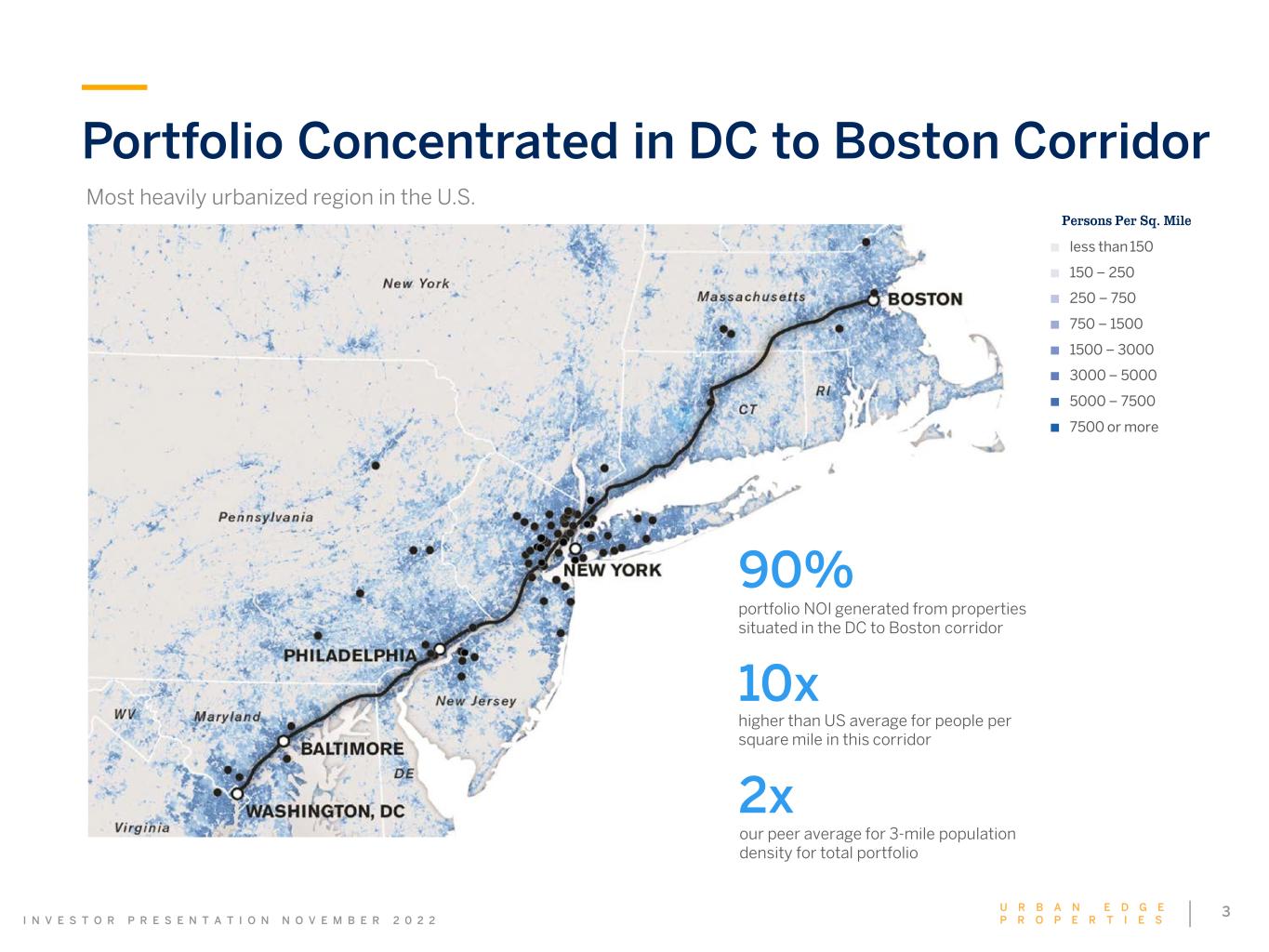

I N V E S T O R P R E S E N T A T I O N 3U R B A N E D G E P R O P E R T I E SI N V E S T O R P R E S E N T A T I O N N O V E M B E R 2 0 2 2 Portfolio Concentrated in DC to Boston Corridor Most heavily urbanized region in the U.S. Persons Per Sq. Mile ■ less than 150 ■ 150 – 250 ■ 250 – 750 ■ 750 – 1500 ■ 1500 – 3000 ■ 3000 – 5000 ■ 5000 – 7500 ■ 7500 or more 90% portfolio NOI generated from properties situated in the DC to Boston corridor 2x our peer average for 3-mile population density for total portfolio 10x higher than US average for people per square mile in this corridor

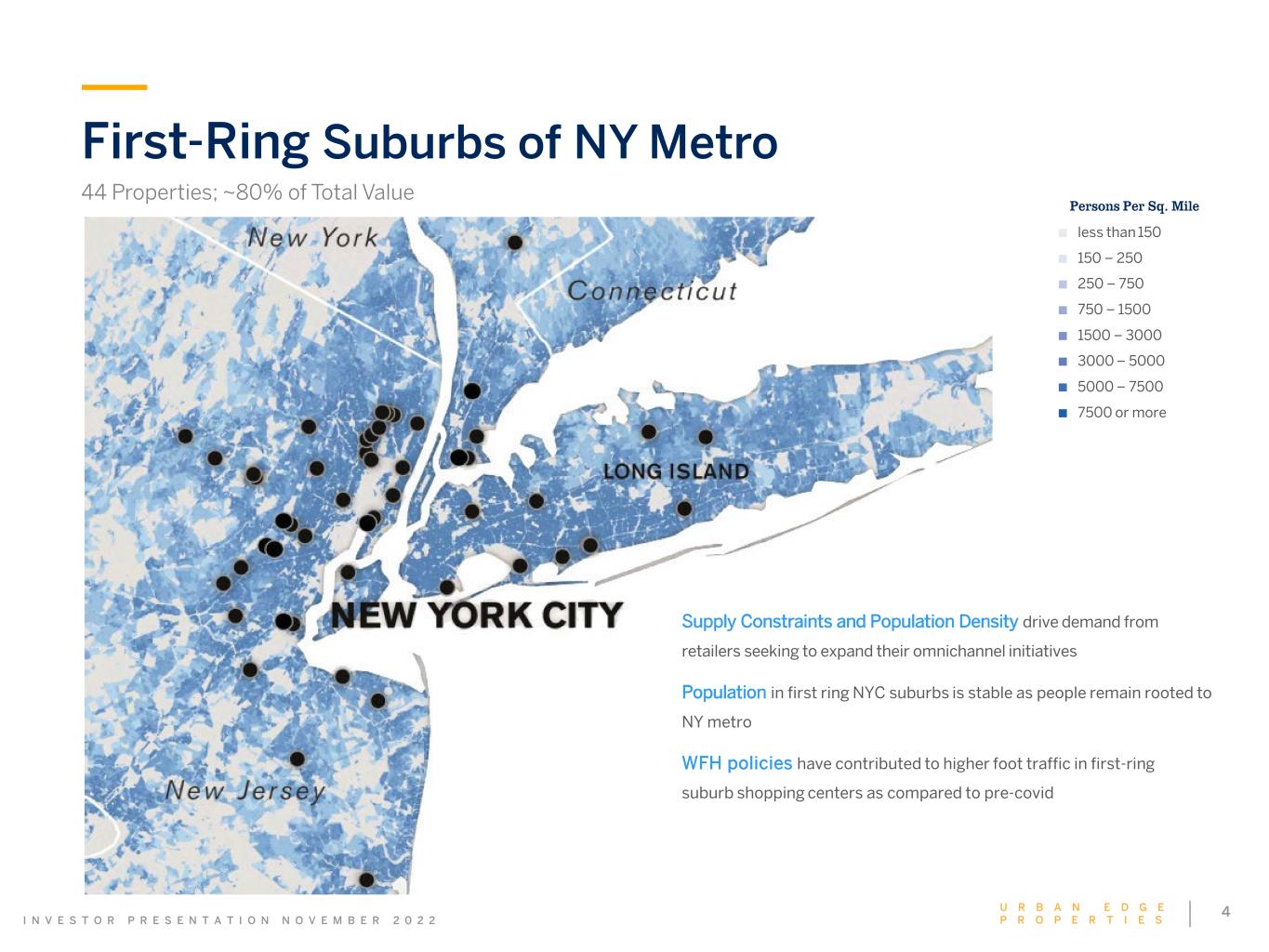

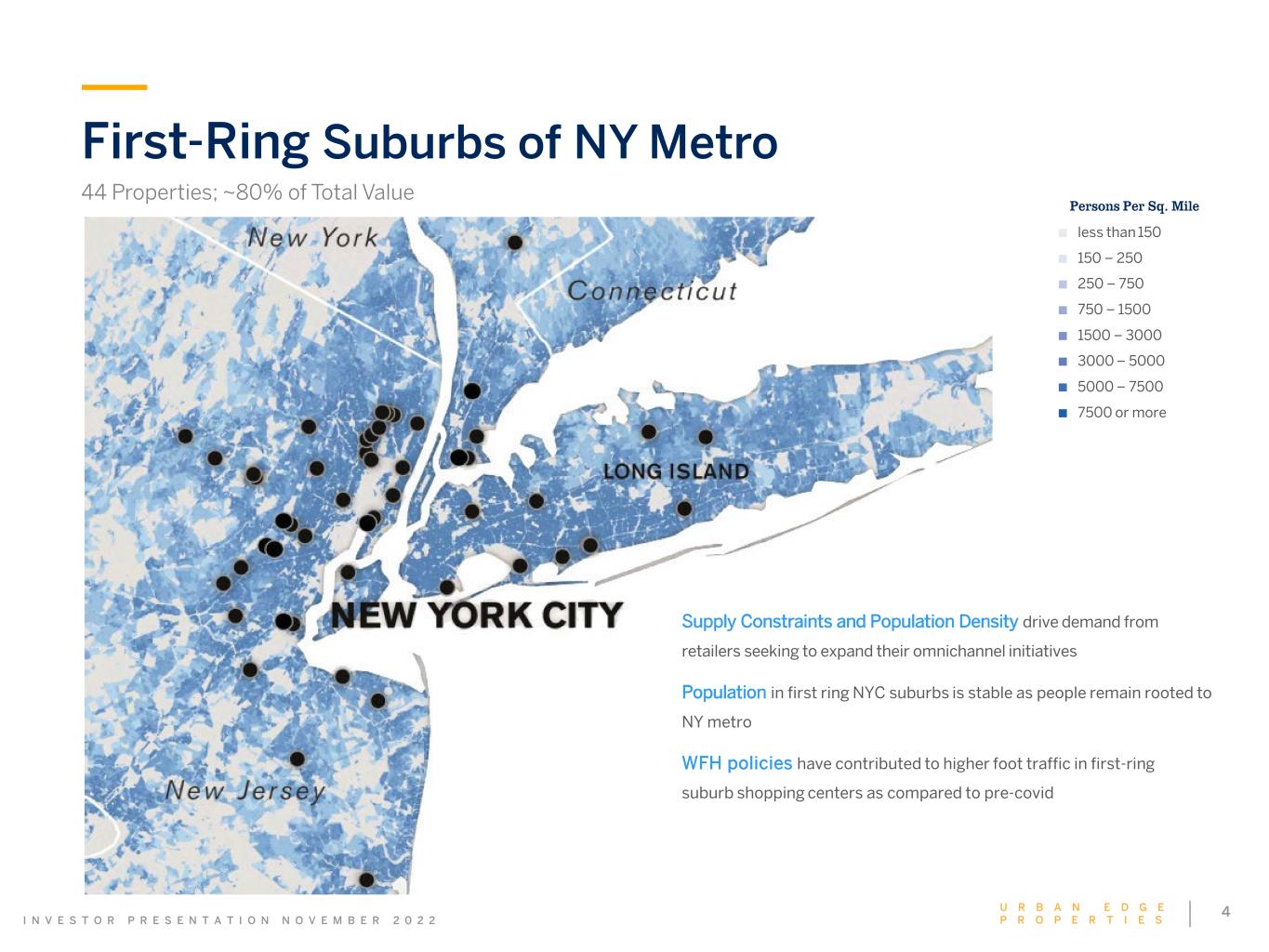

I N V E S T O R P R E S E N T A T I O N 4U R B A N E D G E P R O P E R T I E SI N V E S T O R P R E S E N T A T I O N N O V E M B E R 2 0 2 2 First-Ring Suburbs of NY Metro 44 Properties; ~80% of Total Value Persons Per Sq. Mile ■ less than 150 ■ 150 – 250 ■ 250 – 750 ■ 750 – 1500 ■ 1500 – 3000 ■ 3000 – 5000 ■ 5000 – 7500 ■ 7500 or more Supply Constraints and Population Density drive demand from retailers seeking to expand their omnichannel initiatives Population in first ring NYC suburbs is stable as people remain rooted to NY metro WFH policies have contributed to higher foot traffic in first-ring suburb shopping centers as compared to pre-covid

5U R B A N E D G E P R O P E R T I E SI N V E S T O R P R E S E N T A T I O N N O V E M B E R 2 0 2 2 • FFO as Adjusted was $0.30/share in 3Q22, up $0.02/share or 8% compared to 3Q21 • Executed 36 new leases, renewals and options totaling 308,000 sf in 3Q22 • Total liquidity of ~$952 million, comprised of $152 million of cash as of 9/30/22 and $800 million available under our line of credit • SP leased occupancy was 94.7%, up 180 bps compared to 3Q21 , down 20 bps compared to 2Q22 • Approximately $29 million of future annual gross rent (12% of current NOI) from signed leases not yet rent commenced • Executed 139K sf lease with Target at Bruckner Commons in October • Leasing pipeline includes approximately 1 million square feet, representing an additional 10% of annualized NOI • $261 million of active redevelopment projects under way, $175 million remains to be funded, expected to generate a 10% unlevered yield • Active projects are lower risk with average investments of ~$11 million per project with anchor leases executed prior to construction • Significant value creation opportunity from monetizing land parcels where highest and best use is industrial, medical office, and/or residential Highlights Recent Results Leasing Activity Development & Redevelopment

6U R B A N E D G E P R O P E R T I E SI N V E S T O R P R E S E N T A T I O N N O V E M B E R 2 0 2 2 2022 Outlook $1.17 $1.19 Same Property NOI with Redevelopment Growth 1.5% 2.5% Issued guidance for fiscal year 2022 as part of our third quarter earnings release. 2022 operating FFO is projected to increase year over year by 8%. Same Property NOI Growth 3.0% 4.0% Selected Assumptions 2022 Guidance(1) Operating FFO as Adj per diluted share (1) Does not include any items that impact FFO comparability, including loss on extinguishment of debt, acquisitions, dispositions, new financing transactions, litigation and other non-routine legal expenses, transaction costs, or any one-time items outside of the ordinary course of business.

Urban Edge Team Scott Auster SVP, Head of Leasing Cecilia Li SVP, Chief Information Officer John Villapiano SVP, Development Leigh Lyons SVP, Leasing Andrea Drazin Chief Accounting Officer Jeff Olson Chairman and Chief Executive Officer Mark Langer EVP, Chief Financial Officer Danielle De Vita EVP, Development Rob Milton EVP, & General Counsel Jeff Mooallem Chief Operating Officer Sandi Danick SVP, Leasing Paul Schiffer SVP, Leasing Dan Reilly SVP, Property Accounting Etan Bluman SVP, Finance & Investor Relations Helen Schultz SVP, Deputy General Counsel

8U R B A N E D G E P R O P E R T I E SI N V E S T O R P R E S E N T A T I O N N O V E M B E R 2 0 2 2 Top 20 Tenants By Annualized Base Rent Data as of September 30, 2022 Tenant S&P Rating # of Stores Total Square Feet (000s) ABR in Millions % of Total ABR The Home Depot A 6 809 16 6% TJX Companies A 21 670 13 5% Lowe's BBB+ 6 976 9 3% Best Buy BBB+ 8 360 9 3% Walmart AA 5 708 7 3% Burlington BB+ 7 416 7 3% Kohl's BB+ 7 633 7 2% PetSmart B 10 229 6 2% BJ's Wholesale Club BB+ 4 454 6 2% Stop & Shop NR 5 363 5 2% ShopRite NR 4 296 5 2% Target A 3 336 5 2% LA Fitness NR 6 287 5 2% Amazon / Whole Foods AA 3 145 5 2% The Gap BB 11 166 5 2% Staples NR 8 168 4 1% Bob's Discount Furniture NR 4 171 3 1% Bed Bath & Beyond CCC 7 206 3 1% Dick's Sporting Goods BBB 4 186 3 1% 24 Hour Fitness NR 1 54 3 1% Total / Weighted Average BBB+ 130 7,633 126 46%

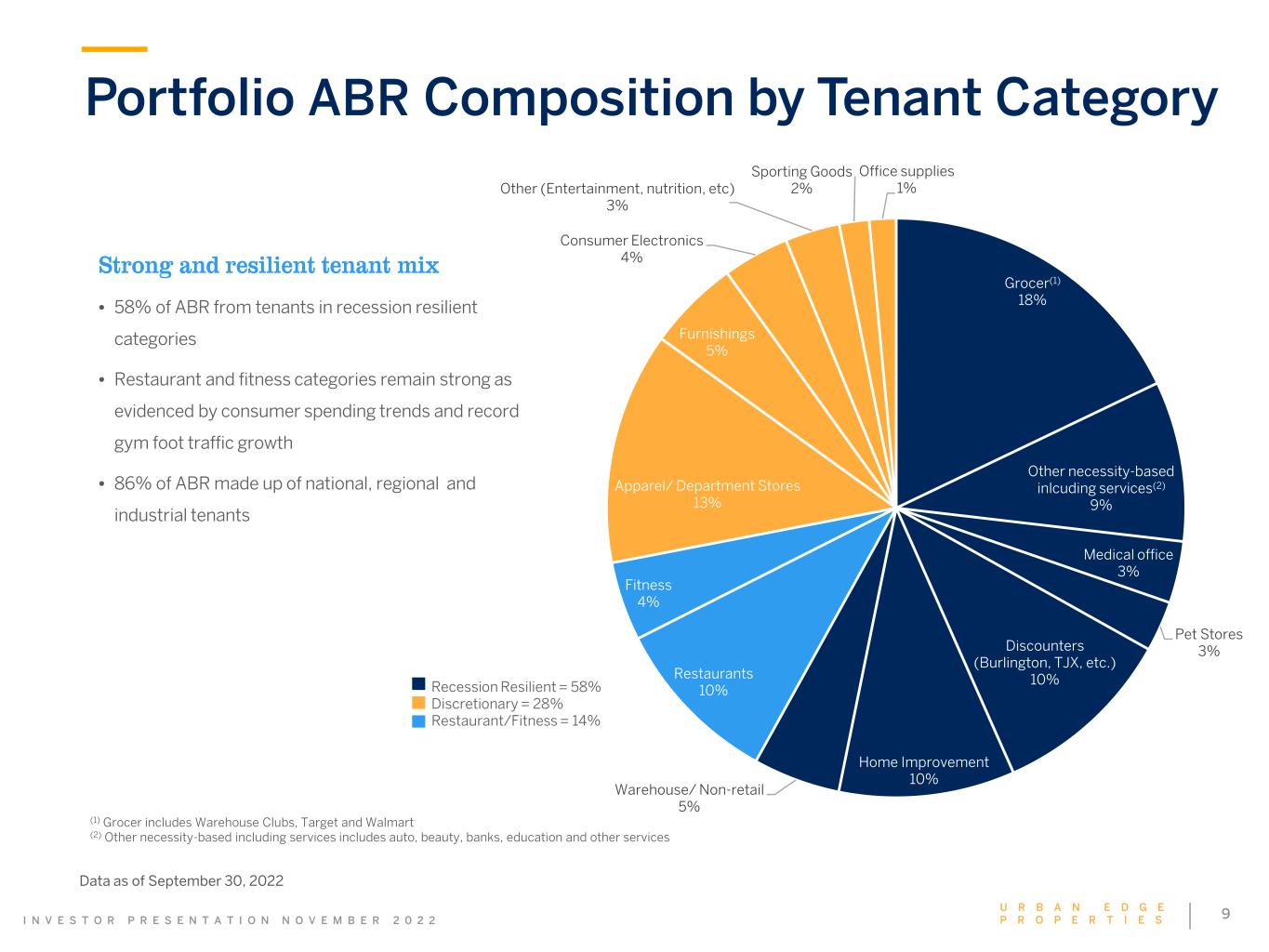

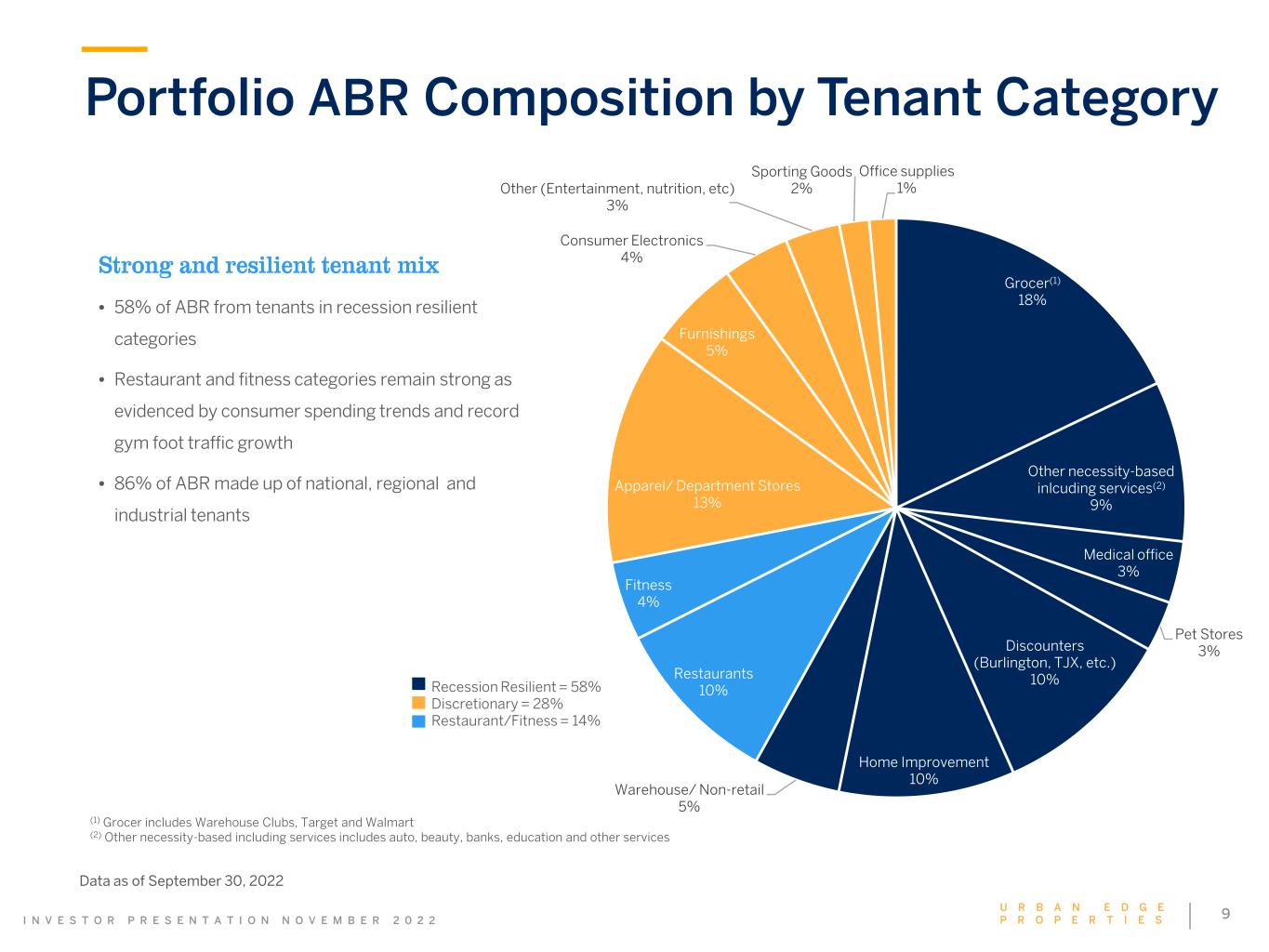

9U R B A N E D G E P R O P E R T I E SI N V E S T O R P R E S E N T A T I O N N O V E M B E R 2 0 2 2 Portfolio ABR Composition by Tenant Category Data as of September 30, 2022 (1) Grocer includes Warehouse Clubs, Target and Walmart (2) Other necessity-based including services includes auto, beauty, banks, education and other services Strong and resilient tenant mix • 58% of ABR from tenants in recession resilient categories • Restaurant and fitness categories remain strong as evidenced by consumer spending trends and record gym foot traffic growth • 86% of ABR made up of national, regional and industrial tenants Grocer(1) 18% Other necessity-based inlcuding services(2) 9% Medical office 3% Pet Stores 3%Discounters (Burlington, TJX, etc.) 10% Home Improvement 10% Warehouse/ Non-retail 5% Restaurants 10% Fitness 4% Apparel/ Department Stores 13% Furnishings 5% Consumer Electronics 4% Other (Entertainment, nutrition, etc) 3% Sporting Goods 2% Office supplies 1% Recession Resilient = 58% Discretionary = 28% Restaurant/Fitness = 14%

10U R B A N E D G E P R O P E R T I E SI N V E S T O R P R E S E N T A T I O N N O V E M B E R 2 0 2 2 Cash Flow Stream is Stronger from New Anchors Note: Percentages shown reflect portfolio value by asset type Industrial/Self-Storage 7% Lodi Route 17 Grocery Anchored Assets 65% Bergen Town Center Home Improvement Anchored 10% West Branch Commons Other Assets 18% (Discounters/Gyms/etc) Kearny CommonsTonnelle Commons

11U R B A N E D G E P R O P E R T I E SI N V E S T O R P R E S E N T A T I O N N O V E M B E R 2 0 2 2 LEASING

12U R B A N E D G E P R O P E R T I E SI N V E S T O R P R E S E N T A T I O N N O V E M B E R 2 0 2 2 Retailers are growing their omnichannel platforms and leasing demand continues to be strong. • ~60% of the top 500 retail chains offered curbside pickup up in 2021, up from 10% in 2019. • ~80% of the top 500 retail chains offered buy online, pick up in store in 2021, up from 70% in 2019. • The cost of online advertising and shipping has increased significantly making local store fulfillment more desirable. • U.S. retail vacancy fell to 6.1% in the second quarter, the lowest level in at least 15 years, with little new construction helping market rent growth. Retail Update During the second quarter, Dick’s stores enabled over 90% of total sales. Target fulfilled more than 95% of its second-quarter sales through its stores In 2Q22, ~60% of Best Buy online sales were either picked up in stores or shipped from a store. During 2Q22, ~37% of Kohl’s digital sales were fulfilled by stores. More than 50% of online orders were fulfilled through Home Depot stores in the second quarter. Walmart stores have become hybrid, serving as both stores and fulfillment centers. They have increased the volume of orders fulfilled by stores 40% versus one year ago. Note: Data per respective 2Q22 Earnings Calls (1) Includes retailers’ websites and partnerships with delivery apps Nearly 100% of our retail assets have tenants with omnichannel offerings(1)

13U R B A N E D G E P R O P E R T I E SI N V E S T O R P R E S E N T A T I O N N O V E M B E R 2 0 2 2 Leases Executed in 2022

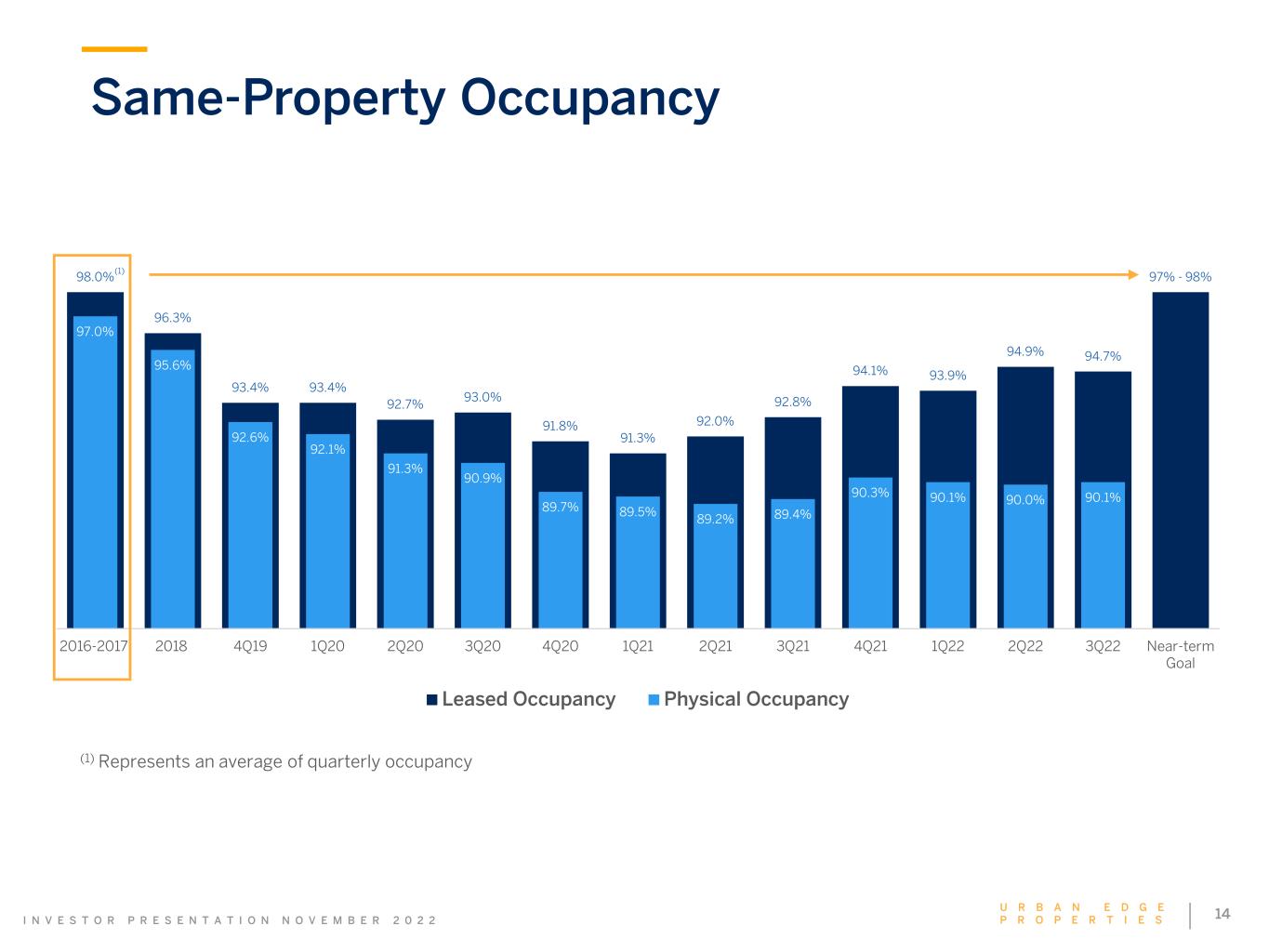

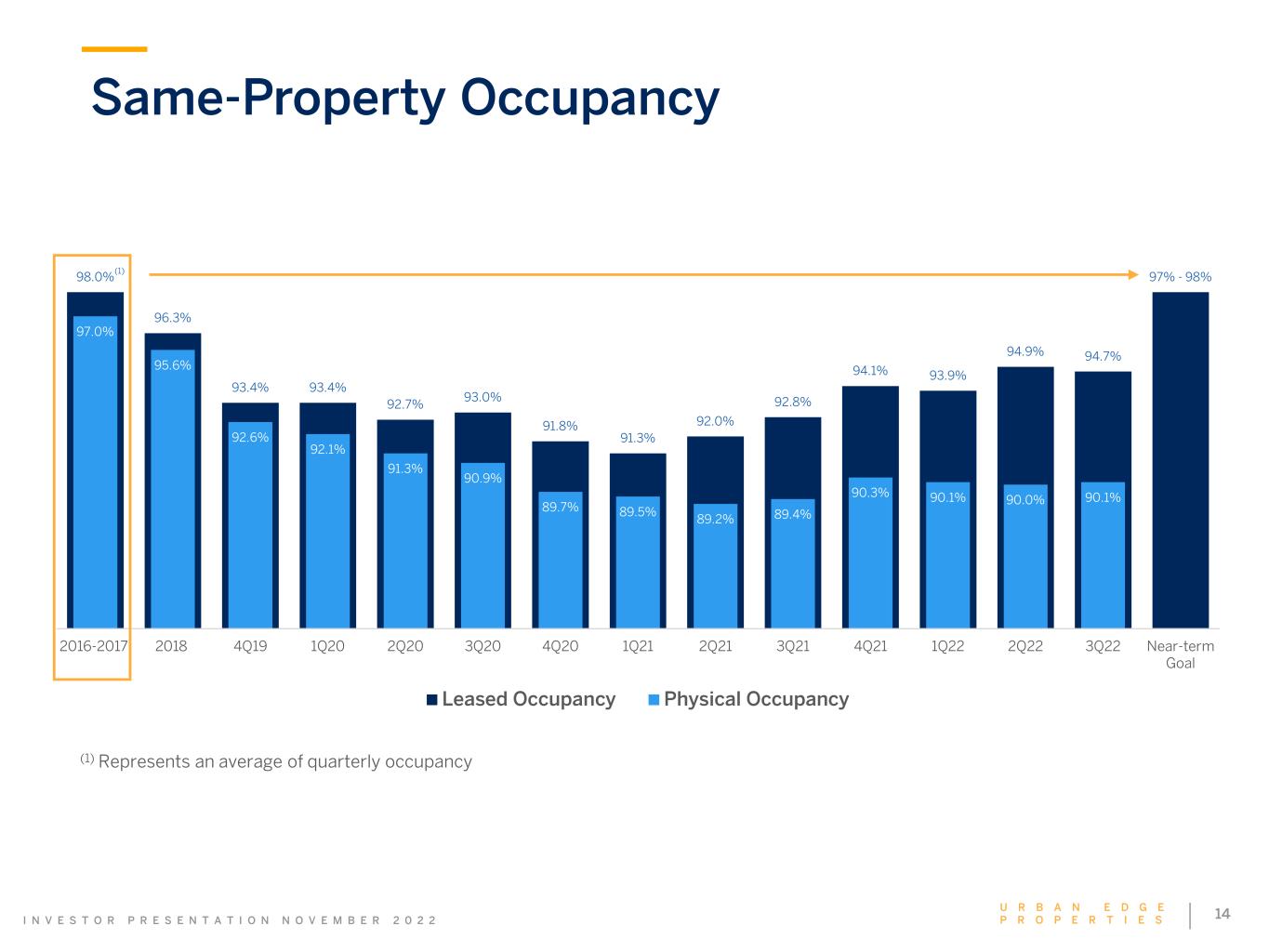

14U R B A N E D G E P R O P E R T I E SI N V E S T O R P R E S E N T A T I O N N O V E M B E R 2 0 2 2 Same-Property Occupancy 98.0% 96.3% 93.4% 93.4% 92.7% 93.0% 91.8% 91.3% 92.0% 92.8% 94.1% 93.9% 94.9% 94.7% 97% - 98% 97.0% 95.6% 92.6% 92.1% 91.3% 90.9% 89.7% 89.5% 89.2% 89.4% 90.3% 90.1% 90.0% 90.1% 2016-2017 2018 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 Near-term Goal Leased Occupancy Physical Occupancy (1) Represents an average of quarterly occupancy (1)

15U R B A N E D G E P R O P E R T I E SI N V E S T O R P R E S E N T A T I O N N O V E M B E R 2 0 2 2 Leases Executed But Not Yet Rent Commenced CityMD Morris Plains, NJ Est Stabilization 2Q23 Approximately $29M of future annual gross rent from leases executed, but not yet rent commenced will provide significant earnings growth over the upcoming years. Approximately $23M of this amount is being driven by leases included as part of our Active Redevelopment projects. National, regional, and industrial tenants represent 81% of the leased but not yet rent commenced pipeline. Briarcliff Commons Montehiedra 0.4 6.7 13.3 19.9 23.1 0.2 4.3 5.9 6.1 6.1 $0 $5 $10 $15 $20 $25 $30 2022 2023 2024 2025 2026 Leases included in redevelopment projects Other leases $29.2M $26.0M $19.2M $11.0M $0.6M Marlton Commons Walgreens San Juan, PR Est Stabilization 1Q23 First Watch Marlton, NJ Est Stabilization 3Q24 Note: Represents total gross rent on vacant spaces and incremental rent on spaces still occupied

16U R B A N E D G E P R O P E R T I E SI N V E S T O R P R E S E N T A T I O N N O V E M B E R 2 0 2 2 DEVELOPMENT

17U R B A N E D G E P R O P E R T I E SI N V E S T O R P R E S E N T A T I O N N O V E M B E R 2 0 2 2 Development Update Featured Projects: Active Project Est Gross Cost ($000s) Target Stabilization Status Bergen Town Center (Phase B) $44,300 2Q25 Ground-up development for 80K sf Hackensack Meridian Health on outparcel facing Rt 4 Bruckner Commons 38,700 2Q25 Re-tenanting former Kmart box with Target Bergen Town Center (Phase A) 25,600 4Q22 Re-tenanting former Century 21 box with Kohl’s Huntington Commons (Phase A) 23,000 4Q22 Re-tenanting former Kmart box with ShopRite and Marshalls Las Catalinas 12,900 2Q23 Re-tenanting former Kmart box with Sector Sixty6 The Outlets at Montehiedra (Phase C) 12,600 3Q24 Demising and re-tenanting former Kmart box with Ralph’s Food Warehouse and Urology Hub Broomall Commons (Phase B) 10,300 4Q23 Re-tenanting 19K sf with Nemours Children’s Hospital and remaining 41K sf of former Giant box Hudson Mall (Phase A) 9,700 1Q24 Re-tenanting former Toys "R" Us box with national retailer Shops at Bruckner (Phase B) 9,100 2Q23 Re-tenanting with Aldi and Lot Less • $261 million of active projects as of September 30, 2022, with $175 million remaining to be funded • Expecting 10% unlevered yield • Upgrading large vacant spaces with grocers, discounters, entertainment and medical uses

18U R B A N E D G E P R O P E R T I E SI N V E S T O R P R E S E N T A T I O N N O V E M B E R 2 0 2 2 Bruckner Commons | Bronx, NY Re-tenanting former Kmart box with Target Target Stabilization 2Q25 BEFORE AFTER

19U R B A N E D G E P R O P E R T I E SI N V E S T O R P R E S E N T A T I O N N O V E M B E R 2 0 2 2 Bruckner Commons | Bronx, NY

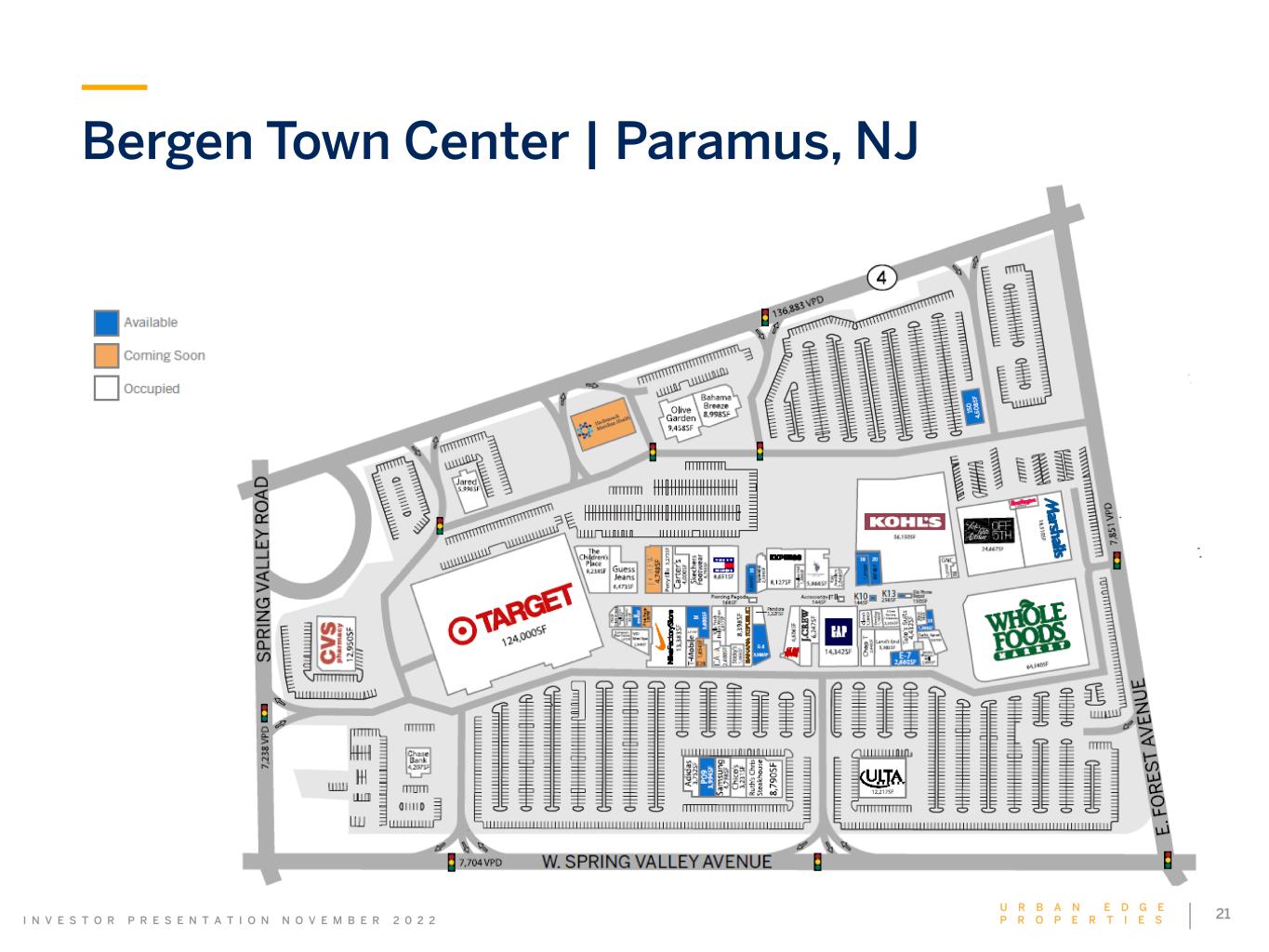

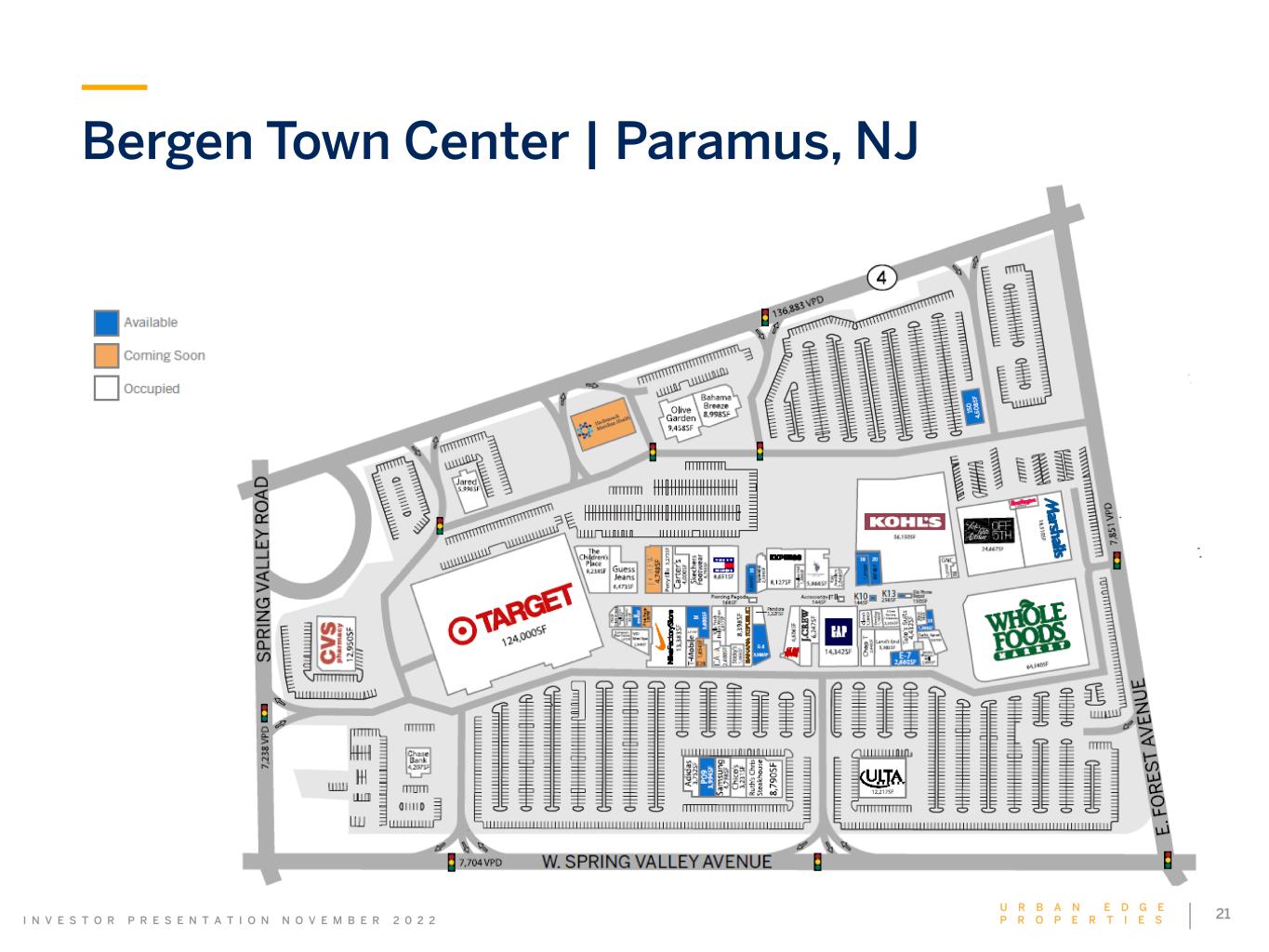

20U R B A N E D G E P R O P E R T I E SI N V E S T O R P R E S E N T A T I O N N O V E M B E R 2 0 2 2 Bergen Town Center | Paramus, NJ Phase B: Re-tenant former Century 21 box with Kohl’s Opened October 2022 Phase A: Ground-up development of an 80,000 sf medical office building for Hackensack Meridian Health on vacant outparcel facing Route 4 Target Stabilization 2Q25

21U R B A N E D G E P R O P E R T I E SI N V E S T O R P R E S E N T A T I O N N O V E M B E R 2 0 2 2 Bergen Town Center | Paramus, NJ

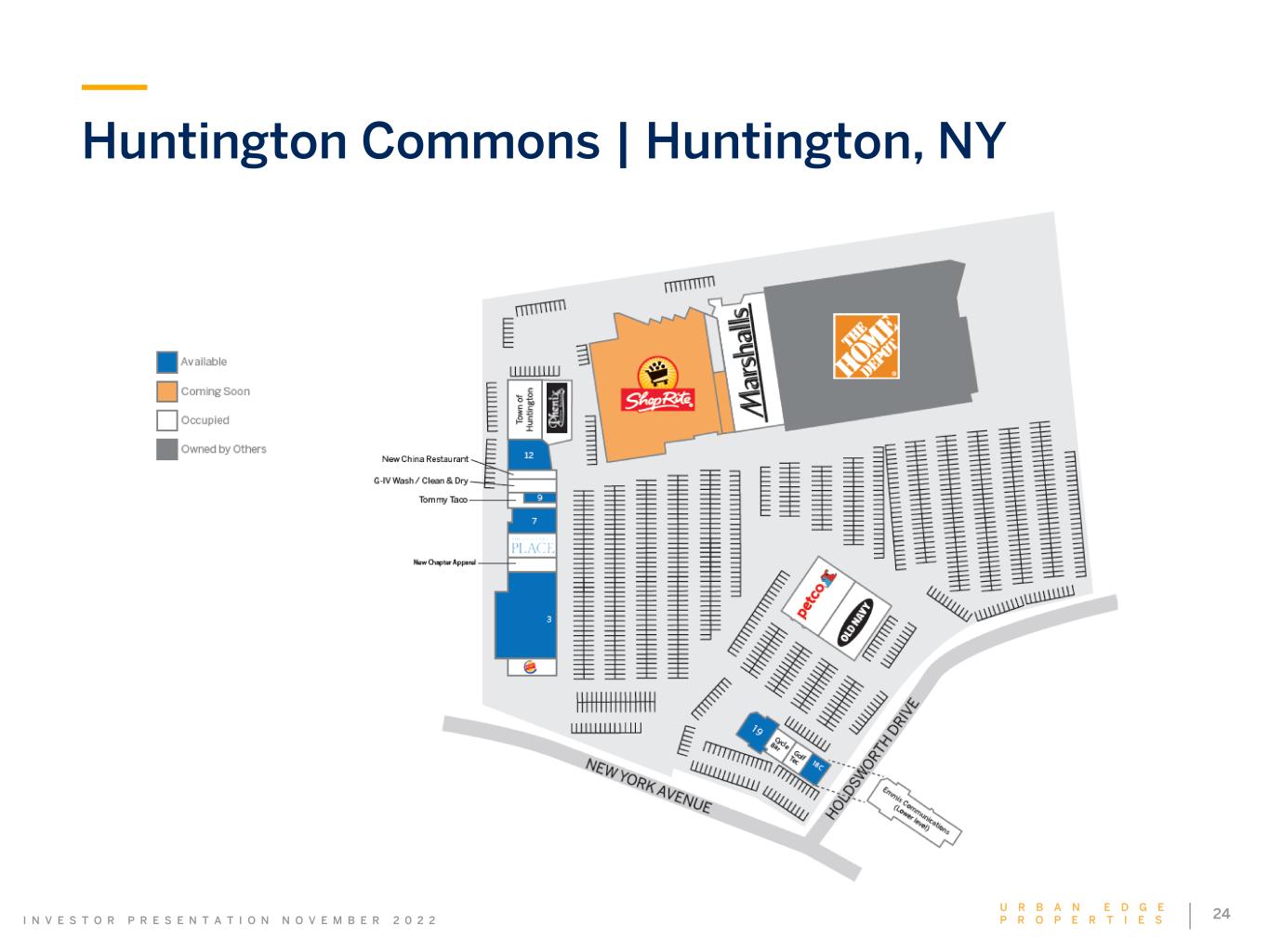

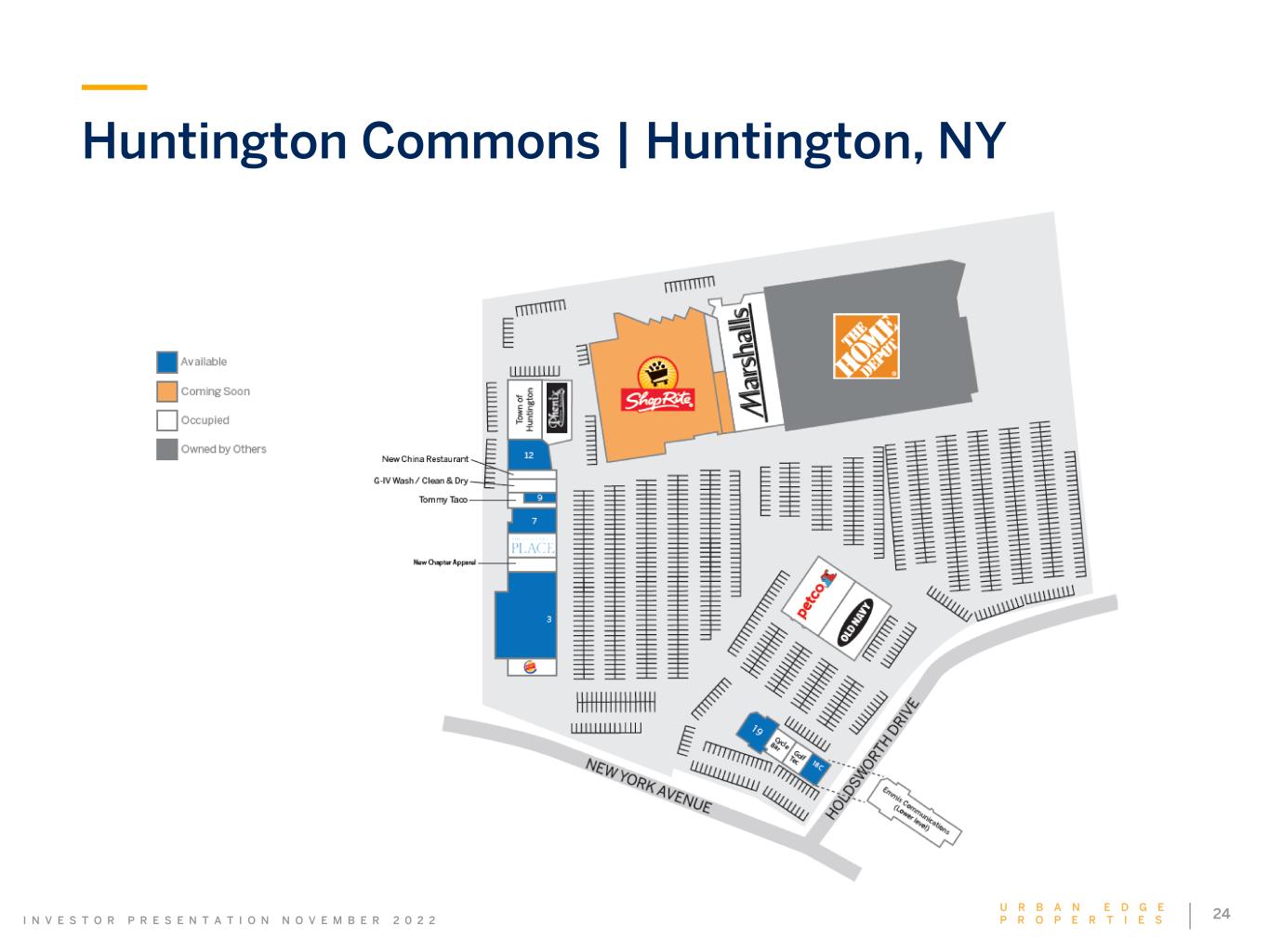

22U R B A N E D G E P R O P E R T I E SI N V E S T O R P R E S E N T A T I O N N O V E M B E R 2 0 2 2 Huntington Commons | Huntington, NY BEFORE AFTER Phase A: Re-tenanting former Kmart box with ShopRite and Marshalls relocation Target Stabilization 4Q22

23U R B A N E D G E P R O P E R T I E SI N V E S T O R P R E S E N T A T I O N N O V E M B E R 2 0 2 2 Huntington Commons | Huntington, NY AFTER BEFORE Phase B: Re-tenant relocated Marshalls box, small shops and upgraded façade, parking, and landscaping Target Stabilization 4Q23

24U R B A N E D G E P R O P E R T I E SI N V E S T O R P R E S E N T A T I O N N O V E M B E R 2 0 2 2 Huntington Commons | Huntington, NY

25U R B A N E D G E P R O P E R T I E SI N V E S T O R P R E S E N T A T I O N N O V E M B E R 2 0 2 2 Las Catalinas | Caguas, Puerto Rico AFTER BEFORE Re-tenanting 122,000± sf Kmart box with Sector Sixty6 Target Stabilization 2Q23

26U R B A N E D G E P R O P E R T I E SI N V E S T O R P R E S E N T A T I O N N O V E M B E R 2 0 2 2 Las Catalinas | Caguas, Puerto Rico

27U R B A N E D G E P R O P E R T I E SI N V E S T O R P R E S E N T A T I O N N O V E M B E R 2 0 2 2 The Outlets at Montehiedra | San Juan, Puerto Rico Phase C: Demising and re-tenanting former Kmart box with Ralph’s Food Warehouse and Urology Hub. Target Stabilization 3Q24 BEFORE AFTER

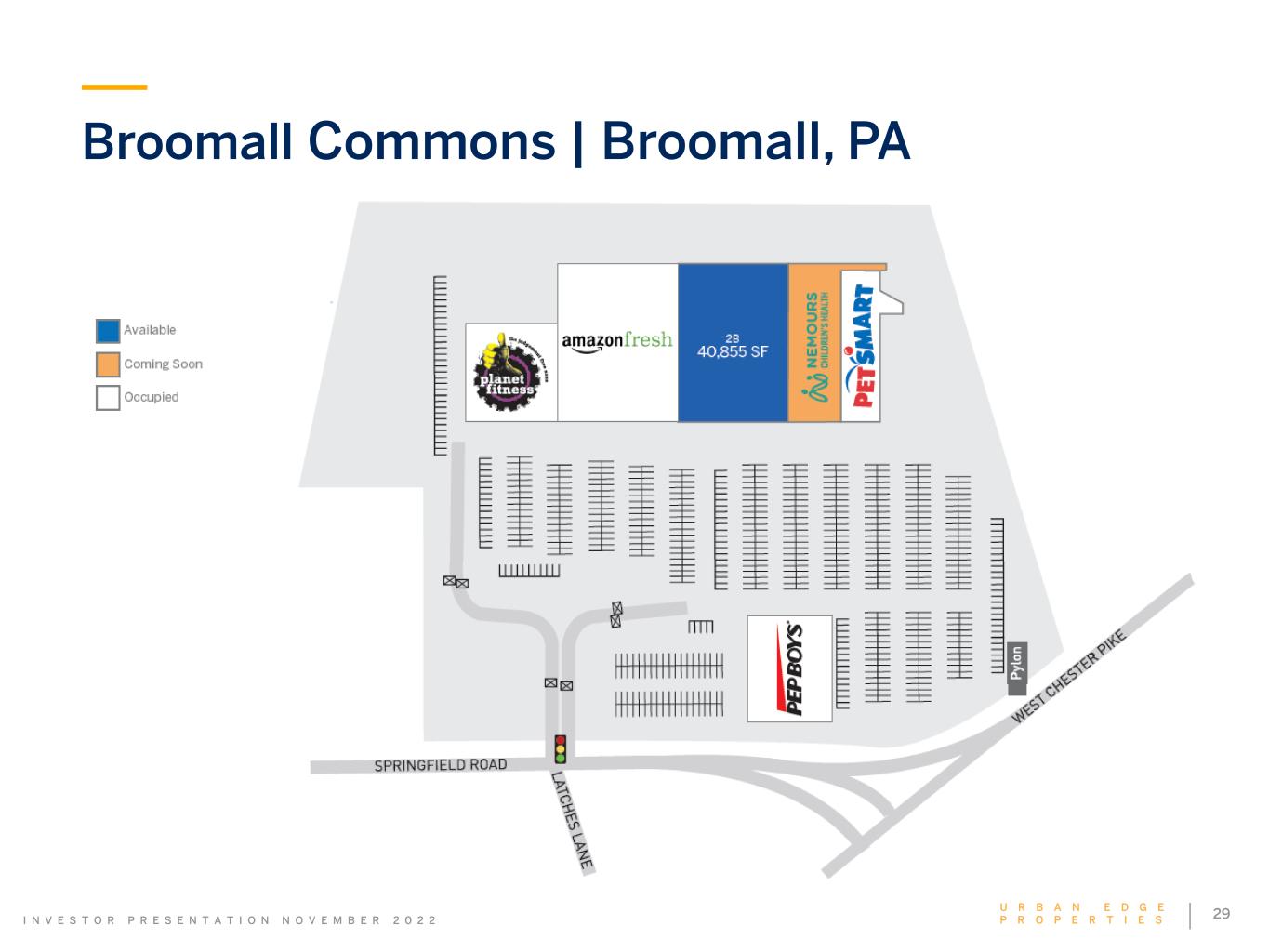

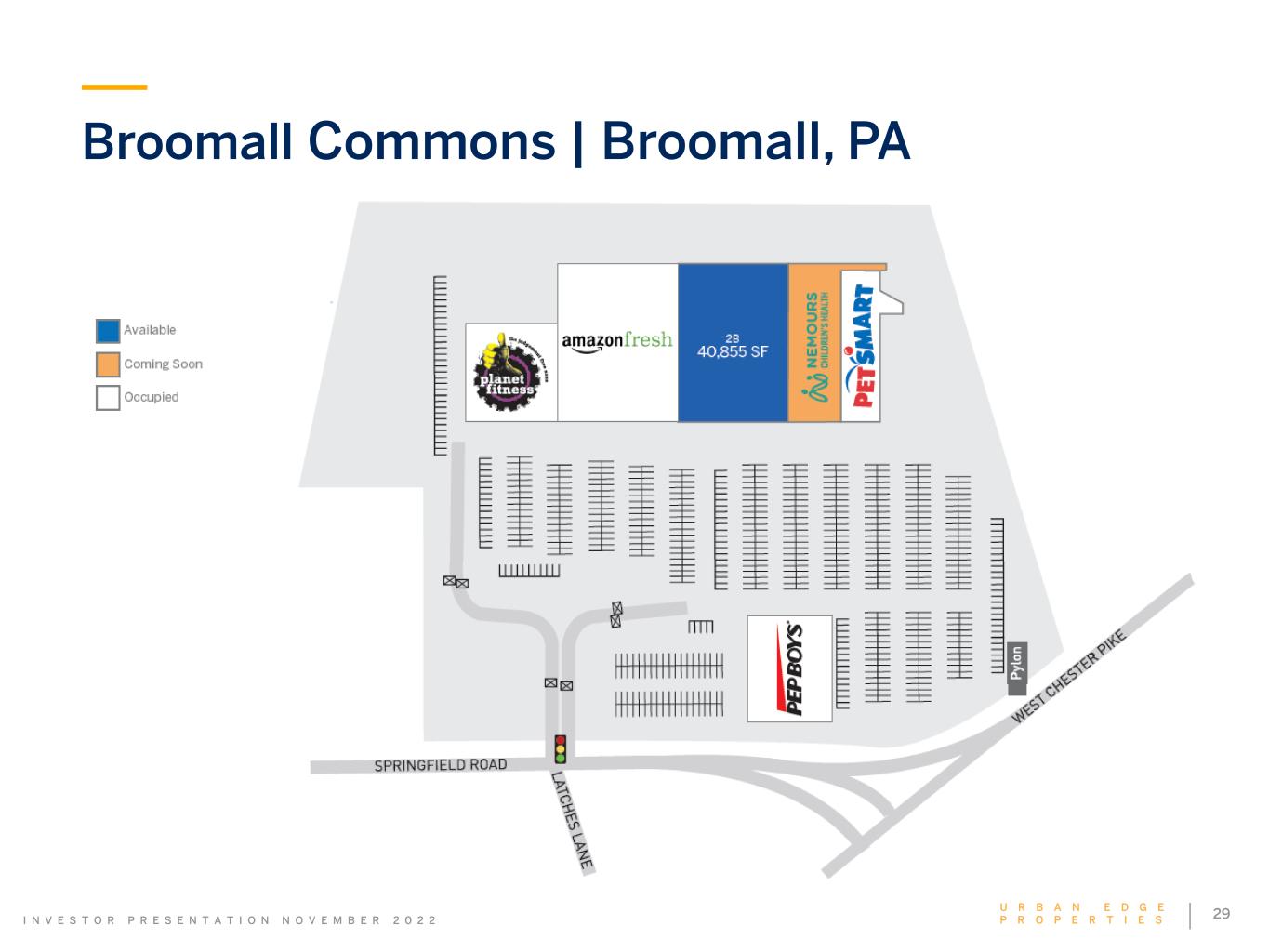

28U R B A N E D G E P R O P E R T I E SI N V E S T O R P R E S E N T A T I O N N O V E M B E R 2 0 2 2 Broomall Commons | Broomall, PA Phase B: Re-tenanting 19K sf with Nemours Children’s Hospital and remaining 41K sf of former Giant box Target Stabilization 4Q23 AFTER BEFORE

29U R B A N E D G E P R O P E R T I E SI N V E S T O R P R E S E N T A T I O N N O V E M B E R 2 0 2 2 Broomall Commons | Broomall, PA

30U R B A N E D G E P R O P E R T I E SI N V E S T O R P R E S E N T A T I O N N O V E M B E R 2 0 2 2 The Shops at Bruckner | Bronx, NY AFTER BEFORE Phase A: Relocating Jimmy Jazz, adding Five Below Target Stabilization 4Q22 Phase B: Re-tenanting former Fallas space with Aldi and Lot Less Target Stabilization 2Q23

31U R B A N E D G E P R O P E R T I E SI N V E S T O R P R E S E N T A T I O N N O V E M B E R 2 0 2 2 The Shops at Bruckner | Bronx, NY

32U R B A N E D G E P R O P E R T I E SI N V E S T O R P R E S E N T A T I O N N O V E M B E R 2 0 2 2 Other Ongoing Projects Active Project Est Gross Cost ($000s) Target Stabilization Status Kearny Commons 11,900 4Q22 Expand by 22K sf for 10K sf Ulta (open) and small shops as well as freestanding Starbucks (open) The Outlets at Montehiedra (Phase A) 9,200 1Q23 New 14K± sf building for Walgreens and Global Mattress and a new 3K± sf pad for Arby's Huntington Commons (Phase B) 8,500 4Q23 Center repositioning and renovations Marlton Commons 7,300 3Q24 Redeveloping Friendly’s with new 10,700± sf multi-tenant pad (executed First Watch) Burnside Commons 6,900 4Q23 Re-tenanting anchor vacancy with Bingo Wholesale Shops at Bruckner (Phase A) 6,200 4Q22 Relocating Jimmy Jazz to former Carter's space and re-tenanting former Jimmy Jazz and Danice spaces with Five Below Brick Commons 4,500 3Q24 Replacing former bank with two quick service restaurants (executed Shake Shack) Huntington Commons (Phase C) 4,200 1Q24 Re-demising former Outback to create three small shop spaces; (executed CycleBar and GolfTec) Walnut Creek 3,500 4Q23 Re-tenanting former Z Gallerie with Sweetgreen (open) and remaining 4,000 sf Mt. Kisco Commons 3,100 1Q23 Converting former sit-down restaurant into a Chipotle (open) and Dunkin’ The Plaza at Cherry Hill 2,800 2Q23 Relocating and expanding Total Wine Briarcliff Commons (Phase B) 2,700 2Q23 Developing new 4,000± sf pad for CityMD The Outlets at Montehiedra (Phase B) 2,200 2Q24 Developing new 6,000± sf pad for Texas Roadhouse Yonkers Gateway Center 1,700 3Q23 Re-tenanting end cap space with Wren Kitchens Total $74,700 Enhancing value through repositioning and re-tenanting of previous vacancies Upgrading tenancy with vibrant quick-service restaurants Unlocking undeveloped land through the creation of new buildings and pads totaling 66K of new sf

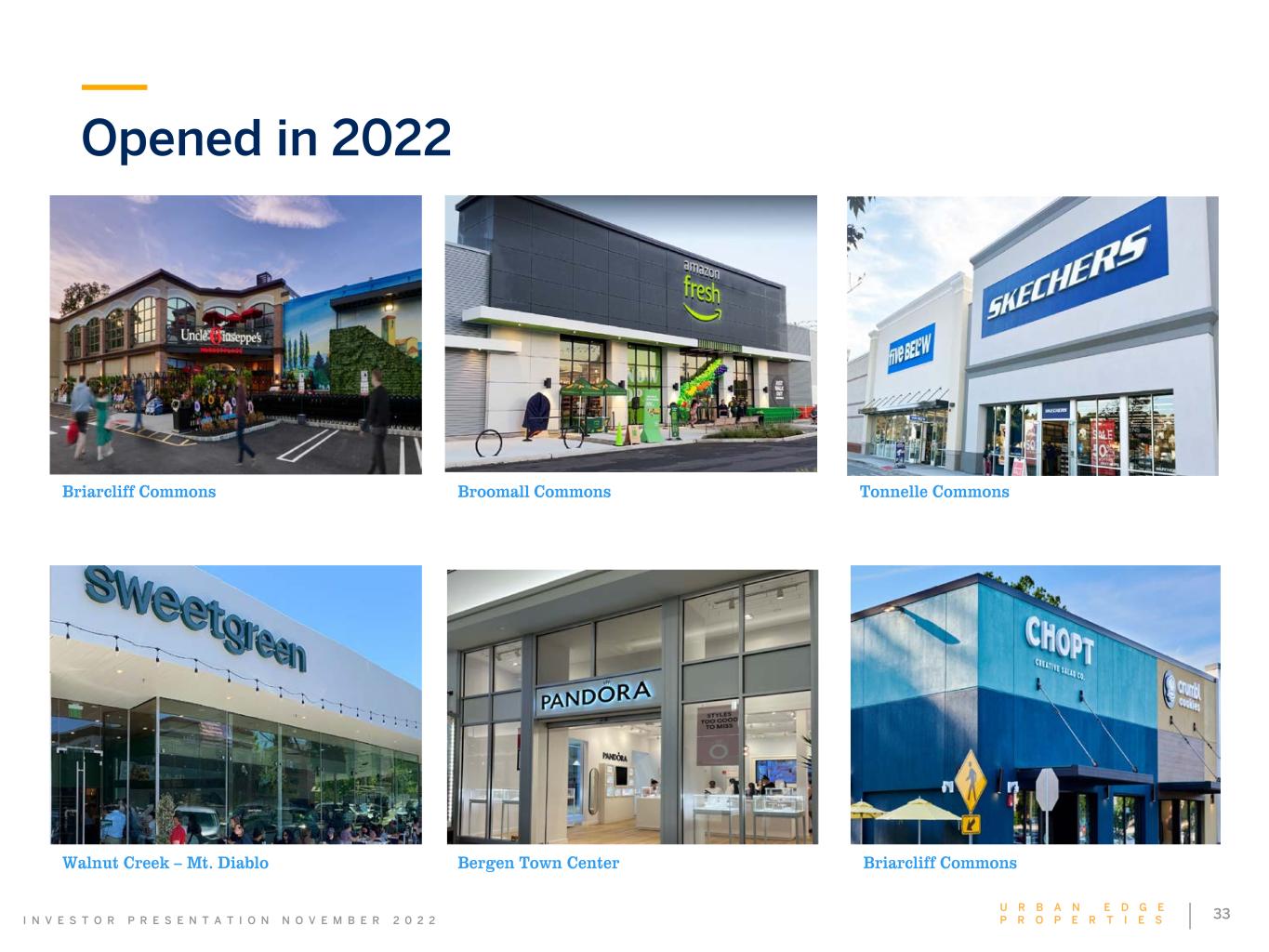

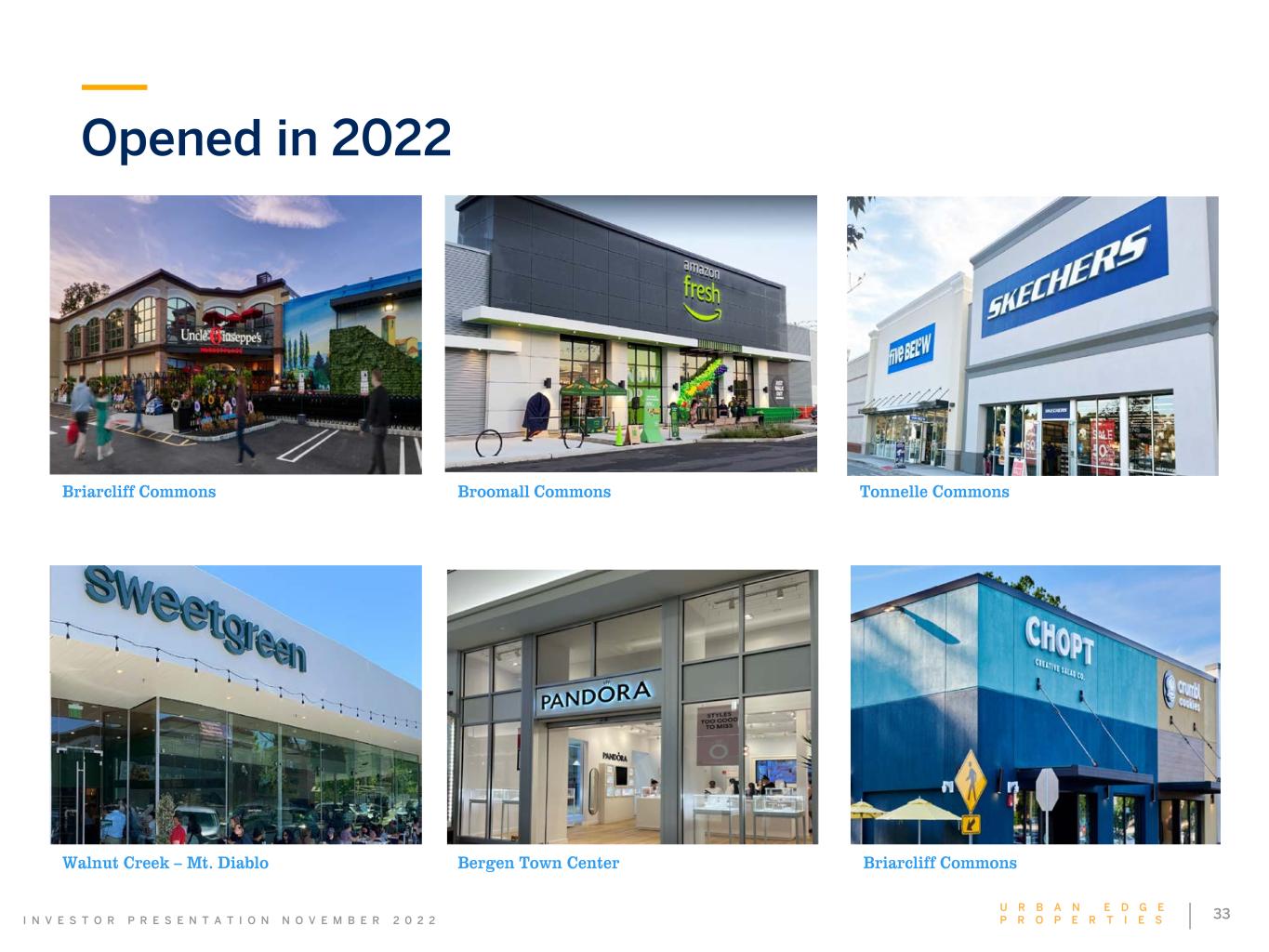

33U R B A N E D G E P R O P E R T I E SI N V E S T O R P R E S E N T A T I O N N O V E M B E R 2 0 2 2 Opened in 2022 Briarcliff Commons Broomall Commons Tonnelle Commons Walnut Creek – Mt. Diablo Bergen Town Center Briarcliff Commons

34U R B A N E D G E P R O P E R T I E SI N V E S T O R P R E S E N T A T I O N N O V E M B E R 2 0 2 2 ACQUISITIONS UPDATE

35U R B A N E D G E P R O P E R T I E SI N V E S T O R P R E S E N T A T I O N N O V E M B E R 2 0 2 2 Acquisition/Disposition Strategy Opportunistically target value-add assets • Assets with attractive yield and/or potential for value creation through leasing, redevelopment and repurposing • Focus on larger-scale properties, distressed/motivated sellers and special situations • Assets that are synergistic or complementary to existing properties • Generate off-market opportunities and early looks through relationships with owners, brokers, lenders and third parties Disposition focus • Smaller assets in non-core markets • Return on capital or time no longer attractive • Seek to achieve tax efficient transactions where possible via 1031 exchange Acquisition focus • D.C. to Boston with ability to target other infill submarkets with high-quality demographics • NOI growth with below market rents, above average sales and sustainable health ratios • Attractive, risk-adjusted returns

36U R B A N E D G E P R O P E R T I E SI N V E S T O R P R E S E N T A T I O N N O V E M B E R 2 0 2 2 Prior Acquisitions • 712,000 sf regional shopping center anchored by Wegmans and Costco in Glenarden, MD • Purchase price of $193.4 million • Partially funded with 10-year, $117.2 million non-recourse mortgage with a fixed interest rate of 3.39% • Initial unleveraged yield is ~6.4% and levered yield is ~11% • In active negotiations with national tenants in health & beauty and quick service restaurant categories to backfill remaining vacancy • 78,000 sf shopping center anchored by PriceRite and Planet Fitness in Hyde Park, MA • Purchase price of $32.9 million • Partially funded with 7-year, $21,5 million non-recourse mortgage with a fixed interest rate of 4.25% • Initial unleveraged yield is ~6% and levered yield is ~9% Woodmore Towne Centre – December 2021 The Shops at Riverwood – June 2022

37U R B A N E D G E P R O P E R T I E SI N V E S T O R P R E S E N T A T I O N N O V E M B E R 2 0 2 2 LIQUIDITY AND BALANCE SHEET

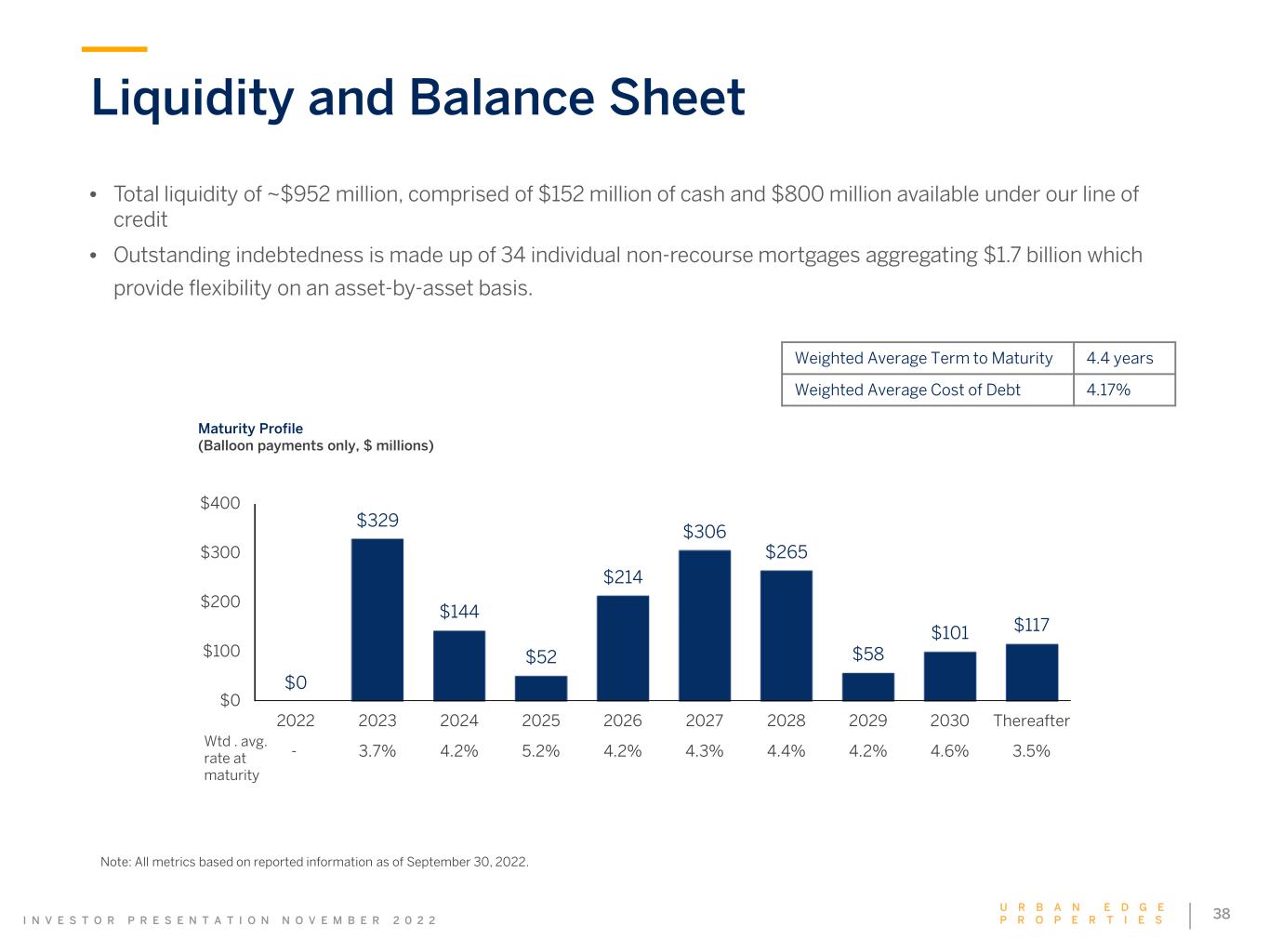

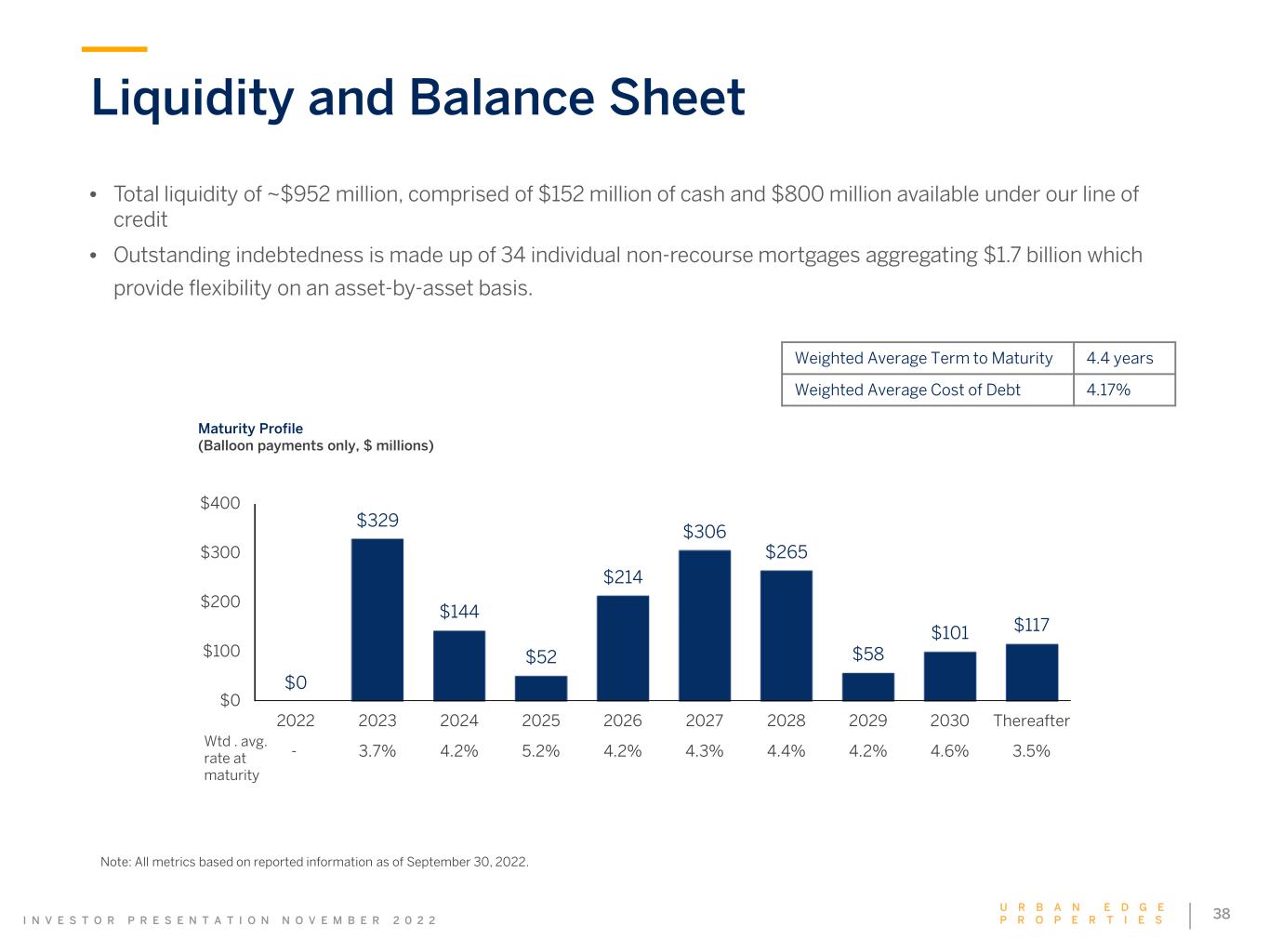

38U R B A N E D G E P R O P E R T I E SI N V E S T O R P R E S E N T A T I O N N O V E M B E R 2 0 2 2 Liquidity and Balance Sheet • Total liquidity of ~$952 million, comprised of $152 million of cash and $800 million available under our line of credit • Outstanding indebtedness is made up of 34 individual non-recourse mortgages aggregating $1.7 billion which provide flexibility on an asset-by-asset basis. Maturity Profile (Balloon payments only, $ millions) $0 $329 $144 $52 $214 $306 $265 $58 $101 $117 $0 $100 $200 $300 $400 2022 2023 2024 2025 2026 2027 2028 2029 2030 Thereafter - 3.7% 4.2% 5.2% 4.2% 4.3% 4.4% 4.2% 4.6% 3.5% Wtd . avg. rate at maturity Note: All metrics based on reported information as of September 30, 2022. Weighted Average Term to Maturity 4.4 years Weighted Average Cost of Debt 4.17%

39U R B A N E D G E P R O P E R T I E SI N V E S T O R P R E S E N T A T I O N N O V E M B E R 2 0 2 2 ENVIRONMENTAL, SOCIAL, GOVERNANCE (ESG)

40U R B A N E D G E P R O P E R T I E SI N V E S T O R P R E S E N T A T I O N N O V E M B E R 2 0 2 2 Environmental, Social and Governance (ESG) Environmental Initiatives • We have undertaken a number of initiatives that conserve energy, save water and improve waste management including: LED lighting retrofits, energy efficient roofing, renewable energy, water leak detection, smart irrigation and waste recycling programs. • Since 2015, we have reduced our scope 1 and scope 2 emissions by 27 percent. • Our new form lease includes green lease language that fosters collaboration between Urban Edge and our tenants. Social Responsibility • We regularly engage with shareholders, employees, tenants and the communities we serve to gain an understanding of their primary concerns. • We have integrated our Diversity Equity & Inclusion (“DEI”) Program with our monthly Wellness Program, with a focus on education, unconscious bias and inclusion. • We have a robust community-outreach program and encourage our employees to participate in a number of local and national charitable organizations by offering matched donations. Since 2015, we have donated over $600K to various charitable initiative Our Commitment • We are committed to maintaining sustainable operations and believe that our long-term sustainability goals will provide positive financial and environmental outcomes for shareholders, tenants, employees and the communities in which we invest. • Our internal ESG Committee, which is represented by all departments is creating a sense of purpose that promotes sustainable business practices across the enterprise. • We received our second annual Global Real Estate Sustainability Benchmark (“GRESB”) assessment score in October 2022, a 45% improvement over the prior year and above our peer group average. Corporate Governance • We are committed to sound corporate governance, which strengthens the accountability of our Board and promotes the long-term interests of our shareholders and other stakeholders. We believe that our corporate governance standards and policies yield honest, transparent and accountable trustees and executive officers. • Our ESG Committee reviews the company’s ESG strategy with the Corporate Governance and Nominating Committee of the Board of Trustees. • We utilize a risk-based approach to prioritize and allocate our efforts and resources to minimize cyber risks in alignment with the National Institute of Standards and Technology (“NIST”), Cybersecurity Framework (CSF), and Microsoft best practices.

I N V E S T O R P R E S E N T A T I O N N O V E M B E R 2 0 2 2 41U R B A N E D G E P R O P E R T I E S ESG Focus Areas Utilizing our environmental management system framework to help us achieve our environmental goals We performed a gap analysis based on our latest GRESB submission to identify the biggest opportunities to improve our oversight and management of ESG performance. Enhancing tenant engagement utilizing newly implemented communication tools Evaluating greenhouse gas reduction targets using data gathered from building technical assessments Improving diversity, equity and inclusion metrics by expanding the DEI policies in our HR practices Increasing energy, water and waste data coverage and reporting to include data maintained and controlled by tenants Further integrating ESG into the strategic planning process of each business unit Developing procedures and standards related to data collection and reporting so that ESG disclosures are appropriately supported and verified Enhancing employee awareness of ESG priorities both within and outside of their departments

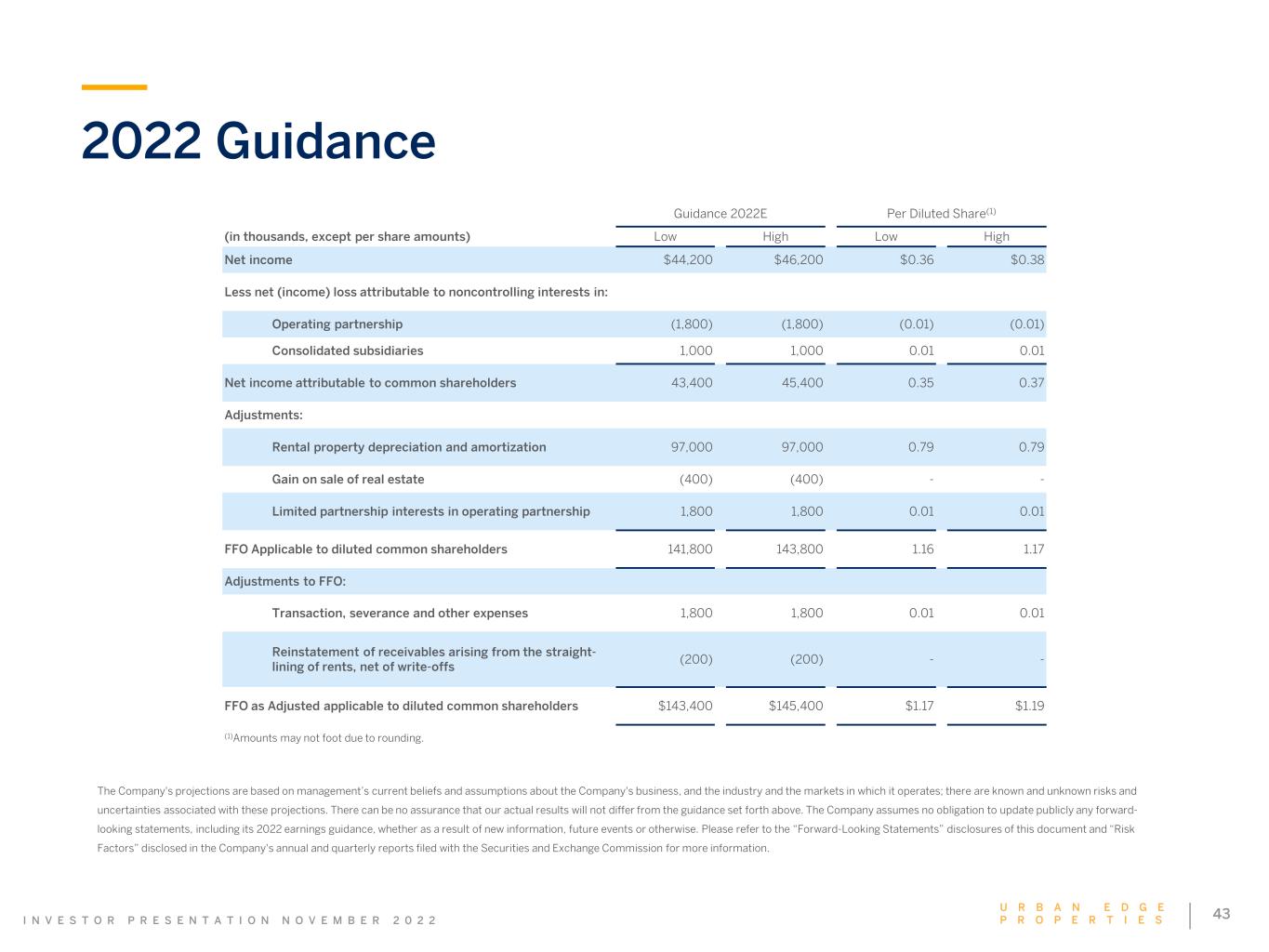

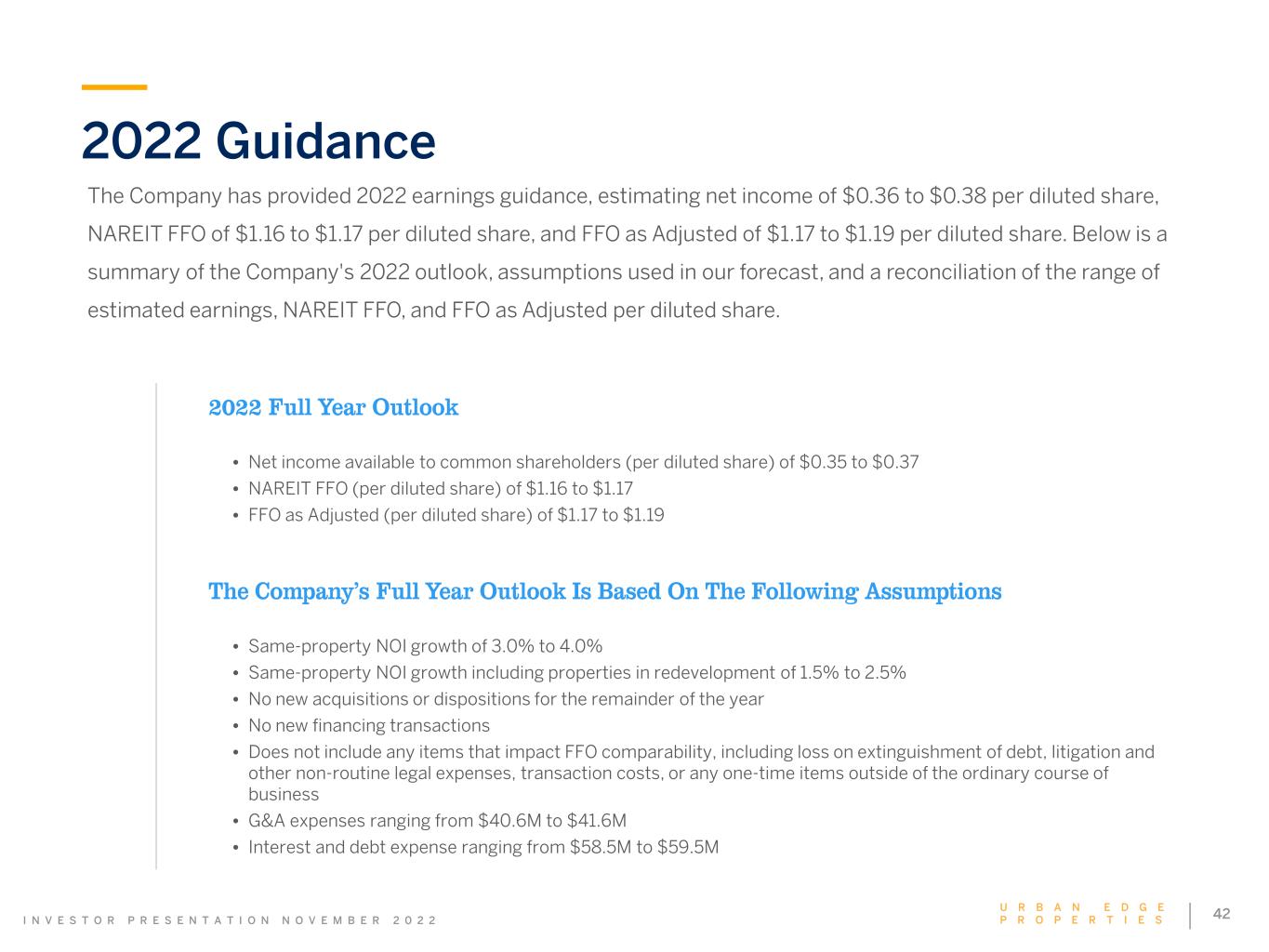

I N V E S T O R P R E S E N T A T I O N N O V E M B E R 2 0 2 2 42U R B A N E D G E P R O P E R T I E S 2022 Guidance The Company has provided 2022 earnings guidance, estimating net income of $0.36 to $0.38 per diluted share, NAREIT FFO of $1.16 to $1.17 per diluted share, and FFO as Adjusted of $1.17 to $1.19 per diluted share. Below is a summary of the Company's 2022 outlook, assumptions used in our forecast, and a reconciliation of the range of estimated earnings, NAREIT FFO, and FFO as Adjusted per diluted share. 2022 Full Year Outlook • Net income available to common shareholders (per diluted share) of $0.35 to $0.37 • NAREIT FFO (per diluted share) of $1.16 to $1.17 • FFO as Adjusted (per diluted share) of $1.17 to $1.19 The Company’s Full Year Outlook Is Based On The Following Assumptions • Same-property NOI growth of 3.0% to 4.0% • Same-property NOI growth including properties in redevelopment of 1.5% to 2.5% • No new acquisitions or dispositions for the remainder of the year • No new financing transactions • Does not include any items that impact FFO comparability, including loss on extinguishment of debt, litigation and other non-routine legal expenses, transaction costs, or any one-time items outside of the ordinary course of business • G&A expenses ranging from $40.6M to $41.6M • Interest and debt expense ranging from $58.5M to $59.5M

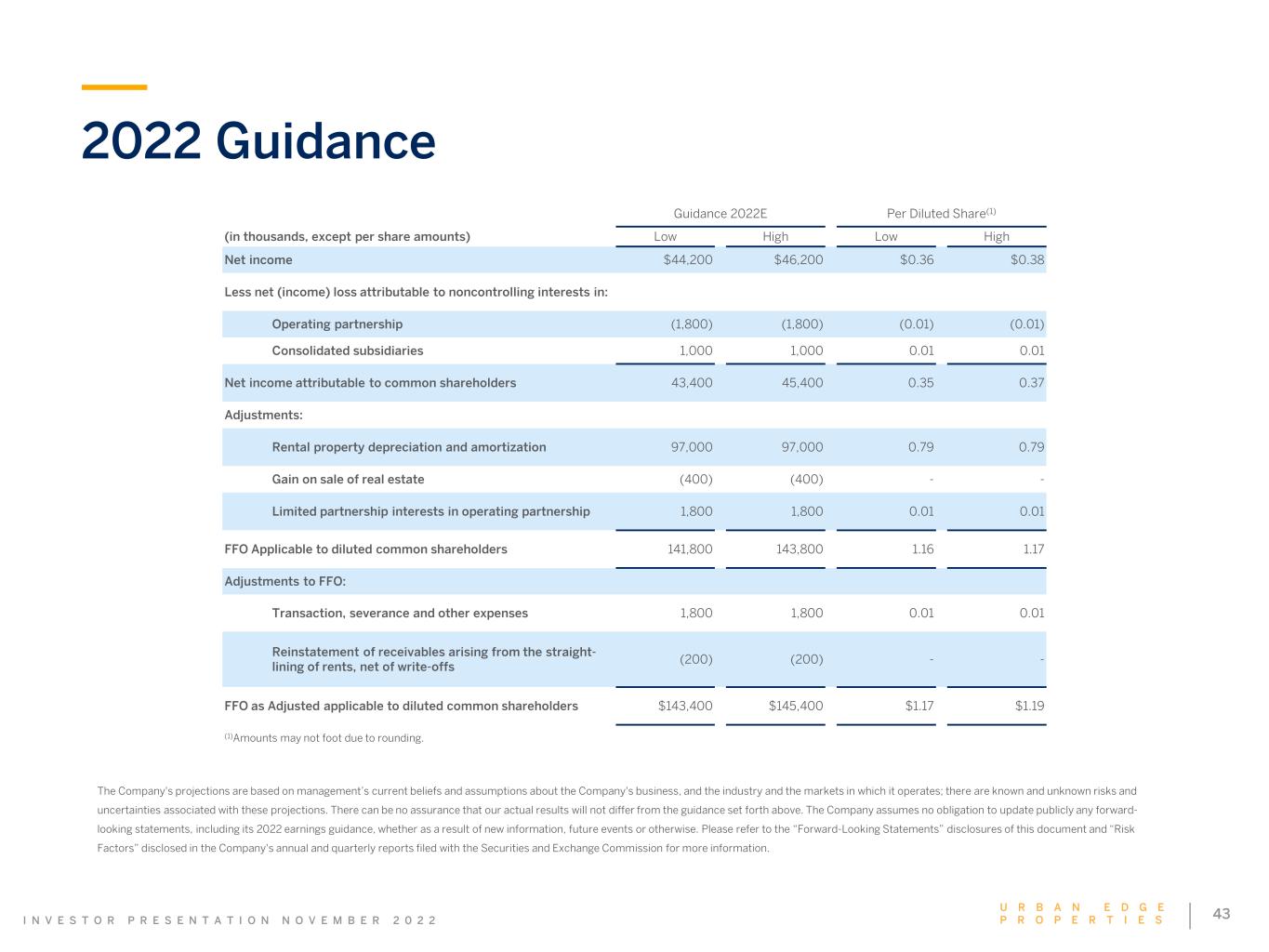

I N V E S T O R P R E S E N T A T I O N N O V E M B E R 2 0 2 2 43U R B A N E D G E P R O P E R T I E S 2022 Guidance Guidance 2022E Per Diluted Share(1) (in thousands, except per share amounts) Low High Low High Net income $44,200 $46,200 $0.36 $0.38 Less net (income) loss attributable to noncontrolling interests in: Operating partnership (1,800) (1,800) (0.01) (0.01) Consolidated subsidiaries 1,000 1,000 0.01 0.01 Net income attributable to common shareholders 43,400 45,400 0.35 0.37 Adjustments: Rental property depreciation and amortization 97,000 97,000 0.79 0.79 Gain on sale of real estate (400) (400) - - Limited partnership interests in operating partnership 1,800 1,800 0.01 0.01 FFO Applicable to diluted common shareholders 141,800 143,800 1.16 1.17 Adjustments to FFO: Transaction, severance and other expenses 1,800 1,800 0.01 0.01 Reinstatement of receivables arising from the straight- lining of rents, net of write-offs (200) (200) - - FFO as Adjusted applicable to diluted common shareholders $143,400 $145,400 $1.17 $1.19 (1)Amounts may not foot due to rounding. The Company's projections are based on management’s current beliefs and assumptions about the Company's business, and the industry and the markets in which it operates; there are known and unknown risks and uncertainties associated with these projections. There can be no assurance that our actual results will not differ from the guidance set forth above. The Company assumes no obligation to update publicly any forward- looking statements, including its 2022 earnings guidance, whether as a result of new information, future events or otherwise. Please refer to the “Forward-Looking Statements” disclosures of this document and “Risk Factors” disclosed in the Company's annual and quarterly reports filed with the Securities and Exchange Commission for more information.

44U R B A N E D G E P R O P E R T I E SI N V E S T O R P R E S E N T A T I O N N O V E M B E R 2 0 2 2 Certain statements contained herein constitute forward-looking statements as such term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are not guarantees of future performance. They represent our intentions, plans, expectations and beliefs and are subject to numerous assumptions, risks and uncertainties. Our future results, financial condition, business and targeted occupancy may differ materially from those expressed in these forward-looking statements. You can identify many of these statements by words such as “approximates,” “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “would,” “may” or other similar expressions in this presentation. Many of the factors that will determine the outcome of forward-looking statements are beyond our ability to control or predict and include, among others: (i) the economic, political and social impact of, and uncertainty relating to, the COVID-19 pandemic and related COVID-19 variants, including its potential impact on our retail tenants and their ability to make rent and other payments or honor their commitments under existing leases; (ii) the loss or bankruptcy of major tenants; (iii) the ability and willingness of the Company’s tenants to renew their leases with the Company upon expiration and the Company’s ability to re-lease its properties on the same or better terms, or at all, in the event of non-renewal or in the event the Company exercises its right to replace an existing tenant; (iv) the impact of e-commerce on our tenants’ business; (v) macroeconomic conditions, such as rising inflation and disruption of, or lack of access to, the capital markets, as well as potential volatility in the Company’s share price; (vi) the Company’s success in implementing its business strategy and its ability to identify, underwrite, finance, consummate and integrate diversifying acquisitions and investments; (vii) changes in general economic conditions or economic conditions in the markets in which the Company competes, and their effect on the Company’s revenues, earnings and funding sources, and on those of its tenants; (viii) increases in the Company’s borrowing costs as a result of changes in interest rates, rising inflation, and other factors, including the discontinuation of USD LIBOR, which is currently anticipated to occur in 2023; (ix) the Company’s ability to pay down, refinance, restructure or extend its indebtedness as it becomes due and potential limitations on the Company’s ability to borrow funds under its existing credit facility as a result of covenants relating to the Company’s financial results; (x) potentially higher costs associated with the Company’s development, redevelopment and anchor repositioning projects, and the Company’s ability to lease the properties at projected rates; (xi) the Company’s liability for environmental matters; (xii) damage to the Company’s properties from catastrophic weather and other natural events, and the physical effects of climate change; (xiii) the Company’s ability and willingness to maintain its qualification as a REIT in light of economic, market, legal, tax and other considerations; (xiv) information technology security breaches; (xv) the loss of key executives; and (xvi) the accuracy of methodologies and estimates regarding our environmental, social and governance (“ESG”) metrics, goals and targets, tenant willingness and ability to collaborate towards reporting ESG metrics and meeting ESG goals and targets, and the impact of governmental regulation on our ESG efforts. For further discussion of factors that could materially affect the outcome of our forward-looking statements, see “Risk Factors” in Part I, Item 1A, of the Company's Annual Report on Form 10-K for the year ended December 31, 2021. We claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 for any forward-looking statements included in this Press Release. You are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date of this presentation. All subsequent written and oral forward- looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. We do not undertake any obligation to release publicly any revisions to our forward-looking statements to reflect events or circumstances occurring after the date of this presentation. Forward-Looking Statements

45U R B A N E D G E P R O P E R T I E SI N V E S T O R P R E S E N T A T I O N N O V E M B E R 2 0 2 2 Non-GAAP Financial Measures The Company uses certain non-GAAP performance measures, in addition to the primary GAAP presentations, as we believe these measures improve the understanding of the Company's operational results. We continually evaluate the usefulness, relevance, limitations, and calculation of our reported non-GAAP performance measures to determine how best to provide relevant information to the investing public, and thus such reported measures are subject to change. The Company's non-GAAP performance measures have limitations as they do not include all items of income and expense that affect operations, and accordingly, should always be considered as supplemental financial results. Additionally, the Company's computation of non-GAAP metrics may not be comparable to similarly titled non-GAAP metrics reported by other REITs or real estate companies that define these metrics differently and, as a result, it is important to understand the manner in which the Company defines and calculates each of its non-GAAP metrics. The following non-GAAP measures are commonly used by the Company and investing public to understand and evaluate our operating results and performance: • FFO: The Company believes FFO is a useful, supplemental measure of its operating performance that is a recognized metric used extensively by the real estate industry and, in particular real estate investment trusts ("REITs"). FFO, as defined by the National Association of Real Estate Investment Trusts ("Nareit") and the Company, is net income (computed in accordance with GAAP), excluding gains (or losses) from sales of depreciable real estate and land when connected to the main business of a REIT, impairments on depreciable real estate or land related to a REIT's main business and rental property depreciation and amortization expense. The Company believes that financial analysts, investors and shareholders are better served by the presentation of comparable period operating results generated from FFO primarily because it excludes the assumption that the value of real estate assets diminishes predictably. FFO does not represent cash flows from operating activities in accordance with GAAP, should not be considered an alternative to net income as an indication of our performance, and is not indicative of cash flow as a measure of liquidity or our ability to make cash distributions. • FFO as Adjusted: The Company provides disclosure of FFO as Adjusted because it believes it is a useful supplemental measure of its core operating performance that facilitates comparability of historical financial periods. FFO as Adjusted is calculated by making certain adjustments to FFO to account for items the Company does not believe are representative of ongoing core operating results, including non-comparable revenues and expenses. The Company's method of calculating FFO as Adjusted may be different from methods used by other REITs and, accordingly, may not be comparable to such other REITs.