- FRPT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Freshpet (FRPT) DEF 14ADefinitive proxy

Filed: 5 Aug 15, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to §240.14a-12 |

Freshpet, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ | No fee required. |

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

1) | Title of each class of securities to which transaction applies: |

2) | Aggregate number of securities to which transaction applies: |

3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

4) | Proposed maximum aggregate value of transaction: |

5) | Total fee paid: |

☐ | Fee paid previously with preliminary materials. |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

1) | Amount Previously Paid: |

2) | Form, Schedule or Registration Statement No.: |

3) | Filing Party: |

4) | Date Filed: |

To the Stockholders of Freshpet, Inc.:

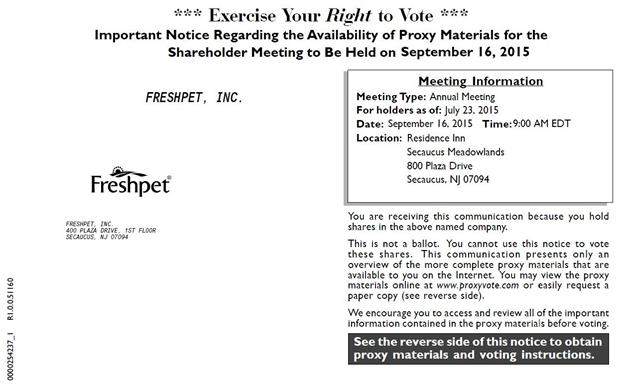

I am pleased to invite you to attend the Annual Meeting of Stockholders of Freshpet, Inc. (the “Company”), which will be held at the Residence Inn Secaucus Meadowlands, located at 800 Plaza Drive, Secaucus, NJ 07094, on September 16, 2015 at 9:00 a.m., local time. You will be able to attend and submit your questions during the Annual Meeting.

Information about the Annual Meeting, nominees for the election of directors and the other proposals to be voted on by stockholders is presented in the following notice of annual meeting and proxy statement.

It is important that your shares be represented. Whether or not you plan to attend the Annual Meeting, please vote using the procedures described on the notice of internet availability of proxy materials or on the proxy card. Your vote will mean that you are represented at the Annual Meeting regardless of whether or not you attend in person. Returning the proxy does not deprive you of your right to attend the meeting and to vote your shares in person.

We look forward to speaking with you at the Annual Meeting on September 16, 2015.

Sincerely,

Richard C. Thompson

Chief Executive Officer

400 Plaza Drive, 1st Floor

Secaucus, NJ 07094

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

September 16, 2015

To the Stockholders of Freshpet, Inc.:

The Annual Meeting of Stockholders of Freshpet, Inc. (the “Company”) will be held at the Residence Inn Secaucus Meadowlands, located at 800 Plaza Drive, Secaucus, NJ 07094, on September 16, 2015 at 9:00 a.m., local time, for the following purposes:

Items of Business

(1) To elect three members of the Board of Directors. The Board intends to present for reelection the following three nominees: Christopher B. Harned, Daryl G. Brewster, and Robert C. King;

(2) To ratify the appointment of KPMG LLP as the independent registered public accounting firm for 2015; and

(3) To transact such other business as may properly come before the Annual Meeting and any postponement or adjournment thereof.

Record Date

Close of business on July 23, 2015.

Sincerely,

Charles A. Norris

Chairman of the Board

Secaucus, New Jersey

August 5, 2015

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON SEPTEMBER 16, 2015: The Company’s Notice of Annual Meeting, Proxy Statement and 2014 Annual Report to stockholders are available on the internet at www.proxyvote.com.

TABLE OF CONTENTS

1 | |

1 | |

4 | |

14 | |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 15 |

17 | |

20 | |

26 | |

27 | |

28 | |

30 |

FRESHPET, INC.

400 Plaza Drive, 1st Floor

Secaucus, NJ 07094

PROXY STATEMENT

The accompanying proxy is solicited on behalf of the Board of Directors (the “Board of Directors” or the “Board”) of Freshpet, Inc., a Delaware corporation (the “Company” or “Freshpet”), for use at the 2015 Annual Meeting of Stockholders (the “Annual Meeting”) to be held at Residence Inn Secaucus Meadowlands, located at 800 Plaza Drive, Secaucus, NJ 07094, on September 16, 2015 at 9:00 a.m., local time. This Proxy Statement and the accompanying form of proxy were first mailed to stockholders on or about August 5, 2015. An Annual Report for the year ended December 31, 2014 is enclosed with this Proxy Statement. An electronic copy of this proxy statement and annual report are available at www.proxyvote.com and www.freshpet.com.

Voting Rights, Quorum and Required Vote

Only holders of record of our common stock at the close of business on July 23, 2015, which is the record date, will be entitled to vote at the Annual Meeting. At the close of business on July 23, 2015, we had 33,506,125 shares of common stock outstanding and entitled to vote. Holders of the Company’s common stock are entitled to one vote for each share held as of the above record date. A quorum is required for our stockholders to conduct business at the Annual Meeting. The holders of a majority in voting power of all issued and outstanding stock entitled to vote at the Annual Meeting, present in person or represented by proxy, will constitute a quorum for the transaction of business. Abstentions and “broker non-votes” (described below) will be counted in determining whether there is a quorum.

Proposal No. 1—Election of Directors, directors will be elected by a plurality of the votes of the shares of common stock cast at the Annual Meeting, which means that the three nominees receiving the highest number of “for” votes will be elected. Withheld votes and broker non-votes (as defined below) will have no effect on Proposal No. 1.

Proposal No. 2—Ratification of Appointment of Independent Registered Public Accounting Firm, requires the affirmative vote of the holders of a majority in voting power of the stock entitled to vote at the Annual Meeting, present in person or represented by proxy. Abstentions will count the same as votes against Proposal No. 2. Broker non-votes will have no effect on Proposal No. 2.

Voting Your Shares

If you are a registered holder, meaning that you hold our stock directly (not through a bank, broker or other nominee), you may vote in person at the Annual Meeting or vote by completing, dating and signing the accompanying proxy and promptly returning it in the enclosed envelope, by telephone, or electronically through the Internet by following the instructions included on your proxy card. All signed, returned proxies that are not revoked will be voted in accordance with the instructions contained therein. Signed proxies that give no instructions as to how they should be voted on a particular proposal at the Annual Meeting will be counted as votes “for” such proposal or in the case of the election of directors, as a vote “for” election of all nominees presented by the Board.

If your shares are held through a bank, broker or other nominee, you are considered the beneficial owner of those shares. You may be able to vote by telephone or electronically through the Internet in accordance with the voting instructions provided by that nominee. You must obtain a legal proxy from the nominee that holds your shares if you wish to vote in person at the Annual Meeting. If you do not provide voting instructions to your broker in advance of

1

the Annual Meeting, NASDAQ Stock Market (“NASDAQ”) rules grant your broker discretionary authority to vote on “routine” proposals. Where a proposal is not “routine,” a broker who has received no instructions from its clients does not have discretion to vote its clients’ uninstructed shares on that proposal, and the unvoted shares are referred to as “broker non-votes.”

In the event that sufficient votes in favor of the proposals are not received by the date of the Annual Meeting, the Chairman of the Annual Meeting may adjourn the Annual Meeting to permit further solicitations of proxies.

The telephone and Internet voting procedures are designed to authenticate stockholders’ identities, to allow stockholders to give their voting instructions and to confirm that stockholders’ instructions have been recorded properly. Stockholders voting via the telephone or Internet should understand that there may be costs associated with telephonic or electronic access, such as usage charges from telephone companies and Internet access providers, which must be borne by the stockholder.

Expenses of Solicitation

The expenses of any solicitation of proxies to be voted at the Annual Meeting will be paid by the Company. We have engaged Broadridge Financial Solutions, Inc. (“Broadridge”) to assist with the preparation and distribution of the proxy solicitation materials for the Annual Meeting and to act as vote tabulator, at a base fee of $7,000, plus reimbursement of reasonable expenses. Following the original mailing of the proxies and other soliciting materials, the Company and its directors, officers or employees (for no additional compensation) may also solicit proxies in person, by telephone or email. The Company will also request that banks, brokers and other nominees forward copies of the proxy and other soliciting materials to persons for whom they hold shares of common stock and request authority for the exercise of proxies. We will reimburse banks, brokers and other nominees for reasonable charges and expenses incurred in forwarding soliciting materials to their clients.

Revocability of Proxies

Any person submitting a proxy has the power to revoke it prior to the Annual Meeting or at the Annual Meeting prior to the vote. A proxy may be revoked by a writing delivered to the Company stating that the proxy is revoked, by a subsequent proxy that is submitted via telephone or Internet no later than 11:59 p.m. (ET) on September 15, 2015, by a subsequent proxy that is signed by the person who signed the earlier proxy and is delivered before or at the Annual Meeting, or by attendance at the Annual Meeting and voting in person. In order for beneficial owners to change any of your previously provided voting instructions, you must contact your bank, broker or other nominee directly.

Delivery of Proxy Materials

Beginning on or about August 5, 2015, we mailed or e-mailed to our stockholders a Notice of Internet Availability of Proxy Materials with instructions on how to access our proxy materials and Annual Report over the Internet and how to vote. If you received a notice and would prefer to receive paper copies of the proxy materials and Annual Report, you may request such materials by telephone at 1-800-579-1639, by email at sendmaterial@proxyvote.com, or over the Internet at www.proxyvote.com.

Inspector of Election

A representative from Broadridge will serve as the inspector of election for the Annual Meeting.

Stockholder Proposals

Notice of any proposal that a stockholder intends to present at the 2016 annual meeting of stockholders, as well as any director nominations, must be delivered to the principal executive offices of the Company not earlier than the close of business on May 19, 2016 nor later than the close of business on June 18, 2016 (assuming the Company does not change the date of the 2016 annual meeting of stockholders by more than 30 days before or 70 days after the anniversary of the 2015 Annual Meeting). The notice must be submitted by a stockholder of record and must set forth the information required by the Company’s bylaws with respect to each director nomination or other proposal

2

that the stockholder intends to present at the 2016 annual meeting of stockholders. A copy of the Company’s bylaws is available on the Company’s corporate website at www.freshpet.com. Our website is not part of this proxy statement.

Explanatory Note

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). For as long as we are an emerging growth company, we will not be required to provide an auditor's attestation report on management's assessment of the effectiveness of our system of internal control over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002, or seek non-binding stockholder advisory votes on any golden parachute payments not previously approved. In addition, because we are an emerging growth company, we are not required to include a Compensation Discussion and Analysis section in this proxy statement and have elected to comply with the scaled-down executive compensation disclosure requirements applicable to emerging growth companies.

We could be an emerging growth company until the end of the fiscal year following the fifth anniversary of the completion of our initial public offering (“IPO”) in November 2014, or if earlier, (i) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which would occur at the end of the fiscal year during which the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period. Under Section 107(b) of the JOBS Act, emerging growth companies may delay adopting new or revised accounting standards until such time as those standards apply to private companies.

3

DIRECTORS, EXECUTIVE OFFICERS, AND CORPORATE GOVERNANCE

Board of Directors

Set forth below is the name, age (as of August 5, 2015), position and a description of the business experience of each of our directors and director nominees:

Name |

| Age |

| Position(s) |

| Class |

| Appointed |

| Current Term Expiration |

Director Nominees: |

|

|

|

|

|

|

|

|

|

|

Christopher B. Harned |

| 52 |

| Director |

| I |

| October 2006 |

| 2015 |

Daryl G. Brewster |

| 58 |

| Director |

| I |

| January 2011 |

| 2015 |

Robert C. King |

| 56 |

| Director |

| I |

| November 2014 |

| 2015 |

Continuing Directors: |

|

|

|

|

|

|

|

|

|

|

Charles A. Norris |

| 69 |

| Chairman of the Board and Director |

| III |

| October 2006 |

| 2017 |

Richard Thompson |

| 64 |

| Director and Chief Executive Officer |

| III |

| December 2010 |

| 2017 |

Jonathan S. Marlow |

| 35 |

| Director |

| III |

| December 2010 |

| 2017 |

J. David Basto |

| 43 |

| Director |

| II |

| December 2010 |

| 2016 |

Lawrence S. Coben |

| 57 |

| Director |

| II |

| November 2014 |

| 2016 |

Walter N. George III |

| 58 |

| Director |

| II |

| November 2014 |

| 2016 |

Craig D. Steeneck |

| 57 |

| Director |

| II |

| November 2014 |

| 2016 |

Background of Directors

Director Nominees

Director—Christopher B. Harned has been a member of our Board of Directors since 2006. Mr. Harned also served as our Vice Chairman from October 2006 to December 2010. Mr. Harned has been a Managing Director in the Investment Banking Group of Nomura Securities International Inc. since September 2014. Prior to joining Nomura, Mr. Harned was a Managing Director with Robert W. Baird & Co., Inc. from November 2011 through September 2014. Prior to joining Baird, Mr. Harned served as a Partner with The Cypress Group LLC from 2001 through November 2011, where he directed the firm’s investment strategy in the consumer products sector and led the investment in The Meow Mix Company. Prior to joining The Cypress Group, Mr. Harned was a Managing Director and Global Head of Consumer Products M&A at Lehman Brothers, where he worked for over 16 years, from September 1985 to November 2001. Mr. Harned currently serves on the board of directors of Quad/Graphics, Inc., a global printer and media channel integrator, and bswift, LLC, a human resources and employee benefits software-as-a-service business. Mr. Harned provides the Board of Directors with expertise in the consumer products sector, the capital markets, public company experience and audit and finance committee experience.

4

Director—Daryl G. Brewster has been a member of our Board of Directors since January 2011. Since 2013, Mr. Brewster has served as the Chief Executive Officer of Committee Encouraging Corporate Philanthropy, a coalition of over 200 large cap companies focused on addressing societal challenges through business. Since 2008, Mr. Brewster has also been the founder/CEO of Brookside Management, LLC, a boutique consulting firm that provides C-level insights and support to consumer companies and service providers to the industry. In 2013, Mr. Brewster co-founded Brewster Foods Group, a family-run business focused on investing in and operating small cap food businesses, where he continues to act as the company’s co-founder and co-chair. Between 2009 and 2013, Mr. Brewster was a Management Advisor to MidOcean Partners (“MidOcean”). Prior to that, Mr. Brewster served as the Chief Executive Officer of Krispy Kreme Doughnuts, Inc. from March 2006 through January 2008. From 1996 to 2006, Mr. Brewster was a senior executive at Kraft, Inc. (which acquired Nabisco in 2000), where he served in numerous senior executive roles, most recently as Group Vice President and President, Snacks, Biscuits and Cereal. Before joining Nabisco, Mr. Brewster served as Managing Director, Campbell’s Grocery Products Ltd.—UK; Vice-President, Campbell’s Global Strategy, and Business Director, Campbell’s U.S. Soup. Mr. Brewster serves on the board of MP Holdco LLC and the boards of several middle-market growth companies, and previously served on the board of E*Trade Financial Services, Inc. Mr. Brewster provides the Board of Directors with experience in corporate leadership, public company operations, and an understanding of the pet and consumer packaged goods industries.

Director—Robert C. King has been a member of our Board of Directors since November 2014. Mr. King served as the Chief Executive Officer of Cytosport, Inc., a sports nutrition company and maker of Muscle Milk, from July 2013 to August 2014. Prior to joining Cytosport, Mr. King was an advisor to TSG Consumer Partners, a mid-market private equity firm specializing in consumer packaged goods companies, from March 2011 to July 2013. Mr. King spent 21 years in the North America Pepsi system, from 1989 to 2010, including serving as Executive Vice President and President of North America for Pepsi Bottling Group from 2008 to his retirement in 2010, President of North America for Pepsi Bottling Group from 2006 to 2008, President of Field Bottling from 2005 to 2006 and Senior Vice President and General Manager for the Mid-Atlantic Business Unit from 2002 to 2005. Before joining the North America Pepsi system, Mr. King worked in various sales and marketing positions with E&J Gallo Winery from 1984 to 1989, most recently as Western Region Sales Manager, and with Procter & Gamble from 1980 to 1984, most recently as Unit Manager. Mr. King has served as non-executive chairman of the board of Gehl Foods, a Wind Point Partners firm, since 2015 and previously served as a board member of Cytosport, Island Oasis Frozen Cocktail Co., Inc. and Neurobrands, LLC, a producer of premium functional beverages. Mr. King provides the Board of Directors with corporate leadership, public company experience, operations expertise and more than 30 years of consumer packaged goods experience.

Continuing Directors

Chairman of the Board and Director—Charles A. Norris has been a member of our Board of Directors and Chairman of the Board since October 2006. Mr. Norris has served as the Chairman of Glacier Water Services Inc. since 2001. He is also a member of the board of directors of Advanced Engineering Management, a position he has held since 2004, member of the board of directors of MP Holdco LLC, a position he has held since 2015, and was Chairman of the Board of Day Runner from September 2001 to November 2003, when it was sold. Mr. Norris is the retired President of McKesson Water Products Company, a bottled water company and division of McKesson Corporation, where he served as President from 1990 until he retired in October 2000. From 1981 through 1989, Mr. Norris served as President of Deer Park Spring Water Company, which was a division of Nestle USA, and then led an investor group that acquired the business in 1985 until it was sold to Clorox in 1987. Mr. Norris remained with Clorox through 1989 following their acquisition of Deer Park. From 1973 to 1985, Mr. Norris served in various operational executive positions with Nestle in both Switzerland and the United States. Mr. Norris provides the Board of Directors with extensive corporate leadership experience as well as a deep understanding of our business.

Director and CEO—Richard Thompson has been a member of our Board of Directors since December 2010 and has served as Chief Executive Officer since January 2011 when MidOcean made its initial investment in us. From 2007 to 2010, Mr. Thompson made investments in various businesses including ZooToo, an online

5

community for pet lovers. He served as Chief Executive Officer of The Meow Mix Company from 2002 until its sale to Del Monte Foods in 2006. Mr. Thompson has been involved in a number of successful ventures, including the American Italian Pasta Company, which he founded in 1985 and where he served as its President and Chief Executive Officer from 1986 to 1991. Mr. Thompson provides the Board of Directors with knowledge of the daily affairs of the Company, public company experience and expertise in the consumer products industry.

Director—Jonathan S. Marlow has been a member of our Board of Directors since December 2010. Mr. Marlow is a Principal at MidOcean, and has been with the firm since 2009, where he has focused on investments within the consumer sector. Prior to MidOcean, Mr. Marlow worked for Investcorp International Inc. in the private equity group from 2006 through 2008. Previously, Mr. Marlow held positions at J.F. Lehman & Company and Bear, Stearns & Co. Inc. Mr. Marlow currently serves on the board of directors of Agilex Fragrances. Mr. Marlow provides the Board of Directors with expertise in investment strategies and insight into the consumer sector.

Director—J. David Basto has been a member of our Board of Directors since December 2010. Mr. Basto is Founding Partner and Managing Director of Broad Sky Partners, a position he has held since its formation in 2013. Prior to co-founding Broad Sky Partners, Mr. Basto worked for MidOcean from its inception in 2003 through 2013, most recently as Managing Director and co-head of MidOcean’s consumer sector investing team. Prior to MidOcean, Mr. Basto worked for DB Capital Partners and its predecessor BT Capital Partners from 1998 through 2003. Previously, Mr. Basto held positions with Juno Partners and Tucker Anthony Inc. Mr. Basto currently serves on the board of directors of SBD Holdings Group Corp., the parent company of South Beach Diet Corp., and as a director and co-chairman of MP Holdco LLC. Mr. Basto provides the Board of Directors with expertise in analyzing financial issues and insights into the consumer sector.

Director—Lawrence S. Coben, Ph.D., has been a member of our Board of Directors since November 2014. Mr. Coben is currently Chairman and Chief Executive Officer of Tremisis Energy Corporation LLC, positions he has held since May 2006. Mr. Coben was also Chairman and Chief Executive Officer of Tremisis Energy Acquisition Corporation II from July 2007 through March 2009 and of Tremisis Energy Acquisition Corporation from February 2004 to May 2006. From January 2001 to January 2004, Mr. Coben was a Senior Principal of Sunrise Capital Partners L.P., a private equity firm. From 1997 to January 2001, Mr. Coben was an independent consultant and, from 1994 to 1996, he was Chief Executive Officer of Bolivian Power Company. Mr. Coben currently serves on the board of NRG Energy, Inc. and is an Advisory Partner of the Morgan Stanley Infrastructure Partners. Mr. Coben served on the board of directors of Chilean Utility SAESA from 2008 to 2010 and the British power developer Rurelec PLC from 2011 to 2014. Mr. Coben is also Executive Director of the Sustainable Prevention Initiative and a Consulting Scholar at the University of Pennsylvania Museum of Archaeology and Anthropology. Mr. Coben provides the Board of Directors with significant managerial, strategic, and financial expertise, particularly as it relates to company financings, transactions and development initiatives.

Director—Walter N. George III has been a member of our Board of Directors since November 2014. Mr. George is the President of G3 Consulting, LLC, a boutique advisory firm specializing in value creation in small and mid-market consumer products companies, a company he founded in 2013. Mr. George served as President of the American Italian Pasta Company and Corporate Vice President of Ralcorp Holdings from 2010 until its sale to ConAgra Foods in 2013. Mr. George served as Chief Operating Officer at American Italian Pasta Company from 2008 to 2010. From 2001 to 2008, Mr. George served in other executive roles with American Italian Pasta Company, including Senior Vice President—Supply Chain and Logistics and Executive Vice President—Operations and Supply Chain. From 1988 through 2001, Mr. George held a number of senior operating positions with Hill’s Pet Nutrition, a subsidiary of Colgate Palmolive Company, most recently as Vice President of Supply Chain. Mr. George serves on the board of directors of Vision Bank and Old World Spice and Seasoning Company. Mr. George provides the Board of Directors with operations expertise, consumer products and pet food industry expertise and public company experience.

6

Director—Craig D. Steeneck has been a member of our Board of Directors since November 2014. Mr. Steeneck has served as the Executive Vice President and Chief Financial Officer of Pinnacle Foods Inc. since July 2007, where he oversees the company’s financial operations, treasury, tax and information technology. From June 2005 to July 2007, Mr. Steeneck served as Executive Vice President, Supply Chain Finance and IT of Pinnacle Foods, helping to redesign the supply chain to generate savings and improved financial performance. From April 2003 to June 2005, Mr. Steeneck served as Executive Vice President, Chief Financial Officer and Chief Administrative Officer of Cendant Timeshare Resort Group (now Wyndham Worldwide), playing key roles in wide-scale organization of internal processes and staff management. From March 2001 to April 2003, Mr. Steeneck served as Executive Vice President and Chief Financial Officer of Resorts Condominiums International, a subsidiary of Cendant. From October 1999 to February 2001, he was the Chief Financial Officer of International Home Foods Inc. Mr. Steeneck is also a Certified Public Accountant in the State of New Jersey. Mr. Steeneck provides the Board of Directors with extensive management experience in the consumer packaged goods industry as well as accounting and financial expertise.

Director Compensation

Our non-employee directors are compensated for their services on our Board of Directors as follows:

· | each non-employee director receives an annual fee of $75,000 ($37,500 in cash plus an equity grant equal to $37,500) except for the Chairman of the Board who receives an annual fee of $125,000 ($62,500 in cash plus an equity grant equal to $62,500); |

· | the Chairman of the Audit Committee receives an additional annual fee of $10,000; |

· | the Chairman of the Compensation Committee receives an additional annual fee of $5,000; and |

· | the Chairman of the Nominating and Corporate Governance Committee receives an additional annual fee of $5,000. |

During fiscal 2014, our directors received compensation for their services on our Board of Directors from November 7, 2014 (the date of our IPO) through the end of the fiscal year on a pro-rata basis.

Each annual fee is payable in arrears in four equal quarterly installments on the last day of each quarter, provided that the amount of each payment will be prorated for any portion of a quarter that a director is not serving on our Board.

Each member of our Board of Directors is also entitled to reimbursement for reasonable travel and other expenses incurred in connection with attending meetings of the Board of Directors and any committee of the Board of Directors on which he or she serves.

Prior to our IPO, we did not pay cash retainers or provided other forms of compensation such as non-equity awards, equity awards or perquisites, with respect to service on our Board of Directors. We have historically reimbursed our directors for reasonable travel and other expenses incurred in connection with attending meetings of the Board of Directors.

Family Relationships

There are no family relationships among any of our directors or executive officers.

Corporate Governance, Board Structure and Director Independence

In accordance with our Certificate of Incorporation and Bylaws, our Board of Directors consists of 10 members and is divided into three classes with staggered three-year terms. At each annual general meeting of

7

stockholders, the successors to directors whose terms then expire will be elected to serve from the time of election and qualification until the third annual meeting following election. The authorized number of directors may be changed by resolution of the Board of Directors. Vacancies on the Board of Directors can be filled by resolution of the Board of Directors. Mr. Norris serves as the Chairman of our Board of Directors. We believe that each of the members of our Board of Directors except Mr. Thompson is independent consistent with the rules of NASDAQ. Mr. Harned, Mr. Brewster and Mr. King are the current Class I directors and are nominated for re-election as Class I directors. Mr. Basto, Mr. George, Mr. Steeneck and Mr. Coben are the Class II directors and their terms will expire in 2016. Mr. Norris, Mr. Marlow and Mr. Thompson are the Class III directors and their terms will expire in 2017. The division of our Board of Directors into three classes with staggered three-year terms may delay or prevent a change of our management or a change in control.

Our Board of Directors met 11 times during 2014. Under the Company’s corporate governance guidelines, Board members are expected to attend all meetings of the Board and committees on which they serve. Each director serving on the Board in 2014 attended at least 75% of the total meetings of the Board and of Committees on which he served during the time he was on the Board in 2014. Our corporate governance guidelines are available on our corporate website at www.freshpet.com. Our website is not part of this proxy statement.

Mr. Norris serves as a managing member of Freshpet Investors LLC, Mr. Harned and Mr. Coben are investors in Freshpet Investors LLC and Mr. Marlow serves as a principal of MidOcean. See “Security Ownership of Certain Beneficial Owner and Management” and “Certain Relationships and Related Party Transactions.”

Board Committees

Our Board of Directors has three standing committees: an Audit Committee, a Nominating and Corporate Governance Committee and a Compensation Committee. Each of the committees reports to the Board of Directors as they deem appropriate, and as the Board of Directors may request. The composition, duties and responsibilities of these committees are set forth below. In the future, our Board of Directors may establish other committees, as it deems appropriate, to assist it with its responsibilities.

Audit Committee

The Audit Committee is responsible for, among other matters: (1) appointing, compensating, retaining, evaluating, terminating and overseeing our independent registered public accounting firm; (2) discussing with our independent registered public accounting firm their independence from management; (3) reviewing with our independent registered public accounting firm the scope and results of their audit and the audit fee; (4) approving all audit and permissible non-audit services to be performed by our independent registered public accounting firm, including taking into consideration whether the independent auditor’s provision of any non-audit services to us is compatible with maintaining the independent auditor’s independence; (5) overseeing the financial reporting process and discussing with management and our independent registered public accounting firm the interim and annual consolidated financial statements that we file with the SEC; (6) reviewing and monitoring our accounting principles, accounting policies, financial and accounting controls and compliance with legal and regulatory requirements; (7) establishing procedures for the confidential anonymous submission of concerns regarding questionable accounting, internal controls or auditing matters; (8) reviewing and approving related person transactions; (9) annually reviewing the Audit Committee charter and the committee’s performance; and (10) handling such other matters that are specifically delegated to the Audit Committee by our Board of Directors from time to time.

Our Audit Committee consists of Mr. Steeneck (chair), Mr. Harned and Mr. Basto. Our Board of Directors has affirmatively determined that Mr. Steeneck, Mr. Harned, and Mr. Basto meet the definition of “independent directors” for purposes of serving on an Audit Committee under applicable SEC and NASDAQ rules. In addition, Mr. Steeneck qualifies as our “audit committee financial expert,” as such term is defined in Item 407 of Regulation S-K. The Audit Committee met one time during 2014 following our IPO, when the Audit Committee was formed.

8

Our Board of Directors adopted a written charter for the Audit Committee, which is available on our corporate website at www.freshpet.com. Our website is not part of this proxy statement.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee is responsible for developing and recommending to the Board of Directors criteria for identifying and evaluating candidates for directorships and making recommendations to the Board of Directors regarding candidates for election or reelection to the Board of Directors at each annual stockholders’ meeting. In addition, the Nominating and Corporate Governance Committee is responsible for overseeing our corporate governance guidelines and reporting and making recommendations to the Board of Directors concerning corporate governance matters. The Nominating and Corporate Governance Committee is also responsible for making recommendations to the Board of Directors concerning the structure, composition and function of the Board of Directors and its committees.

In considering director nominees, the Nominating and Corporate Governance Committee considers a number of factors, including:

· | the independence, judgment, strength of character, reputation in the business community, ethics and integrity of the individual; |

· | the business or other relevant experience, skills and knowledge that the individual may have that will enable him or her to provide effective oversight of the Company’s business; |

· | the fit of the individual’s skill set and personality with those of the other Board members so as to build a Board that works together effectively and constructively; and |

· | the individual’s ability to devote sufficient time to carry out his or her responsibilities as a director in light of his or her occupation and the number of boards of directors of other public companies on which he or she serves. |

When formulating its Board membership recommendations, the Nominating and Corporate Governance Committee will consider advice and recommendations from stockholders, management and others as it deems appropriate. The Nominating and Corporate Governance Committee has not adopted a separate policy pertaining to the consideration of diversity in the selection of nominees to the Board. Upon identifying a potential nominee, members of the Nominating and Corporate Governance Committee will interview the candidate, and based upon that interview, reference checks and committee discussions, make a recommendation to the Board.

The Nominating and Corporate Governance Committee evaluates director candidates recommended by a stockholder according to the same criteria as a candidate identified by the Nominating and Corporate Governance Committee. To date, the Company has not received a recommendation for a director candidate from our stockholders.

Stockholders may recommend candidates at any time, but to be considered by the Nominating and Corporate Governance Committee for inclusion in the Company’s proxy statement for the 2016 annual meeting of stockholders, recommendations must be submitted to the attention of the Chairman of the Nominating and Corporate Governance Committee not earlier than the close of business on May 19, 2016 nor later than the close of business on June 18, 2016 (assuming the Company does not change the date of the 2016 annual meeting of stockholders by more than 30 days before or 70 days after the anniversary of the 2015 Annual Meeting). A stockholder recommendation must contain:

· | the candidate’s name, a detailed biography outlining the candidate’s relevant background, professional and business experience and other significant accomplishments; |

9

· | an acknowledgement from the candidate that he or she would be willing to serve on the Board, if elected; |

· | a statement by the stockholder outlining the reasons why this candidate’s skills, experience and background would make a valuable contribution to the Board; and |

· | a minimum of two references from individuals that have either worked with the candidate, served on a board of directors or board of trustees with the candidate, or can otherwise provide relevant perspective on the candidate’s capabilities as a potential Board member. |

Stockholder submissions recommending director candidates for consideration must be sent to the Company’s corporate offices, located at 400 Plaza Drive, 1st Floor, Secaucus, NJ 07094.

Our Nominating and Corporate Governance Committee consists of Mr. Coben (chair), Mr. George and Mr. King. Our Board of Directors has affirmatively determined that Mr. Coben, Mr. George and Mr. King meet the definition of “independent directors” for purposes of serving on a Nominating and Corporate Governance Committee under applicable SEC and NASDAQ rules. Our Nominating and Corporate Governance Committee met one time during 2014 following our IPO, when the Nominating and Corporate Governance Committee was formed.

Our Board of Directors adopted a written charter for the Nominating and Corporate Governance Committee, which is available on our corporate website at www.freshpet.com. Our website is not part of this proxy statement.

Compensation Committee

The Compensation Committee is responsible for, among other matters: (1) reviewing key employee compensation goals, policies, plans and programs; (2) reviewing and approving the compensation of our directors, chief executive officer and other executive officers; (3) reviewing and approving employment agreements and other similar arrangements between us and our executive officers; and (4) administering our stock plans and other incentive compensation plans. The Compensation Committee may delegate its responsibilities to a subcommittee formed by the Compensation Committee. The Compensation Committee, in its sole discretion, may also engage legal, accounting, or other consultants or experts, including compensation consultants, to assist in carrying out its responsibilities.

Our Compensation Committee consists of Mr. Marlow (chair), Mr. Brewster, Mr. Harned and Mr. King. Our Board of Directors has affirmatively determined that Mr. Marlow, Mr. Brewster, Mr. Harned and Mr. King meet the definition of “independent directors” for purposes of serving on a Compensation Committee under applicable SEC and NASDAQ rules. Our Compensation Committee met one time during 2014 following our IPO, when the Compensation Committee was formed.

Our Board of Directors adopted a new written charter for the Compensation Committee, which is available on our corporate website at www.freshpet.com. Our website is not part of this proxy statement.

Risk Oversight

Our Board of Directors is currently responsible for overseeing our risk management process. The Board of Directors focuses on our general risk management strategy and the most significant risks facing us and ensures that appropriate risk mitigation strategies are implemented by management. The Board of Directors is also apprised of particular risk management matters in connection with its general oversight and approval of corporate matters and significant transactions.

Our Board of Directors does not have a standing risk management committee, but rather administers this oversight function directly through our Board of Directors as a whole, as well as through various standing committees of our Board of Directors that address risks inherent in their respective areas of oversight. In particular,

10

our Board of Directors is responsible for monitoring and assessing strategic risk exposure, our Audit Committee is responsible for overseeing our major financial risk exposures and the steps our management has taken to monitor and control these exposures and our Compensation Committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage unnecessary risk-taking. In addition, our Audit Committee oversees the performance of our internal audit function and considers and approves or disapproves any related-party transactions.

Our management is responsible for day-to-day risk management. This oversight includes identifying, evaluating, and addressing potential risks that may exist at the enterprise, strategic, financial, operational, compliance and reporting levels.

Leadership Structure of the Board of Directors

The positions of Chairman of the Board and Chief Executive Officer are presently separated. We believe that separating these positions allows our Chief Executive Officer to focus on our day-to-day business, while allowing the Chairman of the Board to lead the Board of Directors in its fundamental role of providing advice to and independent oversight of management. Our Board of Directors recognizes the time, effort and energy that the Chief Executive Officer is required to devote to his position in the current business environment, as well as the commitment required to serve as our Chairman, particularly as the Board of Directors’ oversight responsibilities continue to grow. While our Bylaws and corporate governance guidelines do not require that our Chairman and Chief Executive Officer positions be separate, our Board of Directors believes that having separate positions is the appropriate leadership structure for us at this time and demonstrates our commitment to good corporate governance.

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee is or has been an executive officer or employee of the Company, nor did they have any relationships requiring disclosure by the Company under Item 404 of Regulation S-K. None of our executive officers served as a director or a member of a compensation committee (or other committee serving an equivalent function) of any other entity, an executive officer of which served as one of our directors or a member of the Compensation Committee during 2014.

Code of Ethics

We adopted a written General Code of Ethics (“General Code”) which applies to all of our directors, officers and other employees, including our principal executive officer, principal financial officer and controller. In addition, we adopted a written Code of Ethics for Executive Officers and Principal Accounting Personnel (“Code of Ethics”), which applies to our principal executive officer, principal financial officer, controller and other designated members of our management. Copies of each code are available on our corporate website at www.freshpet.com. The information contained on our website does not constitute a part of this proxy statement. We will provide any person, without charge, upon request, a copy of our General Code or Code of Ethics. Such requests should be made in writing to the attention of our Corporate Secretary at the following address: Freshpet, Inc., 400 Plaza Drive, 1st Floor, Secaucus, New Jersey 07094.

Communications to the Board of Directors

Stockholders and other interested parties may contact any member (or all members) of the Board by U.S. mail. Such correspondence should be sent c/o Corporate Secretary, Freshpet, Inc., 400 Plaza Drive, 1st Floor, Secaucus, New Jersey 07094.

All communications received as set forth in the preceding paragraph will be opened by the Corporate Secretary for the sole purpose of determining whether the contents represent a message to the Company’s directors.

11

The Corporate Secretary will forward copies of all correspondence that, in the opinion of the Corporate Secretary, deals with the functions of the Board or its committees or that he or she otherwise determines requires the attention of any member, group or committee of the Board. The Corporate Secretary will not forward other correspondence.

Executive Officers

Set forth below is the name, age (as of August 5, 2015), position and a description of the business experience of each of our executive officers (business experience for Mr. Thompson, who is both a director and executive officer, can be found in the section entitled—Board of Directors).

Name |

| Age |

|

| Position(s) |

Richard Thompson |

| 64 |

|

| Director and Chief Executive Officer |

Richard Kassar |

| 68 |

|

| Chief Financial Officer |

Scott Morris |

| 46 |

|

| Chief Operating Officer |

Cathal Walsh |

| 43 |

|

| Senior Vice President of Cooler Operations |

Stephen Weise |

| 56 |

|

| Executive Vice President of Manufacturing and Supply Chain |

Michael Hieger |

| 41 |

|

| Senior Vice President of Manufacturing Operations |

Stephen Macchiaverna |

| 57 |

|

| Senior Vice President, Controller and Secretary |

Thomas Farina |

| 50 |

|

| Senior Vice President of Sales |

Kathryn Winstanley |

| 35 |

|

| Vice President of Marketing |

Background of Executive Officers

CFO—Richard Kassar has served as Chief Financial Officer since January 2011. He previously served as our Chief Executive Officer from July 2006 to January 2011 and as President from January 2011 to June 2014. Mr. Kassar has acted as our principal financial and accounting officer since 2006. Prior to joining Freshpet, he was Senior Vice President and Chief Financial Officer of The Meow Mix Company until its sale to Del Monte Foods in 2006. From 1999 to 2001, he served as Co-President and Chief Financial Officer of Global Household Brands. From 1986 to 1999, Mr. Kassar was employed by Chock Full O’ Nuts in various positions and most recently served as Senior Vice President, Chief Operating Officer and Corporate Controller. Mr. Kassar has been a director of World Fuel Services Corporation since 2002. Mr. Kassar has over 20 years’ experience in the consumer brands industry.

COO & Co-Founder—Scott Morris is a co-founder of Freshpet and has served as Senior Vice President of Sales and Marketing from 2010 to 2013, Chief Marketing Officer from January 2014 to June 2015, and Chief Operating Officer since July 2015. Mr. Morris is involved in all aspects of Company development and day-to-day operations. Prior to joining Freshpet, Mr. Morris was Vice President of Marketing at The Meow Mix Company from 2002 to 2006. Previously, Mr. Morris worked at Ralston Purina from 1990 to 2002, holding various leadership positions in Sales and Marketing, most recently Pet Food Group Director. Mr. Morris founded The Freshpet Foundation, a 501(c)(3) non-profit charitable organization. He has over 20 years’ experience in consumer packaged goods sales, management and marketing.

SVP Cooler Operations & Co-Founder—Cathal Walsh is a co-founder of Freshpet and has served as Senior Vice President of Cooler Operations since January 2011 and previously served as our Chief Operating Officer from October 2006 to January 2011. Prior to joining Freshpet, Mr. Walsh was Zone Marketing Manager at

12

Nestlé Worldwide from 2000 to 2005 and was Marketing Manager at Nestlé Pet Care from 1996 to 2000. Mr. Walsh has over 16 years’ experience in packaged goods marketing, sales and management, including in international food markets.

EVP Manufacturing and Supply Chain—Stephen Weise joined the Company in July of 2015 as the EVP of Manufacturing and Supply Chain. Mr. Weise has over 25 years of experience in the manufacturing and distribution of consumer products. Prior to joining Freshpet, from June 2013 to July 2015 Mr. Weise was an Account Manager at TBM Consulting, a consulting firm that specialized in operational excellence and lean manufacturing. From 2003 to February 2013, Mr. Weise held the role of COO at the Arthur Wells Group, a 3PL specializing in consumer products and temperature controlled distribution. Prior to that, from 2002 to 2003, he served as the SVP of Operations for the B. Manischewitz Company, a specialty food manufacturer. From 2000-2002, he served as COO at the Eight in One Pet Products Company, from 1995-2000 as VP of Manufacturing at Chock Full O’ Nuts, and from 1986 to 1995 in various positions at Kraft Foods.

SVP Manufacturing Operations—Michael Hieger has served as Senior Vice President of Manufacturing Operations since January 2014. Mr. Hieger was Vice President of Manufacturing Operations from 2007 to 2013. In addition to plant-wide day-to-day activities, he is involved in new product development and co-manufacturing operations. Prior to joining Freshpet, Mr. Hieger focused on dry pet food extrusion as the Engineering Manager with The Meow Mix Company from 2002 to 2006 and as the Pet Treats Manager with Ralston Purina from 1997 to 2002. Mr. Hieger has over 17 years’ experience in pet food manufacturing.

SVP, Controller & Secretary—Stephen Macchiaverna has served as Senior Vice President, Controller and Secretary since October 2006. Prior to joining Freshpet, Mr. Macchiaverna was the Controller for The Meow Mix Company from its inception in 2002 through its sale and transition to Del Monte Foods in 2006. From 1999 to 2001, he was the Vice President of Finance and Treasurer of Virgin Drinks USA, Inc. Mr. Macchiaverna began his consumer packaged goods career with First Brands Corporation, where he worked from 1986 to 1999, most recently as Divisional Controller for all domestic subsidiaries. He has over 25 years’ experience in consumer packaged goods financial management.

SVP Sales—Thomas Farina has served as Senior Vice President of Sales since January 2013 and as our Eastern Region Vice President from 2006 to 2013. Before joining Freshpet, Mr. Farina worked as Eastern Region Vice President at The Meow Mix Company from 2001 to 2006. From 1989 to 1995, Mr. Farina held various positions with American Home Food Products and after its sale, he worked in various positions at International Home Foods from 1996 to 2000, including Regional Vice President. Mr. Farina has over 25 years’ experience in consumer packaged goods.

VP Marketing—Kathryn Winstanley has served as Vice President of Marketing since 2006. Prior to joining Freshpet, Ms. Winstanley was a Senior Brand Manager at The Meow Mix Company from 2004 to 2006 and was a Brand Manager at Snapple Beverage Group from 2001 to 2003. She has over 13 years’ experience in consumer packaged goods marketing and management.

13

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act, requires the Company’s directors, executive officers and persons who beneficially own more than 10 percent of the Company’s common stock (collectively, “Reporting Persons”) to file with the SEC initial reports of ownership and changes in ownership of the Company’s common stock. Reporting Persons are required by SEC regulations to furnish the Company with copies of all Section 16(a) reports they file. Based solely on its review of the copies of such reports received or written representations from certain Reporting Persons that no other reports were required, the Company believes that during its fiscal year ended December 31, 2014 all filing requirements applicable to the Reporting Persons were timely met, except that each of Mr. Basto, Mr. George, Mr. King, Mr. Steeneck, Mr. Brewster and Ms. Winstanley were late in filing a Form 4 relating to one transaction in conjunction with the IPO.

14

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table shows information about the beneficial ownership of our common stock, as of July 23, 2015, by:

· | each person known by us to beneficially own 5% or more of our outstanding common stock; |

· | each of our directors and executive officers; and |

· | all of our directors and executive officers as a group. |

For further information regarding material transactions between us and certain of our stockholders, see “Certain Relationships and Related Party Transactions.”

The numbers listed below are based on 33,506,125 shares of our common stock outstanding as of July 23, 2015. Unless otherwise indicated, the address of each individual listed in this table is c/o Freshpet, Inc., 400 Plaza Drive, 1st Floor, Secaucus, New Jersey 07094.

Name and Address of Beneficial Owner(1) |

| Amount and Nature of Beneficial Ownership |

|

| Percent of Common Stock Outstanding |

| ||

Principal Stockholders: |

|

|

|

|

|

|

|

|

MidOcean(2) |

|

| 6,941,000 |

|

|

| 20.7 | % |

Freshpet Investors LLC(3) |

|

| 3,803,085 |

|

|

| 11.4 | % |

Executive Officers and Directors: |

|

|

|

|

|

|

|

|

Charles A. Norris(4) |

|

| 3,931,530 |

|

|

| 11.7 | % |

Richard Thompson(5) |

|

| 790,936 |

|

|

| 2.4 | % |

J. David Basto |

|

| 5,833 |

|

| * |

| |

Daryl G. Brewster |

|

| 38,745 |

|

| * |

| |

Lawrence S. Coben |

|

| 8,135 |

|

| * |

| |

Walter N. George III |

|

| 19,167 |

|

| * |

| |

Christopher B. Harned |

|

| 2,500 |

|

| * |

| |

Robert C. King |

|

| 12,500 |

|

| * |

| |

Jonathan S. Marlow |

|

| — |

|

|

| — |

|

Craig D. Steeneck |

|

| 19,167 |

|

| * |

| |

Richard Kassar |

|

| 246,110 |

|

| * |

| |

Scott Morris(6) |

|

| 262,086 |

|

| * |

| |

Cathal Walsh |

|

| 141,844 |

|

| * |

| |

Stephen Weise |

|

| — |

|

| — |

| |

Michael Hieger |

|

| 33,666 |

|

| * |

| |

Stephen Macchiaverna |

|

| 97,536 |

|

| * |

| |

Thomas Farina |

|

| 107,922 |

|

| * |

| |

Kathryn Winstanley |

|

| 31,575 |

|

| * |

| |

Executive Officers and Directors as a Group (18 persons) |

|

| 5,749,322 |

|

|

| 17.2 | % |

*Less than 1%

15

(1) | A “beneficial owner” of a security is determined in accordance with Rule 13d-3 under the Exchange Act and generally means any person who, directly or indirectly, through any contract, arrangement, understanding, relationship, or otherwise, has or shares: |

• | voting power which includes the power to vote, or to direct the voting of, such security; and/or |

• | investment power which includes the power to dispose, or to direct the disposition of, such security. |

(2) | Unless otherwise indicated, each person named in the table above has sole voting and investment power, or shares voting and investment power with his spouse (as applicable), with respect to all shares of stock listed as owned by that person. Shares issuable upon the exercise of options exercisable on July 23, 2015 or within 60 days thereafter are considered outstanding and to be beneficially owned by the person holding such options for the purpose of computing such person’s percentage beneficial ownership, but are not deemed outstanding for the purposes of computing the percentage of beneficial ownership of any other person. The address of our executive officers is 400 Plaza Drive, 1st Floor, Secaucus, New Jersey 07094. |

(3) | Includes 4,291,219 shares of common stock held by MidOcean Partners III, L.P., 2,281,377 shares of common stock held by MidOcean Partners III-A, L.P. and 365,904 shares of common stock held by MidOcean Partners III-D, L.P. (collectively, the “MidOcean Entities”). MidOcean Associates, SPC by and on behalf of its Segregated Portfolio, MidOcean Partners Segregated Portfolio III (“Associates”) is the General Partner of each of the MidOcean Entities. MidOcean US Advisor, L.P. (“US Advisor”) provides investment advisory services to each of the MidOcean Entities and Associates. 2,500 shares of restricted common stock are held by US Advisor. J. Edward Virtue indirectly controls the shares of common stock held by the MidOcean Entities. Accordingly, Associates, US Advisor and Mr. Virtue may be deemed to have beneficial ownership of the shares of common stock held by the MidOcean Entities, although each of Associates, US Advisor and Mr. Virtue disclaims beneficial ownership of the shares owned of record by any other person or entity except to the extent of their pecuniary interest therein. The address for each of the MidOcean Entities, Associates, US Advisor and Mr. Virtue is 320 Park Avenue, 16th Floor, New York, New York 10022. |

(4) | Charles A. Norris and Kayne Anderson Capital Advisors L.P. are the managing members of Freshpet Investors LLC and share voting and investment power over the shares of common stock held by Freshpet Investors LLC. Richard Kayne majority owner and chairman of Kayne Anderson Capital Advisors L.P. Mr. Norris, Mr. Kayne and Kayne Anderson Capital Advisors L.P. disclaim beneficial ownership of all of the shares of common stock held or controlled by Freshpet Investors LLC except to the extent of their pecuniary interest therein. |

(5) | Includes 4,166 shares of common stock held by Mr. Norris directly, 124,279 shares of common stock held by Norris Trust dtd 6/18/02 and 3,803,085 shares of common stock held by Freshpet Investors LLC (see footnote 3). Mr. Norris disclaims beneficial ownership of all of the shares of common stock held or controlled by Freshpet Investors LLC except to the extent of his pecuniary interest therein. |

(6) | Includes 355,102 shares of common stock held directly by Mr. Thompson and 435,834 shares of common stock held by Thompson Holdings, LLP and Thompson FP Food, LLC. Mr. Thompson has voting and investment power over the shares held of record by Thompson Holdings, LLP and Thompson FP Food, LLC. |

(7) | Includes 243,420 shares of common stock held by Mr. Morris directly and 18,666 shares of common stock held by Morris Mutts LLC. Mr. Morris has voting and investment power over the shares held of record by Morris Mutts LLC. |

16

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

Stockholders Agreement

We are party to a Second Amended and Restated Stockholders Agreement with MidOcean, Freshpet Investors LLC and certain of our other stockholders (the “Stockholders Agreement”), pursuant to which certain of the stockholders party thereto are entitled to registration rights. As of July 23, 2015, the stockholders holding an aggregate of 11,294,651 shares, or 33.7%, of our common stock are entitled to registration rights pursuant to the Stockholders Agreement.

Demand Registrations

Under the Stockholders Agreement, holders of a majority of the shares subject to the agreement (the “Registrable Securities”) are able to require us to use our best efforts to file a registration statement under the Securities Act of 1933, as amended (the “Securities Act”) (“Demand Registration”), and we are required to notify the remaining holders of Registrable Securities in the event of such request (a “Demand Registration Request”). The holders of Registrable Securities can issue up to eight Demand Registration Requests. All eligible holders will be entitled to participate in any Demand Registration upon proper notice to us. We have certain limited rights to delay or postpone such registration.

Piggyback Registrations

Under the Stockholders Agreement, if at any time we propose or are required to register any of our equity securities under the Securities Act (other than a Demand Registration or certain excluded registrations), we will be required to notify each holder of Registrable Securities of its right to participate in such registration (a “Piggyback Registration”). We have the right to terminate or postpone any registration statement in which holders of Registrable Securities have elected to exercise Piggyback Registration rights.

Expenses of Registration

We are required to bear the registration expenses (other than underwriting discounts) incident to any registration in accordance with the Stockholders Agreement, including the reasonable fees of counsel chosen by the holders of a majority of the Registrable Securities included in the registration.

Indemnification

Under the Stockholders Agreement, we must, subject to certain limitations, indemnify each holder of Registrable Securities and its employees, partners, members, officers, directors, and stockholders of each such holder; agents, representatives, and advisors, including legal counsel and accountants for each such holder; any underwriter (as defined in the Securities Act) for each such holder; and each person, if any, who controls such holder or underwriter within the meaning of the Securities Act or the Exchange Act, against all losses, claims, damages, liabilities and expenses in certain circumstances and to pay any expenses reasonably incurred in connection with investigating and defending such losses, claims, damages, liabilities and expenses, except insofar as the same arise out of or are based upon actions or omissions made in reliance upon and in conformity with written information furnished by or on behalf of any such holder expressly for us in connection with a registration effected pursuant to the Stockholders Agreement.

Selldown Agreement

We are party to a selldown agreement with Freshpet Investors LLC pursuant to which Freshpet Investors LLC agreed for a period of 18 months from the completion of our IPO (the “Selldown Period”) not to offer, transfer,

17

distribute, sell, contract to sell, pledge, grant any option to purchase, make any short sale or otherwise dispose of any shares of our common stock, or any options or warrants to purchase any shares of our common stock, or any securities convertible into, exchangeable for or that represent the right to receive shares of our common stock (collectively, the “applicable securities”), whether owned by Freshpet Investors LLC at the time of the completion of the offering or acquired by it thereafter. Notwithstanding the above restriction, Freshpet Investors LLC may:

(i) | in any 90 day period (x) during the time beginning on the day that is 181 days following the completion of our IPO and ending on the day that is 12 months following the completion of our IPO, transfer up to 7.5% of the applicable securities held by it on the date of the agreement and (y) during the time beginning on the day that is 366 days following the completion of our IPO and ending at the conclusion of the Selldown Period transfer up to 10% of the applicable securities held by it on the date of the agreement, in each case as a distribution to its members, affiliates or any investment fund or other entity controlled or managed by it; or |

(ii) | transfer its applicable securities pursuant to a bona fide third party tender offer, merger, consolidation or other similar transaction made to all holders of our common stock involving a change of control (as defined in the selldown agreement) of us following the completion of our IPO. |

In connection with a secondary offering of our common stock completed in May 2015, we and Freshpet Investors LLC entered into a waiver to the selldown agreement, which permitted Freshpet Investors LLC to sell shares of our common stock in such secondary offering.

Indemnification Agreements

We have entered into indemnification agreements with each of our directors and executive officers. Each indemnification agreement provides that, subject to limited exceptions, and among other things, we will indemnify the director or executive officer to the fullest extent permitted by law for claims arising in his or her capacity as our director or officer.

Guarantee Agreement

In connection with a $62.5 million revolving note payable (the “$62.5 Million Revolver”), we entered into a Fee and Reimbursement Agreement with MidOcean, certain individuals associated with Freshpet Investors LLC (an entity related to Charles A. Norris, our Chairman of the Board of Directors), Charles A. Norris, Richard Thompson (our Chief Executive Officer), and Richard Kassar (our Chief Financial Officer), each a guarantor of a portion of the $62.5 Million Revolver. MidOcean, certain individuals associated with Freshpet Investors LLC, Charles A. Norris, Richard Thompson and Richard Kassar guaranteed $32.9 million, $24.3 million, $4.3 million, $0.3 million and $0.7 million, respectively. The agreement stipulated that we would pay each guarantor a contingent fee equal to 10% per annum of the amount that each guarantor committed to guarantee. Payments were to be made in the form of newly issued shares of Series C Preferred Stock at the price of $5.25 per share. The fee accrued only from and after the date that the guarantor entered into the guarantee, and if at any time any guarantor’s obligation was terminated in full or in part, the fee continued to accrue only with respect to the amount, if any, of such guarantor’s remaining commitment under the credit agreement governing the $62.5 Million Revolver. The fee was contingent in that it would become due and payable only if all principal and interest under the $62.5 Million Revolver was repaid and a Change of Control (as defined in the agreement) had occurred.

We used a portion of the proceeds from our IPO and related debt refinancing to repay the borrowings under the $62.5 Million Revolver, relieving us of future fees on the debt guarantee. In addition, all of the outstanding guarantee fees were converted into shares of our Series C preferred stock, par value $0.001, (“Series C Preferred Stock”), which were subsequently converted into shares of common stock. As a result, MidOcean, certain individuals associated with Freshpet Investors LLC, Charles A. Norris, Mr. Thompson and Mr. Kassar were issued 1,302,408, 958,852, 168,036, 21,401, and 27,059 shares of Series C Preferred Stock, respectively, which were converted into 963,260, 709,152, 124,279, 15,828 and 20,012 shares of common stock, respectively.

18

Tyson Agreement

Effective January 9, 2009, we entered into a distribution agreement with Tyson Foods, Inc. (“Tyson”), which is one of our stockholders. Pursuant to the distribution agreement, Tyson agreed to perform certain distribution and logistical services for us. Our agreement with Tyson expires on December 31, 2015. For the years ended December 31, 2013 and 2014, we paid $6.1 million and $8.9 million, respectively, for work performed by Tyson under the agreement.

We also purchase, on an as needed basis, certain raw materials from Tyson. For the years ended December 31, 2013 and 2014, we paid $0.5 million and $0.6 million, respectively, to Tyson for raw materials provided to us.

The Stockholder Note

We issued $1.5 million of notes to certain stockholders of the Company. The Stockholder Note accrued interest compounded annually at a rate of 10%. The Stockholder Note and all accrued interest were due on December 23, 2020. Freshpet Investors LLC and Tyson held $0.6 million and $0.7 million, respectively, of the Stockholder Note. No other stockholder held an amount exceeding $120,000. We used a portion of the proceeds from our IPO and related debt refinancing to repay the Stockholder Note.

The Convertible Notes

We issued $2.0 million in aggregate principal amount of convertible notes on October 23, 2014 to certain stockholders (the “Convertible Notes”). Beginning on December 7, 2014, the Convertible Notes accrued interest at a rate of 15%, compounded annually and added to the principal amount of the Convertible Notes. The Convertible Notes were issued at 98% of par and were convertible, at the option of the holder, into Series C Preferred Stock, at a price of $5.25 per share, at any time after December 31, 2014 if the Convertible Notes were outstanding at that time. The Convertible Notes would have matured on November 1, 2017.

We used a portion of the proceeds from our IPO and related debt refinancing to repay the Convertible Notes. MidOcean, Charles A. Norris (our Chairman of the Board) and David Shladovsky held $1.0 million, $0.5 million and $0.5 million, respectively, in aggregate principal amounts of Convertible Notes.

Procedures for Approval of Related Party Transactions

Our Board of Directors has adopted a written related party transaction policy, which sets forth the policies and procedures for the review and approval or ratification of related party transactions. This policy is administrated by our Audit Committee. These policies provide that, in determining whether or not to recommend the initial approval or ratification of a related party transaction, the relevant facts and circumstances available shall be considered, including, among other factors it deems appropriate, whether the interested transaction is on terms no less favorable than terms generally available to an unaffiliated third party under the same or similar circumstances and the extent of the related party’s interest in the transaction.

19

This section describes the material elements of compensation awarded to, earned by each of our named executive officers (the “NEOs”) in fiscal 2014. Our NEOs for 2014 are Richard Thompson, who served as our Chief Executive Officer during 2014, Scott Morris, who served as our Chief Marketing Officer during 2014, and Richard Kassar, who served as our Chief Financial Officer during 2014. This section also provides qualitative information regarding the manner and context in which compensation is awarded to and earned by our executive officers and is intended to place in perspective the data presented in the tables and narrative that follow.

Compensation Philosophy and Objectives

Our compensation philosophy is to align executive compensation with the interests of our stockholders by basing certain compensation decisions on financial objectives that our Board of Directors believes are primary determinants of long-term stockholder value. An important goal of our executive compensation program is to ensure that we hire and retain talented and experienced executives who are motivated to achieve or exceed our short-term and long-term corporate goals. Our executive compensation programs are designed to reinforce a strong pay-for-performance orientation and to serve the following purposes:

· | to reward our NEOs for sustained financial and operating performance and leadership excellence; |

· | to align their interests with those of our stockholders; and |

· | to encourage our NEOs to remain with us for the long-term. |

Elements of Compensation

Base Salary

We pay our NEOs a base salary based on the experience, skills, knowledge and responsibilities required of each officer. We believe base salaries are an important element in our overall compensation program because base salaries provide a fixed element of compensation that reflects job responsibilities and value to us. In 2014, we paid base salaries of $450,000 to Mr. Thompson, $325,000 to Mr. Morris and $275,000 to Mr. Kassar. None of our NEOs is currently party to an employment agreement or other agreement or arrangement that provides for automatic or scheduled increases in base salary. Base salaries for our NEOs are determined by our full Board of Directors at its sole discretion, and no NEO has the right to automatic or scheduled increases in base salary.

Annual Incentive Bonuses

Through the completion of fiscal year 2014, our Board of Directors had not adopted a formal plan or set of formal guidelines with respect to annual incentive or bonus payments, and had rather relied on an annual assessment of the Company’s operating performance, including Adjusted EBITDA, as well as the performance of our executives during the preceding year to make annual incentive and bonus determinations. For 2014, the full Board of Directors determined to pay performance-based bonuses of $96,000 to Mr. Thompson, $57,600 to Mr. Morris, and $48,000 to Mr. Kassar. The performance-based bonuses, which are calculated as a percentage of base salary, are designed to motivate our employees to achieve annual goals based on our strategic, financial, and operating performance objectives. In addition, the Board of Directors determined to pay bonuses in connection with the completion of our IPO of $24,000 to Mr. Thompson, $34,000 to Mr. Morris, and $24,000 to Mr. Kassar. In connection with our efforts to formalize our compensation practices, our Board of Directors adopted an annual incentive plan, in which our NEOs are eligible to participate beginning in fiscal year 2015. Our Board of Directors retained the discretion to pay any amounts due under such incentive plan in cash or equity or a combination of both.

20

Long-Term Equity Compensation

Although we do not have a formal policy with respect to the grant of equity incentive awards to our executive officers, or any formal equity ownership guidelines applicable to them, we believe that equity grants provide our executives with a strong link to our long-term performance, create an ownership culture and help to align the interests of our executives and our stockholders. In addition, we believe that equity grants with a time-based vesting feature promote executive retention because this feature incents our executive officers to remain in our employment during the vesting period. Accordingly, our Board of Directors periodically reviews the equity incentive compensation of our NEOs and from time to time may grant equity incentive awards to them in the form of stock options.

On November 7, 2014, we entered into amendments to all outstanding option agreements under the 2010 Stock Option Plan (the “2010 Plan”) with our employees, including certain of our NEOs, modifying certain of the vesting terms of the options and reducing the number of options subject to the awards. As amended, the options granted to our NEOs become vested and exercisable as follows, subject to the NEOs’ continued employment during the applicable vesting period: (i) the vesting terms of a first tranche of time-vesting options has not been amended and the options subject to such tranche became fully vested on December 31, 2014, (ii) a performance-vesting tranche of the options becomes vested and exercisable in equal installments on each of December 31, 2015 and December 31, 2016, subject to the achievement of certain annual earnings targets, and (iii) a second tranche of time-vesting options becomes vested and exercisable with respect to 40% of such options on November 7, 2015 and with respect to the remaining 60% of such options on November 7, 2016. Further, a second tranche of time-vesting options becomes fully vested upon the occurrence of a Change in Control (as defined in the 2010 Plan) and the performance-vesting tranche becomes fully vested if a Change in Control occurs on or before December 31, 2016, subject to the Change in Control per share price of the Company’s common stock being equal to or in excess of $21.30 per share.