ICR Conference Presentation: January 2018 Exhibit 99.1

Forward Looking Statements This presentation contains “forward-looking” statements that involve risks, uncertainties and assumptions. If the risks or uncertainties ever materialize or the assumptions prove incorrect, the Company’s results may differ materially from those expressed or implied by such forward-looking statements. All statements other than statements of historical fact could be deemed forward-looking, including, but not limited to, the Company’s intentions, beliefs or current expectations concerning, among other things, the Company’s results of operations, financial condition, liquidity, prospects, growth, strategies and the industry in which we operate and any statements of assumptions underlying any of the foregoing. These statements are based on estimates and information available to us at the time of this presentation and are not guarantees of future performance. These forward-looking statements are based on certain assumptions and are subject to risks and uncertainties, including those described in the “Risk Factors” section and elsewhere in the preliminary prospectus for this offering. You should read the prospectus, including the Risk Factors set forth therein and the documents that the Company has filed as exhibits to the registration statement, of which the prospectus is a part, completely and with the understanding that if any such risks or uncertainties materialize or if any of the relevant assumptions prove incorrect, the Company’s actual results could differ materially from the results expressed or implied by these forward-looking statements. Except as required by law we assume no obligation to update these forward-looking statements publicly, or to update the reasons why actual results could differ materially from those anticipated in the forward-looking statements, even if new information becomes available in the future. Safe Harbor

A disruptive innovation in a huge and growing industry A socially responsible, pet health-centric brand built around the contemporary consumer We are redefining what good pet food is in ways that are intuitive to consumers We deliver a value proposition relevant to the average consumer and every class of pet retailer We have a scalable and very difficult to replicate business model Who Is Freshpet?

Freshpet Lives at the Intersection of Two Very Powerful Macro-Trends in CPG Humanization of Pets Fresh, Wholesome, All-Natural Foods

We Operate Differently Delighting consumers with fresh food & our company ideology Environmentally Focused Employee Engagement Community & Consumer Engagement

High Brand Loyalty Alignment with deep pet parent emotional motivations Differentiated Innovative forms, technologies, and appearance Manufacturing Proprietary technology, processes, and infrastructure Freshpet Fridge Branded, company-owned real estate Supply Chain Only refrigerated pet food network in North America Retailer Partners Delivers benefits in traffic, frequency and retailer margins A Difficult Business to Replicate 6

With Growth Potential in Fresh E-Commerce Strategy: Grow with winning players in fresh e-commerce 7 Curbside Online Fresh Retail Home Delivery

In 2017, we launched our new strategy . . .

The essence of our strategic bet in 2017 . . . . 71% Repurchase Rate

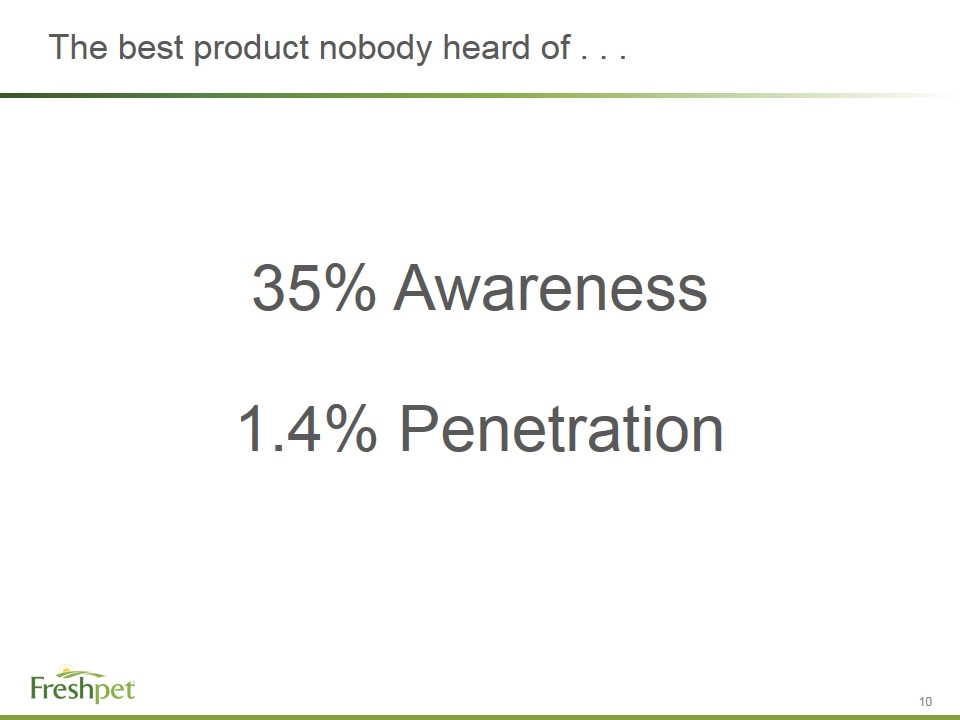

The best product nobody heard of . . . 1.4% Penetration 35% Awareness

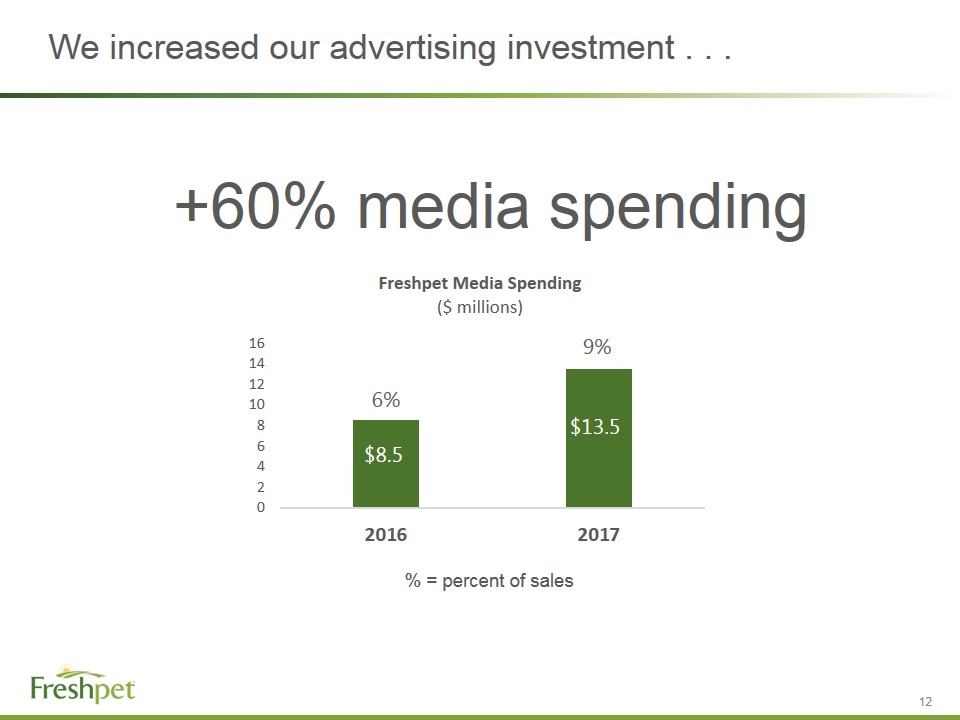

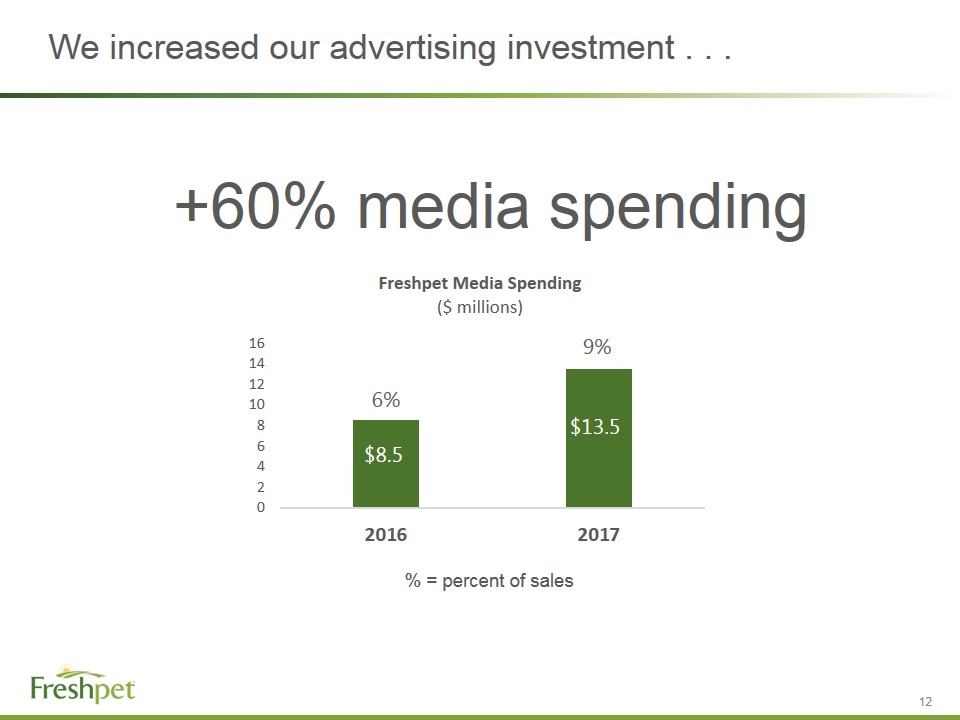

We increased our advertising investment . . . +60% media spending $13.5 $8.5 6% 9% % = percent of sales

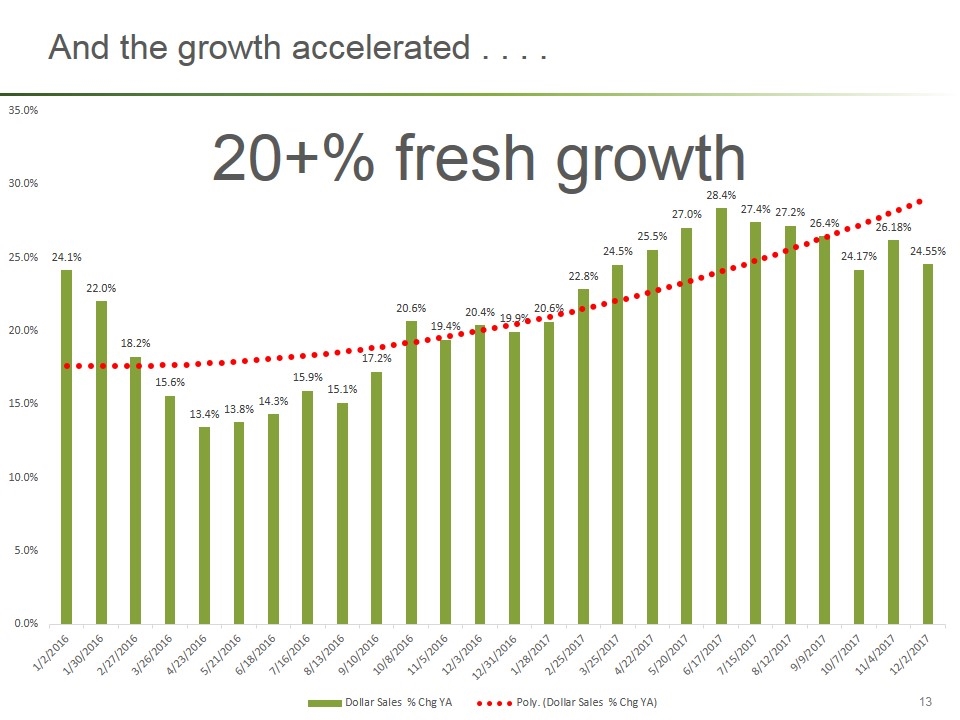

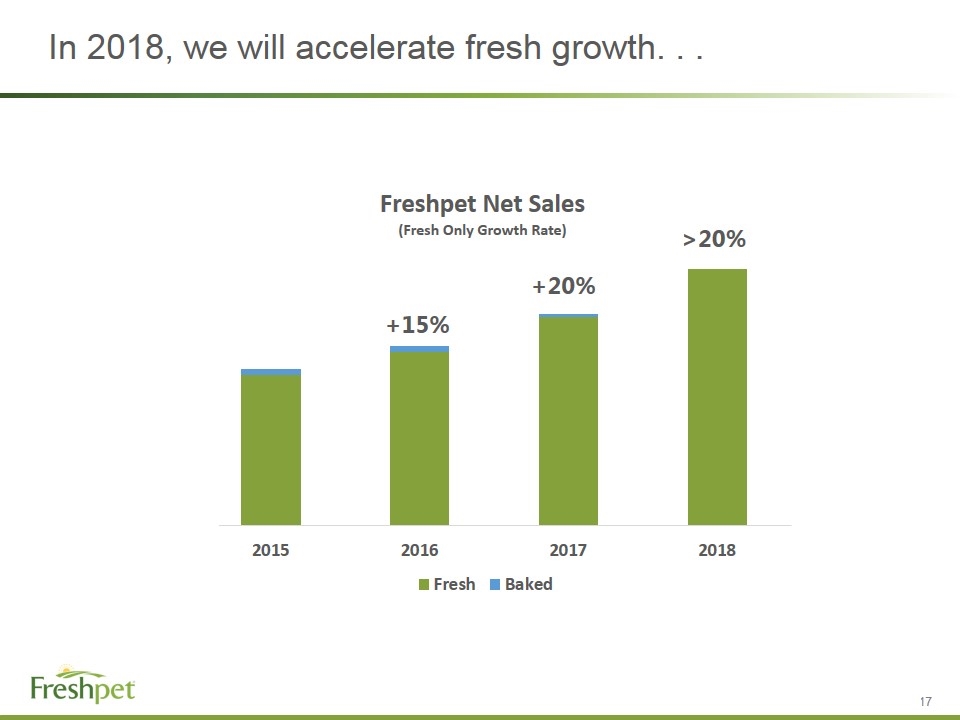

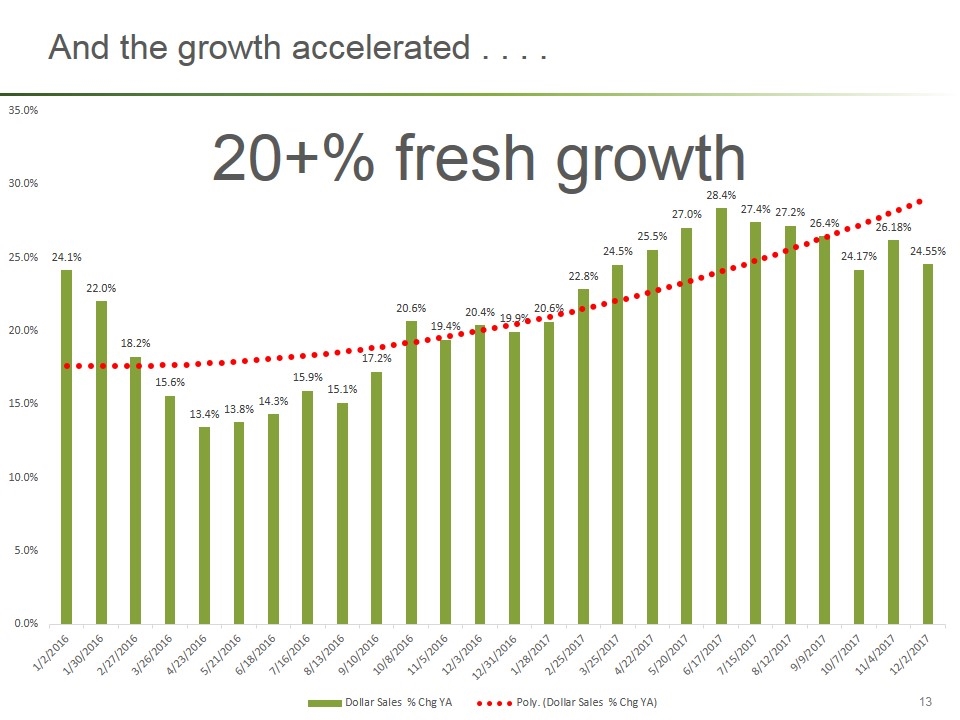

And the growth accelerated . . . . 20+% fresh growth

The media delivered an attractive financial return. . . 90% pay back (about 13 months to get our money back – and accelerating)

Increased awareness and penetration . . . 1.8% Penetration (+0.4 points) 40% Awareness (+5 points)

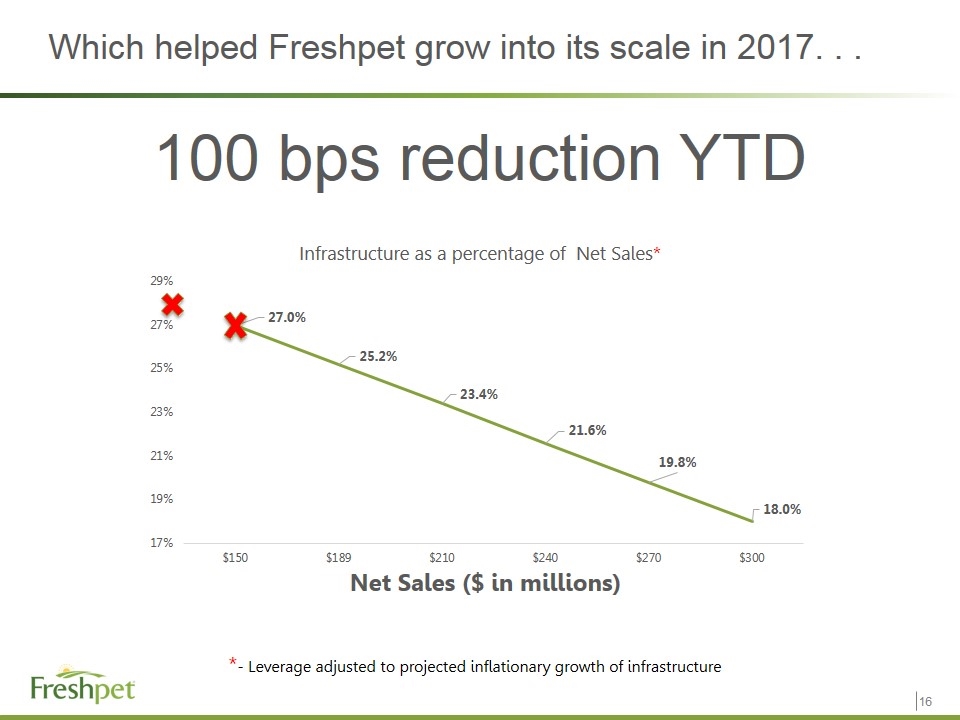

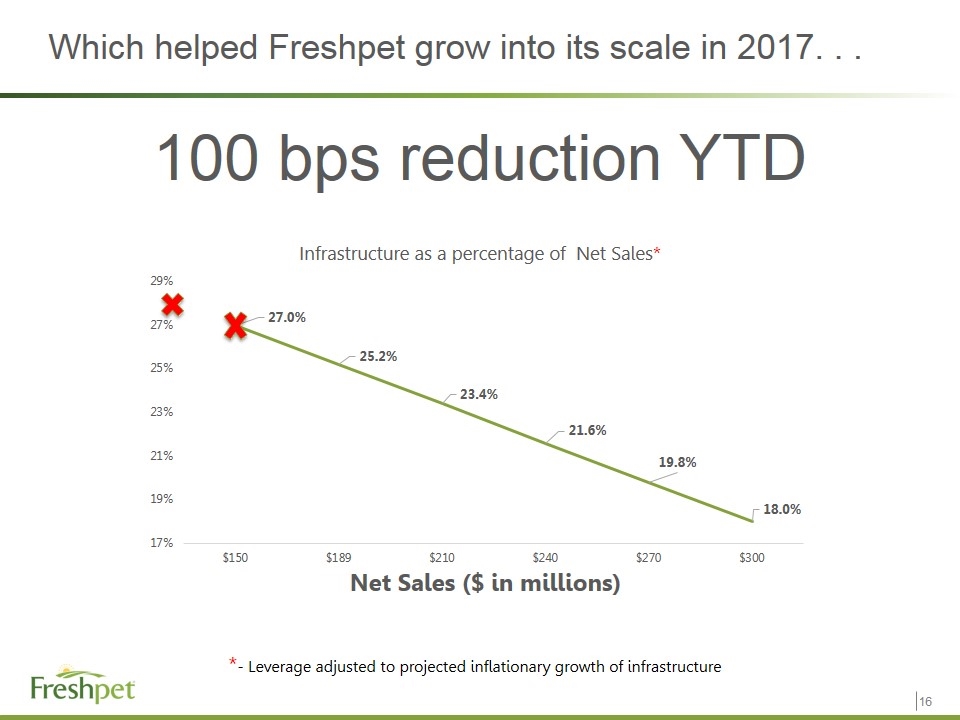

Which helped Freshpet grow into its scale in 2017. . . 100 bps reduction YTD *- Leverage adjusted to projected inflationary growth of infrastructure

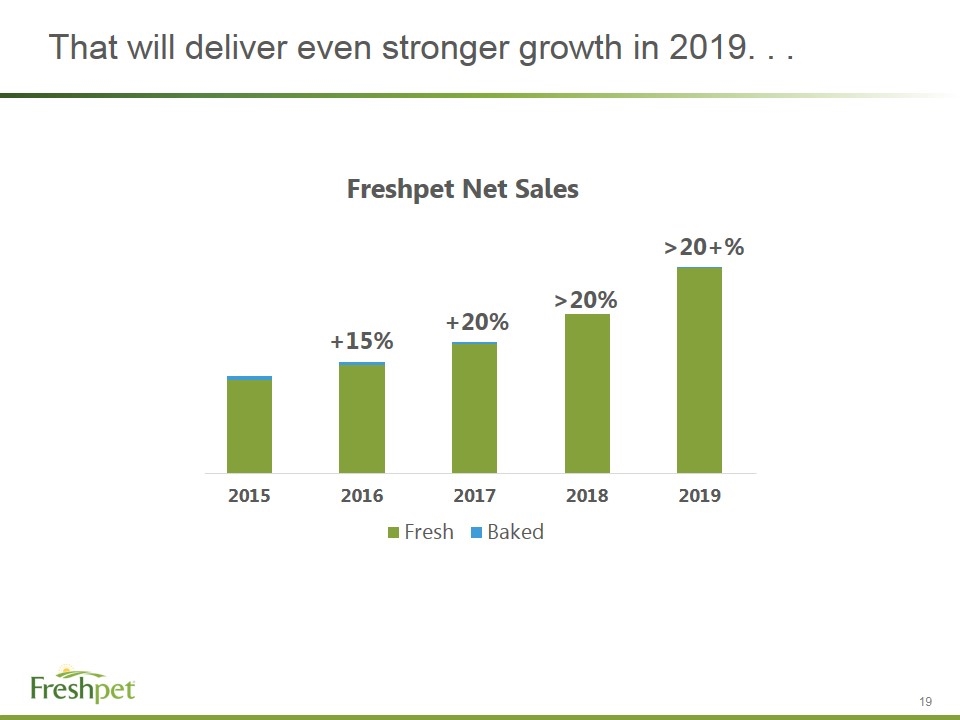

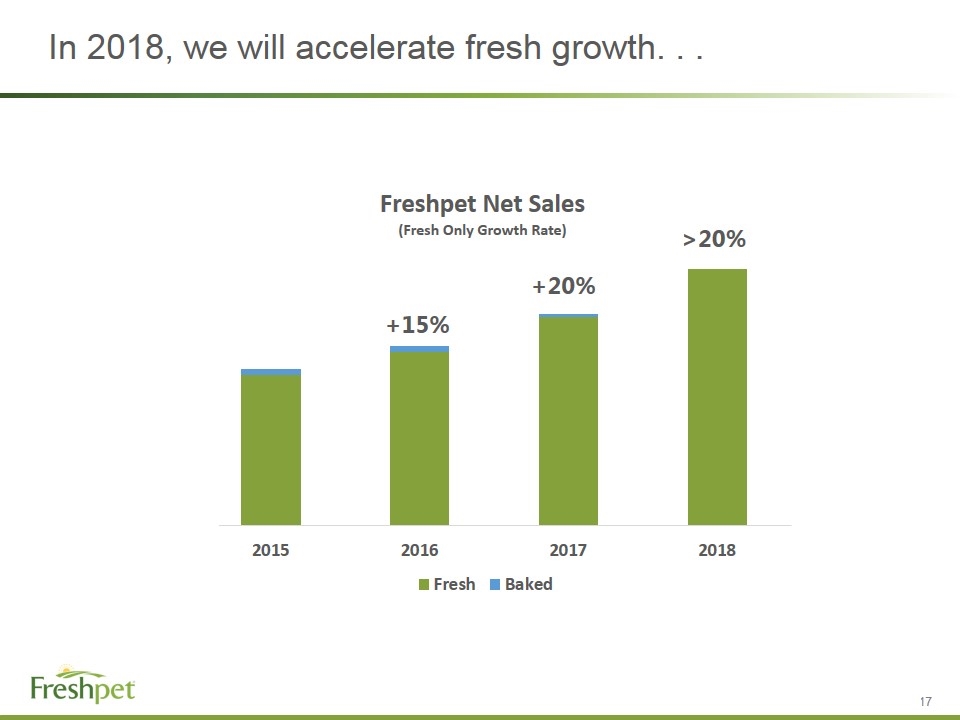

In 2018, we will accelerate fresh growth. . . +15% +20% >20%

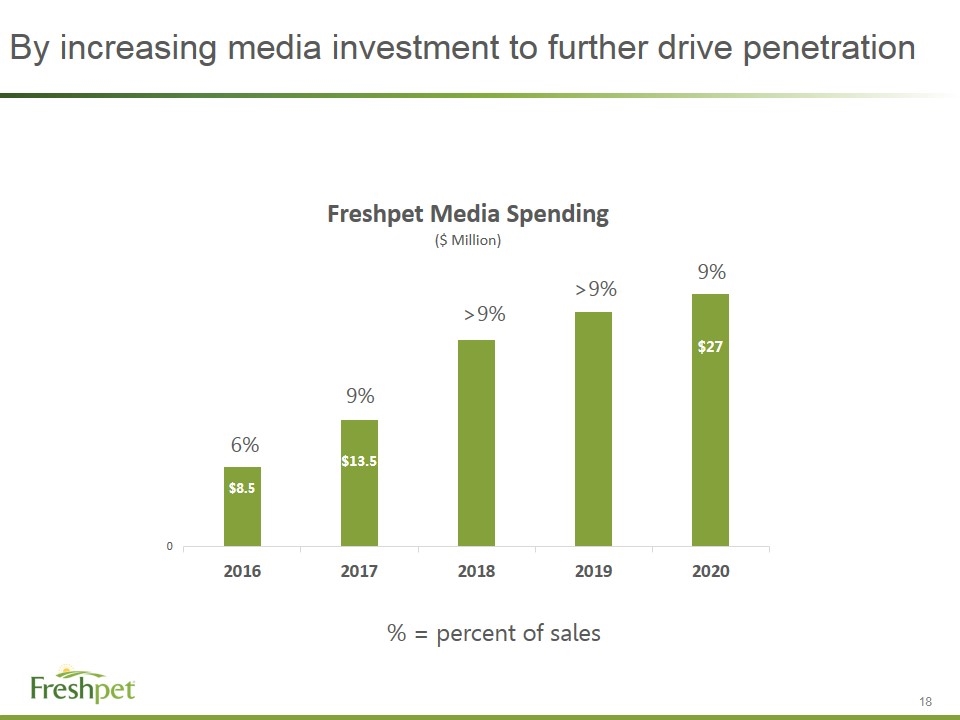

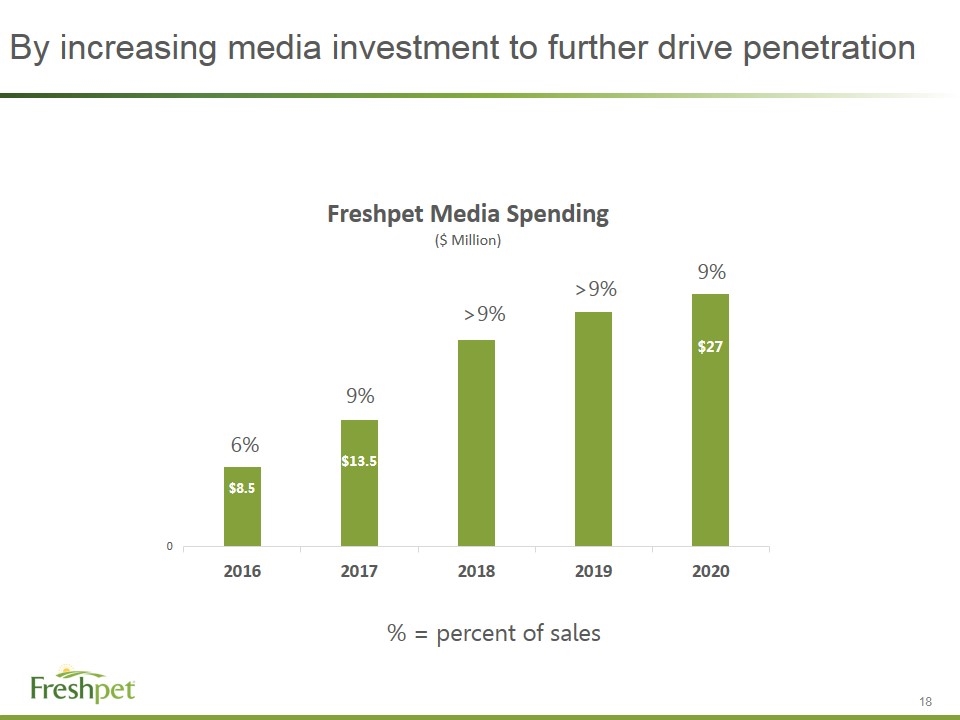

By increasing media investment to further drive penetration $27 $13.5 $8.5 6% 9% 9% >9% >9% % = percent of sales

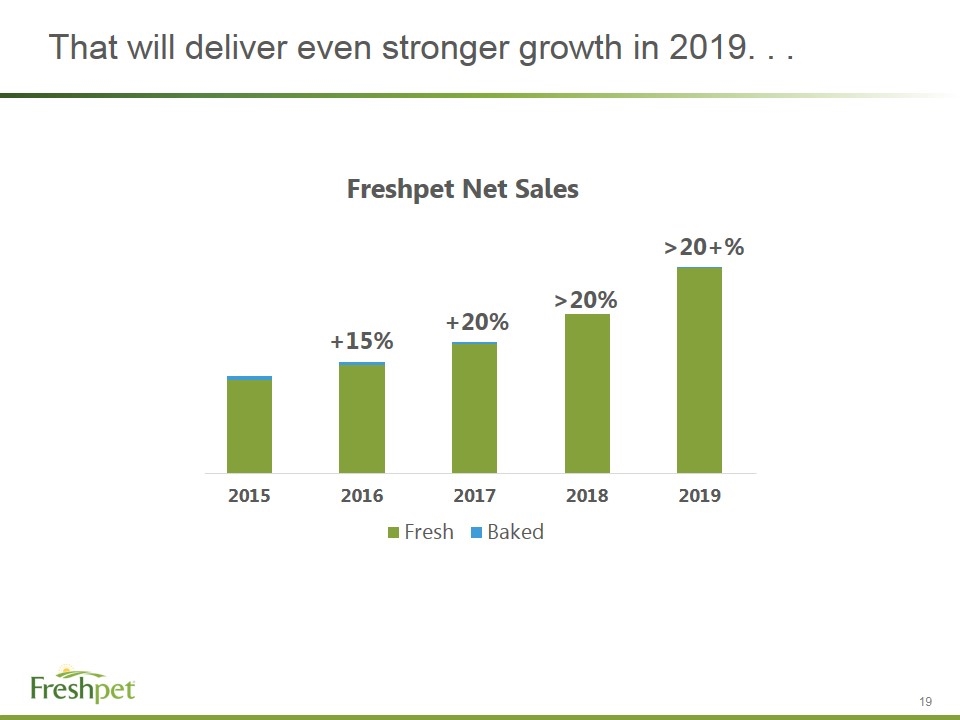

That will deliver even stronger growth in 2019. . . +15% +20% >20% >20+%

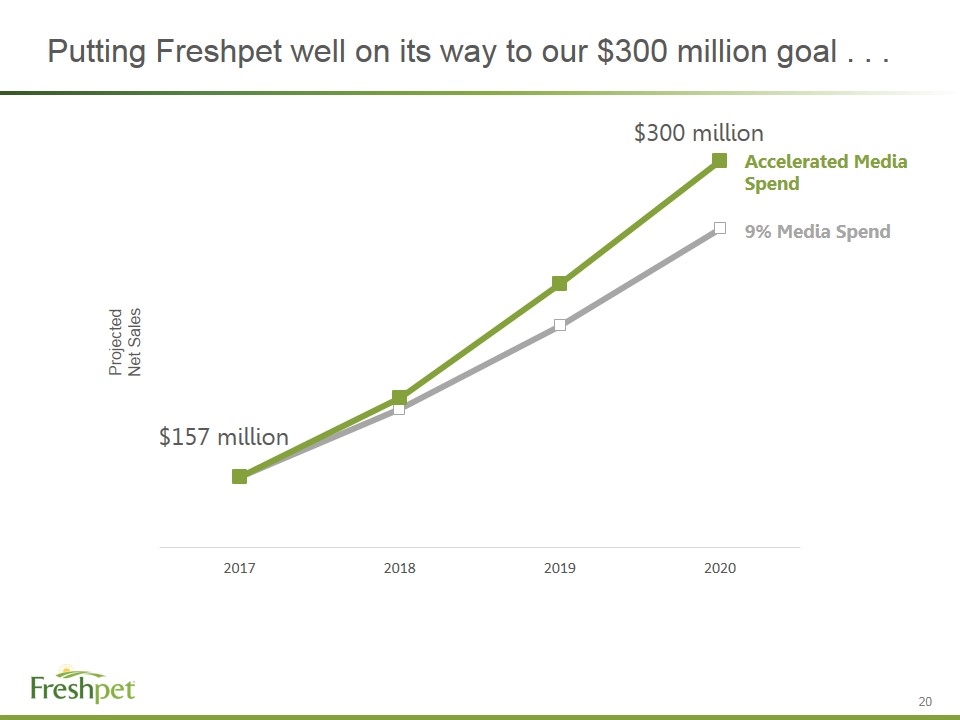

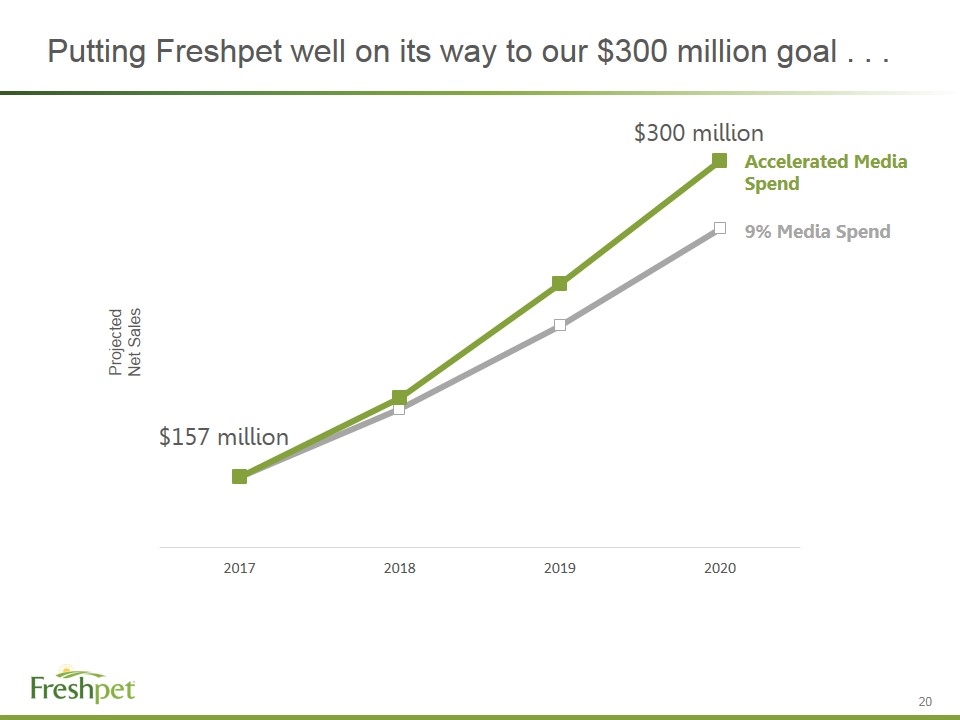

Putting Freshpet well on its way to our $300 million goal . . . Accelerated Media Spend 9% Media Spend Projected Net Sales $300 million $157 million

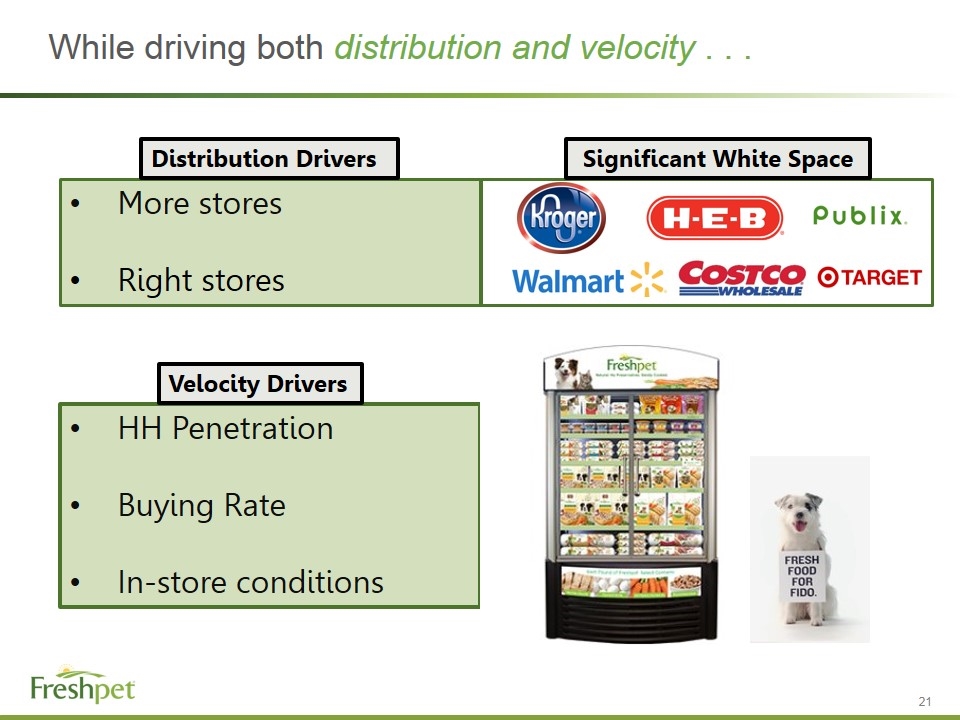

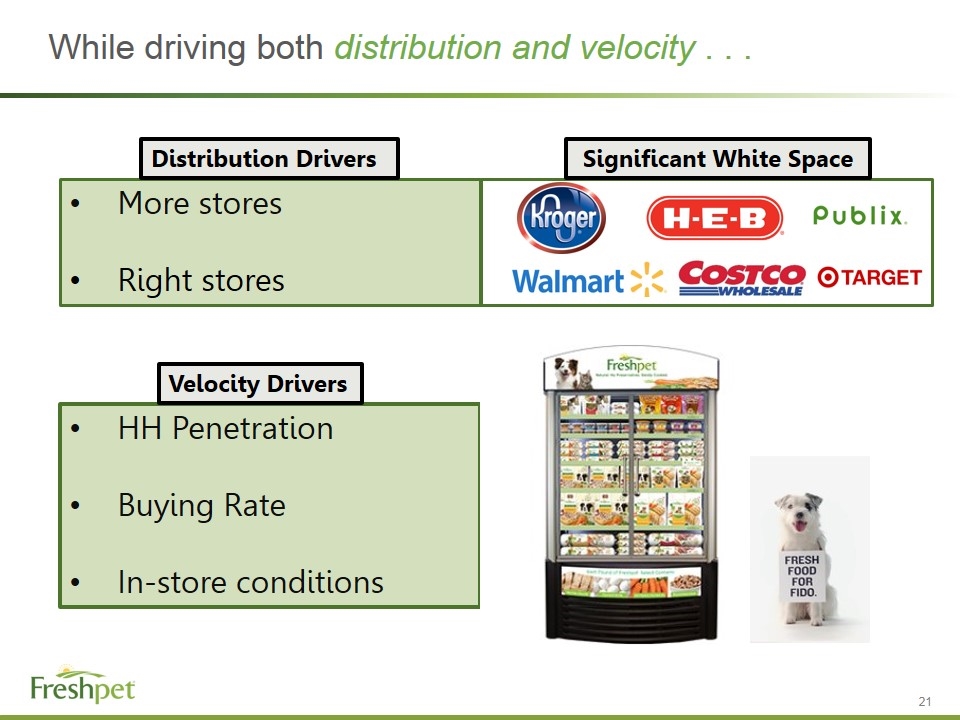

xxx More stores Right stores While driving both distribution and velocity . . . HH Penetration Buying Rate In-store conditions Distribution Drivers Velocity Drivers Significant White Space

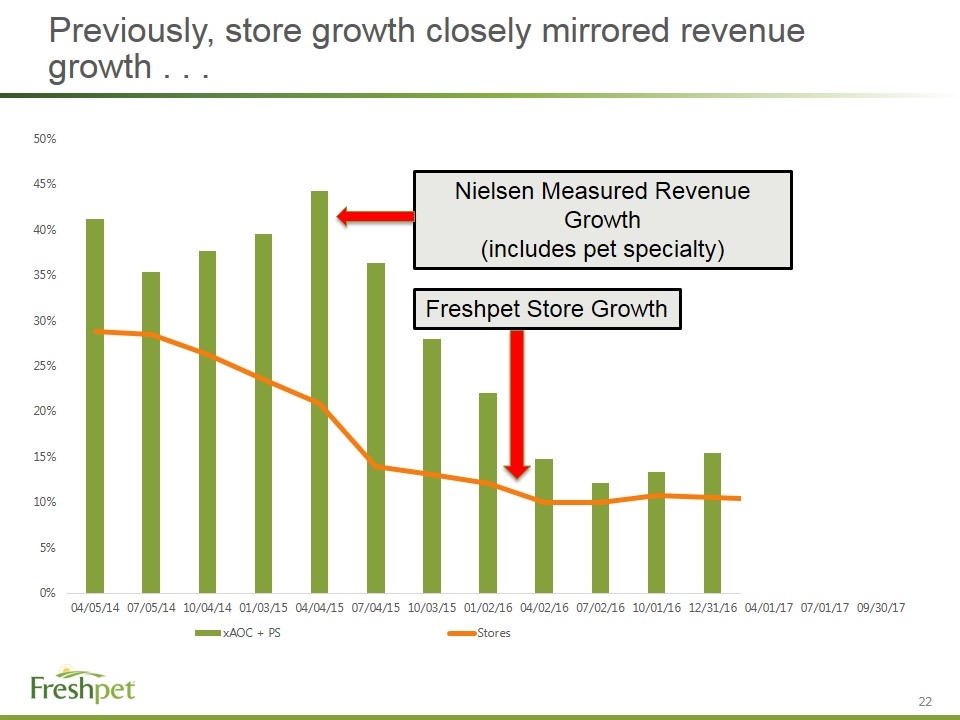

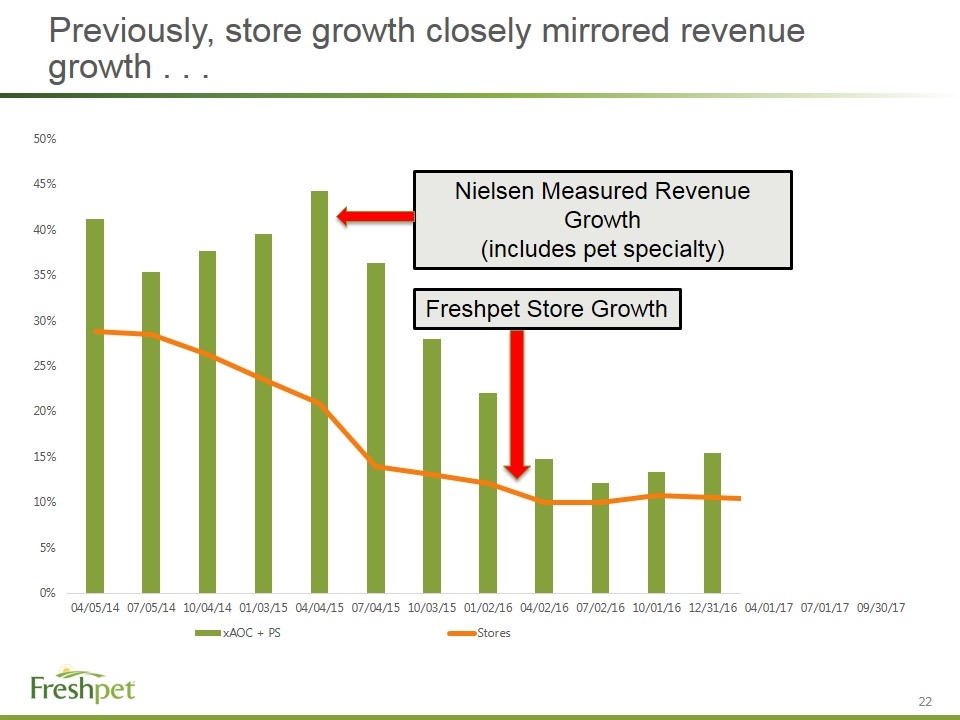

Previously, store growth closely mirrored revenue growth . . . Nielsen Measured Revenue Growth (includes pet specialty) Freshpet Store Growth

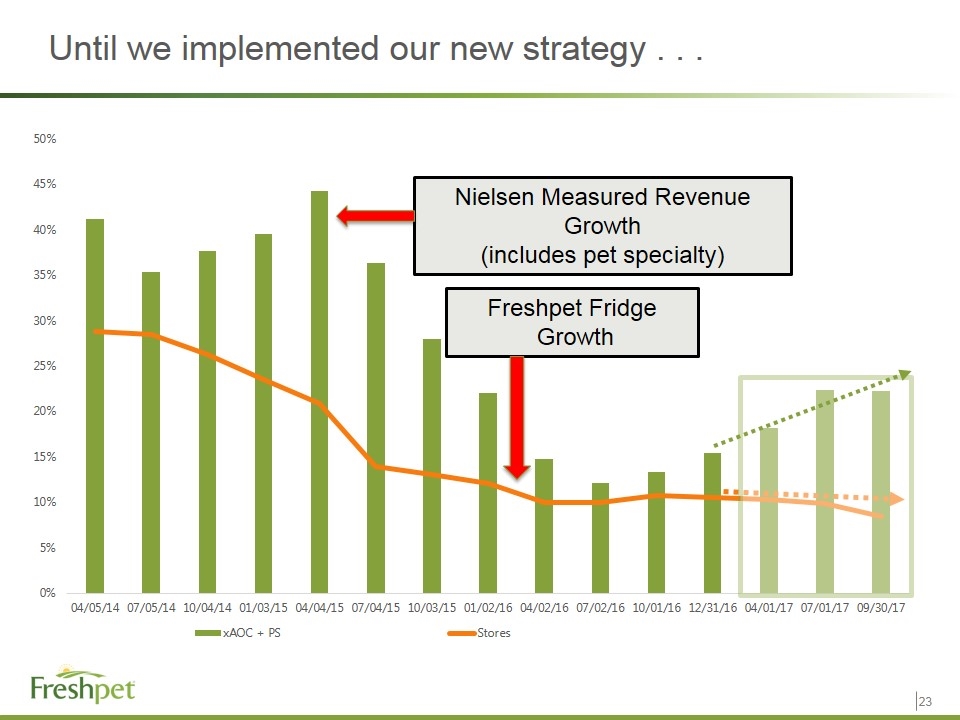

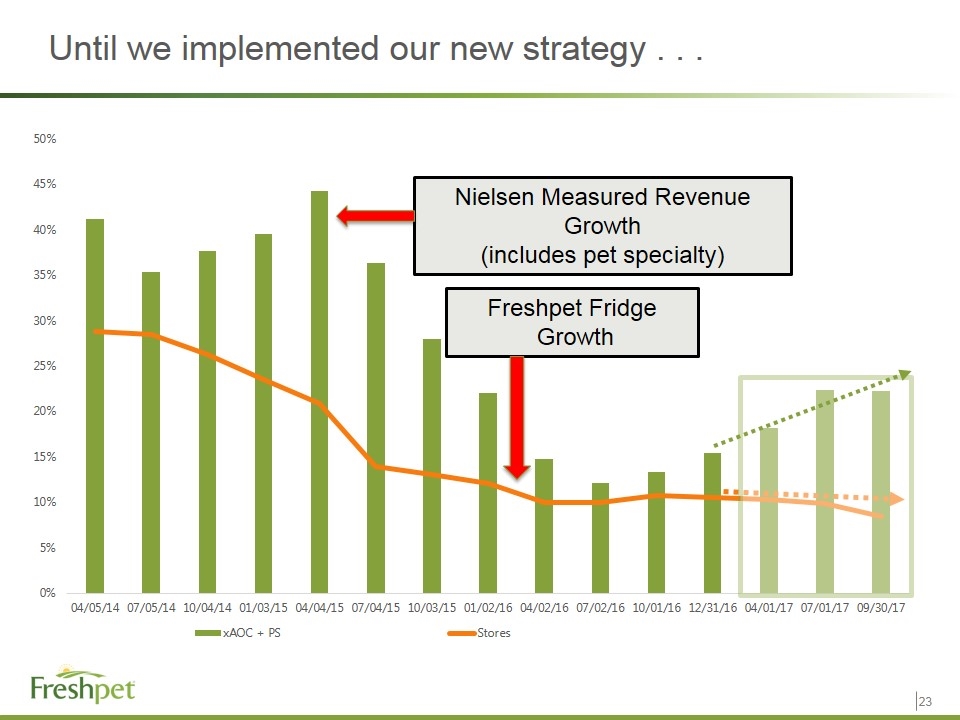

Until we implemented our new strategy . . . Nielsen Measured Revenue Growth (includes pet specialty) Freshpet Fridge Growth

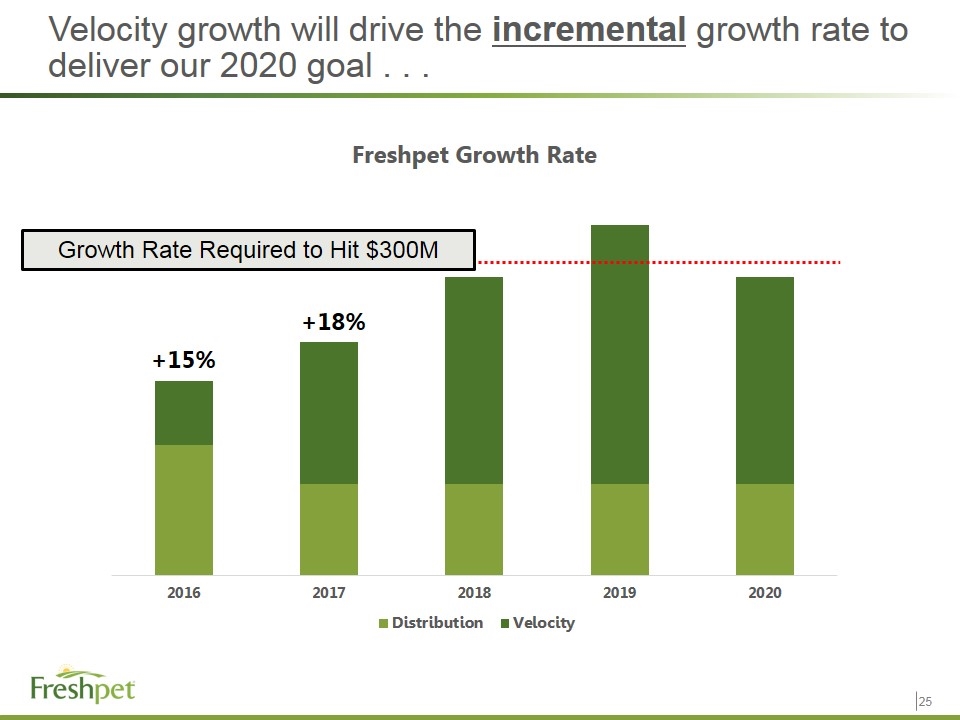

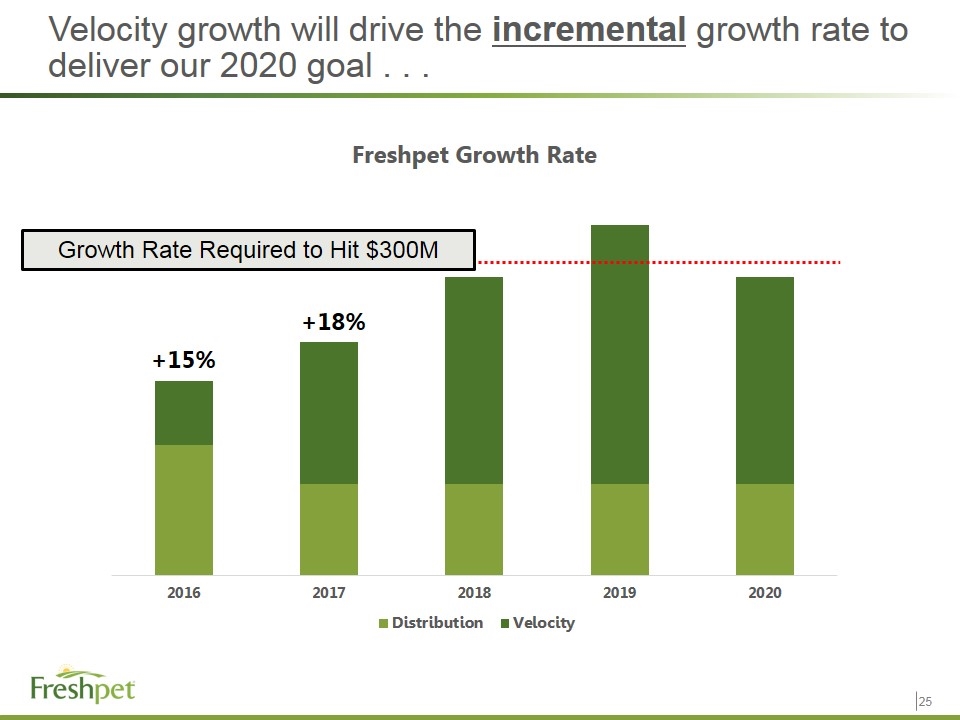

Velocity growth will drive the incremental growth rate to deliver our 2020 goal . . . +15% +18% Growth Rate Required to Hit $300M

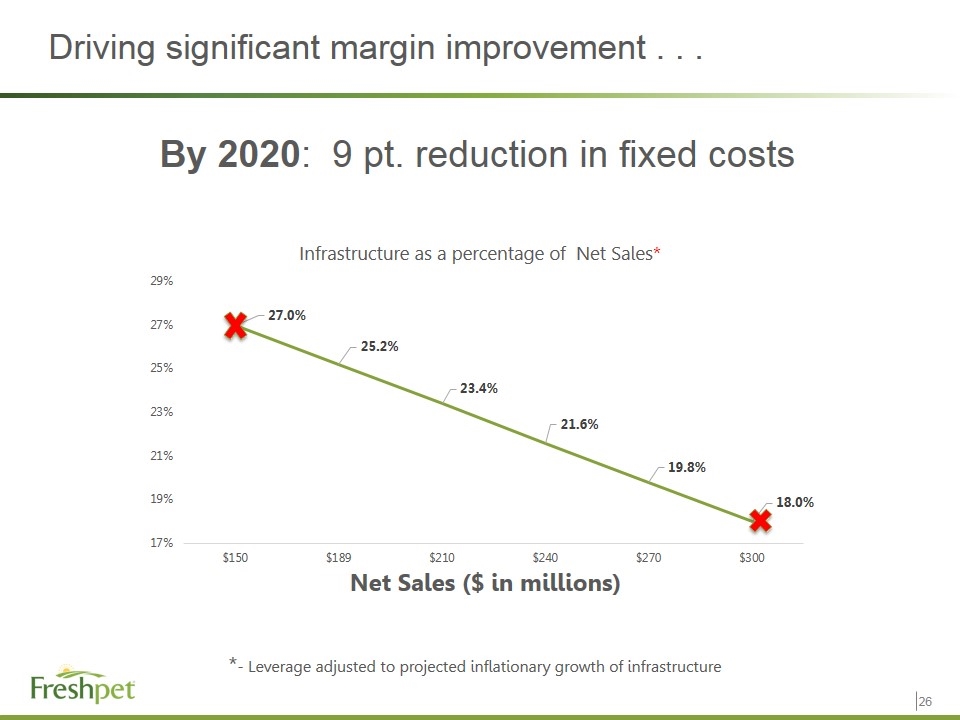

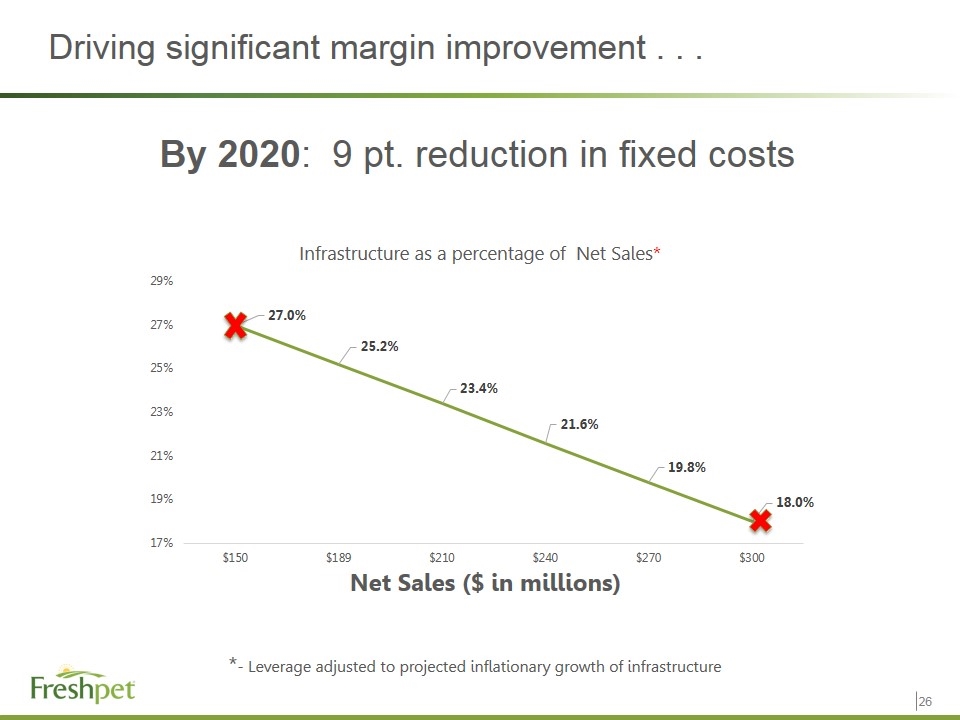

Driving significant margin improvement . . . *- Leverage adjusted to projected inflationary growth of infrastructure By 2020: 9 pt. reduction in fixed costs

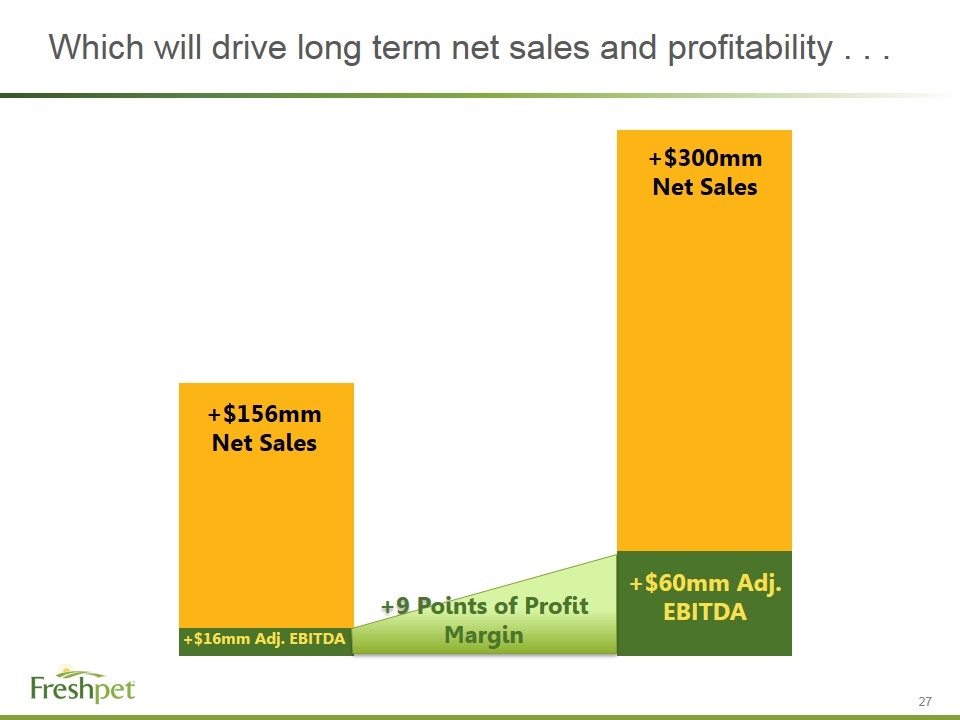

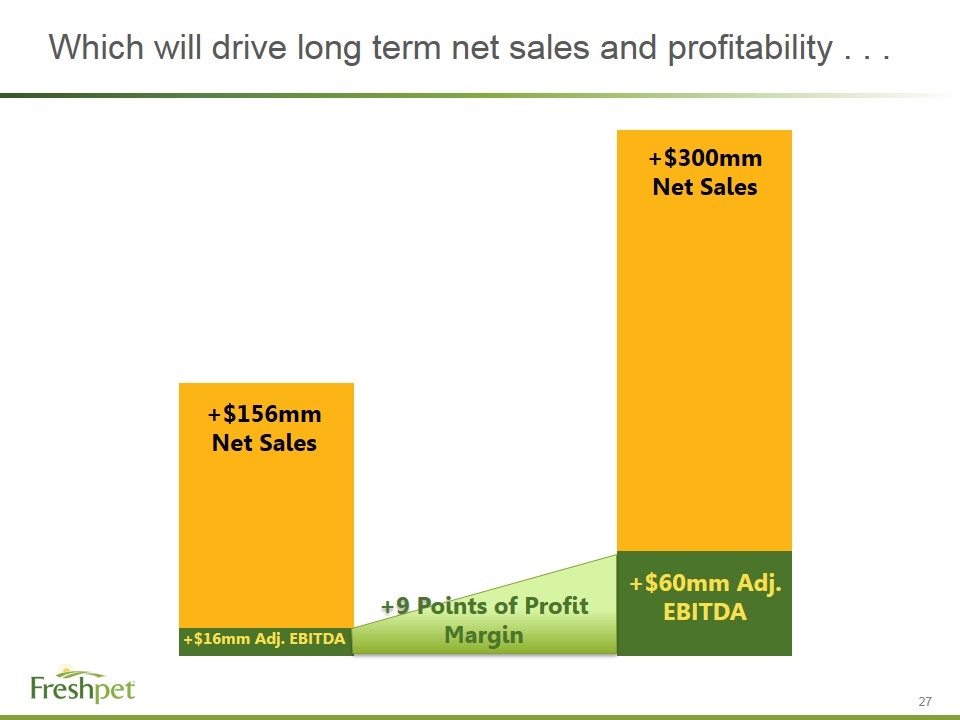

Which will drive long term net sales and profitability . . . +$156mm Net Sales +$300mm Net Sales +9 Points of Profit Margin +$16mm Adj. EBITDA +$60mm Adj. EBITDA

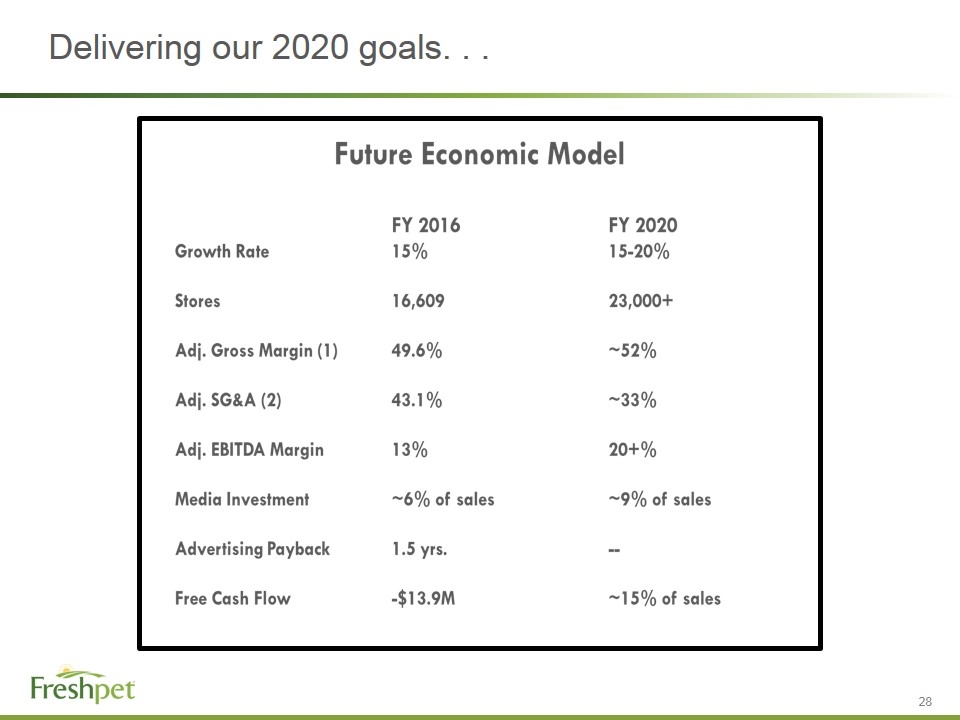

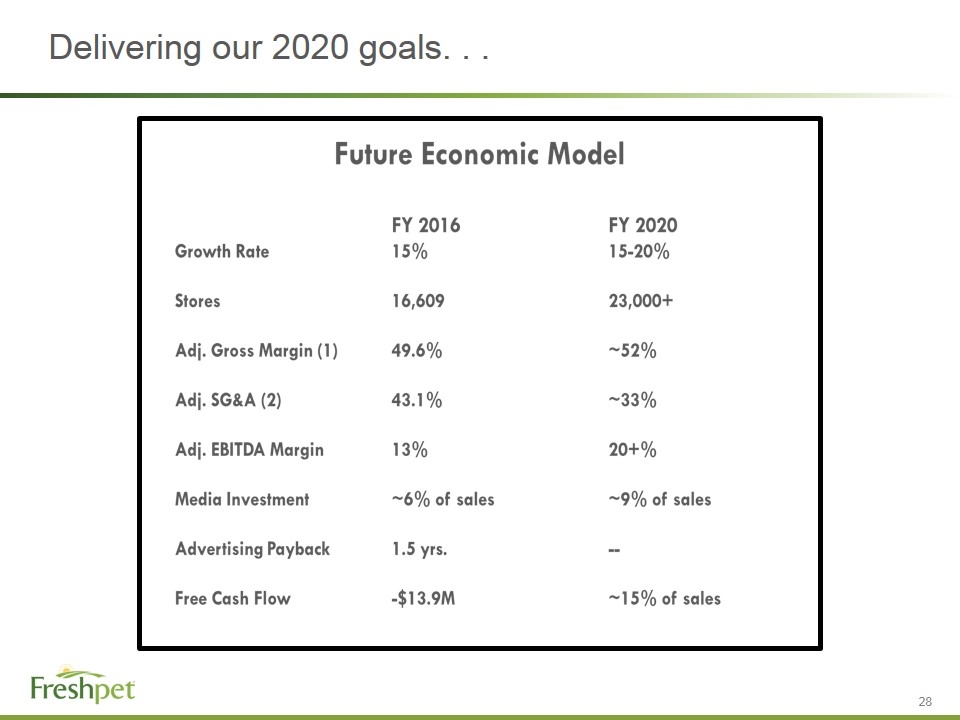

Delivering our 2020 goals. . .

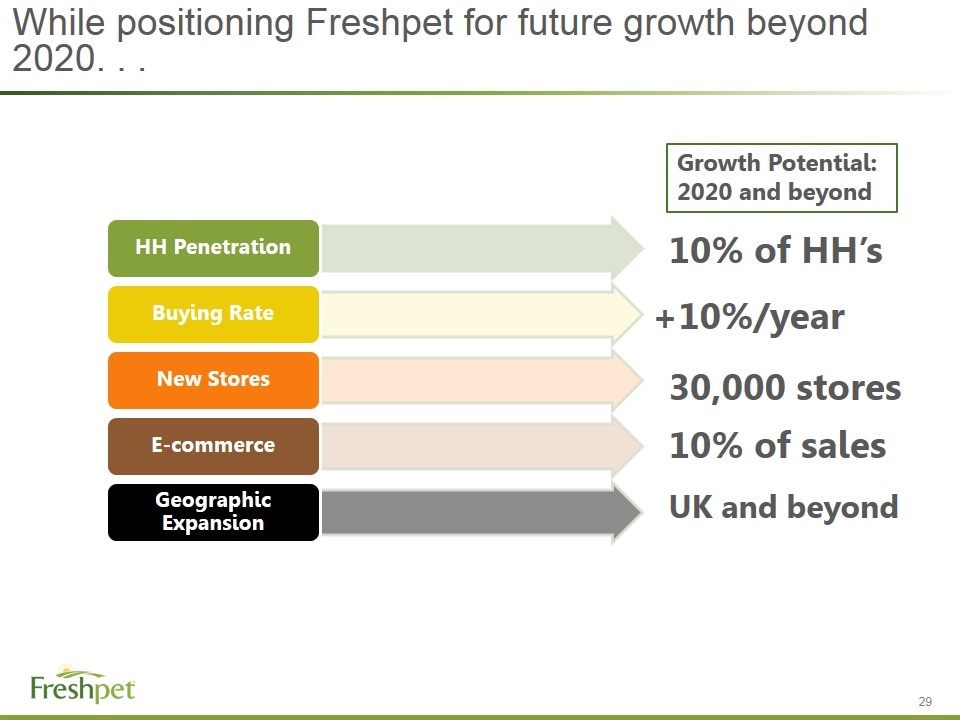

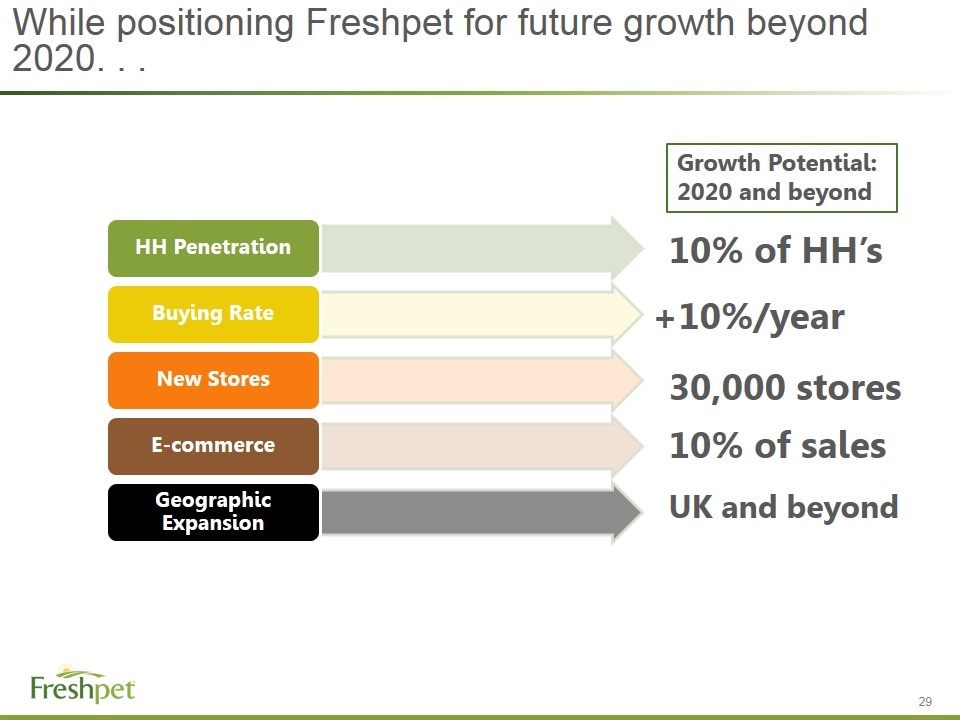

While positioning Freshpet for future growth beyond 2020. . . 10% of HH’s +10%/year 10% of sales UK and beyond 30,000 stores Growth Potential: 2020 and beyond HH Penetration Buying Rate New Stores Geographic Expansion E-commerce

Further strengthening our barriers to entry . . .

Delighting pet parents, pets, shareholders and employees . . .

APPENDIX

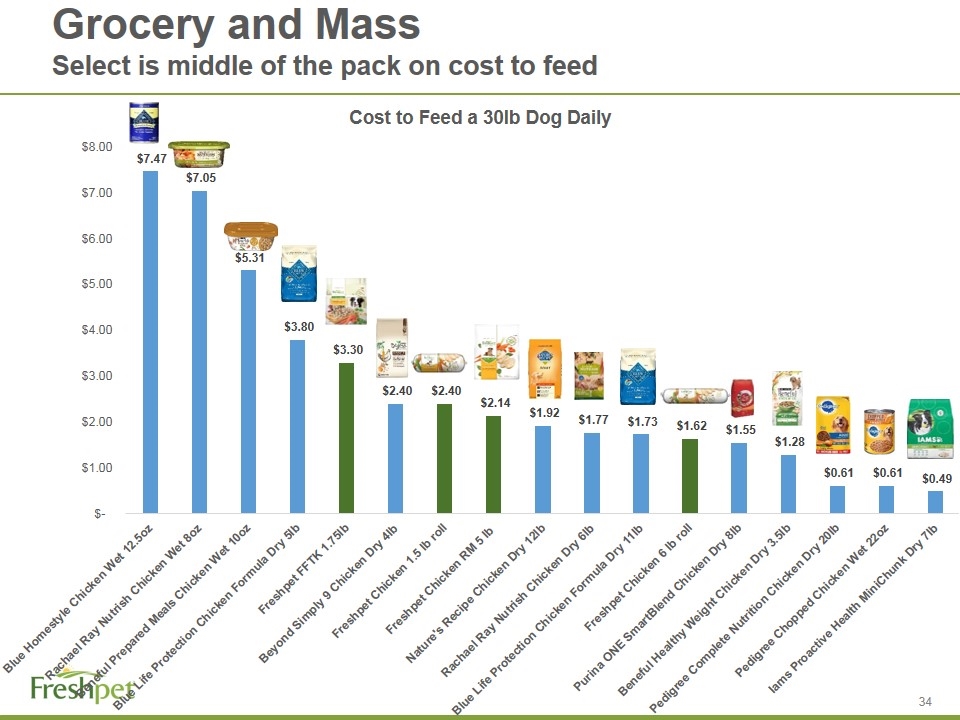

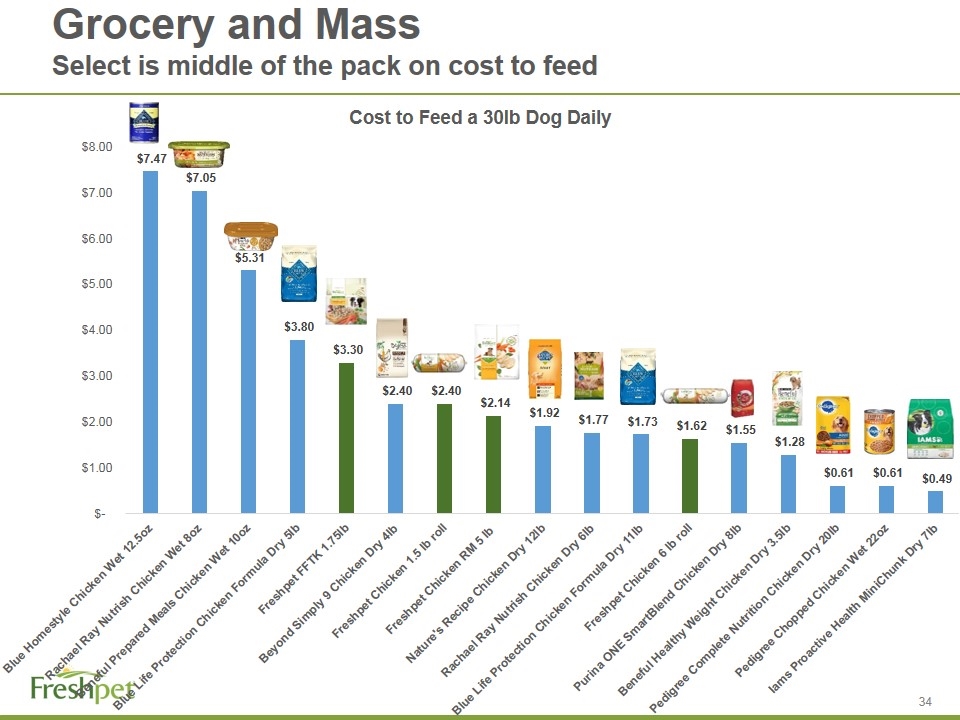

Grocery and Mass Select is middle of the pack on cost to feed

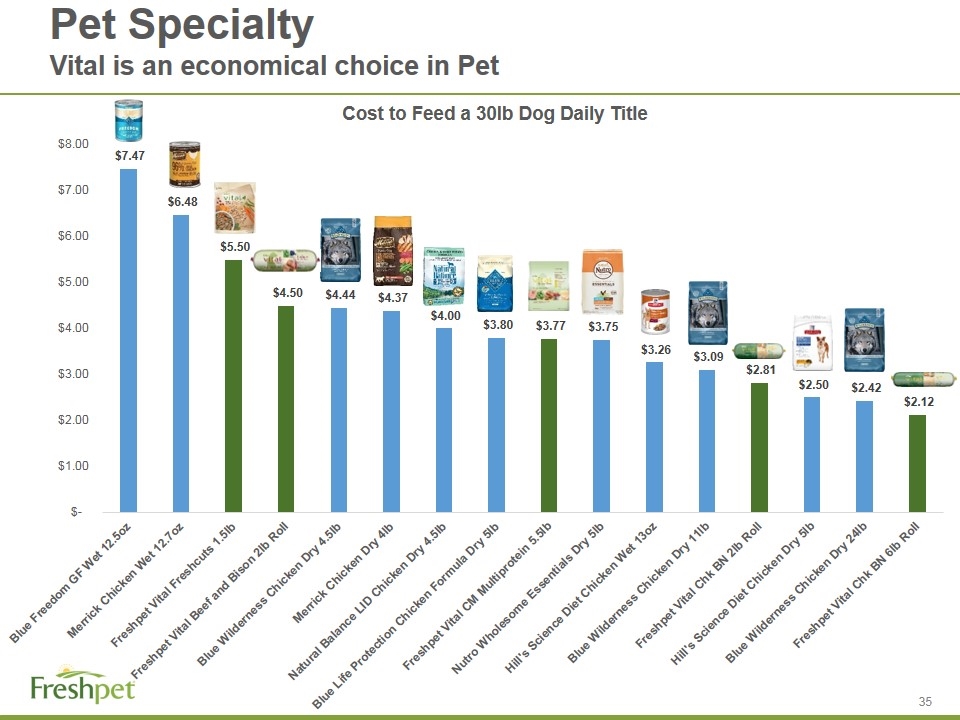

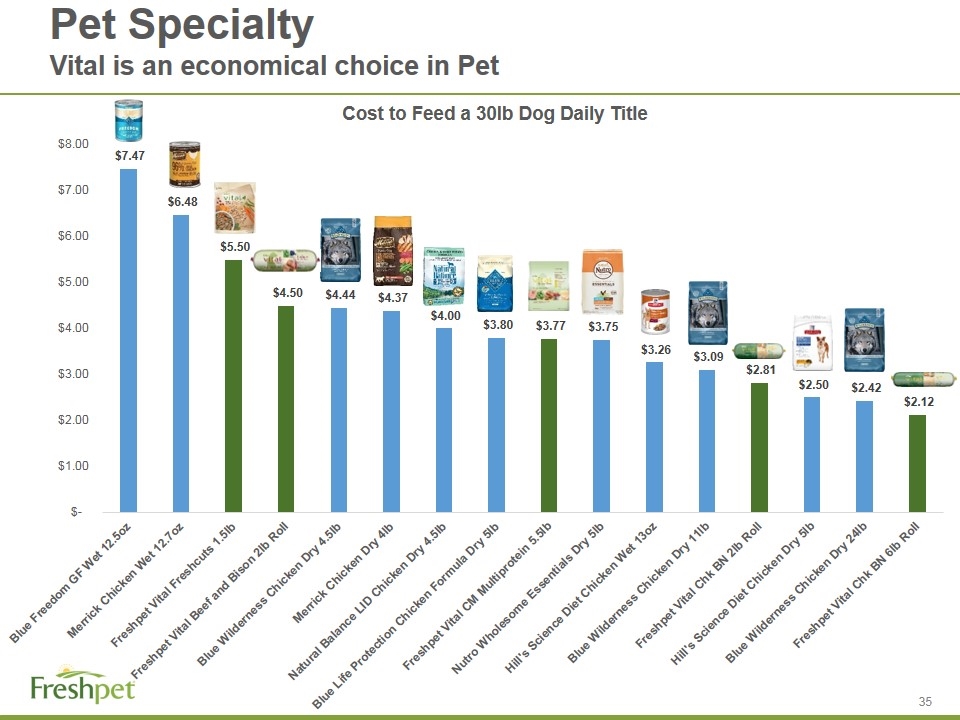

Pet Specialty Vital is an economical choice in Pet