Fourth Quarter & Full Year 2017 Results 2018 Plan Review Exhibit 99.2

Forward Looking Statements This presentation contains “forward-looking” statements that involve risks, uncertainties and assumptions. If the risks or uncertainties ever materialize or the assumptions prove incorrect, the Company’s results may differ materially from those expressed or implied by such forward-looking statements. All statements other than statements of historical fact could be deemed forward-looking, including, but not limited to, the Company’s intentions, beliefs or current expectations concerning, among other things, the Company’s results of operations, financial condition, liquidity, prospects, growth, strategies and the industry in which we operate and any statements of assumptions underlying any of the foregoing. These statements are based on estimates and information available to us at the time of this presentation and are not guarantees of future performance. These forward-looking statements are based on certain assumptions and are subject to risks and uncertainties, including those described in the “Risk Factors” section and elsewhere in the preliminary prospectus for this offering. You should read the prospectus, including the Risk Factors set forth therein and the documents that the Company has filed as exhibits to the registration statement, of which the prospectus is a part, completely and with the understanding that if any such risks or uncertainties materialize or if any of the relevant assumptions prove incorrect, the Company’s actual results could differ materially from the results expressed or implied by these forward-looking statements. Except as required by law we assume no obligation to update these forward-looking statements publicly, or to update the reasons why actual results could differ materially from those anticipated in the forward-looking statements, even if new information becomes available in the future. Safe Harbor

Agenda Freshpet Full Year 2017 Review Billy Cyr, Chief Executive Officer Financial Review & 2018 Guidance Dick Kassar, Chief Financial Officer 2018 Strategic Plan Billy Cyr, Chief Executive Officer Q&A Billy Cyr, Chief Executive Officer Dick Kassar, Chief Financial Officer Scott Morris, Chief Operating Officer

Billy Cyr Chief Executive Officer

Freshpet Financial Highlights & Business Performance Q4 net sales grew 19.5% with fresh sales +21.9% Double digit growth in all classes of trade FY17 net sales grew 17.5% with fresh sales +20.1% Accelerated growth rate from FY16’s +15% FY17 Adjusted EBITDA of $17.6 million Flat vs. YA despite +60% increase in media spending HH penetration, awareness and buying rate all increased significantly Still significant room to grow Velocity grew 16% in FY17

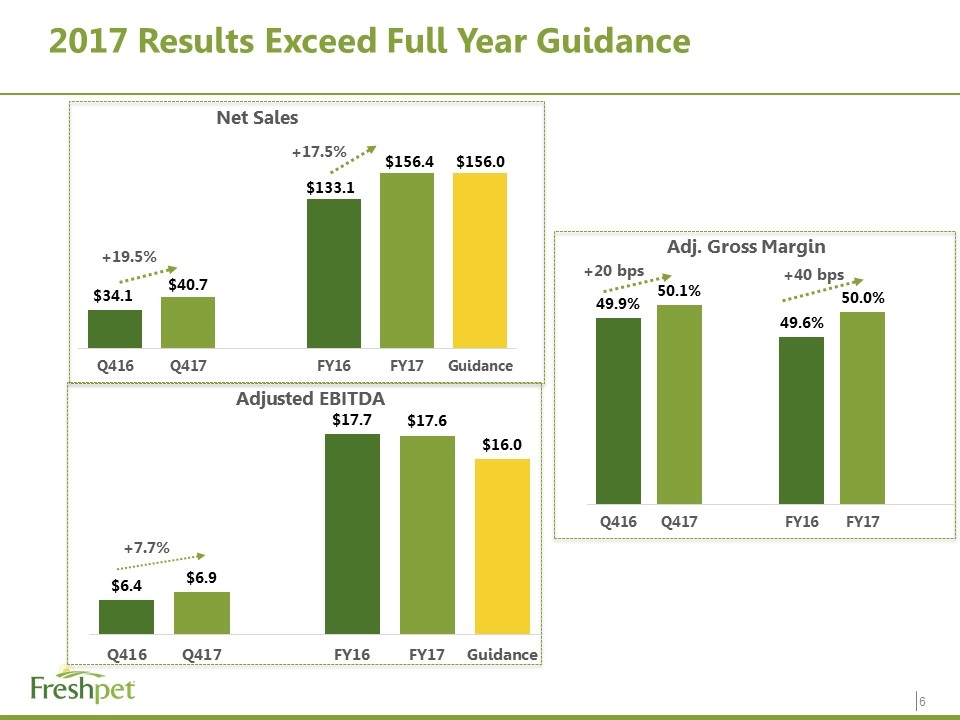

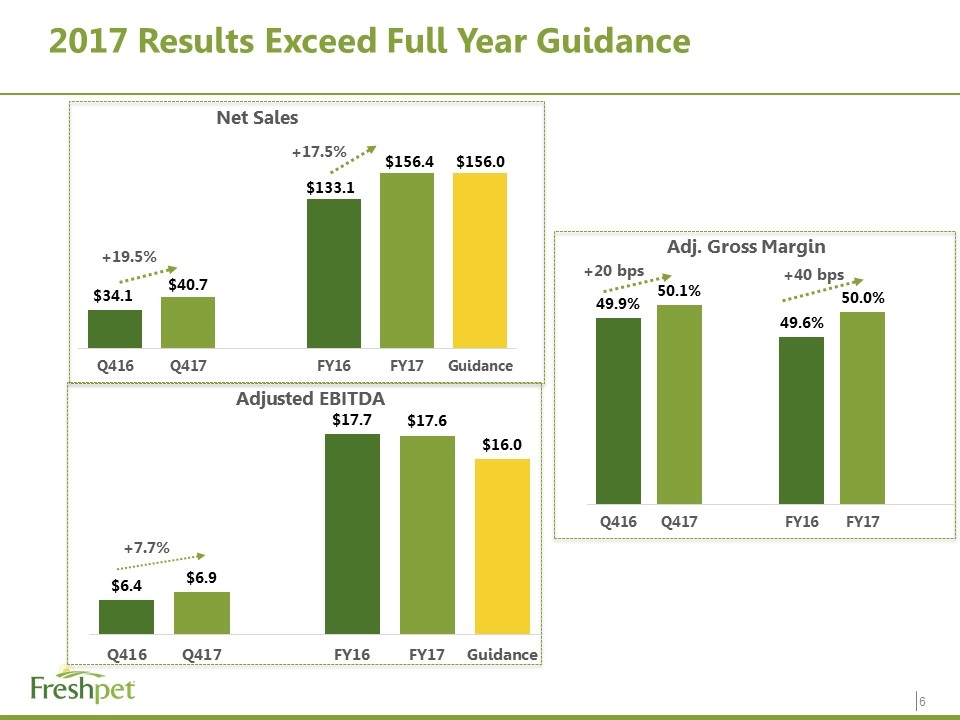

2017 Results Exceed Full Year Guidance $34.1 +19.5% $40.7 $156.4 $133.1 $156.0 +40 bps +20 bps

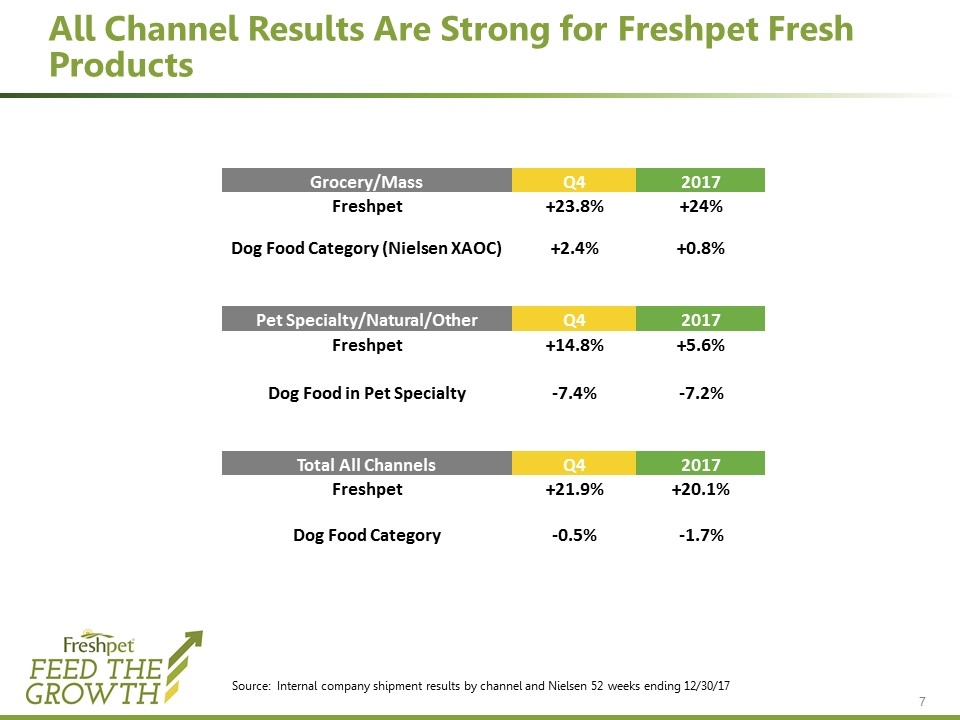

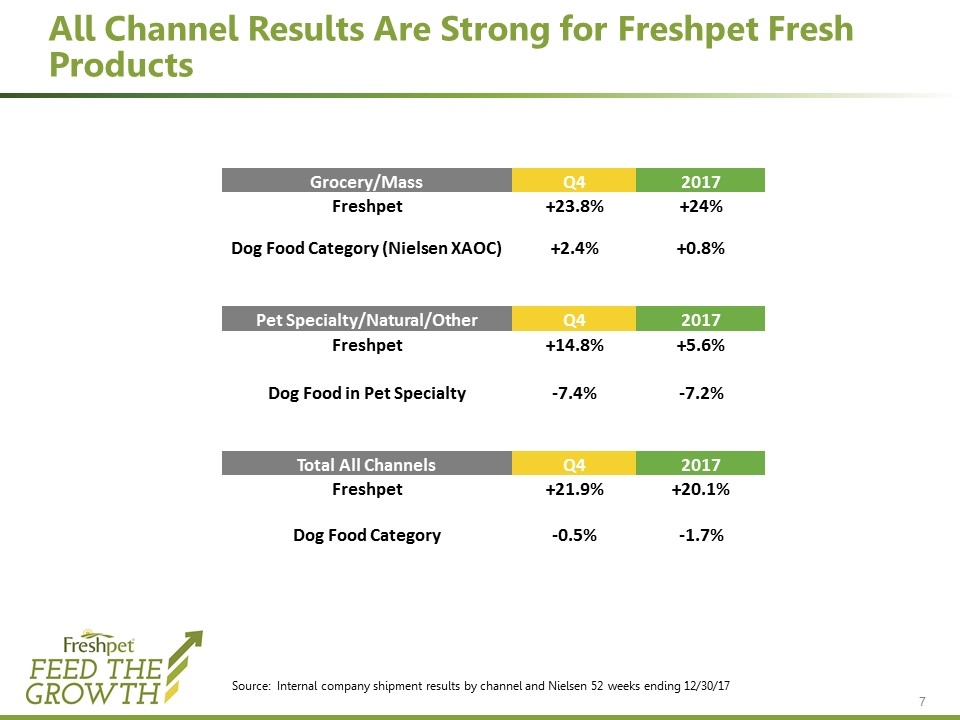

All Channel Results Are Strong for Freshpet Fresh Products Source: Internal company shipment results by channel and Nielsen 52 weeks ending 12/30/17 Grocery/Mass Q4 2017 Freshpet +23.8% +24% Dog Food Category (Nielsen XAOC) +2.4% +0.8% Pet Specialty/Natural/Other Q4 2017 Freshpet +14.8% +5.6% Dog Food in Pet Specialty -7.4% -7.2% Total All Channels Q4 2017 Freshpet +21.9% +20.1% Dog Food Category -0.5% -1.7%

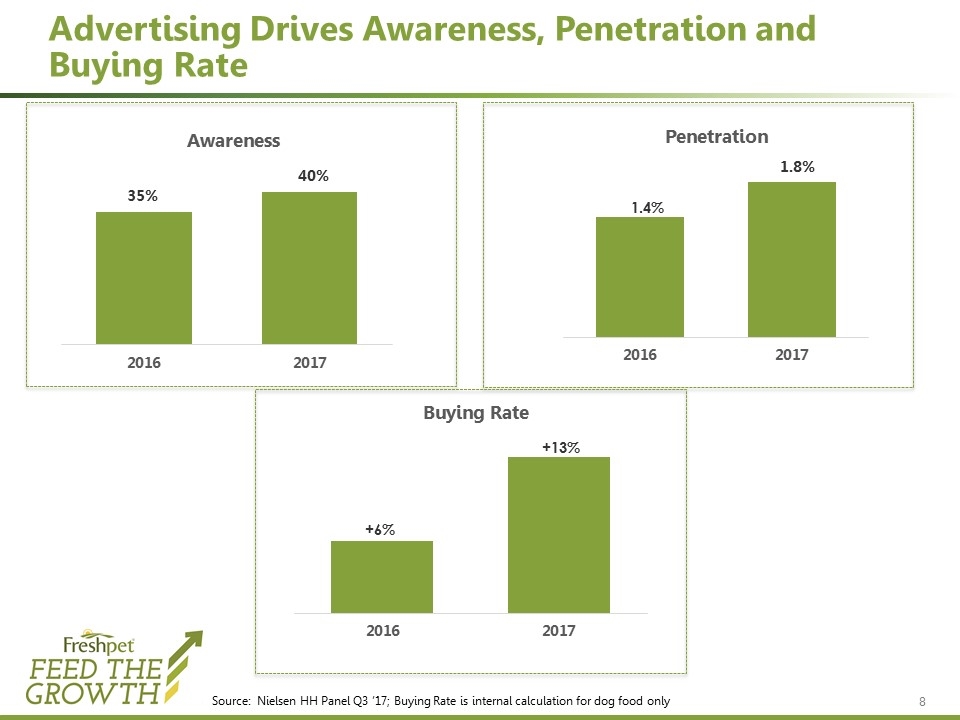

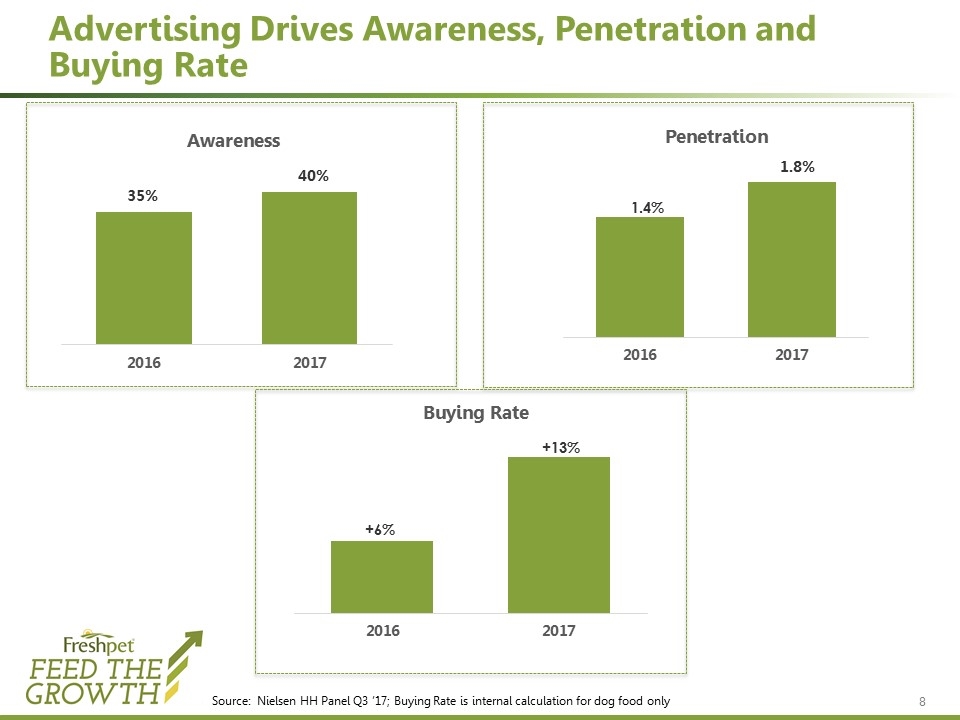

Advertising Drives Awareness, Penetration and Buying Rate Source: Nielsen HH Panel Q3 ’17; Buying Rate is internal calculation for dog food only 1.4%

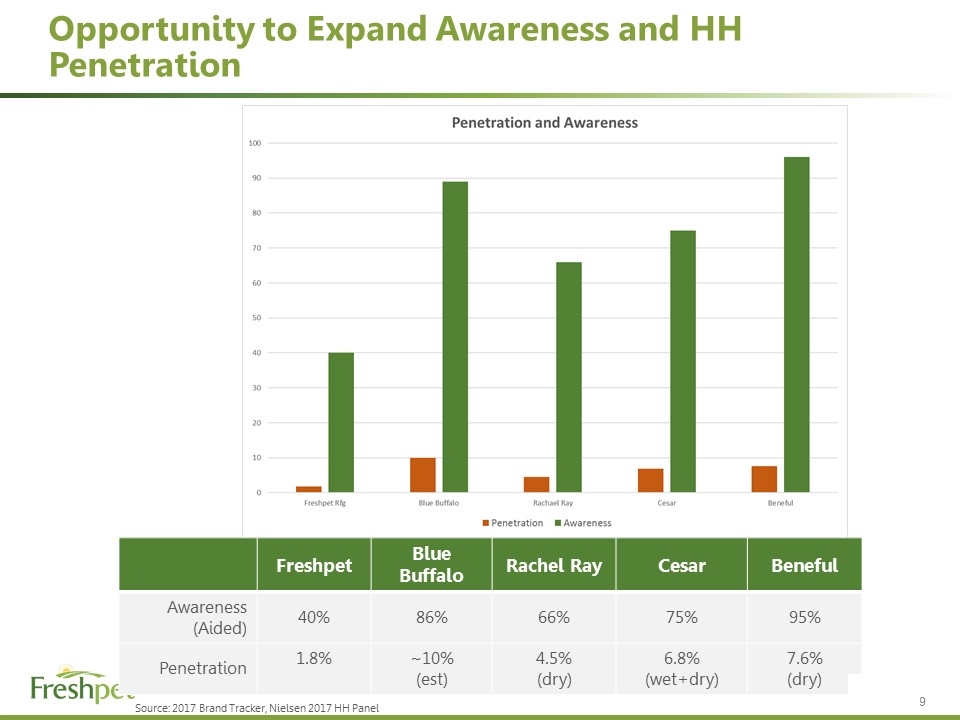

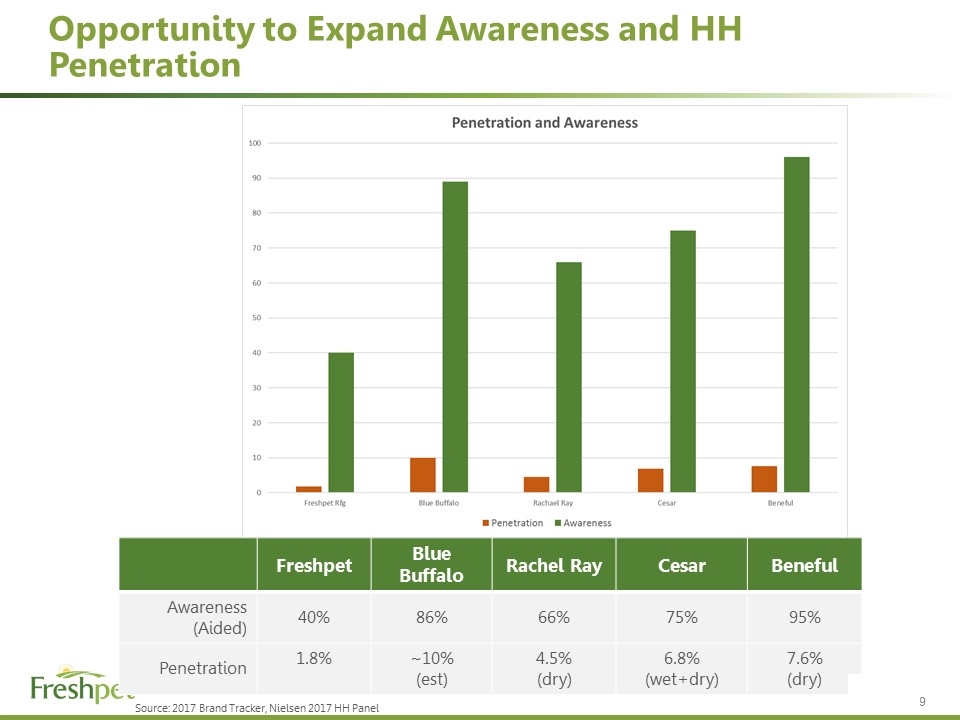

Opportunity to Expand Awareness and HH Penetration Freshpet Blue Buffalo Rachel Ray Cesar Beneful Awareness (Aided) 40% 86% 66% 75% 95% Penetration 1.8% ~10% (est) 4.5% (dry) 6.8% (wet+dry) 7.6% (dry) Source: 2017 Brand Tracker, Nielsen 2017 HH Panel

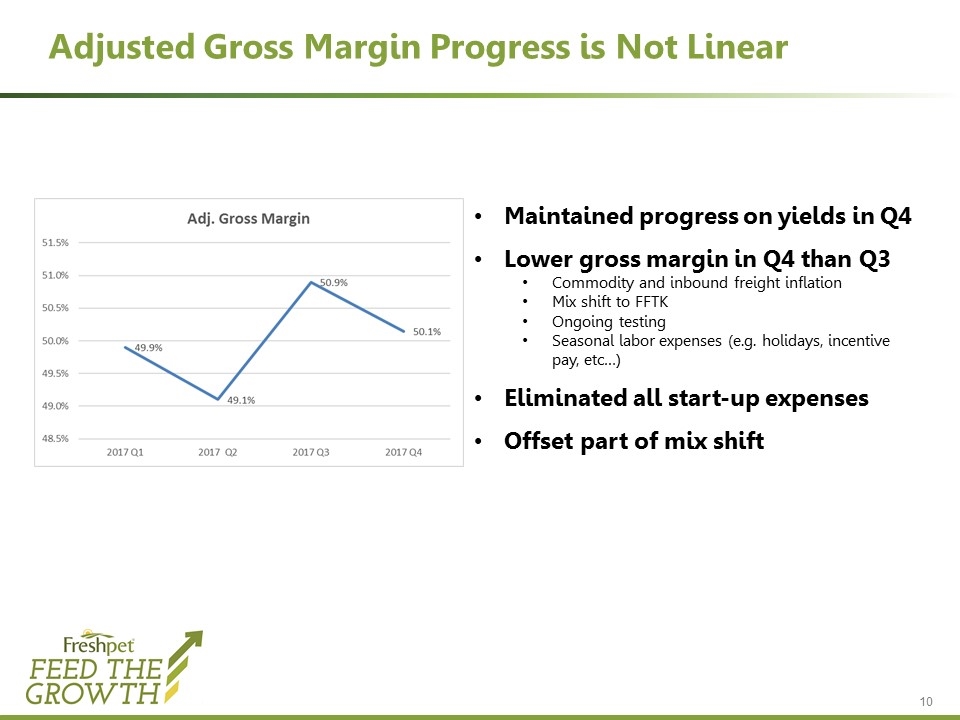

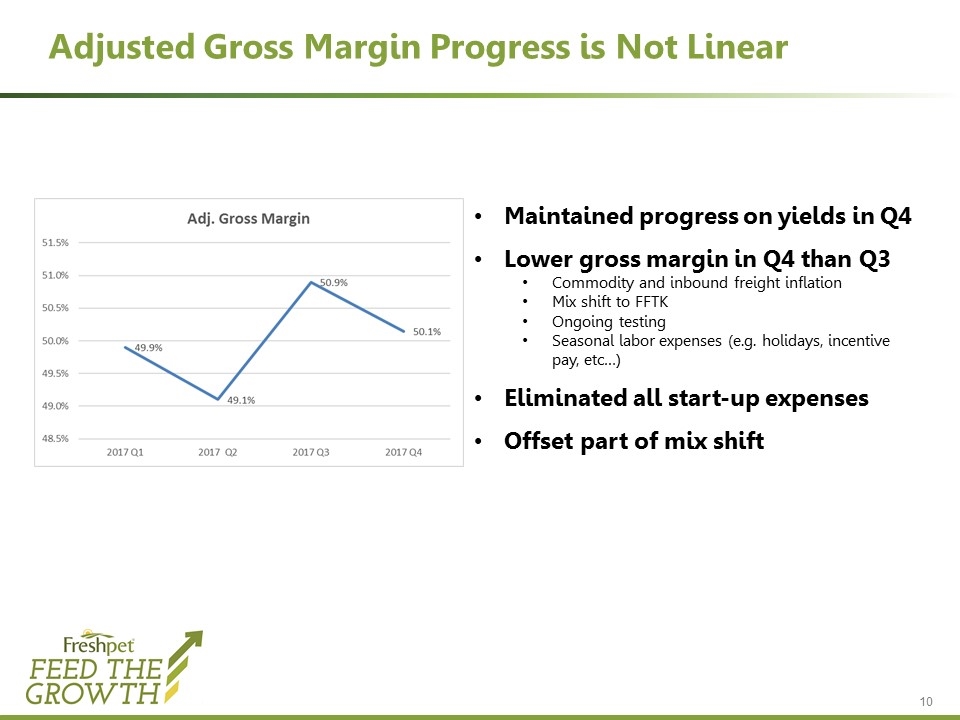

Adjusted Gross Margin Progress is Not Linear Maintained progress on yields in Q4 Lower gross margin in Q4 than Q3 Commodity and inbound freight inflation Mix shift to FFTK Ongoing testing Seasonal labor expenses (e.g. holidays, incentive pay, etc…) Eliminated all start-up expenses Offset part of mix shift

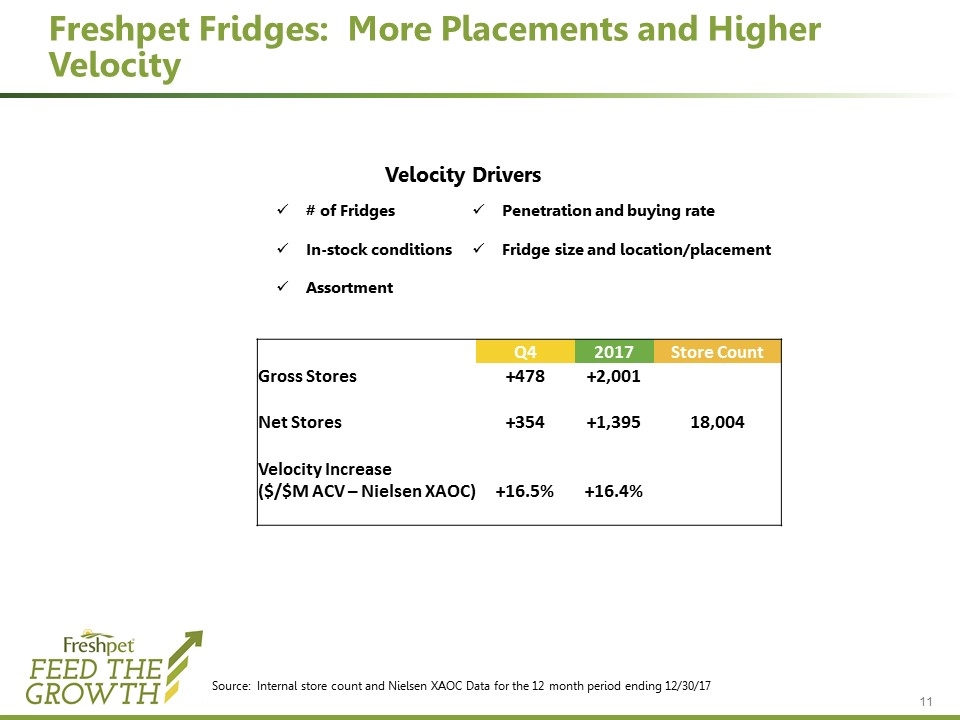

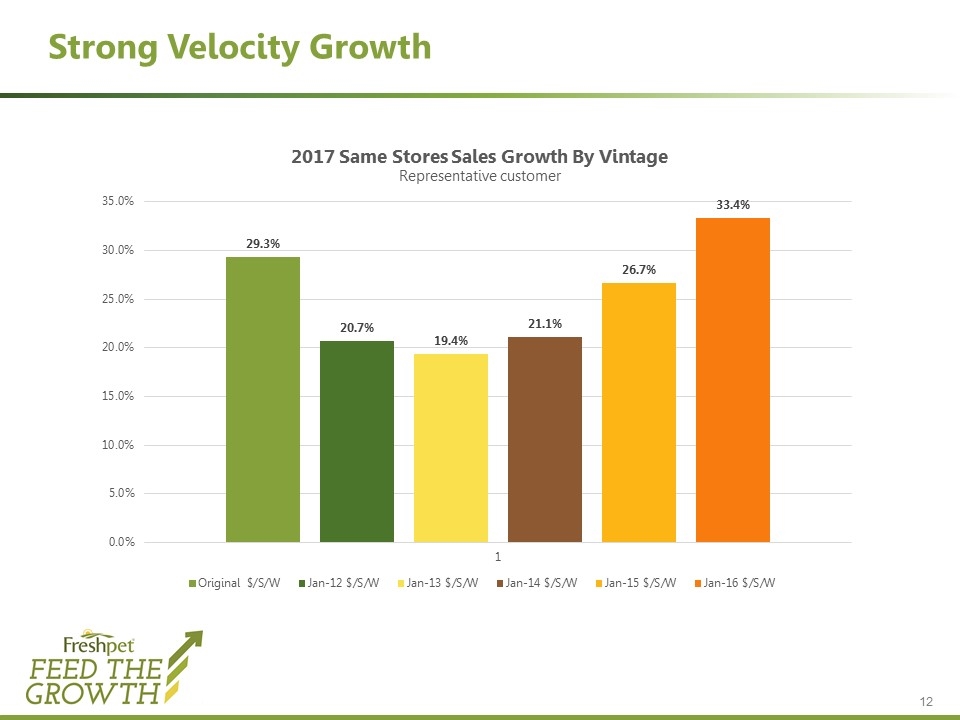

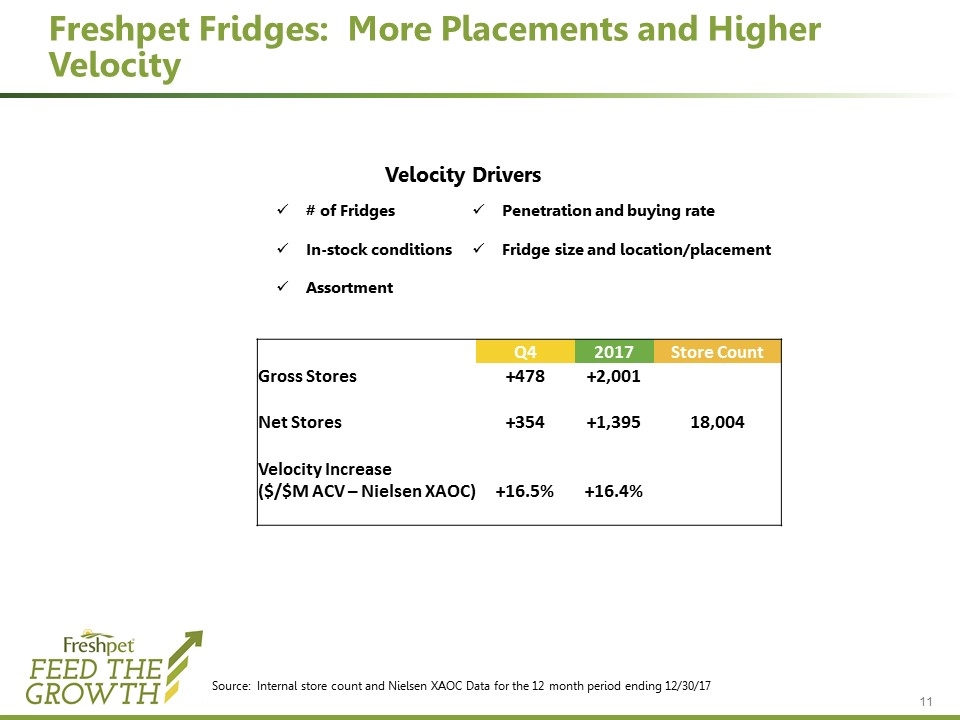

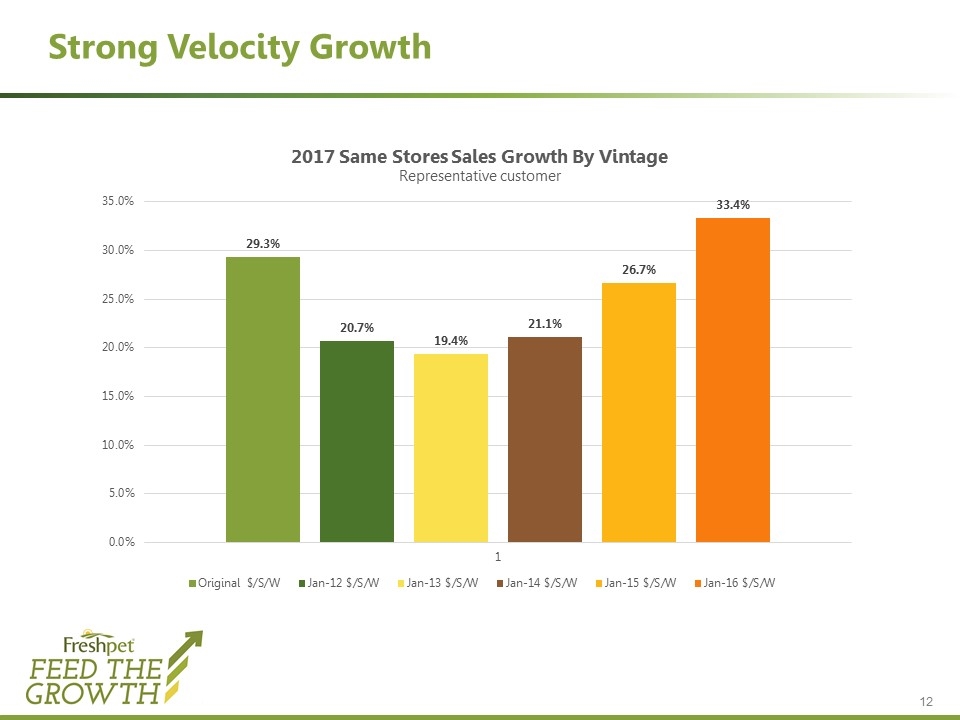

Freshpet Fridges: More Placements and Higher Velocity Velocity Drivers # of Fridges In-stock conditions Assortment Penetration and buying rate Fridge size and location/placement Q4 2017 Store Count Gross Stores +478 +2,001 Net Stores +354 +1,395 18,004 Velocity Increase ($/$M ACV – Nielsen XAOC) +16.5% +16.4% Source: Internal store count and Nielsen XAOC Data for the 12 month period ending 12/30/17

Strong Velocity Growth

Dick Kassar Chief Financial Officer

Tax Reform Impact No meaningful impact to earnings or the balance sheet The Company has a $175 million NOL that will eliminate most federal taxes for many years The NOL was not capitalized so there is no balance sheet impact from the change in tax rates Other changes in the tax reform law will have minor impact on the company

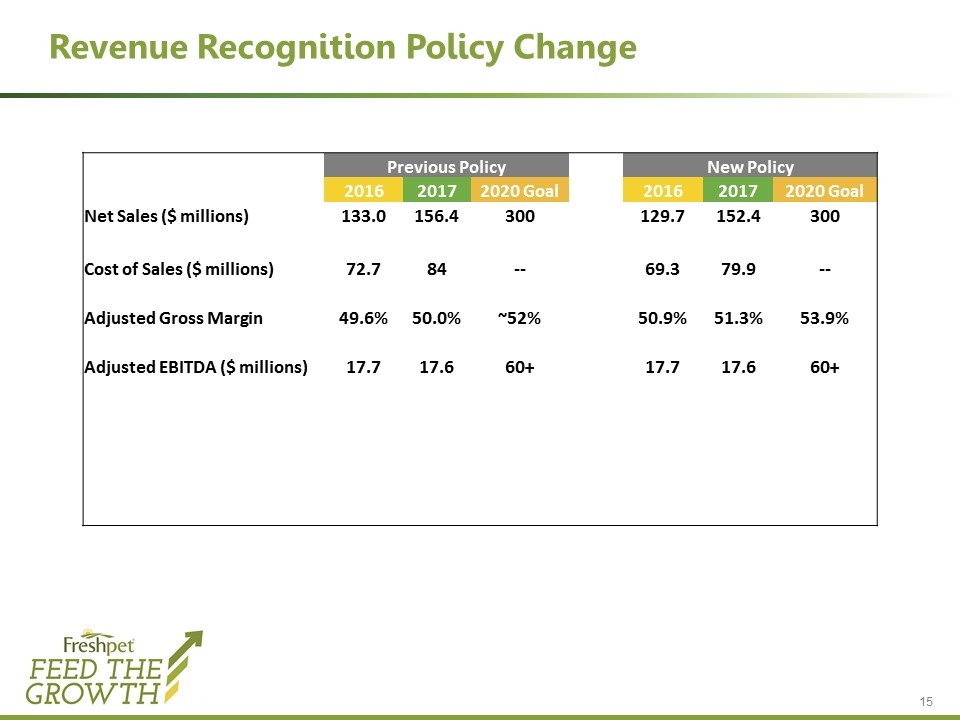

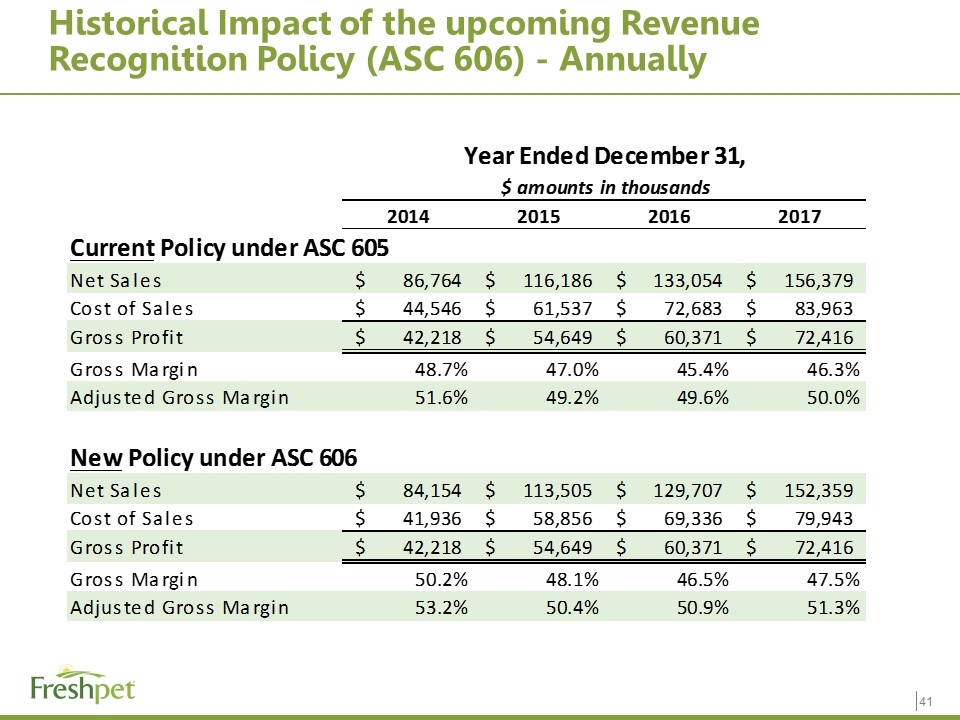

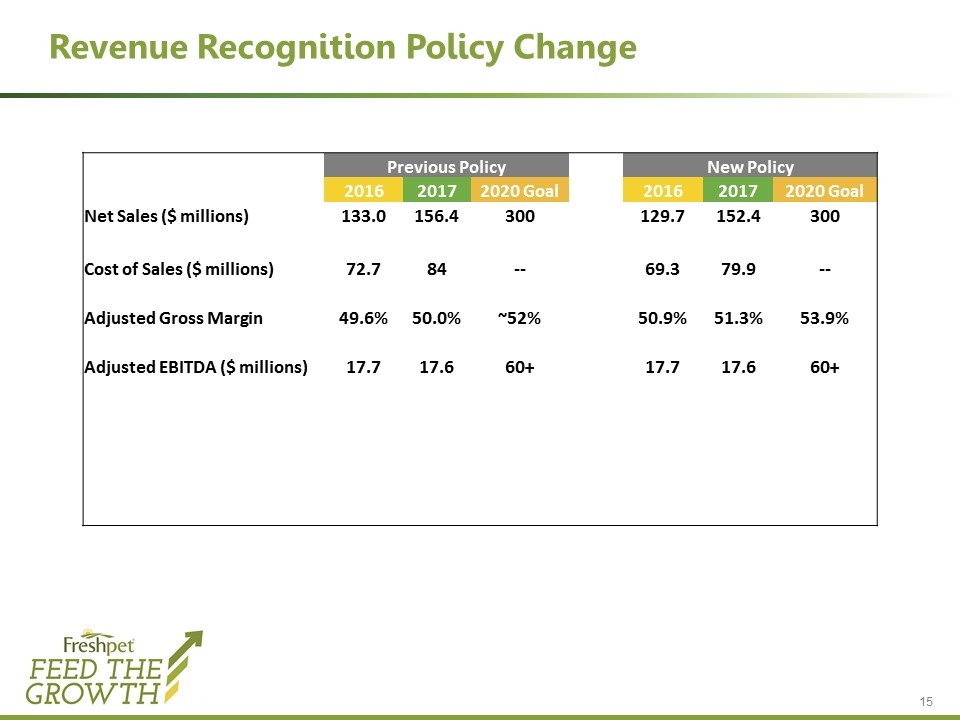

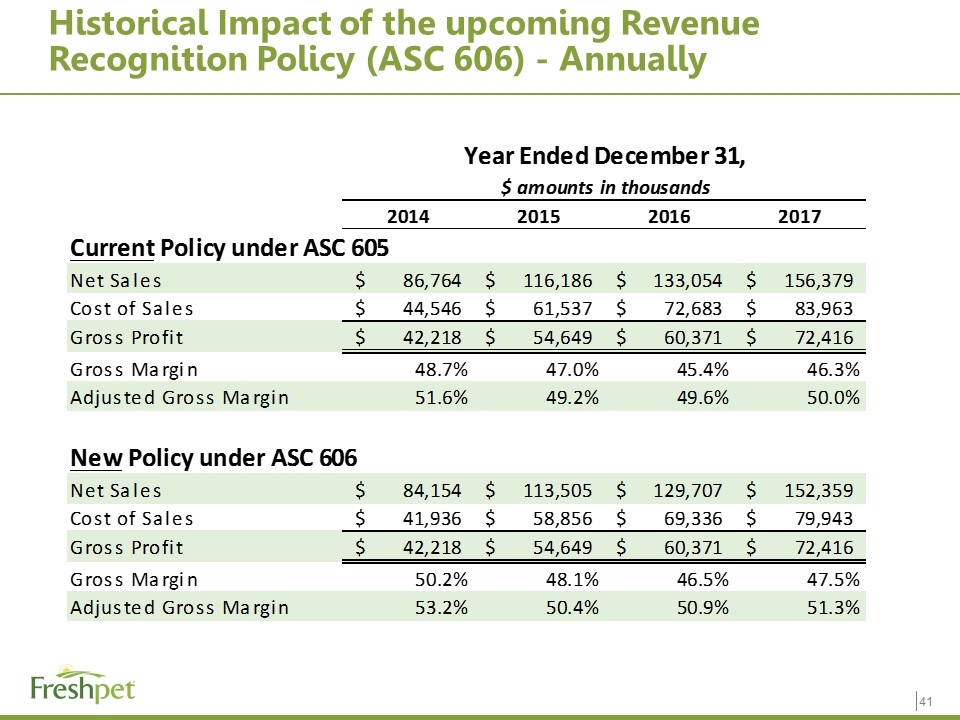

Revenue Recognition Policy Change Previous Policy New Policy 2016 2017 2020 Goal 2016 2017 2020 Goal Net Sales ($ millions) 133.0 156.4 300 129.7 152.4 300 Cost of Sales ($ millions) 72.7 84 -- 69.3 79.9 -- Adjusted Gross Margin 49.6% 50.0% ~52% 50.9% 51.3% 53.9% Adjusted EBITDA ($ millions) 17.7 17.6 60+ 17.7 17.6 60+

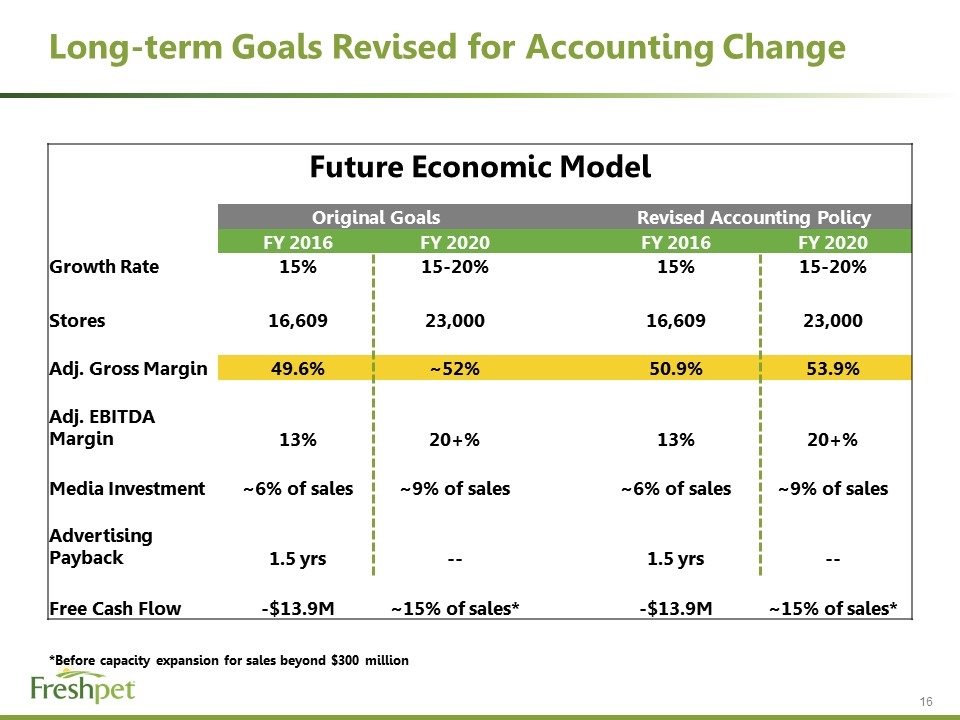

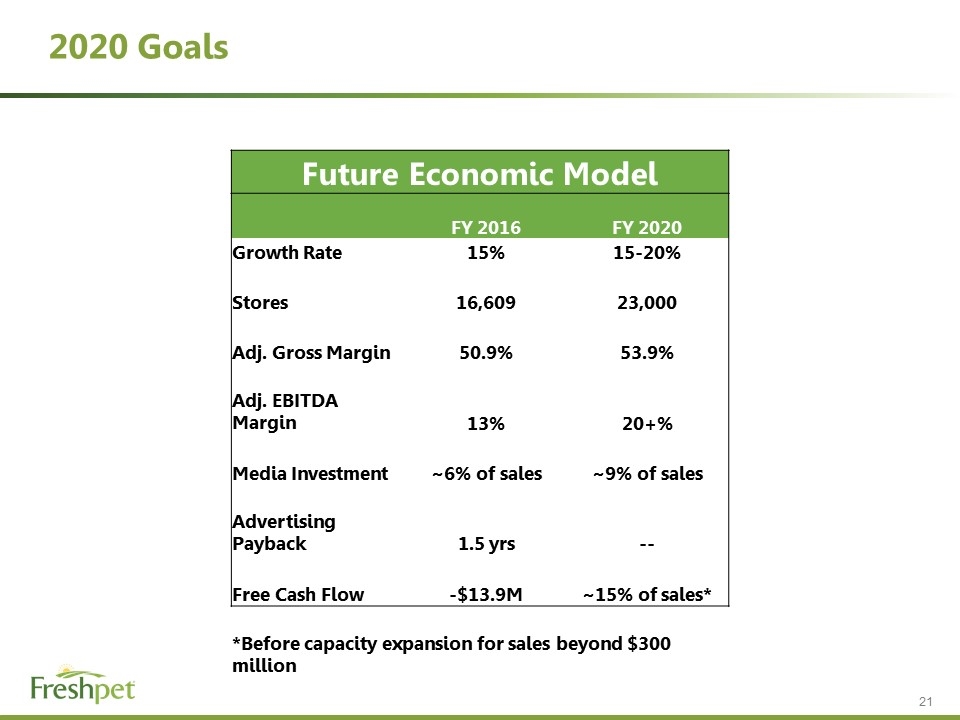

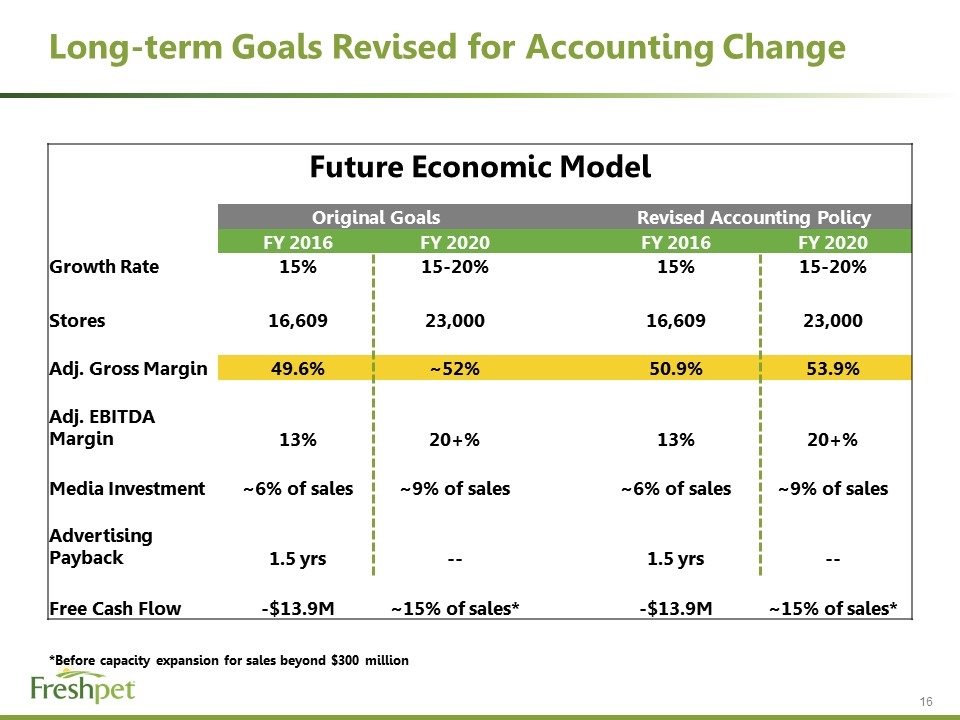

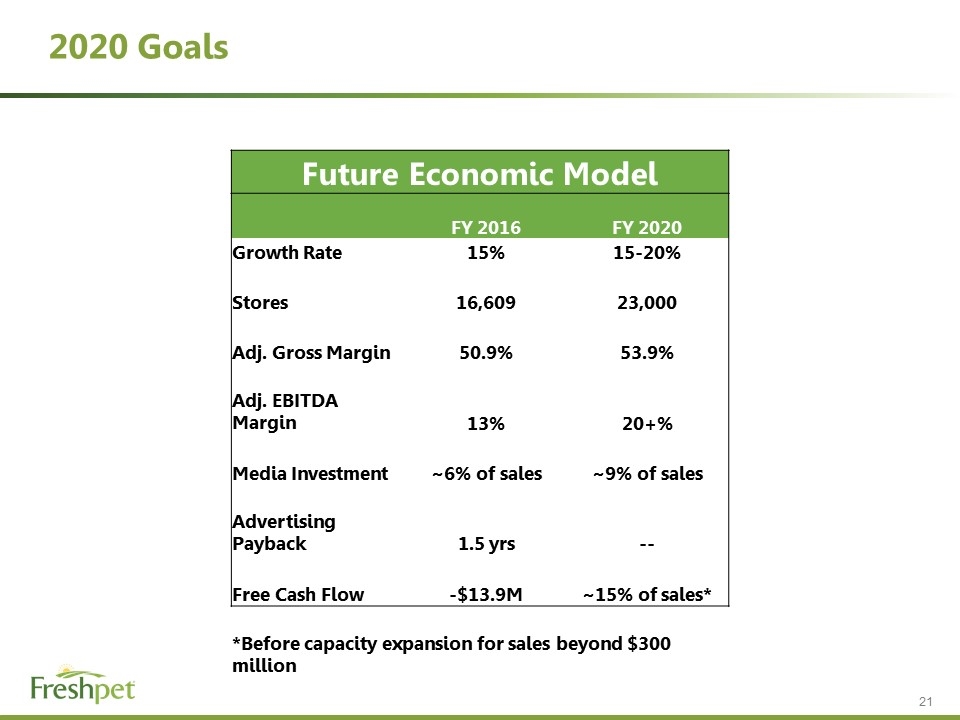

Long-term Goals Revised for Accounting Change Future Economic Model Original Goals Revised Accounting Policy FY 2016 FY 2020 FY 2016 FY 2020 Growth Rate 15% 15-20% 15% 15-20% Stores 16,609 23,000 16,609 23,000 Adj. Gross Margin 49.6% ~52% 50.9% 53.9% Adj. EBITDA Margin 13% 20+% 13% 20+% Media Investment ~6% of sales ~9% of sales ~6% of sales ~9% of sales Advertising Payback 1.5 yrs -- 1.5 yrs -- Free Cash Flow -$13.9M ~15% of sales* -$13.9M ~15% of sales* *Before capacity expansion for sales beyond $300 million

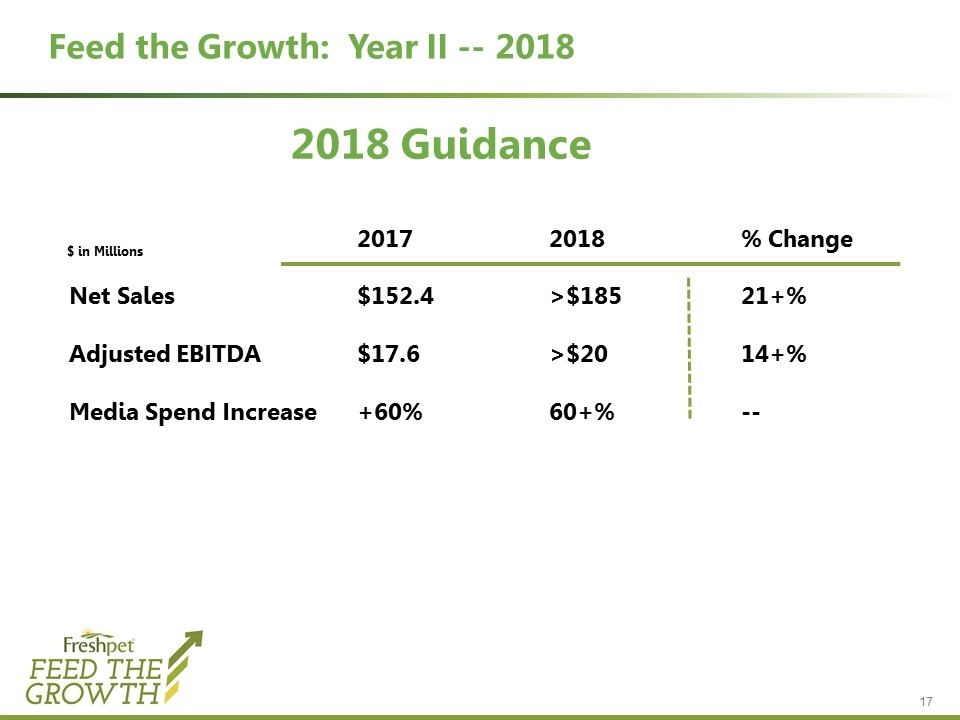

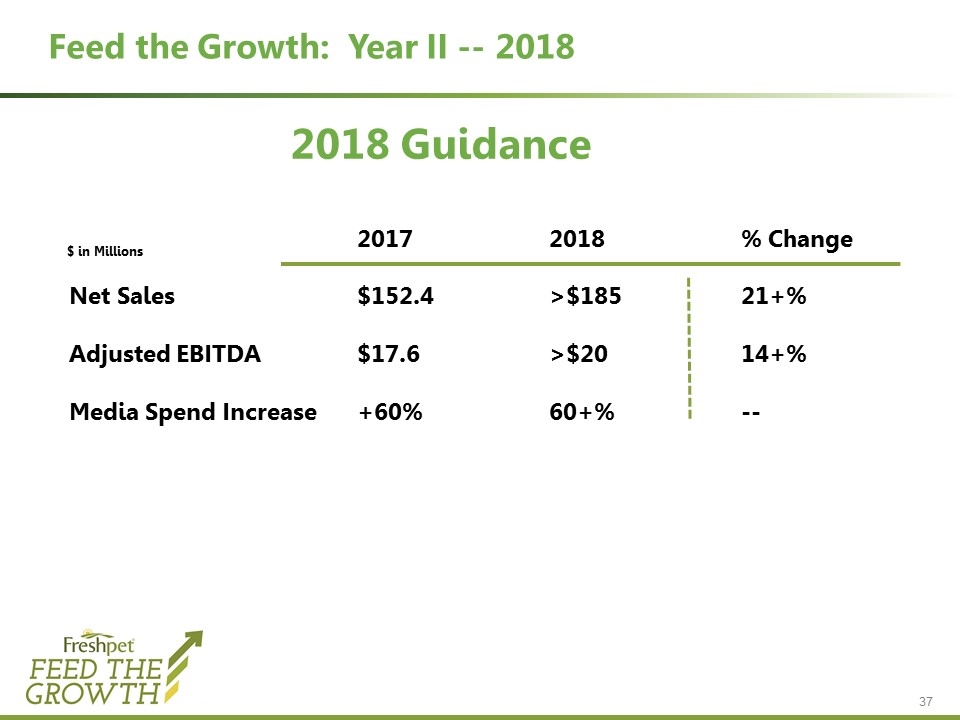

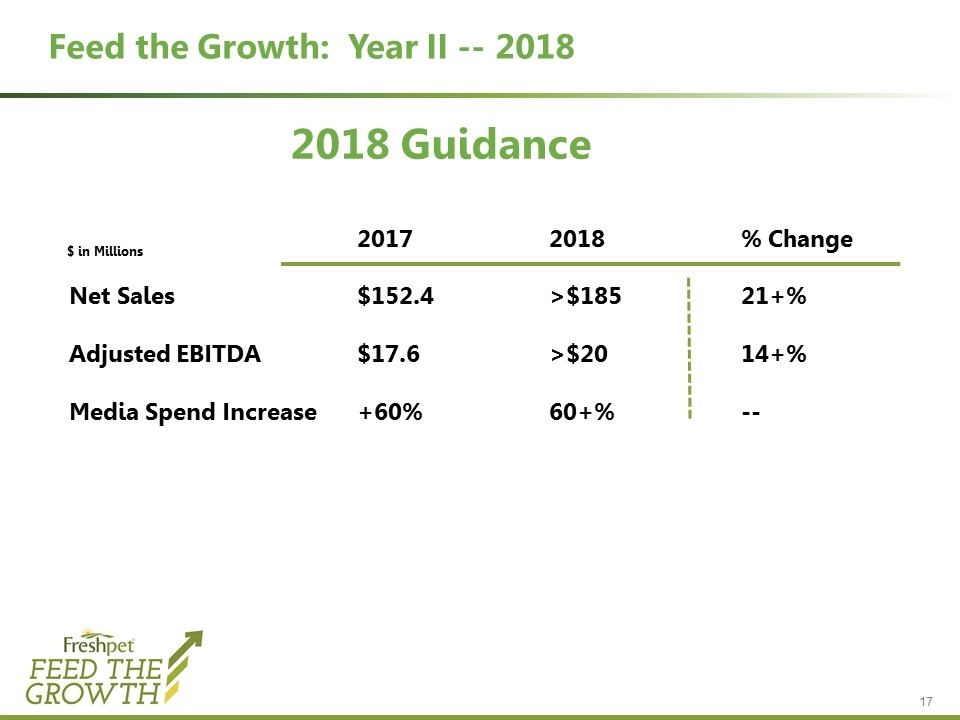

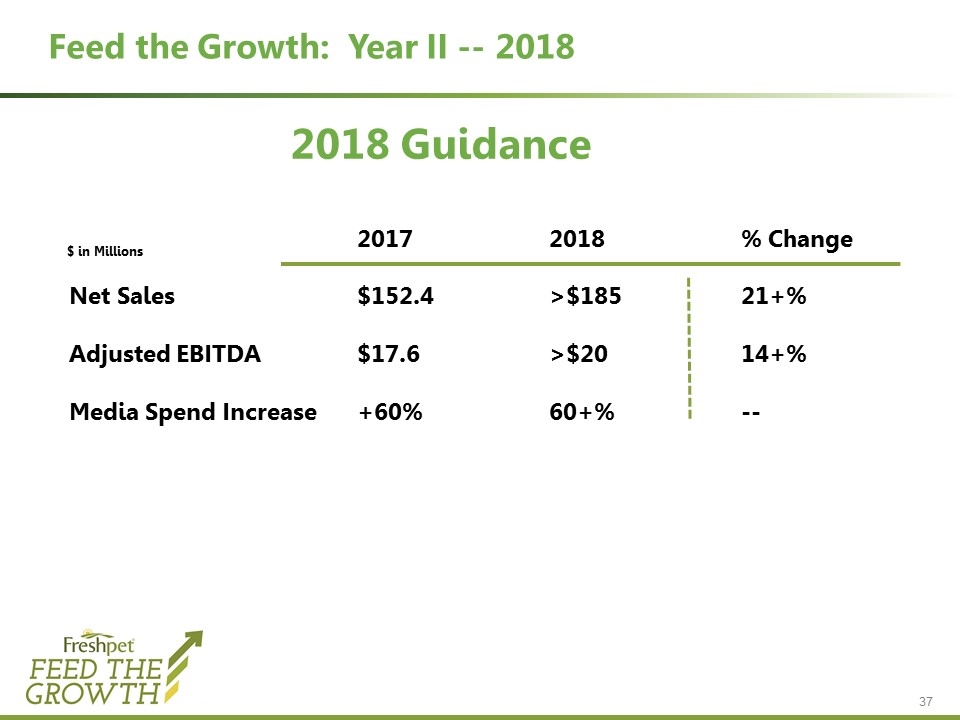

Feed the Growth: Year II -- 2018 2018 Guidance 20172018% Change Net Sales$152.4>$18521+% Adjusted EBITDA$17.6>$2014+% Media Spend Increase+60%60+%-- $ in Millions

Billy Cyr Chief Executive Officer

We Operate Differently Delighting consumers with fresh food & our company ideology Environmentally Focused Employee Engagement Community & Consumer Engagement

2020 Goals Future Economic Model FY 2016 FY 2020 Growth Rate 15% 15-20% Stores 16,609 23,000 Adj. Gross Margin 50.9% 53.9% Adj. EBITDA Margin 13% 20+% Media Investment ~6% of sales ~9% of sales Advertising Payback 1.5 yrs -- Free Cash Flow -$13.9M ~15% of sales* *Before capacity expansion for sales beyond $300 million

YEAR II: Bigger and Faster

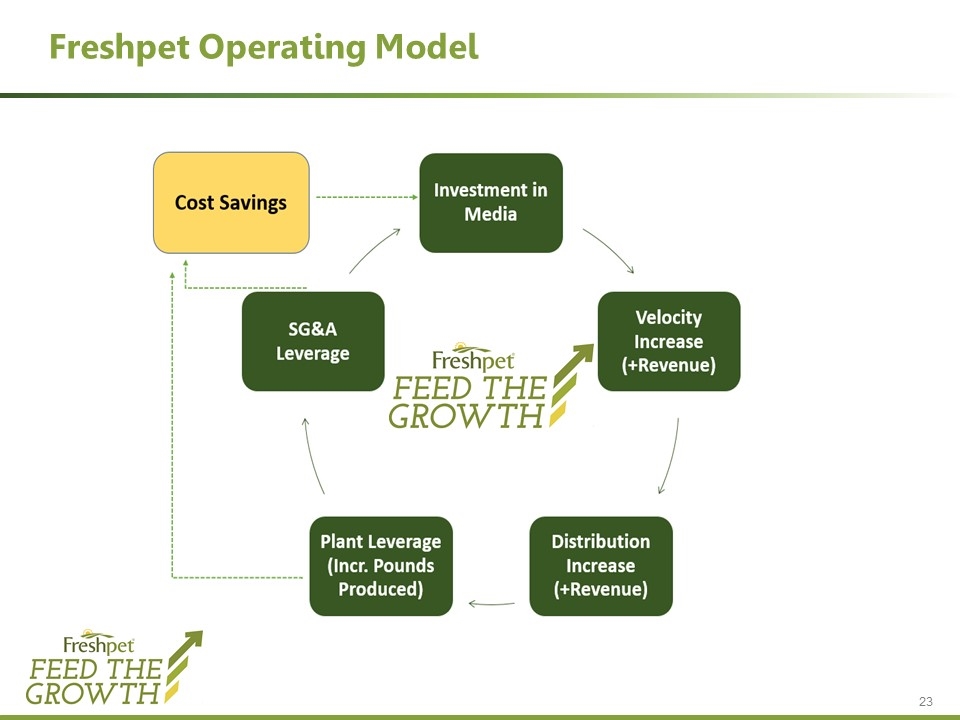

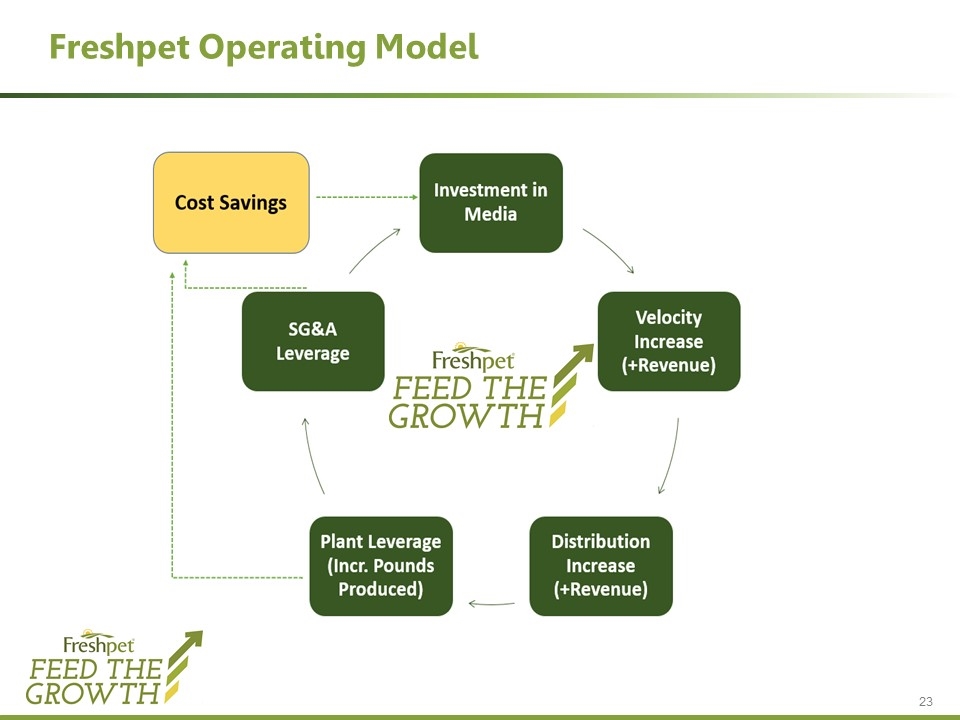

Freshpet Operating Model

Advertising Investment Drives Consumption Consistently TV On Air TV Off Air TV On Air TV Off Air

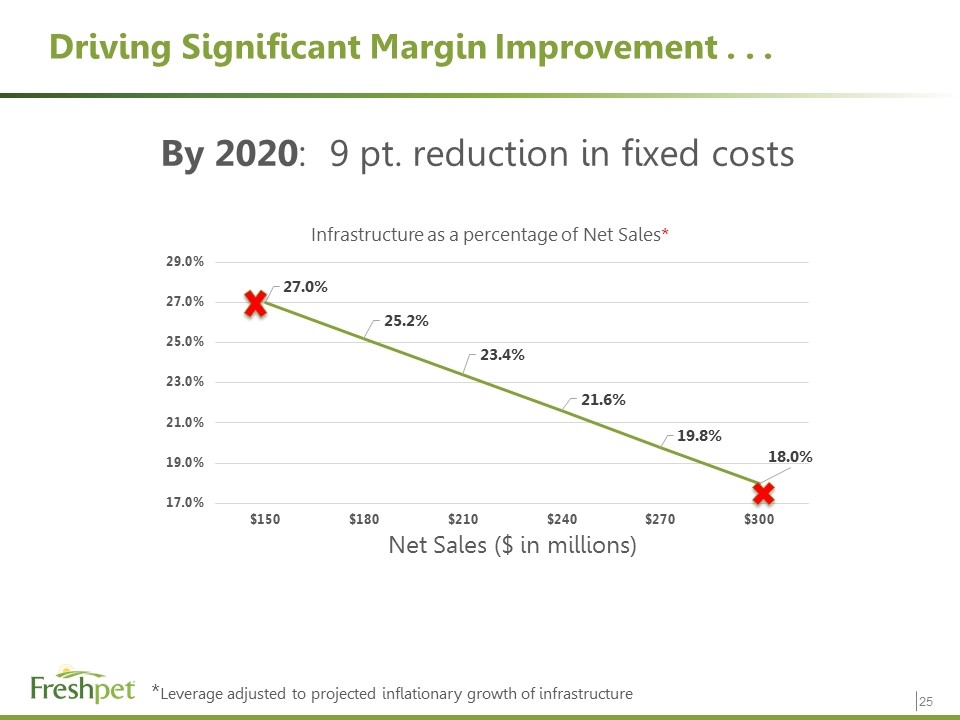

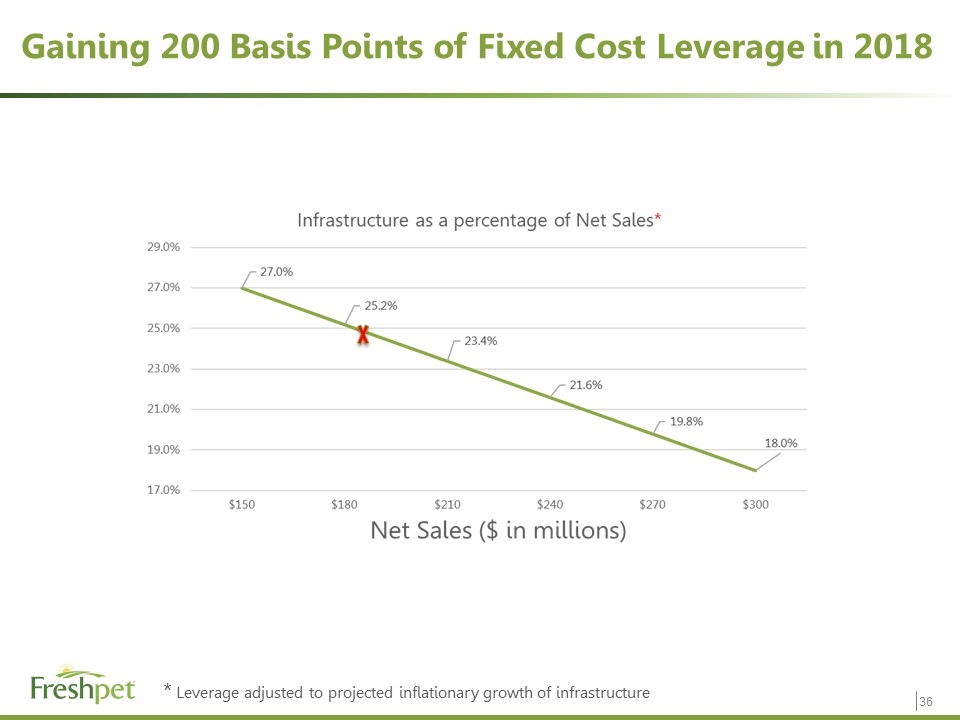

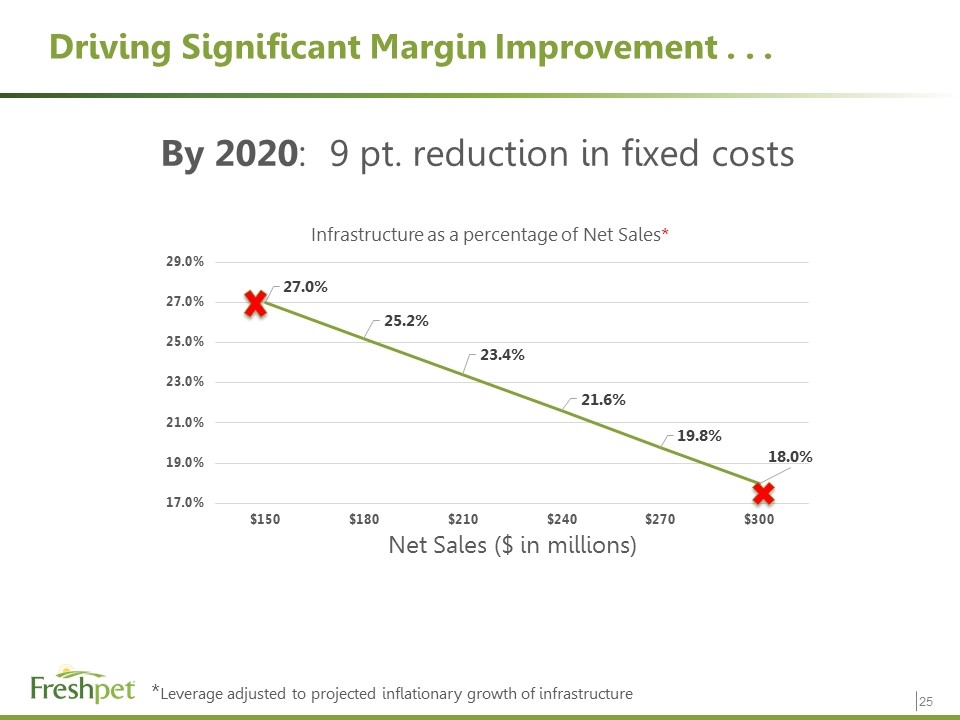

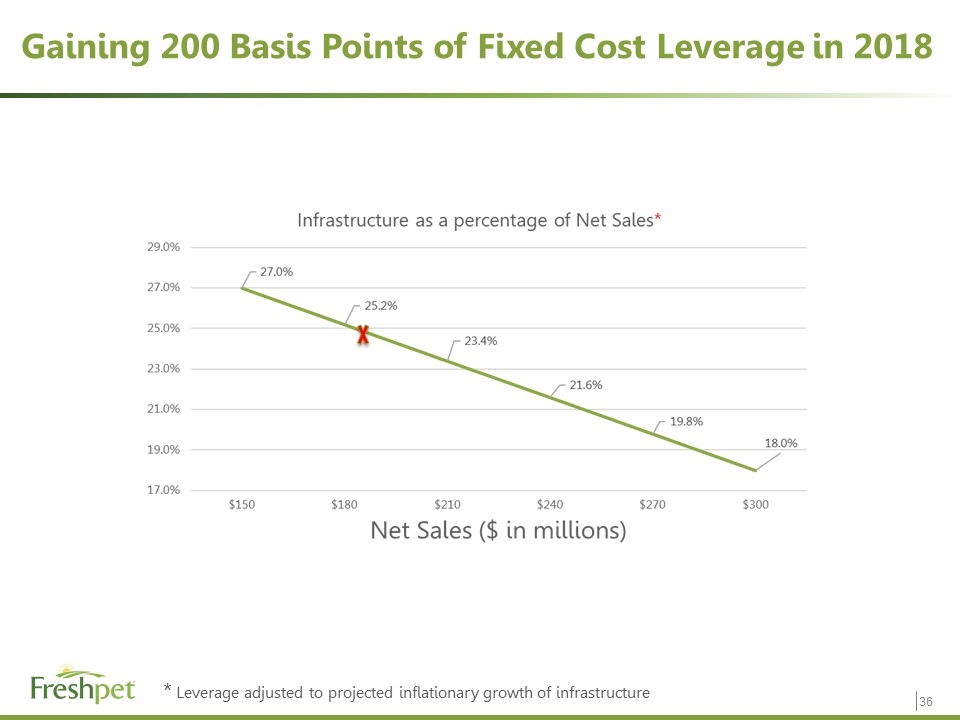

Driving Significant Margin Improvement . . . *Leverage adjusted to projected inflationary growth of infrastructure By 2020: 9 pt. reduction in fixed costs

Strong Barriers to Entry: A Difficult Business to Replicate High Brand Loyalty Alignment with deep pet parent emotional motivations Differentiated Innovative forms, technologies, and appearance Manufacturing Proprietary technology, processes, and infrastructure Freshpet Fridge Branded, company-owned real estate Supply Chain Only refrigerated pet food network in North America Retailer Partners Delivers benefits in traffic, frequency and retailer margins

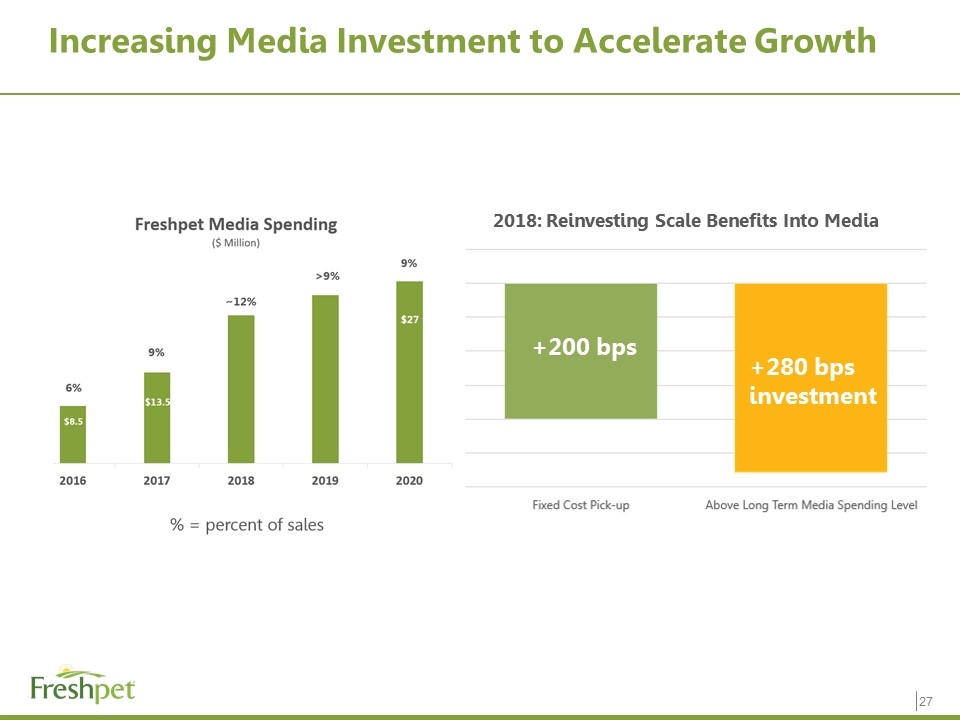

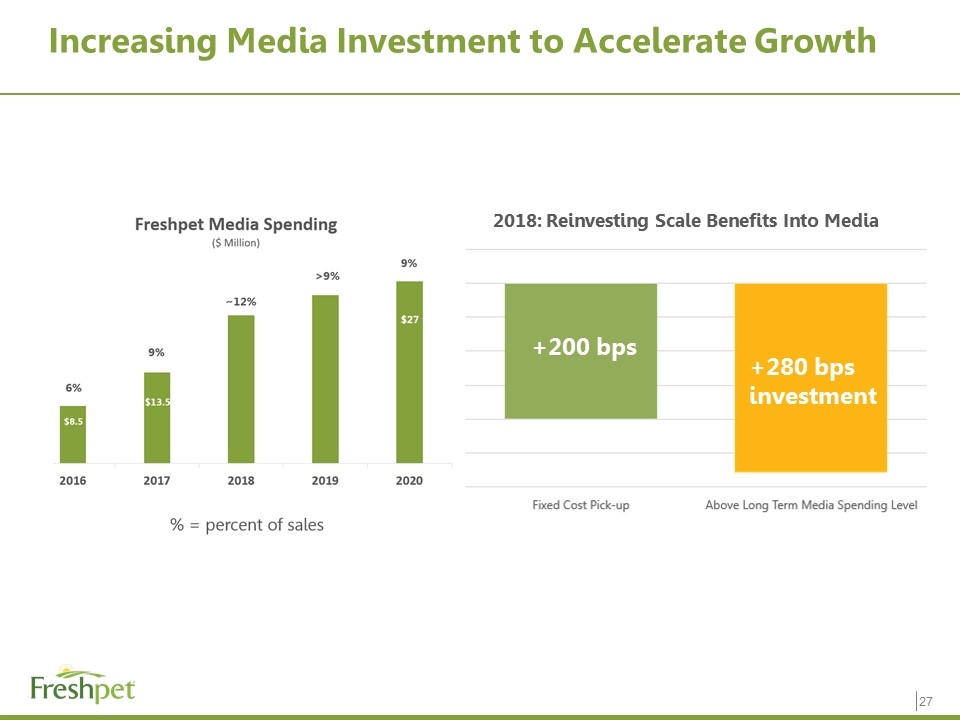

Increasing Media Investment to Accelerate Growth +200 bps +280 bps investment 2018: Reinvesting Scale Benefits Into Media

In 2018, We Expect to Accelerate Fresh Growth. . . and Carry Momentum into 2019 +15% +17.5% >21% >23% Fresh-only sales: +23%

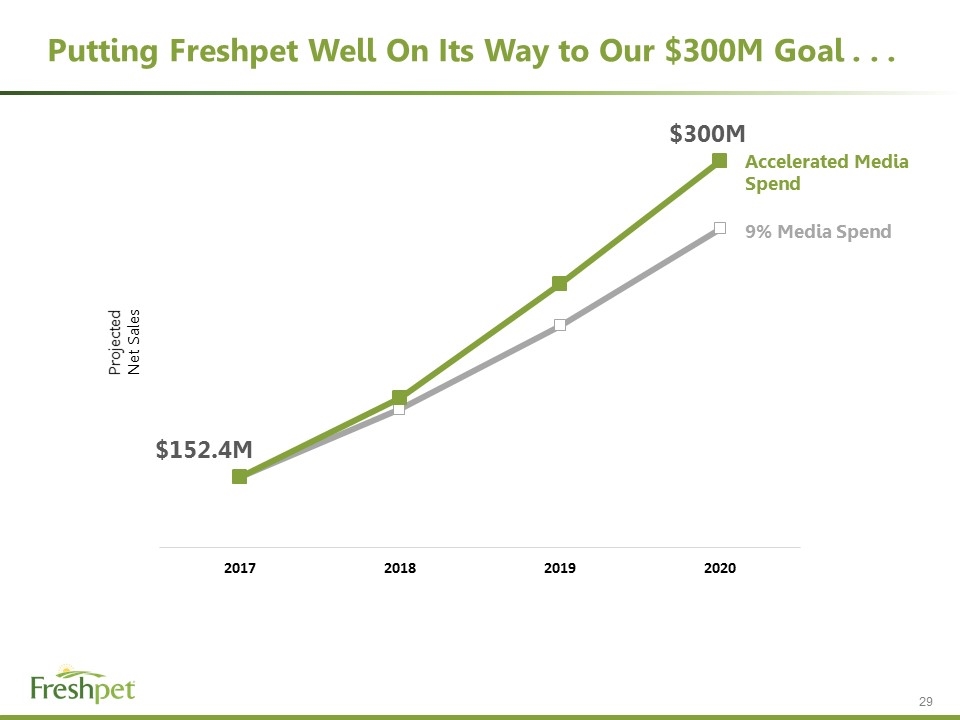

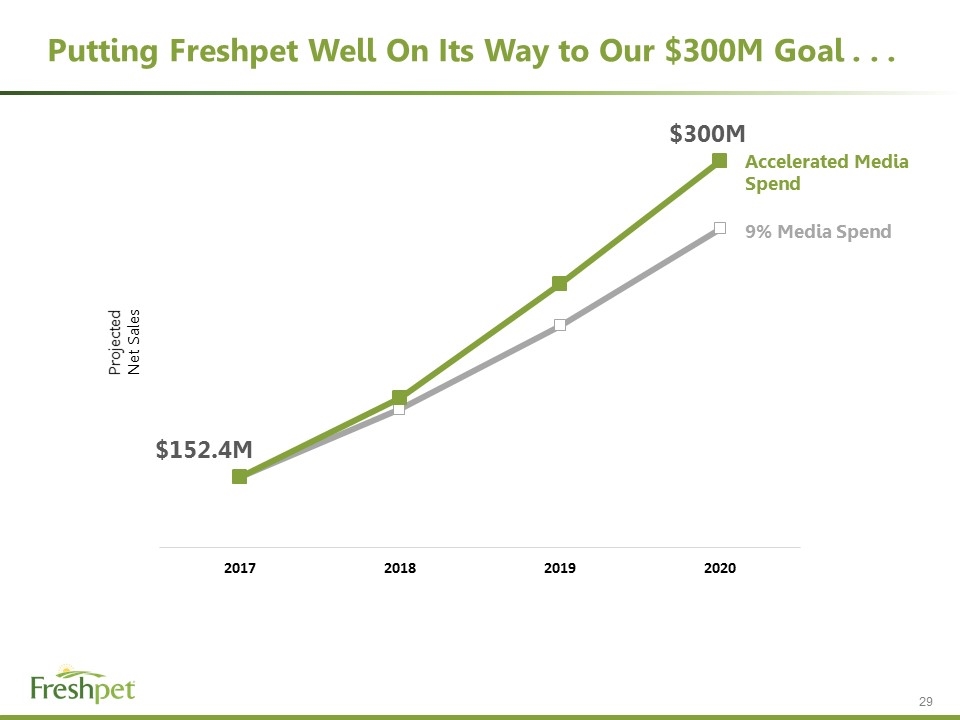

Putting Freshpet Well On Its Way to Our $300M Goal . . . Accelerated Media Spend 9% Media Spend Projected Net Sales $300M $152.4M

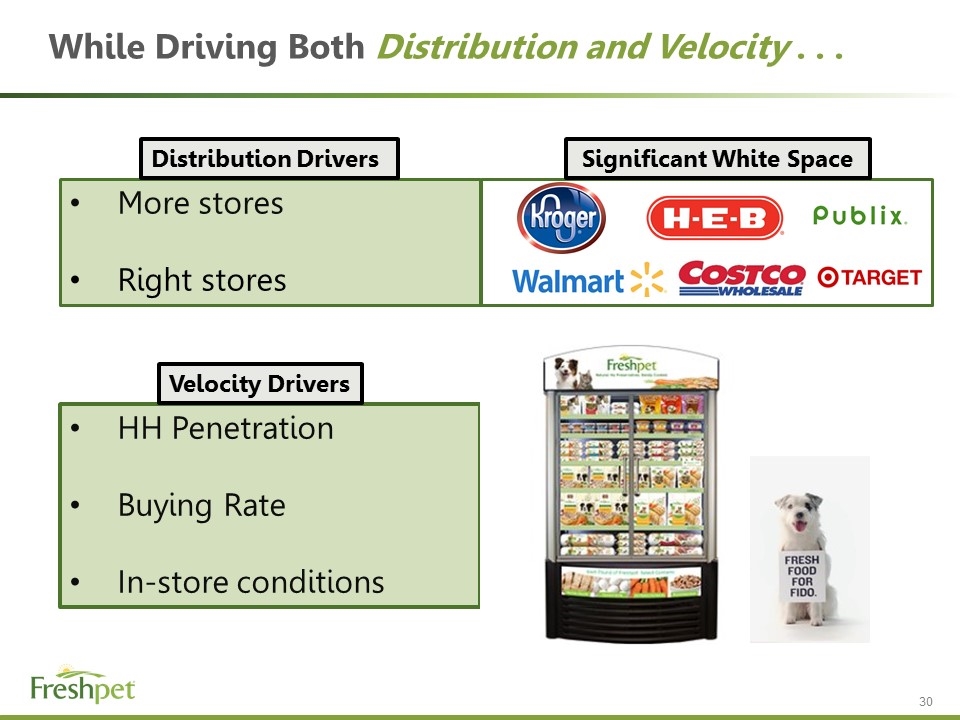

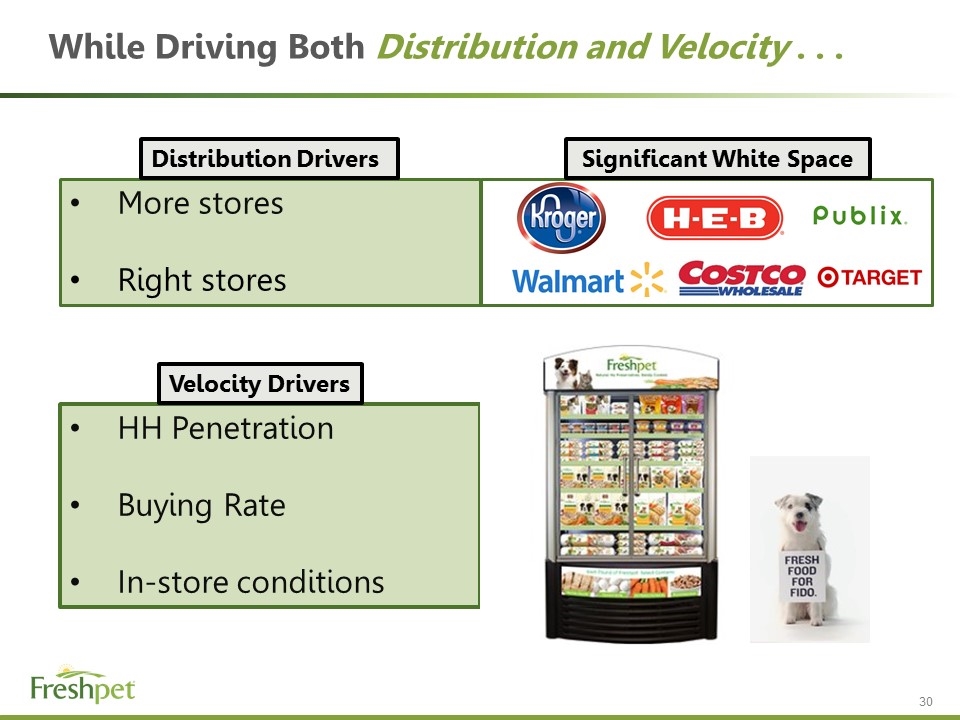

xxx More stores Right stores While Driving Both Distribution and Velocity . . . HH Penetration Buying Rate In-store conditions Distribution Drivers Velocity Drivers Significant White Space

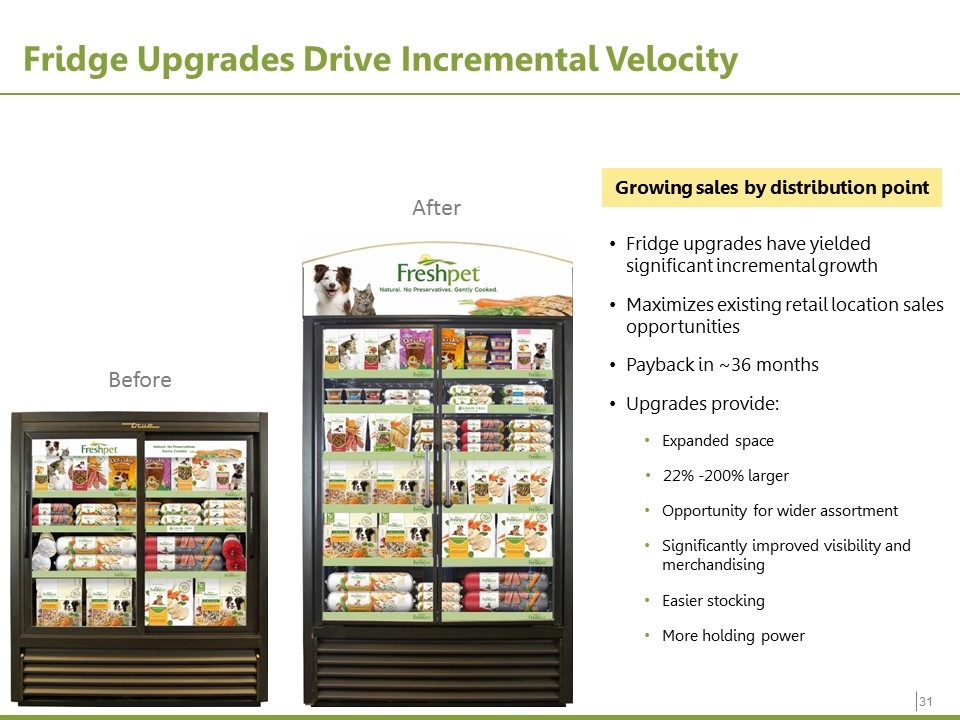

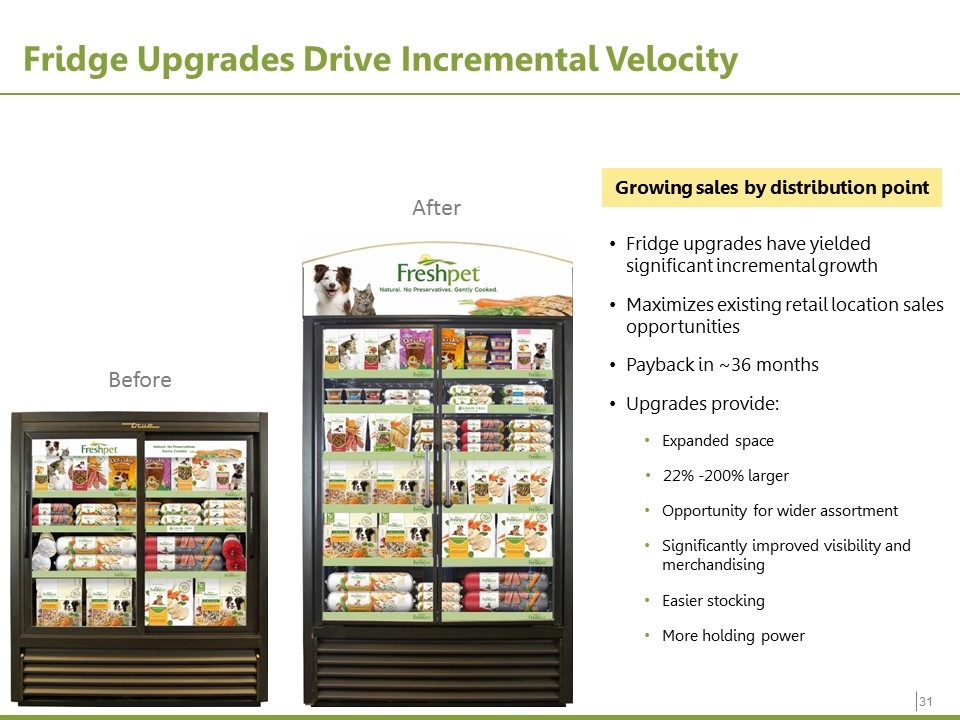

After Before Fridge Upgrades Drive Incremental Velocity Fridge upgrades have yielded significant incremental growth Maximizes existing retail location sales opportunities Payback in ~36 months Upgrades provide: Expanded space 22% -200% larger Opportunity for wider assortment Significantly improved visibility and merchandising Easier stocking More holding power Growing sales by distribution point

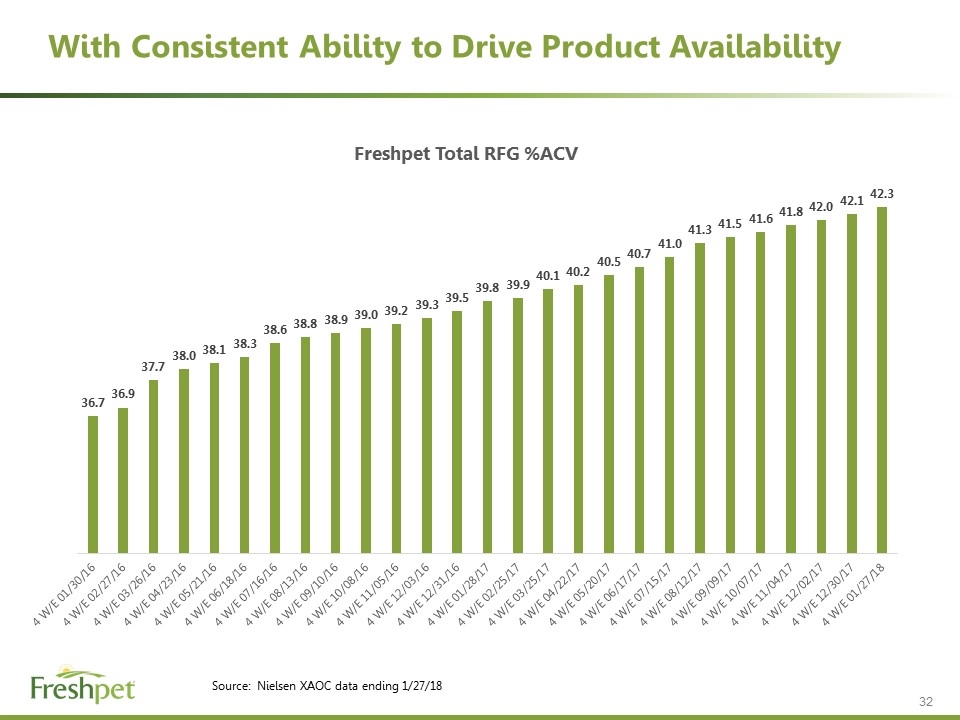

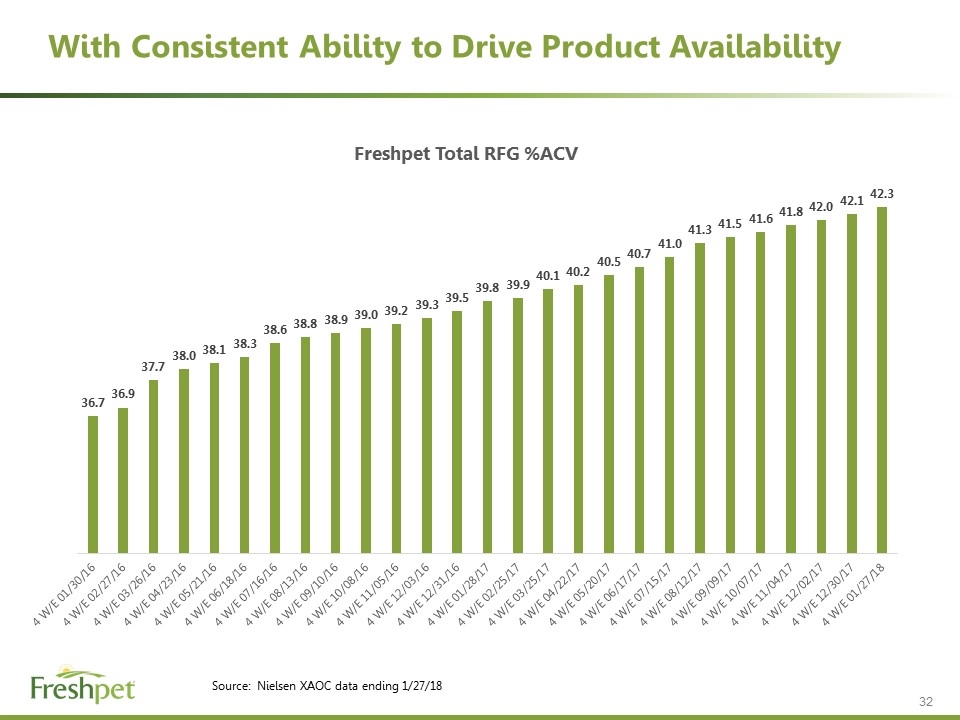

With Consistent Ability to Drive Product Availability Source: Nielsen XAOC data ending 1/27/18

And With Growth Potential in Fresh E-commerce Strategy: Grow with winning players in fresh e-commerce Curbside Online Fresh Retail Home Delivery

Freshpet Long-Term Capacity Planning Existing Kitchens can support $300M to 400M in net sales – depending on product mix If we deliver our 2020 goals, we will need new bag capacity sometime in 2020, rolls in 2021 It takes two years to add capacity: Year 1: Planning and permitting plus ordering long lead-time equipment Year 2: Construction and start-up Need to have a plan in place before the end of 2018 Location Size and Scope Technology Financial commitments would be made in late 2018 and throughout 2019 We will update plans and commitments later in the year

Guiding Principles for Capacity Expansion Freshpet has tremendous growth potential ahead of it Capacity increases must envision and enable future expansions in a cost effective way Manufacturing expertise must remain a competitive advantage We will continue to advance our mastery of the technology Particular focus on efficiency, reliability and safety improvements We will not dilute our focus on gross margin improvement efforts in the existing facility We will dedicate engineering staffing to design and build the next facility We will replace that staffing in the existing facility with full-time operating talent The location decision will consider the full range of risks/opportunities that come with each location Considerations will include access to raw material supply, labor, utilities, technology transfer risk, freight costs, local incentives, supply diversification, etc.

Gaining 200 Basis Points of Fixed Cost Leverage in 2018 * Leverage adjusted to projected inflationary growth of infrastructure

Feed the Growth: Year II -- 2018 2018 Guidance 20172018% Change Net Sales$152.4>$18521+% Adjusted EBITDA$17.6>$2014+% Media Spend Increase+60%60+%-- $ in Millions

Further Strengthening Our Barriers to Entry . . .

While delighting pet parents, pets, shareholders and employees . . .

Appendix

Historical Impact of the upcoming Revenue Recognition Policy (ASC 606) - Annually

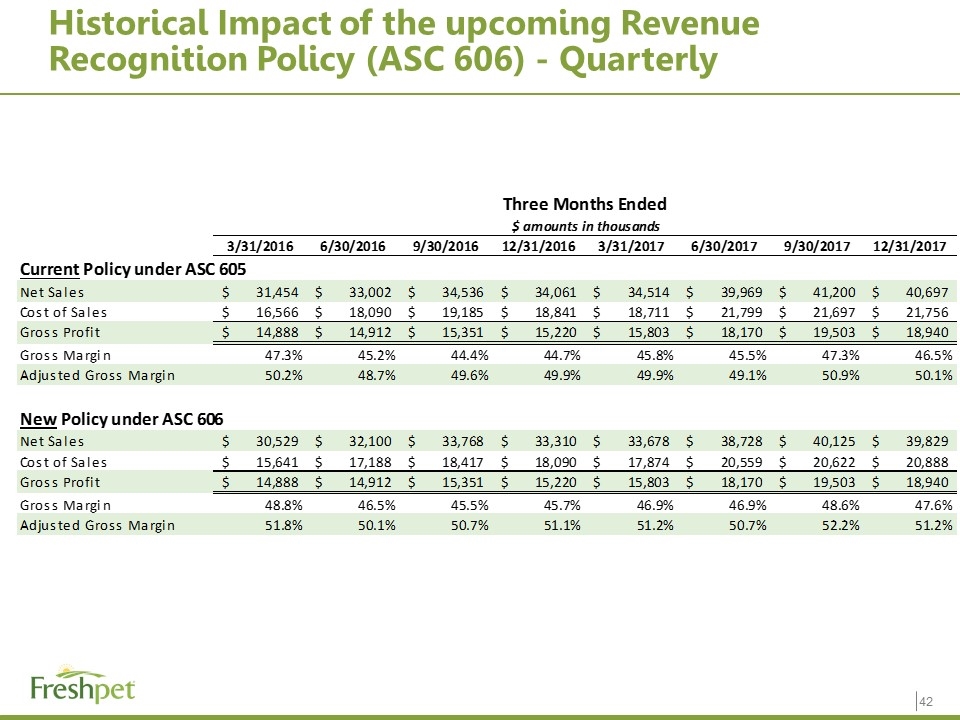

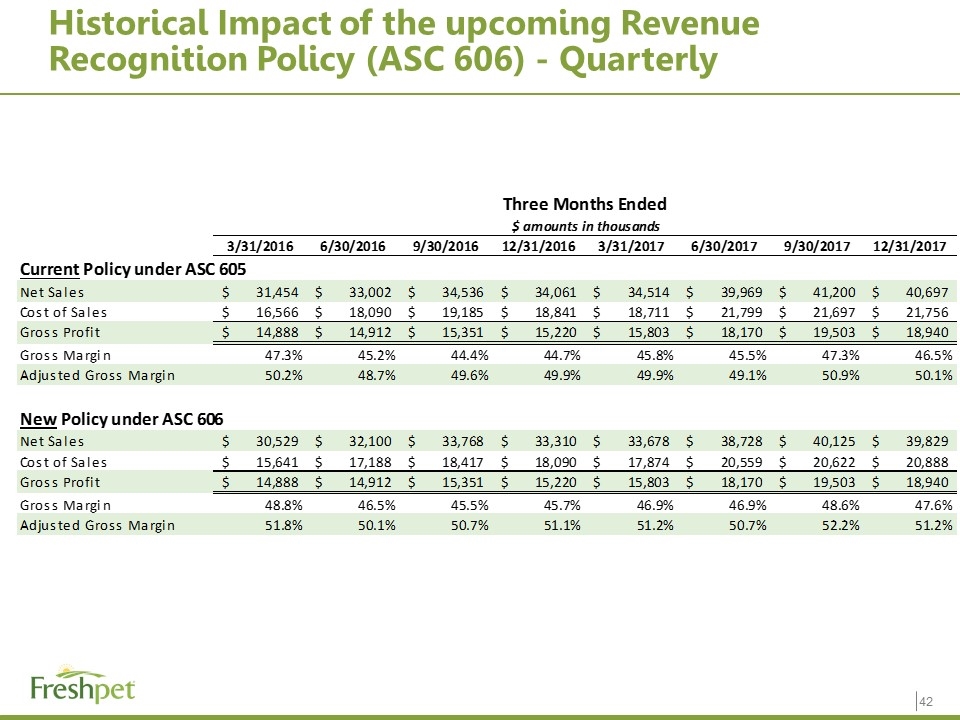

Historical Impact of the upcoming Revenue Recognition Policy (ASC 606) - Quarterly