Q4 & FY 2024 EARNINGS PRESENTATION1 Q4 & FY 2024 Earnings February 20, 2025

Q4 & FY 2024 EARNINGS PRESENTATION2 Q4 & FY 024 EAR INGS PR SEN ATION Forward Looking Statements & Non-GAAP Measures FORWARD-LOOKING STATEMENTS Certain statements in this presentation by Freshpet, Inc. (the “Company”) constitute “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995 and are based on our current expectations and assumptions. These forward- looking statements, which include any statements related to the timing of new production capacity, capital spend, our long-term strategy, pace in achieving our goals, growth prospects, FY 2025 guidance and associated considerations and 2027 targets. Words such as "anticipate", "believe", "could", "estimate", "expect", "guidance", "intend", "may", "might", "outlook", "plan", "predict", "seek", "will", "would" and variations of such word and similar future or conditional expressions are intended to identify forward looking statements. Such statements are subject to risks and uncertainties that could cause actual results to differ materially from those discussed in the forward- looking statements including difficulties in construction, third party data presented accompanying such statements, and most prominently, the risks discussed under the heading “Risk Factors” in the Company's latest annual report on Form 10-K and quarterly reports on Form 10-Q filed with the Securities and Exchange Commission. Such forward-looking statements are made only as of the date of this presentation. Freshpet undertakes no obligation to publicly update or revise any forward-looking statement because of new information, future events or otherwise, except as otherwise required by law. If we do update one or more forward-looking statements, no inference should be made that we will make additional updates with respect to those or other forward-looking statements. NON-GAAP MEASURES Freshpet uses certain non-GAAP financial measures, including EBITDA, adjusted EBITDA, adjusted EBITDA as a % of net sales (adjusted EBITDA Margin), adjusted Gross Profit, adjusted Gross Profit as a % of net sales (adjusted Gross Margin), adjusted SG&A and adjusted SG&A as a % of net sales. These non-GAAP financial measures should be considered as supplements to GAAP reported measures, should not be considered replacements for, or superior to, GAAP measures and may not be comparable to similarly named measures used by other companies. Freshpet defines EBITDA as net income (loss) plus interest expense, income tax expense and depreciation and amortization expense, and adjusted EBITDA as EBITDA plus net income (loss) on equity method investment, non-cash share-based compensation, fees related to equity offerings of our common stock, implementation and other costs associated with the implementation of an ERP system, and other expenses, including loss on disposal of equipment, COVID-19 expenses and organization changes designed to support long-term growth objectives. Freshpet defines adjusted Gross Profit as gross profit before depreciation expense, COVID-19 expense and non-cash share- based compensation, and adjusted SG&A as SG&A expenses before depreciation and amortization expense, non-cash share-based compensation, gain (loss) on disposal of equipment, fees related to equity offerings of our common stock, implementation and other costs associated with the implementation of an ERP system, COVID-19 expense and organization changes designed to support long term growth objectives. Management believes that the non-GAAP financial measures are meaningful to investors because they provide a view of the Company with respect to ongoing operating results. Non-GAAP financial measures are shown as supplemental disclosures in this presentation because they are widely used by the investment community for analysis and comparative evaluation. They also provide additional metrics to evaluate the Company’s operations and, when considered with both the Company’s GAAP results and the reconciliation to the most comparable GAAP measures, provide a more complete understanding of the Company’s business than could be obtained absent this disclosure. adjusted EBITDA is also an important component of internal budgeting and setting management compensation. The non-GAAP measures are not and should not be considered an alternative to the most comparable GAAP measures or any other figure calculated in accordance with GAAP, or as an indicator of operating performance. The Company’s calculation of the non-GAAP financial measures may differ from methods used by other companies. Management believes that the non-GAAP measures are important to an understanding of the Company’s overall operating results in the periods presented. The non-GAAP financial measures are not recognized in accordance with GAAP and should not be viewed as an alternative to GAAP measures of performance. Certain of these measures represent the Company's guidance for fiscal year 2024. The Company is unable to reconcile these forward-looking non-GAAP financial measures to the most directly comparable GAAP measures without unreasonable efforts because the Company is currently unable to predict with a reasonable degree of certainty the type and impact of certain items, including the timing of and amount of costs of goods sold and selling, general and administrative expenses, that would be expected to impact GAAP measures for these periods but would not impact the non-GAAP measures. The unavailable information could significantly impact our financial results. These items are not within the Company's control and may vary greatly between periods. Based on the foregoing, the Company believes that providing estimates of the amounts that would be required to reconcile these forecasted non-GAAP measures to forecasted GAAP measures would imply a degree of precision that would be confusing or misleading to investors for the reasons identified above.

Q4 & FY 2024 EARNINGS PRESENTATION3 Freshpet strengthens the bond between people and our pets so that we both live longer, healthier and happier lives while being kind to the planet.

Q4 & FY 2024 EARNINGS PRESENTATION4 Highlights

Q4 & FY 2024 EARNINGS PRESENTATION5 “Fiscal year 2024 was a breakout year for Freshpet. We continued to deliver the exceptional net sales growth investors have come to expect from Freshpet but also delivered very strong profit improvements… This strong performance also enables us to raise our long-term profit margin targets today to reflect the additional scale benefits we believe we can deliver as we transform the pet food category and nourish pets, people, and the planet.”

Q4 & FY 2024 EARNINGS PRESENTATION6 Source: Internal Data, Numerator for L52W ended 12/31/24 FINANCIAL RETAIL Q4 2024 FY 2024 FY 2024 Net Sales $262.7M $975.2M Household Penetration +17% Net Sales Growth YoY +22% +27% Buy Rate +6% Adjusted Gross Margin* 48.1% 46.5% Cubic Feet +12% Adjusted EBITDA $52.6M $161.8M Store Count +5% Adjusted EBITDA Margin* 20.0% 16.6% Total Distribution Points +18% Logistics Costs* 6.2% 6.0% Input Costs* 28.4% 29.7% Quality Costs* 2.7% 2.6% Operating Cash Flow $50.4M $154.3M *As a percent of net sales Q4 & FY 2024: Solid growth with scale advantages All comparisons to prior year period

Q4 & FY 2024 EARNINGS PRESENTATION7 Strong performance driven by key fundamentals: • Strong, consistent net sales growth • Volume-based growth of 26% in fiscal year 2024 • Household penetration growth of 17% and heaviest users growing even faster • Media spend continuing to drive household penetration at favorable costs • 740 basis point improvement across quality, input, and logistics costs in FY 2024 and exceeded previously provided 2027 targets • Reducing turnover and skilled production workforce were instrumental in creating sustainable operating leverage • Expanding capacity on-budget and on-time while improving margins • Strong fill rates (99%+ in Q4 2024) demonstrate effectiveness of disciplined growth strategy Strength of the Freshpet growth model Improved operational effectiveness Operating discipline to balance capacity and demand at a high growth rate Source: Internal data; Numerator Panel data for the 52-week periods ending 12/31/24

Q4 & FY 2024 EARNINGS PRESENTATION8 Long-term tailwinds supporting our growth: • Growing importance of pets in our lives; long-term trend we have seen for over a decade • Parents waiting longer to have kids, having less kids and getting pet instead • Consumers recognize quality for the price, not just price • Find value in a differentiated product • Heaviest users growing faster than total households Humanization of Pets Value

Q4 & FY 2024 EARNINGS PRESENTATION9 Vast runway for growth in a growing category 1. NIQ Total US Pet Food $ - OmniChannel by Category 52 Weeks Ended 12/28/24 2. NIQ MegaChannel 52 Weeks Ended 12/28/24, Gently Cooked Fresh/Frozen Branded Dog Food $54B U.S. pet food category1 $37B Dog food category1 3.4% Freshpet market share of dog food1 Freshpet market share of fresh/frozen in measured channels2 96%

Q4 & FY 2024 EARNINGS PRESENTATION10 7.3 8.6 9.9 11.6 13.5 2020 2021 2022 2023 2024 +17% +17% +15% +17% Continued growth in consumer franchise; added ~2m households YoY Source: Numerator Panel data for the 52-week periods ending 12/31/20, 12/31/21, 12/31/22, 12/31/23, and 12/31/24 Freshpet Household Penetration Growth (in millions) (52 weeks)

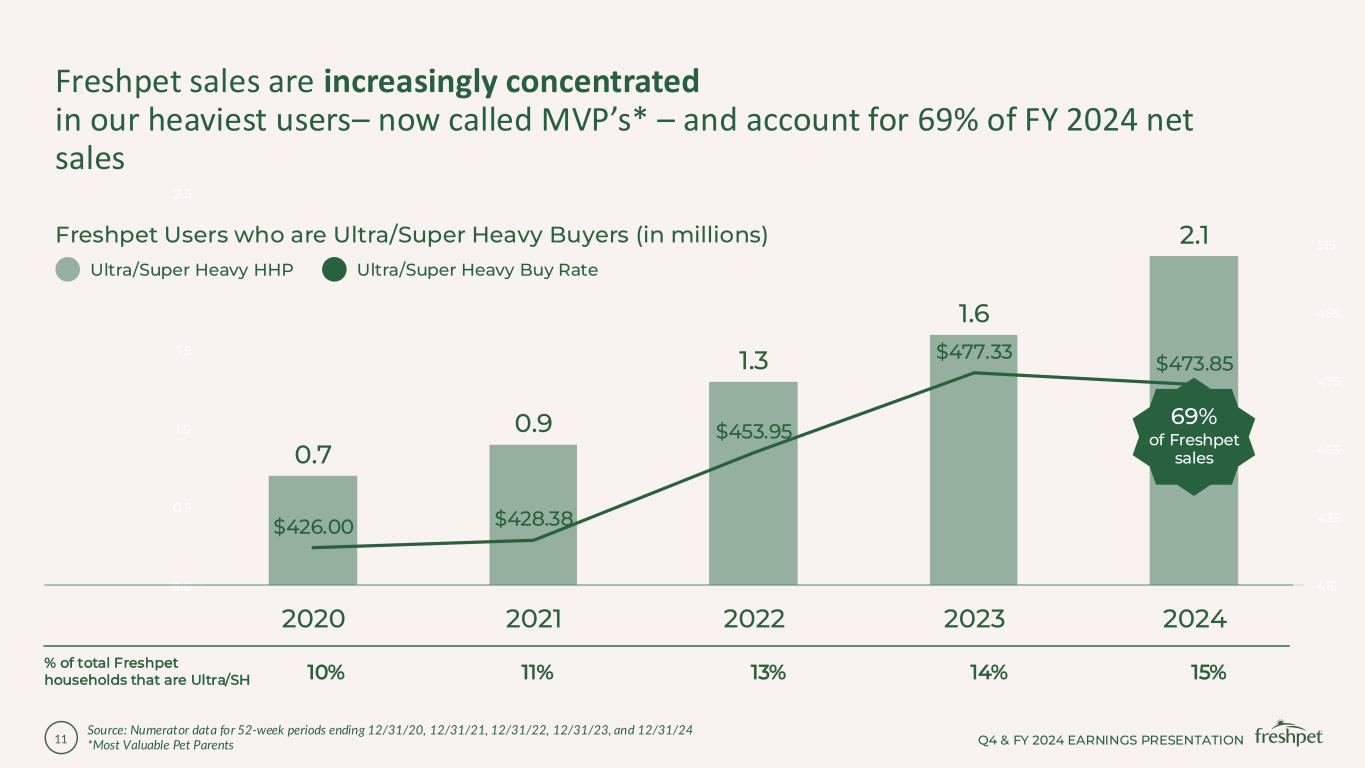

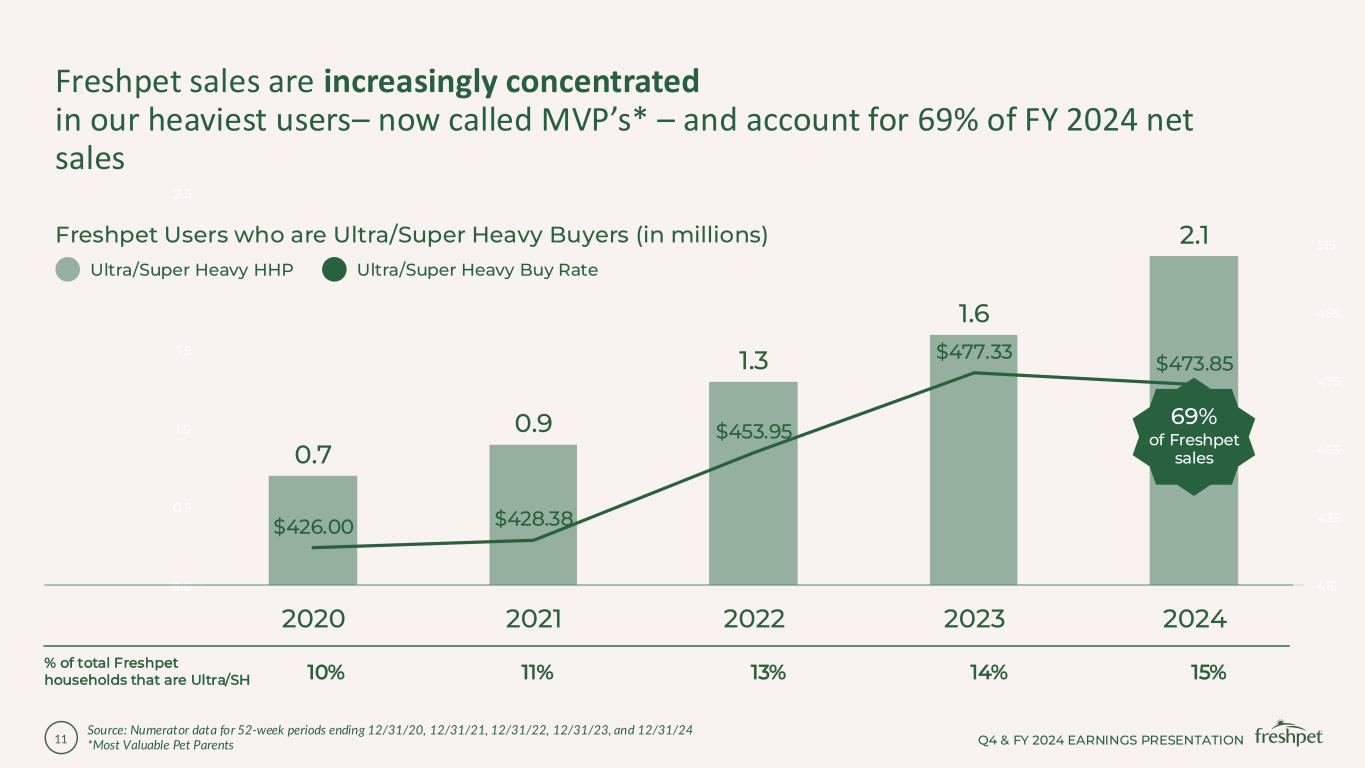

Q4 & FY 2024 EARNINGS PRESENTATION11 0.7 0.9 1.3 1.6 2.1 $426.00 $428.38 $453.95 $477.33 $473.85 415 435 455 475 495 515 0.0 0.5 1.0 1.5 2.0 2.5 2020 2021 2022 2023 2024 Freshpet sales are increasingly concentrated in our heaviest users– now called MVP’s* – and account for 69% of FY 2024 net sales Source: Numerator data for 52-week periods ending 12/31/20, 12/31/21, 12/31/22, 12/31/23, and 12/31/24 *Most Valuable Pet Parents % of total Freshpet households that are Ultra/SH 10% 11% 13% 14% 15% Freshpet Users who are Ultra/Super Heavy Buyers (in millions) Ultra/Super Heavy HHP Ultra/Super Heavy Buy Rate 69% of Freshpet sales

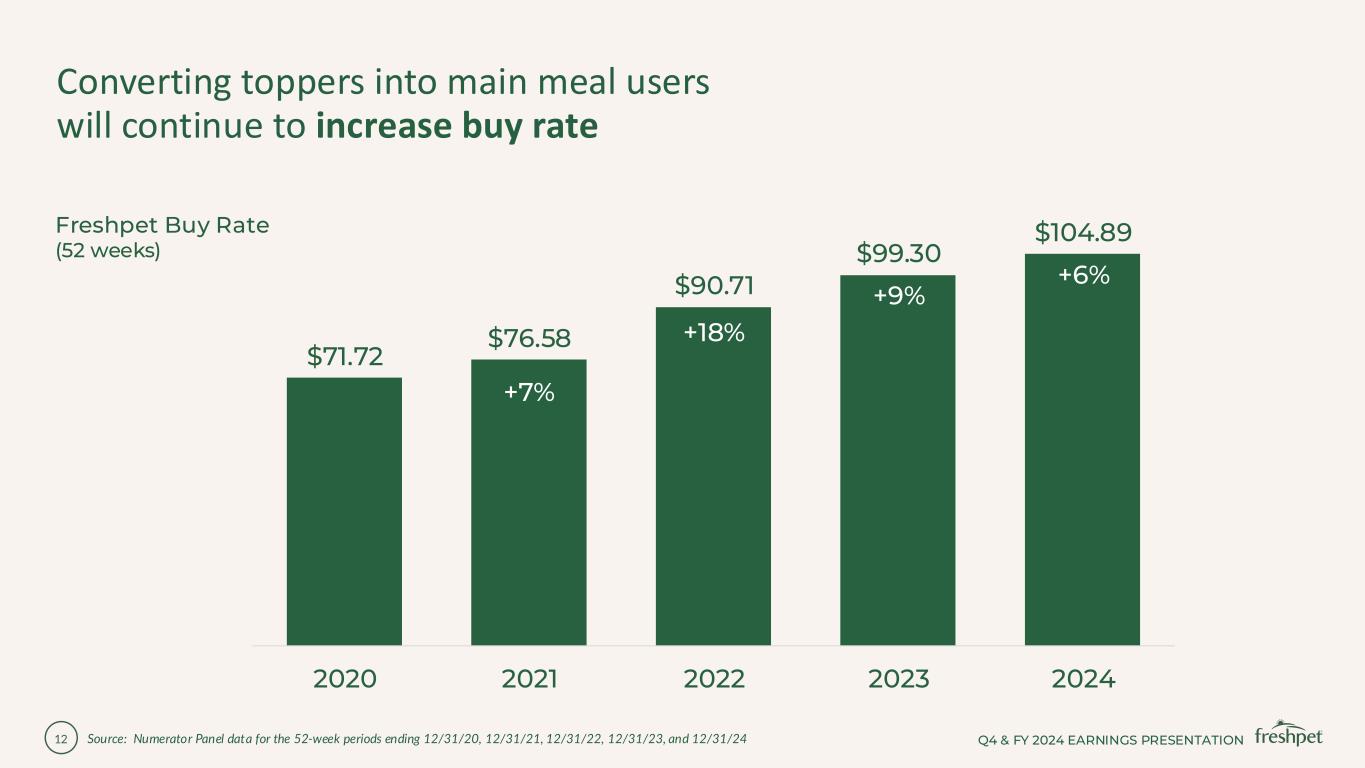

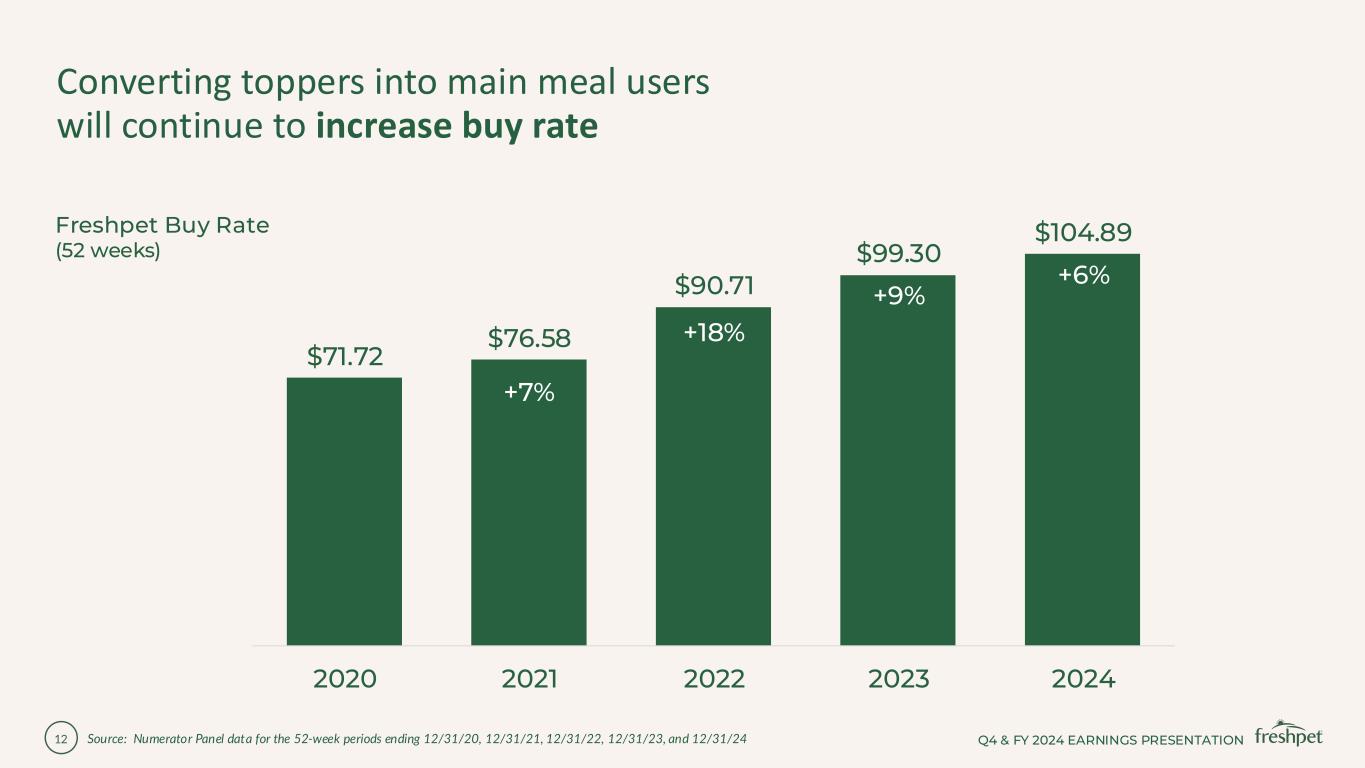

Q4 & FY 2024 EARNINGS PRESENTATION12 $71.72 $76.58 $90.71 $99.30 $104.89 2020 2021 2022 2023 2024 Converting toppers into main meal users will continue to increase buy rate Source: Numerator Panel data for the 52-week periods ending 12/31/20, 12/31/21, 12/31/22, 12/31/23, and 12/31/24 Freshpet Buy Rate (52 weeks) +6% +9% +18% +7%

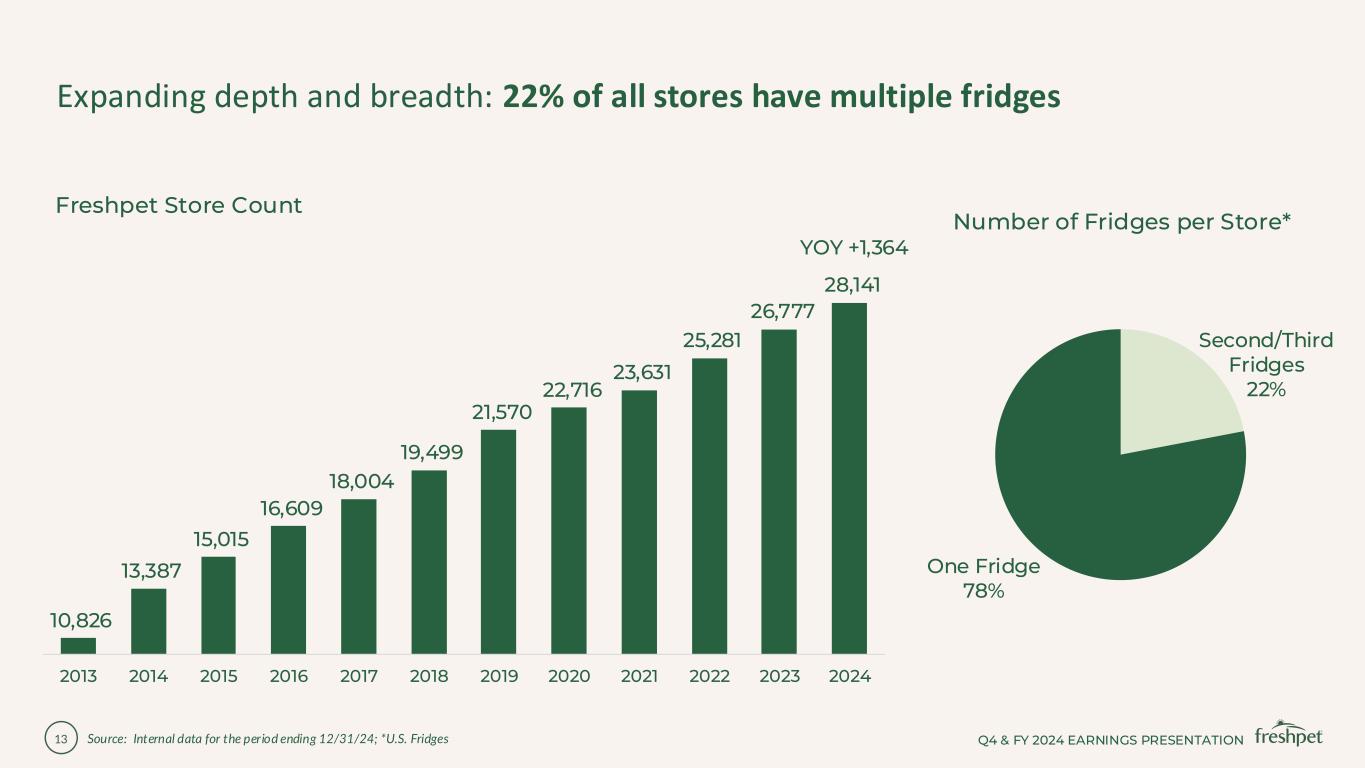

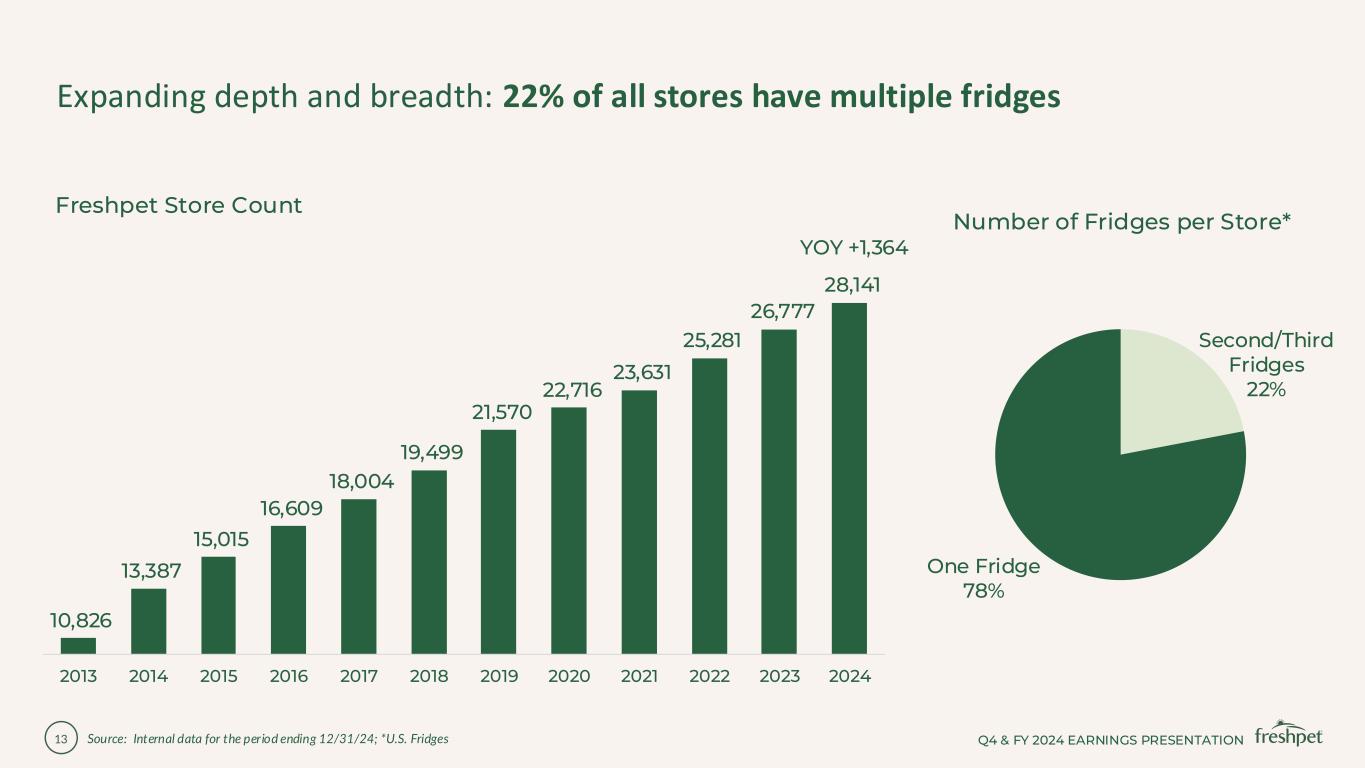

Q4 & FY 2024 EARNINGS PRESENTATION13 Expanding depth and breadth: 22% of all stores have multiple fridges Source: Internal data for the period ending 12/31/24; *U.S. Fridges Freshpet Store Count Number of Fridges per Store* Second/Third Fridges 22% One Fridge 78% YOY +1,364 10,826 13,387 15,015 16,609 18,004 19,499 21,570 22,716 23,631 25,281 26,777 28,141 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024

Q4 & FY 2024 EARNINGS PRESENTATION14 -150 bps FY 2024 -150 bps FY 2024 -440 bps FY 2024 Improved costs by 740 bps in FY 2024 across key focus areas Source: Internal Data; All comparisons to prior year period

Q4 & FY 2024 EARNINGS PRESENTATION15 Capacity Update Source: Internal Data Facility # Lines Today # Lines Projected Bethlehem Kitchen 6 7 Kitchen South 3 7 Ennis Kitchen 5 10+ Total 14 24+ Q4 & FY 2024 EARNINGS PRESENTATION Fifth roll line in Ennis installed and provides necessary roll capacity well into 2026 Kitchen South bag line install underway, startup expected later in 1Q 2025 New production technology for bag product commencing in Bethlehem – to be commissioned in 4Q 2025

Q4 & FY 2024 EARNINGS PRESENTATION16 Capital Efficiency Framework MORE OUT OF EXISTING LINES MORE OUT OF EXISTING SITES DEVELOP & IMPLEMENT NEW TECHNOLOGIES

Q4 & FY 2024 EARNINGS PRESENTATION17 Q4 2024 Results

Q4 & FY 2024 EARNINGS PRESENTATION18 Q4 results demonstrate strong growth in-line with our guidance $215.4 $262.7 Q4 2023 Q4 2024 +22% Q4 2024 Net Sales ($m) Q4 2024 Net Sales Bridge Source: Internal Data 21.7% 2.0% -1.7% 22.0% Measured Sales Growth Non-Measured Growth Trade Inventory Reduction Net Sales GrowthMeasured Sales Growth Non-Measured Sales Growth Trade Inventory Reduction Net Sales Growth

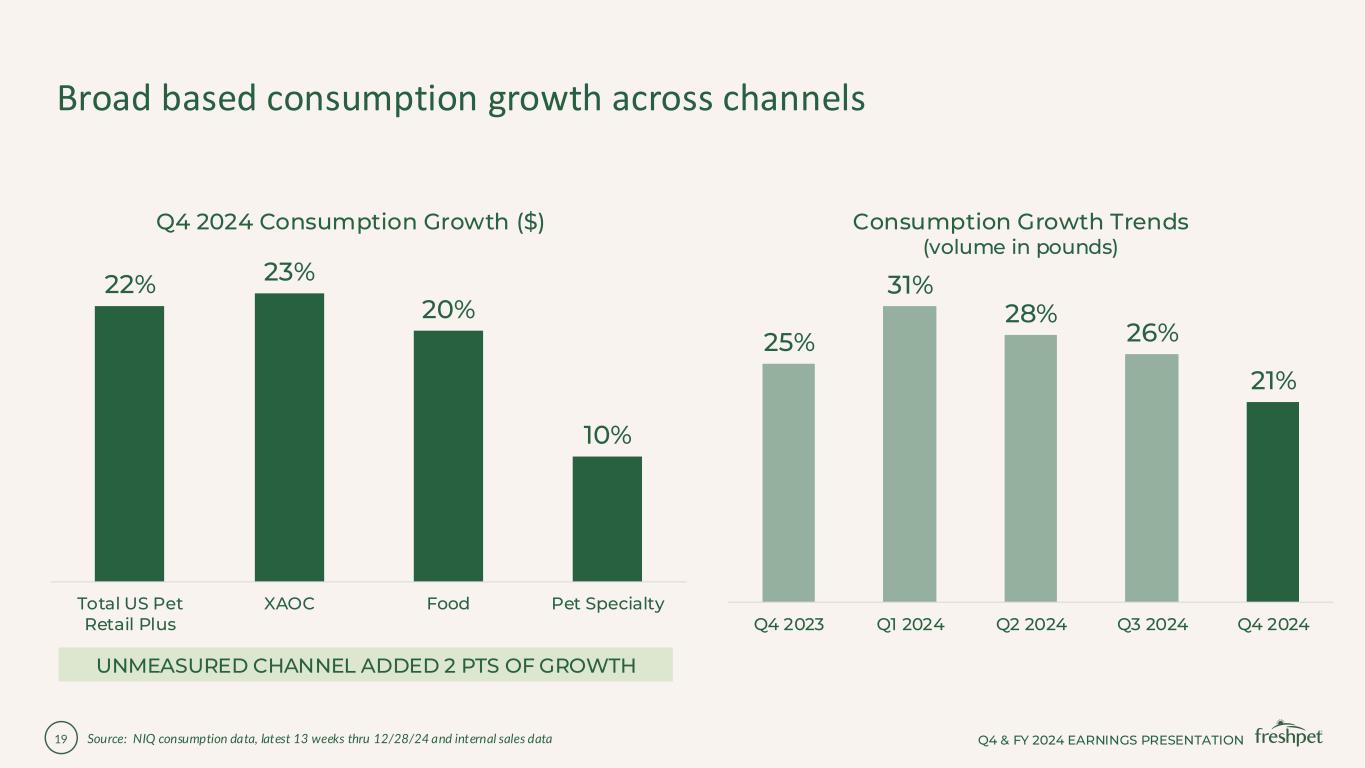

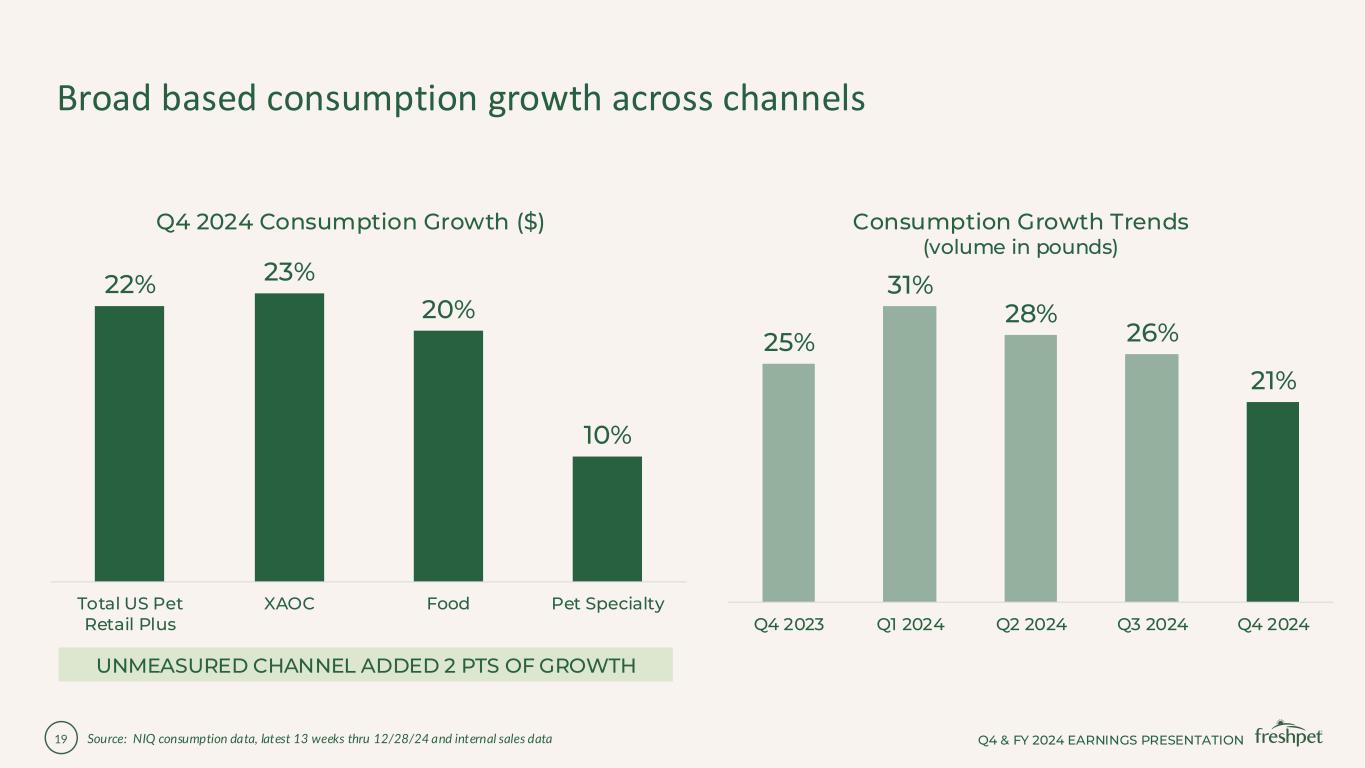

Q4 & FY 2024 EARNINGS PRESENTATION19 Broad based consumption growth across channels Source: NIQ consumption data, latest 13 weeks thru 12/28/24 and internal sales data Q4 2024 Consumption Growth ($) Consumption Growth Trends (volume in pounds) 22% 23% 20% 10% Total US Pet Retail Plus XAOC Food Pet Specialty 25% 31% 28% 26% 21% Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 UNMEASURED CHANNEL ADDED 2 PTS OF GROWTH

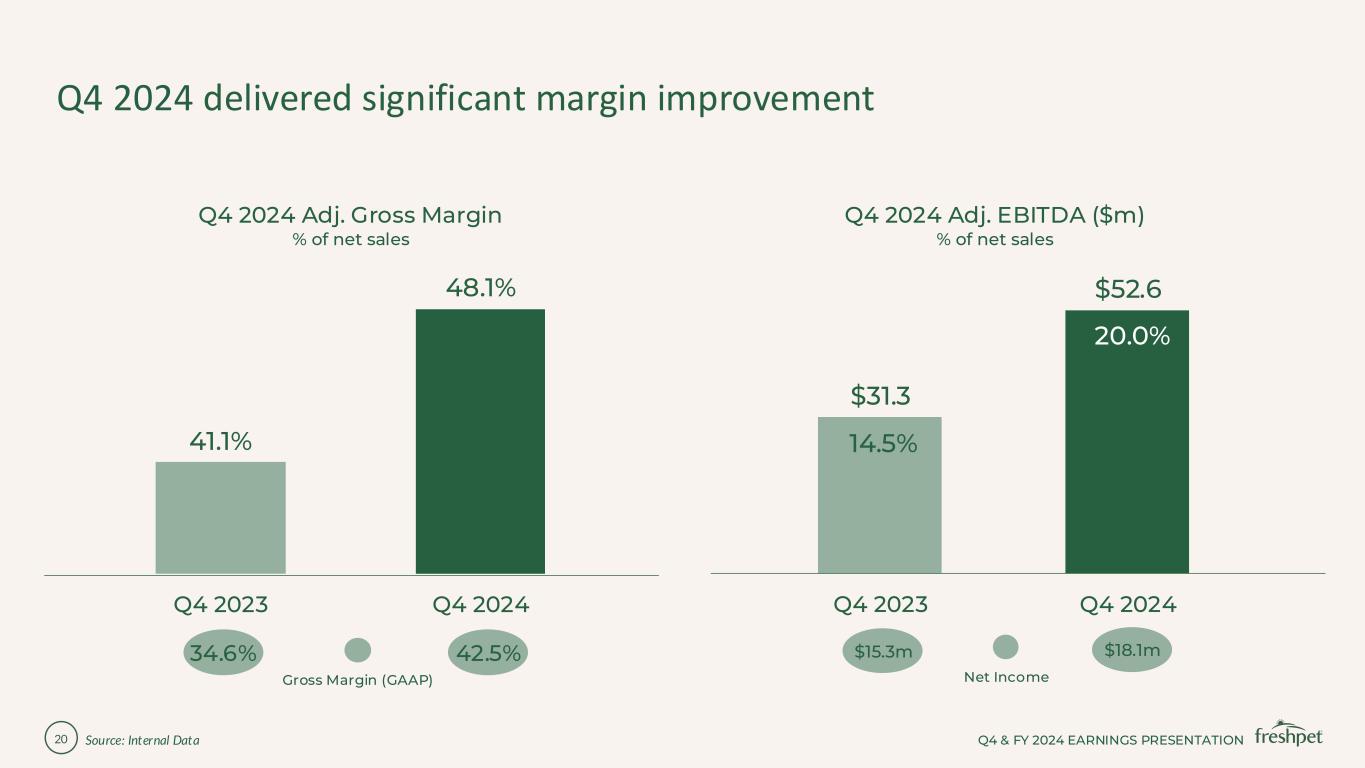

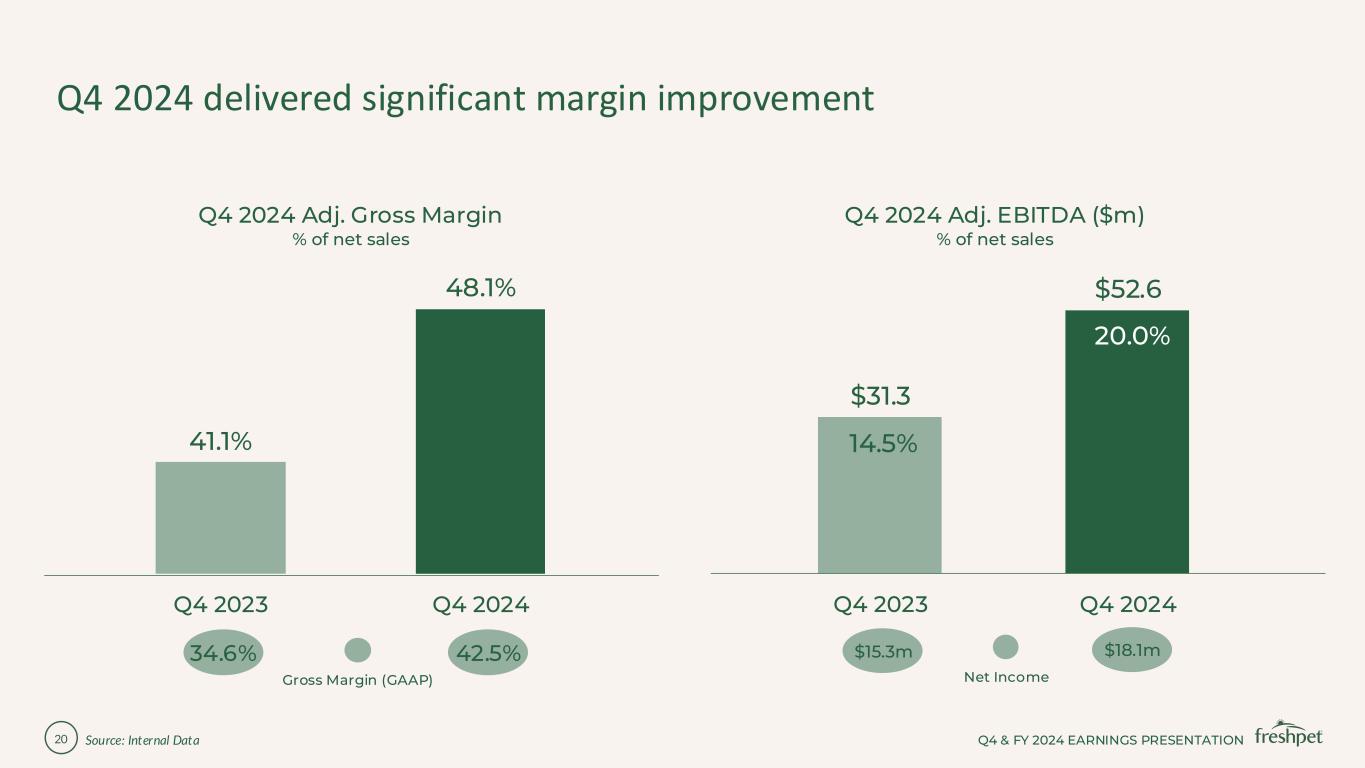

Q4 & FY 2024 EARNINGS PRESENTATION20 Q4 2024 delivered significant margin improvement Gross Margin (GAAP) 42.5%34.6% Q4 2024 Adj. Gross Margin % of net sales Q4 2024 Adj. EBITDA ($m) % of net sales 41.1% 48.1% Q4 2023 Q4 2024 $31.3 $52.6 Q4 2023 Q4 2024 14.5% 20.0% Net Income $15.3m $18.1m Source: Internal Data

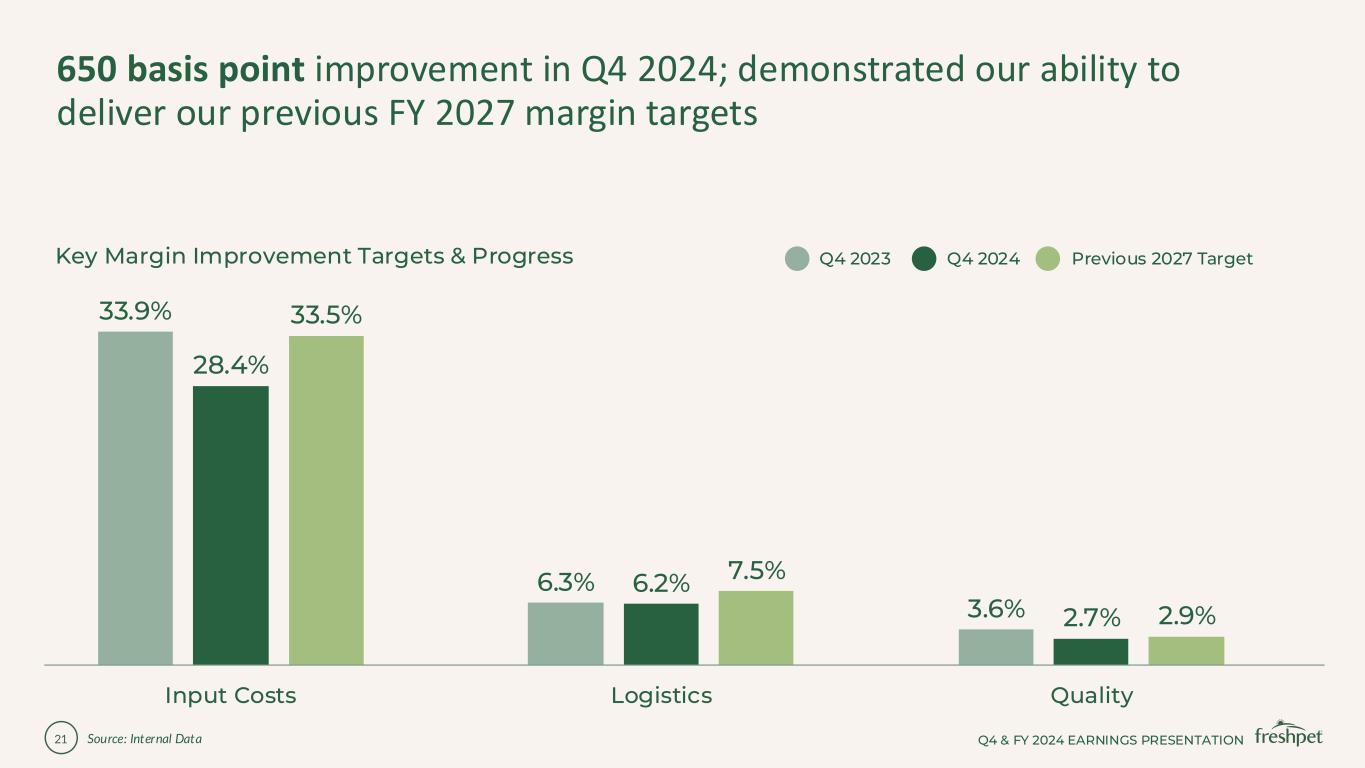

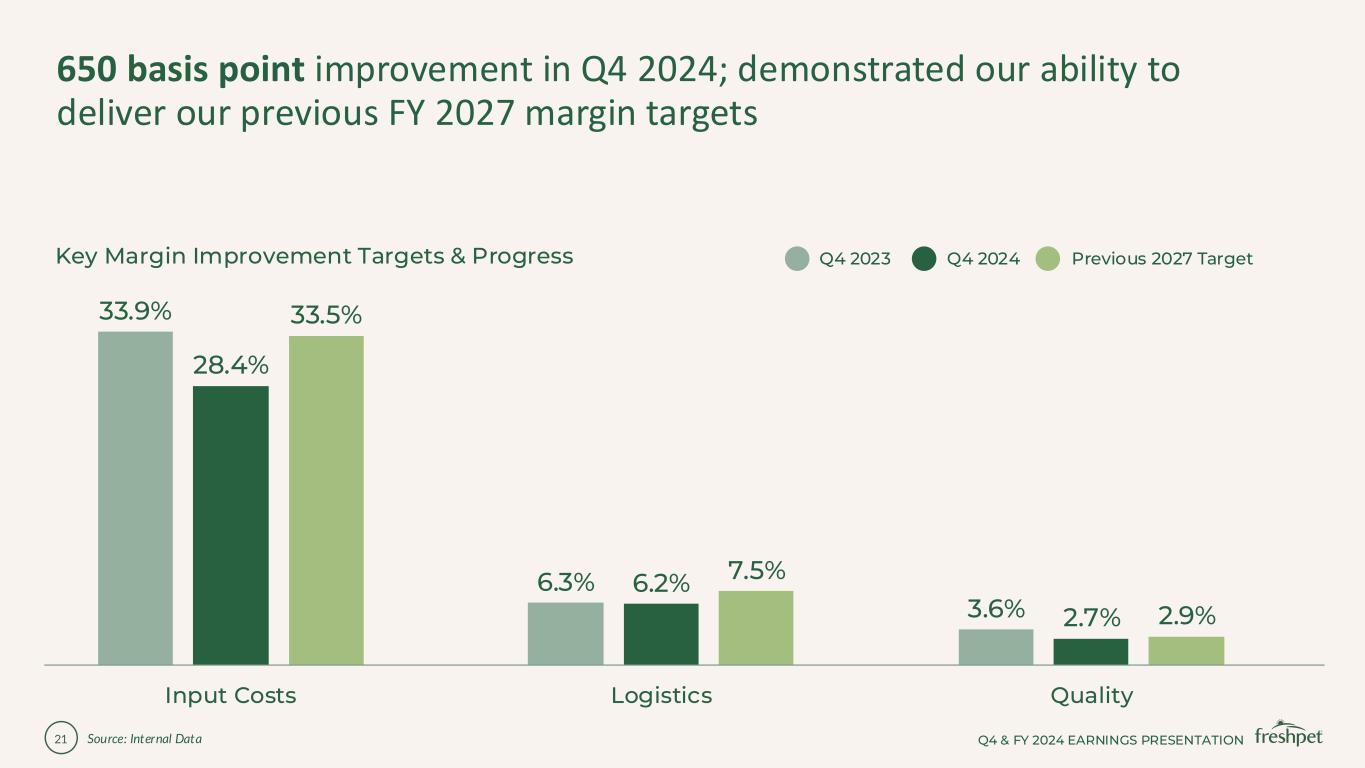

Q4 & FY 2024 EARNINGS PRESENTATION21 33.9% 6.3% 3.6% 28.4% 6.2% 2.7% 33.5% 7.5% 2.9% Input Costs Logistics Quality 650 basis point improvement in Q4 2024; demonstrated our ability to deliver our previous FY 2027 margin targets Key Margin Improvement Targets & Progress Q4 2023 Q4 2024 Previous 2027 Target Source: Internal Data

Q4 & FY 2024 EARNINGS PRESENTATION22 FY 2024 Results

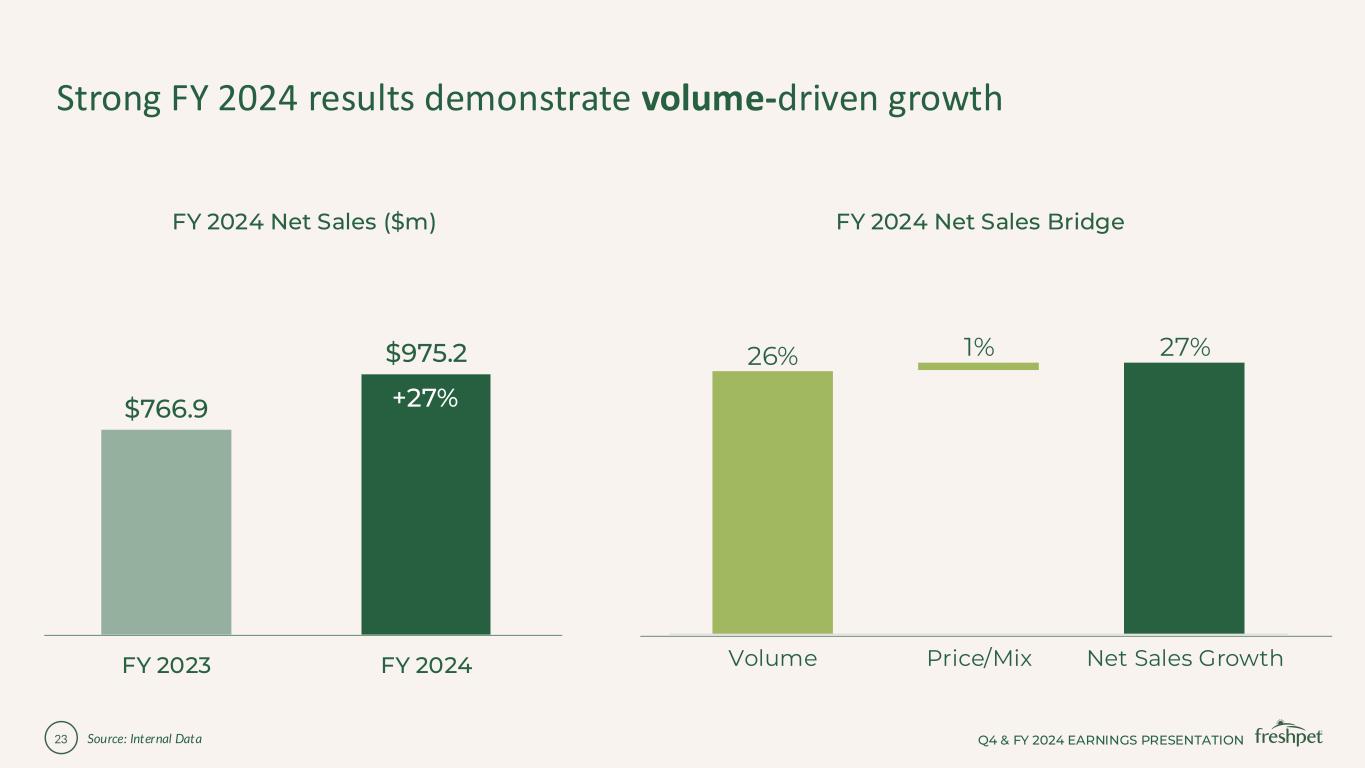

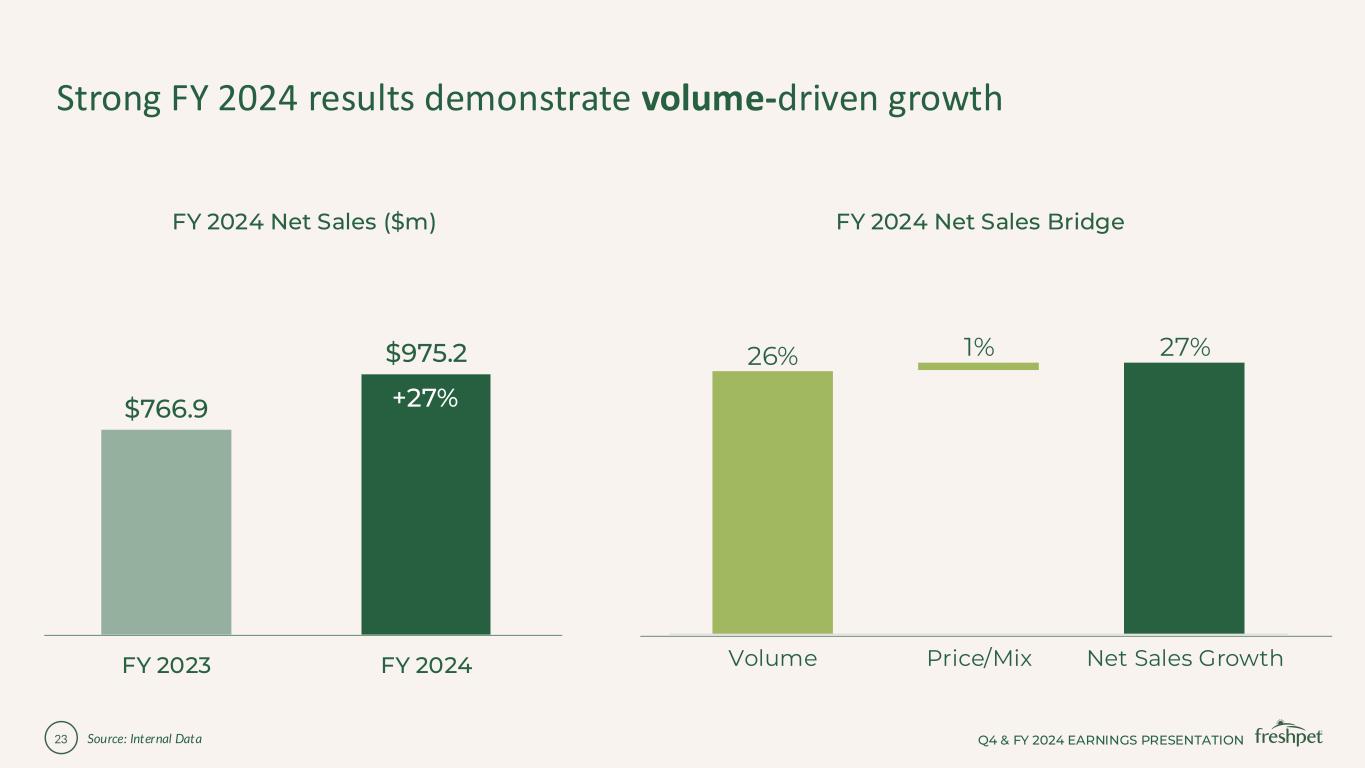

Q4 & FY 2024 EARNINGS PRESENTATION23 Strong FY 2024 results demonstrate volume-driven growth $766.9 $975.2 FY 2023 FY 2024 +27% FY 2024 Net Sales ($m) FY 2024 Net Sales Bridge Source: Internal Data 26% 1% 27% Volume Price/Mix Net Sales Growth

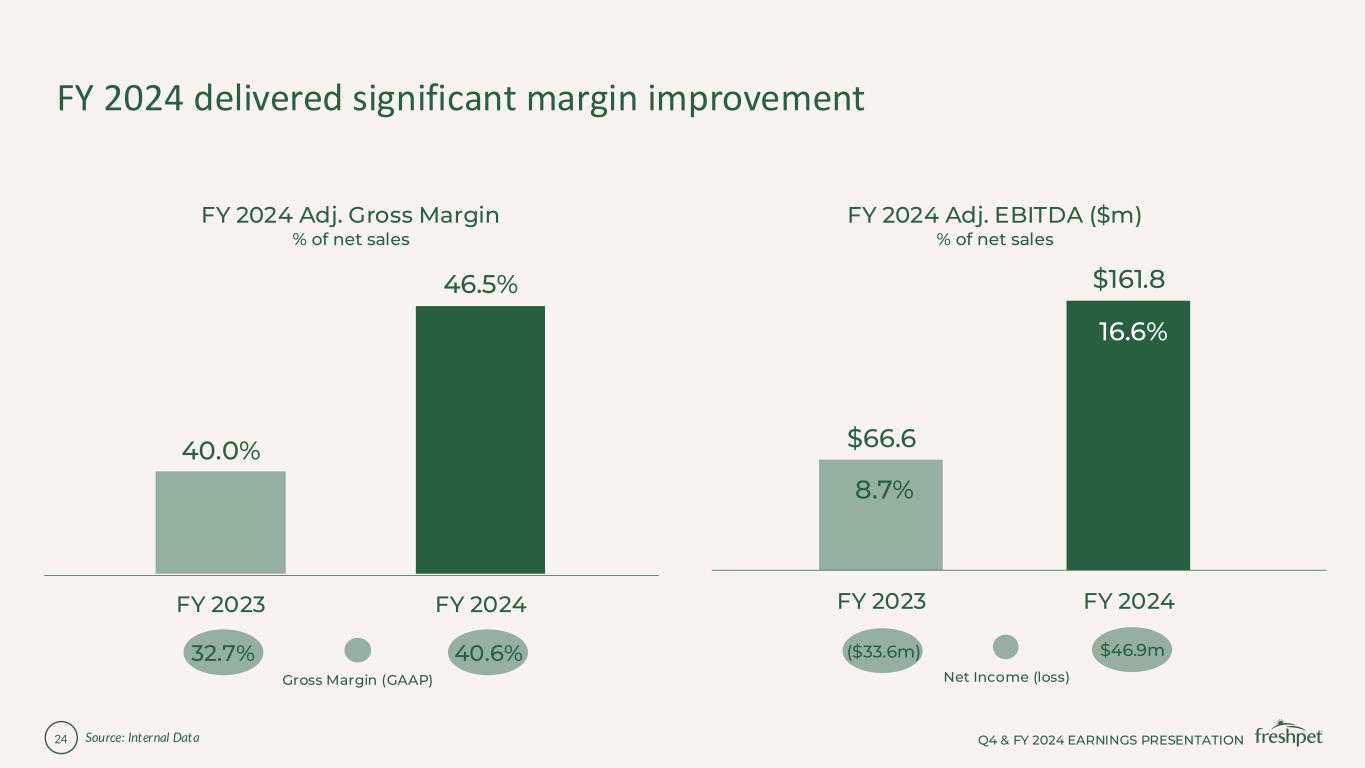

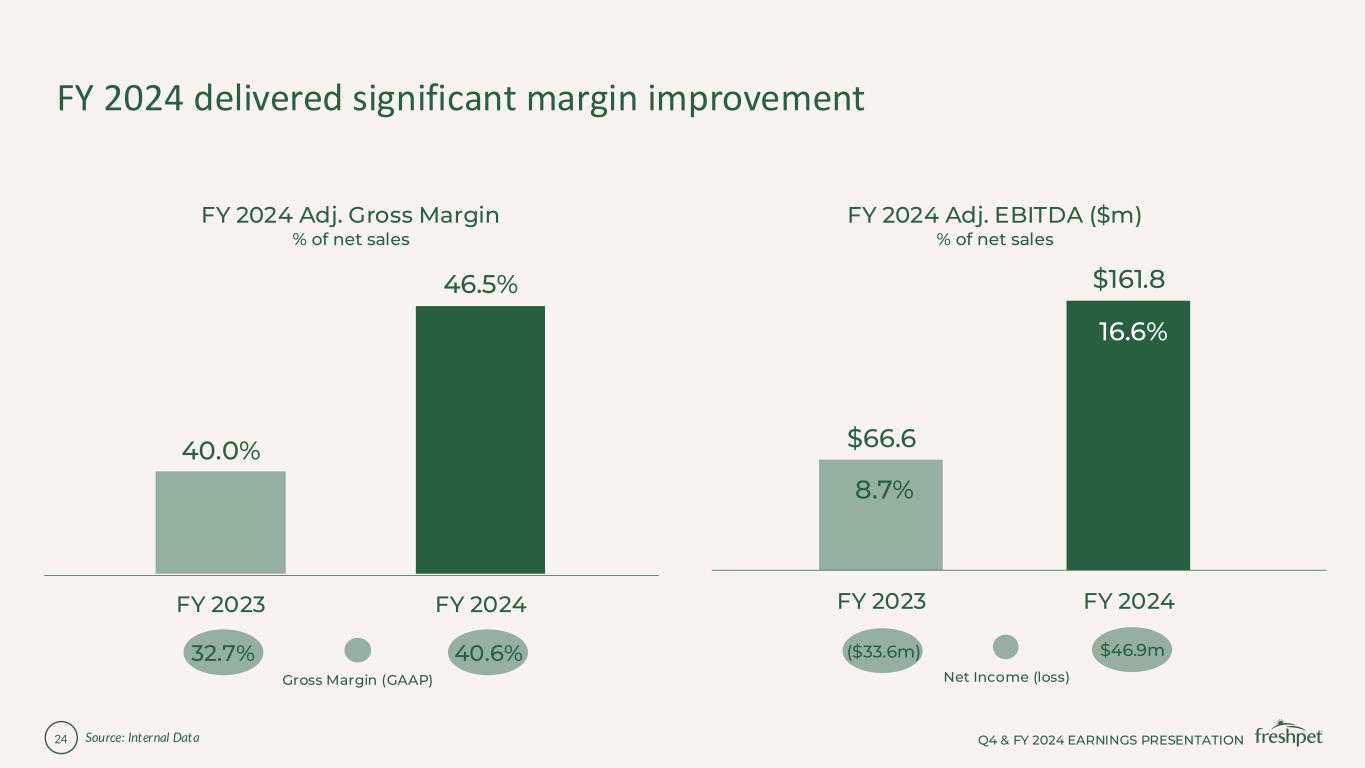

Q4 & FY 2024 EARNINGS PRESENTATION24 FY 2024 delivered significant margin improvement Gross Margin (GAAP) 40.6%32.7% FY 2024 Adj. Gross Margin % of net sales FY 2024 Adj. EBITDA ($m) % of net sales 40.0% 46.5% FY 2023 FY 2024 $66.6 $161.8 FY 2023 FY 2024 8.7% 16.6% Net Income (loss) ($33.6m) $46.9m Source: Internal Data

Q4 & FY 2024 EARNINGS PRESENTATION25 34.1% 7.5% 4.1% 29.7% 6.0% 2.6% 33.5% 7.5% 2.9% Input Costs Logistics Quality 740 basis point improvement in FY 2024; demonstrated our ability to deliver FY 2027 margin targets again Key Margin Improvement Targets & Progress FY 2023 FY 2024 Previous 2027 Target Source: Internal Data

Q4 & FY 2024 EARNINGS PRESENTATION26 Significant Adj. Gross Margin improvement YOY; ahead of our previous long- term target 40.0% 46.5% 45.0% FY 2023 FY 2024 Previous 2027 Target Adj. Gross Margin Progress vs. Previous 2027 Target Source: Internal Data

Q4 & FY 2024 EARNINGS PRESENTATION27 FY 2025 Guidance

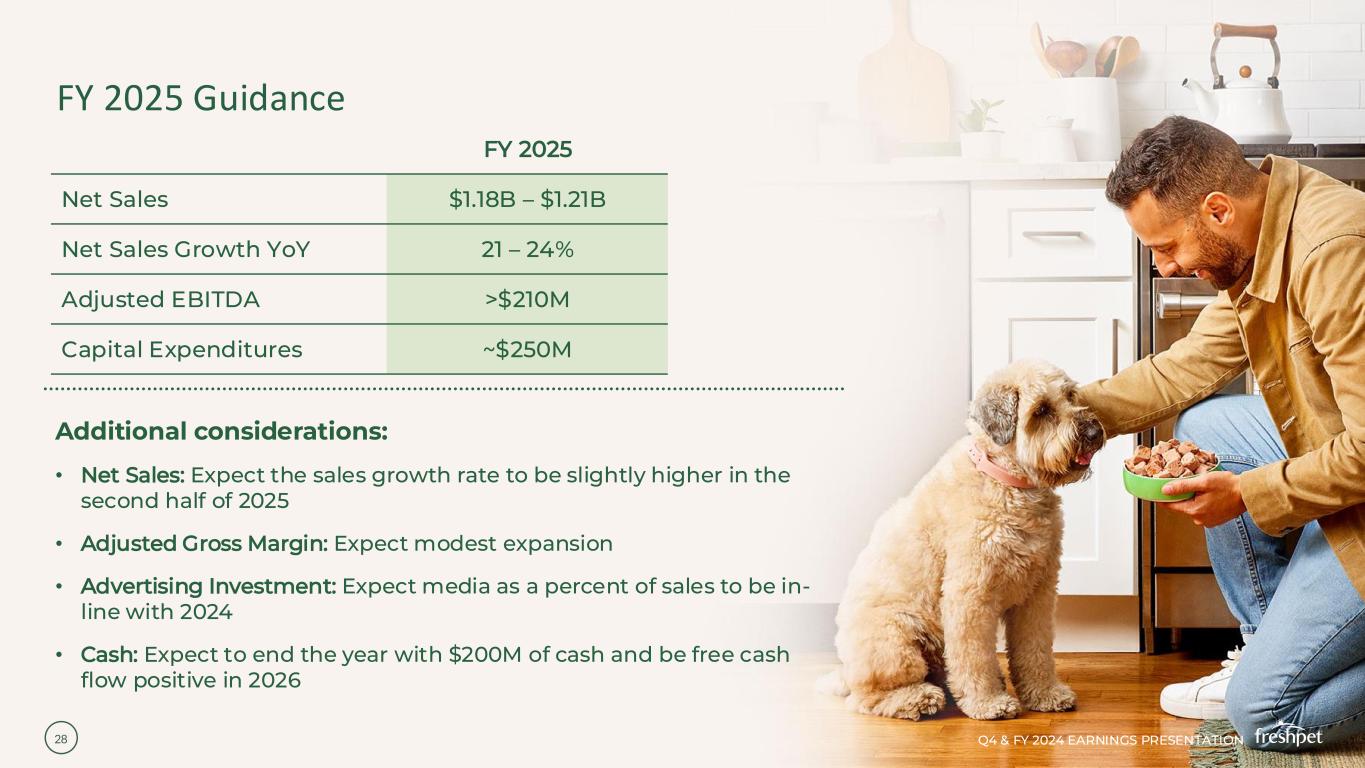

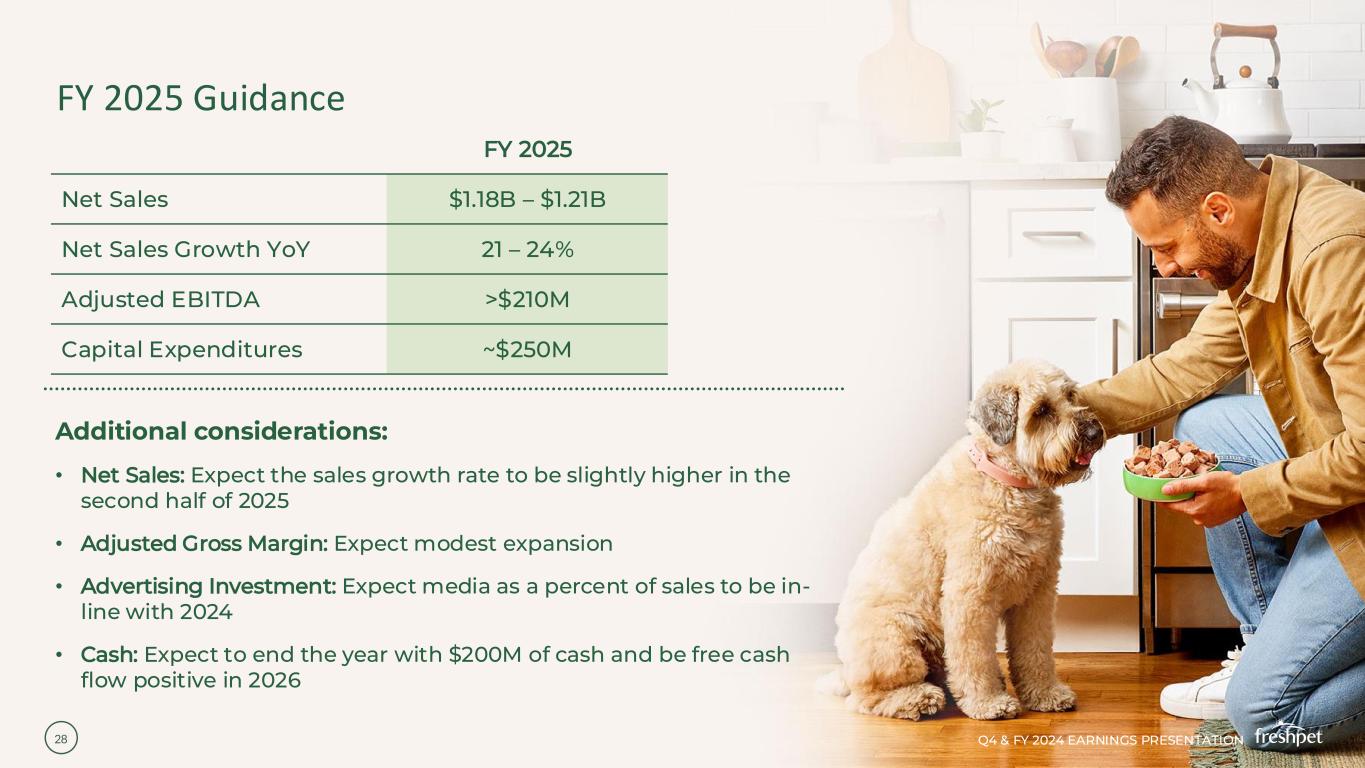

Q4 & FY 2024 EARNINGS PRESENTATION28 FY 2025 Guidance Additional considerations: • Net Sales: Expect the sales growth rate to be slightly higher in the second half of 2025 • Adjusted Gross Margin: Expect modest expansion • Advertising Investment: Expect media as a percent of sales to be in- line with 2024 • Cash: Expect to end the year with $200M of cash and be free cash flow positive in 2026 FY 2025 Net Sales $1.18B – $1.21B Net Sales Growth YoY 21 – 24% Adjusted EBITDA >$210M Capital Expenditures ~$250M

Q4 & FY 2024 EARNINGS PRESENTATION29 Updated 2027 Targets Expand HH Penetration Increase Velocity Advertising & Innovation Expand Visibility & Availability Drive Efficiencies Build Organization Capability to Increase Effectiveness & Leverage Scale Expand Capacity 22% Adjusted EBITDA Margin Target (18% previously) $1.8 billion Net Sales Target 20 million Target Freshpet Households by 2027 Target 48% Adjusted Gross Margin Target (45% previously)

Q4 & FY 2024 EARNINGS PRESENTATION30 Capital Spending, Cash Flow & Liquidity

Q4 & FY 2024 EARNINGS PRESENTATION31 Significant improvement in operating cash flow YoY Capital Spending: • Key projects remain on-track and on-budget • 2024 spend of $187 million and estimated 2025 spending of $250 million due to the shift in spend and installation of new capacity across all three Kitchens Cash flow: • Generated $154.3 million of operating cash flow in 2024, a YoY improvement of $78.3 million driven by: • Adj. EBITDA growth • Working capital position • Expect to be free cash flow positive in 2026 Liquidity: • $268.6 million of cash-on-hand as of 12/31/24 and expect to end 2025 with $200 million in cash Operating Cash Flow ($m) $75.9 $154.3 FY 2023 FY 2024 Source: Internal Data

Q4 & FY 2024 EARNINGS PRESENTATION32 Appendix

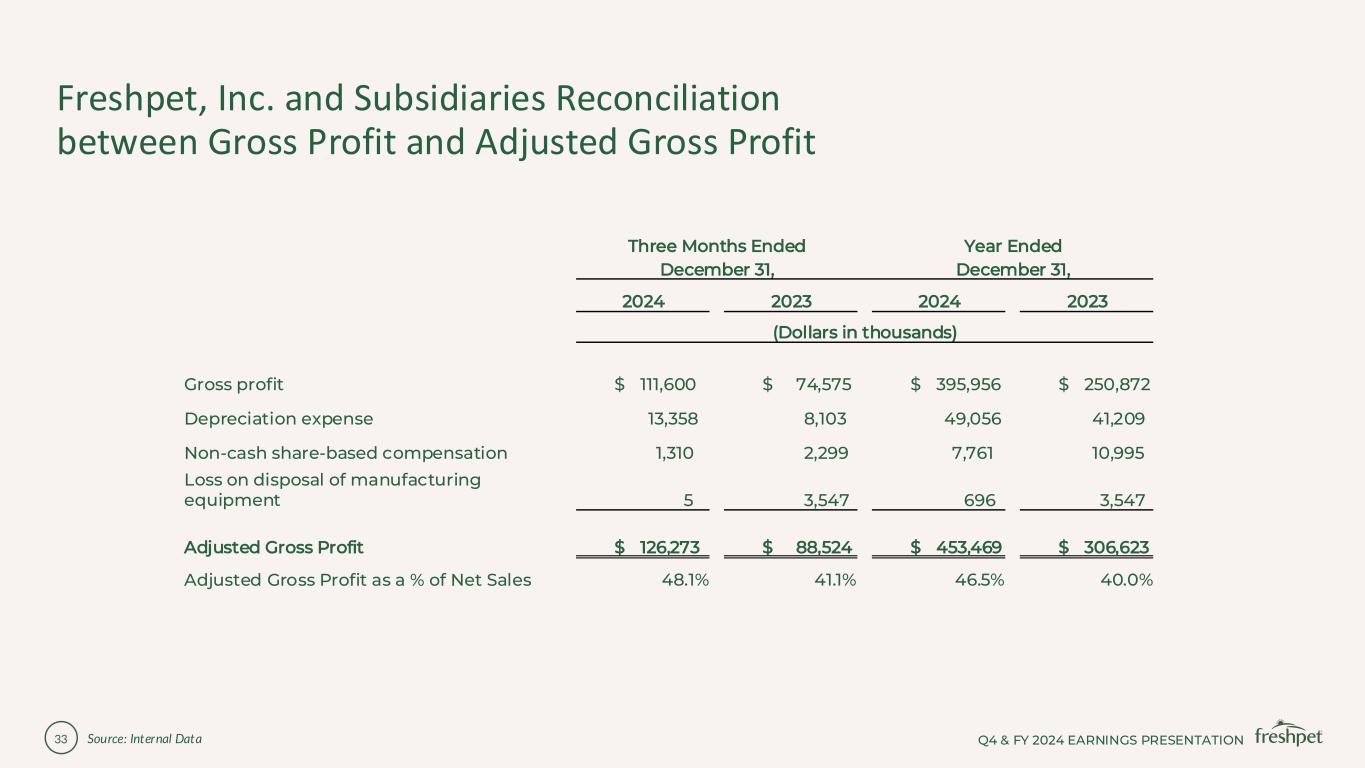

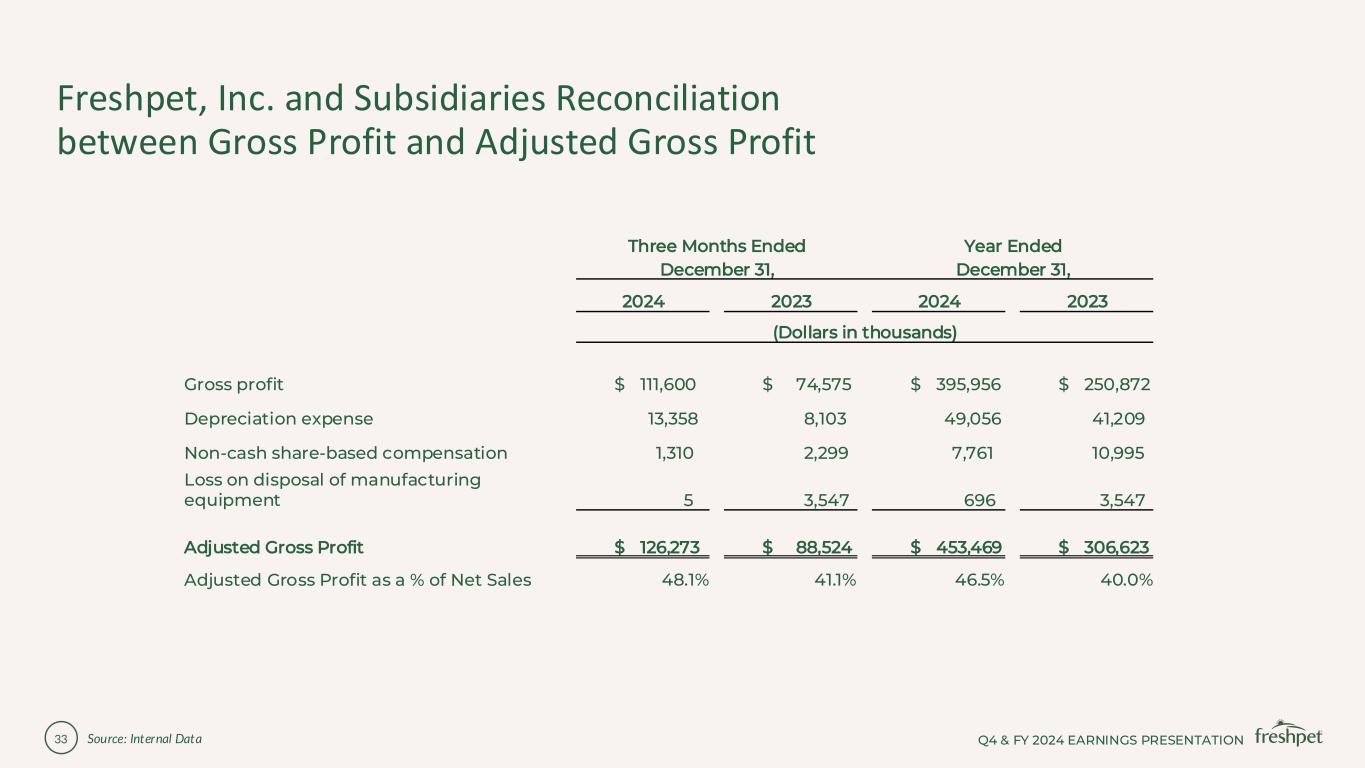

Q4 & FY 2024 EARNINGS PRESENTATION33 Freshpet, Inc. and Subsidiaries Reconciliation between Gross Profit and Adjusted Gross Profit Three Months Ended December 31, Year Ended December 31, 2024 2023 2024 2023 (Dollars in thousands) Gross profit $ 111,600 $ 74,575 $ 395,956 $ 250,872 Depreciation expense 13,358 8,103 49,056 41,209 Non-cash share-based compensation 1,310 2,299 7,761 10,995 Loss on disposal of manufacturing equipment 5 3,547 696 3,547 Adjusted Gross Profit $ 126,273 $ 88,524 $ 453,469 $ 306,623 Adjusted Gross Profit as a % of Net Sales 48.1% 41.1% 46.5% 40.0% Source: Internal Data

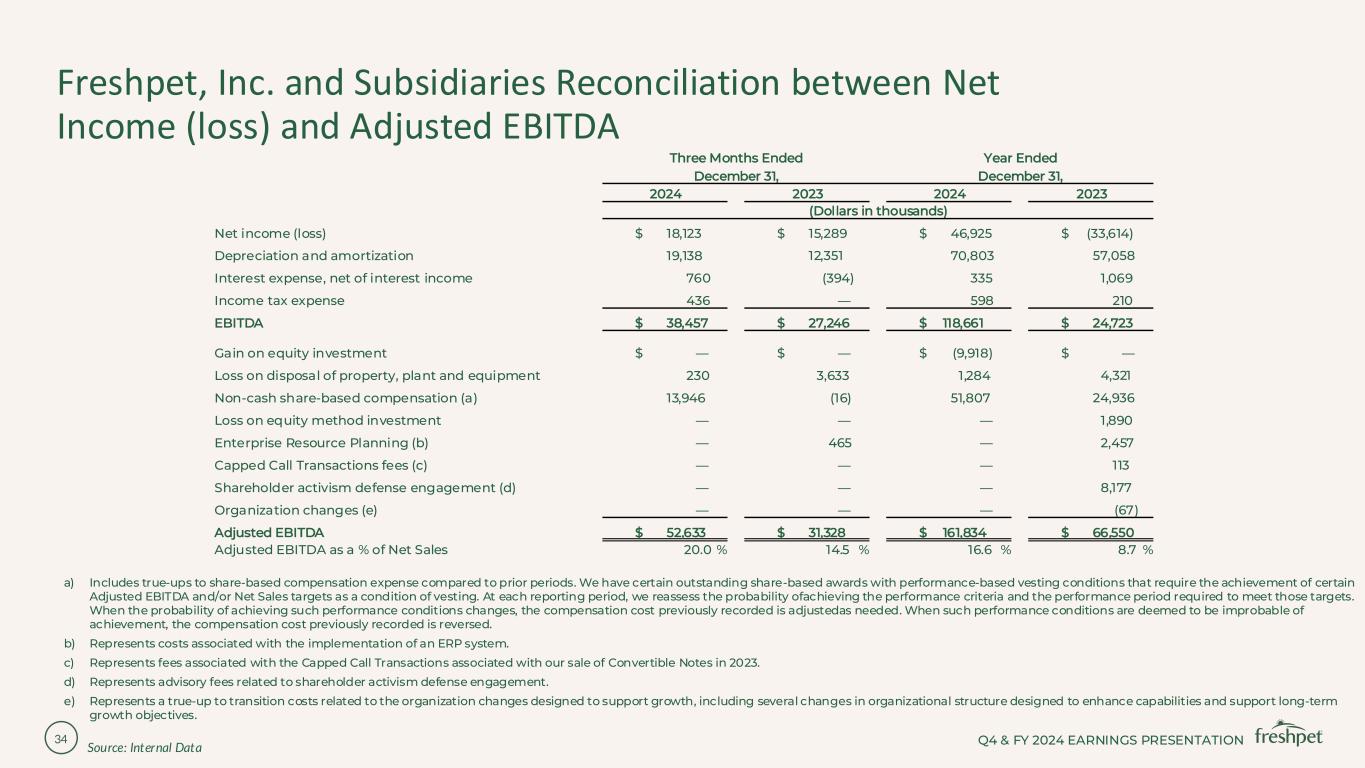

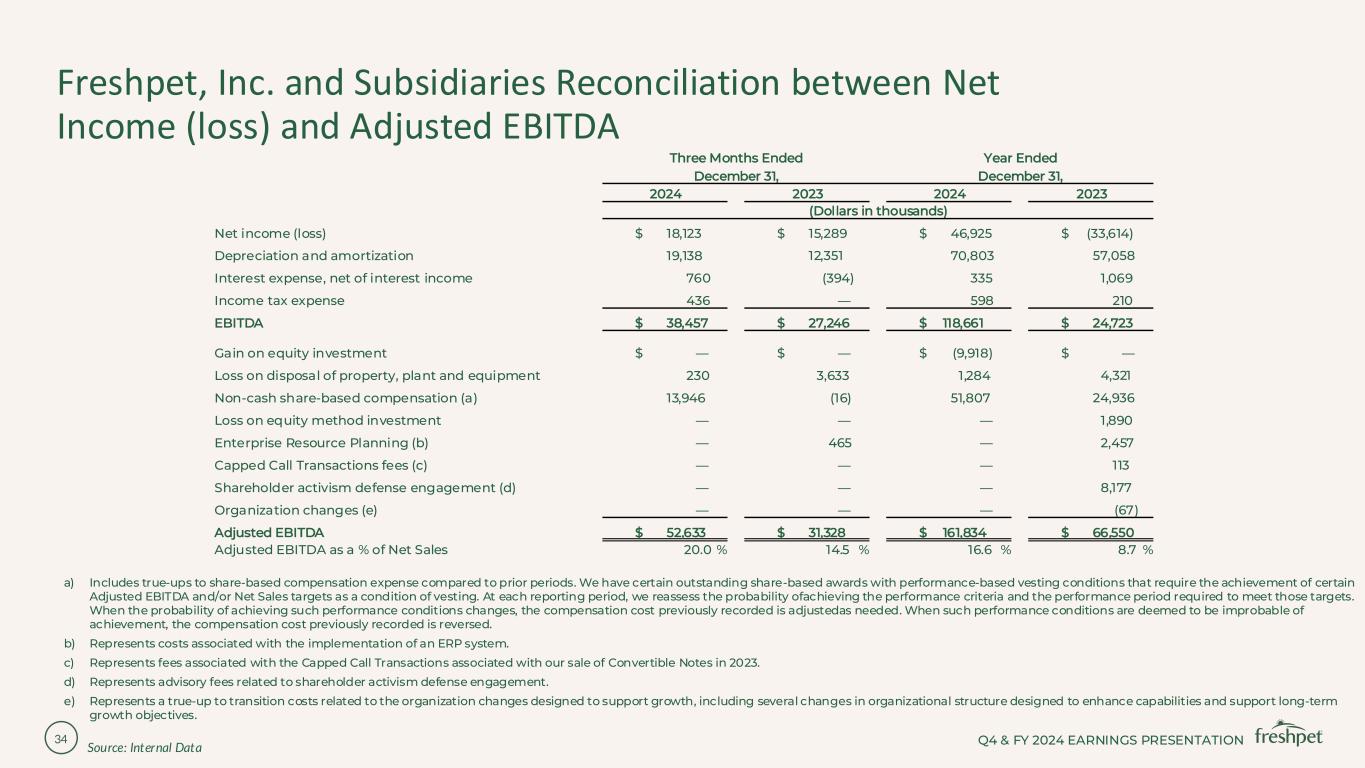

Q4 & FY 2024 EARNINGS PRESENTATION34 Freshpet, Inc. and Subsidiaries Reconciliation between Net Income (loss) and Adjusted EBITDA a) Includes true-ups to share-based compensation expense compared to prior periods. We have certain outstanding share-based awards with performance-based vesting conditions that require the achievement of certain Adjusted EBITDA and/or Net Sales targets as a condition of vesting. At each reporting period, we reassess the probability of achieving the performance criteria and the performance period required to meet those targets. When the probability of achieving such performance conditions changes, the compensation cost previously recorded is adjusted as needed. When such performance conditions are deemed to be improbable of achievement, the compensation cost previously recorded is reversed. b) Represents costs associated with the implementation of an ERP system. c) Represents fees associated with the Capped Call Transactions associated with our sale of Convertible Notes in 2023. d) Represents advisory fees related to shareholder activism defense engagement. e) Represents a true-up to transition costs related to the organization changes designed to support growth, including several changes in organizational structure designed to enhance capabilities and support long-term growth objectives. Source: Internal Data Three Months Ended December 31, Year Ended December 31, 2024 2023 2024 2023 (Dollars in thousands) Net income (loss) $ 18,123 $ 15,289 $ 46,925 $ (33,614) Depreciation and amortization 19,138 12,351 70,803 57,058 Interest expense, net of interest income 760 (394) 335 1,069 Income tax expense 436 — 598 210 EBITDA $ 38,457 $ 27,246 $ 118,661 $ 24,723 Gain on equity investment $ — $ — $ (9,918) $ — Loss on disposal of property, plant and equipment 230 3,633 1,284 4,321 Non-cash share-based compensation (a) 13,946 (16) 51,807 24,936 Loss on equity method investment — — — 1,890 Enterprise Resource Planning (b) — 465 — 2,457 Capped Call Transactions fees (c) — — — 113 Shareholder activism defense engagement (d) — — — 8,177 Organization changes (e) — — — (67) Adjusted EBITDA $ 52,633 $ 31,328 $ 161,834 $ 66,550 Adjusted EBITDA as a % of Net Sales 20.0 % 14.5 % 16.6 % 8.7 %

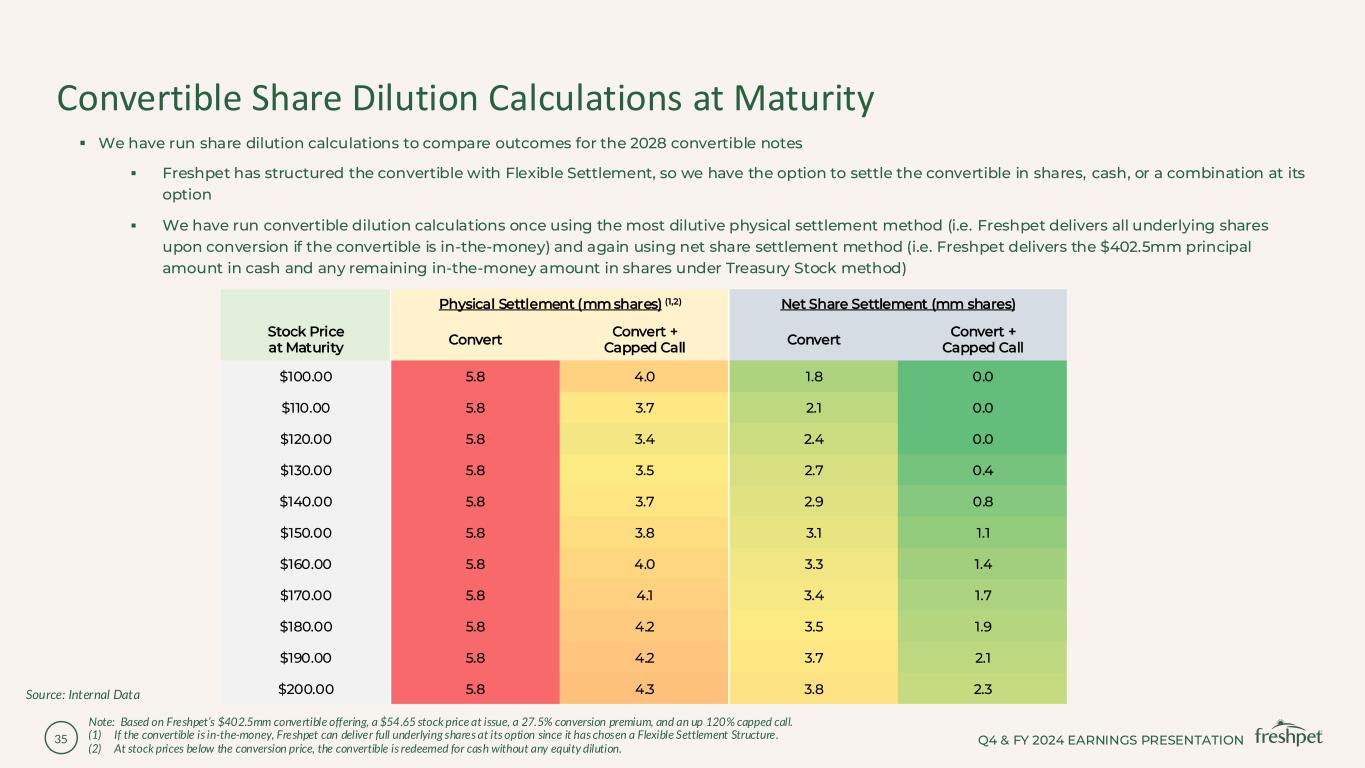

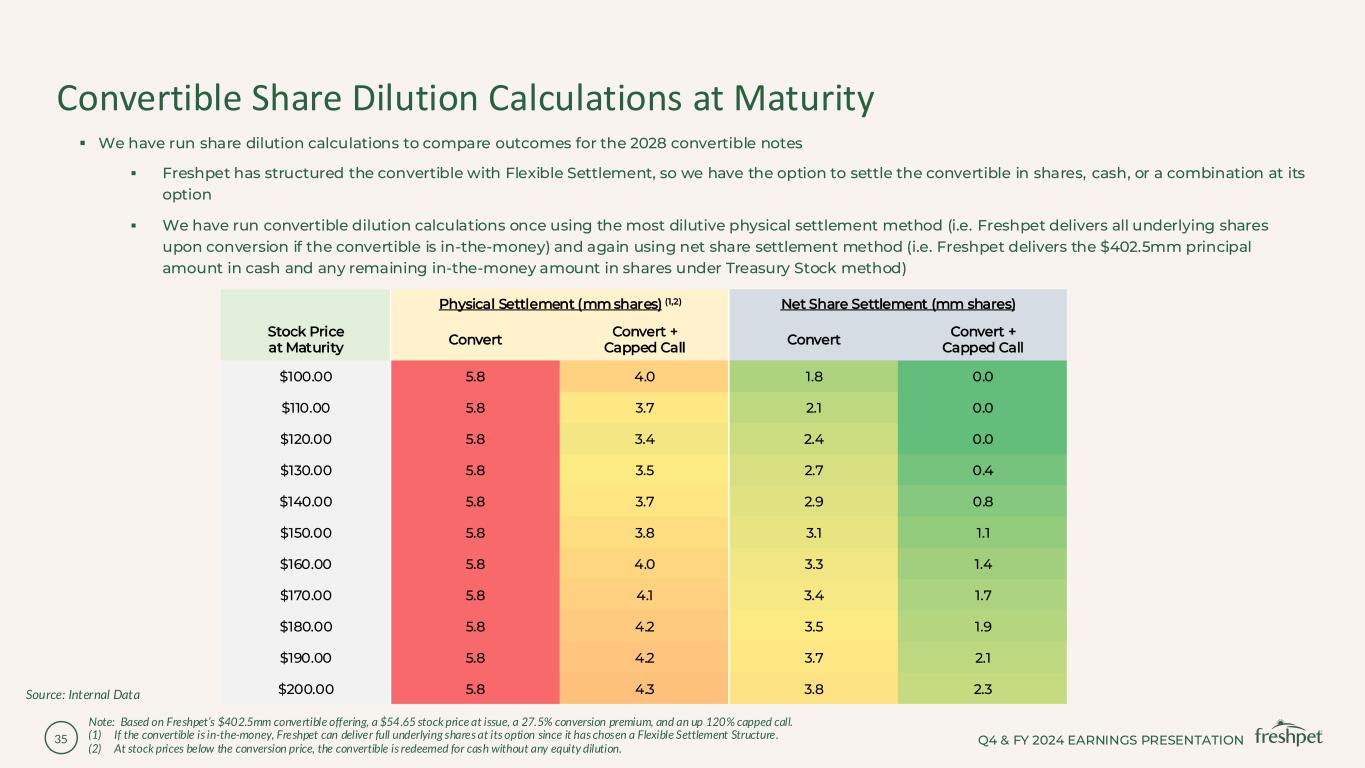

Q4 & FY 2024 EARNINGS PRESENTATION35 Convertible Share Dilution Calculations at Maturity ▪ We have run share dilution calculations to compare outcomes for the 2028 convertible notes ▪ Freshpet has structured the convertible with Flexible Settlement, so we have the option to settle the convertible in shares, cash, or a combination at its option ▪ We have run convertible dilution calculations once using the most dilutive physical settlement method (i.e. Freshpet delivers all underlying shares upon conversion if the convertible is in-the-money) and again using net share settlement method (i.e. Freshpet delivers the $402.5mm principal amount in cash and any remaining in-the-money amount in shares under Treasury Stock method) Note: Based on Freshpet’s $402.5mm convertible offering, a $54.65 stock price at issue, a 27.5% conversion premium, and an up 120% capped call. (1) If the convertible is in-the-money, Freshpet can deliver full underlying shares at its option since it has chosen a Flexible Settlement Structure. (2) At stock prices below the conversion price, the convertible is redeemed for cash without any equity dilution. Physical Settlement (mm shares) (1,2) Net Share Settlement (mm shares) Stock Price at Maturity Convert Convert + Capped Call Convert Convert + Capped Call $100.00 5.8 4.0 1.8 0.0 $110.00 5.8 3.7 2.1 0.0 $120.00 5.8 3.4 2.4 0.0 $130.00 5.8 3.5 2.7 0.4 $140.00 5.8 3.7 2.9 0.8 $150.00 5.8 3.8 3.1 1.1 $160.00 5.8 4.0 3.3 1.4 $170.00 5.8 4.1 3.4 1.7 $180.00 5.8 4.2 3.5 1.9 $190.00 5.8 4.2 3.7 2.1 $200.00 5.8 4.3 3.8 2.3Source: Internal Data

Q4 & FY 2024 EARNINGS PRESENTATION36

Q4 & FY 2024 EARNINGS PRESENTATION37