QuickLinks -- Click here to rapidly navigate through this document | | |

| |

Christina E. Melendi

Direct Phone: 212.705.7814

Direct Fax: 212.702.3624

christina.melendi@bingham.comSeptember 22, 2014 VIA EDGAR Suzanne Hayes

Assistant Director

Division of Corporate Finance

Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549 Re: OM Asset Management Limited

Amendment No. 4 to Registration Statement on Form S-1 Dear Ms. Hayes: As previously discussed with the staff of the Division of Corporation Finance (the "Staff"), on behalf of our client, OM Asset Management Limited (the "Company"), we are submitting supplementally for the Staff's review as Attachment A to this letter certain excerpted pages from the Company's Registration Statement on Form S-1 (Registration No. 333-183963) (the "Registration Statement") which have been revised to reflect: (i) the number of ordinary shares of the Company proposed to be sold under the Registration Statement and the price range, (ii) the pro forma effect of the offering on the equity capital structure of the Company on its pro forma balance sheet, and (iii) a pro forma balance sheet in its financial statements reflecting certain planned distributions to the Company's parent. Please direct any general questions or comments concerning the enclosed supplemental information, and any requests for additional information, to the undersigned at (212) 705-7814. Sincerely yours, /s/ Christina E Melendi Christina E. Melendi Enclosures cc: Stephen H. Belgrad (OM Asset Management Limited)

Floyd I. Wittlin (Bingham MCutchen LLP) |

ATTACHMENT A

(See Attached)

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion. Dated September 23, 2014

22,000,000 Ordinary Shares

Ordinary Shares

This is an initial public offering of ordinary shares of OM Asset Management Limited.

All of the ordinary shares offered by this prospectus are being sold by OM Group (UK) Limited, which we refer to as OMGUK or the Selling Shareholder. We are not selling any ordinary shares under this prospectus, and we will not receive any of the proceeds from the sale of the ordinary shares being sold by the Selling Shareholder. Upon completion of this offering, Old Mutual plc, which is our parent company and which we refer to as our Parent, indirectly through the Selling Shareholder, will beneficially own approximately 80.7% of our outstanding ordinary shares, or 77.9% if the underwriters exercise their over-allotment option in full. As a result of this ownership and other rights of our Parent under a Shareholder Agreement, including the right to appoint a majority of the directors to our Board of Directors for so long as it remains the majority owner of our ordinary shares, our Parent will have significant power to control our affairs and policies. See "Certain Relationships and Related Party Transactions—Relationship with Our Parent and OMGUK Following This Offering—Shareholder Agreement."

No public market for our ordinary shares existed prior to this offering. It is currently estimated that the initial public offering price per share will be between $15.00 and $17.00. Our ordinary shares have been approved for listing on the New York Stock Exchange under the symbol "OMAM."

Investing in our ordinary shares involves risks that are described in the "Risk Factors" section beginning on page 13 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| | | | |

| | | | |

| |

| | Per share

| | Total

|

|---|

| |

Initial public offering price | | $ | | $ |

| |

Underwriting discount | | $ | | $ |

| |

Proceeds, before expenses, to the Selling Shareholder | | $ | | $ |

|

The Selling Shareholder has granted the underwriters an option to purchase up to an additional 3,300,000 ordinary shares.

The underwriters expect to deliver the ordinary shares against payment on , 2014.

| | | | | | |

| BofA Merrill Lynch | | Morgan Stanley | | Citigroup | | Credit Suisse |

RBC Capital Markets |

|

Wells Fargo Securities

|

| | | | |

| Keefe, Bruyette & Woods | | Sandler O'Neill + Partners, L.P. | | Sanford C. Bernstein |

| A Stifel Company | | |

Prospectus dated , 2014

- •

- Our profit margins and net income are dependent on the ability of our Affiliates to maintain current fee levels for the products and services they offer. Trends in the asset management industry have led to lower fees in certain segments of the asset management market. There can be no assurance that our Affiliates will be able to maintain their current pricing structures. A reduction in the fees charged by our Affiliates, or limited opportunities to increase fees, will reduce or limit our revenues and could reduce or limit our net income.

- •

- The investment management industry is highly competitive with competition based on a variety of factors, including investment performance, fee rates, continuity of investment professionals, client relationships, the quality of services provided to clients, reputation and the strategies offered. We and our Affiliates compete against a broad range of domestic and international asset management firms, broker-dealers, hedge funds, investment banking firms and other financial institutions. The capital resources, scale, name recognition and geographic footprints of many of these organizations are greater than ours. The recent trend toward consolidation in the investment management industry, and the financial services industry generally, has served to increase the size and strength of a number of our competitors.

- •

- Upon the completion of this offering, our Parent, through the Selling Shareholder, will beneficially own approximately 80.7% of our outstanding ordinary shares, or 77.9% if the underwriters exercise their over-allotment option in full. As a result of this ownership, a shareholder agreement that we will enter into with our Parent prior to or concurrently with the consummation of this offering, which we refer to as the Shareholder Agreement, and policies and procedures adopted by our Board of Directors, our Parent will, for so long as it continues to own at least 20% of our outstanding ordinary shares, have significant power to control our affairs and policies.

- •

- Future changes in tax laws or the failure by the United States taxing authorities to treat OMAM as a foreign corporation for U.S. federal tax purposes could limit our ability to utilize tax attributes to offset taxable income and adversely affect our results of operations.

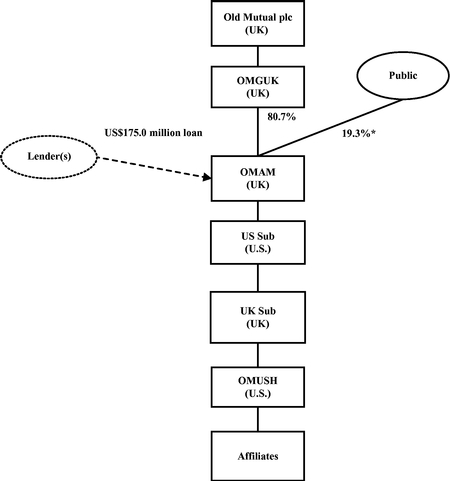

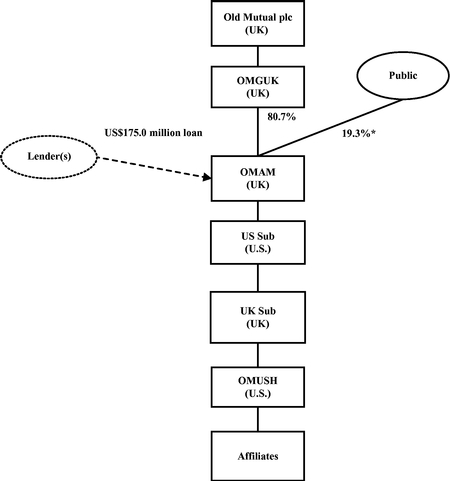

Our Structure and Reorganization

Old Mutual (US) Holdings Inc., or OMUSH, has historically been an indirect wholly-owned subsidiary of Old Mutual plc. Prior to the consummation of this offering, we will effect a reorganization pursuant to which OMAM, incorporated under the laws of England and Wales, will become the indirect parent company of OMUSH. See "Reorganization" for a detailed summary of the steps that will be taken in the reorganization of our Company.

Our Principal Shareholder

Upon and after the consummation of this offering, our Parent will indirectly hold a majority of the voting power of our share capital through OMGUK's ownership of 80.7% of our outstanding ordinary shares, or 77.9% if the underwriters exercise their over-allotment option in full. Pursuant to the Shareholder Agreement, our Parent will, for so long as it remains the majority owner of our ordinary shares, have the right to appoint a majority of the directors to our Board of Directors and, for so long as it owns certain specified percentages of our outstanding ordinary shares that are less than a majority but greater than 7%, the right to appoint a certain number of directors to our Board of Directors. These rights and certain other rights described below give our Parent significant power to control our policies and affairs. The Shareholder Agreement also grants our Parent approval rights over certain matters ending on the date that our Parent ceases to beneficially own at least 20% of our outstanding ordinary shares, including, among others, certain mergers and acquisitions and certain issuances of share capital, and for periods after our Parent ceases to beneficially own more than 50% of our outstanding ordinary shares the incurrence of debt above a specified threshold and the declaration or payment of a dividend other than in accordance with our dividend policy approved by our Board of

6

The Offering

| | |

Issuer | | OM Asset Management Limited. We will change our name to OM Asset Management plc upon the consummation of the Reorganization. |

Ordinary shares offered by OM Group (UK) Limited | | 22,000,000 ordinary shares. |

Underwriters' over-allotment option to purchase additional shares | | 3,300,000 ordinary shares from OMGUK. |

Ordinary shares to be outstanding immediately after this offering | | 120,000,000 ordinary shares. |

Use of proceeds | | All of the ordinary shares offered by this prospectus are being sold by OMGUK. We will not receive any proceeds from the sale of ordinary shares in this offering, including from any exercise by the underwriters of their over-allotment option. |

Voting rights | | One vote per share. |

Dividend policy | | We will initially target a dividend payout in the range of 25% of ENI, subject to maintaining a sustainable quarterly dividend per share. Any declaration of dividends will be at the discretion of our Board of Directors and subject to the approval of our Parent, and will depend on our financial condition, earnings, cash needs, regulatory constraints, capital requirements and any other factors that our Board of Directors or Parent deems relevant in making such a determination. See "Dividend Policy." |

Listing | | Our ordinary shares have been approved for listing on the New York Stock Exchange (which we refer to as the NYSE) under the trading symbol "OMAM." |

Risk factors | | Please read the section entitled "Risk Factors" for a discussion of some of the factors you should consider before investing in our ordinary shares. |

Directed Share Program | | At our request, the underwriters have reserved up to 1,100,000 ordinary shares being offered by this prospectus for sale at the initial public offering price to our directors, officers, employees and other individuals associated with us and members of their families. See "Underwriting." |

Unless otherwise noted, the number of ordinary shares outstanding after this offering and other information based thereon in this prospectus excludes:

- •

- 9,600,000 ordinary shares reserved for future issuance under our Equity Incentive Plan; and

- •

- 2,400,000 ordinary shares reserved for future issuance under our Non-employee Director Equity Incentive Plan.

8

Our Affiliates' business operations are complex, and a failure to properly perform operational tasks or maintain infrastructure could have an adverse effect on our revenues and income.

In addition to providing investment management services, our Affiliates must have the necessary operational capabilities to manage their businesses effectively in accordance with client expectations and applicable law. The required non-investment management functions include sales, marketing, portfolio recordkeeping and accounting, security pricing, trading activity, investor reporting, corporate governance, compliance, net asset value computations, account reconciliations and calculations of required distributions to accounts. Some of these functions are performed either independently or with the support of or in conjunction with us or third-party service providers that are overseen by our Affiliates. Also, certain of our Affiliates are highly dependent on specially developed proprietary systems. Any material failure to properly perform and monitor these non-investment management functions and operations, or adequately oversee the entities that provide the services, could result in potential liability to clients, regulatory sanctions, investment losses, loss of clients and reputational damage.

Reputational harm could result in a loss of assets under management and revenues for our Affiliates and us.

The integrity of our brand and reputation, as well as the integrity of the brand and reputation of each of our Affiliates, is critical to the ability of us and our Affiliates to attract and retain clients, business partners and employees and maintain relationships with consultants. We operate within the highly regulated financial services industry and various potential scenarios could result in harm to our reputation. They include internal operational failures, failure to follow investment or legal guidelines in the management of accounts, intentional or unintentional misrepresentation of our Affiliates' products and services in offering or advertising materials, public relations information, social media or other external communications, employee misconduct or investments in businesses or industries that are controversial to certain special interest groups. The negative publicity associated with any of these factors could harm our reputation and those of our Affiliates and adversely impact relationships with existing and potential clients, third-party distributors, consultants and other business partners and subject us to regulatory sanctions. Damage to our brands or reputations would negatively impact our standing in the industry and result in loss of business in both the short term and the long term.

Our brand and reputation are also tied to the brand and reputation of our Parent and those of our Parent's other subsidiaries. Immediately following this offering and, after giving effect to the transactions described herein, our Parent will indirectly own approximately 80.7% of our outstanding ordinary shares, or 77.9% if the underwriters exercise their over-allotment option in full. We exercise no control over the activities of our Parent or its affiliates. We may be subject to reputational harm, or our relationships with existing and potential clients, third-party distributors, consultants and other business partners could be harmed, if our Parent or any of its affiliates, previously, or in the future, among other things, engages in poor business practices, experiences adverse results, becomes subject to litigation or otherwise damages its reputation or business prospects. Any of these events might in turn adversely affect our own reputation, our revenues and our business prospects.

We or our Affiliates may not always successfully manage actual or potential conflicts of interests that may arise in our businesses.

As we continue to expand the scope of our business, we increasingly confront actual, potential and perceived conflicts of interest relating to our activities and the investment activities of our Affiliates. Conflicts may arise with respect to decisions by our Affiliates regarding the allocation of specific investment opportunities among accounts in which Affiliates may receive an allocation of profits and accounts in which they do not or among client accounts that have overlapping investment objectives yet different fee structures.

17

our and our Affiliates' abilities to monitor and promptly react to legislative and regulatory changes. It is impossible to determine the extent of the impact of any new laws, regulations or initiatives that may be proposed, or whether any of the proposals will become law. Any new laws or regulations could make compliance more difficult and expensive and affect the manner in which we and our Affiliates conduct business.

Failure to comply with applicable laws or regulations could result in fines, suspension or revocation of an Affiliate's registration as an investment adviser, suspensions of individual employees, revocation of licenses to operate in certain jurisdictions or other sanctions, which could materially adversely affect our business, financial condition and results of operations. Even if an investigation or proceeding did not result in a fine or sanction, or the fine or sanction imposed against an Affiliate or us or our respective employees by a regulator were small in monetary amount, the adverse publicity relating to an investigation, proceeding or imposition of a fine or sanction could cause us to suffer financial loss, harm our reputation and cause us to lose business or fail to attract new business which would have a direct adverse impact on our business, financial condition and results of operations.

If we were deemed an investment company under the Investment Company Act, we would become subject to burdensome regulatory requirements and our business activities could be restricted.

We do not believe that we are an "investment company" under the Investment Company Act. Generally, a company is an "investment company" if, absent an applicable exemption, it (i) is, or holds itself out as being, engaged primarily, or proposes to engage primarily, in the business of investing, reinvesting or trading in securities or (ii) engages, or proposes to engage, in the business of investing, reinvesting, owning, holding or trading in securities and owns or proposes to acquire "investment securities" having a value exceeding 40% of the value of its total assets (exclusive of U.S. government securities and cash items) on an unconsolidated basis. We believe we are primarily engaged in a non-investment company business and that less than 40% of our total assets (exclusive of U.S. government securities and cash items) on an unconsolidated basis are comprised of assets that could be considered investment securities.

We and our Affiliates intend to conduct our operations so that we will not be deemed an investment company under the Investment Company Act. However, if we were to be deemed an investment company, restrictions imposed by the Investment Company Act, including limitations on our capital structure and our ability to transact with our Affiliates, could make it impractical for us to continue our business as currently conducted and could have a material adverse effect on our financial performance and operations.

Risks Related to Our Ownership Structure

Our Parent will continue to control us after this offering and will have significant power to control our business, affairs and policies.

Upon completion of this offering, our Parent will beneficially own approximately 80.7% of our outstanding ordinary shares, or 77.9% if the underwriters exercise their over-allotment option in full. As a result of this ownership, and pursuant to the rights of our Parent under the Shareholder Agreement that we will enter into with our Parent prior to or concurrently with the consummation of this offering and policies and procedures adopted by our Board of Directors, our Parent will have significant power to control our business, affairs and policies, including the right to appoint a majority of the directors to our Board of Directors, and, accordingly, the appointment of management, the adoption of amendments to our articles of association and the number of ordinary shares available for issuance under our equity incentive plans for our prospective and existing employees. This concentration of ownership may have the effect of delaying or preventing a change in control of us or discouraging others from making tender offers for our ordinary shares, which could prevent shareholders from receiving a premium for their ordinary shares. It also may make it difficult for other shareholders to replace management and may adversely impact the trading price of our ordinary shares because investors often perceive disadvantages in owning ordinary shares in companies with controlling shareholders.

30

Intellectual Property Agreement. The license term shall be for the period commencing on the date of the closing of this offering and ending six months after the date on which our Parent ceases to directly or indirectly own a majority of our outstanding ordinary shares; provided, however that under the Intellectual Property Agreement, our Parent and OMLACSA have given us a perpetual right (i) to use the name "OM Asset Management" as all or part of our corporate or trade names, (ii) to use "OMAM" in all or part of our corporate or trade names, businesses and activities, including in any advertising or promotional materials, and as a ticker symbol and (iii) to use omam.com as a website and an email address. After this license expires, we must cease using the licensed intellectual property (other than as described above and in the Intellectual Property Agreement) and any benefits that we derived from the use of the "Old Mutual" brand name and logo will likely be diminished or eliminated.

In addition, certain of our Parent's other affiliates have established investment advisory and other investment-advisory related relationships with our Affiliates pursuant to which our Affiliates derive revenue. For the quarter ended June 30, 2014, our Parent and its subsidiaries (other than the Company and our Affiliates) contributed less than 2% of total ENI revenue including equity-accounted Affiliates. We cannot predict whether these relationships would continue when we are no longer a wholly-owned subsidiary of our Parent.

This offering could adversely impact our relationships with certain of our current or potential business partners as we may no longer be viewed as a part of our Parent's group of companies. If we no longer are entitled to benefit from the relationship with our Parent as a result of this offering, we may not be able to obtain certain services at the same level or obtain the same benefit through new, independent relationships with third-party vendors. Likewise, we may not be able to replace the service and arrangement in a timely manner or on terms and conditions, including cost, as favorable as those we previously have received as a subsidiary of our Parent. Some third parties may re-price, modify or terminate their vendor relationships with us after we are no longer a wholly-owned subsidiary of our Parent.

The risks relating to our separation from our Parent could materialize or evolve at any time, including immediately upon the completion of this offering, when our Parent's beneficial ownership in our ordinary shares will decrease to approximately 80.7% (or approximately 77.9% if the underwriters' over-allotment option to purchase additional shares is exercised in full), and at a later date if our Parent were to decide to decrease its ownership of our ordinary shares.

We cannot accurately predict the impact that our separation from our Parent will have on our business and the businesses of our Affiliates, distribution partners, service providers, vendors and other business partners.

Risks Related to Our Tax Matters

The Internal Revenue Service, or the IRS, may not agree to treat OMAM as a foreign corporation for U.S. federal tax purposes.

Although OMAM is incorporated in England and Wales, which are part of the United Kingdom, the IRS may assert that it should be treated as a U.S. corporation (and, therefore, a U.S. tax resident) for U.S. federal tax purposes pursuant to section 7874 of the Code. For U.S. federal tax purposes, a corporation generally is considered a tax resident in the jurisdiction of its organization or incorporation. Because OMAM is a United Kingdom incorporated entity, it would generally be classified as a foreign corporation (and, therefore, a non-U.S. tax resident) under these rules. Section 7874 of the Code provides an exception under which a foreign incorporated entity may, in certain circumstances, be treated as a U.S. corporation for U.S. federal tax purposes.

For OMAM to be treated as a foreign corporation for U.S. federal tax purposes under section 7874 of the Code, immediately after the Reorganization, either (i) the former stockholders of OMUSH, i.e., OMGUK, must own (within the meaning of section 7874 of the Code) less than 80% (by both vote and value) of our ordinary shares by reason of holding shares in OMUSH immediately prior

35

these shares, 97,868,395 ordinary shares (excluding any ordinary shares sold by our Parent if the over-allotment option is exercised) will be subject to a 180-day contractual lock-up (subject to extension) with the underwriters. Certain of the representatives of the underwriters may permit our officers, directors, employees and current shareholders who are subject to the contractual lock-up to sell ordinary shares or to demand piggy-back registration rights prior to the expiration of the lock-up agreements.

Sales by OMGUK or other shareholders or the possibility that these sales may occur also may make it more difficult for us to raise additional capital by selling equity securities in the future, at a time and price that we deem appropriate.

Pursuant to a registration rights agreement that we will enter into with our Parent, we will agree to use our reasonable best efforts to file registration statements from time to time for the sale of ordinary shares held by OMGUK now or in the future. See "Certain Relationships and Related Party Transactions—Relationship with Our Parent and OMGUK Following This Offering—Parent Registration Rights Agreement." See also "Ordinary Shares Eligible for Future Sale" for further details regarding the number of ordinary shares eligible for sale in the public market after this offering.

We cannot predict the size of future issuances of our ordinary shares or the effect, if any, that future issuances and sales of our ordinary shares may have on the market price of our ordinary shares. Sales or distributions of substantial amounts of our ordinary shares, including shares issued in connection with an acquisition, or the perception that such sales or distributions could occur, may cause the market price of our ordinary shares to decline.

The pro forma net tangible book value per share of our ordinary shares is lower than the offering price of our ordinary shares. You will experience substantial dilution as a result of investing in this offering.

The initial public offering price per share is substantially higher than the pro forma net tangible book value per share of our ordinary shares outstanding. As a result, investors purchasing ordinary shares in this offering will experience immediate substantial dilution of $17.44 comparing the tangible book value per ordinary share to the offering price (based on the mid-point of the range on the front cover of the prospectus).

We will incur additional costs due to operating as a public company whose ordinary shares are publicly traded in the United States, and our management expects to devote substantial time to compliance with our public company legal and reporting obligations.

As a public company whose ordinary shares are traded in the United States, we will incur additional legal, accounting and other expenses that we did not incur as a private company. In addition, we will be subject to the reporting requirements of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and will be required to implement specific corporate governance practices and adhere to a variety of reporting requirements under the Sarbanes-Oxley Act of 2002, or Sarbanes-Oxley, and the related rules and regulations of the SEC, as well as the rules of the NYSE. The Exchange Act will require us to file annual, quarterly and current reports with respect to our business and financial condition. Our management and other personnel will need to devote substantial time to compliance with our public company obligations. Moreover, these rules and regulations will increase our legal and financial compliance costs and will make some activities more time-consuming and costly. For example, we expect these new rules and regulations to make it more difficult and more expensive for us to obtain director and officer liability insurance, and we may be required to incur additional costs to maintain the same or similar coverage.

In addition, Sarbanes-Oxley requires, among other things, that we maintain effective internal control over financial reporting and disclosure controls and procedures. In particular, commencing with our Annual Report on Form 10-K for fiscal year 2015, we must perform system and process evaluation and testing of our internal control over financial reporting to allow management to report on the effectiveness of our internal control over financial reporting, as required by Section 404 of Sarbanes-

41

- 7.

- OMAM will undergo a reduction of share capital to maximize distributable reserves, be re-registered in the United Kingdom as a public limited company, amend its articles of association to reflect the same and organize its share capital for purposes of this offering.

- 8.

- OMAM will issue third-party debt amounting to $175.0 million and pay a $175.0 million pre-offering dividend to OMGUK. OMAM also intends to issue a non-interest bearing promissory note to OMGUK in the principal amount of $37.0 million (of which $18.5 million relates to the return of co-investment capital) which will be paid as funds become available from Affiliate distributions, subject to the maintenance of a minimum level of cash holdings. Other than this dividend and note payable, OMAM does not intend to make any further pre-IPO dividend or debt repayment to OMGUK following June 30, 2014.

For a more detailed description of the Reorganization steps and pro forma financial statements giving effect to the Reorganization, see "Unaudited Pro Forma Consolidated Financial Data".

After the Reorganization

Following these transactional steps, and immediately following the consummation of this offering, our share ownership structure, in relevant part, will appear as follows (excluding any ordinary shares sold by our Parent if the over-allotment option is exercised):

- *

- Includes 1,163,482 restricted ordinary shares, or 1.0%, issued to certain employees as part of an exchange program with our Parent. See "Compensation Discussion and Analysis—Compensation Plans Expected Post-Offering—Exchange from Old Mutual plc Restricted Shares."

49

DILUTION

If you invest in our ordinary shares in this offering, your ownership interest will be immediately diluted to the extent of the difference between the initial public offering price per ordinary share and the net tangible book value per ordinary share. Dilution results from the fact that the initial public offering price per ordinary share is substantially in excess of the net pro forma tangible book value per ordinary share.

Our pro forma net tangible book value as of June 30, 2014 was approximately $2.4 billion, or $19.61 per ordinary share based on 120,000,000 outstanding ordinary shares. Our pro forma net tangible book value represents the amount of total tangible assets less total liabilities, after giving effect to the Reorganization, and our pro forma net tangible book value per ordinary share represents pro forma net tangible book value divided by the number of ordinary shares outstanding. We believe that the resulting net tangible book value of $19.61 per ordinary share does not appropriately reflect the dilutive effects of the offering because it includes net assets attributable to non-controlling and redeemable interests in consolidated Funds, which if included in the calculation would have resulted in anti-dilution.

The following table illustrates the substantial and immediate dilution per ordinary share to a purchaser in this offering after removing the effect that the consolidated Funds have on the net tangible book value per ordinary share:

| | | | | | | |

| |

| | As of

June 30, 2014 | |

|---|

Initial public offering price per ordinary share (based on the mid-point of the range on the front cover of the prospectus) | | | | | $ | 16.00 | |

Pro forma net tangible book value per ordinary share as of June 30, 2014, after giving effect to the Reorganization | | | 19.61 | | | | |

Less: Net tangible book value per ordinary share attributed to total non-controlling interests in consolidated Funds as of June 30, 2014 | | | (21.05 | ) | | | |

| | | | | | | |

| | | | | | | | |

Adjusted pro forma net tangible book value per ordinary share after giving effect to this offering, net of non-controlling interests attributed to consolidated Funds | | | | | | (1.44 | ) |

| | | | | | | |

| | | | | | | | |

Dilution per ordinary share to purchasers in this offering (based on the mid-point of the range on the front cover of the prospectus) | | | | | $ | 17.44 | |

| | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | |

52

SELECTED HISTORICAL CONSOLIDATED FINANCIAL DATA

We present economic net income, or ENI, to help us describe our operating and financial performance. ENI is the key measure our management uses to evaluate the financial performance of, and make operational decisions for, our business. ENI is not audited, and is not a substitute for net income or other performance measures that are derived in accordance with U.S. GAAP. Furthermore, our calculation of ENI may differ from similarly titled measures provided by other companies. Please refer to "Management's Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Supplemental Performance Measure—Economic Net Income" for a more thorough discussion of ENI and a reconciliation of ENI to U.S. GAAP net income.

The following table sets forth selected historical consolidated financial data for our Company as of the dates and for the periods indicated. The selected statement of operations data for the years ended December 31, 2013, 2012 and 2011, and the balance sheet data as of December 31, 2013 and 2012 have been derived from our audited Consolidated Financial Statements included elsewhere in this prospectus.

The selected statement of operations data for the years ended December 31, 2010 and 2009, and the balance sheet data as of December 31, 2011, 2010 and 2009 have been derived from our Consolidated Financial Statements not included in this prospectus, which were audited in accordance with International Financial Reporting Standards, and have been adjusted to be in accordance with U.S. GAAP for the purposes of the following selected historical and consolidated financial data presentation. The selected consolidated financial data for the six months ended June 30, 2014 and 2013 and as of June 30, 2014 have been derived from our unaudited Consolidated Financial Statements included elsewhere in this prospectus. Unaudited consolidated balance sheets dated as of December 31, 2011, 2010 and 2009 and as of June 30, 2014 and 2013 and unaudited statements of operations for the years ended December 31, 2010 and 2009 and for the six months ended June 30, 2014 and 2013 have been prepared on substantially the same basis as our Consolidated Financial Statements that were audited in accordance with U.S. GAAP and include all adjustments that we consider necessary for a fair statement of our consolidated statements of operations and balance sheets for the periods and as of the dates presented therein. Our results for the six months ended June 30, 2014 are not necessarily indicative of our results for a full fiscal year.

You should read our following selected historical consolidated financial data together with "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the historical Consolidated Financial Statements and the related notes thereto, included elsewhere in this prospectus.

| | | | | | | | | | | | | | | | | | | | | | |

| | Six Months

Ended

June 30, | | Years Ended December 31, | |

|---|

($ in millions, except as noted)

| | 2014(1) | | 2013(1) | | 2013 | | 2012 | | 2011 | | 2010(1) | | 2009(1) | |

|---|

U.S. GAAP Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | | | |

Management fees(2) | | $ | 275.4 | | $ | 233.1 | | $ | 478.2 | | $ | 399.3 | | $ | 398.2 | | $ | 387.5 | | $ | 347.5 | |

Performance fees | | | 2.4 | | | 8.3 | | | 18.1 | | | 14.1 | | | 4.3 | | | 2.2 | | | 0.4 | |

Other revenues | | | 0.3 | | | 1.1 | | | 1.8 | | | 0.5 | | | 0.3 | | | 0.8 | | | 2.3 | |

Consolidated Funds revenue(2) | | | 251.6 | | | 227.8 | | | 430.5 | | | 289.6 | | | 321.4 | | | 350.7 | | | 310.0 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Total revenue | | $ | 529.7 | | $ | 470.3 | | $ | 928.6 | | $ | 703.5 | | $ | 724.2 | | $ | 741.2 | | $ | 660.2 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Net income before tax from continuing operations attributable to controlling interests(2) | | $ | 39.6 | | $ | 13.2 | | $ | 32.7 | | $ | 27.3 | | $ | 22.0 | | $ | 4.8 | | $ | 9.0 | |

Net income/(loss) from continuing operations attributable to controlling interests(2) | | | 23.4 | | | 7.2 | | | 19.4 | | | 24.0 | | | 26.2 | | | (13.9 | ) | | (87.4 | ) |

Net income/(loss) from continuing operations | | | (51.9 | ) | | (74.0 | ) | | (97.1 | ) | | (50.0 | ) | | (68.7 | ) | | (97.4 | ) | | (198.6 | ) |

U.S. GAAP operating margin(2) | | | (8 | )% | | (14 | )% | | (11 | )% | | (9 | )% | | (11 | )% | | (10 | )% | | (9 | )% |

U.S. GAAP basic and diluted Earnings Per Share from continuing operations attributable to controlling interests | | $ | 0.20 | | $ | 0.06 | | $ | 0.16 | | $ | 0.20 | | $ | 0.22 | | $ | (0.12 | ) | $ | (0.73 | ) |

53

Unaudited Pro Forma Consolidated Statement of Operations

For the Year Ended December 31, 2013

| | | | | | | | | | | | | | | | |

($ in millions, except for per share data)

| | OMAM

2013 | | Debt

elimination/

consolidation

and new

financing(1) | | Allocation of

co-investments

to OMGUK(2) | | Affiliate

equity

transaction(3) | | OMAM

Pro Forma | |

|---|

Management fees | | $ | 478.2 | | $ | — | | $ | — | | $ | — | | $ | 478.2 | |

Performance fees | | | 18.1 | | | — | | | — | | | — | | | 18.1 | |

Other revenue | | | 1.8 | | | — | | | — | | | — | | | 1.8 | |

Consolidated Funds' revenue: | | | | | | | | | | | | | | | | |

Revenue from timber | | | 401.1 | | | — | | | — | | | — | | | 401.1 | |

Other revenue | | | 29.4 | | | — | | | — | | | — | | | 29.4 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Total revenue | | | 928.6 | | | — | | | — | | | — | | | 928.6 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Compensation and benefits | | | 352.3 | | | — | | | — | | | (17.8 | ) | | 334.5 | |

General and administrative expense | | | 68.7 | | | — | | | — | | | — | | | 68.7 | |

Amortization and impairment of acquired intangibles | | | 0.1 | | | — | | | — | | | — | | | 0.1 | |

Depreciation and amortization | | | 4.9 | | | — | | | — | | | — | | | 4.9 | |

Consolidated Funds' expense: | | | | | | | | | | | | | | | | |

Interest and dividend expense | | | 150.1 | | | — | | | — | | | — | | | 150.1 | |

Timber expense | | | 238.4 | | | — | | | — | | | — | | | 238.4 | |

Other expense | | | 213.6 | | | — | | | — | | | — | | | 213.6 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Total operating expenses | | | 1,028.1 | | | — | | | — | | | (17.8 | ) | | 1,010.3 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Operating income (loss) | | | (99.5 | ) | | — | | | — | | | 17.8 | | | (81.7 | ) |

Non-operating income and (expense): | | | | | | | | | | | | | | | | |

Investment income (loss) | | | 10.7 | | | — | | | (3.0 | ) | | — | | | 7.7 | |

Interest income | | | 0.5 | | | — | | | — | | | — | | | 0.5 | |

Interest expense (A) | | | (72.2 | ) | | 68.7 | | | — | | | — | | | (3.5 | ) |

Net gains from consolidated Funds | | | 76.7 | | | — | | | — | | | — | | | 76.7 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Income (loss) from continuing operations before taxes (B) | | | (83.8 | ) | | 68.7 | | | (3.0 | ) | | 17.8 | | | (0.3 | ) |

Provision for income taxes(4) | | | 13.3 | | | 2.9 | | | (1.2 | ) | | 7.2 | | | 22.2 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Income (loss) from continuing operations | | | (97.1 | ) | | 65.8 | | | (1.8 | ) | | 10.6 | | | (22.5 | ) |

Net income (loss) from continuing operations attributable to non-controlling interests (C) | | | (116.5 | ) | | — | | | — | | | — | | | (116.5 | ) |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Net income (loss) from continuing operations attributable to controlling interests | | $ | 19.4 | (5) | $ | 65.8 | | $ | (1.8 | ) | $ | 10.6 | | $ | 94.0 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

Pro forma continuing operations earnings (loss) per share (basic and diluted) attributable to controlling interests(6) | | | 0.16 | | | 0.55 | | | (0.2 | ) | | 0.09 | | | 0.78 | |

Net income before tax and interest expense from continuing operations attributable to controlling interests (B-A-C) | | $ | 104.9 | | $ | — | | $ | (3.0 | ) | $ | 17.8 | | $ | 119.7 | |

58

Unaudited Pro Forma Consolidated Statement of Operations

For the Six Months Ended June 30, 2014

| | | | | | | | | | | | | | | | |

($ in millions, except for per share data)

| | OMAM

June 30,

2014 | | Debt

elimination/

consolidation

and new

financing(1) | | Allocation of

co-investments

to OMGUK(2) | | Affiliate

equity

transaction(3) | | OMAM

Pro Forma | |

|---|

Management fees | | $ | 275.4 | | $ | — | | $ | — | | $ | — | | $ | 275.4 | |

Performance fees | | | 2.4 | | | — | | | — | | | — | | | 2.4 | |

Other revenue | | | 0.3 | | | — | | | — | | | — | | | 0.3 | |

Consolidated Funds' revenue: | | | | | | | | | | | | | | | | |

Revenue from timber | | | 239.4 | | | — | | | — | | | — | | | 239.4 | |

Other revenue | | | 12.2 | | | — | | | — | | | — | | | 12.2 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Total revenue | | | 529.7 | | | — | | | — | | | — | | | 529.7 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Compensation and benefits | | | 181.3 | | | — | | | — | | | (2.4 | ) | | 178.9 | |

General and administrative expense | | | 37.1 | | | — | | | — | | | — | | | 37.1 | |

Amortization and impairment of acquired intangibles | | | 0.1 | | | — | | | — | | | — | | | 0.1 | |

Depreciation and amortization | | | 2.9 | | | — | | | — | | | — | | | 2.9 | |

Consolidated Funds' expense: | | | | | | | | | | | | | | | | |

Interest and dividend expense | | | 67.2 | | | — | | | — | | | — | | | 67.2 | |

Timber expense | | | 144.9 | | | — | | | — | | | — | | | 144.9 | |

Other expense | | | 136.2 | | | — | | | — | | | — | | | 136.2 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Total operating expenses | | | 569.7 | | | — | | | — | | | (2.4 | ) | | 567.3 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Operating income (loss) | | | (40.0 | ) | | — | | | — | | | 2.4 | | | (37.6 | ) |

Non-operating income and (expense): | | | | | | | | | | | | | | | | |

Investment income (loss) | | | 5.9 | | | — | | | (1.4 | ) | | — | | | 4.5 | |

Interest income | | | 0.1 | | | — | | | — | | | — | | | 0.1 | |

Interest expense (A) | | | (33.2 | ) | | 31.5 | | | — | | | — | | | (1.7 | ) |

Net gains from consolidated Funds | | | 31.5 | | | — | | | — | | | — | | | 31.5 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Income (loss) from continuing operations before taxes (B) | | | (35.7 | ) | | 31.5 | | | (1.4 | ) | | 2.4 | | | (3.2 | ) |

Provision for income taxes(4) | | | 16.2 | | | 1.4 | | | (0.6 | ) | | 1.0 | | | 18.0 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Income (loss) from continuing operations | | | (51.9 | ) | | 30.1 | | | (0.8 | ) | | 1.4 | | | (21.2 | ) |

Net income (loss) from continuing operations attributable to non-controlling interests (C) | | | (75.3 | ) | | — | | | — | | | — | | | (75.3 | ) |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Net income (loss) from continuing operations attributable to controlling interests | | $ | 23.4 | (5) | $ | 30.1 | | $ | (0.8 | ) | $ | 1.4 | | $ | 54.1 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

Pro forma continuing operations earnings (loss) per share (basic and diluted) attributable to controlling interests(6) | | | 0.20 | | | 0.25 | | | (0.01 | ) | | 0.01 | | | 0.45 | |

Net income before tax and interest expense from continuing operations attributable to controlling interests (B-A-C) | | $ | 72.8 | | $ | — | | $ | (1.4 | ) | $ | 2.4 | | $ | 73.8 | |

59

The following table illustrates the tax effect of the above pro forma U.S. GAAP adjustments for the six months ended June 30, 2014:

| | | | | | | | | | | | | | | | | | | | | | |

($ in millions)

| | OMAM

June 30,

2014 | | Offshore

taxable

income(A) | | Offshore

third

party

debt

costs(A) | | Allocation of

co-investments

to

OMGUK(B) | | Affiliate

Equity

Transactions(B) | | Eliminations(A) | | OMAM

Pro Forma | |

|---|

Net income before tax and interest expense from continuing operations attributable to controlling interests | | $ | 72.8 | | $ | 33.2 | | $ | — | | $ | (1.4 | ) | $ | 2.4 | | $ | (33.2 | ) | $ | 73.8 | |

Interest expense on external debt | | | — | | | — | | | (1.7 | ) | | — | | | — | | | — | | | (1.7 | ) |

Deductible intercompany interest expense(A) | | | (33.2 | ) | | — | | | — | | | — | | | — | | | 33.2 | | | — | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Taxable income from continuing operations | | $ | 39.6 | | $ | 33.2 | | $ | (1.7 | ) | $ | (1.4 | ) | $ | 2.4 | | $ | — | | $ | 72.1 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Taxes payable at the statutory rate | | $ | (15.9 | ) | $ | (1.7 | ) | $ | 0.3 | | $ | 0.6 | | $ | (1.0 | ) | $ | — | | $ | (17.7 | ) |

Non-recurring deferred tax and timing adjustments | | | (0.3 | ) | | — | | | — | | | — | | | — | | | — | | | (0.3 | ) |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Tax expense on continuing operations | | $ | (16.2 | ) | $ | (1.7 | ) | $ | 0.3 | | $ | 0.6 | | $ | (1.0 | ) | $ | — | | $ | (18.0 | ) |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Effective tax rate | | | 41.0 | % | | 5 | % | | 20 | % | | 40 | % | | 40 | % | | | | | 24.9 | % |

- (A)

- As noted above, our ongoing annual cost of debt is estimated at $3.5 million, or $1.7 million for the six months ended June 30, 2014. The existing intercompany debt will be eliminated in our consolidated results. As noted in our unaudited pro forma consolidated statement of operations under "Debt elimination/consolidation and new financing", the net tax effect of the changes in financing arrangements is estimated at $1.4 million in additional tax expense. This is comprised of $1.7 million in incremental tax expense on intragroup interest income to be earned by us, at an effective U.K. tax rate of 5.0%, net of $0.3 million in tax benefits on external interest to be paid by us at the U.K. statutory rate of tax of 20%.

- (B)

- The allocation of co-investments to OMGUK and Affiliate equity transactions have been tax-effected at our average U.S. statutory rate of tax of 40.2%.

- 5)

- The following table reconciles our net income from continuing operations attributable to controlling interests to net income attributable to controlling interests:

| | | | | | | |

| | Six Months Ended | | Year Ended | |

|---|

($ in millions)

| | June 30,

2014 | | December 31,

2013 | |

|---|

Net income from continuing operations attributable to controlling interests | | $ | 23.4 | | $ | 19.4 | |

Discontinued operations attributable to controlling interests | | | (4.3 | ) | | 6.3 | |

| | | | | | |

| | | | | | | | |

Net income attributable to controlling interests | | $ | 19.1 | | $ | 25.7 | |

- 6)

- Pro forma earnings per share is calculated based upon 120,000,000 pro forma weighted average ordinary shares outstanding. There are no pro forma dilutive shares.

62

Unaudited Pro Forma Consolidated Balance Sheet

As of June 30, 2014

| | | | | | | | | | | | | | | | | | | | | | |

| |

| | Reorganization and other adjustments | |

| |

| |

|---|

($ in millions)

| | OMAM

June 30,

2014 | | IPO dividend

and new

financing(1) | | Debt

elimination/

consolidation(2) | | Assignment

of benefits(3) | | Affiliate

equity

transaction(4) | | Initial

public

offering(5) | | OMAM

Pro Forma | |

|---|

Current assets | | | | | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 113.7 | | $ | — | | $ | — | | $ | — | | $ | (60.0 | ) | $ | — | | $ | 53.7 | |

Investment advisory fees receivable | | | 134.7 | | | — | | | — | | | — | | | — | | | — | | | 134.7 | |

Property and equipment, net | | | 23.1 | | | — | | | — | | | — | | | — | | | — | | | 23.1 | |

Investments (excluding co-investments) | | | 116.4 | | | — | | | — | | | — | | | — | | | — | | | 116.4 | |

Co-investments into Real Estate and Timber products | | | 42.3 | | | — | | | — | | | (42.3 | ) | | — | | | — | | | — | |

Co-investments assigned to Parent | | | — | | | — | | | — | | | 42.3 | | | — | | | — | | | 42.3 | |

Acquired intangibles, net | | | 1.1 | | | — | | | — | | | — | | | — | | | — | | | 1.1 | |

Goodwill | | | 126.5 | | | — | | | — | | | — | | | — | | | — | | | 126.5 | |

Other assets | | | 41.9 | | | — | | | — | | | — | | | — | | | — | | | 41.9 | |

Note receivable due from related party | | | 32.2 | | | — | | | (32.2 | ) | | — | | | — | | | — | | | — | |

Deferred tax assets | | | 274.4 | | | — | | | — | | | (184.3 | ) | | — | | | — | | | 90.1 | |

Deferred tax assets subject to tax sharing arrangement | | | — | | | — | | | — | | | 184.3 | | | — | | | — | | | 184.3 | |

Assets of consolidated Funds: | | | | | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | | 107.1 | | | — | | | — | | | — | | | — | | | — | | | 107.1 | |

Investments, at fair value | | | 62.4 | | | — | | | — | | | — | | | — | | | — | | | 62.4 | |

Restricted cash in Timber Funds | | | 2,487.6 | | | — | | | — | | | — | | | — | | | — | | | 2,487.6 | |

Timber assets | | | 4,394.0 | | | — | | | — | | | — | | | — | | | — | | | 4,394.0 | |

Other assets | | | 91.8 | | | — | | | — | | | — | | | — | | | — | | | 91.8 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 8,049.2 | | $ | — | | $ | (32.2 | ) | $ | — | | $ | (60.0 | ) | $ | — | | $ | 7,957.0 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Current liabilities | | | | | | | | | | | | | | | | | | | | | | |

Accounts payable and accrued expenses | | $ | 30.0 | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 30.0 | |

Accrued incentive compensation | | | 79.1 | | | — | | | — | | | — | | | — | | | — | | | 79.1 | |

Accrued income taxes | | | 5.0 | | | — | | | — | | | — | | | — | | | — | | | 5.0 | |

Notes payable to related parties | | | 1,003.5 | | | 37.0 | | | (1,003.5 | ) | | — | | | — | | | — | | | 37.0 | |

Third party borrowings | | | 2.5 | | | 175.0 | | | — | | | — | | | — | | | — | | | 177.5 | |

Other amounts due to related parties | | | 5.0 | | | — | | | — | | | 332.1 | | | — | | | — | | | 337.1 | |

Other liabilities | | | 220.9 | | | — | | | — | | | — | | | (27.2 | ) | | — | | | 193.7 | |

Liabilities of consolidated Funds: | | | | | | | | | | | | | | | | | | | | | | |

Accounts payable and accrued expenses | | | 41.6 | | | — | | | — | | | — | | | — | | | — | | | 41.6 | |

Long term debt | | | 3,797.3 | | | — | | | — | | | — | | | — | | | — | | | 3,797.3 | |

Related party debt | | | 625.9 | | | — | | | — | | | — | | | — | | | — | | | 625.9 | |

Securities sold, not yet purchased, at fair value | | | 22.2 | | | — | | | — | | | — | | | — | | | — | | | 22.2 | |

Other liabilities | | | 129.3 | | | — | | | — | | | — | | | — | | | — | | | 129.3 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Total liabilities | | $ | 5,962.3 | | $ | 212.0 | | $ | (1,003.5 | ) | $ | 332.1 | | $ | (27.2 | ) | $ | — | | $ | 5,475.7 | |

Redeemable non-controlling interests in consolidated Funds | | | 49.7 | | | — | | | — | | | — | | | — | | | — | | | 49.7 | |

Equity: | | | | | | | | | | | | | | | | | | | | | | |

Ordinary shares (nominal value $0.001, issued and outstanding 120,000,000 shares) | | | — | | | — | | | — | | | — | | | — | | | 0.1 | | | 0.1 | |

Retained earnings (deficit) | | | — | | | — | | | — | | | — | | | — | | | (49.2 | ) | | (49.2 | ) |

Additional paid-in capital | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

Parent equity (deficit) | | | (443.5 | ) | | (212.0 | ) | | 971.3 | | | (332.1 | ) | | (32.8 | ) | | 49.1 | | | — | |

Other comprehensive income | | | 7.4 | | | — | | | — | | | — | | | — | | | — | | | 7.4 | |

Non-controlling interests | | | (3.6 | ) | | — | | | — | | | — | | | — | | | — | | | (3.6 | ) |

Non-controlling interests in consolidated Funds | | | 2,476.9 | | | — | | | — | | | — | | | — | | | — | | | 2,476.9 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Total liabilities, equity and redeemable equity | | $ | 8,049.2 | | $ | — | | $ | (32.2 | ) | $ | — | | $ | (60.0 | ) | $ | — | | $ | 7,957.0 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

63

Unaudited Pro Forma Consolidated Balance Sheet

As of June 30, 2014

Pro Forma U.S. GAAP Adjustments to the Consolidated Balance Sheet

Reorganization and other adjustments to our Consolidated Balance Sheet consist of:

| | | | | | | | | | |

| | As of

June 30,

2014 | | OMGUK

Tax-sharing

Arrangement | | Pro Forma—

Ordinary

Shareholders | |

|---|

Federal net operating losses and interest carry-forwards | | $ | 279.3 | | $ | (279.3 | ) | $ | — | |

Liability for uncertain tax positions | | | (88.6 | ) | | 88.6 | | | — | |

Foreign tax credits and share awards | | | 10.5 | | | (10.5 | ) | | — | |

Valuation allowance | | | (45.9 | ) | | 16.9 | | | (29.0 | ) |

Other deferred tax adjustments | | | 119.1 | | | — | | | 119.1 | |

| | | | | | | | |

| | | | | | | | | | | |

Deferred tax asset | | $ | 274.4 | | $ | (184.3 | ) | $ | 90.1 | |

| | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | |

- 4)

- In connection with the Reorganization, as a result of a pre-existing contractual provision, we have increased our ownership percentage in an Affiliate. Reflecting this Affiliate equity transaction, we have shown a reduction in cash of $60.0 million, a reduction of liabilities of

64

65

Exchange from Old Mutual plc Restricted Shares

In connection with this offering, certain of our employees who hold unvested Old Mutual plc restricted shares will be given the opportunity to exchange their Old Mutual plc restricted shares for restricted shares of our company currently held by OMGUK with vesting conditions similar to those to which they are currently subject in order to strengthen the alignment between the shareholders and senior management. This exchange program is intended to provide employees who elect to participate with restricted share awards of our ordinary shares of equivalent value to the Old Mutual plc restricted shares they currently hold. The exchange will value our ordinary shares at the price sold to investors in this offering. The exchange will value Old Mutual plc's ordinary shares using the weighted-average sale price over the three consecutive trading days on the London Stock Exchange up to and including the date of the exchange. The exchange will occur on the effective date of the registration statement of which this prospectus forms a part. We expect that OMGUK will transfer 1,163,482 restricted ordinary shares to employees as part of this exchange program (based on the mid-point of the range set forth on the cover of this prospectus and the weighted-average sale price of Old Mutual plc's ordinary shares over the three consecutive trading days ended September 18, 2014).

Benefits

The Company does not plan to amend its policy on benefits following the completion of this offering.

Tax Deductibility of Compensation

When our Compensation Committee reviews compensation matters, it will consider the anticipated tax and accounting treatment of various payments and benefits to us and, when relevant, to our named executive officers, although these considerations are not dispositive. Section 162(m) of the Code, or Section 162(m), generally disallows a tax deduction to a publicly-traded corporation that pays compensation in excess of $1 million to any of its named executive officers (other than the chief financial officer) in any taxable year, unless the compensation plan and awards meet certain requirements. As a wholly-owned subsidiary of our Parent, Section 162(m) does not currently apply to our compensation arrangements. However, following this offering, we will become subject to the deduction limits of Section 162(m). Accordingly, following this offering, we will generally endeavor to structure compensation to qualify as performance-based under Section 162(m), where it is reasonable to do so while meeting our compensation objectives. However, our Compensation Committee may approve compensation arrangements, or changes to plans, programs or awards, that may cause the compensation or awards to our executive officers to exceed the limitation under Section 162(m) if it determines that such action is in our best interests and will promote our varying corporate goals.

Employee Equity Incentive Plan

Our Equity Incentive Plan will be approved by our Board of Directors and our shareholder prior to the effective date of the registration statement of which this prospectus forms a part. No grants will be made pursuant to this plan until such time subsequent to this offering.

General

Our Equity Incentive Plan is intended to encourage ownership of our ordinary shares by our employees and those of our subsidiaries and to provide additional incentive for them to promote the success of our business through the grant of awards of, or pertaining to, our ordinary shares. The plan is intended to be an incentive stock option plan within the meaning of Section 422 of the Code, although not all awards granted under the plan are required to be incentive stock options.

160

Our Equity Incentive Plan provides for the grant of (i) incentive stock options, (ii) options that are not intended to qualify as incentive stock options, or "nonqualified stock options," (iii) stock appreciation rights, (iv) restricted stock, (v) restricted stock units, (vi) performance units and (vii) stock grants or any combination thereof. Incentive stock options may be granted only to our employees or employees of our subsidiary corporations. Other awards may be granted to our employees and those of our subsidiaries.

The plan is not subject to any provisions of ERISA, and is not a qualified plan within the meaning of Section 401(a) of the Code.

This summary of our Equity Incentive Plan is qualified by the actual terms of the plan, which will be filed as an exhibit to the registration statement of which this prospectus is a part.

Administration of the Plan

Our Equity Incentive Plan is administered by our Compensation Committee. Our Board of Directors may also exercise any of the powers of the Compensation Committee under the plan at any time.

Our Compensation Committee has full power and authority to administer and interpret the plan in its discretion, including the power to (i) determine who will receive awards, (ii) determine the fair market value of our ordinary shares, (iii) interpret the terms of the plan and the awards thereunder, (iv) specify the terms and conditions of awards, such as the exercise price, the number of shares subject to each award, the vesting schedule, the exercisability of awards and the form of consideration payable upon exercise or settlement, (v) prescribe, amend and rescind rules and regulations relating to the plan, and (vi) delegate ministerial, non-discretionary functions to any of our officers or employees or to any third-party stock plan administrator. Our Compensation Committee's grant or acceleration of awards to any participant is subject to the approval of our Parent at any time during which our Parent continues to own at least a majority of our outstanding ordinary shares.

Securities Subject to the Plan

The maximum number of our ordinary shares which may be issued pursuant to awards or subject to outstanding awards under the plan (including incentive stock options) is 9,600,000.

The maximum number of our ordinary shares subject to options or stock appreciation rights or any combination thereof that may be granted to any one person during any single calendar year is 4,000,000. The maximum number of our ordinary shares subject to all other awards or any combination thereof (excluding stock grants) that may be granted to any one person during any single calendar year that are intended to be qualified performance-based awards is 4,000,000. These per participant limits will be construed and applied consistent with Section 162(m) of the Code.

Term

We anticipate that our Equity Incentive Plan will terminate ten years from the date our Board of Directors adopted the plan, unless it is terminated earlier by our Board of Directors.

Adjustment of Awards

Our Equity Incentive Plan provides that, if the number of our ordinary shares is increased or decreased, or if our ordinary shares are exchanged for a different number or kind of shares or other securities, or if additional shares or new or different shares or other securities are distributed with respect to our ordinary shares as a result of a reorganization, recapitalization, reclassification, stock dividend, stock split, reverse stock split, or other similar distribution, then a proportional adjustment of awards shall be made to: (i) the maximum numbers and kinds of shares that may be issued under the

161

Except where necessary to satisfy any law or regulation, including Section 409A of the Code, or to satisfy any accounting standard, or where the Board of Directors or the Compensation Committee determines that a participant's benefits under an award are not reasonably likely to be significantly diminished or that any such diminution has been adequately compensated, the Board and the Compensation Committee may not amend the plan or an award in a manner that impairs the rights of the holder of an outstanding award without his or her consent.

Change of Control and Severance Arrangements

Change of Control

Equity compensation has historically been awarded in the form of restricted ordinary shares of our Parent. In the event of a change of control of our Parent current forfeitable share awards vest in full and are considered as deferred short-term incentive awards that have already been earned. It is our intention to continue this practice with respect to our own share programs, and we expect that shares would vest in the event of a change of control of our Company or our Parent's change of control, provided that our Parent retains majority ownership.

Currently we have no change-of-control agreements with any executives, and do not intend to enter into any such agreements following this offering.

We entered into employment agreements with Mr. Bain and Ms. Gibson upon the start of their employment with us in 2011 and 2002 respectively. See "—Employment Agreements" for further detail. We do not plan to change these agreements post-offering.

Except to the extent described in the employment agreements with Mr. Bain and Ms. Gibson (See "—Employment Agreements" for further detail), we have no severance agreements with any executives.

Pursuant to Mr. Bain's employment agreement, if Mr. Bain's employment had been terminated by us other than for cause and without notice on December 31, 2013, he would have been entitled to receive the following: a monthly severance payment of $54,167 for six months, a bonus payment of $7,405,400, which is based on Mr. Bain's 2012 bonus but would be subject to approval by our Parent, and a payment of $15,207 relating to COBRA coverage. If Mr. Bain's employment was terminated due to disability or death on December 31, 2013, he (or his estate) would have been entitled to receive a bonus payment of $7,405,400, subject to approval by our Parent.

Pursuant to a severance arrangement and Ms. Gibson's employment agreement, if Ms. Gibson's employment had been terminated by us other than for cause and without notice on December 31, 2013, she would have been entitled to receive the following: a monthly severance payment of $216,667 for twelve months, a bonus payment of $2,225,000, which is based on Ms. Gibson's 2012 bonus but would be subject to approval by our Parent, and a payment of $30,414 relating to COBRA coverage. If Ms. Gibson's employment was terminated due to disability or death on December 31, 2013, she (or her estate) would have been entitled to receive a bonus payment of $2,225,000, subject to approval by our Parent.

165

return on deferral amounts. For these plans, no earnings are reported in the 2013 Summary Compensation Table because the plans do not provide for above-market or preferential earnings.

Director Compensation

OMAM was formed in May 2014 and, therefore, did not pay any director compensation in 2013. We do not expect to pay our directors who are also our employees any compensation for their services as directors. OMAM anticipates compensating its non-employee directors with an annual cash retainer and an annual equity award. OMAM also anticipates providing additional compensation to the chairpersons of its Audit Committee, Compensation Committee and the Nominating and Corporate Governance Committee.

Non-Employee Director Equity Incentive Plan

Our Board of Directors and our shareholder will adopt our Non-Employee Director Equity Incentive Plan prior to the effective date of the registration statement of which this prospectus forms a part. No grants will be made pursuant to this plan until such time subsequent to this offering.

Our Non-Employee Director Equity Incentive Plan is intended to encourage ownership of our ordinary shares by our non-employee directors and those of our subsidiaries and to provide additional incentive for them to promote the success of our business through the grant of awards of, or pertaining to, our ordinary shares. Our Non-Employee Director Equity Incentive Plan provides for the grant of (i) options that are not intended to qualify as incentive stock options, or "nonqualified stock options," (ii) stock appreciation rights, (iii) restricted stock, (iv) restricted stock units, (v) performance units and (vi) stock grants or any combination thereof. The plan is administered by our Compensation Committee.

The maximum number of our ordinary shares which may be issued pursuant to awards or subject to outstanding awards under the plan is 2,400,000. The maximum number of our ordinary shares that may be subject to awards granted to any non-employee director in his or her capacity as such during any single calendar year is 40,000. We anticipate that our Non-Employee Director Equity Incentive Plan will terminate ten years from the date our Board of Directors adopted the plan, unless it is terminated earlier by our Board of Directors.

172

the purpose of computing the percentage ownership of any other person. Beneficial ownership representing less than 1% is denoted with an asterisk (*).

| | | | | | | | | | | | | | | | | | | | | | |

| |

| |

| |

| |

| |

| | Shares Beneficially

Owned After

Offering With

Over-Allotment | |

|---|

| | Shares Beneficially

Owned Prior to

Offering | |

| | Shares Beneficially

Owned After

Offering | |

|---|

| | Number of

Shares

Offered | |

|---|

Name of Beneficial Owner | | Number | | Percentage | | Number | | Percentage | | Number | | Percentage | |

|---|

5% Shareholders | | | | | | | | | | | | | | | | | | | | | | |

Old Mutual plc(1)(2) | | | 120,000,000 | | | 100 | % | | 22,000,000 | | | 96,836,518 | (3) | | 80.7 | % | | 93,536,518 | (3) | | 77.9 | % |

Directors and Executive Directors | | | | | | | | | | | | | | | | | | | | | | |

Peter L. Bain | | | — | | | — | | | — | | | 645,715 | (3) | | * | | | 645,715 | (3) | | * | |

Stephen H. Belgrad | | | — | | | — | | | — | | | 140,021 | (3) | | * | | | 140,021 | (3) | | * | |

Linda T. Gibson | | | — | | | — | | | — | | | 144,011 | (3) | | * | | | 144,011 | (3) | | * | |

Christopher Hadley | | | — | | | — | | | — | | | 18,963 | (3) | | * | | | 18,963 | (3) | | * | |

Aidan J. Riordan | | | — | | | — | | | — | | | 83,167 | (3) | | * | | | 83,167 | (3) | | * | |

Julian Roberts | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

Ian D. Gladman | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

Kyle P. Legg | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

James J. Ritchie | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

John D. Rogers | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

Donald J. Schneider | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

All current executive officers and directors as a group (eleven persons) | | | — | | | — | | | — | | | 1,031,877 | (3) | | * | | | 1,031,877 | (3) | | * | |

- (1)

- The address of Old Mutual plc is 5th Floor, Millennium Bridge House, 2 Lambeth Hill, London, England EC4V 4GG.

- (2)

- Old Mutual plc owns its ordinary shares indirectly through OMGUK, its wholly-owned subsidiary.

- (3)

- Includes an aggregate of 1,031,877 ordinary shares transferred by OMGUK to each of Messrs. Bain, Belgrad, Hadley and Riordan and Ms. Gibson. The exchange will value our ordinary shares at the price sold to investors in this offering. The exchange will value Old Mutual plc's ordinary shares using the weighted-average sale price over the three consecutive trading days on the London Stock Exchange up to and including the date of exchange. The exchange will occur on the effective date of the registration statement of which this prospectus forms a part. The number of shares set forth above assumes that the value of our ordinary shares is the mid-point of the range set forth on the cover of this prospectus.

183

ORDINARY SHARES ELIGIBLE FOR FUTURE SALE

Prior to this offering, there has been no established public market for our ordinary shares, and we cannot predict the effect, if any, that sales of ordinary shares or availability of any ordinary shares for sale will have on the market price of our ordinary shares prevailing from time to time. Issuances or sales of substantial amounts of ordinary shares (including ordinary shares issued on the exercise of options, warrants or convertible securities, if any) or the perception that such issuances or sales could occur, could adversely affect the market price of our ordinary shares and our ability to raise additional capital through a future sale of securities.

Upon completion of this offering, we will have 120,000,000 ordinary shares issued and outstanding. All of the 22,000,000 ordinary shares sold in this offering will be freely tradable without restriction or further registration under the Securities Act, unless such shares are purchased by "affiliates" as that term is defined in Rule 144 under the Securities Act or are subject to a lock-up agreement (described below). Upon completion of this offering, approximately 81.6% of our outstanding ordinary shares will be held by "affiliates" as that term is defined in Rule 144 or be subject to a lock-up agreement (assuming no shares are sold in this offering to a holder that is subject to a lock-up agreement). The ordinary shares held by "affiliates" will be "restricted securities" as that phrase is defined in Rule 144. Subject to certain contractual restrictions, including the lock-up agreements, holders of restricted shares will be entitled to sell those shares in the public market if they qualify for an exemption from registration under Rule 144 or any other applicable exemption under the Securities Act. Subject to the lock-up agreements and the provisions of Rules 144 and 701 under the Securities Act, additional shares will be available for sale as set forth below.

Registration Statement on Form S-8

In addition to our issued and outstanding ordinary shares, we intend to file a registration statement on Form S-8 to register an aggregate of approximately 12,000,000 ordinary shares reserved for issuance under our incentive programs. That registration statement will become effective upon filing and ordinary shares covered by such registration statement are eligible for sale in the public market immediately after the effective date of such registration statement (unless held by affiliates), subject to the lock-up agreements described below. See "Compensation Discussion and Analysis—2013 Compensation Process and Elements—2013 Compensation Elements—Equity-based Compensation Awards."

Lock-Up Agreements

See "Underwriting" for a description of the lock-up agreements entered into with the underwriters in connection with this offering. Upon the completion of this offering, we, our executive officers and directors and the Selling Shareholder will agree with Merrill Lynch, Pierce, Fenner & Smith Incorporated and Morgan Stanley & Co. LLC to not sell or otherwise dispose of any ordinary shares owned by us or them (other than to certain permitted transferees) for a period of 180 days (subject to adjustment) following the completion of this offering.

Registration Rights

Concurrently with the closing of this offering, we expect to enter into a registration rights agreement with our Parent. Under this registration rights agreement, following the first anniversary of the closing of this offering, our Parent, which will be the beneficial owner of 96,836,518 ordinary shares or 93,536,518 if the underwriters exercise their over-allotment option in full, will have the right to require us to register the offer and sale of its shares, or to include its shares in registration statements we file, in each case as described in "Certain Relationships and Related Party Transactions—Relationship with Our Parent and OMGUK Following This Offering—Parent Registration Rights Agreement".

203

In addition, concurrently with the closing of this offering, we expect to enter into a registration rights agreement with certain of our employees who will receive restricted ordinary shares pursuant to an exchange program described in "Compensation Discussion and Analysis—Compensation Plans Expected Post-Offering—Exchange from Old Mutual plc Restricted Shares". See "Certain Relationships and Related Party Transactions—Relationship with our Parent and OMGUK Following This Offering—Employee Registration Rights Agreement."

Rule 144

In general, under Rule 144 under the Securities Act, a person (or persons whose shares are aggregated) who is not deemed to have been an affiliate of ours at any time during the three months preceding a sale, and who has beneficially owned restricted securities within the meaning of Rule 144 for at least six months (including any period of consecutive ownership of preceding non-affiliated holders), will be entitled to sell those shares, subject only to the availability of current public information about us. A non-affiliated person who has beneficially owned restricted securities within the meaning of Rule 144 for at least one year will be entitled to sell those shares without regard to the provisions of Rule 144.