Use these links to rapidly review the document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. ) |

| | |

Filed by the Registrant ý |

Filed by a Party other than the Registrant o |

| Check the appropriate box: |

| ý | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material under §240.14a-12 |

|

| | | |

| OM ASSET MANAGEMENT PLC |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): |

| ý | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1 | ) | Title of each class of securities to which transaction applies: |

| | (2 | ) | Aggregate number of securities to which transaction applies: |

| | (3 | ) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4 | ) | Proposed maximum aggregate value of transaction: |

| | (5 | ) | Total fee paid: |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1 | ) | Amount Previously Paid: |

| | (2 | ) | Form, Schedule or Registration Statement No.: |

| | (3 | ) | Filing Party: |

| | (4 | ) | Date Filed: |

OM ASSET MANAGEMENT PLC

Ground Floor, Millennium Bridge House

2 Lambeth Hill

London EC4V 4GG, United Kingdom

|

| | | |

| | NOTICE OF GENERAL MEETING OF SHAREHOLDERS | |

To the Holders of Ordinary Shares of OM Asset Management plc:

Notice is hereby given that a general meeting of shareholders (the "Meeting") of OM Asset Management plc (the "Company") will be held at [ ] Eastern Time on Tuesday, March 15, 2016 at [ ].

Details regarding the Meeting, the business to be conducted at the Meeting, and information about the Company that you should consider when you vote your ordinary shares of the Company, nominal value $0.001 per share (the "Ordinary Shares"), are described in the accompanying proxy statement.

At the Meeting, you will be asked to consider and vote on the following proposal:

Proposal — Ordinary resolution regarding the terms and forms of share repurchase contracts, repurchase counterparties and repurchase authorization:

To (i) approve the terms and forms of the off-market purchase contracts produced at the Meeting and initialed by the Chairman for the purpose of identification between the counterparty or counterparties named therein for use in effecting purchases of Ordinary Shares and to approve the counterparties with whom the Company may conduct such repurchase transactions and (ii) authorize the Company to make off-market purchases of our Ordinary Shares, up to an aggregate amount of $150 million, pursuant to such contracts.

Other Business

To transact such other business that is properly presented at the Meeting and any adjournments or postponements thereof.

THE BOARD RECOMMENDS THE APPROVAL OF THE ABOVE PROPOSAL. SUCH OTHER BUSINESS WILL BE TRANSACTED AS MAY PROPERLY COME BEFORE THE MEETING.

The Company is a public limited company incorporated under the laws of England and Wales. In accordance with the Company's articles of association (the "Articles"), the resolution will be taken on a poll. Voting on a poll means that each share represented in person or by proxy will be counted in the vote. The resolution will be proposed as an ordinary resolution, which under applicable law means that the resolution must be passed by a simple majority of the total voting rights of the shareholders who vote on such resolution, whether in person or by proxy.

You may vote if you were the record owner of Ordinary Shares at the close of business on February 26, 2016. A list of shareholders of record will be available at the Meeting and, during the 10 days prior to the Meeting, at our registered office.

All shareholders are cordially invited to attend the Meeting. Whether you plan to attend the Meeting or not, we urge you to vote in accordance with the instructions set forth in this proxy statement and submit your proxy by the Internet, telephone or mail in order to ensure the presence of a quorum. You may change or revoke your proxy at any time before it is voted at the Meeting.

|

| |

| | BY ORDER OF THE BOARD OF DIRECTORS

|

| | /s/ MOLLY S. MUGLER |

| | Molly S. Mugler Secretary |

Ground Floor, Millennium Bridge House, 2 Lambeth Hill

London EC4V 4GG, United Kingdom

[ ], 2016

TABLE OF CONTENTS

PRELIMINARY PROXY STATEMENT - SUBJECT TO COMPLETION

OM ASSET MANAGEMENT PLC

Ground Floor, Millennium Bridge House

2 Lambeth Hill

London EC4V 4GG, United Kingdom

PROXY STATEMENT FOR OM ASSET MANAGEMENT PLC

GENERAL MEETING OF SHAREHOLDERS TO BE HELD ON MARCH 15, 2016

This proxy statement, along with the accompanying notice of the general meeting of shareholders (the "Meeting"), contains information about the Meeting, including any adjournments or postponements of the Meeting. We are holding the Meeting at [ ] Eastern Time on Tuesday, March 15, 2016 at [ ].

In this proxy statement, we refer to OM Asset Management plc as "OMAM," "the Company," "we" and "us."

This proxy statement relates to the solicitation of proxies by our Board of Directors (the "Board") for use at the Meeting.

On [ ], 2016, we sent to our shareholders of record as of February 26, 2016 this proxy statement, the attached Notice of Meeting and the accompanying proxy card. As permitted by the rules of the Securities and Exchange Commission (the "SEC"), we are also making our proxy materials, including the Notice of Meeting, this proxy statement and the accompanying proxy card (collectively, the "proxy materials") available to all shareholders electronically via the Internet.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

MEETING TO BE HELD ON MARCH 15, 2016

This proxy statement is available for viewing, printing and downloading at www.omam.com.

IMPORTANT INFORMATION ABOUT THE MEETING AND VOTING

Why is the Company Soliciting My Proxy?

The Board is soliciting your proxy to vote at the Meeting to be held at [ ] Eastern Time on Tuesday, March 15, 2016 at [ ] and any adjournments or postponement of the Meeting. The proxy statement along with the accompanying Notice of Meeting summarizes the purposes of the Meeting and the information you need to know to vote at the Meeting.

We have made available to you on the Internet and/or have sent you this proxy statement, the Notice of Meeting and the proxy card because you owned ordinary shares of the Company, nominal value $0.001 per share (the "Ordinary Shares"), on the record date of February 26, 2016 (the "record date"). We completed distribution of the proxy materials to shareholders by [ ], 2016.

Who Can Vote?

Only shareholders who owned the Ordinary Shares at the close of business on the record date are entitled to attend and vote at the Meeting. On the record date, there were 121,063,817 Ordinary Shares outstanding and entitled to vote. The Ordinary Shares are our only class of voting shares.

If you are a shareholder who is entitled to attend and vote at the Meeting, you are entitled to appoint a proxy to exercise all of your rights to attend, speak and vote at the Meeting and you should have received a proxy card with this proxy statement. You can only appoint a proxy using the procedures set out in these notes and the notes to the proxy card.

A proxy does not need to be a shareholder of the Company but must attend the Meeting to represent you. You may appoint more than one proxy provided that each proxy is appointed to exercise rights attached to different shares. You may not appoint more than one proxy to exercise rights attached to any one share.

Appointment of a proxy does not preclude you from attending the Meeting and voting in person. Attending the Meeting in person will not in and of itself revoke a previously submitted proxy. To terminate your proxy appointment you must deliver a notice of termination to us at least 24 hours before the start of the Meeting. The notice of termination may be (i) delivered by post or by hand in hard copy form to OMAM, Ground Floor Millennium Bridge House, 2 Lambeth Hill, London EC4V 4GG, United Kingdom, Attention: Company Secretary or (ii) received in electronic form at info@omam.com with a subject title "Revocation of Previous Proxy Appointment—Attention Company Secretary."

In the case of joint holders, where more than one of the joint holders completes a proxy card, only the appointment submitted by the most senior holder will be accepted. Seniority is determined by the order in which the names of the joint holders appear in the Company's register of members in respect of the joint holding (the first-named being the most senior).

A corporation which is a shareholder can appoint one or more corporate representatives who may exercise, on its behalf, all its powers as a shareholder, provided that no more than one corporate representative exercises powers over the same share.

You do not need to attend the Meeting to vote your Ordinary Shares. Ordinary Shares represented by valid proxies, received in time for the Meeting and not revoked prior to the Meeting, will be voted at the Meeting. For instructions on how to change or revoke your proxy, see "May I Change or Revoke My Proxy?" below.

How Many Votes Do I Have?

Each Ordinary Share that you own entitles you to one vote.

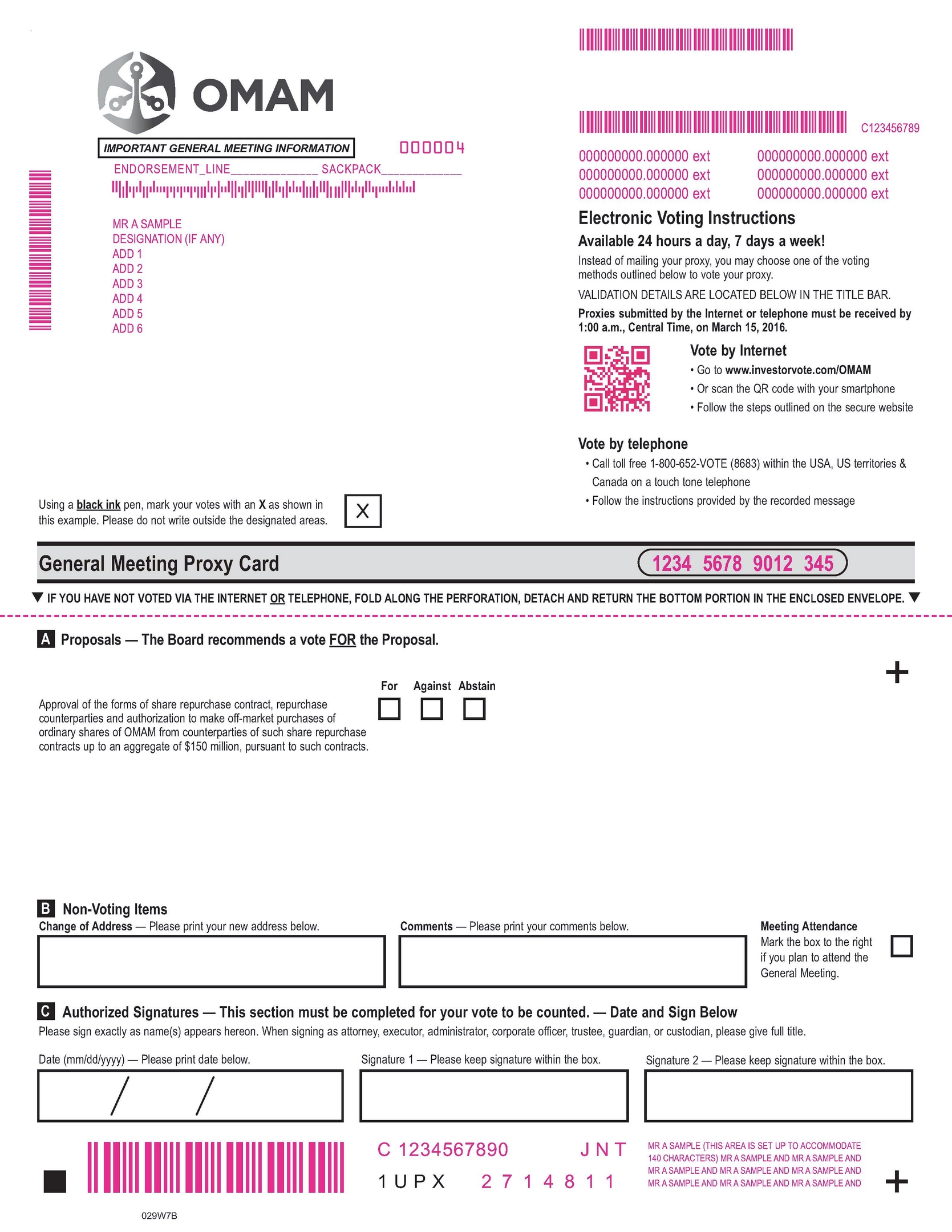

How Do I Vote?

Whether you plan to attend the Meeting or not, we urge you to vote by proxy. All Ordinary Shares represented by valid proxies that we receive through this solicitation, and that are not revoked, will be voted in accordance with your instructions on the proxy card or as instructed via Internet or telephone. You may specify whether your Ordinary Shares should be voted for, against or abstain with respect to the proposal. If you properly submit a proxy without giving specific voting instructions, your Ordinary Shares will be voted in accordance with the Board's recommendations as noted below. Voting by proxy will not affect your right to attend the Meeting. If your Ordinary Shares are registered directly in your name through our share transfer agent, Computershare Trust Company, N.A., or you have share certificates registered in your name, you may vote:

| |

| • | By Internet or by telephone. Follow the instructions included in the proxy card to vote by Internet or telephone. |

| |

| • | By mail. If you received a proxy card by mail, you can vote by mail by completing, signing, dating and returning the proxy card as instructed on the card. If you sign the proxy card but do not specify how you want your Ordinary Shares voted, they will be voted in accordance with the Board's recommendations as noted below. |

| |

| • | In person at the Meeting. If you attend the Meeting, you may deliver a completed proxy card in person or you may vote by completing a ballot, which will be available at the Meeting. |

Telephone and Internet proxy appointment facilities for shareholders of record will be available 24 hours a day. If you give instructions as to your proxy appointment by telephone or through the Internet, such instructions must be received by 1:00 a.m. U.S. Central time, on March 15, 2016, the day of the Meeting. If you properly give instructions as to your proxy appointment by telephone, through the Internet or by executing and returning a paper proxy card, and your proxy appointment is not subsequently revoked, your Ordinary Shares will be voted in accordance with your instructions. If you are a shareholder of record and you execute and return a proxy card but do not give instructions, your proxy will be voted in accordance with the Board's recommendations as noted below.

If your Ordinary Shares are held in "street name" (held in the name of a bank, broker or other holder of record), you will receive instructions from the holder of record. You must follow the instructions of the holder of record in order for your Ordinary Shares to be voted. Telephone and Internet voting also will be offered to shareholders owning Ordinary Shares through certain banks and brokers. If your Ordinary Shares are not registered in your own name and you plan to vote your Ordinary Shares in person at the Meeting, you should contact your broker or agent to obtain a legal proxy or broker's proxy card and bring it to the Meeting in order to vote.

How Does the Board Recommend That I Vote on the Proposals?

The Board recommends that you vote "FOR" authorization of the terms and forms of the off-market purchase contracts of the Company to make off-market purchases of our Ordinary Shares, up to an aggregate amount of $150 million, pursuant to such contracts, by way of ordinary resolution.

If any other matter is presented at the Meeting, your proxy provides that your Ordinary Shares will be voted by the proxy holder listed in the proxy in accordance with his best judgment. At the time this proxy statement was first made available, we knew of no matters that needed to be acted on at the Meeting, other than those discussed in this proxy statement.

May I Change or Revoke My Proxy?

If you give us your proxy, you may change or revoke it at any time before the Meeting. You may change or revoke your proxy in any one of the following ways:

| |

| • | if you received a proxy card, by signing a new proxy card with a date later than your previously delivered proxy and submitting it as instructed above; |

| |

| • | by re-voting by Internet or by telephone as instructed above; or |

| |

| • | by notifying the Company Secretary in writing before the Meeting that you have revoked your proxy in accordance with the procedures in the following paragraph. |

Attending the Meeting in person will not in and of itself revoke a previously submitted proxy. To terminate your proxy appointment you must deliver a notice of termination to the Company at least 24 hours before the start of the Meeting. The notice of termination may be (i) delivered by post or by hand in hard copy form to OMAM, Ground Floor Millennium Bridge House, 2 Lambeth Hill, London EC4V 4GG, United Kingdom, Attention: Company Secretary or (ii) received in electronic form at info@omam.com with a subject title "Revocation of Previous Proxy Appointment—Attention Company Secretary."

Your most current vote, whether by telephone, Internet or proxy card is the one that will be counted.

What if I Receive More Than One Notice or Proxy Card?

You may receive more than one notice or proxy card if you hold Ordinary Shares in more than one account, which may be in registered form or held in street name. Please vote in the manner described above under "How Do I Vote?" for each account to ensure that all of your Ordinary Shares are voted.

Will My Ordinary Shares be Voted if I Do Not Vote?

If your Ordinary Shares are registered in your name or if you have share certificates, they will not be counted if you do not vote as described above under "How Do I Vote?" We encourage you to provide voting instructions to your bank, broker or other nominee. This ensures your Ordinary Shares will be voted at the Meeting and in the manner you desire. A "broker non-vote" will occur if your broker cannot vote your Ordinary Shares on a particular matter because it has not received instructions from you and does not have discretionary voting authority on that matter or because your broker chooses not to vote on a matter for which it does have discretionary voting authority.

Your bank, broker or other nominee is prohibited from voting your uninstructed Ordinary Shares on certain non-routine matters. Thus, if you hold your Ordinary Shares in street name and you do not instruct your bank, broker or other nominee how to vote with respect to the non-routine matters, votes will not be cast on such proposals on your behalf.

The proposal is a matter considered non-routine under the rules of the New York Stock Exchange (the "NYSE Rules"). A broker, bank or other nominee may not vote on the this non-routine matter without specific voting instructions from the beneficial owner. As a result, there may be broker non-votes with respect to the proposal.

Is Voting Confidential?

We will keep all the proxies, ballots and voting tabulations private. We only let our Inspectors of Election, Computershare Trust Company, N.A., examine these documents. Management will not know how you voted on a specific proposal unless it is necessary to meet legal requirements. We will, however, forward to management any written comments you make on the proxy card or otherwise provide.

Where Can I Find the Voting Results of the Meeting?

The preliminary voting results will be announced at the Meeting, and we will publish preliminary, or final results if available, in a Current Report on Form 8-K within four business days of the Meeting. If final results are unavailable at the time we file the Form 8-K, then we will file an amended report on Form 8-K to disclose the final voting results within four business days after the final voting results are known.

What Are the Costs of Soliciting these Proxies?

We will pay all of the costs of soliciting these proxies. Our directors and employees may solicit proxies in person or by telephone, fax or email. We will pay these employees and directors no additional compensation for these services. We will ask banks, brokers and other institutions, nominees and fiduciaries to forward these proxy materials to their beneficial owners and to obtain authority to execute proxies. We will then reimburse them for their expenses.

What Constitutes a Quorum for the Meeting?

The quorum for the Meeting is two persons present being either holders of Ordinary Shares or their representatives (in the case of a corporate holder of Ordinary Shares) or proxies appointed by holders of Ordinary Shares in relation to the Meeting and entitled to vote.

Attending the Meeting

The Meeting will be held at [ ] Eastern Time on Tuesday, March 15, 2016 at [ ]. When you arrive at [ ], signs will direct you to the appropriate meeting rooms. You need not attend the Meeting in order to vote.

Householding of Annual Disclosure Documents

SEC rules concerning the delivery of disclosure documents allow us or your broker to send a single set of our proxy materials to any household at which two or more of our shareholders reside, if we or your broker believe that the shareholders are members of the same family. This practice, referred to as "householding," benefits both you and us. It reduces the volume of duplicate information received at your household and helps to reduce our expenses. The rule applies to our notices, annual reports, proxy statements and information statements. Once you receive notice from your broker or from us that communications to your address will be "householded," the practice will continue until you are otherwise notified or until you revoke your consent to the practice. Shareholders who participate in householding will continue to have access to and utilize separate proxy voting instructions.

If your household received a single notice or, if applicable, a single set of proxy materials this year, but you would prefer to receive your own copy, please contact our transfer agent, Computershare Trust Company, N.A., by calling their toll free number, 1-866-281-0717.

If you do not wish to participate in "householding" and would like to receive your own set of our proxy materials in future years, follow the instructions described below. Conversely, if you share an address with another OMAM shareholder and together both of you would like to receive only a singleset of proxy materials, follow these instructions:

| |

| • | If your Ordinary Shares are registered in your own name, please contact our transfer agent, Computershare Trust Company, N.A., and inform them of your request by calling them at 1-866-281-0717 or writing them at Computershare Trust Company, N.A., P.O. BOX 30170, College Station, TX, 77842. |

| |

| • | If a broker or other nominee holds your Ordinary Shares, please contact the broker or other nominee directly and inform them of your request. Be sure to include your name, the name of your brokerage firm and your account number. |

PROPOSAL — SHARE REPURCHASE CONTRACTS, REPURCHASE COUNTERPARTIES AND REPURCHASE AUTHORIZATION

Our Board proposes that the shareholders adopt the following resolution:

To (i) approve the terms and forms of the off-market share purchase contracts produced at the Meeting and initialed by the Chairman for the purpose of identification between the counterparty or counterparties named therein for use in effecting off-market purchases of Ordinary Shares and (ii) authorize our company to make off-market purchases of our Ordinary Shares from the counterparty or counterparties named in such off-market purchase contracts, up to an aggregate amount of $150 million, pursuant to such contracts, such authority to expire on the fifth anniversary of the date on which the shareholders' resolution is approved.

What am I voting on?

Approval of the forms of share repurchase contract, repurchase counterparties and authorization of our company to make off-market purchases of Ordinary Shares from the counterparties of such share repurchase contracts up to an aggregate amount of $150 million, pursuant to such contracts.

Under the Companies Act 2006 (the "Act"), we may only repurchase our Ordinary Shares in accordance with specific procedures for "off-market purchases" of such shares. The New York Stock Exchange is not a recognized investment exchange for purposes of English law, thus, solely for the purposes of the Act, any repurchase of our Ordinary Shares through the New York Stock Exchange constitutes an "off-market" transaction. As such, under the Act, these repurchases may only be made pursuant to a share repurchase contract which has been authorized by our shareholders. This authorization, if granted, will be valid for five years commencing on the date of the general meeting.

There can be no assurance as to whether we will repurchase any of our own Ordinary Shares or as to the amount of any such repurchases or the prices at which such repurchases may be made.

What are the material terms of the repurchase contracts?

We are seeking the approval for two forms of share repurchase contract.

One form of share repurchase contract provides that the counterparty will purchase Ordinary Shares for its own account on the New York Stock Exchange at such prices and in such quantities as we may instruct from time to time, subject to the limitations set forth in Rule 10b-18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), the Ordinary Shares so purchased by the counterparty to be repurchased by us in accordance with the share repurchase contract.

A second form of share repurchase contract is a form of repurchase plan which we may enter into from time to time, pursuant to which the counterparty will purchase for its own account from time to time, subject to the limitations set forth in Rule 10b5-1 of the Exchange Act to purchase a specified dollar amount of Ordinary Shares on the New York Stock Exchange each day if the Ordinary Shares are trading below a specified price, the Ordinary Shares so purchased by the counterparty to be repurchased by us in accordance with the share repurchase contract. The amount to be purchased each day, the limit price and the total amount that may be purchased under the contract will be determined at the time the plan is executed.

The particular contracts with each of the counterparties will be produced at the Meeting for review and authorization pursuant to the resolution. The particular contracts will also be made available for inspection by our shareholders at our registered office for not less than 15 days ending with the date of the Meeting.

Who are the counterparties with whom the share repurchase contracts will be entered into?

We seek authorization to conduct repurchases of our Ordinary Shares pursuant to the share repurchase contracts with the following counterparty (or its subsidiaries or affiliates from time to time):

[ ]

When does this authorization expire?

If this proposal is approved, we may repurchase our Ordinary Shares pursuant to the forms of contract produced at the Meeting with the approved counterparties until the fifth anniversary of the Meeting.

What vote is required for the proposal to be approved?

The resolution will be proposed as an ordinary resolution, which under applicable law means that the resolution will be passed if approved by a simple majority of the total voting rights of the shareholders who vote on such resolution, whether in person or by proxy.

In accordance with our articles of association, a resolution put to the vote of a general meeting shall be decided on a poll. A poll is a vote whereby each shareholder has one vote for each share held.

How does the Board recommend that I vote?

THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE "FOR" AUTHORIZATION OF THE FORMS OF SHARE REPURCHASE CONTRACT AND AUTHORIZATION OF REPURCHASES MADE PURSUANT TO THEM.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership of our Ordinary Shares as of February 16, 2016 by:

| |

| • | our Parent, through its wholly-owned subsidiary, OMGUK; |

| |

| • | each of our named executive officers; |

| |

| • | each person, or group of affiliated persons, who is known by us to beneficially own more than 5% of the Ordinary Shares; and |

| |

| • | all of our directors and executive officers as a group. |

Beneficial ownership is determined in accordance with the rules of the SEC. These rules generally attribute beneficial ownership of securities to persons who possess sole or shared voting power or investment power with respect to those securities and include Ordinary Shares issuable upon the exercise of options to purchase Ordinary Shares that are immediately exercisable or exercisable within 60 days after February 16, 2016. Except as otherwise indicated, all persons listed below have sole voting and investment power with respect to the Ordinary Shares beneficially owned by them, subject to applicable community property laws. The information is not necessarily indicative of beneficial ownership for any other purpose.

Percentage ownership calculations for beneficial ownership are based on 121,063,817 Ordinary Shares outstanding as of February 16, 2016. Except as otherwise indicated in the table below, addresses of named beneficial owners are care of OMAM Inc., 200 Clarendon Street, 53rd Floor, Boston, Massachusetts 02116.

In computing the number of Ordinary Shares beneficially owned by a person and the percentage ownership of that person, we deemed outstanding Ordinary Shares that a person has the right to acquire within 60 days of February 16, 2016. We did not deem these Ordinary Shares outstanding, however, for the purpose of computing the percentage ownership of any other person. Beneficial ownership representing less than 1% is denoted with an asterisk (*).

|

| | | | | | |

| | Shares Beneficially Owned | |

| Name of Beneficial Owner | Number | | Percent | |

| Old Mutual plc(1)(2) | 79,260,859 |

| | 65.47 | % | |

| FMR LLC(3) | 11,891,770 |

| | 9.82 | % | |

| Peter L. Bain | 1,052,641 |

| | * |

| |

| Stephen H. Belgrad | 230,406 |

| | * |

| |

| Linda T. Gibson | 252,899 |

| | * |

| |

| Christopher Hadley | 38,829 |

| | * |

| |

| Aidan J. Riordan | 149,458 |

| | * |

| |

| Ian D. Gladman | — |

| | * |

| |

| Kyle Prechtl Legg | 7,500 |

| | * |

| |

| James J. Ritchie | 3,500 |

| | * |

| |

| John D. Rogers | 5,000 |

| | * |

| |

| Donald J. Schneider | 3,500 |

| | * |

| |

| All directors and current executive officers as a group (11 persons) | | | 1.44 | % | |

_______________________________________________________________________________

| |

| (1) | Amounts shown reflect the aggregate number of Ordinary Shares held by Old Mutual plc based solely on information set forth in Amendment No. 1 to Schedule 13G filed with the SEC on June 23, 2015. Old Mutual plc reported sole voting and dispositive power over all of the 79,260,859 ordinary shares. The address of Old Mutual plc is 5th Floor, Millennium Bridge House, 2 Lambeth Hill, London, England EC4V 4GG. |

| |

| (2) | Old Mutual plc owns its Ordinary Shares indirectly through OMGUK, its wholly-owned subsidiary. |

| |

| (3) | Based solely on information set forth in Amendment No. 1 to Schedule 13G filed with the SEC on February 12, 2016 by FMR LLC on behalf of itself and Abigail P. Johnson. FMR LLC reported sole voting power over 1,455,405 Ordinary Shares, shared voting power over none of the Ordinary Shares and sole dispositive power over 11,891,770 Ordinary Shares. Abigail P. Johnson reported sole voting power over none of the Ordinary Shares, shared voting power over none of the Ordinary Shares and sole dispositive power over 11,891,770 of the Ordinary Shares. The Schedule 13G further states that members of the Johnson family, including Abigail P. Johnson, are the predominant owners, directly or through trusts, of Series B voting common shares of FMR LLC, representing 49% of the voting power of FMR LLC. The Johnson family group and all other Series B shareholders have entered into a shareholders' voting agreement under which all Series B voting common shares will be voted in accordance with the majority vote of Series B voting common shares. Accordingly, through their ownership of voting common shares and the execution of the shareholders' voting agreement, members of the Johnson family may be deemed, under the Investment Company Act of 1940, to form a controlling group with respect to FMR LLC. Neither FMR LLC nor Abigail P. Johnson has the sole power to vote or direct the voting of the shares owned directly by the various investment companies registered under the Investment Company Act ("Fidelity Funds") advised by Fidelity Management & Research Company ("FMR Co"), a wholly owned subsidiary of FMR LLC, which power resides with the Fidelity Funds' Boards of Trustees. FMR Co carries out the voting of the shares under written guidelines established by the Fidelity Funds' Boards of Trustees. The address of FMR LLC is 245 Summer Street, Boston, Massachusetts 02210. |

OTHER MATTERS

The Board knows of no other business which will be presented to the Meeting. If any other business is properly brought before the Meeting, proxies will be voted in accordance with the judgment of the persons named therein.

REGARDLESS OF THE NUMBER OF SHARES YOU OWN, YOUR VOTE IS IMPORTANT TO US. PLEASE SUBMIT A PROXY BY INTERNET, BY TELEPHONE OR BY RETURNING A COMPLETED, SIGNED, AND DATED PROXY CARD OR VOTING INSTRUCTION FORM.

SHAREHOLDER PROPOSALS AND NOMINATIONS FOR DIRECTOR

To be considered for inclusion in the proxy statement relating to our 2016 Annual General Meeting of Shareholders, we must have received shareholder proposals (other than for director nominations) no later than December 30, 2015. In accordance with the Articles, and without prejudice to the rights of a shareholder of record under applicable law, to have been considered for presentation at the 2016 Annual General Meeting, although not included in the proxy statement, proposals (including director nominations that are not requested to be included in our proxy statement) must have been received no earlier than January 21, 2016 nor later than February 20, 2016 together with all supporting documentation required by the Articles. Proposals that are not received in a timely manner will not be voted on at the 2016 Annual General Meeting. If a proposal is received on time, the proxies that management solicits for the meeting may still exercise discretionary voting authority on the proposal under circumstances consistent with the proxy rules of the SEC. All shareholder proposals should be marked for the attention of Secretary, OM Asset Management plc, Ground Floor, Millennium Bridge House, 2 Lambeth Hill, London EC4V 4GG, United Kingdom.

|

| |

| | BY ORDER OF THE BOARD OF DIRECTORS |

| |

/s/ MOLLY S. MUGLER |

| | Molly S. Mugler Secretary |

Ground Floor, Millennium Bridge House,

2 Lambeth Hill

London EC4V 4GG, United Kingdom

[ ], 2016