Use these links to rapidly review the document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. ) |

| | |

Filed by the Registrant ý |

Filed by a Party other than the Registrant o |

| Check the appropriate box: |

ý

| Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material under §240.14a-12 |

|

| | | |

| BRIGHTSPHERE INVESTMENT GROUP PLC |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): |

| ý | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1 | ) | Title of each class of securities to which transaction applies: |

| | (2 | ) | Aggregate number of securities to which transaction applies: |

| | (3 | ) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4 | ) | Proposed maximum aggregate value of transaction: |

| | (5 | ) | Total fee paid: |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1 | ) | Amount Previously Paid: |

| | (2 | ) | Form, Schedule or Registration Statement No.: |

| | (3 | ) | Filing Party: |

| | (4 | ) | Date Filed: |

|

| | |

| | BRIGHTSPHERE Investment Group plc |

Millennium Bridge House

2 Lambeth Hill

London EC4V 4GG, United Kingdom

|

| | | |

| | NOTICE OF 2018 ANNUAL GENERAL MEETING OF SHAREHOLDERS | |

To the Holders of Ordinary Shares of BrightSphere Investment Group plc:

Notice is hereby given that the 2018 annual general meeting of shareholders (the “Annual Meeting”) of BrightSphere Investment Group plc (the “Company”) will be held at 9:00 a.m. Eastern Time on Tuesday, June 19, 2018 at 101 Park Avenue, 39th Floor, New York, NY 10178.

Details regarding the Annual Meeting, the business to be conducted at the Annual Meeting, and information about the Company that you should consider when you vote your ordinary shares of the Company, nominal value $0.001 per share (the “Ordinary Shares”), are described in the accompanying proxy statement.

At the Annual Meeting, you will be asked to consider and vote on the following proposals:

| |

| 1. | Proposal 1—Ordinary resolutions to elect directors of the Company: |

To elect, by way of separate resolutions, six directors to serve on the Company’s Board of Directors (the “Board”) until, subject to the provisions of the Company’s articles of association and the U.K. Companies Act 2006, the Company’s 2019 Annual General Meeting and until their respective successors are duly elected and qualified, on the following basis:

1.01—To re-elect Mr. Stephen H. Belgrad as a director of the Company;

1.02—To re-elect Mr. Robert J. Chersi as a director of the Company;

1.03—To re-elect Mr. Suren S. Rana as a director of the Company;

1.04—To re-elect Mr. James J. Ritchie as a director of the Company;

1.05—To re-elect Ms. Barbara Trebbi as a director of the Company; and

1.06—To re-elect Mr. Guang Yang as a director of the Company.

| |

| 2. | Proposal 2—Ordinary resolution regarding ratification of independent registered public accounting firm: |

To ratify the appointment of KPMG LLP (“KPMG”) as the Company’s independent registered public accounting firm for the year ending December 31, 2018.

| |

| 3. | Proposal 3—Ordinary resolution to appoint KPMG as our statutory auditor: |

To appoint KPMG as the Company’s U.K. statutory auditor pursuant to the U.K. Companies Act 2006 (to hold office until the conclusion of the Company’s next Annual General Meeting at which accounts are laid before the shareholders).

| |

| 4. | Proposal 4—Ordinary resolution regarding our U.K. statutory auditor’s remuneration: |

To authorize the directors to determine the remuneration of KPMG as the Company’s U.K. statutory auditor.

| |

| 5. | Proposal 5—Advisory resolution on executive compensation: |

To approve, on an advisory basis, the compensation of the Company’s named executive officers as described in the accompanying proxy statement under the section titled Compensation Discussion and Analysis and the tabular and narrative disclosure contained in the accompanying proxy statement.

| |

| 6. | Proposal 6—Advisory resolution on the directors’ remuneration report: |

To approve, on an advisory basis, the directors’ remuneration report contained in Appendix A to the accompanying proxy statement, for the period commencing on January 1, 2017 and ending December 31, 2017.

| |

| 7. | Proposal 7—Ordinary resolution regarding the authorization of share repurchases, amendment to form of repurchase contract: |

To approve the form of amendment to the previously approved off-market share purchase contract, between the Company and Citigroup Global Markets Inc., set forth in Appendix B; such form of amendment to be produced at the Annual Meeting and initialed by the Chairman for purposes of identification. If approved, the Company may make off-market purchases of its Ordinary Shares from Citigroup Global Markets Inc. over the next five years via the Repurchase Contract, as amended by the Amendment (each as defined in the accompanying proxy statement).

Other business.

To transact such other business that is properly presented at the Annual Meeting and any adjournments or postponements thereof.

THE BOARD RECOMMENDS THE APPROVAL OF EACH OF THE ABOVE PROPOSALS. SUCH OTHER BUSINESS WILL BE TRANSACTED AS MAY PROPERLY COME BEFORE THE ANNUAL MEETING.

The Company is a public limited company incorporated under the laws of England and Wales. In accordance with the Company’s Articles of Association, all resolutions will be taken on a poll. A poll is a vote whereby each shareholder has one vote for each share held. All resolutions will be proposed as ordinary resolutions, which under English law means that the resolution is passed if a simple majority of the total voting rights of the shareholders who vote on such resolution, whether in person or by proxy, are cast in favor of it.

You may vote if you were the record owner of Ordinary Shares at the close of business on April 23, 2018. A list of shareholders of record will be available at the Annual Meeting and, during the 10 days prior to the Annual Meeting, at our registered office.

All shareholders are cordially invited to attend the Annual Meeting. Whether you plan to attend the Annual Meeting or not, we urge you to vote in accordance with the instructions set forth in this proxy statement and submit your proxy by the Internet, telephone or mail in order to ensure the presence of a quorum. You may change or revoke your proxy at any time before it is voted at the Annual Meeting.

|

| |

| | BY ORDER OF THE BOARD OF DIRECTORS

|

| | /s/ RICHARD J. HART |

| | Richard J. Hart Secretary |

Millennium Bridge House, 2 Lambeth Hill

London EC4V 4GG, United Kingdom

April [ ], 2018

TABLE OF CONTENTS

PRELIMINARY PROXY STATEMENT - SUBJECT TO COMPLETION

|

| | |

| | BRIGHTSPHERE Investment Group plc |

BRIGHTSPHERE INVESTMENT GROUP PLC

Millennium Bridge House

2 Lambeth Hill

London EC4V 4GG, United Kingdom

PROXY STATEMENT FOR BRIGHTSPHERE INVESTMENT GROUP PLC

|

|

| 2018 ANNUAL GENERAL MEETING OF SHAREHOLDERS TO BE HELD ON JUNE 19, 2018 |

This proxy statement, along with the accompanying notice of the 2018 annual general meeting of shareholders (the “Annual Meeting”), contains information about the Annual Meeting, including any adjournments or postponements of the Annual Meeting. We are holding the Annual Meeting at 9:00 a.m. Eastern Time on Tuesday, June 19, 2018 at 101 Park Avenue, 39th Floor, New York, NY 10178.

In this proxy statement, we refer to BrightSphere Investment Group plc (formerly known as OM Asset Management plc) as “BrightSphere,” “the Company,” “we” and “us.” Unless we state otherwise or the context otherwise requires, references in this proxy statement to “Affiliates” or an “Affiliate” refer to the asset management firms in which we have an ownership interest.

This proxy statement relates to the solicitation of proxies by our Board of Directors (the “Board”) for use at the Annual Meeting.

On April [ ], 2018, we sent to our shareholders of record as of April 23, 2018 this proxy statement, the attached Notice of Annual Meeting, the accompanying proxy card and our Annual Report to Shareholders on Form 10-K. As permitted by the rules of the Securities and Exchange Commission (the “SEC”), we are also making our proxy materials, including the Notice of Annual Meeting, this proxy statement and the accompanying proxy card and our Annual Report to Shareholders on Form 10-K (collectively, the “proxy materials”) available to all shareholders electronically via the Internet.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

ANNUAL MEETING TO BE HELD ON JUNE 19, 2018

This proxy statement is available for viewing, printing and downloading at www.bsig.com. Additionally, you can find a copy of our Annual Report on Form 10-K, which includes our financial statements, for the fiscal year ended December 31, 2017 on the website of the SEC at www.sec.gov, or in the “Public Filings” section of the “Investor Relations” section of our website at www.bsig.com.

IMPORTANT INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Why is the Company soliciting my proxy?

The Board is soliciting your proxy to vote at the Annual Meeting to be held at 9:00 a.m. Eastern Time on Tuesday, June 19, 2018 at 101 Park Avenue, 39th Floor, New York, NY 10178 and any adjournments or postponement of the Annual Meeting. The proxy statement along with the accompanying Notice of Annual Meeting summarizes the purposes of the Annual Meeting and the information you need to know to vote at the Annual Meeting.

We have made available to you on the Internet and/or have sent you this proxy statement, the Notice of Annual Meeting, the proxy card and a copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2017 because you owned ordinary shares of the Company, nominal value $0.001 per share (the “Ordinary Shares”), on the record date of April 23, 2018 (the “Record Date”). We completed distribution of the proxy materials to shareholders by April [ ], 2018.

Who can vote?

Only shareholders who owned the Ordinary Shares at the close of business on the Record Date are entitled to attend and vote at the Annual Meeting. On the Record Date, there were [ ] Ordinary Shares outstanding and entitled to vote. The Ordinary Shares are our only class of voting shares.

If your Ordinary Shares are held in “street name” (held in the name of a bank, broker or other holder of record), you will receive instructions from the holder of record. You must follow the instructions of the holder of record in order for your Ordinary Shares to be voted. Telephone and Internet voting also will be offered to shareholders owning Ordinary Shares through certain banks and brokers. If your Ordinary Shares are not registered in your own name and you plan to vote your Ordinary Shares in person at the Annual Meeting, you should contact your broker or agent to obtain a legal proxy or broker’s proxy card and bring it to the Annual Meeting in order to vote.

If you are a shareholder who is entitled to attend and vote at the Annual Meeting, you are entitled to appoint a proxy to exercise all of your rights to attend, speak and vote at the Annual Meeting and you should have received a proxy card with this proxy statement. You can only appoint a proxy using the procedures set out in this proxy statement and in the proxy card.

A proxy does not need to be a shareholder of the Company but must attend the Annual Meeting to represent you. You may appoint more than one proxy provided that each proxy is appointed to exercise rights attached to different shares. You may not appoint more than one proxy to exercise rights attached to any one share.

Appointment of a proxy does not preclude you from attending the Annual Meeting and voting in person. Attending the Annual Meeting in person will not in and of itself revoke a previously submitted proxy. To terminate your proxy appointment you must deliver a notice of termination to us at least 24 hours before the start of the Annual Meeting. The notice of termination may be (i) delivered by post or by hand in hard copy form to BrightSphere, Millennium Bridge House, 2 Lambeth Hill, London EC4V 4GG, United Kingdom, Attention: Company Secretary or (ii) received in electronic form at info@bsig.com with a subject title “Revocation of Previous Proxy Appointment—Attention: Company Secretary.”

In the case of joint holders, where more than one of the joint holders completes a proxy card, only the appointment submitted by the most senior holder will be accepted. Seniority is determined by the order in which the names of the joint holders appear in the Company’s register of members in respect of the joint holding (the first-named being the most senior).

A corporation which is a shareholder can appoint one or more corporate representatives who may exercise, on its behalf, all its powers as a shareholder, provided that no more than one corporate representative exercises powers over the same share.

You do not need to attend the Annual Meeting to vote your Ordinary Shares. Ordinary Shares represented by valid proxies, received in time for the Annual Meeting and not revoked prior to the Annual Meeting, will be voted at the Annual Meeting. For instructions on how to change or revoke your proxy, see “May I change or revoke my proxy?” below.

How many votes do I have?

Each Ordinary Share that you own entitles you to one vote.

How do I vote?

Whether you plan to attend the Annual Meeting or not, we urge you to vote by proxy. All Ordinary Shares represented by valid proxies that we receive through this solicitation, and that are not revoked, will be voted in accordance with your instructions on the proxy card or as instructed via Internet or telephone. You may specify whether your Ordinary Shares should be voted for, against or abstain with respect to each of the proposals. If you properly submit a proxy without giving specific voting instructions, your Ordinary Shares will be voted in accordance with the Board’s recommendations as noted below. Voting by proxy will not affect your right to attend the Annual Meeting. If your Ordinary Shares are registered directly in your name through our share transfer agent, Computershare Trust Company, N.A., or you have share certificates registered in your name, you may vote:

| |

| • | By Internet or by telephone. Follow the instructions included in the proxy card to vote by Internet or telephone. |

| |

| • | By mail. If you received a proxy card by mail, you can vote by mail by completing, signing, dating and returning the proxy card as instructed on the card. If you sign the proxy card but do not specify how you want your Ordinary Shares voted, they will be voted in accordance with the Board’s recommendations as noted below. |

| |

| • | In person at the Annual Meeting. If you attend the Annual Meeting, you may deliver a completed proxy card in person or you may vote by completing a ballot, which will be available at the Annual Meeting. |

Telephone and Internet proxy appointment facilities for shareholders of record will be available 24 hours a day. If you give instructions as to your proxy appointment by telephone or through the Internet, such instructions must be received by 2:00 a.m. U.S. Eastern Time, on Tuesday, June 19, 2018, the day of the Annual Meeting. If you mail your signed proxy card, such proxy card must be received by June 18, 2018. If you properly give instructions as to your proxy appointment by telephone, through the Internet or by executing and returning a paper proxy card, and your proxy appointment is not subsequently revoked, your Ordinary Shares will be voted in accordance with your instructions. If you are a shareholder of record and you execute and return a proxy card but do not give instructions, your proxy will be voted in accordance with the Board’s recommendations as noted below.

If you hold your shares in “street name” (i.e. your shares are held of record by a broker, bank, trustee or other nominee), your broker, bank, trustee or other nominee will provide you with materials and instructions for voting your shares, including a voting instruction form.

How does the Board recommend that I vote on the proposals?

Each of the proposals will be proposed as ordinary resolutions, which means that the affirmative vote of a majority of the Ordinary Shares cast at the Annual Meeting is required to approve each proposal. The Board recommends that you vote as follows:

| |

| • | “FOR” the election of all nominees for director named in this proxy statement (in each case to be approved by way of a separate resolution); |

| |

| • | “FOR” the ratification of the appointment of KPMG as our independent registered public accounting firm for the 2018 fiscal year; |

| |

| • | “FOR” the appointment of KPMG as our U.K. statutory auditor; |

| |

| • | “FOR” authorizing the Board to determine remuneration of KPMG; |

| |

| • | “FOR” advisory approval of the compensation of our named executive officers; |

| |

| • | “FOR” advisory approval of the directors’ remuneration report; and |

| |

| • | “FOR” approval of the repurchase authorization and amendment to the form of share repurchase contract. |

If any other matter is presented at the Annual Meeting, your proxy provides that your Ordinary Shares will be voted by the proxy holder listed in the proxy in accordance with his best judgment. At the time this proxy statement was first made available, we knew of no matters that needed to be acted on at the Annual Meeting, other than those discussed in this proxy statement.

May I change or revoke my proxy?

If you give us your proxy, you may change or revoke it at any time before the Annual Meeting. You may change or revoke your proxy in any one of the following ways:

| |

| • | if you received a proxy card, by signing a new proxy card with a date later than your previously delivered proxy and submitting it as instructed above; |

| |

| • | by re-voting by Internet or by telephone as instructed above; or |

| |

| • | by notifying the Company Secretary in writing before the Annual Meeting that you have revoked your proxy in accordance with the procedures in the following paragraph. |

Attending the Annual Meeting in person will not in and of itself revoke a previously submitted proxy. To terminate your proxy appointment you must deliver a notice of termination to the Company at least 24 hours before the start of the Annual Meeting. The notice of termination may be (i) delivered by post or by hand in hard copy form to BrightSphere, Millennium Bridge House, 2 Lambeth Hill, London EC4V 4GG, United Kingdom, Attention: Company Secretary or (ii) received in electronic form at info@bsig.com with a subject title “Revocation of Previous Proxy Appointment—Attention: Company Secretary.”

If your shares are held in the name of a broker, bank, trustee or other nominee, that institution will instruct you as to how your vote may be changed.

Your most current vote, whether by telephone, Internet or proxy card is the one that will be counted.

What if I receive more than one notice or proxy card?

You may receive more than one notice or proxy card if you hold Ordinary Shares in more than one account, which may be in registered form or held in street name. Please vote in the manner described above under “How do I vote?” for each account to ensure that all of your Ordinary Shares are voted.

Will my ordinary shares be voted if I do not vote?

If your Ordinary Shares are registered in your name or if you have share certificates, they will not be counted if you do not vote as described above under “How do I vote?” If your Ordinary Shares are held in street name and you do not provide voting instructions to the bank, broker or other nominee that holds your Ordinary Shares as described above, the bank, broker or other nominee that holds your Ordinary Shares has the authority to vote your unvoted Ordinary Shares only on certain routine matters without receiving instructions from you. Therefore, we encourage you to provide voting instructions to your bank, broker or other nominee. This ensures your Ordinary Shares will be voted at the Annual Meeting on all matters and in the manner you desire. A “broker non-vote” will occur if your broker cannot vote your Ordinary Shares on a particular matter because it has not received instructions from you and does not have discretionary voting authority on that matter or because your broker chooses not to vote on a matter for which it does have discretionary voting authority.

Your bank, broker or other nominee is prohibited from voting your uninstructed Ordinary Shares on certain non-routine matters. Thus, if you hold your Ordinary Shares in street name and you do not instruct your bank, broker or other nominee how to vote with respect to the non-routine matters, votes will not be cast on such proposals on your behalf.

What proposals are considered “routine” or “non-routine”?

Proposals 2, 3 and 4 (ratification of the appointment of KPMG as our independent registered public accounting firm for 2018, appointment of KPMG as our U.K. statutory auditor and authorizing our Board to determine auditor remuneration) are each considered a routine matter under the rules of the New York Stock Exchange (the “NYSE”). A broker, bank or other nominee may generally vote on routine matters, and therefore no broker non-votes are expected to occur in connection with Proposals 2, 3 or 4.

Proposals 1, 5, 6 and 7 (the election of directors, the advisory vote on executive compensation, the advisory vote on the directors’ remuneration report and the amendment to the repurchase agreement matters) are matters considered non-routine under the rules of the NYSE (the “NYSE Rules”). A broker, bank or other nominee may not vote on these non-routine matters without specific voting instructions from the beneficial owner. As a result, there may be broker non-votes with respect to Proposals 1, 5, 6 and 7.

While proposals 1 (the election of directors) and 5 (the advisory vote on executive compensation) relate to matters considered non-routine under the NYSE Rules and thus could result in broker non-votes, proposals 1 and 5 are typical proposals of companies whose shares are traded on the NYSE. While proposal 6 (the advisory vote on the directors’ remuneration report) relates to matters considered non-routine under the NYSE Rules and thus could result in broker non-votes, proposal 6 is a typical proposal of U.K. domiciled companies.

Is voting confidential?

We will keep all the proxies, ballots and voting tabulations private. We only let our Inspectors of Election, Computershare Trust Company, N.A., examine these documents.

Where Can I Find the Voting Results of the Annual Meeting?

The preliminary voting results will be announced at the Annual Meeting, and we will publish preliminary, or final results if available, in a Current Report on Form 8-K within four business days of the Annual Meeting. If final results are unavailable at the time we file the Form 8-K, then we will file an amended report on Form 8-K/A to disclose the final voting results within four business days after the final voting results are known.

What are the costs of soliciting these proxies?

We will pay all of the costs of soliciting these proxies. Our directors and employees may solicit proxies in person or by telephone, fax or email. We will pay these employees and directors no additional compensation for these services. We will ask banks, brokers and other institutions, nominees and fiduciaries to forward these proxy materials to their beneficial owners and to obtain authority to execute proxies. We will then reimburse them for their expenses.

What constitutes a quorum for the Annual Meeting?

The quorum for the Annual Meeting is two persons present being either holders of Ordinary Shares or their representatives (in the case of a corporate holder of Ordinary Shares) or proxies appointed by holders of Ordinary Shares in relation to the Annual Meeting and entitled to vote.

Attending the Annual Meeting

The Annual Meeting will be held at 9:00 a.m. Eastern Time on Tuesday, June 19, 2018 at 101 Park Avenue, 39th Floor, New York, NY 10178. When you arrive at the address, signs will direct you to the appropriate meeting rooms. You need not attend the Annual Meeting in order to vote.

Householding of annual disclosure documents

SEC rules concerning the delivery of annual disclosure documents allow us or your broker to send a single set of our proxy materials to any household at which two or more of our shareholders reside, if we or your broker believe that the shareholders are members of the same family. This practice, referred to as “householding,” benefits both you and us. It reduces the volume of duplicate information received at your household and helps to reduce our expenses. The rule applies to our notices, annual reports, proxy statements and information statements. Once you receive notice from your broker or from us that communications to your address will be “householded,” the practice will continue until you are otherwise notified or until you revoke your consent to the practice. Shareholders who participate in householding will continue to have access to and utilize separate proxy voting instructions.

If your household received a single notice or, if applicable, a single set of proxy materials this year, but you would prefer to receive your own copy, please contact our transfer agent, Computershare Trust Company, N.A., by calling their toll free number: 1-866-281-0717.

If you do not wish to participate in householding and would like to receive your own set of our proxy materials in future years, follow the instructions described below. Conversely, if you share an address with another BrightSphere shareholder and together both of you would like to receive only a single set of proxy materials, follow these instructions:

| |

| • | If your Ordinary Shares are registered in your own name, please contact our transfer agent, Computershare Trust Company, N.A., and inform them of your request by calling them at 1-866-281-0717 or writing them at Computershare Trust Company, N.A., P.O. BOX 30170, College Station, TX, 77842. |

| |

| • | If a broker or other nominee holds your Ordinary Shares, please contact the broker or other nominee directly and inform them of your request. Be sure to include your name, the name of your brokerage firm and your account number. |

Website publication of audit concerns

Under section 527 of the UK Companies Act 2006 (the “Act”), a shareholder or shareholders meeting the criteria set out in the following paragraphs have the right to request us to publish on our website a statement setting out any matter that such shareholders propose to raise at the Annual Meeting relating to the audit of our accounts.

Where we are required to publish such a statement on our website:

| |

| • | we may not require the shareholders making the request to pay any expenses incurred by us in complying with the request; |

| |

| • | we must forward the statement to our auditors no later than the time the statement is made available on our website; and |

| |

| • | the statement must be dealt with as part of the business of the Annual Meeting. |

The request (i) may be in hard copy form or in electric form, (ii) must either set out the statement in full or, if supporting a statement sent by another shareholder, clearly identify the statement which is being supported, (iii) must be authenticated by the person or persons making it, and (iv) must be received by us at least one week before the Annual Meeting.

In order to be able to exercise the shareholders’ right to require us to publish audit concerns, the relevant request must be made by either (a) a shareholder or shareholders having a right to vote at the Annual Meeting and holding at least 5% of our issued and outstanding Ordinary Shares, or (b) at least 100 shareholders having a right to vote at the Annual Meeting and holding, on average, at least £100 of paid up share capital.

Where a shareholder or shareholders wish to request us to publish audit concerns, such request must be made by either sending (a) a hard copy request which is signed by the relevant shareholder(s), stating their full name(s) and address(es) to BrightSphere Investment Group plc, Millennium Bridge House, 2 Lambeth Hill, London, England EC4V 4GG Attention: Company Secretary, or (b) a request which states the full name(s) and address(es) of the relevant shareholder(s) to info@bsig.com. Any e-mail addressed to us pursuant to sub-paragraph (b) above should be entitled “AGM—Shareholder Audit Concerns” in the subject line of the e-mail.

|

|

PROPOSAL 1—ELECTION OF DIRECTORS |

Our business and affairs are managed under the direction of our Board. On April 18, 2018, our Board accepted the recommendation of the Nominating and Corporate Governance Committee and voted to nominate Messrs. Stephen H. Belgrad, Robert J. Chersi, Suren S. Rana, James J. Ritchie and Guang Yang and Ms. Barbara Trebbi, for re-election at the Annual Meeting to serve as directors, until their respective successors have been elected and qualified. Each of the nominees is currently serving as a director of our Company. As of the date of this proxy statement, Kyle Prechtl Legg* is a Director of the Company, and a member of the Compensation Committee and Audit Committee.

Set forth below are the names of the nominees, their ages, their offices in the Company, if any, their principal past occupations or past employment, the length of their tenure as directors and the names of other companies in which such persons hold or have held directorships. Additionally, information about the specific experience, qualifications, attributes or skills that led to our Board’s conclusion at the time of filing of this proxy statement that each person listed below should serve as a director is set forth below. The biographical and other background information set forth below concerning each nominee for re-election as a director is as of April 17, 2018. Prior to the assignment of certain rights under the Shareholder Agreement (as defined below under “Corporate Governance”) from Old Mutual plc to HNA Eagle Holdco LLC (together with HNA Capital (U.S.) Holdings LLC, “HNA”) Mr. Yang was appointed by Old Mutual plc under the Shareholder Agreement as an OM plc Director (as defined in the Shareholder Agreement). After the assignment of the aforementioned rights under the Shareholder Agreement, Mr. Rana was appointed by HNA under the Shareholder Agreement pursuant to the assigned appointment rights.

The Directors currently determined to be independent by the Board are: Mses. Legg and Trebbi and Messrs. Chersi, Rana, Ritchie and Yang.

|

| | | | | |

| Name | | Age | | Position with the Company |

| Mr. Stephen H. Belgrad | | 55 |

| | President, Chief Executive Officer and Director |

| Mr. James J. Ritchie | | 63 |

| | Chairman of the Board |

| Mr. Robert J. Chersi | | 56 |

| | Director |

| Mr. Suren S. Rana | | 38 |

| | Director |

| Ms. Barbara Trebbi | | 52 |

| | Director |

| Dr. Guang Yang | | 54 |

| | Director |

Each of the six directors will be elected by way of a separate ordinary resolution. A shareholder may (i) vote for the election of a nominee for director, (ii) withhold their vote for the election of a nominee for director or (iii) abstain from voting for a nominee for director.

__________________

* In anticipation of future time commitments, Kyle Prechtl Legg will not stand for re-election at the Annual Meeting. Ms. Legg will serve on the Board until the conclusion of the Annual Meeting on June 19, 2018. Accordingly, Ms. Legg will resign from each of the Company's Audit Committee and Compensation Committee, effective as of the conclusion of the Annual Meeting. The Board wishes to thank Ms. Legg for her service as a Director for the entire duration of the Company’s existence as a public company, including for her roles on the Audit Committee and Compensation Committee (including as Chair of the Compensation Committee) and wishes her well in her future endeavors.

Unless a proxy contains instructions to the contrary, it is intended that the proxies will be voted FOR each of the separate resolutions relating to the re-election of each of the six nominees for director named above, to hold office until the 2019 annual general meeting of shareholders or until their respective successors are duly elected and qualified. We have no reason to believe that any of the nominees will not be available to serve as a director. However, if any nominee should become unavailable to serve for any reason, the proxies will be voted for such substitute nominees as may be designated by the Board.

|

|

| THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE RE-ELECTION OF ALL NOMINEES, AND PROXIES SOLICITED BY THE BOARD WILL BE VOTED IN FAVOR OF SUCH RE-ELECTION UNLESS A SHAREHOLDER INDICATES OTHERWISE ON THE PROXY. |

Stephen H. Belgrad is our President, Chief Executive Officer, a member of our Board and a member of our Executive Management Team. Mr. Belgrad has served on our Board since January 2018 and was appointed as our President and Chief Executive Officer, effective as of March 2, 2018. Before being appointed as the Company’s President, Chief Executive Officer and a Director of the Company, Mr. Belgrad was Executive Vice President, Chief Financial Officer and a member of the Executive Management Team of the Company. Mr. Belgrad held these positions since the Company’s initial public offering and has held comparable positions with BrightSphere Inc., where he also acts as director, since 2011. As Chief Financial Officer, Mr. Belgrad was responsible for the Company’s finance, investor relations, legal and IT/operations functions and jointly responsible for corporate development. From 2008 to May 2011, Mr. Belgrad was chief financial officer of HarbourVest Global Private Equity Limited (HVPE), a publicly-traded closed-end investment company. Mr. Belgrad previously was a vice president in the new investments group at Affiliated Managers Group, Inc., a publicly traded global asset management company, and, prior to that, senior vice president and treasurer at Janus Capital Group Inc., a publicly traded investment management firm. He began his career at Morgan Stanley & Co., a global financial services firm, where, over the course of 15 years, he held various positions in investment banking, corporate strategy and Morgan Stanley’s asset management division. Mr. Belgrad received a B.A. in economics from Princeton University and an M.B.A. from Harvard Business School.

Mr. Belgrad’s qualifications to serve on our Board include his extensive business, finance and leadership skills, as well as his deep knowledge of our Company. His extensive background in finance, strategy and M&A will provide valuable guidance to our Board on the strategic direction of the Company and the deployment of its financial resources.

James J. Ritchie has been a member of our Board since October 2014 and the Chair of our Board since October 30, 2015. Mr. Ritchie also served as our Interim President and CEO from July 1, 2017 to March 2, 2018. Mr. Ritchie served as a director of BrightSphere Inc. from January 2007 until October 2014 and as chairman and a member of the Audit and Risk Committee of the board of directors of BrightSphere Inc. from August 2007 until October 2014. Mr. Ritchie also has served as a member of the board and chairman of the audit committee of Kinsale Capital Group, Ltd. since January 2013 and as a member of the board and chairman of the audit committee of Old Mutual (Bermuda) Ltd. since February 2009. Mr. Ritchie began his career with PricewaterhouseCoopers LLP, an accounting firm. From 1986 through 2000, Mr. Ritchie held various positions with CIGNA Corporation, an insurance company, including chief financial officer of the company’s international division and head of its internal audit division. From 2001 until his retirement in 2003, Mr. Ritchie served as managing director and chief financial officer of White Mountains Insurance Group, Ltd.’s OneBeacon Insurance Company, a specialty insurance company, and as the group chief financial officer for White Mountains Insurance Group, Ltd., a financial services holding company. Mr. Ritchie’s former board experience includes: member of the board and chairman of the audit committee of Ceres Group, Inc.; member and non-executive chairman of the board and member of the compensation committee of Fidelity & Guaranty Life Insurance Company (formerly Old Mutual Financial

Life Insurance Company, Inc.); member of the board and member of the audit and compensation committees of KMG America Corporation; member of the board, chairman of the audit committee and member of the compensation committee of Lloyd’s Syndicate 4000; and member and non-executive chairman of the board and former chairman of the audit committee of Quanta Capital Holdings Ltd. Mr. Ritchie is a member of the National Association of Corporate Directors and the American Institute of Certified Public Accountants. Mr. Ritchie received a B.A. in economics with honors from Rutgers College and an M.B.A. from Rutgers Graduate School of Business Administration.

Mr. Ritchie’s qualifications to serve on our Board include his extensive background in finance, substantial board experience, strategic and operational leadership and wide-ranging knowledge of operational, risk and control initiatives. His extensive background in strategy, finance and M&A will provide valuable guidance to our Board on the strategic direction of the Company, the deployment of its financial resources and the execution of its M&A objectives.

Robert J. Chersi has been a member of our Board since March 2016. Mr. Chersi has been with Pace University since 2013, currently serving as the Executive Director for its Center for Global Governance, Reporting & Regulation, as well as an adjunct professor in its Department of Finance & Economics. In addition, since 2013, Mr. Chersi has served as the Helpful Executive in Reach (HEIR) in the Department of Accounting and Information Systems at Rutgers University, and has acted in an advisory capacity to financial services industry clients as an individual as well as through Chersi Services LLC, which he founded in 2014. Prior to joining Pace, Mr. Chersi was a member of the Executive Committee and Chief Financial Officer of Financial Services at Fidelity Investments in Boston, from 2008 to 2012. While at Fidelity, as CFO Mr. Chersi led the finance, compliance, risk management, business consulting and strategic new business development functional organizations. From 1988 to 2008, Mr. Chersi served in numerous positions at UBS AG, including CFO of U.S. Wealth Management and Deputy CFO of Global Wealth Management and Business Banking. Mr. Chersi had several executive leadership positions while at UBS, including service on the UBS AG Group Managing Board from 2004 to 2008, which played an important role in developing and implementing the firm’s direction, values and principles and in promoting its global culture. He began his career as an audit manager in the Financial Service Practice of KPMG LLP in 1983. Mr. Chersi currently serves as a member of the Advisory Board of the Pace University Lubin School of Business, and has previously been a member of the Board, Audit Committee and Risk Committee of UBS Bank USA, a member of the Board of PW Partners R&D III, Chairman of the Board of Trustees of the UBS USA Foundation, a member of the Board of Bon Secours New Jersey/St. Mary’s Hospital Foundation, and a Trustee of Fidelity Investments’ Political Action Committee. Mr. Chersi also currently serves as a member of the Board of Trustees of Thrivent Funds. He has held the Certified Public Accountant designation, and is a 1983 graduate of Pace University, where he earned a BBA in Accounting, summa cum laude.

Mr. Chersi’s qualifications to serve on our Board include his extensive experience in the financial services industry and deep knowledge of corporate governance, financial reporting and regulatory compliance. In addition, his background in risk management, business consulting and strategic business development will further enhance our Board’s proficiency.

Suren S. Rana has been a member of our Board since November 2017. Mr. Rana is the Chief Investment Officer at HNA Capital International with primary responsibility to invest in high quality companies and facilitate their continued success and growth. Mr. Rana's team has led several investments in the United States on behalf of HNA Group. Mr. Rana has been involved in the financial services sector for more than fourteen years. Prior to joining HNA in September 2016, he served as an investment banker at UBS from November 2015 to August 2016, Royal Bank of Canada from September 2011 to November 2014 and Merrill Lynch where he advised clients on M&A, IPOs, financings and other strategic matters. He also served as a Principal at Och-Ziff Capital’s private equity affiliate, Equifin Capital

Partners, from September 2008 to September 2011 where he led control investments in the financial services sector. Mr. Rana began his career at GE Capital with responsibilities in credit risk management and audit. Mr. Rana holds a bachelor’s degree from the University of Delhi, a graduate degree from the Indian Institute of Management Ahmedabad and an MBA from Harvard Business School.

Mr. Rana’s qualifications to serve on our Board include his extensive investment and financial knowledge, particularly relating to financial services companies. His experience with regard to M&A, financing and other strategic matters provides valuable insight to the Board.

Barbara Trebbi has been a member of our Board since January 2018. Ms. Trebbi was a General Partner and co-managing partner at Mercator Asset Management, L.P. (“Mercator”) until October 2017. At Mercator, which she joined in 2000, she was a senior member of the investment team, with a focus on international equities, in particular, continental European investments, as well as Asia and other emerging markets. Her clients included a wide range of institutional investors and sub-advisory accounts. Ms. Trebbi started her career in 1988 as an international equity research analyst at Mackenzie Investment Management Inc., and progressed over 12 years to become head of international equities. She has over 30 years of international investment experience. Ms. Trebbi is a Chartered Financial Analyst, a member of the CFA Institute, and also is a member of the CFA Society of South Florida, where she served as President from 1994 to 1995. She also serves on a number of non-profit boards related to primary, secondary and higher education. She has a Graduate Diploma from the London School of Economics and Political Science and a B.S. degree from the University of Florida.

Ms. Trebbi’s qualifications to serve on our Board include her deep investment experience, with a particular emphasis on international investments. This experience, combined with extensive knowledge of the institutional and sub-advisory markets will allow her to provide valuable insight to our Board.

Guang Yang has been a member of our Board since May 2017. Dr. Yang is the CEO of HNA Capital International, which he joined in January 2016 and the Founder and Chairman of Finergy Capital, a Beijing-based private equity fund, since October 2010. Dr. Yang is also a former CEO of Finergy Capital. Dr. Yang previously spent 15 years as an Executive Vice President, Senior Portfolio Manager and Research Analyst at Franklin Templeton Investments Global Equities. He also served as the Chairman for Franklin Templeton China. Prior to joining Franklin Templeton Investments, he worked as a Research Scientist at Harvard Medical School and at Massachusetts General Hospital. Dr. Yang holds a B.S. from the University of Science and Technology of China, a Ph.D. in Neuroscience from Australian National University and an MBA from Harvard Business School. Dr. Yang is also a Chartered Financial Analyst (CFA) charterholder.

Dr. Yang’s qualifications to serve on our Board include his extensive leadership, investment and financial knowledge as well as his extensive experience at HNA. His experience with regard to M&A, financing, strategy and leadership within the financial services industry will provide valuable insight to the Board.

CORPORATE GOVERNANCE

Director Independence

Our business and affairs are managed under the direction of our Board. Our Board has an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. As discussed under “Certain Relationships and Related Party Transactions—Relationship with OM plc, OMGUK and HNA—Shareholder Agreement,” pursuant to a Shareholder Agreement we entered into with OM plc and OM Group (UK) Ltd. (“OMGUK”) dated September 29, 2014 (the “Shareholder Agreement”), OM plc had the right to appoint certain of our directors to the Board and the right to increase the size of our Board from seven to nine directors. As previously disclosed, on March 25, 2017, OM plc announced that it had agreed to sell a 24.95% shareholding in us to HNA in a two-step transaction (the “HNA Minority Sale”). The HNA Minority Sale comprised a sale of an aggregate of 24.95% of our Ordinary Shares. The second tranche of the HNA Minority Sale closed on November 10, 2017. In connection with the closing of the second tranche of the HNA Minority Sale, OM plc assigned to HNA certain of its assignable rights under the Shareholder Agreement, including the right to designate two directors to our Board. Pursuant to the Shareholder Agreement, HNA will continue to have the right to appoint up to two directors until it ceases to own at least 20% of the Company's outstanding ordinary shares and the right to appoint one director if it owns between 20% and 7% of the Company's outstanding ordinary shares. As previously reported, Guang Yang, CEO of HNA Capital International, joined the Board of Directors on May 24, 2017 and Suren Rana, Chief Investment Officer at HNA Capital International, joined the Board on November 15, 2017, each as an appointee of HNA.

Prior to May 12, 2017, because OM plc, through OMGUK, indirectly owned a majority of our Ordinary Shares, we were a “controlled company” for purposes of the NYSE Rules. While we were a controlled company, we utilized the exemptions from the requirements of the NYSE Rules that a majority of our directors be independent and our Compensation Committee and our Nominating and Corporate Governance Committee consist solely of independent directors. As of May 12, 2017, OM plc no longer owned a majority of the Company's outstanding Ordinary Shares and there is no one beneficial holder who owns a majority of the outstanding Ordinary Shares. As such, we are no longer a controlled company and our Board is required to consist of a majority of independent directors by the one-year anniversary of the status change. Our Board has consisted of a majority of independent directors since June 30, 2017. The Nominating and Corporate Governance Committee of our Board has consisted entirely of independent directors since July 24, 2017 and the Compensation Committee of our Board has consisted entirely of independent directors since May 19, 2017. Our Board has determined that Ms. Legg, Ms. Trebbi and Messrs. Chersi, Rana, Ritchie and Yang are independent under the NYSE Rules. Mr. Ritchie was not deemed to be an independent director during his tenure as Interim Chief Executive Officer, but is deemed to be independent following his term as Interim Chief Executive Officer.

Committees of the Board and Meetings

Meeting Attendance

During the fiscal year ended December 31, 2017, there were 14 formal meetings of the Board, and the various committees of the Board met a total of 34 times (13 Audit Committee meetings, 11 Nominating and Corporate Governance Committee meetings and 10 Compensation Committee meetings). In addition, during the fiscal year ended December 31, 2017, the Board acted by written consent three times. No director, including any alternate director appointed pursuant to the Company’s Articles of Association, attended fewer than 75% of the total number of meetings of the Board and of committees of the Board on which he or she served during fiscal year 2017. The Board has adopted a policy under which each member of the Board is expected to attend, in person or telephonically, each annual general meeting of our shareholders absent exigent circumstances that prevent their attendance. All directors were in attendance, either in person or telephonically, at our 2017 Annual General Meeting.

Audit Committee

Our Audit Committee met 13 times during fiscal year 2017. The Audit Committee is currently composed of Ms. Legg and Messrs. Chersi and Rana, and Mr. Chersi is the Chair. John Rogers, who is not standing for reelection this year, served as a member of the Audit Committee until January 31, 2018. On December 7, 2017, Mr. Rana was appointed as a member of the Audit Committee. The Board has determined that each member of the Audit Committee meets the independence requirements of Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the NYSE Rules and is “financially literate” as such term is defined in the NYSE Rules. In addition, our Board has determined that each member of the Audit Committee is an “audit committee financial expert” within the meaning of SEC regulations and the NYSE Rules.

The Audit Committee has a charter that sets forth the Audit Committee’s purpose and responsibilities, which include (i) assisting the Board in fulfilling its oversight responsibilities over the financial reports and other financial information filed with the SEC, (ii) recommending to the Board the appointment of our independent auditors and evaluating their independence, (iii) reviewing our audit procedures and controls, and (iv) overseeing our internal audit function and risk and compliance function. Please also see the report of the Audit Committee set forth elsewhere in this proxy statement.

A copy of the Audit Committee’s written charter is publicly available on our website at www.bsig.com.

Compensation Committee

Our Compensation Committee met 10 times during fiscal year 2017. The Compensation Committee is currently composed of Ms. Legg and Messrs. Chersi and Yang. Mr. Chersi is the acting Chair of our Compensation Committee. Former directors Stuart Bohart and Donald Schneider served as members of the Compensation Committee until May 19, 2017. On June 23, 2017, Mr. Chersi was appointed as a member of the Compensation Committee. On June 30, 2017, Mr. Yang was appointed as a member of the Compensation Committee. Mr. Rogers served as a member of the Compensation Committee until January 31, 2018. Our Board has determined that each member of the Compensation Committee is independent under NYSE Rules. The Compensation Committee of our Board has consisted entirely of independent directors since May 19, 2017.

The Compensation Committee has a charter that sets forth the Compensation Committee’s purpose and responsibilities, which include annually reviewing and approving the compensation of our executive officers and reviewing and making recommendations with respect to our equity incentive plans.

The Compensation Committee’s processes and procedures for the consideration and determination of executive compensation as well as disclosure regarding the role of the Company’s compensation consultant are set forth below in “Compensation Discussion and Analysis.”

A copy of the Compensation Committee’s written charter is publicly available on our website at www.bsig.com.

Please also see the report of the Compensation Committee set forth elsewhere in this proxy statement.

Directors’ Remuneration Reports

Under Section 385 of the Act, we are required to produce a directors’ remuneration report for each fiscal year. For this Annual Meeting, our Directors’ remuneration report includes an annual report on remuneration for 2017, and on how the current policy will be implemented in the next financial year. The Directors’ remuneration report is subject to an annual advisory shareholder vote. At our 2017 annual general meeting of shareholders, our shareholders approved our directors’ remuneration policy, which is subject to a binding shareholder vote at least once every three years. You may find a copy of our directors’ remuneration policy attached to our 2017 proxy statement, filed on April 3, 2017. The Act requires that remuneration payments to executive directors of the Company and payments to them for loss of office must be consistent with the approved directors’ remuneration policy or, if not, must be specifically approved by the shareholders at a general meeting.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee met 11 times during fiscal year 2017. The Nominating and Corporate Governance Committee is currently composed of Ms. Trebbi and Messrs. Chersi and Yang. Following the departure of Mr. Rogers, the Board of Directors has not yet named a Chair of our Nominating and Corporate Governance Committee. Our Board has determined that Ms. Trebbi and Messrs. Chersi and Yang are independent under the NYSE Rules. The Nominating and Corporate Governance Committee of our Board has consisted entirely of independent directors since July 24, 2017. On April 18, 2018, Ms. Trebbi was appointed as a member of the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee has a charter that sets forth the Committee’s purpose and responsibilities, which include reviewing and recommending nominees for election as directors, assessing the performance of our directors, reviewing Corporate Governance Guidelines for our Company and reviewing and recommending for approval to the non-interested directors of the Board, the directors’ remuneration on a biennial basis.

Under our current corporate governance policies, the Nominating and Corporate Governance Committee may consider director candidates recommended by shareholders as well as from other sources, such as other directors or officers, third party search firms or other appropriate sources. For all potential candidates, the Nominating and Corporate Governance Committee may consider all factors it deems relevant, such as a candidate’s integrity, personal and professional reputation, experience and expertise, business judgment, ability to devote time, possible conflicts of interest, concern for the long-term interests of the shareholders, independence, range of backgrounds and experience and the extent to which the candidate would fill a present need on the Board. In general, persons recommended by shareholders will be considered on the same basis as candidates from other sources. If a shareholder wishes to nominate a candidate for director who is not to be included in our proxy statement, it must follow the procedures described in our Articles and in “Shareholder Proposals and Nominations For Director” at the end of this proxy statement.

Although the Nominating and Corporate Governance Committee does not have a formal policy with regard to diversity, the Nominating and Corporate Governance Committee considers a broad range of backgrounds and experiences as well as gender, ethnic and other forms of diversity when selecting potential nominees for membership on the Board.

A copy of the Nominating and Corporate Governance Committee’s written charter is publicly available on the Company’s website at www.bsig.com.

Executive Sessions of Non-Employee Directors

In accordance with the NYSE Rules and our Corporate Governance Guidelines, our Non-Employee Directors meet in regularly scheduled executive sessions without management present. The Chair of these executive sessions is an informal position and no one director has been chosen to preside as Chair over all of these executive sessions. Each session is presided over by one of the directors as the participants of the particular executive session so determine.

Board Leadership Structure and Role in Risk Oversight

Mr. Belgrad serves as our President and Chief Executive Officer and Mr. Ritchie currently serves as the Chairman of our Board. From July 1, 2017 until March 2, 2018, Mr. Ritchie served as our Interim Chief Executive Officer. The Board has no set policy with respect to the separation of the offices of Chairman and the Chief Executive Officer; provided, however, it is the Board’s practice to separate such offices absent extreme and unforeseen circumstances. The Board believes that this issue is part of the succession planning process and that it is in the best interest of our Company for the Board to make a particular determination from time to time given the circumstances.

The Board oversees the business and affairs of our Company including all aspects of risk, which includes risk assessment, risk appetite and risk management, focusing on, among other things, major strategic risks (e.g. acquisitions and dispositions, Affiliate investment performance and Affiliate relationships). In executing its risk oversight function, the Board has delegated to the Audit Committee the direct oversight over risk functions. However, the Audit Committee is not responsible for day to day management of risk. The Audit Committee reviews and subsequently reports to the Board any issues which arise with respect to the performance of our risk function including operational risks and risks relating to the quality or integrity of our financial statements. The Audit Committee also, at least annually, reviews our policies with respect to risk assessment, risk appetite and risk management.

Website Availability of our Corporate Governance Guidelines

A copy of our Corporate Governance Guidelines is publicly available on the Company’s website at www.bsig.com.

Compensation Committee Interlocks and Insider Participation

The members of the Compensation Committee during fiscal year 2017 are set forth above under “—Compensation Committee.” No member of the Compensation Committee was, during fiscal year 2017, or previously, an officer or employee of BrightSphere. No executive officer of the Company serves on the compensation committee or board of directors of another company that has an executive officer that serves on our Compensation Committee or Board.

Shareholder and Other Interested Party Communications to the Board

Generally, shareholders and other interested parties who have questions or concerns should contact our Investor Relations department at (617) 369-7300. However, any shareholders or other interested parties who wish to address questions regarding our business directly with the Board, or any individual director, should direct his or her questions in writing to the Board of BrightSphere at Millennium Bridge House, 2 Lambeth Hill, London, England EC4V 4GG. Communications will be distributed to the Board, or to any individual director or directors as appropriate, depending on the facts and circumstances outlined in the communications. Shareholders and other interested parties may communicate directly with the Company’s Non-Employee Directors by sending a letter addressed to the attention of the NEDs of BrightSphere, Millennium Bridge House, 2 Lambeth Hill, London, England EC4V 4GG.

Items that are unrelated to the duties and responsibilities of the Board may be excluded, such as:

| |

| • | junk mail and mass mailings; |

| |

| • | resumes and other forms of job inquiries; |

| |

| • | solicitations or advertisements. |

In addition, any material that is unduly hostile, threatening, or illegal in nature may be excluded, provided that any communication that is filtered out will be made available to any non-employee director upon request.

|

|

| PROPOSAL 2—RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

The Audit Committee has appointed KPMG as our independent registered public accounting firm, to audit our financial statements for the fiscal year ending December 31, 2018. The Board proposes that the shareholders ratify this appointment. KPMG audited our financial statements for the fiscal year ended December 31, 2017. We expect that representatives of KPMG will be present at the Annual Meeting, will be able to make a statement if they so desire, and will be available to respond to appropriate questions.

In deciding to appoint KPMG, the Audit Committee reviewed auditor independence issues and existing commercial relationships with KPMG and concluded that KPMG has no commercial relationship with the Company that would impair its independence for the fiscal year ending December 31, 2018.

The following table presents fees for professional audit services rendered by KPMG for the audit of our annual financial statements for the years ended December 31, 2017, and December 31, 2016, and fees billed for other services rendered by KPMG during those periods.

|

| | | | | | | | |

| Type of Fee | | 2017 | | 2016 |

Audit fees(1) | | $ | 3,253,840 |

| | $ | 2,898,450 |

|

Audit related fees(2) | | 425,650 |

| | 485,900 |

|

Tax fees(3) | | 58,590 |

| | 35,000 |

|

| All other fees | | — |

| | — |

|

| Total | | $ | 3,738,080 |

| | $ | 3,419,350 |

|

| |

| (1) | Audit fees consisted of audit work performed in the preparation of financial statements, as well as work generally only the independent registered public accounting firm can reasonably be expected to provide, such as statutory audits. |

| |

| (2) | Audit related fees consisted principally of audits of employee benefit plans, and special procedures related to regulatory filings. |

| |

| (3) | Tax fees consisted principally of assistance with matters related to domestic and international tax compliance and reporting. |

Audit Committee Pre-Approval Policies and Procedures

Subject to any necessary approvals required from our shareholders pursuant to the Act, the Audit Committee has the sole authority to approve the scope, fees and terms of all audit engagements, as well as all permissible non-audit engagements of the independent registered public accounting firm (together with the U.K. statutory auditor, the “External Auditor”). Consistent with SEC policies regarding auditor independence, the Audit Committee has responsibility for appointing, setting compensation and overseeing the work of the External Auditor. The Audit Committee pre-approves all audit and permissible non-audit services to be performed for us by the External Auditor. These services may include audit services, audit-related services, tax services and other services. On an annual basis, the Audit Committee considers whether the provision of non-audit services by our External Auditor, on an overall basis, is compatible with maintaining the External Auditor’s independence from management.

In addition to the pre-approval procedures described immediately above, the Audit Committee has adopted a written Pre-Approval Policy for Non-Audit Services Provided by External Accounting Firms (the

“Non-Audit Services Policy”). Under the Non-Audit Services Policy, the Audit Committee must pre-approve the provision of non-audit services to be performed for us by any external accounting firm, subject to a de minimis threshold. Requests for non-audit services to be performed for us by an external accounting firm are submitted to the Chair of the Audit Committee via written request. The Chair of the Audit Committee reviews the request with the other members of the Audit Committee and the Audit Committee determines whether to approve the request. The Non-Audit Services Policy sets forth certain non-audit services prohibited to be performed by external accounting firms.

In the event the shareholders do not ratify the appointment of KPMG as our independent registered public accounting firm, the Audit Committee will reconsider its appointment.

The affirmative vote of a majority of the Ordinary Shares cast at the Annual Meeting is required to ratify the appointment of the independent registered public accounting firm.

|

|

| THE BOARD UNANIMOUSLY RECOMMENDS A VOTE TO RATIFY THE APPOINTMENT OF KPMG AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE YEAR ENDING DECEMBER 31, 2018, AND PROXIES SOLICITED BY THE BOARD WILL BE VOTED IN FAVOR OF SUCH RATIFICATION UNLESS A SHAREHOLDER INDICATES OTHERWISE ON THE PROXY. |

|

|

PROPOSAL 3—APPOINTMENT OF KPMG AS THE COMPANY’S U.K. STATUTORY AUDITORS UNDER THE U.K. COMPANIES ACT 2006 (TO HOLD OFFICE UNTIL THE CONCLUSION OF THE NEXT ANNUAL GENERAL MEETING AT WHICH ACCOUNTS ARE LAID BEFORE THE SHAREHOLDERS). |

Under section 489 of the Act, for each financial year for which U.K. statutory auditors are to be appointed, the U.K. statutory auditors must be appointed before the end of the general meeting at which the annual report and accounts are presented to shareholders. If this proposal does not receive the affirmative vote of the holders of a majority of the Ordinary Shares entitled to vote and present in person or represented by proxy at the Annual Meeting, the Board may appoint an auditor to fill the vacancy.

|

|

| THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE APPOINTMENT OF KPMG AS OUR U.K. STATUTORY AUDITORS UNDER THE U.K. COMPANIES ACT 2006 (TO HOLD OFFICE UNTIL THE CONCLUSION OF THE NEXT ANNUAL GENERAL MEETING AT WHICH ACCOUNTS ARE LAID BEFORE THE SHAREHOLDERS), AND PROXIES SOLICITED BY THE BOARD WILL BE VOTED IN FAVOR OF SUCH APPOINTMENT UNLESS A SHAREHOLDER INDICATES OTHERWISE ON THE PROXY. |

|

|

PROPOSAL 4—AUTHORIZATION OF THE BOARD TO DETERMINE THE COMPANY’S U.K. STATUTORY AUDITOR’S REMUNERATION |

Under section 492 of the Act, the remuneration of a U.K. statutory auditor appointed by the shareholders must be fixed by the shareholders by ordinary resolution or in such manner as the shareholders may by ordinary resolution determine. We are asking our shareholders to authorize, by way of ordinary resolution, our Board to determine KPMG’s remuneration as our U.K. statutory auditor.

|

|

| THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE AUTHORIZATION OF THE BOARD TO DETERMINE OUR U.K. STATUTORY AUDITOR’S REMUNERATION AND PROXIES SOLICITED BY THE BOARD WILL BE VOTED IN FAVOR OF SUCH APPOINTMENT UNLESS A SHAREHOLDER INDICATES OTHERWISE ON THE PROXY. |

REPORT OF AUDIT COMMITTEE

The Audit Committee currently consists of Ms. Legg and Messrs. Chersi and Rana and Mr. Chersi is the Chair. Mr. Rogers served as a member of the Audit Committee until January 31, 2018. On December 7, 2017, Mr. Rana was appointed as a member of the Audit Committee. The Board has determined that each member of the Audit Committee meets the independence requirements of Rule 10A-3 under the Exchange Act and the NYSE Rules and is “financially literate” as such term is defined in the NYSE Rules. In addition, the Board has determined that each member of the Audit Committee is an “audit committee financial expert” within the meaning of SEC regulations and the NYSE Rules. The Audit Committee held 13 meetings during the fiscal year ended December 31, 2017.

The Audit Committee assists the Board in fulfilling its oversight responsibilities of the financial reports and other financial information filed with the SEC and/or Companies House, recommends to the Board the appointment of BrightSphere’s independent auditors and evaluates their independence, reviews BrightSphere’s financial reporting procedures and controls, and oversees BrightSphere’s internal audit, risk and compliance functions. The Audit Committee’s role and responsibilities are set forth in the Audit Committee Charter adopted by the Board, which is available on BrightSphere’s website at www.bsig.com. The Audit Committee reviews and reassesses its charter annually and recommends any changes to the Board for approval. The Audit Committee is responsible for overseeing BrightSphere’s overall financial reporting process, and for the appointment, compensation, retention, and oversight of the work of the Company’s external auditor. In fulfilling its responsibilities for the financial statements for fiscal year 2017, the Audit Committee took the following actions:

| |

| • | Reviewed and discussed the audited financial statements for the fiscal year ended December 31, 2017 with management and KPMG, our independent registered public accounting firm; |

| |

| • | Discussed with KPMG the matters required to be discussed in accordance with Auditing Standard No. 16—Communications with Audit Committees; |

| |

| • | Received written disclosures and a letter from KPMG regarding its independence as required by applicable requirements of the Public Company Accounting Oversight Board (the “PCAOB”) regarding KPMG communications with the Audit Committee and the Audit Committee further discussed with KPMG its independence. The Audit Committee also considered the status of pending litigation, taxation matters and other areas of oversight relating to the financial reporting and the audit process that the Audit Committee determined appropriate; |

| |

| • | Discussed with KPMG, as BrightSphere’s U.K. statutory auditor, the conformity of BrightSphere’s financial statements with the requirements of the U.K. Companies Act 2006; |

| |

| • | Discussed with KPMG, as BrightSphere’s U.K. statutory auditor, the matters that are required to be discussed under the U.K. Companies Act 2006; |

| |

| • | Discussed with KPMG the independence of KPMG from BrightSphere and its management and concluded that KPMG is independent; |

| |

| • | Reviewed and discussed with management and KPMG the significant accounting policies applied by BrightSphere in its financial statements. |

Management also reports to the Audit Committee and the Board of Directors regarding enhancements made to our risk management processes and controls in light of evolving market, business, regulatory and other conditions, including those related to privacy and cyber security.

BrightSphere’s management is responsible for the financial reporting process, for the preparation, presentation and integrity of financial statements in accordance with generally accepted accounting principles in the United States and for the establishment and effectiveness of BrightSphere’s internal controls and procedures designed to assure compliance with accounting standards and laws and regulations. BrightSphere’s independent auditors are responsible for auditing those financial statements in accordance with generally accepted auditing standards, attesting to the effectiveness of BrightSphere’s internal control over financial reporting and expressing an opinion as to whether those audited financial statements fairly present, in all material respects, the financial position, results of operation and cash flows of BrightSphere in conformity with generally accepted accounting principles in the United States. The Audit Committee monitors and reviews these processes. Members of the Audit Committee rely without independent verification on the information provided to them and on the representations made by management and BrightSphere’s independent auditors. Accordingly, the Audit Committee’s oversight does not provide an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the Audit Committee’s review and discussions referred to above do not assure that the audit of the Company’s financial statements has been carried out in accordance with the standards of the PCAOB, that the financial statements are presented in accordance with generally accepted accounting principles in the United States or that KPMG is in fact “independent.”

The Audit Committee evaluates the independent auditor’s qualifications, performance and independence, including the performance of the independent auditor’s lead partner, taking into consideration the opinions of management and the Company’s internal auditors. The Audit Committee and its Chair ensure the rotation of the lead partner and the audit partner responsible for reviewing the audit to the extent required by law, are directly involved in the selection of the new lead partner and the audit partner responsible for reviewing the audit and consider whether regular rotation of the audit firm is necessary or appropriate to ensure continuing auditor independence. The Audit Committee reports on its evaluation and conclusions, and any actions taken pursuant thereto, to the Board. The Audit Committee and the Board believe that the retention of KPMG as the Company’s independent auditor for the year ending December 31, 2018 is in the best interests of the Company and its shareholders. Based on this evaluation, the Audit Committee decided to retain KPMG to serve as independent auditors for the year ending December 31, 2018. In considering the retention of KPMG, the Audit Committee considers, among other things, the quality of the services provided, KPMG’s capability and knowledge in the industry, tenure as the Company’s auditor and knowledge of the Company and its operations. Under the Audit Committee Charter, subject to any necessary approvals required from the Company’s shareholders pursuant to the Act, the Audit Committee has the authority to appoint the independent auditor.

KPMG has acted as the Company’s independent registered public accounting firm continuously since the Company’s inception.

Based on the Audit Committee’s review of the audited financial statements and discussions with management and KPMG, the Audit Committee recommended to the Board that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2017 for filing with the SEC.

|

| |

| | Members of the BrightSphere Audit Committee Robert J. Chersi (Chair) Kyle Prechtl Legg Suren S. Rana |

COMPENSATION COMMITTEE REPORT

The Compensation Committee of our Board has reviewed and discussed the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K, which appears elsewhere in this proxy statement, with our management. Based on this review and discussion, the Compensation Committee has recommended to the Board that the Compensation Discussion and Analysis be included in our proxy statement and incorporated into BrightSphere’s Annual Report on Form 10-K.

|

| |

| | Members of the BrightSphere Investment Group plc Compensation Committee Robert Chersi (Acting Chair) Kyle Prechtl Legg Guang Yang |

Introduction

We welcome the opportunity to provide information on the material components of our compensation programs. BrightSphere Investment Group plc is subject to disclosure requirements in the U.S. and U.K., and as a result, the disclosure is provided in two parts. The information contained in this section of the Proxy Statement constitutes the Compensation Discussion and Analysis (“CD&A”), as required by the SEC, and provides information on our named executive officers (“NEOs”) who are employed by BrightSphere Inc., a wholly-owned subsidiary of Brightsphere Investment Group plc. Additionally, Appendix A contains the BrightSphere Investment Group plc Remuneration Report as required in the U.K. by the Enterprise and Regulatory Reform Act of 2013 and The Large and Medium-Sized Companies and Groups (Accounts and Reports) (amendment) Regulations 2013, and provides information on both the Executive Director and Non-Executive Directors (“NEDs”).

The following discussion and analysis of compensation arrangements of our NEOs for 2017 should be read together with the compensation tables and related disclosures set forth below.

This CD&A focuses on our NEOs for 2017 who are our Chief Executive Officers (“CEO”), Chief Financial Officer (“CFO”), and remaining three executive officers:

| |

| • | James J. Ritchie, Interim CEO from July 1, 2017 until March 2, 2018 |

| |

| • | Peter L. Bain, President and Chief Executive Officer until June 30, 2017 |

| |

| • | Stephen H. Belgrad, Executive Vice President and Chief Financial Officer until March 2, 2018 and CEO as of March 2, 2018 |

| |

| • | Linda T. Gibson, Executive Vice President and Head of Global Distribution until December 31, 2017 |

| |

| • | Aidan J. Riordan, Executive Vice President and Head of Affiliate Management |

| |

| • | Christopher Hadley, Executive Vice President and Chief Talent Officer |

Our CD&A is presented in the following sections:

| |

| • | Summary of Executive Compensation Governance Practices |

| |

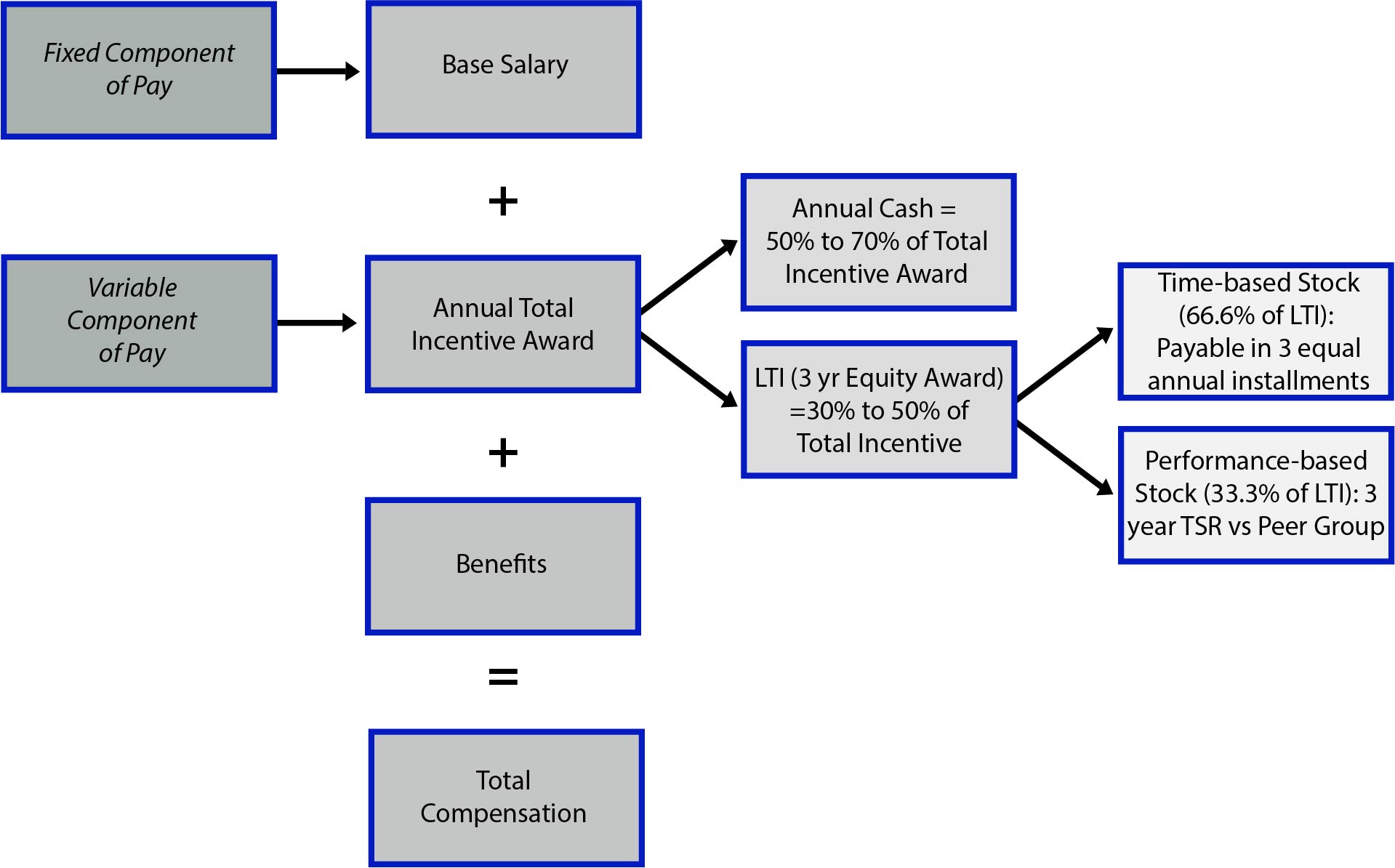

| • | Our Executive Compensation Governance provides a summary of our Executive Compensation program along with subsections containing information on: |

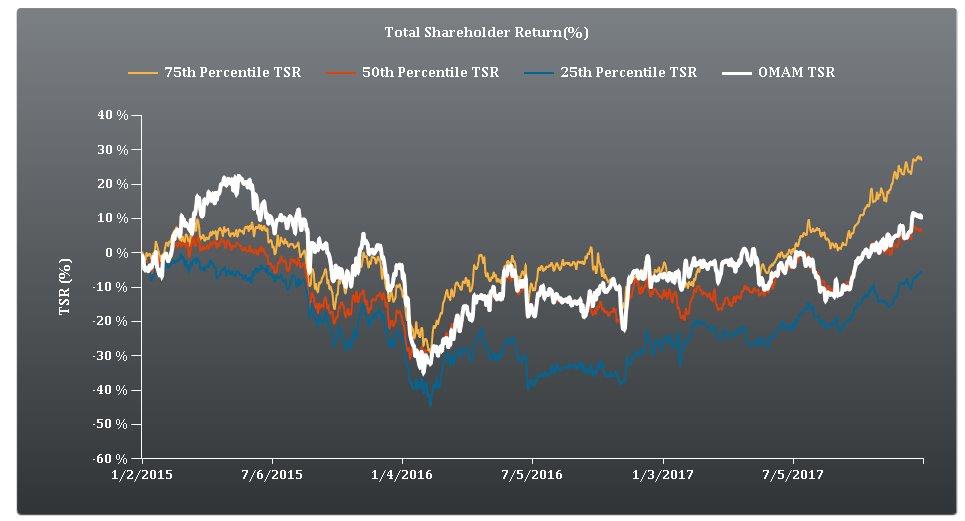

| |