CORSAIR OPPORTUNITY FUND

(a Delaware Statutory Trust)

Notes to Financial Statements (continued)

September 30, 2016

therefore, a portion of the Incentive Fee, if any, would be payable to the Adviser) up to twelve times each fiscal year. For purposes of determining the Fund’s net asset value, the Incentive Fee is calculated and accrued daily as an expense of the Fund (as if each day is the end of the Fund’s fiscal year).

The Incentive Fee will be payable for a Fiscal Period only if there is no positive balance in the Fund’s loss carryforward account. The loss carryforward account is an account that is credited as of the end of each Fiscal Period with the amount of any net loss of the Fund for that Fiscal Period and will be debited with the amount of any net profits of the Fund for that Fiscal Period, as applicable. This is sometimes known as a “high water mark.”

Unlike a traditional high water mark incentive fee structure, the Incentive Fee is paid based on a loss carryforward account for the Fund as a whole and not loss carryforward accounts for each individual shareholder. This means that a shareholder is subject to the Incentive Fee as reflected in the net asset value of his or her shares, so long as the Fund did not have a positive balance in its loss carryforward account and had positive net profits at the end of a Fiscal Period.

As of September 30, 2016, there was no incentive fee payable by the Fund. During the period ended September 30, 2016, no Incentive Fee was paid to the Adviser.

Each Independent Trustee receives an annual retainer of $10,000 plus reimbursement of reasonable out-of-pocket expenses. Trustees that are not Independent Trustees do not receive any annual or other fee from the Fund. The officers of the Fund serve without compensation.

5. ADMINISTRATION AND CUSTODY AGREEMENT

UMB Fund Services, Inc., serves as administrator (the “Administrator”) to the Fund and provides certain accounting, administrative, record keeping and investor related services. The Fund pays a monthly fee to the Administrator based upon average net assets, subject to certain minimums.

UMB Bank, N.A. (the “Custodian”), an affiliate of the Administrator, serves as the primary custodian of the assets of the Fund, and may maintain custody of such assets with U.S. and non-U.S. sub-custodians, securities depositories and clearing agencies.

6. INVESTMENT TRANSACTIONS

For the period ended September 30, 2016, total long-term purchases and sales amounted to $5,622,370 and $5,844,260, respectively. The total securities sold short and covered amounted to $356,893 and $232,491, respectively.

7. INDEMNIFICATION

In the normal course of business, the Fund enters into contracts that provide general indemnifications. The Fund’s maximum exposure under these agreements is dependent on future claims that may be made against the Fund, and therefore cannot be established; however, the Fund expects the risk of loss from such claims to be remote.

8. RISK FACTORS

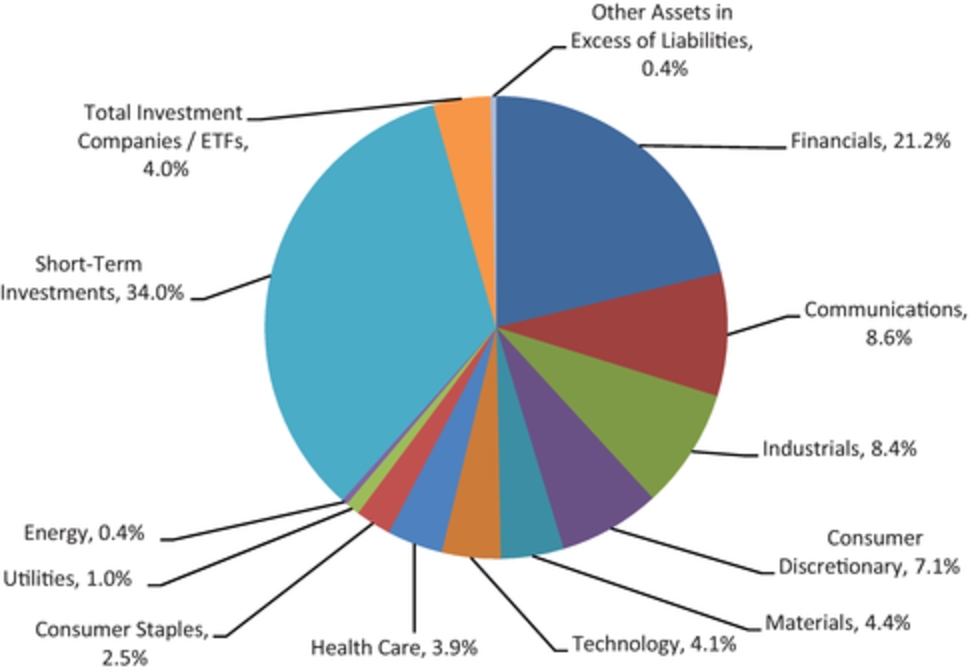

The Fund is subject to substantial risks, including general economic and market condition risks, liquidity risks and non-diversification risks. A further discussion of the risks associated with an investment in the Fund is provided in the Fund’s Prospectus and Statement of Additional Information.

Risk of Equity Securities: The Fund primarily invests in publicly-traded “equity securities,” which, for these purposes, means common and preferred stocks (including initial public offerings or “IPOs”), convertible securities, stock options (covered call and put options), warrants and rights. Thus, the value of the Fund’s portfolio will be affected by daily movements in the prices of equity securities. These price movements may result from factors affecting individual companies, industries or the securities markets as a whole. Individual companies may report poor