Exhibit (c)(1)

| Project Eagle – Financial Analysis August 5, 2020 |

| Table of Contents I.Transaction Summary II.Financial Analysis Appendix 2 |

| I.Transaction Summary |

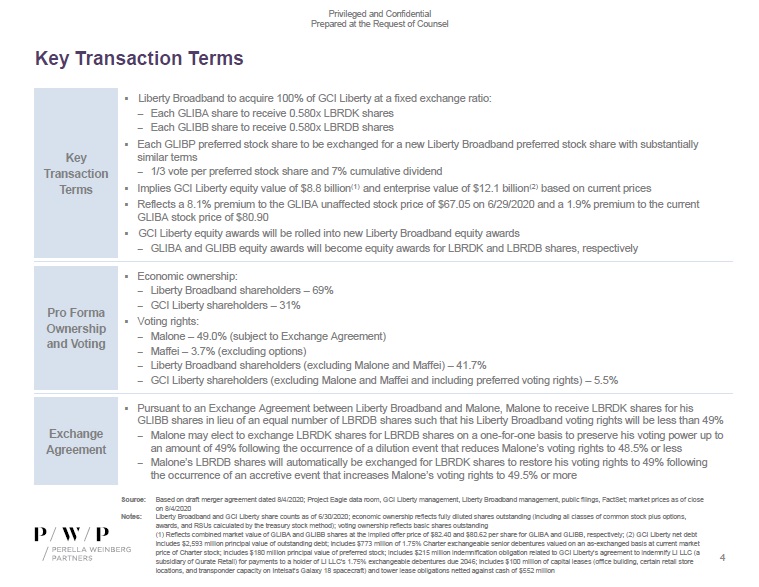

| Key Transaction Terms Key Transaction Terms ▪ Liberty Broadband to acquire 100% of GCI Liberty at a fixed exchange ratio: – Each GLIBA share to receive 0.580x LBRDK shares – Each GLIBB share to receive 0.580x LBRDB shares ▪ Each GLIBP preferred stock share to be exchanged for a new Liberty Broadband preferred stock share with substantially similar terms – 1/3 vote per preferred stock share and 7% cumulative dividend ▪ Implies GCI Liberty equity value of $8.8 billion(1) and enterprise value of $12.1 billion(2) based on current prices ▪ Reflects a 8.1% premium to the GLIBA unaffected stock price of $67.05 on 6/29/2020 and a 1.9% premium to the current GLIBA stock price of $80.90 ▪ GCI Liberty equity awards will be rolled into new Liberty Broadband equity awards – GLIBA and GLIBB equity awards will become equity awards for LBRDK and LBRDB shares, respectively Pro Forma Ownership and Voting ▪ Economic ownership: – Liberty Broadband shareholders – 69% – GCI Liberty shareholders – 31% ▪ Voting rights: – Malone – 49.0% (subject to Exchange Agreement) – Maffei – 3.7% (excluding options) – Liberty Broadband shareholders (excluding Malone and Maffei) – 41.7% – GCI Liberty shareholders (excluding Malone and Maffei and including preferred voting rights) – 5.5% Exchange Agreement ▪ Pursuant to an Exchange Agreement between Liberty Broadband and Malone, Malone to receive LBRDK shares for his GLIBB shares in lieu of an equal number of LBRDB shares such that his Liberty Broadband voting rights will be less than 49% – Malone may elect to exchange LBRDK shares for LBRDB shares on a one-for-one basis to preserve his voting power up to an amount of 49% following the occurrence of a dilution event that reduces Malone’s voting rights to 48.5% or less – Malone’s LBRDB shares will automatically be exchanged for LBRDK shares to restore his voting rights to 49% following the occurrence of an accretive event that increases Malone’s voting rights to 49.5% or more Source: Based on draft merger agreement dated 8/4/2020; Project Eagle data room, GCI Liberty management, Liberty Broadband management, public filings, FactSet; market prices as of close on 8/4/2020 Notes:Liberty Broadband and GCI Liberty share counts as of 6/30/2020; economic ownership reflects fully diluted shares outstanding (including all classes of common stock plus options, awards, and RSUs calculated by the treasury stock method); voting ownership reflects basic shares outstanding (1) Reflects combined market value of GLIBA and GLIBB shares at the implied offer price of $82.40 and $80.62 per share for GLIBA and GLIBB, respectively; (2) GCI Liberty net debt includes $2,593 million principal value of outstanding debt; includes $773 million of 1.75% Charter exchangeable senior debentures valued on an as-exchanged basis at current market price of Charter stock; includes $180 million principal value of preferred stock; includes $215 million indemnification obligation related to GCI Liberty’s agreement to indemnify LI LLC (a subsidiary of Qurate Retail) for payments to a holder of LI LLC's 1.75% exchangeable debentures due 2046; includes $100 million of capital leases (office building, certain retail store4 |

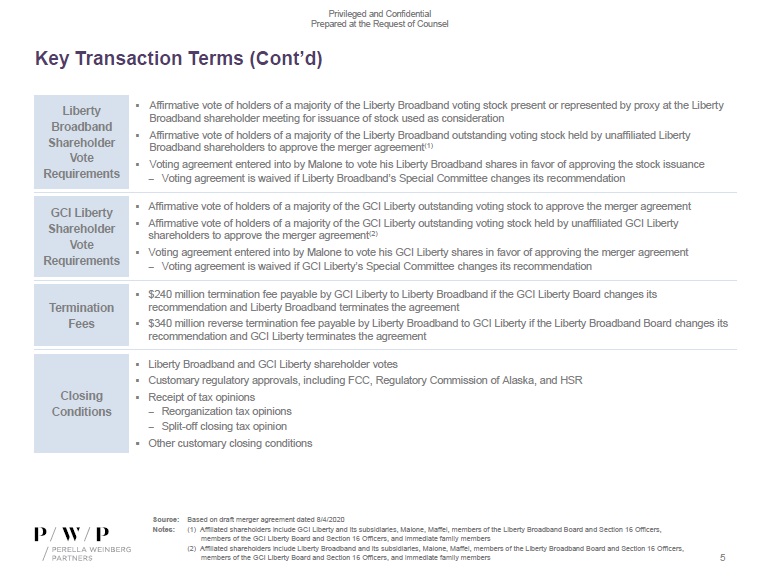

| Key Transaction Terms (Cont’d) Liberty Broadband Shareholder Vote Requirements GCI Liberty Shareholder Vote Requirements ▪ Affirmative vote of holders of a majority of the Liberty Broadband voting stock present or represented by proxy at the Liberty Broadband shareholder meeting for issuance of stock used as consideration ▪ Affirmative vote of holders of a majority of the Liberty Broadband outstanding voting stock held by unaffiliated Liberty Broadband shareholders to approve the merger agreement(1) ▪ Voting agreement entered into by Malone to vote his Liberty Broadband shares in favor of approving the stock issuance – Voting agreement is waived if Liberty Broadband’s Special Committee changes its recommendation ▪ Affirmative vote of holders of a majority of the GCI Liberty outstanding voting stock to approve the merger agreement ▪ Affirmative vote of holders of a majority of the GCI Liberty outstanding voting stock held by unaffiliated GCI Liberty shareholders to approve the merger agreement(2) ▪ Voting agreement entered into by Malone to vote his GCI Liberty shares in favor of approving the merger agreement – Voting agreement is waived if GCI Liberty’s Special Committee changes its recommendation Termination Fees ▪ $240 million termination fee payable by GCI Liberty to Liberty Broadband if the GCI Liberty Board changes its recommendation and Liberty Broadband terminates the agreement ▪ $340 million reverse termination fee payable by Liberty Broadband to GCI Liberty if the Liberty Broadband Board changes its recommendation and GCI Liberty terminates the agreement Closing Conditions ▪ Liberty Broadband and GCI Liberty shareholder votes ▪ Customary regulatory approvals, including FCC, Regulatory Commission of Alaska, and HSR ▪ Receipt of tax opinions – Reorganization tax opinions – Split-off closing tax opinion ▪ Other customary closing conditions Source: Based on draft merger agreement dated 8/4/2020 Notes:(1) Affiliated shareholders include GCI Liberty and its subsidiaries, Malone, Maffei, members of the Liberty Broadband Board and Section 16 Officers, members of the GCI Liberty Board and Section 16 Officers, and immediate family members (2) Affiliated shareholders include Liberty Broadband and its subsidiaries, Malone, Maffei, members of the Liberty Broadband Board and Section 16 Officers, members of the GCI Liberty Board and Section 16 Officers, and immediate family members5 |

| Liberty Broadband / GCI Liberty Combination – Strategic Rationale ▪ Expands Liberty Broadband’s portfolio with the addition of the GCI Holdings operating business, which generated $109 million of free cash flow in 2019(1) and is expected to generate $171 million of free cash flow in 2020(2) – Complementary business and product offerings to Charter and reinforces Liberty Broadband’s broadband-centric portfolio ▪ Enhances Liberty Broadband’s future strategic optionality – Potential alternatives for Skyhook, Evite, or LendingTree stake ▪ Simplifies Liberty Broadband’s equity capital structure via buying back and collapsing GCI Liberty’s 23% stake in Liberty Broadband ▪ Strengthens trading liquidity in Liberty Broadband’s LBRDK shares by increasing LBRDK’s float – LBRDK float would increase from 110 million shares(3) to 169 million shares(4) on a pro forma basis ▪ Expected to be accretive to Liberty Broadband’s NAV / share, adjusted NAV / share, and proportional 2020E EBITDA / share ▪ Potential synergies from consolidating Liberty Broadband and GCI Liberty corporate costs, e.g., public company reporting costs Source: Project Eagle data room, GCI Liberty management, Liberty Broadband management, public filings, FactSet; market prices as of close on 8/4/2020 Notes:Liberty Broadband share count as of 6/30/2020; economic ownership figures reflect fully diluted shares outstanding (including all classes of common stock plus options, awards, and RSUs calculated by the treasury stock method) (1) Reflects Adjusted EBITDA minus capex; Adjusted EBITDA is reduced by stock-based compensation and is prior to normalization adjustments (2) Per GCI Holdings management projections; reflects Adjusted EBITDA minus capex; Adjusted EBITDA is reduced by stock-based compensation and includes normalization adjustments (3) Reflects 153.0 million LBRDK basic shares outstanding less 42.7 million LBRDK shares held by GCI Liberty (4) Reflects 153.0 million LBRDK basic shares outstanding less 42.7 million LBRDK shares acquired by Liberty Broadband plus 58.8 million shares issued6 |

| II.Financial Analysis |

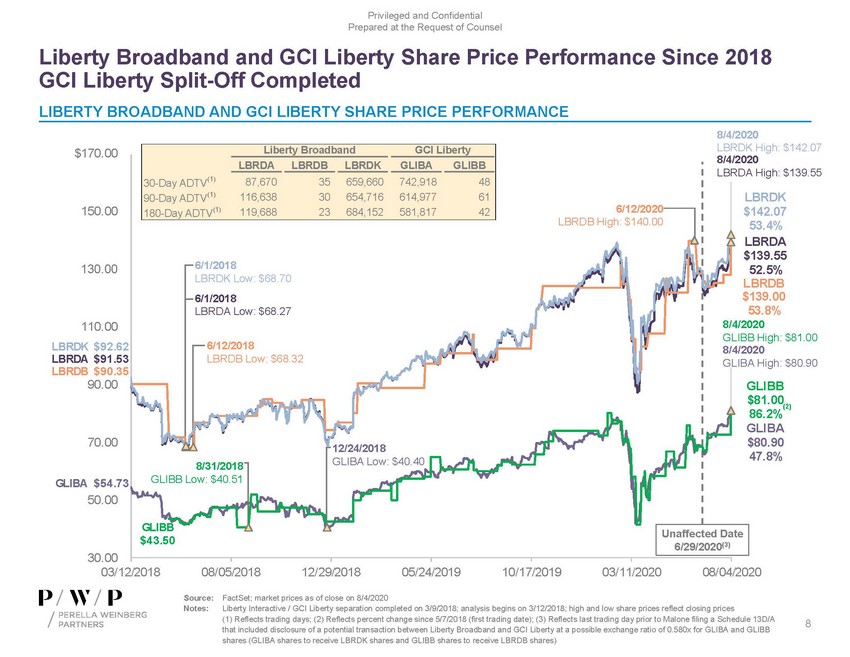

| Liberty Broadband and GCI Liberty Share Price Performance Since 2018 GCI Liberty Split-Off Completed LIBERTY BROADBAND AND GCI LIBERTY SHARE PRICE PERFORMANCE $170.00 Liberty Broadband GCI Liberty 30-Day ADTV(1) 87,670 35 659,660 742,918 48 90-Day ADTV(1) 116,638 30 654,716 614,977 61 180-Day ADTV(1) 119,688 23 684,152 581,817 42 8/4/2020 LBRDK High: $142.07 8/4/2020 LBRDA High: $139.55 150.00 130.00 110.00 LBRDK $92.62 LBRDA $91.53 LBRDB $90.35 90.00 70.00 GLIBA $54.73 50.00 6/1/2018 LBRDK Low: $68.70 6/1/2018 LBRDA Low: $68.27 6/12/2018 LBRDB Low: $68.32 8/31/2018 GLIBB Low: $40.51 12/24/2018 GLIBA Low: $40.40 6/12/2020 LBRDB High: $140.00 LBRDK $142.07 53.4% LBRDA $139.55 52.5% LBRDB $139.00 53.8% 8/4/2020 GLIBB High: $81.00 8/4/2020 GLIBA High: $80.90 GLIBB $81.00 (2) 86.2% GLIBA $80.90 47.8% 30.00 GLIBB $43.50 Unaffected Date 6/29/2020(3) 03/12/2018 08/05/2018 12/29/2018 05/24/2019 10/17/2019 03/11/2020 08/04/2020 Source: FactSet; market prices as of close on 8/4/2020 Notes:Liberty Interactive / GCI Liberty separation completed on 3/9/2018; analysis begins on 3/12/2018; high and low share prices reflect closing prices (1) Reflects trading days; (2) Reflects percent change since 5/7/2018 (first trading date); (3) Reflects last trading day prior to Malone filing a Schedule 13D/A8 that included disclosure of a potential transaction between Liberty Broadband and GCI Liberty at a possible exchange ratio of 0.580x for GLIBA and GLIBB |

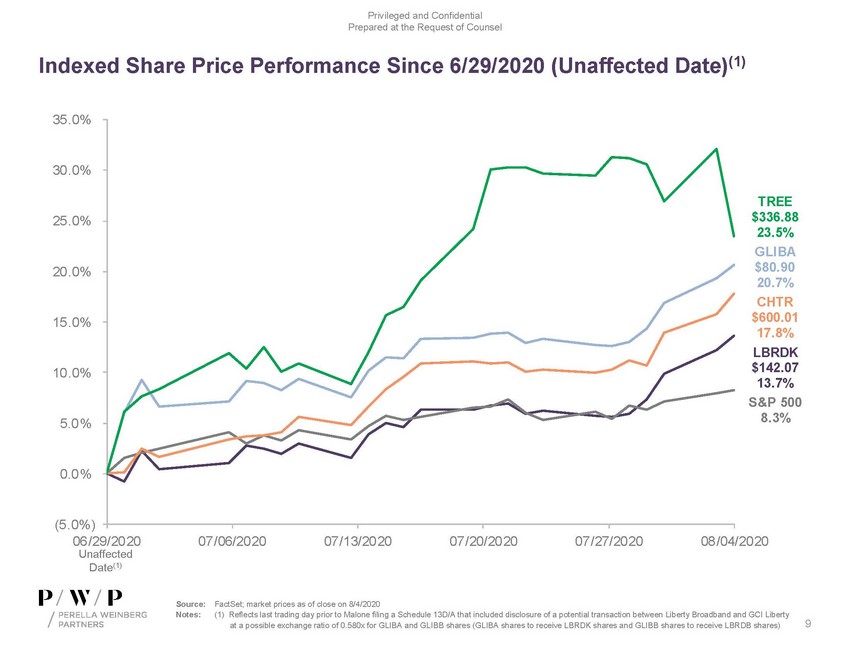

| Indexed Share Price Performance Since 6/29/2020 (Unaffected Date)(1) 35.0% 30.0% 25.0% 20.0% 15.0% 10.0% 5.0% TREE $336.88 23.5% GLIBA $80.90 20.7% CHTR $600.01 17.8% LBRDK $142.07 13.7% S&P 500 8.3% 0.0% (5.0%) 06/29/202007/06/202007/13/202007/20/202007/27/202008/04/2020 Unaffected Date(1) Source: FactSet; market prices as of close on 8/4/2020 Notes:(1) Reflects last trading day prior to Malone filing a Schedule 13D/A that included disclosure of a potential transaction between Liberty Broadband and GCI Liberty at a possible exchange ratio of 0.580x for GLIBA and GLIBB shares (GLIBA shares to receive LBRDK shares and GLIBB shares to receive LBRDB shares)9 |

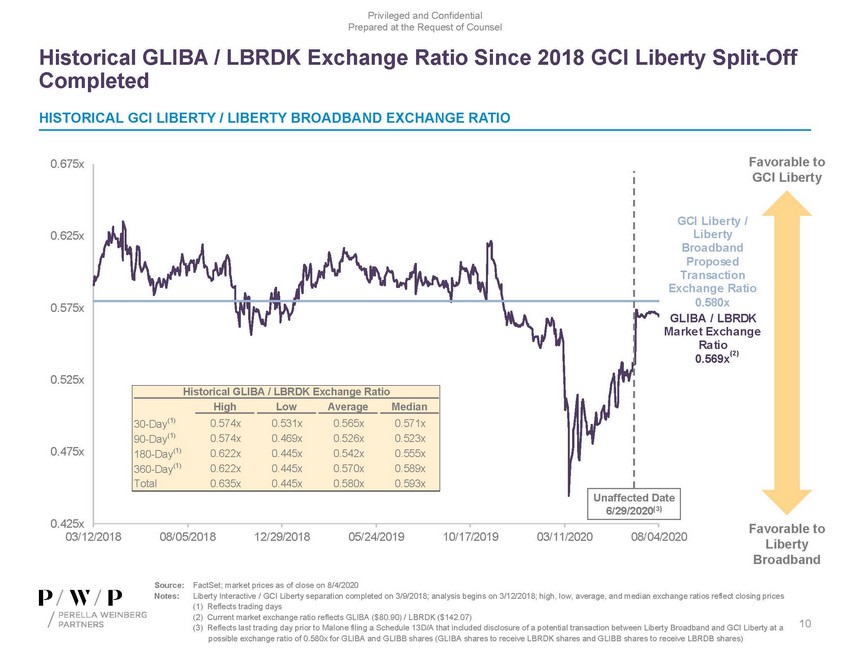

| Historical GLIBA / LBRDK Exchange Ratio Since 2018 GCI Liberty Split-Off Completed HISTORICAL GCI LIBERTY / LIBERTY BROADBAND EXCHANGE RATIO 0.675x Favorable to GCI Liberty 0.625x 0.575x GCI Liberty / Liberty Broadband Proposed Transaction Exchange Ratio 0.580x GLIBA / LBRDK Market Exchange Ratio 0.525x 0.475x 0.425x Historical GLIBA / LBRDK Exchange Ratio High Low Average Median 30-Day(1) 0.574x 0.531x 0.565x 0.571x 90-Day(1) 0.574x 0.469x 0.526x 0.523x 180-Day(1) 0.622x 0.445x 0.542x 0.555x 360-Day(1) 0.622x 0.445x 0.570x 0.589x Total 0.635x 0.445x 0.580x 0.593x Unaffected Date 6/29/2020(3) 0.569x (2) Favorable to 03/12/2018 08/05/2018 12/29/2018 05/24/2019 10/17/2019 03/11/2020 08/04/2020 Liberty Broadband Source: FactSet; market prices as of close on 8/4/2020 Notes:Liberty Interactive / GCI Liberty separation completed on 3/9/2018; analysis begins on 3/12/2018; high, low, average, and median exchange ratios reflect closing prices (1) Reflects trading days (2) Current market exchange ratio reflects GLIBA ($80.90) / LBRDK ($142.07) (3) Reflects last trading day prior to Malone filing a Schedule 13D/A that included disclosure of a potential transaction between Liberty Broadband and GCI Liberty at a10 |

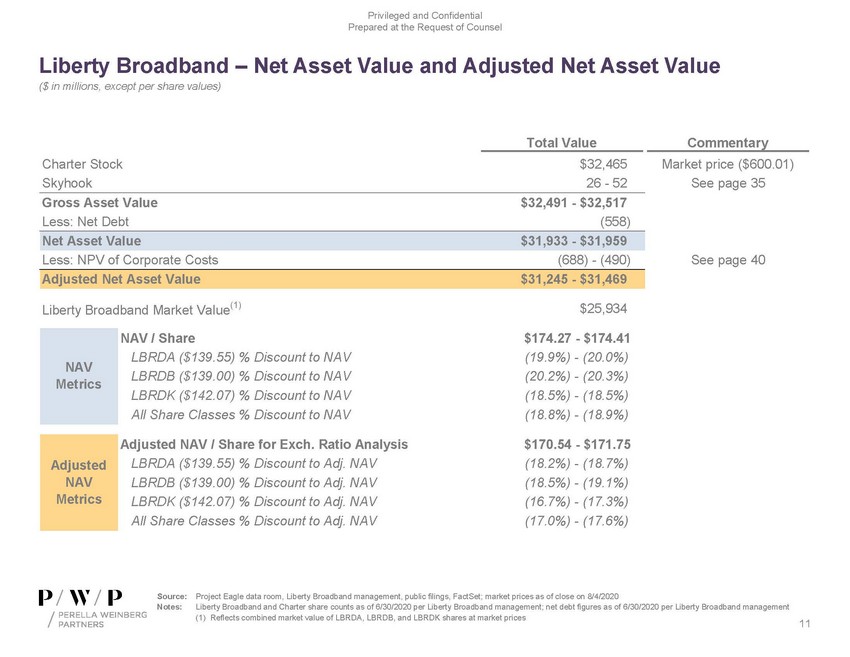

| Liberty Broadband – Net Asset Value and Adjusted Net Asset Value ($ in millions, except per share values) Total Value Commentary Charter Stock $32,465 Market price ($600.01) Skyhook 26 - 52 See page 35 Gross Asset Value $32,491 - $32,517 Less: Net Debt (558) Net Asset Value $31,933 - $31,959 Less: NPV of Corporate Costs (688) - (490) See page 40 Adjusted Net Asset Value $31,245 - $31,469 Liberty Broadband Market Value(1) $25,934 NAV Metrics Adjusted NAV Metrics NAV / Share $174.27 - $174.41 LBRDA ($139.55) % Discount to NAV (19.9%) - (20.0%) LBRDB ($139.00) % Discount to NAV (20.2%) - (20.3%) LBRDK ($142.07) % Discount to NAV (18.5%) - (18.5%) All Share Classes % Discount to NAV (18.8%) - (18.9%) Adjusted NAV / Share for Exch. Ratio Analysis $170.54 - $171.75 LBRDA ($139.55) % Discount to Adj. NAV (18.2%) - (18.7%) LBRDB ($139.00) % Discount to Adj. NAV (18.5%) - (19.1%) LBRDK ($142.07) % Discount to Adj. NAV (16.7%) - (17.3%) All Share Classes % Discount to Adj. NAV (17.0%) - (17.6%) Source: Project Eagle data room, Liberty Broadband management, public filings, FactSet; market prices as of close on 8/4/2020 Notes:Liberty Broadband and Charter share counts as of 6/30/2020 per Liberty Broadband management; net debt figures as of 6/30/2020 per Liberty Broadband management (1) Reflects combined market value of LBRDA, LBRDB, and LBRDK shares at market prices 11 |

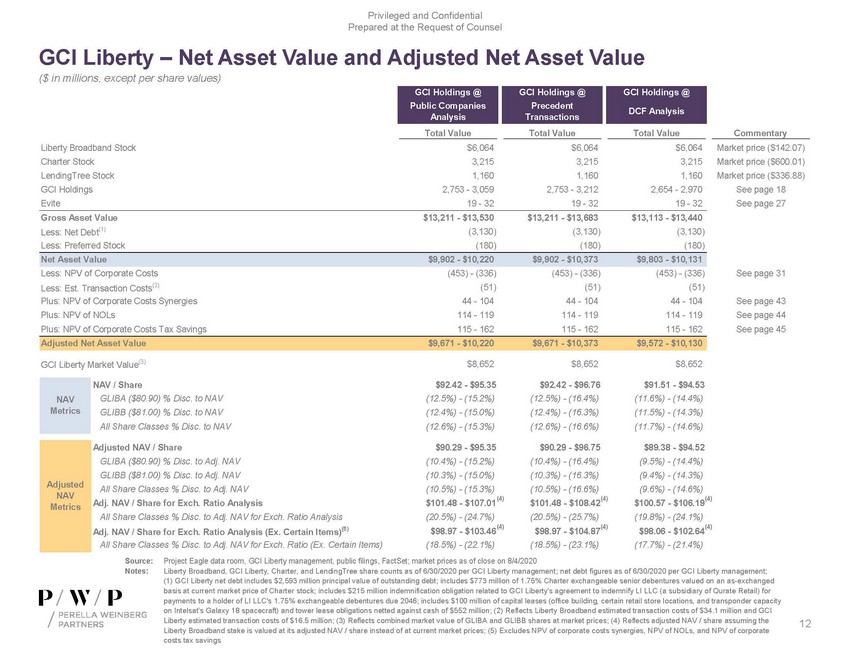

| GCI Liberty – Net Asset Value and Adjusted Net Asset Value ($ in millions, except per share values) GCI Holdings @ GCI Holdings @ GCI Holdings @ Public Companies Analysis Precedent Transactions DCF Analysis Total Value Total Value Total Value Commentary Liberty Broadband Stock $6,064 $6,064 $6,064 Market price ($142.07) Charter Stock 3,215 3,215 3,215 Market price ($600.01) LendingTree Stock 1,160 1,160 1,160 Market price ($336.88) GCI Holdings 2,753 - 3,059 2,753 - 3,212 2,654 - 2,970 See page 18 Evite 19 - 32 19 - 32 19 - 32 See page 27 Gross Asset Value $13,211 - $13,530 $13,211 - $13,683 $13,113 - $13,440 Less: Net Debt(1) (3,130) (3,130) (3,130) Less: Preferred Stock (180) (180) (180) Net Asset Value $9,902 - $10,220 $9,902 - $10,373 $9,803 - $10,131 Less: NPV of Corporate Costs (453) - (336) (453) - (336) (453) - (336) See page 31 Less: Est. Transaction Costs(2) (51) (51) (51) Plus: NPV of Corporate Costs Synergies 44 - 104 44 - 104 44 - 104 See page 43 Plus: NPV of NOLs 114 - 119 114 - 119 114 - 119 See page 44 Plus: NPV of Corporate Costs Tax Savings 115 - 162 115 - 162 115 - 162 See page 45 Adjusted Net Asset Value $9,671 - $10,220 $9,671 - $10,373 $9,572 - $10,130 GCI Liberty Market Value(3) $8,652 $8,652 $8,652 NAV Metrics Adjusted NAV Metrics NAV / Share $92.42 - $95.35 $92.42 - $96.76 $91.51 - $94.53 Adjusted NAV / Share GLIBA ($80.90) % Disc. to Adj. NAV $90.29 - $95.35 (10.4%) - (15.2%) $90.29 - $96.75 (10.4%) - (16.4%) $89.38 - $94.52 (9.5%) - (14.4%) GLIBB ($81.00) % Disc. to Adj. NAV (10.3%) - (15.0%) (10.3%) - (16.3%) (9.4%) - (14.3%) All Share Classes % Disc. to Adj. NAV (10.5%) - (15.3%) (10.5%) - (16.6%) (9.6%) - (14.6%) Adj. NAV / Share for Exch. Ratio Analysis (4) $101.48 - $107.01 (4) $101.48 - $108.42 ( $100.57 - $106.19 All Share Classes % Disc. to Adj. NAV for Exch. Ratio Analysis Adj. NAV / Share for Exch. Ratio Analysis (Ex. Certain Items)(5) (20.5%) - (24.7%) (4) $98.97 - $103.46 (20.5%) - (25.7%) (4) $98.97 - $104.87 (19.8%) - (24.1%) ( $98.06 - $102.64 All Share Classes % Disc. to Adj. NAV for Exch. Ratio (Ex. Certain Items) (18.5%) - (22.1%) (18.5%) - (23.1%) (17.7%) - (21.4%) 4) 4) Source: Project Eagle data room, GCI Liberty management, public filings, FactSet; market prices as of close on 8/4/2020 Notes:Liberty Broadband, GCI Liberty, Charter, and LendingTree share counts as of 6/30/2020 per GCI Liberty management; net debt figures as of 6/30/2020 per GCI Liberty management; (1) GCI Liberty net debt includes $2,593 million principal value of outstanding debt; includes $773 million of 1.75% Charter exchangeable senior debentures valued on an as-exchanged basis at current market price of Charter stock; includes $215 million indemnification obligation related to GCI Liberty’s agreement to indemnify LI LLC (a subsidiary of Qurate Retail) for payments to a holder of LI LLC's 1.75% exchangeable debentures due 2046; includes $100 million of capital leases (office building, certain retail store locations, and transponder capacity on Intelsat’s Galaxy 18 spacecraft) and tower lease obligations netted against cash of $552 million; (2) Reflects Liberty Broadband estimated transaction costs of $34.1 million and GCI Liberty estimated transaction costs of $16.5 million; (3) Reflects combined market value of GLIBA and GLIBB shares at market prices; (4) Reflects adjusted NAV / share assuming the12 Liberty Broadband stake is valued at its adjusted NAV / share instead of at current market prices; (5) Excludes NPV of corporate costs synergies, NPV of NOLs, and NPV of corporate |

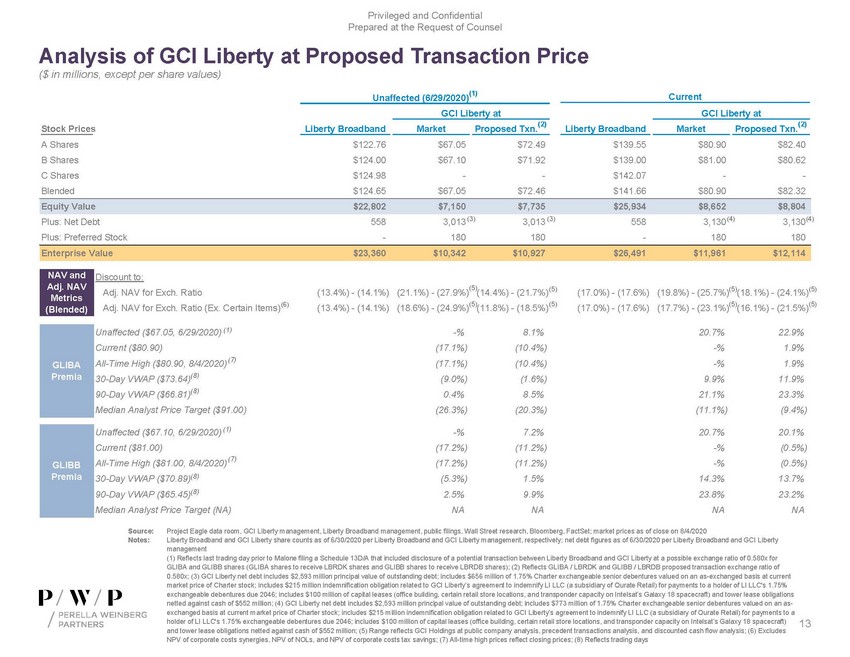

| Analysis of GCI Liberty at Proposed Transaction Price ($ in millions, except per share values) Stock Prices A Shares Liberty Broadband $122.76 Market Prop $67.05 (2) sed Txn. $72.49 Liberty Broadband $139.55 Market Prop $80.90 (2) sed Txn. $82.40 $80.62 - $82.32 $8,804 B Shares $124.00 $67.10 $71.92 $139.00 $81.00 C Shares $124.98 - - $142.07 - Blended $124.65 $67.05 $72.46 $141.66 $80.90 Equity Value $22,802 $7,150 $7,735 $25,934 $8,652 Plus: Net Debt 558 3,013 (3) 3,013 (3) 558 3,130 (4) 3,130(4) Plus: Preferred Stock - 180 180 - 180 180 o o (5) ) (14.4%) - (21.7%)(17.0%) - (17.6 %) (19.8%) - (25.7%) (18.1%) - (24.1%) NAV and Adj. NAV Metrics Discount to: Adj. NAV for Exch. Ratio(13.4%) - (14.1%) (21.1%) - (27.9% (5) (5) (5) (Blended) Adj. NAV for Exch. Ratio (Ex. Certain Items)(6) (13.4%) - (14.1%) (18.6%) - (24.9%)(5)(11.8%) - (18.5%)(5) (17.0%) - (17.6%) (17.7%) - (23.1%)(5)(16.1%) - (21.5%)(5) Unaffected ($67.05, 6/29/2020) (1) -%8.1%20.7%22.9% Current ($80.90)(17.1%)(10.4%)-%1.9% GLIBA Premia All-Time High ($80.90, 8/4/2020) (7) 30-Day VWAP ($73.64)(8) 90-Day VWAP ($66.81)(8) (17.1%)(10.4%)-%1.9% (9.0%)(1.6%)9.9%11.9% 0.4%8.5%21.1%23.3% Median Analyst Price Target ($91.00)(26.3%)(20.3%)(11.1%)(9.4%) Unaffected ($67.10, 6/29/2020) (1) -%7.2%20.7%20.1% GLIBB Current ($81.00)(17.2%)(11.2%)-%(0.5%) All-Time High ($81.00, 8/4/2020) (7) (17.2%)(11.2%)-%(0.5%) Premia 30-Day VWAP ($70.89)(8) 90-Day VWAP ($65.45)(8) (5.3%)1.5%14.3%13.7% 2.5%9.9%23.8%23.2% Median Analyst Price Target (NA)NANANANA Source:Project Eagle data room, GCI Liberty management, Liberty Broadband management, public filings, Wall Street research, Bloomberg, FactSet; market prices as of close on 8/4/2020 Notes:Liberty Broadband and GCI Liberty share counts as of 6/30/2020 per Liberty Broadband and GCI Liberty management, respectively; net debt figures as of 6/30/2020 per Liberty Broadband and GCI Liberty management (1) Reflects last trading day prior to Malone filing a Schedule 13D/A that included disclosure of a potential transaction between Liberty Broadband and GCI Liberty at a possible exchange ratio of 0.580x for GLIBA and GLIBB shares (GLIBA shares to receive LBRDK shares and GLIBB shares to receive LBRDB shares); (2) Reflects GLIBA / LBRDK and GLIBB / LBRDB proposed transaction exchange ratio of 0.580x; (3) GCI Liberty net debt includes $2,593 million principal value of outstanding debt; includes $656 million of 1.75% Charter exchangeable senior debentures valued on an as-exchanged basis at current market price of Charter stock; includes $215 million indemnification obligation related to GCI Liberty’s agreement to indemnify LI LLC (a subsidiary of Qurate Retail) for payments to a holder of LI LLC's 1.75% exchangeable debentures due 2046; includes $100 million of capital leases (office building, certain retail store locations, and transponder capacity on Intelsat’s Galaxy 18 spacecraft) and tower lease obligations netted against cash of $552 million; (4) GCI Liberty net debt includes $2,593 million principal value of outstanding debt; includes $773 million of 1.75% Charter exchangeable senior debentures valued on an as-exchanged basis at current market price of Charter stock; includes $215 million indemnification obligation related to GCI Liberty’s agreement to indemnify LI LLC (a subsidiary of Qurate Retail) for payments to a holder of LI LLC's 1.75% exchangeable debentures due 2046; includes $100 million of capital leases (office building, certain retail store locations, and transponder capacity on Intelsat’s Galaxy 18 spacecraft)13 and tower lease obligations netted against cash of $552 million; (5) Range reflects GCI Holdings at public company analysis, precedent transactions analysis, and discounted cash flow analysis; (6) Excludes NPV of corporate costs synergies, NPV of NOLs, and NPV of corporate costs tax savings; (7) All-time high prices reflect closing prices; (8) Reflects trading days |

| Exchange Ratio Analysis ($ in millions) GCI Holdings EV Implied GCI Liberty / Liberty Broadband Exchange Ratio Public Companies Analysis $2,753 - $3,059 (9.0x - 10.0x (1) Adjusted NAV 0.591x 0.628x 2020E EBITDA) Adjusted NAV Ex. Certain Items(2) 0.576x 0.607x GCI Holdings Methodologies $2,753 - $3,212 (9.0x - 10.5x (1) Adjusted NAV 0.591x 0.636x 2020E EBITDA) Adjusted NAV Ex. Certain Items(2) Adjusted NAV 0.576x 0.586x 0.615x 0.623x DCF Analysis $2,654 - $2,970 Adjusted NAV Ex. Certain Items(2) 0.571x 0.602x GLIBA / LBRDK Methodologies (GLIBA / LBRDK)(3)NA 52-Week High and Low (GLIBA / LBRDK)(3)NA 0.476x 0.445x 0.619x 0.622x Unaffected Current Market Proposed Transaction Market Exchange Exchange Exchange Ratio: Ratio(4): 0.536x Ratio(5): 0.569x 0.580x Source:Project Eagle data room, GCI Liberty management, Liberty Broadband management, public filings, Wall Street research, Bloomberg, FactSet; market prices as of close on 8/4/2020 Notes:Liberty Broadband’s Adjusted Net Asset Value includes its stake in Charter and Skyhook, NPV of corporate costs, and is adjusted for net debt; GCI Liberty’s Adjusted Net Asset Value includes its stake in Charter, Liberty Broadband, LendingTree, GCI Holdings, Evite, NPV of corporate costs, NPV of corporate costs synergies, NPV of NOLs, and NPV of corporate costs tax savings, and is adjusted for net debt and $180 million of preferred stock; Liberty Broadband, GCI Liberty, Charter, and LendingTree share counts as of 6/30/2020; (1) Reflects GCI Holdings 2020E EBITDA of $306 million; reflects Normalized Adjusted EBITDA reduced by stock-based compensation per GCI Liberty management; (2) Excludes NPV of corporate costs synergies, NPV of NOLs, and NPV of corporate costs tax savings; (3) Implied GLIBA / LBRDK Exchange Ratio bars not drawn to scale; (4) Unaffected market exchange ratio reflects GLIBA ($67.05) / LBRDK ($124.98); unaffected date 14 reflects last trading day prior to Malone filing a Schedule 13D/A that included disclosure of a potential transaction between Liberty Broadband and GCI Liberty at a possible exchange ratio of 0.580x for GLIBA and GLIBB shares (GLIBA shares to receive LBRDK shares and GLIBB shares to receive LBRDB shares); (5) Current market exchange ratio reflects GLIBA ($80.90) / LBRDK ($142.07) |

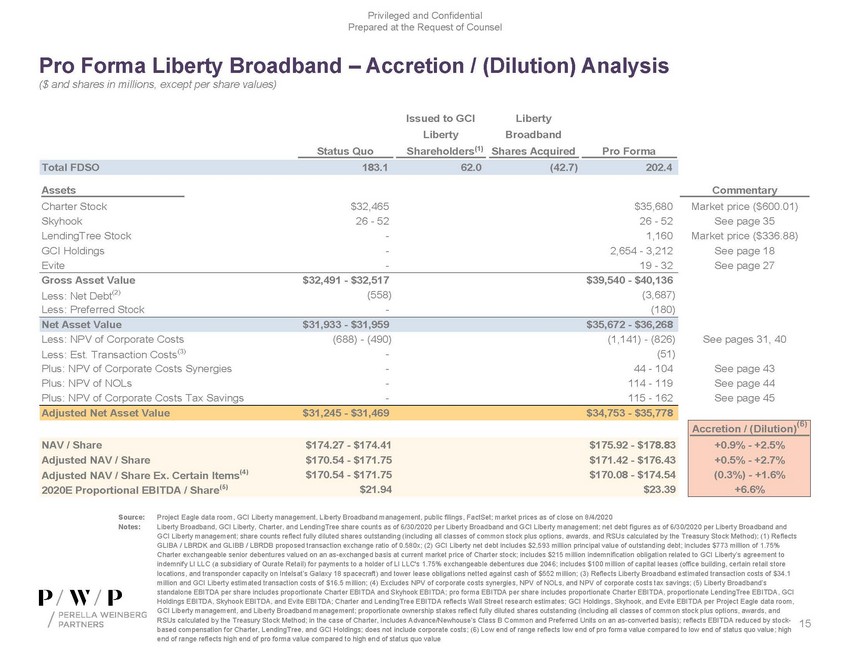

| Pro Forma Liberty Broadband – Accretion / (Dilution) Analysis ($ and shares in millions, except per share values) Issued to GCI Liberty Liberty Broadband Status Quo Shareholders(1) Shares Acquired Pro Forma Total FDSO 183.1 62.0 (42.7) 202.4 Assets Charter Stock $32,465 $35,680 Skyhook 26 - 52 26 - 52 LendingTree Stock - 1,160 GCI Holdings - 2,654 - 3,212 Evite - 19 - 32 Gross Asset Value $32,491 - $32,517 $39,540 - $40,136 Less: Net Debt(2) (558) (3,687) Less: Preferred Stock - (180) Net Asset Value $31,933 - $31,959 $35,672 - $36,268 Less: NPV of Corporate Costs (688) - (490) (1,141) - (826) Less: Est. Transaction Costs(3) - (51) Plus: NPV of Corporate Costs Synergies - 44 - 104 Plus: NPV of NOLs - 114 - 119 Plus: NPV of Corporate Costs Tax Savings - 115 - 162 Adjusted Net Asset Value $31,245 - $31,469 $34,753 - $35,778 NAV / Share $174.27 - $174.41 $175.92 - $178.83 Adjusted NAV / Share $170.54 - $171.75 $171.42 - $176.43 Adjusted NAV / Share Ex. Certain Items(4) 2020E Proportional EBITDA / Share(5) $170.54 - $171.75 $21.94 $170.08 - $174.54 $23.39 Market price ($336.88) See page 18 See page 27 See pages 31, 40 See page 43 See page 44 See page 45 Accretion / (Dilution)(6) +0.9% - +2.5% +0.5% - +2.7% (0.3%) - +1.6% +6.6% Source: Project Eagle data room, GCI Liberty management, Liberty Broadband management, public filings, FactSet; market prices as of close on 8/4/2020 Notes: Liberty Broadband, GCI Liberty, Charter, and LendingTree share counts as of 6/30/2020 per Liberty Broadband and GCI Liberty management; net debt figures as of 6/30/2020 per Liberty Broadband and GCI Liberty management; share counts reflect fully diluted shares outstanding (including all classes of common stock plus options, awards, and RSUs calculated by the Treasury Stock Method); (1) Reflects GLIBA / LBRDK and GLIBB / LBRDB proposed transaction exchange ratio of 0.580x; (2) GCI Liberty net debt includes $2,593 million principal value of outstanding debt; includes $773 million of 1.75% Charter exchangeable senior debentures valued on an as-exchanged basis at current market price of Charter stock; includes $215 million indemnification obligation related to GCI Liberty’s agreement to indemnify LI LLC (a subsidiary of Qurate Retail) for payments to a holder of LI LLC's 1.75% exchangeable debentures due 2046; includes $100 million of capital leases (office building, certain retail store locations, and transponder capacity on Intelsat’s Galaxy 18 spacecraft) and tower lease obligations netted against cash of $552 million; (3) Reflects Liberty Broadband estimated transaction costs of $34.1 million and GCI Liberty estimated transaction costs of $16.5 million; (4) Excludes NPV of corporate costs synergies, NPV of NOLs, and NPV of corporate costs tax savings; (5) Liberty Broadband’s standalone EBITDA per share includes proportionate Charter EBITDA and Skyhook EBITDA; pro forma EBITDA per share includes proportionate Charter EBITDA, proportionate LendingTree EBITDA, GCI Holdings EBITDA, Skyhook EBITDA, and Evite EBITDA; Charter and LendingTree EBITDA reflects Wall Street research estimates; GCI Holdings, Skyhook, and Evite EBITDA per Project Eagle data room, GCI Liberty management, and Liberty Broadband management; proportionate ownership stakes reflect fully diluted shares outstanding (including all classes of common stock plus options, awards, and RSUs calculated by the Treasury Stock Method; in the case of Charter, includes Advance/Newhouse’s Class B Common and Preferred Units on an as-converted basis); reflects EBITDA reduced by stock-15 based compensation for Charter, LendingTree, and GCI Holdings; does not include corporate costs; (6) Low end of range reflects low end of pro forma value compared to low end of status quo value; high end of range reflects high end of pro forma value compared to high end of status quo value |

| Appendix I PERELLA WEINBERG PARTNERS |

| A.GCI Liberty Analysis |

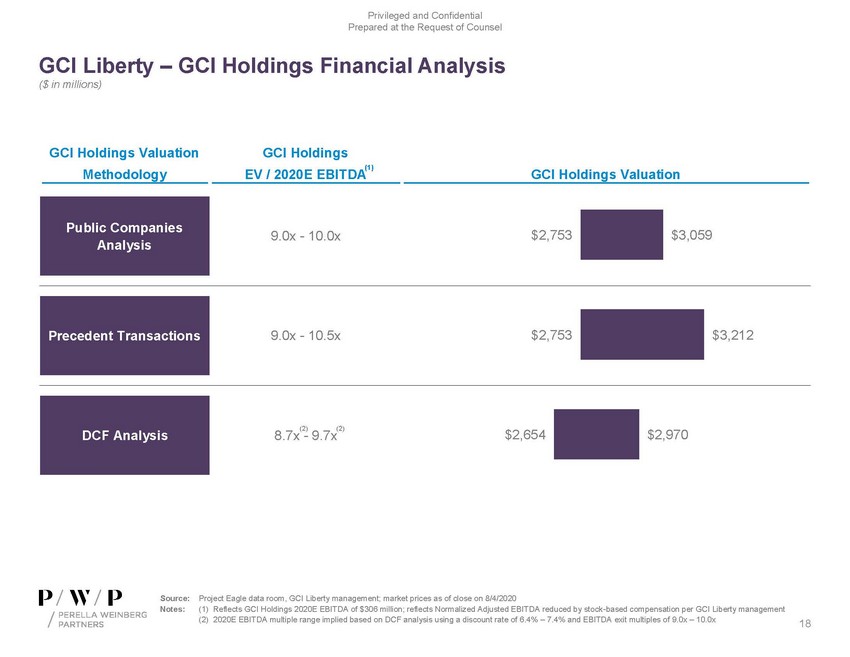

| GCI Liberty – GCI Holdings Financial Analysis ($ in millions) GCI Holdings Valuation GCI Holdings (1) Methodology EV / 2020E EBITDA GCI Holdings Valuation Public Companies Analysis9.0x - 10.0x Precedent Transactions9.0x - 10.5x (2)(2) DCF Analysis8.7x - 9.7x $2,753 $2,753 $2,654 $3,059 $2,970 $3,212 Source: Project Eagle data room, GCI Liberty management; market prices as of close on 8/4/2020 Notes:(1) Reflects GCI Holdings 2020E EBITDA of $306 million; reflects Normalized Adjusted EBITDA reduced by stock-based compensation per GCI Liberty management (2) 2020E EBITDA multiple range implied based on DCF analysis using a discount rate of 6.4% – 7.4% and EBITDA exit multiples of 9.0x – 10.0x18 |

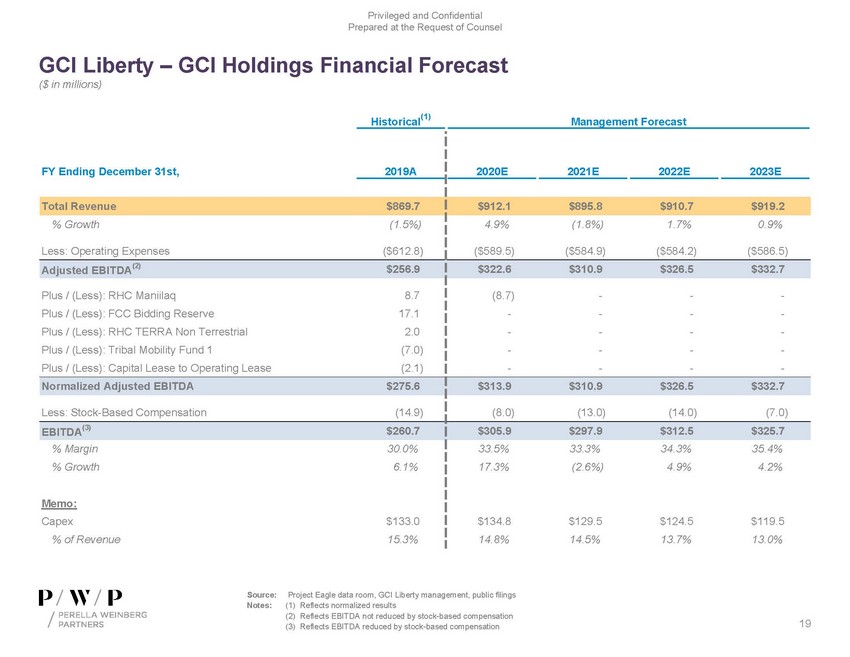

| GCI Liberty – GCI Holdings Financial Forecast ($ in millions) Historical(1) Management Forecast Source:Project Eagle data room, GCI Liberty management, public filings Notes:(1) Reflects normalized results (2) Reflects EBITDA not reduced by stock-based compensation (3) Reflects EBITDA reduced by stock-based compensation19 |

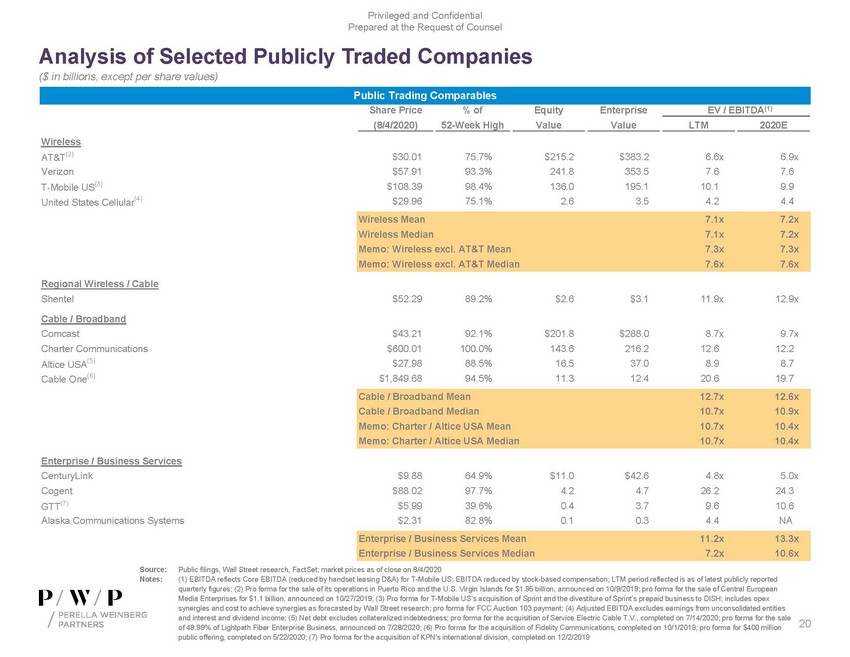

| Analysis of Selected Publicly Traded Companies ($ in billions, except per share values) Public Trading Comparables Share Price% ofEquityEnterprise EV / EBITDA(1) (8/4/2020) 52-Week High Value Value LTM 2020E GTT(7)$5.9939.6%0.43.79.610.6 Alaska Communications Systems$2.3182.8%0.10.34.4NA Source: Public filings, Wall Street research, FactSet; market prices as of close on 8/4/2020 Notes: (1) EBITDA reflects Core EBITDA (reduced by handset leasing D&A) for T-Mobile US; EBITDA reduced by stock-based compensation; LTM period reflected is as of latest publicly reported quarterly figures; (2) Pro forma for the sale of its operations in Puerto Rico and the U.S. Virgin Islands for $1.95 billion, announced on 10/9/2019; pro forma for the sale of Central European Media Enterprises for $1.1 billion, announced on 10/27/2019; (3) Pro forma for T-Mobile US’s acquisition of Sprint and the divestiture of Sprint’s prepaid business to DISH; includes opex synergies and cost to achieve synergies as forecasted by Wall Street research; pro forma for FCC Auction 103 payment; (4) Adjusted EBITDA excludes earnings from unconsolidated entities and interest and dividend income; (5) Net debt excludes collateralized indebtedness; pro forma for the acquisition of Service Electric Cable T.V., completed on 7/14/2020; pro forma for the sale of 49.99% of Lightpath Fiber Enterprise Business, announced on 7/28/2020; (6) Pro forma for the acquisition of Fidelity Communications, completed on 10/1/2019; pro forma for $400 million 20 |

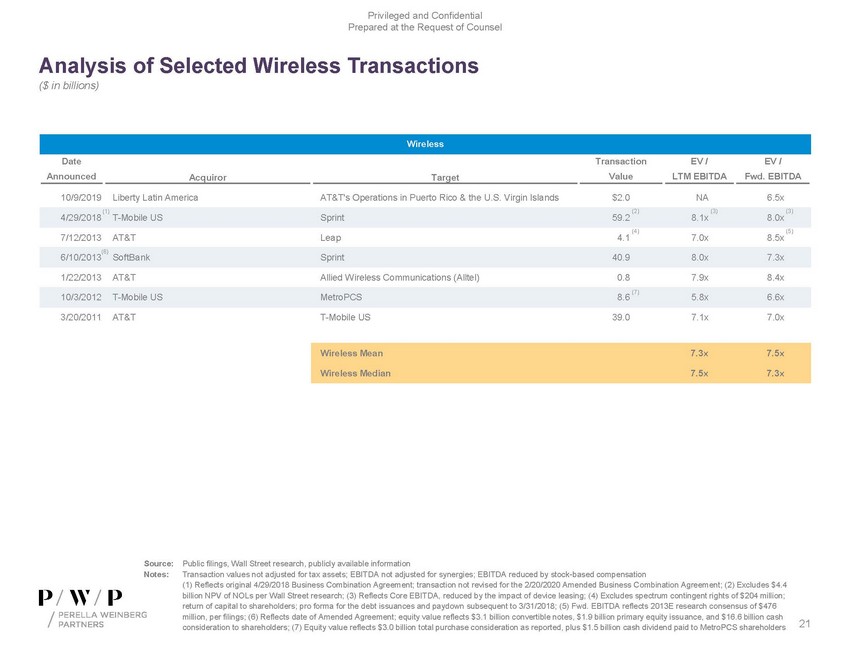

| Analysis of Selected Wireless Transactions ($ in billions) Date Wireless Transaction EV / EV / Announced Acquiror Target Value LTM EBITDA Fwd. EBITDA Source: Public filings, Wall Street research, publicly available information Notes:Transaction values not adjusted for tax assets; EBITDA not adjusted for synergies; EBITDA reduced by stock-based compensation (1) Reflects original 4/29/2018 Business Combination Agreement; transaction not revised for the 2/20/2020 Amended Business Combination Agreement; (2) Excludes $4.4 billion NPV of NOLs per Wall Street research; (3) Reflects Core EBITDA, reduced by the impact of device leasing; (4) Excludes spectrum contingent rights of $204 million; return of capital to shareholders; pro forma for the debt issuances and paydown subsequent to 3/31/2018; (5) Fwd. EBITDA reflects 2013E research consensus of $476 million, per filings; (6) Reflects date of Amended Agreement; equity value reflects $3.1 billion convertible notes, $1.9 billion primary equity issuance, and $16.6 billion cash |

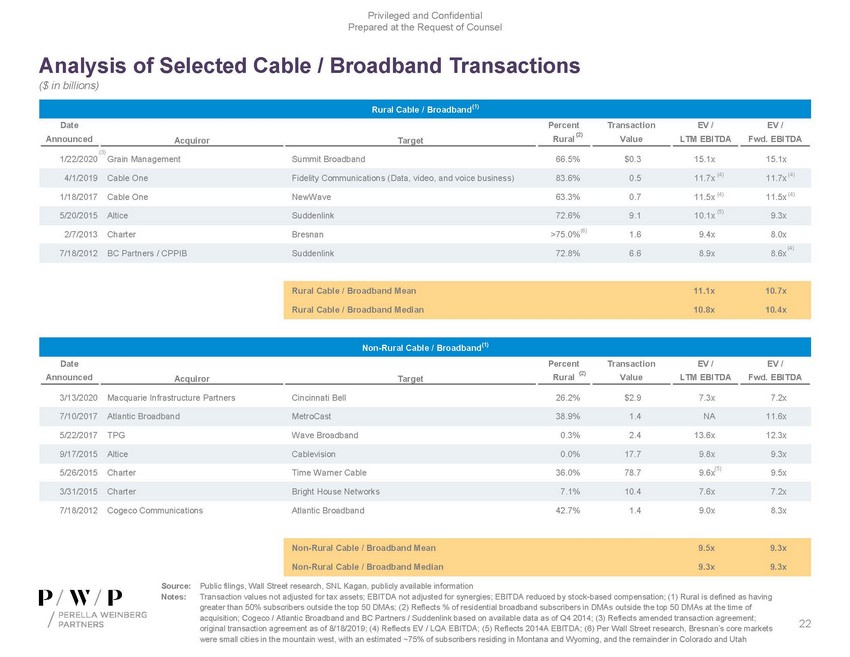

| Analysis of Selected Cable / Broadband Transactions ($ in billions) 7/18/2012 BC Partners / CPPIBSuddenlink72.8%6.68.9x8.6x (4) Source: Public filings, Wall Street research, SNL Kagan, publicly available information Notes:Transaction values not adjusted for tax assets; EBITDA not adjusted for synergies; EBITDA reduced by stock-based compensation; (1) Rural is defined as having greater than 50% subscribers outside the top 50 DMAs; (2) Reflects % of residential broadband subscribers in DMAs outside the top 50 DMAs at the time of acquisition; Cogeco / Atlantic Broadband and BC Partners / Suddenlink based on available data as of Q4 2014; (3) Reflects amended transaction agreement;22 |

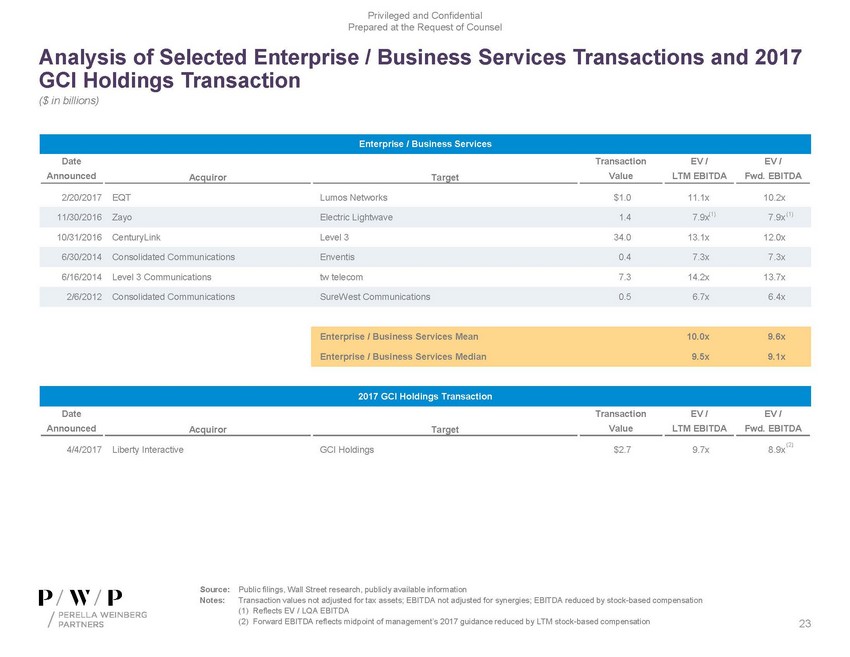

| Analysis of Selected Enterprise / Business Services Transactions and 2017 GCI Holdings Transaction ($ in billions) Enterprise / Business Services 2017 GCI Holdings Transaction Source: Public filings, Wall Street research, publicly available information Notes:Transaction values not adjusted for tax assets; EBITDA not adjusted for synergies; EBITDA reduced by stock-based compensation (1) Reflects EV / LQA EBITDA (2) Forward EBITDA reflects midpoint of management’s 2017 guidance reduced by LTM stock-based compensation23 |

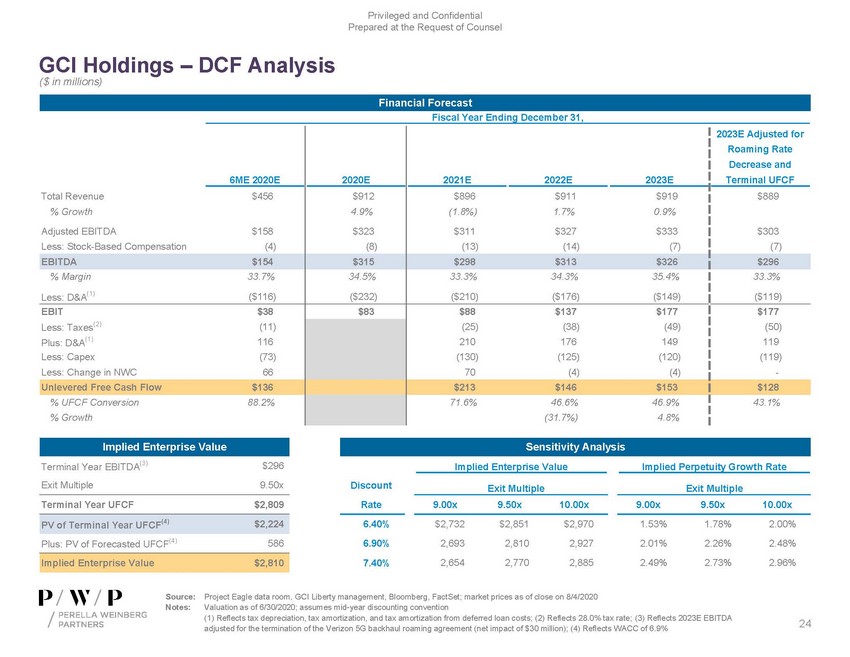

| GCI Holdings – DCF Analysis ($ in millions) Financial Forecast Fiscal Year Ending December 31, Source: Project Eagle data room, GCI Liberty management, Bloomberg, FactSet; market prices as of close on 8/4/2020 Notes:Valuation as of 6/30/2020; assumes mid-year discounting convention (1) Reflects tax depreciation, tax amortization, and tax amortization from deferred loan costs; (2) Reflects 28.0% tax rate; (3) Reflects 2023E EBITDA adjusted for the termination of the Verizon 5G backhaul roaming agreement (net impact of $30 million); (4) Reflects WACC of 6.9%24 |

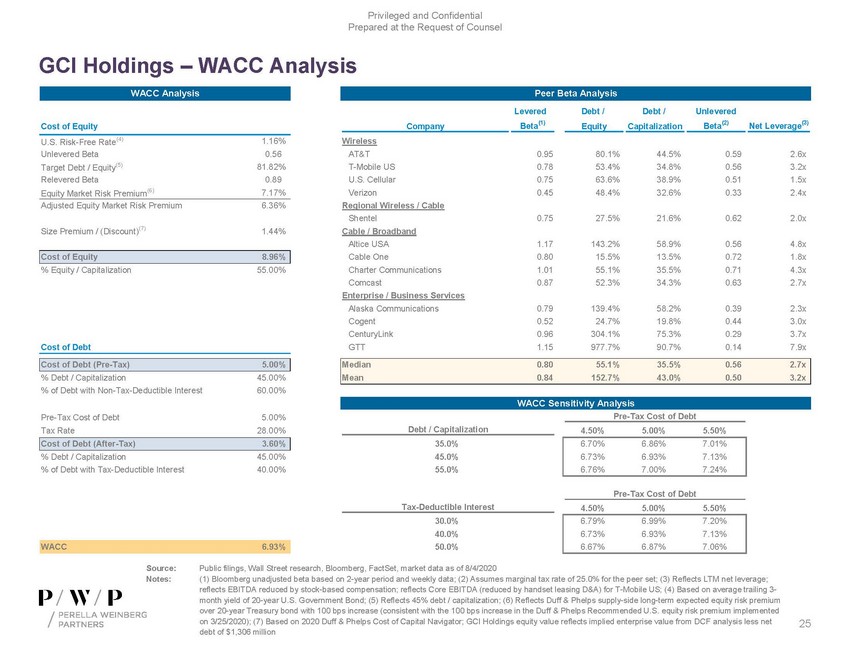

| GCI Holdings – WACC Analysis WACC Analysis Peer Beta Analysis Size Premium / (Discount)(7) Shentel 0.75 27.5% 21.6% 0.62 2.0x 1.44% Cable / Broadband Altice USA 1.17 143.2% 58.9% 0.56 4.8x Cost of Equity 8.96% Cable One 0.80 15.5% 13.5% 0.72 1.8x % Equity / Capitalization 55.00% Charter Communications 1.01 55.1% 35.5% 0.71 4.3x Comcast 0.87 52.3% 34.3% 0.63 2.7x Enterprise / Business Services Alaska Communications 0.79 139.4% 58.2% 0.39 2.3x Cogent 0.52 24.7% 19.8% 0.44 3.0x CenturyLink 0.96 304.1% 75.3% 0.29 3.7x Cost of Debt GTT 1.15 977.7% 90.7% 0.14 7.9x Cost of Debt (Pre-Tax) 5.00% Median 0.80 55.1% 35.5% 0.56 2.7x % Debt / Capitalization 45.00% Mean 0.84 152.7% 43.0% 0.50 3.2x % of Debt with Non-Tax-Deductible Interest 60.00% WACC Sensitivity Analysis Pre-Tax Cost of Debt5.00% Pre-Tax Cost of Debt Source:Public filings, Wall Street research, Bloomberg, FactSet, market data as of 8/4/2020 Notes:(1) Bloomberg unadjusted beta based on 2-year period and weekly data; (2) Assumes marginal tax rate of 25.0% for the peer set; (3) Reflects LTM net leverage; reflects EBITDA reduced by stock-based compensation; reflects Core EBITDA (reduced by handset leasing D&A) for T-Mobile US; (4) Based on average trailing 3-month yield of 20-year U.S. Government Bond; (5) Reflects 45% debt / capitalization; (6) Reflects Duff & Phelps supply-side long-term expected equity risk premium over 20-year Treasury bond with 100 bps increase (consistent with the 100 bps increase in the Duff & Phelps Recommended U.S. equity risk premium implemented on 3/25/2020); (7) Based on 2020 Duff & Phelps Cost of Capital Navigator; GCI Holdings equity value reflects implied enterprise value from DCF analysis less net25 debt of $1,306 million |

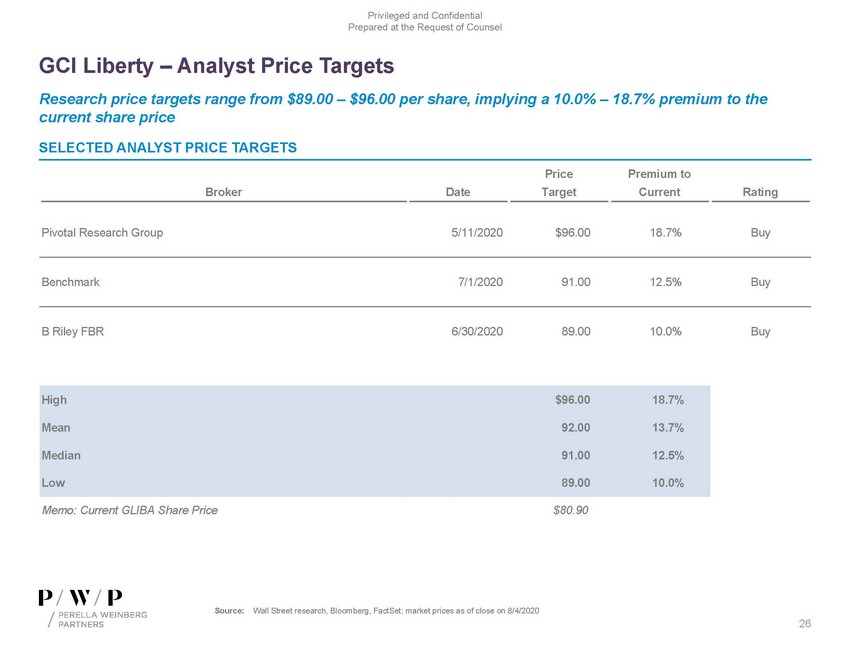

| GCI Liberty – Analyst Price Targets Research price targets range from $89.00 – $96.00 per share, implying a 10.0% – 18.7% premium to the current share price SELECTED ANALYST PRICE TARGETS Broker Date Price Target Premium to Current Rating Pivotal Research Group 5/11/2020 $96.00 18.7% Buy Benchmark 7/1/2020 91.00 12.5% Buy B Riley FBR 6/30/2020 89.00 10.0% Buy Source: Wall Street research, Bloomberg, FactSet; market prices as of close on 8/4/2020 |

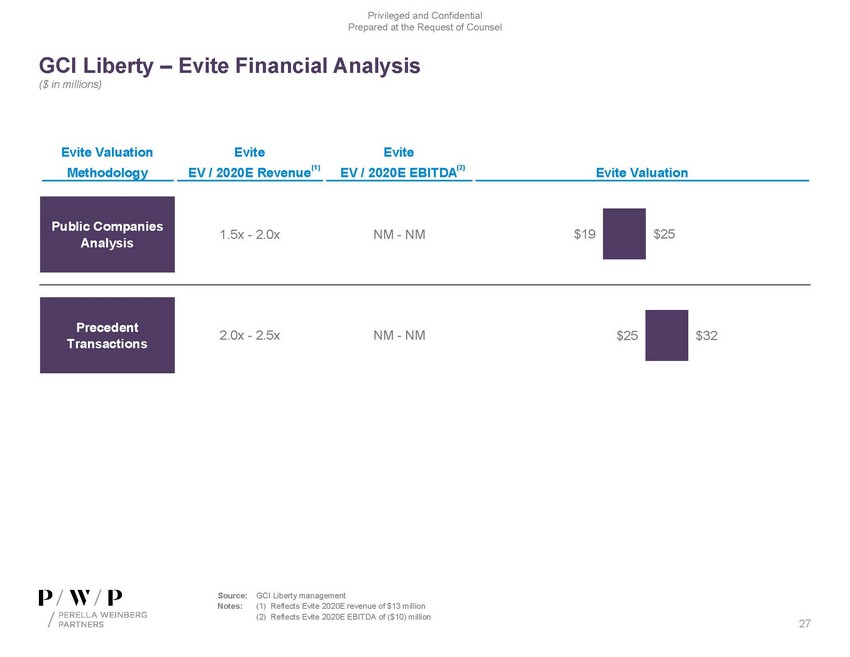

| GCI Liberty – Evite Financial Analysis ($ in millions) Evite Valuation Evite Evite Methodology EV / 2020E Revenue(1) EV / 2020E EBITDA(2) Evite Valuation Public Companies Analysis1.5x - 2.0xNM - NM Precedent Transactions2.0x - 2.5xNM - NM $19 $25 $25 $32 Source: GCI Liberty management Notes:(1) Reflects Evite 2020E revenue of $13 million (2) Reflects Evite 2020E EBITDA of ($10) million |

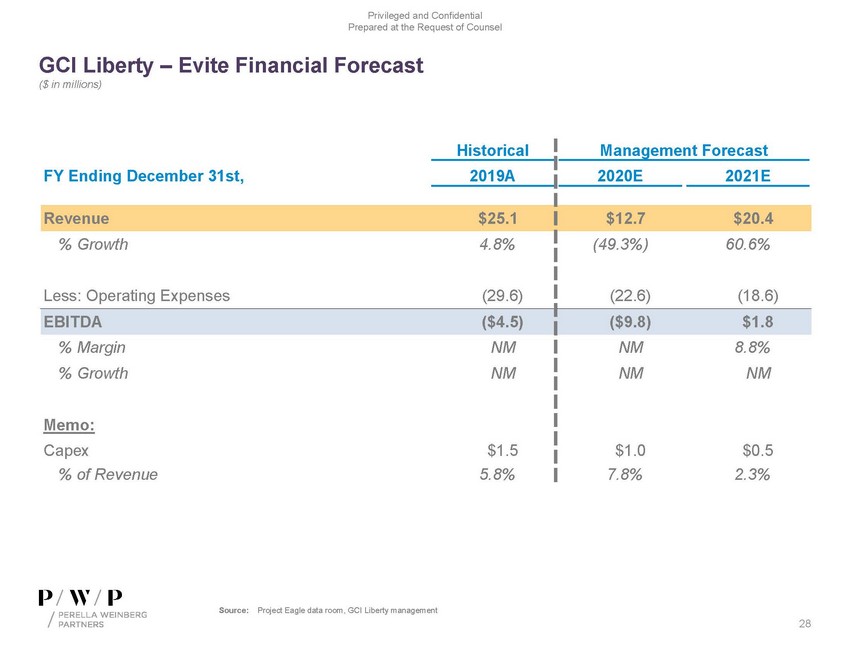

| GCI Liberty – Evite Financial Forecast ($ in millions) |

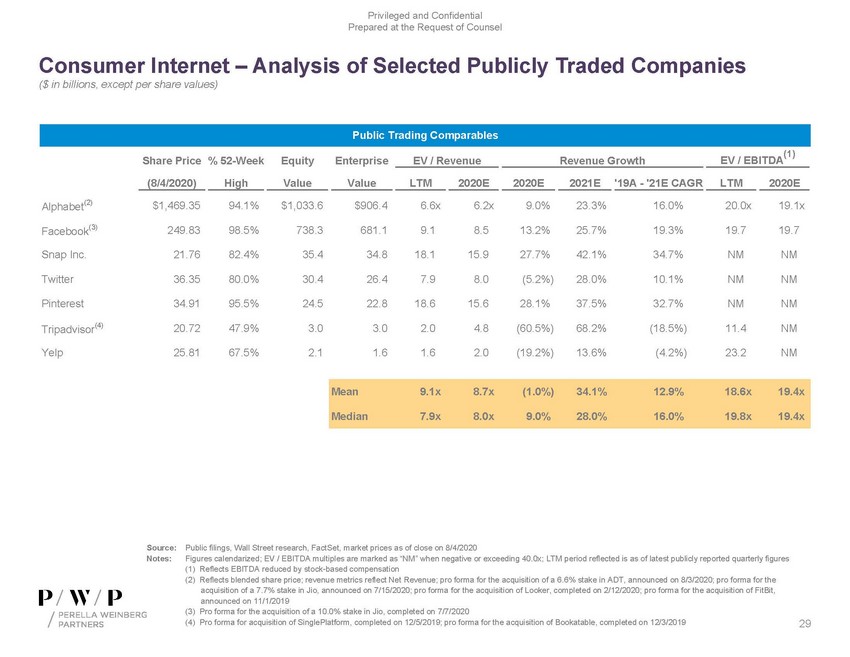

| Consumer Internet – Analysis of Selected Publicly Traded Companies ($ in billions, except per share values) Public Trading Comparables (1) Share Price % 52-WeekEquityEnterprise EV / Revenue Revenue Growth EV / EBITDA (8/4/2020) High Value Value LTM 2020E 2020E 2021E '19A - '21E CAGR LTM 2020E Alphabet(2) $1,469.3594.1%$1,033.6$906.46.6x6.2x9.0%23.3%16.0%20.0x19.1x Source: Public filings, Wall Street research, FactSet, market prices as of close on 8/4/2020 Notes:Figures calendarized; EV / EBITDA multiples are marked as “NM” when negative or exceeding 40.0x; LTM period reflected is as of latest publicly reported quarterly figures (1) Reflects EBITDA reduced by stock-based compensation (2) Reflects blended share price; revenue metrics reflect Net Revenue; pro forma for the acquisition of a 6.6% stake in ADT, announced on 8/3/2020; pro forma for the acquisition of a 7.7% stake in Jio, announced on 7/15/2020; pro forma for the acquisition of Looker, completed on 2/12/2020; pro forma for the acquisition of FitBit, announced on 11/1/2019 (3) Pro forma for the acquisition of a 10.0% stake in Jio, completed on 7/7/2020 (4) Pro forma for acquisition of SinglePlatform, completed on 12/5/2019; pro forma for the acquisition of Bookatable, completed on 12/3/201929 |

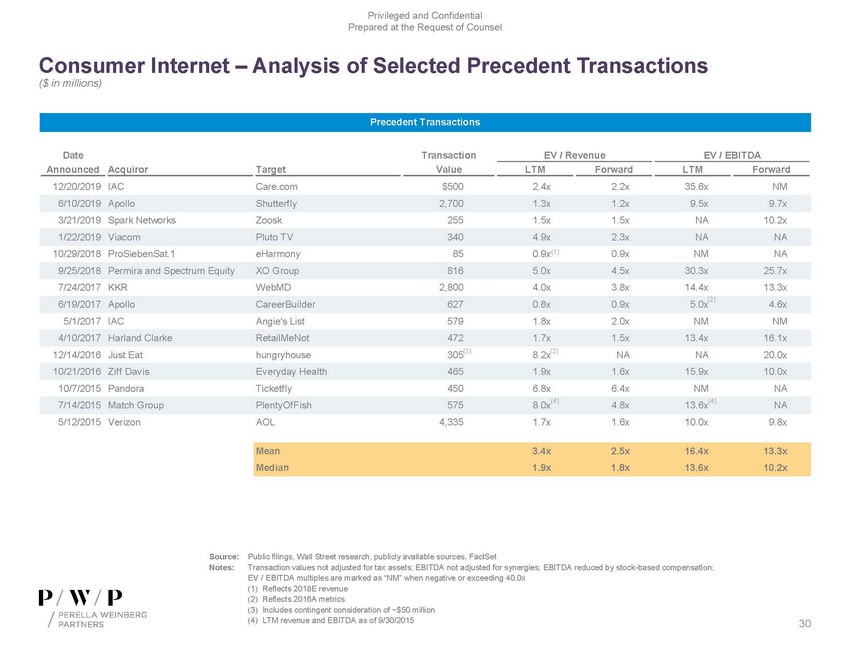

| Consumer Internet – Analysis of Selected Precedent Transactions ($ in millions) Precedent Transactions DateTransaction EV / Revenue EV / EBITDA Announced Acquiror Target Value LTM Forward LTM Forward Source: Public filings, Wall Street research, publicly available sources, FactSet Notes:Transaction values not adjusted for tax assets; EBITDA not adjusted for synergies; EBITDA reduced by stock-based compensation; EV / EBITDA multiples are marked as “NM” when negative or exceeding 40.0x (1) Reflects 2018E revenue (2) Reflects 2016A metrics (3) Includes contingent consideration of ~$50 million (4) LTM revenue and EBITDA as of 9/30/201530 |

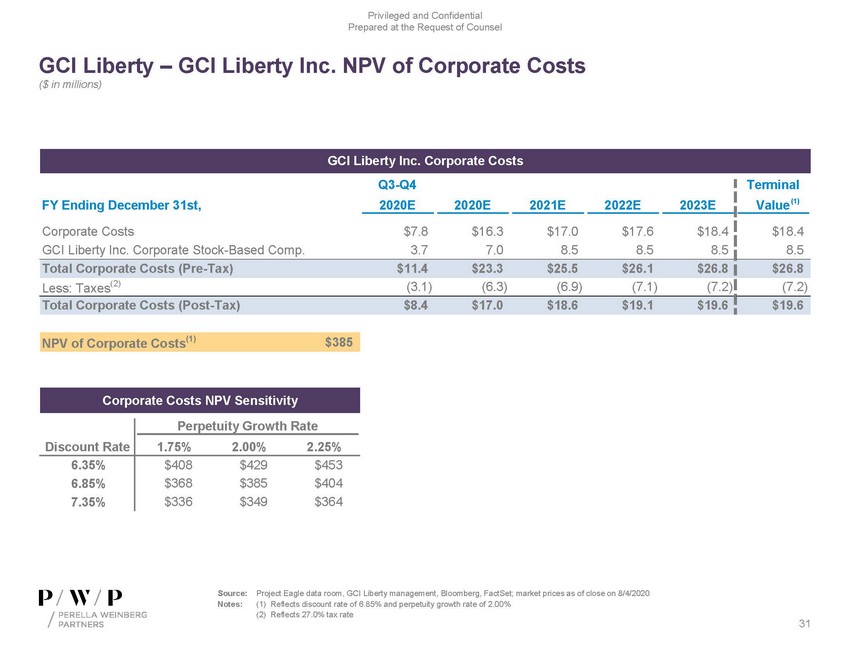

| GCI Liberty – GCI Liberty Inc. NPV of Corporate Costs ($ in millions) GCI Liberty Inc. Corporate Costs NPV of Corporate Costs(1) $385 Corporate Costs NPV Sensitivity Perpetuity Growth Rate Discount Rate 1.75% 2.00% 2.25% 6.35% $408 $429 $453 6.85% $368 $385 $404 7.35% $336 $349 $364 Source: Project Eagle data room, GCI Liberty management, Bloomberg, FactSet; market prices as of close on 8/4/2020 Notes:(1) Reflects discount rate of 6.85% and perpetuity growth rate of 2.00% (2) Reflects 27.0% tax rate 31 |

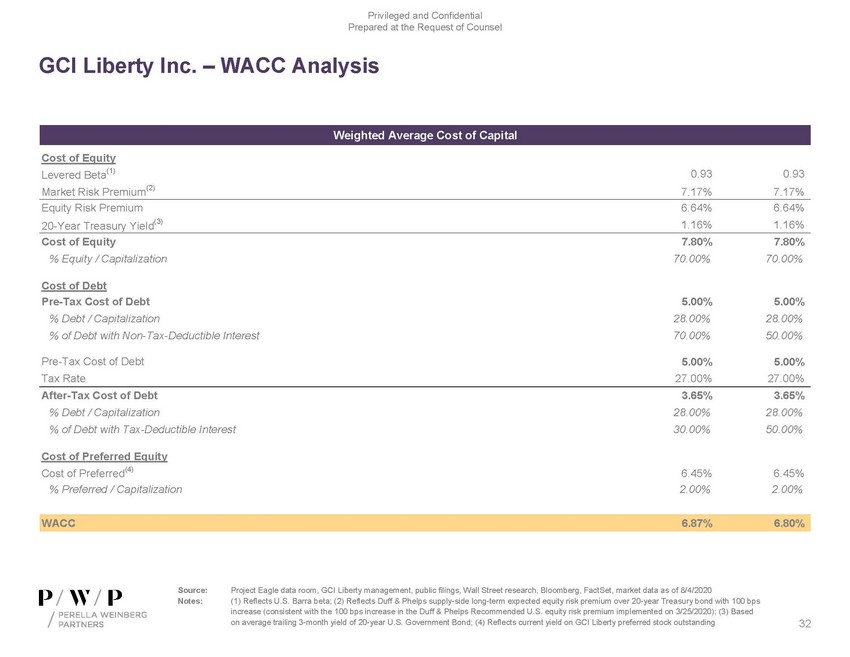

| GCI Liberty Inc. – WACC Analysis Source:Project Eagle data room, GCI Liberty management, public filings, Wall Street research, Bloomberg, FactSet, market data as of 8/4/2020 Notes:(1) Reflects U.S. Barra beta; (2) Reflects Duff & Phelps supply-side long-term expected equity risk premium over 20-year Treasury bond with 100 bps increase (consistent with the 100 bps increase in the Duff & Phelps Recommended U.S. equity risk premium implemented on 3/25/2020); (3) Based on average trailing 3-month yield of 20-year U.S. Government Bond; (4) Reflects current yield on GCI Liberty preferred stock outstanding32 |

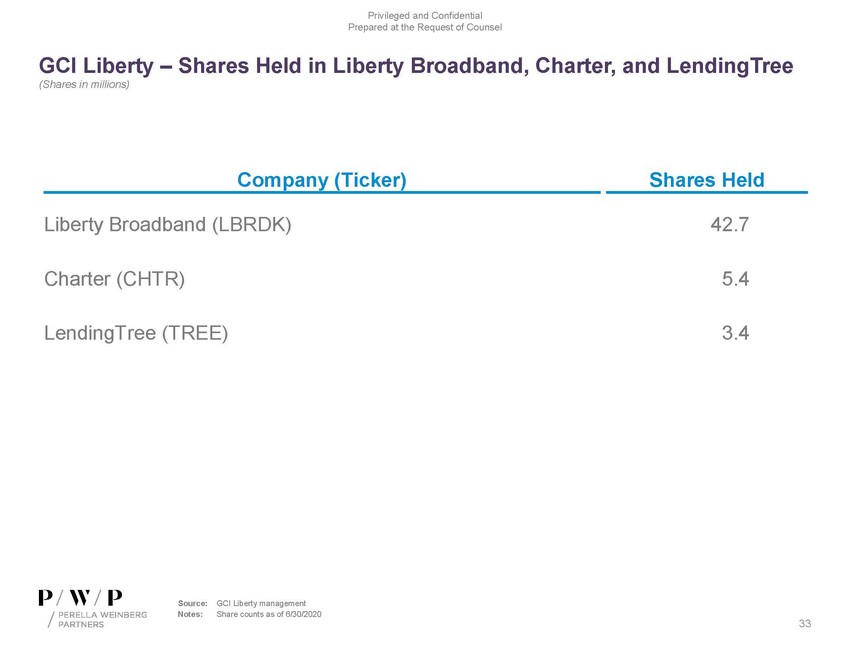

| GCI Liberty – Shares Held in Liberty Broadband, Charter, and LendingTree (Shares in millions) Company (Ticker) Shares Held Liberty Broadband (LBRDK) 42.7 Charter (CHTR) 5.4 LendingTree (TREE) 3.4 Source: GCI Liberty management Notes:Share counts as of 6/30/2020 |

| B.Liberty Broadband Analysis |

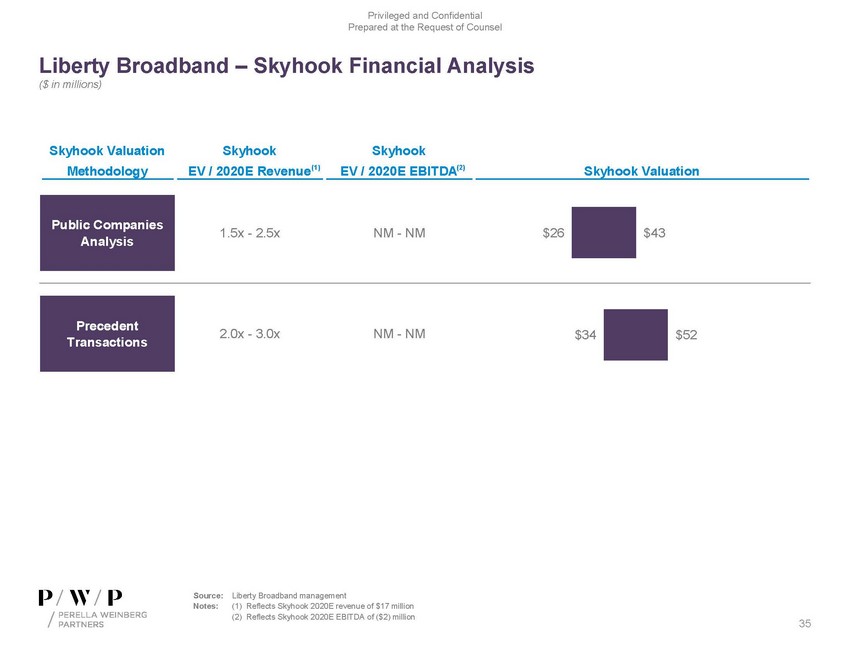

| Liberty Broadband – Skyhook Financial Analysis ($ in millions) Skyhook Valuation Skyhook Skyhook Methodology EV / 2020E Revenue(1) EV / 2020E EBITDA(2) Skyhook Valuation Public Companies Analysis1.5x - 2.5xNM - NM Precedent Transactions2.0x - 3.0xNM - NM $26 $34 $43 $52 Source: Liberty Broadband management Notes:(1) Reflects Skyhook 2020E revenue of $17 million (2) Reflects Skyhook 2020E EBITDA of ($2) million |

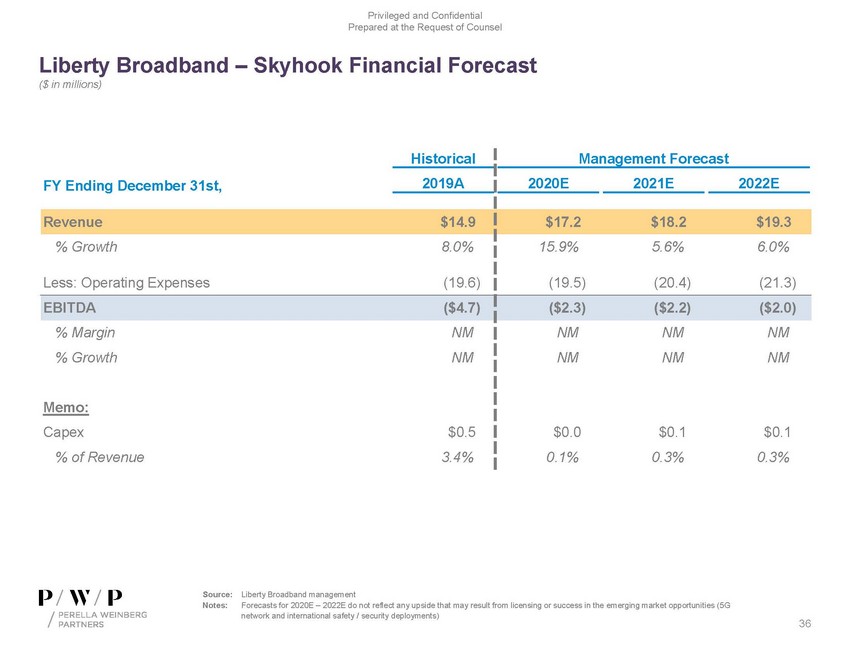

| Liberty Broadband – Skyhook Financial Forecast ($ in millions) Source: Liberty Broadband management Notes:Forecasts for 2020E – 2022E do not reflect any upside that may result from licensing or success in the emerging market opportunities (5G |

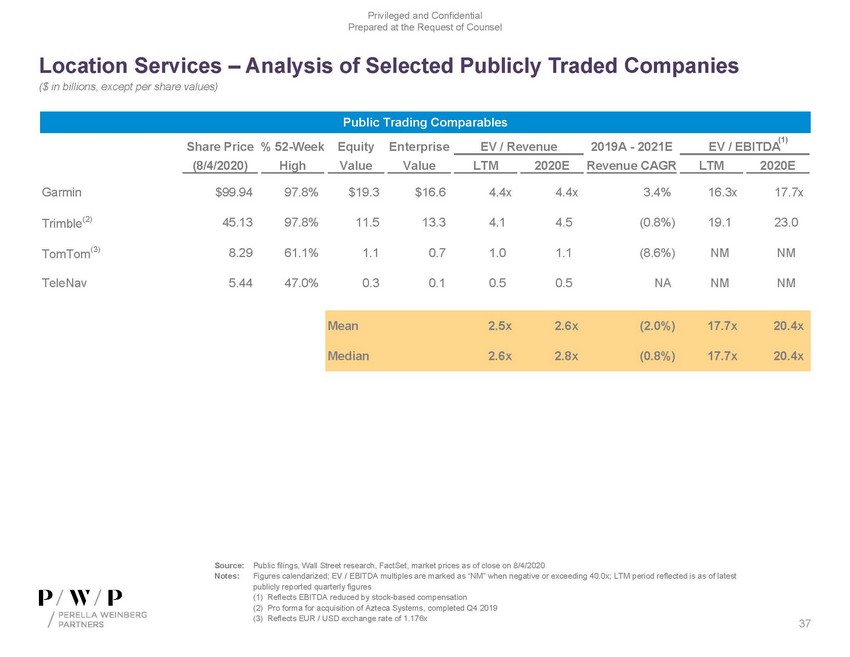

| Location Services – Analysis of Selected Publicly Traded Companies ($ in billions, except per share values) Public Trading Comparables (1) Share Price % 52-WeekEquityEnterprise EV / Revenue 2019A - 2021E EV / EBITDA (8/4/2020) High Value Value LTM 2020E Revenue CAGR LTM 2020E Source: Public filings, Wall Street research, FactSet, market prices as of close on 8/4/2020 Notes:Figures calendarized; EV / EBITDA multiples are marked as “NM” when negative or exceeding 40.0x; LTM period reflected is as of latest publicly reported quarterly figures (1) Reflects EBITDA reduced by stock-based compensation (2) Pro forma for acquisition of Azteca Systems, completed Q4 2019 (3) Reflects EUR / USD exchange rate of 1.176x37 |

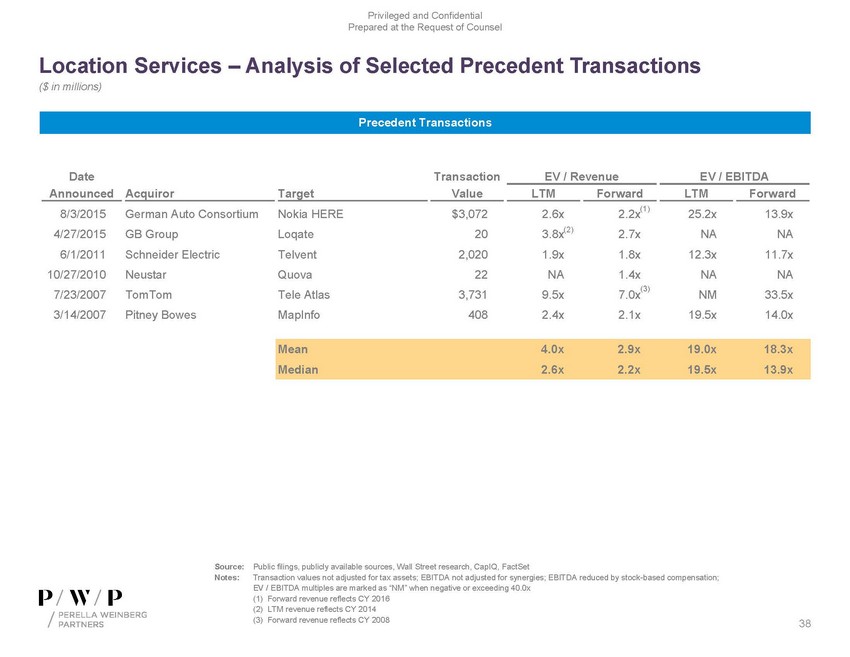

| Location Services – Analysis of Selected Precedent Transactions ($ in millions) Precedent Transactions DateTransaction EV / Revenue EV / EBITDA Announced Acquiror Target Value LTM Forward LTM Forward 8/3/2015German Auto ConsortiumNokia HERE$3,0722.6x2.2x(1) 25.2x13.9x 4/27/2015GB GroupLoqate203.8x(2) 2.7xNANA 6/1/2011Schneider ElectricTelvent2,0201.9x1.8x12.3x11.7x 10/27/2010NeustarQuova22NA1.4xNANA (3) 7/23/2007TomTomTele Atlas3,7319.5x7.0xNM33.5x 3/14/2007Pitney BowesMapInfo4082.4x2.1x19.5x14.0x Mean4.0x2.9x19.0x18.3x Median2.6x2.2x19.5x13.9x Source: Public filings, publicly available sources, Wall Street research, CapIQ, FactSet Notes:Transaction values not adjusted for tax assets; EBITDA not adjusted for synergies; EBITDA reduced by stock-based compensation; EV / EBITDA multiples are marked as “NM” when negative or exceeding 40.0x (1) Forward revenue reflects CY 2016 (2) LTM revenue reflects CY 2014 (3) Forward revenue reflects CY 200838 |

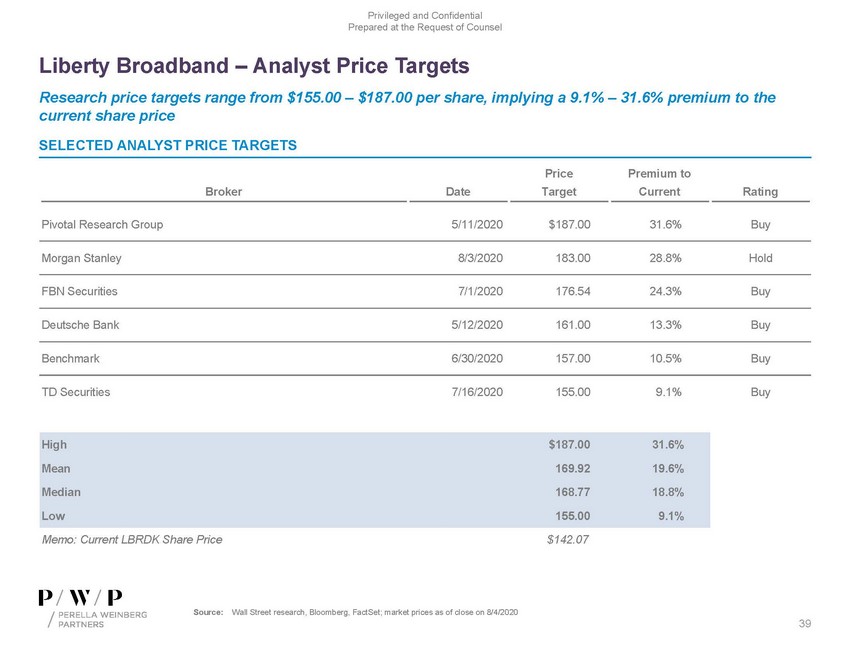

| Liberty Broadband – Analyst Price Targets Research price targets range from $155.00 – $187.00 per share, implying a 9.1% – 31.6% premium to the current share price SELECTED ANALYST PRICE TARGETS |

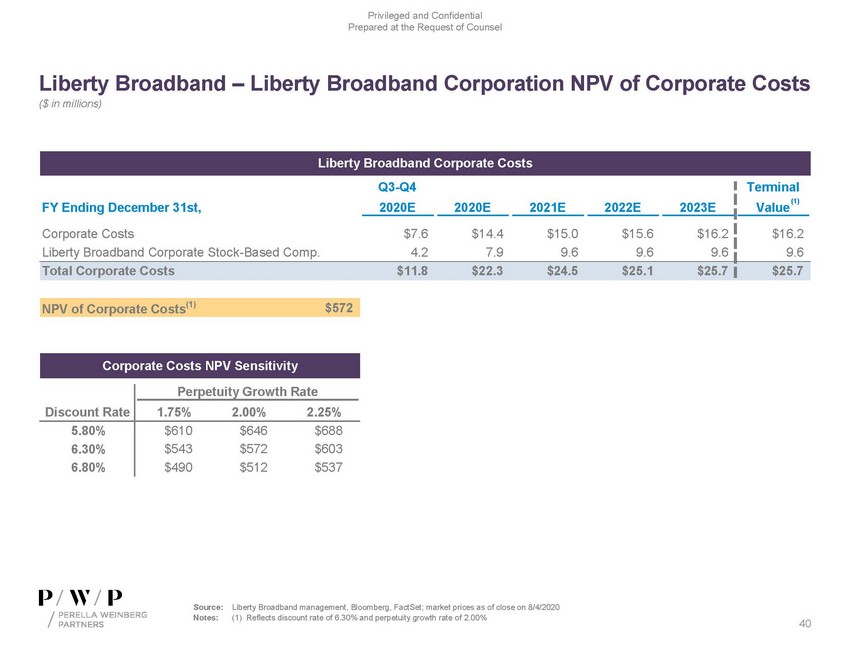

| Liberty Broadband – Liberty Broadband Corporation NPV of Corporate Costs ($ in millions) Liberty Broadband Corporate Costs NPV of Corporate Costs(1) $572 Corporate Costs NPV Sensitivity Perpetuity Growth Rate Discount Rate 1.75% 2.00% 2.25% 5.80% $610 $646 $688 6.30% $543 $572 $603 6.80% $490 $512 $537 |

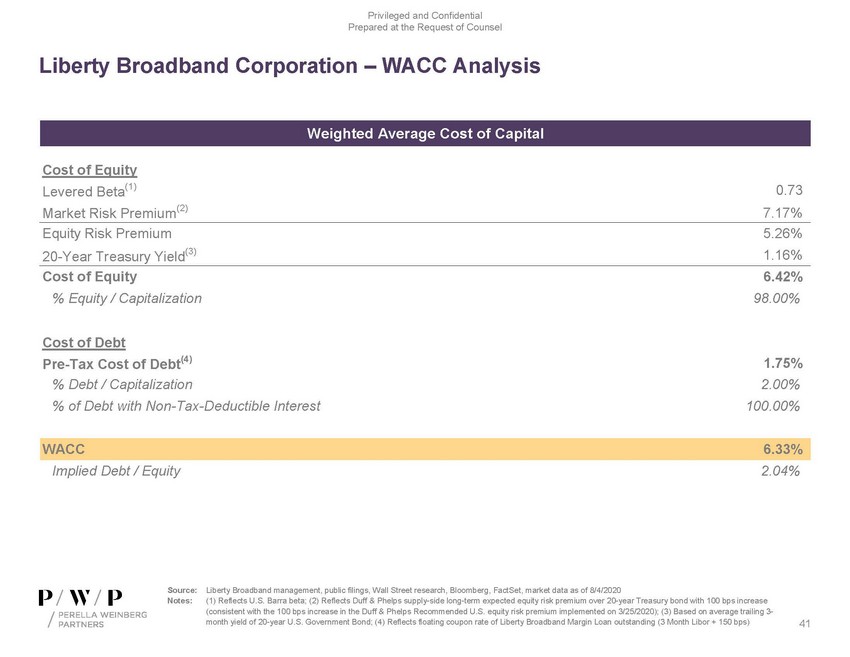

| Liberty Broadband Corporation – WACC Analysis % Debt / Capitalization2.00% % of Debt with Non-Tax-Deductible Interest100.00% WACC6.33% Implied Debt / Equity2.04% Source: Liberty Broadband management, public filings, Wall Street research, Bloomberg, FactSet, market data as of 8/4/2020 Notes:(1) Reflects U.S. Barra beta; (2) Reflects Duff & Phelps supply-side long-term expected equity risk premium over 20-year Treasury bond with 100 bps increase (consistent with the 100 bps increase in the Duff & Phelps Recommended U.S. equity risk premium implemented on 3/25/2020); (3) Based on average trailing 3-month yield of 20-year U.S. Government Bond; (4) Reflects floating coupon rate of Liberty Broadband Margin Loan outstanding (3 Month Libor + 150 bps)41 |

| Privileged and Confidential Prepared at the Request of Counsel C.Pro Forma Financial Analysis |

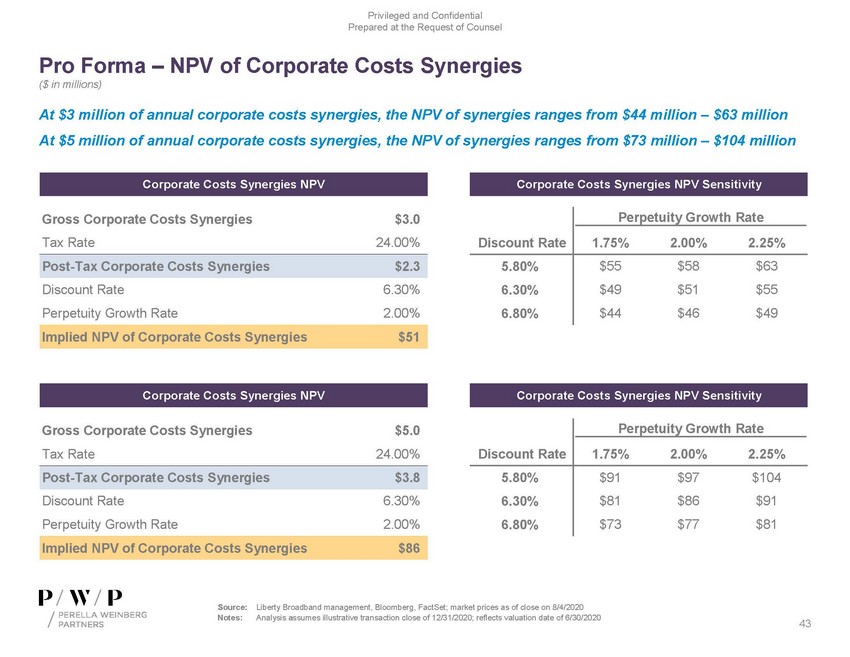

| Pro Forma – NPV of Corporate Costs Synergies ($ in millions) At $3 million of annual corporate costs synergies, the NPV of synergies ranges from $44 million – $63 million At $5 million of annual corporate costs synergies, the NPV of synergies ranges from $73 million – $104 million Corporate Costs Synergies NPV Corporate Costs Synergies NPV Sensitivity Gross Corporate Costs Synergies $3.0 Perpetuity Growth Rate Tax Rate 24.00% Discount Rate 1.75% 2.00% 2.25% Post-Tax Corporate Costs Synergies $2.3 5.80% $55 $58 $63 Discount Rate 6.30% 6.30% $49 $51 $55 Perpetuity Growth Rate 2.00% 6.80% $44 $46 $49 Implied NPV of Corporate Costs Synergies $51 Corporate Costs Synergies NPV Corporate Costs Synergies NPV Sensitivity Gross Corporate Costs Synergies $5.0 Perpetuity Growth Rate Tax Rate 24.00% Discount Rate 1.75% 2.00% 2.25% Post-Tax Corporate Costs Synergies $3.8 5.80% $91 $97 $104 Discount Rate 6.30% 6.30% $81 $86 $91 Perpetuity Growth Rate 2.00% 6.80% $73 $77 $81 Implied NPV of Corporate Costs Synergies $86 Source: Liberty Broadband management, Bloomberg, FactSet; market prices as of close on 8/4/2020 Notes:Analysis assumes illustrative transaction close of 12/31/2020; reflects valuation date of 6/30/2020 |

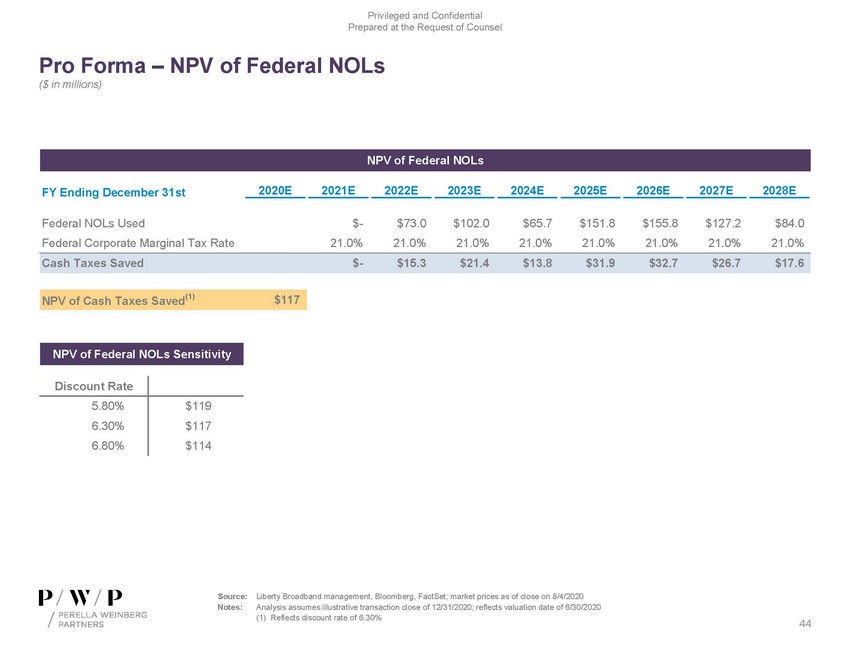

| Pro Forma – NPV of Federal NOLs ($ in millions) NPV of Federal NOLs FY Ending December 31st 2020E 2021E 2022E 2023E 2024E 2025E 2026E 2027E 2028E NPV of Federal NOLs Sensitivity Discount Rate 5.80% $119 6.30% $117 6.80% $114 Source: Liberty Broadband management, Bloomberg, FactSet; market prices as of close on 8/4/2020 Notes:Analysis assumes illustrative transaction close of 12/31/2020; reflects valuation date of 6/30/2020 (1) Reflects discount rate of 6.30% |

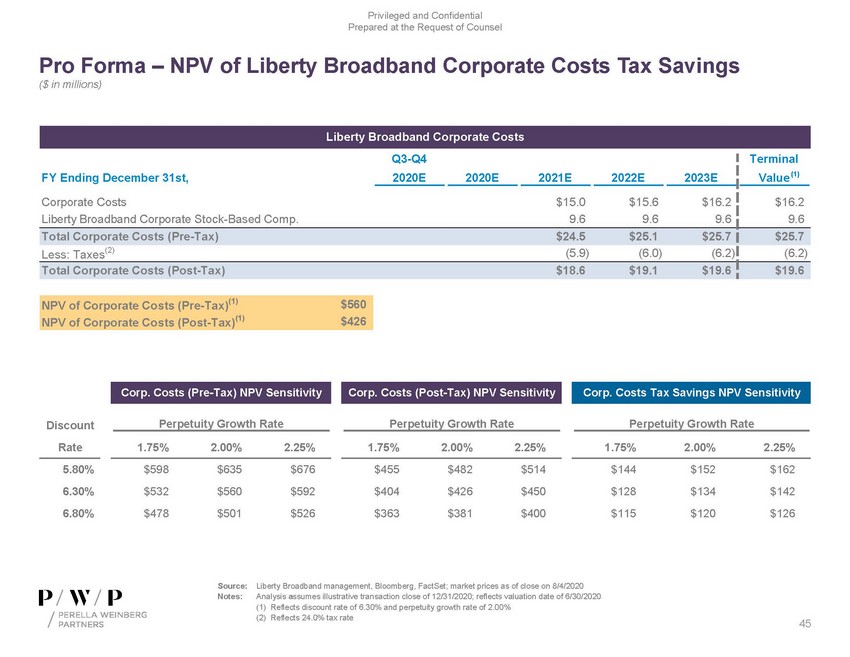

| Pro Forma – NPV of Liberty Broadband Corporate Costs Tax Savings ($ in millions) Liberty Broadband Corporate Costs NPV of Corporate Costs (Pre-Tax)(1) $560 NPV of Corporate Costs (Post-Tax)(1) $426 Source: Liberty Broadband management, Bloomberg, FactSet; market prices as of close on 8/4/2020 |

| Legal Disclaimer This Presentation has been provided to you by Perella Weinberg Partners and its affiliates (collectively “Perella Weinberg Partners” or the “Firm”) and may not be used or relied upon for any purpose without the written consent of Perella Weinberg Partners. The information contained herein (the “Information”) is confidential. By accepting this Information, you agree that you and your directors, partners, officers, employees, attorney(s), agents and representatives agree to use it for informational purposes only and will not divulge any such Information to any other party. Reproduction of this Information, in whole or in part, is prohibited. These contents are proprietary and a product of Perella Weinberg Partners. The Information contained herein is not an offer to buy or sell or a solicitation of an offer to buy or sell any corporate advisory services or security or to participate in any corporate advisory services or trading strategy. Any decision regarding corporate advisory services or to invest in the investments described herein should be made after, as applicable, reviewing such definitive offering memorandum, conducting such investigations as you deem necessary and consulting the investor’s own investment, legal, accounting and tax advisors in order to make an independent determination of the suitability and consequences of an investment or service. The information used in preparing these materials may have been obtained from or through you or your representatives or from public sources. Perella Weinberg Partners assumes no responsibility for independent verification of such information and has relied on such information being complete and accurate in all material respects. To the extent such information includes estimates and/or forecasts of future financial performance (including estimates of potential cost savings and synergies) prepared by or reviewed or discussed with the managements of your company and/or other potential transaction participants or obtained from public sources, we have assumed that such estimates and forecasts have been reasonably prepared on bases reflecting the best currently available estimates and judgments of such managements (or, with respect to estimates and forecasts obtained from public sources, represent reasonable estimates). The Firm has no obligation (express or implied) to update any or all of the Information or to advise you of any changes; nor do we make any express or implied warranties or representations as to the completeness or accuracy or accept responsibility for errors. Nothing contained herein should be construed as tax, accounting or legal advice. You (and each of your employees, representatives or other agents) may disclose to any and all persons, without limitation of any kind, the tax treatment and tax structure of the transactions contemplated by these materials and all materials of any kind (including opinions or other tax analyses) that are provided to you relating to such tax treatment and structure. For this purpose, the tax treatment of a transaction is the purported or claimed U.S. federal income tax treatment of the transaction and the tax structure of a transaction is any fact that may be relevant to understanding the purported or claimed U.S. federal income tax treatment of the transaction. |