Research and Development Costs

Research and development costs were €88.1 million for the three months ended March 31, 2021, an increase of €30.6 million, or 53%, compared to €57.5 million for the three months ended March 31, 2020.

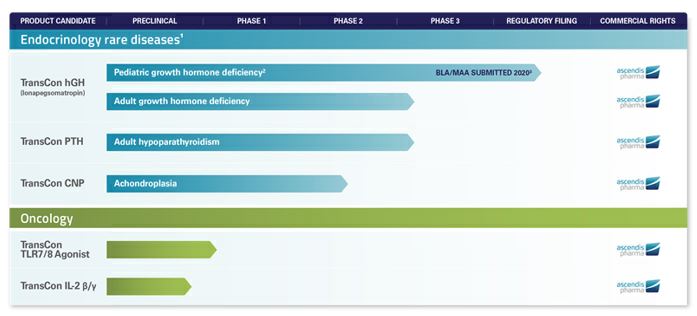

External development costs related to lonapegsomatropin increased by €10.1 million compared to the same period last year, reflecting higher costs for manufacturing of product supply, but also reflecting higher costs for the ongoing clinical trials.

External development costs related to TransCon PTH increased by €1.8 million, primarily reflecting increased costs related to manufacturing of validation batches, device development, and increasing costs for clinical trials and clinical supplies, compared to the same period last year.

External development costs related to TransCon CNP increased by €5.9 million, primarily reflecting an increase in clinical trial costs and clinical supplies, but also increasing manufacturing costs.

External development costs related to our oncology product candidates, primarily TransCon TLR7/8 Agonist and TransCon IL-2 ß/g increased by €5.5 million, reflecting an increase in manufacturing costs and preclinical costs as these product candidates progress through the early development stages and into manufacturing and clinical trials.

Other research and development costs increased by €7.3 million, primarily driven by an increase in personnel costs of €5.0 million and non-cash share-based payment of €5.3 million due to a higher number of employees in research and development functions. Other costs allocated to research and development functions decreased by a total of €3.0 million, primarily relating to IT, travel costs, and professional fees.

Research and development costs included non-cash share-based payment of €14.2 million for the three months ended March 31, 2021, compared to €8.9 million for the three months ended March 31, 2020.

Selling, General and Administrative Expenses

Selling, general and administrative expenses were €37.2 million for the three months ended March 31, 2021, an increase of €19.3 million, or 108%, compared to €17.9 million for the three months ended March 31, 2020. The higher expenses were primarily due to an increase in personnel costs of €4.8 million and non-cash share-based payment of €2.8 million for additional commercial and administrative personnel. Other costs allocated to selling, general and administrative functions increased by a total of €11.7 million, primarily reflecting increasing IT costs, including the implementation of a new ERP-system of €5.1 million, insurance costs of €2.2 million, professional fees of €1.6 million, and costs related to building our commercial business of €1.8 million.

Selling, general and administrative expenses included non-cash share-based payment of €8.9 million for the three months ended March 31, 2021, compared to €6.1 million for the three months ended March 31, 2020.

Net Profit / (Loss) of Associate

Net profit of associate was €28.1 million for the three months ended March 31, 2021, compared to a net loss of €1.5 million for the three months ended March 31, 2020.

For the three months ended March 31, 2021, the net profit of associate comprises a non-cash gain of €42.3 million as a result of the Series B financing in VISEN on January 8, 2021, and the Company’s share of loss of €14.2 million. The Series B financing has not changed the Company’s accounting treatment of VISEN.

Finance Income and Finance Expenses

Finance income was €34.4 million for the three months ended March 31, 2021 compared to €11.8 million for the three months ended March 31, 2020. Finance expenses were €0.9 million for the three months ended March 31, 2021 compared to €0.4 million for the same period in 2020. As we hold positions of marketable securities and cash and cash equivalents in U.S. Dollar, we are affected by exchange rate fluctuations when reporting our financial results in Euro. For the three months ended March 31, 2021, as well as for the same period last year, we recognized net exchange rate gains when reporting our U.S. Dollar positions in Euro, reflecting positive exchange rate fluctuations.

We did not have any interest-bearing debt for any of the periods presented. However, IFRS 16, “Leases”, requires interest expenses to be recognized on lease liabilities.

10