- ASND Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Ascendis Pharma A/S (ASND) 6-KCurrent report (foreign)

Filed: 13 Jan 25, 6:05am

Exhibit 99.1 Ascendis Pharma A/S J.P. Morgan Healthcare Conference San Francisco January 2025 For investor communication only. Not for use in product promotion. Not for further distribution.

Cautionary Note on Forward-Looking Statements This presentation contains forward-looking statements. All statements other than statements of historical facts contained in this presentation, such as statements regarding our products and prospective product candidates; revenue and growth expectations; PDUFA goal dates; clinical trial results; the expected timing of future clinical trial results, regulatory filings and feedback from regulatory authorities; the scope, progress, results and costs of developing our product candidates or any other future product candidates; timing and likelihood of success; patient enrollment; timing and expansion of commercial launches, pipelines, and investments; potential payments and royalties relating to investments and partnerships; plans and objectives of management for future operations and commercialization and manufacturing activities; and future results of current and/or anticipated products and product candidates are forward-looking statements. These forward-looking statements are based on our current expectations and beliefs, as well as assumptions concerning future events. These statements involve known and unknown risks, uncertainties and other factors that could cause our actual results to differ materially from the results discussed in the forward-looking statements. These risks, uncertainties and other factors are more fully described in our reports filed with or submitted to the Securities and Exchange Commission (“SEC”), including, without limitation, our prospectus supplement filed on September 20, 2024 and our current and future reports filed with or submitted to the SEC, including our most recent Annual Report on Form 20-F filed with the SEC on February 7, 2024, particularly in the sections titled “Risk Factors” and “Operating and Financial Review and Prospects.” In light of the significant uncertainties in our forward-looking statements, you should not place undue reliance on these statements or regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified timeframe, or at all. Any forward-looking statement made by us in this presentation speaks only as of the date of this presentation and represents our estimates and assumptions only as of the date of this presentation. Except as required by law, we assume no obligation to update these statements publicly, whether as a result of new information, future events, changed circumstances or otherwise after the date of this presentation. This presentation concerns Ascendis Pharma approved products as well as Ascendis Pharma investigational product candidates that are or have been under clinical investigation and which have not yet been approved for marketing by the U.S. Food and Drug Administration, European Medicines Agency or other foreign regulatory authorities. These investigational product candidates are currently limited by law to investigational use, and no representations are made as to their safety or effectiveness for the purposes for which they are being investigated. This presentation is for investor and insurance carrier communications only. Not for use in product promotion. This presentation also contains estimates and other statistical data made by independent parties and by us relating to market size and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such data and estimates. In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk. This presentation contains trademarks, services marks, trade names and copyrights of the company and other companies, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade name or products in this presentation is not intended to, and does not imply, a relationship with the company, or an endorsement of sponsorship by the company. 2 For investor communication only. Not for use in product promotion. Not for further distribution.

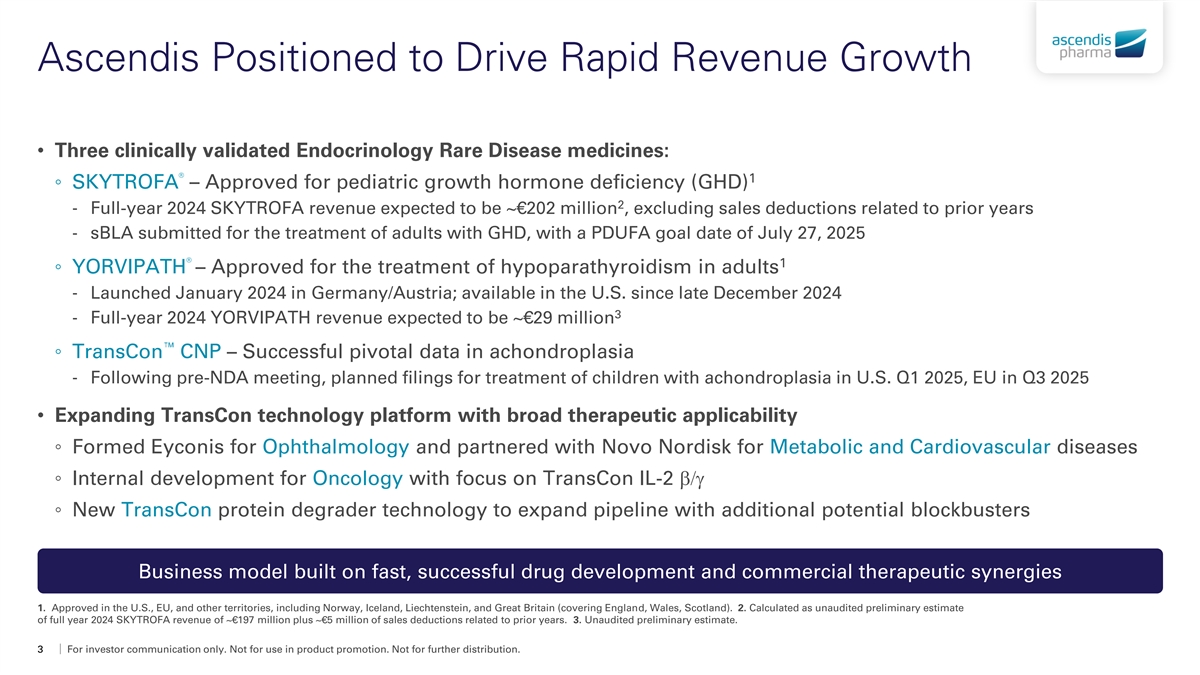

Ascendis Positioned to Drive Rapid Revenue Growth • Three clinically validated Endocrinology Rare Disease medicines: ® 1 ◦ SKYTROFA – Approved for pediatric growth hormone deficiency (GHD) 2 - Full-year 2024 SKYTROFA revenue expected to be ~€202 million , excluding sales deductions related to prior years - sBLA submitted for the treatment of adults with GHD, with a PDUFA goal date of July 27, 2025 ® 1 ◦ YORVIPATH – Approved for the treatment of hypoparathyroidism in adults - Launched January 2024 in Germany/Austria; available in the U.S. since late December 2024 3 - Full-year 2024 YORVIPATH revenue expected to be ~€29 million ◦ TransCon CNP – Successful pivotal data in achondroplasia - Following pre-NDA meeting, planned filings for treatment of children with achondroplasia in U.S. Q1 2025, EU in Q3 2025 • Expanding TransCon technology platform with broad therapeutic applicability ◦ Formed Eyconis for Ophthalmology and partnered with Novo Nordisk for Metabolic and Cardiovascular diseases ◦ Internal development for Oncology with focus on TransCon IL-2 b/g ◦ New TransCon protein degrader technology to expand pipeline with additional potential blockbusters Business model built on fast, successful drug development and commercial therapeutic synergies 1. Approved in the U.S., EU, and other territories, including Norway, Iceland, Liechtenstein, and Great Britain (covering England, Wales, Scotland). 2. Calculated as unaudited preliminary estimate of full year 2024 SKYTROFA revenue of ~€197 million plus ~€5 million of sales deductions related to prior years. 3. Unaudited preliminary estimate. 3 For investor communication only. Not for use in product promotion. Not for further distribution.

Vision 2030 Achieve blockbuster status for multiple products and expand our engine for future innovation Be the Leading Endocrinology Rare Disease Company • Achieve blockbuster status (>$1B) for each of TransCon PTH, TransCon hGH, and TransCon CNP through worldwide commercialization • Be the leader in Growth Disorders and Hypoparathyroidism, pursuing clinical conditions, innovative LCM, and complementary patient offerings • Expand pipeline with Endocrinology Rare Disease blockbuster product opportunities Create Value in Additional Therapeutic Areas through Innovative Business Models • Obtain accelerated approval in Oncology with registrational trials ongoing • Pursue TransCon product opportunities in >$5B indications • Maximize value creation of these product opportunities through collaboration with therapeutic area market leaders Differentiate with Ascendis Fundamentals • Outperform industry drug development benchmarks with Ascendis’ product innovation algorithm • Remain independent as a profitable biopharma through lean and flexible ways of working • Let our values Patients, Science, Passion drive our decisions to success Ascendis Pharma’s 2025 - 2030 strategic roadmap 4 For investor communication only. Not for use in product promotion. Not for further distribution.

Overview of TransCon Technologies TransCon Linker Aromatic Cyclic Imide DKP Carbamate Bicin AEG Pyroglutamate TransCon TransCon Prodrug: Carrier 3 components Soluble Carriers Insoluble Carriers Albumin Avidity Parent Drug Antibodies, Antibody Fragments, Proteins, Peptides and Small Molecules Protein Degraders Continued expansion of TransCon technologies, enabling new product candidates 5 For investor communication only. Not for use in product promotion. Not for further distribution.

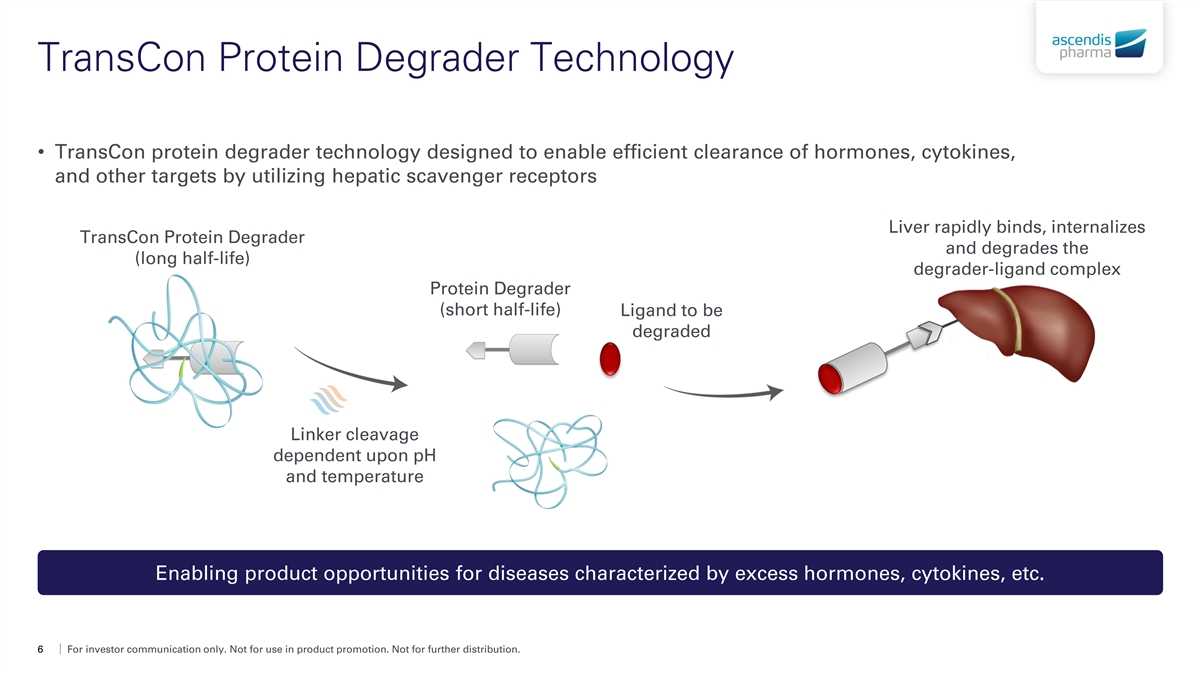

TransCon Protein Degrader Technology • TransCon protein degrader technology designed to enable efficient clearance of hormones, cytokines, and other targets by utilizing hepatic scavenger receptors Liver rapidly binds, internalizes TransCon Protein Degrader and degrades the (long half-life) degrader-ligand complex Protein Degrader (short half-life) Ligand to be degraded Linker cleavage dependent upon pH and temperature Enabling product opportunities for diseases characterized by excess hormones, cytokines, etc. 6 For investor communication only. Not for use in product promotion. Not for further distribution.

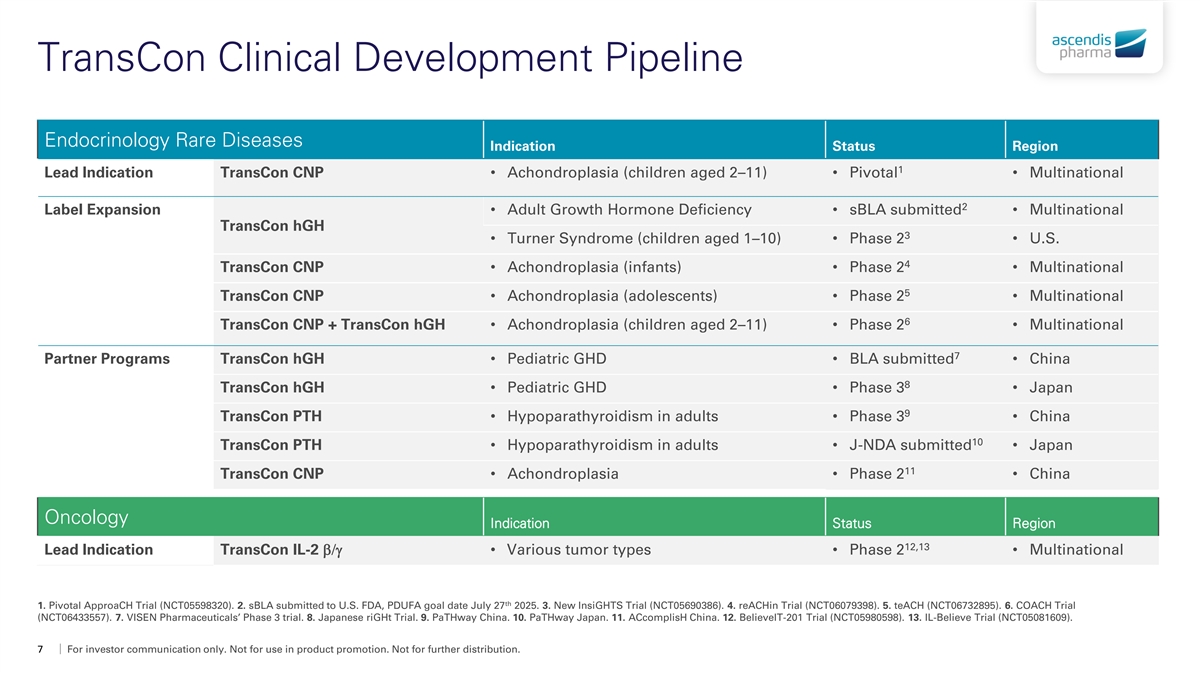

TransCon Clinical Development Pipeline Endocrinology Rare Diseases Indication Status Region 1 Lead Indication TransCon CNP• Achondroplasia (children aged 2–11)• Pivotal• Multinational 2 Label Expansion• Adult Growth Hormone Deficiency• sBLA submitted• Multinational TransCon hGH 3 • Turner Syndrome (children aged 1–10)• Phase 2• U.S. 4 TransCon CNP• Achondroplasia (infants)• Phase 2• Multinational 5 TransCon CNP• Achondroplasia (adolescents)• Phase 2• Multinational 6 TransCon CNP + TransCon hGH • Achondroplasia (children aged 2–11)• Phase 2• Multinational 7 Partner Programs TransCon hGH• Pediatric GHD• BLA submitted• China 8 TransCon hGH• Pediatric GHD• Phase 3• Japan 9 TransCon PTH• Hypoparathyroidism in adults• Phase 3• China 10 TransCon PTH• Hypoparathyroidism in adults• J-NDA submitted• Japan 11 TransCon CNP• Achondroplasia• Phase 2• China Oncology Indication Status Region 12,13 Lead Indication TransCon IL-2 b/g• Various tumor types• Phase 2• Multinational th 1. Pivotal ApproaCH Trial (NCT05598320). 2. sBLA submitted to U.S. FDA, PDUFA goal date July 27 2025. 3. New InsiGHTS Trial (NCT05690386). 4. reACHin Trial (NCT06079398). 5. teACH (NCT06732895). 6. COACH Trial (NCT06433557). 7. VISEN Pharmaceuticals’ Phase 3 trial. 8. Japanese riGHt Trial. 9. PaTHway China. 10. PaTHway Japan. 11. ACcomplisH China. 12. BelieveIT-201 Trial (NCT05980598). 13. IL-Believe Trial (NCT05081609). 7 For investor communication only. Not for use in product promotion. Not for further distribution.

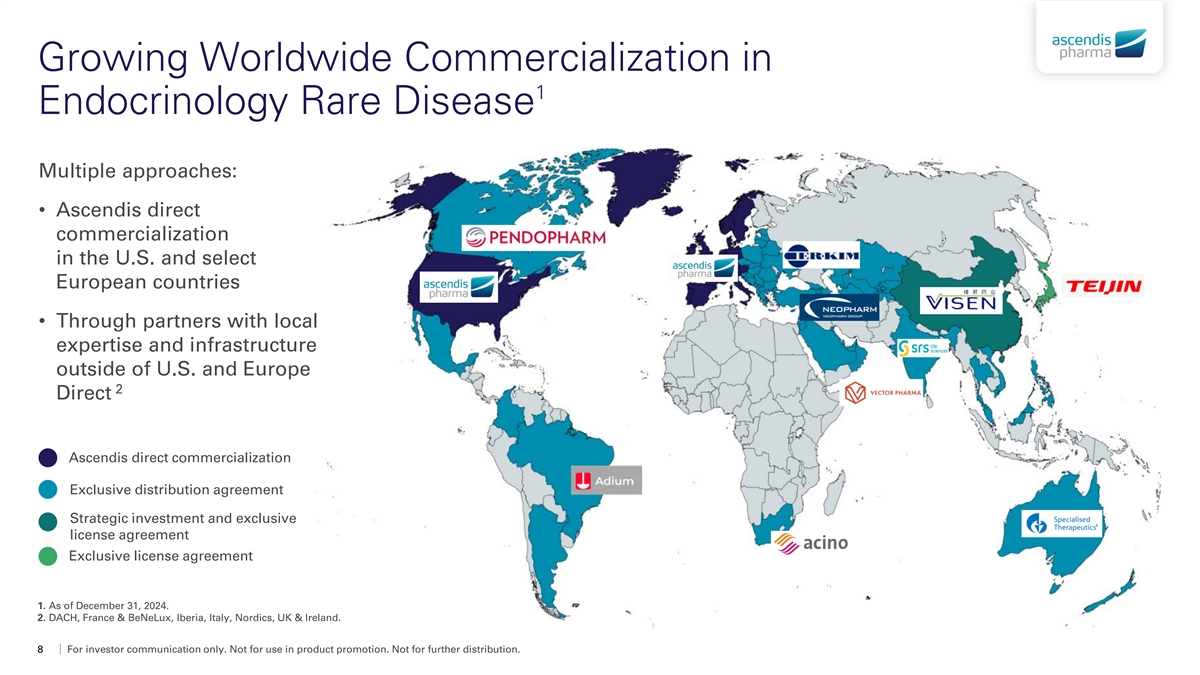

Growing Worldwide Commercialization in 1 Endocrinology Rare Disease Multiple approaches: • Ascendis direct commercialization in the U.S. and select European countries • Through partners with local expertise and infrastructure outside of U.S. and Europe 2 Direct Ascendis direct commercialization Exclusive distribution agreement Strategic investment and exclusive license agreement Exclusive license agreement 1. As of December 31, 2024. 2. DACH, France & BeNeLux, Iberia, Italy, Nordics, UK & Ireland. 8 For investor communication only. Not for use in product promotion. Not for further distribution.

® SKYTROFA TransCon hGH Once-weekly growth hormone therapy For investor communication only. Not for use in product promotion. Not for further distribution.

SKYTROFA - High Value Growth Hormone Brand • Launched for pediatric growth hormone deficiency SKYTROFA Revenue (€ million) in U.S. in Q4 21, Germany in Q3 23 ◦ Successful Phase 3 riGHt Trial in Japan € 225 1 € 202 ◦ Planned expansion across multiple countries € 200 € 179 € 175 • Planned label expansion to drive growth € 150 ◦ sBLA accepted for adult growth hormone € 125 deficiency; PDUFA goal date of July 27, 2025 € 100 ◦ Positive topline results from Phase 2 New € 75 InsiGHTS Trial in Turner syndrome € 50 € 36 ◦ Submit IND or similar for a basket trial evaluating 2 € 25 additional indications in Q3 2025 € 1 € - 2021 2022 2023 2024E Committed to making SKYTROFA the global leading product in value in a growing growth hormone market sBLA = supplemental Biologics License Application. 1. Calculated as unaudited preliminary estimate of full year 2024 SKYTROFA revenue of ~€197 million plus ~€5 million of sales deductions related to prior years. 2. Planned for small for gestational age without catch-up growth [“SGA”]; Idiopathic short stature [“ISS”]; SHOX deficiency (including Turner syndrome). 10 For investor communication only. Not for use in product promotion. Not for further distribution.

TransCon hGH Program Summary and Outlook 1 • 2024 SKYTROFA revenue, with single indication in pediatric GHD, expected to be ~€202 million ◦ High-value brand in the U.S., revenue per patient of around 3 times that of daily growth hormone 2 ◦ Volume (mg) increased 84% in 2024 resulting in 6.5% market share of total U.S. growth hormone market • Adult GHD ◦ sBLA submitted to FDA; PDUFA goal date of July 27, 2025 ◦ U.S. commercial launch planned in Q4 2025, pending approval • Turner syndrome ◦ Phase 2 New InsiGHTS Trial achieved primary objective at Week 26 3 • Plan to submit IND or similar for basket trial evaluating additional indications in Q3 2025 • Planned commercial launches across multiple indications and countries Committed to making SKYTROFA a blockbuster product 1. Calculated as unaudited preliminary estimate of full-year 2024 SKYTROFA revenue of ~€197 million plus ~€5 million of sales deductions related to prior years. 2. Based on third party prescription data for 2024. 3. Planned for small for gestational age without catch-up growth [“SGA”]; Idiopathic short stature [“ISS”]; SHOX deficiency (including Turner syndrome). 11 For investor communication only. Not for use in product promotion. Not for further distribution.

® YORVIPATH TransCon PTH Treatment of hypoparathyroidism in adults For investor communication only. Not for use in product promotion. Not for further distribution.

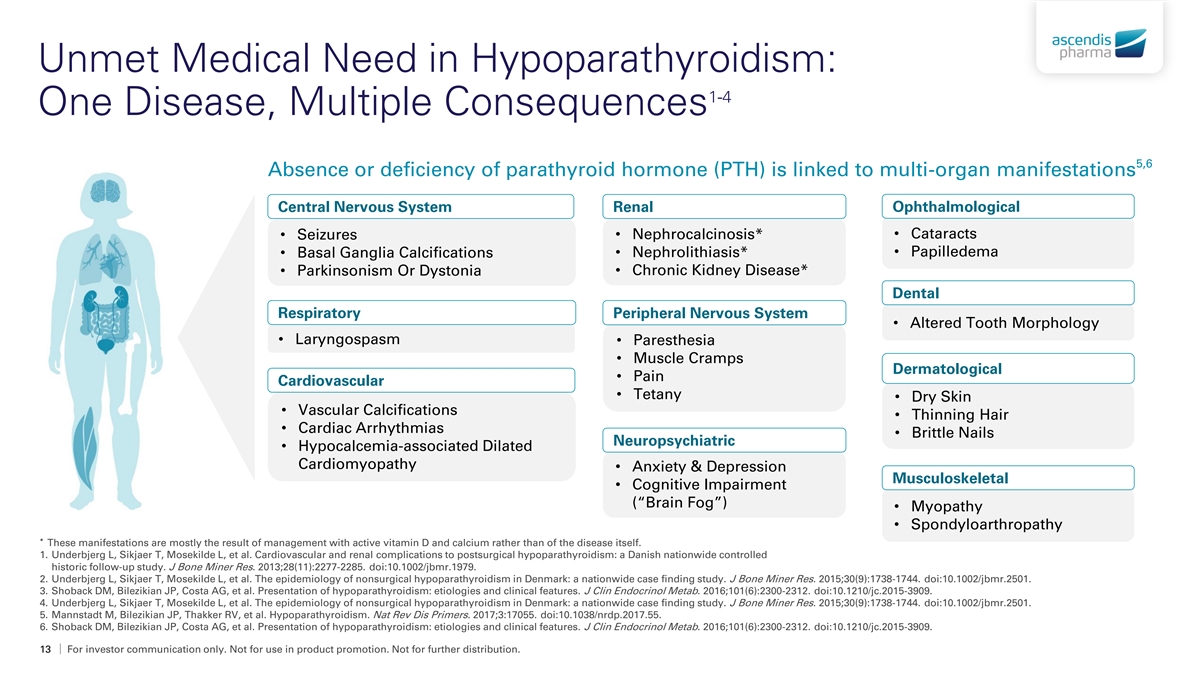

Unmet Medical Need in Hypoparathyroidism: 1-4 One Disease, Multiple Consequences 5,6 Absence or deficiency of parathyroid hormone (PTH) is linked to multi-organ manifestations Central Nervous System Renal Ophthalmological • Nephrocalcinosis*• Cataracts • Seizures • Papilledema • Basal Ganglia Calcifications• Nephrolithiasis* • Chronic Kidney Disease* • Parkinsonism Or Dystonia Dental Respiratory Peripheral Nervous System • Altered Tooth Morphology • Laryngospasm • Paresthesia • Muscle Cramps Dermatological • Pain Cardiovascular • Tetany • Dry Skin • Vascular Calcifications • Thinning Hair • Cardiac Arrhythmias • Brittle Nails Neuropsychiatric • Hypocalcemia-associated Dilated Cardiomyopathy • Anxiety & Depression Musculoskeletal • Cognitive Impairment (“Brain Fog”) • Myopathy • Spondyloarthropathy * These manifestations are mostly the result of management with active vitamin D and calcium rather than of the disease itself. 1. Underbjerg L, Sikjaer T, Mosekilde L, et al. Cardiovascular and renal complications to postsurgical hypoparathyroidism: a Danish nationwide controlled historic follow-up study. J Bone Miner Res. 2013;28(11):2277-2285. doi:10.1002/jbmr.1979. 2. Underbjerg L, Sikjaer T, Mosekilde L, et al. The epidemiology of nonsurgical hypoparathyroidism in Denmark: a nationwide case finding study. J Bone Miner Res. 2015;30(9):1738-1744. doi:10.1002/jbmr.2501. 3. Shoback DM, Bilezikian JP, Costa AG, et al. Presentation of hypoparathyroidism: etiologies and clinical features. J Clin Endocrinol Metab. 2016;101(6):2300-2312. doi:10.1210/jc.2015-3909. 4. Underbjerg L, Sikjaer T, Mosekilde L, et al. The epidemiology of nonsurgical hypoparathyroidism in Denmark: a nationwide case finding study. J Bone Miner Res. 2015;30(9):1738-1744. doi:10.1002/jbmr.2501. 5. Mannstadt M, Bilezikian JP, Thakker RV, et al. Hypoparathyroidism. Nat Rev Dis Primers. 2017;3:17055. doi:10.1038/nrdp.2017.55. 6. Shoback DM, Bilezikian JP, Costa AG, et al. Presentation of hypoparathyroidism: etiologies and clinical features. J Clin Endocrinol Metab. 2016;101(6):2300-2312. doi:10.1210/jc.2015-3909. 13 For investor communication only. Not for use in product promotion. Not for further distribution.

Current Clinical Practice Guideline • Consider PTH replacement therapy in patients not adequately controlled on conventional therapy • Inadequate control is considered to be any one of the following: ◦ Symptomatic hypocalcemia ◦ Hyperphosphatemia ◦ Renal insufficiency ◦ Hypercalciuria ◦ Poor quality of life • In addition, individuals with poor compliance, malabsorption, or who are intolerant of large doses of calcium and active vitamin D may also benefit from PTH replacement therapy Vast majority of patients with hypoparathyroidism fulfill guideline for PTH replacement therapy Khan AA, Bilezikian JP, Brandi ML, et al. Evaluation and Management of Hypoparathyroidism Summary Statement and Guidelines from the Second International Workshop. J Bone Miner Res. Dec 2022;37(12):2568-2585. doi:10.1002/jbmr.4691 14 For investor communication only. Not for use in product promotion. Not for further distribution.

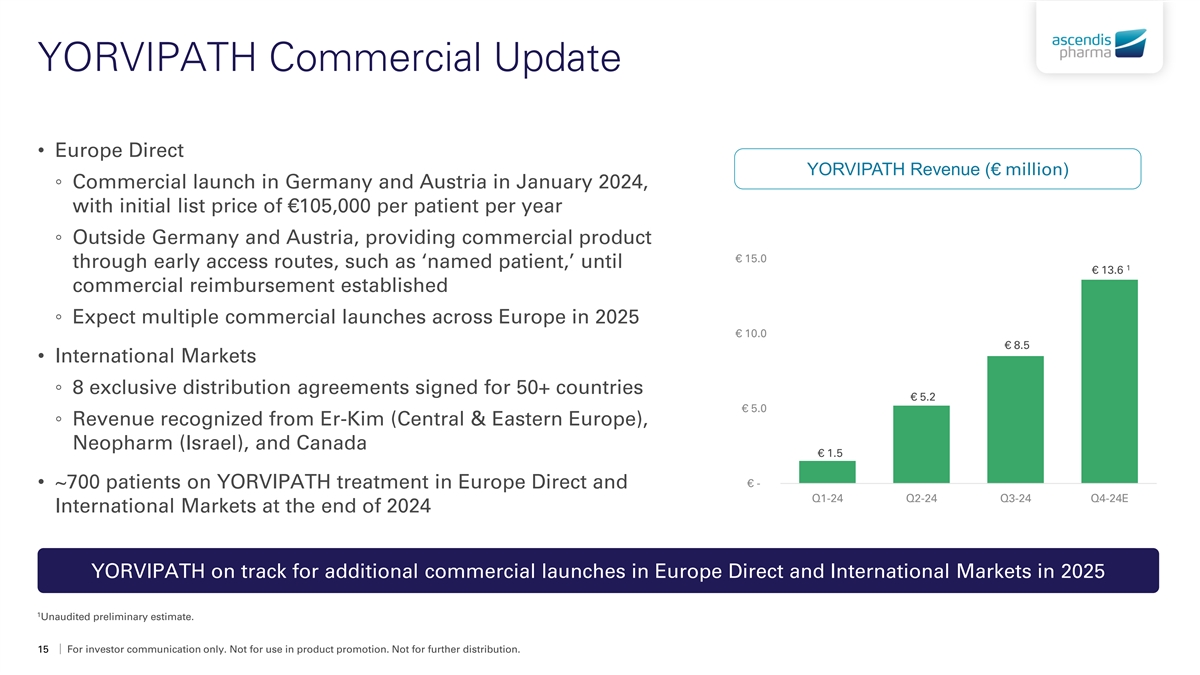

YORVIPATH Commercial Update • Europe Direct YORVIPATH Revenue (€ million) ◦ Commercial launch in Germany and Austria in January 2024, with initial list price of €105,000 per patient per year ◦ Outside Germany and Austria, providing commercial product € 15.0 through early access routes, such as ‘named patient,’ until 1 € 13.6 commercial reimbursement established ◦ Expect multiple commercial launches across Europe in 2025 € 10.0 € 8.5 • International Markets ◦ 8 exclusive distribution agreements signed for 50+ countries € 5.2 € 5.0 ◦ Revenue recognized from Er-Kim (Central & Eastern Europe), Neopharm (Israel), and Canada € 1.5 € - • ~700 patients on YORVIPATH treatment in Europe Direct and Q1-24 Q2-24 Q3-24 Q4-24E International Markets at the end of 2024 YORVIPATH on track for additional commercial launches in Europe Direct and International Markets in 2025 1 Unaudited preliminary estimate. 15 For investor communication only. Not for use in product promotion. Not for further distribution.

® YORVIPATH U.S. FDA Approved and Now Commercially Available • YORVIPATH is the first and only product indicated for the treatment of 1 hypoparathyroidism in adults • Commercially available in the U.S. December 2024 1. Limitations of Use: YORVIPATH was not studied for acute post-surgical hypoparathyroidism. YORVIPATH’s titration scheme was only evaluated in adults who first achieved an albumin-corrected serum calcium of at least 7.8 mg/dL using calcium and active vitamin D treatment. YORVIPATH [package insert]. Princeton, NJ: Ascendis Pharma Endocrinology, Inc. August 2024. 16 For investor communication only. Not for use in product promotion. Not for further distribution.

Hypoparathyroidism: U.S. Patient Population Total U.S. Prevalence PTH Newly 1,3 ~25k–32k 70,000–90,000 Experienced Diagnosed • Currently on active 2 ~4,000 ~25k–– 5,000 32k vitamin D and calcium 3 ~3,~25k 000 ann–32k ually (“conventional therapy”) • Patients previously • Post-surgical, auto- treated with PTH immune, genetic, or idiopathic YORVIPATH annual WAC price of ~$285,000 WAC = Wholesale Acquisition Cost. 1. U.S. prevalence literature review (Powers, Clarke). 2. Internal estimates and Symphony Metys data. 3. U.S. prevalence literature review and epi meta-analysis (Powers, Clarke, Milliman project, ipm.ai claims project; HCUPnet, Healthcare Cost and Utilization Project. Agency for Healthcare Research and Quality, Rockville, MD for surgical cohort projection). 17 For investor communication only. Not for use in product promotion. Not for further distribution.

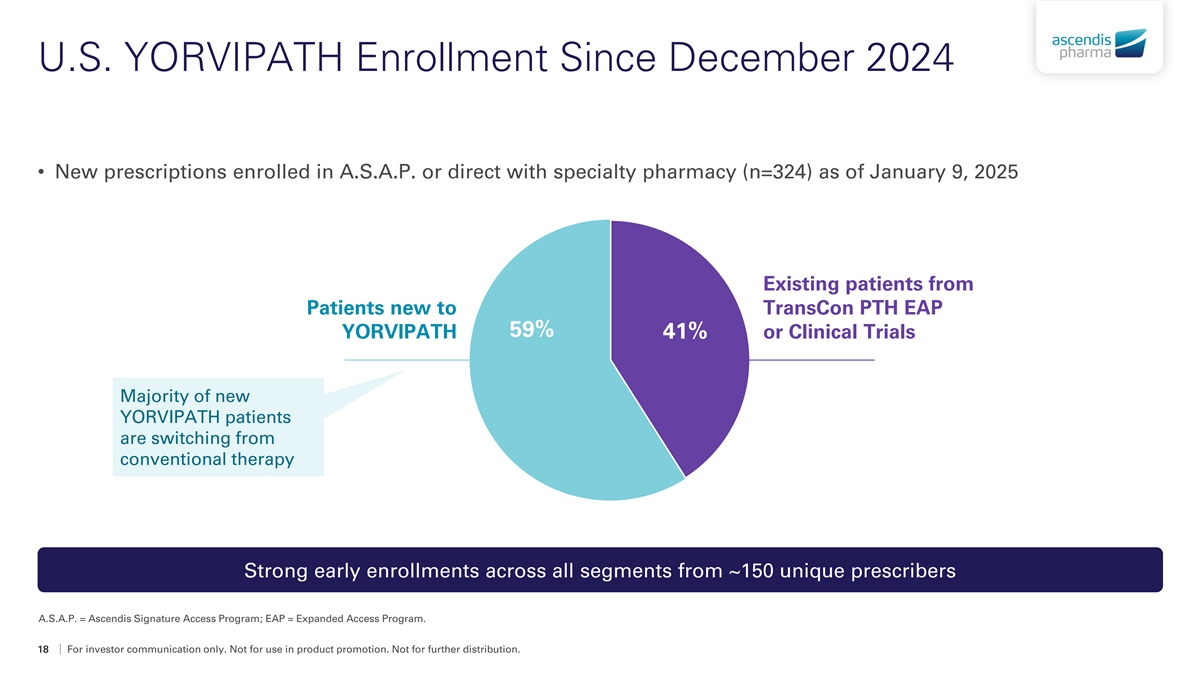

U.S. YORVIPATH Enrollment Since December 2024 • New prescriptions enrolled in A.S.A.P. or direct with specialty pharmacy (n=324) as of January 9, 2025 Existing patients from Patients new to TransCon PTH EAP 59% YORVIPATH 41% or Clinical Trials Majority of new YORVIPATH patients are switching from conventional therapy Strong early enrollments across all segments from ~150 unique prescribers A.S.A.P. = Ascendis Signature Access Program; EAP = Expanded Access Program. 18 For investor communication only. Not for use in product promotion. Not for further distribution.

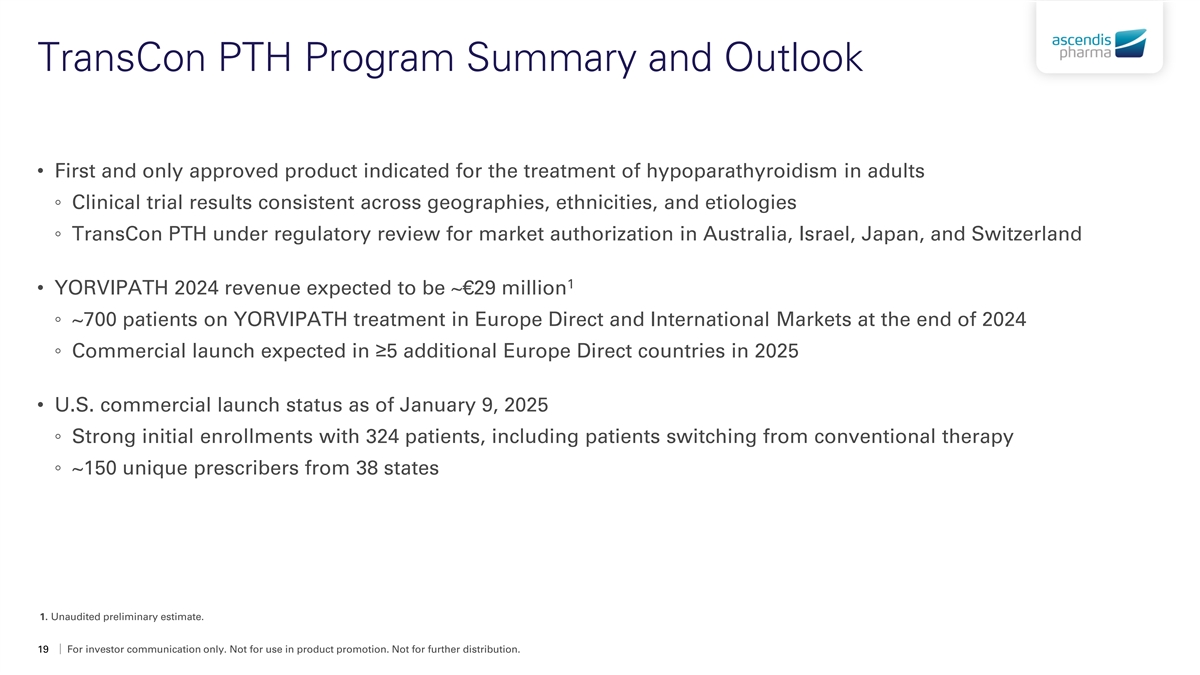

TransCon PTH Program Summary and Outlook • First and only approved product indicated for the treatment of hypoparathyroidism in adults ◦ Clinical trial results consistent across geographies, ethnicities, and etiologies ◦ TransCon PTH under regulatory review for market authorization in Australia, Israel, Japan, and Switzerland 1 • YORVIPATH 2024 revenue expected to be ~€29 million ◦ ~700 patients on YORVIPATH treatment in Europe Direct and International Markets at the end of 2024 ◦ Commercial launch expected in ≥5 additional Europe Direct countries in 2025 • U.S. commercial launch status as of January 9, 2025 ◦ Strong initial enrollments with 324 patients, including patients switching from conventional therapy ◦ ~150 unique prescribers from 38 states 1. Unaudited preliminary estimate. 19 For investor communication only. Not for use in product promotion. Not for further distribution.

® YORVIPATH TransCon CNP TransCon PTH (navepegritide) Investigatio Treatment of nal Hypo prod parath rug of yroidism CNP designed to provide in sustained Adults release and continuous exposure of active CNP for the treatment of pediatric achondroplasia TransCon CNP is an investigational product candidate. For investor communication only. Not for use in product promotion. Not for further distribution.

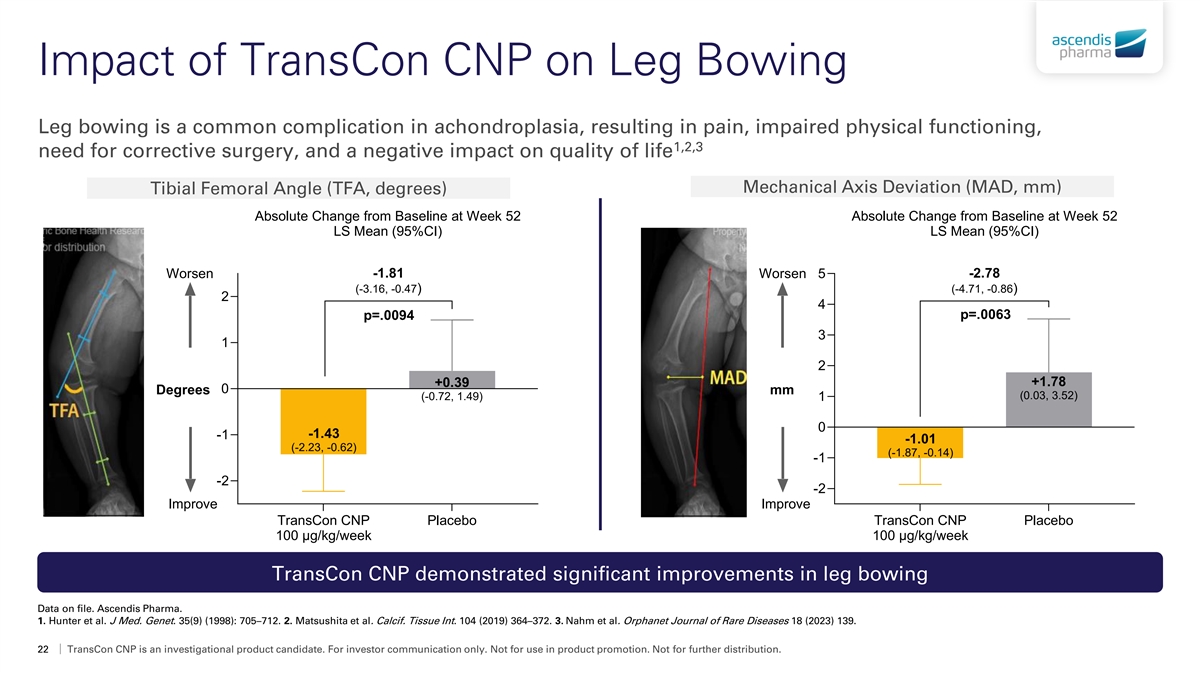

Pivotal ApproaCH Trial Summary • The pivotal ApproaCH Trial in children aged 2-11 years achieved primary objective ◦ TransCon CNP demonstrated LS mean AGV of 5.89 cm/year with LS mean treatment difference of 1.49 cm/year at Week 52 compared to placebo (p<0.0001) ◦ For children aged 5-11 years TransCon CNP demonstrated LS mean AGV of 5.79 cm/year with a change from baseline AGV superior to placebo with LS mean treatment difference of 1.78 cm/year at Week 52 (p<0.0001) • Other endpoints support that TransCon CNP may provide benefits beyond linear growth ◦ Treatment with TransCon CNP resulted in numerical improvements in health-related quality of life compared to placebo as observed in several ACEM domains ◦ Treatment benefit in muscle functionality demonstrated in sub-group of children aged 5-8 years ◦ Treatment with TransCon CNP showed improvement in body proportionality, leg bowing, and other parameters • TransCon CNP was generally well-tolerated, with low frequency of injection site reactions (all mild), and no evidence of hypotensive effect Once-weekly TransCon CNP may address the need for an efficacious, safe, tolerable, and convenient treatment Data on file. Ascendis Pharma. ACEM = Achondroplasia Child Experience Measure. 21 TransCon CNP is an investigational product candidate. For investor communication only. Not for use in product promotion. Not for further distribution.

Impact of TransCon CNP on Leg Bowing Leg bowing is a common complication in achondroplasia, resulting in pain, impaired physical functioning, 1,2,3 need for corrective surgery, and a negative impact on quality of life Mechanical Axis Deviation (MAD, mm) Tibial Femoral Angle (TFA, degrees) Absolute Change from Baseline at Week 52 Absolute Change from Baseline at Week 52 LS Mean (95%CI) LS Mean (95%CI) -1.81 -2.78 Worsen Worsen 5 (-3.16, -0.47) (-4.71, -0.86) 2 4 p=.0063 p=.0094 3 1 2 +1.78 +0.39 0 Degrees mm (0.03, 3.52) (-0.72, 1.49) 1 0 -1.43 -1 -1.01 (-2.23, -0.62) (-1.87, -0.14) -1 -2 -2 Improve Improve TransCon CNP Placebo TransCon CNP Placebo 100 μg/kg/week 100 μg/kg/week TransCon CNP demonstrated significant improvements in leg bowing Data on file. Ascendis Pharma. 1. Hunter et al. J Med. Genet. 35(9) (1998): 705–712. 2. Matsushita et al. Calcif. Tissue Int. 104 (2019) 364–372. 3. Nahm et al. Orphanet Journal of Rare Diseases 18 (2023) 139. 22 TransCon CNP is an investigational product candidate. For investor communication only. Not for use in product promotion. Not for further distribution.

TransCon CNP Program Summary and Outlook • In pivotal ApproaCH Trial, TransCon CNP demonstrated significant improvements in linear growth and body proportionality, as well as benefits beyond linear growth ◦ Following pre-NDA meeting, planned filings for treatment of children with achondroplasia in U.S. Q1 2025, EU in Q3 2025 • Comprehensive development plans continue with ongoing and planned trials to support TransCon CNP in additional patient populations • COACH Trial – first combination trial of TransCon hGH and TransCon CNP to further accelerate growth in achondroplasia; topline Week 26 data in children aged 2-11 expected in Q2 2025 • Plan to submit IND or similar for the treatment of hypochondroplasia in Q4 2025 With SKYTROFA and TransCon CNP, Ascendis is well-positioned to become the leader in growth disorders 23 TransCon CNP is an investigational product candidate. For investor communication only. Not for use in product promotion. Not for further distribution.

Expanding the Endocrine Rare Disease Pipeline and Beyond For investor communication only. Not for use in product promotion. Not for further distribution.

X-Linked Hypophosphatemia Background Limitations of Existing Therapy • Increase in serum phosphorous from baseline • Characterized by excess FGF-23 production leading to 1,2 plateaus at 1.0-1.5 mg/dL, irrespective of burosumab excessive renal phosphate wasting 3 drug exposure • Affecting ~1:20000 • At the recommended doses, serum phosphorous 3 remained in the lower limit of normal Deformity & Pain Short Stature Teeth Loss Fractures • Significant unmet medical need remains within the 4,5 XLH patient population Clear biological rationale for applying TransCon protein degrader technology to normalize FGF-23 levels FGF-23 = Fibroblast growth factor 23. XLH = X-linked hypophosphatemia. 1. International XLH alliance. 2 Beck-Nielsen Orphanet J Rare Dis. 2019. 3. FDA Multi-Disciplinary Review BLA 761068. 4. Padidela Calcif Tissue Int 2021 5. Linglart JCEM 2022. 25 For investor communication only. Not for use in product promotion. Not for further distribution.

Collaboration with Novo Nordisk • Development and commercialization of TransCon Technology-based products in metabolic (including obesity and type 2 diabetes) and cardiovascular diseases • Highlights of the multi-product collaboration: ◦ Upfront fee of $100 million for the exclusive license and funding of the programs by Novo Nordisk ◦ Lead program: once-monthly TransCon Semaglutide product candidate initially targeting obesity and type 2 diabetes - Potential to receive additional payments of up to $185 million in development and regulatory milestone payments - Potential to receive escalating tiered, mid-single digit royalties on global net sales and sales milestone payments ◦ Novo Nordisk responsible for clinical development, regulatory, commercial manufacturing, and commercialization Reflects our Vision 2030 to create value in additional large therapeutic areas 26 For investor communication only. Not for use in product promotion. Not for further distribution.

Other Investments and Partnerships • Eyconis (exclusive global rights for TransCon based ophthalmology products) ◦ Formed Eyconis in January 2024 with a $150 million commitment from external investors • Teijin (exclusive rights for TransCon hGH, PTH, and CNP in Japan) ◦ In December 2024, submitted a J-NDA to the Japanese medical authorities for TransCon PTH for the treatment of adults in Japan with hypoparathyroidism • VISEN Pharmaceuticals (exclusive rights for TransCon hGH, PTH, and CNP in Greater China) ◦ Announced in September 2024, Phase 3 PaTHway China Trial success for TransCon PTH, achieving primary and key secondary endpoints in treating adults with hypoparathyroidism Creating value through innovative business models 27 For investor communication only. Not for use in product promotion. Not for further distribution.

Financial Update & 2025 Selected Milestones For investor communication only. Not for use in product promotion. Not for further distribution.

2024 Financial Update 1 • Total full-year 2024 product revenue expected to be ~€226 million, driven by: 2 ◦ SKYTROFA full-year 2024 revenue expected to be ~€202 million, excluding sales deductions related to prior years 1 ◦ YORVIPATH full-year 2024 revenue expected to be ~€29 million 1 • Full-year 2024 total revenue expected to be ~€364 million ◦ Includes $100 million Novo Nordisk milestone payment as non-product revenue 3 • December 31, 2024 pro forma cash balance of ~€655 million • Looking ahead… ◦ Investment in YORVIPATH launch in the U.S. and Europe Direct and TransCon CNP pre-launch activities ◦ Stable R&D investment as current portfolio matures and early-stage pipeline renews Plan to be well-capitalized through cash flow breakeven and beyond 1. Unaudited preliminary estimate. 2. Calculated as unaudited preliminary estimate of full year 2024 SKYTROFA revenue of ~€197 million plus ~€5 million of sales deductions related to prior years. 3. Calculated as unaudited preliminary estimate of December 31, 2024 cash balance of €560 million plus expected payment from Novo Nordisk of $100 million. 29 For investor communication only. Not for use in product promotion. Not for further distribution.

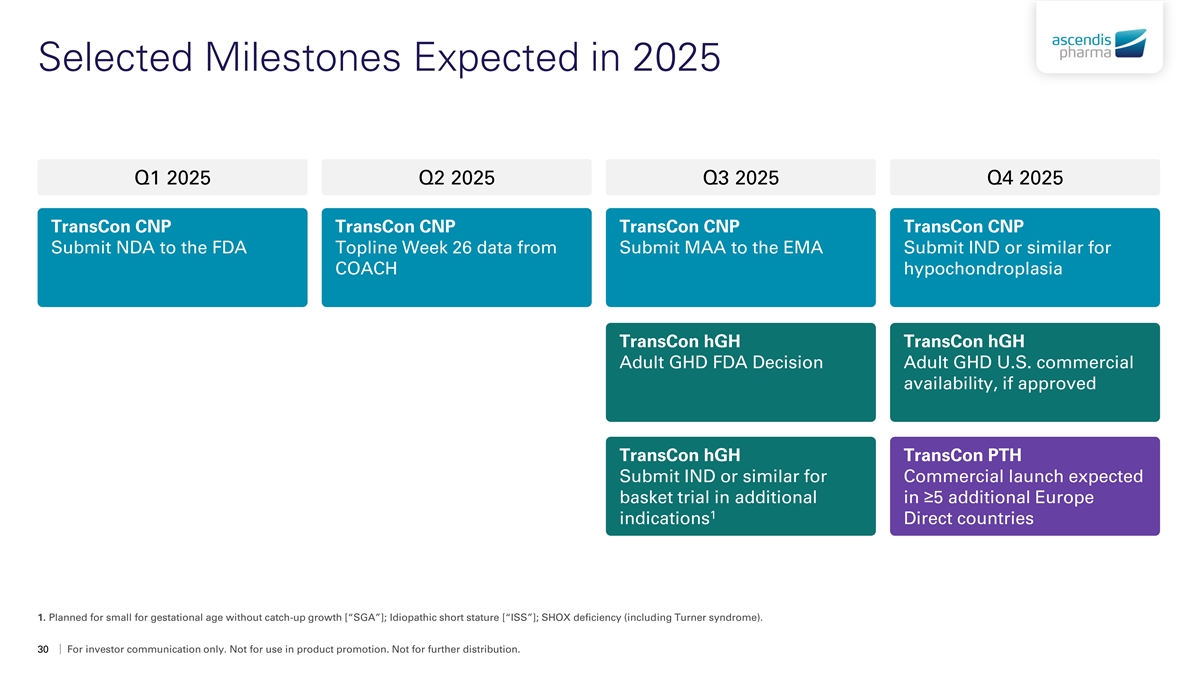

Selected Milestones Expected in 2025 Q1 2025 Q2 2025 Q3 2025 Q4 2025 TransCon CNP TransCon CNP TransCon CNP TransCon CNP Submit NDA to the FDA Topline Week 26 data from Submit MAA to the EMA Submit IND or similar for COACH hypochondroplasia TransCon hGH TransCon hGH Adult GHD FDA Decision Adult GHD U.S. commercial availability, if approved TransCon hGH TransCon PTH Submit IND or similar for Commercial launch expected basket trial in additional in ≥5 additional Europe 1 indications Direct countries 1. Planned for small for gestational age without catch-up growth [“SGA”]; Idiopathic short stature [“ISS”]; SHOX deficiency (including Turner syndrome). 30 For investor communication only. Not for use in product promotion. Not for further distribution.

Thank you Investor Relations ir@ascendispharma.com https://investors.ascendispharma.com/ © 2025 Ascendis Pharma. Ascendis, Ascendis Pharma, the Ascendis Pharma logo, the company logo, TransCon, Skytrofa and Yorvipath are trademarks owned by the Ascendis Pharma group. For investor communication only. Not for use in product promotion. Not for further distribution.