Exhibit 99.1

THE JOINT CORP. | NASDAQ: JYNT | thejoint.com

SAFE HARBOR STATEMENT Certain statements contained in this presentation are "forward - looking statements." We have tried to identify these forward - look ing statements by using words such as "may," "might," " will," "expect,” "anticipate,'' "'believe,“ "could," " intend," "plan," "estimate," "should," "if,“ "project," and similar expressions. All st ate ments other than statements of historical facts contained in this presentation, including statements regarding our growth strategies, our vision, future operations, future financial position, future revenue, project ed costs, prospects, plans, objectives of management and expected market growth and potential are forward - looking statements. We have based these forward - looking statements on our current expectations and pro jections about future events. However, these forward - looking statements are subject to risks, uncertainties, assumptions and other factors that may cause our actual results, performance or achievements to be materially different from our expectations and projections. Some of these risks, uncertainties and other factors are set forth in this presentation and in other documents w e w ill file with the Securities and Exchange Commission (the "SEC"). Given these risks and uncertainties, readers are cautioned not to place undue reliance on our forward - looking statements. Projec tions and other forward - looking statements included in this presentation have been prepared based on assumptions, which we believe to be reasonable, but not in accordance with U.S. GAAP or any guide lin es of the SEC. Actual results may vary, perhaps materially. You are strongly cautioned not to place undue reliance on such projections and other forward - looking statements. All subsequent written and oral forward - looking statements attributable us or to persons acting on our behalf are expressly qualified in their entirety by these cautionary statements. Except as required by federal securities la ws, we disclaim any intention or obligation to update or revise any forward - looking statements, whether as a result of new information, future events or otherwise. Any such forward - looking statements, whe ther made in this presentation or elsewhere, should be considered in the context of the various disclosures made by us about our businesses including, without limitation, the risk factors discussed abo ve. In addition to results presented in accordance with U.S. GAAP, this presentation includes a presentation of EBITDA and Adjust ed EBITDA, which are non - GAAP financial measures. EBITDA and Adjusted EBITDA are presented because they are important measures used by management to assess financial performance, as management be lie ves they provide a more transparent view of the Company’s underlying operating performance and operating trends. Reconciliations of net loss to EBITDA and Adjusted EBITDA are presente d w here applicable. The Company defines EBITDA as net income (loss) before net interest, taxes, depreciation and amortization expenses. The Company defines Adjusted EBITDA as EBITDA before acqu isi tion - related expenses, bargain purchase gain, loss on disposition or impairment, and stock - based compensation expenses. EBITDA and Adjusted EBITDA do not represent and should not be considered alternatives to net income or cash flows from operat ion s, as determined by accounting principles generally accepted in the United States, or GAAP. While EBITDA and Adjusted EBITDA are frequently used as measures of financial performance and the abi lit y to meet debt service requirements, they are not necessarily comparable to other similarly titled captions of other companies due to potential inconsistencies in the methods of calculati on. EBITDA and Adjusted EBITDA should be reviewed in conjunction with the Company’s financial statements filed with the SEC. BUSINESS STRUCTURE The Joint Corp. is a franchisor of clinics and an operator of clinics in certain states. In Arkansas, California, Colorado, F lor ida, Illinois, Kansas, Minnesota, New Jersey, New York, North Carolina, Oregon, Pennsylvania, and Tennessee, The Joint Corp. and its franchisees provide management services to affiliated professional chiro pra ctic practices . 2

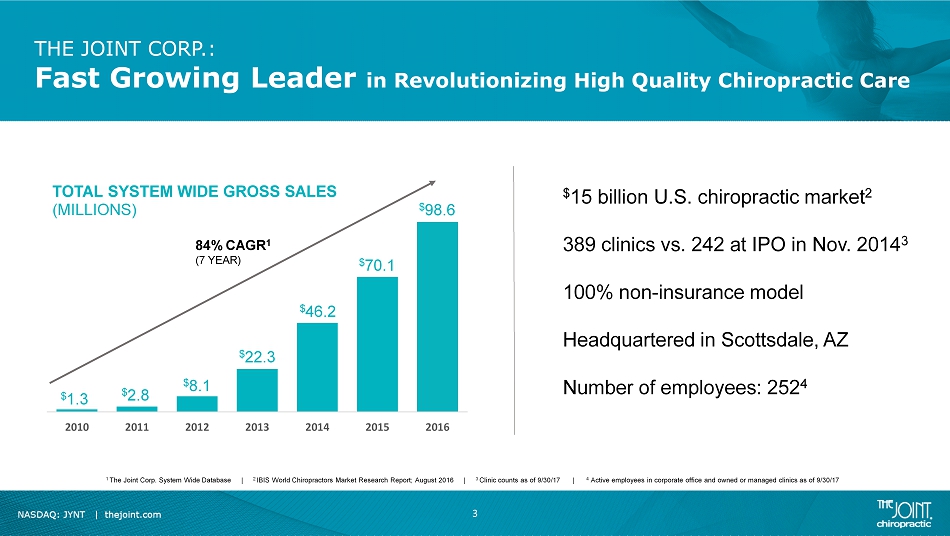

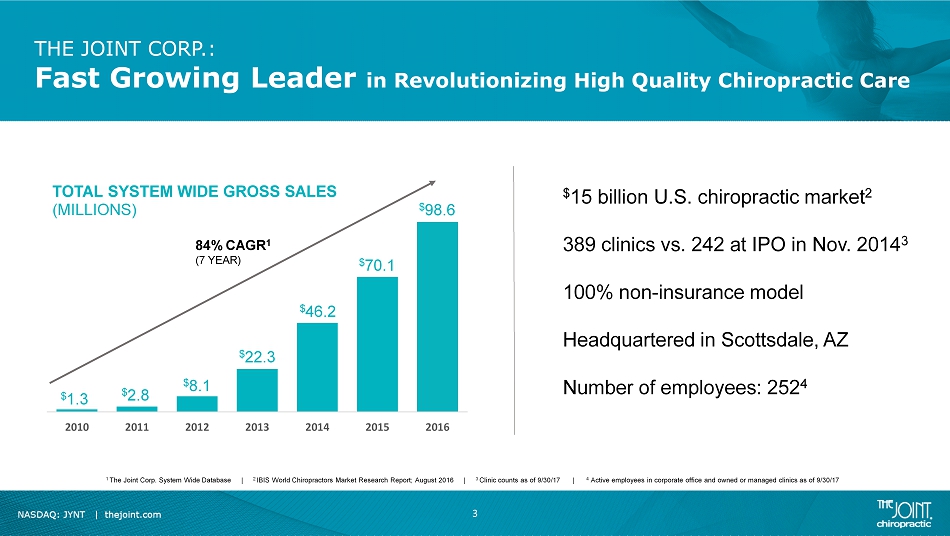

THE JOINT CORP.: Fast Growing Leader in Revolutionizing High Quality Chiropractic Care $ 15 billion U.S. chiropractic market 2 389 clinics vs. 242 at IPO in Nov. 2014 3 100 % non - insurance model Headquartered in Scottsdale, AZ Number of employees: 252 4 1 The Joint Corp. System Wide Database | 2 IBIS World Chiropractors Market Research Report; August 2016 | 3 Clinic counts as of 9 /30/17 | 4 Active employees in corporate office and owned or managed clinics as of 9 /30/17 2010 2011 2012 2013 2014 2015 2016 TOTAL SYSTEM WIDE GROSS SALES (MILLIONS) $ 1.3 $ 2.8 $ 8.1 $ 22.3 $ 46.2 $ 70.1 $ 98.6 84% CAGR 1 (7 YEAR) 3

4

5

6

Chiropractic is a L arge, Dynamically Growing Market • $ 90 billion spent on back pain each year 1 • 62 million Americans saw a chiropractor in last 5 years, 35.5 million in last 12 months 2 • $ 15 billion growing chiropractic market 3 1 Bureau of Labor Statistics, U.S. Department of Labor, Occupational Outlook Handbook, 2016 - 17 Edition | 2 Gallup - Palmer College of Chiropractic Report 2016 | 3 IBIS World Chiropractors Market Research Report; August 2016 4 Noninvasive Treatments for Acute, Subacute, and Chronic Low Back Pain. Ann Intern Med. [Epub ahead of print 14 February 2017] doi: 10.7326/P17 - 9032 7

Management Has Extensive Experience in Building and Supporting Large Franchise Systems POSITION EXPERIENCE UNITS 1 PRESIDENT & CEO Peter D. Holt 5,100+ VP, OPERATIONS Jorge Armenteros 17,100+ VP, MARKETING Donna Smith 4,500+ VP, FRANCHISE SALES Eric Simon 5,745+ 8 1 Represents total franchised and/or company owned units in operation during tenure

The Joint Corp. is Revolutionizing Traditional Chiropractic Care FEATURES PROBLEMS (INDUSTRY) SOLUTIONS (THE JOINT) Affordability (per appointment) $ 74 Average 1 $ 24 Average 2 Convenient Locations Medical Centers / Offices Retail Locations Multiple Locations Limited Locations 389 Units 3 Walk - in / No Appointment Appointments Required No Appointments Insurance / Caps / Co - pays Yes Private Pay Inviting Consumer - centric Design Clinical Approachable, Consumer Friendly Service Hours Limited / Inconsistent Open 6 - 7 Days + Nights & Weekends 6 Average Patient Visits per Clinic 4 Less Than 600 Per Month 5 1,000+ Per Month 2 1 Chiropractic Economics, October 2016 | 2 The Joint Corp. System Wide Database 2016 actuals | 3 Clinic counts as of 9 /30/17 | 4 Number includes multiple visits per patient | 5 Chiropractic Economics, May 2016 | 6 Hours vary by clinic 9

The Joint Corp.’s Solutions are Working • Industry CAGR 1.2% 1 vs. The Joint Corp. 84% 2 • 1+ million patients served 4 • 4.1 million patient visits in 2016 4 • 21% of our customers are new to chiropractic 3 • 75% of revenue from recurring memberships 4 1 IBIS World Chiropractors Market Research Report; August 2016, 2012 to 2017 | 2 The Joint Corp. System Wide Database – 7 Year CAGR | 3 WestGroup Research, August, 2016 Patients Survey | 4 The Joint Corp. System Wide Database 2016 Actuals 10

OPPORTUNITY: Chiropractic is a Highly Fragmented Market CLINICS 1 STATES 1 FRANCHISE OWNED OR MANAGED INSURANCE PRIVATE PAY The Joint Corp . 389 30 ط ط ط HealthSource Chiropractic 264 34 ط ط ChiroOne 41 1 ط ط AlignLife Chiropractic 23 7 ط ط ChiroWay 8 2 ط ط Simply Chiropractic 8 5 ط ط NuSpine 3 2 ط ط Independent Offices 39,000 2 50 ط Varies Varies 1 Clinic and state counts as of 9/30/17 | 2 First Research Industry Report; August 2015 11

OPPORTUNITY: Ability to Grow to 1,700+ Clinics Based on Current Usage Patterns Projected Core Customer & Trade Area Potential GOOD BEST FAIR POOR 12

BUSINESS MODEL: Transformative for Chiropractors INDUSTRY THE JOINT Starting Salary $ 30K - $ 40K 1 $ 50K - $ 60K plus bonus potential 2 Accessibility • Appointments required • Medical centers and offices • Traditional office hours • No appointments • Clustered, h igh - visibility retail locations • Open evenings + weekends 3 Practice & Insurance • Challenges of managing a business without support • Difficulty attracting new patients • I nsurance hassles • Slow payment cycle • Ongoing training and coaching • Ability to perfect technique • Less administration • Higher patient focus • Better cash flow 1 Bureau of Labor Statistics, U.S. Department of Labor, Occupational Outlook Handbook, 2016 - 17 Edition | 2 Based on Joint Corp. Company - owned or managed actual salaries | 3 Hours vary by clinic 13

1 Total Investment includes clinic development costs and working capital to breakeven | 2 Breakeven is achievable at $22K in monthly gross sales and operating expenses, with 243 active patients at 13 months in opera ti on growing sales at historical rates. Breakeven varies on a clinic by clinic basis based on operating expenses BUSINESS MODEL: Company - Owned or Managed & Franchised Units COMPANY - OWNED OR MANAGED UNITS FRANCHISED UNITS • $ 250K Total Investment 1 • 12 - 18 Month Breakeven 2 • Contribution Margin Potential >35% • $ 39.9K Per License Cash Inflow • 7% Royalty on Gross Sales 5x Company - owned or managed contribution margin potential in year 5 vs . franchised 14

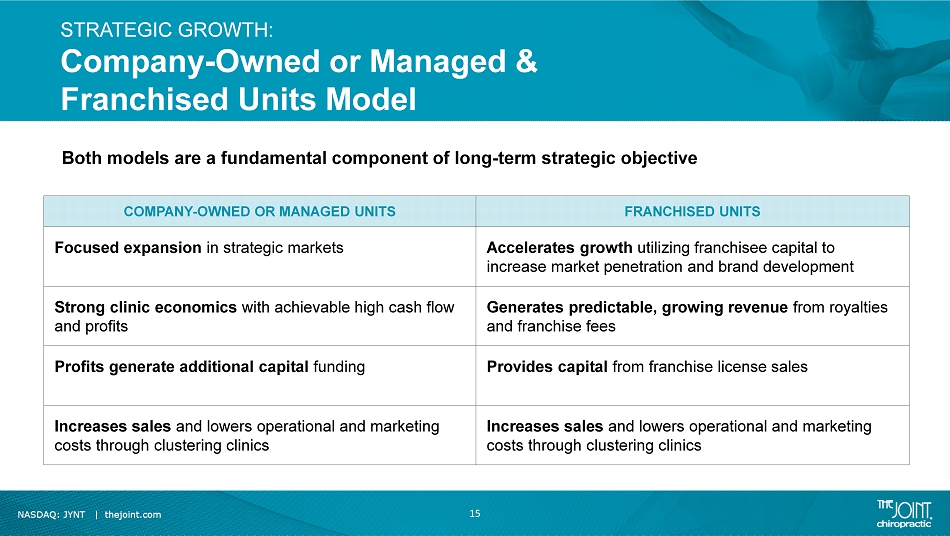

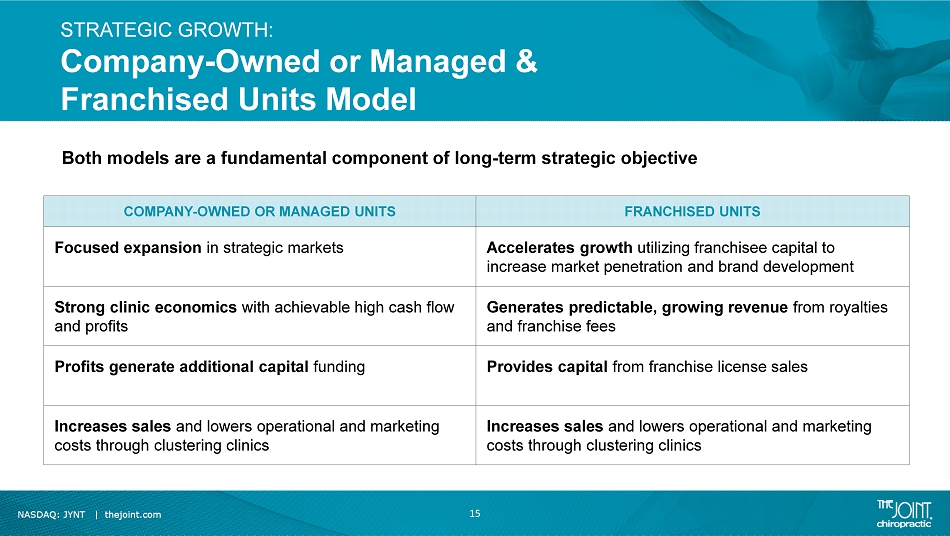

STRATEGIC GROWTH: Company - Owned or Managed & Franchised Units Model COMPANY - OWNED OR MANAGED UNITS FRANCHISED UNITS Focused expansion in strategic markets Accelerates growth utilizing franchisee capital to increase market penetration and brand development Strong clinic economics with achievable high cash flow and profits Generates predictable, growing revenue from royalties and franchise fees Profits generate additional capital funding Provides capital from franchise license sales Increases sales and lowers operational and marketing costs through clustering clinics Increases sales and lowers operational and marketing costs through clustering clinics 15 Both models are a fundamental component of long - term strategic objective

STRATEGIC GROWTH: Building Upon a Robust National Footprint 389 Clinics 1 30 States 1 Franchised Clinics Company - Owned or Managed Clinics 16 1 Clinic and state counts as of 9/30/17

STRATEGIC GROWTH: A Proven Model TOTAL UNITS (U.S. ONLY) 2016 SALES (WORLDWIDE) 4,669 Total Units 1 1,163 Franchised / 3,506 Company - Owned $ 3.3 Billion 2 23,853 Total Units 1 18,184 Franchised / 5,669 Company - Owned $ 82.7 Billion 2 303 Total Units 1 190 Franchised / 113 Company - Owned $ 1.2 Billion 2 1 Latest Entrepreneur 500 website, 2016 numbers | 2 http:// www.franchisetimes.com/FT - Top - 200 The Joint Corp. is using the same proven hybrid company - owned or managed and franchised units model as other successful small - box retail companies 17

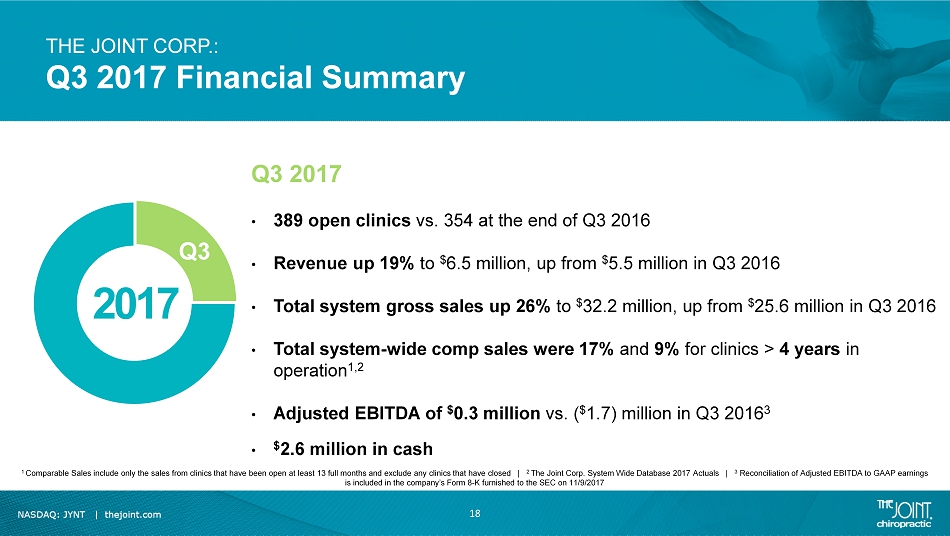

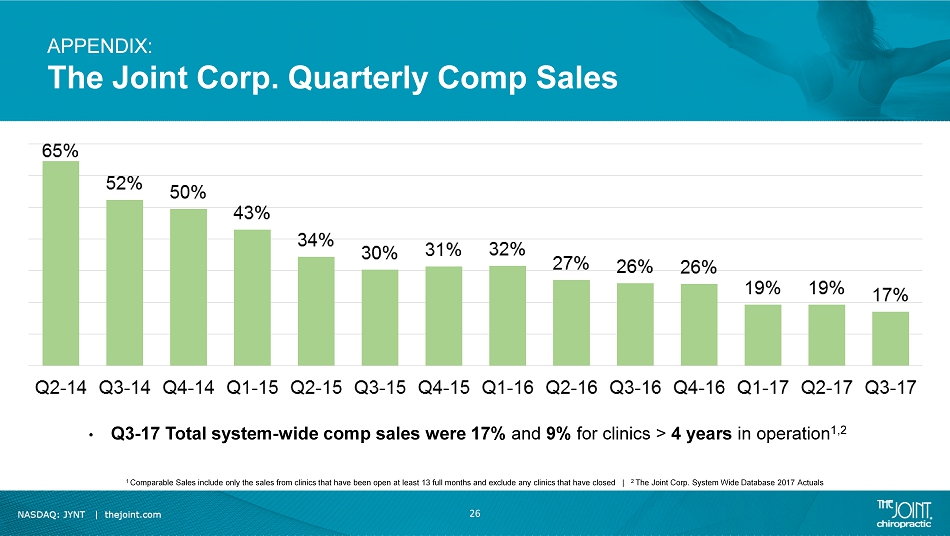

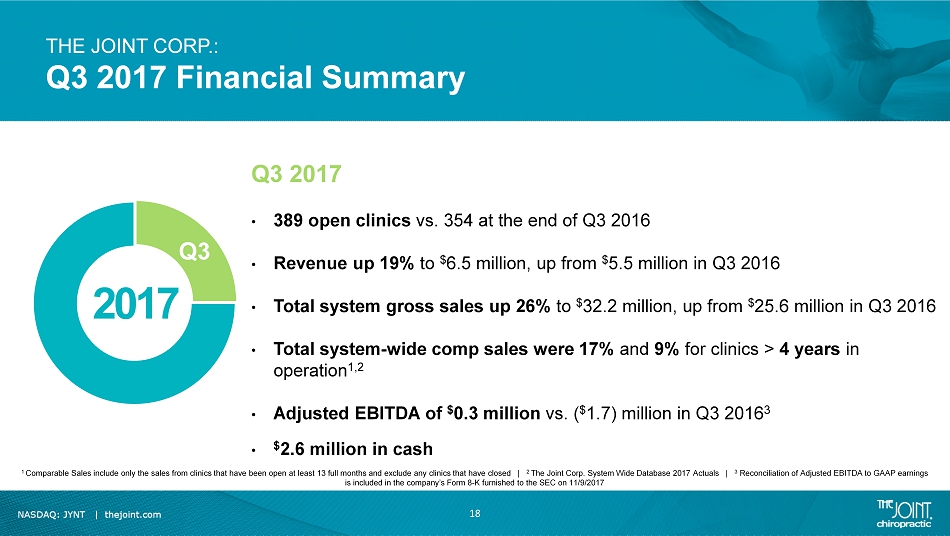

THE JOINT CORP.: Q3 2017 Financial Summary Q3 2017 • 389 open clinics vs . 354 at the end of Q3 2016 • Revenue up 19% to $ 6.5 million, up from $ 5.5 million in Q3 2016 • Total system gross sales up 26% to $ 32.2 million, up from $ 25.6 million in Q3 2016 • Total s ystem - wide comp sales were 17% and 9 % for clinics > 4 years in operation 1,2 • Adjusted EBITDA of $ 0.3 million vs. ( $ 1.7) million in Q3 2016 3 • $ 2.6 million in cash 2017 Q3 18 1 Comparable Sales include only the sales from clinics that have been open at least 13 full months and exclude any clinics that ha ve closed | 2 The Joint Corp. System Wide Database 2017 Actuals | 3 Reconciliation of Adjusted EBITDA to GAAP earnings is included in the company’s Form 8 - K furnished to the SEC on 11/9/2017

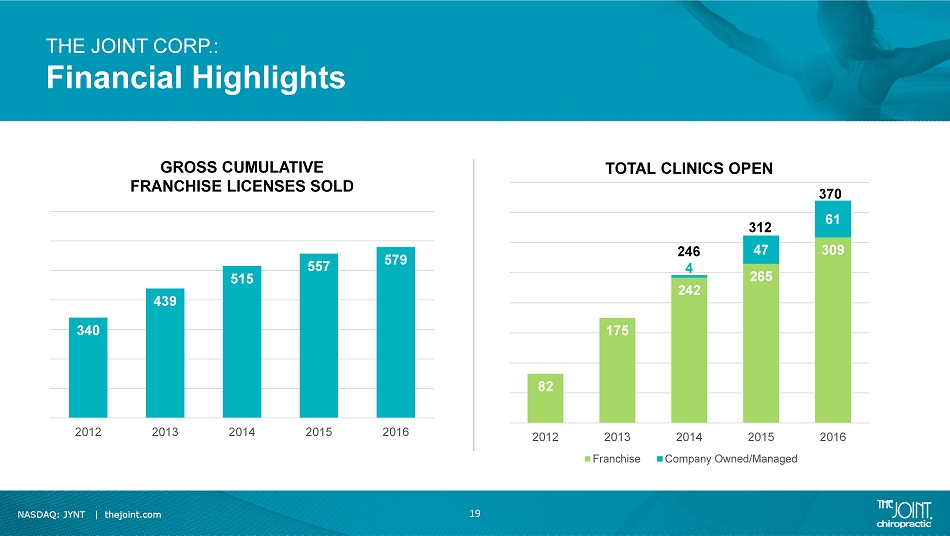

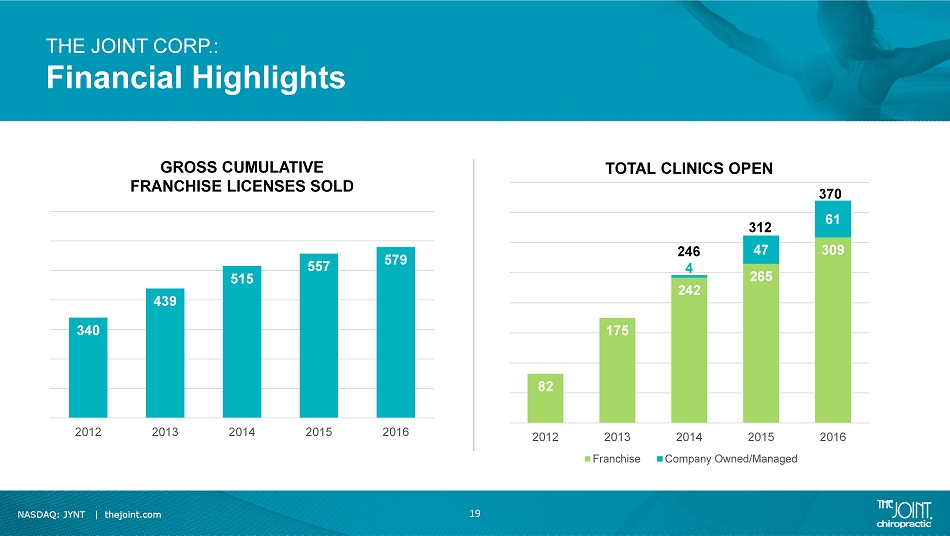

THE JOINT CORP.: Financial Highlights GROSS CUMULATIVE FRANCHISE LICENSES SOLD TOTAL CLINICS OPEN 340 439 515 557 579 2012 2013 2014 2015 2016 82 175 242 265 309 4 47 61 2012 2013 2014 2015 2016 Franchise Company Owned/Managed 246 312 370 19

$2.8 $6.0 $7.1 $13.8 $20.5 2012 2013 2014 2015 2016 REVENUES ($ millions) THE JOINT CORP.: Financial Highlights CONTINUED GROSS SALES ($ millions) $8.1 $22.3 $46.2 $70.1 $98.6 2012 2013 2014 2015 2016 20

GUIDANCE ELEMENTS LOW HIGH Net New Clinic Openings 1 40 50 Revenues ($ millions ) $ 24.0 $ 26.0 Adjusted EBITDA ($ millions ) ( $ 0 .5 ) $ 0.5 THE JOINT CORP.: 2017 Guidance 1 Net New Clinic Openings includes New Franchised clinics and New Company - Owned or Managed clinics and excludes acquired clinics 21

INVESTMENT SUMMARY: Stable Operating Model with Significant Growth Potential 1 IBIS World Chiropractors Market Research Report; August 2016 | 2 The Joint Corp. System Wide Database – 7 Year CAGR | 3 The Joint Corp. System Wide Database, 2016 Actuals • $ 15 billion growing chiropractic market 1 • Experienced, p roven m anagement • 1,700+ clinic national footprint opportunity • 7 year 84% CAGR in gross sales 2 • 75% of revenue from recurring memberships 3 • High returns, self funding growth strategy 22

APPENDIX 23

APPENDIX: Unit Economics of Owned or Managed vs. Franchised Cash Contribution ($ thousands) 24 • Franchise l icense income included in Yr. 1 • Gross sales growing at The Joint Corp. total system average historical rates 1 • Model assumes $ 22K average monthly operating expense for owned or managed clinic 2 • 5x Company - owned or managed contribution margin potential in year 5 vs. franchised 1 Based on average historical gross sales growth rates from January 2013 through September 2017 | 2 Breakeven is achievable at $22K in monthly gross sales and operating expenses, with 243 active patients at 13 months in opera ti on growing sales at historical rates. Breakeven varies on a clinic by clinic basis based on actual gross sales and operating expenses.

APPENDIX: The Joint Corp. Quarterly Financial Highlights 25 GROSS SALES ($ millions) $4.3 $5.0 $5.5 $5.8 $5.7 $6.0 $6.5 $(2.7) $(2.0) $(1.7) $(1.4) $(0.5) $(0.3) $0.3 Q1-16 Q2-16 Q3-16 Q4-16 Q1-17 Q2-17 Q3-17 Revenue Adj. EBITDA REVENUE & ADJ. EBITDA 1 ($ millions) $22.0 $23.8 $25.6 $27.2 $28.1 $30.5 $32.2 Q1-16 Q2-16 Q3-16 Q4-16 Q1-17 Q2-17 Q3-17 3 Reconciliation of Adjusted EBITDA to GAAP earnings is included in the company’s Form 8 - K furnished to the SEC on 11/13/2017

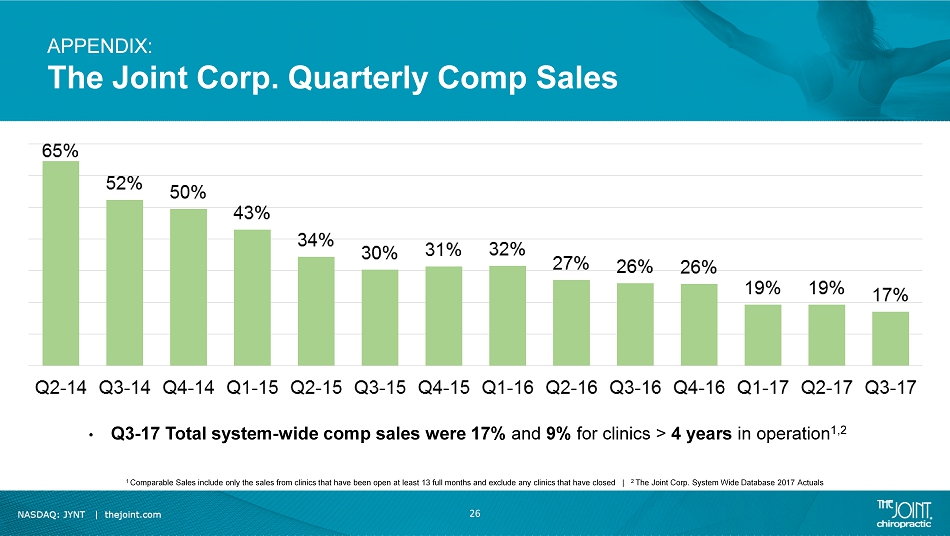

APPENDIX: The Joint Corp. Quarterly Comp Sales 26 • Q3 - 17 Total system - wide comp sales were 17% and 9 % for clinics > 4 years in operation 1,2 1 Comparable Sales include only the sales from clinics that have been open at least 13 full months and exclude any clinics that ha ve closed | 2 The Joint Corp. System Wide Database 2017 Actuals

Corporate Clinics Franchise Operations Unallocated Corporate The Joint Consolidated Total Revenues 2,930$ 3,616$ -$ 6,546$ Operating Expenses (2,747) (1,945) (1,763) (6,455) Depreciation and Amortization (379) - (90) (469) Operating Income (Loss) (196) 1,671 (1,853) (378) Other (Income) Expense, net - - 10 10 Loss before income tax expense (196) 1,671 (1,843) (368) Corporate Clinics Franchise Operations Unallocated Corporate The Joint Consolidated Total Revenues 8,106$ 10,128$ -$ 18,234$ Operating Expenses (8,117) (5,649) (5,867) (19,633) Depreciation and Amortization (1,222) - (328) (1,550) Operating Income (Loss) (1,233) 4,479 (6,195) (2,949) Other (Income) Expense, net - - (34) (34) Loss before income tax expense (1,233) 4,479 (6,228) (2,983) APPENDIX: 2017 Segment Performance Q3 2017 YTD ($ thousands) 2017 Q3 27 ($ thousands)

APPENDIX: 2016 Financial Summary 1 Comparable Sales include only the sales from clinics that have been open at least 13 full months and exclude any clinics that ha ve closed | 2 The Joint Corp. System Wide Database 2016 Actuals | 3 Reconciliation of Adjusted EBITDA to GAAP earnings is included in the company’s Form 8 - K furnished to the SEC on 3/28/2017 • 370 open clinics, vs. 312 at the end of 2015 • Total system gross sales up 41% to $ 98.6 million, up from $ 70.1 million in 2015 • Total system - wide comp sales were 28% and 16% for clinics > 4 years in operation 1,2 • Revenue up 48% to $ 20.5 million, up from $ 13.8 million in 2015 • Adjusted EBITDA ( $ 7.7) million 3 • $ 3.0 million in cash 2016 28

The Joint Corp. Contact Information The Joint Corp 16767 N. Perimeter Dr., Suite 240 Scottsdale, AZ 85260 (480) 245 - 5960 Peter D. Holt President and CEO peter.holt@thejoint.com John P. Meloun Chief Financial Officer john.meloun@thejoint.com 29 https :// www.facebook.com/thejointchiro (@ thejointchiro) https :// twitter.com/thejointchiro (@ thejointchiro) https :// www.youtube.com/thejointcorp (@ thejointcorp)