Exhibit 99.1

STRICTLY CONFIDENTIAL STRICTLY CONFIDENTIAL E XECUTIVE S UMMARY M AY 10 2017 Developing Low - Cost LNG Export Solutions from the Permian Basin and Eagle Ford Shale in South Texas E XECUTIVE S UMMARY P ROPOSED M ERGER N EXT D ECADE , LLC H ARMONY M ERGER C ORP .

PAGE 1 The information provided in this Executive Summary with respect to NextDecade, LLC (the “Company”) has been provided for informational purposes only . This Executive Summary shall neither constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction . This Executive Summary relates to the proposed business combination between Harmony and NextDecade and does not contain all of the information that should be considered concerning the business combination nor is it intended to provide a basis for any investment decision or any other decision in respect of the business combination . Harmony and its directors and executive officers may be deemed to be participants in the solicitation of proxies in connection with the special meeting of Harmony Stockholders to be held to approve the proposed business combination . Stockholders are advised to read, when available, Harmony’s definitive proxy statement in connection with the solicitation of proxies for the special meeting because these materials will contain important information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to approve the business combination . The definitive proxy statement for the special meeting will be mailed to stockholders as of a record date to be established for voting on the proposed business combination . Stockholders will also be able to obtain copies of the proxy statement, without charge, by directing a request to : Harmony Merger Corp . , 777 Third Avenue, 37 th Floor, New York, NY 10017 . The proxy statement and definitive proxy statement, once available, can be obtained, without charge, at the Securities and Exchange Commission’s internet site, www . sec . gov . Neither the Company nor any of its affiliates or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of this Executive Summary or any of the information contained herein, or any other written or oral communication transmitted or made available to the recipient or its affiliates or representatives . The Company and its affiliates or representatives expressly disclaim to the fullest extent permitted by law any and all liability based, in whole or in part, on this Executive Summary or any information contained herein and any other written or oral communication transmitted or made available to the recipient or its affiliates or representatives, including, without limitation, with respect to errors therein or omissions therefrom . This Executive Summary does not attempt to present all the information that prospective investors may require . Recipients should not assume that the information in this Executive Summary is accurate as of any date other than May 10 , 2017 . Nothing contained herein is, or should be relied upon as, a promise or representation as to future performance . The Company does not undertake any obligation to update or revise this Executive Summary to reflect events or circumstances after the date of this Executive Summary . Certain of the information contained herein concerning industry and market data, economic trends, market position and competitiveness is based upon or derived from information provided by third - party consultants and other industry sources . While the Company believes these sources to be reliable, none of the Company or any of its affiliates or representatives can guarantee the accuracy of such information . Further, none of the Company or any of its affiliates or representatives have reviewed or independently verified the assumptions upon which projections of future trends and performance in such information are based . Recipients should not construe the contents of this Executive Summary, or any prior or subsequent communications from or with the Company or its advisors, as legal, tax or business advice . Each recipient should consult its own attorney and business advisor as to the legal, business, and tax and related matters concerning the Company . Forward Looking Statements This Executive Summary includes certain forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 , including statements regarding future financial performance, future growth and future acquisitions . These statements are based on NextDecade’s and Harmony’s managements’ current expectations or beliefs as well as assumptions concerning the events and are subject to uncertainty and changes in circumstances . Actual results may vary materially from those expressed or implied by the statements herein due to changes in economic, business, competitive and/or regulatory factors, and other risks and uncertainties affecting the development of NextDecade’s business . These risks, uncertainties and contingencies include : business conditions ; weather and natural disasters ; changing interpretations of GAAP ; outcomes of government reviews ; inquiries and investigations and related litigation ; continued compliance with government regulations ; legislation or regulatory environments ; requirements or changes adversely affecting the business in which NextDecade is engaged ; fluctuations in customer demand ; management of rapid growth ; intensity of competition from other providers of liquefied natural gas (LNG) and related services ; general economic conditions ; geopolitical events and regulatory changes ; the possibility that the proposed business combination does not close, including due to the failure to receive required security holder approvals or the failure of other closing conditions ; and other factors set forth in Harmony’s filings with the Securities and Exchange Commission and available at www . sec . gov . The information set forth herein should be read in light of such risks . Forward - looking statements speak only as of the date of this document . Neither Harmony nor NextDecade undertakes, and expressly disclaims any obligation to, update or alter its forward - looking statements to reflect events or circumstances after the date of this Executive Summary, whether as a result of new information, future events, changes in assumptions or otherwise . Disclaimer and Forward Looking Statements

PAGE 2 NextDecade is a liquefied natural gas (“LNG”) development company focused on LNG export projects and associated pipelines in the State of Texas. The management team is comprised of industry leaders with experience across the global LNG value chain. NextDecade’s first proposed LNG export facility, the Rio Grande LNG (“RGLNG”) project located in Brownsville, Texas, is optimally located in close proximity to associated and stranded gas resources in the Permian Basin and Eagle Ford Shale. RGLNG and the associated Rio Bravo Pipeline (“RBPL”), originating in the Agua Dulce market area, are well - positioned among the second wave of U.S. LNG projects. Using proven technology and a seasoned engineering, procurement, and construction (“EPC”) contractor, NextDecade expects to provide its customers around the world with flexible solutions for low - cost, reliable LNG as the global LNG market faces an impending supply shortfall early in the next decade. Introduction

PAGE 3 Proposed Merger • NextDecade and Harmony Merger Corp. announced plans to merge on March 13, 2017 • All - stock transaction expected to yield combined entity with pro forma EV of approximately $1.0 billion at closing Highlights (1 of 2) Capital Cost, Liquefaction Technology, Engineering • Selected proven and widely utilized technology from Air Products (C3MR TM ); collaborating with EPC contractor (CB&I) and key equipment providers (GE Oil & Gas) and vendors to ensure engineering and cost optimization • NextDecade estimates construction costs for the first three liquefaction trains of the RGLNG project of $478 - 502/ton before owners’ costs, financing costs, and contingencies; target reduction to less than $450/ton • Finalizing negotiations for lump - sum turnkey (“LSTK”) EPC contract with performance, time, and cost guarantees Management, Current Financial Partners, Invested Capital to Date • NextDecade’s management team is comprised of pioneers in the global LNG industry with experience developing some of the most prestigious projects across the global LNG value chain • Principal members of NextDecade include funds managed by York Capital Management, Valinor Management, and Halcyon Capital Management • Earlier this year, GE Oil & Gas made a $25 million common equity commitment and secured right to invest up to $1.0 billion of project - level financing (equity or debt) for RGLNG at final investment decision (“FID”) • NextDecade continued investing during the commodity downturn in 2015 and 2016 to further drive down the overall project cost, and believes its resulting advanced position facilitates an expected FID in mid - 2018

PAGE 4 Commercial • Executed non - binding Heads of Agreement (“HOAs”) with prospective customers; substantive sale and purchase agreement (“SPA”) negotiations ongoing with array of customers in Asian, European, and other global markets • Choice of flexible offtake contracting models such as tolling, free on board (“FOB”) or delivered ex - ship (“DES”); also deploying strategies for customers to capture full LNG value chain through collaboration with producers Highlights (2 of 2) Gas Supply • NextDecade’s RGLNG is optimally located close to key reserve basins (especially the Permian Basin and Eagle Ford Shale) with large quantities of associated gas (a byproduct of oil production) • Significant gas production with anticipated takeaway capacity constraints could lead to negative price differential vis - à - vis Henry Hub, potentially affording RGLNG a competitive advantage relative to other project sponsors Valuation • NextDecade and Harmony believe transaction valuation is at a significant discount to intrinsic value derived from a discounted cash flow (DCF) analysis and public market peer - group valuations • Business combination expected to close in mid - 2017 Regulatory • RGLNG and RBPL filed formal Federal Energy Regulatory Commission (“FERC”) applications on May 5, 2016 • Draft Environmental Impact Statement (“DEIS”) expected to be issued in mid - 2017 • Final authorization expected in mid - 2018

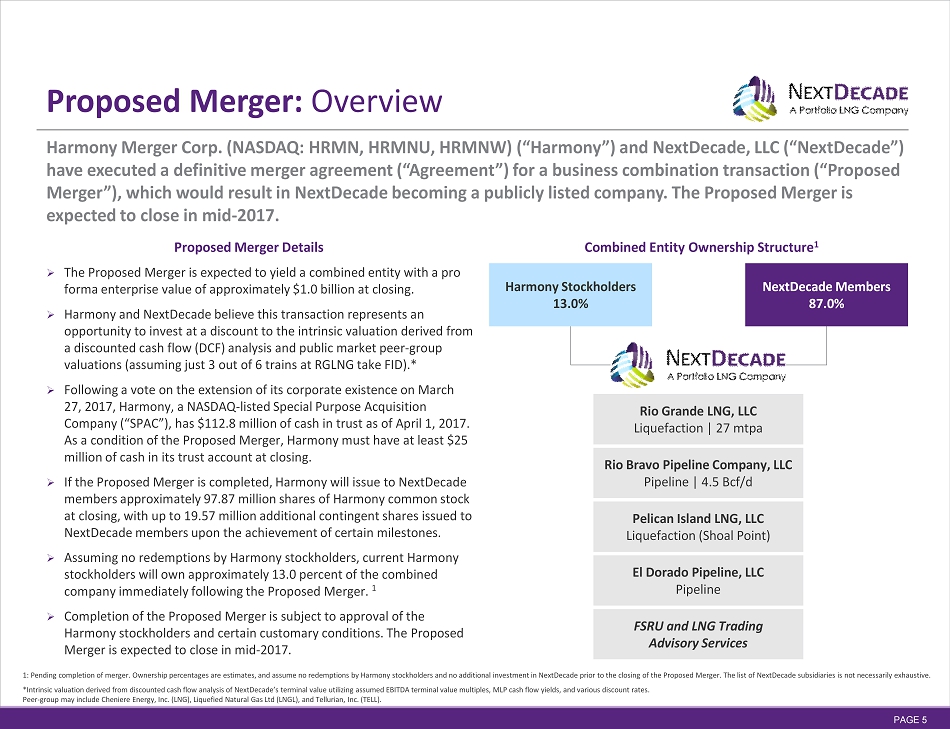

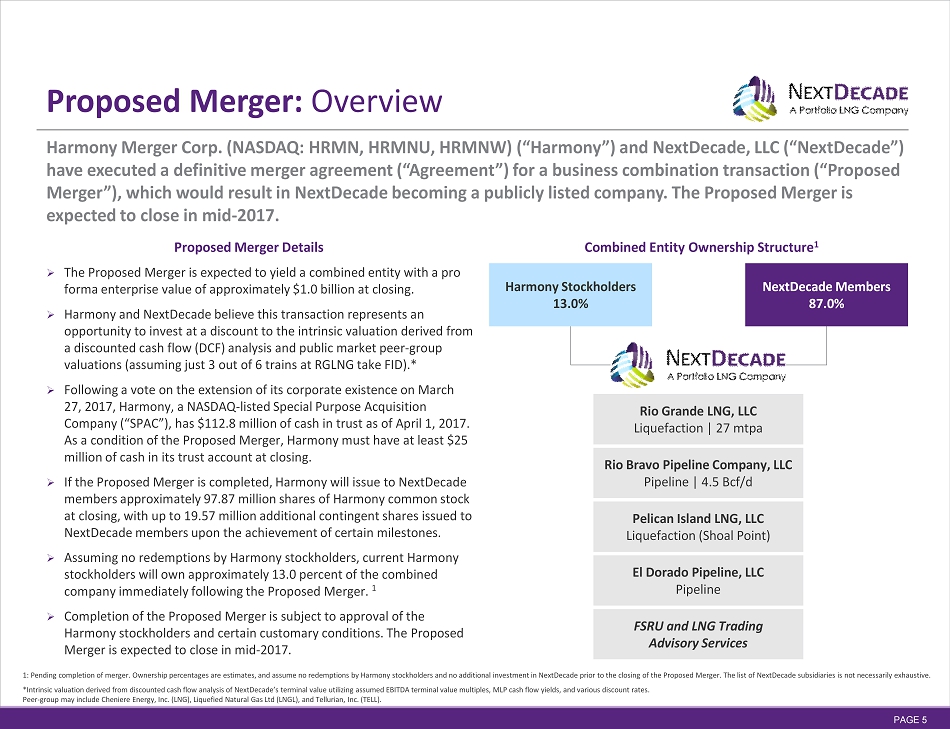

PAGE 5 Harmony Merger Corp. (NASDAQ: HRMN, HRMNU, HRMNW) (“Harmony”) and NextDecade, LLC (“NextDecade”) have executed a definitive merger agreement (“Agreement”) for a business combination transaction (“Proposed Merger”), which would result in NextDecade becoming a publicly listed company. The Proposed Merger is expected to close in mid - 2017. 1: Pending completion of merger. Ownership percentages are estimates, and assume no redemptions by Harmony stockholders and n o a dditional investment in NextDecade prior to the closing of the Proposed Merger. The list of NextDecade subsidiaries is not ne ces sarily exhaustive. *Intrinsic valuation derived from discounted cash flow analysis of NextDecade’s terminal value utilizing assumed EBITDA termi nal value multiples, MLP cash flow yields, and various discount rates. Peer - group may include Cheniere Energy, Inc. (LNG), Liquefied Natural Gas Ltd (LNGL), and Tellurian, Inc. (TELL). » The Proposed Merger is expected to yield a combined entity with a pro forma enterprise value of approximately $1.0 billion at closing. » Harmony and NextDecade believe this transaction represents an opportunity to invest at a discount to the intrinsic valuation derived from a discounted cash flow (DCF) analysis and public market peer - group valuations (assuming just 3 out of 6 trains at RGLNG take FID).* » Following a vote on the extension of its corporate existence on March 27, 2017, Harmony, a NASDAQ - listed Special Purpose Acquisition Company (“SPAC”), has $112.8 million of cash in trust as of April 1, 2017. As a condition of the Proposed Merger, Harmony must have at least $25 million of cash in its trust account at closing. » If the Proposed Merger is completed, Harmony will issue to NextDecade members approximately 97.87 million shares of Harmony common stock at closing, with up to 19.57 million additional contingent shares issued to NextDecade members upon the achievement of certain milestones. » Assuming no redemptions by Harmony stockholders, current Harmony stockholders will own approximately 13.0 percent of the combined company immediately following the Proposed Merger. 1 » Completion of the Proposed Merger is subject to approval of the Harmony stockholders and certain customary conditions. The Proposed Merger is expected to close in mid - 2017. Combined Entity Ownership Structure 1 Proposed Merger Details Proposed Merger: Overview Harmony Stockholders 13.0% NextDecade Members 87.0% Rio Bravo Pipeline Company, LLC Pipeline | 4.5 Bcf/d Pelican Island LNG, LLC Liquefaction (Shoal Point) El Dorado Pipeline, LLC Pipeline FSRU and LNG Trading Advisory Services Rio Grande LNG, LLC Liquefaction | 27 mtpa

PAGE 6 NextDecade and Harmony believe the Proposed Merger creates value for both companies’ current and future stakeholders, positioning RGLNG for positive FID in mid - 2018. *Intrinsic valuation derived from discounted cash flow analysis of NextDecade’s terminal value utilizing assumed EBITDA termi nal value multiples, MLP cash flow yields, and various discount rates. Peer - group may include Cheniere Energy, Inc. (LNG), Liquefied Natural Gas Ltd (LNGL), and Tellurian, Inc. (TELL). NextDecade is likely to experience ce rtain operating budget increases as a result of becoming a public company. NextDecade is not now, and will not be immediately post - merger, a master limited partnership (“MLP”). • Public listing enhances global profile among prospective customers, financing counterparties, and strategic partners of NextDecade’s LNG export projects and associated pipelines in Texas • Proposed Merger expected to enhance NextDecade’s ability to provide solutions to customers and producers, affording access to public markets and bolstering its cash position prior to a positive FID • NextDecade to achieve further de - risking of its projects via a lower cost of capital enhancing the ability to attract additional world - class customers and partners with binding commercial offtake and gas supply • Partnership with Harmony’s principal executives affords NextDecade incremental expertise in public company operations Harmony Rationale • Proposed Merger provides Harmony stockholders a unique opportunity to participate in the U.S. LNG export market through projects with access to abundant and low - cost natural gas resources in the Permian Basin and Eagle Ford Shale • With significant invested capital to date, NextDecade plans to secure project - level financing to enable construction of liquefaction facilities and pipelines with residual cash flows to NextDecade stockholders • Proposed all - stock transaction valued at a discount to the intrinsic valuation derived from a discounted cash flow (DCF) analysis and public market peer - group valuations (assuming just 3 out of 6 trains at RGLNG take FID)* NextDecade Rationale Proposed Merger: Rationale

PAGE 7 NextDecade is a LNG development company focused on LNG export projects and associated pipelines in the State of Texas. NextDecade’s first proposed LNG export facility, RGLNG in Brownsville, Texas, along with the associated RBPL originating in the Agua Dulce market area, is well - positioned among the second wave of U.S. LNG projects. Rio Grande LNG Overview • 984 - acre site optimally located in the Port of Brownsville, Texas, in close proximity to associated and stranded gas resources in the Permian Basin and Eagle Ford Shale • Planned capacity of 27 million tons per annum (mtpa) (6 trains x 4.5 mtpa each) • Significant volume of HOAs signed • Up to 4.5 Bcf/d from key Texas hub via planned RBPL • FERC application filed May 2016; draft EIS expected in mid - 2017 • DOE authorization for FTA countries; non - FTA approval pending • Start - up planned for 2022 • Second 994 - acre site leased on the Houston Ship Channel in Texas City (Shoal Point) Competitive Advantages • Competitive EPC costs, with construction cost estimates of $478 - 502/ton before owners’ costs, financing costs, and contingencies, and with target cost reduction to less than $450/ton • Proximity to low - cost feed gas sourced from Permian Basin and Eagle Ford Shale • Proven and widely utilized Air Products C3MR™ technology • Experienced team, strong relationships with technical and commercial partners • Limited project and ship channel congestion at Brownsville site • Flexible offtake models (toll, FOB, and DES) NextDecade: Overview Artist’s Rendering

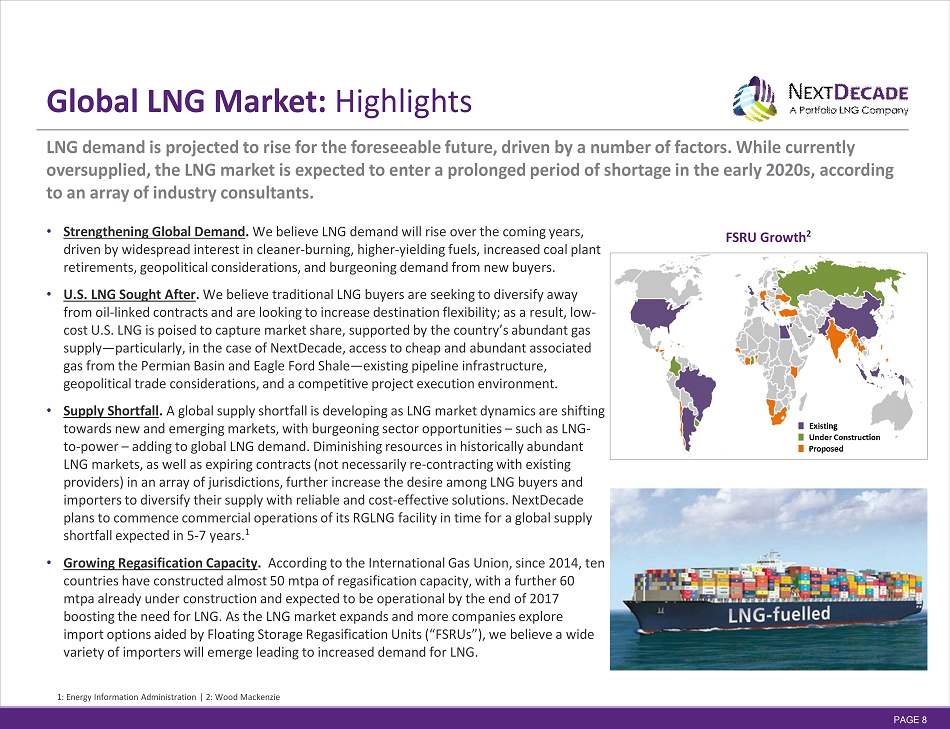

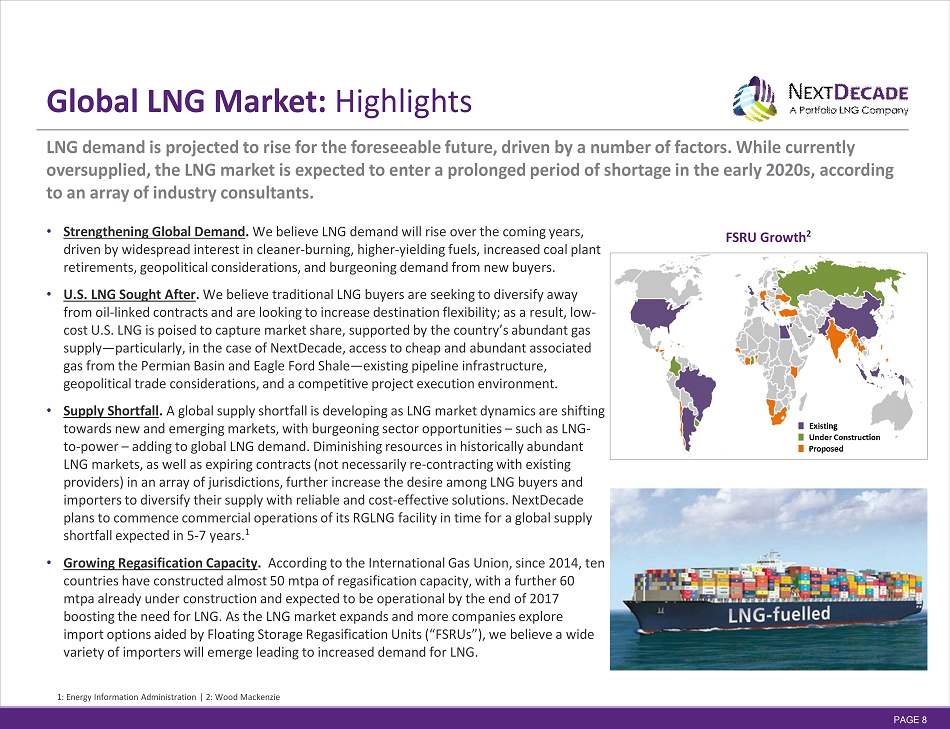

PAGE 8 LNG demand is projected to rise for the foreseeable future, driven by a number of factors. While currently oversupplied, the LNG market is expected to enter a prolonged period of shortage in the early 2020s, according to an array of industry consultants. • Strengthening Global Demand . We believe LNG demand will rise over the coming years, driven by widespread interest in cleaner - burning, higher - yielding fuels, increased coal plant retirements, geopolitical considerations, and burgeoning demand from new buyers. • U.S. LNG Sought After . We believe traditional LNG buyers are seeking to diversify away from oil - linked contracts and are looking to increase destination flexibility; as a result, low - cost U.S. LNG is poised to capture market share, supported by the country’s abundant gas supply — particularly, in the case of NextDecade, access to cheap and abundant associated gas from the Permian Basin and Eagle Ford Shale — existing pipeline infrastructure, geopolitical trade considerations, and a competitive project execution environment. • Supply Shortfall . A global supply shortfall is developing as LNG market dynamics are shifting towards new and emerging markets, with burgeoning sector opportunities – such as LNG - to - power – adding to global LNG demand. Diminishing resources in historically abundant LNG markets, as well as expiring contracts (not necessarily re - contracting with existing providers) in an array of jurisdictions, further increase the desire among LNG buyers and importers to diversify their supply with reliable and cost - effective solutions. NextDecade plans to commence commercial operations of its RGLNG facility in time for a global supply shortfall expected in 5 - 7 years. 1 • Growing Regasification Capacity . According to the International Gas Union, since 2014, ten countries have constructed almost 50 mtpa of regasification capacity, with a further 60 mtpa already under construction and expected to be operational by the end of 2017 boosting the need for LNG. As the LNG market expands and more companies explore import options aided by Floating Storage Regasification Units (“FSRUs”), we believe a wide variety of importers will emerge leading to increased demand for LNG. Global LNG Market: Highlights 1: Energy Information Administration | 2: Wood Mackenzie FSRU Growth 2

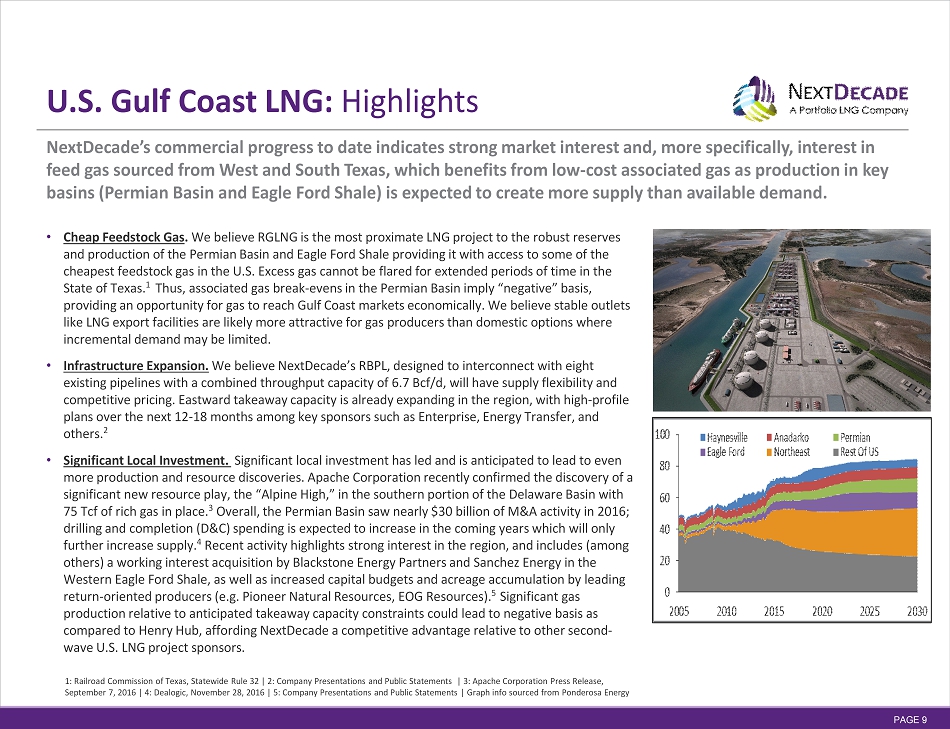

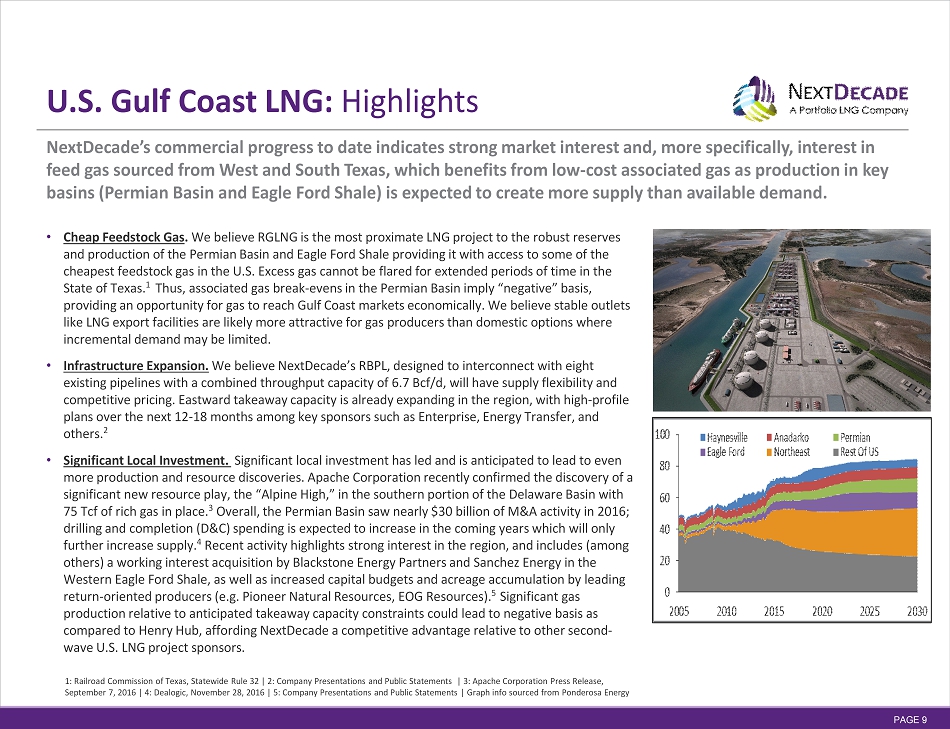

PAGE 9 NextDecade’s commercial progress to date indicates strong market interest and, more specifically, interest in feed gas sourced from West and South Texas, which benefits from low - cost associated gas as production in key basins (Permian Basin and Eagle Ford Shale) is expected to create more supply than available demand. • Cheap Feedstock Gas . We believe RGLNG is the most proximate LNG project to the robust reserves and production of the Permian Basin and Eagle Ford Shale providing it with access to some of the cheapest feedstock gas in the U.S. Excess gas cannot be flared for extended periods of time in the State of Texas. 1 Thus, associated gas break - evens in the Permian Basin imply “negative” basis, providing an opportunity for gas to reach Gulf Coast markets economically. We believe stable outlets like LNG export facilities are likely more attractive for gas producers than domestic options where incremental demand may be limited. • Infrastructure Expansion. We believe NextDecade’s RBPL, designed to interconnect with eight existing pipelines with a combined throughput capacity of 6.7 Bcf/d, will have supply flexibility and competitive pricing. Eastward takeaway capacity is already expanding in the region, with high - profile plans over the next 12 - 18 months among key sponsors such as Enterprise, Energy Transfer, and others. 2 • Significant Local Investment. Significant local investment has led and is anticipated to lead to even more production and resource discoveries. Apache Corporation recently confirmed the discovery of a significant new resource play, the “Alpine High,” in the southern portion of the Delaware Basin with 75 Tcf of rich gas in place. 3 Overall, the Permian Basin saw nearly $30 billion of M&A activity in 2016; drilling and completion (D&C) spending is expected to increase in the coming years which will only further increase supply. 4 Recent activity highlights strong interest in the region, and includes (among others) a working interest acquisition by Blackstone Energy Partners and Sanchez Energy in the Western Eagle Ford Shale, as well as increased capital budgets and acreage accumulation by leading return - oriented producers (e.g. Pioneer Natural Resources, EOG Resources). 5 Significant gas production relative to anticipated takeaway capacity constraints could lead to negative basis as compared to Henry Hub, affording NextDecade a competitive advantage relative to other second - wave U.S. LNG project sponsors. U.S. Gulf Coast LNG: Highlights 1: Railroad Commission of Texas, Statewide Rule 32 | 2: Company Presentations and Public Statements | 3: Apache Corporation Pre ss Release, September 7, 2016 | 4: Dealogic, November 28, 2016 | 5: Company Presentations and Public Statements | Graph info sourced from Po nderosa Energy

PAGE 10 NextDecade has made substantial progress with prospective customers to date. NextDecade is in the midst of advanced negotiations with an array of prospective customers in key Asian, European, and other global markets that comprise portfolio buyers, traders, and utilities in these jurisdictions, among others. » NextDecade’s management team intends to leverage its experience from decades in the natural gas and LNG industries to create and/or capture substantial demand from both new and existing buyers. » In particular, NextDecade’s management has distinctive knowledge of and experience with developing FSRUs, enhancing the prospect of capturing new demand growth in emerging markets. » Ms. Eisbrenner, NextDecade’s Chairman and CEO, is a member of the National Petroleum Council. Additionally, she was invited to sit on JERA’s Fuel Business Expert Advisory Board in 2017. JERA is the world’s largest LNG buying consortium, and this role elevates NextDecade’s profile and credibility among critical East Asian customers. » NextDecade plans to accommodate various levels of buyer sophistication, and as such can offer various pricing models, including pure toll, FOB, and DES. Prospective Customer Overview » NextDecade has engaged a variety of potential customers, almost all of which represent “end - use” demand, in key markets around the globe. » Many of these prospective customers have indicated an interest in diversifying away from oil - linked supplies, and further diversifying from Henry Hub - linked U.S. supplies. » NextDecade is in ongoing discussions with (i) international oil companies, (ii) established utilities currently importing LNG and facing contract roll - off or uneconomical pricing, (iii) new importers of LNG seeking to develop smaller - scale facilities, including FSRU capabilities near shore to growing LNG markets, and (iv) other prospective customers.* » NextDecade has also had discussions with entities facing flagging domestic production amidst aging resource basins. As energy demand around the world rises, some of these countries are facing new supply shortages or are not able to fulfill existing contracts. Commercial Strategy Rio Grande LNG: Commercial Artist’s Rendering * Among other FSRU capabilities and experience, NextDecade announced a HOA with FLEX LNG on December 12, 2016.

PAGE 11 RGLNG’s EPC liquefaction costs are expected to be among the most competitive in the world due to NextDecade’s close collaboration with its EPC contractor (Chicago Bridge & Iron) and equipment providers (GE Oil & Gas), as well as its use of proven technology (AP - C3MR™). » NextDecade engaged CB&I to conduct its front - end engineering and design (“FEED”) work, and is in the process of finalizing detailed negotiations for a LSTK EPC contract that includes performance, time, and cost guarantees. » Air Products’ C3MR TM Technology is used in a wide array of LNG projects around the world, including in several LNG projects under construction in the United States. On April 25, 2017, NextDecade announced its intent to utilize GE’s gas turbine and compressor equipment, representing another step in de - risking aspects of the project. » NextDecade’s FERC applications contemplate the project’s entire six trains of production. NextDecade’s base case is to start with three trains at RGLNG, though the Company can take an initial positive FID on as few as two trains. » NextDecade estimates construction costs for the first three liquefaction trains of the RGLNG project of approximately $478 - 502/ton before owners’ costs, financing costs, and contingencies. Next Decade estimates construction costs for a positive FID on just two trains would be $536 - 563/ton. » NextDecade believes that value improvements identified by CB&I and NextDecade could achieve further potential EPC cost reduction to approximately $500 - 535/ton for two trains, with a target reduction to less than $450/ton in the three - train base case, through optimization efforts undertaken by NextDecade in conjunction with its EPC contractor, equipment suppliers, and other integrated system vendors. Capital Cost, Liquefaction Technology, and Engineering Rio Grande LNG: Engineering Artist’s Rendering 3 Trains $478 - 502/ton 2 Trains $536 - 563/ton

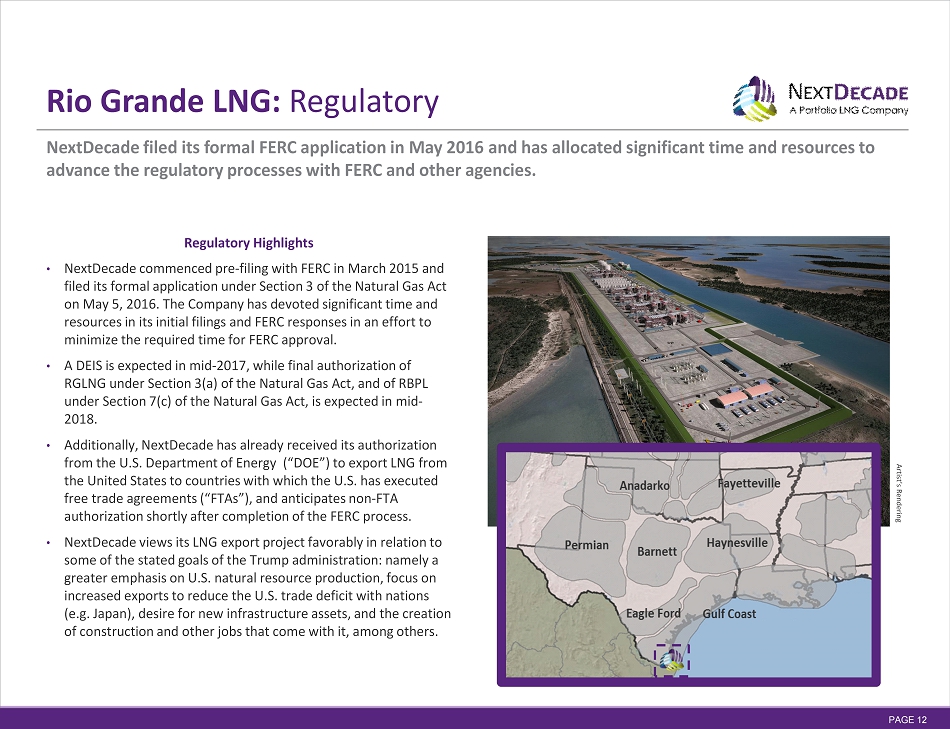

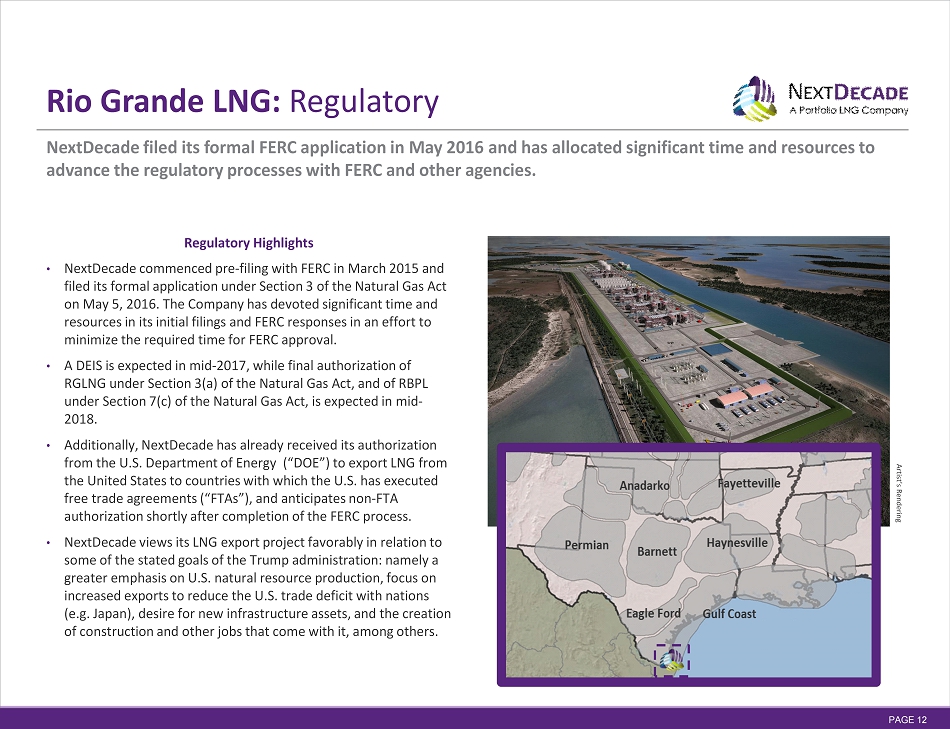

PAGE 12 NextDecade filed its formal FERC application in May 2016 and has allocated significant time and resources to advance the regulatory processes with FERC and other agencies. • NextDecade commenced pre - filing with FERC in March 2015 and filed its formal application under Section 3 of the Natural Gas Act on May 5, 2016. The Company has devoted significant time and resources in its initial filings and FERC responses in an effort to minimize the required time for FERC approval. • A DEIS is expected in mid - 2017, while final authorization of RGLNG under Section 3(a) of the Natural Gas Act, and of RBPL under Section 7(c) of the Natural Gas Act, is expected in mid - 2018. • Additionally, NextDecade has already received its authorization from the U.S. Department of Energy (“DOE”) to export LNG from the United States to countries with which the U.S. has executed free trade agreements (“FTAs”), and anticipates non - FTA authorization shortly after completion of the FERC process. • NextDecade views its LNG export project favorably in relation to some of the stated goals of the Trump administration: namely a greater emphasis on U.S. natural resource production, focus on increased exports to reduce the U.S. trade deficit with nations (e.g. Japan), desire for new infrastructure assets, and the creation of construction and other jobs that come with it, among others. Regulatory Highlights Rio Grande LNG: Regulatory Artist’s Rendering

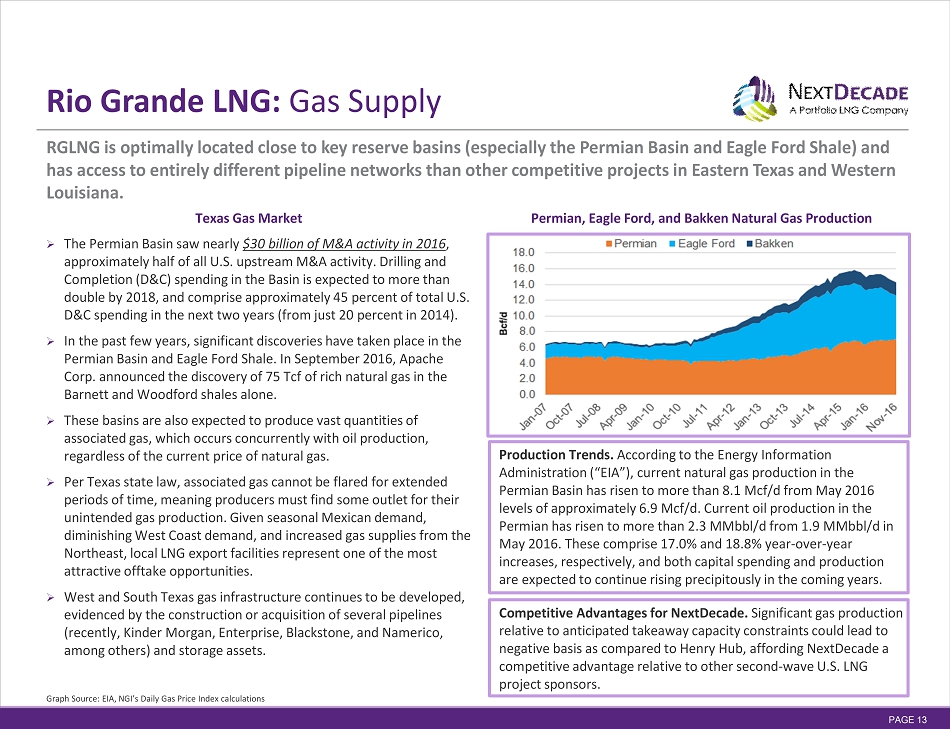

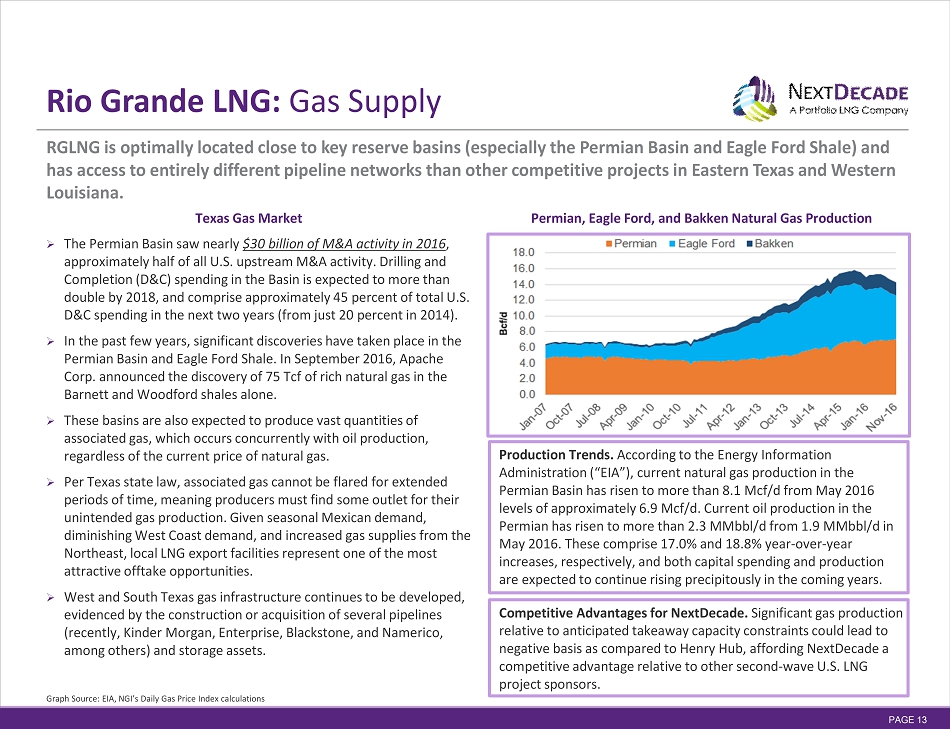

PAGE 13 RGLNG is optimally located close to key reserve basins (especially the Permian Basin and Eagle Ford Shale) and has access to entirely different pipeline networks than other competitive projects in Eastern Texas and Western Louisiana. Graph Source: EIA, NGI’s Daily Gas Price Index calculations » The Permian Basin saw nearly $30 billion of M&A activity in 2016 , approximately half of all U.S. upstream M&A activity. Drilling and Completion (D&C) spending in the Basin is expected to more than double by 2018, and comprise approximately 45 percent of total U.S. D&C spending in the next two years (from just 20 percent in 2014). » In the past few years, significant discoveries have taken place in the Permian Basin and Eagle Ford Shale. In September 2016, Apache Corp. announced the discovery of 75 Tcf of rich natural gas in the Barnett and Woodford shales alone. » These basins are also expected to produce vast quantities of associated gas, which occurs concurrently with oil production, regardless of the current price of natural gas. » Per Texas state law, associated gas cannot be flared for extended periods of time, meaning producers must find some outlet for their unintended gas production. Given seasonal Mexican demand, diminishing West Coast demand, and increased gas supplies from the Northeast, local LNG export facilities represent one of the most attractive offtake opportunities. » West and South Texas gas infrastructure continues to be developed, evidenced by the construction or acquisition of several pipelines (recently, Kinder Morgan, Enterprise, Blackstone, and Namerico, among others) and storage assets. Permian, Eagle Ford, and Bakken Natural Gas Production Texas Gas Market Rio Grande LNG: Gas Supply Competitive Advantages for NextDecade. Significant gas production relative to anticipated takeaway capacity constraints could lead to negative basis as compared to Henry Hub, affording NextDecade a competitive advantage relative to other second - wave U.S. LNG project sponsors. Production Trends. According to the Energy Information Administration (“EIA”), current natural gas production in the Permian Basin has risen to more than 8.1 Mcf/d from May 2016 levels of approximately 6.9 Mcf/d. Current oil production in the Permian has risen to more than 2.3 MMbbl/d from 1.9 MMbbl/d in May 2016. These comprise 17.0% and 18.8% year - over - year increases, respectively, and both capital spending and production are expected to continue rising precipitously in the coming years.

PAGE 14 NextDecade: Management Kathleen Eisbrenner oversees development and execution of NextDecade’s liquefaction and pipeline strategies. She was formerly ex ecutive vice president at Royal Dutch Shell, where she was responsible for the company’s global LNG portfolio management and LNG trading. Prior to Shell, Eisbrenne r w as the founder and CEO of Excelerate Energy, focused on developing the FSRU industry. Eisbrenner also held various senior management positions at El Paso Energy. Eis brenner is a member of the National Petroleum Council, American Bureau of Shipping, JERA’s Fuel Business Expert Advisory Board, and Junior Achievement of Southea st Texas, among others. She is a former member of the Board of Directors of Chesapeake Energy. Eisbrenner holds a Bachelor of Science degree in civil engineering fro m t he University of Notre Dame. René van Vliet is responsible for developing midstream LNG solutions at NextDecade. Prior to his work at NextDecade, van Vlie t w orked at Shell International for almost 32 years, most recently as vice president of Global LNG, Shell Gas & Power. He has been involved in LNG developments since 1992, ov erseeing projects on four continents. During his time at Shell, he was responsible for a global LNG project portfolio, including land - based LNG, floating LNG, regasif ication, and small - scale LNG. van Vliet holds a Master of Science degree in civil engineering from the Technical University of Eindhoven. Alfonso Puga oversees NextDecade’s efforts to sign long - term offtake contracts with NextDecade’s customers around the world. Pug a has spent more than 18 years in the natural gas and LNG industries, initially at Gas Natural and then Union Fenosa Gas, where he managed a portfolio of 6 Bcm of LNG . Following his time at Union Fenosa, Puga worked at both Essent Trading (today RWE) and Goldman Sachs, where he formed the LNG trading desk. Puga holds a degree i n I ndustrial Electrical Engineering from the Polytechnic University of Catalonia and earned an Executive MBA from the IMD - Lausanne. Ben Atkins is responsible for NextDecade’s financial strategy, reporting, controls, and budgeting. Before joining NextDecade, At kins served as senior vice president at GE Capital, where he spent 10 years primarily in underwriting and portfolio management roles for thermal power and midstream equ ity investments. Atkins previously worked at McKinsey & Company and as a risk manager in State Street Corporation’s Securities Finance division. Atkins is a CFA charte rho lder and a licensed Certified Public Accountant in Connecticut and Texas. He was valedictorian of his class at the United States Naval Academy, and served as a nu cle ar engineer in the United States Navy Submarine Force. Kathleen Eisbrenner Chief Executive Officer René van Vliet Chief Operating Officer Alfonso Puga Chief Commercial Officer Ben Atkins Chief Financial Officer Shaun Davison leads NextDecade’s commercial project development efforts in North America. Davison has spent more than 20 year s i n the energy industry including with Consolidated Natural Gas and Dominion Resources, where he focused on business development, marketing, corporate strategy and maj or M&A transactions including Dominion’s purchase of the Cove Point LNG import terminal. Davison previously worked for Teekay Corporation and Excelerate En erg y, where he led global project development for LNG regasification opportunities in nine countries and managed small - scale LNG projects in the Caribbean and Bal tic regions. He holds a Bachelor of Science degree in management science and economics from West Virginia Wesleyan College and a Master of Business Administratio n f rom West Virginia University. Shaun Davison SVP, Development & Regulatory Affairs Krysta De Lima is responsible for all of NextDecade’s legal and contractual matters. De Lima worked in Bechtel’s Oil, Gas and Ch emicals business unit where she advised on major EPC contracts and transactions across the globe. Prior to that, De Lima served as lead counsel at BG Group plc where sh e a dvised on upstream, midstream and downstream projects and investments, including on BG Group’s investments in all four trains at Atlantic LNG in Trinidad. Prio r t o BG Group, De Lima worked in private practice at Arthur Andersen. De Lima is qualified to practice law in New York, France, England, the British Virgin Islands an d T rinidad and Tobago. Krysta De Lima General Counsel NextDecade is supported by a management team that has experience developing some of the most prestigious projects across the global LNG value chain.

PAGE 15 NextDecade has strong financial partners in York Capital Management, Valinor Management, Halcyon Capital Management, and GE Oil & Gas. » York Capital Management ∙ ND Board: Matthew Bonanno, David Magid, William Vrattos - AUM: $17 billion* - Founder: James Dinan (1991) - York Capital Management is a global investment firm that seeks to generate attractive risk - adjusted returns across business and market cycles through a combination of focused research, investment selection, and disciplined risk management. York Capital Management invests in distressed and event - driven strategies in both public and private assets. » Valinor Management ∙ ND Board: Brian Belke - AUM: $3 billion* - Founder: David Gallo (2007) - Valinor Management is a long - term value investor that employs a disciplined, bottom - up fundamental approach to its investment process. The firm primarily invests in public markets, but has a number of private investments in its portfolio and a private equity fund. » Halcyon Capital Management ∙ ND Board: Avinash Kripalani - AUM: $9 billion* - Founder: Alan B. Slifka (1981) - Halcyon Capital Management seeks to provide clients with solutions to their investment needs offering commingled funds, managed accounts, CLOs and bespoke structures. Halcyon has institutionalized investment, research, and risk management processes across its strategies. Strategic Entities » GE Oil & Gas - Under an investment agreement executed earlier this year, GE Oil & Gas has made a $25 million common equity commitment ($15 million of which has been invested to date). - Under a framework agreement, N extDecade named GE Oil & Gas as the exclusive supplier of gas turbine and compressor equipment for the first three liquefaction trains of the RGLNG project. - NextDecade and GE agreed upon an option for GE to provide a limited notice to proceed (“LNTP”) facility amounting to $150 million to place orders for long - lead time equipment items. - GE was also granted a right to invest up to $1.0 billion of project - level financing (equity or debt) for RGLNG at FID. » Strategic Partners - Harmony and NextDecade have reserved $100 million of capacity for strategic partners to invest in NextDecade prior to the closing of the Proposed Merger. Pursuant to the definitive merger agreement filed with the SEC on April 18, 2017, strategic partners could receive a discount to the transaction price. Financial Entities NextDecade: Current Financial Partners * AUM figures are approximate.

Valinor

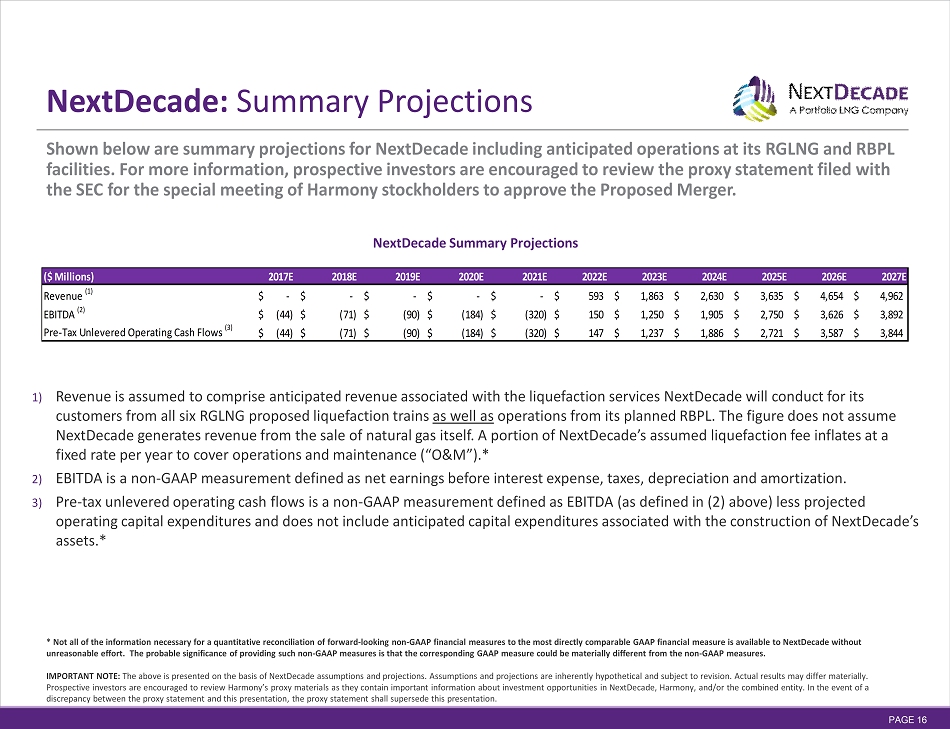

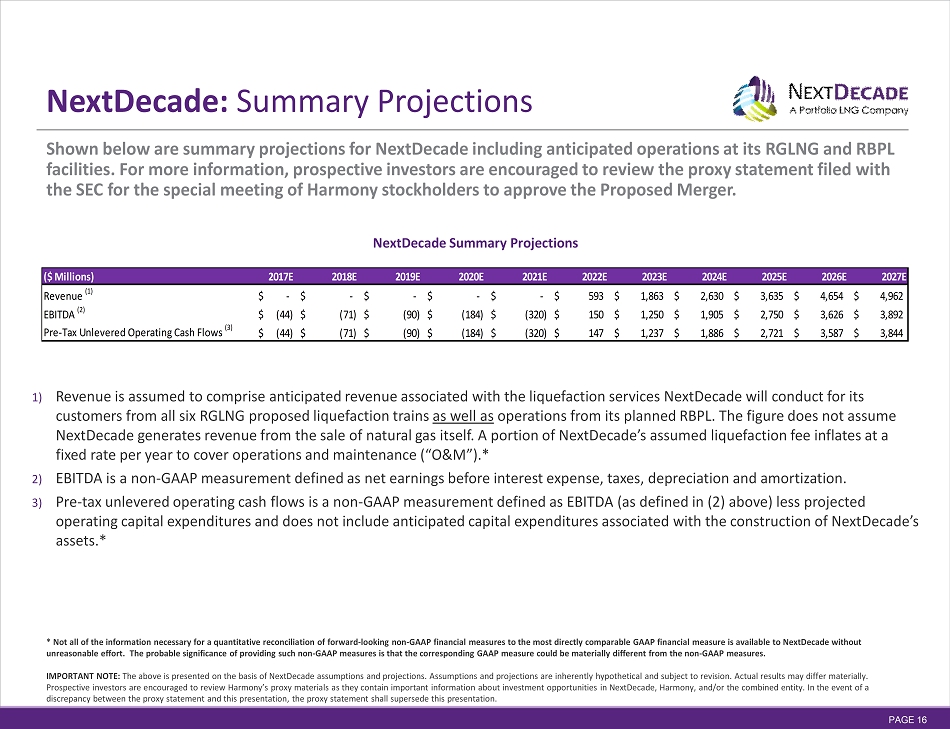

PAGE 16 Shown below are summary projections for NextDecade including anticipated operations at its RGLNG and RBPL facilities. For more information, prospective investors are encouraged to review the proxy statement filed with the SEC for the special meeting of Harmony stockholders to approve the Proposed Merger. NextDecade: Summary Projections NextDecade Summary Projections 1) Revenue is assumed to comprise anticipated revenue associated with the liquefaction services NextDecade will conduct for its customers from all six RGLNG proposed liquefaction trains as well as operations from its planned RBPL. The figure does not assume NextDecade generates revenue from the sale of natural gas itself. A portion of NextDecade’s assumed liquefaction fee inflates at a fixed rate per year to cover operations and maintenance (“O&M”).* 2) EBITDA is a non - GAAP measurement defined as net earnings before interest expense, taxes, depreciation and amortization. 3) Pre - tax unlevered operating cash flows is a non - GAAP measurement defined as EBITDA (as defined in (2) above) less projected operating capital expenditures and does not include anticipated capital expenditures associated with the construction of Next Dec ade’s assets.* * Not all of the information necessary for a quantitative reconciliation of forward - looking non - GAAP financial measures to the m ost directly comparable GAAP financial measure is available to NextDecade without unreasonable effort. The probable significance of providing such non - GAAP measures is that the corresponding GAAP measure could be materially different from the non - GAAP measures. IMPORTANT NOTE: The above is presented on the basis of NextDecade assumptions and projections. Assumptions and projections are inherently hyp ot hetical and subject to revision. Actual results may differ materially. Prospective investors are encouraged to review Harmony’s proxy materials as they contain important information about investme nt opportunities in NextDecade, Harmony, and/or the combined entity. In the event of a discrepancy between the proxy statement and this presentation, the proxy statement shall supersede this presentation. ($ Millions) 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E 2025E 2026E 2027E Revenue (1) -$ -$ -$ -$ -$ 593$ 1,863$ 2,630$ 3,635$ 4,654$ 4,962$ EBITDA (2) (44)$ (71)$ (90)$ (184)$ (320)$ 150$ 1,250$ 1,905$ 2,750$ 3,626$ 3,892$ Pre-Tax Unlevered Operating Cash Flows (3) (44)$ (71)$ (90)$ (184)$ (320)$ 147$ 1,237$ 1,886$ 2,721$ 3,587$ 3,844$

PAGE 17 Contact Harmony Merger Corp. 777 Third Avenue, 37th Floor New York, New York 10017 David Sgro, Chief Operating Officer T: + 1 (212) 319 7676 | E: ds@harmonymergercorp.com H ARMONY Ward CC (for NextDecade) 5959 West Loop South, Suite 510 Bellaire, Texas 77401 Molly LeCronier, Vice President T: + 1 (713) 869 0707 | E: mlecronier@wardcc.com C OMMUNICATIONS Height Securities, LLC* 1775 Pennsylvania Avenue NW, 11th Floor Washington, D.C. 20006 Patrick Hughes, Managing Director T: + 1 (202) 629 0004 | E: phughes@heightllc.com F INANCIAL A DVISOR * Height Securities, LLC is a broker - dealer registered with the Financial Industry Regulatory Authority (FINRA) and the U.S. Sec urities and Exchange Commission (SEC), and is a member of the Securities Investor Protection Corporation (SIPC). NextDecade, LLC 3 Waterway Square Place, Suite 400 The Woodlands, Texas 77380 Ben Atkins, Chief Financial Officer T: + 1 (832) 404 2064 | E: ben@next - decade.com