UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22979

Goldman Sachs MLP and Energy Renaissance Fund

(Exact name of registrant as specified in charter)

200 West Street

New York, NY 10282

(Address of principal executive offices) (Zip code)

| | |

Copies to: |

Caroline Kraus, Esq. | | Stephen H. Bier, Esq. |

Goldman, Sachs & Co. | | Allison M. Fumai, Esq. |

200 West Street | | Dechert LLP |

New York, New York 10282 | | 1095 Avenue of the Americas |

| | New York, NY 10036-6797 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (212) 902-1000

Date of fiscal year end: November 30

Date of reporting period: May 31, 2017

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| | The Semi-Annual Report to Shareholders is filed herewith. |

Goldman Sachs Closed-End Funds

| | | | |

| | |

| Semi-Annual Report | | | | May 31, 2017 |

| | |

| | | | MLP and Energy Renaissance Fund MLP Income Opportunities Fund |

Goldman Sachs Closed-End Funds

| ∎ | | MLP AND ENERGY RENAISSANCE FUND |

| ∎ | | MLP INCOME OPPORTUNITIES FUND |

| | | | |

| | | |

| NOT FDIC-INSURED | | May Lose Value | | No Bank Guarantee |

GOLDMAN SACHS CLOSED-END FUNDS

What Differentiates Goldman Sachs’ Closed-End Funds Investment Process?

The MLP and Energy Renaissance Fund and MLP Income Opportunities Fund (each, a “Fund” and collectively, the “Funds”) each seek a high level of total return with an emphasis on current distributions to shareholders. The MLP and Energy Renaissance Fund seeks to achieve its investment objective by investing in Master Limited Partnerships (“MLPs”) and other energy investments. The MLP Income Opportunities Fund seeks to achieve its investment objectives by investing primarily in MLPs. We seek to invest in quality companies with well located assets (exposed to what we believe are favorable commodities and geographies), strong balance sheets, and experienced management teams. We view an MLP as a company, not just a collection of assets, as we emphasize cash flow based valuation metrics and focus on balance sheet liabilities. We seek to avoid being overly myopic by assessing the entire energy value chain (from producers to users) to estimate the impact on midstream assets.

| ∎ | | To capture the full energy chain, we analyze energy production and user trends that ultimately impact income opportunities. |

| ∎ | | We rigorously assess companies on both the asset and equity level. |

| ∎ | | Macro Trend Analysis First, we analyze overall energy trends through capital spending shifts and drilling trends, in addition to regional supply and demand imbalances. |

| ∎ | | Top-Down Sector Selection Secondly, we establish the impact of macro and regional trends on energy infrastructure. |

| ∎ | | Bottom-Up Security Selection Finally, we select investments by evaluating a company’s management, assets, expected returns and technicals. |

| ∎ | | Our team of MLP dedicated investment professionals includes lead portfolio managers averaging over 12 years of investment experience. |

| ∎ | | Ability to leverage energy-related resources across GSAM Equity, Fixed Income and Commodity groups, as well as utilize risk management resources. |

| ∎ | | Unique investment approach stemming from a more holistic view across the extremes of the energy value chain, corporate access, broader valuation understanding, and resource advantages. |

1

MARKET REVIEW

Goldman Sachs Closed-End Funds

Market Review

Energy master limited partnerships (“MLPs”), as represented by the Alerian MLP Index,1 generated a positive return of 2.28% during the six-month period ended May 31, 2017 (the “Reporting Period”). The Alerian MLP Index is a leading measure of energy MLPs. The Cushing® MLP High Income Index2 produced a return of 0.19%. During the Reporting Period, the Alerian MLP Index outperformed the AMEX Energy Select Sector Index (“IXE”) (-11.09%) and underperformed the S&P 500® Index (+10.80%).3 The Alerian MLP Index also underperformed utilities (+17.19%) and real estate investment trusts (“REITs”) (+7.45%), as represented by the Philadelphia Stock Exchange (PHLX) Utility Sector Index and the FTSE NAREIT (National Association of Real Estate Investment Trusts) U.S. Real Estate Index, respectively.4 (All index returns are presented on a total return basis.)

In energy markets, West Texas Intermediate (“WTI”) crude oil prices, after a strong recovery from lows set in early 2016, remained range-bound during the first half of the Reporting Period. In our opinion market participants seemed to be waiting to assess the impact of the Organization of the Petroleum Exporting Countries’ (“OPEC”) November 30, 2016 production cuts on crude oil supply. During the second half of the Reporting Period, WTI crude oil prices experienced some volatility, as U.S. crude oil inventories continued to build during the first few months of 2017. WTI crude oil prices fell 2.27% during the Reporting Period.5 Part of the reason for the weakness in WTI crude oil prices was the rapid recovery of U.S. shale production, which we believe was swifter than many market participants expected and was driven largely by drilling efficiency gains and cost reductions. After U.S. shale production bottomed at 8.4 million barrels per day in July 2016, it rebounded 10.8% to 9.3 million barrels per day in May 2017.6 Because of the continued inventory surplus, OPEC extended its production cuts for another nine months through 2018 to “do whatever it takes” to reduce inventory levels to historical averages.

Natural gas prices also experienced weakness during the Reporting Period. Prices declined more than 20% at the beginning of 2017 to $2.56 per million British thermal units (“MMbtu”) on February 21, 2017. Natural gas prices then rallied to $3.07 per MMbtu on May 31, 2017 to end the Reporting Period down 8.38%.7 Warmer than consensus expected winter weather in the U.S. was a headwind for natural gas prices, though export growth of liquefied natural gas helped offset some of the weather-related slump. The price of natural gas liquids increased

| 1 | | Source: Alerian. The Alerian MLP Index is a float-adjusted, capitalization-weighted index, whose constituents represent approximately 85% of total float-adjusted market capitalization. It is disseminated real-time on a price-return basis (AMZ) and on a total-return basis (AMZX). |

| 2 | | Source: Cushing® Asset Management. The Cushing® MLP High Income Index tracks the performance of the 30 publicly traded energy and shipping MLP securities with an emphasis on current yield. |

| 3 | | The AMEX Energy Select Sector Index (IXE) is a modified market capitalization-based index intended to track the movements of companies that are components of the S&P 500® Index and are involved in the development or production of energy products. The S&P 500® Index is a diverse index that includes 500 American companies that represent more than 70% of the total market capitalization of the U.S. stock market. |

| 4 | | The PHLX Utility Sector Index is composed of geographically diverse public U.S. utility stocks. The FTSE NAREIT U.S. Real Estate Index Series is an index that spans the commercial real estate space across the U.S. economy, offering exposure to all investment and property sectors. |

| 6 | | Source: U.S. Energy Information Administration, weekly U.S. Field Production of Crude Oil, data as of May 26, 2017. |

2

MARKET REVIEW

during the Reporting Period, led by propane, which was up approximately 10% on strong international demand.8

In the energy MLP market, the increase in U.S. production volumes and lingering high inventory levels dampened investor sentiment during the Reporting Period. We believe, however, that U.S. volume growth is positive for midstream9 energy MLPs long term. Our view began to materialize during the Reporting Period, as evidenced by the difference in performance between WTI crude oil prices, upstream10 energy equities and midstream energy MLPs. During the Reporting Period, midstream energy MLPs (as measured by the price-return of the Alerian MLP Index) outpaced WTI crude oil prices and upstream energy equities (as measured by the IXE) by 4.55% and 13.37%, respectively (including dividends).

Overall, energy MLPs continued to benefit from strong fundamentals during the Reporting Period. They also experienced increased mergers and acquisition activity through consolidation and simplification transactions.11 As companies sought to gain exposure to the most productive areas, high growth basins such as the Permian Basin made up a large portion of the consolidation transactions during the Reporting Period. Simplification transactions also continued, with general partners completing incentive distribution rights restructurings that led to lower costs of capital and improved growth profiles for underlying limited partners. Incentive distribution rights allow a general partner to receive incrementally larger percentages of an energy MLP’s total distributions as the energy MLP grows the distribution beyond established targets. In addition, with officials in Washington, D.C. playing an important role in expediting project approvals, energy MLPs announced new projects in an effort to increase organic growth. Several Presidential executive orders issued during the Reporting Period were aimed at accelerating pipeline projects, which seemed likely to benefit the energy infrastructure sector.

Capital markets and investment flows also played important roles during the Reporting Period. The capital markets had become more accessible for energy MLPs, and the initial public offering (“IPO”) market began reopening to energy MLPs, with two IPOs pricing in the last two months of the Reporting Period. Investment flows also began to recover, but remained below levels seen prior to the downturn in WTI crude oil prices.

Looking Ahead

At the end of the Reporting Period, we believed the U.S. was well positioned in the global energy landscape, with growth potential across energy commodities. In our view, the U.S. midstream space is one of the most compelling areas in which to invest as it stands to benefit, we believe, from long-term secular growth trends in U.S. commodity volumes.

| 8 | | Source: U.S. Energy Information Administration, based on year-over-year export data as of May 31, 2017. |

| 9 | | The midstream component of the energy industry is usually defined as those companies providing products or services that help link the supply side, i.e. energy producers, and the demand side, i.e. energy end-users, for any type of energy commodity. Such midstream business can include, but are not limited to, those that process, store, market and transport various energy commodities. |

| 10 | | The upstream component of the energy industry is usually defined as those operations stages in the oil and gas industry that involve exploration and production. Upstream operations deal primarily with the exploration stages of the oil and gas industry, with upstream firms taking the first steps to first locate, test and drill for oil and gas. Later, once reserves are proven, upstream firms will extract any oil and gas from the reserve. |

| 11 | | A simplification transaction is when multiple entities controlled by the same corporate parent simplify their corporate structure through actions such as mergers, acquisitions or reduction of incentive distribution rights. |

3

MARKET REVIEW

In terms of crude oil, we expect the market to be structurally balanced for the remainder of 2017, propelled by continued demand growth and a lack of supply growth outside the U.S. More specifically, we expect demand to increase at its historic pace of approximately one million barrels per day per year, driven primarily by increased consumption in developing economies. On the supply side, we believe OPEC will continue to enact disciplined supply policy in an effort to normalize global inventory levels. The absence of large upstream capital expenditures outside of the U.S. has reduced the number of new crude oil projects, which in our view, will likely not be enough to offset natural decline rates12 on existing production outside of countries cooperating with OPEC-led supply cuts. We expect U.S. shale production to grow and be a significant source of supply to cover a potential global supply deficit, as U.S. shale project lead times are typically much shorter than those of the rest of the world. Consistent with the U.S. Energy Information Administration, we expect U.S. crude oil production to continue growing in 2017 and beyond, as efficiency gains and technological advances allow the U.S. to be cost competitive with other global producers. At the end of the Reporting Period, U.S. rig counts, a leading indicator of production, were up approximately 125% from their lows in May 2016, indicating that capital is being deployed to grow production in the U.S.13 transition from coal to natural gas power generation and the continued buildout of the U.S.’ export capabilities.

Looking ahead, we believe the energy MLP sector could potentially provide attractive yield and capital appreciation over the long term. In the short term, we believe energy MLPs could continue to offer distribution growth, albeit at a slower pace than the double-digit growth seen before the recent steep drop in crude oil prices. While lower distribution growth trajectories will result, in our view, in smaller payout increases for investors in the near term, they will also allow energy MLPs to finance more of their capital expenditures with internal capital, thus potentially reducing reliance, we believe, on external debt and equity markets.

Finally, we believe investors should recognize a growing dispersion in performance. Rising U.S. production has greatly altered the energy landscape, proving beneficial to some regions and detrimental to others. As a result, we believe the dispersion between the energy “haves” and “have nots” has increased. In our opinion, rigorous fundamental analysis is essential in seeking to take advantage of the powerful energy revolution theme that we believe persists.

| 12 | | The natural decline rate is the decline in oil and gas production that takes place over a period of time without taking into account an increase in production resulting from enhanced oil recovery techniques. |

4

PORTFOLIO RESULTS

Goldman Sachs MLP and Energy Renaissance Fund

Investment Objective and Principal Strategy

The Fund seeks a high level of total return with an emphasis on current distributions to shareholders. The Fund seeks to achieve its investment objective by investing primarily in master limited partnership (“MLP”) and other energy investments. The Fund intends to use leverage to seek to achieve its investment objective. It concentrates its investments in the energy sector, with an emphasis on midstream MLP investments. Under normal market conditions, the Fund will invest at least 80% of its managed assets in MLPs and other energy investments. The Fund’s MLP investments may include, but are not limited to, MLPs structured as limited partnerships (“LPs”) or limited liability companies (“LLCs”); MLPs that are organized as LPs or LLCs, but taxed as “C” corporations; equity securities that represent an indirect interest in an MLP issued by an MLP affiliate, including institutional units and MLP general partner or managing member interests; “C” corporations whose predominant assets are interests in MLPs; MLP equity securities, including MLP common units, MLP subordinated units, MLP convertible subordinated units and MLP preferred units; private investments in public equities issued by MLPs; MLP debt securities; and other U.S. and non-U.S. equity and fixed income securities and derivative instruments that provide exposure to the MLP market, including pooled investment vehicles that primarily hold MLP interests and exchange-traded notes. The Fund’s other energy investments may include equity and fixed income securities of U.S. and non-U.S. companies other than MLPs that (i) are classified by a third party as operating within the oil and gas storage, transportation, refining, marketing, drilling, exploration or production sub-industries or (ii) have at least 50% of their assets, income, sales or profits committed to, or derived from, the exploration, development, production, gathering, transportation (including marine), transmission, terminal operation, processing, storage, refining, distribution, mining or marketing of natural gas, natural gas liquids (including propane), crude oil, refined petroleum products, coal, electricity or other energy sources, energy-related equipment or services.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Energy and Infrastructure Team discusses the Goldman Sachs MLP and Energy Renaissance Fund’s (the “Fund”) performance and positioning for the six-month period ended May 31, 2017 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s cumulative total return based on its net asset value (“NAV”) was 1.66%. The Fund’s cumulative total return based on market price was 10.01% for the same period. By way of reference, the Alerian MLP Index1 had a cumulative total return of 2.28% during the Reporting Period. By comparison, the Cushing® MLP High Income Index2 had a cumulative total return of 0.19% for the Reporting Period. As of May 31, 2017, the Fund’s NAV was $7.39, and its market price was $7.50. |

| | 1 | | Source: Alerian. The Alerian MLP Index is a composite of prominent energy MLPs that captures about 85% of the total float-adjusted market capitalization of the energy MLP sector. |

| | 2 | | Source: Cushing® Asset Management. The Cushing® MLP High Income Index tracks the performance of 30 publicly traded energy and shipping MLP securities with an emphasis on current yield. |

| Q | | What was the Fund’s current distribution rate at the end of the Reporting Period? |

| A | | During the Reporting Period overall, the Fund declared dividends totaling $0.32 per unit. We note that this matches the $0.32 per unit of declared dividends for the six months ended November 30, 2016. As of May 31, 2017, the Fund’s current annualized distribution rate based on its NAV was 8.66%. The Fund’s current annualized distribution rate based on its market price was 8.53% on May 31, 2017. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | Security selection and the macro environment in the commodity markets drove the Fund’s performance during the Reporting Period, as volatility increased the dispersion of individual stock returns. The volatility was generally magnified in names that had greater exposure to commodities, making them the worst performers. |

5

PORTFOLIO RESULTS

| | | In terms of its exposures, the Fund was negatively impacted by its positions in the petroleum pipeline transportation and the midstream3 services subsectors.4 Petroleum pipeline transportation was the Fund’s worst-performing subsector, with security selection detracting most from returns. The midstream services subsector, which is sensitive to commodity prices, also detracted from the Fund’s results as commodities experienced significant volatility during the Reporting Period. On the positive side, the Fund was helped by its exposure to the gathering and processing and the liquids storage subsectors. Both subsectors benefited from the rebound in U.S. natural gas and crude oil production, with the gathering and processing subsector seeing the most direct benefit as it is closest to the wellhead and therefore, tends to experience the greatest fluctuation in volumes. High inventories of crude oil, refined products and natural gas liquids were also advantageous for the liquids storage subsector. |

| Q | | What individual holdings detracted from the Fund’s performance during the Reporting Period? |

| A | | During the Reporting Period, Plains All American Pipeline, L.P.; Targa Resources Corp.; and CSI Compressco LP detracted from the Fund’s performance. |

| | | Plains All American Pipeline, L.P. (PAA) was the top detractor from Fund performance during the Reporting Period. PAA is a crude oil-focused midstream energy MLP with significant assets in the Permian Basin. Its stock fell in sympathy with crude oil prices, which were volatile throughout the Reporting Period, most notably in the later months. Crude oil prices moved lower on concerns around global production and U.S. inventory builds. Overall, lower than market expected first quarter 2017 financial results and a higher beta to crude oil were headwinds for PPA’s stock performance. (Beta is a measure of the volatility, or systematic risk, of a security compared to the market as a whole.) The Fund continued to hold PAA at the end of the Reporting Period, as the stock is fundamentally undervalued, in our view, and offers favorable exposure to a rebound in commodity prices. |

| | | Another detractor from the Fund’s returns was Targa Resources Corp. (TRGP), a natural gas and natural gas liquids-focused company with major operations in the Permian Basin. TRGP’s performance was initially quite strong, as expectations for production volume growth in the Permian Basin drove its stock price higher. However, the stock fell sharply after an earnings report showed that volumes came in below expectations. At the end of the Reporting Period, the Fund maintained a position in TRGP to maintain its exposure to commodities, specifically through companies that have exposure to the most prolific U.S. basins, such as the Permian Basin. Additionally, we view the stock as fundamentally undervalued and see upside potential from its levels at the end of the Reporting Period. |

| | | A third detractor during the Reporting Period was CSI Compressco LP (CCLP). CCLP provides compression-based production services to natural gas and oil exploration and production companies, generating revenue through fee-based contracts for its fleet equipment and personnel. In February 2017, CCLP reported fourth quarter and full year 2016 results, including a fourth quarter loss that was greater than analyst expectations, which put pressure on CCLP’s share price. After the earnings announcement, CCLP shares moved lower with the broader crude oil market, then experienced significant weakness in April 2017 after the company announced a 50% distribution cut. The distribution cut came as a surprise to the investor base and triggered a selloff of approximately 10% on April 24, 2017. At the end of the Reporting Period, the Fund continued to own CCLP because we view the stock as fundamentally undervalued after the selloff and we consider the yield attractive. |

| Q | | What individual holdings added to the Fund’s performance during the Reporting Period? |

| A | | Investments in ONEOK Partners L.P.; Western Refining Logistics, LP; and Sunoco LP added to the Fund’s returns during the Reporting Period. |

| | | The top contributor to the Fund’s performance was ONEOK Partners L.P. (OKS), which owns and operates natural gas and natural gas liquids midstream assets, with exposure to most major basins in the U.S. During the Reporting Period, OKS announced a simplification transaction5 in which it was acquired by its general partner, ONEOK (OKE). Under the agreement, each outstanding common unit of OKS will be converted to 0.985 shares of OKE common stock, representing a 22.4% premium over OKS’s closing price on January 27, 2017. The simplification transaction was well received by the market, and shares of OKS rose approximately 20% on January 31, 2017, the day of the transaction. We sold the Fund’s position in OKS by the end of the Reporting Period in an effort to capture profits. |

| | 3 | | The midstream component of the energy industry is usually defined as those companies providing products or services that help link the supply side, i.e. energy producers, and the demand side, i.e. energy end-users, for any type of energy commodity. Such midstream businesses can include, but are not limited to, those that process, store, market and transport various energy commodities. |

| | 4 | | Sector and subsector allocations are defined by GSAM and may differ from sector allocations used by the Alerian MLP Index. |

| | 5 | | A simplification transaction is when multiple entities controlled by the same corporate parent simplify their corporate structure through actions such as mergers, acquisitions or reduction of incentive distribution rights. |

6

PORTFOLIO RESULTS

| | | Western Refining Logistics, LP (WNRL) was also a notable contributor to the Fund’s returns. WNRL transports crude oil through its pipeline assets and also stores crude oil and refined products in its terminals and storage facilities. As refining services providers tend to have a lower beta to crude oil prices than the broader midstream energy MLP market, WNRL was able to maintain its performance amid the pullback in crude oil prices during the Reporting Period. Additionally, WNRL benefited from its general partner Western Refining’s acquisition of Northern Tier Energy LP, which was widely expected to encourage higher distribution growth at the MLP level and generally supported investors’ constructive view of WNRL. The Fund continued to hold WNRL at the end of the Reporting Period, as the stock has a strong growth profile and we believe it offers an attractive yield. |

| | | Another top contributor to the Fund’s performance was Sunoco LP (SUN), which distributes motor fuel to its retail and commercial distribution network and also operates its own convenience stores and retail fuel sites. During the Reporting Period, shares of SUN were volatile, falling after fourth quarter 2016 financial results, but recovering strongly in April 2017 after the company announced a strategic asset divestiture, wherein SUN entered into a definitive asset purchase agreement with retailer 7-Eleven. Under the agreement, 7-Eleven will purchase approximately 1,100 convenience store locations along the U.S. east coast and in Texas, a transaction valued at approximately $3.3 billion. At the end of the Reporting Period, we maintained the Fund’s position in SUN for its attractive yield and because it has a business model with a low beta to crude oil prices. |

| Q | | Were there any notable purchases or sales during the Reporting Period? |

| A | | During the Reporting Period, the Fund initiated a position in NGL Energy Partners LP (NGL), a full service midstream provider. In our view, the market did not fully appreciate the company’s upside potential and/or its ability to grow distributions at an attractive rate. As a result, we considered the stock undervalued and took advantage of the opportunity to establish a position in the name. |

| | | Another purchase made during the Reporting Period was USA Compression Partners, LP (USAC), which provides compression services to producers, processors, gatherers and transporters of natural gas in the U.S. In our view, USAC’s revenue streams are inherently linked to U.S. production volumes, which we believe are poised to increase due to growing global market share, potential crude oil price stability and lower breakeven prices. As a result, we decided to build a position in the company. |

| | | A notable sale during the Reporting Period was Golar LNG Partners LP (GMLP), which owns floating storage/ regasification units and liquefied natural gas carriers that the company leases for long term charters. While we remain constructive on the name and still believe there are positive catalysts on the horizon, we decided to exit the Fund’s position during January 2017 as the stock traded close to what we considered fundamental value. |

| | | As mentioned previously, we sold the Fund’s investment in OKS during the Reporting Period after the general partner, OKE, announced it would acquire the remaining public stake in OKS for $17.2 billion. The transaction was well received by the market and drove the share price higher, but the transaction agreement would result in a lower yield for the position. Therefore, we decided to take profits and transition the proceeds into names that had more robust growth and yield profiles, in our view. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | During the Reporting Period, the Fund did not use derivatives or similar instruments. |

| Q | | How did the Fund use leverage during the Reporting Period? |

| A | | The Fund is permitted to obtain leverage using any form or combination of financial leverage instruments, including through funds borrowed from banks or other financial institutions (i.e., a credit facility), margin facilities or notes issued by the Fund and the leverage attributable to similar transactions entered into by the Fund, and it reserves the right to obtain leverage to the extent permitted by the Investment Company Act of 1940. During the Reporting Period, the Fund obtained leverage through a margin facility.6 The use of this leverage added to the Fund’s performance during the Reporting Period. Consistent with our positive outlook for the energy MLP sector, the Fund sought to increase the amount of dollars borrowed in an effort to enhance returns as the sector recovers. That said, as volatility increased toward the end of the Reporting Period, we strategically reduced the Fund’s leverage. The proceeds from borrowings were generally invested in securities with an intent to grow cash flows for the Fund. During the Reporting Period, the Fund’s leverage was maintained at a level between 30% and 33%. As of May 31, 2017, the margin facility represented 32.39% of the Fund’s managed assets. |

7

| | 6 | | The Goldman Sachs MLP and Energy Renaissance Fund currently has a fixed/floating rate margin loan facility with a major financial institution, which it entered into on July 27, 2015. |

FUND BASICS

Goldman Sachs MLP and Energy Renaissance Fund

as of May 31, 2017

| | | | | | |

| | FUND SNAPSHOT | |

| | | As of May 31, 2017 | | | |

| | Net Asset Value (NAV)1 | | $ | 7.39 | |

| | Market Price1 | | $ | 7.50 | |

| | Premium (Discount) to NAV2 | | | 1.49 | % |

| | Leverage3 | | | 32.39 | % |

| | Distribution Rate – NAV4 | | | 8.66 | % |

| | | Distribution Rate – Market Price4 | | | 8.53 | % |

| | 1 | | The Market Price is the price at which the Fund’s common shares are trading on the NYSE. The Market Price of the Fund’s common shares will fluctuate and, at the time of sale, common shares may be worth more or less than the original investment or the Fund’s then current net asset value (“NAV”). The NAV is the market value of one share of the Fund. This amount is derived by dividing the total value of all the securities in the Fund’s portfolio, plus any other assets, less any liabilities, by the number of Fund shares outstanding. The Fund cannot predict whether its common shares will trade at, above or below NAV. Shares of closed-end investment companies frequently trade at a discount from their NAV, which may increase investors’ risk of loss. |

| | 2 | | The premium/discount to NAV is calculated as the market price divided by the NAV of the Fund minus 1, expressed as a percentage. If this value is positive, the Fund is trading at a premium to its NAV. If the value is negative, the Fund is trading at a discount to its NAV. |

| | 3 | | The Fund is permitted to obtain leverage using any form or combination of financial leverage instruments, including through funds borrowed from banks or other financial institutions (i.e., a credit facility), margin facilities or notes issued by the Fund and the leverage attributable to similar transactions entered into by the Fund. The Fund’s use of leverage through a credit facility is calculated as a percentage of the Fund’s Managed Assets. Managed Assets are defined as total assets of the Fund (including assets attributable to borrowings for investment purposes) minus the sum of the Fund’s accrued liabilities (other than liabilities representing borrowings for investment purposes). |

| | 4 | | The Distribution Rate is calculated by annualizing the most recent distribution amount declared divided by the most recent closing Market Price or NAV. The Distribution Rate is subject to change and is not an indication of Fund performance. A portion of the Fund’s distributions will likely be treated for tax purposes as a return of capital. A return of capital is not taxable and results in a reduction in the tax basis of a shareholder’s investment. The final determination regarding the nature of the distributions will be made after the end of the Fund’s fiscal year when the Fund can determine its earnings and profits. The final tax status of the distribution may differ substantially and will be made available to shareholders after the close of each calendar year. The proportion of distributions that are treated as taxable distributions may also vary and or increase in future years. The ultimate composition of these distributions may vary due to a variety of factors including projected income and expenses, depreciation and depletion, and any tax elections made by the MLP. |

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | December 1, 2016–May 31, 2017 | | Fund Total Return

(based on NAV)5 | | | Fund Total Return

(based on Market Price)5 | |

| | | Common Shares | | | 1.66 | % | | | 10.01 | % |

| | 5 | | Total returns are calculated assuming purchase of a share at the market price or NAV on the first day and sale of a share at the market price or NAV on the last day of each period reported. Dividends and distributions, if any, are assumed, for purposes of this calculation, to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. The Total Returns based on NAV and Market Price do not reflect brokerage commissions or sales charges in connection with the purchase or sale of Fund shares, which if included would lower the performance shown above. The NAV used in the Total Return calculation includes all management fees, interest expense (if any) and operating expenses incurred by the Fund. Operating expenses include custody, accounting and administrative services, professional fees, transfer agency fees, registration, printing and mailing costs and Trustee fees. Total returns for periods less than one full year are not annualized. |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment returns and principal value will fluctuate. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Closed-end funds, unlike open-end funds, are not continuously offered. Once issued in a public offering, shares of closed-end funds are traded in the open market through a stock exchange.

8

FUND BASICS

| | | | | | | | |

| | TOP TEN HOLDINGS AS OF 5/31/176 |

| | | Holding | | % of Net Assets | | | Line of Business |

| | Energy Transfer Partners LP | | | 17.3 | % | | Pipeline Transportation | Natural Gas |

| | DCP Midstream LP | | | 14.3 | | | Gathering + Processing |

| | Targa Resources Corp. | | | 13.0 | | | Gathering + Processing |

| | Plains All American Pipeline LP | | | 12.0 | | | Pipeline Transportation | Petroleum |

| | Williams Partners LP | | | 11.8 | | | Gathering + Processing |

| | NuStar Energy LP | | | 11.6 | | | Pipeline Transportation | Petroleum |

| | Buckeye Partners LP | | | 6.1 | | | Pipeline Transportation | Petroleum |

| | Western Refining Logistics LP | | | 4.9 | | | Storage | Liquids |

| | Antero Midstream Partners LP | | | 4.9 | | | Gathering + Processing |

| | | Enviva Partners LP | | | 4.2 | | | Power Generation |

| | 6 | | The top 10 holdings may not be representative of the Fund’s future investments. |

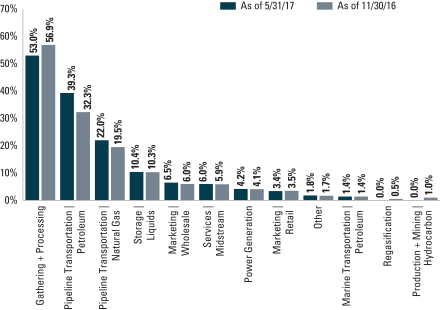

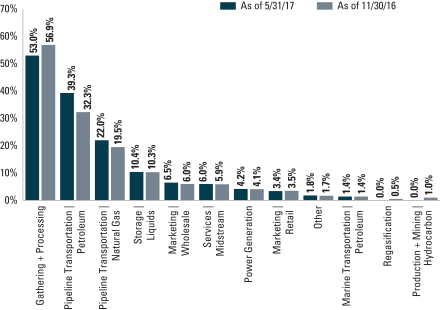

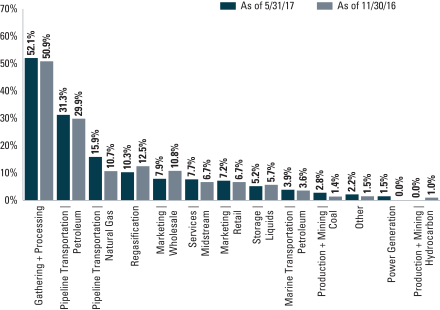

| | 7 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The percentage shown for each investment category reflects the value of investments in that category as a percentage of total net assets. For periods shown prior to the period ended May 31, 2017, the Fund used a different sector classification methodology. Information for these prior periods have been reclassified with the Fund’s current sector classification methodology. As a result of borrowings, the percentages may add to an amount in excess of 100%. Sector allocations are defined by GSAM and may differ from sector allocations used by the Alerian Index. |

9

PORTFOLIO RESULTS

Goldman Sachs MLP Income Opportunities Fund

Investment Objective and Principal Strategy

The Fund seeks a high level of total return with an emphasis on current distributions to shareholders. The Fund seeks to achieve its investment objective by investing primarily in master limited partnerships (“MLPs”). The Fund intends to use leverage to seek to achieve its investment objective. Under normal market conditions, the Fund will invest at least 80% of its managed assets in MLP investments. The Fund’s MLP investments may include, but are not limited to, MLPs structured as limited partnerships (“LPs”) or limited liability companies (“LLCs”); MLPs that are organized as LPs or LLCs, but taxed as “C” corporations; equity securities that represent an indirect interest in an MLP issued by an MLP affiliate, including institutional units and MLP general partner or managing member interests; “C” corporations whose predominant assets are interests in MLPs; MLP equity securities, including MLP common units, MLP subordinated units, MLP convertible subordinated units and MLP preferred units; private investments in public equities issued by MLPs; MLP debt securities; and other U.S. and non-U.S. equity and fixed income securities and derivative instruments that provide exposure to the MLP market, including pooled investment vehicles that primarily hold MLP interests and exchange-traded notes. The Fund currently expects to concentrate its investments in the energy sector, with an emphasis on midstream MLP investments, including companies that are engaged in the treatment, gathering, compression, processing, transportation, transmission, fractionation, storage and terminalling of natural gas, natural gas liquids, crude oil, refined products or coal.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Energy and Infrastructure Team discusses the Goldman Sachs MLP Income Opportunities Fund’s (the “Fund”) performance and positioning for the six-month period ended May 31, 2017 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s cumulative total return based on its net asset value (“NAV”) was 1.32%. The Fund’s cumulative total return based on market price was 7.51% for the same period. By way of reference, the Alerian MLP Index1 had a cumulative total return of 2.28% during the Reporting Period. By comparison, the Cushing® MLP High Income Index2 had a cumulative total return of 0.19% for the Reporting Period. As of May 31, 2017, the Fund’s NAV was $10.01, and its market price was $9.93. |

| Q | | What was the Fund’s current distribution rate at the end of the Reporting Period? |

| A | | During the Reporting Period overall, the Fund declared dividends totaling $0.42 per unit. We note that this matches the $0.42 per unit of declared dividends for the six months ended November 30, 2016. As of May 31, 2017, the Fund’s current annualized distribution rate based on its NAV was 8.39%. The Fund’s current annualized distribution rate based on its market price was 8.46% on May 31, 2017. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | Security selection and the macro environment in the commodity markets drove the Fund’s performance during the Reporting Period, as volatility increased the dispersion of individual stock returns. The volatility was generally magnified in names that had greater exposure to commodities, making them the worst performers. |

| | | In terms of its exposures, the Fund was negatively impacted by its positions in the petroleum pipeline transportation and the midstream3 services subsectors.4 Midstream services, which is sensitive to commodity prices, was the Fund’s |

| | 1 | | Source: Alerian. The Alerian MLP Index is a composite of prominent energy MLPs that captures about 85% of the total float-adjusted market capitalization of the energy MLP sector. |

| | 2 | | Source: Cushing® Capital Management. The Cushing® MLP High Income Index tracks the performance of 30 publicly traded energy and shipping MLP securities with an emphasis on current yield. |

| | 3 | | The midstream component of the energy industry is usually defined as those companies providing products or services that help link the supply side, i.e. energy producers, and the demand side, i.e. energy end-users, for any type of energy commodity. Such midstream businesses can include, but are not limited to, those that process, store, market and transport various energy commodities. |

| | 4 | | Sector and subsector allocations are defined by GSAM and may differ from sector allocations used by the Alerian MLP Index. |

10

PORTFOLIO RESULTS

| | | worst-performing subsector as commodities experienced significant volatility during the Reporting Period. The petroleum pipeline transportation subsector also hampered Fund returns, with security selection detracting from results. On the positive side, the Fund was helped by its exposure to the gathering and processing and the liquids storage subsectors. Both subsectors benefited from the rebound in U.S. natural gas and crude oil production, with the gathering and processing subsector seeing the most direct benefit as it is closest to the wellhead and therefore, tends to experience the greatest fluctuation in volumes. High inventories of crude oil, refined products and natural gas liquids were also advantageous for the liquids storage subsector. |

| Q | | What individual holdings detracted from the Fund’s performance during the Reporting Period? |

| A | | During the Reporting Period, NGL Energy Partners LP; Plains All American Pipeline, L.P.; and CSI Compressco LP detracted from the Fund’s performance. |

| | | NGL Energy Partners LP (NGL) was the top detractor from Fund returns during the Reporting Period. NGL is a full service midstream provider focused on crude oil and natural gas liquids logistics in the U.S. In February 2017, NGL released its fiscal third quarter results, which included expected distribution growth of 28% for its 2018 fiscal year and growth of 10% for each of the following three fiscal years. However, at the end of April 2017, the company reduced this guidance, noting the decision was made as part of an effort to focus on strengthening its balance sheet. The announcement drove down NGL’s share price, dampening the Fund’s performance. At the end of the Reporting Period, we maintained the Fund’s position in NGL, as we view the security as fundamentally undervalued. |

| | | Also detracting from the Fund’s results was Plains All American Pipeline, L.P. (PAA), a crude oil-focused midstream energy MLP with significant assets in the Permian Basin. Its stock fell in sympathy with crude oil prices, which were volatile throughout the Reporting Period, most notably in the later months. Crude oil prices moved lower on concerns around global production and U.S. inventory builds. Overall, lower than market expected first quarter 2017 financial results and a higher beta to crude oil were headwinds for PPA’s stock performance. (Beta is a measure of the volatility, or systematic risk, of a security compared to the market as a whole.) The Fund continued to hold PAA at the end of the Reporting Period, as the stock is fundamentally undervalued, in our view, and offers favorable exposure to a rebound in commodity prices. |

| | | A third detractor during the Reporting Period was CSI Compressco LP (CCLP). CCLP provides compression-based production services to natural gas and oil exploration and production companies, generating revenue through fee-based contracts for its fleet equipment and personnel. In February 2017, CCLP reported fourth quarter and full year 2016 results, including a fourth quarter loss that was greater than analyst expectations, which put pressure on CCLP’s share price. After the earnings announcement, CCLP’s shares moved lower with the broader crude oil market, then experienced significant weakness in April 2017 after the company announced a 50% distribution cut. The distribution cut came as a surprise to the investor base and triggered a selloff of approximately 10% on April 24, 2017. At the end of the Reporting Period, the Fund maintained a position in CCLP, as we view the stock as fundamentally undervalued after the selloff and we consider the yield attractive. |

| Q | | What individual holdings added to the Fund’s performance during the Reporting Period? |

| A | | Investments in ONEOK Partners L.P., William Partners L.P. and Sprague Resources LP bolstered returns during the Reporting Period. |

| | | The top contributor to the Fund’s performance was ONEOK Partners L.P. (OKS), which owns and operates natural gas and natural gas liquids midstream assets, with exposure to most major basins in the U.S. During the Reporting Period, OKS announced a simplification transaction5 in which it was acquired by its general partner, ONEOK (OKE). Under the agreement, each outstanding common unit of OKS will be converted to 0.985 shares of OKE common stock, representing a 22.4% premium over OKS’s closing price on January 27, 2017. The simplification transaction was well received by the market, and shares of OKS rose approximately 20% on January 31, 2017, the day of the transaction. We trimmed the Fund’s position in OKS during the Reporting Period in an effort to capture profits. |

| | | The Fund benefited from an investment in Williams Partners L.P. (WPZ), which owns and operates natural gas gathering systems and other midstream assets with exposure to most major basins in the U.S. During the Reporting Period, parent company Williams Companies (WMB) agreed to eliminate all incentive distribution rights in exchange for 289 million newly issues units of WPZ in a deal valued at approximately |

| | 5 | | A simplification transaction is when multiple entities controlled by the same corporate parent simplify their corporate structure through actions such as mergers, acquisitions or reduction of incentive distribution rights. |

11

PORTFOLIO RESULTS

| | $11.4 billion. The elimination of incentive distribution rights reduces WPZ’s cost of capital and was well received by the market, allowing the MLP’s stock price to move higher. The Fund continued to hold WPZ at the end of the Reporting Period in order to maintain natural gas exposure, specifically through companies that have favorable exposure to U.S. basins. |

| | | Another key contributor to Fund performance was Sprague Resources LP (SRLP), which stores, distributes and sells refined petroleum products and natural gas in the U.S. Although shares of SRLP were volatile during the Reporting Period, they had a strong finish after first quarter 2017 earnings, released in May, reported that four acquisitions had already been completed and that the acquisition pipeline, which included opportunities to expand SRLP’s geographic footprint, remained robust. At the end of the Reporting Period, we maintained the Fund’s position in SRLP, as we believe the company offers an attractive yield. |

| Q | | Were there any notable purchases or sales during the Reporting Period? |

| A | | During the Reporting Period, the Fund initiated a position in USA Compression Partners, LP (USAC), which provides compression services to producers, processors, gatherers and transporters of natural gas in the U.S. In our view, USAC’s revenue streams are inherently linked to U.S. production volumes, which we believe are poised to increase due to growing global market share, crude oil price stability and lower breakeven prices. As a result, we decided to build a position in the name. |

| | | Another purchase during the Reporting Period was Antero Midstream Partners LP (AM), which operates a system of gathering pipelines and compressor stations in the Marcellus and Utica Basins. We view AM’s growth and distribution profile as favorable due to its exposure to rapidly growing northeast gas production. We established the position through a follow-on equity offering6 in February 2017. |

| | | The Fund did not eliminate any positions during the Reporting Period. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | During the Reporting Period, the Fund did not use derivatives or similar instruments. |

| Q | | How did the Fund use leverage during the Reporting Period? |

| A | | The Fund is permitted to obtain leverage using any form or combination of financial leverage instruments, including through funds borrowed from banks or other financial institutions (i.e., a credit facility), margin facilities or notes issued by the Fund and the leverage attributable to similar transactions entered into by the Fund, and it reserves the right to obtain leverage to the extent permitted by the Investment Company Act of 1940. During the Reporting Period, the Fund obtained leverage through a margin facility.7 The use of this leverage contributed positively to the Fund’s performance during the Reporting Period. Consistent with our positive outlook for the energy MLP sector, the Fund sought to increase the amount of dollars borrowed in an effort to enhance returns as the sector recovers. That said, as volatility increased toward the end of the Reporting Period, we strategically reduced the Fund’s leverage. The proceeds from borrowings were generally invested in securities with an intent to grow cash flows for the Fund. During the Reporting Period, the Fund’s leverage was maintained at a level between 30% and 33%. As of May 31, 2017, the margin facility represented 32.53% of the Fund’s managed assets. |

| | 6 | | A follow-on equity offering is an issuing of stock subsequent to a company’s initial public offering. |

| | 7 | | The Goldman Sachs MLP Income Opportunities Fund currently has a fixed/floating rate margin loan facility with a major financial institution, which it entered into on July 24, 2015. |

12

FUND BASICS

Goldman Sachs MLP Income Opportunities Fund

as of May 31, 2017

| | | | | | |

| | FUND SNAPSHOT | |

| | | As of May 31, 2017 | | | |

| | Net Asset Value (NAV)1 | | $ | 10.01 | |

| | Market Price1 | | $ | 9.93 | |

| | Premium (Discount) to NAV2 | | | (0.80) | % |

| | Leverage3 | | | 32.53 | % |

| | Distribution Rate – NAV4 | | | 8.39 | % |

| | | Distribution Rate – Market Price4 | | | 8.46 | % |

| | 1 | | The Market Price is the price at which the Fund’s common shares are trading on the NYSE. The Market Price of the Fund’s common shares will fluctuate and, at the time of sale, common shares may be worth more or less than the original investment or the Fund’s then current net asset value (“NAV”). The NAV is the market value of one share of the Fund. This amount is derived by dividing the total value of all the securities in the Fund’s portfolio, plus any other assets, less any liabilities, by the number of Fund shares outstanding. The Fund cannot predict whether its common shares will trade at, above or below NAV. Shares of closed-end investment companies frequently trade at a discount from their NAV, which may increase investors’ risk of loss. |

| | 2 | | The premium/discount to NAV is calculated as the market price divided by the NAV of the Fund minus 1, expressed as a percentage. If this value is positive, the Fund is trading at a premium to its NAV. If the value is negative, the Fund is trading at a discount to its NAV. |

| | 3 | | The Fund is permitted to obtain leverage using any form or combination of financial leverage instruments, including through funds borrowed from banks or other financial institutions (i.e., a credit facility), margin facilities or notes issued by the Fund and the leverage attributable to similar transactions entered into by the Fund. The Fund’s use of leverage through a credit facility is calculated as a percentage of the Fund’s Managed Assets . Managed Assets are defined as total assets of the Fund (including assets attributable to borrowings for investment purposes) minus the sum of the Fund’s accrued liabilities (other than liabilities representing borrowings for investment purposes). |

| | 4 | | The Distribution Rate is calculated by annualizing the most recent distribution amount declared divided by the most recent closing Market Price or NAV. The Distribution Rate is subject to change and is not an indication of Fund performance. A portion of the Fund’s distributions will likely be treated for tax purposes as a return of capital. A return of capital is not taxable and results in a reduction in the tax basis of a shareholder’s investment. The final determination regarding the nature of the distributions will be made after the end of the Fund’s fiscal year when the Fund can determine its earnings and profits. The final tax status of the distribution may differ substantially and will be made available to shareholders after the close of each calendar year. The proportion of distributions that are treated as taxable distributions may also vary and or increase in future years. The ultimate composition of these distributions may vary due to a variety of factors including projected income and expenses, depreciation and depletion, and any tax elections made by the MLP. |

13

FUND BASICS

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | December 1, 2016–May 31, 2017 | | Fund Total Return

(based on NAV)5 | | | Fund Total Return

(based on Market Price)5 | |

| | | Common Shares | | | 1.32 | % | | | 7.51 | % |

| | 5 | | Total returns are calculated assuming purchase of a share at the market price or NAV on the first day and sale of a share at the market price or NAV on the last day of each period reported. Dividends and distributions, if any, are assumed, for purposes of this calculation, to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. The Total Returns based on NAV and Market Price do not reflect brokerage commissions or sales charges in connection with the purchase or sale of Fund shares, which if included would lower the performance shown above. The NAV used in the Total Return calculation includes all management fees, interest expense (if any) and operating expenses incurred by the Fund. Operating expenses include custody, accounting and administrative services, professional fees, transfer agency fees, registration, printing and mailing costs and Trustee fees. Total returns for periods less than one full year are not annualized. |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment returns and principal value will fluctuate. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Closed-end funds, unlike open-end funds, are not continuously offered. Once issued in a public offering, shares of closed-end funds are traded in the open market through a stock exchange.

| | | | | | | | |

| | TOP TEN HOLDINGS AS OF 5/31/176 |

| | | Holding | | % of Net Assets | | | Line of Business |

| | Energy Transfer Partners LP | | | 11.7 | % | | Pipeline Transportation | Natural Gas |

| | DCP Midstream LP | | | 11.2 | | | Gathering + Processing |

| | Hoegh LNG Partners LP | | | 8.5 | | | Regasification |

| | Targa Resources Corp. | | | 8.1 | | | Gathering + Processing |

| | Williams Partners LP | | | 7.8 | | | Gathering + Processing |

| | Plains All American Pipeline LP | | | 7.4 | | | Pipeline Transportation | Petroleum |

| | AmeriGas Partners LP | | | 7.2 | | | Marketing | Retail |

| | NuStar Energy LP | | | 5.3 | | | Pipeline Transportation | Petroleum |

| | PBF Logistics LP | | | 4.7 | | | Pipeline Transportation | Petroleum |

| | | Sprague Resources LP | | | 4.6 | | | Marketing | Wholesale |

| | 6 | | The top 10 holdings may not be representative of the Fund’s future investments. |

14

FUND BASICS

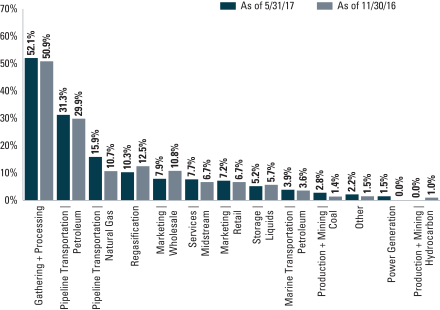

| | 7 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The percentage shown for each investment category reflects the value of investments in that category as a percentage of total net assets. For periods shown prior to the period ended May 31, 2017, the Fund used a different sector classification methodology. Information for these prior periods have been reclassified with the Fund’s current sector classification methodology. As a result of borrowings, the percentages may add to an amount in excess of 100%. Sector allocations are defined by GSAM and may differ from sector allocations used by the Alerian Index. |

15

GOLDMAN SACHS MLP AND ENERGY RENAISSANCE FUND

Schedule of Investments

May 31, 2017 (Unaudited)

| | | | | | | | |

Shares | | | Description | | Value | |

| Common Stocks – 147.6% | |

| Gathering + Processing – 53.0% | |

| | 821,835 | | | Antero Midstream Partners LP | | $ | 28,468,364 | |

| | 2,479,401 | | | DCP Midstream LP | | | 83,754,166 | |

| | 714,354 | | | Enable Midstream Partners LP | | | 11,022,482 | |

| | 537,161 | | | Rice Midstream Partners LP | | | 13,165,817 | |

| | 570,389 | | | Sanchez Production Partners LP | | | 7,899,888 | |

| | 1,655,827 | | | Targa Resources Corp. | | | 76,052,134 | |

| | 278,503 | | | Western Gas Equity Partners LP | | | 12,084,245 | |

| | 145,458 | | | Western Gas Partners LP | | | 8,106,374 | |

| | 1,759,648 | | | Williams Partners LP | | | 68,925,412 | |

| | | | | | | | |

| | | | | | | 309,478,882 | |

| | |

| Marine Transportation | Petroleum – 1.4% | |

| | 381,587 | | | KNOT Offshore Partners LP | | | 8,089,644 | |

| | |

| Marketing | Retail – 3.4% | |

| | 445,025 | | | AmeriGas Partners LP | | | 19,732,409 | |

| | |

| Marketing | Wholesale – 6.5% | |

| | 448,159 | | | CrossAmerica Partners LP | | | 10,769,261 | |

| | 459,734 | | | Sprague Resources LP | | | 11,700,230 | |

| | 529,005 | | | Sunoco LP | | | 15,774,929 | |

| | | | | | | | |

| | | | | | | 38,244,420 | |

| | |

| Other – 1.8% | |

| | 292,628 | | | CorEnergy Infrastructure Trust, Inc. | | | 10,294,653 | |

| | |

| Pipeline Transportation | Natural Gas – 22.0% | |

| | 501,740 | | | Energy Transfer Equity LP | | | 8,549,649 | |

| | 4,657,585 | | | Energy Transfer Partners LP | | | 101,349,050 | |

| | 254,843 | | | EQT Midstream Partners LP | | | 18,797,220 | |

| | | | | | | | |

| | | | | | | 128,695,919 | |

| | |

| Pipeline Transportation | Petroleum – 39.3% | |

| | 555,627 | | | Buckeye Partners LP | | | 35,560,128 | |

| | 511,514 | | | NGL Energy Partners LP | | | 6,956,590 | |

| | 1,487,454 | | | NuStar Energy LP | | | 67,798,153 | |

| | 1,026,537 | | | PBF Logistics LP | | | 20,120,125 | |

| | 226,947 | | | Phillips 66 Partners LP | | | 11,238,416 | |

| | 2,636,192 | | | Plains All American Pipeline LP | | | 69,806,364 | |

| | 401,909 | | | Valero Energy Partners LP | | | 18,170,306 | |

| | | | | | | | |

| | | | | | | 229,650,082 | |

| | |

| Power Generation(a) – 4.2% | |

| | 869,745 | | | Enviva Partners LP | | | 24,439,834 | |

| | |

| Services | Midstream – 5.6% | |

| | 1,408,512 | | | Archrock Partners LP | | | 21,817,851 | |

| | 1,229,887 | | | CSI Compressco LP | | | 6,764,379 | |

| | 284,487 | | | USA Compression Partners LP | | | 4,372,565 | |

| | | | | | | | |

| | | | | | | 32,954,795 | |

| | |

| Storage | Liquids – 10.4% | |

| | 367,000 | | | Arc Logistics Partners LP | | | 5,200,390 | |

| | 469,349 | | | TransMontaigne Partners LP | | | 19,501,451 | |

| | 400,000 | | | VTTI Energy Partners LP | | | 7,800,000 | |

| | 1,152,760 | | | Western Refining Logistics LP | | | 28,473,172 | |

| | | | | | | | |

| | | | | | | 60,975,013 | |

| | |

| | TOTAL COMMON STOCKS | |

| | (Cost $833,387,640) | | $ | 862,555,651 | |

| | |

| Preferred Stock – 0.4% | |

| Services | Midstream – 0.4% | |

CSI Compressco LP | |

| 231,413 | | | 11.000 | % | | $ | 2,409,013 | |

| (Cost $2,566,688) | | | | | |

| |

| | | | | | | | |

| Investment Company(b)(c) – 0.0% | |

Goldman Sachs Financial Square Government Fund – Institutional Shares | |

| 1,060 | | | 0.678% | | | $ | 1,060 | |

| (Cost $1,060) | | | | | |

| |

| TOTAL INVESTMENTS – 148.0% | |

| (Cost $835,955,388) | | | $ | 864,965,724 | |

| |

| BORROWINGS – (47.9)% | | | | (280,000,000 | ) |

| |

| OTHER LIABILITIES IN EXCESS OF OTHER ASSETS – (0.1)% | | | | (596,315 | ) |

| |

| NET ASSETS – 100.0% | | | $ | 584,369,409 | |

| |

| | |

| The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. |

(a) | | Represents an affiliated issuer. |

(b) | | Represents an affiliated fund. |

(c) | | Variable or floating rate security. Interest rate disclosed is that which is in effect on May 31, 2017. |

| | |

|

Investment Abbreviations: |

LP | | —Limited Partnership |

|

| | |

| 16 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS MLP INCOME OPPORTUNITIES FUND

Schedule of Investments

May 31, 2017 (Unaudited)

| | | | | | | | |

Shares | | | Description | | Value | |

| Common Stocks – 147.6% | |

| Gathering + Processing – 52.1% | |

| | 255,282 | | | Antero Midstream Partners LP | | $ | 8,842,968 | |

| | 428,035 | | | Cone Midstream Partners LP | | | 9,087,183 | |

| | 1,470,693 | | | DCP Midstream LP | | | 49,680,010 | |

| | 628,687 | | | Enable Midstream Partners LP | | | 9,700,640 | |

| | 36,742 | | | Hess Midstream Partners LP* | | | 853,884 | |

| | 472,706 | | | MPLX LP | | | 15,622,933 | |

| | 410,493 | | | ONEOK Partners LP | | | 20,077,213 | |

| | 428,742 | | | Rice Midstream Partners LP | | | 10,508,467 | |

| | 539,541 | | | Sanchez Production Partners LP | | | 7,472,643 | |

| | 511,482 | | | Summit Midstream Partners LP | | | 11,815,234 | |

| | 779,969 | | | Targa Resources Corp. | | | 35,823,976 | |

| | 203,989 | | | Western Gas Equity Partners LP | | | 8,851,083 | |

| | 146,641 | | | Western Gas Partners LP | | | 8,172,303 | |

| | 887,158 | | | Williams Partners LP | | | 34,749,979 | |

| | | | | | | | |

| | | | | | | 231,258,516 | |

| | |

| Marine Transportation | Petroleum – 3.9% | |

| | 828,143 | | | Capital Product Partners LP | | | 2,757,716 | |

| | 695,695 | | | KNOT Offshore Partners LP | | | 14,748,734 | |

| | | | | | | | |

| | | | | | | 17,506,450 | |

| | |

| Marketing | Retail – 7.2% | |

| | 720,781 | | | AmeriGas Partners LP | | | 31,959,429 | |

| | |

| Marketing | Wholesale – 7.9% | |

| | 610,998 | | | CrossAmerica Partners LP | | | 14,682,282 | |

| | 800,000 | | | Sprague Resources LP | | | 20,360,000 | |

| | | | | | | | |

| | | | | | | 35,042,282 | |

| | |

| Other – 2.2% | |

| | 279,926 | | | CorEnergy Infrastructure Trust, Inc. | | | 9,847,797 | |

| | |

| Pipeline Transportation | Natural Gas – 15.9% | |

| | 349,758 | | | Energy Transfer Equity LP | | | 5,959,876 | |

| | 2,383,139 | | | Energy Transfer Partners LP | | | 51,857,105 | |

| | 171,390 | | | EQT Midstream Partners LP | | | 12,641,726 | |

| | | | | | | | |

| | | | | | | 70,458,707 | |

| | |

| Pipeline Transportation | Petroleum – 31.3% | |

| | 180,156 | | | Buckeye Partners LP | | | 11,529,984 | |

| | 376,571 | | | Delek Logistics Partners LP | | | 11,410,101 | |

| | 149,745 | | | Holly Energy Partners LP | | | 4,905,646 | |

| | 577,087 | | | NGL Energy Partners LP | | | 7,848,383 | |

| | 517,848 | | | NuStar Energy LP | | | 23,603,512 | |

| | 1,057,471 | | | PBF Logistics LP | | | 20,726,432 | |

| | 151,544 | | | Phillips 66 Partners LP | | | 7,504,459 | |

| | 1,232,594 | | | Plains All American Pipeline LP | | | 32,639,089 | |

| | 190,331 | | | Tesoro Logistics LP | | | 10,083,736 | |

| | 189,751 | | | Valero Energy Partners LP | | | 8,578,643 | |

| | | | | | | | |

| | | | | | | 138,829,985 | |

| | |

| Power Generation – 1.5% | |

| | 232,163 | | | Enviva Partners LP | | | 6,523,780 | |

| | |

| Production + Mining | Coal – 2.8% | |

| | 569,593 | | | Alliance Resource Partners LP | | | 12,246,249 | |

| | |

| Common Stocks – (continued) | |

| Regasification – 10.3% | |

| | 425,730 | | | Golar LNG Partners LP | | | 8,412,425 | |

| | 1,966,019 | | | Hoegh LNG Partners LP(a) | | | 37,550,963 | |

| | | | | | | | |

| | | | | | | 45,963,388 | |

| | |

| Services | Midstream – 7.3% | |

| | 732,384 | | | Archrock Partners LP | | | 11,344,628 | |

| | 1,957,500 | | | CSI Compressco LP(a) | | | 10,766,250 | |

| | 658,477 | | | USA Compression Partners LP | | | 10,120,792 | |

| | | | | | | | |

| | | | | | | 32,231,670 | |

| | |

| Storage | Liquids – 5.2% | |

| | 319,999 | | | Arc Logistics Partners LP | | | 4,534,386 | |

| | 27,417 | | | TransMontaigne Partners LP | | | 1,139,176 | |

| | 250,000 | | | VTTI Energy Partners LP | | | 4,875,000 | |

| | 515,152 | | | Western Refining Logistics LP | | | 12,724,255 | |

| | | | | | | | |

| | | | | | | 23,272,817 | |

| | |

| | TOTAL COMMON STOCKS | |

| | (Cost $635,463,950) | | $ | 655,141,070 | |

| | |

| | | | | | | | |

| Shares | | Rate | | | Value | |

| Preferred Stock(a) – 0.4% | |

| Services | Midstream – 0.4% | |

CSI Compressco LP | |

| 174,308 | | | 11.000 | % | | $ | 1,814,550 | |

| (Cost $1,933,308) | | | | | |

| |

| | | | | | | | |

| Investment Company(b)(c) – 0.0% | |

Goldman Sachs Financial Square Government Fund – Institutional Shares | |

| 1,279 | | | 0.678 | % | | $ | 1,279 | |

| (Cost $1,279) | | | | | |

| |

| TOTAL INVESTMENTS – 148.0% | |

| (Cost $637,398,537) | | | $ | 656,956,899 | |

| |

| BORROWINGS – (48.2)% | | | | (214,000,000 | ) |

| |

| OTHER ASSETS IN EXCESS OF OTHER LIABILITIES – 0.2% | | | | 953,964 | |

| |

| NET ASSETS – 100.0% | | | $ | 443,910,863 | |

| |

| | |

| The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. |

* | | Newly issued security: non-income producing. |

(a) | | Represents an affiliated issuer. |

(b) | | Represents an affiliated fund. |

(c) | | Variable rate security. Interest rate disclosed is that which is in effect at May 31, 2017. |

| | |

|

Investment Abbreviation: |

LP | | —Limited Partnership |

|

| | |

| The accompanying notes are an integral part of these financial statements. | | 17 |

GOLDMAN SACHS CLOSED-END FUNDS

Statements of Assets and Liabilities

May 31, 2017 (Unaudited)

| | | | | | | | | | |

| | | | | MLP and Energy

Renaissance

Fund | | | MLP Income

Opportunities

Fund | |

| | Assets: | | | | | | | | |

| | Investments of unaffiliated issuers, at value (cost $821,526,219 and $561,758,492) | | $ | 840,524,830 | | | $ | 606,823,857 | |

| | Investments of affiliated issuers, at value (cost $14,429,169 and $75,640,045) | | | 24,440,894 | | | | 50,133,042 | |

| | Cash | | | 2,909,384 | | | | 5,889,895 | |

| | Receivables: | | | | | | | | |

| | Investments sold | | | 2,576,158 | | | | 3,387,552 | |

| | Dividends | | | 261,215 | | | | 173,560 | |

| | Current taxes | | | 42,793 | | | | 3,513,699 | |

| | Other assets | | | 243,460 | | | | 116,876 | |

| | Total assets | | | 870,998,734 | | | | 670,038,481 | |

| | | | | | | | | | |

| | Liabilities: | | | | | | | | |

| | Payables: | | | | | | | | |

| | Borrowings on credit facility | | | 280,000,000 | | | | 214,000,000 | |

| | Investments purchased | | | 2,476,549 | | | | 3,398,871 | |

| | Interest on borrowing | | | 1,119,796 | | | | 872,643 | |

| | Management fees | | | 772,786 | | | | 588,188 | |

| | Deferred taxes, net | | | 1,351,998 | | | | 6,516,060 | |

| | Accrued expenses | | | 908,196 | | | | 751,856 | |

| | Total liabilities | | | 286,629,325 | | | | 226,127,618 | |

| | | | | | | | | | |

| | Net Assets: | | | | | | | | |

| | Paid-in capital | | | 1,318,603,057 | | | | 706,341,368 | |

| | Distributions in excess of net investment income, net of taxes | | | (29,624,852 | ) | | | (40,427,713 | ) |

| | Accumulated net realized loss, net of taxes | | | (733,674,562 | ) | | | (242,136,355 | ) |

| | Net unrealized gain, net of taxes | | | 29,065,766 | | | | 20,133,563 | |

| | NET ASSETS | | $ | 584,369,409 | | | $ | 443,910,863 | |

| | Shares Outstanding $0.001 par value (unlimited shares authorized): | | | 79,123,745 | | | | 44,344,020 | |

| | Net asset value | | | $7.39 | | | | $10.01 | |

| | |

| 18 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS CLOSED-END FUNDS

Statements of Operations

For the Six Months Ended May 31, 2017 (Unaudited)

| | | | | | | | | | |

| | | | | MLP and Energy

Renaissance

Fund | | | MLP Income

Opportunities

Fund | |

| | Investment income: | | | | | | | | |

| | Dividends — unaffiliated issuers | | $ | 36,124,335 | | | $ | 25,958,149 | |

| | Dividends — affiliated issuers | | | 941,520 | | | | 2,859,726 | |

| | Less: return of capital on dividends | | | (32,731,261 | ) | | | (23,446,946 | ) |

| | Total investment income | | | 4,334,594 | | | | 5,370,929 | |

| | | | | | | | | | |

| | Expenses: | | | | | | | | |

| | Management fees | | | 4,778,908 | | | | 3,615,583 | |

| | Interest on borrowings | | | 4,040,816 | | | | 3,034,874 | |

| | Professional fees | | | 255,416 | | | | 241,653 | |

| | Franchise tax expense | | | 194,248 | | | | 221,038 | |

| | Trustee fees | | | 129,626 | | | | 129,624 | |

| | Printing and mailing costs | | | 51,401 | | | | 37,885 | |

| | Custody, accounting and administrative services | | | 45,759 | | | | 41,679 | |

| | Transfer Agency fees | | | 8,727 | | | | 7,482 | |

| | Other | | | 144,904 | | | | 119,076 | |

| | Total operating expenses, before income taxes | | | 9,649,805 | | | | 7,448,894 | |

| | Less — expense reductions | | | (2,555 | ) | | | (2,513 | ) |

| | Net operating expenses, before income taxes | | | 9,647,250 | | | | 7,446,381 | |

| | NET INVESTMENT LOSS, BEFORE INCOME TAXES | | | (5,312,656 | ) | | | (2,075,452 | ) |

| | Current and deferred tax expense | | | (10,241 | ) | | | (82,902 | ) |

| | NET INVESTMENT LOSS, NET OF TAXES | | | (5,322,897 | ) | | | (2,158,354 | ) |

| | | | | | | | | | |

| | Realized and unrealized gain (loss): | | | | | | | | |

| | Net realized gain (loss) from: | |

| | Investments — unaffiliated issuers | | | 51,282,044 | | | | 50,984,801 | |

| | Investments — affiliated issuers | | | 12,807 | | | | (944,249 | ) |

| | Current and deferred tax benefit/(expense) | | | 170,221 | | | | (741,375 | ) |

| | Net change in unrealized gain (loss) on: | | | | | | | | |

| | Investments — unaffiliated issuers | | | (35,615,670 | ) | | | (31,225,496 | ) |

| | Investments — affiliated issuers | | | 842,835 | | | | (7,265,593 | ) |

| | Current and deferred tax expense | | | (72,319 | ) | | | (681,623 | ) |

| | Net realized and unrealized gain, net of taxes | | | 16,619,918 | | | | 10,126,465 | |

| | NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 11,297,021 | | | $ | 7,968,111 | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 19 |

GOLDMAN SACHS MLP AND ENERGY RENAISSANCE FUND

Statements of Changes in Net Assets

| | | | | | | | | | |

| | | | | MLP and Energy Renaissance Fund | |

| | | | For the

Six Months Ended

May 31, 2017

(Unaudited) | | | For the Fiscal

Year Ended

November 30, 2016 | |

| | From operations: | | | | | | | | |

| | Net investment loss, net of taxes | | $ | (5,322,897 | ) | | $ | (10,260,231 | ) |

| | Net realized gain (loss), net of taxes | | | 51,465,072 | | | | (387,022,370 | ) |

| | Net change in unrealized gain (loss), net of taxes | | | (34,845,154 | ) | | | 457,085,307 | |

| | Net increase in net assets resulting from operations | | | 11,297,021 | | | | 59,802,706 | |

| | | | | | | | | | |

| | Distributions to shareholders: | | | | | | | | |

| | From net investment income | | | (25,286,192 | ) | | | — | |

| | From return of capital | | | — | | | | (50,543,858 | ) |

| | Total distributions to shareholders | | | (25,286,192 | ) | | | (50,543,858 | ) |

| | | | | | | | | | |

| | From share transactions: | | | | | | | | |

| | Reinvestment of distributions | | | 800,712 | | | | 846,844 | |

| | TOTAL INCREASE (DECREASE) | | | (13,188,459 | ) | | | 10,105,692 | |

| | | | | | | | | | |

| | Net assets: | | | | | | | | |

| | Beginning of period | | | 597,557,868 | | | | 587,452,176 | |

| | End of period | | $ | 584,369,409 | | | $ | 597,557,868 | |

| | Undistributed (distributions in excess of) net investment loss, net of taxes | | $ | (29,624,852 | ) | | $ | 984,237 | |

| | |

| 20 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS MLP INCOME OPPORTUNITIES FUND

Statements of Changes in Net Assets

| | | | | | | | | | |

| | | | MLP Income Opportunities Fund | |

| | | | For the

Six Months Ended

May 31, 2017

(Unaudited) | | | For the Fiscal

Year Ended

November 30, 2016 | |

| | From operations: | | | | |

| | Net investment loss, net of taxes | | $ | (2,158,354 | ) | | $ | (3,869,563 | ) |

| | Net realized gain (loss), net of taxes | | | 49,299,177 | | | | (240,821,253 | ) |

| | Net change in unrealized gain (loss), net of taxes | | | (39,172,712 | ) | | | 278,415,460 | |

| | Net increase in net assets resulting from operations | | | 7,968,111 | | | | 33,724,644 | |

| | | | | | | | | | |

| | Distributions to shareholders: | | | | | | | | |

| | From net investment income | | | (18,624,488 | ) | | | — | |

| | From return of capital | | | — | | | | (37,248,976 | ) |

| | Total distributions to shareholders | | | (18,624,488 | ) | | | (37,248,976 | ) |

| | TOTAL DECREASE | | | (10,656,377 | ) | | | (3,524,332 | ) |

| | | | | | | | | | |

| | Net assets: | | | | |

| | Beginning of period | | | 454,567,240 | | | | 458,091,572 | |

| | End of period | | $ | 443,910,863 | | | $ | 454,567,240 | |

| | Distributions in excess of net investment loss, net of taxes | | $ | (40,427,713 | ) | | $ | (19,644,871 | ) |

| | |

| The accompanying notes are an integral part of these financial statements. | | 21 |

GOLDMAN SACHS MLP AND ENERGY RENAISSANCE FUND

Statement of Cash Flows

For the Six Months Ended May 31, 2017 (Unaudited)

| | | | | | |

| | | | | | |

| | Increase/(Decrease) in cash –

Cash flows provided by operating activities: | | | | |

| | Net increase in net assets from operations | | $ | 11,297,021 | |

| | Adjustments to reconcile net increase in net assets from operations to net cash provided by/(used in) operating activities: | |

| | Payments for purchases of investments | | | (167,523,078 | ) |

| | Proceeds from sales of investment securities | | | 141,485,482 | |

| | Purchases of short term investments, net | | | (199 | ) |

| | Increase in return of capital on dividends | | | 32,731,261 | |

| | (Increase) Decrease in Assets: | |

| | Receivable for investments sold | | | (2,156,813 | ) |

| | Receivable for dividends | | | (143,066 | ) |

| | Receivable for current taxes | | | 759,606 | |

| | Prepaid state and local income tax payable | | | 236,690 | |

| | Other assets | | | (200,842 | ) |

| | Increase (Decrease) in Liabilities: | |

| | Payable for investments purchased | | | 2,049,208 | |

| | Management fees Payable | | | 87,506 | |

| | Interest on borrowings payable | | | 126,096 | |

| | Deferred taxes, net | | | (87,662 | ) |

| | Accrued expenses | | | (59,928 | ) |

| | Net realized gain on investments | | | (51,294,851 | ) |

| | Net change in unrealized gain on investments | | | 34,772,835 | |