UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22979

Goldman Sachs MLP and Energy Renaissance Fund

(Exact name of registrant as specified in charter)

200 West Street,

New York, NY 10282

(Address of principal executive offices) (Zip code)

| | |

Copies to: |

Caroline Kraus, ESQ. | | Stephen H. Bier, ESQ. |

Goldman Sachs & Co. LLC | | Allison M. Fumai, ESQ. |

200 West Street | | Dechert LLP |

New York, New York 10282 | | 1095 Avenue of the Americas |

| | New York, NY 10036-6797 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (212) 902-1000

Date of fiscal year end: November 30

Date of reporting period: November 30, 2018

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| | The Annual Report to Shareholders is filed herewith. |

Goldman Sachs Closed-End Funds

| | | | |

| | |

| Annual Report | | | | November 30, 2018 |

| | |

| | | | MLP and Energy Renaissance Fund MLP Income Opportunities Fund |

It is our intention that beginning on January 1, 2021, paper copies of the Funds’ annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from a Fund or from your financial intermediary. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. At any time, you may elect to receive reports and certain communications from a Fund electronically by calling Computershare toll-free 1-855-807-2742, by logging into your Investor Center account at www.computershare.com/investor and going to “Communication Preferences” or by contacting your financial intermediary.

You may elect to receive all future shareholder reports in paper free of charge by calling Computershare toll-free 1-855-807-2742, by logging into your Investor Center account at www.computershare.com/investor and going to “Communication Preferences” or by contacting your financial intermediary. Your election to receive reports in paper will apply to all Goldman Sachs Funds in which you are invested and may apply to all funds held with your financial intermediary.

Goldman SachsClosed-End Funds

| ∎ | | MLP AND ENERGY RENAISSANCE FUND |

| ∎ | | MLP INCOME OPPORTUNITIES FUND |

| | | | |

| | | |

| NOT FDIC-INSURED | | May Lose Value | | No Bank Guarantee |

GOLDMAN SACHSCLOSED-END FUNDS

What Differentiates Goldman Sachs’Closed-End Funds Investment Process?

The MLP and Energy Renaissance Fund and MLP Income Opportunities Fund (each, a “Fund” and collectively, the “Funds”)each seek a high level of total return with an emphasis on current distributions to shareholders. The MLP and Energy Renaissance Fund seeks to achieve its investment objective by investing in Master Limited Partnerships (“MLPs”) and other energy investments. The MLP Income Opportunities Fund seeks to achieve its investment objective by investing primarily in MLPs. We seek to invest in quality companies with well located assets (exposed to what we believe are favorable commodities and geographies), strong balance sheets, and experienced management teams. We view an MLP as a company, not just a collection of assets, as we emphasize cash flow based valuation metrics and focus on balance sheet liabilities. We seek to avoid being overly myopic by assessing the entire energy value chain (from producers to users) to estimate the impact on midstream assets.

| ∎ | | To capture the full energy value chain, we analyze energy production and user trends that ultimately impact income opportunities. |

| ∎ | | We rigorously assess companies on both the asset and equity level. |

| ∎ | | Macro Trend Analysis First, we analyze overall energy trends through capital spending shifts and drilling trends, in addition to regional supply and demand imbalances. |

| ∎ | | Top-Down Sector Selection Secondly, we establish the impact of macro and regional trends on energy infrastructure. |

| ∎ | | Bottom-Up Security Selection Finally, we select investments by evaluating a company’s management, assets, expected returns and technicals. |

| ∎ | | Our team of MLP dedicated investment professionals includes lead portfolio managers averaging over 14 years of investment experience. |

| ∎ | | Ability to leverage energy-related resources across GSAM Equity, Fixed Income and Commodity groups, as well as utilize risk management resources. |

| ∎ | | Unique investment approach stemming from a more holistic view across the extremes of the energy value chain, corporate access, broader valuation understanding, and resource advantages. |

1

MARKET REVIEW

Goldman SachsClosed-End Funds

Market Review

Energy MLPs, as represented by the Alerian MLP Index,1 generated a total return of 1.21% during the12-month period ended November 30, 2018 (the “Reporting Period”) overall. The Alerian MLP Index outperformed the AMEX Energy Select Sector Index (“IXE”)(-1.64%) and underperformed the S&P 500® Index (+6.27%).2 In addition, the Alerian MLP Index underperformed utilities (+1.65%) and real estate investment trusts (“REITs”) (+3.87%), as represented by the Philadelphia Stock Exchange (PHLX) Utility Sector Index and the FTSE NAREIT (National Association of Real Estate Investment Trusts) U.S. Real Estate Index Series, respectively.3 (All index returns are presented on a total return basis.)

In energy markets, West Texas Intermediate (“WTI”) crude oil prices rallied during the first half of the Reporting Period, rising 16.79%. They stabilized above $65 per barrel near the end of May 2018, as the global supply/demand story continued to strengthen due to worldwide supply constraints and robust demand expectations. Crude oil prices continued to move higher during the summer, and the price of WTI crude oil reached $75 per barrel at Septembermonth-end — the highest level since the 2014-2015 commodity price collapse. Crude oil prices fell sharply thereafter, declining 30.47% by the conclusion of the Reporting Period. The weakness was driven by market concerns around slowing global economic growth, in addition to investor uncertainty around ongoing trade tensions and how they could potentially weaken global crude oil demand. Meanwhile, the market’s oversupply worries increased amid unexpectedly strong Saudi Arabian production, which rose from 10.42 million barrels per day in June 2018 to 11.02 million barrels per day in November, and amid mounting U.S. crude oil production, which grew by nearly 1.5 million barrels per day between the beginning of January and the end of November 2018.4 In the second half of the Reporting Period, Iranian sanction waivers provided by the U.S. tempered a widely expected decline in Iranian crude oil production, further adding to the market’s oversupply concerns. For the Reporting Period overall, WTI and Brent crude oil prices fell 11.27% and 7.65%, respectively.5

As for natural gas prices, they fell to a low of $2.56 per million British thermal units (“MMbtu”) in February 2018, down 29.55% from their January 2018 highs, due to the mild winter and to investors’ oversupply concerns. These oversupply concerns were driven by elevated levels of natural gas associated with crude oil drilling throughout the U.S., especially in the Permian Basin. After February, natural gas prices rebounded somewhat, rising 15.67% to finish May 2018 at $2.95 per MMbtu. In the second half of the Reporting Period, they experienced a strong recovery, climbing 56.23% to $4.61 per MMbtu. Much of that increase came during November 2018, which was approximately 22% colder than the seasonally adjusted average. Because of the cold weather, natural gas demand accelerated, leading to early draws from natural gas inventories, which dropped to multi-year lows. This, in turn, caused a surge in natural gas prices in spite of strong 2018 production growth, which has been

| 1 | | The Alerian MLP Index is a composite of prominent energy MLPs that captures about 85% of the total float-adjusted market capitalization of the energy MLP sector. |

| 2 | | The AMEX Energy Select Sector Index (IXE) is a modified market capitalization-based index intended to track the movements of companies that are components of the S&P 500® Index and are involved in the development or production of energy products. The S&P 500® Index is a diverse index that includes 500 American companies that represent more than 70% of the total market capitalization of the U.S. stock market. |

| 3 | | The PHLX Utility Sector Index is composed of geographically diverse public U.S. utility stocks. The FTSE NAREIT U.S. Real Estate Index Series is an index that spans the commercial real estate space across the U.S. economy, offering exposure to all investment and property sectors. |

| 4 | | Source (except where noted) of production data: Bloomberg. |

| 5 | | Source of crude oil and natural gas price data: Bloomberg. |

2

MARKET REVIEW

largely driven by increases in associated gas. (Associated gas is a byproduct of crude oil production.)

As for the energy MLP market, it started the Reporting Period strongly, following two months of weak performance. In October and November 2017, before the Reporting Period began, heavytax-loss harvesting in energy infrastructure investments, concerns surrounding tax reform and fears around the Organization of the Petroleum Exporting Countries (“OPEC”) quotas not being extended had driven the market to its lowest level since February 2016. Investors returned to the energy MLP market in the opening weeks of the Reporting Period, as they sought to take advantage of depressed valuations amid continuing healthy fundamentals. The market experienced heavy investment inflows, helping the Alerian MLP Index post a gain of 17.62% between the start of the Reporting Period and January 23, 2018. Investor sentiment then reversed and continued to weigh on the energy MLP market through March. In our view, there were four reasons for the shift in sentiment. First, investor appetite for high-yielding assets diminished as the market adjusted for rising interest rates. Second, from January 26th through February 13th, crude oil prices dropped approximately 11%, as oversupply concerns mounted and the U.S. dollar strengthened, hindering the performance of energy-related securities broadly. Third, thesell-off in crude oil prices coincided with weak earnings from several large integrated energy companies, pushing the IXE down approximately 13.01% from January 26th through February 13th. Fourth, and what we consider the most impactful, the Federal Energy Regulatory Commission (“FERC”) announced a surprise policy revision on March 15th. The revised policy mandated that regulated interstate natural gas and liquids pipelines owned by energy MLPs could no longer claim an income tax allowance in theircost-of-service methodology (a method used to set rates for pipeline customers). The policy change also potentially applies to liquids pipelines’cost-of-service calculation on inflation-indexed pipelines, which will be revisited in the FERC’s five-year review (expected to commence in 2021). At first, the scope of the policy revision was unclear to investors, driving a nearly 10%intra-day decline in the Alerian MLP Index, which then rebounded to end March 15th with a loss of 4.56%. Between March 15th and March 31st, the Alerian MLP Index recorded a decline of 7.97%. We believe investors overreacted to the FERC announcement, as the policy revision should affect only a subset of energy infrastructure companies. Between March 31st and May 31st, the energy MLP market recovered from its FERC-related lows, with the Alerian MLP Index climbing back abovepre-announcement levels, as investors continued to digest and understand the impact of the policy revision. In addition, toward the end of May, investor sentiment grew more positive overall, which we attribute to the strong fundamental backdrop for U.S. energy infrastructure, continued earnings momentum, and management teams’ increased focus on investor concerns, such as complex corporate structures, balance sheet management and capital market reliance.

The Alerian MLP Index continued to rise during June 2018 and through the end of September, benefiting from a supportive market backdrop for crude oil. Underinvestment in the energy space following the 2014-2015 commodity price collapse, coupled with geopolitical pressures, had resulted in decreased global crude oil production. This, paired with strong global demand, pushed crude oil supply from surplus to shortage, and consequently, WTI crude oil prices rallied from a low of $30 per barrel in 2016 to more than $70 per barrel in September 2018 and the first half of October 2018. U.S. shale producers responded to the shortage by increasing their drilling, which drove U.S. production toall-time highs during the Reporting Period and allowed the U.S. to capture a larger percentage of the global energy market. The record production started to strain U.S. energy infrastructure capacity, with pipeline bottlenecks arising in key U.S. production basins during the Reporting Period, suggesting the

3

MARKET REVIEW

need for additional energy infrastructure. This environment was favorable for midstream6 assets, helping the Alerian MLP Index to move higher. In addition, the energy MLP market overall benefited from clarifications by the FERC, provided in July 2018, regarding a number of open questions, including the final process by which natural gas and liquid pipelines owned by energy MLPs could implement the income tax adjustment and handle the accumulated deferred income tax. First, natural gas and liquids pipelines that chose to eliminate their tax allowance could also, according to the FERC, eliminate their accumulated deferred income tax, which might have a favorable impact on a pipeline’s rate base and thus mitigate any potential rate impact that could arise from higher than expected returns on equity for certain interstate regulated pipelines. Second, although the FERC reiterated its belief that the inclusion of a tax allowance in a pipeline’scost-of-service methodology would result in a “double recovery” of income tax costs, the commission said the pipeline could choose to reflect the 21% corporate tax rate passed into law by the Tax Cuts and Jobs Act, which became effective on January 1, 2018, instead of eliminating the tax allowance completely. For pipeline companies that choose to reduce their income tax allowance to the new 21% corporate rate, the FERC has guaranteed a three-year moratorium on rate investigations as long as the pipeline is not overearning relative to the FERC’s allowable return on equity threshold. The market considered the FERC’s clarifications to be favorable for impacted energy MLPs, as they helped remove some regulatory uncertainty that had weighed on the energy MLP market.

In October 2018, the energy sector and the broader equity market experienced substantial weakness due to investor concerns around global economic growth, rising interest rates and U.S.-China trade tensions. The S&P 500® Index ended the month down 6.8%, while the IXE and the Alerian MLP Index fell 11.3% and 8.0%, respectively. The decline in the IXE, which is inherently more sensitive to commodity prices, and in the Alerian MLP Index can be partially attributed to a 10.8%drop in WTI crude oil prices during October, which was, in turn, driven by the possibility that slowing global economic growth could soften crude oil demand and that U.S. sanction waivers could reduce losses in Iranian supply. In November 2018, the energy MLP sector remained relatively resilient, despite weakness in the broader energy sector. In our view, this was a function of continued momentum in midstream earnings results and persistent growth in U.S. crude oil and natural gas production. For October and November overall, the Alerian MLP Index fell 8.7%.

The energy MLP market was further hampered during the second half of the Reporting Period by weak investment flows. In the third quarter of 2018, actively managedopen-end energy MLP mutual funds, exchange traded funds (“ETFs”) and exchange traded notes (“ETNs”) experienced net investment outflows of $589 million.7 This marked the first ever quarter of net investment outflows since the inception of the Alerian MLP Index in 2006. The weakness was driven by $833 million of investment outflows from ETFs and ETNs, partially offset by investment inflows from actively managedopen-end mutual funds. In our opinion, regulatory uncertainty sidelined some investors despite energy MLPs’ strong operational results during the Reporting Period. We also noticed general investor apathy towards energy MLPs and energy infrastructure securities broadly given their relative underperformance versus other equity market segments during the last couple of years. Despite recent investor pessimism, we

| 6 | | The midstream component of the energy industry is usually defined as those companies providing products or services that help link the supply side, i.e. energy producers, and the demand side, i.e. energy end-users, for any type of energy commodity. Such midstream businesses can include, but are not limited to, those that process, store, market and transport various energy commodities. |

| 7 | | Source of investment flows data: U.S. Capital Advisors. |

4

MARKET REVIEW

note that energy MLPs continue to benefit from strong corporate execution, healthy macroeconomic factors and inexpensive valuations during the Reporting Period.

In other noteworthy news during the Reporting Period, a Colorado ballot measure — Colorado Proposition 112 — pressured midstream companies with exposure to that state’s oil and gas industry. Colorado Proposition 112 was an initiative that would have required future drilling permits to have a minimum setback of 2,500 feet from publicly occupied spaces, such as homes, schools, hospitals, parks and water sources. If it was passed by voters in November, the proposition may have effectively eliminated Colorado’s oil and gas industry, as little to no new development would occur after 2020 and natural production decline rates would reduce existing production over time. Uncertainty around the vote was an overhang for Alerian MLP Index constituents with Colorado exposure (approximately 10% of the Alerian MLP Index), starting in August 2018, as they sold off on fears the ballot measure would pass. On November 6th, Colorado Proposition 112 was defeated, with 56% of total votes in opposition to the proposed drilling regulation. We considered this a positive outcome for midstream owners and operators with revenue exposure to Colorado’s oil and gas production.

Finally, the Tax Cuts and Jobs Act has implications for energy MLPs and pooled investment vehicles, such as the Funds, that are structured as “C” corporations.

| • | | Implications for Energy MLPs. The energy MLP structure remains intact and the asset class also preserves itstax-advantageous position relative to entities structured as “C” corporations (albeit to a slightly lesser extent). Additionally, “C” corporation investors may benefit from a reduction in the corporate tax rate. A new income tax deduction for individuals, generally applicable to income from energy MLPs, may also benefit energy MLP investors. |

| • | | Implications for “C” corporation funds. Tax alterations that may impact “C” corporation funds include the reduction in the U.S. corporate tax rate and changes with respect to the utilization of net operating losses. |

Looking Ahead

When the Reporting Period started and through the end of September 2018, the global supply and demand picture appeared relatively healthy, supporting a 27.61% and 30.12% increase in WTI and Brent crude oil prices, respectively, despite some modest macro-related volatility along the way. However, during the last two months of the Reporting Period, WTI and Brent crude oil prices fell 30.47% and 29.03%, respectively, on lowered investor expectations for crude oil demand from the emerging markets, unexpectedly strong supply growth from the U.S. and Saudi Arabia, and Iranian sanction waivers. As of September 2018, which was the latest available data at the end of the Reporting Period, the U.S. was the largest producer of crude oil in the world at 11.47 million barrels per day and was exporting in excess of two million barrels per day of crude oil to global markets.8 Furthermore, according to net import/export figures during the week starting Sunday, November 25th, the U.S. became a net exporter of crude oil and petroleum products for the first time in 75 years.8 Although this data was reported in only a single week, we believe it is a milestone in the general trend towards U.S. energy independence and is a positive indicator for U.S. energy export infrastructure demand. The strength in U.S. production has resulted in increased throughput and utilization on U.S. midstream infrastructure and, in turn, has positively impacted the earnings power of

| 8 | | Source: U.S. Energy Information Administration. |

5

MARKET REVIEW

U.S.-based energy infrastructure assets. Over the course of the Reporting Period, we saw strong results from midstream companies, who by and large continued to meet and/or beat consensus expectations. We believe this positive earnings momentum should continue in 2019, supported by ongoing strength in U.S. crude oil and natural gas production, which we expect to grow by 10.85% and 8.03%, respectively, in 2019.9

At the end of the Reporting Period, we, along with the broader market, were focused on the upcoming December 6, 2018 “OPEC+” meeting at which supply-side concerns were likely to be a key topic of discussion. (OPEC+ is composed of the OPEC andnon-OPEC oil producing countries.) Leading into the meeting, market participants generally anticipated a production cut, though there was uncertainty around its size and whether it would address global oversupply expectations for 2019. (The December 6th meeting resulted in asix-month agreement to reduce production by 1.2 million barrels per day, effective January 1, 2019, and a plan to revisit the agreement during April 2019. Of that production cut, 0.8 million barrels per day are the responsibility of OPEC countries and 0.4 million barrels per day are the responsibility ofnon-OPEC countries, such as Russia.10) In our view, output limits should help global oversupply concerns, though it is unclear if global supply and demand will actually be balanced in 2019. Overall, market participants appear to have differing views about crude oil demand from the emerging markets, conformity with imposed OPEC cuts during 2019 and continued growth in U.S. production. We believe the uncertainty is likely to keep crude oil prices range-bound between $45 and $60 per barrel during the 2019 calendar year. In our view, this range is supportive for continued U.S. production growth and therefore, U.S.-based midstream assets. We base this view on two observations. First, U.S. crude oil production rose by nearly 1.3 million barrels per day during 2017, a time when crude oil prices averaged approximately $51 per barrel — which is in line with crude oil prices at the end of the Reporting Period. This suggests to us that a $45 to $60 per barrel price may be sufficient for producers to continue drilling at a healthy pace. Second, the forward curve for crude oil at the end of the Reporting Period indicated thatone-year forward prices could be close to $52 per barrel. (The forward curve is a function graph that defines the prices at which a contract for future delivery or payment can be concluded on the present day.One-year forward prices are the implied prices one year from the present day.) Accordingly, we expect U.S. crude oil producers to move aggressively to lock in that price, which we think would allow for continued production growth.

Beyond the macro environment, we continued to see positive trends at the company level during the Reporting Period. Companies were showing what we believe is increased capital discipline, which has historically been a point of contention between management teams and investors. Many energy MLPs have either cut or reduced distribution growth rates to maintain higher distribution coverage, thus retaining more capital within their businesses. In many cases, this action was taken with the goal of moving to a more self-funding11 model in order to rely less on the equity capital markets to fund growth. Also, many energy MLPs have become more selective about the capital projects they undertake and are choosing to invest only in what they consider their highest return opportunities. In our opinion, this shift should result in healthier balance sheets and ultimately stronger and more sustainable returns for unitholders. On another front, management teams appear to be addressing complexities around their

| 9 | | Based on data sourced from the U.S. Energy Information Administration. |

| 11 | | Self-funding means that organically generated cash flow in excess of distributions will be the source of funding for potential growth opportunities rather than reliance on the equity capital markets. |

6

MARKET REVIEW

corporate structure, with consolidation becoming an increasingly common theme. Consolidation transactions can come in many forms, such as abuy-in of incentive distribution rights12 by the limited partner or a roll up13 of assets between the limited partner and the general partner. We believe these strategies could help address the cost of capital burden associated with the general partner/limited partner relationship. During the Reporting Period, we saw several high-profile simplification transactions14 occur, and we believe structural simplifications may well contribute to positive performance for the sector as entities pursue less complex corporate structures and seek to align management and shareholder interests. This may boost investor sentiment and increase interest from institutional investors who have historically avoided energy infrastructure assets entirely. In our view, these trends may continue going forward, lowering hurdle rates15 and potentially strengthening returns on invested capital.

In our view, a number of the aforementioned factors may address investor concerns that have weighed on energy MLP valuations during the last several years. However, we believe there is a clear disconnect between the market’s distributable cash flow/unit expectations and current valuations. Based on multiple valuation metrics, such as enterprisevalue-to-earnings before interest, taxes, depreciation and amortization (“EBITDA”),16price-to-earnings ratios and the spread (difference in yields) versus10-year U.S. Treasury securities, energy MLPs remain cheap compared to historical averages, as well as relative to other income-oriented asset classes, such as REITs and utilities. We believe the market environment and increased discipline from management teams should warrant multiple expansion and appreciation in asset prices, with a reversion to historical levels suggesting to us that there is significant upside potential for energy MLPs.

| 12 | | Incentive distribution rights allow a general partner to receive incrementally larger percentages of an energy MLP’s total distributions as the energy MLP grows the distribution beyond established targets. |

| 13 | | A roll up is a process used by which assets are merged. The principal aim of a roll up is to reduce costs through economies of scale. |

| 14 | | A simplification transaction is when multiple entities controlled by the same corporate parent simplify their corporate structure through actions such as mergers, acquisitions or reduction of incentive distribution rights. |

| 15 | | A hurdle rate is the minimum rate of return on a project or investment required by an investor. The hurdle rate denotes appropriate compensation for the level of risk present; riskier projects generally have higher hurdle rates than those that are deemed to be less risky. |

| 16 | | Enterprise value is the market value of debt, common equity and preferred equity minus the value of cash. Enterprise value/EBITDA is a financial ratio that measures a company’s value. |

7

PORTFOLIO RESULTS

Goldman Sachs MLP and Energy Renaissance Fund

Investment Objective and Principal Strategy

The Fund seeks a high level of total return with an emphasis on current distributions to shareholders. The Fund seeks to achieve its investment objective by investing primarily in master limited partnership (“MLP”) and other energy investments. The Fund intends to use leverage to seek to achieve its investment objective. It concentrates its investments in the energy sector, with an emphasis on midstream MLP investments. Under normal market conditions, the Fund will invest at least 80% of its managed assets in MLPs and other energy investments. The Fund’s MLP investments may include, but are not limited to, MLPs structured as limited partnerships (“LPs”) or limited liability companies (“LLCs”); MLPs that are organized as LPs or LLCs, but taxed as “C” corporations; equity securities that represent an indirect interest in an MLP issued by an MLP affiliate, including institutional units and MLP general partner or managing member interests; “C” corporations whose predominant assets are interests in MLPs; MLP equity securities, including MLP common units, MLP subordinated units, MLP convertible subordinated units and MLP preferred units; private investments in public equities issued by MLPs; MLP debt securities; and other U.S. and non-U.S. equity and fixed income securities and derivative instruments that provide exposure to the MLP market, including pooled investment vehicles that primarily hold MLP interests and exchange-traded notes. The Fund’s other energy investments may include equity and fixed income securities of U.S. and non-U.S. companies other than MLPs that (i) are classified by a third party as operating within the oil and gas storage, transportation, refining, marketing, drilling, exploration or production sub-industries or (ii) have at least 50% of their assets, income, sales or profits committed to, or derived from, the exploration, development, production, gathering, transportation (including marine), transmission, terminal operation, processing, storage, refining, distribution, mining or marketing of natural gas, natural gas liquids (including propane), crude oil, refined petroleum products, coal, electricity or other energy sources, energy-related equipment or services.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Energy and Infrastructure Team discusses the Goldman Sachs MLP and Energy Renaissance Fund’s (the “Fund”) performance and positioning for the 12-month period ended November 30, 2018 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s average annual total return based on its net asset value (“NAV”) was 6.31%. The Fund’s average annual total return based on market price was 3.86% for the same period. By way of reference, the Alerian MLP Index1 had an average annual total return of 1.21% during the Reporting Period. By comparison, the Cushing® MLP High Income Index2 had an average annual total return of -2.46% for the Reporting Period. As of November 30, 2018, the Fund’s NAV was $5.80, and its market price was $5.31. |

| | 1 | | Source: Alerian. The Alerian MLP Index is a composite of prominent energy MLPs that captures about 85% of the total float-adjusted market capitalization of the energy MLP sector. |

| | 2 | | Source: Cushing® Asset Management. The Cushing® MLP High Income Index tracks the performance of 30 publicly traded energy and shipping MLP securities with an emphasis on current yield. |

| Q | | What was the Fund’s current distribution rate at the end of the Reporting Period? |

| A | | During the Reporting Period overall, the Fund declared dividends totaling $0.64 per unit. We note that this matches the $0.64 per unit of declared distributions for the 12 months ended November 30, 2017. As of November 30, 2018, the Fund’s current annualized distribution rate based on its NAV was 11.03%. The Fund’s current annualized distribution rate based on its market price was 12.05% on November 30, 2018. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | Security selection, the macro environment in the crude oil and natural gas markets, and the regulatory environment drove the Fund’s performance during the Reporting Period. Securities with the greatest exposure to commodity prices and volumes were the Fund’s best performers, as commodity |

8

PORTFOLIO RESULTS

| | prices rallied from the beginning of the Reporting Period through September 2018. Conversely, securities with a lower beta to commodity prices were the worst Fund performers. (In this context, having a lower beta means these securities tended to be less correlated to commodity prices.) |

| | | Regarding its exposures, the Fund was positively impacted by positions in the petroleum pipeline transportation and the gathering and processing subsectors.3 These subsectors benefited from record U.S. natural gas and crude oil production, with the gathering and processing subsector seeing the most direct benefit as it is closest to the wellhead and, therefore, experienced the greatest fluctuation in volumes. On the negative side, the natural gas pipeline transportation subsector was the worst performer amid investor concerns about project completions as well as questions around leverage and distribution growth potential. |

| Q | | What individual holdings added to the Fund’s performance during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s holdings of Energy Transfer Partners, L.P., Williams Partners L.P. and Crestwood Equity Partners LP contributed positively to performance. |

| | | The Fund’s top contributor was Energy Transfer Partners, L.P. (ETP), which offers natural gas, natural gas liquids, crude oil and refined products transportation and storage services. At the beginning of the Reporting Period, ETP benefited from its first quarter 2018 earnings announcement, which included stronger than market expected results for its interstate and intrastate transportation/storage segment. During the second half of the Reporting Period, its shares rose on the announcement of a simplification transaction4 in which ETP’s general partner, Energy Transfer Equity, L.P., would acquire its remaining public stake in ETP in a deal valued at $60.3 billion. The transaction was viewed positively by the market, which expects it to generate annual savings of more than $1.5 billion for the combined entity and to align investor and management interests. Because we shared this constructive view, the Fund maintained its exposure to ETP through a position in the combined entity, known as Energy Transfer L.P., at the end of the Reporting Period. |

| | | Williams Partners L.P. (WPZ), an energy infrastructure company focused on connecting North America’s natural gas and natural gas liquids market, also added to the Fund’s performance during the Reporting Period. The company benefited most from its merger with parent company Williams Companies (WMB), which acquired WPZ at a 7% premium and in an all stock-for-unit transaction valued at $10.5 billion. Market participants appeared to believe the merger would provide immediate benefits to shareholders, while also simplifying the company’s corporate structure, streamlining its governance and preserving its investment grade credit rating. By the end of the Reporting Period, we had exited the Fund’s position in WPZ and WMB to allocate capital to higher yielding names. |

| | | Crestwood Equity Partners LP (CEQP), which has both a natural gas and storage business and a natural gas liquids and crude oil services business, was another notable contributor to the Fund’s returns during the Reporting Period. The company reported solid first and second quarter 2018 results, driven by new projects in the Permian and Bakken Basins. CEQP was also helped by increased profits from its Bakken Basin investments and additional growth opportunities in the Delaware and Powder River Basins, as producer activity there remained strong. We added to the Fund’s position in CEQP during the Reporting Period because we believe it offers favorable exposure to a potential increase in crude oil prices. |

| Q | | What individual holdings detracted from the Fund’s performance during the Reporting Period? |

| A | | Investments in Energy Transfer L.P., Buckeye Partners, L.P. and Shell Midstream Partners, L.P. detracted from the Fund’s returns. |

| | | The top detractor from Fund performance during the Reporting Period was Energy Transfer L.P. (ET), which engages in natural gas midstream,5 liquid transportation and storage businesses. In our opinion, its shares were challenged by technical (supply/demand) selling pressure after a simplification transaction, discussed earlier, in which Energy Transfer Equity, L.P. acquired its remaining public stake in ETP and became the combined entity known as ET. We also believe that toward the end of the Reporting Period, shares of ET were hurt by the broad decline in crude oil and natural gas |

| | 3 | | Sector and subsector allocations are defined by GSAM and may differ from sector allocations used by the Alerian MLP Index. |

| | 4 | | A simplification transaction is when multiple entities controlled by the same corporate parent simplify their corporate structure through actions such as mergers, acquisitions or reduction of incentive distribution rights. |

| | 5 | | The midstream component of the energy industry is usually defined as those companies providing products or services that help link the supply side, i.e. energy producers, and the demand side, i.e. energy end-users, for any type of energy commodity. Such midstream businesses can include, but are not limited to, those that process, store, market and transport various energy commodities. |

9

PORTFOLIO RESULTS

| | liquid prices. At the conclusion of the Reporting Period, the Fund continued to hold ET because of our positive view on the company. |

| | | The Fund was further hampered by an investment in Buckeye Partners, L.P. (BPL), an operator of refined product pipelines and terminals. BPL reported earnings in the first, second and third quarters of 2018 that missed consensus expectations, citing challenging market conditions and contract expirations. Additionally, in its third quarter earnings announcement, the company said it would implement a distribution cut of approximately 40% as it sought to improve its distribution coverage ratio.6 We decided to trim the Fund’s position in BPL in order to allocate capital to higher yielding names. |

| | | Another detractor from Fund performance was Shell Midstream Partners, L.P. (SHLX), which owns, operates, develops and acquires pipelines and other midstream assets. Its shares declined after the company’s announcement of a sizable equity offering in the unfavorable market environment. Additionally, the company’s failure to address its incentive distribution rights7 continued to be a point of contention within its investor base during the Reporting Period. We had initiated a Fund position in the stock after the equity offering announcement because we believed the company was trading at attractive valuations and had strong distribution growth potential. For the same reasons, the Fund continued to hold the stock at the end of the Reporting Period. |

| Q | | Were there any notable purchases or sales during the Reporting Period? |

| A | | In addition to the purchase of SHLX, mentioned previously, the Fund purchased MPLX LP (MPLX), which acquires, owns, operates and develops crude oil, refined products and other hydrocarbon-based product pipelines. We established the position over the course of the Reporting Period, as MPLX was trading at what we considered to be attractive levels based on its healthy fundamentals, strong distribution coverage ratio and robust growth plan. |

| | | By the end of the Reporting Period, the Fund exited its investment in Plains All American Pipeline, L.P. (PAA), a partnership involved in intrastate crude oil pipeline transportation and terminalling storage activities, in addition to the gathering and marketing of crude oil, refined products and natural gas liquids. We first reduced the position after PAA’s fourth quarter 2017 announcement of a distribution cut, keeping a modest weighting to maintain the Fund’s exposure to the Permian Basin. In early May 2018, we eliminated the position and reallocated the assets to higher yielding opportunities. |

| | | The Fund also sold its investment in TransMontaigne Partners LP (TLP) during the Reporting Period. TLP provides integrated terminalling, storage, transportation and related services for customers engaged in the distribution and marketing of light and heavy refined petroleum products. In July 2018, TLP received a cash buyout offer from its private equity sponsor at a 13% premium. We maintained the Fund’s position in the stock, as we expected TLP to receive a potential sweetener on top of the buyout premium. (A sweetener is an added incentive aimed at making a transaction more attractive.) Once the sweetener was provided, we sold the holding to reallocate the capital to what we viewed as more attractively valued companies. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | During the Reporting Period, the Fund did not use derivatives or similar instruments. |

| Q | | How did the Fund use leverage during the Reporting Period? |

| A | | The Fund is permitted to obtain leverage using any form or combination of financial leverage instruments, including through funds borrowed from banks or other financial institutions (i.e., a credit facility), margin facilities or notes issued by the Fund and the leverage attributable to similar transactions entered into by the Fund, and it reserves the right to obtain leverage to the extent permitted by the Investment Company Act of 1940. During the Reporting Period, the Fund obtained leverage through a margin facility.8 The use of this leverage added to the Fund’s performance during the Reporting Period. During the Reporting Period, the Fund’s leverage was maintained at a level between 29% and 34%. As of November 30, 2018, the margin facility represented 33.53% of the Fund’s managed assets. |

| | 6 | | The distribution coverage ratio is an energy MLP’s distributable cash flow divided by the total amount of distributions it has paid out. It is an indication of an energy MLP’s ability to maintain its current cash distribution level. |

| | 7 | | Incentive distribution rights allow a general partner to receive incrementally larger percentages of an energy MLP’s total distributions as the energy MLP grows the distribution beyond established targets. |

| | 8 | | The Fund currently has a fixed/floating rate margin loan facility with a major financial institution. |

10

FUND BASICS

Goldman Sachs MLP and Energy Renaissance Fund

as of November 30, 2018

| | | | | | |

| | FUND SNAPSHOT | |

| | | As of November 30, 2018 | | | |

| | Net Asset Value (NAV)1 | | $ | 5.80 | |

| | Market Price1 | | $ | 5.31 | |

| | Premium (Discount) to NAV2 | | | -8.45 | % |

| | Leverage3 | | | 33.53 | % |

| | Distribution Rate – NAV4 | | | 11.03 | % |

| | | Distribution Rate – Market Price4 | | | 12.05 | % |

| | 1 | | The Market Price is the price at which the Fund’s common shares are trading on the NYSE. The Market Price of the Fund’s common shares will fluctuate and, at the time of sale, common shares may be worth more or less than the original investment or the Fund’s then current net asset value (“NAV”). The NAV is the market value of one share of the Fund. This amount is derived by dividing the total value of all the securities in the Fund’s portfolio, plus any other assets, less any liabilities, by the number of Fund shares outstanding. The Fund cannot predict whether its common shares will trade at, above or below NAV. Shares ofclosed-end investment companies frequently trade at a discount from their NAV, which may increase investors’ risk of loss. |

| | 2 | | The premium/discount to NAV is calculated as the market price divided by the NAV of the Fund minus 1, expressed as a percentage. If this value is positive, the Fund is trading at a premium to its NAV. If the value is negative, the Fund is trading at a discount to its NAV. |

| | 3 | | The Fund is permitted to obtain leverage using any form or combination of financial leverage instruments, including through funds borrowed from banks or other financial institutions (i.e., a credit facility), margin facilities or notes issued by the Fund and the leverage attributable to similar transactions entered into by the Fund. The Fund’s use of leverage through a credit facility is calculated as a percentage of the Fund’s Managed Assets. Managed Assets are defined as total assets of the Fund (including assets attributable to borrowings for investment purposes) minus the sum of the Fund’s accrued liabilities (other than liabilities representing borrowings for investment purposes). |

| | 4 | | The Distribution Rate is calculated by annualizing the most recent distribution amount declared divided by the most recent closing Market Price or NAV. The Distribution Rate is subject to change and is not an indication of Fund performance. A portion of the Fund’s distributions will likely be treated for tax purposes as a return of capital. A return of capital is not taxable and results in a reduction in the tax basis of a shareholder’s investment. The final determination regarding the nature of the distributions will be made after the end of the Fund’s fiscal year when the Fund can determine its earnings and profits. The final tax status of the distribution may differ substantially and will be made available to shareholders after the close of each calendar year. The proportion of distributions that are treated as taxable distributions may also vary and/or increase in future years. The ultimate composition of these distributions may vary due to a variety of factors including projected income and expenses, depreciation and depletion, and any tax elections made by the MLP. |

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | December 1, 2017–November 30, 2018 | | Fund Total Return

(based on NAV)5 | | | Fund Total Return

(based on Market Price)5 | |

| | | Common Shares | | | 6.31 | % | | | 3.86 | % |

| | 5 | | Total returns are calculated assuming purchase of a share at the market price or NAV on the first day and sale of a share at the market price or NAV on the last day of each period reported. Dividends and distributions, if any, are assumed, for purposes of this calculation, to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. The Total Returns based on NAV and Market Price do not reflect brokerage commissions or sales charges in connection with the purchase or sale of Fund shares, which if included would lower the performance shown above. The NAV used in the Total Return calculation includes all management fees, interest expense (if any) and operating expenses incurred by the Fund. Operating expenses include custody, accounting and administrative services, professional fees, transfer agency fees, registration, printing and mailing costs and Trustee fees. Total returns for periods less than one full year are not annualized. |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment returns and principal value will fluctuate. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com/CEF to obtain the most recentmonth-end returns.Closed-end funds, unlikeopen-end funds, are not continuously offered. Once issued in a public offering, shares ofclosed-end funds are traded in the open market through a stock exchange.

11

FUND BASICS

| | | | | | | | |

| | TOP TEN HOLDINGS AS OF 11/30/186 |

| | | Holding | | % of Net Assets | | | Line of Business |

| | Energy Transfer LP | | | 19.1 | % | | Pipeline Transportation | Natural Gas |

| | DCP Midstream LP | | | 14.8 | | | Gathering + Processing |

| | Targa Resources Corp. | | | 13.7 | | | Gathering + Processing |

| | MPLX LP | | | 12.1 | | | Gathering + Processing |

| | Western Gas Partners LP | | | 9.4 | | | Gathering + Processing |

| | Sunoco LP | | | 8.6 | | | Marketing | Wholesale |

| | NuStar Energy LP | | | 8.6 | | | Pipeline Transportation | Petroleum |

| | Crestwood Equity Partners LP | | | 7.1 | | | Gathering + Processing |

| | Shell Midstream Partners L.P. | | | 6.4 | | | Pipeline Transportation | Petroleum |

| | | PBF Logistics LP | | | 6.2 | | | Pipeline Transportation | Petroleum |

| | 6 | | The top 10 holdings may not be representative of the Fund’s future investments. |

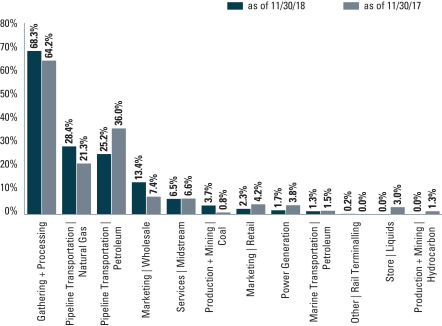

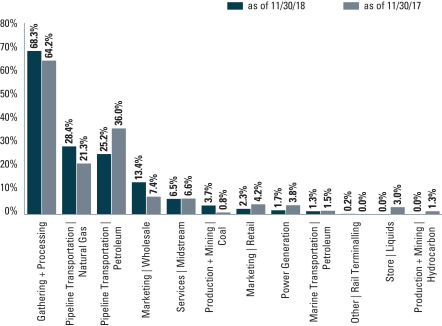

| | 7 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The percentage shown for each investment category reflects the value of investments in that category as a percentage of total net assets. As a result of borrowings, the percentages may add to an amount in excess of 100%. Sector allocations are defined by GSAM and may differ from sector allocations used by the Alerian MLP Index. |

12

PORTFOLIO RESULTS

Goldman Sachs MLP Income Opportunities Fund

Investment Objective and Principal Strategy

The Fund seeks a high level of total return with an emphasis on current distributions to shareholders. The Fund seeks to achieve its investment objective by investing primarily in master limited partnerships (“MLPs”). The Fund intends to use leverage to seek to achieve its investment objective. Under normal market conditions, the Fund will invest at least 80% of its managed assets in MLP investments. The Fund’s MLP investments may include, but are not limited to, MLPs structured as limited partnerships (“LPs”) or limited liability companies (“LLCs”); MLPs that are organized as LPs or LLCs, but taxed as “C” corporations; equity securities that represent an indirect interest in an MLP issued by an MLP affiliate, including institutional units and MLP general partner or managing member interests; “C” corporations whose predominant assets are interests in MLPs; MLP equity securities, including MLP common units, MLP subordinated units, MLP convertible subordinated units and MLP preferred units; private investments in public equities issued by MLPs; MLP debt securities; and other U.S. and non-U.S. equity and fixed income securities and derivative instruments that provide exposure to the MLP market, including pooled investment vehicles that primarily hold MLP interests and exchange-traded notes. The Fund currently expects to concentrate its investments in the energy sector, with an emphasis on midstream MLP investments, including companies that are engaged in the treatment, gathering, compression, processing, transportation, transmission, fractionation, storage and terminalling of natural gas, natural gas liquids, crude oil, refined products or coal.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Energy and Infrastructure Team discusses the Goldman Sachs MLP Income Opportunities Fund’s (the “Fund”) performance and positioning for the 12-month period ended November 30, 2018 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s average annual total return based on its net asset value (“NAV”) was 4.83%. The Fund’s average annual total return based on market price was 4.44% for the same period. By way of reference, the Alerian MLP Index1 had an average annual total return of 1.21% during the Reporting Period. By comparison, the Cushing® MLP High Income Index2 had an average annual total return of -2.46% for the Reporting Period. As of November 30, 2018, the Fund’s NAV was $8.39, and its market price was $7.96. |

| Q | | What was the Fund’s current distribution rate at the end of the Reporting Period? |

| A | | During the Reporting Period overall, the Fund declared dividends totaling $0.84 per unit. We note that this matches the $0.84 per unit of declared distributions for the 12 months ended November 30, 2017. As of November 30, 2018, the Fund’s current annualized distribution rate based on its NAV was 10.01%. The Fund’s current annualized distribution rate based on its market price was 10.55% on November 30, 2018. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | Security selection, the macro environment in the crude oil and natural gas markets, and the regulatory environment drove the Fund’s performance during the Reporting Period. Securities with the greatest exposure to commodity prices and volumes were the Fund’s best performers, as commodity prices rallied from the beginning of the Reporting Period through September 2018. Conversely, securities with a lower beta to commodity prices were the worst Fund performers. (In this context, having a lower beta means these securities tended to be less correlated to commodity prices.) |

| | Regarding its exposures, the Fund was positively impacted by positions in the petroleum pipeline transportation and the gathering and processing subsectors.3 These subsectors benefited from record U.S. natural gas and crude oil production, with the gathering and processing subsector |

| | 1 | | Source: Alerian. The Alerian MLP Index is a composite of prominent energy MLPs that captures about 85% of the total float-adjusted market capitalization of the energy MLP sector. |

| | 2 | | Source: Cushing® Asset Management. The Cushing® MLP High Income Index tracks the performance of 30 publicly traded energy and shipping MLP securities with an emphasis on current yield. |

| | 3 | | Sector and subsector allocations are defined by GSAM and may differ from sector allocations used by the Alerian MLP Index. |

13

PORTFOLIO RESULTS

| | seeing the most direct benefit as it is closest to the wellhead and, therefore, experienced the greatest fluctuation in volumes. On the negative side, the natural gas pipeline transportation subsector was the worst performer amid investor concerns about project completions as well as questions around leverage and distribution growth potential. |

| Q | | What individual holdings added to the Fund’s performance during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s holdings of Energy Transfer Partners, L.P.; Targa Resources Corp. and Plains All American Pipeline L.P. contributed positively to returns. |

| | Energy Transfer Partners, L.P. (ETP), which offers natural gas, natural gas liquids, crude oil and refined products transportation and storage services, added most to the Fund’s performance. At the beginning of the Reporting Period, ETP benefited from its first quarter 2018 earnings announcement, which included stronger than market expected results for its interstate and intrastate transportation/storage segment. During the second half of the Reporting Period, its shares rose on the announcement of a simplification transaction4 in which ETP’s general partner, Energy Transfer Equity, L.P., would acquire its remaining public stake in ETP in a deal valued at $60.3 billion. The transaction was viewed positively by the market, which expects it to generate annual savings of more than $1.5 billion for the combined entity and to align investor and management interests. Because we shared this constructive view, the Fund maintained its exposure to ETP through a position in the combined entity, known as Energy Transfer L.P., at the end of the Reporting Period. |

| | Another notable contributor during the Reporting Period was Targa Resources Corp. (TRGP), an independent midstream5 services provider that is primarily engaged in gathering, storing, processing and transporting oil, natural gas and refined petroleum products. TRGP benefited from rising crude oil prices during the first half of the Reporting Period and from positive fundamentals in the natural gas liquids market during the second half of the Reporting Period. We trimmed the Fund’s position in TRGP by the end of the Reporting Period to allocate capital to companies with what we considered more attractive valuations. |

| | The Fund was also helped during the Reporting Period by its investment in Plains All American Pipeline L.P. (PAA), which is involved in intrastate crude oil pipeline transportation and terminalling storage activities, in addition to the gathering and marketing of crude oil, refined products and natural gas liquids. PAA benefited from its leading position in the Permian Basin, where takeaway capacity constraints drove widening price differentials and higher crude oil prices led to volume growth. Additionally, widening price differentials and higher crude oil prices boosted profitability in PAA’s marketing and transportation segments. During the Reporting Period, we eliminated the Fund’s position in PAA and reallocated the capital to higher yielding opportunities. We first reduced the size of the position after PAA announced a distribution cut in the fourth quarter of 2017 but kept a modest weighting to maintain the Fund’s exposure to the Permian Basin. In early May 2018, we eliminated the holding completely. |

| Q | | What individual holdings detracted from the Fund’s performance during the Reporting Period? |

| A | | Investments in Energy Transfer L.P., EQM Midstream Partners, LP and Buckeye Partners, L.P. hurt the Fund’s performance during the Reporting Period. |

| | The Fund’s top detractor was Energy Transfer L.P. (ET), which engages in natural gas midstream, liquid transportation and storage businesses. In our opinion, its shares were challenged by technical (supply/demand) selling pressure after a simplification transaction, discussed earlier, in which Energy Transfer Equity, L.P. acquired its remaining public stake in ETP and became the combined entity known as ET. We also believe that toward the end of the Reporting Period, shares of ET were hurt by the broad decline in crude oil and natural gas liquid prices. At the conclusion of the Reporting Period, the Fund continued to hold ET because of our constructive view on the company. |

| | EQM Midstream Partners, LP (EQM), which acquires, owns and develops midstream natural gas assets in the Appalachian Basin, also hampered Fund returns. EQM’s shares declined after the company announced a reduction in production forecasts and also because of increased market concerns |

| | 4 | | A simplification transaction is when multiple entities controlled by the same corporate parent simplify their corporate structure through actions such as mergers, acquisitions or reduction of incentive distribution rights. |

| | 5 | | The midstream component of the energy industry is usually defined as those companies providing products or services that help link the supply side, i.e. energy producers, and the demand side, i.e. energy end-users, for any type of energy commodity. Such midstream businesses can include, but are not limited to, those that process, store, market and transport various energy commodities. |

14

PORTFOLIO RESULTS

| | about the treatment of incentive distribution rights6 in a potential simplification transaction. We added to the Fund’s position in EQM during the Reporting Period, as we thought its valuations were attractive and because the company offered what we considered to be a high and stable yield. |

| | Another key detractor was Buckeye Partners, L.P. (BPL), an operator of refined product pipelines and terminals. BPL reported earnings in the first, second and third quarters of 2018 that missed consensus expectations, citing challenging market conditions and contract expirations. Additionally, in its third quarter earnings announcement, the company said it would implement a distribution cut of approximately 40% as it sought to improve its distribution coverage ratio.7 We decided to add to the Fund’s position in BPL during the Reporting Period, as we believed the stock was trading below its fundamental value. |

| Q | | Were there any notable purchases or sales during the Reporting Period? |

| A | | During the Reporting Period, the Fund initiated a position in Sunoco LP (SUN), which distributes motor fuel to convenience stores, independent dealers, commercial customers and distributors. We added the position, as we believe SUN offers an attractive and sustainable yield and has strong fundamentals. |

| | Another purchase made during the Reporting Period was Shell Midstream Partners, L.P. (SHLX), which owns, operates, develops and acquires pipelines and other midstream assets. We established the position when SHLX was trading at what we considered to be attractive levels after it made an equity offering announcement. Additionally, we continue to believe SHLX has strong distribution growth potential. |

| | In addition to the sale of PAA, mentioned previously, we exited the Fund’s position in Hoegh LNG Partners L.P. (HMLP), a provider of floating liquefied natural gas services. We decided to eliminate HMLP due to our uncertainty about its distribution sustainability, and reallocated the capital to companies we believed had higher distribution growth potential. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | During the Reporting Period, the Fund did not use derivatives or similar instruments. |

| Q | | How did the Fund use leverage during the Reporting Period? |

| A | The Fund is permitted to obtain leverage using any form or combination of financial leverage instruments, including through funds borrowed from banks or other financial institutions (i.e., a credit facility), margin facilities or notes issued by the Fund and the leverage attributable to similar transactions entered into by the Fund, and it reserves the right to obtain leverage to the extent permitted by the Investment Company Act of 1940. During the Reporting Period, the Fund obtained leverage through a margin facility.8 The use of this leverage added to the Fund’s performance during the Reporting Period. During the Reporting Period, the Fund’s leverage was maintained at a level between 29% and 34%. As of November 30, 2018, the margin facility represented 33.52% of the Fund’s managed assets. |

| | 6 | | Incentive distribution rights allow a general partner to receive incrementally larger percentages of an energy MLP’s total distributions as the energy MLP grows the distribution beyond established targets. |

| | 7 | | The distribution coverage ratio is an energy MLP’s distributable cash flow divided by the total amount of distributions it has paid out. It is an indication of an energy MLP’s ability to maintain its current cash distribution level. |

| | 8 | | The Fund currently has a fixed/floating rate margin loan facility with a major financial institution. |

15

FUND BASICS

Goldman Sachs MLP Income Opportunities Fund

as of November 30, 2018

| | | | | | |

| | FUND SNAPSHOT | |

| | | As of November 30, 2018 | | | |

| | Net Asset Value (NAV)1 | | $ | 8.39 | |

| | Market Price1 | | $ | 7.96 | |

| | Premium (Discount) to NAV2 | | | -5.13 | % |

| | Leverage3 | | | 33.52 | % |

| | Distribution Rate – NAV4 | | | 10.01 | % |

| | | Distribution Rate – Market Price4 | | | 10.55 | % |

| | 1 | | The Market Price is the price at which the Fund’s common shares are trading on the NYSE. The Market Price of the Fund’s common shares will fluctuate and, at the time of sale, common shares may be worth more or less than the original investment or the Fund’s then current net asset value (“NAV”). The NAV is the market value of one share of the Fund. This amount is derived by dividing the total value of all the securities in the Fund’s portfolio, plus any other assets, less any liabilities, by the number of Fund shares outstanding. The Fund cannot predict whether its common shares will trade at, above or below NAV. Shares ofclosed-end investment companies frequently trade at a discount from their NAV, which may increase investors’ risk of loss. |

| | 2 | | The premium/discount to NAV is calculated as the market price divided by the NAV of the Fund minus 1, expressed as a percentage. If this value is positive, the Fund is trading at a premium to its NAV. If the value is negative, the Fund is trading at a discount to its NAV. |

| | 3 | | The Fund is permitted to obtain leverage using any form or combination of financial leverage instruments, including through funds borrowed from banks or other financial institutions (i.e., a credit facility), margin facilities or notes issued by the Fund and the leverage attributable to similar transactions entered into by the Fund. The Fund’s use of leverage through a credit facility is calculated as a percentage of the Fund’s Managed Assets. Managed Assets are defined as total assets of the Fund (including assets attributable to borrowings for investment purposes) minus the sum of the Fund’s accrued liabilities (other than liabilities representing borrowings for investment purposes). |

| | 4 | | The Distribution Rate is calculated by annualizing the most recent distribution amount declared divided by the most recent closing Market Price or NAV. The Distribution Rate is subject to change and is not an indication of Fund performance. A portion of the Fund’s distributions will likely be treated for tax purposes as a return of capital. A return of capital is not taxable and results in a reduction in the tax basis of a shareholder’s investment. The final determination regarding the nature of the distributions will be made after the end of the Fund’s fiscal year when the Fund can determine its earnings and profits. The final tax status of the distribution may differ substantially and will be made available to shareholders after the close of each calendar year. The proportion of distributions that are treated as taxable distributions may also vary and/or increase in future years. The ultimate composition of these distributions may vary due to a variety of factors including projected income and expenses, depreciation and depletion, and any tax elections made by the MLP. |

16

FUND BASICS

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | December 1, 2017–November 30, 2018 | | Fund Total Return

(based on NAV)5 | | | Fund Total Return

(based on Market Price)5 | |

| | | Common Shares | | | 4.83 | % | | | 4.44 | % |

| | 5 | | Total returns are calculated assuming purchase of a share at the market price or NAV on the first day and sale of a share at the market price or NAV on the last day of each period reported. Dividends and distributions, if any, are assumed, for purposes of this calculation, to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. The Total Returns based on NAV and Market Price do not reflect brokerage commissions or sales charges in connection with the purchase or sale of Fund shares, which if included would lower the performance shown above. The NAV used in the Total Return calculation includes all management fees, interest expense (if any) and operating expenses incurred by the Fund. Operating expenses include custody, accounting and administrative services, professional fees, transfer agency fees, registration, printing and mailing costs and Trustee fees. Total returns for periods less than one full year are not annualized. |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment returns and principal value will fluctuate. Current performance may be lower or higher than theperformance quoted above. Please visit our web site at www.GSAMFUNDS.com/CEF to obtain the most recentmonth-end returns.Closed-end funds, unlikeopen-end funds, are not continuously offered. Once issued in a public offering, shares ofclosed-end funds are traded in the open market through a stock exchange.

| | | | | | | | |

| | TOP TEN HOLDINGS AS OF 11/30/186 |

| | | Holding | | % of Net Assets | | | Line of Business |

| | Energy Transfer LP | | | 17.9 | % | | Pipeline Transportation | Natural Gas |

| | EQM Midstream Partners, LP | | | 12.0 | | | Pipeline Transportation | Natural Gas |

| | MPLX LP | | | 11.7 | | | Gathering + Processing |

| | Alliance Resource Partners LP | | | 9.6 | | | Production + Mining | Coal |

| | Sunoco LP | | | 9.0 | | | Marketing | Wholesale |

| | Targa Resources Corp. | | | 9.0 | | | Gathering + Processing |

| | DCP Midstream LP | | | 8.6 | | | Gathering + Processing |

| | Shell Midstream Partners L.P. | | | 7.6 | | | Pipeline Transportation | Petroleum |

| | Western Gas Partners LP | | | 6.3 | | | Gathering + Processing |

| | | USA Compression Partners LP | | | 5.9 | | | Services | Midstream |

| | 6 | | The top 10 holdings may not be representative of the Fund’s future investments. |

17

FUND BASICS

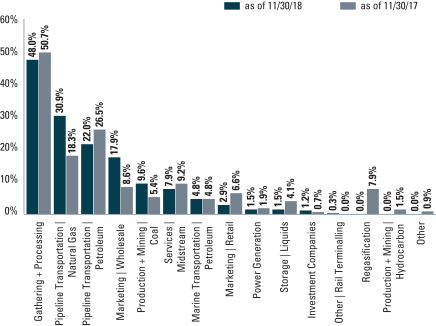

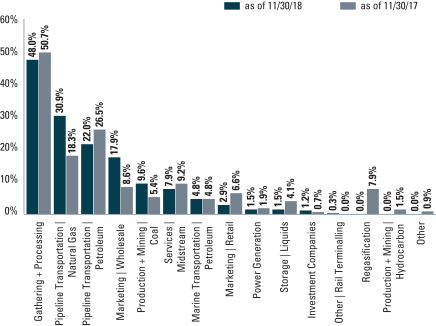

| | 7 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The percentage shown for each investment category reflects the value of investments in that category as a percentage of total net assets. As a result of borrowings, the percentages may add to an amount in excess of 100%. Sector allocations are defined by GSAM and may differ from sector allocations used by the Alerian MLP Index. |

18

GOLDMAN SACHS MLP AND ENERGY RENAISSANCE FUND

Schedule of Investments

November 30, 2018

| | | | | | | | |

| Shares | | | Description | | Value | |

| Common Stocks – 150.7% | | | |

| Gathering + Processing – 68.3% | | | |

| | 525,033 | | | Antero Midstream GP LP | | $ | 7,775,739 | |

| | 683,913 | | | Antero Midstream Partners LP | | | 18,917,033 | |

| | 389,715 | | | CNX Midstream Partners LP | | | 7,053,841 | |

| | 1,109,498 | | | Crestwood Equity Partners LP | | | 32,952,091 | |

| | 2,004,770 | | | DCP Midstream LP | | | 68,322,562 | |

| | 1,211,582 | | | Enable Midstream Partners LP | | | 16,162,504 | |

| | 1,683,205 | | | MPLX LP | | | 55,764,582 | |

| | 560,600 | | | Sanchez Midstream Partners LP | | | 1,653,770 | |

| | 1,412,000 | | | Targa Resources Corp. | | | 63,017,560 | |

| | 975,901 | | | Western Gas Partners LP | | | 43,369,040 | |

| | | | | | | | |

| | | | | | | 314,988,722 | |

| | |

| Marine Transportation | Petroleum – 1.3% | | | |

| | 304,737 | | | KNOT Offshore Partners LP | | | 6,106,929 | |

| | |

| Marketing | Retail – 2.3% | | | |

| | 280,500 | | | AmeriGas Partners LP | | | 10,423,380 | |

| | 10,000 | | | Suburban Propane Partners LP | | | 233,600 | |

| | | | | | | | |

| | | | | | | 10,656,980 | |

| | |

| Marketing | Wholesale – 13.4% | | | |

| | 832,573 | | | CrossAmerica Partners LP | | | 13,138,002 | |

| | 487,869 | | | Sprague Resources LP | | | 8,693,825 | |

| | 1,422,327 | | | Sunoco LP | | | 39,768,263 | |

| | | | | | | | |

| | | | | | | 61,600,090 | |

| | |

| Other | Rail Terminalling – 0.2% | | | |

| | 96,186 | | | USD Partners LP | | | 1,008,991 | |

| | |

| Pipeline Transportation | Natural Gas – 28.4% | | | |

| | 6,037,500 | | | Energy Transfer LP | | | 87,966,375 | |

| | 947,421 | | | Enterprise Products Partners LP | | | 24,869,801 | |

| | 379,055 | | | EQM Midstream Partners LP | | | 18,065,761 | |

| | | | | | | | |

| | | | | | | 130,901,937 | |

| | |

| Pipeline Transportation | Petroleum – 25.2% | | | |

| | 70,000 | | | Andeavor Logistics LP | | | 2,612,400 | |

| | 527,500 | | | Buckeye Partners LP | | | 15,592,900 | |

| | 1,638,764 | | | NuStar Energy LP | | | 39,608,926 | |

| | 1,427,957 | | | PBF Logistics LP | | | 28,673,377 | |

| | 1,573,930 | | | Shell Midstream Partners LP | | | 29,652,841 | |

| | | | | | | | |

| | | | | | | 116,140,444 | |

| | |

| Power Generation – 1.7% | | | |

| | 272,679 | | | Enviva Partners LP | | | 7,834,068 | |

| | |

| Production + Mining | Coal – 3.7% | | | |

| | 854,864 | | | Alliance Resource Partners LP | | | 16,798,078 | |

| | |

| Services | Midstream – 6.2% | | | |

| | 1,378,095 | | | CSI Compressco LP | | | 5,774,218 | |

| | 1,584,960 | | | USA Compression Partners LP | | | 22,918,522 | |

| | | | | | | | |

| | | | | | | 28,692,740 | |

| | |

| | TOTAL COMMON STOCKS | | | | |

| | (Cost $770,207,002) | | $ | 694,728,979 | |

| | |

| Shares | | | Dividend

Rate | | Value | |

| Preferred Stock(a)(b) – 0.3% | | | |

| Services | Midstream – 0.3% | | | |

| | CSI Compressco LP | |

| | 104,872 | | | 20.660% | | $ | 1,197,318 | |

| | (Cost $967,158) | | | | |

| | |

| | TOTAL INVESTMENTS – 151.0% | | | | |

| | (Cost $771,174,160) | | $ | 695,926,297 | |

| | |

| | BORROWINGS – (50.5)% | | | (232,500,000 | ) |

| | |

| OTHER LIABILITIES IN EXCESS OF

OTHER ASSETS – (0.5)% | | | (2,488,236 | ) |

| | |

| | NET ASSETS – 100.0% | | $ | 460,938,061 | |

| | |

| | |

| The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. |

(a) | | Significant unobservable inputs were used in the valuation of this portfolio security; i.e. Level 3. |

(b) | | Pay-in-kind securities. Payments made are in shares. |

| | | | |

|

Investment Abbreviations: |

GP | | —General Partnership |

LP | | —Limited Partnership |

|

| | |

| The accompanying notes are an integral part of these financial statements. | | 19 |

GOLDMAN SACHS MLP INCOME OPPORTUNITIES FUND

Schedule of Investments

November 30, 2018

| | | | | | | | |

| Shares | | | Description | | Value | |

| Common Stocks – 147.1% | | | |

| Gathering + Processing – 48.0% | | | |

| | 675,000 | | | Antero Midstream Partners LP | | $ | 18,670,500 | |

| | 275,000 | | | CNX Midstream Partners LP | | | 4,977,500 | |

| | 937,500 | | | DCP Midstream LP | | | 31,950,000 | |

| | 930,000 | | | Enable Midstream Partners LP | | | 12,406,200 | |

| | 1,312,500 | | | MPLX LP | | | 43,483,125 | |

| | 650,000 | | | Sanchez Midstream Partners LP | | | 1,917,500 | |

| | 230,000 | | | Summit Midstream Partners LP | | | 2,826,700 | |

| | 750,000 | | | Targa Resources Corp. | | | 33,472,500 | |

| | 200,000 | | | Western Gas Equity Partners LP | | | 5,796,000 | |

| | 525,000 | | | Western Gas Partners LP | | | 23,331,000 | |

| | | | | | | | |

| | | | | | | 178,831,025 | |

| | |

| Marine Transportation | Petroleum – 4.8% | | | |

| | 1,824,557 | | | Capital Product Partners LP | | | 4,397,182 | |

| | 665,000 | | | KNOT Offshore Partners LP | | | 13,326,600 | |

| | | | | | | | |

| | | | | | | 17,723,782 | |

| | |

| Marketing | Retail – 2.9% | | | |

| | 137,500 | | | AmeriGas Partners LP | | | 5,109,500 | |

| | 250,000 | | | Suburban Propane Partners LP | | | 5,840,000 | |

| | | | | | | | |

| | | | | | | 10,949,500 | |

| | |

| Marketing | Wholesale – 17.9% | | | |

| | 950,000 | | | CrossAmerica Partners LP | | | 14,991,000 | |

| | 350,000 | | | Global Partners LP | | | 6,048,000 | |

| | 685,000 | | | Sprague Resources LP | | | 12,206,700 | |

| | 1,200,000 | | | Sunoco LP | | | 33,552,000 | |

| | | | | | | | |

| | | | | | | 66,797,700 | |

| | |

| Other | Rail Terminalling – 0.3% | | | |

| | 115,443 | | | USD Partners LP | | | 1,210,997 | |

| | |

| Pipeline Transportation | Natural Gas – 30.9% | | | |

| | 4,575,000 | | | Energy Transfer LP | | | 66,657,750 | |

| | 150,000 | | | Enterprise Products Partners LP | | | 3,937,500 | |

| | 937,500 | | | EQM Midstream Partners LP | | | 44,681,250 | |

| | | | | | | | |

| | | | | | | 115,276,500 | |

| | |

| Pipeline Transportation | Petroleum – 22.0% | | | |

| | 187,500 | | | Andeavor Logistics LP | | | 6,997,500 | |

| | 300,000 | | | Buckeye Partners LP | | | 8,868,000 | |

| | 325,000 | | | Delek Logistics Partners LP | | | 9,906,000 | |

| | 200,000 | | | NuStar Energy LP | | | 4,834,000 | |

| | 1,045,000 | | | PBF Logistics LP | | | 20,983,600 | |

| | 1,500,000 | | | Shell Midstream Partners LP | | | 28,260,000 | |

| | 50,000 | | | Valero Energy Partners LP | | | 2,103,500 | |

| | | | | | | | |

| | | | | | | 81,952,600 | |

| | |

| Power Generation – 1.5% | | | |

| | 195,000 | | | Enviva Partners LP | | | 5,602,350 | |

| | |

| Production + Mining | Coal – 9.6% | | | |

| | 1,825,000 | | | Alliance Resource Partners LP | | | 35,861,250 | |

| | |

| Services | Midstream – 7.7% | | | |

| | 1,677,319 | | | CSI Compressco LP | | | 7,027,967 | |

| | |

| Common Stocks – (continued) | | | |

| Services | Midstream – (continued) | | | |

| | 1,512,500 | | | USA Compression Partners LP | | | 21,870,750 | |

| | | | | | | | |

| | | | | | | 28,898,717 | |

| | |

| Storage | Liquids – 1.5% | | | |