UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22979

Goldman Sachs MLP and Energy Renaissance Fund

(Exact name of registrant as specified in charter)

200 West Street

New York, NY 10282

(Address of principal executive offices) (Zip code)

| | |

Copies to: |

Caroline Kraus, Esq. | | Stephen H. Bier, Esq. |

Goldman Sachs & Co. LLC | | Allison M. Fumai, Esq. |

200 West Street | | Dechert LLP |

New York, New York 10282 | | 1095 Avenue of the Americas |

| | New York, NY 10036-6797 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (212) 902-1000

Date of fiscal year end: November 30

Date of reporting period: May 31, 2021

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| | The Semi-Annual Report to Shareholders is filed herewith. |

Goldman Sachs Closed-End Fund

| | | | |

| | |

| Semi-Annual Report | | | | May 31, 2021 |

| | |

| | | | MLP and Energy Renaissance Fund |

Goldman Sachs MLP and Energy Renaissance Fund

| | | | |

| | | |

| NOT FDIC-INSURED | | May Lose Value | | No Bank Guarantee |

PORTFOLIO RESULTS

Goldman Sachs MLP and Energy Renaissance Fund

Investment Objective and Principal Investment Strategy

The Fund seeks a high level of total return with an emphasis on current distributions to shareholders. The Fund seeks to achieve its investment objective by investing primarily in master limited partnership (“MLP”) and other energy investments. The Fund intends to selectively use leverage to seek to achieve its investment objective. It concentrates its investments in the energy sector, with an emphasis on midstream MLP investments. Under normal market conditions, the Fund will invest at least 80% of its managed assets in MLPs and other energy investments. The Fund’s MLP investments may include, but are not limited to, MLPs structured as limited partnerships (“LPs”) or limited liability companies (“LLCs”); MLPs that are organized as LPs or LLCs, but taxed as “C” corporations; equity securities that represent an indirect interest in an MLP issued by an MLP affiliate, including institutional units and MLP general partner or managing member interests; “C” corporations whose predominant assets are interests in MLPs; MLP equity securities, including MLP common units, MLP subordinated units, MLP convertible subordinated units and MLP preferred units; private investments in public equities issued by MLPs; MLP debt securities; and other U.S. and non-U.S. equity and fixed income securities and derivative instruments that provide exposure to the MLP market, including pooled investment vehicles that primarily hold MLP interests and exchange-traded notes. The Fund’s other energy investments may include equity and fixed income securities of U.S. and non-U.S. companies other than MLPs that (i) are classified by a third party as operating within the oil and gas storage, transportation, refining, marketing, drilling, exploration or production sub-industries or (ii) have at least 50% of their assets, income, sales or profits committed to, or derived from, the exploration, development, production, gathering, transportation (including marine), transmission, terminal operation, processing, storage, refining, distribution, mining or marketing of natural gas, natural gas liquids (including propane), crude oil, refined petroleum products, coal, electricity or other energy sources, energy-related equipment or services.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Energy and Infrastructure Team (the “Team”) discusses the Goldman Sachs MLP and Energy Renaissance Fund’s (the “Fund”) performance and positioning for the six-month period ended May 31, 2021 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s cumulative total return based on its net asset value (“NAV”) was 39.02%. The Fund’s cumulative total return based on market price was 54.49% for the same period. By way of reference, the Alerian MLP Index1 had a cumulative total return of 44.09% during the Reporting Period. In comparison, the Cushing® MLP High Income Index2 had a cumulative total return of 51.48% for the Reporting Period. As of May 31, 2021, the Fund’s NAV was $13.21, and its market price was $11.52. |

| Q | | What was the Fund’s current distribution rate at the end of the Reporting Period? |

| A | | During the Reporting Period, the Fund declared two quarterly distributions. On February 12, 2021, the Fund declared a quarterly distribution of $0.155 per share, which matches the quarterly distribution declared on November 13, 2020. On May 14, 2021, the Fund declared a quarterly distribution of $0.165 per share, reflecting an approximately 6% increase in the Fund’s distribution compared to the quarterly distribution in February 2021. The increased distribution level is representative of the Team’s view of improving fundamentals in the broader equity and energy markets and the Fund’s cash flow generation. On May 31, 2021, the Fund’s current annualized distribution rate based on its NAV was 5.00%, and the Fund’s current annualized distribution rate based on its market price was 5.73%. |

| 1 | | Source: Alerian. The Alerian MLP Index is the leading gauge of energy infrastructure MLPs. The capped, float-adjusted, capitalization-weighted index, whose constituents earn the majority of their cash flow from midstream activities involving energy commodities, is disseminated real-time on a price-return basis (AMZ) and on a total-return basis (AMZX). It is not possible to invest directly in an unmanaged index. |

| 2 | | Source: Cushing® Asset Management. The Cushing® MLP High Income Index tracks the performance of 30 publicly traded energy and shipping MLP securities with an emphasis on current yield. It is not possible to invest directly in an unmanaged index. |

1

PORTFOLIO RESULTS

| Q | | How did energy-related assets overall perform during the Reporting Period? |

| A | | Benefiting from rising crude oil prices, energy-related assets broadly gained during the Reporting Period. Energy infrastructure master limited partnerships (“MLPs”) generally, as measured by the Alerian MLP Index, produced a total return of 44.09%, while higher-yielding energy infrastructure MLPs, as measured by the Cushing® MLP High Income Index, posted a total return of 51.48%. The broader midstream3 sector, as measured by the Alerian Midstream Energy Index4 (“ANMA Index”) (which includes both energy MLPs and “C” corporations), posted a total return of 36.75%. |

| | West Texas Intermediate (“WTI”) crude oil prices increased 46.27% during the Reporting Period, driven higher by a meaningful improvement in global oil demand and by supply-side discipline from OPEC+ and the U.S.5 (OPEC+ is composed of the Organization of the Petroleum Exporting Countries (“OPEC”) countries and non-OPEC oil producing countries, most notably Russia.) Despite a few setbacks in Europe and other regions of the world, global demand rose alongside the rollout of COVID-19 vaccinations. China and certain parts of Asia, which were the first regions affected by the COVID-19 outbreak, saw a full recovery in oil demand, with consumption rising above 2019 levels by the end of the Reporting Period. In the U.S., oil demand continued to improve, with the rolling four-week average down just 5.97% relative to its 2019 levels, while U.S. refinery capacity utilization experienced a significant uptick relative to 2019.6 |

| | With regard to supply, OPEC+ continued to show a commitment to balanced global oil markets during the Reporting Period and seemed focused on maximizing revenue instead of growing market share. (In May 2020, OPEC+ had put in place a production cut of more than seven million barrels per day, and in February and March 2021, Saudi Arabia had implemented an additional voluntary production cut of two million barrels per day.) Amid improving demand during the Reporting Period, OPEC+ members started to gradually increase production — by two million barrels per day through July 2021, of which one million barrels per day would be due to the unwinding of Saudi Arabia’s voluntary production cuts. The U.S. also demonstrated unprecedented supply discipline during the Reporting Period. For example, U.S. production in May 2021 was 10.58% lower than it had been during the entire 2019 calendar year.7 In addition, many market participants thought U.S. production appeared less price elastic8 than it had once been given that — despite the rise in crude oil prices — U.S. oil rig counts were down more than 50% at the end of the Reporting Period compared to their 2019 levels.9 In our view, U.S. producers became more focused on free cash flow generation, with management incentives aligned to prioritize return of capital to investors after several years of criticism that had led to significant multiples compression and equity price declines. |

| | Regarding natural gas, associated gas production (a byproduct of crude oil drilling) dropped along with the decline in crude oil production during 2020, but the change in overall U.S. gas supply was relatively muted during the Reporting Period. Associated gas had flooded the energy markets in 2019 when crude oil production grew more than 10%, resulting in an 8% increase in natural gas supply even as gas rig counts fell 37%. Furthermore, lower production decline rates in natural gas-focused basins allowed producers to maintain production levels despite commodity price weakness during 2020.10 |

| | Within the midstream energy sector, company earnings before interest, taxes, depreciation and amortization (“EBITDA”) remained resilient despite the challenges associated with the COVID-19 outbreak. During the 2020 calendar year, the collective EBITDA for a group of the largest U.S. midstream energy companies fell only about 1%.11 This compared to an 8% decline in U.S. crude oil production and a 12% decline in U.S. refined product consumption during the same year.12 Interestingly, the |

| 3 | | The midstream component of the energy industry is usually defined as those companies providing products or services that help link the supply side (i.e., energy producers) and the demand side (i.e., energy end-users for any type of energy commodity). Such midstream businesses can include, but are not limited those that process, store, market and transport various energy commodities. |

| 4 | | Source: Alerian. The Alerian Midstream Energy Index is a broad-based composite of North American energy infrastructure companies. The capped, float-adjusted, capitalization-weighted index, whose constituents earn the majority of their cash flow from midstream activities involving energy commodities, is disseminated real-time on a price-return (AMNA), total-return (AMNAX), net total-return (AMNAN), and adjusted net total-return (AMNTR) basis. |

| 5 | | Source of crude oil price data: Bloomberg. |

| 6 | | Source of oil demand data: U.S. Department of Energy. |

| 7 | | Source of production data: OPEC and Bloomberg. |

| 8 | | Price elasticity is a measure of the relationship between a change in the quantity demanded of a particular good and a change in its price. |

| | 9 | | Source of U.S. oil rig count data: Baker Hughes. |

| 10 | | Source: Energy Information Administration, Bloomberg. |

| 11 | | Source: Public company filings. |

| 12 | | Source of production data: Energy Information Administration. |

2

PORTFOLIO RESULTS

| | emergence of COVID-19 sparked an operational shift by midstream company management teams, which drastically reduced capital budgets and operating expenses. These management teams also indicated they would maintain cost discipline going forward. In our view, the effects of the COVID-19 pandemic accelerated the broader energy sector’s transformation from “growth at all costs” to a greater focus on capital discipline, free cash flow generation and returning capital to shareholders. In addition, commodity price uncertainty during 2020 led many U.S.-based exploration and production companies to significantly reduce rig count and planned capital expenditures, which, in turn, lowered crude oil production estimates for 2021 and 2022, with these companies broadly prioritizing free cash flow. Lower production estimates also led many midstream energy companies to cancel or delay planned projects, as the additional capacity was no longer needed. This, coupled with rationalization in operating expenses (i.e., a reorganization that seeks to decrease operating expenses) and, in some cases, distribution reductions, significantly improved consensus expectations for free cash flow in 2021 and beyond. Midstream energy companies also continued to bolster their balance sheets. At the end of the Reporting Period, the midstream energy sector remained one of the highest yielding income-oriented asset classes. Although some companies had cut distributions and dividends during the COVID-19 pandemic, the Alerian MLP Index continued to trade near a 6%-7% yield during the Reporting Period, and distribution coverage ratios13 were some of the healthiest on record, in our view, with only about 75% of 2021 free cash flow expected to be used for dividend/distribution payments.14 |

| | In terms of the regulatory environment, the first 100 days of the new U.S. Administration delivered a largely expected series of policy initiatives, which affected both traditional and renewable energy sectors. First, in January 2021, the White House announced a 60-day moratorium on oil and gas leases and drilling permits on federal lands and waters. The moratorium had limited near-term impact on production as the order was temporary and many exploration and production companies had accumulated permits ahead of this widely anticipated announcement. (In June 2021, after the end of the Reporting Period, a federal judge blocked the moratorium and ordered that lease sales continue.) Second, the Keystone XL crude oil pipeline’s border permit was revoked on January 20, 2021, resulting in a suspension of the proposed pipeline designed to transport crude oil produced in Western Canada to U.S. Gulf Coast refineries and to global markets. (During June 2021, the pipeline’s sponsor canceled the project entirely.) Third, a $1.9 trillion stimulus package, the American Rescue Plan, was signed into law in March 2021. While the direct impact on the energy sector was limited, we believed greater fiscal spending was likely to be positive for energy demand and might also weaken the U.S. dollar, both of which could be supportive of crude oil prices. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s performance was driven by security selection and by the strong recovery of the energy markets following severe weakness during the 2020 calendar year. |

| | In terms of its exposures, the Fund was helped most by its positions in the petroleum pipeline transportation and the gathering and processing subsectors.15 The petroleum pipeline transportation subsector benefited from macro improvements, as crude oil demand and volume expectations increased following the approval announcement of the first COVID-19 vaccines. The gathering and processing subsector benefited from the strong recovery in crude oil and natural gas liquid prices during the Reporting Period, given that this subsector is closer to the wellhead and therefore tends to be more sensitive to commodity price movements. |

| Q | | What individual holdings added to the Fund’s performance during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s positions in MPLX LP, Energy Transfer LP and Enterprise Products Partners added to performance. |

| | The Fund’s top contributor was MPLX LP (MLPX), a well-diversified midstream company that acquires, owns, operates and develops crude oil, refined products and other hydrocarbon-based product pipelines across the U.S. MPLX’s diversified and contracted assets, resilient earnings results during 2020 and continued focus on increasing free cash flow profile led to its strong performance during the Reporting Period. The company also benefited from its |

| 13 | | The distribution coverage ratio is an energy company’s distributable cash flow divided by the total amount of distributions it has paid out. It is an indication of an energy company’s ability to maintain its current cash distribution level. |

| 14 | | Source: Public company filings, Bloomberg. |

| 15 | | Sector and subsector allocations are defined by GSAM and may differ from sector allocations used by the Alerian MLP Index. |

3

PORTFOLIO RESULTS

| | emphasis on lower capital spending compared to previous years and its efforts to return cash to shareholders via stock buybacks — factors we believe were critical to the strong performance of the midstream energy sector broadly during the Reporting Period. |

| | Also adding to the Fund’s performance was Energy Transfer LP (ET), which operates a diversified portfolio of energy assets, including natural gas midstream, crude oil, natural gas liquids and refined products, as well as transportation and storage services. During the Reporting Period, ET benefited alongside the broad rally in the midstream energy sector. Strong first quarter 2021 earnings results, which beat consensus EBITDA estimates by $2.4 billion, largely due to positive contributions arising from Winter Storm Uri, further bolstered its performance. As a result of this one-time benefit, ET raised its full-year 2021 guidance. The excess cash received due to the storm also accelerated ET’s deleveraging timeline, which we believed was well received by the market. Meanwhile, the stock was temporarily pressured by concerns that the Dakota Access Pipeline (“DAPL”) — to which ET has revenue exposure — could be temporarily shut down by a federal district court while the U.S. Army Corp of Engineers prepared an Environmental Impact Statement (“EIS”). However, on May 21, 2021, a District Court Judge ruled that DAPL could remain in service while the EIS was completed. Although there remained a possibility the ruling would be appealed, DAPL seemed likely to remain in service through the completion of the EIS, which helped remove an overhang on the stock. We added to the Fund’s position in ET during the Reporting Period, as we continued to have a positive view of the company. |

| | The Fund’s performance was further boosted by an investment in Enterprise Products Partners (EPD), one of the leading players in the North American midstream energy market. EPD connects producers of natural gas, natural gas liquids and crude oil in major North American supply basins with domestic and international consumers. Its operations include natural gas processing, natural gas liquids fractionation, propylene production, petrochemical services, crude oil transportation and marine transportation. EPD’s share price rallied during the Reporting Period, driven by improving commodity prices and positive investor sentiment around the future performance of midstream energy companies. We added to the Fund’s position in EPD during the Reporting Period, as we believed it was positioned to benefit from what we expect to be continued strength in commodity prices amid improving global demand driven by accelerating COVID-19 vaccinations and economic reopenings. |

| Q | | What individual holdings detracted from the Fund’s performance during the Reporting Period? |

| A | | Only two holdings — ECP Environmental Group Opportunities Corp. and Brookfield Renewable Partners — detracted from the Fund’s performance during the Reporting Period. |

| | The Fund’s top detractor was ECP Environmental Growth Opportunities Corp. (“ENNVU”), a growth-oriented Special Purpose Acquisition Company (also known as an “SPAC”) managed by Energy Capital Partners Management, LP (“ECP”). ECP, a private equity firm founded in 2005 with more than $20 billion of committed capital, is focusing its search for a target business on companies combating climate change through electrification or sustainable technology and services, including renewable energy production, battery storage and related technologies. No acquisition target was announced during the Reporting Period. As a result, ENNVU’s stock traded near its $10 per share net asset value and was down modestly at the end of the Reporting Period. |

| | Brookfield Renewable Partners (“BEP”) is a global leader in hydroelectric power that also owns, operates and invests in global wind, solar, distributed generation and storage facilities. During the Reporting Period, clean energy infrastructure stocks underperformed traditional energy infrastructure stocks. Investor concerns about increased competition and higher interest rates, coupled with a rebalance of the most closely followed clean energy index (the S&P Global Clean Energy Index16), resulted in increased volatility and weakness across the clean energy infrastructure sector. Despite 14 years of experience with contracted renewable assets and a robust growth outlook, BEP was hurt by the negative macro themes associated with clean energy infrastructure, in our view. We exited the Fund’s position in the stock during March 2021 as we sought to reduce the Fund’s clean energy exposure and increase its exposure to midstream equities, which we believed were better positioned to benefit from continued upward momentum in commodity prices. |

| Q | | Were there any notable purchases or sales during the Reporting Period? |

| A | | During the Reporting Period, the Fund established a position in Rattler Midstream LP (RTLR), which owns and operates |

| 16 | | Source: S&P Dow Jones Indices. The S&P Global Clean Energy Index is designed to measure the performance of companies in global clean energy-related businesses from both developed and emerging markets, with a target constituent count of 100. |

4

PORTFOLIO RESULTS

| | crude oil, natural gas and water-related midstream assets in the Permian Basin. We initiated the position because of the company’s exposure to higher commodity prices as well as to a potential increase in rig activity. The company should be well positioned to benefit from increased activity in the Permian Basin, in our opinion, as its assets sit on top of some of the premier acreage in the Midland and Delaware Basins. Additionally, RTLR continues to focus on growing free cash flow and returning cash to shareholders, which we think should result in equity price appreciation. |

| | Another notable Fund purchase was Targa Resources Corp. (TRGP), a vertically integrated natural gas and natural gas liquids infrastructure company that gathers, fractionates, treats, transports and sells natural gas liquids and related products. TRGP is geographically diversified in several U.S. upstream17 basins with downstream18 logistics assets on the U.S. Gulf Coast. The company has one of the premier gathering and processing networks in the Permian Basin, giving it significant exposure to the largest and fastest-growing U.S. shale basin. We decided to establish a Fund position in TRGP to gain exposure to what we consider its top-tier midstream growth story. |

| | In addition to the sale of Brookfield Renewable Partners, mentioned earlier, we sold the Fund’s position during the Reporting Period in USD Partners LP, an MLP formed to acquire, develop and operate energy-related logistics assets, including rail terminals and other midstream infrastructure. We closed the Fund’s position in the stock so we could reallocate the capital to companies we believed had less trading liquidity concerns. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | During the Reporting Period, the Fund did not use derivatives or similar instruments. |

| Q | | How did the Fund use leverage during the Period? |

| A | | The Fund is permitted to obtain leverage using any form or combination of financial leverage instruments, including through funds borrowed from banks or other financial institutions (i.e., a credit facility), margin facilities or notes issued by the Fund and the leverage attributable to similar transactions entered into by the Fund, and it reserves the right to obtain leverage to the extent permitted by the Investment Company Act of 1940. |

| | At the beginning of the Reporting Period, the Fund was not leveraged, as we had previously reduced its overall risk profile amid COVID-19-related demand destruction and a producer price war between OPEC nations and Russia. However, general market conditions steadily improved during the Reporting Period, with crude oil demand starting to recover, producers demonstrating unprecedented supply-side discipline and OPEC+ members showing solidarity. This, coupled with additional clarity around COVID-19 vaccines and a better line of sight into 2021 cash flows for the companies held by the Fund, led us to add a modest amount of leverage. On January 4, 2021, we introduced a small amount of leverage to the Fund, representing 2.85% of its managed assets, through a fixed/floating rate margin loan facility with a major financial institution. As market conditions continued to improve, we added additional leverage and by the end of the Reporting Period, the Fund held leverage representing 6.51% of its managed assets. While we introduced leverage back into the Fund during the Reporting Period, it is important to highlight that we expect our leverage strategy to remain more conservative compared to the Fund’s historic levels of leverage and that the strategy is intended to seek higher price returns, not to pay higher than market yields. |

| Q | | What is the Fund’s tactical view and strategy for the months ahead? |

| A | | During the Reporting Period, the Alerian MLP Index and the AMNA Index, on both a price-return and total-return basis, each outperformed the S&P 500 Index significantly. These gains were driven, in our opinion, by continued improvement in crude oil fundamentals, the reflationary trade,19 COVID-19 vaccine roll-outs, U.S. federal stimulus packages and investor expectations for post-pandemic economic growth. At the end of the Reporting Period, we expected this |

| 17 | | The upstream component of the energy industry is usually defined as those operations stages in the oil and gas industry that involve exploration and production. Upstream operations deal primarily with the exploration stages of the oil and gas industry, with upstream firms taking the first steps to first locate, test and drill for oil and gas. Later, once reserves are proven, upstream firms will extract any oil and gas from the reserve. |

| 18 | | The downstream component of the energy industry is usually defined as the oil and gas operations that take place after the production phase, through to the point of sale. Downstream operations can include refining crude oil and distributing the by-products down to the retail level. By-products can include gasoline, natural gas liquids, diesel and a variety of other energy sources. |

| 19 | | The reflationary trade tends to involve assets exposed to faster economic growth, price pressures and higher yields. |

5

PORTFOLIO RESULTS

| | momentum to continue in the near term, as we believed there was still meaningful upside potential for the midstream sector, as represented by the Alerian MLP Index, to reestablish its 2020 pre-COVID-19 highs and historic valuation multiples. |

| | We had a positive outlook for crude oil prices at the end of the Reporting Period supported by what we saw as the healthy commodity backdrop, improving demand and continued supply discipline. Along with many market participants, we believed crude oil prices might reach $80 per barrel in the third quarter of 2021,20 which would imply an approximately 20% upside from their levels at the end of the Reporting Period. Longer term, crude oil prices could move above $100 per barrel, according to some industry analysts, if post-COVID-19 pandemic economic growth accelerates and global infrastructure spending drives greater industrial energy and distillate demand. We also expected significant growth in petrochemical demand from developing countries, which could help offset some oil demand destruction associated with renewable generation sources and electric vehicle adoption. |

| | As for natural gas prices, associated gas production was down at the end of the Reporting Period but demand remained healthy, which we considered positive for prices. In addition, we believed the continued build-out of U.S. liquid natural gas facilities, coupled with strong international demand, could continue to support robust liquid natural gas exports, with capacity expected to grow to 16.4 billion cubic feet per day by 2025, representing growth of more than 60% from levels seen at the end of the Reporting Period.21 Separately, we believed natural gas was important in the multi-decade growth of renewable energy sources given that existing wind and solar technologies cannot fully power an economy. Therefore, in our view, natural gas will likely remain essential as a baseload22 power source, since it has lower carbon emissions compared to other types of fuel, such as coal and oil. |

| | Regarding the midstream sector, we believed the COVID-19 pandemic had resulted in meaningful changes from management teams to their operating models. Specifically, significant reductions in operating and capital expenditures |

| | had paved a path for substantial free cash flow generation, with market expectations of approximately $70-$80 billion of free cash flow after distributions from 2021 through 2025. We believed that with this excess cash, management teams were in the financial position to focus on shareholder value by continuing to improve company balance sheets, reduce debt and, if needed, strengthen coverage metrics and/or implement share buyback programs — all of which could be positive for equity returns. The positive outlook for commodity price fundamentals, combined with healthy operating models for midstream companies (resilient EBITDA, cost rationalization, improved free cash flow metrics, strong distribution coverage ratios and lower overall debt levels), made a strong fundamental case for a continued recovery in midstream equity prices, in our view. |

| | Accordingly, we maintained our positive view of the risk-reward profile of midstream equities at the end of the Reporting Period. We planned to continue focusing the Fund’s investments going forward on companies we deemed to be of high quality, with favorable asset footprints, strong dividend and distribution coverage ratios, healthy balance sheets and robust free cash flow outlooks. |

| 20 | | Source: Goldman Sachs Global Investment Research |

| 21 | | Source: U.S. Capital Advisors. |

| 22 | | Baseload is the minimum amount of electric power delivered or required over a given period of time at a steady rate. |

6

FUND BASICS

Goldman Sachs MLP and Energy Renaissance Fund

as of May 31, 2021

| | | | | | |

| | FUND SNAPSHOT | |

| | |

| | | As of May 31, 2021 | | | |

| | |

| | Net Asset Value (NAV)1 | | $

| 13.21

|

|

| | Market Price1 | | $ | 11.52 | |

| | Premium (Discount) to NAV2 | | | -12.79 | % |

| | Leverage3 | | | 6.51 | % |

| | Distribution Rate – NAV4 | | | 5.00 | % |

| | | Distribution Rate – Market Price4 | | | 5.73 | % |

| 1 | | The Market Price is the price at which the Fund’s common shares are trading on the NYSE. The Market Price of the Fund’s common shares will fluctuate and, at the time of sale, common shares may be worth more or less than the original investment or the Fund’s then current net asset value (“NAV”). The NAV is the market value of one share of the Fund. This amount is derived by dividing the total value of all the securities in the Fund’s portfolio, plus any other assets, less any liabilities, by the number of Fund shares outstanding. The Fund cannot predict whether its common shares will trade at, above or below NAV. Shares of closed-end investment companies frequently trade at a discount from their NAV, which may increase investors’ risk of loss. |

| 2 | | The premium/discount to NAV is calculated as the market price divided by the NAV of the Fund minus 1, expressed as a percentage. If this value is positive, the Fund is trading at a premium to its NAV. If the value is negative, the Fund is trading at a discount to its NAV. |

| 3 | | The Fund is permitted to obtain leverage using any form or combination of financial leverage instruments, including through funds borrowed from banks or other financial institutions (i.e., a credit facility), margin facilities or notes issued by the Fund and the leverage attributable to similar transactions entered into by the Fund. The Fund’s use of leverage through a credit facility is calculated as a percentage of the Fund’s Managed Assets. Managed Assets are defined as total assets of the Fund (including assets attributable to borrowings for investment purposes) minus the sum of the Fund’s accrued liabilities (other than liabilities representing borrowings for investment purposes). |

| 4 | | The Distribution Rate is calculated by annualizing the most recent distribution amount declared divided by the most recent closing Market Price or NAV. The Distribution Rate is subject to change and is not an indication of Fund performance. A portion of the Fund’s distributions will likely be treated for tax purposes as a return of capital. A return of capital is not taxable and results in a reduction in the tax basis of a shareholder’s investment. The final determination regarding the nature of the distributions will be made after the end of the Fund’s fiscal year when the Fund can determine its earnings and profits. The final tax status of the distribution may differ substantially and will be made available to shareholders after the close of each calendar year. The proportion of distributions that are treated as taxable distributions may also vary and/or increase in future years. The ultimate composition of these distributions may vary due to a variety of factors including projected income and expenses, depreciation and depletion, and any tax elections made by the underlying MLP investments. |

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | |

| | | December 1, 2020–May 31, 2021 | | Fund Total Return

(based on NAV)5 | | | Fund Total Return

(based on Market Price)5 | |

| | | |

| | | Common Shares | | | 39.02 | % | | | 54.49 | % |

| 5 | | Total returns are calculated assuming purchase of a share at the market price or NAV on the first day and sale of a share at the market price or NAV on the last day of each period reported. Dividends and distributions, if any, are assumed, for purposes of this calculation, to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. The Total Returns based on NAV and Market Price do not reflect brokerage commissions or sales charges in connection with the purchase or sale of Fund shares, which if included would lower the performance shown above. The NAV used in the Total Return calculation includes all management fees, interest expense (if any) and operating expenses incurred by the Fund. Operating expenses include custody, accounting and administrative services, professional fees, transfer agency fees, registration, printing and mailing costs and Trustee fees. Total returns for periods less than one full year are not annualized. |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment returns and principal value will fluctuate. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com/CEF to obtain the most recent month-end returns. Closed-end funds, unlike open-end funds, are not continuously offered. Once issued in a public offering, shares of closed-end funds are traded in the open market through a stock exchange.

7

FUND BASICS

| | | | | | | | |

| | TOP TEN HOLDINGS AS OF 5/31/21‡ |

| | | |

| | | Holding | | % of Net Assets | | | Line of Business |

| | | |

| | MPLX LP | | | 11.9 | % | | Gathering + Processing |

| | Enterprise Products Partners LP | | | 10.7 | | | Pipeline Transportation | Natural Gas |

| | Magellan Midstream Partners LP | | | 9.5 | | | Pipeline Transportation | Petroleum |

| | Energy Transfer LP | | | 8.3 | | | Pipeline Transportation | Natural Gas |

| | Plains All American Pipeline LP | | | 7.1 | | | Pipeline Transportation | Petroleum |

| | Western Midstream Partners LP | | | 6.9 | | | Gathering + Processing |

| | Kinder Morgan, Inc. | | | 4.0 | | | Pipeline Transportation | Natural Gas |

| | Phillips 66 Partners LP | | | 3.7 | | | Pipeline Transportation | Petroleum |

| | DCP Midstream LP | | | 3.1 | | | Gathering + Processing |

| | | Pembina Pipeline Corp. | | | 3.1 | | | Pipeline Transportation | Petroleum |

| ‡ | | The top 10 holdings may not be representative of the Fund’s future investments. |

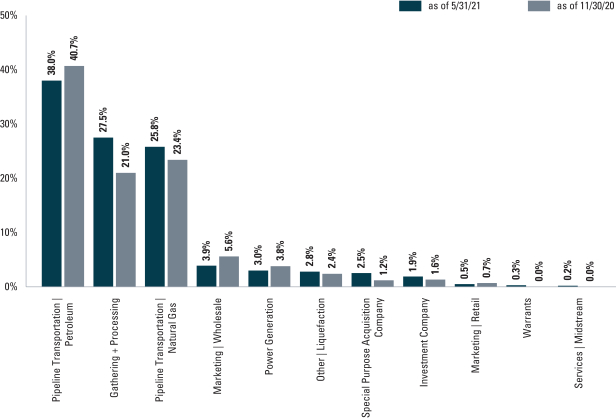

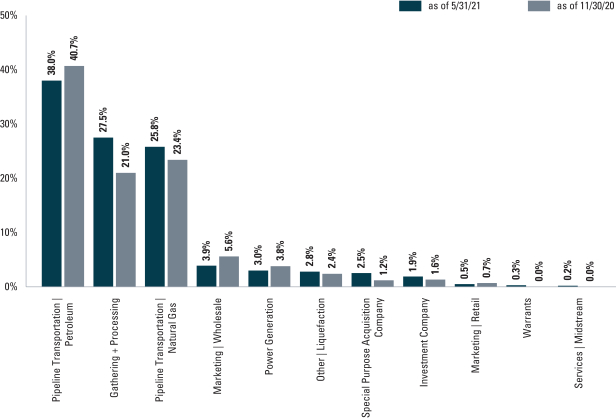

| † | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The percentage shown for each investment category reflects the value of investments in that category as a percentage of total net assets. As a result of borrowings, if any, the percentages may add to an amount in excess of 100%. Sector allocations are defined by GSAM and may differ from sector allocations used by the Alerian MLP Index. |

For more information about the Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about the Fund’s investment strategies, holdings, and performance.

8

GOLDMAN SACHS MLP AND ENERGY RENAISSANCE FUND

Schedule of Investments

May 31, 2021 (Unaudited)

| | | | | | | | |

| Shares | | | Description | | Value | |

| |

| Common Stocks – 101.7% | | | |

| Gathering + Processing – 27.5% | | | |

| | 234,555 | | | Antero Midstream Corp. | | $ | 2,251,728 | |

| | 285,968 | | | Crestwood Equity Partners LP | | | 8,195,843 | |

| | 268,363 | | | DCP Midstream LP | | | 6,754,697 | |

| | 23,239 | | | Hess Midstream LP Class A | | | 591,897 | |

| | 895,895 | | | MPLX LP | | | 25,649,474 | |

| | 25,226 | | | Targa Resources Corp. | | | 980,282 | |

| | 739,952 | | | Western Midstream Partners LP | | | 14,784,241 | |

| | | | | | | | |

| | | | | | | 59,208,162 | |

| | |

| Marketing | Retail – 0.5% | | | |

| | 73,176 | | | Suburban Propane Partners LP | | | 1,075,687 | |

| | |

| Marketing | Wholesale – 3.9% | | | |

| | 206,224 | | | CrossAmerica Partners LP | | | 4,033,741 | |

| | 126,074 | | | Sunoco LP | | | 4,417,633 | |

| | | | | | | | |

| | | | | | | 8,451,374 | |

| | |

| Other | Liquefaction – 2.8% | | | |

| | 146,340 | | | Cheniere Energy Partners LP | | | 6,037,988 | |

| | |

| Pipeline Transportation | Natural Gas – 25.8% | | | |

| | 1,798,555 | | | Energy Transfer LP | | | 17,805,695 | |

| | 972,017 | | | Enterprise Products Partners LP | | | 22,949,322 | |

| | 271,683 | | | Equitrans Midstream Corp. | | | 2,238,668 | |

| | 467,098 | | | Kinder Morgan, Inc. | | | 8,566,577 | |

| | 76,255 | | | TC Energy Corp. | | | 3,893,580 | |

| | | | | | | | |

| | | | | | | 55,453,842 | |

| | |

| Pipeline Transportation | Petroleum – 38.0% | | | |

| | 237,829 | | | BP Midstream Partners LP | | | 3,362,902 | |

| | 111,063 | | | Delek Logistics Partners LP | | | 4,863,449 | |

| | 86,024 | | | Enbridge, Inc. | | | 3,310,203 | |

| | 136,765 | | | Holly Energy Partners LP | | | 2,908,992 | |

| | 415,879 | | | Magellan Midstream Partners LP | | | 20,498,676 | |

| | 335,197 | | | NuStar Energy LP | | | 6,150,865 | |

| | 367,992 | | | PBF Logistics LP | | | 5,983,550 | |

| | 207,145 | | | Pembina Pipeline Corp. | | | 6,694,926 | |

| | 200,734 | | | Phillips 66 Partners LP | | | 8,045,419 | |

| | 1,454,808 | | | Plains All American Pipeline LP | | | 15,319,128 | |

| | 312,253 | | | Shell Midstream Partners LP | | | 4,508,933 | |

| | | | | | | | |

| | | | | | | 81,647,043 | |

| | |

| Power Generation – 3.0% | | | |

| | 7,530 | | | Atlantica Sustainable Infrastructure PLC | | | 273,715 | |

| | 16,307 | | | NextEra Energy Partners LP | | | 1,114,910 | |

| | 69,076 | | | NextEra Energy, Inc. | | | 5,057,745 | |

| | | | | | | | |

| | | | | | | 6,446,370 | |

| | |

| Services | Midstream – 0.2% | | | |

| | 42,014 | | | Rattler Midstream LP | | | 442,828 | |

| | |

| | TOTAL COMMON STOCKS | | | | |

| | (Cost $174,599,290) | | $ | 218,763,294 | |

| | |

| Units | | | Description | | Value | |

|

| Special Purpose Acquisition Companies* – 2.5% | |

| | 295,889 | | | ECP Environmental Growth Opportunities Corp. | | $ | 2,881,959 | |

| | 34,371 | | | ECP Environmental Growth Opportunities Corp. Founder Shares(a)(b) | | | — | |

| | 163,116 | | | Rice Acquisition Corp. Class A | | | 2,567,446 | |

| | |

| | SPECIAL PURPOSE ACQUISITION COMPANIES | |

| | (Cost $4,339,043) | | $ | 5,449,405 | |

| | |

| | | | | | | | |

| | | | | | | | | | | | | | |

| Units | | | Expiration

Date | | | Strike

Price | | | Value | |

| |

| Warrants*– 0.3% | | | | |

| Special Purpose Acquisition Companies – 0.3% | | | | |

| | ECP Environmental Growth Opportunities Corp. | |

| | 73,972 | | | | 02/11/28 | | | $ | 11.50 | | | $ | 60,664 | |

| | ECP Environmental Growth Opportunities Corp. Private(a)(b) | |

| | 56,189 | | | | 02/11/28 | | | | 11.50 | | | | 84,284 | |

| | Rice Acquisition Corp. | | | | | |

| | 97,558 | | | | 10/26/27 | | | | 11.50 | | | | 461,449 | |

| | |

| TOTAL WARRANTS

(Cost $370,193) |

| | $ | 606,397 | |

| | |

| | | | | | | | | | | | | | |

| | | | | | | | |

| Shares | | Dividend

Rate | | | Value | |

| |

| Investment Company(c) – 1.9% | | | | |

Goldman Sachs Financial Square Government Fund – Institutional Shares | |

| 4,128,162 | | | 0.026% | | | $ | 4,128,162 | |

| (Cost $4,128,162) | | | | | | | | |

| |

| TOTAL INVESTMENTS – 106.4% | |

| (Cost $183,436,688) | | | $ | 228,947,258 | |

| |

| BORROWINGS – (7.0)% | | | | (15,000,000 | ) |

| |

| OTHER ASSETS IN EXCESS OF OTHER LIABILITIES – 0.6% | | | | 1,248,811 | |

| |

| NET ASSETS – 100.0% | | | $ | 215,196,069 | |

| |

| | |

|

| The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. |

| |

* | | Non-income producing security. |

| |

(a) | | Restricted securities are not registered under the Securities Act of 1933, as amended, and are subject to legal restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are subsequently registered. Disposal of these securities may involve time consuming negotiations and prompt sale at an acceptable price may be difficult. Total market value of Restricted securities amounts to $84,284, |

| | |

| The accompanying notes are an integral part of these financial statements. | | 9 |

GOLDMAN SACHS MLP AND ENERGY RENAISSANCE FUND

Schedule of Investments (continued)

May 31, 2021 (Unaudited)

| | |

| | which represents approximately 0.0% of the Fund’s net assets as of May 31, 2021. See additional details below: |

| | | | | | | | | | |

| | | Restricted Security | | Acquisition

Date | | | Cost | |

| | ECP Environmental Growth Opportunities Corp. Private Warrants | | | 02/11/21 | | | $ | 84,284 | |

| | ECP Environmental Growth Opportunities Corp. Founder Shares | | | 02/11/21 | | | | — | |

| | |

| |

(b) | | Significant unobservable inputs were used in the valuation of this portfolio security; i.e., Level 3. |

| |

(c) | | Represents an affiliated issuer. |

| | |

|

Investment Abbreviations: |

LP | | —Limited Partnership |

PIPE | | —Private Investment in Public Equity |

PLC | | —Public Limited Company |

|

|

| ADDITIONAL INVESTMENT INFORMATION |

UNFUNDED PIPE COMMITMENTS — At May 31, 2021, the Fund had unfunded PIPE commitments pursuant to a subscription agreement with the following issuer:

| | | | | | |

| Issuer | | Shares | | Current

Value | | Unrealized

Gain (Loss) |

| | | |

Rice Acquisition Corp.(a) | | 112,938 | | $1,129,380 | | $— |

| | (a) | | Significant unobservable inputs were used in the valuation of this portfolio security; i.e., Level 3. |

| | |

| 10 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS MLP AND ENERGY RENAISSANCE FUND

Statement of Assets and Liabilities

May 31, 2021 (Unaudited)

| | | | | | |

| | | | | | |

| | Assets: | | | | |

| | |

| | Investments of unaffiliated issuers, at value (cost $179,308,526) | | $ | 224,819,096 | |

| | |

| | Investments of affiliated issuers, at value (cost $4,128,162) | | | 4,128,162 | |

| | |

| | Cash | | | 1,108,795 | |

| | |

| | Receivables: | | | | |

| | |

| | Investments sold | | | 10,535,508 | |

| | |

| | Current taxes | | | 1,027,950 | |

| | |

| | Dividends | | | 140,524 | |

| | |

| | Other assets | | | 18,026 | |

| | |

| | Total assets | | | 241,778,061 | |

| | | | | | |

| | Liabilities: | | | | |

| | |

| | Payables: | | | | |

| | |

| | Borrowings on credit facility | | | 15,000,000 | |

| | |

| | Investments purchased | | | 10,701,026 | |

| | |

| | Management fees | | | 194,834 | |

| | |

| | Professional fees | | | 180,913 | |

| | |

| | Fund shares repurchased | | | 179,606 | |

| | |

| | Interest on borrowing | | | 40,573 | |

| | |

| | Distributions payable | | | 33,584 | |

| | |

| | Accrued expenses | | | 251,456 | |

| | |

| | Total liabilities | | | 26,581,992 | |

| | | | | | |

| | Net Assets: | | | | |

| | |

| | Paid-in capital | | | 1,274,072,710 | |

| | |

| | Total distributable earnings (loss) | | | (1,058,876,641 | ) |

| | |

| | NET ASSETS | | $ | 215,196,069 | |

| | |

| | Shares Outstanding $0.001 par value (unlimited shares authorized): | | | 16,287,089 | |

| | |

| | Net asset value per share: | | | $13.21 | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 11 |

GOLDMAN SACHS MLP AND ENERGY RENAISSANCE FUND

Statement of Operations

For the Six Months Ended May 31, 2021 (Unaudited)

| | | | | | |

| | | | | |

| | Investment income: | | | | |

| | |

| | Dividends — unaffiliated issuers (net of foreign withholding taxes of $72,204) | | $ | 8,288,106 | |

| | |

| | Dividends — affiliated issuers | | | 304 | |

| | |

| | Less: Return of Capital on Dividends | | | (7,317,332 | ) |

| | |

| | Total investment income | | | 971,078 | |

| | | | | | |

| | Expenses: | | | | |

| | |

| | Management fees | | | 1,001,364 | |

| | |

| | Professional fees | | | 357,095 | |

| | |

| | Trustee fees | | | 79,130 | |

| | |

| | Interest on borrowings | | | 66,739 | |

| | |

| | Custody, accounting and administrative services | | | 36,941 | |

| | |

| | Printing and mailing costs | | | 30,724 | |

| | |

| | Franchise tax expense | | | 28,482 | |

| | |

| | Transfer Agency fees | | | 7,693 | |

| | |

| | Other | | | 58,920 | |

| | |

| | Total operating expenses, before taxes | | | 1,667,088 | |

| | |

| | Less — expense reductions | | | (1,943 | ) |

| | |

| | Net operating expenses, before taxes | | | 1,665,145 | |

| | |

| | NET INVESTMENT LOSS, BEFORE TAXES | | | (694,067 | ) |

| | |

| | Current and deferred tax benefit | | | 11,481 | |

| | |

| | NET INVESTMENT LOSS, NET OF TAXES | | | (682,586 | ) |

| | | | | | |

| | Realized and unrealized gain (loss): | | | | |

| | |

| | Net realized gain from: | | | | |

| | |

| | Investments — unaffiliated issuers | | | 15,049,986 | |

| | |

| | Foreign currency transactions | | | 4,061 | |

| | |

| | Current and deferred tax expense | | | (250,477 | ) |

| | |

| | Net change in unrealized gain (loss) on: | | | | |

| | |

| | Investments — unaffiliated issuers | | | 47,263,449 | |

| | |

| | Foreign currency translation | | | (688 | ) |

| | |

| | Current and deferred tax expense | | | (786,604 | ) |

| | |

| | Net realized and unrealized gain, net of taxes | | | 61,279,727 | |

| | |

| | NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 60,597,141 | |

| | |

| 12 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS MLP AND ENERGY RENAISSANCE FUND

Statements of Changes in Net Assets

| | | | | | | | | | |

| | | | | For the

Six Months Ended

May 31, 2021

(Unaudited) | | | For the Fiscal

Year Ended

November 30, 2020 | |

| | From operations: | | | | | |

| | | |

| | Net investment loss, net of taxes | | $ | (682,586 | ) | | $ | (41,836,740 | ) |

| | | |

| | Net realized gain (loss), net of taxes | | | 14,803,570 | | | | (302,741,498 | ) |

| | | |

| | Net change in unrealized gain, net of taxes | | | 46,476,157 | | | | 135,177,146 | |

| | | |

| | Net increase (decrease) in net assets resulting from operations | | | 60,597,141 | | | | (209,401,092 | ) |

| | | | | | | | | | |

| | Distributions to shareholders: | | | | | | | | |

| | | |

| | From distributable earnings | | | (5,312,789 | ) | | | — | |

| | | |

| | From return of capital | | | — | | | | (18,131,005 | ) |

| | | |

| | Total distributions to shareholders | | | (5,312,789 | ) | | | (18,131,005 | ) |

| | | | | | | | | | |

| | From share transactions: | | | | | | | | |

| | | |

| | Proceeds received in connection with reorganization | | | — | | | | 67,864,483 | |

| | | |

| | Increase from reinvestment of distributions | | | — | | | | 777,286 | |

| | | |

| | Cost of shares repurchased as a result of the Share Repurchase Program | | | (8,881,513 | ) | | | — | |

| | | |

| | Net increase (decrease) in net assets resulting from share transactions | | | (8,881,513 | ) | | | 68,641,769 | |

| | | |

| | TOTAL INCREASE (DECREASE) | | | 46,402,839 | | | | (158,890,328 | ) |

| | | | | | | | | | |

| | Net assets: | | | | | | | | |

| | | |

| | Beginning of period | | | 168,793,230 | | | | 327,683,558 | |

| | | |

| | End of period | | $ | 215,196,069 | | | $ | 168,793,230 | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 13 |

GOLDMAN SACHS MLP AND ENERGY RENAISSANCE FUND

Financial Highlights

Selected Share Data for a Share Outstanding Throughout Each Period

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Goldman Sachs MLP and Energy Renaissance Fund | |

| | | | | Six Months Ended

May 31, 2021

(Unaudited) | | | Year Ended November 30, | |

| | | | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

| | Per Share Data* | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | Net asset value, beginning of period | | $ | 9.80 | | | $ | 37.08 | | | $ | 52.20 | | | $ | 54.45 | | | $ | 68.04 | | | $ | 67.05 | |

| | | | | | | |

| | Net investment loss(a) | | | (0.04 | ) | | | (4.06 | ) | | | (1.08 | ) | | | (1.35 | ) | | | (1.89 | ) | | | (1.17 | ) |

| | | | | | | |

| | Net realized and unrealized gain (loss) | | | 3.65 | | | | (21.31 | ) | | | (8.28 | ) | | | 4.86 | | | | (5.94 | ) | | | 7.92 | |

| | | | | | | |

| | Total from investment operations | | | 3.61 | | | | (25.37 | ) | | | (9.36 | ) | | | 3.51 | | | | (7.83 | ) | | | 6.75 | |

| | | | | | | |

| | Distributions to shareholders from net investment income | | | (0.32 | ) | | | — | | | | (0.18 | ) | | | (3.87 | ) | | | (3.15 | ) | | | — | |

| | | | | | | |

| | Distributions to shareholders from return of capital | | | — | | | | (1.91 | ) | | | (5.58 | ) | | | (1.89 | ) | | | (2.61 | ) | | | (5.76 | ) |

| | | | | | | |

| | Total distributions | | | (0.32 | ) | | | (1.91 | ) | | | (5.76 | ) | | | (5.76 | ) | | | (5.76 | ) | | | (5.76 | ) |

| | | | | | | |

| | Fund Share Transactions from Share Repurchase Program | | | 0.12 | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | |

| | Net asset value, end of period | | | 13.21 | | | | 9.80 | | | | 37.08 | | | | 52.20 | | | | 54.45 | | | | 68.04 | |

| | | | | | | |

| | Market price, end of period | | $ | 11.52 | | | $ | 7.69 | | | $ | 35.28 | | | $ | 47.79 | | | $ | 51.03 | | | $ | 63.81 | |

| | | | | | | |

| | Total return based on net asset value(b) | | | 39.02 | % | | | (70.47 | )% | | | (18.85 | )% | | | 6.31 | % | | | (12.32 | )% | | | 12.13 | % |

| | | | | | | |

| | Total return based on market price(b) | | | 54.49 | % | | | (75.64 | )% | | | (15.66 | )% | | | 3.86 | % | | | (12.38 | )% | | | 4.20 | % |

| | | | | | | |

| | Net assets, end of period (in 000s) | | | 215,196 | | | | 168,793 | | | | 327,684 | | | | 460,938 | | | | 479,443 | | | | 597,558 | |

| | | | | | | |

| | Ratio of net expenses to average net assets after interest expense and tax benefit/(expenses)(c) | | | 2.22 | %(d) | | | 26.26 | % | | | 2.78 | % | | | 3.46 | % | | | 2.79 | % | | | 3.29 | % |

| | | | | | | |

| | Ratio of net expenses to average net assets after interest expense and before tax benefit/(expenses) | | | 1.69 | %(d) | | | 26.27 | % | | | 3.48 | % | | | 2.88 | % | | | 3.03 | % | | | 3.01 | % |

| | | | | | | |

| | Ratio of total expenses to average net assets before interest expense and tax benefit/(expenses) | | | 1.66 | %(d) | | | 2.21 | % | | | 1.77 | % | | | 1.65 | % | | | 1.68 | % | | | 1.75 | % |

| | | | | | | |

| | Ratio of net investment loss to average net assets(e) | | | (0.71 | )%(d) | | | (25.67 | )% | | | (2.09 | )% | | | (2.28 | )% | | | (2.78 | )% | | | (2.01 | )% |

| | | | | | | |

| | Portfolio turnover rate(f) | | | 34 | % | | | 61 | % | | | 69 | % | | | 61 | % | | | 31 | % | | | 64 | % |

| | | | | | | |

| | Asset coverage, end of period per $1,000(g) | | $ | 15,346 | | | $ | — | | | $ | 2,618 | | | $ | 2,983 | | | $ | 2,998 | | | $ | 3,339 | |

| | * | | On April 13, 2020, the Fund effected a 9-for-1 reverse share split. All per share data prior to April 13, 2020 has been adjusted to reflect the reverse share split. |

| | (a) | | Calculated based on the average shares outstanding methodology. |

| | (b) | | Total returns are calculated assuming purchase of a share at the market price or NAV on the first day and sale of a share at the market price or NAV on the last day of the period reported. Dividends and distributions, if any, are assumed, for purposes of this calculation, to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. Total return does not reflect brokerage commissions or sales charges in connection with the purchase or sale of Fund shares. Total returns for periods less than one full year are not annualized. |

| | (c) | | Current and deferred tax expense/benefit for the ratio calculation is derived from the net investment income (loss), and realized and unrealized gains (losses). |

| | (d) | | Annualized with the exception of tax expenses/(benefit) and interest expense (including breakage fees). |

| | (e) | | Current and deferred tax expense/benefit for the ratio calculation is derived from the net investment income (loss) only. |

| | (f) | | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short term investments. If such transactions were included, the Fund’s portfolio turnover rate may be higher. On September 25, 2020, Goldman Sachs MLP and Energy Renaissance Fund acquired all of the net assets of Goldman Sachs MLP Income Opportunities Fund pursuant to an Agreement and Plan of Reorganization. Portfolio turnover excludes purchases and sales of securities by Goldman Sachs MLP Income Opportunities Fund (acquired fund) prior to the reorganization date. |

| | (g) | | Calculated by dividing the Fund’s Managed Assets by the amount of borrowings outstanding under the credit facility at period end. |

| | |

| 14 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS MLP AND ENERGY RENAISSANCE FUND

Notes to Financial Statements

May 31, 2021 (Unaudited)

The Goldman Sachs MLP and Energy Renaissance Fund (the “Fund”) is a non-diversified, closed-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”) and the Securities Act of 1933, as amended (the “1933 Act”). The Fund was organized as a Delaware statutory trust on July 7, 2014. The shares of the Fund are listed on the New York Stock Exchange (“NYSE”) and trade under the symbol “GER”.

Goldman Sachs Asset Management, L.P. (“GSAM”), an affiliate of Goldman Sachs & Co. LLC, serves as investment adviser to the Fund pursuant to a management agreement (the “Agreement”) with the Fund.

On April 13, 2020, the Goldman Sachs MLP and Energy Renaissance Fund had a 9-for-1 reverse share split, effective after the market close on April 13, 2020. The share split had no impact on the overall value of a shareholder’s investment in the Fund.

Pursuant to an Agreement and Plan of Reorganization (the “Reorganization Agreement”) approved by the Fund’s Board of Trustees and shareholders of the Goldman Sachs MLP Income Opportunities Fund (the “Acquired Fund”), all of the assets and liabilities of the Acquired Fund were transferred to the Goldman Sachs MLP and Energy Renaissance Fund (“Survivor Fund”) as of the close of business on September 25, 2020 (the “Reorganization”). Shareholders of the Fund also approved the issuance of additional common shares in connection with the Reorganization. As part of the Reorganization, holders of the Acquired Fund’s shares received shares of the Fund in an amount equal to the aggregate net asset value of their investment in the Acquired Fund. The Reorganization was a tax-free event to shareholders.

|

| 2. SIGNIFICANT ACCOUNTING POLICIES |

The financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and require management to make estimates and assumptions that may affect the reported amounts and disclosures. Actual results may differ from those estimates and assumptions. The Fund is an investment company under GAAP and follows the accounting and reporting guidance applicable to investment companies.

A. Investment Valuation — The Fund’s valuation policy is to value investments at fair value.

B. Investment Income and Investments — Investment income includes interest income, dividend income, net of any foreign withholding taxes and less any amounts reclaimable. Interest income is accrued daily and adjusted for amortization of premiums and accretion of discounts. Dividend income is recognized on ex-dividend date or, for certain foreign securities, as soon as such information is obtained subsequent to the ex-dividend date. Non-cash dividends, if any, are recorded at the fair market value of the securities received. Investment transactions are reflected on trade date. Realized gains and losses are calculated using identified cost. Investment transactions are recorded on the following business day for daily net asset value (“NAV”) calculations. Distributions from master limited partnerships (“MLPs”) are generally recorded based on the characterization reported on a Fund’s schedule K-1 received from the MLPs. The Fund records its pro-rata share of the income/loss and capital gains/losses, allocated from the underlying partnerships and adjust the cost basis of the underlying partnerships accordingly.

C. Expenses — Expenses incurred by the Fund, which may not specifically relate to the Fund, may be shared with other registered investment companies having management agreements with GSAM or its affiliates, as appropriate. These expenses are allocated to the Fund on a straight-line and/or pro-rata basis depending upon the nature of the expenses and are accrued daily.

D. Distributions to Shareholders — While the Fund seeks to distribute substantially all of the Fund’s distributable cash flow received as cash distributions from MLPs, interest payments received on debt securities owned by the Fund and other payments on securities owned by the Fund, less Fund expenses, in order to permit the Fund to maintain more stable quarterly distributions, the distributions paid by the Fund may be more or less than the amount of net distributable earnings actually earned by the Fund. These distributions could include a return of a shareholder’s invested capital which would reduce such Fund’s NAV. The Fund estimates that only a portion of the distributions paid to shareholders will be treated as dividend income. The remaining portion of the Fund’s distribution, which may be significant, is expected to be a return of capital. These estimates are based on the Fund’s operating results during the period, and their final federal income tax characterization may differ.

The characterization of distributions to shareholders for financial reporting purposes is determined in accordance with federal income tax rules, which may differ from GAAP. Certain components of the Fund’s net assets on the Statement of Assets and Liabilities reflect permanent GAAP/Tax differences based on the appropriate tax character.

15

GOLDMAN SACHS MLP AND ENERGY RENAISSANCE FUND

Notes to Financial Statements (continued)

May 31, 2021 (Unaudited)

|

| 2. SIGNIFICANT ACCOUNTING POLICIES (continued) |

E. Income Taxes — The Fund does not intend to qualify as a regulated investment company pursuant to Subchapter M of the Internal Revenue Code of 1986, as amended, but will rather be taxed as a corporation. As a result, the Fund is obligated to pay federal, state and local income tax on its taxable income. The Fund invests primarily in MLPs, which generally are treated as partnerships for federal income tax purposes. As a limited partner in the MLPs, the Fund must report its allocable share of the MLPs’ taxable income or loss in computing its own taxable income or loss.

The Fund’s tax expense or benefit is included in the Statement of Operations based on the component of income or gains/ losses to which such expense or benefit relates. Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. Such temporary differences are principally: (i) taxes on unrealized gains/losses, which are attributable to the temporary difference between fair market value and tax basis, (ii) the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting and income tax purposes, and (iii) the net tax benefit of accumulated net operating losses and capital loss carryforwards. The Fund will accrue a deferred income tax liability balance, at the currently effective statutory United States (“U.S.”) federal income tax rate plus an estimated state and local income tax rate, for its future tax liability associated with the capital appreciation of its investments and the distributions received by the Fund on interests of MLPs considered to be return of capital and for any net operating gains. The Fund may also record a deferred tax asset balance, which reflects an estimate of the Fund’s future tax benefit associated with net operating losses, capital loss carryforwards, and/or unrealized losses.

To the extent the Fund has a deferred tax asset, consideration is given to whether or not a valuation allowance, which would offset the value of some or all of the deferred tax asset balance, is required. A valuation allowance is required if based on the evaluation criterion provided by Accounting Standards Codification (“ASC”) 740, Income Taxes (ASC 740) it is more likely than not that some portion, or all, of the deferred tax asset will not be realized. The factors considered in assessing the Fund’s valuation allowance include: the nature, frequency and severity of current and cumulative losses, the duration of the statutory carryforward periods and the associated risks that operating and capital loss carryforwards may expire unutilized. From time to time, as new information becomes available, the Fund will modify its estimates or assumptions regarding the deferred tax liability or asset. Unexpected significant decreases in cash distributions from the Fund’s MLP investments or significant declines in the fair value of its investments may change the Fund’s assessment regarding the recoverability of their deferred tax assets and may result in a valuation allowance. If a valuation allowance is required to reduce any deferred tax asset in the future, it could have a material impact on the Fund’s NAV and results of operations in the period it is recorded. The Fund will rely to some extent on information provided by MLPs, which may not be provided to the Fund on a timely basis, to estimate operating income/loss and gains/losses and current taxes and deferred tax liabilities and/or asset balances for purposes of daily reporting of NAVs and financial statement reporting. In addition, sales of MLP investments will result in allocations to the Fund of taxable ordinary income or loss and capital gain or loss, each in amounts that will not be reported to the Fund until the following year, in magnitudes often not readily estimable before such reporting is made.

It is the Fund’s policy to classify interest and penalties associated with underpayment of federal and state income taxes, if any, as income tax expense on its Statement of Operations. The Fund anticipates filing income tax returns in the U.S. federal jurisdiction and various states, and such returns are subject to examination by the tax jurisdictions. The Fund has reviewed all major jurisdictions and concluded that there is no significant impact on its net assets and no tax liability resulting from unrecognized tax benefits or expenses relating to uncertain tax positions expected to be taken on its tax returns.

Return of Capital Estimates — Distributions received from the Fund’s investments in MLPs generally are comprised of income and return of capital. The Fund records investment income and return of capital based on estimates made at the time such distributions are received. Such estimates are based on historical information available from each MLP and other industry sources. These estimates may subsequently be revised based on information received from MLPs after their tax reporting periods are concluded.

| | |

| 3. INVESTMENTS AND FAIR VALUE MEASUREMENTS | | |

U.S. GAAP defines the fair value of a financial instrument as the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price); the Fund’s policy is to use the market approach. GAAP establishes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities

16

GOLDMAN SACHS MLP AND ENERGY RENAISSANCE FUND

|

| 3. INVESTMENTS AND FAIR VALUE MEASUREMENTS (continued) |

(Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). The level in the fair value hierarchy within which the fair value measurement in its entirety falls shall be determined based on the lowest level input that is significant to the fair value measurement in its entirety. The levels used for classifying investments are not necessarily an indication of the risk associated with investing in these investments. The three levels of the fair value hierarchy are described below:

Level 1 — Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities;

Level 2 — Quoted prices in markets that are not active or financial instruments for which significant inputs are observable (including, but not limited to, quoted prices for similar investments, interest rates, foreign exchange rates, volatility and credit spreads), either directly or indirectly;

Level 3 — Prices or valuations that require significant unobservable inputs (including GSAM’s assumptions in determining fair value measurement).

The Board of Trustees (“Trustees”) has approved Valuation Procedures that govern the valuation of the portfolio investments held by the Fund, including investments for which market quotations are not readily available. The Trustees have delegated to GSAM day-to-day responsibility for implementing and maintaining internal controls and procedures related to the valuation of the Fund’s portfolio investments. To assess the continuing appropriateness of pricing sources and methodologies, GSAM regularly performs price verification procedures and issues challenges as necessary to third party pricing vendors or brokers, and any differences are reviewed in accordance with the Valuation Procedures.

A. Level 1 and Level 2 Fair Value Investments — The valuation techniques and significant inputs used in determining the fair values for investments classified as Level 1 and Level 2 are as follows:

Equity Securities — Equity securities traded on a United States (“U.S.”) securities exchange or the NASDAQ system, or those located on certain foreign exchanges, including but not limited to the Americas, are valued daily at their last sale price or official closing price on the principal exchange or system on which they are traded. If there is no sale or official closing price or such price is believed by GSAM to not represent fair value, equity securities will be valued at the valid closing bid price for long positions and at the valid closing ask price for short positions (i.e. where there is sufficient volume, during normal exchange trading hours). If no valid bid/ask price is available, the equity security will be valued pursuant to the Valuation Procedures approved by the Trustees and consistent with applicable regulatory guidance. To the extent these investments are actively traded, they are classified as Level 1 of the fair value hierarchy, otherwise they are generally classified ss Level 2. Certain equity securities containing unique attributes may be classified as Level 2.

Unlisted equity securities for which market quotations are available are valued at the last sale price on the valuation date, or if no sale occurs, at the last bid price, and are generally classified as Level 2.

Private Investments in Public Equities — Private investments in public equities (“PIPEs”) are valued the same as other equity securities as noted above. A Liquidity Value Adjustment (LVA) may be applied to securities which are subject to externally imposed and legally enforceable trading restrictions or which convert to publicly traded securities in the future when certain conditions are met. An LVA is a discount to the market price of an issuer’s common stock, which is based on the length of the lock-up time period and volatility of the underlying security. PIPEs are classified as Level 2 until such time as the trading restriction is removed.

Investments in an unfunded commitment to purchase a PIPE via a subscription agreement are subject to certain significant contingencies. The Fund is obligated to purchase the PIPE only upon such contingencies being satisfied.

Money Market Funds — Investments in the Goldman Sachs Financial Square Government Fund—Institutional Shares (“Underlying Fund”) are valued at the NAV on the day of valuation. These investments are generally classified as Level 1 of the fair value hierarchy. For information regarding an Underlying Fund’s accounting policies and investment holdings, please see the Underlying Fund’s shareholder report.

B. Level 3 Fair Value Investments — To the extent that significant inputs to valuation models and other alternative pricing sources are unobservable, or if quotations are not readily available, or if GSAM believes that such quotations do not accurately

17

GOLDMAN SACHS MLP AND ENERGY RENAISSANCE FUND

Notes to Financial Statements (continued)

May 31, 2021 (Unaudited)

|

| 3. INVESTMENTS AND FAIR VALUE MEASUREMENTS (continued) |

reflect fair value, the fair value of the Fund’s investments may be determined under Valuation Procedures approved by the Trustees. GSAM, consistent with its procedures and applicable regulatory guidance, may make an adjustment to the most recent valuation prices of either domestic or foreign securities in light of significant events to reflect what it believes to be the fair value of the securities at the time of determining a Fund’s NAV. To the extent investments are valued using single source broker quotations obtained directly from the broker or passed through from third party pricing vendors, such investments are classified as Level 3 investments.

B. Fair Value Hierarchy — The following is a summary of the Fund’s investments classified in the fair value hierarchy as of May 31, 2021:

| | | | | | | | | | | | |

| | | |

| Investment Type | | Level 1 | | | Level 2 | | | Level 3 | |

|

| Assets | |

|

Common Stock(a) | |

| | | |

MLPs | | | | | | | | | | | | |

| | | |

North America | | $ | 185,495,870 | | | $ | — | | | $ | — | |

| | | |

Corporations | | | | | | | | | | | | |

| | | |

Europe | | | 273,715 | | | | — | | | | — | |

| | | |

North America | | | 32,993,709 | | | | — | | | | — | |

| | | |

Special Purpose Acquisition Companies | | | 5,449,405 | | | | — | | | | — | |

| | | |

Warrants | | | — | | | | 522,113 | | | | 84,284 | |

| | | |

Investment Company | | | 4,128,162 | | | | — | | | | — | |

| | | |

Unfunded PIPE Commitment(b) | | | — | | | | — | | | | — | |

| | | |

| Total | | $ | 228,340,861 | | | $ | 522,113 | | | $ | 84,284 | |

| (a) | | Amounts are disclosed by continent to highlight the impact of time zone differences between local market close and the calculation of net asset value. Security valuations are based on the principal exchange or system on which they are traded, which may differ from country of domicile. |

| (b) | | Amount shown represents unrealized gain (loss) at period end. |

For further information regarding security characteristics, see the Schedule of Investments.

Total income taxes are computed by applying the federal statutory rate plus a blended state income tax rate. During the six months ended May 31, 2021, the Fund reevaluated its blended state income tax rate, decreasing the rate from 2.11% to 2.02% due to anticipated changes in state apportionment of income and gains and changes in the corporate tax rates. The reconciliation between the federal statutory income tax rate of 21% and the effective tax rate on net investment income/loss and realized and unrealized gain/loss is as follows:

| | | | | | | | |

| | | |

Application of statutory income tax rate | | $ | 12,725,400 | | | | 21.00 | % |

| | |

State income taxes, net of federal benefit | | | 1,224,062 | | | | 2.02 | % |

| | |

Change in estimated deferred tax rate | | | 670,488 | | | | 1.11 | % |

| | |

Effect of permanent differences | | | 1,026,112 | | | | 1.69 | % |

| | |

Provision to Return Adjustments | | | (4,435,742 | ) | | | (7.32 | )% |

| | |

Change in Valuation Allowance | | | (10,184,720 | ) | | | (16.81 | )% |

| | |

| Total current and deferred income tax expense/(benefit), net | | $ | 1,025,600 | | | | 1.69 | % |

18

GOLDMAN SACHS MLP AND ENERGY RENAISSANCE FUND

Deferred tax assets and liabilities are measured using effective tax rates expected to apply to taxable income in the years such temporary differences are realized or otherwise settled. At May 31, 2021, components of the Fund’s deferred tax assets and liabilities are as follows:

| | | | |

Deferred tax assets: | | | | |

Net operating loss carryforward — see table below for expiration | | $ | 18,048,800 | |

Capital loss carryforward (tax basis) — see table below for expiration | | | 156,974,821 | |

Other tax assets | | | 1,299,369 | |

Valuation Allowance | | | (157,554,582 | ) |

Total Deferred Tax assets | | $ | 18,768,408 | |

| |

| Deferred tax liabilities: | | | | |

Book vs. tax partnership income to be recognized | | $ | (5,377,435 | ) |

Net unrealized gain on investment securities (tax basis) | | | (13,390,973 | ) |

Total Deferred Tax Liabilities | | $ | (18,768,408 | ) |