- MDT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Medtronic (MDT) DEF 14ADefinitive proxy

Filed: 19 Aug 22, 4:31pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

| ☑ Filed by the Registrant | ☐ Filed by a Party other than the Registrant |

| Check the appropriate box: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |

MEDTRONIC PLC

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | ||

| ☑ | No fee required. | |

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |

Notice of Annual General Meeting

Thursday, December 8, 2022

8:00 a.m. local time

Shelbourne Hotel, 27 St. Stephen’s Green, Dublin, Ireland*

MEETING AGENDA

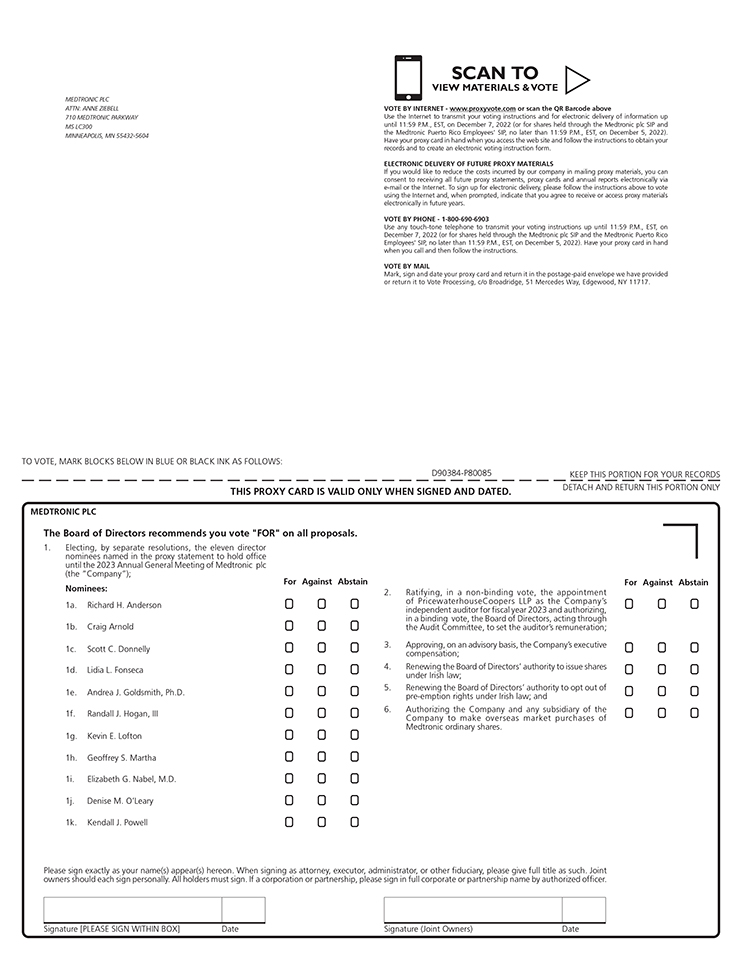

| 1. | Electing, by separate resolutions, the eleven director nominees named in the proxy statement to hold office until the 2023 Annual General Meeting of Medtronic plc (the “Company”); |

| 2. | Ratifying, in a non-binding vote, the appointment of PricewaterhouseCoopers LLP as the Company’s independent auditor for fiscal year 2023 and authorizing, in a binding vote, the Board of Directors, acting through the Audit Committee, to set the auditor’s remuneration; |

| 3. | Approving, on an advisory basis, the Company’s executive compensation; |

| 4. | Renewing the Board of Directors’ authority to issue shares under Irish law; |

| 5. | Renewing the Board of Directors’ authority to opt out of pre-emption rights under Irish law; |

| 6. | Authorizing the Company and any subsidiary of the Company to make overseas market purchases of Medtronic ordinary shares; |

| 7. | Receiving and considering the Company’s Irish Statutory Financial Statements for the fiscal year ended April 29, 2022 and the reports of the directors and auditors thereon, and reviewing the affairs of the Company; and |

| 8. | Transacting any other business that may properly come before the meeting. |

Proposals 1, 2, 3, 4, and 6 above are ordinary resolutions requiring a simple majority of the votes cast at the meeting to be approved. Proposal 5 is a special resolution requiring at least 75% of the votes cast at the meeting to be approved. All proposals are more fully described in this proxy statement. There is no requirement under Irish law that Medtronic’s Irish Statutory Financial Statements for the fiscal year ended April 29, 2022, or the directors’ and auditor’s reports thereon be approved by the shareholders, and no such approval will be sought at the Annual General Meeting.

RECORD DATE

Shareholders of record at the close of business on October 11, 2022, will be entitled to vote at the meeting.

ONLINE PROXY DELIVERY AND VOTING

As permitted by the Securities and Exchange Commission, we are making this proxy statement, the Company’s annual report to shareholders, and our Irish statutory financial statements available to our shareholders electronically via the Internet. We believe electronic delivery expedites your receipt of materials, reduces the environmental impact of our Annual General Meeting and reduces costs significantly. The Notice Regarding Internet Availability of Proxy Materials (the “Notice”) contains instructions on how you can access the proxy materials and how to vote online. If you received the Notice by mail, you will not receive a printed copy of the proxy materials unless you request one in accordance with the instructions provided in the Notice. The Notice will be mailed to shareholders on or about October 27, 2022 and will provide instructions on how you may access and review the proxy materials on the Internet and how to vote.

ADMISSION TO THE ANNUAL GENERAL MEETING

The well-being of all attendees and participants at the Annual General Meeting is a primary concern for the Company and in this context we are monitoring developments in relation to the COVID-19 pandemic. While all shareholders are invited to attend the Annual General Meeting, the Annual General Meeting will proceed subject to the guidance provided by the Irish

Government and the Department of Health (of Ireland) or any other governmental agency in place at the time of the meeting and such other measures as the Board considers appropriate to address health and safety concerns. As a result, there may be restrictions on travel and/or gatherings that affect or prohibit travel to and in-person attendance at the Annual General Meeting. Due to the ongoing risks posed by the COVID-19 pandemic, the members of our Board and senior management may not be physically present at our Annual General Meeting in Ireland and may instead participate remotely. Furthermore, to promote the health and safety of attendees, we may impose additional procedures or limitations on meeting attendance based on applicable governmental requirements or recommendations or facility requirements. Such additional procedures or limitations may include, but are not limited to, thorough screenings of attendees (including temperature checks), limits on the number of attendees to promote social distancing and requiring the use of face masks.

We therefore strongly encourage all shareholders to vote their shares by proxy in advance of the Annual General Meeting to ensure you can vote and be represented at the Annual General Meeting if attending in person is not feasible or not recommended. This can be done in advance of the Annual General Meeting by using one of the voting options detailed in the accompanying proxy statement.

If you wish to attend the Annual General Meeting, you must be a shareholder on the record date and either request an admission ticket in advance by visiting www.proxyvote.com and following the instructions provided (you will need the control number included on your proxy card, voter instruction form or Notice), or bring proof of ownership of ordinary shares to the meeting. Tickets will be issued to registered and beneficial owners and to one guest accompanying each registered or beneficial owner.

,

| * | Depending on concerns about and developments relating to the COVID-19 pandemic, we may need to change the date, time, location and or format of the meeting, subject to Irish law requirements. The Company would publicly announce any such changes and how to participate in the meeting by press release and a filing with the U.S. Securities and Exchange Commission (“SEC”) as soon as practicable prior to the meeting. Any such determinations and changes will be made and communicated in accordance with Irish law and SEC rules and requirements. The Company will be obliged to comply with any legal restrictions that are imposed as a consequence of COVID-19 and that affect the meeting. |

Important Notice Regarding the Availability of Proxy Materials for the Annual General Meeting of Shareholders to be held on December 8, 2022: This proxy statement, the Company’s 2022 Annual Report to Shareholders and our Irish Statutory Financial Statements for the year ended April 29, 2022, are available at www.proxyvote.com.

| YOUR VOTE IS IMPORTANT. WE ENCOURAGE YOU TO VOTE. |

If possible, please vote your shares over the internet using the instructions found in the Notice. Alternatively, you may request a printed copy of the proxy materials and vote using the toll-free telephone number on the proxy card or by marking, signing, dating and mailing your proxy form in the postage-paid envelope that will be provided. Voting by any of these methods will not limit your right to vote during the Annual General Meeting. All proxies will be forwarded to the Company’s registered office electronically. |

Under New York Stock Exchange rules, if you hold your shares in “street” name through a brokerage account, your broker will NOT be able to vote your shares on non-routine matters being considered at the Annual General Meeting unless you have given instructions to your broker prior to the meeting on how to vote your shares. Proposals 1 and 3 are considered non-routine matters under New York Stock Exchange rules. This means that you must give specific voting instructions to your broker on how to vote your shares so that your vote can be counted.

|

Medtronic | 2022 Proxy Statement

Proxy Summary

|

This summary highlights information described in more detail elsewhere in this proxy statement. It does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting.

2022 Annual General Meeting of Shareholders

| Date and Time:* | Thursday, December 8, 2022 at 8:00 a.m. Local Time | ||

| Place: | Shelbourne Hotel 27 St. Stephen’s Green Dublin, Ireland | ||

| Commence Mail Date: | October 27, 2022 | ||

| Record Date: | October 11, 2022 | ||

| * | Depending on concerns about and developments relating to the COVID-19 pandemic, we may need to change the date, time, location and or format of the meeting, subject to Irish law requirements. The Company would publicly announce any such changes and how to participate in the meeting by press release and a filing with the U.S. Securities and Exchange Commission (“SEC”) as soon as practicable prior to the meeting. Any such determinations and changes will be made and communicated in accordance with Irish law and SEC rules and requirements. The Company will be obliged to comply with any legal restrictions that are imposed as a consequence of COVID-19 and that affect the meeting. |

Advance Voting Methods and Deadlines

Method | Instruction | Deadline | ||

Internet | Go to http://www.proxyvote.com and follow the instructions (have your proxy card or internet notice in hand when you access the website) | Internet and telephone voting are available 24 hours a day, seven days a week up to these deadlines:

Shares held through the Medtronic Savings and Investment Plan and the Medtronic Puerto Rico Employees’ Savings and Investment Plan – 11:59 p.m., Eastern Standard Time, on December 5, 2022

Registered Shareholders or Beneficial Owners – 11:59 p.m., Eastern Standard Time, on December 7, 2022 | ||

Telephone | Dial 1-800-690-6903 and follow the instructions (have your proxy card or internet notice in hand when you call) | Shares held through the Medtronic Savings and Investment Plan and the Medtronic Puerto Rico Employees’ Savings and Investment Plan – 11:59 p.m., Eastern Standard Time, on December 5, 2022

Registered Shareholders or Beneficial Owners – 11:59 p.m., Eastern Standard Time, on December 7, 2022 | ||

| If you received paper copies of our proxy materials, mark your selections on the enclosed proxy card

• Date and sign your name exactly as it appears on proxy card

• Promptly mail the proxy card in the enclosed postage-paid envelope | Return promptly to ensure it is received before the date of the Annual General Meeting

Shares held through the Medtronic Savings and Investment Plan and the Medtronic Puerto Rico Employees’ Savings and Investment Plan – 11:59 p.m., Eastern Standard Time, on December 5, 2022

Registered Shareholders or Beneficial Owners – 11:59 p.m., Eastern Standard Time, on December 7, 2022 | ||

Medtronic | 2022 Proxy Statement 1

Proxy Summary

|

Questions and Answers About Attending our Annual General Meeting and Voting

The Company encourages you to review the questions and answers about the Annual General Meeting and voting beginning on page 86 to learn more about the rules and procedures surrounding the proxy and Annual General Meeting process, as well as the business to be conducted at the Annual General Meeting. If you plan to attend the Annual General Meeting in person, please direct your attention to the information following “Admission to the Meeting” on page 87.

IF YOU WISH TO ATTEND THE ANNUAL GENERAL MEETING, YOU MUST EITHER REQUEST AN ADMISSION TICKET IN ADVANCE OR BRING PROOF OF OWNERSHIP OF ORDINARY SHARES TO THE MEETING. YOUR VOTE IS IMPORTANT! PLEASE CAST YOUR VOTE AND PLAY A PART IN THE FUTURE OF MEDTRONIC. |

Voting Matters and Board Recommendations

Proposal | Board Recommendation | For More Information | ||||

| Proposal 1 – | To elect, by separate resolutions, the eleven director nominees named in the proxy statement to hold office until the 2023 Annual General Meeting of the Company | “FOR” all nominees | Page 12 | |||

| Proposal 2 – | To ratify, in a non-binding vote, the appointment of PricewaterhouseCoopers LLP as Medtronic’s independent auditor for fiscal year 2023 and to authorize, in a binding vote, the Board of Directors, acting through the Audit Committee, to set the auditor’s remuneration | “FOR” | Page 77 | |||

| Proposal 3 – | To approve in a non-binding advisory vote, named executive officer compensation (a “Say-on-Pay” vote) | “FOR” | Page 79 | |||

| Proposal 4 – | To renew the Board’s authority to issue shares | “FOR” | Page 81 | |||

| Proposal 5 – | To renew the Board’s authority to opt out of pre-emption rights | “FOR” | Page 82 | |||

| Proposal 6 – | Authorizing the Company and any subsidiary of the Company to make overseas market purchases of Medtronic ordinary shares | “FOR” | Page 84 | |||

2 Medtronic | 2022 Proxy Statement

Proxy Summary

|

Director Nominees

You are being asked to vote, by separate resolutions, on the election of the following eleven Directors. Each Director nominee is elected annually by a majority of votes cast. Detailed information about each Director’s background, skill sets and areas of expertise can be found beginning on page 13.

Committee Memberships

| Other Current Public Boards | |||||||||||||||||||||

Name | Age (1) | Director Since | Principal Position | Indep. | AC | CC | FFRC | NCGC | QC | STC | ||||||||||||

Richard H. Anderson | 67 | 2002 | Retired President and Chief Executive Officer of Amtrak | Y | M | M | M | — | ||||||||||||||

Craig Arnold (2) | 62 | 2015 | Chairman and Chief Executive Officer of Eaton Corporation | Y | C | M | 1 | |||||||||||||||

Scott C. Donnelly | 60 | 2013 | Chairman, President and Chief Executive Officer of Textron, Inc. | Y | M | M | M | 1 | ||||||||||||||

Lidia L. Fonseca | 53 | 2022 (3) | Executive Vice President, Chief Digital and Technology Officer, Pfizer, Inc. | Y | M | M | 1 | |||||||||||||||

Andrea J. Goldsmith, Ph.D. | 57 | 2019 | Dean of the School of Engineering and Applied Science at Princeton University | Y | M | C | 2 | |||||||||||||||

Randall J. Hogan, III | 66 | 2015 | Chairman of nVent Electric plc | Y | M | C | 1 | |||||||||||||||

Kevin E. Lofton | 67 | 2020 | Retired Chief Executive Officer of CommonSpirit Health | Y | M | C | 1 | |||||||||||||||

Geoffrey S. Martha | 52 | 2019 | Chief Executive Officer of Medtronic plc | N | — | |||||||||||||||||

Elizabeth G. Nabel, M.D. | 70 | 2014 | Chief Medical Officer, Opko Health, Inc. | Y | C | M | 3 | |||||||||||||||

Denise M. O’Leary | 64 | 2000 | Private Venture Capital Investor | Y | C | M | M | 1 | ||||||||||||||

Kendall J. Powell | 68 | 2007 | Retired Chairman and Chief Executive Officer of General Mills, Inc. | Y | M | M | M | — | ||||||||||||||

| (1) | As of July 1, 2022. |

| (2) | Lead Independent Director. |

| (3) | Effective June 27, 2022. |

| AC: | Audit Committee | NCGC: | Nominating and Corporate Governance Committee | C: | Chair | |||||||||||

| CC: | Compensation Committee | QC: | Quality Committee | M: | Member | |||||||||||

| FFRC: | Finance and Financial Risk Committee | STC: | Science and Technology Committee | |||||||||||||

Medtronic | 2022 Proxy Statement 3

Proxy Summary

|

Corporate Governance Highlights

Strong Lead Independent Director See page 19 | Annual Board and Committee See page 19 |

Robust Risk Management Program See page 20 | ||||||

Stock Ownership Guidelines See pages 31 and 50 |

Annual Board of Director Elections See pages 3 and 12 |

Regular Executive Sessions of Independent Directors See page 20 | ||||||

ESG Oversight Responsibility See page 10 | Sustainability and ESG Highlights See page 9 | Corporate Governance Principles See page 19 | ||||||

| High Ethical Standards Established in Written Policies and Actions (Includes Codes of Conduct, U.S. Patient Privacy Principles, Political Contribution Policy, and Policies Regarding Environmental, Health and Safety and the Use of Animals) See page 28 and our investor relations website | ||||||||

4 Medtronic | 2022 Proxy Statement

Proxy Summary

|

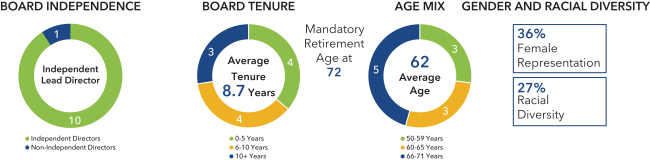

2022 Nominee Director Board Composition

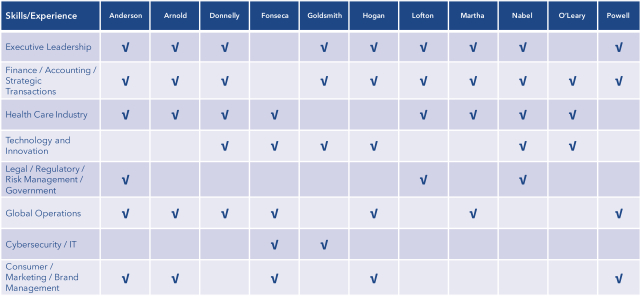

2022 Nominee Director Skills Matrix

Skills Matrix – Definitions

Executive Leadership – Current or former CEO, COO or equivalent

Finance/Accounting/Strategic Transactions – Current or former CFO or chief accounting officer; Audit Committee Financial Expert; other finance or accounting expertise and experience; M&A or equivalent

Healthcare Industry – Experience in the healthcare industry, including as a physician/clinician

Technology and Innovation – Current or former chief R&D officer or equivalent; CEO or COO of a large, complex technology company; experience as a senior-level scientist or technology leader

Legal/Regulatory/Risk Management/Government – Current or former chief legal, regulatory or risk officer or equivalent; prior service as a high-level government official or regulator

Global Operations – Management of or responsibility for large, complex global operations

Cybersecurity/IT – Expertise and experience in cybersecurity or information technology; CIO, CISO or equivalent

Consumer/Marketing/Brand Management – Expertise and experience in consumer marketing or brand management

Medtronic | 2022 Proxy Statement 5

Proxy Summary

|

Director Selection Process

As part of its ongoing board refreshment process, the Nominating and Corporate Governance Committee has primary responsibility for identifying and evaluating candidates for appointment to the Company’s Board of Directors. Qualified individuals are also identified through independent third party search firms, independent recommendations, and from outreach through non-traditional channels to ensure a broad and diverse pool of candidates. Candidates engage in a rigorous review and interview process with the Company’s Nominating and Corporate Governance Committee, as well as with other members of the Board of Directors, including the Lead Independent Director. Candidates are assessed on such items as diversity of background including relevant skills, industry and other experience, and personal attributes, and an in-depth due diligence process is also conducted to ensure independence and integrity. At the conclusion of assessment and due diligence processes, the Nominating and Corporate Governance Committee presents qualified candidates to the full Board of Directors for review and approval. In 2021 the Board of Directors adopted a formal Board Diversity Policy to publicly codify the importance of and commitment to diverse representation on the Board of Directors.

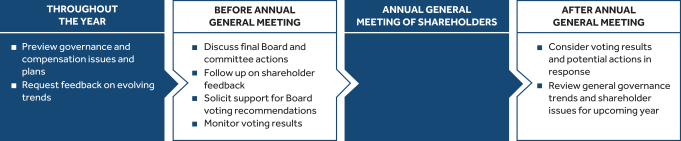

Shareholder Outreach on Governance

The Company recognizes the value of shareholder engagement and takes a proactive approach to shareholder outreach on governance matters. Every year, the company has dialogue with many of its institutional investors, and specifically seeks input on governance, executive compensation, and strategic issues, as well as understanding their concerns and addressing their questions. The Company brings feedback from its shareholders to the Board; such feedback is instrumental to the Board’s decision-making process.

ENGAGEMENT CYCLE

Fiscal Year 2022 Performance Highlights

Medtronic is a leading global healthcare technology company, boldly attacking the most challenging health problems facing humanity and united by its Mission to alleviate pain, restore health, and extend life for millions of people around the world. The Company’s fiscal year 2022 (“FY22”) financial performance was affected by the impact of COVID-19, the impact in the second half of the fiscal year from the lack of new product approvals in its U.S. Diabetes business, and the impact of temporary supply chain issues, particularly in its Surgical Innovation business, in the fourth fiscal quarter. At the same time, Medtronic continued to advance its long-term strategies of innovation-driven growth, operational excellence, and disciplined capital allocation and portfolio management.

FY22 revenue of $31.7 billion increased 5% as reported and on an organic basis, in-line with the Company’s long-range plan of growing organic revenue 5%+. FY22 GAAP diluted earnings per share (EPS) of $3.73 increased 40%, while non-GAAP diluted EPS of $5.55 increased 26%, up significantly due to the impact of the pandemic on prior year earnings, and significantly above the Company’s long-range plan of growing non-GAAP EPS at 8%+. Cash flow from operations was $7.3 billion, an increase of 18%. FY22 free cash flow was $6.0 billion, an increase of 22%. Free cash flow conversion from non-GAAP earnings was 80%, at the Company’s goal of achieving 80% or greater conversion from non-GAAP net earnings.

Despite the difficult operating environment resulting from the pandemic and supply chain impacts, Medtronic had numerous highlights in FY22, including:

| • | Continued Transformation – first full year working under the Company’s new operating model and enhanced “Medtronic Mindset” culture of acting boldly, competing to win, moving with speed and decisiveness, fostering belonging, and delivering results the right way; |

6 Medtronic | 2022 Proxy Statement

Proxy Summary

|

| • | Scientific Evidence and Product Pipeline – conducted approximately 300 clinical trials globally and received over 200 regulatory approvals across the U.S., Europe, Japan, and China; |

| • | Future Innovation Investment – Record organic R&D spend of $2.7 billion to fuel innovative product pipeline; |

| • | Environmental, Social, and Governance – selected for inclusion on the Dow Jones Sustainability World Index (DJSI World) as one of the world’s leading companies for sustainability; hosted its inaugural ESG investor briefing where company leaders highlighted its sustainability strategy; |

| • | Healthcare Access – Medtronic LABS has screened over 1 million people, with 40,000 lives improved and 2,500 healthcare workers trained; announced partnership with Amazon Web Services to deliver better colon screening in underserved communities using our GI Genius; |

| • | Health Equity – announced partnership with Amazon Web Services and the American Society for Gastrointestinal Endoscopy (ASGE) to deliver better colon screening in communities with low screening rates using Medtronic GI Genius intelligent endoscopy modules; |

| • | Net Zero Carbon Emissions – announced ambition of achieving net zero carbon emissions within the Company’s operations and across its value chain (scopes 1, 2, & 3) by FY45, building upon its existing goal of reaching carbon neutrality by FY30; |

| • | Inclusion, Diversity, and Equity (ID&E) – ranked #10 on Diversity Inc’s Top 50 US Companies for Diversity, and introduced ID&E metrics as part of management compensation; |

| • | Operational Excellence – leveraging the Company’s scale, consolidated global operations and supply chain functions, which were previously fragmented throughout the organization; |

| • | Market Share - won share in an increasing number of its businesses, driven by the Company’s differentiated product offering; |

| • | Tuck-In Acquisitions – announced four acquisitions with combined $2.1 billion in present value total consideration, including Intersect ENT and Affera; |

| • | Shareholder Returns – returned $5.5 billion to its shareholders, or 92% of free cash flow, through its growing dividend and net share repurchase. |

To conclude with the Company’s most important statistic, Medtronic served over 76 million patients globally in FY22. More than two patients are benefitting from Medtronic therapies and services every second. This is a direct result of the dedication and passion of its global team of 95,000+ full-time employees, collaborating with the Company’s partners in healthcare, to fulfill the Medtronic Mission.

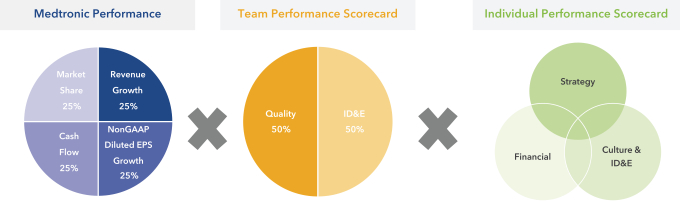

Executive Compensation Philosophy

The Company’s compensation programs align the interests of all its executives, including named executive officers (“NEOs”), with those of the stakeholders, particularly shareholders. The Company’s programs are market-competitive to ensure it attracts, retains and engages highly talented executives with compensation packages established pursuant to the following principles:

| • | Market-Competitive. We benchmark and assess our program annually to ensure market-competitive target total direct compensation consisting of base salary, target annual cash incentive and long-term incentives. The benchmarking process ensures that each element of target total direct compensation is within a market competitive range relative to our 27-company Comparison Group. |

| • | Pay for Performance. We emphasize pay for performance by making at least 75% of target total direct compensation payable to each NEO contingent on the attainment of annual and long-term Company performance goals. The commitment to pay for performance provides actual compensation outcomes with varying levels of competitiveness based on our absolute and relative performance results. |

| • | Shareholder Value Alignment. We align incentive programs with shareholder value creation by using annual and three-year performance measures that drive shareholder value. Incentive goals come directly from our Board-approved annual operating plan and our Board-approved long-term strategic plan. |

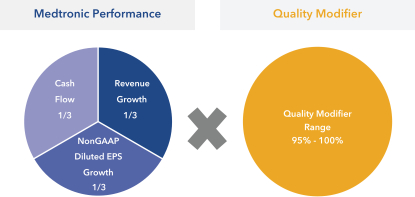

| • | ESG Metrics. Both Quality and Inclusion, Diversity, and Equity (ID&E) are components of our scorecard that directly impact payouts of our annual incentive plan. The quality goals can only reduce a payout, while the ID&E goals can increase or reduce a payout. Quality and ID&E also directly align to the Medtronic Mission, “To strive without reserve for the greatest possible reliability and quality in our products.” |

Medtronic | 2022 Proxy Statement 7

Proxy Summary

|

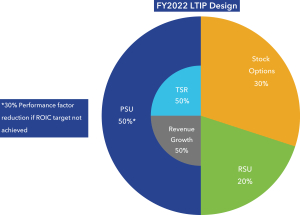

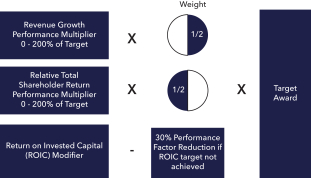

Executive Compensation Program Design

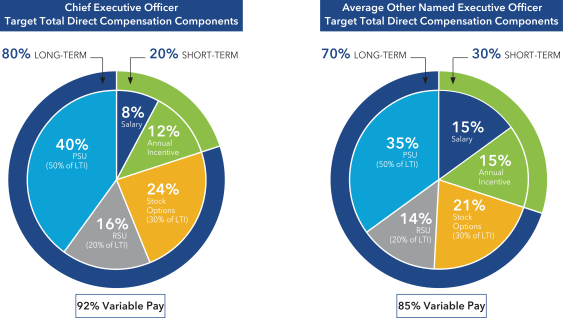

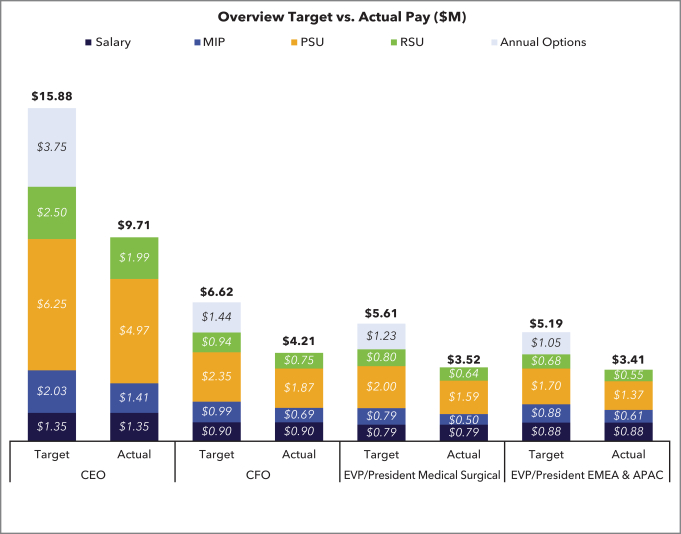

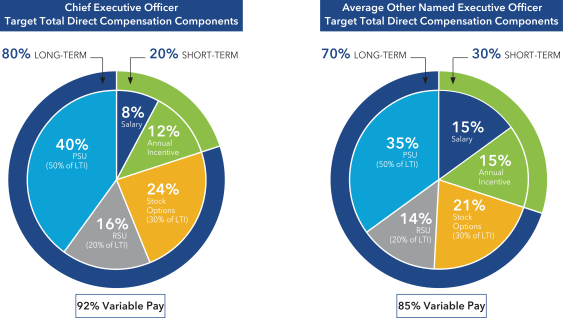

Our executive compensation program design supports our philosophy by emphasizing incentives, specifically long-term incentives. As the graphs bellow highlight, a significant majority (85% – 92%) of target total direct compensation is variable via incentives.

8 Medtronic | 2022 Proxy Statement

Proxy Summary

|

Sustainability and ESG Highlights

Medtronic’s approach to sustainability and environmental, social and governance (“ESG”) is grounded in its Mission, which articulates the Company’s purpose and acknowledges its responsibility to contribute to human welfare; deliver the highest-quality products, therapies and services to patients; make a fair profit; recognize the personal worth of employees; and maintain good citizenship as a company.

The Company’s Mission has been its corporate sustainability roadmap for more than 60 years, and its relevance is magnified in today’s global business environment which calls upon companies to contribute in meaningful ways to sustainable development.

The Company’s priority ESG issues – which were identified by internal and external stakeholders and are distinctly aligned with the Mission – allow Medtronic to achieve sustainable growth while also contributing to the United Nations Sustainable Development Goals (“U.N. SDG”).

|

| MISSION | PRIORITY ESG ISSUES | U.N. SDG ALIGNMENT | |||

Tenet 1 | Contribute to human welfare... alleviate pain, restore health, extend life |

• Innovation & Access • Integrated Care |  | |||

Tenet 2 | Direct growth in areas of biomedical engineering build on these areas through education and knowledge assimilation |

• Innovation & Access • Integrated Care |  | |||

Tenet 3 | Strive without reserve for the greatest possible reliability and quality in our products... be recognized as a company of dedication, honesty, integrity, and service | • Product Quality & Safety • Technology & Device Security • Data Privacy & Security • Ethics in Sales & Marketing • Corruption & Bribery • Transparency |

| |||

Tenet 4 |

Make a fair profit... to meet our obligations, sustain our growth, and reach our goals | • Affordability & Fair Pricing • Climate Risk & Resilience • Responsible Supply Management • Product Stewardship |

| |||

Tenet 5 |

Recognize the personal worth of all employees... advancement opportunity |

• Inclusion & Diversity • Talent |

| |||

Tenet 6 |

Maintain good citizenship as a company | As a good corporate citizen we use all of our resources, including philanthropy and community investment, to address our material ESG issues. | ||||

Medtronic | 2022 Proxy Statement 9

Proxy Summary

|

While Medtronic is committed to advancing performance related to all of the Company’s priority ESG issues, it elevates three that provide its greatest opportunity for global impact.

INNOVATION & ACCESS

| PRODUCT QUALITY & SAFETY

| INCLUSION & DIVERSITY

| ||

Increasing the availability of treatments to address significant disease burden, including those currently unmet, through therapy innovation, new application of existing technologies, and/or scientific cooperation and partnership, as well as accessibility to them through capacity building, infrastructure improvement, regulatory approval, and remote diagnosis or treatment. | Managing product quality as it relates to all key stakeholders – patients, physicians, hospital administrators and Medtronic businesses – through industry-leading design, reliability, manufacturability; supplier quality; global compliance and corrective action; and investments in personnel, training, IT tools and automation. | Advancing fair treatment and adequate representation of ethnicities and gender at all levels of our workforce through equal professional opportunities and pay and proactive inclusion of groups facing barriers. This includes cultivating strong employee engagement through global diversity networks and local employee-led affinity groups designed to help employees both professionally and personally.

|

Because climate risk and resilience are of growing concern to our stakeholders, Medtronic announced an ambition to be carbon neutral in the company’s owned and operated facilities (Scope 1 and 2) by fiscal year 2030 and net zero across our value chain (Scope 3) by fiscal year 2045, and we have posted a high-level decarbonization roadmap on Medtronic.com. In addition, we continue to integrate climate risk assessment into business continuity and enterprise risk management processes.

ESG Governance and Management

Recognizing the significant impact that ESG issues have on the company’s ability to achieve sustainable growth, the Nominating and Governance Committee of the Company’s Board of Directors has responsibility to oversee the Company’s ESG performance, including the impacts of its operations on society and the environment.

An executive-level Sustainability Steering Committee, sponsored by the Chief Financial Officer, oversees the Company’s sustainability strategy, performance and disclosure related to the Company’s priority ESG issues.

The Company’s Sustainability Program Office identifies and drives performance on activities related to our material ESG issues, including emerging risks and opportunities, and escalates them to the Sustainability Steering Committee as appropriate. The program office also sets performance and disclosure expectations and engages stakeholders on relevant topics.

Performance and Disclosure

Medtronic has set public targets to reduce the environmental impacts of company operations since 2007 and released its third set of long-term targets through 2025 in the company’s 2020 Integrated Performance Report. The Global Human Rights, Responsible Supply Management and Product Stewardship programs continue to mature, as the company embeds management of these issues to achieve compliance with emerging regulations and customer and stakeholder expectations. Medtronic releases an Integrated Performance Report annually, which follows the guidance of the Global Reporting Initiative, Sustainability Accounting Standards Board and Task Force on Climate-related Financial Disclosures frameworks. This report outlines the Company’s sustainability management approach and performance related to its priority ESG issues, including key metrics and targets. Medtronic’s CEO also was among 60-plus executive officers who publicly adopted the World Economic Forum Stakeholder Capitalism Metrics which were identified by the International Business Council. The Company began identifying these metrics in its 2021 Integrated Performance Report. Medtronic also releases an annual Inclusion, Diversity and Equity Report that publicly shares the company’s efforts to create an inclusive work environment, remove bias, and amplify its impact in local communities.

10 Medtronic | 2022 Proxy Statement

Cautionary Note Regarding Forward-Looking Statements

|

Cautionary Note Regarding Forward-Looking Statements

This proxy statement contains forward-looking statements within the meaning of the U.S. federal securities laws. Forward-looking statements may be identified by words like “anticipate,” “expect,” “project,” “believe,” “plan,” “may,” “estimate,” “intend” and other similar words. Forward-looking statements in this proxy statement include, but are not limited to, statements regarding individual and Company performance objectives and targets, statements relating to the benefits of Medtronic’s acquisitions, product launches and business strategies, and Medtronic’s intent to return capital to shareholders through dividends and share repurchases. These and other forward-looking statements are based on the Company’s beliefs, assumptions and estimates using information available to us at the time and are not intended to be guarantees of future events or performance. Factors that may cause actual results to differ materially from those contemplated by the statements in this proxy statement, including the potential or anticipated direct or indirect impact of the COVID-19 pandemic on the Company’s business, results of operations and/or financial condition, can be found in Medtronic’s periodic reports on file with the U.S. Securities and Exchange Commission. The forward-looking statements speak only as of the date of this proxy statement and undue reliance should not be placed on these statements. Medtronic disclaims any intention or obligation to publicly update or revise any forward-looking statements. This cautionary statement is applicable to all forward-looking statements contained in this document.

Medtronic | 2022 Proxy Statement 11

Proposal 1

|

Election Of Directors

The Company’s Board of Directors currently has eleven members, all of whom will serve until the 2022 Annual General Meeting. All nominees for election at the 2022 Annual General Meeting are currently serving Medtronic directors who were elected by shareholders at the 2021 Annual General Meeting, other than Lidia L. Fonseca, who, as previously announced, was appointed by our Board of Directors upon recommendation of the Nominating and Corporate Governance Committee, with an effective date of June 27, 2022. The Nominating and Corporate Governance Committee engaged a third-party search firm to identify qualified candidates, including Ms. Fonseca, and each Board member had an opportunity to meet with Ms. Fonseca prior to her appointment to confirm that her appointment would further the Board’s commitment to seek out candidates with diverse backgrounds, skills and experiences. Proxies cannot be voted for a greater number of individuals than the number of nominees named in this Proxy Statement.

In order to be elected as a director, each nominee must be appointed by an ordinary resolution and each must receive the affirmative vote of a majority of the votes cast by the holders of ordinary shares represented at the Annual General Meeting in person or by proxy. If a nominee becomes unable or declines to serve, the individuals acting as proxies will have the authority to vote for any substitute who may be nominated in accordance with Medtronic’s Articles of Association. The Company has no reason to believe this will occur.

The Nominating and Corporate Governance Committee considers candidates for Board membership, including those suggested by shareholders, applying the same criteria to all candidates. Any shareholder who wishes to recommend a prospective nominee for the Board for consideration by the Nominating and Corporate Governance Committee must notify the Company Secretary in writing at Medtronic’s registered office at 20 on Hatch, Lower Hatch Street, Dublin 2, D02 XH02, Ireland. Any such recommendations should provide whatever supporting material the shareholder considers appropriate, but should at a minimum include such background and biographical material as will enable the Nominating and Corporate Governance Committee to make an initial determination as to whether the nominee satisfies the criteria for directors set out in the Governance Principles.

If the Nominating and Corporate Governance Committee identifies a need to replace a current member of the Board, to fill a vacancy on the Board, or to expand the size of the Board, it considers candidates from a variety of sources, including third-party search firms that assist with identifying, evaluating and conducting due diligence on potential director candidates. The process followed to identify and evaluate candidates includes meetings to review biographical information and background material relating to candidates, and interviews of selected candidates by members of the Board. Recommendations of candidates for inclusion in the Board slate of director nominees are based upon the criteria set forth in the Governance Principles. These criteria include business experience and skills, judgment, honesty and integrity, the ability to commit sufficient time and attention to Board activities, and the absence of potential conflicts with Medtronic’s interests. Consistent with the formal Board Diversity Policy adopted by the Board in 2021, the Nominating and Corporate Governance Committee seeks directors who represent a mix of backgrounds and experiences that will enhance the quality of the Board’s deliberations and decisions. When evaluating candidates for Board membership, the Nominating and Corporate Governance Committee considers, among other factors, diversity with respect to viewpoint, skills, experience, and community involvement, and input from other members of the Board.

After completing the evaluation process, the Nominating and Corporate Governance Committee makes a recommendation to the full Board as to individuals who should be nominated by the Board. The Board determines the nominees after considering the recommendations and report of the Nominating and Corporate Governance Committee and such other nominees and evaluations as it deems appropriate.

Shareholders who intend to participate in the Annual General Meeting to nominate a candidate for election by the shareholders at the meeting (in cases where the Board does not intend to nominate the candidate or where the Nominating and Corporate Governance Committee was not requested to consider the candidacy) must comply with the procedures in Medtronic’s Articles of Association, which are described under “Other Information – Shareholder Proposals and Director Nominations” on page 88 of this proxy statement.

12 Medtronic | 2022 Proxy Statement

Proposal 1

|

NOMINEES FOR DIRECTOR FOR ONE-YEAR TERMS ENDING IN 2023:

| Richard H. Anderson

Retired President and Amtrak |

| Craig Arnold

Chairman and Chief Executive Officer, Eaton Corporation | |||||||

Age: 67

Director Since: 2002

Committees: Audit, Compensation, and Finance and Financial Risk

Experience: Mr. Anderson served without compensation as the President and Chief Executive Officer of Amtrak, an intercity passenger rail service provider, from July 2017 until his retirement on April 15, 2020. From 2007 until May 2016, Mr. Anderson served as Chief Executive Officer and a director of Delta Air Lines, Inc., a commercial airline. Upon retiring as Chief Executive Officer of Delta Air Lines, Inc. in May 2016, he became the Executive Chairman of the board of directors of Delta Air Lines, Inc. until October 2016. He was Executive Vice President of UnitedHealth Group Incorporated, a diversified health care company, from 2004 until 2007. Mr. Anderson was Chief Executive Officer of Northwest Airlines Corporation from 2001 to 2004. Mr. Anderson is a former director of Delta Air Lines, Inc.

Qualifications: Mr. Anderson’s qualifications to serve on the Board include his more than 25 years of business, operational, financial and executive management experience. He has also served on the board of directors of another public company. Mr. Anderson’s extensive experience, including within the health care industry, for Fortune 500 companies and for large privately-owned companies, allows him to contribute valuable executive leadership, strategic portfolio management, risk management and global operations insight to Medtronic.

Other Public Company Directorships: None | Age: 62

Director Since: 2015

Committees: Nominating and Corporate Governance (Chair), and Science and Technology

Experience: Mr. Arnold has been Chairman and Chief Executive Officer of Eaton Corporation, a multinational power management company, since June 2016. From September 2015 to May 2016, Mr. Arnold served as President and Chief Operating Officer of Eaton Corporation. Prior to that, Mr. Arnold served as the Vice Chairman and Chief Operating Officer, Industrial Sector, of Eaton Corporation. From 2000 to 2008 he served as Senior Vice President of Eaton Corporation and Group Executive of the Fluid Power Group of Eaton. Prior to joining Eaton, Mr. Arnold was employed in a series of progressively more responsible positions at General Electric Company from 1983 to 2000. Mr. Arnold was appointed to the Board of Directors of Eaton Corporation in 2015. Mr. Arnold is a former director of Covidien plc.

Qualifications: Mr. Arnold brings years of demonstrated executive leadership, senior management, and global operations experience including supply chain, manufacturing operations, sales and marketing and technology innovation. His position as Chief Executive Officer of the Eaton Corporation gives Mr. Arnold critical insights into the operational requirements of a large, multinational company including customers, end markets and talent development. In addition, as a CEO of a global company and through his experience previously serving on the Audit Committee of another public company, Mr. Arnold gained valuable knowledge and understanding of accounting principles and financial reporting rules and regulations, evaluating financial results, and generally overseeing the financial reporting process of a large public corporation.

Other Public Company Directorships: Eaton Corporation

| |||||||||

Medtronic | 2022 Proxy Statement 13

Proposal 1

|

| Scott C. Donnelly

Chairman, President and Textron, Inc. |

| Lidia L. Fonseca

Executive Vice President, Chief Digital and Technology Officer, Pfizer, Inc. | |||||||

Age: 60

Director Since: 2013

Committees: Audit, Nominating and Corporate Governance, and Science and Technology

Experience: Mr. Donnelly is Chairman, President and Chief Executive Officer of Textron, Inc., a producer of aircraft, defense and industrial products. Mr. Donnelly joined Textron in June 2008 as Executive Vice President and Chief Operating Officer and was promoted to President and Chief Operating Officer in January 2009. He was appointed to the Board of Directors in October 2009, and became Chief Executive Officer of Textron in December 2009 and Chairman of the Board in September 2010. Previously, Mr. Donnelly was the President and CEO of General Electric Company’s aviation business unit, GE Aviation, a leading maker of commercial and military jet engines and components as well as integrated digital, electric power and mechanical systems for aircraft. Prior to July 2005, Mr. Donnelly held various other management positions since joining General Electric in 1989.

Qualifications: Mr. Donnelly’s qualifications to serve on the Board include more than two decades of business experience in innovation, manufacturing, operations, sales and marketing, portfolio management, talent development, and business processes. Mr. Donnelly also serves on the board of directors of another public company. In addition, Mr. Donnelly’s extensive executive decision-making experience, corporate governance work and diverse perspectives, add value and expertise to our board.

Other Public Company Directorships: Textron, Inc. | Age: 53

Director Since: 2022

Committees: Compensation, and Science and Technology

Experience: Lidia Fonseca is the Executive Vice President, Chief Digital and Technology Officer at Pfizer, Inc. where she is responsible for enterprise wide digital, data and technology strategy, products and solutions, as well as the Learning and Development and Business Process Excellence functions, a position she has held since January 2019. Prior to her current role, Ms. Fonseca was the Senior Vice President and CIO at Quest Diagnostics from April 2014 to December 2018. Previously, Ms. Fonseca served as the Senior Vice President and Chief Information Officer at Labcorp from 2008 to 2013. She was named to the list of 50 Most Powerful Latinas in 2020 and 2021 by the Association of Latino Professionals for America, was named a 2020 Healthcare Influencer and 2019 Healthcare Transformer by Medical, Marketing & Media, and she received the 2017 Forbes CIO Innovation Award.

Qualifications: Ms. Fonseca’s qualifications to serve on the Board include her extensive industry experience leading and overseeing digital transformation initiatives, data deployment strategies, technology innovation and technology systems infrastructure at a number of different companies. Ms. Fonseca brings expertise in improving operational processes through automation and robotics, as well as identifying means to use advanced data analytics to deliver insights supporting better decision making. In addition, Ms. Fonseca’s direct to consumer-focused experience and perspective makes her a valuable member of our Board.

Other Public Company Directorships: Tegna, Inc.

| |||||||||

14 Medtronic | 2022 Proxy Statement

Proposal 1

|

| Andrea J. Goldsmith, Ph. D.

Dean of the School of Engineering and Applied Science, Princeton University |

| Randall J. Hogan, III

Chairman, nVent Electric plc | |||||||

Age: 57

Director Since: 2019

Committees: Quality, and Science and Technology (Chair)

Experience: Dr. Goldsmith serves as the Dean of the School of Engineering and Applied Sciences at Princeton University. Prior to becoming Dean at Princeton, Dr. Goldsmith served as the Stephen Harris professor in the School of Engineering at Stanford University from 2012-2020 and served as a professor, associate professor or assistant professor of Electrical Engineering at Stanford University since January 1999. Dr. Goldsmith also founded and served as Chief Technology Officer of Plume WiFi (formerly, Accerlera, Inc.) from August 2010 to August 2014 and Quantenna Communications, Inc. (formerly, mySource Communications, Inc.) from 2005 to 2009. In addition, Dr. Goldsmith a member of the President’s Council of Advisers on Science and Technology, and currently serves on the Technical Advisory Board of Cohere Technologies. Dr. Goldsmith is a frequent lecturer and writer regarding wireless technologies.

Qualifications: Dr. Goldsmith’s qualifications to serve on the Board include her nationally recognized status in science and engineering, as a member of the National Academy of Engineering and the American Academy of Arts and Sciences and as a Fellow of the Institute of Electrical and Electronics Engineers. Dr. Goldsmith also serves on the board of directors of other public companies. Dr. Goldsmith’s academic research focuses on the design, analysis, and fundamental performance limits of wireless systems and networks, and her insights and perspectives on the intersection between fundamental science and technology developments and commercial innovation make her a valuable member of the Board.

Other Public Company Directorships: Crown Castle International Corp., Intel Corporation | Age: 66

Director Since: 2015

Committees: Audit, and Finance and Financial Risk (Chair)

Experience: Mr. Hogan has been the Chairman of nVent Electric plc, a manufacturing company for electrical connection and protection products, since May 2018. From January 2001 until May 2018, Mr. Hogan served as Chief Executive Officer of Pentair plc, an industrial manufacturing company, and was appointed Chairman in May 2002. From December 1999 to December 2000, he was President and Chief Operating Officer of Pentair, and prior to that he was Executive Vice President and President of Pentair’s Electrical and Electronic Enclosures Group. Prior to joining Pentair, he was President of the Carrier Transicold Division of United Technologies Corporation. Before that, he was with the Pratt & Whitney division of United Technologies, General Electric Company and McKinsey & Company. Mr. Hogan is a past Chair of the board of the Federal Reserve Bank of Minneapolis. Mr. Hogan is a former director of Covidien plc. and Pentair plc.

Qualifications: Serving as Chairman of nVent Electric plc and having served in the roles of Chairman, Chief Executive Officer, President and Chief Operating Officer of Pentair, Mr. Hogan offers a wealth of management experience and business acumen. Running a public company gave Mr. Hogan front-line exposure to many of the issues facing public companies, particularly on the operational, financial and corporate governance fronts. Mr. Hogan’s service on the Board of Directors and Governance Committee of Unisys as well as on the Board of the Federal Reserve Bank of Minneapolis and service as former Chair of the Audit Committee of Covidien plc further augments his range of knowledge, providing experience on which he can draw while serving as a member of the Board and Audit Committee.

Other Public Company Directorships: nVent Electric plc

| |||||||||

Medtronic | 2022 Proxy Statement 15

Proposal 1

|

| Kevin E. Lofton

Retired Chief Executive Officer, CommonSpirit Health |

| Geoffrey S. Martha

Chairman of the Board and | |||||||

Age: 67

Director Since: 2020

Committees: Finance and Financial Risk, and Quality (Chair)

Experience: Mr. Lofton served as the Chief Executive Officer of CommonSpirit Health from February 2019, following the merger between Catholic Health Initiatives and Dignity Health, until his retirement in June 2020. Mr. Lofton previously served as the Chief Executive Officer of Catholic Health Initiatives from 2003 to 2019, and also held various executive management roles with Catholic Health Initiatives beginning in 1998. Mr. Lofton has also served as the Executive Director and Chief Executive Officer from 1993 to 1998 at UAB Hospital and from 1990 to 1993 at Howard University Hospital, as well as the Executive Vice President and Chief Operation Officer of University Medical Center – Florida from 1986 to 1990. In addition, Mr. Lofton served as the 2007 Chairman of the Board of the American Hospital Association, the largest health system trade association in the United States.

Qualifications: Mr. Lofton’s qualifications to serve on the Board include over 40 years of executive experience in the healthcare industry as a senior level executive in hospital administration, most recently as Chief Executive Officer of CommonSpirit Health and Catholic Health Initiatives since 2003. Mr. Lofton’s long and broad experience leading healthcare provider organizations and his ability to successfully navigate evolving commercial, regulatory and public policy changes over time provide the Board with valuable perspective and insights. In addition, his extensive experience as a CEO along with his general business management expertise make Mr. Lofton a strong member of the Board.

Other Public Company Directorships: Gilead Sciences, Inc. | Age: 52

Director Since: 2019

Committees: None

Experience: Mr. Martha is the Chairman of the Board of Directors and Chief Executive Officer of Medtronic. Mr. Martha assumed the role of CEO on April 27, 2020 and became Chairman of the Board on December 11, 2020. Prior to his role as Chairman and CEO, he served as President of Medtronic from November 1, 2019 through April 27, 2020 and joined the Board of Directors in November 2019. Previously, Mr. Martha served as Executive Vice President and President, Restorative Therapies Group, a role he held since August 2015. Mr. Martha previously served as Senior Vice President of Strategy and Business Development of Medtronic plc beginning in January 2015 and of Medtronic, Inc. beginning in August 2011. Prior to that, he served as Managing Director of Business Development at GE Healthcare from April 2007 to July 2011; General Manager for GE Capital Technology Finance Services from November 2003 to March 2007; Senior Vice President, Business Development for GE Capital Vendor Financial Services from February 2002 to October 2003; General Manager for GE Capital Colonial Pacific Leasing from February 2001 to January 2002; and Vice President, Business Development for Potomac Federal, the GE Capital federal financing investment bank from May 1998 to January 2001.

Qualifications: Mr. Martha’s qualifications to serve on the Board include more than twenty years in business management, with over fifteen years in the health care industry. Mr. Martha’s strong business experience leading the Company as Chief Executive Officer, as well as his history of success in development, implementation and execution of corporate strategy and executive management, make Mr. Martha a qualified and valuable member of the Board.

Other Public Company Directorships: None

| |||||||||

16 Medtronic | 2022 Proxy Statement

Proposal 1

|

| Elizabeth G. Nabel, M.D.

Chief Medical Officer, Opko Health, Inc. |

| Denise M. O’Leary

Private Venture Capital Investor | |||||||

Age: 70

Director Since: 2014

Committees: Compensation (Chair), and Quality

Experience: Dr. Nabel is the Chief Medical Officer of Opko Health, Inc., a position she began in May 2022. From March 2021 to April 2022, Dr. Nabel was Executive Vice President, Strategy of ModeX Therapeutics, a company focused on immunotherapies for cancer and infectious disease, a position she began in March 2021. From 2010 to February 2021, Dr. Nabel served as the President of Brigham Health, a system including hospitals and physician organizations operating inpatient and outpatient facilities, clinics, primary care health centers, and diagnostic and treatment technologies, research laboratories, and postgraduate medical and scientific education and training programs. Dr. Nabel was also a Professor of Medicine at Harvard Medical School from 2010 to February, 2021. Prior to that, Dr. Nabel held a variety of roles, including Director, at the National Heart, Lung and Blood Institute at the National Institutes of Health, a federal agency funding research, training, and education programs to promote the prevention and treatment of heart, lung, and blood diseases, from 1999 to 2009. Dr. Nabel is an elected member of the National Academy of Medicine of the National Academy of Sciences.

Qualifications: Dr. Nabel’s qualifications to serve on the Board include extensive experience in the health care field, including senior positions with a number of research universities and organizations. Dr. Nabel has a deep understanding of medical sciences and healthcare innovation, as well as the physicians and other health care providers who are central to the use and development of the Company’s products. In addition, Dr. Nabel has extensive experience in operating, managing and overseeing a large, complex hospital system and physician organization, which bring value to our Board.

Other Public Company Directorships: Moderna, Inc., Lyell Immunopharma, Inc., Accolade, Inc.

| Age: 64

Director Since: 2000

Committees: Audit (Chair), Finance and Financial Risk, and Nominating and Corporate Governance

Experience: Ms. O’Leary has been a private venture capital investor in a variety of early stage companies since 1996. She was a member of the Stanford University Board of Trustees from 1996 through 2006, where she chaired the Committee of the Medical Center. Ms. O’Leary is a former director of US Airways Group, Inc. and Calpine Corporation. In addition, Ms. O’Leary is a member of the Board of Trustees of the University of Denver, where she served as Chair from July 2018 until June 2022.

Qualifications: Ms. O’Leary’s qualifications to serve on the Board include her extensive experience with companies, including technology companies, at a variety of stages and her success in analyzing the business strategy, operational plans and structure, and financial deal models of these companies. She also serves on the board of directors of another public company. Her financial expertise, experience in the oversight of risk management, and thorough knowledge and understanding of capital markets provide valuable insight with regard to corporate governance and financial matters.

Other Public Company Directorships: American Airlines Group, Inc.

| |||||||||

Medtronic | 2022 Proxy Statement 17

Proposal 1

|

| Kendall J. Powell

Retired Chairman and General Mills, Inc. | |||||||||

Age: 68

Director Since: 2007

Committees: Compensation, Finance and Financial Risk, and Quality

Experience: Mr. Powell was Chairman of General Mills, Inc., an international producer, marketer and distributor of cereals, snacks and processed foods, from 2008 until December 2017 and was Chief Executive Officer of General Mills, Inc. from 2007 until June 2017. He was President and Chief Operating Officer of General Mills, Inc. from 2006 to 2007, and became a director of General Mills, Inc. in 2006. He was Executive Vice President and Chief Operating Officer, U.S. Retail from 2005 to 2006; and Executive Vice President of General Mills, Inc. from 2004 to 2005. From 1999 to 2004, Mr. Powell was Chief Executive Officer of Cereal Partners Worldwide, a joint venture of General Mills, Inc. and the Nestle Corporation. Mr. Powell joined General Mills, Inc. in 1979. Mr. Powell is a former director of General Mills, Inc. Mr. Powell is also the Chair of the University of Minnesota Board of Regents.

Qualifications: As a retired Chairman and former CEO of a Fortune 500 company, Mr. Powell brings more than three decades of business, operational and management experience in the U.S. and internationally. Mr. Powell has also served on the board of directors of another public company. His extensive marketing, direct-to-consumer expertise, executive decision-making and corporate governance experience make Mr. Powell a valuable director.

Other Public Company Directorships: None

| ||||||||||

18 Medtronic | 2022 Proxy Statement

Corporate Governance

|

Corporate Governance Principles

The Board of Directors has adopted Principles of Corporate Governance (the “Governance Principles”). The Governance Principles describe Medtronic’s corporate governance practices, policies, and framework. Among other things, the Governance Principles include the provisions below.

| • | A majority of the members of the Board must be independent directors and no more than two directors may be Medtronic employees. Geoffrey S. Martha is an employee and is not independent. |

| • | Medtronic maintains Audit, Compensation, Finance and Financial Risk, Nominating and Corporate Governance, Quality, and Science and Technology Committees, each of which consists entirely of independent directors. |

In 2021 the Board of Directors adopted a formal Board Diversity Policy to publicly codify the importance of and commitment to diverse representation on the Board of Directors. The Company’s Governance Principles, the charters of the Audit, Compensation, Finance and Financial Risk, Nominating and Corporate Governance, Quality, and Science and Technology Committees, our codes of conduct and our Board Diversity Policy are published on the Company’s website at www.medtronic.com/us-en/about/corporate-governance/overview.html. These materials are available in print to any shareholder upon request. From time to time, the Board reviews and updates these documents as it deems necessary and appropriate to keep abreast of governance regulations.

Pursuant to the Company’s Governance Principles, the Board of Directors and all Committees undergo an annual performance self-evaluation process. The evaluation process encourages candid feedback from each Director to foster transparency and help ensure the effectiveness, leadership and cooperation of members of the Board and each Committee.

Surveys are administered by the Corporate Secretary’s office to each director regarding the Board and the Committee(s) on which the director served during the fiscal year, followed by Lead Independent Director review to identify any potential areas of concern. Results are presented and discussed with each Committee and the full Board.

Surveys and evaluations assess the following, among other factors:

| • | Efficiency and effectiveness |

| • | Communication and open discussion |

| • | Opportunities for improvement |

| • | Satisfaction with performance of third party consultants |

| • | Board and Committee structure and operating mechanisms |

| • | Cooperation and access between Board and Company management |

Medtronic believes that the self-evaluation and feedback are important tools for improvement and the continued effectiveness of the Board and Committees, and as a result, the Company.

Lead Independent Director and Chairman; Executive Sessions

The Company’s Board of Directors selects the Company’s Chairman of the Board in the manner it determines to be in the best interests of the Company. Geoffrey S. Martha is Chairman of the Board and Chief Executive Officer. The Board believes it is appropriate for Mr. Martha to serve as Chairman of the Board due to his extensive knowledge of, and experience in, the global health care industry generally and in the medical device industry specifically. This knowledge and experience is critical in identifying strategic priorities and providing unified leadership in the execution of strategy. The Company believes

Medtronic | 2022 Proxy Statement 19

Corporate Governance

|

that Mr. Martha’s experience and knowledge as the Chief Executive Officer of the Company, combined with his role as Chairman of the Board, is an asset to Medtronic and promotes efficient board functioning, with independent board leadership provided by the Lead Independent Director.

Under Medtronic’s Principles of Corporate Governance, the independent directors annually elect a Lead Independent Director to ensure the integrity of independent board leadership is maintained and to oversee the periodic refreshment of Board leadership roles. The Company’s current Lead Independent Director is Craig Arnold, who succeeded Scott C. Donnelly as Lead Independent Director in March 2022.

As Lead Independent Director, Mr. Arnold’s duties include:

| • | presiding as chair of regularly scheduled meetings of the independent directors, and presiding as chair of Board meetings at which the Chairman of the Board is not in attendance; |

| • | reviewing and approving the agenda for each meeting of the Board of Directors and each of its committees; |

| • | leading Board discussion; |

| • | overseeing the directors’ annual evaluation of the Board and each of its committees and advising the Chairman of the Board on the conduct of Board meetings; |

| • | facilitating teamwork and communications between the non-management directors and management, serving as a liaison between the two; |

| • | overseeing the process for identifying and evaluating Board nominees, as the chair of the Nominating and Corporate Governance Committee; |

| • | leading the process for assessing appropriate committee leadership and membership on a periodic basis; |

| • | recommending, as appropriate, changes to governance policies and practices; |

| • | reviewing all committee materials; and |

| • | acting as the focal point on the Board for suggestions from non-management directors, especially on sensitive issues. |

In keeping with Medtronic’s commitment to corporate governance best practices, Mr. Arnold also takes the lead in both the Board’s ongoing, thoughtful evaluation of Medtronic’s governance structure and constructive shareholder engagement on emerging governance issues. Medtronic’s accountability to its shareholders is clearly indicated by its openness to their engagement, including through its proxy access policy and strong Lead Independent Director. In this role, Mr. Arnold ensures that he is available, if appropriately requested by shareholders, for consultation and direct communication.

In fiscal year 2022 the Board held five regular meetings and three special meetings. At each regular Board and committee meeting, the independent directors meet in executive session with no Company management present.

The Company’s Board of Directors, in exercising its overall responsibility to oversee the management of the business, considers risks when reviewing the Company’s strategic plan, financial results, merger and acquisition-related activities, legal and regulatory matters and its public filings with the Securities and Exchange Commission. The Board is also deeply engaged in the Company’s Enterprise Risk Management (“ERM”) program and has received briefings on the outcomes of the ERM program and the steps the Company is taking to mitigate risks that program has identified. The Board’s oversight of risk management includes full and open communications with management to review the adequacy and functionality of the risk management processes used by management. In addition, the Board of Directors uses its committees to assist in its risk oversight responsibility as follows:

| • | Audit Committee: Assists the Board of Directors in its oversight of the integrity of the financial reporting of the Company and its compliance with applicable legal and regulatory requirements. It also oversees the internal controls and compliance activities. The Audit Committee periodically discusses policies with respect to risk assessment and risk management, including appropriate guidelines and policies to govern the process, as well as the Company’s major financial and business risk exposures and certain contingent liabilities and the steps management has undertaken to monitor and control such exposures. It also meets privately with representatives from the Company’s independent registered public accounting firm. |

| • | Finance and Financial Risk Committee: Assists the Board of Directors in its oversight of risk relating to the Company’s assessment of its significant financial risks and certain contingent liabilities. |

20 Medtronic | 2022 Proxy Statement

Corporate Governance

|

| • | Compensation Committee: Assists the Board of Directors in its oversight of risk relating to the Company’s assessment of its compensation policies and practices. |

| • | Nominating and Corporate Governance Committee: Assists the Board of Directors in its oversight of risk relating to the Company’s actions and governance policies in furtherance of its corporate social responsibility, including considering the sustainability and impact of the Company’s business operations on employees, citizens, communities and the environment. |

| • | Quality Committee: Assists the Board of Directors in its oversight of risk relating to product quality and safety. |

| • | Science and Technology Committee: Assists the Board of Directors in its oversight of risk relating to product technology and technological innovation. |

The Company conducted a risk assessment of its compensation policies and practices during fiscal year 2022 and concluded that such policies and practices do not create risks that are reasonably likely to have a material adverse effect on the Company. The framework for the assessment was developed using materials from the Compensation Committee’s independent consultant, Semler Brossy Consulting Group LLC (“Semler Brossy”). The Company evaluated its compensation plans and practices against the established framework and noted the following:

| • | Base salaries at Medtronic are generally competitive in the median range of the executive compensation peer companies, not subject to any performance risk and act as a meaningful component of total compensation for most Medtronic employees. |

| • | Incentive plans for senior management and executive officers are appropriately weighted between short-term and long-term performance and between cash and equity compensation. In addition, the Company’s practice of establishing long-term incentive performance targets at the beginning of each of its overlapping three-year performance periods increases the incentives for sustained value creation. |

| • | Short-term and long-term incentive plans (referred to as MIP and LTPP) cap payouts to mitigate excessive risk in any one specific performance period. |

| • | Short-term incentive performance goals are recalibrated annually, based upon Medtronic’s annual operating plan approved by the Board, and are different from the long-term performance measures. |

| • | Executives and directors are subject to stock ownership and retention guidelines that require directors to maintain ownership of Medtronic stock equal to five times their annual retainer, Medtronic’s CEO to maintain ownership of Medtronic stock equal to six times his annual salary, and other NEOs to maintain Medtronic stock equal to three times their annual salary. Until the ownership guideline is met, the CEO and directors must retain 75% of after-tax Medtronic shares received through settlement of equity compensation awards, and other NEOs must retain 50% of such shares. |

| • | Medtronic has implemented policies designed to recoup payments or gains from incentive and equity compensation improperly paid or granted to executives. |

Committees of the Board and Meetings

The Company’s standing Board committees consist solely of independent directors, as defined in the New York Stock Exchange (“NYSE”) Corporate Governance Standards. The Audit Committee was established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934 (the “Exchange Act”). Each director attended 75% or more of the total Board and Board committee meetings on which the director served in fiscal year 2022. In addition, it has been the longstanding practice of Medtronic for all directors to attend the Annual General Meeting of Shareholders. All directors serving at that time attended the last Annual General Meeting.

Medtronic | 2022 Proxy Statement 21

Corporate Governance

|

The following table summarizes (i) the membership of the Board as of the end of fiscal year 2022, (ii) the members of each of the Board’s standing committees as of the end of fiscal year 2022, and (iii) the number of times each standing committee met during fiscal year 2022.

AS OF APRIL 29, 2022 (1)

|

| Board | Audit | Compensation | Finance and Financial Risk | Nominating and Corporate Governance | Quality | Science and Technology | |||||||

Richard H. Anderson |  |  |  |  |

|

|

| |||||||

Craig Arnold |  |

|

|

|  |

|  | |||||||

Scott C. Donnelly |  |  |

|

|  |

|  | |||||||

Andrea J. Goldsmith, Ph.D. |  |

|

|

|

|  |  | |||||||

Randall J. Hogan, III |  |  |

|  |

|

|

| |||||||

Kevin E. Lofton |  |

|

|  |

|  |

| |||||||

Geoffrey S. Martha |  |

|

|

|

|

|

| |||||||

Elizabeth G. Nabel, M.D. |  |

|  |

|

|  |

| |||||||

Denise M. O’Leary |  |  |

|  |  |

|

| |||||||

Kendall J. Powell |  |

|  |  |

|  |

| |||||||

Number of fiscal year 2022 meetings | 8 (2) | 9 | 6 | 5 | 4 | 5 | 4 | |||||||

| Member | |

|

Chair |

| (1) | Lidia L. Fonseca joined the Board effective June 27, 2022, and is a member of the Compensation Committee and Science and Technology Committee. |

| (2) | The Board held five regular meetings and three special meetings in fiscal year 2022. |

The principal functions of the six standing committees – the Audit Committee, the Compensation Committee, the Finance and Financial Risk Committee, the Nominating and Corporate Governance Committee, the Quality Committee, and the Science and Technology Committee – are described below.

| Audit Committee (1) | ||

Denise O’Leary (Chair) Richard H. Anderson Randall J. Hogan III Scott C. Donnelly | Number of meetings during Fiscal Year 2022 9 |

Responsibilities:

| • | Overseeing the integrity of Medtronic’s financial reporting |

| • | Overseeing the independence, qualifications and performance of Medtronic’s external independent registered public accounting firm and the performance of Medtronic’s internal auditors |

| • | Overseeing Medtronic’s compliance with applicable legal and regulatory requirements, including overseeing Medtronic’s engagements with, and payments to, physicians and other health care providers |

| • | Reviewing with the General Counsel and independent registered public accounting firm: legal matters that may have a material impact on the financial statements; any fraud involving management or other employees who have a significant role in Medtronic’s internal controls; compliance policies; and any material reports or inquiries received that raise material issues regarding Medtronic’s financial statements and accounting or compliance policies |

22 Medtronic | 2022 Proxy Statement

Corporate Governance

|

| • | Reviewing annual audited financial statements with management and Medtronic’s independent registered public accounting firm and recommending to the Board whether the financial statements should be included in Medtronic’s Annual Report on Form 10-K |

| • | Reviewing and discussing with management and Medtronic’s independent registered public accounting firm quarterly financial statements and earnings releases |

| • | Reviewing major issues and changes to Medtronic’s accounting and auditing principles and practices, including analyses of the effects of non-GAAP financial measures, regulatory and accounting initiatives and off-balance sheet structures on Medtronic’s financial statements |

| • | Discussing policies with respect to risk assessment and risk management, including risks affecting Medtronic’s financial statements, operations, business continuity, and reputation and the reliability and security of the Company’s information technology and security systems, and the steps management has undertaken to monitor and control such exposures |

| • | Undertaking the appointment, compensation (subject to the requirements of Irish corporate law), retention and oversight of the independent registered public accounting firm, which reports directly to the Audit Committee |

| • | Pre-approving all audit and permitted non-audit services to be provided by the independent registered public accounting firm |

| • | Reviewing, at least annually, a report by the independent registered public accounting firm describing its internal quality-control procedures and any material issues raised by the most recent internal quality-control review and any recent investigations by regulatory or professional agencies, and any steps taken to deal with any such issues, and all relationships between the independent registered public accounting firm and Medtronic |

| • | Reviewing the experience and qualifications of the lead partner of the independent registered public accounting firm each year and considering whether there should be rotation of the lead partner or the independent auditor itself |

| • | Establishing clear policies for hiring current and former employees of the independent registered public accounting firm |

| • | Preparing the Report of the Audit Committee |

| • | Meeting with the independent registered public accounting firm prior to the audit to review the scope and planning of the audit |

| • | Reviewing the results of the annual audit examination |

| • | Reviewing with the independent registered public accounting firm its evaluation of Medtronic’s identification of, accounting for, and disclosure of related party transactions |

| • | Advising the Board with regard to Medtronic’s policies and procedures regarding compliance with laws and regulations |

| • | Considering, at least annually, the independence of the independent registered public accounting firm |