Exhibit 99.1

Revolutionizing the way sleep disorders are diagnosed and managed Investor Presentation August 13, 2020

Disclaimer 2 Itamar Medical Ltd . (the " Company ") is furnishing this presentation and any information given during this presentation, solely for the consideration of eligible investors who have the knowledge and experience in financial and business matters and the capability to conduct their own due diligence investigation in connection with the investment outlined herein . Prospective investors are urged to conduct an independent evaluation of the Company . This presentation does not constitute an offer or a solicitation to participate in any investment in the Company . This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any of the securities of the Company in the United States or Israel . The offering of the Company’s securities (including all underlying securities thereof) has not been, nor will it be, registered under the United States Securities Act of 1933 , as amended (the “ 1933 Act”), any state securities laws, or Israeli securities laws and such securities may not be offered or sold within the United States, or to, or for the account or benefit of, U . S . persons, except pursuant to an effective registration statement under the 1933 Act or an applicable exemption from the U . S . registration requirements . The statements in this presentation should not be regarded as a basis for an investment decision of any kind, or as recommendation or opinion, or a substitute for investor discretion . Forward Looking Statements This presentation contains forward - looking statements within the meaning of the "safe harbor" provisions of applicable securities laws . Statements preceded by, followed by, or that otherwise include the words "believes", "expects", "anticipates", "intends", "estimates", "plans", and similar expressions or future or conditional verbs such as "will", "should", "would", "may" and "could" are generally forward - looking in nature and not historical facts . For example, when we discuss growing appreciation within the cardiology community of the role of WatchPAT, we are using forward - looking statements . Because such statements deal with future events, they are subject to various risks, uncertainties and assumptions, including events and circumstances out of the Company's control and actual results, expressed or implied by such forward - looking statements, could differ materially from the Company's current expectations . Factors that could cause or contribute to such differences include, but are not limited to, risks, uncertainties and assumptions discussed from time to time by the Company in reports filed with, or furnished to, the Israel Securities Authority and the U . S . Securities and Exchange Commission . Except as otherwise required by law, the Company undertakes no obligation to publicly release any revisions to these forward - looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events . The United States and Israeli securities laws prohibit any person who has material non - public information about a company (" Inside Information "), from purchasing or selling securities of such company, or from communicating such information to any other person under circumstances in which it is reasonably foreseeable that such person is likely to purchase or sell such securities . Statements in this presentation and in any information given during this presentation might be considered as Inside Information, in accordance with the Securities Law . Therefore, any person aware of this presentation or of any information given during this presentation, may neither use, nor cause any third party to use, any Inside Information or any other information provided in connection with the presentation, in contravention of the Securities Law or any such rules and regulations thereunder . The Company, and its respective affiliates, employees and representatives expressly disclaim any and all liability relating to or resulting from the use of this presentation or any information given during this presentation or such other information by a prospective investor or any of its affiliates or representatives . * The contents of any website or hyperlinks mentioned in this presentation are for informational purposes and the contents thereof are not part of this presentation .

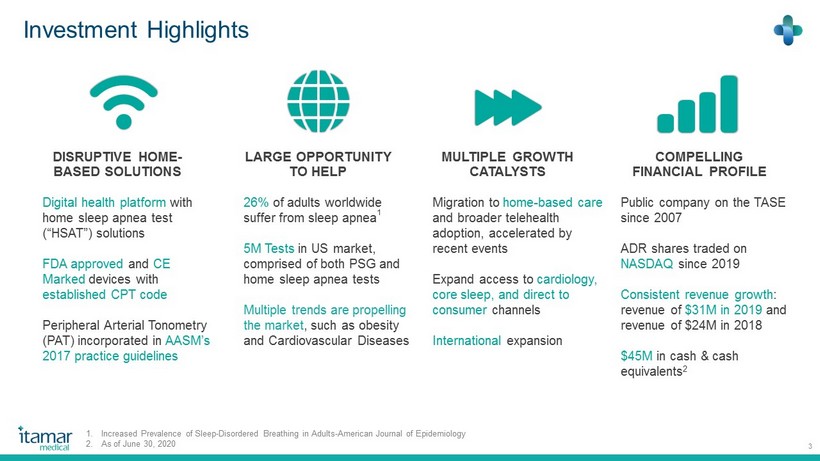

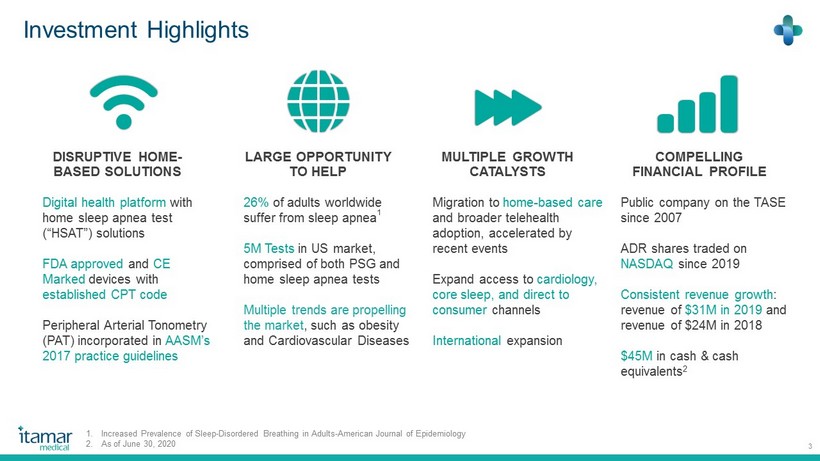

Investment Highlights 3 DISRUPTIVE HOME - BASED SOLUTIONS LARGE OPPORTUNITY TO HELP MULTIPLE GROWTH CATALYSTS COMPELLING FINANCIAL PROFILE Digital health platform with home sleep apnea test (“HSAT”) solutions FDA approved and CE Marked devices with established CPT code Peripheral Arterial Tonometry (PAT) incorporated in AASM’s 2017 practice guidelines Public company on the TASE since 2007 ADR shares traded on NASDAQ since 2019 Consistent revenue growth : revenue of $ 31 M in 2019 and revenue of $ 24 M in 2018 $ 45 M in cash & cash equivalents 2 Migration to home - based care and broader telehealth adoption, accelerated by recent events Expand access to cardiology, core sleep, and direct to consumer channels International expansion 26% of adults worldwide suffer from sleep apnea 1 5M Tests in US market, comprised of both PSG and home sleep apnea tests Multiple trends are propelling the market , such as obesity and Cardiovascular Diseases 1. Increased Prevalence of Sleep - Disordered Breathing in Adults - American Journal of Epidemiology 2. As of June 30, 2020

Vision and Mission 4 Our vision is become the world leader in sleep apnea management solutions with a focus on additional care pathways Our Mission: to address the 80% undiagnosed and untreated Obstructive Sleep Apnea (OSA) patients through our digital health platform

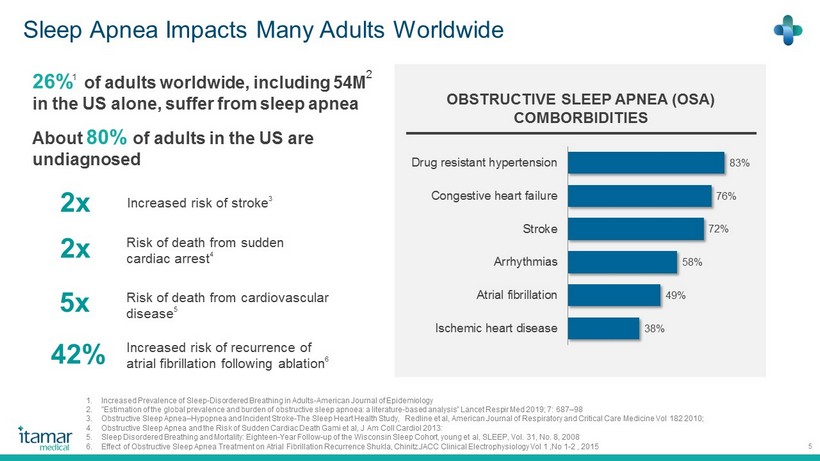

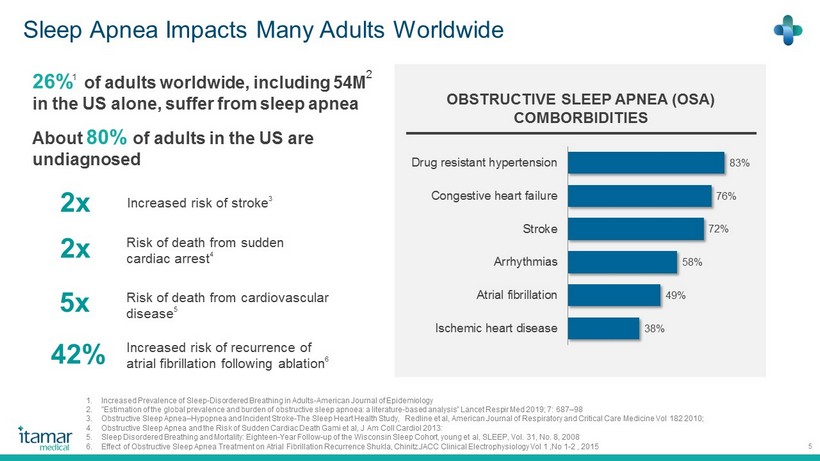

Sleep Apnea Impacts Many Adults Worldwide 5 OBSTRUCTIVE SLEEP APNEA (OSA) COMBORBIDITIES 83% 76 % 72% 58% 49% 38% Drug resistant hypertension Congestive heart failure Stroke Arrhythmias Atrial fibrillation Ischemic heart disease 26% 1 of adults worldwide, including 54M 2 in the US alone, suffer from sleep apnea About 80% of adults in the US are undiagnosed Increased risk of stroke 3 2x Increased risk of recurrence of atrial fibrillation following ablation 6 42% Risk of death from cardiovascular disease 5 5x Risk of death from sudden cardiac arrest 4 2x 1. Increased Prevalence of Sleep - Disordered Breathing in Adults - American Journal of Epidemiology 2. "Estimation of the global prevalence and burden of obstructive sleep apnoea : a literature - based analysis” Lancet Respir Med 2019 ; 7 : 687 – 98 3. Obstructive Sleep Apnea – Hypopnea and Incident Stroke - The Sleep Heart Health Study, Redline et al, American Journal of Respiratory and Critical Care Medicine Vol 182 2010 ; 4. Obstructive Sleep Apnea and the Risk of Sudden Cardiac Death Gami et al, J Am Coll Cardiol 2013 : 5. Sleep Disordered Breathing and Mortality: Eighteen - Year Follow - up of the Wisconsin Sleep Cohort, young et al, SLEEP, Vol. 31 , No. 8 , 2008 6. Effect of Obstructive Sleep Apnea Treatment on Atrial Fibrillation Recurrence Shukla, Chinitz JACC Clinical Electrophysiology Vol 1 ,No 1 - 2 , 2015

Multiple Trends Propelling the Market 6 Source: Sleep Apnea Types, Mechanisms, and Clinical Cardiovascular Consequences, Javaheri,et al, JACC VOL. 69, NO. 7, 2017 841 - 58

For Most Untreated Patients, the Journey is Cumbersome 7 Traditionally, we estimate 65 % of sleep tests have been conducted in sleep labs Sleep patient journey is lengthy (~3 months) multiple locations: � inconvenient and high cost ($ 3,500 - $ 8,700 ) 2 1. There are potentially 54M patients each year that require a visit or follow - up with one of ~5,000 board - certified sleep physicians in the US 1 , or over 10,000 patients per physician. 2. Sleep experts typically recommend Polysomnography (PSG) at a sleep lab, but not everyone chooses to comply 3. Once the sleep test is interpreted, they may prescribe CPAP during a follow - up consultation 1. “ The Past Is Prologue: The Future of Sleep Medicine” J Clin Sleep Med. 2017 Jan 15 ; 13 ( 1 ): 127 – 135 . 2. Based on CMS 2018 claims data

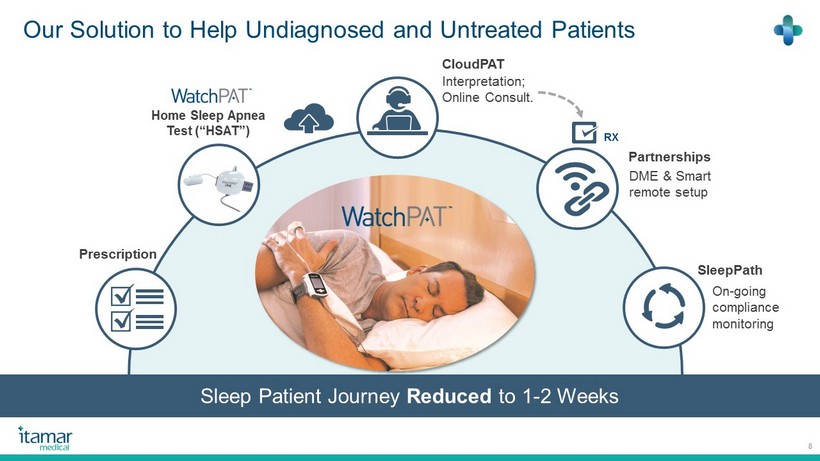

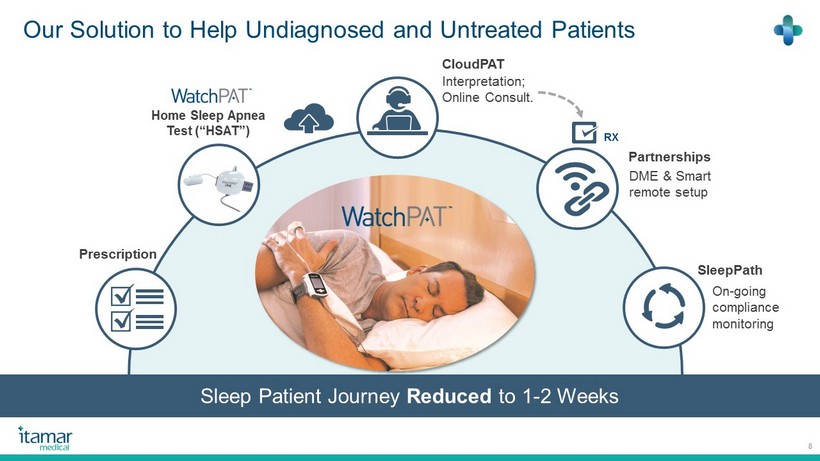

Our Solution to Help Undiagnosed and Untreated Patients 8 SleepPath On - going compliance monitoring Partnerships DME & Smart remote setup CloudPAT Interpretation; Online Consult. Home Sleep Apnea Test (“HSAT”) RX Prescription Sleep Patient Journey Reduced to 1 - 2 Weeks

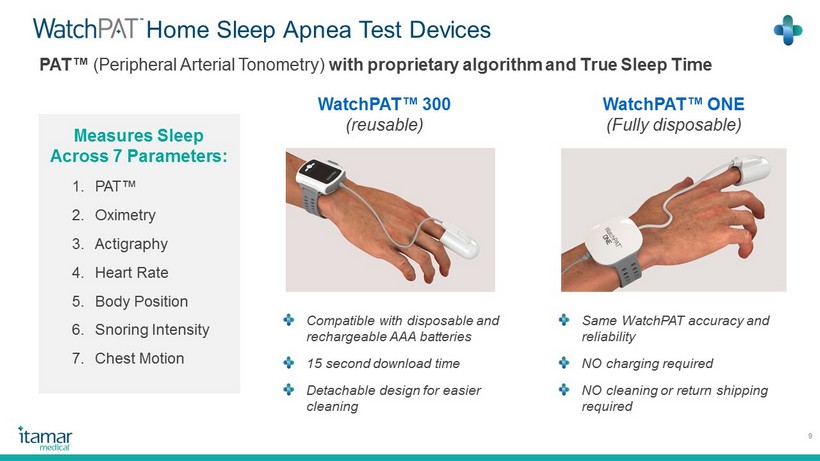

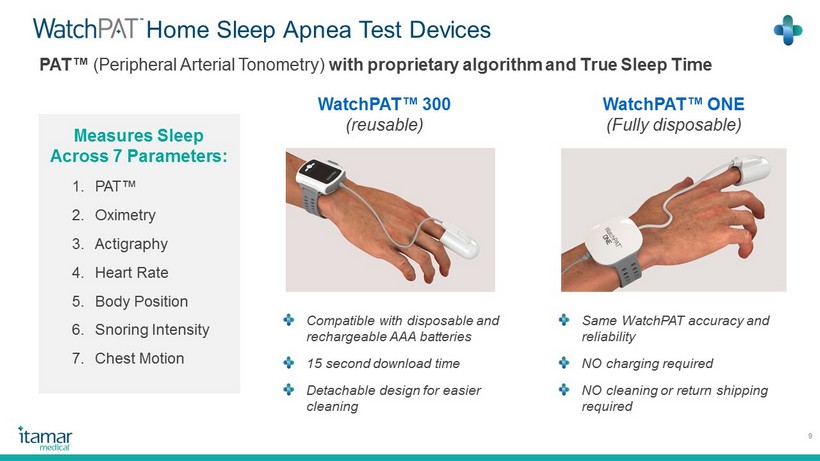

Home Sleep Apnea Test Devices 9 WatchPAT™ ONE (Fully disposable) WatchPAT™ 300 (reusable) Same WatchPAT accuracy and reliability NO charging required NO cleaning or return shipping required PAT™ (Peripheral Arterial Tonometry) with proprietary algorithm and True Sleep Time 1. PAT™ 2. Oximetry 3. Actigraphy 4. Heart Rate 5. Body Position 6. Snoring Intensity 7. Chest Motion Measures Sleep Across 7 Parameters: Compatible with disposable and rechargeable AAA batteries 15 second download time Detachable design for easier cleaning

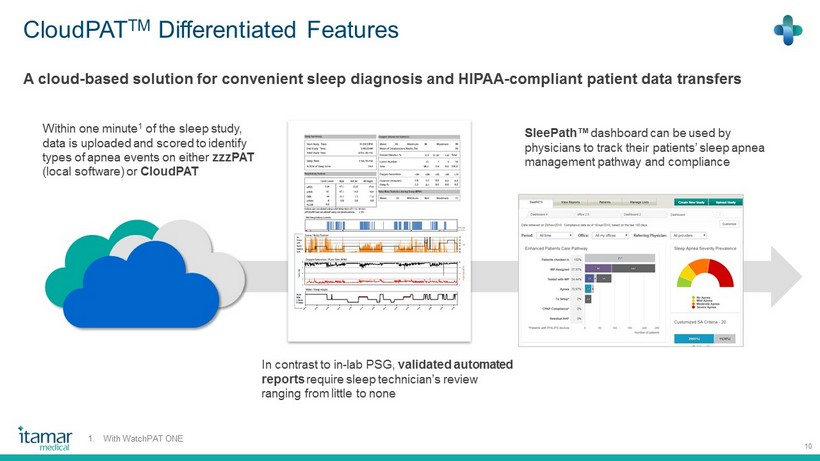

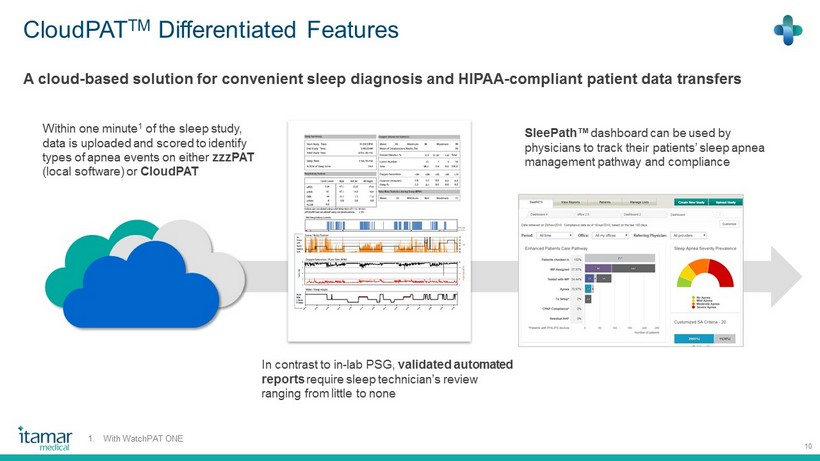

CloudPAT TM Differentiated Features 10 SleePath ™ dashboard can be used by physicians to track their patients’ sleep apnea management pathway and compliance A cloud - based solution for convenient sleep diagnosis and HIPAA - compliant patient data transfers Within one minute 1 of the sleep study, data is uploaded and scored to identify types of apnea events on either zzzPAT (local software) or CloudPAT In contrast to in - lab PSG, validated automated reports require sleep technician’s review ranging from little to none 1. With WatchPAT ONE

CloudPAT TM Digital Health Architecture 11 CloudPAT Customer EMRs API (HL 7 /FHIR) CPAP Compliance Data Server(s) Interpretation marketplace RPAT Smart Client WatchPAT ONE Backend Patient portal HIPPA Compliant Online consultations Secure DME Referrals/integrations AWS (SOC 2 )

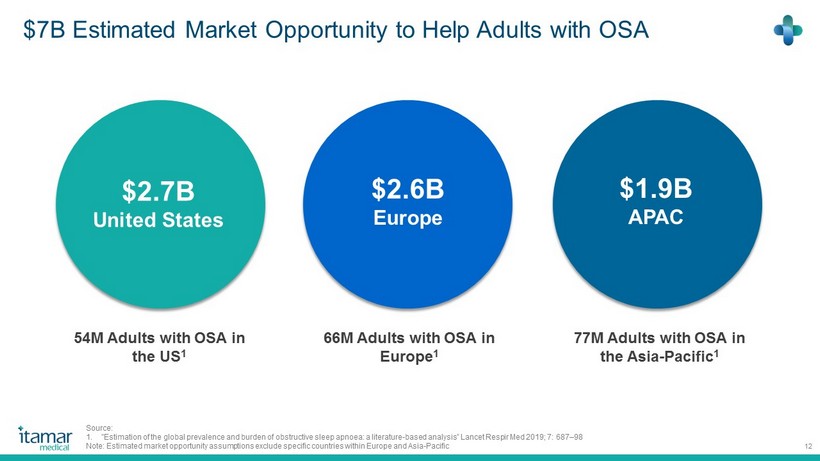

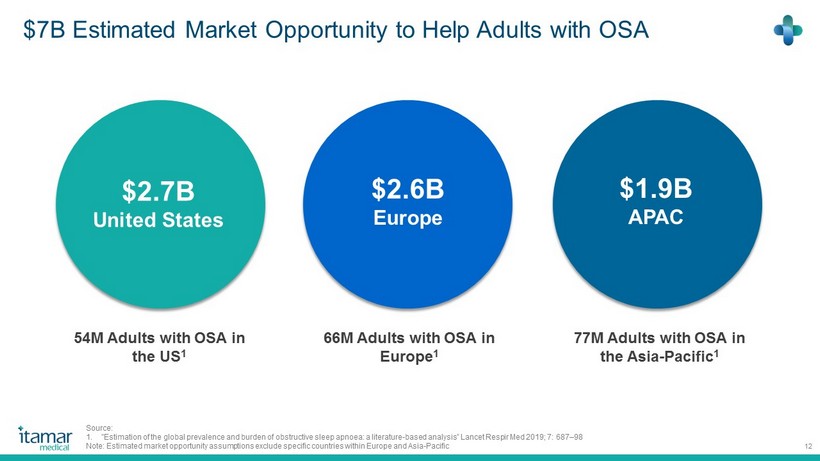

$7B Estimated Market Opportunity to Help Adults with OSA 12 $2.6B Europe $ 1.9 B APAC 77M Adults with OSA in the Asia - Pacific 1 54 M Adults with OSA in the US 1 66M Adults with OSA in Europe 1 Source: 1. "Estimation of the global prevalence and burden of obstructive sleep apnoea : a literature - based analysis” Lancet Respir Med 2019 ; 7 : 687 – 98 Note: Estimated market opportunity assumptions exclude specific countries within Europe and Asia - Pacific $2.7B United States

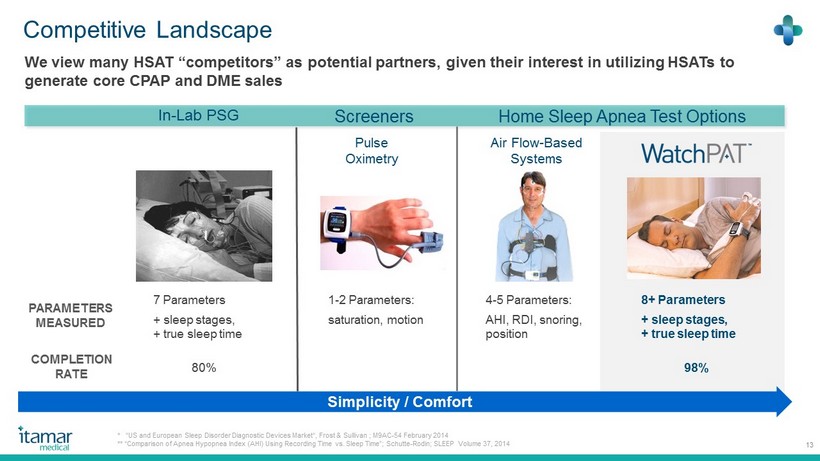

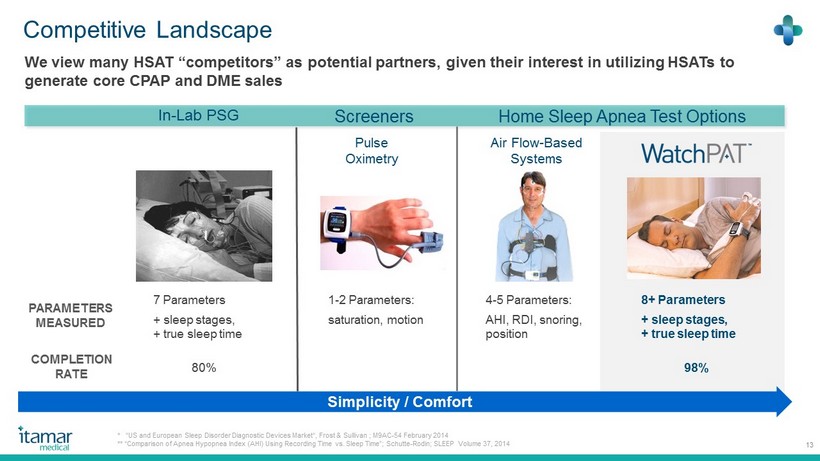

Competitive Landscape 13 In - Lab PSG We view many HSAT “competitors” as potential partners, given their interest in utilizing HSATs to generate core CPAP and DME sales Home Sleep Apnea Test Options PARAMETERS MEASURED 7 Parameters + sleep stages, + true sleep time Air Flow - Based Systems Pulse Oximetry Simplicity / Comfort 1 - 2 Parameters: saturation, motion 4 - 5 Parameters: AHI, RDI, snoring, position 8 + Parameters + sleep stages, + true sleep time COMPLETION RATE 80 % 98% * “US and European Sleep Disorder Diagnostic Devices Market“, Frost & Sullivan ; M 9 AC - 54 February 2014 ** “Comparison of Apnea Hypopnea Index (AHI) Using Recording Time vs. Sleep Time”; Schutte - Rodin; SLEEP Volume 37 , 2014 Screeners

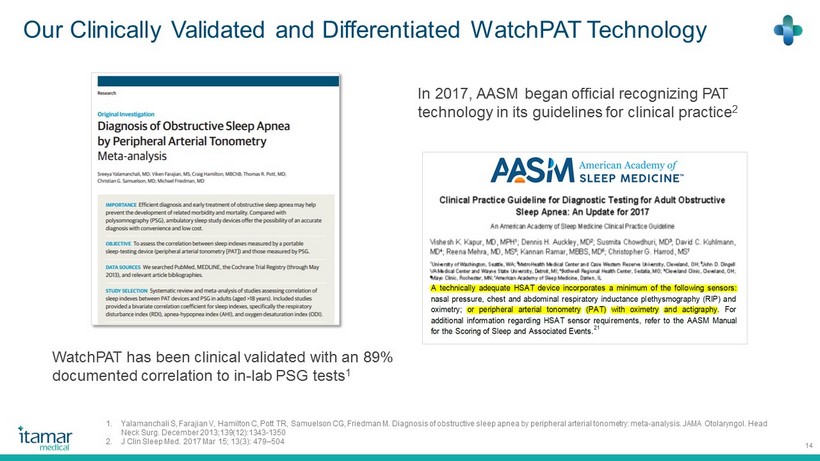

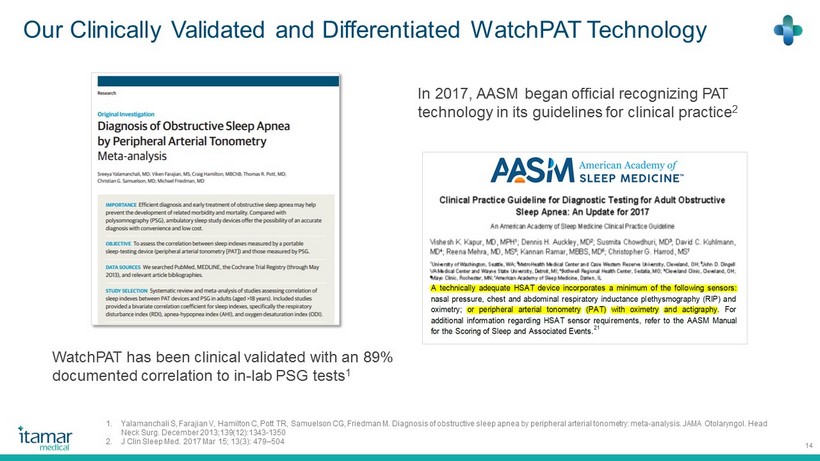

Our Clinically Validated and Differentiated WatchPAT Technology 14 1. Yalamanchali S, Farajian V, Hamilton C, Pott TR, Samuelson CG, Friedman M. Diagnosis of obstructive sleep apnea by peripheral arterial tonometry: meta - analysis. JAMA Otolaryngol . Head Neck Surg. December 2013 ; 139 ( 12 ): 1343 - 1350 2. J Clin Sleep Med. 2017 Mar 15 ; 13 ( 3 ): 479 – 504 WatchPAT has been clinical validated with an 89% documented correlation to in - lab PSG tests 1 In 2017 , AASM began official recognizing PAT technology in its guidelines for clinical practice 2

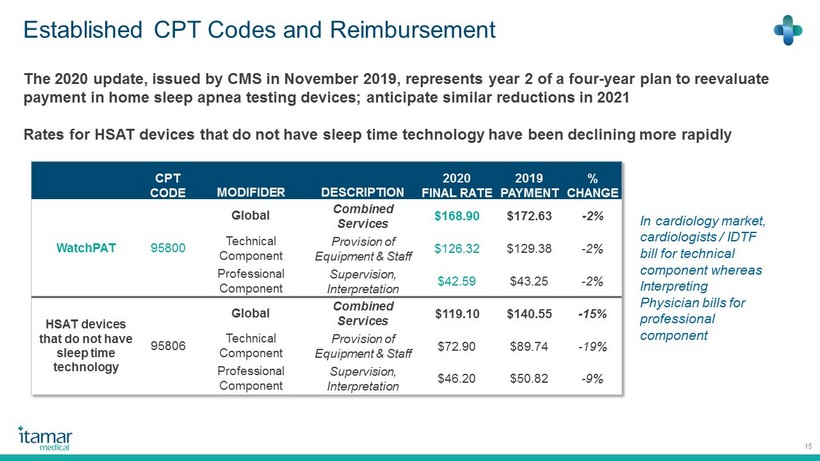

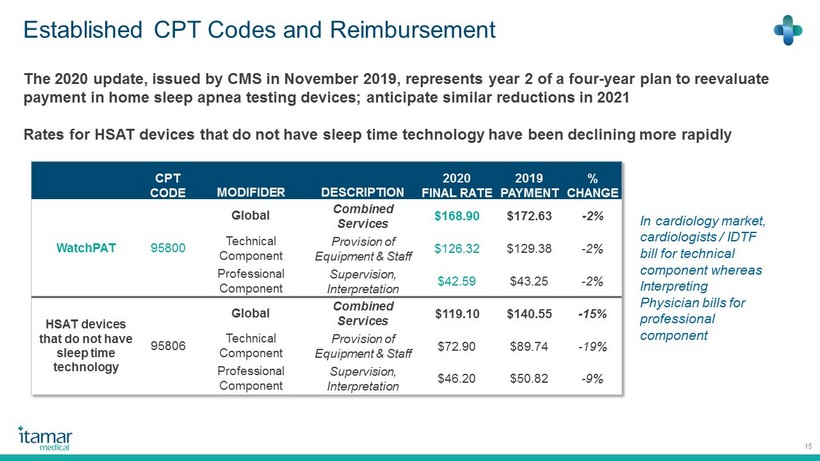

Established CPT Codes and Reimbursement 15 CPT CODE MODIFIDER DESCRIPTION 2020 FINAL RATE 2019 PAYMENT % CHANGE WatchPAT 95800 Global Combined Services $168.90 $172.63 - 2% Technical Component Provision of Equipment & Staff $126.32 $129.38 - 2% Professional Component Supervision, Interpretation $42.59 $43.25 - 2% HSAT devices that do not have sleep time technology 95806 Global Combined Services $119.10 $140.55 - 15% Technical Component Provision of Equipment & Staff $72.90 $89.74 - 19% Professional Component Supervision, Interpretation $46.20 $50.82 - 9% The 2020 update, issued by CMS in November 2019 , represents year 2 of a four - year plan to reevaluate payment in home sleep apnea testing devices; anticipate similar reductions in 2021 Rates for HSAT devices that do not have sleep time technology have been declining more rapidly In cardiology market, cardiologists / IDTF bill for technical component whereas Interpreting Physician bills for professional component

COVID - 19 Update: Recommendations Impact 16 Source: https://aasm.org/covid - 19 - resources/covid - 19 - mitigation - strategies - sleep - clinics - labs The AASM began issuing its “COVID - 19 Mitigation Strategies for Sleep Clinics and Labs” in March and has subsequently updated it for reopening • Postpone and reschedule PSG for children and adults except in emergencies • Postpone and reschedule non - emergency, in - person appointments; conduct telemedicine SLEEP CLINIC & LAB STRATEGIES • Consider using single - use, fully disposable devices and/or components • If using reusable devices, best to remove from service for > 72 hours and disinfect before use HSAT SERVICE PARAMETERS AASM MITIGATION STRATEGIES ITAMAR COMMENTARY ON IMPACT • WatchPAT ONE is the only commercially available disposable HSAT device • Surge in demand for WatchPAT One is tempered with softness in demand for multiuse tests • Onboarded an average of 21 new WatchPAT ONE customers per week from April 1 to May 22, 2020, compared to single digit onboarding levels in Q1

Multiple Growth Drivers 17 HOME - BASED CARE CARDIOLOGY ROW EXPANSION + DIRECT TO CONSUMER CORE SLEEP 1 2 3 4 5

US Telehealth Reimbursement and Home - Based Care Trends 18 50 states and Washington DC provide reimbursement for some form of live video in Medicaid fee - for - service 1 42 states and DC have laws that govern private payer reimbursement of telehealth, some of which require reimbursement be equal to in - person coverage 1 In April 2020, CMS issued an interim rule to add 80+ telehealth services to its list of services covered by Medicare Effective January 2019, the bipartisan Budget Act authorized five telehealth expansions 1. “State Telehealth Laws and Reimbursement Policies” Public Health Institute / Center for Connected Health Policy. Spring 2020

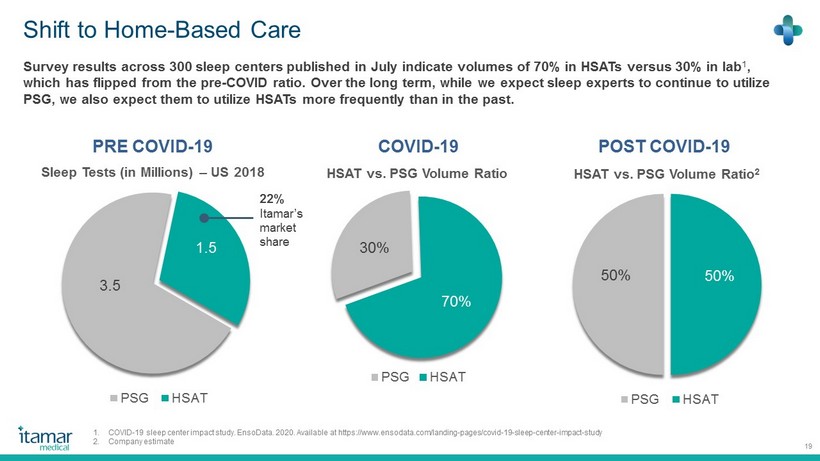

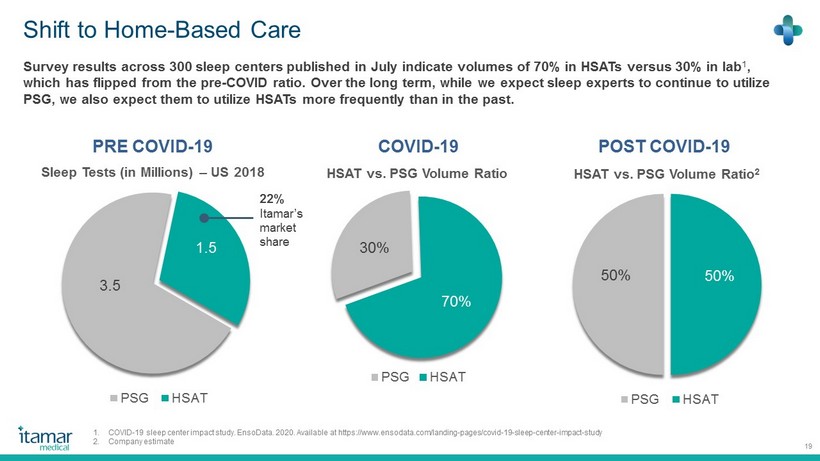

Shift to Home - Based Care 19 3.5 1.5 Sleep Tests (in Millions) – US 2018 PSG HSAT PRE COVID - 19 50 % 50% HSAT vs. PSG Volume Ratio 2 PSG HSAT POST COVID - 19 Survey results across 300 sleep centers published in July indicate volumes of 70% in HSATs versus 30% in lab 1 , which has flipped from the pre - COVID ratio. Over the long term, while we expect sleep experts to continue to utilize PSG, we also expect them to utilize HSATs more frequently than in the past. 1. COVID - 19 sleep center impact study. EnsoData . 2020. Available at https://www.ensodata.com/landing - pages/covid - 19 - sleep - center - impact - study 2. Company estimate 22 % Itamar’s market share 30% 70 % HSAT vs. PSG Volume Ratio PSG HSAT COVID - 19

Three - Pronged US Commercialization Strategy 20 CHANNEL STRATEGY Core Sleep Cardiology Direct to Consumer OPPORTUNITY - Direct Sales - Partnerships (e.g. CPAP and DME vendors) 2,500+ Sleep Centers 1 13,678 Practice Sites 2 54 M Americans with Undiagnosed OSA 3 - Direct Sales - Partnerships (e.g. Cardiology Device and DME vendors) - Partnerships (e.g. CPAP - related vendors) 1. “ AASM response to closing of Sleep HealthCenters facilities in New England and Arizona” AASM Press Release. January 27, 2013 2. “Nationwide Physician Specialties by State” IQVIA Market Insights Report. August 2019 3. “Americas Prevalence of OSA in Adults: Estimation Using Currently Available Data” Sleep, Volume 42, Issue Supplement_1, April 20 19, Page A191

Business Models for Different Needs 21 WatchPAT™ devices, including WatchPAT 300 Finger - mounted probes Capital Sales Marketplace Services Test as a Service ( TaaS ) Delivery Services Fixed fee per home sleep apnea test (“HSAT”) WatchPAT One Includes the disposable biosensor, hardware rental fees (as applicable) and access to the CloudPAT ™ platform for sleep report interpretation SleepPath ™ care pathway module for cardiologists to monitor patient sleep apnea management status and compliance with CPAP therapeutic devices Remote interpretation and consultation WatchPAT™ Direct set of logistic support services including delivery of device to the patient and the shipment back to service center Turnkey solution

Notable Partnerships 22 Collaboration with Lunella , a subsidiary of SoClean, in DTC channel Digital platform for Prescription, Interpretation, On - line consult with Therapy recommendation Digital DME for fast and seamless treatment integration Therapeutic part of the Total Sleep Solution Offering Turnkey solution for cardiology clinics from screening to treatment including billing

Quarterly Revenue and Non - IFRS Gross Margin Progression 23 Q1/17 Q2/17 Q3/17 Q4/17 Q1/18 Q2/18 Q3/18 Q4/18 Q1/19 Q2/19 Q3/19 Q4/19 Q1/20 Q2/20 US and Canada WP Revenue $2.6M $3.4M $3.8M $4.0M $3.2M $4.2M $4.9M $4.4M $4.3M $5.0M $5.8M $7.3M $6.1M $6.6M Total Revenue $4.3M $5.1M $5.3M $6.0M $5.5M $6.1M $6.1M $6.6M $6.1M $7.4M $8.1M $9.8M $8.4M $8.9M GM % - Non-IFRS 76.6% 76.6% 76.8% 77.1% 78.2% 77.7% 75.2% 78.6% 78.2% 79.1% 78.6% 79.5% 76.8% 69.9% 60.0% 65.0% 70.0% 75.0% 80.0% 85.0% - $2.0M $4.0M $6.0M $8.0M $10.0M $12.0M * For IFRS gross margin and reconciliation between IFRS and Non - IFRS gross margin, please refer to page 31

Key Takeaways 24 We are revolutionizing the way sleep disorders are diagnosed and managed with our home - based solutions and digital health platform We have a large market opportunity to help 26 % of adults worldwide, and we have only 22 % est. market share within the United States HSAT market We expect multiple growth drivers to add incremental value, ranging from international expansion to the shift to home - based care Our financial profile is compelling, with 29 % y/y revenue growth as of 2019 YE, high gross margins, and $ 45 M in cash & cash equivalents

25 Appendix

Management Team 26 Gilad Glick President & CEO Shy Basson CFO & US COO Jeff Schmidt SVP, Sales North America Dan Shlezak VP, Operations, Engineering and R&D Ira Prigat President, Japan and China Efrat Litman VP, Advanced Research & Development & Regulatory Moti Mikles VP, Quality & Healthcare Compliance Amit Shafrir VP & General Manager Cardiology Business Eilon Livne VP, Sales & Channels Development EMEA & AP Shiri Shneorson VP & General Manager, Digital Health Business Unit

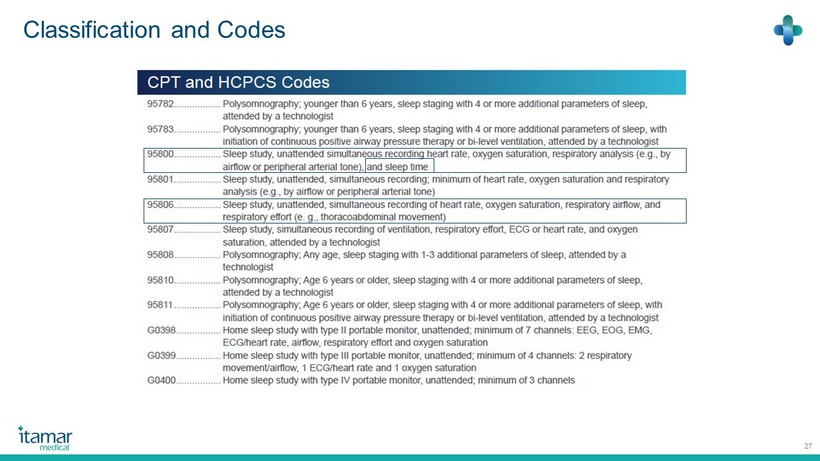

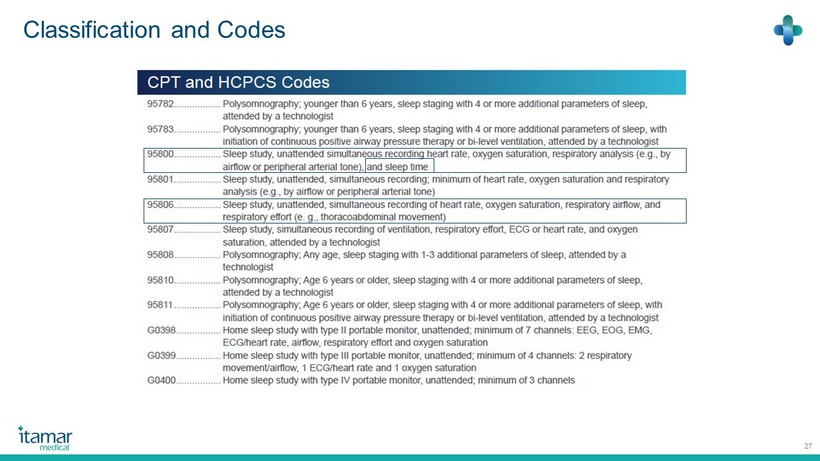

Classification and Codes 27

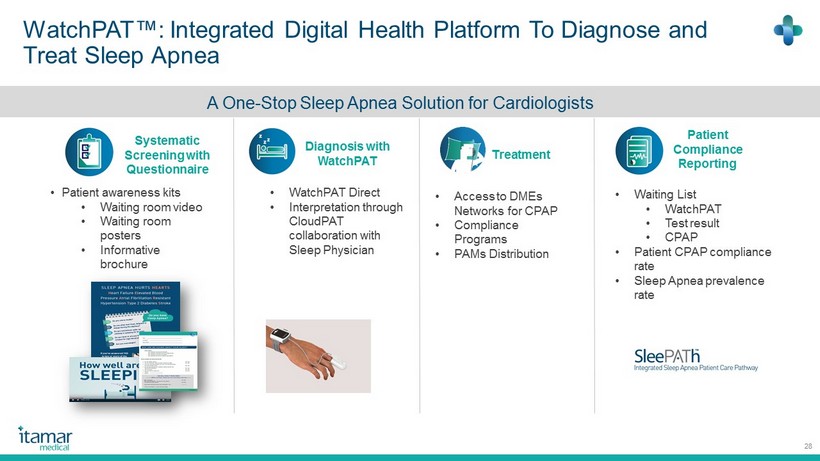

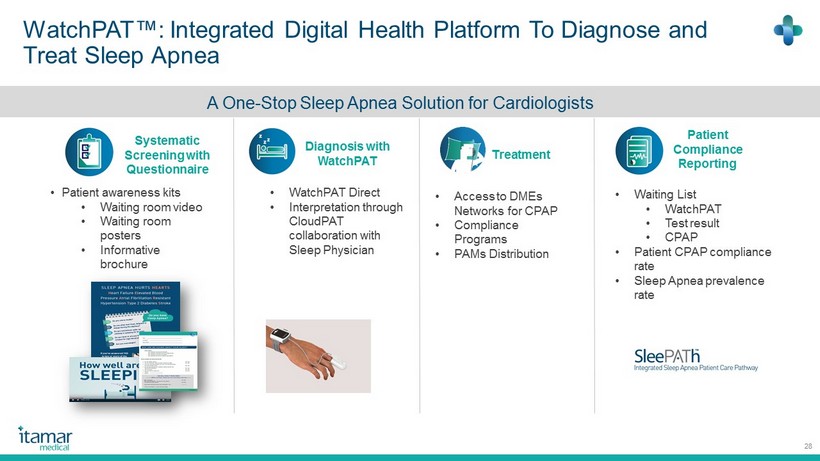

WatchPAT ™: Integrated Digital Health Platform To Diagnose and Treat Sleep Apnea 28 Systematic Screening with Questionnaire Diagnosis with WatchPAT Treatment Patient Compliance Reporting • Access to DMEs Networks for CPAP • Compliance Programs • PAMs Distribution • WatchPAT Direct • Interpretation through CloudPAT collaboration with Sleep Physician • Patient awareness kits • Waiting room video • Waiting room posters • Informative brochure • Waiting List • WatchPAT • Test result • CPAP • Patient CPAP compliance rate • Sleep Apnea prevalence rate A One - Stop Sleep Apnea Solution for Cardiologists

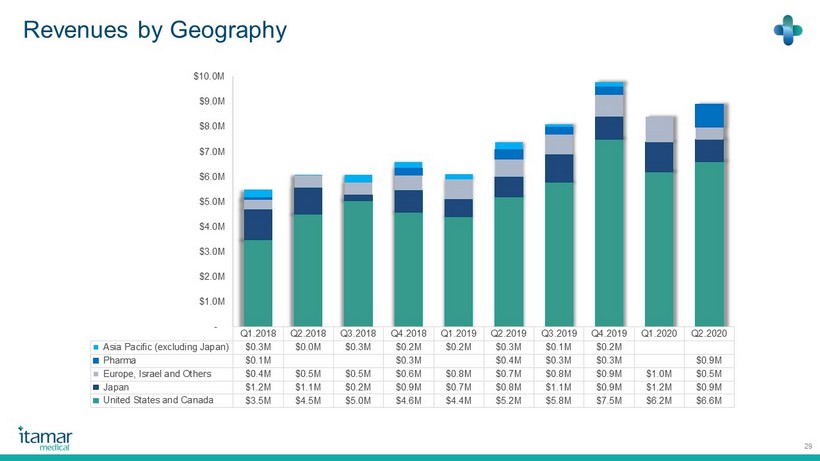

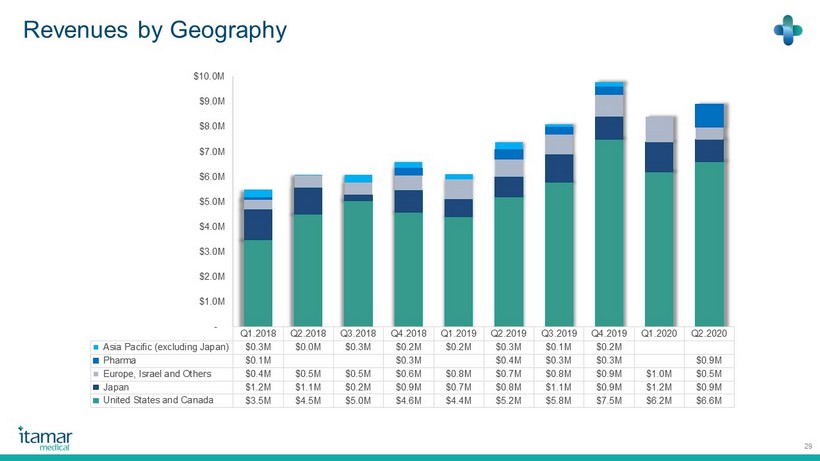

Revenues by Geography 29 Q1.2018 Q2.2018 Q3.2018 Q4.2018 Q1.2019 Q2.2019 Q3.2019 Q4.2019 Q1.2020 Q2.2020 Asia Pacific (excluding Japan) $0.3M $0.0M $0.3M $0.2M $0.2M $0.3M $0.1M $0.2M Pharma $0.1M $0.3M $0.4M $0.3M $0.3M $0.9M Europe, Israel and Others $0.4M $0.5M $0.5M $0.6M $0.8M $0.7M $0.8M $0.9M $1.0M $0.5M Japan $1.2M $1.1M $0.2M $0.9M $0.7M $0.8M $1.1M $0.9M $1.2M $0.9M United States and Canada $3.5M $4.5M $5.0M $4.6M $4.4M $5.2M $5.8M $7.5M $6.2M $6.6M - $1.0M $2.0M $3.0M $4.0M $5.0M $6.0M $7.0M $8.0M $9.0M $10.0M

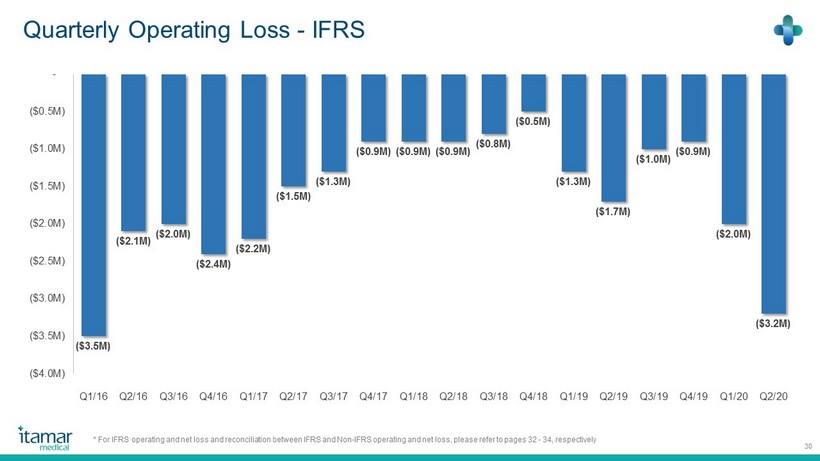

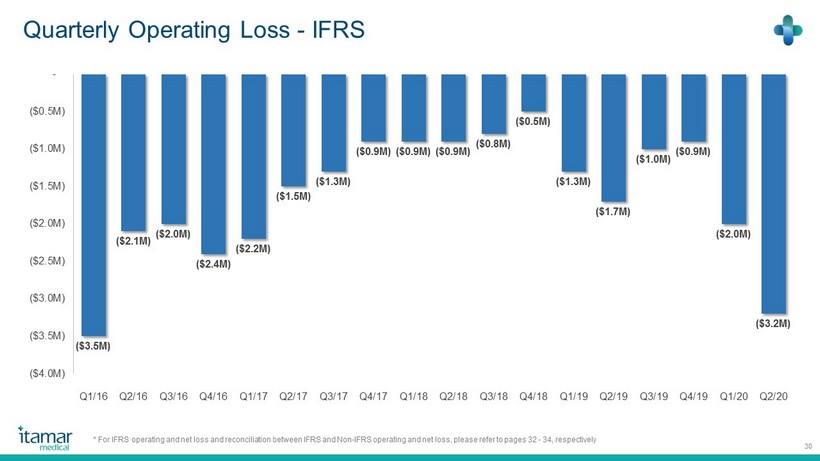

Quarterly Operating Loss - IFRS 30 ($3.5M) ($2.1M) ($ 2.0 M) ($2.4M) ($2.2M) ($ 1.5 M) ($1.3M) ($ 0.9 M) ($0.9M) ($0.9M) ($ 0.8 M) ($0.5M) ($1.3M) ($ 1.7 M) ($1.0M) ($ 0.9 M) ($2.0M) ($3.2M) ($4.0M) ($3.5M) ($3.0M) ($2.5M) ($2.0M) ($1.5M) ($1.0M) ($0.5M) - Q1/16 Q2/16 Q3/16 Q4/16 Q1/17 Q2/17 Q3/17 Q4/17 Q1/18 Q2/18 Q3/18 Q4/18 Q1/19 Q2/19 Q3/19 Q4/19 Q1/20 Q2/20 * For IFRS operating and net loss and reconciliation between IFRS and Non - IFRS operating and net loss, please refer to pages 32 - 34 , respectively

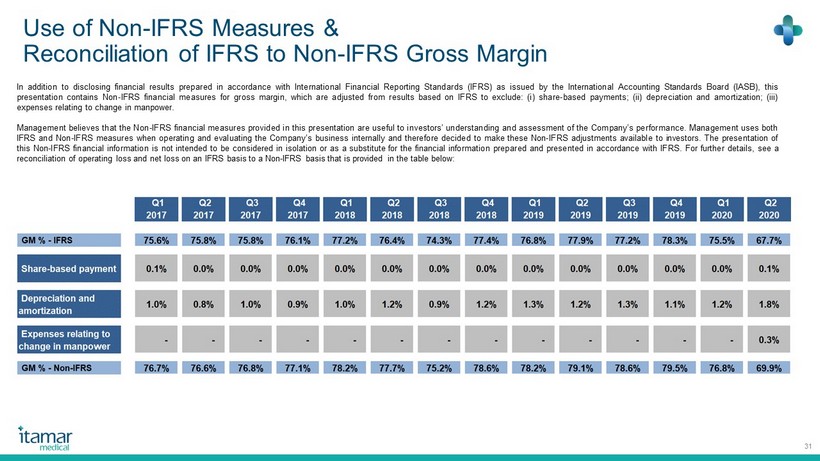

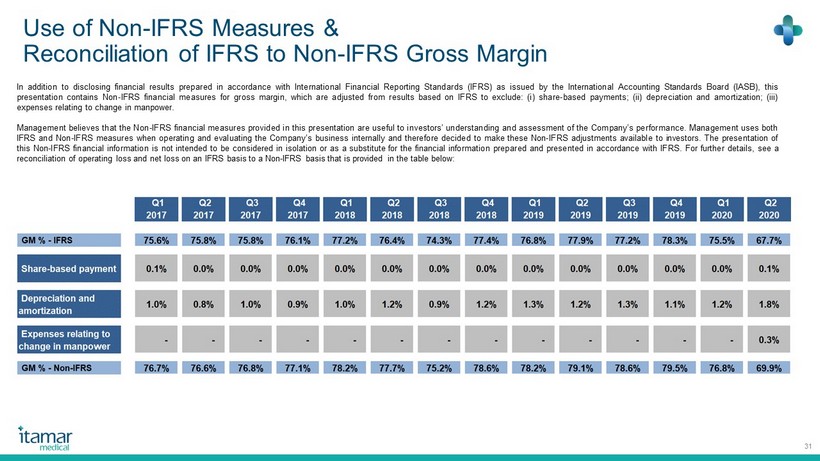

Use of Non - IFRS Measures & Reconciliation of IFRS to Non - IFRS Gross Margin 31 In addition to disclosing financial results prepared in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB), this presentation contains Non - IFRS financial measures for gross margin, which are adjusted from results based on IFRS to exclude : ( i ) share - based payments ; (ii) depreciation and amortization ; (iii) expenses relating to change in manpower . Management believes that the Non - IFRS financial measures provided in this presentation are useful to investors’ understanding and assessment of the Company’s performance . Management uses both IFRS and Non - IFRS measures when operating and evaluating the Company’s business internally and therefore decided to make these Non - IFRS adjustments available to investors . The presentation of this Non - IFRS financial information is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with IFRS . For further details, see a reconciliation of operating loss and net loss on an IFRS basis to a Non - IFRS basis that is provided in the table below :

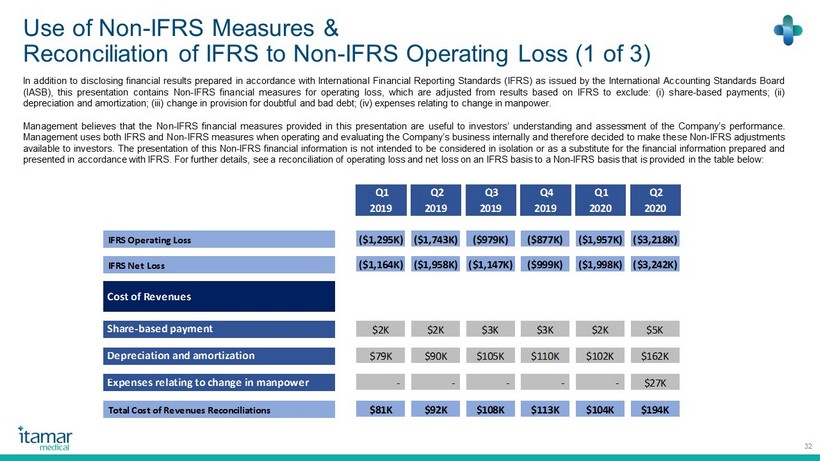

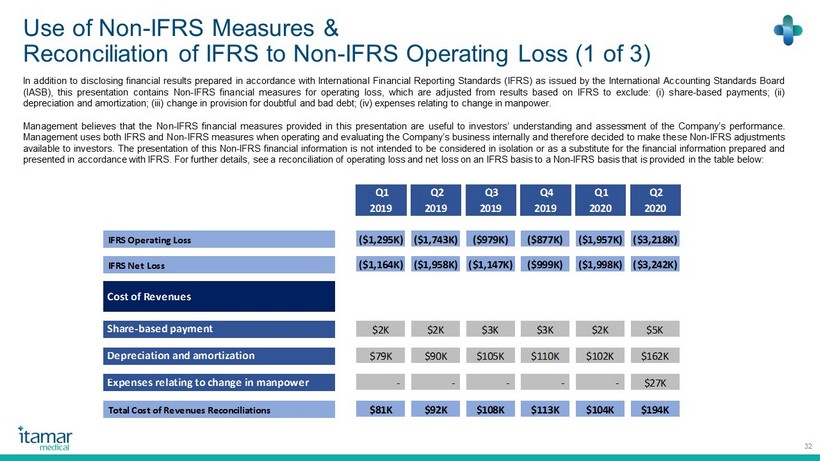

Use of Non - IFRS Measures & Reconciliation of IFRS to Non - IFRS Operating Loss (1 of 3) 32 In addition to disclosing financial results prepared in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB), this presentation contains Non - IFRS financial measures for operating loss, which are adjusted from results based on IFRS to exclude : ( i ) share - based payments ; (ii) depreciation and amortization ; (iii) change in provision for doubtful and bad debt ; (iv) expenses relating to change in manpower . Management believes that the Non - IFRS financial measures provided in this presentation are useful to investors’ understanding and assessment of the Company’s performance . Management uses both IFRS and Non - IFRS measures when operating and evaluating the Company’s business internally and therefore decided to make these Non - IFRS adjustments available to investors . The presentation of this Non - IFRS financial information is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with IFRS . For further details, see a reconciliation of operating loss and net loss on an IFRS basis to a Non - IFRS basis that is provided in the table below : Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 IFRS Operating Loss ($1,295K) ($1,743K) ($979K) ($877K) ($1,957K) ($3,218K) IFRS Net Loss ($1,164K) ($1,958K) ($1,147K) ($999K) ($1,998K) ($3,242K) Cost of Revenues Share-based payment $2K $2K $3K $3K $2K $5K Depreciation and amortization $79K $90K $105K $110K $102K $162K Expenses relating to change in manpower - - - - - $27K Total Cost of Revenues Reconciliations $81K $92K $108K $113K $104K $194K

Use of Non - IFRS Measures & Reconciliation of IFRS to Non - IFRS Operating Loss (2 of 3) 33 Selling and Marketing Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Share-based payment - $169K $129K $85K $119K $80K Depreciation and amortization $28K $30K $14K $52K $31K $37K Expenses relating to change in manpower - - - - - $63K Total Selling and Marketing Reconciliations $28K $199K $143K $137K $150K $180K Research and Development Share-based payment $29K $25K $47K $69K $71K $71K Depreciation and amortization $12K $16K $34K - $19K $31K Expenses relating to change in manpower - $115K - - - $18K Total Research and Development Reconciliations $41K $156K $81K $69K $90K $120K General and Administrative Share-based payment $139K $153K $170K $209K $164K $147K Depreciation and amortization $13K $14K $14K $5K $16K $18K Change in provision for doubtful and bad debt ($13K) $207K ($2K) $157K $32K $126K Expenses relating to change in manpower - - - - - $9K Total General and Administrative Reconciliations $139K $374K $182K $371K $212K $300K Non - IFRS Operating Loss ($1,006K) ($922K) ($465K) ($187K) ($1,401K) ($2,424K)

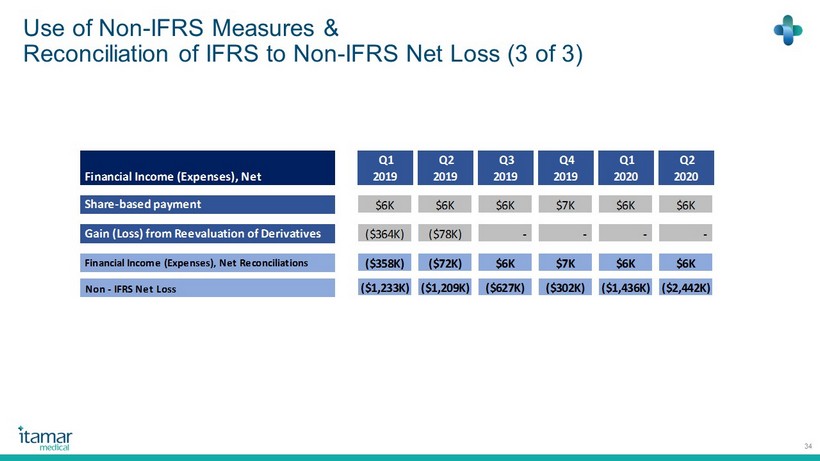

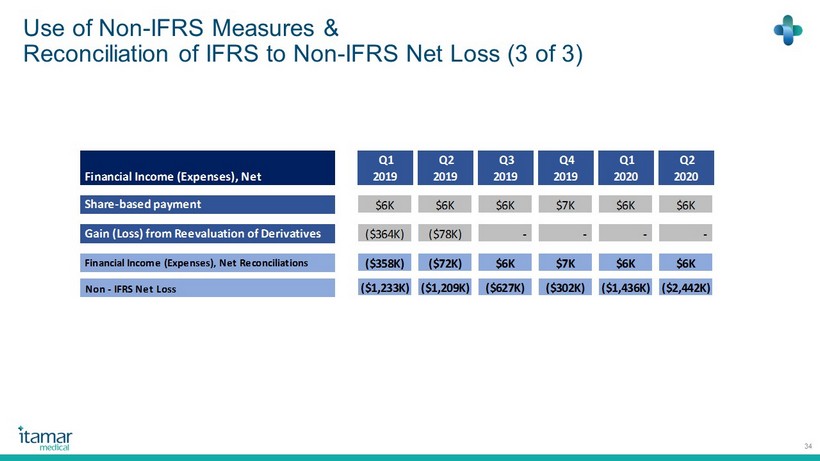

Use of Non - IFRS Measures & Reconciliation of IFRS to Non - IFRS Net Loss (3 of 3) 34 Financial Income (Expenses), Net Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Share-based payment $6K $6K $6K $7K $6K $6K Gain (Loss) from Reevaluation of Derivatives ($364K) ($78K) - - - - Financial Income (Expenses), Net Reconciliations ($358K) ($72K) $6K $7K $6K $6K Non - IFRS Net Loss ($1,233K) ($1,209K) ($627K) ($302K) ($1,436K) ($2,442K)

35