Exhibit 99.1

Revolutionizing the way sleep disorders are diagnosed and managed Investor Presentation August 2021

Disclaimer 2 Itamar Medical Ltd . (the "Company") is furnishing this presentation and any information given during this presentation, solely for the consideration of eligible investors who have the knowledge and experience in financial and business matters and the capability to conduct their own due diligence investigation in connection with the investment outlined herein . Prospective investors are urged to conduct an independent evaluation of the Company . This presentation does not constitute an offer or a solicitation to participate in any investment in the Company . This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any of the securities of the Company in the United States or Israel . The offering of the Company ’ s securities (including all underlying securities thereof) has not been, nor will it be, registered under the United States Securities Act of 1933 , as amended (the “ Securities Act ” ), any state securities laws, or Israeli securities laws and such securities may not be offered or sold within the United States, or to, or for the account or benefit of, U . S . persons, except pursuant to an effective registration statement under the Securities Act or an applicable exemption from the U . S . registration requirements . The statements in this presentation should not be regarded as a basis for an investment decision of any kind, or as recommendation or opinion, or a substitute for investor discretion . Forward Looking Statements This presentation contains forward - looking statements within the meaning of the "safe harbor" provisions of applicable securities laws . Statements preceded by, followed by, or that otherwise include the words "believes," "expects," "anticipates," "intends," "estimates," "plans," and similar expressions or future or conditional verbs such as "will," "should," "would," "may" and "could" are generally forward - looking in nature and not historical facts . For example, when we discuss growing appreciation within the cardiology community of the role of WatchPAT, we are using forward - looking statements . Because such statements deal with future events, they are subject to various risks, uncertainties and assumptions, including events and circumstances out of the Company's control and actual results, expressed or implied by such forward - looking statements, could differ materially from the Company's current expectations . Factors that could cause or contribute to such differences include, but are not limited to, risks, uncertainties and assumptions discussed from time to time by the Company in reports filed with, or furnished to, the Israel Securities Authority and the U . S . Securities and Exchange Commission . Except as otherwise required by law, the Company undertakes no obligation to publicly release any revisions to these forward - looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events . The United States and Israeli securities laws prohibit any person who has material non - public information about a company ("Inside Information"), from purchasing or selling securities of such company, or from communicating such Inside Information to any other person under circumstances in which it is reasonably foreseeable that such person is likely to purchase or sell such securities . Statements in this presentation and in any information given during this presentation might be considered as Inside Information, in accordance with the applicable securities laws . Therefore, any person aware of this presentation or of any information given during this presentation, may neither use, nor cause any third party to use, any Inside Information or any other information provided in connection with the presentation, in contravention of the applicable securities laws or any such rules and regulations thereunder . The Company, and its respective affiliates, employees and representatives expressly disclaim any and all liability relating to or resulting from the use of this presentation or any information given during this presentation or such other information by a prospective investor or any of its affiliates or representatives . Use of Non - IFRS Financial Matters This presentation includes non - IFRS financial measures, and the Company believes that these non - IFRS financial measures are useful to investors for two principal reasons . First, the Company believes these measures may assist investors in comparing performance over various reporting periods on a consistent basis . Second, these measure are used by the Company ’ s management to assess its performance and may enable investors to compare the performance of the Company to its competition . The Company believes that the use of these non - IFRS financial measures provides an additional tool for investors in evaluating ongoing operating results and trends . These non - IFRS measures should not be considered in isolation from, or an alternative to, financial measures determined in accordance with IFRS . For reconciliation of the non - IFRS measures used in this presentation, see the “ Appendix ” at the end of this presentation . * The contents of any website or hyperlinks mentioned in this presentation are for informational purposes and the contents thereof are not part of this presentation .

Investment Highlights 3 DISRUPTIVE HOME - BASED SOLUTIONS LARGE OPPORTUNITY TO HELP MULTIPLE GROWTH CATALYSTS COMPELLING FINANCIAL PROFILE Digital health platform with home sleep apnea test ( “ HSAT ” ) solutions FDA approved and CE Marked devices with established CPT code Peripheral Arterial Tonometry (PAT) incorporated in American Academy of Sleep Medicine ’ s 2017 practice guidelines Public company on the Tel Aviv Stock Exchange since 2007 ADSs traded on NASDAQ since 2019 Consistent revenue growth : Revenue of ~$ 12 M in Q .2021 (~ 4 % year - over - year growth), revenue of ~$ 24.5 M in H 1.2021 (~ 42 % year - over - year growth) and revenue of ~$ 41 M in 2020 (~ 31 % annual growth) $ 73.0 M in cash, cash equivalents and short - term bank deposits 2 Migration to home - based care and broader telehealth adoption, accelerated by recent events Expand access to cardiology, core sleep, and direct to consumer channels International expansion 26% of adults worldwide suffer from sleep apnea 1 Five million tests in US market, comprised of both polysomnography (“PSG”) and HSATs Multiple trends are propelling the market , such as obesity and cardiovascular diseases 1. “Increased Prevalence of Sleep - Disordered Breathing in Adults” American Journal of Epidemiology, April 2013 2. As of June 30 th, 2021

Vision and Mission 4 Our vision is to become the world leader in sleep apnea management solutions with a focus on additional care pathways Our Mission: to address the 80 % undiagnosed and untreated Obstructive Sleep Apnea ( “ OSA ” ) patients through our digital health platform Cardiology Focus Home - Based Digital Platform

Sleep Apnea Prevalence and Comorbidities 5 OBSTRUCTIVE SLEEP APNEA COMORBIDITIES 7 71 - 90 % 63 - 83% 76 % 58% 49 % 38% 36% Stroke Drug resistant hypertension Congestive heart failure Arrhythmias Atrial fibrillation Ischemic heart disease Type 2 diabetes 26% 1 of adults worldwide, including 54M 2 in the US alone, suffer from sleep apnea About 80% of adults in the US are undiagnosed Increased risk of stroke 3 2x Increased risk of recurrence of atrial fibrillation following ablation 6 42 % Risk of death from cardiovascular disease 5 5x Risk of death from sudden cardiac arrest 4 2 x 1. Increased Prevalence of Sleep - Disordered Breathing in Adults - American Journal of Epidemiology 2. "Estimation of the global prevalence and burden of obstructive sleep apnoea : a literature - based analysis” Lancet Respir Med 2019; 7: 687 – 98 3. Obstructive Sleep Apnea – Hypopnea and Incident Stroke - The Sleep Heart Health Study, Redline et al, American Journal of Respiratory and Critical Care Medicine Vol 182 2010 ; 4. Obstructive Sleep Apnea and the Risk of Sudden Cardiac Death Gami et al, J Am Coll Cardiol 2013: 5. Sleep Disordered Breathing and Mortality: Eighteen - Year Follow - up of the Wisconsin Sleep Cohort, young et al, SLEEP, Vol. 31, No . 8, 2008 6. Effect of Obstructive Sleep Apnea Treatment on Atrial Fibrillation Recurrence Shukla, Chinitz JACC Clinical Electrophysiology Vol 1, No 1 - 2, 2015 7. 2010 study published in Anesthesiology Clinics and 2018 study published by the Journal of the American Heart Association

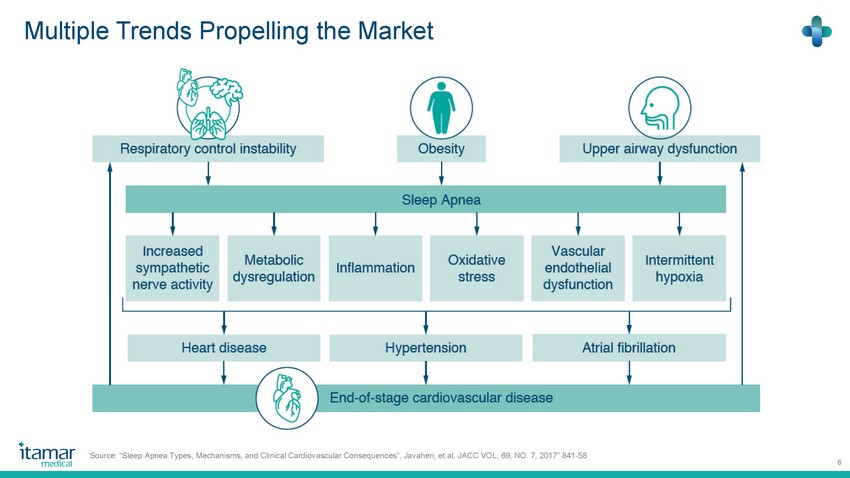

Multiple Trends Propelling the Market 6 Source: “Sleep Apnea Types, Mechanisms, and Clinical Cardiovascular Consequences”, Javaheri , et al, JACC VOL. 69, NO. 7, 2017” 841 - 58

For Most Untreated Patients, the Journey is Cumbersome 7 Traditionally, we estimate 65 % of sleep tests have been conducted in sleep labs 1. There are potentially 54M patients each year that require a visit or follow - up with one of ~5,000 board - certified sleep physicians in the US 1 , or over 10,000 patients per physician 2. Sleep experts typically recommend PSG at a sleep lab, but not everyone chooses to comply 3. Once the sleep test is interpreted, they may prescribe continuous positive airway pressure (“CPAP”) devices during a follow - up consultation 1. “ The Past Is Prologue: The Future of Sleep Medicine ” J Clin Sleep Med. 2017 Jan 15 ; 13 ( 1 ): 127 – 135 .

Care Provider GP, Cardio, ENT >400k in the US Sleep Expert only 5 k in the US A B C D E Sleep Lab PSG default (HSAT as fallback) RX RX Sleep Expert Study outcome consult Sleep test interpreted DME CPAP Focus on 3 month compliance Ongoing Resupply Push More than 50% give up 3 ~ 60 % Of Tests in PSG 3 ~33% patient compliance 3 54 M Patients 1 50% don’t make it 3 12k / physician Sleep patient journey is lengthy (~3 months) Multiple locations: inconvenient and expensive ($ 3,500 - $ 8,700 ) 2 1. “Estimation of the global prevalence and burden of obstructive sleep apnea: a literature - based analysis” Lancet Respir Med 2019; 7: 687 – 98 2. Based on CMS 2018 claims data 3. Company estimates The Traditional Sleep Patient Journey 8

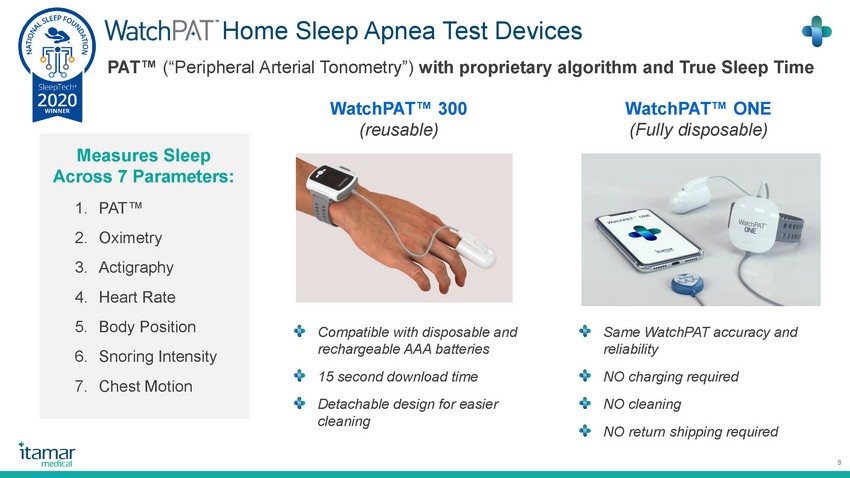

Home Sleep Apnea Test Devices WatchPAT Œ ONE (Fully disposable) WatchPAT Œ 300 (reusable) Same WatchPAT accuracy and reliability NO charging required NO cleaning NO return shipping required PAT Œ ( “ Peripheral Arterial Tonometry ” ) with proprietary algorithm and True Sleep Time 1. PAT Œ 2. Oximetry 3. Actigraphy 4. Heart Rate 5. Body Position 6. Snoring Intensity 7. Chest Motion Measures Sleep Across 7 Parameters: Compatible with disposable and rechargeable AAA batteries 15 second download time Detachable design for easier cleaning 9

Our Solution to Help Undiagnosed and Untreated Patients 10 SleePath ΠOngoing compliance monitoring Partnerships DME & smart remote setup CloudPAT Interpretation; Online Consult HSAT RX Prescription Sleep Patient Journey Reduced to 1 - 2 Weeks

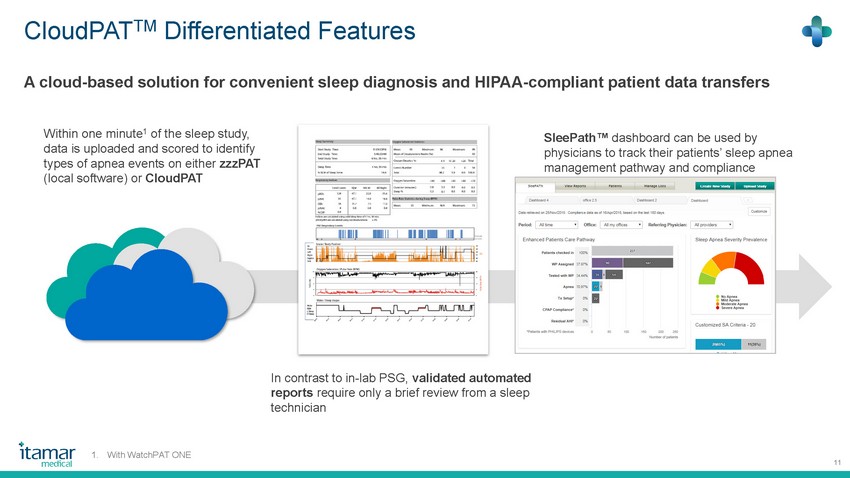

CloudPAT TM Differentiated Features 11 SleePath Œ dashboard can be used by physicians to track their patients’ sleep apnea management pathway and compliance A cloud - based solution for convenient sleep diagnosis and HIPAA - compliant patient data transfers Within one minute 1 of the sleep study, data is uploaded and scored to identify types of apnea events on either zzzPAT (local software) or CloudPAT In contrast to in - lab PSG, validated automated reports require only a brief review from a sleep technician 1. With WatchPAT ONE

CloudPAT TM Digital Health Architecture 12 CloudPAT Customer EMRs API (HL7/FHIR) CPAP Compliance Data Server(s) Interpretation marketplace RPAT Smart Client WatchPAT ONE Backend Patient portal HIPAA Compliant Online consultations Secure DME Referrals/integrations AWS (SOC2) AWS – Amazon Web Services SOC2 - System and Organization Controls

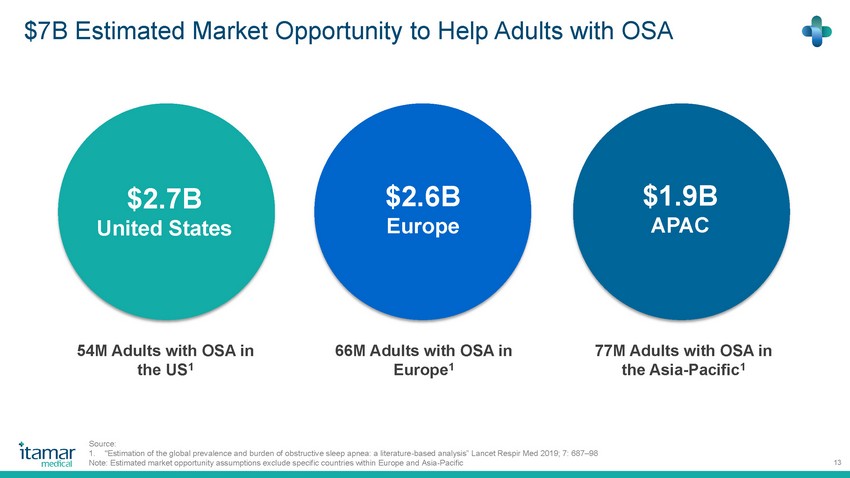

$7B Estimated Market Opportunity to Help Adults with OSA 13 $2.6B Europe $ 1.9 B APAC 77M Adults with OSA in the Asia - Pacific 1 54 M Adults with OSA in the US 1 66M Adults with OSA in Europe 1 Source: 1. "Estimation of the global prevalence and burden of obstructive sleep apnea: a literature - based analysis” Lancet Respir Med 2019; 7: 687 – 98 Note: Estimated market opportunity assumptions exclude specific countries within Europe and Asia - Pacific $2.7B United States

Competitive Landscape 14 In - Lab PSG Our large competitors in the HSAT space are relatively “passive” given their interest in utilizing HSATs to generate core CPAP and DME sales Home Sleep Apnea Test Options PARAMETERS MEASURED 8 Parameters: 1 + sleep stages + true sleep time Air Flow - Based Systems Pulse Oximetry Comprehensiveness 1 - 2 Parameters: saturation, motion 4 - 5 Parameters: AHI, RDI, snoring, position 7 Parameters: + sleep stages + true sleep time COMPLETION RATE 80% 98% 1. Sleep apnea - related 2. “ US and European Sleep Disorder Diagnostic Devices Market “ , Frost & Sullivan ; M 9 AC - 54 February 2014 3. “ Comparison of Apnea Hypopnea Index (AHI) Using Recording Time vs. Sleep Time ” ; Schutte - Rodin; SLEEP Volume 37 , 2014 Screeners Completion rate 98 % vs 80 % 2 Misdiagnosis 3 % vs 20 % 3 Central Apnea DX WatchPAT Œ vs other HSATs: More Less

Our Clinically Validated and Differentiated WatchPAT Œ Technology 15 1. Yalamanchali S, Farajian V, Hamilton C, Pott TR, Samuelson CG, Friedman M. “ Diagnosis of obstructive sleep apnea by peripheral arterial tonometry: meta - analysis ” . JAMA Otolaryngol . Head Neck Surg. December 2013 ; 139 ( 12 ): 1343 - 1350 2. J Clin Sleep Med. 2017 Mar 15 ; 13 ( 3 ): 479 – 504 WatchPAT Œ has been clinically validated with an 89% documented correlation to in - lab PSG tests 1 In 2017 , AASM began officially recognizing PAT Œ technology in its guidelines for clinical practice 2

Established CPT Codes and Reimbursement 16 CPT CODE MODIFIDER DESCRIPTION 2021 FINAL RATE 2020 PAYMENT % CHANGE WatchPAT 95800 Global Combined Services $170.28 $168.90 0.8% Technical Component Provision of Equipment & Staff $128.41 $126.32 1.7% Professional Component Supervision, Interpretation $41.87 $42.59 - 1.7% HSAT devices that do not have sleep time technology 95806 Global Combined Services $102.59 $119.10 - 13.9% Technical Component Provision of Equipment & Staff $57.22 $72.90 - 21.5% Professional Component Supervision, Interpretation $45.36 $46.20 - 1.8% The 2021 update, issued by CMS in December 2020, represents the third year of a four - year plan to reevaluate payment in home sleep apnea testing devices; more changes anticipated in 2022 In the cardiology market, cardiologists / independent diagnostics testing facilities bill for technical component whereas the interpreting physician bills for professional component Rates for HSAT devices that do not have sleep time technology have been declining more rapidly

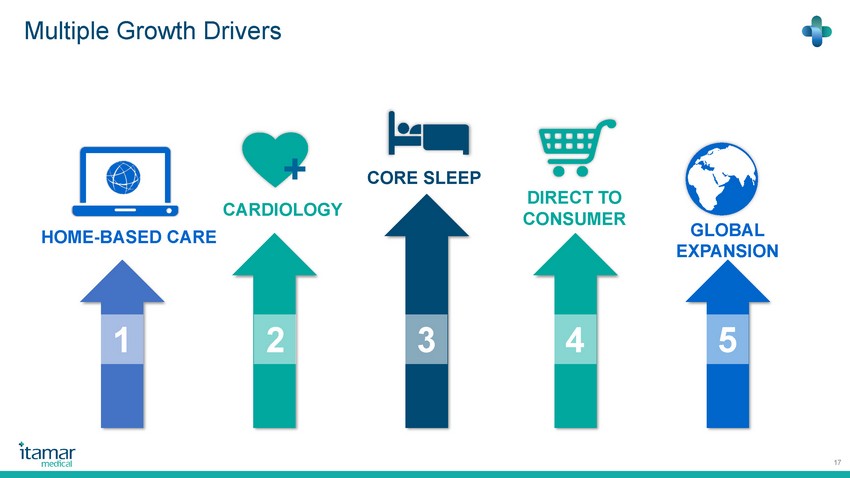

Multiple Growth Drivers 17 HOME - BASED CARE CARDIOLOGY GLOBAL EXPANSION + DIRECT TO CONSUMER CORE SLEEP 1 2 3 4 5

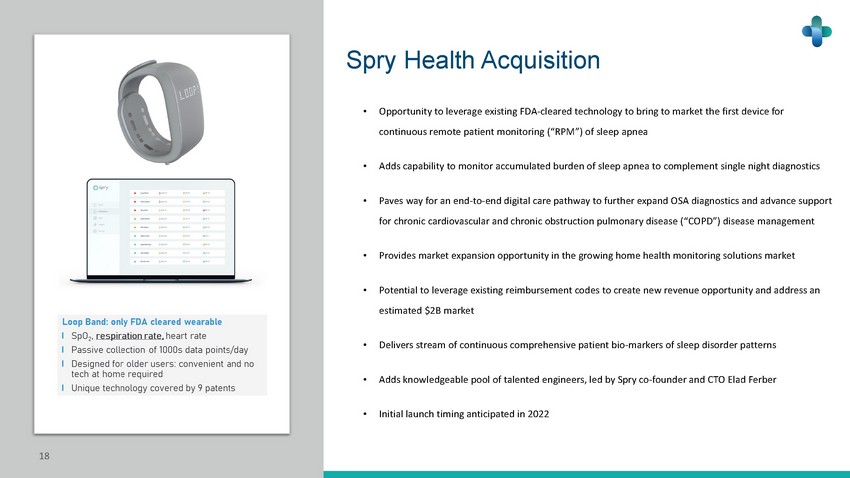

Spry Health Acquisition • Opportunity to leverage existing FDA - cleared technology to bring to market the first device for continuous remote patient monitoring (“RPM”) of sleep apnea • Adds capability to monitor accumulated burden of sleep apnea to complement single night diagnostics • Paves way for an end - to - end digital care pathway to further expand OSA diagnostics and advance support for chronic cardiovascular and chronic obstruction pulmonary disease (“COPD”) disease management • Provides market expansion opportunity in the growing home health monitoring solutions market • Potential to leverage existing reimbursement codes to create new revenue opportunity and address an estimated $2B market • Delivers stream of continuous comprehensive patient bio - markers of sleep disorder patterns • Adds knowledgeable pool of talented engineers, led by Spry co - founder and CTO Elad Ferber • Initial launch timing anticipated in 2022 18

Shift to Home - Based Care 19 Market data indicate that there was a shift to HSAT with a 25% increase in HSAT versus a 10% decrease in PSG within the last thr ee years. 1 Itamar Medical Market survey results across 212 sleep professionals conducted in Feb/March 2021 indicates that , 66 % of them utilize HSAT for more than 50 % of their patients . COVID - 19 had significant impacts on sleep clinics daily practice . During COVID, 67 % had moderate/significant decreased in PSG patients, while 66 % had moderate/significant increase on HSAT use . Majority of the clinics with 65 % believe that this new trend will remain after COVID and HSAT will be the first choice for sleep apnea diagnosis . 2 1. Company estimates based on CMS 2017 - 2019 number of procedures 2. Itamar Medical Feb/March 2021 Market survey 4.2 M 4 M 3.8 M 1.2 M 1.4 M 1.5 M 19.7% 20.7% 24.0 % 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 0 0.5 1 1.5 2 2.5 3 3.5 4 4.5 2017 2018 2019 PSG Market Size HSAT Market Size Market Share Market Shift to HSAT PSG/HSAT Mix Expectation After COVID 35 % 65% 75% and more PSG 50% and More HSAT

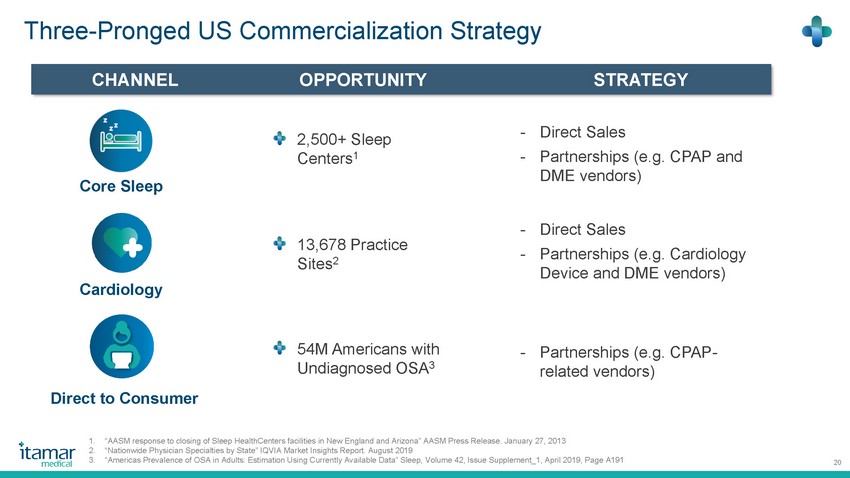

Three - Pronged US Commercialization Strategy 20 CHANNEL STRATEGY Core Sleep Cardiology Direct to Consumer OPPORTUNITY - Direct Sales - Partnerships (e.g. CPAP and DME vendors) 2,500+ Sleep Centers 1 13,678 Practice Sites 2 54 M Americans with Undiagnosed OSA 3 - Direct Sales - Partnerships (e.g. Cardiology Device and DME vendors) - Partnerships (e.g. CPAP - related vendors) 1. “ AASM response to closing of Sleep HealthCenters facilities in New England and Arizona ” AASM Press Release. January 27 , 2013 2. “ Nationwide Physician Specialties by State ” IQVIA Market Insights Report. August 2019 3. “ Americas Prevalence of OSA in Adults: Estimation Using Currently Available Data ” Sleep, Volume 42 , Issue Supplement_ 1 , April 2019 , Page A 191

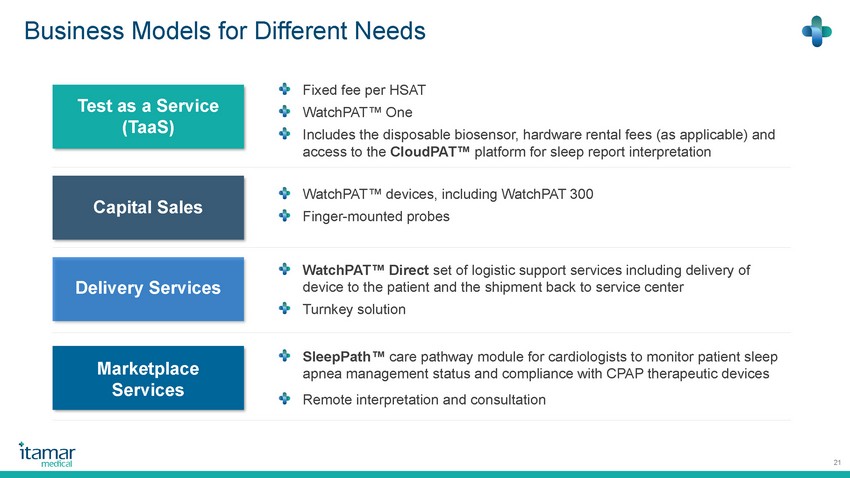

Business Models for Different Needs 21 WatchPAT Πdevices, including WatchPAT 300 Finger - mounted probes Capital Sales Delivery Services Test as a Service ( TaaS ) Marketplace Services Fixed fee per HSAT WatchPAT ΠOne Includes the disposable biosensor, hardware rental fees (as applicable) and access to the CloudPAT Πplatform for sleep report interpretation SleepPath Πcare pathway module for cardiologists to monitor patient sleep apnea management status and compliance with CPAP therapeutic devices Remote interpretation and consultation WatchPAT ΠDirect set of logistic support services including delivery of device to the patient and the shipment back to service center Turnkey solution

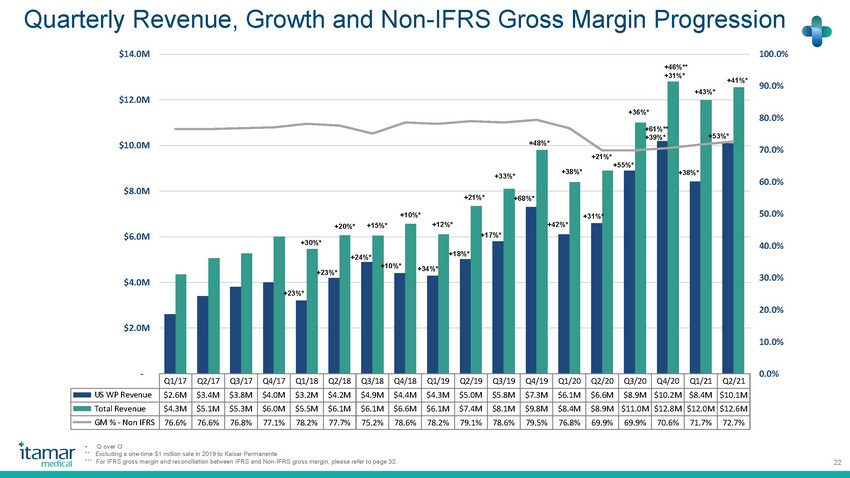

Quarterly Revenue, Growth and Non - IFRS Gross Margin Progression 22 • Q over Q ** Excluding a one - time $ 1 million sale in 2019 to Kaiser Permanente *** For IFRS gross margin and reconciliation between IFRS and Non - IFRS gross margin, please refer to page 32 . Q1/17 Q2/17 Q3/17 Q4/17 Q1/18 Q2/18 Q3/18 Q4/18 Q1/19 Q2/19 Q3/19 Q4/19 Q1/20 Q2/20 Q3/20 Q4/20 Q1/21 Q2/21 US WP Revenue $2.6M $3.4M $3.8M $4.0M $3.2M $4.2M $4.9M $4.4M $4.3M $5.0M $5.8M $7.3M $6.1M $6.6M $8.9M $10.2M $8.4M $10.1M Total Revenue $4.3M $5.1M $5.3M $6.0M $5.5M $6.1M $6.1M $6.6M $6.1M $7.4M $8.1M $9.8M $8.4M $8.9M $11.0M $12.8M $12.0M $12.6M GM % - Non IFRS 76.6% 76.6% 76.8% 77.1% 78.2% 77.7% 75.2% 78.6% 78.2% 79.1% 78.6% 79.5% 76.8% 69.9% 69.9% 70.6% 71.7% 72.7% 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% 80.0% 90.0% 100.0% - $2.0M $4.0M $6.0M $8.0M $10.0M $12.0M $14.0M + 10 %* + 23 %* + 30 %* + 10 %* + 15 %* + 20 %* + 23 %* + 24 %* + 34 %* + 12 %* + 18 %* + 68 %* + 33 %* + 17 %* + 8 %* + 21 %* + 48 %* + %* + 21 %* + 31 %* + 55 %* + 36 %* + 46 %** + 31 %* + 61 %** + 39 %* + 43 %* + 38 %* + 41 %* + 53 %*

Key Takeaways 23 We are revolutionizing the way sleep disorders are diagnosed and managed with our home - based solutions and digital health platform We have a large market opportunity to help 26 % of adults worldwide, and we have only ~ 24 % market share 1 within the United States HSAT market We expect multiple growth drivers to add incremental value, ranging from international expansion to the shift to home - based care Our financial profile is compelling, with ~ 41 % and ~ 31 % quarter over quarter and year - over - year (respectively) revenue growth as of June 30 , 2021 , and December 31 , 2020 , (respectively), high gross margins, and $ 73.0 M 2 in cash, cash equivalents and short - term bank deposits 1. Market share measured by number of tests 2. As of June 30 th, 2021 .

Appendix

HCPCS Code G - 0399 25 State 95800 95806 G - 0399 (old) G - 0399 (new) Pennsylvania (Philadelphia) $182.80 $ 109.36 $270.37 $109.36 DC (and MD/VA suburbs $205.17 $121.01 $243.72 $121.01 New Jersey (Northern NJ) $199.30 $117.63 $248.66 $117.63 Louisiana (New Orleans) $161.06 $98.72 $203.82 $98.72 Florida (Miami) $176.31 $107.56 $163.12 $107.56 Missouri (Metropolitan Kansas City) $163.84 $99.29 $213.54 $99.29 Massachusetts (Boston) $199.65 $117.66 $276.18 $117.66 Illinois (Chicago) $178.23 $107.76 $233.18 $107.76 While CMS use the RVU system to determine CPT codes reimbursement rates, G - codes rates are decided by the local “ Medicare Administrative Contractor ” (MAC) Though CPT 95806 and G - 0399 describe the exact same service, in some localities G - 0399 reimbursement was over 250 % higher Code Description G0399 Home sleep test (HST) with type III portable monitor, unattended ; minimum of 4 channels: 2 respiratory movement/airflow , 1 ECG/heart rate and 1 oxygen saturation 95806 Sleep study, unattended , simultaneous recording of, heart rate , oxygen saturation , respiratory airflow, and respiratory effort (e.g., thoracoabdominal movement) In Q 2 Novitas and First Coast matched G - 0399 to 95860 , NGS and WPS published they will do the same effective July 1 st . These 4 MACS covers 58 % of Medicare FFS beneficiaries

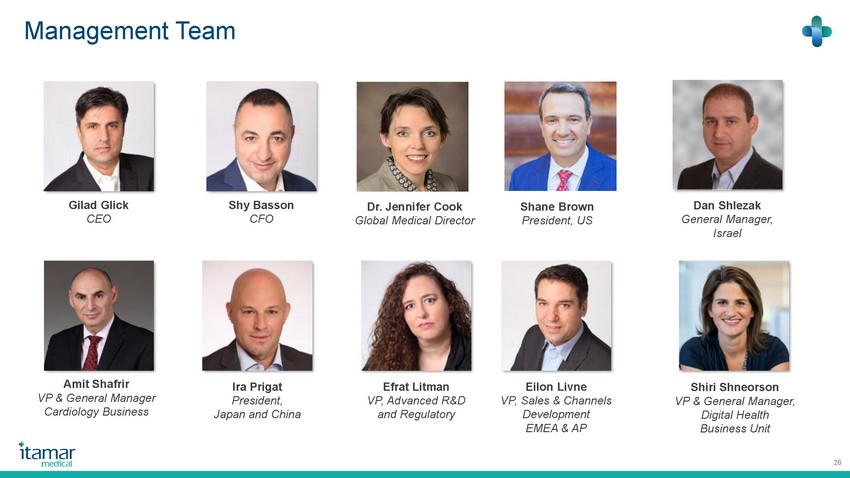

Management Team 26 Gilad Glick CEO Shy Basson CFO Dan Shlezak General Manager, Israel Ira Prigat President, Japan and China Efrat Litman VP, Advanced R&D and Regulatory Amit Shafrir VP & General Manager Cardiology Business Eilon Livne VP, Sales & Channels Development EMEA & AP Shiri Shneorson VP & General Manager, Digital Health Business Unit Dr. Jennifer Cook Global Medical Director Shane Brown President, US

Classification and Codes 27

Loop Analytics: patient risk stratification Demonstrated 4.5 ROI for payers Enables early, cost - effective intervention Implementation under 30 days, APIs available for integration with EMRs Generates reimbursement reports for CMS Spry Health Offering Loop Band: only FDA cleared wearable SpO 2 , respiration rate, heart rate Passive collection of 1000s data points/day Designed for older users: convenient and no tech at home required Unique technology covered by 9 patents 28

- $1.0M $2.0M $3.0M $4.0M $5.0M $6.0M $7.0M $8.0M $9.0M $10.0M $11.0M $12.0M $13.0M $14.0M Q1.2018 Q2.2018 Q3.2018 Q4.2018 Q1.2019 Q2.2019 Q3.2019 Q4.2019 Q1.2020 Q2.2020 Q3.2020 Q4.2020 Q1.2021 Q2.2021 Asia Pacific (excluding Japan) $0.3M $0.0M $0.3M $0.2M $0.2M $0.3M $0.1M $0.2M - - $0.1M $0.1M $0.5M $0.4M Pharma $0.1M $0.3M $0.4M $0.3M $0.3M $0.9M $0.3M $0.3M $0.5M $0.2M Europe, Israel and Others $0.4M $0.5M $0.5M $0.6M $0.8M $0.7M $0.8M $1.2M $1.0M $0.5M $0.7M $0.7M $0.9M $0.9M Japan $1.2M $1.1M $0.2M $0.9M $0.7M $0.8M $1.1M $0.9M $1.2M $0.9M $0.9M $0.9M $1.4M $0.9M United States $3.5M $4.5M $5.0M $4.6M $4.4M $5.2M $5.8M $7.5M $6.2M $6.6M $9.0M $9.0M $8.7M $10.2M United States Japan Europe, Israel and Others Pharma Asia Pacific (excluding Japan) Revenues by Geography 29 December 31 st , 20 1 E June 30 h , 20 1 A December 31 st , 20 A December 31 st , 2019 A December 31 st , 2018 A December 31 st , 2017 A 43 * 3 7 * 3 * 27 * 19 * 16 * # of US Territories * Including three verticals – Kaiser, VA and Dental $ 5.5 M $ 6.1 M $ 6.1 M $ 6.6 M $ 6.1 M $ 7.4 M $ 8.1 M $ 10.1 M $ 8.4 M $ 8.9 M $ 11.0 M $ .8 M $ .0 M $ .6 M

($6.0M) ($5.0M) ($4.0M) ($3.0M) ($2.0M) ($1.0M) - ($ 3.5 M) ($ 2.1 M) ($ 2.0 M) ($ 2.4 M) ($ 2.2 M) ($ 1.5 M) ($ 1.3 M) ($ 0.9 M) ($ 0.9 M) ($ 0.9 M) ($ 0.8 M) ($ 0.5 M) ($ 1.3 M) ($ 1.7 M) ($ 1.0 M) ($ 0.9 M) ($ 2.0 M) ($ 3.2 M) ($ 2.5 M) ($ 2.7 M) ($ 5.3 M) ($ 4.6 M) Quarterly Operating Loss - IFRS 30 (*) *Include: • Expenses of $ 1.1 M associated with research and development of the Remote Patient Monitoring or RPM technology (including amortization of inta ngi ble assets of $ 0.4 M) ** For IFRS operating and net loss and reconciliation between IFRS and Non - IFRS operating and net loss, please refer to pages 33 - 35 , respectively

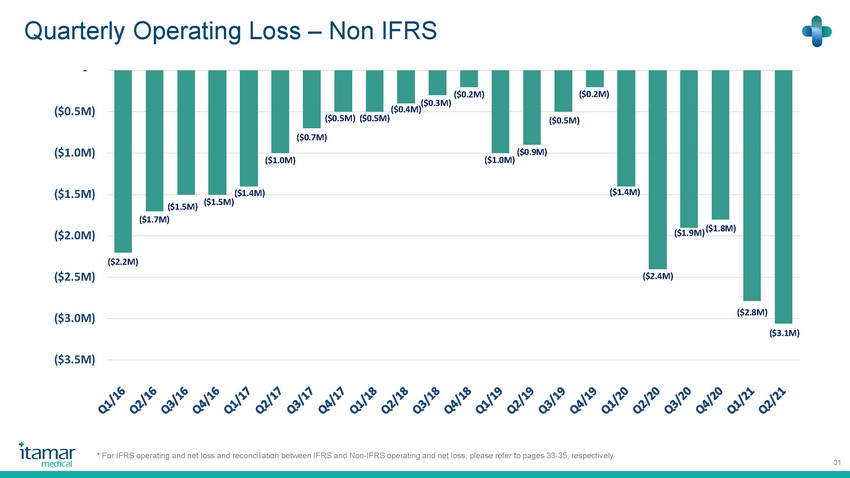

Quarterly Operating Loss – Non IFRS 31 * For IFRS operating and net loss and reconciliation between IFRS and Non - IFRS operating and net loss, please refer to pages 33 - 35 , respectively ($ 2.2 M) ($ 1.7 M) ($ 1.5 M) ($ 1.5 M) ($ 1.4 M) ($ 1.0 M) ($ 0.7 M) ($ 0.5 M) ($ 0.5 M) ($ 0.4 M) ($ 0.3 M) ($ 0.2 M) ($ 1.0 M) ($ 0.9 M) ($ 0.5 M) ($ 0.2 M) ($ 1.4 M) ($ 2.4 M) ($ 1.9 M) ($ 1.8 M) ($ 2.8 M) ($ 3.1 M) ($3.5M) ($3.0M) ($2.5M) ($2.0M) ($1.5M) ($1.0M) ($0.5M) -

Use of Non - IFRS Measures & Reconciliation of IFRS to Non - IFRS Gross Margin 32 In addition to disclosing financial results prepared in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB), this presentation contains Non - IFRS financial measures for gross margin, which are adjusted from results based on IFRS to exclude : ( i ) share - based payments ; (ii) depreciation and amortization ; (iii) expenses relating to change in manpower . Management believes that the Non - IFRS financial measures provided in this presentation are useful to investors ’ understanding and assessment of the Company ’ s performance . Management uses both IFRS and Non - IFRS measures when operating and evaluating the Company ’ s business internally and therefore decided to make these Non - IFRS adjustments available to investors . The presentation of this Non - IFRS financial information is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with IFRS . For further details, see a reconciliation of operating loss and net loss on an IFRS basis to a Non - IFRS basis that is provided in the table below : Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 GM % - IFRS 77.2% 76.4% 74.3% 77.4% 76.8% 77.9% 77.2% 78.3% 75.5% 67.7% 68.4% 69.2% 66.9% 71.2% Share-based payment 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.1% 0.1% 0.1% 0.4% 0.1% Depreciation and amortization 1.0% 1.2% 0.9% 1.2% 1.3% 1.2% 1.3% 1.1% 1.2% 1.8% 1.4% 1.3% 1.4% 1.4% Relocating the Company's production facilities to a new location - - - - - - - - - - - - 3.1% - Expenses relating to change in manpower - - - - - - - - - 0.3% - - - - GM % - Non-IFRS 78.2% 77.7% 75.2% 78.6% 78.2% 79.1% 78.6% 79.5% 76.8% 69.9% 69.9% 70.7% 71.7% 72.7%

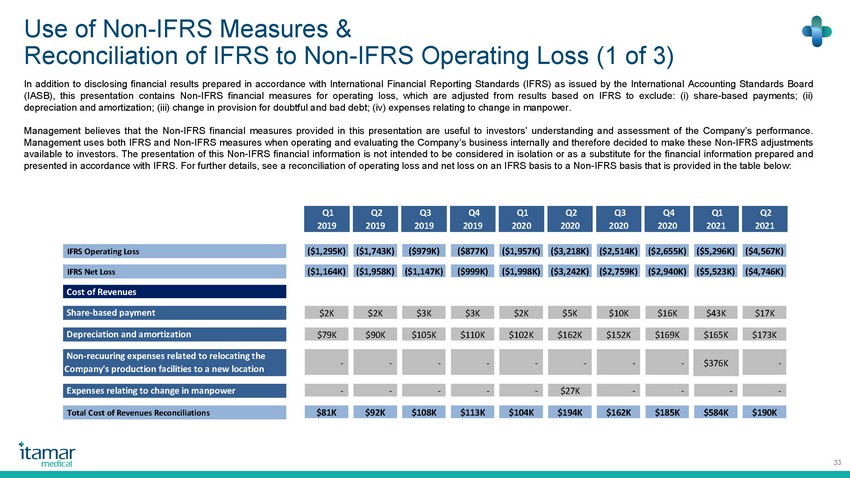

Use of Non - IFRS Measures & Reconciliation of IFRS to Non - IFRS Operating Loss ( 1 of 3 ) 33 In addition to disclosing financial results prepared in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB), this presentation contains Non - IFRS financial measures for operating loss, which are adjusted from results based on IFRS to exclude : ( i ) share - based payments ; (ii) depreciation and amortization ; (iii) change in provision for doubtful and bad debt ; (iv) expenses relating to change in manpower . Management believes that the Non - IFRS financial measures provided in this presentation are useful to investors ’ understanding and assessment of the Company ’ s performance . Management uses both IFRS and Non - IFRS measures when operating and evaluating the Company ’ s business internally and therefore decided to make these Non - IFRS adjustments available to investors . The presentation of this Non - IFRS financial information is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with IFRS . For further details, see a reconciliation of operating loss and net loss on an IFRS basis to a Non - IFRS basis that is provided in the table below : Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 IFRS Operating Loss ($1,295K) ($1,743K) ($979K) ($877K) ($1,957K) ($3,218K) ($2,514K) ($2,655K) ($5,296K) ($4,567K) IFRS Net Loss ($1,164K) ($1,958K) ($1,147K) ($999K) ($1,998K) ($3,242K) ($2,759K) ($2,940K) ($5,523K) ($4,746K) Cost of Revenues Share-based payment $2K $2K $3K $3K $2K $5K $10K $16K $43K $17K Depreciation and amortization $79K $90K $105K $110K $102K $162K $152K $169K $165K $173K Non-recuuring expenses related to relocating the Company's production facilities to a new location - - - - - - - - $376K - Expenses relating to change in manpower - - - - - $27K - - - - Total Cost of Revenues Reconciliations $81K $92K $108K $113K $104K $194K $162K $185K $584K $190K

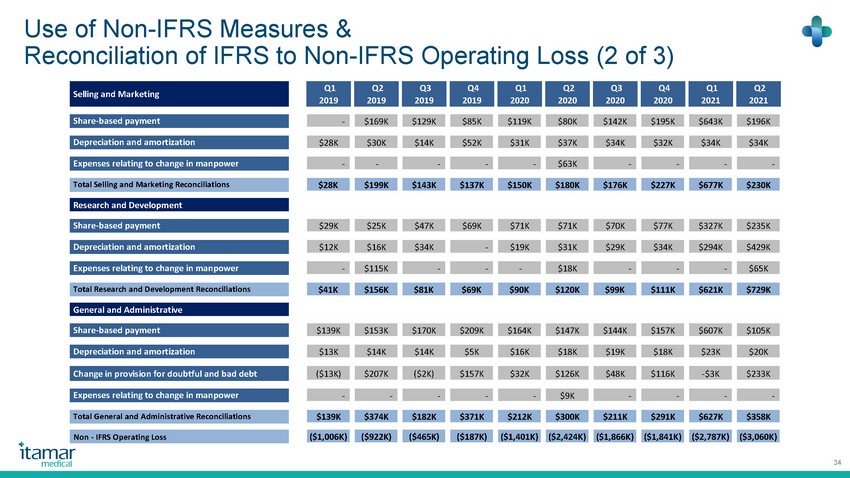

Use of Non - IFRS Measures & Reconciliation of IFRS to Non - IFRS Operating Loss ( 2 of 3 ) 34 Selling and Marketing Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Share-based payment - $169K $129K $85K $119K $80K $142K $195K $643K $196K Depreciation and amortization $28K $30K $14K $52K $31K $37K $34K $32K $34K $34K Expenses relating to change in manpower - - - - - $63K - - - - Total Selling and Marketing Reconciliations $28K $199K $143K $137K $150K $180K $176K $227K $677K $230K Research and Development Share-based payment $29K $25K $47K $69K $71K $71K $70K $77K $327K $235K Depreciation and amortization $12K $16K $34K - $19K $31K $29K $34K $294K $429K Expenses relating to change in manpower - $115K - - - $18K - - - $65K Total Research and Development Reconciliations $41K $156K $81K $69K $90K $120K $99K $111K $621K $729K General and Administrative Share-based payment $139K $153K $170K $209K $164K $147K $144K $157K $607K $105K Depreciation and amortization $13K $14K $14K $5K $16K $18K $19K $18K $23K $20K Change in provision for doubtful and bad debt ($13K) $207K ($2K) $157K $32K $126K $48K $116K -$3K $233K Expenses relating to change in manpower - - - - - $9K - - - - Total General and Administrative Reconciliations $139K $374K $182K $371K $212K $300K $211K $291K $627K $358K Non - IFRS Operating Loss ($1,006K) ($922K) ($465K) ($187K) ($1,401K) ($2,424K) ($1,866K) ($1,841K) ($2,787K) ($3,060K)

Use of Non - IFRS Measures & Reconciliation of IFRS to Non - IFRS Net Loss ( 3 of 3 ) 35 Financial Income (Expenses), Net Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Share-based payment $6K $6K $6K $7K $6K $6K $6K $7K - - Gain (Loss) from Reevaluation of Derivatives ($364K) ($78K) - - - - - - - - Financial Income (Expenses), Net Reconciliations ($358K) ($72K) $6K $7K $6K $6K $6K $7K - - Non - IFRS Net Loss ($1,233K) ($1,209K) ($627K) ($302K) ($1,436K) ($2,442K) ($2,105K) ($2,119K) ($3,014K) ($3,239K)