[Letterhead of Sullivan & Cromwell LLP]

September 30, 2014

Michael R. Clampitt

Division of Corporation Finance,

Securities and Exchange Commission,

100 F Street, NE,

Washington, DC 20549.

| | Re: | Great Western Bancorp, Inc. |

| | | Registration Statement on Form S-1 |

Dear Mr. Clampitt:

On behalf of our client, Great Western Bancorp, Inc. (the “Company”), we advise you that the Company intends to file an amendment to its Registration Statement on Form S-1 (the “Registration Statement”) with the Securities and Exchange Commission to reflect a change in the Formation Transactions as previously disclosed in the “Prospectus Summary” and “Management Discussions and Analysis of Financial Condition and Results of Operations” sections of the Registration Statement. The revised description of the Formation Transactions that the Company expects to include in such amendment is enclosed herewith. Like the prior structure disclosed in the Registration Statement, the accounting impact of the Formation Transactions will be immaterial as the combined financial statements presented for the Company and Great Western Bancorporation, Inc. (“GWBI”) following the Formation Transactions will differ from GWBI’s financial statements only to reflect a de minimis increase in assets and stockholder’s equity resulting from the Company’s initial formation and capitalization in July 2014.

* * *

Securities and Exchange Commission

September 30, 2014

- 2 -

Any questions or comments with respect to the Registration Statement or the matters discussed above may be communicated to the undersigned at (212) 558-4175 or by email (clarkinc@sullcrom.com) or to Zachary L. Cochran at (212) 558-4735 or by email (cochranz@sullcrom.com). Please send copies of any correspondence relating to the Registration Statement or this letter to Catherine M. Clarkin by email and facsimile, at (212) 291-9025, with the original by mail to Sullivan & Cromwell LLP, 125 Broad Street, New York, New York 10004.

|

| Yours truly, |

|

| /s/ Catherine M. Clarkin |

| Catherine M. Clarkin |

(Enclosure)

| | (Securities and Exchange Commission) |

| | (Great Western Bancorp, Inc.) |

| | (Sullivan & Cromwell LLP) |

Great Western Bancorporation, Inc., or GWBI, is a wholly owned subsidiary of NAI and an Iowa corporation formed in 1962 and has been the direct holding company for Great Western Bank. Prior to May 2006, GWBI filed public reports in connection with trust preferred securities listed on the American Stock Exchange.

Formation Transactions

Prior to the consummation of this offering, the following transactions will be taken in the order listed below:

| | • | | the NAB selling stockholder will make a cash contribution to Great Western Bancorp, Inc. equal to the total stockholder’s equity of GWBI; |

| | • | | NAI will sell 100% of the outstanding capital stock of GWBI to Great Western Bancorp, Inc. for an amount in cash equal to the total stockholder’s equity of GWBI; and |

| | • | | GWBI will merge with and into Great Western Bancorp, Inc., with Great Western Bancorp, Inc. continuing as the surviving corporation and succeeding to all the assets, liabilities and business of GWBI. |

As a result of these transactions, Great Western Bancorp, Inc. will succeed to the business of GWBI, whose consolidated financial statements and related notes thereto are included in this prospectus.

The Formation Transactions will not result in a change in our business or our management team.

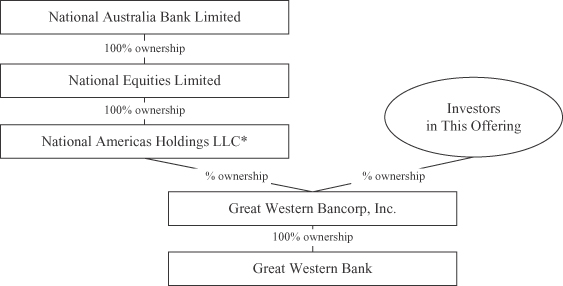

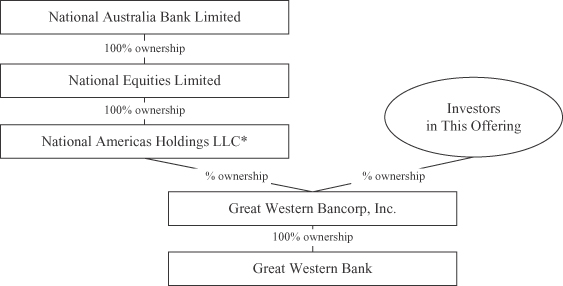

Following the completion of the Formation Transactions and this offering, we will be a publicly traded bank holding company and will directly own all outstanding capital stock issued by our bank. The diagram below depicts our organizational structure immediately following the Formation Transactions and the completion of this offering.

| * | National Americas Investment, Inc. will merge with and into National Americas Holdings LLC following the sale of Great Western Bancorporation, Inc. capital stock to Great Western Bancorp, Inc. |

Separation from and Relationship with NAB

Separation from NAB

On August 29, 2014 in Australia, NAB announced that it intends to divest itself of our bank over time, subject to market conditions. NAB’s announced divestiture of our bank is consistent with its strategy of focusing on its core Australian and New Zealand franchises. This offering of shares of our common stock by the

12

United States and parts of Asia. Historically, NAB and its affiliates have provided financial and administrative support to us. In connection with this offering, we and NAB intend to enter into certain agreements that will provide a framework for our ongoing relationship, including a Stockholder Agreement governing NAB’s rights as a controlling stockholder and a Transitional Services Agreement pursuant to which NAB will agree to continue to provide us with certain services for a transition period. We do not expect our costs associated with these services to be significant. These arrangements are described in greater detail below under “Our Relationship with NAB and Certain Other Related Party Transactions.”

Formation Transactions

Following the formation of Great Western Bancorp, Inc. and prior to the consummation of this offering, the following transactions will be taken in the order listed below:

| | • | | the NAB selling stockholder will make a cash contribution to Great Western Bancorp, Inc. equal to the total stockholder’s equity of GWBI; |

| | • | | NAI will sell 100% of the outstanding capital stock of GWBI to Great Western Bancorp, Inc. for an amount in cash equal to the total stockholder’s equity of GWBI; and |

| | • | | GWBI will merge with and into Great Western Bancorp, Inc., with Great Western Bancorp, Inc. continuing as the surviving corporation and succeeding to all the assets, liabilities and business of GWBI. |

As a result of these transactions, Great Western Bancorp, Inc. will succeed to the business of GWBI, whose consolidated financial statements and related notes thereto are included in this prospectus. The Formation Transactions will not result in a change in our business or our management team.

Following the completion of the Formation Transactions and this offering, we will be a publicly traded bank holding company and will directly own all outstanding capital stock issued by our bank. See “Prospectus Summary—Our Structure and Formation Transactions.”

Key Factors Affecting Our Business and Financial Statements

Economic Conditions

Our loan portfolio can be affected in several ways by changes in economic conditions in our local markets and across the country. For example, declining local economic prospects can reduce borrowers’ willingness to take out new loans or our expectations of their ability to repay existing loans, while declining national conditions can limit the markets for our commercial and agribusiness borrowers’ products. Conversely, rising consumer and business confidence can increase demand for loans to fund consumption and investments, which can lead to opportunities for us to grant new loans and further develop our banking relationships with our customers. Some elements of the business environment that affect our financial performance include short-term and long-term interest rates, inflation and price levels (particularly for agricultural commodities), monetary policy, unemployment and the strength of the domestic economy and the local economy in the markets in which we operate. Because commercial non-real estate and owner-occupied CRE borrowers are particularly exposed to external economic conditions such as consumer sentiment, repayment of commercial non-real estate loans and owner-occupied CRE loans may be more sensitive than other types of loans to adverse conditions in the real estate market or the general economy. These loans totaled approximately $2.74 billion, or 41%, of our loan portfolio as of June 30, 2014. In addition, agricultural loans, which comprised 25% of our loan portfolio as of June 30, 2014, depend on the health of the agricultural industry broadly and in the location of the borrower in particular and on commodity prices. Overall, our markets continue to experience moderate economic growth, although leading indicators point to some softening. Farm income has seen recent declines as a result of lower crop prices and some drought conditions. The United States Department of Agriculture expects farm income to

70