Annual Stockholder Meeting | February 27, 2017

Andrew “Skip” Hove, Jr. Chairman of the Board Great Western Bancorp, Inc. 2

Board of Directors Ken Karels President & CEO Dan Rykhus CEO, Raven Industries Jim Brannen CEO, FBL Financial Group Steve Lacy CEO, Meredith Corp. Jim Spies President, Spies Corp. Frances Grieb Retired Partner, Deloitte LLP Tom Henning CEO, Assurity Group, Inc. 3 Jim Israel Retired Executive, Deere & Co

James Israel • New director since the last Annual Stockholder Meeting • Retired financial executive with 35 years of experience in various roles at Deere & Co. • Nominee for election to serve until the 2020 Annual Stockholder Meeting • Welcome Jim! Welcome Jim 4

Frances Grieb • Director since July 2014 • Retired Deloitte LLP Partner Other Nominees 5 Stephen Lacy • Director since August 2015 • Chairman and CEO, Meredith Corporation

Business Matters Donald Straka General Counsel • Proposal #1 – Election of the three nominees for Director named in the Proxy Statement to hold office until the 2020 Annual Meeting of Stockholders. The nominees are: • Stephen Lacy, Chairman and CEO of Meredith Corporation; • Frances Grieb, Retired Deloitte LLP Partner; and • James Israel, Retired Deere & Co. Executive. • Proposal #2 – Advisory vote to approve executive compensation. • Proposal #3 – Advisory vote on the frequency of future advisory votes on executive compensation. • Proposal #4 – Ratification of Ernst & Young LLP as independent registered public accounting firm. • Other Business. 6

Registered Public Accountants 7

Custodian 8

Ken Karels President & CEO Great Western Bancorp, Inc. Financial Highlights & Performance 9

GWB Management Ken Karels President & CEO Peter Chapman EVP & CFO Steve Ulenberg EVP & CRO Scott Erkonen CIO Doug Bass Regional President Bryan Kindopp Regional President Cheryl Olson Head of Marketing Andy Pederson Head of P&C / L&D10

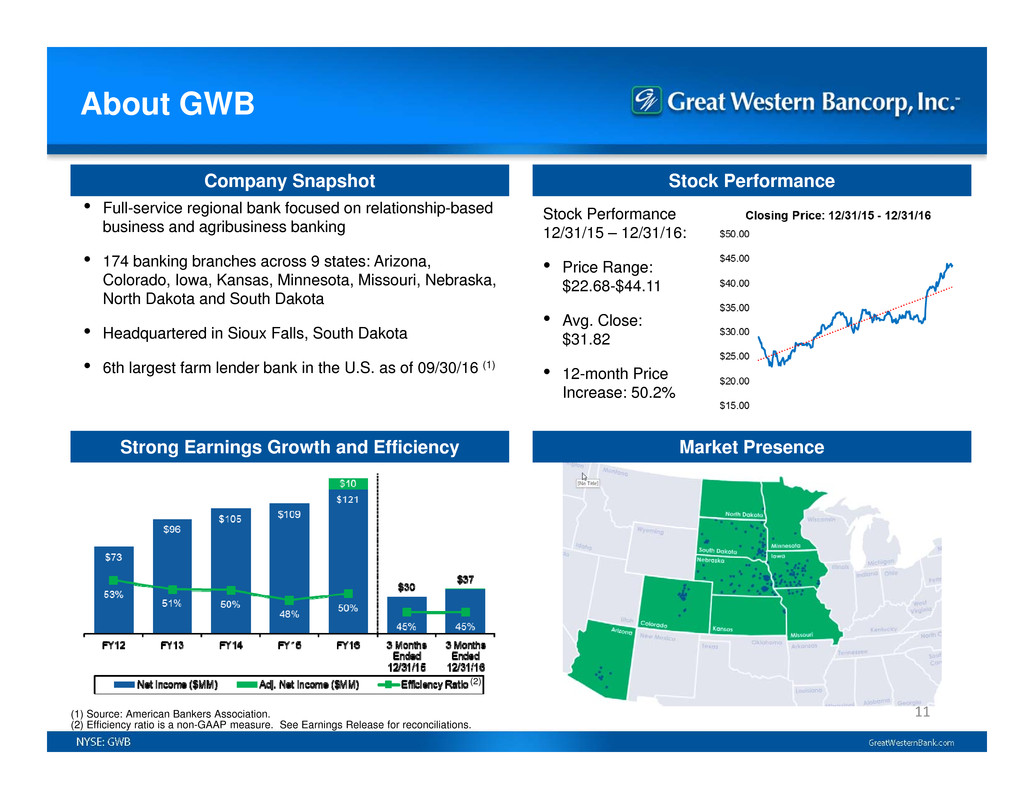

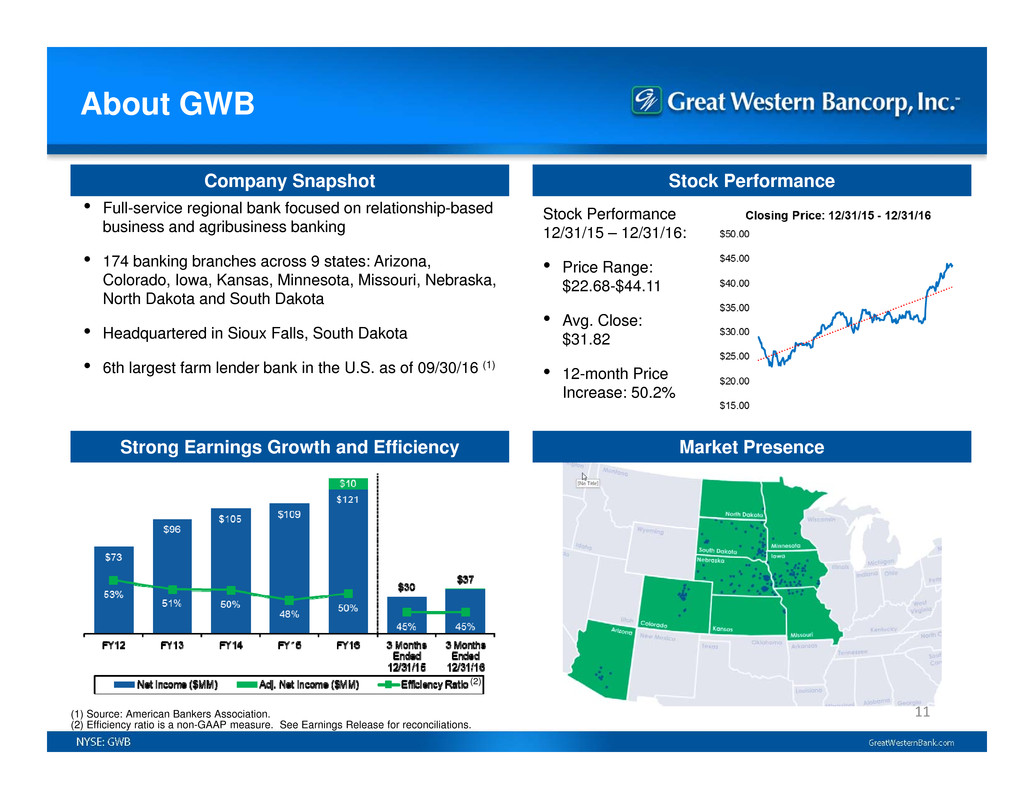

(1) Source: American Bankers Association. (2) Efficiency ratio is a non-GAAP measure. See Earnings Release for reconciliations. About GWB 11 Company Snapshot Stock Performance Strong Earnings Growth and Efficiency Market Presence • Full-service regional bank focused on relationship-based business and agribusiness banking • 174 banking branches across 9 states: Arizona, Colorado, Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota and South Dakota • Headquartered in Sioux Falls, South Dakota • 6th largest farm lender bank in the U.S. as of 09/30/16 (1) Stock Performance 12/31/15 – 12/31/16: • Price Range: $22.68-$44.11 • Avg. Close: $31.82 • 12-month Price Increase: 50.2% (2)

Proven Business Strategy 12 Focused Business Banking Franchise with Agribusiness Expertise Risk Management Driving Strong Credit Quality Attract and Retain High-Quality Relationship Bankers Invest in Organic Growth While Optimizing Footprint Deepen Customer Relationships Strong Profitability and Growth Driven by a Highly Efficient Operating Model Strong Capital Generation and Attractive Dividend Explore Accretive Strategic Acquisition Opportunities

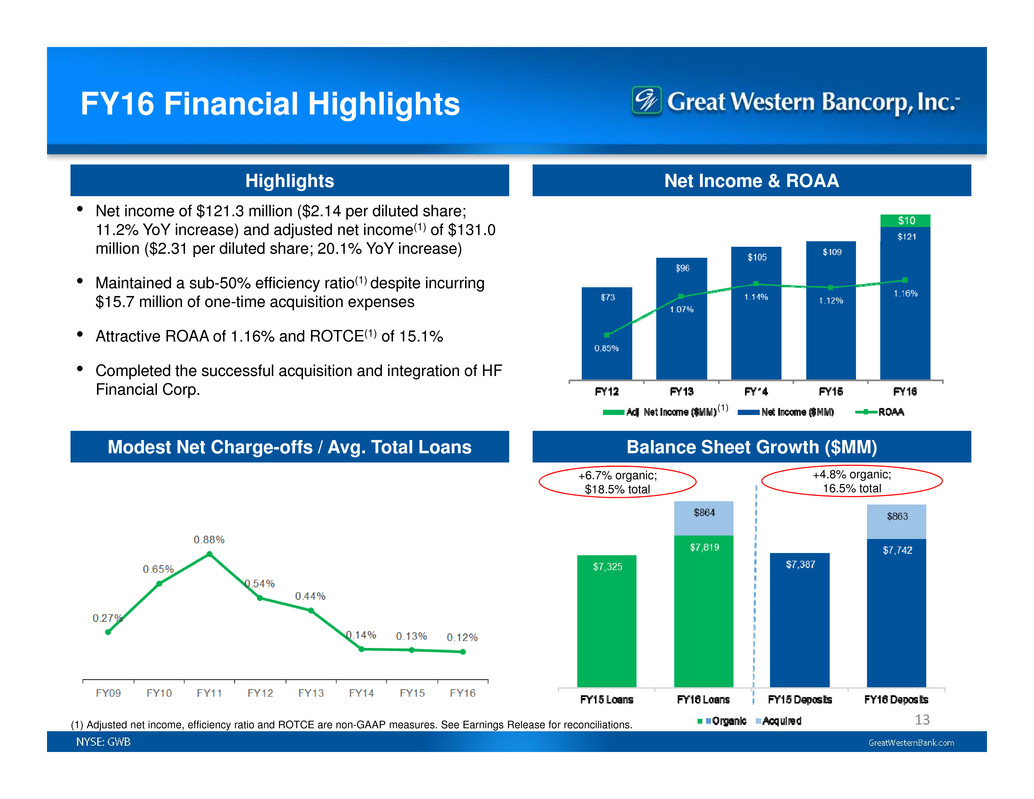

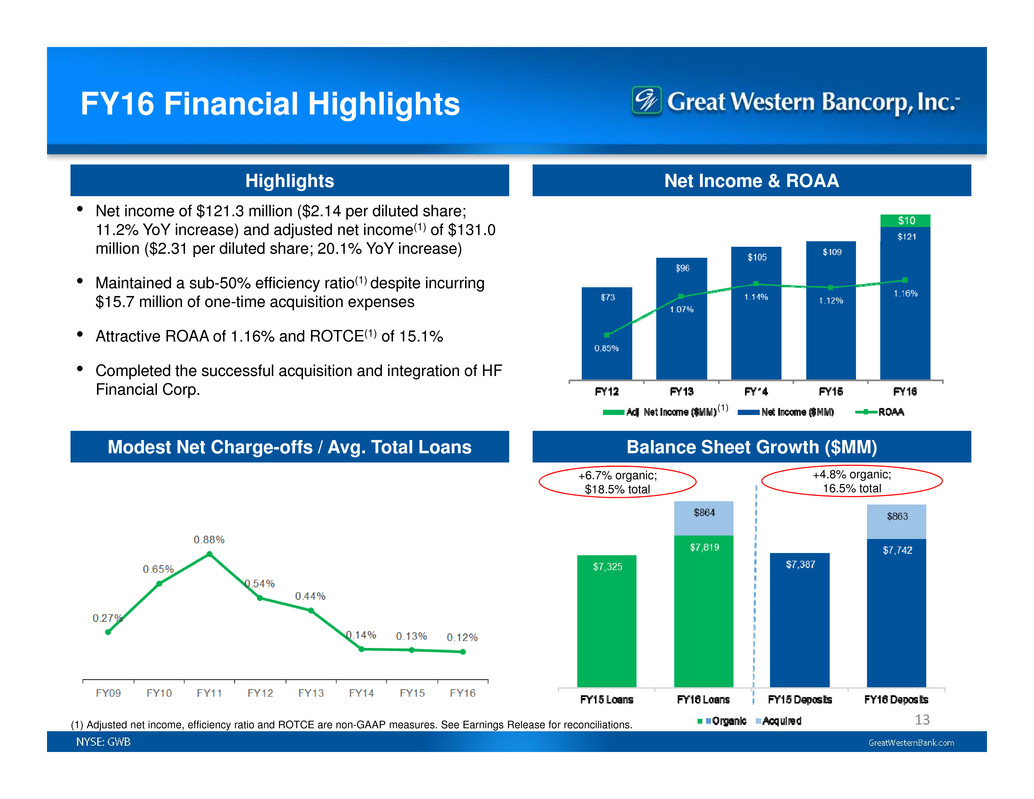

(1) Adjusted net income, efficiency ratio and ROTCE are non-GAAP measures. See Earnings Release for reconciliations. FY16 Financial Highlights Highlights Net Income & ROAA Modest Net Charge-offs / Avg. Total Loans Balance Sheet Growth ($MM) • Net income of $121.3 million ($2.14 per diluted share; 11.2% YoY increase) and adjusted net income(1) of $131.0 million ($2.31 per diluted share; 20.1% YoY increase) • Maintained a sub-50% efficiency ratio(1) despite incurring $15.7 million of one-time acquisition expenses • Attractive ROAA of 1.16% and ROTCE(1) of 15.1% • Completed the successful acquisition and integration of HF Financial Corp. 13 +6.7% organic; $18.5% total +4.8% organic; 16.5% total (1)

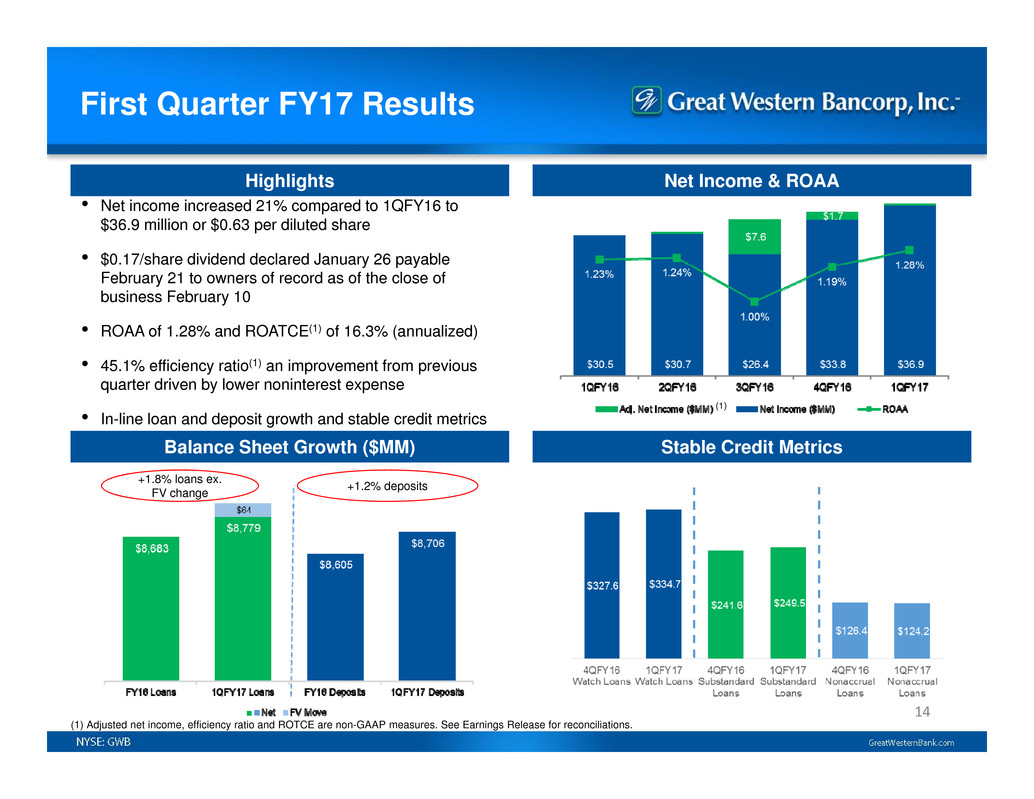

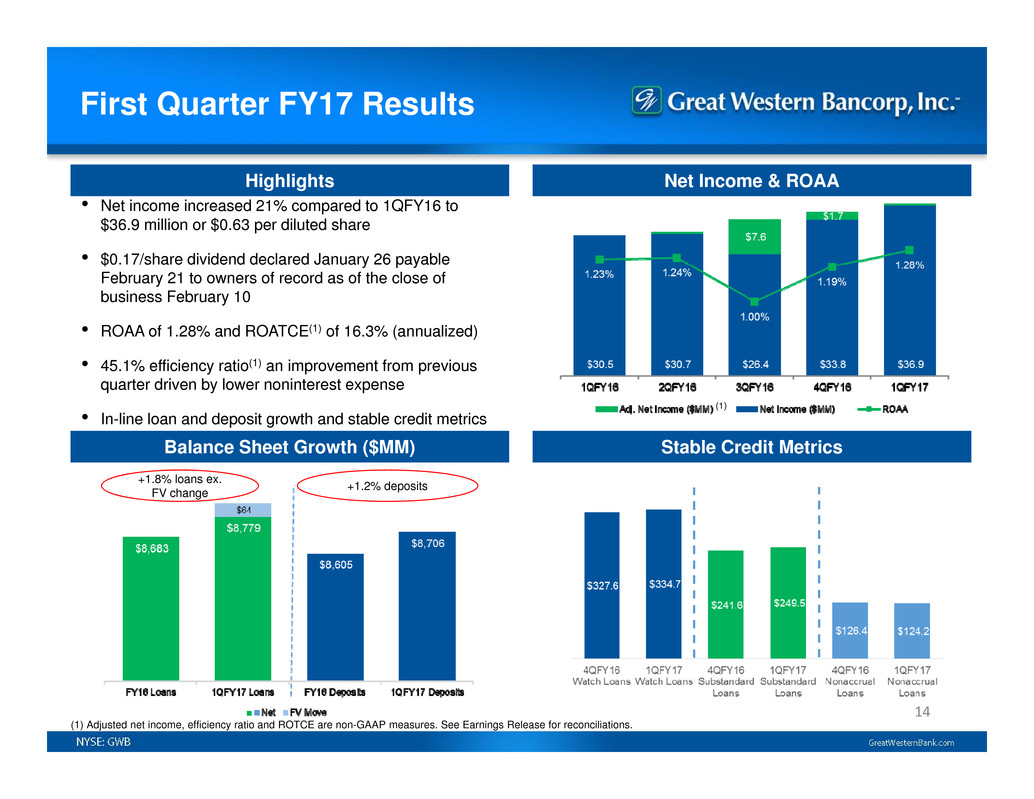

First Quarter FY17 Results 14 Highlights Net Income & ROAA Balance Sheet Growth ($MM) Stable Credit Metrics • Net income increased 21% compared to 1QFY16 to $36.9 million or $0.63 per diluted share • $0.17/share dividend declared January 26 payable February 21 to owners of record as of the close of business February 10 • ROAA of 1.28% and ROATCE(1) of 16.3% (annualized) • 45.1% efficiency ratio(1) an improvement from previous quarter driven by lower noninterest expense • In-line loan and deposit growth and stable credit metrics +1.8% loans ex. FV change +1.2% deposits (1) Adjusted net income, efficiency ratio and ROTCE are non-GAAP measures. See Earnings Release for reconciliations. (1)

Corporate Responsibility • Core part of mission and culture is to give back to the communities we serve • Developing creative and meaningful relationships in Education, Financial Literacy, Community Development, Healthcare and more • $2.05 million in sponsorships and donations in FY16 • Launched the Making Life Great Grants program in FY16 to expand what we do for our communities 15

Andrew “Skip” Hove, Jr. Thank you for over 15 years of service on the Boards of Great Western Bancorp, Inc. and its predecessors from your fellow directors and GWB’s employees! Thank You Skip 16

Voting Results [OPEN TO COMPLETE] 17

Forward-Looking Statements: This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Statements about Great Western Bancorp, Inc.’s expectations, beliefs, plans, strategies, predictions, forecasts, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. These statements are often, but not always, made through the use of words or phrases such as “anticipates,” “believes,” “can,” “could,” “may,” “predicts,” “potential,” “should,” “will,” “estimate,” “plans,” “projects,” “continuing,” “ongoing,” “expects,” “intends” and similar words or phrases. In particular, the statements included in this press release concerning Great Western Bancorp, Inc.’s expected performance and strategy, the outlook for its agricultural lending segment and the interest rate environment, beyond the first quarter of fiscal year 2017 are not historical facts and are forward-looking. Accordingly, the forward-looking statements in this press release are only predictions and involve estimates, known and unknown risks, assumptions and uncertainties, including those related to the recently-completed acquisition of HF Financial Corp., that could cause actual results to differ materially from those expressed. All forward-looking statements are necessarily only estimates of future results, and there can be no assurance that actual results will not differ materially from expectations, and, therefore, you are cautioned not to place undue reliance on such statements. Any forward-looking statements are qualified in their entirety by reference to the factors discussed in the sections titled “Item 1A. Risk Factors” and "Cautionary Note Regarding Forward- Looking Statements" in Great Western Bancorp, Inc.’s Annual Report on Form 10-K for the fiscal year ended September 30, 2016, and other periodic filings with the SEC, including its Quarterly Reports on Form 10-Q for the periods ended December 31, 2015, March 31, 2016, June 30, 2016 and December 31, 2016. Further, any forward-looking statement speaks only as of the date on which it is made, and Great Western Bancorp, Inc. undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. Non-GAAP Financial Measures: This presentation contains non-GAAP measures which our management relies on in making financial and operational decisions about our business and which exclude certain items that we do not consider reflective of our business performance. We believe that the presentation of these measures provides investors with greater transparency and supplemental data relating to our financial condition and results of operations. These non-GAAP measures should be considered in context with our GAAP results. Reconciliations of these non-GAAP measures appear in our earnings releases dated October 27, 2016 and January 26, 2017. Explanatory Note: In this presentation, all financial information presented refers to the financial results of Great Western Bancorp, Inc. combined with those of its predecessor, Great Western Bancorporation, Inc. Disclosures 18

THANK YOU 19