Quarterly Investor Relations Presentation At and for the three months ended December 31, 2018

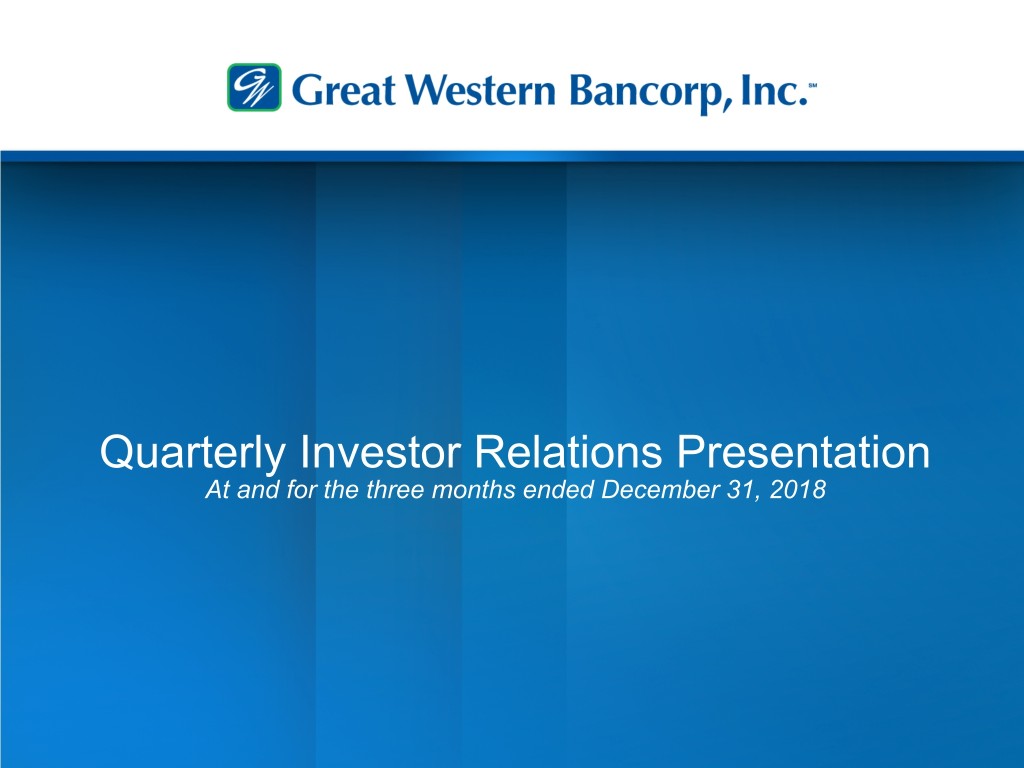

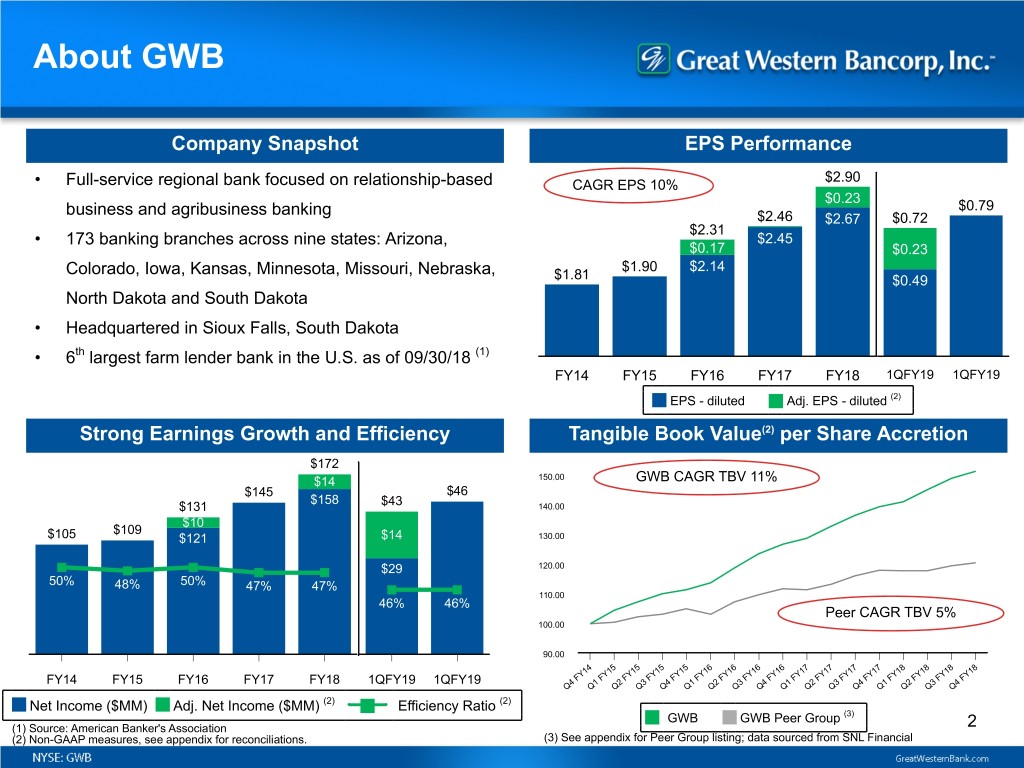

About GWB Company Snapshot EPS Performance $2.90 • Full-service regional bank focused on relationship-based CAGR EPS 10% $0.23 business and agribusiness banking $0.79 $2.46 $2.67 $0.72 $2.31 • 173 banking branches across nine states: Arizona, $2.45 $0.17 $0.23 Colorado, Iowa, Kansas, Minnesota, Missouri, Nebraska, $1.90 $2.14 $1.81 $0.49 North Dakota and South Dakota • Headquartered in Sioux Falls, South Dakota • 6th largest farm lender bank in the U.S. as of 09/30/18 (1) FY14 FY15 FY16 FY17 FY18 1QFY19 1QFY19 EPS - diluted Adj. EPS - diluted (2) Strong Earnings Growth and Efficiency Tangible Book Value(2) per Share Accretion $172 $14 150.00 GWB CAGR TBV 11% $145 $46 $158 $43 $131 140.00 $10 $109 $105 $121 $14 130.00 $29 120.00 50% 48% 50% 47% 47% 110.00 46% 46% Peer CAGR TBV 5% 100.00 90.00 14 15 15 15 15 16 16 16 16 17 17 17 17 18 18 18 18 Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y F F F F F F F F F F F F F F F F F FY14 FY15 FY16 FY17 FY18 1QFY19 1QFY19 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Net Income ($MM) Adj. Net Income ($MM) (2) Efficiency Ratio (2) GWB GWB Peer Group (3) (1) Source: American Banker's Association 2 (2) Non-GAAP measures, see appendix for reconciliations. (3) See appendix for Peer Group listing; data sourced from SNL Financial

About GWB Company Snapshot Exchange / Ticker • NYSE: GWB Market Cap • 56.9 million shares outstanding / $1.90 billion Ownership • 100% publicly traded Total Assets • $12.57 billion ROA / ROTCE • 1.48% / 17.1% Efficiency Ratio • 46.1% Locations • 173 branches in nine states FTEs • Approximately 1,600 Business & Ag • 90% of loans in business and ag segments; 6th largest farm lender bank in the U.S.(1) Expertise (1) As of September 30, 2018. Source: American Banker's Association NOTE: All financial data is as of or for the three months ended December 31, 2018 unless otherwise noted. Market Cap calculated based on January 8, 2019 closing price of $33.32. Branch count as of December 31, 2018. See appendix for non-GAAP reconciliation of ROTCE and efficiency ratio. 3

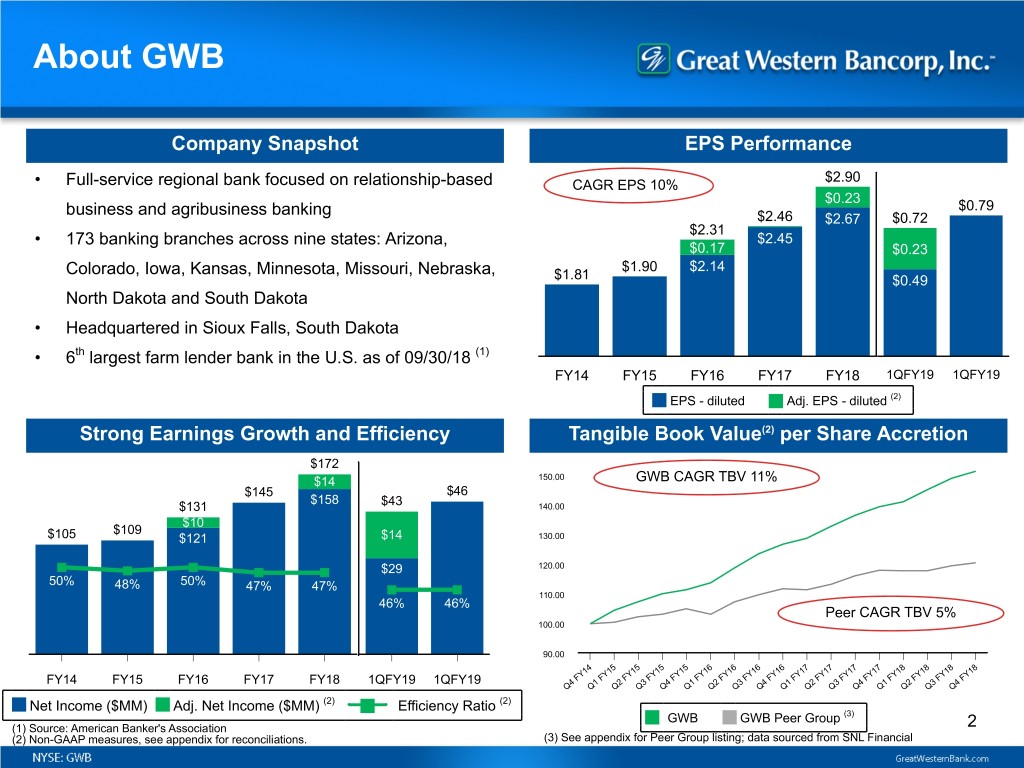

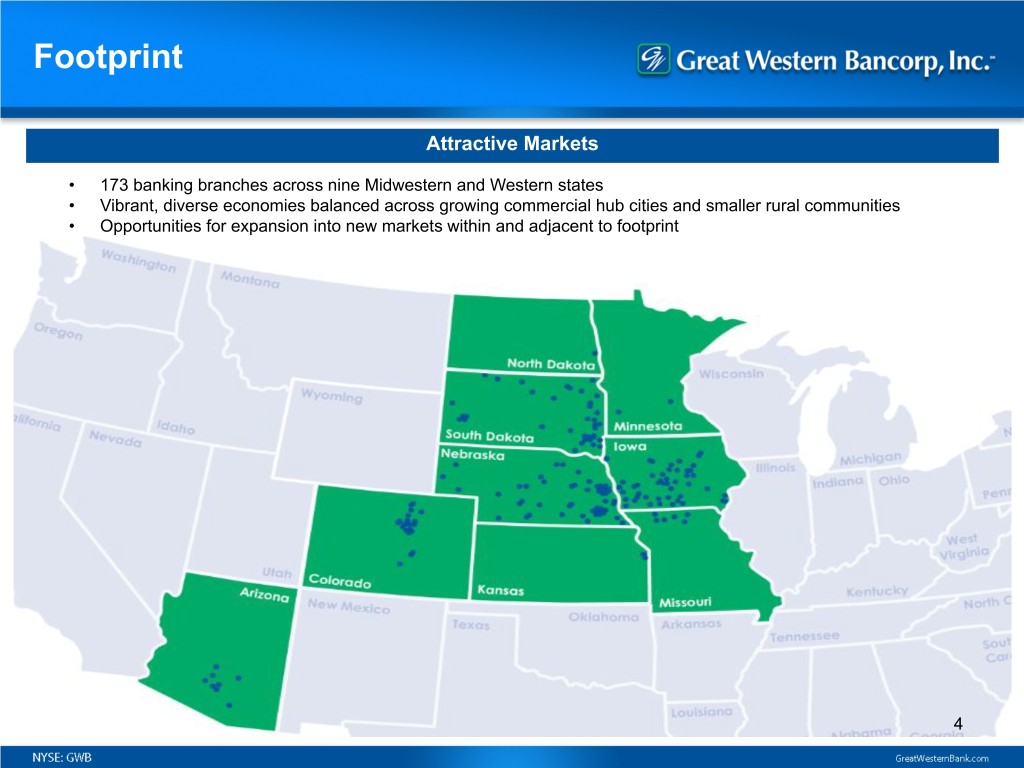

Footprint Attractive Markets • 173 banking branches across nine Midwestern and Western states • Vibrant, diverse economies balanced across growing commercial hub cities and smaller rural communities • Opportunities for expansion into new markets within and adjacent to footprint 4

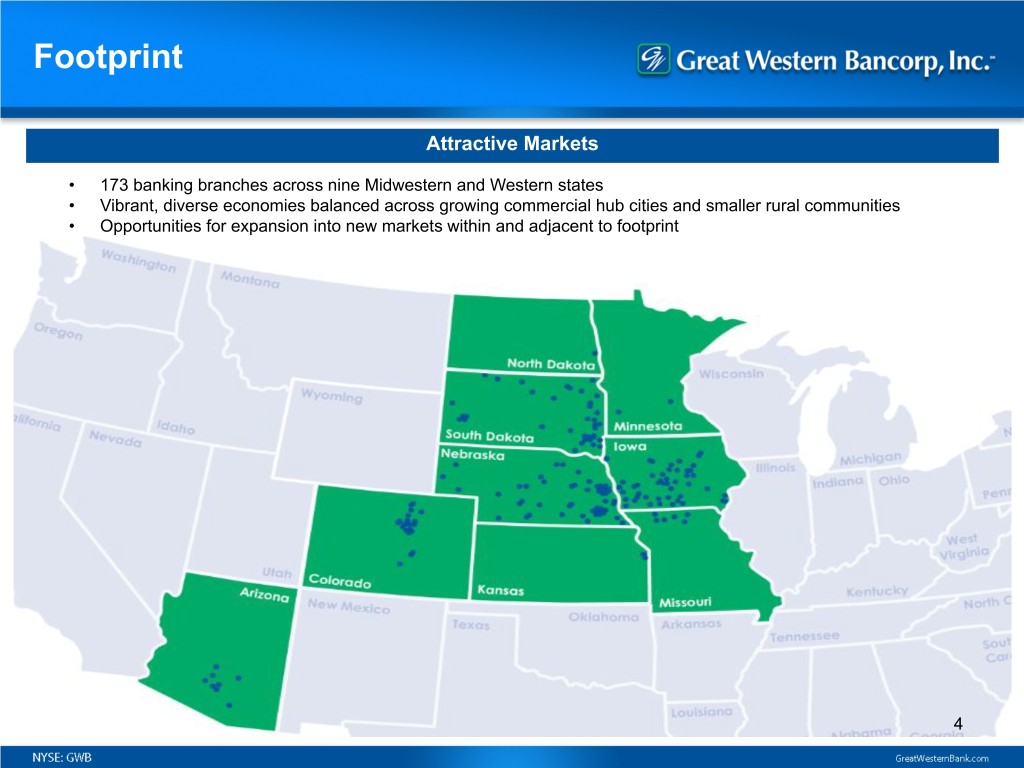

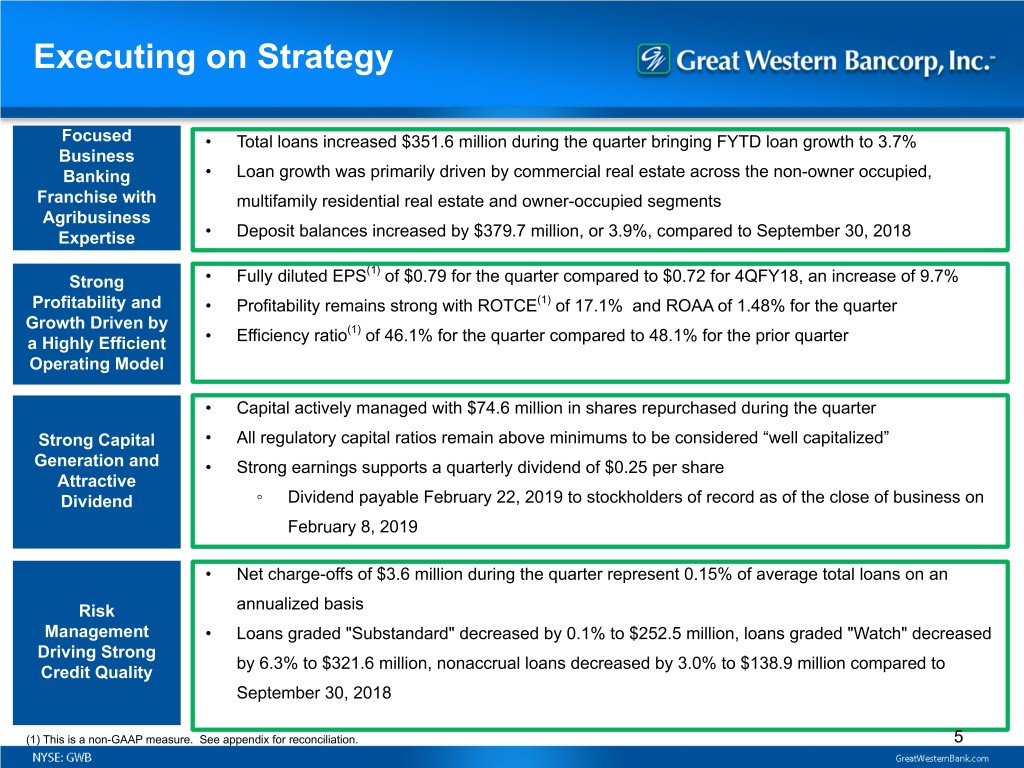

Executing on Strategy Focused • Total loans increased $351.6 million during the quarter bringing FYTD loan growth to 3.7% Business Banking • Loan growth was primarily driven by commercial real estate across the non-owner occupied, Franchise with multifamily residential real estate and owner-occupied segments Agribusiness Expertise • Deposit balances increased by $379.7 million, or 3.9%, compared to September 30, 2018 (1) Strong • Fully diluted EPS of $0.79 for the quarter compared to $0.72 for 4QFY18, an increase of 9.7% Profitability and • Profitability remains strong with ROTCE(1) of 17.1% and ROAA of 1.48% for the quarter Growth Driven by (1) a Highly Efficient • Efficiency ratio of 46.1% for the quarter compared to 48.1% for the prior quarter Operating Model • Capital actively managed with $74.6 million in shares repurchased during the quarter Strong Capital • All regulatory capital ratios remain above minimums to be considered “well capitalized” Generation and • Strong earnings supports a quarterly dividend of $0.25 per share Attractive Dividend ◦ Dividend payable February 22, 2019 to stockholders of record as of the close of business on February 8, 2019 • Net charge-offs of $3.6 million during the quarter represent 0.15% of average total loans on an Risk annualized basis Management • Loans graded "Substandard" decreased by 0.1% to $252.5 million, loans graded "Watch" decreased Driving Strong by 6.3% to $321.6 million, nonaccrual loans decreased by 3.0% to $138.9 million compared to Credit Quality September 30, 2018 (1) This is a non-GAAP measure. See appendix for reconciliation. 5

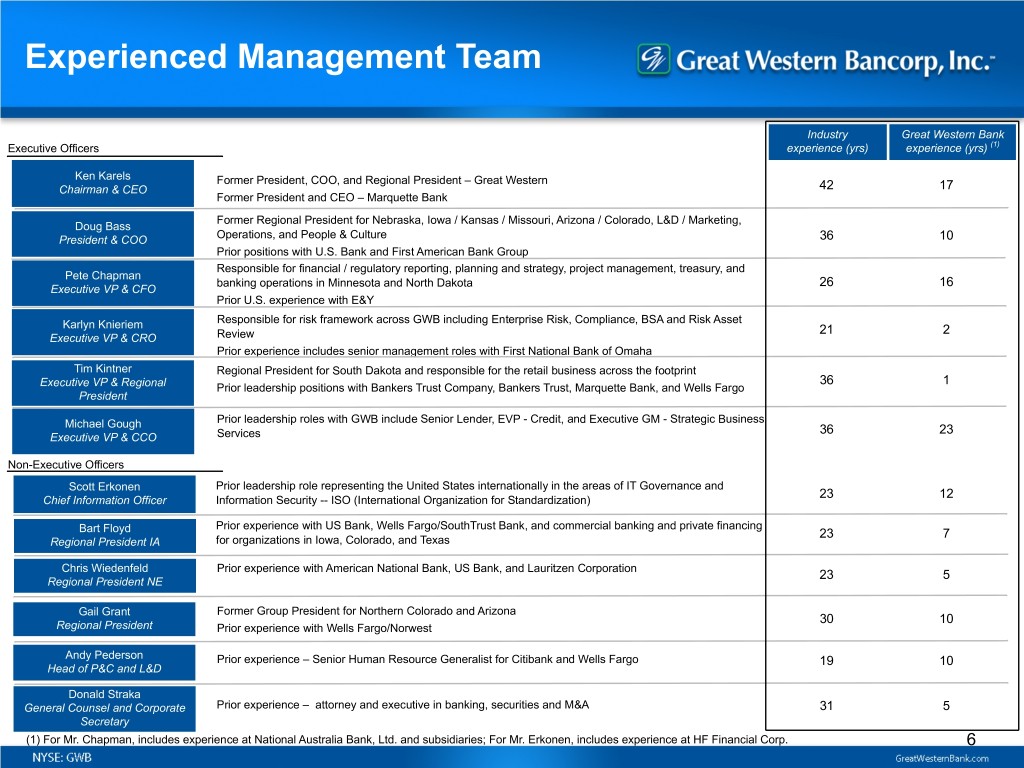

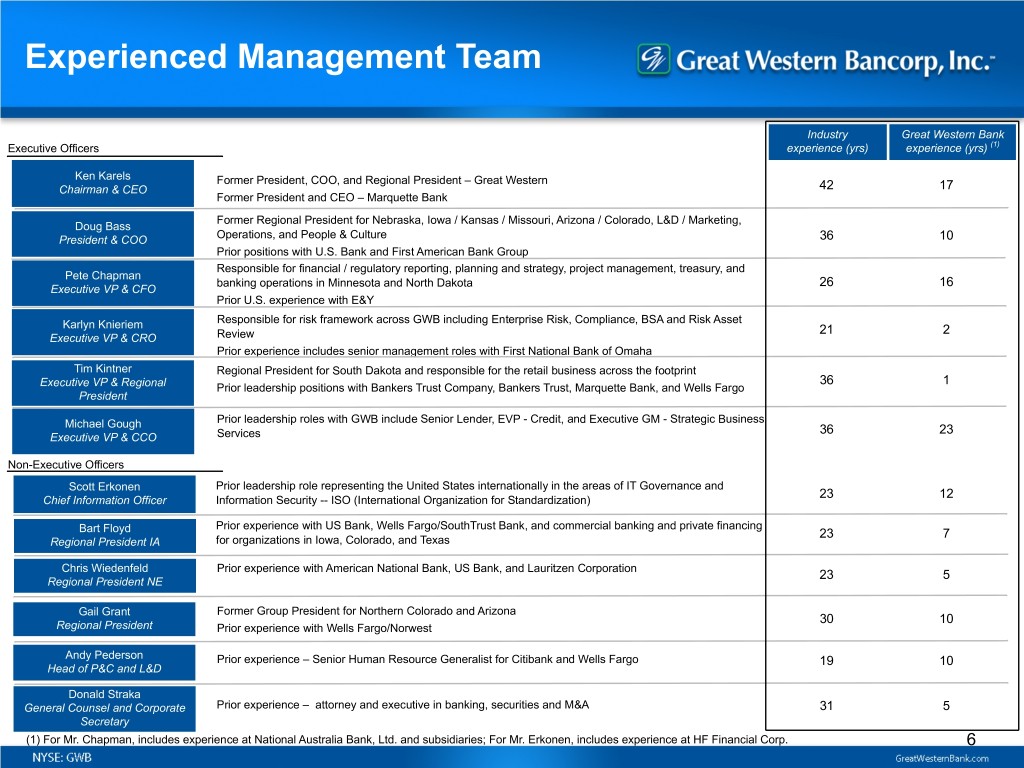

Experienced Management Team Industry Great Western Bank Executive Officers experience (yrs) experience (yrs) (1) Ken Karels Former President, COO, and Regional President – Great Western Chairman & CEO 42 17 Former President and CEO – Marquette Bank Former Regional President for Nebraska, Iowa / Kansas / Missouri, Arizona / Colorado, L&D / Marketing, Doug Bass President & COO Operations, and People & Culture 36 10 Prior positions with U.S. Bank and First American Bank Group Responsible for financial / regulatory reporting, planning and strategy, project management, treasury, and Pete Chapman banking operations in Minnesota and North Dakota 26 16 Executive VP & CFO Prior U.S. experience with E&Y Responsible for risk framework across GWB including Enterprise Risk, Compliance, BSA and Risk Asset Karlyn Knieriem 21 2 Executive VP & CRO Review Prior experience includes senior management roles with First National Bank of Omaha Tim Kintner Regional President for South Dakota and responsible for the retail business across the footprint 36 1 Executive VP & Regional Prior leadership positions with Bankers Trust Company, Bankers Trust, Marquette Bank, and Wells Fargo President Prior leadership roles with GWB include Senior Lender, EVP - Credit, and Executive GM - Strategic Business Michael Gough 36 23 Executive VP & CCO Services Non-Executive Officers Scott Erkonen Prior leadership role representing the United States internationally in the areas of IT Governance and 23 12 Chief Information Officer Information Security -- ISO (International Organization for Standardization) Prior experience with US Bank, Wells Fargo/SouthTrust Bank, and commercial banking and private financing Bart Floyd 23 7 Regional President IA for organizations in Iowa, Colorado, and Texas Chris Wiedenfeld Prior experience with American National Bank, US Bank, and Lauritzen Corporation 23 5 Regional President NE Gail Grant Former Group President for Northern Colorado and Arizona 30 10 Regional President Prior experience with Wells Fargo/Norwest Andy Pederson Prior experience – Senior Human Resource Generalist for Citibank and Wells Fargo 19 10 Head of P&C and L&D Donald Straka General Counsel and Corporate Prior experience – attorney and executive in banking, securities and M&A 31 5 Secretary (1) For Mr. Chapman, includes experience at National Australia Bank, Ltd. and subsidiaries; For Mr. Erkonen, includes experience at HF Financial Corp. 6

Acquisition History Acquired First Community Bank's Colorado franchise Acquired HF Acquired Security Acquired North Central and a branch from Financial Corp. Bank Bancshares Inc. Wachovia ($1.1 billion total) ($0.1 billion) ($0.4 billion total) ($0.6 billion total) Acquired F&M $12.6 Acquired Bank-Iowa and $12.1 $12.0 Sunstate Bank $11.7 TierOne Bank $11.5 and three ($3.0 billion total) branches from $10.0 HF Financial $9.8 $9.4 Corp. $9.1 ($0.2 billion $9.0 total) $8.3 $8.2 $8.0 $6.0 $5.2 $4.3 $4.0 $3.4 $3.1 $2.0 $0.0 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 1QFY19 Pre-Acquisition Assets Acquired Assets Note: Total assets are as of September 30 of each fiscal year unless otherwise noted. Acquired assets are the total of the fair value of total assets acquired and the net cash and cash equivalents received, at the time of acquisition of each indicated year. 7

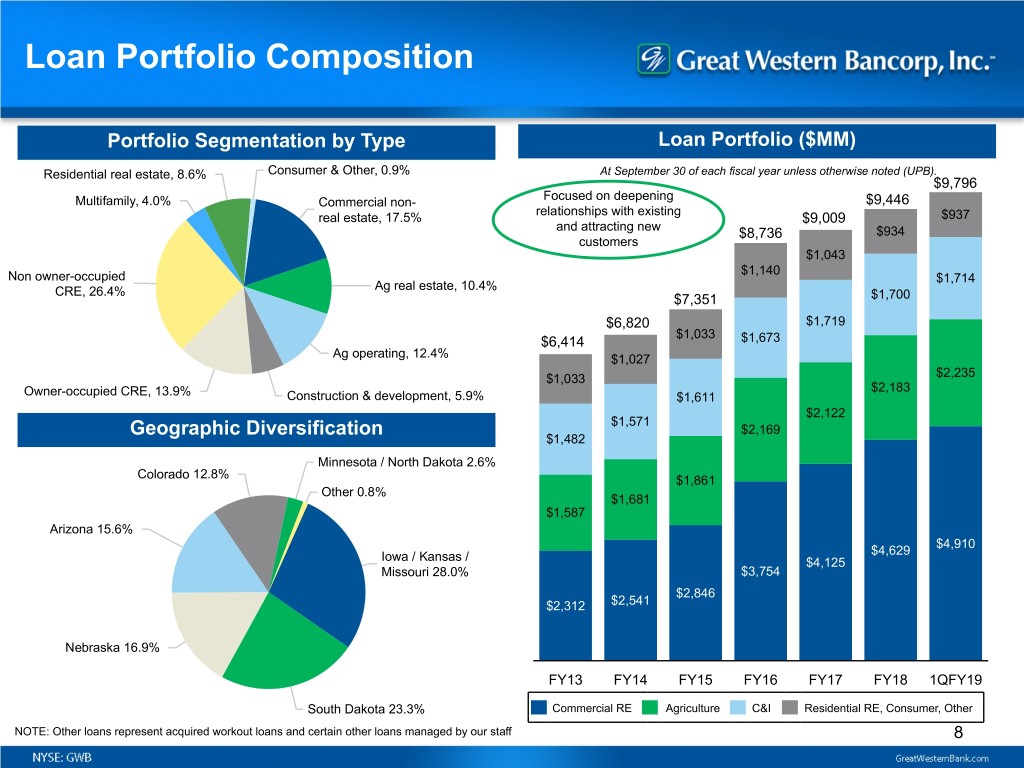

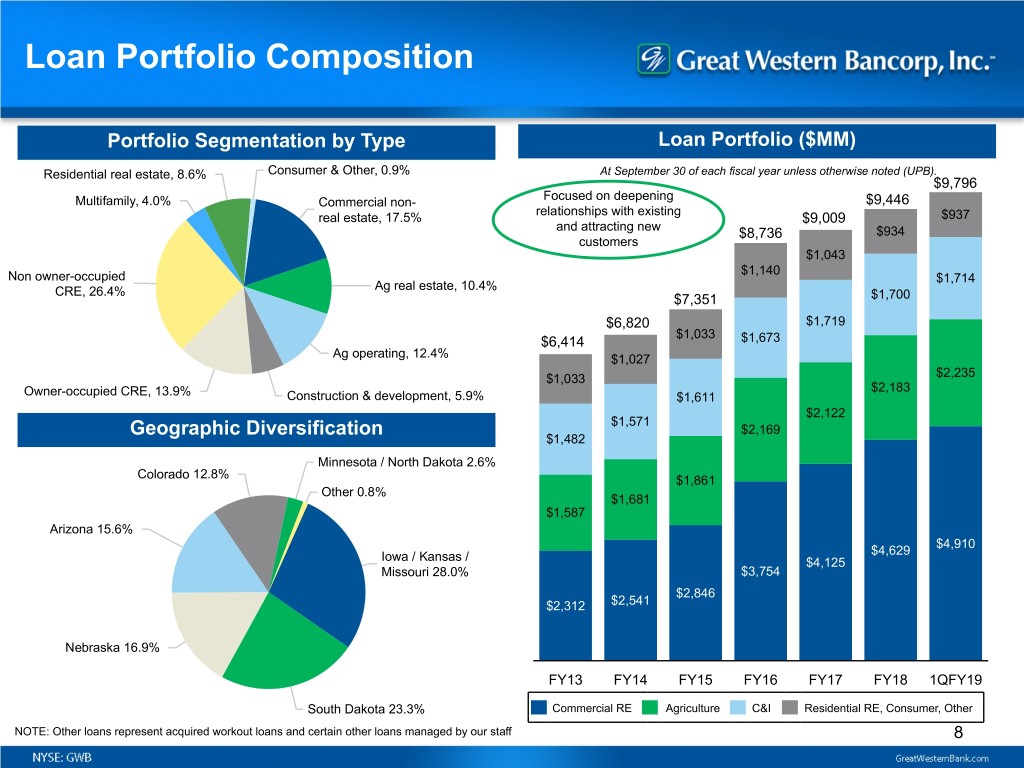

Loan Portfolio Composition Portfolio Segmentation by Type Loan Portfolio ($MM) Residential real estate, 8.6% Consumer & Other, 0.9% At September 30 of each fiscal year unless otherwise noted (UPB). $9,796 Focused on deepening Multifamily, 4.0% Commercial non- $9,446 relationships with existing real estate, 17.5% $9,009 $937 and attracting new $8,736 $934 customers $1,043 $1,140 Non owner-occupied $1,714 CRE, 26.4% Ag real estate, 10.4% $7,351 $1,700 $6,820 $1,719 $1,033 $6,414 $1,673 Ag operating, 12.4% $1,027 $1,033 $2,235 $2,183 Owner-occupied CRE, 13.9% Construction & development, 5.9% $1,611 $2,122 $1,571 Geographic Diversification $2,169 $1,482 Minnesota / North Dakota 2.6% Colorado 12.8% $1,861 Other 0.8% $1,681 $1,587 Arizona 15.6% $4,910 $4,629 Iowa / Kansas / $4,125 Missouri 28.0% $3,754 $2,846 $2,312 $2,541 Nebraska 16.9% FY13 FY14 FY15 FY16 FY17 FY18 1QFY19 South Dakota 23.3% Commercial RE Agriculture C&I Residential RE, Consumer, Other NOTE: Other loans represent acquired workout loans and certain other loans managed by our staff 8

Additional Loan Information Highlights Incremental Impact from Acquired Loans ($MM) • Loan portfolio is managed to Board-approved Includes ASC 310-20 accretion, ASC 310-30 accretion in excess of contractual interest and concentration limits and regulatory guidelines indem. asset amortization $6.1 • Income statement impact from acquired loans (including $3.1 $2.1 $2.1 indemnification asset amortization) has not significantly $1.4 $1.5 $1.7 $0.2 $0.5 $0.2 inflated earnings and is not expected to in the future • Management remains comfortable with credit coverage levels $(3.3) $(5.6) 2014 2015 2016 2017 2018 FY19 YTD ASC 310-30 Non ASC 310-30 Comprehensive Credit-Related Coverage ($MM) GWB Legacy - GWB Legacy - Loans at Loans at Fair HF Financial Corp. Other Acquired Amortized Cost Value Acquired Loans Loans Total ALLL $ 63,250 $ — $ 1,048 $ 1,895 $ 66,193 Remaining Loan Discount $ — $ — $ 11,763 $ 4,910 $ 16,673 Fair Value Adjustment (Credit) $ — $ 6,796 $ — $ — $ 6,796 Total ALLL / Discount / FV Adj. $ 63,250 $ 6,796 $ 12,811 $ 6,805 $ 89,662 Total Loans $ 8,334,240 $ 845,345 $ 488,137 $ 99,754 $ 9,767,476 ALLL / Total Loans 0.76% —% 0.21% 1.90% 0.68% Discount / Total Loans —% —% 2.41% 4.92% 0.17% FV Adj. / Total Loans —% 0.80% —% —% 0.07% Total Coverage / Total Loans (1) 0.76% 0.80% 2.62% 6.82% 0.92% (1) Comprehensive Credit-Related Coverage is a non-GAAP measure that Management believes is useful to demonstrate that the FV adjustments related to credit and remaining loan discounts consider credit risk and should be considered as part of total coverage. 9

Focused CRE Lending Highlights CRE Portfolio Composition by Type (UPB $MM) • Focus on commercial property investors, owner-occupied Multifamily, 8.0%, properties, multi-family property investors and a diverse range $393,223 of commercial construction with limited exposure to land development and other speculative projects Non-owner- Construction and occupied CRE, development, 11.8%, $579,941 • Continued customer demand to finance CRE construction and 52.5%, $2,577,158 development, especially in larger markets within our footprint • Regulatory CRE levels of 279% (300% test) and 55% (100% test) Owner-occupied CRE, • 10 largest CRE exposures represent 8.9% of total CRE and 27.7%, $1,359,979 average $44 million CRE Portfolio Exposure Sizes (UPB) CRE Net Charge-offs / Average Loans (1) ($MM) <$250K: 2.4% $250K - $1M: 8.0% $15M+: 25.6% 0.8% $1M - $5M: 27.9% 0.1% 0.1% 0.1% 0.1% —% —% FY13 FY14 FY15 FY16 FY17 FY18 FY19 YTD $18.96 $1.73 $0.63 $2.91 $1.55 $3.39 $0.77 $5M- $15M: 36.1% NOTE: All customer references are aggregated based on CIF and do not group CIFs with related ownership groups. Industry disclosures based on NAICS codes. (1) Net charge-offs / average loans represent charge-offs, net of recoveries, as a percent of average loans for each period. Average loans are calculated as the two point average of each period. Ratios annualized for partial-year periods. 10

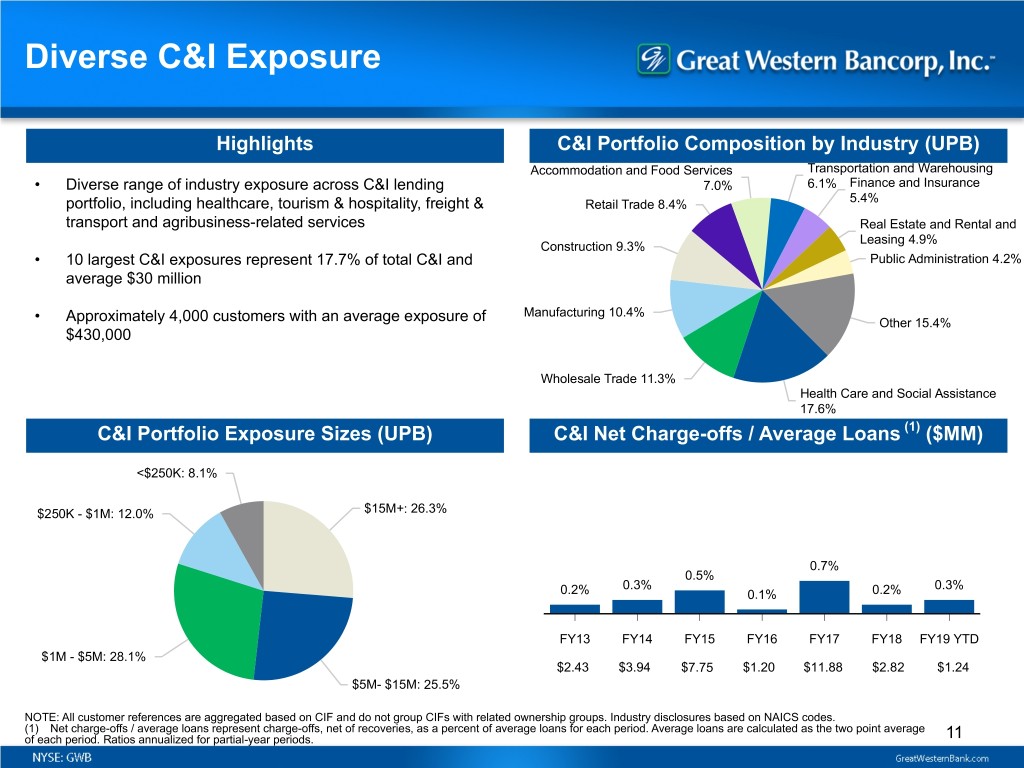

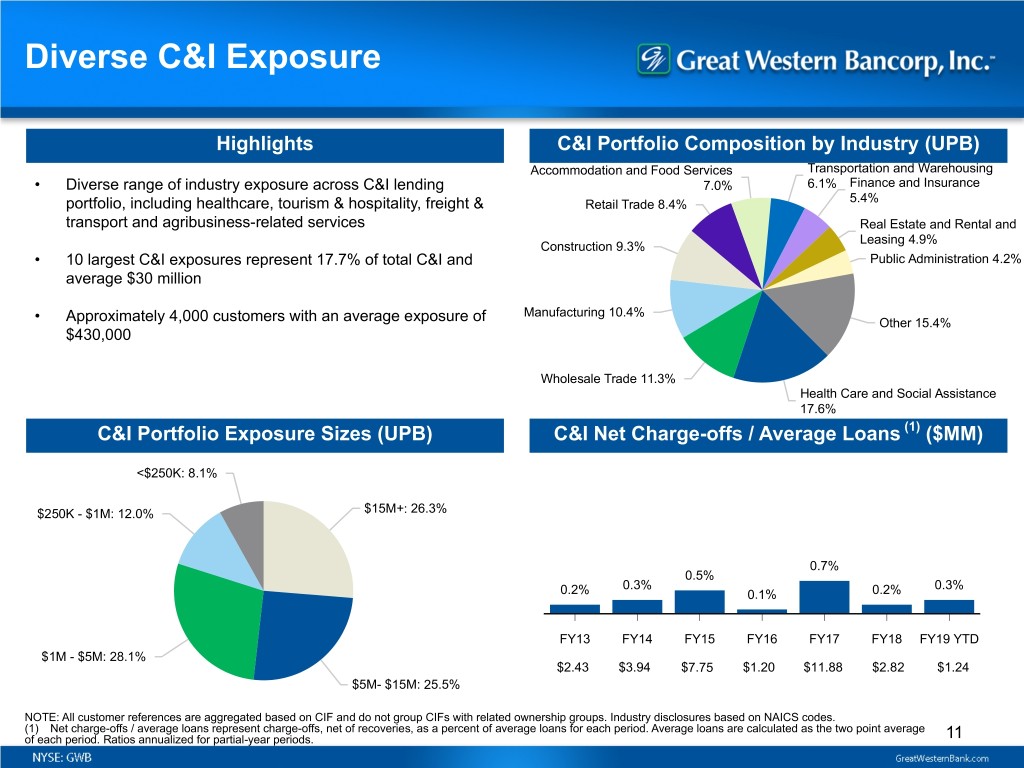

Diverse C&I Exposure Highlights C&I Portfolio Composition by Industry (UPB) Accommodation and Food Services Transportation and Warehousing • Diverse range of industry exposure across C&I lending 7.0% 6.1% Finance and Insurance 5.4% portfolio, including healthcare, tourism & hospitality, freight & Retail Trade 8.4% transport and agribusiness-related services Real Estate and Rental and Leasing 4.9% Construction 9.3% • 10 largest C&I exposures represent 17.7% of total C&I and Public Administration 4.2% average $30 million Manufacturing 10.4% • Approximately 4,000 customers with an average exposure of Other 15.4% $430,000 Wholesale Trade 11.3% Health Care and Social Assistance 17.6% C&I Portfolio Exposure Sizes (UPB) C&I Net Charge-offs / Average Loans (1) ($MM) <$250K: 8.1% $250K - $1M: 12.0% $15M+: 26.3% 0.7% 0.5% 0.3% 0.3% 0.2% 0.1% 0.2% FY13 FY14 FY15 FY16 FY17 FY18 FY19 YTD $1M - $5M: 28.1% $2.43 $3.94 $7.75 $1.20 $11.88 $2.82 $1.24 $5M- $15M: 25.5% NOTE: All customer references are aggregated based on CIF and do not group CIFs with related ownership groups. Industry disclosures based on NAICS codes. (1) Net charge-offs / average loans represent charge-offs, net of recoveries, as a percent of average loans for each period. Average loans are calculated as the two point average of each period. Ratios annualized for partial-year periods. 11

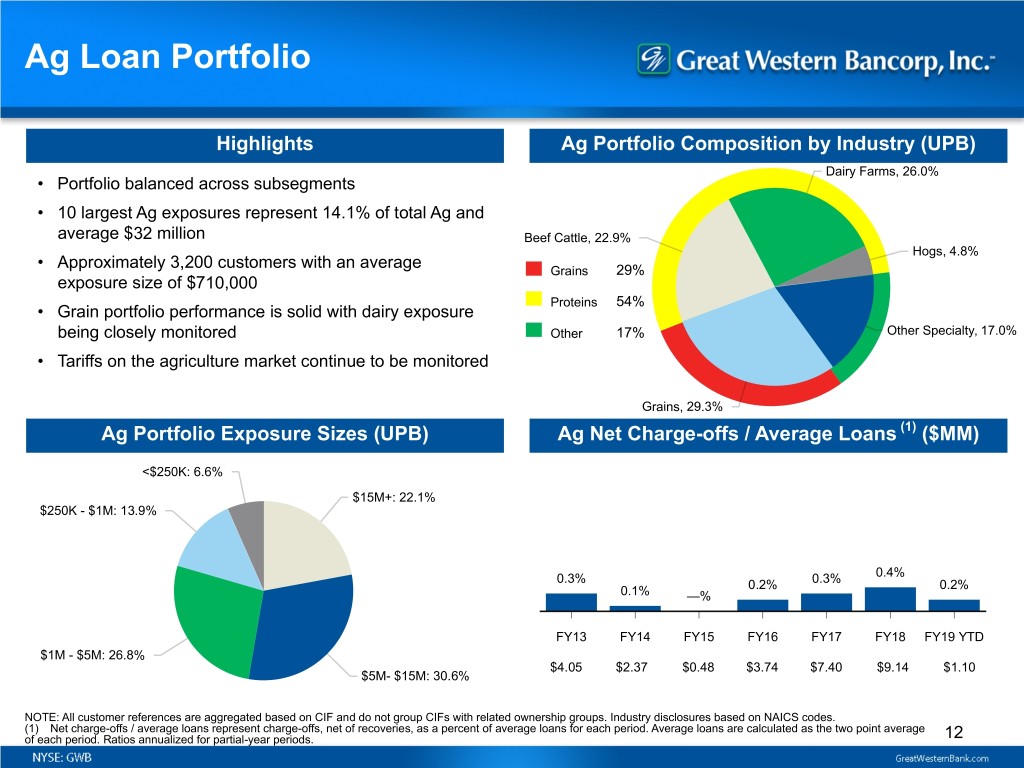

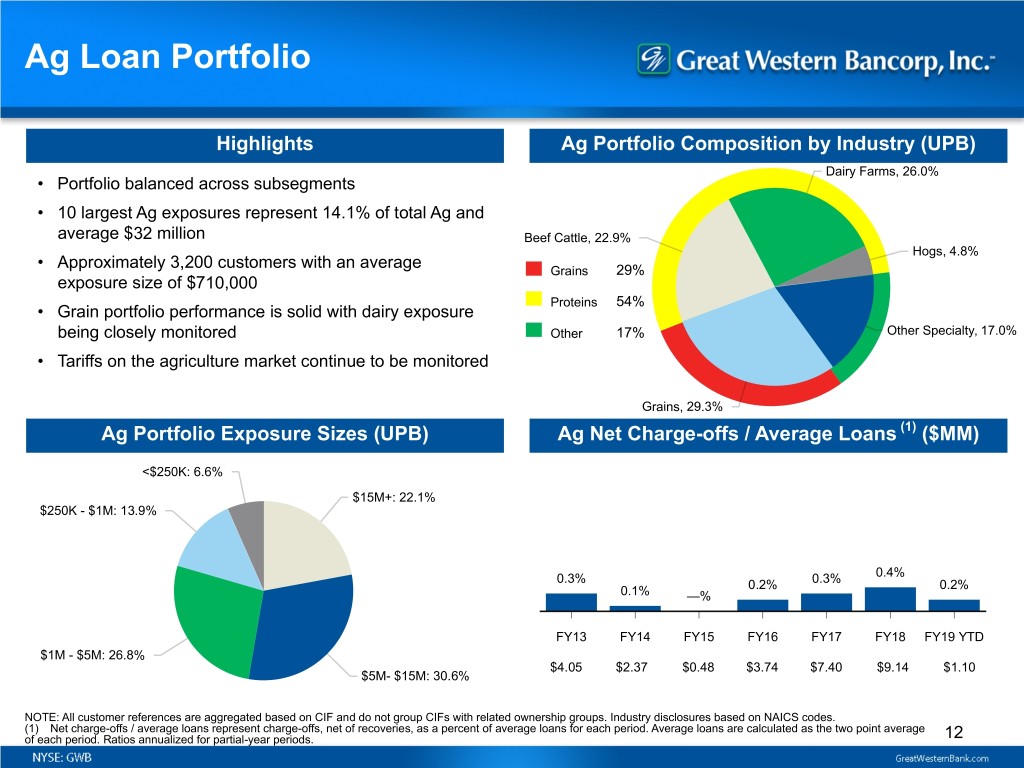

Ag Loan Portfolio Highlights Ag Portfolio Composition by Industry (UPB) Dairy Farms, 26.0% • Portfolio balanced across subsegments • 10 largest Ag exposures represent 14.1% of total Ag and average $32 million Beef Cattle, 22.9% Hogs, 4.8% • Approximately 3,200 customers with an average Grains 29% exposure size of $710,000 Proteins 54% • Grain portfolio performance is solid with dairy exposure being closely monitored Other 17% Other Specialty, 17.0% • Tariffs on the agriculture market continue to be monitored Grains, 29.3% Ag Portfolio Exposure Sizes (UPB) Ag Net Charge-offs / Average Loans (1) ($MM) <$250K: 6.6% $15M+: 22.1% $250K - $1M: 13.9% 0.4% 0.3% 0.2% 0.3% 0.2% 0.1% —% FY13 FY14 FY15 FY16 FY17 FY18 FY19 YTD $1M - $5M: 26.8% $4.05 $2.37 $0.48 $3.74 $7.40 $9.14 $1.10 $5M- $15M: 30.6% NOTE: All customer references are aggregated based on CIF and do not group CIFs with related ownership groups. Industry disclosures based on NAICS codes. (1) Net charge-offs / average loans represent charge-offs, net of recoveries, as a percent of average loans for each period. Average loans are calculated as the two point average of each period. Ratios annualized for partial-year periods. 12

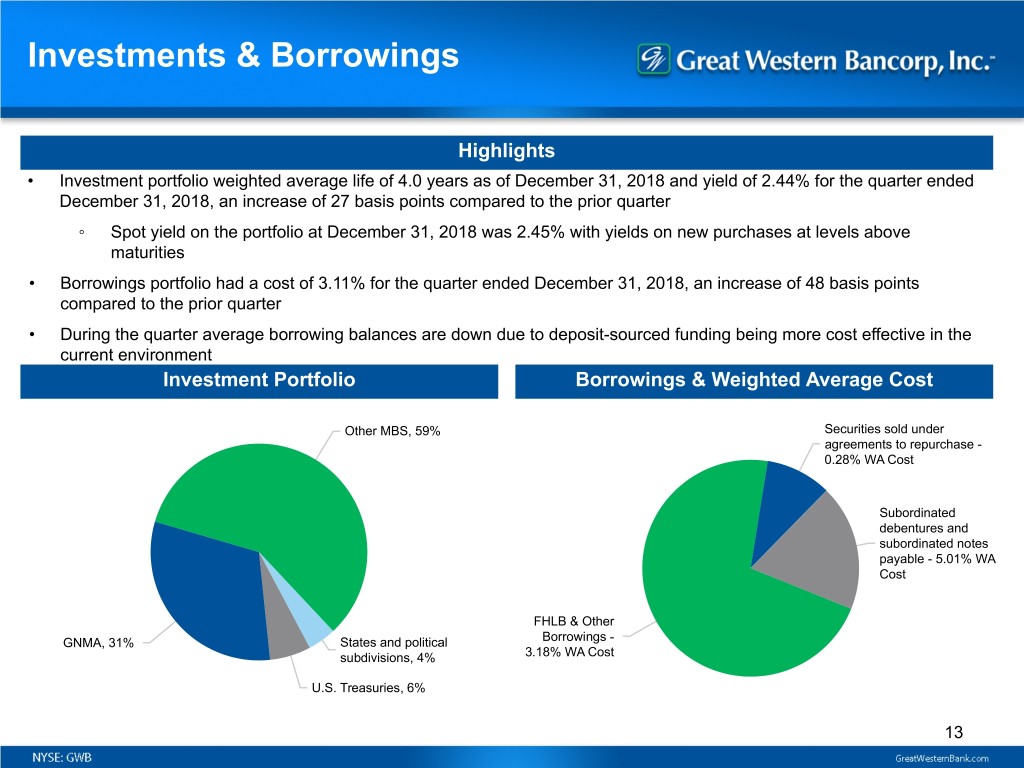

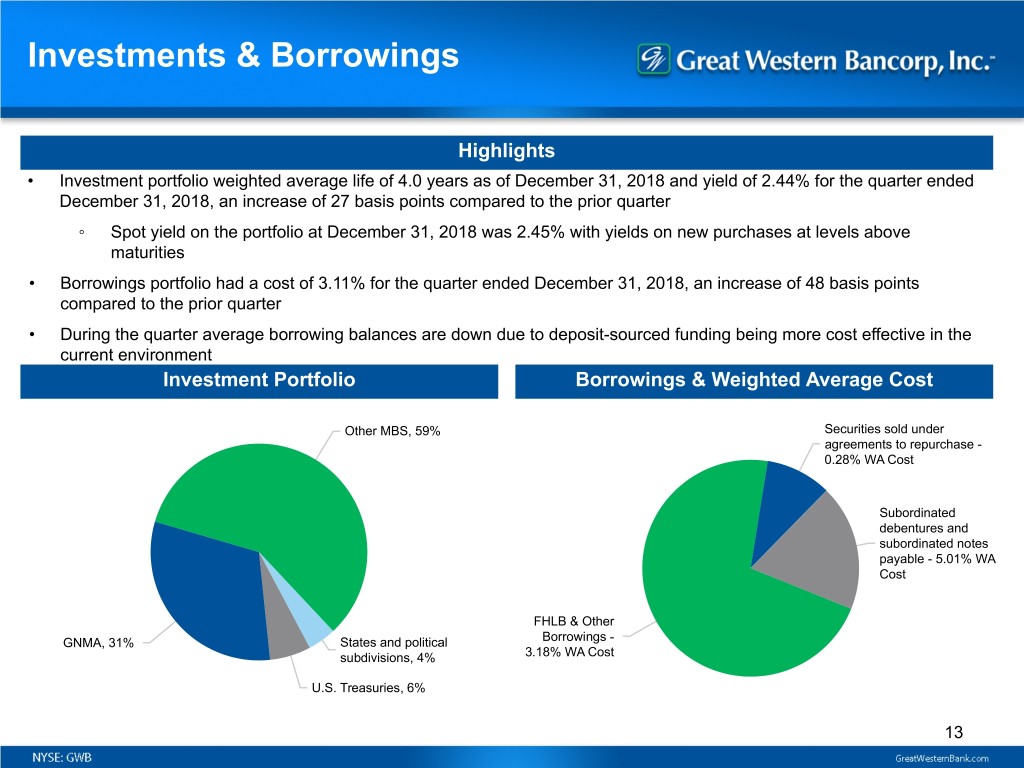

Investments & Borrowings Highlights • Investment portfolio weighted average life of 4.0 years as of December 31, 2018 and yield of 2.44% for the quarter ended December 31, 2018, an increase of 27 basis points compared to the prior quarter ◦ Spot yield on the portfolio at December 31, 2018 was 2.45% with yields on new purchases at levels above maturities • Borrowings portfolio had a cost of 3.11% for the quarter ended December 31, 2018, an increase of 48 basis points compared to the prior quarter • During the quarter average borrowing balances are down due to deposit-sourced funding being more cost effective in the current environment Investment Portfolio Borrowings & Weighted Average Cost Other MBS, 59% Securities sold under agreements to repurchase - 0.28% WA Cost Subordinated debentures and subordinated notes payable - 5.01% WA Cost FHLB & Other GNMA, 31% States and political Borrowings - subdivisions, 4% 3.18% WA Cost U.S. Treasuries, 6% 13

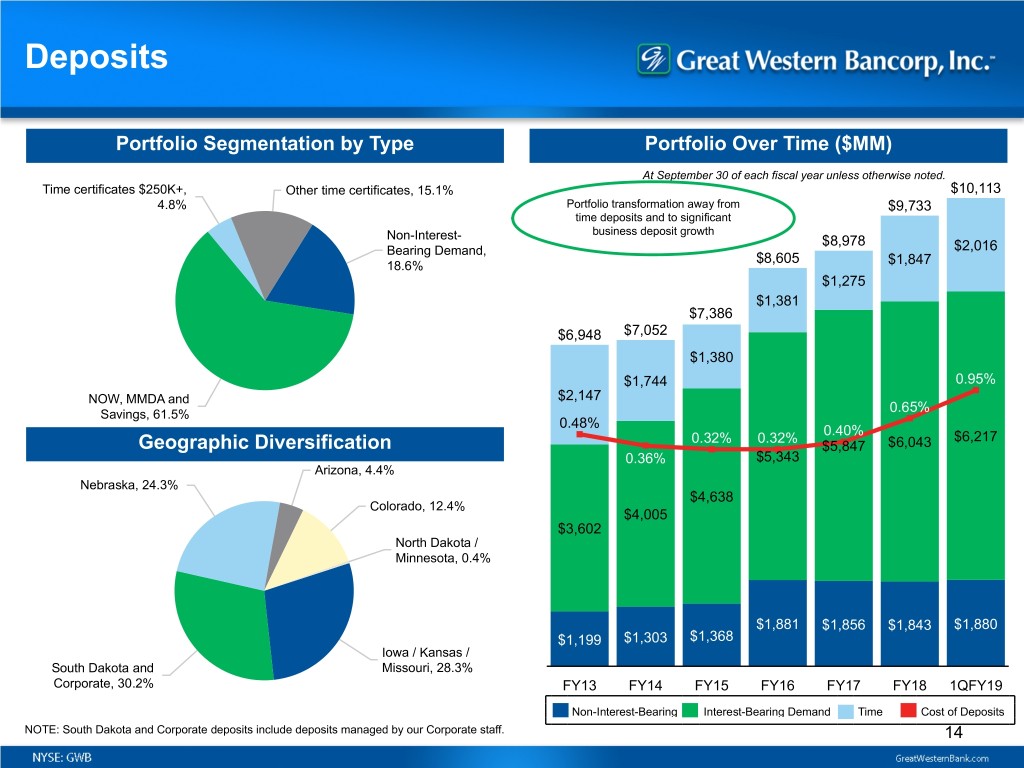

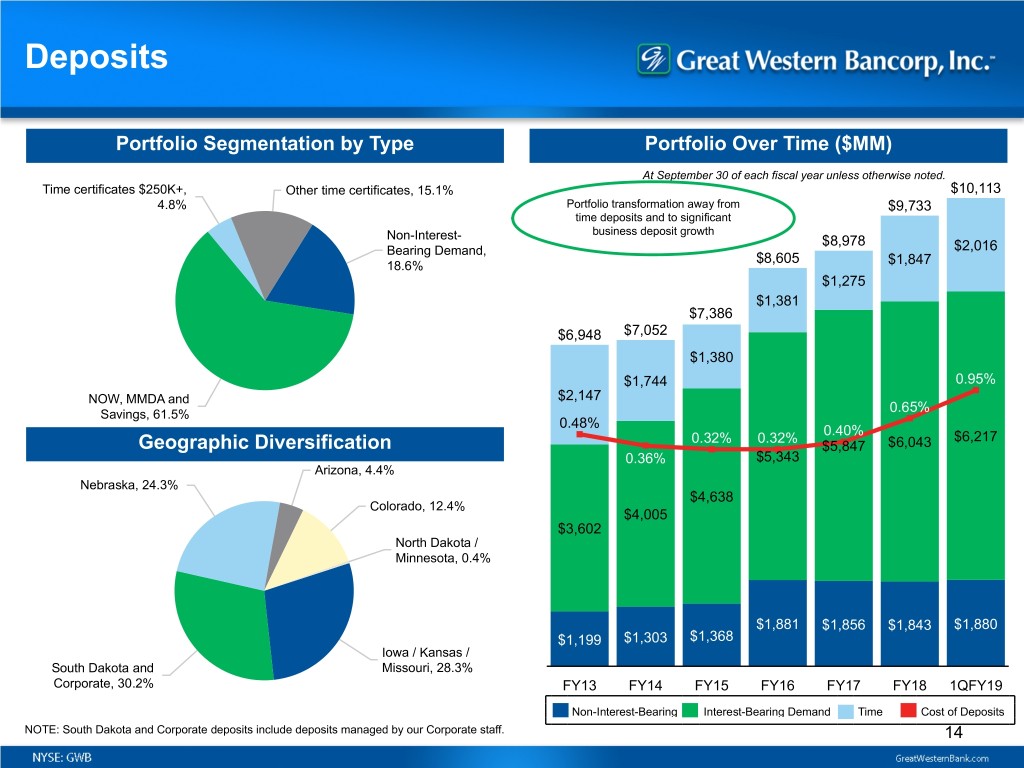

Deposits Portfolio Segmentation by Type Portfolio Over Time ($MM) At September 30 of each fiscal year unless otherwise noted. Time certificates $250K+, Other time certificates, 15.1% $10,113 4.8% Portfolio transformation away from $9,733 time deposits and to significant business deposit growth Non-Interest- $8,978 Bearing Demand, $2,016 $8,605 18.6% $1,847 $1,275 $1,381 $7,386$7,386 $6,948 $7,052 $1,380 $1,744 0.95% NOW, MMDA and $2,147 0.65% Savings, 61.5% 0.48% 0.40% 0.32% 0.32% $6,217 Geographic Diversification $5,847 $6,043 0.36% $5,343 Arizona, 4.4% Nebraska, 24.3% $4,638 Colorado, 12.4% $4,005 $3,602 North Dakota / Minnesota, 0.4% $1,881 $1,856 $1,843 $1,880 $1,199 $1,303 $1,368 Iowa / Kansas / South Dakota and Missouri, 28.3% Corporate, 30.2% FY13 FY14 FY15 FY16 FY17 FY18 1QFY19 Non-Interest-Bearing Interest-Bearing Demand Time Cost of Deposits NOTE: South Dakota and Corporate deposits include deposits managed by our Corporate staff. 14

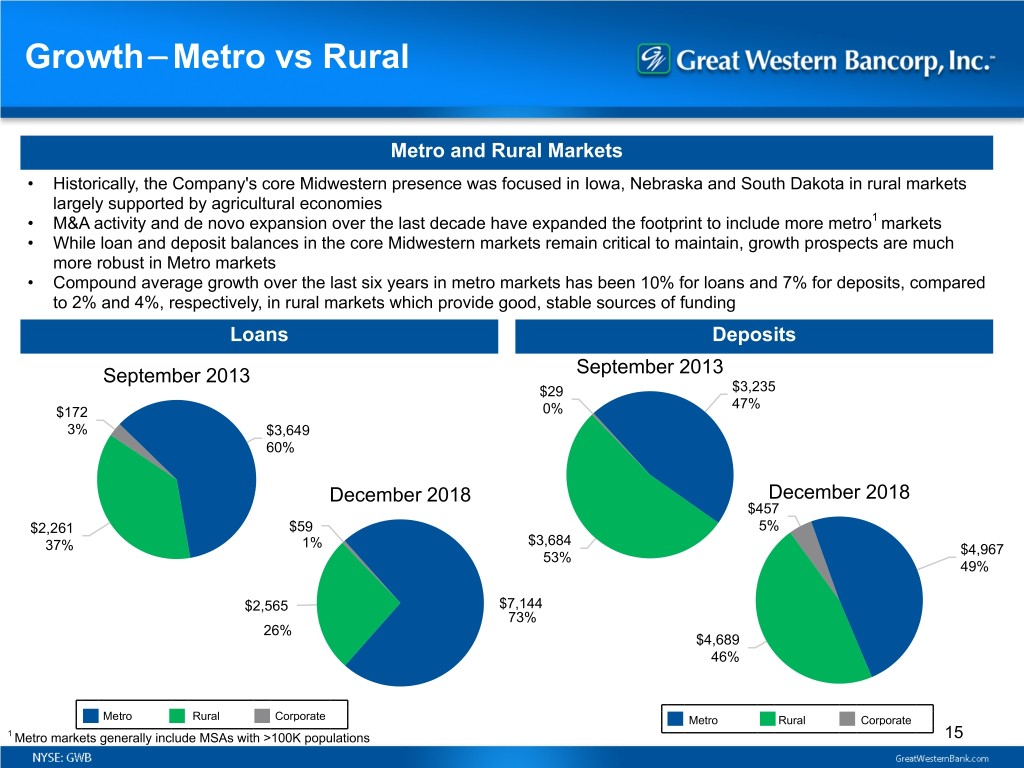

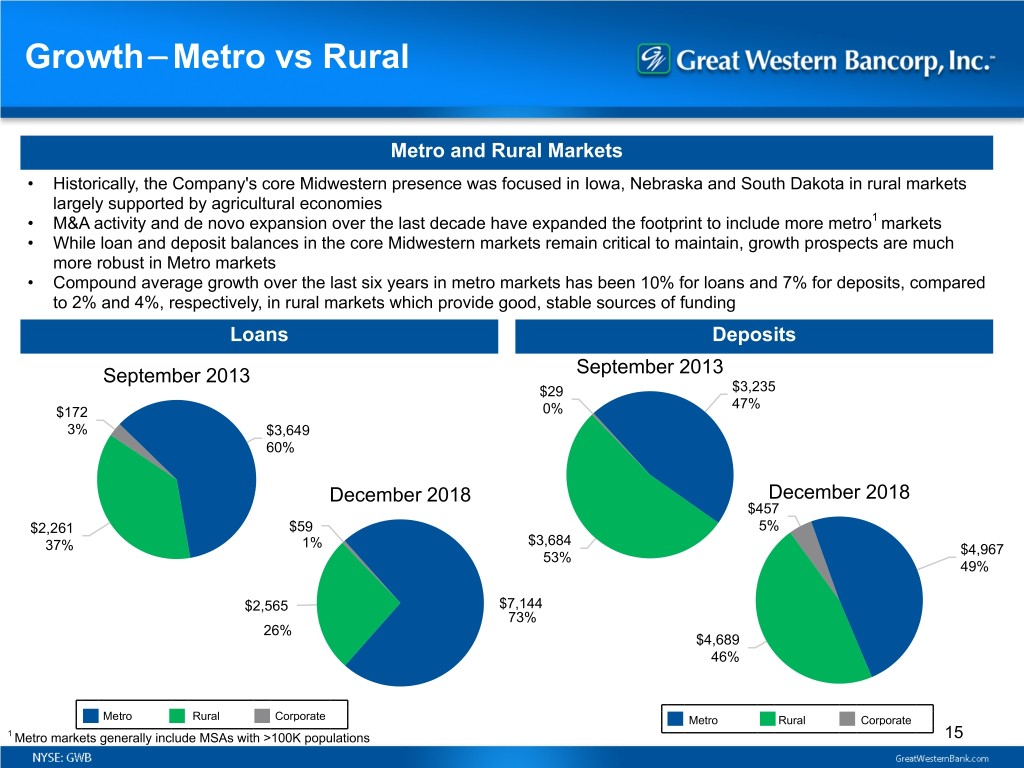

Growth Metro vs Rural Metro and Rural Markets • Historically, the Company's core Midwestern presence was focused in Iowa, Nebraska and South Dakota in rural markets largely supported by agricultural economies • M&A activity and de novo expansion over the last decade have expanded the footprint to include more metro1 markets • While loan and deposit balances in the core Midwestern markets remain critical to maintain, growth prospects are much more robust in Metro markets • Compound average growth over the last six years in metro markets has been 10% for loans and 7% for deposits, compared to 2% and 4%, respectively, in rural markets which provide good, stable sources of funding Loans Deposits September 2013 September 2013 $29 $3,235 47% $172 0% 3% $3,649 60% December 2018 December 2018 $457 $2,261 $59 5% $3,684 37% 1% $4,967 53% 49% $2,565 $7,144 73% 26% $4,689 46% Metro Rural Corporate Metro Rural Corporate 1 Metro markets generally include MSAs with >100K populations 15

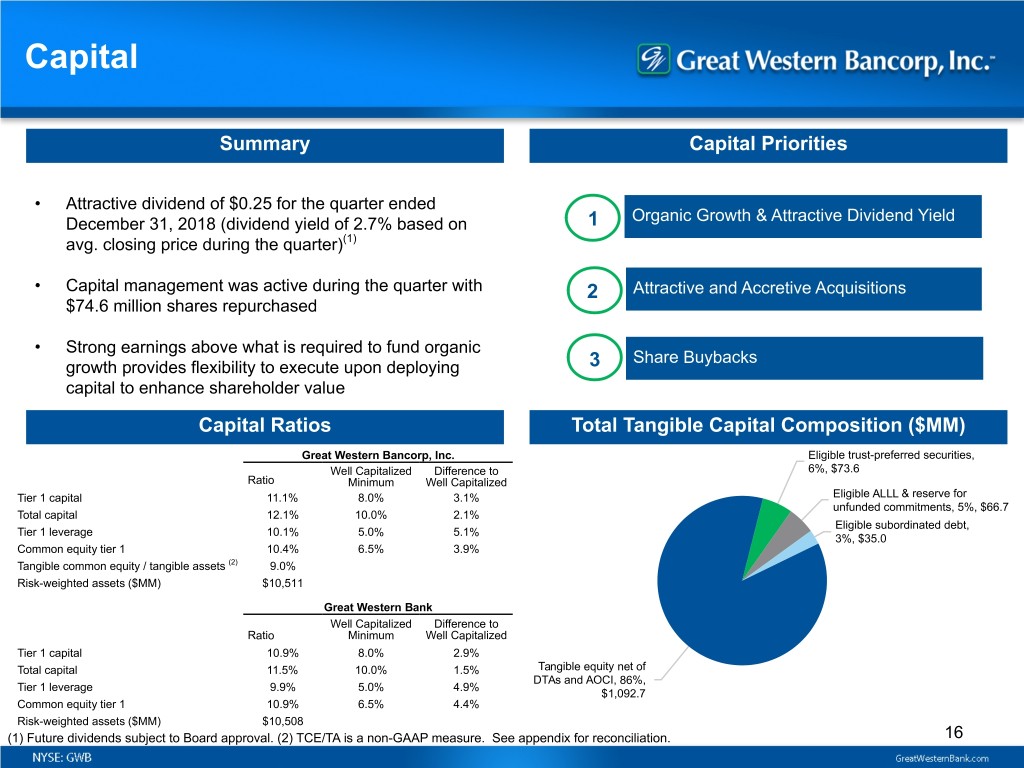

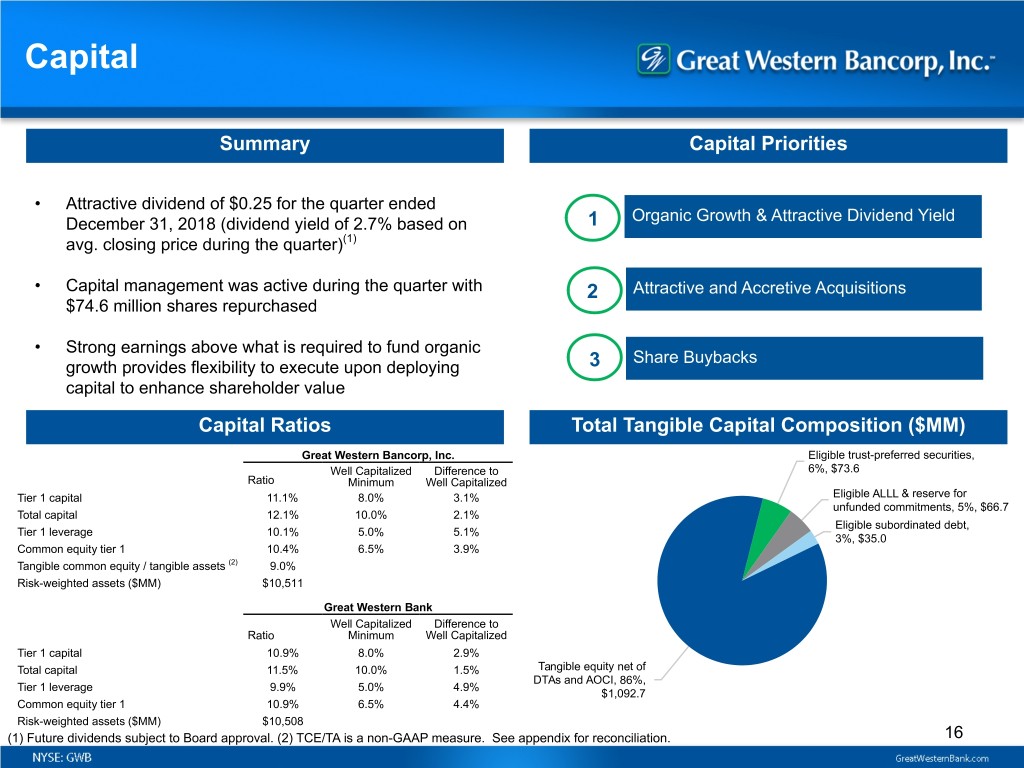

Capital Summary Capital Priorities • Attractive dividend of $0.25 for the quarter ended Organic Growth & Attractive Dividend Yield December 31, 2018 (dividend yield of 2.7% based on 1 avg. closing price during the quarter)(1) • Capital management was active during the quarter with 2 Attractive and Accretive Acquisitions $74.6 million shares repurchased • Strong earnings above what is required to fund organic Share Buybacks growth provides flexibility to execute upon deploying 3 capital to enhance shareholder value Capital Ratios Total Tangible Capital Composition ($MM) Great Western Bancorp, Inc. Eligible trust-preferred securities, Well Capitalized Difference to 6%, $73.6 Ratio Minimum Well Capitalized Tier 1 capital 11.1% 8.0% 3.1% Eligible ALLL & reserve for unfunded commitments, 5%, $66.7 Total capital 12.1% 10.0% 2.1% Eligible subordinated debt, Tier 1 leverage 10.1% 5.0% 5.1% 3%, $35.0 Common equity tier 1 10.4% 6.5% 3.9% Tangible common equity / tangible assets (2) 9.0% Risk-weighted assets ($MM) $10,511 Great Western Bank Well Capitalized Difference to Ratio Minimum Well Capitalized Tier 1 capital 10.9% 8.0% 2.9% Total capital 11.5% 10.0% 1.5% Tangible equity net of DTAs and AOCI, 86%, Tier 1 leverage 9.9% 5.0% 4.9% $1,092.7 Common equity tier 1 10.9% 6.5% 4.4% Risk-weighted assets ($MM) $10,508 (1) Future dividends subject to Board approval. (2) TCE/TA is a non-GAAP measure. See appendix for reconciliation. 16

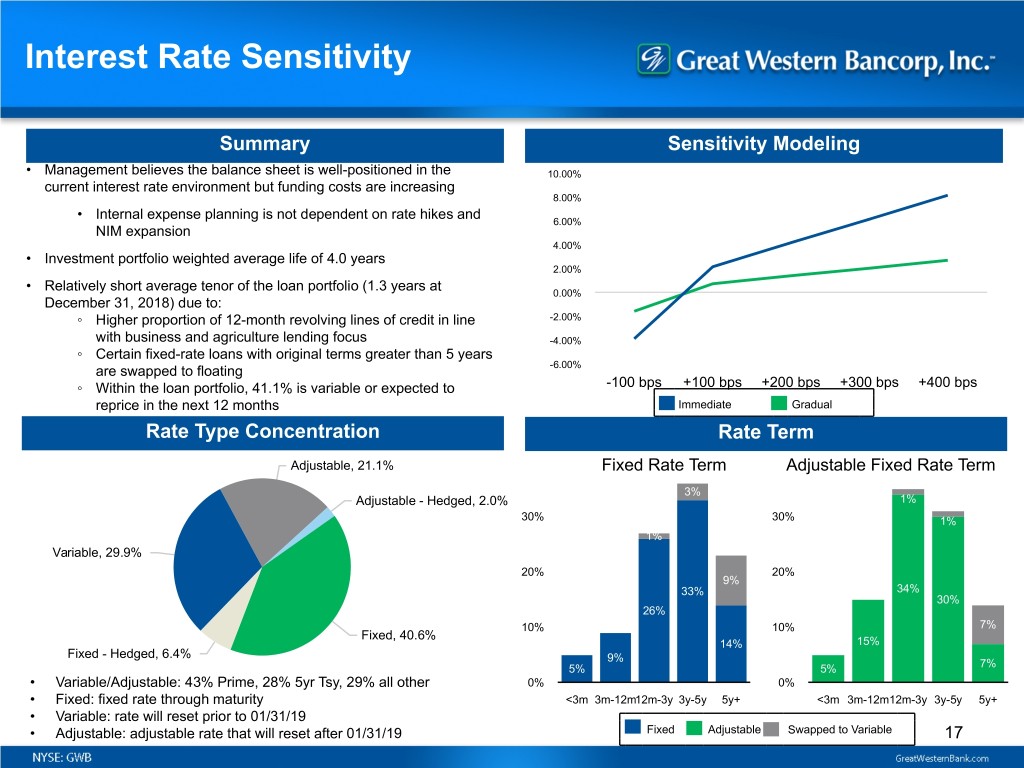

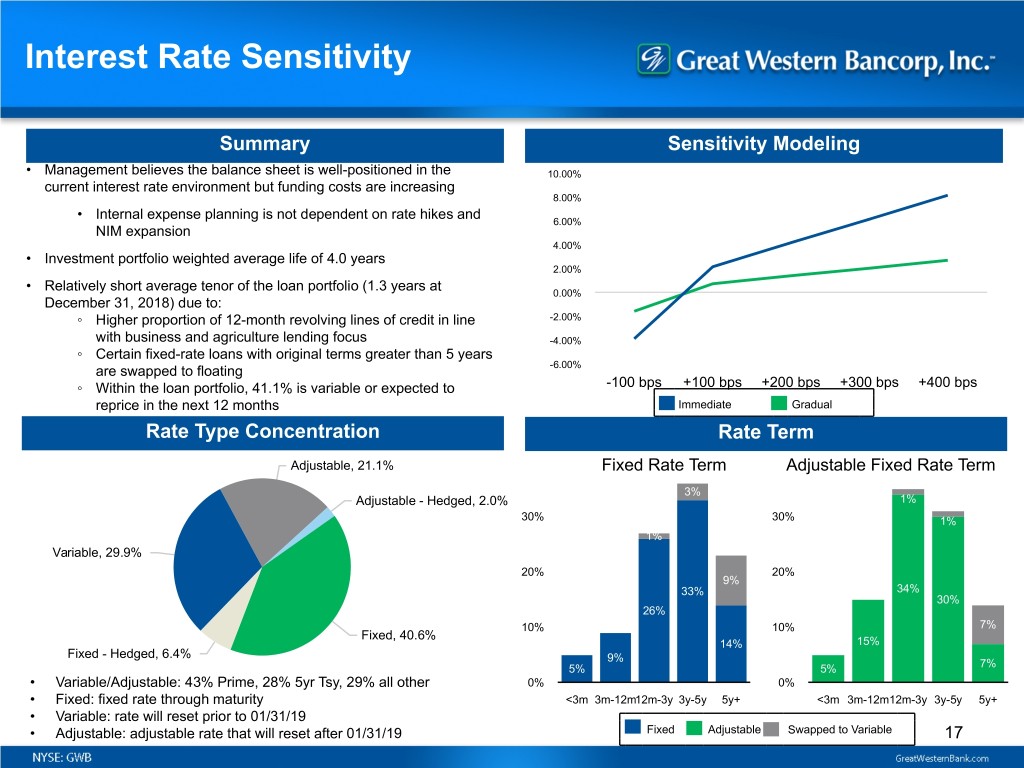

Interest Rate Sensitivity Summary Sensitivity Modeling • Management believes the balance sheet is well-positioned in the 10.00% current interest rate environment but funding costs are increasing 8.00% • Internal expense planning is not dependent on rate hikes and 6.00% NIM expansion 4.00% • Investment portfolio weighted average life of 4.0 years 2.00% • Relatively short average tenor of the loan portfolio (1.3 years at 0.00% December 31, 2018) due to: ◦ Higher proportion of 12-month revolving lines of credit in line -2.00% with business and agriculture lending focus -4.00% ◦ Certain fixed-rate loans with original terms greater than 5 years are swapped to floating -6.00% ◦ Within the loan portfolio, 41.1% is variable or expected to -100 bps +100 bps +200 bps +300 bps +400 bps reprice in the next 12 months Immediate Gradual Rate Type Concentration Rate Term Adjustable, 21.1% Fixed Rate Term Adjustable Fixed Rate Term 3% Adjustable - Hedged, 2.0% 1% 30% 30% 1% 1% Variable, 29.9% 20% 20% 9% 33% 34% 30% 26% 10% 10% 7% Fixed, 40.6% 14% 15% Fixed - Hedged, 6.4% 9% 5% 5% 7% • Variable/Adjustable: 43% Prime, 28% 5yr Tsy, 29% all other 0% 0% • Fixed: fixed rate through maturity <3m 3m-12m12m-3y 3y-5y 5y+ <3m 3m-12m12m-3y 3y-5y 5y+ • Variable: rate will reset prior to 01/31/19 • Adjustable: adjustable rate that will reset after 01/31/19 Fixed Adjustable Swapped to Variable 17

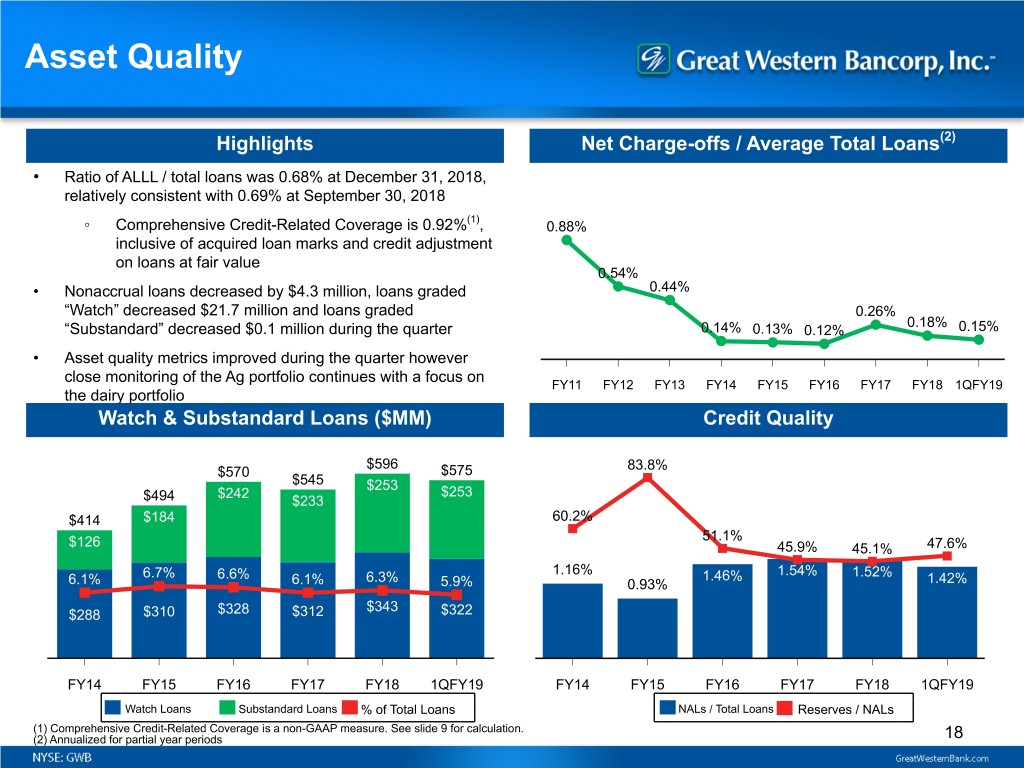

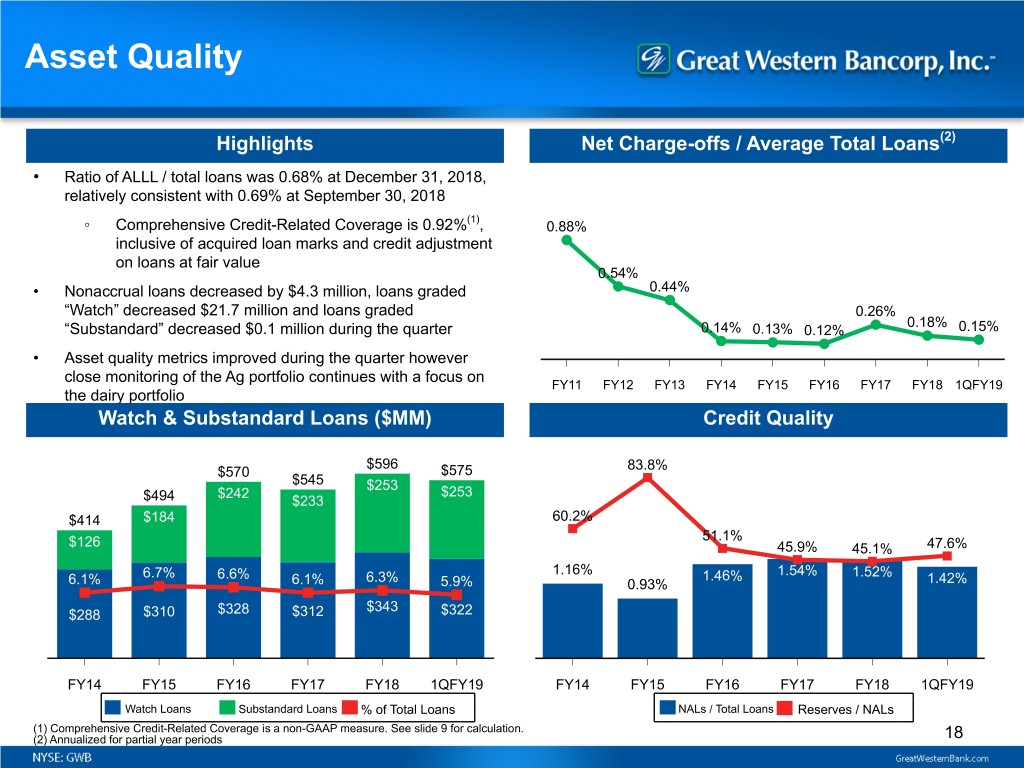

Asset Quality Highlights Net Charge-offs / Average Total Loans(2) • Ratio of ALLL / total loans was 0.68% at December 31, 2018, relatively consistent with 0.69% at September 30, 2018 (1) ◦ Comprehensive Credit-Related Coverage is 0.92% , 0.88% inclusive of acquired loan marks and credit adjustment on loans at fair value 0.54% • Nonaccrual loans decreased by $4.3 million, loans graded 0.44% “Watch” decreased $21.7 million and loans graded 0.26% 0.18% “Substandard” decreased $0.1 million during the quarter 0.14% 0.13% 0.12% 0.15% • Asset quality metrics improved during the quarter however close monitoring of the Ag portfolio continues with a focus on FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18 1QFY19 the dairy portfolio Watch & Substandard Loans ($MM) Credit Quality $596 $570 $575 83.8% $545 $253 $242 $253 $494 $233 $414 $184 60.2% 51.1% $126 45.9% 45.1% 47.6% 1.16% 6.7% 6.6% 6.3% 1.46% 1.54% 1.52% 6.1% 6.1% 5.9% 0.93% 1.42% $343 $288 $310 $328 $312 $322 FY14 FY15 FY16 FY17 FY18 1QFY19 FY14 FY15 FY16 FY17 FY18 1QFY19 Watch Loans Substandard Loans % of Total Loans NALs / Total Loans Reserves / NALs (1) Comprehensive Credit-Related Coverage is a non-GAAP measure. See slide 9 for calculation. (2) Annualized for partial year periods 18

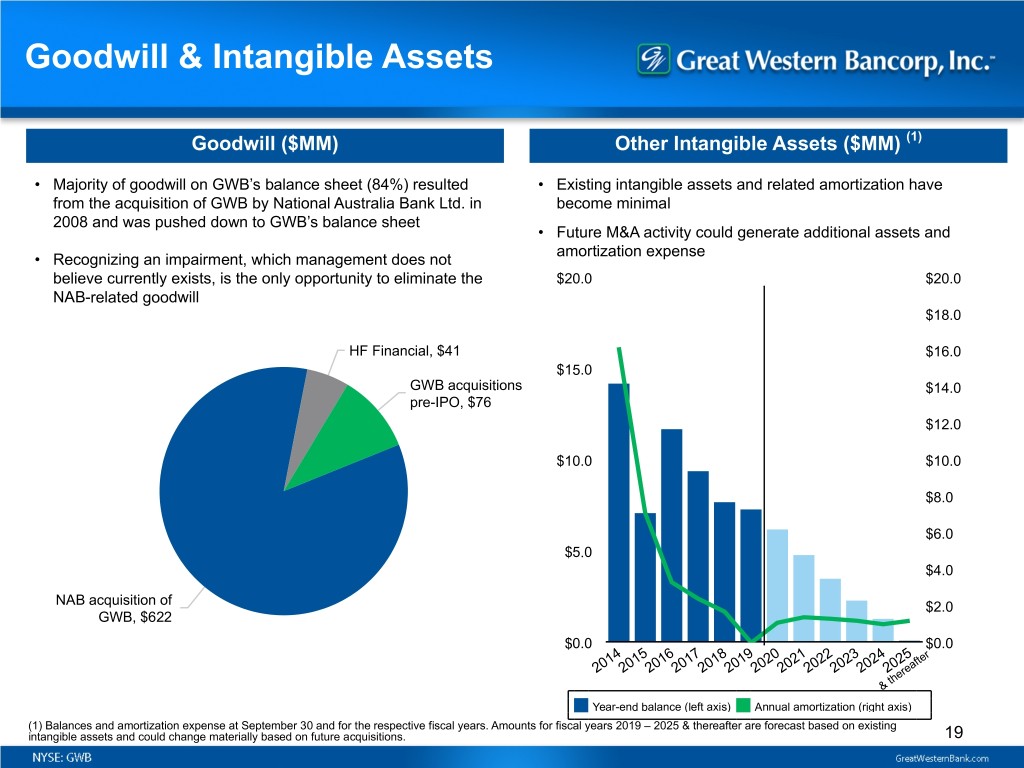

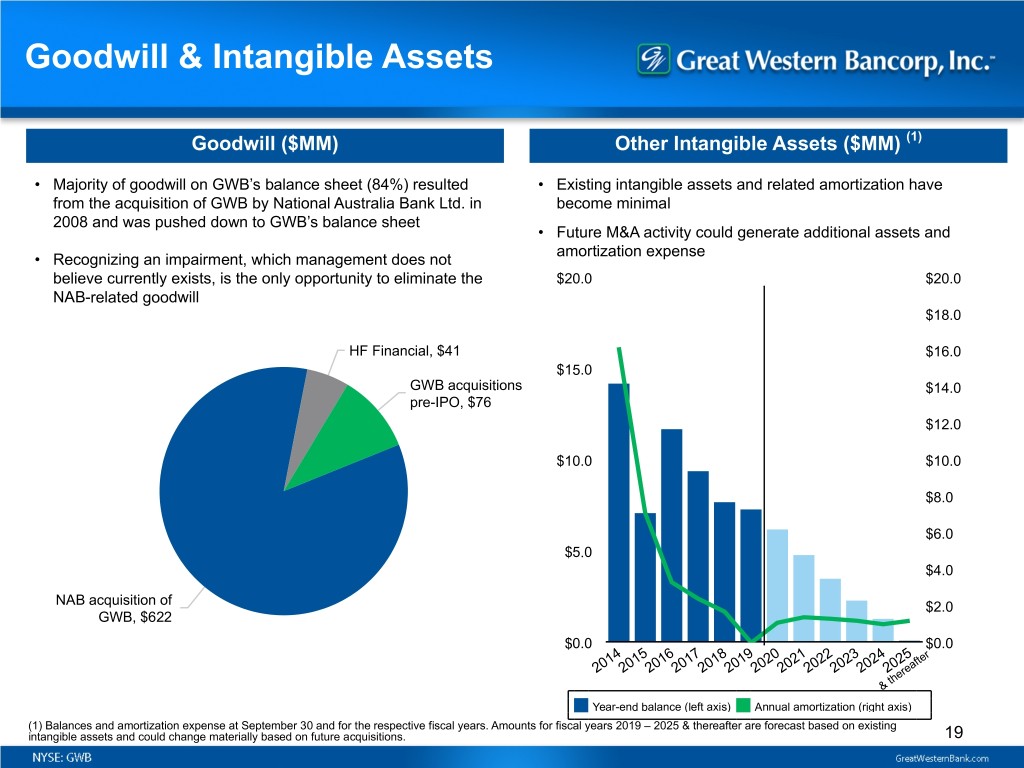

Goodwill & Intangible Assets Goodwill ($MM) Other Intangible Assets ($MM) (1) • Majority of goodwill on GWB’s balance sheet (84%) resulted • Existing intangible assets and related amortization have from the acquisition of GWB by National Australia Bank Ltd. in become minimal 2008 and was pushed down to GWB’s balance sheet • Future M&A activity could generate additional assets and amortization expense • Recognizing an impairment, which management does not believe currently exists, is the only opportunity to eliminate the $20.0 $20.0 NAB-related goodwill $18.0 HF Financial, $41 $16.0 $15.0 GWB acquisitions $14.0 pre-IPO, $76 $12.0 $10.0 $10.0 $8.0 $6.0 $5.0 $4.0 NAB acquisition of $2.0 GWB, $622 $0.0 $0.0 14 15 16 17 18 19 20 21 22 23 24 25 20 20 20 20 20 20 20 20 20 20 20 20 & thereafter Year-end balance (left axis) Annual amortization (right axis) (1) Balances and amortization expense at September 30 and for the respective fiscal years. Amounts for fiscal years 2019 – 2025 & thereafter are forecast based on existing intangible assets and could change materially based on future acquisitions. 19

Income Statement Summary

Revenue Revenue Highlights Net Interest Income ($MM) and NIM • Net interest income (FTE) increased 2.6% to $106.4 million $106.4 compared to 4QFY18 $102.2 $103.7 ◦ Higher loan interest income was driven by growth in average loan balances and yield and higher returns on the investment 3.89% portfolio partially offset by higher interest expense associated 3.79% 3.81% with a 13 basis point increase in cost of deposits 3.80% 3.77% 3.81% • NIM (FTE) up 2 basis points and adjusted NIM (FTE) (2) up 4 basis points compared to 4QFY18 • Noninterest income, excluding the change in fair value of fair value option loans and the net gain (loss) on related derivatives, 1QFY18 4QFY18 1QFY19 decreased 15.8% compared to 4QFY18 Net Interest Income (FTE) NIM (FTE) Adjusted NIM (FTE)(2) NIM Analysis Noninterest Income (1) 0.06% Wealth management, $2,241 (0.07)% 0.05% 0.03% (0.05)% Mortgage banking Service charges, $1,762 3.81% income, net, $1,320 3.79% 3.77% Other, $1,084 Other Service fees, $2,519 Interchange income, 4QFY18 1QFY19 $2,950 Time NOW/Svgs/ Deposits Cash and Nonaccruals Core Loans MMDA Investments NIM (FTE) Adjusted NIM (FTE) (2) OD/NSF fees, $4,458 (1) Chart excludes changes related to loans and derivatives at fair value which netted $0.9 million for the quarter and loss on sale of securities. Dollars in thousands. 21 (2) Adjusted NIM (FTE) is a non-GAAP measure. See appendix for reconciliations.

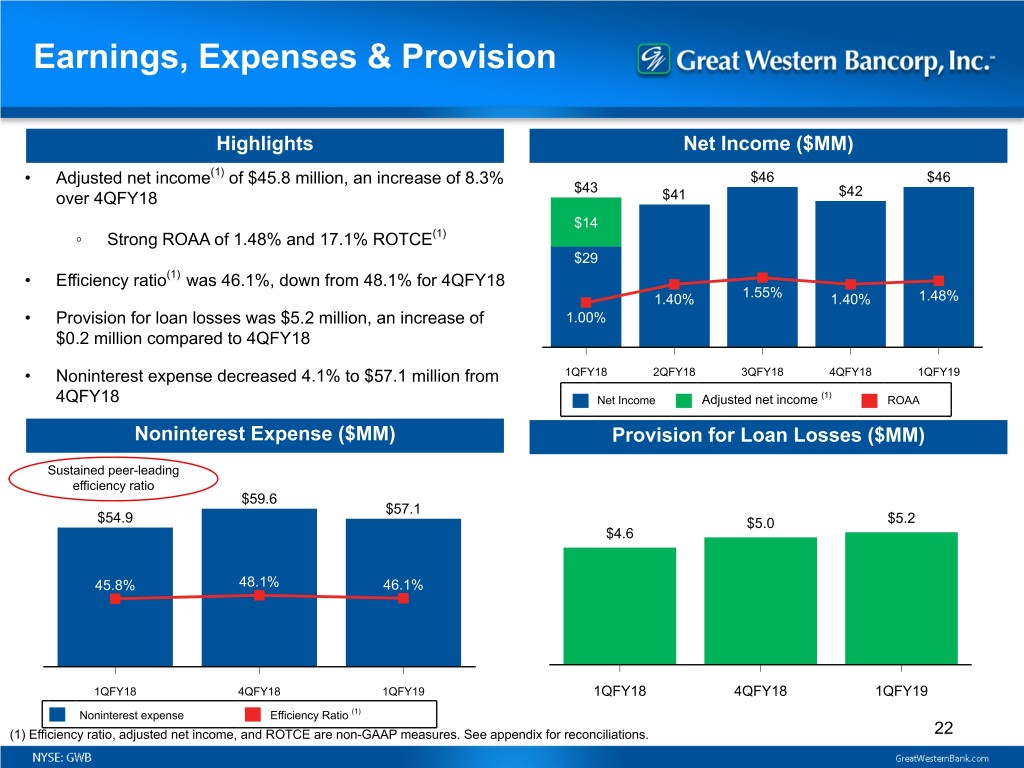

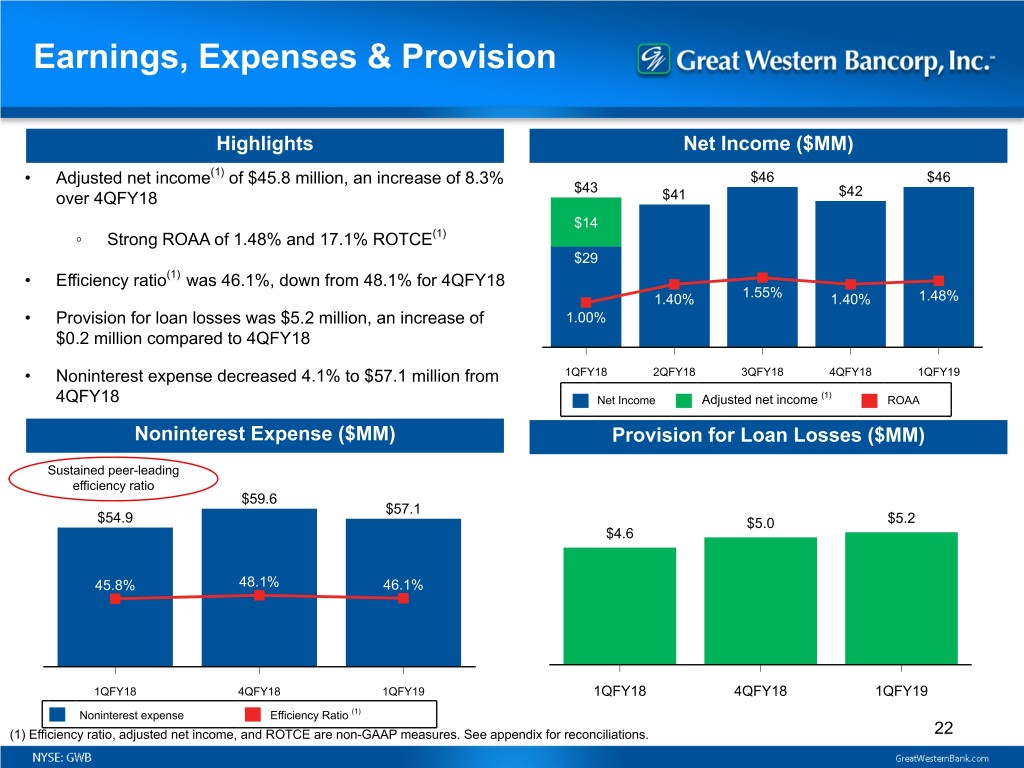

Earnings, Expenses & Provision Highlights Net Income ($MM) • Adjusted net income(1) of $45.8 million, an increase of 8.3% $46 $46 $43 over 4QFY18 $41 $42 $14 ◦ Strong ROAA of 1.48% and 17.1% ROTCE(1) $29 • Efficiency ratio(1) was 46.1%, down from 48.1% for 4QFY18 1.40% 1.55% 1.40% 1.48% • Provision for loan losses was $5.2 million, an increase of 1.00% $0.2 million compared to 4QFY18 • Noninterest expense decreased 4.1% to $57.1 million from 1QFY18 2QFY18 3QFY18 4QFY18 1QFY19 4QFY18 Net Income Adjusted net income (1) ROAA Noninterest Expense ($MM) Provision for Loan Losses ($MM) Sustained peer-leading efficiency ratio $59.6 $57.1 $54.9 $5.0 $5.2 $4.6 45.8% 48.1% 46.1% 1QFY18 4QFY18 1QFY19 1QFY18 4QFY18 1QFY19 Noninterest expense Efficiency Ratio (1) (1) Efficiency ratio, adjusted net income, and ROTCE are non-GAAP measures. See appendix for reconciliations. 22

Proven Business Strategy Focused Business Banking Franchise with Agribusiness Expertise Attract and Retain High-Quality Relationship Bankers Invest in Organic Growth While Optimizing Footprint Deepen Customer Relationships Explore Accretive Strategic Acquisition Opportunities Strong Profitability and Growth Driven by a Highly Efficient Operating Model Strong Capital Generation and Attractive Dividend Risk Management Driving Solid Credit Quality 23

Disclosures Forward-Looking Statements: This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Statements about Great Western Bancorp, Inc.’s expectations, beliefs, plans, strategies, predictions, forecasts, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. These statements are often, but not always, made through the use of words or phrases such as “anticipates,” “believes,” “can,” “could,” “may,” “predicts,” “potential,” “should,” “will,” “estimate,” “plans,” “projects,” “continuing,” “ongoing,” “expects,” “views,” “intends” and similar words or phrases. In particular, the statements included in this Presentation concerning Great Western Bancorp, Inc.’s expected performance and strategy, the outlook for its agricultural lending segment and the interest rate environment are not historical facts and are forward-looking. Accordingly, the forward-looking statements in this Presentation are only predictions and involve estimates, known and unknown risks, assumptions and uncertainties, that could cause actual results to differ materially from those expressed. All forward-looking statements are necessarily only estimates of future results, and there can be no assurance that actual results will not differ materially from expectations, and, therefore, you are cautioned not to place undue reliance on such statements. Any forward-looking statements are qualified in their entirety by reference to the factors discussed in the sections titled “Item 1A. Risk Factors” and "Cautionary Note Regarding Forward- Looking Statements" in Great Western Bancorp, Inc.’s Annual Report on Form 10-K for the fiscal year ended September 30, 2018. Further, any forward-looking statement speaks only as of the date on which it is made, and Great Western Bancorp, Inc. undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. Non-GAAP Financial Measures: This presentation contains non-GAAP measures which our management relies on in making financial and operational decisions about our business and which exclude certain items that we do not consider reflective of our business performance. We believe that the presentation of these measures provides investors with greater transparency and supplemental data relating to our financial condition and results of operations. These non-GAAP measures should be considered in context with our GAAP results. A reconciliation of these non-GAAP measures appears in our earnings release dated January 24, 2019 and in Appendix 1 to this presentation. Our earnings release and this presentation are available in the Investor Relations section of our website at www.greatwesternbank.com. Our earnings release and this presentation are also available as part of our Current Report on Form 8-K filed with the SEC on January 24, 2019. Explanatory Note: In this presentation, all financial information presented refers to the financial results of Great Western Bancorp, Inc. combined with those of its predecessor, Great Western Bancorporation, Inc. 24

Appendix 1 Non-GAAP Measures

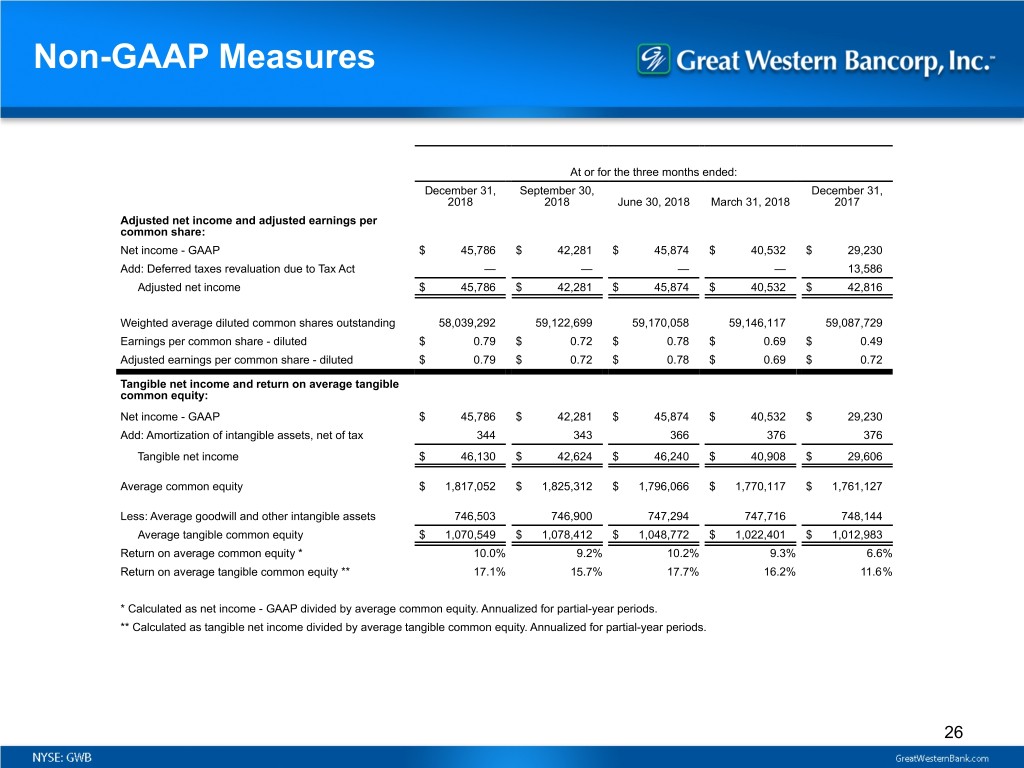

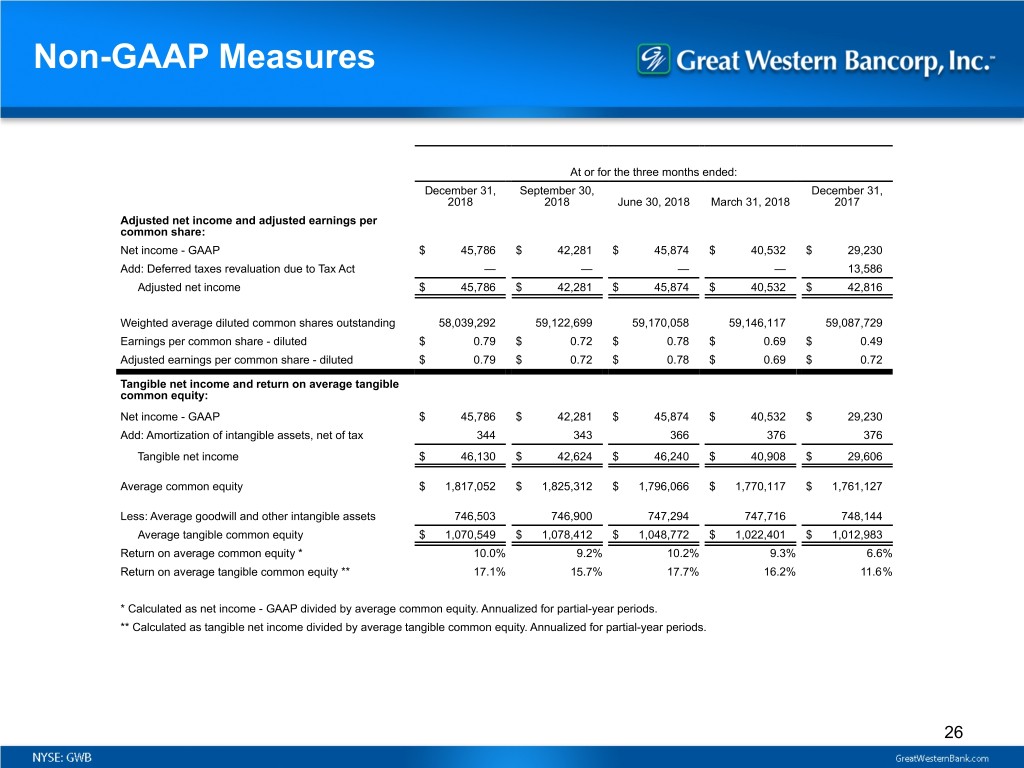

Non-GAAP Measures At or for the three months ended: December 31, September 30, December 31, 2018 2018 June 30, 2018 March 31, 2018 2017 Adjusted net income and adjusted earnings per common share: Net income - GAAP $ 45,786 $ 42,281 $ 45,874 $ 40,532 $ 29,230 Add: Deferred taxes revaluation due to Tax Act — — — — 13,586 Adjusted net income $ 45,786 $ 42,281 $ 45,874 $ 40,532 $ 42,816 Weighted average diluted common shares outstanding 58,039,292 59,122,699 59,170,058 59,146,117 59,087,729 Earnings per common share - diluted $ 0.79 $ 0.72 $ 0.78 $ 0.69 $ 0.49 Adjusted earnings per common share - diluted $ 0.79 $ 0.72 $ 0.78 $ 0.69 $ 0.72 Tangible net income and return on average tangible common equity: Net income - GAAP $ 45,786 $ 42,281 $ 45,874 $ 40,532 $ 29,230 Add: Amortization of intangible assets, net of tax 344 343 366 376 376 Tangible net income $ 46,130 $ 42,624 $ 46,240 $ 40,908 $ 29,606 Average common equity $ 1,817,052 $ 1,825,312 $ 1,796,066 $ 1,770,117 $ 1,761,127 Less: Average goodwill and other intangible assets 746,503 746,900 747,294 747,716 748,144 Average tangible common equity $ 1,070,549 $ 1,078,412 $ 1,048,772 $ 1,022,401 $ 1,012,983 Return on average common equity * 10.0% 9.2% 10.2% 9.3% 6.6% Return on average tangible common equity ** 17.1% 15.7% 17.7% 16.2% 11.6% * Calculated as net income - GAAP divided by average common equity. Annualized for partial-year periods. ** Calculated as tangible net income divided by average tangible common equity. Annualized for partial-year periods. 26

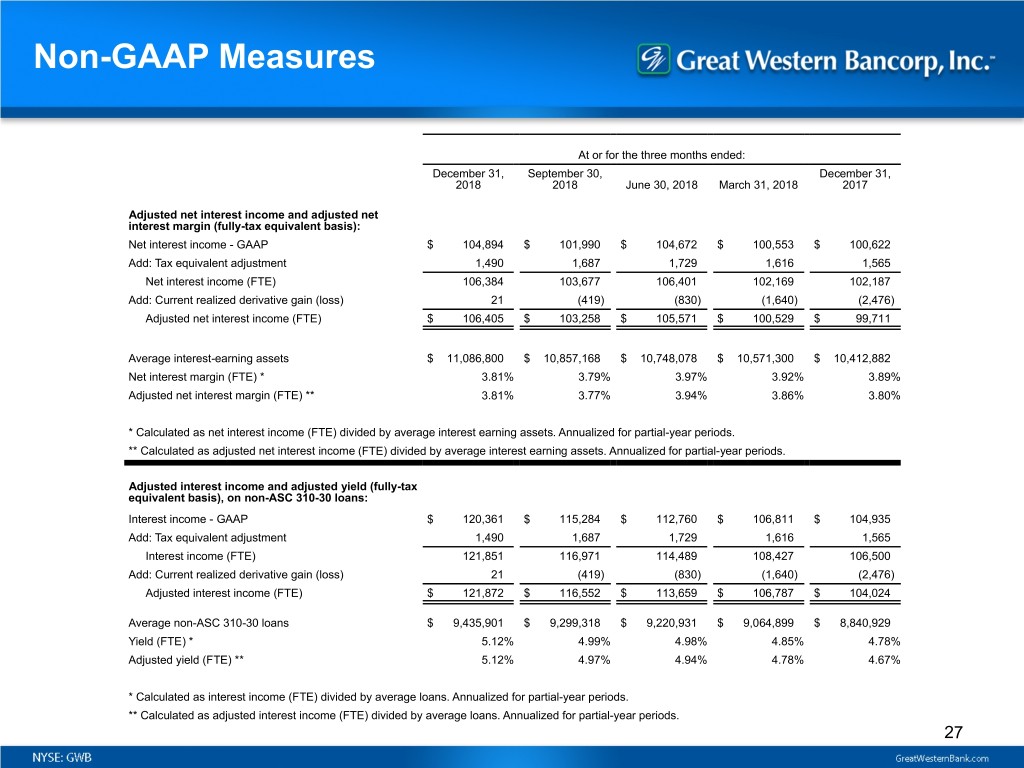

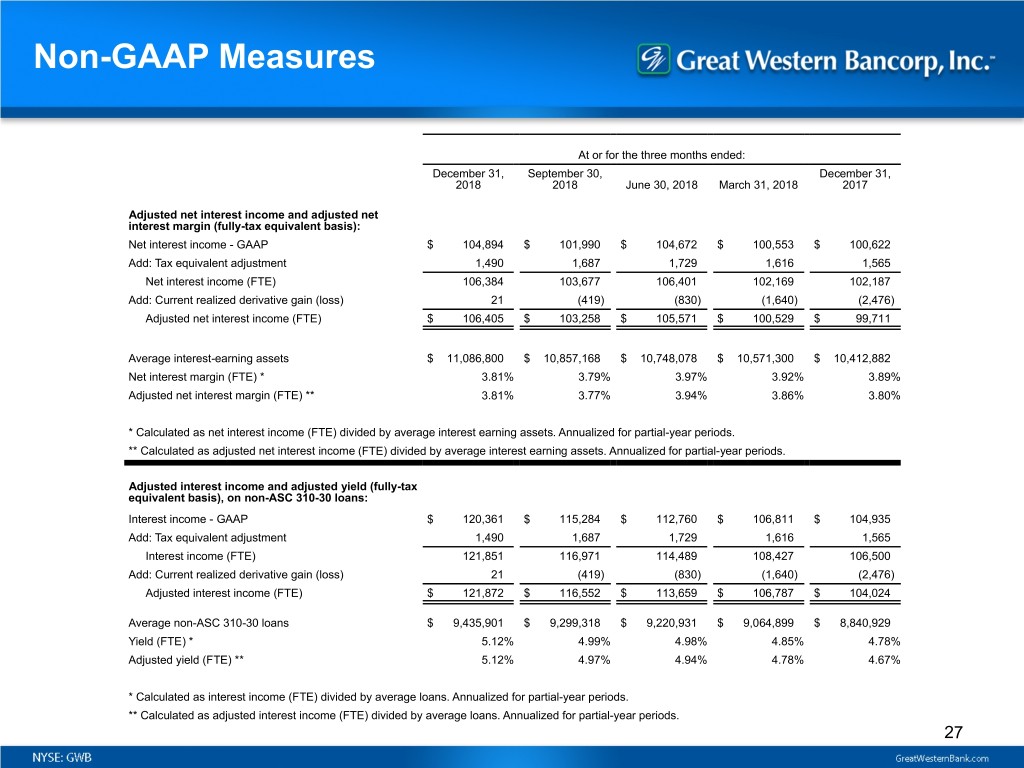

Non-GAAP Measures At or for the three months ended: December 31, September 30, December 31, 2018 2018 June 30, 2018 March 31, 2018 2017 Adjusted net interest income and adjusted net interest margin (fully-tax equivalent basis): Net interest income - GAAP $ 104,894 $ 101,990 $ 104,672 $ 100,553 $ 100,622 Add: Tax equivalent adjustment 1,490 1,687 1,729 1,616 1,565 Net interest income (FTE) 106,384 103,677 106,401 102,169 102,187 Add: Current realized derivative gain (loss) 21 (419) (830) (1,640) (2,476) Adjusted net interest income (FTE) $ 106,405 $ 103,258 $ 105,571 $ 100,529 $ 99,711 Average interest-earning assets $ 11,086,800 $ 10,857,168 $ 10,748,078 $ 10,571,300 $ 10,412,882 Net interest margin (FTE) * 3.81% 3.79% 3.97% 3.92% 3.89% Adjusted net interest margin (FTE) ** 3.81% 3.77% 3.94% 3.86% 3.80% * Calculated as net interest income (FTE) divided by average interest earning assets. Annualized for partial-year periods. ** Calculated as adjusted net interest income (FTE) divided by average interest earning assets. Annualized for partial-year periods. Adjusted interest income and adjusted yield (fully-tax equivalent basis), on non-ASC 310-30 loans: Interest income - GAAP $ 120,361 $ 115,284 $ 112,760 $ 106,811 $ 104,935 Add: Tax equivalent adjustment 1,490 1,687 1,729 1,616 1,565 Interest income (FTE) 121,851 116,971 114,489 108,427 106,500 Add: Current realized derivative gain (loss) 21 (419) (830) (1,640) (2,476) Adjusted interest income (FTE) $ 121,872 $ 116,552 $ 113,659 $ 106,787 $ 104,024 Average non-ASC 310-30 loans $ 9,435,901 $ 9,299,318 $ 9,220,931 $ 9,064,899 $ 8,840,929 Yield (FTE) * 5.12% 4.99% 4.98% 4.85% 4.78% Adjusted yield (FTE) ** 5.12% 4.97% 4.94% 4.78% 4.67% * Calculated as interest income (FTE) divided by average loans. Annualized for partial-year periods. ** Calculated as adjusted interest income (FTE) divided by average loans. Annualized for partial-year periods. 27

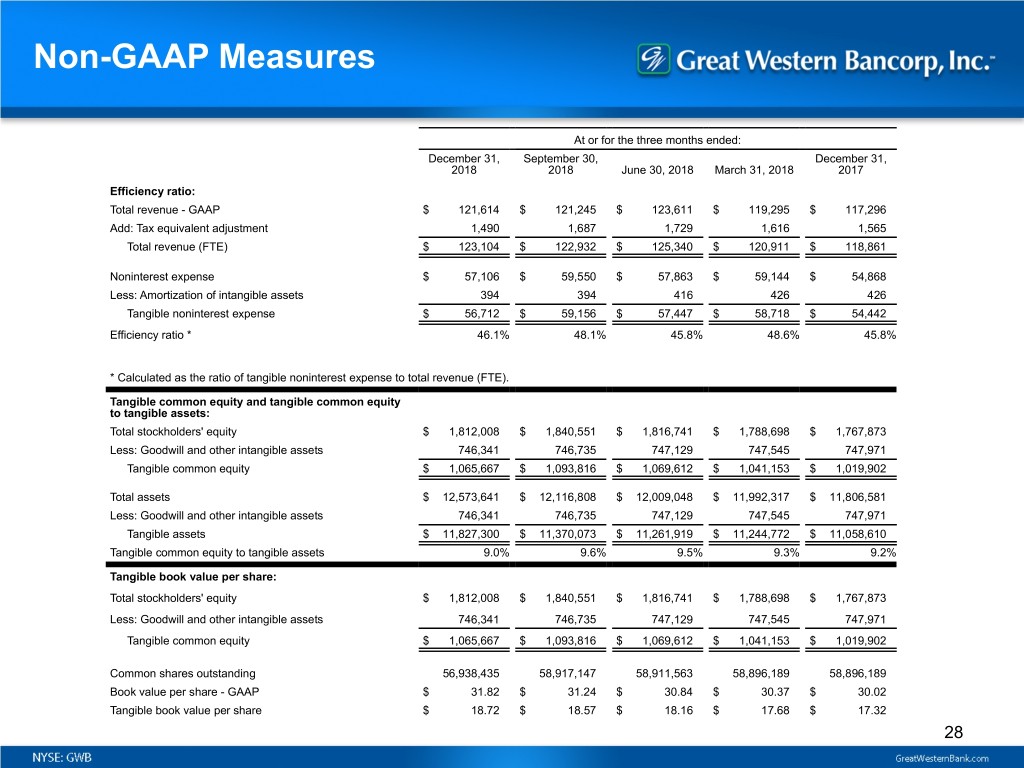

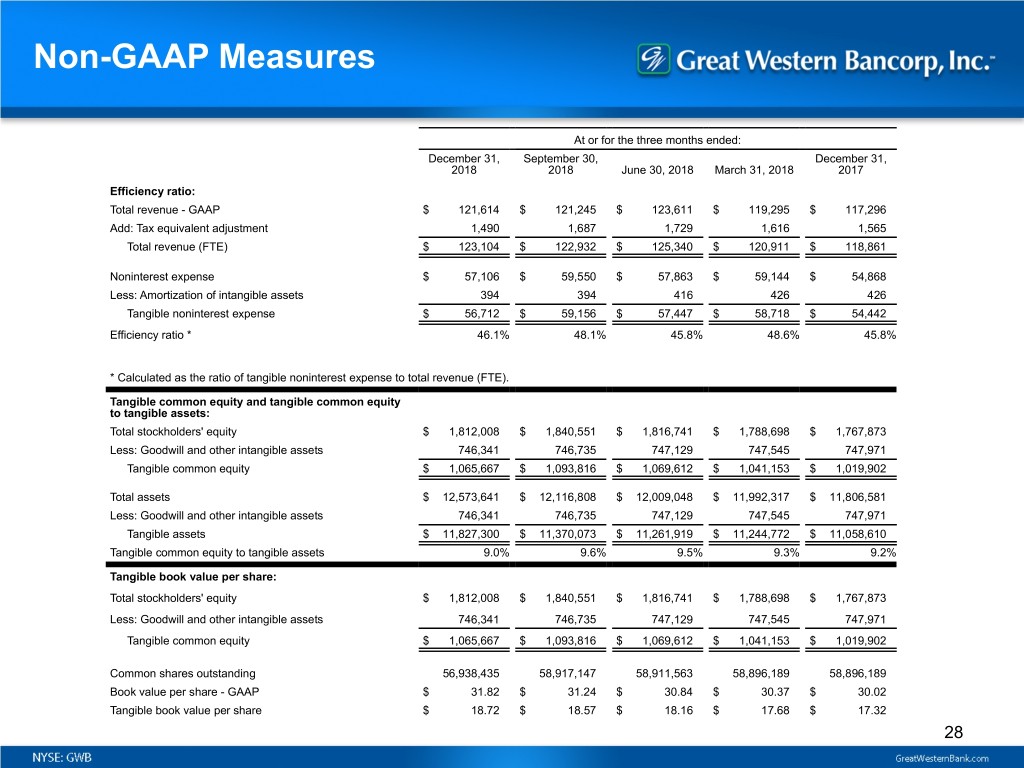

Non-GAAP Measures At or for the three months ended: December 31, September 30, December 31, 2018 2018 June 30, 2018 March 31, 2018 2017 Efficiency ratio: Total revenue - GAAP $ 121,614 $ 121,245 $ 123,611 $ 119,295 $ 117,296 Add: Tax equivalent adjustment 1,490 1,687 1,729 1,616 1,565 Total revenue (FTE) $ 123,104 $ 122,932 $ 125,340 $ 120,911 $ 118,861 Noninterest expense $ 57,106 $ 59,550 $ 57,863 $ 59,144 $ 54,868 Less: Amortization of intangible assets 394 394 416 426 426 Tangible noninterest expense $ 56,712 $ 59,156 $ 57,447 $ 58,718 $ 54,442 Efficiency ratio * 46.1% 48.1% 45.8% 48.6% 45.8% * Calculated as the ratio of tangible noninterest expense to total revenue (FTE). Tangible common equity and tangible common equity to tangible assets: Total stockholders' equity $ 1,812,008 $ 1,840,551 $ 1,816,741 $ 1,788,698 $ 1,767,873 Less: Goodwill and other intangible assets 746,341 746,735 747,129 747,545 747,971 Tangible common equity $ 1,065,667 $ 1,093,816 $ 1,069,612 $ 1,041,153 $ 1,019,902 Total assets $ 12,573,641 $ 12,116,808 $ 12,009,048 $ 11,992,317 $ 11,806,581 Less: Goodwill and other intangible assets 746,341 746,735 747,129 747,545 747,971 Tangible assets $ 11,827,300 $ 11,370,073 $ 11,261,919 $ 11,244,772 $ 11,058,610 Tangible common equity to tangible assets 9.0% 9.6% 9.5% 9.3% 9.2% Tangible book value per share: Total stockholders' equity $ 1,812,008 $ 1,840,551 $ 1,816,741 $ 1,788,698 $ 1,767,873 Less: Goodwill and other intangible assets 746,341 746,735 747,129 747,545 747,971 Tangible common equity $ 1,065,667 $ 1,093,816 $ 1,069,612 $ 1,041,153 $ 1,019,902 Common shares outstanding 56,938,435 58,917,147 58,911,563 58,896,189 58,896,189 Book value per share - GAAP $ 31.82 $ 31.24 $ 30.84 $ 30.37 $ 30.02 Tangible book value per share $ 18.72 $ 18.57 $ 18.16 $ 17.68 $ 17.32 28

Appendix 2 Agriculture Lending & Economy

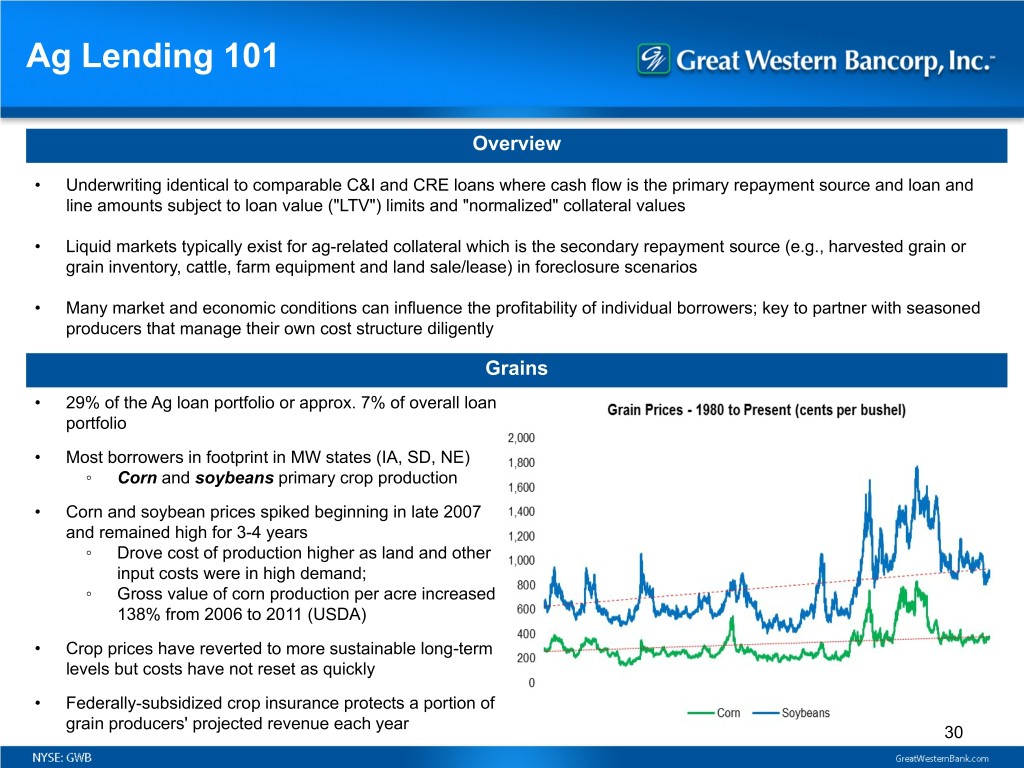

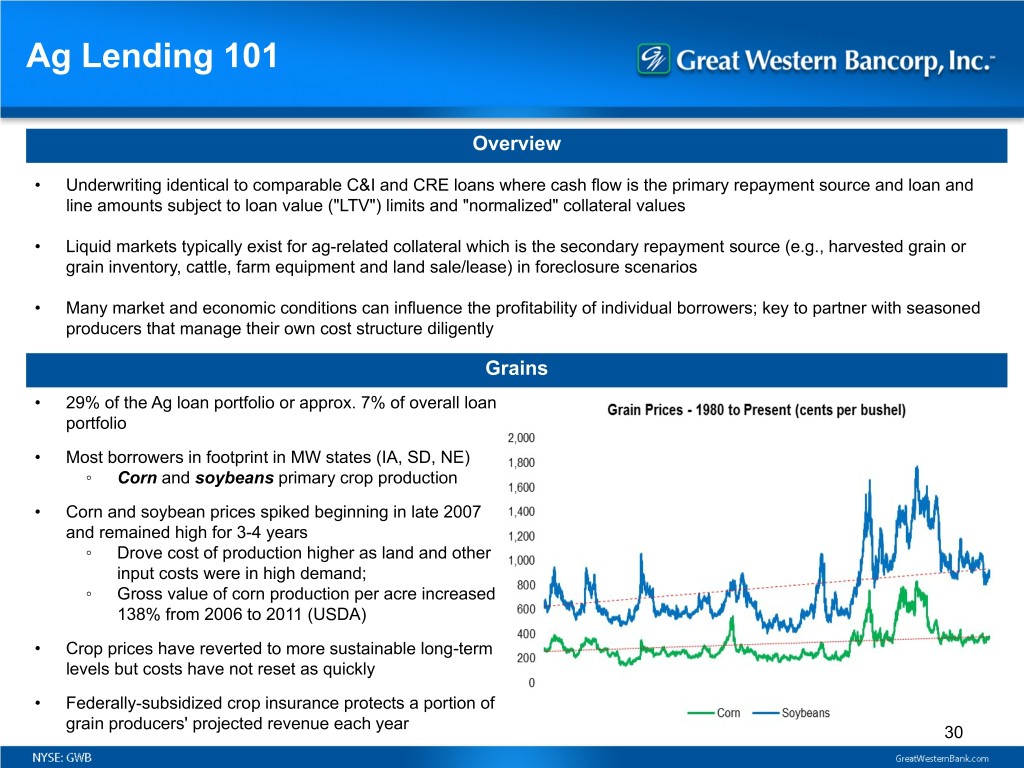

Ag Lending 101 Overview • Underwriting identical to comparable C&I and CRE loans where cash flow is the primary repayment source and loan and line amounts subject to loan value ("LTV") limits and "normalized" collateral values • Liquid markets typically exist for ag-related collateral which is the secondary repayment source (e.g., harvested grain or grain inventory, cattle, farm equipment and land sale/lease) in foreclosure scenarios • Many market and economic conditions can influence the profitability of individual borrowers; key to partner with seasoned producers that manage their own cost structure diligently Grains • 29% of the Ag loan portfolio or approx. 7% of overall loan portfolio • Most borrowers in footprint in MW states (IA, SD, NE) ◦ Corn and soybeans primary crop production • Corn and soybean prices spiked beginning in late 2007 and remained high for 3-4 years ◦ Drove cost of production higher as land and other input costs were in high demand; ◦ Gross value of corn production per acre increased 138% from 2006 to 2011 (USDA) • Crop prices have reverted to more sustainable long-term levels but costs have not reset as quickly • Federally-subsidized crop insurance protects a portion of grain producers' projected revenue each year 30

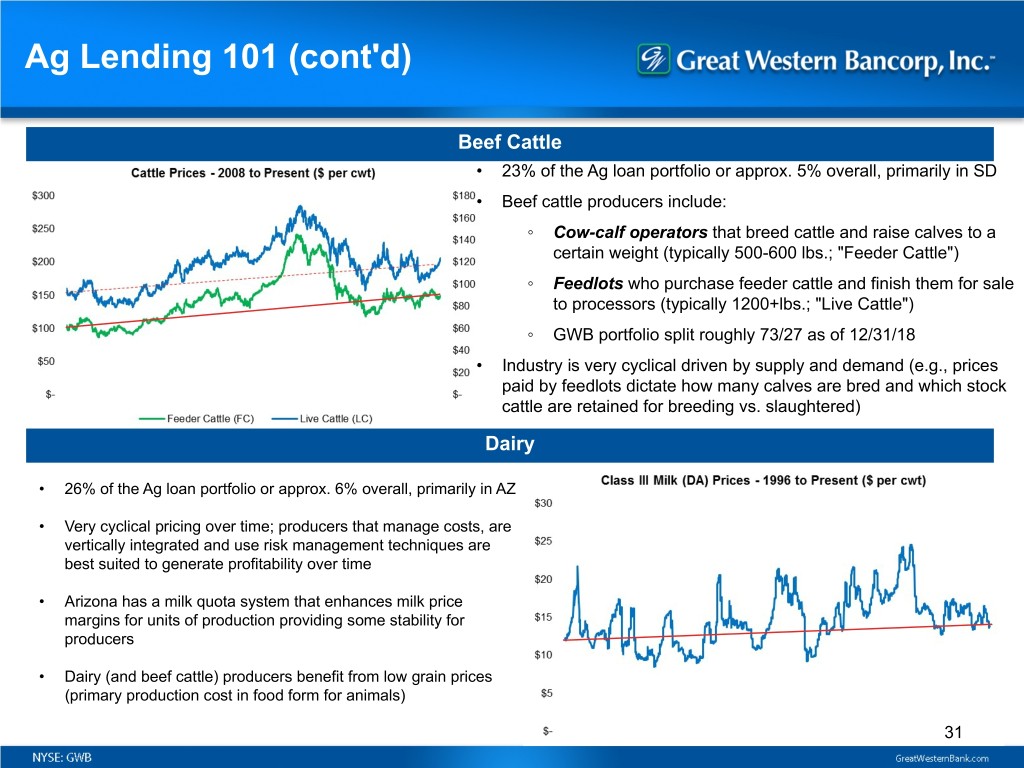

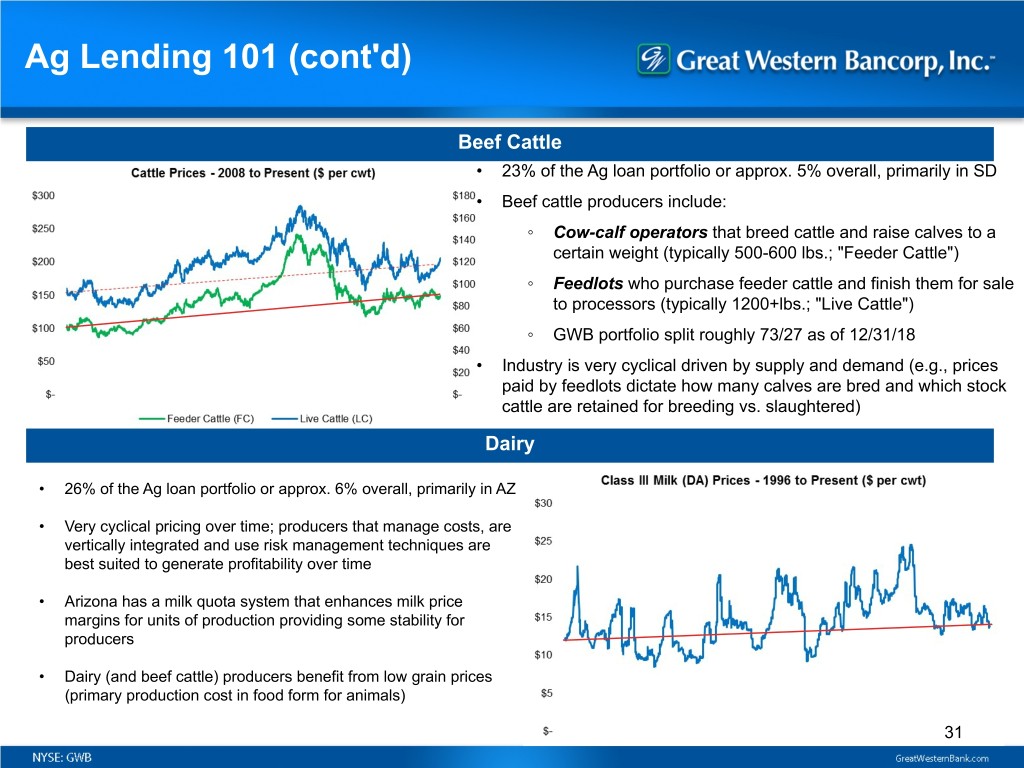

Ag Lending 101 (cont'd) Beef Cattle • 23% of the Ag loan portfolio or approx. 5% overall, primarily in SD • Beef cattle producers include: ◦ Cow-calf operators that breed cattle and raise calves to a certain weight (typically 500-600 lbs.; "Feeder Cattle") ◦ Feedlots who purchase feeder cattle and finish them for sale to processors (typically 1200+lbs.; "Live Cattle") ◦ GWB portfolio split roughly 73/27 as of 12/31/18 • Industry is very cyclical driven by supply and demand (e.g., prices paid by feedlots dictate how many calves are bred and which stock cattle are retained for breeding vs. slaughtered) Dairy • 26% of the Ag loan portfolio or approx. 6% overall, primarily in AZ • Very cyclical pricing over time; producers that manage costs, are vertically integrated and use risk management techniques are best suited to generate profitability over time • Arizona has a milk quota system that enhances milk price margins for units of production providing some stability for producers • Dairy (and beef cattle) producers benefit from low grain prices (primary production cost in food form for animals) 31

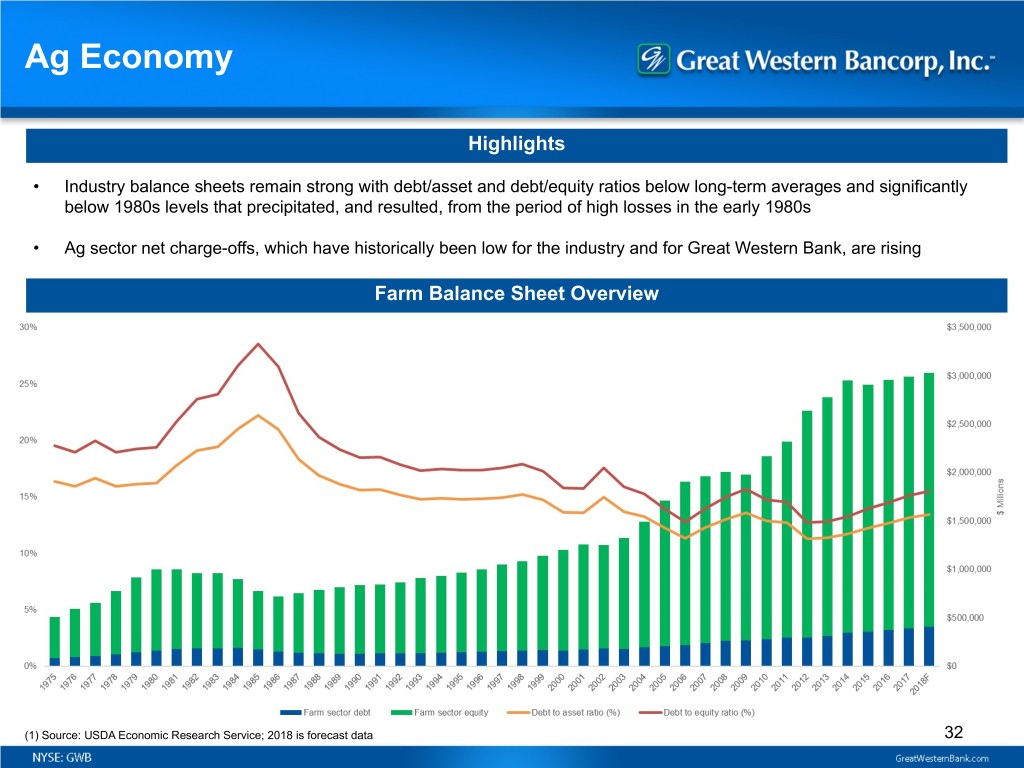

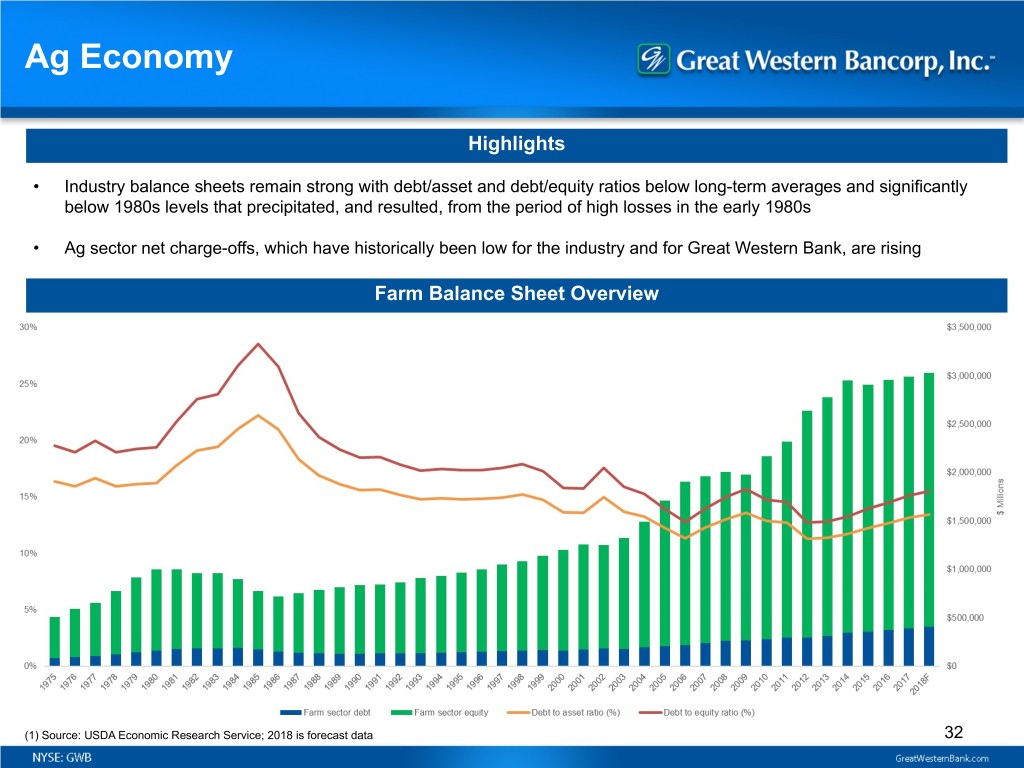

Ag Economy Highlights • Industry balance sheets remain strong with debt/asset and debt/equity ratios below long-term averages and significantly below 1980s levels that precipitated, and resulted, from the period of high losses in the early 1980s • Ag sector net charge-offs, which have historically been low for the industry and for Great Western Bank, are rising Farm Balance Sheet Overview (1) Source: USDA Economic Research Service; 2018 is forecast data 32

Appendix 3 Peer Group

Peer Group • 1st Source Corporation • MB Financial, Inc. • BancFirst Corporation • Old National Bancorp • BancorpSouth Bank • Park National Corporation • Banner Corporation • Renasant Corporation • Berkshire Hills Bancorp, Inc. • S&T Bancorp, Inc. • Columbia Banking System, Inc. • TCF Financial Corporation • CVB Financial Corp. • Trustmark Corporation • First Busey Corporation • UMB Financial Corporation • First Financial Bankshares, Inc. • Umpqua Holdings Corporation • First Midwest Bancorp, Inc. • United Bankshares, Inc. • Fulton Financial Corporation • United Community Banks, Inc. • Glacier Bancorp, Inc. • Valley National Bancorp • Heartland Financial USA, Inc. 34

Appendix 4 MSA Highlights

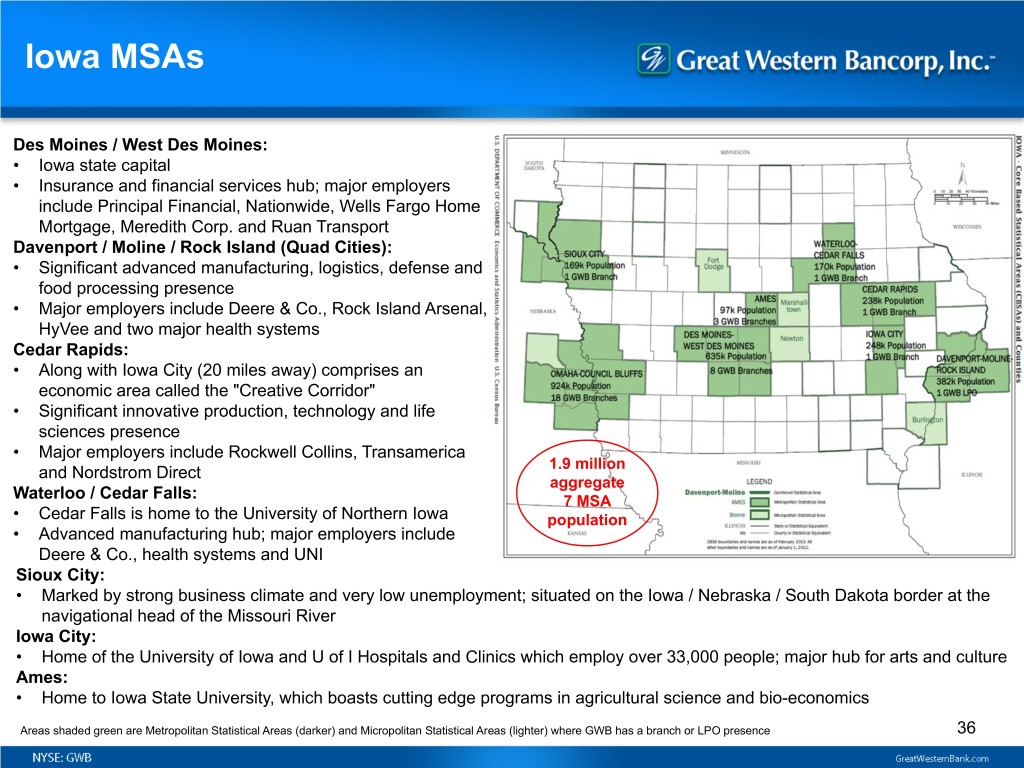

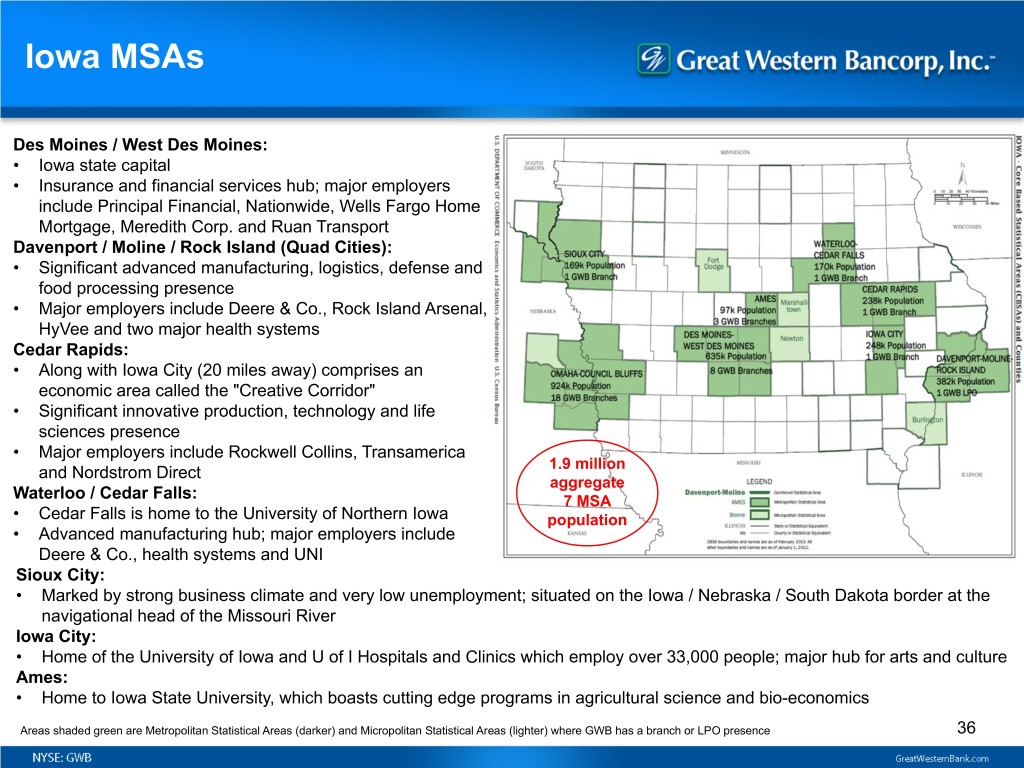

Iowa MSAs Des Moines / West Des Moines: • Iowa state capital • Insurance and financial services hub; major employers include Principal Financial, Nationwide, Wells Fargo Home Mortgage, Meredith Corp. and Ruan Transport Davenport / Moline / Rock Island (Quad Cities): • Significant advanced manufacturing, logistics, defense and food processing presence • Major employers include Deere & Co., Rock Island Arsenal, HyVee and two major health systems Cedar Rapids: • Along with Iowa City (20 miles away) comprises an economic area called the "Creative Corridor" • Significant innovative production, technology and life sciences presence • Major employers include Rockwell Collins, Transamerica 1.9 million and Nordstrom Direct aggregate Waterloo / Cedar Falls: 7 MSA • Cedar Falls is home to the University of Northern Iowa population • Advanced manufacturing hub; major employers include Deere & Co., health systems and UNI Sioux City: • Marked by strong business climate and very low unemployment; situated on the Iowa / Nebraska / South Dakota border at the navigational head of the Missouri River Iowa City: • Home of the University of Iowa and U of I Hospitals and Clinics which employ over 33,000 people; major hub for arts and culture Ames: • Home to Iowa State University, which boasts cutting edge programs in agricultural science and bio-economics Areas shaded green are Metropolitan Statistical Areas (darker) and Micropolitan Statistical Areas (lighter) where GWB has a branch or LPO presence 36

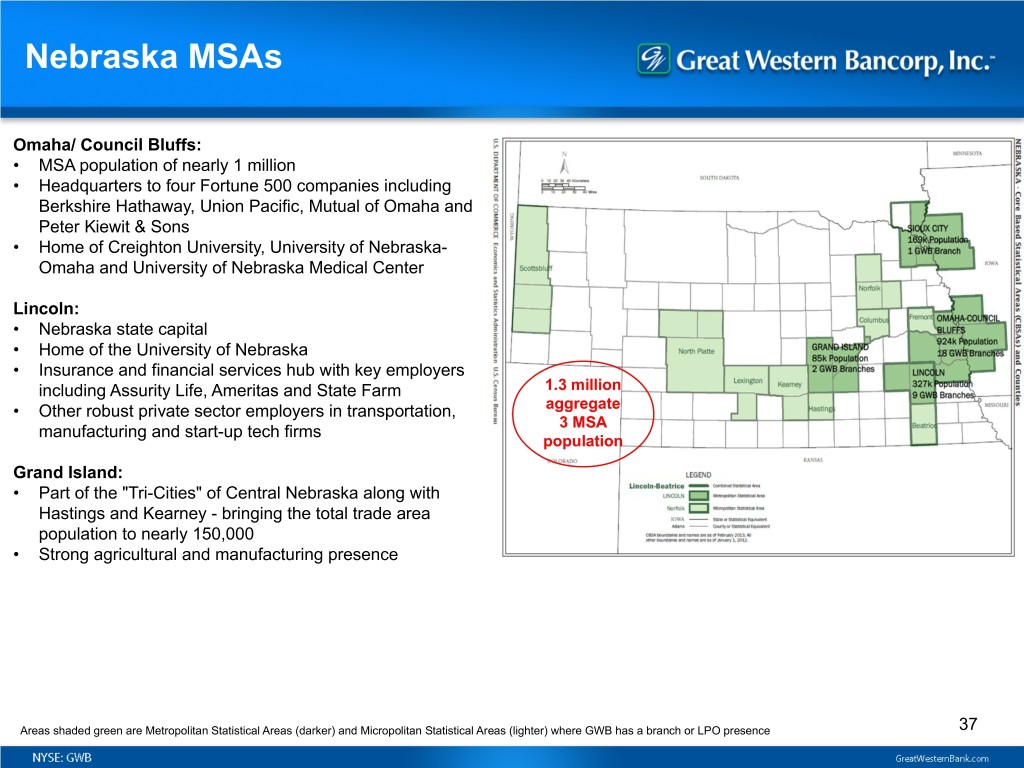

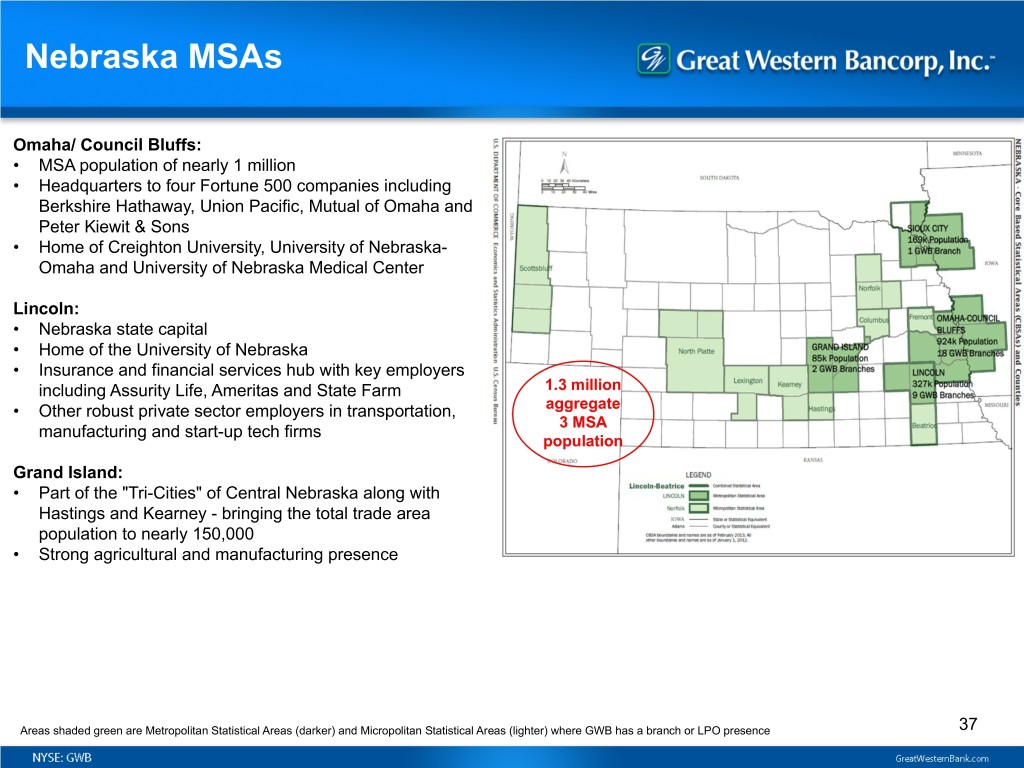

Nebraska MSAs Omaha/ Council Bluffs: • MSA population of nearly 1 million • Headquarters to four Fortune 500 companies including Berkshire Hathaway, Union Pacific, Mutual of Omaha and Peter Kiewit & Sons • Home of Creighton University, University of Nebraska- Omaha and University of Nebraska Medical Center Lincoln: • Nebraska state capital • Home of the University of Nebraska • Insurance and financial services hub with key employers including Assurity Life, Ameritas and State Farm 1.3 million • Other robust private sector employers in transportation, aggregate 3 MSA manufacturing and start-up tech firms population Grand Island: • Part of the "Tri-Cities" of Central Nebraska along with Hastings and Kearney - bringing the total trade area population to nearly 150,000 • Strong agricultural and manufacturing presence Areas shaded green are Metropolitan Statistical Areas (darker) and Micropolitan Statistical Areas (lighter) where GWB has a branch or LPO presence 37

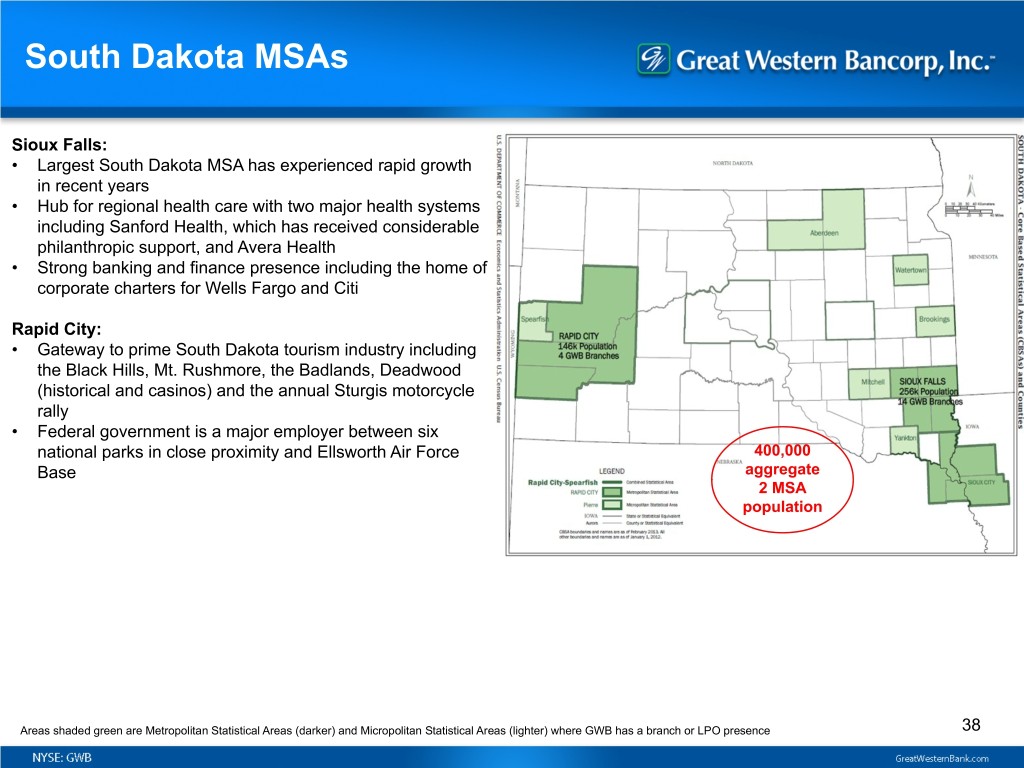

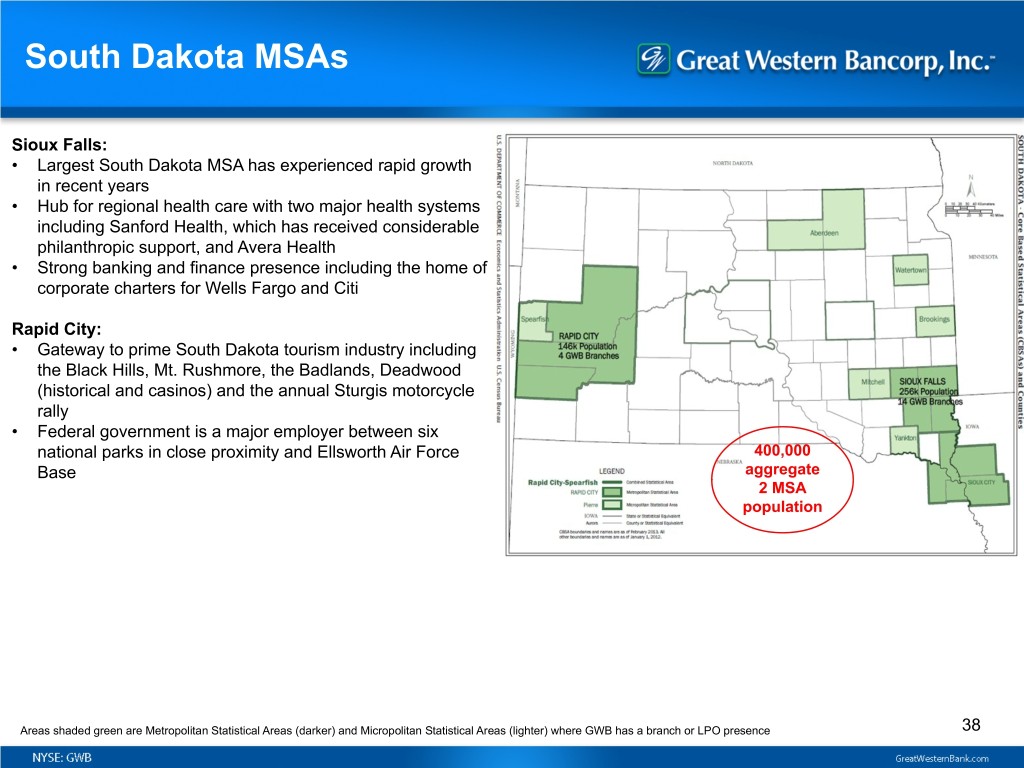

South Dakota MSAs Sioux Falls: • Largest South Dakota MSA has experienced rapid growth in recent years • Hub for regional health care with two major health systems including Sanford Health, which has received considerable philanthropic support, and Avera Health • Strong banking and finance presence including the home of corporate charters for Wells Fargo and Citi Rapid City: • Gateway to prime South Dakota tourism industry including the Black Hills, Mt. Rushmore, the Badlands, Deadwood (historical and casinos) and the annual Sturgis motorcycle rally • Federal government is a major employer between six national parks in close proximity and Ellsworth Air Force 400,000 Base aggregate 2 MSA population Areas shaded green are Metropolitan Statistical Areas (darker) and Micropolitan Statistical Areas (lighter) where GWB has a branch or LPO presence 38

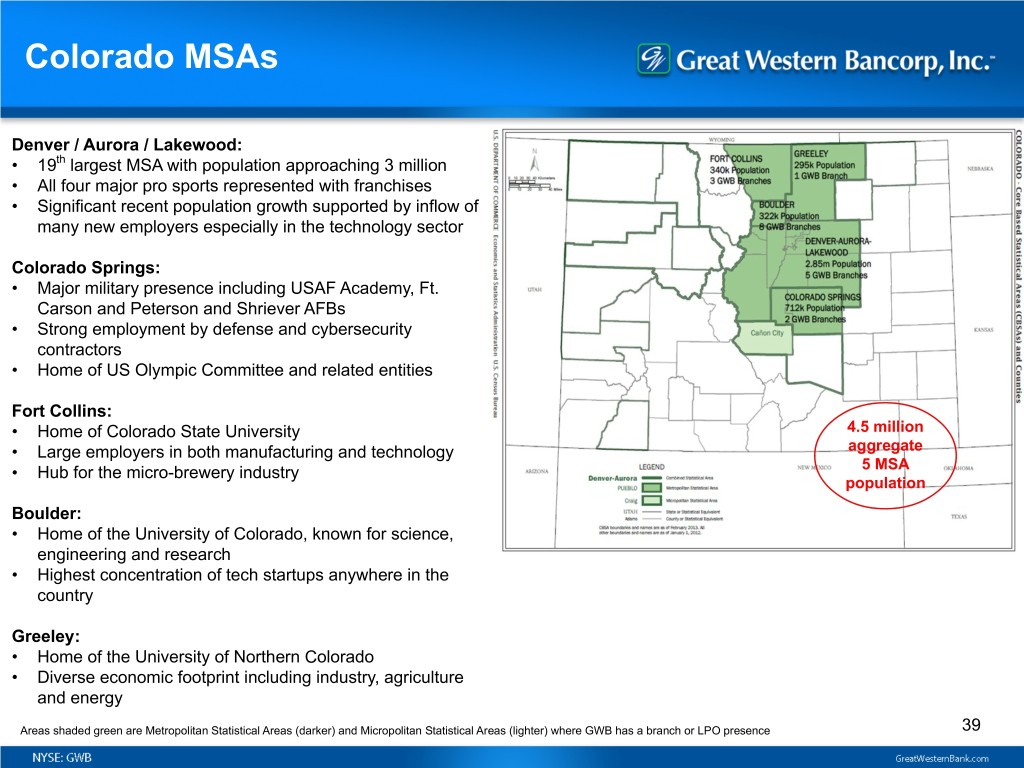

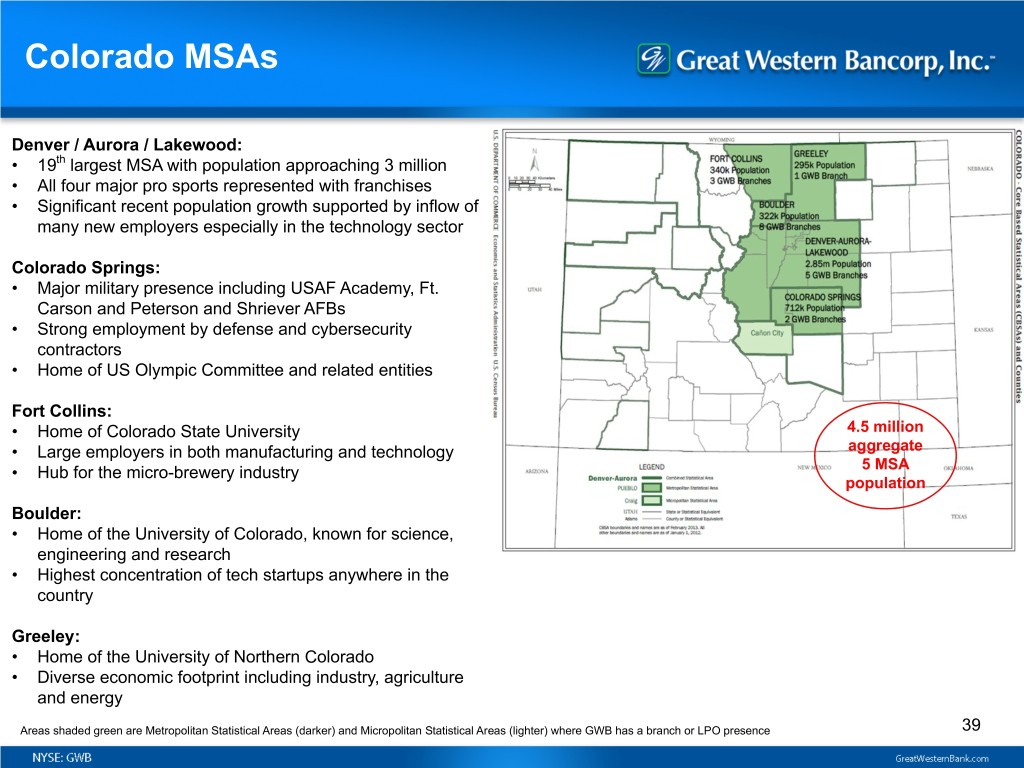

Colorado MSAs Denver / Aurora / Lakewood: • 19th largest MSA with population approaching 3 million • All four major pro sports represented with franchises • Significant recent population growth supported by inflow of many new employers especially in the technology sector Colorado Springs: • Major military presence including USAF Academy, Ft. Carson and Peterson and Shriever AFBs • Strong employment by defense and cybersecurity contractors • Home of US Olympic Committee and related entities Fort Collins: • Home of Colorado State University 4.5 million • Large employers in both manufacturing and technology aggregate • Hub for the micro-brewery industry 5 MSA population Boulder: • Home of the University of Colorado, known for science, engineering and research • Highest concentration of tech startups anywhere in the country Greeley: • Home of the University of Northern Colorado • Diverse economic footprint including industry, agriculture and energy Areas shaded green are Metropolitan Statistical Areas (darker) and Micropolitan Statistical Areas (lighter) where GWB has a branch or LPO presence 39

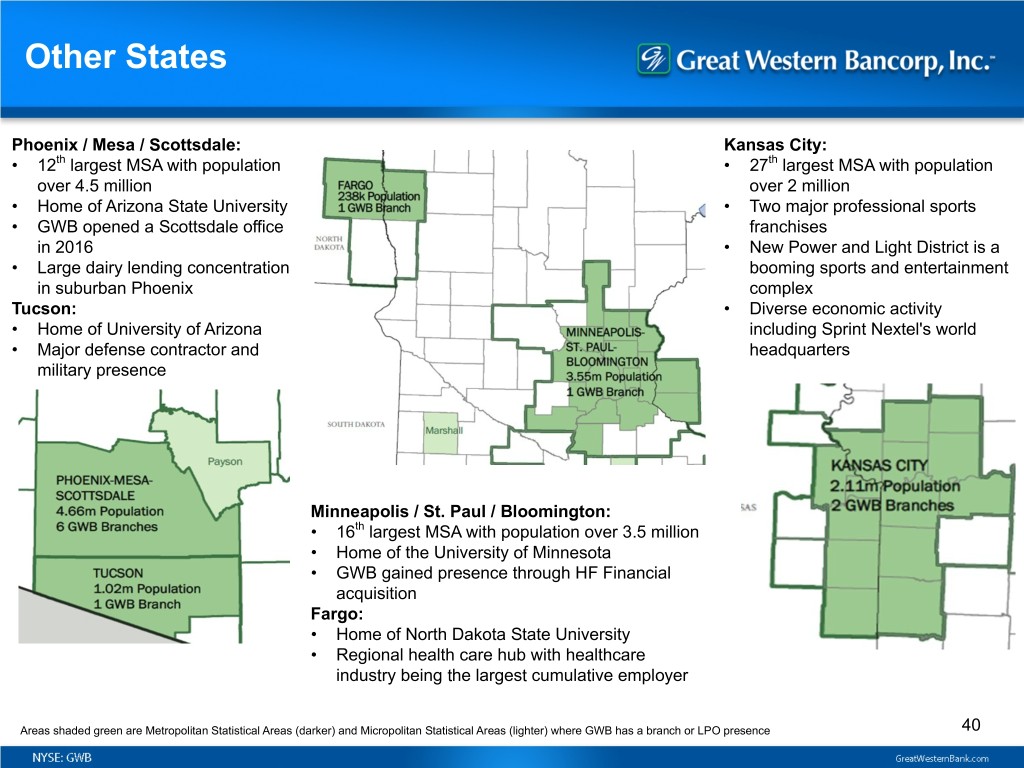

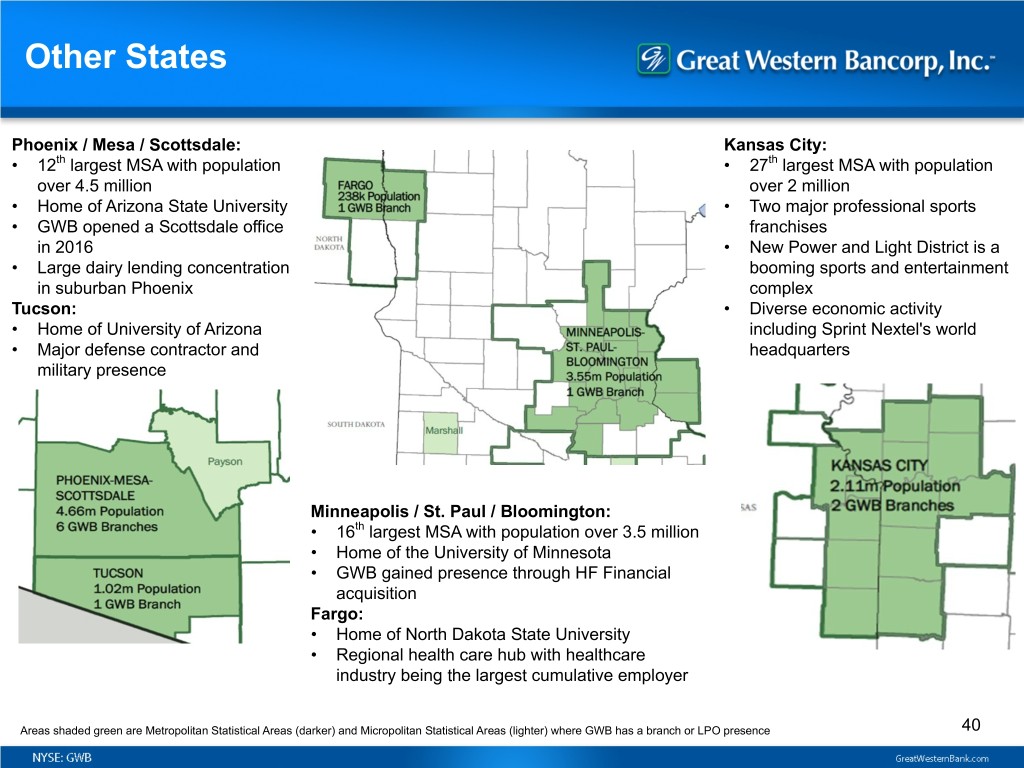

Other States Phoenix / Mesa / Scottsdale: Kansas City: • 12th largest MSA with population • 27th largest MSA with population over 4.5 million over 2 million • Home of Arizona State University • Two major professional sports • GWB opened a Scottsdale office franchises in 2016 • New Power and Light District is a • Large dairy lending concentration booming sports and entertainment in suburban Phoenix complex Tucson: • Diverse economic activity • Home of University of Arizona including Sprint Nextel's world • Major defense contractor and headquarters military presence Minneapolis / St. Paul / Bloomington: • 16th largest MSA with population over 3.5 million • Home of the University of Minnesota • GWB gained presence through HF Financial acquisition Fargo: • Home of North Dakota State University • Regional health care hub with healthcare industry being the largest cumulative employer Areas shaded green are Metropolitan Statistical Areas (darker) and Micropolitan Statistical Areas (lighter) where GWB has a branch or LPO presence 40

Appendix 5 Accounting for Loans at FV and Related Derivatives

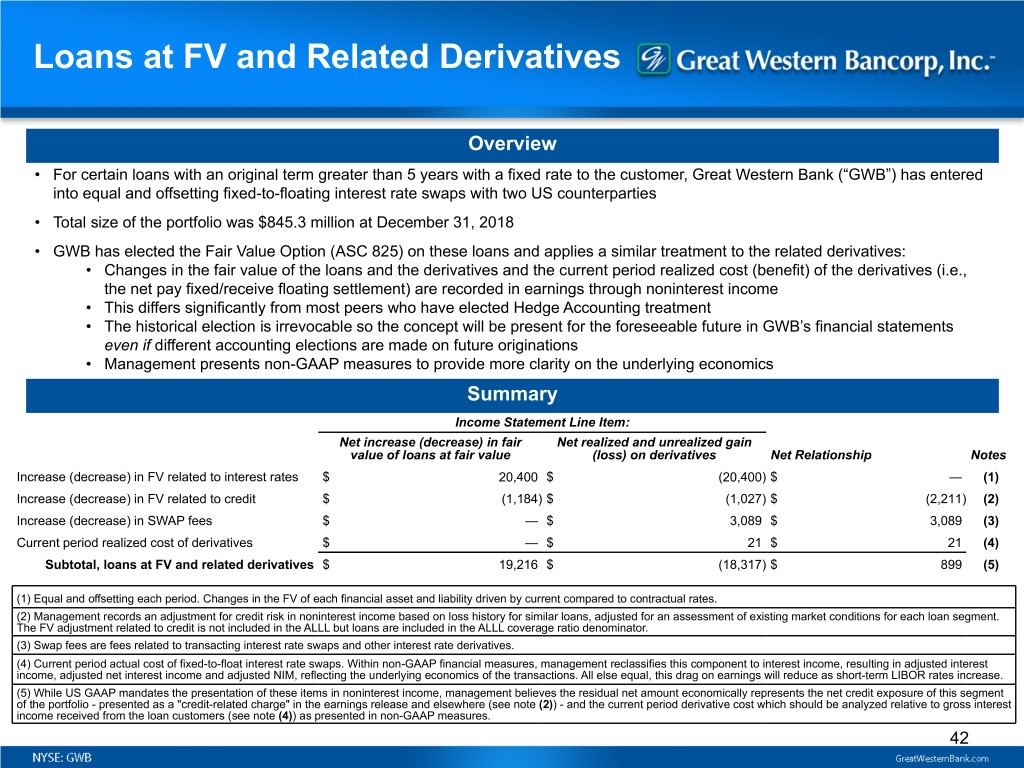

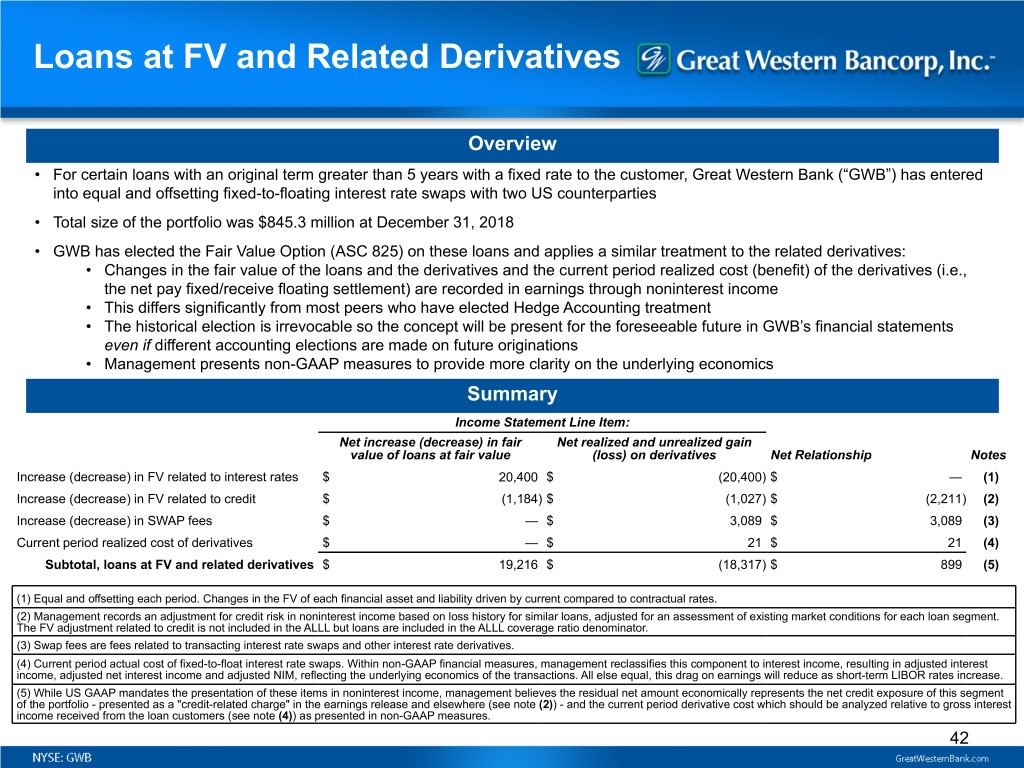

Loans at FV and Related Derivatives Overview • For certain loans with an original term greater than 5 years with a fixed rate to the customer, Great Western Bank (“GWB”) has entered into equal and offsetting fixed-to-floating interest rate swaps with two US counterparties • Total size of the portfolio was $845.3 million at December 31, 2018 • GWB has elected the Fair Value Option (ASC 825) on these loans and applies a similar treatment to the related derivatives: • Changes in the fair value of the loans and the derivatives and the current period realized cost (benefit) of the derivatives (i.e., the net pay fixed/receive floating settlement) are recorded in earnings through noninterest income • This differs significantly from most peers who have elected Hedge Accounting treatment • The historical election is irrevocable so the concept will be present for the foreseeable future in GWB’s financial statements even if different accounting elections are made on future originations • Management presents non-GAAP measures to provide more clarity on the underlying economics Summary Income Statement Line Item: Net increase (decrease) in fair Net realized and unrealized gain value of loans at fair value (loss) on derivatives Net Relationship Notes Increase (decrease) in FV related to interest rates $ 20,400 $ (20,400) $ — (1) Increase (decrease) in FV related to credit $ (1,184) $ (1,027) $ (2,211) (2) Increase (decrease) in SWAP fees $ — $ 3,089 $ 3,089 (3) Current period realized cost of derivatives $ — $ 21 $ 21 (4) Subtotal, loans at FV and related derivatives $ 19,216 $ (18,317) $ 899 (5) (1) Equal and offsetting each period. Changes in the FV of each financial asset and liability driven by current compared to contractual rates. (2) Management records an adjustment for credit risk in noninterest income based on loss history for similar loans, adjusted for an assessment of existing market conditions for each loan segment. The FV adjustment related to credit is not included in the ALLL but loans are included in the ALLL coverage ratio denominator. (3) Swap fees are fees related to transacting interest rate swaps and other interest rate derivatives. (4) Current period actual cost of fixed-to-float interest rate swaps. Within non-GAAP financial measures, management reclassifies this component to interest income, resulting in adjusted interest income, adjusted net interest income and adjusted NIM, reflecting the underlying economics of the transactions. All else equal, this drag on earnings will reduce as short-term LIBOR rates increase. (5) While US GAAP mandates the presentation of these items in noninterest income, management believes the residual net amount economically represents the net credit exposure of this segment of the portfolio - presented as a "credit-related charge" in the earnings release and elsewhere (see note (2)) - and the current period derivative cost which should be analyzed relative to gross interest income received from the loan customers (see note (4)) as presented in non-GAAP measures. 42