Investor Presentation | September 30, 2021

FISCAL YEAR 2021 PROGRESS 2 Asset Quality Improvement Nonperforming assets lower by 41.3% Classified loans down by 21.4% Special mention loans down 31.4% from their peak this year Capital Strength Total capital of 16.3%, up from 13.3% and CET1 of 14.3%, up from 11.0% ROE of 18.4%, up from (44.2)% and ROTCE of 18.6%, up from 2.9% Net income of $203 million, up from $(681) million and PTPP of $224 million, up from $217 million Business Initiatives Developed and launched small business center across the footprint Loan growth returning in majority of markets, both metro and rural New Wealth Management leader alongside Ag, Retail and Treasury Management business lines Advanced Diversity, Equity & Inclusion with #beU campaign and first-ever Director appointment

EARNINGS OVERVIEW 3 4QFY21 Net Interest Income-GAAP $93.5 Noninterest Income (excl FVO Credit Adj) $14.9 Noninterest Expense $63.7 PTPP 1 $44.7 Provision for (recapture of) Credit Losses $(20.9) FVO Credit Adj $1.0 Tax $14.7 Net Income $51.9 Strong quarter of net income supported by lower credit costs • Net interest income benefited from reduced funding costs helping to counter lower PPP fees, lower nonaccrual interest recoveries and the impact from reduced loan volume • Noninterest income benefited from improvements in service charges and wealth management, helping to offset lower mortgage income and a lower derivative credit adjustment • Expenses benefiting from favorable OREO trends and lower salary costs, partially offsetting $5.2 million in merger-related costs • Provision recapture driven by reduced loans and improved economic forecasts • PTPP1 decreased $7.6 million from the prior quarter primarily due to lower NII from a decrease in PPP income and reduced loan volumes and increased expenses from $5.2 million of merger-related costs • PTPP1 decreased by $7.1 million from the comparable quarter prior year with a 15.0% expense reduction offsetting lower NII resulting from a shift in interest earning asset mix Pre-tax Pre-provision Income¹ (PTPP) $51.8 $66.3 $60.9 $52.2 $44.7 4QFY20 1QFY21 2QFY21 3QFY21 4QFY21 1 See Non-GAAP table in appendix for reconciliation

NIM Analysis 3.13% (0.08)% (0.03)% (0.05)% (0.03)% 0.03% 0.03% 3.00% 3.23% 3.10% NIM (FTE) Adjusted NIM (FTE)¹ 3QFY21 Liquidity FASB Fees/A CL Loans Nonaccr ual R ecoveries PPP Funding 4QFY21 Net Interest Income ($MM) and NIM $425.6 $408.1 $107.5 $109.5 $104.4 $99.1 $95.1 3.59% 3.36% 3.51% 3.63% 3.51% 3.23% 3.10%3.51% 3.26% 3.40% 3.52% 3.40% 3.13% 3.00% Net Interest Income (FTE) NIM (FTE) Adjusted NIM (FTE)¹ FY20 FY21 4QFY20 1QFY21 2QFY21 3QFY21 4QFY21 NET INTEREST INCOME 4 • Net interest income was $95.1 million for the quarter, down $4.0 million; adjusted net interest income1 was $92.0 million, down $3.9 million ◦ Loan interest reflects a $0.9 million decrease in PPP interest and fees, a $1.0 million decrease in recoveries of interest on nonaccrual loans and a $3.4 million net decrease from lower volumes and lower yields ◦ Interest expense was lower, driven by a $0.2 million decrease in time deposit interest and $0.6 million decrease in interest on other interest bearing deposits • Net interest margin was 3.10%, a 13 basis point decrease from 3.23%; adjusted net interest margin1 was 3.00%, a 13 basis point decrease from 3.13% 1 Non-GAAP measures, see appendix for reconciliations. NOTE: All references to net interest income and net interest margin are presented on a fully-tax equivalent basis unless otherwise noted.

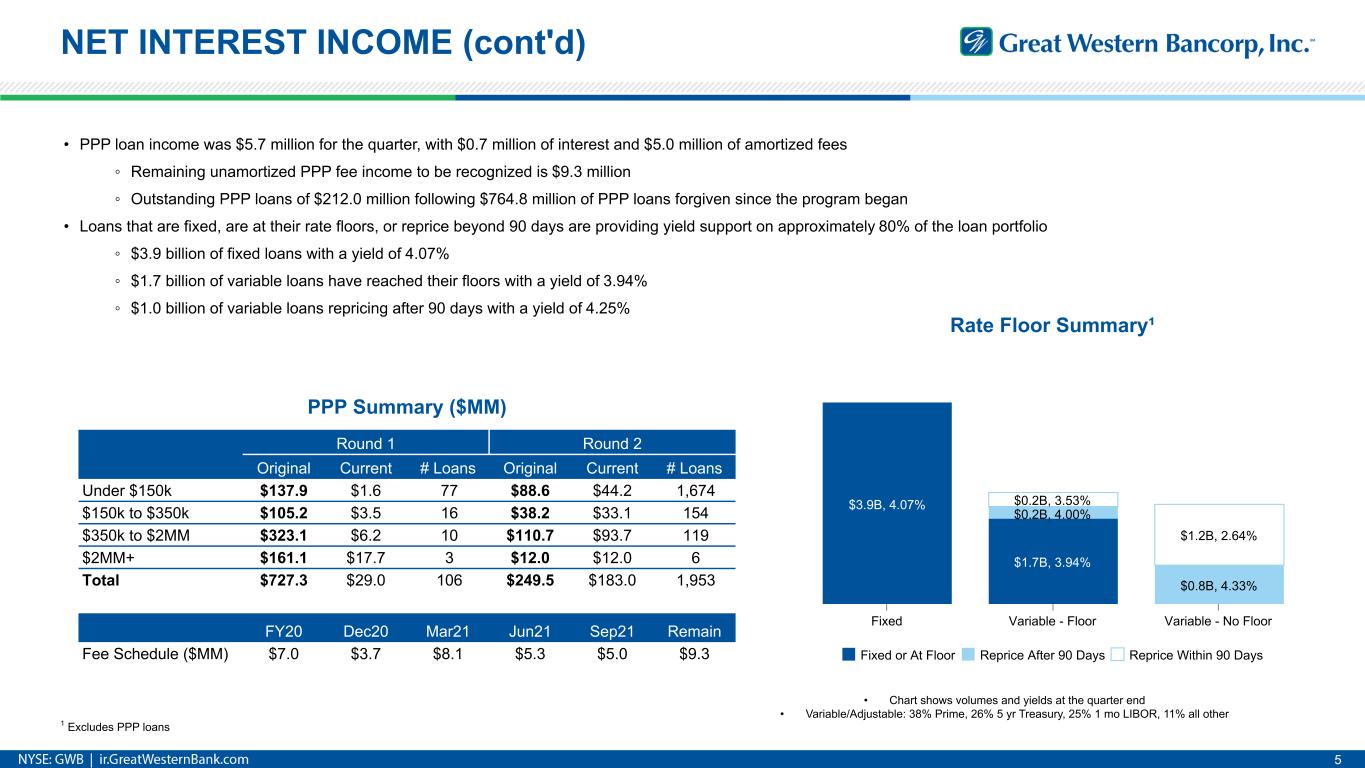

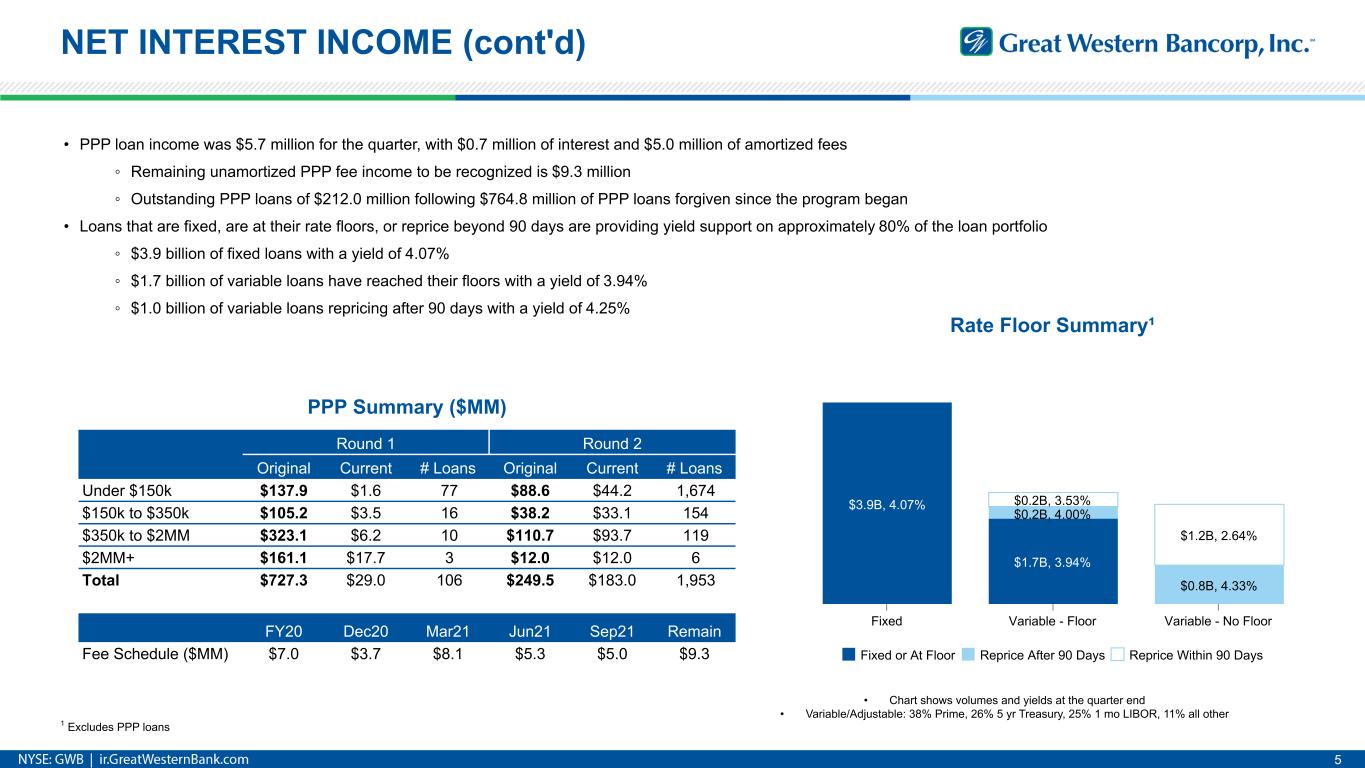

NET INTEREST INCOME (cont'd) 5 • PPP loan income was $5.7 million for the quarter, with $0.7 million of interest and $5.0 million of amortized fees ◦ Remaining unamortized PPP fee income to be recognized is $9.3 million ◦ Outstanding PPP loans of $212.0 million following $764.8 million of PPP loans forgiven since the program began • Loans that are fixed, are at their rate floors, or reprice beyond 90 days are providing yield support on approximately 80% of the loan portfolio ◦ $3.9 billion of fixed loans with a yield of 4.07% ◦ $1.7 billion of variable loans have reached their floors with a yield of 3.94% ◦ $1.0 billion of variable loans repricing after 90 days with a yield of 4.25% Rate Floor Summary¹ $3.9B, 4.07% $1.7B, 3.94% $0.2B, 4.00% $0.8B, 4.33% $0.2B, 3.53% $1.2B, 2.64% Fixed or At Floor Reprice After 90 Days Reprice Within 90 Days Fixed Variable - Floor Variable - No Floor • Chart shows volumes and yields at the quarter end • Variable/Adjustable: 38% Prime, 26% 5 yr Treasury, 25% 1 mo LIBOR, 11% all other PPP Summary ($MM) Round 1 Round 2 Original Current # Loans Original Current # Loans Under $150k $137.9 $1.6 77 $88.6 $44.2 1,674 $150k to $350k $105.2 $3.5 16 $38.2 $33.1 154 $350k to $2MM $323.1 $6.2 10 $110.7 $93.7 119 $2MM+ $161.1 $17.7 3 $12.0 $12.0 6 Total $727.3 $29.0 106 $249.5 $183.0 1,953 FY20 Dec20 Mar21 Jun21 Sep21 Remain Fee Schedule ($MM) $7.0 $3.7 $8.1 $5.3 $5.0 $9.3 1 Excludes PPP loans

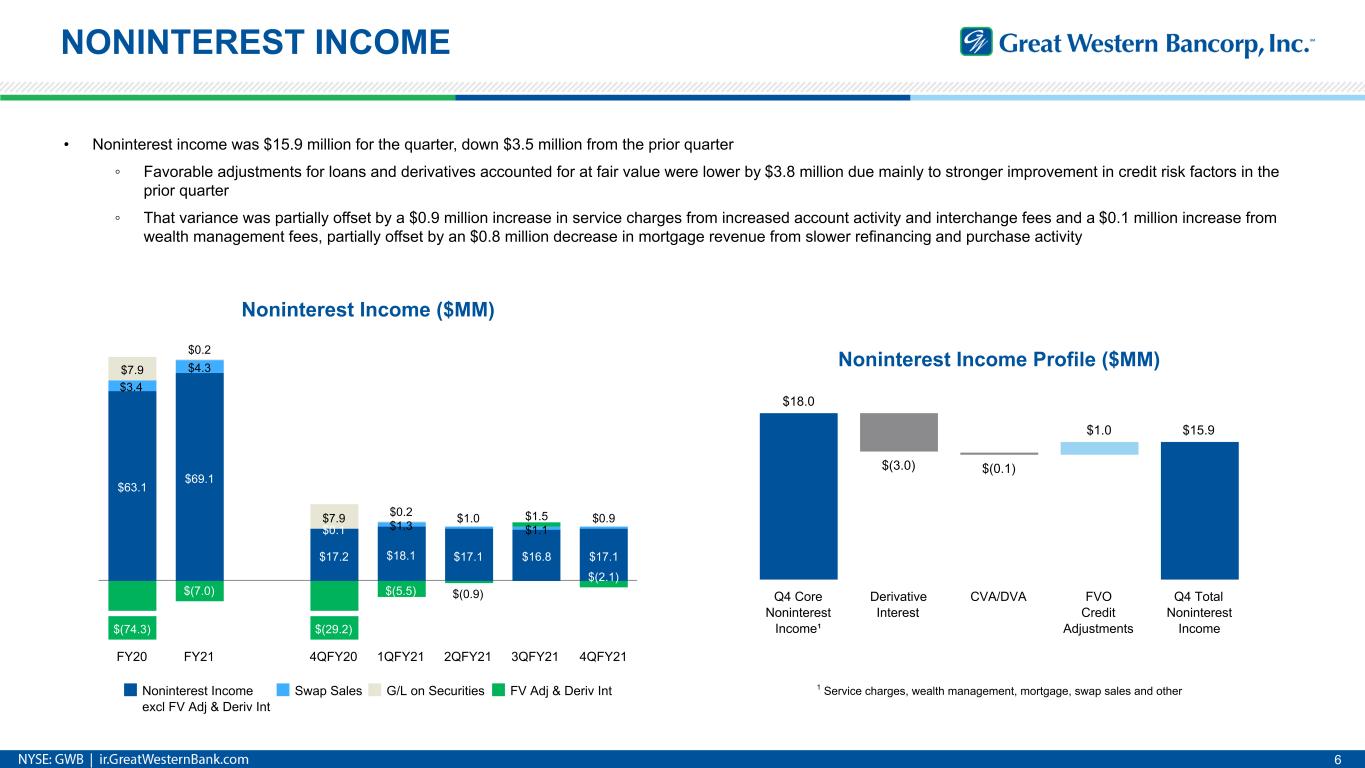

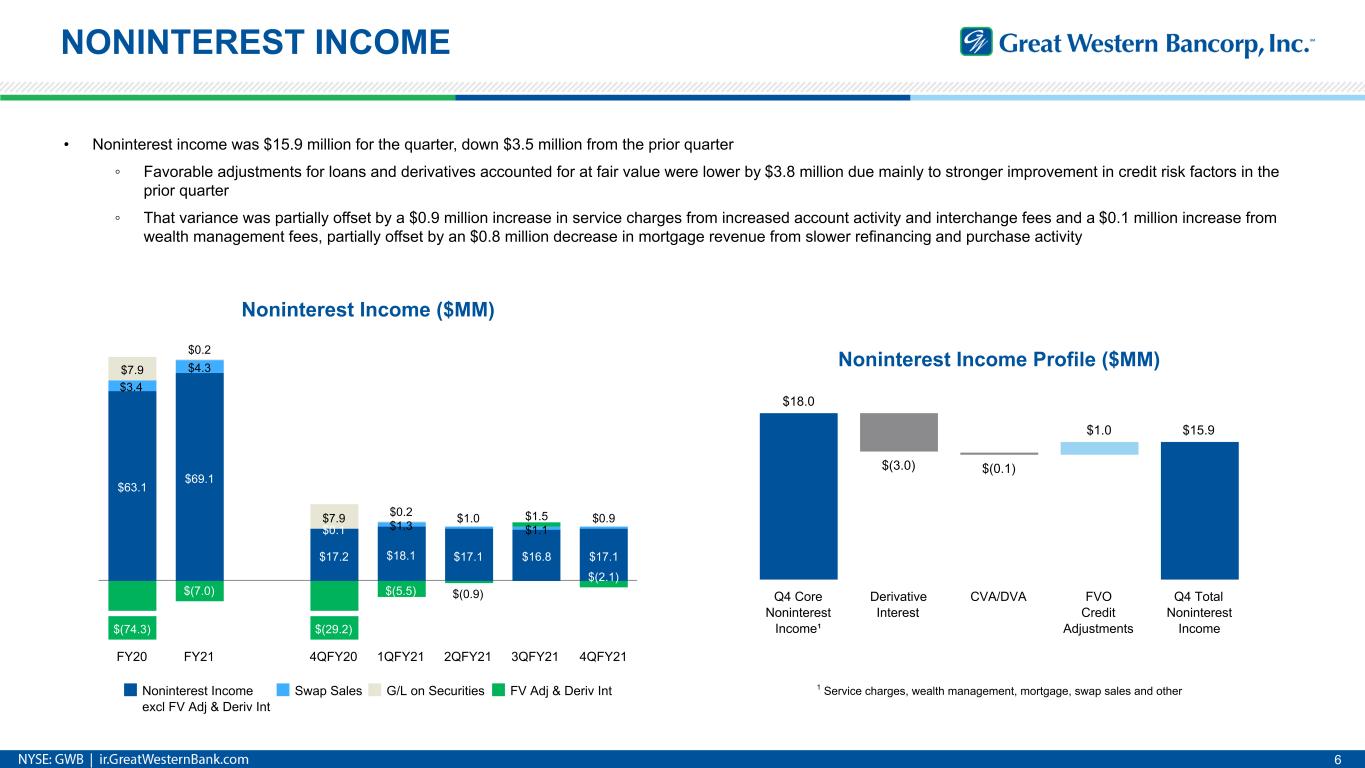

6 NONINTEREST INCOME • Noninterest income was $15.9 million for the quarter, down $3.5 million from the prior quarter ◦ Favorable adjustments for loans and derivatives accounted for at fair value were lower by $3.8 million due mainly to stronger improvement in credit risk factors in the prior quarter ◦ That variance was partially offset by a $0.9 million increase in service charges from increased account activity and interchange fees and a $0.1 million increase from wealth management fees, partially offset by an $0.8 million decrease in mortgage revenue from slower refinancing and purchase activity Noninterest Income ($MM) $63.1 $69.1 $17.2 $18.1 $17.1 $16.8 $17.1 $3.4 $4.3 $0.1 $1.3 $1.0 $1.1 $0.9 $7.9 $0.2 $7.9 $0.2 $(74.3) $(7.0) $(29.2) $(5.5) $(0.9) $1.5 $(2.1) Noninterest Income excl FV Adj & Deriv Int Swap Sales G/L on Securities FV Adj & Deriv Int FY20 FY21 4QFY20 1QFY21 2QFY21 3QFY21 4QFY21 1 Service charges, wealth management, mortgage, swap sales and other Noninterest Income Profile ($MM) $15.9 $18.0 $(3.0) $(0.1) $1.0 Q4 Core Noninterest Income¹ Derivative Interest CVA/DVA FVO Credit Adjustments Q4 Total Noninterest Income

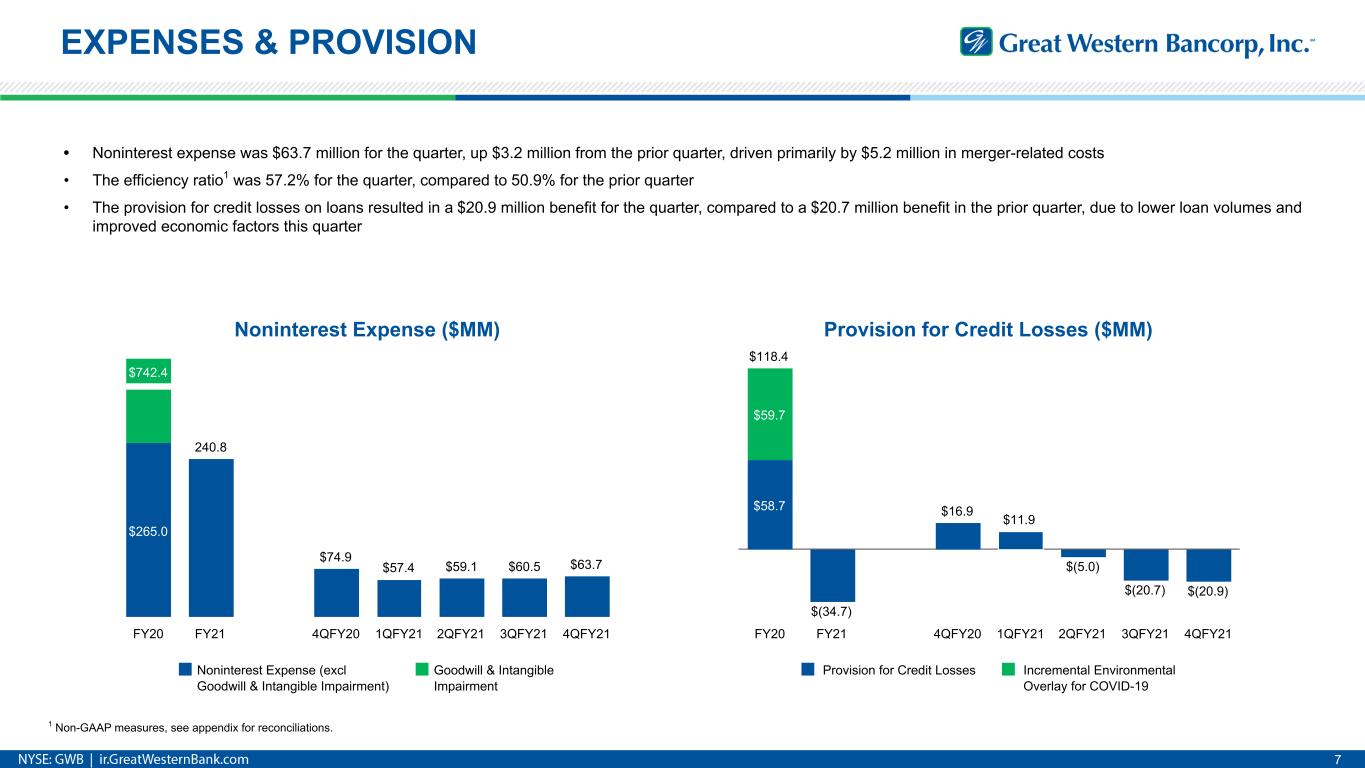

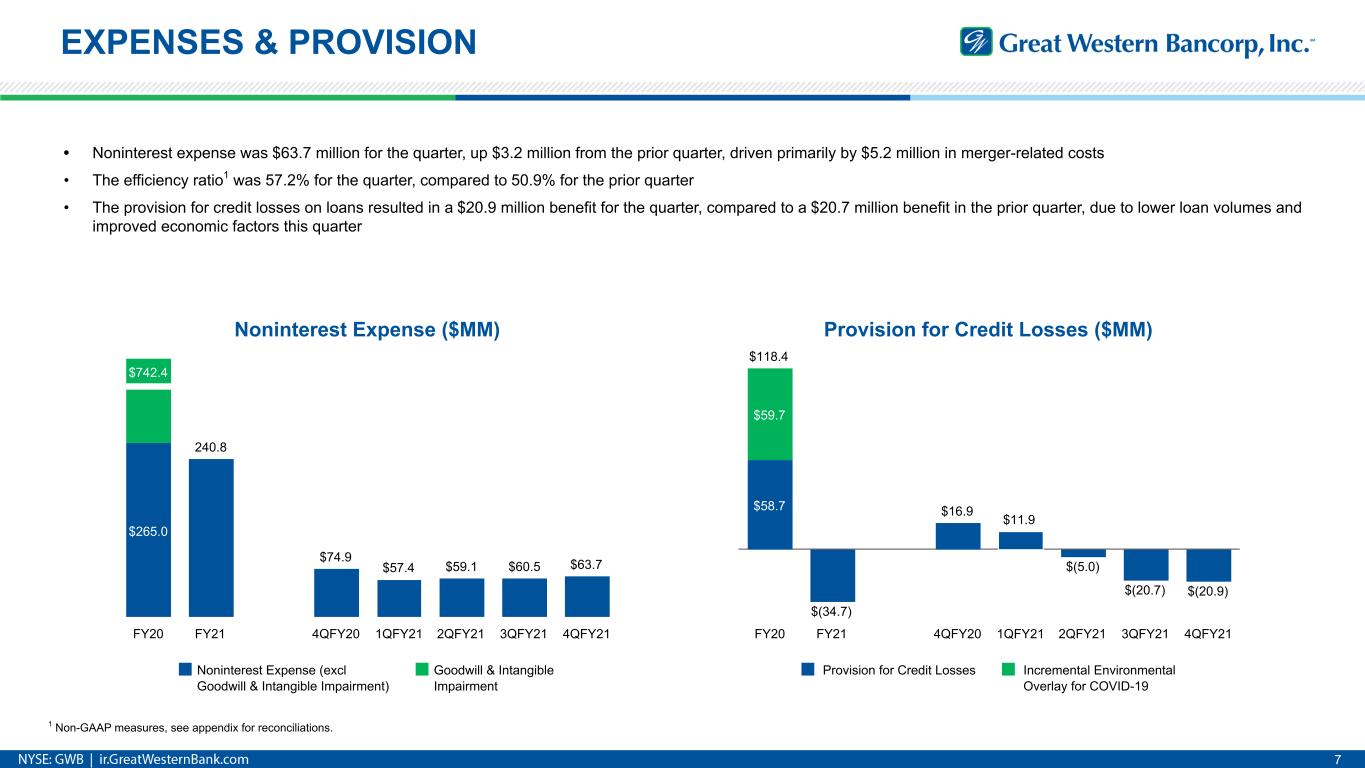

Provision for Credit Losses ($MM) $118.4 $16.9 $11.9 $(34.7) $(5.0) $(20.7) $(20.9) $58.7 $59.7 Provision for Credit Losses Incremental Environmental Overlay for COVID-19 FY20 FY21 4QFY20 1QFY21 2QFY21 3QFY21 4QFY21 7 EXPENSES & PROVISION • Noninterest expense was $63.7 million for the quarter, up $3.2 million from the prior quarter, driven primarily by $5.2 million in merger-related costs • The efficiency ratio1 was 57.2% for the quarter, compared to 50.9% for the prior quarter • The provision for credit losses on loans resulted in a $20.9 million benefit for the quarter, compared to a $20.7 million benefit in the prior quarter, due to lower loan volumes and improved economic factors this quarter Noninterest Expense ($MM) $265.0 240.8 $74.9 $57.4 $59.1 $60.5 $63.7 $742.4 Noninterest Expense (excl Goodwill & Intangible Impairment) Goodwill & Intangible Impairment FY20 FY21 4QFY20 1QFY21 2QFY21 3QFY21 4QFY21 1 Non-GAAP measures, see appendix for reconciliations.

ACL & CREDIT COVERAGE 8 • The ACL (CECL adopted October 1, 2020), was $246.0 million as of September 30, 2021, down $24.3 million from $270.3 million in the prior quarter • The ratio of ACL to total loans was 3.01% as of September 30, 2021, down from 3.19% in the prior quarter • In addition, $22.3 million of the fair value adjustment for these loans relates to credit risk, which is 4.26% of the fair value option loans and 0.28% of total loans excluding PPP loans • Economic Factors: Oxford GDP, Unemployment and qualitative adjustments; Portfolio Changes: changes in loan volumes, mix, age, credit quality and charge-off activity CECL Waterfall ($MM) $149.9 $177.3 $(18.8) $0.4 $(8.9) $(3.9) $(18.1) $(7.6) $(21.5) $(2.8) $30.5 $327.2 $308.8 $296.0 $270.3 $246.0 $30.5 $27.5 $27.4 $23.3 $22.3 ACL² (ALLL on Sep 30, 2020) FV Adjustment³ Sep 30, 2020 Day 1 Adjustment Oct 1, 2020 Economic Factors Portfolio Changes Dec 31, 2020 Economic Factors Portfolio Changes Mar 31, 2021 Economic Factors Portfolio Changes Jun 30, 2021 Economic Factors Portfolio Changes Sep 30, 2021 2019 2020 QE Mar21 QE Jun21 QE Sep21 QE Dec21 2022 2023 GDP1 2.3 -3.4 6.3 6.6 2.7 4.5 4.4 2.6 Unemployment1 3.7 8.1 6.2 5.9 5.2 4.5 4 3.6 Total Credit Coverage excluding PPP4 = 3.38% 1 Source: Oxford Economics - Annual Percentage Change 2 ACL excludes Unfunded Commitment Reserve; Oct 1 = $2.4 million; Dec 31 = $2.3 million; Mar 31 = $2.3 million; Jun 30 = $2.1 million; Sep 30 = $1.3 million 3 FV adjustment reflects effective coverage on the loan portfolio accounted for at fair value 4 Total Credit Coverage is ACL, FV Adjustment and Unfunded Commitment Reserve/Net Loans

CAPITAL 9 • All regulatory capital ratios improved over the prior quarter, and all remain above regulatory minimums to be considered "well capitalized" ◦ Total capital ratio of 16.3%, up from 16.0% ◦ Tier 1 capital ratio of 15.1%, up from 14.5% ◦ Common equity tier 1 capital ratio of 14.3%, up from 13.7% ◦ Tier 1 leverage ratio of 10.6%, up from 10.1% • On October 26, 2021, the Company's Board of Directors declared a dividend of $0.05 per common share, payable on November 26, 2021 to stockholders of record as of close of business on November 12, 2021 Capital Trend 11.4% 12.0% 11.7% 11.8% 15.1% 12.5% 13.0% 12.7% 13.3% 16.3% 9.2% 9.6% 9.6% 9.2% 9.3% Tier 1 Capital Total Capital TCE / TA¹ FY17 FY18 FY19 FY20 FY21 1 Non-GAAP measures, see appendix for reconciliations Capital Ratio Summary 10.0% 8.0% 6.5% 5.0% 6.3% 7.1% 7.8% 5.6% 16.3% 15.1% 14.3% 10.6% 9.3% Well-Capitalized Difference to Well-Capitalized Total Capital Tier 1 Capital CET1 Leverage Ratio TCE Ratio¹

DEPOSITS 10 • Total deposits were $11.31 billion as of September 30, 2021, down $227.3 million from the prior quarter, driven by a $167.3 million decrease in other interest-bearing deposits, a $44.6 million decrease in time deposits, and a $15.4 million decrease in checking and savings balances • Deposit yields decreased 2 basis points to 0.10% ◦ Time deposits yield of 0.37%, a decrease of 4 basis points from 0.41% in the prior quarter ◦ Interest-bearing deposits yield of 0.11%, a decrease of 2 basis points from 0.13% in the prior quarter Deposits ($MM) $1,843 $1,956 $2,587 $2,858 $2,845 $2,958 $2,609 $6,043 $6,248 $7,139 $7,436 $7,797 $7,782 $7,967 $1,847 $2,096 $1,283 $1,079 $922 $798 $734 $9,733 $10,300 $11,009 $11,373 $11,564 $11,538 $11,310 Noninterest-Bearing Interest-Bearing Demand Time FY18 FY19 4QFY20 1QFY21 2QFY21 3QFY21 4QFY21 Cost of Deposits 0.28% 0.21% 0.16% 0.12% 0.10% 0.25% 0.25% 0.25% 0.25% 0.25% Cost of Deposits Fed Funds Rate 4QFY20 1QFY21 2QFY21 3QFY21 4QFY21

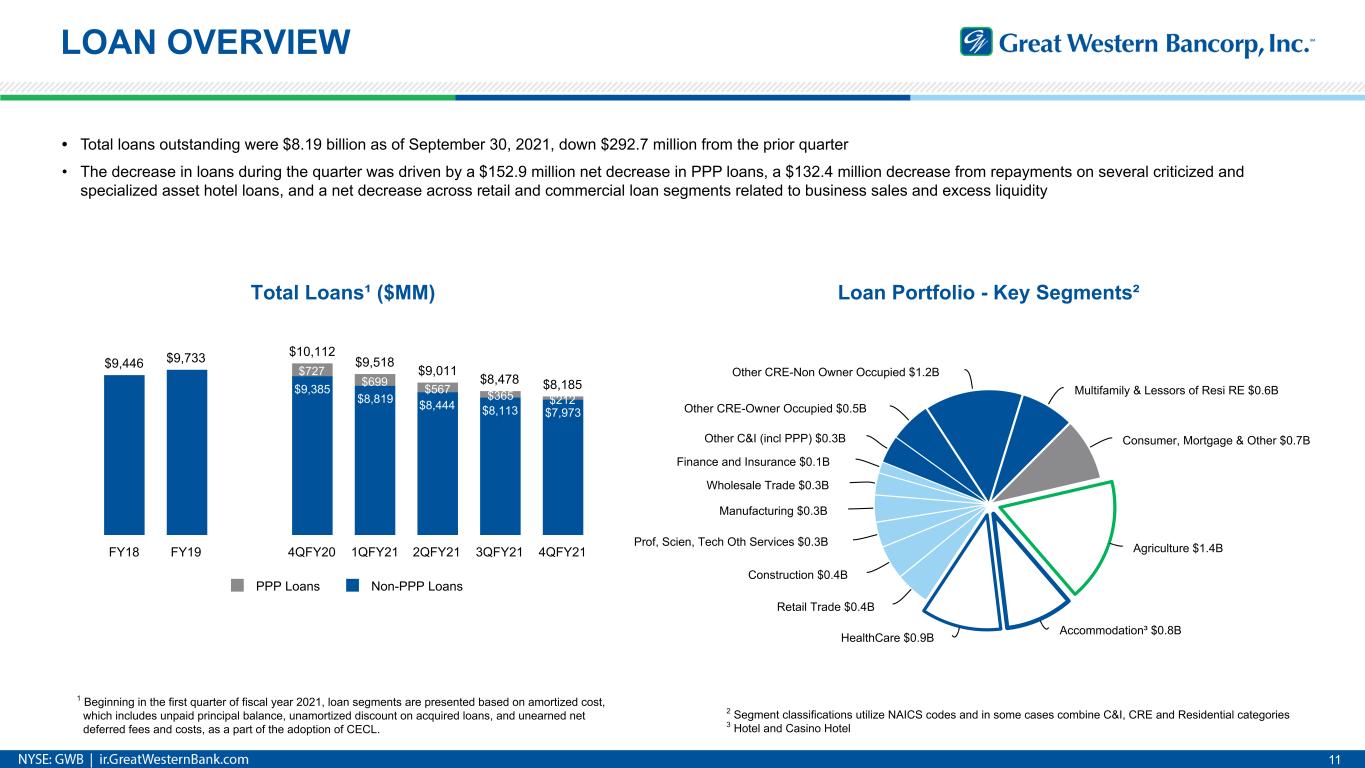

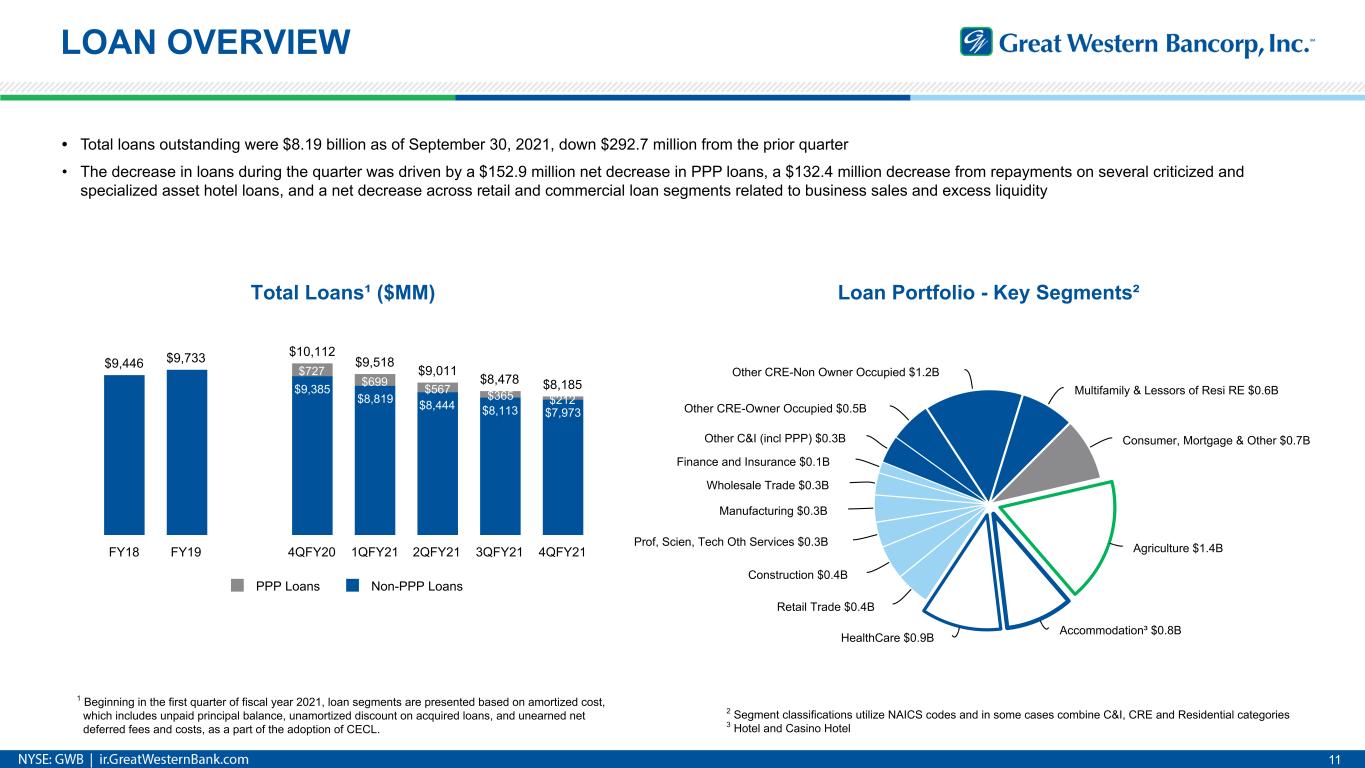

Loan Portfolio - Key Segments² Agriculture $1.4B Accommodation³ $0.8BHealthCare $0.9B Retail Trade $0.4B Construction $0.4B Prof, Scien, Tech Oth Services $0.3B Manufacturing $0.3B Wholesale Trade $0.3B Finance and Insurance $0.1B Other C&I (incl PPP) $0.3B Other CRE-Owner Occupied $0.5B Other CRE-Non Owner Occupied $1.2B Multifamily & Lessors of Resi RE $0.6B Consumer, Mortgage & Other $0.7B LOAN OVERVIEW 11 • Total loans outstanding were $8.19 billion as of September 30, 2021, down $292.7 million from the prior quarter • The decrease in loans during the quarter was driven by a $152.9 million net decrease in PPP loans, a $132.4 million decrease from repayments on several criticized and specialized asset hotel loans, and a net decrease across retail and commercial loan segments related to business sales and excess liquidity 2 Segment classifications utilize NAICS codes and in some cases combine C&I, CRE and Residential categories 3 Hotel and Casino Hotel Total Loans¹ ($MM) $9,385 $8,819 $8,444 $8,113 $7,973 $727 $699 $567 $365 $212 $9,446 $9,733 $10,112 $9,518 $9,011 $8,478 $8,185 PPP Loans Non-PPP Loans FY18 FY19 4QFY20 1QFY21 2QFY21 3QFY21 4QFY21 1 Beginning in the first quarter of fiscal year 2021, loan segments are presented based on amortized cost, which includes unpaid principal balance, unamortized discount on acquired loans, and unearned net deferred fees and costs, as a part of the adoption of CECL.

CREDIT OVERVIEW 12 Key Highlights: • Continued progress on asset quality ◦ Reduced nonaccrual loans by $12.2 million in the quarter (5.8%) and by $127.0 million fiscal year to date (39.1%) ◦ Reduced classified loans by $7.3 million in the quarter (1.2%) and by $164.6 million fiscal year to date (21.4%) ◦ Reduced special mention loans by $23.3 million in the quarter (6.2%) and by $151.5 million fiscal year to date (30.1%) ◦ Reduced OREO by $7.0 million in the quarter (61.0%) and $15.5 million fiscal year to date (77.6%) • Nonaccrual loan balance concentration includes $111.3 million with the 5 largest ag relationships and $37.5 million with the 5 largest non-ag relationships Nonaccrual Loan Concentration ($MM) $111.3 $37.5 $21.4 $27.7 Top 5 Relationships in Segment All Other Relationships in Segment Ag Non Ag Nonaccrual Loans $325 $292 $285 $210 $198 4Q FY20 1Q FY21 2Q FY21 3Q FY21 4Q FY21 Classified Loans $770 $717 $674 $612 $605 4Q FY20 1Q FY21 2Q FY21 3Q FY21 4Q FY21

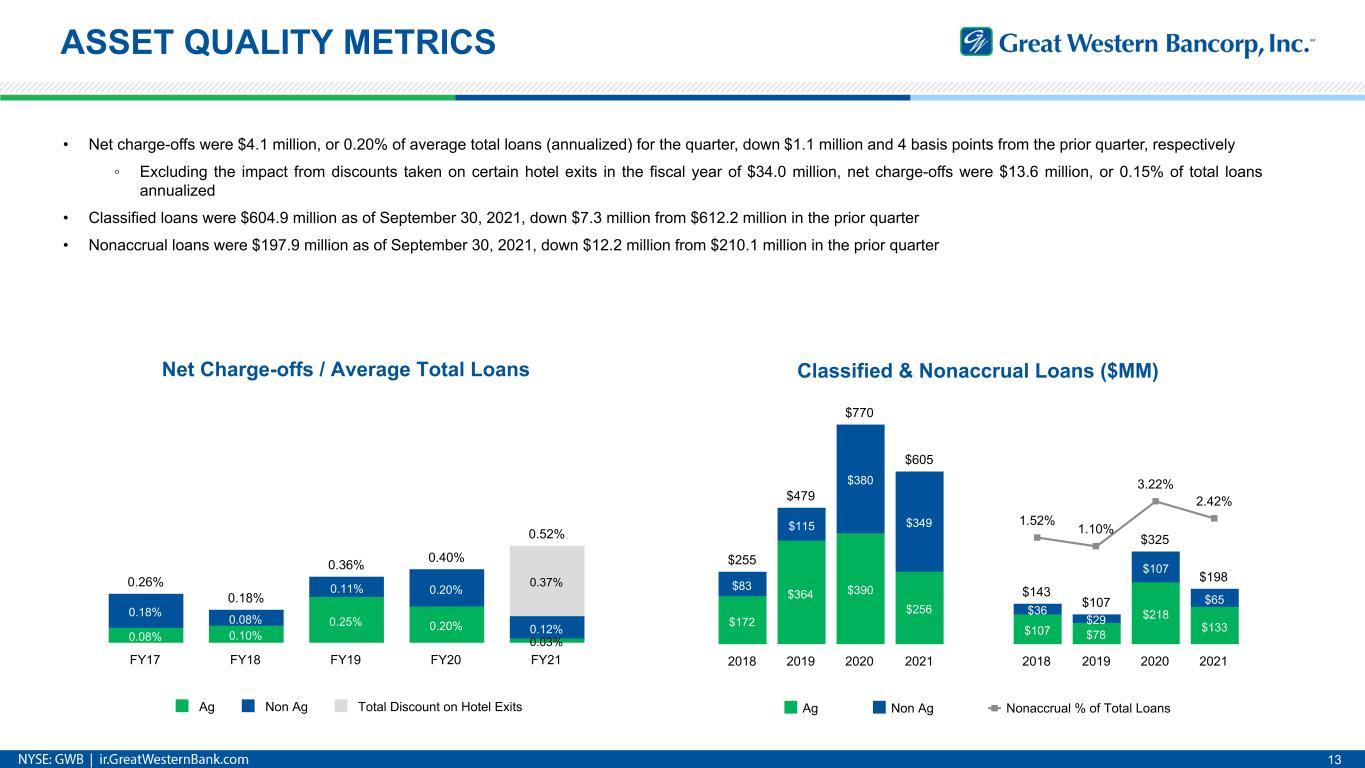

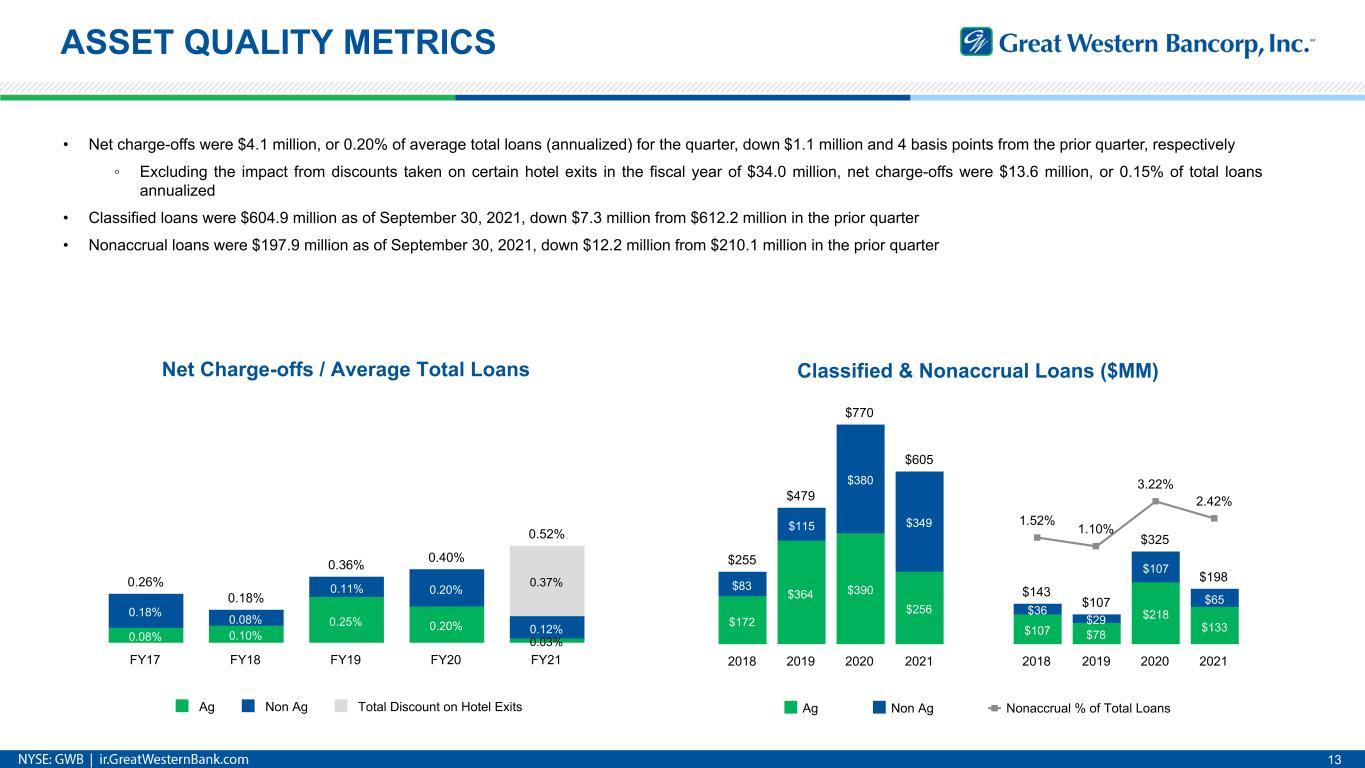

Net Charge-offs / Average Total Loans 0.08% 0.10% 0.25% 0.20% 0.03% 0.18% 0.08% 0.11% 0.20% 0.12% 0.37%0.26% 0.18% 0.36% 0.40% 0.52% Ag Non Ag Total Discount on Hotel Exits FY17 FY18 FY19 FY20 FY21 ASSET QUALITY METRICS 13 • Net charge-offs were $4.1 million, or 0.20% of average total loans (annualized) for the quarter, down $1.1 million and 4 basis points from the prior quarter, respectively ◦ Excluding the impact from discounts taken on certain hotel exits in the fiscal year of $34.0 million, net charge-offs were $13.6 million, or 0.15% of total loans annualized • Classified loans were $604.9 million as of September 30, 2021, down $7.3 million from $612.2 million in the prior quarter • Nonaccrual loans were $197.9 million as of September 30, 2021, down $12.2 million from $210.1 million in the prior quarter Classified & Nonaccrual Loans ($MM) $172 $364 $390 $256 $107 $78 $218 $133 $83 $115 $380 $349 $36 $29 $107 $65 $255 $479 $770 $605 $143 $107 $325 $198 1.52% 1.10% 3.22% 2.42% Ag Non Ag Nonaccrual % of Total Loans 2018 2019 2020 2021 2018 2019 2020 2021

KEY LOAN SEGMENTS 14 Midwest, 48% Western, 38% Hotel & Casino Hotel Balances by State ($MM) IA $153 SD $85 NE $67 MN $38 Other $32 CO $166 AZ $131 Non-Footprint² $107 1 Consists of 65 PPP loans, most of which are related to non-PPP relationships reflected in the chart 2 Includes AK $27, CA $18, FL $18, among others, and mostly relates to experienced in-footprint customers • Accommodation portfolio comprised of $619.1 million in hotels (excl casino hotels), $133.3 million of casino hotels, and $27.2 million of PPP loans across both segments • 86% of the accommodation balance is concentrated within the bank's footprint • Diversified across more than 100 cities with largest hotel balance concentrations in Colorado Springs, CO; Rapid City, SD; Des Moines, IA; Sioux Falls, SD; and Omaha, NE, and casino hotels located in rural IA and MN • LTV of approximately 61% for accommodation relationships over $1 million (86% of balance) • 92% of hotel (excl casino hotels) relationships over $1 million are flagged (90% of balance) Risk Rating excl PPP ($MM) $462 $373 $113 $133 $144 $141 $103 $105 Pass Special Mention Classified Jun Hotels Sep Hotels Jun Casino Hotels Sep Casino Hotels Balances ($MM) and Counts by Relationship Size 107 24 15 6$26 $127 $162 $203 $127$1 $1 $17 $38 $77 Hotels Casino Hotels PPP¹ 0-5MM 5-10MM 10-25MM 25MM+ NOTE: Accommodation portfolio consists of hotels (excl casino hotels) and casino hotels segmented by NAICS. Chart values exclude $0.4 million of balances with NAICS of hotel (excl casino hotels) that do not have a commercial classification.

Ag Portfolio by Industry Grains, 28.4% Beef Cattle, 19.1% Dairy Farms, 28.3% Hogs, 3.8% Other Specialty, 20.4% Grains, 28.4% Proteins, 51.2% Other, 20.4% KEY LOAN SEGMENTS (cont'd) 15 Health Care Portfolio Senior Care, 39.9% Skilled Nursing, 22.8% Hospitals, 21.6% All Other, 15.7% • Senior Care is $369 million or 4.5% of total loans, 99% CRE, and consists of approximately 37 relationships • Skilled Nursing is $211 million or 2.6% of total loans, 96% CRE, and consists of approximately 28 relationships • Hospitals are $199 million or 2.4% of total loans, more aligned to C&I at 51% and consist of approximately 21 relationships • All other health care is $146 million or 1.8% of total loans, is 71% CRE, and is much more fragmented across 357 relationships that include physicians, dentists, optometrists, therapists, and other specialty services as well as social assistance • Ag portfolio remains well diversified across key sub-segments • USDA October 12, 2021, corn harvest progress report shows SD at 33%, IA at 30% and NE at 29%, compared to the national average at 41% • Also from the USDA report, soybean harvest progress is tracking well with SD at 69%, IA at 56% and NE at 60%, well ahead of the national average at 49% • Dairy market conditions remain supportive with Class III milk price at $16.53 per hundredweight in September, up from $15.95 in August and down from $17.21 in June* *Dairy Program report as of September 29, 2021, which can be found at www.usda.gov Total $1.4B Total $0.9B

Forward Looking Statements: This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, which involve inherent risks and uncertainties. Statements about GWBI’s, FIBK's or the combined company's expectations, beliefs, plans, strategies, predictions, forecasts, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. These statements are often, but not always, made through the use of words or phrases such as “anticipates,” “believes,” “can,” “could,” “may,” “predicts,” “potential,” “should,” “will,” “estimate,” “plans,” “projects,” “continuing,” “ongoing,” “expects,” “views,” “intends” and similar words or phrases. In particular, the statements included in this press release concerning GWBI’s expected performance and strategy, strategies for managing troubled loans, the appropriateness of the ACL, the impact on the business arising from the COVID-19 pandemic, the interest rate environment and the business combination transaction between GWBI and FIBK (the "Transaction") are not historical facts and are forward-looking. Accordingly, the forward-looking statements in this press release are only predictions and involve estimates, known and unknown risks, assumptions and uncertainties that could cause actual results to differ materially from those expressed. All forward-looking statements are necessarily only estimates of future results, and there can be no assurance that actual results will not differ materially from expectations, and, therefore, you are cautioned not to place undue reliance on such statements. In addition to factors previously disclosed in GWBI's and FIBK's reports filed with the U.S. Securities and Exchange Commission (the "SEC") and those identified elsewhere in this press release, the following factors, among others, could cause actual results to differ materially from forward-looking statements or historical performance: the occurrence of any event, change or other circumstance that could give rise to the right of one or both of the parties to terminate the definitive merger agreement between GWBI and FIBK; the outcome of any legal proceedings that may be instituted against GWBI or FIBK; the possibility that the Transaction does not close when expected or at all because required regulatory, shareholder, or other approvals and other conditions to closing are not received or satisfied on a timely basis or at all (and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the Transaction); the risk that the benefits from the Transaction may not be fully realized or may take longer to realize than expected, including as a result of changes in, or problems arising from, general economic and market conditions, interest and exchange rates, monetary policy, laws and regulations and their enforcement, and the degree of competition in the geographic and business areas in which GWBI and FIBK operate; the ability to promptly and effectively integrate the businesses of GWBI and FIBK; the possibility that the Transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; reputational risk and potential adverse reactions of GWBI's or FIBK's customers, employees or other business partners, including those resulting from the announcement or completion of the Transaction; the dilution caused by FIBK's issuance of additional shares of its capital stock in connection with the Transaction; the diversion of management's attention and time from ongoing business operations and opportunities on merger-related matters; and the impact of the global COVID-19 pandemic on GWBI's and FIBK's businesses, the ability to complete the Transaction or any of the other foregoing risks. These factors are not necessarily all of the factors that could cause GWBI's, FIBK's or the combined company's actual results, performance, or achievements to differ materially from those expressed in or implied by any of the forward-looking statements. Other unknown or unpredictable factors also could harm GWBI's, FIBK's or the combined company's results. All forward-looking statements attributable to GWBI, FIBK or the combined company, or persons acting on GWBI's or FIBK's behalf, are expressly qualified in their entirety by the cautionary statements set forth above. Forward-looking statements speak only as of the date they are made and GWBI and FIBK do not undertake or assume any obligation to update publicly any of these statements to reflect actual results, new information or future events, changes in assumptions, or changes in other factors affecting forward-looking statements, except to the extent required by applicable law. If GWBI or FIBK update one or more forward-looking statements, no inference should be drawn that GWBI or FIBK will make additional updates with respect to those or other forward-looking statements. Further information regarding GWBI, FIBK and the factors which could affect the forward-looking statements contained herein can be found in GWBI's Annual Report on Form 10-K for the fiscal year ended September 30, 2020, Form 10-Q for the quarters ended December 31, 2020, March 31, 2021 and June 30, 2021 and in other filings with the SEC and in FIBK's Annual Report on Form 10-K for the fiscal year ended December 31, 2020, Form 10-Q for the quarters ended March 31, 2021 and June 30, 2021, and its other filings with the SEC. Non-GAAP Financial Measures: This presentation contains non-GAAP measures which our management relies on in making financial and operational decisions about our business and which exclude certain items that we do not consider reflective of our business performance. We believe that the presentation of these measures provides investors with greater transparency and supplemental data relating to our financial condition and results of operations. These non-GAAP measures should be considered in context with our GAAP results. A reconciliation of these non-GAAP measures appears in our earnings release dated October 26, 2021 and in Appendix 1 to this presentation. Our earnings release and this presentation are available in the Investor Relations section of our website at www.greatwesternbank.com. Our earnings release and this presentation are also available as part of our Current Report on Form 8-K filed with the Securities and Exchange Commission on October 26, 2021. Explanatory Note: In this presentation, all financial information presented refers to the financial results of Great Western Bancorp, Inc. combined with those of its predecessor, Great Western Bancorporation, Inc. Also note loan balance information is presented using unpaid principal balances (UPB) unless otherwise noted. DISCLOSURES 16

Appendix 1 Supplemental Data

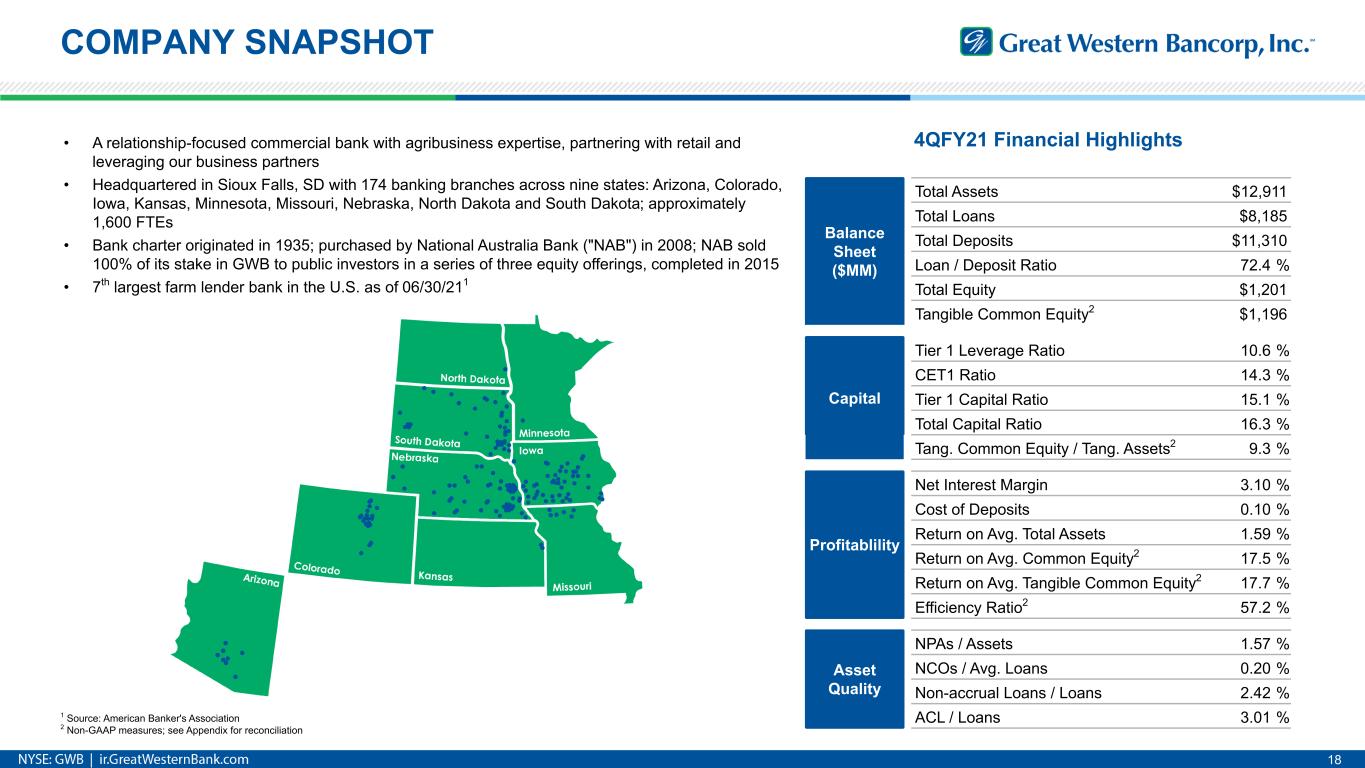

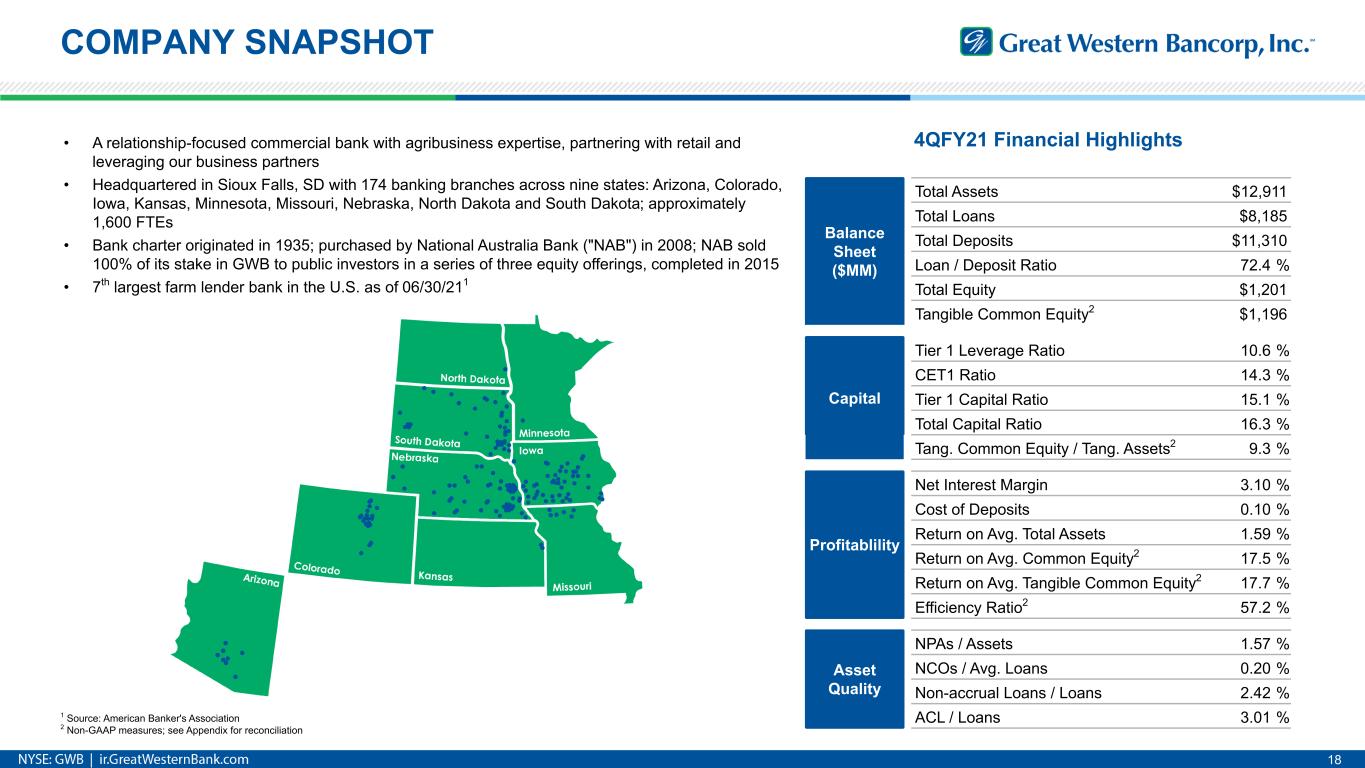

Footprint 18 COMPANY SNAPSHOT • A relationship-focused commercial bank with agribusiness expertise, partnering with retail and leveraging our business partners • Headquartered in Sioux Falls, SD with 174 banking branches across nine states: Arizona, Colorado, Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota and South Dakota; approximately 1,600 FTEs • Bank charter originated in 1935; purchased by National Australia Bank ("NAB") in 2008; NAB sold 100% of its stake in GWB to public investors in a series of three equity offerings, completed in 2015 • 7th largest farm lender bank in the U.S. as of 06/30/211 4QFY21 Financial Highlights Balance Sheet ($MM) Total Assets $12,911 Total Loans $8,185 Total Deposits $11,310 Loan / Deposit Ratio 72.4 % Total Equity $1,201 Tangible Common Equity2 $1,196 Capital Tier 1 Leverage Ratio 10.6 % CET1 Ratio 14.3 % Tier 1 Capital Ratio 15.1 % Total Capital Ratio 16.3 % Tang. Common Equity / Tang. Assets2 9.3 % Profitablility Net Interest Margin 3.10 % Cost of Deposits 0.10 % Return on Avg. Total Assets 1.59 % Return on Avg. Common Equity2 17.5 % Return on Avg. Tangible Common Equity2 17.7 % Efficiency Ratio2 57.2 % Asset Quality NPAs / Assets 1.57 % NCOs / Avg. Loans 0.20 % Non-accrual Loans / Loans 2.42 % ACL / Loans 3.01 %1 Source: American Banker's Association 2 Non-GAAP measures; see Appendix for reconciliation

COMMERCIAL LOANS 19 Commercial Segments1 Balance ($MM) % of Total Loans Real Estate & Leasing Lessors of Non Residential RE $1,152 14.1 % Lessors of Residential RE/Oth $194 2.4 % Accommodation & Food/Drink Hotel (excl Casino Hotels) $645 7.9 % Food/Drink $150 1.8 % Casino Hotels $135 1.6 % Other Accommodation $5 0.1 % Health Care & Social Assistance Senior Care $369 4.5 % Skilled Nursing $211 2.6 % Hospitals $200 2.4 % Health Services $146 1.8 % Retail Trade Motor Vehicle & Parts Dealers $148 1.8 % Convenience Stores $69 0.8 % Other Retail Trade $183 2.2 % Construction $396 4.8 % Manufacturing $316 3.9 % Prof, Scien, Tech Oth Services $294 3.6 % Wholesale Trade $257 3.1 % Arts Entertainment and Recreation $163 2.0 % Transportation & Warehousing $144 1.8 % Finance and Insurance $133 1.6 % Other $176 2.2 % Total $5,486 67.0 % • Real Estate & Leasing ◦ Major property types are 23% office buildings, 19% warehouses & manufacturing, 14% retail strip malls, 14% retail stores and 8% multifamily residential • Accommodation & Food/Drink ▪ See Key Loan Segments slides for additional details • Health Care & Social Assistance ▪ See Key Loan Segments slides for additional details • Retail Trade ◦ Largely comprised of automobile and other motorized vehicle dealers (37%), convenience stores (17%) and various other segments like furniture stores, building materials, and other retailers (46%) • Construction ◦ Diversified mix with 37% in various specialty contractors, 18% in civil engineering and construction, and 45% in building construction • Manufacturing ◦ Top 3 categories in cement & mineral-based, food and metal fabrication 1 Reflects C&I, CRE and C&D and certain Multifamily loans utilizing NAICS classifications including PPP loans

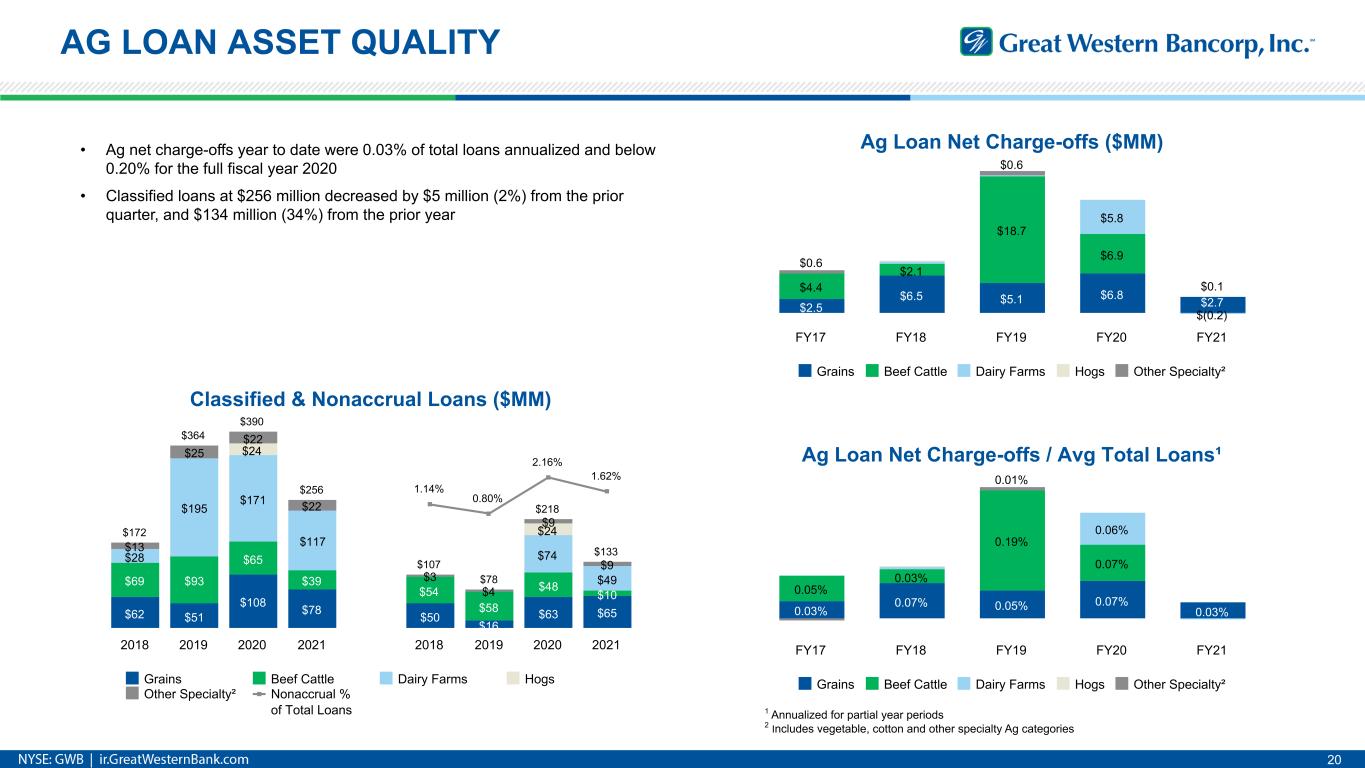

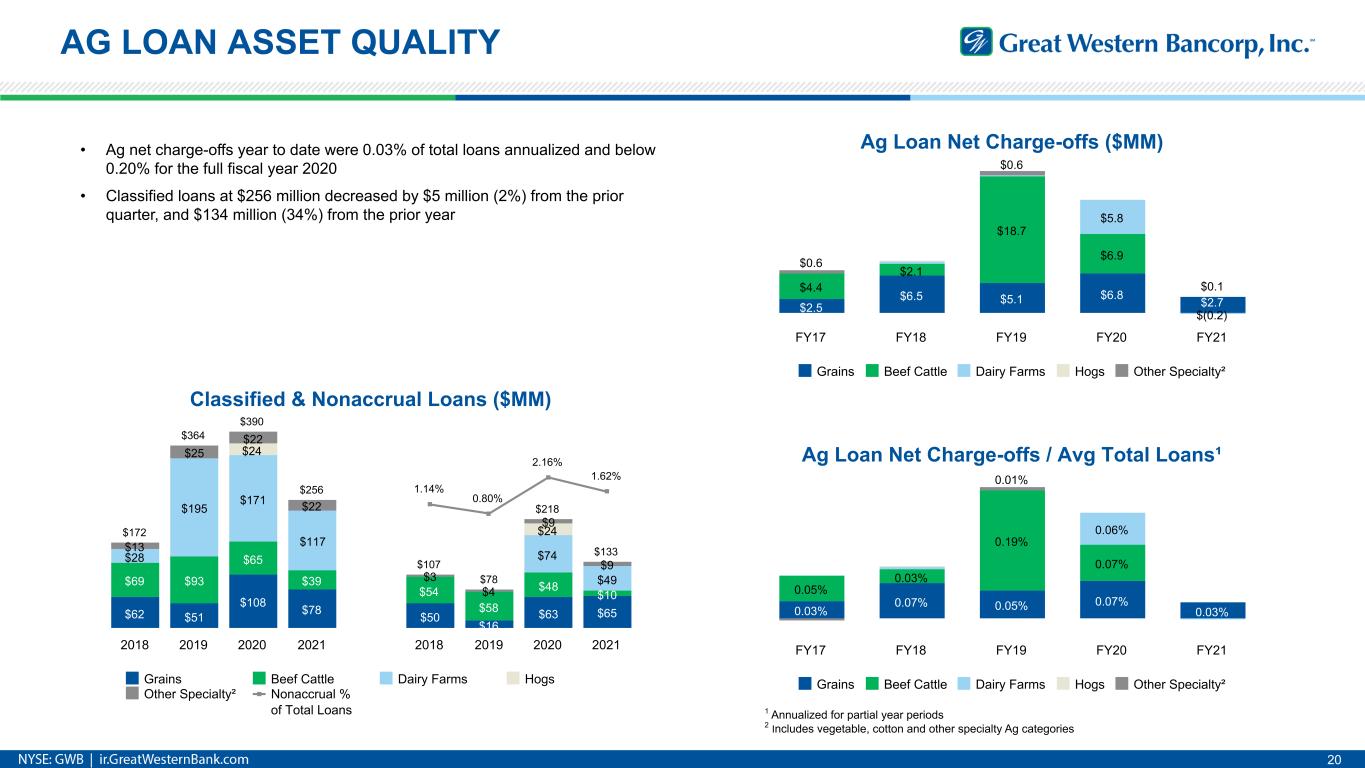

Ag Loan Net Charge-offs / Avg Total Loans¹ 0.03% 0.07% 0.05% 0.07% 0.03% 0.05% 0.03% 0.19% 0.07% 0.06% 0.01% Grains Beef Cattle Dairy Farms Hogs Other Specialty² FY17 FY18 FY19 FY20 FY21 AG LOAN ASSET QUALITY 20 Classified & Nonaccrual Loans ($MM) $62 $51 $108 $78 $50 $16 $63 $65 $69 $93 $65 $39 $54 $58 $48 $10 $28 $195 $171 $117 $74 $49 $24 $24 $13 $25 $22 $22 $3 $4 $9 $9 $172 $364 $390 $256 $107 $78 $218 $133 1.14% 0.80% 2.16% 1.62% Grains Beef Cattle Dairy Farms Hogs Other Specialty² Nonaccrual % of Total Loans 2018 2019 2020 2021 2018 2019 2020 2021 1 Annualized for partial year periods 2 Includes vegetable, cotton and other specialty Ag categories • Ag net charge-offs year to date were 0.03% of total loans annualized and below 0.20% for the full fiscal year 2020 • Classified loans at $256 million decreased by $5 million (2%) from the prior quarter, and $134 million (34%) from the prior year Ag Loan Net Charge-offs ($MM) $2.5 $6.5 $5.1 $6.8 $2.7 $4.4 $2.1 $18.7 $6.9 $5.8 $(0.2) $0.6 $0.6 $0.1 Grains Beef Cattle Dairy Farms Hogs Other Specialty² FY17 FY18 FY19 FY20 FY21

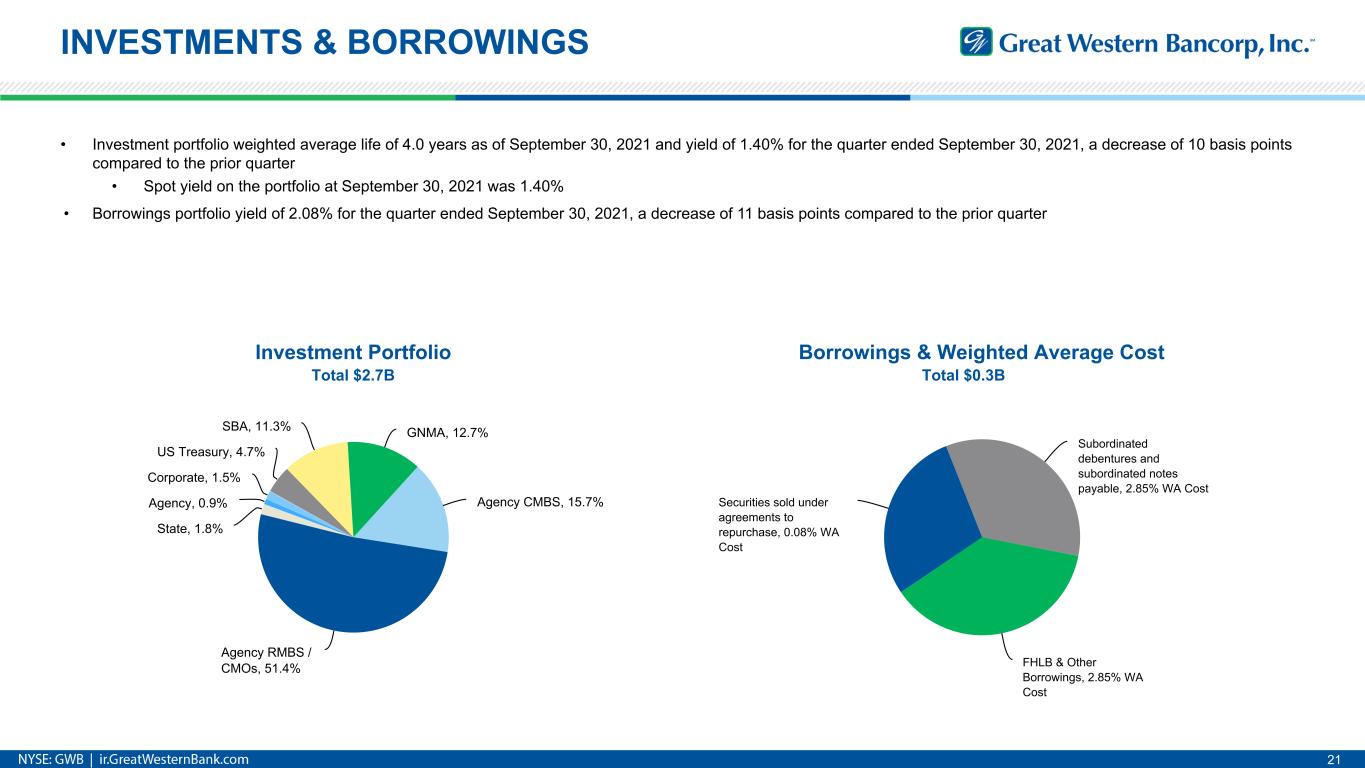

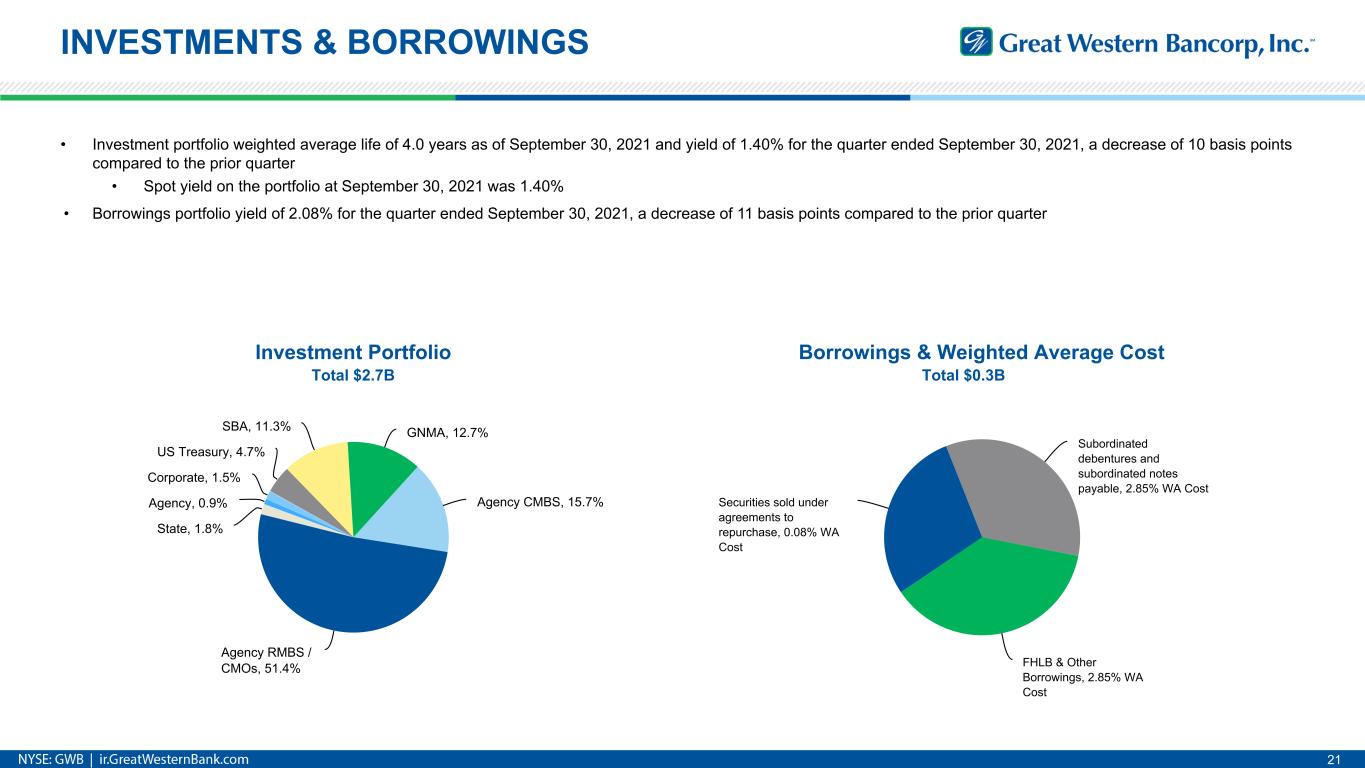

INVESTMENTS & BORROWINGS 21 • Investment portfolio weighted average life of 4.0 years as of September 30, 2021 and yield of 1.40% for the quarter ended September 30, 2021, a decrease of 10 basis points compared to the prior quarter • Spot yield on the portfolio at September 30, 2021 was 1.40% • Borrowings portfolio yield of 2.08% for the quarter ended September 30, 2021, a decrease of 11 basis points compared to the prior quarter Investment Portfolio US Treasury, 4.7% SBA, 11.3% GNMA, 12.7% Agency CMBS, 15.7% Agency RMBS / CMOs, 51.4% State, 1.8% Agency, 0.9% Corporate, 1.5% Borrowings & Weighted Average Cost FHLB & Other Borrowings, 2.85% WA Cost Securities sold under agreements to repurchase, 0.08% WA Cost Subordinated debentures and subordinated notes payable, 2.85% WA Cost Total $0.3BTotal $2.7B

LIQUIDITY & INTEREST RATE SENSITIVITY 22 Rate Term 5.2% 9.6% 19.7% 32.2% 24.5% 51.9% 11.3% 10.0% 13.4% 9.3% 0.1% 0.1% 1.4% 1.5% 5.7% 0.3% 0.1% 3.7% Fixed Swapped to Variable Adjustable <3m 3m- 12m 12m- 3y 3y-5y 5y+ <3m 3m- 12m 12m- 3y 3y-5y 5y+ Sensitivity Modeling Immediate Gradual -100 bps +100 bps +200 bps +300 bps +400 bps -5.00% 0.00% 5.00% 10.00% 15.00% 20.00% Additional Sources of Bank Funding Type Amount Outstanding ($MM) Available ($MM) Cash and Unencumbered Securities $3,198 FHLB, Notes Payable $120 $1,656 FHLB Fed Funds Advance $0 FRB Discount Window $0 $934 Unsecured Federal Funds $0 $125 Total $120 $5,913 Holding Company Detail Type Amount Outstanding ($MM) Available ($MM) Cash and Due from Banks $29 Subordinated Debt $35 Trust Preferred $74 Total $109 $29

Net Cash Income by State¹ ($B) 6.5 6.4 5.5 5.1 3.8 3.7 3.1 15.2 4.7 4.0 7.4 3.3 GWB Footprint² GWB Adjacent All Other States CA TX IA NE MN KS IL WI ND SD IN MO FARM INCOME 23 • 2021 net cash income is projected to be $135 billion, up 22% from 2020 with increased commodity prices in both crops and livestock, partially offset by reduction in government payments combined with an 8% increase in production costs • Farm income by state was well-balanced with 33% in our footprint, 31% adjacent to our footprint, and 36% non-adjacent • Average profits in each of the key sectors are forecasted to increase in 2021, aside from dairy coming off a record year in 2020 to a level more consistent with the 5 year average Source for commentary and graph data: USDA/ERS Farm Income and Wealth Statistics as of September 2, 2021 1 Data through 2020 2 AZ = $0.6M, CO = $1.6M US Net Cash Income ($B) 57 62 51 72 84 87 68 77 85 74 96 123 135 136 131 107 96 101 103 107 111 135 20 00 20 01 20 02 20 03 20 04 20 05 20 06 20 07 20 08 20 09 20 10 20 11 20 12 20 13 20 14 20 15 20 16 20 17 20 18 20 19 20 20 20 21 F Avg Net Cash Income per Farm by Sector 18,500 276,700 233,700 502,400 165,000 2016 2017 2018 2019 2020 2021F Cattle Corn Dairy Hogs Soybeans 32.8% 30.9% 36.3%

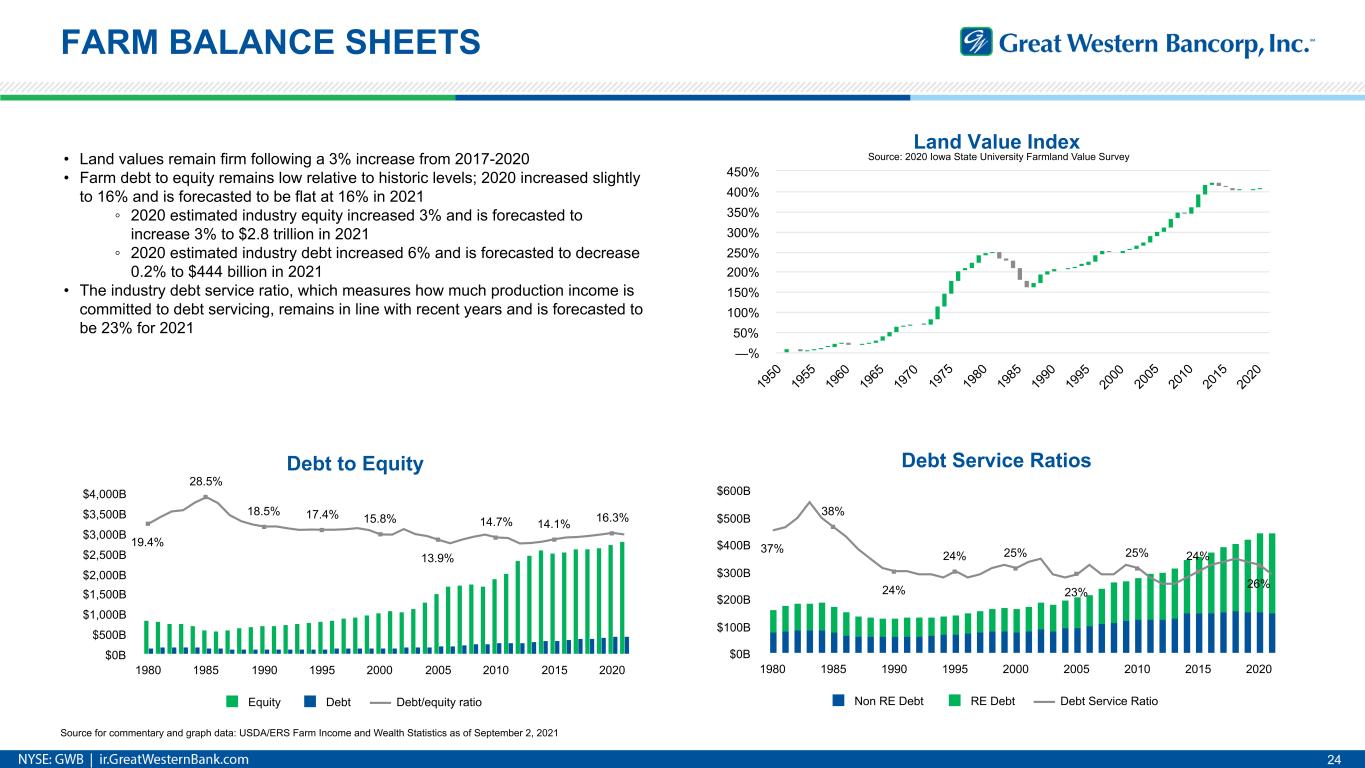

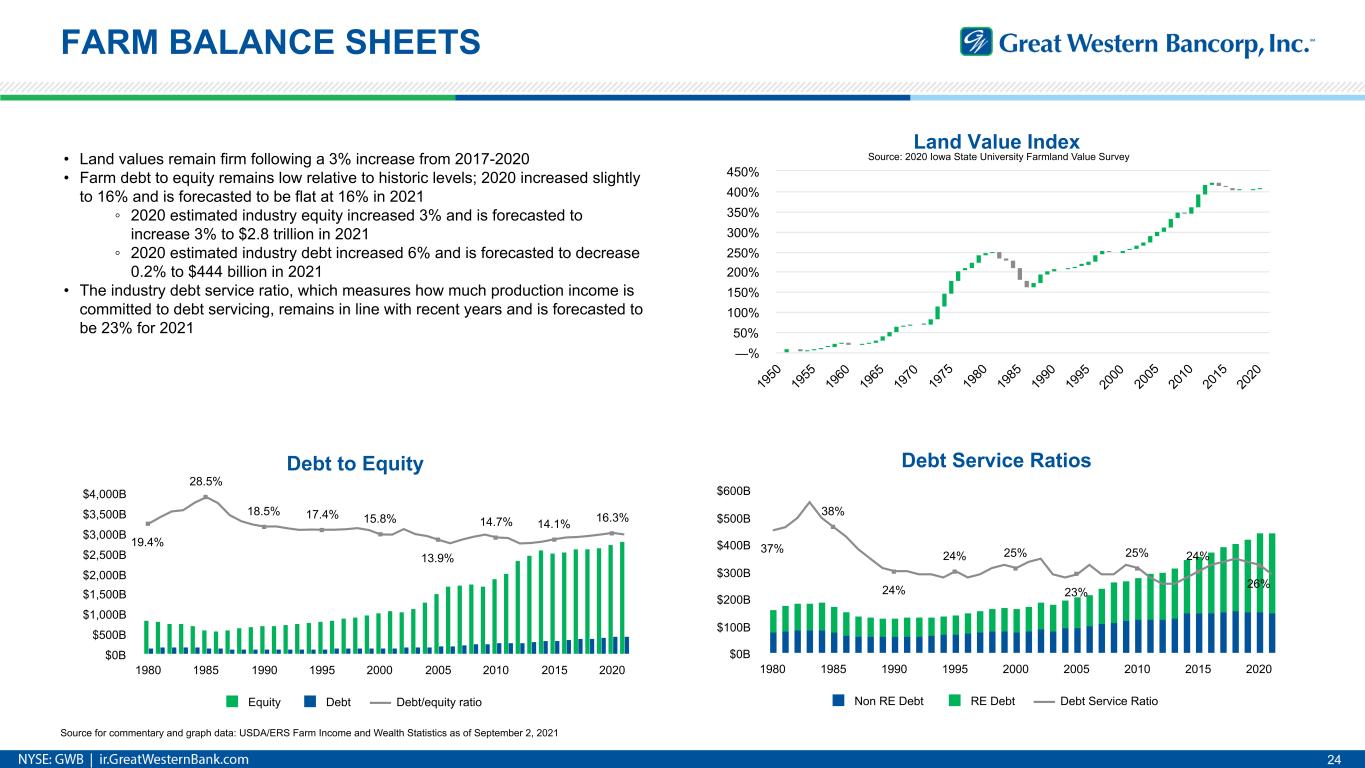

FARM BALANCE SHEETS 24 Debt to Equity 19.4% 28.5% 18.5% 17.4% 15.8% 13.9% 14.7% 14.1% 16.3% Equity Debt Debt/equity ratio 1980 1985 1990 1995 2000 2005 2010 2015 2020 $0B $500B $1,000B $1,500B $2,000B $2,500B $3,000B $3,500B $4,000B Debt Service Ratios 37% 38% 24% 24% 25% 23% 25% 24% 26% Non RE Debt RE Debt Debt Service Ratio 1980 1985 1990 1995 2000 2005 2010 2015 2020 $0B $100B $200B $300B $400B $500B $600B Land Value Index 19 50 19 55 19 60 19 65 19 70 19 75 19 80 19 85 19 90 19 95 20 00 20 05 20 10 20 15 20 20 —% 50% 100% 150% 200% 250% 300% 350% 400% 450% • Land values remain firm following a 3% increase from 2017-2020 • Farm debt to equity remains low relative to historic levels; 2020 increased slightly to 16% and is forecasted to be flat at 16% in 2021 ◦ 2020 estimated industry equity increased 3% and is forecasted to increase 3% to $2.8 trillion in 2021 ◦ 2020 estimated industry debt increased 6% and is forecasted to decrease 0.2% to $444 billion in 2021 • The industry debt service ratio, which measures how much production income is committed to debt servicing, remains in line with recent years and is forecasted to be 23% for 2021 Source for commentary and graph data: USDA/ERS Farm Income and Wealth Statistics as of September 2, 2021 Source: 2020 Iowa State University Farmland Value Survey

Appendix 2 Non-GAAP Measures

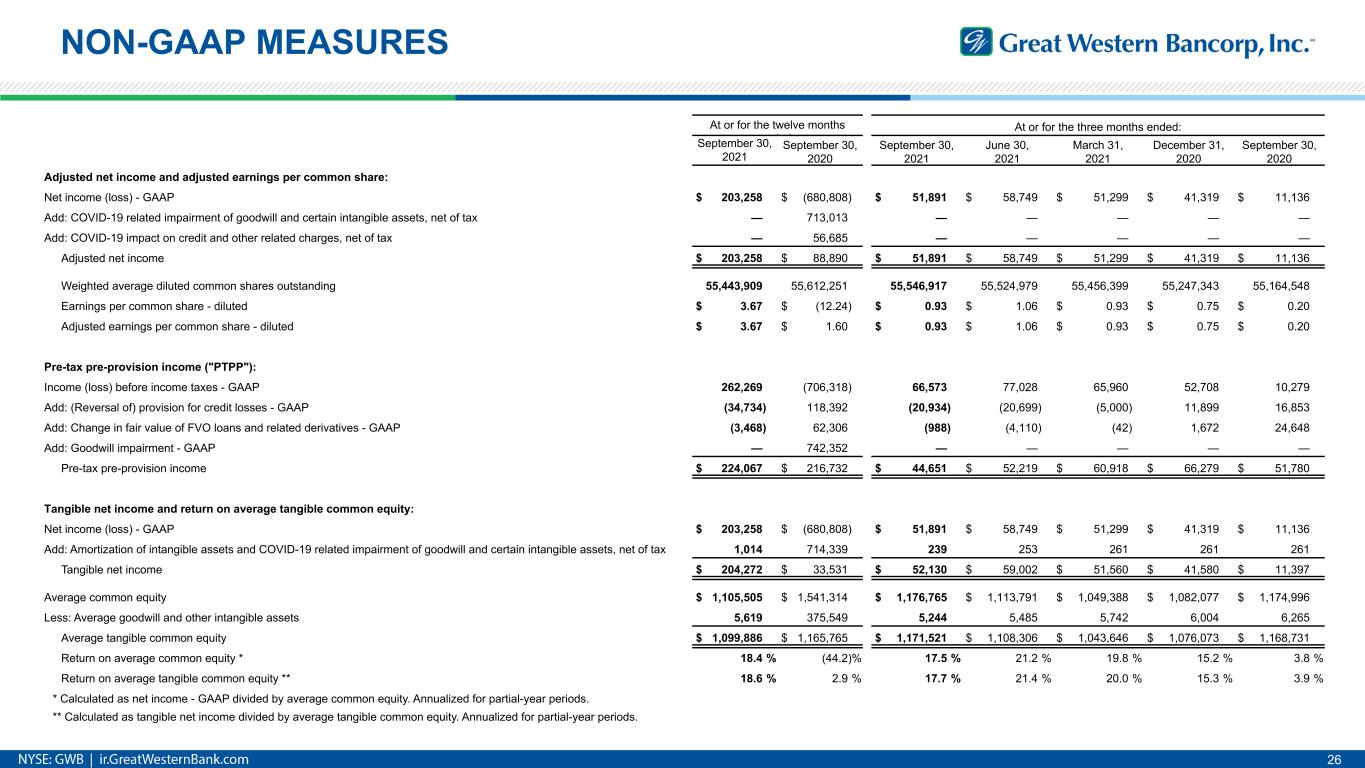

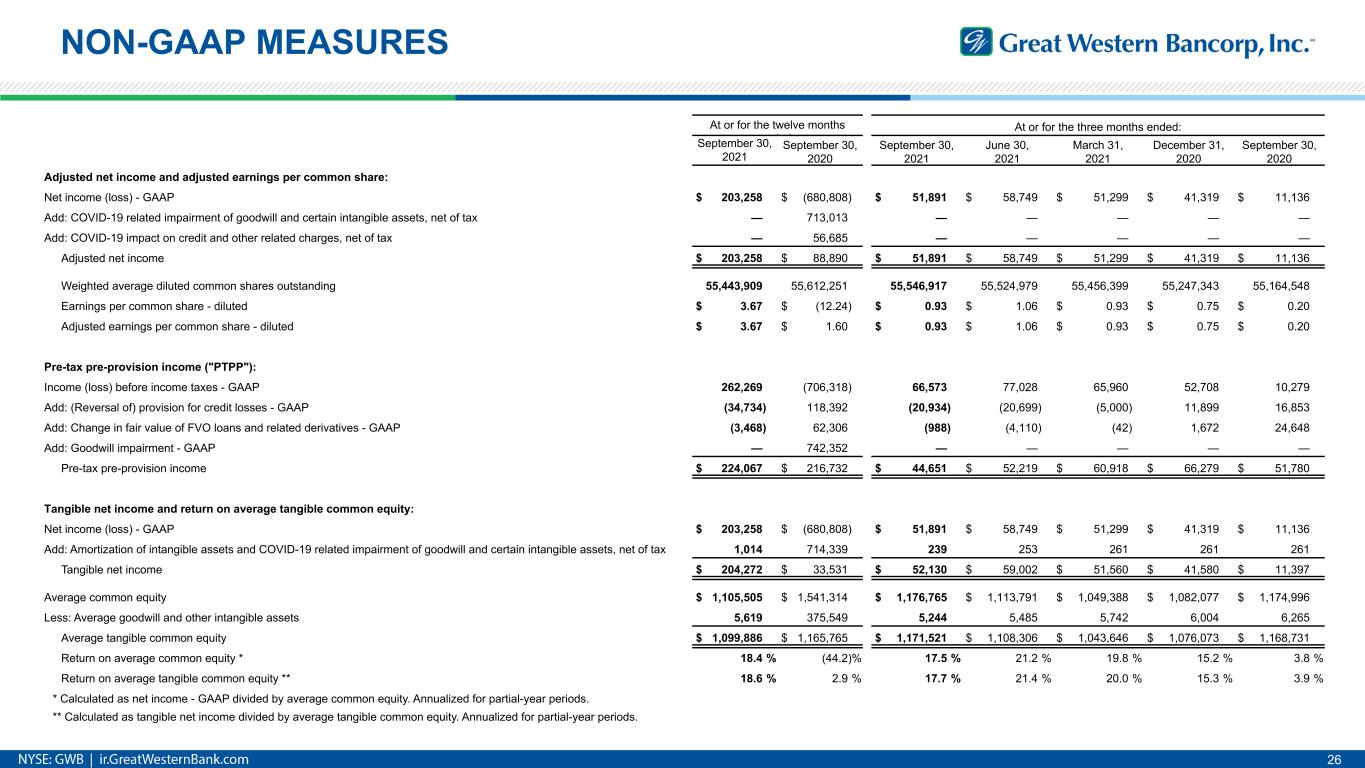

NON-GAAP MEASURES 26 At or for the twelve months ended: At or for the three months ended: September 30, 2021 September 30, 2020 September 30, 2021 June 30, 2021 March 31, 2021 December 31, 2020 September 30, 2020 Adjusted net income and adjusted earnings per common share: Net income (loss) - GAAP $ 203,258 $ (680,808) $ 51,891 $ 58,749 $ 51,299 $ 41,319 $ 11,136 Add: COVID-19 related impairment of goodwill and certain intangible assets, net of tax — 713,013 — — — — — Add: COVID-19 impact on credit and other related charges, net of tax — 56,685 — — — — — Adjusted net income $ 203,258 $ 88,890 $ 51,891 $ 58,749 $ 51,299 $ 41,319 $ 11,136 Weighted average diluted common shares outstanding 55,443,909 55,612,251 55,546,917 55,524,979 55,456,399 55,247,343 55,164,548 Earnings per common share - diluted $ 3.67 $ (12.24) $ 0.93 $ 1.06 $ 0.93 $ 0.75 $ 0.20 Adjusted earnings per common share - diluted $ 3.67 $ 1.60 $ 0.93 $ 1.06 $ 0.93 $ 0.75 $ 0.20 Pre-tax pre-provision income ("PTPP"): Income (loss) before income taxes - GAAP 262,269 (706,318) 66,573 77,028 65,960 52,708 10,279 Add: (Reversal of) provision for credit losses - GAAP (34,734) 118,392 (20,934) (20,699) (5,000) 11,899 16,853 Add: Change in fair value of FVO loans and related derivatives - GAAP (3,468) 62,306 (988) (4,110) (42) 1,672 24,648 Add: Goodwill impairment - GAAP — 742,352 — — — — — Pre-tax pre-provision income $ 224,067 $ 216,732 $ 44,651 $ 52,219 $ 60,918 $ 66,279 $ 51,780 Tangible net income and return on average tangible common equity: x x x x x Net income (loss) - GAAP $ 203,258 $ (680,808) $ 51,891 $ 58,749 $ 51,299 $ 41,319 $ 11,136 Add: Amortization of intangible assets and COVID-19 related impairment of goodwill and certain intangible assets, net of tax 1,014 714,339 239 253 261 261 261 Tangible net income $ 204,272 $ 33,531 $ 52,130 $ 59,002 $ 51,560 $ 41,580 $ 11,397 Average common equity $ 1,105,505 $ 1,541,314 $ 1,176,765 $ 1,113,791 $ 1,049,388 $ 1,082,077 $ 1,174,996 Less: Average goodwill and other intangible assets 5,619 375,549 5,244 5,485 5,742 6,004 6,265 Average tangible common equity $ 1,099,886 $ 1,165,765 $ 1,171,521 $ 1,108,306 $ 1,043,646 $ 1,076,073 $ 1,168,731 Return on average common equity * 18.4 % (44.2) % 17.5 % 21.2 % 19.8 % 15.2 % 3.8 % Return on average tangible common equity ** 18.6 % 2.9 % 17.7 % 21.4 % 20.0 % 15.3 % 3.9 % * Calculated as net income - GAAP divided by average common equity. Annualized for partial-year periods. ** Calculated as tangible net income divided by average tangible common equity. Annualized for partial-year periods.

NON-GAAP MEASURES 27 At or for the twelve months ended: At or for the three months ended: September 30, 2021 September 30, 2020 September 30, 2021 June 30, 2021 March 31, 2021 December 31, 2020 September 30, 2020 Adjusted net interest income and adjusted net interest margin (fully-tax equivalent basis), on non-ASC 310-30 loans: Net interest income - GAAP $ 401,727 $ 419,425 $ 93,486 $ 97,463 $ 102,870 $ 107,908 $ 106,018 Add: Tax equivalent adjustment 6,344 6,146 1,574 1,595 1,577 1,598 1,508 Net interest income (FTE) 408,071 425,571 95,060 99,058 104,447 109,506 107,526 Add: Derivative interest expense (12,727) (8,721) (3,035) (3,117) (3,182) (3,393) (3,541) Adjusted net interest income (FTE) $ 395,344 $ 416,850 $ 92,025 $ 95,941 $ 101,265 $ 106,113 $ 103,985 Average interest-earning assets $ 12,129,324 $ 11,868,666 $ 12,179,199 $ 12,299,046 $ 12,073,497 $ 11,965,555 $ 12,184,093 Net interest margin (FTE) * 3.36 % 3.59 % 3.10 % 3.23 % 3.51 % 3.63 % 3.51 % Adjusted net interest margin (FTE) ** 3.26 % 3.51 % 3.00 % 3.13 % 3.40 % 3.52 % 3.40 % * Calculated as net interest income (FTE) divided by average interest earning assets. Annualized for partial-year periods. ** Calculated as adjusted net interest income (FTE) divided by average interest earning assets. Annualized for partial-year periods. Adjusted interest income and adjusted yield (fully-tax equivalent basis), on non-ASC 310-30 loans: x x x x x Interest income - GAAP $ 388,977 $ 443,709 $ 88,052 $ 93,328 $ 100,274 $ 107,323 $ 106,305 Add: Tax equivalent adjustment 6,344 6,146 1,574 1,595 1,577 1,598 1,508 Interest income (FTE) 395,321 449,855 89,626 94,923 101,851 108,921 107,813 Add: Derivative interest expense (12,727) (8,721) (3,035) (3,117) (3,182) (3,393) (3,541) Adjusted interest income (FTE) $ 382,594 $ 441,134 $ 86,591 $ 91,806 $ 98,669 $ 105,528 $ 104,272 Average non-ASC310-30 loans $ 8,784,577 $ 9,750,677 $ 8,053,490 $ 8,500,919 $ 9,016,221 $ 9,567,679 $ 9,977,591 Yield (FTE) * 4.50 % 4.61 % 4.42 % 4.48 % 4.58 % 4.52 % 4.30 % Adjusted yield (FTE) ** 4.36 % 4.52 % 4.27 % 4.33 % 4.44 % 4.38 % 4.16 % * Calculated as interest income (FTE) divided by average loans. Annualized for partial-year periods. ** Calculated as adjusted interest income (FTE) divided by average loans. Annualized for partial-year periods.

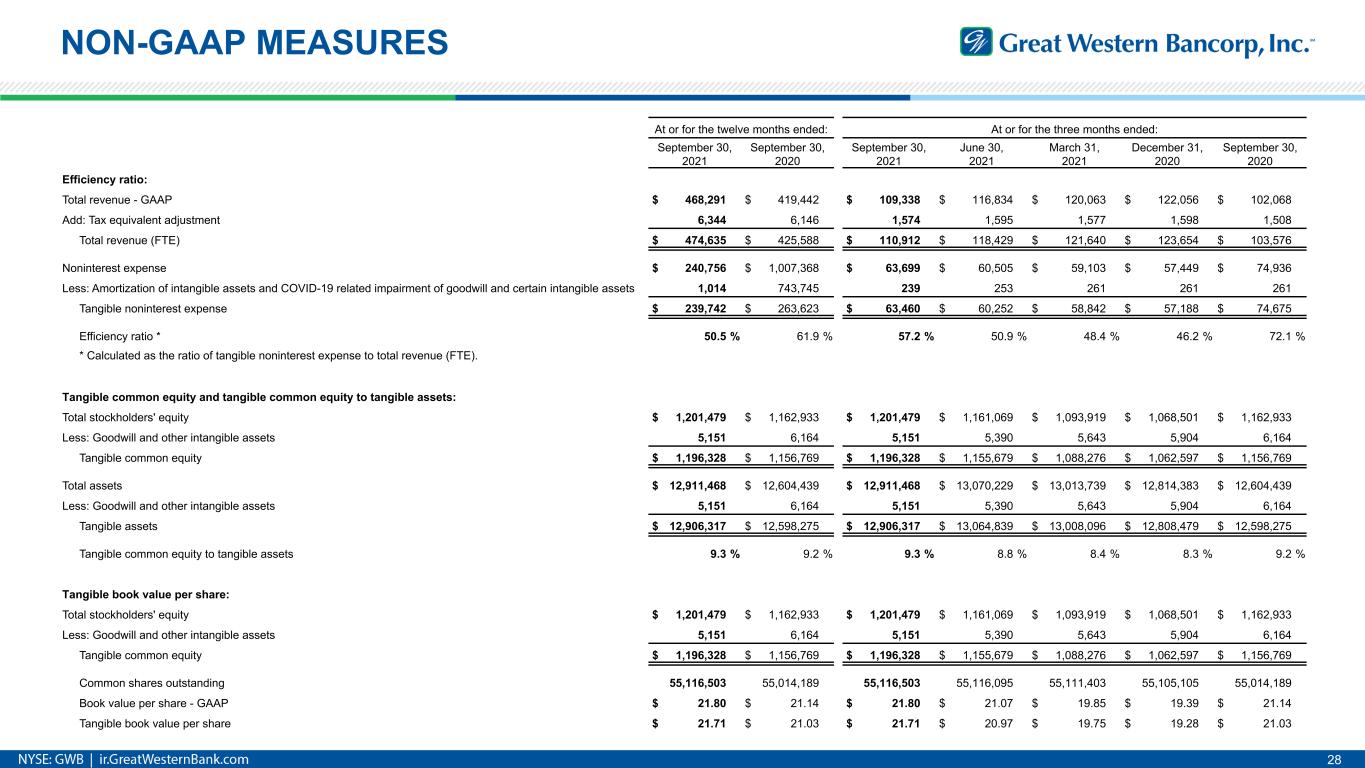

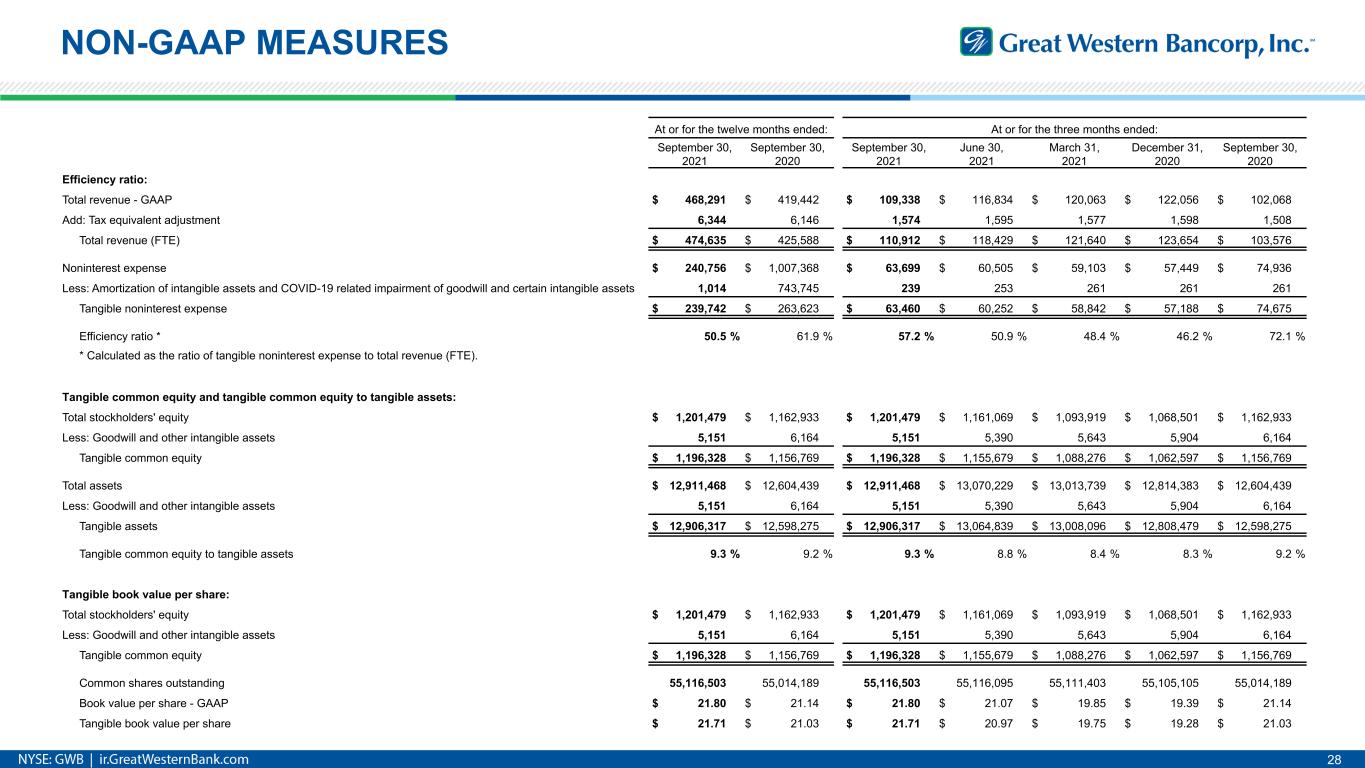

NON-GAAP MEASURES 28 At or for the twelve months ended: At or for the three months ended: September 30, 2021 September 30, 2020 September 30, 2021 June 30, 2021 March 31, 2021 December 31, 2020 September 30, 2020 Efficiency ratio: Total revenue - GAAP $ 468,291 $ 419,442 $ 109,338 $ 116,834 $ 120,063 $ 122,056 $ 102,068 Add: Tax equivalent adjustment 6,344 6,146 1,574 1,595 1,577 1,598 1,508 Total revenue (FTE) $ 474,635 $ 425,588 $ 110,912 $ 118,429 $ 121,640 $ 123,654 $ 103,576 Noninterest expense $ 240,756 $ 1,007,368 $ 63,699 $ 60,505 $ 59,103 $ 57,449 $ 74,936 Less: Amortization of intangible assets and COVID-19 related impairment of goodwill and certain intangible assets 1,014 743,745 239 253 261 261 261 Tangible noninterest expense $ 239,742 $ 263,623 $ 63,460 $ 60,252 $ 58,842 $ 57,188 $ 74,675 Efficiency ratio * 50.5 % 61.9 % 57.2 % 50.9 % 48.4 % 46.2 % 72.1 % * Calculated as the ratio of tangible noninterest expense to total revenue (FTE). Tangible common equity and tangible common equity to tangible assets: x x x x x Total stockholders' equity $ 1,201,479 $ 1,162,933 $ 1,201,479 $ 1,161,069 $ 1,093,919 $ 1,068,501 $ 1,162,933 Less: Goodwill and other intangible assets 5,151 6,164 5,151 5,390 5,643 5,904 6,164 Tangible common equity $ 1,196,328 $ 1,156,769 $ 1,196,328 $ 1,155,679 $ 1,088,276 $ 1,062,597 $ 1,156,769 Total assets $ 12,911,468 $ 12,604,439 $ 12,911,468 $ 13,070,229 $ 13,013,739 $ 12,814,383 $ 12,604,439 Less: Goodwill and other intangible assets 5,151 6,164 5,151 5,390 5,643 5,904 6,164 Tangible assets $ 12,906,317 $ 12,598,275 $ 12,906,317 $ 13,064,839 $ 13,008,096 $ 12,808,479 $ 12,598,275 Tangible common equity to tangible assets 9.3 % 9.2 % 9.3 % 8.8 % 8.4 % 8.3 % 9.2 % Tangible book value per share: x x x x x Total stockholders' equity $ 1,201,479 $ 1,162,933 $ 1,201,479 $ 1,161,069 $ 1,093,919 $ 1,068,501 $ 1,162,933 Less: Goodwill and other intangible assets 5,151 6,164 5,151 5,390 5,643 5,904 6,164 Tangible common equity $ 1,196,328 $ 1,156,769 $ 1,196,328 $ 1,155,679 $ 1,088,276 $ 1,062,597 $ 1,156,769 Common shares outstanding 55,116,503 55,014,189 55,116,503 55,116,095 55,111,403 55,105,105 55,014,189 Book value per share - GAAP $ 21.80 $ 21.14 $ 21.80 $ 21.07 $ 19.85 $ 19.39 $ 21.14 Tangible book value per share $ 21.71 $ 21.03 $ 21.71 $ 20.97 $ 19.75 $ 19.28 $ 21.03