- Company Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Cadence Bancorporation 8-KRegulation FD Disclosure

Filed: 27 Jul 18, 12:00am

ANALYST PRESENTATION February 7, 2017 Paul B. Murphy, Jr. Chairman and CEO July 2018 Investor Presentation Exhibit 99.1

Disclaimers This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements reflect our current views with respect to, among other things, future events and our results of operations, financial condition and financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “projection,” “would” and “outlook,” or the negative version of those words or other comparable words of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Accordingly, we caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although we believe that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. Such factors include, without limitation, the “Risk Factors” referenced in our Registration Statement on Form S-3 filed with the Securities and Exchange Commission (SEC), other risks and uncertainties listed from time to time in our reports and documents filed with the SEC, including our Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q, and the following factors: business and economic conditions generally and in the financial services industry, nationally and within our current and future geographic market areas; economic, market, operational, liquidity, credit and interest rate risks associated with our business; lack of seasoning in our loan portfolio; deteriorating asset quality and higher loan charge-offs; the laws and regulations applicable to our business; our ability to achieve organic loan and deposit growth and the composition of such growth; increased competition in the financial services industry, nationally, regionally or locally; our ability to maintain our historical earnings trends; our ability to raise additional capital to implement our business plan; material weaknesses in our internal control over financial reporting; systems failures or interruptions involving our information technology and telecommunications systems or third-party servicers; the composition of our management team and our ability to attract and retain key personnel; the fiscal position of the U.S. federal government and the soundness of other financial institutions; the composition of our loan portfolio, including the identify of our borrowers and the concentration of loans in energy-related industries and in our specialized industries; the portion of our loan portfolio that is comprised of participations and shared national credits; and the amount of nonperforming and classified assets we hold. Cadence can give no assurance that any goal or plan or expectation set forth in forward-looking statements can be achieved and readers are cautioned not to place undue reliance on such statements. The forward-looking statements are made as of the date of this communication, and Cadence does not intend, and assumes no obligation, to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events or circumstances, except as required by applicable law. Certain of the financial measures and ratios we present are supplemental measures that are not required by, or are not presented in accordance with, U.S. generally accepted accounting principles (GAAP). We refer to these financial measures and ratios as “non-GAAP financial measures.” We consider the use of select non-GAAP financial measures and ratios to be useful for financial and operational decision making and useful in evaluating period-to-period comparisons. These non-GAAP financial measures should not be considered a substitute for financial information presented in accordance with GAAP and you should not rely on non-GAAP financial measures alone as measures of our performance. More information regarding non-GAAP financial measures, including a reconciliation of non-GAAP financial measures to the comparable GAAP financial measures, is included in our earnings release and in the appendix to this presentation.

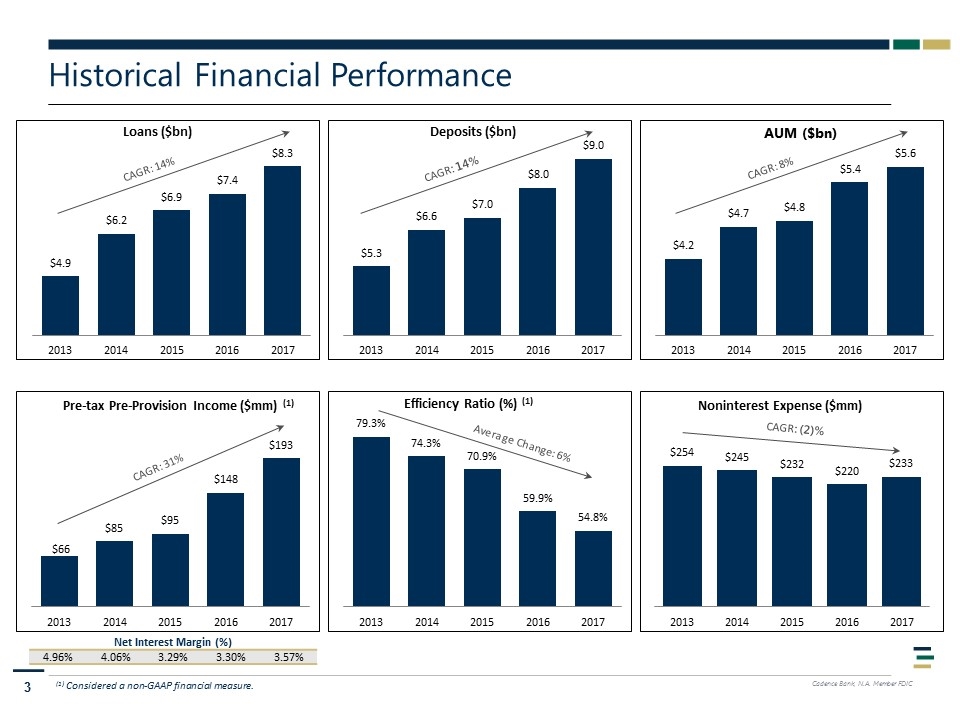

Historical Financial Performance 44% 62% 74% 17% 26% 74% 80% 84% 20% 16% 92% 8% 96% 4% (1) Considered a non-GAAP financial measure. Net Interest Margin (%) 4.96% 4.06% 3.29% 3.30% 3.57% CAGR: 14% CAGR: 14% CAGR: 31% Average Change: 6% CAGR: (2)% CAGR: 8%

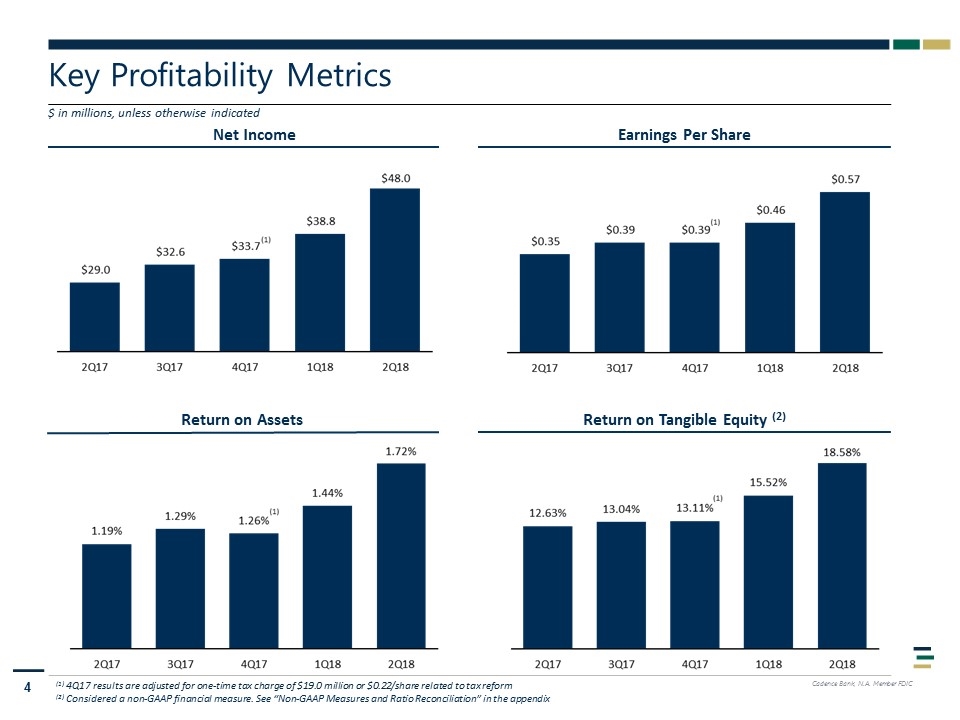

Net Income Key Profitability Metrics Earnings Per Share Return on Tangible Equity (2) $ in millions, unless otherwise indicated Return on Assets (1) 4Q17 results are adjusted for one-time tax charge of $19.0 million or $0.22/share related to tax reform (2) Considered a non-GAAP financial measure. See “Non-GAAP Measures and Ratio Reconciliation” in the appendix

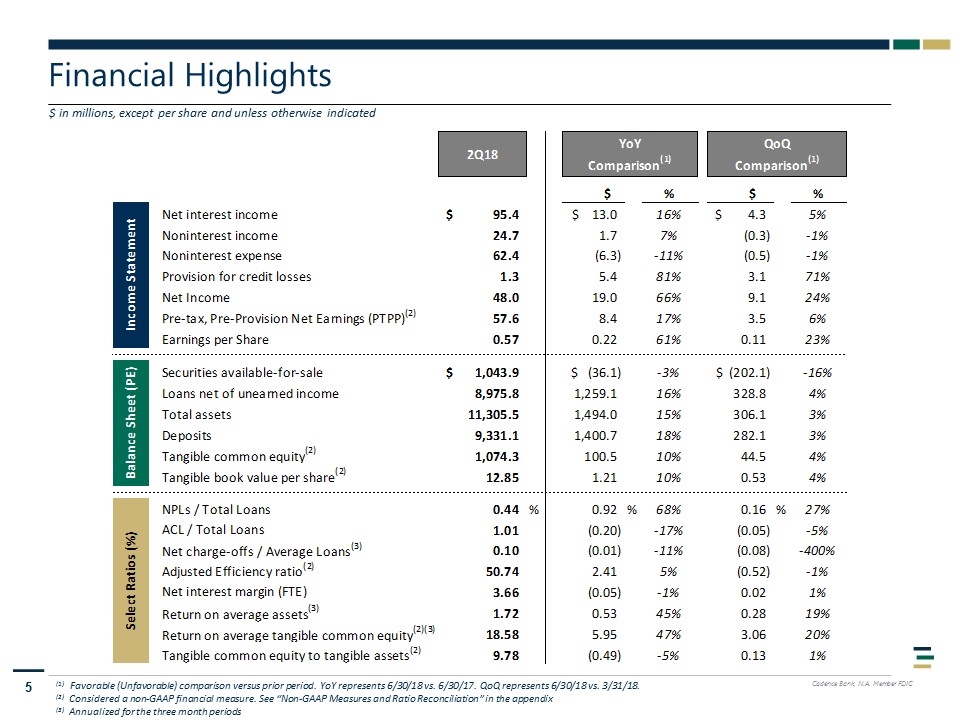

Financial Highlights $ in millions, except per share and unless otherwise indicated (1) Favorable (Unfavorable) comparison versus prior period. YoY represents 6/30/18 vs. 6/30/17. QoQ represents 6/30/18 vs. 3/31/18. (2) Considered a non-GAAP financial measure. See “Non-GAAP Measures and Ratio Reconciliation” in the appendix (3) Annualized for the three month periods

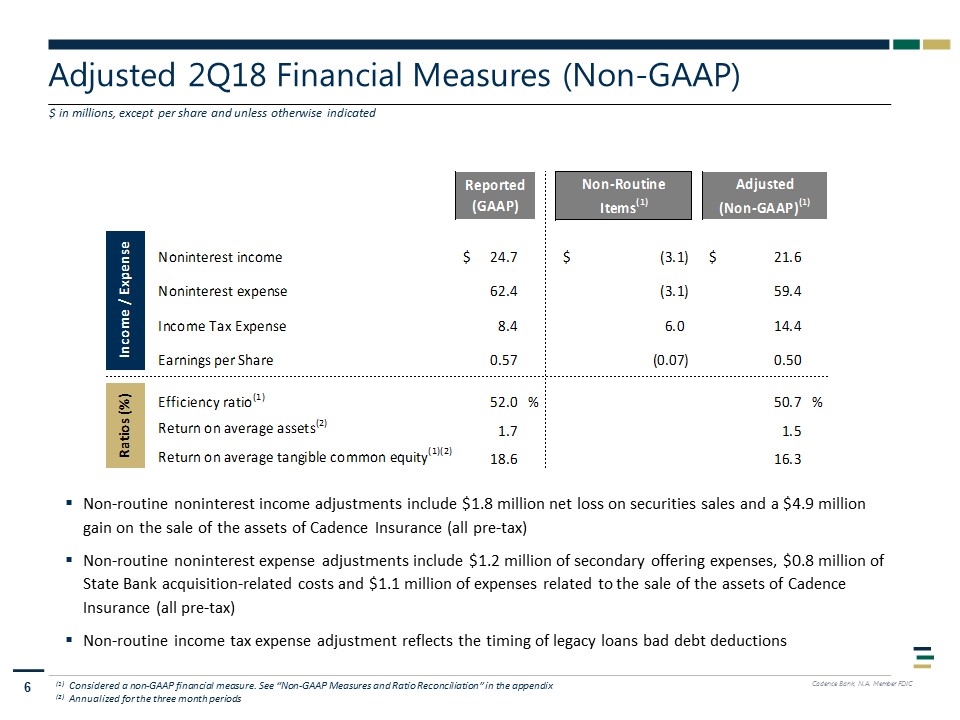

Adjusted 2Q18 Financial Measures (Non-GAAP) Non-routine noninterest income adjustments include $1.8 million net loss on securities sales and a $4.9 million gain on the sale of the assets of Cadence Insurance (all pre-tax) Non-routine noninterest expense adjustments include $1.2 million of secondary offering expenses, $0.8 million of State Bank acquisition-related costs and $1.1 million of expenses related to the sale of the assets of Cadence Insurance (all pre-tax) Non-routine income tax expense adjustment reflects the timing of legacy loans bad debt deductions (1) Considered a non-GAAP financial measure. See “Non-GAAP Measures and Ratio Reconciliation” in the appendix (2) Annualized for the three month periods $ in millions, except per share and unless otherwise indicated

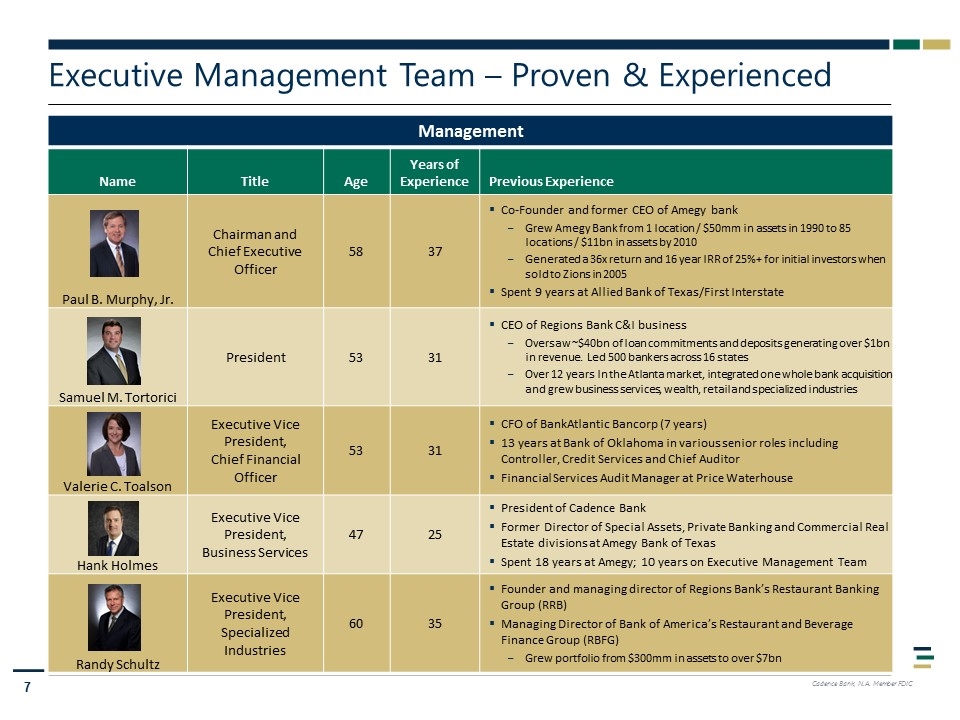

Management Name Title Age Years of Experience Previous Experience Paul B. Murphy, Jr. Chairman and Chief Executive Officer 58 37 Co-Founder and former CEO of Amegy bank Grew Amegy Bank from 1 location / $50mm in assets in 1990 to 85 locations / $11bn in assets by 2010 Generated a 36x return and 16 year IRR of 25%+ for initial investors when sold to Zions in 2005 Spent 9 years at Allied Bank of Texas/First Interstate Samuel M. Tortorici President 53 31 CEO of Regions Bank C&I business Oversaw ~$40bn of loan commitments and deposits generating over $1bn in revenue. Led 500 bankers across 16 states Over 12 years In the Atlanta market, integrated one whole bank acquisition and grew business services, wealth, retail and specialized industries Valerie C. Toalson Executive Vice President, Chief Financial Officer 53 31 CFO of BankAtlantic Bancorp (7 years) 13 years at Bank of Oklahoma in various senior roles including Controller, Credit Services and Chief Auditor Financial Services Audit Manager at Price Waterhouse Hank Holmes Executive Vice President, Business Services 47 25 President of Cadence Bank Former Director of Special Assets, Private Banking and Commercial Real Estate divisions at Amegy Bank of Texas Spent 18 years at Amegy; 10 years on Executive Management Team Randy Schultz Executive Vice President, Specialized Industries 60 35 Founder and managing director of Regions Bank’s Restaurant Banking Group (RRB) Managing Director of Bank of America’s Restaurant and Beverage Finance Group (RBFG) Grew portfolio from $300mm in assets to over $7bn Executive Management Team – Proven & Experienced

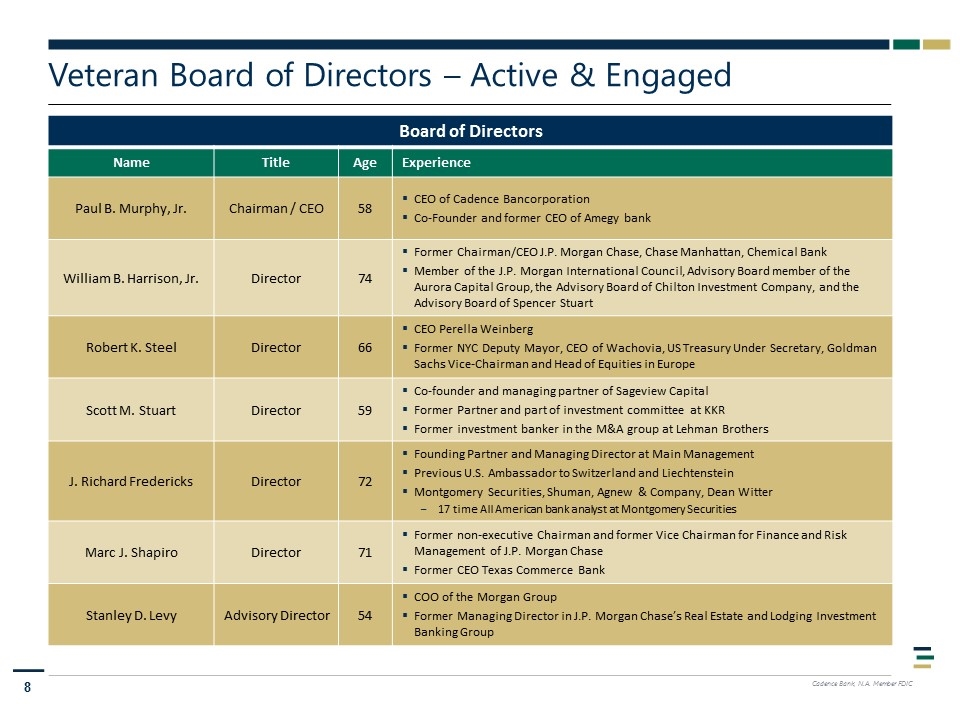

Veteran Board of Directors – Active & Engaged Board of Directors Name Title Age Experience Paul B. Murphy, Jr. Chairman / CEO 58 CEO of Cadence Bancorporation Co-Founder and former CEO of Amegy bank William B. Harrison, Jr. Director 74 Former Chairman/CEO J.P. Morgan Chase, Chase Manhattan, Chemical Bank Member of the J.P. Morgan International Council, Advisory Board member of the Aurora Capital Group, the Advisory Board of Chilton Investment Company, and the Advisory Board of Spencer Stuart Robert K. Steel Director 66 CEO Perella Weinberg Former NYC Deputy Mayor, CEO of Wachovia, US Treasury Under Secretary, Goldman Sachs Vice-Chairman and Head of Equities in Europe Scott M. Stuart Director 59 Co-founder and managing partner of Sageview Capital Former Partner and part of investment committee at KKR Former investment banker in the M&A group at Lehman Brothers J. Richard Fredericks Director 72 Founding Partner and Managing Director at Main Management Previous U.S. Ambassador to Switzerland and Liechtenstein Montgomery Securities, Shuman, Agnew & Company, Dean Witter 17 time All American bank analyst at Montgomery Securities Marc J. Shapiro Director 71 Former non-executive Chairman and former Vice Chairman for Finance and Risk Management of J.P. Morgan Chase Former CEO Texas Commerce Bank Stanley D. Levy Advisory Director 54 COO of the Morgan Group Former Managing Director in J.P. Morgan Chase’s Real Estate and Lodging Investment Banking Group

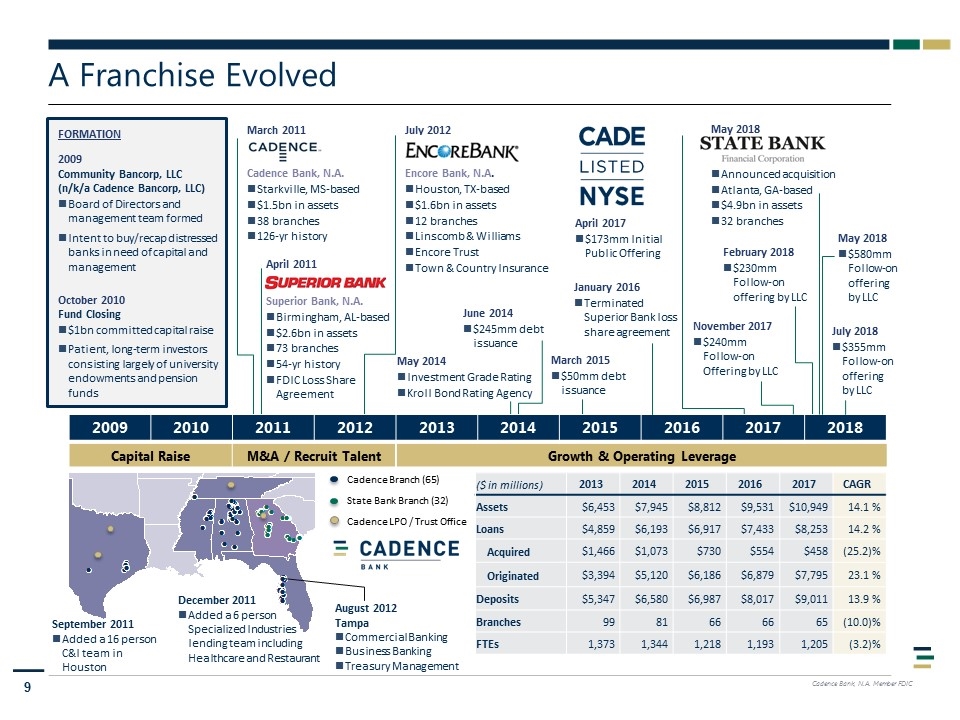

A Franchise Evolved March 2011 Cadence Bank, N.A. Starkville, MS-based $1.5bn in assets 38 branches 126-yr history July 2012 Encore Bank, N.A. Houston, TX-based $1.6bn in assets 12 branches Linscomb & Williams Encore Trust Town & Country Insurance May 2014 Investment Grade Rating Kroll Bond Rating Agency June 2014 $245mm debt issuance March 2015 $50mm debt issuance April 2011 Superior Bank, N.A. Birmingham, AL-based $2.6bn in assets 73 branches 54-yr history FDIC Loss Share Agreement January 2016 Terminated Superior Bank loss share agreement ($ in millions) 2013 2014 2015 2016 2017 CAGR Assets $6,453 $7,945 $8,812 $9,531 $10,949 14.1 % Loans $4,859 $6,193 $6,917 $7,433 $8,253 14.2 % Acquired $1,466 $1,073 $730 $554 $458 (25.2)% Originated $3,394 $5,120 $6,186 $6,879 $7,795 23.1 % Deposits $5,347 $6,580 $6,987 $8,017 $9,011 13.9 % Branches 99 81 66 66 65 (10.0)% FTEs 1,373 1,344 1,218 1,193 1,205 (3.2)% September 2011 Added a 16 person C&I team in Houston December 2011 Added a 6 person Specialized Industries lending team including Healthcare and Restaurant August 2012 Tampa Commercial Banking Business Banking Treasury Management April 2017 $173mm Initial Public Offering Capital Raise M&A / Recruit Talent Growth & Operating Leverage FORMATION 2009 Community Bancorp, LLC (n/k/a Cadence Bancorp, LLC) Board of Directors and management team formed Intent to buy/recap distressed banks in need of capital and management October 2010 Fund Closing $1bn committed capital raise Patient, long-term investors consisting largely of university endowments and pension funds February 2018 $230mm Follow-on offering by LLC November 2017 $240mm Follow-on Offering by LLC 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 Cadence Branch (65) State Bank Branch (32) Cadence LPO / Trust Office May 2018 Announced acquisition Atlanta, GA-based $4.9bn in assets 32 branches July 2018 $355mm Follow-on offering by LLC May 2018 $580mm Follow-on offering by LLC

Straightforward Business Model Markets People Mission, Values and Vision Our Vision … To be one of the top performing banks in the nation. Our Core Values … Do Right: Do right by others. Your customers, your colleagues and yourself. Own It: Own your actions. Be as accountable for what works as what doesn't. Doers are those who try new approaches. And every step forward eventually becomes the path for others to follow. Embrace We: Nothing is more powerful than what comes from bringing together a diverse group of passionate professionals committed to their colleagues, customers and community. Fresh Thinking Welcome Here: Achieving our vision depends on each of us challenging convention to find new and better ways to do the things that will separate us from our competition and best serve our clients. We must be willing to lead in order to create meaningful solutions for our clients. The Cadence Difference To deliver a better banking experience for every client. Our Mission … We will design for them. Respond to them. And learn from them. We will ignite our talented team to relentlessly pursue the most innovative products and best services and practices in all we do. We will utilize technology to deliver timely and superior solutions for our customers. We will be a bank our customers will be proud of. We will be the bank to get it right. It Matters Who You Choose to be Your Banker

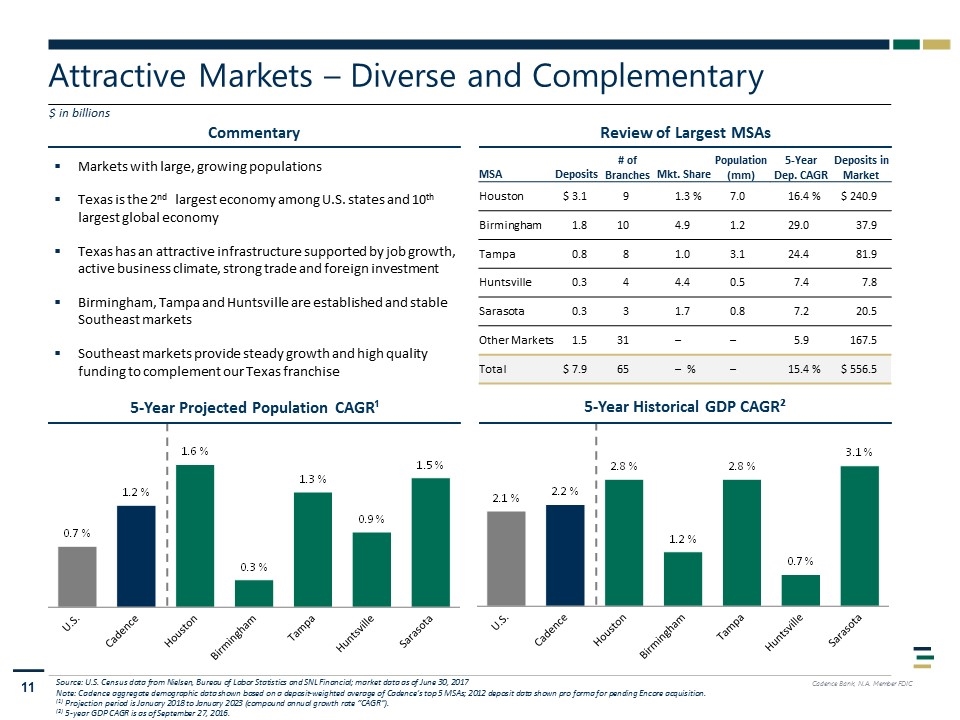

Commentary $ in billions Markets with large, growing populations Texas is the 2nd largest economy among U.S. states and 10th largest global economy Texas has an attractive infrastructure supported by job growth, active business climate, strong trade and foreign investment Birmingham, Tampa and Huntsville are established and stable Southeast markets Southeast markets provide steady growth and high quality funding to complement our Texas franchise Source: U.S. Census data from Nielsen, Bureau of Labor Statistics and SNL Financial; market data as of June 30, 2017 Note: Cadence aggregate demographic data shown based on a deposit-weighted average of Cadence’s top 5 MSAs; 2012 deposit data shown pro forma for pending Encore acquisition. (1) Projection period is January 2018 to January 2023 (compound annual growth rate “CAGR”). (2) 5-year GDP CAGR is as of September 27, 2016. 5-Year Historical GDP CAGR² Attractive Markets – Diverse and Complementary Review of Largest MSAs MSA Deposits # of Branches Mkt. Share Population (mm) 5-Year Dep. CAGR Deposits in Market Houston $ 3.1 9 1.3 % 7.0 16.4 % $ 240.9 Birmingham 1.8 10 4.9 1.2 29.0 37.9 Tampa 0.8 8 1.0 3.1 24.4 81.9 Huntsville 0.3 4 4.4 0.5 7.4 7.8 Sarasota 0.3 3 1.7 0.8 7.2 20.5 Other Markets 1.5 31 –. –. 5.9 167.5 Total $ 7.9 65 –. % –. 15.4 % $ 556.5 5-Year Projected Population CAGR¹

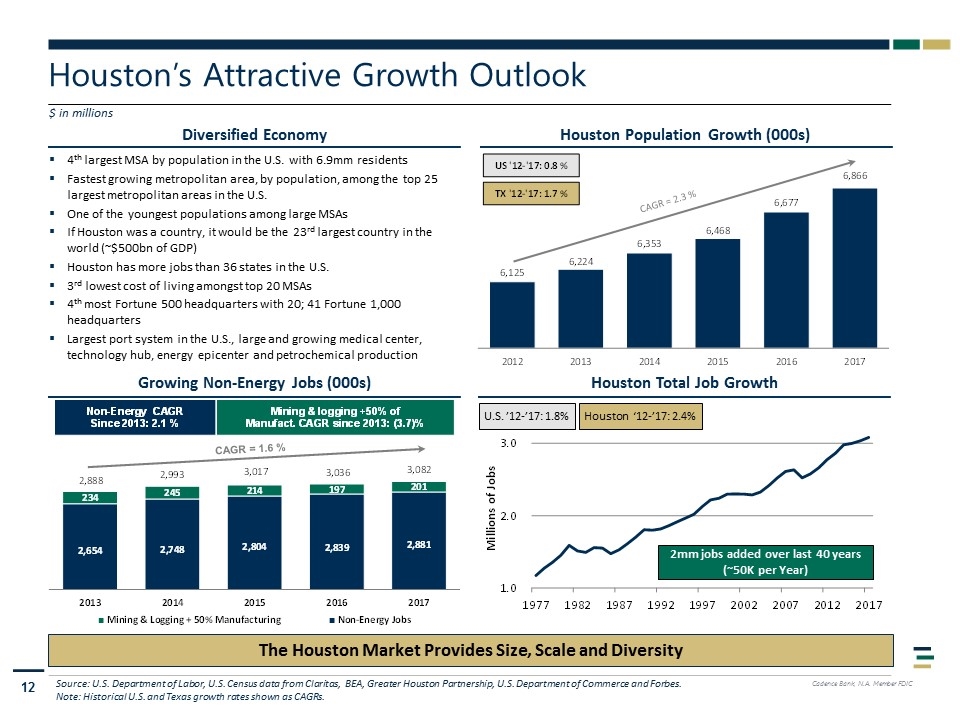

Houston’s Attractive Growth Outlook Source: U.S. Department of Labor, U.S. Census data from Claritas, BEA, Greater Houston Partnership, U.S. Department of Commerce and Forbes. Note: Historical U.S. and Texas growth rates shown as CAGRs. $ in millions 4th largest MSA by population in the U.S. with 6.9mm residents Fastest growing metropolitan area, by population, among the top 25 largest metropolitan areas in the U.S. One of the youngest populations among large MSAs If Houston was a country, it would be the 23rd largest country in the world (~$500bn of GDP) Houston has more jobs than 36 states in the U.S. 3rd lowest cost of living amongst top 20 MSAs 4th most Fortune 500 headquarters with 20; 41 Fortune 1,000 headquarters Largest port system in the U.S., large and growing medical center, technology hub, energy epicenter and petrochemical production The Houston Market Provides Size, Scale and Diversity U.S. ’12-’17: 1.8% Houston ‘12-’17: 2.4% 2mm jobs added over last 40 years (~50K per Year) Diversified Economy Houston Population Growth (000s) Growing Non-Energy Jobs (000s) Houston Total Job Growth

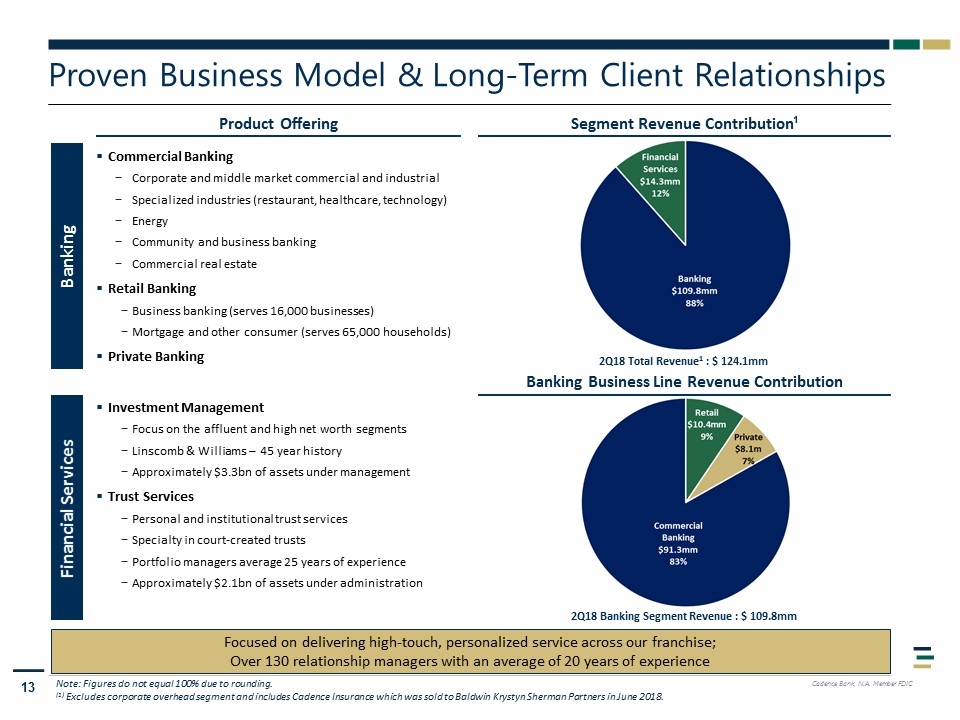

Proven Business Model & Long-Term Client Relationships Banking Financial Services Note: Figures do not equal 100% due to rounding. (1) Excludes corporate overhead segment and includes Cadence Insurance which was sold to Baldwin Krystyn Sherman Partners in June 2018. Segment Revenue Contribution¹ Banking Business Line Revenue Contribution Product Offering Commercial Banking Corporate and middle market commercial and industrial Specialized industries (restaurant, healthcare, technology) Energy Community and business banking Commercial real estate Retail Banking Business banking (serves 16,000 businesses) Mortgage and other consumer (serves 65,000 households) Private Banking Investment Management Focus on the affluent and high net worth segments Linscomb & Williams – 45 year history Approximately $3.3bn of assets under management Trust Services Personal and institutional trust services Specialty in court-created trusts Portfolio managers average 25 years of experience Approximately $2.1bn of assets under administration Focused on delivering high-touch, personalized service across our franchise; Over 130 relationship managers with an average of 20 years of experience 2Q18 Banking Segment Revenue : $ 109.8mm 2Q18 Total Revenue1 : $ 124.1mm

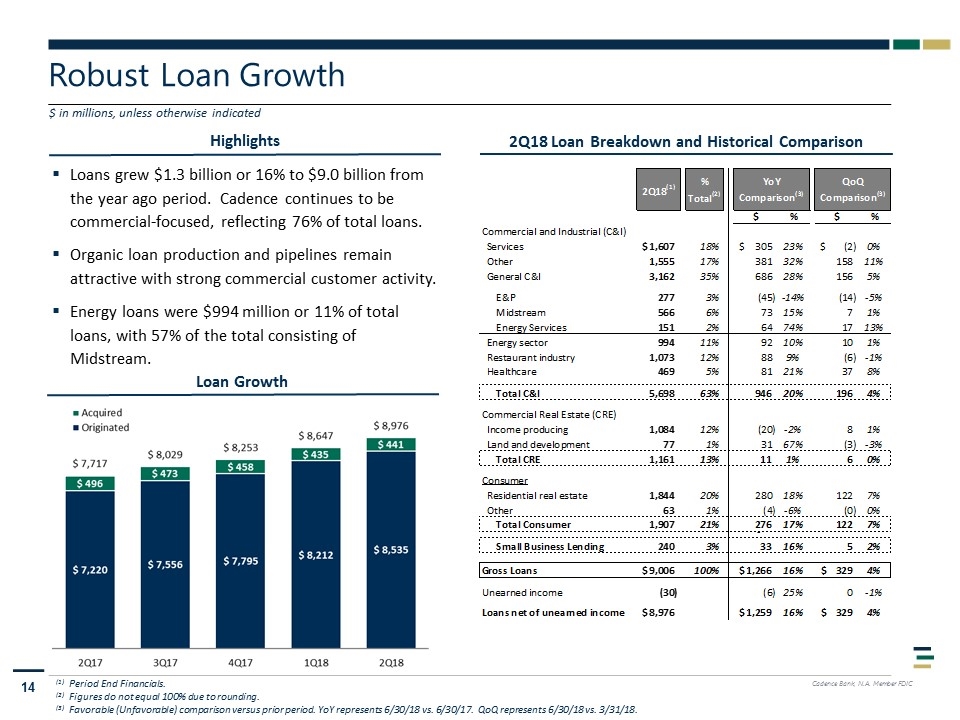

Highlights Robust Loan Growth $ in millions, unless otherwise indicated Loan Growth Loans grew $1.3 billion or 16% to $9.0 billion from the year ago period. Cadence continues to be commercial-focused, reflecting 76% of total loans. Organic loan production and pipelines remain attractive with strong commercial customer activity. Energy loans were $994 million or 11% of total loans, with 57% of the total consisting of Midstream. (1) Period End Financials. (2) Figures do not equal 100% due to rounding. (3) Favorable (Unfavorable) comparison versus prior period. YoY represents 6/30/18 vs. 6/30/17. QoQ represents 6/30/18 vs. 3/31/18. 2Q18 Loan Breakdown and Historical Comparison

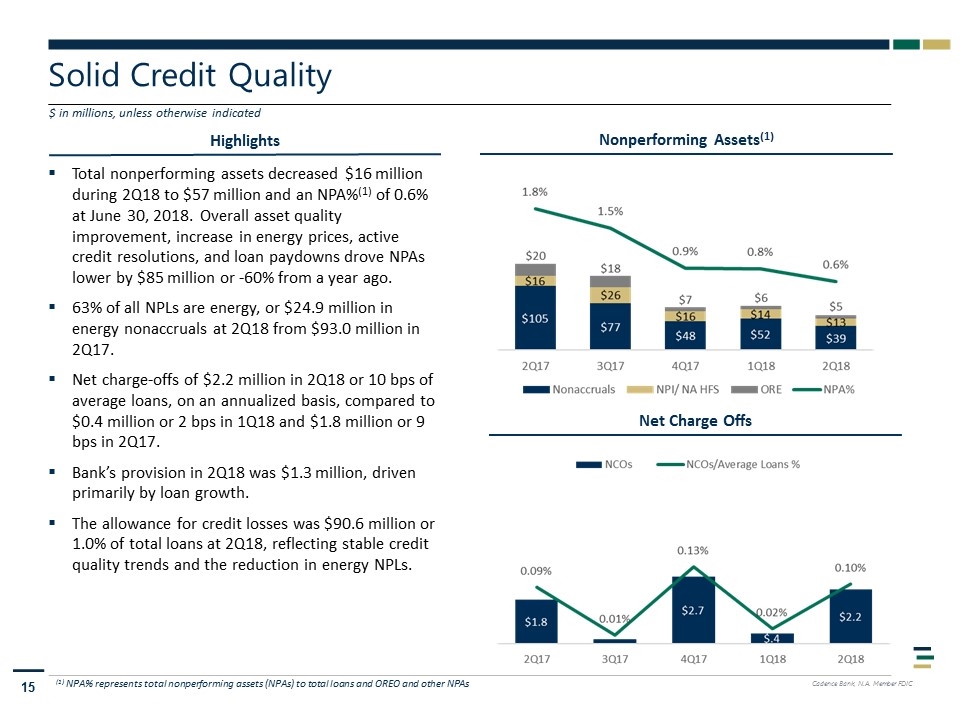

Solid Credit Quality $ in millions, unless otherwise indicated Nonperforming Assets(1) Highlights Net Charge Offs Total nonperforming assets decreased $16 million during 2Q18 to $57 million and an NPA%(1) of 0.6% at June 30, 2018. Overall asset quality improvement, increase in energy prices, active credit resolutions, and loan paydowns drove NPAs lower by $85 million or -60% from a year ago. 63% of all NPLs are energy, or $24.9 million in energy nonaccruals at 2Q18 from $93.0 million in 2Q17. Net charge-offs of $2.2 million in 2Q18 or 10 bps of average loans, on an annualized basis, compared to $0.4 million or 2 bps in 1Q18 and $1.8 million or 9 bps in 2Q17. Bank’s provision in 2Q18 was $1.3 million, driven primarily by loan growth. The allowance for credit losses was $90.6 million or 1.0% of total loans at 2Q18, reflecting stable credit quality trends and the reduction in energy NPLs. (1) NPA% represents total nonperforming assets (NPAs) to total loans and OREO and other NPAs

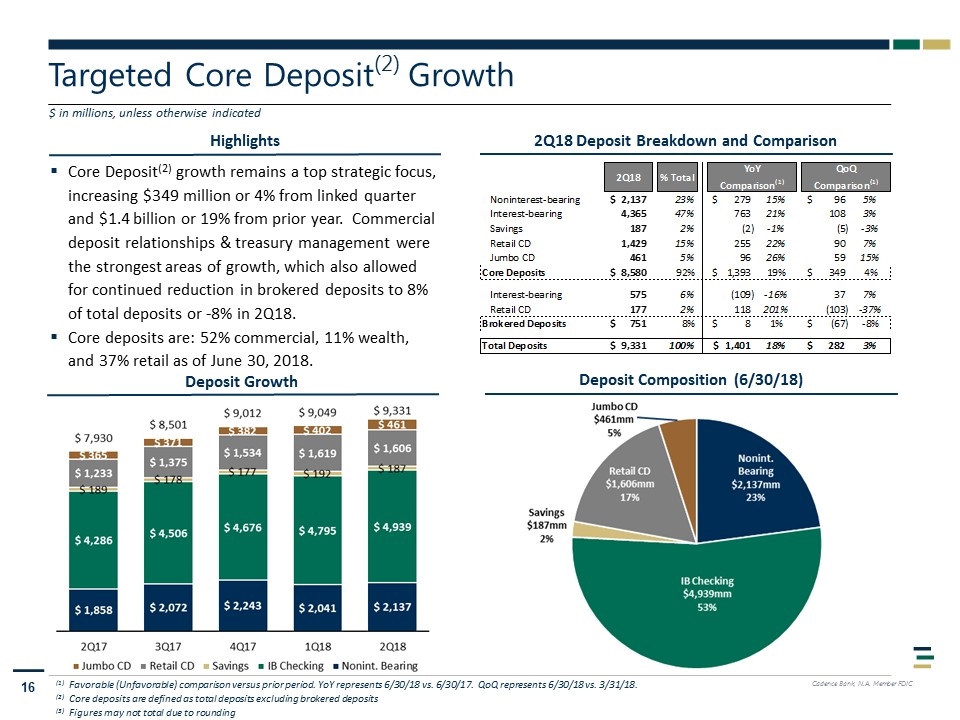

Highlights Targeted Core Deposit(2) Growth $ in millions, unless otherwise indicated Deposit Growth 2Q18 Deposit Breakdown and Comparison Core Deposit(2) growth remains a top strategic focus, increasing $349 million or 4% from linked quarter and $1.4 billion or 19% from prior year. Commercial deposit relationships & treasury management were the strongest areas of growth, which also allowed for continued reduction in brokered deposits to 8% of total deposits or -8% in 2Q18. Core deposits are: 52% commercial, 11% wealth, and 37% retail as of June 30, 2018. (1) Favorable (Unfavorable) comparison versus prior period. YoY represents 6/30/18 vs. 6/30/17. QoQ represents 6/30/18 vs. 3/31/18. (2) Core deposits are defined as total deposits excluding brokered deposits (3) Figures may not total due to rounding Deposit Composition (6/30/18)

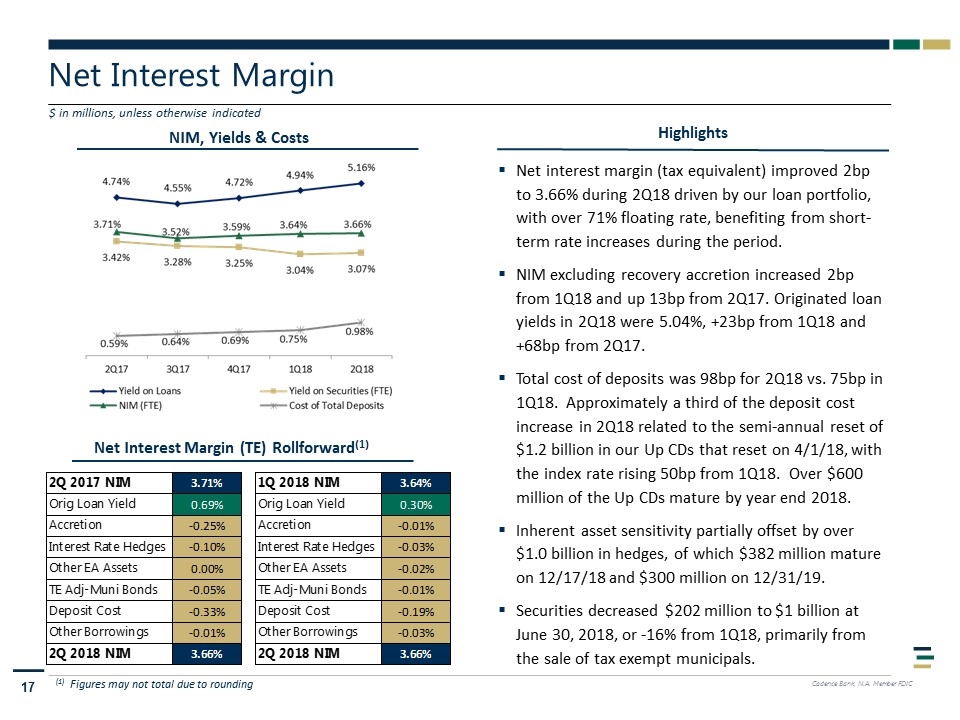

Net Interest Margin $ in millions, unless otherwise indicated Highlights Net interest margin (tax equivalent) improved 2bp to 3.66% during 2Q18 driven by our loan portfolio, with over 71% floating rate, benefiting from short-term rate increases during the period. NIM excluding recovery accretion increased 2bp from 1Q18 and up 13bp from 2Q17. Originated loan yields in 2Q18 were 5.04%, +23bp from 1Q18 and +68bp from 2Q17. Total cost of deposits was 98bp for 2Q18 vs. 75bp in 1Q18. Approximately a third of the deposit cost increase in 2Q18 related to the semi-annual reset of $1.2 billion in our Up CDs that reset on 4/1/18, with the index rate rising 50bp from 1Q18. Over $600 million of the Up CDs mature by year end 2018. Inherent asset sensitivity partially offset by over $1.0 billion in hedges, of which $382 million mature on 12/17/18 and $300 million on 12/31/19. Securities decreased $202 million to $1 billion at June 30, 2018, or -16% from 1Q18, primarily from the sale of tax exempt municipals. NIM, Yields & Costs (1) Figures may not total due to rounding Net Interest Margin (TE) Rollforward(1)

Interest Rate Sensitivity – Positively Positioned $ in millions, unless otherwise indicated Highlights Projected 5.5% increase in net interest income in +100bp scenario and up 10.8% in +200bp(3). The originated loan beta was 70% in 2Q18 and 83% cycle-to-date(2) demonstrating the interest-sensitivity of the loan portfolio. 71% of the loan portfolio is floating rate of which 86% driven by 30/60/90 day LIBOR. Commercial deposit betas were 36% in 2Q18 and 15% cycle-to-date(2), while consumer deposit betas were 84% in 2Q18 and 39% cycle-to-date(2). Total deposit betas were 73% in 2Q18 vs. 21% in prior quarter and 42% year ago. The cycle-to-date(2) total deposit beta is 35% and we are currently forecasting 55% total deposit beta over the long-term in our internal Asset/Liability model. The 2Q18 increase in the deposit beta was impacted by the semiannual reset of $1.2 billion in our Up CDs increasing 50bp. (1) Figures may not total due to rounding (2) Cycle-to-date reflects changes since 4Q15 and incorporates the seven (7) increases in the Fed Funds rate since December 16, 2015 (3) Based on June 30, 2018 interest rate sensitivity modeling of instantaneous rate shock over 1-12 months Cumulative Betas (Cycle-to-date) Quarterly Betas Note: Betas are calculated by dividing the change in loan yields or deposit costs by change in the average 1-month LIBOR, which reflects the bank’s balance sheet positioning and is consistent with internal Asset/Liability modeling.

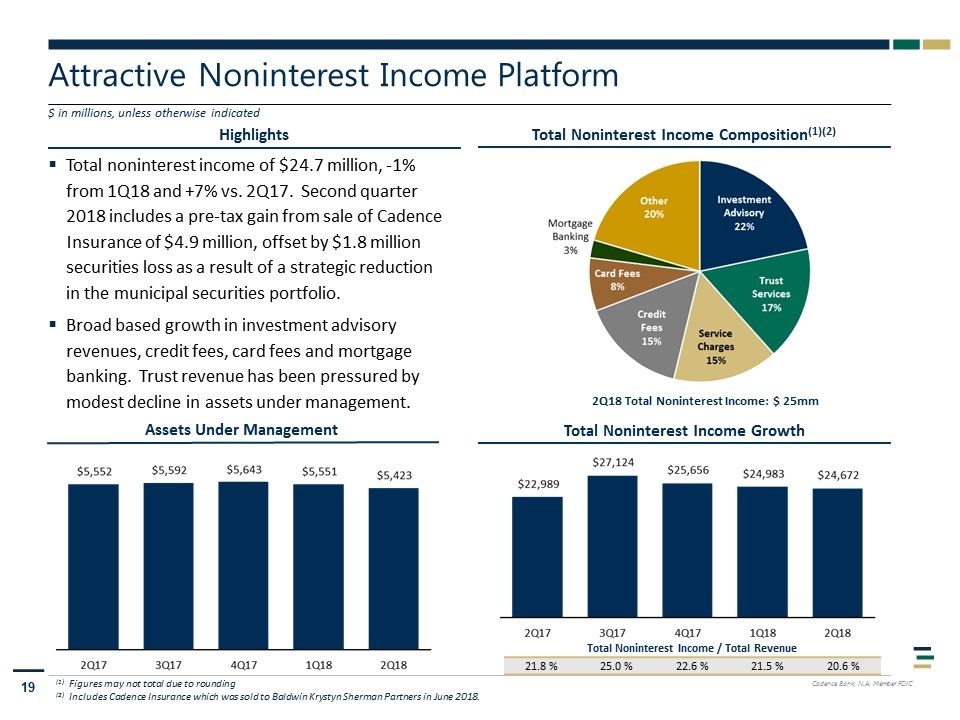

Highlights Attractive Noninterest Income Platform Total Noninterest Income Composition(1)(2) Total Noninterest Income Growth $ in millions, unless otherwise indicated 2Q18 Total Noninterest Income: $ 25mm Total noninterest income of $24.7 million, -1% from 1Q18 and +7% vs. 2Q17. Second quarter 2018 includes a pre-tax gain from sale of Cadence Insurance of $4.9 million, offset by $1.8 million securities loss as a result of a strategic reduction in the municipal securities portfolio. Broad based growth in investment advisory revenues, credit fees, card fees and mortgage banking. Trust revenue has been pressured by modest decline in assets under management. Assets Under Management (1) Figures may not total due to rounding (2) Includes Cadence Insurance which was sold to Baldwin Krystyn Sherman Partners in June 2018. Total Noninterest Income / Total Revenue 21.8 % 25.0 % 22.6 % 21.5 % 20.6 %

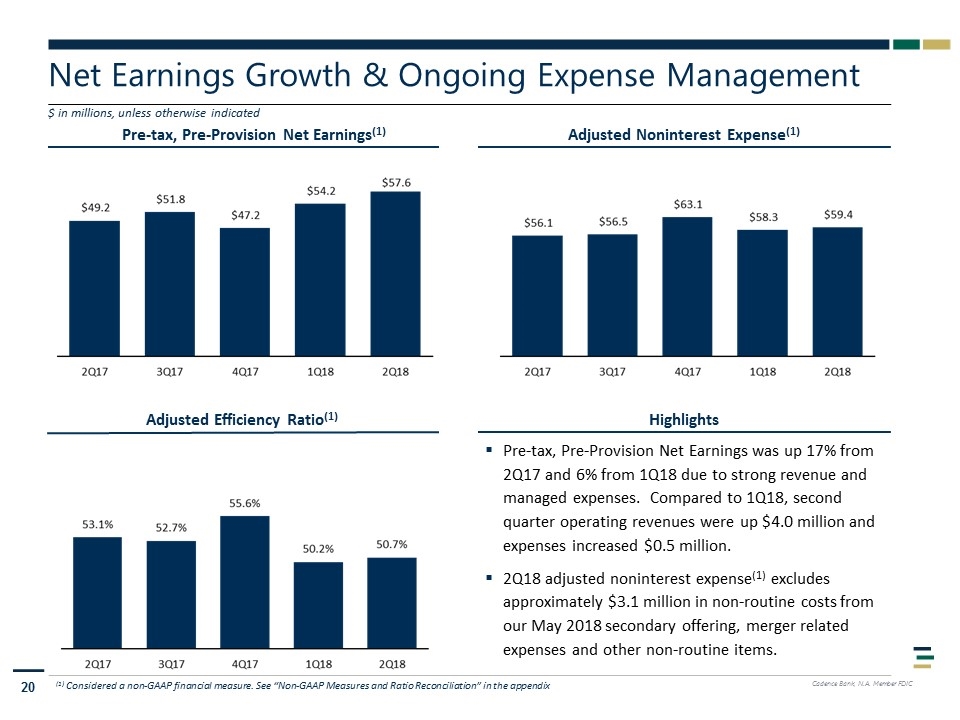

Pre-tax, Pre-Provision Net Earnings(1) Net Earnings Growth & Ongoing Expense Management Adjusted Noninterest Expense(1) Highlights $ in millions, unless otherwise indicated Pre-tax, Pre-Provision Net Earnings was up 17% from 2Q17 and 6% from 1Q18 due to strong revenue and managed expenses. Compared to 1Q18, second quarter operating revenues were up $4.0 million and expenses increased $0.5 million. 2Q18 adjusted noninterest expense(1) excludes approximately $3.1 million in non-routine costs from our May 2018 secondary offering, merger related expenses and other non-routine items. Adjusted Efficiency Ratio(1) (1) Considered a non-GAAP financial measure. See “Non-GAAP Measures and Ratio Reconciliation” in the appendix

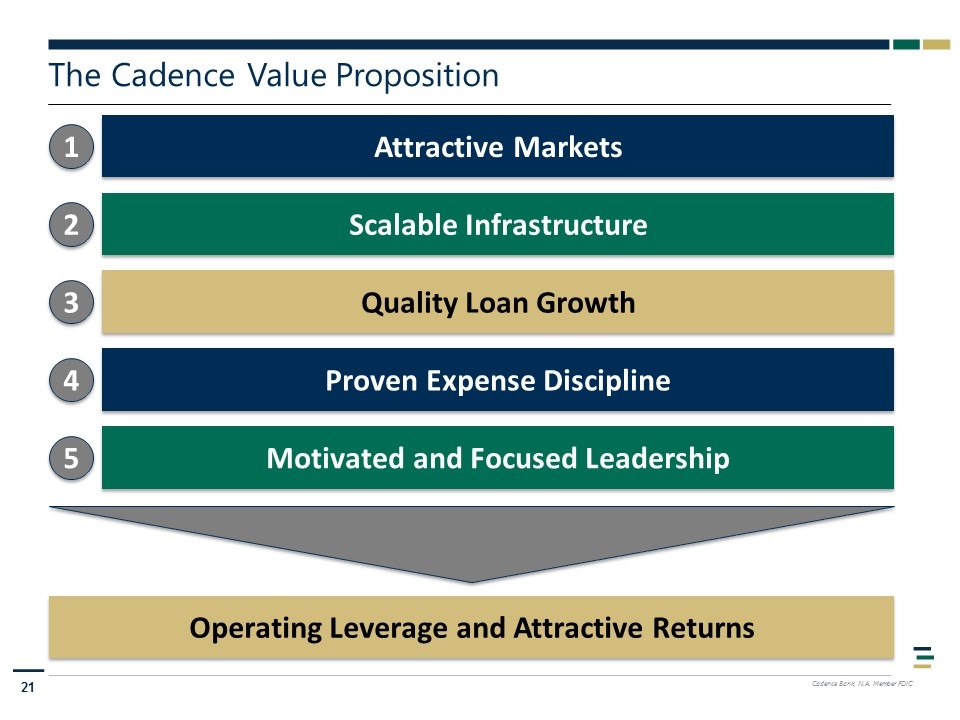

Operating Leverage and Attractive Returns The Cadence Value Proposition Attractive Markets 1 Scalable Infrastructure 2 Quality Loan Growth 3 Proven Expense Discipline 4 Motivated and Focused Leadership 5

Enhancing A Compelling Growth Story

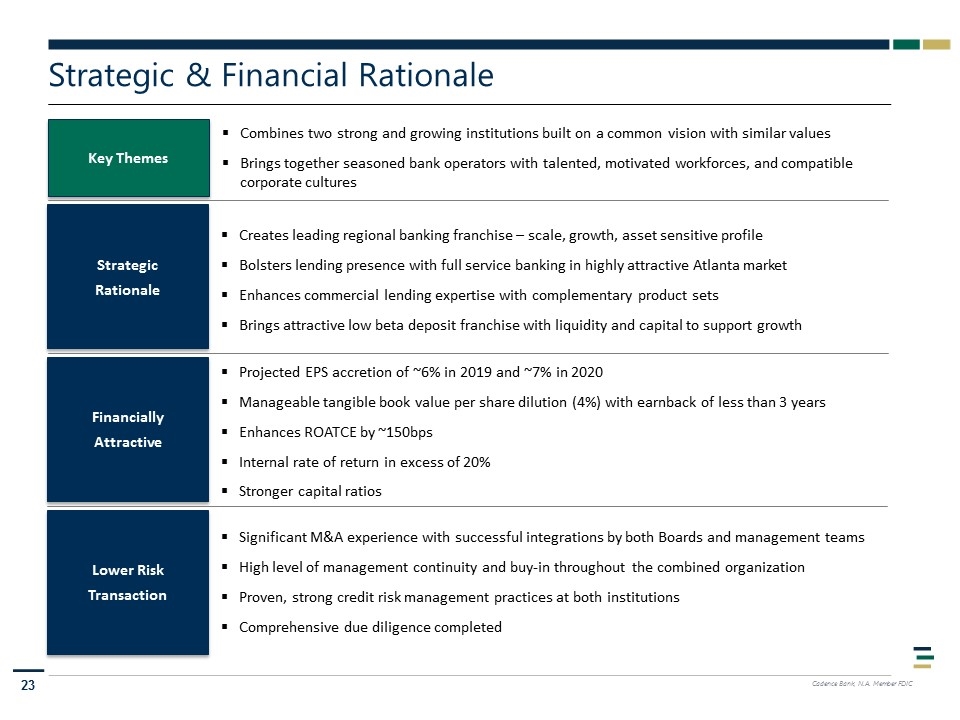

Strategic & Financial Rationale Strategic Rationale Financially Attractive Lower Risk Transaction Creates leading regional banking franchise – scale, growth, asset sensitive profile Bolsters lending presence with full service banking in highly attractive Atlanta market Enhances commercial lending expertise with complementary product sets Brings attractive low beta deposit franchise with liquidity and capital to support growth Projected EPS accretion of ~6% in 2019 and ~7% in 2020 Manageable tangible book value per share dilution (4%) with earnback of less than 3 years Enhances ROATCE by ~150bps Internal rate of return in excess of 20% Stronger capital ratios Significant M&A experience with successful integrations by both Boards and management teams High level of management continuity and buy-in throughout the combined organization Proven, strong credit risk management practices at both institutions Comprehensive due diligence completed Key Themes Combines two strong and growing institutions built on a common vision with similar values Brings together seasoned bank operators with talented, motivated workforces, and compatible corporate cultures

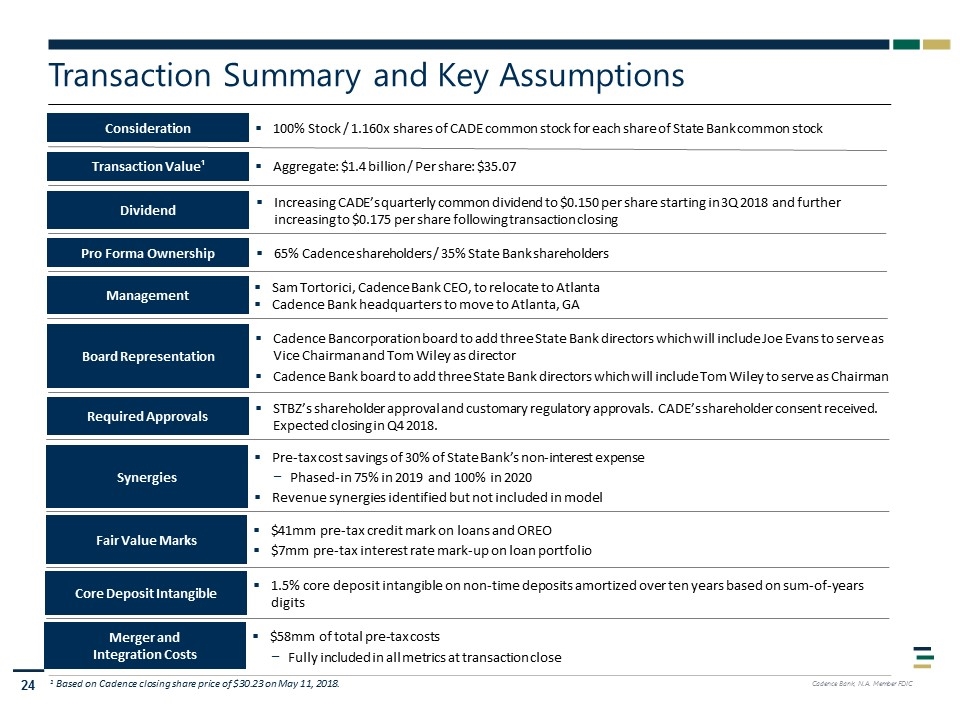

65% Cadence shareholders / 35% State Bank shareholders Transaction Summary and Key Assumptions 1 Based on Cadence closing share price of $30.23 on May 11, 2018. Management Sam Tortorici, Cadence Bank CEO, to relocate to Atlanta Cadence Bank headquarters to move to Atlanta, GA Cadence Bancorporation board to add three State Bank directors which will include Joe Evans to serve as Vice Chairman and Tom Wiley as director Cadence Bank board to add three State Bank directors which will include Tom Wiley to serve as Chairman Board Representation Increasing CADE’s quarterly common dividend to $0.150 per share starting in 3Q 2018 and further increasing to $0.175 per share following transaction closing Dividend Pro Forma Ownership Required Approvals STBZ’s shareholder approval and customary regulatory approvals. CADE’s shareholder consent received. Expected closing in Q4 2018. Aggregate: $1.4 billion / Per share: $35.07 Transaction Value¹ 100% Stock / 1.160x shares of CADE common stock for each share of State Bank common stock Consideration Pre-tax cost savings of 30% of State Bank’s non-interest expense Phased-in 75% in 2019 and 100% in 2020 Revenue synergies identified but not included in model Synergies $41mm pre-tax credit mark on loans and OREO $7mm pre-tax interest rate mark-up on loan portfolio Fair Value Marks 1.5% core deposit intangible on non-time deposits amortized over ten years based on sum-of-years digits Core Deposit Intangible $58mm of total pre-tax costs Fully included in all metrics at transaction close Merger and Integration Costs

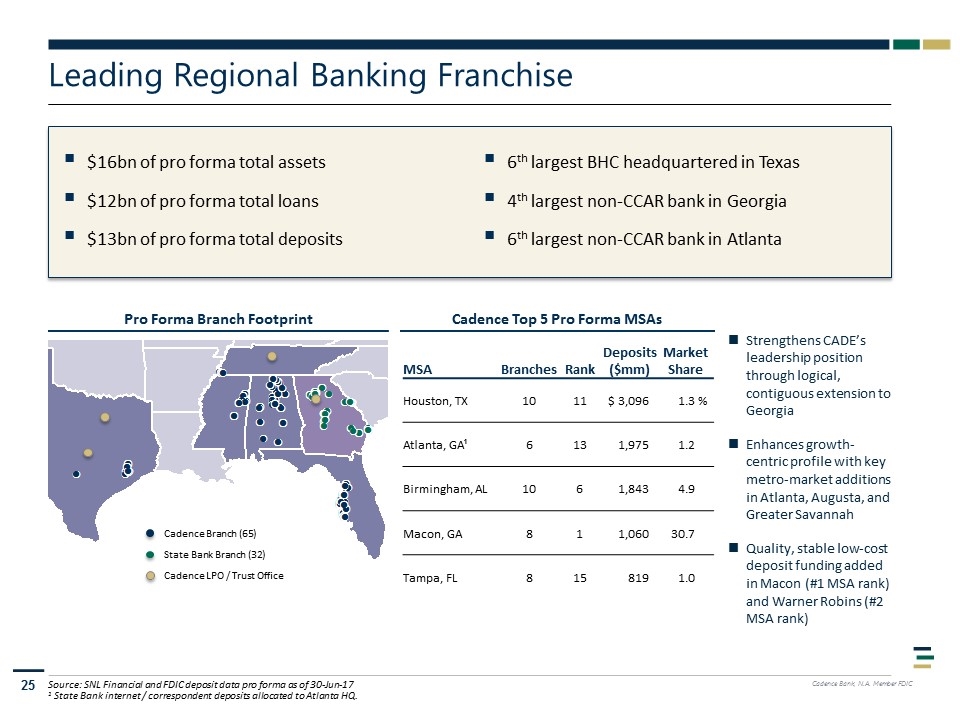

$16bn of pro forma total assets $12bn of pro forma total loans $13bn of pro forma total deposits Leading Regional Banking Franchise Cadence Top 5 Pro Forma MSAs Pro Forma Branch Footprint Source: SNL Financial and FDIC deposit data pro forma as of 30-Jun-17 1 State Bank internet / correspondent deposits allocated to Atlanta HQ. 6th largest BHC headquartered in Texas 4th largest non-CCAR bank in Georgia 6th largest non-CCAR bank in Atlanta Strengthens CADE’s leadership position through logical, contiguous extension to Georgia Enhances growth-centric profile with key metro-market additions in Atlanta, Augusta, and Greater Savannah Quality, stable low-cost deposit funding added in Macon (#1 MSA rank) and Warner Robins (#2 MSA rank) MSA Branches Rank Deposits ($mm) Market Share Houston, TX 10 11 $ 3,096 1.3 % Atlanta, GA¹ 6 13 1,975 1.2 Birmingham, AL 10 6 1,843 4.9 Macon, GA 8 1 1,060 30.7 Tampa, FL 8 15 819 1.0 Cadence Branch (65) State Bank Branch (32) Cadence LPO / Trust Office

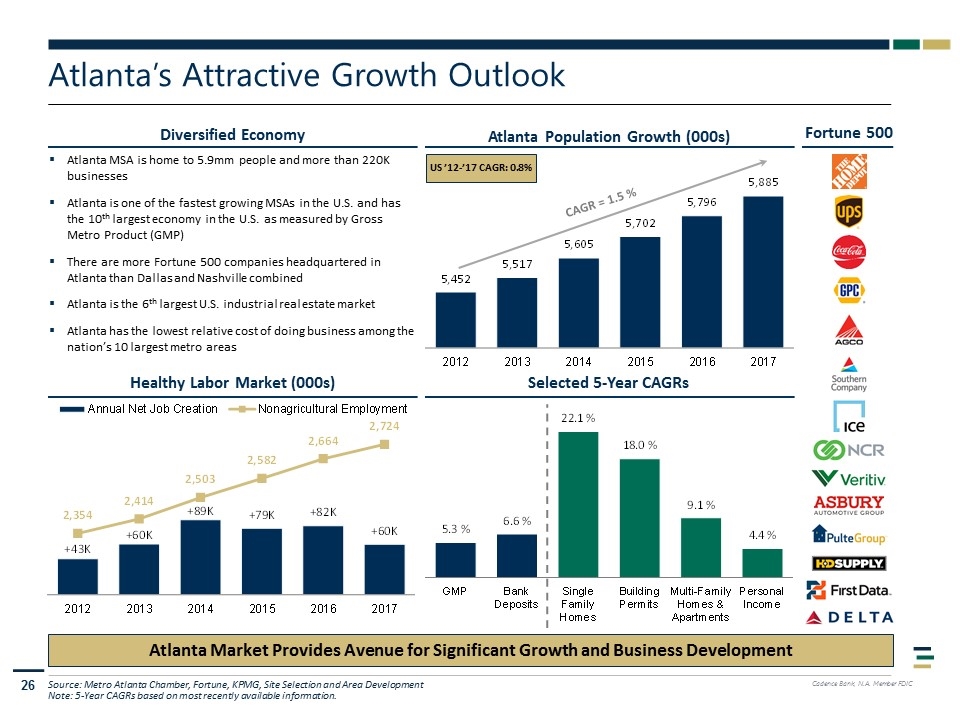

Atlanta’s Attractive Growth Outlook Source: Metro Atlanta Chamber, Fortune, KPMG, Site Selection and Area Development Note: 5-Year CAGRs based on most recently available information. Atlanta MSA is home to 5.9mm people and more than 220K businesses Atlanta is one of the fastest growing MSAs in the U.S. and has the 10th largest economy in the U.S. as measured by Gross Metro Product (GMP) There are more Fortune 500 companies headquartered in Atlanta than Dallas and Nashville combined Atlanta is the 6th largest U.S. industrial real estate market Atlanta has the lowest relative cost of doing business among the nation’s 10 largest metro areas Atlanta Market Provides Avenue for Significant Growth and Business Development Diversified Economy Atlanta Population Growth (000s) Healthy Labor Market (000s) Selected 5-Year CAGRs Fortune 500 US ’12-’17 CAGR: 0.8%

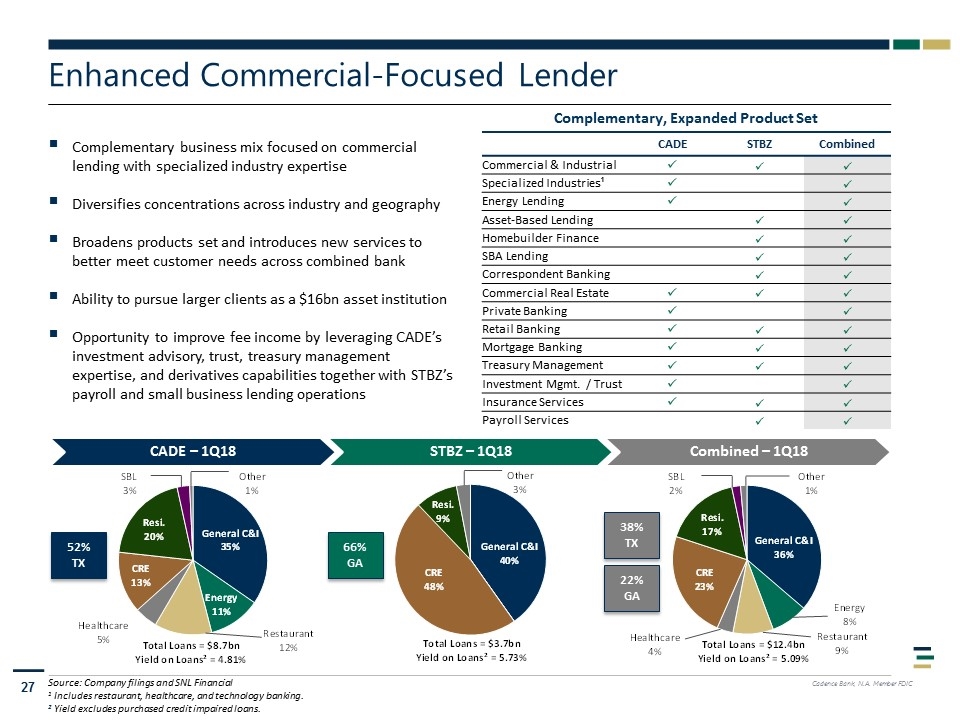

Enhanced Commercial-Focused Lender Complementary business mix focused on commercial lending with specialized industry expertise Diversifies concentrations across industry and geography Broadens products set and introduces new services to better meet customer needs across combined bank Ability to pursue larger clients as a $16bn asset institution Opportunity to improve fee income by leveraging CADE’s investment advisory, trust, treasury management expertise, and derivatives capabilities together with STBZ’s payroll and small business lending operations CADE STBZ Combined Commercial & Industrial ü ü ü Specialized Industries¹ ü ü Energy Lending ü ü Asset-Based Lending ü ü Homebuilder Finance ü ü SBA Lending ü ü Correspondent Banking ü ü Commercial Real Estate ü ü ü Private Banking ü ü Retail Banking ü ü ü Mortgage Banking ü ü ü Treasury Management ü ü ü Investment Mgmt. / Trust ü ü Insurance Services ü ü ü Payroll Services ü ü Complementary, Expanded Product Set CADE – 1Q18 STBZ – 1Q18 Combined – 1Q18 Source: Company filings and SNL Financial 1 Includes restaurant, healthcare, and technology banking. 2 Yield excludes purchased credit impaired loans. 52% TX 66% GA 38% TX 22% GA

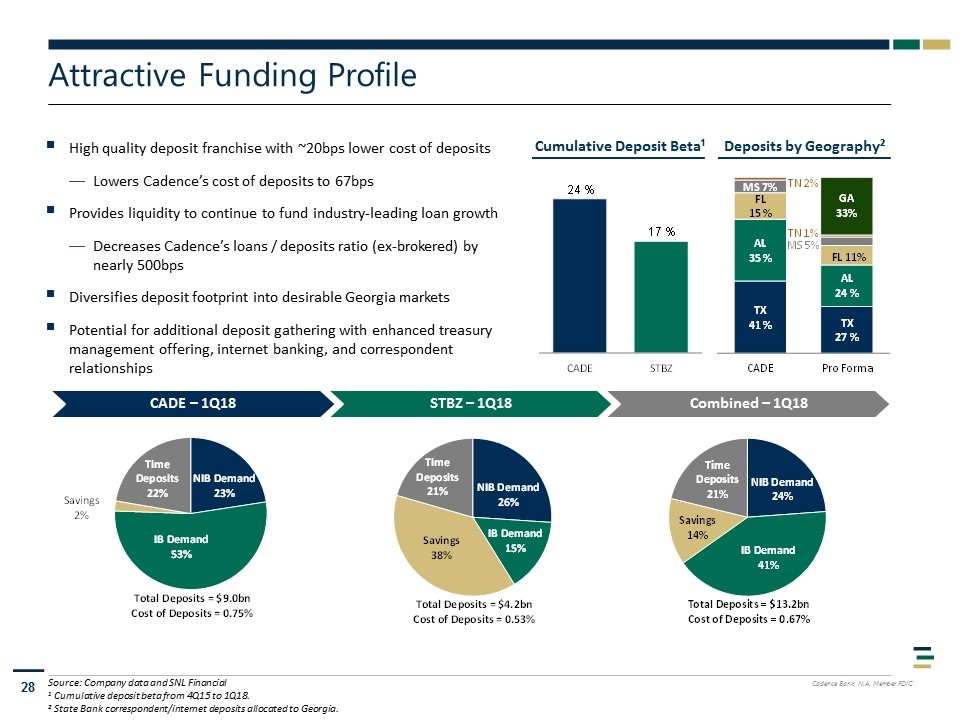

Attractive Funding Profile CADE – 1Q18 STBZ – 1Q18 Combined – 1Q18 High quality deposit franchise with ~20bps lower cost of deposits Lowers Cadence’s cost of deposits to 67bps Provides liquidity to continue to fund industry-leading loan growth Decreases Cadence’s loans / deposits ratio (ex-brokered) by nearly 500bps Diversifies deposit footprint into desirable Georgia markets Potential for additional deposit gathering with enhanced treasury management offering, internet banking, and correspondent relationships Cumulative Deposit Beta¹ Source: Company data and SNL Financial 1 Cumulative deposit beta from 4Q15 to 1Q18. 2 State Bank correspondent/internet deposits allocated to Georgia. Deposits by Geography²

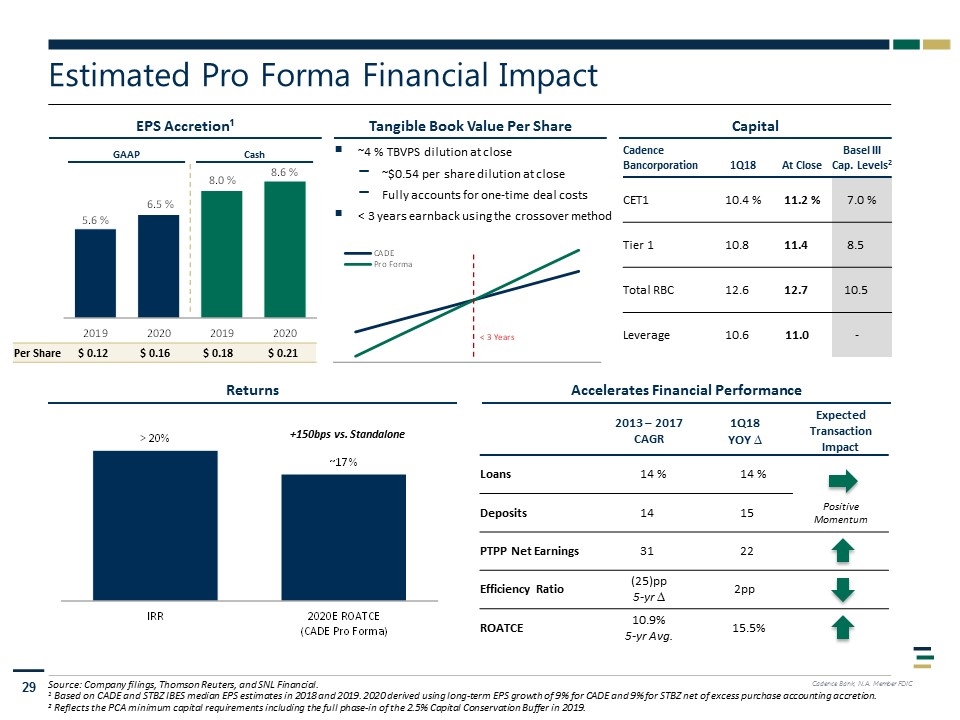

Cadence Bancorporation 1Q18 At Close Basel III Cap. Levels2 CET1 10.4 % 11.2 % 7.0 % Tier 1 10.8 % 11.4 % 8.5 % Total RBC 12.6 % 12.7 % 10.5 % Leverage 10.6 % 11.0% -% Estimated Pro Forma Financial Impact Accelerates Financial Performance Returns Source: Company filings, Thomson Reuters, and SNL Financial. 1 Based on CADE and STBZ IBES median EPS estimates in 2018 and 2019. 2020 derived using long-term EPS growth of 9% for CADE and 9% for STBZ net of excess purchase accounting accretion. 2 Reflects the PCA minimum capital requirements including the full phase-in of the 2.5% Capital Conservation Buffer in 2019. Tangible Book Value Per Share EPS Accretion¹ Per Share $ 0.12 $ 0.16 $ 0.18 $ 0.21 ~4 % TBVPS dilution at close ~$0.54 per share dilution at close Fully accounts for one-time deal costs < 3 years earnback using the crossover method +150bps vs. Standalone GAAP Cash Capital 2013 – 2017 CAGR 1Q18 YOY ∆ Expected Transaction Impact Loans 14 % 14 % Positive Momentum Deposits 14 15 PTPP Net Earnings 31 22 Efficiency Ratio (25)pp 5-yr ∆ 2pp ROATCE 10.9% 5-yr Avg. 15.5%

Supplementary Information

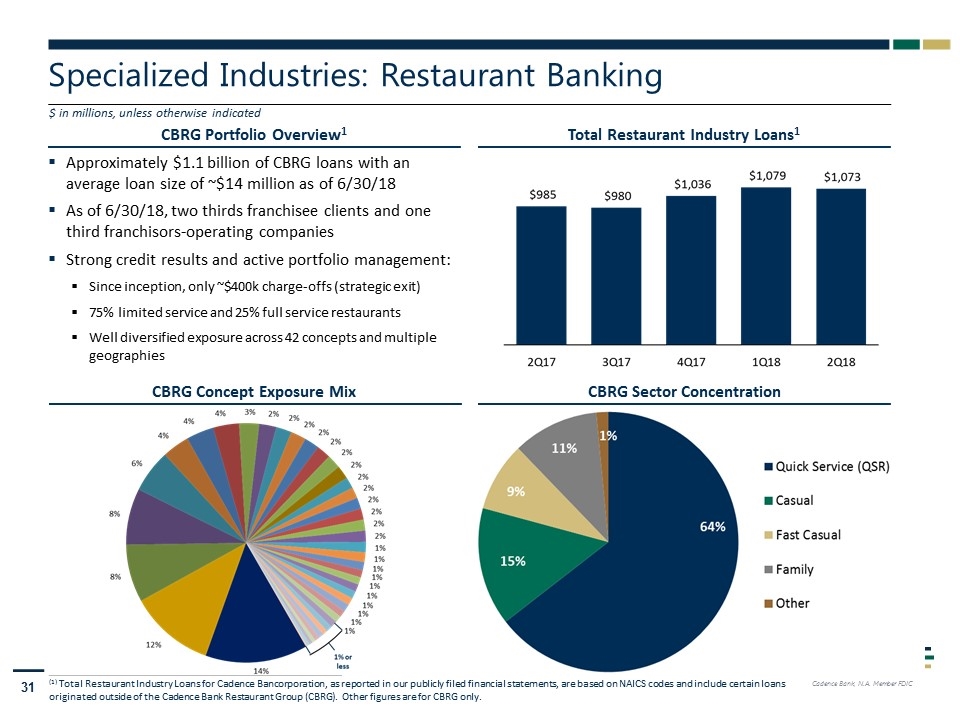

CBRG Portfolio Overview1 Specialized Industries: Restaurant Banking $ in millions, unless otherwise indicated Total Restaurant Industry Loans1 Approximately $1.1 billion of CBRG loans with an average loan size of ~$14 million as of 6/30/18 As of 6/30/18, two thirds franchisee clients and one third franchisors-operating companies Strong credit results and active portfolio management: Since inception, only ~$400k charge-offs (strategic exit) 75% limited service and 25% full service restaurants Well diversified exposure across 42 concepts and multiple geographies (1) Total Restaurant Industry Loans for Cadence Bancorporation, as reported in our publicly filed financial statements, are based on NAICS codes and include certain loans originated outside of the Cadence Bank Restaurant Group (CBRG). Other figures are for CBRG only. CBRG Sector Concentration CBRG Concept Exposure Mix

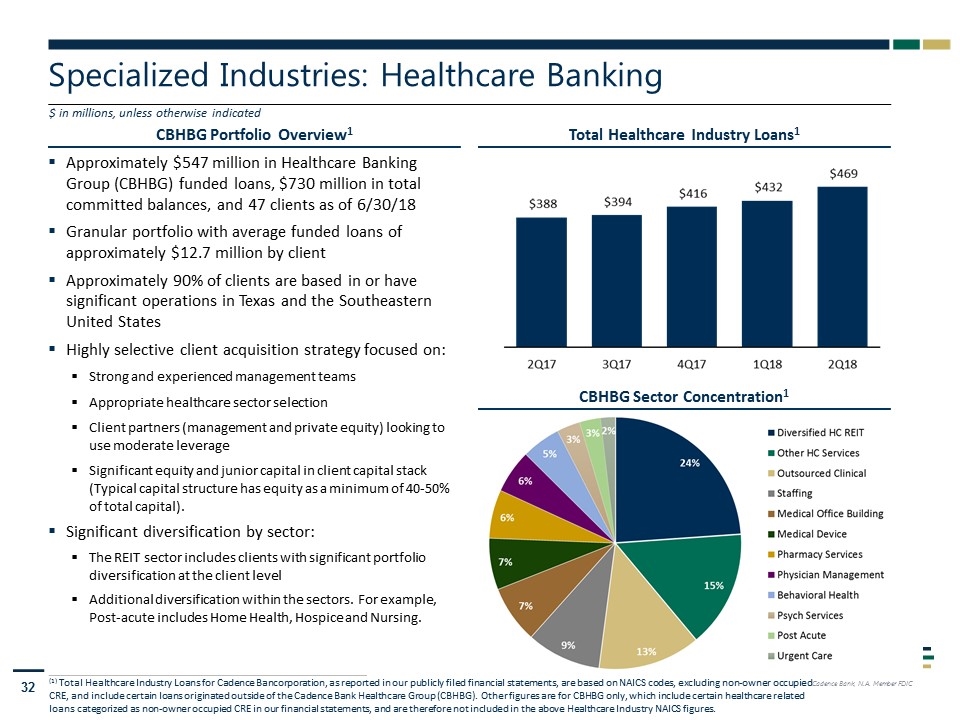

CBHBG Portfolio Overview1 Specialized Industries: Healthcare Banking $ in millions, unless otherwise indicated Total Healthcare Industry Loans1 Approximately $547 million in Healthcare Banking Group (CBHBG) funded loans, $730 million in total committed balances, and 47 clients as of 6/30/18 Granular portfolio with average funded loans of approximately $12.7 million by client Approximately 90% of clients are based in or have significant operations in Texas and the Southeastern United States Highly selective client acquisition strategy focused on: Strong and experienced management teams Appropriate healthcare sector selection Client partners (management and private equity) looking to use moderate leverage Significant equity and junior capital in client capital stack (Typical capital structure has equity as a minimum of 40-50% of total capital). Significant diversification by sector: The REIT sector includes clients with significant portfolio diversification at the client level Additional diversification within the sectors. For example, Post-acute includes Home Health, Hospice and Nursing. (1) Total Healthcare Industry Loans for Cadence Bancorporation, as reported in our publicly filed financial statements, are based on NAICS codes, excluding non-owner occupied CRE, and include certain loans originated outside of the Cadence Bank Healthcare Group (CBHBG). Other figures are for CBHBG only, which include certain healthcare related loans categorized as non-owner occupied CRE in our financial statements, and are therefore not included in the above Healthcare Industry NAICS figures. CBHBG Sector Concentration1

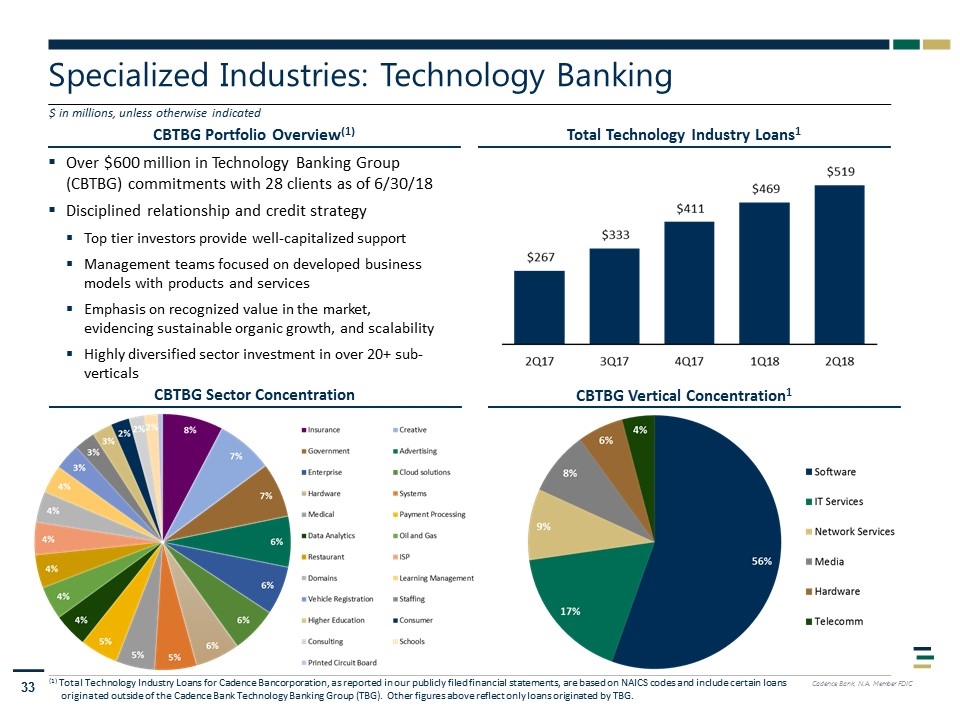

CBTBG Portfolio Overview(1) Specialized Industries: Technology Banking $ in millions, unless otherwise indicated Total Technology Industry Loans1 Over $600 million in Technology Banking Group (CBTBG) commitments with 28 clients as of 6/30/18 Disciplined relationship and credit strategy Top tier investors provide well-capitalized support Management teams focused on developed business models with products and services Emphasis on recognized value in the market, evidencing sustainable organic growth, and scalability Highly diversified sector investment in over 20+ sub-verticals (1) Total Technology Industry Loans for Cadence Bancorporation, as reported in our publicly filed financial statements, are based on NAICS codes and include certain loans originated outside of the Cadence Bank Technology Banking Group (TBG). Other figures above reflect only loans originated by TBG. CBTBG Sector Concentration CBTBG Vertical Concentration1

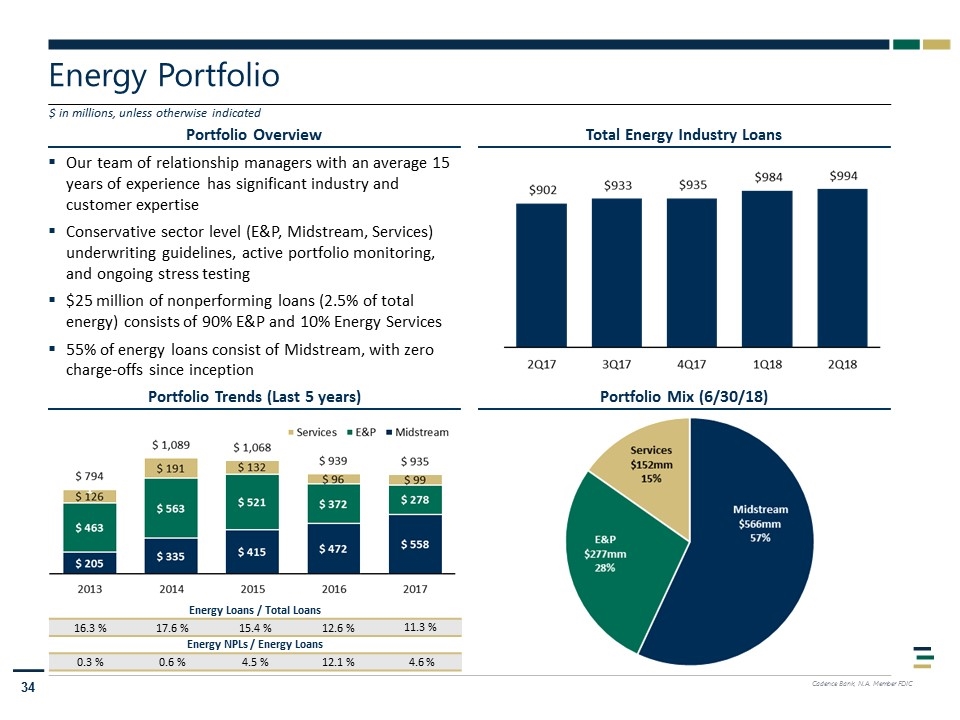

Portfolio Overview Energy Portfolio $ in millions, unless otherwise indicated Total Energy Industry Loans Our team of relationship managers with an average 15 years of experience has significant industry and customer expertise Conservative sector level (E&P, Midstream, Services) underwriting guidelines, active portfolio monitoring, and ongoing stress testing $25 million of nonperforming loans (2.5% of total energy) consists of 90% E&P and 10% Energy Services 55% of energy loans consist of Midstream, with zero charge-offs since inception Portfolio Mix (6/30/18) Portfolio Trends (Last 5 years) Energy Loans / Total Loans 16.3 % 17.6 % 15.4 % 12.6 % 11.3 % Energy NPLs / Energy Loans 0.3 % 0.6 % 4.5 % 12.1 % 4.6 %

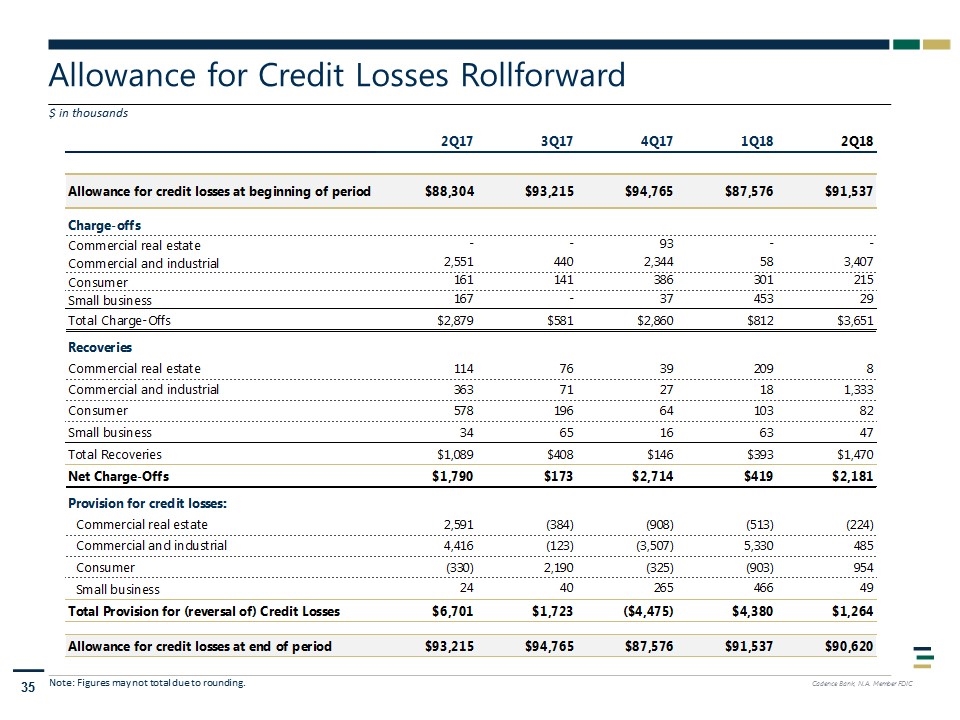

Allowance for Credit Losses Rollforward $ in thousands Note: Figures may not total due to rounding.

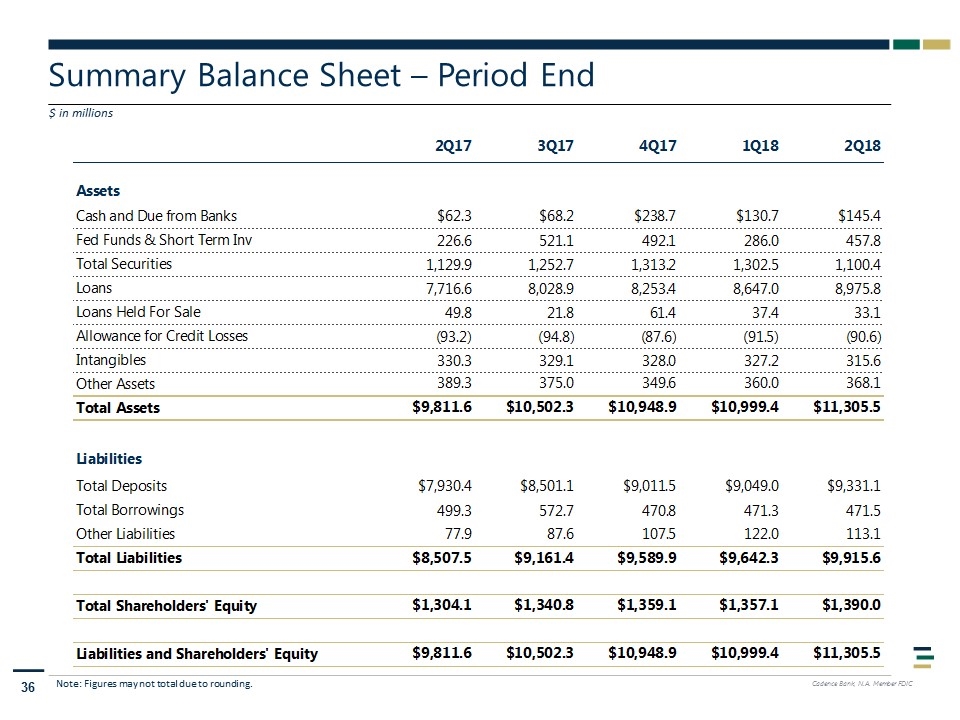

Summary Balance Sheet – Period End $ in millions Note: Figures may not total due to rounding.

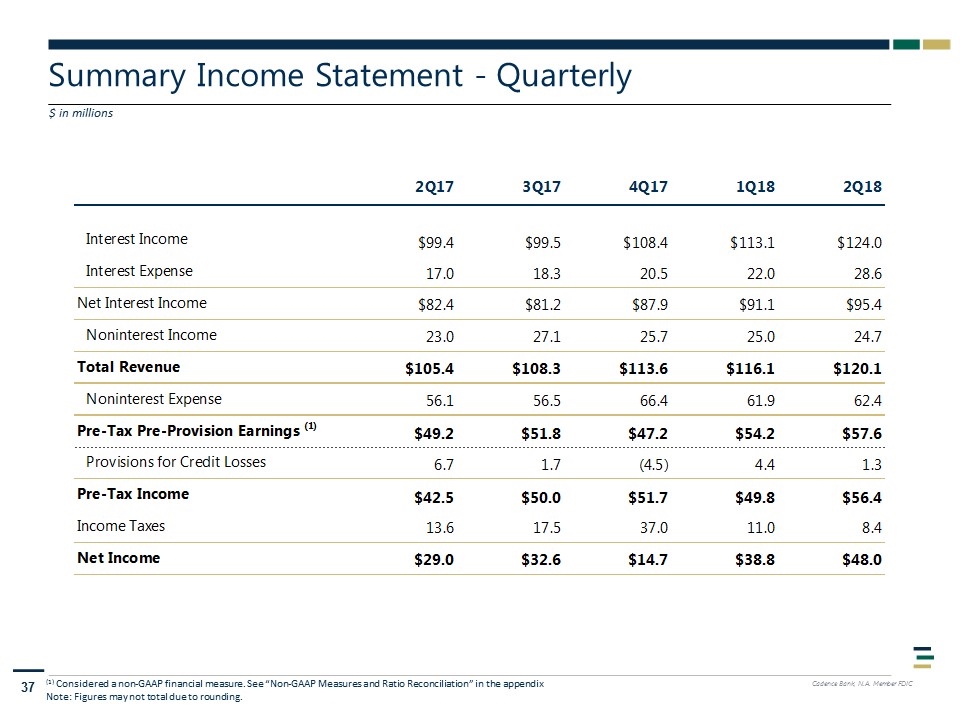

Summary Income Statement - Quarterly $ in millions (1) Considered a non-GAAP financial measure. See “Non-GAAP Measures and Ratio Reconciliation” in the appendix Note: Figures may not total due to rounding.

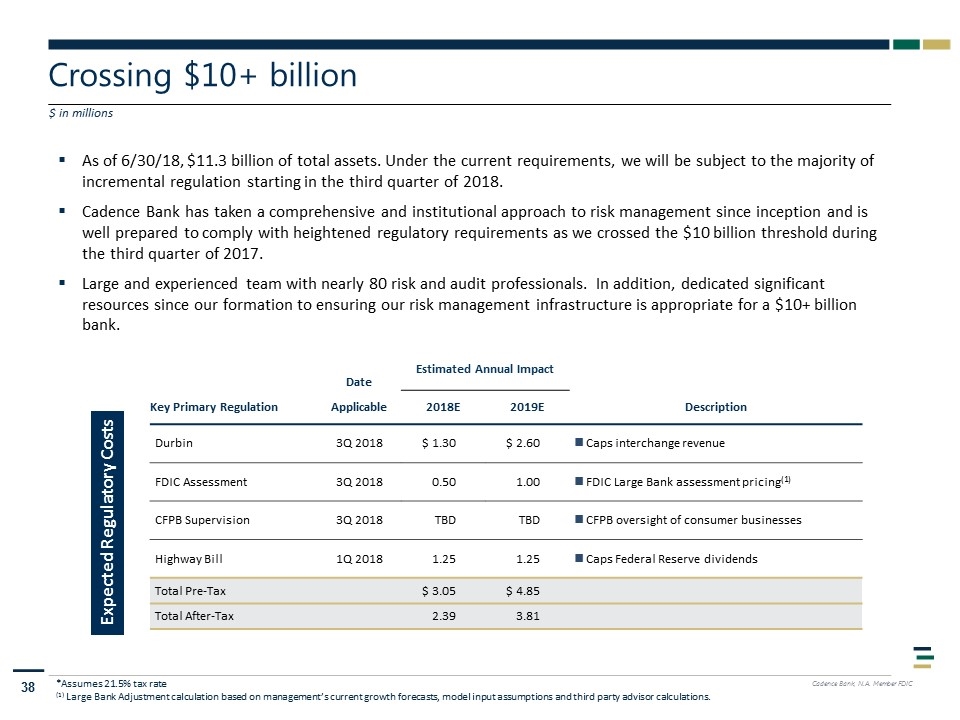

Crossing $10+ billion *Assumes 21.5% tax rate (1) Large Bank Adjustment calculation based on management’s current growth forecasts, model input assumptions and third party advisor calculations. As of 6/30/18, $11.3 billion of total assets. Under the current requirements, we will be subject to the majority of incremental regulation starting in the third quarter of 2018. Cadence Bank has taken a comprehensive and institutional approach to risk management since inception and is well prepared to comply with heightened regulatory requirements as we crossed the $10 billion threshold during the third quarter of 2017. Large and experienced team with nearly 80 risk and audit professionals. In addition, dedicated significant resources since our formation to ensuring our risk management infrastructure is appropriate for a $10+ billion bank. $ in millions Expected Regulatory Costs Date Estimated Annual Impact Key Primary Regulation Applicable 2018E 2019E Description Durbin 3Q 2018 $ 1.30 $ 2.60 Caps interchange revenue FDIC Assessment 3Q 2018 0.50 1.00 FDIC Large Bank assessment pricing(1) CFPB Supervision 3Q 2018 TBD TBD CFPB oversight of consumer businesses Highway Bill 1Q 2018 1.25 1.25 Caps Federal Reserve dividends Total Pre-Tax $ 3.05 $ 4.85 Total After-Tax 2.39 3.81

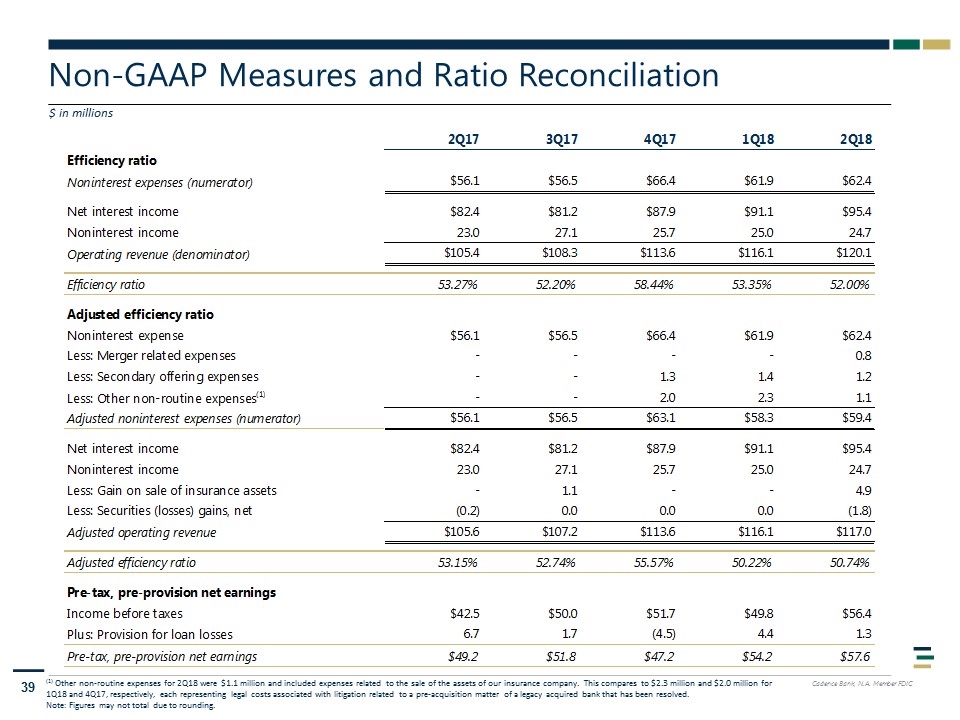

Non-GAAP Measures and Ratio Reconciliation $ in millions (1) Other non-routine expenses for 2Q18 were $1.1 million and included expenses related to the sale of the assets of our insurance company. This compares to $2.3 million and $2.0 million for 1Q18 and 4Q17, respectively, each representing legal costs associated with litigation related to a pre-acquisition matter of a legacy acquired bank that has been resolved. Note: Figures may not total due to rounding.

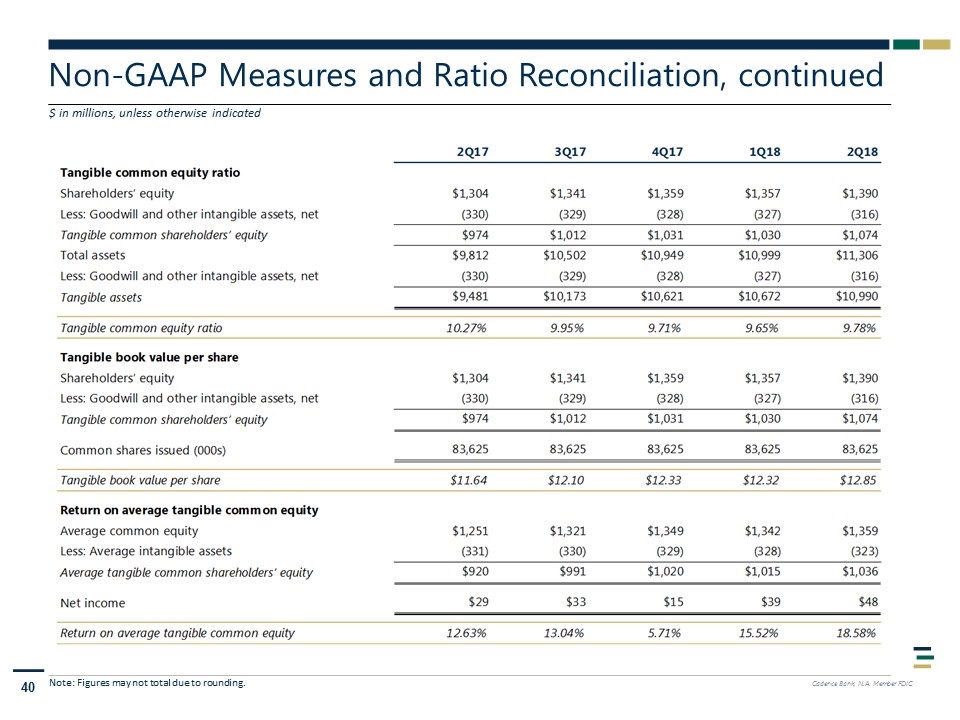

Non-GAAP Measures and Ratio Reconciliation, continued Note: Figures may not total due to rounding. $ in millions, unless otherwise indicated

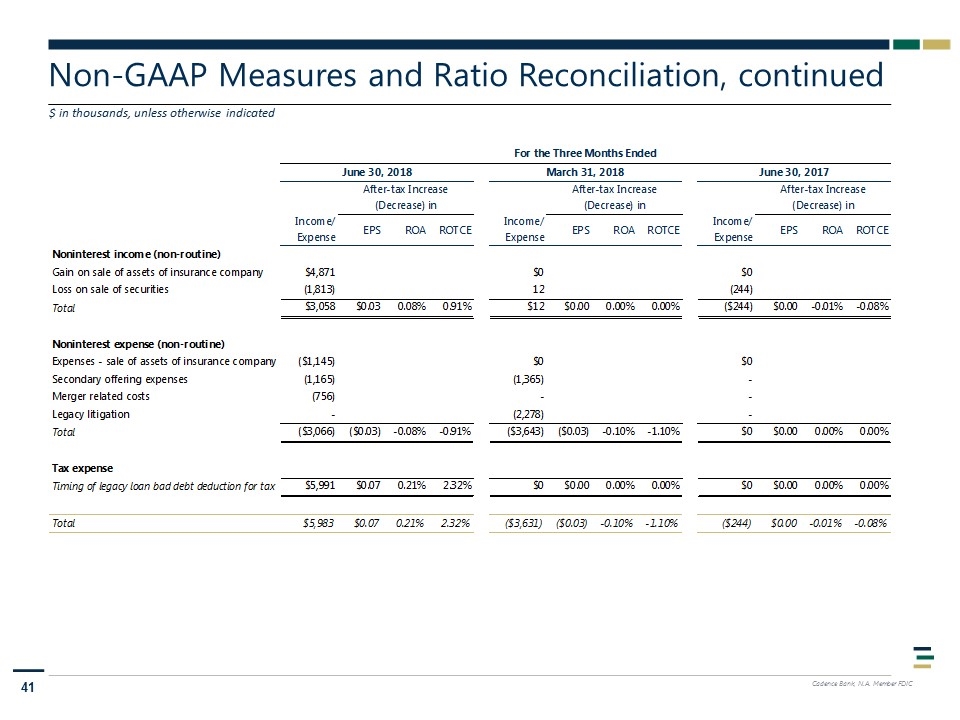

Non-GAAP Measures and Ratio Reconciliation, continued $ in thousands, unless otherwise indicated

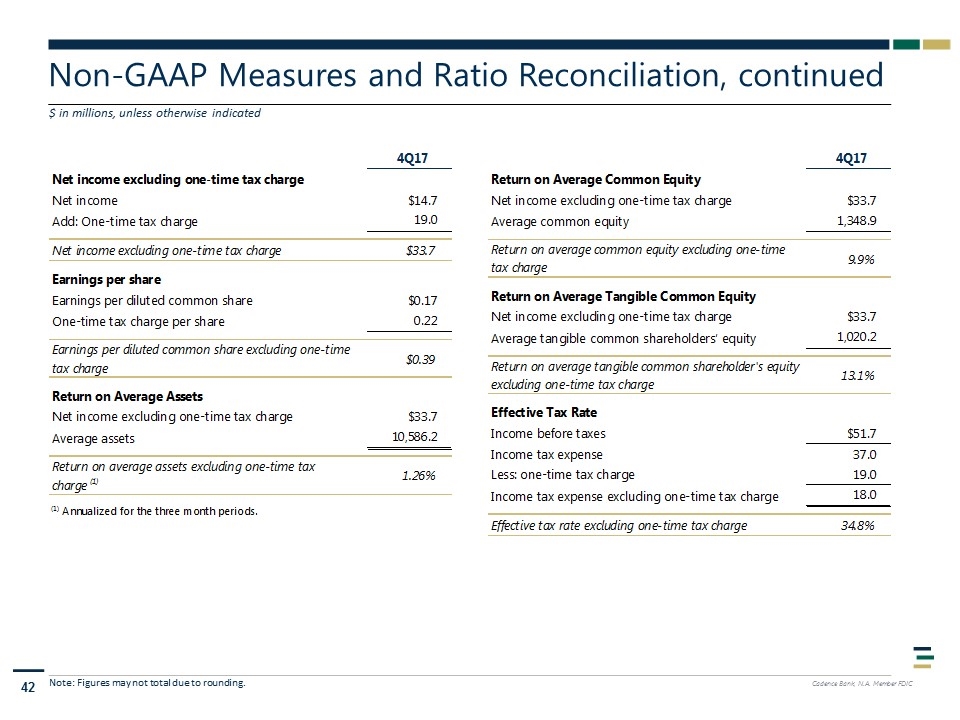

Non-GAAP Measures and Ratio Reconciliation, continued Note: Figures may not total due to rounding. $ in millions, unless otherwise indicated