ANALYST PRESENTATION February 7, 2017 Paul B. Murphy, Jr. Chairman and CEO Investor Presentation November 2020 Exhibit 99.1

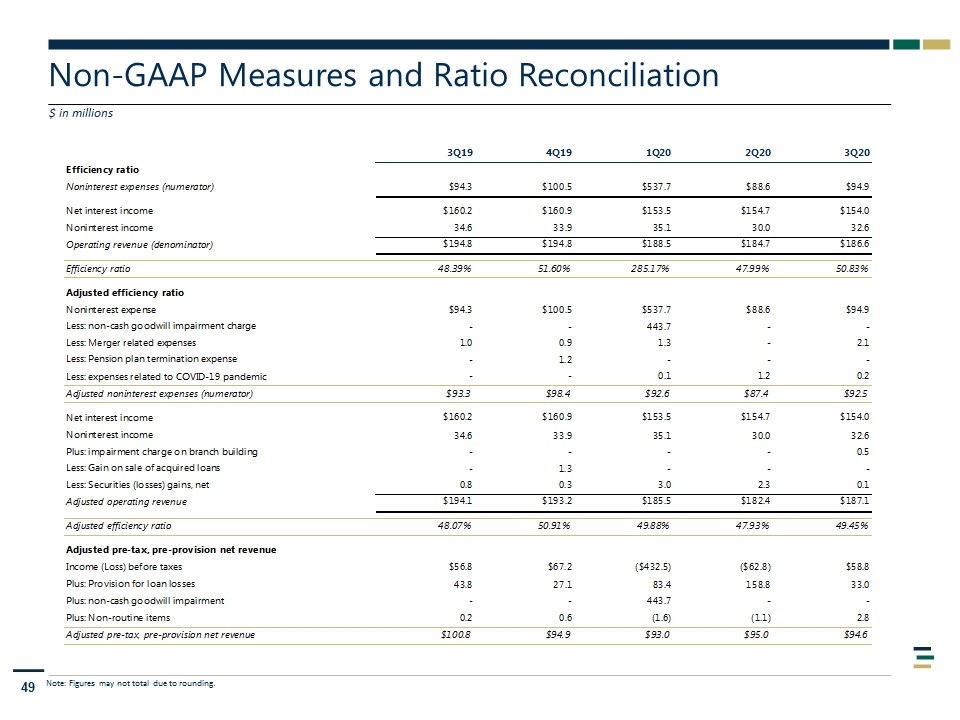

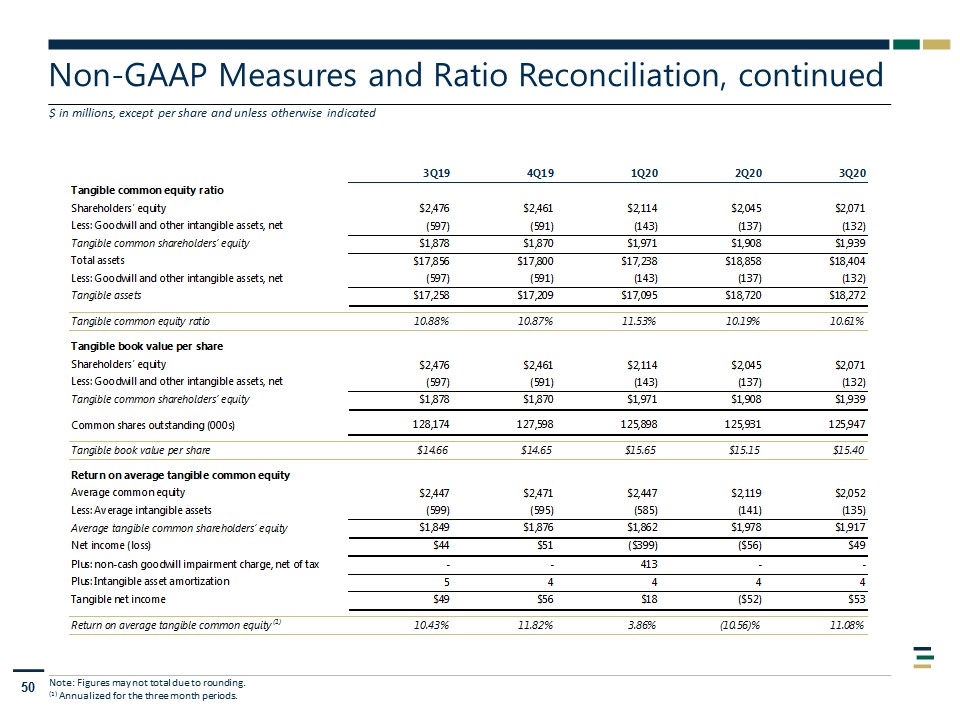

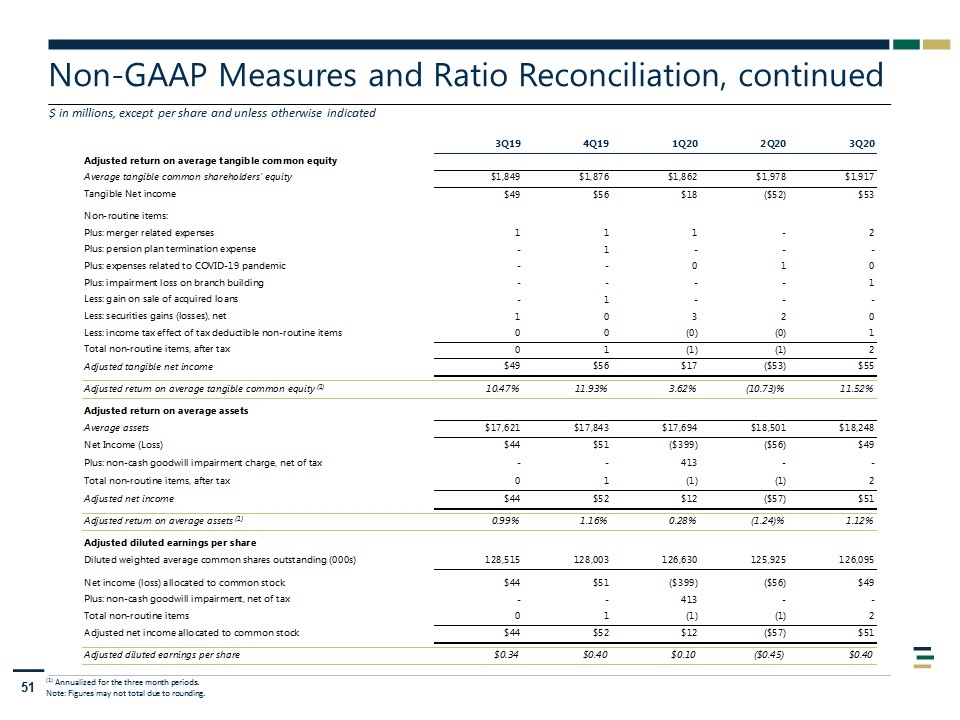

Disclaimers This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements reflect our current views with respect to, among other things, future events and our results of operations, financial condition and financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “projection,” “would” and “outlook,” or the negative version of those words or other comparable words of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Accordingly, we caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although we believe that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. Such factors include, without limitation, the “Risk Factors” referenced in our Registration Statement on Form S-3 filed with the Securities and Exchange Commission (the “SEC”) on May 21, 2018, and our Registration Statement on Form S-4 filed with the SEC on July 20, 2018, other risks and uncertainties listed from time to time in our reports and documents filed with the SEC, including our Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q, and the following factors: business and economic conditions generally and in the financial services industry, nationally and within our current and future geographic market areas; economic, market, operational, liquidity, credit and interest rate risks associated with our business; deteriorating asset quality and higher loan charge-offs; the laws and regulations applicable to our business; our ability to achieve organic loan and deposit growth and the composition of such growth; increased competition in the financial services industry, nationally, regionally or locally; our ability to maintain our historical earnings trends; our ability to raise additional capital to implement our business plan; material weaknesses in our internal control over financial reporting; systems failures or interruptions involving our information technology and telecommunications systems or third-party servicers; the composition of our management team and our ability to attract and retain key personnel; the fiscal position of the U.S. federal government and the soundness of other financial institutions; the composition of our loan portfolio, including the identity of our borrowers and the concentration of loans in energy-related industries and in our specialized industries; the portion of our loan portfolio that is comprised of participations and shared national credits; the amount of nonperforming and classified assets we hold; the extent of the impact of the COVID-19 pandemic on us and our customers, counterparties, employees and third-party service providers, and the impacts to our business, financial position, results of operations, and prospects. Cadence can give no assurance that any goal or plan or expectation set forth in forward-looking statements can be achieved and readers are cautioned not to place undue reliance on such statements. The forward-looking statements are made as of the date of this communication, and Cadence does not intend, and assumes no obligation, to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events or circumstances, except as required by applicable law. Certain of the financial measures and ratios we present, including “efficiency ratio,” “adjusted efficiency ratio,” “adjusted noninterest expenses,” “adjusted operating revenue,” “tangible common equity ratio,” “tangible book value per share” and “return on average tangible common equity”, “adjusted return on average tangible common equity”, “adjusted return on average assets”, “adjusted diluted earnings per share”, “pre-tax, pre-provision net revenue” and "adjusted pre-tax pre-provision net revenue,“ are supplemental measures that are not required by, or are not presented in accordance with, U.S. generally accepted accounting principles (GAAP). We refer to these financial measures and ratios as “non-GAAP financial measures.” We consider the use of select non-GAAP financial measures and ratios to be useful for financial and operational decision making and useful in evaluating period-to-period comparisons. We believe that these non-GAAP financial measures provide meaningful supplemental information regarding our performance by excluding certain expenditures or assets that we believe are not indicative of our primary business operating results or by presenting certain metrics on a fully taxable equivalent basis. We believe that management and investors benefit from referring to these non-GAAP financial measures in assessing our performance and when planning, forecasting, analyzing and comparing past, present and future periods. These non-GAAP financial measures should not be considered a substitute for financial information presented in accordance with GAAP and you should not rely on non-GAAP financial measures alone as measures of our performance. The non-GAAP financial measures we present may differ from non-GAAP financial measures used by our peers or other companies. We compensate for these limitations by providing the equivalent GAAP measures whenever we present the non-GAAP financial measures and by including a reconciliation of the impact of the components adjusted for in the non-GAAP financial measure so that both measures and the individual components may be considered when analyzing our performance. A reconciliation of non-GAAP financial measures to the comparable GAAP financial measures is included in the Appendix.

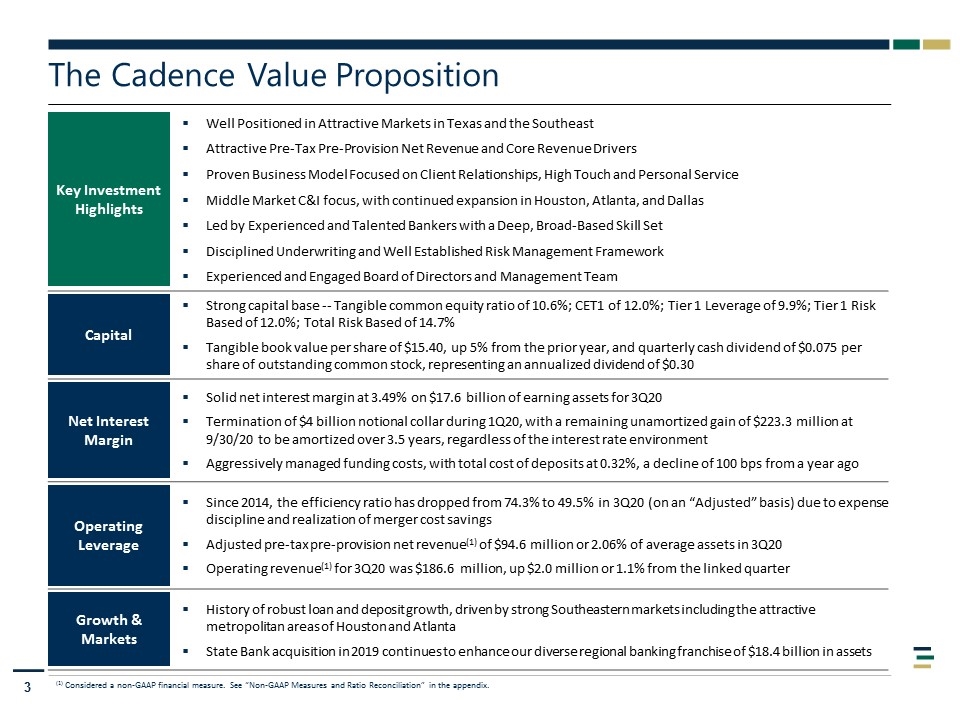

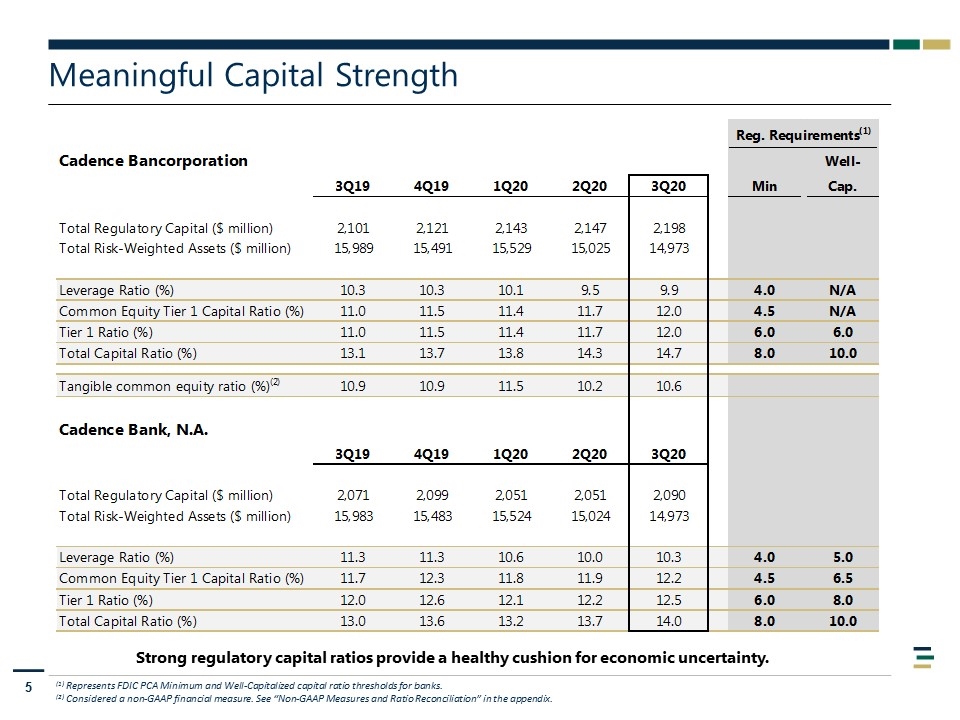

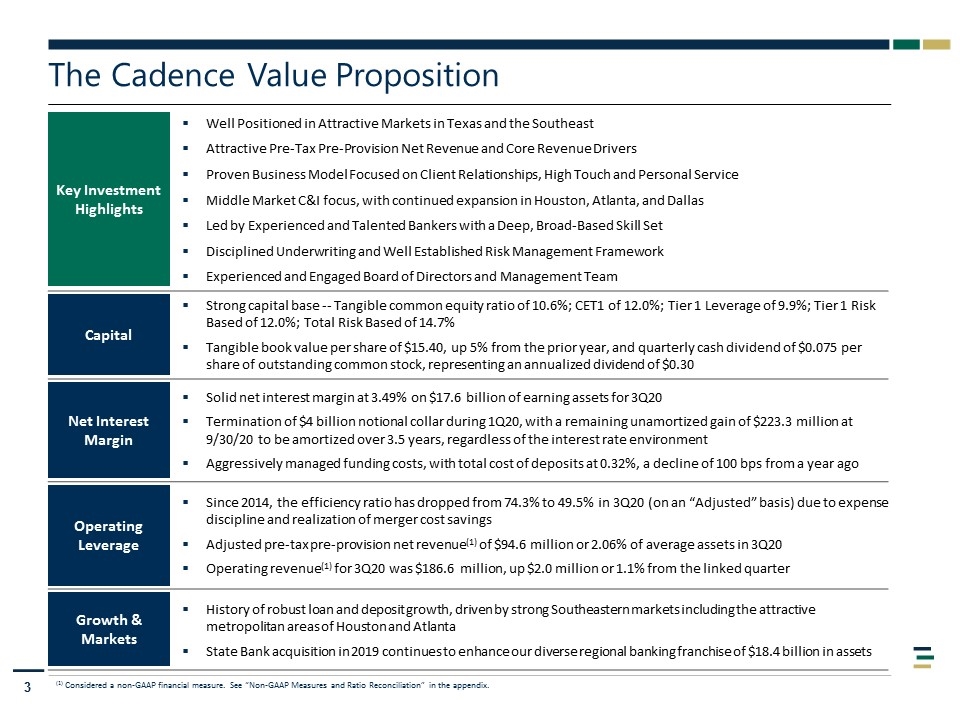

The Cadence Value Proposition Key Investment Highlights Well Positioned in Attractive Markets in Texas and the Southeast Attractive Pre-Tax Pre-Provision Net Revenue and Core Revenue Drivers Proven Business Model Focused on Client Relationships, High Touch and Personal Service Middle Market C&I focus, with continued expansion in Houston, Atlanta, and Dallas Led by Experienced and Talented Bankers with a Deep, Broad-Based Skill Set Disciplined Underwriting and Well Established Risk Management Framework Experienced and Engaged Board of Directors and Management Team Capital Strong capital base -- Tangible common equity ratio of 10.6%; CET1 of 12.0%; Tier 1 Leverage of 9.9%; Tier 1 Risk Based of 12.0%; Total Risk Based of 14.7% Tangible book value per share of $15.40, up 5% from the prior year, and quarterly cash dividend of $0.075 per share of outstanding common stock, representing an annualized dividend of $0.30 Net Interest Margin Solid net interest margin at 3.49% on $17.6 billion of earning assets for 3Q20 Termination of $4 billion notional collar during 1Q20, with a remaining unamortized gain of $223.3 million at 9/30/20 to be amortized over 3.5 years, regardless of the interest rate environment Aggressively managed funding costs, with total cost of deposits at 0.32%, a decline of 100 bps from a year ago Operating Leverage Since 2014, the efficiency ratio has dropped from 74.3% to 49.5% in 3Q20 (on an “Adjusted” basis) due to expense discipline and realization of merger cost savings Adjusted pre-tax pre-provision net revenue(1) of $94.6 million or 2.06% of average assets in 3Q20 Operating revenue(1) for 3Q20 was $186.6 million, up $2.0 million or 1.1% from the linked quarter Growth & Markets History of robust loan and deposit growth, driven by strong Southeastern markets including the attractive metropolitan areas of Houston and Atlanta State Bank acquisition in 2019 continues to enhance our diverse regional banking franchise of $18.4 billion in assets (1) Considered a non-GAAP financial measure. See “Non-GAAP Measures and Ratio Reconciliation” in the appendix.

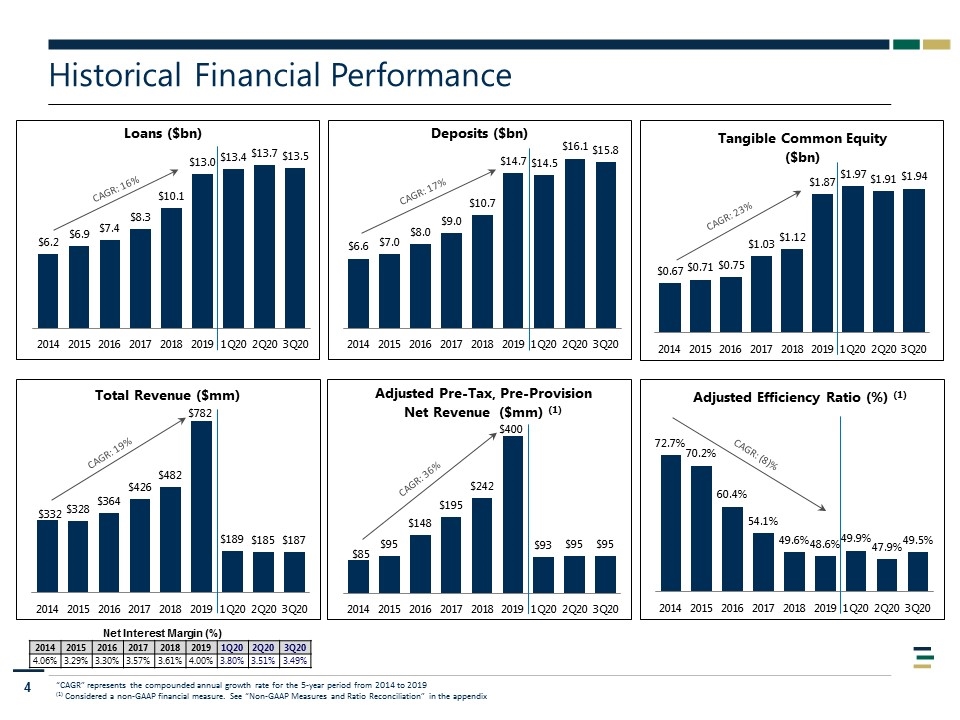

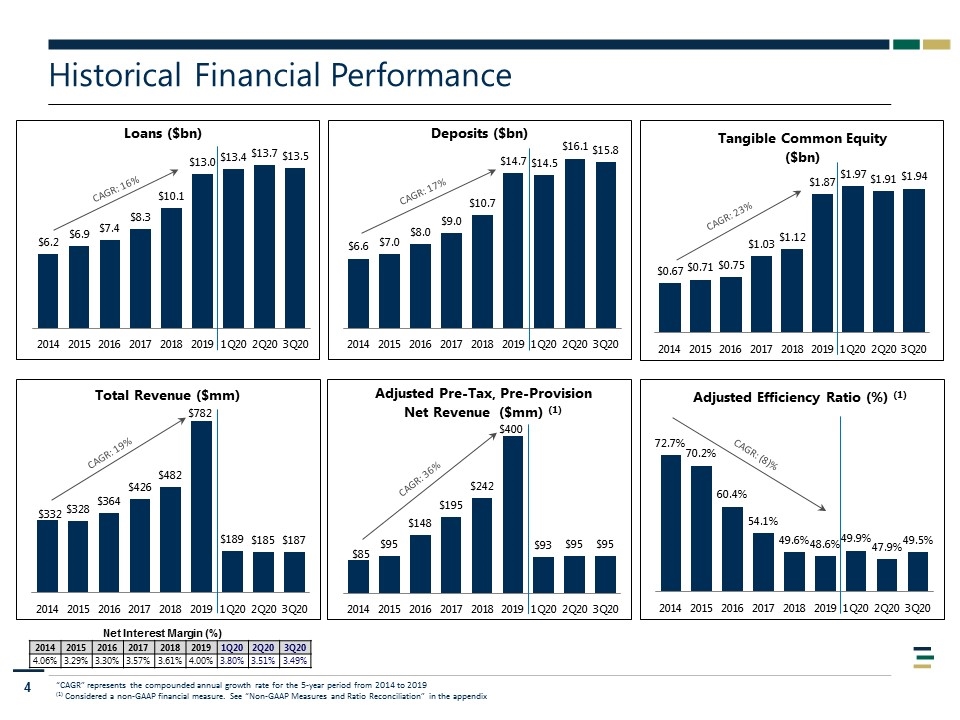

Historical Financial Performance 44% 62% 74% 17% 26% 74% 80% 84% 20% 16% 92% 8% 96% 4% “CAGR” represents the compounded annual growth rate for the 5-year period from 2014 to 2019 (1) Considered a non-GAAP financial measure. See “Non-GAAP Measures and Ratio Reconciliation” in the appendix 2014 2015 2016 2017 2018 2019 1Q20 2Q20 3Q20 4.06% 3.29% 3.30% 3.57% 3.61% 4.00% 3.80% 3.51% 3.49% Net Interest Margin (%) CAGR: 16% CAGR: 17% CAGR: 19% CAGR: 36% CAGR: (8)% CAGR: 23%

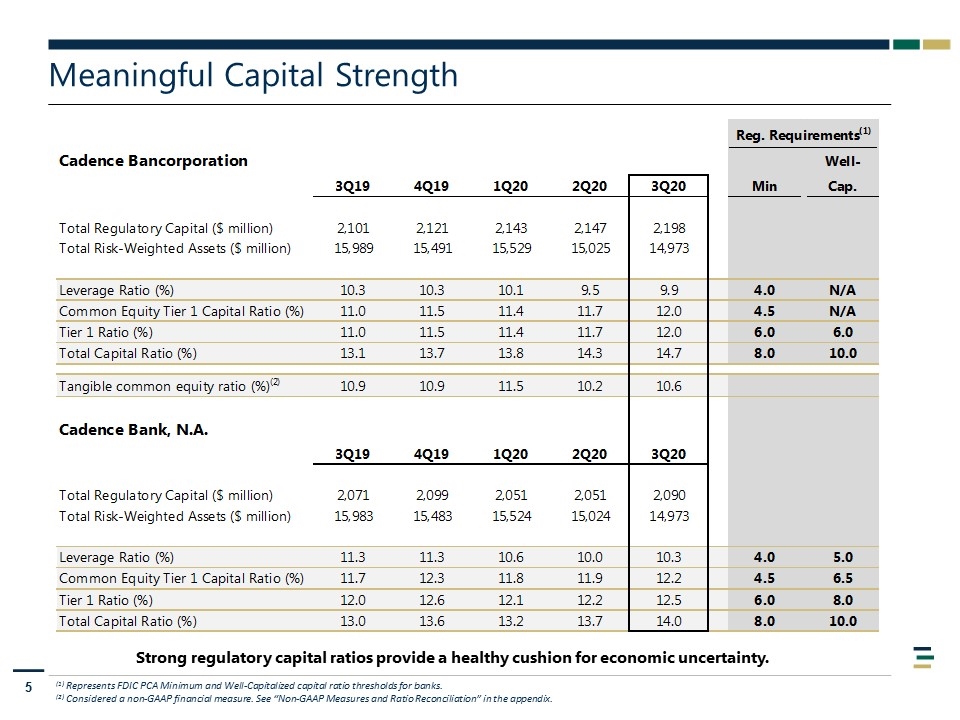

Meaningful Capital Strength (1) Represents FDIC PCA Minimum and Well-Capitalized capital ratio thresholds for banks. (2) Considered a non-GAAP financial measure. See “Non-GAAP Measures and Ratio Reconciliation” in the appendix. Strong regulatory capital ratios provide a healthy cushion for economic uncertainty.

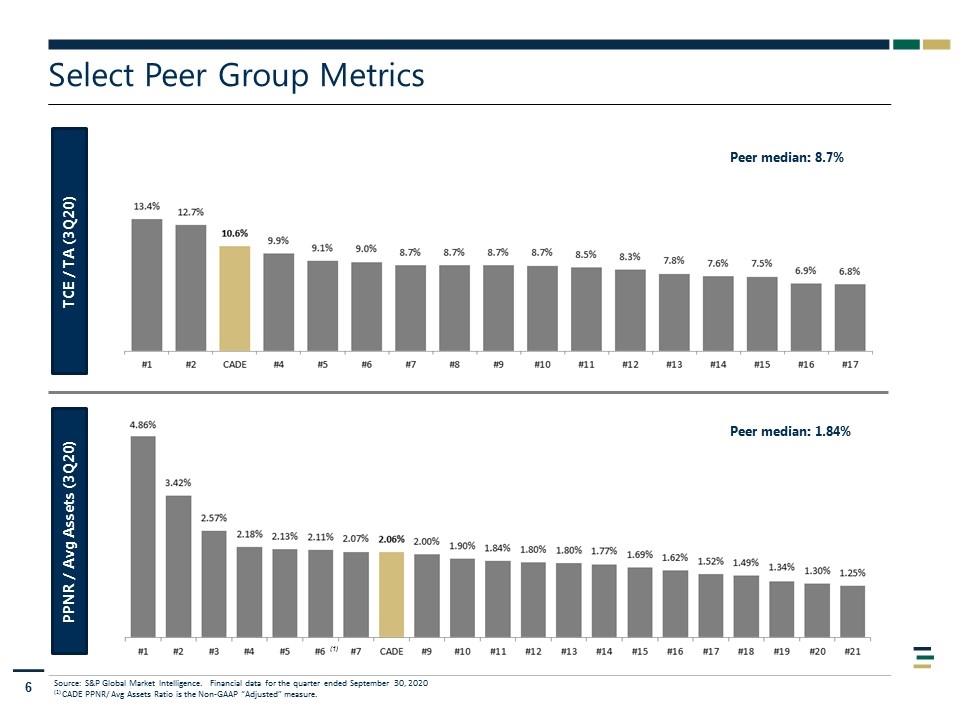

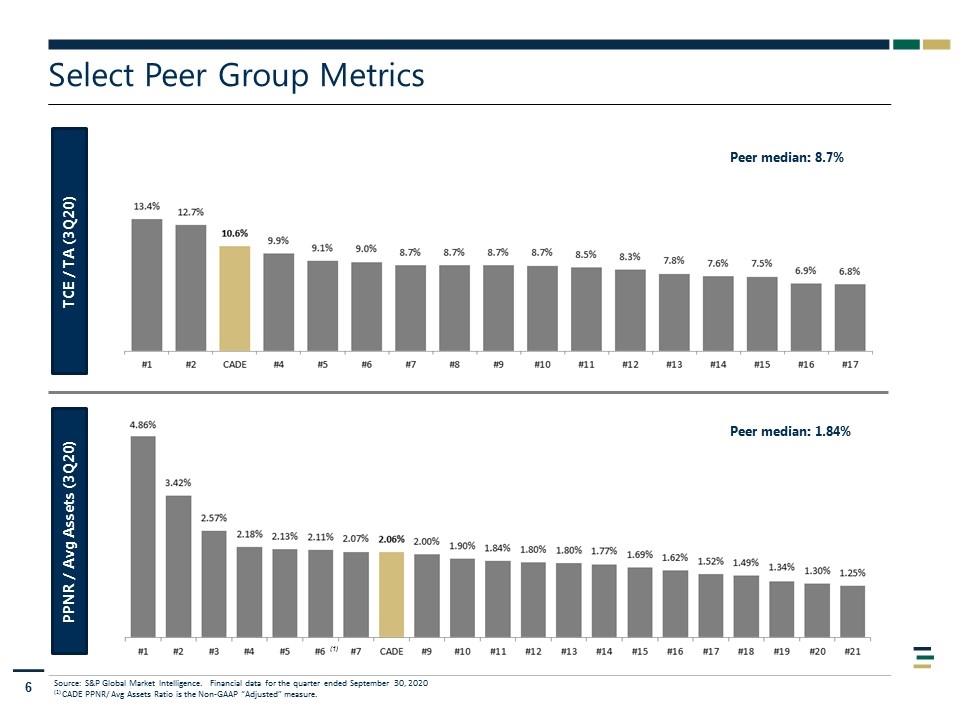

Select Peer Group Metrics TCE / TA (3Q20) PPNR / Avg Assets (3Q20) Peer median: 8.7% Peer median: 1.84% Source: S&P Global Market Intelligence. Financial data for the quarter ended September 30, 2020 (1) CADE PPNR/ Avg Assets Ratio is the Non-GAAP “Adjusted” measure. (1)

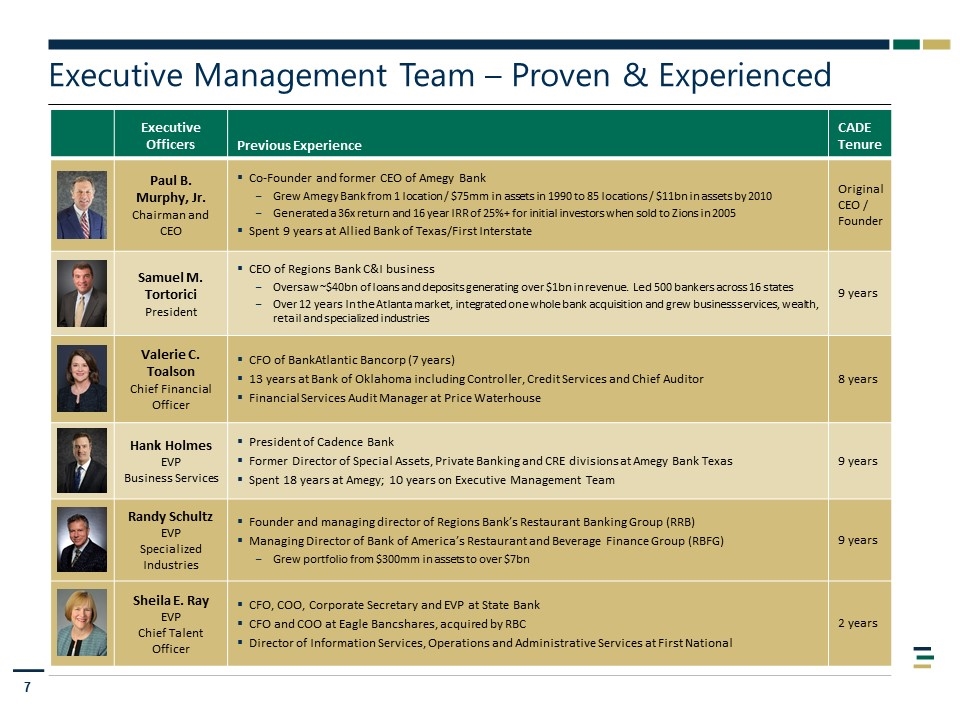

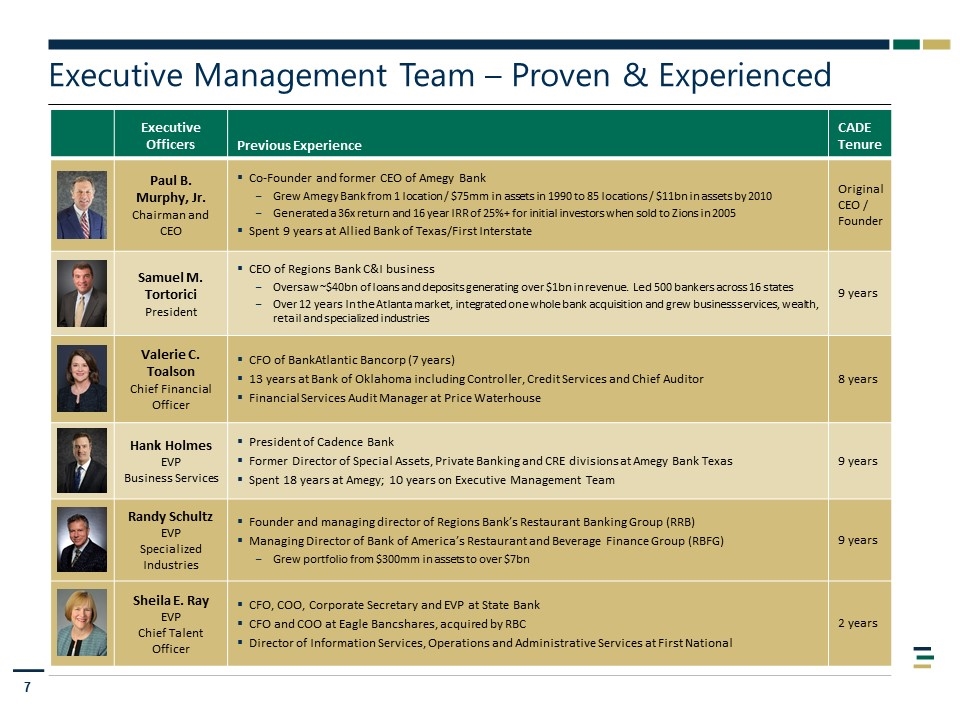

Executive Management Team – Proven & Experienced Executive Officers Previous Experience CADE Tenure Paul B. Murphy, Jr. Chairman and CEO Co-Founder and former CEO of Amegy Bank Grew Amegy Bank from 1 location / $75mm in assets in 1990 to 85 locations / $11bn in assets by 2010 Generated a 36x return and 16 year IRR of 25%+ for initial investors when sold to Zions in 2005 Spent 9 years at Allied Bank of Texas/First Interstate Original CEO / Founder Samuel M. Tortorici President CEO of Regions Bank C&I business Oversaw ~$40bn of loans and deposits generating over $1bn in revenue. Led 500 bankers across 16 states Over 12 years In the Atlanta market, integrated one whole bank acquisition and grew business services, wealth, retail and specialized industries 9 years Valerie C. Toalson Chief Financial Officer CFO of BankAtlantic Bancorp (7 years) 13 years at Bank of Oklahoma including Controller, Credit Services and Chief Auditor Financial Services Audit Manager at Price Waterhouse 8 years Hank Holmes EVP Business Services President of Cadence Bank Former Director of Special Assets, Private Banking and CRE divisions at Amegy Bank Texas Spent 18 years at Amegy; 10 years on Executive Management Team 9 years Randy Schultz EVP Specialized Industries Founder and managing director of Regions Bank’s Restaurant Banking Group (RRB) Managing Director of Bank of America’s Restaurant and Beverage Finance Group (RBFG) Grew portfolio from $300mm in assets to over $7bn 9 years Sheila E. Ray EVP Chief Talent Officer CFO, COO, Corporate Secretary and EVP at State Bank CFO and COO at Eagle Bancshares, acquired by RBC Director of Information Services, Operations and Administrative Services at First National 2 years

Board of Directors – Active & Engaged Precious W. Owodunni Virginia A. Hepner J. Thomas Wiley, Jr. Marc J. Shapiro J. Richard Fredericks William B. Harrison, Jr. Joseph W. Evans Paul B. Murphy, Jr. President of Mountaintop Consulting, LLC Former President and CEO of the Woodruff Arts Center and retired EVP of Wachovia Bank Former Director, Vice Chairman, and Chief Executive Officer of State Bank Financial Founding Partner and Managing Director at Main Management, LLC Lead Outside Director of Cadence Bancorporation, Retired CEO of JPMorgan Chase & Co. Vice Chairman of Cadence Bancorporation, Former Chairman of State Bank Financial Chairman and CEO Officer of Cadence Bancorporation Kathy Waller Former Chief Financial Officer and President, Enabling Services of The Coca-Cola Company Retired Non-Executive Chairman of JPMorgan Chase & Co.’s Texas operations Experienced…..Diversified…..Dedicated

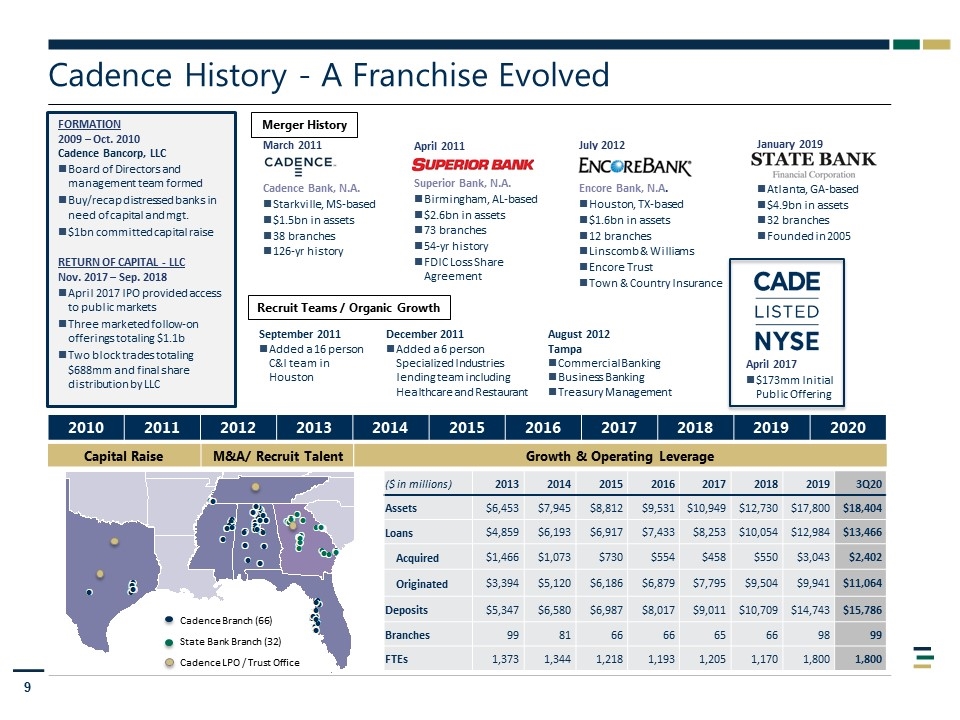

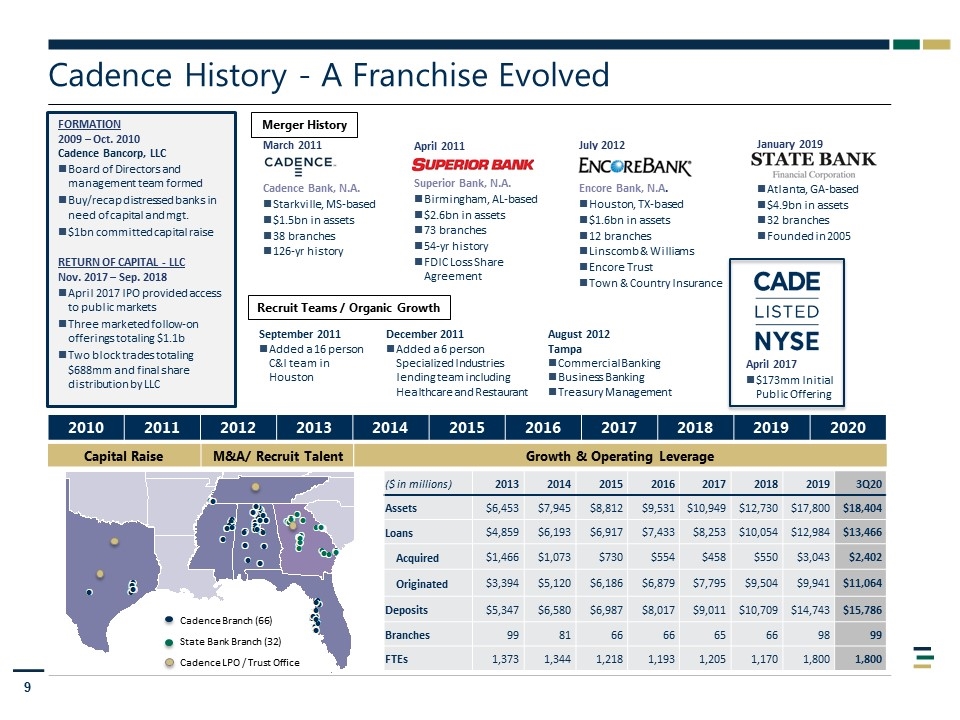

Cadence History - A Franchise Evolved March 2011 Cadence Bank, N.A. Starkville, MS-based $1.5bn in assets 38 branches 126-yr history July 2012 Encore Bank, N.A. Houston, TX-based $1.6bn in assets 12 branches Linscomb & Williams Encore Trust Town & Country Insurance April 2011 Superior Bank, N.A. Birmingham, AL-based $2.6bn in assets 73 branches 54-yr history FDIC Loss Share Agreement ($ in millions) 2013 2014 2015 2016 2017 2018 2019 3Q20 Assets $6,453 $7,945 $8,812 $9,531 $10,949 $12,730 $17,800 $18,404 Loans $4,859 $6,193 $6,917 $7,433 $8,253 $10,054 $12,984 $13,466 Acquired $1,466 $1,073 $730 $554 $458 $550 $3,043 $2,402 Originated $3,394 $5,120 $6,186 $6,879 $7,795 $9,504 $9,941 $11,064 Deposits $5,347 $6,580 $6,987 $8,017 $9,011 $10,709 $14,743 $15,786 Branches 99 81 66 66 65 66 98 99 FTEs 1,373 1,344 1,218 1,193 1,205 1,170 1,800 1,800 September 2011 Added a 16 person C&I team in Houston December 2011 Added a 6 person Specialized Industries lending team including Healthcare and Restaurant August 2012 Tampa Commercial Banking Business Banking Treasury Management April 2017 $173mm Initial Public Offering Capital Raise M&A/ Recruit Talent Growth & Operating Leverage FORMATION 2009 – Oct. 2010 Cadence Bancorp, LLC Board of Directors and management team formed Buy/recap distressed banks in need of capital and mgt. $1bn committed capital raise RETURN OF CAPITAL - LLC Nov. 2017 – Sep. 2018 April 2017 IPO provided access to public markets Three marketed follow-on offerings totaling $1.1b Two block trades totaling $688mm and final share distribution by LLC 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Cadence Branch (66) State Bank Branch (32) Cadence LPO / Trust Office January 2019 Atlanta, GA-based $4.9bn in assets 32 branches Founded in 2005 Merger History Recruit Teams / Organic Growth

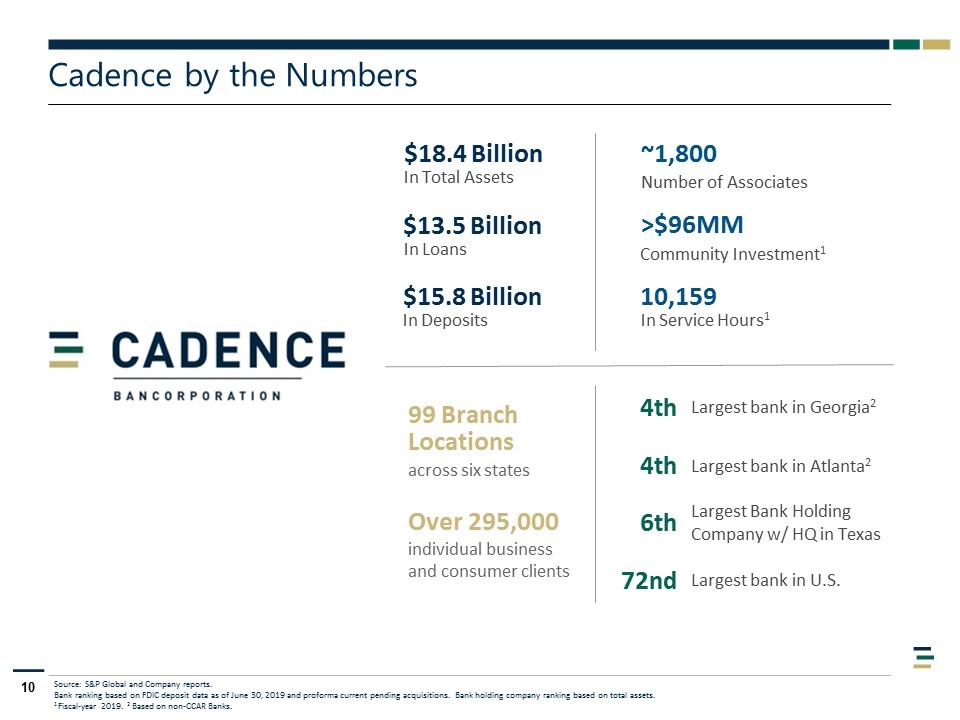

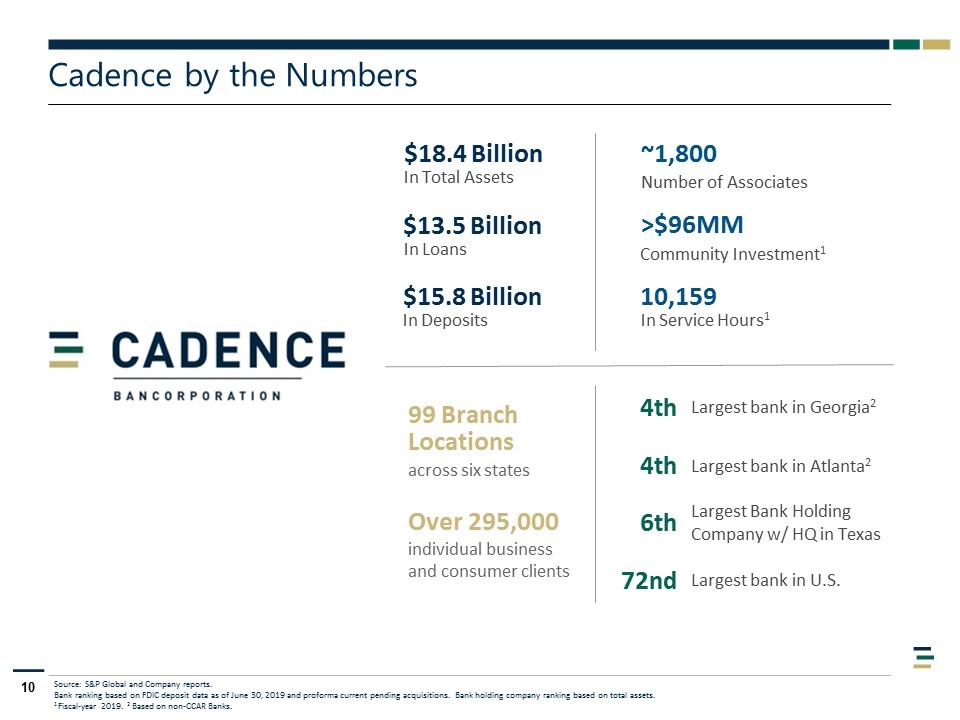

Cadence by the Numbers 99 Branch Locations across six states Over 295,000 individual business and consumer clients 4th Largest bank in Georgia2 Largest bank in Atlanta2 4th 72nd Largest bank in U.S. Largest Bank Holding Company w/ HQ in Texas 6th In Total Assets $18.4 Billion In Loans $13.5 Billion In Deposits $15.8 Billion Number of Associates ~1,800 Community Investment1 >$96MM In Service Hours1 10,159 Source: S&P Global and Company reports. Bank ranking based on FDIC deposit data as of June 30, 2019 and proforma current pending acquisitions. Bank holding company ranking based on total assets. 1 Fiscal-year 2019. 2 Based on non-CCAR Banks.

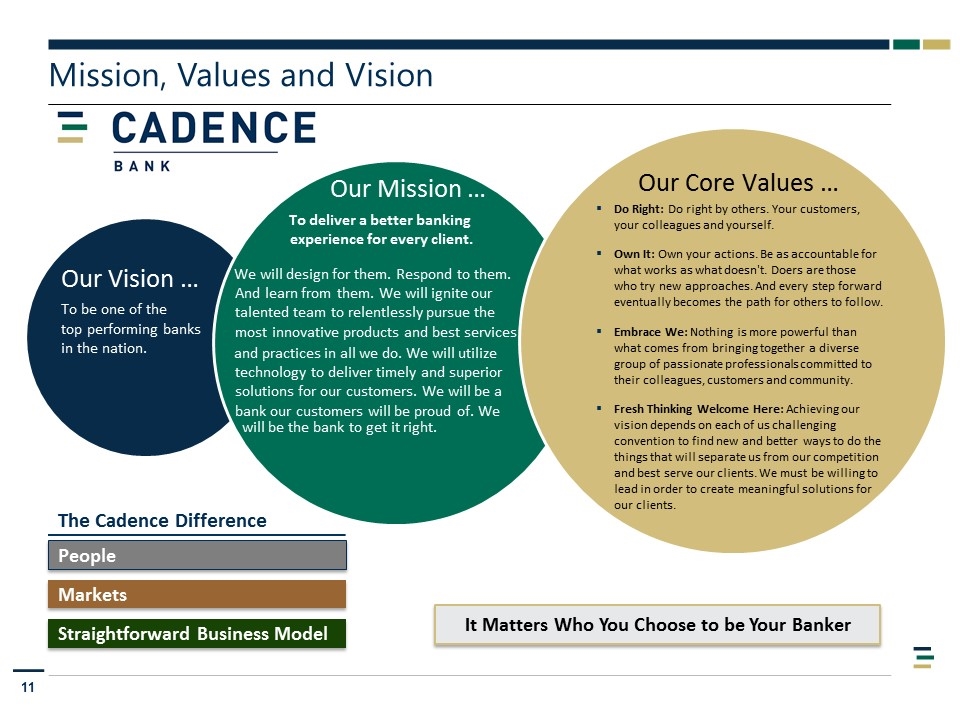

Straightforward Business Model Markets People Mission, Values and Vision Our Vision … To be one of the top performing banks in the nation. Our Core Values … Do Right: Do right by others. Your customers, your colleagues and yourself. Own It: Own your actions. Be as accountable for what works as what doesn't. Doers are those who try new approaches. And every step forward eventually becomes the path for others to follow. Embrace We: Nothing is more powerful than what comes from bringing together a diverse group of passionate professionals committed to their colleagues, customers and community. Fresh Thinking Welcome Here: Achieving our vision depends on each of us challenging convention to find new and better ways to do the things that will separate us from our competition and best serve our clients. We must be willing to lead in order to create meaningful solutions for our clients. The Cadence Difference To deliver a better banking experience for every client. Our Mission … We will design for them. Respond to them. And learn from them. We will ignite our talented team to relentlessly pursue the most innovative products and best services and practices in all we do. We will utilize technology to deliver timely and superior solutions for our customers. We will be a bank our customers will be proud of. We will be the bank to get it right. It Matters Who You Choose to be Your Banker

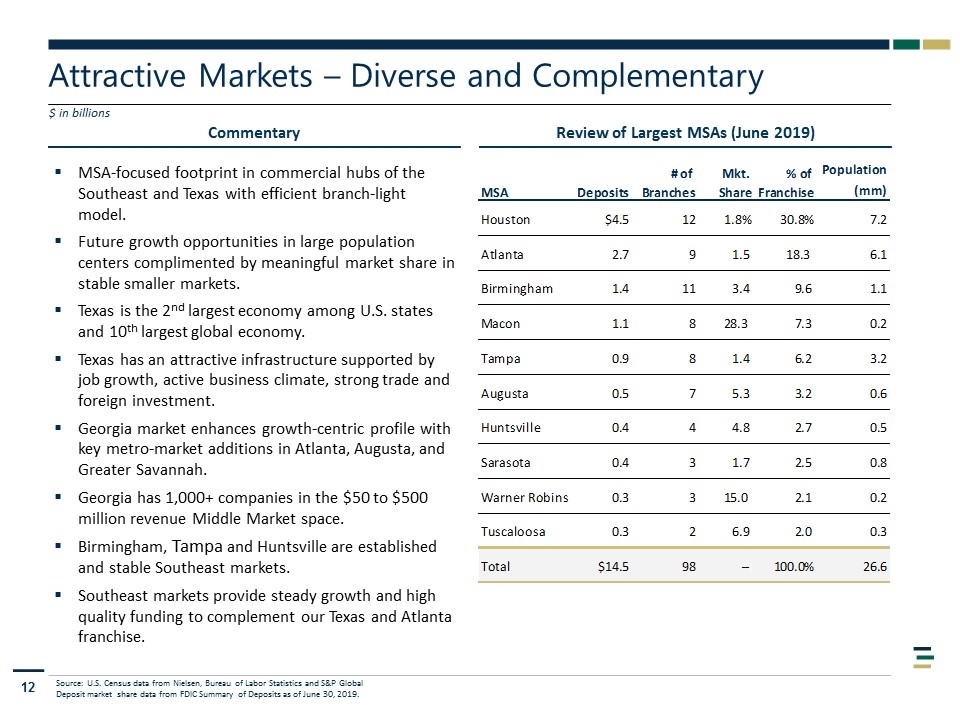

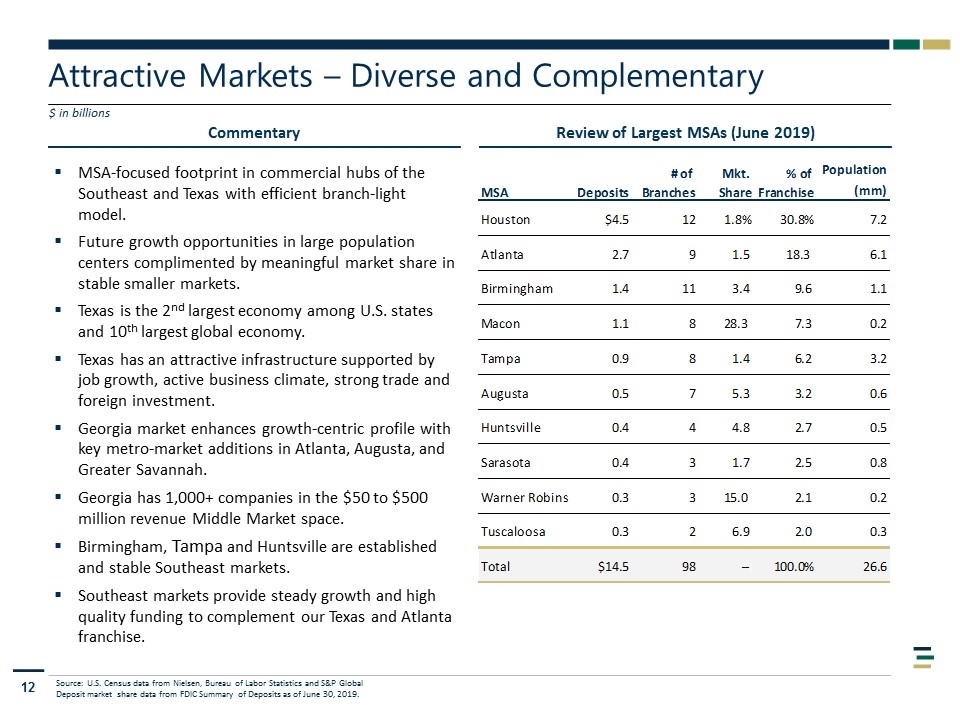

Commentary $ in billions MSA-focused footprint in commercial hubs of the Southeast and Texas with efficient branch-light model. Future growth opportunities in large population centers complimented by meaningful market share in stable smaller markets. Texas is the 2nd largest economy among U.S. states and 10th largest global economy. Texas has an attractive infrastructure supported by job growth, active business climate, strong trade and foreign investment. Georgia market enhances growth-centric profile with key metro-market additions in Atlanta, Augusta, and Greater Savannah. Georgia has 1,000+ companies in the $50 to $500 million revenue Middle Market space. Birmingham, Tampa and Huntsville are established and stable Southeast markets. Southeast markets provide steady growth and high quality funding to complement our Texas and Atlanta franchise. Source: U.S. Census data from Nielsen, Bureau of Labor Statistics and S&P Global Deposit market share data from FDIC Summary of Deposits as of June 30, 2019. Attractive Markets – Diverse and Complementary Review of Largest MSAs (June 2019)

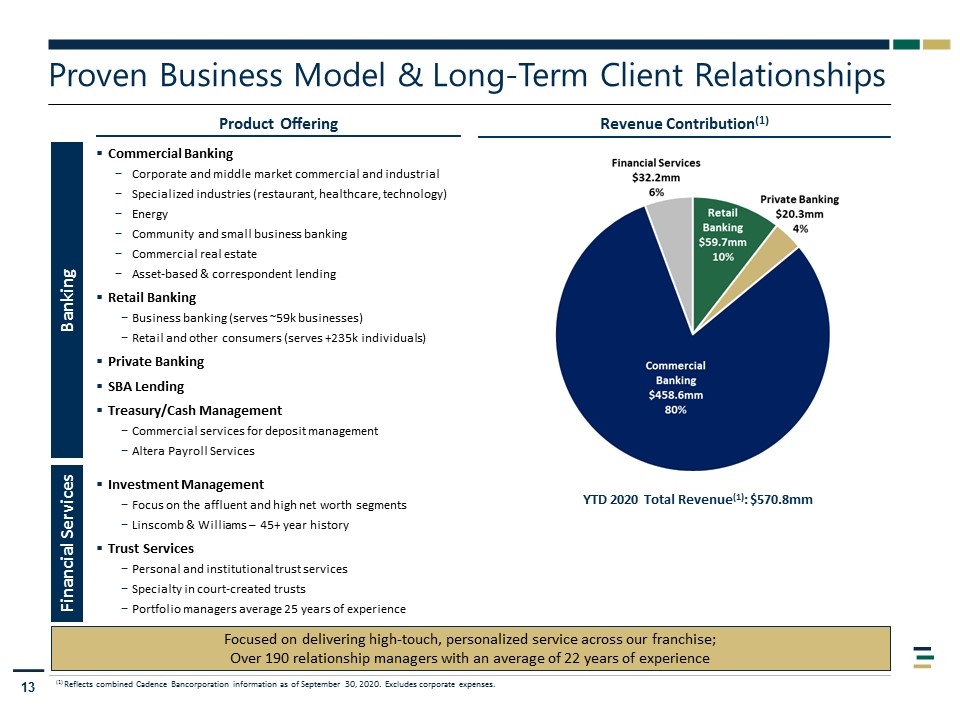

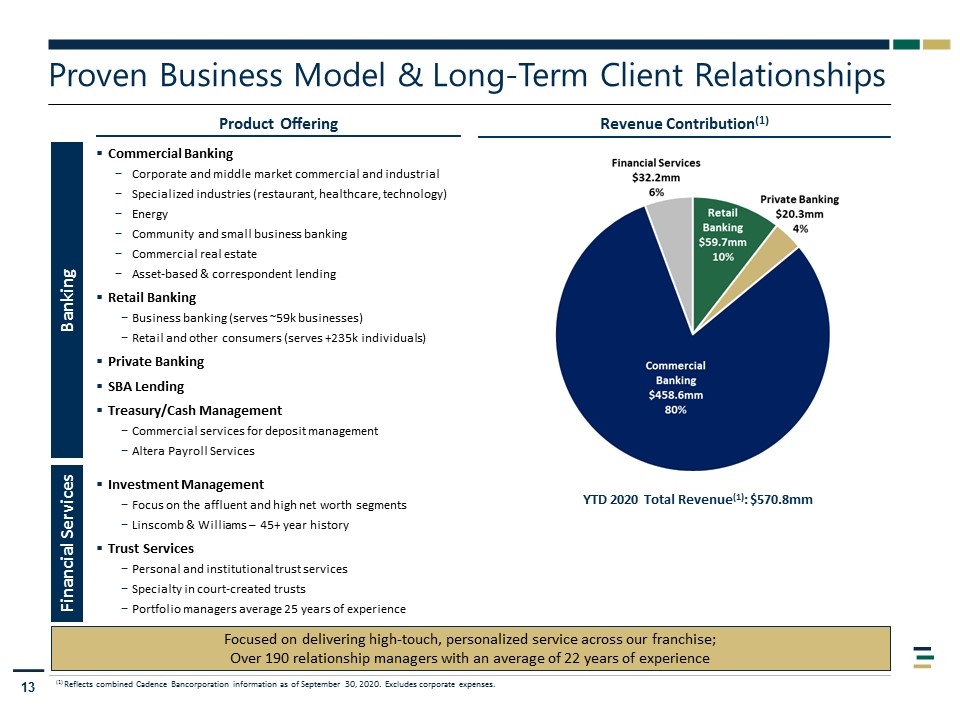

Proven Business Model & Long-Term Client Relationships Banking Financial Services (1) Reflects combined Cadence Bancorporation information as of September 30, 2020. Excludes corporate expenses. Revenue Contribution(1) Product Offering Commercial Banking Corporate and middle market commercial and industrial Specialized industries (restaurant, healthcare, technology) Energy Community and small business banking Commercial real estate Asset-based & correspondent lending Retail Banking Business banking (serves ~59k businesses) Retail and other consumers (serves +235k individuals) Private Banking SBA Lending Treasury/Cash Management Commercial services for deposit management Altera Payroll Services Investment Management Focus on the affluent and high net worth segments Linscomb & Williams – 45+ year history Trust Services Personal and institutional trust services Specialty in court-created trusts Portfolio managers average 25 years of experience Focused on delivering high-touch, personalized service across our franchise; Over 190 relationship managers with an average of 22 years of experience YTD 2020 Total Revenue(1): $570.8mm

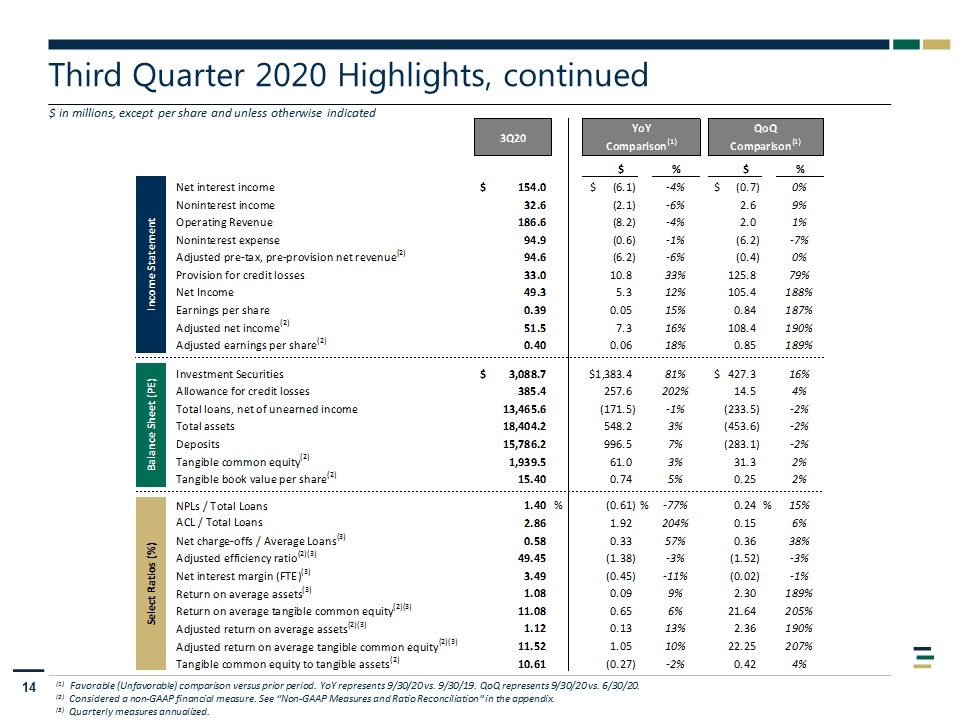

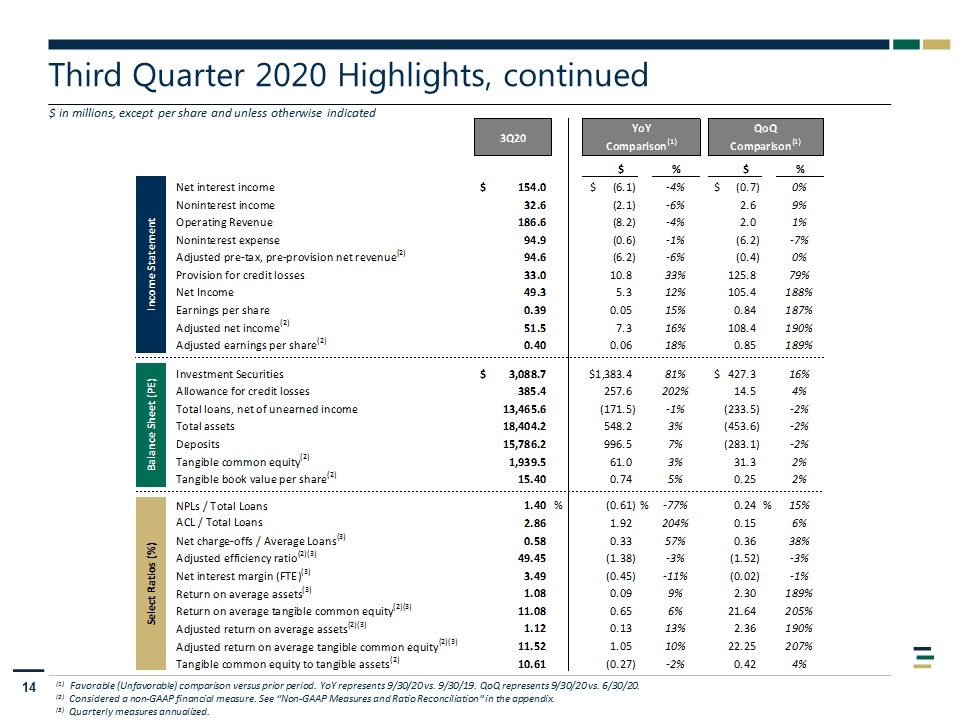

Third Quarter 2020 Highlights, continued $ in millions, except per share and unless otherwise indicated (1) Favorable (Unfavorable) comparison versus prior period. YoY represents 9/30/20 vs. 9/30/19. QoQ represents 9/30/20 vs. 6/30/20. (2) Considered a non-GAAP financial measure. See “Non-GAAP Measures and Ratio Reconciliation” in the appendix. (3) Quarterly measures annualized.

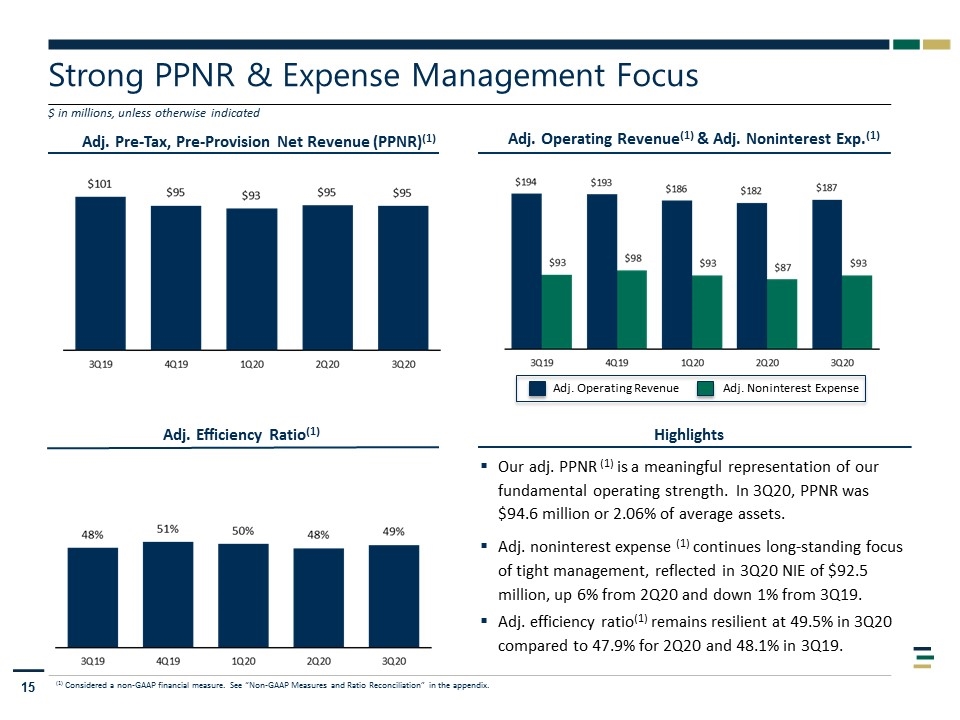

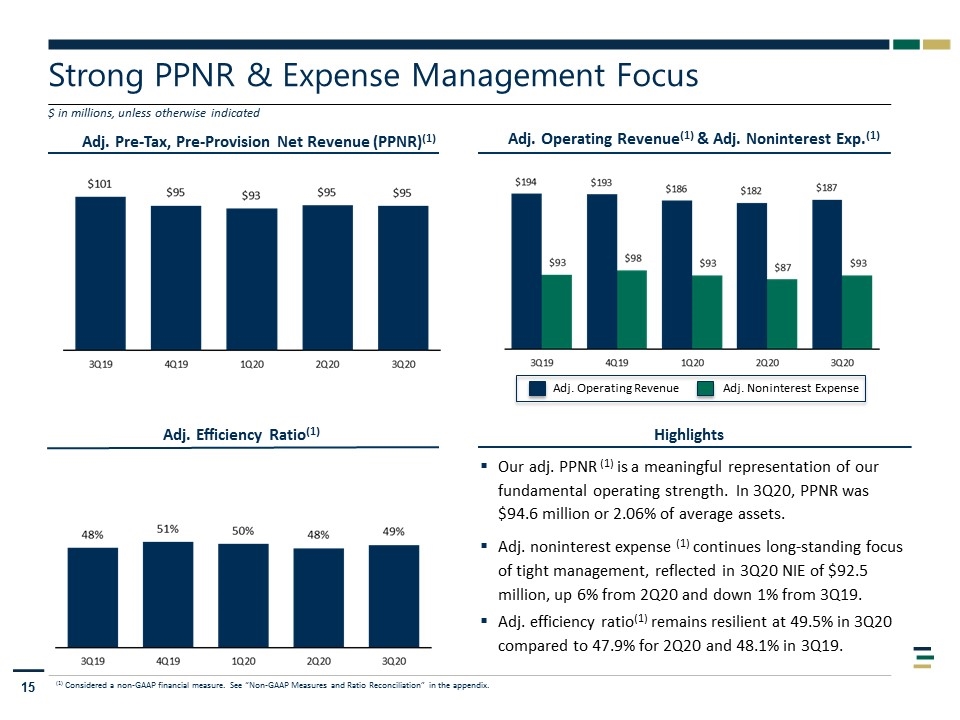

Strong PPNR & Expense Management Focus Adj. Pre-Tax, Pre-Provision Net Revenue (PPNR)(1) Highlights Adj. Efficiency Ratio(1) (1) Considered a non-GAAP financial measure. See “Non-GAAP Measures and Ratio Reconciliation” in the appendix. Adj. Operating Revenue(1) & Adj. Noninterest Exp.(1) $ in millions, unless otherwise indicated Adj. Operating Revenue Adj. Noninterest Expense Our adj. PPNR (1) is a meaningful representation of our fundamental operating strength. In 3Q20, PPNR was $94.6 million or 2.06% of average assets. Adj. noninterest expense (1) continues long-standing focus of tight management, reflected in 3Q20 NIE of $92.5 million, up 6% from 2Q20 and down 1% from 3Q19. Adj. efficiency ratio(1) remains resilient at 49.5% in 3Q20 compared to 47.9% for 2Q20 and 48.1% in 3Q19.

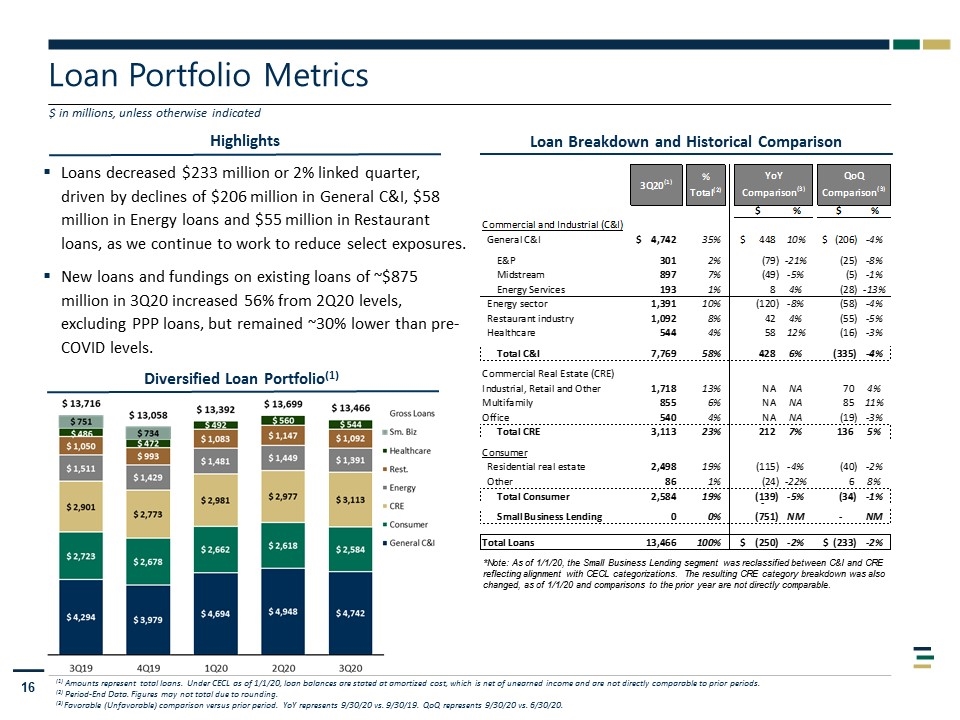

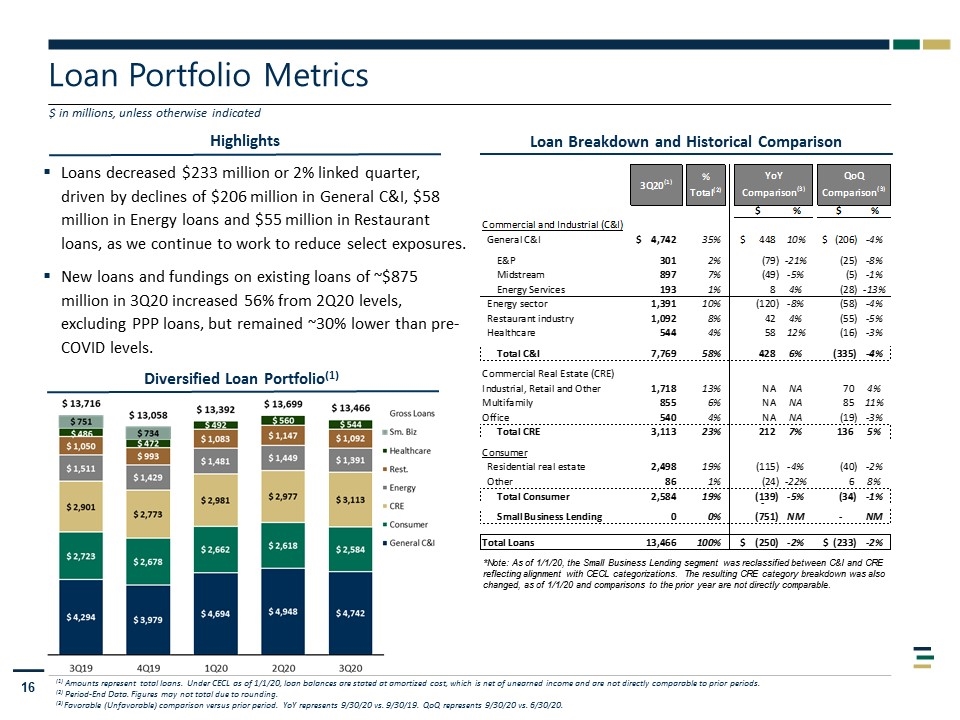

Highlights Loan Portfolio Metrics $ in millions, unless otherwise indicated Diversified Loan Portfolio(1) (1) Amounts represent total loans. Under CECL as of 1/1/20, loan balances are stated at amortized cost, which is net of unearned income and are not directly comparable to prior periods. (2) Period-End Data. Figures may not total due to rounding. (3) Favorable (Unfavorable) comparison versus prior period. YoY represents 9/30/20 vs. 9/30/19. QoQ represents 9/30/20 vs. 6/30/20. Loan Breakdown and Historical Comparison *Note: As of 1/1/20, the Small Business Lending segment was reclassified between C&I and CRE reflecting alignment with CECL categorizations. The resulting CRE category breakdown was also changed, as of 1/1/20 and comparisons to the prior year are not directly comparable. Loans decreased $233 million or 2% linked quarter, driven by declines of $206 million in General C&I, $58 million in Energy loans and $55 million in Restaurant loans, as we continue to work to reduce select exposures. New loans and fundings on existing loans of ~$875 million in 3Q20 increased 56% from 2Q20 levels, excluding PPP loans, but remained ~30% lower than pre-COVID levels.

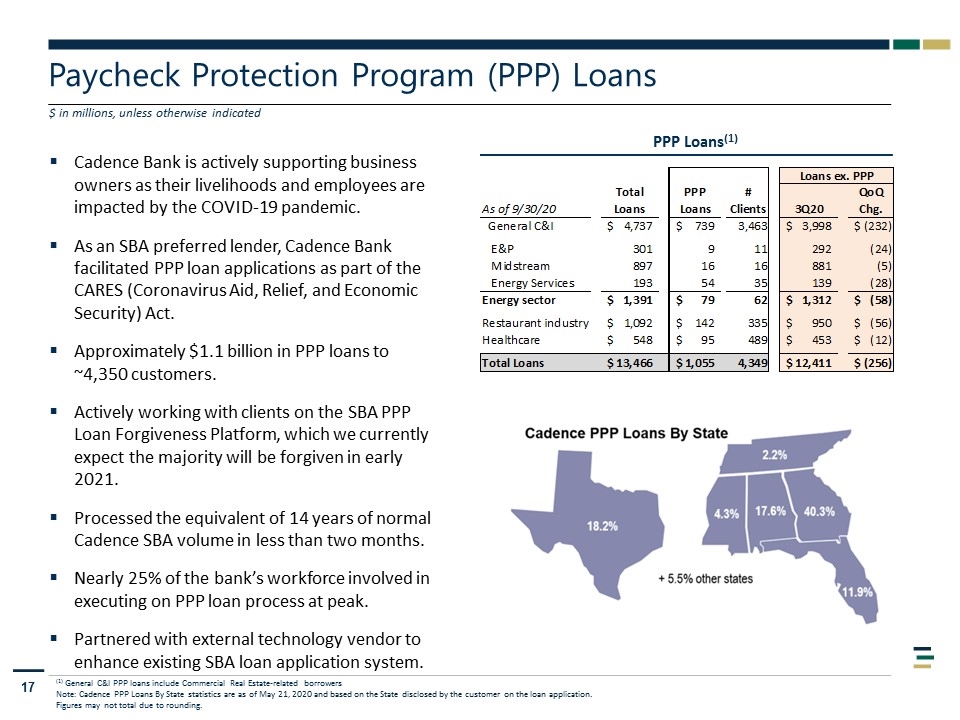

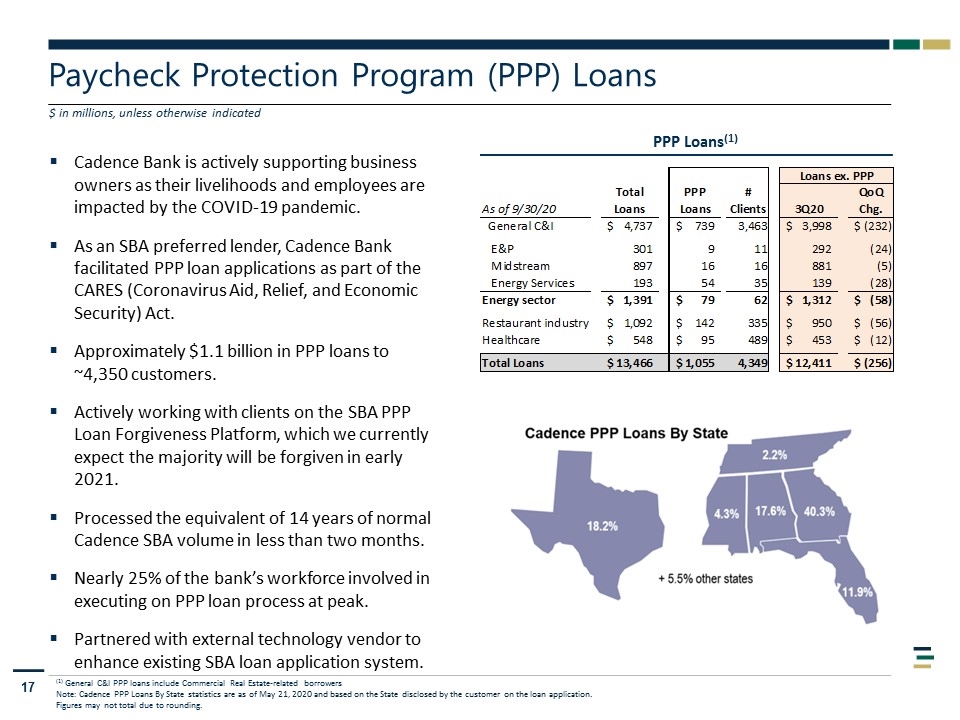

Paycheck Protection Program (PPP) Loans $ in millions, unless otherwise indicated PPP Loans(1) Cadence Bank is actively supporting business owners as their livelihoods and employees are impacted by the COVID-19 pandemic. As an SBA preferred lender, Cadence Bank facilitated PPP loan applications as part of the CARES (Coronavirus Aid, Relief, and Economic Security) Act. Approximately $1.1 billion in PPP loans to ~4,350 customers. Actively working with clients on the SBA PPP Loan Forgiveness Platform, which we currently expect the majority will be forgiven in early 2021. Processed the equivalent of 14 years of normal Cadence SBA volume in less than two months. Nearly 25% of the bank’s workforce involved in executing on PPP loan process at peak. Partnered with external technology vendor to enhance existing SBA loan application system. (1) General C&I PPP loans include Commercial Real Estate-related borrowers Note: Cadence PPP Loans By State statistics are as of May 21, 2020 and based on the State disclosed by the customer on the loan application. Figures may not total due to rounding.

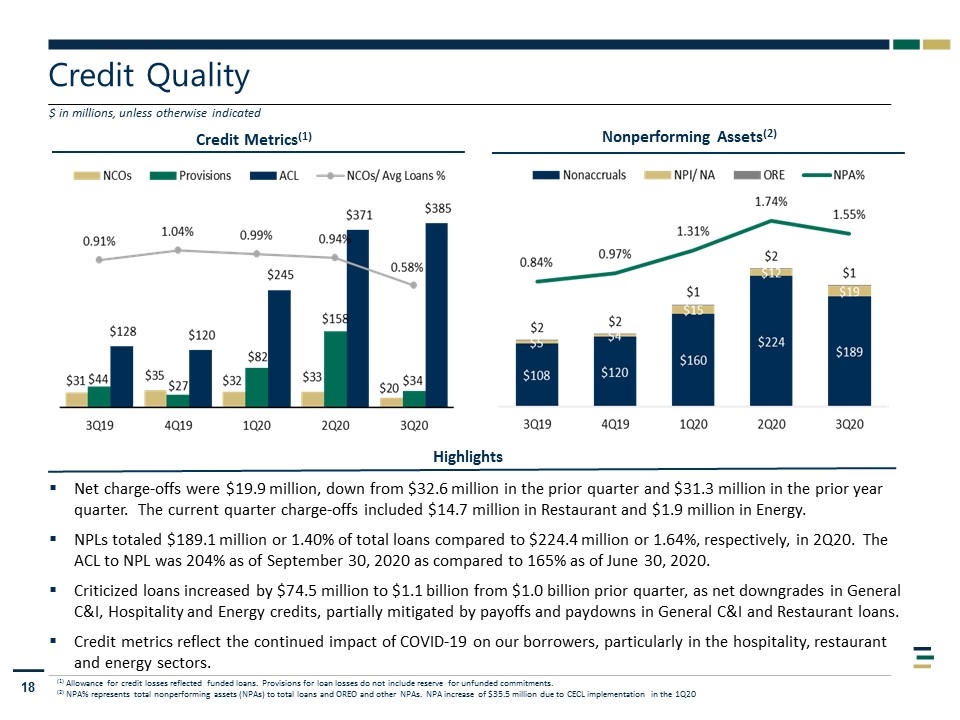

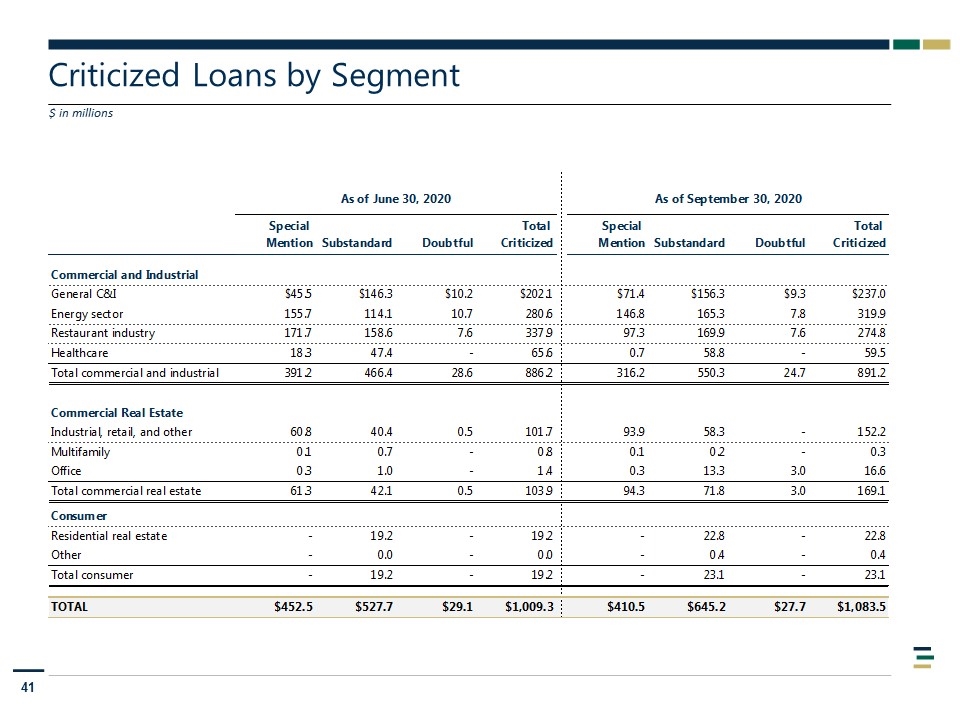

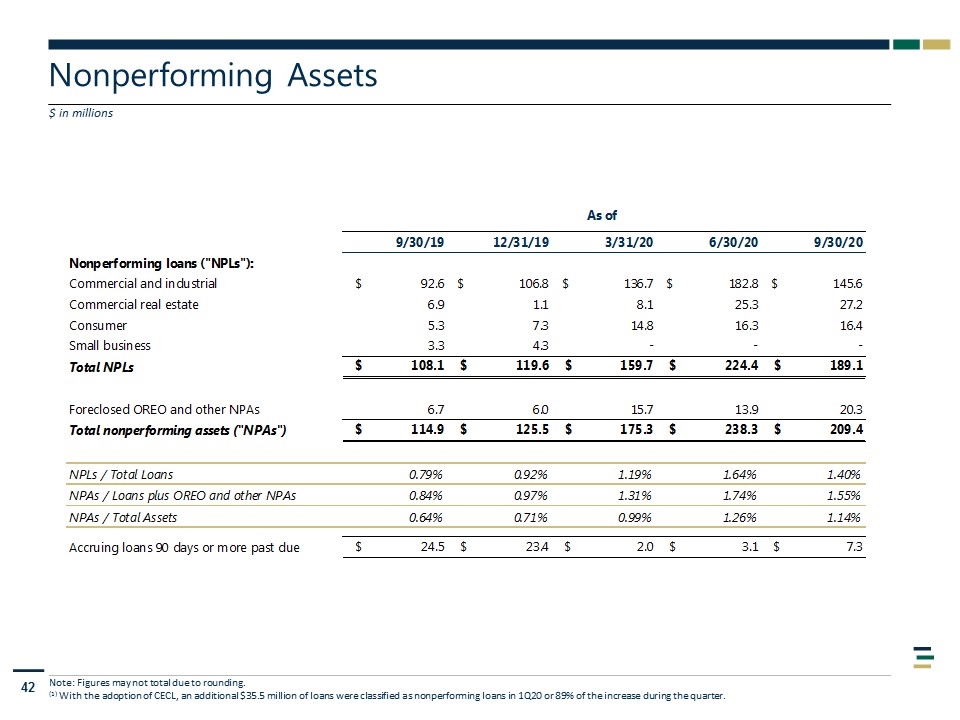

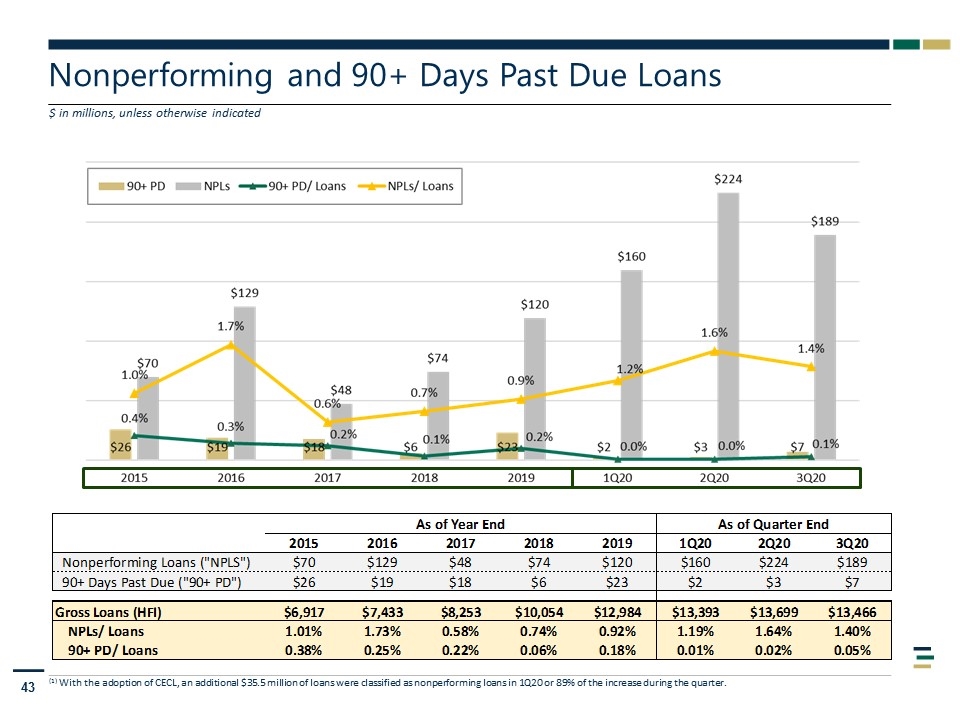

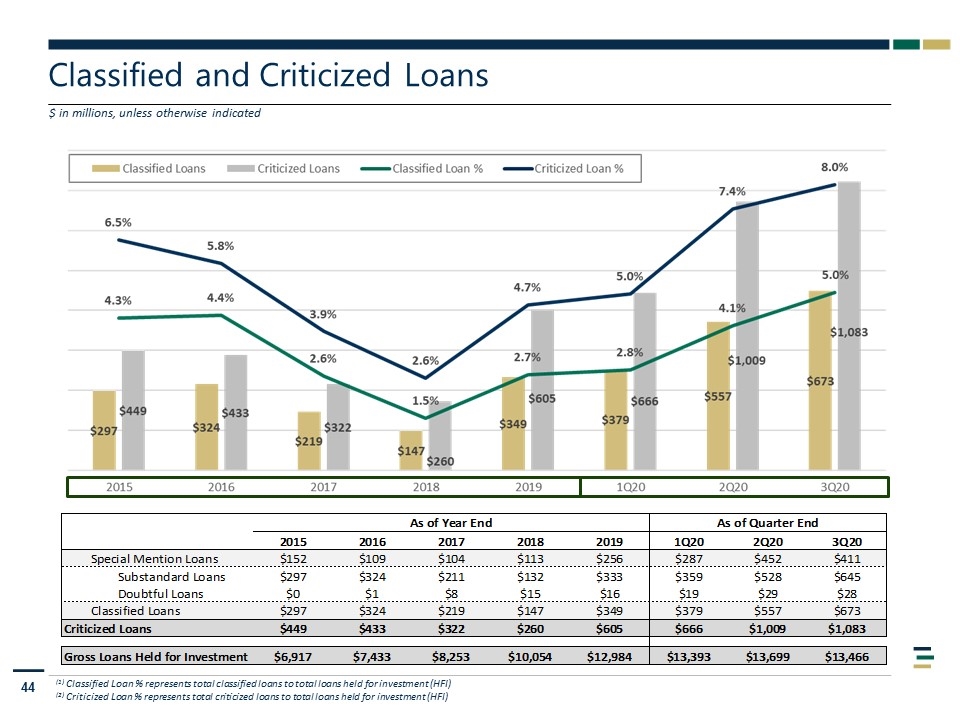

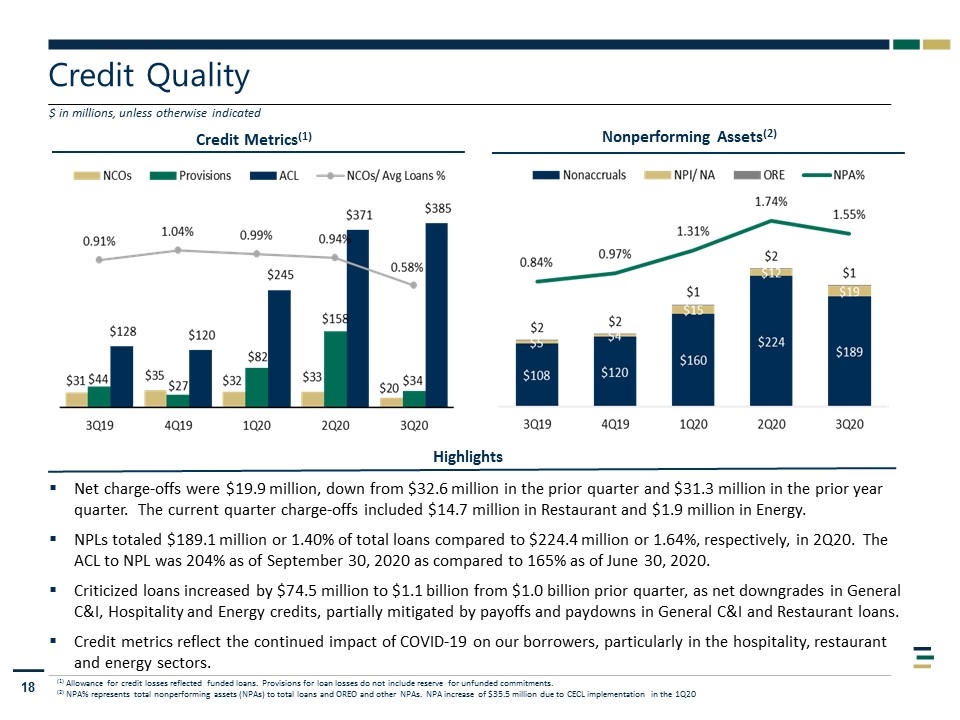

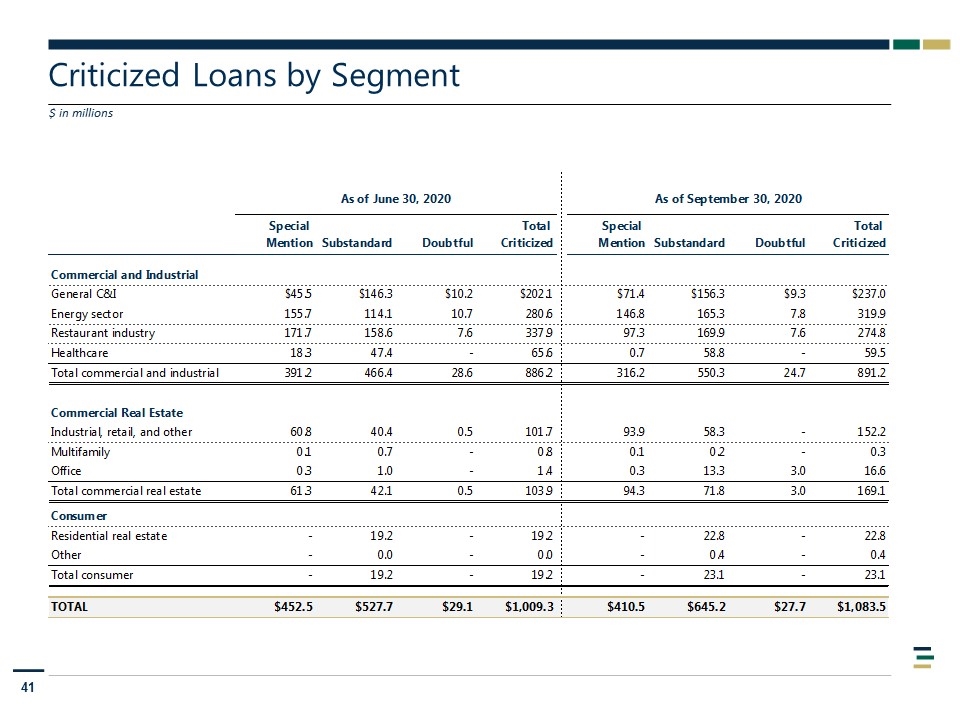

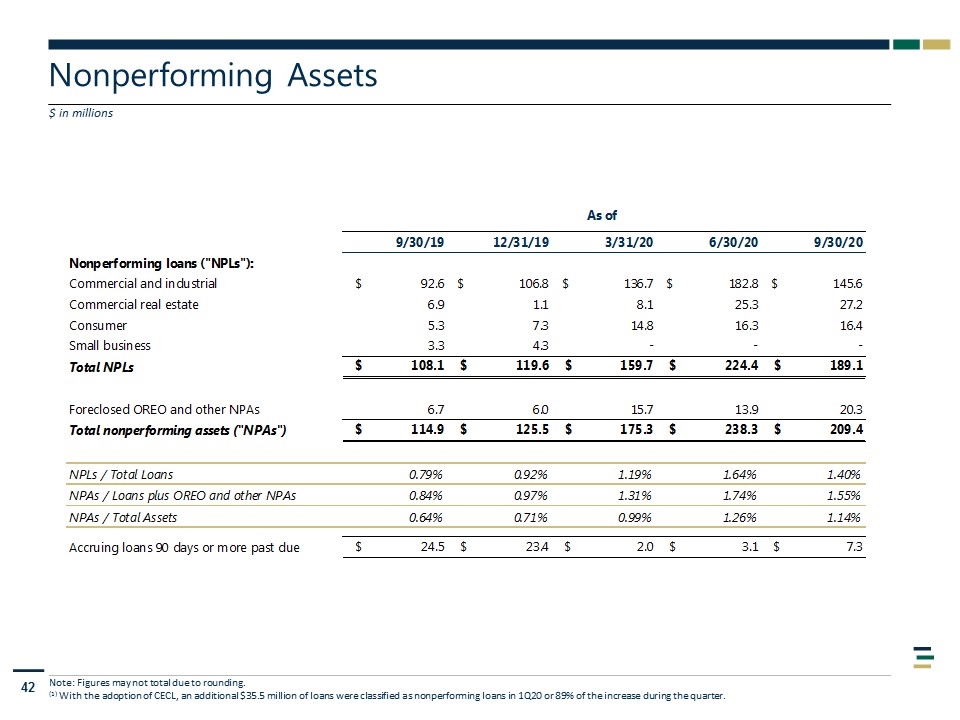

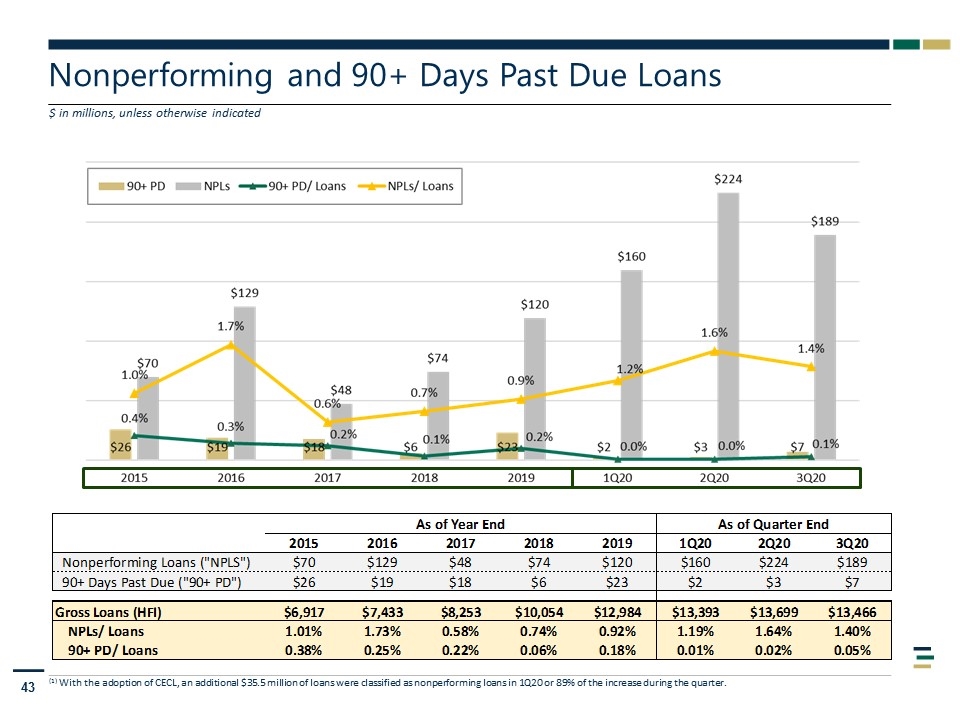

Net charge-offs were $19.9 million, down from $32.6 million in the prior quarter and $31.3 million in the prior year quarter. The current quarter charge-offs included $14.7 million in Restaurant and $1.9 million in Energy. NPLs totaled $189.1 million or 1.40% of total loans compared to $224.4 million or 1.64%, respectively, in 2Q20. The ACL to NPL was 204% as of September 30, 2020 as compared to 165% as of June 30, 2020. Criticized loans increased by $74.5 million to $1.1 billion from $1.0 billion prior quarter, as net downgrades in General C&I, Hospitality and Energy credits, partially mitigated by payoffs and paydowns in General C&I and Restaurant loans. Credit metrics reflect the continued impact of COVID-19 on our borrowers, particularly in the hospitality, restaurant and energy sectors. Credit Quality $ in millions, unless otherwise indicated Nonperforming Assets(2) Highlights Credit Metrics(1) (1) Allowance for credit losses reflected funded loans. Provisions for loan losses do not include reserve for unfunded commitments. (2) NPA% represents total nonperforming assets (NPAs) to total loans and OREO and other NPAs. NPA increase of $35.5 million due to CECL implementation in the 1Q20

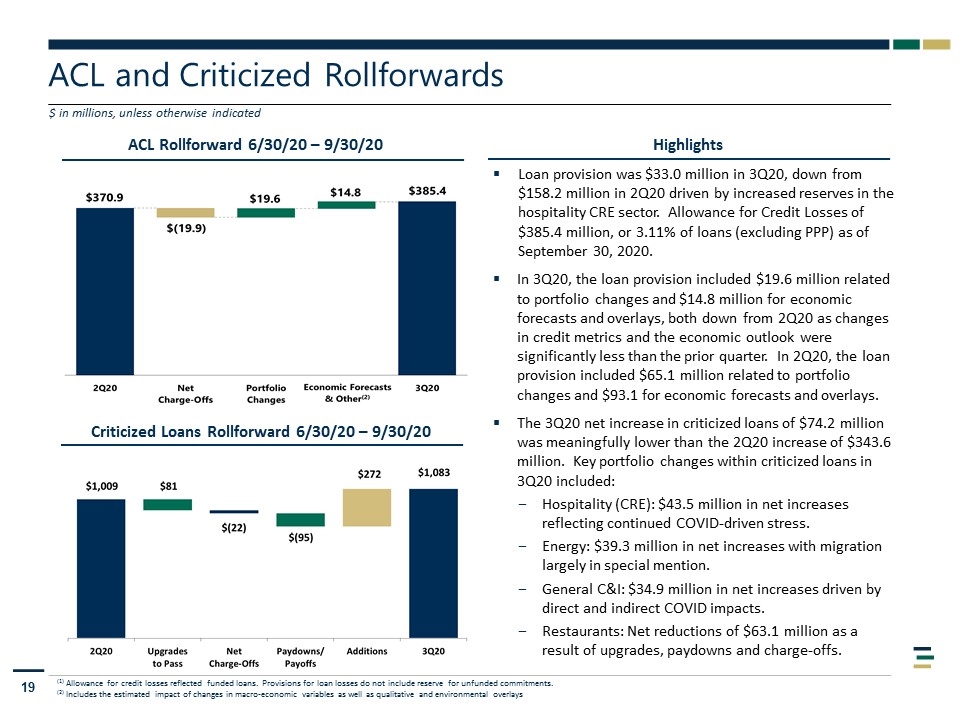

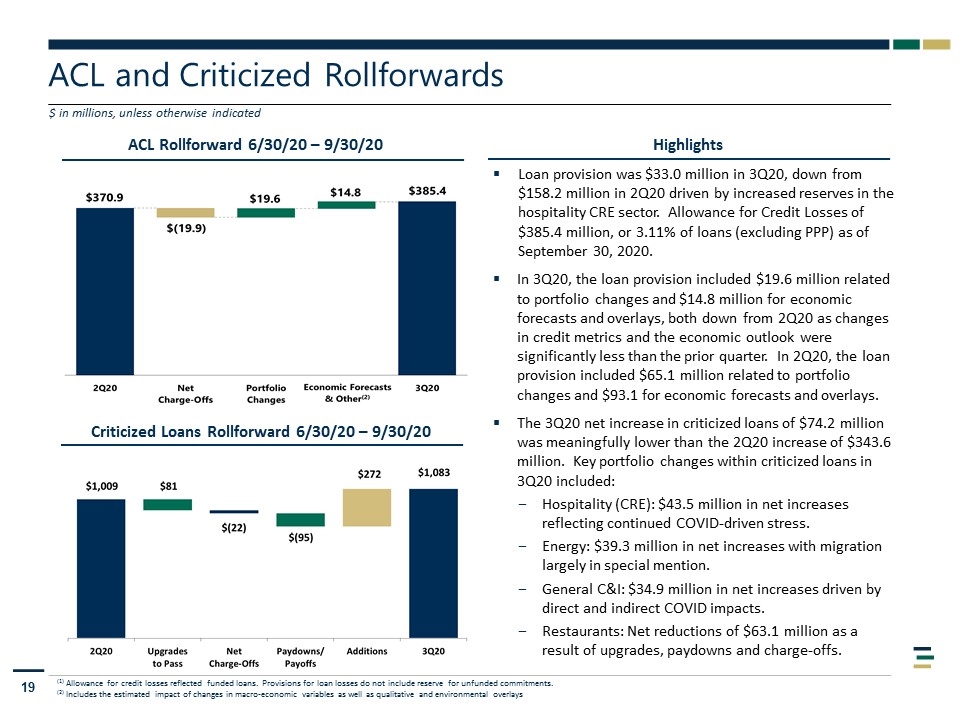

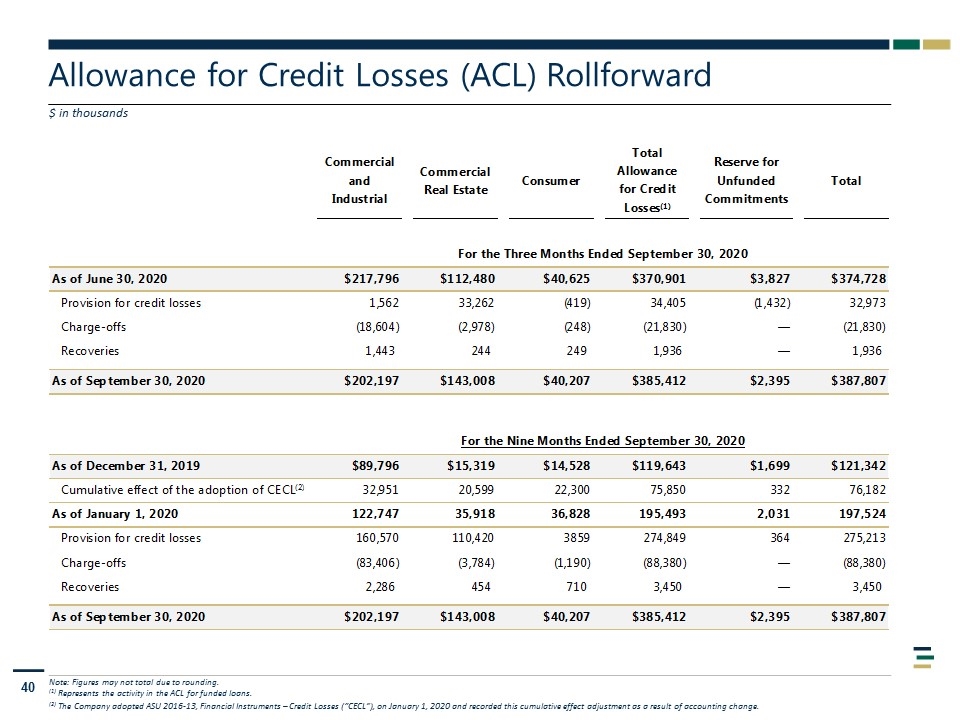

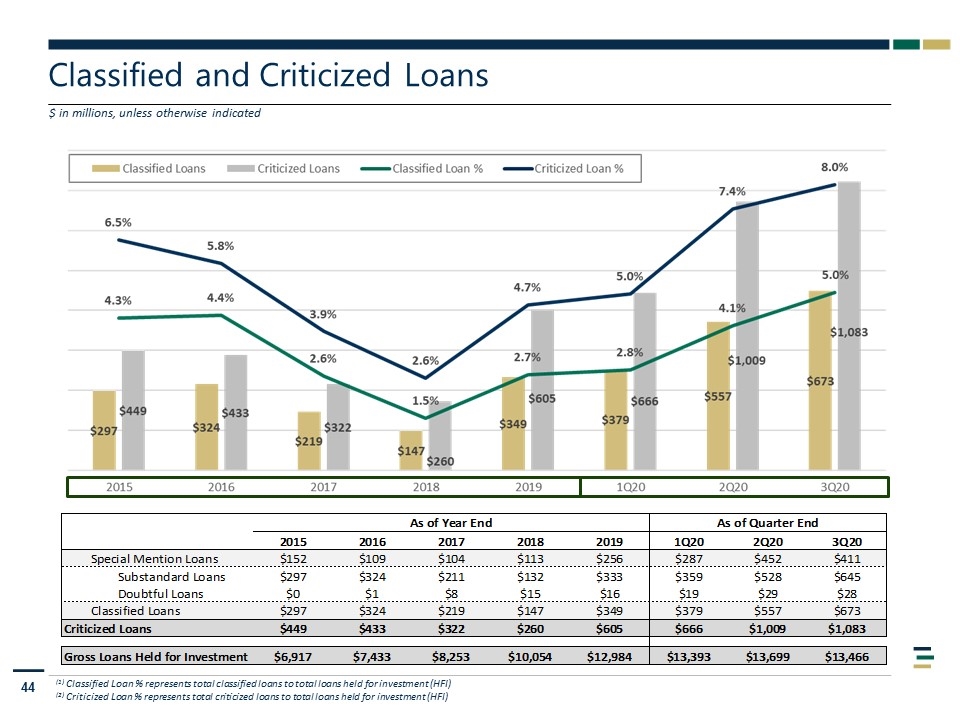

ACL and Criticized Rollforwards $ in millions, unless otherwise indicated (1) Allowance for credit losses reflected funded loans. Provisions for loan losses do not include reserve for unfunded commitments. (2) Includes the estimated impact of changes in macro-economic variables as well as qualitative and environmental overlays Loan provision was $33.0 million in 3Q20, down from $158.2 million in 2Q20 driven by increased reserves in the hospitality CRE sector. Allowance for Credit Losses of $385.4 million, or 3.11% of loans (excluding PPP) as of September 30, 2020. In 3Q20, the loan provision included $19.6 million related to portfolio changes and $14.8 million for economic forecasts and overlays, both down from 2Q20 as changes in credit metrics and the economic outlook were significantly less than the prior quarter. In 2Q20, the loan provision included $65.1 million related to portfolio changes and $93.1 for economic forecasts and overlays. The 3Q20 net increase in criticized loans of $74.2 million was meaningfully lower than the 2Q20 increase of $343.6 million. Key portfolio changes within criticized loans in 3Q20 included: Hospitality (CRE): $43.5 million in net increases reflecting continued COVID-driven stress. Energy: $39.3 million in net increases with migration largely in special mention. General C&I: $34.9 million in net increases driven by direct and indirect COVID impacts. Restaurants: Net reductions of $63.1 million as a result of upgrades, paydowns and charge-offs. ACL Rollforward 6/30/20 – 9/30/20 Criticized Loans Rollforward 6/30/20 – 9/30/20 Highlights

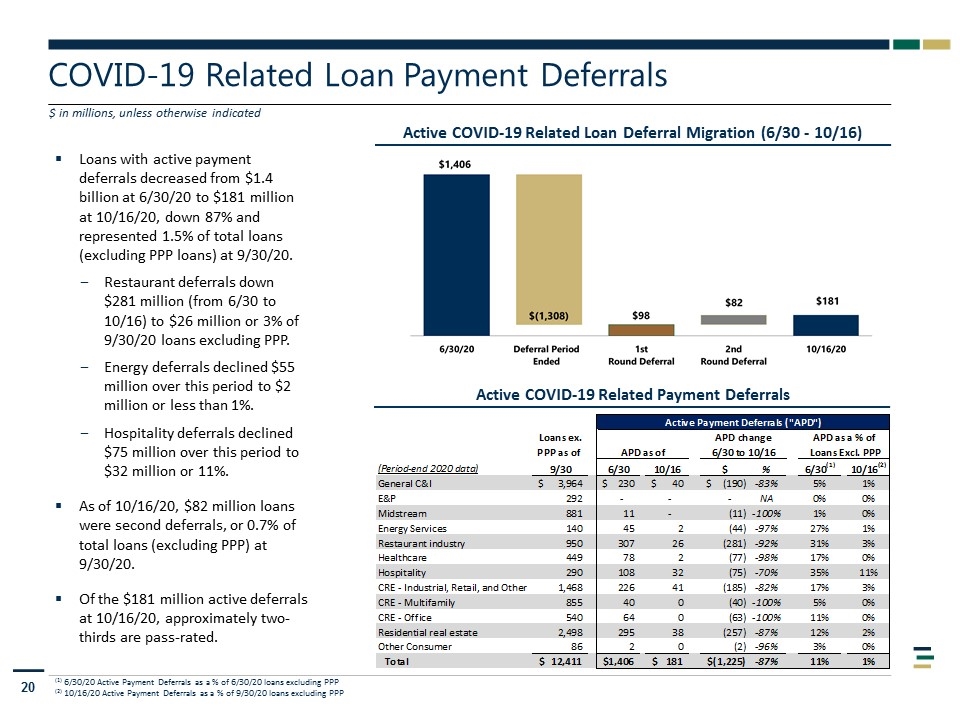

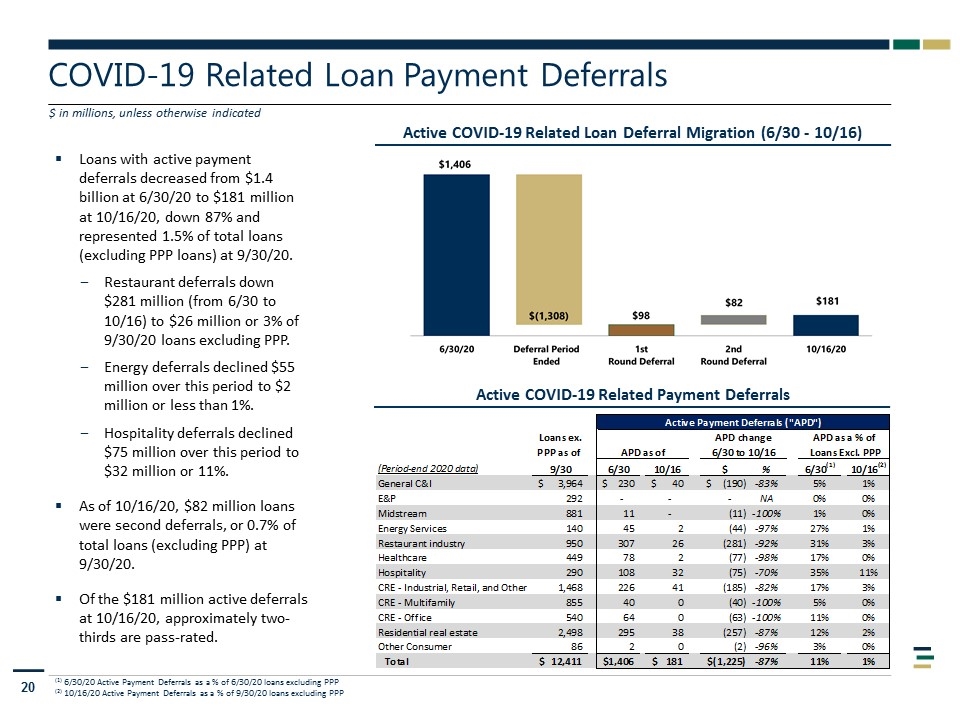

COVID-19 Related Loan Payment Deferrals $ in millions, unless otherwise indicated Loans with active payment deferrals decreased from $1.4 billion at 6/30/20 to $181 million at 10/16/20, down 87% and represented 1.5% of total loans (excluding PPP loans) at 9/30/20. Restaurant deferrals down $281 million (from 6/30 to 10/16) to $26 million or 3% of 9/30/20 loans excluding PPP. Energy deferrals declined $55 million over this period to $2 million or less than 1%. Hospitality deferrals declined $75 million over this period to $32 million or 11%. As of 10/16/20, $82 million loans were second deferrals, or 0.7% of total loans (excluding PPP) at 9/30/20. Of the $181 million active deferrals at 10/16/20, approximately two-thirds are pass-rated. Active COVID-19 Related Loan Deferral Migration (6/30 - 10/16) Active COVID-19 Related Payment Deferrals (1) 6/30/20 Active Payment Deferrals as a % of 6/30/20 loans excluding PPP (2) 10/16/20 Active Payment Deferrals as a % of 9/30/20 loans excluding PPP

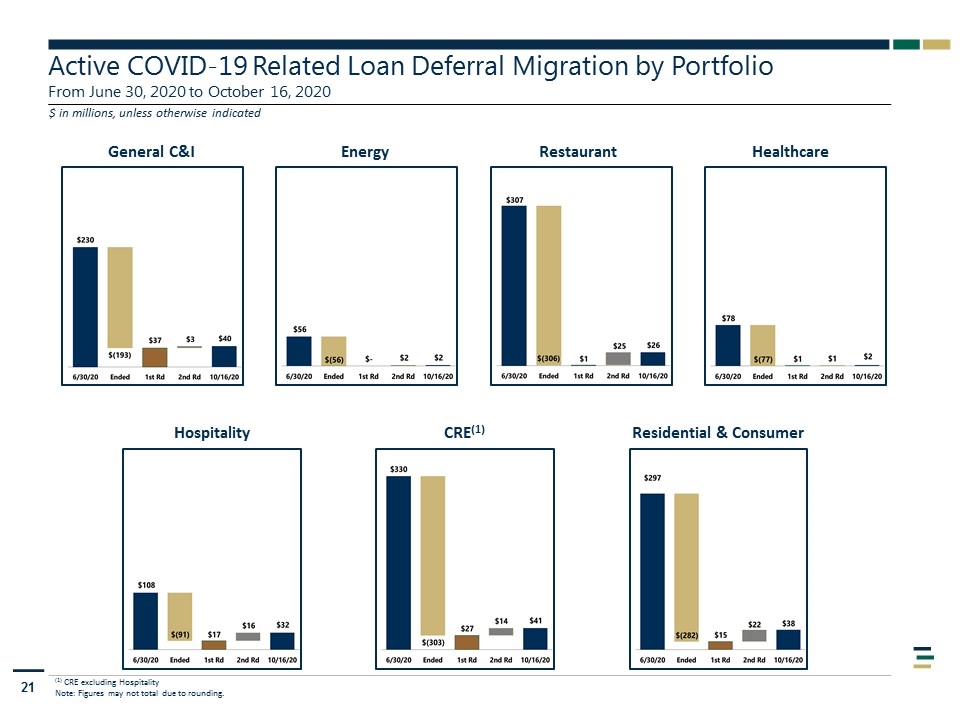

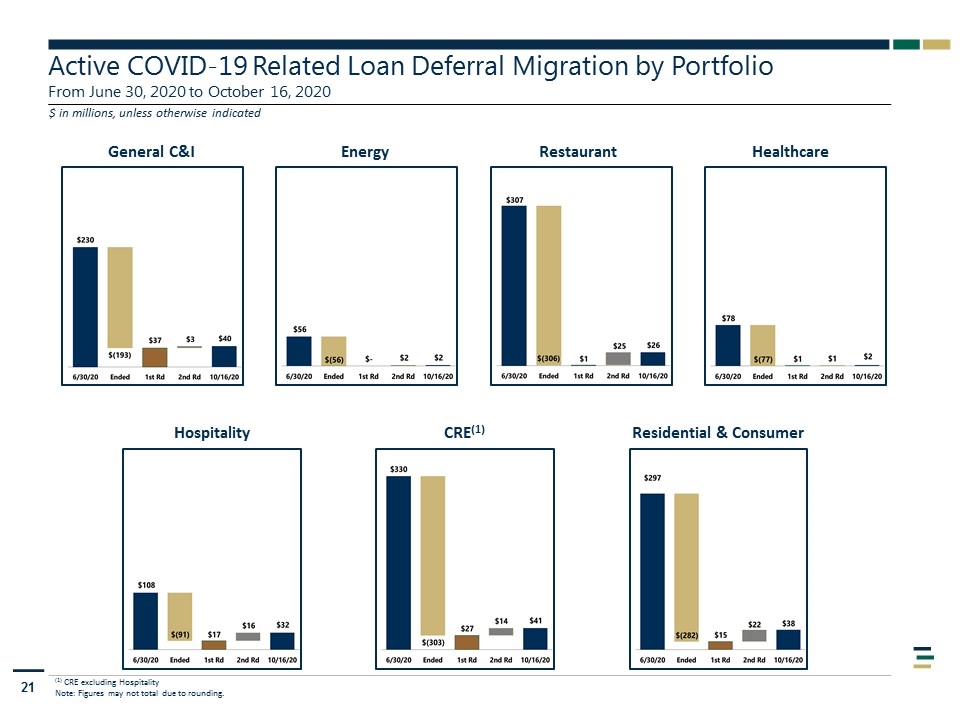

Active COVID-19 Related Loan Deferral Migration by Portfolio From June 30, 2020 to October 16, 2020 $ in millions, unless otherwise indicated (1) CRE excluding Hospitality Note: Figures may not total due to rounding. General C&I Energy Restaurant Healthcare Hospitality CRE(1) Residential & Consumer

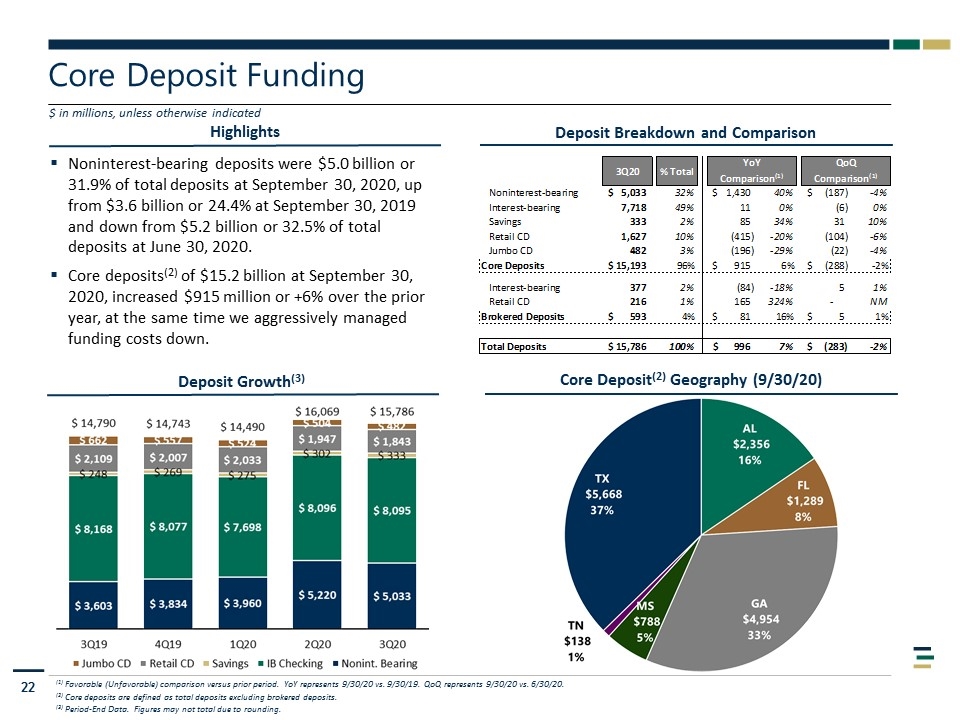

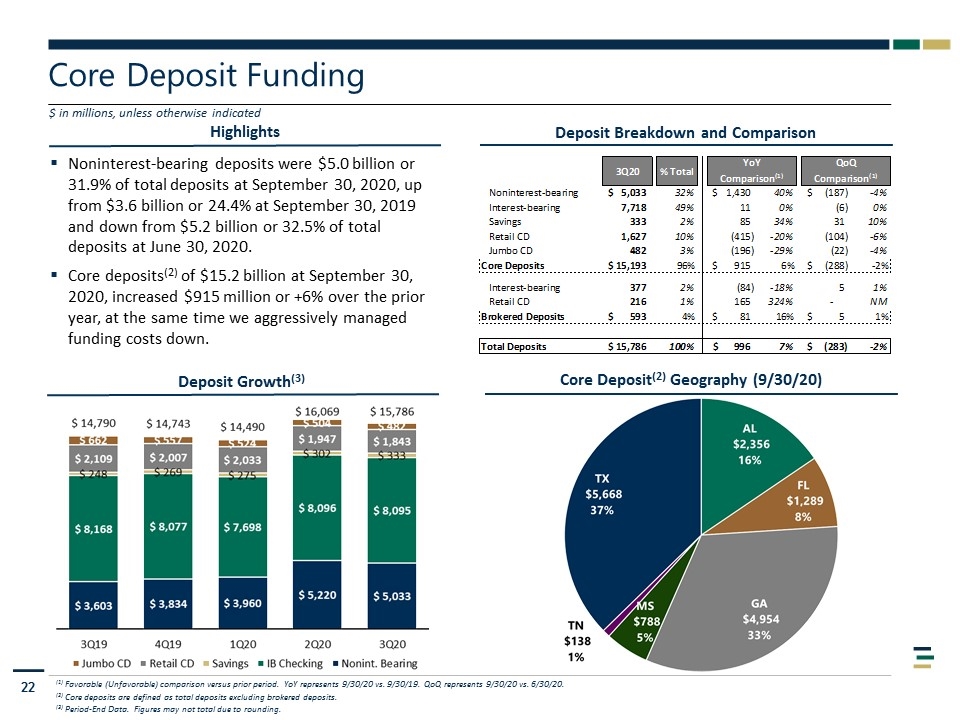

Highlights Core Deposit Funding $ in millions, unless otherwise indicated Deposit Growth(3) Deposit Breakdown and Comparison (1) Favorable (Unfavorable) comparison versus prior period. YoY represents 9/30/20 vs. 9/30/19. QoQ represents 9/30/20 vs. 6/30/20. (2) Core deposits are defined as total deposits excluding brokered deposits. (3) Period-End Data. Figures may not total due to rounding. Core Deposit(2) Geography (9/30/20) Noninterest-bearing deposits were $5.0 billion or 31.9% of total deposits at September 30, 2020, up from $3.6 billion or 24.4% at September 30, 2019 and down from $5.2 billion or 32.5% of total deposits at June 30, 2020. Core deposits(2) of $15.2 billion at September 30, 2020, increased $915 million or +6% over the prior year, at the same time we aggressively managed funding costs down.

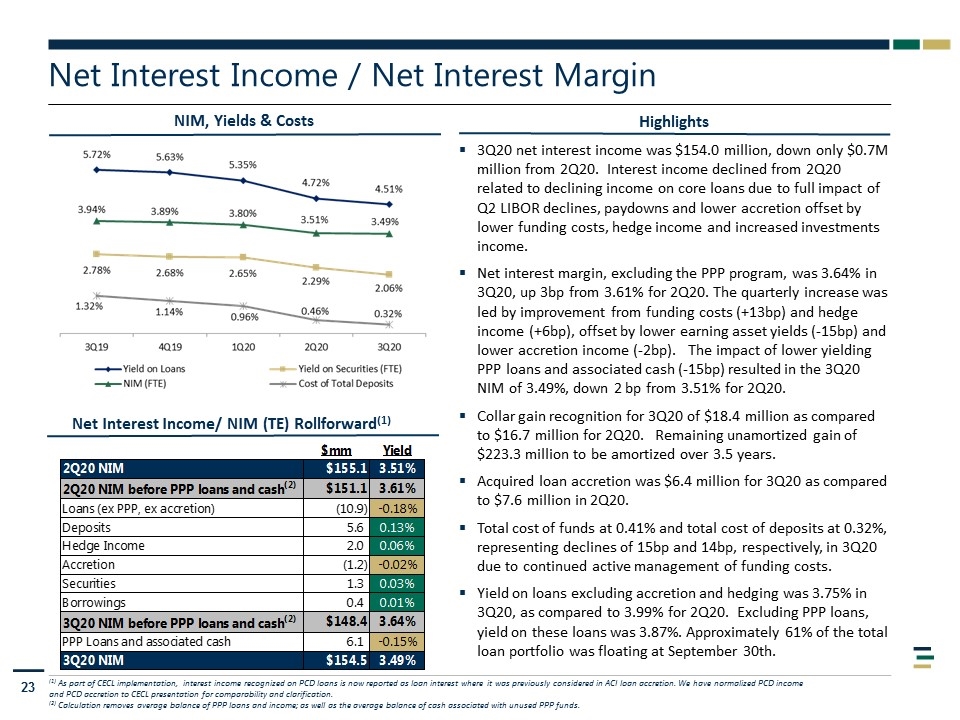

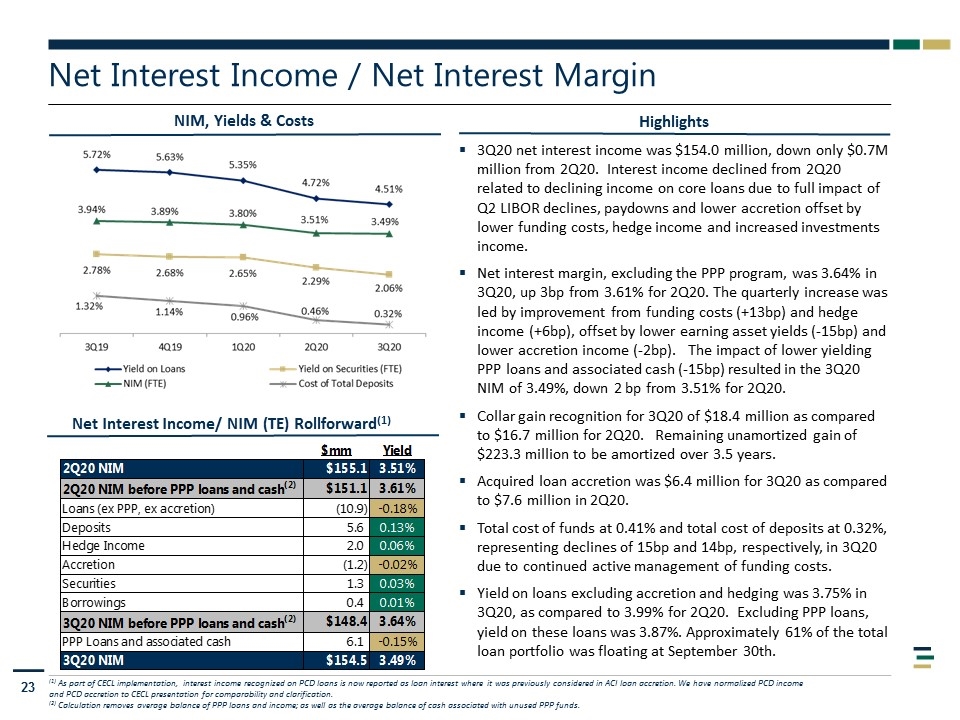

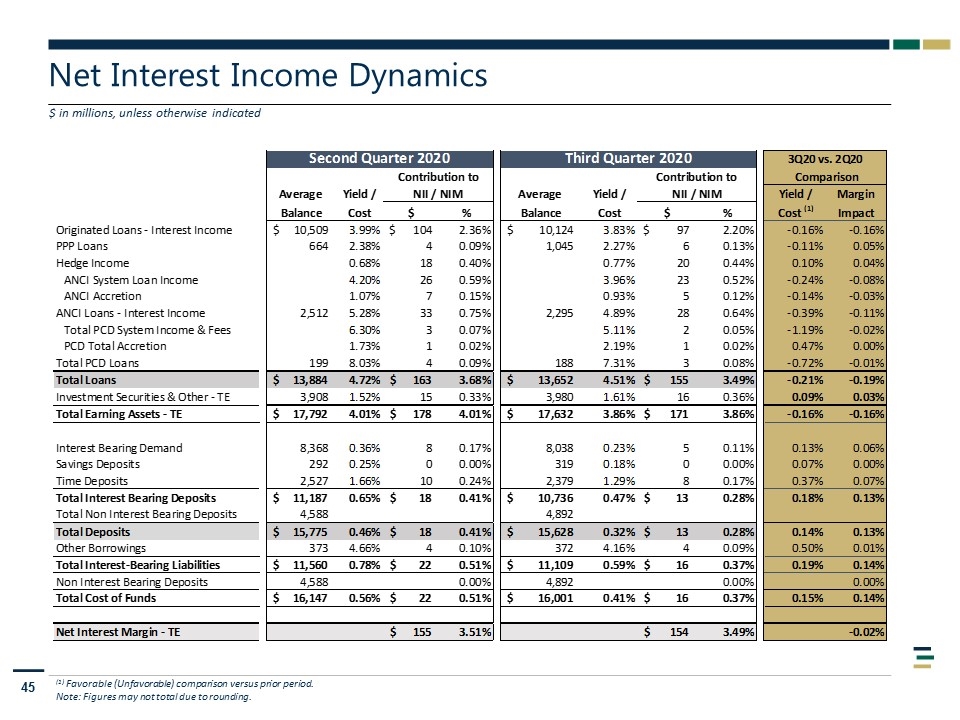

Net Interest Income / Net Interest Margin Highlights (1) As part of CECL implementation, interest income recognized on PCD loans is now reported as loan interest where it was previously considered in ACI loan accretion. We have normalized PCD income and PCD accretion to CECL presentation for comparability and clarification. (2) Calculation removes average balance of PPP loans and income; as well as the average balance of cash associated with unused PPP funds. NIM, Yields & Costs 3Q20 net interest income was $154.0 million, down only $0.7M million from 2Q20. Interest income declined from 2Q20 related to declining income on core loans due to full impact of Q2 LIBOR declines, paydowns and lower accretion offset by lower funding costs, hedge income and increased investments income. Net interest margin, excluding the PPP program, was 3.64% in 3Q20, up 3bp from 3.61% for 2Q20. The quarterly increase was led by improvement from funding costs (+13bp) and hedge income (+6bp), offset by lower earning asset yields (-15bp) and lower accretion income (-2bp). The impact of lower yielding PPP loans and associated cash (-15bp) resulted in the 3Q20 NIM of 3.49%, down 2 bp from 3.51% for 2Q20. Collar gain recognition for 3Q20 of $18.4 million as compared to $16.7 million for 2Q20. Remaining unamortized gain of $223.3 million to be amortized over 3.5 years. Acquired loan accretion was $6.4 million for 3Q20 as compared to $7.6 million in 2Q20. Total cost of funds at 0.41% and total cost of deposits at 0.32%, representing declines of 15bp and 14bp, respectively, in 3Q20 due to continued active management of funding costs. Yield on loans excluding accretion and hedging was 3.75% in 3Q20, as compared to 3.99% for 2Q20. Excluding PPP loans, yield on these loans was 3.87%. Approximately 61% of the total loan portfolio was floating at September 30th. Net Interest Income/ NIM (TE) Rollforward(1)

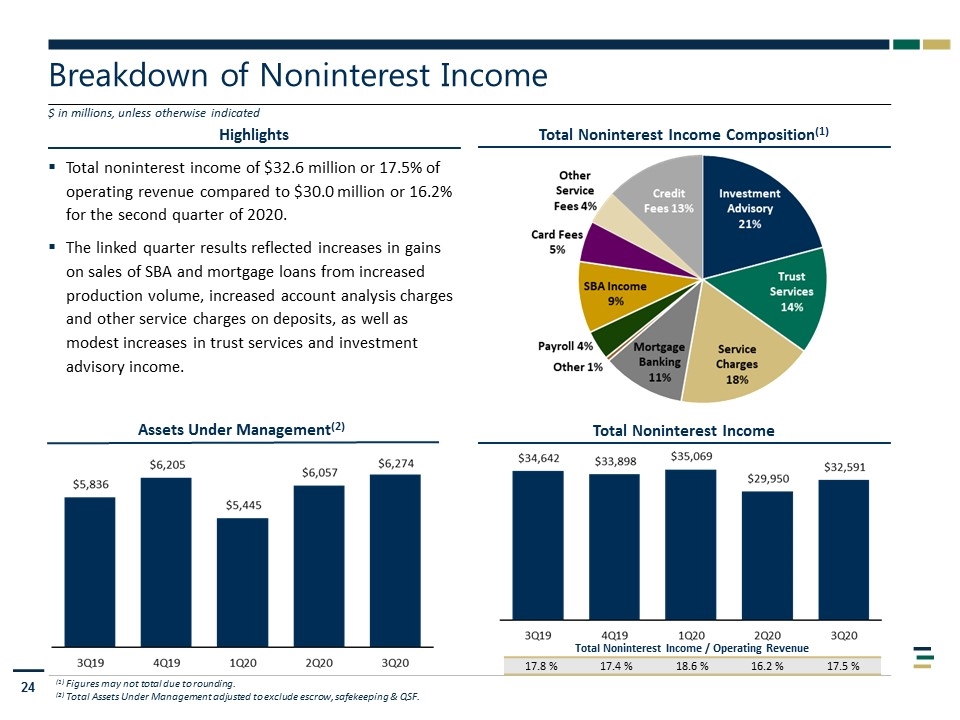

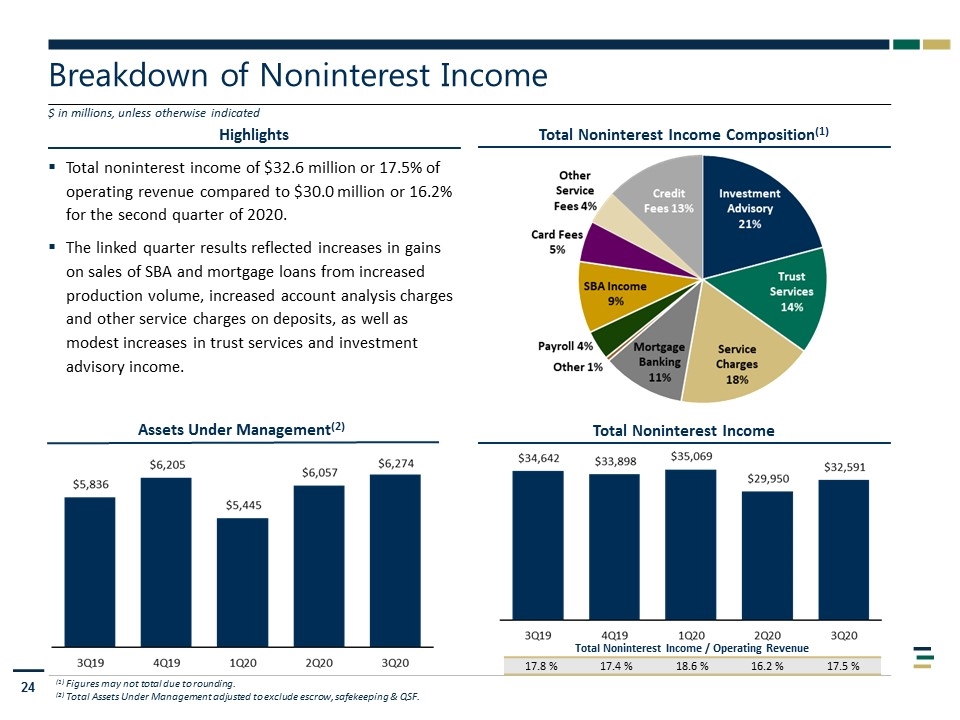

Highlights Breakdown of Noninterest Income Total Noninterest Income Composition(1) Total Noninterest Income $ in millions, unless otherwise indicated Assets Under Management(2) (1) Figures may not total due to rounding. (2) Total Assets Under Management adjusted to exclude escrow, safekeeping & QSF. Total Noninterest Income / Operating Revenue 17.8 % 17.4 % 18.6 % 16.2 % 17.5 % Total noninterest income of $32.6 million or 17.5% of operating revenue compared to $30.0 million or 16.2% for the second quarter of 2020. The linked quarter results reflected increases in gains on sales of SBA and mortgage loans from increased production volume, increased account analysis charges and other service charges on deposits, as well as modest increases in trust services and investment advisory income.

Supplementary Information

Select COVID-Impacted Portfolios Energy criticized loans increased $39.3 million in 3Q20 as demand levels remain uncertain due to COVID. Energy prices have stabilized recently, as a majority of the shut-ins and curtailments have come back online. Restaurant criticized loans and nonaccruals decreased due to upgrades, net paydowns and charge-offs, while the ACL/Total Loans increased to 6.5%. Revenues in the industry have increased from prior quarter, however non-Quick Service Restaurants (“QSR”) continue to reflect greater stress than the QSR segment. Hospitality criticized loans and nonaccruals increased as the hotel industry continues to experience lower average occupancy rates as a result of COVID. The credit migration and anticipated extended period of stress drove the ACL/Total Loans meaningfully higher in the quarter to 14.6%. Highlights $ in millions, unless otherwise indicated

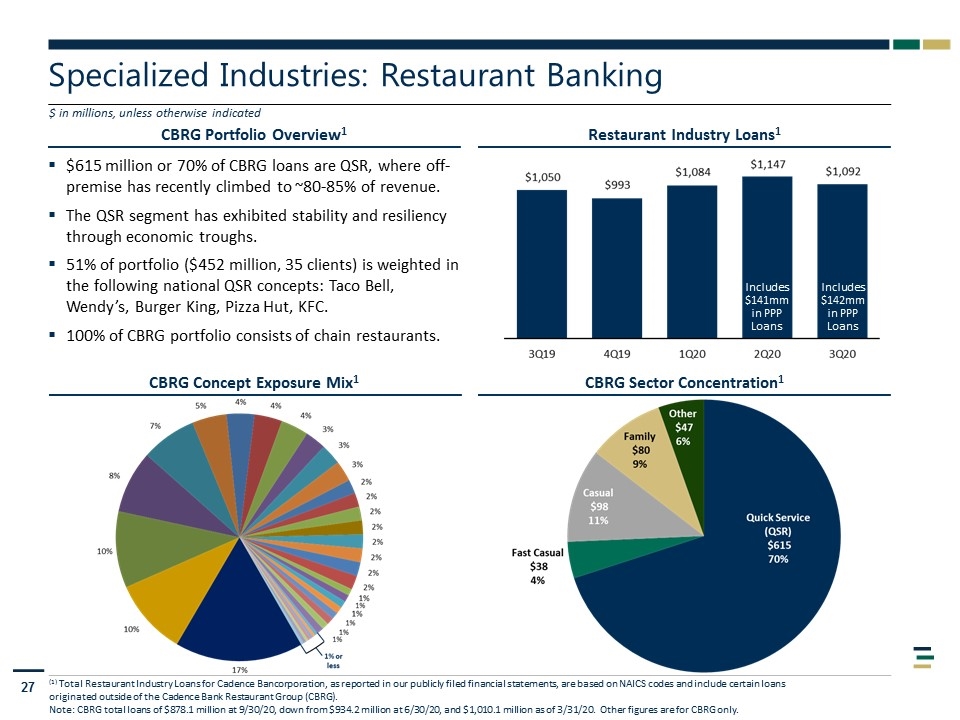

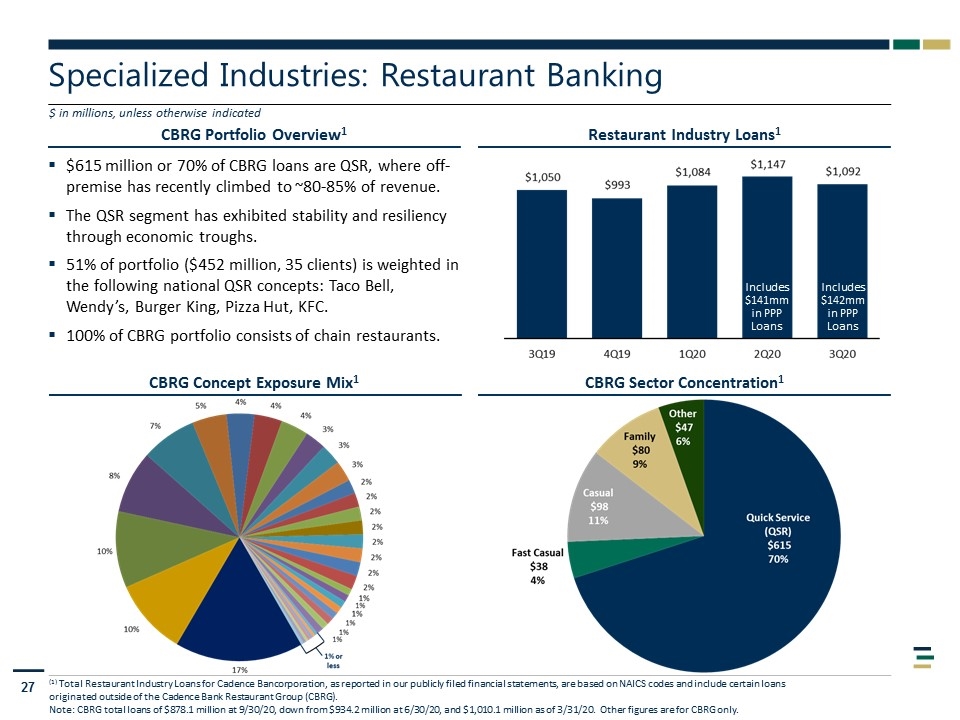

CBRG Portfolio Overview1 Specialized Industries: Restaurant Banking $ in millions, unless otherwise indicated Restaurant Industry Loans1 (1) Total Restaurant Industry Loans for Cadence Bancorporation, as reported in our publicly filed financial statements, are based on NAICS codes and include certain loans originated outside of the Cadence Bank Restaurant Group (CBRG). Note: CBRG total loans of $878.1 million at 9/30/20, down from $934.2 million at 6/30/20, and $1,010.1 million as of 3/31/20. Other figures are for CBRG only. CBRG Sector Concentration1 CBRG Concept Exposure Mix1 $615 million or 70% of CBRG loans are QSR, where off-premise has recently climbed to ~80-85% of revenue. The QSR segment has exhibited stability and resiliency through economic troughs. 51% of portfolio ($452 million, 35 clients) is weighted in the following national QSR concepts: Taco Bell, Wendy’s, Burger King, Pizza Hut, KFC. 100% of CBRG portfolio consists of chain restaurants. Includes $142mm in PPP Loans Includes $141mm in PPP Loans

Restaurant Portfolio (continued) Limited Service ($653mm or 74%) QSR ($615mm or 70%) Consists of large multi-unit franchisees in nationally recognized brands and account for over 7,500 units geographically diversified throughout the US. Showing resiliency as off-premise channels (drive-thru, delivery, and curbside) have evolved to 80% - 85% of revenue mix vs historical of 70%. Approx. two-thirds of franchisees operate > 100 units. $452mm of our total portfolio is underpinned by franchisee loans to leading brands – $305mm or 35% to Taco Bell, KFC and Pizza Hut (YUM! Brands) and another $147mm or 17% to franchisees of Wendy’s and Burger King. These are well-established franchisors with a history of supporting their brands and franchisees. Fast Casual ($38mm or 4%) Dining rooms re-opening with limited capacity under social distancing guidelines. Off-premise (takeout and delivery) now contributing to more meaningful portion of sales mix. Full Service ($178mm or 20%) Casual and Family dining remain most stressed segment of the portfolio with continued uncertainty and inconsistencies with dining-room closures and/or partial re-openings across the U.S. Sales have improved substantially from down approximately 60% to 90% in April YoY to down 15% to 35% in Aug/Sept. Majority indicating ability to continue for an extended period adjusting business and labor. (1) Total Restaurant Industry Loans for Cadence Bancorporation, as reported in our publicly filed financial statements, are based on NAICS codes and include certain loans originated outside of the Cadence Bank Restaurant Group (CBRG). Note: CBRG total loans of $878.1 million at 9/30/20, down from $934.2 million at 6/30/20, and $1,010.1 million as of 3/31/20. Other figures are for CBRG only. As of 9/30/20 unless otherwise indicated

Restaurant Portfolio (continued) Other Portfolio Observations We bank 20 of the Top 40 franchisees in the country, representing ~$375mm or 43% of our CBRG restaurant portfolio. These borrowers have size, scale and experience with a combined $12B in annual revenue and an average of 350 stores per borrower. Our restaurant portfolio was built around strong relationships with larger companies in national brands, access to capital, national/global advertising spend, training programs, active menu development and roll out plans. $263mm (30% of portfolio) is underpinned by real estate collateral. Pizza QSR of $98mm or 11% – significant sales increases continuing throughout the crisis as existing delivery/pick up is allowing chain pizza brands to report best same store sales in years. As of 9/30/20 unless otherwise indicated (1) Total Restaurant Industry Loans for Cadence Bancorporation, as reported in our publicly filed financial statements, are based on NAICS codes and include certain loans originated outside of the Cadence Bank Restaurant Group (CBRG). Note: CBRG total loans of $878.1 million at 9/30/20, down from $934.2 million at 6/30/20, and $1,010.1 million as of 3/31/20. Other figures are for CBRG only.

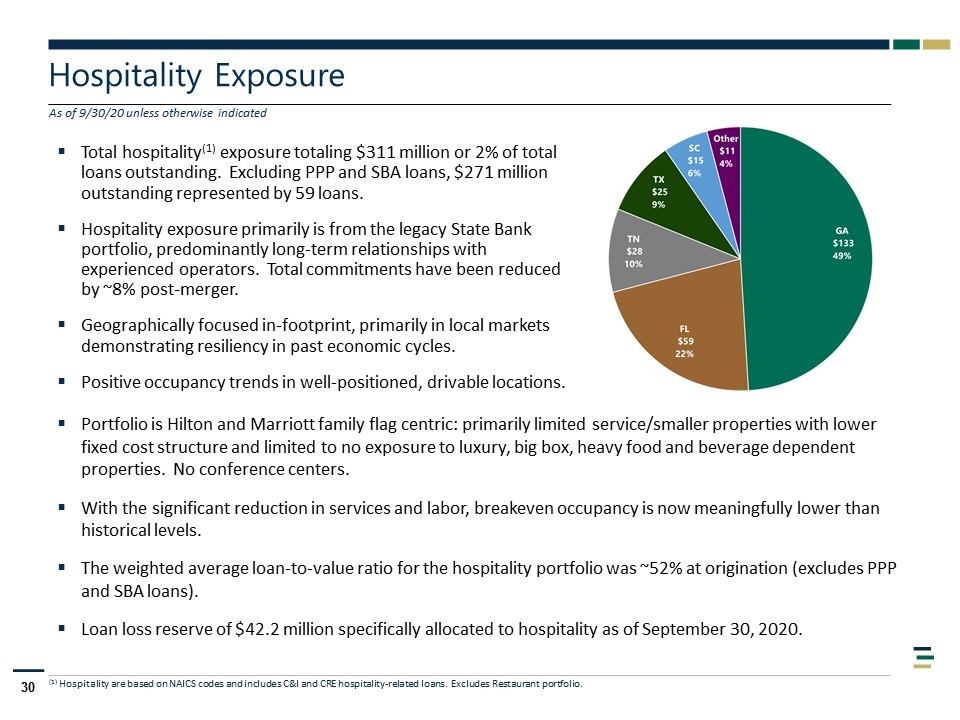

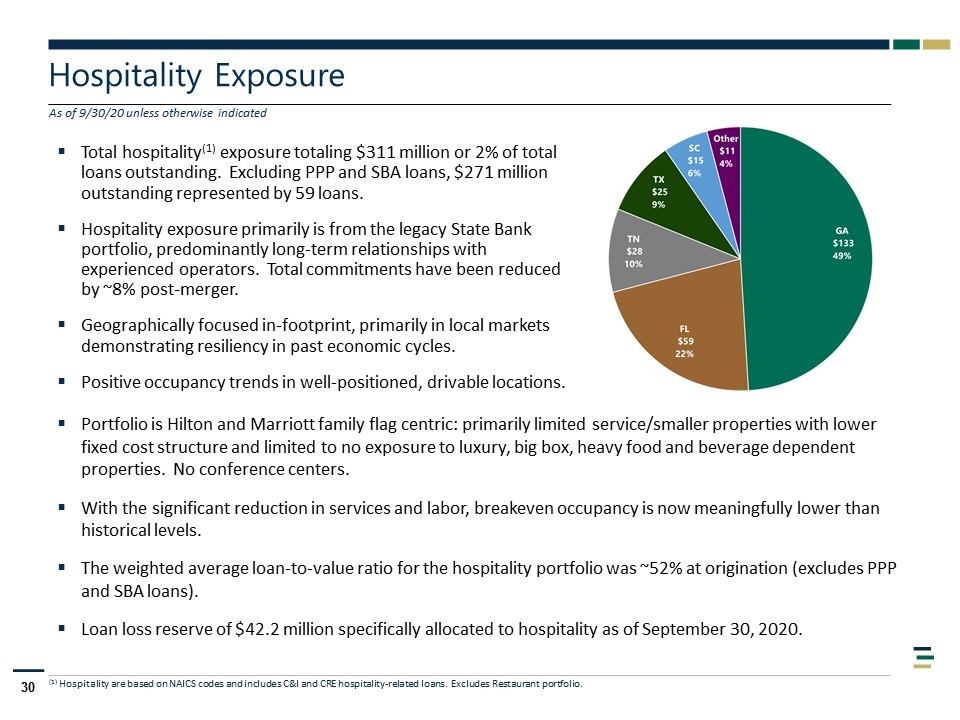

Hospitality Exposure Total hospitality(1) exposure totaling $311 million or 2% of total loans outstanding. Excluding PPP and SBA loans, $271 million outstanding represented by 59 loans. Hospitality exposure primarily is from the legacy State Bank portfolio, predominantly long-term relationships with experienced operators. Total commitments have been reduced by ~8% post-merger. Geographically focused in-footprint, primarily in local markets demonstrating resiliency in past economic cycles. Positive occupancy trends in well-positioned, drivable locations. (1) Hospitality are based on NAICS codes and includes C&I and CRE hospitality-related loans. Excludes Restaurant portfolio. As of 9/30/20 unless otherwise indicated Portfolio is Hilton and Marriott family flag centric: primarily limited service/smaller properties with lower fixed cost structure and limited to no exposure to luxury, big box, heavy food and beverage dependent properties. No conference centers. With the significant reduction in services and labor, breakeven occupancy is now meaningfully lower than historical levels. The weighted average loan-to-value ratio for the hospitality portfolio was ~52% at origination (excludes PPP and SBA loans). Loan loss reserve of $42.2 million specifically allocated to hospitality as of September 30, 2020.

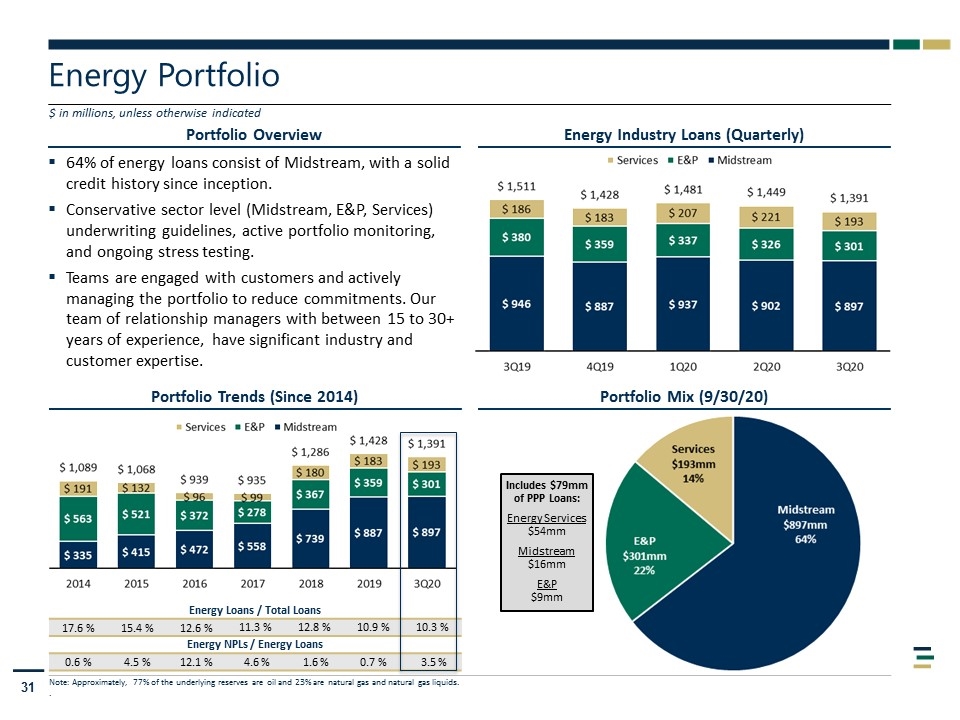

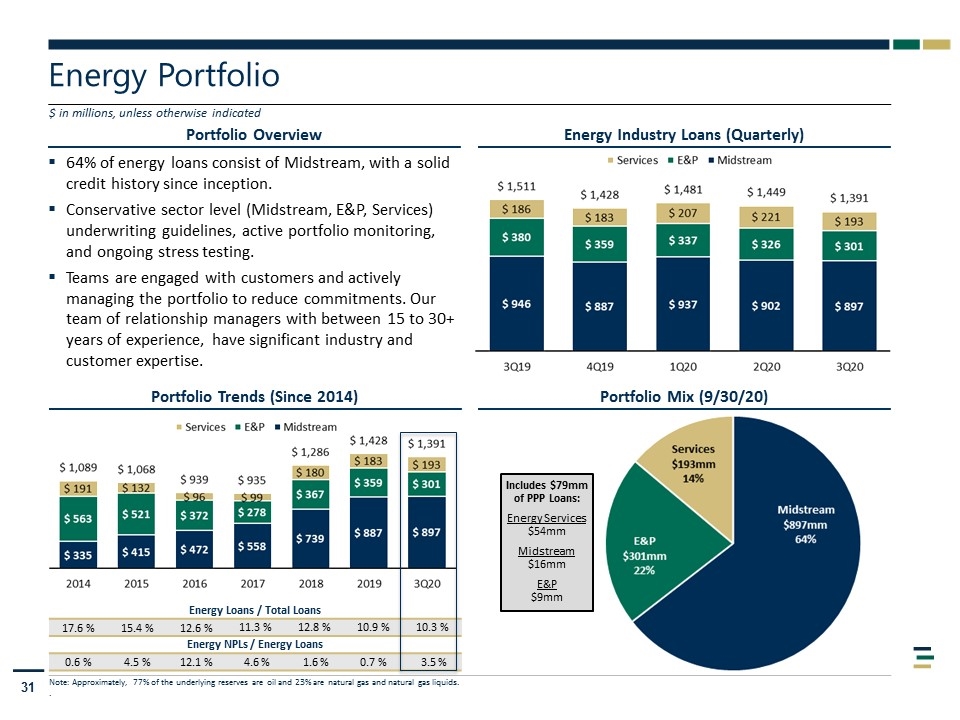

Portfolio Overview Energy Portfolio $ in millions, unless otherwise indicated Energy Industry Loans (Quarterly) Portfolio Mix (9/30/20) Portfolio Trends (Since 2014) Energy Loans / Total Loans 17.6 % 15.4 % 12.6 % 11.3 % 12.8 % 10.9 % 10.3 % Energy NPLs / Energy Loans 0.6 % 4.5 % 12.1 % 4.6 % 1.6 % 0.7 % 3.5 % Note: Approximately, 77% of the underlying reserves are oil and 23% are natural gas and natural gas liquids. . 64% of energy loans consist of Midstream, with a solid credit history since inception. Conservative sector level (Midstream, E&P, Services) underwriting guidelines, active portfolio monitoring, and ongoing stress testing. Teams are engaged with customers and actively managing the portfolio to reduce commitments. Our team of relationship managers with between 15 to 30+ years of experience, have significant industry and customer expertise. Includes $79mm of PPP Loans: Energy Services $54mm Midstream $16mm E&P $9mm

Energy Portfolio (continued) Midstream 88 borrowers: $897mm of funded balances ($10mm avg) - 64% of total energy loans from 31% in 2014. Midstream portfolio are almost exclusively comprised of long-term, fee-based revenue (generally with no direct commodity price exposure) with Acreage Dedications and Minimum Volume Contracts. Majority of the portfolio backed by large energy focused PE funds and operated by highly experienced management teams with long term relationships and track records with Cadence Midstream bankers. Low portfolio leverage (average of ~2.6x) and significant equity capitalization (average debt/capital ~37%). The majority of the portfolio was impacted by some level of reduced volumes from shut-ins in April/May; however, almost all of these volumes have come back on-line in June and July. Exploration & Production 34 borrowers: $301mm of funded balances ($9mm avg) - 22% of total energy loans from 52% in 2014. Excluding PPP loans: 26 borrowers and $292mm of funded balances ($11mm avg). 3Q20 total of $301mm is down from a peak of $591mm, as a result of the “risk off” strategy since 2014. Our client selection and underwriting strategy proving to be resilient to date. Straightforward portfolio strategy: manage the existing client portfolio through the market disruption, determine which existing clients and bank partners are part of go-forward traditional energy strategy and exit those that are not, and develop energy transition client deposit calling and lending capabilities. Energy Services 57 borrowers: $193mm of funded balances ($3mm avg) - 14% of total energy loans from 18% in 2014. Limited Energy Services exposure to drilling and majority of the exposure in ongoing well production. As of 9/30/20

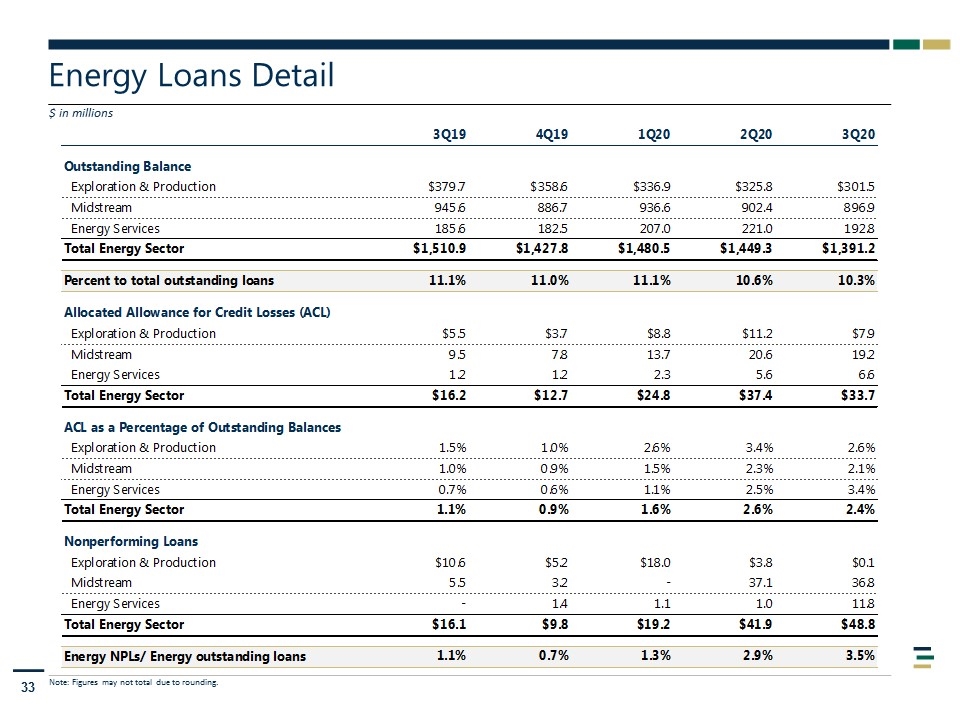

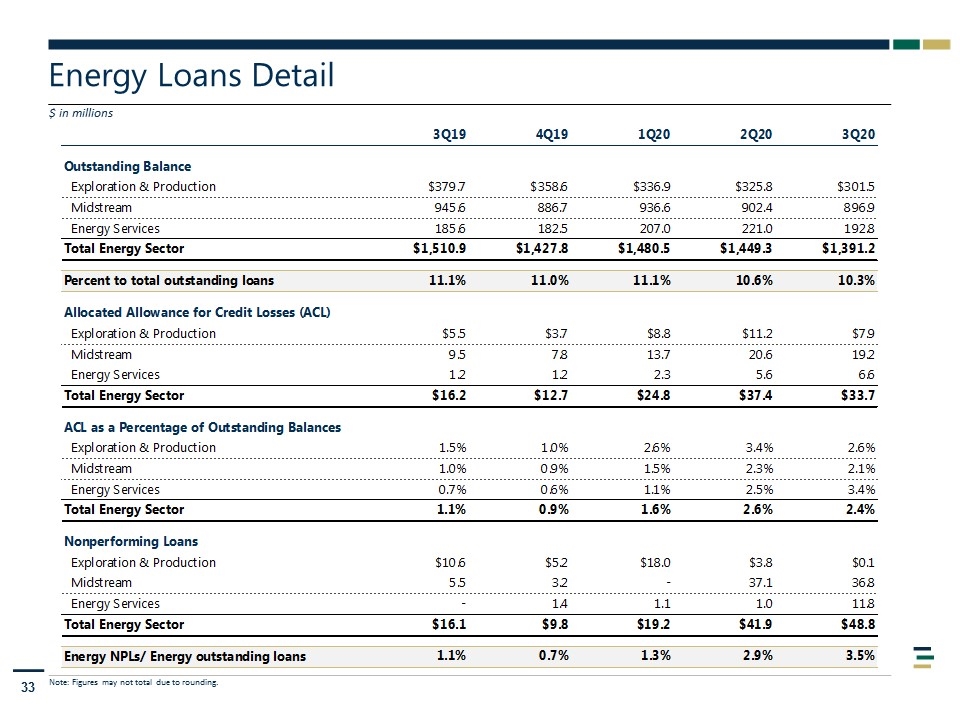

Energy Loans Detail $ in millions Note: Figures may not total due to rounding.

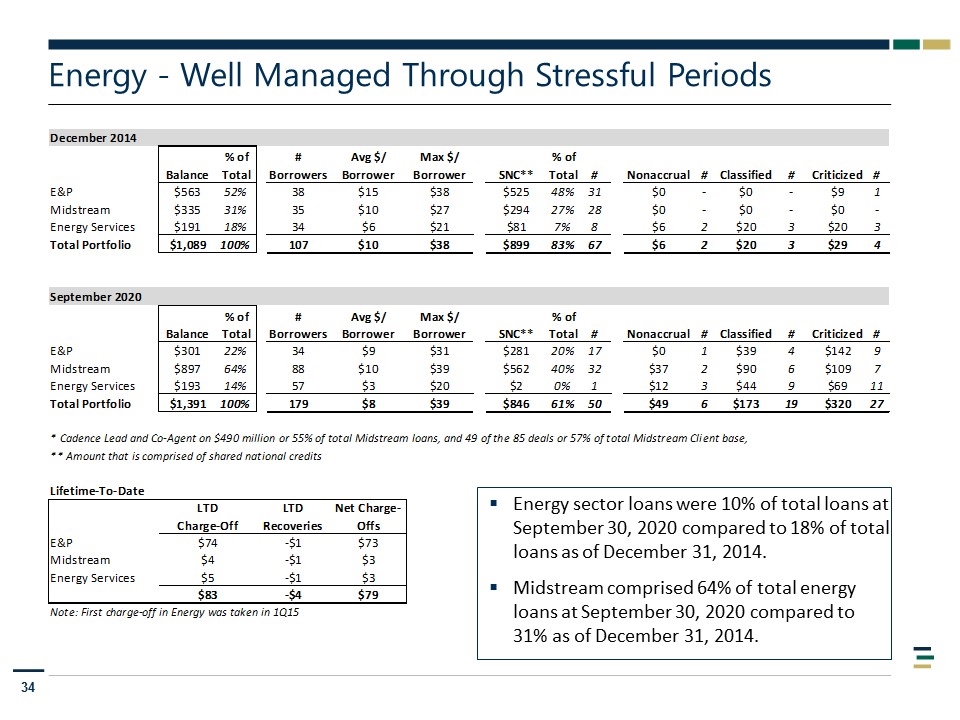

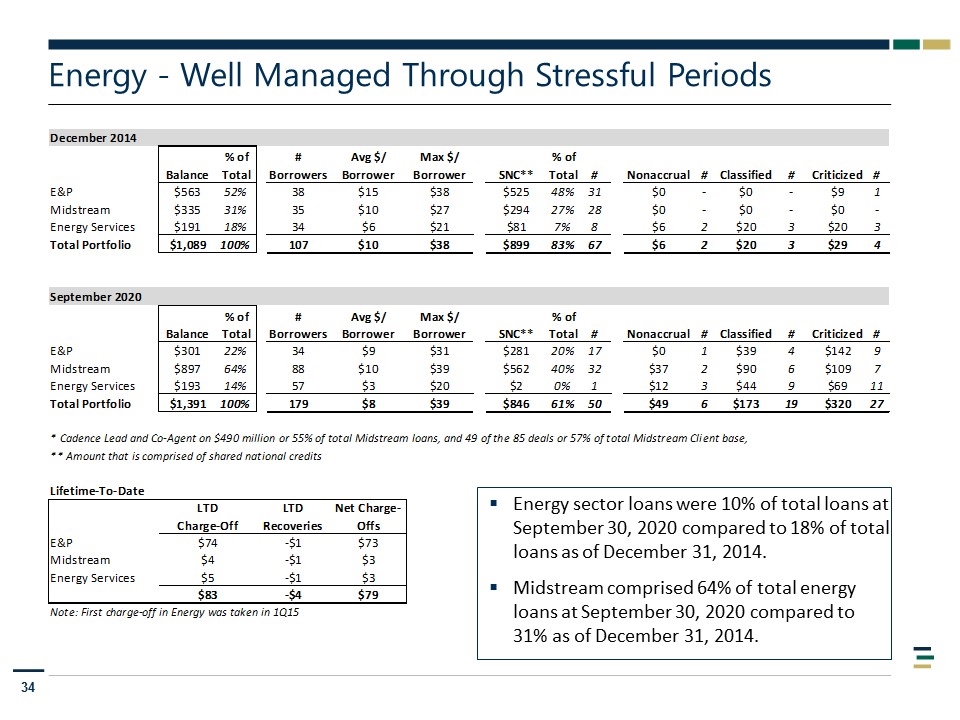

Energy - Well Managed Through Stressful Periods Energy sector loans were 10% of total loans at September 30, 2020 compared to 18% of total loans as of December 31, 2014. Midstream comprised 64% of total energy loans at September 30, 2020 compared to 31% as of December 31, 2014.

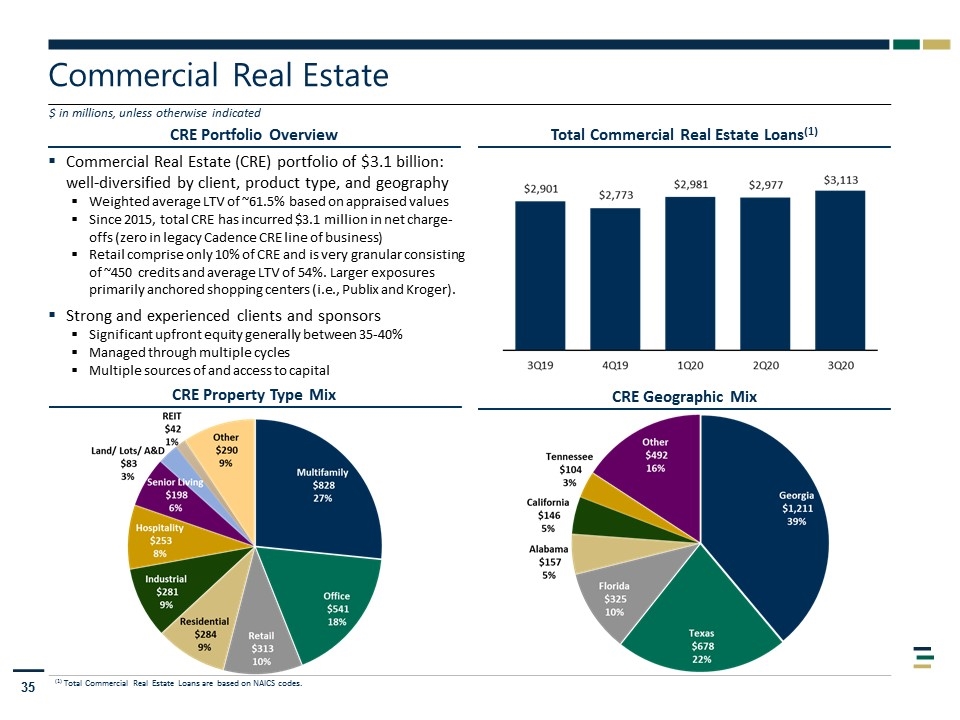

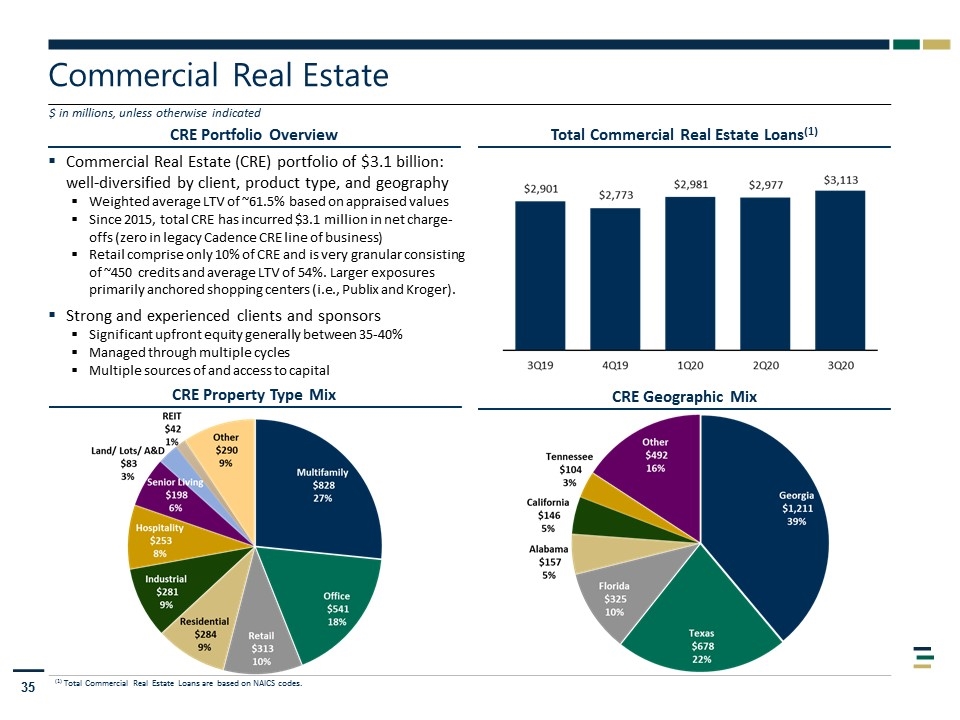

CRE Portfolio Overview Commercial Real Estate $ in millions, unless otherwise indicated Total Commercial Real Estate Loans(1) Commercial Real Estate (CRE) portfolio of $3.1 billion: well-diversified by client, product type, and geography Weighted average LTV of ~61.5% based on appraised values Since 2015, total CRE has incurred $3.1 million in net charge-offs (zero in legacy Cadence CRE line of business) Retail comprise only 10% of CRE and is very granular consisting of ~450 credits and average LTV of 54%. Larger exposures primarily anchored shopping centers (i.e., Publix and Kroger). Strong and experienced clients and sponsors Significant upfront equity generally between 35-40% Managed through multiple cycles Multiple sources of and access to capital (1) Total Commercial Real Estate Loans are based on NAICS codes. CRE Geographic Mix CRE Property Type Mix

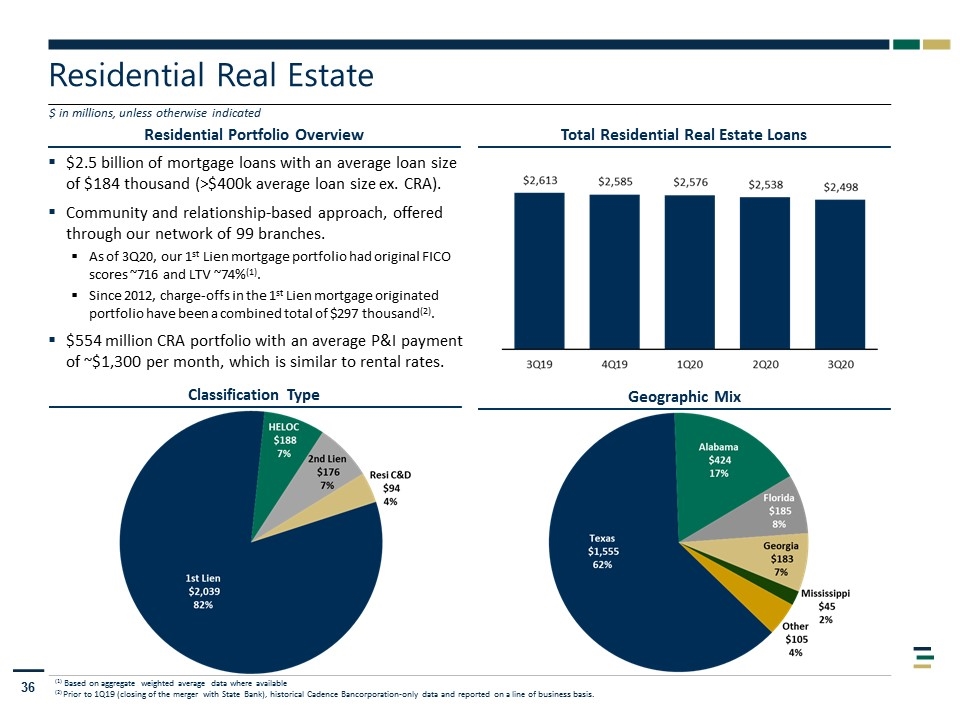

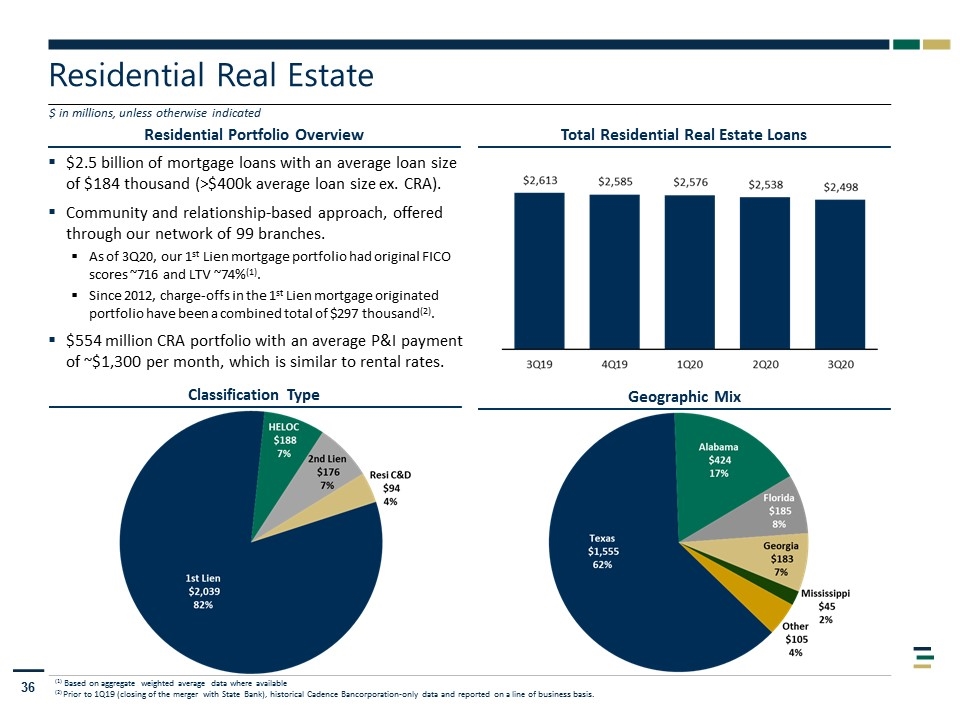

Residential Portfolio Overview Residential Real Estate $ in millions, unless otherwise indicated Total Residential Real Estate Loans $2.5 billion of mortgage loans with an average loan size of $184 thousand (>$400k average loan size ex. CRA). Community and relationship-based approach, offered through our network of 99 branches. As of 3Q20, our 1st Lien mortgage portfolio had original FICO scores ~716 and LTV ~74%(1). Since 2012, charge-offs in the 1st Lien mortgage originated portfolio have been a combined total of $297 thousand(2). $554 million CRA portfolio with an average P&I payment of ~$1,300 per month, which is similar to rental rates. Geographic Mix Classification Type (1) Based on aggregate weighted average data where available (2) Prior to 1Q19 (closing of the merger with State Bank), historical Cadence Bancorporation-only data and reported on a line of business basis.

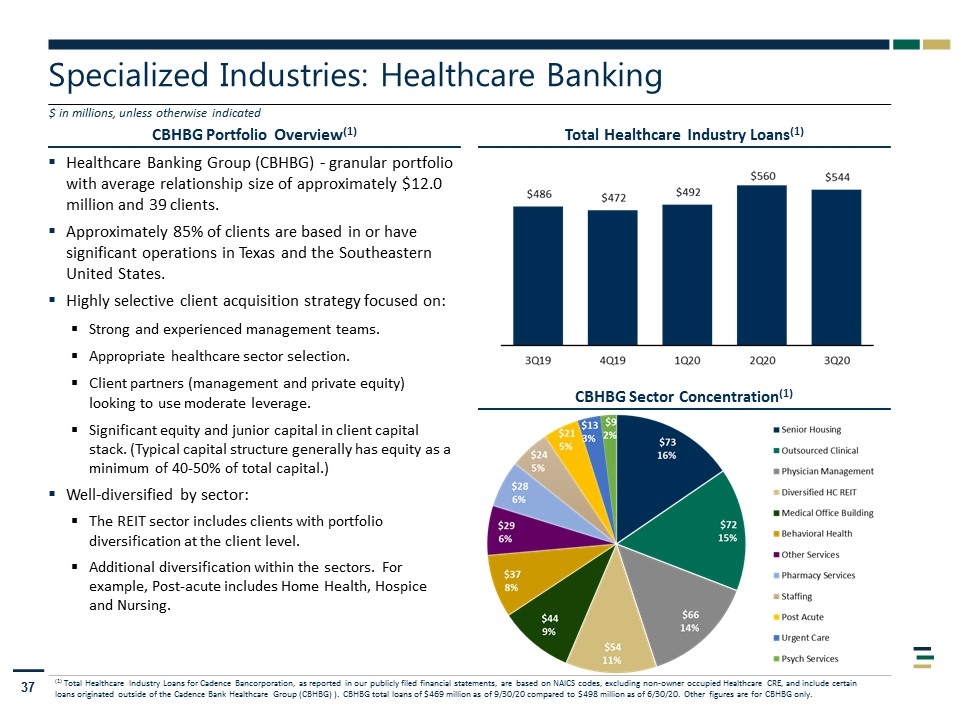

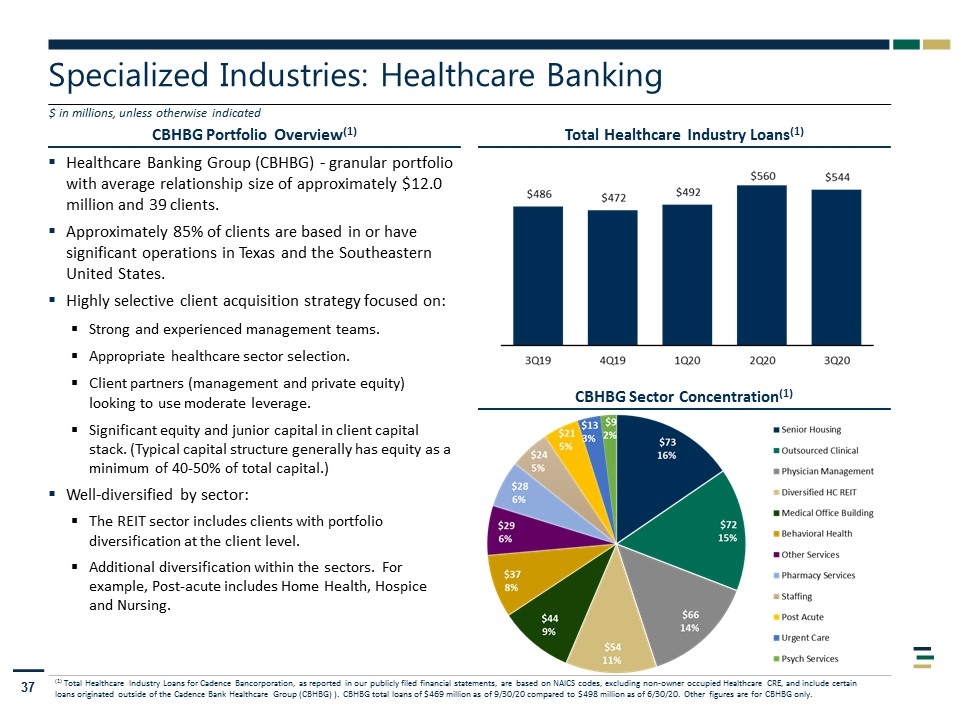

CBHBG Portfolio Overview(1) Specialized Industries: Healthcare Banking $ in millions, unless otherwise indicated Total Healthcare Industry Loans(1) Healthcare Banking Group (CBHBG) - granular portfolio with average relationship size of approximately $12.0 million and 39 clients. Approximately 85% of clients are based in or have significant operations in Texas and the Southeastern United States. Highly selective client acquisition strategy focused on: Strong and experienced management teams. Appropriate healthcare sector selection. Client partners (management and private equity) looking to use moderate leverage. Significant equity and junior capital in client capital stack. (Typical capital structure generally has equity as a minimum of 40-50% of total capital.) Well-diversified by sector: The REIT sector includes clients with portfolio diversification at the client level. Additional diversification within the sectors. For example, Post-acute includes Home Health, Hospice and Nursing. (1) Total Healthcare Industry Loans for Cadence Bancorporation, as reported in our publicly filed financial statements, are based on NAICS codes, excluding non-owner occupied Healthcare CRE, and include certain loans originated outside of the Cadence Bank Healthcare Group (CBHBG) ). CBHBG total loans of $469 million as of 9/30/20 compared to $498 million as of 6/30/20. Other figures are for CBHBG only. CBHBG Sector Concentration(1)

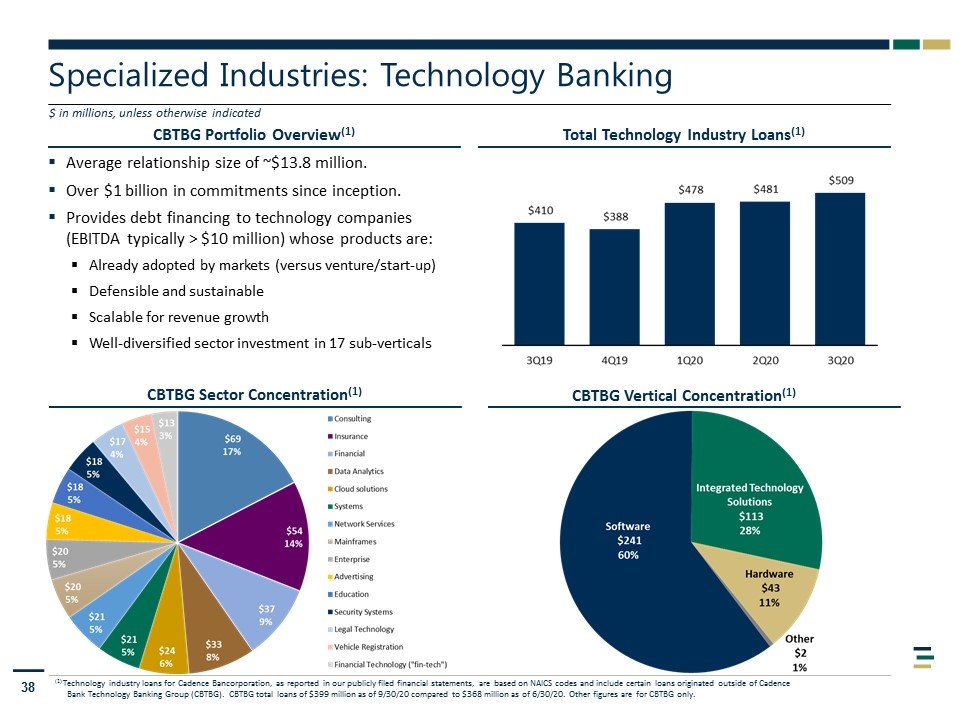

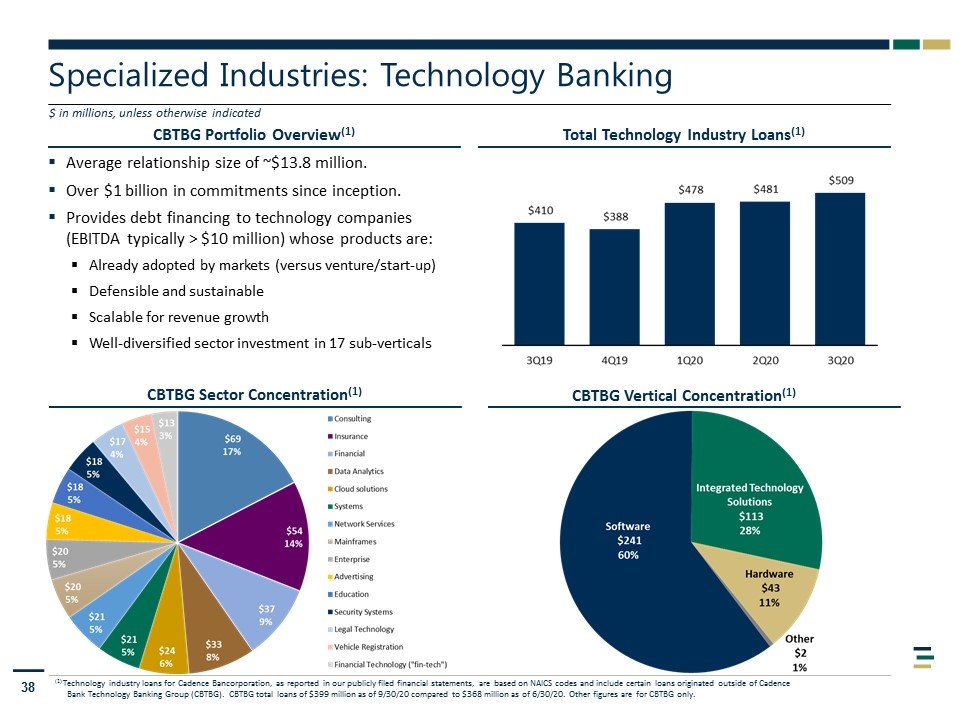

CBTBG Portfolio Overview(1) Specialized Industries: Technology Banking $ in millions, unless otherwise indicated Total Technology Industry Loans(1) Average relationship size of ~$13.8 million. Over $1 billion in commitments since inception. Provides debt financing to technology companies (EBITDA typically > $10 million) whose products are: Already adopted by markets (versus venture/start-up) Defensible and sustainable Scalable for revenue growth Well-diversified sector investment in 17 sub-verticals (1) Technology industry loans for Cadence Bancorporation, as reported in our publicly filed financial statements, are based on NAICS codes and include certain loans originated outside of Cadence Bank Technology Banking Group (CBTBG). CBTBG total loans of $399 million as of 9/30/20 compared to $368 million as of 6/30/20. Other figures are for CBTBG only. CBTBG Sector Concentration(1) CBTBG Vertical Concentration(1)

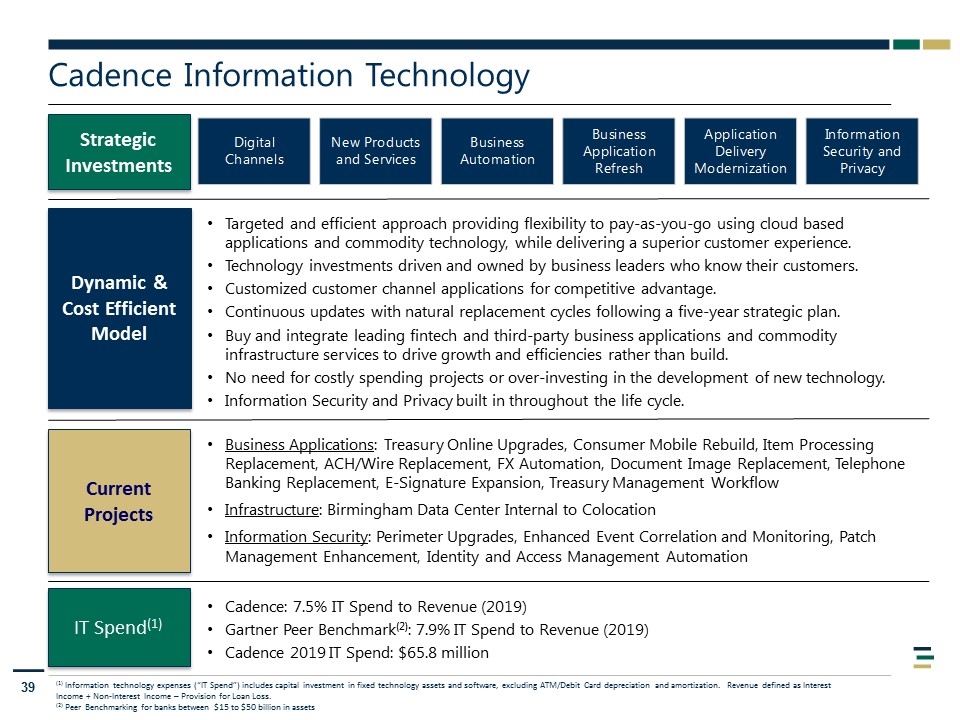

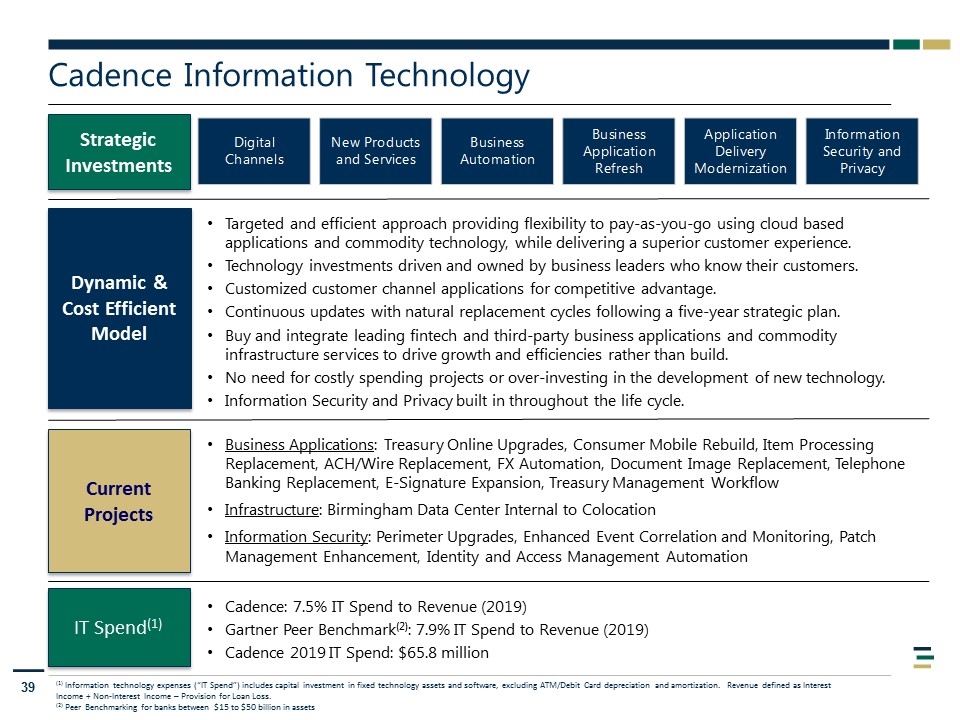

Dynamic & Cost Efficient Model Strategic Investments Current Projects IT Spend(1) Cadence Information Technology Targeted and efficient approach providing flexibility to pay-as-you-go using cloud based applications and commodity technology, while delivering a superior customer experience. Technology investments driven and owned by business leaders who know their customers. Customized customer channel applications for competitive advantage. Continuous updates with natural replacement cycles following a five-year strategic plan. Buy and integrate leading fintech and third-party business applications and commodity infrastructure services to drive growth and efficiencies rather than build. No need for costly spending projects or over-investing in the development of new technology. Information Security and Privacy built in throughout the life cycle. Cadence: 7.5% IT Spend to Revenue (2019) Gartner Peer Benchmark(2): 7.9% IT Spend to Revenue (2019) Cadence 2019 IT Spend: $65.8 million Business Applications: Treasury Online Upgrades, Consumer Mobile Rebuild, Item Processing Replacement, ACH/Wire Replacement, FX Automation, Document Image Replacement, Telephone Banking Replacement, E-Signature Expansion, Treasury Management Workflow Infrastructure: Birmingham Data Center Internal to Colocation Information Security: Perimeter Upgrades, Enhanced Event Correlation and Monitoring, Patch Management Enhancement, Identity and Access Management Automation (1) Information technology expenses (“IT Spend”) includes capital investment in fixed technology assets and software, excluding ATM/Debit Card depreciation and amortization. Revenue defined as Interest Income + Non-Interest Income – Provision for Loan Loss. (2) Peer Benchmarking for banks between $15 to $50 billion in assets

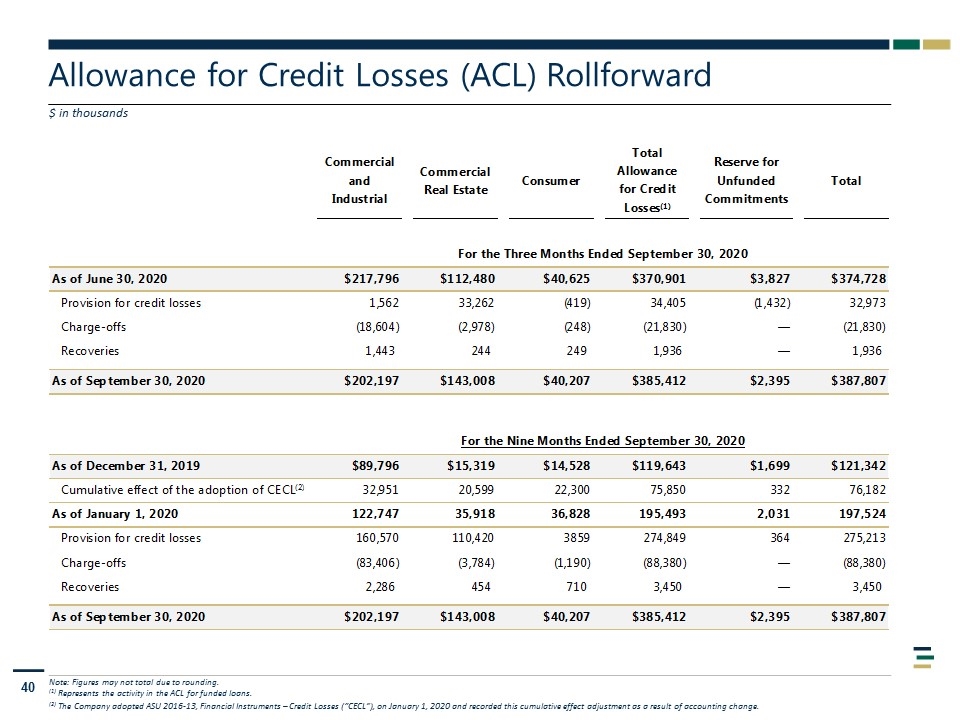

Allowance for Credit Losses (ACL) Rollforward $ in thousands Note: Figures may not total due to rounding. (1) Represents the activity in the ACL for funded loans. (2) The Company adopted ASU 2016-13, Financial Instruments – Credit Losses (“CECL”), on January 1, 2020 and recorded this cumulative effect adjustment as a result of accounting change.

Criticized Loans by Segment $ in millions

Nonperforming Assets $ in millions Note: Figures may not total due to rounding. (1) With the adoption of CECL, an additional $35.5 million of loans were classified as nonperforming loans in 1Q20 or 89% of the increase during the quarter.

Nonperforming and 90+ Days Past Due Loans $ in millions, unless otherwise indicated (1) With the adoption of CECL, an additional $35.5 million of loans were classified as nonperforming loans in 1Q20 or 89% of the increase during the quarter. (1) (1)

Classified and Criticized Loans $ in millions, unless otherwise indicated (1) Classified Loan % represents total classified loans to total loans held for investment (HFI) (2) Criticized Loan % represents total criticized loans to total loans held for investment (HFI)

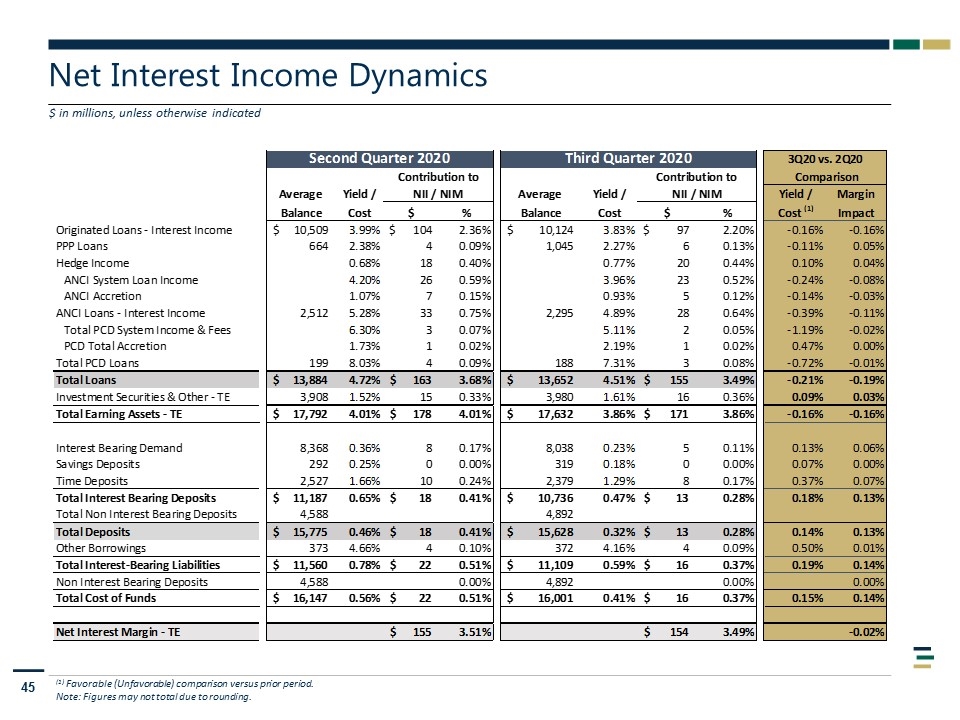

Net Interest Income Dynamics $ in millions, unless otherwise indicated (1) Favorable (Unfavorable) comparison versus prior period. Note: Figures may not total due to rounding.

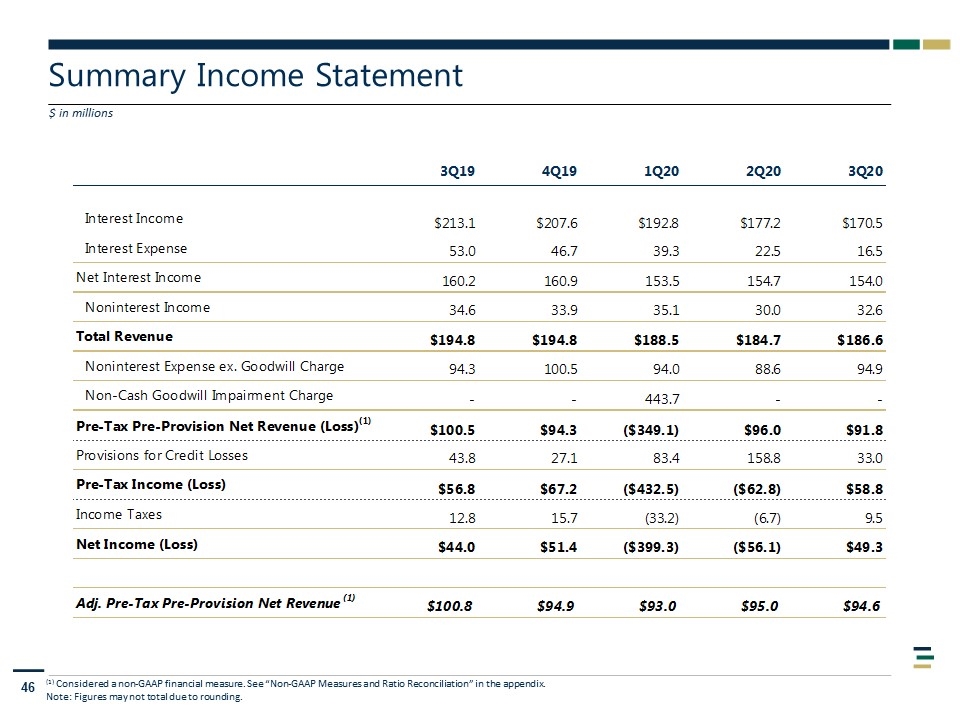

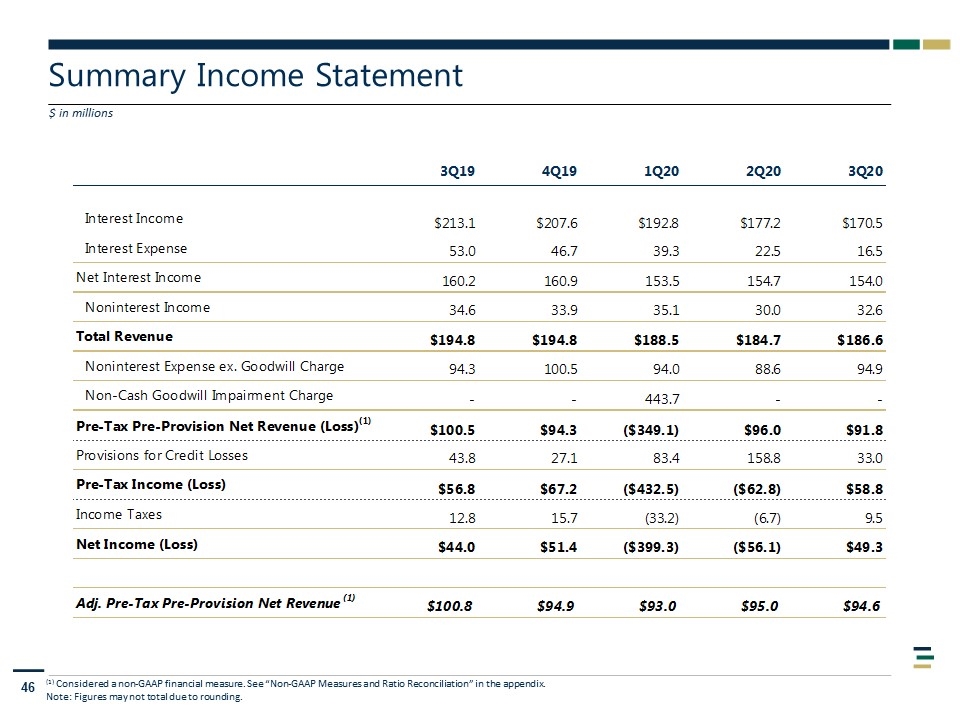

Summary Income Statement $ in millions (1) Considered a non-GAAP financial measure. See “Non-GAAP Measures and Ratio Reconciliation” in the appendix. Note: Figures may not total due to rounding.

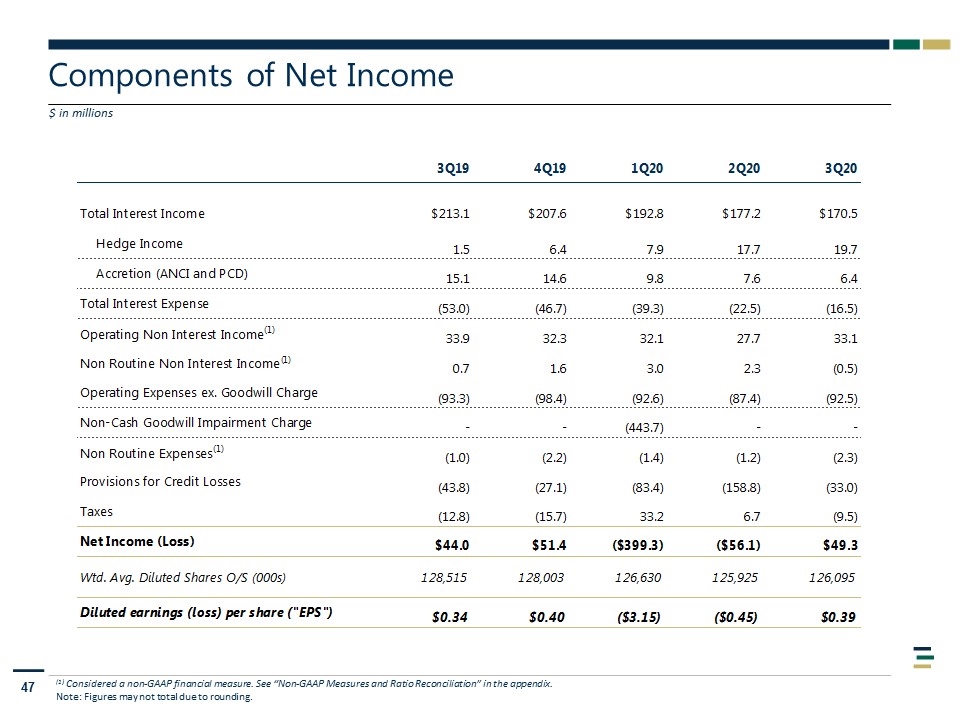

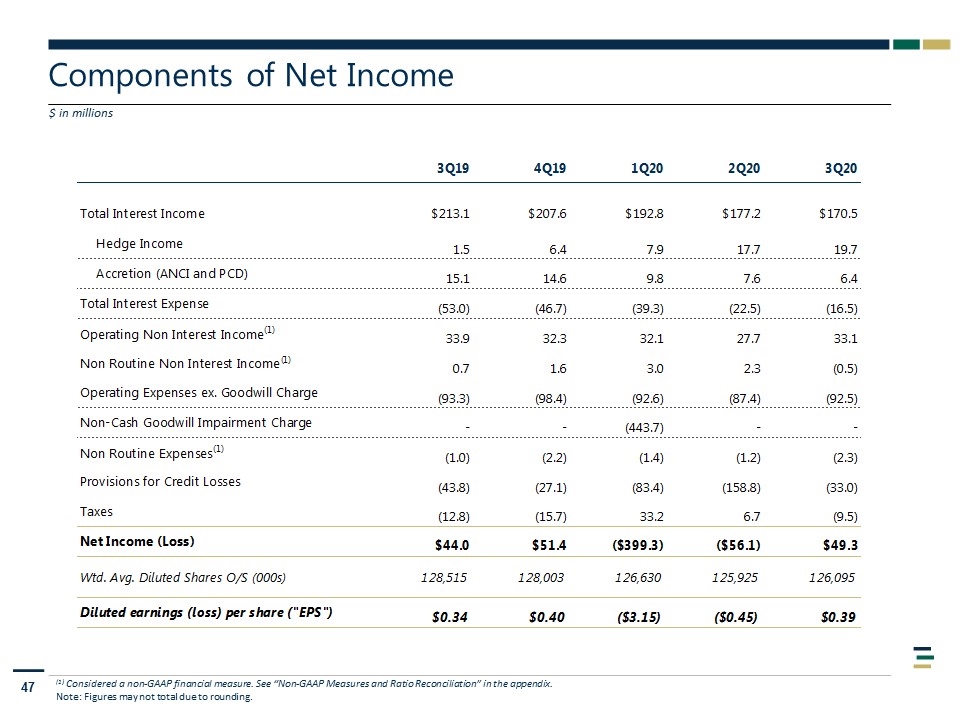

Components of Net Income $ in millions (1) Considered a non-GAAP financial measure. See “Non-GAAP Measures and Ratio Reconciliation” in the appendix. Note: Figures may not total due to rounding.

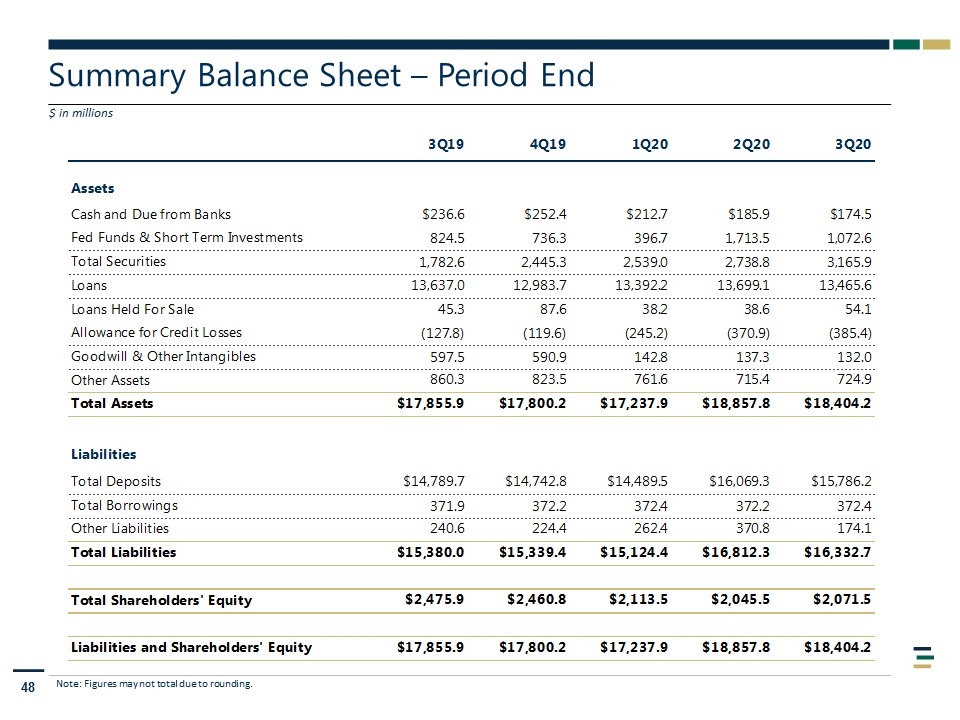

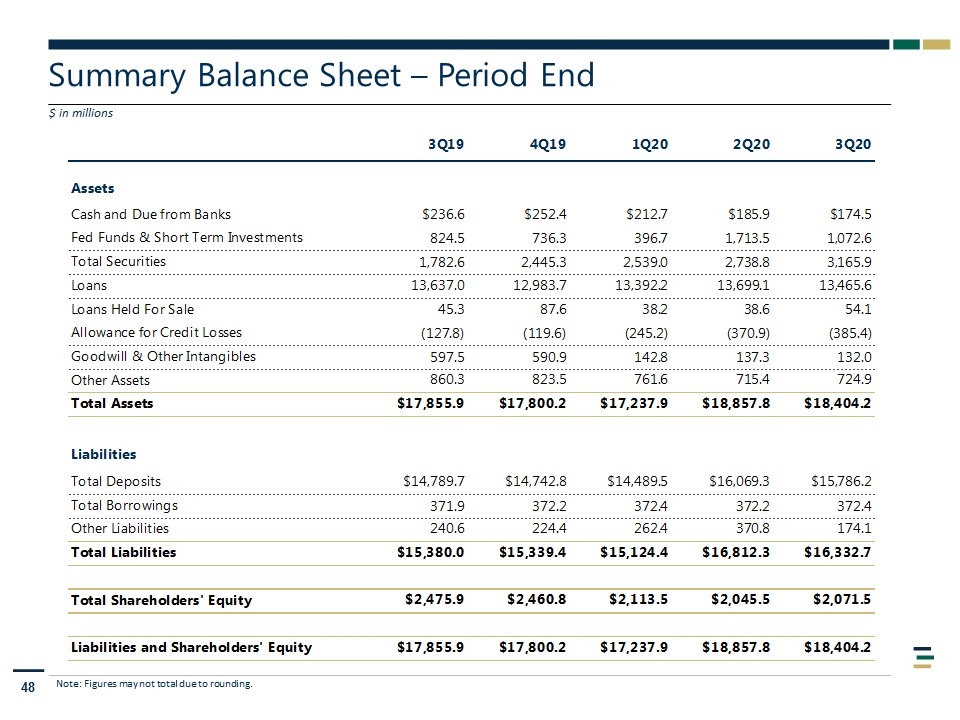

Summary Balance Sheet – Period End $ in millions Note: Figures may not total due to rounding.

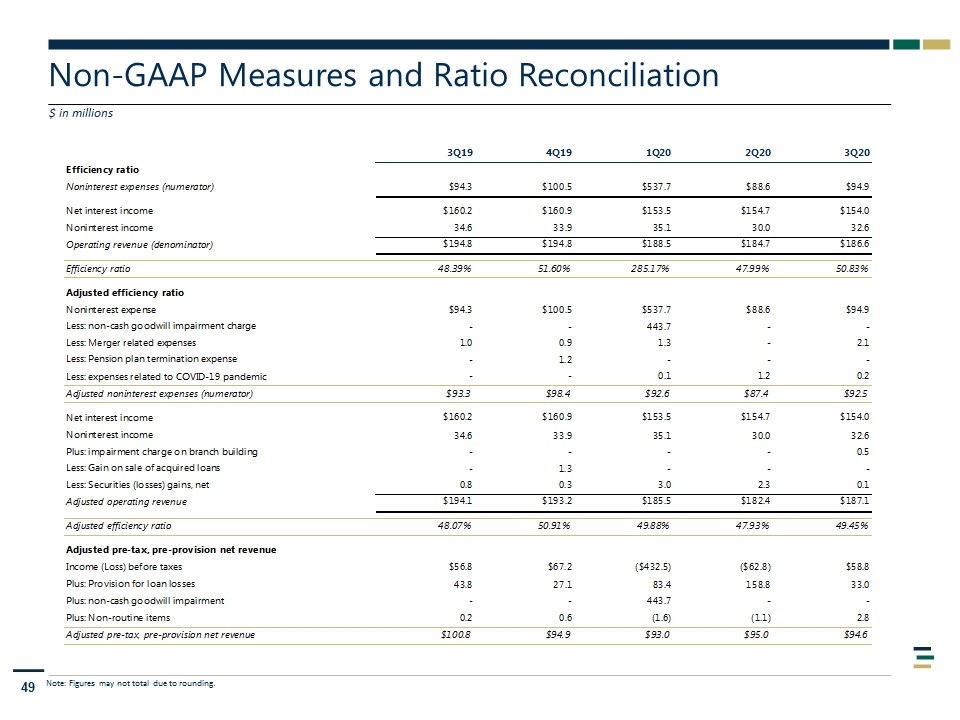

Non-GAAP Measures and Ratio Reconciliation $ in millions Note: Figures may not total due to rounding.

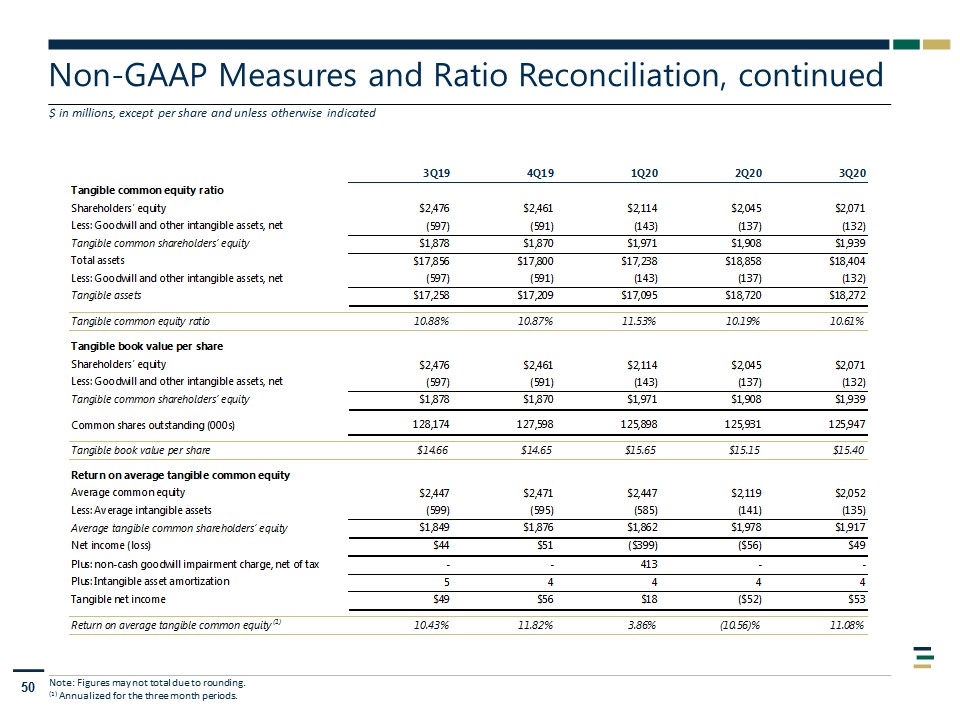

Non-GAAP Measures and Ratio Reconciliation, continued Note: Figures may not total due to rounding. (1) Annualized for the three month periods. $ in millions, except per share and unless otherwise indicated

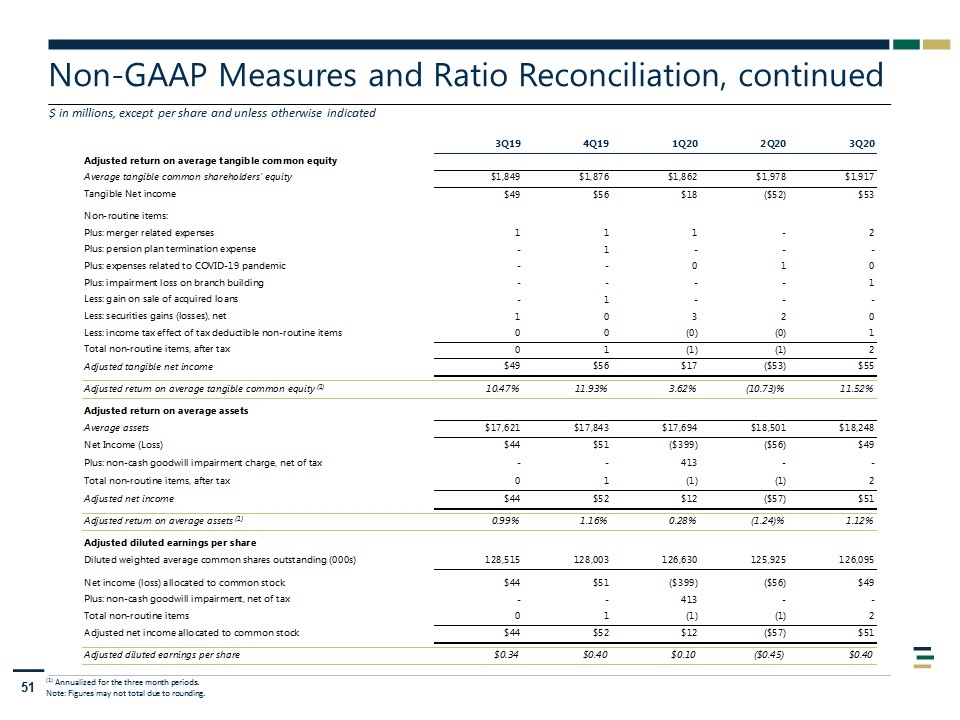

Non-GAAP Measures and Ratio Reconciliation, continued $ in millions, except per share and unless otherwise indicated (1) Annualized for the three month periods. Note: Figures may not total due to rounding.