ANALYST PRESENTATION February 7, 2017 Paul B. Murphy, Jr. Chairman and CEO First Quarter 2021 Financial Results April 22, 2021 Exhibit 99.2

2 Disclaimers Certain statements in this communication may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995,Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended with respect to BancorpSouth Bank’s and Cadence Bancorporation’s and Cadence Bank’s (together, “Cadence”) beliefs, plans, goals, expectations, and estimates. Forward-looking statements are not a representation of historical information but instead pertain to future operations, strategies, financial results or other developments. These forward-looking statements may be identified by their reference to a future period or periods or by the use of forward-looking terminology such as “anticipate,” “believe,” “could,” “continue,” “seek,” “intend,” “estimate,” “expect,” “foresee,” “hope,” “intend,” “may,” “might,” “plan,” “should,” “predict,” “project,” “goal,” “outlook,” “potential,” “will,” “will result,” “will likely result,” or “would” or future or conditional verb tenses and variations or negatives of such terms. These forward-looking statements include, without limitation, those relating to the terms, timing and closing of the proposed transaction. Cadence cautions readers not to place undue reliance on the forward-looking statements contained in this communication, in that actual results could differ materially from those indicated in such forward-looking statements as a result of a variety of factors, many of which are beyond the control of BancorpSouth Bank and Cadence. The factors that could cause actual results to differ materially include the following: the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the definitive merger agreement between BancorpSouth Bank and Cadence; the outcome of any legal proceedings that may be instituted against BancorpSouth Bank or Cadence; the possibility that the proposed transaction will not close when expected or at all because required regulatory, shareholder or other approvals are not received or other conditions to the closing are not satisfied on a timely basis or at all, or are obtained subject to conditions that are not anticipated; the ability of BancorpSouth Bank and Cadence to meet expectations regarding the timing, completion and accounting and tax treatments of the proposed transaction; the risk that any announcements relating to the proposed transaction could have adverse effects on the market price of the common stock of either or both parties to the proposed transaction; the possibility that the anticipated benefits of the proposed transaction will not be realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy and competitive factors in the areas where BancorpSouth Bank and Cadence do business; certain restrictions during the pendency of the proposed transaction that may impact the parties’ ability to pursue certain business opportunities or strategic transactions; the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; diversion of management’s attention from ongoing business operations and opportunities; the possibility that the parties may be unable to achieve expected synergies and operating efficiencies in the merger within the expected timeframes or at all and to successfully integrate Cadence’s operations and those of BancorpSouth Bank; such integration may be more difficult, time consuming or costly than expected; revenues following the proposed transaction may be lower than expected; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the proposed transaction; BancorpSouth Bank and Cadence’s success in executing their respective business plans and strategies and managing the risks involved in the foregoing; the dilution caused by BancorpSouth Bank’s issuance of additional shares of its capital stock in connection with the proposed transaction; business and economic conditions generally and in the financial services industry, nationally and within our current and future geographic market areas; economic, market, operational, liquidity, credit and interest rate risks associated with our business; deteriorating asset quality and higher loan charge-offs; the laws and regulations applicable to our business; our ability to achieve organic loan and deposit growth and the composition of such growth; increased competition in the financial services industry, nationally, regionally or locally; our ability to maintain our historical earnings trends; our ability to raise additional capital to implement our business plan; material weaknesses in our internal control over financial reporting; systems failures or interruptions involving our information technology and telecommunications systems or third-party servicers; the composition of our management team and our ability to attract and retain key personnel; the fiscal position of the U.S. federal government and the soundness of other financial institutions; the composition of our loan portfolio, including the identity of our borrowers and the concentration of loans in energy-related industries and in our specialized industries; the portion of our loan portfolio that is comprised of participations and shared national credits; the amount of nonperforming and classified assets we hold; the extent of the impact of the COVID-19 pandemic on us and our customers, counterparties, employees and third-party service providers, and the impacts to our business, financial position, results of operations, and prospects; and other factors that may affect future results of BancorpSouth Bank and Cadence; and the other factors discussed in “Risk Factors” in BancorpSouth Bank’s Annual Report on Form 10-K for the year ended December 31, 2020 and BancorpSouth Bank’s other filings with the Federal Deposit Insurance Corporation (the “FDIC”), which are available at https://www.fdic.gov/ and in the “Investor Relations” section of BancorpSouth Bank’s website, https://www.bancorpsouth.com/, under the heading “Public Filings,” and in Cadence’s Annual Report on Form 10-K for the year ended December 31, 2020 and in Cadence’s other filings with the U.S. Securities and Exchange Commission (the “SEC”), which are available at http://www.sec.gov and in the “Investor Relations” section of Cadence’s website, https://cadencebancorporation.com/, under the heading “SEC Filings.” BancorpSouth Bank and Cadence assume no obligation to update the information in this communication, except as otherwise required by law.

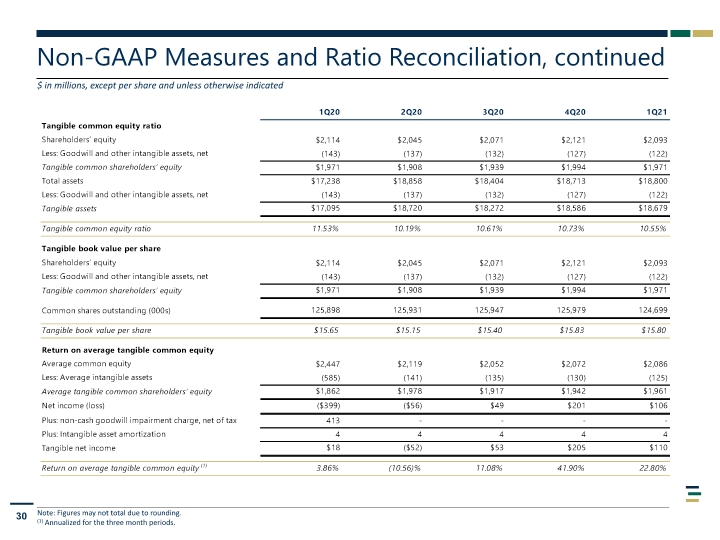

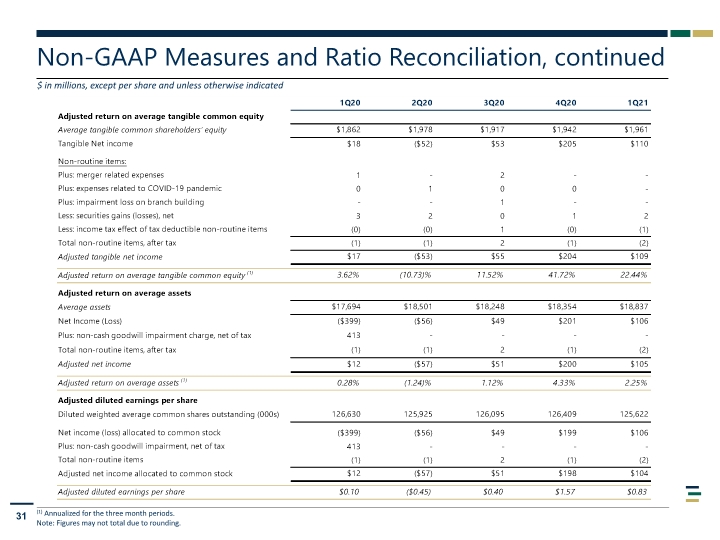

3 Disclaimers, continued Additional Information and Where to Find It This communication may be deemed to be solicitation material in respect of the proposed transaction by BancorpSouth Bank and Cadence. In connection with the proposed acquisition, BancorpSouth Bank and Cadence intend to file relevant materials with the FDIC and SEC, respectively, including the parties’ joint proxy statement on Schedule 14A, which shall include an offering circular with respect to the common stock of BancorpSouth Bank. STOCKHOLDERS OF BANCORPSOUTH BANK AND CADENCE ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE FDIC AND SEC WHEN THEY BECOME AVAILABLE, INCLUDING THE JOINT PROXY STATEMENT/OFFERING CIRCULAR, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain the documents free of charge at the FDIC’s website, https://www.fdic.gov/, and the SEC’s website, http://www.sec.gov, and the Cadence stockholders will receive information at an appropriate time on how to obtain transaction-related documents free of charge from Cadence. Such documents are not currently available. Participants in Solicitation BancorpSouth Bank and its directors and executive officers, and Cadence and its directors and executive officers, may be deemed to be participants in the solicitation of proxies from the holders of BancorpSouth Bank common stock and the holders of Cadence common stock in respect of the proposed transaction. Information about the directors and executive officers of BancorpSouth Bank is set forth in the proxy statement for BancorpSouth Bank’s 2021 Annual Meeting of Stockholders, which was filed with the FDIC on March 12, 2021. Information about the directors and executive officers of Cadence is set forth in the proxy statement for Cadence’s 2021 Annual Meeting of Stockholders, which was filed with the SEC on March 26, 2021. Investors may obtain additional information regarding the interest of such participants by reading the joint proxy statement/offering circular regarding the proposed transaction when it becomes available. Free copies of this document may be obtained as described in the preceding paragraph. About Non-GAAP Financial Measures Certain of the financial measures and ratios we present, including “efficiency ratio,” “adjusted efficiency ratio,” “adjusted noninterest expenses,” “adjusted operating revenue,” “tangible common equity ratio,” “tangible book value per share” and “return on average tangible common equity”, “adjusted return on average tangible common equity”, “adjusted return on average assets”, “adjusted diluted earnings per share”, and “pre-tax, pre-provision net revenue” are supplemental measures that are not required by, or are not presented in accordance with, U.S. generally accepted accounting principles (GAAP). We refer to these financial measures and ratios as “non-GAAP financial measures.” We consider the use of select non-GAAP financial measures and ratios to be useful for financial and operational decision making and useful in evaluating period-to-period comparisons. We believe that these non-GAAP financial measures provide meaningful supplemental information regarding our performance by excluding certain expenditures or assets that we believe are not indicative of our primary business operating results or by presenting certain metrics on a fully taxable equivalent basis. We believe that management and investors benefit from referring to these non-GAAP financial measures in assessing our performance and when planning, forecasting, analyzing and comparing past, present and future periods. These non-GAAP financial measures should not be considered a substitute for financial information presented in accordance with GAAP and you should not rely on non-GAAP financial measures alone as measures of our performance. The non-GAAP financial measures we present may differ from non-GAAP financial measures used by our peers or other companies. We compensate for these limitations by providing the equivalent GAAP measures whenever we present the non-GAAP financial measures and by including a reconciliation of the impact of the components adjusted for in the non-GAAP financial measure so that both measures and the individual components may be considered when analyzing our performance. A reconciliation of non-GAAP financial measures to the comparable GAAP financial measures is included in the appendix.

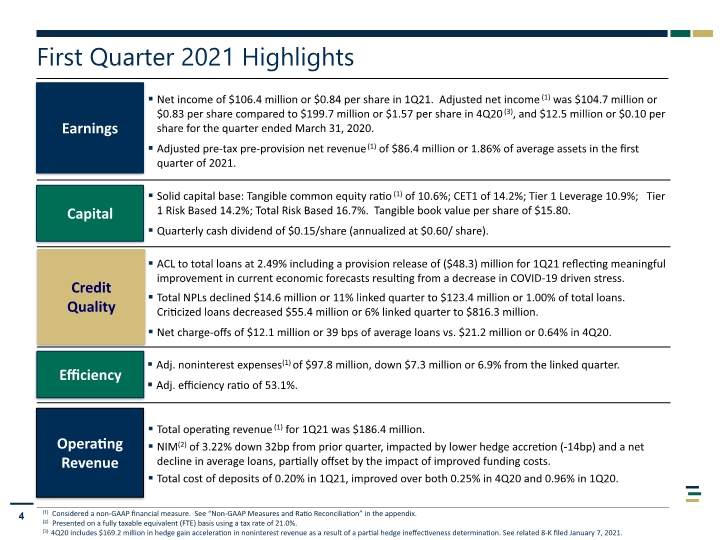

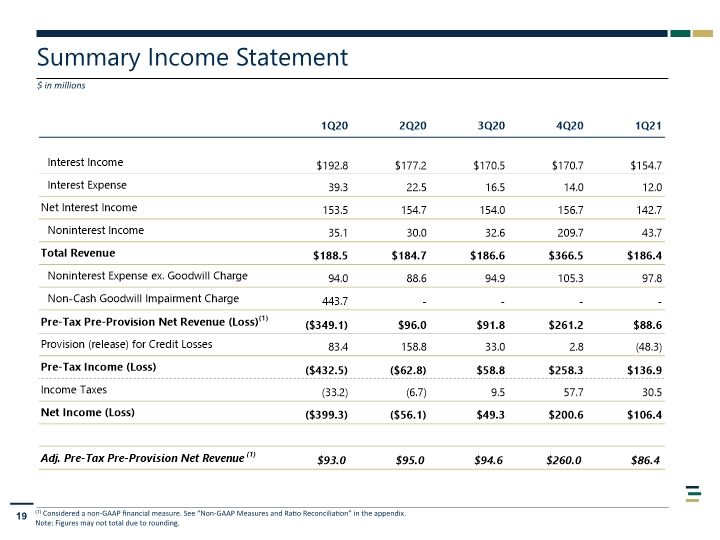

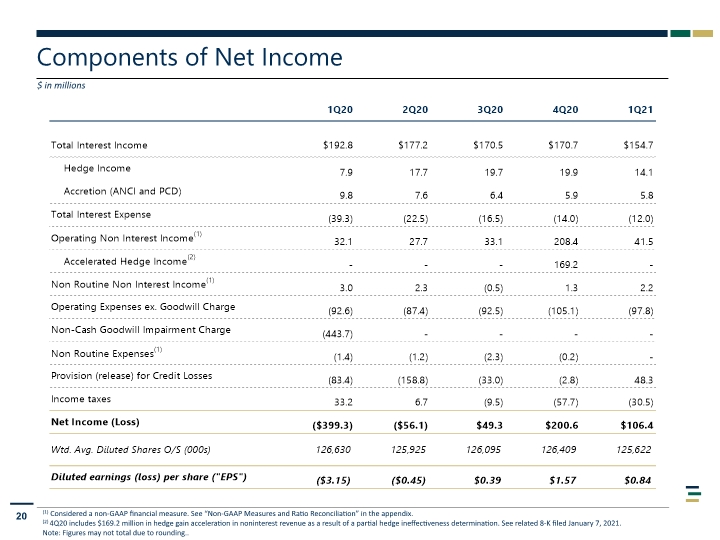

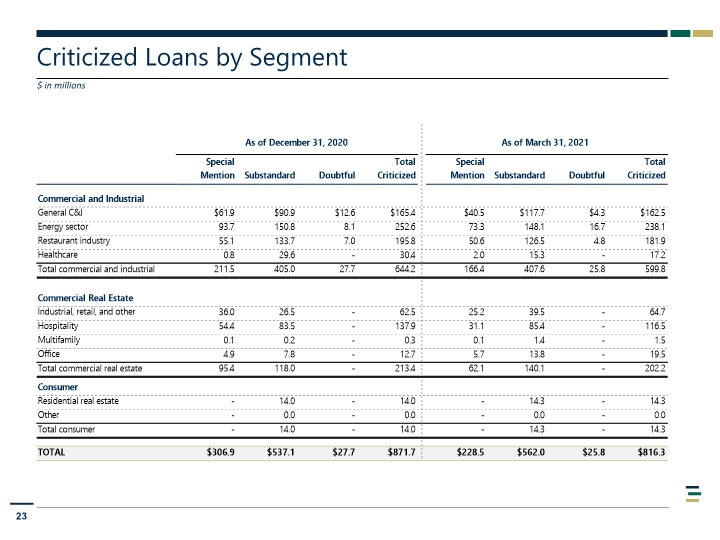

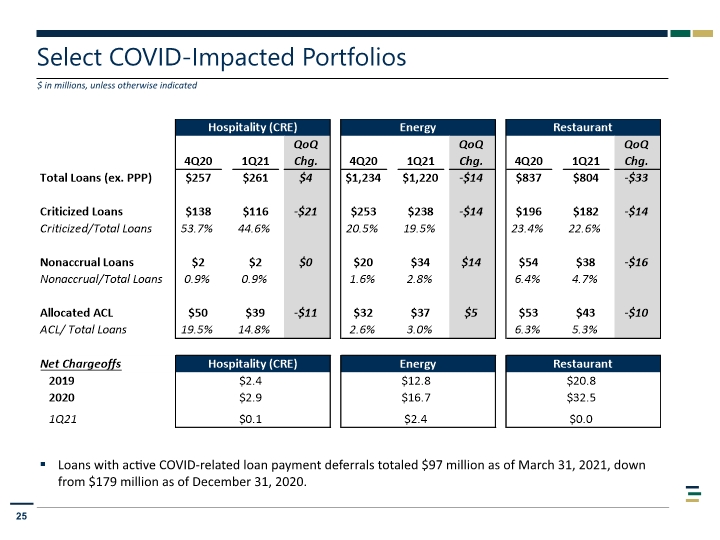

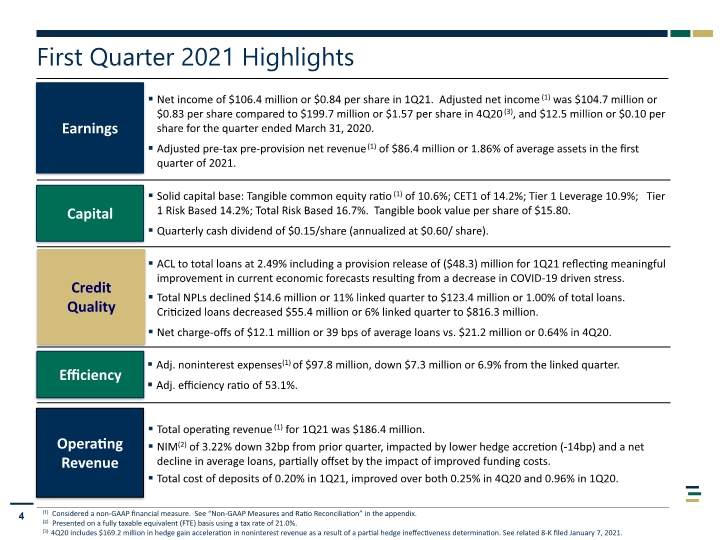

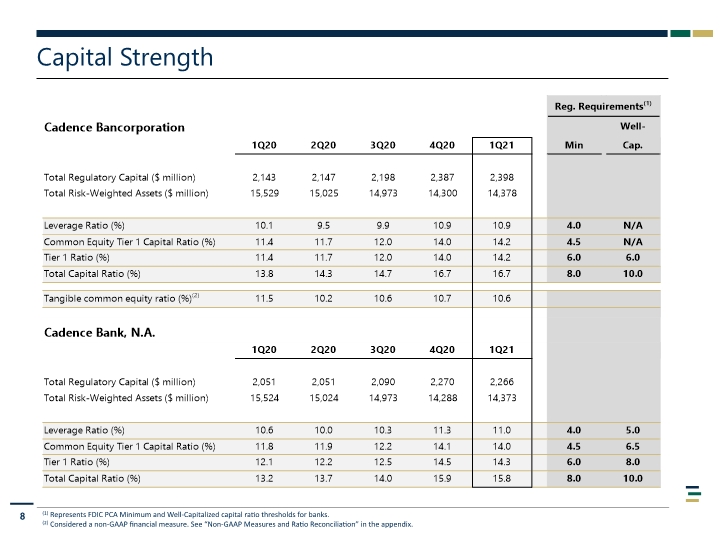

4 Earnings Net income of $106.4 million or $0.84 per share in 1Q21. Adjusted net income(1) was $104.7 million or $0.83 per share compared to $199.7 million or $1.57 per share in 4Q20(3), and $12.5 million or $0.10 per share for the quarter ended March 31, 2020. Adjusted pre-tax pre-provision net revenue(1) of $86.4 million or 1.86% of average assets in the first quarter of 2021. Capital Operating Revenue Efficiency Credit Quality Solid capital base: Tangible common equity ratio(1) of 10.6%; CET1 of 14.2%; Tier 1 Leverage 10.9%; Tier 1 Risk Based 14.2%; Total Risk Based 16.7%. Tangible book value per share of $15.80. Quarterly cash dividend of $0.15/share (annualized at $0.60/ share). Total operating revenue (1) for 1Q21 was $186.4 million. NIM(2) of 3.22% down 32bp from prior quarter, impacted by lower hedge accretion (-14bp) and a net decline in average loans, partially offset by the impact of improved funding costs. Total cost of deposits of 0.20% in 1Q21, improved over both 0.25% in 4Q20 and 0.96% in 1Q20. Adj. noninterest expenses(1) of $97.8 million, down $7.3 million or 6.9% from the linked quarter. Adj. efficiency ratio of 53.1%. ACL to total loans at 2.49% including a provision release of ($48.3) million for 1Q21 reflecting meaningful improvement in current economic forecasts resulting from a decrease in COVID-19 driven stress. Total NPLs declined $14.6 million or 11% linked quarter to $123.4 million or 1.00% of total loans. Criticized loans decreased $55.4 million or 6% linked quarter to $816.3 million. Net charge-offs of $12.1 million or 39 bps of average loans vs. $21.2 million or 0.64% in 4Q20. (1) Considered a non-GAAP financial measure. See “Non-GAAP Measures and Ratio Reconciliation” in the appendix. (2) Presented on a fully taxable equivalent (FTE) basis using a tax rate of 21.0%. (3) 4Q20 includes $169.2 million in hedge gain acceleration in noninterest revenue as a result of a partial hedge ineffectiveness determination. See related 8-K filed January 7, 2021. First Quarter 2021 Highlights

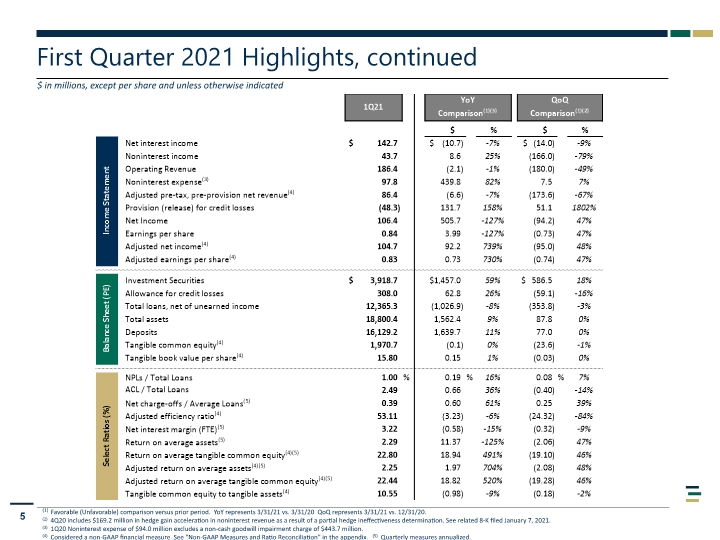

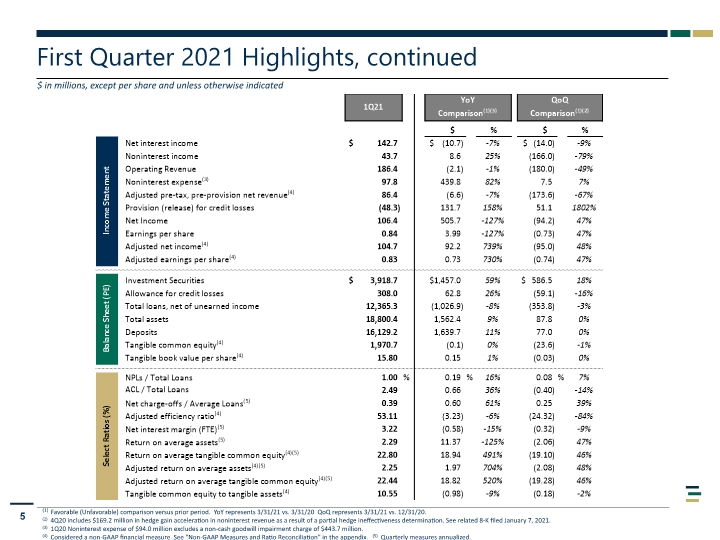

5 First Quarter 2021 Highlights, continued $ in millions, except per share and unless otherwise indicated (1) Favorable (Unfavorable) comparison versus prior period. YoY represents 3/31/21 vs. 3/31/20 QoQ represents 3/31/21 vs. 12/31/20. (2) 4Q20 includes $169.2 million in hedge gain acceleration in noninterest revenue as a result of a partial hedge ineffectiveness determination. See related 8-K filed January 7, 2021. (3) 1Q20 Noninterest expense of $94.0 million excludes a non-cash goodwill impairment charge of $443.7 million. (4) Considered a non-GAAP financial measure. See “Non-GAAP Measures and Ratio Reconciliation” in the appendix. (5) Quarterly measures annualized.

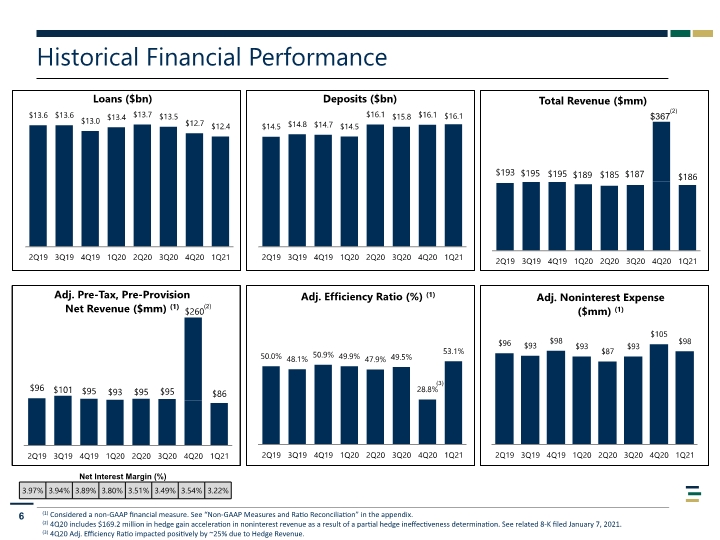

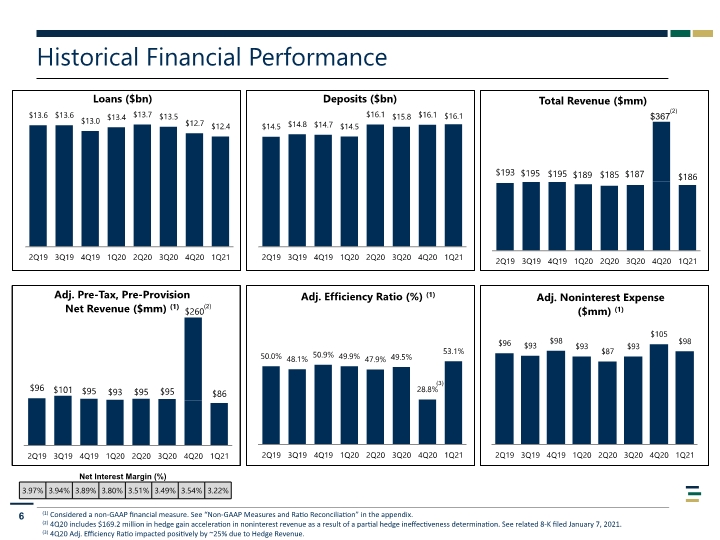

Historical Financial Performance 6 44% 62% 74% 17% 26% 74% 80% 84% 20% 16% 92% 8% 96% 4% (1) Considered a non-GAAP financial measure. See “Non-GAAP Measures and Ratio Reconciliation” in the appendix. (2) 4Q20 includes $169.2 million in hedge gain acceleration in noninterest revenue as a result of a partial hedge ineffectiveness determination. See related 8-K filed January 7, 2021. (3) 4Q20 Adj. Efficiency Ratio impacted positively by ~25% due to Hedge Revenue. Net Interest Margin (%) (2) (2) (3)

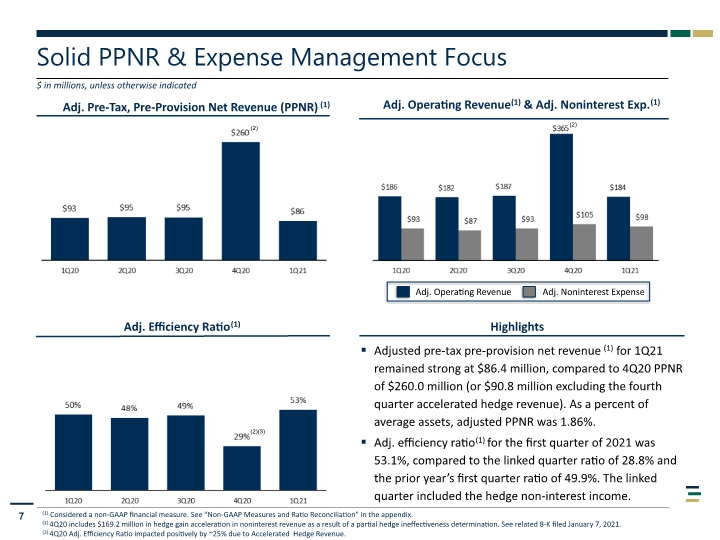

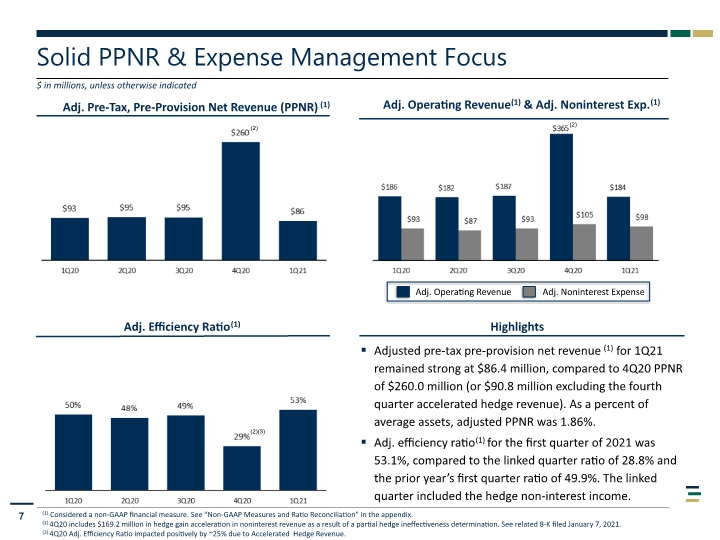

Solid PPNR & Expense Management Focus 7 Adj. Pre-Tax, Pre-Provision Net Revenue (PPNR)(1) Highlights Adj. Efficiency Ratio(1) (1) Considered a non-GAAP financial measure. See “Non-GAAP Measures and Ratio Reconciliation” in the appendix. (2) 4Q20 includes $169.2 million in hedge gain acceleration in noninterest revenue as a result of a partial hedge ineffectiveness determination. See related 8-K filed January 7, 2021. (3) 4Q20 Adj. Efficiency Ratio impacted positively by ~25% due to Accelerated Hedge Revenue. Adj. Operating Revenue(1) & Adj. Noninterest Exp.(1) $ in millions, unless otherwise indicated Adj. Operating Revenue Adj. Noninterest Expense Adjusted pre-tax pre-provision net revenue(1) for 1Q21 remained strong at $86.4 million, compared to 4Q20 PPNR of $260.0 million (or $90.8 million excluding the fourth quarter accelerated hedge revenue). As a percent of average assets, adjusted PPNR was 1.86%. Adj. efficiency ratio(1) for the first quarter of 2021 was 53.1%, compared to the linked quarter ratio of 28.8% and the prior year’s first quarter ratio of 49.9%. The linked quarter included the hedge non-interest income. (2) (2)(3) (2)

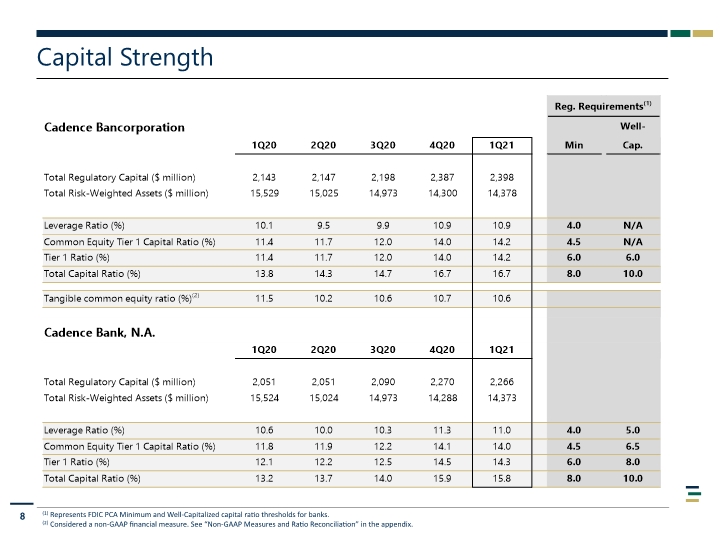

8 Capital Strength (1) Represents FDIC PCA Minimum and Well-Capitalized capital ratio thresholds for banks. (2) Considered a non-GAAP financial measure. See “Non-GAAP Measures and Ratio Reconciliation” in the appendix.

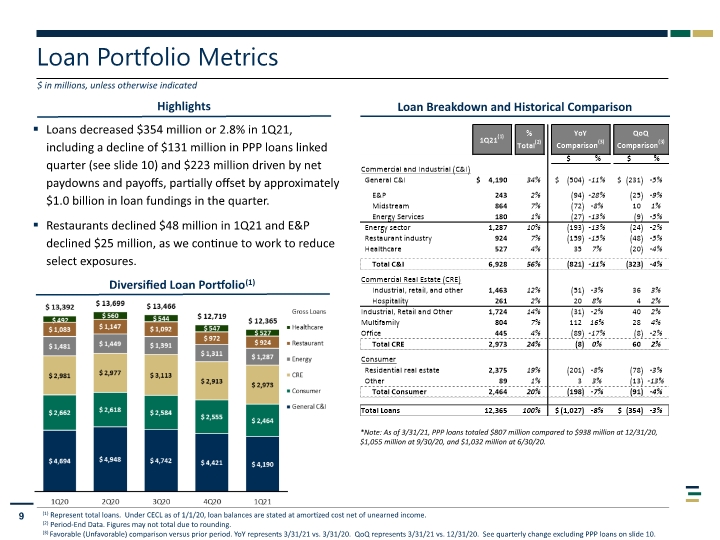

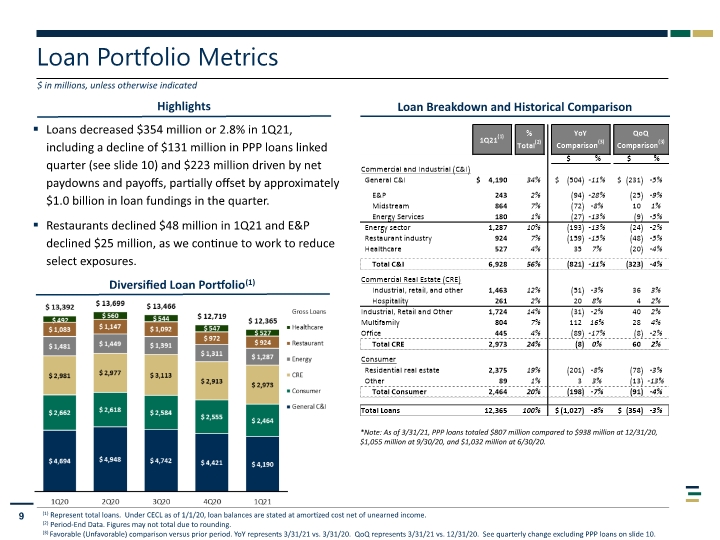

Highlights Loan Portfolio Metrics 9 $ in millions, unless otherwise indicated Diversified Loan Portfolio(1) (1) Represent total loans. Under CECL as of 1/1/20, loan balances are stated at amortized cost net of unearned income. (2) Period-End Data. Figures may not total due to rounding. (3) Favorable (Unfavorable) comparison versus prior period. YoY represents 3/31/21 vs. 3/31/20. QoQ represents 3/31/21 vs. 12/31/20. See quarterly change excluding PPP loans on slide 10. Loan Breakdown and Historical Comparison Loans decreased $354 million or 2.8% in 1Q21, including a decline of $131 million in PPP loans linked quarter (see slide 10) and $223 million driven by net paydowns and payoffs, partially offset by approximately $1.0 billion in loan fundings in the quarter. Restaurants declined $48 million in 1Q21 and E&P declined $25 million, as we continue to work to reduce select exposures. *Note: As of 3/31/21, PPP loans totaled $807 million compared to $938 million at 12/31/20, $1,055 million at 9/30/20, and $1,032 million at 6/30/20.

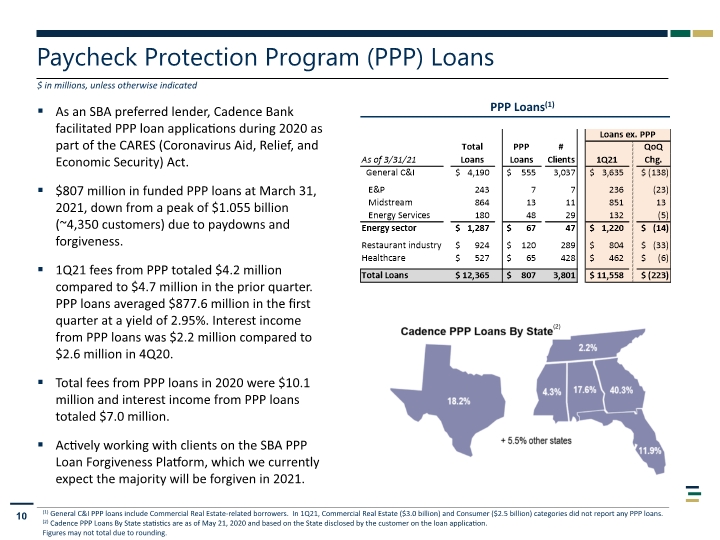

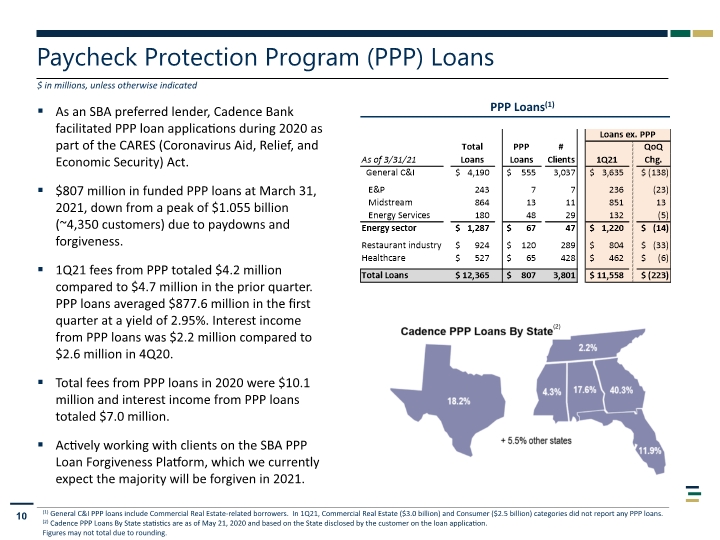

Paycheck Protection Program (PPP) Loans 10 $ in millions, unless otherwise indicated PPP Loans(1) As an SBA preferred lender, Cadence Bank facilitated PPP loan applications during 2020 as part of the CARES (Coronavirus Aid, Relief, and Economic Security) Act. $807 million in funded PPP loans at March 31, 2021, down from a peak of $1.055 billion (~4,350 customers) due to paydowns and forgiveness. 1Q21 fees from PPP totaled $4.2 million compared to $4.7 million in the prior quarter. PPP loans averaged $877.6 million in the first quarter at a yield of 2.95%. Interest income from PPP loans was $2.2 million compared to $2.6 million in 4Q20. Total fees from PPP loans in 2020 were $10.1 million and interest income from PPP loans totaled $7.0 million. Actively working with clients on the SBA PPP Loan Forgiveness Platform, which we currently expect the majority will be forgiven in 2021. (1) General C&I PPP loans include Commercial Real Estate-related borrowers. In 1Q21, Commercial Real Estate ($3.0 billion) and Consumer ($2.5 billion) categories did not report any PPP loans. (2) Cadence PPP Loans By State statistics are as of May 21, 2020 and based on the State disclosed by the customer on the loan application. Figures may not total due to rounding. (2)

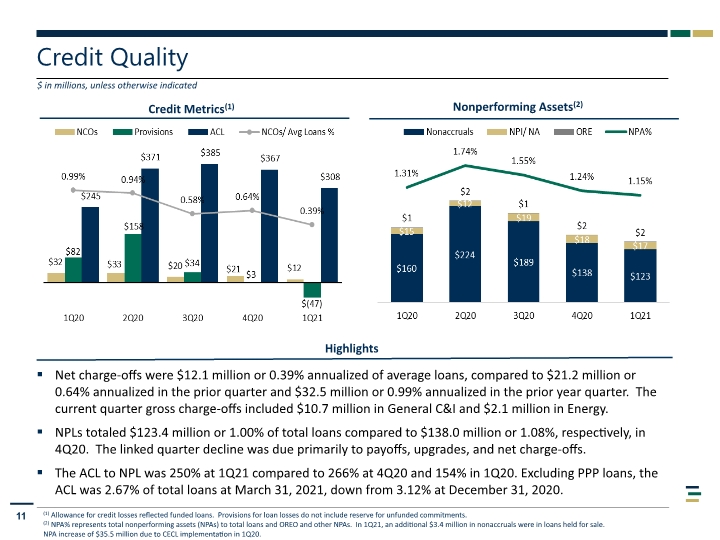

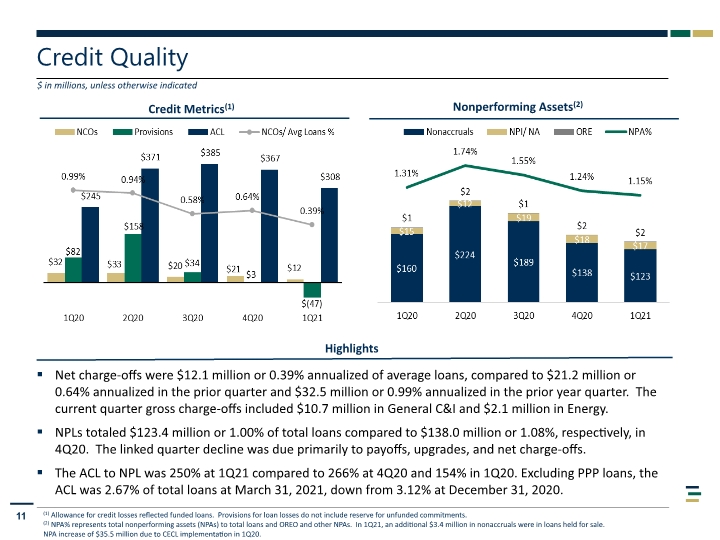

Net charge-offs were $12.1 million or 0.39% annualized of average loans, compared to $21.2 million or 0.64% annualized in the prior quarter and $32.5 million or 0.99% annualized in the prior year quarter. The current quarter gross charge-offs included $10.7 million in General C&I and $2.1 million in Energy. NPLs totaled $123.4 million or 1.00% of total loans compared to $138.0 million or 1.08%, respectively, in 4Q20. The linked quarter decline was due primarily to payoffs, upgrades, and net charge-offs. The ACL to NPL was 250% at 1Q21 compared to 266% at 4Q20 and 154% in 1Q20. Excluding PPP loans, the ACL was 2.67% of total loans at March 31, 2021, down from 3.12% at December 31, 2020. Credit Quality 11 $ in millions, unless otherwise indicated Nonperforming Assets(2) Highlights Credit Metrics(1) (1) Allowance for credit losses reflected funded loans. Provisions for loan losses do not include reserve for unfunded commitments. (2) NPA% represents total nonperforming assets (NPAs) to total loans and OREO and other NPAs. In 1Q21, an additional $3.4 million in nonaccruals were in loans held for sale. NPA increase of $35.5 million due to CECL implementation in 1Q20.

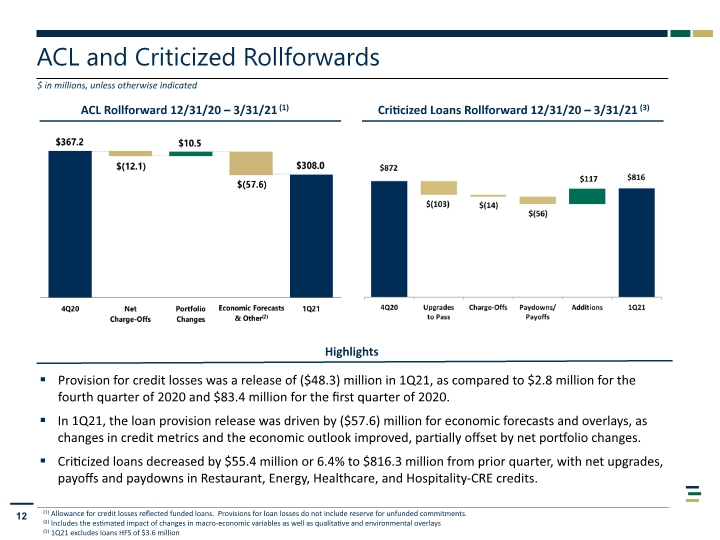

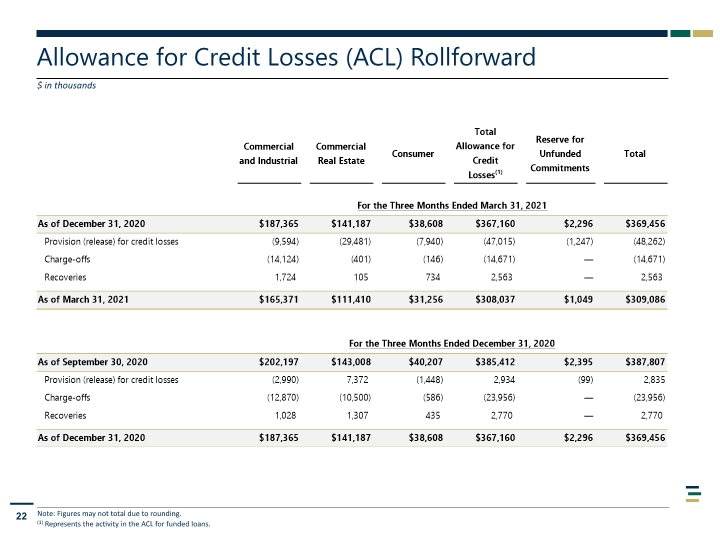

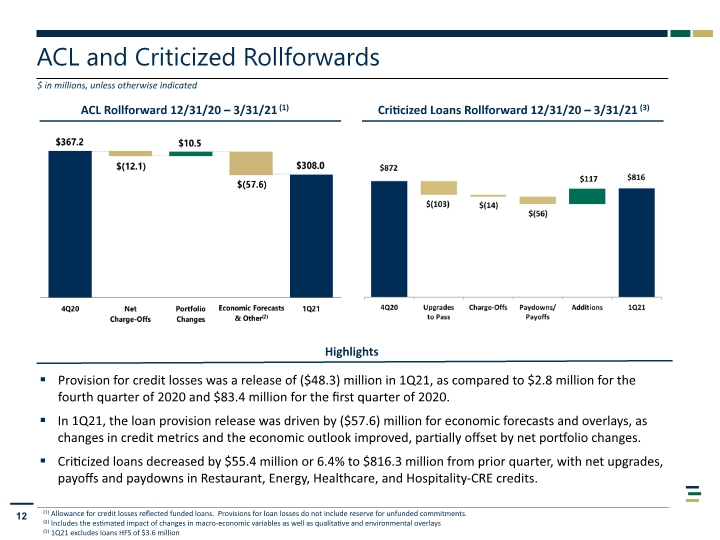

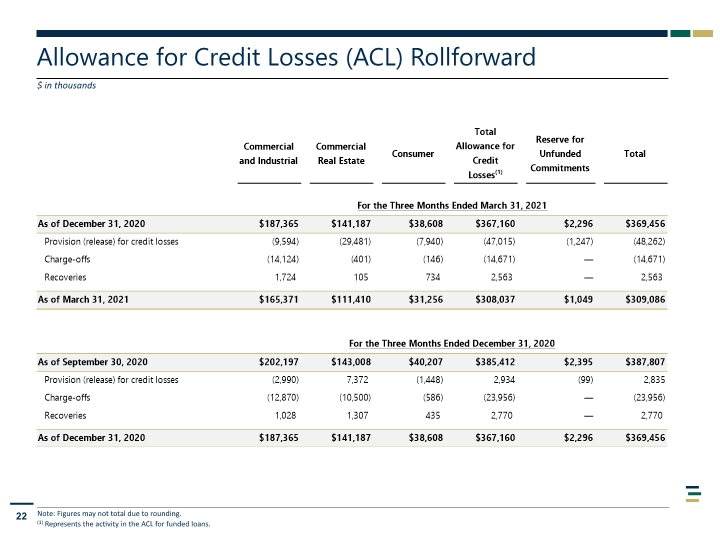

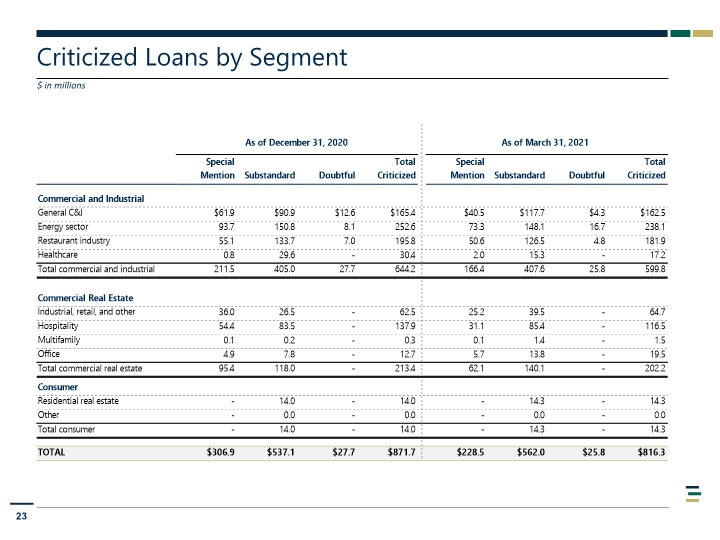

ACL and Criticized Rollforwards 12 $ in millions, unless otherwise indicated (1) Allowance for credit losses reflected funded loans. Provisions for loan losses do not include reserve for unfunded commitments. (2) Includes the estimated impact of changes in macro-economic variables as well as qualitative and environmental overlays (3) 1Q21 excludes loans HFS of $3.6 million Provision for credit losses was a release of ($48.3) million in 1Q21, as compared to $2.8 million for the fourth quarter of 2020 and $83.4 million for the first quarter of 2020. In 1Q21, the loan provision release was driven by ($57.6) million for economic forecasts and overlays, as changes in credit metrics and the economic outlook improved, partially offset by net portfolio changes. Criticized loans decreased by $55.4 million or 6.4% to $816.3 million from prior quarter, with net upgrades, payoffs and paydowns in Restaurant, Energy, Healthcare, and Hospitality-CRE credits. ACL Rollforward 12/31/20 – 3/31/21(1) Criticized Loans Rollforward 12/31/20 – 3/31/21(3) Highlights

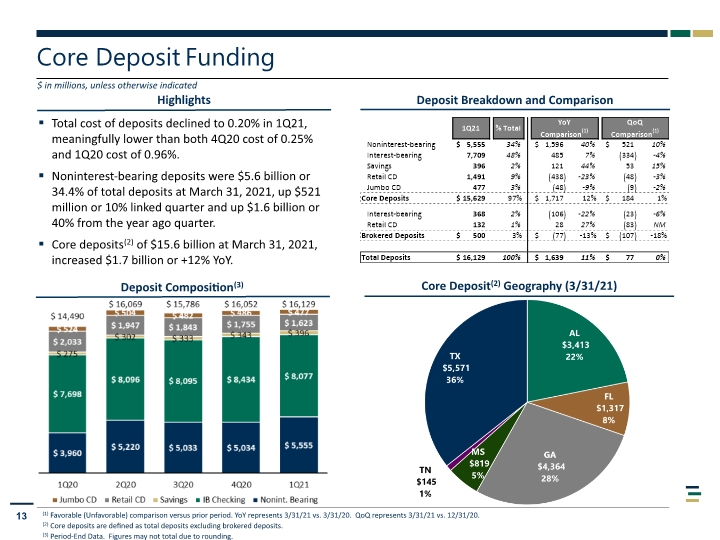

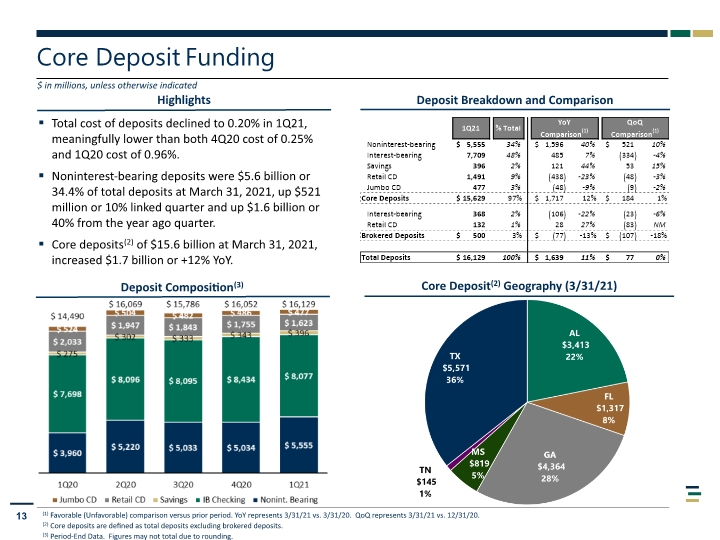

Highlights Core Deposit Funding 13 $ in millions, unless otherwise indicated Deposit Composition(3) Deposit Breakdown and Comparison (1) Favorable (Unfavorable) comparison versus prior period. YoY represents 3/31/21 vs. 3/31/20. QoQ represents 3/31/21 vs. 12/31/20. (2) Core deposits are defined as total deposits excluding brokered deposits. (3) Period-End Data. Figures may not total due to rounding. Core Deposit(2) Geography (3/31/21) Total cost of deposits declined to 0.20% in 1Q21, meaningfully lower than both 4Q20 cost of 0.25% and 1Q20 cost of 0.96%. Noninterest-bearing deposits were $5.6 billion or 34.4% of total deposits at March 31, 2021, up $521 million or 10% linked quarter and up $1.6 billion or 40% from the year ago quarter. Core deposits(2) of $15.6 billion at March 31, 2021, increased $1.7 billion or +12% YoY.

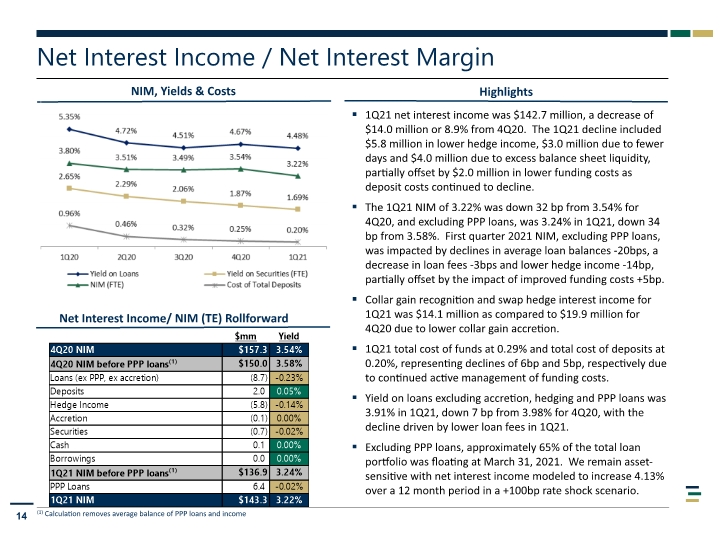

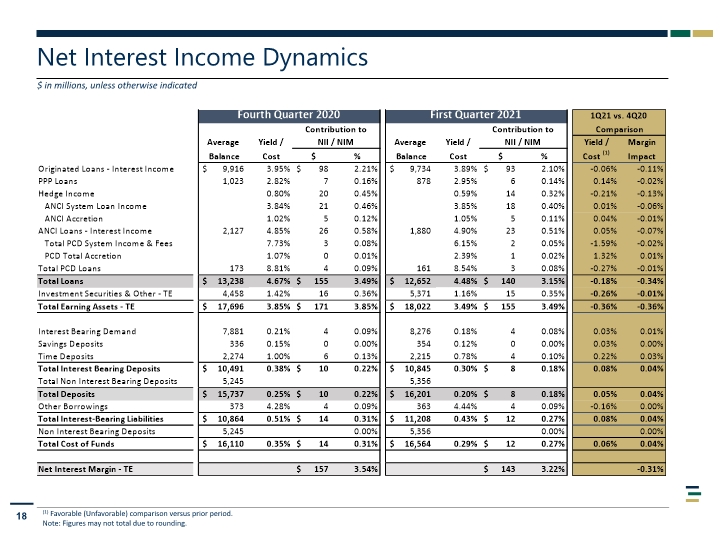

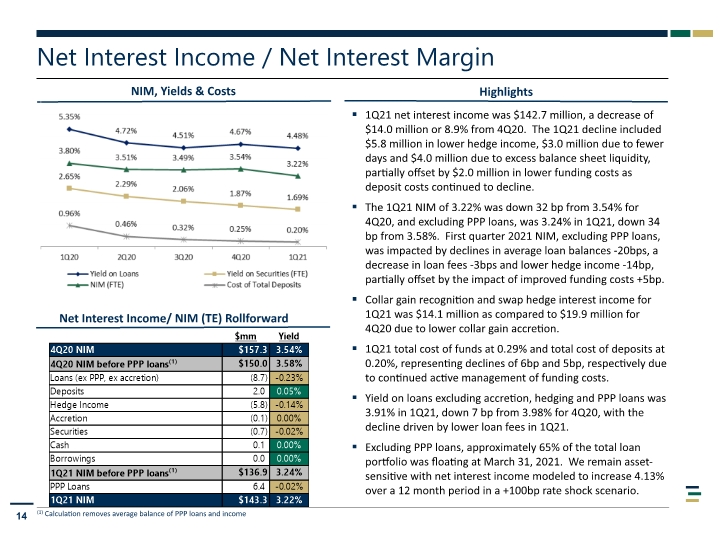

Net Interest Income / Net Interest Margin 14 Highlights (1) Calculation removes average balance of PPP loans and income NIM, Yields & Costs 1Q21 net interest income was $142.7 million, a decrease of $14.0 million or 8.9% from 4Q20. The 1Q21 decline included $5.8 million in lower hedge income, $3.0 million due to fewer days and $4.0 million due to excess balance sheet liquidity, partially offset by $2.0 million in lower funding costs as deposit costs continued to decline. The 1Q21 NIM of 3.22% was down 32 bp from 3.54% for 4Q20, and excluding PPP loans, was 3.24% in 1Q21, down 34 bp from 3.58%. First quarter 2021 NIM, excluding PPP loans, was impacted by declines in average loan balances -20bps, a decrease in loan fees -3bps and lower hedge income -14bp, partially offset by the impact of improved funding costs +5bp. Collar gain recognition and swap hedge interest income for 1Q21 was $14.1 million as compared to $19.9 million for 4Q20 due to lower collar gain accretion. 1Q21 total cost of funds at 0.29% and total cost of deposits at 0.20%, representing declines of 6bp and 5bp, respectively due to continued active management of funding costs. Yield on loans excluding accretion, hedging and PPP loans was 3.91% in 1Q21, down 7 bp from 3.98% for 4Q20, with the decline driven by lower loan fees in 1Q21. Excluding PPP loans, approximately 65% of the total loan portfolio was floating at March 31, 2021. We remain asset-sensitive with net interest income modeled to increase 4.13% over a 12 month period in a +100bp rate shock scenario. Net Interest Income/ NIM (TE) Rollforward

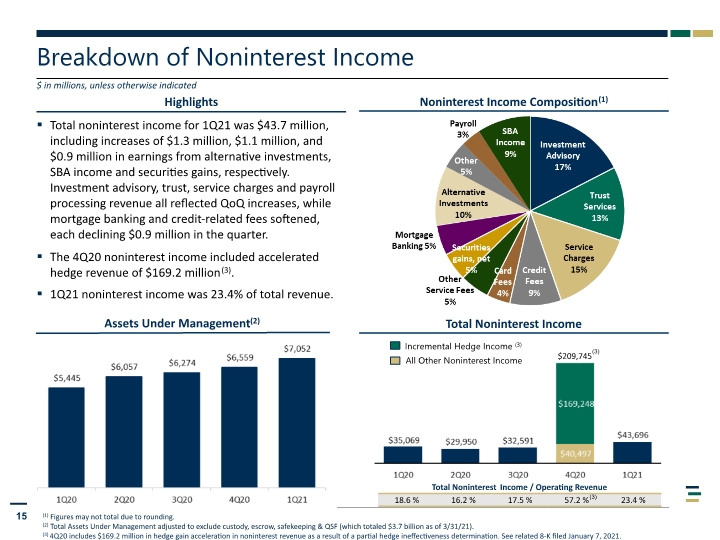

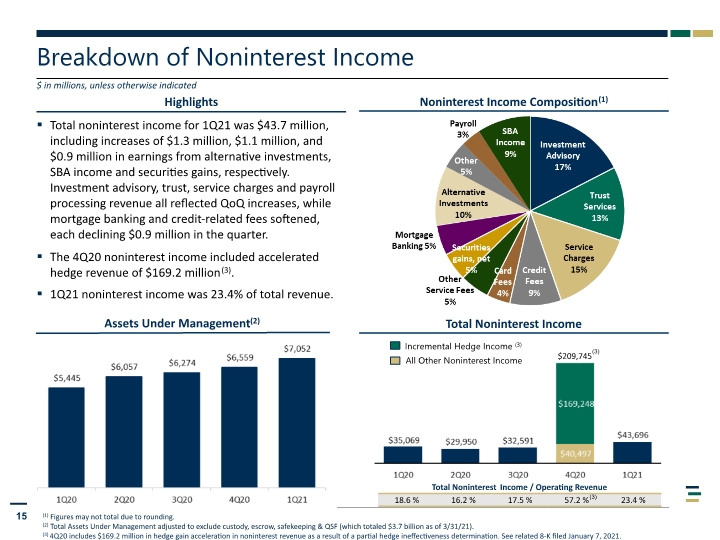

Highlights Breakdown of Noninterest Income 15 Noninterest Income Composition(1) Total Noninterest Income $ in millions, unless otherwise indicated Assets Under Management(2) (1) Figures may not total due to rounding. (2) Total Assets Under Management adjusted to exclude custody, escrow, safekeeping & QSF (which totaled $3.7 billion as of 3/31/21). (3) 4Q20 includes $169.2 million in hedge gain acceleration in noninterest revenue as a result of a partial hedge ineffectiveness determination. See related 8-K filed January 7, 2021. Total noninterest income for 1Q21 was $43.7 million, including increases of $1.3 million, $1.1 million, and $0.9 million in earnings from alternative investments, SBA income and securities gains, respectively. Investment advisory, trust, service charges and payroll processing revenue all reflected QoQ increases, while mortgage banking and credit-related fees softened, each declining $0.9 million in the quarter. The 4Q20 noninterest income included accelerated hedge revenue of $169.2 million(3). 1Q21 noninterest income was 23.4% of total revenue. (3) (3) Incremental Hedge Income (3) All Other Noninterest Income $209,745

Appendix

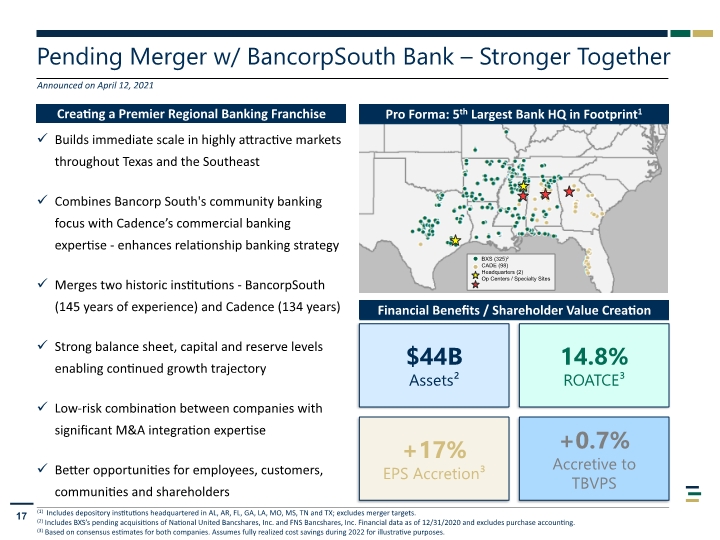

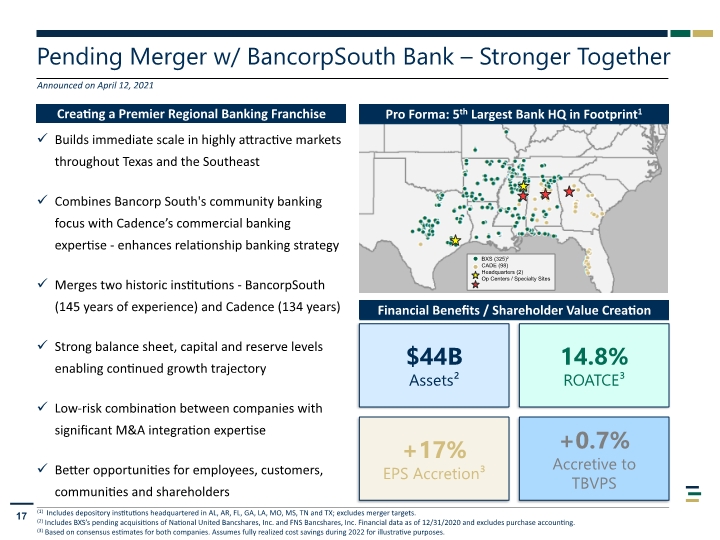

Pending Merger w/ BancorpSouth Bank – Stronger Together 17 Pro Forma: 5th Largest Bank HQ in Footprint1 Financial Benefits / Shareholder Value Creation (1) Includes depository institutions headquartered in AL, AR, FL, GA, LA, MO, MS, TN and TX; excludes merger targets. (2) Includes BXS’s pending acquisitions of National United Bancshares, Inc. and FNS Bancshares, Inc. Financial data as of 12/31/2020 and excludes purchase accounting. (3) Based on consensus estimates for both companies. Assumes fully realized cost savings during 2022 for illustrative purposes. Builds immediate scale in highly attractive markets throughout Texas and the Southeast Combines Bancorp South's community banking focus with Cadence’s commercial banking expertise - enhances relationship banking strategy Merges two historic institutions - BancorpSouth (145 years of experience) and Cadence (134 years) Strong balance sheet, capital and reserve levels enabling continued growth trajectory Low-risk combination between companies with significant M&A integration expertise Better opportunities for employees, customers, communities and shareholders $44B Assets² 14.8% ROATCE³ +17% EPS Accretion³ +0.7% Accretive to TBVPS Creating a Premier Regional Banking Franchise Announced on April 12, 2021

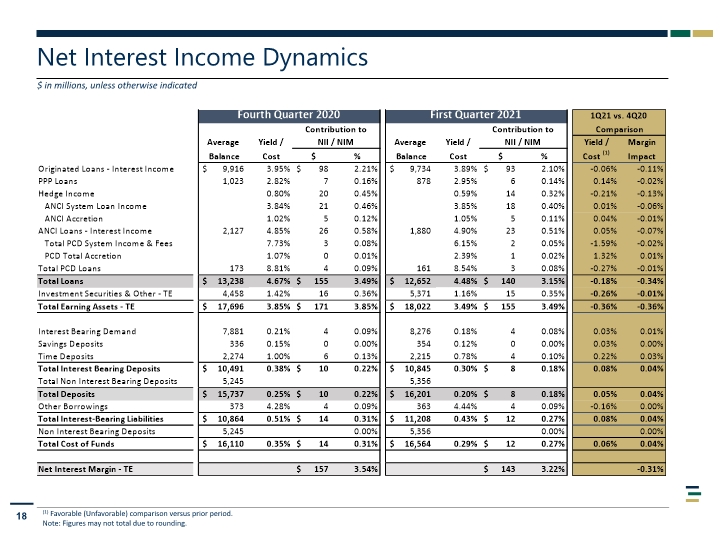

Net Interest Income Dynamics 18 $ in millions, unless otherwise indicated (1) Favorable (Unfavorable) comparison versus prior period. Note: Figures may not total due to rounding.

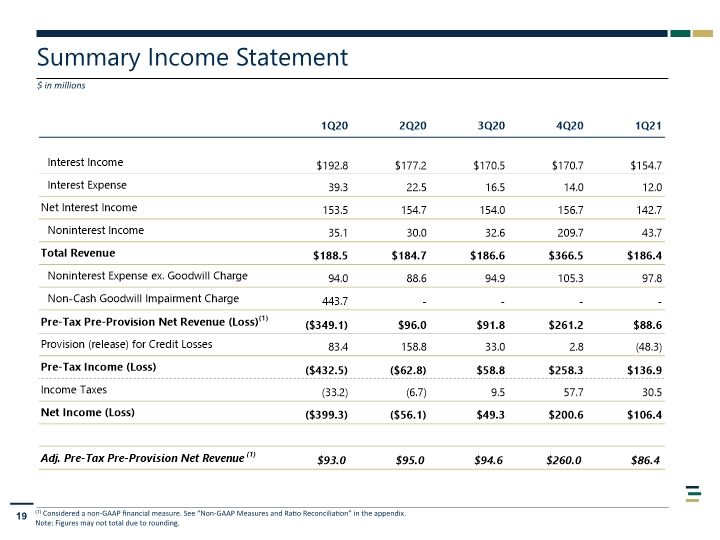

Summary Income Statement $ in millions (1) Considered a non-GAAP financial measure. See “Non-GAAP Measures and Ratio Reconciliation” in the appendix. Note: Figures may not total due to rounding.

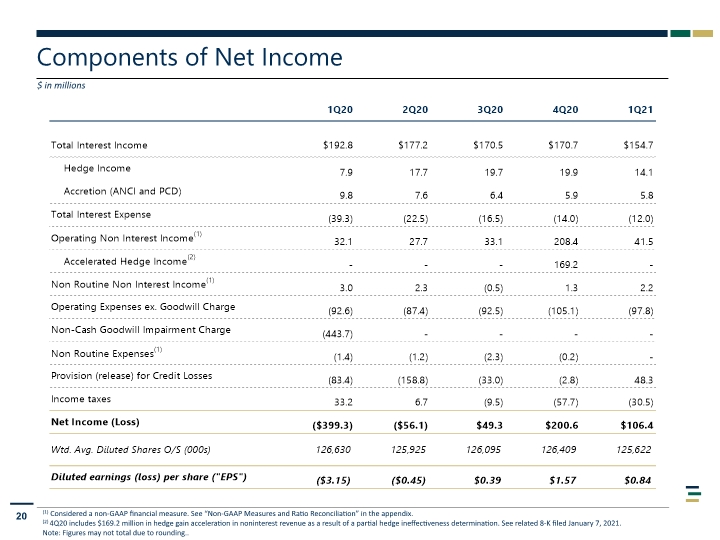

Components of Net Income 20 $ in millions (1) Considered a non-GAAP financial measure. See “Non-GAAP Measures and Ratio Reconciliation” in the appendix. (2) 4Q20 includes $169.2 million in hedge gain acceleration in noninterest revenue as a result of a partial hedge ineffectiveness determination. See related 8-K filed January 7, 2021. Note: Figures may not total due to rounding..

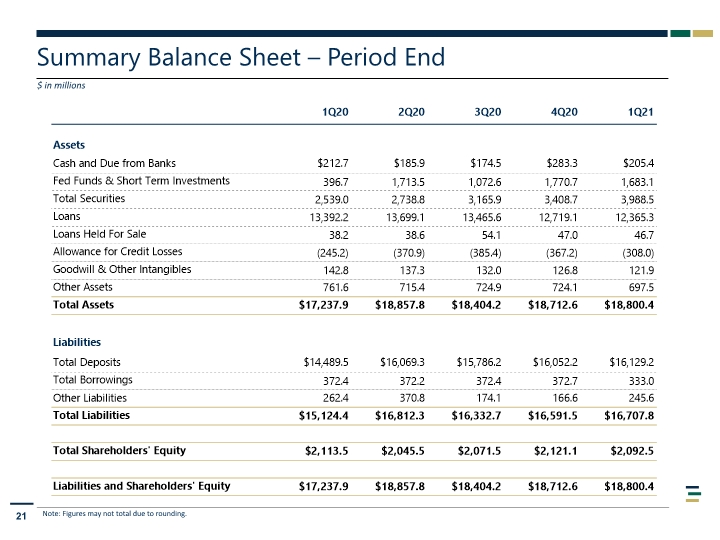

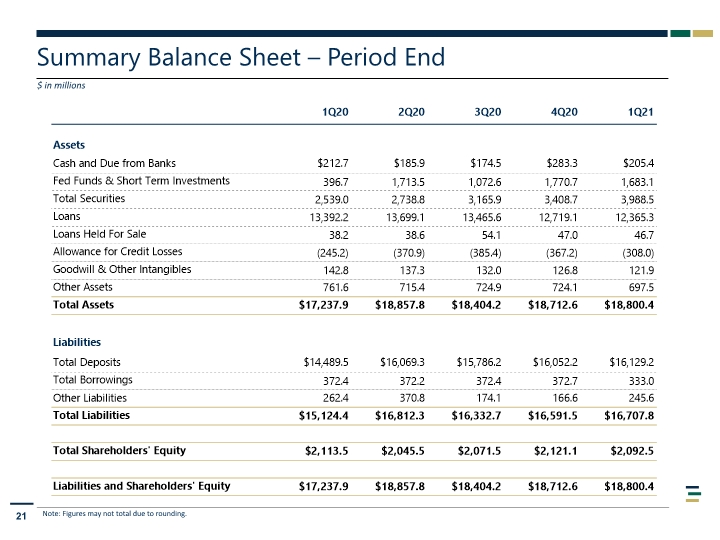

Summary Balance Sheet – Period End 21 $ in millions Note: Figures may not total due to rounding.

Allowance for Credit Losses (ACL) Rollforward 22 $ in thousands Note: Figures may not total due to rounding. (1) Represents the activity in the ACL for funded loans.

Criticized Loans by Segment 23 $ in millions

Nonperforming Assets 24 $ in millions Note: Figures may not total due to rounding. (1) With the adoption of CECL, an additional $35.5 million of loans were classified as nonperforming loans in 1Q20 or 89% of the increase during the quarter.

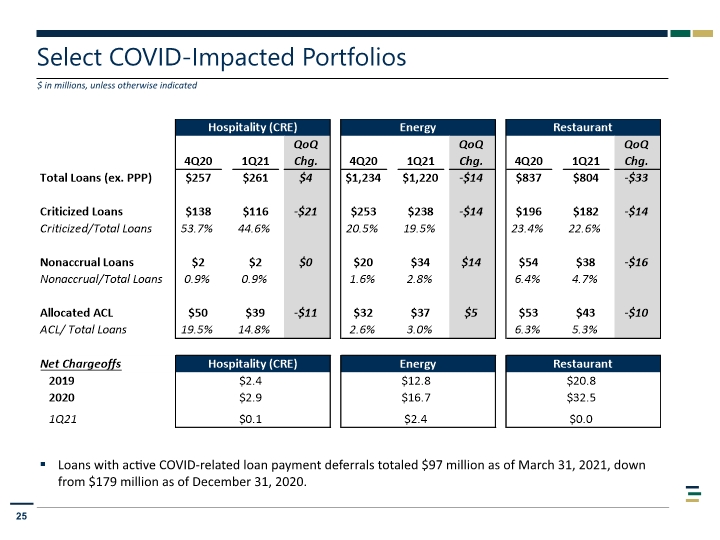

Select COVID-Impacted Portfolios 25 $ in millions, unless otherwise indicated Loans with active COVID-related loan payment deferrals totaled $97 million as of March 31, 2021, down from $179 million as of December 31, 2020.

CBRG Portfolio Overview1 Specialized Industries: Restaurant Banking 26 $ in millions, unless otherwise indicated Restaurant Industry Loans1 (1) Total Restaurant Industry Loans for Cadence Bancorporation, as reported in our publicly filed financial statements, are based on NAICS codes and include certain loans originated outside of the Cadence Bank Restaurant Group (CBRG). Note: CBRG total loans of $739.1 million at 3/31/21 down from $770.9 million linked quarter and $1,010.1 million in the year ago quarter. Other figures are for CBRG only. CBRG Sector Concentration1 CBRG Concept Exposure Mix1 $551 million or 75% of CBRG loans are QSR and fast casual. These segments have exhibited stability and resiliency through economic troughs. 55% of portfolio ($407 million, 36 clients) is weighted in the following national QSR concepts: Taco Bell, Wendy’s, Burger King, Pizza Hut, KFC. 100% of CBRG portfolio consists of chain restaurants. Large franchisors can provide scale for advertising, menu refresh, and other operating budget items. PPP loans Top 5 Concepts

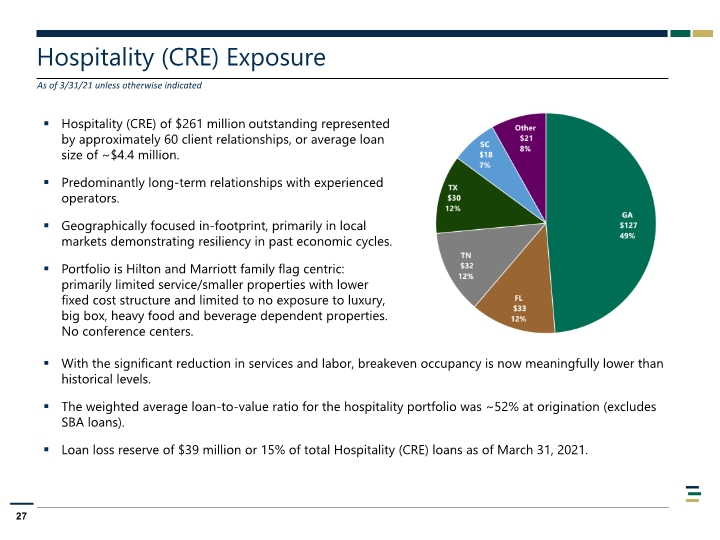

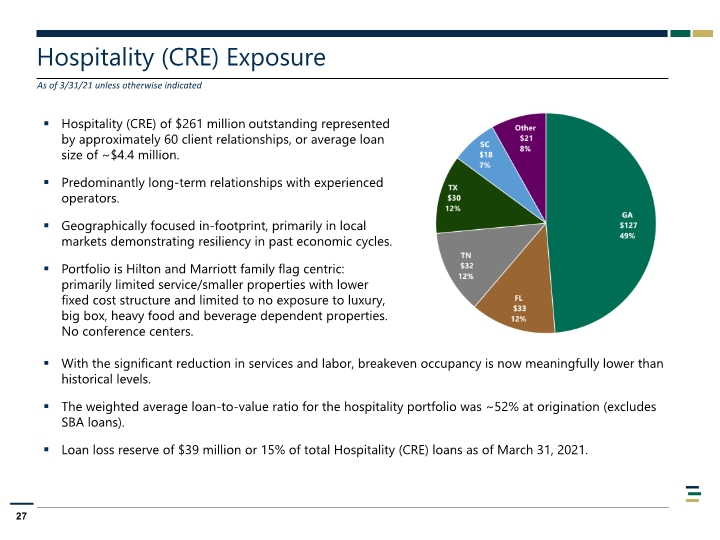

Hospitality (CRE) Exposure Hospitality (CRE) of $261 million outstanding represented by approximately 60 client relationships, or average loan size of ~$4.4 million. Predominantly long-term relationships with experienced operators. Geographically focused in-footprint, primarily in local markets demonstrating resiliency in past economic cycles. Portfolio is Hilton and Marriott family flag centric: primarily limited service/smaller properties with lower fixed cost structure and limited to no exposure to luxury, big box, heavy food and beverage dependent properties. No conference centers. 27 As of 3/31/21 unless otherwise indicated With the significant reduction in services and labor, breakeven occupancy is now meaningfully lower than historical levels. The weighted average loan-to-value ratio for the hospitality portfolio was ~52% at origination (excludes SBA loans). Loan loss reserve of $39 million or 15% of total Hospitality (CRE) loans as of March 31, 2021.

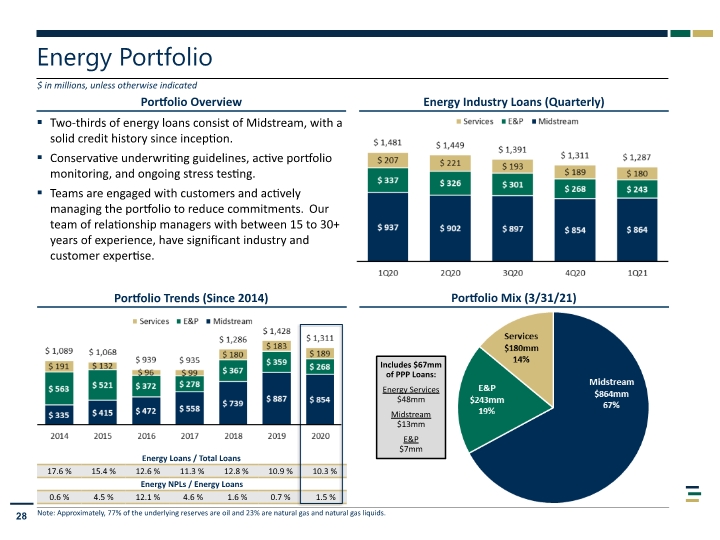

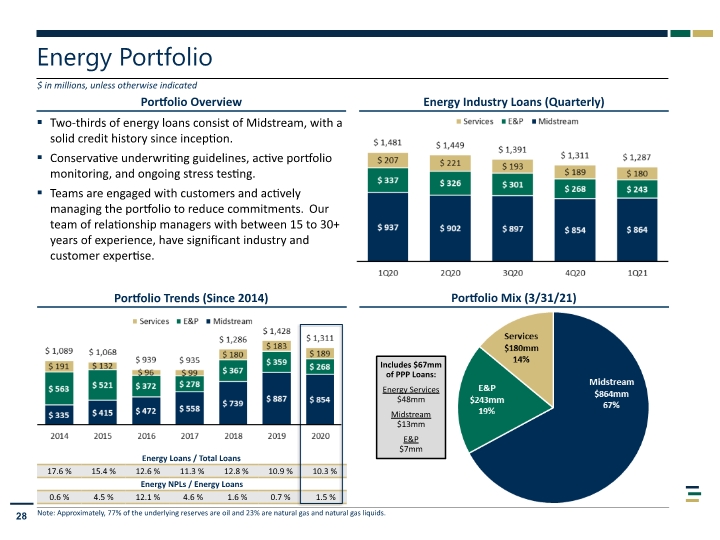

Portfolio Overview Energy Portfolio 28 $ in millions, unless otherwise indicated Energy Industry Loans (Quarterly) Portfolio Mix (3/31/21) Portfolio Trends (Since 2014) Note: Approximately, 77% of the underlying reserves are oil and 23% are natural gas and natural gas liquids. Two-thirds of energy loans consist of Midstream, with a solid credit history since inception. Conservative underwriting guidelines, active portfolio monitoring, and ongoing stress testing. Teams are engaged with customers and actively managing the portfolio to reduce commitments. Our team of relationship managers with between 15 to 30+ years of experience, have significant industry and customer expertise. Includes $67mm of PPP Loans: Energy Services $48mm Midstream $13mm E&P $7mm

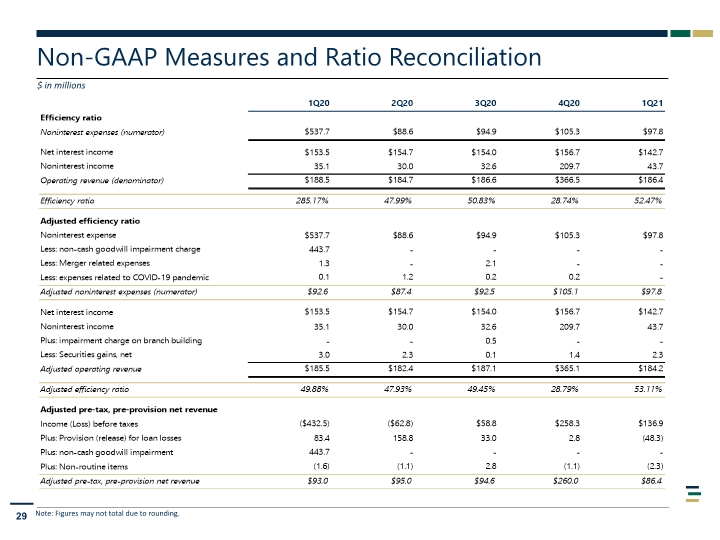

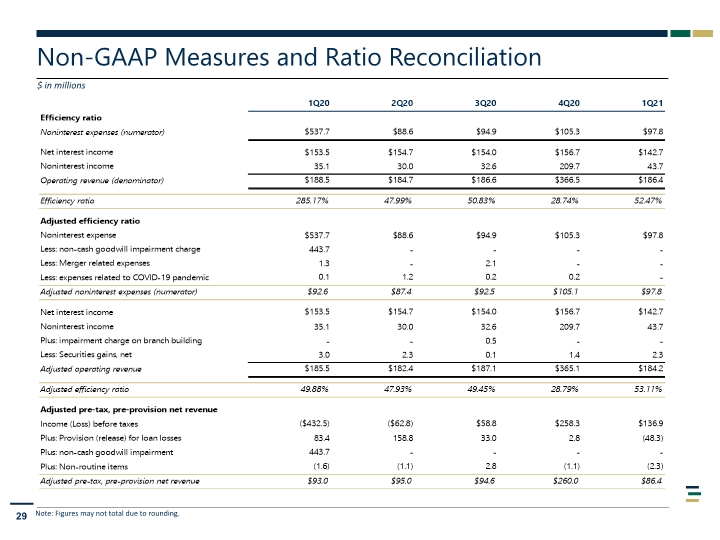

Non-GAAP Measures and Ratio Reconciliation 29 $ in millions Note: Figures may not total due to rounding.

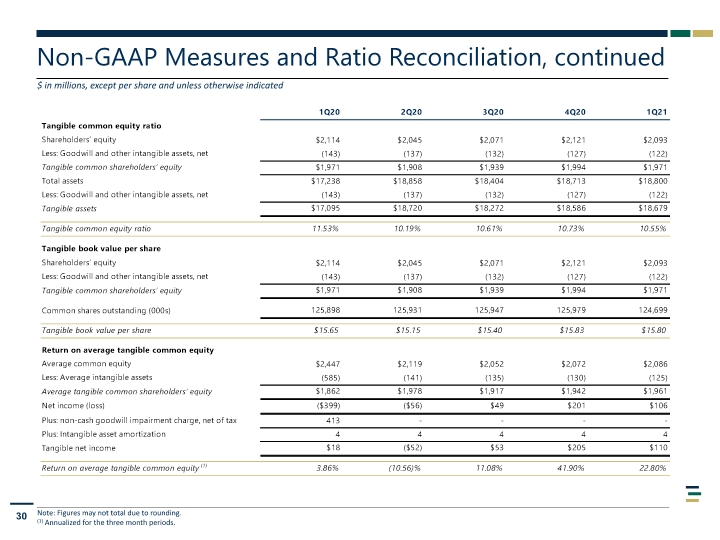

Non-GAAP Measures and Ratio Reconciliation, continued 30 Note: Figures may not total due to rounding. (1) Annualized for the three month periods. $ in millions, except per share and unless otherwise indicated

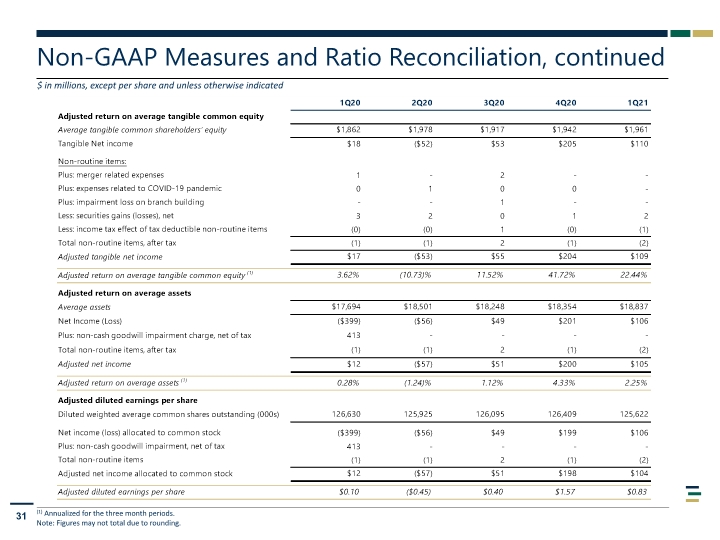

Non-GAAP Measures and Ratio Reconciliation, continued 31 $ in millions, except per share and unless otherwise indicated (1) Annualized for the three month periods. Note: Figures may not total due to rounding.