U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant to Section 12(b) of the Securities Exchange Act of 1934

KIBUSH CAPITAL CORPORATION |

(Exact name of registrant as specified in its charter) |

Nevada | | 57-1218088 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

c/o McGee Law Firm, LLC

5635 N. Scottsdale Rd., Suite 130

Scottsdale, AZ 85250

(Address of principal executive offices)

480-729-6208

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Exchange Act: None

Securities registered pursuant to Section 12(g) of the Exchange Act: Common Stock, $0.001 par value

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | ¨ | Accelerated filer | ¨ |

Non-accelerated filer | ¨ | Smaller Reporting Company | x |

(Do not check if a smaller reporting company) | | | |

TABLE OF CONTENTS

| | | | Page | |

Item 1 | Business | | | 4 | |

Item 1A | Risk Factors | | | 10 | |

Item 2 | Financial Information | | | 16 | |

Item 3 | Properties | | | 20 | |

Item 4 | Security Ownership of Certain Beneficial Owners and Management | | | 24 | |

Item 5 | Directors and Executive Officers | | | 26 | |

Item 6 | Executive Compensation | | | 27 | |

Item 7 | Certain Relationships and Related Transactions, and Director Independence | | | 28 | |

Item 8 | Legal Proceedings | | | 28 | |

Item 9 | Market Price of and Dividends on Registrant’s Common Equity and Related Stockholder Matters | | | 29 | |

Item 10 | Recent Sales of Unregistered Securities | | | 30 | |

Item 11 | Description of Securities to be Registered | | | 31 | |

Item 12 | Indemnification of Directors and Officers | | | 31 | |

Item 13 | Financial Statements and Supplementary Data | | | 32 | |

Item 14 | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | | | 33 | |

Item 15 | Financial Statements and Exhibits | | | 33 | |

Forward-Looking Statements

Forward-looking statements reflect the current view about future events. When used in this Form 10, the words “anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,” “plan,” or the negative of these terms and similar expressions, as they relate to us or our management, identify forward-looking statements. Such statements, include, but are not limited to, statements contained in this Form 10 relating to our business strategy, our future operating results and liquidity and capital resources outlook. Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because forward–looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Our actual results may differ materially from those contemplated by the forward-looking statements. They are neither statements of historical fact nor guarantees of assurance of future performance. We caution you therefore against relying on any of these forward-looking statements. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, without limitation, a continued decline in general economic conditions; decreased demand for our products and services; market acceptance of our products and services; the impact of any infringement actions or other litigation brought against us; competition from other companies; our ability to develop our and commercialize new and improved products and services; our ability to raise capital to fund continuing operations; changes in government regulation; our ability to complete customer transactions and capital raising transactions; and other factors (including the risks contained in the section of this prospectus entitled “Risk Factors”) relating to our industry and our operations. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Item 1. Description of Business.

Overview

Kibush Capital Corporation ("we", "us", "our", the "Company" or the "Registrant") was incorporated in the State of Nevada on January 5, 2005 under the name Premier Platform Holding Company, Inc. The Company changed its name to Paolo Nevada Enterprises, Inc. on February 4, 2005 and then to David Loren Corporation on January 10, 2006.

On August 18, 2006, the Company completed a merger with Premier Platform Holding Company, Inc., a Colorado corporation.

On July 5, 2013, the Company and Beachwood Capital, LLC, a Nevada limited liability company (“Beachwood Capital”) and the owner of 67,163,048 shares of our common stock and 3,000,0000 shares of our Series A preferred stock (the "Preferred Stock"), consummated the transaction contemplated by the Stock Purchase Agreement as of June 20, 2013 with More Superannuation Fund, an Australian entity, pursuant to which the Buyer purchased all the shares of common stock and the Preferred Stock from Beachwood Capital. The purchase price for the shares was $100,000. As a result of this change in control, the current sole officer and director of the Company is Warren Sheppard.

On August 23, 2013, the Company changed its name to Kibush Capital Corporation.

On October 15, 2013, the Company completed the acquisition of 80% of the common stock of Instacash Pty Ltd., a micro-lender licensed in Australia (“Instacash”), for a purchase price of $500,000 payable by a $500,000 promissory note.

On May 26, 2014, the Company completed the acquisition of 49% of the common stock of Aqua Mining Limited, a Papua New Guinea limited company (“Aqua Mining”), in exchange for the transfer of the Korangi Agreement.

On December 10, 2014, the Company completed the acquisition of 50% of the common stock of Angel Jade Pty Ltd., an Australian limited company (“Angel Jade”), in exchange for 14,000,000 shares of our common stock. Previously, on October 9, 2014, we acquired 2,500,000 shares (approximately 1%) of the common stock of Angel Jade for $100,000 cash. We now own approximately a 51% share of the common stock of Angel Jade.

The Company is an “emerging growth company” as defined in the Jumpstart Our Business Startups Act (“JOBS Act”).

Our Business

Our business is represented by two distinct operations: (1) micro-lending through our subsidiary InstaCash and (2) mining activities through our subsidiaries Aqua Mining and Angel Jade.

(1) Micro-lending

We are engaged in the micro-lending business through our new acquired subsidiary, Instacash. InstaCash is a micro lender licensed to provide currency services and financial products, the demand for which we believe is rapidly increasing in an underserved market because of stringent new government regulations in Australia to which the Company adheres. Micro lenders typically make small short-term loans to consumers who have limited access to credit, including consumers with low incomes or poor credit scores. Loans have a fixed fee, low annual interest charges and require repayment via a direct debit authority. We believe that micro lending offers easy and fast processing from application to approval and provision of funds.

InstaCash was founded in 2010 and specializes in servicing under-banked consumers for short term credit contracts in Australia.

The financial products currently offered by Instacash consist of small loans (between $100 and $2,000).

Industry Overview

The micro lending industry is designed to provide individuals with small amount loans to meet unexpected or a one off expenses such as new tires, car repairs, registration, medical, excursions, etc. However we are seeing a trend towards micro loans being sought for the costs of everyday essentials. Because loans of less than $5,000 are typically not provided by banks, we believe that there is a real gap in the market for this type of loan. The Australian Securities and Investment Corporation (“ASIC”) estimates that there are 400 credit provider licenses in Australia that define their chosen industry as “micro finance”. The National Financial Services Federation, widely recognized in Australia as the voice of the industry and heavily consulted by legislators and regulators, estimates that there are 625 outlets across Australia servicing $1.2 billion in loans to over 750,000 consumers and has realized growth on average of 15.5% per annum compounded in 2013.

Why customers use the service:

· | Cash Flow Crisis-Consumers with $40,000-$60,000 in household income have little liquidity to fund unexpected bills or emergencies |

· | Easy to Execute-A consumer can produce the required documentation and have cash within an hour and existing customers in 15 minutes or less. A credit card increase or overdraft could take 3-4 business days to be approved by a mainstream lender. |

· | Less expensive and less embarrassing than incurring a dishonored transaction - Banks may charge a dishonor fee of between $25 and $40 for dishonored or late transactions. Additionally the entity receiving the payment may also impose a late payment fee. These combined charges can exceed the cost of a short term loan |

Business Strategy

Our aim is to be the most respected finance provider by our customers, our industry peers and regulators by delivering exceptional customer service, sustainable financial performance and growth in a compliance driven framework.

We believe that current financial services market banks are seeking to extract higher returns from their customer base which marginalizes and excludes a significant group of individuals from traditional banking products. We are an alternative financial services provider to this section of the market. Instacash currently operates via mobile lenders which entail sales personnel who are not based at a fixed location but who have face-to-face meetings with prospective clients at their locations.

Our key differentiator will be the quality of service we provide our customers. Key measures are the level of customer’s satisfaction with their most recent experience and their commitment to the relationship. A critical component of our business model is customer loyalty as we believe there is a strong correlation between customer retention and profitability. Higher levels of customer retention drive higher profits as:

· | The cost of customer acquisition occurs at the beginning of the relationship, the longer the relationship, the lower the amortized cost; |

· | Account maintenance costs decline as a percentage of total costs (or as a percentage of revenue); |

· | Long term customers initiate word of mouth promotions and referrals; |

· | We believe that long term customers are more likely to purchase ancillary products and high margin supplemental services, such as payment plans for utilities, insurance and credit card history cleaning or credit card debt negotiations; and |

· | Long term customers have a greater sense of responsibility due to the relationships they have developed with our customer service staff and we believe are less likely to default. |

Summary of how revenue is earned:

New Loan $500 x 24% = $120 (this fee is paid up front)

Total credit amount =$620 x 48% (4% per month) /365 x 29 (average days in loan term) = $23.64 interest. Total repayment $643.64.

There are several different ways in which a customer can make repayments, direct debit, EFT to our account, or by money order. We find the preferred option is by cash transfer by internet banking. Customers generally make weekly repayments so we have many opportunities to engage them with other services such as payments plans for utilities, insurance and credit card debt negotiation.

With a focus on responsible lending we believe that we have minimized our exposure to bad debt. As noted above, the Company hopes to incorporate complimentary products/services and build on bringing solution-specific products to the market. We are often asked about such items as larger longer term loans, credit cards, insurance, check cashing, money transfers, foreign exchange and bill payments. Our team has experience in all of these areas and we have built our IT systems with these growth initiatives in mind. However, the Company does not currently offer services other than small loans.

Marketing/Sales

We believe that service quality and high visibility stores on the high street are by far the industries best marketing tools. Accordingly, Instacash plans to:

· | Continue to fit out stores with bright professional interiors coupled with high impact signage; |

· | Provide a level of service and presence that we believe is not now common in today’s financial market place; |

· | Promote the customer centric experience to encourage a high referral rate; |

· | Develop a membership rewards program; and |

· | Develop a web presence for customer acquisition and delivering new products and services. |

Competition

The Company believes that InstaCash faces competition from 3 primary companies in the Australian market for short-term credit contracts:

Money 3- An Australian Stock Exchange listed company (ASX:MNY) 25 locations last reported revenues of $13.5 million and net profits of $2.4 million as of April 2014.

Cash Stop- 40 locations also provides check cashing, money transfers and cash for gold. Privately-held company revenues not available.

Cash Converters- an ASX listed company (ASX:CCV) and London stock exchange (LSE:CCVU) With 89 franchisees and 41 corporate stores in Australia. Cash Convertors core business is pawn broking but over the last 5 years they have stepped up their offering of short term loans. In their semi-annual report in 2013, they reported a combined EBIT of $17.4 million on just personal and cash advance loans.

Since the introduction of new reforms in July 2013, many small operators have left the micro-lending market due to the management of the regulation and cost of compliance after operating in a “self- regulated” manner. We were in already in compliance with the new regulations prior to the effectiveness in 2013. Our management has always capitalized on and we believe that our experience provides us with excellent opportunities for growth.

Raw Materials, Principal Suppliers and Customers

We do not currently have any principal customers for our micro-lending business Instacash, rather we have hundreds of small clients that engage in one or more transactions with us.

Intellectual Property

Instacash does not have any intellectual property of value.

Government Regulations

Instacash is licensed as an Australian Credit Licensee by the Australian Securities and Investment Commission (“ASIC”) under the National Consumer Credit Protection Act of 2009 to provide financial products and has lending processes and controls in place and has invested heavily in training and compliance. The license requires Instacash to among other things, maintain professional indemnity insurance and comply with certain dispute resolution procedures and record keeping requirements.

In order to maintain its Australian Credit License annual proof must be provided as to its personnel with respect to being fit and proper to engage in credit activities, certain compliance measures must be in place to carry on a credit business, and continued professional development is required.

The compliance regime for credit providers implemented by ASIC imposes the same performance requirements on small lenders as for the largest banks and credit providers. The legislative framework within which Instacash operates provides that it comply with responsible lending obligations and various price control methodology.

The following lending obligations became effective July 1, 2013:

Fees charged on small amount loans (up to $2,000) are capped. Credit providers can only charge the following fees:

· | A one-off establishment fee (of not more than 20% of the loan amount) |

· | A monthly account keeping fee (of not more than 4% of the loan amount) |

· | A government fee or charge |

· | Default fees or charges (the credit provider cannot collect more than 200% of the amount loaned if in default) |

· | Enforcement expenses (costs incurred by the credit provider to recover the money owed if there is a default on the loan) |

Fees and charges allowed on loans of more than $2,000 are capped. Fee limits on medium amount loans ($2,001-$5,000) to be repaid between 16 days and 2 years, fees are limited to:

· | A one-off fee of $400 |

· | A maximum annual interest rate of 48%, including all other fees and charges. |

InstaCash is a member of Credit Ombudsman Services Ltd, an external dispute resolution scheme (“EDR”). It is required to have and uphold the EDR membership as a requirement of its Australian Credit License. InstaCash also has a robust internal dispute resolution policy. To date it has not had any disputes or complaints that could not be solved at store level.

(2) Mining Activities

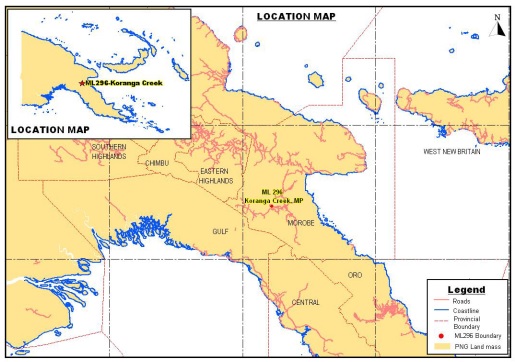

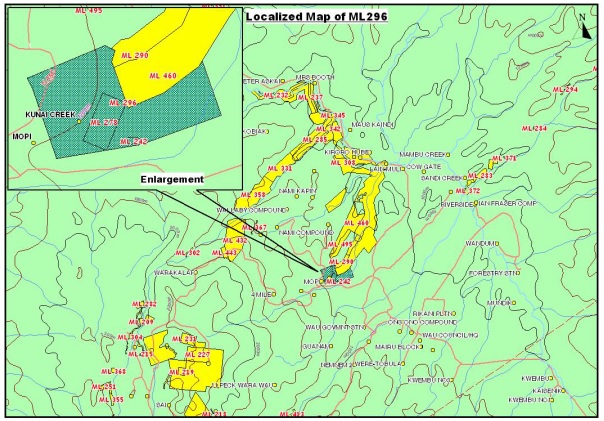

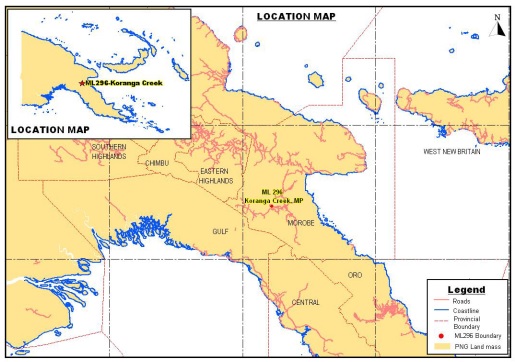

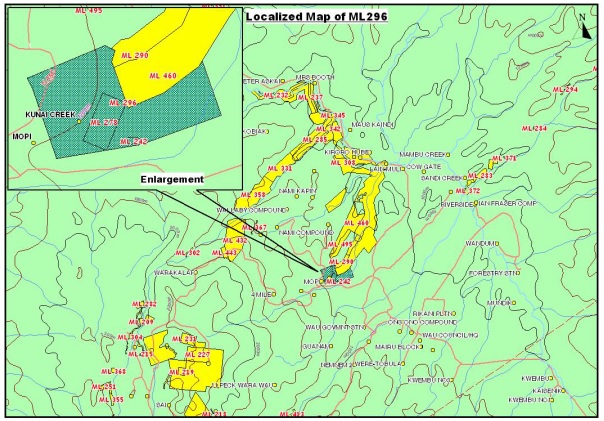

On February 14, 2014, we entered into an Assignment and Bill of Sale with Five Arrows Limited (“Five Arrows”) pursuant to which Five Arrows agreed to assign to the Company all of its right, title and interest in two 50 ton per hour trammels, one 35 ton excavator, a warehouse/office, a concrete processing apron feeding to the operations area in the warehouse and four 35 ton per hour particle concentrators for use in our alluvial mining operations. In consideration therefor, the Company issued 40,000,000 shares of its common stock to Five Arrows. On February 28, 2014, we entered into a joint venture agreement with the holders of alluvial gold mining leases (“Leaseholders”) of Mining Leases ML296-301 and ML278 covering approximately 26 hectares located at Koranga in Wau, Morobe Province, Papua, New Guinea for alluvial gold mining operations (“Joint Venture Agreement”). The leases are located in an area that has been producing gold since 1920. Data from a geophysics survey of the leases conducted by Elliot Geophysics (PNG) Ltd. estimates that there is potentially a resource of more than of 450,000 ounces of gold. The Joint Venture Agreement entitles the leaseholders to 30% and the Company to 70% of net profits from the joint venture. The Company will manage and carry out the operations at the site, including entering into contracts with third parties and subcontractors (giving priority to the Leaseholders and their relatives and the local community for employment opportunities and spin-off business) at its cost, and all assets, including equipment and structures built on the site, will be the property of the Company. The Leaseholders and the Company will each contribute 1% from their share of net profits to a trust account for landowner and government requirements. For the period ending September 30, 2014 we have incurred expenditure of $208,512 primarily spent on exploration. From October through to December there has been an expenditure of $56,526 on capital equipment and further exploration costs.

The joint venture involves a lease that has supported miners since its discovery in the early 1900’s and has been mined since that time. It has also accommodated operations of varying scales including mechanized mining, the joint venture project only requires confirming depositional extents and gold grade distribution characteristics subsurface before commencing a mining operation. We believe that this project also provides a unique alluvial gold deposit potential in that the gold bearing sequence has thickness exceeding 150m, it is widespread and that the material is all free dig. Recent mining, between 2008 and 2011, has produced a total of 55,300 cubic meters of ore which was processed to extract 51,000 grams of gold – raw weight (approximately 31kg pure gold) over the three years of operations. Gold production in 2010 averaged 1.97kg per month and in 2011 averaged 2.26kg per month. The overall raw gold grade is 0.92g per cubic meter. Pure gold grade is 0.55g per cubic meter. The Company hopes that this operation will be cash flow positive and profitable within 6 months. If and when successful, the Company may endeavor to undertake additional joint ventures on neighboring leaseholds (8 leaseholds border the area) to capitalize on the infrastructure and equipment we would install at Koranga.

We entered into a memorandum of understanding, dated May 1, 2014 with New Guinea Gold Corporation, for the purchase of New Guinea Gold Ltd., which was terminated by us on May 24, 2014 prior to commencing any transactions contemplated in connection therewith. The Company has no continuing obligations as a result of such termination.

Aqua Mining

Aqua Mining was created to undertake the managerial and operational opportunities that exist within the mining sector of the economy of Papua New Guinea. The Director Mr. Vincent Appo, has extensive experience and knowledge in this sector and has over the years assembled a vast network of contacts and contractors that will assist the company in their managerial and operational endeavors. From the outset the company is negotiating over 2 alluvial mine sites that will come into operation in the coming months. These operations will be ongoing and the company is looking to an investment company in the future to take an interest via shareholding to further the company’s endeavors.

Angel Jade

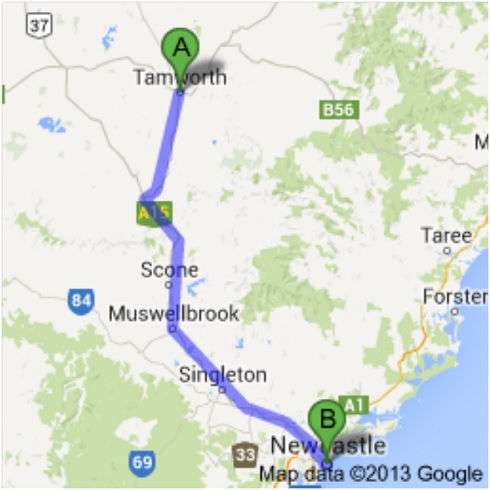

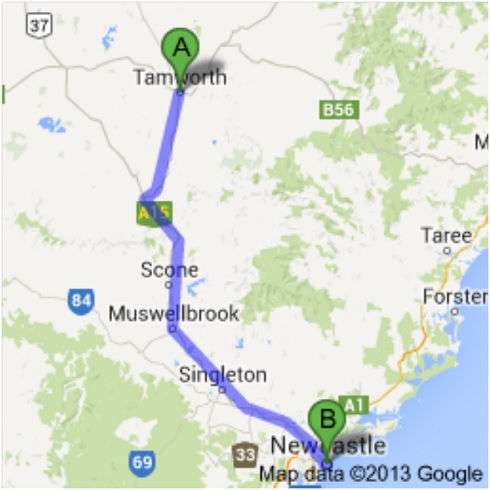

The Company acquired 51% of the ordinary shares of Angel Jade Pty Ltd, an Australian company. The structure of the transaction allows for options to purchase additional equity in the project going forward. The assets of Angel Jade are comprised of Exploration License 8104, the area covered is 35 km SE of Tamworth, 300 sq. km in size, 250 km from the port of Newcastle, NSW and accessible by sealed road. The resource is predominantly jade. This nephrite jade occurs in the New England Fold Belt, which extends from northeast New South Wales into southeast Queensland. Within the boundaries of the EL there is also a large unmeasured, but potentially valuable rhodonite resource within the tenement.

Angel Jade has identified a 3 tiered exploitation of the jade resource. The First Tier, finely ground lower quality jade to nano particle sized powder, enabling the jade to release infra-red radiation. These particles can be added to paint, ceramic tiles and to cotton for use in fabrics. The Second Tier, exclusive works of art created by the renowned artist Xie Shen. These carved pieces will weigh between 0.5 and 2 tonnes each, and will be showcased at major Asian Art Galleries. The Third Tier is to establish a premium high end Jade Brand for jewelry and art, to be sold and marketed through respected gallery and jewelry outlets. The current price of jade per kilogram has a spread of $5 to $50 depending on the grade.

The Market

Angel Jade

Nephrite jade is not a common mineral and occurs in nature very rarely and usually in remote locations, hence its prized status and value. It is currently mined in New Zealand, Pakistan, Canada, Russia and Australia. Climatic concerns limit the amount of mining that can be done in Canada and Russia and political extremism is a threat in Pakistan. New Zealand nephrite whilst generally high grade only occurs under the southern alps and glaciers and is usually only of the green variety and found in isolated small pods in small quantities.

In Australia, nephrite occurs in South Australia near Cowell, in Western Australia near Ninghan in the Murchison region outside of Perth and in New South Wales at the Angel Jade tenements near Tamworth. The Cowell and Ninghan nephrite deposits consist of ‘black’ nephrite mainly and are generally lower grade with small quantities of high-grade commercial saleable material.

The Angel Jade Tamworth occurrences are extensive, ranging along the great NS serpentinite belt of NSW that runs for over 200kms. The nephrite found there ranges in quality and varietal characteristics from classic imperial green, through to blue, black and the much prized ‘mutton fat’ coloration. Angel Jade is better placed than its competitors to be able to successfully continually supply quality and quantity of material to its selected markets.

Aqua Mining

The primary product is Gold and our market price based on the London Metals Exchange Daily Rate. This rate determines a market price for all material sold within the Refinery Market. Outside of that market competition dictates the price available, and that competition has effectively no difference in the quality of the material as it based on a gold percentage. A higher price can be obtained by selling to the spot traders who can distribute the material at lower volumes to industry consumers.

Marketing and Distribution:

Angel Jade

A four pronged distribution approach for our nephrite (jade) has been developed that target: wholesale building suppliers through industry groups and trade shows, wholesale jewelry suppliers in China and SE Asia, direct marketing to the high end art market in China and the Middle East via brokers and producing material suitable for high tech industrial usage such as substrates and insulators through an industry based online campaign targeting research universities, R&D facilities and allied scientific suppliers.

Aqua Mining

As the principal material is gold, the options are to sell either to a refinery and be paid the daily spot rate, or to sell to the jewelry wholesale market. Both of these options exist internally within PNG however the wholesale market is quite small. There is significant options when the material is exported from PNG, again it could be to any refinery within the region and that rate again would be the daily spot rate. The wholesale market outside the country would be significant and there are many opportunities within Australia to sell at a higher than spot rate to that market. There are also a number of parties that would take up the material on a contractual basis, effectively pre selling production.

Competition

The mining industry is acutely competitive in all of its phases. We face strong competition from other mining companies in connection with the acquisition of exploration stage properties or properties containing gold, jade and other mineral reserves. Many of these companies have greater financial resources, operational experience and technical capabilities than us. It is our goal to find under valued properties and team up with local joint venture partners to streamline our time to market and costs. In PNG in particular we are finding a number of such properties, as the enforcement of the Mining Act has forced traditional landowners to comply with the relevant requirements of the act. Their ability to do so is limited as they do not have the financial, or management resources to comply.

Raw Materials, Principal Suppliers and Customers

Angel Jade

We are not dependent on any principal suppliers and our raw materials are produced principally through our own mining activities. Our principal customers for our mining activities are wholesale markers in China, SE Asia and the Middle East. A customer base is yet to be established but that will occur over the next 12 months.

Aqua Mining

We are not dependent on any principal suppliers and our raw materials are produced principally through our own mining activities. Our principal customers for our mining activities are Refineries based in PNG. A wholesale customer base is yet to be established but that will occur over the next 12 months, after the company received the appropriate export licenses from the PNG government.

Intellectual Property

Angel Jade

IP is not a large part of the jade business model as we are selling a not unique material through mainly conventional channels. A brand may yet be developed if that will enhance value adding in the supply chain.

Aqua Mining

IP is not a large part of the jade business model as we are selling a not unique material through mainly conventional channels. A brand may yet be developed if that will enhance value adding in the supply chain.

Government Regulations

Alluvial Mining business

We are required to obtain approval from the Investment Promotion Authority of Papua New Guinea to be recognized as a foreign investor either as a corporation in our own right operating in Papua New Guinea or as a majority shareholder in a Papua, New Guinea corporate entity, for our joint venture with the Leaseholders of approximately 26 hectares located at Koranga in Wau, Morobe Province, Papua, New Guinea for alluvial gold processing operations. We are a 49% owner of Aqua Mining [PNG] Limited, a Papua, New Guinea company, for our alluvial mining operations in New Guinea. The appropriate forms have been submitted to the relevant government departments to qualify us as a recognized foreign investor. As we are using a non-mechanized process, we are not required to obtain approval and we are currently not regulated by the New Guinea Mining Resources Authority. We will make application to the New Guinea Mining Resources Authority for Alluvial Mining Leases which will allow for mechanized processing.

Angel Jade

The mining industry in Australia is governed by Federal Government law but administered by the States. Angel Jade tenements are administered and regulated by the NSW Department of Trade and Industry (DTI). Its principal field office for the mining sector is located in Maitland, approx. 250kms from Tamworth. To maintain the company’s tenements in good order and standing with the DTI, an Annual Report must be lodged every year detailing all works to date and monies expended toward same. An environmental bond is also held by the DTI to ensure compliance and remediation on vacation of the tenement.

Angel Jade currently holds an Exploration License, EL8104, which requires renewal every two years. Current date of renewal is June 30, 2015. Renewal is usually only withheld where there have been serious compliance issues. During the course of the exploration program, the company may elect to apply for one or more mining leases within the boundaries of its EL. This would be subject to satisfactory interpretation of geological data suggesting a commercial mining operation would be viable and could be established with some certainty. Indications at this time are that there are at least two areas which will interest the company immediately. Mining Lease applications must be approved or denied by the DTI with within 45 days of lodgment by law. The company may also decide to extend the boundaries of its current EL, relinquish part of the EL, or apply for more ELs in different prospective locations.

In Australia, we need government approval for mechanised processing. Upon approval of an AML licence we will be restricted to 50,000 tonnes of processing per year, and our mining activities would be restricted to a 5 hectare area at any one time. We believe the prospects for approval of an AML license are high as we have been working with the government body to identify and address the areas of concern with the application. We must report monthly to the Mining Resource Authority and comply with the terms of the agreements with the landowners, and community.

Aqua Mining

We are required to obtain approval from the Investment Promotion Authority of Papua New Guinea to be recognized as a foreign investor either as a corporation in our own right operating in Papua New Guinea or as a majority shareholder in a Papua, New Guinea corporate entity, for our joint venture with the Leaseholders of approximately 26 hectares located at Koranga in Wau, Morobe Province, Papua, New Guinea for alluvial gold processing operations. We are a 49% owner of Aqua Mining [PNG] Limited, a Papua, New Guinea company, for our alluvial mining operations in New Guinea. The appropriate forms have been submitted to the relevant government departments to qualify us as a recognized foreign investor. We are in the process of lodging application for mechanized processing with the New Guinea Mining Resources Authority.

Environmental Regulations:

Angel Jade

Environmental issues and compliance are administered by the NSW EPA. The proposed mining activity and processing by Angel Jade will not involve the use of any chemicals, hence the key areas of concern to the EPA will be in the areas of soil erosion, flora and fauna, water monitoring and effective remediation. The EPA can issue non compliance notices that in the case of serious breaches may jeopardize the tenement’s standing. However, this is considered a low risk for this style of mining where no chemicals are utilized and the mining activity is near surface.

Aqua Mining

As we are making application under an Alluvial Mining Lease we must comply with the provisions of the Mining Act pertaining to Environmental requirements. Once operational, we will be subject to applicable environmental legislation including specific site conditions attached to the mining tenements imposed by the PNG Government Department of Environment and Conservation (“DEC”), the terms and conditions of operating licenses issued by the PNG Mineral Resources Authority (“MRA”) and DEC, and the environment permits for water extraction and waste discharge issued by DEC. In the fourth quarter of fiscal 2014, the PNG Parliament approved the change of the Department of Environment and Conservation to the Conservation Environment Protection Authority and this change is expected to be completed in early 2015.

Employees

As of December 31, 2014, the Company has 8 full time employees.

Item 1A. Risk Factors

Risk Related to Our Company and Business

We will require additional funds in the future to achieve our current business strategy and our inability to obtain funding will cause our business to fail.

We will need to raise additional funds through public or private debt or equity sales in order to fund our future operations. These financings may not be available when needed. Even if these financings are available, it may be on terms that we deem unacceptable or are materially adverse to your interests with respect to dilution of book value, dividend preferences, liquidation preferences, or other terms. Our inability to obtain financing would have an adverse effect on our ability to implement our current business plan and as a result, could require us to diminish or suspend our operations and possibly cease our existence.

Our ability to continue as a going concern is dependent on our ability to commence operations.

We were a development stage company. Our ability to continue as a going concern is dependent upon our ability to commence a commercially viable operation and to achieve profitability. Our auditor’s report in our financial statements for the fiscal year ended September 30, 2014 contains a going concern opinion. We had a net loss of $1,635,234 for our year ended September 30, 2014, an accumulated deficit of $1,225,051 as of September 30, 2014 and insufficient cash resources to meet our business objectives. These factors raise substantial doubt about our ability to continue as a going concern. Management continues to actively seek additional sources of capital to fund current and future operations. There are no assurances that we will be successful in raising additional capital or successfully develop our business.

We are a development stage company and have generated no revenues to date.

We have generated no revenues from operations to date, and we have nominal assets. Although we were incorporated in 2005, our lack of operating history in our current businesses makes it difficult to evaluate our business. We face all of the risks inherent in a new business with all of the unforeseen costs, expenses, problems, and difficulties to which such ventures are subject. Accordingly, we expect to incur substantial operating losses. We cannot assure you that we will be able to generate revenues or profits from operation of our business or that we will be able to generate or sustain profitability in the future.

We expect losses in the future because we have no revenue to offset losses.

As reflected in our financial statements filed in this Form 10, we are in the development stage. As of September 30, 2014, we have incurred a net loss of $10,225,051 since inception. As we have no current revenue, we are expecting losses over the next 12 months because we do not yet have any revenues to offset the expenses associated with the development and implementation of our business plan. We cannot guarantee that we will ever be successful in generating revenues in the future. We recognize that if we are unable to generate revenues, we will not be able to earn profits or continue operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide investors with no assurance that we will generate any operating revenues or ever achieve profitable operations.

We do not expect positive cash flow from operations in the near term. If we are unable to obtain financing in the amounts and on terms deemed acceptable to us, we may be required to scale back or curtail exploration operations.

We do not expect positive cash flow from operations in the near term. In particular, additional capital may be required in the event that exploration and completion costs for our properties increase beyond our expectations. We will depend almost exclusively on outside capital to pay for the acquisition and continued exploration and development of our properties. Such outside capital may include the sale of additional stock and/or commercial borrowing. We can provide no assurances that any financing will be successfully completed. If we are unable to obtain financing in the amounts and on terms deemed acceptable to us, we may be required to scale back or curtail operations for our business.

We will require additional funds which we plan to raise through the sales of our common stock.

We anticipate that our current cash will not be sufficient to complete our planned exploration program and acquisition of properties. Subsequent acquisition and exploration activities will require additional funding. Our only present means of funding is through the sale of our common stock and common stock equivalents. The sale of common stock requires favorable market conditions for exploration companies like ours, as well as specific interest in our stock. If we are unable to raise additional funds in the future, our business will need to be curtailed.

The exploration and mining industry is highly competitive.

We face significant competition in our business of exploration and mining, a business in which we will compete with other resource exploration and development companies for financing and for the acquisition of new properties. Many of the mineral resource exploration and development companies with whom we compete have greater financial and technical resources than us. Accordingly, these competitors may be able to spend greater amounts on acquisitions of mining properties of merit, and they may spend more on extraction and processing for their properties. In addition, they may be able to afford greater geological expertise in the targeting and exploitation of properties. This competition could result in competitors having properties of greater quality and interest to prospective investors who may finance additional mining activities. This competition could adversely impact on our ability to finance further acquisitions and to achieve the financing necessary for us to develop existing properties.

Mining operations in general involve a high degree of risk, which we may be unable, or may not choose to insure against, making exploration and/or development activities we may pursue subject to potential legal liability for certain claims.

Our operations are subject to all of the hazards and risks normally encountered in the exploration, development and production of minerals. These include unusual and unexpected geological formations, rock falls, flooding and other conditions involved in the drilling and removal of material, any of which could result in damage to, or destruction of, mines and other producing facilities, damage to life or property, environmental damage and possible legal liability. Although we plan to take adequate precautions to minimize these risks, and risks associated with equipment failure or failure of retaining dams which may result in environmental pollution, there can be no assurance that even with our precautions, damage or loss will not occur and that we will not be subject to liability which will have a material adverse effect on our business, results of operation and financial condition.

Weather interruptions in New Guinea may affect and delay our exploration operations.

The weather is a hot and humid tropical wet and dry climate according to the Köppen climate classification system. Despite being located relatively close to the equator, the area has distinct wet and dry seasons. Wet seasons in Papua New Guinea cover a substantial portion of the year, running from December through March.

We may not have access to all of the supplies and materials we need to begin exploration which could cause us to delay or suspend operations.

Competition and unforeseen limited sources of supplies in the industry could result in occasional spot shortages of supplies, such as explosives, and certain equipment such as bulldozers and excavators that we might need to conduct exploration. If we cannot find the products and equipment we need, we will have to suspend our exploration plans until we do find the products and equipment we need.

We are completely dependent on the services of our executive officer, Warren Sheppard. If we should lose his services before we are able to engage and retain qualified employees or consultants to execute our business plan, we may not be able to continue with our business.

The Company’s operations and business strategy are completely dependent upon the knowledge and business contacts of Warren Sheppard, our chief executive officer. We have an employment agreement in place with Mr. Sheppard. However, if he should choose to leave us for any reason before we have hired a suitable replacement, our operations may fail.

Our officer has limited experience in the micro-lending business.

Mr. Sheppard is an accountant with over thirty years experience however due to his lack of experience in the micro-lending business he may make wrong decisions and choices regarding our business. Consequently our operations, earnings and ultimate financial success could suffer irreparable harm due to management's lack of experience in these industries.

Our Chief Executive Officer, through an affiliate, owns a controlling interest in our voting stock. Therefore investors will not have any voice in our management, which could result in decisions adverse to our other stockholders’ interest.

Our Chief Executive Officer beneficially owns or has the right to vote approximately 94.4% of our outstanding common stock, which includes 3,298,503 shares held by More Superannuation Fund (“More”) of which Mr. Sheppard is co-trustee and co-member and shares voting and investment power of the shares held by More, 3,001,702 shares authorized by the Company to be issued pursuant to Mr. Sheppard’s employment agreement through September 30, 2014 and 50,000,000 shares held by Five Arrows of which Mr. Sheppard is the sole owner. Mr. Sheppard also has shared voting and investment power over 3,000,000 shares of Preferred Stock held by More Superannuation Fund. Each share of Preferred Stock has voting rights to 20 shares of common stock. Mr. Sheppard may also be entitled pursuant to his employment agreement with the Company should the Company have insufficient funds to pay Mr. Sheppard’s salary, to shares of common stock in an amount equal to three times the amount of unpaid base salary and shares in the amount of $150,000 upon the acquisition of a subsidiary or business valued at greater than $1,000,000 as a bonus. As a result, he will have the ability to control substantially all matters submitted to our stockholders for approval including:

· | election of our board of directors; |

· | removal of any of our directors; |

· | amendment of our Articles of Incorporation or bylaws; and |

· | adoption of measures that could delay or prevent a change in control or impede a merger, takeover or other business combination involving us. |

As a result of his ownership and positions, our director and executive officer is able to influence all matters requiring shareholder approval, including the election of directors and approval of significant corporate transactions. In addition, the future prospect of sales of significant amounts of shares held by our director and executive officer could affect the market price of our common stock if the marketplace does not orderly adjust to the increase in shares in the market and the value of your investment in our company may decrease. Management's stock ownership may discourage a potential acquirer from making a tender offer or otherwise attempting to obtain control of us, which in turn could reduce our stock price or prevent our shareholders from realizing a premium over our stock price.

Because our industry is highly competitive, if we are unable to attract, train and retain highly qualified personnel, the quality of our services may decline and we may not successfully execute our growth strategies.

Our success depends in large part upon our ability to continue to attract, train, motivate and retain highly skilled and experienced employees in the micro-lending business. Qualified employees periodically are in great demand and may be unavailable in the time frame required to satisfy our customers’ requirements. There can be no assurance that we will be able to attract and retain sufficient numbers of highly skilled and experienced employees in the future. The loss of personnel or our inability to hire or retain sufficient personnel at competitive rates of compensation could harm our business.

Our micro-lending business is subject to loan defaults.

Although we attempt to mitigate the incidence of customer defaults on the loans that we make by due diligence of the customer prior to making the loan, there can be no guarantee that our customers will be able to repayment their loans, in which case, we will incur the cost of diligence, compliance and administration and will not recoup on the loan. In addition, there may be collection and court expenses, all of which will have an adverse affect on our financial condition.

Our success is dependent on our ability to realize and process alluvial gold deposits.

We hope to generate revenues from alluvial gold processing from our leased properties located in New Guinea. We cannot guarantee that we will ever be successful in doing this. It is not possible for us to predict the future level of gold processing, if any, or if we will be able to effectuate our business plan. We recognize that if we are unable to generate revenues, we will not be able to earn profits or continue operations.

Our success is dependent on our ability to realize and process alluvial nephrite (jade) deposits.

We hope to generate revenues from alluvial nephrite processing from our leased properties located in Australia. We cannot guarantee that we will ever be successful in doing this. It is not possible for us to predict the future level of nephrite processing, if any, or if we will be able to effectuate our business plan. We recognize that if we are unable to generate revenues, we will not be able to earn profits or continue operations.

We must obtain approval as a foreign investor in New Guinea.

We are required to obtain approval from the Investment Promotion Authority of Papua New Guinea to be recognized as a foreign investor either as a corporation in our own right operating in Papua New Guinea or as a majority shareholder in a Papua New Guinea corporate entity for our joint venture with the Leaseholders of approximately 26 hectares located at Koranga in Wau, Morobe Province, Papua, New Guinea for alluvial gold processing operations. We are a 49% owner of Aqua Mining [PNG] Limited, a Papua, New Guinea company, for our alluvial mining operations in New Guinea. The appropriate forms have been submitted to the relevant government departments to qualify us as a recognized foreign investor. If we do not obtain approval our joint venture operations could be at risk.

Renewal of government approval in Australia

Angel Jade currently holds an Exploration License, EL8104, which requires renewal every two years. Current date of renewal is June 30, 2015. There is a risk that the government fails to renew the license if there are compliance issues or other areas of concern. There is also a risk that the government will fail to approve new mining leases for the Company. Furthermore, any failure by the Company to meet the requirements of the NSW EPA may jeopardize the tenement’s standing.

If the price of gold drops, our ability to continue production may be adversely affected.

Although geology studies, both current and past, as well as historical data from prior mining indicates there are commercial grades of gold to be processed, if the London Metal Exchange Spot Price for gold drops, the cost of extraction may not allow sufficient margin to maintain production and our alluvial mining business would have to be curtailed.

If the price of jade or other minerals drop, our ability to continue production of such items may be adversely affected.

Although geology studies, both current and past, as well as historical data from prior mining indicates there are commercial grades of jade and other minerals to be processed, if the market price for jade or such other minerals drops, the cost of extraction and/or processing may not allow sufficient margin to maintain production and our alluvial mining business for such products would have to be curtailed.

Our operations will be subject to applicable law and government regulation. These laws and regulations could restrict or prohibit our alluvial processing business.

Our operations require permits from various foreign, federal, state, provincial and local governmental authorities and are governed by laws and regulations, including those with respect to prospecting, transport, export, taxation, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. There can be no assurance that we will be able to obtain or maintain any of the permits or approvals required for our proposed business subject to the Joint Venture Agreement. To the extent such approvals are required and are not obtained, we may be delayed or prohibited from proceeding with planned business activities. If we cannot accomplish these objectives, we will not be able to effectuate our business goals.

We must comply with the Foreign Corrupt Practices Act.

We are required to comply with the United States Foreign Corrupt Practices Act, which prohibits U.S. companies from engaging in bribery or other prohibited payments to foreign officials for the purpose of obtaining or retaining business. Foreign companies, including some of our competitors, are not subject to these prohibitions.

Since our joint venture is located in a third world country, we are subject to additional risks.

The Company is undertaking mining ventures in Papua, New Guinea, a third world country. As such, it is possible that the political environment could become unstable and a foreign operation such as our proposed one could be adversely affected by government expropriation, the inability to secure needed government permits and cooperation, and a condition not physically safe for foreign laborers or management. If any of these situations would occur, we would have to suspend operations in New Guinea, which would prevent us from our alluvial mining activities.

RISKS RELATING TO OUR COMMON STOCK

We may in the future issuance additional shares of our common stock which may have a dilutive effect on our stockholders.

Our Articles of Incorporation authorizes the issuance of 500,000,000,000 shares of common stock of which 59,397,485 shares of common stock are issued and outstanding as of February 1, 2015 and an additional 3,001,702 shares of common stock are authorized for issuance to Warren Sheppard pursuant to his employment agreement. The future issuance of our common stock and/or preferred stock may result in substantial dilution in the percentage of our common stock held by our then existing stockholders. We may value any common stock issued in the future on an arbitrary basis. The issuance of common stock for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors, and might have an adverse effect on any trading market for our common stock. In addition, 1,050,000 shares are issuable upon the conversion of a convertible debenture, assuming a conversion price of $0.30 which represents a conversion price of 50% of the average closing bid price of our common stock for the 10 business days prior to the conversion date to our sole director and officer, Warren Sheppard. Also, pursuant to his employment agreement with the Company, should the Company have insufficient funds to pay Mr. Sheppard’s salary, Mr. Sheppard is entitled to be paid in shares of common stock of the Company in an amount equal to three times the amount of unpaid base salary and shall be entitled to a bonus to be paid in shares of common stock in the amount equal to $150,000 upon the acquisition of a subsidiary or business valued at greater than $1,000,000. Such stock issuances will cause stockholders' interests in our company to be diluted. Such dilution will negatively affect the value of investors’ shares.

We may issue shares of preferred stock in the future that may adversely impact your rights as holders of our common stock.

Our Articles of Incorporation authorizes us to issue up to 50,000,000 shares of preferred stock, of which 10,000,000 shares are designated as Series A Preferred Stock and 3,000,000 shares of Series A Preferred stock are issued and outstanding as of July 17, 2014. Our board of directors will have the authority to fix and determine the relative rights and preferences of preferred stock, as well as the authority to issue such shares, without further shareholder approval. As a result, our board of directors could authorize the issuance of a series of preferred stock that would grant to holders preferred rights to our assets upon liquidation, the right to receive dividends before dividends are declared to holders of our common stock, and the right to the redemption of such preferred shares, together with a premium, prior to the redemption of the common stock. To the extent that we do issue such additional shares of preferred stock, your rights as holders of common stock could be impaired thereby, including, without limitation, dilution of your ownership interest in us. In addition, shares of preferred stock could be issued with terms calculated to delay or prevent a change in control or make removal of management more difficult, which may not be in your interest as holders of common stock. In addition, our Board could authorize the issuance of a series of preferred stock that has greater voting power than our common stock or that is convertible into our common stock, such as our Series A Preferred Stock, which could decrease the relative voting power of our common stock or result in dilution to our existing common stockholders.

Any of the actions described in the preceding paragraph could significantly adversely affect the investment made by holders of our common stock. Holders of common stock could potentially not receive dividends that they might otherwise have received. In addition, holders of our common stock could receive less proceeds in connection with any future sale of the Company, whether in liquidation or on any other basis.

Because we do not intend to pay any cash dividends on our shares of common stock, our shareholders will not be able to receive a return on their shares unless they sell them.

We intend to retain any future earnings to finance the development and expansion of our business. We do not anticipate paying any cash dividends on our common stock in the foreseeable future. Unless we pay dividends, our shareholders will not be able to receive a return on their shares unless they sell them at a price higher than that which they initially paid for such shares.

We may be exposed to potential risks resulting from requirements under Section 404 of the Sarbanes-Oxley Act of 2002.

If we become registered with the SEC, we will be required, pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, to include in our annual report our assessment of the effectiveness of our internal control over financial reporting. We do not have a sufficient number of employees to segregate responsibilities and may be unable to afford increasing our staff or engaging outside consultants or professionals to overcome our lack of employees.

The costs to meet our reporting and other requirements as a public company subject to the Exchange Act of 1934 will be substantial and may result in us having insufficient funds to expand our business or even to meet routine business obligations.

If we become a public entity, subject to the reporting requirements of the Exchange Act of 1934, we will incur ongoing expenses associated with professional fees for accounting, legal and a host of other expenses for annual reports and proxy statements. We estimate that these costs will be higher if our business volume and activity increases. As a result, we may not have sufficient funds to grow our operations.

We qualify as an “emerging growth company” under the JOBS Act. As a result, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements. For so long as we are an emerging growth company, we will not be required to:

· | have an auditor report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act; |

· | comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis); |

· | submit certain executive compensation matters to shareholder advisory votes, such as “say-on-pay” and “say-on-frequency;” and |

· | disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the Chief Executive’s compensation to median employee compensation. |

We will remain an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our total annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, which would occur if the market value of our ordinary shares that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

Until such time, however, we cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

Since we have elected under Section 107 of the JOBS Act to use the extended transition period with respect to complying with new or revised accounting standards, our financial statements may not be comparable to companies that comply with public company effective dates making it more difficult for an investor to compare our results with other public companies.

Section 107 of the JOBS Act provides that an emerging growth company can take advantage of the extended transition period provided in Section 102(b)(2)(B) of the Act for complying with new or revised accounting standards. In other words, as an emerging growth company we can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended transition period. Our financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards.

Our common stock is considered penny stock.

Our common stock is classified as a penny stock, which is quoted on the OTCQB Market. As a result, an investor may find it more difficult to dispose of or obtain accurate quotations as to the price of the shares of the common stock. In addition, the “penny stock” rules adopted by the Securities and Exchange Commission subject the sale of the shares of the common stock to certain regulations which impose sales practice requirements on broker-dealers. For example, broker-dealers selling such securities must, prior to effecting the transaction, provide their customers with a document that discloses the risks of investing in such securities. Furthermore, if the person purchasing the securities is someone other than an accredited investor or an established customer of the broker-dealer, the broker-dealer must also approve the potential customer’s account by obtaining information concerning the customer’s financial situation, investment experience and investment objectives. The broker-dealer must also make a determination whether the transaction is suitable for the customer and whether the customer has sufficient knowledge and experience in financial matters to be reasonably expected to be capable of evaluating the risk of transactions in such securities. Accordingly, the Commission’s rules may result in the limitation of the number of potential purchasers of the shares of the common stock. In addition, the additional burdens imposed upon broker-dealers by such requirements may discourage broker-dealers from effecting transactions in the Common Stock, which could severely limit the market of the Company’s common stock.

Item 2. Financial Information.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Certain statements contained in this Form 10, including statements regarding the anticipated development and expansion of our business, our intent, belief or current expectations, primarily with respect to the future operating performance of our company and the products and services we expect to offer and other statements contained herein regarding matters that are not historical facts, are "forward-looking" statements. Our Management’s Discussion and Analysis contains not only statements that are historical facts, but also forward-looking statements which involve risks and uncertainties and assumptions. Because forward-looking statements are inherently subject to risks and uncertainties, our actual results may differ materially from the results discussed in the forward-looking statements. The following discussion and analysis of financial condition and results of operations of the Company is based upon, and should be read in conjunction with, the audited financial statements and related notes elsewhere in this Form 10.

Overview

Until 2013 we were engaged in the design, production and wholesale merchandising of quality women's and men's apparel, and home furnishings. Since then our business operations are conducted through our wholly-owned subsidiaries. Our business consists of micro-lending activities through Instacash, a jade mining venture in Australia and an alluvial gold mining venture in Papua, New Guinea.

We qualify as an “emerging growth company” under the JOBS Act. As a result, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements. For so long as we are an emerging growth company, we will not be required to:

· | have an auditor report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act; |

· | comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis); |

· | submit certain executive compensation matters to shareholder advisory votes, such as “say-on-pay” and “say-on-frequency;” and |

· | disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the CEO’s compensation to median employee compensation. |

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended transition period. Our financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards.

We will remain an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our total annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, which would occur if the market value of our ordinary shares that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

Plan of Operations

The Company’s current strategy is to engage in mining and commercial activities. The mining division is currently focused on building its management team. The Company hopes to undertake a number of additional mining projects so the cost of the team could be amortized over a number of cost centers. We believe that this team would enable the Company to consider operations in various geographical locations in addition to Papua New Guinea. The commercial division would endeavor to make strategic investments in consumer products/services. For example, there are a number of projects that we have identified that would flow from our involvement in our mining joint venture in Papua New Guinea. Under the terms of our joint venture we are able to supply food, clothing, housing and medical supplies which we would hope to be able to service not only our requirements in the region but to expand and supply other markets within that region. We believe that there may be other opportunities that would evolve from our presence in Papua, New Guinea if we have an infrastructure to capitalize on those opportunities. We currently believe that we will need $2,000,000 over the next 12 months to develop plans for our business.

We have commenced taking sellable samples from the area covered by the Angel Jade License. This material need to be graded and from that we will be preparing web sites to show potential customers the quality and quantity that is available. We have identified possible customers in Asia and will be making the appropriate representations to them on the available material.

Results of Operations

For the year ended September 30, 2014 and September 30, 2013

Revenues

The Company had no revenue for the years ended September 30, 2014 and September 30, 2013. Revenue from all prior years was written off by the Company.

Operating expenses

The Company had operating expenses of $818,588 for the year ended September 30, 2014 consisting of general and administrative expenses, as compared with operating expenses of $125,230 for the year ended September 30, 2013 consisting of research and development of $31,408 and general and administrative expenses of $93,822. The increase of $693,358 was attributable in part to the establishment of our mining license in PNG and additional administrative expense.

Net Loss

The Company had a net operating loss of $818,588 for the year ended September 30, 2014 compared with a net operating loss of $125,230 for the one-year period ended September 30, 2013. The increase of $724,766 was attributable to increases in the following categories: Bad Debts $279,000; Interest Expense $370,000; Derivative Expense $378,000; Amortization of Debt Discount $126,000 and Wages of $250,000.

Operating Activities

Net cash used in operating activities was $193,239 for the year ended September 30, 2014 compared to net cash used in operating activities of $28,622 for the year ended September 30, 2013. The increase of $164,617 was a result mainly from in part to the establishment of our mining license in PNG and additional administrative expense.

Investing Activities

Net cash used in investing activities was $92,586 for the year ended September 30, 2014 compared to $0 for the year ended September 30, 2013. This increase resulted from the acquisition of Instacash.

Financing Activities

Net cash provided by financing activities was $33,920 for the year ended September 30, 2014 compared to $22,255 for the year ended September 30, 2013. The increase of $17,665 was mainly due to general expenditures. Net cash provided by financing activities was $6,719,383 for the period from inception through September 30, 2014, which was mainly from the issuance of common stock and proceeds from the issuance of convertible notes payable.

Liquidity and Capital Resources

As of September 30, 2014, the Company had total current assets of $236,280 and total current liabilities of $1,745,730 resulting in a working capital deficit of $1,509,450. As of December 31, 2013, the Company had total current assets of $1,035 and total current liabilities of $92,327 resulting in a working capital deficit of $91,292. The increase in working capital deficit arose mainly due to increase in loans owing to related parties, who provided advances to the Company for working capital purposes. The Company had cash as of September 30, 2014 of $110,152. The Company intends to fund its operations through the sale of its equity securities. However, there can be no assurance that the Company will be successful doing so. We currently have no agreements, arrangements or understandings with any person to obtain funds through bank loans, lines of credit or any other sources. We currently believe that the Company will need approximately $2,000,000 over the next 12 months to implement our desired expansion of mining activities.

Going Concern

The Company is in the development stage and has insufficient revenues to cover its operating costs. As of September 30, 2014, the Company had an accumulated deficit of $10,225,051 and a working capital deficiency and insufficient cash resources to meet its planned business objectives. These and other factors raise substantial doubt about the Company’s ability to continue as a going concern.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements.

Critical Accounting Policies and Estimates

The Company’s discussion and analysis of its financial condition and the results of operations are based upon the consolidated financial statements included in this Form 10 and the data used to prepare them. The consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America and management is required to make judgments, estimates and assumptions in the course of such preparation. The Summary of Significant Accounting Policies included with the consolidated financial statements describes the significant accounting policies and methods used in the preparation of the consolidated financial statements. On an ongoing basis, the Company re-evaluates its judgments, estimates and assumptions, including those related to revenue recognition, product warranties, accounts receivable and allowance for doubtful accounts, valuation of inventories, income taxes and valuation allowance on deferred tax assets, and share based compensation. The Company bases its judgment and estimates on historical experience, knowledge of current conditions, and its beliefs of what could occur in the future considering available information. Actual results may differ from these estimates under different assumptions or conditions. Management has identified the following as the Company’s critical accounting policies:

Goodwill

Goodwill as of the acquisition date is measured as the excess of consideration transferred and the net of the acquisition date fair values of the assets acquired and the liabilities assumed. While the Company uses its best estimates and assumptions as a part of the purchase price allocation process to accurately value assets acquired, including intangible assets, and liabilities assumed at the acquisition date, estimates are inherently uncertain and subject to refinement. As a result, during the measurement period, which may be up to one year from the acquisition date, the Company records adjustments to the assets acquired and liabilities assumed, with the corresponding offset to goodwill. Upon the conclusion of the measurement period or final determination of the values of assets acquired or liabilities assumed, whichever comes first, any subsequent adjustments are recorded to our consolidated statements of operations.

Goodwill is not amortized, instead it is tested for impairment annually by applying fair value based tests or whenever events or changes in circumstances indicate that the carrying amount may not be recoverable.

The goodwill impairment test consists of a two-step process. In step one the estimated fair value of a reporting unit is compared to its carrying value. Step two is required only if the estimated fair value is less than the carrying value. In step two the actual amount of the goodwill impairment is calculated by comparing the implied fair value of the reporting unit's goodwill with the carrying amount of that goodwill. The implied fair value is determined in the same manner as the amount of goodwill recognized in a business combination.

Beneficial Conversion Features of Debentures

In accordance with FASB ASC 470-20, Accounting for Convertible Securities with Beneficial Conversion Features or Contingently Adjustable Conversion Ratios, we recognize the advantageous value of conversion rights attached to convertible debt. Such rights give the debt holder the ability to convert his debt into common stock at a price per share that is less than the trading price to the public on the day the loan is made to us. The beneficial value is calculated as the intrinsic value (the market price of the stock at the commitment date in excess of the conversion rate) of the beneficial conversion feature of debentures and related accruing interest is recorded as a discount to the related debt and an addition to additional paid in capital. The discount is amortized over the remaining outstanding period of related debt using the interest method.

Revenue Recognition

The Company recognizes revenue when persuasive evidence of an arrangement exists, delivery of service has occurred, the sales price is fixed or determinable and collectability is reasonably assured.

Non-Controlling Interests

A non-controlling interest in a subsidiary is an ownership interest in a consolidated entity that is reported as equity in the consolidated financial statements and separate from the Company’s equity. In addition, net income/(loss) attributable to non-controlling interests is reported separately from net income attributable to the Company in the consolidated financial statements. The Company’s consolidated statements present the full amount of assets, liabilities, income and expenses of all of our consolidated subsidiaries, with a partially offsetting amount shown in non-controlling interests for the portion of these assets and liabilities that are not controlled by us.

Income Taxes