SCHEDULE 14A

Proxy Statement Pursuant to Section 14(A)

of the Securities Exchange Act of 1934

Filed by the Registrant / X /

Filed by a Party other than the Registrant / /

Check the appropriate box:

/ / Preliminary Proxy Statement.

/ / Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e) (2)).

/ X / Definitive Proxy Statement.

/ / Definitive Additional Materials.

/ / Soliciting Material Pursuant to § 240.14a-12.

eaton Vance Growth Trust

Eaton Vance Investment Trust

Eaton Vance Municipals Trust

Eaton Vance municipals Trust II

Eaton Vance mutual funds trust

Eaton Vance series Fund, Inc.

Eaton Vance Series Trust

Eaton Vance Series Trust II

Eaton Vance Special Investment Trust

Eaton Vance variable Trust

Eaton Vance NextShares Trust

Eaton vance NextShares Trust II

Core Bond Portfolio

Emerging Markets Local Income Portfolio

Eaton Vance Floating Rate Portfolio

Global Income Builder Portfolio

Global Macro Absolute Return Advantage Portfolio

Global Macro Capital Opportunities Portfolio

GLobal Macro Portfolio

Global Opportunities Portfolio

Greater India Portfolio

High Income Opportunities Portfolio

International Income Portfolio

Senior Debt Portfolio

Stock Portfolio

Tax-Managed Growth Portfolio

Tax-Managed International Equity Portfolio

Tax-Managed Multi-Cap Growth Portfolio

Tax-Managed Small-Cap Portfolio

Tax-Managed Value Portfolio

5-to-15 Year Laddered Municipal Bond Portfolio

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

/ X / No fee required.

/ / Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction |

computed pursuant to Exchange Act Rule 0-11 (set forth the

amount on which the filing fee is calculated and state how it

was determined):

| (4) | Proposed maximum aggregate value of transaction: |

/ / Fee paid previously with preliminary materials.

/ / Check box if any part of the fee is offset as provided by Exchange Act Rule

0-11(a)(2) and identify the filing for which the offsetting fee was paid

previously. Identify the previous filing by registration statement

number, or the form or schedule and the date of its filing.

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

Eaton Vance Funds

Two International Place

Boston, Massachusetts 02110

December 23, 2020

Dear Shareholder:

We cordially invite you to attend the joint special meeting of shareholders of the funds listed in Appendix A of the attached Proxy Statement (each, a “Series” and, collectively, the “Series”) scheduled to be held at the principal office of the Series, Two International Place, Boston, Massachusetts 02110, on February 18, 2021 at 11:30 a.m. Eastern Time (the “Meeting”). The Meeting is being held to approve matters important to your Series relating to Morgan Stanley’s proposed acquisition of Eaton Vance Corp. (“EVC”). In addition, if you are a shareholder of a Series that is organized as a feeder fund in a master-feeder structure or an investing fund in a fund-of-funds structure (in each case, an “Investing Fund”), you also will be asked to provide instructions to your Investing Fund as to how such Investing Fund should vote its interest in the master fund or underlying funds in which it invests in connection with the approval of the new investment advisory agreement and, as applicable, the new investment sub-advisory agreement for such fund(s) (each, an “Underlying Fund”).

On October 7, 2020, EVC entered into a definitive agreement with Morgan Stanley, a leading global financial services firm providing a wide range of investment banking, securities, wealth management, and investment management services, pursuant to which Morgan Stanley will acquire EVC (the “Transaction”), subject to the completion or waiver of various conditions (the “Closing”). EVC is the parent company of Eaton Vance Management (“Eaton Vance”) and Boston Management and Research (“BMR” and, together with Eaton Vance, the “Advisers” and, each individually, an “Adviser”). Eaton Vance and BMR serve as investment adviser and/or administrator to each Series and BMR serves as investment adviser to the Underlying Funds that are not Series (the “Portfolios” and, together with the Series, the “Funds”). The Closing may be deemed to cause each Fund’s current investment advisory agreement with its Adviser and, with respect to certain Funds, each such Fund’s current investment sub-advisory agreement between its Adviser and Eaton Vance Advisers International Ltd. (“EVAIL”), Parametric Portfolio Associates LLC (“Parametric”), Goldman Sachs Asset Management, L.P. (“GSAM”), BMO Global Asset Management (Asia) Limited (“BMO GAM (Asia)”), Atlanta Capital Management Company, LLC (“Atlanta Capital”), Hexavest Inc. (“Hexavest”), or Richard Bernstein Advisors LLC (“RBA”) (each a “Sub-Adviser” and, collectively, the “Sub-Advisers”) to terminate in accordance with applicable law.

Some Series, identified in Appendix B of the attached Proxy Statement (the “New IAA Series”), which are organized as feeder funds in master-feeder structures where the master fund is a Portfolio, do not currently have investment advisory agreements or, as applicable, investment sub-advisory agreements in place. With respect to the New IAA Series, new investment advisory agreements with Eaton Vance and, as applicable, a new investment sub-advisory agreement with EVAIL or Parametric, are being proposed. Please see “Why am I being asked to vote?” under the “Questions and Answers” section of the attached Proxy Statement for additional information regarding the Proposals for the New IAA Series.

In order to help ensure that each Fund’s investment program continues uninterrupted upon the Closing and, with respect to New IAA Series, for consistency across similarly structured funds and investment flexibility, we are asking shareholders of each Series to approve and, as applicable, to provide voting instructions for their Investing Fund to approve, a new investment advisory agreement and, as applicable, a new investment sub-advisory agreement.

Each Fund’s Board of Trustees or Board of Directors, as applicable (the “Board”), has approved its new agreement(s). It is important to note that the investment advisory fee rate(s) of the Funds under the new agreements will not change as a result of the Transaction (and, with respect to the New IAA Series, such new agreement will not increase fees for the New IAA Series), that the Transaction is not expected to result in any change in the investment objective(s) or strategies of the Funds, and that the portfolio managers for the Funds are expected to continue in such roles upon consummation of the Transaction (except that each New IAA Series will now have the same portfolio management team as its master fund Portfolio).

As more fully described in the enclosed Proxy Statement, the purpose of the Meeting is (a) to seek your vote, with respect to the Series in which you are invested, on (i) the approval of a new investment advisory agreement for your Series and (ii) for certain Series, the approval of a new investment sub-advisory agreement; and (b) for shareholders of an Investing Fund, to seek your instruction with respect to how the Investing Fund should vote its interest in the Underlying Fund(s) in which it invests in connection with (i) the approval of a new investment advisory agreement for such Underlying Fund(s) and (ii) for certain Portfolios, the approval of a new investment sub-advisory agreement.

The Boards have carefully considered each of these proposals and, as described more fully in the enclosed Proxy Statement, unanimously recommend that shareholders vote, or submit voting instructions, FOR each proposal. In particular, the Boards believe that approving the new investment advisory agreements with the Advisers and, as applicable, the new investment sub-advisory agreements with the Sub-Advisers, is in the best interests of the Funds.

We hope that you will be able to attend the Meeting. Whether or not you plan to attend, and regardless of the number of shares you own, it is important that your shares be represented. We urge you to mark, sign, date, and mail the enclosed proxy card in the postage-paid envelope provided or to record your voting instructions by telephone or via the internet as soon as possible to ensure that your shares are represented at the Meeting.

Your vote is important to us. We appreciate your consideration of these important matters. If you have questions about the proposals, please call our proxy information line at 866-864-3926 or contact your financial intermediary.

Sincerely yours,

/s/ Thomas E. Faust Jr.

Thomas E. Faust Jr.

Chairman of the Board and Chief Executive Officer

Eaton Vance Corp.

*******

Table of Contents

| Notice of Joint Special Meeting of Shareholders | 1 |

| Important Information for Owners of Variable Annuity or Life Insurance Contracts Invested in |

| the Funds | 7 |

| Important Information for Shareholders of Series that Invest Pursuant to Master-Feeder or |

| Funds-of-Funds Arrangements | 8 |

| Proxy Statement | 9 |

| General Information | 9 |

| Questions and Answers | 11 |

| Summary of Proposals | 18 |

| Further Information About Voting and the Joint Special Meeting | 83 |

| Additional Meeting Information | 85 |

| Appendix A – Funds Included in the Joint Proxy Statement | A-1 |

| Appendix B – New Investment Advisory Agreements for New IAA Series | B-1 |

| Appendix C – Portfolios | C-1 |

| Appendix D – Investment Advisory Agreements: Compensation | D-1 |

| Appendix E – Investment Advisory and Administrative Agreements: Compensation | E-1 |

| Appendix F – Investment Sub-Advisory Agreements: Compensation | F-1 |

| Appendix G – Expense Reimbursement Arrangements | G-1 |

| Appendix H – Number of Shares Outstanding as of the Record Date | H-1 |

| Appendix I – Form of New Eaton Vance/BMR Investment Advisory Agreement: Series | I-1 |

| Appendix J – Form of New Eaton Vance Investment Advisory and |

| Administrative Agreement | J-1 |

| Appendix K – Form of New BMR Investment Advisory Agreement: Portfolios | K-1 |

| Appendix L – Investment Advisory Agreements and Investment Sub-Advisory Agreements: |

| Dates and Approvals | L-1 |

| Appendix M – Board Considerations | M-1 |

| Appendix N – Form of New EVAIL, Parametric, and Atlanta Capital Investment Sub-Advisory |

| Agreements: Series | N-1 |

| Appendix O – Form of New GSAM Investment Sub-Advisory Agreement: Series | O-1 |

| Appendix P – Form of New BMO GAM (Asia) Investment Sub-Advisory Agreement | P-1 |

| Appendix Q – Form of New Hexavest Investment Sub-Advisory Agreement | Q-1 |

| Appendix R – Form of New RBA Investment Sub-Advisory Agreement | R-1 |

| Appendix S – Form of New EVAIL and Parametric Investment Sub-Advisory Agreement: |

| Portfolios | S-1 |

| Appendix T – Form of New GSAM Investment Sub-Advisory Agreement: Portfolio | T-1 |

| Appendix U – Investing Funds and Related Underlying Funds | U-1 |

| Appendix V – Other Similar Funds Advised or Sub-Advised by the Advisers and Sub- |

| Advisers | V-1 |

| Appendix W – Payments to the Advisers, the Sub-Advisers or Affiliates | W-1 |

| Appendix X – Funds’ Trustees or Directors and Officers | X-1 |

| Appendix Y – 5% Ownership and Ownership of Fund Management | Y-1 |

| Appendix Z – Affiliated Brokerage Commissions | Z-1 |

Notice of Joint Special Meeting of Shareholders

To be held on February 18, 2021

eaton Vance Growth Trust Eaton Vance Investment Trust Eaton Vance Municipals Trust Eaton Vance municipals Trust II Eaton Vance mutual funds trust Eaton Vance series Fund, Inc. Eaton Vance Series Trust Eaton Vance Series Trust II Eaton Vance Special Investment Trust Eaton Vance variable Trust Eaton Vance NextShares Trust Eaton vance NextShares Trust II |

The separate series of each trust and corporation listed above, as set forth on Appendix A to the enclosed Proxy Statement, are referred to herein as the “Series.”

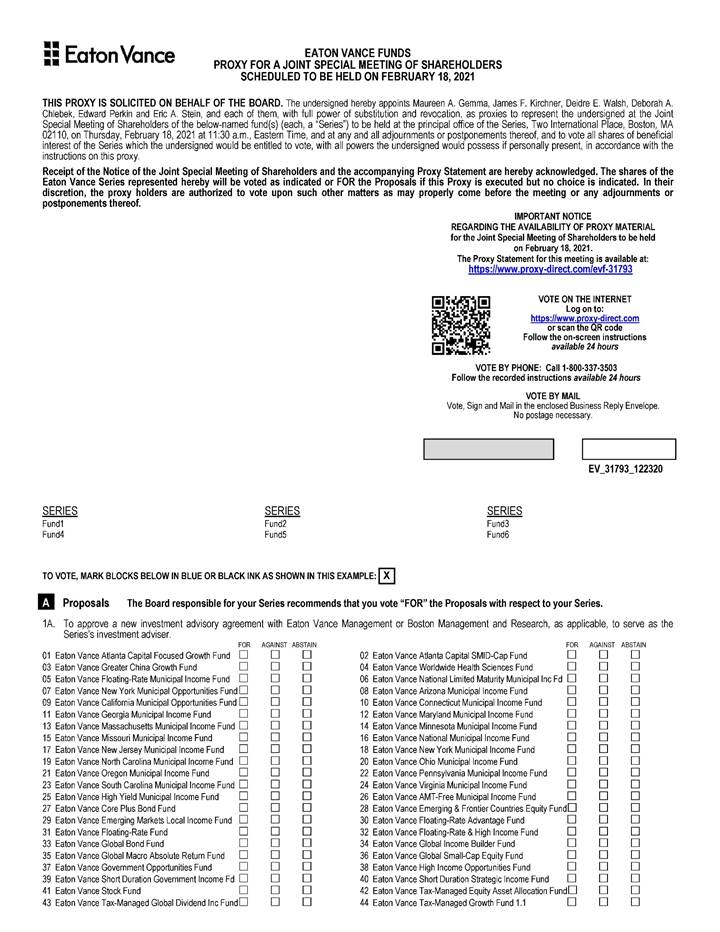

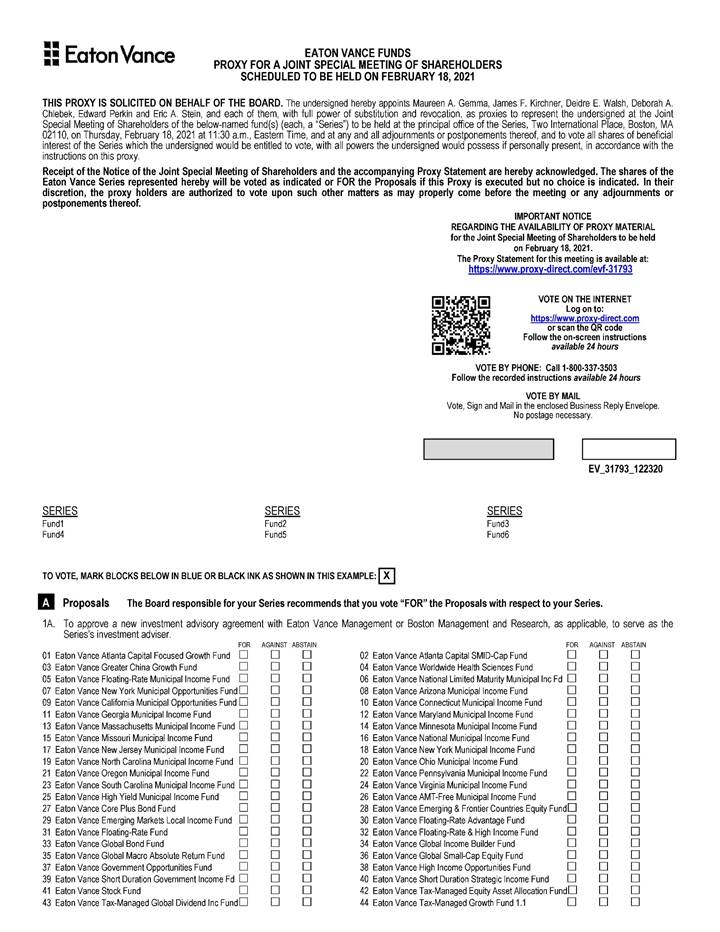

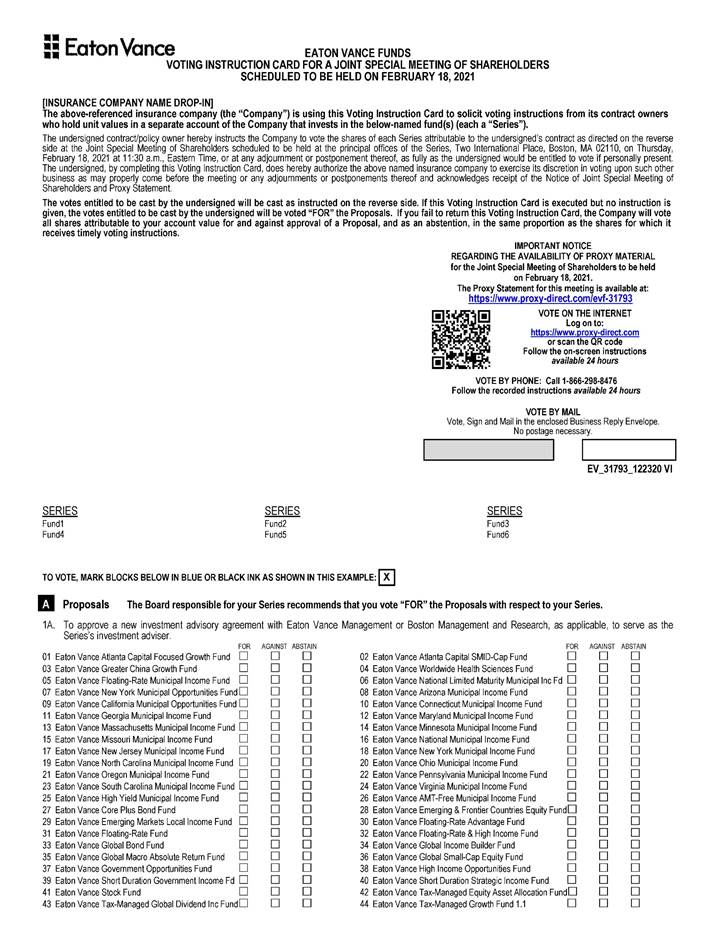

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE MEETING OF THE SERIES SCHEDULED TO BE HELD ON FEBRUARY 18, 2021: The notice of joint special meeting of shareholders, Proxy Statement, and the forms of proxy card are available at https://www.proxy-direct.com/evf-31793.

To the shareholders of each Series:

The joint special meeting of shareholders of your Series will be held on February 18, 2021 at 11:30 a.m., Eastern Time, at the principal office of the Series, Two International Place, Boston, Massachusetts 02110 (the “Meeting”), to consider the proposals described in the accompanying Proxy Statement (each, a “Proposal”).

As more fully described in the enclosed Proxy Statement, the purpose of the Meeting is: (a) to seek your vote, with respect to the Series in which you are invested, on (i) the approval of a new investment advisory agreement for your Series and (ii) for certain Series, the approval of a new investment sub-advisory agreement; and (b) for shareholders of a Series that is organized as a feeder fund in a master-feeder structure or an investing fund in a fund-of-funds structure (each such feeder fund and investing fund, an “Investing Fund,” and each such master fund and other underlying fund, an “Underlying Fund”), to seek your instruction to the Investing Fund with respect to how the Investing Fund should vote its interest in the Underlying Fund(s) in which it invests in connection with (i) the approval of a new investment advisory agreement for such Underlying Fund(s) and (ii) for certain Underlying Funds, the approval of a new investment sub-advisory agreement. The Underlying Funds that are not Series are referred to herein as “Portfolios” and are listed on Appendix C of the enclosed Proxy Statement.

Proposals:

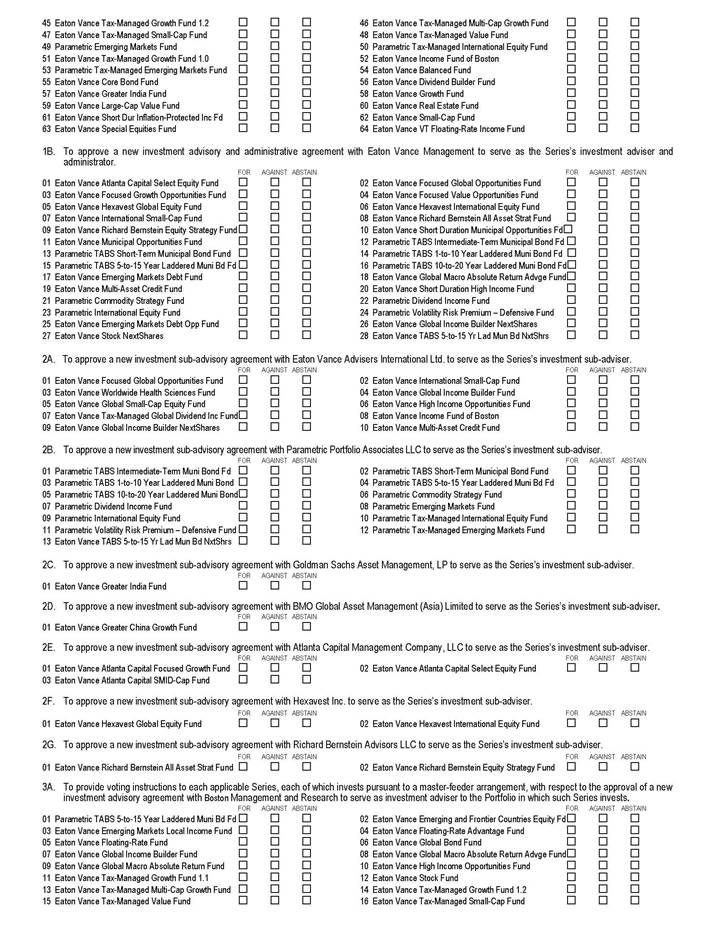

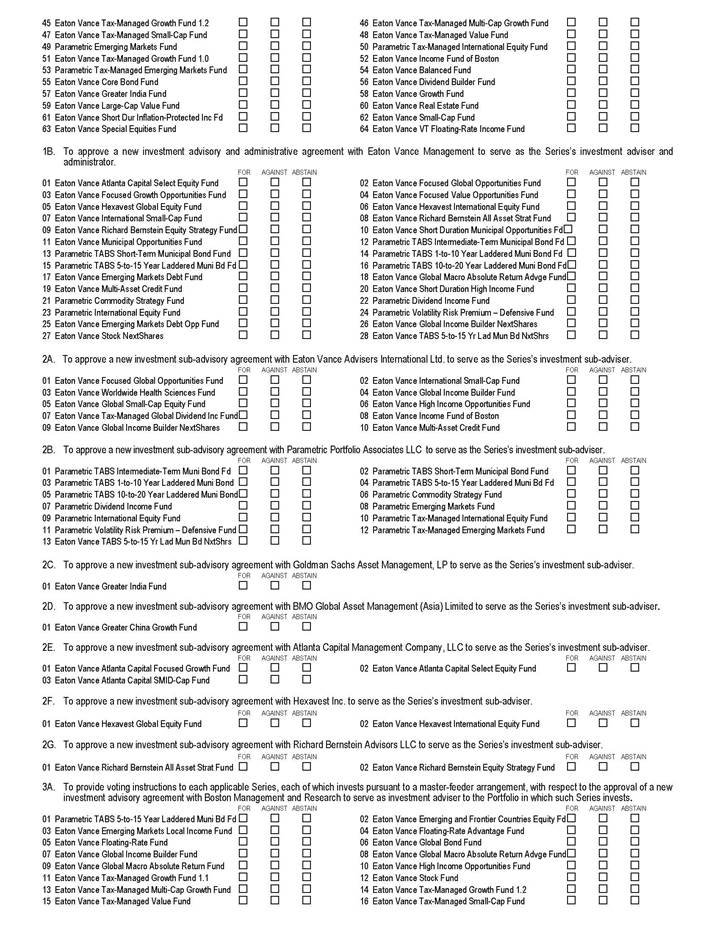

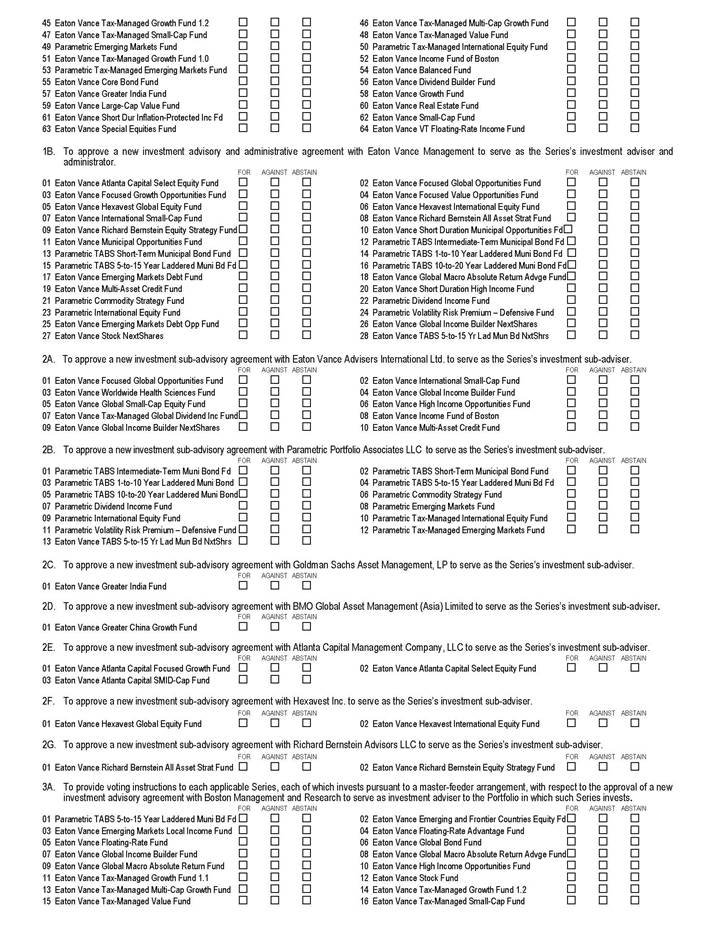

| 1. | To approve a new investment advisory agreement for each Series with Eaton Vance Management (“Eaton Vance”) or Boston Management and Research (“BMR”), as applicable |

| 1A. | To approve a new investment advisory agreement with Eaton Vance or BMR, as applicable, to serve as investment adviser to each Series listed in Proposal 1A in the attached Proxy Statement |

| 1B. | To approve a new investment advisory and administrative agreement with Eaton Vance to serve as the investment adviser and administrator to each Series listed in Proposal 1B in the attached Proxy Statement |

| 2. | To approve a new investment sub-advisory agreement with the noted sub-adviser for each applicable Series listed under Proposal 2 in the attached Proxy Statement |

| 2A. | To approve a new investment sub-advisory agreement with Eaton Vance Advisers International Ltd. (“EVAIL”) to serve as the Series’s investment sub-adviser |

| 2B. | To approve a new investment sub-advisory agreement with Parametric Portfolio Associates LLC (“Parametric”) to serve as the Series’s investment sub-adviser |

| 2C. | To approve a new investment sub-advisory agreement with Goldman Sachs Asset Management, L.P. (“GSAM”) to serve as the Series’s investment sub-adviser |

| 2D. | To approve a new investment sub-advisory agreement with BMO Global Asset Management (Asia) Limited (“BMO GAM (Asia)”) to serve as the Series’s investment sub-adviser |

| 2E. | To approve a new investment sub-advisory agreement with Atlanta Capital Management Company, LLC (“Atlanta Capital”) to serve as the Series’s investment sub-adviser |

| 2F. | To approve a new investment sub-advisory agreement with Hexavest Inc. (“Hexavest”) to serve as the Series’s investment sub-adviser |

| 2G. | To approve a new investment sub-advisory agreement with Richard Bernstein Advisors LLC (“RBA”) to serve as the Series’s investment sub-adviser |

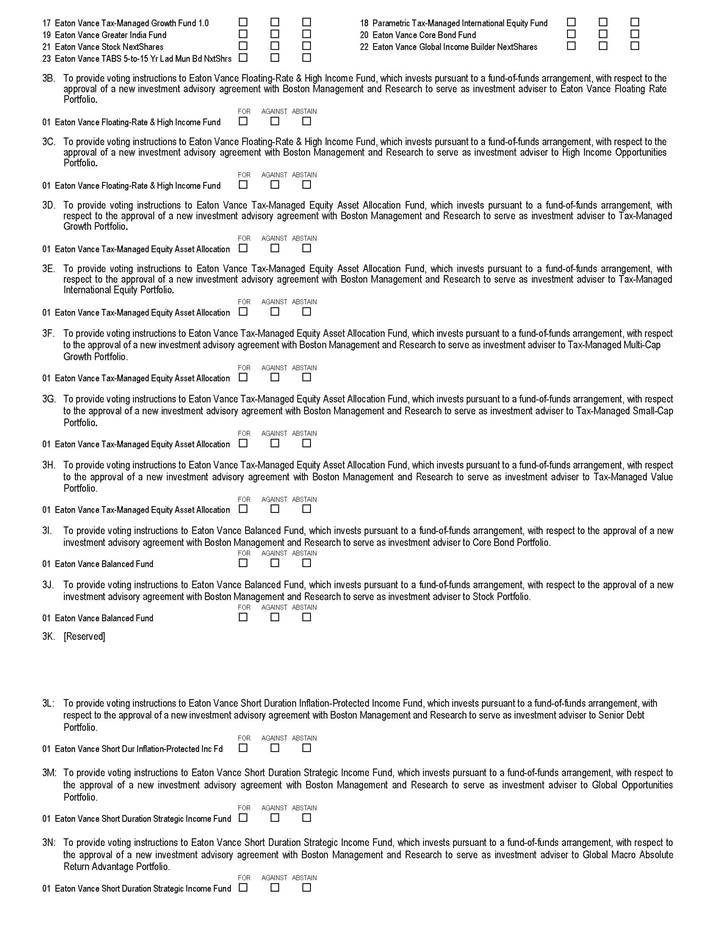

| 3. | To provide voting instructions to each applicable Investing Fund with respect to the approval of a new investment advisory agreement with Eaton Vance or BMR, as applicable, to serve as investment adviser to the Underlying Funds in which such Investing Fund invests |

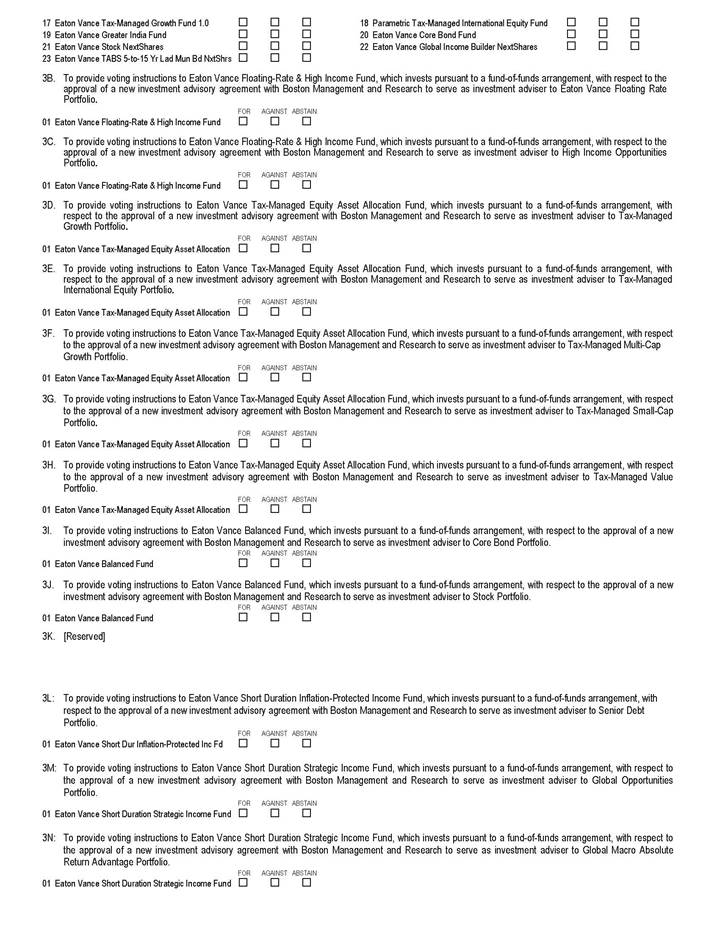

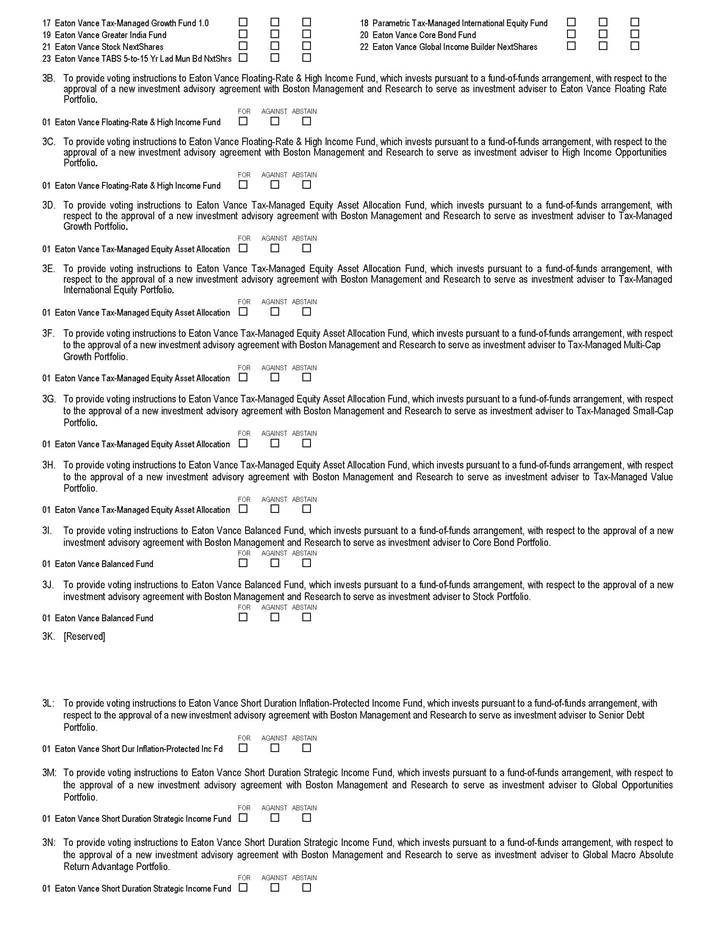

| 3A. | To provide voting instructions to each applicable Investing Fund listed under Proposal 3A in the attached Proxy Statement, which invests pursuant to a master-feeder arrangement, with respect to the approval of a new investment advisory agreement with BMR to serve as investment adviser to the Portfolio in which such Investing Fund invests |

| 3B. | To provide voting instructions to Eaton Vance Floating-Rate & High Income Fund, which invests pursuant to a fund-of-funds arrangement, with respect to the approval of a new investment advisory agreement with BMR to serve as investment adviser to Eaton Vance Floating Rate Portfolio |

| 3C. | To provide voting instructions to Eaton Vance Floating-Rate & High Income Fund, which invests pursuant to a fund-of-funds arrangement, with respect to the approval of a new investment advisory agreement with BMR to serve as investment adviser to High Income Opportunities Portfolio |

| 3D. | To provide voting instructions to Eaton Vance Tax-Managed Equity Asset Allocation Fund, which invests pursuant to a fund-of-funds arrangement, with respect to the approval of a new investment advisory agreement with BMR to serve as investment adviser to Tax-Managed Growth Portfolio |

| 3E. | To provide voting instructions to Eaton Vance Tax-Managed Equity Asset Allocation Fund, which invests pursuant to a fund-of-funds arrangement, with respect to the approval of a new investment advisory agreement with BMR to serve as investment adviser to Tax-Managed International Equity Portfolio |

| 3F. | To provide voting instructions to Eaton Vance Tax-Managed Equity Asset Allocation Fund, which invests pursuant to a fund-of-funds arrangement, with respect to the approval of a new investment advisory agreement with BMR to serve as investment adviser to Tax-Managed Multi-Cap Growth Portfolio |

| 3G. | To provide voting instructions to Eaton Vance Tax-Managed Equity Asset Allocation Fund, which invests pursuant to a fund-of-funds arrangement, with respect to the approval of a new investment advisory agreement with BMR to serve as investment adviser to Tax-Managed Small-Cap Portfolio |

| 3H. | To provide voting instructions to Eaton Vance Tax-Managed Equity Asset Allocation Fund, which invests pursuant to a fund-of-funds arrangement, with respect to the approval of a new investment advisory agreement with BMR to serve as investment adviser to Tax-Managed Value Portfolio |

| 3I. | To provide voting instructions to Eaton Vance Balanced Fund, which invests pursuant to a fund-of-funds arrangement, with respect to the approval of a new investment advisory agreement with BMR to serve as investment adviser to Core Bond Portfolio |

| 3J. | To provide voting instructions to Eaton Vance Balanced Fund, which invests pursuant to a fund-of-funds arrangement, with respect to the approval of a new investment advisory agreement with BMR to serve as investment adviser to Stock Portfolio |

| 3L. | To provide voting instructions to Eaton Vance Short Duration Inflation-Protected Income Fund, which invests pursuant to a fund-of-funds arrangement, with respect to the approval of a new investment advisory agreement with BMR to serve as investment adviser to Senior Debt Portfolio |

| 3M. | To provide voting instructions to Eaton Vance Short Duration Strategic Income Fund, which invests pursuant to a fund-of-funds arrangement, with respect to the approval of a new investment advisory agreement with BMR to serve as investment adviser to Global Opportunities Portfolio |

| 3N. | To provide voting instructions to Eaton Vance Short Duration Strategic Income Fund, which invests pursuant to a fund-of-funds arrangement, with respect to the approval of a new investment advisory agreement with BMR to serve as investment adviser to Global Macro Absolute Return Advantage Portfolio |

| 3O. | To provide voting instructions to Eaton Vance Short Duration Strategic Income Fund, which invests pursuant to a fund-of-funds arrangement, with respect to the approval of a new investment advisory agreement with BMR to serve as investment adviser to Senior Debt Portfolio |

| 3P. | To provide voting instructions to Eaton Vance Short Duration Strategic Income Fund, which invests pursuant to a fund-of-funds arrangement, with respect to the approval of a new investment advisory agreement with BMR to serve as investment adviser to Emerging Markets Local Income Portfolio |

| 3Q. | To provide voting instructions to Eaton Vance Short Duration Strategic Income Fund, which invests pursuant to a fund-of-funds arrangement, with respect to the approval of a new investment advisory and administrative agreement with Eaton Vance to serve as investment adviser and administrator to Eaton Vance Emerging Markets Debt Opportunities Fund |

| 4. | To provide voting instructions to each applicable Investing Fund with respect to the approval of a new investment sub-advisory agreement with the noted sub-adviser to serve as investment sub-adviser to the Portfolio(s) in which such Investing Fund invests |

| 4A. | To provide voting instructions to each applicable Investing Fund listed under Proposal 4A in the attached Proxy Statement, each of which invests pursuant to a master-feeder arrangement, with respect to the approval of a new investment sub-advisory agreement with EVAIL to serve as the investment sub-adviser to the Portfolio in which such Investing Fund invests |

| 4B. | To provide voting instructions to Eaton Vance Floating-Rate & High Income Fund, which invests pursuant to a fund-of-funds arrangement, with respect to the approval of a new investment sub-advisory agreement with EVAIL to serve as the investment sub-adviser to High Income Opportunities Portfolio |

| 4C. | To provide voting instructions to Eaton Vance Tax-Managed Equity Asset Allocation Fund, which invests pursuant to a fund-of-funds arrangement, with respect to the approval of a new investment sub-advisory agreement with Parametric to serve as the investment sub-adviser to Tax-Managed International Equity Portfolio |

| 4D. | To provide voting instructions to each applicable Investing Fund listed under Proposal 4D in the attached Proxy Statement, which invests pursuant to a master-feeder arrangement, with respect to the approval of a new investment sub-advisory agreement with Parametric to serve as the investment sub-adviser to the Portfolio in which such Investing Fund invests |

| 4E. | To provide voting instructions to Eaton Vance Greater India Fund, which invests pursuant to a master-feeder arrangement, with respect to the approval of a new investment sub-advisory agreement with GSAM to serve as the investment sub-adviser to Greater India Portfolio |

Shareholders at the Meeting also may consider and act upon such other matters as may properly come before the Meeting and any adjournments and postponements thereof. Holders of record of shares of the Series at the close of business on December 11, 2020 who have voting power with respect to such shares are entitled to vote, or to provide voting instructions for their Investing Fund to vote, at the Meeting and at any adjournments or postponements thereof. As part of our effort to maintain a safe and healthy environment at the Meeting, the Series and the Series’ Boards of Trustees or Board of Directors, as applicable (each a “Board” and, collectively, the “Boards”), are closely monitoring statements issued by the Centers for Disease Control and Prevention (cdc.gov) and local authorities regarding the novel coronavirus disease, COVID-19. For that reason, the Boards reserve the right to reconsider the date, time, and/or means of convening the Meeting for one or more Series. Subject to any

restrictions imposed by applicable law, the Boards may choose to conduct the Meeting of one or more Series solely by means of remote communications, or may hold a “hybrid” meeting where some participants attend in person and others attend by means of remote communications. If the Boards choose to change the date, time, and/or means of convening the Meeting for a Series, the Series will publicly announce the decision to do so in advance, and details on how to participate will be issued by press release and filed with the U.S. Securities and Exchange Commission as additional proxy material.

This notice and the related proxy materials first are being mailed to shareholders on or about December 23, 2020. This proxy is being solicited on behalf of the Board of each Series.

By Order of the Boards,

/s/ Maureen A. Gemma

Maureen A. Gemma

Secretary

We urge you to mark, sign, date, and mail the enclosed voting proxy card in the postage-paid envelope provided or to record your voting instructions by telephone or via the internet so that your shares are represented at the Meeting.

December 23, 2020

Important Information for Owners of Variable Annuity or Life Insurance Contracts Invested in the Funds

Shares of certain Funds are available to variable life insurance separate accounts and variable annuity contracts (each, a “Contract”) offered by the separate accounts, or sub-accounts thereof, of certain life insurance companies (“Participating Insurance Companies”) and certain qualified plans. Shares of Eaton Vance VT Floating-Rate Income Fund, a series of Eaton Vance Variable Trust, are offered exclusively to such Contracts. The Participating Insurance Companies own shares of these Funds (each, an “Insurance Underlying Fund”) as depositors for the owners of their respective Contracts (each, a “Contract Owner”). Thus, individual Contract Owners are not the “shareholders” of an Insurance Underlying Fund. Rather, the Participating Insurance Companies and their separate accounts are the shareholders. To the extent required to be consistent with the interpretations of voting requirements by the staff of the Securities and Exchange Commission, each Participating Insurance Company will offer to Contract Owners the opportunity to instruct it as to how it should vote shares held by it and the separate accounts on the proposed matters. This Proxy Statement is, therefore, furnished to Contract Owners entitled to give voting instructions with regard to the Insurance Underlying Funds. All persons entitled to direct the voting of shares of an Insurance Underlying Fund, whether or not they are shareholders, are described as voting for purposes of this Proxy Statement.

This document contains a Proxy Statement, Notice of a Special Meeting of Shareholders, and a proxy card. This document explains what you should know before voting on the matters described herein. You may receive a separate voting instruction form by mail. You can use your voting instruction form to instruct your insurance company how to vote on your behalf on these important issues relating to your investment in an Insurance Underlying Fund. If you complete and sign the voting instruction form (or instruct your insurance company by telephone or through the internet how to vote on your behalf), your insurance company will vote the shares corresponding to your insurance contract exactly as you indicate. If you simply sign the voting instruction form, your insurance company will vote the shares corresponding to your insurance contract in accordance with the Trustees’ recommendation on each Proposal applicable to your Insurance Underlying Fund. If you do not return your voting instruction form or record your voting instructions by telephone or through the internet, your insurance company will vote your shares in the same proportion as shares for which instructions have been received.

We urge you to review the Proxy Statement carefully and either fill out your voting instruction form and return it by mail or record your voting instructions by telephone or through the internet. Your prompt return of the enclosed voting instruction form (or providing voting instructions by telephone or through the internet) may save the necessity and expense of further solicitations.

If you have any questions, please call Computershare Fund Services (“Computershare”), your Fund’s proxy solicitor, at the special toll-free number we have set up for you, 866-864-3926, or contact your insurance company.

Important Information for Shareholders of Series that Invest Pursuant to Master-Feeder or Funds-of-Funds Arrangements

Certain Series that are Investing Funds invest their assets in Underlying Funds (including Portfolios and other Underlying Funds) in a master-feeder or fund-of-funds arrangement. The Underlying Fund(s) in which these Investing Funds invest are set forth in Appendix U to the attached Proxy Statement. Shareholders of each Investing Fund are being asked to provide instructions regarding how the Investing Funds, as beneficial owner of interests in an Underlying Fund, should vote on the proposals to approve the new investment advisory agreement and any applicable new investment sub-advisory agreement for the Underlying Fund. This means that each Investing Fund will vote its interests in the Underlying Fund in accordance with the voting instructions received from the Investing Fund’s shareholders and will vote its interests in the Underlying Fund with respect to which it has not received voting instructions in the same proportion (for, against, or abstain) as the interest for which it has received timely instructions from other Series shareholders (this is known as “echo voting”). The Investing Funds do not require that a specified number of shareholders submit voting instructions before an Investing Fund will vote its interests in the applicable Underlying Fund at the applicable meeting for holders of an Underlying Fund (the meeting for the interestholders of the Portfolios to be held separately from the Meeting held for shareholders of the Series). Because each Investing Fund will vote its interest in one or more Underlying Funds using echo voting, a small number of shareholders could determine how an Investing Fund votes its interest in the applicable Underlying Fund. If an Underlying Fund has interestholders in addition to an Investing Fund, it is possible that a Proposal may be approved by the Underlying Fund even if it is not approved by such Investing Fund’s shareholders.

If you are a shareholder in an Investing Fund, you will be asked to vote to approve the new investment advisory agreement and, if applicable, the new sub-advisory agreement for your Investing Fund and will also be asked to provide voting instructions with respect to the approval of the new investment advisory agreement and, if applicable, the new investment sub-advisory agreement for the Underlying Fund(s) in which your Investing Fund invests.

We urge you to review the Proxy Statement carefully and either fill out your proxy card and return it by mail or record your voting instructions by telephone or through the internet. Your prompt return of the enclosed proxy card (or providing voting instructions by telephone or through the internet) may save the necessity and expense of further solicitations.

PROXY STATEMENT

For the Joint Special Meeting of Shareholders

To be held on February 18, 2021

The Trusts/CORPORATIONS eaton Vance Growth Trust Eaton Vance Investment Trust Eaton Vance Municipals Trust Eaton Vance municipals Trust II Eaton Vance mutual funds trust Eaton Vance series Fund, Inc. Eaton Vance Series Trust Eaton Vance Series Trust II Eaton Vance Special Investment Trust Eaton Vance variable Trust Eaton Vance NextShares Trust Eaton vance NextShares Trust II (each a “Trust”) | The portfolios Core Bond Portfolio Emerging Markets Local Income Portfolio Eaton Vance Floating Rate Portfolio Global Income Builder Portfolio GLOBAL MACRO ABSOLUTE RETURN ADVANTAGE PORTFOLIO Global Macro Capital Opportunities Portfolio GLobal Macro Portfolio Global Opportunities Portfolio Greater India Portfolio High Income Opportunities Portfolio International Income Portfolio Senior Debt Portfolio Stock Portfolio Tax-Managed Growth Portfolio Tax-Managed International Equity Portfolio Tax-Managed Multi-Cap Growth Portfolio Tax-Managed Small-Cap Portfolio Tax-Managed Value Portfolio 5-to-15 Year Laddered Municipal Bond Portfolio (each a “Portfolio” and, together, the “Portfolios”) |

The separate series of each Trust as set forth on Appendix A to the enclosed Proxy Statement (each a “Series”), together with the Portfolios, are collectively referred to herein as the “Funds” and, each individually, a “Fund.”

**********

General Information

This Proxy Statement is being furnished in connection with the solicitation of proxies by the Boards of Trustees or Boards of Directors, as applicable (each, a “Board” and, collectively, the “Boards”), of your Series at a meeting to be held jointly at the principal office of the Series, Two International Place, Boston, Massachusetts 02110, on February 18, 2021 at 11:30 a.m. (Eastern Time), and at any and all adjournments or postponements thereof (the “Meeting”), at which shareholders of each Series will be asked to approve, or to submit voting instructions to approve, a new investment advisory agreement with Eaton Vance Management (“Eaton Vance”) or Boston Management and Research (“BMR” and, together with Eaton Vance, the “Advisers” and, each individually, an “Adviser”), as applicable, and shareholders of certain Series will also be asked to approve, or to submit voting instructions to approve, a new investment sub-advisory agreement (each, a “Proposal” and, collectively, the “Proposals”).

This Proxy Statement, along with the enclosed Notice of Joint Special Meeting of Shareholders and the accompanying proxy card(s), is being mailed to shareholders on or about December 23, 2020. It explains what you should know before voting or providing voting instructions on the matters described herein. Please read it carefully and keep it for future reference.

The Advisers provide investment advisory and, in many cases, administrative services to the Funds (except for Series listed on Appendix B that do not currently have investment advisory agreements in place (the “New IAA Series”), for which new investment advisory agreements are being proposed with Eaton Vance and, if applicable, sub-advisory agreements with the applicable sub-adviser). For some Funds advised by Eaton Vance, Eaton Vance provides investment advisory services pursuant to an investment advisory agreement and administrative services pursuant to a separate administrative services agreement. For other Funds advised by Eaton Vance, Eaton Vance provides investment advisory and administrative services

pursuant to a single investment advisory and administrative agreement. For Funds advised by BMR, BMR provides investment advisory services pursuant to an investment advisory agreement and for some, but not all such Funds, Eaton Vance provides administrative services pursuant to a separate administrative services agreement. For the purposes of this Proxy Statement, the term “investment advisory agreement” is, unless otherwise noted, used to refer to each investment advisory agreement and investment advisory and administrative agreement (regardless of the counterparty or type of agreement).

In addition, certain Funds have investment sub-advisory relationships with Eaton Vance Advisers International Ltd. (“EVAIL”), Parametric Portfolio Associates LLC (“Parametric”), Goldman Sachs Asset Management, L.P. (“GSAM”), BMO Global Asset Management (Asia) Limited (“BMO GAM (Asia)”), Atlanta Capital Management Company, LLC (“Atlanta Capital”), Hexavest Inc. (“Hexavest”), or Richard Bernstein Advisors LLC (“RBA”) (each a “Sub-Adviser” and, collectively, the “Sub-Advisers”). Each of EVAIL, Parametric, Atlanta Capital, and Hexavest is an affiliate of the Advisers. For the purposes of this Proxy Statement, the term “investment sub-advisory agreement” is, unless otherwise noted, used to refer to agreements with any of the Sub-Advisers.

Each Proposal is described in detail below. You are being asked to vote on Proposal 1 and Proposal 2, as applicable. With respect to Proposal 3 and Proposal 4, if your Series invests its assets in a Portfolio or other underlying Fund pursuant to a master-feeder or fund-of-funds arrangement (as listed in Appendix U) (each, an “Investing Fund” and the Portfolios and other underlying Funds, the “Underlying Funds”), you are being asked to provide voting instructions to the Investing Fund with respect to how, as a beneficial owner of an interest in the Underlying Fund, the Investing Fund should vote in connection with the approval of a new investment advisory agreement and, if applicable, a new investment sub-advisory agreement for such Underlying Fund.

The new investment advisory agreements with Eaton Vance for the New IAA Series and the new investment sub-advisory agreements with EVAIL or Parametric for the New IAA Series are proposed to become effective for the New IAA Series regardless of whether the Transaction (as defined below) is completed. If approved by shareholders, the new investment advisory agreements and the new investment sub-advisory agreements for the New IAA Series will take effect as of the closing of the Transaction or on another date determined by an officer of the Series. The implementation of the new investment advisory and investment sub-advisory agreements with respect to the other Funds are subject to the closing of the Transaction. Shareholders are not entitled to any appraisal rights or similar rights of dissenters in connection with any Proposal to be considered at the Meeting.

Questions and Answers

Q: Why am I being asked to vote?

A: On October 7, 2020, Eaton Vance Corp. (“EVC”), the parent company of the Advisers, entered into a definitive agreement and plan of merger (the “Merger Agreement”) with Morgan Stanley pursuant to which Morgan Stanley will acquire EVC and its affiliates, including both of the Advisers (the “Transaction”). The closing of the Transaction is subject to the completion or waiver of various conditions, and is expected to close in the second quarter of 2021 (the “Closing”).

The Transaction is relevant to your Fund(s) because either Eaton Vance or BMR serves as investment adviser to your Fund or as investment adviser to a Fund in which your Fund invests. In addition, certain Funds have investment sub-advisory relationships with the Sub-Advisers. Because each of the Advisers, EVAIL, Parametric, and Atlanta Capital are wholly-owned subsidiaries of EVC, upon the Closing, each of the Advisers, EVAIL, Parametric, and Atlanta Capital will become indirect wholly-owned subsidiaries of Morgan Stanley. Hexavest, which is 49% owned by an affiliate of EVC, will become 49% owned directly or indirectly by Morgan Stanley upon the Closing.

Upon the Closing, each Fund’s investment advisory agreement with its Adviser and, if applicable, investment sub-advisory agreement with its Sub-Adviser, may be deemed to automatically terminate. This is because the Investment Company Act of 1940, as amended (the “1940 Act”), which regulates investment companies such as the Funds, requires investment advisory and investment sub-advisory agreements to terminate automatically in the event of an assignment of the agreement.

With respect to the New IAA Series, which invest their assets in a Portfolio pursuant to a master-feeder arrangement, there is currently no investment advisory agreement or sub-advisory agreement in place. Rather, there exists an investment advisory agreement between the underlying Portfolio and BMR and, if applicable, a sub-advisory agreement between BMR and the applicable Sub-Adviser, and the New IAA Series allocates all of its assets to such underlying Portfolio. For consistency across similarly structured funds and investment flexibility, Eaton Vance proposed, and the Board of each such New IAA Series has approved, new investment advisory agreements and, where applicable, sub-advisory agreements, with respect to the New IAA Series. These agreements are being proposed irrespective of the Transaction and are proposed to become effective even if the Closing does not occur. If the investment advisory agreement and, if applicable, investment sub-advisory agreement are approved by shareholders of a New IAA Series, the new agreement(s) will become effective as of the Closing or on another date determined by an officer of the Series. If the Closing does not occur, EVC will continue to be the parent company of each of the Advisers, EVAIL, Parametric, and Atlanta Capital and an affiliate of EVC will continue to own 49% of Hexavest.

Each Fund’s Board unanimously recommends that you approve, and/or submit voting instructions to approve, a new investment advisory agreement with the applicable Adviser and, if applicable, a new investment sub-advisory agreement with the applicable Sub-Adviser, to ensure that these entities will serve as the Funds’ investment advisers and, if applicable, sub-advisers upon the Closing. In connection with the Transaction, each Adviser proposed, and each Fund’s Board approved, a new investment advisory agreement and, if applicable, investment sub-advisory agreement for each Fund. This Proxy Statement describes the Transaction and the new investment advisory agreement and, if applicable, the new investment sub-advisory agreement for each Fund.

Q: How will the Transaction affect the Advisers and the Sub-Advisers?

A: Following the Closing, each of Eaton Vance and BMR is expected to operate as an indirect wholly-owned subsidiary of Morgan Stanley and is expected to retain its existing portfolio management and other key personnel who provide services to the Funds. Further, EVAIL, Parametric, Atlanta Capital, and Hexavest are expected to maintain their respective portfolio management and other key personnel who provide services to the Funds. The Transaction is not expected to affect GSAM, BMO GAM (Asia), or RBA.

Q: How will the Transaction potentially benefit my Fund?

A: It is expected that the Transaction will deliver long-term financial benefits for the Funds. The combined business of EVC and Morgan Stanley will offer a unique public and private market investment solution set to clients in the industry and is expected to have the resources to bring deep capital markets and value-added service excellence to EVC and its affiliates’ relationships. Approval of the new investment advisory and investment sub-advisory agreements will provide continuity of the investment program you selected through your investment in the Fund(s) and help to ensure that each Fund’s operations continue uninterrupted after the Closing.

Q: How does the proposed investment advisory agreement and proposed investment sub-advisory agreement, as applicable, differ from my Fund’s current investment advisory agreement and investment sub-advisory agreement, as applicable?

A: While certain provisions have been updated, the proposed investment advisory agreements with each Adviser are substantially similar to the current investment advisory agreements with such Adviser, and the proposed investment sub-advisory agreements with each Sub-Adviser are substantially similar to the current investment sub-advisory agreements with such Sub-Adviser. The services that your Fund(s) will receive under the new investment advisory agreement and, if applicable, investment sub-advisory agreement are expected to be substantially similar to those it receives under the current investment advisory agreement and, if applicable, investment sub-advisory agreement.

The material differences between (i) the provisions of the proposed investment advisory agreement and each Fund’s current investment advisory agreement and, if applicable, (ii) the provisions of the proposed investment sub-advisory agreement and a Fund’s current investment sub-advisory agreement, are described in more detail within this Proxy Statement and in various Appendices to this Proxy Statement.

For each New IAA Series, the proposed investment advisory agreement with Eaton Vance and, if applicable, the proposed investment sub-advisory agreement between Eaton Vance and the applicable Sub-Adviser, are substantially similar to the current investment advisory agreements between BMR and the applicable Portfolio in which each such New IAA Series invests and, if applicable, the current investment sub-advisory agreement between BMR and the applicable Sub-Adviser.

Q: Will my Fund’s contractual management fee rates increase?

A: No. As shown in Appendices D and E hereto, respectively, the investment advisory fee rates and the investment advisory and administrative services fee rates (collectively referred to as “management fee” rates) proposed for the Funds will remain the same as under their existing agreements. No Sub-Adviser will receive increased investment sub-advisory fees as a result of the Transaction, as shown in Appendix F. The Advisers and certain of the Sub-Advisers have contractually agreed to reimburse certain Funds’ expenses for a specified period and will continue to do so following the Transaction, as set forth in Appendix G.

No changes in the management fees paid by the New IAA Series are anticipated if these agreements are approved by shareholders. Eaton Vance will not charge a management fee with respect to Series assets invested in an underlying Portfolio or other investment company for which Eaton Vance or its affiliates serve as investment adviser and receive an advisory fee. In the event Eaton Vance manages directly any assets of a New IAA Series, the applicable management fee rate payable by such New IAA Series will be the same as that payable to BMR by its corresponding Portfolio. Each New IAA Series expects to continue to invest all of its assets in its respective underlying Portfolio.

Q: Will the new investment advisory agreement and the new investment sub-advisory agreement result in any changes in the portfolio management, investment objective(s), or investment strategy of my Fund?

A: No. The new agreements are not expected to result in any changes to any Fund’s investment objective(s) or investment strategy. Further, the portfolio managers for each Fund (except the New IAA Series, which currently have no portfolio managers) are expected to continue in such roles upon the Closing. The New IAA Series will have the same portfolio managers as their respective corresponding Portfolio, although Eaton Vance will serve as investment adviser to the New IAA Series and BMR will continue to serve as investment adviser to the Portfolios. Eaton Vance and BMR are each wholly-owned subsidiaries of EVC that share common officers, employees, and resources with respect to the management of the applicable Series.

Q: Will one Proposal pass if the other Proposals are not approved?

A: Except with respect to the New IAA Series, the Proposals are subject to the Closing. If the Closing does not occur, the Proposals will be deemed null and the Boards will consider whether other actions are warranted, except that investment advisory and sub-advisory agreements for New IAA Series will be implemented if approved by shareholders. Proposal 1 is not contingent on the approval of any other Proposal. Proposal 2, with respect to a particular Series, is contingent upon approval of Proposal 1 by that Series. If the shareholders of a given Series do not approve Proposal 1, then Proposal 2 will be deemed null with respect to that Series and the Board of that Series will then consider whether other actions, if any, are warranted.

Proposal 3 and Proposal 4 request instructions on how an Investing Fund should vote its interest in one or more Underlying Funds, and are therefore not contingent on the approval of any other Proposal. At the meetings of the Underlying Funds, which will take place on February 18, 2021, the approval of an Underlying Fund’s investment advisory agreement (for which Proposal 3 seeks your instructions) will not be contingent on the approval of any other proposal and the approval of an Underlying

Fund’s investment sub-advisory agreement, as applicable (for which Proposal 4 seeks your instructions), will be contingent on the approval of such Underlying Fund’s investment advisory agreement. If the interestholders of a given Underlying Fund do not approve the new investment advisory agreement for such Underlying Fund (for which Proposal 3 seeks your instructions), then any approval of the new investment sub-advisory agreement for such Underlying Fund (for which Proposal 4 seeks your instructions) will be deemed null with respect to that Underlying Fund and the Board of that Underlying Fund will then consider whether other actions, if any, are warranted.

Q: Will the Transaction be completed if the Proposal(s) are not approved?

A: The Closing may take place even if shareholders of a Fund(s) do not approve the Proposal(s). If this should happen, the Board(s) of such Fund(s) would consider what additional actions to take, which could include continuing to solicit approval of a new investment advisory or sub-advisory agreement. In addition, the Advisers could (and expect to) propose that the Board of each Fund approve an interim investment advisory agreement and, as applicable, an interim investment sub-advisory agreement to permit continuity of management while solicitation continues. The terms of the interim investment advisory and sub-advisory agreements would be identical to those of the current agreements except for term and escrow provisions required by applicable law.

Q: I am the shareholder of a Series that invests its assets in one or more Portfolios or other Underlying Funds. Why am I being asked to provide voting instructions for Proposals 3 and 4?

A: Certain Series are Investing Funds that invest their assets in one or more Underlying Funds (Portfolios or other Underlying Funds) in a master-feeder or fund-of-funds arrangement. The Underlying Fund(s) in which these Investing Funds invest are set forth in Appendix U. Shareholders of each Investing Fund are being asked to provide instructions regarding how their Investing Fund(s), as beneficial owner of interests in the Underlying Fund, should vote on the proposals to approve the new investment advisory agreement and any applicable new investment sub-advisory agreement for the Underlying Fund. This means that each Investing Fund will vote its interest in the Underlying Fund in accordance with the voting instructions received from the Investing Fund’s shareholders and will vote its interest in the Underlying Fund with respect to which it has not received voting instructions in the same proportion (for, against, or abstain) as the interest for which it has received timely instructions from other Series shareholders (this is known as “echo voting”). The Investing Funds do not require that a specified number of shareholders submit voting instructions before an Investing Fund will vote its interest in the applicable Underlying Fund at the applicable meeting of holders of such Underlying Fund (the meeting of the interestholders of the Portfolios to be held separately from the Meeting held for shareholders of the Series). Because each Investing Fund will vote its interest in one or more Underlying Funds using echo voting, a small number of shareholders could determine how an Investing Fund votes its interest in the applicable Underlying Fund. If an Underlying Fund has interestholders in addition to an Investing Fund, it is possible that a Proposal may be approved by the Underlying Fund even if it is not approved by such Investing Fund’s shareholders.

If you are a shareholder in an Investing Fund that invests in an Underlying Fund, you will be asked to vote to approve the new investment advisory agreement and, if applicable, a new investment sub-advisory agreement for your Investing Fund and will also be asked to provide voting instructions with respect to the approval of the new investment advisory agreement and, if applicable, a new investment sub-advisory agreement for the Underlying Fund(s) in which your Investing Fund invests.

Q: How does the Board recommend that shareholders of each Fund vote on the Proposals?

A: Each Board unanimously recommends that you vote, or submit voting instructions, FOR each Proposal applicable to your Fund(s).

Q: Who is asking for my vote?

A: The enclosed proxy card is solicited by each Series’s Board for use at the Meeting of each Series to be held on February 18, 2021 and, if your Series’s Meeting is adjourned or postponed, at any later meetings held, as permitted by such Series’s organizational documents, for the purposes stated in the Notice of Joint Special Meeting provided herewith. The Notice of Joint Special Meeting, the proxy cards, and the Proxy Statement are expected to be mailed beginning on or about December 23, 2020. The Investing Funds will vote their interests in the Portfolios at a separate meeting of Portfolio interestholders to be held on February 18, 2021.

Q: Who is eligible to vote?

A: Shareholders of record of each Series at the close of business on December 11, 2020 (the “Record Date”) who have voting power with respect to such shares are entitled to be present and to vote and, as applicable, give instruction at the Meeting. Such Record Date shall apply to any adjourned or postponed meeting unless the Board fixes a new record date.

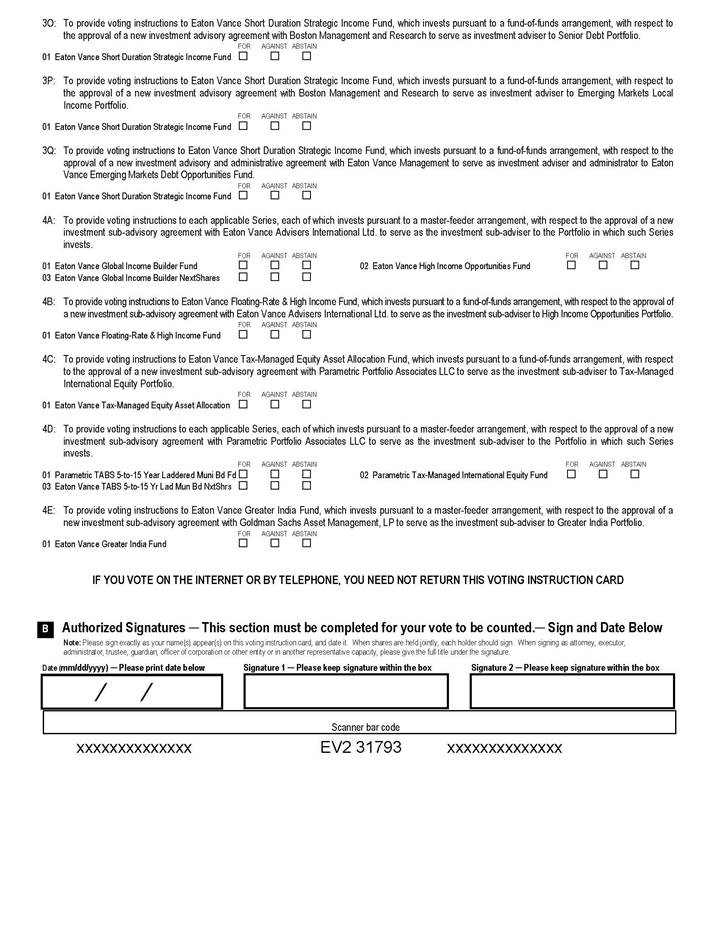

The number of voting securities of each Series outstanding and entitled to vote on the Record Date, is shown in Appendix H. Each whole share held by a shareholder having voting power with respect to such share is entitled to one vote, with fractional shares voting proportionately. Shares represented by your duly executed proxy card(s) will be voted in accordance with your instructions. If you sign the proxy card, but do not fill in a vote, your shares will be voted in accordance with the Board’s recommendation. If any other business is brought before your Series’s Meeting, your shares will be voted at the discretion of the persons designated on the proxy card.

Q: I am the owner of a variable life insurance separate account or a variable annuity contract offered by my insurance company. I am not a shareholder of the Funds. Why am I being asked to vote on proposals for Fund shareholders?

A: You have previously directed your insurance company to invest certain proceeds relating to your variable life insurance separate account and/or variable annuity contract (each a “Contract”) in Eaton Vance VT Floating-Rate Income Fund or another Fund whose shares are available as an investment vehicle for Contracts (each an, “Insurance Underlying Fund”). Although you receive the gains, losses, and income from this investment, your insurance company holds on your behalf any shares corresponding to your account’s investment in an Insurance Underlying Fund. Thus, you are not the “shareholder” of an Insurance Underlying Fund; rather, your insurance company is the shareholder. However, you have the right to instruct your insurance company on how to vote your Insurance Underlying Fund shares corresponding to your investment through your Contract. It is your insurance company, as the shareholder, that will actually vote the shares that correspond to your investment (likely by executing a proxy card) once it receives instructions from its Contract owners.

This Proxy Statement is, therefore, used to solicit voting instructions from you and other owners of Contracts. All persons entitled to direct the voting of shares of an Insurance Underlying Fund, whether or not they are shareholders, are described as voting for purposes of the Proxy Statement.

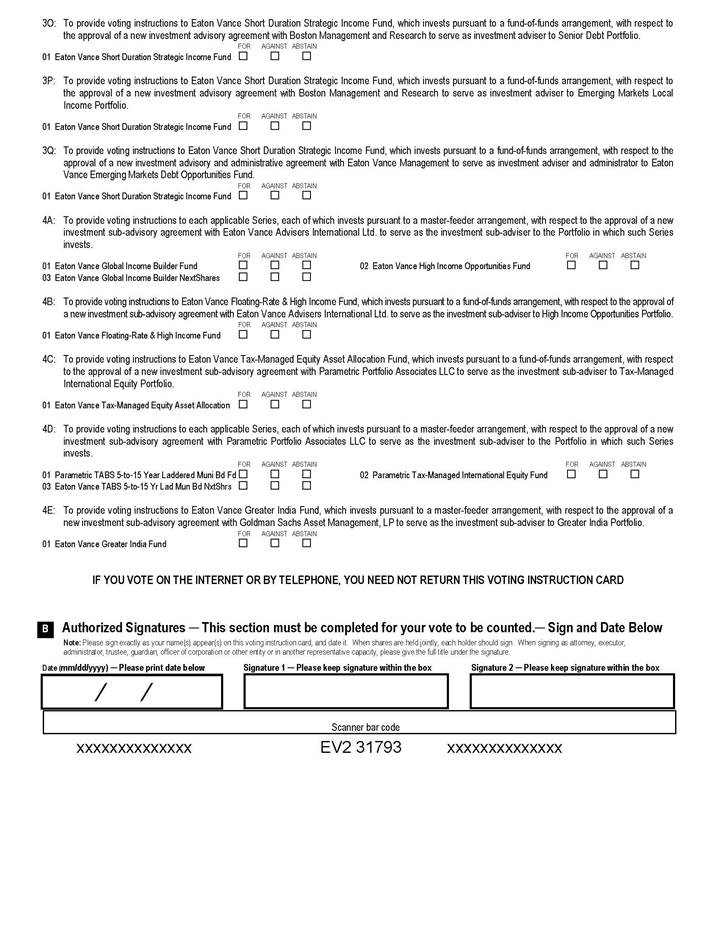

Q: How do I vote my shares?

A: You may vote your shares in one of four ways:

| · | By telephone: Call the toll-free number printed on the enclosed proxy card(s) and follow the directions. |

| · | By internet: Access the website address printed on the enclosed proxy card(s) and follow the directions on the website. |

| · | By mail: Complete, sign, and date the proxy card(s) you received and return in the self-addressed, postage-paid envelope. |

| · | At the Meeting: Vote your shares at the Meeting scheduled to be held at the principal office of the Funds, Two International Place, Boston, Massachusetts 02110, on February 18, 2021 at 11:30 a.m. Eastern Time. |

Q: Is my Fund paying for the Transaction or this proxy solicitation?

A: No. The Funds will not bear any portion of the costs associated with the Transaction. All costs of this Proxy Statement and the Meeting, including proxy solicitation costs, legal fees, and the costs of printing and mailing this Proxy Statement, will be borne by EVC.

Summary of Proposals

The following is a summary of each Proposal to be presented at the Meeting, and identifies which Series’s shareholders are being asked to vote on, or provide voting instructions with respect to, each Proposal. The enclosed proxy card(s) indicate the Series in which you hold shares and the Proposals on which you are being asked to vote or provide instructions.

Proposals:

| 1. | To approve a new investment advisory agreement for each Series with Eaton Vance Management (“Eaton Vance”) or Boston Management and Research (“BMR”), as applicable |

| 1A. | To approve a new investment advisory agreement with Eaton Vance or BMR, as applicable, to serve as the Series’s investment adviser |

Eaton Vance

Eaton Vance Growth Trust

Eaton Vance Worldwide Health Sciences Fund

Eaton Vance Mutual Funds Trust

Eaton Vance AMT-Free Municipal Income Fund

Eaton Vance Emerging and Frontier Countries Equity Fund

Eaton Vance Emerging Markets Local Income Fund

Eaton Vance Floating-Rate Advantage Fund*

Eaton Vance Floating-Rate Fund*

Eaton Vance Floating-Rate & High Income Fund

Eaton Vance High Income Opportunities Fund*

Eaton Vance Global Bond Fund

Eaton Vance Global Macro Absolute Return Fund

Eaton Vance Short Duration Strategic Income Fund

Eaton Vance Stock Fund*

Eaton Vance Tax-Managed Equity Asset Allocation Fund

Eaton Vance Tax-Managed Global Dividend Income Fund

Eaton Vance Tax-Managed Growth Fund 1.1*

Eaton Vance Tax-Managed Growth Fund 1.2*

Eaton Vance Tax-Managed Multi-Cap Growth Fund*

Eaton Vance Tax-Managed Small-Cap Fund*

Eaton Vance Tax-Managed Value Fund*

Parametric Emerging Markets Fund

Parametric Tax-Managed International Equity Fund*

Eaton Vance Series Trust

Eaton Vance Tax-Managed Growth Fund 1.0*

Eaton Vance Series Trust II

Parametric Tax-Managed Emerging Markets Fund

Eaton Vance Special Investment Trust

Eaton Vance Balanced Fund

Eaton Vance Core Bond Fund*

Eaton Vance Real Estate Fund

Eaton Vance Short Duration Inflation-Protected Income Fund

Eaton Vance Variable Trust

Eaton Vance VT Floating-Rate Income Fund

* Denotes Series that currently have no investment advisory agreement and for which approval is being sought for a new investment advisory agreement (New IAA Series).

BMR

Eaton Vance Growth Trust

Eaton Vance Atlanta Capital Focused Growth Fund

Eaton Vance Atlanta Capital SMID-Cap Fund

Eaton Vance Greater China Growth Fund

Eaton Vance Investment Trust

Eaton Vance Floating-Rate Municipal Income Fund

Eaton Vance National Limited Maturity Municipal Income Fund

Eaton Vance New York Municipal Opportunities Fund

Eaton Vance Municipals Trust

Eaton Vance Arizona Municipal Income Fund

Eaton Vance California Municipal Opportunities Fund

Eaton Vance Connecticut Municipal Income Fund

Eaton Vance Georgia Municipal Income Fund

Eaton Vance Maryland Municipal Income Fund

Eaton Vance Massachusetts Municipal Income Fund

Eaton Vance Minnesota Municipal Income Fund

Eaton Vance Missouri Municipal Income Fund

Eaton Vance National Municipal Income Fund

Eaton Vance New Jersey Municipal Income Fund

Eaton Vance New York Municipal Income Fund

Eaton Vance North Carolina Municipal Income Fund

Eaton Vance Ohio Municipal Income Fund

Eaton Vance Oregon Municipal Income Fund

Eaton Vance Pennsylvania Municipal Income Fund

Eaton Vance South Carolina Municipal Income Fund

Eaton Vance Virginia Municipal Income Fund

Eaton Vance Municipals Trust II

Eaton Vance High Yield Municipal Income Fund

Eaton Vance Mutual Funds Trust

Eaton Vance Core Plus Bond Fund

Eaton Vance Global Income Builder Fund

Eaton Vance Global Small-Cap Equity Fund

Eaton Vance Government Opportunities Fund

Eaton Vance Short Duration Government Income Fund

Eaton Vance Series Trust II

Eaton Vance Income Fund of Boston

Eaton Vance Special Investment Trust

Eaton Vance Dividend Builder Fund

Eaton Vance Greater India Fund

Eaton Vance Growth Fund

Eaton Vance Large-Cap Value Fund

Eaton Vance Small-Cap Fund

Eaton Vance Special Equities Fund

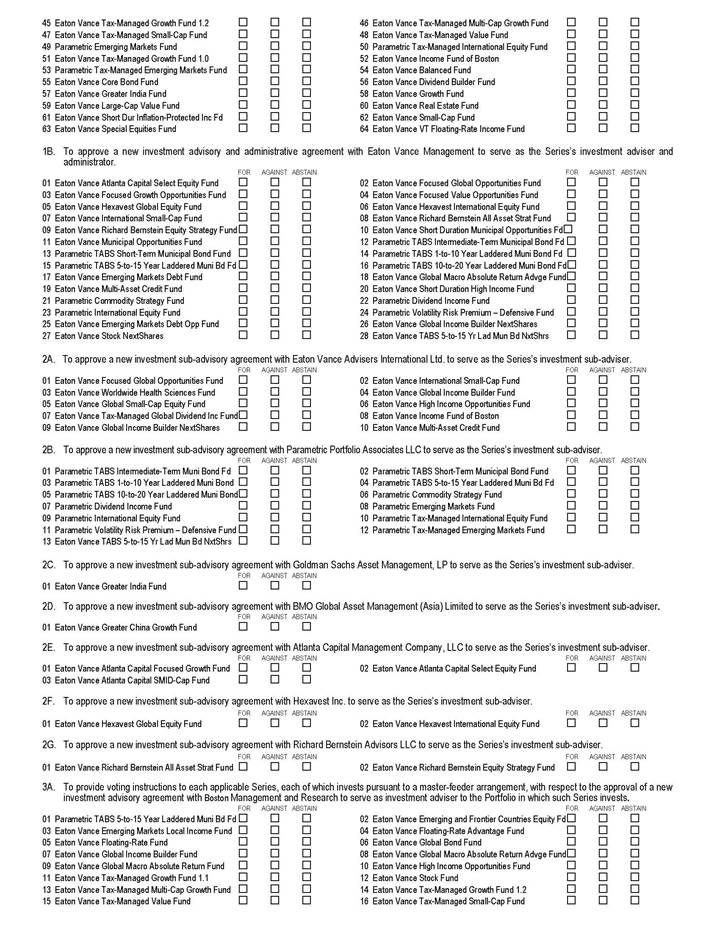

| 1B. | To approve a new investment advisory and administrative agreement with Eaton Vance to serve as the Series’s investment adviser and administrator |

Eaton Vance Growth Trust

Eaton Vance Atlanta Capital Select Equity Fund

Eaton Vance Focused Global Opportunities Fund

Eaton Vance Focused Growth Opportunities Fund

Eaton Vance Focused Value Opportunities Fund

Eaton Vance Hexavest Global Equity Fund

Eaton Vance Hexavest International Equity Fund

Eaton Vance International Small-Cap Fund

Eaton Vance Richard Bernstein All Asset Strategy Fund

Eaton Vance Richard Bernstein Equity Strategy Fund

Eaton Vance Investment Trust

Eaton Vance Short Duration Municipal Opportunities Fund

Eaton Vance Municipals Trust

Eaton Vance Municipal Opportunities Fund

Eaton Vance Municipals Trust II

Parametric TABS Intermediate-Term Municipal Bond Fund

Parametric TABS Short-Term Municipal Bond Fund

Parametric TABS 1-to-10 Year Laddered Municipal Bond Fund

Parametric TABS 5-to-15 Year Laddered Municipal Bond Fund

Parametric TABS 10-to-20 Year Laddered Municipal Bond Fund

Eaton Vance Mutual Funds Trust

Eaton Vance Emerging Markets Debt Fund

Eaton Vance Global Macro Absolute Return Advantage Fund

Eaton Vance Multi-Asset Credit Fund

Eaton Vance Short Duration High Income Fund

Parametric Commodity Strategy Fund

Parametric Dividend Income Fund

Parametric International Equity Fund

Parametric Volatility Risk Premium – Defensive Fund

Eaton Vance Series Fund, Inc.

Eaton Vance Emerging Markets Debt Opportunities Fund

Eaton Vance NextShares Trust

Eaton Vance Global Income Builder NextShares

Eaton Vance Stock NextShares

Eaton Vance NextShares Trust II

Eaton Vance TABS 5-to-15 Year Laddered Municipal Bond NextShares

| 2. | To approve a new investment sub-advisory agreement with the noted Sub-Adviser for each applicable Series listed below |

| 2A. | To approve a new investment sub-advisory agreement with Eaton Vance Advisers International Ltd. (“EVAIL”) to serve as the Series’s investment sub-adviser |

Eaton Vance Growth Trust

Eaton Vance Focused Global Opportunities Fund

Eaton Vance International Small-Cap Fund

Eaton Vance Worldwide Health Sciences Fund

Eaton Vance Mutual Funds Trust

Eaton Vance Global Income Builder Fund

Eaton Vance Global Small-Cap Equity Fund

Eaton Vance High Income Opportunities Fund*

Eaton Vance Multi-Asset Credit Fund

Eaton Vance Tax-Managed Global Dividend Income Fund

Eaton Vance Series Trust II

Eaton Vance Income Fund of Boston

Eaton Vance NextShares Trust

Eaton Vance Global Income Builder NextShares

* Denotes New IAA Series that currently have no investment sub-advisory agreement and for which approval is being sought for a new investment sub-advisory agreement.

| 2B. | To approve a new investment sub-advisory agreement with Parametric Portfolio Associates LLC (“Parametric”) to serve as the Series’s investment sub-adviser |

Eaton Vance Municipals Trust II

Parametric TABS Intermediate-Term Municipal Bond Fund

Parametric TABS Short-Term Municipal Bond Fund

Parametric TABS 1-to-10 Year Laddered Municipal Bond Fund

Parametric TABS 5-to-15 Year Laddered Municipal Bond Fund

Parametric TABS 10-to-20 Year Laddered Municipal Bond Fund

Eaton Vance Mutual Funds Trust

Parametric Commodity Strategy Fund

Parametric Dividend Income Fund

Parametric Emerging Markets Fund

Parametric International Equity Fund

Parametric Tax-Managed International Equity Fund*

Parametric Volatility Risk Premium – Defensive Fund

Eaton Vance Series Trust II

Parametric Tax-Managed Emerging Markets Fund

Eaton Vance NextShares Trust II

Eaton Vance TABS 5-to-15 Year Laddered Municipal Bond NextShares

* Denotes New IAA Series that currently has no investment sub-advisory agreement and for which approval is being sought for a new investment sub-advisory agreement.

| 2C. | To approve a new investment sub-advisory agreement with Goldman Sachs Asset Management, L.P. (“GSAM”) to serve as the Series’s investment sub-adviser |

Eaton Vance Special Investment Trust

Eaton Vance Greater India Fund

| 2D. | To approve a new investment sub-advisory agreement with BMO Global Asset Management (Asia) Limited (“BMO GAM (Asia)”) to serve as the Series’s investment sub-adviser |

Eaton Vance Growth Trust

Eaton Vance Greater China Growth Fund

| 2E. | To approve a new investment sub-advisory agreement with Atlanta Capital Management Company, LLC (“Atlanta Capital”) to serve as the Series’s investment sub-adviser |

Eaton Vance Growth Trust

Eaton Vance Atlanta Capital Focused Growth Fund

Eaton Vance Atlanta Capital Select Equity Fund

Eaton Vance Atlanta Capital SMID-Cap Fund

| 2F. | To approve a new investment sub-advisory agreement with Hexavest Inc. (“Hexavest”) to serve as the Series’s investment sub-adviser |

Eaton Vance Growth Trust

Eaton Vance Hexavest Global Equity Fund

Eaton Vance Hexavest International Equity Fund

| 2G. | To approve a new investment sub-advisory agreement with Richard Bernstein Advisors LLC (“RBA”) to serve as the Series’s investment sub-adviser |

Eaton Vance Growth Trust

Eaton Vance Richard Bernstein All Asset Strategy Fund

Eaton Vance Richard Bernstein Equity Strategy Fund

| 3. | To provide voting instructions to each applicable Investing Fund with respect to the approval of a new investment advisory agreement with Eaton Vance or BMR, as applicable, to serve as investment adviser to the Underlying Fund(s) in which such Investing Fund invests |

| 3A. | To provide voting instructions to each applicable Investing Fund, each of which invests pursuant to a master-feeder arrangement, with respect to the approval of a new investment advisory agreement with BMR to serve as investment adviser to the Portfolio in which such Investing Fund invests |

| Investing Fund | Portfolio |

| Eaton Vance Core Bond Fund | Core Bond Portfolio |

| Eaton Vance Emerging and Frontier Countries Equity Fund | Global Macro Capital Opportunities Portfolio |

| Eaton Vance Emerging Markets Local Income Fund | Emerging Markets Local Income Portfolio |

| Eaton Vance Floating-Rate Advantage Fund | Senior Debt Portfolio |

| Eaton Vance Floating-Rate Fund | Eaton Vance Floating Rate Portfolio |

| Eaton Vance Global Bond Fund | International Income Portfolio |

| Eaton Vance Global Income Builder Fund | Global Income Builder Portfolio |

| Eaton Vance Global Income Builder NextShares | Global Income Builder Portfolio |

| Eaton Vance Global Macro Absolute Return Advantage Fund | Global Macro Absolute Return Advantage Portfolio |

| Eaton Vance Global Macro Absolute Return Fund | Global Macro Portfolio |

| Eaton Vance Greater India Fund | Greater India Portfolio |

| Eaton Vance High Income Opportunities Fund | High Income Opportunities Portfolio |

| Eaton Vance Stock Fund | Stock Portfolio |

| Eaton Vance Stock NextShares | Stock Portfolio |

| Eaton Vance TABS 5-to-15 Year Laddered Municipal Bond NextShares | 5-to-15 Year Laddered Municipal Bond Portfolio |

| Eaton Vance Tax-Managed Growth Fund 1.0 | Tax-Managed Growth Portfolio |

| Eaton Vance Tax-Managed Growth Fund 1.1 | Tax-Managed Growth Portfolio |

| Eaton Vance Tax-Managed Growth Fund 1.2 | Tax-Managed Growth Portfolio |

| Eaton Vance Tax-Managed Multi-Cap Growth Fund | Tax-Managed Multi-Cap Growth Portfolio |

| Eaton Vance Tax-Managed Small-Cap Fund | Tax-Managed Small-Cap Portfolio |

| Eaton Vance Tax-Managed Value Fund | Tax-Managed Value Portfolio |

| Parametric TABS 5-to-15 Year Laddered Municipal Bond Fund | 5-to-15 Year Laddered Municipal Bond Portfolio |

| Parametric Tax-Managed International Equity Fund | Tax-Managed International Equity Portfolio |

| 3B. | To provide voting instructions to Eaton Vance Floating-Rate & High Income Fund, which invests pursuant to a fund-of-funds arrangement, with respect to the approval of a new investment advisory agreement with BMR to serve as investment adviser to Eaton Vance Floating Rate Portfolio |

| 3C. | To provide voting instructions to Eaton Vance Floating-Rate & High Income Fund, which invests pursuant to a fund-of-funds arrangement, with respect to the approval of a new investment advisory agreement with BMR to serve as investment adviser to High Income Opportunities Portfolio |

| 3D. | To provide voting instructions to Eaton Vance Tax-Managed Equity Asset Allocation Fund, which invests pursuant to a fund-of-funds arrangement, with respect to the approval of a new investment advisory agreement with BMR to serve as investment adviser to Tax-Managed Growth Portfolio |

| 3E. | To provide voting instructions to Eaton Vance Tax-Managed Equity Asset Allocation Fund, which invests pursuant to a fund-of-funds arrangement, with respect to the approval of a new investment advisory agreement with BMR to serve as investment adviser to Tax-Managed International Equity Portfolio |

| 3F. | To provide voting instructions to Eaton Vance Tax-Managed Equity Asset Allocation Fund, which invests pursuant to a fund-of-funds arrangement, with respect to the approval of a new investment advisory agreement with BMR to serve as investment adviser to Tax-Managed Multi-Cap Growth Portfolio |

| 3G. | To provide voting instructions to Eaton Vance Tax-Managed Equity Asset Allocation Fund, which invests pursuant to a fund-of-funds arrangement, with respect to the approval of a new investment advisory agreement with BMR to serve as investment adviser to Tax-Managed Small-Cap Portfolio |

| 3H. | To provide voting instructions to Eaton Vance Tax-Managed Equity Asset Allocation Fund, which invests pursuant to a fund-of-funds arrangement, with respect to the approval of a new investment advisory agreement with BMR to serve as investment adviser to Tax-Managed Value Portfolio |

| 3I. | To provide voting instructions to Eaton Vance Balanced Fund, which invests pursuant to a fund-of-funds arrangement, with respect to the approval of a new investment advisory agreement with BMR to serve as investment adviser to Core Bond Portfolio |

| 3J. | To provide voting instructions to Eaton Vance Balanced Fund, which invests pursuant to a fund-of-funds arrangement, with respect to the approval of a new investment advisory agreement with BMR to serve as investment adviser to Stock Portfolio |

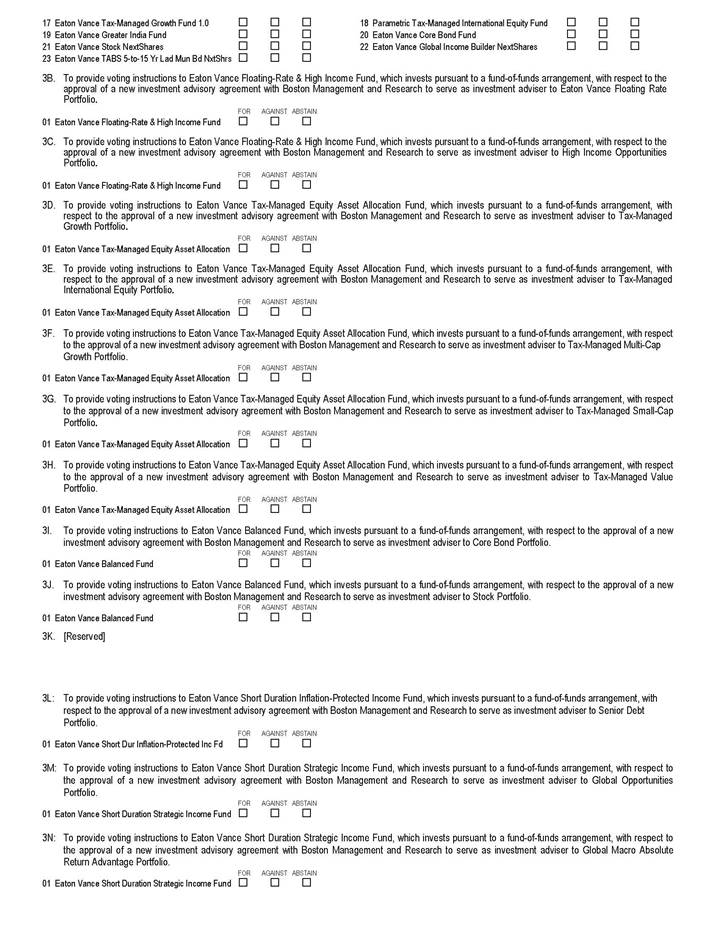

| 3L. | To provide voting instructions to Eaton Vance Short Duration Inflation-Protected Income Fund, which invests pursuant to a fund-of-funds arrangement, with respect to the approval of a new investment advisory agreement with BMR to serve as investment adviser to Senior Debt Portfolio |

| 3M. | To provide voting instructions to Eaton Vance Short Duration Strategic Income Fund, which invests pursuant to a fund-of-funds arrangement, with respect to the approval of a new investment advisory agreement with BMR to serve as investment adviser to Global Opportunities Portfolio |

| 3N. | To provide voting instructions to Eaton Vance Short Duration Strategic Income Fund, which invests pursuant to a fund-of-funds arrangement, with respect to the approval of a new investment advisory agreement with BMR to serve as investment adviser to Global Macro Absolute Return Advantage Portfolio |

| 3O. | To provide voting instructions to Eaton Vance Short Duration Strategic Income Fund, which invests pursuant to a fund-of-funds arrangement, with respect to the approval of a new investment advisory agreement with BMR to serve as investment adviser to Senior Debt Portfolio |

| 3P. | To provide voting instructions to Eaton Vance Short Duration Strategic Income Fund, which invests pursuant to a fund-of-funds arrangement, with respect to the approval of a new investment advisory agreement with BMR to serve as investment adviser to Emerging Markets Local Income Portfolio |

| 3Q. | To provide voting instructions to Eaton Vance Short Duration Strategic Income Fund, which invests pursuant to a fund-of-funds arrangement, with respect to the approval of a new investment advisory and administrative agreement with Eaton Vance to serve as investment adviser and administrator to Eaton Vance Emerging Markets Debt Opportunities Fund |

| 4. | To provide voting instructions to each applicable Investing Fund with respect to the approval of a new investment sub-advisory agreement with the noted Sub-Adviser to serve as investment sub-adviser to the Portfolio(s) in which such Investing Fund invests |

| 4A. | To provide voting instructions to each applicable Investing Fund, each of which invests pursuant to a master-feeder arrangement, with respect to the approval of a new investment sub-advisory agreement with EVAIL to serve as the investment sub-adviser to the Portfolio in which such Investing Fund invests |

| Investing Fund | Portfolio |

| Eaton Vance Global Income Builder Fund | Global Income Builder Portfolio |

| Eaton Vance Global Income Builder NextShares | Global Income Builder Portfolio |

| Eaton Vance High Income Opportunities Fund | High Income Opportunities Portfolio |

| 4B. | To provide voting instructions to Eaton Vance Floating-Rate & High Income Fund, which invests pursuant to a fund-of-funds arrangement, with respect to the approval of a new investment sub-advisory agreement with EVAIL to serve as the investment sub-adviser to High Income Opportunities Portfolio |

| 4C. | To provide voting instructions to Eaton Vance Tax-Managed Equity Asset Allocation Fund, which invests pursuant to a fund-of-funds arrangement, with respect to the approval of a new investment sub-advisory agreement with Parametric to serve as the investment sub-adviser to Tax-Managed International Equity Portfolio |

| 4D. | To provide voting instructions to each applicable Investing Fund, each of which invests pursuant to a master-feeder arrangement, with respect to the approval of a new investment sub-advisory agreement with Parametric to serve as the investment sub-adviser to the Portfolio in which such Investing Fund invests |

| Investing Fund | Portfolio |

| Parametric Tax-Managed International Equity Fund | Tax-Managed International Equity Portfolio |

| Parametric TABS 5-to-15 Year Laddered Municipal Bond Fund | 5-to-15 Year Laddered Municipal Bond Portfolio |

| Eaton Vance TABS 5-to-15 Year Laddered Municipal Bond NextShares | 5-to-15 Year Laddered Municipal Bond Portfolio |

| 4E. | To provide voting instructions to Eaton Vance Greater India Fund, which invests pursuant to a master-feeder arrangement, with respect to the approval of a new investment sub-advisory agreement with GSAM to serve as the investment sub-adviser to Greater India Portfolio |

Proposal 1

TO APPROVE A NEW INVESTMENT ADVISORY AGREEMENT

Each Board has unanimously approved, and recommends that shareholders of each Series approve, a new investment advisory agreement between the Series and Eaton Vance or BMR, as applicable, as investment adviser. Eaton Vance and BMR are each wholly-owned subsidiaries of EVC that share common officers, employees, and resources with respect to the management of the applicable Series.

| Proposal 1A: | To Approve a New Investment Advisory Agreement with Eaton Vance or BMR, as applicable |

It is proposed that Eaton Vance or BMR, as applicable, serve as investment adviser to each Series listed in Proposal 1A under “Summary of Proposals” herein pursuant to a new investment advisory agreement between each such Series and Eaton Vance or BMR, as applicable.

The form of the proposed investment advisory agreement with Eaton Vance or BMR, as applicable, is attached as Appendix I. You should refer to Appendix I for the complete terms of each applicable Series’s proposed investment advisory agreement.

| Proposal 1B: | To Approve a New Investment Advisory and Administrative Agreement with Eaton Vance |

It is proposed that Eaton Vance serve as investment adviser and administrator to each Series listed in Proposal 1B under “Summary of Proposals” herein pursuant to a new investment advisory and administrative agreement between each such Series and Eaton Vance.

The form of the proposed investment advisory and administrative agreement is attached as Appendix J. You should refer to Appendix J for the complete terms of each Series’s applicable proposed investment advisory and administrative agreement.

| Proposal 1A: | To Approve a New Investment Advisory Agreement with Eaton Vance or BMR |

Comparison of New Investment Advisory Agreements with Current Investment Advisory Agreements