First Quarter Investor Presentation May 5, 2022

Safe Harbor Disclosure 2 We make forward-looking statements in this presentation that are subject to risks and uncertainties. These forward-looking statements include information about possible or assumed future results of our business, financial condition, liquidity, results of operations, cash flow and plans and objectives. When we use the words “believe,” “expect,” “anticipate,” “estimate,” “plan,” “continue,” “intend,” “should,” “may” or similar expressions, we intend to identify forward-looking statements. Statements regarding the following subjects, among others, may be forward-looking: market trends in our industry, interest rates, real estate values, the debt financing markets or the general economy or the demand for and availability of residential and small-balance commercial real estate loans; our business and investment strategy; our projected operating results; actions and initiatives of the U.S. government and changes to U.S. government policies and the execution and impact of these actions, initiatives and policies; the state of the U.S. economy generally or in specific geographic regions; economic trends and economic recoveries; our ability to obtain and maintain financing arrangements; changes in the value of our mortgage portfolio; changes to our portfolio of properties; impact of and changes in governmental regulations, tax law and rates, accounting guidance and similar matters; our ability to satisfy the real estate investment trust qualification requirements for U.S. federal income tax purposes; availability of qualified personnel; estimates relating to our ability to make distributions to our stockholders in the future; general volatility of the capital markets and the market price of our shares of common stock; and the degree and nature of our competition. The forward-looking statements included in this presentation are based on our current beliefs, assumptions and expectations of our future performance. Forward-looking statements are not predictions of future events. Our beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are currently known to us or reasonably expected to occur at this time. If a change in our beliefs, assumptions or expectations occurs, our business, financial condition, liquidity and results of operations may vary materially from the forward-looking statements included in this presentation. Forward-looking statements are subject to risks and uncertainties, including, among other things, those resulting from the pandemic caused by Covid-19 or one its variants and those described under Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2021, which can be accessed through the link to our Securities and Exchange Commission ("SEC") filings on our website (www.greatajax.com) or at the SEC's website (www.sec.gov). Other risks, uncertainties and factors that could cause actual results to differ materially from the forward-looking statements included in this presentation may be described from time to time in reports we file with the SEC. Any forward-looking statement speaks only as of the date on which it is made. New risks and uncertainties arise over time, and it is not possible for us to predict those events or how they may affect us. Except as required by law, we are not obligated to, and do not intend to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Unless stated otherwise, financial information included in this presentation is as of March 31, 2022.

Business Overview 3 Leverage longstanding relationships to acquire mortgage loans through privately negotiated transactions from a diverse group of customers and in joint venture investments with institutional investors – Acquisitions made in 356 transactions since inception. Four transactions closed in Q1 2022 Use our manager’s proprietary analytics to price each mortgage pool on an asset-by-asset basis – We own 19.8% of our manager – Adjust individual loan bid price to accumulate clusters of loans in attractive demographic metropolitan areas Our affiliated servicer services the loans asset-by-asset and borrower-by-borrower – We own 8% and hold warrants to purchase up to an additional 12% of our affiliated servicer – Analytics and processes of our manager and servicer enable us to broaden our reach through joint ventures with third-party institutional investors We use modest mark to market leverage to fund our investments in debt securities and primarily non mark to market leverage to fund our mortgage portfolio As of March 31, 2022, we own a 22.2% equity interest in Gaea Real Estate Corp. (“GAEA”), an equity REIT that invests in multifamily properties with a focus on property appreciation and triple net lease vet clinics

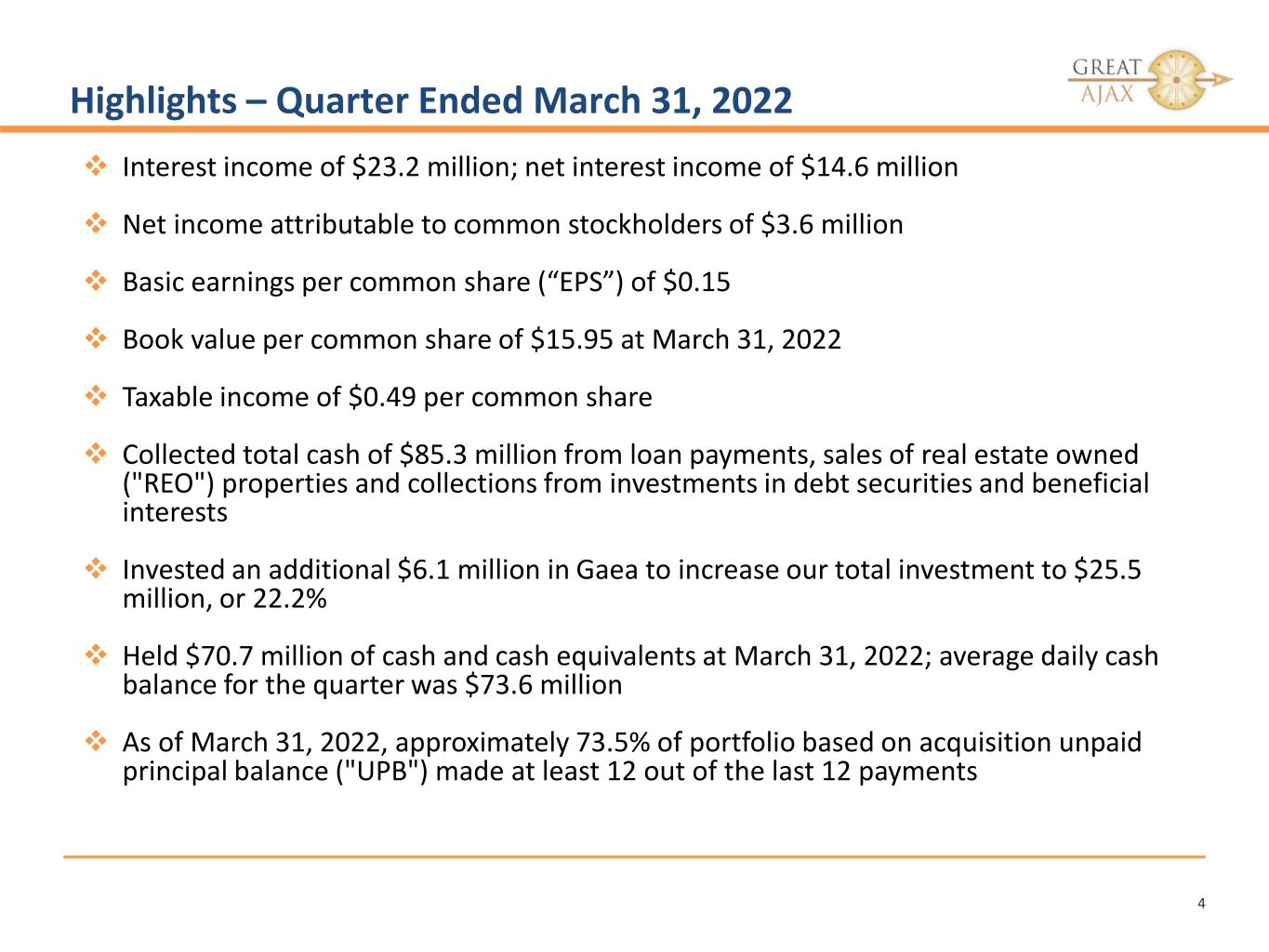

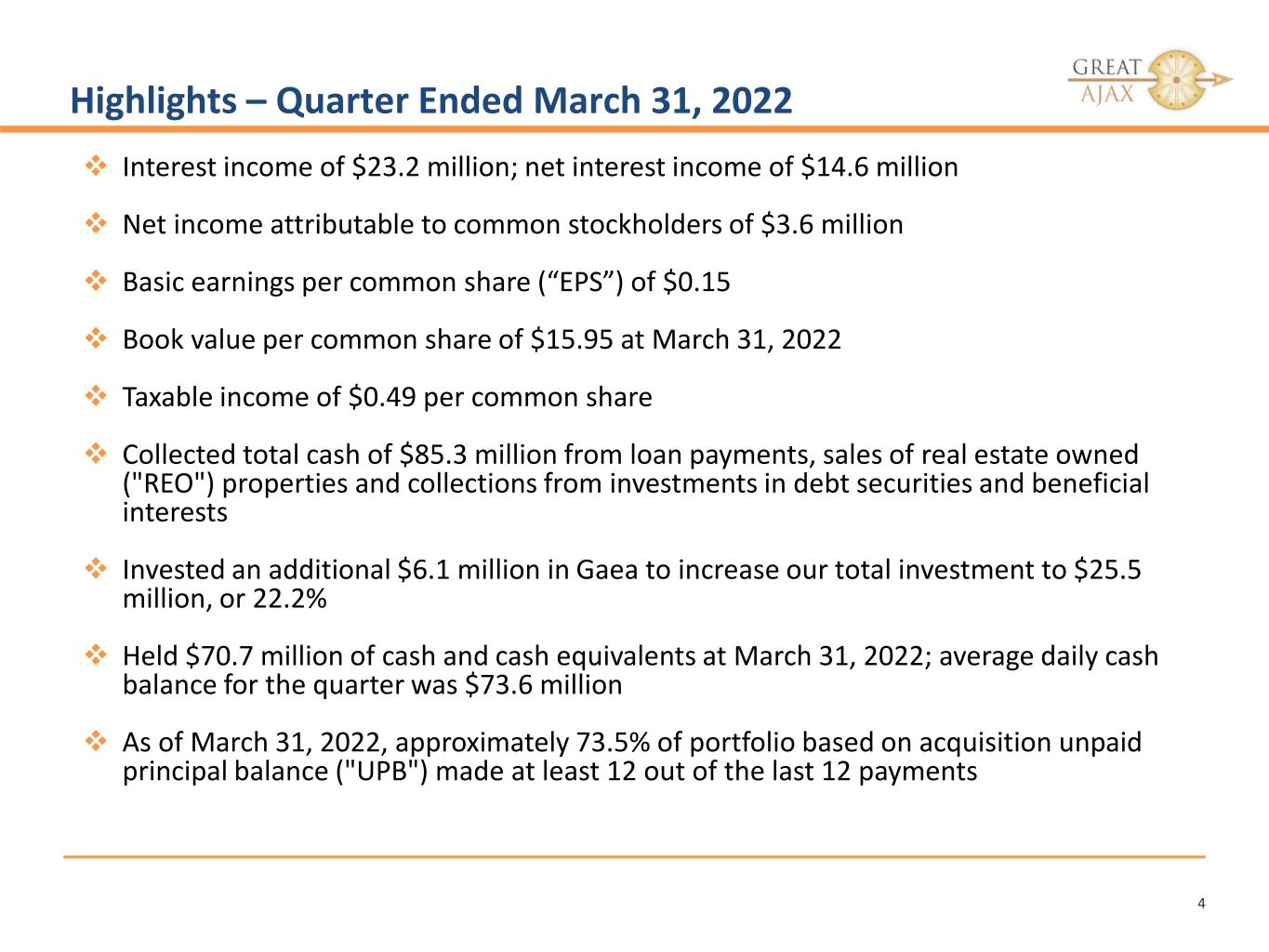

Highlights – Quarter Ended March 31, 2022 4 Interest income of $23.2 million; net interest income of $14.6 million Net income attributable to common stockholders of $3.6 million Basic earnings per common share (“EPS”) of $0.15 Book value per common share of $15.95 at March 31, 2022 Taxable income of $0.49 per common share Collected total cash of $85.3 million from loan payments, sales of real estate owned ("REO") properties and collections from investments in debt securities and beneficial interests Invested an additional $6.1 million in Gaea to increase our total investment to $25.5 million, or 22.2% Held $70.7 million of cash and cash equivalents at March 31, 2022; average daily cash balance for the quarter was $73.6 million As of March 31, 2022, approximately 73.5% of portfolio based on acquisition unpaid principal balance ("UPB") made at least 12 out of the last 12 payments

Loan Portfolio Overview – as of March 31, 2022 5 $1,111.6 MM RPL1: $987.1 MM NPL : $124.5 MM $2,181.0 MM RPL: $1,961.3 MM NPL: $ 211.7 MM REO & Rental2: $ 8.0 MM 1 Includes $1.03 million UPB in joint ventures with third party institutional accredited investors that are required to be consolidated for GAAP 2 REO and rental property value is presented at estimated property fair value less expected liquidation costs 89% 11% Unpaid Principal Balance RPL NPL 89.9% 9.7% 0.4% Property Value RPL NPL REO

Loan Portfolio Growth 6 RPL UPB includes $19.2 million of SBC loans, which are performing loans. RPL status stays constant based on initial purchase status $974 $1,397 $1,427 $1,171 $1,156 $987 $1,196 $1,881 $1,969 $1,864 $1,943 $1,961 $774 $1,167 $1,230 $1,023 $990 $876 0 500 1,000 1,500 2,000 2,500 3/31/2017 3/31/2018 3/31/2019 3/31/2020 3/31/2021 3/31/2022 M ill io ns Re-performing Loans UPB Property Value Price

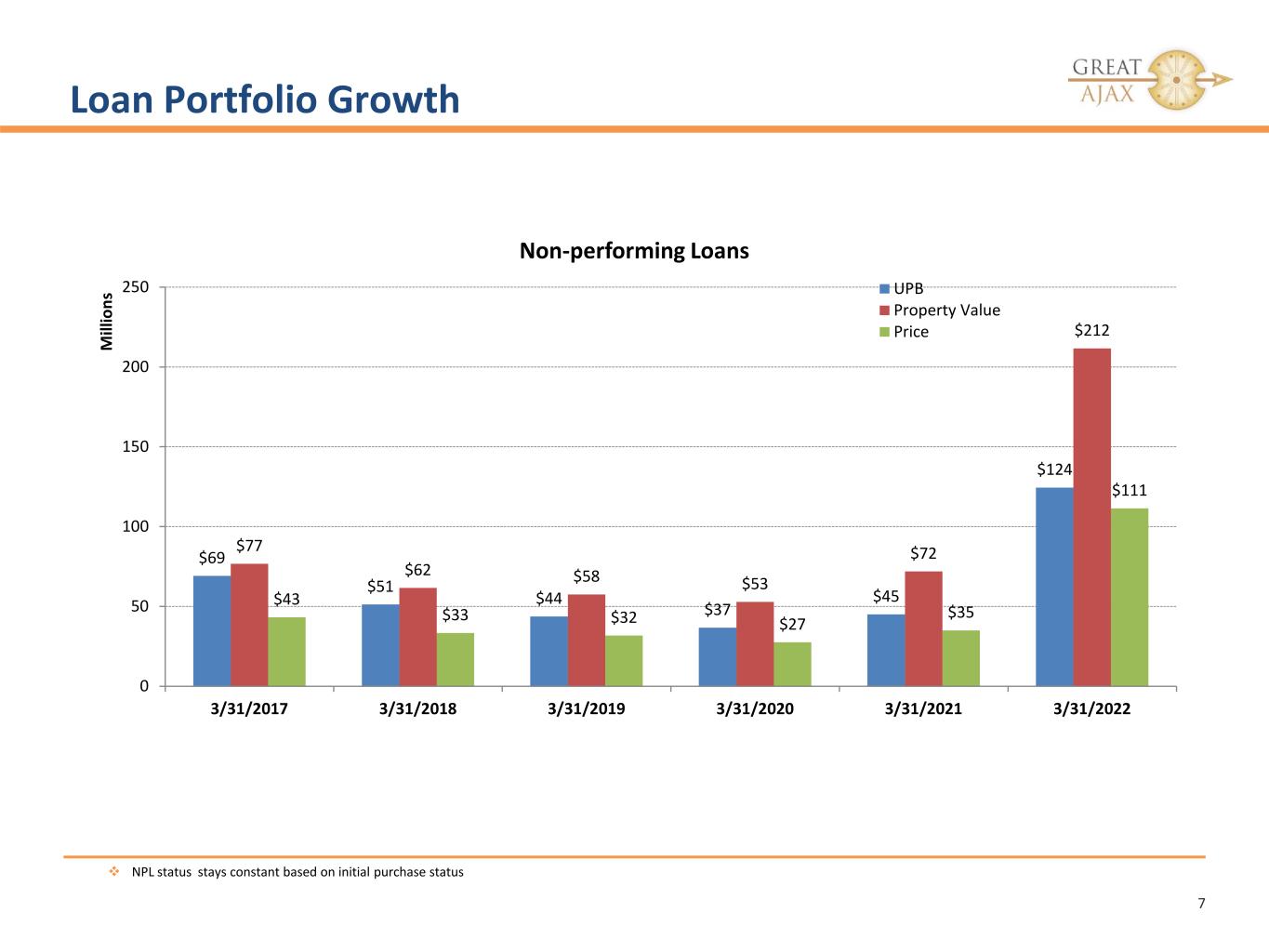

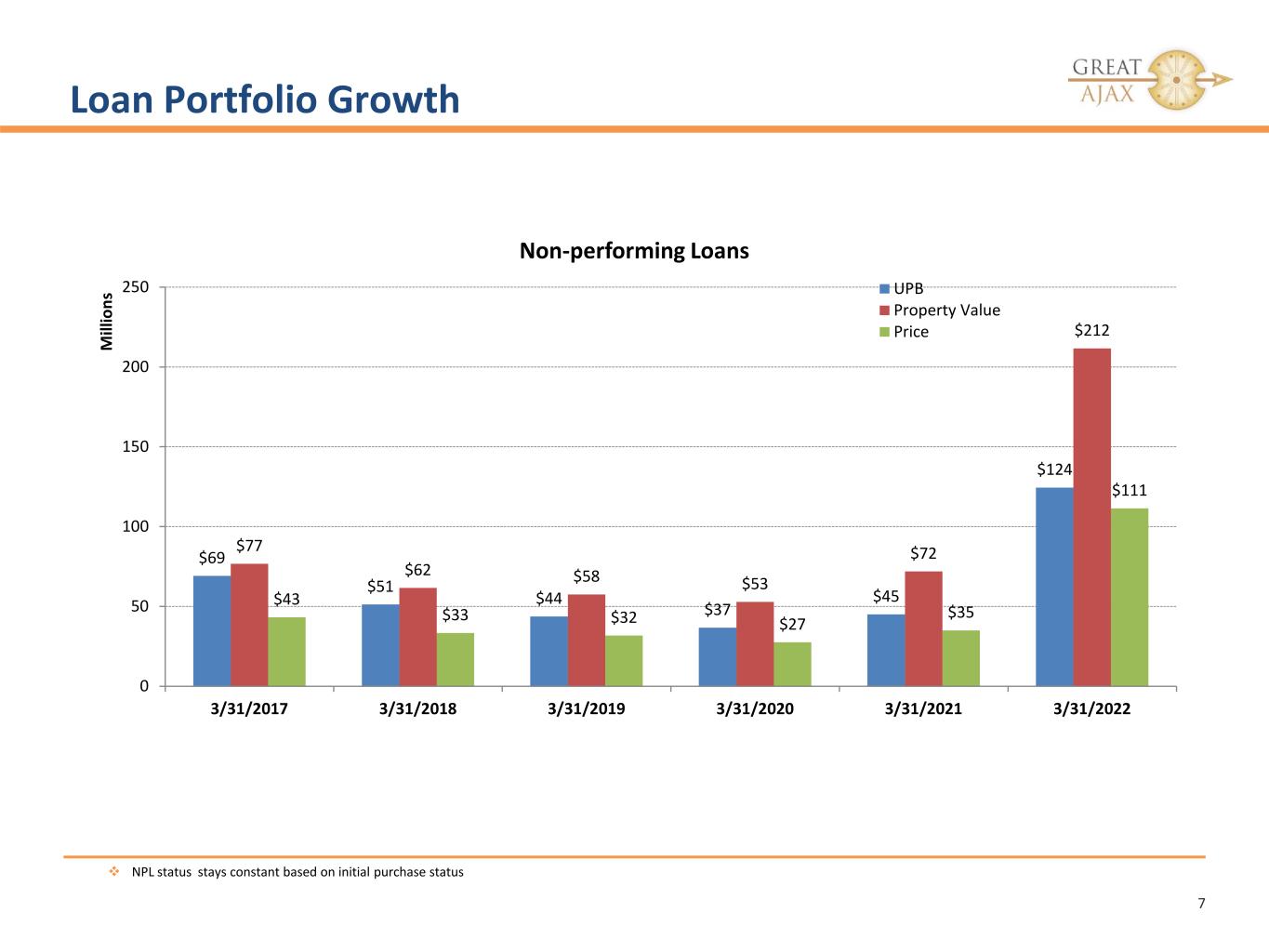

Loan Portfolio Growth 7 NPL status stays constant based on initial purchase status $69 $51 $44 $37 $45 $124 $77 $62 $58 $53 $72 $212 $43 $33 $32 $27 $35 $111 0 50 100 150 200 250 3/31/2017 3/31/2018 3/31/2019 3/31/2020 3/31/2021 3/31/2022 M ill io ns Non-performing Loans UPB Property Value Price

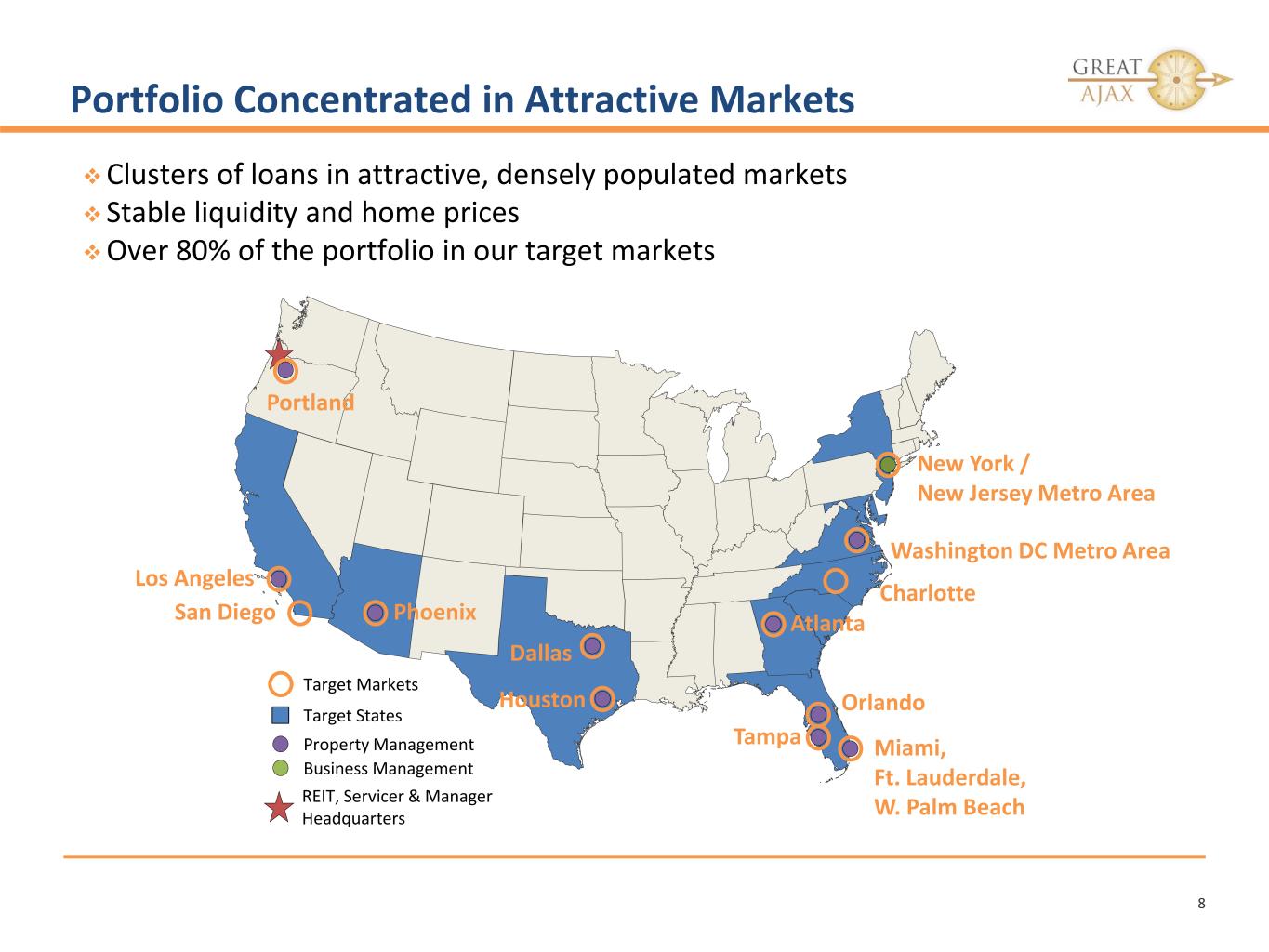

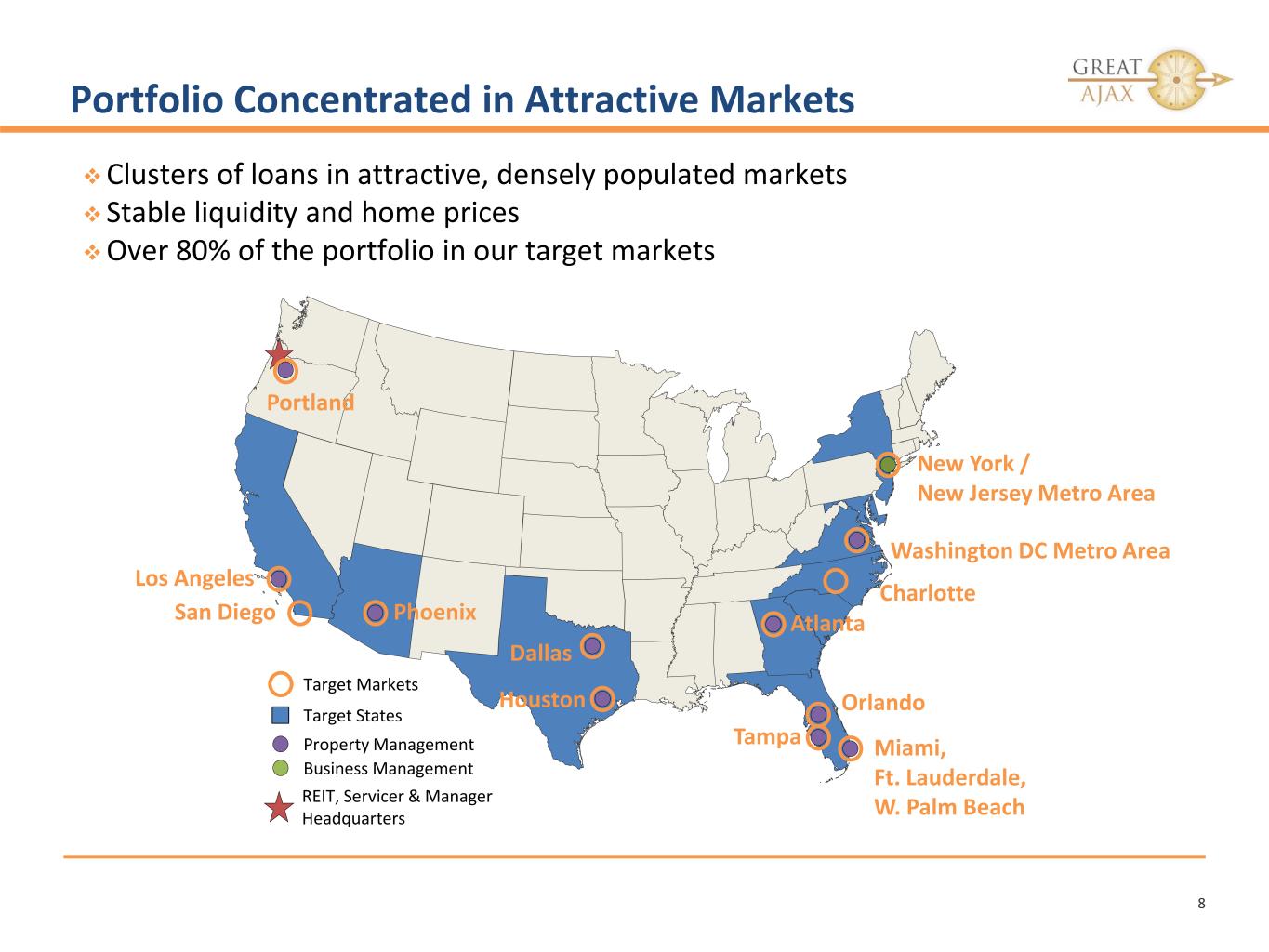

Portfolio Concentrated in Attractive Markets 8 Clusters of loans in attractive, densely populated markets Stable liquidity and home prices Over 80% of the portfolio in our target markets Target States Target Markets Los Angeles San Diego Dallas Portland Phoenix Washington DC Metro Area Atlanta Orlando Tampa Miami, Ft. Lauderdale, W. Palm Beach New York / New Jersey Metro Area REIT, Servicer & Manager Headquarters Property Management Business Management Houston Charlotte

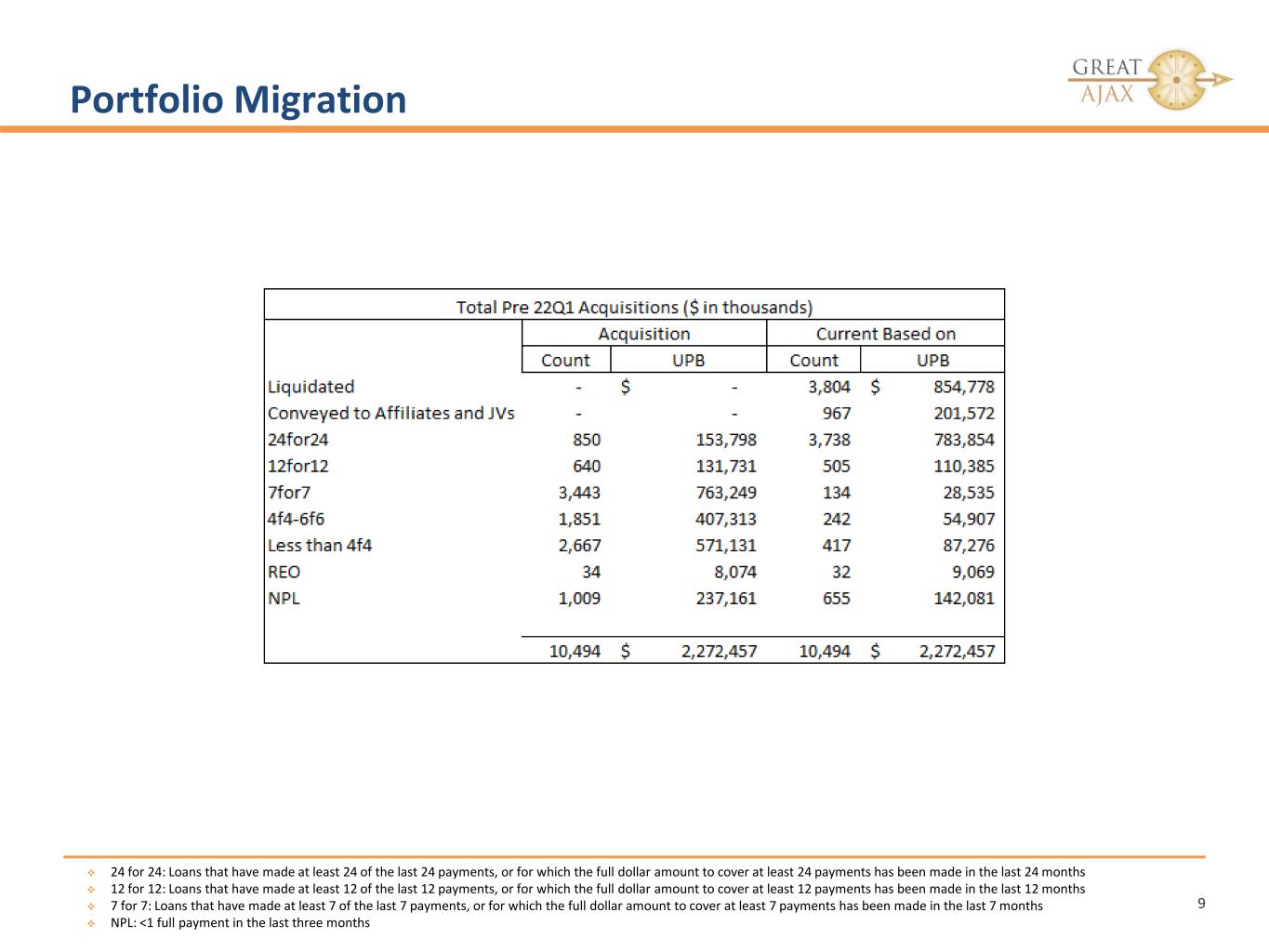

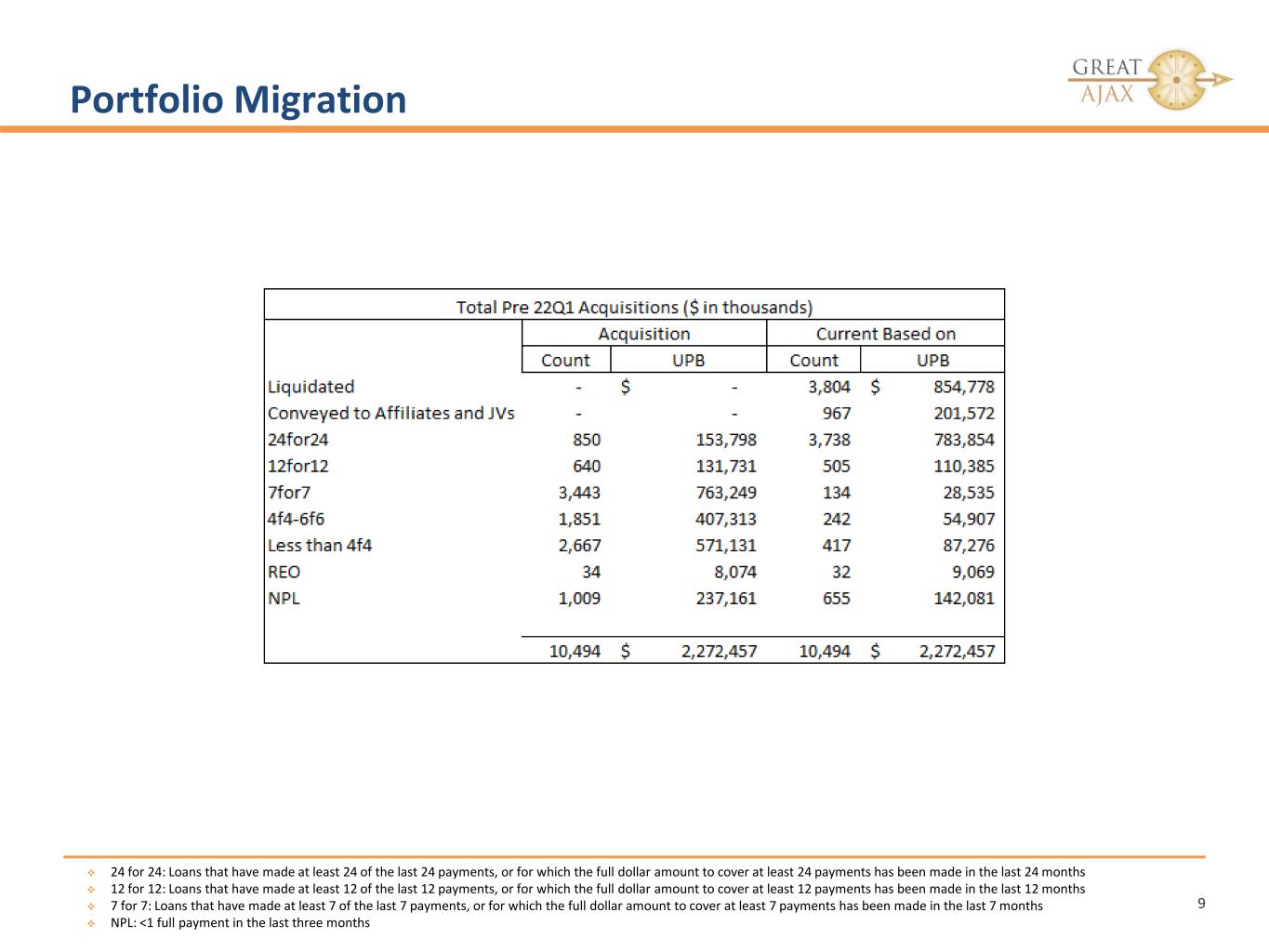

Portfolio Migration 9 24 for 24: Loans that have made at least 24 of the last 24 payments, or for which the full dollar amount to cover at least 24 payments has been made in the last 24 months 12 for 12: Loans that have made at least 12 of the last 12 payments, or for which the full dollar amount to cover at least 12 payments has been made in the last 12 months 7 for 7: Loans that have made at least 7 of the last 7 payments, or for which the full dollar amount to cover at least 7 payments has been made in the last 7 months NPL: <1 full payment in the last three months

Subsequent Events 10 1 While these acquisitions are expected to close, there can be no assurance that these acquisitions will close or that the terms thereof may not change. Acquisitions Under Contract1 RPL UPB: $6.7MM Collateral Value: $15.3MM Price/UPB: 97.2% Price/Collateral Value: 42.6% 26 loans in 7 transactions NPL UPB: $3.9MM Collateral Value: $8.6MM Price/UPB: 102.0% Price/Collateral Value: 46.3% 27 loans in 1 transaction Acquisitions Closed since 3/31/2022 RPL UPB: $184.4K Collateral Value: $387.9K Price/UPB: 93.1% Price/Collateral Value: 44.3% 2 loans in 2 transactions NPL UPB: $170.6K Collateral Value: $347.0K Price/UPB: 94.0% Price/Collateral Value: 46.2% 1 loan in 1 transaction On April 14, 2022, with an accredited institutional investor we refinanced our 2018-D and 2018-G joint ventures into 2022-A and retained $47.7 million of varying classes of agency rated securities and equity. We acquired 23.28% of the securities and trust certificates from the trust. 2022-A acquired 811 RPLs and NPLs with UPB of $215.5 million and an aggregate property value of $518.8 million. The AAA through A rated securities represent 71.9% of the UPB of the underlying mortgage loans and carry a weighted average coupon of 3.47%. This is the first fully rated securitization structure to include a substantial amount of NPLs. Approximately 33.9% of loan UPB in 2022-A was 60 days or more delinquent A dividend of $0.26 share, to be paid on May 31, 2022 to common stockholders of record as of May 16, 2022

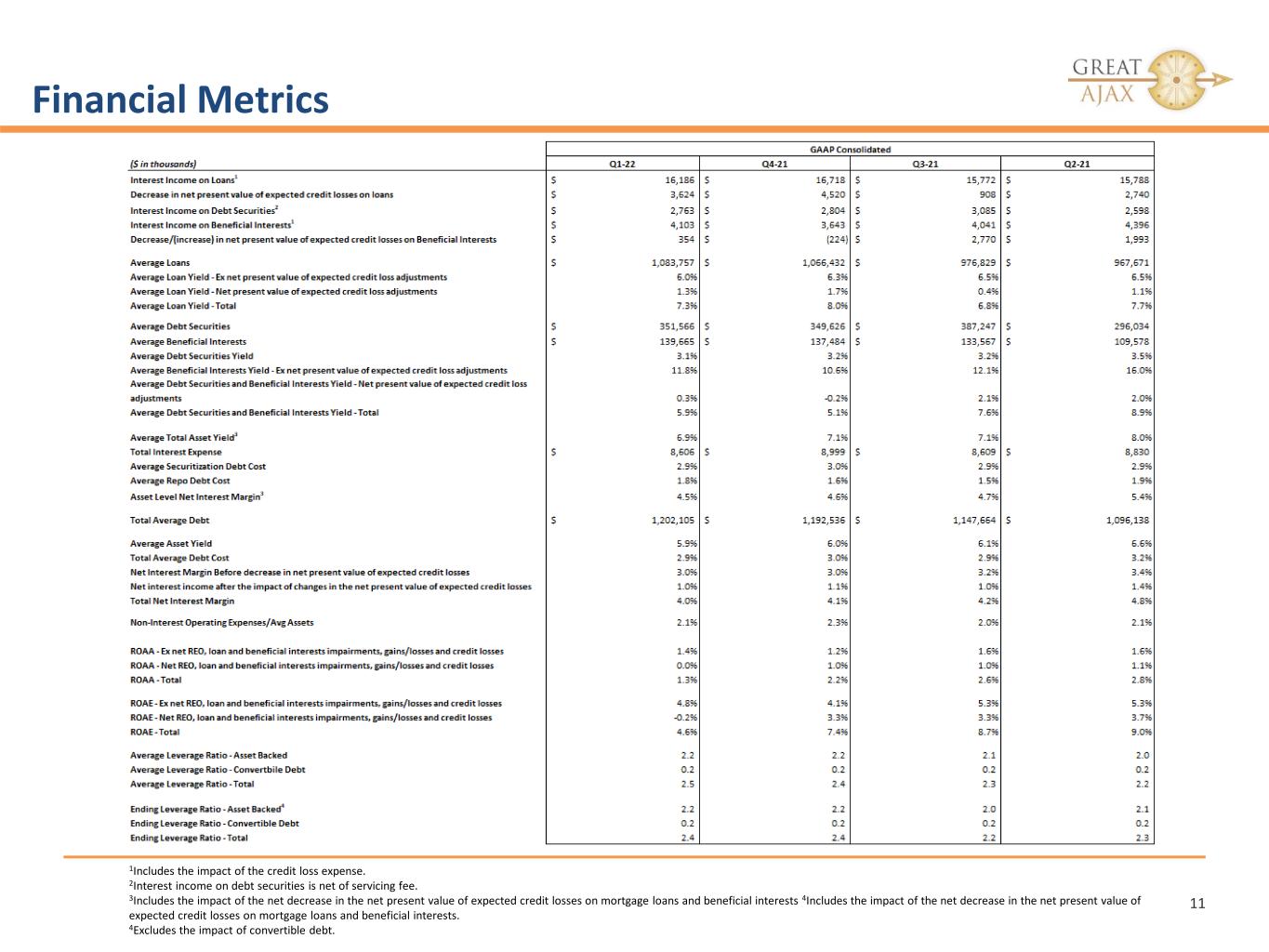

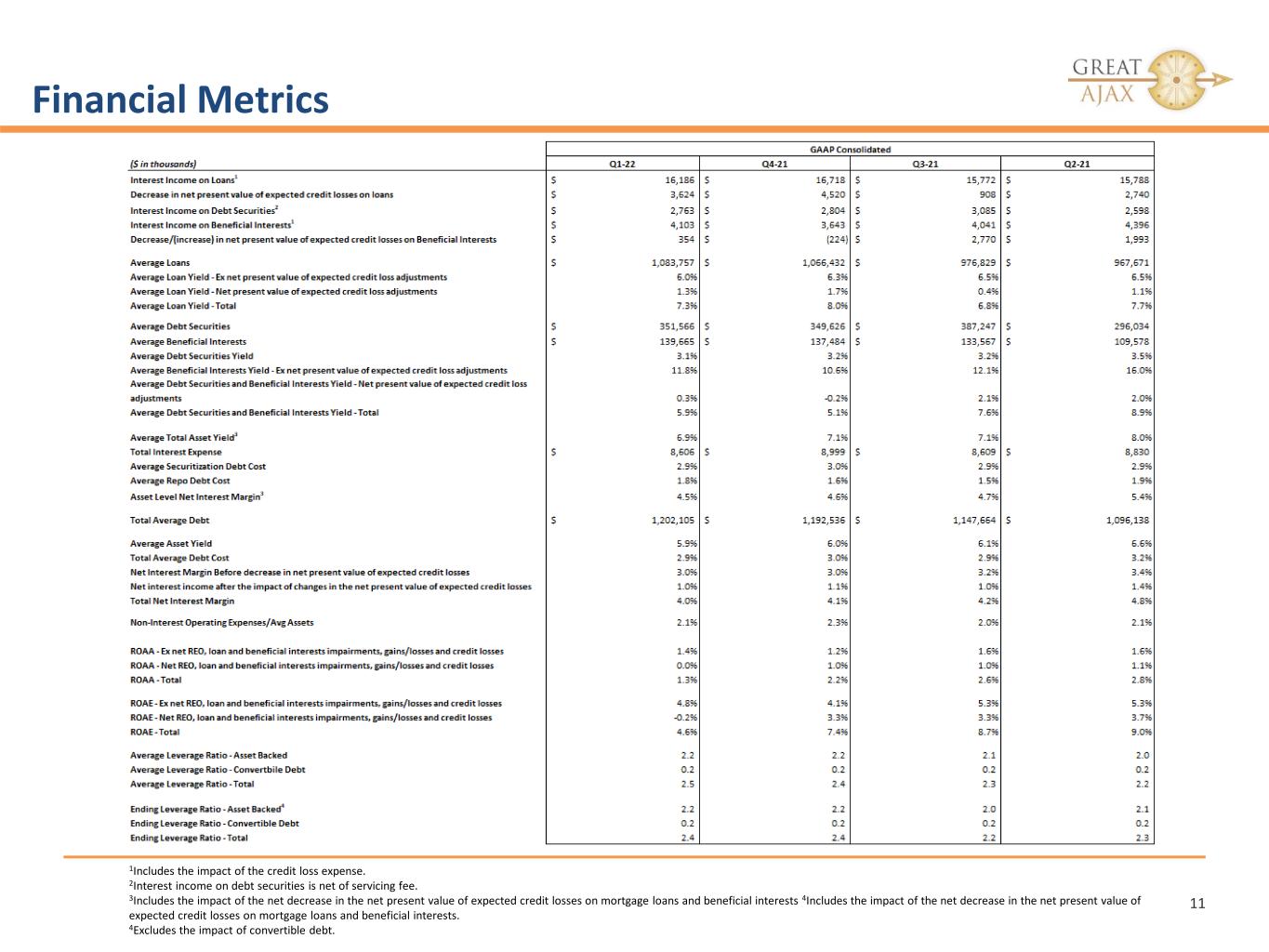

Financial Metrics 11 1Includes the impact of the credit loss expense. 2Interest income on debt securities is net of servicing fee. 3Includes the impact of the net decrease in the net present value of expected credit losses on mortgage loans and beneficial interests 4Includes the impact of the net decrease in the net present value of expected credit losses on mortgage loans and beneficial interests. 4Excludes the impact of convertible debt.

Securities and Loan Repurchase Agreement Funding 12

Consolidated Statements of Income 13 1Net decrease in the net present value of expected credit losses represents the net decrease to the allowance resulting from changes in actual and expected cash flows during the quarters ended March 31, 2022, December 31, 2022, September 30, 2021 and June 30, 2021. It represents the net increase of the present value of the expected cash flows in excess of contractual cash flows offset by any incremental provision expense on the Mortgage loan pools and Beneficial interests. The decrease is calculated at the pool level for Mortgage loans and at the security level for Beneficial interests. To the extent a pool or Beneficial interest has an associated allowance, the decrease in expected credit losses is recorded in the period in which the change occurs, otherwise it is recognized prospectively as an increase in yield.

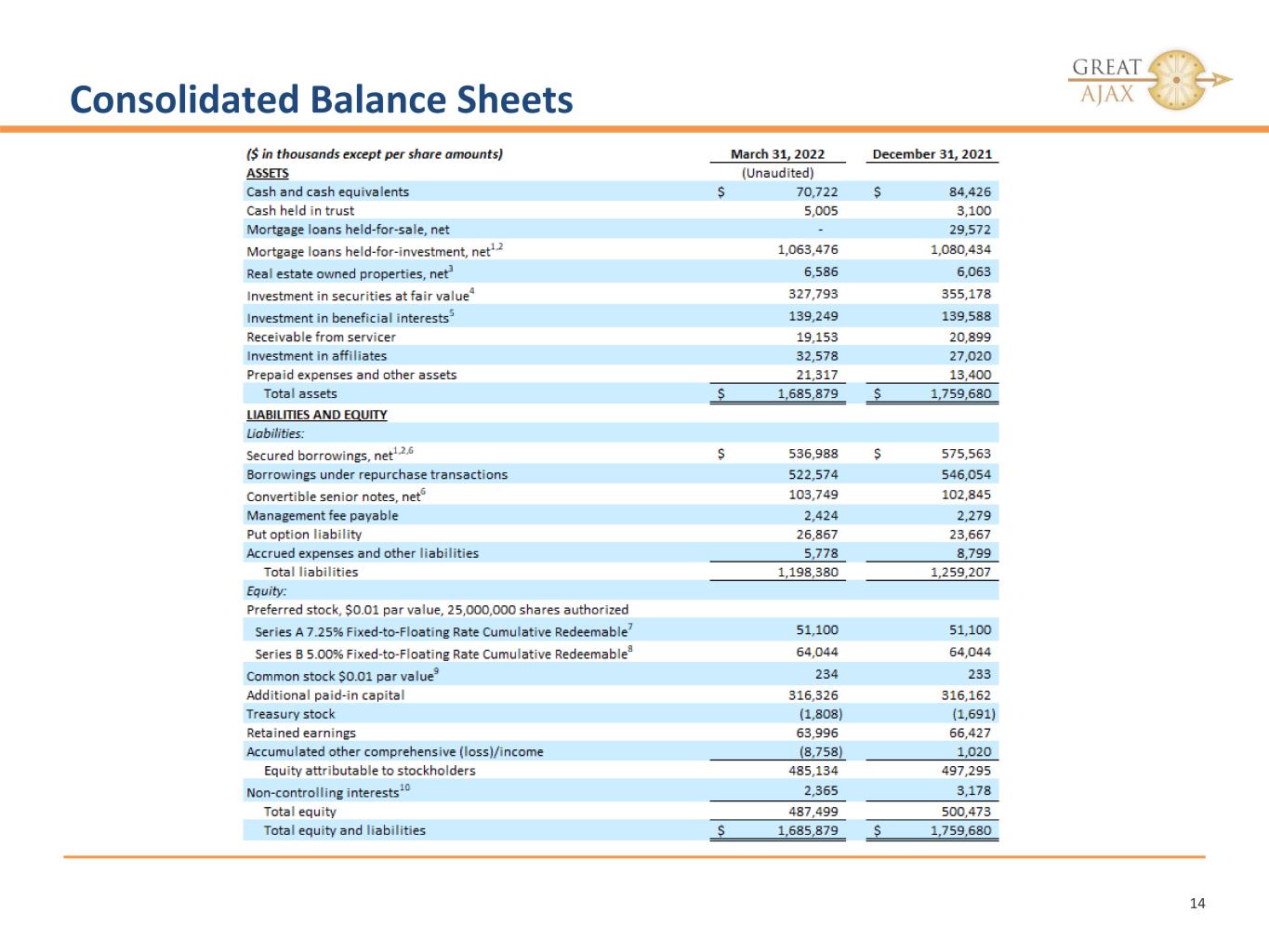

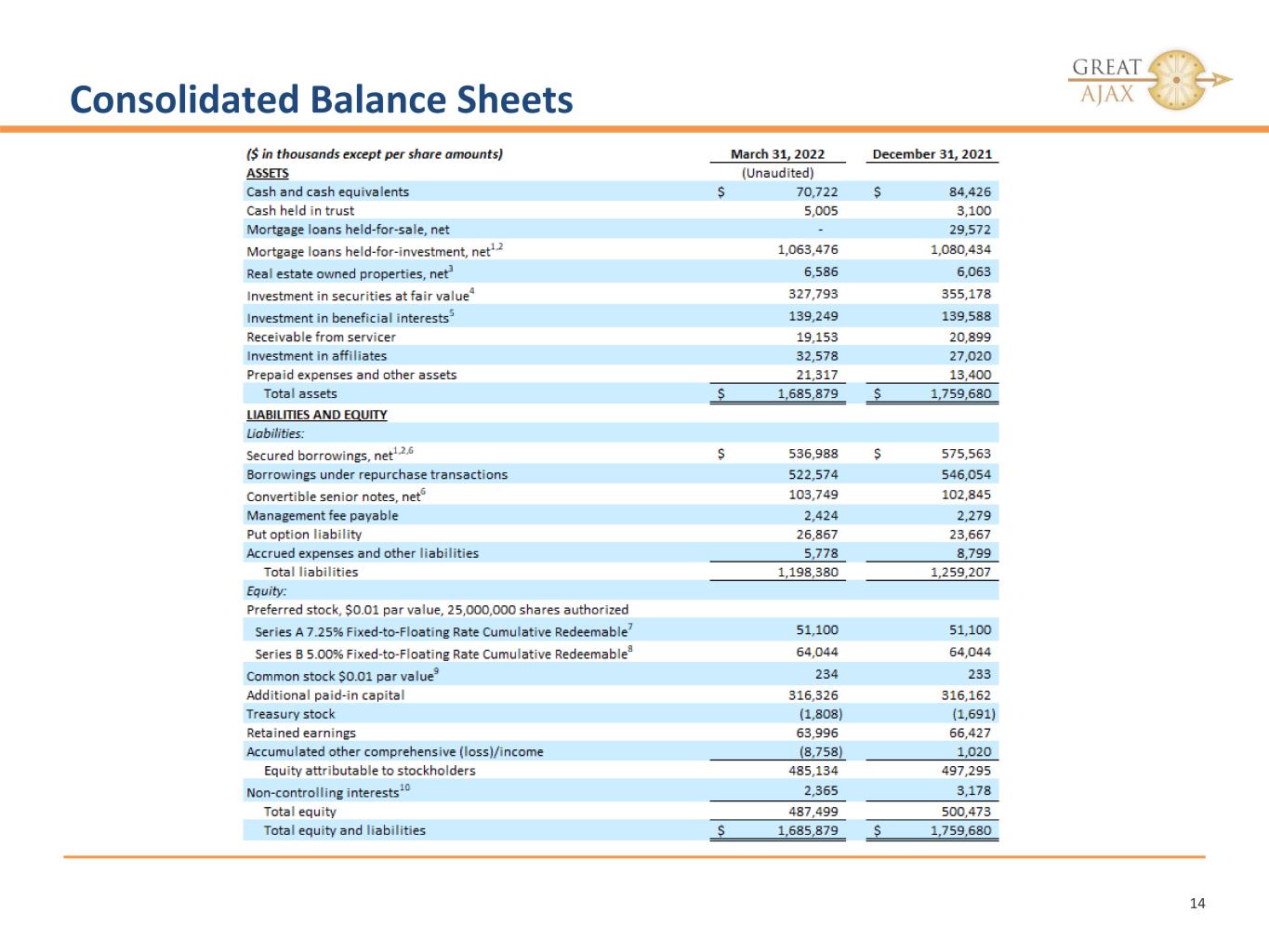

Consolidated Balance Sheets 14

Consolidated Balance Sheets Footnotes 15 1. Mortgage loans held-for-investment, net include $729.0 million and $756.8 million of loans at March 31, 2022 and December 31, 2021, respectively, transferred to securitization trusts that are variable interest entities (“VIEs”); these loans can only be used to settle obligations of the VIEs. Secured borrowings consist of notes issued by VIEs that can only be settled with the assets and cash flows of the VIEs. The creditors do not have recourse to the primary beneficiary (Great Ajax Corp.). Mortgage loans held-for-investment, net include $7.7 million and $7.1 million of allowance for expected credit losses at March 31, 2022 and December 31, 2021, respectively. 2. As of March 31, 2022 and December 31, 2021, balances for Mortgage loans held-for-investment, net include $1.0 million and $1.4 million, respectively, from a 50.0% owned joint venture, which we consolidate under U.S. Generally Accepted Accounting Principles ("U.S. GAAP"). The creditors do not have recourse to the primary beneficiary (Great Ajax Corp.). 3. Real estate owned properties, net, are presented net of valuation allowances of $0.6 million and $0.5 million at March 31, 2022 and December 31, 2021, respectively. 4. As of March 31, 2022, Investments in securities at fair value include amortized cost basis of $336.6 million and a net unrealized loss of $8.8 million. As of December 31, 2021, Investments in securities at fair value include amortized cost basis of $354.2 million and net unrealized gains $1.0 million. 5. Investments in beneficial interests includes allowance for expected credit losses of zero and $0.6 million at March 31, 2022 and December 31, 2021, respectively. 6. Secured borrowings, net are presented net of deferred issuance costs of $6.5 million at March 31, 2022 and $7.3 million at December 31, 2021. Convertible senior notes, net are presented net of deferred issuance costs of $0.8 million at March 31, 2022 and $1.7 million at December 31, 2021. 7. $25.00 liquidation preference per share, 2,307,400 shares issued and outstanding at March 31, 2022 and December 31, 2021. 8. $25.00 liquidation preference per share, 2,892,600 shares issued and outstanding at March 31, 2022 and December 31, 2021. 9. 125,000,000 shares authorized, 23,194,566 shares issued and outstanding at March 31, 2022 and 23,146,775 shares issued and outstanding at December 31, 2021. 10. As of March 31, 2022 non-controlling interests includes $1.1 million from a 50.0% owned joint venture, $1.2 million from a 53.1% owned subsidiary and $0.1 million from a 99.9% owned subsidiary. As of December 31, 2021 non-controlling interests includes $1.8 million from the 50.0% owned joint venture, $1.3 million from a 53.1% owned subsidiary and $0.1 million from a 99.9% owned subsidiary which we consolidates under U.S. GAAP.