to

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2020

OR

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-38093

Veritone, Inc.

(Exact name of registrant as specified in its charter)

Delaware | | 47-1161641 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

1515 Arapahoe St., Tower 3, Suite 400, Denver, Colorado | | 80202 |

(Address of principal executive offices) | | (Zip Code) |

| | |

Registrant’s telephone number, including area code: (888) 507-1737

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

Common Stock, Par Value $0.001 per share | | VERI | | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of June 30, 2020, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the common stock held by non-affiliates of the registrant was approximately $337.9 million, calculated based upon the closing price of the registrant’s common stock as reported by the NASDAQ Global Market on such date.

As of February 28, 2021, 32,299,008 shares of the registrant’s common stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The information that is required to be included in Part III of this Annual Report on Form 10-K is incorporated by reference to the definitive proxy statement to be filed by the registrant within 120 days of December 31, 2020. Only those portions of the definitive proxy statement that are specifically incorporated by reference herein shall constitute a part of this Annual Report on Form 10-K.

TABLE OF CONTENTS

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and we intend that such forward-looking statements be subject to the safe harbors created thereby. For this purpose, any statements made in this Annual Report on Form 10-K that are not historical or current facts may be deemed to be forward-looking statements. Without limiting the generality of the foregoing, words such as “anticipates,” “believes,” “seeks,” “estimates,” “expects,” “intends,” “continue,” “can,” “may,” “plans,” “potential,” “projects,” “should,” “could,” “will,” “would” or similar expressions and the negatives of those expressions are intended to identify forward-looking statements. Such statements include, but are not limited to, any statements that refer to projections of our future financial condition and results of operations, capital needs and financing plans, competitive position, industry environment, potential growth and market opportunities, acquisition plans and strategies, compensation plans, governance structure and policies and/or the price of our common stock.

The forward-looking statements included herein represent our management’s current expectations and assumptions based on information available as of the date of this report. These statements involve numerous known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Factors that may cause or contribute to such differences include, but are not limited to, those discussed in more detail in Item 1 (Business) and Item 1A (Risk Factors) of Part I and Item 7 (Management’s Discussion and Analysis of Financial Condition and Results of Operations) of Part II of this Annual Report on Form 10-K. Readers should carefully review these risks, as well as the additional risks described in other documents we file from time to time with the Securities and Exchange Commission (“SEC”). In light of the significant risks and uncertainties inherent in the forward-looking information included herein, the inclusion of such information should not be regarded as a representation by us or any other person that such results will be achieved, and readers are cautioned not to place undue reliance on such forward-looking information, which speak only as of the date of this report.

Moreover, we operate in an evolving environment. New risks and uncertainties emerge from time to time, and it is not possible for our management to predict all risks and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual future results to be materially different from those expressed or implied by any forward-looking statements.

Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future. We qualify all of our forward-looking statements by these cautionary statements.

ii

SUMMARY OF RISK FACTORS

Below is a summary of certain material factors that could harm our business, operating results and/or financial condition, impair our future prospects, and/or cause the price of our common stock to decline. Please refer to the additional discussion of the risks summarized below in Item 1A (Risk Factors) of Part I of this Annual Report on Form 10-K, which should be carefully considered, together with other information in this Annual Report on Form 10-K and in our other filings with the SEC, before making an investment decision regarding our common stock.

Risks Related to the Early Stage of Development of Our Business and Our Financial Condition

| • | Our efforts to expand our aiWARE SaaS business may not be successful. |

| • | The market for AI-based software applications is new and unproven and may decline or experience limited growth, and concerns over the use of AI may hinder the adoption of AI technologies. |

| • | We expect to require additional capital to support our business, and this capital might not be available on acceptable terms, if at all. |

| • | Our quarterly results may fluctuate significantly and period-to-period comparisons of our results may not be meaningful. |

| • | We have had a history of losses and we may not be able to achieve or sustain profitability. |

| • | Failure to manage our growth effectively could increase our expenses, decrease our revenue and prevent us from implementing our business strategy. |

| • | We intend to continue to pursue the acquisition of other companies, businesses or technologies, which could be expensive, divert our management’s attention, fail to achieve the expected benefits and/or expose us to other risks or difficulties. |

| • | We plan to expand our international operations, which exposes us to significant risks. |

| • | Our business has been affected by the COVID-19 pandemic, and the continuing impacts of COVID-19 in the future are highly unpredictable. |

Risks Related to the Development and Operation of Our aiWARE Platform

| • | We may not be able to enhance our products or introduce new products that achieve market acceptance and keep pace with technological developments. |

| • | Our competitors, partners or others may acquire third party technologies used in our platform, which could result in them blocking us from using the technology in our platform, or these third party technology providers may otherwise terminate their relationships with us. |

| • | We rely on third parties to develop AI models for our platform and in some cases to integrate them with our platform. |

| • | We may not be able to develop a strong brand for our platform or increase market awareness of our company and our platform. |

| • | We may experience interruptions or performance problems associated with our technology and infrastructure, or that of our third party service providers. |

| • | The security of our platform, networks or computer systems may be breached, resulting in unauthorized access to our customer data. |

Risks Related to Target Markets, Competition and Customers

| • | The success of our business depends on our ability to expand into new vertical markets and attract new customers in a cost-effective manner. |

| • | Recent and proposed laws regarding the use of facial recognition technology could adversely impact the demand for certain of our products. |

| • | We may not be able to compete effectively in providing our aiWARE SaaS solutions. |

iii

| • | We currently generate significant revenue from a limited number of key customers, and we may lose one or more of these key customers. |

| • | Our sales efforts related to our aiWARE SaaS solutions involve considerable time and expense, and our sales cycle is often long and unpredictable. |

| • | We may not be able to remain competitive in providing our advertising services, and we may lose key advertising clients. |

| • | Acquiring and retaining advertising clients depends on our ability to avoid and manage conflicts of interest arising from other client relationships and attracting and retaining key personnel. |

Risks Related to Intellectual Property

| • | We face risks arising from our digital content licensing services, including potential liability resulting from claims by third parties for infringement or violation of copyrights, publicity or other rights, as well as indemnification claims by rights holders and customers. |

| • | We may be sued by third parties for alleged infringement of their proprietary rights. |

| • | We could incur substantial costs in protecting or defending our intellectual property rights, and may not be able to protect our intellectual property. |

| • | Our use of open source software could negatively affect our ability to sell our products and subject us to possible litigation. |

Risks Related to Human Capital Management

| • | We depend on our executive officers and other key employees, and we may lose one or more of these employees. |

| • | We may not be able to hire, retain and motivate qualified personnel in the key areas in which we require highly skilled employees, such as engineering, sales and marketing. |

Risks Related to Regulatory Compliance

| • | Data protection and privacy laws and regulations could require us to make changes to our business, impose additional costs on us and reduce the demand for our software solutions. |

| • | We could be subject to liability for historical and future sales, use and similar taxes. |

Risks Related to the Ownership of Our Securities and Our Public Company Operations

| • | Our common stock price has been extremely volatile and could continue to fluctuate widely in price, which could result in substantial losses for investors. |

| • | If we fail to maintain an effective system of disclosure controls and internal control over financial reporting, our ability to produce timely and accurate financial statements or comply with applicable regulations could be impaired. |

| • | We are an “emerging growth company” and a “smaller reporting company” under the U.S. federal securities laws, and the reduced reporting requirements applicable to emerging growth companies and smaller reporting companies could make our common stock less attractive to investors. |

| • | We expect to incur increased costs as a public company, including costs relating to compliance with the Sarbanes-Oxley Act and other regulations, in the future. |

| • | We do not currently expect to pay any cash dividends. |

| • | Our anti-takeover provisions could prevent or delay a change in control of our company, even if such change in control would be beneficial to our stockholders. |

| • | Our amended and restated certificate of incorporation designates the Court of Chancery of the State of Delaware as the sole and exclusive forum for certain types of actions and proceedings that may be initiated by our stockholders, which could limit our stockholders’ ability to obtain a favorable judicial forum for disputes with us or our directors, officers or other employees. |

iv

PART I

Overview

Veritone, Inc. (collectively with our subsidiaries, referred to as “Veritone,” “Company,” “we,” “our,” and “us”) is a provider of artificial intelligence (“AI”) computing solutions. We are driven by the belief that AI is key to building a safer, more vibrant, transparent and empowered society. Our mission is to be an active contributor to making the world better through AI.

Today, over 80% of new data created worldwide is unstructured, which is increasing at an annual growth rate of 30-60% per year, according to Gartner (2020 Strategic Roadmap for Storage, July 1, 2020). This creates significant challenges for companies and governments across the globe – specifically, how to create systematic solutions to address the ever-increasing volume of unstructured data. Whether it is a local police department trying to rapidly solve crimes through analysis of video evidence, a media company searching years of television archives for specific images and video content, or the U.S. military trying to analyze huge volumes of satellite and other aerial images, we believe AI is the only efficient solution to these complex challenges.

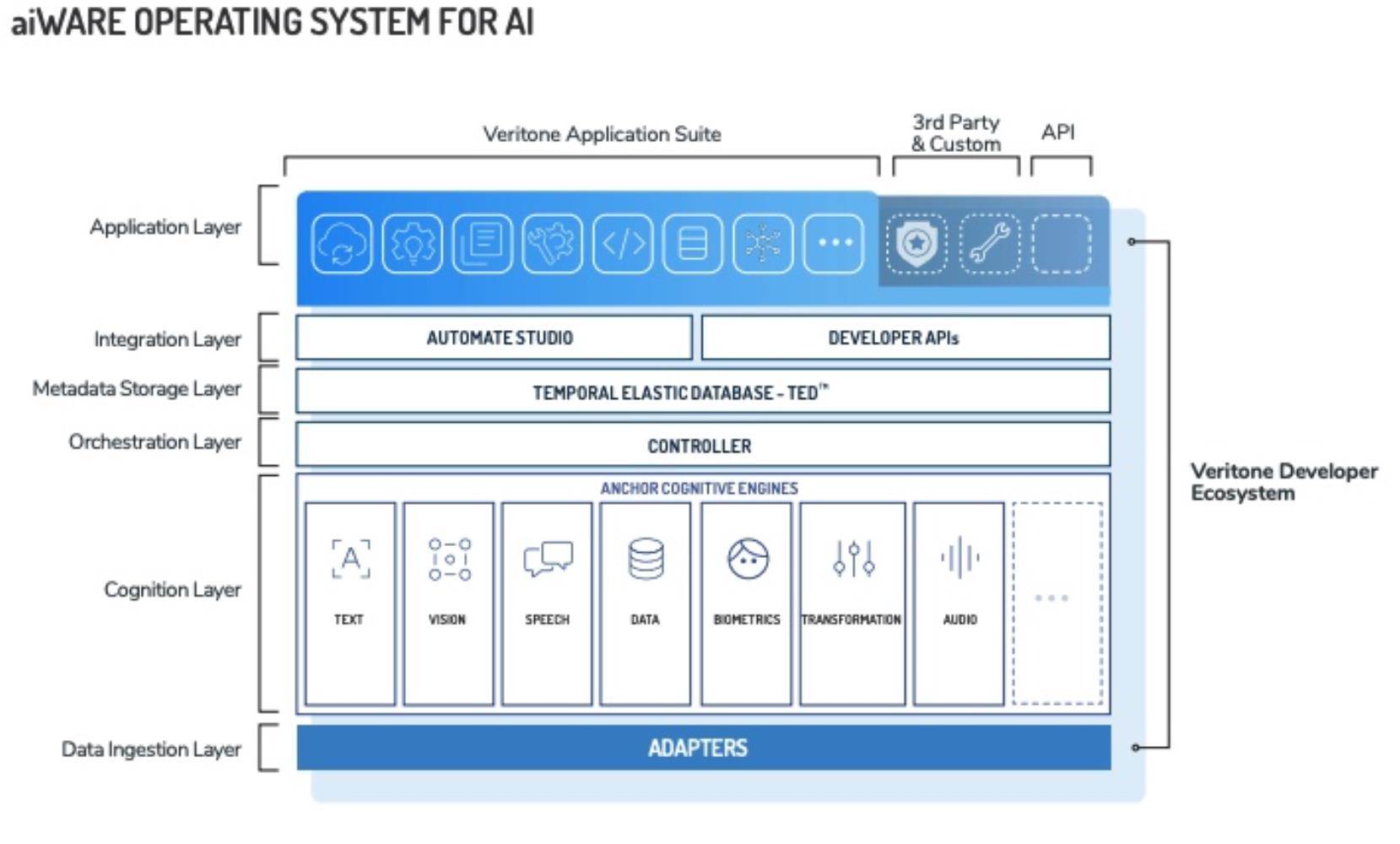

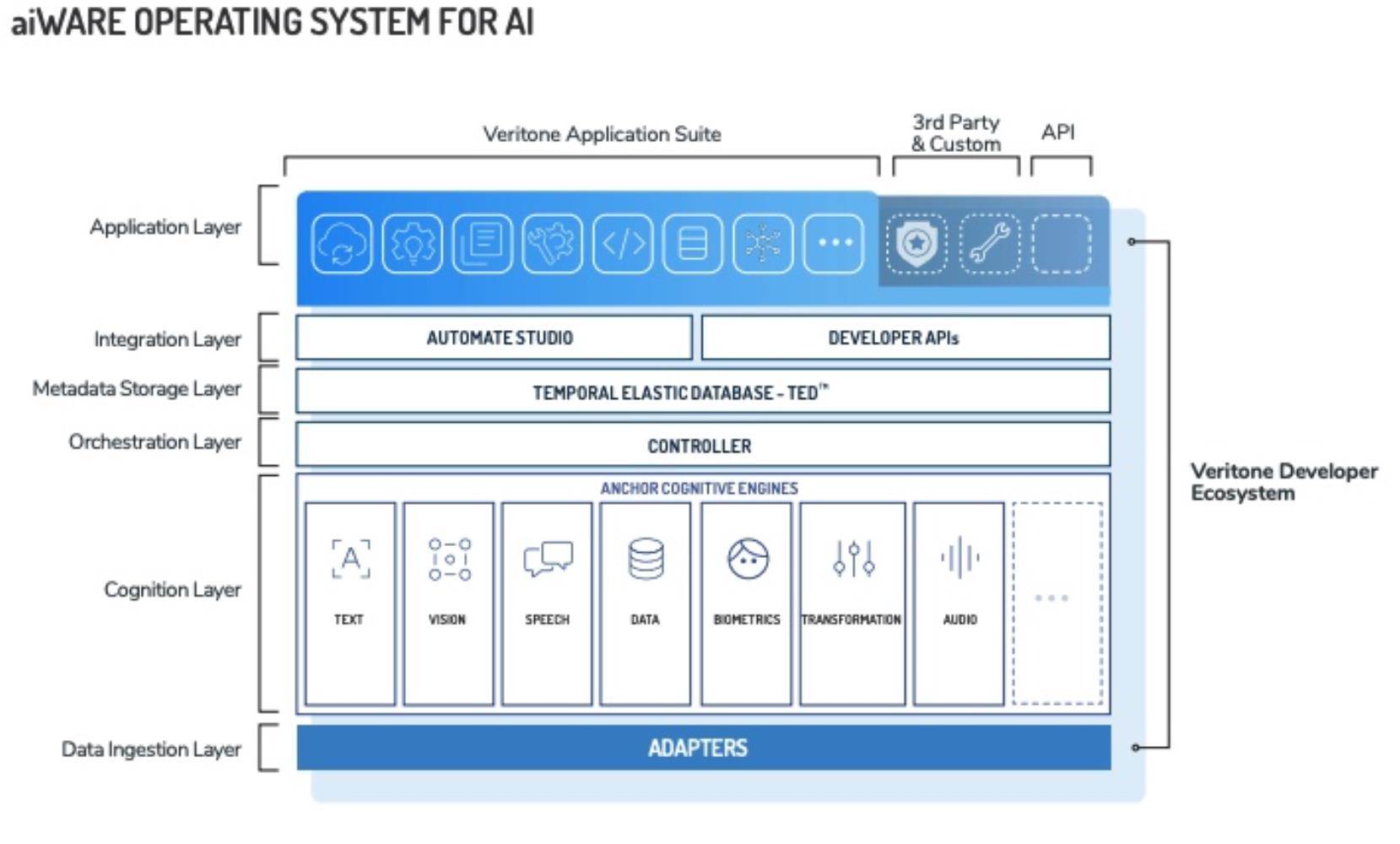

To address the ever-growing challenges surrounding unstructured data, we developed aiWARE™, our proprietary AI operating system. aiWARE orchestrates machine learning algorithms, or AI models, together with a suite of powerful applications, to reveal valuable insights from vast amounts of structured and unstructured data. Our multi-faceted aiWARE platform offers capabilities that mimic human cognitive functions such as perception, prediction, problem solving and optimization, enabling users to quickly, efficiently and cost effectively transform unstructured data into structured data, and analyze and optimize data to drive business processes and insights.

aiWARE is based on an open architecture that enables new AI models, applications and workflows to be added quickly and efficiently, resulting in a future proof, scalable and evolving solution that can be easily leveraged by organizations in a broad range of industries that capture or use audio, video and other unstructured data, together with structured data, such as the media and entertainment, government, legal and compliance, energy and other vertical markets, driving down the cost, complexity and time to develop, deploy and distribute AI-enabled applications in their operations. Our aiWARE platform is offered primarily through a software-as-a-service (“SaaS”) delivery model and can be deployed in a number of environments and configurations to meet customers’ needs.

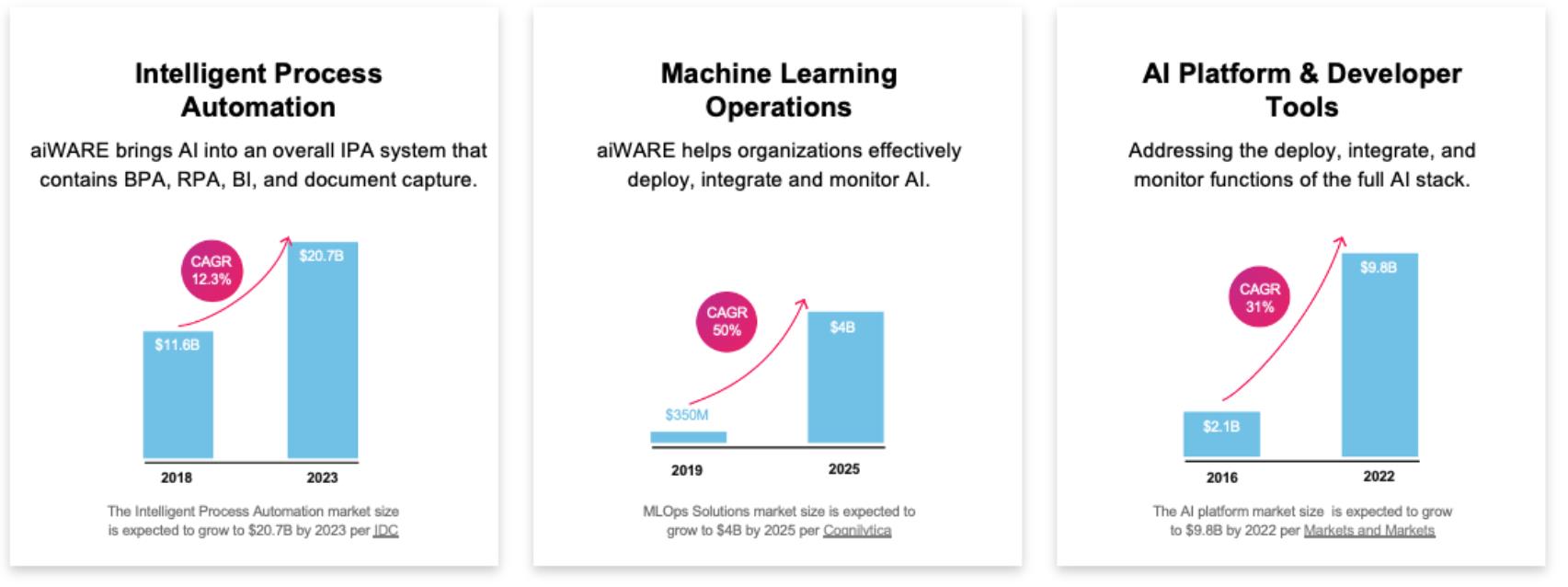

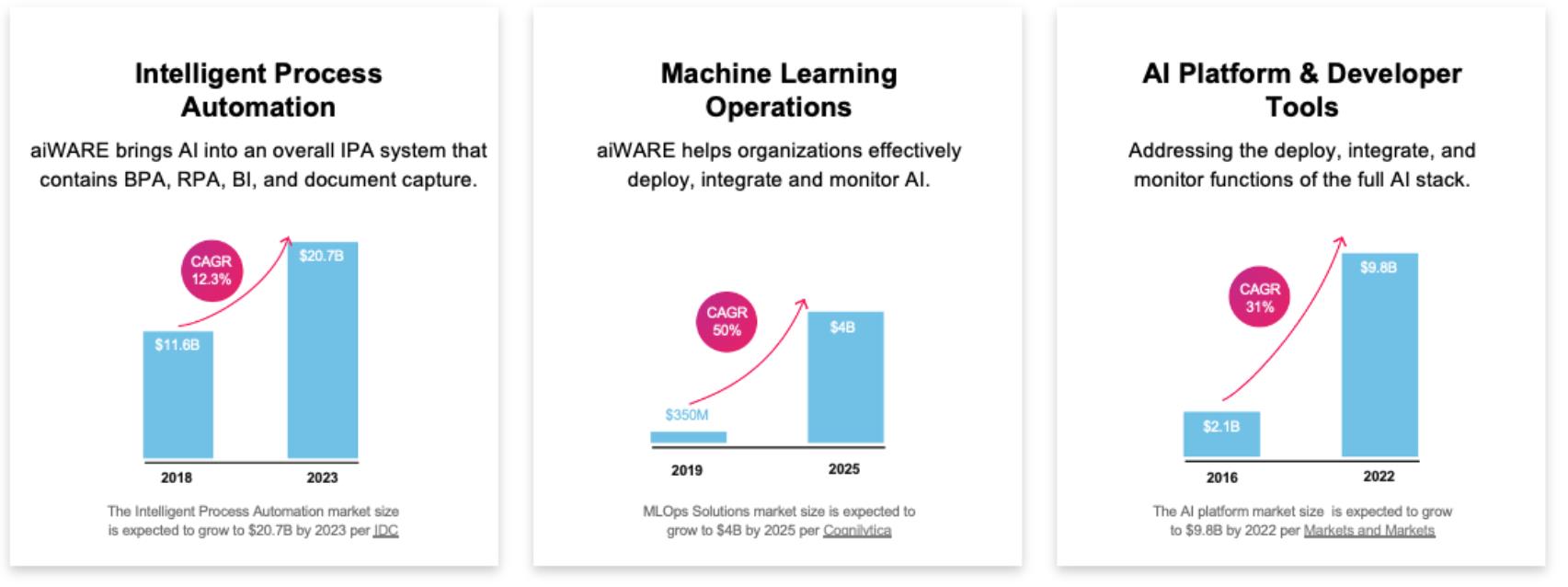

We believe the opportunity to create a sustainable and growing business around AI and AI-enabled solutions is large and growing significantly. According to Omdia (Artificial Intelligence Software Market Forecast, 2020), the AI market today is expected to grow at a compounded annual growth rate (CAGR) of 35%, to reach $100.0 billion in 2025. We believe that our current solutions address opportunities in intelligent process automation, machine learning operations and AI platform and developer tools, which markets are expected to total approximately $34.5 billion by 2025.

Sources:

1. IDC, Worldwide Capture Software Market Shares, 2018: Focus on Intelligent Process Automation (July 2019)

2. Cognilytica, ML Model Management and Operations 2020 (March 3, 2020)

3. Markets and Markets, AI Platform Market Trends, Growth, Size and Share - 2022 (November 2017)

1

In particular, we believe that there are tremendous near and long term opportunities to grow our business in the government and energy markets. According to Bloomberg Government (BGOV) (Fiscal 2021 Government Contracting Playbook, 2020), the U.S. Government is preparing to invest more than $6 billion in AI-related research and development projects in fiscal 2021. The U.S. General Services Administration’s Artificial Intelligence Center of Excellence and the U.S. Department of Defense’s Joint Artificial Intelligence Center have been created to speed the adoption of AI technologies by civilian and defense agencies, respectively, and the U.S. Departments of Energy and Veterans Affairs have opened their own AI research offices. Meanwhile, federal contract spending on AI is on pace to grow by almost 50%, according to BGOV projections, reaching $3.0 billion in fiscal 2021. In the energy market, according to Frost and Sullivan (Growth Opportunities from Decarbonization in the Global Power Market, 2019-2030), it is estimated that $3.4 trillion will be invested in renewable energy over the next 10 years. We believe that the applicability of our AI solutions will extend beyond utilities and across the global $1.5 trillion electric energy market (inspirecleanenergy.com, Understanding the Energy Market, March 2017), including improved optimization to reduce energy production lost, which we have estimated to be over $21 billion in the U.S. annually over the last 10 years based on data published by the U.S. Energy Information Administration (Frequently Asked Questions, https://www.eia.gov/tools/faqs/index.php).

We have expanded and enhanced our aiWARE SaaS solutions and services through acquisitions of complementary businesses and technologies. Through our acquisition of Wazee Digital, Inc. (“Wazee Digital”) in 2018, we added to our offerings digital asset management solutions and digital content licensing services. We have integrated the cognitive functionality of aiWARE with these Wazee Digital solutions and services, which allows us to provide our customers with unique capabilities to more effectively monetize and enrich their content. In 2017, we acquired the advanced data analytics software and related intellectual property assets of Atigeo Corporation, including its cooperative distributed inferencing (“CDI”) technology that is based on Hamiltonian models and other proprietary algorithms, adding proprietary AI-based forecasting, optimization and intelligent control capabilities to our growing body of technology and intellectual property in data science. We have developed solutions utilizing our CDI technology to address a number of use cases, particularly in the energy market, and we have integrated these solutions with aiWARE to deploy, integrate and operate them for customers. We plan to continue to selectively pursue acquisitions and strategic investments in businesses and technologies that strengthen our business, enhance our AI capabilities and/or expand our market presence in our core vertical markets or in new markets.

Leveraging our AI media solutions, we also operate a full service advertising agency, which we expanded in 2018 through our acquisition of S Media Limited, doing business as Performance Bridge Media (“Performance Bridge”), a leading podcast advertising agency, becoming one of the world’s largest full service performance-based audio advertising agencies. Our services include media planning and strategy, advertisement buying and placement, campaign messaging, clearance verification and attribution, and custom analytics. Our advertising business utilizes our aiWARE platform to help our clients improve their advertising placements and maximize the return on their advertising spending using real-time ad verification and analytics, which we believe gives us a competitive advantage over other traditional advertising agencies.

In late 2019, we launched our VeriAdsTM Network, which enables broadcasters, podcasters and social media influencers to generate incremental advertising revenue from premium advertisers looking to expand their audience reach through new unique ad units and influencers. The VeriAds Network leverages our aiWARE platform to programmatically manage clearance and verification of ads and to analyze programming content to identify new contextually relevant advertising opportunities.

aiWARE SaaS Solutions

aiWARE Overview

Our innovative aiWARE operating system intelligently orchestrates an ecosystem of top performing AI models within a single software solution to process volumes of information that far exceed human cognitive capabilities. Our proprietary technology enables users to run comprehensive, multivariate cognitive queries, predictions, correlations and analyses in near real-time using AI models across multiple categories, such as transcription, face recognition and object recognition, creating integrated and refined outputs, which can also be analyzed in conjunction with structured data, allowing for even deeper insights. Our suite of general and industry-specific applications enables users to leverage the power of aiWARE to perform key processes far more efficiently and with greater scalability than their existing manual processes.

2

Our aiWARE platform encompasses the following:

| • | Ingestion. We have built a scalable, source and type agnostic ingestion process that utilizes adapters, which are lightweight, pluggable software modules based on docker microservices, to capture a wide range of unstructured data, such as audio files, video files, images and documents, as well as structured data, such as public and private databases, from wherever they reside, to ingest them into our platform and normalize them for further processing, correlation and analytics. The open architecture of our solution also enables external developers to write these adapters to extend the platform to be able to ingest data of any type and from any source for their particular use cases. |

| • | Orchestration and Cognitive Processing. Source data ingested into our platform can be processed through one or more AI models, which extract from and/or add useful metadata to structured and unstructured data. Our platform includes an innovative, open AI ecosystem that currently incorporates hundreds of AI models across over 20 different cognitive capabilities from multiple third-party vendors, including Amazon, Google, IBM and Microsoft, among others, as well as our own proprietary AI models, which use advanced algorithms to perform a variety of cognitive processes, including transcription, language translation, face detection, face recognition, object detection, object recognition, logo recognition, sentiment analysis, text keyword/topic analysis, audio/video fingerprinting, geolocation, visual moderation and optical character recognition, among others. Our open architecture allows us and third-party developers to easily integrate additional AI models within our platform, which makes our solution readily scalable for a broad range of processes and vertical markets. We have developed our proprietary ConductorTM technology to analyze data and intelligently orchestrate cognitive processing in our platform. This technology allows us to orchestrate the correlation of data from multiple structured and unstructured data sources, together with the cognitive processing outputs from different cognitive classes, to improve the performance of the data analysis process, enabling users to achieve higher accuracy and/or derive more robust intelligence from their data. |

| • | Proprietary Indexing and Storage. The results of processed data are indexed and stored in a scalable, time-correlated temporal elastic database within aiWARE. This intelligent data lake gives us the unique ability to synthesize various disparate cognitive results in a cohesive, time-based format, and to dissect and analyze this information, producing a multi-dimensional index for ease of search, discovery and analytics, allowing users to access multivariate intelligence previously unattainable from their data. Our architecture leverages several commercial, open source, distributed and non-relational databases with proven scalability and performance characteristics. |

| • | Integration. Through our self-service development environment, developers, including end customers, system integrators and application developers, can access our application programming interfaces (“APIs”) and developer tools, including Automate Studio, to rapidly build, integrate, deploy and operate AI models and AI-powered workflows and applications on aiWARE to satisfy specific use cases. Automate Studio is our low-code workflow |

3

| | designer that provides an intuitive drag-and-drop user interface to allow users to easily create intelligent workflows that leverage aiWARE’s scalable, event-driven architecture and ecosystem of AI models, to design and operationalize AI-powered business processes at scale, without the need for in-depth coding skills or AI expertise. In addition, we recently integrated aiWARE with Alteryx, Inc.’s analytic process automation platform. Our AI tools are available for download by Alteryx users, allowing users to access and run our AI models within Alteryx and blend both structured data and unstructured data, including video, images, audio, sensor data, and text, to generate rapid AI-enabled analytics for greater insights and more informed decision making. |

| • | Applications and Cognitive Analytics. We have developed a suite of core applications and several industry targeted applications, which are discussed in more detail below, to facilitate the use of our platform and enable users to unlock actionable insights from their diverse datasets. As noted above, the modular structure of our aiWARE platform enables rapid development and deployment of applications that are relevant to the specific needs of different markets. This allows us and third parties to quickly and easily build and deploy new applications on top of our aiWARE architecture or integrate existing applications with aiWARE. |

Our aiWARE platform is available through multiple deployment models that can be configured to meet each customer’s specific requirements. These deployment models include fully cloud-based options hosted by us in Amazon Web Services (“AWS”) and Microsoft Azure (“Azure”) commercial and secure government cloud environments; on-premises options, which allow users to utilize aiWARE’s cognitive processing and certain other capabilities in their controlled environment; and hybrid cloud/on-premises options, which give users of our on-premises capabilities the option to also connect to our services in the cloud, either to provision additional services to run within their controlled environment, or to use our additional cloud-based services to process data, search and analyze the results. We currently hold an Authority to Operate (“ATO”) under the Federal Risk and Authorization Management Program (“FedRAMP”) for our AWS secure government cloud platform to support government customers.

We have made significant enhancements to our operating system’s architecture, which have resulted in greater portability and operating efficiency of the platform. Our current architecture gives us the flexibility to deploy many of aiWARE’s capabilities in virtually any environment, including select arm64 architectures, with improved scalability and reliability. We are continuing to enhance the portability of aiWARE in order to provide substantially all of the features and functionality of the platform within any environment to meet customers’ needs.

Core Applications

We have developed a suite of core applications that comprise the base level services of our platform. These core applications can be used independently for numerous use cases and also serve as a foundation for other applications that we and third parties have developed, or may develop in the future, to address specific customer use cases within our key markets.

aiWARE’s core applications include:

| • | CMS. Content Management System (“CMS”) enables our users to ingest, process and search their data. The CMS application provides a common workflow for adding data sources through ingestion adapters. Cognitive workflows can be assigned to data sources, allowing the automated and customized processing of data from each distinct source. Once data has been ingested into the CMS system, it can be managed, reviewed, edited and further processed by AI models. |

| • | Discovery and Collections. Discovery allows users to create and execute direct searches against AI model outputs, through either predefined queries called Watchlists or ad-hoc searches. Users are able to take several actions on search results, such as viewing and downloading the media snippet, editing the AI model metadata, verifying content in the search results and sharing the search results and associated media clips individually or as part of a Collection. A Collection of search results can be titled and described, then shared externally, via email, link or embedded widget. |

| • | Library. Library enables users to create libraries of reference training data such as known faces, objects, or audio files. AI models can then be trained against specific private or public libraries to facilitate specialized AI model processing to maximize accuracy. |

| • | Automate Studio. As discussed above, Automate Studio is our low-code workflow designer that enables users to easily create and deploy intelligent workflows that leverage aiWARE’s capabilities, without the need for in-depth coding skills or AI expertise. |

4

Solutions for Key Target Markets

As the volume of data being created and collected continues to explode, we believe that AI technology will play an increasingly larger role in solving some of the world’s most complicated challenges. We have identified numerous ways in which our aiWARE platform and related AI technology may be used to extract valuable insights from large volumes of data to solve real-world problems across a broad range of markets. Today, we are focused on the needs of our customers in the media and entertainment, government, legal and compliance, and energy markets, and we have developed several applications and services addressing specific customer use cases within these target markets. We intend to leverage the capabilities that we have developed for these key markets to expand into other markets in the future.

Media and Entertainment Market

We have developed solutions to address the needs of leading media companies, including national radio and television broadcasters, major studios, networks and sports organizations. These customers are leveraging our AI technologies to unlock value from their content, drive revenue, enhance post-production and media archive retrieval workflows, and gain operational efficiencies in their businesses. Some of the world’s largest and most recognizable media and entertainment companies rely on these solutions to store, manage, search, discover, analyze, distribute and monetize petabytes of content.

Applications used by our customers in the media and entertainment market include:

| • | aiWARE Essentials. aiWARE Essentials is a bundled offering of our core applications, CMS, Discovery and Collections. Utilizing aiWARE Essentials, media broadcasters are able to ingest their live and archived media into aiWARE and run an array of AI models on the media to identify keywords, faces, logos and objects, enriching the content with additional metadata to allow it to be quickly and easily searched, analyzed, curated and shared in near real-time. Our Discovery application includes advanced analytics features that allow users to customize their analytics dashboards and reports and generate live interactive charts with robust filtering capabilities. aiWARE Essentials transforms the way these media broadcasters conduct their business by implementing AI-powered applications in their ad tracking and verification workflows, enabling them to provide advertisers with near real-time ad verification and integrated audience analytics. |

| • | Attribute. Attribute is an AI-powered media attribution application that tracks the efficacy of advertising in broadcast radio and television. The application delivers customer behavior impact analytics from pre-recorded, native and organic mentions, enabling broadcasters to analyze the effect of an advertiser’s advertising placements. The application systematically verifies advertisements and mentions in broadcasts and correlates them with the advertiser’s website data, and displays the correlated information in a media attribution dashboard. Attribute empowers broadcasters to demonstrate an advertiser’s campaign effectiveness and reveal data-driven insights for optimization of ad placements to drive greater customer return on investment, helping to drive increases in customer advertising spending. |

| • | Digital Media Hub. Digital Media Hub is a cloud-native, AI-enabled media management solution through which rights holders can ingest, manage and organize their content and offer global access to their content to key stakeholders, including news media and corporate partners, in a secure, permission-based cloud environment. Digital Media Hub offers intelligent search and discovery capabilities and robust reporting tools, which allow users to access content quickly, and allow rights holders to track downloads and understand what content is most important to users. The solution leverages the power of aiWARE’s AI capabilities to automatically enrich the metadata of content through preconfigured workflows that route ingested assets for cognitive processing, such as transcription, facial recognition or logo recognition processing, to make content discoverable and unlock its value. Rights holders can customize the look and feel of Digital Media Hub to represent their own brands and configure their customer-branded portals for media asset purchases. |

Customers in the media and entertainment market can also access our aiWARE cognitive capabilities through our open architecture and robust APIs. For example, aiWARE can be easily integrated with content owners’ digital asset management systems, enhancing these systems with AI-enabled search capabilities and workflows. In addition, podcast publishers can integrate aiWARE with their distribution platforms to programmatically transcribe and tag audio streams with topical, descriptive and time-correlated keyword metadata prior to publishing, allowing for advanced contextual ad targeting at scale.

Government, Legal and Compliance Markets

We have developed AI-powered solutions to address the needs of customers in the government, legal and compliance markets, including law enforcement and other government agencies, legal and judicial professionals, and companies and regulatory bodies in highly regulated industries. Law enforcement and other government agencies accumulate large amounts

5

of unstructured audio and video data on a daily basis, including from police body cameras, police car recorders, interview room cameras, 911 audio tapes and surveillance cameras. Historically, in most cases, investigators have had to review audio and video data manually in separately siloed systems, a task that consumes huge amounts of time and delays investigations. In addition, public agencies are required to provide certain information, including in many cases audio and video files, in response to requests from the public. Recently, statutes in several states have broadened the scope of information required to be disclosed and have shortened the time periods in which such disclosures must be made, and the volume of public information requests received by agencies has increased significantly. Reviewing video footage to identify and authenticate the appropriate footage to be disclosed, and to redact facial images and other sensitive information from the footage prior to disclosure, have historically been time-consuming and largely manual processes. Today, law enforcement and other government agencies can leverage our aiWARE platform and applications to organize, review, analyze and gain insight from their various data sources to greatly enhance their investigative workflows and to support their public disclosure requirements.

Within the legal market, our AI technologies support eDiscovery, the process of identifying, collecting and producing electronically stored information (“ESI”), where audio and video content analysis is playing an increasingly important role in civil litigation and criminal proceedings. Historically, the eDiscovery process has been focused primarily on text-based documents such as emails, and audio and video files have often been excluded from production requirements due to the high cost and complexity involved in automatically identifying relevant keywords, phrases or other details contained therein. Today, legal and judicial professionals must deal with escalating volumes of audio and video content resulting from recorded telephone calls, voice mails, video recordings and other sources in meeting eDiscovery requirements, including statutory requirements that have expanded the types of evidence that must be produced in a case, including electronically created or stored information, and accelerated production timeframes. Our aiWARE platform’s applications and cognitive capabilities enable users to quickly search and analyze large volumes of audio files, video files, text-based documents and other ESI to identify particular words, phrases, faces, objects and voices, and to redact sensitive information prior to production, greatly increasing the speed, reducing the cost, and improving the results of discovery processes.

Applications used by our customers in the government, legal and compliance markets include:

| • | IDentify. Our IDentify application is a powerful AI-driven tool that enables law enforcement and judicial agencies to increase the speed and efficiency of investigative workflows. IDentify allows users to upload and maintain booking and known offender databases in aiWARE and use facial recognition technology to automatically compare video and photographic evidence, such as footage from body cameras, dash cameras and CCTV surveillance cameras, with these databases to identify potential suspects for further investigation. Users can optionally add detected but unknown faces to a persons of interest database for future digital evidence comparison. IDentify gives agencies a powerful tool to augment their investigative workflows, saving valuable time and resources and helping them solve cases faster. |

| • | Illuminate. Our Illuminate application provides users with an effective means of searching voluminous sets of media and electronic documents to support eDiscovery efforts, and particularly their early case assessment efforts. This application allows users to rapidly ingest, process and search large volumes of audio, video, image and text-based documents, to identify and segregate relevant evidence for further review and analysis. Illuminate’s text analytics capabilities allow users to visually explore entities, such as the persons, organizations and locations identified in the data. Once processed and reviewed through the application, users are able to transfer a relevant subset of media and documents to our Redact application if redaction is necessary, or export it for transfer to their eDiscovery or case management platform for further processing and workflows. |

| • | Redact. Our Redact application enables law enforcement and judicial agencies to leverage AI to automate the redaction of faces and other sensitive information within audio, video and image-based evidence, significantly streamlining their redaction workflows. Redact employs AI technology to automatically detect when persons appear in evidence for review and selection. Users can also define other sensitive items appearing in video evidence and choose to automatically track the defined items for redaction throughout the video or at a single time stamp. The application then systematically obscures selected portions of the data in the evidence. With Redact, agencies can complete their review and redaction of evidence in a fraction of the amount of time spent on manual processes, freeing up valuable resources while also complying with stringent disclosure requirements. |

The open architecture of aiWARE, together with our robust developer tools such as Automate Studio, allows us and third parties to easily integrate aiWARE with third party software and platforms, enabling customers in the government, legal and compliance markets to leverage the AI capabilities of aiWARE within existing systems to enhance their business processes. For example, we have integrated our aiWARE platform with Relativity and other industry leading eDiscovery software platforms, enabling users to leverage our AI capabilities, including speech-to-text transcription, translation and

6

object detection processing, within these review platforms as part of their eDiscovery efforts. We have completed, or are currently in the process of completing, a number of technology integrations with other third party solutions including public records management systems, data analytics and visualization platforms, and geospatial exploitation and analysis software.

We have also identified a need of customers in a broad range of industries, such as the financial services, insurance, healthcare and other highly-regulated industries, to utilize AI technology to increase the effectiveness and efficiency of their compliance efforts. We plan to continue to expand the capabilities of our aiWARE platform to support these compliance workflows.

Energy Market

AI is revolutionizing the way the world produces, transmits, and consumes energy. Leveraging our patented CDI technology, we have developed a suite of solutions that enable customers in the energy market, including utility companies, equipment providers, battery providers and independent energy aggregators, to optimize and synchronize the energy grid, using predictive AI to make clean energy more predictable, efficient, safe, reliable, and cost effective. Our energy solutions power next generation smart grids by continuously collecting and synthesizing large amounts of data, empowering utilities to predict optimal energy supply mix and pricing to meet grid demand and ensure grid reliability and resiliency.

Our patented AI-based energy solutions for predictive real-time control management and adaptation of smart grids consist of three subsystems:

| • | Forecaster. Forecaster is a distributed forecaster that generates predictions of the state of the smart grid devices, as well as of power generation output, demand and pricing. |

| • | Optimizer. Optimizer is a real-time CDI agent that learns, optimizes and tunes models of smart grid components, generates desired behavior directions and provides synchronization of smart grid components. |

| • | Controller. Controller is a bank of edge controllers that implements the desired behavior as a function of the predictive state of the smart grid. |

Our Arbitrage solution brings these subsystems together to deliver predictive energy buy, sell and dispatch capabilities.

We also offer Simulator, which incorporates advanced modeling techniques with high-performance algorithms to deliver the latest in end-use load modeling technology. Simulator couples power flow calculations with distribution automation models, building energy use and appliance demand models and market models. Energy operators can use Simulator to verify and validate new control strategies, equipment, procedures and sequences, or to investigate optimization and energy savings opportunities.

All of our energy solutions are built on aiWARE, which we utilize to deploy, integrate and operate these solutions for customers.

aiWARE Content Licensing and Media Services

We offer digital content licensing services, through which we manage and license content on behalf of leading rights holders to end users in the film, television, sports, and advertising industries. Content is licensed either through our own Commerce web portal, customer-branded web portals or other licensing arrangements. Our Commerce web portal represents iconic archives from major brands and independent suppliers, and licensees rely on Commerce to acquire broadcast-quality digital assets for their productions, including films, documentaries and major advertising campaigns. We utilize aiWARE’s cognitive capabilities to enable richer and more efficient searching of content in our Commerce and customer-branded web portals, allowing users to quickly find and acquire content for their projects.

Advertising

Media Agency Services

We operate a full service media advertising agency through our wholly owned subsidiary, Veritone One, Inc. Veritone One is one of the world’s largest full service performance-based audio advertising agencies, specializing in host-endorsed and influencer advertising. Our services include media planning and strategy, media buying and placement, campaign messaging, clearance verification and attribution, and custom analytics.

7

We leverage our aiWARE platform to help our advertising clients improve their media placements and maximize the return on their advertising spending using real-time ad verification and media analytics, which we believe gives us a competitive advantage over other advertising agencies. Using our platform, we can manage, deliver, optimize, verify and quantify native and spot-based advertising campaigns and content distribution for our clients across multiple channels, including broadcast and satellite radio, streaming audio, podcasting, broadcast and cable television, and digital video services such as YouTube.

In 2020, we placed approximately $257.8 million in media advertising for our advertising clients, which included 1-800 flowers.com, Inc., Audible, Inc., DraftKings, Inc., Express VPN International, Ltd., HelloFresh, LinkedIn Corporation, Raycon Global, Inc., SimpliSafe, Inc., Uber Technologies, Inc., and many others.

VeriAds Network

Our VeriAdsTM Network is comprised of three programs that enable radio and television broadcasters, podcasters and social media influencers to generate incremental advertising revenue from premium advertisers, and enable these advertisers to expand their audience reach through unique ad units and new influencer avenues:

| • | Spot Network. Similar to traditional broadcast network programs, the Spot Network manages the liquidation and fulfillment of run-of-schedule and dayparted ad units for radio and television broadcasters. |

| • | MicroMentions™. With MicroMentions, we have introduced a unique new ad unit to the market, available exclusively through VeriAds. MicroMentions is an on-demand live read solution that gives broadcasters the opportunity to execute 10, 15 or 30 second ads outside of their scheduled ad inventory on a guaranteed CPM (cost per thousand) basis. MicroMentions leverages aiWARE to programmatically manage clearance and verification of, and provide near real-time analytics for, these live reads. |

| • | Influencer Bridge™. Influencer Bridge is a pay-per-performance advertising program that enables audio and video content creators, including podcast, Instagram and YouTube influencers, to monetize their content through CPA (cost per action) advertisements by pairing them with premium brands looking to expand their audience reach through new influencer avenues. Using aiWARE, we can analyze content of podcast episodes and YouTube videos included in the Influencer Bridge program to help identify new contextually relevant advertising opportunities for premier brands based on the subject matter presented, as well as to provide insights for brand safety and content transparency. |

Sales and Marketing

aiWARE SaaS Solutions

We conduct sales and marketing activities related to our aiWARE SaaS solutions through a combination of our direct sales force and indirect channel partners such as value-added resellers (“VARs”), distributors, system integrators, managed services providers and referral partners. Our direct sales organization is comprised of teams of business development managers, account executives and sales managers, who are supported by sales development representatives, sales engineers, solutions architects and other inside sales personnel. These sales teams are generally organized based on their specialized knowledge and expertise within each of our target markets. Our sales team collaborates closely with our product marketing, management and development teams to evaluate and develop solutions to address the needs of customers.

We have also established, and we intend to continue to expand, an indirect sales channel comprised of VARs, distributors and referral partners. We have entered into agreements with channel partners located in the United States and internationally. These agreements generally provide the channel partners with discounts below our standard prices, have terms of one year which automatically renew on an annual basis, and are generally terminable by either party for convenience following a specified notice period. Substantially all of our agreements with channel partners are nonexclusive; however, we allow channel partners to register sales opportunities through our deal registration program, in which case we may grant a channel partner priority to pursue an opportunity for a specified period of time, subject to certain conditions.

aiWARE Content Licensing Services

We conduct sales and marketing activities relating to our digital content licensing services business through our direct sales representatives, who identify, develop and manage our relationships with strategic customers in the advertising, entertainment/documentary and network broadcasting industries. We maintain our Commerce web portal, where stock content and select libraries can be licensed and downloaded directly, but the majority of our business is driven through high-value libraries that require an approval process in order to gain access. We also cross-sell additional Veritone products and services, including media management and aiWARE, to our content licensor partners.

8

Advertising

We market and sell our advertising services through a combination of our direct sales and indirect channel sales. We primarily market and sell directly to advertisers through outbound sales networking and client and partner referrals. Our indirect sales channel consists of referral partners who are mainly advertising agencies or marketing consultants who are unable to provide certain services to their clients, such as radio, podcast and YouTube placements. In addition to our sales efforts for new clients, we further expand sales opportunities and upsell through our campaign strategists who work directly with our advertising clients to optimize and enhance media spending on advertising campaigns.

Customers

We market and sell our aiWARE SaaS solutions to customers primarily in the media and entertainment, government, legal and compliance, and energy markets. No single customer accounted for 10% or more of our consolidated net revenues in 2020.

During 2020, ten customers accounted for approximately 53% of the total revenues from our aiWARE SaaS solutions, of which seven customers in the media and entertainment market accounted for approximately 36%, two customers in the government market accounted for approximately 9%, and one customer in the energy market accounted for approximately 8%, of our total revenues from these solutions. As we continue to grow our revenues from our aiWARE SaaS solutions across our markets, we believe that our dependence on any single customer or group of customers will be minimized.

For our advertising services, we target clients that make significant investments in advertising, particularly in native and spot-based advertising campaigns delivered over broadcast radio, satellite audio, streaming audio, podcasting, digital video services and other social media channels. During 2020, ten advertising clients accounted for approximately 58% of the total revenues from our advertising services, with one customer accounting for approximately 15% of the total revenues from these services. We have continued to grow and diversify our advertising client base over the past few years, which has reduced our dependency on a limited number of large clients.

For our content licensing services, we target customers such as major sports networks, advertising agencies, and film production companies that require high value content for their broadcasts and projects. During 2020, ten customers accounted for approximately 38% of the total revenues from our content licensing services.

We believe that our relationships with our key customers are good. However, if our key customers discontinue or reduce their business with us, or suffer downturns in their businesses, it could have a significant negative impact on our financial results on a short-term basis. If we lose business from key customers and we are unable to sufficiently expand our customer base to replace the lost business, it would have a long-term negative impact on our business, financial condition and results of operations.

Competition

aiWARE SaaS Solutions. The market for AI-enabled solutions is rapidly evolving and highly competitive, with new AI capabilities and solutions introduced by both large established players that target multiple vertical markets or enterprise functions, as well as smaller emerging companies developing point solutions that generally only address a single cognitive category or a specific industry segment. We believe the following competitive attributes are necessary for us to successfully compete in the AI industry for commercial and government customers for our aiWARE SaaS solutions:

| • | Applications to enable our platform to be effectively leveraged for a wide variety of use cases; |

| • | Ability to seamlessly utilize multiple AI models in the same and different classes; |

| • | Breadth and depth of cognitive processing and other AI capabilities; |

| • | Performance of AI models, particularly accuracy and speed; |

| • | Availability of cloud-based and on-premises deployment models and functionality; |

| • | Ease of deployment and integration; |

| • | Platform scalability, reliability and security; and |

| • | Cost of deploying and using our products. |

9

We believe that we compete favorably on the basis of the factors listed above. We believe that few of our competitors currently compete directly with us across all of our cognitive capabilities and vertical markets, and that none of our competitors currently deploy an AI operating system with an open ecosystem comprised of a comparable number of multiple proprietary and third party AI models that can be accessed by customers from a single integrated platform.

Competitors for our aiWARE SaaS solutions fall into the following primary categories:

| • | Infrastructure-based cloud computing vendors offering cognitive processing services via APIs, such as IBM Watson via IBM Cloud, Microsoft Cognitive Services via Azure and Amazon Machine Learning via AWS; |

| • | Smaller AI-focused vendors offering solutions within a single cognitive category such as facial recognition, object recognition, or natural language processing; |

| • | Enterprise services and solutions providers that combine their services with technology developed in-house to address specific challenges for organizations, such as Palantir and C3.ai; |

| • | System integrators that aggregate and integrate solutions from multiple underlying providers of cognitive services for clients, such as Accenture and Deloitte Consulting; and |

| • | Providers of hardware and/or software solutions serving a particular market, which are incorporating into their solutions automated processing, search and/or data analytics capabilities that provide functionality similar to our industry targeted applications, including the following: |

| o | In the media and entertainment market, providers of digital asset management systems; |

| o | In the public safety market, providers of police body cameras and car recorders and associated content storage and management systems; and |

| o | In the legal market, providers of eDiscovery solutions and/or associated hosting and managed services. |

Advertising. Competitors of our advertising services are mainly traditional advertising agencies that are either large full-service agencies or smaller niche agencies with a particular specialization or focus, such as radio media placement or podcast advertising, as well as large consulting firms in the media industry. We also face competition from clients that have the resources and ability to service their advertising and marketing needs in-house. We believe that we currently are, and will continue to, compete successfully against our competitors on several key factors. We are a leader in endorsed radio and podcast advertising services, and we leverage our platform to provide our clients with innovative technology that we believe provides them with better analytics and insights into their advertising campaigns than our competitors for better advertising performance and optimization.

Content Licensing. We do not currently face significant competition from third parties for our content licensing services, particularly in North America; however, many rights holders manage the licensing of their content in-house, and rights holders that we currently represent may choose to license their own content directly in the future. As we expand our content licensing services internationally, we believe that we will face greater competition from third parties, including large global events and talent management companies. We believe that we may also face more competition in North America in the future, as new representation companies emerge or expand their business in the region. We believe that our ability to use the cognitive capabilities of aiWARE to enrich and enhance the searchability of content, and to leverage relationships with customers and vendors across our aiWARE SaaS and advertising businesses, gives us a competitive advantage over other representation companies and allows us to achieve greater benefits for rights holders than they can achieve through their own in-house efforts.

Some of our competitors have greater financial, technical and other resources, greater name recognition, larger sales and marketing budgets and larger intellectual property portfolios. As a result, certain of our competitors may be able to respond more quickly and effectively than we can to new or changing opportunities, technologies, standards or customer requirements. In addition, some competitors may offer products or services that address one or a limited number of functions at lower prices, with greater depth than our products or geographies where we do not operate. With the introduction of new products and services and new market entrants, we expect competition to intensify in the future.

Research and Development

Our research and development organization is comprised of employees who are responsible for the design, development and testing of our AI and software solutions, including software engineers, quality engineers, data scientists, data engineers, product managers and user experience designers. Our research and development organization is generally organized in teams, with one team focused on our core aiWARE architecture and capabilities and other teams focused on solutions and applications that address specific use cases in our key markets. We focus our efforts on developing new

10

features and expanding the core technologies that further enhance the usability, functionality, reliability, performance and flexibility of our platform, as well as allow us to operate in new vertical markets. In addition, we contract with select third-party engineering services to support development and quality assurance testing. We plan to continue to make significant investments in developing our AI technologies, expanding the functionality and capabilities of our aiWARE platform and related solutions, and building new software capabilities.

Intellectual Property

We rely on a combination of patent, copyright, trademark and trade secret laws in the United States and other jurisdictions, as well as license agreements and other contractual protections, to protect our proprietary technology. We also rely on a number of registered and unregistered trademarks to protect our brand.

As of February 28, 2021, in the United States, we had 27 issued patents, which expire between 2027 and 2039, and had 25 patent applications pending for examination. As of such date, we also had nine issued patents and 23 patent applications pending for examination in foreign jurisdictions (including international PCT applications), all of which are related to our U.S. patents and patent applications. In addition, we have registered, or have applied for registration of, numerous trademarks, including Veritone and aiWARE, in the United States and in several foreign jurisdictions. We seek to protect our intellectual property rights by implementing a policy that requires our employees and independent contractors involved in development of intellectual property on our behalf to enter into agreements acknowledging that all works or other intellectual property generated or conceived by them on our behalf are our property, and assigning to us any rights, including intellectual property rights, that they may claim or otherwise have in those works or property, to the extent allowable under applicable law.

Regulatory Environment

We are subject to a number of U.S. federal and state and foreign laws and regulations that involve matters central to our business. These laws and regulations involve privacy, data protection, intellectual property, competition, consumer protection and other subjects.

Our customers utilize our aiWARE SaaS solutions and related services to process, analyze and store data, which may contain personal information that is subject to data protection and privacy laws in various jurisdictions. For example, in providing certain solutions and related services to customers located in Europe, we are deemed to be a data processor under the European Union General Data Protection Regulation (“GDPR”). The GDPR applies to all companies processing personal data of EU residents, regardless of the company’s location. As a result, we are obligated to comply with the GDPR in processing personal data on behalf of our customers. We must also comply with the GDPR (and similar regulations in other jurisdictions such as the United Kingdom) as a data controller with respect to personal data of certain employees and individuals employed or engaged by our current or prospective customers, vendors and service providers, which we receive and process in the course of our business. We are also required to comply with the California Consumer Privacy Act (“CCPA”) and the regulations implemented thereunder with respect to personal information of California consumers that we collect and process, both directly and indirectly as a service provider to our customers.

Under the GDPR and/or the CCPA, as well as similar data protection regulations implemented in other jurisdictions, including the United Kingdom and in other states within the United States, we are required to maintain appropriate technical and organizational measures to ensure the security and protection of personal data and information, and we must comply (either directly or indirectly in support of our customers’ compliance efforts, as provided for in our contracts with customers) with a number of requirements with respect to individuals whose personal data or information we collect and process, including, among others, notification requirements and requirements to comply with requests from individuals to (i) opt out of collection, processing and/or sale of their data or information, (ii) delete their data or information, and (iii) receive copies of and other information regarding our collection and processing of their data or information.

The California Privacy Rights Act (“CPRA”), which will take effect on January 1, 2023, amends and expands the CCPA to include additional obligations of businesses with respect to collecting, processing and sharing personal information and responding to requests from consumers related to their personal information. We will be obligated to comply with the CPRA and the regulations to be implemented thereunder commencing in January 2023.

Human Capital Resources

As of February 28, 2021, we had a total of 308 employees, substantially all of which were full-time employees.

We believe that our employees are our greatest assets and our company culture is a critical component of our success. We strive to create a work environment in which all employees feel a strong sense of community and embody our core

11

values. We have implemented a number of initiatives to ensure that our employees are engaged and motivated to work hard, and have fun at the same time. We conduct employee engagement surveys to gauge employee satisfaction, identify areas for improvement and implement positive change in order to evolve and better our company culture.

We strive to hire, develop and retain the top talent in the industry. To attract top talent, we strive to offer competitive salaries, incentives, equity compensation and benefits. We conduct a regular quarterly talent review process, in which we obtain employee feedback, evaluate performance, and establish goals, objectives and development plans for all employees. We continuously monitor and evaluate employee turnover to identify and address areas of concern to improve employee retention.

Company Information

We were incorporated as a Delaware corporation on June��13, 2014. Our corporate headquarters are located at 1515 Arapahoe Street, Tower 3, Suite 400, Denver, Colorado 80202. Our telephone number is (888) 507-1737. Our principal website address is www.veritone.com. The information provided on, or accessible through, our website is not a part of this Annual Report on Form 10-K, nor is such information incorporated by reference herein, and such information should not be relied upon in determining whether to make an investment in our common stock.

Available Information

This Annual Report on Form 10-K and our quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to reports filed or furnished pursuant to Sections 13(a) and 15(d) of the Exchange Act, are available free of charge on the investor relations section of our website at investors.veritone.com as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. We will also provide electronic or paper copies of such reports free of charge, upon request made to our Corporate Secretary at 1515 Arapahoe Street, Tower 3, Suite 400, Denver, Colorado 80202. The SEC maintains an internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at http://www.sec.gov.

We use our investor relations website as a channel of distribution for important company information, including news and commentary about our business and financial performance, webcasts of our earnings calls and investor events, SEC filings, and corporate governance information, including information regarding our board of directors, our board committee charters and code of ethics. The information provided on, or accessible through, our investor relations website is not a part of this Annual Report on Form 10-K, nor is such information incorporated by reference herein, and such information should not be relied upon in determining whether to make an investment in our common stock.

Item 1A. Risk Factors.

The following is a summary of certain risks we face in our business. They are not the only risks we face. Additional risks that we do not yet know of or that we currently believe are immaterial may also impair our business operations. If any of the events or circumstances described in the following risks actually occurs, our business, financial condition or results of operations could suffer, and the trading price of our common stock could decline. In assessing these risks, investors should also refer to the other information contained or incorporated by reference in our other filings with the Securities and Exchange Commission. Certain statements contained in this section constitute forward-looking statements. See the information included in “Cautionary Note Regarding Forward-Looking Statements” on page ii of this Annual Report on Form 10-K.

Risks Related to the Early Stage of Development of Our Business and Our Financial Condition

Our efforts to expand our aiWARE SaaS business may not be successful.

In order for us to grow our business and achieve profitability, we must expand our revenue base by entering into licensing agreements with additional customers and expanding our business with existing customers. We may not be able to succeed with respect to these efforts. Many factors may adversely affect our ability to establish a viable and profitable business for our aiWARE platform, including but not limited to:

| • | Failure to add market-specific applications to our aiWARE platform with sufficient levels of capability to provide compelling benefits to users in our target vertical markets; |

| • | Failure to add AI models with sufficient levels of capability or trainability into our platform, difficulties integrating AI models, loss of access to, or increases in the cost of, AI models; |

12

| • | Inability to expand the number of AI models in different classes that can operate in a network-isolated manner, which would limit the capabilities of aiWARE available in our FedRAMP environment or under private cloud, on-premises and hybrid deployment models; |

| • | Difficulties in adding technical capabilities to our platform and ensuring future compatibility of additional third party providers; |

| • | Failure to articulate the perceived benefits of our solution, or to generate broad customer acceptance of or interest in our solutions; |

| • | Introduction of competitive offerings by larger, better financed and more well-known companies; |

| • | Introduction of new products or technologies that have performance and/or cost advantages over our aiWARE platform; |

| • | Inability to integrate our platform with products of other companies to pursue particular vertical markets, or the failure of such relationships to achieve their anticipated benefits; |

| • | Long and complex sales cycles, particularly for customers in the government and energy markets; and |

| • | Challenges in operating our platform on secure government cloud platforms and complying with government security requirements. |

If we fail to develop a successful licensing business for our aiWARE platform, or if we are unable to ramp up our operations in a timely manner or at all, our business, results of operations and financial condition will suffer.

The market for AI-based software applications is new and unproven and may decline or experience limited growth, and concerns over the use of AI may hinder the adoption of AI technologies, which would adversely affect our ability to fully realize the potential of our platform.

The market for AI-based software applications is relatively new and evaluating the size and scope of the market is subject to a number of risks and uncertainties. We believe that our future success will depend in large part on the growth of this market. The utilization of our platform by customers is still relatively new, and customers may not recognize the need for, or benefits of, our platform, which may prompt them to cease use of our platform or decide to adopt alternative products and services to satisfy their cognitive computing, search and analytics requirements. Our ability to access and extend our position in the markets that our platform is designed to address depends upon a number of factors, including the cost, performance and perceived value of our platform. Market opportunity estimates are subject to significant uncertainty and are based on assumptions and estimates, including our internal analysis and industry experience. Assessing the market for our solutions is particularly difficult due to a number of factors, including limited available information and rapid evolution of the market.

In addition, as with many developing technologies, AI presents risks and challenges that could hinder its further development, adoption and use in the markets that we serve. AI algorithms may be flawed, datasets may be insufficient or contain biased information, and the results and analyses that our AI solutions assist in producing may be deficient or inaccurate. Further, use of AI technologies in certain scenarios present ethical concerns. Though our technologies and business practices are designed to mitigate many of these risks, if we enable or offer AI solutions that produce deficient or inaccurate results and analyses, or that are controversial due to human rights, privacy or other social issues, we may experience lower-than-expected demand for our products and services, or competitive, brand or reputational harm.

If the market for AI-based solutions does not experience significant growth, or if demand for our platform does not increase in line with our projections, then our business, results of operations and financial condition will be adversely affected.

We expect to require additional capital to support our business, and this capital might not be available on acceptable terms, if at all.

We intend to continue to make investments to support our business, which will require additional funds. In particular, we expect to seek additional funds to continue to develop and enhance our aiWARE SaaS solutions and services, expand our operations, including our sales and marketing organizations and our presence outside of the United States, improve our infrastructure or acquire complementary businesses, technologies, services, products and other assets. Accordingly, we expect to engage in equity and/or debt financings to secure additional funds. If we raise additional funds through future issuances of equity or convertible debt securities, our stockholders could suffer significant dilution, and any new equity securities we issue could have rights, preferences and privileges superior to those of holders of our common stock. Any debt financing that we may secure in the future could involve debt service obligations and restrictive covenants relating to our

13

capital raising activities and other financial and operational matters, which may make it more difficult for us to obtain additional capital and to pursue business opportunities. We may not be able to obtain additional financing on terms favorable to us, if at all. If we are unable to obtain adequate financing or financing on terms satisfactory to us when we require it, our ability to continue to support our business growth, scale our infrastructure, develop product enhancements and to respond to business challenges could be significantly impaired, and our business, results of operations and financial condition may be adversely affected.

Our quarterly results may fluctuate significantly and period-to-period comparisons of our results may not be meaningful.