© 2020 Salarius Pharmaceuticals, Inc. Non Confidential 3Q 2020 Company Overview Exhibit 99.3

Safe Harbor Statement This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any statement in this presentation that is not a historical fact is a forward-looking statement. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially and reported results should not be considered as an indication of future performance. Examples of such statements include, but are not limited to: statements relating to the overall ability of epigenetic regulator drugs to correct gene changes in disease, including how modulation of LSD1 may increase responsiveness to checkpoint inhibition; the commercial or market opportunity and expansion for each therapeutic option, including the availability and value of a pediatric priority review voucher for in-clinic treatments and potential for accelerated approval; the adequacy of our capital to support our future operations and our ability to successfully initiate and complete clinical trials and regulatory submissions; Seclidemstat’s impact in Ewing sarcoma and as a potential new and less-toxic treatment; expected dose escalation and dose expansion; expected cohort readouts; expected therapeutic options for SP-2577 and related effects and projected efficacy, including SP-2577’s ability to inhibit LSD1; the potential for SP-2577 to differentiate itself from competing LSD1-inhibitors; timing of development and future milestones, including for each of SP-2577’s indications; the nature, strategy and focus of Salarius; and the development, expected timeline and commercial potential of any of our product candidates or our competitors. We may not actually achieve the plans, carry out the intentions or meet the expectations, objectives or projections disclosed in the forward-looking statements and you should not place undue reliance on these forward-looking statements. Such statements are based on management’s current expectations and involve risks and uncertainties. Actual results and performance could differ materially from those projected in the forward-looking statements as a result of many factors, including, without limitation: risks and uncertainties associated with the availability of sufficient resources to meet our business objectives and operational requirements, including amounts remaining available under the CPRIT grant; the risk that we may not obtain or maintain sufficient levels of reimbursement for our clinical trials and product development, including from CPRIT; the ability to project future cash utilization and reserves needed for contingent future liabilities and business operations; the fact that the results of earlier studies and trials may not be predictive of future clinical trial results; our quarter-end closing procedures and finalization of our quarterly financial results; the sufficiency of our intellectual property protections; risks related to the drug development and the regulatory approval process; other legal and regulatory uncertainties; the market price of our common stock and our ability to maintain the listing of our common stock on Nasdaq; the impact of the ongoing COVID-19 pandemic and the success of any measures we have taken or may take in response thereto; and the impact of competitive products and technological changes. We disclaim any intent or obligation to update these forward-looking statements to reflect events or circumstances that exist after the date on which they were made. You should review additional disclosures we make in our filings with the Securities and Exchange Commission, including our Quarterly Reports on Form 10-Q, Annual Reports on Form 10-K, and Current Reports on Form 8-K. You may access these documents for no charge at http://www.sec.gov. This presentation shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or other jurisdiction.

Risk Factors Investing in our securities includes a high degree of risk. You should consider carefully the specific factors discussed below, together with all of the other information contained in our SEC filings. If any of the following risks actually occurs, our business, financial condition, results of operations and future prospects would likely be materially and adversely affected. This could cause the market price of our securities to decline and could cause you to lose all or part of your investment. Risks include but are not limited to: The approach Salarius is taking to discover and develop novel oncology therapeutics using epigenetic enzymes to moderate transcription factors and thereby control abnormal protein expression is unproven and may never lead to marketable products. Salarius’ therapeutic product candidates are based on a relatively novel technology, which makes it difficult to predict the timing and cost of development and of subsequently obtaining regulatory approval, if at all. Salarius’ product candidates may cause undesirable side effects or have other properties that could delay or prevent their regulatory approval, limit the commercial viability of an approved label, or result in significant negative consequences following marketing approval, if any. Some of Salarius’ product candidates may produce results in pre-clinical or clinical settings for indications other than those for which Salarius contemplates conducting development and seeking FDA approval, and Salarius cannot give any assurance that it will generate data for any of its product candidates sufficient to receive regulatory approval in its planned indications, which will be required before they can be commercialized. Salarius may find it difficult to enroll patients in its clinical trials given the limited number of patients who have the diseases for which its product candidates are being studied. Difficulty in enrolling patients is a common hurdle faced by early stage biotechnology companies and could, and often does, delay or prevent clinical trials of product candidates. Salarius has never generated any revenue from product sales and may never generate revenue or be profitable. Raising additional capital may cause dilution to Salarius’ stockholders, restrict its operations, or require Salarius to relinquish rights. Salarius may seek breakthrough therapy designation by the FDA for one or more of its product candidates, but it might not receive such designation. A potential breakthrough therapy designation by the FDA for Salarius’ product candidates may not lead to a faster development or regulatory review or approval process, and it does not increase the likelihood that Salarius’ product candidates will receive marketing approval.

Mission Statement Developing treatments for patients that need them the most

Corporate Overview Drugs that regulate gene expression (“epigenetics”) have shown clinical efficacy plus immuno-oncology potential Non-Dilutive funding in addition to low monthly burn rate Up to an aggregate of $18.7M1 from Cancer Prevention Research Institute of Texas (CPRIT) Financial support from the National Pediatric Cancer Foundation Lead candidate, seclidemstat is a novel, oral, reversible LSD1 inhibitor that regulates gene expression and is currently in Phase 1/2 Ewing sarcoma and Phase 1/2 solid tumor clinical trials Seclidemstat FDA designations for Ewing sarcoma: (1) Rare Pediatric Disease Designation, (2) Orphan Drug Designation, and (3) Fast Track Approval Market expansion in targeted cancers with LSD1 sensitive mutations and immunotherapy (checkpoint inhibitor combos) $ 1 As of June 30, 2020, the Company had received $9.6M from CPRIT and there is up to $9.1M available subject to certain requirements and spending restrictions.

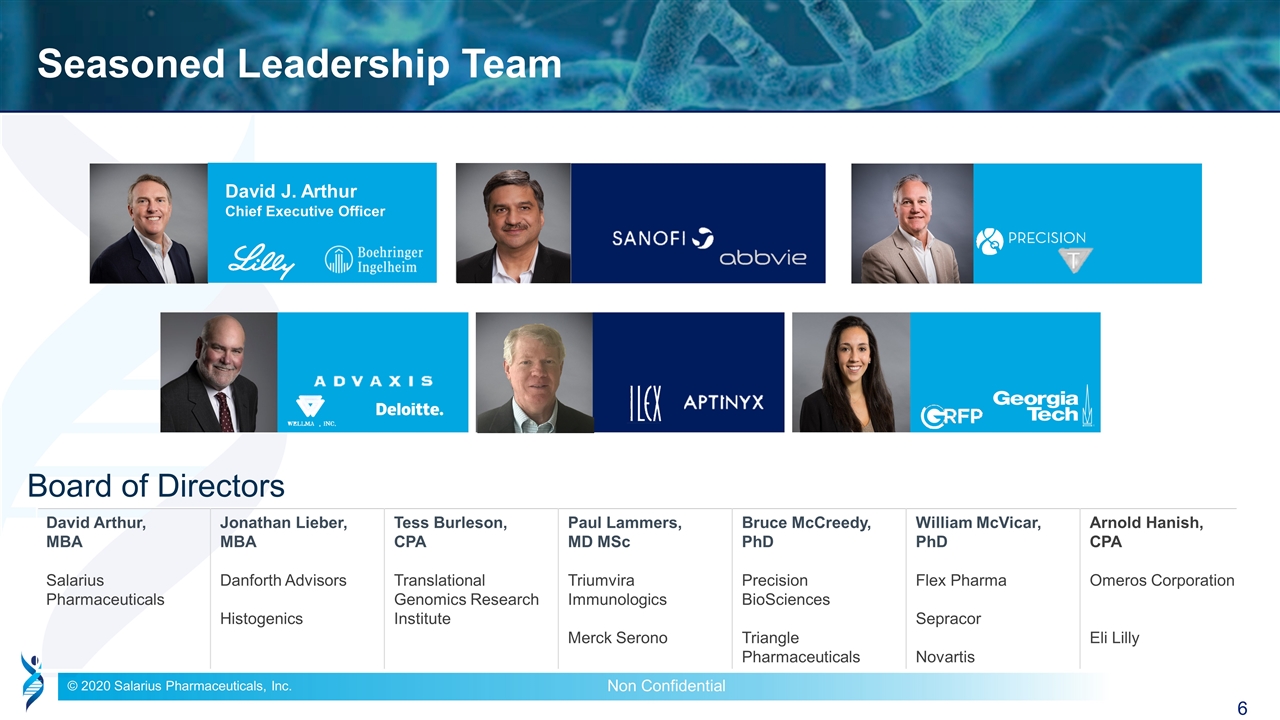

Seasoned Leadership Team Board of Directors David J. Arthur Chief Executive Officer David Arthur, MBA Salarius Pharmaceuticals Jonathan Lieber, MBA Danforth Advisors Histogenics Tess Burleson, CPA Translational Genomics Research Institute Paul Lammers, MD MSc Triumvira Immunologics Merck Serono Bruce McCreedy, PhD Precision BioSciences Triangle Pharmaceuticals William McVicar, PhD Flex Pharma Sepracor Novartis Arnold Hanish, CPA Omeros Corporation Eli Lilly

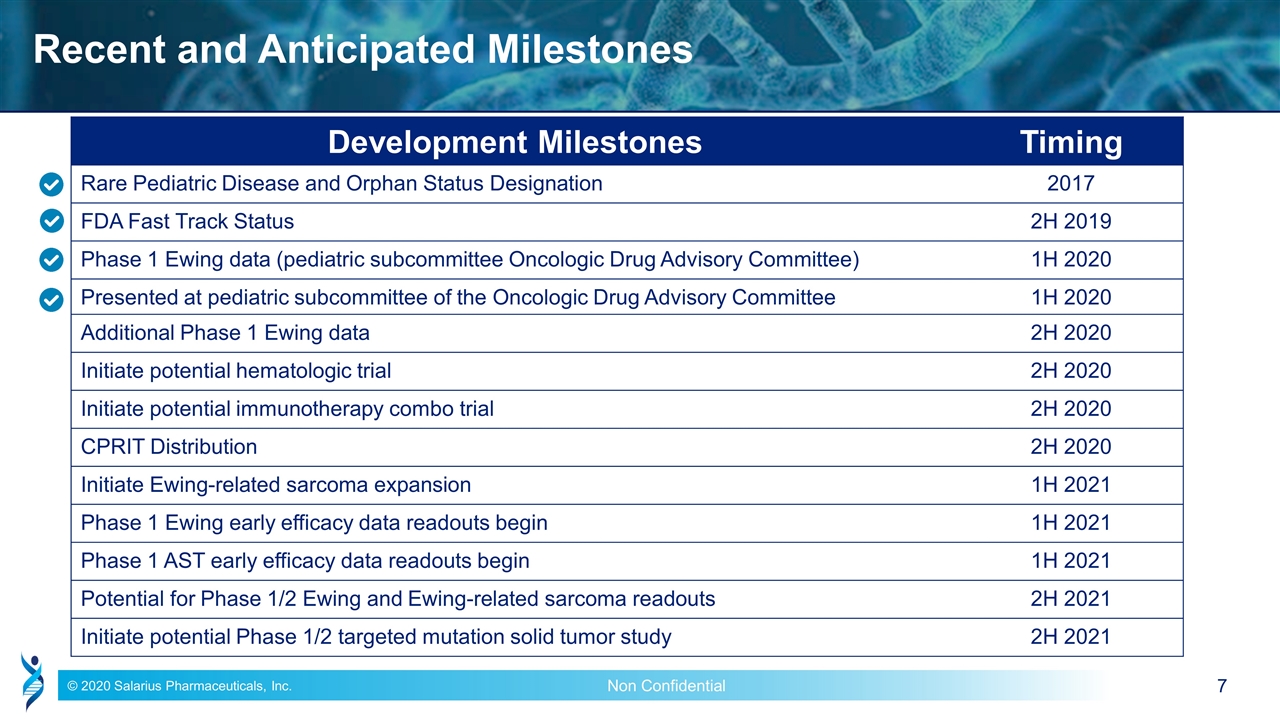

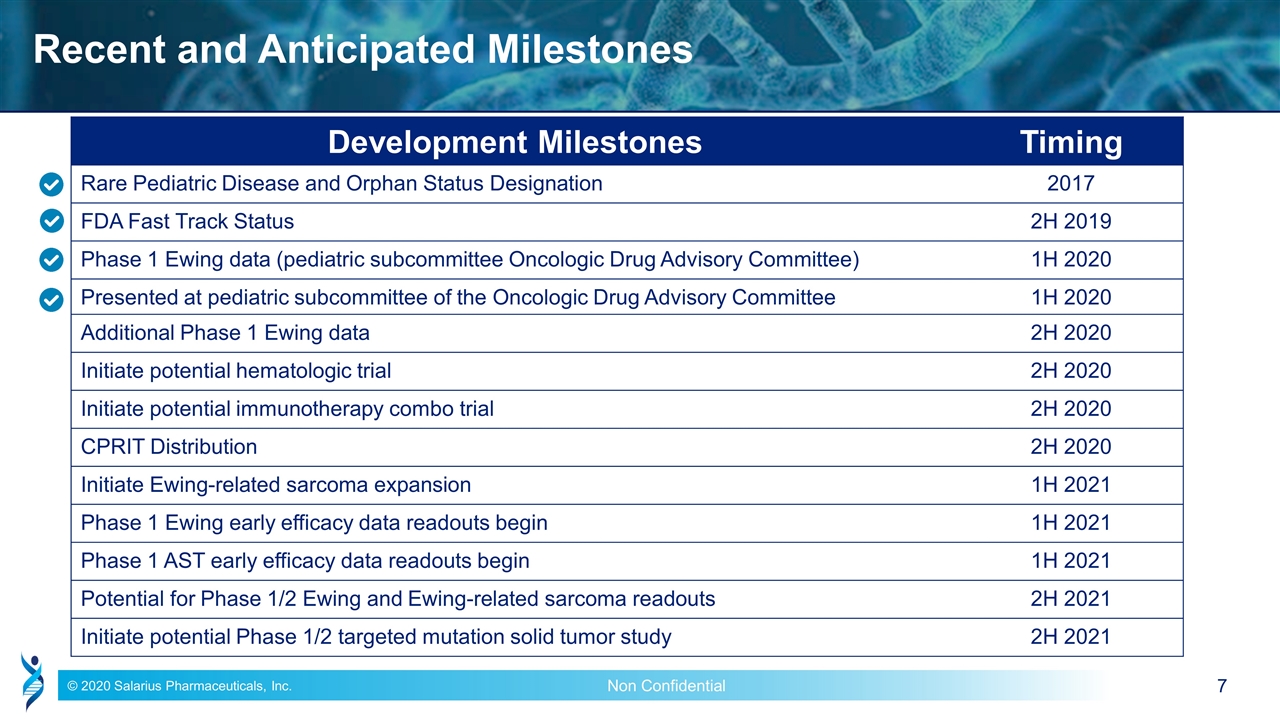

Recent and Anticipated Milestones Development Milestones Timing Rare Pediatric Disease and Orphan Status Designation 2017 FDA Fast Track Status 2H 2019 Phase 1 Ewing data (pediatric subcommittee Oncologic Drug Advisory Committee) 1H 2020 Presented at pediatric subcommittee of the Oncologic Drug Advisory Committee 1H 2020 Additional Phase 1 Ewing data 2H 2020 Initiate potential hematologic trial 2H 2020 Initiate potential immunotherapy combo trial 2H 2020 CPRIT Distribution 2H 2020 Initiate Ewing-related sarcoma expansion 1H 2021 Phase 1 Ewing early efficacy data readouts begin 1H 2021 Phase 1 AST early efficacy data readouts begin 1H 2021 Potential for Phase 1/2 Ewing and Ewing-related sarcoma readouts 2H 2021 Initiate potential Phase 1/2 targeted mutation solid tumor study 2H 2021

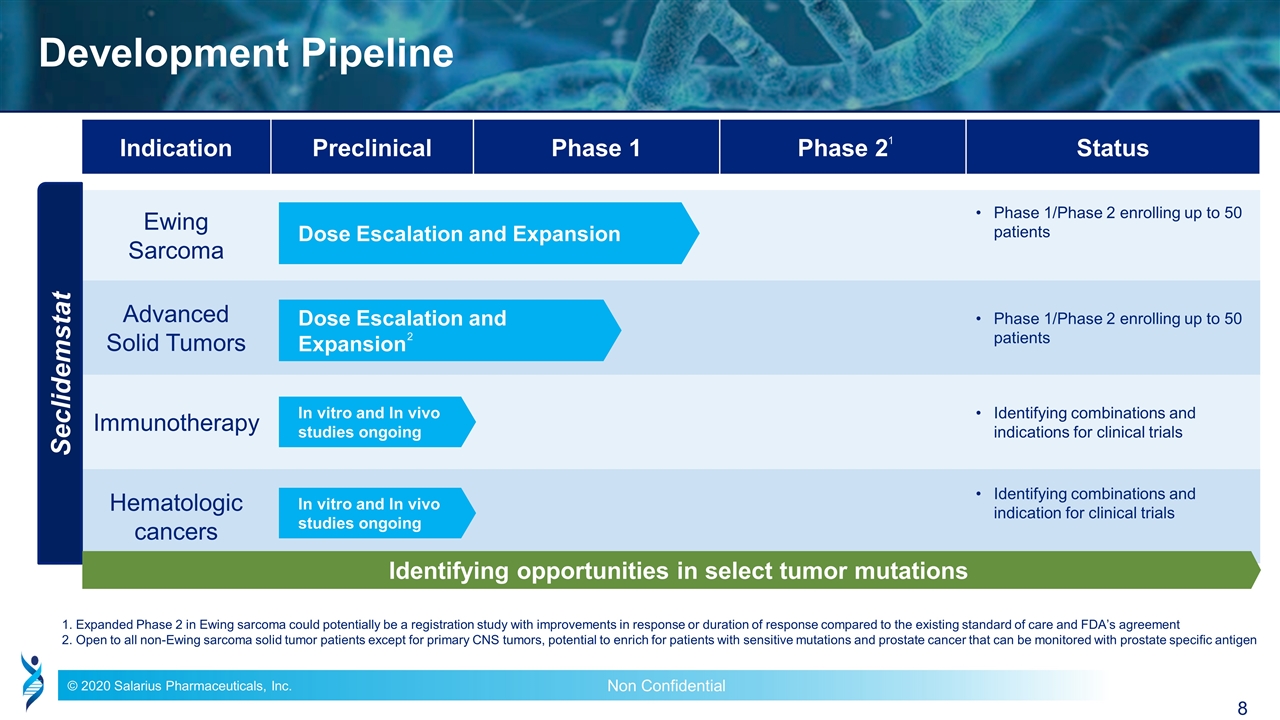

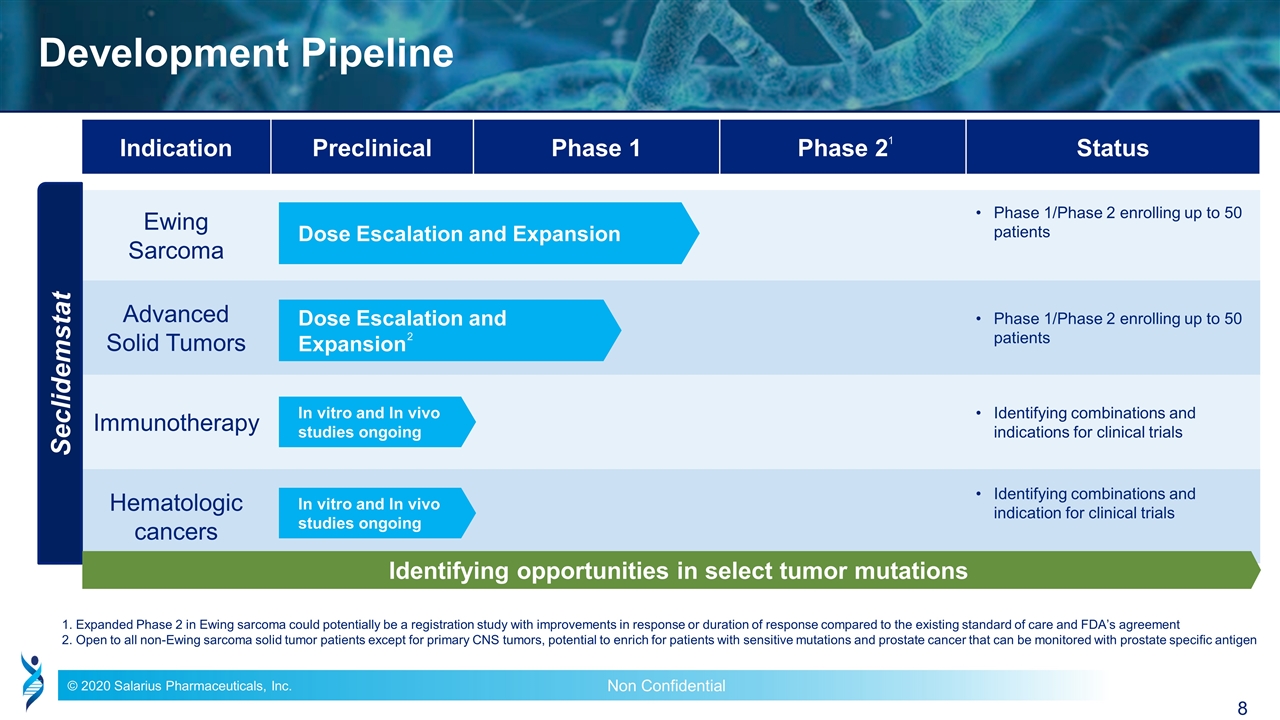

Indication Preclinical Phase 1 Phase 2 Status Ewing Sarcoma Phase 1/Phase 2 enrolling up to 50 patients Advanced Solid Tumors Phase 1/Phase 2 enrolling up to 50 patients Immunotherapy Identifying combinations and indications for clinical trials Hematologic cancers Identifying combinations and indication for clinical trials Development Pipeline 1. Expanded Phase 2 in Ewing sarcoma could potentially be a registration study with improvements in response or duration of response compared to the existing standard of care and FDA’s agreement 2. Open to all non-Ewing sarcoma solid tumor patients except for primary CNS tumors, potential to enrich for patients with sensitive mutations and prostate cancer that can be monitored with prostate specific antigen Seclidemstat Dose Escalation and Expansion Dose Escalation and Expansion In vitro and In vivo studies ongoing Identifying opportunities in select tumor mutations 1 2 In vitro and In vivo studies ongoing

Seclidemstat Overview

Epigenetic enzymes are attractive targets for cancer therapy Epigenetic modifying enzymes affect gene expression by manipulating the chromatin structure Open chromatin Transcription permissive Closed chromatin Transcription non-permissive Dysregulated epigenetic enzymes can disrupt the transcriptional balance and lead to cancer development Dysregulated epigenetic enzyme Drugs that correct dysregulated epigenetic enzymes can help treat cancer by restoring to a balanced transcriptional state Epigenetic inhibitors Tumor growth genes Tumor suppressive genes Adapted from Marcin et al. Biomed Intel 2018. Adapted from Holliday, H. Breast Cancer Research 2018 H3K4Me3

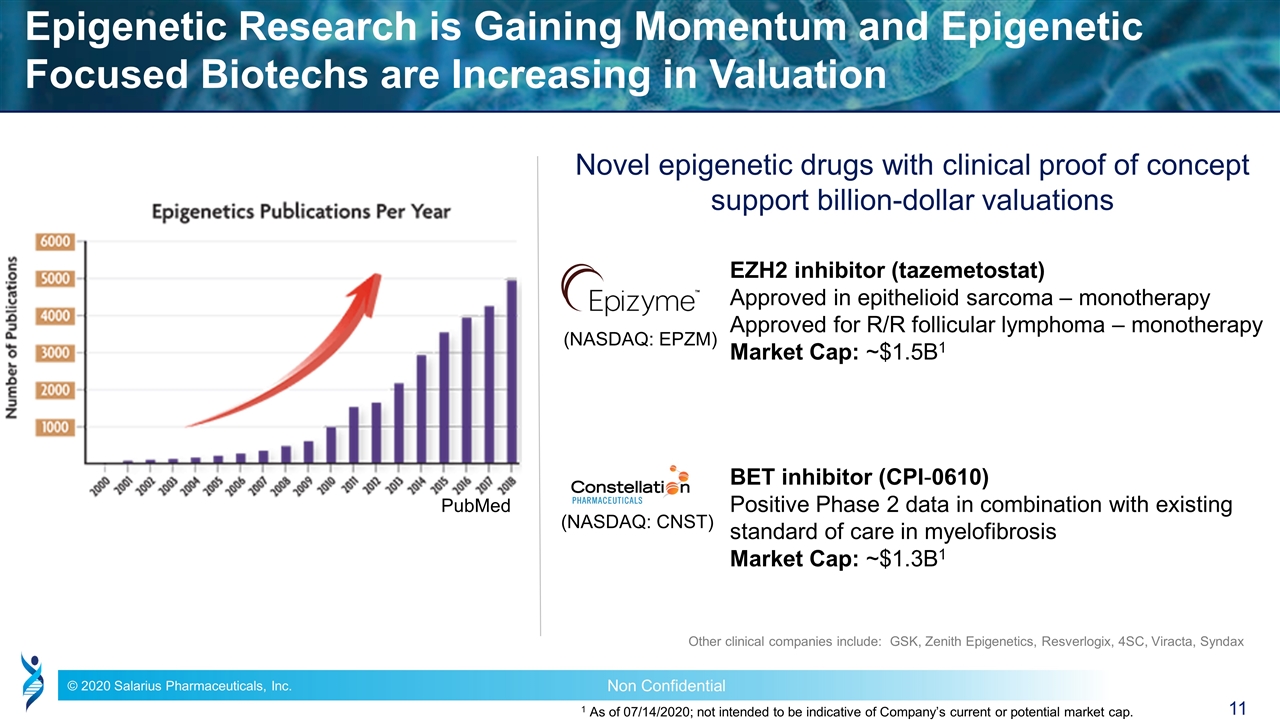

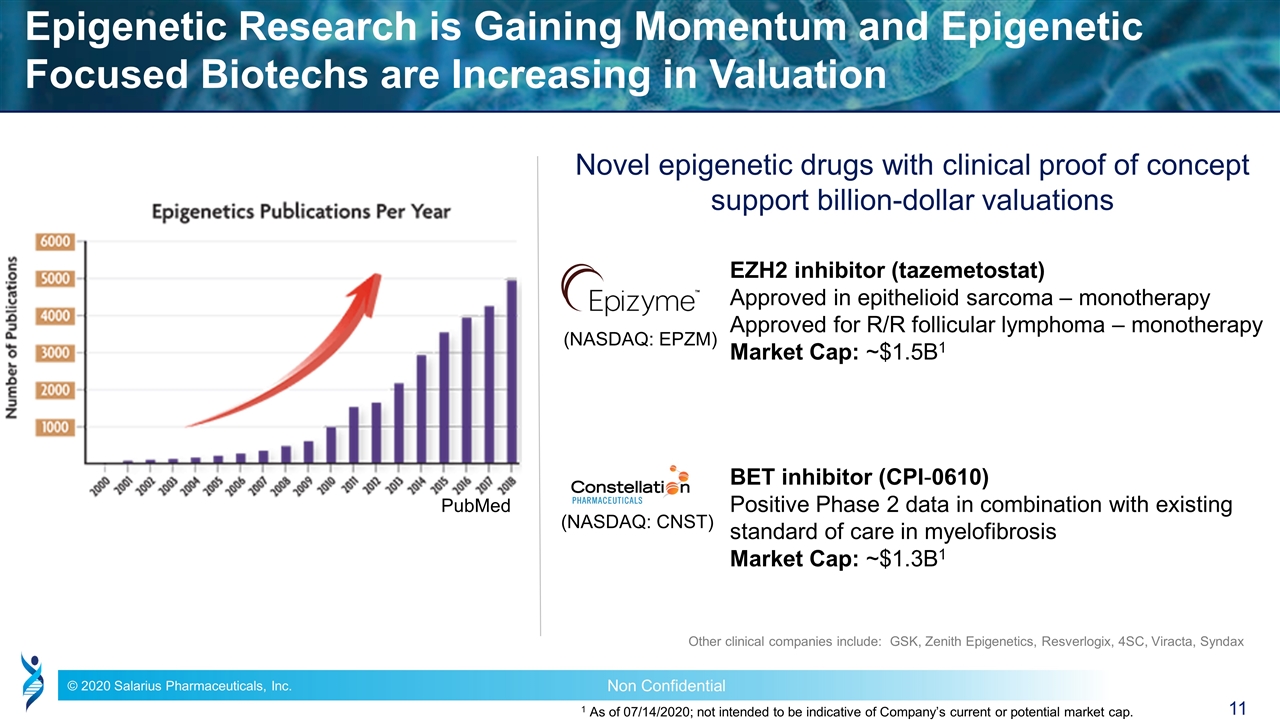

Epigenetic Research is Gaining Momentum and Epigenetic Focused Biotechs are Increasing in Valuation Novel epigenetic drugs with clinical proof of concept support billion-dollar valuations Other clinical companies include: GSK, Zenith Epigenetics, Resverlogix, 4SC, Viracta, Syndax EZH2 inhibitor (tazemetostat) Approved in epithelioid sarcoma – monotherapy Approved for R/R follicular lymphoma – monotherapy Market Cap: ~$1.5B1 BET inhibitor (CPI-0610) Positive Phase 2 data in combination with existing standard of care in myelofibrosis Market Cap: ~$1.3B1 PubMed (NASDAQ: EPZM) (NASDAQ: CNST) 1 As of 07/14/2020; not intended to be indicative of Company’s current or potential market cap.

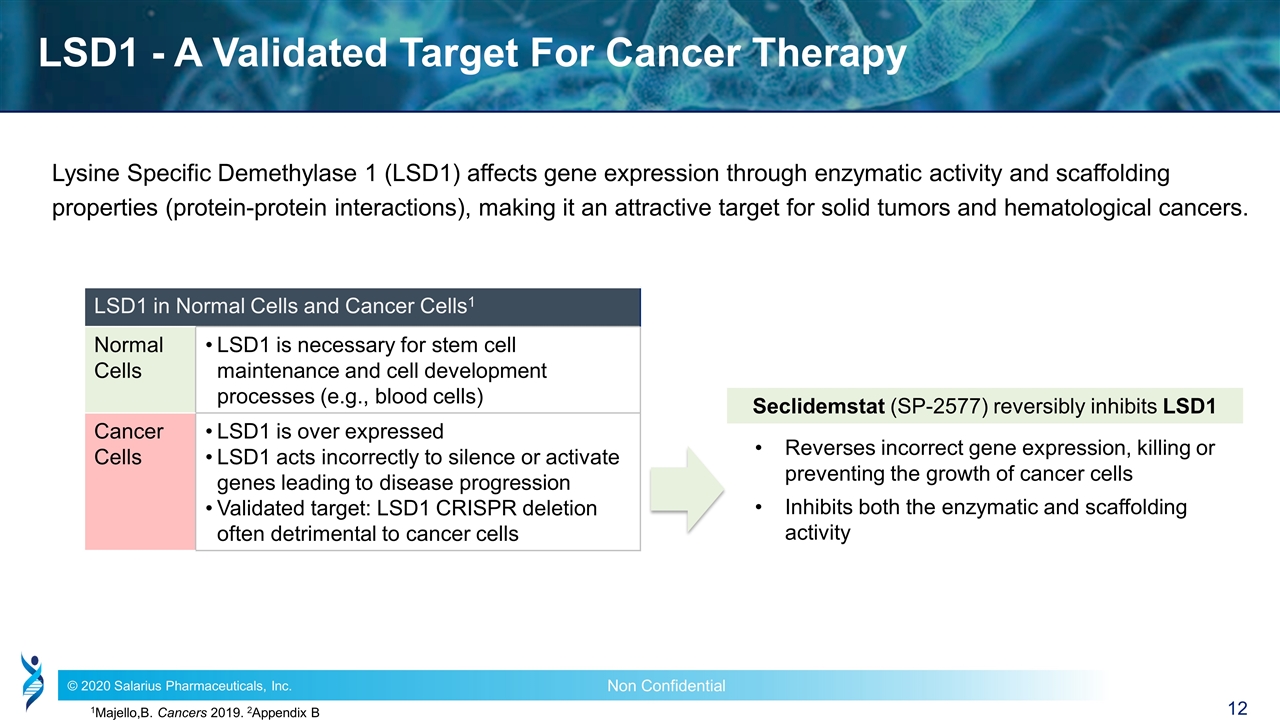

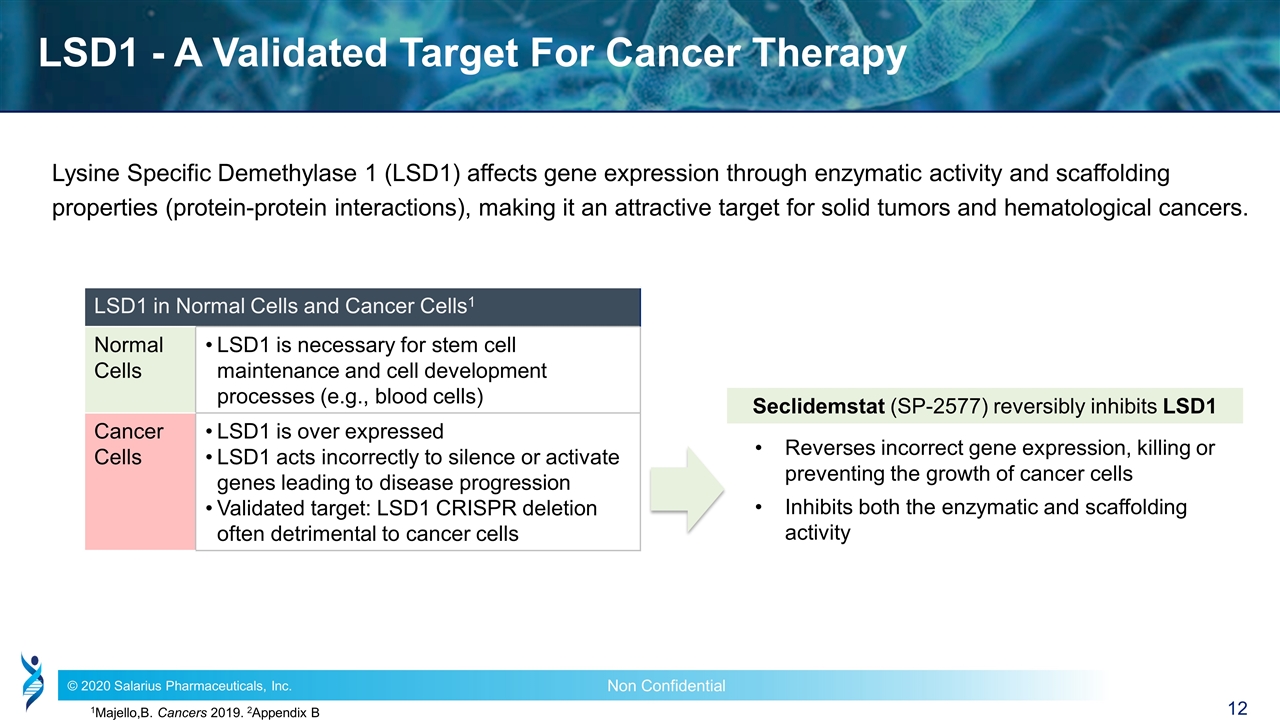

LSD1 - A Validated Target For Cancer Therapy Lysine Specific Demethylase 1 (LSD1) affects gene expression through enzymatic activity and scaffolding properties (protein-protein interactions), making it an attractive target for solid tumors and hematological cancers. 1Majello,B. Cancers 2019. 2Appendix B LSD1 in Normal Cells and Cancer Cells1 Normal Cells LSD1 is necessary for stem cell maintenance and cell development processes (e.g., blood cells) Cancer Cells LSD1 is over expressed LSD1 acts incorrectly to silence or activate genes leading to disease progression Validated target: LSD1 CRISPR deletion often detrimental to cancer cells Seclidemstat (SP-2577) reversibly inhibits LSD1 Reverses incorrect gene expression, killing or preventing the growth of cancer cells Inhibits both the enzymatic and scaffolding activity

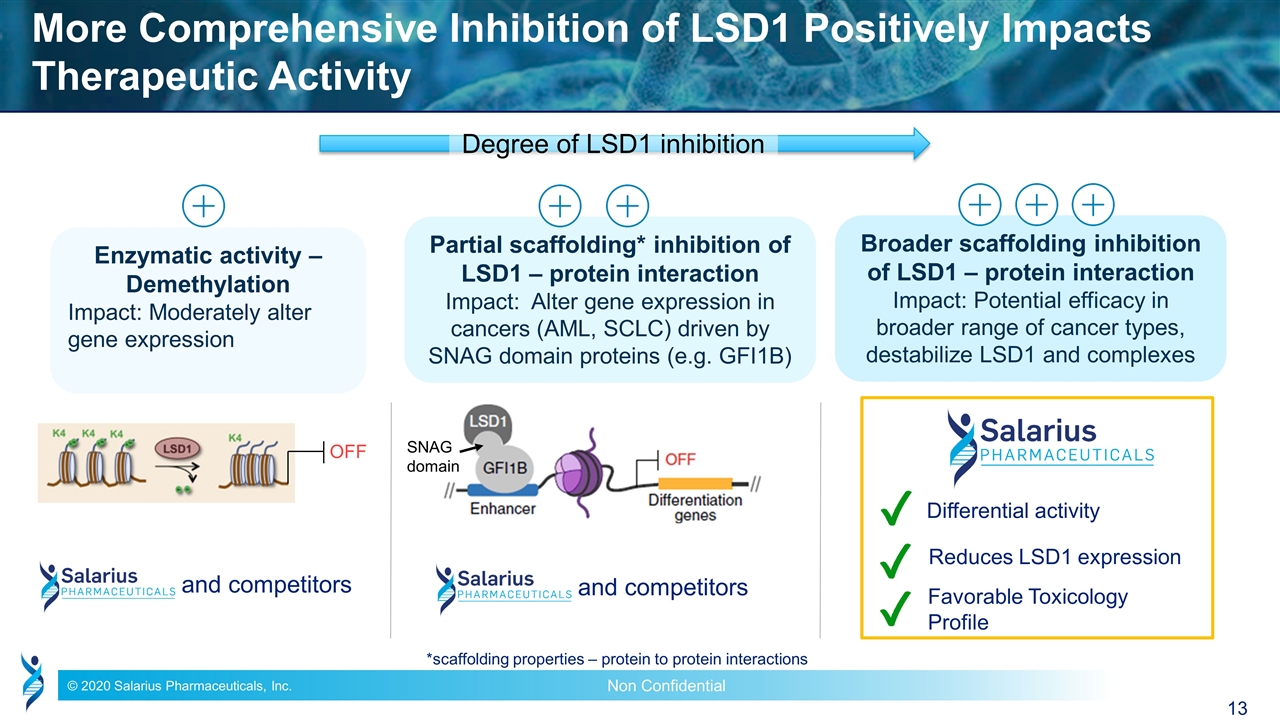

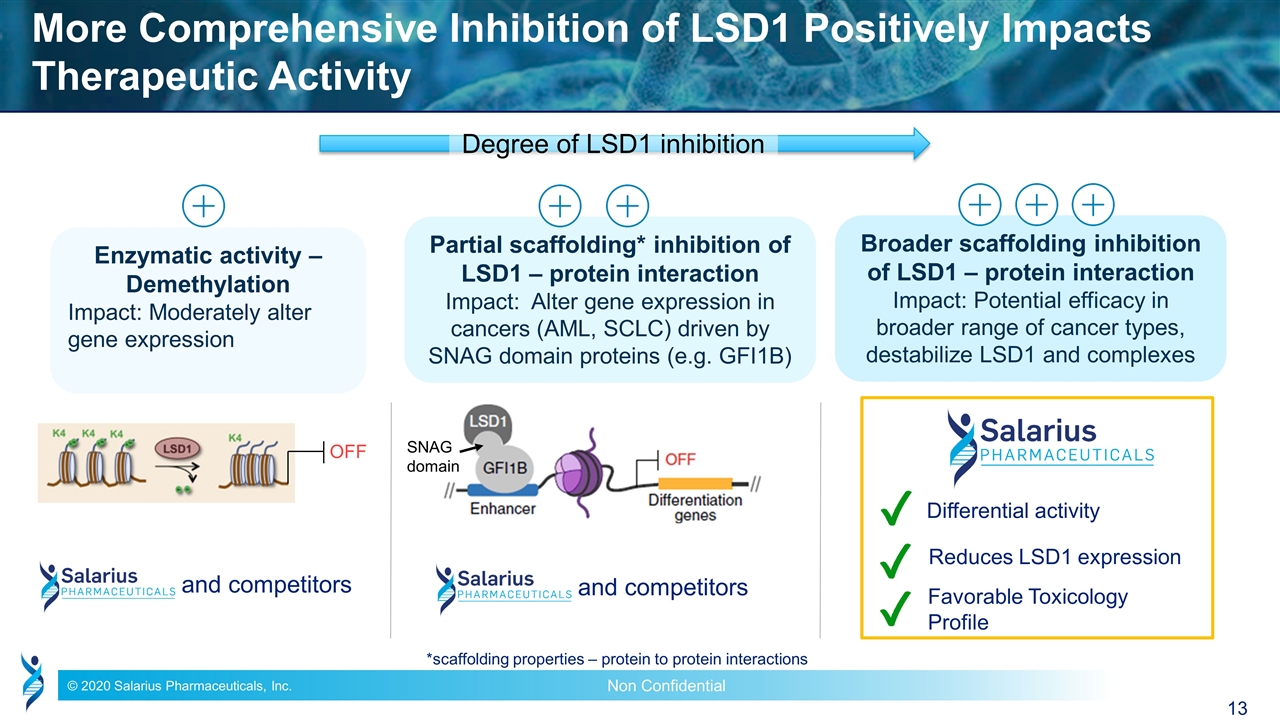

More Comprehensive Inhibition of LSD1 Positively Impacts Therapeutic Activity Enzymatic activity – Demethylation Impact: Moderately alter gene expression Partial scaffolding* inhibition of LSD1 – protein interaction Impact: Alter gene expression in cancers (AML, SCLC) driven by SNAG domain proteins (e.g. GFI1B) Broader scaffolding inhibition of LSD1 – protein interaction Impact: Potential efficacy in broader range of cancer types, destabilize LSD1 and complexes Favorable Toxicology Profile Differential activity and competitors Reduces LSD1 expression and competitors OFF SNAG domain Degree of LSD1 inhibition *scaffolding properties – protein to protein interactions

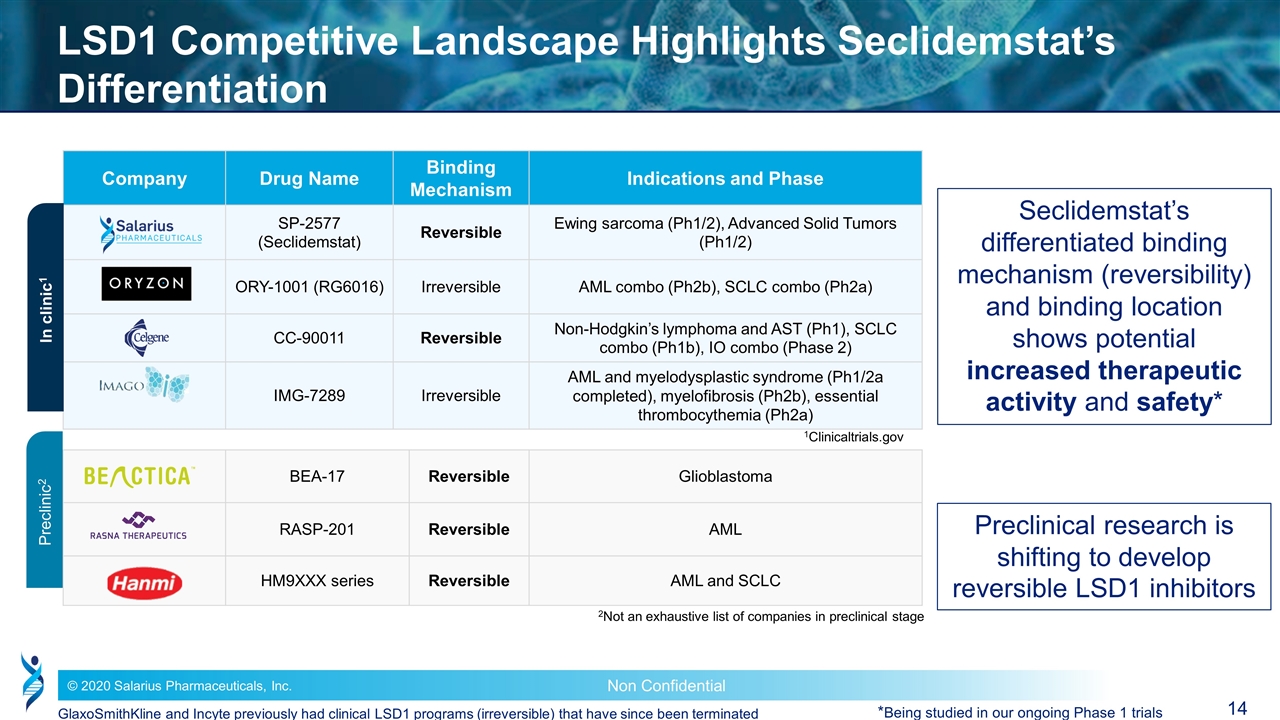

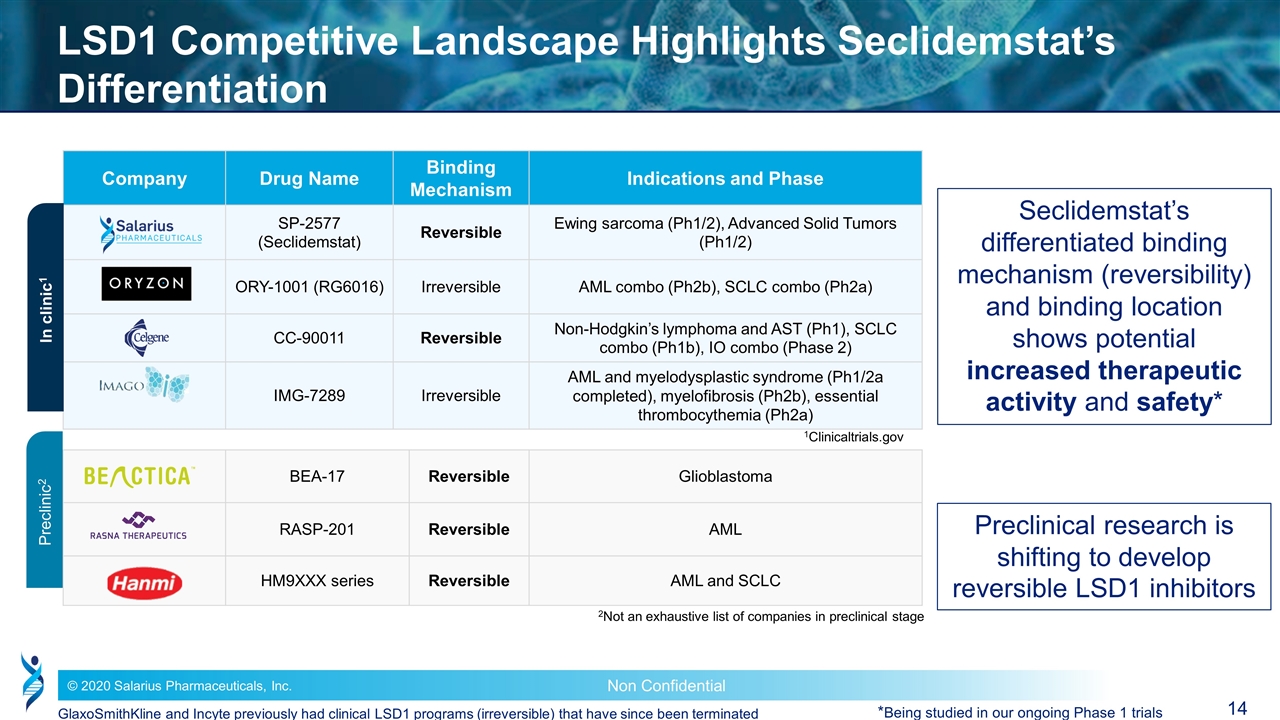

Company Drug Name Binding Mechanism Binding Mechanism Indications and Phase SP-2577 (Seclidemstat) Reversible Reversible Ewing sarcoma (Ph1/2), Advanced Solid Tumors (Ph1/2) ORY-1001 (RG6016) Irreversible Irreversible AML combo (Ph2b), SCLC combo (Ph2a) CC-90011 Reversible Reversible Non-Hodgkin’s lymphoma and AST (Ph1), SCLC combo (Ph1b), IO combo (Phase 2) IMG-7289 Irreversible Irreversible AML and myelodysplastic syndrome (Ph1/2a completed), myelofibrosis (Ph2b), essential thrombocythemia (Ph2a) BEA-17 Reversible Glioblastoma RASP-201 Reversible AML HM9XXX series Reversible AML and SCLC LSD1 Competitive Landscape Highlights Seclidemstat’s Differentiation 2Not an exhaustive list of companies in preclinical stage In clinic1 Preclinic2 1Clinicaltrials.gov Seclidemstat’s differentiated binding mechanism (reversibility) and binding location shows potential increased therapeutic activity and safety* Preclinical research is shifting to develop reversible LSD1 inhibitors *Being studied in our ongoing Phase 1 trials GlaxoSmithKline and Incyte previously had clinical LSD1 programs (irreversible) that have since been terminated

SPEED TO MARKET Seclidemstat in Ewing Sarcoma

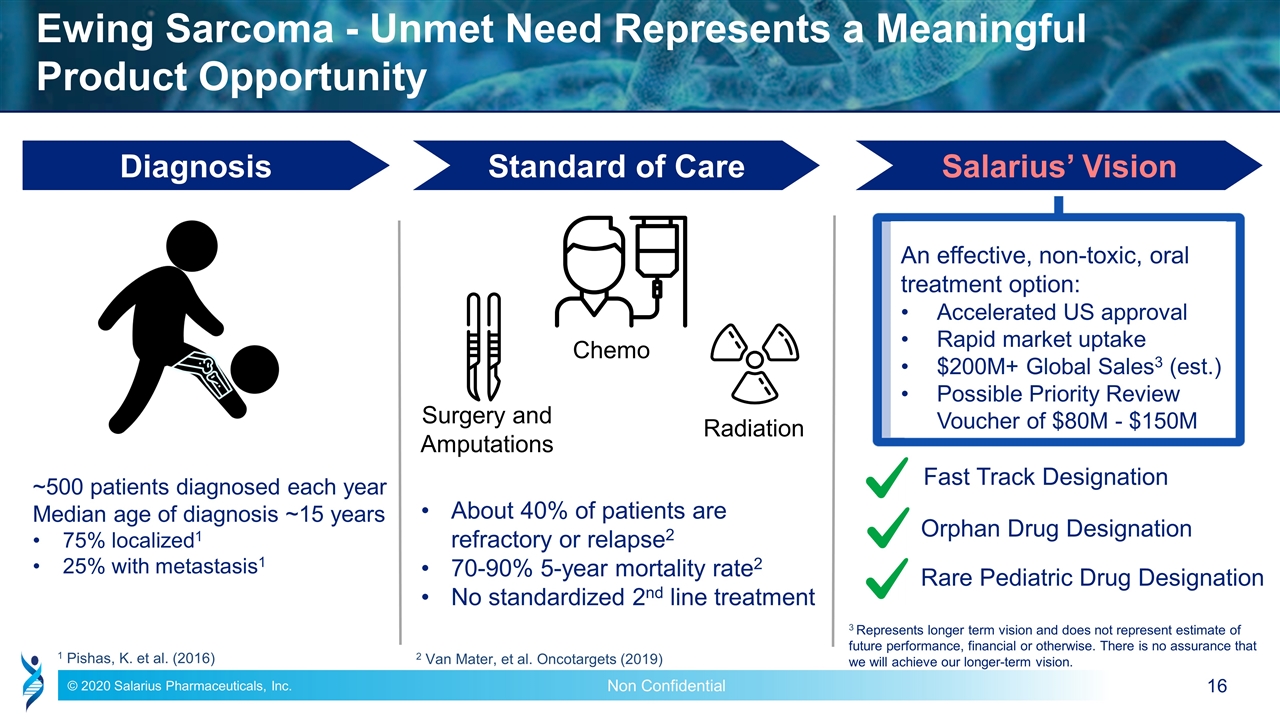

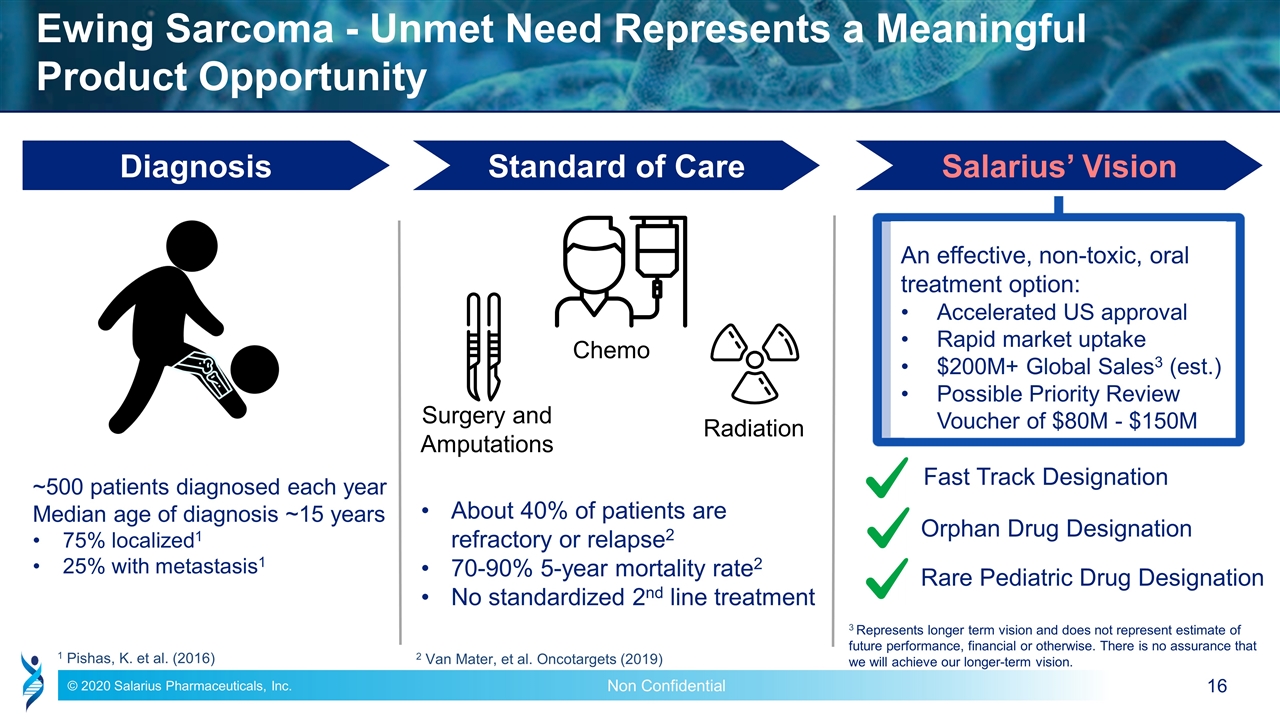

Ewing Sarcoma - Unmet Need Represents a Meaningful Product Opportunity ~500 patients diagnosed each year Median age of diagnosis ~15 years 75% localized1 25% with metastasis1 About 40% of patients are refractory or relapse2 70-90% 5-year mortality rate2 No standardized 2nd line treatment Diagnosis Standard of Care Salarius’ Vision An effective, non-toxic, oral treatment option: Accelerated US approval Rapid market uptake $200M+ Global Sales3 (est.) Possible Priority Review Voucher of $80M - $150M Fast Track Designation Rare Pediatric Drug Designation 2 Van Mater, et al. Oncotargets (2019) 1 Pishas, K. et al. (2016) Orphan Drug Designation Surgery and Amputations Chemo Radiation 3 Represents longer term vision and does not represent estimate of future performance, financial or otherwise. There is no assurance that we will achieve our longer-term vision.

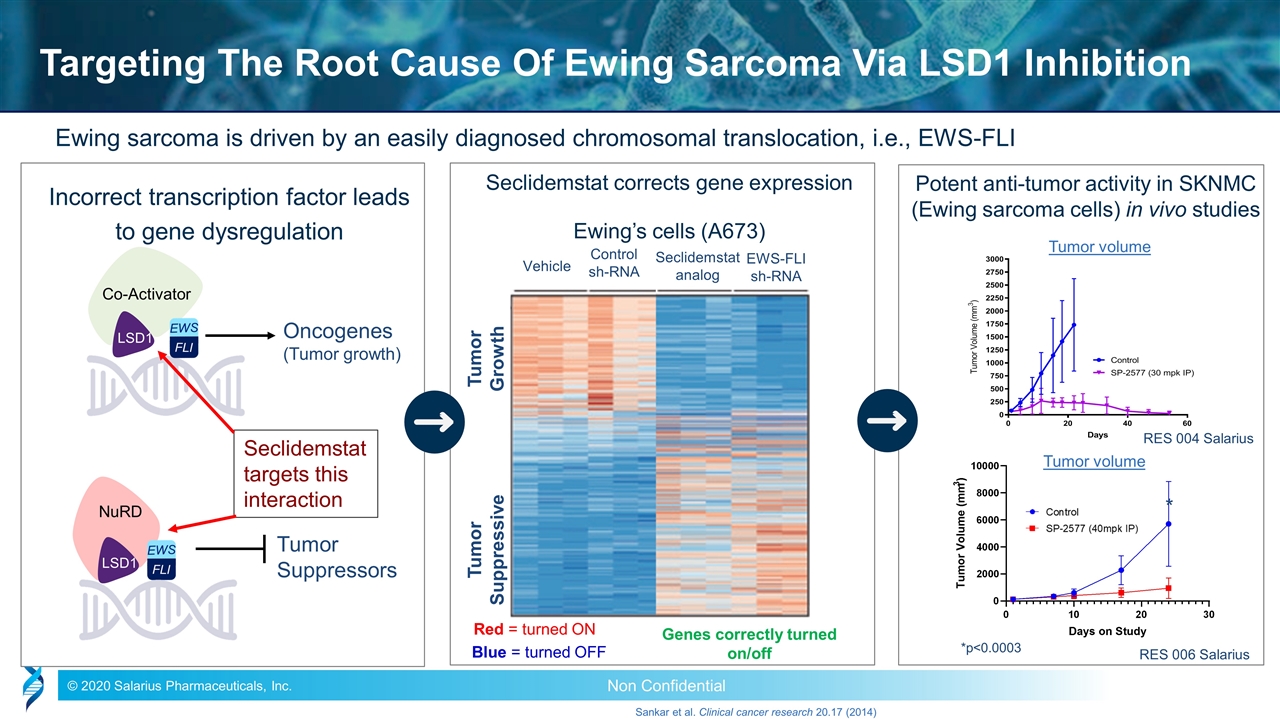

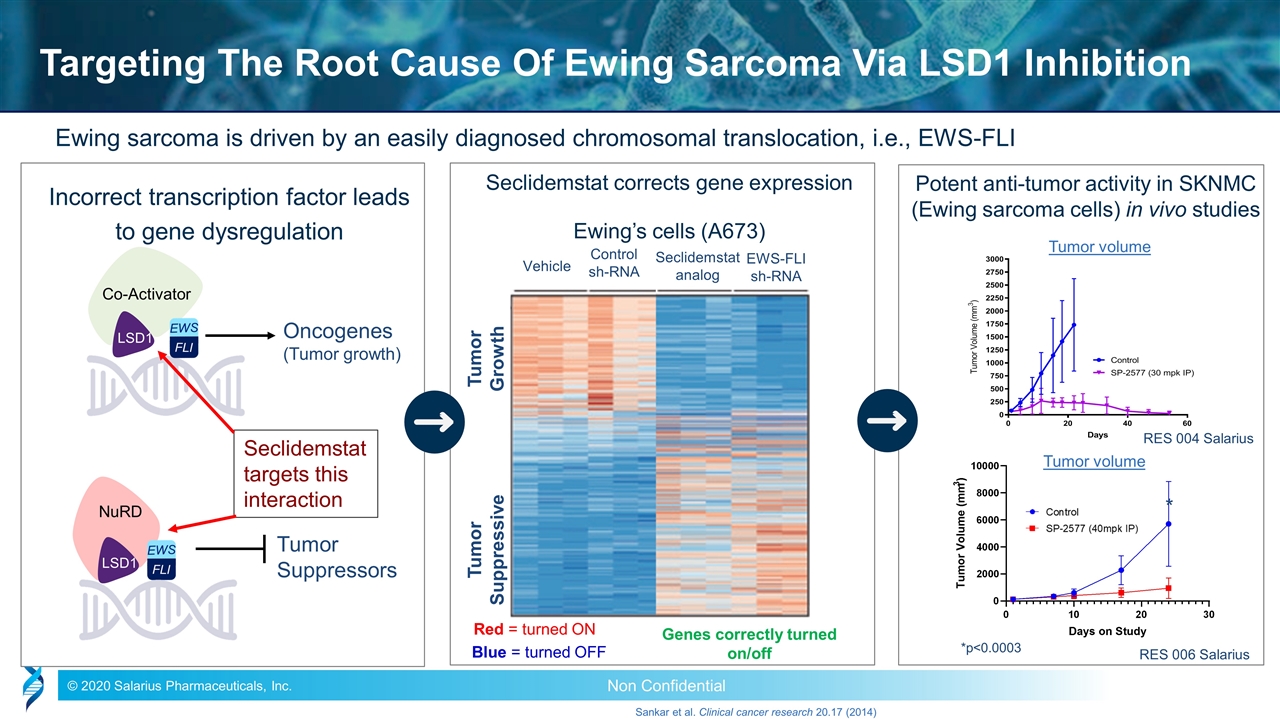

Ewing sarcoma is driven by an easily diagnosed chromosomal translocation, i.e., EWS-FLI Sankar et al. Clinical cancer research 20.17 (2014) Oncogenes (Tumor growth) Co-Activator LSD1 Tumor Suppressors NuRD LSD1 Incorrect transcription factor leads to gene dysregulation Targeting The Root Cause Of Ewing Sarcoma Via LSD1 Inhibition Ewing’s cells (A673) Tumor Growth Tumor Suppressive Vehicle Control sh-RNA Seclidemstat analog EWS-FLI sh-RNA Genes correctly turned on/off Seclidemstat corrects gene expression Red = turned ON Blue = turned OFF Potent anti-tumor activity in SKNMC (Ewing sarcoma cells) in vivo studies Tumor volume Tumor volume RES 004 Salarius RES 006 Salarius *p<0.0003 * Seclidemstat targets this interaction

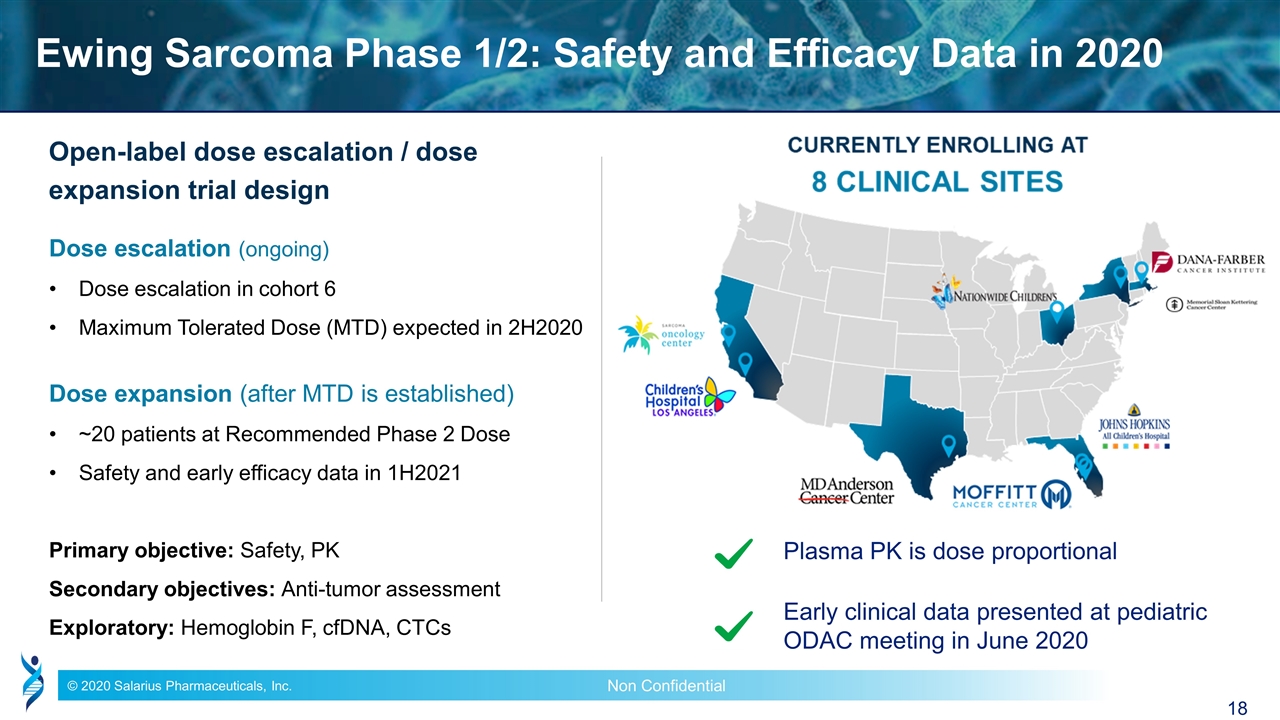

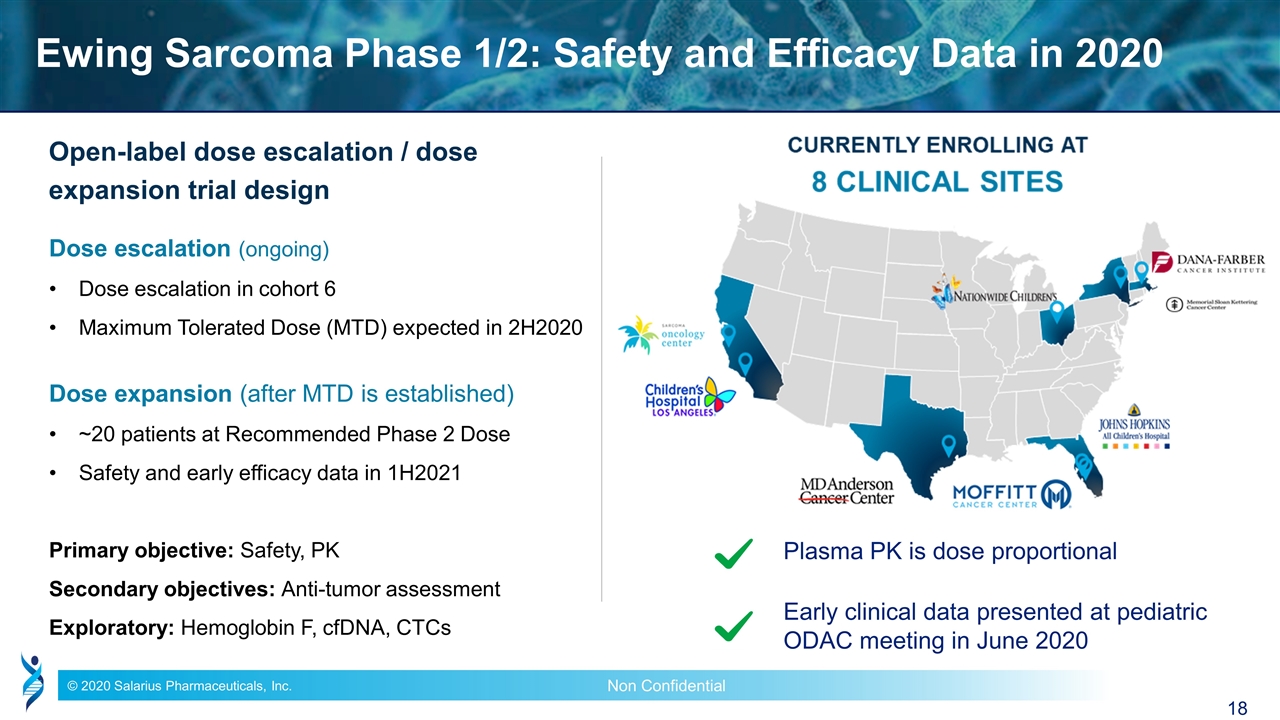

Ewing Sarcoma Phase 1/2: Safety and Efficacy Data in 2020 Open-label dose escalation / dose expansion trial design Dose escalation (ongoing) Dose escalation in cohort 6 Maximum Tolerated Dose (MTD) expected in 2H2020 Dose expansion (after MTD is established) ~20 patients at Recommended Phase 2 Dose Safety and early efficacy data in 1H2021 Primary objective: Safety, PK Secondary objectives: Anti-tumor assessment Exploratory: Hemoglobin F, cfDNA, CTCs Plasma PK is dose proportional Early clinical data presented at pediatric ODAC meeting in June 2020

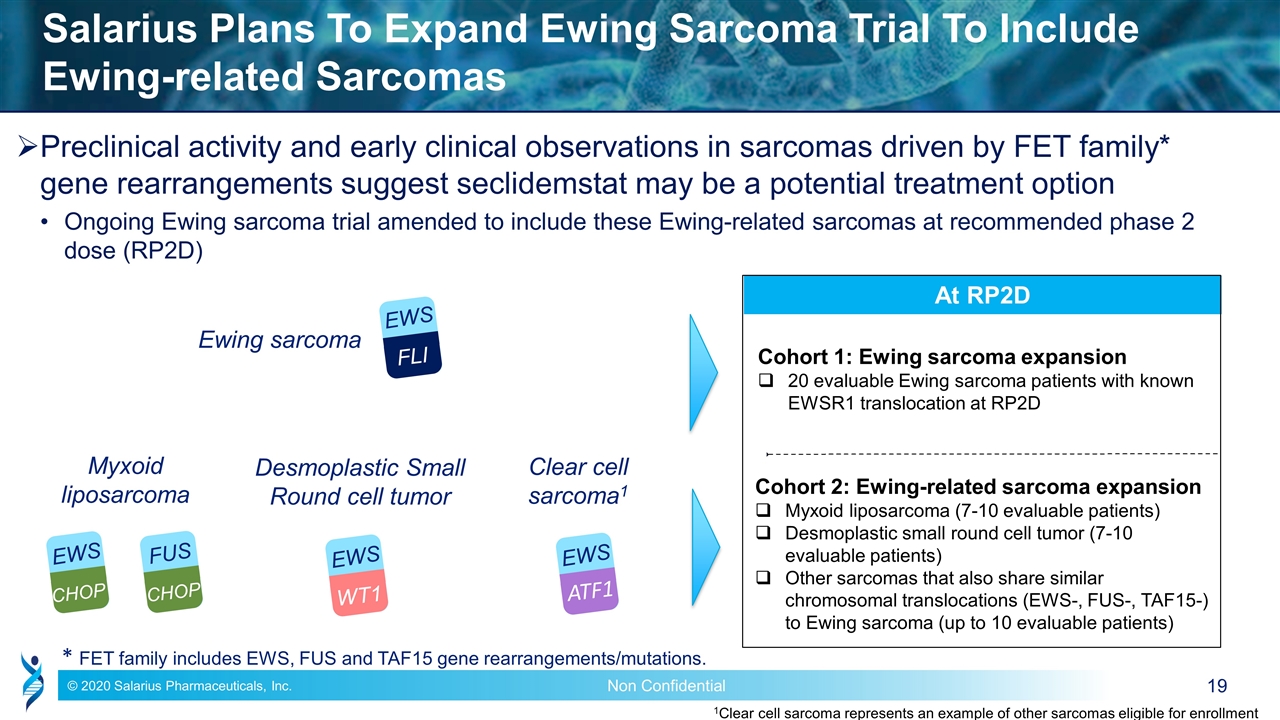

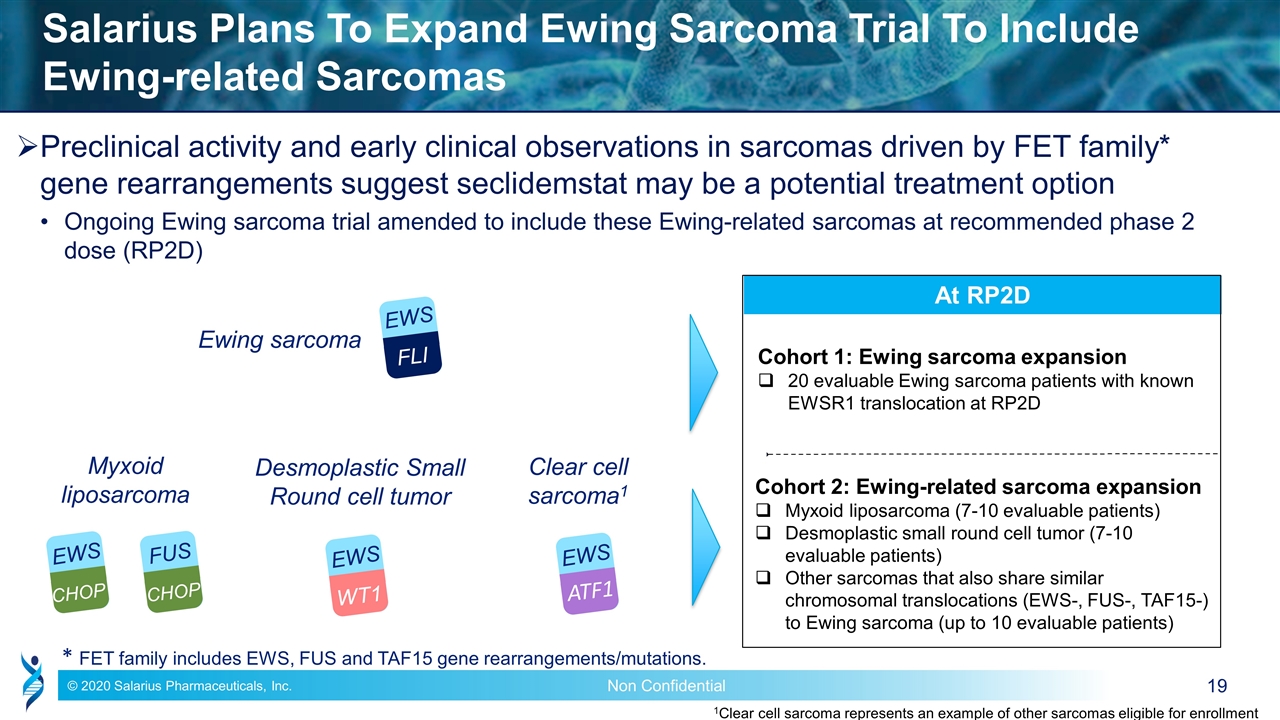

Preclinical activity and early clinical observations in sarcomas driven by FET family* gene rearrangements suggest seclidemstat may be a potential treatment option Ongoing Ewing sarcoma trial amended to include these Ewing-related sarcomas at recommended phase 2 dose (RP2D) Salarius Plans To Expand Ewing Sarcoma Trial To Include Ewing-related Sarcomas EWS FLI Ewing sarcoma Myxoid liposarcoma EWS CHOP FUS CHOP Clear cell sarcoma1 EWS ATF1 At RP2D Cohort 1: Ewing sarcoma expansion 20 evaluable Ewing sarcoma patients with known EWSR1 translocation at RP2D Cohort 2: Ewing-related sarcoma expansion Myxoid liposarcoma (7-10 evaluable patients) Desmoplastic small round cell tumor (7-10 evaluable patients) Other sarcomas that also share similar chromosomal translocations (EWS-, FUS-, TAF15-) to Ewing sarcoma (up to 10 evaluable patients) 1Clear cell sarcoma represents an example of other sarcomas eligible for enrollment * FET family includes EWS, FUS and TAF15 gene rearrangements/mutations. EWS WT1 Desmoplastic Small Round cell tumor

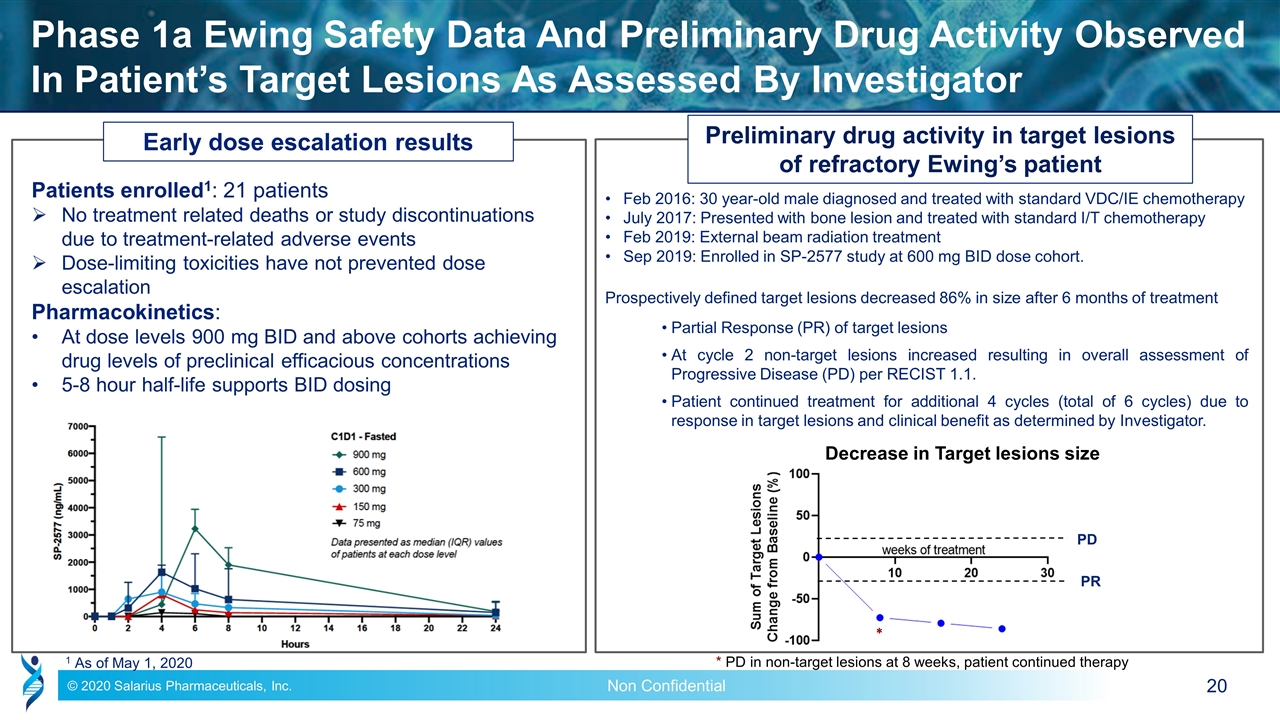

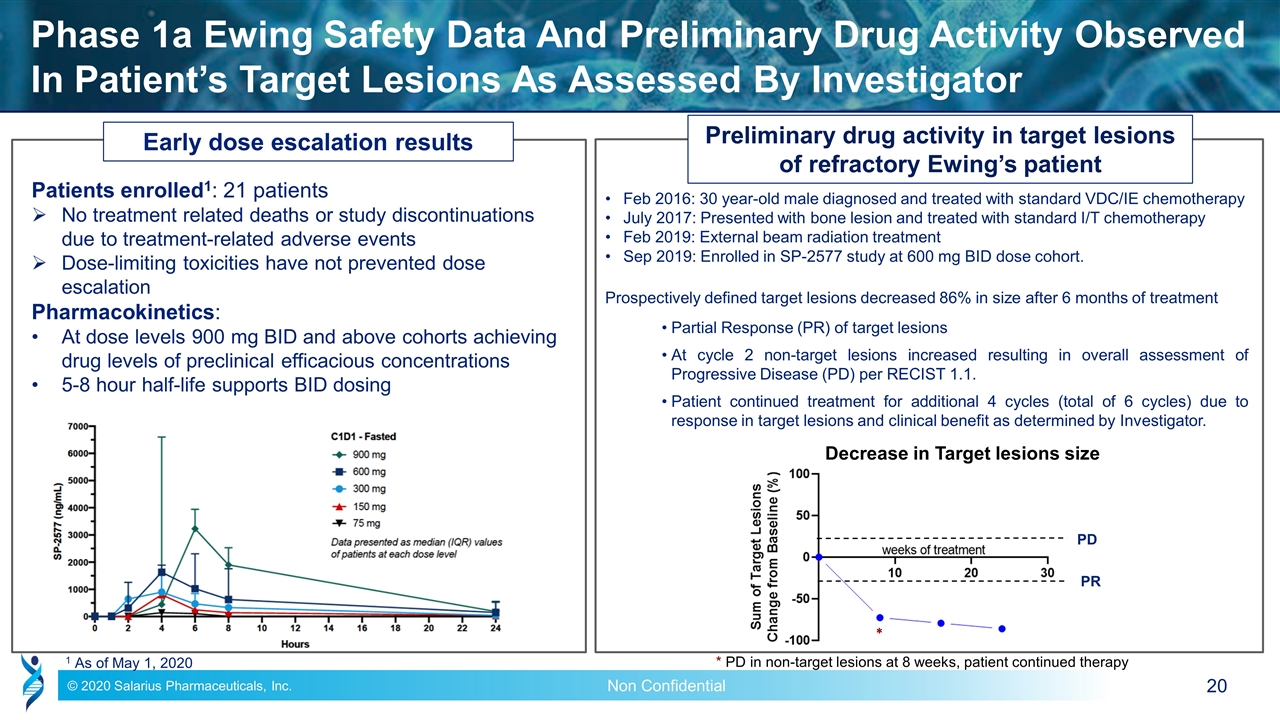

Phase 1a Ewing Safety Data And Preliminary Drug Activity Observed In Patient’s Target Lesions As Assessed By Investigator Preliminary drug activity in target lesions of refractory Ewing’s patient Feb 2016: 30 year-old male diagnosed and treated with standard VDC/IE chemotherapy July 2017: Presented with bone lesion and treated with standard I/T chemotherapy Feb 2019: External beam radiation treatment Sep 2019: Enrolled in SP-2577 study at 600 mg BID dose cohort. Prospectively defined target lesions decreased 86% in size after 6 months of treatment Partial Response (PR) of target lesions At cycle 2 non-target lesions increased resulting in overall assessment of Progressive Disease (PD) per RECIST 1.1. Patient continued treatment for additional 4 cycles (total of 6 cycles) due to response in target lesions and clinical benefit as determined by Investigator. 1 As of May 1, 2020 Decrease in Target lesions size * PD in non-target lesions at 8 weeks, patient continued therapy Early dose escalation results Patients enrolled1: 21 patients No treatment related deaths or study discontinuations due to treatment-related adverse events Dose-limiting toxicities have not prevented dose escalation Pharmacokinetics: At dose levels 900 mg BID and above cohorts achieving drug levels of preclinical efficacious concentrations 5-8 hour half-life supports BID dosing * PR PD

MARKET EXPANSION Seclidemstat in Advanced Solid Tumors Select Tumor Mutations Immunotherapy

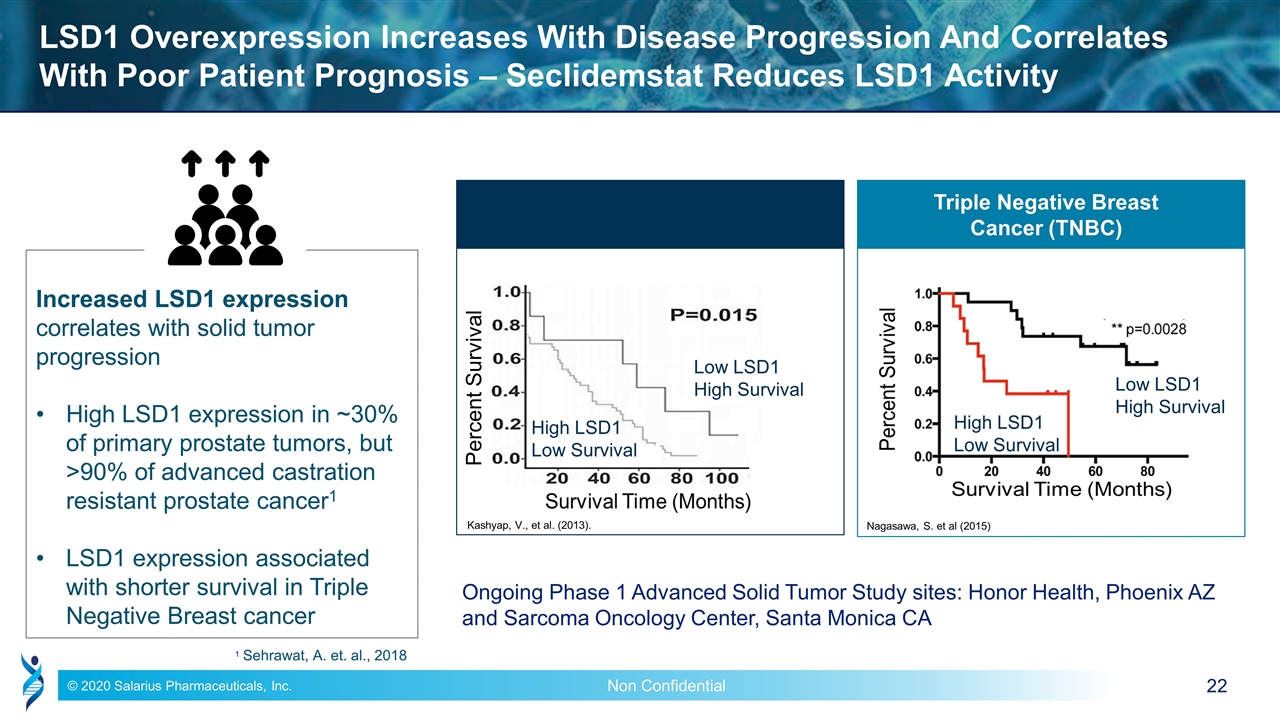

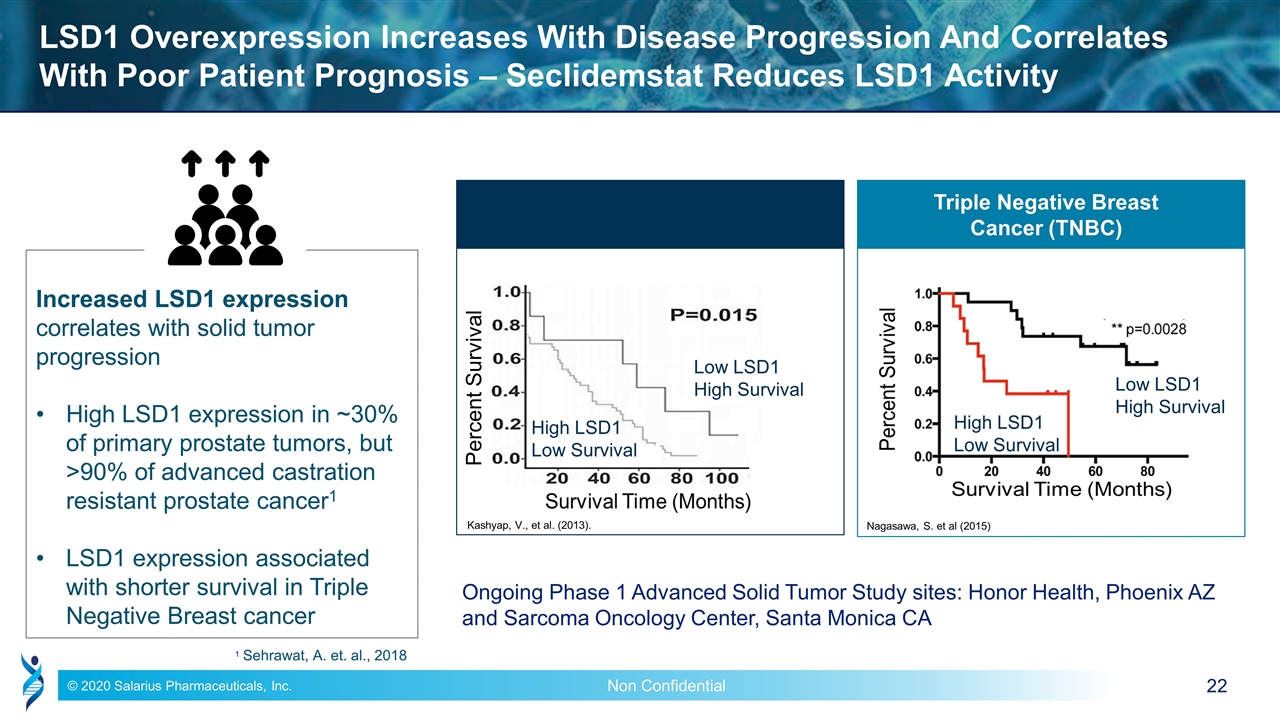

LSD1 Overexpression Increases With Disease Progression And Correlates With Poor Patient Prognosis – Seclidemstat Reduces LSD1 Activity Low LSD1 High Survival High LSD1 Low Survival Nagasawa, S. et al (2015) Low LSD1 High Survival High LSD1 Low Survival Kashyap, V., et al. (2013). Triple Negative Breast Cancer (TNBC) Percent Survival 1 Sehrawat, A. et. al., 2018 Increased LSD1 expression correlates with solid tumor progression High LSD1 expression in ~30% of primary prostate tumors, but >90% of advanced castration resistant prostate cancer1 LSD1 expression associated with shorter survival in Triple Negative Breast cancer Ongoing Phase 1 Advanced Solid Tumor Study sites: Honor Health, Phoenix AZ and Sarcoma Oncology Center, Santa Monica CA

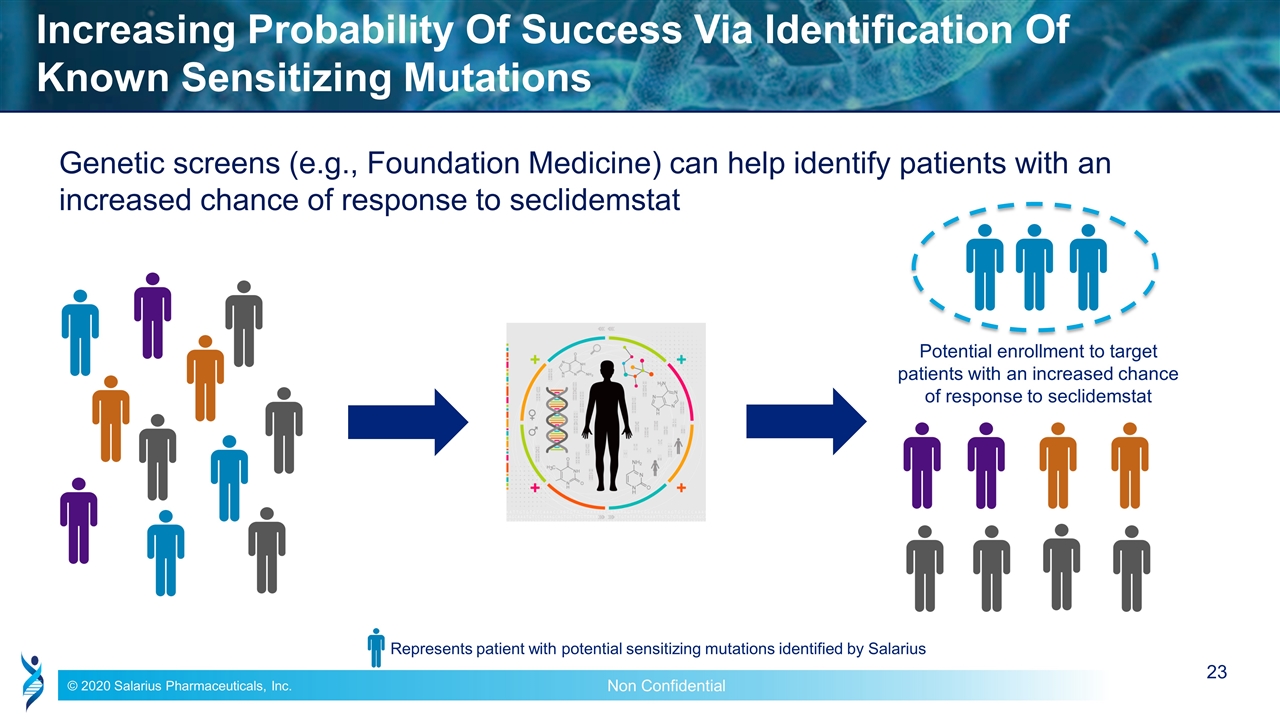

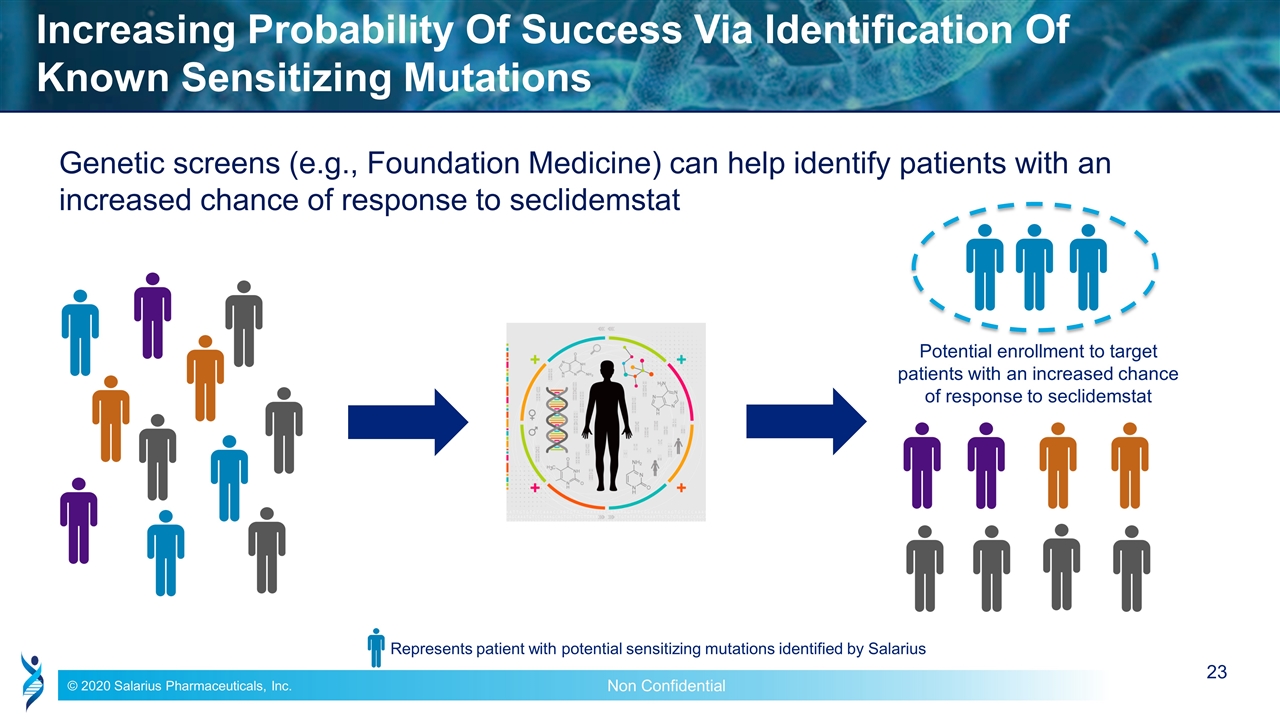

Increasing Probability Of Success Via Identification Of Known Sensitizing Mutations Genetic screens (e.g., Foundation Medicine) can help identify patients with an increased chance of response to seclidemstat Potential enrollment to target patients with an increased chance of response to seclidemstat Represents patient with potential sensitizing mutations identified by Salarius

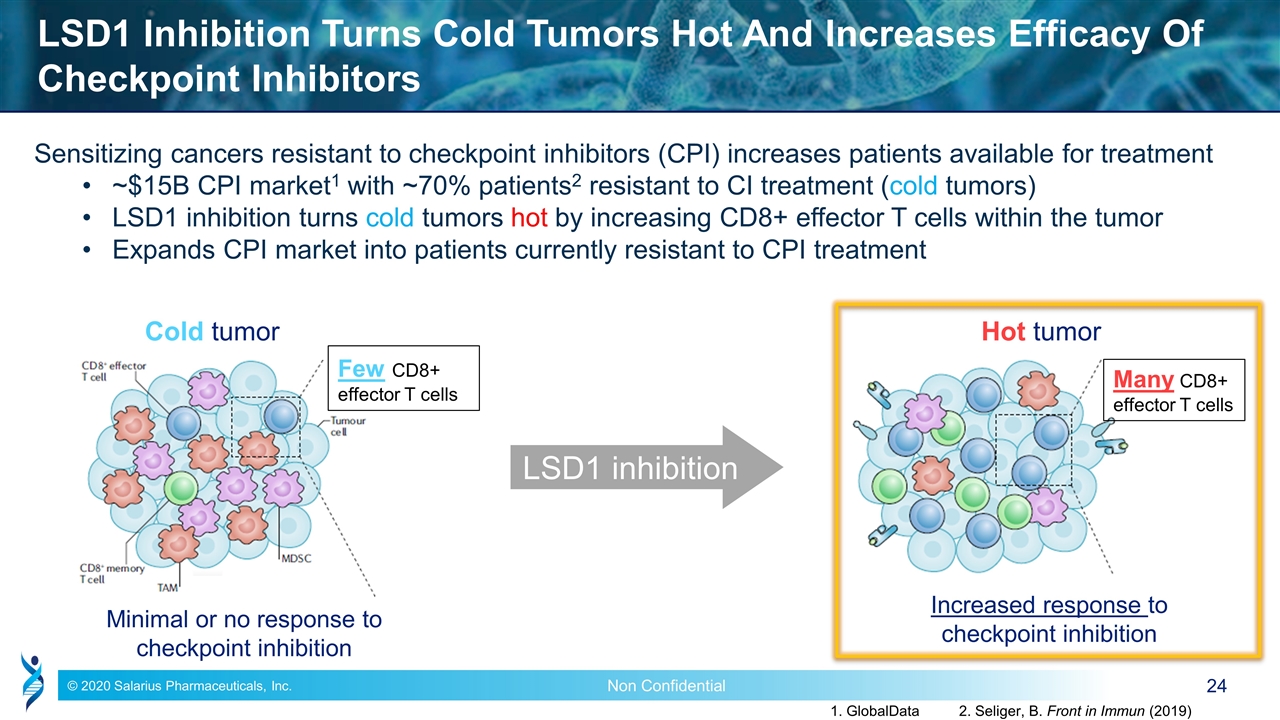

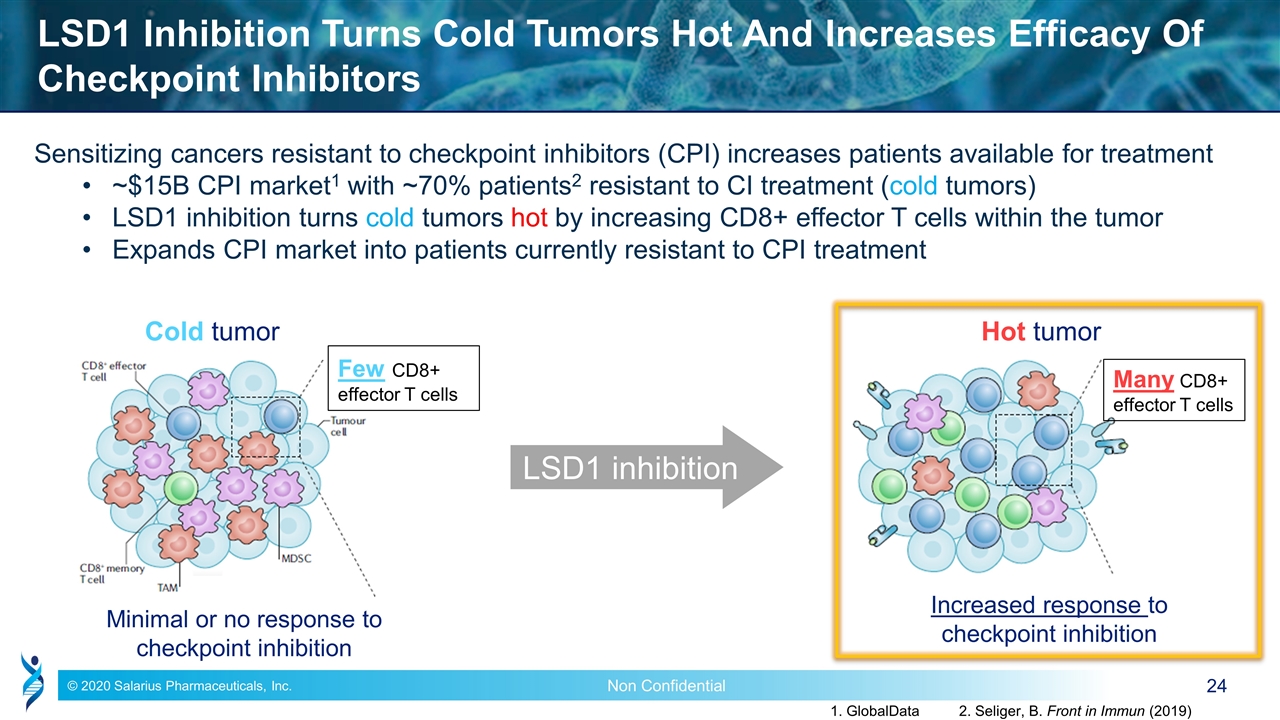

LSD1 Inhibition Turns Cold Tumors Hot And Increases Efficacy Of Checkpoint Inhibitors Sensitizing cancers resistant to checkpoint inhibitors (CPI) increases patients available for treatment ~$15B CPI market1 with ~70% patients2 resistant to CI treatment (cold tumors) LSD1 inhibition turns cold tumors hot by increasing CD8+ effector T cells within the tumor Expands CPI market into patients currently resistant to CPI treatment Cold tumor Minimal or no response to checkpoint inhibition LSD1 inhibition Hot tumor Increased response to checkpoint inhibition Many CD8+ effector T cells Few CD8+ effector T cells 1. GlobalData 2. Seliger, B. Front in Immun (2019)

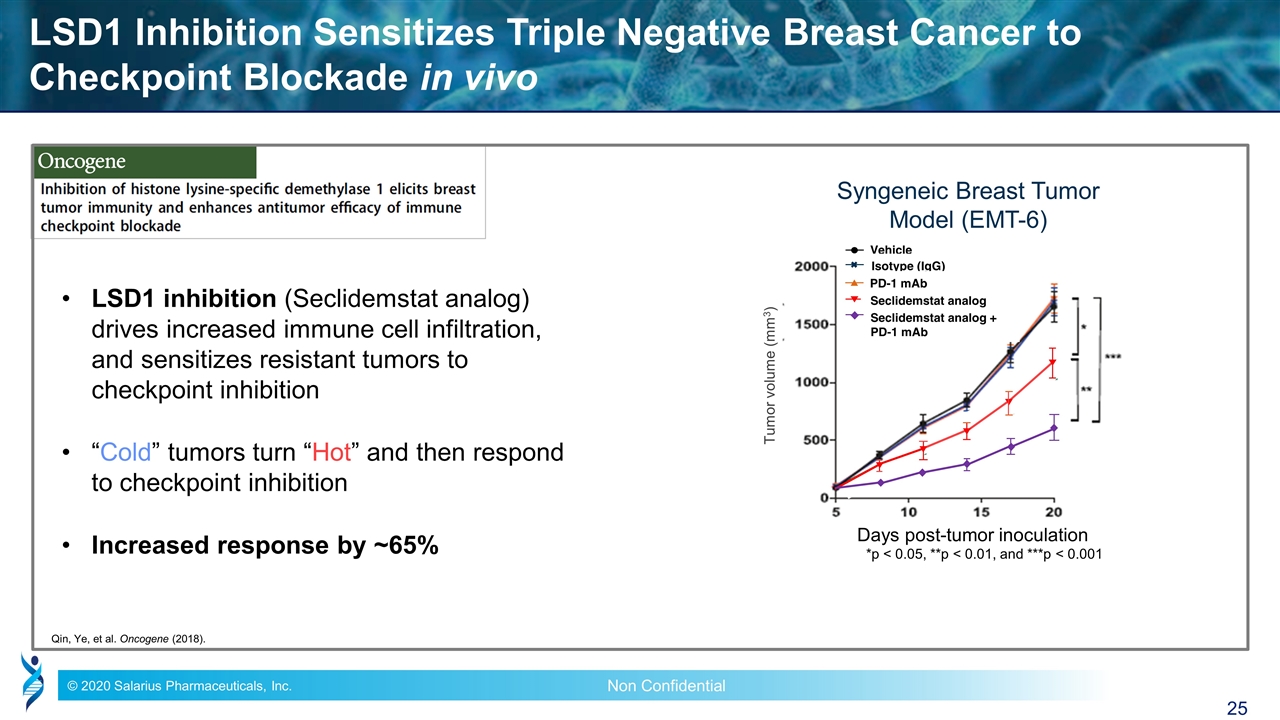

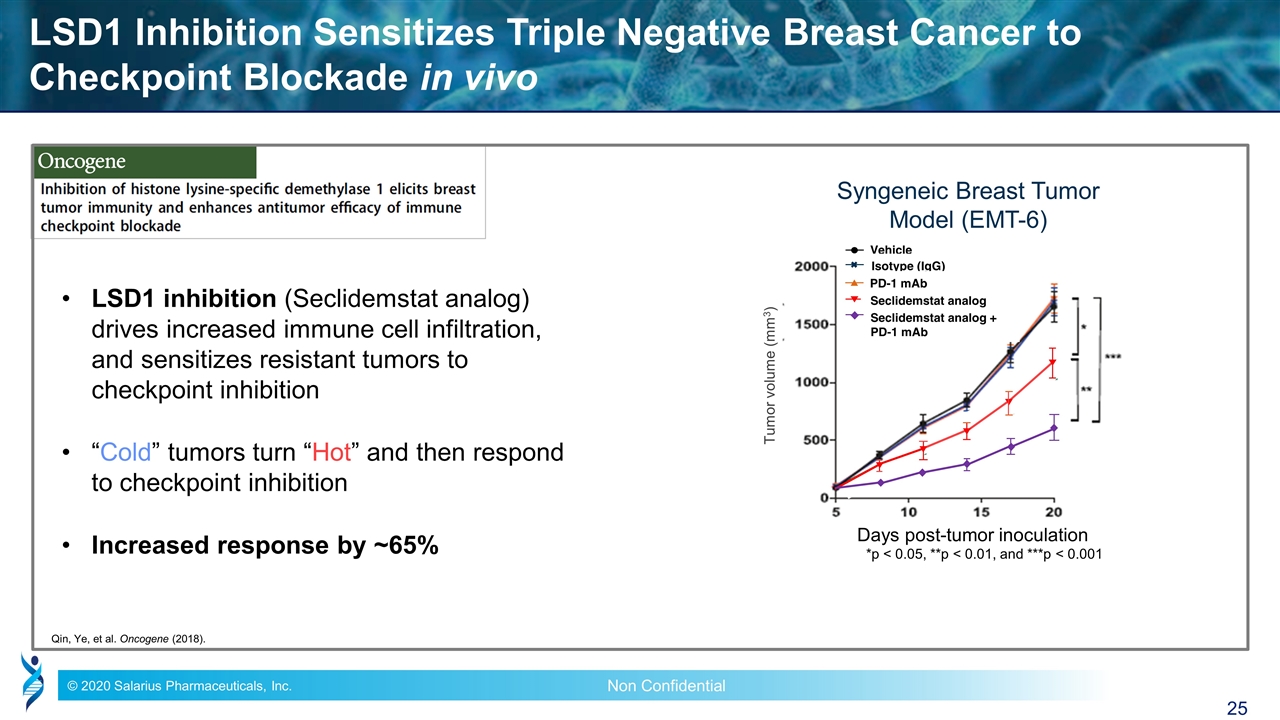

LSD1 Inhibition Sensitizes Triple Negative Breast Cancer to Checkpoint Blockade in vivo LSD1 inhibition (Seclidemstat analog) drives increased immune cell infiltration, and sensitizes resistant tumors to checkpoint inhibition “Cold” tumors turn “Hot” and then respond to checkpoint inhibition Increased response by ~65% Qin, Ye, et al. Oncogene (2018). Vehicle Isotype (IgG) PD-1 mAb Seclidemstat analog + PD-1 mAb Days post-tumor inoculation Tumor volume (mm3) Syngeneic Breast Tumor Model (EMT-6) Seclidemstat analog *p < 0.05, **p < 0.01, and ***p < 0.001

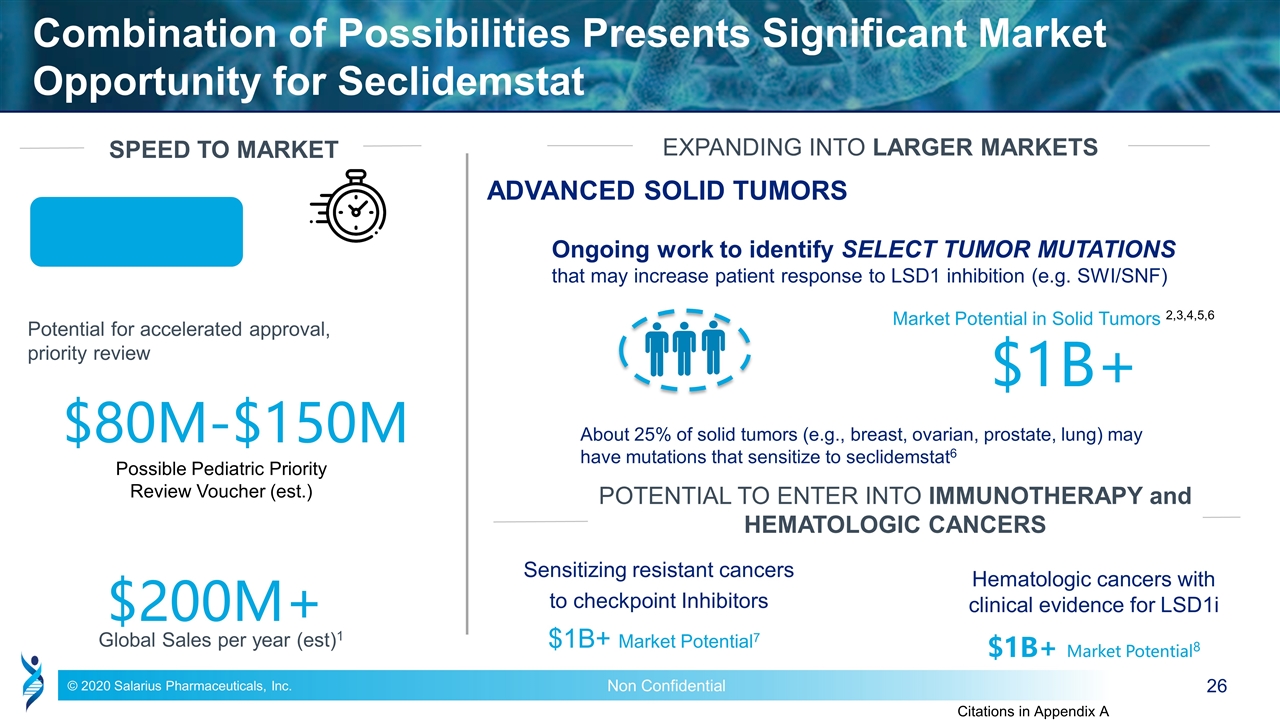

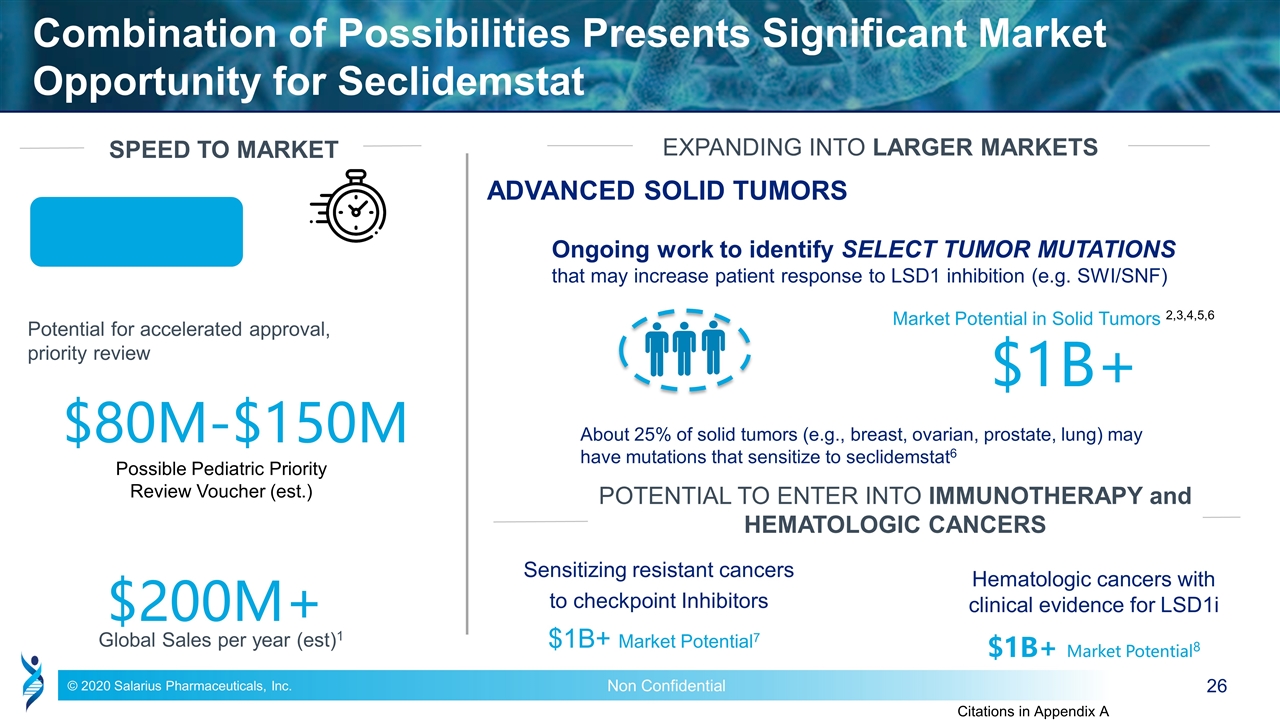

Combination of Possibilities Presents Significant Market Opportunity for Seclidemstat Potential for accelerated approval, priority review Possible Pediatric Priority Review Voucher (est.) $80M-$150M $200M+ Global Sales per year (est)1 Market Potential in Solid Tumors 2,3,4,5,6 $1B+ EXPANDING INTO LARGER MARKETS ADVANCED SOLID TUMORS SPEED TO MARKET Ongoing work to identify SELECT TUMOR MUTATIONS that may increase patient response to LSD1 inhibition (e.g. SWI/SNF) Sensitizing resistant cancers to checkpoint Inhibitors $1B+ Market Potential7 $1B+ Market Potential8 Citations in Appendix A POTENTIAL TO ENTER INTO IMMUNOTHERAPY and HEMATOLOGIC CANCERS About 25% of solid tumors (e.g., breast, ovarian, prostate, lung) may have mutations that sensitize to seclidemstat6 Hematologic cancers with clinical evidence for LSD1i

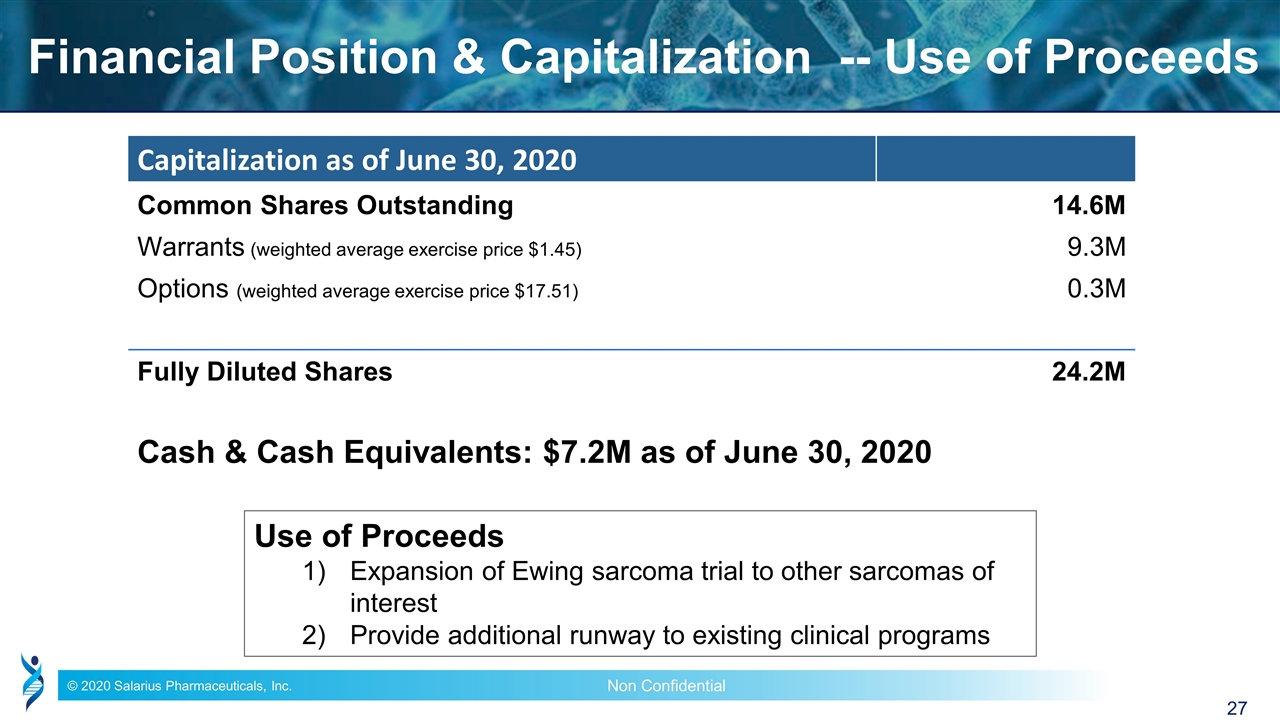

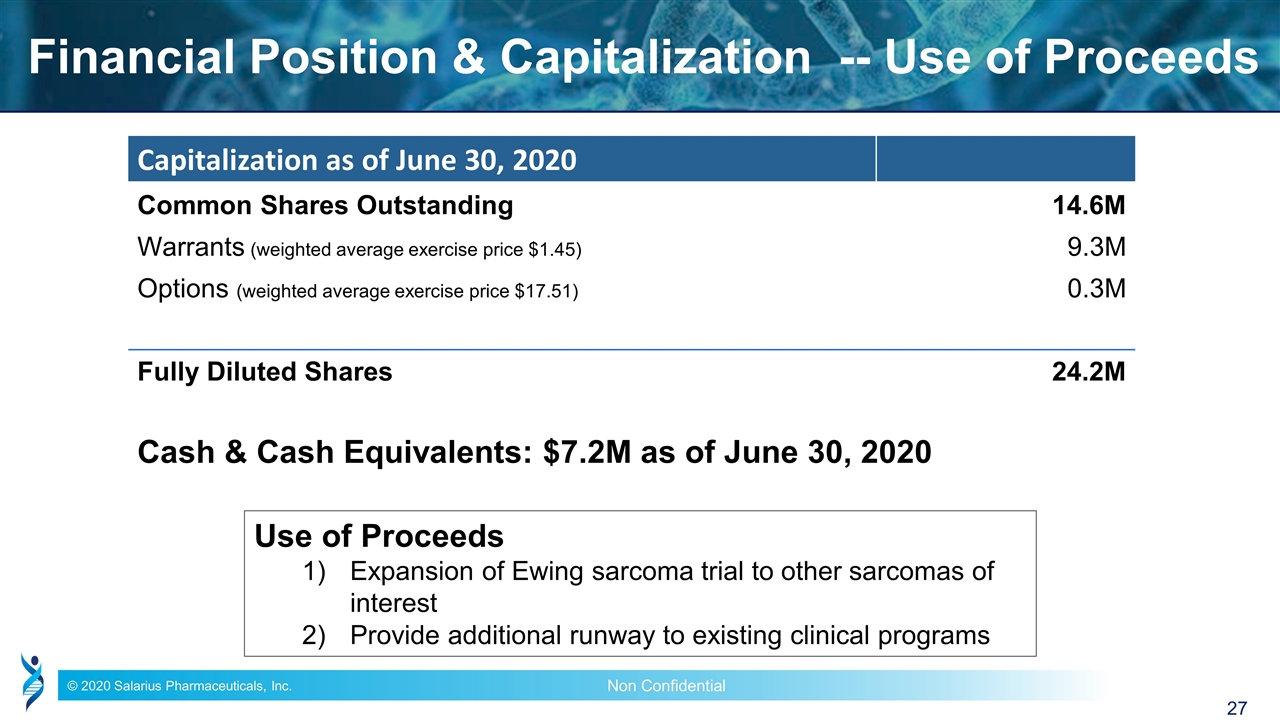

Financial Position & Capitalization -- Use of Proceeds Capitalization as of June 30, 2020 Common Shares Outstanding 14.6M Warrants (weighted average exercise price $1.45) 9.3M Options (weighted average exercise price $17.51) 0.3M Fully Diluted Shares 24.2M Cash & Cash Equivalents: $7.2M as of June 30, 2020 Use of Proceeds Expansion of Ewing sarcoma trial to other sarcomas of interest Provide additional runway to existing clinical programs

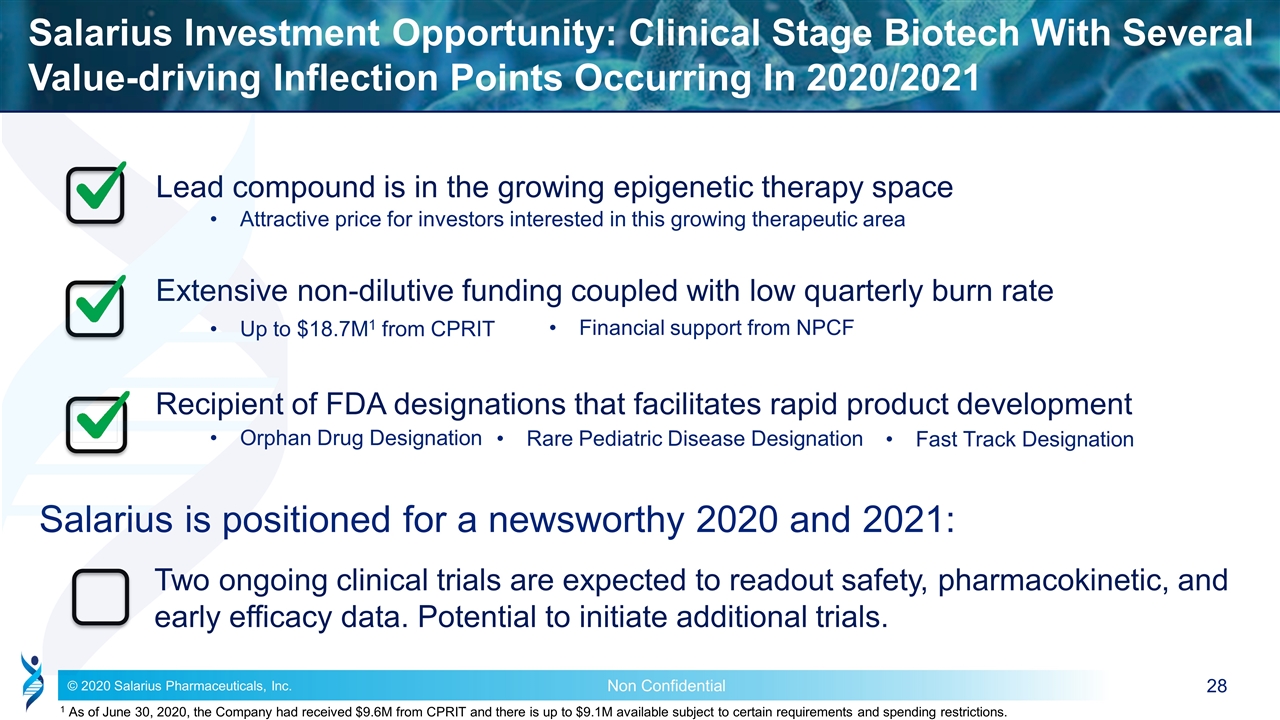

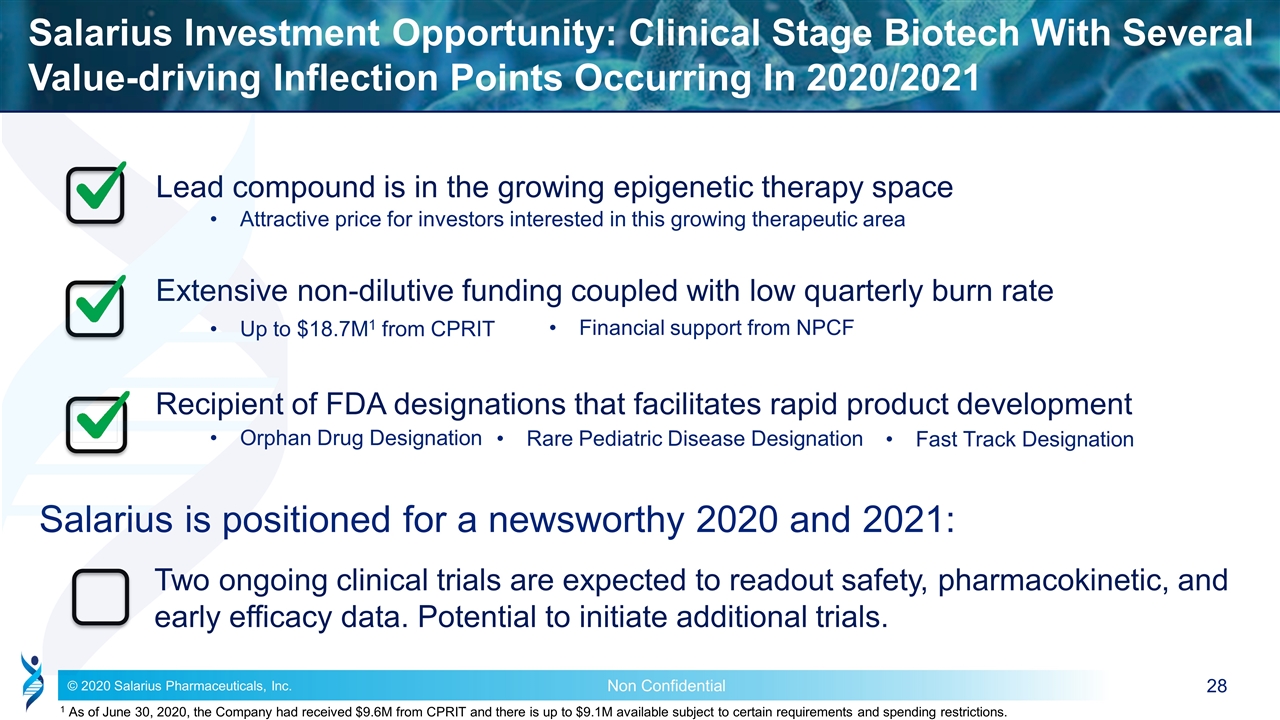

Lead compound is in the growing epigenetic therapy space Extensive non-dilutive funding coupled with low quarterly burn rate Recipient of FDA designations that facilitates rapid product development Two ongoing clinical trials are expected to readout safety, pharmacokinetic, and early efficacy data. Potential to initiate additional trials. Up to $18.7M1 from CPRIT Financial support from NPCF Orphan Drug Designation Rare Pediatric Disease Designation Fast Track Designation Salarius is positioned for a newsworthy 2020 and 2021: Attractive price for investors interested in this growing therapeutic area 1 As of June 30, 2020, the Company had received $9.6M from CPRIT and there is up to $9.1M available subject to certain requirements and spending restrictions. Salarius Investment Opportunity: Clinical Stage Biotech With Several Value-driving Inflection Points Occurring In 2020/2021

© 2020 Salarius Pharmaceuticals, Inc. Thank you!

Appendix A: Additional Sources Combination of Possibilities Presents Significant Market Opportunity for Seclidemstat 1 Represents longer term vision and does not represent estimate of future performance, financial or otherwise. There is no assurance that we will achieve our longer term vision. 2 Cancer of the Ovary – Cancer Stat Facts, The National Cancer Institute: Surveillance, Epidemiology and End Results Program https://seer.cancer.gov/statfacts/html/ovary.html. 3 GlobalData: Prostate Cancer: Global Drug Forecast and Market Analysis to 2028 4 GlobalData and Epidemiology Market Size Database, TNBC 5 GlobalData: Opportunity Analyzer: Ovarian Cancer - Opportunity Analysis and Forecast to 2025 6 Morel, D., et al. Ann of Oncology 2017 7 https://www.forbes.com/sites/greatspeculations/2019/03/12/how-much-can-mercks-share-price-grow-if-keytruda-gets-10-share-of-oncology-drug-market/#77edba677e18 8 Hematological Malignancies. Apr 2020. Brand Essence Market Research.

Appendix B: US Intellectual Property Portfolio Composition of matter: #8,987,335 Composition of matter: #9,266,838 Methods of Use: #9,642,857 Methods of Use: #9,555,024