UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | |

| ¨ | | Preliminary Proxy Statement |

| | |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

| ¨ | | Definitive Proxy Statement |

| | |

| x | | Definitive Additional Materials |

| | |

| ¨ | | Soliciting Material under § 240.14a-12 |

AR Capital Acquisition Corp.

(Name of registrant as specified in its charter)

Payment of Filing Fee (Check the appropriate box):

| | | | | |

| | |

| x | | No fee required. |

| | |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | |

| | | (1) | | Title of each class of securities to which the transaction applies: |

| | | (2) | | Aggregate number of securities to which the transaction applies: |

| | | (3) | | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | (4) | | Proposed maximum aggregate value of the transaction: |

| | | (5) | | Total fee paid: |

| | |

| ¨ | | Fee paid previously with preliminary materials. |

| | |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | |

| | | (1) | | Amount Previously Paid: |

| | | (2) | | Form, Schedule or Registration Statement No.: |

| | | (3) | | Filing Party: |

| | | (4) | | Date Filed: |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): September 27, 2016

AR Capital Acquisition Corp.

(Exact Name of Registrant as Specified in Charter)

| Delaware | | 001-36669 | | 47-1434549 |

(State or other jurisdiction of

incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification

Number) |

405 Park Avenue — 14th Floor

New York, New York 10022

(Address, including zip code, of principal executive offices)

(212) 415-6500

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act |

Item 1.01. Entry into a Material Definitive Agreement.

On September 27, 2016, AR Capital Acquisition Corp. (the “Company”) entered into a First Amendment (the “Amendment”) to the Agreement, dated September 16, 2016, by and among the Company, AR Capital, LLC (“AR Capital”) and Axar Master Fund Ltd. (“Axar”) (the “Transfer Agreement”), relating to, among other things, the purchase by Axar of all of AR Capital’s securities of the Company.

The Amendment amends the Transfer Agreement to:

| · | Revise the recitals to reflect the Company’s intention to seek stockholder approval of an extension of the date by which the Company must consummate an initial business combination from December 31, 2017 to (i) October 1, 2017 or (ii) if prior to October 1, 2017, the Company publicly discloses that an extension past October 1, 2017 will not prevent the Company from maintaining the listing of its securities on The Nasdaq Capital Market, December 31, 2017, in each of the proposed amendments to the Company’s amended and restated certificate of incorporation and the trust agreement the Company entered into in connection with the Company’s initial public offering (the “IPO”); |

| · | Increase the warrant dividend to be declared on each share of Company’s common stock (“Common Stock”) from one-third of one warrant to one-half of one warrant to purchase Common Stock, and to clarify that such warrants will be exercisable beginning on the later of (A) the date that is 30 days after completion of a business combination and (B) the date that is 12 months from the date such warrants are issued, and that such will otherwise have the same terms and conditions as the public warrants included as part of the units sold in the IPO without giving effect to the warrant amendment contemplated under the Transfer Agreement; |

| · | Clarify that the maximum purchase price payable to AR Capital upon the Company’s consummation of a business combination is $2,500,000; and |

| · | Revise the date through which Axar has agreed to make certain quarterly loans to the Company, commencing on January 1, 2017, to be deposited by the Company into a trust account (the “Trust Account”), from the first day of each fiscal quarter through the fiscal quarter in which the Company consummates a business combination or liquidates the Trust Account to the first business day of the three fiscal quarters following January 1, 2017 (or the two fiscal following January 1, 2017 if the date by which the Company must complete a business combination is extended to October 1, 2017). |

The foregoing summary of the Amendment is qualified in its entirety by reference to the text of the Amendment, which is attached as Exhibit 2.1 hereto and incorporated herein by reference.

Item 7.01. Regulation FD Disclosure.

Attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated into this Item 7.01 by reference is the investor presentation that will be used by the Company in making presentations to certain existing and potential stockholders and public warrantholders of the Company in connection with the special meeting of stockholders and special meeting of public warrantholders to be held in connection with the transactions contemplated by the Transfer Agreement (the “special meetings”).

The preceding paragraph (including Exhibit 99.1 hereto) is being furnished pursuant to Item 7.01 and shall not be deemed to be filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise be subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act.

Item 9.01. Financial Statement and Exhibits.

| Exhibit | | Description |

| | | |

| 2.1 | | First Amendment to Agreement, dated September 27, 2016, by and among the Company, AR Capital, LLC and Axar Master Fund Ltd. |

| | | |

| 99.1 | | Investor Presentation. |

Additional Information About The Special Meetings And Where To Find It

The Company has filed a definitive proxy statement with the Securities and Exchange Commission (the “SEC”) relating to the matters to be voted upon at the special meetings. The Company mailed the definitive proxy statement to its stockholders and public warrantholders, as applicable, of record as of September 20, 2016. The Company’s stockholders and public warrantholders and other interested persons are advised to read the definitive proxy statement and any amendments or supplements thereto because these documents contain important information about the Company, Axar and the proposals to be voted on at the special meetings. Stockholders and public warrantholders, as applicable, may obtain copies of the definitive proxy statement without charge at the SEC’s Internet site at http://www.sec.gov or by directing a request to: AR Capital Acquisition Corp., 405 Park Avenue, 14th Floor, New York, New York 10022, tel. (212) 415-6500, Attention: Legal Department.

Participants In The Solicitation

The Company and its directors and officers may be deemed participants in the solicitation of proxies to the Company’s stockholders and public warrantholders with respect to the special meetings. A list of the names of those directors and officers and a description of their interests in the Company is contained in the definitive proxy statement for the special meetings.

Forward Looking Statements

This report includes “forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “anticipate”, “believe”, “expect”, “estimate”, “plan”, “outlook”, and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters and includes statements regarding expected future financial and operating performance. A number of factors could cause actual results or outcomes to differ materially from those indicated by such forward looking statements. You are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made, and the Company and Axar undertake no obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | AR Capital Acquisition Corp. |

| | |

| | By: | /s/ William Kahane |

| Dated: September 27, 2016 | | Name: William Kahane |

| | | Title: CEO |

Exhibit 2.1

FIRST AMENDMENT TO AGREEMENT

THIS FIRST AMENDMENT TO AGREEMENT, is dated as of September 27, 2016 (this “Amendment”), by and among Axar Master Fund Ltd., a Cayman Islands exempted company, AR Capital, LLC, a Delaware limited liability company, and AR Capital Acquisition Corp., a Delaware corporation (collectively the “Parties”).

RECITALS

WHEREAS, Parties entered into that certain Agreement, dated as of September 16, 2016 (the “Agreement”);

WHEREAS, the Parties desire to amend the terms of the Agreement as set forth herein; and

WHEREAS, pursuant toSection 8.3 of the Agreement, any valid amendment or modification to the Agreement must be in writing and duly executed by the Parties affected by such amendment or modification.

NOW, THEREFORE, in consideration of the foregoing, and for good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Parties hereto agree as follows:

1. Defined Terms. Except as otherwise provided herein, all capitalized but undefined terms used in this Amendment have the meanings ascribed to such terms in the Agreement (as amended by this Amendment).

2. Amendments. The Agreement is hereby amended as follows:

(a) Amendment to the Extension Recital. The fifth (5th) recital of the Agreement is amended replacing “December 31, 2017” with “(A) October 1, 2017 or (B) if prior to October 1, 2017, the Company publicly discloses that an extension past October 1, 2017 will not prevent the Company from maintaining the listing of its securities on The Nasdaq Capital Market, December 31, 2017”;

(b) Amendment to the Trust Amendment Recital. The sixth (6th) recital of the Agreement is amended by replacing “December 31, 2017” with “(A) October 1, 2017 or (B) if prior to October 1, 2017, the Company publicly discloses that an extension past October 1, 2017 will not prevent the Company from maintaining the listing of its securities on The Nasdaq Capital Market, December 31, 2017”;

(c) Amendment to the Warrant Dividend Recital. The ninth (9th) recital of the Agreement is hereby amended and restated in its entirety as follows:

“WHEREAS, the Parties desire that, following the completion of the Company Actions and Extension Redemptions, the Company declare a dividend on each share of its Common Stock in the form of one-half of one warrant to purchase Common Stock, where (i) each whole warrant entitles the holder to purchase one share of Common Stock at an exercise price of $12.50 per share, (ii) such warrants will be exercisable beginning on the later of (A) the date that is 30 days after the first date on which the Company completes a Business Combination and (B) the date that is 12 months from the date such warrants are issued, and (iii) such warrants otherwise have the same terms and conditions as the Public Warrants without giving effect to the Warrant Amendment (the “Warrant Dividend”);”

(d) Amendment to Section 2.1.Section 2.1 of the Agreement is hereby amended by replacing the reference to “$3,000,000” with “$2,500,000”.

(e) Amendment to Section 2.4.2(i).Section 2.4.2(i) is hereby amended and restated in its entirety to read as follows:

“(i) On January 1, 2017 and the first (1st) business day of each of the following three fiscal quarters commencing thereafter (or, if the date of the Extension is October 1, 2017, the following two fiscal quarters commencing thereafter) the Purchaser shall loan to the Company an amount equal to the lesser of (X) $250,000.00 and (Y) $0.05 multiplied by the number of outstanding Public Shares following the completion of the Company Actions and Extension Redemptions (collectively, the “Trust Loans”), the proceeds of which shall be deposited by the Company into the Trust Account.”

3. Effect of the Agreement. Except as expressly provided herein, all other terms and provisions of the Agreement shall remain unaffected by the terms of this Amendment.

4. Miscellaneous.Article 8 of the Agreement is hereby incorporated by reference into this Amendment and the terms thereof shall be applied,mutatis mutandis, to this Amendment.

[Remainder of page intentionally blank.]

IN WITNESS WHEREOF,the Parties have caused this Amendment to be duly executed as of the date first above written.

| | AR CAPITAL ACQUISITION CORP. |

| | |

| | By: | /s/ William M. Kahane |

| | | Name: William M. Kahane | |

| | | Title: CEO Date: | |

IN WITNESS WHEREOF,the Parties have caused this Amendment to be duly executed as of the date first above written.

| | AR CAPITAL, LLC |

| | |

| | By: | /s/ Edward Michael Weil, Jr. |

| | | Name: | Edward Michael Weil, Jr. |

| | | Title: Date: | CEO |

IN WITNESS WHEREOF,the Parties have caused this Amendment to be duly executed as of the date first above written.

| | AXAR MASTER FUND LTD. |

| | |

| | By: Axar Capital Management LP, its investment manager |

| | By: Axar GP LLC, its general partner |

| | |

| | By: | /s/ Andrew Axelrod |

| | | Name: | Andrew Axelrod |

| | | Title: Date: | Sole Member |

Exhibit 99.1

AR CAPITAL ACQUISITION CORP. INVESTOR PRESENTATION September 27, 2016

1 Page 1 DISCLAIMER The information in this presentation (this “Presentation”) is being provided by AR Capital Acquisition Corp . (“AUMA”) to you (“Recipient”, “you” or “your”) in connection with AUMA’s special meeting of stockholders and special meeting of warrant holders relating to the proposed acquisition of all of the founder shares and private placement warrants held by AUMA’s current sponsor by an investment fund managed by Axar Capital Management L . P . (“ Axar”) and the proposals to be voted on at the special meetings (the “Proposals”) including, without limitation, proposals to change AUMA name to Axar Acquisition Corp . and to extend the date by which AUMA must complete a business combination to (i) October 1 , 2017 or (ii) if prior to October 1 , 2017 the SPAC publicly discloses that an extension past October 1 , 2017 will not prevent the SPAC from maintaining the listing of its securities on The Nasdaq Capital Market, December 31 , 2017 . This Presentation is for informational purposes only and does not constitute a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the Proposals and shall not constitute an offer to sell or a solicitation of an offer to buy the securities of AUMA, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction . This Presentation has been prepared to assist interested parties in making their own evaluation with respect to the Proposals and for no other purpose . The information contained herein is not, and should not be assumed to be, complete . No securities commission or securities regulatory authority or other regulatory or other authority in the United States or any other jurisdiction has in any way passed upon the merits of, or the accuracy and adequacy of, this Presentation . The data contained herein is derived from various internal and external sources . No representation is made as to the reasonableness of the assumptions made within or the accuracy or completeness of any projections or any other information contained herein . Any data on past performance is no indication as to future performance . Forward Looking Statements This presentation includes “forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995 . Forward - looking statements may be identified by the use of words such as “anticipate”, “believe”, “expect”, “estimate”, “plan”, “outlook”, and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters . Such forward looking statements are based on current expectations that are subject to risks and uncertainties . A number of factors could cause actual results or outcomes to differ materially from those indicated by such forward looking statements including those described in the definitive proxy statement relating to the Proposals (the “Definitive Proxy Statement”) filed with the Securities and Exchange Commission (“SEC”) on September 26 , 2016 , and other filings with the SEC by AUMA . You are cautioned not to place undue reliance upon any forward - looking statements, which speak only as of the date made, and AUMA and Axar undertake no obligation to update or revise the forward - looking statements, whether as a result of new information, future events or otherwise .

2 Page 2 DISCLAIMER Additional Information In connection with the Proposals, AUMA has filed the Definitive Proxy Statement with the SEC and mailed such proxy statement and other relevant documents to AUMA stockholders . This Presentation does not contain all the information that should be considered concerning the Proposals . It is not intended to form the basis of any voting or investment decision or any other decision in connection with the Proposals . AUMA stockholders and other interested persons are advised to read the Definitive Proxy Statement and any amendments thereto, because these materials contain important information about the Proposals . The record date established for voting on the Proposals is September 20 , 2016 . Stockholders may obtain a copy of the Definitive Proxy Statement, without charge, at the SEC’s website at http : //www . sec . gov, or by directing a request to AR Capital Acquisition Corp . , 405 Park Avenue, 14 th Floor, New York, New York 10022 , Attention : Legal Department, Tel . ( 212 ) 415 - 6500 . Participants in the Solicitation AUMA and its directors and officers may be deemed participants in the solicitation of proxies to AUMA’s stockholders with respect to the transaction . A list of the names of those directors and officers and a description of their interests in AUMA is contained in the Definitive Proxy Statement .

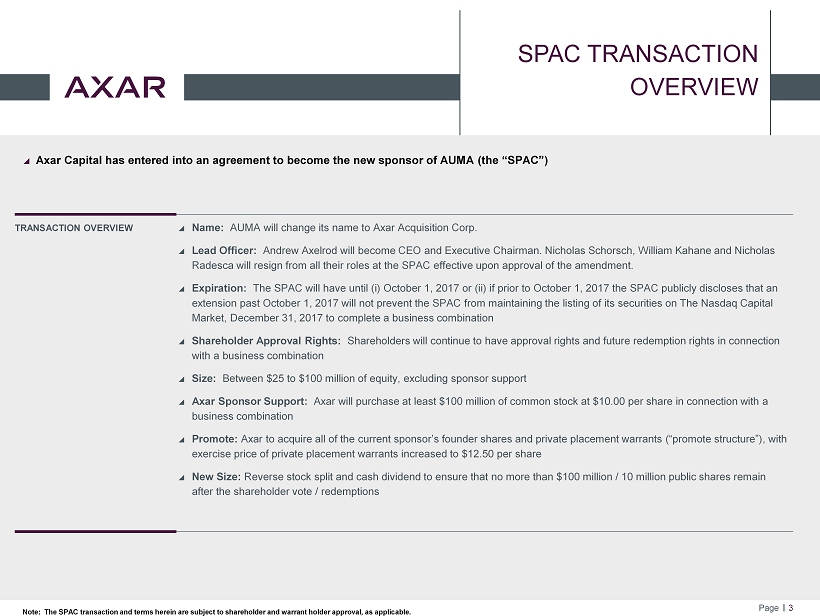

3 Page 3 SPAC TRANSACTION OVERVIEW Axar Capital has entered into an agreement to become the new sponsor of AUMA (the “SPAC ”) TRANSACTION OVERVIEW Name: AUMA will change its name to Axar Acquisition Corp. Lead Officer: Andrew Axelrod will become CEO and Executive Chairman. Nicholas Schorsch , William Kahane and Nicholas Radesca will resign from all their roles at the SPAC effective upon approval of the amendment. Expiration: The SPAC will have until (i) October 1, 2017 or (ii) if prior to October 1, 2017 the SPAC publicly discloses that an extension past October 1, 2017 will not prevent the SPAC from maintaining the listing of its securities on The Nasdaq Capital Market, December 31, 2017 to complete a business combination Shareholder Approval Rights: Shareholders will continue to have approval rights and future redemption rights in connection with a business combination Size: Between $25 to $100 million of equity, excluding sponsor support Axar Sponsor Support: Axar will purchase at least $100 million of common stock at $10.00 per share in connection with a business combination Promote: Axar to acquire all of the current sponsor’s founder shares and private placement warrants (“promote structure”), with exercise price of private placement warrants increased to $12.50 per share New Size: Reverse stock split and cash dividend to ensure that no more than $100 million / 10 million public shares remain after the shareholder vote / redemptions Note : The SPAC transaction and terms herein are subject to shareholder and warrant holder approval, as applicable.

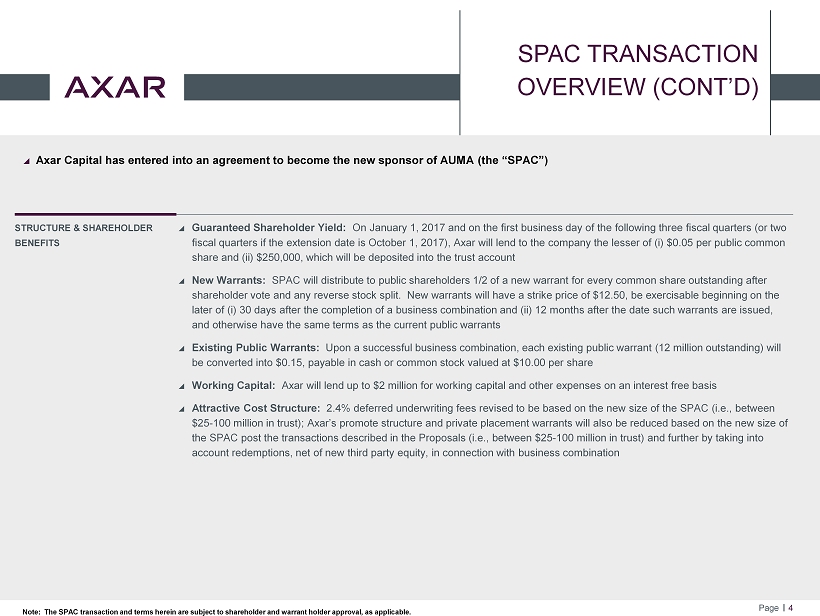

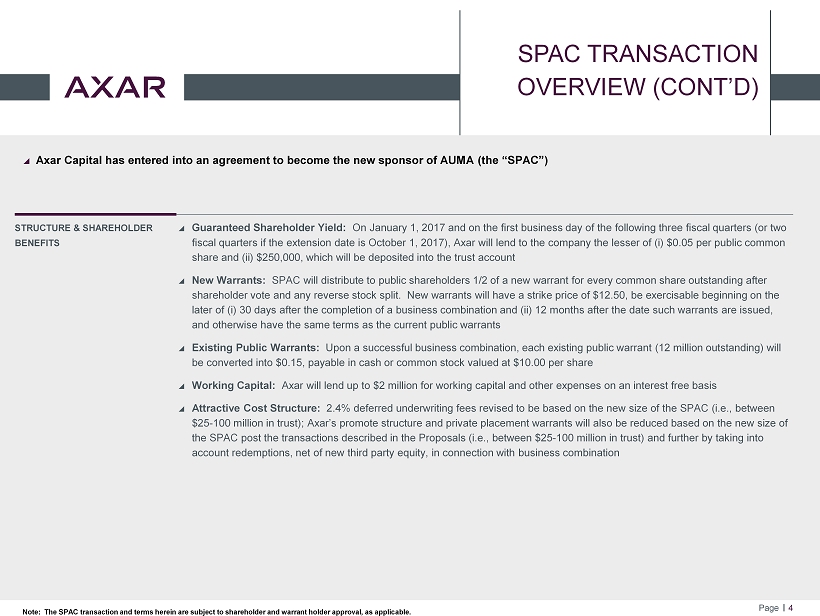

4 Page 4 SPAC TRANSACTION OVERVIEW (CONT’D) Axar Capital has entered into an agreement to become the new sponsor of AUMA (the “SPAC ”) STRUCTURE & SHAREHOLDER BENEFITS Guaranteed Shareholder Yield: On January 1, 2017 and on the first business day of the following three fiscal quarters (or two fiscal quarters if the extension date is October 1, 2017), Axar will lend to the company the lesser of (i) $0.05 per public common share and (ii) $250,000, which will be deposited into the trust account New Warrants: SPAC will distribute to public shareholders 1/2 of a new warrant for every common share outstanding after shareholder vote and any reverse stock split . New warrants will have a strike price of $12.50, be exercisable beginning on the later of (i) 30 days after the completion of a business combination and (ii) 12 months after the date such warrants are issue d, and otherwise have the same terms as the current public warrants Existing Public Warrants: Upon a successful business combination, each existing public warrant (12 million outstanding) will be converted into $0.15, payable in cash or common stock valued at $10.00 per share Working Capital: Axar will lend up to $2 million for working capital and other expenses on an interest free basis Attractive Cost Structure: 2.4% deferred underwriting fees revised to be based on the new size of the SPAC (i.e., between $25 - 100 million in trust); Axar’s promote structure and private placement warrants will also be reduced based on the new size of the SPAC post the transactions described in the Proposals (i.e., between $25 - 100 million in trust) and further by taking into account redemptions, net of new third party equity, in connection with business combination Note : The SPAC transaction and terms herein are subject to shareholder and warrant holder approval, as applicable.

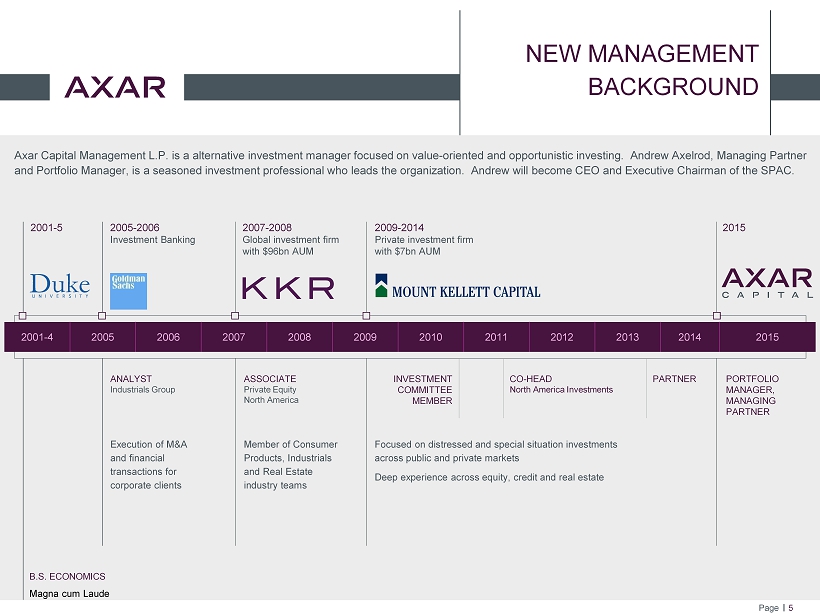

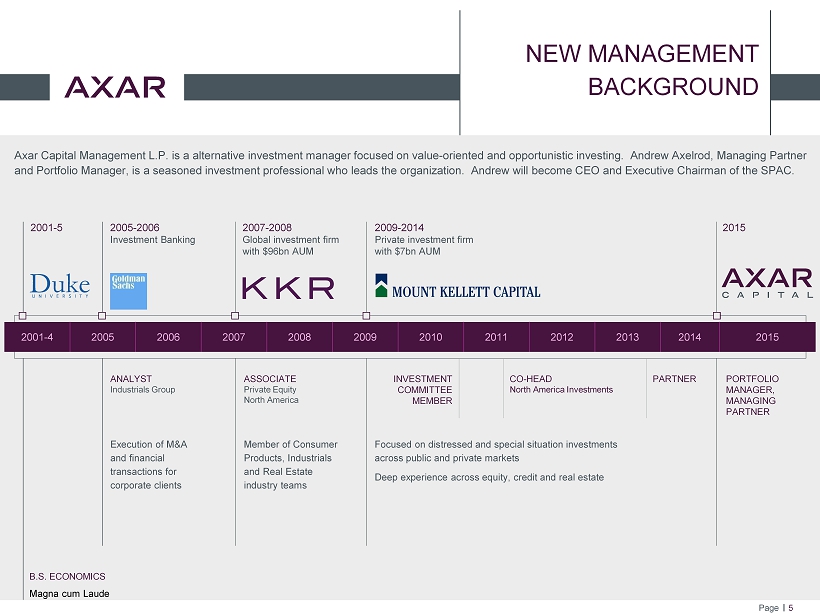

5 Page 5 2001 - 4 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2007 - 2008 Global investment firm with $96bn AUM Axar Capital Management L.P. is a alternative investment manager focused on value - oriented and opportunistic investing. Andrew Axelrod, Managing Partner and Portfolio Manager, is a seasoned investment professional who leads the organization. Andrew will become CEO and Executive Chairman of the SPAC. 2001 - 5 2005 - 2006 Investment Banking B.S. ECONOMICS Magna cum Laude ANALYST Industrials Group ASSOCIATE Private Equity North America 2009 - 2014 Private investment firm with $7bn AUM Execution of M&A and financial transactions for corporate clients Member of Consumer Products, Industrials and Real Estate industry teams Focused on distressed and special situation investments across public and private markets Deep experience across equity, credit and real estate PORTFOLIO MANAGER, MANAGING PARTNER 2015 CO - HEAD North America Investments PARTNER INVESTMENT COMMITTEE MEMBER NEW MANAGEMENT BACKGROUND

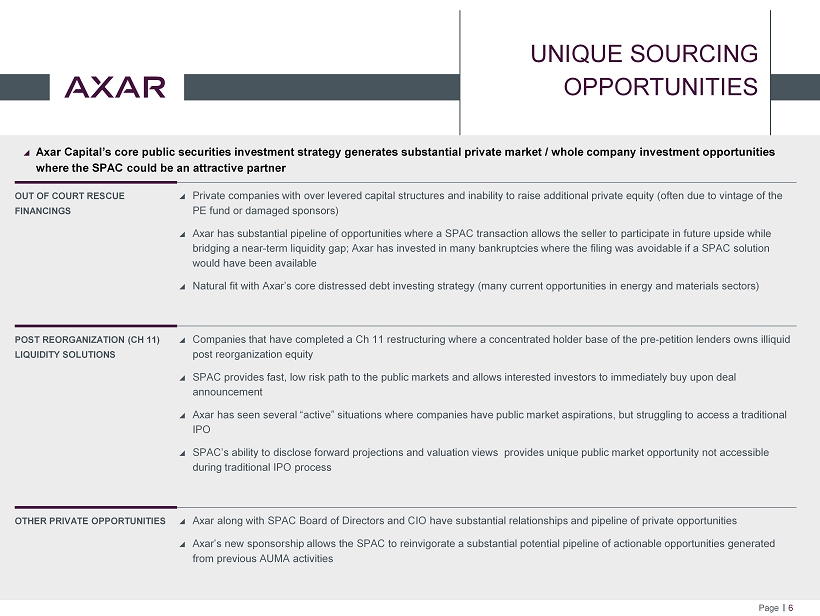

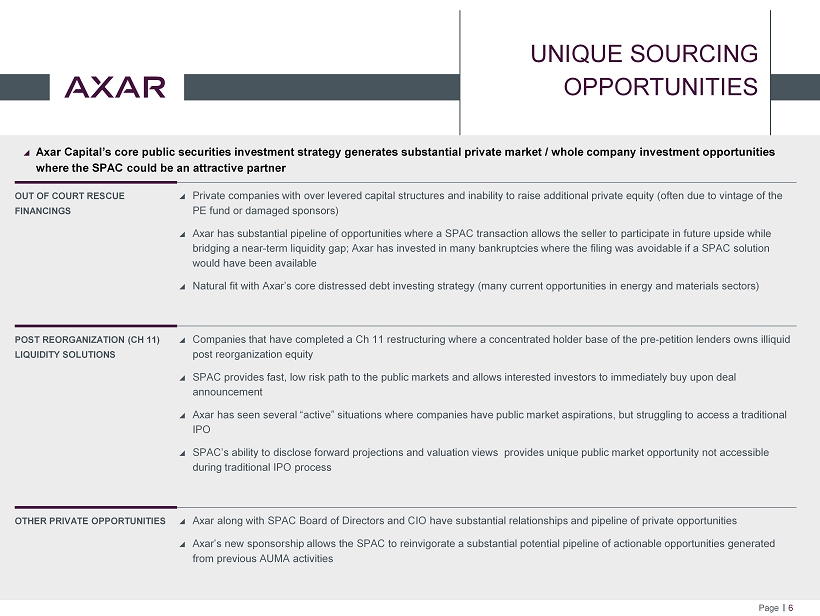

6 Page 6 UNIQUE SOURCING OPPORTUNITIES Axar Capital’s core public securities investment strategy generates substantial private market / whole company investment opportun it ies where the SPAC could be an attractive partner OUT OF COURT RESCUE FINANCINGS Private companies with over levered capital structures and inability to raise additional private equity (often due to vintage of the PE fund or damaged sponsors) Axar has substantial pipeline of opportunities where a SPAC transaction allows the seller to participate in future upside while bridging a near - term liquidity gap; Axar has invested in many bankruptcies where the filing was avoidable if a SPAC solution would have been available Natural fit with Axar’s core distressed debt investing strategy (many current opportunities in energy and materials sectors) POST REORGANIZATION (CH 11) LIQUIDITY SOLUTIONS Companies that have completed a Ch 11 restructuring where a concentrated holder base of the pre - petition lenders owns illiquid post reorganization equity SPAC provides fast, low risk path to the public markets and allows interested investors to immediately buy upon deal announcement Axar has seen several “active” situations where companies have public market aspirations, but struggling to access a traditional IPO SPAC’s ability to disclose forward projections and valuation views provides unique public market opportunity not accessible during traditional IPO process OTHER PRIVATE OPPORTUNITIES Axar along with SPAC Board of Directors and CIO have substantial relationships and pipeline of private opportunities Axar’s new sponsorship allows the SPAC to reinvigorate a substantial potential pipeline of actionable opportunities generated from previous AUMA activities