widely available to employees. As of March 31, 2019, and December 31,2018, 2017 and 2016, direct loans by IFS or its subsidiaries to employees, directors, officers, and key management of IFS and its subsidiaries amounted to S/212.3 million, S/223.4 million, S/183.6 million and S/153.4 million, respectively. Payment dates vary, and may be monthly, quarterly, or at maturity. See “Regulation and Supervision-Banking Regulation and Supervision” for information on the regulation of IFS and its subsidiaries and on the protection of deposits.

Inteligo Bank is operating pursuant to its original license, with a related party exposure of up to 25% of its capital.

For additional information about loans, including tabular disclosure, to, and certain other transactions with, related parties and affiliates including directors and officers, see Note 28 to our audited annual consolidated financial statements.

In the normal course of our operations, related party transactions are evaluated in accordance with Peruvian banking and securities regulations, as described in this section. These transactions are subject to prevailing market conditions and transfer pricing regulations. We and our subsidiaries have a number of such transactions with our parent company, subsidiaries of our parent company, affiliates pursuant to the criteria of the SBS and other related parties. See “Presentation of financial and other information—Certain definitions” for a brief description of a number of these parties. For additional information including tabular disclosure, about loans, to, and certain other transactions with, related parties and affiliates including directors and officers, see Note 28 to our audited annual consolidated financial statements.

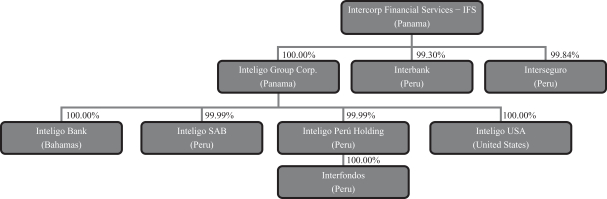

IFS

Investment in InRetail Perú Corp.

Since 2012, IFS held 2,396,920 shares from InRetail Perú Corp. a subsidiary of Intercorp, valued at U.S.$37.00 per share, as of March 31, 2019, which had an aggregate value of U.S.$85.57 million.

Interbank

Lease Agreements between Interbank and Supermercados Peruanos

In December 2003, Interbank and Supermercados Peruanos, a subsidiary of Intercorp, entered into a master area assignment agreement, as amended, pursuant to which Supermercados Peruanos agreed to grant a lease for 1,000 square meters of floor space in favor of Interbank, at U.S.$80.00 plus taxes per square meter per month for the first five years (2004-2009); U.S.$ 92.00 plus taxes for the following five years (2009-2014); and U.S.$113.3 plus taxes, for the last five years (2014-2019) of the term of the agreement. The agreement expires on October 1, 2019. Under the terms of the agreement, the Supermercados Peruanos granted to Interbank, for a term of 15 years, the right to use an area in its supermarkets for the operation of its stores. Interbank made an advanced payment of U.S.$8 million to be applied to the monthly rental payments, and a security deposit of U.S.$2 million also to be applied, among others, as warranty of the payment of the monthly consideration.

In September 2009, Interbank and Supermercados Peruanos entered into a second amendment to the agreement, pursuant to which Supermercados Peruanos agreed to grant a lease 1,038 square meters of additional floor space, corresponding to areas in new supermarkets, at U.S.$80 per square meter per month in favor of Interbank, plus taxes. Interbank made an advanced payment of U.S.$6.0 million, to be applied to the first 80 monthly rental payments.

Loan Agreement between Interbank and GTP Inversionistas S.A.C.

In May 2017, Interbank and GTP Inversionistas S.A.C. an affiliate, pursuant to the criteria of the SBS, entered into a loan agreement under which Interbank disbursed to the latter U.S.$32.6 million for the indirect

290