September 25, 2014

VIA EDGAR AND ELECTRONIC MAIL

Tom Kluck

Legal Branch Chief

Division of Corporation Finance

Securities and Exchange Commission

Mail Stop 4720

Washington, D.C. 20549

| | |

| Re: | | Wells Fargo Real Estate Investment Corporation |

| | Draft Registration Statement on Form S-11 |

| | Submitted August 12, 2014 |

| | CIK No. 0001616093 |

Dear Mr. Kluck:

In response to the comments by the staff (“Staff”) of the Securities and Exchange Commission (“Commission”) contained in the Staff’s letter dated September 11, 2014, regarding the Draft Registration Statement on Form S-11 of Wells Fargo Real Estate Investment Corporation (“WFREIC,” “Company,” “we,” or “our”), we submit the following information.

For your convenience, the Staff’s comments have been restated below in their entirety, with the response to each comment set forth immediately below the comment. The revisions to the filing described below are reflected in the Company’s Registration Statement on Form S-11 (the “Amended Registration Statement”) which amends our previous Draft Registration Statement on Form S-11 and is being filed simultaneously with this letter. Courtesy copies of the Amended Registration Statement, marked to reflect these revisions, are being delivered to the Staff.

Capitalized terms used and not defined herein shall have the meanings ascribed to them in the Amended Registration Statement.

General

| 1. | We note that you intend to operate your business in a manner that will permit you to maintain an exemption from registration under the 1940 Act. Please provide us with a detailed analysis of the exemption that you intend to rely on and how your investment strategy will support that exemption. Please note that we will refer your response to the Division of Investment Management for further review. |

Tom Kluck

September 25, 2014

Page 2

Company Response:

We intend to rely upon the exemption from registration under the Investment Company Act of 1940, as amended (the “1940 Act”), provided by Section 3(c)(5)(C) thereof, which excludes from the definition of “investment company”:

Any person who is not engaged in the business of issuing redeemable securities, face-amount certificates of the installment type or periodic payment plan certificates, and who is primarily engaged in … purchasing or otherwise acquiring mortgages and other liens on and interests in real estate.

In a line of no-action letters relating to Section 3(c)(5)(C) of the 1940 Act, the Staff has taken the position that an issuer may rely on the exclusion provided by Section 3(c)(5)(C) if at least 55% of its assets consist of “mortgages and other liens on and interests in real estate” (“Qualifying Interests”) and the remaining 45% of its assets consist primarily of “real estate-type” interests.1 To meet the 45% real estate-type interests test, an issuer must invest at least 25% of its total assets in real estate-type interests (subject to reduction to the extent that the issuer invests more than 55% of its total assets in Qualifying Interests) and may invest no more than 20% of its total assets in miscellaneous investments.2

The Staff has not objected to a company relying on the exclusion provided by Section 3(c)(5)(C) where (1) interests used to satisfy the 55% test include loans meeting the following criteria (“Class I Real Estate Loans”): (i) loans are secured by a mortgage or deed of trust on one or more tracts or parcels of real estate, (ii) 100% of the principal amount of the loans as indicated in the credit files of the originating bank are secured by real estate at the time of origination, and (iii) 100% of the fair market value of the loans is secured by real estate at the time the company acquires the loans; (2) at least 25% in value of the company’s assets consists of loans which do not qualify as Class I Real Estate Loans, but at least 55% of the fair market value of each such loan is secured by real estate at the time the company acquires the loan (“Class II Real Estate Loans”); and (3) not more than 20% in value of the company’s total assets consist of miscellaneous investments not qualifying as either a Class I or Class II Real Estate Loan.3

The Staff has also taken the position that an issuer that holds “participation interests” in mortgage loans may rely on Section 3(c)(5)(C) if the mortgage participation interests have attributes that would easily classify them as being interests in real estate rather than as being

1See,e.g., Commission Staff No-Action Letter, Citytrust (publicly available December 19, 1990); Commission StaffNo-Action Letter, NAB Asset Corporation (publicly available June 20, 1991); Commission Staff No-Action Letter, Greenwich Capital Acceptance Inc. (publicly available August 8, 1991); Commission Staff No-Action Letter, Capital Trust, Inc. (publicly available May 24, 2007).

2Id.

3See Commission Staff No-Action Letter, NAB Asset Corporation (publicly available June 20, 1991).

Tom Kluck

September 25, 2014

Page 3

interests in the nature of a security in another person engaged in the real estate business.4 For example, the Staff has not objected to a trust relying on the exclusion provided in Section 3(c)(5)(C) when the trust held participation interests in mortgage loans that were fully secured by real property and the trustee had the right by itself to foreclose on the mortgage securing the loan in the event of default.5

We note that that the participation interests currently owned by us (and which we intend to own in the future) represent 100% of the interest in the actual mortgage loans that are fully secured by real property and give us the right to control foreclosure and related matters. In addition, we evaluate the purchase of these participation interests in the same way as we would evaluate the purchase of the actual loans involved. Finally, we are treated as owning the underlying loans involved for U.S. Federal income tax purposes. As such, our participation interests are the equivalent to owning the underlying loans in all material respects.

In view of the foregoing, we believe that we may rely on the exclusion provided in Section 3(c)(5)(C) for the following reasons:

| | 1. | We are not engaged, nor intend to engage, in the business of issuing “redeemable securities”, “face-amount certificates” of the “installment type” or “periodic payment plan certificates”, as each such term is defined in the 1940 Act; |

| | 2. | At least 55% of our total assets (the “Total Assets”) currently consist of, and we intend that at least 55% of the Total Assets shall at all times consist of, Class I Real Estate Loans or 100% participation interests in Class I Real Estate Loans; |

| | 3. | At least 25% of the Total Assets that are not included in the first 55% of the Total Assets that are Class I Real Estate Loans or participation interests in Class I Real Estate Loans consist of, and we intend that at all times at least 25% of the Total Assets that are not included in the first 55% of the Total Assets that are Class I Real Estate Loans or participation interests in Class I Real Estate Loans shall consist of, Class II Real Estate Loans or 100% participation interests in Class II Real Estate Loans; |

| | 4. | No more than 20% of the Total Assets consist of, and we intend that at all times no more than 20% of the Total Assets shall consist of, assets other than Class I Real Estate Loans and Class II Real Estate Loans or participation interests in such loans; and |

4See Commission Staff No-Action Letter, Capital Trust, Inc. (publicly available February 3, 2009) (citing Commission Staff No-Action Letter, Northwestern Ohio Building and Construction Trades Foundation (publicly available May 21, 1984)).

5 See Commission Staff No-Action Letter, Northwestern Ohio Building and Construction Trades Foundation (publicly available May 21, 1984)

Tom Kluck

September 25, 2014

Page 4

| | 5. | Our participation interests in real estate loans give us, and we intend that any participation interests we acquire in the future shall give us, the unilateral right to foreclose on the mortgages securing the loans. |

| 2. | Please supplementally provide us with copies of all written communications, as defined in Rule 405 under the Securities Act, that you, or anyone authorized to do so on your behalf, present to potential investors in reliance on Section 5(d) of the Securities Act, whether or not they retain copies of the communications. Similarly, please supplementally provide us with any research reports about you that are published or distributed in reliance upon Section 2(a)(3) of the Securities Act of 1933 added by Section 105(a) of the Jumpstart Our Business Startups Act by any broker or dealer that is participating or will participate in your offering. |

Company Response:

We have not made, and do not expect to make, any written communications, as defined in Rule 405 under the Securities Act of 1933, as amended (the “Securities Act”), to potential investors in reliance on Section 5(d) of the Securities Act. In addition, there have been no research reports published or distributed in reliance upon Section 2(a)(3) of the Securities Act, added by Section 105(a) of the JOBS Act. If in the future there are any written communications, as defined in Rule 405, to potential investors in reliance on Section 5(d) or research reports published in reliance upon Section 2(a)(3) of the Securities Act, we will provide them to you.

| 3. | Please provide us with copies of any graphics, maps, photographs, and related captions or other artwork including logos that you intend to use in the prospectus. Such graphics and pictorial representations should not be included in any preliminary prospectus distributed to prospective investors prior to our review. |

Company Response:

We intend to use our Wells Fargo logo in the prospectus. The logo is reprinted below:

We do not intend to use any other graphics, maps, photographs, and related captions or other artwork in the prospectus.

Tom Kluck

September 25, 2014

Page 5

| 4. | Please tell us whether Wells Fargo or the Bank or any of their affiliates have programs with similar investment objectives that compete with you. We may have further comment. |

Company Response:

Our principal business is to acquire, hold and manage interests in predominantly domestic mortgage assets and other authorized investments, the majority of which are interests in 1-4 family real estate mortgages. In addition to WFREIC, Wells Fargo and the Bank have other subsidiaries (“Other Subsidiaries”) that hold participation interests in mortgage assets primarily originated by the Bank.

Wells Fargo’s portfolios of real estate 1-4 family mortgages and commercial real estate loans totaled approximately $431 billion at June 30, 2014. We believe that these real estate portfolios are more than sufficient to meet WFREIC’s and the Other Subsidiaries’ business needs. Moreover, Wells Fargo originated and retained $11.0 billion and $19.2 billion, respectively, in high quality non-conforming6 1-4 family first lien mortgages in the second quarter and first half of 2014, which are available to be participated to WFREIC and/or the Other Subsidiaries as needed. Thus, we believe that loans Wells Fargo originates and retains in the future will be more than sufficient to offset loan maturities and pay-downs and meet future business requirements of WFREIC and the Other Subsidiaries. Accordingly, we do not anticipate material competition among WFREIC and Wells Fargo, the Bank or any of the Other Subsidiaries for acquisition of participation interests in loans. Additionally, although it has not done so to date, WFREIC may purchase whole loans or loan participations from third party originators not otherwise affiliated with Wells Fargo.

6 Substantially all non-conforming loans originated in second quarter 2014 were classified as non-conforming due to the loan amount exceeding conventional conforming loan amount limits established by the government-sponsored entities (GSEs), including FNMA, FHLMC and GNMA.

Tom Kluck

September 25, 2014

Page 6

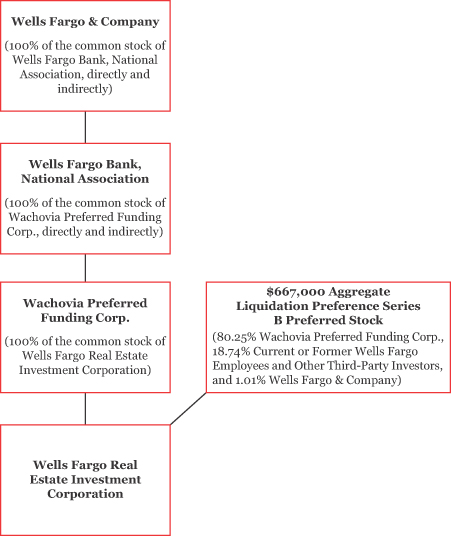

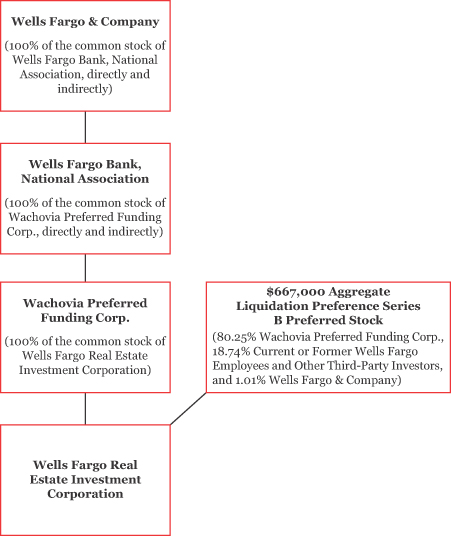

Our Organizational Structure, pg 2

| 5. | Please revise the chart to make more legible. |

Company Response:

We have revised the chart reflecting our organizational structure in the Amended Registration Statement. For your convenience, the revised chart is reprinted below:

Tom Kluck

September 25, 2014

Page 7

Use of Proceeds

| 6. | We note your disclosure that you “intend to use the net proceeds from this offering for general corporate purposes, including the acquisition of qualifying REIT assets or the reduction of any outstanding balances on our line of credit with the Bank.” Please revise to provide the following (or appropriate cross-references), as applicable: |

| | • | | The approximate amount intended to be used for each stated purpose; and |

| | • | | Information required by Instructions 3, 4 and 5 to Item 504 of Regulation S-K, as applicable. |

Company Response:

We have revised the relevant disclosure in the Amended Registration Statement. For your convenience, the revised disclosure is provided below:

We intend to use the net proceeds from this offering for general corporate purposes, including the acquisition of qualifying REIT assetsor the reduction of any outstanding balances on our line of credit with the Bank in the ordinary course of our business, either by purchasing qualifying REIT assets in fourth quarter 2014 or reducing any outstanding balance on our line of credit used to fund purchases of qualifying REIT assets made during 2014 and using the additional borrowing capacity thereunder to purchase additional qualifying REIT assets in the future. Based on our expectation of the timing of this offering, we anticipate the net proceeds will be used to reduce the outstanding balance on our line of credit.

Our revolving line of credit enables us to borrow $1.2 billion from the Bank as a short-term liquidity source. The outstanding balance on the line of credit at June 30, 2014 was $559.6 million. The line of credit bears a rate of interest equal to the average federal funds rate plus 12.5 basis points (0.125%).

We do not anticipate that any material amounts of other funds will be necessary to accomplish the purposes stated above.

Tom Kluck

September 25, 2014

Page 8

Management’s Discussion and Analysis of Financial Condition and Results of Operations, page 48

| 7. | We note that you have recently made material acquisitions, which have increased your asset base. With a view to disclosure, please tell us how the credit quality of the acquired assets differs from existing portfolio. |

Company Response:

WPFC contributed comparable qualifying REIT assets and related assets in November 2013. The credit quality of those assets was consistent with the qualifying REIT assets owned by WFREIC. To provide additional credit information, we have revised the relevant disclosure in the Amended Registration Statement. For your convenience, the revised disclosure is provided below:

Asset Contributions

In November 2013, WPFC contributed $7.1 billion of consumer and commercial loans, $18.0 million of accrued interest and $2.4 million of foreclosed assets to the Company. The contribution of assets was an equity transaction between entities under common control; therefore, the assets were recorded at their WPFC book value, including the allowance for credit losses of $197.1 million and unamortized premiums and discounts on loans. WPFC also contributed $1.5 billion of cash during 2013. We did not issue additional common stock to WPFC; accordingly, the contributions were recorded as an increase in additional paid-in capital. See Note 1 (Summary of Significant Accounting Policies) to the Audited Financial Statements for additional information.

The weighted average Fair Isaac Corporation (“FICO”) score and loan-to-value (“LTV”) ratio for real estate 1-4 family first mortgage loans included within the November 2013 contribution was 712 and 62%, respectively, compared with 752 and 60%, respectively, for the existing WFREIC portfolio. The weighted average FICO score and combined LTV for the contributed real estate 1-4 family junior lien mortgage portfolio was 706 and 85%, respectively, compared with 702 and 88%, respectively, for the existing WFREIC portfolio. The percentage of contributed commercial loan risk ratings, based on recorded investment, designated as Pass under the Bank’s borrower and collateral quality ratings was 97%, compared with 84% for the existing WFREIC commercial portfolio.

Tom Kluck

September 25, 2014

Page 9

Noninterest Expense, page 54

| 8. | Please revise, where applicable, to provide detailed disclosure on the make-up of the management fees, including fixed asset management fees, performance fees and expense reimbursements that separately specifies salary reimbursement amounts, as applicable, or advise. |

Company Response:

The management fees included within noninterest expense do not represent fixed asset management or performance-based fees, but reflect WFREIC’s allocated portion of Wells Fargo’s general overhead expenses, which includes personnel as well as non-personnel operating costs as part of the allocable pool of technology, finance and accounting, risk management and other overhead expenses. While revenue and total average assets are a factor in determining the allocation of fees, such fees are not intended to be performance based. The mix of costs included within the pool of allocable general overhead expenses varies depending on the expenses Wells Fargo may incur for a given period. For those periods presented in the Amended Registration Statement, approximately one-third of the allocated general overhead expenses relate to technology support costs and the remainder consists of a combination of finance and accounting, risk management and other general overhead expenses. Although allocated costs represented by management fees may include personnel costs, total allocated costs are not significant to WFREIC ($2.0 million for the year ended December 31, 2013 and $1.5 million for the six months ended June 30, 2014). We have revised the relevant disclosure in the Amended Registration Statement to include how the management fees are calculated. For your convenience, the revised disclosure is provided below:

Management fees represent reimbursements made to the Bank for general overhead expenses,including allocations of technology support and a combination of finance and accounting, risk management and other general overhead expenses incurred on our behalf.Management fees are calculated based on Wells Fargo’s total monthly allocable costs multiplied by a formula. The formula is based on our proportion of Wells Fargo’s consolidated: (1) full-time equivalent employees, (2) total average assets and (3) total revenue. Management fees were $1.5 million in the first half of 2014 compared with $851 thousand for the same period a year ago. The increase in management fees related to an increase in base expenses allocated from the Bank,mainly technology and related support costs. Management fees were $2.0 million in 2013, compared with $2.1 million in 2012 and $1.5 million in 2011. While the 2013 expense was consistent with the prior year, the 2012 increase in management fees related to an increase in technology system and support expenses.

Tom Kluck

September 25, 2014

Page 10

Table 3: Taxable income before dividends paid deduction, page 56

| 9. | You indicate within footnote (1) that 2013 REIT taxable income is an estimate. Please tell us and expand your disclosures to discuss why this is the case. |

Company Response:

WFREIC’s 2013 REIT taxable income was an estimate at the time we furnished WFREIC’s Draft Form S-11 Registration Statement to the Commission. Since that time, WFREIC has finalized and filed its 2013 income tax return. Consequently, we have revised the relevant disclosure in the Amended Registration Statement to reflect the finalized REIT taxable income. For your convenience, the revised disclosure is reprinted below:

Table 3: Taxable income before dividends paid deduction

| | | | | | | | | | | | |

| |

| | | December 31, | |

| | | | |

| (in thousands) | | 2013 | | | 2012 | | | 2011 | |

| |

Net income | | $ | 257,430 | | | | 143,092 | | | | 189,379 | |

Tax Adjustments: | | | | | | | | | | | | |

Purchase accounting | | | 57,629 | | | | 38,948 | | | | 47,744 | |

Allowance for credit losses | | | (20,306 | ) | | | (3,076 | ) | | | (11,775 | ) |

Other | | | 1,292 | | | | 732 | | | | (142 | ) |

| |

REIT taxable income | | | 296,045 | | | | 179,696 | | | | 225,206 | |

| |

Dividends | | | 320,057 | | | | 186,057 | | | | 233,057 | |

| |

Liquidity and Funding, pages 70 – 71

| 10. | You indicate that dividends are expected to be funded through cash generated by operations or paid-in capital. Reference is made to your statement of cash flows on page F-6, which indicates that historically for the last three years cash dividends paid has exceeded net cash provided by operating activities. Please tell us and expand your disclosures to discuss and provide additional details about the source of funding for such cash dividends. |

Company Response:

For the last three years, cash dividends paid have exceeded net cash provided by operating activities. Such distributions, based on REIT taxable income, have exceeded net cash provided by operating activities primarily due to the impact of purchase accounting adjustments attributable to the Company from the 2008 acquisition of Wachovia Corporation by Wells Fargo. The remaining purchase accounting adjustments at December 31, 2013 are not expected to cause a significant variance between GAAP net income and REIT taxable income in future periods. Accordingly, cash distributions in future periods are expected to be funded through net cash provided by operating activities or by paid-in capital.

Tom Kluck

September 25, 2014

Page 11

We have expanded our disclosure in the Amended Registration Statement to clarify the source of funding for future distributions. For your convenience, the revised disclosure is provided below:

Our primary liquidity needs are to pay operating expenses, fund our lending commitments, purchase loans to replace existing loans that mature or repay, and pay dividends.Primarily due to the impact on REIT taxable income of purchase accounting adjustments attributable to the Company from the 2008 acquisition of Wachovia Corporation by Wells Fargo, dividend distributions to shareholders in 2011 through 2013, based on REIT taxable income, exceeded net cash provided by operating activities. As the remaining purchase accounting adjustments at December 31, 2013 are not expected to cause a significant variance between GAAP net income and REIT taxable income in future years,Operating operating expenses and dividends are expected to be funded through cash generated by operations or paid-in capital., while f Funding commitments and the acquisition of loans are intended to be funded with the proceeds obtained from repayment of principal balances by individual borrowers and our line of credit with the Bank. In the first half of 2014, we purchased $879.0 million of loans from the Bank, compared with $1.8 billion in the first half of 2013. In 2013, we purchased $3.9 billion of loans from the Bank. If in future periods we do not reinvest loan pay-downs at sufficient levels, management may request our board of directors to consider a return of capital to the holders of our common stock. Annually, we expect to distribute an aggregate amount of outstanding capital stock dividends equal to approximately 100% of our REIT taxable income for federal tax purposes. Such distributions may exceed net income determined under GAAP.

Executive Compensation, page 79

| 11. | Please tell us if you intend to reimburse Wells Fargo or the Bank for personnel costs. If so, please revise your disclosure to specifically disclose, if true, that you will reimburse Wells Fargo and/or the Bank for the salaries and benefits to be paid to your named executive officers. In addition, in future filings that require Item 402 or Item 404 of Regulation S-K disclosure, please disclose the amount of fees paid to Wells Fargo and/or the Bank, break out the amounts paid pursuant to the base management fee, incentive fee and the reimbursement provision, as applicable, and within reimbursements specify any amounts reimbursed for salaries or benefits of a named executive officer. |

Company Response:

As discussed in response to comment 8, the management fee charged to WFREIC reflects its allocated portion of Wells Fargo’s general overhead expenses, which includes personnel as well as non-personnel operating costs as part of the allocable pool of technology, finance and accounting, risk management and other overhead expenses. Although personnel costs of the named executive officers are included in the total pool, the portion of the total pool allocated to

Tom Kluck

September 25, 2014

Page 12

WFREIC and attributable to such costs isde minimis. Wells Fargo does not directly use the management fees collected from WFREIC to determine or pay the salary and benefits of WFREIC’s named executive officers.

In future filings that require Item 402 or Item 404 of Regulation S-K disclosure, we will disclose the amount of fees paid to Wells Fargo and the Bank, and specify any amounts reimbursed for salaries or benefits of a named executive officer, if applicable.

Certain Relationships and Related Party Transactions, page 80

| 12. | Please provide quantitative disclosure on how the Wells Fargo management fee is calculated or advise. |

Company Response:

As discussed in our response to comment 8, the management fee charged to WFREIC reflects its allocated portion of Wells Fargo’s general overhead expenses. The mix of costs included within the pool of allocable general overhead expenses varies depending on the expenses Wells Fargo may incur for a given period. For those periods presented in the Draft Registration Statement on Form S-11, approximately one-third of the allocated general overhead expenses relate to technology support costs and the remainder consists of a combination of finance and accounting, risk management and other general overhead expenses. Although total allocated costs are not significant to WFREIC ($2.0 million for the year ended December 31, 2013 and $1.5 million for the six months ended June 30, 2014), we have revised the relevant disclosure in the Amended Registration Statement as set forth below:

Additionally, we are subject to Wells Fargo’s management fee policy and thus reimburse the Bank on a monthly basis for general overhead expenses, and we are dependent on the Bank and others for servicing the loans in our portfolio. Management feesfor 2013, 2012, and 2011 wereare calculated based on Wells Fargo’s total monthly allocable costs multiplied by a formula. The formula is based on our proportion of Wells Fargo’s consolidated: (1) full-time equivalent employees, (2) total average assets and (3) total revenue.Management fees were $1.5 million in the first half of 2014 compared with $851 thousand for the same period a year ago. The increase in management fees related to an increase in expenses allocated from the Bank, mainly technology and related support costs. Management fees were $2.0 million in 2013, compared with $2.1 million in 2012 and $1.5 million in 2011. While the 2013 expense was consistent with the prior year, the 2012 increase in management fees related to an increase in technology system and support expenses.

See our response to comments 8 and 11 for additional information about the Wells Fargo management fee.

Tom Kluck

September 25, 2014

Page 13

| 13. | You disclose that the Bank will pay you a fee for the pledge of your loan assets, and that the fee is not inconsistent with market terms. Additionally, you state that terms of the loan participation and servicing agreements between the Bank or its affiliates and you are consistent with those resulting from arm’s-length negotiations. Please tell us how you are able to substantiate these representations. |

Company Response:

WFREIC engages in various transactions and agreements with affiliated parties. Due to the nature of these relationships, material agreements between WFREIC and the Bank and its affiliates require approval by the majority of the independent directors of WFREIC.

Because Wells Fargo is a servicer of loans to third parties, WFREIC reviews the rates charged for the servicing of its loans within the participation and servicing agreements with Wells Fargo consumer and commercial lending businesses to ensure servicing rates being charged are not inconsistent with rates that they charge to third parties for servicing of similar loans. Additionally, we review industry publications to assess the reasonableness of rates being charged between ourselves and the Bank.

As WFREIC does not currently pledge assets, we do not have a pledge agreement in place. In 2015, WFREIC may enter into agreements to pledge its loans to third parties on behalf of the Bank so that the Bank has access to funding from those third parties. This transaction resembles a standby letter of credit commitment where a bank provides an uncollateralized committed facility to a borrower to provide funding. As such, we would expect to obtain pricing for an unsecured standby letter of credit using credit equivalent to that of the Bank to determine the reasonableness of the fee charged for pledging WFREIC’s assets.

Report of Independent Registered Public Accounting Firm, page F-2

| 14. | Please tell us if your auditors conducted their audits in accordance with the standards of the PCAOB, as opposed to just the auditing standards of the PCAOB. If applicable, have your auditors revise their audit opinion to reflect that they conducted their audits in accordance with the standards of the PCAOB. Please refer to PCAOB Auditing Standard No. 1. |

Company Response:

KPMG LLP (“KPMG”) audited our financial statements as of December 31, 2013 and 2012, and for each of the years in the three-year period ended December 31, 2013. KPMG conducted their audits in accordance with “the standards of the Public Company Accounting Oversight Board (United States)”, and the Report of Independent Registered Public Accounting Firm has been revised accordingly. The revised Report of Independent Registered Public Accounting Firm is included on page F-2 of the Amended Registration Statement.

Tom Kluck

September 25, 2014

Page 14

Income Taxes, page F-12

| 15. | We are unclear how you believe there would only be a minimal adverse effect on your company if you fail to qualify as a REIT. Please advise or revise. |

Company Response:

If WFREIC were to fail to qualify as a REIT, earnings and cash provided by operating activities available for distribution to shareholders would be reduced by the amount of any applicable income tax obligation. However, given the level of earning assets, we currently expect there would be sufficient earnings and ample cash to pay preferred dividends. While the decrease in after tax income would reduce the net income available to common stockholders, common and preferred dividends would be eligible for the dividends-received deduction. We have revised the relevant footnote disclosure in the Amended Registration Statement. For your convenience, the revision of the footnote disclosure is provided in our response to comment 16.

We have also updated the discussion in the REIT Tax Status section of “Management’s Discussion and Analysis of Financial Condition and Results of Operations included on page 48 of the Amended Registration Statement. For your convenience, the revised disclosure is provided below:

In the event we do not continue to qualify as a REIT,earnings and cash provided by operating activities available for distribution to shareholders would be reduced by the amount of any applicable income tax obligation. Given the level of earning assets, we currently expect there would be sufficient earnings and ample cash to pay preferred dividends.we believe there should be minimal adverse effect of that characterization to us or to our shareholders.Thepreferred dividends we pay as a REIT are ordinary investment income not eligible for thedividends-received deduction for corporate shareholders or for the favorable qualified dividend tax rate applicable to non-corporate taxpayers. If we were not a REIT,preferred dividends we pay generally would qualify for thedividends-received deduction for corporate shareholders and the favorable qualified dividend tax rate applicable to non-corporate taxpayers.

Note 5 – Common and Preferred Stock, page F-28

| 16. | Please revise to disclose the tax status of dividends per common share pursuant to Rule 3-15(c) of Regulation S-X. |

Company Response:

We have updated the discussion in Note 1 (Summary of Significant Accounting Policies) to the Audited Financial Statements to disclose the tax status of dividends per common share pursuant

Tom Kluck

September 25, 2014

Page 15

to Rule 3-15(c) of Regulation S-X. For your convenience, the revised disclosure is provided below:

As a REIT, dividends paid on common shares generally constitute ordinary income to the shareholder. However, distributions paid on common shares in excess of REIT taxable income, computed without regard to the dividends paid deduction, do not qualify as dividend income, and instead constitute a return of capital. In the event we do not continue to qualify as a REIT, earnings and cash provided by operating activities available for distribution to shareholders would be reduced by the amount of any applicable income tax obligation.we believe there should be minimal adverse effect of that characterization to us or to our shareholders.Thepreferred dividends we pay as a REIT are ordinary investment income not eligible for thedividends-received deduction for corporate shareholders or for the favorable qualified dividend tax rate applicable to non-corporate taxpayers. If we were not a REIT,the preferred dividends we pay generally would qualify for thedividends-received deduction for corporate shareholders and the favorable qualified dividend tax rate applicable to non-corporate taxpayers.

Note 6 – Transactions With Related Parties, pages F-29 – F-30

| 17. | We note that you purchase loans from and sell loans to the Bank and that these sales are transacted at fair value resulting in purchase discounts and premiums or gains and losses on sales. Based on organizational charts disclosed throughout your filing it appears that you are an indirect wholly owned subsidiary of the Bank. Given this fact, please clarify your basis within GAAP for accounting for such transactions at fair value and recognizing the gains and losses within your statement of income. |

Company Response:

The on-going purchases and sales of loans from the Bank in the ordinary course of business represent transfers of financial instruments in exchange for cash proceeds, which are subject to the recognition and measurement principles of ASC 860, Transfers and Servicing. Accordingly, such transfers of financial instruments are recognized and measured at fair value. Fair value measurement of the loans purchased from the Bank reflects WFREIC’s best estimate of the economic substance of transactions that would occur in arms-length transactions between two unrelated parties.

In contrast, the November 2013 contribution of loans and related assets did not represent a transfer of financial instruments subject to ASC 860. The contribution represented an exchange of assets for equity between entities under common control, which is recognized in equity and measured at carryover basis.

Tom Kluck

September 25, 2014

Page 16

Schedule IV – Mortgage Loans On Real Estate

| 18. | Please revise to comply with the requirements of Rule 5-04 of Regulation S-X for Schedule IV “Mortgage Loans On Real Estate”. |

Company Response:

We have updated the Form S-11 Registration Statement to comply with the requirements of Rule 5-04 of Regulation S-X for Schedule IV “Mortgage Loans On Real Estate.” For your convenience, the disclosure is provided within the Appendix to this letter.

Relationships with Underwriters, page 116

| 19. | When the full syndication has been determined, please revise to identify each underwriter that has a material relationship with you and state the nature of the relationship. |

Company Response:

Wells Fargo Securities LLC, an indirect wholly-owned subsidiary of Wells Fargo, is the lead underwriter for the Series A preferred stock offering. We do not expect there will be any other underwriters with a material relationship with us or Wells Fargo. If other underwriters with a material relation to us or Wells Fargo are identified, we will update the disclosure on page 116 to identify each underwriter with which we have a material relationship and state the nature of the relationship.

Exhibit Index

| 20. | If you are not in a position to file your legal and tax opinions with the next filing, please provide draft copies for our review. |

Company Response:

Sullivan & Cromwell LLP will provide the Staff via email with draft copies of the legal and tax opinions.

* * * * *

Tom Kluck

September 25, 2014

Page 17

In responding to the Staff’s comments, the Company acknowledges that:

| | • | | the Company is responsible for the adequacy and accuracy of the disclosure in the filing; |

| | • | | Staff comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| | • | | the Company may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

Questions concerning the information set forth in this letter may be directed to me at(415) 222-3119.

|

| Very truly yours, |

|

| /s/ Richard D. Levy |

| Richard D. Levy |

| Executive Vice President and Controller |

| (Principal Accounting Officer) |

cc: Michael J. Loughlin, President and Chief Executive Officer

John R. Shrewsberry, Senior Executive Vice President and Chief Financial Officer

Tom Kluck

September 25, 2014

Appendix

Wells Fargo Real Estate Investment Corporation

Schedule IV – Mortgage Loans on Real Estate

December 31, 2013

Mortgage Loans on Real Estate (1)

| | | | | | | | | | | | | | | | | | | | |

| |

| (dollars in thousands) | | Number

of loans | | | Weighted average

interest

rate | | | Weighted average

maturity

in years | | | Recorded

investment

in loans (2) | | | Past due

amounts (3) | |

| |

Commercial secured by real estate: | | | | | | | | | | | | | | | | | | | | |

Original balances less than $1,000 | | | 509 | | | | 2.81 | % | | | 3.6 | | | $ | 497,886 | | | | 7,524 | |

Original balances $1,000 – $10,000 | | | 520 | | | | 2.63 | | | | 3.5 | | | | 1,204,882 | | | | 6,693 | |

Original balances over $10,000 | | | 60 | | | | 2.35 | | | | 3.1 | | | | 1,156,894 | | | | – | |

| | | | | | | | | | | | | |

Total commercial secured by real estate | | | 1,089 | | | | 2.55 | | | | 3.3 | | | | 2,859,662 | | | | 14,217 | |

| | | | | | | | | | | | | |

Real estate 1-4 family first mortgage: | | | | | | | | | | | | | | | | | | | | |

Original balances less than $500 | | | 57,845 | | | | 6.02 | | | | 18.3 | | | | 4,184,439 | | | | 217,206 | |

Original balances $500 – $1,000 | | | 3,820 | | | | 4.69 | | | | 24.0 | | | | 2,274,232 | | | | 35,869 | |

Original balances over $1,000 | | | 1,277 | | | | 3.96 | | | | 24.7 | | | | 1,570,474 | | | | 35,343 | |

| | | | | | | | | | | | | |

Total real estate 1-4 family first mortgage | | | 62,942 | | | | 5.24 | | | | 20.9 | | | | 8,029,146 | | | | 288,418 | |

| | | | | | | | | | | | | |

Real estate 1-4 family junior lien mortgage: | | | | | | | | | | | | | | | | | | | | |

Original balances less than $500 | | | 51,785 | | | | 7.18 | | | | 16.7 | | | | 2,104,737 | | | | 91,311 | |

Original balances $500 – $1,000 | | | 81 | | | | 6.00 | | | | 20.3 | | | | 38,173 | | | | 330 | |

Original balances over $1,000 | | | 9 | | | | 5.73 | | | | 20.2 | | | | 8,570 | | | | – | |

| | | | | | | | | | | | | |

Total real estate 1-4 family junior lien mortgage | | | 51,875 | | | | 7.15 | | | | 16.9 | | | | 2,151,480 | | | | 91,641 | |

| |

Total loans | | | 115,906 | | | | 4.97 | % | | | 16.4 | | | $ | 13,040,288 | | | | 394,276 | |

| |

| (1) | Wells Fargo Real Estate Investment Corporation’s mortgage portfolio consists of “Commercial secured by real estate,” “Real estate 1-4 family first mortgage,” and “Real estate 1-4 junior lien mortgage.” None of our loans individually exceeds three percent of the total recorded investment in loans. |

| (2) | Recorded investment is net of charge-downs. Aggregate recorded investment of loans as of December 31, 2013, for Federal income tax purposes is $13.0 billion. Recorded investment includes net related party discount of $332.3 million. |

| (3) | Amounts greater than 30 days past due. All loans were acquired from related parties. Amounts do not include purchase credit-impaired loans, which are considered to be accruing because they continue to earn interest from accretable yield, independent of performance in accordance with their contractual terms. |

Recorded Investment (1)

| | | | | | | | | | | | |

| |

| (in thousands) | | 2013 | | | 2012 | | | 2011 | |

| |

Balance, beginning of period | | $ | 4,065,226 | | | | 2,992,390 | | | | 3,977,882 | |

Purchases | | | 3,849,096 | | | | 1,956,014 | | | | – | |

Accretion and amortization of adjustments on loans | | | 11,361 | | | | 23,374 | | | | 43,649 | |

Non-cash loan contribution from Wachovia Preferred Funding Corp. | | | 7,116,854 | | | | – | | | | – | |

| |

Loan balance increases | | | 10,977,311 | | | | 1,979,388 | | | | 43,649 | |

| |

Proceeds from principal payments and sales | | | (1,957,934 | ) | | | (850,838 | ) | | | (976,733 | ) |

Charge-offs | | | (41,337 | ) | | | (50,615 | ) | | | (48,686 | ) |

Transfers from loans to foreclosed assets | | | (2,978 | ) | | | (5,099 | ) | | | (3,722 | ) |

| |

Loan balance decreases | | | (2,002,249 | ) | | | (906,552 | ) | | | (1,029,141 | ) |

| |

Balance, end of period | | $ | 13,040,288 | | | | 4,065,226 | | | | 2,992,390 | |

| |

| (1) | Table presents annual changes in the recorded investment in loans. All loan purchase and sale transactions were with related parties. See Note 1 (Summary of Significant Accounting Policies) and Note 2 (Loans and Allowance for Credit Losses) to financial statements for additional information on loan transactions, including term extensions in the form of TDRs. |