Filed pursuant to Rule 424(b)(3).

Registration Statement No. 333-198948.

Wells Fargo Real Estate Investment Corporation

11,000,000 Shares

6.375% Cumulative Perpetual Preferred Stock, Series A

(Liquidation Preference $25 Per Share) Wells Fargo Real Estate Investment Corporation originally issued its 6.375% Cumulative Perpetual Preferred Stock, Series A (the “Series A preferred stock”) on December 11, 2014 in an underwritten public offering.

The Series A preferred stock is listed on the New York Stock Exchange (the “NYSE”) under the symbol “WFE Pr A”. The last reported sale price of the Series A preferred stock on January 22, 2016 was $26.18.

We are an “emerging growth company” defined under federal securities laws, and as such, we may elect to comply with certain reduced public company reporting requirements in this prospectus and in our filings

Investing in our Series A preferred stock involves risks. See “Risk Factors” beginning on page 38 of our Annual Report on Form 10-K for the year ended December 31, 2014 (the “2014 Annual Report”) and on page 14 of this prospectus for a description of certain risk factors that you should consider before investing in our Series A preferred stock.

The Series A preferred stock solely represents an interest in us and is not the obligation of, or guaranteed by, any other entity, including Wells Fargo & Company and Wells Fargo Bank, National Association. Shares of the Series A preferred stock are not deposits or accounts and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This prospectus has been prepared for and may be used by Wells Fargo Securities, LLC or any other affiliate of Wells Fargo Real Estate Investment Corporation in connection with offers and sales of the Series A preferred stock in market-making transactions, including block positioning and block trades, and unless such affiliate informs the purchaser otherwise in the confirmation of the sale, this prospectus is being used by such affiliate in a market-making transaction. Such market-making transactions will be made at negotiated prices related to prevailing market prices at the time. Any such broker-dealer affiliates, including Wells Fargo Securities, LLC, may act as principal or agent in such transactions and may receive compensation in the form of discounts and commissions from such market-making transactions. Wells Fargo Real Estate Investment Corporation will not receive any proceeds from such market‑making transactions.

Prospectus dated January 22, 2016

For purposes of this prospectus, “WFREIC,” the “Company,” “we,” “our,” and “us” refer to Wells Fargo Real Estate Investment Corporation, and where relevant, Wells Fargo Bank, National Association, acting on our behalf; “WPFC” refers to Wachovia Preferred Funding Corp.; the “Bank” refers to Wells Fargo Bank, National Association; and “Wells Fargo” refers to Wells Fargo & Company.

TABLE OF CONTENTS

|

| |

Explanatory Note

| |

Where You Can Find More Information About WFRIEC

| |

Forward-Looking Statements

| |

Prospectus Summary

| |

Risk Factors

| |

Use of Proceeds

| |

Capitalization

| |

Ratio of Earnings to Fixed Charges and Preferred Dividends

| |

Federal Income Tax Considerations

| |

ERISA Considerations

| |

Plan of Distribution

| |

Experts

| |

Validity of the Series A Preferred Stock

| |

Neither we nor any dealer has authorized anyone to provide any information other than that contained in or incorporated by reference into this prospectus or to which we have referred you. Neither we nor any dealer take responsibility for, nor can provide any assurance as to the reliability of, any other information that others may give you. Offers to sell, and solicitation of offers to buy, the Series A preferred stock are made only under circumstances and in jurisdictions where offers and sales are permitted. The information contained in or incorporated by reference into this prospectus is accurate only as of the date of this prospectus or the date of the document incorporated by reference into this prospectus, regardless of the time of delivery of this prospectus or of any sale of any Series A preferred stock. Our business, prospects, financial condition and results of operations may have changed since such dates.

Explanatory Note

The Series A preferred stock was originally issued on December 11, 2014 in an underwritten public offering.

Wells Fargo Securities, LLC or any other affiliate of Wells Fargo Real Estate Investment Corporation may use this prospectus in connection with offers and sales of the Series A preferred stock in market-making transactions, including block positioning and block trades. Such market-making transactions will be made at negotiated prices related to prevailing market prices at the time of sale. Any such broker-dealer affiliates, including Wells Fargo Securities, LLC, may act as principal or agent in such transactions. Broker-dealers purchasing the Series A preferred stock from affiliates of Wells Fargo Real Estate Investment Corporation or Wells Fargo & Company, including Wells Fargo Securities, LLC, may be deemed to be underwriters as that term is defined in the Securities Act of 1933, as amended (the “Securities Act”), and subject to applicable prospectus delivery requirements.

Such broker-dealer affiliates may receive compensation in the form of discounts and commissions from such market-making transactions.

Wells Fargo Real Estate Investment Corporation will not receive any proceeds from such market-making transactions.

Where You Can Find More Information About WFRIEC

Registration Statement

We have filed with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S-3 under the Securities Act for our Series A preferred stock being offered by this prospectus. This prospectus, which is part of the registration statement, does not contain all of the information included in the registration statement and its exhibits. For further information about us, you should refer to the registration statement and its exhibits as well as information we incorporate by reference into this prospectus as described below. With respect to documents described in this prospectus, we refer you to the copy of the document if it is filed as an exhibit to the registration statement.

WFREIC’s SEC Filings

We file annual, quarterly and current reports and other information with the SEC. Our SEC filings are available to the public over the Internet at the SEC’s web site at http://www.sec.gov. You may also read and copy any document we file with the SEC at its Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You can also obtain copies of the documents at prescribed rates by writing to the Office of Investor Education and Advocacy of the SEC at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the public reference facilities. Our SEC filings are also available at the offices of the New York Stock Exchange. For further information on obtaining copies of our public filings at the New York Stock Exchange, you should call (212) 656-3000.

WFREIC does not maintain its own website. WFREIC’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), are accessible without charge on Wells Fargo & Company’s website, www.wellsfargo.com/invest_relations/filings.

Incorporation of Certain Information by Reference

We incorporate by reference into this prospectus the information we file with the SEC, which means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is an important part of this prospectus. Information that we subsequently file with the SEC will automatically update this prospectus. In other words, in the case of a conflict or inconsistency between information set forth in this prospectus and/or information incorporated by reference into this prospectus, you should rely on the information contained in the document that we filed later. Any statement contained in a document incorporated, or deemed to be, incorporated by reference into this prospectus is deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or in any other subsequently filed document that also is, or is deemed to be, incorporated by reference into this prospectus modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

We incorporate by reference into this prospectus the documents (or portions thereof) listed below, all of which were filed with the SEC under File No. 001-36768:

| |

| • | our 2014 Annual Report on Form 10-K; |

| |

| • | our Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2015, June 30, 2015 and September 30, 2015; |

| |

| • | our Current Report on Form 8-K dated March 18, 2015; and |

| |

| • | the description of the Series A preferred stock contained in our Registration Statement on Form 8-A, filed on December 3, 2014, that incorporates by reference the information set forth under the caption “Description of the |

Series A Preferred Stock” in the prospectus dated December 4, 2014, filed with the SEC pursuant to Securities Act Rule 424(b), that forms part of the Registration Statement on Form S-11 (File No. 333-198948), including any amendment or report filed to update such description (the “Form 8-A”).

We also incorporate by reference into this prospectus all documents we file with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act on or after the date of this prospectus and prior to the date that our affiliates cease offering securities in market-making transactions pursuant to this prospectus (other than any documents or any portions of any documents that are not deemed “filed” under the Exchange Act in accordance with the Exchange Act and applicable SEC rules).

Documents Available Without Charge from WFREIC

WFREIC will provide, without charge, to each person, including any beneficial owner, to whom a copy of this prospectus (or in lieu thereof, the notice referred to in Rule 173 under the Securities Act) is delivered, upon written or oral request of such person, a copy of the document referred to above that has been incorporated by reference into this prospectus. You should direct requests for this document to:

Office of the Corporate Secretary

Wells Fargo & Company

Wells Fargo Center

MAC #N9305-173

Sixth and Marquette

Minneapolis, Minnesota 55479

Phone: (612) 667-0087

Forward-Looking Statements

This prospectus contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects,” “target”, “projects,” “outlook,” “forecast,” “will,” “may,” “could,” “should,” “can” and similar references to future periods. Examples of forward-looking statements include, but are not limited to, statements we make about: future results of WFREIC; expectations for consumer and commercial credit performance and the appropriateness of our allowance for credit losses; our expectations regarding net interest income; expectations regarding loan acquisitions and pay-downs; future capital expenditures; future dividends and other capital distributions; the expected outcome and impact of legal, regulatory and legislative developments, as well as our expectations regarding compliance therewith; the outcome of contingencies, such as legal proceedings; and our plans, objectives and strategies.

Forward-looking statements are not based on historical facts but instead represent our current expectations and assumptions regarding our business, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Our actual results may differ materially from those contemplated by the forward-looking statements. We caution, therefore, against relying on any of these forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance. While there is no assurance that any list of risks and uncertainties or risk factors is complete, important factors that could cause actual results to differ materially from those in the forward-looking statements include the following:

| |

| • | economic conditions that affect the general economy, housing prices, the job market, consumer confidence and spending habits, including our borrowers’ prepayment and repayment of our loans; |

| |

| • | the effect of the current low interest rate environment or changes in interest rates on our net interest income; |

| |

| • | the level and volatility of the capital markets, interest rates, currency values and other market indices that affect the value of our assets and liabilities; |

| |

| • | the effect of political conditions and geopolitical events; |

| |

| • | losses relating to natural disasters, including, with respect to our loan portfolio, damage or loss to the collateral underlying loans in our portfolio or the unavailability of adequate insurance coverage or government assistance for borrowers; |

| |

| • | adverse developments in the availability of desirable investment opportunities, whether they are due to competition, regulation or otherwise; |

| |

| • | the extent of loan modification efforts, as well as the effects of regulatory requirements or guidance regarding loan modifications; |

| |

| • | the availability and cost of both credit and capital; |

| |

| • | investor sentiment and confidence in the financial markets; |

| |

| • | our reputation and the reputation of Wells Fargo and the Bank; |

| |

| • | financial services reform and the impact of other current, pending and future legislation, regulation and legal actions applicable to us, the Bank or Wells Fargo, including the Dodd-Frank Wall Street Reform and Consumer Protection Act and related regulations, and the final definition of qualified mortgage issued by the Consumer Financial Protection Bureau; |

| |

| • | changes in accounting standards, rules and interpretations; |

| |

| • | various monetary and fiscal policies and regulations of the U.S. and foreign governments; |

| |

| • | failure in or breach of our, the Bank’s or Wells Fargo’s operational or security systems or infrastructure, or those of third party vendors and other security providers, including as a result of cyber attacks; and |

| |

| • | the other factors described in “Risk Factors” in this prospectus and in our 2014 Annual Report that is incorporated by reference into this prospectus. |

In addition to the above factors, we also caution that our allowance for credit losses currently may not be appropriate to cover future credit losses, especially if housing prices decline, unemployment worsens, or general economic conditions deteriorate. Increases in loan charge-offs or in the allowance for credit losses and related provision expense could materially adversely affect our financial results and condition.

Any forward-looking statement made by us in this prospectus speaks only as of the date on which it is made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law.

Prospectus Summary

Before you decide to invest in the Series A preferred stock, you should carefully read the following summary, together with the more detailed information and financial statements and related notes contained elsewhere in, or incorporated by reference into, this prospectus, especially the risks of investing in the Series A preferred stock discussed under “Risk Factors” in this prospectus and in our 2014 Annual Report that is incorporated by reference into this prospectus and the description of our Series A preferred stock in our Form 8-A that is incorporated by reference into this prospectus. Such summary description of our Series A preferred stock is qualified in its entirety by reference to the terms and provisions of our amended and restated certificate of incorporation that is filed as an exhibit to the registration statement of which this prospectus forms a part.

Wells Fargo Real Estate Investment Corporation

We are a Delaware corporation incorporated on August 29, 1996 and have been operating as a real estate investment trust (“REIT”) for U.S. federal income tax purposes since our formation. We are a direct subsidiary of WPFC and an indirect subsidiary of Wells Fargo and the Bank.

Our principal business is to acquire, hold and manage interests in predominantly domestic mortgage loan assets and other authorized investments.

As of September 30, 2015, we had $13.2 billion in assets, consisting substantially of real estate loan participation interests. Although we have the authority to acquire interests in real estate loans and other authorized investments from unaffiliated third parties, as of September 30, 2015, substantially all of our interests in mortgage and other assets have been acquired from the Bank pursuant to loan participation and servicing and assignment agreements among the Bank, certain of its subsidiaries and us. The Bank originated the loans, purchased them from other financial institutions or acquired them as part of the acquisition of other financial institutions. In addition, we may acquire from time to time mortgage-backed securities and a limited amount of additional non-mortgage related securities from the Bank. We do not have lending operations. Unless the context otherwise requires, in this prospectus we generally refer to participation interests and whole loans as “loans.”

Substantially all of our loans are serviced by the Bank pursuant to the terms of loan participation and servicing and assignment agreements. The Bank has delegated servicing responsibility for certain loans to third parties, which are not affiliated with us or the Bank or its affiliates.

As a REIT, we generally will not be required to pay U.S. federal income tax on distributed income if we distribute at least 90% of our earnings to our stockholders and continue to meet a number of other requirements as discussed in “Federal Income Tax Considerations-Taxation of WFREIC as a REIT."

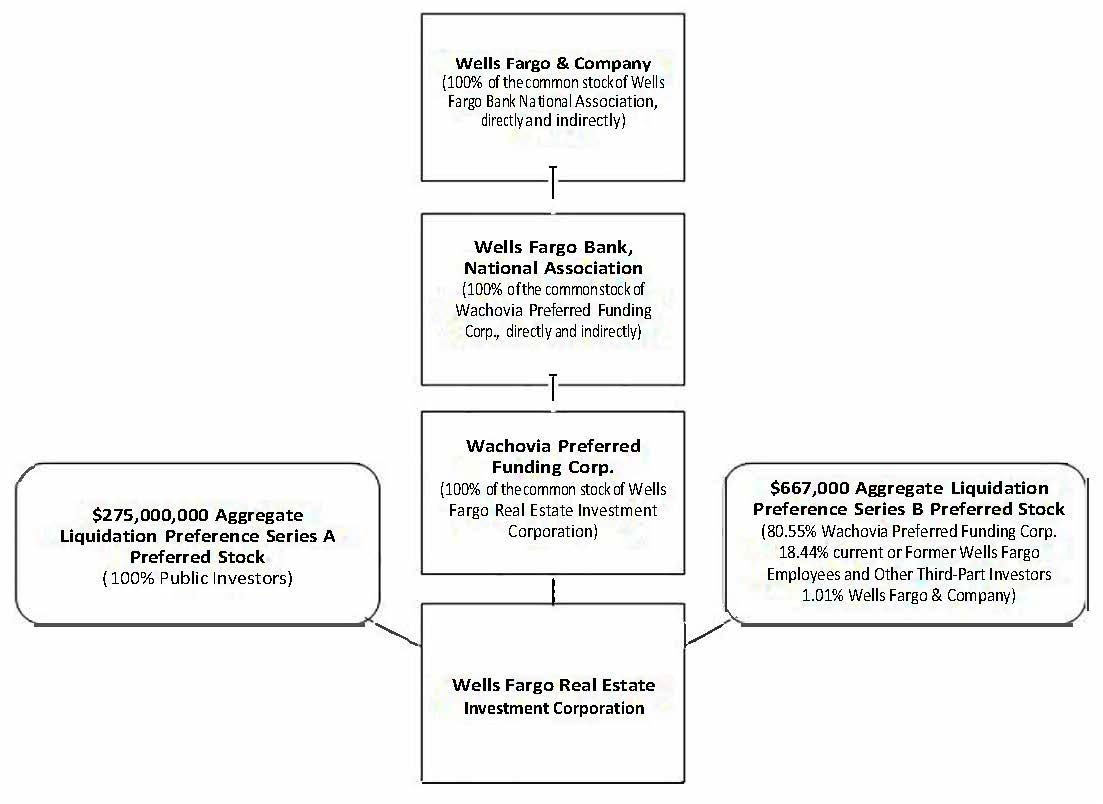

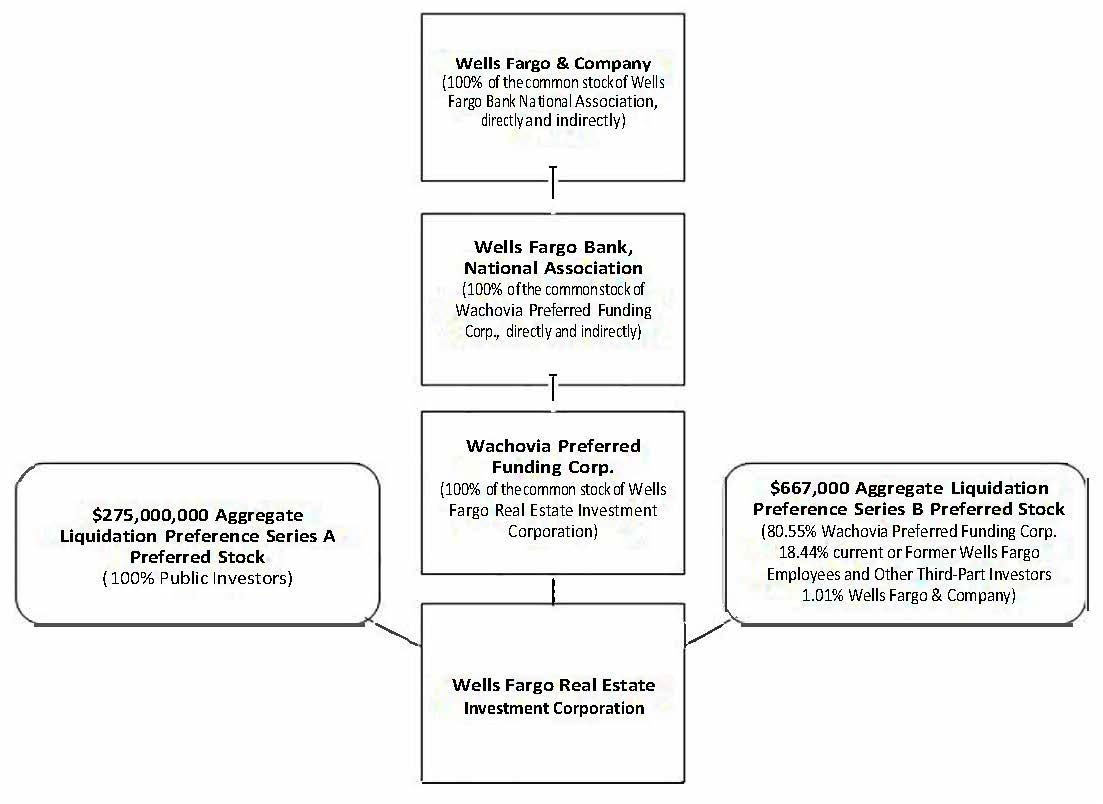

Our organizational structure as of September 30, 2015 was:

Assets

As of September 30, 2015 and December 31, 2014, we had $13.2 billion and $12.9 billion of assets, $0.8 billion and $0.5 billion of liabilities and $12.4 billion and $12.4 billion of stockholders’ equity, respectively. Our assets are primarily comprised of residential mortgage loans secured by 1-4 family real estate properties (which we refer to as “real estate 1-4 family first mortgage loans” for loans secured by first liens and as “real estate 1-4 family junior lien mortgage loans” for loans secured by second or more junior liens, and together as “consumer loans” or “real estate 1-4 family mortgage loans”) and commercial properties secured by real estate loans (“CSRE loans”). We also currently hold a limited amount of commercial and industrial loans (“C&I loans,” and together with CSRE loans, “commercial loans”). At September 30, 2015 and December 31, 2014, consumer loans represented 80% and 75% of loans, respectively, and commercial loans represented the balance of our loan portfolio.

We have acquired both conforming and non-conforming real estate 1-4 family mortgage loans from the Bank. The properties underlying real estate 1-4 family mortgage loans consist of single-family detached units, individual condominium units, 2-4 family dwelling units and townhouses. Our portfolio of real estate 1-4 family mortgage loans consists of both adjustable and fixed rate mortgage loans.

Our real estate 1-4 family junior lien mortgage loans are secured by a junior lien mortgage that primarily is on the borrower’s residence and typically are made for reasons such as home improvements, acquisition of furniture and fixtures, purchases of automobiles and debt consolidation. Generally, junior liens are repaid on an amortization basis. As of September 30, 2015, predominantly all of our real estate 1-4 family junior lien mortgage loans bear interest at fixed rates.

Our commercial loan portfolio consists of C&I loans and CSRE loans. C&I loans are loans for commercial, financial or industrial purposes, whether secured or unsecured, single-payment or installment. CSRE loans are loans secured by a mortgage or deed of trust on a multi-family residential or commercial real estate property or real estate construction loans secured by real property.

As of September 30, 2015, most of the loans in our C&I loan portfolio were unsecured and the remainder were secured by short-term assets, such as accounts receivable, inventory and securities, or long-lived assets, such as equipment and other business assets. Generally, the collateral securing this portfolio represents a secondary source of repayment. Our CSRE loan portfolio consists of both mortgage loans and construction loans and these loans are primarily secured by real estate.

Our commercial loan portfolio consists of both adjustable and fixed rate loans. As of September 30, 2015, substantially all of our commercial loans bear interest at adjustable rates.

Our assets consisted of the following as of September 30, 2015:

| |

| • | $9.0 billion, or 68%, of our assets were real estate 1-4 family first mortgage loans; |

| |

| • | $1.5 billion, or 11%, of our assets were real estate 1-4 family junior lien mortgage loans; and |

| |

| • | $2.6 billion, or 20%, of our assets were CSRE loans. |

In addition, as of September 30, 2015, less than 1% of our assets consisted of C&I loans and less than 1% consisted of other assets. See “Business- Assets in General; Participation Interests and Transfers” in our 2014 Annual Report for more details on our asset portfolio.

We generally have acquired, or accepted as capital contributions, participation interests in loans both secured and not secured by real estate along with other assets. We anticipate that we will acquire, or receive as capital contributions, loans or other assets from the Bank pursuant to loan participation and servicing and assignment agreements. The Bank initially transfers the loans to certain subsidiaries of the Bank, which then sell (or, in the case of the November 2013 contribution by WPFC, contribute) the loans to us, in each case, in the form of participation interests. See “Business-Assets in General; Participation Interests and Transfers” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations-Overview-Asset Contributions” in our 2014 Annual Report. We also have the authority to acquire interests in loans and other assets directly from unaffiliated third parties, although we have not done so to date. In addition, we may acquire from time to time mortgage-backed securities and a limited amount of additional non-mortgage related securities from the Bank.

In November 2013, WPFC contributed to us approximately $7.1 billion of loans in the form of an assignment of their participation interests from the Bank, consisting of approximately $5.4 billion of consumer loans and the remainder commercial loans, $18.0 million of accrued interest thereon and $2.4 million of foreclosed assets. The contributed assets were recorded at their WPFC book value, including the allowance for credit losses of approximately $197.1 million and unamortized premiums and discounts on loans. We did not issue additional shares of common stock to WPFC in respect of this contribution.

Dividends

We expect to distribute annually an aggregate amount of dividends with respect to our outstanding capital stock equal to approximately 100% of our REIT taxable income for U.S. federal income tax purposes, which excludes capital gains. In order to remain qualified as a REIT, we are required to distribute annually at least 90% of our REIT taxable income to our stockholders, including Wells Fargo, WPFC and the holders of the Series A preferred stock. Assuming we are at that time current on the payment of dividends on the Series A preferred stock, the substantial majority of such dividends will be payable to WPFC as the holder of our common stock.

Dividends will be authorized and declared at the discretion of our board of directors after considering our distributable funds, financial condition and capital needs, the impact of current and pending legislation and regulations, Delaware corporate law, economic conditions, tax considerations, our continued qualification as a REIT and other factors. We currently expect that both our cash available for distribution and our REIT taxable income will be in excess of amounts needed to pay dividends on the Series A preferred stock, at the annual dividend rate of 6.375% on the $25 liquidation preference per share, in the foreseeable future because:

| |

| • | substantially all of our real estate loans and other authorized investments are interest-bearing; |

| |

| • | while from time to time we may incur indebtedness, we will not incur an aggregate amount that exceeds 20% of our stockholders’ equity; |

| |

| • | we expect that our interest-earning assets will continue to exceed the aggregate liquidation preference of all of our preferred stock; and |

| |

| • | we anticipate that, in addition to cash flows from operations, additional cash will be available from principal payments on the loans we hold. |

Pledge of Assets on Behalf of the Bank

We may pledge our loan assets in an aggregate amount not exceeding 80% of our total assets at any time as collateral on behalf of the Bank for the Bank’s access to secured borrowing facilities through Federal Home Loan Banks and Federal Reserve Banks; provided that, after giving effect to any and all such pledges of loan assets, the unpaid principal balance of our total unpledged, performing assets (which, for the avoidance of doubt, shall not be pledged in respect of any other indebtedness we incur or otherwise) will equal or exceed three times the sum of the aggregate liquidation preference of the Series A preferred stock then outstanding plus any other parity stock then outstanding. But see “Risk Factors-Because we may, without the approval of the holders of the Series A preferred stock, pledge up to 80% of our total assets to secure certain borrowings by the Bank and incur indebtedness of up to 20% of our stockholders’ equity, it is possible that upon liquidation the pledgees of our assets, together with the lenders of that indebtedness, would have claims superior to those of the holders of Series A preferred stock on substantially all of our assets.”

In the second quarter of 2015, we began pledging a portion of our loans to the Federal Home Loan Bank of Des Moines. At September 30, 2015, the total carrying amount of pledged loans was $5.8 billion.

In exchange for the pledge of our loan assets, the Bank pays us a fee. We earned $1.5 million in pledge fees during the third quarter of 2015. Such fee is an amount we believe represents an arrangement that is not inconsistent with market terms. Such fee may be renegotiated by us and the Bank from time to time. Any material amendment to the terms of agreements related to the pledge of our loan assets on behalf of the Bank, including with respect to fees, will require the approval of a majority of our independent directors. See “Business -Pledge of Loans on Behalf of the Bank” in our 2014 Annual Report that is incorporated by reference into this prospectus.

Management

Our board of directors is currently composed of four members. One member of our board of directors is an executive officer of WFREIC. The three remaining members of our board of directors are not employees or directors of Wells Fargo, and each satisfies the definition of being “independent” as set forth in Rule 10A-3 of the Exchange Act. We currently have two executive officers. Both of our executive officers are also executive officers of Wells Fargo and executive officers and directors of the Bank. All our day-to-day activities and substantially all of the servicing of the loans we hold currently are administered, pursuant to loan participation and servicing and assignment agreements, by the Bank, which is our indirect parent company, although, in some instances, the Bank has delegated servicing responsibility to third parties.

Risk Factors

A purchase of our Series A preferred stock is subject to a number of risks described in more detail under “Risk Factors” in this prospectus and in our 2014 Annual Report that is incorporated by reference into this prospectus. These risks include:

| |

| • | You are not entitled to receive dividends unless authorized and declared by our board of directors. |

| |

| • | Regulatory restrictions on the Bank, as well as Wells Fargo, may limit our ability to pay dividends on the Series A preferred stock. |

| |

| • | The holders of our Series A preferred stock have limited voting rights, including that we may liquidate, dissolve or wind up at any time without your approval or consent. |

| |

| • | Neither the Bank nor Wells Fargo guarantees our obligations on the Series A preferred stock, and neither is prohibited, pursuant to the terms of the Series A preferred stock, from paying dividends at any time, even if we have not paid dividends on the Series A preferred stock. |

| |

| • | Our financial results and condition may be adversely affected by difficult business and economic and other conditions, particularly if housing prices decline, unemployment worsens or general economic conditions deteriorate. |

| |

| • | We are effectively controlled by Wells Fargo and our relationship with Wells Fargo and/or the Bank may create potential conflicts of interest. |

| |

| • | We have no control over changes in interest rates and such changes could negatively impact our financial condition, results of operations and ability to pay dividends. |

| |

| • | We have not obtained a third-party valuation of any of our assets acquired from affiliated parties. Therefore, there can be no assurance that the terms by which we acquired such assets did not differ from the terms that could have been obtained from unaffiliated parties. |

| |

| • | Our no longer qualifying for an exclusion from the definition of an investment company under the Investment Company Act (as defined below) could have a material adverse effect on us. |

| |

| • | Legislative and regulatory proposals may restrict or limit our ability to engage in our current business or in businesses that we desire to enter into. |

| |

| • | We may suffer adverse tax consequences if we fail to qualify as a REIT. |

| |

| • | We may pledge up to 80% of our assets as collateral on behalf of the Bank for the Bank’s access to secured borrowing facilities through Federal Home Loan Banks and Federal Reserve Banks, which subjects us to the Bank’s default risk. |

Conflicts of Interest

Because our day-to-day business affairs currently are managed by the Bank, conflicts of interest will arise from time to time between us and the Bank or its affiliates. These conflicts of interest relate to, among other things:

| |

| • | the amount, type and price of loans and other assets we acquire from or sell to the Bank; |

| |

| • | the servicing of the underlying loans, particularly with respect to loans that are placed on non-accrual status; |

| |

| • | the amount of loan servicing costs and management fees paid to the Bank; |

| |

| • | the pledge of our assets on behalf of the Bank; |

| |

| • | the treatment of new business opportunities identified by the Bank or its affiliates; and |

| |

| • | the modification of the loan participation and servicing and assignment agreements. |

We have adopted policies with a view to ensuring that all financial dealings between the Bank or its affiliates and us will be fair to both parties and not inconsistent with market terms.

Investment Company Act of 1940

Section 3(a)(1)(A) of the Investment Company Act of 1940, as amended (the “Investment Company Act”), defines an investment company as any issuer that is or holds itself out as being engaged primarily, or proposes to engage primarily, in the business of investing, reinvesting or trading in securities, which for these purposes includes loans and participation interests therein. Section 3(a)(1)(C) of the Investment Company Act defines an investment company as any issuer that is engaged or proposes to engage in the business of investing, reinvesting, owning, holding or trading in securities and owns or proposes to acquire investment securities having a value exceeding 40% of the value of the issuer’s total assets (exclusive of U.S. Government securities and cash items) on an unconsolidated basis.

We believe that we qualify, and intend to conduct our operations so as to continue to qualify, for the exclusion from the definition of an investment company provided by Section 3(c)(5)(C) of the Investment Company Act. Section 3(c)(5)(C) excludes from the definition of an investment company entities that are “primarily engaged in the business of purchasing or otherwise acquiring mortgages and other liens on and interests in real estate.” As reflected in a series of no-action letters, the SEC staff’s position on Section 3(c)(5)(C) generally requires that in order to qualify for this exclusion, an issuer must maintain

| |

| • | at least 55% of the value of its assets in “mortgages and other liens on and interests in real estate” (“Qualifying Interests”), |

| |

| • | at least an additional 25% of its assets in other permitted real estate-type interests (reduced by any amount the issuer held in excess of the 55% minimum requirement for Qualifying Interests), and |

| |

| • | no more than 20% of its assets in other than Qualifying Interests and real estate-type assets, |

and also that the interests in real estate meet other criteria described in such no-action letters. Mortgage loans that were fully and exclusively secured by real property are typically qualifying for these purposes. In addition, participation interests in such loans meeting certain criteria described in such no-action letters are generally qualifying real estate assets for purposes of the exclusion. See “Business-General Description of Mortgage Assets and Other Authorized Investments; Investment Policy-Investment Company Act of 1940” in our 2014 Annual Report that is incorporated herein by reference. We believe that our participation interests in mortgage loans satisfy these criteria and that we otherwise qualify for the exclusion provided by Section 3(c)(5)(C) of the Investment Company Act.

In August 2011, the SEC issued a concept release which indicated that the SEC is reviewing whether issuers who own certain mortgage related investments that rely on the exclusion from the definition of an investment company provided by Section 3(c)(5)(C) of the Investment Company Act should continue to be allowed to rely on such exclusion. The concept release and the public comments thereto have not yet resulted in SEC rulemaking or interpretive guidance and we cannot predict what form any such rulemaking or interpretive guidance may take. We cannot provide you with any assurance that the outcome of the SEC’s review will not require us to register under the Investment Company Act. If a change in the laws or the interpretations of those laws were to occur, we could be required to either change the manner in which we conduct our operations to avoid being required to register as an investment company or register as an investment company, either of which could have a material adverse effect on us and the price of the Series A preferred stock, and could give us the right and/or cause us to redeem the Series A preferred stock, as applicable. See “Risk Factors-Holders of the Series A preferred stock have no right to require redemption; however, we may redeem the Series A preferred stock upon certain events, and at any time after December 11, 2019” in this prospectus.

Corporate Information

Our principal executive offices are located at 90 South 7th Street, 13th Floor, Minneapolis, Minnesota 55402, and our telephone number is (855) 825-1437.

Our executive officers are also executive officers and directors of the Bank, our indirect parent. The Bank currently provides day-to-day management and substantially all of the servicing of the loans in our portfolio.

Our executive officers are also executive officers of Wells Fargo, our ultimate indirect parent.

The Offering

|

| |

| Issuer | Wells Fargo Real Estate Investment Corporation, a Delaware corporation that is an indirect subsidiary of Wells Fargo and the Bank, and operates as a REIT for U.S. federal income tax purposes. |

| Securities Offered | We originally issued 11,000,000 shares of 6.375% Cumulative Perpetual Preferred Stock, Series A on December 11, 2014 in an underwritten public offering. This prospectus has been prepared for and may be used by Wells Fargo Securities, LLC or any other affiliates of Wells Fargo Real Estate Investment Corporation in connection with offers and sales of the Series A preferred stock in market-making transactions. |

| Dividends | Dividends on the Series A preferred stock are payable at the annual rate of 6.375% on the liquidation preference of $25 per share, if, when, and as authorized and declared by our board of directors. If declared, dividends are payable quarterly in arrears on March 31, June 30, September 30 and December 31 of each year and commenced on March 31, 2015. If any such day is not a business day, dividends will be payable on the next business day, unless the next business day falls in a different calendar year, in which case the dividend will be paid on the preceding business day. A business day is any day other than a Saturday, Sunday or day on which banking institutions in Minneapolis, Minnesota, New York, New York or San Francisco, California generally are required by law or other governmental action to close. Dividends are calculated on a 30/360 basis. |

| | Dividends on the Series A preferred stock are cumulative and accrue from, and including, the date of original issue. Dividends on the Series A preferred stock accrue in each quarterly dividend period (as defined below) from the first day of such period, whether or not dividends are paid with respect to the preceding period. If for any reason our board of directors does not declare a dividend on the Series A preferred stock for a particular quarterly dividend period or if our board of directors declares less than a full dividend, we will remain obligated to pay the unpaid portion of the dividend for that period. After the relevant quarterly dividend period, any accumulated but unpaid dividends for such prior period will compound on each subsequent dividend date (meaning that dividends for future quarterly dividend periods will accrue on any unpaid dividend amounts for prior quarterly dividend periods). Dividends on the Series A preferred stock accrue and accumulate regardless of whether (i) we have earnings, (ii) there are funds legally available for the payment of dividends, or (iii) such dividends are declared by our board of directors. |

| | If full dividends are not paid on the Series A preferred stock for a quarterly dividend period, we will not be permitted to pay dividends on our common stock (100% of which is owned directly or indirectly by Wells Fargo and its affiliates) or any other class or series of capital stock that ranks junior to the Series A preferred stock for any subsequent quarterly dividend period until we have paid the required amount of such accumulated dividends, as well as any other accumulated but unpaid dividends (including dividends accrued on any unpaid dividends), plus accrued interest, if any, on the aggregate amount payable from the last dividend payment date to the date of payment, with respect to any other prior quarterly dividend periods, in full. |

| | Additionally, our ability to pay dividends on any class or series of capital stock that ranks junior to the Series A preferred stock, except with the consent or affirmative vote of the holders of at least two-thirds of the Series A preferred stock, voting as a separate class, is subject to the limitations described below under “-Voting Rights.” |

| Ranking | With respect to the payment of dividends and liquidation preference, the Series A preferred stock ranks equal to our outstanding $667 thousand aggregate liquidation preference Series B preferred stock (as of September 30, 2015), which we refer to as the Series B preferred stock, and senior to our common stock. However, the Series B preferred stock does not have a right to elect additional directors in the circumstances described below under “-Voting Rights.” Additional preferred stock ranking senior to the Series A preferred stock, which we refer to as “senior stock,” may not be issued without the approval of holders of at least two-thirds of the Series A preferred stock and any other series that ranks on parity with the Series A preferred stock (including the Series B preferred stock), each voting as a separate class. |

| | When dividends are not paid in full on, or a sum sufficient for such full payment is not set apart for, the Series A preferred stock and any parity stock, or in the event of our liquidation, dissolution and winding up, and we do not have funds legally available to pay the full liquidation value of the Series A preferred stock and any parity stock, any funds that are legally available to pay such amounts will be declared or paid, as applicable, pro rata to the Series A preferred stock and any outstanding parity stock. |

|

| |

| | We may, from time to time, issue additional shares of capital stock ranking junior to, or on parity with, the Series A preferred stock (which we refer to as “junior stock” and “parity stock,” respectively) as to dividends and/or on liquidation, dissolution and winding-up of WFREIC; provided that, with respect to the issuance of additional parity stock, (A) after giving effect to such issuance, our aggregate pro forma funds from operations (“FFO”) (that is, net income (computed in accordance with U.S. generally accepted accounting principles (“GAAP”)), excluding gains or losses from sales of property) for the aggregate four fiscal quarters beginning with the fiscal quarter in which such parity stock is proposed to be issued equals or exceeds 150% of the amount that would be required to pay full annual dividends on all Series A preferred stock then outstanding, any parity stock then outstanding and any such additional parity stock that we propose to issue (the “Pro Forma FFO Test”) (calculated assuming that such proposed shares are issued and that, if outstanding or proposed new shares bear dividends based on a floating rate, the applicable dividend rate will not change during such four fiscal quarters from the rate in effect on the applicable date of determination), and (B) after giving effect to such issuance, the pro forma unpaid principal balance of our total unpledged, performing assets will equal or exceed three times the sum of the aggregate liquidation preference of the Series A preferred stock then outstanding, any parity stock then outstanding and any such additional parity stock that we propose to issue (the “Pro Forma Unpaid Principal Balance Test”). |

| | The issuance of parity stock also requires the approval of a majority of our independent directors. |

| Liquidation Preference | The liquidation preference for each Series A preferred share is $25, plus an amount equal to the sum of (i) any authorized, declared but unpaid dividends and (ii) any accumulated but unpaid dividends (including, in each case, dividends accrued on any unpaid dividends), plus accrued interest, if any, on the aggregate amount payable from the last dividend payment date to the date of the liquidation payment, before any distribution of assets is made to holders of junior stock and subject to the rights of the holders of any class or series of capital stock ranking senior to the Series A preferred stock as to rights upon liquidation and subject to the rights of general creditors. |

| Redemption | The Series A preferred stock is not redeemable prior to December 11, 2019, except upon the occurrence of a Tax Event, a Regulatory Event or an Investment Company Act Event (each, as defined below). On and after December 11, 2019, the Series A preferred stock may be redeemed for cash at our option, in whole or in part, at any time and from time to time, at a redemption price of $25 per share, plus an amount equal to the sum of (i) any authorized, declared but unpaid dividends and (ii) any accumulated but unpaid dividends (including, in each case, dividends accrued on any unpaid dividends), plus accrued interest, if any, on the aggregate amount payable from the last dividend payment date to the date of redemption. Within 90 days of the occurrence of a Tax Event, a Regulatory Event or an Investment Company Act Event, we will have the right prior to December 11, 2019, to provide notice of our intent to redeem, and subsequently redeem the Series A preferred stock in whole, but not in part, at a redemption price of $25 per share, plus an amount equal to the sum of (i) any authorized, declared but unpaid dividends and (ii) any accumulated but unpaid dividends (including, in each case, dividends accrued on any unpaid dividends), plus accrued interest, if any, on the aggregate amount payable from the last dividend payment date to the date of redemption. The Series A preferred stock is not subject to any sinking fund or mandatory redemption and is not convertible into any of our other capital stock. |

| Voting Rights | Holders of the Series A preferred stock are not entitled to voting rights other than those required by applicable Delaware law, the rules of the NYSE and as set forth in our amended and restated certificate of incorporation. Without the consent of holders of two-thirds of the outstanding Series A preferred stock, voting as a separate class, we will not: |

| | Ÿamend, alter or repeal our amended and restated certificate of incorporation in a manner that materially and adversely affects the existing terms of the Series A preferred stock; |

| | Ÿissue any senior stock; |

| | Ÿissue any additional common stock to any person, other than to Wells Fargo, the Bank, WPFC or any other entity that is an affiliate of Wells Fargo; |

| | Ÿincur indebtedness for borrowed money, including any guarantees of indebtedness (which does not include any pledges of our assets on behalf of the Bank or one of our other affiliates as described above under “-Pledge of Assets on Behalf of the Bank”), at any time; provided that we may incur indebtedness in an aggregate amount not exceeding 20% of our stockholders’ equity, as determined in accordance with GAAP; |

|

| |

| | Ÿpay dividends on our common stock or other junior stock unless our FFO for the four full prior fiscal quarters equals or exceeds 150% of the amount that would be required to pay full annual dividends on the Series A preferred stock, as well as any other parity stock then outstanding, except as may be necessary to maintain our status as a REIT; |

| | Ÿmake any payment of interest or principal with respect to our indebtedness to the Bank or any of our other affiliates unless our FFO for the four full prior fiscal quarters equals or exceeds 150% of the amount that would be required to pay full annual dividends on the Series A preferred stock, as well as any other parity stock then outstanding, except as may be necessary to maintain our status as a REIT; |

| | Ÿfail to make investments of the proceeds of our assets in other interest-earning assets such that our FFO over any period of four fiscal quarters will be anticipated to equal or exceed 150% of the amount that would be required to pay full annual dividends on the Series A preferred stock, as well as any other parity stock then outstanding, except as may be necessary to maintain our status as a REIT; or |

| | Ÿeffect our consolidation, conversion, or merger with or into, or a share exchange with, another entity, except that we may consolidate or merge with or into, or enter into a share exchange with, another entity if: |

| | Ÿsuch entity is an affiliate of Wells Fargo; |

| | Ÿsuch entity is not regulated as an investment company and is a REIT for U.S. federal income tax purposes; |

| | Ÿsuch other entity expressly assumes all of our obligations and commitments; |

| | Ÿto the extent we are not the surviving entity of such a transaction, the outstanding shares of the Series A preferred stock are exchanged for or converted into securities of the surviving entity having preferences, limitations, and relative voting and other rights substantially identical to those of the Series A preferred stock;

|

| | Ÿany such consolidation, conversion, or merger or share exchange is tax-free to holders of the Series A preferred stock; |

| | Ÿafter giving effect to such merger, consolidation, or share exchange, no breach, or event that, with the giving of notice or passage of time or both, could become a breach by us of obligations under our amended and restated certificate of incorporation, will have occurred and be continuing; and |

| | Ÿwe have received written notice from each of the rating agencies then rating the Series A preferred stock, if any, and delivered a copy of such written notice to the transfer agent, confirming that such merger, consolidation, or share exchange will not result in a reduction of the rating assigned by any of such rating agencies to the Series A preferred stock or the preferred interests of any surviving corporation, trust or entity, issued in replacement of the Series A preferred stock. |

| | Holders of the Series A preferred stock, voting together as a single and separate class with the holders of any parity stock with similar voting rights, also have the right to elect two directors in addition to the directors then in office if we fail to pay, or declare and set aside for payment, dividends on the Series A preferred stock for six quarterly dividend periods. The term of such additional directors will terminate when we pay for three consecutive quarterly dividend periods and pay or declare and set aside for payment for the fourth consecutive quarterly dividend period full dividends, and have paid all dividends in arrears, on the Series A preferred stock or, if earlier, upon the redemption of all Series A preferred stock. |

| Listing | The Series A preferred stock is listed on the NYSE under the symbol “WFE Pr A”. |

|

| |

| Use of Proceeds | This prospectus is being delivered in connection with market-making transactions. We will not receive any proceeds from such market-making transactions. |

| Tax Consequences | As long as we qualify as a REIT, corporate holders of the Series A preferred stock will not be entitled to a dividends-received deduction for any income recognized from the Series A preferred stock. |

| | Further, we expect that distributions paid on the Series A preferred stock will not qualify for taxation of dividends at preferential capital gains rates. |

| | See “Federal Income Tax Considerations” in this prospectus. |

| ERISA Considerations | If you are a fiduciary of a pension, profit-sharing or other employee benefit plan subject to the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), or Section 4975 of the Internal Revenue Code of 1986, as amended (the “Code”), you should consider the requirements of ERISA and the Code in the context of the plan’s particular circumstances and ensure the availability of an applicable exemption before authorizing an investment in the Series A preferred stock. See “ERISA Considerations” in this prospectus. |

|

| |

Regulatory Capital Considerations | The Series A preferred stock does not qualify as regulatory capital of the Bank or Wells Fargo under the risk-based capital guidelines of the Office of the Comptroller of the Currency (the “OCC”) applicable to national banking organizations or the risk-based capital guidelines of the Board of Governors of the Federal Reserve System (the “Federal Reserve”) applicable to bank holding companies. |

Risk Factors

An investment in our Series A preferred stock involves a high degree of risk. You should carefully consider the following risk factors and “Risk Factors” beginning on page 38 of our 2014 Annual Report, together with all the information contained in, or incorporated into, this prospectus, including our historical financial statements and the notes thereto and our Form 8-A, before making an investment decision to purchase our Series A preferred stock. The occurrence of any of the following risks could materially and adversely affect our business and could cause you to lose all or a significant part of your investment in our Series A preferred stock. Some statements in this prospectus, including statements in the following risk factors, constitute forward-looking statements. See the section entitled “Forward-Looking Statements” in this prospectus.

You are not entitled to receive dividends unless authorized and declared by our board of directors.

Our board of directors may determine that it would be in our best interests to pay less than the full amount of the stated dividends on the Series A preferred stock or no dividends for any quarterly dividend period even though funds are available. Factors that would generally be considered by our board of directors in making this determination are the amount of our distributable funds, our financial condition and capital needs, the impact of current and pending legislation and regulations, economic conditions, tax considerations and our continued qualification as a REIT for U.S. federal income tax purposes. If we fail to pay, or fail to declare and set aside for payment, dividends on the Series A preferred stock for six quarterly dividend periods, the holders of the Series A preferred stock, voting together as a single and separate class with the holders of our other capital stock ranking on parity with our Series A preferred stock having similar voting rights, have the right to elect two directors in addition to those already on the board of directors.

Regulatory restrictions on the Bank, as well as Wells Fargo, may limit our ability to pay dividends on the Series A preferred stock.

Because we are an indirect subsidiary of the Bank, banking regulatory authorities, including the OCC, have the right to examine us and our activities, and, under certain circumstances, to impose restrictions on the Bank or us that could impact our ability to conduct business pursuant to our business plan and that could adversely affect our financial condition and results of operations. If the OCC, which is the Bank’s primary federal regulator, determines that the Bank’s relationship with us is an unsafe and unsound banking practice, then the OCC will have the authority to restrict our ability to transfer assets, to make distributions to our stockholders (including dividends to the holders of Series A preferred stock) or to redeem the Series A preferred stock. Such banking regulatory authorities may also require the Bank to sever its relationship with or divest its direct and indirect ownership of us or to liquidate us.

Payments or distributions on the Series A preferred stock are subject to certain regulatory limitations. Among other limitations, regulatory capital guidelines limit the total dividend payments made by a consolidated banking entity to the sum of earnings for the current year and prior two years less dividends paid during the same periods. Any dividends paid in excess of this amount can only be made with the approval of the Bank’s regulator.

The payment of a dividend on the Series A preferred stock would be prohibited under the OCC’s prompt corrective action regulations if the Bank becomes or would become “undercapitalized” for purposes of such regulations, which is currently defined as having a total risk-based capital ratio of less than 8.0%, a Tier 1 risk-based capital ratio of less than 6.0%, a common equity Tier 1 risk-based capital ratio of less than 4.5% or a Tier 1 leverage ratio of less than 4.0%. In addition, effective January 1, 2018, the Bank would become “undercapitalized” for purposes of such regulations if it had a supplementary leverage ratio of less than 3.0%.

Starting in second quarter 2015, the Bank began using the Basel III Advanced Approaches capital framework, in addition to the Standardized Approaches, to determine its risk-based capital ratios. The Bank reports the lower of its risk-based capital ratios calculated under the Standardized Approach and under the Advanced Approach. As of September 30, 2015, the Bank was “well-capitalized” under applicable regulatory capital adequacy guidelines. As of that date, the Bank’s total risk-based capital ratio was 12.40%, its Tier 1 risk-based capital ratio was 10.45%, its common equity Tier 1 risk-based capital ratio was 10.45% and its Tier 1 leverage ratio was 8.08%, in each case under the lower of the Standardized or Advanced Approaches.

Finally, Wells Fargo and its subsidiaries, including WFREIC, are subject to broad prudential supervision by the Federal Reserve, which may result in a limitation on or the elimination of our ability to pay dividends on the Series A preferred stock, including, for example, in the event that the OCC had not otherwise restricted the payment of such dividends as described above and the Federal Reserve determines that such payment would constitute an unsafe and unsound practice. To the extent the payment of dividends on the Series A preferred stock were restricted or eliminated by the OCC or the Federal Reserve in such a manner, such dividends would nevertheless continue to accumulate.

The holders of the Series A preferred stock have limited voting rights.

Except as specified in our amended and restated certificate of incorporation, the holders of the Series A preferred stock are not entitled to voting rights. Wells Fargo indirectly owns 100% of our common stock and therefore has effective control over voting. We are prohibited by our amended and restated certificate of incorporation from materially and adversely altering the terms of the Series A preferred stock without the consent or vote of holders of at least two-thirds of the then outstanding Series A preferred stock, voting as a separate class.

We may liquidate, dissolve or wind up at any time without your approval or consent.

Our amended and restated certificate of incorporation provides that, subject to the terms of the capital stock we have outstanding at the time, we may liquidate, dissolve or wind up upon the affirmative vote of a majority of our independent directors. However, since the holders of the Series A preferred stock do not have voting rights as a separate class with respect to these matters, WPFC, which is currently the holder of all of our common stock and substantially all of our Series B preferred stock, has control over our liquidation, dissolution or winding up. Although WPFC has no present intention to cause such an event to occur, it may in the future cause us to liquidate, dissolve or wind up at any time or for any reason. If such an event were to occur, you may not be able to invest your liquidation proceeds in securities with a dividend yield comparable to that of the Series A preferred stock.

Holders of the Series A preferred stock have no right to require redemption; however, we may redeem the Series A preferred stock upon certain events, and at any time after December 11, 2019.

Within 90 days of the occurrence of a Tax Event, a Regulatory Event or an Investment Company Act Event, even if such event occurs prior to December 11, 2019, we will have the right to provide notice of our intent to redeem, and subsequently redeem the Series A preferred stock in whole or in part. The occurrence of such Tax Event, Regulatory Event or Investment Company Act Event will not, however, give a stockholder any right to request that the Series A preferred stock be redeemed. Tax Event, Regulatory Event and Investment Company Act Event are defined as follows:

| |

| • | A Tax Event means our determination, based on our receipt of an opinion of counsel, rendered by a law firm experienced in such matters, in form and substance satisfactory to us, which states that there is a significant risk that dividends paid or to be paid by us with respect to our capital stock are not or will not be fully deductible by us for U.S. federal income tax purposes or that we are or will be subject to additional taxes, duties, or other governmental charges, determined by reference to the effect on the tax liability of any consolidated, combined, unitary or similar tax group of which we are a part, in an amount we reasonably determine to be significant as a result of: |

| |

| • | any amendment to, clarification of, or change in, the laws, treaties, or related regulations of the United States or any of its political subdivisions or their taxing authorities affecting taxation; or |

| |

| • | any judicial decision, official administrative pronouncement, published or private ruling, technical advice memorandum, Chief Counsel Advice, as such term is defined in the Code, regulatory procedure, notice, or official announcement, which we refer to collectively as “Administrative Actions”; |

which amendment, clarification, or change, or such official pronouncement or decision, is announced, on or after the original date of issuance of the Series A preferred stock.

| |

| • | A Regulatory Event means our reasonable determination, as evidenced by a certificate of one of our senior executive officers, that the Series A preferred stock remaining outstanding would (x) not be consistent with any applicable law or regulation or (y) have a material adverse effect on either us or any of Wells Fargo or the Bank (or any of their respective successors), in each case, as a result of a change in law or regulation or a written change in interpretation or application of law or regulation, by any legislative body, court, governmental agency, or regulatory authority occurring on or after the original date of issuance of the Series A preferred stock, such change in law being reflected in an opinion of counsel, in form and substance satisfactory to us. |

| |

| • | An Investment Company Act Event means our determination, based on our receipt of an opinion of counsel, rendered by a law firm experienced in such matters, in form and substance satisfactory to us, which states that there is a significant risk that we are or will be considered an “investment company” that is required to be registered under the Investment Company Act, as a result of the occurrence of a change in law or regulation or a written change in interpretation or application of law or regulation, by any legislative body, court, governmental agency, or regulatory authority. |

See “Risk Factors-Our no longer qualifying for an exclusion from the definition of an investment company under the Investment Company Act could have a material adverse effect on us” in our 2014 Annual Report that is incorporated by reference into this prospectus.

While the Series A preferred stock may be redeemed at our option under certain circumstances described herein, investors in the Series A preferred stock will have no right to reclaim their initial investment from us and the Series A preferred stock may never be redeemed. If investors in Series A preferred stock choose to sell their shares of Series A preferred stock in order to reclaim all or part of their initial investment in the absence of any redemption, those investors may not be able to sell their securities in the secondary market, or if such a sale occurs the sale price may not be at or above the initial price at which such shares were purchased.

If we redeem the Series A preferred stock, you may not be able to invest your redemption proceeds in securities with a dividend yield comparable to that of the Series A preferred stock.

The Series A preferred stock ranks subordinate to claims of our creditors and on parity with our outstanding Series B preferred stock and any other capital stock on parity with the Series A preferred stock that we may issue in the future.

The Series A preferred stock ranks subordinate to all claims of our creditors and, with respect to assets pledged on behalf of the Bank, subordinate to claims on such assets. The Series A preferred stock ranks on parity with our outstanding $667 thousand of aggregate liquidation preference Series B preferred stock (as of September 30, 2015) with respect to dividend rights and upon our liquidation, dissolution and winding up. In addition, our board of directors has the power to create and issue additional stock

that will rank on parity with the Series A preferred stock without the consent of the holders of the Series A preferred stock so long as we satisfy the Pro Forma FFO Test and the Pro Forma Unpaid Principal Balance Test and such issuance is approved by a majority of our independent directors. Accordingly, if

| |

| • | we do not have funds legally available to pay full dividends on the Series A preferred stock and any other parity stock that we may issue; or |

| |

| • | in the event of our liquidation, dissolution and winding up, we do not have funds legally available to pay the full liquidation value of the Series A preferred stock and any other parity stock, |

any funds that are legally available to pay such amounts will be paid pro rata to the Series A preferred stock and any other outstanding parity stock.

Because we may, without the approval of the holders of the Series A preferred stock, pledge up to 80% of our total assets to secure certain borrowings by the Bank and incur indebtedness of up to 20% of our stockholders’ equity, it is possible that upon liquidation the pledgees of our assets, together with the lenders of that indebtedness, would have claims superior to those of the holders of Series A preferred stock on substantially all of our assets.

We have the right to pledge our loan assets in an aggregate amount not exceeding 80% of our total assets at any time as collateral on behalf of the Bank for the Bank’s access to secured borrowing facilities through the Federal Home Loan Banks and Federal Reserve Banks. In addition, without the consent of holders of the Series A preferred stock, we have the ability to incur indebtedness at any time in an aggregate amount not exceeding 20% of our stockholders’ equity (determined in accordance with GAAP). As of September 30, 2015, our stockholders’ equity of $12.4 billion was equal to 94% of our total assets of $13.2 billion. GAAP does not require that pledges of assets used to secure the Bank’s borrowing obligations be treated as liabilities. Accordingly, it is possible that upon liquidation the pledgees of our assets, together with the lenders of indebtedness we are permitted to incur, would have claims superior to those of the holders of Series A preferred stock on substantially all of our assets, in which case those claims would prevent holders of the Series A preferred stock from obtaining any recovery upon our liquidation.

The level of our assets relative to the aggregate liquidation preference of the Series A preferred stock could decline over time because of, among other things, dividends paid by us on our common stock, or other junior stock, if any such junior stock is issued at a future date.

If we have paid full dividends on the Series A preferred stock and, except in the case of dividends necessary to be paid to maintain our status as a REIT, our FFO for the four full preceding fiscal quarters equals or exceeds 150% of the amount that would be required to pay full annual dividends on the Series A preferred stock and any other parity stock then outstanding, we are not prohibited from paying dividends, whether in cash or in kind, that could cause the level of our assets relative to the aggregate liquidation preference of the Series A preferred stock to decline. Additionally, we have the power to create and issue parity stock without the consent of the holders of the Series A preferred stock so long as we satisfy the Pro Forma FFO Test and the Pro Forma Unpaid Principal Balance Test and the issuance has been approved by a majority of our independent directors.

As various loans prepay or repay principal and distributions, subject to the limitations referenced above, we may choose to apply such amounts to pay dividends or return capital on our common stock. Additionally, subject to the limitations referenced above, we could distribute a portion of our assets as a return of capital on our common stock. We have no current intention to declare a return of capital, and Wells Fargo and the Bank have no current intention to cause or permit us to declare a return of capital. Nevertheless, dividends paid by us on our common stock could result in a reduction in our assets that could have the consequence of us not having funds available to pay full dividends on the Series A preferred stock in future periods or loss to you of some or all of the amount of your investment should we be liquidated.

There may be no active trading market for the Series A preferred stock.

There may be no active trading market for the Series A preferred stock. The market value of our Series A preferred stock could be substantially affected by general market conditions, including the extent of institutional investor interest in us, the general reputation of REITs and the attractiveness of their equity securities in comparison to other equity securities (including securities issued by other real estate-based companies), our financial performance and general stock and bond market conditions.

Stock markets, including the NYSE (on which shares of our Series A preferred stock are currently listed), have from time to time experienced significant price and volume fluctuations. As a result, the market price of shares of our Series A preferred stock may be similarly volatile, and investors in shares of our Series A preferred stock may from time to time experience a decrease in the value of their shares, including decreases unrelated to our operating performance or prospects. The price of shares of our Series A preferred stock could be subject to wide fluctuations in response to a number of factors, including those listed in this “Risk Factors” section of this prospectus and in “Risk Factors” in our Annual Report and others such as:

| |

| • | our operating performance and the performance of other similar companies; |

| |

| • | actual or anticipated differences in our quarterly operating results; |

| |

| • | changes in our revenues or earnings estimates or recommendations by securities analysts; |

| |

| • | publication of research reports about us, the residential mortgage loan, commercial loan or industrial loan sectors or the real estate industry; |

| |

| • | the level and volatility of capital markets, interest rates, currency values and other market indices that affect the value of our assets and liabilities; |

| |

| • | increases in market interest rates or other changes in monetary policy, which may lead investors to demand higher distribution yields for shares of our Series A preferred stock; |

| |

| • | the availability and cost of both credit and capital, and our ability to obtain financing; |

| |

| • | increased competition in the residential mortgage loan, commercial real estate or industrial financing business; |

| |

| • | strategic decisions by us and our affiliates or our competitors, such as acquisitions, divestments, spin-offs, joint ventures, strategic investments or changes in business strategy and the ability to execute on them; |

| |

| • | the impact of current, pending and future legislation, regulation and legal actions applicable to us, the Bank, Wells Fargo or our industry; |

| |

| • | speculation in the press or investment community; |

| |

| • | actions by institutional stockholders; |

| |

| • | security issuances by us, or resales by our stockholders, or the perception that such issuances or resales may occur; |

| |

| • | changes in accounting standards, rules and interpretations or actual, potential or perceived accounting problems; |

| |

| • | failure to qualify as a REIT; |

| |

| • | cyber-attacks, terrorist acts, natural or man-made disasters or threatened or actual armed conflicts; and |

| |

| • | economic conditions that affect the general economy, housing prices, the job market, consumer confidence and spending habits, including our borrowers’ prepayment and repayment of our loans (particularly in states where we have significant exposure), including factors unrelated to our performance. |

The market price of shares of our Series A preferred stock may fluctuate or decline significantly in the future and holders of shares of our Series A preferred stock may not be able to sell their shares when desired on favorable terms, or at all. From time to time in the past, securities class action litigation has been instituted against companies following periods of extreme volatility in their stock price. This type of litigation could result in substantial costs and divert our management’s attention and resources.

The Series A preferred stock solely represents an interest in us and is not the obligation of, or guaranteed by, any other entity.

The Series A preferred stock does not constitute an obligation or equity security of Wells Fargo, the Bank or any other entity, nor is our obligation with respect to the Series A preferred stock guaranteed by any other entity. In particular, none of Wells Fargo, the Bank or any other entity guarantees that we will declare or pay any dividends nor are they obligated to provide additional capital or other support to us to enable us to pay dividends in the event our assets and results of operations are insufficient for such purpose.

The shares of Series A preferred stock are not deposits or accounts and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. Neither the Bank nor Wells Fargo is prohibited, pursuant to the terms of the Series A preferred stock, from paying dividends at any time, even if we have not paid dividends on the Series A preferred stock.

Dividends payable by REITs do not qualify for the favorable tax treatment available for some dividends.

The maximum tax rate applicable to qualified dividend income payable to certain non-corporate U.S. stockholders has been reduced to an effective 23.8%. Dividends payable by REITs, however, generally are not eligible for the reduced rates. In addition, dividends payable by REITs generally are not eligible for the dividends-received deduction available to certain corporate holders of stock in other corporations. Although these limitations do not adversely affect the taxation of REITs or dividends payable by REITs, the more favorable treatment applicable to regular corporate qualified dividends could cause certain investors to perceive investments in REITs to be relatively less attractive than investments in the stocks of non-REIT corporations that pay dividends, which could adversely affect the value of the shares of REITs, including our Series A preferred stock.

Use of Proceeds

This prospectus is being delivered in connection with market-making transactions. We will not receive any proceeds from such market-making transactions.

Capitalization

The following table sets forth our capitalization as of September 30, 2015.

|

| | | | | |

| |

| (in thousands) | September 30, 2015 | |

| Long-term debt | $ | — | |

| Stockholders’ equity | | |

| Preferred stock: | | |

| Series A preferred stock, $0.01 par value per share, $275 million liquidation preference, cumulative, 11,000,000 shares authorized, issued and outstanding | 110 | |

| Outstanding Series B preferred stock, $0.01 par value per share, $1 million liquidation preference, cumulative, 1,000 shares authorized, 667 issued and outstanding | — | |

| Total Preferred Stock | 110 | |

| Common stock, $0.01 par value, 100,000,000 shares authorized, 12,900,000 issued and outstanding | 129 | |

| Additional paid-in capital | 12,550,822 | |

| Retained earnings (deficit) | (145,213 | ) |

| Total stockholders’ equity | $ | 12,405,848 | |

| Total capitalization | $ | 12,405,848 | |

Computation of Ratio of Earnings to Fixed Charges and Preferred Dividends

|

| | | | | | | | | | | | | | |

| | |

| | Nine months ended September 30, | | | Year ended December 31, | |

(in thousands)

| 2015 |

| 2014 |

| | 2014 |

| 2013 |

| 2012 |

| 2011 |

|

Excluding interest on deposits (1)

| | | | | | | |