|

| |

| (formerly Stem Cell Therapeutics Corp.) |

| |

| |

| |

| ANNUAL INFORMATION FORM |

| |

| FOR THE YEAR ENDED DECEMBER 31, 2014 |

| |

| |

| |

| 96 Skyway Avenue |

| Toronto, Ontario M9W 4Y9 |

| www.trilliumtherapeutics.com |

| |

| |

| Unless otherwise indicated, all information in the Annual Information Form |

| is presented as at and for the year ended December 31, 2014 |

| |

| |

| March 23, 2015 |

TABLE OF CONTENTS

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Annual Information Form, or AIF, contains forward-looking statements within the meaning of applicable securities laws. All statements contained herein that are not clearly historical in nature are forward-looking, and the words “anticipate”, “believe”, “expect”, “estimate”, “may”, “will”, “could”, “leading”, “intend”, “contemplate”, “shall” and similar expressions are generally intended to identify forward-looking statements. Forward-looking statements in this AIF include, but are not limited to, statements with respect to:

| • | our expected future loss and accumulated deficit levels; |

| • | our projected financial position and estimated cash burn rate; |

| • | our expectations about the timing of achieving milestones and the cost of our development programs; |

| • | our observations and expectations regarding the binding profile of SIRPαFc with red blood cells compared to anti-CD47 monoclonal antibodies and proprietary CD47-blocking agents and the potential benefits to patients; |

| • | our requirements for, and the ability to obtain, future funding on favorable terms or at all; |

| • | our projections for the SIRPαFc development plan and progress of each of our products and technologies, particularly with respect to the timely and successful completion of studies and trials and availability of results from such studies and trials; |

| • | our expectations about our products’ safety and efficacy; |

| • | our expectations regarding our ability to arrange for the manufacturing of our products and technologies; |

| • | our expectations regarding the progress, and the successful and timely completion, of the various stages of the regulatory approval process; |

| • | our ability to secure strategic partnerships with larger pharmaceutical and biotechnology companies; |

| • | our strategy to acquire and develop new products and technologies and to enhance the capabilities of existing products and technologies; |

| • | our plans to market, sell and distribute our products and technologies; |

| • | our expectations regarding the acceptance of our products and technologies by the market; |

| • | our ability to retain and access appropriate staff, management, and expert advisers; |

| • | our expectations with respect to existing and future corporate alliances and licensing transactions with third parties, and the receipt and timing of any payments to be made by us or to us in respect of such arrangements; and |

| • | our strategy with respect to the protection of our intellectual property. |

All forward-looking statements reflect our beliefs and assumptions based on information available at the time the assumption was made. These forward-looking statements are not based on historical facts but rather on management’s expectations regarding future activities, results of operations, performance, future capital and other expenditures (including the amount, nature and sources of funding thereof), competitive advantages, business prospects and opportunities. By its nature, forward-looking information involves numerous assumptions, inherent risks and uncertainties, both general and specific, known and unknown, that contribute to the possibility that the predictions, forecasts, projections or other forward-looking statements will not occur. Factors which could cause future outcomes to differ materially from those set forth in the forward-looking statements include, but are not limited to:

| • | the effect of continuing operating losses on our ability to obtain, on satisfactory terms, or at all, the capital required to maintain us as a going concern; |

| • | the ability to obtain sufficient and suitable financing to support operations, preclinical development, clinical trials, and commercialization of products; |

| • | the risks associated with the development of novel compounds at early stages of development in our intellectual property portfolio; |

| • | the risks of reliance on third-parties for the planning, conduct and monitoring of clinical trials and for the manufacture of drug product; |

| • | the risks associated with the development of our product candidates including the demonstration of efficacy and safety; |

| • | the risks related to clinical trials including potential delays, cost overruns and the failure to demonstrate efficacy and safety; |

3

| • | the risks of delays and inability to complete clinical trials due to difficulties enrolling patients; |

| • | risks associated with our inability to successfully develop companion diagnostics for our development candidates; |

| • | delays or negative outcomes from the regulatory approval process; |

| • | our ability to successfully compete in our targeted markets; |

| • | our ability to attract and retain key personnel, collaborators and advisors; |

| • | risks relating to the increase in operating costs from expanding existing programs, acquisition of additional development programs and increased staff; |

| • | risk of negative results of clinical trials or adverse safety events by us or others related to our product candidates; |

| • | the potential for product liability claims; |

| • | our ability to achieve our forecasted milestones and timelines on schedule; |

| • | financial risks related to the fluctuation of foreign currency rates and expenses denominated in foreign currencies; |

| • | our ability to adequately protect proprietary information and technology from competitors; |

| • | risks related to changes in patent laws and their interpretations; |

| • | our ability to source and maintain licenses from third-party owners; |

| • | the risk of patent-related litigation and the ability to protect trade secrets; and |

| • | the risk of reduced liquidity and market value decline resulting from a potential share consolidation, |

all as further and more fully described under the section of this AIF entitled “Risk Factors”.

Although the forward-looking statements contained in this AIF are based upon what our management believes to be reasonable assumptions, we cannot assure readers that actual results will be consistent with these forward-looking statements.

Any forward-looking statements represent our estimates only as of the date of this AIF and should not be relied upon as representing our estimates as of any subsequent date. We undertake no obligation to update any forward-looking statement or statements to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events, except as may be required by securities legislation.

All references in this AIF to “the Company”, “Trillium”, “we”, “us”, or “our” refer to Trillium Therapeutics Inc. and the subsidiaries through which it conducts its business, unless otherwise indicated.

All amounts are in Canadian dollars, unless otherwise indicated.

4

CORPORATE INFORMATION

We were incorporated under the Business Corporations Act (Alberta) on March 31, 2004 as Neurogenesis Biotech Corp. On October 19, 2004, we amended our articles of incorporation to change our name from Neurogenesis Biotech Corp. to Stem Cell Therapeutics Corp., or SCT. On November 7, 2013 SCT was continued under the Business Corporations Act (Ontario), or OBCA. On June 1, 2014 we filed articles of amalgamation to amalgamate SCT with our wholly-owned subsidiary, Trillium Therapeutics Inc., or TrilliumPrivateco, and renamed the combined company Trillium Therapeutics Inc. We are a company domiciled in Ontario, Canada.

We had one wholly-owned subsidiary, Stem Cell Therapeutics Inc., which was incorporated under the Business Corporations Act (Alberta) on December 22, 1999 and was continued under the OBCA on November 12, 2003 and then extra-provincially registered in Alberta on January 11, 2005. This inactive subsidiary was dissolved on September 17, 2014.

Our head and registered offices are located at 96 Skyway Avenue, Toronto, Ontario, Canada M9W 4Y9. Our website address is www.trilliumtherapeutics.com.

BUSINESS

Overview

We are an immuno-oncology company developing innovative therapies for the treatment of cancer. Our lead program, SIRPαFc, is a novel, antibody-like protein that harnesses the innate immune system by blocking the activity of CD47, a molecule whose expression is increased on cancer cells to evade the host immune system. Expressed at high levels on the cell surface of a variety of liquid and solid tumors, CD47 functions as a signal that inhibits the destruction of tumor cells by macrophages via phagocytosis. By blocking the activity of CD47, we believe SIRPαFc has the ability to promote the macrophage-mediated killing of tumor cells in a broad variety of cancers both as a monotherapy and in combination with other immune therapies. We expect to file an investigational new drug, or IND, application in the third quarter of 2015, and shortly thereafter commence phase I studies in acute myeloid leukemia, or AML, and myelodysplastic syndrome, or MDS. In the first phase I study we are also considering dosing patients with solid tumors or lymphomas who have normal bone marrow function in order to more clearly assess the potential hematological toxicity of SIRPαFc. We also plan to continue to conduct preclinical studies in other liquid and solid tumors to identify future clinical indications.

The immune system is the body’s mechanism to identify and eliminate pathogens, and can be divided into the innate immune system and the adaptive immune system. The innate immune system is the body’s first line of defense and consists of proteins and cells, such as macrophages, that identify and provide an immediate response to pathogens. The adaptive immune system is activated by, and adapts to, pathogens, creating a targeted and durable response. Cancer cells often have the ability to reduce the immune system’s ability to recognize and destroy them. We believe SIRPαFc plays a critical role in enhancing the innate immune system and importantly, because of its ability to target macrophages, also has an important downstream effect on the adaptive immune system.

Immuno-oncology is altering cancer treatment

While the concept of using the immune system to treat cancer can trace its roots back to late nineteenth century, it was only recently that the field of immuno-oncology received validation with the approval of antibodies that block CTLA-4 (ipilimumab) and PD-1 (pembrolizumab and nivolumab). These drugs have established the clinical principle that anti-tumor responses can be induced by interfering with the negative signals that normally shut down immune responses. The field of immuno-oncology is now regarded as causing a “paradigm shift” in cancer treatment and has been predicted by equity research analysts to generate US$20 to US$44 billion in revenue by the mid-2020s.

5

Our Strategy

Our goal is to become a leading innovator in the field of immuno-oncology by targeting immune-regulatory pathways that tumor cells exploit to evade the host immune system. We believe that SIRPαFc has the potential to improve survival and quality of life for cancer patients.

| • | Rapidly advance the clinical development of SIRPαFc. Following the completion of ongoing toxicology studies and cGMP production of our clinical lot, we plan to file an IND in the third quarter of 2015 for a first-in-human trial of SIRPαFc in AML and MDS patients, and possibly solid tumor or lymphoma patients with normal bone marrow function. |

| • | Expand our SIRPαFc clinical program to include additional cancer indications. Because CD47 is highly expressed by multiple liquid and solid tumors, and high expression is correlated with worse clinical outcomes, we believe SIRPαFc has potential to be effective in a wide variety of tumors. We plan to carry out the preclinical work necessary to select additional, high potential cancer indications for clinical development. |

| • | Maximize value of SIRPαFc through scientific collaborations. SIRPαFc has broad potential applicability in various cancer indications, and we believe it is well suited for use as both a monotherapy and in combination with other agents. We plan to selectively and opportunistically pursue scientific collaborations with academic researchers as well as other companies, in order to realize the full value proposition of SIRPαFc. |

| • | To become a leading integrated immuno-oncology company. Developing cancer immunotherapies requires significant experience and development expertise. Our experienced management team, board of directors, scientific advisory board and in-house capabilities enable us to execute our product development plan. We intend to continue to invest in the infrastructure and personnel to support our continued growth that will enable us to become a leading immuno-oncology company. |

SIRPαFc Key Attributes

| • | Potential efficacy in a broad range of cancers. SIRPαFc blocks the tumor’s ability to transmit a “do not eat” signal allowing macrophages to destroy tumor cells; a mechanism that we believe has broad applicability. |

| • | Potential for use as monotherapy and in combination with other therapies. We intend to develop SIRPαFc as a monotherapy as well as potentially for use in combination with other cancer immuno- therapies. |

| • | Differentiated pharmacokinetic and safety profile. We believe SIRPαFc’s low level of binding to red blood cells lowers the risk of anemia and lowers the loss of drug from circulation. This pharmacokinetic profile potentially allows for lower dosing and a positive safety profile. |

| • | May enhance both innate and adaptive immune response. SIRPαFc may enhance stimulation of tumor attacking T-cells, since macrophages, in addition to their role in phagocytosis, can also prime T-cells through antigen-presentation. |

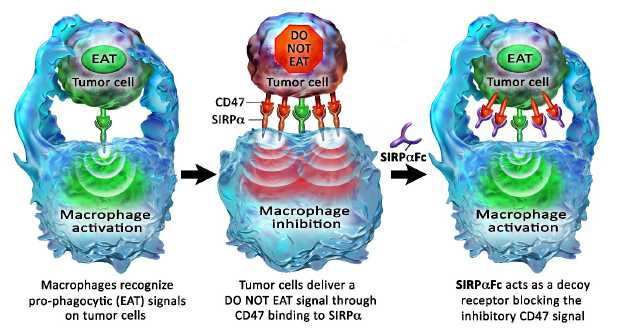

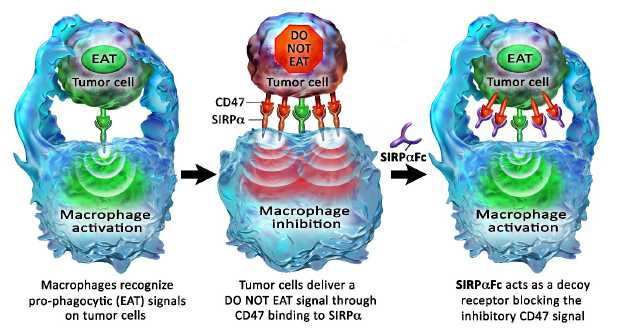

Blocking the CD47 “do not eat” signal using the SIRPαFc decoy receptor

Macrophages are a type of white blood cell that can ingest and destroy (phagocytose) other cells. They are part of the innate immune system that helps to protect the body from infection. More recently, a role for macrophages in the control of tumors has been described.

Macrophage activity is controlled by both positive “eat” and negative “do not eat” signals. Tumor cells may express “eat” signals (e.g., calreticulin) that make themselves visible to macrophages. To counterbalance this increased visibility the tumor cells often express high levels of CD47, which transmits a “do not eat” signal by binding the signal regulatory protein alpha, or SIRPα, on the surface of macrophages. We believe that the higher expression of CD47 on the tumor cell helps it evade destruction by the macrophage by overwhelming any activating “eat” signals.

SIRPαFc is an antibody-like protein that consists of the CD47-binding domain of human SIRPα linked to the Fc region of a human immunoglobulin. It is designed to act as a soluble decoy receptor, preventing CD47 from delivering its inhibitory signal. Neutralization of the inhibitory CD47 signal enables the activation of macrophage anti-tumor effects by the pro-phagocytic “eat” signals. The Fc region of SIRPαFc may, depending on its identity, also assist in the activation of macrophages by engaging Fc receptors.

6

Figure 1, below, illustrates how SIRPαFc blocks the CD47 “do not eat” signal.

In addition to their direct anti-tumor activity, macrophages can also function as antigen-presenting cells and stimulate antigen-specific T cells. Recent data in mice have demonstrated that CD47 antibody blockade increases antigen presentation by macrophage and stimulates the development of anti-tumor cytotoxic T cell responses. We hypothesize that increasing macrophage phagocytosis by SIRPαFc treatment may also enhance tumor-specific T cell responses. Thus, SIRPαFc may enhance both the innate (macrophage) and adaptive (T cell) components of an anti-tumor immune response.

SIRPαFc has broad clinical potential

We believe that SIRPαFc has broad clinical potential in both hematological and solid tumors. High expression of the CD47 “do not eat” signal on tumor cells has been observed in acute myeloid leukemia, or AML, myelodysplastic syndrome, or MDS, chronic myeloid leukemia, or CML, acute lymphoblastic leukemia, or ALL, diffuse large B cell lymphoma, chronic lymphocytic leukemia, follicular lymphoma, mantle cell lymphoma, marginal zone lymphoma, multiple myeloma and in the following solid tumors: bladder, brain, breast, colon, leiomyosarcoma, liver, melanoma, ovarian and prostate. In a number of these cancers high CD47 expression was shown to have negative clinical consequences, correlating with more aggressive disease and poor survival. In normal karyotype AML patients, for example, high CD47 expression was correlated with worse event-free survival (6.8 vs. 17.1 months) and worse overall survival (9.1 vs. 22.1 months) compared to low CD47 expression. These data are consistent with CD47 providing a survival advantage to tumor cells. Furthermore, numerous studies have shown that antibody blockade of CD47 has demonstrated activity in mice engrafted with human tumors.

In vitro studies with blood cancer lines derived from ALL, B lymphoma, AML, CML and multiple myeloma patients demonstrated that SIRPαFc frequently triggered significant macrophage-mediated tumor cell phagocytosis compared to control treatment.

Figure 2, below, shows how SIRPαFc triggers macrophage-mediated phagocytosis of many different human blood cancer cell lines.

7

***p<0.0001; **p<0.01; *p<0.05: NS: Thep value is a probability value, with values <0.05 considered statistically significant versus control treatment. NS indicatesp>0.05, which is considered not statistically significant versus control treatment.

In August 2014, we entered into a collaboration with academic investigators to explore the therapeutic potential of SIRPαFc in a variety of solid tumor models. The research is being conducted in the laboratories of Drs. James Koropatnick and Ting-Yim Lee, at the Lawson Health Research Institute and the Robarts Research Institute, University of Western Ontario. Our funding is matched 1:1 by a grant from the Ontario Research Fund – Research Excellence providing the collaboration with a research budget approximating $600,000. We are also working with collaborators at from University Health Network, or UHN, and Hospital for Sick Children, or HSC, and plan to further expand our collaboration network in 2015.

SIRPαFc for the Treatment of AML and MDS

We currently expect our first clinical evaluation of a potential indication for SIRPαFc will be for the treatment of AML and MDS patients. We may also add solid tumor or lymphoma patients with normal bone marrow function. AML is the most common type of acute leukemia in adults, with approximately 13,000 new cases diagnosed each year in the United States. The majority of AML patients receive induction chemotherapy. In patients under 60 years of age, remission rates of up to 75% can be achieved, and patients with good-risk or standard-risk chromosomal changes will typically receive post-remission therapy with high dose cytarabine. However, relapses are common, and the majority of patients will die from their disease. AML in patients over 60 years of age is very difficult to treat, with five-year survival rates reported of less than 10%. There is ample evidence that AML is sustained by leukemic stem cells, or LSCs, and the resistance of these LSCs to conventional chemotherapy is thought to be responsible for disease relapse. CD47 is overexpressed by both bulk differentiated AML cancer cells as well as LSCs.

MDS is a heterogeneous group of closely related blood disorders characterized by one or more peripheral blood cytopenias secondary to bone marrow dysfunction. It is considered a premalignant condition and often progresses to AML when additional genetic abnormalities are acquired. There are approximately 13,000 new cases of MDS diagnosed in the United States each year. The median survival times for MDS patients range from 5.7 years (low risk) to 5 months (high risk).

8

As described above, AML tumor cells have been shown to have high levels of CD47, and CD47 expression has been shown to correlate with worse clinical outcome. Antibody blockade of CD47 has been shown to promote phagocytosis of AML cells in vitro and promote anti-leukemic activity in mouse models. CD47 expression has also been shown to be elevated in bone marrow progenitor cells from high risk MDS patients compared to low risk.

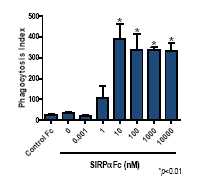

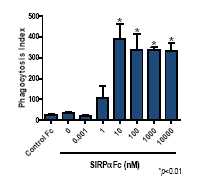

In cell-based experiments, SIRPαFc has been shown to promote the phagocytosis of patient-derived AML tumor samples. In the absence of SIRPαFc treatment, human macrophages are poorly phagocytic. However, treatment of tumor cells with SIRPαFc at doses equal or greater to 10 nanomolar (nM) results in a dramatic increase in tumor cell phagocytosis. This effect is seen visually using confocal microscopy and quantified by expressing a phagocytosis index (number of engulfed tumor cells per 100 macrophages).

Figure 3, below, illustrates how SIRPαFc enables macrophages to kill human AML tumor cells.

*p<0.01: Thep value is a probability value, with values <0.05 considered statistically significant versus control treatment.

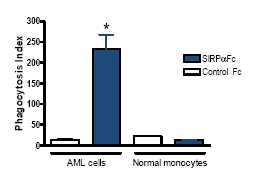

Since AML is a heterogeneous disease, we assessed the impact of SIRPαFc on a panel of 10 AML tumor samples isolated from a diverse patient population at various disease stages and different genetic abnormalities. SIRPαFc was shown to be active against 9 of these 10 samples, indicating that the pro-phagocytic effect of SIRPαFc is not restricted to a subset of AML tumors.

Figure 4, below, illustrates how SIRPαFc is active against a diverse panel of AML samples.

9

***p<0.0001; **p<0.01; *p<0.05; NS: The p value is a probability value, with values <0.05 considered statistically significant versus control treatment. NS indicatesp>0.05, which is considered not statistically significant versus control treatment.

The below table sets forth the AML patient characteristics supporting the information in Figure 4, above.

| Patient | | Age | | Sex | | FAB Subtype(1) | | Blast (%)(2) |

| 80559 | | 68 | | M | | M5a | | 20 |

| 80567 | | 69 | | F | | M5a | | 90 |

| 90174 | | 41 | | M | | M4 | | N/A |

| 90543 | | 33 | | M | | M2 | | 82 |

| 90596 | | 69 | | M | | M0 | | 97 |

| 90650 | | 67 | | M | | M1 | | 90 |

| 90765 | | 94 | | F | | M2 | | 90 |

| 100116 | | 66 | | F | | M4 | | N/A |

| 100622 | | 65 | | F | | M4Eo | | 40 |

| 100857 | | 73 | | M | | M2 | | 10 |

Notes:

| (1) | The French-American-British, or FAB, classification system divides AML into eight subtypes, M0 through to M7, based on the type of cell from which the leukemia developed and its degree of maturity. |

| | |

| (2) | Blast (%) refers to the percentage of leukemic myeloblasts, or blood cells affected by disease, compared to all blood cells in the sample. |

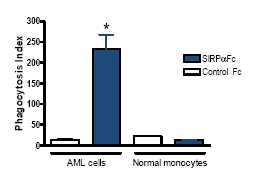

The ability of macrophages to kill normal cells in the presence of SIRPαFc was also assessed by confocal microscopy. SIRPαFc enabled macrophages to phagocytose AML tumor cells but spared normal peripheral blood-derived mononuclear cells. This indicates that SIRPαFc-mediated phagocytosis is tumor cell-specific, and strongly suggests that a therapeutic window exists in which SIRPαFc can promote the killing of tumor cells while sparing normal hematopoietic targets. These results are consistent with similar published data using CD47 antibodies. The strong selectivity for tumor cells may be due to the expression of pro-phagocytic “eat” signals such as calreticulin on malignant cells but not on normal cells.

Figure 5, below, illustrates how SIRPαFc induces tumor cell-specific phagocytosis.

*Thep value is a probability value, with values <0.05 considered statistically significant versus control treatment.

10

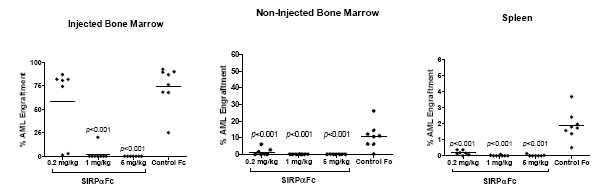

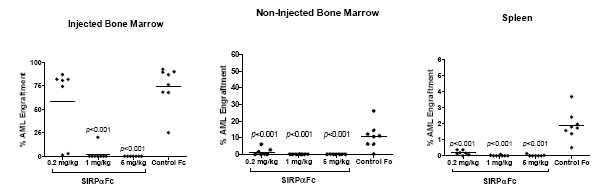

The activity of SIRPαFc was assessed by engrafting AML patient tumor cells into nonobese diabetic NOD.SCID, or NS, mice. In this model, tumor cells were injected directly into the bone marrow of an NS mouse and three weeks later therapy was initiated with SIRPαFc or a control Fc protein. After treating for 4 weeks, the mice were sacrificed and leukemia in the bone marrow (harvested from the injected and non-injected femurs) and spleen was measured by flow cytometry. Treatment with SIRPαFc in this model resulted in the reduction of leukemia to non-detectable levels in all three tissues in most mice. These results are further validated by independent research demonstrating activity of CD47 blockade using monoclonal antibodies.

Figure 6, below, illustrates how SIRPαFc has potent anti-leukemic activityin vivo.The information presented in Figure 6 is based on the treatment of mice with a human SIRPαFc at a dose of 8 mg/kg intraperitoneal, or IP, three times per week for four weeks, starting 21 days after engraftment.

Thep value is a probability value, with values <0.05 considered statistically significant versus control treatment.

The human SIRPαFc used in the above model does not bind mouse CD47 and thus does not model a potential “antigen sink” effect, whereby drug is rapidly removed from circulation by binding target on non-tumor (host) cells. To overcome this limitation, tumor studies were conducted using a mouse surrogate drug that contains the SIRPα sequence from the NS mouse strain, which has the unusual property of binding both mouse and human CD47 and thus can be used in studies in which human tumor cells are transplanted into mice. The mouse surrogate drug was shown to mediate strong anti-leukemic activity in AML tumor studies, even at relatively low doses (<1 mg/kg). These data demonstrate that the presence of CD47 target on normal cells does not interfere with drug activity.

Figure 7, below, illustrates how SIRPαFc has strong anti-leukemic activity even at low doses. The information presented in Figure 7 is based on the treatment of mice with a mouse SIRPαFc at doses of 0.2, 1 or 5 mg/kg IP for three times per week for four weeks, starting 21 days after engraftment.

Thep value is a probability value, with values <0.05 considered statistically significant versus control treatment.

Additional AML tumor studies have been conducted, examining various therapeutic dosing regimens, as well as the effect of different Fc regions. The data continue to demonstrate significant anti-tumor activity at doses below 1 mg/kg. The results have also shown that the identity of the Fc region directly impactsin vivo potency.

11

Several preliminary non-good laboratory practice safety studies have been conducted in cynomolgus monkeys. The results have provided supportive safety and pharmacokinetic data and provided valuable guidance for the design of our formal IND-enabling toxicology program which commenced in February 2015.

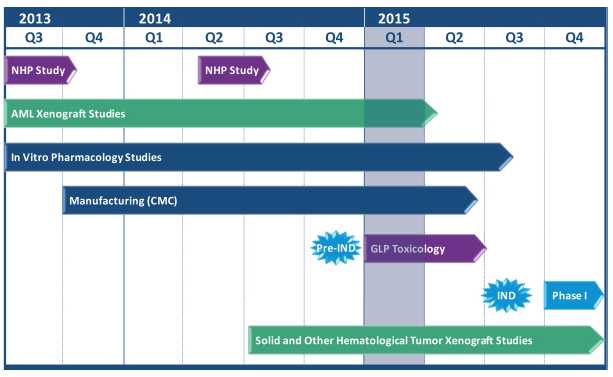

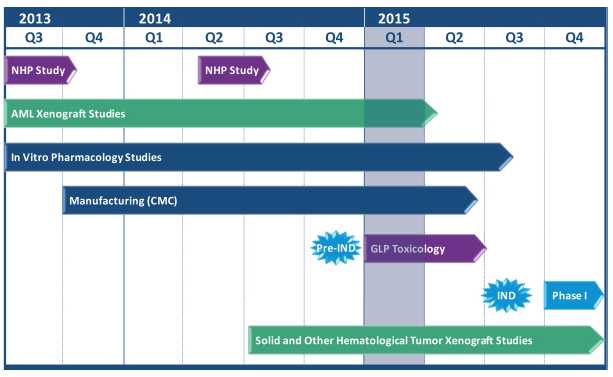

Clinical development plan

Figure 8, below, illustrates the SIRPαFc preclinical development plan. We have completed production of the SIRPαFc toxicology lots and commenced formal IND-enabling toxicology studies. We expect to complete current Good Manufacturing Practice, or cGMP, production of our clinical lot in the second quarter of 2015 and file an IND in the third quarter of 2015 for a first-in-human trial of SIRPαFc in AML and MDS patients. The first clinical study may also involve patients with solid tumors or lymphoma who have normal bone marrow function.

Combination Therapy

SIRPαFc is currently being developed as a monotherapy. However, we believe that SIRPαFc enhancement of macrophage activity and possibly T cell responses could be synergistic with other immune-mediated therapies. Studies conducted by third parties provide evidence that SIRPαFc may be useful in combination with approved anti-cancer antibodies (e.g., Rituxan®, Herceptin®, Campath®). Since many cancer antibodies work at least in part by activating cells of the innate immune system, it may be possible to enhance the potency of these agents by blocking the negative “do not eat” CD47 signal that tumor cells deliver to macrophages. We hypothesize that SIRPαFc may act synergistically with other immunological agents, including T cell checkpoint inhibitors, cancer vaccines, oncolytic viruses or chimeric antigen receptor, or CAR, T cells. We therefore plan to explore SIRPαFc in combination studies using preclinical tumor models.

Competition - CD47/ AML

SIRPαFc competes directly with CD47 blocking antibodies from Stanford University and Celgene Corporation, both of which have entered early clinical development. Novimmune SA also has a bispecific (anti-CD47/anti-CD19) antibody program, although it is still in the discovery stage.

12

We believe that our approach of using SIRPα, the natural binding partner for CD47, may have important advantages over treatment with CD47-specific antibodies. In April 2014, we presented data at the 105th American Association for Cancer Research annual meeting demonstrating that our SIRPαFc fusion proteins bind very poorly to human red blood cells, or RBCs, compared to both commercial anti-CD47 monoclonal antibodies and proprietary CD47-blocking agents. In Figure 9, below, on the left, we demonstrate the poor binding of SIRPαFc to RBCs compared to four anti-CD47 antibodies. This profound difference in binding was not seen with other cell types, including an AML cell line (AML-2, right side), suggesting it is an RBC-specific phenomenon. Our observation is consistent with a prior report demonstrating a notable difference in human RBC binding between CD47 antibody and recombinant SIRPα. Furthermore, the lack of significant binding of SIRPαFc to RBCs is unique to humans, since SIRPαFc bound strongly to mouse and monkey RBCs. While the mechanism behind this observation is still under investigation, our preliminary data suggest that it may relate to unique structural features of CD47 in the human RBC membrane.

Figure 9, below, illustrates how SIRPαFc binds very poorly to human RBCs compared to CD47 antibodies. The information presented in Figure 9 is based on the binding of commercially available anti-CD47 monoclonal antibodies and SIRPαFc to human RBCs (n=14 donors) and AML-2 cells.

The very low RBC binding profile of our SIRPαFc proteins may provide two important advantages over other CD47 blocking agents. First, there may be a lower risk of RBC toxicity (anemia) with SIRPαFc. Anemia is a condition in which the blood is deficient in red blood cells, in hemoglobin, or in total volume. This potential advantage would translate into improved patient care, particularly in diseases such as AML where patients are predisposed to developing anemia. Second, there may be much lower loss of SIRPαFc from circulation in treated patients compared to CD47 antibodies, which bind strongly to circulating RBCs. The ability of RBCs to absorb and remove circulating CD47-specific antibodies, a so called “antigen-sink effect”, may necessitate high doses of drug in order to effectively target the tumor cells, which could lead to potentially higher off-target toxicity. Therefore, SIRPαFc may have a better safety profile and drug kinetics than CD47-specific antibodies based on these preclinical analyses.

While there is significant competitive clinical activity in AML, there are very few agents in development that are pursuing the same unique mechanism of action (enhancement of macrophage phagocytic activity) as SIRPαFc. To our knowledge, there are a few parties pursuing CD47-blocking antibodies, but no one else developing a SIRPαFc protein. In addition, there are few agents in development targeting AML LSCs. Similar to our targeting of CD47, we believe other agents in development targeting AML LSCs are largely focused on cell surface proteins such as CD123 and CD44.

Plan of Operations

Over the next 12 months, our primary focus is the advancement of our SIRPαFc development program with the intent to initiate the first phase I clinical trial of SIRPαFc in AML and MDS patients. This study may also involve patients with solid tumors or lymphomas who have normal bone marrow function. The major tasks to be performed to accomplish this include completion of manufacturing of cGMP material suitable for clinical testing, completion of IND-enabling toxicology and pharmacology studies, submission of our IND application for FDA approval to start the trial in the third quarter of 2015 and the initiation of the clinical trial in the fourth quarter of 2015. We will also continue preclinical studies in other blood cancers and solid tumors to identify potential future clinical indications.

13

Agreements with Catalent Pharma Solutions

In connection with our development of SIRPαFc, we entered into two agreements on August 12, 2014 with Catalent pursuant to which we acquired the right to use two of Catalent’s proprietary GPEx® expression cell lines for the manufacture of two SIRPαFc proteins: TTI-621 and TTI-622. One agreement relates to the manufacture of TTI-621 and the other agreement relates to the manufacture of TTI-622. In consideration for the purchase of the expression cell lines, each agreement provides that we will pay Catalent up to US$875,000 upon reaching certain pre-marketing approval milestones and up to an additional US$28.8 million for reaching certain sales milestones. We will also pay Catalent an annual product maintenance fee until the first product derived from the expression cell lines receives a regulatory approval other than a pricing or reimbursement approval.

Under the agreements, we may use the two expression cell lines to secure such regulatory approvals and to develop, test, market and otherwise commercially exploit products originating from the cell lines. We may transfer the expression cell lines to a third party contract manufacturer who may utilize the cell lines in a similar fashion. We, or a third-party, cannot use or modify the cell lines, or any portions of the cell lines, to create a new cell line.

We plan to further develop the expression cell lines for use in our pre-IND toxicology and pharmacology studies, as well as to supply our phase I clinical trial. We will be required to indemnify Catalent for any costs Catalent incurs related to regulatory filings and related claims or proceedings, for the conduct of any clinical trials and for any manufacture, packaging, sale, promotion, distribution, use of or exposure to the expression cell lines or products. As a result of this risk, we are obligated to maintain several designated insurance policies throughout the term of the agreements.

We may terminate the agreements upon 90 days’ written notice to Catalent, upon their bankruptcy or upon their material breach and failure to cure within 30 days. Similarly, Catalent may terminate the agreements upon our bankruptcy or upon our material breach and failure to cure within 30 days. If our material breach is for nonpayment, however, we will only have 10 days to cure before Catalent may terminate the agreement.

Product for Development with Partners – CD200 Monoclonal Antibodies

Our CD200 monoclonal antibody program also targets a key pathway that tumor cells use to evade attack from the immune system. There is evidence that CD200 is highly expressed by many different types of blood cell and solid tumors, and in numerous cases this high expression correlates with disease progression and poor clinical outcome. This is consistent with tumor cells using CD200 as a means of evading immune-mediated destruction. Tumor-expressed CD200 can modulate anti-tumor responses in vitro and in vivo, and antibodies that block CD200 have been shown to promote anti-tumor immunity in animal models of cancer.

Our CD200 monoclonal antibody is a fully human monoclonal antibody that blocks the activity of CD200. We have conducted in vitro and in vivo preclinical oncology-focused studies. Our antibodies bind strongly to human CD200, potently neutralizing CD200 function in vitro, and have shown anti-tumor activity in a transplanted human tumor cell model. We are seeking a development partner to advance this program into formal preclinical IND-enabling studies.

Intellectual Property

We own or control patent rights covering our key products and their therapeutic end uses. The patents and patent applications are either granted or pending in major pharmaceutical markets. In all, the patent estate includes five key patent families, including five key issued patents and two key pending patent applications in the U.S. and various other patent applications pending in Europe, Canada, Australia, China, India, and Japan. These include four granted patents in the U.S. relating to the immune modulating use of CD200 monoclonal antibodies, and a granted patent in the U.S. for an assay useful to detect CD200 in cancer patients, as well as a filing for novel human antibodies to CD200.

14

In connection specifically with patent applications relating to SIRPαFc, we control two patent families that comprise eight individual filings. One family has claims that embrace species of SIRPαFc found to have certain therapeutic properties and their use for the treatment of cancer. These patent rights are owned outright by Trillium and national patent filings are planned. Patents emerging from this family will expire in 2033. A second SIRPα patent family was in-licensed on an exclusive basis from co-owners UHN and HSC. This family has been filed in major markets, including the U.S., Europe, Japan, Canada, Australia, China and India. The claims cover the use of various forms of SIRPα to treat CD47-positive cancers. Patents issuing from this family begin to expire in the year 2030.

In connection specifically with CD200 monoclonal antibody patents, we have four granted U.S. patents that cover the use of CD200 antibodies for the treatment of autoimmune and related disorders that will begin to expire in 2018. We more recently made a patent filing that covers particular species of human antibodies to human CD200. A patent family based on this filing would expire in 2035.

We intend to protect additional intellectual property developed by us through the filing of patent applications within appropriate jurisdictions throughout the world.

Regulatory Process

Government authorities in the United States, including federal, state, and local authorities, and in other countries, extensively regulate, among other things, the manufacturing, research and clinical development, marketing, labeling and packaging, storage, distribution, post-approval monitoring and reporting, advertising and promotion, and export and import of biological products, such as those we are developing. The process of obtaining regulatory approvals and the subsequent compliance with appropriate federal, state, local, and foreign statutes and regulations require the expenditure of substantial time and financial resources.

Securing final regulatory approval for the manufacture and sale of biological products in the U.S., Europe, Canada and other commercial territories, is a long and costly process that is controlled by that particular territory’s regulatory agency. The regulatory agency in the U.S. is the FDA, in Canada it is HC, and in Europe it is the European Medicines Agency, or EMA. Other regulatory agencies have similar regulatory approval processes, but each regulatory agency has its own approval processes. Approval in the U.S., Canada or Europe does not assure approval by other regulatory agencies, although often test results from one country may be used in applications for regulatory approval in another country.

None of our products have been completely developed or tested and, therefore, we are not yet in a position to seek final regulatory approval to market any of our products.

U.S. Government Regulation

In the U.S., the FDA regulates drugs under the Federal Food, Drug, and Cosmetic Act, or FDCA, and its implementing regulations, and biologics under the FDCA and the Public Health Service Act, or PHSA, and its implementing regulations. FDA approval is required before any new unapproved drug or biologic or dosage form, including a new use of a previously approved drug, can be marketed in the United States. Drugs and biologics are also subject to other federal, state, and local statutes and regulations. If we fail to comply with applicable FDA or other requirements at any time during the product development process, clinical testing, the approval process or after approval, we may become subject to administrative or judicial sanctions. These sanctions could include the FDA’s refusal to approve pending applications, license suspension or revocation, withdrawal of an approval, warning letters, product recalls, product seizures, total or partial suspension of production or distribution, civil monetary penalties or criminal prosecution. Any FDA enforcement action could have a material adverse effect on us.

15

The process required by the FDA before product candidates may be marketed in the United States generally involves the following:

| • | completion of extensive preclinical laboratory tests and preclinical animal studies, all performed in accordance with the Good Laboratory Practices regulations; |

| • | submission to the FDA of an investigational new drug application, or IND, which must become effective before human clinical trials may begin and must be updated annually; |

| • | approval by an independent institutional review board, or IRB, or ethics committee representing each clinical site before each clinical trial may be initiated; |

| • | performance of adequate and well-controlled human clinical trials to establish the safety and efficacy of the product candidate for each proposed indication; |

| • | preparation of and submission to the FDA of a new drug application, or NDA, or biologics license application, or BLA, after completion of all pivotal clinical trials; |

| • | potential review of the product application by an FDA advisory committee, where appropriate and if applicable; |

| • | a determination by the FDA within 60 days of its receipt of an NDA or BLA to file the application for review; |

| • | satisfactory completion of an FDA pre-approval inspection of the manufacturing facilities where the proposed product is produced to assess compliance with current Good Manufacturing Practices, or cGMP; |

| • | a potential FDA audit of the preclinical research and clinical trial sites that generated the data in support of the NDA or BLA; and |

| • | FDA review and approval of an NDA or BLA prior to any commercial marketing or sale of the product in the U.S. |

The preclinical research and clinical testing and approval process require substantial time, effort, and financial resources, and we cannot be certain that any approvals for our product candidates will be granted on a timely basis, if at all.

An IND is a request for authorization from the FDA to administer an investigational new drug product to humans in clinical trials. The central focus of an IND submission is on the general investigational plan and the protocol(s) for human clinical trials. The IND also includes results of animal studies assessing the toxicology, pharmacokinetics, pharmacology, and pharmacodynamic characteristics of the product; chemistry, manufacturing, and controls information; and any available human data or literature to support the use of the investigational new drug. An IND must become effective before human clinical trials may begin. An IND will automatically become effective 30 days after receipt by the FDA, unless before that time the FDA raises concerns or questions related to the proposed clinical trials. In such a case, the IND may be placed on clinical hold and the IND sponsor and the FDA must resolve any outstanding concerns or questions before clinical trials can begin. Accordingly, submission of an IND may or may not result in the FDA allowing clinical trials to commence.

Clinical Trials

Clinical trials involve the administration of the investigational new drug to human subjects under the supervision of qualified investigators in accordance with Good Clinical Practices, or GCPs, which include the requirement that all research subjects provide their informed consent for their participation in any clinical trial. Clinical trials are conducted under protocols detailing, among other things, the objectives of the study, the parameters to be used in monitoring safety, and the efficacy criteria to be evaluated. A protocol for each clinical trial and any subsequent protocol amendments must be submitted to the FDA as part of the IND. Additionally, approval must also be obtained from each clinical trial site’s IRB or ethics committee, before the trials may be initiated, and the IRB or ethics committee must monitor the trial until completed. There are also requirements governing the reporting of ongoing clinical trials and clinical trial results to public registries.

The clinical investigation of a drug is generally divided into three or four phases. Although the phases are usually conducted sequentially, they may overlap or be combined.

16

| • | Phase I. The drug is initially introduced into healthy human subjects or patients with the target disease or condition. These studies are designed to evaluate the safety, dosage tolerance, metabolism and pharmacologic actions of the investigational new drug in humans, the side effects associated with increasing doses, and if possible, to gain early evidence on effectiveness. |

| • | Phase II. The drug is administered to a limited patient population to evaluate dosage tolerance and optimal dosage, identify possible adverse side effects and safety risks, and preliminarily evaluate efficacy. |

| • | Phase III. The drug is administered to an expanded patient population, generally at geographically dispersed clinical trial sites to generate enough data to statistically evaluate dosage, clinical effectiveness and safety, to establish the overall benefit-risk relationship of the investigational new drug product, and to provide an adequate basis for physician labeling. |

| • | Phase IV. In some cases, the FDA may condition approval of an NDA or BLA for a product candidate on the sponsor’s agreement to conduct additional clinical trials after approval. In other cases, a sponsor may voluntarily conduct additional clinical trials after approval to gain more information about the drug. Such post-approval studies are typically referred to as phase IV clinical trials. |

Clinical trial sponsors must also report to the FDA, within certain timeframes, serious and unexpected adverse reactions, any clinically important increase in the rate of a serious suspected adverse reaction over that listed in the protocol or investigator’s brochure, or any findings from other studies or animal testing that suggest a significant risk in humans exposed to the product candidate. The FDA, the IRB or ethics committee, or the clinical trial sponsor may suspend or terminate a clinical trial at any time on various grounds, including a finding that the research subjects are being exposed to an unacceptable health risk. Additionally, some clinical trials are overseen by an independent group of qualified experts organized by the clinical trial sponsor, known as a data safety monitoring board or committee. This group provides authorization for whether or not a trial may move forward at designated check points based on access to certain data from the trial.

The clinical trial process can take years to complete, and there can be no assurance that the data collected will support FDA approval or licensure of the product. Results from one trial are not necessarily predictive of results from later trials. We may also suspend or terminate a clinical trial based on evolving business objectives and/or competitive climate.

Submission of an NDA or BLA to the FDA

Assuming successful completion of all required preclinical studies and clinical testing in accordance with all applicable regulatory requirements, detailed investigational new drug product information is submitted to the FDA in the form of an NDA or BLA requesting approval to market the product for one or more indications. Under federal law, the submission of most NDAs and BLAs is subject to an application user fee. For fiscal year 2015, the application user fee exceeds $2.3 million, and the sponsor of an approved NDA or BLA is also subject to annual product and establishment user fees, set at $110,370 per product and $569,200 per establishment. These fees are typically increased annually. Applications for orphan drug products are exempted from the NDA and BLA application user fee, unless the application includes an indication for other than a rare disease or condition, and may be exempted from product and establishment user fees under certain conditions.

An NDA or BLA must include all relevant data available from pertinent preclinical studies and clinical trials, including negative or ambiguous results as well as positive findings, together with detailed information relating to the product’s chemistry, manufacturing, controls, and proposed labeling, among other things. Data comes from company-sponsored clinical trials intended to test the safety and effectiveness of a use of a product, and may also come from a number of alternative sources, including trials initiated by investigators. To support marketing approval, the data submitted must be sufficient in quality and quantity to establish the safety and effectiveness of the investigational new drug product to the satisfaction of the FDA.

Once an NDA or BLA has been submitted, the FDA’s goal is to review the application within ten months after it accepts the application for filing, or, if the application relates to an unmet medical need in a serious or life-threatening indication, six months after the FDA accepts the application for filing. The review process is often significantly extended by the FDA’s requests for additional information or clarification.

17

Before approving an NDA or BLA, the FDA typically will inspect the facility or facilities where the product is manufactured. The FDA will not approve an application unless it determines that the manufacturing processes and facilities are in compliance with cGMP requirements and adequate to assure consistent production of the product within required specifications. Additionally, before approving an NDA or BLA, the FDA will typically inspect one or more clinical sites to assure compliance with GCP.

The FDA is required to refer an NDA or BLA for a novel drug (in which no active ingredient has been approved in any other application) to an advisory committee or explain why such referral was not made. Typically, an advisory committee is a panel of independent experts, including clinicians and other scientific experts, that reviews, evaluates and provides a recommendation as to whether the application should be approved and under what conditions. The FDA is not bound by the recommendations of an advisory committee, but it considers such recommendations carefully when making decisions.

The FDA’s Decision on an NDA or BLA

After the FDA evaluates the NDA or BLA and conducts inspections of manufacturing facilities where the product will be produced, the FDA will issue either an approval letter or a Complete Response Letter. An approval letter authorizes commercial marketing of the drug with specific prescribing information for specific indications. A Complete Response Letter indicates that the review cycle of the application is complete and the application is not ready for approval. In order to satisfy deficiencies identified in a Complete Response Letter, additional clinical data and/or an additional phase III clinical trial(s), and/or other significant, expensive and time-consuming requirements related to clinical trials, preclinical studies or manufacturing may be required for the product candidate. Even if such additional information is submitted, the FDA may ultimately decide that the NDA or BLA does not satisfy the criteria for approval. The FDA could also approve the NDA or BLA with a risk evaluation and mitigation strategy, plan to mitigate risks, which could include medication guides, physician communication plans, or elements to assure safe use, such as restricted distribution methods, patient registries and other risk minimization tools. The FDA also may condition approval on, among other things, changes to proposed labeling, development of adequate controls and specifications, or a commitment to conduct one or more post-market studies or clinical trials. Such post-market testing may include phase IV clinical trials and surveillance to further assess and monitor the product’s safety and effectiveness after commercialization. New government requirements, including those resulting from new legislation, may be established, or the FDA’s policies may change, which could delay or prevent regulatory approval of our products under development.

Patent Term Restoration

Depending upon the timing, duration, and specifics of the FDA approval of the use of our product candidates, some of our U.S. patents may be eligible for limited patent term extension under the Drug Price Competition and Patent Term Restoration Act of 1984, commonly referred to as the Hatch-Waxman Amendments. The Hatch-Waxman Amendments permit a patent restoration term of up to five years as compensation for patent term lost during product development and the FDA regulatory review process. However, patent term restoration cannot extend the remaining term of a patent beyond a total of 14 years from the product’s approval date. The patent term restoration period is generally one-half the time between the effective date of an IND and the submission date of an NDA or BLA, plus the time between the submission date and the approval of that application. Only one patent applicable to an approved product is eligible for the extension and the application for the extension must be submitted prior to the expiration of the patent and within 60 days of the product’s approval. The U.S. Patent and Trademark Office, in consultation with the FDA, reviews and approves the application for any patent term extension or restoration. In the future, we may apply for restoration of patent term for one of our currently owned or licensed patents to add patent life beyond its current expiration date, depending on the expected length of the clinical trials and other factors involved in the filing of the relevant NDA or BLA.

Companion Diagnostics

In its August 6, 2014, guidance document entitled “In Vitro Companion Diagnostic Devices,” the FDA defines an IVD companion diagnostic device to be an in vitro diagnostic device that provides information that is essential for the safe and effective use of a corresponding therapeutic product. Use of an IVD companion diagnostic device is considered essential when its use is required in the labeling of a therapeutic product, for example, to select appropriate patients for a product or those who should not use the product, or to monitor patients to achieve safety or effectiveness. In most circumstances, the IVD companion diagnostic device should be approved or cleared by FDA under the device authorities of the FDCA contemporaneously with the therapeutic product’s approval under section 505 of the FDCA for a drug or section 351 of the PHSA for a biological product. FDA expects the therapeutic product sponsor to address the need for an approved or cleared IVD companion diagnostic device in its therapeutic product development plan. The therapeutic product sponsor may develop its own IVD companion diagnostic device, partner with a diagnostic device sponsor to develop an IVD companion diagnostic device, or explore modifying an existing IVD diagnostic device to develop a new intended use. The FDA explains if a diagnostic device and a therapeutic device are studied together to support their respective approvals, both products can be studied in the same investigational study that meets both the requirements of the Investigational Device Exemption, or IDE, regulations and the IND regulations. Depending on the study plan and participants, a sponsor may seek to submit an IND alone, or both an IND and IDE.

18

Raw Materials, Manufacturing, and Supply

We have limited experience in manufacturing products for clinical or commercial purposes. We produce small quantities of SIRPαFc and CD200 monoclonal antibody in our laboratories for internal use. We believe that sources of raw materials pertinent to our laboratory operations and for manufacturing of our SIRPαFc product by our CMO are generally available.

We have established a contract manufacturing relationship for the supply of SIRPαFc that we believe will provide sufficient material for early clinical trials. In addition, we are establishing the basis for long-term commercial production capabilities. However, there can be no assurance that our contract manufacturer will be successful at scaling up and producing our product with the required quality and in the quantities and timelines that we will need for clinical and/or commercial purposes.

We expect to similarly rely on contract manufacturing relationships for any products that we may further develop, or in-license or acquire in the future. However, there can be no assurance that we will be able to successfully contract with such manufacturers on terms acceptable to us, or at all.

Contract manufacturers are subject to ongoing periodic and unannounced inspections by the FDA, the U.S. Drug Enforcement Administration and corresponding state agencies to ensure strict compliance with cGMP and other state and federal regulations. We do not have control over third-party manufacturers’ compliance with these regulations and standards, other than through contractual obligations and periodic auditing. If they are deemed out of compliance with such regulations, approvals could be delayed, product recalls could result, inventory could be destroyed, production could be stopped and supplies could be delayed or otherwise disrupted.

If we need to change manufacturers after commercialization, the FDA and corresponding foreign regulatory agencies must approve these new manufacturers in advance, which will involve testing and additional inspections to ensure compliance with FDA regulations and standards and may require significant lead times and delay, and disruption of supply. Furthermore, switching manufacturers may be difficult because the number of potential manufacturers is limited. It may be difficult or impossible for us to find a replacement manufacturer quickly or on terms acceptable to us, or at all.

Property, Plant and Equipment

We operate from approximately 10,000 square feet of leased laboratory and office space at 96 Skyway Avenue, Toronto, Ontario, Canada, M9W 4Y9. We perform research and development in our facility and use qualified vendors and collaborators to conduct research and development and manufacturing on our behalf. We incur capital expenditures mainly for laboratory equipment, office equipment, computer equipment and leaseholds in the operation of our business. As at December 31, 2014 the net carrying value of our property and equipment was $235,402.

19

Employees

As at March 23, 2015, we had eighteen full-time employees including four senior management, twelve research and development staff and two finance and administrative staff. All employees are located at our head office and lab facilities in Toronto, Ontario, Canada.

We also use consultants and outside contractors to carry on many of our activities, including preclinical testing and validation, formulation, assay development, manufacturing, clinical and regulatory affairs, toxicology and clinical trials.

Legal Proceedings

To our knowledge, there have not been any legal or arbitration proceedings, including those relating to bankruptcy, receivership or similar proceedings, those involving any third party, and governmental proceedings pending or known to be contemplated, which may have, or have had in the recent past, significant effect our financial position or profitability.

Also, to our knowledge, there have been no material proceedings in which any director, any member of senior management, or any of our affiliates is either a party adverse to us or any of our subsidiaries or has a material interest adverse to us or any of our subsidiaries.

GENERAL DEVELOPMENT OF THE BUSINESS – 3 YEAR SUMMARY

Acquisition of Trillium Privateco

During 2013, we refocused our product pipeline through the strategic acquisition of Trillium Privateco, a private biopharmaceutical company specializing in immune regulation and the development of cancer therapeutics, which included the SIRPαFc and CD200 preclinical cancer programs. On April 9, 2013, we completed a merger with Trillium Privateco, to access its SIRPαFc immuno-oncology program. Prior to this merger, we were focused on regenerative stem cell technologies. Following the merger, in July 2013, we ceased all activities associated with our regenerative neurology programs and abandoned all related intellectual property filings.

As consideration for the merger, we paid $1,200,000 in cash and issued 92,639 common shares and 110,000 units. Each unit consisted of one common share and 30 common share purchase warrants, with each 30 common share purchase warrants allowing their holder to acquire one additional common share at an exercise price of $12.00 until March 15, 2018. Cash used in the investment of $647,996 was determined by subtracting cash acquired of $552,004 from cash consideration of $1,200,000. Post-closing, Trillium Privateco shareholders held approximately 16% of the issued and outstanding common shares, and Trillium Privateco became our wholly-owned subsidiary.

Trillium Privateco’s SIRPαFc program originated from leading researchers in the field, including Drs. John Dick and Jean Wang of the UHN and Dr. Jayne Danska of HSC. Exclusive rights to SIRPαFc have been licensed from UHN and HSC pursuant to a license agreement amended and restated as of June 1, 2012. The licensed intellectual property relates to methods and compounds used in the modulation of SIRPα-CD47 interaction for therapeutic cancer applications. The license agreement requires us to use commercially reasonable efforts to commercialize the licensed technology. The license agreement will terminate on a country-by-country basis, in countries where a valid claim exists, when the last valid claim expires in such country, or if no valid claim exists, when the last valid claim expires in the U.S.

The license includes commitments to pay an annual maintenance fee of $25,000, as well as payments on patent issuances, development milestone payments ranging from $100,000 to $300,000 on the initiation of phase I, II and III clinical trials, and payments on the achievement of certain regulatory milestones as well as low single digit royalties on commercial sales. The payments due on submission of the first biologics license application, or BLA, and receipt of a first regulatory approval in the U.S. are $1,000,000 for each milestone. The aggregate milestones payable on their first achievement under the agreement in the major markets of the U.S., Europe and Asia combined are $5,660,000. We are also required to pay 20% of any sublicensing revenues to the licensors on the first $50 million of sublicensing revenues received and 15% thereafter.

20

Share capital issued – for the year ended December 31, 2014

On November 14, 2014, we consolidated our outstanding common shares issuing one post-consolidated share for each 30 pre-consolidated shares. All references in this AIF to the number of common shares, stock options and deferred share units, or DSUs, refer to the post-consolidated amounts.

In the year ended December 31, 2014, 2,596,251 warrants were exercised for 86,540 common shares and for proceeds of $946,813 and 2,614 stock options were exercised for proceeds of $19,600. Also, 909,091 warrants issued in March 2011 expired unexercised.

During the year ended December 31, 2014, 8,390,476 Series I First Preferred Shares were converted into 279,682 common shares.

Share capital issued – for the year ended December 31, 2013

We consolidated our outstanding common shares issuing one post-consolidated share for each 10 pre-consolidated shares and the common shares began trading on a post-consolidated basis on February 6, 2013.

In March 2013, we completed an offering pursuant to a base shelf prospectus and prospectus supplement and in the U.S. pursuant to a private placement memorandum for a total of 424,500 units at a price of $7.50 per unit, for aggregate gross proceeds of $3,185,080 ($2,615,240 net of issuance costs). Each unit consisted of one common share and 30 common share purchase warrants. Each 30 warrants entitle the holder to purchase one common share at a price of $12.00 per share at any time prior to expiry on March 15, 2018 (12,315,000 warrants) and March 27, 2018 (420,000 warrants). In connection with the financing, we issued 814,051 compensation warrants having an aggregate fair value of $48,843 estimated using the Black-Scholes option pricing model. Each 30 compensation warrants entitle the holder to acquire one common share at an exercise price of $7.50 per share prior to expiry on March 16, 2015.

The allocation of the $7.50 common share unit issue price to the common shares and unit warrants was based on the relative fair values of the common shares and the warrants. The fair value of the warrants was determined using the Black-Scholes option pricing model. The common shares were allocated a price of $6.00 per share and the warrants were allocated a price of $1.50 per 30 warrants. The costs of the issue were allocated on a pro rata basis to the common shares and warrants. Accordingly, $2,092,192 was allocated to common shares and $523,048 to warrants, net of issuance costs. Assumptions used to determine the value of the unit warrants were: dividend yield of 0%; risk-free interest rate of 1.1%; expected volatility of 64%; and average expected life of 3 years. Assumptions used to determine the value of the compensation warrants were: dividend yield of 0%; risk-free interest rate of 1.0%; expected volatility of 80%; and average expected life of 2 years.

On April 9, 2013, we issued 202,639 common shares and 3,300,000 common share purchase warrants for partial consideration for the acquisition of Trillium Privateco.

On April 16, 2013, we issued 167,619 common shares and 1,600,000 common share purchase warrants as consideration for the acquisition of certain rights related to tigecycline from UHN.

On December 13, 2013, we completed a private placement of 2,641,590 common share units (each common share unit consisting of one common share and 22.5 common share purchase warrants) at a price of $6.30 per unit and 77,895,165 preferred share units (each preferred share unit consisting of one Series I First Preferred Share and three-quarters of a common share purchase warrant) at a price of $0.21 per unit for gross proceeds of $32,866,025 ($30,713,841 net of issuance costs). Each 30 warrants entitle the holder to purchase one common share at a price of $8.40 at any time prior to expiry on December 13, 2018. In connection with the financing, we issued 5,014,839 compensation warrants having an aggregate fair value of $651,929 estimated using the Black-Scholes option pricing model. Each 30 compensation warrants entitle the holder to acquire one common share at an exercise price of $6.30 per share prior to expiry on December 13, 2015.

21

The allocation of the $6.30 unit issue price to the common shares, 30 Series I First Preferred Shares and 22.5 unit warrants was based on the relative fair values of the common shares, Series I First Preferred Shares and the warrants. The fair value of the warrants was determined using the Black-Scholes option pricing model. The common shares were allocated a price of $4.80 per share, the Series I First Preferred Shares were allocated a price of $4.80 per 30 shares, and the warrants were allocated a price of $1.50 per each 22.5 warrants. The costs of the issue were allocated on a pro rata basis. Accordingly, $11,488,602 was allocated to common shares, $11,292,525 to the Series I First Preferred Shares and $7,932,714 to warrants, net of issuance costs. Assumptions used to determine the value of the unit warrants were: dividend yield of 0%; risk-free interest rate of 1.2%; expected volatility of 70%; and average expected life of 3 years. Assumptions used to determine the value of the compensation warrants were: dividend yield of 0%; risk-free interest rate of 1.1%; expected volatility of 66%; and average expected life of 2 years.

All securities issued under the offering (including the compensation warrants) are subject to statutory resale restrictions.

In the December 2013 private placement, subscribers who purchased preferred share units and certain subscribers who purchased common share units were subject to restrictions on the conversion and exercise of securities of ours convertible into common shares. Such subscribers cannot convert or exercise securities of ours convertible or exercisable into common shares if, after giving effect to the exercise of conversion, the subscriber and its joint actors would have beneficial ownership or direction or control over common shares in excess of 4.99% of the then outstanding common shares. This limit may be increased at the option of the subscriber on 61 days prior written notice: (i) up to 9.99%, (ii) up to 19.99%, subject to stock exchange clearance of a personal information form submitted by the subscriber, and (iii) above 19.99%, subject to stock exchange approval and shareholder approval.

Subject to receipt of any required regulatory approvals, subscribers who purchased a minimum of 10% of the securities sold under the offering have been given rights to purchase securities of ours in future financings to enable each such subscriber to maintain its percentage holding in us for so long as the subscriber holds at least 10% of the outstanding common shares on a fully-diluted basis.

Share capital issued – for the year ended December 31, 2012

There were no common or preferred shares issued in the year ended December 31, 2012.

Tigecycline License

On April 16, 2013, we signed an agreement with UHN to gain rights to intellectual property related to the use of tigecycline for the treatment of leukemia which included a UHN sponsored, open label phase I multicenter dose-escalation tigecycline trial in patients with relapsed or refractory AML. The initial consideration for the UHN license of $1,085,714 was satisfied by the issuance of 167,619 common shares and 1,600,000 common share purchase warrants, with each 30 warrants allowing their holder to acquire one additional common share at an exercise price of $12.00 until March 15, 2018. Additional consideration under the UHN license included an annual license maintenance fee and future development milestones. The fair value of the common shares issued was based on the closing price of our common shares of $6.00 on April 16, 2013 and $7.50 per unit based on the fair value of the common share and common share purchase warrant components as of the date of acquisition.

Since acquiring these rights, we monitored the results of the phase I trial and assessed alternate development strategies for the technology. In August 2014, we completed an evaluation of this program with respect to its scientific merit, commercial potential, strength of intellectual property, as well as its overall fit with our current focus and expertise. We concluded that we should focus our business plan on expanding the SIRPαFc program, rather than continue development of tigecycline, and returned the licensed rights to UHN and recorded an impairment loss of $429,763 in the second quarter of 2014.

Capital Markets

We were listed on the TSX Venture Exchange, or TSXV, until April 22, 2014 when we migrated to the Toronto Stock Exchange, or TSX. We traded under the symbol “SSS” until June 6, 2014 when the symbol was changed to “TR”. We were listed on the OTCQX International under the symbol “SCTPF” from May 20, 2013 until we began trading on the NASDAQ Capital Market under the symbol “TRIL” on December 19, 2014.

22

Capital Expenditures

Prior to the April 2013 merger with Trillium Privateco, we incurred minimal capital expenditures. Capital expenditures are required mainly for laboratory equipment, office equipment, computers and leasehold improvements. Capital expenditures in the years ended December 31, 2014 and 2013 are set out in the following table.

| | | Year ended December 31, | |

| | | 2014 | | | 2013 | |

| Capital expenditures | $ | 173,603 $ | | | 34,017 | |

Trend Information

Historical patterns of expenditures cannot be taken as an indication of future expenditures. The amount and timing of expenditures and therefore liquidity and capital resources vary substantially from period to period depending on the number of research and development programs being undertaken at any one time, the stage of the development programs, the timing of significant expenditures for manufacturing, toxicology and pharmacology studies and clinical trials, and the availability of funding from investors and prospective commercial partners.

Expenses for the three months ended March 31, 2013 were lower due to low development activity levels while we sought new products for development. Subsequent to the April 9, 2013 Trillium Privateco merger, expenses increased significantly as we acquired twelve personnel and an approximately 10,000 square foot leased laboratory and office facility, and thereafter licensed additional technology assets from UHN. In December 2013, we completed a private placement raising gross proceeds of $33 million to advance our SIRPαFc program through phase I clinical trials. In 2014, we advanced the manufacturing of our products. Management expects 2015 expenditures will increase from 2014 levels as we expect to advance our SIRPαFc program through IND-enabling studies, complete manufacturing for and initialize the phase I clinical trial, hire additional personnel, and carry out an expanded preclinical program that includes additional cancer indications and combination studies.

RISK FACTORS

An investment in our common shares involves a high degree of risk and should be considered speculative. An investment in our common shares should only be undertaken by those persons who can afford the total loss of their investment. You should carefully consider the risks and uncertainties described below, as well as other information contained in this AIF. The risks and uncertainties below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we believe to be immaterial may also adversely affect our business. If any of the following risks occur, our business, financial condition and results of operations could be seriously harmed and you could lose all or part of your investment. Further, if we fail to meet the expectations of the public market in any given period, the market price of our common shares could decline. We operate in a highly competitive environment that involves significant risks and uncertainties, some of which are outside of our control.

Risks Related to our Business and our Industry

We expect to incur future losses and we may never become profitable.

We have incurred losses of $12.9 million, $4.3 million and $1.1 million during 2014, 2013 and 2012, respectively, and expect to incur an operating loss in 2015. We have an accumulated deficit since inception through December 31, 2014 of $50.6 million. We believe that operating losses will continue in and beyond 2015 because we are planning to incur significant costs associated with the preclinical and clinical development of SIRPαFc. Our net losses have had and will continue to have an adverse effect on, among other things, our shareholders’ equity, total assets and working capital. We expect that losses will fluctuate from quarter to quarter and year to year, and that such fluctuations may be substantial. We cannot predict when we will become profitable, if at all.

23

We currently have no product revenue and will not be able to maintain our operations and research and development without additional funding.

To date, we have generated no product revenue and cannot predict when and if we will generate product revenue. Our ability to generate product revenue and ultimately become profitable depends upon our ability, alone or with partners, to successfully develop our product candidates, obtain regulatory approval and commercialize products, including any of our current product candidates, or other product candidates that we may develop, in-license or acquire in the future. We do not anticipate generating revenue from the sale of products for the foreseeable future. We expect our research and development expenses to increase substantially in connection with our ongoing activities, particularly as we advance our product candidates into clinical trials.

Our prospects depend on the success of our product candidates which are at early stages of development, and we may not generate revenue for several years, if at all, from these products.