Exhibit 1

AB Value Partners, LP & AB Value Management LLC Bradley Radoff Proxy Contest to Change Leadership at Rocky Mountain Chocolate Factory, Inc. THE CONCERNED SHAREHOLDERS OF Immediate Change is Necessary

The views expressed in this presentation (this “Presentation”) represent the opinions of AB Value Partners, LP and/or certain of its affiliates (collectively, “AB Value”) and the other participants in this solicitation (collectively, the “Concerned Shareholders of Rocky Mountain”) that hold shares in Rocky Mountain Chocolate Factory, Inc . (“RMCF” or the “Company”) . The Presentation is for informational purposes only, and it does not have regard to the specific investment objective, financial situation, suitability or particular need of any specific person who may receive the Presentation and should not be taken as advice on the merits of any investment decision . The views expressed in this Presentation represent the opinions of Concerned Shareholders of Rocky Mountain and are based on publicly available information and the Concerned Shareholders of Rocky Mountain’s analyses . Certain financial information and data used in this Presentation have been derived or obtained from filings made with the Securities and Exchange Commission (the “SEC”) by the Company or other companies that the Concerned Shareholders of Rocky Mountain considers comparable, as well as from third party sources . The Concerned Shareholders of Rocky Mountain have not sought or obtained consent from any third party to use any statements or information indicated in this Presentation as having been obtained or derived from a third party . Any such statements or information should not be viewed as indicating the support of such third party for the views expressed in this Presentation . Information contained in this Presentation has not been independently verified by the Concerned Shareholders of Rocky Mountain . The Concerned Shareholders of Rocky Mountain shall not be responsible or have any liability for any misinformation contained in any third - party SEC filing or third - party report relied upon in good faith by the Concerned Shareholders of Rocky Mountain that is incorporated into this Presentation . The Concerned Shareholders of Rocky Mountain disclaim any obligation to correct or update this Presentation or to otherwise provide any additional materials . The Concerned Shareholders of Rocky Mountain recognize that the Company may possess confidential information that could lead it to disagree with the Concerned Shareholders of Rocky Mountain’s views and/or conclusions . The Concerned Shareholders of Rocky Mountain currently beneficially own, and/or have an economic interest in, shares of the Company . The Concerned Shareholders of Rocky Mountain are in the business of investing in securities . The Concerned Shareholders of Rocky Mountain may buy or sell or otherwise change the form or substance of any of their investments in any manner permitted by law and expressly disclaims any obligation to notify any recipient of this Presentation of any such changes . There may be developments in the future that cause the Concerned Shareholders of Rocky Mountain to engage in transactions that change their beneficial ownership and/or economic interest in the Company . The securities or investment ideas listed are not presented in order to suggest or show profitability of any or all transactions . Under no circumstances is this Presentation to be used or considered as an offer to sell or a solicitation of an offer to buy any security . This document is the property of the Concerned Shareholders of Rocky Mountain and may not be published or distributed without the express written consent of the Concerned Shareholders of Rocky Mountain . All registered or unregistered service marks, trademarks and trade names referred to in this Presentation are the property of their respective owners, and the Concerned Shareholders of Rocky Mountain’s use herein does not imply an affiliation with, or endorsement by, the owners of these service marks, trademarks and trade names . The information herein contains “forward - looking statements . ” Specific forward - looking statements can be identified by the fact that they do not relate strictly to historical or current facts and include, without limitation, words such as “may,” “will,” “expects,” “believes,” “anticipates,” “plans,” “estimates,” “projects,” “targets,” “forecasts,” “seeks,” “could,” “should” or the negative of such terms or other variations on such terms or comparable terminology . Similarly, statements that describe our objectives, plans or goals are forward - looking . Forward - looking statements are subject to various risks and uncertainties and assumptions . There can be no assurance that any idea or assumption herein is, or will be proven, correct . If one or more of the risks or uncertainties materialize, or if the Concerned Shareholders of Rocky Mountain’s underlying assumptions prove to be incorrect, the actual results may vary materially from outcomes indicated by these statements . Accordingly, forward - looking statements should not be regarded as a representation by the Concerned Shareholders of Rocky Mountain that the future plans, estimates or expectations contemplated will ever be achieved . Important Additional Other Information AB VALUE PARTNERS, LP, AB VALUE MANAGEMENT LLC, BRADLEY RADOFF, ANDREW T . BERGER, RHONDA J . PARISH, MARK RIEGEL, SANDRA ELIZABETH TAYLOR AND MARY KENNEDY THOMPSON FILED A DEFINITIVE PROXY STATEMENT AND ACCOMPANYING BLUE PROXY CARD WITH THE SEC TO BE USED TO SOLICIT VOTES AT THE 2021 ANNUAL MEETING OF SHAREHOLDERS (INCLUDING ANY OTHER MEETING OF SHAREHOLDERS HELD IN LIEU THEREOF, AND ADJOURNMENTS, POSTPONEMENTS, RESCHEDULINGS OR CONTINUATIONS THEREOF, THE “ANNUAL MEETING”) OF THE COMPANY . THE CONCERNED SHAREHOLDERS OF ROCKY MOUNTAIN STRONGLY ADVISE ALL STOCKHOLDERS OF THE COMPANY READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS BECAUSE THEY CONTAIN IMPORTANT INFORMATION . SUCH PROXY MATERIALS ARE AVAILABLE AT NO CHARGE ON THE SEC’S WEBSITE AT HTTP : //WWW . SEC . GOV . IN ADDITION, THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE UPON REQUEST . REQUESTS FOR COPIES SHOULD BE DIRECTED TO INVESTORCOM LLC . The Participants in the proxy solicitation are : AB Value Partners, LP, AB Value Management LLC, Andrew T . Berger, Bradley Radoff, Rhonda J . Parish, Mark Riegel, Sandra Elizabeth Taylor and Mary Kennedy Thompson . As of the date hereof, AB Value Partners, LP directly owns 224 , 855 shares of common stock, $ 0 . 001 par value per share of the Company (“Common Stock”) . As of the date hereof, AB Value Management LLC beneficially owns 460 , 189 shares of Common Stock, 235 , 334 of which are held in a managed account . As of the date hereof, Mr . Radoff directly owns 433 , 624 shares of Common Stock . As of the date hereof, Ms . Thompson directly owns 2 , 000 shares of Common Stock . As of the date hereof, none of Mr . Berger, Ms . Parish, Mr . Riegel, or Ms . Taylor directly own any shares of Common Stock . DISCLAIMER

THE CONCERNED SHAREHOLDERS OF AB Value Partners, LP & AB Value Management LLC Bradley Radoff 3 Executive Summary Need for Immediate Change Shareholders' Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix

E x e cu ti v e S u mma ry Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix 1. Total Shareholder Return or TSR is defined as the total accumulated percentage return with adjustments made for dividends (reinvested), splits, and spinoffs per FactSet 2. Form 8 - K filed January 9, 2020 3. Press Release filed August 3, 2021 4 Why We Are Here • Rocky Mountain Chocolate Factory, Inc. (RMCF or the Company) has pursued a strategy resulting in underperforming Total Shareholder Returns (TSR) 1 on a 1 - , 3 - , 5 - , and 10 - year basis, declining margins, contracting revenues, and deteriorating profitability across all major segments • This failed strategy was effected by a Board presently lacking relevant outside expertise and deficient in the core competencies of franchising, confectionary manufacturing/operations and retailing – all while administering poor governance and oversight • The Company’s struggles have been compounded by poor management and failed execution of acquisitions and partnership strategies due to an inferior understanding of terms and an inability to correct course • The 2019 cooperation agreement between RMCF and AB Value Management LLC (together with AB Value Partners, LP, AB Value) led to isolation of elected nominees Andrew T. Berger and Mary K. Thompson – their ideas and recommendations for change were ignored despite them having a clear shareholder mandate after each won 85% vote support at the 2020 Annual Meeting (average support for other incumbent directors was 62%) 2 • In the first two months of his first and only public directorship, we believe that Rahul Mewawalla has been hoisted to the Chairmanship role by entrenched incumbent directors where he has undermined previous consent negotiations with AB Value, usurped the authority of the Nominating Committee through the use of a special committee, and unilaterally attempted to silence shareholder dissent with intimidation 3 • The Board consistently demonstrates an antagonistic relationship with proper corporate governance, including the retention of a non - shareholder approved poison pill with an uncommon and excessive term of 10 years • 100% of Board refreshment occurred in direct reaction to activist pressure and shareholder settlements • The only way to reverse course is to join the Concerned Shareholders of Rocky Mountain Chocolate Factory to implement immediate and necessary change

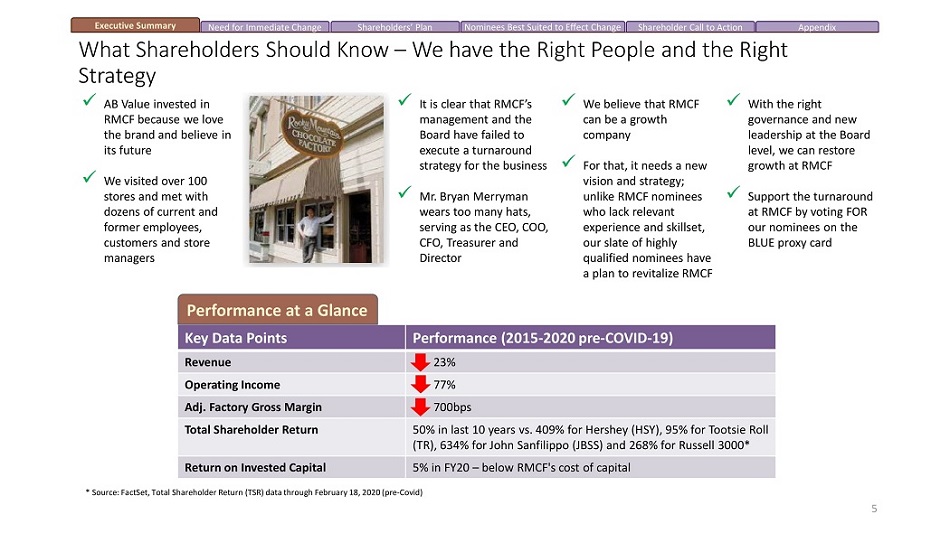

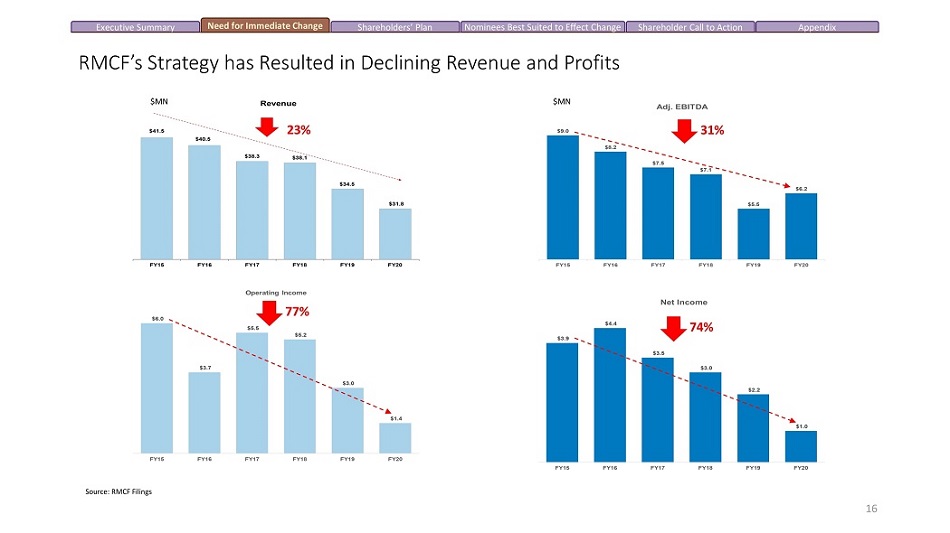

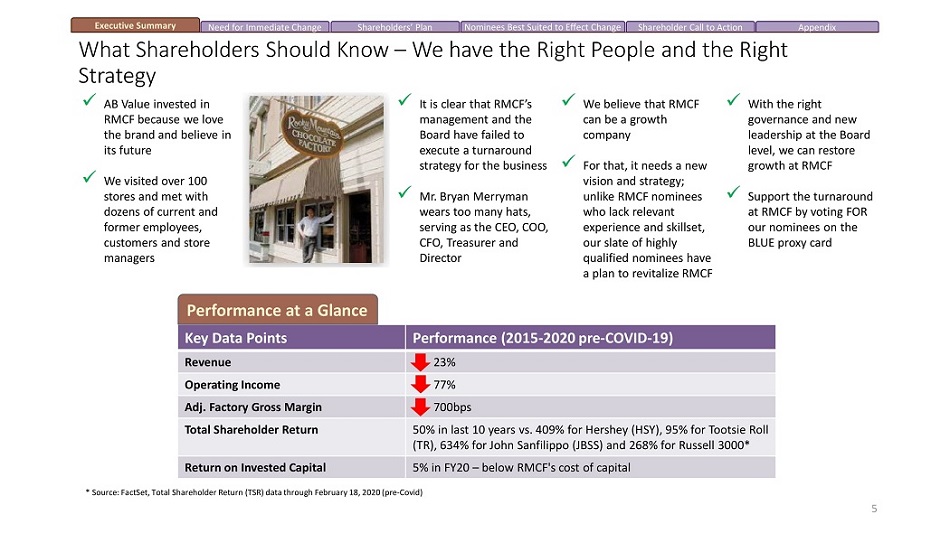

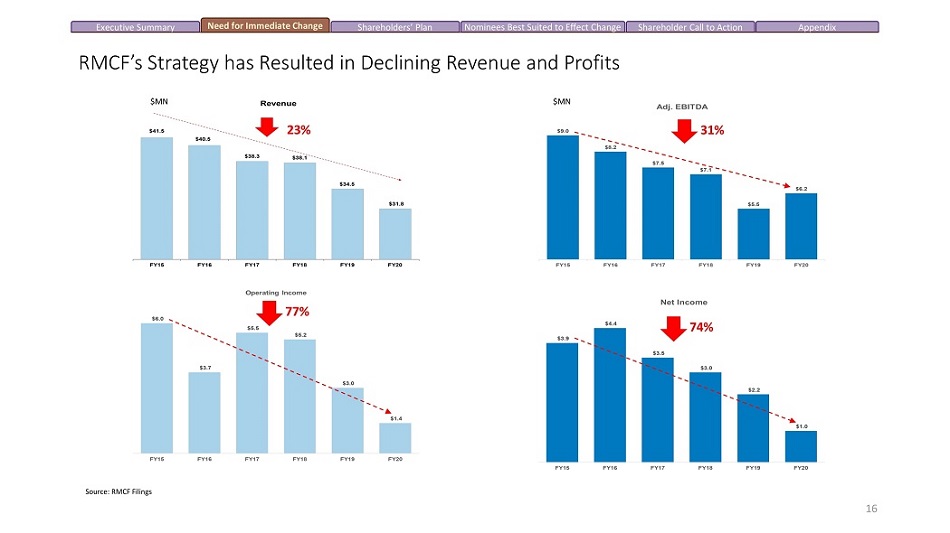

E x e cu ti v e S u mma ry Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix What Shareholders Should Know – We have the Right People and the Right Strategy x AB Value invested in RMCF because we love the brand and believe in its future x We visited over 100 stores and met with dozens of current and former employees, customers and store managers x It is clear that RMCF’s management and the Board have failed to execute a turnaround strategy for the business x Mr. Bryan Merryman wears too many hats, serving as the CEO, COO, CFO, Treasurer and Director x We believe that RMCF can be a growth company x For that, it needs a new vision and strategy; unlike RMCF nominees who lack relevant experience and skillset, our slate of highly qualified nominees have a plan to revitalize RMCF x With the right governance and new leadership at the Board level, we can restore growth at RMCF x Support the turnaround at RMCF by voting FOR our nominees on the BLUE proxy card Performance at a Glance Key Data Points Performance (2015 - 2020 pre - COVID - 19) Revenue 23% Operating Income 77% Adj. Factory Gross Margin 700bps Total Shareholder Return 50% in last 10 years vs. 409% for Hershey (HSY), 95% for Tootsie Roll (TR), 634% for John Sanfilippo (JBSS) and 268% for Russell 3000* Return on Invested Capital 5% in FY20 – below RMCF's cost of capital 5 * Source: FactSet, Total Shareholder Return (TSR) data through February 18, 2020 (pre - Covid)

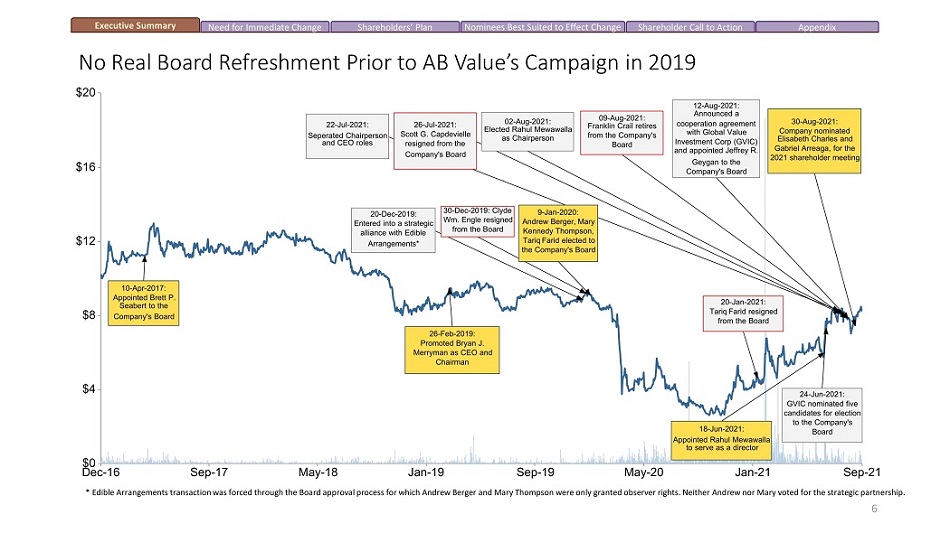

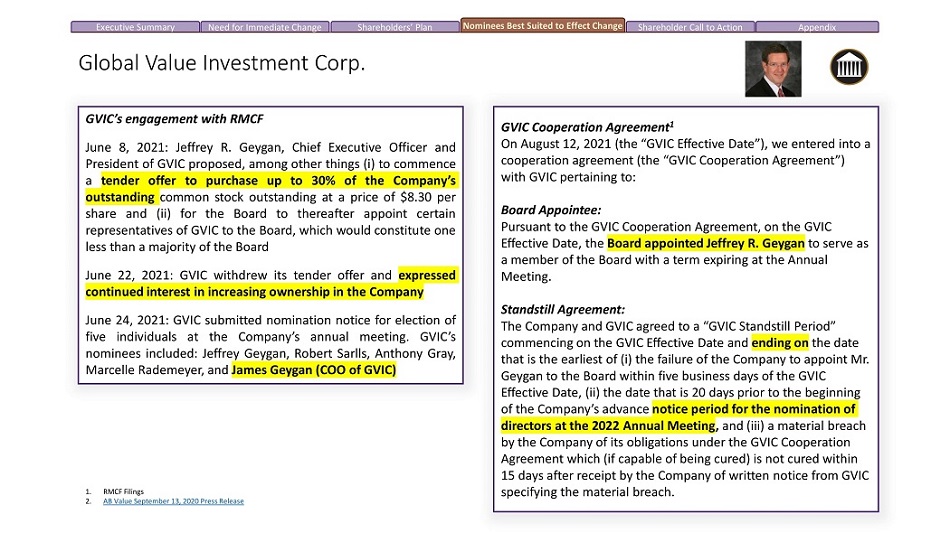

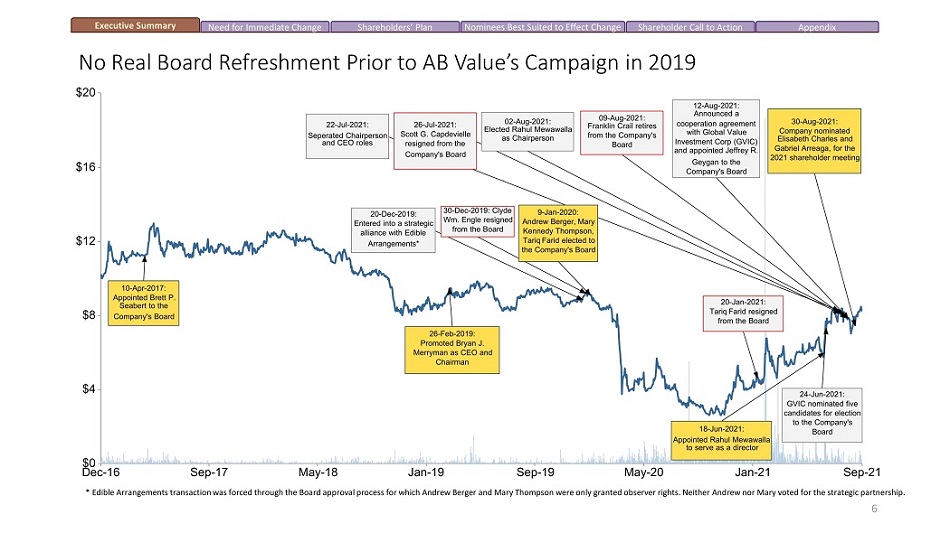

E x e cu ti v e S u mma ry Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix No Real Board Refreshment Prior to AB Value’s Campaign in 2019 $0 Dec - 16 Sep - 17 May - 18 Jan - 19 Sep - 19 May - 20 Jan - 21 Sep - 21 * Edible Arrangements transaction was forced through the Board approval process for which Andrew Berger and Mary Thompson were only granted observer rights. Neither Andrew nor Mary voted for the strategic partnership. $4 $12 $16 $20 10 - Apr - 2017: Appointed Brett P. Seabert to the $8 Company's Board 26 - Feb - 2019: Promoted Bryan J. Merryman as CEO and Chairman 9 - Jan - 2020: Andrew Berger, Mary Kennedy Thompson, Tariq Farid electe d to the Company's Board 20 - Dec - 2019: Entered into a strategic alliance with Edible Arrangements* 20 - Jan - 2021: Tariq Farid resigned from the Board 18 - Jun - 2021: Appointed Rahul Mewawalla to serve as a director 24 - Jun - 2021: GVIC nominated five candidates for election to the Company's Board 22 - Jul - 2021: Seperated Chairperson and CEO roles 26 - Jul - 2021: Scott G. Capdevielle resigned from the Company's Board 02 - Aug - 2021: Elected Rahul Mewawalla as Chairperson 6 09 - Aug - 2021: Franklin Crail retires from the Company's Board 12 - Aug - 2021: Announced a cooperation agreement with Global Value Investment Corp (GVIC) and appointed Jeffrey R. Geygan to the Company's Board 30 - Aug - 2021: Company nominated Elisabeth Charles and Gabriel Arreaga, for the 2021 shareholder meeting 30 - Dec - 2019: Clyde Wm. Engle resigned from the Board

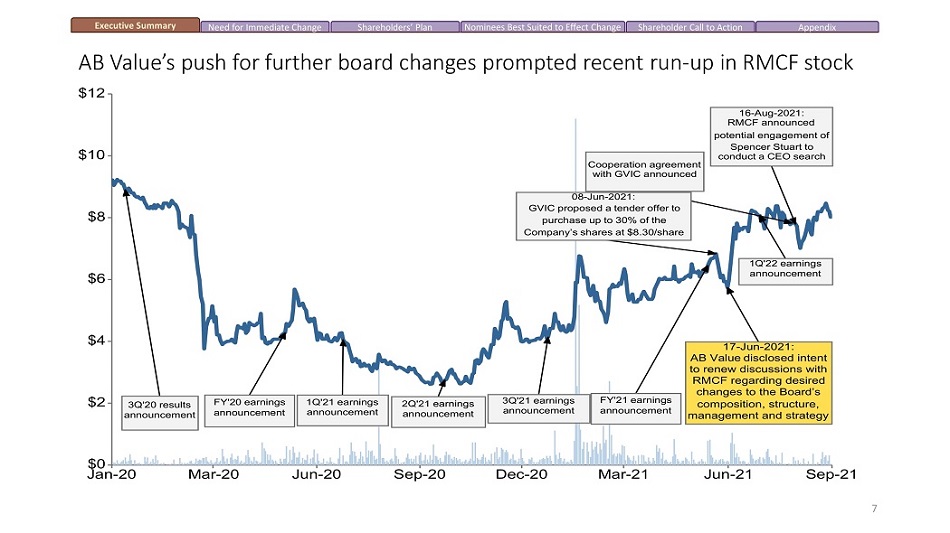

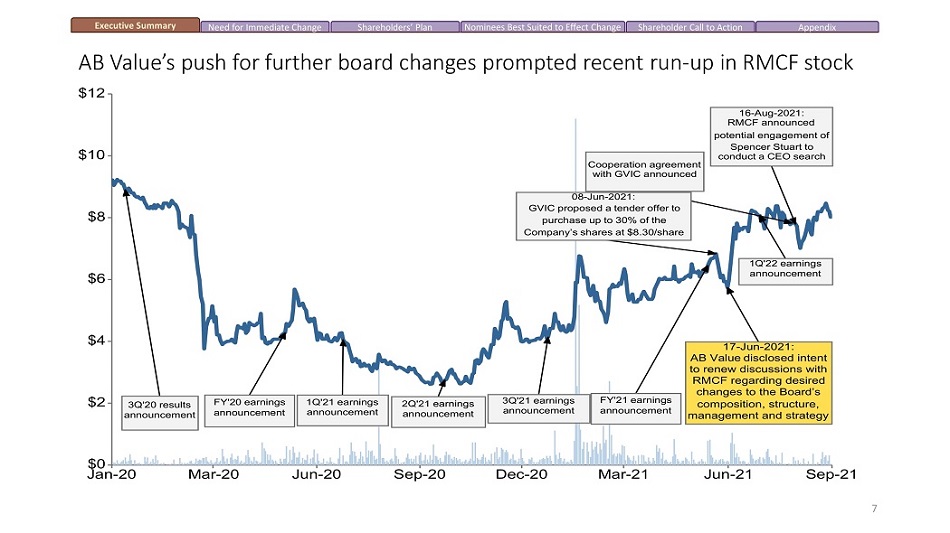

E x e cu ti v e S u mma ry Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix AB Value’s push for further board changes prompted recent run - up in RMCF stock Jan - 20 Mar - 20 Jun - 20 Sep - 20 Dec - 20 Mar - 21 Jun - 21 Sep - 21 $0 $2 $4 $6 $8 $10 $12 3Q'20 results announcement FY'20 earnings announcement 1Q'21 earnings announcement 2Q'21 earnings announcement 3Q'21 earnings announcement FY'21 earnings announcement 1Q'22 earnings announcement Cooperation agreement with GVIC announced 08 - Jun - 2021: GVIC proposed a tender offer to purchase up to 30% of the Company’s shares at $8.30/share 17 - Jun - 2021: AB Value disclosed intent to renew discussions with RMCF regarding desired changes to the Board’s composition, structure, management and strategy 16 - Aug - 2021: RMCF announced potential engagement of Spencer Stuart to conduct a CEO search 7

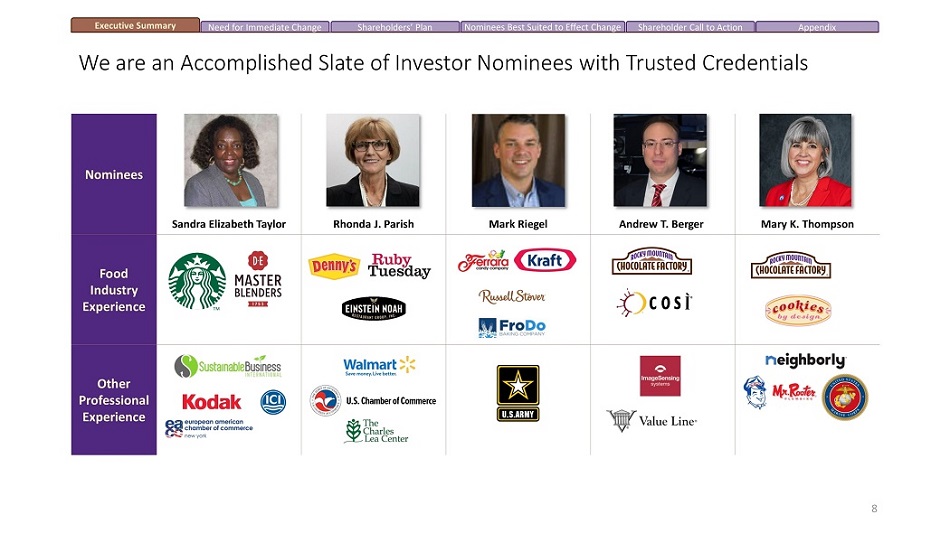

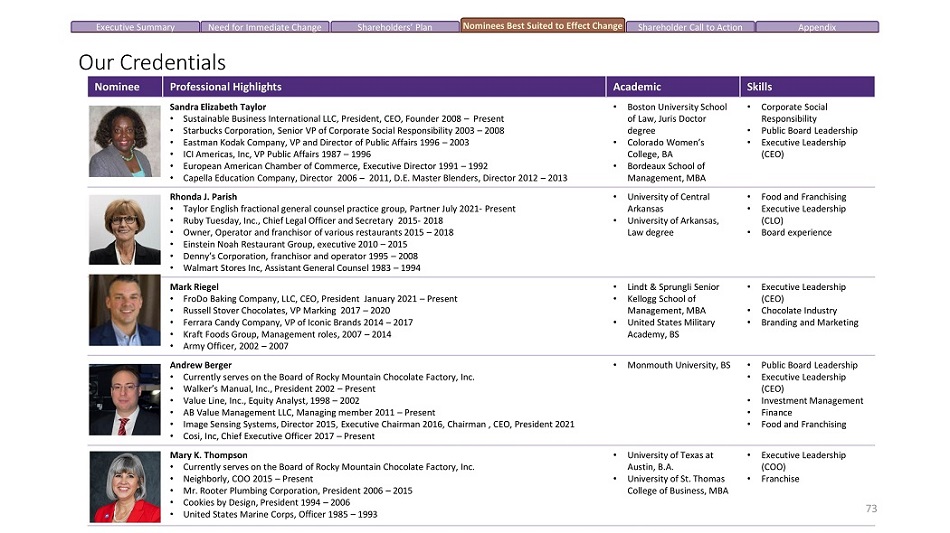

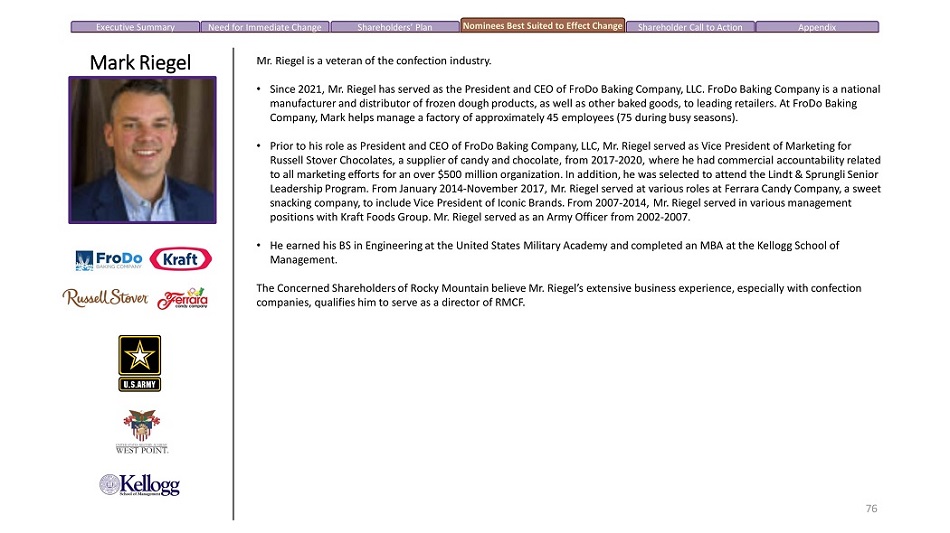

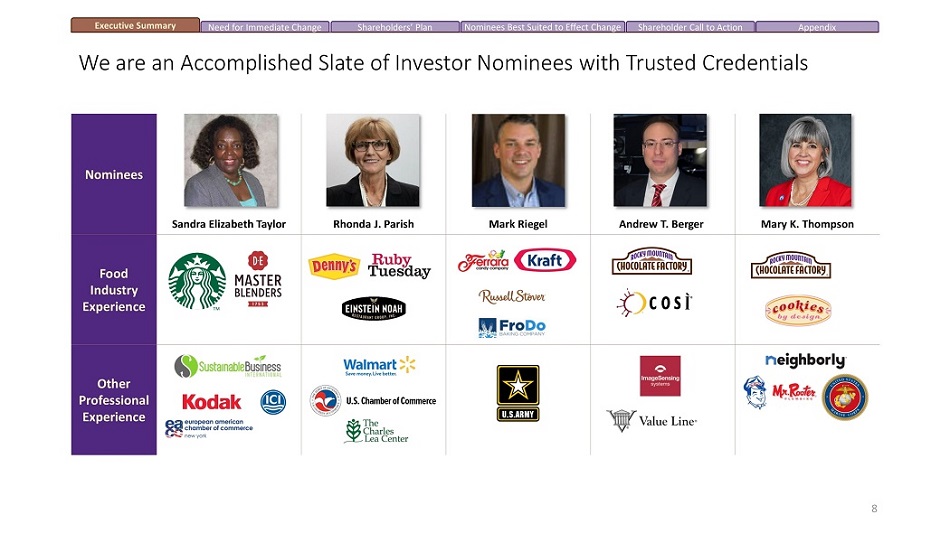

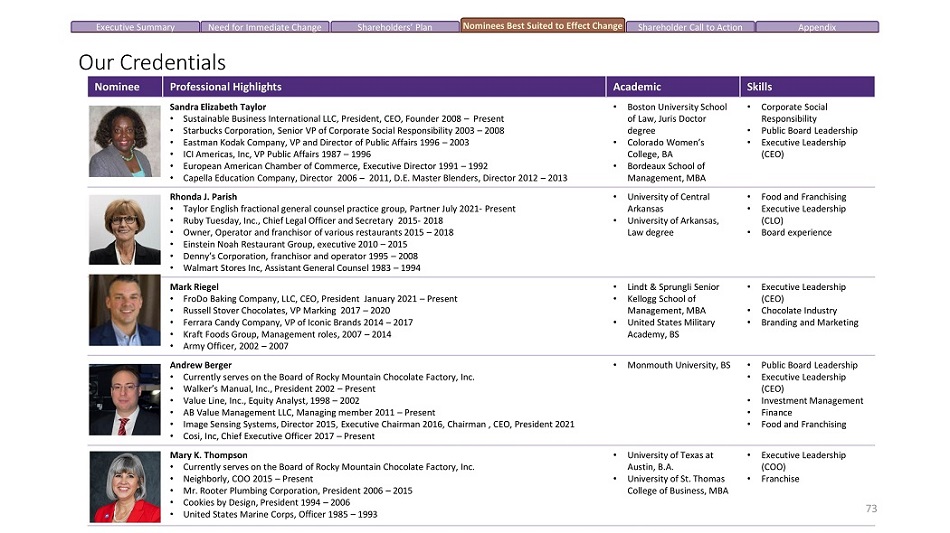

E x e cu ti v e S u mma ry Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix We are an Accomplished Slate of Investor Nominees with Trusted Credentials Nominees Sandra Elizabeth Taylor Rhonda J. Parish Mark Riegel A nd r e w T . B e rg er Mary K. Thompson Food Industry Ex p e r ie n c e Other P r o f e ss i ona l Experience 8

E x e cu ti v e S u mma ry Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix Vote the Blue Proxy Card THE CONCERNED SHAREHOLDERS OF ROCKY MOUNTAIN RECOMMEND A VOTE “FOR” THE NOMINEES LISTED IN PROPOSAL 1, “FOR” PROPOSAL 2, “AGAINST” PROPOSAL 3 AND “FOR” PROPOSAL 4 1. THE CONCERNED SHAREHOLDERS OF ROCKY MOUNTAIN’S PROPOSAL TO ELECT DIRECTORS: 9 FOR ALL NOMINEES WITHHOLD AUTHORITY TO VOTE FOR ALL NOMINEES FOR ALL NOMINEES EXCEPT WRITTEN BELOW No mi n ee s : A nd r e w T . B e rg er Rhonda J . Parish Mark Riegel Sandra Elizabeth Taylor Mary Kennedy Thompson [ ] [ ] 3. COMPANY’S PROPOSAL TO APPROVE THE COMPENSATION OF THE COMPANY’S NAMED EXECUTIVE OFFICERS: FOR [ ] 4. THE CONCERNED SHAREHOLDERS OF ROCKY MOUNTAIN’S PROPOSAL TO REDEEM PREVIOUSLY ISSUED POISON PILLS AND REQUIRE STOCKHOLDER APPROVAL OF POISON PILLS: FOR AGAINST ABSTAIN [ ] [ ] [ x ] 2. COMPANY’S PROPOSAL TO RATIFY THE SELECTION OF PLANTE & MORAN PLLC AS THE COMPANY’S REGISTERED PUBLIC ACCOUNTING FIRM: FO R A G A I N S T A B S T A I N [ x ] [ ] [ ] AGAINST ABSTAIN [ x ] [ ] [ x ]

THE CONCERNED SHAREHOLDERS OF AB Value Partners, LP & AB Value Management LLC Bradley Radoff Executive Summary Need for Immediate Change Shareholders' Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix 10

11 Need For Immediate Change - TSR and Financial Underperformance

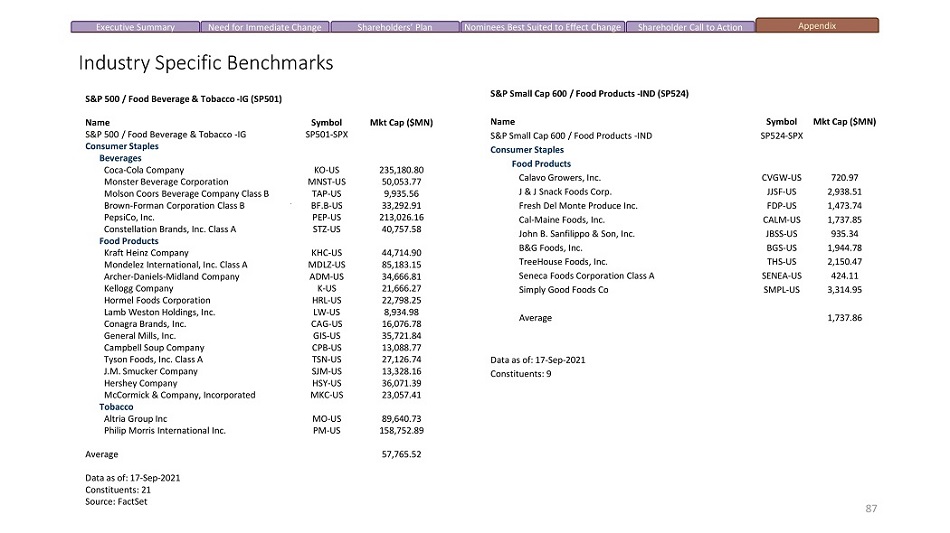

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix Prior to AB Value’s Involvement, RMCF Sustained Prolonged Periods of Underperformance Source: FactSet, TSR as of April 26, 2019; see Appendix for details on S&P500 Small Cap 600 – Food Products and S&P500 Food Beverage & Tobacco 12 1889%

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix RMCF Consistently Underperformed Before COVID - 19 Source: FactSet, TSR as of February 18, 2020 (pre - COVID - 19) 13 634%

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix Bryan Merryman has Failed to Deliver as the CEO S ou rce: F a c tS et Bryan Merryman’s CEO tenure until pre - COVID Bryan Merryman’s CEO’s tenure until AB Value’s 2 nd Intent to Nominate 14

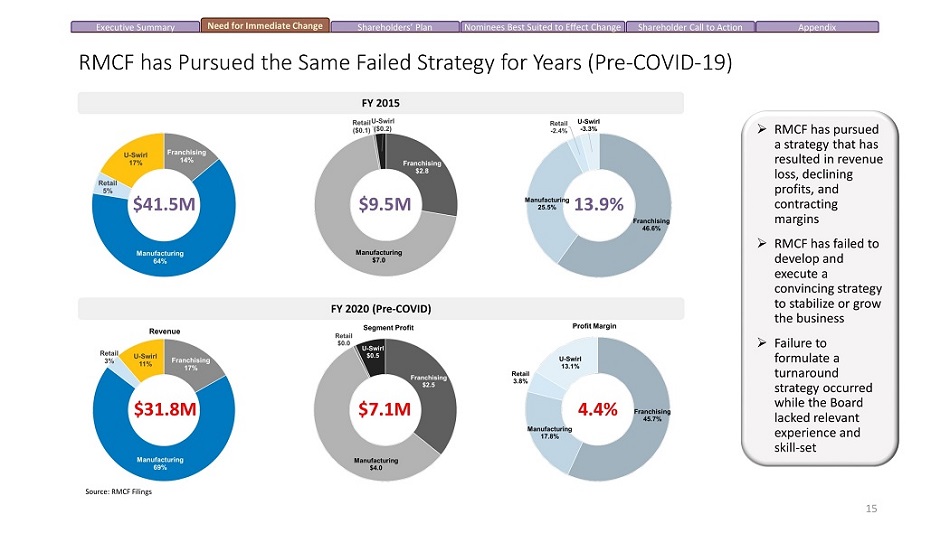

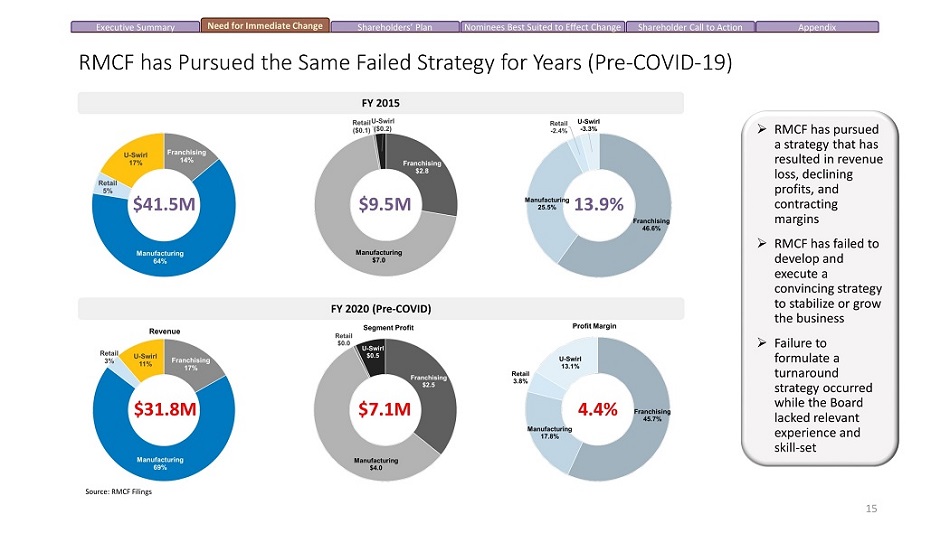

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix RMCF has Pursued the Same Failed Strategy for Years (Pre - COVID - 19) » RMCF has pursued a strategy that has resulted in revenue loss, declining profits, and contracting margins » RMCF has failed to develop and execute a c o n v i n c i ng s t r a t egy to stabilize or grow the business » Failure to formulate a turnaround strategy occurred while the Board lacked relevant experience and skill - set $41.5M $9.5M 13.9% $31.8M $7.1M 4.4% FY 2015 FY 2020 (Pre - COVID) Source: RMCF Filings 15

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix 31% $ M N RMCF’s Strategy has Resulted in Declining Revenue and Profits 23% $ M N 77% 74% Source: RMCF Filings 16

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix The Revenue Decline is Across ALL Major Reported Segments 24% 23% Source: RMCF Filings 17

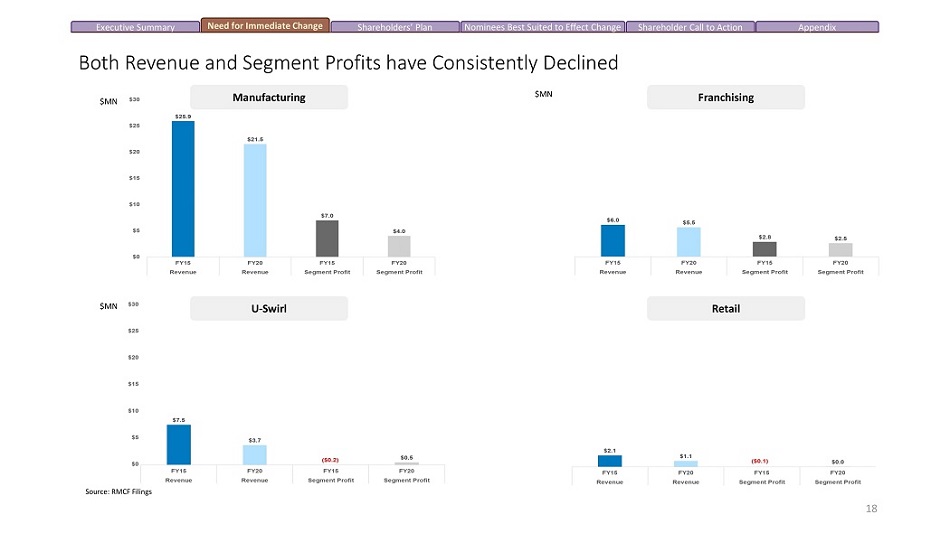

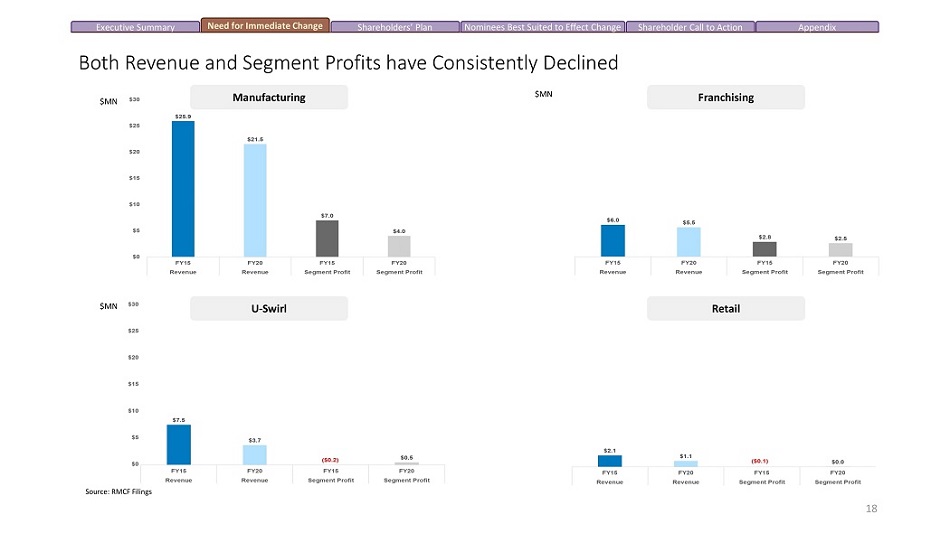

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix Retail Both Revenue and Segment Profits have Consistently Declined $ M N $ M N Franchising U - Swirl Source: RMCF Filings 18 Manufacturing $ M N

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix RMCF has Failed to Keep up with Competitors and has Missed Market Growth Opportunities 19 x Roughly one - third of consumers increased their chocolat e consumption as a result of COVID - 19 Competitor FY2019 FY2020 $13.4 billion $14.5 billion 3 Chocolate sales only $8.2 billion $8.2 billion x The chocolate market is expected to surpass $20 billion by 2025 1 S ou rce: 1. F oo d D iv e A r t i c le 2. Candy Industry Article 3. Ferraro Corporate Website x IRI’s data show gift box chocolate generated just over $317 million in the 52 weeks ending June 13, up 12.9% from a year ago 2 x Chocolate sales grew 4.2% during the pandemic 1 Hershey – Total Revenue ($Bn)

20 Need For Immediate Change - Strategy Failures

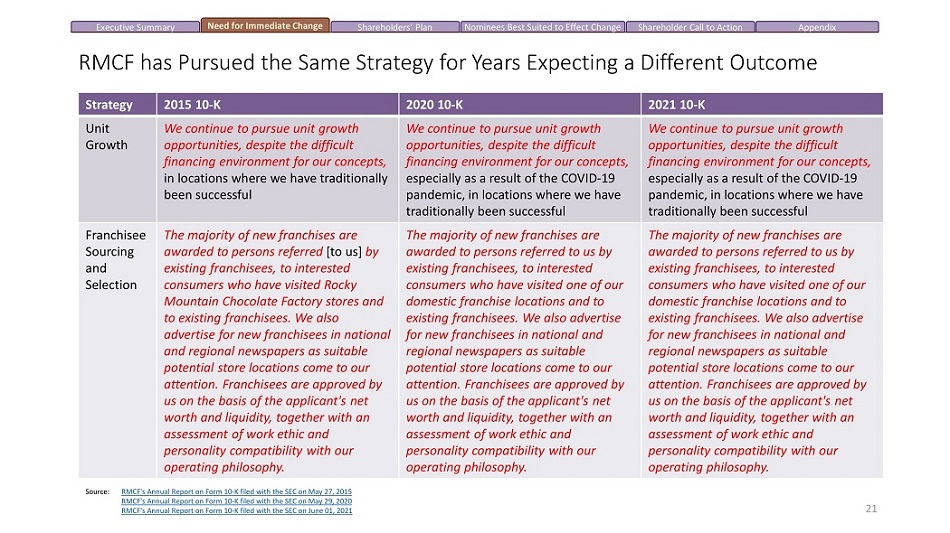

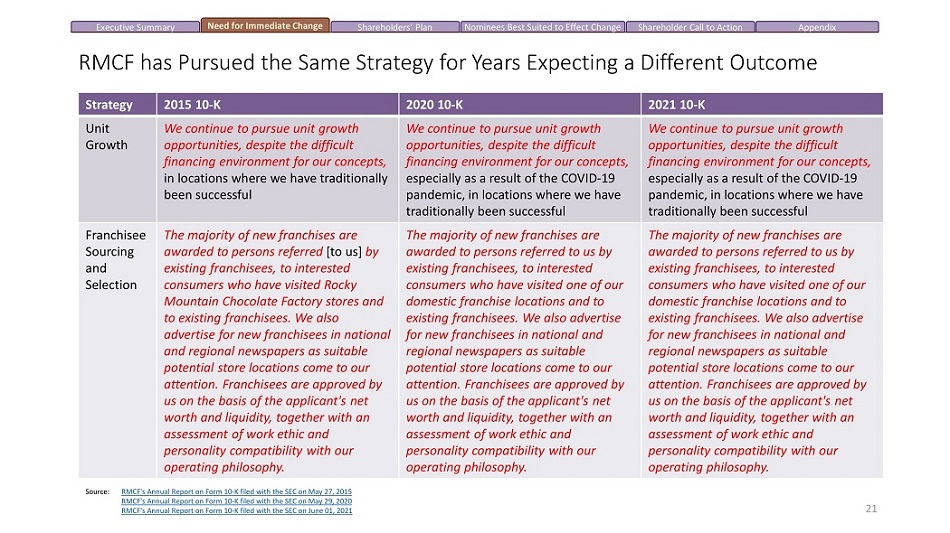

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix RMCF has Pursued the Same Strategy for Years Expecting a Different Outcome 21 Strategy 2015 10 - K 2020 10 - K 2021 10 - K Unit G r o w t h We continue to pursue unit growth opportunities, despite the difficult financing environment for our concepts, in locations where we have traditionally been successful We continue to pursue unit growth opportunities, despite the difficult financing environment for our concepts, especially as a result of the COVID - 19 pandemic, in locations where we have traditionally been successful We continue to pursue unit growth opportunities, despite the difficult financing environment for our concepts, especially as a result of the COVID - 19 pandemic, in locations where we have traditionally been successful F r a n c h i s ee Sourcing and Selection The majority of new franchises are awarded to persons referred [to us] by existing franchisees, to interested consumers who have visited Rocky Mountain Chocolate Factory stores and to existing franchisees. We also advertise for new franchisees in national and regional newspapers as suitable potential store locations come to our attention. Franchisees are approved by us on the basis of the applicant's net worth and liquidity, together with an assessment of work ethic and personality compatibility with our operating philosophy. The majority of new franchises are awarded to persons referred to us by existing franchisees, to interested consumers who have visited one of our domestic franchise locations and to existing franchisees. We also advertise for new franchisees in national and regional newspapers as suitable potential store locations come to our attention. Franchisees are approved by us on the basis of the applicant's net worth and liquidity, together with an assessment of work ethic and personality compatibility with our operating philosophy. The majority of new franchises are awarded to persons referred to us by existing franchisees, to interested consumers who have visited one of our domestic franchise locations and to existing franchisees. We also advertise for new franchisees in national and regional newspapers as suitable potential store locations come to our attention. Franchisees are approved by us on the basis of the applicant's net worth and liquidity, together with an assessment of work ethic and personality compatibility with our operating philosophy. S ou rce: RMCF's Annual Report on Form 10 - K filed with the SEC on May 27 , 2015 RMCF's Annual Report on Form 10 - K filed with the SEC on May 29 , 2020 RMCF's Annual Report on Form 10 - K filed with the SEC on June 01 , 2021

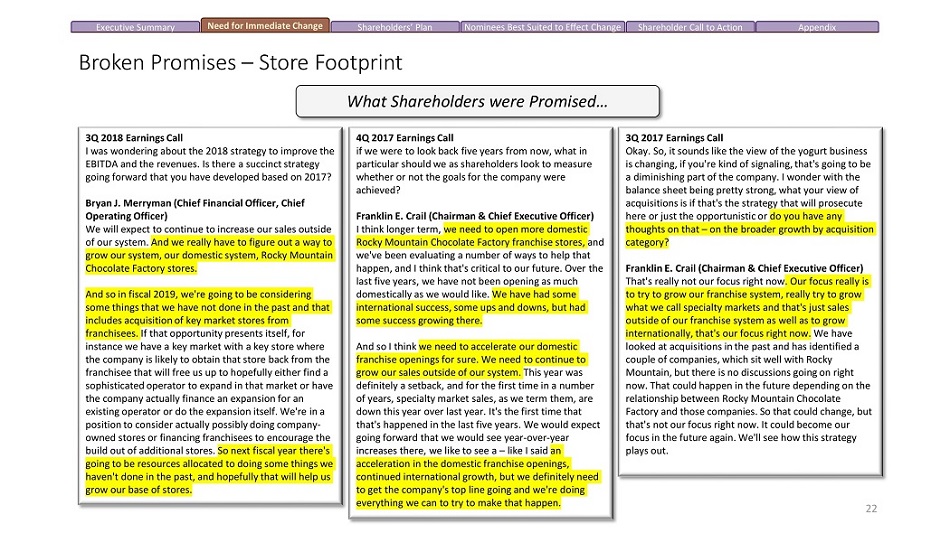

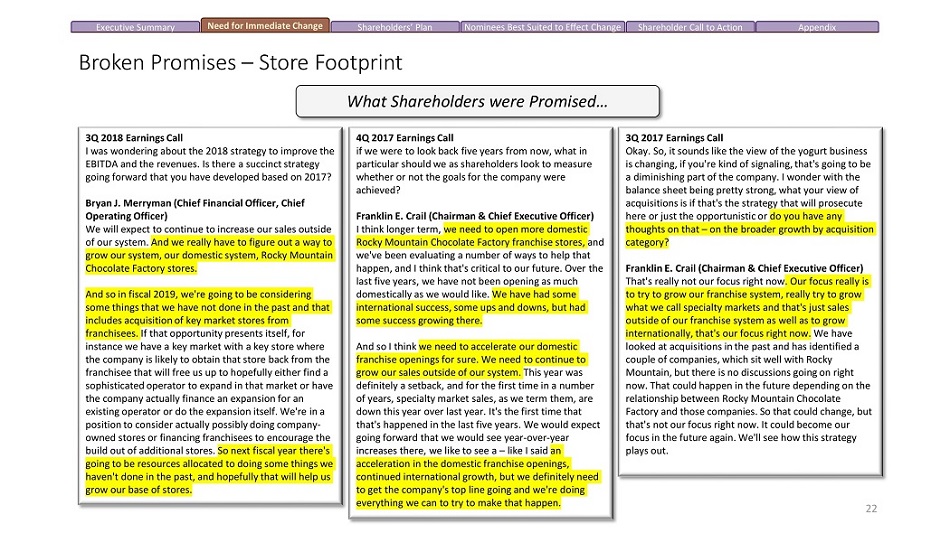

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix Broken Promises – Store Footprint 22 3Q 2018 E a rnin g s Ca l l I was wondering about the 2018 strategy to improve the EBITDA and the revenues. Is there a succinct strategy going forward that you have developed based on 2017? Bryan J . Merryman (Chief Financial Officer, Chief Operating Officer) We will expect to continue to increase our sales outside of our system . And we really have to figure out a way to grow our system, our domestic system, Rocky Mountain Chocolate Factory stores . And so in fiscal 2019, we're going to be considering some things that we have not done in the past and that includes acquisition of key market stores from franchisees. If that opportunity presents itself, for instance we have a key market with a key store where the company is likely to obtain that store back from the franchisee that will free us up to hopefully either find a sophisticated operator to expand in that market or have the company actually finance an expansion for an existing operator or do the expansion itself. We're in a position to consider actually possibly doing company - owned stores or financing franchisees to encourage the build out of additional stores. So next fiscal year there's going to be resources allocated to doing some things we haven't done in the past, and hopefully that will help us grow our base of stores. 4Q 2017 E a rnin g s Ca l l if we were to look back five years from now, what in particular should we as shareholders look to measure whether or not the goals for the company were achieved? Franklin E. Crail (Chairman & Chief Executive Officer) I think longer term, we need to open more domestic Rocky Mountain Chocolate Factory franchise stores, and we've been evaluating a number of ways to help that happen, and I think that's critical to our future. Over the last five years, we have not been opening as much domestically as we would like. We have had some international success, some ups and downs, but had some success growing there. And so I think we need to accelerate our domestic franchise openings for sure. We need to continue to grow our sales outside of our system. This year was definitely a setback, and for the first time in a number of years, specialty market sales, as we term them, are down this year over last year. It's the first time that that's happened in the last five years. We would expect going forward that we would see year - over - year increases there, we like to see a – like I said an acceleration in the domestic franchise openings, continued international growth, but we definitely need to get the company's top line going and we're doing everything we can to try to make that happen. What Shareholders were Promised… 3Q 2017 E a rnin g s Ca l l Okay. So, it sounds like the view of the yogurt business is changing, if you're kind of signaling, that's going to be a diminishing part of the company. I wonder with the balance sheet being pretty strong, what your view of acquisitions is if that's the strategy that will prosecute here or just the opportunistic or do you have any thoughts on that – on the broader growth by acquisition category? Franklin E. Crail (Chairman & Chief Executive Officer) That's really not our focus right now. Our focus really is to try to grow our franchise system, really try to grow what we call specialty markets and that's just sales outside of our franchise system as well as to grow internationally, that's our focus right now. We have looked at acquisitions in the past and has identified a couple of companies, which sit well with Rocky Mountain, but there is no discussions going on right now. That could happen in the future depending on the relationship between Rocky Mountain Chocolate Factory and those companies. So that could change, but that's not our focus right now. It could become our focus in the future again. We'll see how this strategy plays out.

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix Broken Promises – Store Footprint (contd.) Stores open as of year end FY15 FY16 FY17 FY18 FY19 FY20 FY21 Rocky Mountain Chocolate Factory Franchise Stores (domestic stores + domestic kiosks) 201 195 189 183 183 176 158 Company - Owned Stores 4 3 4 5 2 2 2 Cold Stone Creamery Co - branded 68 76 83 87 91 98 96 International License Stores 72 79 94 67 64 61 53 Total Rocky Mountain 345 353 370 342 340 337 309 U - Swirl Franchise Stores (franchised and licensed) 232 202 145 115 96 80 71 Company - Owned Stores (owned and co branded) 10 8 5 5 4 4 3 International License Stores 6 8 2 1 2 2 1 T o t a l U - S wi rl 248 218 152 121 102 86 75 Total No. of Stores 593 571 522 463 442 423 384 What Management delivered x Rocky Mountain franchised stores declined from 201 in FY15 to 176 in FY20 x No meaningful change in company owned stores (2 in FY20) x International licensed stores fell from 72 in FY15 to 61 in FY20 x The number of U - Swirl stores fell from 248 in FY15 to 86 in FY20 23

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix Broken Promises – Store Footprint (contd.) What Management delivered (cont.) x Declining Factory Utilization due to 20 Quarters of Negative Growth in Store Level Volumes 24 Source: RMCF Filings

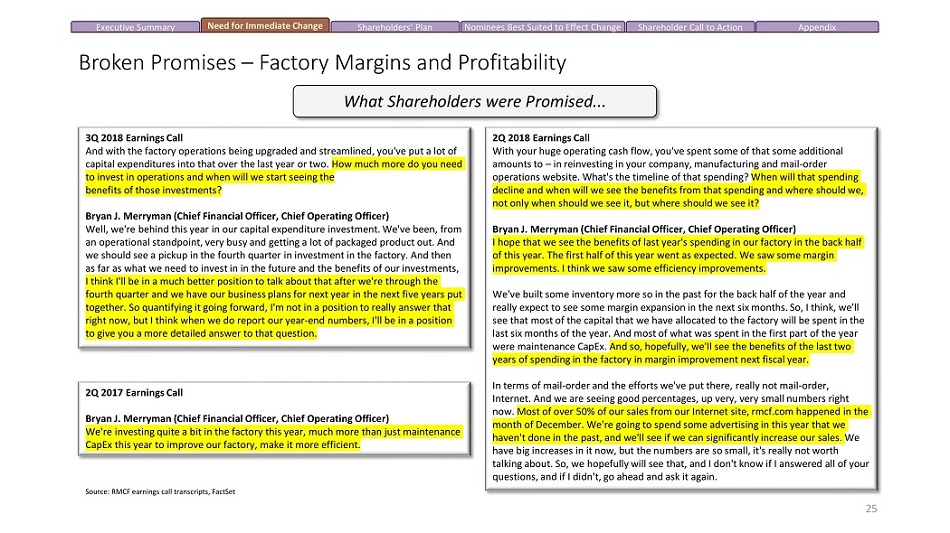

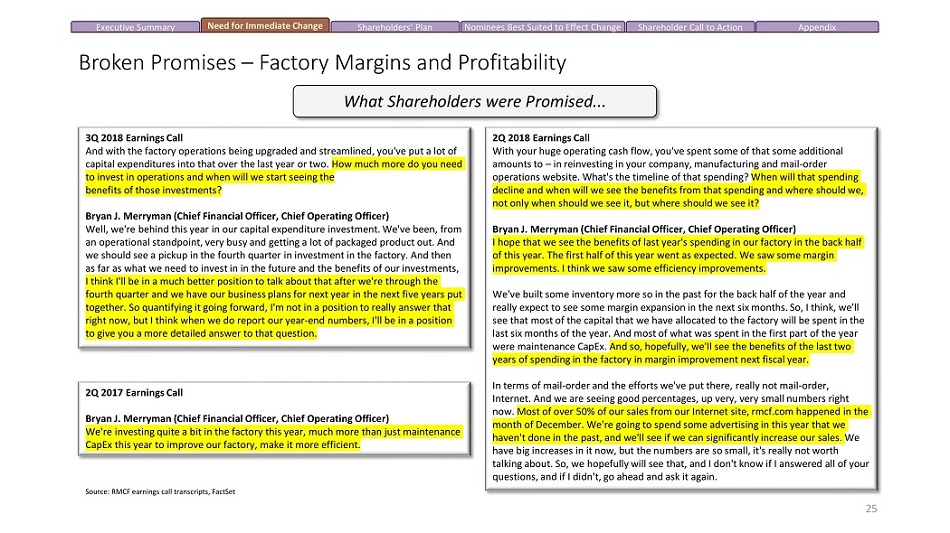

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix Broken Promises – Factory Margins and Profitability 2Q 2018 E a rnin g s Ca l l With your huge operating cash flow, you've spent some of that some additional amounts to – in reinvesting in your company, manufacturing and mail - order operations website. What's the timeline of that spending? When will that spending decline and when will we see the benefits from that spending and where should we, not only when should we see it, but where should we see it? Bryan J. Merryman (Chief Financial Officer, Chief Operating Officer) I hope that we see the benefits of last year's spending in our factory in the back half of this year. The first half of this year went as expected. We saw some margin improvements. I think we saw some efficiency improvements. We've built some inventory more so in the past for the back half of the year and really expect to see some margin expansion in the next six months. So, I think, we'll see that most of the capital that we have allocated to the factory will be spent in the last six months of the year. And most of what was spent in the first part of the year were maintenance CapEx. And so, hopefully, we'll see the benefits of the last two years of spending in the factory in margin improvement next fiscal year. In terms of mail - order and the efforts we've put there, really not mail - order, Internet. And we are seeing good percentages, up very, very small numbers right now. Most of over 50% of our sales from our Internet site, rmcf.com happened in the month of December. We're going to spend some advertising in this year that we haven't done in the past, and we'll see if we can significantly increase our sales. We have big increases in it now, but the numbers are so small, it's really not worth talking about. So, we hopefully will see that, and I don't know if I answered all of your questions, and if I didn't, go ahead and ask it again. 3Q 2018 E a rnin g s Ca l l And with the factory operations being upgraded and streamlined, you've put a lot of capital expenditures into that over the last year or two. How much more do you need to invest in operations and when will we start seeing the benefits of those investments? Bryan J. Merryman (Chief Financial Officer, Chief Operating Officer) Well, we're behind this year in our capital expenditure investment. We've been, from an operational standpoint, very busy and getting a lot of packaged product out. And we should see a pickup in the fourth quarter in investment in the factory. And then as far as what we need to invest in in the future and the benefits of our investments, I think I'll be in a much better position to talk about that after we're through the fourth quarter and we have our business plans for next year in the next five years put together. So quantifying it going forward, I'm not in a position to really answer that right now, but I think when we do report our year - end numbers, I'll be in a position to give you a more detailed answer to that question. What Shareholders were Promised... 2Q 2017 E a rnin g s Ca l l Source: RMCF earnings call transcripts, FactSet 25 Bryan J. Merryman (Chief Financial Officer, Chief Operating Officer) We're investing quite a bit in the factory this year, much more than just maintenance CapEx this year to improve our factory, make it more efficient.

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix Broken Promises – Factory Margins and Profitability (contd.) What Management delivered x Adj. Factory Gross Margin contracted by 700bps b/w FY15 - FY20 x Adj. EBITDA Margin contracted by 220bps b/w FY15 - 20 Source: RMCF Filings 26

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix S ou rce: RMCF's Annual Report on Form 10 - K filed with the SEC on May 27, 2015 RMCF's Annual Report on Form 10 - K filed with the SEC on May 29, 2020 Broken Promises – Factory Margins and Profitability (contd.) “Enhanced Operating Efficiencies (FY20 10 - K) We seek to improve our profitability by controlling costs and increasing the efficiency of our operations. Efforts in the last several years include: the purchase of additional automated factory equipment, implementation of a comprehensive advanced planning and scheduling system for production scheduling, implementation of alternative manufacturing strategies, installation of enhanced point - of - sale systems in all of our Company - owned stores and the majority of our franchised stores, and implementation of a serial/lot tracking and warehouse management system. These measures have significantly improved our ability to deliver our products to our stores safely, quickly and cost - effectively and positively impact store operations. Many efforts we have taken to improve operating efficiencies have been more than offset by declines in production volume. Production volume decreased approximately 30% from FY2017 to FY2020, the result of a decrease in customers, primarily franchisees. We are hopeful that our strategic agreement with Edible will contribute positively to production volume and help us realize enhanced operating efficiencies through the utilization of excess factory capacity.” 27 RMCF's Annual Report on Form 10 - K filed with the SEC on June 01, 2021

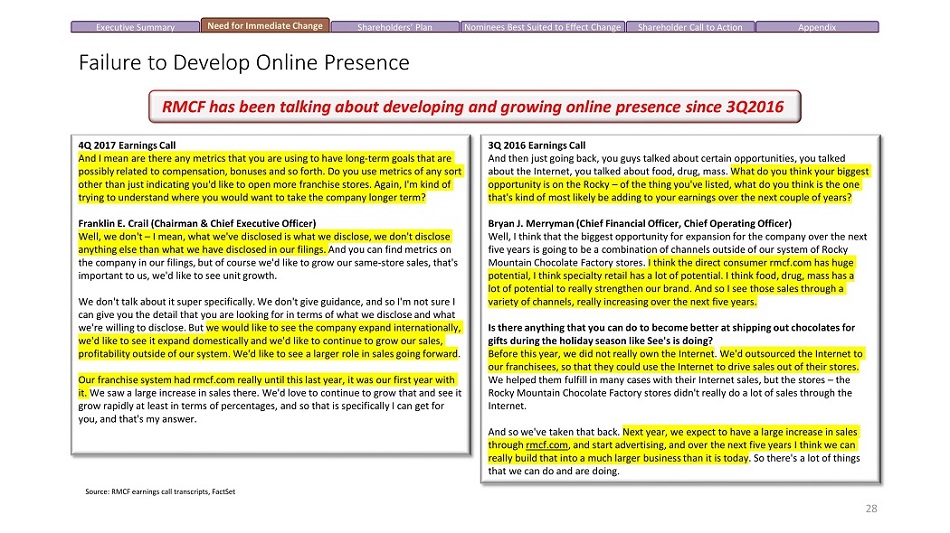

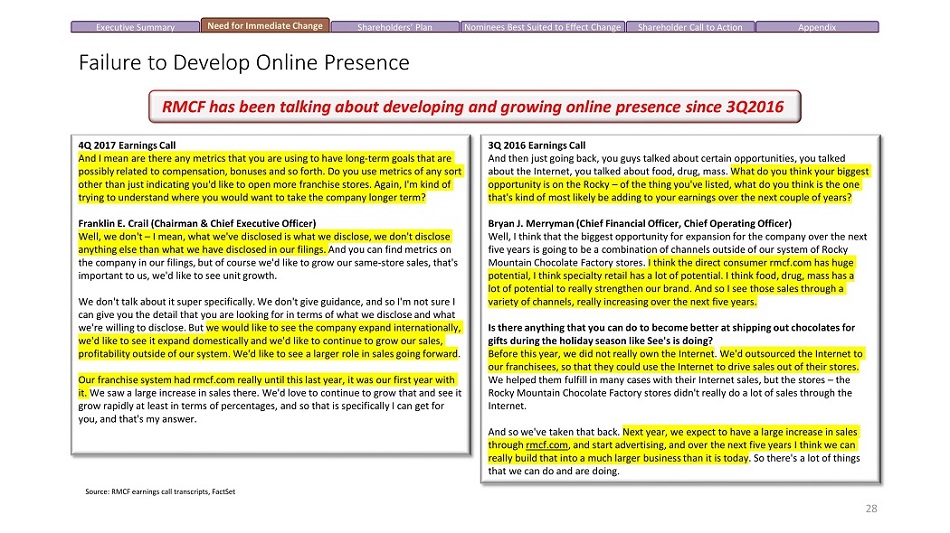

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix Failure to Develop Online Presence 4Q 2017 E a rnin g s Ca l l And I mean are there any metrics that you are using to have long - term goals that are possibly related to compensation, bonuses and so forth. Do you use metrics of any sort other than just indicating you'd like to open more franchise stores. Again, I'm kind of trying to understand where you would want to take the company longer term? Franklin E. Crail (Chairman & Chief Executive Officer) Well, we don't – I mean, what we've disclosed is what we disclose, we don't disclose anything else than what we have disclosed in our filings. And you can find metrics on the company in our filings, but of course we'd like to grow our same - store sales, that's important to us, we'd like to see unit growth. We don't talk about it super specifically. We don't give guidance, and so I'm not sure I can give you the detail that you are looking for in terms of what we disclose and what we're willing to disclose. But we would like to see the company expand internationally, we'd like to see it expand domestically and we'd like to continue to grow our sales, profitability outside of our system. We'd like to see a larger role in sales going forward. Our franchise system had rmcf.com really until this last year, it was our first year with it. We saw a large increase in sales there. We'd love to continue to grow that and see it grow rapidly at least in terms of percentages, and so that is specifically I can get for you, and that's my answer. 3Q 2016 E a rnin g s Ca l l And then just going back, you guys talked about certain opportunities, you talked about the Internet, you talked about food, drug, mass. What do you think your biggest opportunity is on the Rocky – of the thing you've listed, what do you think is the one that's kind of most likely be adding to your earnings over the next couple of years? Bryan J. Merryman (Chief Financial Officer, Chief Operating Officer) Well, I think that the biggest opportunity for expansion for the company over the next five years is going to be a combination of channels outside of our system of Rocky Mountain Chocolate Factory stores. I think the direct consumer rmcf.com has huge potential, I think specialty retail has a lot of potential. I think food, drug, mass has a lot of potential to really strengthen our brand. And so I see those sales through a variety of channels, really increasing over the next five years. Is there anything that you can do to become better at shipping out chocolates for gifts during the holiday season like See's is doing? Before this year, we did not really own the Internet. We'd outsourced the Internet to our franchisees, so that they could use the Internet to drive sales out of their stores. We helped them fulfill in many cases with their Internet sales, but the stores – the Rocky Mountain Chocolate Factory stores didn't really do a lot of sales through the Internet. And so we've taken that back . Next year, we expect to have a large increase in sales through rmcf . com, and start advertising, and over the next five years I think we can really build that into a much larger business than it is today . So there's a lot of things that we can do and are doing . RMCF has been talking about developing and growing online presence since 3Q2016 28 Source: RMCF earnings call transcripts, FactSet

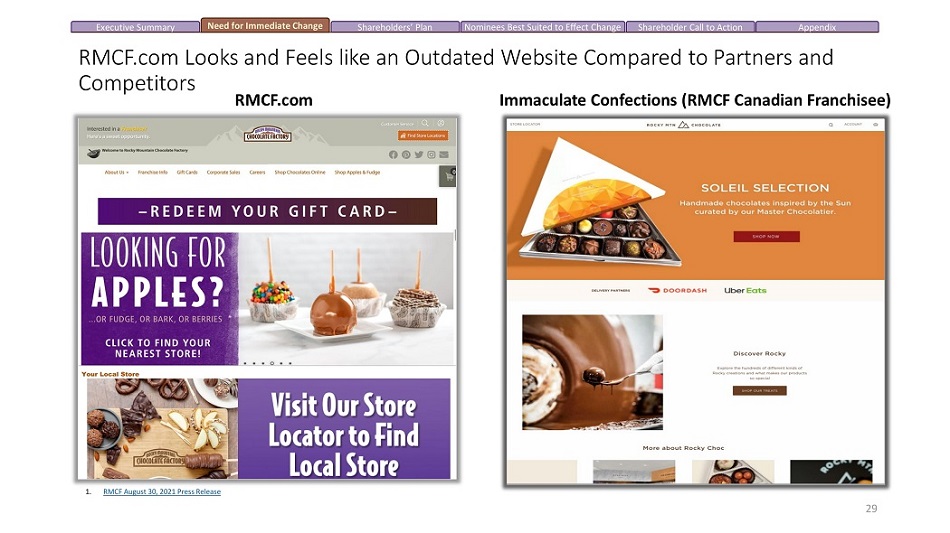

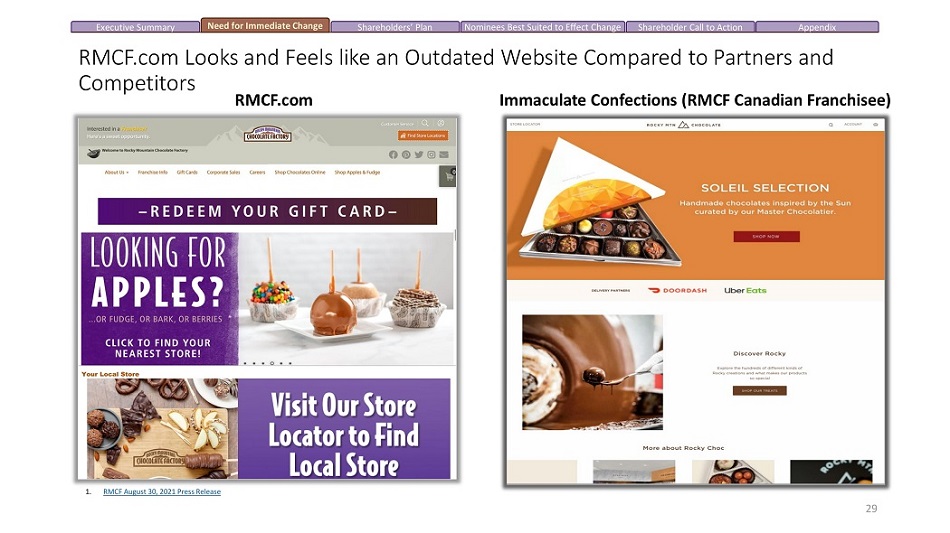

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix RMCF.com Looks and Feels like an Outdated Website Compared to Partners and Competitors RMCF.com Immaculate Confections (RMCF Canadian Franchisee) 1. RMCF August 30, 2021 Press Release 29

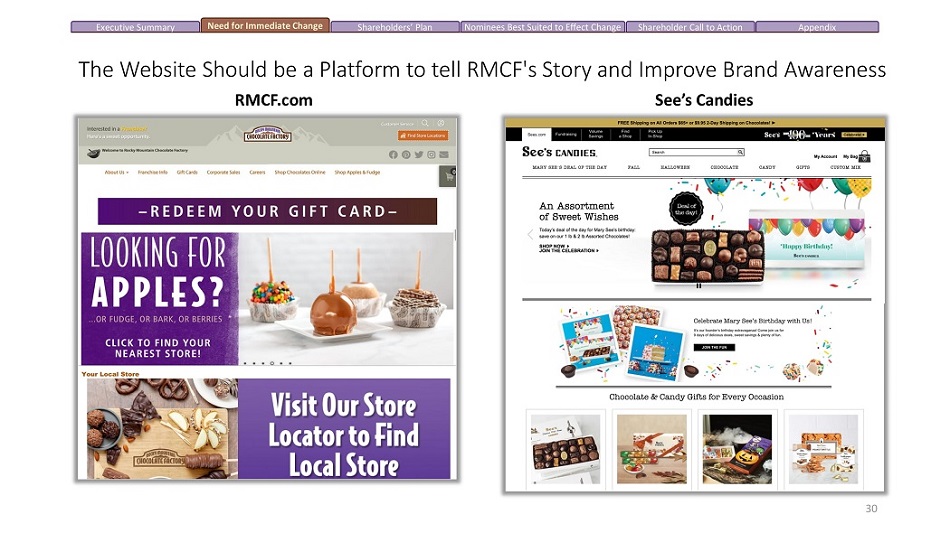

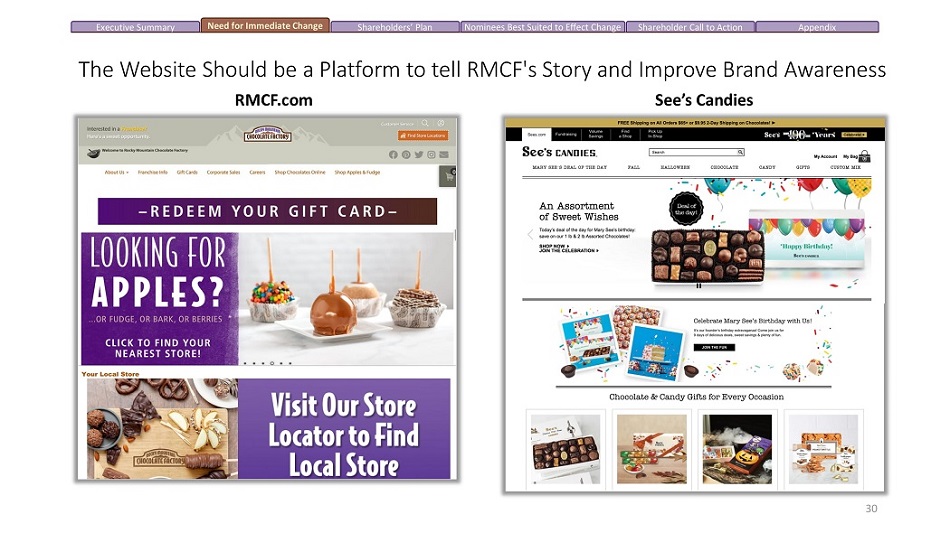

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix The Website Should be a Platform to tell RMCF's Story and Improve Brand Awareness RMCF.com See’s Candies 30

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix The Website Omits Strategic Marketing and E - commerce Opportunities for the Holidays RMCF.com Godiva Chocolates 31

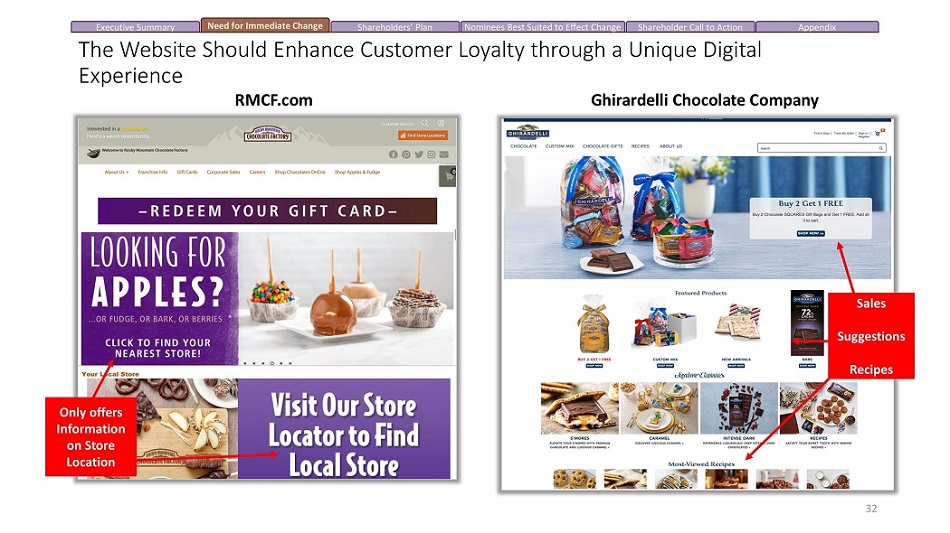

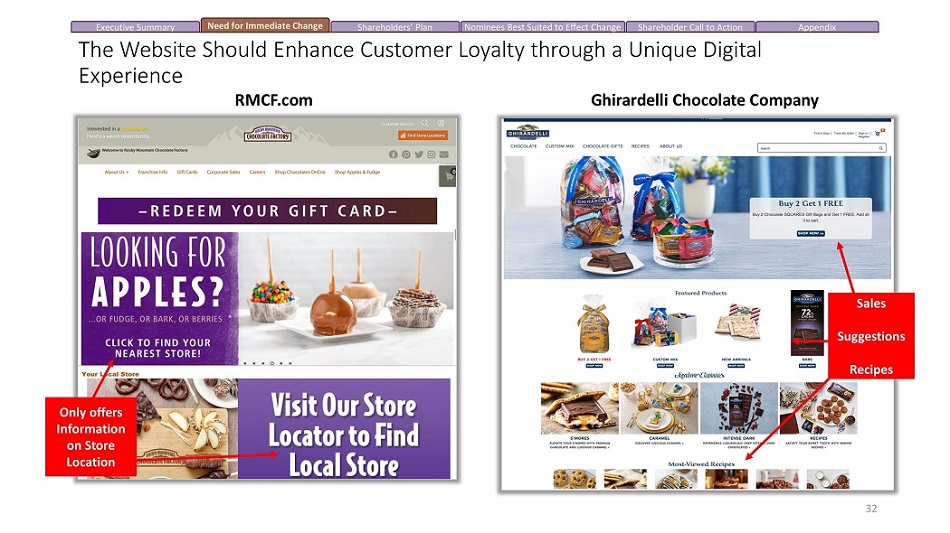

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix Sales S u g g e s t i on s Recipes Only offers In f o rm a t i on on Store Location The Website Should Enhance Customer Loyalty through a Unique Digital Experience RMCF.com Ghirardelli Chocolate Company 32

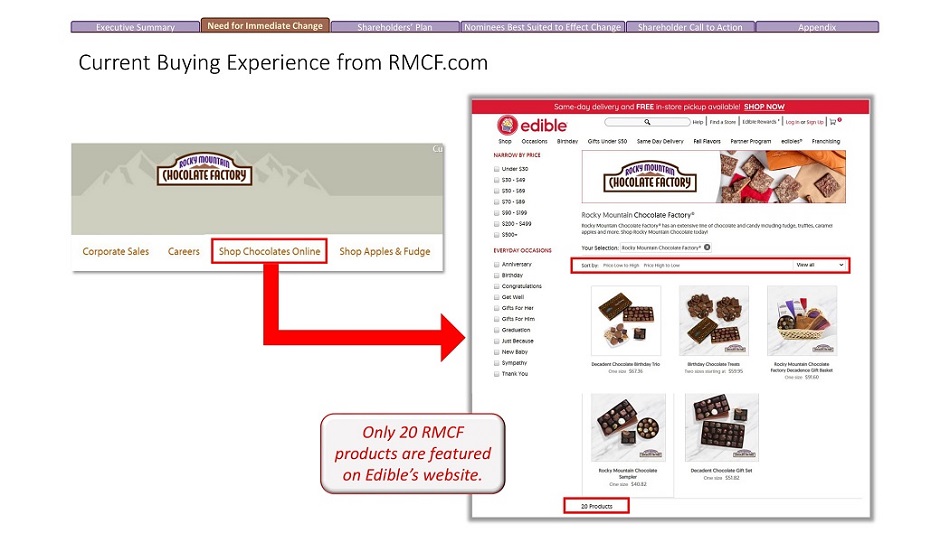

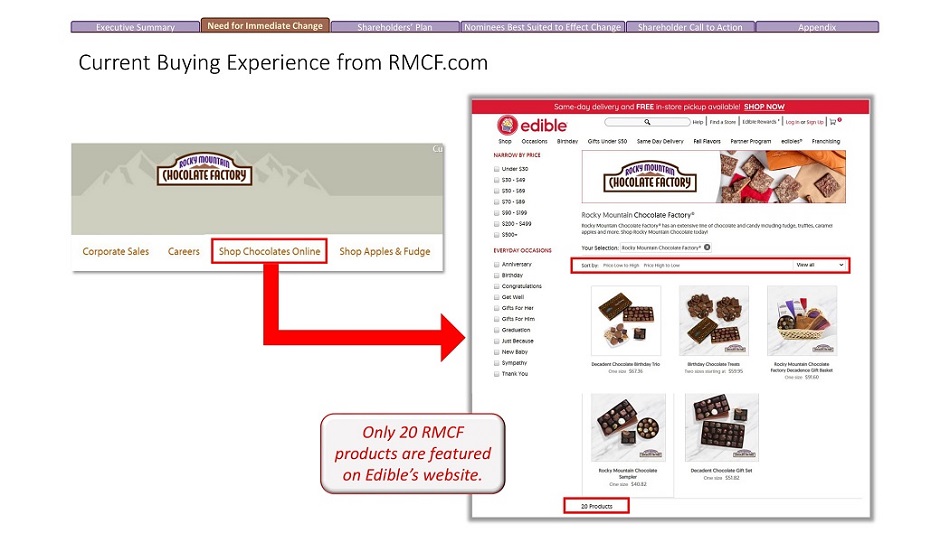

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix Current Buying Experience from RMCF.com Only 20 RMCF products are featured on Edible’s website.

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix How RMCF Missed on E - commerce Opportunity 75% E - commerce revenue growth in 2020 3 E - commerce revenues up 22% in 2021. Since 2019, they are up 77% 1 The number of households that purchased chocolate or candy online at least twice last year was up 76%, according to the National Confectioners Association. 1 E - commerce business grew about 70% in total packages shipped last year (2020) 1Q2021, ecommerce up almost 160% over the first quarter of last year 2 Source: 1. Financial Times Article 2. Y ahoo ! N e w s A r t i c l e 3. C A G N Y 2021 Sus t a i nab l e G ro wt h I n ve s t o r P r e s e n t a t i o n 34

35 Need For Immediate Change - Poor Capital Allocation

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix Broken Promises – Acquisition of U - Swirl 3Q 2015 Earnings Call And on the U - Swirl, could you give us more understanding about your – the growth potential here in the short and medium term, please? Bryan J. Merryman (Chief Financial Officer, Chief Operating Officer) Happy to address that, Bill. It really depends on future acquisitions, how fast U - Swirl can grow. We've been through – really we've been through opportunities to acquire most of the larger players in the industry, not all of them, but most of them, and haven't done any recent acquisitions because in the process that was run to sell those companies, the valuations that we believe were appropriate, management and management advisors for those companies thought was too low. And so right now we don't have any immediate plans to do any more acquisitions of a significant nature until we see valuations come down further. So I still think U - SWIRL can be a major consolidator of the frozen yogurt industry, that time is on our side, but we're going to be very patient as it relates to future acquisitions. 3Q 2016 Earnings Call As regards to the frozen yoghurt business, a couple of years ago, you guys were sort of optimistic on the business, but said it was oversaturated and these [ph] are larger (39:38) consolidation. It sounds like not much has changed and you're still talking a couple of years out. Is there a reason, was the optimism in the rest of the business why we would continue to stay in the yoghurt business? Bryan J. Merryman (Chief Financial Officer, Chief Operating Officer) Well, I think the yoghurt business is very complementary as it relates to our franchising infrastructure. And, again, I think that we've taken a lot of the cost structure of the yoghurt business and leveraged Rocky Mountain Chocolate Factory's cost structure. I think there is maybe some more of that to do. I think it's – what we have right now is a good business. And, while we're in discussions with some small – other small yoghurt players right now, we've really couldn't get to any kind of valuation where we could expand that through acquisition in a bigger way this year. That may change in the future, but I think what we have left of the yoghurt business is in pretty good shape. And it plugs right into Rocky Mountain Chocolate Factory's franchising infrastructure and it will be a contributor in the future. What Shareholders were Promised... 36 Source: RMCF earnings call transcripts, FactSet

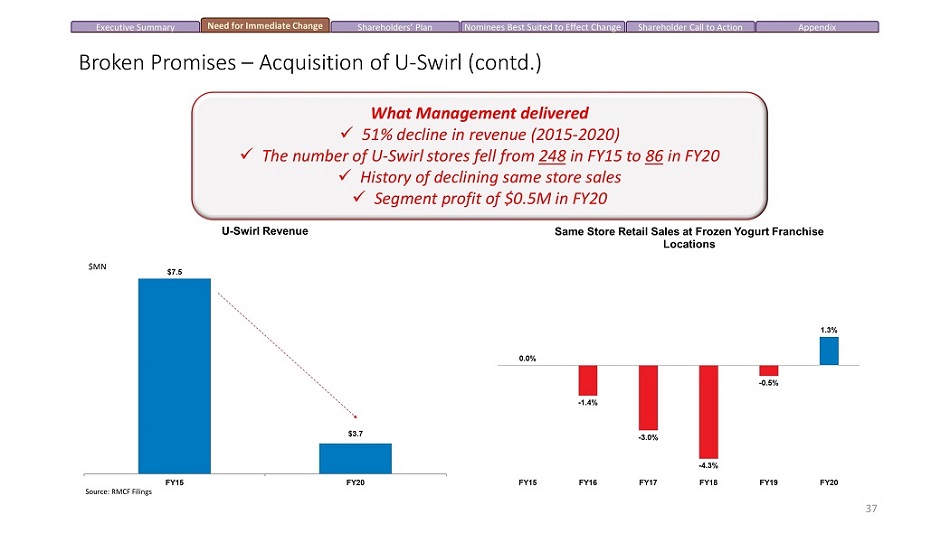

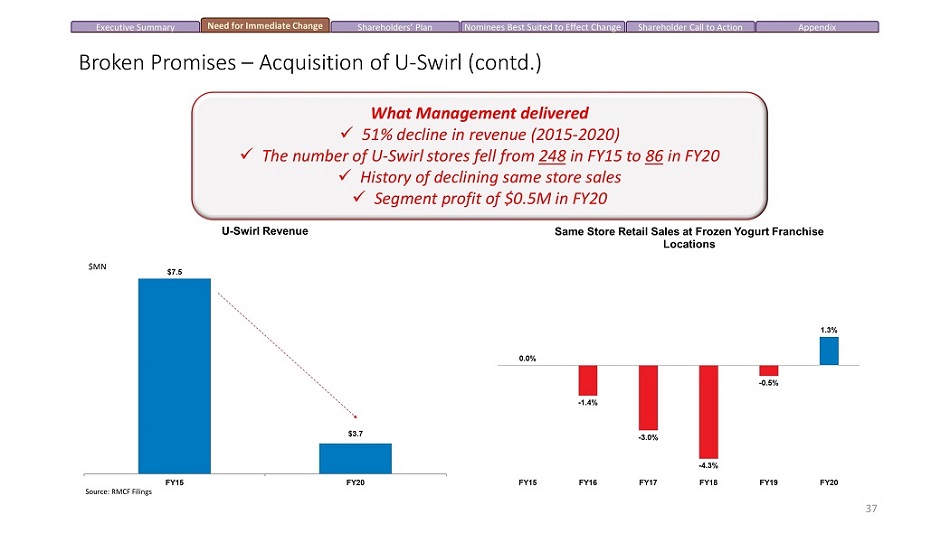

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix Broken Promises – Acquisition of U - Swirl (contd.) What Management delivered x 51% decline in revenue (2015 - 2020) x The number of U - Swirl stores fell from 248 in FY15 to 86 in FY20 x History of declining same store sales x Segment profit of $0.5M in FY20 $ M N Source: RMCF Filings 37

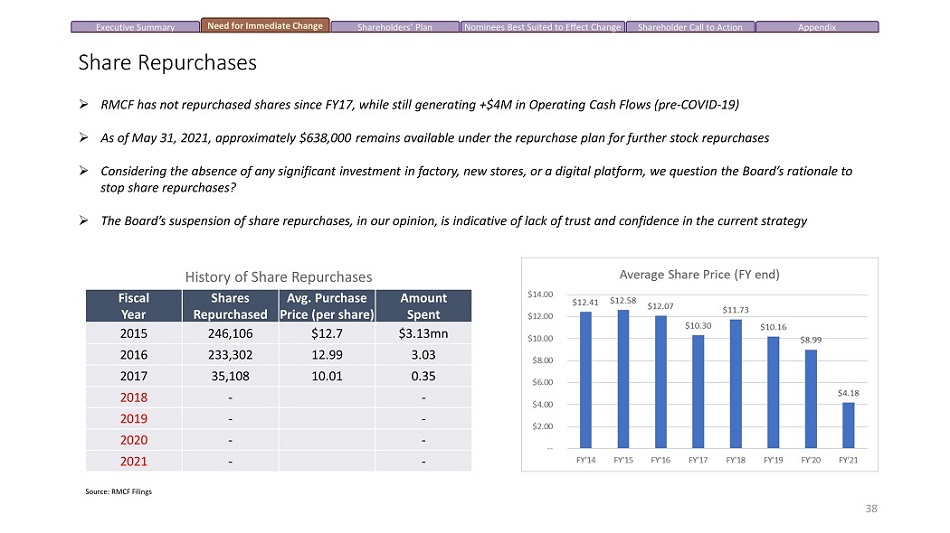

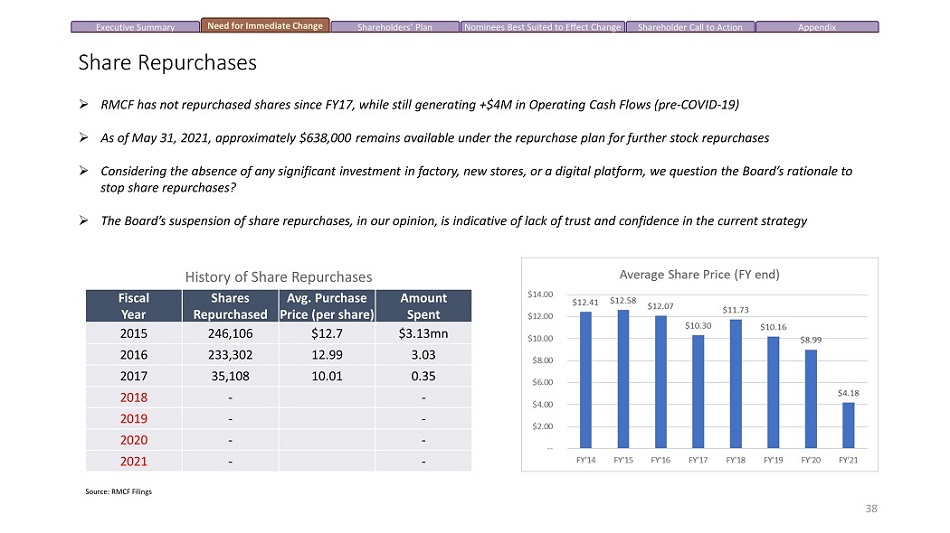

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix » RMCF has not repurchased shares since FY17, while still generating +$4M in Operating Cash Flows (pre - COVID - 19) » As of May 31, 2021, approximately $638,000 remains available under the repurchase plan for further stock repurchases » Considering the absence of any significant investment in factory, new stores, or a digital platform, we question the Board’s rationale to stop share repurchases? » The Board’s suspension of share repurchases, in our opinion, is indicative of lack of trust and confidence in the current strategy History of Share Repurchases Share Repurchases Fiscal Year Shares Repurchased Avg. Purchase Price (per share) Amount Spent 2015 246,106 $12.7 $3.13mn 2016 233,302 12.99 3.03 2017 35,108 10.01 0.35 2018 - - 2019 - - 2020 - - 2021 - - Source: RMCF Filings 38

39 Need For Immediate Change - Failed Partnerships

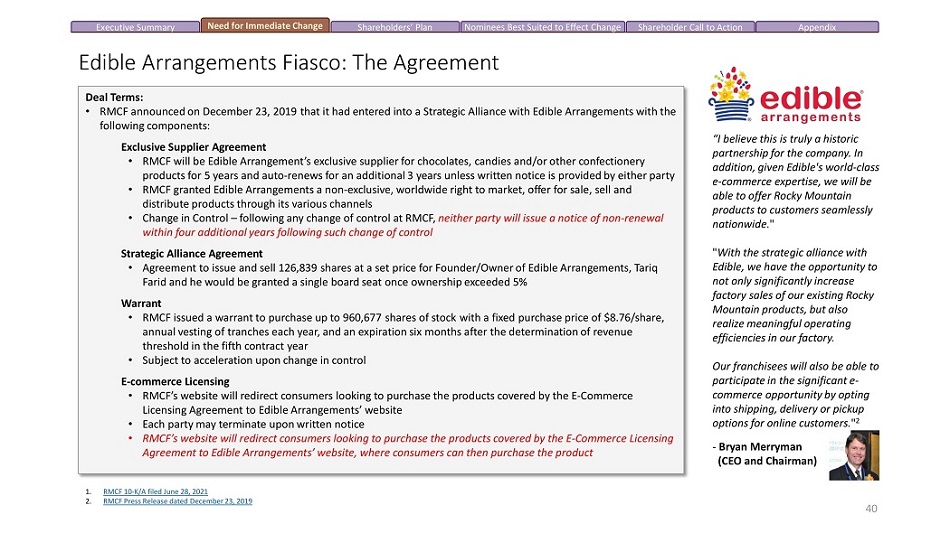

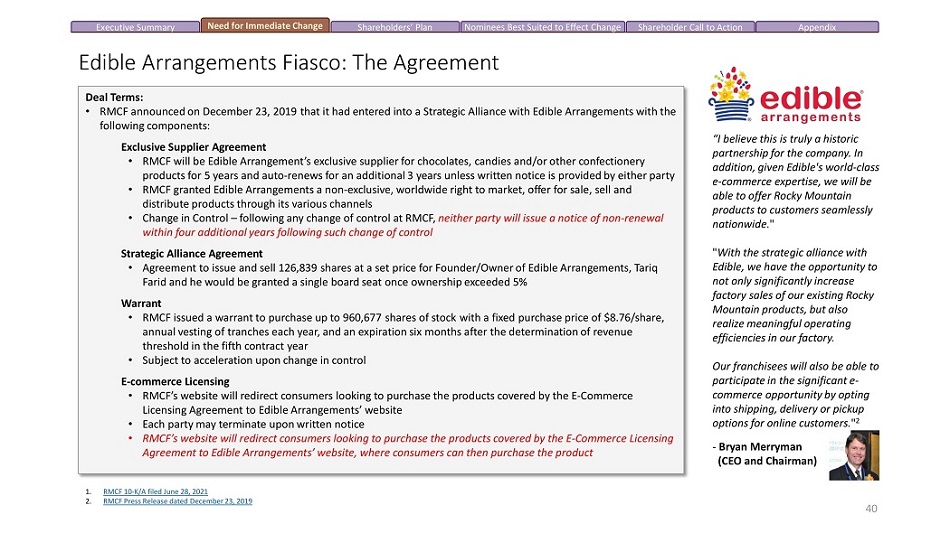

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix Edible Arrangements Fiasco: The Agreement D e a l T e r ms: • RMCF announced on December 23, 2019 that it had entered into a Strategic Alliance with Edible Arrangements with the following components: Exclusive Supplier Agreement • RMCF will be Edible Arrangement’s exclusive supplier for chocolates, candies and/or other confectionery products for 5 years and auto - renews for an additional 3 years unless written notice is provided by either party • RMCF granted Edible Arrangements a non - exclusive, worldwide right to market, offer for sale, sell and distribute products through its various channels • Change in Control – following any change of control at RMCF, neither party will issue a notice of non - renewal within four additional years following such change of control Strategic Alliance Agreement • Agreement to issue and sell 126,839 shares at a set price for Founder/Owner of Edible Arrangements, Tariq Farid and he would be granted a single board seat once ownership exceeded 5% Warrant • RMCF issued a warrant to purchase up to 960,677 shares of stock with a fixed purchase price of $8.76/share, annual vesting of tranches each year, and an expiration six months after the determination of revenue threshold in the fifth contract year • Subject to acceleration upon change in control E - commerce Licensing • RMCF’s website will redirect consumers looking to purchase the products covered by the E - Commerce Licensing Agreement to Edible Arrangements’ website • Each party may terminate upon written notice • RMCF’s website will redirect consumers looking to purchase the products covered by the E - Commerce Licensing Agreement to Edible Arrangements’ website, where consumers can then purchase the product 1. RMCF 10 - K/A filed June 28, 2021 2. R M C F P re s s R e l e a s e da t ed D ecem b er 23 , 201 9 “I believe this is truly a historic partnership for the company. In addition, given Edible's world - class e - commerce expertise, we will be able to offer Rocky Mountain products to customers seamlessly nationwide. " " With the strategic alliance with Edible, we have the opportunity to not only significantly increase factory sales of our existing Rocky Mountain products, but also realize meaningful operating efficiencies in our factory. Our franchisees will also be able to participate in the significant e - c o mm er ce oppo r t un i t y by op t ing into shipping, delivery or pickup options for online customers. " 2 - Bryan Merryman (CEO and Chairman) 40

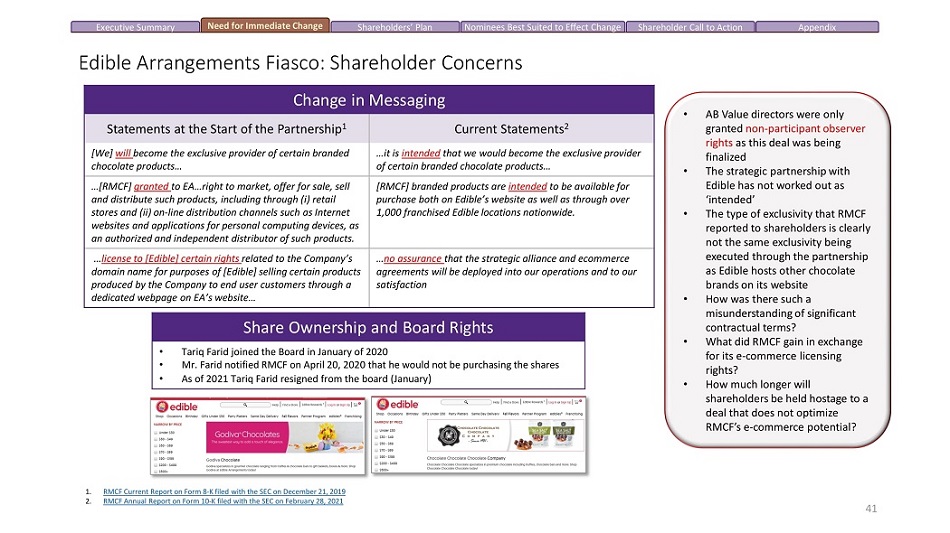

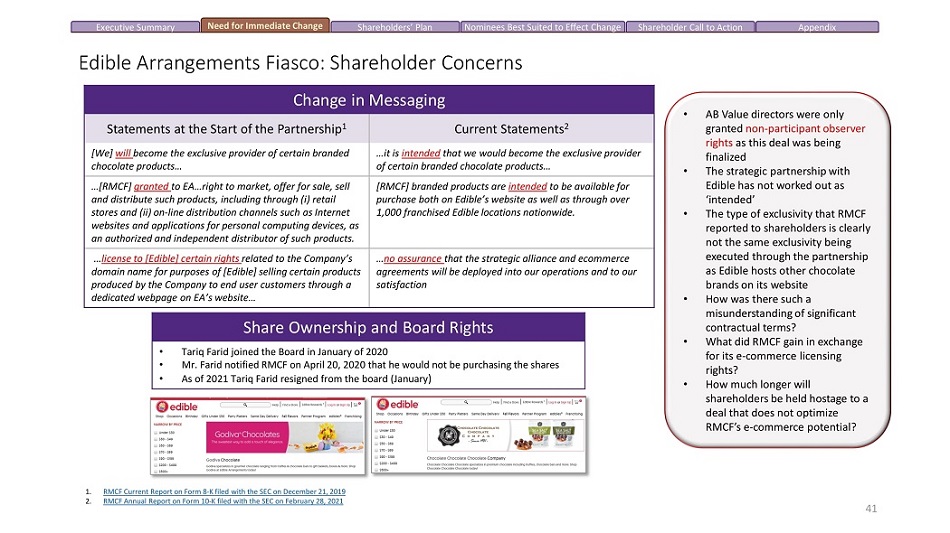

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix Edible Arrangements Fiasco: Shareholder Concerns Change in Messaging Statements at the Start of the Partnership 1 Current Statements 2 [We] will become the exclusive provider of certain branded chocolate products… …it is intended that we would become the exclusive provider of certain branded chocolate products… …[RMCF] granted to EA…right to market, offer for sale, sell and distribute such products, including through (i) retail stores and (ii) on - line distribution channels such as Internet websites and applications for personal computing devices, as an authorized and independent distributor of such products. [RMCF] branded products are intended to be available for purchase both on Edible’s website as well as through over 1 , 000 franchised Edible locations nationwide . … license to [Edible] certain rights related to the Company’s domain name for purposes of [Edible] selling certain products produced by the Company to end user customers through a dedicated webpage on EA’s website… … no assurance that the strategic alliance and ecommerce agreements will be deployed into our operations and to our satisfaction • AB Value directors were only granted non - participant observer rights as this deal was being finalized • T h e s t r a t e g ic p ar t n e r s h ip wi t h Edible has not worked out as ‘intended’ • The type of exclusivity that RMCF reported to shareholders is clearly not the same exclusivity being executed through the partnership as Edible hosts other chocolate brands on its website • How was there such a mi s und e r s t a n d i n g o f s i g n i f i c a n t contractual terms? • What did RMCF gain in exchange for its e - commerce licensing rights? • How much longer will shareholders be held hostage to a deal that does not optimize RMCF’s e - commerce potential? 1. 2. RMCF Current Report on Form 8 - K filed with the SEC on December 21, 2019 RMCF Annual Report on Form 10 - K filed with the SEC on February 28, 2021 41 Share Ownership and Board Rights • Tariq Farid joined the Board in January of 2020 • Mr. Farid notified RMCF on April 20, 2020 that he would not be purchasing the shares • As of 2021 Tariq Farid resigned from the board (January )

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix In the Last 20 Years, the Canadian Franchisee has Generated Revenues of $365.6 Million. 1 VS 42 1. Immaculate Confections Press Release (RMCF Canadian Franchisee)

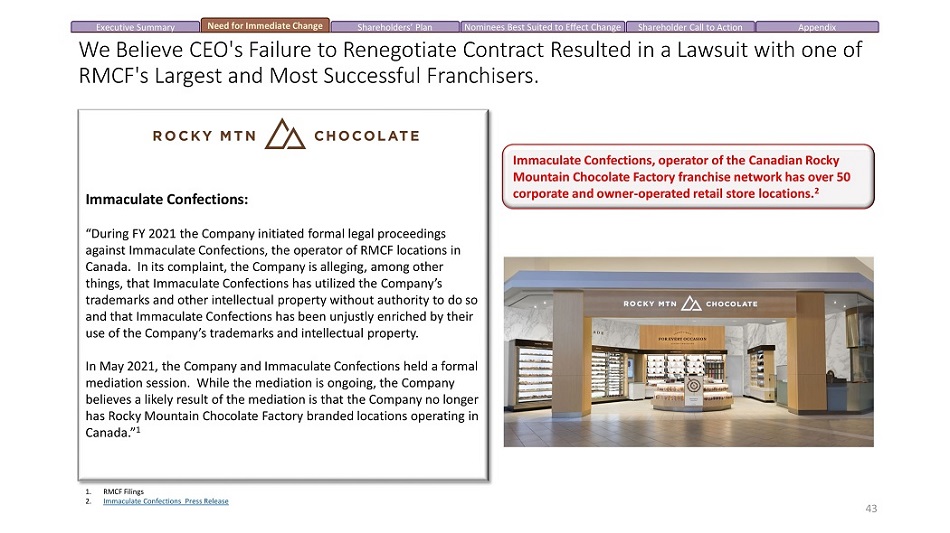

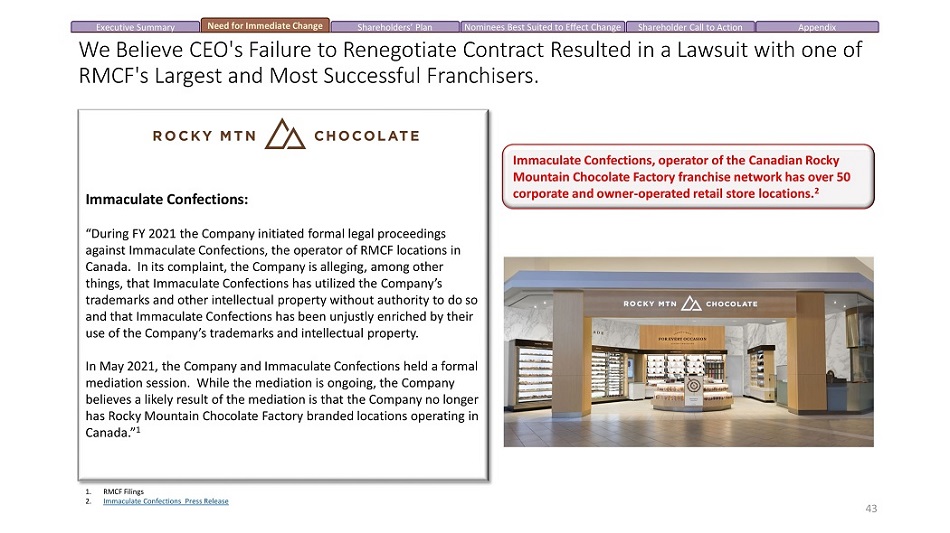

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix We Believe CEO's Failure to Renegotiate Contract Resulted in a Lawsuit with one of RMCF's Largest and Most Successful Franchisers. Immaculate Confections: “During FY 2021 the Company initiated formal legal proceedings against Immaculate Confections, the operator of RMCF locations in Canada. In its complaint, the Company is alleging, among other things, that Immaculate Confections has utilized the Company’s trademarks and other intellectual property without authority to do so and that Immaculate Confections has been unjustly enriched by their use of the Company’s trademarks and intellectual property. In May 2021, the Company and Immaculate Confections held a formal mediation session. While the mediation is ongoing, the Company believes a likely result of the mediation is that the Company no longer has Rocky Mountain Chocolate Factory branded locations operating in Canada.” 1 Immaculate Confections, operator of the Canadian Rocky Mountain Chocolate Factory franchise network has over 50 corporate and owner - operated retail store locations. 2 1. R M C F F ilin gs 2. Immaculate Confections Press Release 43

44 Need For Immediate Change - Weak Corporate Governance

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix AB Value’s Pressure is Responsible for Recent Governance Changes June 2021 AB Value suggested to the Board that the Chairperson and CEO roles be separated, that a management transition should commence immediately and that legacy directors needed to step down Sept. 9, 2019 AB Value expressed d iss at is f act i on w i t h t he unnecessary delay in holding the 2019 Annual Meeting Aug. 23, 2019 RMCF set date of 2019 Annual Meeting for January 9, 2020 May 29, 2019 Rocky Mountain announced it wa s c ondu ct i ng a process to explore and evaluate strategic alternatives May 18, 2019 AB Value delivered Notice of Nomination and submitted a proposal, which called for RMCF to redeem its poison pill unless approved by shareholders within twelve months Sept. 20, 2019 C o mp l a i nt f il e d in the Delaware Court of Chancery alleging RMCF unlawfully deferred the Annual Meeting until January 9, 2020, nearly s e v en t ee n mon t h s after RMCF’s last annual meeting Nov. 9, 2019 The Delaware Court of Chancery ordered RMCF to hold the 2019 Annual Meeting on January 9, 2020. The order further provided that RMCF could not change the date of the 2019 Annual Meeting or its applicable record date without prior Court approval July 24, 2021 AB V a l ue d is c l o s e d t o the Board highly inappropriate public statements on social media by Scott Capdevielle July 21, 2021 R M C F iss u e d a press release announcing its commitme nt to separate the Chairperson and CEO roles, and to start a new CEO search process Aug. 9, 2021 RMCF a nn o un ce d t h a t Franklin Crail, co - founder, was retiring from the Board upon a pp o i n t m e nt of a replacement independent director July 26, 2021 RMCF a nn o un ce d Mr . Capdevielle’s resignation from the Board effective immediately Aug. 10, 2021 R M C F a nn o un ce d formation of a special committee of the Board to oversee the process of i d e n t i fy i ng n e w independent director candidates and retained a global search firm to identify independent board candidates Aug. 2, 2021 AB Value issued a press release calling for immediate board and governance changes due to numerous governance concerns Source: RMCF Filings 45

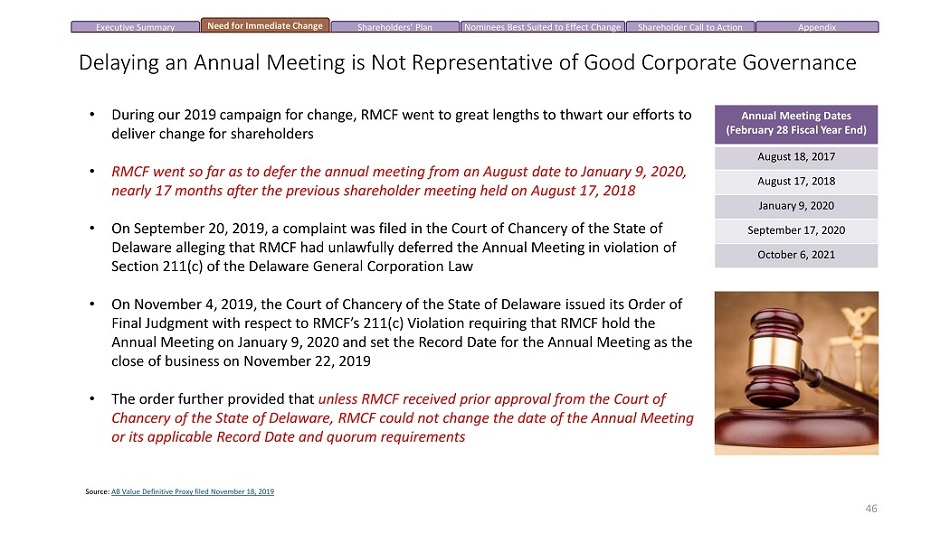

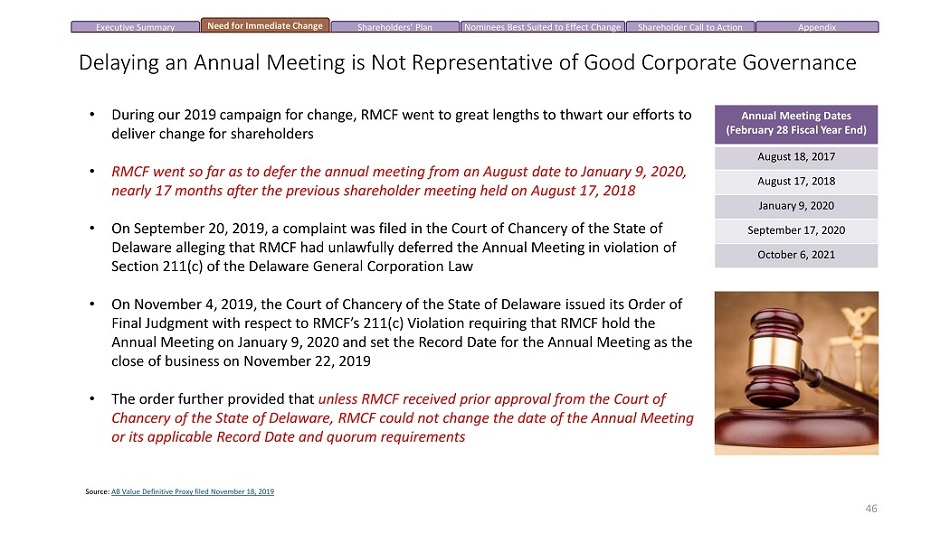

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix Delaying an Annual Meeting is Not Representative of Good Corporate Governance • During our 2019 campaign for change, RMCF went to great lengths to thwart our efforts to deliver change for shareholders • RMCF went so far as to defer the annual meeting from an August date to January 9, 2020, nearly 17 months after the previous shareholder meeting held on August 17, 2018 • On September 20, 2019, a complaint was filed in the Court of Chancery of the State of Delaware alleging that RMCF had unlawfully deferred the Annual Meeting in violation of Section 211(c) of the Delaware General Corporation Law • On November 4, 2019, the Court of Chancery of the State of Delaware issued its Order of Final Judgment with respect to RMCF’s 211(c) Violation requiring that RMCF hold the Annual Meeting on January 9, 2020 and set the Record Date for the Annual Meeting as the close of business on November 22, 2019 • The order further provided that unless RMCF received prior approval from the Court of Chancery of the State of Delaware, RMCF could not change the date of the Annual Meeting or its applicable Record Date and quorum requirements Annual Meeting Dates (February 28 Fiscal Year End) August 18, 2017 August 17, 2018 January 9, 2020 September 17, 2020 October 6, 2021 Source: AB Value Definitive Proxy filed November 18, 2019 46

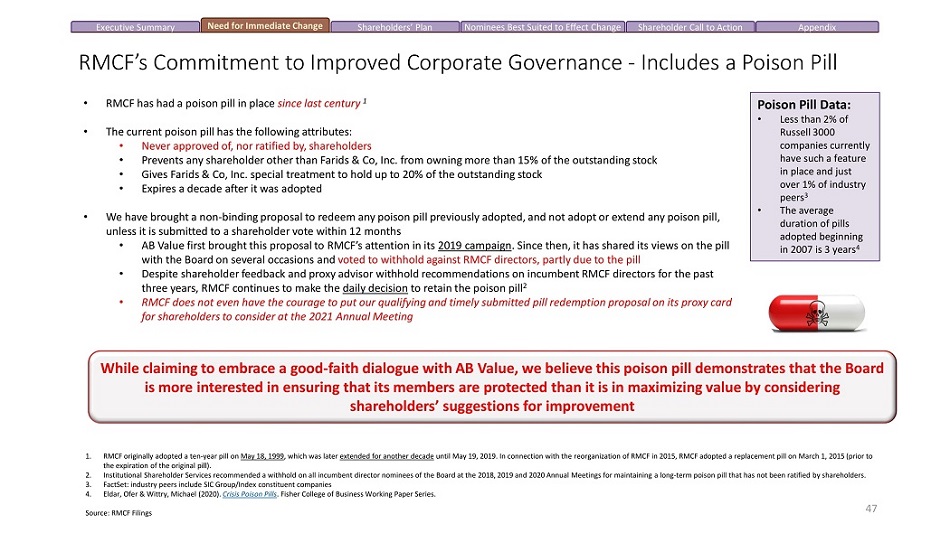

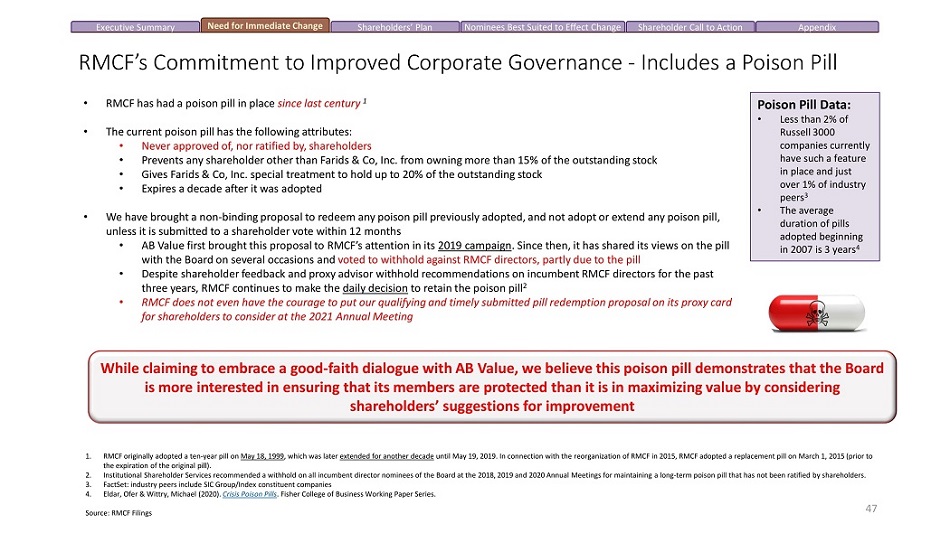

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix • RMCF has had a poison pill in place since last century 1 • The current poison pill has the following attributes: • Never approved of, nor ratified by, shareholders • Prevents any shareholder other than Farids & Co, Inc. from owning more than 15% of the outstanding stock • Gives Farids & Co, Inc. special treatment to hold up to 20% of the outstanding stock • Expires a decade after it was adopted • We have brought a non - binding proposal to redeem any poison pill previously adopted, and not adopt or extend any poison pill, unless it is submitted to a shareholder vote within 12 months • AB Value first brought this proposal to RMCF’s attention in its 2019 campaign . Since then, it has shared its views on the pill with the Board on several occasions and voted to withhold against RMCF directors, partly due to the pill • Despite shareholder feedback and proxy advisor withhold recommendations on incumbent RMCF directors for the past three years, RMCF continues to make the daily decision to retain the poison pill 2 • RMCF does not even have the courage to put our qualifying and timely submitted pill redemption proposal on its proxy card for shareholders to consider at the 2021 Annual Meeting While claiming to embrace a good - faith dialogue with AB Value, we believe this poison pill demonstrates that the Board is more interested in ensuring that its members are protected than it is in maximizing value by considering shareholders’ suggestions for improvement 1. RMCF originally adopted a ten - year pill on May 18, 1999 , which was later extended for another decade until May 19, 2019. In connection with the reorganization of RMCF in 2015, RMCF adopted a replacement pill on March 1, 2015 (prior to the expiration of the original pill). 2. Institutional Shareholder Services recommended a withhold on all incumbent director nominees of the Board at the 2018, 2019 and 2020 Annual Meetings for maintaining a long - term poison pill that has not been ratified by shareholders. 3. FactSet: industry peers include SIC Group/Index constituent companies 4. Eldar, Ofer & Wittry, Michael (2020). Crisis Poison Pills . Fisher College of Business Working Paper Series. Source: RMCF Filings RMCF’s Commitment to Improved Corporate Governance - Includes a Poison Pill Poison Pill Data: • Less than 2% of Russell 3000 c omp a n i e s c u rr e n t l y have such a feature in place and just over 1% of industry peers 3 • The average duration of pills a d o p te d b e g i nn i ng in 2007 is 3 years 4 47

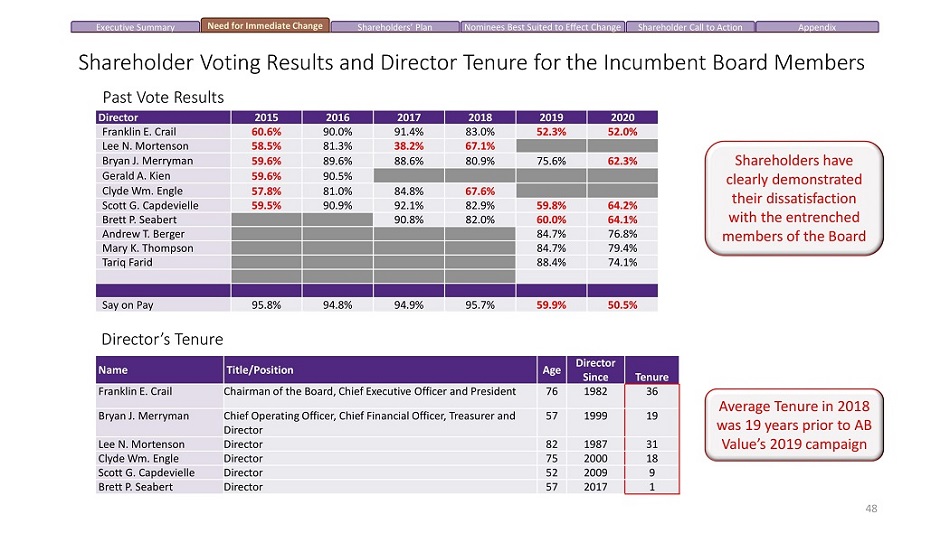

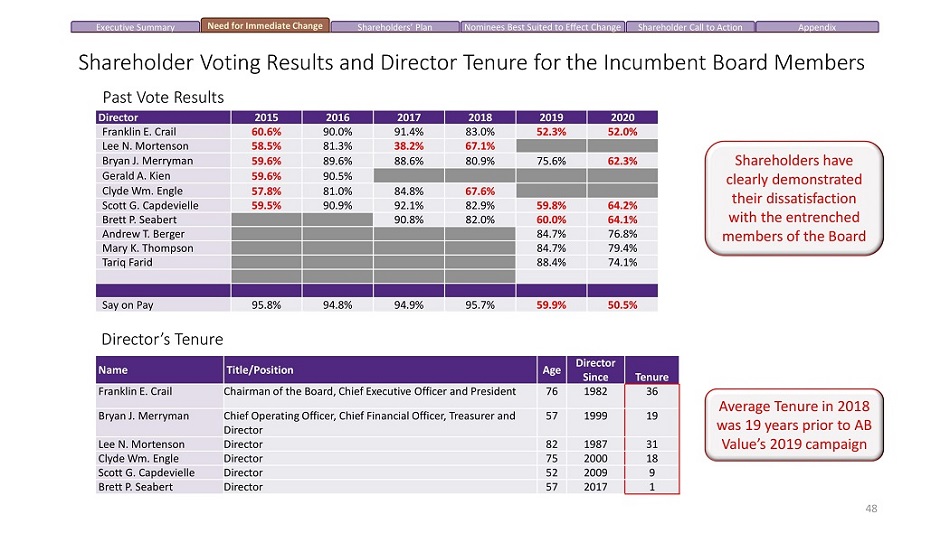

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix Shareholder Voting Results and Director Tenure for the Incumbent Board Members Director 2015 2016 2017 2018 2019 2020 Franklin E. Crail 60.6% 90.0% 91.4% 83.0% 52.3% 52.0% Lee N. Mortenson 58.5% 81.3% 38.2% 67.1% Bryan J. Merryman 59.6% 89.6% 88.6% 80.9% 75.6% 62.3% Gerald A. Kien 59.6% 90.5% Clyde Wm. Engle 57.8% 81.0% 84.8% 67.6% Scott G. Capdevielle 59.5% 90.9% 92.1% 82.9% 59.8% 64.2% B r e t t P . S e ab ert 90.8% 82.0% 60.0% 64.1% And r ew T . B e r g er 84.7% 76.8% Mary K. Thompson 84.7% 79.4% Tariq Farid 88.4% 74.1% Say on Pay 95.8% 94.8% 94.9% 95.7% 59.9% 50.5% Name Title/Position Age Director Since Tenure Franklin E. Crail Chairman of the Board, Chief Executive Officer and President 76 1982 36 Bryan J. Merryman Chief Operating Officer, Chief Financial Officer, Treasurer and Director 57 1999 19 Lee N. Mortenson Director 82 1987 31 Clyde Wm. Engle Director 75 2000 18 Scott G. Capdevielle Director 52 2009 9 B r e t t P . S e ab ert Director 57 2017 1 Shareholders have clearly demonstrated their dissatisfaction with the entrenched members of the Board Average Tenure in 2018 was 19 years prior to AB Value’s 2019 campaign 48 Director’s Tenure Past Vote Results

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix How has the Compensation Committee Responded to Executive Pay Issues Raised and Resulting Low Shareholder Support? Shareholder Support for Say on Pay (Last 3 Annual Meetings) 95.7% 59.9% 50.5% 8/17/2018 1 / 9/ 2 020 9/17/2020 Proxy Advisor Recommendations Proxy Advisor FY 2019 FY 2020 Issues Raised AGAINST AGAINST • No performance - based long - term incentives • Supp leme n t a l on e - o f f g r a n t s a w a r d ed outside of the normal incentive program without any reported link to performance • Lack of share ownership requirements FOR AGAINST • Excessive severance multiple greater t h an 2 . 9 9 x a n nu al s alary + 200 % target bonus • Single - trigger acceleration of vesting for equity awards • Legacy excise tax gross - ups • Lack of risk mitigators such as a claw back policy and stock ownership guidelines • Poor responsiveness to low shareholder support highlighted by no reported shareholder engagement and no substantive changes Adverse proxy advisor recommendations and rapidly declining shareholder support year - over - year have resulted in: • A continued lack of reported shareholder engagement on compensation • No substantive changes in the pay program Source: RMCF Filings 49

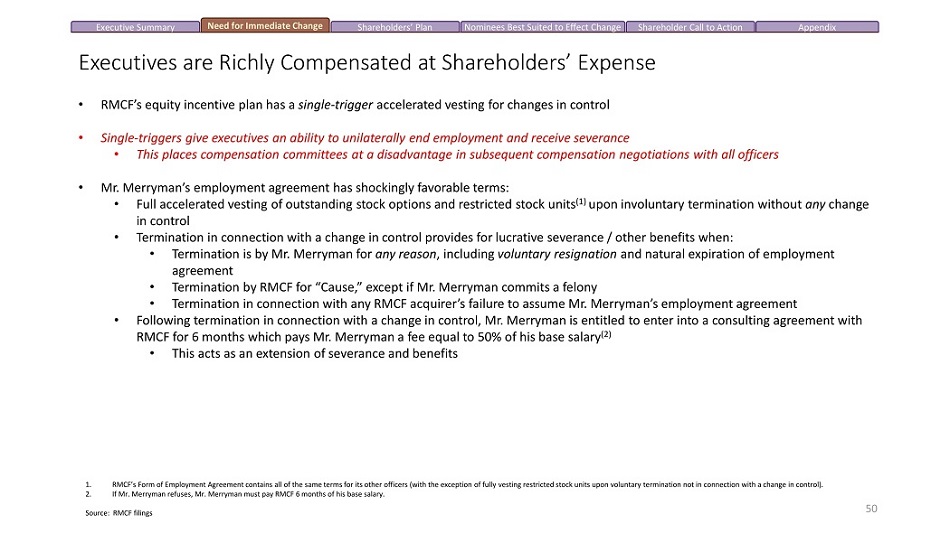

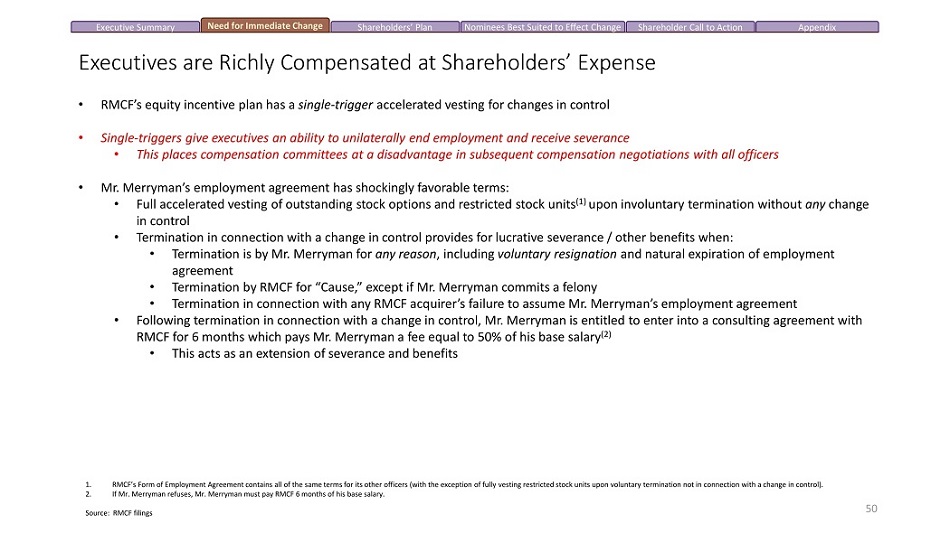

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix • RMCF’s equity incentive plan has a single - trigger accelerated vesting for changes in control • Single - triggers give executives an ability to unilaterally end employment and receive severance • This places compensation committees at a disadvantage in subsequent compensation negotiations with all officers • Mr. Merryman’s employment agreement has shockingly favorable terms: • Full accelerated vesting of outstanding stock options and restricted stock units (1) upon involuntary termination without any change in control • Termination in connection with a change in control provides for lucrative severance / other benefits when: • Termination is by Mr. Merryman for any reason , including voluntary resignation and natural expiration of employment agreement • Termination by RMCF for “Cause,” except if Mr. Merryman commits a felony • Termination in connection with any RMCF acquirer’s failure to assume Mr. Merryman’s employment agreement • Following termination in connection with a change in control, Mr. Merryman is entitled to enter into a consulting agreement with RMCF for 6 months which pays Mr. Merryman a fee equal to 50% of his base salary (2) • This acts as an extension of severance and benefits 1. 2. RMCF’s Form of Employment Agreement contains all of the same terms for its other officers (with the exception of fully vesting restricted stock units upon voluntary termination not in connection with a change in control). If Mr. Merryman refuses, Mr. Merryman must pay RMCF 6 months of his base salary. Source: RMCF filings Executives are Richly Compensated at Shareholders’ Expense 50

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix 1. https://www.newspapers.com/clip/52304131/reno - gazette - journal / Poor Compensation Governance Starts at the Top • Brett Seabert was on the Compensation Committee when the Best Man from his 1986 wedding, Bryan Merryman, was negotiating with the Committee on his new pay package • The potential conflict of interest should have been obvious, but the Board has not addressed any of the following: • Was the Board aware of the extent of the relationship prior to Brett Seabert joining the Board in 2017? • Was Mr. Seabert involved in the contract negotiations of his former Best Man and if so, to what extent? • Who was the Chair of the Compensation Committee during those negotiations? • What precipitated Mr. Seabert’s departure from the Compensation Committee and when exactly did that occur? • We expect that proper diligence and precautions were exercised by the Committee, but silence on this issue sends the wrong message to shareholders regarding the Board’s approach to compensation governance ! Negotiating a new contract with each other in February 2019 when Bryan Merryman was promoted to CEO? Bryan Merryman President and Chief Executive Officer (Best Man) Brett Seabert Former Compensation Committee Chair and Member (Groom) 51

THE CONCERNED SHAREHOLDERS OF AB Value Partners, LP & AB Value Management LLC Bradley Radoff Executive Summary Need for Immediate Change Shareholders' Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix 52

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix Source: RMCF Filings 53 RMCF Currently Has No Real Plan RMCF Claims to Shareholders The Truth The Company accelerated numerous strategic enhancements , pivoted quickly to focus on transforming our business to best position our Company for future opportunities No details around strategic enhancements What specific steps has RMCF taken to transform the business? No disclosure on how RMCF plans to resolve ongoing disagreement with Edible Arrangements which limits its ability to grow online business Many of our stores have met or exceeded pre - COVID - 19 sales levels and same - store sales at domestic franchise locations continue to increase, compared to the same period pre - COVID - 19. Even if FY19 levels are achieved, it still represents significant decline over the years How much of the recent improvement is due to strong market demand for the segment vs. steps taken by the management. to turnaround the business? Why doesn’t RMCF disclose improved metrics? How many stores have met or exceeded pre - COVID - 19 metrics? Based on the most recent 1Q2022 reported results, there is no real turnaround » 1QFY22 revenue is 10% lower than in 1QFY20 (comparable per - COVID - 19) » Adj. Factory Gross Margin were 750bps lower in 1QFY22 vs 1QFY20 » Adj. EBITDA was 40% lower in 1QFY22 vs 1QFY20 Our Board has been focused on bringing world - class strategic, operational and digital expertise to the Board to drive future growth , transformation and innovation . With the exception of Elisabeth Charles, RMCF’s new nominees, including the Chairperson, lack relevant industry experience RMCF’s website still looks and feels dated despite the so called "digital expert" being on the Board for almost 90 days RMCF has failed to present details of the new plan that will lead to innovation and transformation What new hires have been made to implement the new plan?

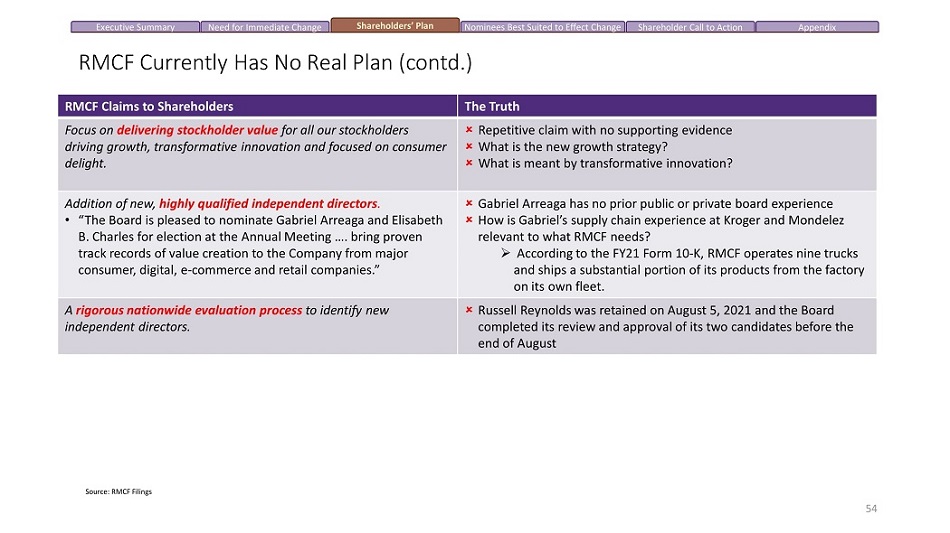

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix Source: RMCF Filings 54 RMCF Claims to Shareholders The Truth Focus on delivering stockholder value for all our stockholders driving growth, transformative innovation and focused on consumer delight. Repetitive claim with no supporting evidence What is the new growth strategy? What is meant by transformative innovation? Addition of new, highly qualified independent directors . • “The Board is pleased to nominate Gabriel Arreaga and Elisabeth B. Charles for election at the Annual Meeting …. bring proven track records of value creation to the Company from major consumer, digital, e - commerce and retail companies.” Gabriel Arreaga has no prior public or private board experience How is Gabriel’s supply chain experience at Kroger and Mondelez relevant to what RMCF needs? » According to the FY21 Form 10 - K, RMCF operates nine trucks and ships a substantial portion of its products from the factory on its own fleet. A rigorous nationwide evaluation process to identify new independent directors. Russell Reynolds was retained on August 5, 2021 and the Board completed its review and approval of its two candidates before the end of August RMCF Currently Has No Real Plan (contd.)

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix There is NO Real Improvement at RMCF % change 1Q20 1Q21 1Q22 1Q22 vs 1Q20 (pre - Covid) Total Revenue $8.4 $2.7 $7.6 - 9.9% Adjusted Factory Gross Margin 25.4% (23.4%) 17.9% Retail gross margin 66.3% 50.6% 67.5% - 750bps 120bps Total Adj. Gross Margin 30.8% (17.4%) 24.6% - 620bps I n c o m e f r o m O p e r a t i ons $0.9 ($4.8) $0.6 - 31.7% Adjusted EBITDA $1.8 ($4.0) $1.1 - 39.7% % Margin 21.5% (149.6%) 14.4% - 710bps Net Income $0.7 ($3.7) $0.6 - 18.5% Source: RMCF Filings 55

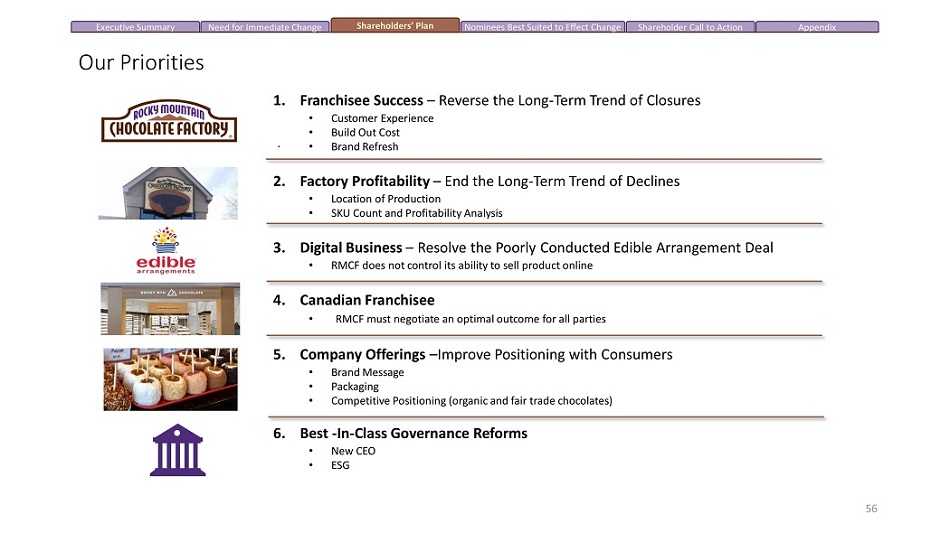

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix Our Priorities 1. Franchisee Success – Reverse the Long - Term Trend of Closures • Customer Experience • Bu ild Ou t C o s t • B r an d R e f r e s h 2. Factory Profitability – End the Long - Term Trend of Declines • Location of Production • SKU Count and Profitability Analysis 3. Digital Business – Resolve the Poorly Conducted Edible Arrangement Deal • RMCF does not control its ability to sell product online 4. Canadian Franchisee • RMCF must negotiate an optimal outcome for all parties 5. Company Offerings – Improve Positioning with Consumers • B r an d M e ss a g e • Packaging • Competitive Positioning (organic and fair trade chocolates) 6. Best - In - Class Governance Reforms • New CEO • ESG 56

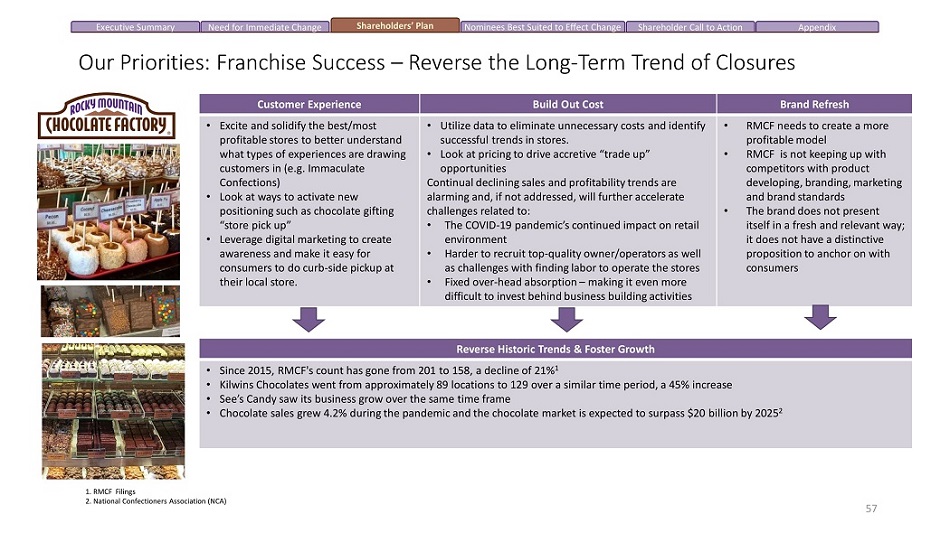

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix Customer Experience Build Out Cost Brand Refresh • Excite and solidify the best/most profitable stores to better understand what types of experiences are drawing customers in (e.g. Immaculate Confections) • Look at ways to activate new po s i t i on i n g s u c h as c ho c o l a t e g i f t i n g “store pick up” • Leverage digital marketing to create awareness and make it easy for consumers to do curb - side pickup at their local store. • Utilize data to eliminate unnecessary costs and identify successful trends in stores. • Look at pricing to drive accretive “trade up” opportunities Continual declining sales and profitability trends are alarming and, if not addressed, will further accelerate challenges related to: • The COVID - 19 pandemic’s continued impact on retail environment • Harder to recruit top - quality owner/operators as well as challenges with finding labor to operate the stores • Fixed over - head absorption – making it even more difficult to invest behind business building activities • RMCF needs to create a more profitable model • RMCF is not keeping up with competitors with product d e v el op i n g , b r and i n g , m a r k e t i ng and brand standards • The brand does not present itself in a fresh and relevant way; it does not have a distinctive proposition to anchor on with consumers Our Priorities: Franchise Success – Reverse the Long - Term Trend of Closures Reverse Historic Trends & Foster Growth • Since 2015, RMCF's count has gone from 201 to 158, a decline of 21% 1 • Kilwins Chocolates went from approximately 89 locations to 129 over a similar time period, a 45% increase • See’s Candy saw its business grow over the same time frame • Chocolate sales grew 4.2% during the pandemic and the chocolate market is expected to surpass $20 billion by 2025 2 1. RMCF Filings 2. National Confectioners Association (NCA) 57

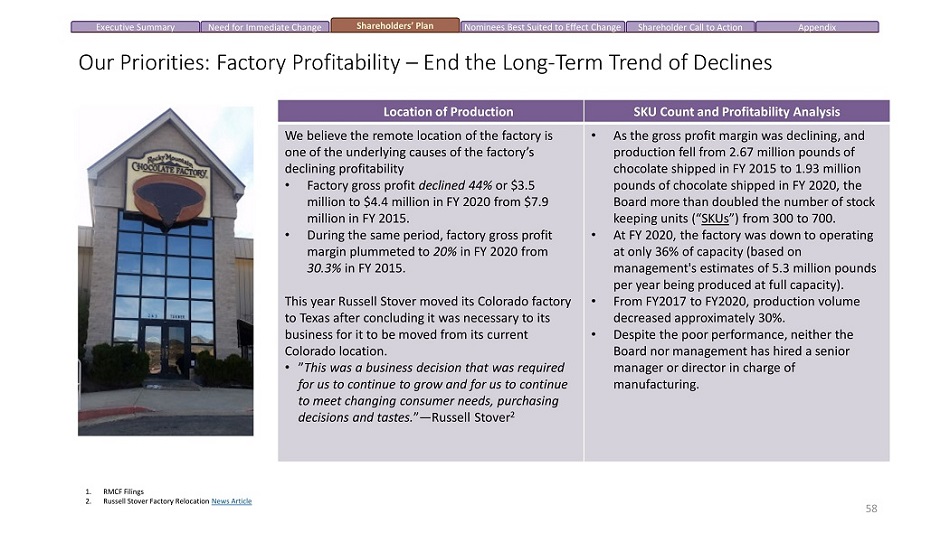

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix Our Priorities: Factory Profitability – End the Long - Term Trend of Declines Location of Production SKU Count and Profitability Analysis We believe the remote location of the factory is one of the underlying causes of the factory’s declining profitability • Factory gross profit declined 44% or $3.5 million to $4.4 million in FY 2020 from $7.9 million in FY 2015. • During the same period, factory gross profit margin plummeted to 20% in FY 2020 from 30.3% in FY 2015. This year Russell Stover moved its Colorado factory to Texas after concluding it was necessary to its business for it to be moved from its current Colorado location. • ” This was a business decision that was required for us to continue to grow and for us to continue to meet changing consumer needs, purchasing decisions and tastes. ” — Russell Stover 2 • As the gross profit margin was declining, and production fell from 2.67 million pounds of chocolate shipped in FY 2015 to 1.93 million pounds of chocolate shipped in FY 2020, the Board more than doubled the number of stock keeping units (“ SKUs ”) from 300 to 700. • At FY 2020, the factory was down to operating at only 36% of capacity (based on management's estimates of 5.3 million pounds per year being produced at full capacity). • From FY2017 to FY2020, production volume decreased approximately 30%. • Despite the poor performance, neither the Board nor management has hired a senior manager or director in charge of manufacturing. 58 1. R M C F F ilin gs 2. Russell Stover Factory Relocation News Article

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix Our Priorities: Factory Profitability – End the Long - Term Trend of Declines (contd.) 4 Hour Drive to I - 25 3 Hour Drive to I - 40 59 3.5 Hour Drive to I - 70 “To make those long journeys possible, Rocky Mountain relies on a team of nine drivers, each with dedicated routes, that get product from Durango to their respective stores every two weeks. As if time and distance weren’t enough, these trips elicit unique challenges that most other drivers don’t have to face.” ‘While Durango may be an ideal place to live, the scenic town is more than four hours away from the nearest interstate. Making it less than ideal from a manufacturing perspective’ - Greg Pope (Senior VP of Development at RMCF) “Furthermore, the geography surrounding Durango results in many long, winding roads that require a certain type of driver and special kind of truck to navigate.” 1 1. Volvo Truck’s News Story Factory Location 265 Turner Drive, Durango, Colorado 81303

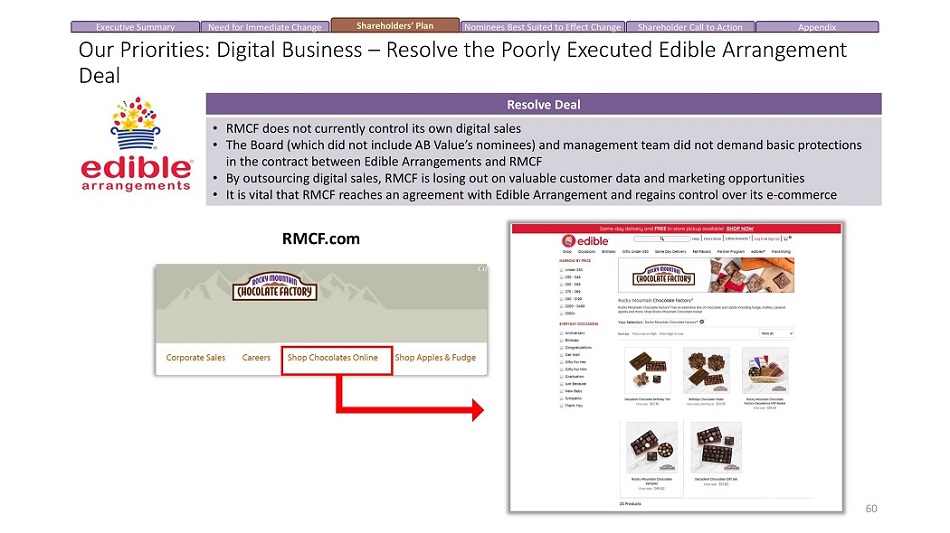

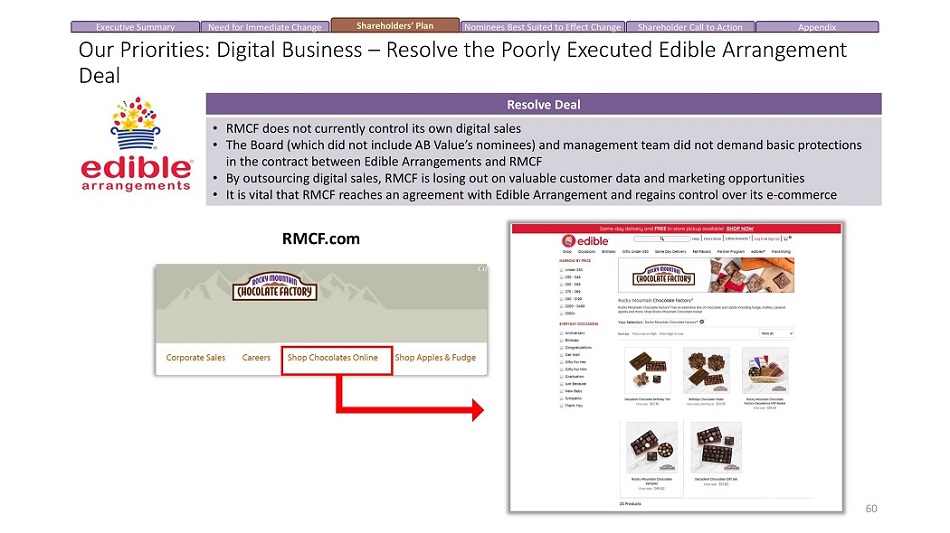

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix Resolve Deal • RMCF does not currently control its own digital sales • The Board (which did not include AB Value’s nominees) and management team did not demand basic protections in the contract between Edible Arrangements and RMCF • By outsourcing digital sales, RMCF is losing out on valuable customer data and marketing opportunities • It is vital that RMCF reaches an agreement with Edible Arrangement and regains control over its e - commerce Our Priorities: Digital Business – Resolve the Poorly Executed Edible Arrangement Deal RMC F . c o m 60

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix Our Priorities: Canadian Franchisee – Reach Mutually Beneficial Agreement with Immaculate Confections Resolve Lawsuit • RMCF has had no contract with its largest franchise group for many years and has been receiving no income from this franchisee over a long period of time. • This is a direct failure of the current CEO of RMCF. • If not properly negotiated, RMCF could lose out on millions of dollars • RMCF’s current plan is to formally terminate all remaining contracts between the parties. • As one of RMCF strongest franchisees, we would seek to reach a mutually beneficial agreement with Immaculate Confections. • Immaculate Confections is a strategically valuable partner not only from a revenue standpoint but also for its insights into rebranding and marketing the RMCF image 61

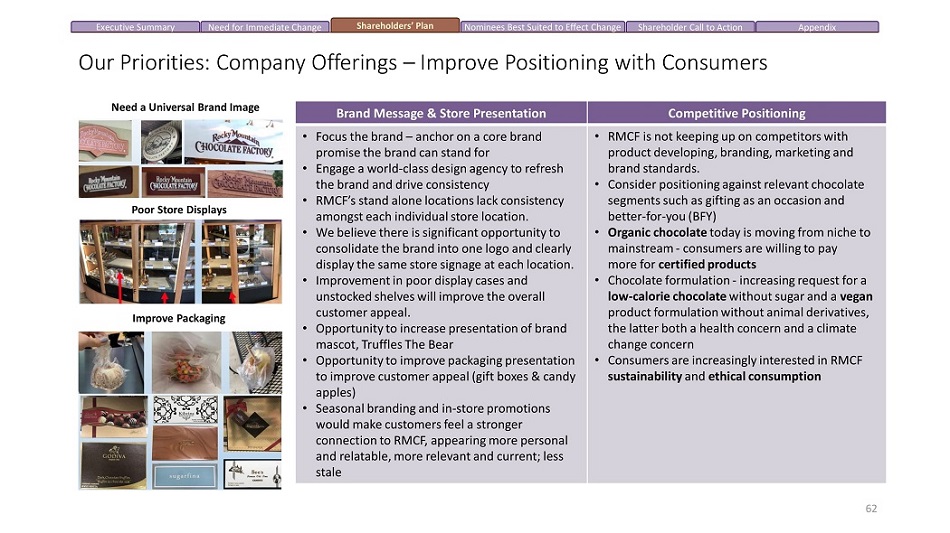

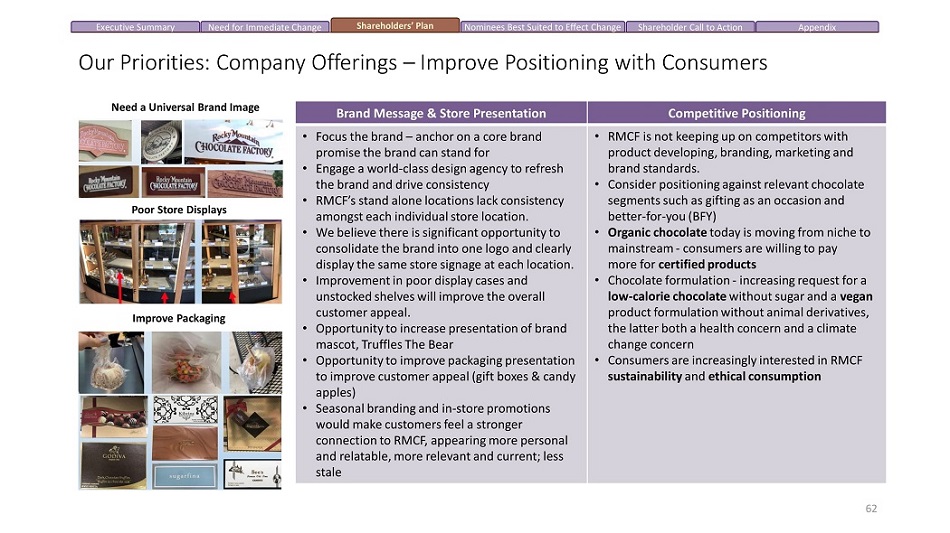

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix Brand Message & Store Presentation Competitive Positioning • Focus the brand – anchor on a core brand promise the brand can stand for • Engage a world - class design agency to refresh the brand and drive consistency • RMCF’s stand alone locations lack consistency a m on g s t e ac h i nd ivi du a l s t o r e l o ca t i on. • We believe there is significant opportunity to consolidate the brand into one logo and clearly display the same store signage at each location. • Improvement in poor display cases and unstocked shelves will improve the overall customer appeal. • O ppo rt un i ty t o i nc r e as e p r e s e n t a t i o n of b r a nd mascot, Truffles The Bear • Opportunity to improve packaging presentation to improve customer appeal (gift boxes & candy apples) • Seasonal branding and in - store promotions would make customers feel a stronger connection to RMCF, appearing more personal and relatable, more relevant and current; less stale • RMCF is not keeping up on competitors with p r oduct de v e l op i n g , b r a nd i n g , m ar k et i ng a nd brand standards. • Consider positioning against relevant chocolate segments such as gifting as an occasion and better - for - you (BFY) • Organic chocolate today is moving from niche to m ain s t r e a m - c o nsu m e r s a r e willin g t o p a y m o r e f or c er tifi e d p r o duc t s • Chocolate formulation - increasing request for a low - c a lo r i e ch o c ol at e wi thout s u g a r a nd a v e g a n p r oduct f o r m u l a t i on wi thout a n i m a l de ri va t i v e s , the latter both a health concern and a climate change concern • Consumers are increasingly interested in RMCF s u s t ai n a b ilit y a nd e t h i c a l c o n s ump tio n Our Priorities: Company Offerings – Improve Positioning with Consumers Need a Universal Brand Image Poor Store Displays Improve Packaging 62

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix 1. https://www.foodnavigator - usa.com/Article/2021/06/16/Chocolate - consumption - on - the - rise - survey - finds 2. id Lack of Product innovation – Understanding Consumer's Chocolate Consumption and Purchasing Preferences will be Key to Long - Term Turnaround What are Consumers Saying? x 52% of consumers choose dark chocolate because they believe it’s a healthier option. 1 x 45% of consumers say they are looking for new types of chocolate products. 2 (Ex: low - calorie, sugar free, organic, vegan, etc...) x Market growth is being fueled by an increasing demand and growing popularity of dark and organic chocolates. x Customers are willing to pay more for chocolate products with label claims including, organic, fair trade and paleo. x Organic is no longer a secondary thought for consumers. Between increased desire for healthy food options, environmental responsibility and widened organic product availability, the consumer shift can no longer go ignored. x 4 out of 10 consumers say their chocolate purchases are influenced by Fair Trade/Fair Trade Certified and Non - GMO Project Certified.) 52% 45% There are numerous opportunities RMCF should be pursuing based off customer trends Products Production Practices • Low/Sugar Free/dark chocolate • Organic/Non - GMO • Vegan • Su s t ai n a b ly s ou r c ed • Fair - trade 63

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix Our Priorities: Best in Class Governance Reforms Reforms • Maintain a board of independent directors who are diverse not only in gender and ethnicity but are also uniquely qualified through their expertise in relevant past experiences • Recruit a CEO with transformation experience • There is no evidence of an ESG strategy at RMCF. • Most domestic public companies are being evaluated and rated on their environmental, social and governance (ESG) performance by various third - party providers of reports and ratings. • Numerous opportunities in the factory, supply chain and values statement to franchisees to promote an ethical and sustainable stance of the brand. 64

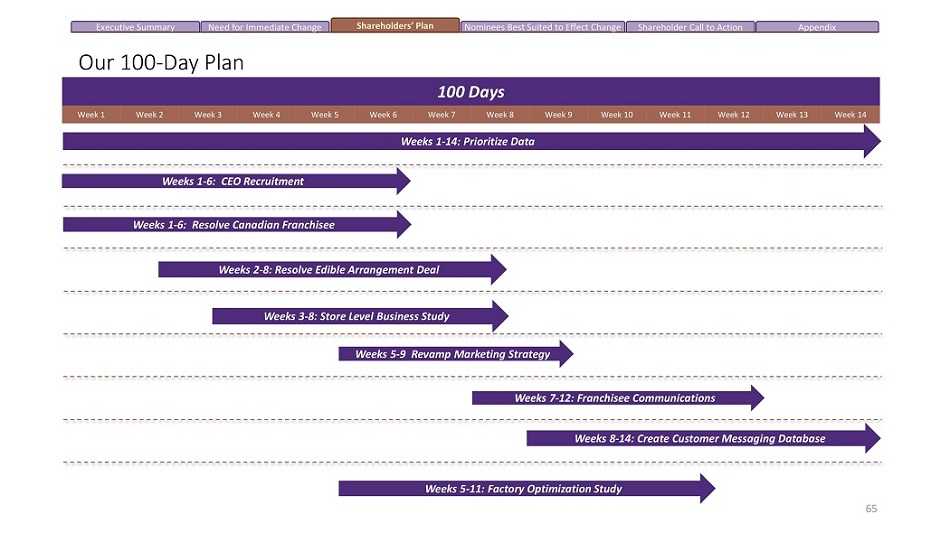

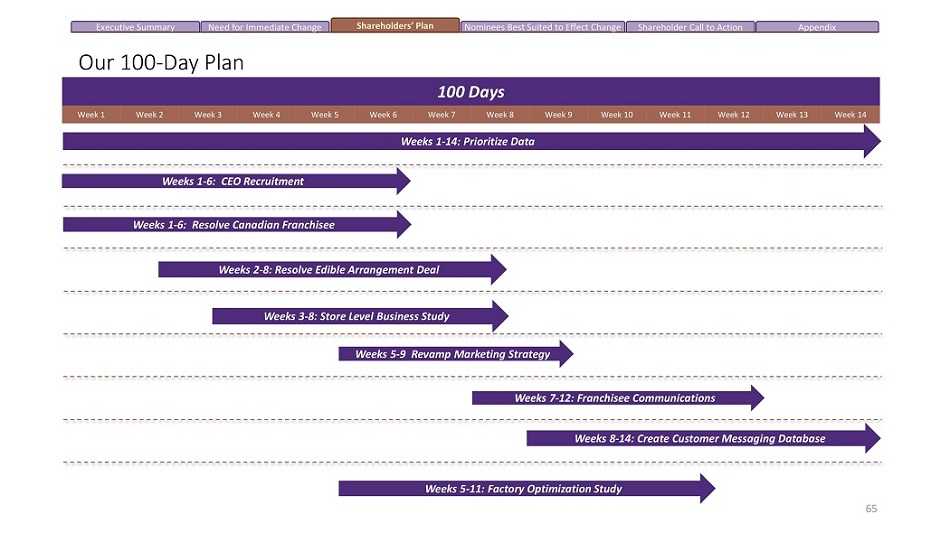

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix Our 100 - Day Plan 100 Days Week 1 Week 2 Week 3 Week 4 Week 5 Week 6 Week 7 Week 8 Week 9 Week 10 Week 11 Week 12 Week 13 Week 14 Weeks 1 - 14: Prioritize Data Weeks 5 - 11: Factory Optimization Study Weeks 1 - 6: CEO Recruitment Weeks 1 - 6: Resolve Canadian Franchisee Weeks 2 - 8: Resolve Edible Arrangement Deal Weeks 3 - 8: Store Level Business Study Weeks 5 - 9 Revamp Marketing Strategy Weeks 7 - 12: Franchisee Communications Weeks 8 - 14: Create Customer Messaging Database 65

THE CONCERNED SHAREHOLDERS OF AB Value Partners, LP & AB Value Management LLC Bradley Radoff Executive Summary Need for Immediate Change Shareholders' Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix 66

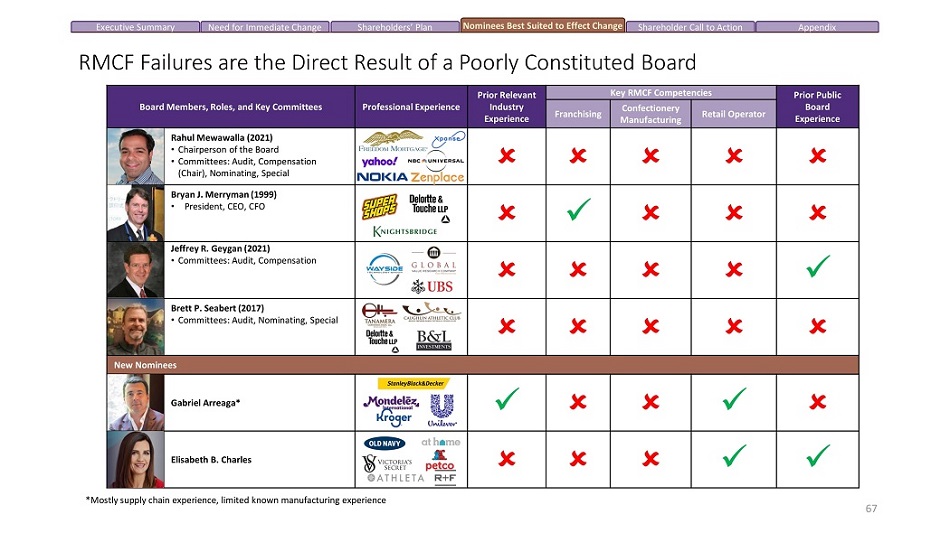

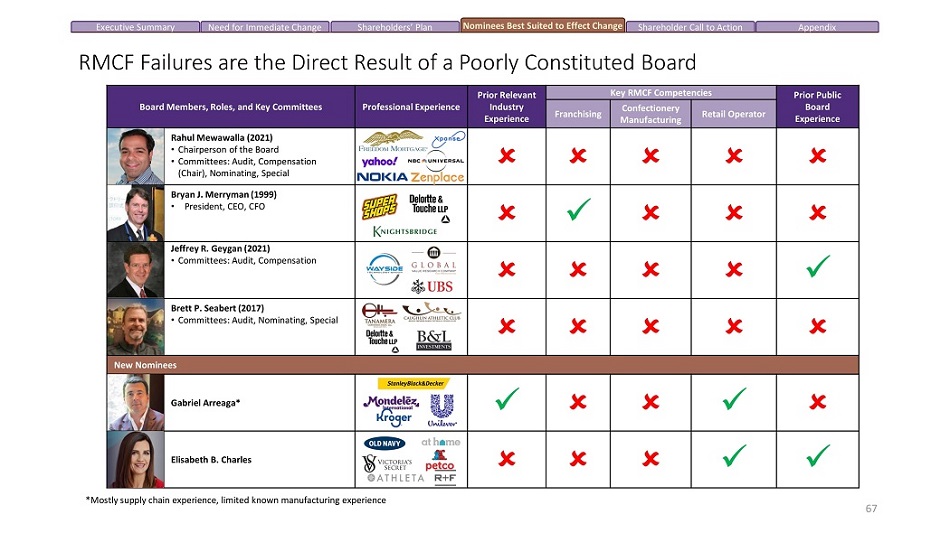

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix *Mostly supply chain experience, limited known manufacturing experience Board Members, Roles, and Key Committees Professional Experience Prior Relevant Industry Experience Key RMCF Competencies P r i or P ub lic Board Experience Franchising Confectionery Ma nuf a c t u r i ng Retail Operator Rahul Mewawalla (2021) • Chairperson of the Board • Committees: Audit, Compensation (Chair), Nominating, Special B r ya n J . M e rr yma n ( 1999) • President, CEO, CFO x Jeffrey R. Geygan (2021) • Committees: Audit, Compensation x Brett P. Seabert (2017) • Committees: Audit, Nominating, Special New Nominees Gabriel Arreaga* x x Elisabeth B. Charles x x RMCF Failures are the Direct Result of a Poorly Constituted Board 67

Executive Summary Need for Immediate Change Shareholders’ Plan Nominees Best Suited to Effect Change Shareholder Call to Action Appendix WORK EXPERIENCE COMPANY YEARS POSITION 1 Chief Executive Officer 2020 – 2021 1 Executive Vice President, Platforms and Technology Businesses and Chief Digital Officer 2020 – 2021 6 CEO and President 2014 – 2020 1 Senior Advisor on Innovation 2013 – 2014 2 Global Head of Business Division, Global P&L Leader, Global Vice President 2010 – 2012 2 Vice President 2008 – 2010 3 Senior Executive 2005 – 2008 5 Principal 2000 – 2005 3 Head of Technology and Product 1996 – 1999 NO PUBLIC BOARD EXPERIENCE Inconsistent Performance: • Average time spent in a role is about 3 years (only 2 years excluding time spent at his startup, Zenplace) • Employment history indicates a lack of commitment and experience navigating long - term strategy • No prior public board experience. No known corporate governance experience • Recent experience with startups appears to have mostly failed Rahul Mewawalla Lacks the Leadership, Skills and Experience RMCF Needs 68