UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

AVENUE FINANCIAL HOLDINGS, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | 1) | | Title of each class of securities to which transaction applies: |

| | 2) | | Aggregate number of securities to which transaction applies: |

| | 3) | | Per unit price of other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | | Proposed maximum aggregate value of the transaction: |

| | 5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials: |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | 1) | | Amount previously paid: |

| | 2) | | Form, Schedule or Registration Statement No.: |

| | 3) | | Filing Party: |

| | 4) | | Date Filed: |

AVENUE FINANCIAL HOLDINGS, INC.

111 – 10th Avenue South, Suite 400

Nashville, Tennessee 37203

(615) 736-6940

April 30, 2015

Dear Shareholder:

You are cordially invited to attend our 2015 annual meeting of the shareholders of Avenue Financial Holdings, Inc., which will be held at theUnion Station Hotel, 1001 Broadway, Nashville, TennesseeonTuesday, June 16, 2015, at 11:00 a.m. CDT. I sincerely hope you will be able to attend the meeting and I look forward to seeing you.

This year you are being asked to elect five Class I directors, each for a term of three years.

The attached notice of the annual meeting and proxy statement describes the formal business to be transacted at the meeting. Your attention is directed to the proxy statement accompanying this notice for a more complete statement regarding the matters proposed to be acted upon at the meeting.

Sincerely,

Ronald L. Samuels

Chief Executive Officer

AVENUE FINANCIAL HOLDINGS, INC.

111 – 10th Avenue South, Suite 400

Nashville, Tennessee 37203

(615) 736-6940

* * * * * * * * *

NOTICE OF THE ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD JUNE 16, 2015

* * * * * * * * *

The annual meeting of shareholders (the “Annual Meeting”) of Avenue Financial Holdings, Inc. (the “Company”) will be held on Tuesday, June 16, 2015, at 11:00 a.m. CDT at the Union Station Hotel, 1001 Broadway, Nashville, Tennessee, for the following purposes:

| | (1) | To elect five Class I directors to the Company’s board of directors; and |

| | (2) | To transact such other business as may properly come before the meeting or any postponement or adjournment of the Annual Meeting. |

The Board of Directors has set the close of business on April 27, 2015, as the record date for determining the shareholders who are entitled to notice of, and to vote at, the meeting or any postponement or adjournment thereof.

By Order of the Board of Directors,

Jeremy Yeagle

Corporate Secretary

Nashville, Tennessee

April 30, 2015

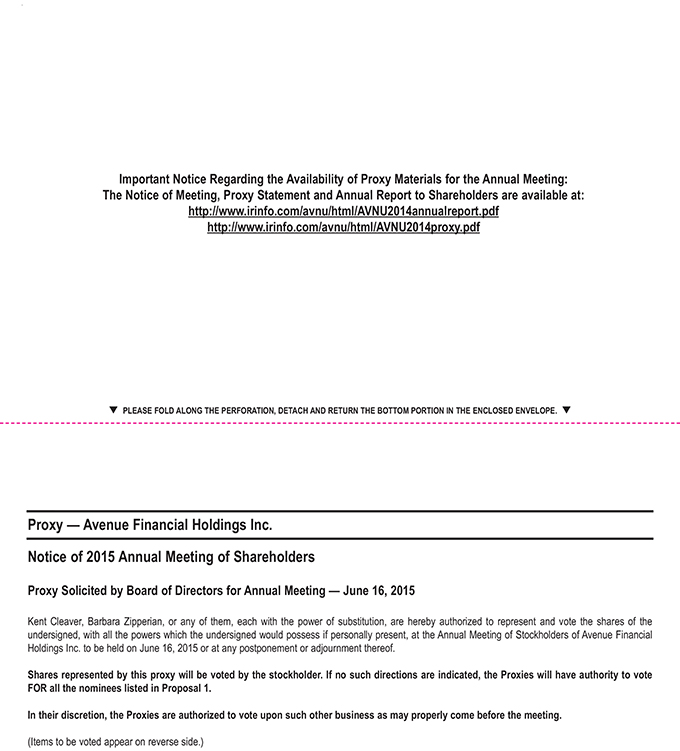

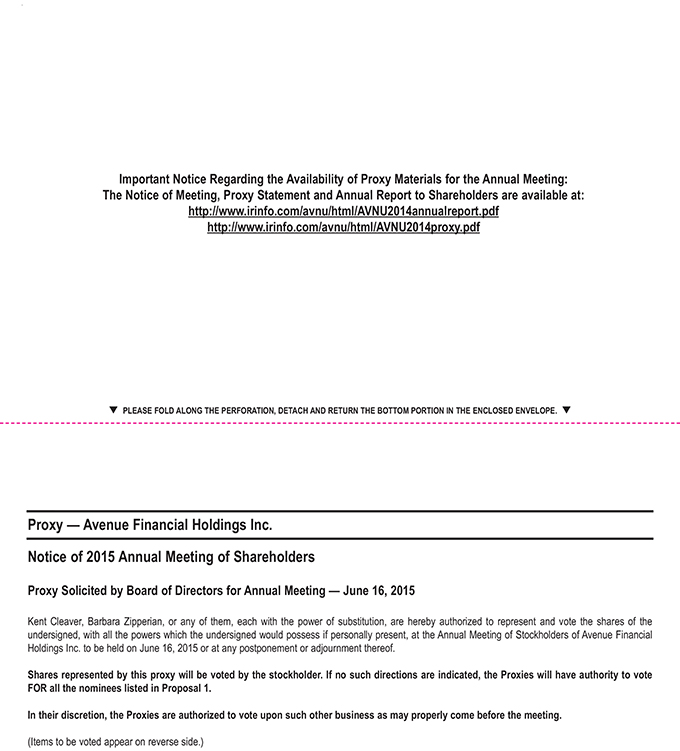

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF

PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 16, 2015

The Notice of Annual Meeting of Shareholders, the Proxy Statement for the Annual Meeting, a form of proxy, and the 2014 Annual Report to Shareholders, which includes the Annual Report on Form 10-K for the year ended December 31, 2014, are available at:

http://www.irinfo.com/avnu/html/AVNU2014annualreport.pdf and

http://www.irinfo.com/avnu/html/AVNU2014proxy.pdf.

AVENUE FINANCIAL HOLDINGS, INC.

111 10th Avenue South, Suite 400

Nashville, Tennessee 37203

(615) 736-6940

PROXY STATEMENT

The Board of Directors (the “Board”) of Avenue Financial Holdings, Inc., a Tennessee corporation (the “Company”) is furnishing this proxy statement in connection with its solicitation of proxies for use at its annual meeting of shareholders (the “Annual Meeting”) to be held at 11:00 a.m. CDT on Tuesday, June 16, 2015 at the Union Station Hotel, Nashville, Tennessee, and at any postponements or adjournments of the meeting. The enclosed proxy is solicited by the Board of the Company.

The purposes of the meeting are the following:

| | (1) | To elect five Class I members to the Company’s Board of Directors for terms of three years each; and |

| | (2) | To transact such other business as may properly come before the Annual Meeting or any postponement or adjournment of the Annual Meeting. |

IMPORTANT MEETING AND VOTING INFORMATION

Who is asking for my vote?

The board of directors of Avenue Financial Holdings, Inc. (the “Company”) is soliciting the enclosed proxy for use at the annual meeting of shareholders to be held on Tuesday, June 16, 2015, at 11:00 a.m., CDT, at Union Station Hotel, 1001 Broadway, Nashville, Tennessee. If the meeting is adjourned, we may also use the proxy at any later meetings for the purposes stated in the notice of annual meeting. Unless the context indicates otherwise, all references to “we,” “us” and “our” in this proxy statement refer to Avenue Financial Holdings, Inc. and our wholly-owned subsidiary bank, Avenue Bank.

What items will be voted on at the annual meeting?

One matter is scheduled for a vote – the election of five Class I directors each to serve for a term of three years or until that person’s successor is duly elected and qualified.

As of the date of this proxy statement, we are not aware of any other matters that will be presented for consideration at the Annual Meeting.

How do your directors recommend that shareholders vote?

The directors recommend that you vote:

| | • | | FOR the election of the five Class I director nominees each to serve for a term of three year or until that person’s successor is duly elected and qualified. |

Who is eligible to vote?

Shareholders of record at the close of business on April 27, 2015 are entitled to be present and to vote at the Annual Meeting or any adjourned meeting. The proxy statement and the form of proxy relating to the Annual Meeting are first being mailed to shareholders on or about May 8, 2015.

What are the rules for voting?

As of the record date, we had 10,227,340 shares of our common stock outstanding and entitled to vote at the Annual Meeting. Each share of our common stock entitles the holder to one vote on all matters voted on at the meeting. All of the shares of common stock vote as a single class.

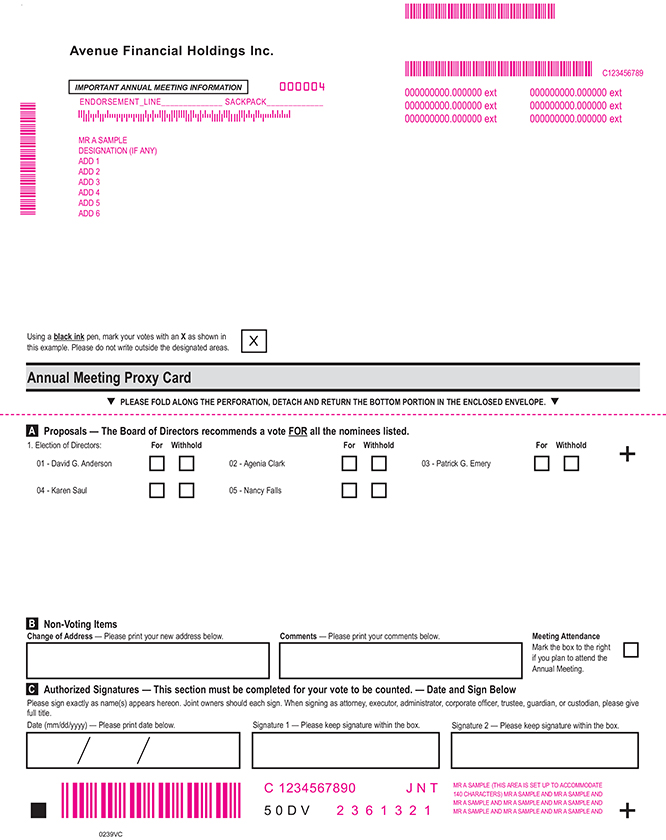

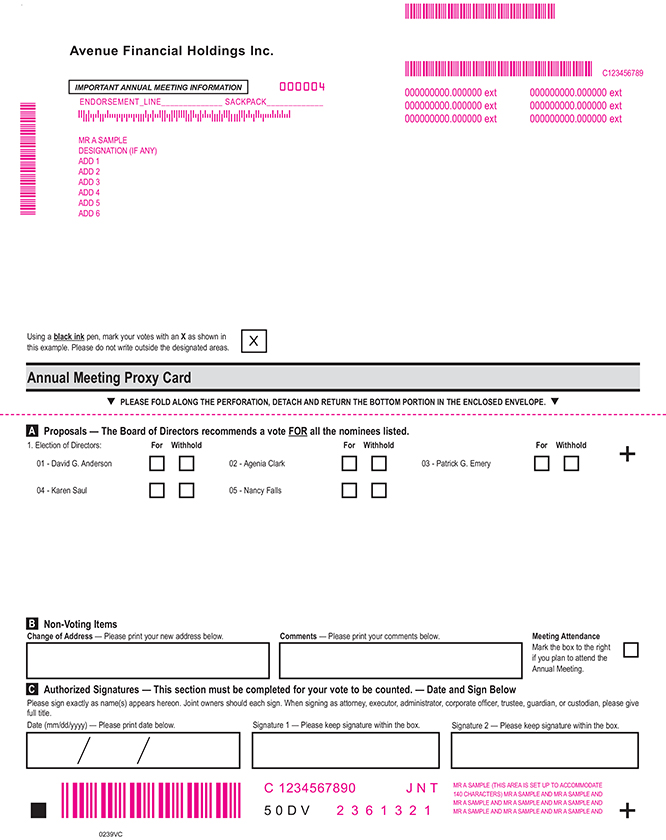

If you hold shares in your own name, you may vote by selecting any of the following options:

| | • | | By Mail: Complete the proxy card, date and sign it, and return it in the postage-paid envelope provided. |

| | • | | Vote in Person: You may choose to vote in person at the meeting. We will distribute written ballots to any shareholder of record who wishes to vote at the meeting. |

If your shares are held in the name of a bank, broker or other holder of record, you are considered the beneficial owner of shares held in “street name,” and you will receive instructions from such holder of record that you must follow for your shares to be voted. Please follow their instructions carefully. Also, please note that if the holder of record of your shares is a bank, broker or other nominee and you wish to vote in person at the Annual Meeting, you must request a legal proxy or broker’s proxy from your bank, broker or other nominee that holds your shares and present that proxy and proof of identification at the Annual Meeting.

Shares represented by signed proxies will be voted as instructed. If you sign the proxy but do not mark your vote, your shares will be voted as the directors have recommended.

As of the date of this proxy statement, we are not aware of any other matters to be presented or considered at the meeting, but your shares will be voted at the discretion of the proxies appointed by the board of directors on any of the following matters:

| | • | | any matter about which we did not receive written notice a reasonable time before we mailed these proxy materials to our shareholders; and |

| | • | | matters incident to the conduct of the meeting. |

Holders of a majority of our outstanding shares of common stock as of the record date must be present at the meeting, either in person or by proxy, to hold the meeting and conduct business. This is called a quorum. In determining whether we have a quorum at the Annual Meeting for purposes of all matters to be voted on, all votes “for” or “against” and all votes to “abstain” will be counted.

If you hold your shares in street name, your brokerage firm may vote your shares under certain circumstances. Brokerage firms have authority under stock exchange rules to vote their customers’ unvoted shares on certain “routine” matters. Since the only matter scheduled for a vote is election of Class I directors and such matter is not considered a “routine” matter under applicable exchange rules, brokerage firms will not be able to vote any of their customers’ unvoted shares at this Annual Meeting.If you hold your shares in street name, please provide voting instructions to your bank, broker or other nominee so that your shares may be voted on all proposals.

2

When a brokerage firm votes its customers’ unvoted shares on routine matters, these shares are counted for purposes of establishing a quorum to conduct business at the meeting. Since no routine matters are being considered at this Annual Meeting, shares held in brokerage accounts will not be considered present for quorum purposes unless the beneficial owners direct the brokers on how those shares are to be voted. If a brokerage firm indicates on a proxy that it does not have discretionary authority to vote certain shares on a particular matter, then those shares will be treated as “broker non-votes.” Shares represented by broker non-votes will be counted in determining whether there is a quorum.

Each share of our common stock entitles the holder to one vote on all matters voted on at the meeting. Provided a quorum is present, our directors will be elected by plurality. This means that the five nominees who receive the largest number of “for” votes cast will be elected as directors. Shareholders do not have cumulative voting rights.

Provided a quorum is present, the affirmative vote by a majority of the votes cast in person or by proxy will be required for all other matters to be approved at the Annual Meeting other than the election of directors. Abstentions will not constitute a vote “for” or “against” any matter being voted on at the Annual Meeting and will not be counted as “votes cast” on any matter. As a result, abstentions, broker non-votes and the failure to return a signed proxy will have no effect on the outcome of such matters.

How can I revoke my proxy?

If you are a shareholder of record (i.e., you hold your shares directly instead of through a brokerage account) and you change your mind after you return your proxy, you may revoke it and change your vote at any time before the polls close at the meeting. You may do this by:

| | • | | signing, dating and returning another proxy with a later date; or |

| | • | | voting in person at the meeting. |

If you hold your shares through a brokerage account, you must contact your brokerage firm to revoke your proxy.

How will we solicit proxies, and who will pay for the cost of the solicitation?

We will pay for the cost of this proxy solicitation. We do not intend to solicit proxies otherwise than by use of the mail or website posting, but certain of our directors, officers and other employees, without additional compensation, may solicit proxies personally or by telephone, facsimile or email on our behalf.

How can a shareholder propose business to be brought before next year’s annual meeting?

We must receive any shareholder proposals intended to be presented at our 2016 annual meeting of shareholders on or before December 31, 2015, for a proposal to be eligible to be included in the proxy statement and form of proxy to be distributed by the board of directors for that meeting.

Any shareholder proposal intended to be presented from the floor at our 2016 annual meeting of shareholders must comply with the advance notice provisions and other requirements of our bylaws and be delivered not less than 90 days and not more than 120 days prior to the first anniversary of the date of this year’s annual meeting of shareholders; provided, however, that if the date of the annual meeting is advanced by more than 30 days prior to the anniversary of this year’s annual meeting or delayed by more

3

than 30 days after such anniversary date, such notice of a shareholder proposal must be received by the Company no later than the tenth day following the day on which notice of the date of annual meeting was mailed or public announcement of the date of annual meeting is first made by the Company. The shareholder notice must be delivered to Avenue Financial Holdings, Inc., 111 10th Avenue South, Suite 400, Nashville, Tennessee 37203, Attention: Corporate Secretary. The shareholder notice must set forth, as to each matter the shareholder proposes to bring before the annual meeting:

| | (1) | the name and record address of the shareholder who intends to propose the business and the class or series and number of shares of capital stock of the Company which are owned beneficially or of record by such shareholder; |

| | (2) | a representation that the shareholder is a holder of record of stock of the Company entitled to vote at such meeting and intends to appear in person or by proxy at the meeting to introduce the business specified in the notice; |

| | (3) | a brief description of the business desired to be brought before the annual meeting and the reasons for conducting such business at the annual meeting; |

| | (4) | any material interest of the shareholder in such business; and |

| | (5) | any other information that is required to be provided by the shareholder under Regulation 14A under the Securities and Exchange Act of 1934. |

For a complete description of the procedures and disclosure requirements to be complied with by shareholders in connection with submitting shareholder proposals, shareholders should refer to the Company’s Amended and Restated Bylaws.

ITEM 1 – ELECTION OF DIRECTORS

Our bylaws provide that our board of directors will consist of up to 15 directors, with the precise number of directors being determined by our board of directors from time to time. As of the date of this proxy statement we have 12 directors, but our board of directors has proposed an increase in the number of directors to 13 directors in connection with the Annual Meeting. Our board of directors is divided into three classes of directors with the number of directors in each class being as equal as possible. As a result, approximately one-third of our directors are elected at each annual meeting of our shareholders for three-year terms and hold office until their successors are duly elected and qualified or until their earlier death, resignation or removal. Shareholders are not entitled to cumulative voting in the election of our directors. Our board of directors also serves as the board of directors of our bank.

At the Annual Meeting the shareholders will vote to elect five persons to serve as Class I members of the Board of Directors. The persons elected to serve as Class I Directors will serve for three-year terms expiring at the 2018 annual meeting (and until their respective successors have been duly elected and qualified). The Class II and Class III directors will not be elected at this Annual Meeting. The persons currently serving as Class II Directors will continue to serve for a term expiring at the 2016 annual meeting and the persons currently serving as Class III Directors will serve for a term expiring at the 2017 annual meeting (and in each case until their respective successors have been duly elected and qualified).

Our board of directors has no reason to believe that any of the nominees will be unavailable to serve as a director. If any nominee should become unavailable before the Annual Meeting, the persons named in the enclosed proxy, or their substitutes, reserve the right to vote for substitute nominees selected by our board of directors.

4

Our Board of Directors recommends that you vote FOR each of the proposed director nominees.

UNLESS A PROXY IS MARKED TO GIVE A DIFFERENT DIRECTION, IT IS THE INTENTION OF THE PERSONS NAMED IN THE PROXY TO VOTE THE SHARES REPRESENTED THEREBY IN FAVOR OF THE ELECTION OF THE DIRECTORS NAMED BELOW.

Nominees for Class I Directors:

David G. Anderson, age 67, has been Senior Vice President – Finance of HCA, one of the nation’s leading provider of healthcare services, since July 1999 and was Treasurer of HCA from July 1999 until July 2014. He is responsible for HCA’s treasury functions, including corporate finance, investment, cash management and ongoing relationships with the financial community. We believe that Mr. Anderson’s experience in finance and accounting, as well as his experience in the healthcare industry in the Nashville community, currently a major focus of our business, qualify him to serve as a member of our board of directors.

Agenia Clark, age 56, has been the President and CEO of the Girl Scout Council of Middle Tennessee, an organization that serves more than 14,000 girls and 7,000 volunteers in 39 counties throughout middle Tennessee, since April 2004. Prior to her tenure with the Girl Scout Council, she was the Vice President of Human Resources for the Tennessee Education Lottery Corporation; a Senior Director of Human Resources at Vanderbilt University from June 2003 to January 2004, and worked in governmental relations, marketing, business ethics and human resources at Nortel Networks, an international telecommunications company from June 1989 to March 2003. Ms. Clark has served as a member of the Tennessee Board of Regents and serves on the Advisory Council to the College of Business at the University of Tennessee, Knoxville. We believe that Ms. Clark’s business experience in the Nashville community, currently a major focus of our business, qualifies her to serve as a member of our board of directors.

Patrick G. Emery, age 65, has been the President of Spectrum Properties | Emery, Inc., a full service commercial real estate company, since August 2009. Spectrum Properties | Emery, Inc. develops, markets and manages class A office space in the Nashville MSA. Spectrum Properties | Emery Inc. now manages more than 1.5 million square feet of class A office space in the Nashville MSA while spearheading the future of the region with projects such as the Nashville Convention Center redevelopment. Mr. Emery served as Executive Vice President of Crescent Resources, Inc., a full service commercial real estate company, from August 1995 to August 2009. We believe that Mr. Emery’s extensive experience in commercial real estate developments, especially in the Nashville community, currently a major focus of our business, qualifies him to serve as a member of our board of directors.

Karen Saul, age 52, has been the Area Chairman of Arthur J. Gallagher & Co., or AJG, since September 2014 and served as Area President from November 2008 until her promotion in 2014. AJG is a global leader in insurance brokerage and risk management services. Ms. Saul previously served as the owner and Chief Executive Officer of The HR Group, LLC, a leader in employee benefits, human resource management and outsourcing from August 1999 until November 2008 when she merged her company with AJG. Ms. Saul has served on the Advisory Board of Medical Reimbursements of America, LLC,the Board of Trustees at The Oak Hill School, the Nashville Area Chamber of Commerce, and the Executive Committee of the Board of Trustees for the United Way of Middle Tennessee. We believe that Ms. Saul’s experience and connections in the Nashville community, currently a major focus of our business, and her business experience in human resources and management practices, qualify her to serve as a member of our board of directors.

5

Nancy Falls, age 58, has served as founder and Chief Executive Officer of The Concinnity Company, a firm engaged in providing leadership and governance advisory services to corporate boards of directors, C-suites and individual executives since June 2013. From March 2007 until May 2013, Ms. Falls served as Managing Partners and National Managing Partner Healthcare for Tatum, a Randstad company, a firm that provides management and advisory services, including executive leadership. Consulting and executive search services to its client companies. From January 2006 until March 2007, Ms. Falls served as managing partner of Montgomery Morgan, LLC, a financial advisory firm. From August 2002 to November 2005, she served as Associate Provost, Finance and Administration for Vanderbilt University. Ms. Falls is a Governance Fellow of the National Association of Corporate Directors. We believe that Ms. Falls’ experience in corporate governance and executive leadership as well as her financial and accounting expertise qualifies her to serve as a member of our board of directors.

The Class II and Class III directors do not stand for election at this Annual Meeting.

Class II Directors:

James F. Deutsch, age 59, has served as a Managing Director of Patriot Financial Partners II, L.P. and Patriot Financial Partners Parallel II, L.P., or collectively Patriot, since April 2011. From November 2004 until April 2011, Mr. Deutsch served as President, CEO and Director of Team Capital Bank, a community bank located in Pennsylvania. He currently serves as a director of Sterling Bancorp, Atlantic Community Bankers Bank, and Bannockburn Global Forex, LLC. Mr. Deutsch was designated as a director by Patriot pursuant to the terms of a Corporate Governance Agreement, dated January 16, 2015, between us and Patriot. See “Certain Relationships and Related Transactions – Corporate Governance Agreement”. Patriot beneficially owned 847,500 shares of our common stock as of March 31, 2015. Mr. Deutsch has over 35 years of banking and investment management experience. He brings to us a breadth of experience, including investment banking, commercial banking and commercial real estate lending, and corporate finance. We believe that Mr. Deutsch’s experience in financial services, and his perspective as both an investor in banks and an operational leader of financial services firms and community banks, qualifies him to serve as a member of our board of directors.

Marty Dickens, age 67, was President of BellSouth/AT&T TN until his retirement in October 2007, having served at the company since June 1969. Mr. Dickens is Chairman of the Board of Trustees of Belmont University, serves on the corporate board of Genesco and Blue Cross/Blue Shield of Tennessee, and serves as Chairman of the Board of Harpeth Capital, an investment banking firm. He currently serves as chairman of the Music City Center Authority, which was responsible for the financing, construction and now the operation of the new Nashville convention center. We believe that Mr. Dickens’ leadership experience and extensive community contacts in the Nashville community, currently a major focus of our business, qualify him to serve as a member of our board of directors.

Joseph C. Galante, age 65, was Chairman of Sony Music from January 1995, until his retirement in July 2010. He helped launch the careers of Alabama, Clint Black, Kenny Chesney, Sara Evans, Dave Matthews, Wu Tang Clan, SWV, The Judds, Lonestar, Martina McBride, K.T. Oslin, Kellie Pickler, Carrie Underwood, Keith Whitley, Chris Young and many more. His leadership bolstered the careers of such superstars as Brooks & Dunn, Alan Jackson, Miranda Lambert and Brad Paisley. He serves on the boards of the Country Music Association, Iroquois Capital, Artist Growth and Fishbowl Spirits. He is currently a mentor in residence at the Entrepreneur Center in Nashville. We believe that Mr. Galante’s extensive experience and contacts in the music industry, and his interest in entrepreneurial development in the Nashville community, currently major focuses of our business, qualify him to serve as a member of our board of directors.

6

Steve Moore, age 61, is the owner of Moore Entertainment, a consulting company to the music industry. He was Chief Executive Officer of the Country Music Association from July 2010 to July 2013 and Executive Vice President of the Nashville office of the global firm, AEG Live! from May 2004 to July 2010. Mr. Moore owns his own country music promotional company, Moore Entertainment, and has created and developed several annual Blues Music festivals in cities in the South and Midwest. Through his company, Independent Booking and Management, Mr. Moore has booked and promoted shows with Huey Lewis, Greg Allman, George Strait, Sting, Amy Grant and Stevie Ray Vaughan. We believe that Mr. Moore’s extensive experience and contacts in the music industry, a major focus of our business, qualify him to serve as a member of our board of directors.

Class III Directors:

David Ingram, age 52, has served as Chairman of Ingram Entertainment Inc., the nation’s largest distributor of DVDs and video games, since April 1996. From April 1996 through August 2012, Mr. Ingram served as Chairman and President of Ingram Entertainment Inc. Mr. Ingram also has served as Chairman of DBI Beverage Inc., an operator of beverage distributorships in eight major markets in California, since he founded that company in February 2002. Prior to these roles, he served as Assistant to the Treasurer of Ingram Industries Inc. and as a Development Officer at Duke University. Mr. Ingram is currently President of The Golf Club of Tennessee, Chairman of the Montgomery Bell Academy Board of Trustees, Chairman of the Vanderbilt Owen Graduate School of Management Board of Visitors, and head of the Investment Committee for the Tennessee Golf Foundation. We believe that Mr. Ingram’s leadership experience and business contacts in the Nashville community, currently a major focus of our business, qualify him to serve as a member of our board of directors.

Ken Robold, age 50, is currently a consultant to the entertainment industry. He was President of Zac Brown’s label, Southern Ground Artists, from April 2013 to May 2014. He oversaw the label’s recorded music, publishing and studio divisions and focused on building the publishing catalog. From December 1990 to March 2013, Mr. Robold was Executive Vice President and General Manager of Universal Music Nashville. Mr. Robold is a member of the Country Music Association and serves as a member of the board of the Academy of Country Music. We believe that Mr. Robold’s extensive connections in the music industry, a major focus of our business, and his financial and accounting expertise qualify him to serve as a member of our board of directors.

Ronald L. Samuels, Chief Executive Officer and Chairman of the Board of Directors, age 68, was one of our co-founders in 2006. He formerly served as Group President of middle Tennessee at Regions Bank. Mr. Samuels is well known as a community leader, with a long history of board service and leadership roles, including The Tennessee Bankers Association, Country Music Association Foundation, Leadership Nashville, Partnership 2010, Music City Center Coalition, Nashville Sports Council, Music City Bowl, and Nashville Predators Foundation. He also served as Chairman of the Nashville Area Chamber of Commerce from 2008 to 2010. We believe that Mr. Samuels’ extensive experience in banking and his connections within the Nashville community, currently a major focus of our business, qualify him to serve as a member of our board of directors.

Kent Cleaver, President and Chief Operating Officer, age 59, was one of our co-founders in 2006, and he has enjoyed a 37-year career in the Nashville banking community, including leadership in retail and commercial banking, sales management, and operational management at a statewide level. He formerly served as the middle Tennessee commercial banking executive for both First Union and Regions Bank. He is an active member of the middle Tennessee community, currently serving on the Executive Committee for the Lipscomb University Business Leadership Council, and as board chair of the Board of Visitors, College of Business, Lipscomb University. He is a graduate of Leadership Nashville (Class of 2013) as well as Leadership Middle Tennessee (Class of 2010). We believe that Mr. Cleaver’s extensive banking experience in the Nashville market, currently a major focus of our business, qualify him to serves as a member of our board of directors.

7

EXECUTIVE MANAGEMENT

Our executive management team brings extensive experience leading departments at large financial institutions in commercial banking, credit administration, retail banking, private banking, mortgage, human resources, marketing, and bank operations. All four members of our executive management team have been working together since 2006, when they founded Avenue Bank. In addition, to Mr. Ronald L. Samuels, our Chief Executive Officer and Chairman, and Mr. Kent Cleaver, our President and Chief Operating Officers, both of whom also serve on our board of directors and whose biographical information is included in the section of the Proxy Statement entitled “Item 1- Election of Directors,” our executive officers also include the following persons:

| | | | | | | | | | |

Name | | Age | | | Since | | | Position with our Company |

Barbara J. Zipperian | | | 57 | | | | 2006 | | | Executive Vice President and Chief Financial Officer |

E. Andrew Moats | | | 38 | | | | 2006 | | | Executive Vice President and Chief Credit Officer |

STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information as of March 31, 2015 regarding the beneficial ownership of our common stock for:

| | • | | each stockholder known by us to be the beneficial owner of more than 5% of our outstanding shares of common stock; |

| | • | | each of our named directors and director nominees; |

| | • | | each of our executive officers who are not directors; and |

| | • | | all of our directors and executive officers as a group. |

We have determined beneficial ownership in accordance with the rules of the SEC. These rules generally provide that a person is the beneficial owner of securities if such person has or shares the power to vote or direct the voting of securities, or to dispose or direct the disposition of securities, or has the right to acquire such powers within 60 days. For purposes of calculating each person’s percentage ownership, common stock issuable pursuant to options exercisable within 60 days are included as outstanding and beneficially owned for that person or group, but are not deemed outstanding for the purposes of computing the percentage ownership of any other person. Except as disclosed in the footnotes to this table and subject to applicable community property laws, we believe that each beneficial owner identified in the table possesses sole voting and investment power over all our common stock shown as beneficially owned by the beneficial owner.

The percentage of beneficial ownership is based on 10,227,340 shares of our common stock outstanding as of March 31, 2015.

Unless otherwise noted, the address for each shareholder listed in the table below is: c/o Avenue Financial Holdings, Inc., 111 10th Avenue South, Suite 400, Nashville, TN 37203.

8

| | | | | | | | | | | | |

| | | | | | Shares Beneficially Owned | |

Name: | | | | | Number of

Shares | | | Percentage

of Shares | |

Greater than 5% shareholders | | | | | | | | | | | | |

Patriot Financial Partners II, L.P Cira Centre 2929 Arch Street, 27th Floor Philadelphia, PA 19104 | | | | | | | 675,917 | | | | 6.61 | % |

| | | |

Patriot Financial Partners Parallel II, L.P Cira Centre 2929 Arch Street, 27th Floor Philadelphia, PA 19104 | | | | | | | 171,583 | | | | 1.68 | % |

| | | |

EJF Capital LLC 2107 Wilson Blvd, Suite 410 Arlington, VA 22201 | | | | | | | 574,717 | | | | 5.62 | % |

| | | |

Directors | | | | | | | | | | | | |

David G. Anderson | | | | | | | 24,118 | | | | 0.24 | % |

Patrick G. Emery | | | | | | | 21,460 | | | | 0.21 | % |

Agenia Clark | | | | | | | 17,789 | | | | 0.17 | % |

G. Kent Cleaver | | | (1) | | | | 209,107 | | | | 2.03 | % |

James F. Deutsch | | | (2) | | | | 848,500 | | | | 8.30 | % |

Marty Dickens | | | | | | | 48,116 | | | | 0.47 | % |

Nancy Falls | | | | | | | 5,000 | | | | 0.05 | % |

Joseph C. Galante | | | | | | | 40,246 | | | | 0.39 | % |

David Ingram | | | (3) | | | | 489,845 | | | | 4.79 | % |

Steve Moore | | | | | | | 28,316 | | | | 0.28 | % |

Ken Robold | | | | | | | 16,033 | | | | 0.16 | % |

Ronald L. Samuels | | | | | | | 207,241 | | | | 2.03 | % |

Karen Saul | | | | | | | 61,438 | | | | 0.60 | % |

| | | |

Executive Officers Who Are Not Directors | | | | | | | | | | | | |

Barbara J. Zipperian | | | (1) | | | | 106,242 | | | | 1.04 | % |

E. Andrew Moats | | | (1) | | | | 37,475 | | | | 0.37 | % |

| | | |

Directors and Executive Officers as a Group (15 persons) | | | (1) | | | | 2,160,926 | | | | 20.94 | % |

| (1) | Amounts and percentages include exercise of stock options granted to Mr. Cleaver, Ms. Zipperian and Mr. Moats, who have been granted stock options for 54,000, 26,000, and 10,000, respectively. All of the options are exercisable within 60 days of March 31, 2015. |

| (2) | Includes shares held by Patriot Financial Partners II, L.P. and Patriot Financial Partners Parallel II, L.P. Mr. Deutsch is a member of the investment committees which make investment decisions on behalf of both entities. |

| (3) | Includes 380,000 shares held in a trust for the benefit of Mr. Ingram’s children, as to which Mr. Ingram’s wife serves as trustee. Mr. Ingram disclaims beneficial ownership of such shares. |

9

CORPORATE GOVERNANCE

We are committed to having sound corporate governance principles, which are essential to running our business efficiently and maintaining our integrity in the marketplace. Our board of directors has adopted Corporate Governance Guidelines, which set forth the framework within which our board of directors, assisted by board committees, direct the affairs of our organization. Our Corporate Governance Guidelines address, among other things, the composition and functions of our board of directors, director independence, compensation of directors, management succession and review, board committees and selection of new directors. Our Corporate Governance Guidelines are available on our website at www.avenuenashville.com.

Director Qualifications. We believe that our directors should have the highest professional and personal ethics and values, consistent with our longstanding values and standards. They should have broad experience at the policy-making level in business, government or banking. They should be committed to enhancing shareholder value and should have sufficient time to carry out their duties and to provide insight and practical wisdom based on experience. Their service on boards of other companies should be limited to a number that permits them, given their individual circumstances, to perform responsibly all director duties. Each director must represent the interests of all shareholders. When considering potential director candidates, our board of directors also considers the candidate’s character, judgment, diversity, age, skills, including financial literacy, and experience in the context of our needs and those of the board of directors.

We have no formal policy regarding the diversity of our board of directors. Our Corporate Governance and Nominations Committee and our board of directors may therefore consider a broad range of factors relating to the qualifications and background of nominees, which may include personal characteristics. Our Corporate Governance and Nominations Committee’s and our board of director’s priority in selecting board members is identification of persons who will further the interests of our shareholders through his or her record of professional and personal experiences and expertise relevant to our growth strategy.

Director Attendance. The full board of directors met 12 times in 2014. During 2014, each director attended at least 75% of the aggregate of the total number of board meetings and the total number of meetings held by committees of the board on which he or she served, other than Dan Crockett, who resigned as a member of the board in October 2014, and Steve Moore who attended two-thirds of the meetings. We expect each director to attend our Annual Meeting of Shareholders, although we recognize that conflicts may occasionally prevent a director from attending an annual meeting. Seven of our 12 then serving directors, attended the 2014 annual meeting.

Director Independence. Under the rules of the NASDAQ Stock Market, independent directors must comprise a majority of our board of directors. The rules of the NASDAQ Stock Market, as well as those of the SEC, also impose several other requirements with respect to the independence of our directors. Our board of directors has evaluated the independence of its members based upon the rules of the NASDAQ Stock Market and the SEC. Applying these standards, our board of directors has affirmatively determined that, with the exception of Messrs. Samuels and Cleaver, who are executive officers, each of our current directors is an independent director, as defined under the applicable rules. Our board of directors determined that Messrs. Samuels and Cleaver do not qualify as independent directors because they are executive officers of our company.

Board Leadership Structure. Our board of directors meets monthly. Our board of directors does not have a policy regarding the separation of the roles of Chief Executive Officer and Chairman of the board of directors, as our board of directors believes that it is in the best interests of our organization to make that determination from time to time based on the position and direction of our organization and the

10

membership of our board of directors. Our board of directors has determined that having our Chief Executive Officer serve as Chairman of the board of directors is in the best interests of our shareholders at this time. This structure makes best use of the Chief Executive Officer’s extensive knowledge of our organization and the banking industry. Our board of directors views this arrangement as also providing an efficient nexus between our organization and our board of directors, enabling our board of directors to obtain information pertaining to operational matters expeditiously and enabling our Chairman to bring areas of concern before our board of directors in a timely manner. Because the positions of Chairman and Chief Executive Officer are held by the same person, our board of directors has designated Mr. Dickens to serve as Lead Independent Director. The Lead Independent Director serves as a liaison between the Chairman and the other independent directors and has the authority to call and chair meetings of the independent directors as often as necessary.

Board Role in Risk Oversight. Our board oversees risks through the adoption of policies and by delegating oversight to certain committees, including the Audit Committee and the Asset Liability Management Committee. Our Audit Committee is primarily responsible for overseeing our financial risk management processes on behalf of the full board. The Audit Committee focuses on (i) financial reporting risk and internal controls; (ii) oversight of the internal audit process and legal compliance; (iii) regulatory compliance; and (iv) review of insurance programs. Our Asset Liability Management Committee focuses on interest rate and credit risks in our investment portfolio. The full board focuses on the most significant risks facing the company, including strategic, market and reputational risks, and attempts to ensure that the risks we undertake are consistent with board policies. While the board oversees our risk management either directly or through its committees, management is responsible for the day-to-day risk management process.

Compensation Committee Interlocks and Insider Participation. None of our executive officers currently serves as a member of the compensation committee or as a director with compensation duties of any entity that has executive officers serving on our Compensation Committee or on our board of directors. None of our executive officers has served in such capacity in the past 12 months. Additionally, no member of our Compensation Committee is or has been an employee of us or our bank.

Code of Conduct

Our board of directors has adopted a Code of Business Conduct and Ethics, or Code of Conduct, governing all of our directors, officers, and employees. The Code of Conduct covers compliance with law; fair and honest dealings with us, with competitors and with others; fair and honest disclosure to the public; and procedures for ensuring accountability and adherence to the Code of Conduct. A copy of our Code of Conduct is available free of charge on our website at www.avenuenashville.com. We expect that any amendments to the Code of Conduct, or any waivers of its requirements, will be disclosed on our website, as well as any other means required by the NASDAQ Stock Market rules.

Family Relationships

There is no family relationship between any of our directors, executive officers or persons nominated to become a director or executive officer.

Committees of our Board of Directors

Our board of directors maintains the authority to appoint committees to perform certain management and administrative functions. Our board of directors has established four permanent committees: the Audit Committee, the Corporate Governance and Nominations Committee, the Compensation Committee, and the Asset Liability Management Committee. Our board of directors has adopted written charters for each of these committees. As necessary from time to time, special committees may be established by our board of directors to address certain issues.

11

Corporate Governance and Nominations Committee

We maintain a Corporate Governance and Nominations Committee consisting of Messrs. Dickens (Committee Chairman), Moore, Ingram and Anderson, each of whom is a nonemployee member of our board of directors. Our Corporate Governance and Nominations Committee is responsible for, among other things, recommending any changes in the size of our board of directors; identifying and recommending potential nominees to stand for election to our board of directors; developing standards to be applied in making determinations regarding material relationships between any director and us; overseeing management continuity and succession planning; and developing and monitoring corporate governance guidance.

Our board of directors has determined that each member of our Corporate Governance and Nominations Committee meets the requirements for independence under the rules of the NASDAQ Stock Market and the SEC rules and regulations. The Corporate Governance and Nominations committee charter is available on our website at www.avenuenashville.com.

Compensation Committee

We maintain a Compensation Committee consisting of Messrs. Dickens (Committee Chairman), Galante, and Ingram and Ms. Saul, each of whom is a nonemployee member of our board of directors.

Our Compensation Committee is responsible for, among other things, reviewing corporate goals relevant to compensation of our Chief Executive Officer, evaluating the performance of, and recommending to our board of directors compensation for, our Chief Executive Officer; recommending to our board of directors compensation for all of our named executive officers; administering our employee benefit plans and equity incentive programs; reviewing and recommending any change in control agreements for our named executive officers; recommending director compensation; and engaging and consulting with outside compensation consultants, legal counsel and other advisors as the committee deems necessary.

Our board of directors has determined that each member of our Compensation Committee meets the requirements for independence under the rules of the NASDAQ Stock Market and the SEC rules and regulations, and qualifies as an “outside director” for purposes of Section 162(m) of the Internal Revenue Code of 1986, as amended, or the Code. The Compensation Committee charter is available on our website at www.avenuenashville.com.

In 2014, our Compensation Committee engaged ChaseCompGroup as an independent advisor to assist the committee in determining and evaluating director and executive compensation. ChaseCompGroup reported directly to the Compensation Committee. ChaseCompGroup provided consulting services to the Compensation Committee in 2014 relating to development of a peer group of publicly-traded financial institutions; providing an understanding of the competitiveness of the compensation levels for our executive officers and directors relative to the market; and designing appropriate future compensation programs for our executive officers and directors. ChaseCompGroup is independent of our management, reports directly to the Compensation Committee and has no economic relationship with the company other than its role as advisor to the Compensation Committee.

12

Asset Liability Management Committee

We maintain an Asset Liability Management Committee, or ALCO Committee, consisting of Messrs. Anderson (Committee Chairman), Emery, and Galante, each of whom is a nonemployee member of our board of directors. Messrs. Samuels, Cleaver and Deutsch and Ms. Zipperian are also members.

Our ALCO Committee is responsible for, among other things: developing and monitoring our asset/liability management process, including developing asset/liability strategies; monitoring our liquidity and funding positions; periodically reviewing our rate sensitivity positions over various time horizons, our loan-to-deposit ratios and the average maturities for certain categories of our liabilities; and reviewing reports of outside advisors, including computer models designed to analyze the maturities of our rate-sensitive assets and liabilities. The ALCO Committee charter is available on our website at www.avenuenashville.com.

Audit Committee

Our Audit Committee consists of Mr. Robold (Committee Chairman), Mr. Moore, Ms. Saul and Ms. Clark. Our Audit Committee is responsible for, among other things: the selection and engagement of, and the resolution of any disagreements with, our independent auditors; the selection, engagement, retention, and compensation of our internal auditing firm; the review of major issues regarding accounting principles and financial statement presentations; the review of internal financial controls; the preparation of any reports required by an audit committee under rules of the SEC; the review and approval of related party transactions; and the evaluation of risks associated with our business and development of monitoring and mitigation programs to reduce such risks. Our audit committee meets at least one time per year with our independent auditors.

Our board of directors has affirmatively determined that Messrs. Robold and Moore, Ms. Saul and Ms. Clark each satisfies the requirements for independence as an audit committee member and Mr. Robold satisfies the requirements for financial literacy under the rules and regulations of the NASDAQ Stock Market and the SEC. Mr. Robold qualifies as an “audit committee financial expert” as defined in the SEC rules and satisfies the financial sophistication requirements of the NASDAQ Stock Market. The Audit Committee charter is available on our website at www.avenuenashville.com.

Report of the Audit Committee

The Audit Committee is responsible for providing oversight of the independent audit process and the independent auditors, reviewing our financial statements and discussing them with management and the independent auditors, reviewing and discussing with management and the independent auditors the adequacy and effectiveness of our internal accounting and disclosure controls and procedures and providing oversight of legal and regulatory compliance and ethics programs. The Audit Committee communicates regularly with our management, including our Chief Financial Officer, our Director of Internal Audit and our independent auditors. The Audit Committee is also responsible for conducting an appropriate review of and pre-approving all related person transactions and evaluating the effectiveness of the Audit Committee charter at least annually.

To comply with the Sarbanes-Oxley Act of 2002, the Audit Committee adopted a policy that pre-approves specified audit services to be provided by our independent auditors. The policy forbids our independent auditors from providing the services enumerated in Section 201(a) of the Sarbanes-Oxley Act.

In performing all of these functions, the Audit Committee acts only in an oversight capacity. In its oversight role, the Audit Committee relies on the work and assurances of our management, which has the primary responsibility for financial statements and reports, and of the independent auditors, who express an opinion on the conformity of our annual financial statements to generally accepted accounting principles in their report.

13

The Audit Committee has reviewed and discussed our 2014 audited financial statements with management. The Audit Committee has discussed with KPMG LLP, our independent registered public accounting firm, those matters required to be discussed by the auditors with the Audit Committee under the rules adopted by the Public Company Accounting Oversight Board. The Audit Committee has received the written disclosures and the letter from KPMG LLP required by applicable requirements of the Public Company Accounting Oversight Board regarding KPMG LLP’s communications with the Audit Committee concerning independence. The Audit Committee has discussed with KPMG LLP their independence from the Company and our management. The Audit Committee reported its findings to our board of directors.

Based on the reviews and discussions described above, the Audit Committee recommended to our board of directors that the audited financial statements be included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2014, for filing with the SEC. A copy of our Annual Report on Form 10-K is part of the Annual Report to Shareholders included with these proxy materials.

Ken Robold, Chairman

Steve Moore

Karen Saul

Agenia Clark

The Audit Committee’s report shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that we specifically incorporate the information contained in the report by reference, and it shall not be deemed filed under such acts.

EXECUTIVE COMPENSATION

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As such, we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies. These include, but are not limited to, reduced disclosure obligations regarding executive compensation in our proxy statements, including the requirement to include a specific form of Compensation Discussion and Analysis, as well as exemptions from the requirement to hold a non-binding advisory vote on executive compensation and the requirements to obtain shareholder approval of any golden parachute payments not previously approved. We have elected to comply with the scaled disclosure requirements applicable to emerging growth companies. As an emerging growth company, we are permitted to limit reporting of compensation disclosure to our principal executive officer and our three other most highly compensated executive officers, which are referred to as our “named executive officers.”

The compensation reported in the Summary Compensation Table below is not necessarily indicative of how we will compensate our named executive officers in the future. We will continue to review, evaluate and modify our compensation framework to maintain a competitive total compensation package. As such, and as a result of our becoming a publicly traded company, the compensation program following this offering could vary from our historical practices.

14

Our named executive officers for 2014, which consist of our principal executive officer and the three other most highly compensated executive officers, are:

| | • | | Ronald L. Samuels, Chairman of the Board and Chief Executive Officer; |

| | • | | G. Kent Cleaver, President and Chief Operating Officer; |

| | • | | Barbara J. Zipperian, Executive Vice President and Chief Financial Officer; and |

| | • | | E. Andrew Moats, Executive Vice President and Chief Credit Officer. |

Summary Compensation Table

The following table sets forth information regarding the compensation paid to each of our named executive officers for 2014, 2013 and 2012.

| | | | | | | | | | | | | | | | | | | | | | | | |

Principal Position | | Year | | | Salary | | | Cash

Bonus | | | Stock

Awards(1) | | | All Other

Compensation(2) | | | Total | |

Ronald L. Samuels Chairman and Chief Executive Officer | | | 2014 | | | $ | 361,250 | | | $ | 100,000 | | | $ | 85,000 | | | $ | 39,642 | | | $ | 585,892 | |

| | | 2013 | | | | 350,000 | | | | 50,000 | | | | 106,335 | | | | 42,094 | | | | 548,429 | |

| | | 2012 | | | | 350,000 | | | | — | | | | — | | | | 36,239 | | | | 386,239 | |

| | | | | | |

G. Kent Cleaver | | | 2014 | | | | 291,250 | | | | 80,000 | | | | 85,000 | | | | 28,845 | | | | 485,095 | |

President and Chief Operating Officer | | | 2013 | | | | 261,250 | | | | 50,000 | | | | 45,578 | | | | 22,481 | | | | 379,309 | |

| | | 2012 | | | | 245,400 | | | | 50,215 | | | | — | | | | 21,810 | | | | 317,425 | |

| | | | | | |

Barbara J. Zipperian | | | 2014 | | | | 197,000 | | | | 33,000 | | | | 21,250 | | | | 7,946 | | | | 259,196 | |

Executive Vice President and Chief Financial Officer | | | 2013 | | | | 187,250 | | | | 20,000 | | | | 35,453 | | | | 7,600 | | | | 250,303 | |

| | | 2012 | | | | 183,800 | | | | 10,173 | | | | — | | | | 8,047 | | | | 202,020 | |

| | | | | | |

E. Andrew Moats | | | 2014 | | | | 200,000 | | | | 33,000 | | | | 170,000 | | | | 2,710 | | | | 405,710 | |

Executive Vice President and Chief Credit Officer | | | 2013 | | | | 167,500 | | | | 20,000 | | | | 19,665 | | | | 1,926 | | | | 209,091 | |

| | | 2012 | | | | 157,500 | | | | 25,000 | | | | — | | | | 1,340 | | | | 183,840 | |

| (1) | Represents the aggregate grant date fair value of restricted stock awards to Messrs. Samuels and Cleaver, Ms. Zipperian and Mr. Moats computed in accordance with FASB ASC Topic 718 based on a per share assumed market price of $7.50 for 2013 awards and $8.50 for 2014 awards. |

| (2) | Consists of 401(k) match, supplemental long-term disability, auto allowance, club membership, and financial planning services. |

Narrative Discussion of Summary Compensation Table

General. We have compensated our named executive officers through a combination of base salary, cash bonuses, equity incentive plan bonuses and other benefits including perquisites. Each of our named executive officers is also an officer of our bank and has substantial responsibilities in connection with the day-to-day operations of our bank. As a result, each named executive officer devotes a substantial majority of his or her business time to the operations of our bank, and the compensation he or she receives is paid largely to compensate that named executive officer for his or her services to our bank.

Base Salary. The base salaries of our named executive officers have been historically reviewed and set annually by our board of directors through the review and recommendations of our Compensation Committee as part of our performance review process as well as upon the promotion of an executive officer to a new position or another change in job responsibility. In establishing base salaries for our

15

named executive officers, our Compensation Committee has relied on external market data obtained from outside sources and peer data provided by our external compensation consultant, the Chase Comp Group. In addition to considering the information obtained from such sources, our Compensation Committee has considered:

| | • | | each named executive officer’s scope of responsibility; |

| | • | | each named executive officer’s years of experience; |

| | • | | the types and amount of the elements of compensation to be paid to each named executive officer; |

| | • | | our financial performance and performance with respect to other aspects of our operations, such as our growth, asset quality, profitability and other matters, including the status of our relationship with the banking regulatory agencies; and |

| | • | | each named executive officer’s individual performance and contributions to our performance, including leadership, team work and community service. |

Cash Bonuses. We typically have paid a cash bonus to named executive officers. Annual incentive awards are intended to recognize and reward those named executive officers who contribute meaningfully to our performance for the year. Our board of directors has, within its sole discretion, determined whether such bonuses will be paid for any year and the amount of any bonus paid. Our board of directors has not relied on any pre-established formula or specific performance measures to determine the amount of the bonuses paid, but our Compensation Committee does review external market data from information provided by the Chase Comp Group in setting the amount of bonuses. In determining whether to pay cash bonuses to any named executive officer for any year and the amount of any cash bonus to be paid, our Compensation Committee and our board of directors have considered such factors as:

| | • | | the personal performance of the executive officer and contributions to our performance for the year, including leadership, team work and community service; |

| | • | | the overall compensation level compared to peers; and |

| | • | | our financial performance, including, our growth, asset quality and profitability. |

Annual Executive Incentive Plan. In 2015, our board of directors approved the Avenue Financial Holdings, Inc. Annual Executive Incentive Plan, or the Incentive Plan. Our board of directors believes that the adoption of the Incentive Plan is in the best interest of the company and its shareholders and is designed to more closely align the interests of executive management with those of our shareholders. The Incentive Plan provides for the grant of bonus awards to certain members of our executive management team with the awards being earned based on the attainment of one or more performance goals. These performance goals may include items such as return on average assets, organic asset growth, nonperforming assets, earnings per share, net interest margin, net loan growth, deposit growth, loan origination, and individual performance review. The specific goals and weighting of those goals are established by the compensation committee and tailored to different roles and responsibilities of the individual participants. Performance goals are measured at the end of the fiscal year and payment for any earned bonuses would be made promptly thereafter. Payment of any earned awards will be in the form of eighty percent (80%) cash and twenty percent (20%) shares of common stock to be issued pursuant to our 2012 Long Term Incentive Plan, valued at the time of payment and vesting one-half in 12 months and the remaining one-half in 24 months. The participant must remain an employee of the company to receive the vested shares. The first year of the Incentive Plan will be 2015. The Incentive Plan has an initial term of three years, subject to the ability of the Board to extend that term.

Stock Awards. The stock awards reflected in the table above all relate to shares of restricted stock issued pursuant to our 2012 LTIP adopted by our board of directors in 2012. The 2012 LTIP provides for the grant to employees of restricted common stock, which may not be transferred by the employee until the shares “vest” and the transfer restrictions lapse.

16

Benefits and Perquisites. The named executive officers are eligible to participate in the same benefit plans designed for all of our fulltime employees, including health, dental, vision, disability and basic group life insurance coverage. In addition, we provide supplemental disability benefits to Messrs. Samuels and Cleaver and Ms. Zipperian. We also provide our employees, including our named executive officers, with a 401(k) plan to assist them in planning for retirement and securing appropriate levels of income during retirement. The purpose of our employee benefit plans is to help us attract and retain quality employees, including executives, by offering benefit plans similar to those typically offered by our competitors. Except as set forth in the table below, none of the benefits or perquisites paid or provided to any of our named executive officers exceeded $25,000 in amount for 2014, 2013 or 2012.

Avenue Bank 401(k) Plan. The Avenue Bank 401(k) Plan, or the 401(k) Plan, is designed to provide retirement benefits to all eligible full-time and part-time employees. The 401(k) Plan provides employees the opportunity to save for retirement on a tax-favored basis. Our named executive officers, all of whom were eligible to participate in the 401(k) Plan during 2014, 2013 and 2012, may elect to participate in the 401(k) Plan on the same basis as all other employees. Employees may defer from 1% to 100% of their compensation to the 401(k) Plan up to the applicable IRS limit. For the year 2014 we matched 20% of an employee’s annual contribution to the 401(k) Plan up to a total contribution of 5% of the employee’s eligible salary. We make our matching contributions in cash, and that contribution is invested according to the employee’s current investment allocation. We made contributions to the accounts of our named executive officers’ accounts in the 401(k) plan in 2014, 2013 and 2012 in varying amounts depending on the amounts of the contributions made by our named executive officers to their respective 401(k) Plan accounts.

Health and Welfare Benefits. Our named executive officers are eligible to participate in our standard health and welfare benefits program, which offers medical, dental, vision, life, accident, and disability coverage to all of our eligible employees. Pursuant to the terms of their employment agreements, Messrs. Samuels and Cleaver and Ms. Zipperian are entitled to life insurance in an amount equal to two times their respective base salary, subject to a maximum of $500,000, and a supplemental disability insurance policy equal to 80% of their respective base salary.

Insurance Premiums. Our bank maintains bank-owned life insurance policies with respect to each of our named executive officers. Although our bank is the named beneficiary of each of those policies, we have agreed with each of those named executive officers that if the officer dies while employed by our bank, we will pay such named executive officer’s estate $100,000 out of the benefits our bank receives under such policy.

Perquisites. We provide certain of our named executive officers with a limited number of perquisites that we believe are reasonable and consistent with our overall compensation program to better enable us to attract and retain superior employees for key positions. Our compensation committee periodically reviews the levels of perquisites and other personal benefits provided to named executive officers. Based on these periodic reviews, perquisites are awarded or adjusted on an individual basis. The perquisites received by our named executive officers in 2014, 2013 and 2012 included automobile allowances, financial planning services, and health/country club memberships.

Outstanding Equity Awards at Fiscal Year End

Equity Incentive Plans

2007 Stock Option Plan (2007 Plan). We maintain the 2007 Plan as a means of providing employees, directors, consultants and other persons eligible to participate under the 2007 Plan with stock options or

17

other awards, including stock appreciation rights. We currently have 361,500 shares of our common stock reserved for awards under the 2007 Plan. As of March 31, 2015, 283,500 stock options were outstanding under the 2007 Plan, 141,417 of which were presently exercisable, and 73,861 restricted stock awards had been issued under the 2007 Plan. All of the options outstanding under the 2007 Plan have an exercise price of $10.00 per share. Under the 2007 Plan, as of March 31, 2015 4,139 shares remain available for issuance to eligible participants.

The 2007 Plan provides for the grant of incentive stock options and non-qualified stock options. Under the 2007 Plan the exercise price of any options (except substitute awards for options issued in connection with assumption of outstanding options from an acquired company) may not be less than the fair market value of the shares with respect to which the options are granted on the date of grant. The maximum term of each option is ten years. The times at which each option will be exercisable and provisions requiring forfeiture of unexercised options at or following termination of employment or upon the occurrence of other events generally are fixed by our Compensation Committee. Options may be exercised by payment of the exercise price in cash or cash equivalents or, at the discretion of our Compensation Committee, using shares having a fair market value equal to the exercise price. Under the 2007 Plan, we are required to adjust the number of shares subject to the plan upon the occurrence of certain specified corporate events such as a stock split, reorganization, merger, repurchase or exchange of shares. The 2007 Plan is administered by our Compensation Committee which is authorized to select participants, determine the type and number of awards to be granted and the number of shares to which awards will relate, specify times at which awards will be exercisable, prescribe the forms of award agreements, establish and interpret performance goals and make all other determinations which may be necessary or advisable for the administration of the 2007 Plan. Our Compensation Committee may specify in the applicable award agreement at or after grant, or otherwise, by resolutions prior to a change in control, as defined in the 2007 Plan, that all or a portion of the outstanding awards shall vest, become immediately exercisable or payable and have all restrictions lifted upon a change in control. Our board of directors may amend, alter, suspend, or terminate the 2007 Plan at any time, without shareholder approval, unless such shareholder approval is necessary to comply with any tax or regulatory requirement as to which the board deemed it necessary to comply.

Long-Term Incentive Plan (2012 LTIP). Our board of directors adopted the 2012 LTIP which permits the grant of restricted common stock to employees. Under the 2012 LTIP Plan, we may issue shares of our common stock. The transfer of these shares is restricted such that the employee cannot transfer the shares until the shares “vest” and the transfer restrictions lapse. The purpose of the plan is to encourage and motivate key employees to contribute to our successful performance and to promote the growth of the value of our common stock, by aligning this portion of our executive compensation program with our common stock value. The 2012 LTIP provides participants with an ownership interest in our common stock and thus achieves a unity of purpose between employees and shareholders. The 2012 LTIP also helps retain key employees.

The 2012 LTIP is administered by our Compensation Committee. In order to be eligible for participation in the 2012 LTIP, an individual must be one of our full-time employees of our bank and must be identified by our Compensation Committee as an employee who is in a position to contribute to our long-term success. In determining awards under the 2012 LTIP, the Compensation Committee takes into account the nature of the services rendered by the eligible employees, their present and potential contributions to our success, and such other factors as the Compensation Committee deems relevant.

A total of 390,836 shares of our common stock is available for grant under the 2012 LTIP. In the event the outstanding shares of our common stock are increased, decreased, changed into or exchanged for a different number or kind of securities as a result of a stock split, reverse stock split, stock dividend, recapitalization, merger, share exchange, acquisition, combination, or reclassification, then appropriate proportionate adjustments will be made in the aggregate number or kind of shares of stock that may be issued under the 2012 LTIP. At March 31, 2015, 112,660 shares of restricted stock had been issued and were outstanding pursuant to the 2012 LTIP, leaving 278,176 shares available for issuance to eligible participants.

18

Each issuance of restricted stock is evidenced by a restricted stock grant agreement between us and the employee. The grant agreement sets forth the terms and conditions of the restrictions on the shares, including the vesting schedule, if any. All named executive officers are eligible and participate currently in the 2012 LTIP.

2012 Restricted Stock Plan for Non-Employee Directors (2012 Director Plan).Our board of directors adopted the 2012 Director Plan which permits the grant of restricted shares of our common stock to non-employee directors. The purpose of the 2012 Director Plan is to encourage non-employee directors to become owners of our common stock and increase their incentive for enhancing shareholder value. The plan also seeks to motivate, retain and attract those highly competent individuals upon whose judgment, initiative, leadership and continued efforts our success in large measure depends.

The 2012 Director Plan is administered by our Compensation Committee, and any of our directors who is not employed by us or any of our subsidiaries at the time of the grant shall be eligible to participate. Restricted stock awards to any eligible director shall be granted as determined by the Compensation Committee in connection with such eligible director serving as a member of our board of directors or the board of directors or any of our subsidiaries or any committee thereof. In lieu of receiving cash compensation for meeting fees an eligible director may elect to receive restricted shares of common stock issued under the 2012 Director Plan.

A total of 100,000 shares of our common stock is available for grant under the 2012 Director Plan. The aggregate number of shares of common stock issuable under the 2012 Director Plan at any time shall equal only the number of shares actually issued pursuant to all outstanding awards and shall not count any shares returned to us upon cancellation, expiration or forfeiture of any award or delivered (either actually or by attestation) in payment or satisfaction of the tax obligation of any award. At March 31, 2015, 37,750 shares of restricted stock had been issued and were outstanding pursuant to the 2012 Director Plan, leaving 62,250 shares available for issuance to eligible directors.

Outstanding Equity Awards at 2014 Fiscal Yearend

The following table provides information regarding outstanding unvested stock awards held by the named executive officers as of December 31, 2014 based on an assumed market value of $7.50 per share on the grant dates for all grants except the grants in 2014 which were based on an assumed market value of $8.50 per share.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Option Awards | | | Stock Awards | |

Name | | Grant Date | | | Number of

Securities

Underlying

Unexercised

Options (#)

Exercisable | | | Number of

Securities

Underlying

Unexercised

Options (#)

Unexercisable(1) | | | Option

exercise

price($) | | | Option

expiration

date | | | Number of

Shares or

Units that

have not

Vested

(#)(2) | | | Market

Value of

Shares or

Units of

Stock that

have not

Vested ($) | |

Ronald L. Samuels | | | 1/22/2013 | | | | — | | | | — | | | | — | | | | — | | | | 10,633 | | | | 79,748 | |

| | | 11/1/2013 | | | | — | | | | — | | | | — | | | | — | | | | 8,571 | | | | 64,283 | |

| | | 1/21/2014 | | | | — | | | | — | | | | — | | | | — | | | | 7,500 | | | | 63,750 | |

G. Kent Cleaver | | | 8/24/2007 | | | | 36,000 | | | | 18,000 | | | | 10.00 | | | | 8/24/2017 | | | | — | | | | — | |

| | | 1/22/2013 | | | | — | | | | — | | | | — | | | | — | | | | 4,558 | | | | 34,185 | |

| | | 1/21/2014 | | | | — | | | | — | | | | — | | | | — | | | | 7,500 | | | | 63,750 | |

Barbara J. Zipperian | | | 8/24/2007 | | | | 17,333 | | | | 8,667 | | | | 10.00 | | | | 8/24/2017 | | | | — | | | | — | |

| | | 1/22/2013 | | | | — | | | | — | | | | — | | | | — | | | | 3,545 | | | | 26,588 | |

E. Andrew Moats | | | 9/17/2007 | | | | 6,667 | | | | 3,333 | | | | 10.00 | | | | 9/17/2017 | | | | — | | | | — | |

| | | 1/22/2013 | | | | — | | | | — | | | | — | | | | — | | | | 1,966 | | | | 14,745 | |

| | | 1/1/2014 | | | | — | | | | — | | | | — | | | | — | | | | 15,000 | | | | 127,500 | |

| (1) | All unexercisable options will vest when we reach cumulative profitability. |

| (2) | All unvested stock awards vest equally over a four year period from the grant date. |

19

Equity Compensation Plan Information

The following table provides certain information with respect to all of our equity compensation plans in effect as of December 31, 2014.

| | | | | | | | | | | | |

Plan Category | | Number of securities

to be issued upon

exercise of

outstanding options,

warrants and rights | | | Weighted-average

exercise price of

outstanding

options, warrants

and rights | | | Number of securities

remaining available

for future issuance

under equity

compensation plans

(excluding securities

reflected in column (a)) | |

| | | (a) | | | (b) | | | (c) | |

Equity compensation plans approved by security holders: | | | | | | | | | | | | |

2007 Plan | | | 283,500 | | | $ | 10.00 | | | | 4,139 | |

Equity compensation plans not approved by securities holders: | | | | | | | | | | | | |

2012 LTIP | | | — | | | | — | | | | 314,032 | |

2012 Director Plan | | | — | | | | — | | | | 72,250 | |

Employment Agreements

We have employment agreements with each of our named executive officers. The employment agreements provide that the executives remain employed by us until either we or the executive terminates the employment agreement. Both parties have the right to terminate the employment agreements at any time, with or without “cause,” as defined in the employment agreements. The employment agreements specify each executive’s base salary and eligibility to participate in certain benefits programs. Our employment agreements with Messrs. Samuels and Cleaver also provide that we will take such steps as may be necessary to cause such executive to be nominated as a member of our board of directors for so long as such executive is employed pursuant to his employment agreement.

20