Investor Presentation Q2 2018 Exhibit 99.3

Disclaimer Forward-looking Statements Various statements in this presentation are “forward-looking statements” within the meaning of the U.S. federal securities laws. Forward-looking statements provide our current expectations or forecasts of future events and are not statements of historical fact. These forward-looking statements include information about our strategic plans and objectives, potential property acquisitions and investments, anticipated capital expenditures (and access to capital), amounts of anticipated cash distributions to our stockholders in the future and other matters. Words such as “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” "will" and variations of these words and other similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and/or could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements. Forward-looking statements involve inherent uncertainty and may ultimately prove to be incorrect or false. For a description of factors that may cause the Company’s actual results or performance to differ from its forward-looking statements, see the sections entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” included in the Company’s most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission (the “SEC”) and other documents filed by the Company with the SEC from time to time. You are cautioned to not place undue reliance on forward-looking statements. Except as otherwise may be required by law, we undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or actual operating results. Information regarding our operators, tenants, and guarantors This presentation includes information regarding certain of our tenants and guarantors, which are not subject to SEC reporting requirements. The information related to our tenants and guarantors contained in this report was provided to us by such tenants or guarantors, as applicable, or was derived from publicly available information. We have not independently investigated or verified this information. We have no reason to believe that this information is inaccurate in any material respect, but we cannot provide any assurance of its accuracy. We are providing this data for informational purposes only. The most recent completed period for which financial and operating information is available for our tenants and guarantors is the period ended December 31, 2017. Definitions and Reconciliations For definitions of certain terms used throughout this presentation, including certain non-GAAP financial measures, see the Glossary included in the Appendix on pages 23-26. For reconciliations of the non-GAAP financial measures to the most directly comparable GAAP measures, see pages 18-19 in the Appendix. Unless otherwise noted, information set forth herein is as of March 31, 2018. On the cover: from top to bottom - Baylor Scott & White Medical Center - Lakeway, Lakeway, TX; Horizon Specialty Hospital of Henderson, Las Vegas, NV; Mira Vista Court, Fort Worth, TX; Physical Rehabilitation and Wellness Center of Spartanburg, Spartanburg, SC.

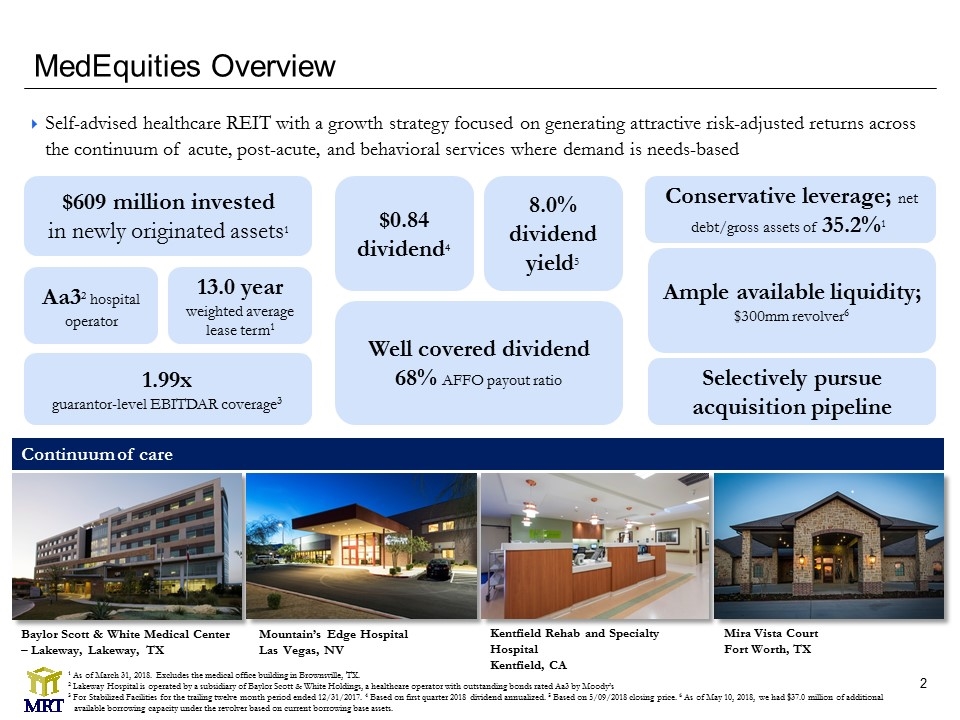

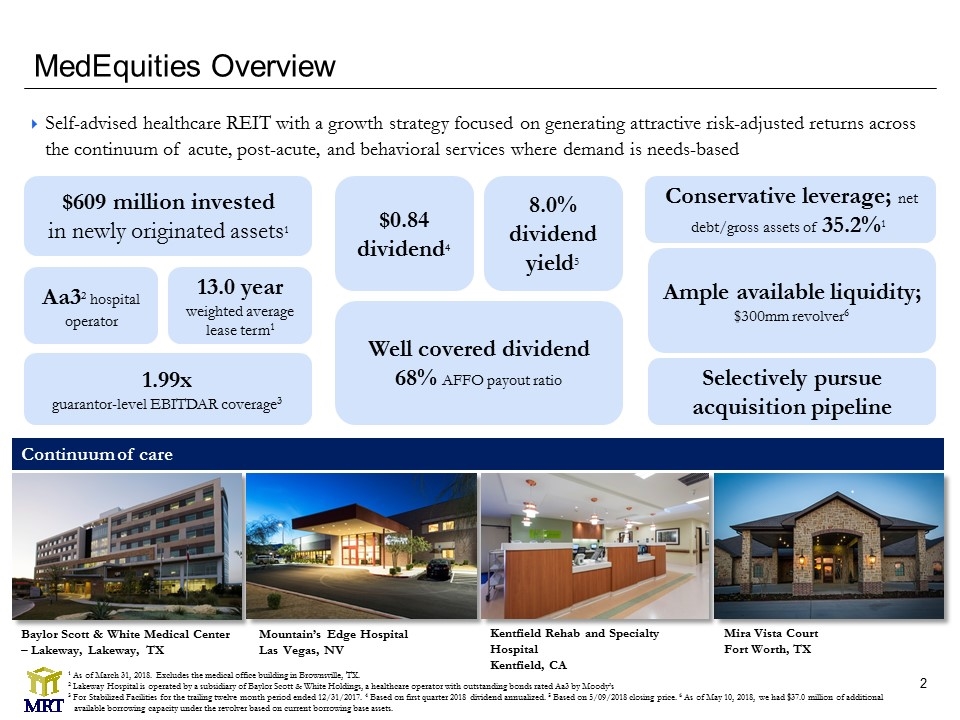

MedEquities Overview Self-advised healthcare REIT with a growth strategy focused on generating attractive risk-adjusted returns across the continuum of acute, post-acute, and behavioral services where demand is needs-based $609 million invested in newly originated assets1 1.99x guarantor-level EBITDAR coverage3 Selectively pursue acquisition pipeline Aa32 hospital operator 13.0 year weighted average lease term1 1 As of March 31, 2018. Excludes the medical office building in Brownsville, TX. 2 Lakeway Hospital is operated by a subsidiary of Baylor Scott & White Holdings, a healthcare operator with outstanding bonds rated Aa3 by Moody’s 3 For Stabilized Facilities for the trailing twelve month period ended 12/31/2017. 4 Based on first quarter 2018 dividend annualized. 5 Based on 5/09/2018 closing price. 6 As of May 10, 2018, we had $37.0 million of additional available borrowing capacity under the revolver based on current borrowing base assets. 8.0% dividend yield5 Well covered dividend 68% AFFO payout ratio $0.84 dividend4 Conservative leverage; net debt/gross assets of 24.6% Baylor Scott & White Medical Center – Lakeway, Lakeway, TX Mountain’s Edge Hospital Las Vegas, NV Continuum of care Mira Vista Court Fort Worth, TX Kentfield Rehab and Specialty Hospital Kentfield, CA Ample available liquidity; $300mm revolver6 Conservative leverage; net debt/gross assets of 35.2%1

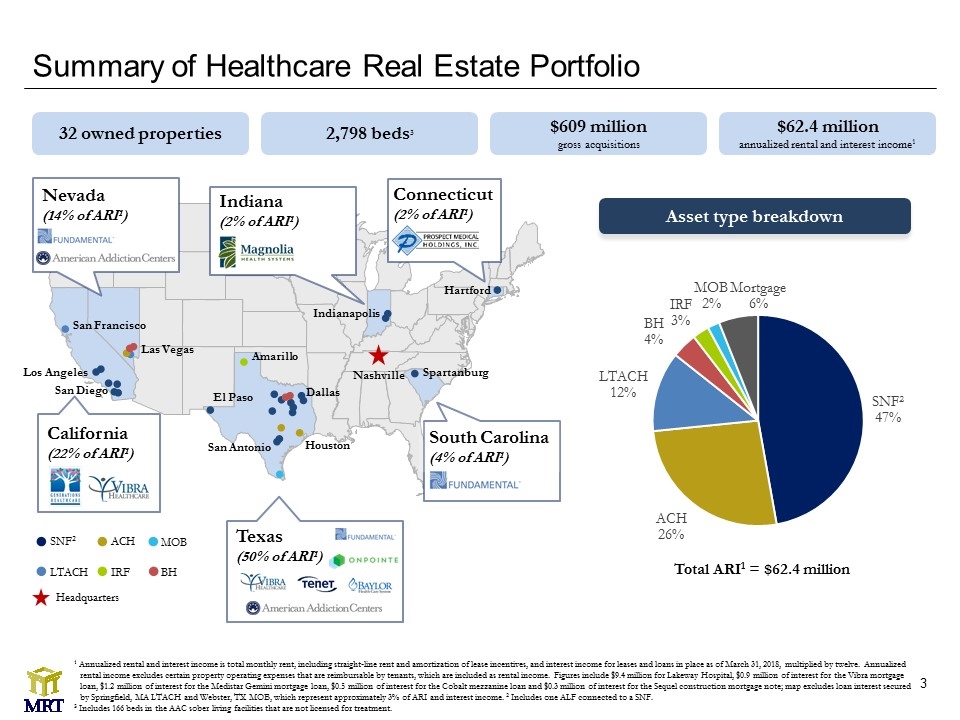

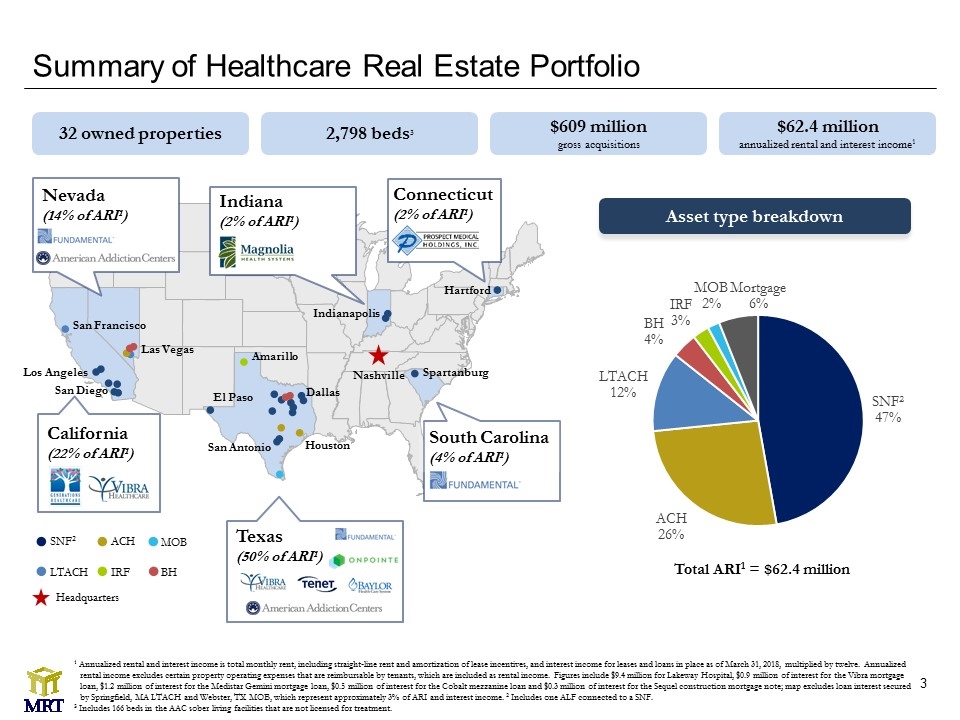

1 Annualized rental and interest income is total monthly rent, including straight-line rent and amortization of lease incentives, and interest income for leases and loans in place as of March 31, 2018, multiplied by twelve. Annualized rental income excludes certain property operating expenses that are reimbursable by tenants, which are included as rental income. Figures include $9.4 million for Lakeway Hospital, $0.9 million of interest for the Vibra mortgage loan, $1.2 million of interest for the Medistar Gemini mortgage loan, $0.5 million of interest for the Cobalt mezzanine loan and $0.3 million of interest for the Sequel construction mortgage note; map excludes loan interest secured by Springfield, MA LTACH and Webster, TX MOB, which represent approximately 3% of ARI and interest income. 2 Includes one ALF connected to a SNF. 3 Includes 166 beds in the AAC sober living facilities that are not licensed for treatment. Summary of Healthcare Real Estate Portfolio Texas (50% of ARI1) Headquarters SNF2 LTACH MOB ACH IRF El Paso California (22% of ARI1) South Carolina (4% of ARI1) Nevada (14% of ARI1) San Francisco Las Vegas San Diego Amarillo Nashville Spartanburg San Antonio Dallas 32 owned properties $609 million gross acquisitions $62.4 million annualized rental and interest income1 2,798 beds3 Asset type breakdown Total ARI1 = $62.4 million Los Angeles Houston Connecticut (2% of ARI1) BH Indiana (2% of ARI1) Indianapolis Hartford

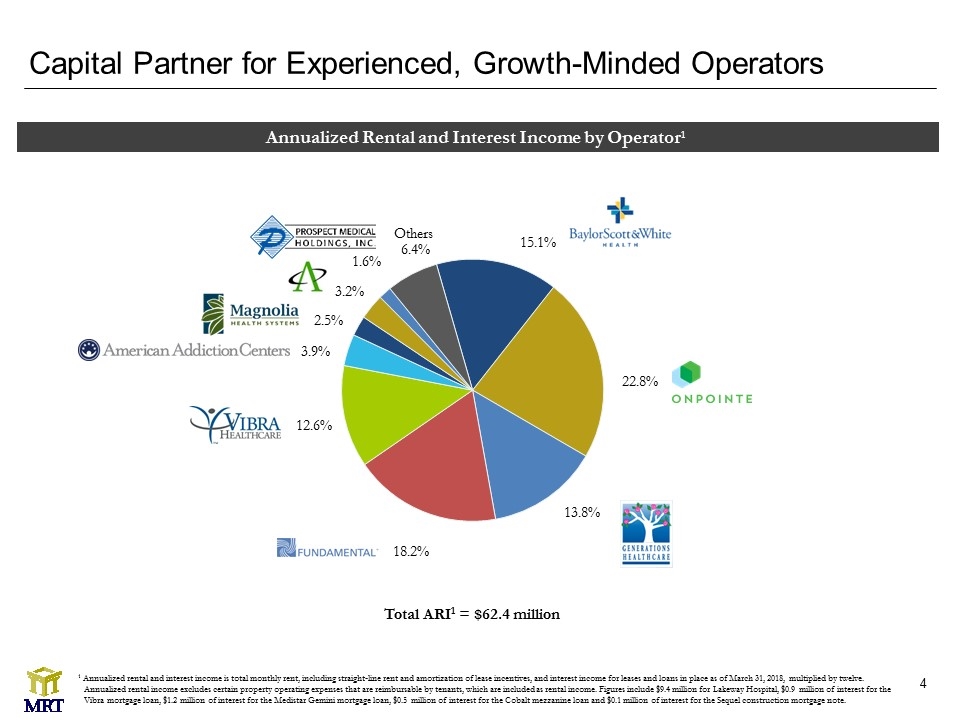

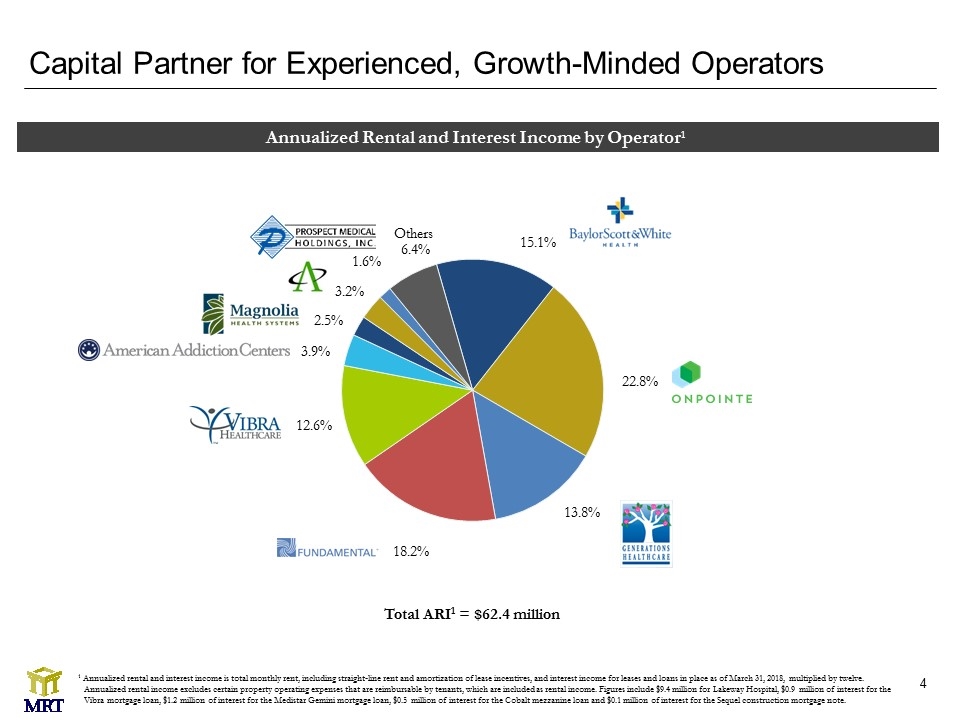

Capital Partner for Experienced, Growth-Minded Operators 1 Annualized rental and interest income is total monthly rent, including straight-line rent and amortization of lease incentives, and interest income for leases and loans in place as of March 31, 2018, multiplied by twelve. Annualized rental income excludes certain property operating expenses that are reimbursable by tenants, which are included as rental income. Figures include $9.4 million for Lakeway Hospital, $0.9 million of interest for the Vibra mortgage loan, $1.2 million of interest for the Medistar Gemini mortgage loan, $0.5 million of interest for the Cobalt mezzanine loan and $0.1 million of interest for the Sequel construction mortgage note. Annualized Rental and Interest Income by Operator1 Total ARI1 = $62.4 million

18 facilities in 5 states ~3,100 licensed beds in acute care and behavioral hospitals and senior living facilities 29 facilities (22 SNF, 7 ALF) $102 million total operating revenue in 2016 34 facilities in 17 states 5 Leading national provider of diversified behavioral health programs for children, adolescents and adults 6 facilities across 5 states Provides inpatient psychiatric stabilization and treatment to adults 48 hospitals 1 $9.1 billion FY 2017 total operating revenue 1 Parent Aa3 rated credit, $11.1 billion total assets Largest not-for-profit health care system in Texas and one of the largest in the U.S. 97 facilities in 10 states $789 million in total operating revenue One of the largest privately owned post-acute operators 43 facilities in 17 states $827 million in total operating revenue Experienced LTACH and IRF operator Largest privately owned LTACH operator 19 facilities in Texas and New Mexico 2 $80 million in total operating revenue 3 Founded by former CEO and COO of Paramount Healthcare 27 facilities with over 3,000 beds $298 million in total operating revenue Award winning operator with an average CMS rating of 4.6 stars 4 33 facilities in 8 states with over 1,300 beds $318 million in total operating revenue Leading provider of addiction treatment services in the behavioral health sector (NYSE: AAC) Source: Company information as of December 2017 with operator financial information provided for fiscal year 2017, unless otherwise noted. 1 According to Baylor Scott and White website. 2 As of May 2018, includes 11 facilities leased by Texas 11 Holding, which are managed by OnPointe, and 8 additional facilities operated by OnPointe. 3 Represents revenue from Texas 11 Holding, formerly known as GruenePointe Holdings. 4 Average star rating reflects those facilities owned by the Company. 5 As of May 2018 per each company’s public website. Capital Partner for Experienced, Growth-Minded Operators

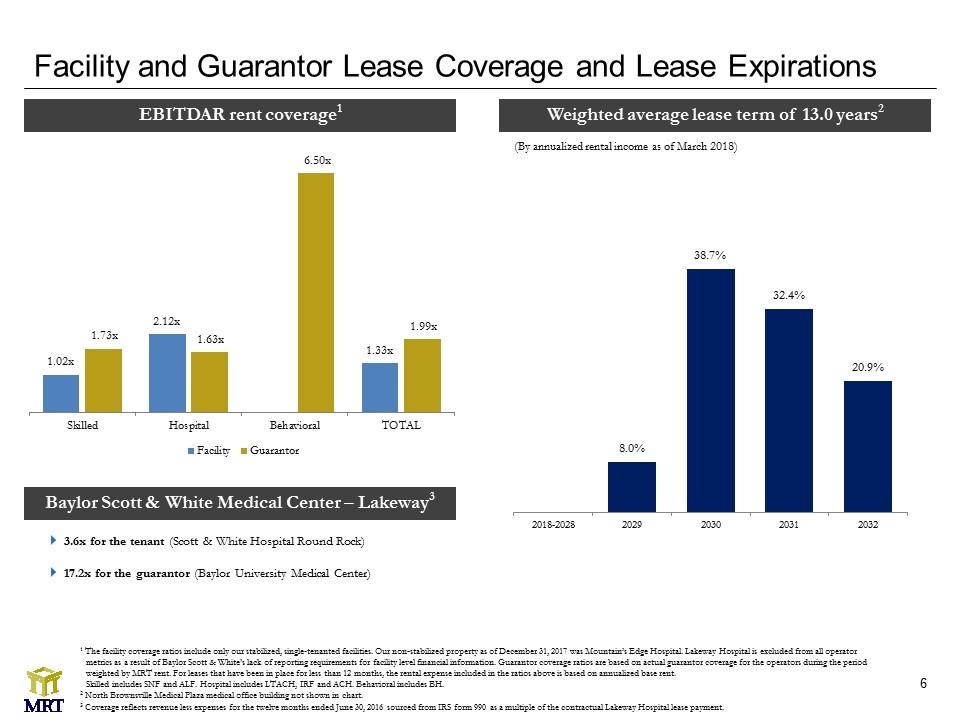

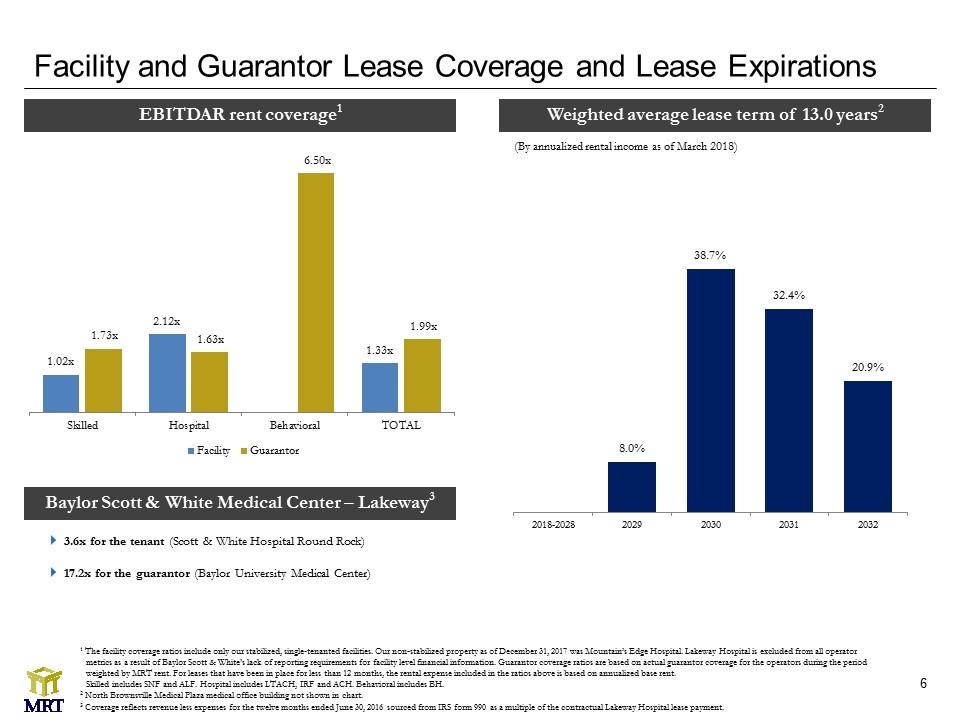

Facility and Guarantor Lease Coverage and Lease Expirations EBITDAR rent coverage1 Weighted average lease term of 13.0 years2 (By annualized rental income as of March 2018) Baylor Scott & White Medical Center – Lakeway3 3.6x for the tenant (Scott & White Hospital Round Rock) 17.2x for the guarantor (Baylor University Medical Center) 1 The facility coverage ratios include only our stabilized, single-tenanted facilities. Our non-stabilized property as of December 31, 2017 was Mountain’s Edge Hospital. Lakeway Hospital is excluded from all operator metrics as a result of Baylor Scott & White's lack of reporting requirements for facility level financial information. Guarantor coverage ratios are based on actual guarantor coverage for the operators during the period weighted by MRT rent. For leases that have been in place for less than 12 months, the rental expense included in the ratios above is based on annualized base rent. Skilled includes SNF and ALF. Hospital includes LTACH, IRF and ACH. Behavioral includes BH. 2 North Brownsville Medical Plaza medical office building not shown in chart. 3 Coverage reflects revenue less expenses for the twelve months ended June 30, 2016 sourced from IRS form 990 as a multiple of the contractual Lakeway Hospital lease payment.

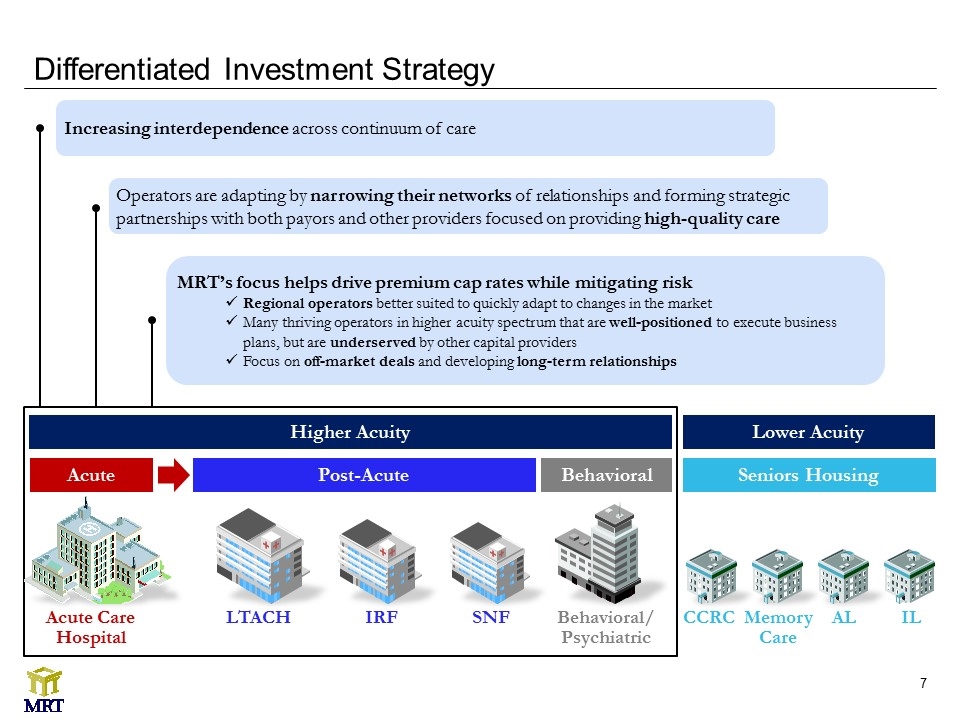

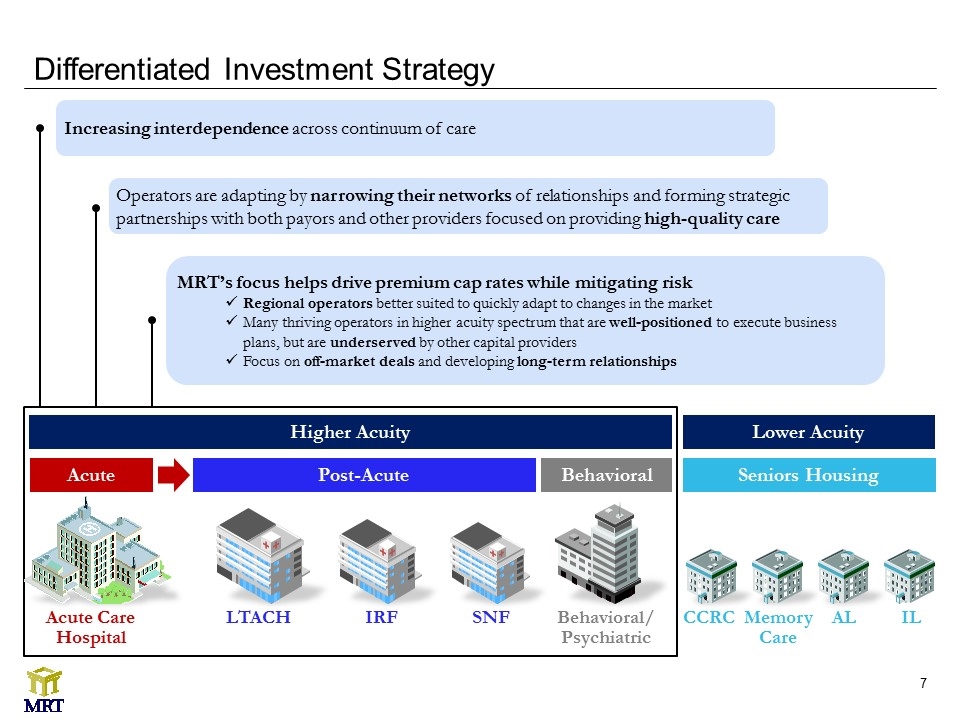

Differentiated Investment Strategy Acute Highest acuity Post-Acute LTACH IRF SNF Acute Care Hospital Seniors Housing CCRC Memory Care AL IL Behavioral Behavioral/ Psychiatric Higher Acuity Lower Acuity Increasing interdependence across continuum of care Operators are adapting by narrowing their networks of relationships and forming strategic partnerships with both payors and other providers focused on providing high-quality care MRT’s focus helps drive premium cap rates while mitigating risk Regional operators better suited to quickly adapt to changes in the market Many thriving operators in higher acuity spectrum that are well-positioned to execute business plans, but are underserved by other capital providers Focus on off-market deals and developing long-term relationships

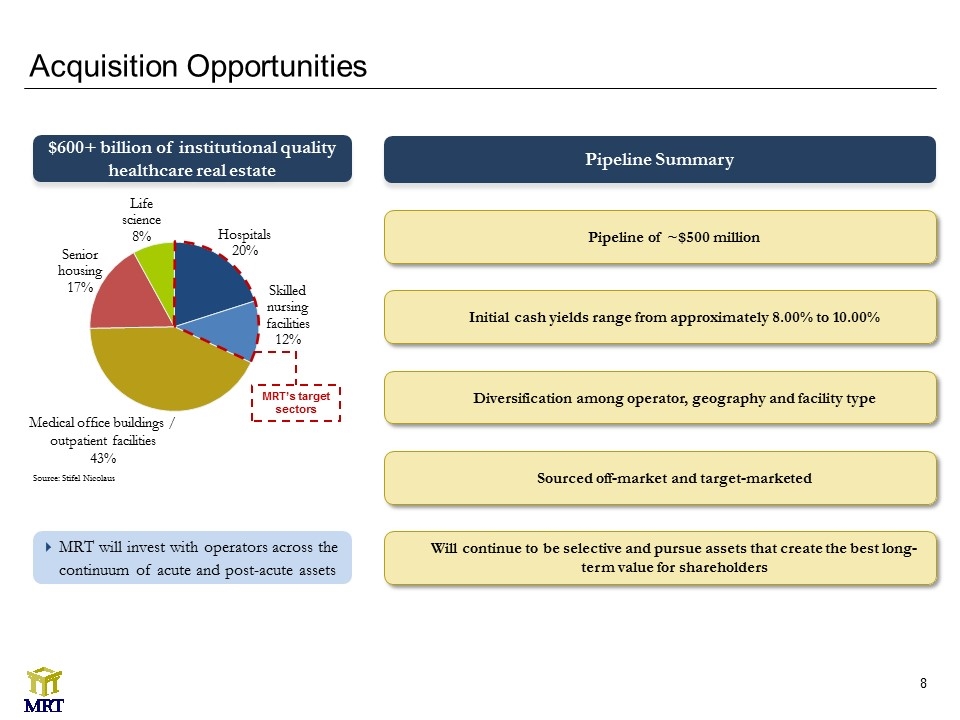

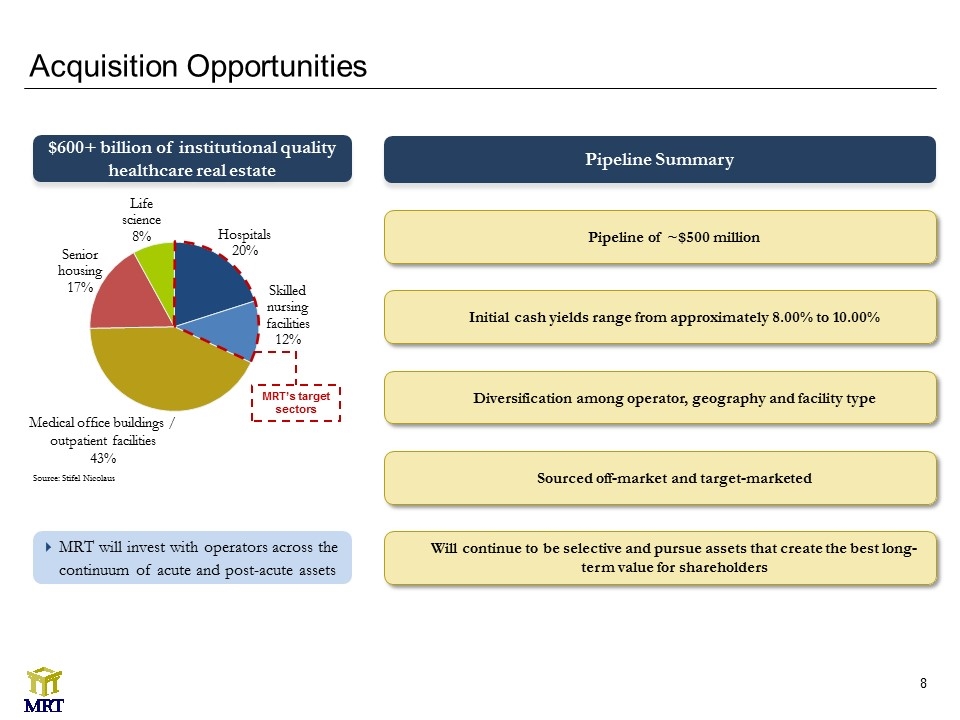

Acquisition Opportunities $600+ billion of institutional quality healthcare real estate MRT will invest with operators across the continuum of acute and post-acute assets Source: Stifel Nicolaus Medical office buildings / outpatient facilities 43% MRT’s target sectors Pipeline Summary Pipeline of ~$500 million Diversification among operator, geography and facility type Initial cash yields range from approximately 8.00% to 10.00% Sourced off-market and target-marketed Will continue to be selective and pursue assets that create the best long-term value for shareholders

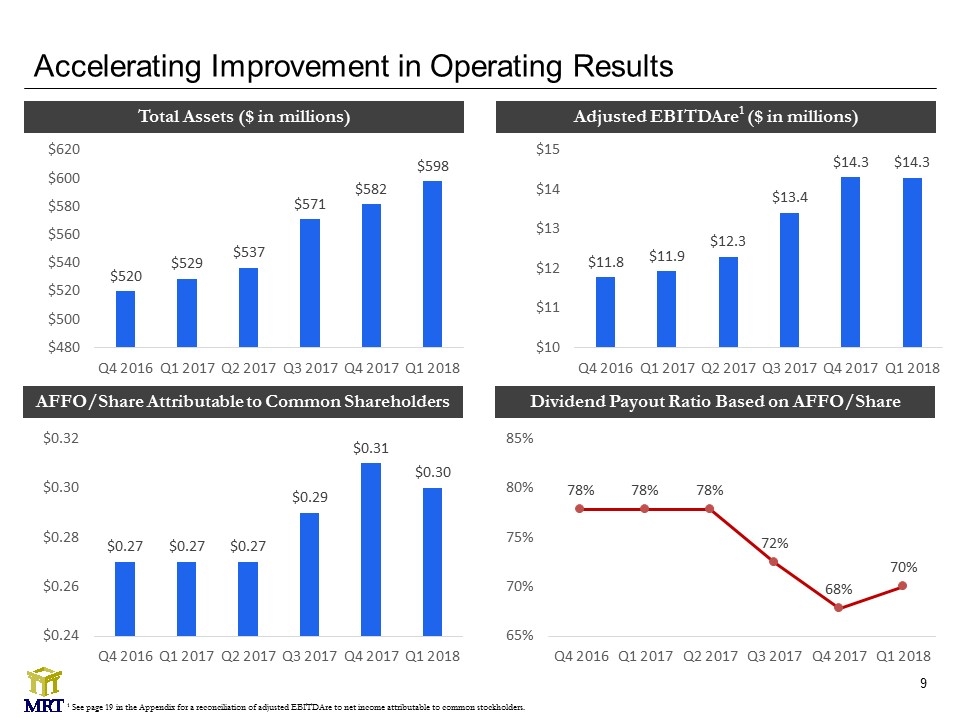

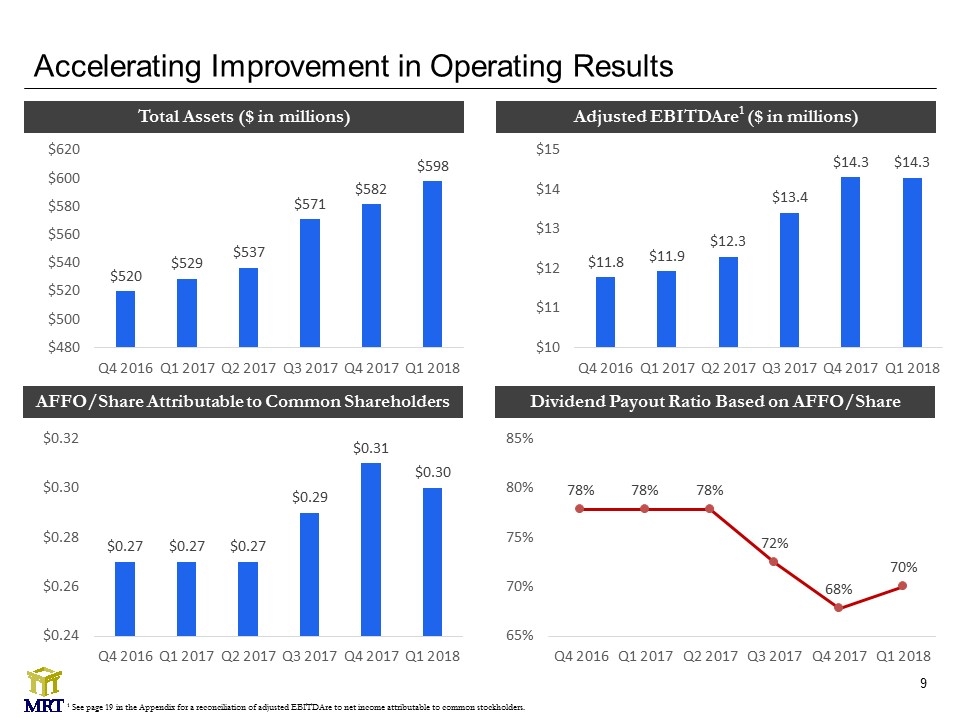

Accelerating Improvement in Operating Results Total Assets ($ in millions) Adjusted EBITDAre1 ($ in millions) AFFO/Share Attributable to Common Shareholders Dividend Payout Ratio Based on AFFO/Share 1 See page 19 in the Appendix for a reconciliation of adjusted EBITDAre to net income attributable to common stockholders.

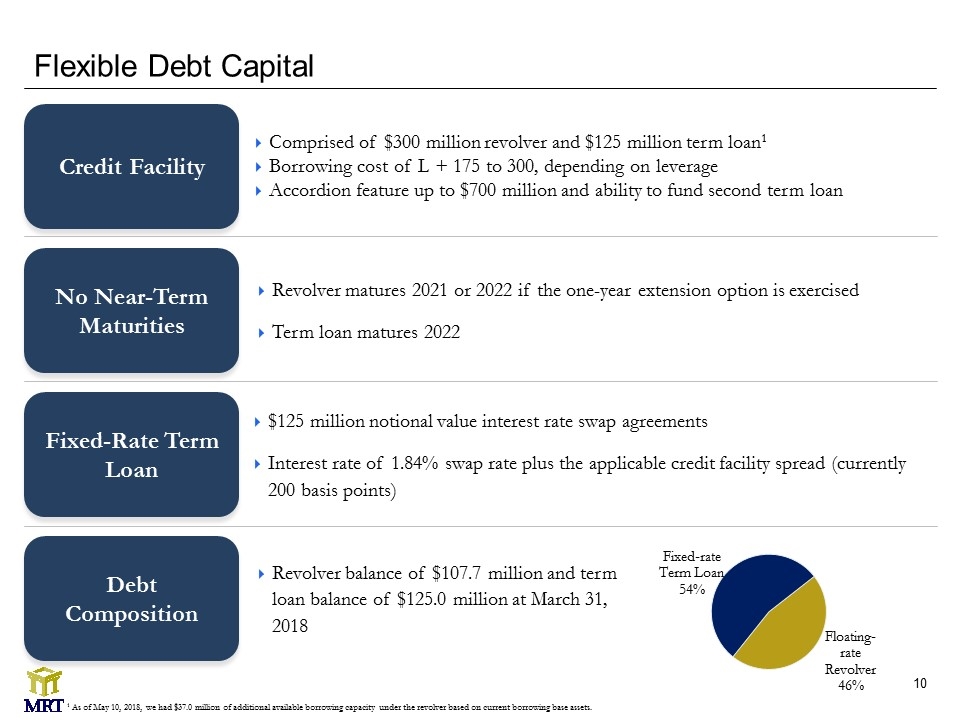

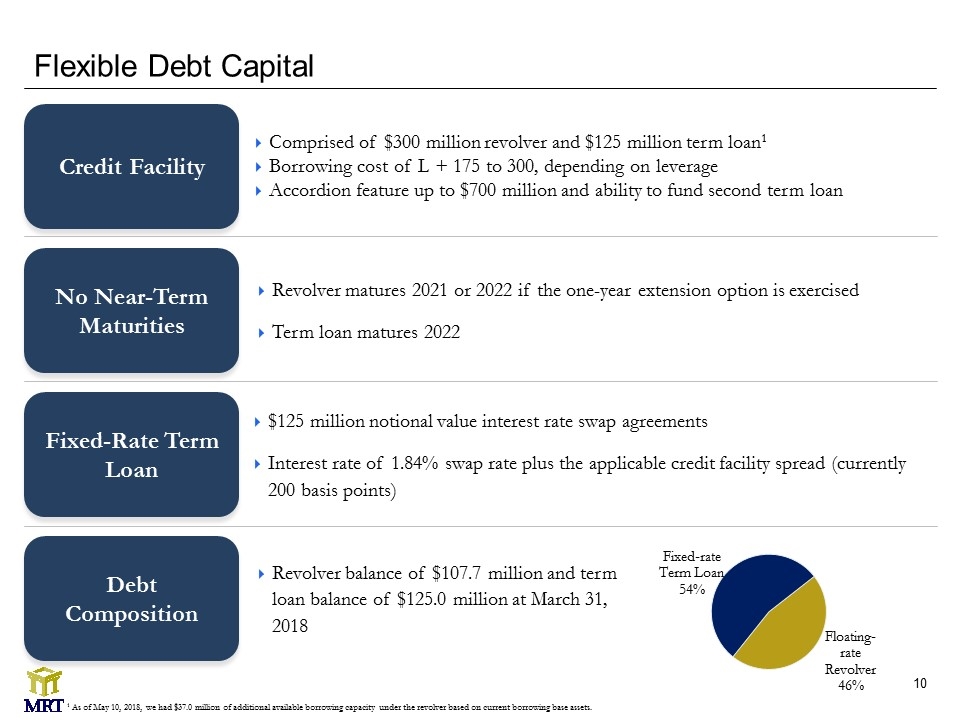

Flexible Debt Capital Comprised of $300 million revolver and $125 million term loan1 Borrowing cost of L + 175 to 300, depending on leverage Accordion feature up to $700 million and ability to fund second term loan Credit Facility Fixed-Rate Term Loan Debt Composition $125 million notional value interest rate swap agreements Interest rate of 1.84% swap rate plus the applicable credit facility spread (currently 200 basis points) Revolver balance of $107.7 million and term loan balance of $125.0 million at March 31, 2018 Revolver matures 2021 or 2022 if the one-year extension option is exercised Term loan matures 2022 No Near-Term Maturities 1 As of May 10, 2018, we had $37.0 million of additional available borrowing capacity under the revolver based on current borrowing base assets.

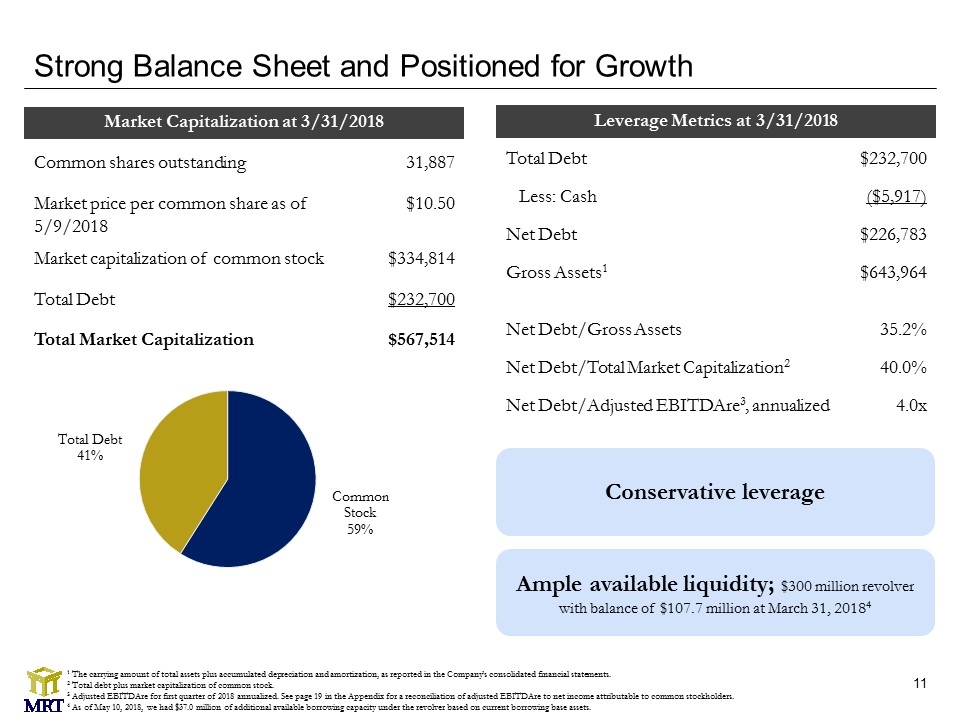

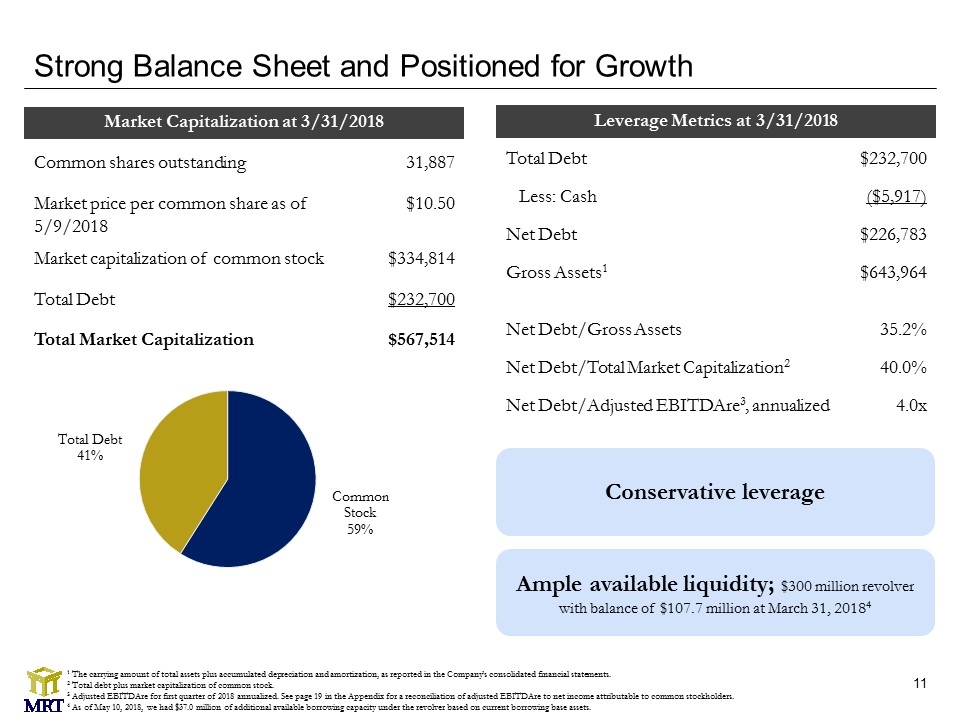

Common shares outstanding 31,887 Market price per common share as of 5/9/2018 $10.50 Market capitalization of common stock $334,814 Total Debt $232,700 Total Market Capitalization $567,514 Strong Balance Sheet and Positioned for Growth Total Debt $232,700 Less: Cash ($5,917) Net Debt $226,783 Gross Assets1 $643,964 Net Debt/Gross Assets 35.2% Net Debt/Total Market Capitalization2 40.0% Net Debt/Adjusted EBITDAre3, annualized 4.0x Market Capitalization at 3/31/2018 Conservative leverage Ample available liquidity; $300 million revolver with balance of $107.7 million at March 31, 20184 Leverage Metrics at 3/31/2018 1 The carrying amount of total assets plus accumulated depreciation and amortization, as reported in the Company’s consolidated financial statements. 2 Total debt plus market capitalization of common stock. 3 Adjusted EBITDAre for first quarter of 2018 annualized. See page 19 in the Appendix for a reconciliation of adjusted EBITDAre to net income attributable to common stockholders. 4 As of May 10, 2018, we had $37.0 million of additional available borrowing capacity under the revolver based on current borrowing base assets.

Opportunities to Increase Shareholder Value Accretive Asset Growth Grow asset base through acquisitions that meet underwriting criteria and return thresholds Portfolio Management Enhance portfolio diversification across tenant, state, and type Actively monitor operator performance and further improve strength of tenant group Balance Sheet Management Target conservative leverage of net debt/gross assets of 35%-45% Achieve longer-term debt maturities and at fixed interest rates Shareholder Return Improve cost of capital Grow FFO & AFFO per share metrics Focus on growing dividend over long-term

Appendix

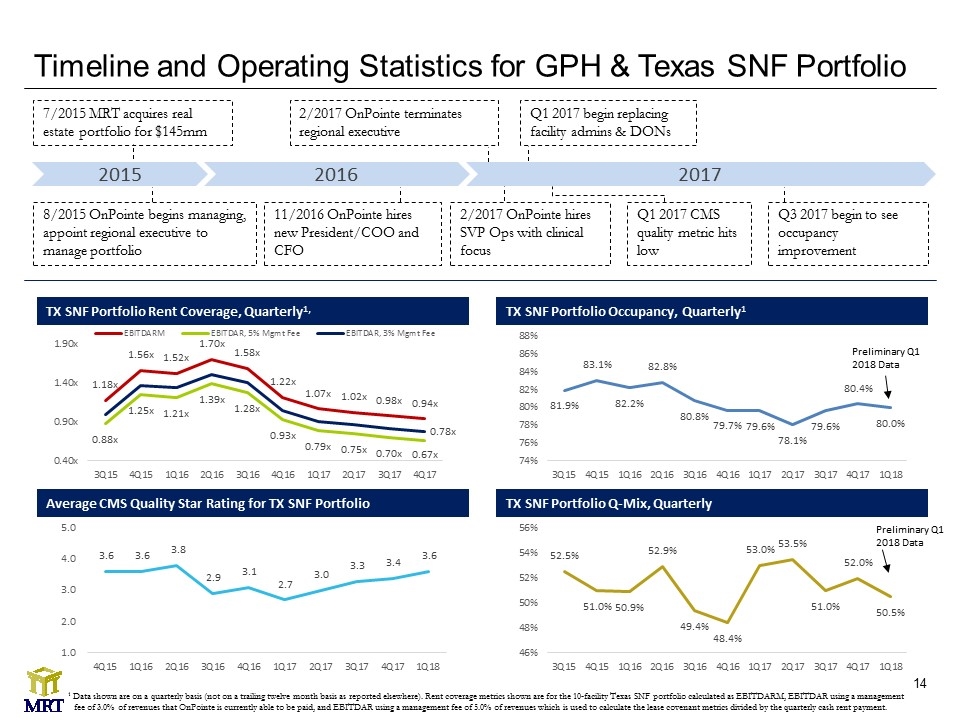

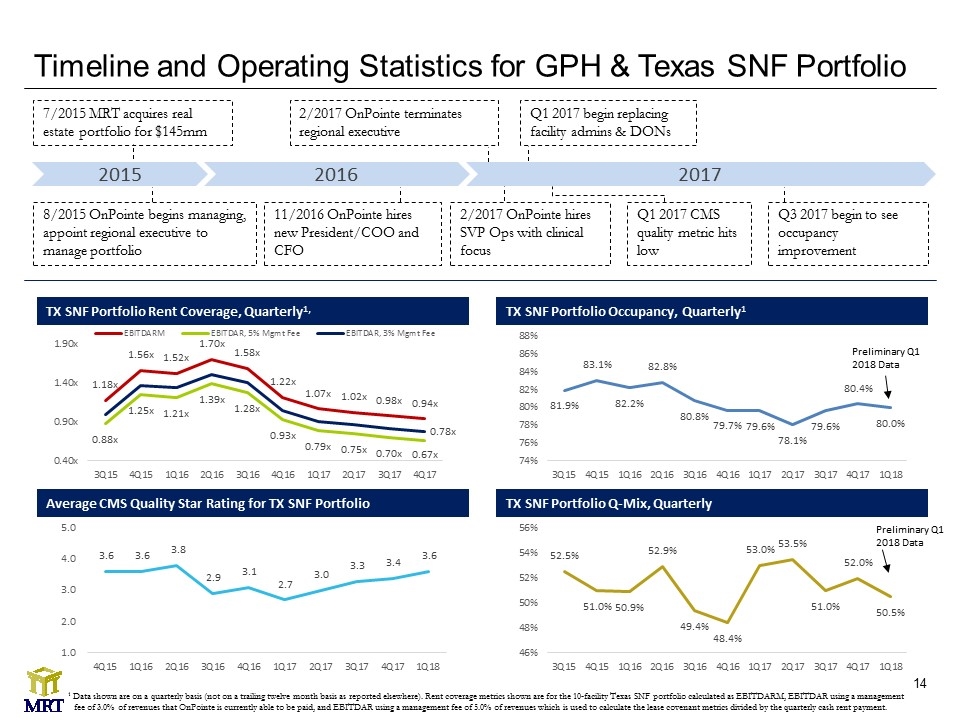

Timeline and Operating Statistics for GPH & Texas SNF Portfolio 2015 2016 2017 7/2015 MRT acquires real estate portfolio for $145mm 11/2016 OnPointe hires new President/COO and CFO 2/2017 OnPointe hires SVP Ops with clinical focus 8/2015 OnPointe begins managing, appoint regional executive to manage portfolio Q1 2017 begin replacing facility admins & DONs 2/2017 OnPointe terminates regional executive Q3 2017 begin to see occupancy improvement Q1 2017 CMS quality metric hits low TX SNF Portfolio Rent Coverage, Quarterly1, TX SNF Portfolio Occupancy, Quarterly1 Average CMS Quality Star Rating for TX SNF Portfolio Preliminary Q1 2018 Data TX SNF Portfolio Q-Mix, Quarterly Preliminary Q1 2018 Data 1 Data shown are on a quarterly basis (not on a trailing twelve month basis as reported elsewhere). Rent coverage metrics shown are for the 10-facility Texas SNF portfolio calculated as EBITDARM, EBITDAR using a management fee of 3.0% of revenues that OnPointe is currently able to be paid, and EBITDAR using a management fee of 5.0% of revenues which is used to calculate the lease covenant metrics divided by the quarterly cash rent payment.

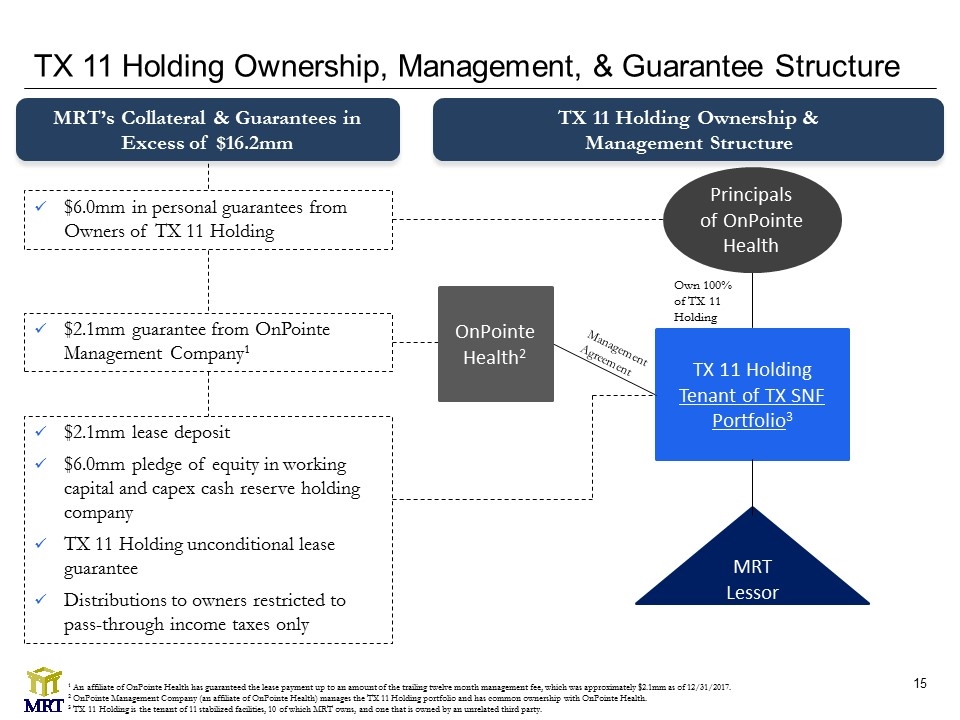

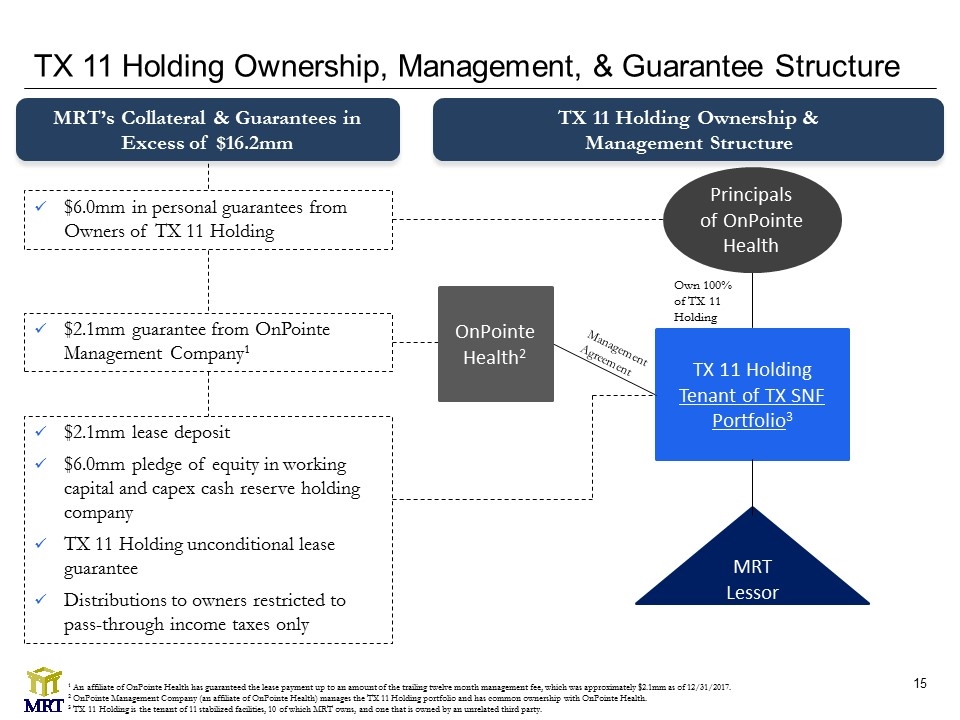

TX 11 Holding Ownership, Management, & Guarantee Structure TX 11 Holding Tenant of TX SNF Portfolio3 Principals of OnPointe Health MRT Lessor OnPointe Health2 Own 100% of TX 11 Holding $6.0mm in personal guarantees from Owners of TX 11 Holding $2.1mm lease deposit $6.0mm pledge of equity in working capital and capex cash reserve holding company TX 11 Holding unconditional lease guarantee Distributions to owners restricted to pass-through income taxes only $2.1mm guarantee from OnPointe Management Company1 MRT’s Collateral & Guarantees in Excess of $16.2mm TX 11 Holding Ownership & Management Structure Management Agreement 1 An affiliate of OnPointe Health has guaranteed the lease payment up to an amount of the trailing twelve month management fee, which was approximately $2.1mm as of 12/31/2017. 2 OnPointe Management Company (an affiliate of OnPointe Health) manages the TX 11 Holding portfolio and has common ownership with OnPointe Health. 3 TX 11 Holding is the tenant of 11 stabilized facilities, 10 of which MRT owns, and one that is owned by an unrelated third party.

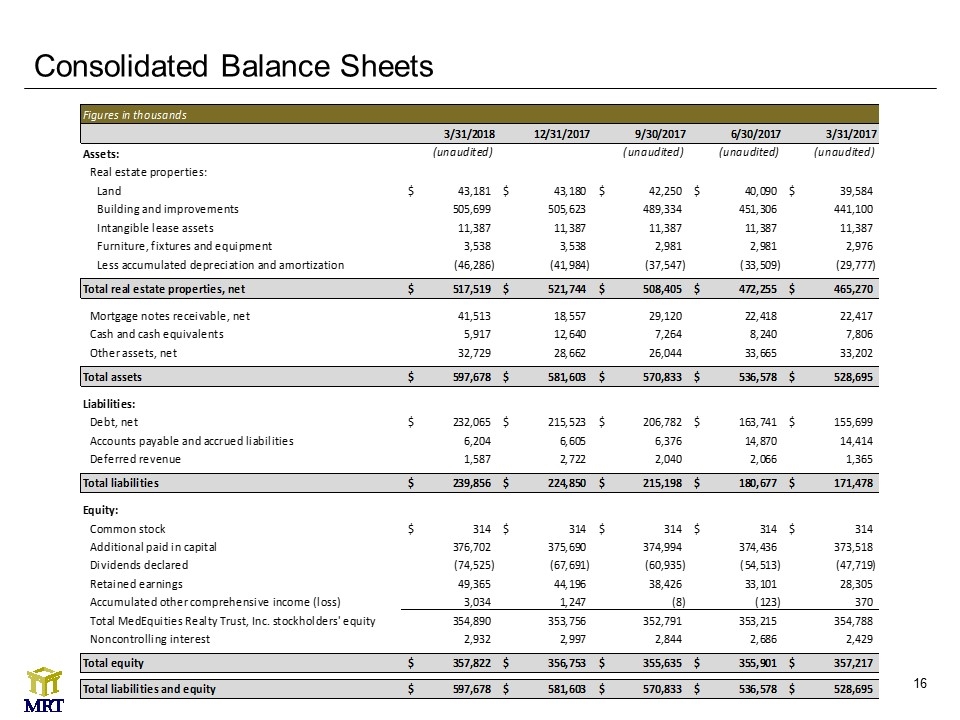

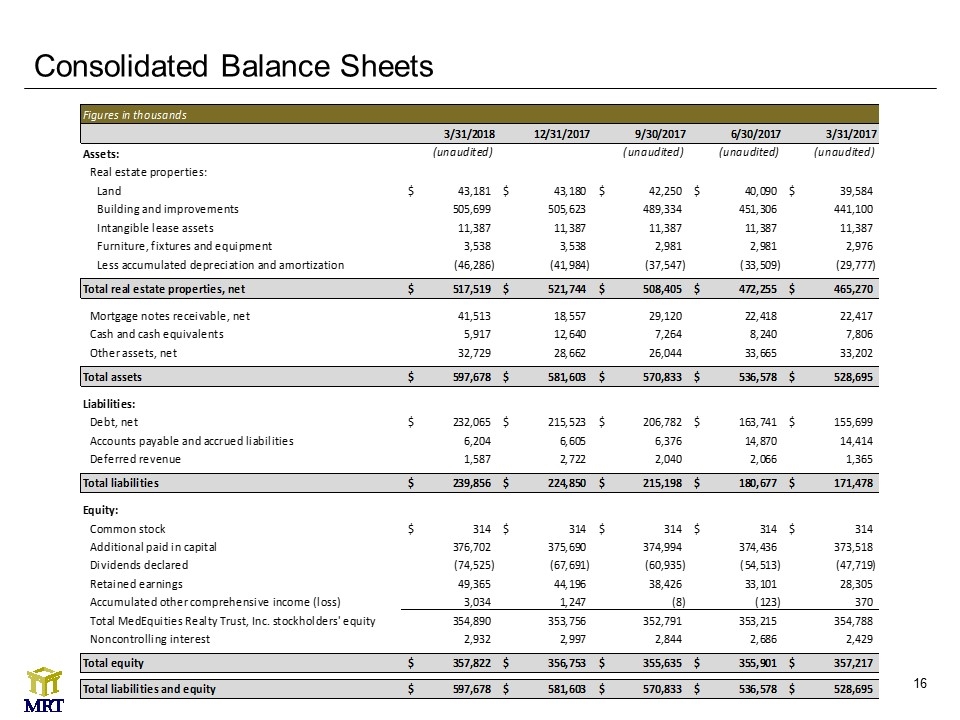

Consolidated Balance Sheets

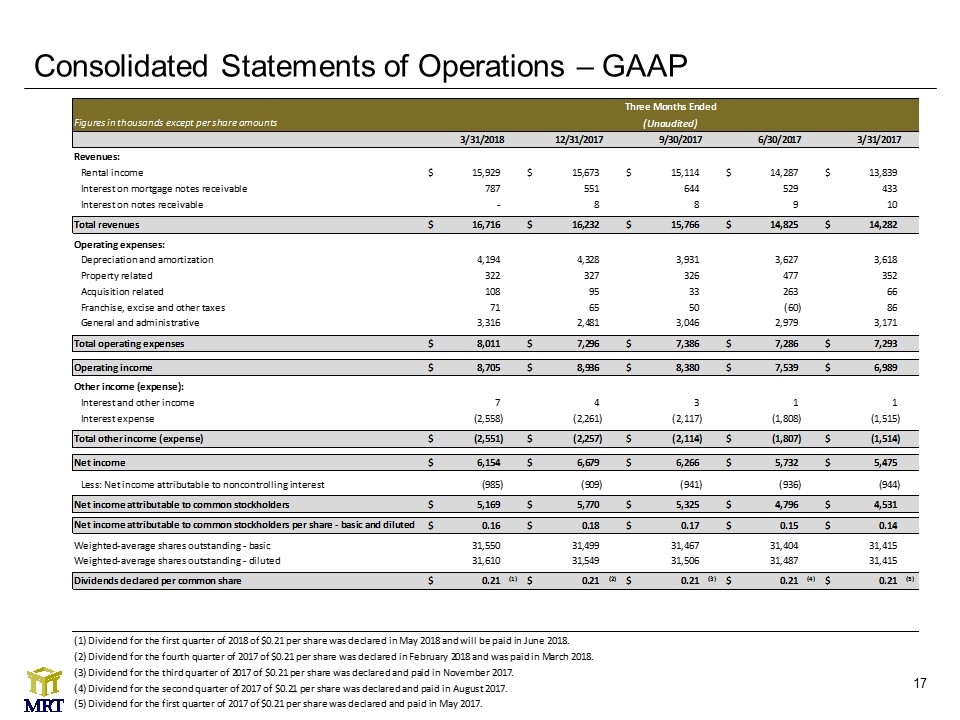

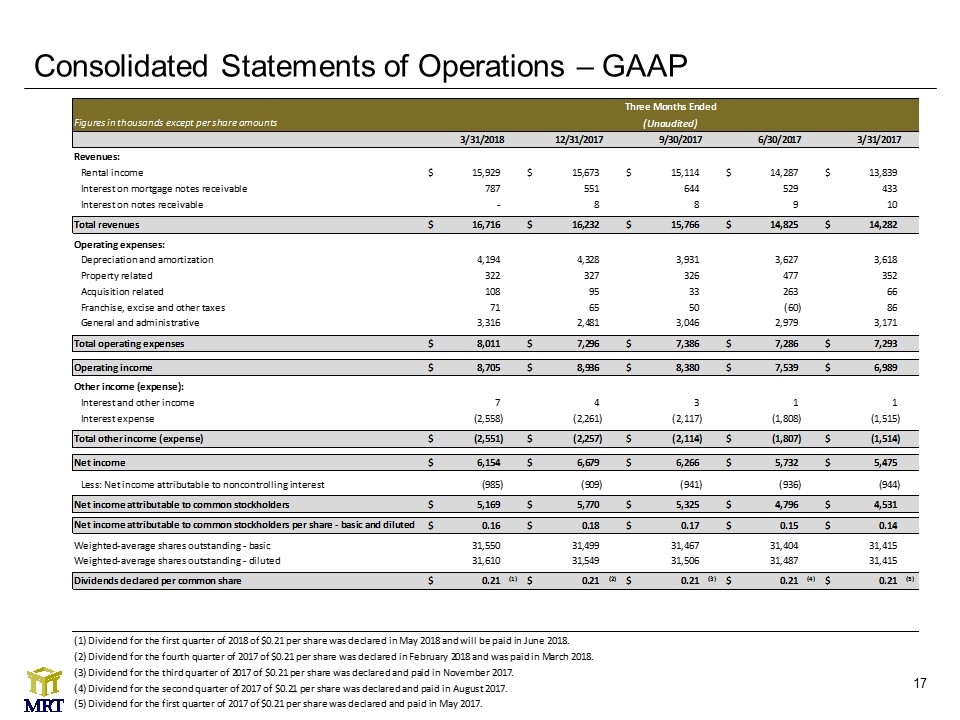

Consolidated Statements of Operations – GAAP

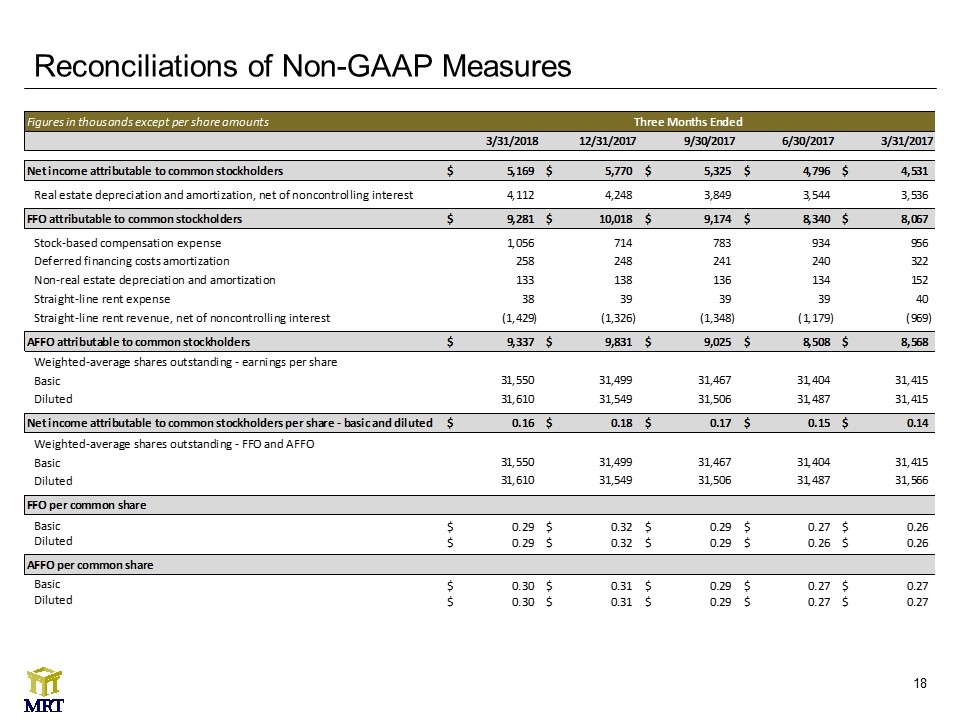

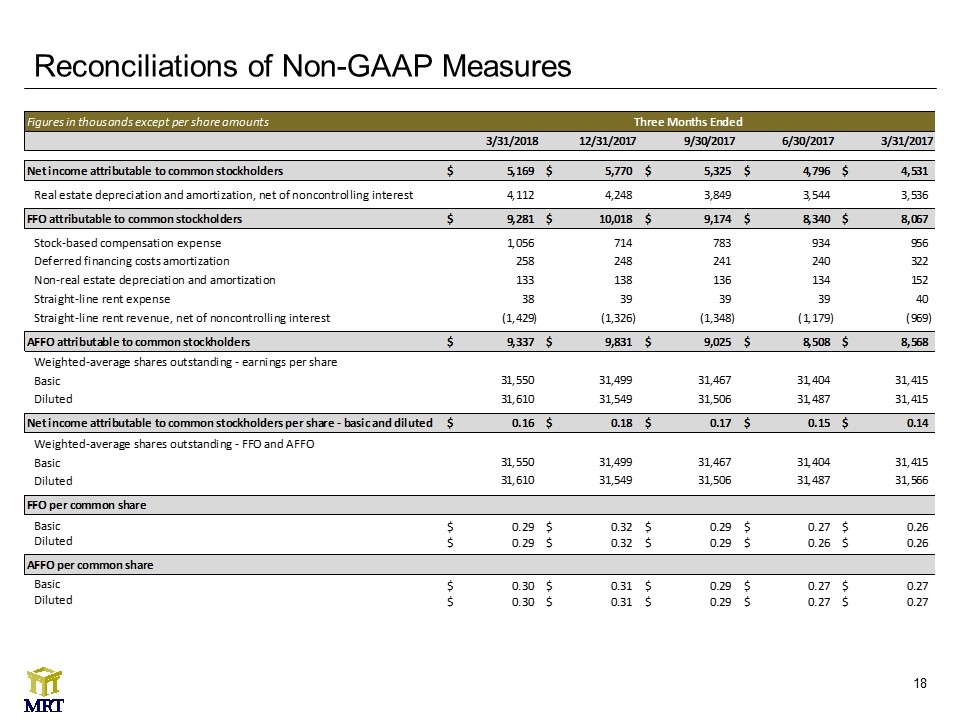

Reconciliations of Non-GAAP Measures Figures in thousands except per share amounts

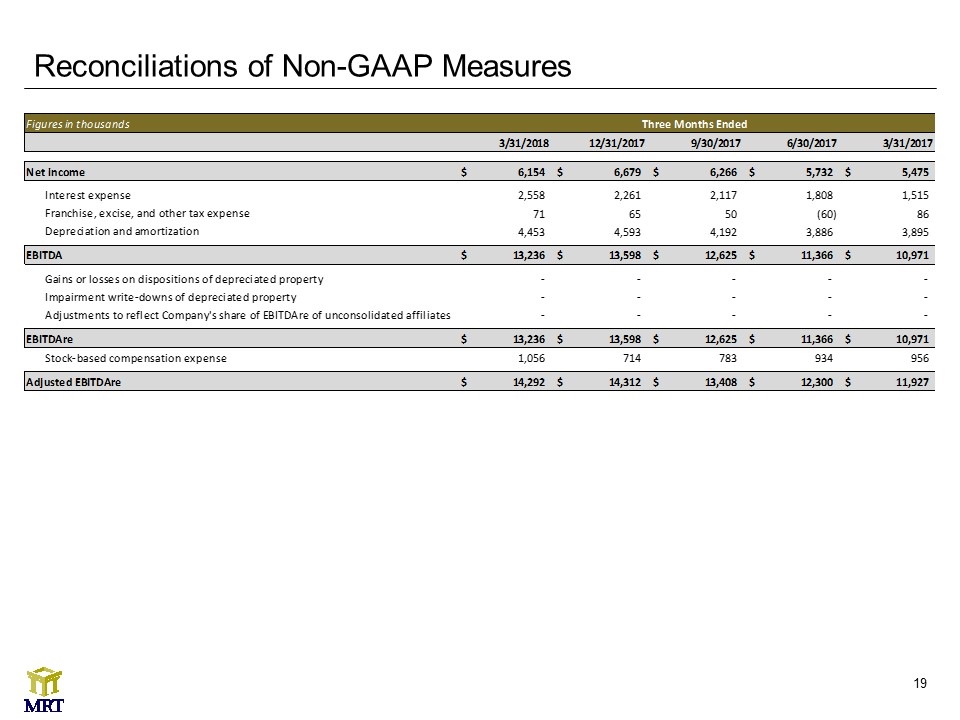

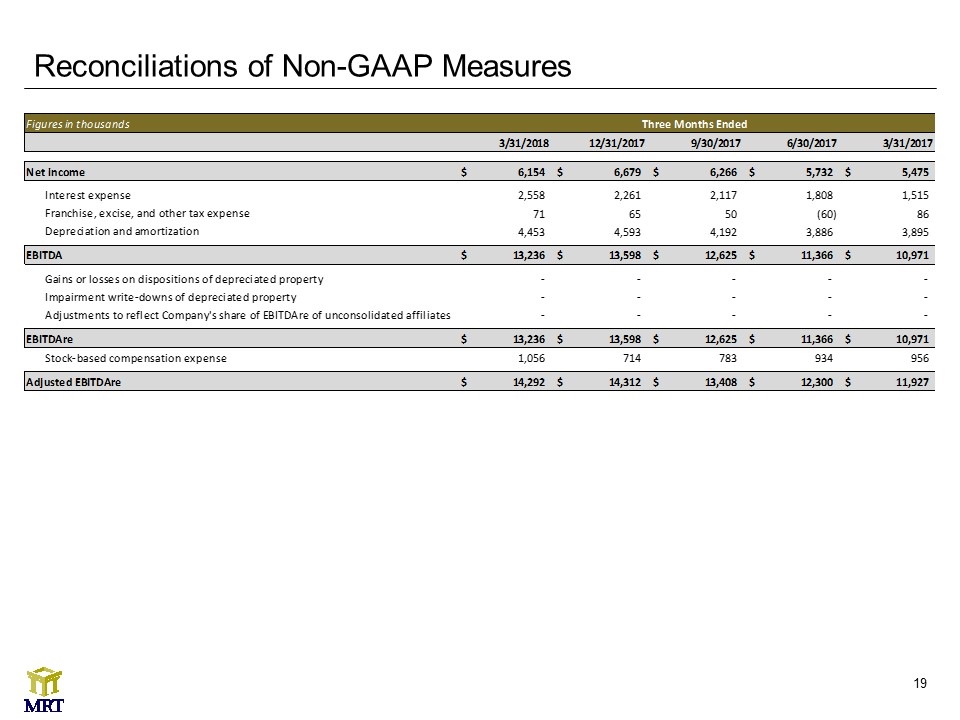

Reconciliations of Non-GAAP Measures Figures in thousands except per share amounts

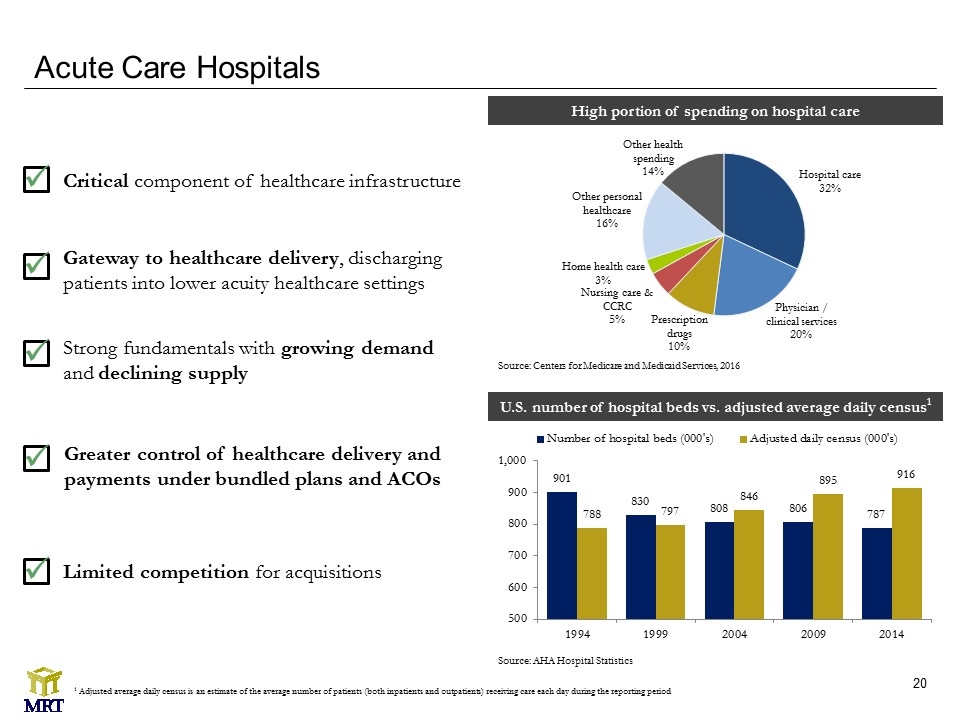

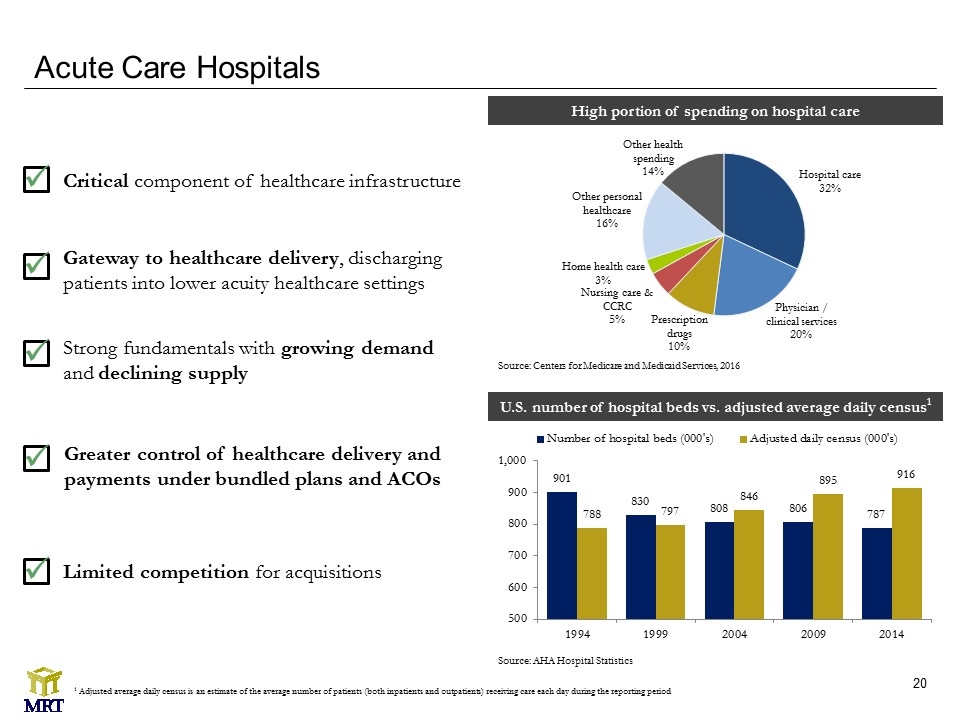

Acute Care Hospitals High portion of spending on hospital care Critical component of healthcare infrastructure ü Gateway to healthcare delivery, discharging patients into lower acuity healthcare settings ü Greater control of healthcare delivery and payments under bundled plans and ACOs ü Strong fundamentals with growing demand and declining supply ü Source: Centers for Medicare and Medicaid Services, 2016 Source: AHA Hospital Statistics Acute care hospitals U.S. number of hospital beds vs. adjusted average daily census1 1 Adjusted average daily census is an estimate of the average number of patients (both inpatients and outpatients) receiving care each day during the reporting period Limited competition for acquisitions ü

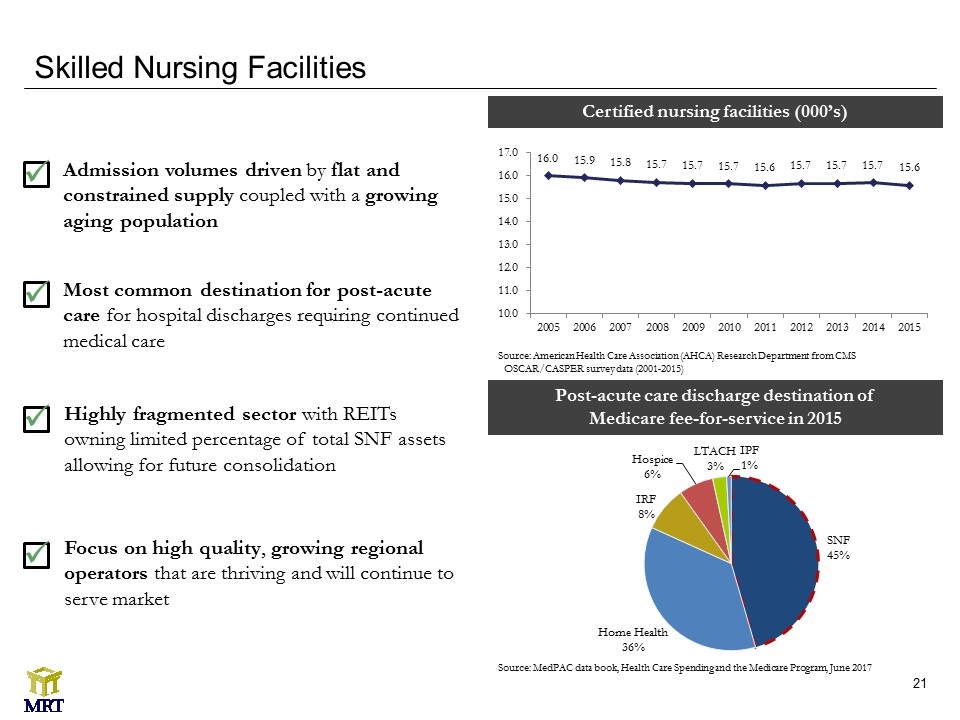

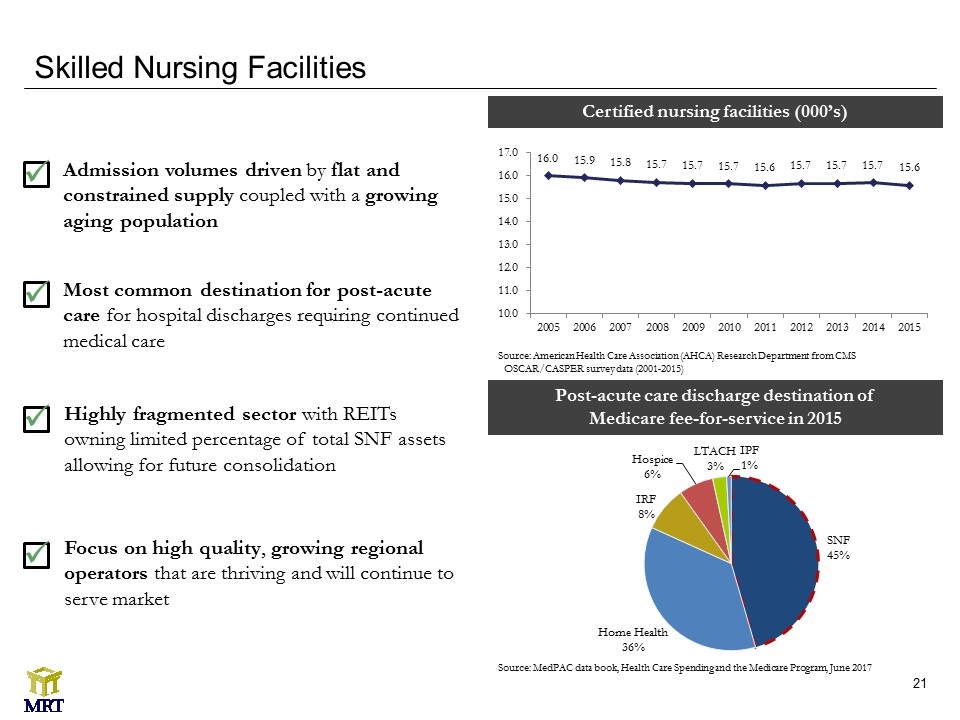

Skilled Nursing Facilities Certified nursing facilities (000’s) Post-acute care discharge destination of Medicare fee-for-service in 2015 Most common destination for post-acute care for hospital discharges requiring continued medical care ü Admission volumes driven by flat and constrained supply coupled with a growing aging population ü Highly fragmented sector with REITs owning limited percentage of total SNF assets allowing for future consolidation ü Source: American Health Care Association (AHCA) Research Department from CMS OSCAR/CASPER survey data (2001-2015) Source: MedPAC data book, Health Care Spending and the Medicare Program, June 2017 Focus on high quality, growing regional operators that are thriving and will continue to serve market ü

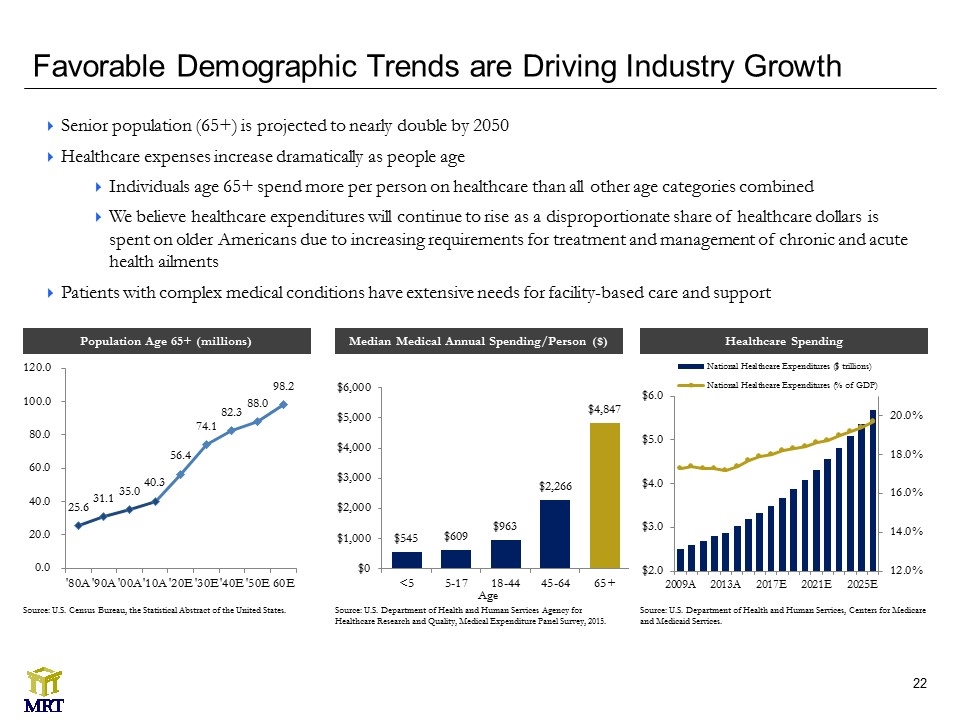

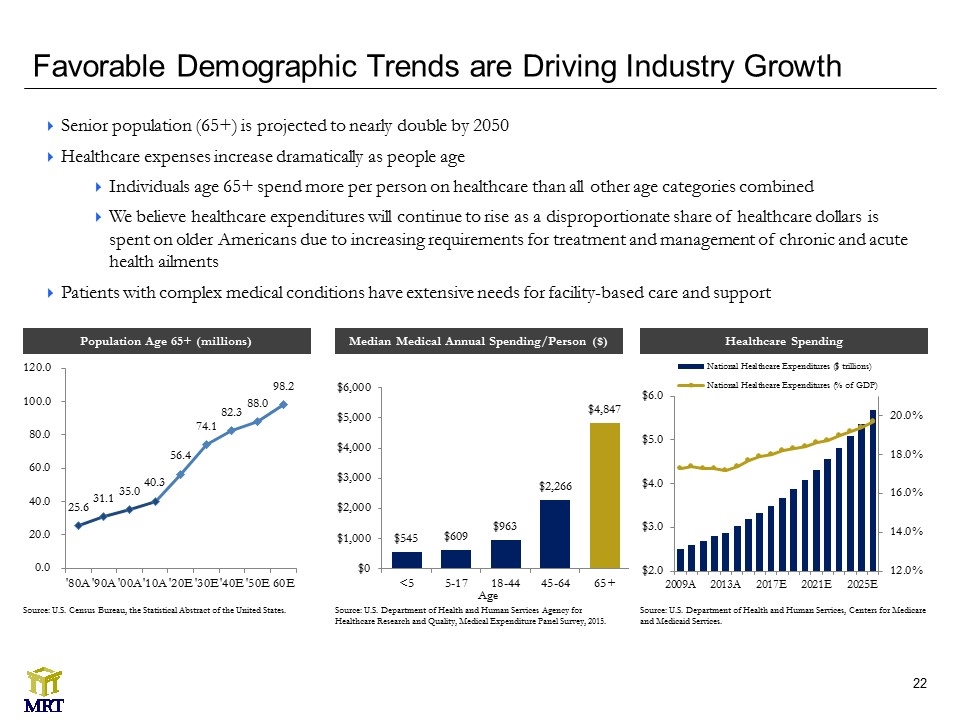

Favorable Demographic Trends are Driving Industry Growth Source: U.S. Department of Health and Human Services Agency for Healthcare Research and Quality, Medical Expenditure Panel Survey, 2015. Median Medical Annual Spending/Person ($) Population Age 65+ (millions) Healthcare Spending Senior population (65+) is projected to nearly double by 2050 Healthcare expenses increase dramatically as people age Individuals age 65+ spend more per person on healthcare than all other age categories combined We believe healthcare expenditures will continue to rise as a disproportionate share of healthcare dollars is spent on older Americans due to increasing requirements for treatment and management of chronic and acute health ailments Patients with complex medical conditions have extensive needs for facility-based care and support Age Source: U.S. Census Bureau, the Statistical Abstract of the United States. Source: U.S. Department of Health and Human Services, Centers for Medicare and Medicaid Services.

Glossary Acute Care Hospital (“ACH”): general medical and surgical hospitals that provide both inpatient and outpatient medical services and are owned and/or operated either by a non-profit or for-profit hospital or hospital system. These facilities often act as feeder hospitals to dedicated specialty facilities. Adjusted EBITDAre: Adjusted EBITDAre represents EBITDAre, as defined below, adjusted further for the effects of acquisition costs, stock-based compensation expense and non-cash write-offs of straight-line rent and accounts receivable. Both EBITDAre and Adjusted EBITDAre are relevant non-GAAP measures broadly used by investors and analysts to evaluate the operating performance of a company and to assess a company’s credit strength, including the ability to service indebtedness. Our calculations of EBITDAre and Adjusted EBITDAre may differ from the methodologies used by other companies and, accordingly, our EBITDAre and Adjusted EBITDAre may not be comparable to amounts reported by other companies. EBITDAre and Adjusted EBITDAre should not be used as a substitute for any GAAP financial measures for the purpose of evaluating our financial performance, financial position or cash flows. Adjusted Funds From Operations (“AFFO”): AFFO is a non-GAAP measure used by many investors and analysts to measure a real estate company’s operating performance by removing the effect of items that do not reflect ongoing property operations. To calculate AFFO, we further adjust FFO for certain items that are not added to net income in the National Association of Real Estate Investment Trusts’ (“Nareit”) definition of FFO, such as acquisition expenses, non-real estate-related depreciation and amortization (including amortization of lease incentives and tenant allowances), stock based compensation expenses, and any other non-comparable or non-operating items that do not relate to the operating performance of our properties. To calculate AFFO, we also adjust FFO to remove the effect of straight-line rent revenue, which represents the recognition of net unbilled rental income expected to be collected in future periods of a lease agreement that exceeds the actual contractual rent due periodically from tenants for their use of the leased real estate under each lease. Noncontrolling interest amounts represent adjustments to reflect only our share of straight line rent revenue. Our calculation of AFFO may differ from the methodology used for calculating AFFO by certain other REITs and, accordingly, our AFFO may not be comparable to AFFO reported by other REITs. AFFO should not be considered as an alternative to net income (computed in accordance with GAAP) as an indicator of our financial performance or to cash flow from operating activities (computed in accordance with GAAP) as an indicator of our liquidity. Assisted Living Facility (“ALF”): residential care facilities that provide housing, meals, personal care and supportive services to older persons and disabled adults who are unable to live independently. They are intended to be a less costly alternative to more restrictive, institutional settings for individuals who do not require 24-hour nursing supervision. Behavioral Health Facility (“BH”): facilities that provide inpatient and outpatient services for the treatment of behavioral health, mental illness and substance abuse. These can include facilities for intensive outpatient treatment, inpatient residential treatment, sober living rehabilitation, and psychiatric care.

Glossary EBITDA: calculated as net income (computed in accordance with GAAP) plus interest expense, taxes, and depreciation and amortization. Our calculation of EBITDA may differ from the methodologies used by other companies and, accordingly, our EBITDA may not be comparable to amounts reported by other companies. EBITDA should not be used as a substitute for any GAAP financial measures for the purpose of evaluating our financial performance, financial position or cash flows. EBITDAR: represents earnings from the operator’s financial statements adjusted for non-recurring, infrequent or unusual items and before interest, taxes, depreciation, amortization and rent. EBITDAre: is calculated as EBITDA plus or minus losses and gains on the disposition of depreciated property, including losses or gains on change of control, plus impairment write‐downs of depreciated property and of investments in unconsolidated affiliates caused by a decrease in value of depreciated property in the affiliate, plus or minus adjustments to reflect the Company's share of EBITDAre of unconsolidated affiliates. Management believes EBITDAre is useful to investors in evaluating and facilitating comparisons of our operating performance between periods and between other REITs. We calculate EBITDAre in accordance with Nareit's definition, which may differ from the methodology for calculating, EBITDAre, or similarly titled measures, used by other companies. As a result, our calculation of EBITDAre may not be comparable to measures calculated by other companies that do not use the Nareit definition of EBITDAre. EBITDAre should not be used as a substitute for any GAAP financial measures for the purpose of evaluating our financial performance, financial position or cash flows. EBITDAR Rent Coverage: represents the operator EBITDAR of our stabilized facilities for the trailing twelve months divided by the contractual lease rent for the same period. For the leases that have been in place for less than 12 months as of the date presented, the annualized base rent under the applicable lease as of such date is used. EBITDARM: represents earnings from the operator’s financial statements before interest, taxes, depreciation, amortization, rent and management fees and may be adjusted for certain non-recurring, infrequent or out-of-period items. EBITDARM Rent Coverage: represents the operator EBITDARM of our stabilized facilities for the trailing twelve months divided by the contractual lease rent for the same period. For the leases that have been in place for less than 12 months as of the date presented, the annualized base rent under the applicable lease as of such date is used.

Glossary Funds From Operations (“FFO”): FFO is a non-GAAP measure used by many investors and analysts that follow the real estate industry. FFO, as defined by Nareit, represents net income (computed in accordance with GAAP), excluding gains (losses) on sales of real estate and impairments of real estate assets, plus real estate-related depreciation and amortization and after adjustments for unconsolidated partnerships and joint ventures. Noncontrolling interest amounts represent adjustments to reflect only our share of depreciation and amortization. We compute FFO in accordance with Nareit’s definition, which may differ from the methodology for calculating FFO, or similarly titled measures, used by other companies. Historical cost accounting for real estate assets implicitly assumes that the value of real estate assets diminishes predictably over time. Since real estate values instead have historically risen or fallen with market conditions, most real estate industry investors consider FFO to be helpful in evaluating a real estate company’s operations. We believe that the presentation of FFO provides useful information to investors regarding our operating performance by excluding the effect of real-estate related depreciation and amortization, gains or losses from sales for real estate, including impairments, extraordinary items and the portion of items related to unconsolidated entities, all of which are based on historical cost accounting, and that FFO can facilitate comparisons of operating performance between periods and between REITs, even though FFO does not represent an amount that accrues directly to common stockholders. Our calculation of FFO may not be comparable to measures calculated by other companies that do not use the Nareit definition of FFO or do not calculate FFO per diluted share in accordance with Nareit guidance. FFO should not be considered as an alternative to net income (computed in accordance with GAAP) as an indicator of our financial performance or to cash flow from operating activities (computed in accordance with GAAP) as an indicator of our liquidity. Gross Assets: The carrying amount of total assets plus accumulated depreciation and amortization, as reported in the company’s consolidated financial statements. Inpatient Rehabilitation Facility (“IRF”): facilities that provide inpatient rehabilitation services for patients recovering from injuries, organ transplants, amputations, cardiovascular surgery, strokes, and complex neurological, orthopedic and other medical conditions following stabilization of their acute medical issues. Long-term Acute Care Hospital (“LTACH”): facilities designed for patients with serious medical problems that require intense, special treatment for an extended period of time (typically at least 25 days), offer more individualized and resource-intensive care than a skilled nursing facility, nursing home or acute rehabilitation facility, and patients are typically transferred to a long-term acute care hospital from the intensive care unit of a traditional hospital. Medical Office Building (“MOB”): single-tenant or multi-tenant buildings where doctors, physician practice groups, hospitals, hospital systems or other healthcare providers lease space and are typically located near or adjacent to acute care hospitals or other facilities where healthcare services are rendered. Medical office buildings can include outpatient surgical centers, diagnostic labs, physical therapy providers and physician office space in a single building.

Glossary Occupancy: occupancy is calculated by dividing the daily number of beds occupied each day during the period presented by the beds in operation (available) for the same period. Post-acute: the period of time following acute care, in which the patient continues to require elevated levels of medical treatment. Q-Mix: quality mix is presented as non-Medicaid revenue as a percentage of total revenue. Skilled Nursing Facility (“SNF”): facilities that usually house elderly patients and provide restorative, rehabilitative and nursing care for patients not requiring more extensive and sophisticated treatment that may be available at acute care hospitals or long-term acute care hospitals. They are distinct from and offer a much higher level of care for older adults compared to senior housing facilities. Patients typically enter skilled nursing facilities after hospitalization. Stabilized Portfolio: as of December 31, 2017, our stabilized, single-tenanted portfolio includes only our 20 stabilized skilled nursing facilities, our four stabilized behavioral health facilities, our two stabilized long-term acute care hospitals, our one stabilized assisted living facility (that is connected to a skilled nursing facility in our portfolio) our one stabilized inpatient rehabilitation facility and our one stabilized acute care hospital. Our non-stabilized, single-tenanted property as of December 31, 2017 was Mountain’s Edge Hospital. We consider a facility to be non-stabilized if it is a newly completed development, is undergoing or has recently undergone a significant addition or renovation, or is being repositioned or transitioned to new operators, but in no event beyond 24 months after the date of classification as non-stabilized. Lakeway Hospital is excluded from all operator metrics as a result of Baylor Scott & White's lack of reporting requirements for facility level financial information. Acquired properties that otherwise meet the definition of a stabilized property are included in operating metrics beginning with the first full quarter of ownership, with the exception of Advanced Diagnostics Hospital East which is included in the operating metrics.

Mission Statement MedEquities Realty Trust provides capital primarily to the acute and post-acute services industry by making disciplined investments in healthcare facilities. We strive to be the capital partner of choice to growth-minded, facility-based healthcare operators led by proven management teams who are focused on providing efficient healthcare delivery and the highest quality outcomes. Mountain’s Edge Hospital Las Vegas, NV The Rio at Mission Trails San Antonio, TX Physical Rehabilitation and Wellness Center of Spartanburg Spartanburg, SC St. Teresa Nursing & Rehabilitation Center El Paso, TX