Exhibit 99.2

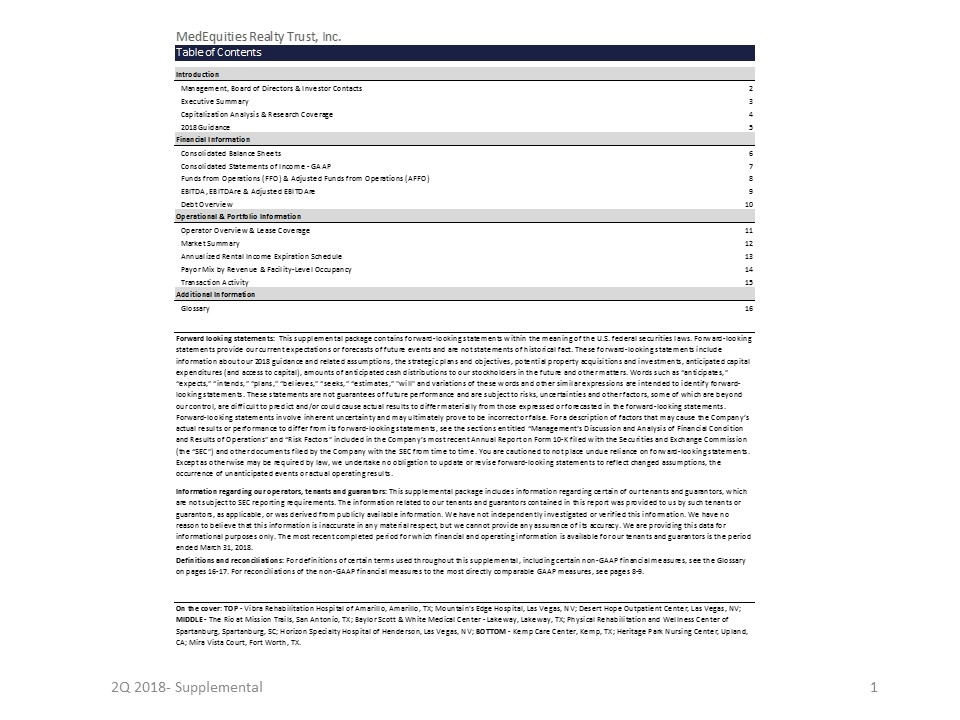

2Q 2018- Supplemental MedEquities Realty Trust, Inc.Table of ContentsIntroductionManagement, Board of Directors & Investor Contacts2Executive Summary3Capitalization Analysis & Research Coverage42018 Guidance5Financial InformationConsolidated Balance Sheets6Consolidated Statements of Income - GAAP7Funds from Operations (FFO) & Adjusted Funds from Operations (AFFO)8EBITDA, EBITDAre & Adjusted EBITDAre9Debt Overview10Operational & Portfolio InformationOperator Overview & Lease Coverage11Market Summary12Annualized Rental Income Expiration Schedule13Payor Mix by Revenue & Facility-Level Occupancy14Transaction Activity15Additional InformationGlossary16Forward looking statements: This supplemental package contains forward-looking statements within the meaning of the U.S. federal securities laws. Forward-looking statements provide our current expectations or forecasts of future events and are not statements of historical fact. These forward-looking statements include information about our 2018 guidance and related assumptions, the strategic plans and objectives, potential property acquisitions and investments, anticipated capital expenditures (and access to capital), amounts of anticipated cash distributions to our stockholders in the future and other matters. Words such as “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” "will" and variations of these words and other similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and/or could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements. Forward-looking statements involve inherent uncertainty and may ultimately prove to be incorrect or false. For a description of factors that may cause the Company’s actual results or performance to differ from its forward-looking statements, see the sections entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” included in the Company’s most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission (the “SEC”) and other documents filed by the Company with the SEC from time to time. You are cautioned to not place undue reliance on forward-looking statements. Except as otherwise may be required by law, we undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or actual operating results.Information regarding our operators, tenants and guarantors: This supplemental package includes information regarding certain of our tenants and guarantors, which are not subject to SEC reporting requirements. The information related to our tenants and guarantors contained in this report was provided to us by such tenants or guarantors, as applicable, or was derived from publicly available information. We have not independently investigated or verified this information. We have no reason to believe that this information is inaccurate in any material respect, but we cannot provide any assurance of its accuracy. We are providing this data for informational purposes only. The most recent completed period for which financial and operating information is available for our tenants and guarantors is the period ended March 31, 2018.Definitions and reconciliations: For definitions of certain terms used throughout this supplemental, including certain non-GAAP financial measures, see the Glossary on pages 16-17. For reconciliations of the non-GAAP financial measures to the most directly comparable GAAP measures, see pages 8-9. On the cover: TOP - Vibra Rehabilitation Hospital of Amarillo, Amarillo, TX; Mountain's Edge Hospital, Las Vegas, NV; Desert Hope Outpatient Center, Las Vegas, NV; MIDDLE - The Rio at Mission Trails, San Antonio, TX; Baylor Scott & White Medical Center - Lakeway, Lakeway, TX; Physical Rehabilitation and Wellness Center of Spartanburg, Spartanburg, SC; Horizon Specialty Hospital of Henderson, Las Vegas, NV; BOTTOM - Kemp Care Center, Kemp, TX; Heritage Park Nursing Center, Upland, CA; Mira Vista Court, Fort Worth, TX.

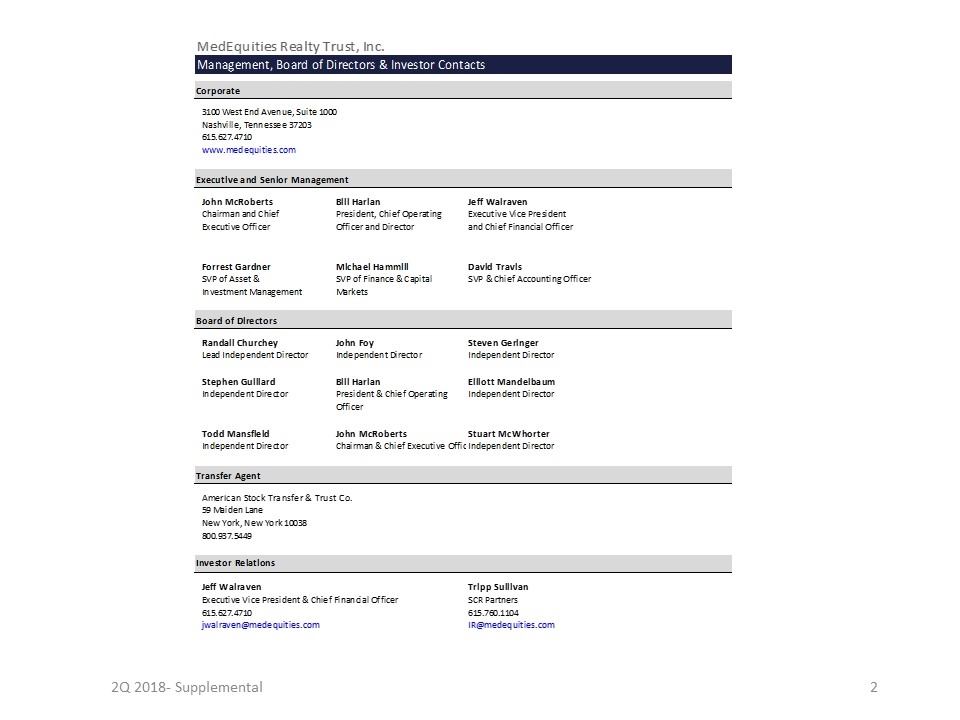

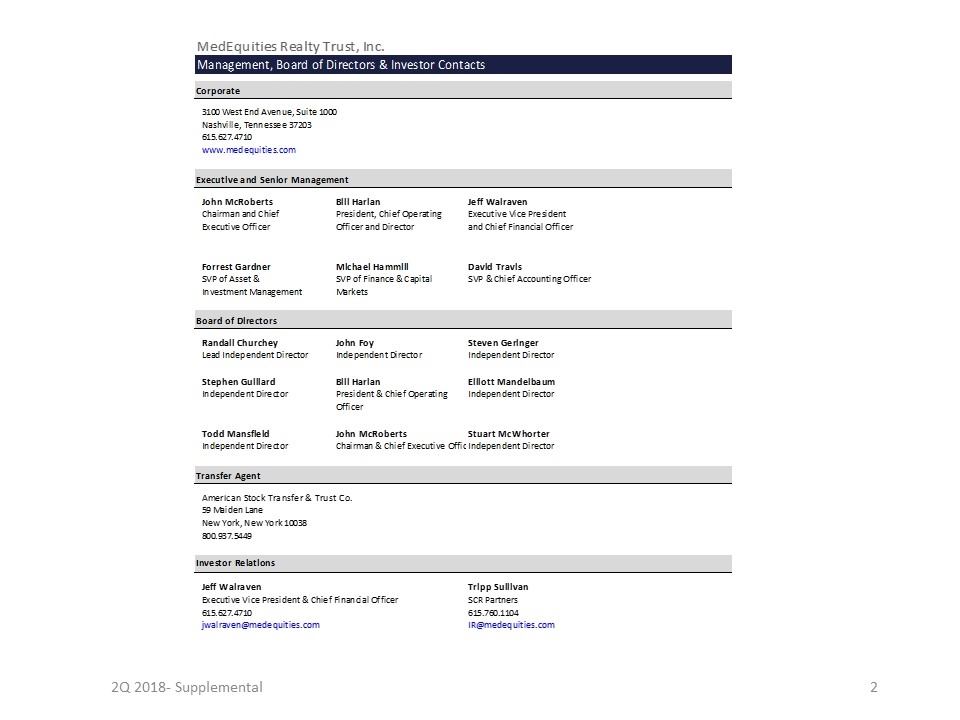

2Q 2018- Supplemental MedEquities Realty Trust, Inc.Management, Board of Directors & Investor ContactsCorporate3100 West End Avenue, Suite 1000Nashville, Tennessee 37203615.627.4710www.medequities.comExecutive and Senior ManagementJohn McRobertsBill HarlanJeff WalravenChairman and ChiefPresident, Chief OperatingExecutive Vice PresidentExecutive OfficerOfficer and Directorand Chief Financial OfficerForrest GardnerMichael HammillDavid TravisSVP of Asset & SVP of Finance & CapitalSVP & Chief Accounting OfficerInvestment ManagementMarketsBoard of DirectorsRandall ChurcheyJohn FoySteven GeringerLead Independent DirectorIndependent DirectorIndependent DirectorStephen GuillardBill HarlanElliott MandelbaumIndependent DirectorPresident & Chief OperatingIndependent DirectorOfficerTodd MansfieldJohn McRobertsStuart McWhorterIndependent DirectorChairman & Chief Executive OfficerIndependent DirectorTransfer AgentAmerican Stock Transfer & Trust Co.59 Maiden LaneNew York, New York 10038800.937.5449Investor RelationsJeff WalravenTripp SullivanExecutive Vice President & Chief Financial OfficerSCR Partners615.627.4710615.760.1104jwalraven@medequities.comIR@medequities.com

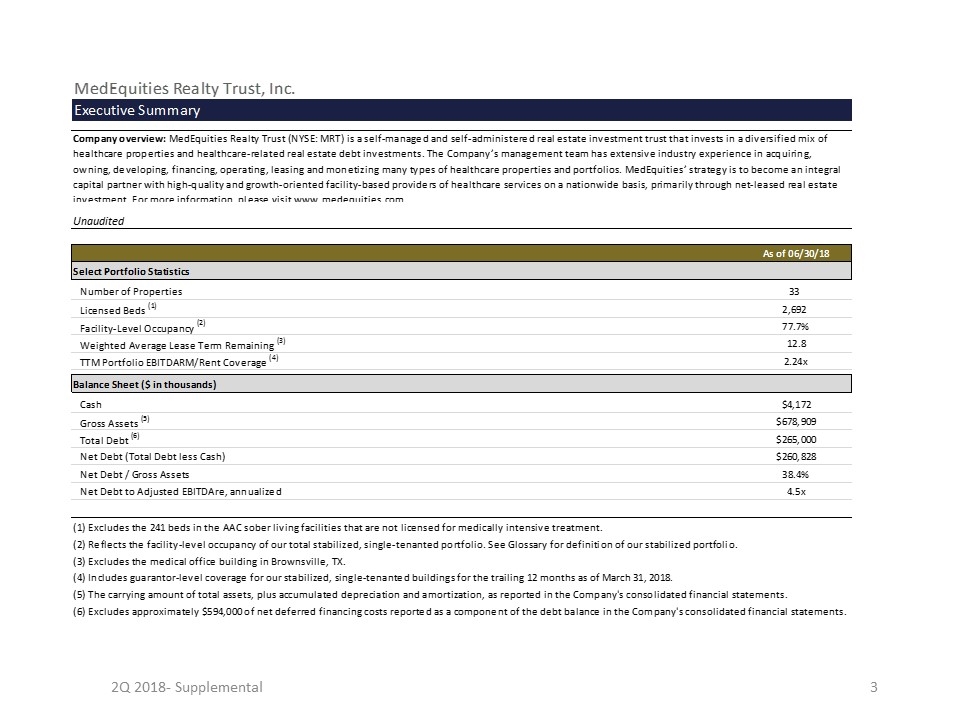

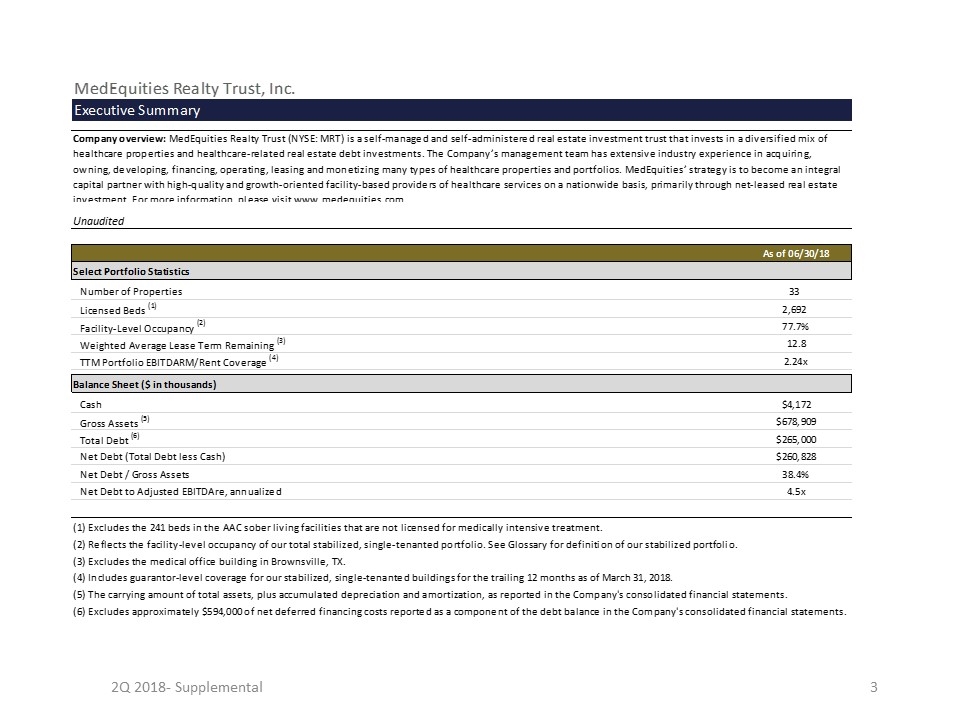

2Q 2018- Supplemental MedEquities Realty Trust, Inc.Executive SummaryCompany overview: MedEquities Realty Trust (NYSE: MRT) is a self-managed and self-administered real estate investment trust that invests in a diversified mix of healthcare properties and healthcare-related real estate debt investments. The Company’s management team has extensive industry experience in acquiring, owning, developing, financing, operating, leasing and monetizing many types of healthcare properties and portfolios. MedEquities’ strategy is to become an integral capital partner with high-quality and growth-oriented facility-based providers of healthcare services on a nationwide basis, primarily through net-leased real estate investment. For more information, please visit www.medequities.com.Unaudited As of 06/30/18Select Portfolio Statistics Number of Properties33 Licensed Beds (1)2,692 Facility-Level Occupancy (2)77.7%Weighted Average Lease Term Remaining (3)12.8TTM Portfolio EBITDARM/Rent Coverage (4)2.24xBalance Sheet ($ in thousands)Cash$4,172Gross Assets (5)$678,909Total Debt (6)$265,000Net Debt (Total Debt less Cash)$260,828Net Debt / Gross Assets38.4%Net Debt to Adjusted EBITDAre, annualized4.5x(1) Excludes the 241 beds in the AAC sober living facilities that are not licensed for medically intensive treatment.(2) Reflects the facility-level occupancy of our total stabilized, single-tenanted portfolio. See Glossary for definition of our stabilized portfolio.(3) Excludes the medical office building in Brownsville, TX.(4) Includes guarantor-level coverage for our stabilized, single-tenanted buildings for the trailing 12 months as of March 31, 2018.(5) The carrying amount of total assets, plus accumulated depreciation and amortization, as reported in the Company's consolidated financial statements.(6) Excludes approximately $594,000 of net deferred financing costs reported as a component of the debt balance in the Company's consolidated financial statements.

2Q 2018- Supplemental MedEquities Realty Trust, Inc.Capitalization Analysis & Research CoverageUnaudited (in thousands except for per-share data and percentages)Three Months Ended6/30/20183/31/201812/31/20179/30/20176/30/2017Common Stock Data Weighted-Average Shares Outstanding - Basic31,552 31,550 31,499 31,467 31,404 Weighted-Average Shares Outstanding - Diluted31,626 31,610 31,549 31,506 31,487 High Closing Price $11.02 $11.32 $11.94 $12.79 $12.76 Low Closing Price $9.75 $9.67 $10.37 $11.37 $11.30 Average Closing Price $10.32 $10.62 $11.33 $11.86 $11.97 Closing Price (as of period end) $11.02 $10.51 $11.22 $11.75 $12.62 Dividends / Share (annualized) (1) $0.84 $0.84 $0.84 $0.84 $0.84 Dividend Yield (annualized) (2)7.6%8.0%7.5%7.1%6.7% Common Shares Outstanding (2)31,885 31,887 31,836 31,756 31,775 Market Value of Common Shares (2) $351,373 $335,132 $357,200 $373,133 $401,001 Total Market Capitalization (2)(3) $616,373 $600,132 $622,200 $638,133 $666,001 Equity Research Coverage (4)B. Riley FBRJMP SecuritiesRBC Capital MarketsBryan MaherPeter MartinMichael Carroll646.885.5423415.835.8904440.715.2649Cantor Fitzgerald & CompanyJ.P. Morgan SecuritiesJoseph FranceMichael Mueller212.915.1239212.622.6689Capital One SecuritiesKeyBanc Capital MarketsDaniel BernsteinJordan Sadler571.835.7202917.368.2280CitigroupRaymond James & AssociatesSmedes RoseJonathan Hughes212.816.6243727.567.1000"Investor Conference Call and Webcast:The Company will host a conference call and live audio webcast, both open for the general public to hear, on August 8, 2018 at 9:00 a.m. Central Time. The number to call for this interactive teleconference is (412) 542-4116. A replay of the call will be available through August 15, 2018 by dialing (412) 317-0088 and entering the replay access code, 10122142."(1) Based on second quarter 2018 dividend of $0.21 that was declared and will be paid in August 2018.(2) Based on closing price and ending shares for the last trading day of the quarter.(3) Market value of shares plus debt as of quarter end.(4) The analysts listed provide research coverage on the Company. Any opinions, estimates or forecasts regarding the Company's performance made by these analysts are theirs alone and do not represent opinions, estimates or forecasts by the Company or its management. The Company does not by reference above imply its endorsement of or concurrence with such information, conclusions or recommendations.

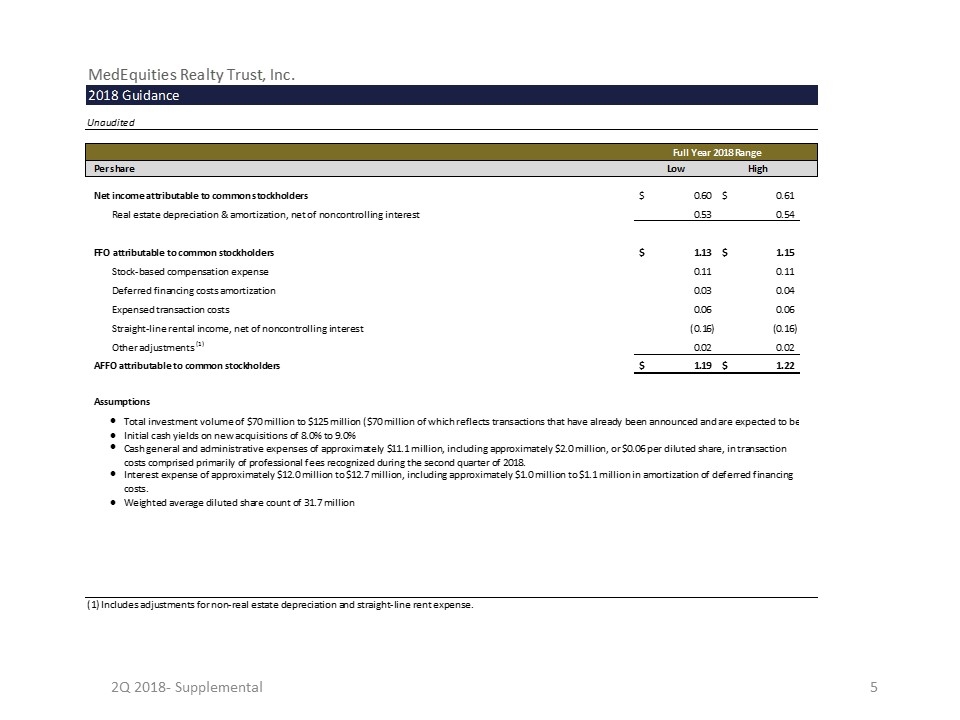

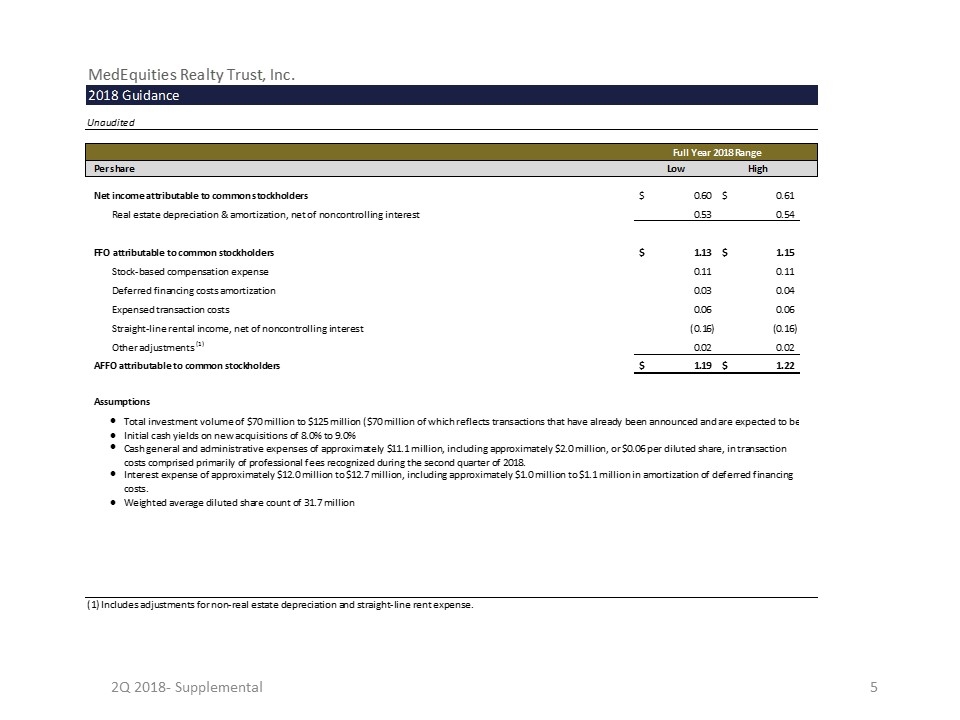

2Q 2018- Supplemental MedEquities Realty Trust, Inc.2018 GuidanceUnauditedFull Year 2018 RangePer shareLowHighNet income attributable to common stockholders $0.60 $0.61 Real estate depreciation & amortization, net of noncontrolling interest 0.53 0.54 FFO attributable to common stockholders $1.13 $1.15 Stock-based compensation expense 0.11 0.11 Deferred financing costs amortization 0.03 0.04 Expensed transaction costs 0.06 0.06 Straight-line rental income, net of noncontrolling interest (0.16) (0.16)Other adjustments (1) 0.02 0.02 AFFO attributable to common stockholders $1.19 $1.22 AssumptionslTotal investment volume of $70 million to $125 million ($70 million of which reflects transactions that have already been announced and are expected to be funded during 2018)lInitial cash yields on new acquisitions of 8.0% to 9.0%lCash general and administrative expenses of approximately $11.1 million, including approximately $2.0 million, or $0.06 per diluted share, in transaction costs comprised primarily of professional fees recognized during the second quarter of 2018. lInterest expense of approximately $12.0 million to $12.7 million, including approximately $1.0 million to $1.1 million in amortization of deferred financing costs.lWeighted average diluted share count of 31.7 million (1) Includes adjustments for non-real estate depreciation and straight-line rent expense.

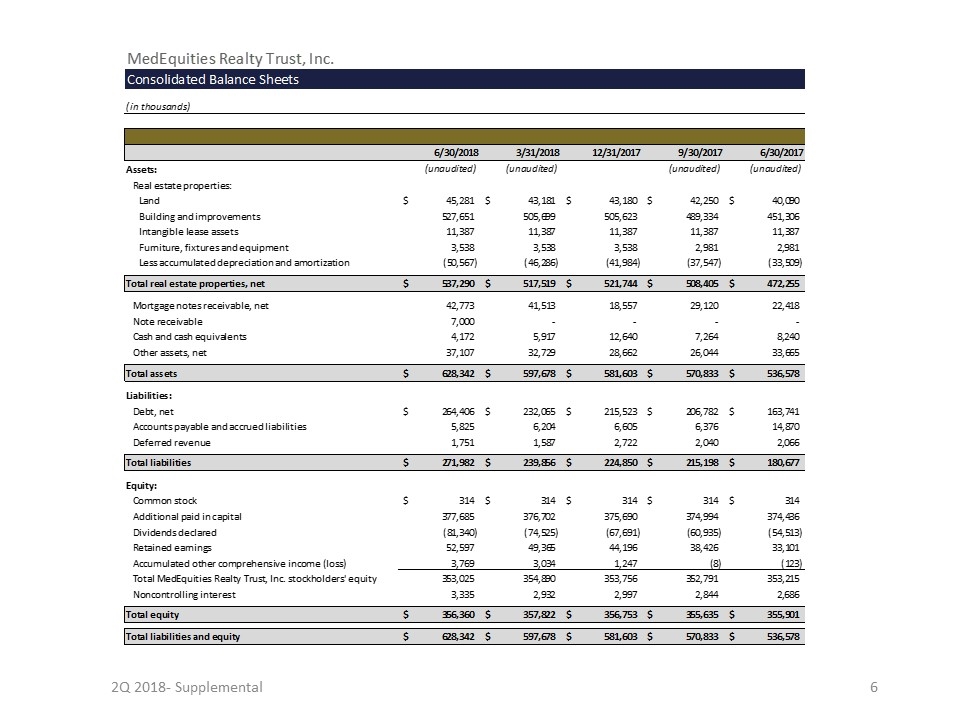

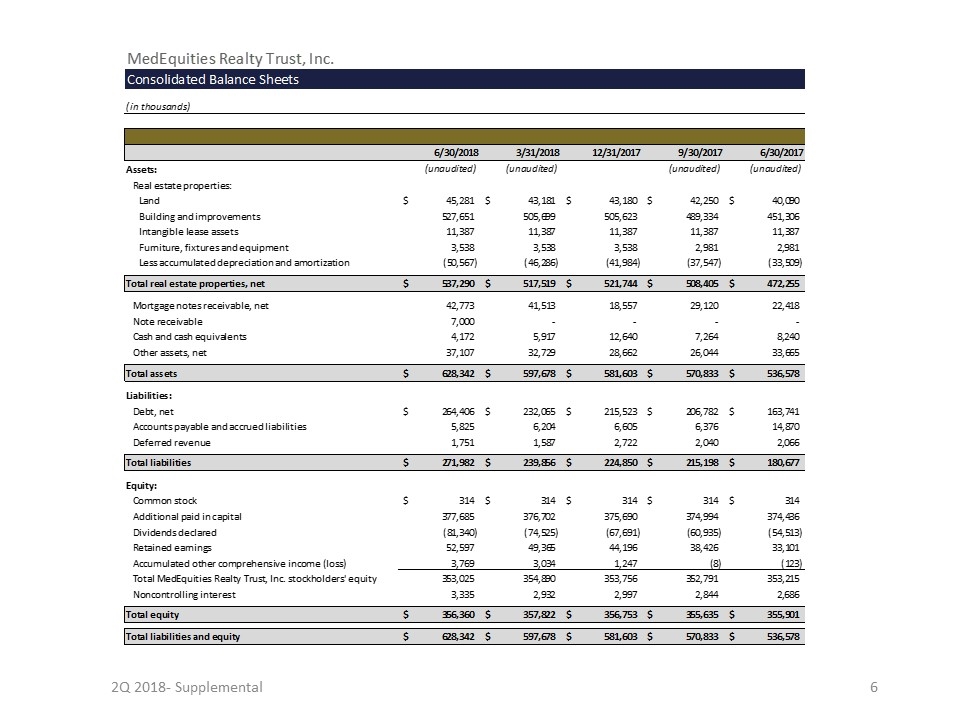

2Q 2018- Supplemental MedEquities Realty Trust, Inc.Consolidated Balance Sheets(in thousands)6/30/20183/31/201812/31/20179/30/20176/30/2017Assets:(unaudited)(unaudited)(unaudited)(unaudited)Real estate properties:Land $45,281 $43,181 $43,180 $42,250 $40,090 Building and improvements 527,651 505,699 505,623 489,334 451,306 Intangible lease assets 11,387 11,387 11,387 11,387 11,387 Furniture, fixtures and equipment 3,538 3,538 3,538 2,981 2,981 Less accumulated depreciation and amortization (50,567) (46,286) (41,984) (37,547) (33,509)Total real estate properties, net $537,290 $517,519 $521,744 $508,405 $472,255 Mortgage notes receivable, net 42,773 41,513 18,557 29,120 22,418 Note receivable 7,000 - - - - Cash and cash equivalents 4,172 5,917 12,640 7,264 8,240 Other assets, net 37,107 32,729 28,662 26,044 33,665 Total assets $628,342 $597,678 $581,603 $570,833 $536,578 Liabilities:Debt, net $264,406 $232,065 $215,523 $206,782 $163,741 Accounts payable and accrued liabilities 5,825 6,204 6,605 6,376 14,870 Deferred revenue 1,751 1,587 2,722 2,040 2,066 Total liabilities $271,982 $239,856 $224,850 $215,198 $180,677 Equity:Common stock $314 $314 $314 $314 $314 Additional paid in capital 377,685 376,702 375,690 374,994 374,436 Dividends declared (81,340) (74,525) (67,691) (60,935) (54,513)Retained earnings 52,597 49,365 44,196 38,426 33,101 Accumulated other comprehensive income (loss) 3,769 3,034 1,247 (8) (123)Total MedEquities Realty Trust, Inc. stockholders' equity 353,025 354,890 353,756 352,791 353,215 Noncontrolling interest 3,335 2,932 2,997 2,844 2,686 Total equity $356,360 $357,822 $356,753 $355,635 $355,901 Total liabilities and equity $628,342 $597,678 $581,603 $570,833 $536,578

2Q 2018- Supplemental MedEquities Realty Trust, Inc.Consolidated Statements of Income - GAAP(in thousands, except per-share amounts)Three Months Ended(Unaudited)6/30/20183/31/201812/31/20179/30/20176/30/2017Revenues:Rental income $16,321 $15,929 $15,673 $15,114 $14,287 Interest on mortgage notes receivable 1,074 787 551 644 529 Interest on notes receivable 165 - 8 8 9 Total revenues $17,560 $16,716 $16,232 $15,766 $14,825 Operating expenses:Depreciation and amortization 4,183 4,194 4,328 3,931 3,627 Property related 1,097 322 327 326 477 Real estate acquisition related 184 108 95 33 263 Franchise, excise and other taxes 71 71 65 50 (60)General and administrative 5,056 3,316 2,481 3,046 2,979 Total operating expenses $10,591 $8,011 $7,296 $7,386 $7,286 Operating income $6,969 $8,705 $8,936 $8,380 $7,539 Other income (expense):Interest and other income 3 7 4 3 1 Interest expense (2,786) (2,558) (2,261) (2,117) (1,808)Total other income (expense) $(2,783) $(2,551) $(2,257) $(2,114) $(1,807)Net income $4,186 $6,154 $6,679 $6,266 $5,732 Less: Net income attributable to noncontrolling interest (954) (985) (909) (941) (936)Net income attributable to common stockholders $3,232 $5,169 $5,770 $5,325 $4,796 Net income attributable to common stockholders per share - basic and diluted $0.10 $0.16 $0.18 $0.17 $0.15 Weighted-average shares outstanding - basic31,552 31,550 31,499 31,467 31,404 Weighted-average shares outstanding - diluted31,626 31,610 31,549 31,506 31,487 Dividends declared per common share $0.21 (1) $0.21 (2) $0.21 (3) $0.21 (4) $0.21 (5) (1) Dividend for the second quarter of 2018 of $0.21 per share was declared and will be paid in August 2018.(2) Dividend for the first quarter of 2018 of $0.21 per share was declared in May 2018 and was paid in June 2018.(3) Dividend for the fourth quarter of 2017 of $0.21 per share was declared in February 2018 and was paid in March 2018.(4) Dividend for the third quarter of 2017 of $0.21 per share was declared and paid in November 2017.(5) Dividend for the second quarter of 2017 of $0.21 per share was declared and paid in August 2017.

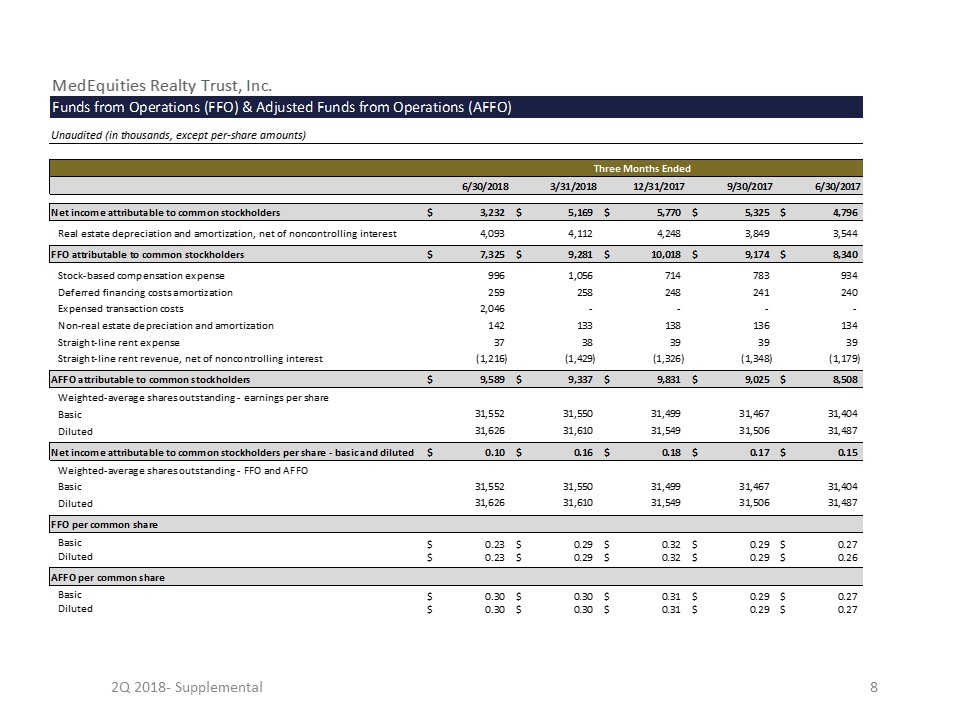

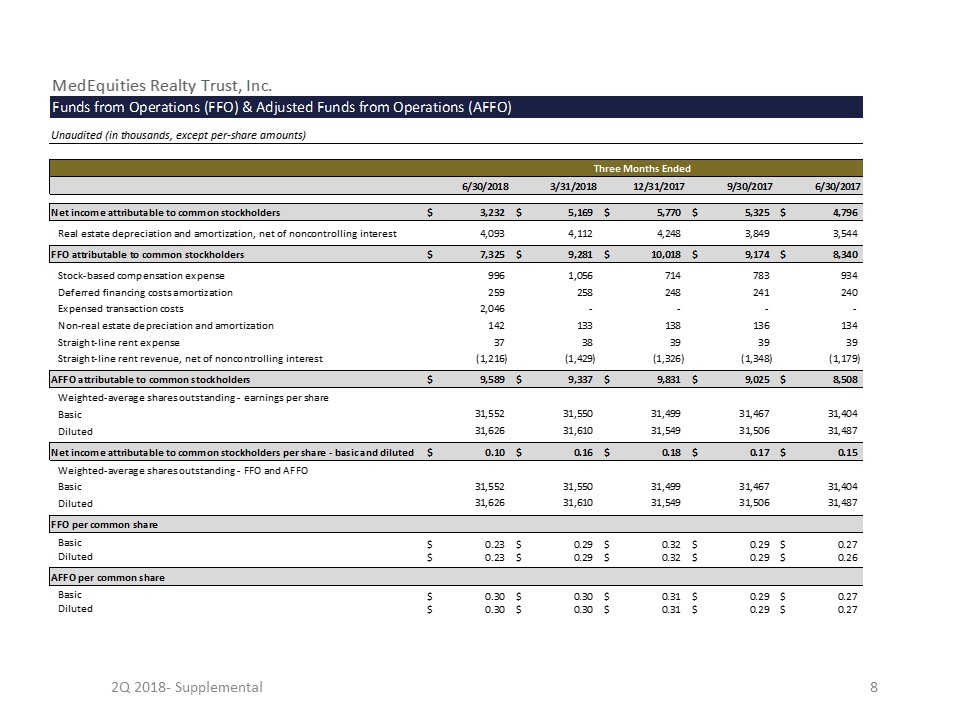

2Q 2018- Supplemental MedEquities Realty Trust, Inc.Funds from Operations (FFO) & Adjusted Funds from Operations (AFFO)Unaudited (in thousands, except per-share amounts)Three Months Ended6/30/20183/31/201812/31/20179/30/20176/30/2017Net income attributable to common stockholders $3,232 $5,169 $5,770 $5,325 $4,796 Real estate depreciation and amortization, net of noncontrolling interest 4,093 4,112 4,248 3,849 3,544 FFO attributable to common stockholders $7,325 $9,281 $10,018 $9,174 $8,340 Stock-based compensation expense 996 1,056 714 783 934 Deferred financing costs amortization 259 258 248 241 240 Expensed transaction costs 2,046 - - - - Non-real estate depreciation and amortization 142 133 138 136 134 Straight-line rent expense 37 38 39 39 39 Straight-line rent revenue, net of noncontrolling interest (1,216) (1,429) (1,326) (1,348) (1,179)AFFO attributable to common stockholders $9,589 $9,337 $9,831 $9,025 $8,508 Weighted-average shares outstanding - earnings per shareBasic 31,552 31,550 31,499 31,467 31,404 Diluted 31,626 31,610 31,549 31,506 31,487 Net income attributable to common stockholders per share - basic and diluted $0.10 $0.16 $0.18 $0.17 $0.15 Weighted-average shares outstanding - FFO and AFFOBasic 31,552 31,550 31,499 31,467 31,404 Diluted 31,626 31,610 31,549 31,506 31,487 FFO per common shareBasic $0.23 $0.29 $0.32 $0.29 $0.27 Diluted $0.23 $0.29 $0.32 $0.29 $0.26 AFFO per common shareBasic $0.30 $0.30 $0.31 $0.29 $0.27 Diluted $0.30 $0.30 $0.31 $0.29 $0.27

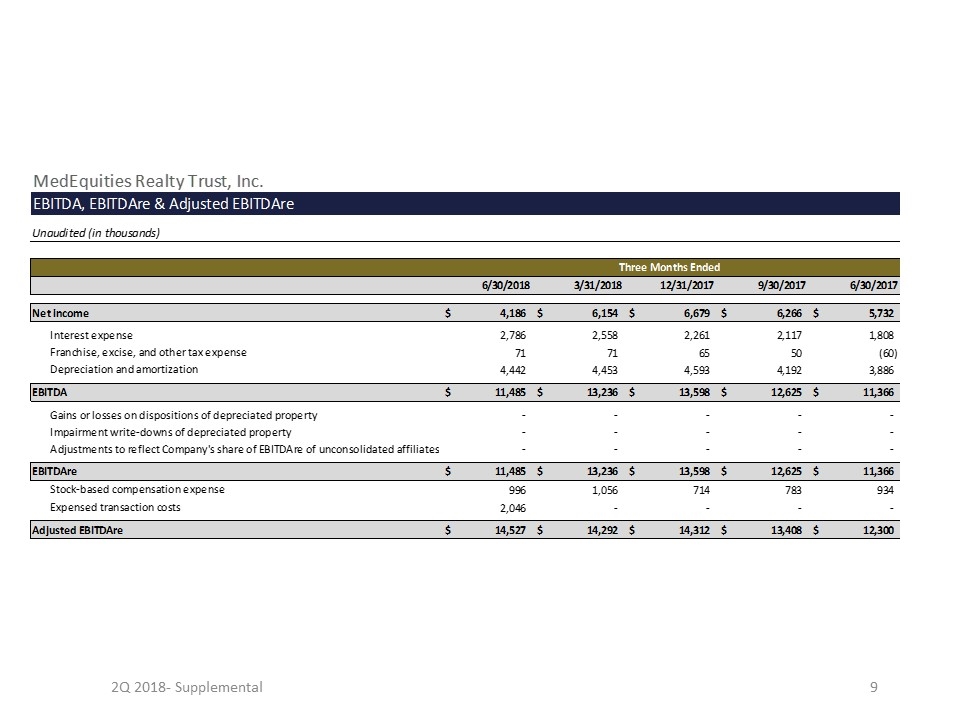

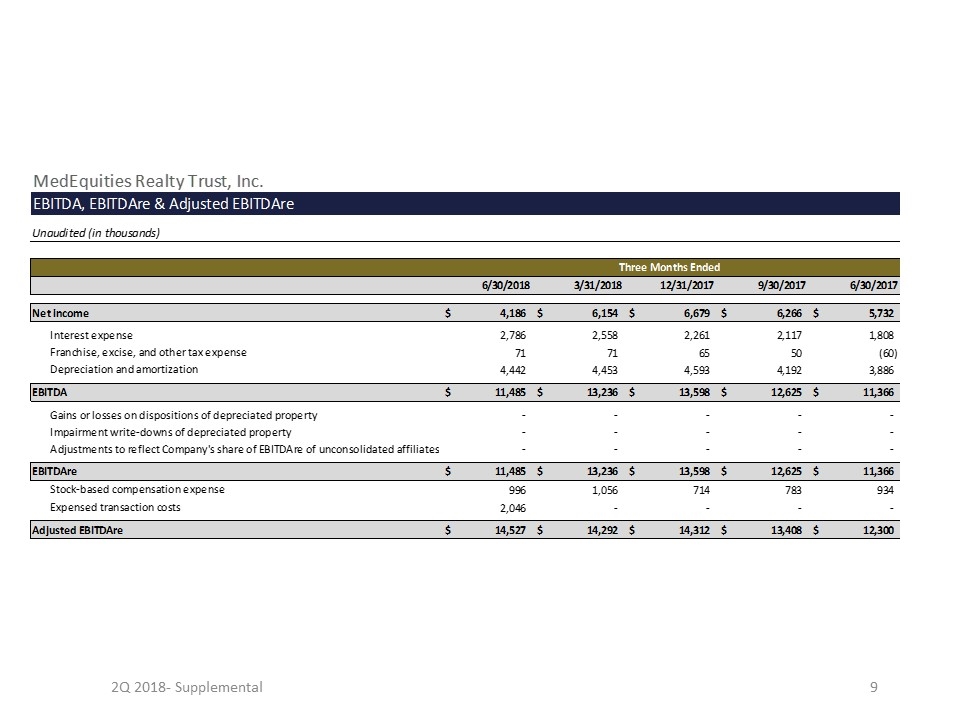

2Q 2018- Supplemental MedEquities Realty Trust, Inc.EBITDA, EBITDAre & Adjusted EBITDAreUnaudited (in thousands)Three Months Ended6/30/20183/31/201812/31/20179/30/20176/30/2017Net income $4,186 $6,154 $6,679 $6,266 $5,732 Interest expense 2,786 2,558 2,261 2,117 1,808 Franchise, excise, and other tax expense 71 71 65 50 (60)Depreciation and amortization 4,442 4,453 4,593 4,192 3,886 EBITDA $11,485 $13,236 $13,598 $12,625 $11,366 Gains or losses on dispositions of depreciated property - - - - - Impairment write-downs of depreciated property - - - - - Adjustments to reflect Company's share of EBITDAre of unconsolidated affiliates - - - - - EBITDAre $11,485 $13,236 $13,598 $12,625 $11,366 Stock-based compensation expense 996 1,056 714 783 934 Expensed transaction costs 2,046 - - - - Adjusted EBITDAre $14,527 $14,292 $14,312 $13,408 $12,300

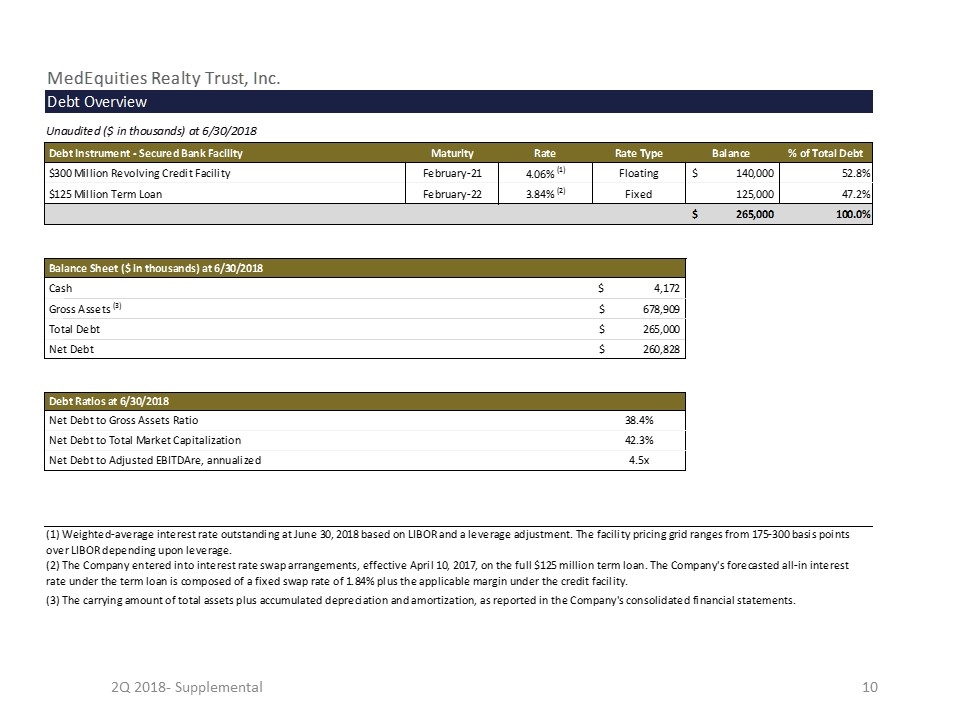

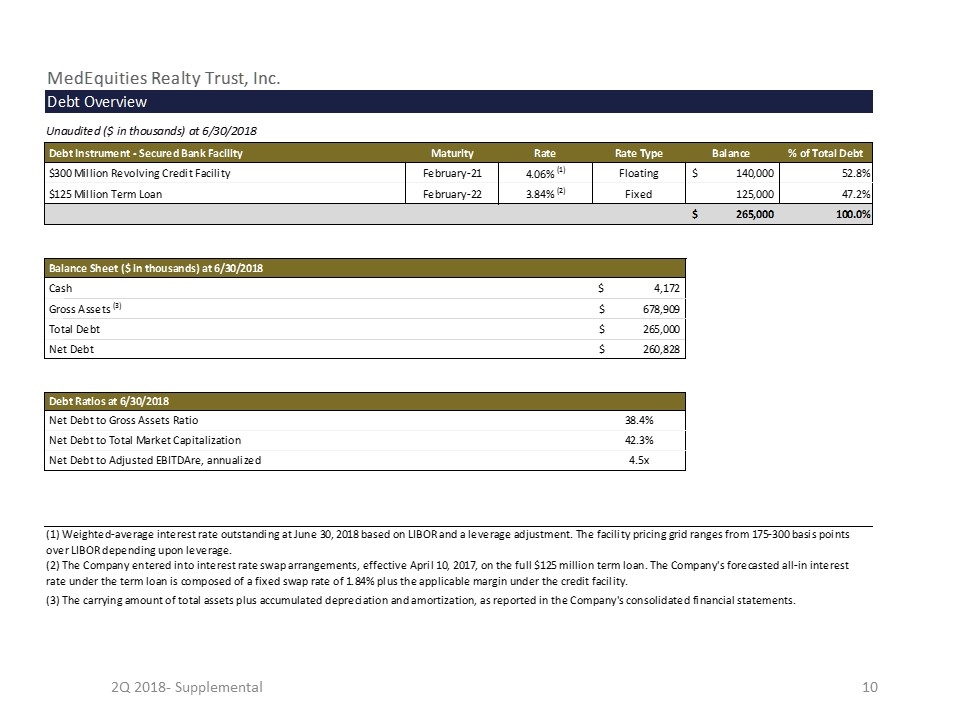

2Q 2018- Supplemental MedEquities Realty Trust, Inc.Debt OverviewUnaudited ($ in thousands) at 6/30/2018 Debt Instrument - Secured Bank FacilityMaturityRateRate TypeBalance % of Total Debt $300 Million Revolving Credit FacilityFebruary-214.06% (1)Floating $140,000 52.8% $125 Million Term LoanFebruary-223.84% (2)Fixed 125,000 47.2% $265,000 100.0% Balance Sheet ($ in thousands) at 6/30/2018 Cash $4,172 Gross Assets (3) $678,909 Total Debt $265,000 Net Debt $260,828 Debt Ratios at 6/30/2018 Net Debt to Gross Assets Ratio38.4% Net Debt to Total Market Capitalization42.3% Net Debt to Adjusted EBITDAre, annualized4.5x(1) Weighted-average interest rate outstanding at June 30, 2018 based on LIBOR and a leverage adjustment. The facility pricing grid ranges from 175-300 basis points over LIBOR depending upon leverage. (2) The Company entered into interest rate swap arrangements, effective April 10, 2017, on the full $125 million term loan. The Company's forecasted all-in interest rate under the term loan is composed of a fixed swap rate of 1.84% plus the applicable margin under the credit facility.(3) The carrying amount of total assets plus accumulated depreciation and amortization, as reported in the Company's consolidated financial statements.

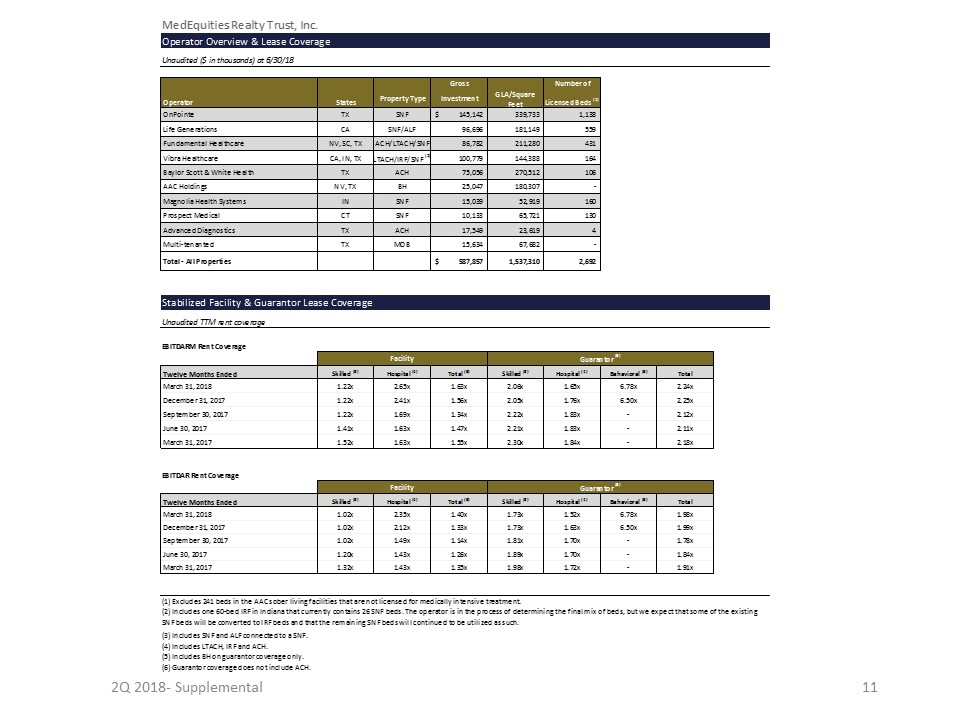

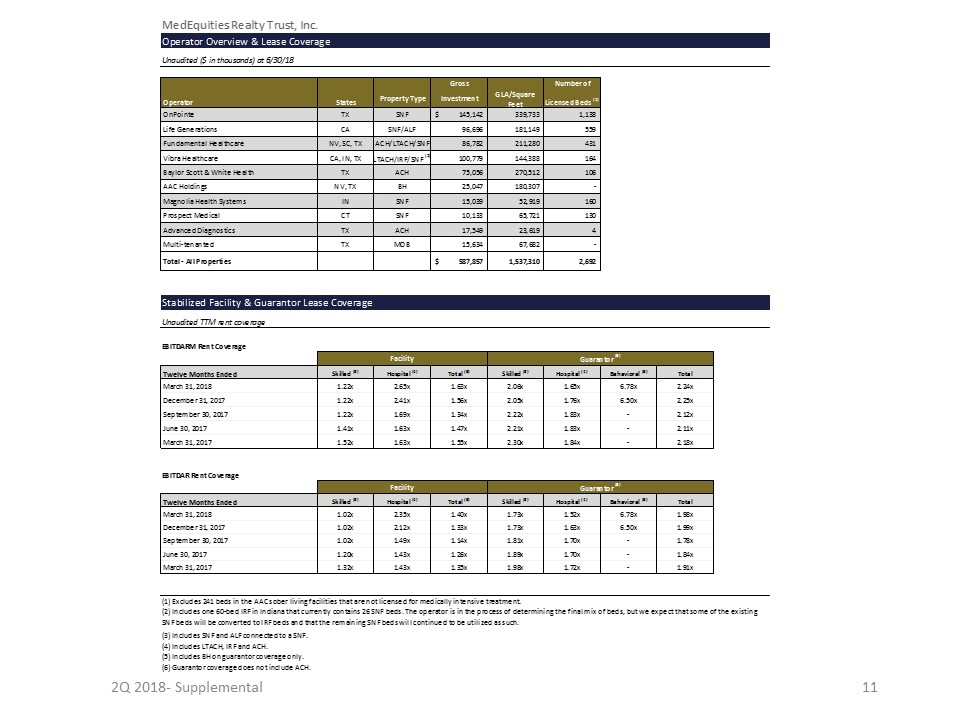

2Q 2018- Supplemental MedEquities Realty Trust, Inc.Operator Overview & Lease CoverageUnaudited ($ in thousands) at 6/30/18 Gross Number of Operator States Property Type Investment GLA/Square FeetLicensed Beds (1) OnPointeTX SNF $145,142 339,733 1,138 Life GenerationsCA SNF/ALF 96,696 181,149 559 Fundamental HealthcareNV, SC, TX ACH/LTACH/SNF 86,782 211,280 431 Vibra HealthcareCA, IN, TXLTACH/IRF/SNF (2) 100,779 144,388 164 Baylor Scott & White HealthTX ACH 75,056 270,512 106 AAC HoldingsNV, TX BH 25,047 180,307 - Magnolia Health SystemsIN SNF 15,039 52,919 160 Prospect MedicalCT SNF 10,133 65,721 130 Advanced DiagnosticsTX ACH 17,549 23,619 4 Multi-tenantedTX MOB 15,634 67,682 - Total - All Properties $587,857 1,537,310 2,692 Stabilized Facility & Guarantor Lease CoverageUnaudited TTM rent coverage EBITDARM Rent CoverageFacilityGuarantor (6) Twelve Months EndedSkilled (3)Hospital (4)Total (5)Skilled (3)Hospital (4)Behavioral (5)Total March 31, 20181.22x2.65x1.63x2.06x1.65x6.78x2.24x December 31, 20171.22x2.41x1.56x2.05x1.76x6.50x2.25x September 30, 20171.22x1.69x1.34x2.22x1.83x-2.12x June 30, 20171.41x1.63x1.47x2.21x1.83x-2.11x March 31, 20171.52x1.63x1.55x2.30x1.84x-2.18xEBITDAR Rent CoverageFacilityGuarantor (6) Twelve Months EndedSkilled (3)Hospital (4)Total (5)Skilled (3)Hospital (4)Behavioral (5)Total March 31, 20181.02x2.35x1.40x1.73x1.52x6.78x1.98x December 31, 20171.02x2.12x1.33x1.73x1.63x6.50x1.99x September 30, 20171.02x1.49x1.14x1.81x1.70x-1.78x June 30, 20171.20x1.43x1.26x1.89x1.70x-1.84x March 31, 20171.32x1.43x1.35x1.98x1.72x-1.91x(1) Excludes 241 beds in the AAC sober living facilities that are not licensed for medically intensive treatment.(2) Includes one 60-bed IRF in Indiana that currently contains 26 SNF beds. The operator is in the process of determining the final mix of beds, but we expect that some of the existing SNF beds will be converted to IRF beds and that the remaining SNF beds will continued to be utilized as such.(3) Includes SNF and ALF connected to a SNF.(4) Includes LTACH, IRF and ACH.(5) Includes BH on guarantor coverage only.(6) Guarantor coverage does not include ACH.

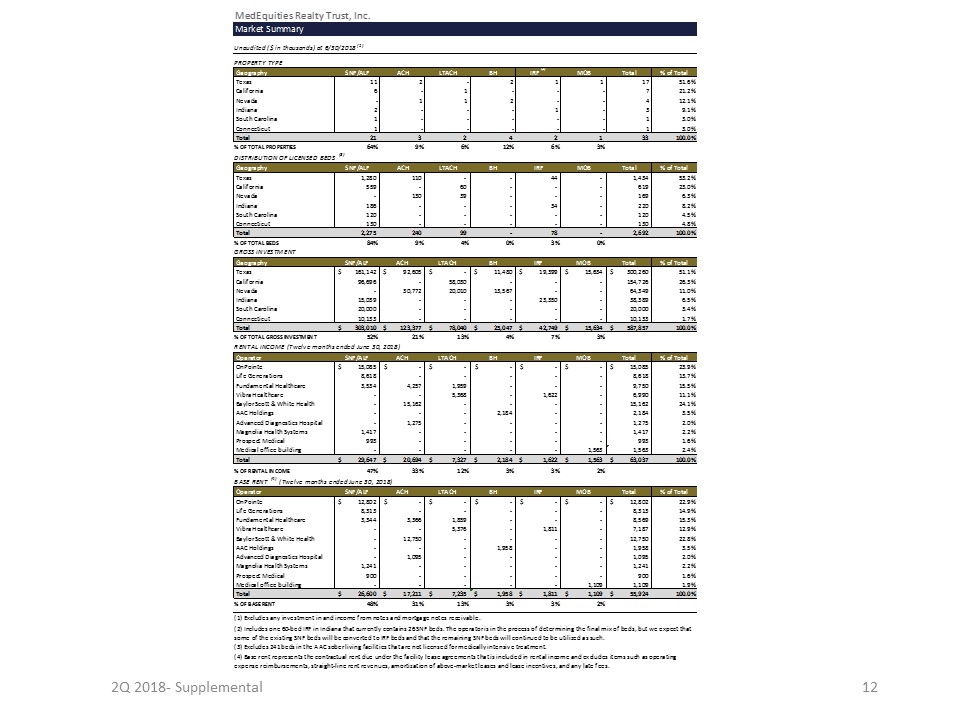

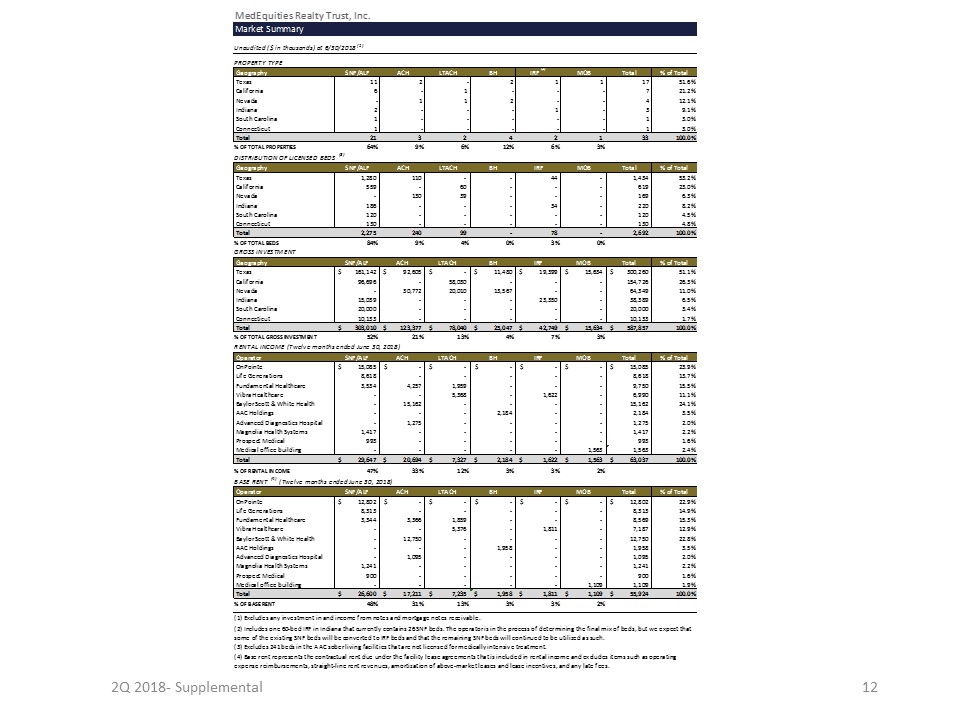

2Q 2018- Supplemental MedEquities Realty Trust, Inc.Market SummaryUnaudited ($ in thousands) at 6/30/2018(1)PROPERTY TYPE Geography SNF/ALF ACH LTACH BH IRF (2) MOB Total % of Total Texas11 2 -2 1 1 17 51.6% California6 -1 ---7 21.2% Nevada-1 1 2 --4 12.1% Indiana2 ---1 -3 9.1% South Carolina1 -----1 3.0% Connecticut1 -----1 3.0% Total21 3 2 4 2 1 33 100.0%% OF TOTAL PROPERTIES64%9%6%12%6%3%DISTRIBUTION OF LICENSED BEDS (3) Geography SNF/ALF ACH LTACH BH IRF MOB Total % of Total Texas 1,280 110 - - 44 - 1,434 53.2% California 559 - 60 - - - 619 23.0% Nevada - 130 39 - - - 169 6.3% Indiana 186 - - - 34 - 220 8.2% South Carolina 120 - - - - - 120 4.5% Connecticut 130 - - - - - 130 4.8% Total 2,275 240 99 - 78 - 2,692 100.0%% OF TOTAL BEDS84%9%4%0%3%0%GROSS INVESTMENT GeographySNF/ALFACHLTACHBHIRFMOBTotal% of Total Texas $161,142 $92,605 $- $11,480 $19,399 $15,634 $300,260 51.1% California 96,696 - 58,030 - - - 154,726 26.3% Nevada - 30,772 20,010 13,567 - - 64,349 11.0% Indiana 15,039 - - - 23,350 - 38,389 6.5% South Carolina 20,000 - - - - - 20,000 3.4% Connecticut 10,133 - - - - - 10,133 1.7% Total $303,010 $123,377 $78,040 $25,047 $42,749 $15,634 $587,857 100.0%% OF TOTAL GROSS INVESTMENT52%21%13%4%7%3%RENTAL INCOME (Twelve months ended June 30, 2018) OperatorSNF/ALFACHLTACHBHIRFMOBTotal% of Total OnPointe $15,085 $- $- $- $- $- $15,085 23.9% Life Generations 8,618 - - - - - 8,618 13.7% Fundamental Healthcare 3,534 4,257 1,959 - - - 9,750 15.5% Vibra Healthcare - - 5,368 - 1,622 - 6,990 11.1% Baylor Scott & White Health - 15,162 - - - - 15,162 24.1% AAC Holdings - - - 2,184 - - 2,184 3.5% Advanced Diagnostics Hospital - 1,275 - - - - 1,275 2.0% Magnolia Health Systems 1,417 - - - - - 1,417 2.2% Prospect Medical 993 - - - - - 993 1.6% Medical office building - - - - - 1,563 1,563 2.4% Total $29,647 $20,694 $7,327 $2,184 $1,622 $1,563 $63,037 100.0%% OF RENTAL INCOME47%33%12%3%3%2%BASE RENT (4) (Twelve months ended June 30, 2018) OperatorSNF/ALFACHLTACHBHIRFMOBTotal% of Total OnPointe $12,802 $- $- $- $- $- $12,802 22.9% Life Generations 8,313 - - - - - 8,313 14.9% Fundamental Healthcare 3,344 3,366 1,859 - - - 8,569 15.3% Vibra Healthcare - - 5,376 - 1,811 - 7,187 12.9% Baylor Scott & White Health - 12,750 - - - - 12,750 22.8% AAC Holdings - - - 1,958 - - 1,958 3.5% Advanced Diagnostics Hospital - 1,095 - - - - 1,095 2.0% Magnolia Health Systems 1,241 - - - - - 1,241 2.2% Prospect Medical 900 - - - - - 900 1.6% Medical office building - - - - - 1,109 1,109 1.9% Total $26,600 $17,211 $7,235 $1,958 $1,811 $1,109 $55,924 100.0%% OF BASE RENT48%31%13%3%3%2%(1) Excludes any investment in and income from notes and mortgage notes receivable.(2) Includes one 60-bed IRF in Indiana that currently contains 26 SNF beds. The operator is in the process of determining the final mix of beds, but we expect that some of the existing SNF beds will be converted to IRF beds and that the remaining SNF beds will continued to be utilized as such.(3) Excludes 241 beds in the AAC sober living facilities that are not licensed for medically intensive treatment.(4) Base rent represents the contractual rent due under the facility lease agreements that is included in rental income and excludes items such as operating expense reimbursements, straight-line rent revenues, amortization of above-market leases and lease incentives, and any late fees.

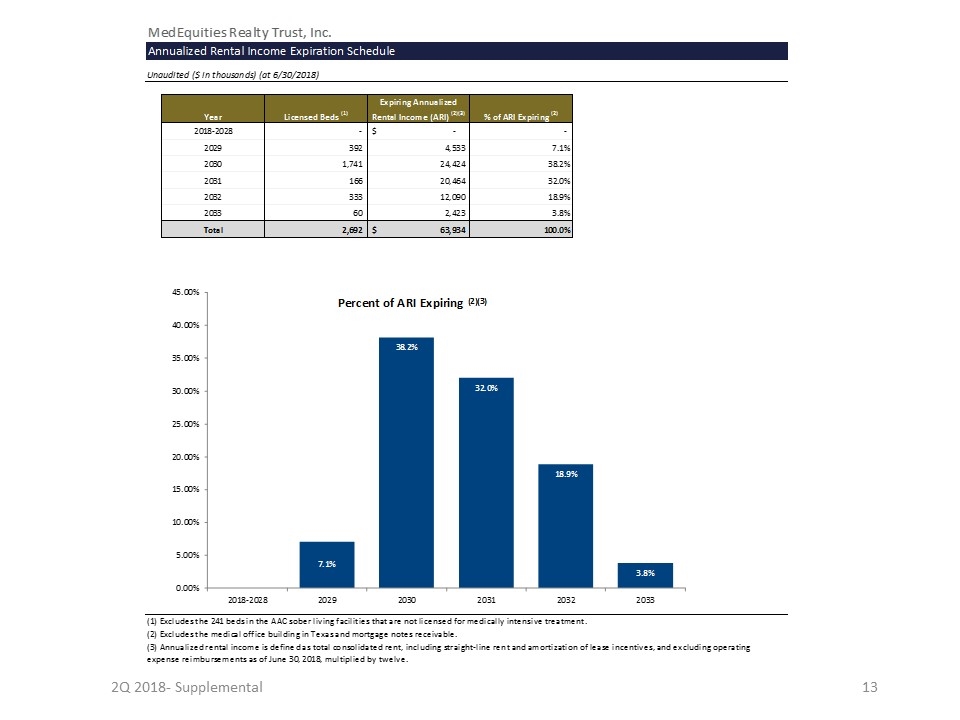

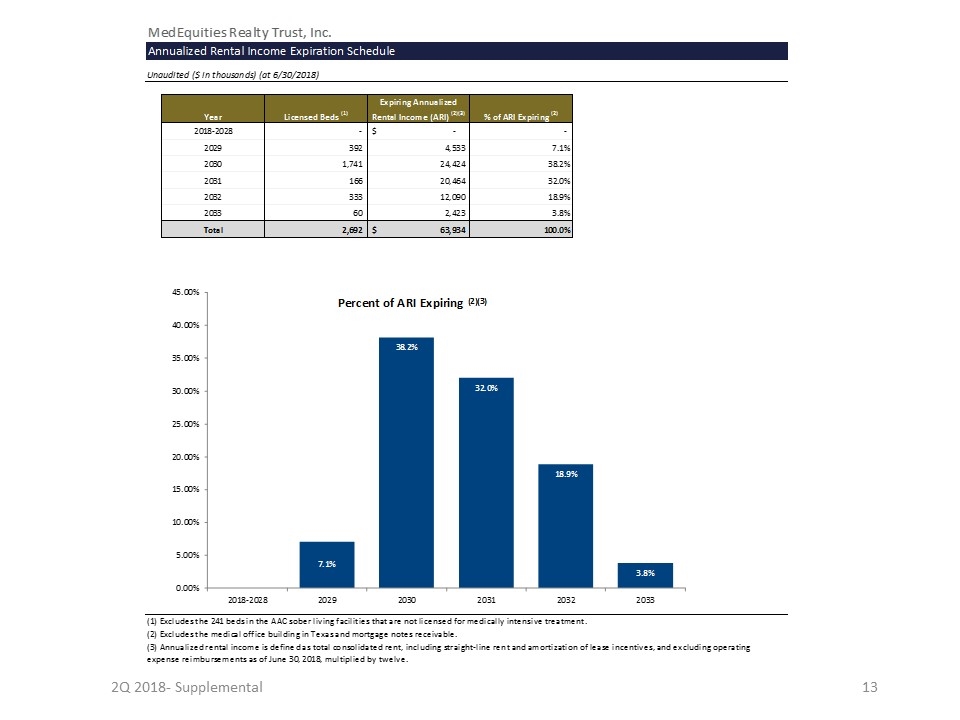

2Q 2018- Supplemental MedEquities Realty Trust, Inc.Annualized Rental Income Expiration ScheduleUnaudited ($ in thousands) (at 6/30/2018)YearLicensed Beds (1)Expiring Annualized Rental Income (ARI) (2)(3)% of ARI Expiring (2)2018-2028 - $- - 2029 392 4,533 7.1%2030 1,741 24,424 38.2%2031 166 20,464 32.0%2032 333 12,090 18.9%2033 60 2,423 3.8%Total 2,692 $63,934 100.0%(1) Excludes the 241 beds in the AAC sober living facilities that are not licensed for medically intensive treatment.(2) Excludes the medical office building in Texas and mortgage notes receivable.(3) Annualized rental income is defined as total consolidated rent, including straight-line rent and amortization of lease incentives, and excluding operating expense reimbursements as of June 30, 2018, multiplied by twelve.

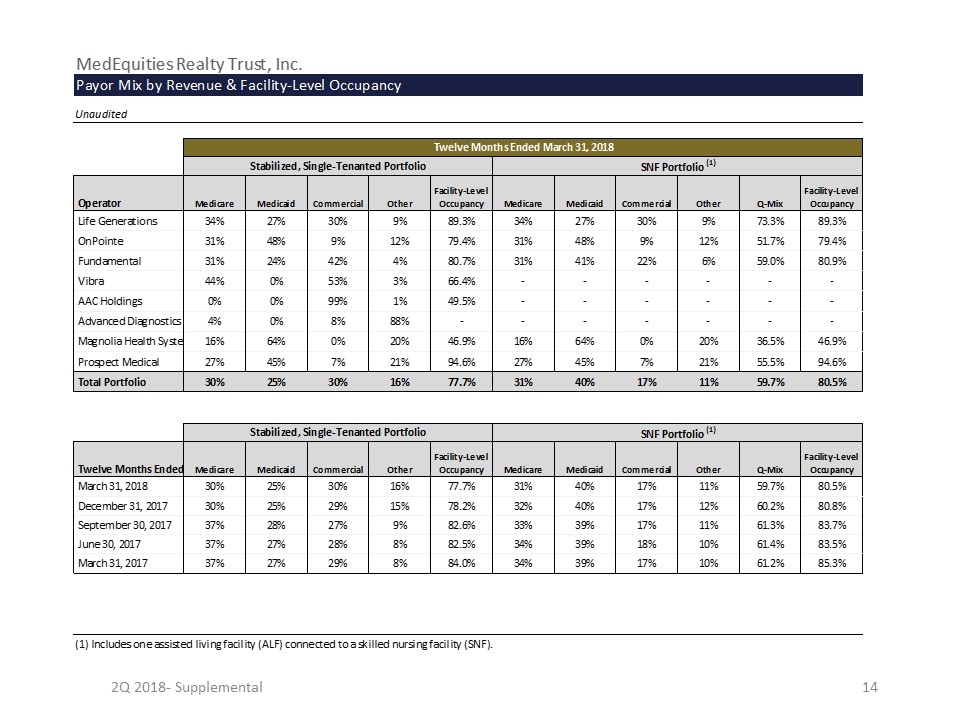

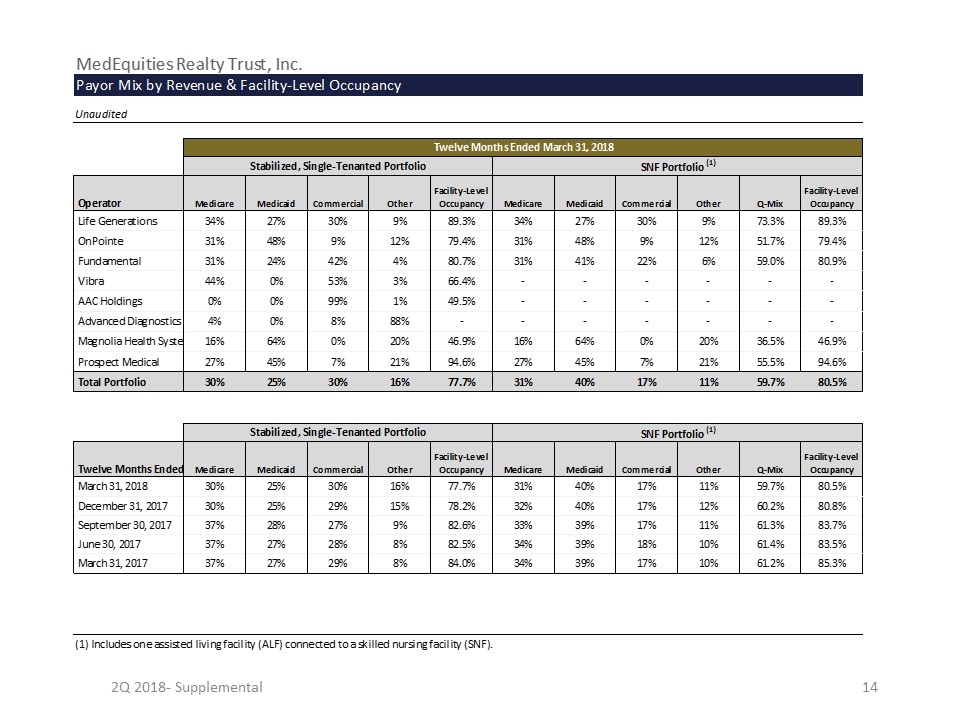

2Q 2018- Supplemental MedEquities Realty Trust, Inc. Payor Mix by Revenue & Facility-Level OccupancyUnauditedTwelve Months Ended March 31, 2018Stabilized, Single-Tenanted PortfolioSNF Portfolio (1) OperatorMedicareMedicaidCommercialOtherFacility-Level OccupancyMedicareMedicaidCommercialOtherQ-MixFacility-Level Occupancy Life Generations34%27%30%9%89.3%34%27%30%9%73.3%89.3% OnPointe31%48%9%12%79.4%31%48%9%12%51.7%79.4% Fundamental31%24%42%4%80.7%31%41%22%6%59.0%80.9% Vibra44%0%53%3%66.4%------ AAC Holdings0%0%99%1%49.5%------ Advanced Diagnostics4%0%8%88%------- Magnolia Health Systems16%64%0%20%46.9%16%64%0%20%36.5%46.9% Prospect Medical27%45%7%21%94.6%27%45%7%21%55.5%94.6% Total Portfolio30%25%30%16%77.7%31%40%17%11%59.7%80.5% Stabilized, Single-Tenanted PortfolioSNF Portfolio (1) Twelve Months EndedMedicareMedicaidCommercialOtherFacility-Level OccupancyMedicareMedicaidCommercialOtherQ-MixFacility-Level Occupancy March 31, 201830%25%30%16%77.7%31%40%17%11%59.7%80.5% December 31, 201730%25%29%15%78.2%32%40%17%12%60.2%80.8% September 30, 201737%28%27%9%82.6%33%39%17%11%61.3%83.7% June 30, 201737%27%28%8%82.5%34%39%18%10%61.4%83.5% March 31, 201737%27%29%8%84.0%34%39%17%10%61.2%85.3%(1) Includes one assisted living facility (ALF) connected to a skilled nursing facility (SNF).

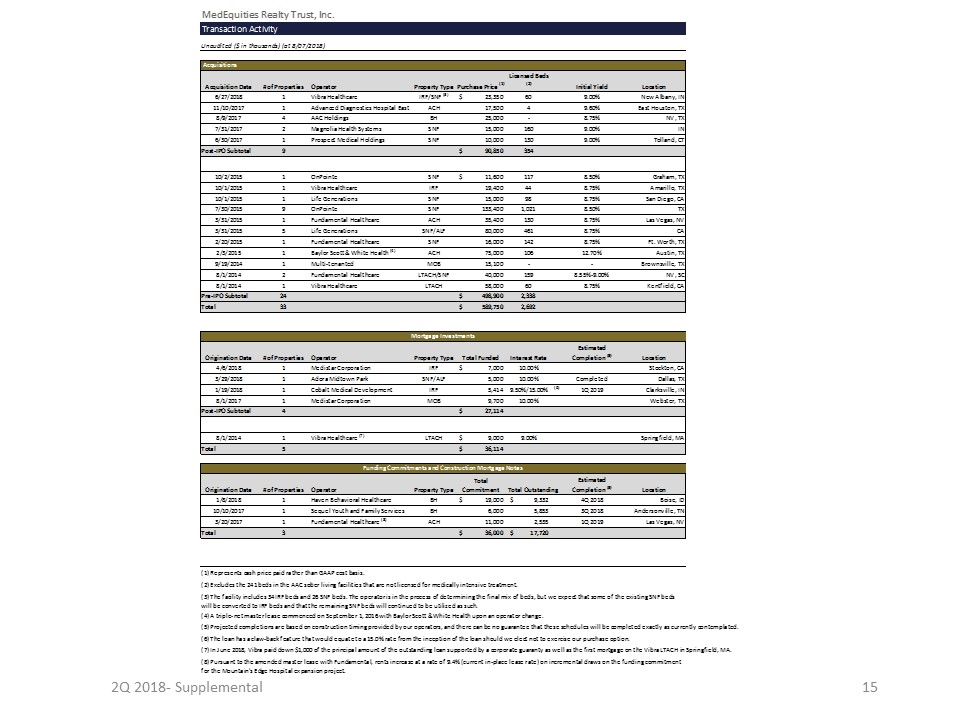

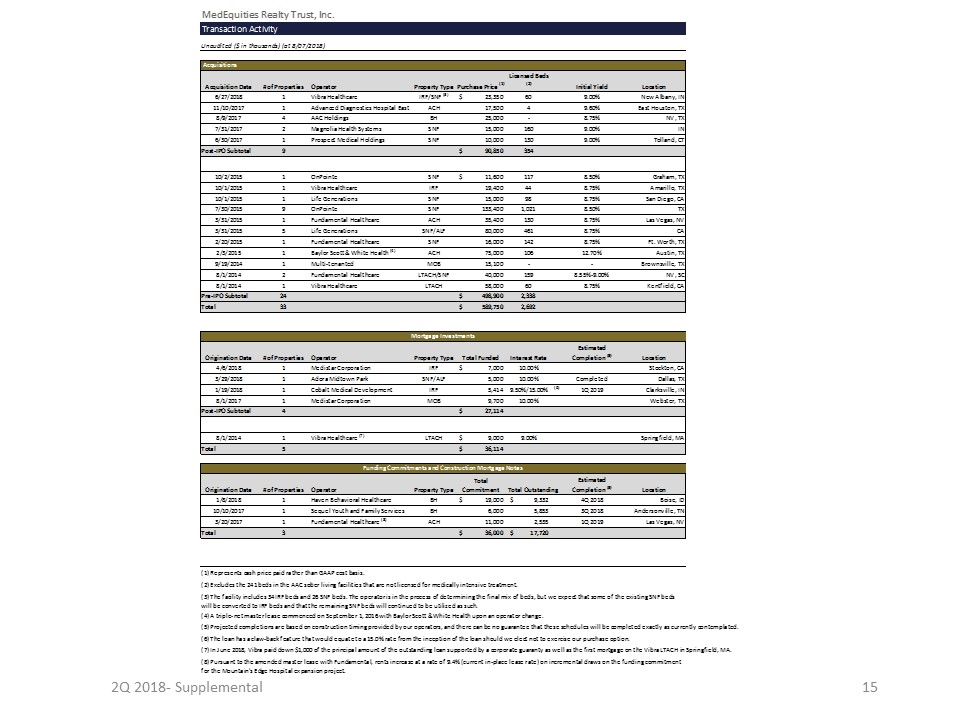

2Q 2018- Supplemental MedEquities Realty Trust, Inc.Transaction ActivityUnaudited ($ in thousands) (at 8/07/2018) AcquisitionsAcquisition Date# of PropertiesOperatorProperty TypePurchase Price (1)Licensed Beds (2)Initial YieldLocation6/27/20181Vibra HealthcareIRF/SNF (3) $23,350 60 9.00%New Albany, IN11/10/20171Advanced Diagnostics Hospital EastACH 17,500 4 9.60%East Houston, TX8/9/20174AAC HoldingsBH 25,000 -8.75%NV, TX7/31/20172Magnolia Health SystemsSNF 15,000 160 9.00%IN6/30/20171Prospect Medical HoldingsSNF 10,000 130 9.00%Tolland, CTPost-IPO Subtotal9 $90,850 354 10/2/20151OnPointeSNF $11,600 117 8.50%Graham, TX10/1/20151Vibra HealthcareIRF 19,400 44 8.75%Amarillo, TX10/1/20151Life GenerationsSNF 15,000 98 8.75%San Diego, CA7/30/20159OnPointeSNF 133,400 1,021 8.50%TX3/31/20151Fundamental HealthcareACH 35,400 130 8.75%Las Vegas, NV3/31/20155Life GenerationsSNF/ALF 80,000 461 8.75%CA2/20/20151Fundamental HealthcareSNF 16,000 142 8.75%Ft. Worth, TX2/3/20151Baylor Scott & White Health (4)ACH 75,000 106 12.70%Austin, TX9/19/20141Multi-tenantedMOB 15,100 --Brownsville, TX8/1/20142Fundamental HealthcareLTACH/SNF 40,000 159 8.55%-9.00%NV, SC8/1/20141Vibra HealthcareLTACH 58,000 60 8.75%Kentfield, CAPre-IPO Subtotal24 $498,900 2,338 Total33 $589,750 2,692 Mortgage InvestmentsOrigination Date# of PropertiesOperatorProperty TypeTotal FundedInterest RateEstimated Completion (5)Location4/6/20181Medistar CorporationIRF $7,000 10.00%Stockton, CA3/29/20181Adora Midtown ParkSNF/ALF 5,000 10.00% Completed Dallas, TX1/19/20181Cobalt Medical DevelopmentIRF 5,414 9.50%/15.00%(6) 1Q 2019 Clarksville, IN8/1/20171Medistar CorporationMOB 9,700 10.00%Webster, TXPost-IPO Subtotal4 $27,114 8/1/20141Vibra Healthcare (7)LTACH $9,000 9.00%Springfield, MATotal5 $36,114 Funding Commitments and Construction Mortgage NotesOrigination Date# of PropertiesOperatorProperty TypeTotal CommitmentTotal OutstandingEstimated Completion (5)Location1/8/20181Haven Behavioral HealthcareBH $19,000 $9,332 4Q 2018 Boise, ID10/10/20171Sequel Youth and Family ServicesBH 6,000 5,853 3Q 2018 Andersonville, TN3/20/20171Fundamental Healthcare (8)ACH 11,000 2,535 1Q 2019 Las Vegas, NVTotal3 $36,000 $17,720 (1) Represents cash price paid rather than GAAP cost basis.(2) Excludes the 241 beds in the AAC sober living facilities that are not licensed for medically intensive treatment.(3) The facility includes 34 IRF beds and 26 SNF beds. The operator is in the process of determining the final mix of beds, but we expect that some of the existing SNF beds will be converted to IRF beds and that the remaining SNF beds will continued to be utilized as such.(4) A triple-net master lease commenced on September 1, 2016 with Baylor Scott & White Health upon an operator change.(5) Projected completions are based on construction timing provided by our operators, and there can be no guarantee that these schedules will be completed exactly as currently contemplated.(6) The loan has a claw-back feature that would equate to a 15.0% rate from the inception of the loan should we elect not to exercise our purchase option.(7) In June 2018, Vibra paid down $1,000 of the principal amount of the outstanding loan supported by a corporate guaranty as well as the first mortgage on the Vibra LTACH in Springfield, MA.(8) Pursuant to the amended master lease with Fundamental, rents increase at a rate of 9.4% (current in-place lease rate) on incremental draws on the funding commitment for the Mountain's Edge Hospital expansion project.

2Q 2018- Supplemental MedEquities Realty Trust, Inc.Glossary"Acute: refers to a disease or condition with a rapid onset and short course.""Acute Care Hospital (“ACH”): general medical and surgical hospitals that provide both inpatient and outpatient medical services and are owned and/or operated either by a non-profit or for-profit hospital or hospital system. These facilities often act as feeder hospitals to dedicated specialty facilities.""Adjusted EBITDAre: Adjusted EBITDAre represents EBITDAre, as defined below, adjusted further for the effects of acquisition costs, stock-based compensation expense and non-cash write-offs of straight-line rent and accounts receivable. Adjusted EBITDAre is a relevant non-GAAP measure broadly used by investors and analysts to evaluate the operating performance of a company and to assess a company’s credit strength, including the ability to service indebtedness. Our calculation of Adjusted EBITDAre may differ from the methodologies used by other companies and, accordingly, our Adjusted EBITDAre may not be comparable to amounts reported by other companies. Adjusted EBITDAre should not be used as a substitute for any GAAP financial measures for the purpose of evaluating our financial performance, financial position or cash flows.""Adjusted Funds From Operations attributable to common stockholders (“AFFO”): AFFO is a non-GAAP measure used by many investors and analysts to measure a real estate company’s operating performance by removing the effect of items that do not reflect ongoing property operations. To calculate AFFO, we further adjust FFO for certain items that are not added to net income in the National Association of Real Estate Investment Trusts' (""Nareit"") definition of FFO, such as acquisition expenses on completed real estate transactions, non-real estate-related depreciation and amortization (including amortization of lease incentives, tenant allowances and leasing costs), stock based compensation expenses, and any other non-comparable or non-operating items that do not relate to the operating performance of our properties. To calculate AFFO, we also adjust FFO to remove the effect of straight-line rent revenue, which represents the recognition of net unbilled rental income expected to be collected in future periods of a lease agreement that exceeds the actual contractual rent due periodically from tenants for their use of the leased real estate under each lease. Noncontrolling interest amounts represent adjustments to reflect only our share of straight line rent revenue. Our calculation of AFFO may differ from the methodology used for calculating AFFO by certain other REITs and, accordingly, our AFFO may not be comparable to AFFO reported by other REITs. AFFO should not be considered as an alternative to net income (computed in accordance with GAAP) as an indicator of our financial performance or to cash flow from operating activities (computed in accordance with GAAP) as an indicator of our liquidity.""Assisted Living Facility (“ALF”): residential care facilities that provide housing, meals, personal care and supportive services to older persons and disabled adults who are unable to live independently. They are intended to be a less costly alternative to more restrictive, institutional settings for individuals who do not require 24-hour nursing supervision."Behavioral Health Facility (“BH”): facilities that provide inpatient and outpatient services for the treatment of behavioral health, mental illness and substance abuse. These can include facilities for intensive outpatient treatment, inpatient residential treatment, sober living rehabilitation and psychiatric care."EBITDA: calculated as net income (computed in accordance with GAAP) plus interest expense, taxes, and depreciation and amortization. Our calculation of EBITDA may differ from the methodologies used by other companies and, accordingly, our EBITDA may not be comparable to amounts reported by other companies. EBITDA should not be used as a substitute for any GAAP financial measures for the purpose of evaluating our financial performance, financial position or cash flows.""EBITDAR: represents earnings from the operator’s financial statements before interest, taxes, depreciation, amortization and rent and may be adjusted for certain non-recurring, infrequent or out-of-period items."EBITDAre: is calculated as EBITDA plus or minor losses and gains on the disposition of depreciated property, including losses or gains on change of control, plus impairment write-downs of depreciated property and of investments in unconsolidated affiliates caused by a decrease in value of depreciated property in the affiliate, plus or minus adjustments to reflect the Company's share of EBITDAre of unconsolidated affiliates. Management believes EBITDAre is useful to investors in evaluating and facilitating comparisons of our operating performance between periods and between other REITs. We calculate EBITDAre in accordance with Nareit's definition, which may differ from the methodology for calculating, EBITDAre, or similarly titled measures, used by other companies. As a result, our calculation of EBITDAre may not be comparable to measures calculated by other companies that do not use the Nareit definition of EBITDAre. EBITDAre should not be used as a substitute for any GAAP financial measures for the purpose of evaluating our financial performance, financial position or cash flows."EBITDAR Rent Coverage: represents the operator EBITDAR of our stabilized facilities for the trailing twelve months divided by the contractual lease rent for the same period. For the leases that have been in place for less than 12 months as of the date presented, the annualized base rent under the applicable lease as of such date is used.""EBITDARM: represents earnings from the operator’s financial statements before interest, taxes, depreciation, amortization, rent and management fees and may be adjusted for certain non-recurring, infrequent or out-of-period items.""EBITDARM Rent Coverage: represents the operator EBITDARM of our stabilized facilities for the trailing twelve months divided by the contractual lease rent for the same period. For the leases that have been in place for less than 12 months as of the date presented, the annualized base rent under the applicable lease as of such date is used."Facility-Level Occupancy: Occupancy is calculated by dividing the daily number of beds occupied each day as reported by the operators at their facilities during the period presented by the beds in operations (available) at the facilities for the same period.Funds From Operations attributable to common stockholders (“FFO”): FFO is a non-GAAP measure used by many investors and analysts that follow the real estate industry. FFO, as defined by Nareit, represents net income (computed in accordance with GAAP), excluding gains (losses) on sales of real estate and impairments of real estate assets, plus real estate-related depreciation and amortization and after adjustments for unconsolidated partnerships and joint ventures. Noncontrolling interest amounts represent adjustments to reflect only our share of depreciation and amortization. We compute FFO in accordance with Nareit’s definition, which may differ from the methodology for calculating FFO, or similarly titled measures, used by other companies. Historical cost accounting for real estate assets implicitly assumes that the value of real estate assets diminishes predictably over time. Since real estate values instead have historically risen or fallen with market conditions, most real estate industry investors consider FFO to be helpful in evaluating a real estate company’s operations. We believe that the presentation of FFO provides useful information to investors regarding our operating performance by excluding the effect of real-estate related depreciation and amortization, gains or losses from sales for real estate, including impairments, extraordinary items and the portion of items related to unconsolidated entities, all of which are based on historical cost accounting, and that FFO can facilitate comparisons of operating performance between periods and between REITs, even though FFO does not represent an amount that accrues directly to common stockholders. Our calculation of FFO may not be comparable to measures calculated by other companies that do not use the Nareit definition of FFO or do not calculate FFO per diluted share in accordance with Nareit guidance. FFO should not be considered as an alternative to net income (computed in accordance with GAAP) as an indicator of our financial performance or to cash flow from operating activities (computed in accordance with GAAP) as an indicator of our liquidity."Gross assets: the carrying amount of total assets plus accumulated depreciation and amortization, as reported in the Company’s consolidated financial statements.""Inpatient Rehabilitation Facility (“IRF”): facilities that provide inpatient rehabilitation services for patients recovering from injuries, organ transplants, amputations, cardiovascular surgery, strokes, and complex neurological, orthopedic and other medical conditions following stabilization of their acute medical issues.""Long-Term Acute Care Hospital (“LTACH”): facilities designed for patients with serious medical problems that require intense, special treatment for an extended period of time (typically at least 25 days), offer more individualized and resource-intensive care than a skilled nursing facility, nursing home or acute rehabilitation facility, and patients are typically transferred to a long-term acute care hospital from the intensive care unit of a traditional hospital."

2Q 2018- Supplemental MedEquities Realty Trust, Inc.Glossary (continued)"Medical Office Building (“MOB”): single-tenant or multi-tenant buildings where doctors, physician practice groups, hospitals, hospital systems or other healthcare providers lease space and are typically located near or adjacent to acute care hospitals or other facilities where healthcare services are rendered. Medical office buildings can include outpatient surgical centers, diagnostic labs, physical therapy providers and physician office space in a single building.""Post-acute: the period of time following acute care, in which the patient continues to require elevated levels of medical treatment.""Q-Mix: Quality mix is presented as non-Medicaid revenue as a percentage of total revenue. ""Skilled Nursing Facility (“SNF”): facilities that usually house elderly patients and provide restorative, rehabilitative and nursing care for patients not requiring more extensive and sophisticated treatment that may be available at acute care hospitals or long-term acute care hospitals. They are distinct from and offer a much higher level of care for older adults compared to senior housing facilities. Patients typically enter skilled nursing facilities after hospitalization."Stabilized Portfolio: as of March 31, 2018, our stabilized, single-tenanted portfolio includes only our 20 stabilized skilled nursing facilities, our four stabilized behavioral health facilities, our two stabilized long-term acute care hospitals, our one stabilized assisted living facility (that is connected to a skilled nursing facility in our portfolio), our one stabilized inpatient rehabilitation facility and our one stabilized acute care hospital. Our non-stabilized, single-tenanted property as of March 31, 2018 was Mountain’s Edge Hospital. We consider a facility to be non-stabilized if it is a newly completed development, is undergoing or has recently undergone a significant addition or renovation, or is being repositioned or transitioned to new operators, but in no event beyond 24 months after the date of classification as non-stabilized. Lakeway Hospital is excluded from all operator metrics as a result of Baylor Scott & White's lack of reporting requirements for facility level financial information. Acquired properties that otherwise meet the definition of a stabilized property are included in operating metrics beginning with the first full quarter of ownership.