- GEAR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

Vista Outdoor (GEAR) 425Business combination disclosure

Filed: 22 Nov 23, 4:34pm

Filed by Colt CZ Group SE

Pursuant to Rule 425 under the Securities Act of 1933

Subject Company: Vista Outdoor Inc.

Commission File No.: 001-36597

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Amendment No. 1)

Under the Securities Exchange Act of 1934

VISTA OUTDOOR INC.

(Name of Issuer)

Common Stock, par value $0.01 per share

(Title of Class of Securities)

928377100

(CUSIP Number)

Colt CZ Group SE

Attn: Josef Adam

náměstí Republiky 2090/3a

Nové Město, 110 00 Praha 1, Czech Republic

420602552479

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

Copies to:

Stuart Rogers

Alston & Bird LLP

90 Park Avenue

New York, New York 10016

November 22, 2023

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are to be sent.

| * | The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

These materials may be deemed to be solicitation material in respect of a proposed transaction between Vista Outdoor Inc. and Colt CZ Group SE. INVESTORS AND STOCKHOLDERS ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE PROPOSED TRANSACTION. Investors and stockholders will be able to obtain any documents filed with respect to the transaction free of charge through the SEC’s website at www.sec.gov.

| 1. | Name of Reporting Person

Colt CZ Group SE | |||||

| 2. | Check the Appropriate Box if a Member of a Group (a) ☐ (b) ☒

| |||||

| 3. | SEC Use Only

| |||||

| 4. | Source of Funds (See Instructions)

WC | |||||

| 5. | Check if Disclosure of Legal Proceeding Is Required Pursuant to Items 2(d) or 2(e) ¨

☐ | |||||

| 6. | Citizenship or Place of Organization

Czech Republic | |||||

Number of Shares Beneficially Owned By Each Reporting Person with

| 7. | Sole Voting Power

0 | ||||

| 8. | Shared Voting Power

1,373,186 | |||||

| 9. | Sole Dispositive Power

0 | |||||

| 10. | Shared Dispositive Power

1,373,186 | |||||

| 11. | Aggregate Amount Beneficially Owned by Each Reporting Person

1,373,186 | |||||

| 12. | Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares

| |||||

| 13. | Percent of Class Represented by Amount in Row (11)

2.4% (1) | |||||

| 14. | Type of Reporting Person

CO, HC | |||||

| (1) | Percentage based upon 58,071,728 shares of the Issuer’s common stock outstanding as of October 30, 2023, according to the Issuer’s Quarterly Report on Form 10-Q filed on November 2, 2023. |

| 1. | Name of Reporting Person

Česká zbrojovka Partners SE | |||||

| 2. | Check the Appropriate Box if a Member of a Group (a) ☐ (b) ☒

| |||||

| 3. | SEC Use Only

| |||||

| 4. | Source of Funds (See Instructions)

AF | |||||

| 5. | Check if Disclosure of Legal Proceeding Is Required Pursuant to Items 2(d) or 2(e) ¨

☐ | |||||

| 6. | Citizenship or Place of Organization

Czech Republic | |||||

Number of Shares Beneficially Owned By Each Reporting Person with

| 7. | Sole Voting Power

0 | ||||

| 8. | Shared Voting Power

1,373,186 | |||||

| 9. | Sole Dispositive Power

0 | |||||

| 10. | Shared Dispositive Power

1,373,186 | |||||

| 11. | Aggregate Amount Beneficially Owned by Each Reporting Person

1,373,186 | |||||

| 12. | Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares

| |||||

| 13. | Percent of Class Represented by Amount in Row (11)

2.4% (1) | |||||

| 14. | Type of Reporting Person

HC, CO | |||||

| (1) | Percentage based upon 58,071,728 shares of the Issuer’s common stock outstanding as of October 30, 2023, according to the Issuer’s Quarterly Report on Form 10-Q filed on November 2, 2023. |

| 1. | Name of Reporting Person

Leima Equity Two a.s. | |||||

| 2. | Check the Appropriate Box if a Member of a Group (a) ☐ (b) ☒

| |||||

| 3. | SEC Use Only

| |||||

| 4. | Source of Funds (See Instructions)

WC | |||||

| 5. | Check if Disclosure of Legal Proceeding Is Required Pursuant to Items 2(d) or 2(e) ¨

☐ | |||||

| 6. | Citizenship or Place of Organization

Czech Republic | |||||

Number of Shares Beneficially Owned By Each Reporting Person with

| 7. | Sole Voting Power

0 | ||||

| 8. | Shared Voting Power

1,387,887 | |||||

| 9. | Sole Dispositive Power

0 | |||||

| 10. | Shared Dispositive Power

1,387,887 | |||||

| 11. | Aggregate Amount Beneficially Owned by Each Reporting Person

1,387,887 | |||||

| 12. | Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares

| |||||

| 13. | Percent of Class Represented by Amount in Row (11)

2.4% (1) | |||||

| 14. | Type of Reporting Person

CO | |||||

| (1) | Percentage based upon 58,071,728 shares of the Issuer’s common stock outstanding as of October 30, 2023, according to the Issuer’s Quarterly Report on Form 10-Q filed on November 2, 2023. |

| 1. | Name of Reporting Person

René Holeček | |||||

| 2. | Check the Appropriate Box if a Member of a Group (a) ☐ (b) ☒

| |||||

| 3. | SEC Use Only

| |||||

| 4. | Source of Funds (See Instructions)

PF, AF | |||||

| 5. | Check if Disclosure of Legal Proceeding Is Required Pursuant to Items 2(d) or 2(e) ¨

☐ | |||||

| 6. | Citizenship or Place of Organization

Czech Republic | |||||

Number of Shares Beneficially Owned By Each Reporting Person with

| 7. | Sole Voting Power

520,000 | ||||

| 8. | Shared Voting Power

2,761,073 | |||||

| 9. | Sole Dispositive Power

520,000 | |||||

| 10. | Shared Dispositive Power

2,761,073 | |||||

| 11. | Aggregate Amount Beneficially Owned by Each Reporting Person

3,281,073 | |||||

| 12. | Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares

| |||||

| 13. | Percent of Class Represented by Amount in Row (11)

5.7% (1) | |||||

| 14. | Type of Reporting Person

IN | |||||

| (1) | Percentage based upon 58,071,728 shares of the Issuer’s common stock outstanding as of October 30, 2023, according to the Issuer’s Quarterly Report on Form 10-Q filed on November 2, 2023. |

| 1. | Name of Reporting Person

Jan Drahota | |||||

| 2. | Check the Appropriate Box if a Member of a Group (a) ☐ (b) ☒

| |||||

| 3. | SEC Use Only

| |||||

| 4. | Source of Funds (See Instructions)

PF, AF | |||||

| 5. | Check if Disclosure of Legal Proceeding Is Required Pursuant to Items 2(d) or 2(e) ¨

☐ | |||||

| 6. | Citizenship or Place of Organization

Czech Republic | |||||

Number of Shares Beneficially Owned By Each Reporting Person with

| 7. | Sole Voting Power

50,000 | ||||

| 8. | Shared Voting Power

1,373,186 | |||||

| 9. | Sole Dispositive Power

50,000 | |||||

| 10. | Shared Dispositive Power

1,373,186 | |||||

| 11. | Aggregate Amount Beneficially Owned by Each Reporting Person

1,423,186 | |||||

| 12. | Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares

| |||||

| 13. | Percent of Class Represented by Amount in Row (11)

2.5% (1) | |||||

| 14. | Type of Reporting Person

IN | |||||

| (1) | Percentage based upon 58,071,728 shares of the Issuer’s common stock outstanding as of October 30, 2023, according to the Issuer’s Quarterly Report on Form 10-Q filed on November 2, 2023. |

This Amendment No. 1 amends the statement on Schedule 13D filed with the U.S. Securities and Exchange Commission by (i) Colt CZ Group SE, a joint stock company organized under the laws of the Czech Republic (“Colt CZ”), (ii) Leima Equity Two a.s., a joint stock company organized under the laws of the Czech Republic (“Leima”), (iii) Česká zbrojovka Partners SE, a joint stock company organized under the laws of the Czech Republic (“CZP”), (iv) Jan Drahota, a citizen of the Czech Republic, and (v) René Holeček, a citizen of the Czech Republic (the foregoing, collectively, the “Reporting Persons”) on October 25, 2023 (the “Schedule 13D”). Capitalized terms used but not defined in this Amendment No. 1 have the meanings set forth in the Schedule 13D. Except as specifically provided herein, this Amendment No. 1 does not modify any of the information previously reported in the Schedule 13D.

Item 4. Purpose of Transaction.

Item 4 of the Schedule 13D is hereby amended and supplemented as follows:

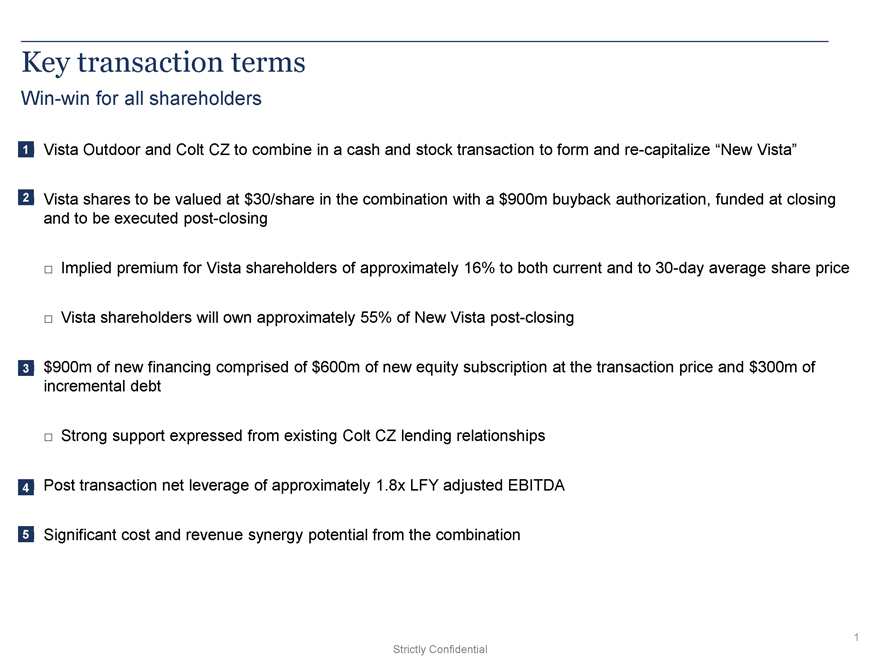

On November 22, 2023, Colt CZ sent a letter to the Board of Directors of the Issuer proposing a strategic combination between Colt CZ and the Issuer that would value the Issuer at $30.00 per share and include a $900 million share repurchase to be executed following closing of the proposed transaction. A copy of the letter to the Board of Directors of the Issuer is attached as Exhibit 99.2.

Item 7. Materials to be Filed as Exhibits.

Item 7 of the Schedule 13D is hereby amended and supplemented as follows:

| Exhibit 99.2 | Letter, dated November 22, 2023, to the Board of Directors of the Issuer. |

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete, and correct.

Date: November 22, 2023

| COLT CZ GROUP SE |

/s/ Jan Drahota |

| Name: Jan Drahota |

| Title: Chairman of the Board of Directors |

/s/ Josef Adam |

| Name: Josef Adam |

| Title: Vice-Chairman of the Board of Directors |

| LEIMA EQUITY TWO A.S. |

/s/ Tomáš Stoszek |

| Name: Tomáš Stoszek |

| Title: Director |

| ČESKÁ ZBROJOVKA PARTNERS SE |

/s/ Hana Balounová |

| Name: Hana Balounová |

| Title: Chairman of the Board of Directors |

/s/ René Holeček |

| René Holeček |

/s/ Jan Drahota |

| Jan Drahota |

Exhibit 99.2

STRICTLY PRIVATE & CONFIDENTIAL

Sent Via E-mail Delivery

November 22, 2023

Board of Directors

Vista Outdoor Inc.

1 Vista Way

Anoka, MN 55303

Dear Directors,

As you are aware from our multiple prior interactions, Colt CZ Group SE (“Colt CZ”) has long admired the historic and leading brands within the Vista portfolio and, as one of your largest shareholders, we are writing to propose a transaction which we believe will recapture shareholder value that has been lost over the 18 months since the initial announcement of your intent to spin off the Outdoor Products segment. Over this time Vista’s share price has declined approximately 32%, falling 14% between the spin announcement and the day before announcement of the sale of the Sporting Products segment to Czechoslovak Group and revised earnings guidance for 2024. The market’s view of the Czechoslovak Group transaction was clear in its reaction to the announcement, which resulted in the rapid fall in share price on October 16, 2023.

Our superior proposal consists of a strategic combination between our businesses that would value Vista at $30/share and include a $900m buyback program executed post-closing, funded by $600m of new equity issued at the transaction price and an incremental $300m of debt. We would keep the company together, allowing continued upside for current Vista shareholders with the “New Vista” retaining its listing in the U.S. The attached presentation outlines our proposal in more detail.

It is apparent to Colt CZ that, with the separation of the Sporting Products segment, the remaining Outdoor Products segment will be subscale as a standalone public company with substantial risks. Once the cash generative Sporting Products segment, with attractive EBITDA margins of over 30%, is separated, shareholders will be left with a business that currently has EBITDA margins of less than 8%. The Outdoor Products business will be overcapitalized and placed to continue its growth through acquisitions; however, based on history, your shareholders consider this strategy a substantial risk rather than an opportunity. Separation of the businesses may ultimately be the right path, but the timing is wrong today, and at least until confidence is re-established in the company and performance of the business is turned around.

Your shareholders also have concerns about the Sporting Products transaction. This deal poses regulatory risks and prolongs the time it will take to separate the businesses. Separation expenses have already exceeded $50 million and this process has created significant distraction and turnover that needs to be addressed.

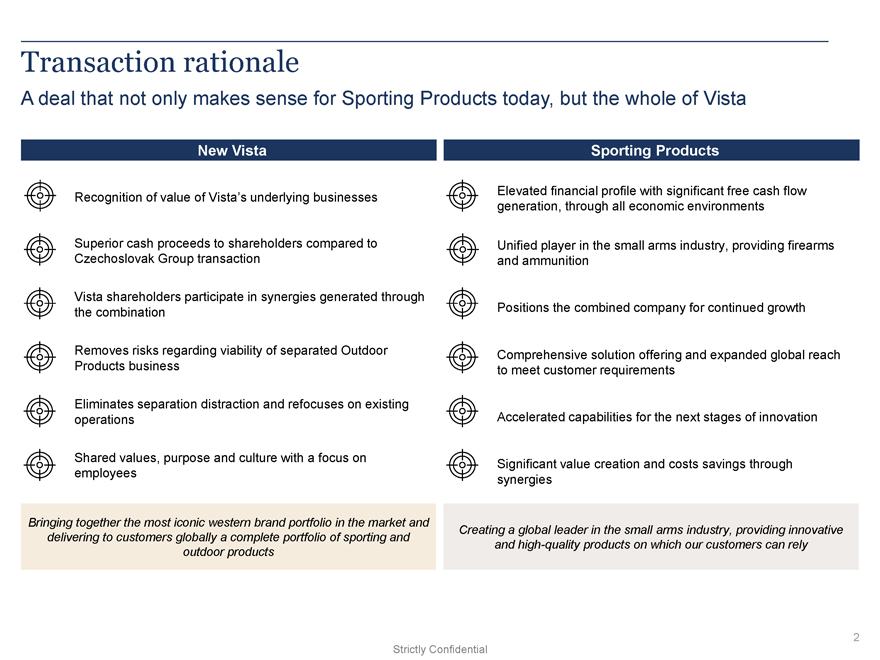

We believe we can bring enormous value to the Sporting Products segment through a combination and also assist you in turning around the performance of Vista as a whole. A combination of Colt CZ and Vista would bring together the most iconic western brands in the market, delivering a complete portfolio of sporting and outdoor brands to customers globally.

Colt CZ Group SE | náměstí Republiky 2090/3a, 110 00 Prague 1, Czech Republic | TIN 29151961 | VAT CZ 29151961 Registered in Commercial Register kept by the Municipal Court in Prague, File H 962

Colt CZ has a strong management team with a track record of value creation for its shareholders, including successfully turning around the Colt’s Manufacturing operations since its acquisition in 2021. As you have seen, we already received substantial commitments from our financing sources to underwrite a transaction with Vista.

Based on your current public valuation, your expectation that the multiples of each segment will be unlocked through separation has unfortunately not been borne out. As such, we propose that you engage with us regarding a superior alternative that enhances value for the current shareholders of Vista.

We look forward to promptly moving forward and, given the significant diligence we have already conducted on Vista, believe we could sign a transaction this calendar year. Please do not hesitate to reach out to me directly to discuss next steps.

Sincerely,

| /s/ Jan Drahota |

Jan Drahota

Colt CZ Group SE, CEO & Chairman of the Board of Directors

Attached: Summary of Colt CZ proposal

Key transaction terms Win-win for all shareholders 1 Vista Outdoor and Colt CZ to combine in a cash and stock transaction to form and re-capitalize “New Vista” 2 Vista shares to be valued at $30/share in the combination with a $900m buyback authorization, funded at closing and to be executed post-closing â–¡ Implied premium for Vista shareholders of approximately 16% to both current and to 30-day average share price â–¡ Vista shareholders will own approximately 55% of New Vista post-closing 3 $900m of new financing comprised of $600m of new equity subscription at the transaction price and $300m of incremental debt â–¡ Strong support expressed from existing Colt CZ lending relationships 4 Post transaction net leverage of approximately 1.8x LFY adjusted EBITDA 5 Significant cost and revenue synergy potential from the combination Strictly Confidential

Transaction rationale A deal that not only makes sense for Sporting Products today, but the whole of Vista New Vista Sporting Products Elevated financial profile with significant free cash flow Recognition of value of Vista’s underlying businesses generation, through all economic environments Superior cash proceeds to shareholders compared to Unified player in the small arms industry, providing firearms Czechoslovak Group transaction and ammunition Vista shareholders participate in synergies generated through Positions the combined company for continued growth the combination Removes risks regarding viability of separated Outdoor Comprehensive solution offering and expanded global reach Products business to meet customer requirements Eliminates separation distraction and refocuses on existing operations Accelerated capabilities for the next stages of innovation Shared values, purpose and culture with a focus on Significant value creation and costs savings through employees synergies Bringing together the most iconic western brand portfolio in the market and Creating a global leader in the small arms industry, providing innovative delivering to customers globally a complete portfolio of sporting and and high-quality products on which our customers can rely outdoor products

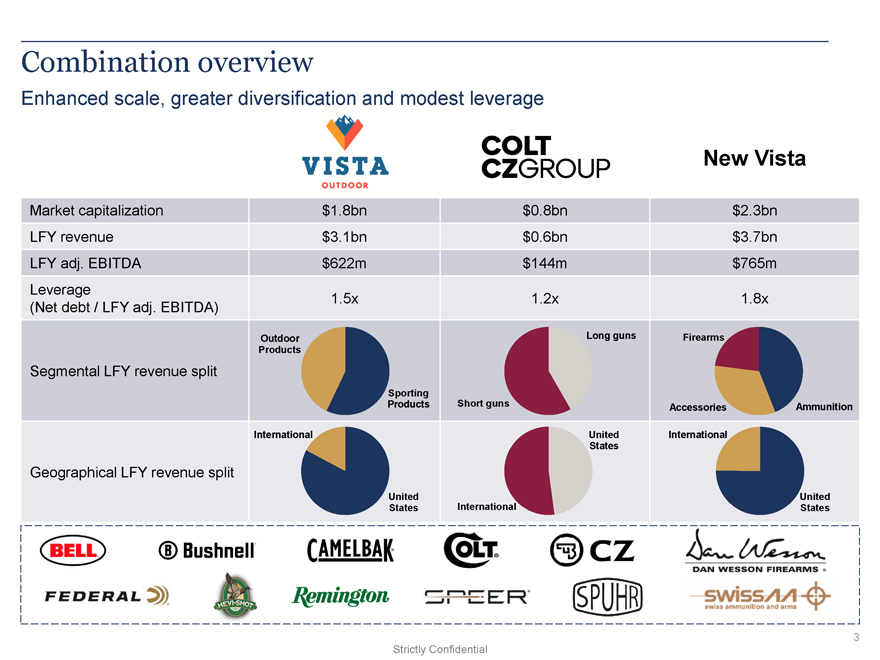

Combination overview Enhanced scale, greater diversification and modest leverage New Vista Market capitalization $1.8bn $0.8bn $2.3bn LFY revenue $3.1bn $0.6bn $3.7bn LFY adj. EBITDA $622m $144m $765m Leverage 1.5x 1.2x 1.8x (Net debt / LFY adj. EBITDA) Outdoor Long guns Firearms Products Segmental LFY revenue split Sporting Products Short guns Accessories Ammunition International United International States Geographical LFY revenue split United United States International States 3 Strictly Confidential