UNITED STATES OF AMERICA

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

| | |

Filed by the Registrant ý |

Filed by a Party other than the Registrant o |

| Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material under §240.14a-12 |

|

| | | | | |

| Vista Outdoor Inc. |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1 | ) | | Title of each class of securities to which transaction applies: |

| | | (2 | ) | | Aggregate number of securities to which transaction applies: |

| | | (3 | ) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | (4 | ) | | Proposed maximum aggregate value of transaction: |

| | | (5 | ) | | Total fee paid: |

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1 | ) | | Amount Previously Paid: |

| | | (2 | ) | | Form, Schedule or Registration Statement No.: |

| | | (3 | ) | | Filing Party: |

| | | (4 | ) | | Date Filed: |

VISTA OUTDOOR INC.

938 University Park Boulevard, Suite 200

Clearfield, UT 84015

June 26, 2015

Dear Stockholder:

You are invited to attend the first Annual Meeting of Stockholders of Vista Outdoor Inc., which will be held at 9:00 a.m. Mountain Daylight Time on Tuesday, August 11, 2015, at the Hilton Salt Lake City Center, 255 S West Temple, Salt Lake City, Utah.

The Notice of Annual Meeting and Proxy Statement that follow describe the business to be conducted at the meeting.

We have elected to take advantage of the "notice and access" rules of the Securities and Exchange Commission to furnish most of our stockholders with proxy materials over the Internet. These rules allow us to provide you with the information you need, while reducing printing and delivery costs.

Your vote on the proposals is important. Whether or not you attend the meeting, we encourage you to vote your shares in order to make certain that you are represented at the meeting. You may vote over the Internet, as well as by telephone or, if you requested to receive printed proxy materials, by mailing a proxy or voting instruction card.

If you plan to attend the meeting, please let us know. See the Admission Policy on the next page for instructions on admission to the meeting.

We look forward to seeing you at the Annual Meeting.

|

| | |

| | | |

| | | Sincerely, |

| | | |

| | | Mark W. DeYoung Chairman and Chief Executive Officer |

| | |

|

| | | Michael Callahan Lead Independent Director |

TABLE OF CONTENTS

|

| |

| | Page |

| Notice of Annual Meeting of Stockholders | |

| General Information | |

| Security Ownership of Certain Beneficial Owners and Management | |

| Section 16(a) Beneficial Ownership Reporting Compliance | |

| Corporate Governance at Vista Outdoor | |

| Related Person Transactions | |

| Director Compensation | |

| Compensation Discussion and Analysis | |

| Named Executive Officer Compensation | |

| Compensation Committee Report | |

| Audit Committee Report | |

| Fees Paid to Independent Registered Public Accounting Firm | |

| Proposal 1 - Election of Directors | |

| Proposal 2 - Advisory Vote to Approve 2015 Named Executive Officer Compensation | |

| Proposal 3 - Advisory Vote on Frequency of Advisory Vote on Named Executive Officer Compensation | |

| Proposal 4 - Ratification of Appointment of Independent Registered Public Accounting Firm | |

| Future Stockholder Proposals | |

ADMISSION POLICY

Stockholders as of the record date, or their duly appointed proxies, may attend the Annual Meeting of Stockholders on August 11, 2015. To be admitted to the meeting, you must request an admission ticket. You may request an admission ticket by calling (801) 779-4657, by emailing corporate.secretary@vistaoutdoor.com or by mailing a request to Vista Outdoor Inc.'s Corporate Secretary at 938 University Park Blvd., Suite 200, Clearfield, Utah 84015, Attn: Annual Meeting Ticket Request. Seating is limited. You may pick up your ticket at the registration table prior to the meeting. Please be prepared to show your photo identification. Please note that if you hold shares in "street name" (that is, through a bank, broker or other nominee), you will also need to bring a copy of a statement reflecting your share ownership as of the record date. If you attend as a representative of an entity that owns shares of record, you will need to bring proper identification indicating your authority to represent that entity.

VISTA OUTDOOR INC.

938 University Park Boulevard, Suite 200

Clearfield, Utah 84015

_______________________________________________________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

___________________________________________________________________

|

| | |

| | | |

| Date and Time: | | Tuesday, August 11, 2015, at 9:00 a.m. Mountain Daylight Time |

| Place: | | Hilton Salt Lake City Center, 255 S West Temple, Salt Lake City, Utah |

| Items of Business: | | • Elect Michael Callahan, Gary McArthur and Robert Tarola as directors of Vista Outdoor Inc. • Approve, on a non-binding advisory basis, the compensation of Vista Outdoor Inc.'s named executive officers. • Approve, on a non-binding advisory basis, the frequency with which Vista Outdoor Inc. will hold a stockholder vote to approve the compensation of its named executive officers. • Ratify the appointment of Deloitte & Touche LLP as the independent registered public accounting firm to audit the Company's financial statements for the fiscal year ending March 31, 2016. • Transact any other business that may properly be considered at the meeting or any adjournment of the meeting.

|

| Record Date: | | June 16, 2015 |

| Voting by Proxy: | | It is important that your shares be represented and voted at the meeting. Whether or not you plan to attend the meeting in person, we encourage you to read this proxy statement and submit your proxy or voting instructions as soon as possible. For specific instructions on how to vote your shares, please refer to the instructions on the Notice of Internet Availability of Proxy Materials you received in the mail, the section entitled "Questions and Answers About the Meeting and Voting" beginning on page 1 of this proxy statement or, if you requested to receive printed proxy materials, your enclosed proxy card. You can revoke a proxy at any time prior to its exercise at the meeting by following the instructions in the accompanying proxy statement. |

| Admission to the Meeting: | | You will be admitted to the meeting only if you have a ticket and provide the proper documentation. See the Admission Policy on the previous page for instructions on obtaining a ticket. |

|

| | |

| | | |

| | | By Order of the Board of Directors, |

| | | |

| | | Scott D. Chaplin Corporate Secretary |

June 26, 2015

VISTA OUTDOOR INC.

938 University Park Boulevard, Suite 200

Clearfield, Utah 84015

________________________________________________

PROXY STATEMENT

FOR

ANNUAL MEETING OF STOCKHOLDERS

August 11, 2015

_________________________________________________

GENERAL INFORMATION

The Board of Directors of Vista Outdoor Inc. ("Vista Outdoor" or the "Company") is soliciting proxies to be used at the Annual Meeting of Stockholders to be held on August 11, 2015 and at any adjournment of the meeting. This proxy statement and the form of proxy, along with Vista Outdoor Inc.'s Annual Report for the fiscal year ended March 31, 2015, are first being sent or given to stockholders on or about June 26, 2015. This will be the first Annual Meeting of Stockholders held by the Company since the spin-off of the Company from Alliant Techsystems Inc. (“ATK”) on February 9, 2015 (the “Spin-Off”).

QUESTIONS AND ANSWERS ABOUT THE MEETING AND VOTING

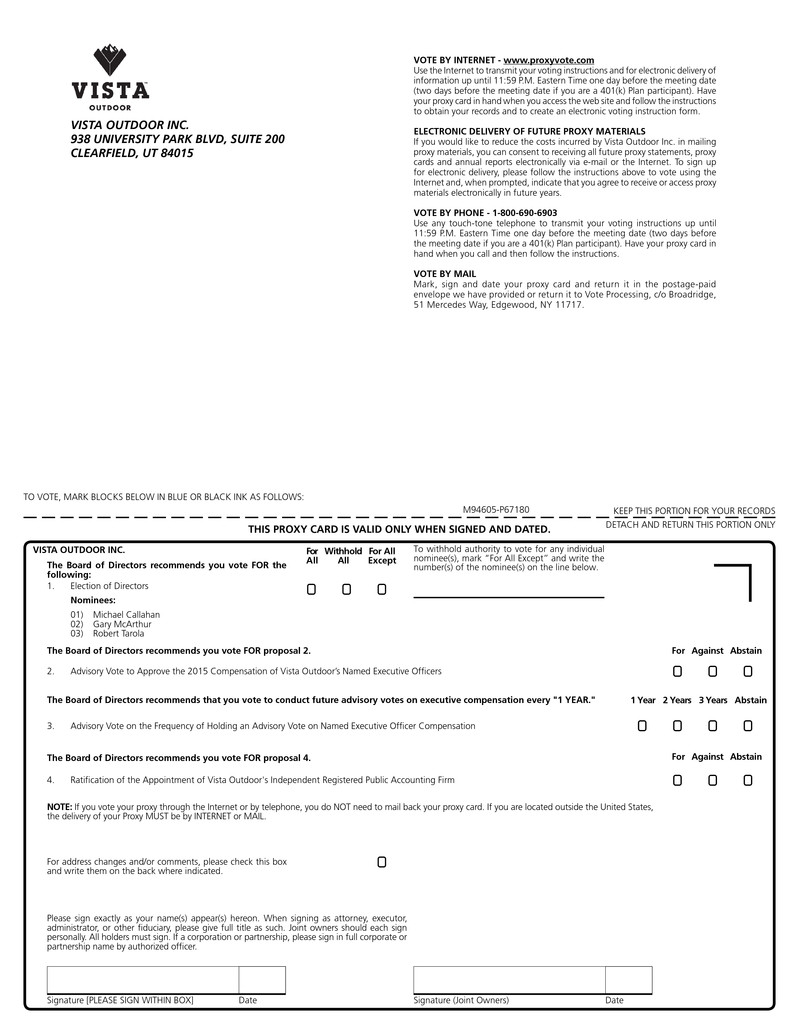

What am I voting on?

| |

| • | The election of Michael Callahan, Gary McArthur and Robert Tarola as directors of Vista Outdoor. |

| |

| • | The approval, on a non-binding advisory basis, of the compensation of Vista Outdoor's named executive officers. |

| |

| • | The approval, on a non-binding advisory basis, of the frequency with which Vista Outdoor will hold a stockholder vote to approve the compensation of its named executive officers. |

| |

| • | The ratification of the Audit Committee's appointment of Deloitte & Touche LLP as the independent registered public accounting firm to audit the Company's financial statements for the fiscal year ending March 31, 2016. |

Who is entitled to vote at the Annual Meeting?

Stockholders can vote their shares of Vista Outdoor common stock at the Annual Meeting if our records show that they owned their shares as of the close of business on June 16, 2015, which was the record date.

What constitutes a quorum at the Annual Meeting?

On the record date, there were 63,471,890 shares of Vista Outdoor common stock outstanding. This does not include 404,155 shares that were held in our treasury and cannot be voted. Each share is entitled to one vote. Holders of a majority of the shares outstanding must be present at the Annual Meeting in order for there to be a quorum. You will be considered present at the Annual Meeting if you are in attendance and vote your shares at the meeting, or if you have properly voted over the Internet or by telephone or submitted a properly completed proxy card.

How can I vote my shares without attending the Annual Meeting?

| |

| • | If you are a stockholder of record, you may vote by proxy. You can vote by proxy over the Internet by following the instructions provided in the Notice of Internet Availability of Proxy Materials or, if you requested to receive printed proxy materials, you can also vote by mail or telephone as instructed on the proxy card. |

| |

| • | If you hold shares beneficially in street name, you may also vote by proxy over the Internet by following the instructions provided in the Notice of Internet Availability of Proxy Materials or, if you requested to receive printed proxy materials, you can also vote by mail or telephone by following the voting instruction card provided to you by your broker, bank, trustee or nominee. |

| |

| • | If you hold shares in Vista Outdoor's 401(k) Plan, please refer to the voting instructions that are provided to you. The Plan trustee will vote your shares as you instruct. |

How can I vote my shares in person at the Annual Meeting?

| |

| • | Even if you plan to attend the Annual Meeting, we recommend that you also submit your proxy or voting instructions as described above so that your vote will be counted if you later decide not to attend the meeting. |

| |

| • | If you are a stockholder of record, you may vote in person at the Annual Meeting. |

| |

| • | If you hold shares beneficially in street name, you may vote in person at the Annual Meeting only if you obtain a legal proxy from the broker, bank, trustee or nominee that holds your shares giving you the right to vote the shares. |

| |

| • | Shares held in Vista Outdoor's 401(k) Plan cannot be voted in person at the Annual Meeting. |

Can I change my vote?

You can change your vote before the vote is taken at the Annual Meeting. If you are a stockholder of record, you can change your vote by:

| |

| • | voting over the Internet or by telephone at a later time, until 11:59 p.m. Eastern Daylight Time on August 10, 2015; |

| |

| • | signing and delivering to our Corporate Secretary a written request to revoke your proxy vote; |

| |

| • | signing and mailing a new, properly completed proxy card with a later date than your original proxy card; or |

| |

| • | attending the Annual Meeting and voting in person. |

If you are not a stockholder of record, you must instruct the party that holds your shares of record for your account of your desire to change or revoke your voting instructions.

Will my shares be voted if they are held in nominee street name, such as by a broker, bank or other nominee?

If you hold your shares in nominee street name, such as by a broker, bank or other nominee, and you do not provide voting instructions, your nominee will not be permitted to vote your shares in their discretion on the election of directors (Proposal 1), the advisory vote on executive compensation (Proposal 2), and the advisory vote on the frequency of shareholder advisory votes on executive compensation (Proposal 3), but may still be permitted to vote in their discretion on the ratification of the Audit Committee's appointment of Deloitte & Touche LLP as the Company's independent registered public accounting firm for the current fiscal year (Proposal 4). Therefore, it is particularly important for street name holders to instruct their brokers as to how they wish to vote their shares.

How are votes counted?

Your shares will be voted as you instruct, assuming that you have properly voted over the Internet or by telephone or that your properly signed proxy card is received in time to be voted at the Annual Meeting.

If you are a stockholder of record and you do not indicate how you wish to vote on a proposal, your shares will be voted as follows on that proposal:

| |

| • | FOR election of Michael Callahan, Gary McArthur and Robert Tarola as directors of Vista Outdoor (Proposal 1). |

| |

| • | FOR the approval, on a non-binding advisory basis, of the compensation of Vista Outdoor's named executive officers (Proposal 2). |

| |

| • | EVERY 1 YEAR, for the frequency with which Vista Outdoor will hold a stockholder vote to approve the compensation of its named executive officers (Proposal 3). |

| |

| • | FOR ratification of the Audit Committee's appointment of Deloitte & Touche LLP as the Vista Outdoor's independent registered public accounting firm for the current fiscal year (Proposal 4). |

Shares held in Vista Outdoor's 401(k) Plan will be voted by the Plan trustee as directed by participants. Shares for which the Plan trustee has not received voting instructions by the voting deadline or that have not been allocated to participant accounts will be voted by the Plan trustee in the same manner and proportion as it votes shares for which it received voting instructions.

What vote is required to approve the proposals?

All stockholders of record are entitled to one vote per share of common stock held for each nominee for director and for each other matter presented for a vote at the meeting.

| |

| • | Proposal 1 requests your vote for the election of three candidates for director. Michael Callahan, Gary McArthur and Robert Tarola will each be elected as a director of Vista Outdoor if the votes cast in favor of such nominee's election |

exceed the votes cast against, or withheld with respect to, such nominee. Cumulative voting for the election of directors is not permitted.

| |

| • | Proposal 2, the advisory approval of the compensation of Vista Outdoor's named executive officers, will be approved if a majority of the votes present in person or represented by proxy are voted in favor of the proposal. |

| |

| • | Proposal 3, the advisory vote to determine the frequency with which Vista Outdoor will hold a stockholder vote to approve the compensation of its named executive officers, will be determined based on which option (every year, every two years, or every three years) receives a majority of the votes present in person or represented by proxy. |

| |

| • | Proposal 4, the ratification of the Audit Committee’s selection of Deloitte & Touche LLP as Vista Outdoor's independent auditors for fiscal year 2016, will be approved if a majority of the votes present in person or represented by proxy are voted in favor of the proposal. |

As described under the caption “Will my shares be voted if they are held in nominee street name, such as by a broker, bank or other nominee?” on page 2, under New York Stock Exchange rules, if you hold your shares in street name and you do not submit voting instructions to the broker, bank, trust or other nominee that holds your shares, the firm will have discretionary authority to vote your shares with respect to Proposal 4. If you do not submit voting instructions, the firm that holds your shares will not have discretion to vote your shares with respect to Proposals 1, 2 and 3. However, broker non-votes will not be considered in determining the vote required to approve Proposals 1, 2 and 3, and will not be deemed to have voted against those proposals.

If you abstain from voting on Proposals 2, 3 or 4, your shares will still be considered in determining the vote required to approve the proposal, and you will be deemed to have voted against that proposal.

Because your votes on Proposals 2 and 3 are advisory, they are non-binding on our Board of Directors. Although non-binding, the Compensation Committee will take into account the results of this advisory vote, as applicable, when considering future executive compensation arrangements.

Who will tabulate the votes at the Annual Meeting?

The Carideo Group, Inc., an investor-relations counseling firm, will provide inspectors of election to tabulate the votes cast before and at the Annual Meeting.

How will the solicitation of proxies be handled?

| |

| • | Proxies are being solicited primarily by Internet and mail, but proxies may also be solicited personally, by telephone, facsimile and similar means. Our directors, officers and other employees may help with the solicitation without additional compensation. |

| |

| • | We will reimburse brokers, banks and other custodians and nominees for their reasonable expenses in forwarding proxy solicitation materials to the owners of the shares they hold. |

| |

| • | We will pay all other expenses of preparing, printing, and mailing or distributing the proxy solicitation materials. |

Why did I receive a notice in the mail regarding the Internet availability of proxy materials instead of a full set of paper copies?

In accordance with rules adopted by the Securities and Exchange Commission, we may furnish proxy materials to our stockholders by providing access to these documents on the Internet instead of mailing printed copies. You will not receive printed copies of the materials unless you request them. Instead, we mailed you the Notice of Internet Availability of Proxy Materials (unless you have previously consented to electronic delivery or already requested to receive paper copies), which instructs you as to how you may access and review all of the proxy materials on the Internet. The Notice of Internet Availability of Proxy Materials explains how to submit your proxy over the Internet. If you would like to receive a paper copy or email copy of the proxy materials, please follow the instructions provided in the Notice of Internet Availability of Proxy Materials.

What other business may be brought up at the Annual Meeting?

| |

| • | Our Board of Directors does not intend to present any other matters for a vote at the Annual Meeting. No other stockholder has given the timely notice required by our Bylaws in order to present a proposal at the Annual Meeting. Similarly, no additional candidates for election as a director can be nominated at the Annual Meeting because no stockholder has given the timely notice required by our Bylaws in order to nominate a candidate for election as a |

director at the Annual Meeting. If any other business is properly brought before the meeting, the persons named as proxy on the proxy card will vote on the matter using their best judgment.

| |

| • | Information regarding the requirements for submitting a stockholder proposal for consideration at next year's annual meeting, or nominating a candidate for election as a director at next year's annual meeting, can be found near the end of this proxy statement under the heading "Future Stockholder Proposals." |

What if I want to attend the Annual Meeting?

Stockholders as of the record date, or their duly appointed proxies, may attend the Annual Meeting of Stockholders on August 11, 2015. To be admitted to the meeting, you must request an admission ticket. You may request an admission ticket by calling (801) 779-4657, by emailing corporate.secretary@vistaoutdoor.com or by mailing a request to Vista Outdoor Inc.'s Corporate Secretary at 938 University Park Blvd., Suite 200, Clearfield, Utah 84015, Attn: Annual Meeting Ticket Request. Seating is limited. You may pick up your ticket at the registration table prior to the meeting. Please be prepared to show your photo identification. Please note that if you hold shares in "street name" (that is, through a bank, broker or other nominee), you will also need to bring a copy of a statement reflecting your share ownership as of the record date. If you attend as a representative of an entity that owns shares of record, you will need to bring proper identification indicating your authority to represent that entity.

How are proxy materials delivered to stockholders who share the same household?

The rules of the Securities and Exchange Commission allow us to deliver a single copy of an annual report and proxy statement to any household at which two or more stockholders reside. We believe this rule benefits everyone. It eliminates duplicate mailings that stockholders living at the same address receive, and it reduces our printing and mailing costs. This rule applies to any annual reports, proxy statements, proxy statements combined with a prospectus and information statements.

If your household would like to receive single rather than duplicate mailings in the future, please write to Broadridge Investor Communications Solutions, Householding Department, 51 Mercedes Way, Edgewood, New York 11717, or call 800-542-1061. Each stockholder will continue to receive a separate proxy card or Notice of Internet Availability of Proxy Materials. If a broker or other nominee holds your shares, you may continue to receive some duplicate mailings. Certain brokers will eliminate duplicate account mailings by allowing stockholders to consent to such elimination, or through implied consent if a stockholder does not request continuation of duplicate mailings. Since not all brokers and nominees offer stockholders the opportunity to eliminate duplicate mailings, you may need to contact your broker or nominee directly to discontinue duplicate mailings from your broker to your household.

Your household may have received a single set of proxy materials this year. If you would like to receive another copy of this year’s proxy materials, please write to Broadridge Investor Communications Solutions, Householding Department, 51 Mercedes Way, Edgewood, New York 11717, or call 800-542-1061.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table shows the number of shares of our common stock beneficially owned (as defined by the Securities and Exchange Commission for proxy statement purposes) as of June 16, 2015 by (1) each person known by the Company to beneficially own more than 5% of the Company's common stock, (2) each of our directors and nominees, (3) each executive officer named in the Summary Compensation Table included later in this proxy statement, and (4) all of the directors and executive officers as a group. Unless otherwise noted, the persons listed in the table have sole voting and investment powers with respect to the shares of common stock owned by them.

|

| | | | | | | | | |

| Name of Beneficial Owner | | Amount and Nature of Beneficial Ownership(1)(2)(3) | | | Percent of Shares Outstanding(4) |

| First Eagle Investment Management, LLC (5) | | 6,928,280 |

| | | | 10.9 | % |

| The London Company (6) |

| 3,846,992 |

|

|

|

| 6.1 | % |

| Mark W. DeYoung (7) | | 543,629 |

| | | | * |

|

| Stephen M. Nolan (8) | | 19,893 |

| | | | * |

|

| Scott D. Chaplin (9) | | 33,901 |

| | | | * |

|

| Stephen S. Clark (10) | | 2,631 |

| | | | * |

|

| Michael Callahan (11) | | 2,892 |

| | | | * |

|

| April H. Foley (12) | | 8,706 |

| | | | * |

|

| Mark A. Gottfredson (13) | | 1,298 |

|

| | | * |

|

| Tig H. Krekel (14) | | 2,108 |

| | | | * |

|

| Gary L. McArthur (15) | | 1,298 |

| | | | * |

|

| Robert M. Tarola (16) | | 1,298 |

| | | | * |

|

| All directors and executive officers as a group (10 persons) | | 617,654 |

| | | | 1.0 | % |

| | | | | | | | |

| * | Less than 1%. | | | | | | |

| (1) | Includes shares covered by stock options exercisable on June 16, 2015, or within 60 days thereafter, for the following beneficial owners: Mark W. DeYoung, 202,746 shares; Stephen M. Nolan, 3,136 shares; Scott D. Chaplin, 16,638 shares; Stephen S. Clark, 0 shares; and all directors and executive officers as a group (10 persons), 222,520 shares. |

| (2) | Includes shares of restricted common stock with voting rights held by certain directors and executive officers. Also includes shares allocated, as of March 31, 2015, to the accounts of executive officers under the Company's 401(k) Plan. |

| (3) | Excludes restricted stock units without voting rights under our 2014 Stock Incentive Plan that will not vest within 60 days of June 16, 2015. Excludes deferred stock units without voting rights held by executive officers under the Company's Nonqualified Deferred Compensation Plan because none of the executive officers has a payment scheduled within 60 days of June 16, 2015. Excludes deferred stock units without voting rights held by directors under the Company's 2014 Stock Incentive Plan because none of the directors has a payment scheduled within 60 days of June 16, 2015. Excludes phantom stock units to be settled in cash that were credited to the accounts of officers who participate in the Company's Nonqualified Deferred Compensation Plan (described under the heading "Executive Compensation" later in this proxy statement) upon the Spin-Off in respect of ATK phantom stock units held by such executive officers. |

| (4) | Assumes the issuance of the shares covered by the exercisable stock options held by each person or the group, as applicable. |

| (5) | Based on a Schedule 13G filed with the Securities and Exchange Commission on March 9, 2015, reporting beneficial ownership as of February 27, 2015. The Schedule 13G reported that First Eagle Investment Management, LLC (“FEIM”) has sole voting power over 6,689,910 shares and sole dispositive power over 6,928,280 shares. FEIM, a registered investment adviser, is deemed to be the beneficial owner of the 6,928,280 shares as a result of acting as adviser to various clients. The First Eagle Global Fund, a registered investment company for which FEIM acts as investment adviser, may be deemed to beneficially own 4,424,582 of the 6,928,280 shares, or 7.0% of the outstanding shares of Vista Outdoor’s common stock. The address of FEIM is 1345 Avenue of the Americas, New York, New York 10105. |

|

| | | | | | | | | |

| (6) | Based on a Schedule 13G filed with the Securities and Exchange Commission on March 9, 2015, reporting beneficial ownership as of February 28, 2015. The schedule 13G reported that The London Company (“TLC”), an investment adviser, has sole voting power over 3,484,469 shares, sole dispositive power over 3,484,469 shares, and shared dispositive power over 362,523 shares. The shares as to which the Schedule 13G was filed by TLC are owned by various investment advisory clients of TLC, which is deemed to be a beneficial owner of those shares due to its discretionary power to make investment decisions over such shares for its clients and/or its ability to vote such shares. No individual client of TLC holds more than 5% of the outstanding shares of Vista Outdoor’s common stock. The address of TLC is 1801 Bayberry Court, Suite 301, Richmond, Virginia 23226.

|

| (7) | Excludes 76,210 restricted stock units without voting rights under our 2014 Stock Incentive Plan that will not vest within 60 days of June 16, 2015. Excludes 20,336 deferred stock units without voting rights held under the Company's Nonqualified Deferred Compensation Plan because no payment of the corresponding shares is scheduled within 60 days of June 16, 2015. Excludes 5,260 phantom stock units to be settled in cash that were credited to Mr. DeYoung's account under the Company's Nonqualified Deferred Compensation Plan (described under the heading "Executive Compensation" later in this proxy statement) upon the Spin-Off in respect of ATK phantom stock units held by such executive officers. |

| (8) | Excludes 17,016 restricted stock units without voting rights under our 2014 Stock Incentive Plan that will not vest within 60 days of June 16, 2015. |

| (9) | Excludes 22,029 restricted stock units without voting rights under our 2014 Stock Incentive Plan that will not vest within 60 days of June 16, 2015. |

| (10) | Excludes 9,367 restricted stock units without voting rights under our 2014 Stock Incentive Plan that will not vest within 60 days of June 16, 2015. |

| (11) | Excludes 2,576 restricted stock units without voting rights under our 2014 Stock Incentive Plan that will not vest within 60 days of June 16, 2015. |

| (12) | Excludes 2,576 restricted stock units without voting rights under our 2014 Stock Incentive Plan that will not vest within 60 days of June 16, 2015. Excludes 3,524 deferred stock units without voting rights held under the Company's 2014 Stock Incentive Plan because no payment of the corresponding shares is scheduled within 60 days of June 16, 2015. |

| (13) | Excludes 2,576 restricted stock units without voting rights under our 2014 Stock Incentive Plan that will not vest within 60 days of June 16, 2015. |

| (14) | Excludes 2,576 restricted stock units without voting rights under our 2014 Stock Incentive Plan that will not vest within 60 days of June 16, 2015. Excludes 13,613 deferred stock units without voting rights held under the Company's 2014 Stock Incentive Plan because no payment of the corresponding shares is scheduled within 60 days of June 16, 2015. |

| (15) | Excludes 2,576 restricted stock units without voting rights under our 2014 Stock Incentive Plan that will not vest within 60 days of June 16, 2015. |

| (16) | Excludes 2,576 restricted stock units without voting rights under our 2014 Stock Incentive Plan that will not vest within 60 days of June 16, 2015. |

SECTION 16(a) BENEFICIAL OWNERSHIP

REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires our directors and executive officers, as well as beneficial owners of more than 10% of the Company's common stock, to file initial reports of ownership and reports of changes in ownership of Company securities with the Securities and Exchange Commission. Directors, executive officers, and beneficial owners of more than 10% of the Company's common stock are required to furnish us with copies of these reports. Based solely on a review of these reports, written representations from our directors and executive officers, and applicable regulations, we believe that all required reports for fiscal year 2015 were timely filed.

CORPORATE GOVERNANCE AT VISTA OUTDOOR INC.

Corporate Governance Guidelines

Our Board of Directors and management are committed to effective corporate governance practices. Our Guidelines on Corporate Governance describe the governance principles and procedures by which the Board functions. The Board annually reviews and updates the Guidelines on Corporate Governance and the Board committee charters in response to corporate governance developments, including regulatory changes, and recommendations by directors in connection with Board and committee evaluations.

Our Guidelines on Corporate Governance are available on our website at www.vistaoutdoor.com by selecting Investors and then Corporate Governance.

Code of Business Ethics

The Company's Board of Directors has adopted a written code of business ethics which applies to all directors, officers and employees. Our Code of Business Ethics is available on our website at www.vistaoutdoor.com by selecting Investors and then Corporate Governance.

Communications with Directors

Procedures for stockholders, or anyone else, to communicate directly with non-management directors are available on our website at www.vistaoutdoor.com by selecting Investors, then Corporate Governance and then Contact Directors.

Any concerns about the Company's accounting, internal controls or auditing matters will be referred to the Audit Committee of the Board of Directors. Other communications sent to the Board of Directors will first be reviewed by the Company's Corporate Secretary, and the Corporate Secretary may elect not to refer the following types of communications to the Board:

| |

| • | Product inquiries or suggestions, |

| |

| • | Employee complaints that are neither significant nor material, and |

| |

| • | Routine complaints regarding the Company's products. |

The Company maintains a record of all communications to the Board, which Board members may review at any time upon request. Furthermore, the Company's Senior Vice President, General Counsel and Secretary provides a quarterly summary to the Chair of the Nominating and Governance Committee of all communications sent to the Board. The following items are not forwarded to the Board: job inquiries; spam or junk mail; surveys; and business solicitations or advertisements.

Director Independence

Under applicable rules of the New York Stock Exchange, a majority of our Board of Directors must be independent. Our Board of Directors has affirmatively determined that each of the current directors, other than Mark W. DeYoung, has no material relationship with the Company and is independent. Our Audit, Nominating and Governance, and Compensation Committees are each composed only of independent directors.

Annually, each director and executive officer completes a questionnaire that elicits information regarding entities with which they and their immediate family members are affiliated. Any person nominated for election as a director must also complete a questionnaire no later than the date he or she will be recommended for nomination by the Nominating and Governance Committee. Any person who becomes an executive officer must complete a questionnaire as soon as reasonably practicable thereafter. Our Nominating and Governance Committee reviews transactions and relationships disclosed in the director questionnaires. The Board of Directors makes a formal determination regarding each director's independence.

In order to qualify as independent, a director must meet each of the New York Stock Exchange's five objective independence standards and our Board of Directors must also affirmatively determine, in its business judgment and in consideration of all relevant facts and circumstances, that the director has no relationship with the Company that is material to that director’s ability to be independent from management. The Nominating and Governance Committee and the Board reviewed transactions and relationships between the Company and our directors, their immediate family members, and entities with which they are affiliated and determined that they were made or established in the ordinary course of business and that the directors had no material relationship with the Company.

The Vista Outdoor Inc. Board of Directors

|

| | |

| Name | Age | |

| Mark W. DeYoung | 56 | Mark W. DeYoung, Chairman and CEO, previously served as President and CEO of ATK. Mr. DeYoung joined ATK in 1985 and has 30 years of extensive experience in finance, operations, facility management, and executive leadership, including business startup and turnarounds. Mr. DeYoung developed the company’s successful strategy to grow the portfolio through successful acquisitions. He also initiated and led the effort for the successful spin-off of Vista Outdoor and the merger of ATK’s Aerospace and Defense Groups with Orbital Sciences Corporation to create Orbital ATK. Mr. DeYoung currently serves as a director of Orbital ATK. Mr. DeYoung has been selected to serve as a director due to his intimate knowledge of our business based on his role as CEO and his extensive operational, marketing, and financial experience gained through his many senior leadership positions at ATK. |

| Michael Callahan | 65 | Mr. Callahan has been the President and Chief Executive Officer of Aspen Partners, a Utah-based consultant to the outdoor sporting industry, since 2008. From 1990 until his retirement in 2008, Mr. Callahan served in various merchandising, marketing, management and senior executive positions with Cabela’s, Inc., most recently as Senior Vice President Business Development & International Operations. Prior to joining Cabela’s, Mr. Callahan spent 15 years working in the outdoor recreation industry. Mr. Callahan has been selected to serve as a director due to his operational, marketing and leadership experience gained through various senior positions in the sporting goods and outdoor industry. Mr. Callahan serves as Lead Independent Director and as a member of the Audit Committee and the Compensation Committee. |

| April H. Foley | 67 | Ambassador Foley served with the U.S. State Department as the Ambassador to Hungary from 2006-2009. Before her diplomatic service, she was First Vice President and Vice Chairman, and a member of the Board of Directors, of the Export-Import Bank of the United States from 2003-2005. She also served as Director of Business Planning of PepsiCo, Inc. from 1981-1993. She is also a director of Xerium Technologies, Inc. Ambassador Foley has been selected to serve as a director due to her global and government experience through her service as an Ambassador and experience in the analysis of financial performance and business plans. Ambassador Foley serves as a member of the Audit Committee and the Nominating and Governance Committee.

|

| Mark A. Gottfredson | 57 | Mr. Gottfredson is a leader in and was the former head of Bain & Company, Inc.’s performance improvement practice. He recently led an engagement for the World Bank related to international trade and has worked with business leaders from many leading international corporations. He served on Bain’s board from 2008 to 2012. He is also a director and member of the Audit Committee of Emerge Energy Services LP. Mr. Gottfredson has been selected to serve as director based on his extensive experience and proven ability advising boards and management on strategic decision making and business performance. Mr. Gottfredson serves as member of the Compensation Committee and the Nominating and Governance Committee. |

|

| | |

| Name | Age | |

| Tig H. Krekel | 61 | Mr. Krekel is Chairman and Founding Partner of Hudson Group, a South Carolina advisory services firm. He was the Vice Chairman and a partner of J.F. Lehman & Company, a New York private-equity investment bank, from 2003 to 2012. Before joining J.F. Lehman, Mr. Krekel served as President and Chief Executive Officer of Hughes Space and Communications and President of Boeing Satellite Systems, the world’s largest manufacturer of commercial and military communications satellites. Mr. Krekel serves as a director on the board of Orbital ATK Inc. Mr. Krekel has been selected to serve as a director due to his leadership, industry and financial experience as former chief executive officer of several large and complex businesses and corporate governance experience. Mr. Krekel serves as chairman of the Nominating and Governance Committee and as a member of the Audit Committee. |

| Gary L. McArthur | 55 | Mr. McArthur recently joined CH2M Hill, an engineering company that provides consulting, design and operations services, as Executive Vice President and Chief Financial Officer. Prior to joining CH2M Hill, he worked more than 15 years for Harris Corporation, an international telecommunications equipment company, where he most recently served as Senior Vice President and Chief Financial Officer. Mr. McArthur has also been associated with Nextel Communications, Inc., Lehman Brothers, Inc. and Deloitte & Touche LLP and served on the boards of Terion Inc. and Live TV Co. Ltd. Mr. McArthur has been selected to serve as a director due to his extensive financial, management and complex problem solving experience. Mr. McArthur serves as chairman of the Compensation Committee and as a member of the Audit Committee. |

| Robert M. Tarola | 65 | Mr. Tarola is currently the president of Right Advisory LLC, a firm whose clients have included large, sophisticated companies. He currently serves as Chief Financial Officer of the Southcoast Health System. Prior to his role with Southcoast, Mr. Tarola was associated with The Howard University where he served as CFO for four years. Prior to his time with Howard, he served as Chief Financial Officer for W.R. Grace & Co. for almost 10 years. Prior to W.R. Grace, he served as Chief Financial Officer of MedStar Health, Inc. and was an audit partner at PricewaterhouseCoopers LLP. He currently serves on the board of Legg Mason Mutual Funds, XBRL International Inc., The American Kidney Fund and previously served on the board of TeleTech Holdings Inc. and is a CPA. Mr. Tarola has been selected to serve as director based on his extensive management experience and deep financial expertise. Mr. Tarola serves as chairman of the Audit Committee and as a member of the Nominating and Governance Committee. |

Organization of the Board of Directors

Board Classification

The Company's Board of Directors is divided into three classes. Mr. Callahan, Mr. McArthur and Mr. Tarola were designated as Class I directors upon completion of the Spin-Off, and have initial terms expiring at the annual meeting of stockholders on August 11, 2015. These directors have been nominated by the Board of Directors for reelection at that meeting, as described below under "Proposal 1 - Election of Directors". Ambassador Foley and Mr. Krekel have been designated as Class II directors and have terms expiring at the Company's annual meeting of stockholders to be held in 2016. Mr. DeYoung and Mr. Gottfredson have been designated as Class III directors and have terms expiring at the Company's annual meeting of stockholders in 2017.

Directors for each class will be elected at the annual meeting of stockholders held in the year in which the term for that class expires and thereafter will serve for a term of three years. At any meeting of stockholders for the election of directors at which a quorum is present, a director will be elected if the votes cast in favor of such nominee’s election exceed the votes cast against, or withheld with respect to, such nominee; provided, however, that, if the Secretary of Vista Outdoor receives a notice that a stockholder has nominated a person for election to the Board of Directors in compliance with the advance notice requirements for stockholder nominees for directors set forth in the Company's amended and restated bylaws and such nomination has not validly been withdrawn, directors shall be elected by a plurality of the votes cast.

Chairman and Chief Executive Officer

The Company's Corporate Governance Guidelines allow the roles of Chairman and Chief Executive Officer to be filled by the same or different individuals, as the Company's Board of Directors deems appropriate. In light of Mr. DeYoung's deep experience in the development of Vista Outdoor's business and strategic vision as a stand-alone company, the Company's Board of Directors strongly believes that it is in the Company’s best interest to have him serve as the Company's Chairman and Chief Executive Officer. Mr. DeYoung served as Chief Executive Officer of ATK from 2010-2015 and successfully led ATK and the Company through the Spin-Off and concurrent merger of ATK's Aerospace and Defense Business with Orbital Sciences Corporation. As CEO of ATK, Mr. DeYoung also successfully completed the strategic acquisitions of Caliber Company (parent company of Savage Arms) and Bushnell Group Holdings, Inc., which include key brands within the Company's portfolio.

Lead Independent Director

The Company's Board of Directors maintains strong independent leadership through an active and empowered Lead Independent Director. The Company's independent directors appointed Mr. Callahan as lead independent director shortly following the Spin-Off. As lead independent director, Mr. Callahan chairs executive sessions and other meetings of the independent directors and communicates, as appropriate, the results of those sessions or meetings to the Chairman, the Board and the Company's management. The lead independent director’s other responsibilities are set forth in a lead independent director charter, that is available on the Company's website at www.vistaoutdoor.com by selecting Investors and then Corporate Governance.

Meetings of the Board

The Company's Board of Directors holds four regularly scheduled meetings each fiscal year. Following the Spin-Off, in fiscal year 2015, the Board of Directors held four meetings. The independent directors of the Board meet in executive session at each regularly scheduled Board meeting. As a general practice, Board members are expected to also attend our annual meetings of stockholders. Each director attended all of the meetings of the Board and applicable committees held following the Spin-Off in fiscal year 2015.

Committees of the Board of Directors

The Board of Directors has established three standing committees, the Audit Committee, the Compensation Committee, and the Nominating and Governance Committee, in connection with the discharge of its responsibilities. Each member of these committees meets the independence requirements set forth in the applicable rules of the Securities and Exchange Commission and the New York Stock Exchange and other requirements set forth in the applicable committee charters, which are available on the Company's website at www.vistaoutdoor.com by selecting Investors and then Corporate Governance.

Audit Committee

|

| | | | |

| Members: | | Robert M. Tarola, Chair | | April H. Foley |

| | | Michael Callahan | | Tig. H. Krekel |

| | | Gary L. McArthur | | |

The Audit Committee is primarily responsible for the integrity of the Company's consolidated financial statements, the Company's compliance with legal and regulatory requirements and the independence, qualifications and performance of the Company's independent registered public accounting firm. Specifically, these duties include: selecting and overseeing the Company's independent registered public accounting firm; reviewing the scope of the audit to be conducted by such firm, as well as the results of its audit; overseeing the Company's financial reporting activities, including the Company's annual and quarterly reports to shareholders and the accounting standards and principles followed; overseeing the Company's compliance with its Code of Business Ethics; overseeing the Company's financial reporting process; approving audit and non-audit services provided to the Company by the independent registered public accounting firm; evaluating requests for waivers related to the Code of Business Ethics; overseeing the Company's legal and regulatory compliance; overseeing the Company's disclosure and internal controls; and preparing the report of the Audit Committee required by the rules and regulations of the Securities and Exchange Commission and included in this Proxy Statement. The Audit Committee is also responsible for oversight of financial risks, including the steps the Company has taken to monitor and mitigate these risks.

All of the Audit Committee members meet the independence and experience requirements of the New York Stock Exchange and the Securities and Exchange Commission. The Board has identified Mr. Tarola as an audit committee financial expert under the rules of the Securities and Exchange Commission. The Audit Committee holds four regularly scheduled

meetings each fiscal year. Following the Spin-Off, in fiscal year 2015, the Audit Committee held two meetings. Generally, the Audit Committee meets separately with the independent auditors and the Company's internal auditors at regularly scheduled meetings and periodically meets separately with management.

Compensation Committee |

| | | | |

| Members: | | Gary L. McArthur, Chair | | Mark. A Gottfredson |

| | | Michael Callahan | | |

The Compensation Committee carries out the responsibilities delegated by the Board of Directors relating to the review and determination of executive compensation, and approves or recommends, as applicable, compensation and incentive plans and programs. The Compensation Committee also produces an annual report regarding executive compensation that has been included in this Proxy Statement. The Compensation Committee also evaluates the performance of the Chief Executive Officer and other executive officers in light of established Company goals and objectives at least once per year and, based on these evaluations, approves (or make recommendations to the Board of Directors regarding approval when appropriate) the compensation of the Company's Chief Executive Officer and other executive officers. The Compensation Committee is also responsible for overseeing the management of risks relating to the Company's executive compensation plans and arrangements. In addition, the Compensation committee has the sole authority to retain or obtain the advice of compensation consultants and other advisors and to determine the services to be provided and the fees for such services. The Compensation Committee also considers the independence of compensation consultants and other advisors and assesses whether the work of any compensation consultant or advisor raises any conflict of interest.

All of the Compensation Committee members meet the independence requirements of the New York Stock Exchange and the Securities and Exchange Commission. The Compensation Committee holds four regularly scheduled meetings each fiscal year. Following the Spin-Off, in fiscal year 2015, the Compensation Committee held four meetings. Additional information regarding the Committee's processes and procedures for establishing and overseeing executive compensation is disclosed below under the heading "Executive Compensation—Compensation Discussion and Analysis."

Nominating and Governance Committee |

| | | | |

| Members: | | Tig H. Krekel, Chair | | April H. Foley |

| | | Mark. A Gottfredson | | Robert M. Tarola |

The Company's Nominating and Governance Committee is responsible for considering and reporting periodically to the Board of Directors on matters relating to the identification, selection and qualification of members of the Board of Directors and candidates nominated to the Board of Directors. The Nominating and Governance Committee also advises and makes recommendations to the Board of Directors with respect to corporate governance matters and oversees annual evaluations of the Board of Directors. The Nominating and Governance committee also receives and reviews, in accordance with the Company's amended and restated bylaws, stockholder recommendations for director candidates. The Nominating and Governance Committee periodically reviews the Company's policies related to such recommendations. The Nominating and Governance Committee, in its role of reviewing and maintaining the Company's Guidelines on Corporate Governance, also manages risks associated with the independence of the Board of Directors and potential conflicts of interest.

All of the Nominating and Governance Committee members meet the independence requirements of the New York Stock Exchange. The Nominating and Governance Committee holds two regularly scheduled meetings each fiscal year. Following the Spin-Off, in fiscal year 2015, the Nominating and Governance Committee held one meeting.

Director Qualifications and Selection Process

The Board has delegated the identification, screening and evaluation of director candidates to the Nominating and Governance Committee. The Nominating and Governance Committee retains from time to time a search firm to help identify, screen and evaluate director candidates. The Nominating and Governance Committee will also consider qualified candidates for Board membership submitted by stockholders, as described below, or by members of the Board of Directors. The Nominating and Governance Committee interviews the candidates who meet the director qualification standards described above, and the Committee selects the candidates who best meet the Board's needs. The Nominating and Governance Committee then recommends to the Board the director nominees for election to the Board.

In evaluating potential director nominees, the Nominating and Governance Committee seeks to ensure that the Board of Directors includes a range of talents, ages, skills, diversity and expertise, particularly in the areas of accounting and finance, management, domestic and international markets, governmental/regulatory, leadership and industry experience, sufficient to provide sound and prudent guidance with respect to the Company's operations and interests.

The Nominating and Governance Committee will consider stockholder recommendations for nominees to the Board. If you wish to recommend a prospective candidate for the Board, you should submit the candidate's name and written information in support of the recommendation to: Corporate Secretary, Vista Outdoor Inc., 938 University Park Blvd., Suite 200, Clearfield, Utah 84015. Additional information regarding the requirements for nominating a person for election as a director at the annual meeting of stockholders is described under the heading "Future Stockholder Proposals" near the end of this proxy statement. Director candidates recommended by stockholders will be considered under the same criteria as candidates recommended by directors or a search firm.

The Board's Role in Risk Oversight

While the Company's management is responsible for the day-to-day management of risks, the Board of Directors has broad oversight responsibility for the Company's risk management programs. The Board of Directors exercises risk management oversight and control, both directly and indirectly through board committees. The Board of Directors regularly reviews information regarding the Company's credit, liquidity and operations, including the risks associated with each. The Compensation Committee is responsible for overseeing the management of risks relating to the Company's executive compensation plans and arrangements. The Audit Committee is responsible for oversight of financial risks, including the steps we have taken to monitor and mitigate these risks. The Nominating and Governance Committee, in its role of reviewing and maintaining our Guidelines on Corporate Governance, manages risks associated with the independence of the Board of Directors and potential conflicts of interest. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire Board of Directors is regularly informed through committee reports and by the Chief Executive Officer about the known risks to the Company's strategy and business.

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee has ever served as an officer or employee of the Company or ATK or has any relationships with the Company requiring disclosure below under the heading "Related Person Transactions." Since the beginning of the last fiscal year, no executive officer of the Company has served on the compensation committee or board of any company that employs a director of the Company.

Stock Ownership Guideline for Non-Employee Directors

The Board has established a stock ownership guideline for non-employee directors of a number of shares of Vista Outdoor common stock equal in value to five (5) times the amount of the annual cash retainer paid to members of the Board of Directors, or $375,000. The Nominating and Governance Committee of the Board reviews the stock ownership of each incumbent director annually prior to the Committee's recommendation to the Board of the nominees for election as directors at the annual meeting of stockholders. Shares of Vista Outdoor common stock owned outright, and restricted stock and deferred stock units granted under the Company's 2014 Stock Incentive Plan are all counted for the purpose of meeting the stock ownership guideline.

RELATED PERSON TRANSACTIONS

The Company is required to disclose material transactions by Vista Outdoor in which ‘‘related persons’’ have a direct or indirect material interest. Related persons include any director, nominee for director, executive officer of Vista Outdoor, any immediate family members of such persons and any persons known by Vista Outdoor to be beneficial owners of more than 5% of Vista Outdoor’s voting securities. Based on information available to the Company and provided by the Company’s directors and executive officers, the Company does not believe that there were any transactions in effect or proposed to be entered into as of the date of this Proxy Statement that would be required to be disclosed as a “related person transaction” pursuant to the SEC’s rules.

The Company has a written policy and procedures for the review, approval or ratification of transactions, arrangements or relationships involving the Company and its directors, nominees for director, executive officers, any immediate family members of such persons and any persons known by Vista Outdoor to be beneficial owners of more than 5% of the Company’s voting securities. Pursuant to the Company's Related Person Transactions Policy, the Nominating and Governance Committee is responsible for approving or ratifying, as applicable, any transactions with related persons that would be disclosable pursuant to applicable Securities and Exchange Commission rules. The Nominating and Governance Committee considers the relevant facts and circumstances available to it regarding the matter, including the material facts as to the director's or officer's relationship to or interest in the transaction. The Nominating and Governance Committee approves or ratifies, as the case may be, a transaction if it determines, in good faith, that the transaction is in, or is not inconsistent with, the best interests of the Company and its stockholders. Any member of the Nominating and Governance Committee who has an interest in the matter under consideration must abstain from voting on the approval or ratification of the transaction, but may, if so requested by the Chair of the Nominating and Governance Committee, participate in all or some of the Nominating and Governance Committee's discussions of the transaction.

DIRECTOR COMPENSATION

Summary Compensation Information

Only non-employee directors receive compensation for service on the Board of Directors. The compensation paid to the Company's non-employee directors for the last fiscal year was as follows:

| |

| • | an award of restricted stock valued at $110,000 at the time of grant following each annual meeting of stockholders; |

| |

| • | an annual cash retainer of $75,000, with no additional fees paid for Board and committee meetings attended; |

| |

| • | an annual cash retainer of $25,000 for the Lead Independent Director of the Board (Michael Callahan); |

| |

| • | an annual cash retainer of $20,000 for the Chair of the Audit Committee, $15,000 for the Chair of the Compensation Committee, and $10,000 for the Chair of the Nominating and Governance Committee; and |

| |

| • | an annual cash retainer of $10,000 for each other member of the Audit Committee, $7,500 for each other member of the Compensation Committee, and $5,000 for each other member of the Nominating and Governance Committee. |

Cash amounts are paid annually in a lump sum following the annual meeting of stockholders.

As described more fully in the table below, in fiscal year 2015 the Company's non-employee directors received a portion of the annual restricted stock award and cash retainers described above, prorated for service on the Board of Directors from the date of their appointment to the Vista Outdoor Board of Directors through the date of the 2015 annual meeting of Company stockholders (August 11, 2015).

Following the Spin-Off, the Company's non-employee directors also received a one-time grant of restricted stock units (a “Director Staking Grant”) valued at $110,000. The Director Staking Grants were awarded as a means of ensuring robust initial equity ownership among the Company's non-employee directors following the Spin-Off. The number of restricted stock units granted to each non-employee director as a Director Staking Grant was determined by dividing the approved award value ($110,000) by the average fair market value of a share of the Company’s common stock over the 30-calendar day period immediately following the Spin-Off, rounded down to the nearest whole share. The Director Staking Grants vest in three equal installments on the first, second and third anniversaries of the grant date.

Non-Employee Director Restricted Stock Awards

As described above, each non-employee director receives an award of restricted common stock under the Company's 2014 Stock Incentive Plan following each annual meeting of stockholders. The stock awards have a market value of $110,000, as determined by the closing market price of Vista Outdoor common stock on the date of grant.

Common stock issued under this program entitles participating directors to all of the rights of a stockholder, including the right to vote the shares and receive any cash dividends. All shares are, however, subject to certain restrictions against sale or transfer for a period, which we refer to as the restricted period, starting on the award date and ending on the earliest to occur of the following:

| |

| • | the first anniversary of the award date; |

| |

| • | the retirement of the director from the Board; |

| |

| • | the termination of the director's service on the Board because of disability or death; or |

| |

| • | the termination of the director's service on the Board following a change in control of Vista Outdoor. |

Restricted stock is released to the director, free and clear of all restrictions, following the expiration of the restricted period. If a director ceases to be a member of the Board for any reason prior to the expiration of the restricted period, the director forfeits all rights in shares or deferred stock units, as applicable, for which the restricted period has not expired.

Non-employee directors may elect to defer receipt of the restricted stock and receive deferred stock units. In general, directors must make these deferral elections by the end of the calendar year preceding the date of the grant of restricted stock. Directors who make a deferral election will have no rights as stockholders of Vista Outdoor with respect to deferred stock units. Payment of deferred stock units will be made in a lump sum in an equal number of shares of unrestricted common stock upon the time specified in the director's deferral election or, if earlier, the director's termination of service on the Board of Directors.

Expense Reimbursement

Non-employee directors are reimbursed for travel and other expenses incurred in the performance of their duties.

Director Compensation

The following table shows the annual retainer and fees earned by the Company's non-employee directors in fiscal year 2015 and either paid in cash or deferred at the election of the director. The table also shows the aggregate grant date fair value of stock awards computed in accordance with generally accepted accounting principles in the United States. Additional information regarding the restricted stock awards and deferred stock units is described in footnote 2 below.

|

| | | | | | | | | | | | | | | | | | | | | |

| Name | | Fees Earned or Paid in Cash ($)(1) | | | Stock Awards ($)(2)(3) | | All Other Compensation ($)(4) | | Total ($) |

| Michael Callahan |

| $ | 15,123 |

|

|

|

| $ | 110,124 |

| |

| $ | — |

| |

| $ | 125,247 |

| |

| April H. Foley |

| $ | 1,260 |

|

|

|

| $ | 110,124 |

| |

| $ | — |

| |

| $ | 111,384 |

| |

| Mark A. Gottfredson |

| $ | 44,109 |

|

| |

| $ | 165,614 |

| |

| $ | — |

| |

| $ | 209,723 |

| |

| Tig H. Krekel |

| $ | 51,013 |

|

| |

| $ | 169,247 |

| |

| $ | — |

| |

| $ | 220,260 |

| |

| Gary L. McArthur |

| $ | 50,410 |

|

|

|

| $ | 165,614 |

| |

| $ | — |

| |

| $ | 216,024 |

| |

| Robert M. Tarola |

| $ | 50,410 |

|

|

|

| $ | 165,614 |

| |

| $ | — |

| |

| $ | 216,024 |

| |

| |

| (1) | The Company's non-employee directors received prorated annual cash retainers for 2015, calculated as follows: (1) directors who did not receive a cash retainer prior to the Spin-Off for service on the Board of Directors of ATK (Mr. Gottfredson, Mr. MacArthur and Mr. Tarola) and directors who serve on both the Board of Directors of ATK and the Board of Directors of Vista Outdoor (Mr. Krekel) received a prorated portion of their full annual cash retainer for service on the Board of Directors and any relevant committees from their date of appointment to the date of the Company's 2015 annual stockholders meeting (Aug. 11, 2015); (2) directors who previously received a cash retainer for service on the Board of Directors of ATK but no longer serve on that board (Ambassador Foley and Mr. Callahan) received a prorated portion of the difference between the annual cash retainer they received from ATK and the annual cash retainer they are entitled to for service on the Board of Directors of Vista Outdoor (including committee and lead independent director retainers) from their date of appointment to the date of the Company's 2015 annual stockholders meeting (Aug. 11, 2015). |

| |

| (2) | This column shows the grant date fair value computed in accordance with generally accepted accounting principles in the United States. The amounts represent restricted stock awards and grants of restricted stock units and deferred stock units that are paid in shares of Vista Outdoor common stock and calculated based on the number of shares granted multiplied by the closing price per share of Vista Outdoor common stock on the date of grant. (The amounts do not reflect the actual amounts that may be realized by the directors.) |

This column includes the grant date value of the Director Staking Grant and any prorated annual grant of restricted stock received by each non-employee director in fiscal year 2015. The number of restricted stock units granted to each non-employee director as a Director Staking Grant was determined by dividing the approved award value ($110,000) by the average fair market value of a share of the Company’s common stock over the 30-calendar day period immediately following the Spin-Off, rounded down to the nearest whole share, which resulted in a grant of 2,576 restricted stock units for each non-employee director.

Certain of the Company's non-employee directors also received prorated annual restricted stock awards for 2015, calculated as follows: (1) directors who did not receive an annual award of ATK restricted stock prior to the Spin-Off for service on the Board of Directors of ATK (Mr. Gottfredson, Mr. MacArthur and Mr. Tarola) and directors who serve on both the Board of Directors of ATK and the Board of Directors of Vista Outdoor (Mr. Krekel) received a prorated portion of their full annual Vista Outdoor restricted stock award for service on the Board of Directors from their date of appointment to the date of the Company's 2015 annual stockholders meeting (Aug. 11, 2015); and (2) directors who previously received an award of ATK restricted stock for service on the Board of Directors of ATK but no longer serve on that board (Ambassador Foley and Mr. Callahan) did not receive a prorated annual award of Vista Outdoor common stock. The prorated annual equity award made to Mr. Krekel was made in the form of deferred stock units pursuant to an existing deferral election made by Mr. Krekel.

The following table shows the total number of shares of restricted stock, restricted stock units and deferred stock units granted to each non-employee director during the fiscal year ended March 31, 2015 and the closing price per share of Vista Outdoor common stock on the date of grant.

|

| | | | | | | | | | |

| Name |

| Grant Date |

| Number of

Shares of

Stock or Units | |

| Closing Price on

Grant Date |

| Michael Callahan |

| 3/23/2015 |

| 2,576 |

| |

| $ | 42.75 |

|

| April H. Foley |

| 3/23/2015 |

| 2,576 |

| |

| $ | 42.75 |

|

| Mark A. Gottfredson |

| 3/23/2015 |

| 3,874 |

| |

| $ | 42.75 |

|

| Tig H. Krekel |

| 3/23/2015 |

| 3,959 |

| |

| $ | 42.75 |

|

| Gary L. McArthur |

| 3/23/2015 |

| 3,874 |

| |

| $ | 42.75 |

|

| Robert M. Tarola |

| 3/23/2015 |

| 3,874 |

| |

| $ | 42.75 |

|

| |

| (3) | The aggregate number of shares of restricted Vista Outdoor common stock, restricted stock units and deferred stock units held by each non-employee director as of March 31, 2015 were as follows: |

|

| | | | |

| Name | | Shares of Restricted Stock and Restricted Stock Units | | Deferred Stock Units |

| Michael Callahan | | 4,060 | | — |

| April H. Foley | | 2,576 | | 3,524 |

| Mark A. Gottfredson | | 3,874 | | — |

| Tig H. Krekel | | 2,576 | | 13,613 |

| Gary L. McArthur | | 3,874 | | — |

| Robert M. Tarola | | 3,874 | | — |

| |

| (4) | None of the non-employee directors received an aggregate of $10,000 or more of perquisites or other personal benefits from the Company in fiscal year 2015. |

COMPENSATION DISCUSSION AND ANALYSIS

Executive Summary

Introduction

This Compensation Discussion and Analysis explains how our Compensation Committee (the “Committee”) made decisions related to the compensation for our executive officers, including the executive officers named in this proxy statement. In addition, this section discusses certain compensation decisions initially made by the Personnel and Compensation Committee (the “ATK Committee”) of the Board of Directors of ATK prior to the Spin-Off of the Company from ATK on February 9, 2015, as well as certain provisions of the Transaction Agreement, dated as of April 28, 2014 (the “Transaction Agreement”), by and among the Company, Vista Merger Sub Inc. (a subsidiary of ATK), and Orbital Sciences Corporation, which provided for the Spin-Off and related transactions. The decisions by the ATK Committee and provisions of the Transactions Agreement discussed herein affected compensation paid to our named executive officers for the fiscal year ended March 31, 2015 (referred to as fiscal year 2015).

Our "named executive officers" for fiscal year 2015 are:

| |

| • | Mark W. DeYoung, Chairman and Chief Executive Officer |

| |

| • | Stephen M. Nolan, Senior Vice President and Chief Financial Officer |

| |

| • | Scott D. Chaplin, Senior Vice President, General Counsel and Secretary |

| |

| • | Stephen S. Clark, Senior Vice President, Human Resources and Corporate Services |

Company Performance in Fiscal 2015

In fiscal 2015, the Company successfully completed its Spin-Off from ATK, resulting in a new publicly traded company with a strong balance sheet, seasoned leadership team, and a powerful and unique portfolio of more than 30 widely recognized brands. The Company's results for fiscal year 2015 were in line with management's expectations, and reflect incremental standalone company costs, stock-based compensation charges and Spin-Off transaction-related expenses. The Company's fiscal year 2015 results also reflected an ongoing correction in the shooting sports market. Key financial results in fiscal year 2015 included:

| |

| • | Sales of $2.08 billion, up 11 percent from the prior year. |

| |

| • | Gross profit of $529 million, up 13 percent from the prior year. |

| |

| • | Operating profit of $184 million, compared to $234 million in the prior year. |

| |

| • | Fully diluted earnings per share of $1.25, compared to $2.09 in the prior year. |

In addition, following the Spin-Off the Company's Board of Directors authorized a repurchase program for up to $200 million of the Company’s common stock. Pursuant to this program the Company repurchased 162,000 shares of common stock for $6.9 million in the fourth quarter of fiscal year 2015.

The Committee believes that the actions taken by the named executive officers in connection with the Spin-Off and throughout fiscal year 2015 have positioned the Company to deliver strong, sustainable financial and operating performance over the long-term.

Key Compensation Decisions for Fiscal Year 2016 and Beyond

In fiscal year 2016, the Company’s management will devote their time and attention and the Company’s financial resources to the development and implementation of corporate strategies and policies that are based on the specific business characteristics of Vista Outdoor. As a result, the Committee has established a compensation strategy for the Company that reflects the size, market segment, growth opportunity and operational strategy, among other factors, applicable to Vista Outdoor as a stand-alone company, each of which is different from that of ATK. As discussed in more detail below, this compensation strategy is designed to enable the Company to attract, motivate and retain a talented executive leadership group that is dedicated to the long-term interests of our shareholders. In furtherance of this compensation strategy, the Committee took the following actions after the Spin-Off, each of which is described in more detail below:

| |

| • | The Committee approved one-time initial equity grants to the Company's named executive officers and certain other key Company employees to create immediate alignment between the long-term interests of management and the Company’s shareholders following the Spin-Off. |

| |

| • | With assistance from Semler Brossy Consulting Group, LLC ("Semler Brossy"), the Committee reviewed the Company's initial compensation program, which was previously approved by the ATK Committee, against the |

compensation programs offered by a peer group made up of 14 consumer products companies of comparable size and business focus. Following this review, the Committee approved certain changes to the base salaries and perquisite packages offered to the Company's named executive officers, but determined that no other significant changes were necessary to the initial compensation packages approved by the ATK Committee.

| |

| • | The Committee approved a diversified mix of types of long-term incentive awards for fiscal year 2016, comprised of performance shares, restricted stock and stock options, in order to achieve the objective of rewarding performance while motivating the Company's leadership team to create long-term shareholder value. |

| |

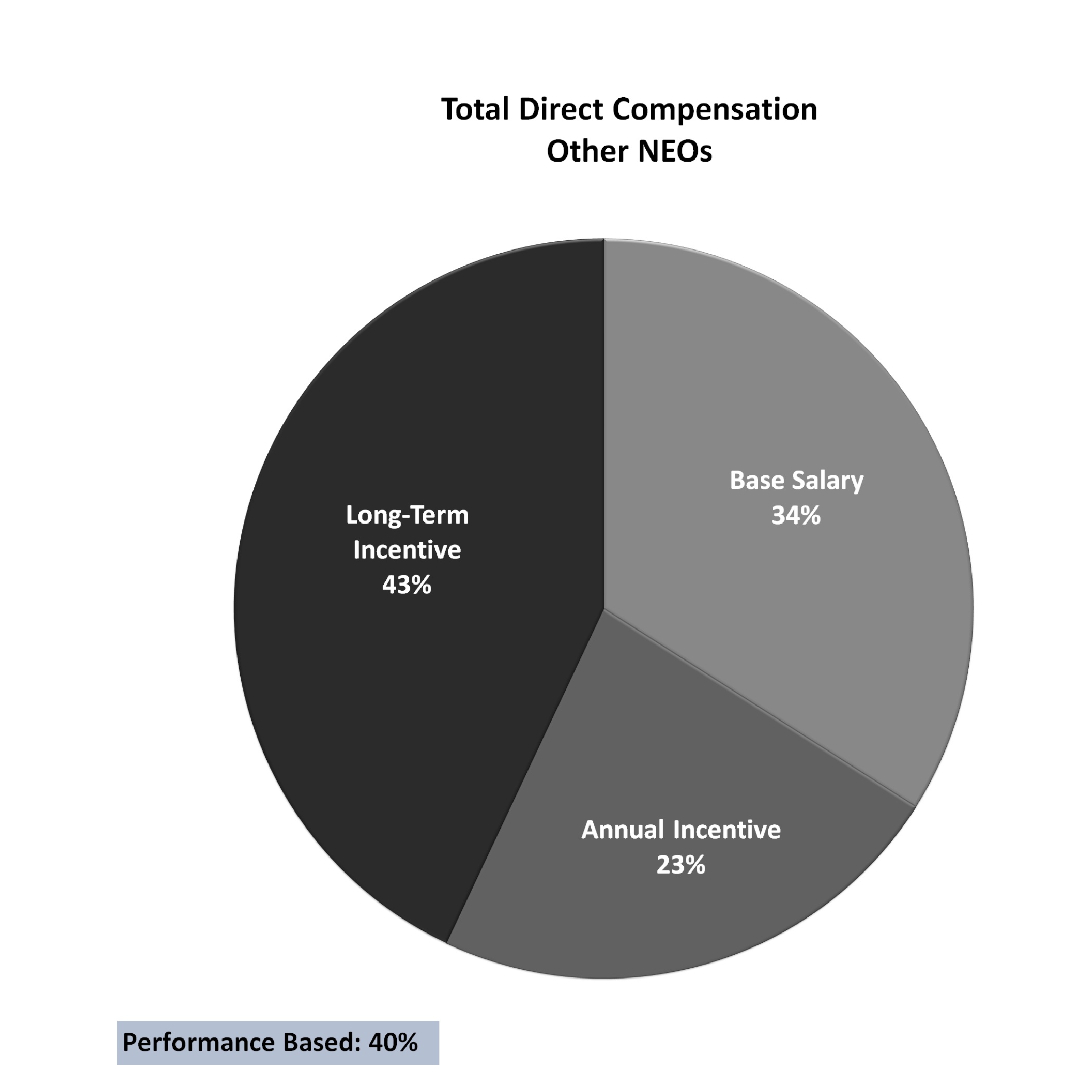

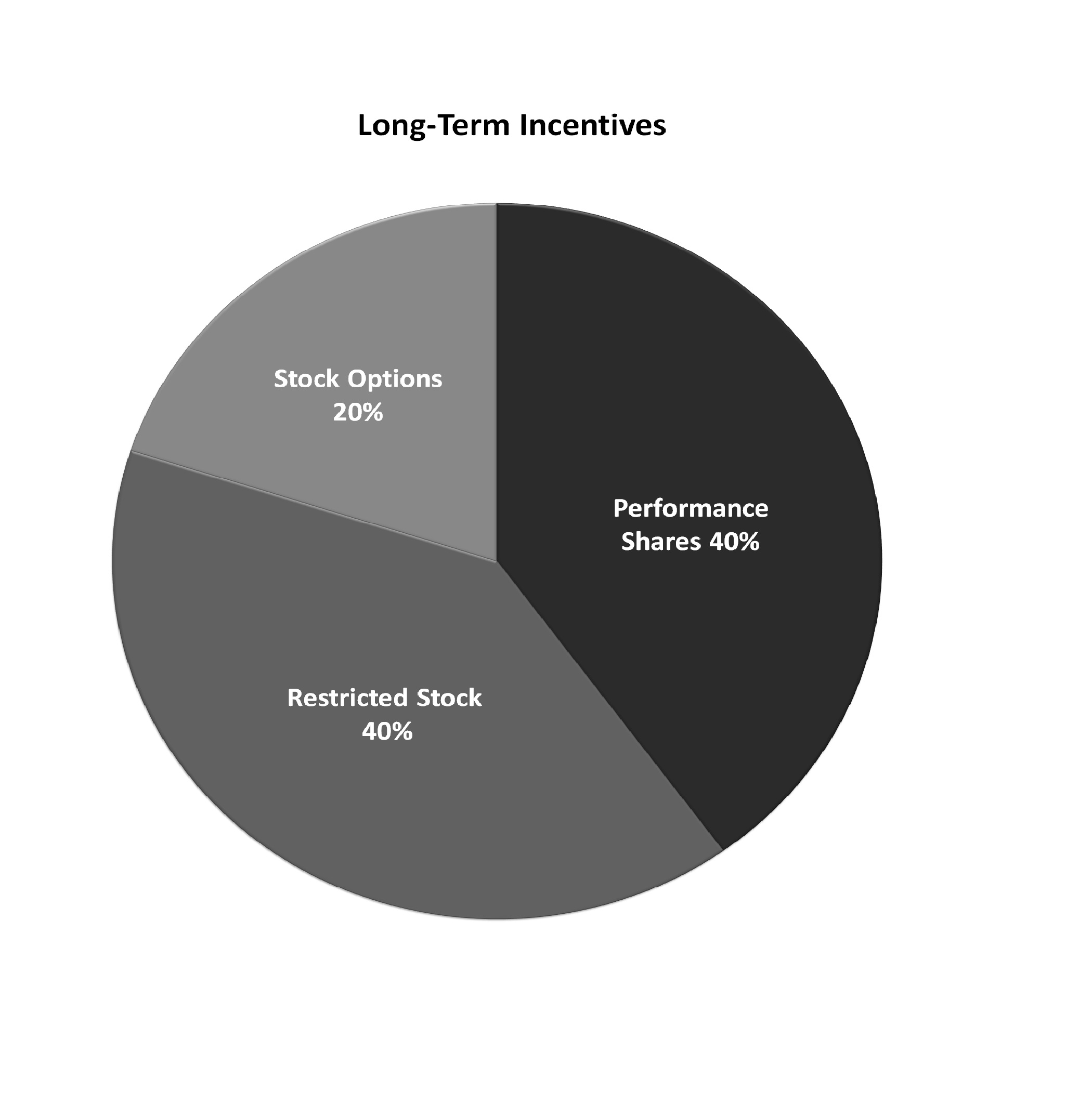

| • | The Committee approved certain modifications to the calculation of Return on Invested Capital (from the calculation previously used by ATK for performance awards) for purposes of determining payouts under the Company's fiscal year 2016-2018 long-term incentive performance share awards. The changes were designed to better align the Company's long-term incentive program with the Company's growth strategy. |