Investor Overview MAY 2017

© 2017 | Vista Outdoor Presentation Certain statements in this presentation and other oral and written statements made by Vista Outdoor from time to time are forward-looking statements, including those that discuss, among other things: Vista Outdoor’s plans, objectives, expectations, intentions, strategies, goals, outlook or other non-historical matters; projections with respect to future revenues, income, earnings per share or other financial measures for Vista Outdoor; and the assumptions that underlie these matters. The words ‘believe’, ‘expect’, ‘anticipate’, ‘intend’, ‘aim’, ‘should’ and similar expressions are intended to identify such forward-looking statements. To the extent that any such information is forward-looking, it is intended to fit within the safe harbor for forward-looking information provided by the Private Securities Litigation Reform Act of 1995. Numerous risks, uncertainties and other factors could cause Vista Outdoor’s actual results to differ materially from expectations described in such forward-looking statements, including the following: general economic and business conditions in the U.S. and Vista Outdoor’s other markets, including conditions affecting employment levels, consumer confidence and spending, and other economic conditions affecting demand for our products and the financial health of our customers; Vista Outdoor’s ability to attract and retain key personnel and maintain and grow its relationships with customers, suppliers and other business partners, including Vista Outdoor’s ability to obtain acceptable third party licenses; Vista Outdoor’s ability to adapt its products to changes in technology, the marketplace and customer preferences; Vista Outdoor’s ability to maintain and enhance brand recognition and reputation; reductions, unexpected changes in or our inability to accurately forecast demand for ammunition, firearms or accessories or other outdoor sports and recreation products; risks associated with Vista Outdoor’s sales to significant customers, including unexpected cancellations, delays and other changes to purchase orders; supplier capacity constraints, production disruptions or quality or price issues affecting Vista Outdoor’s operating costs; Vista Outdoor’s competitive environment; risks associated with compliance and diversification into international and commercial markets; the supply, availability and costs of raw materials and components; increases in commodity, energy and production costs; changes in laws, rules and regulations relating to Vista Outdoor’s business, such as federal and state firearms and ammunition regulations; Vista Outdoor’s ability to execute its long-term growth strategy, including our ability to complete and realize expected benefits from acquisitions and integrate acquired businesses; Vista Outdoor’s ability to take advantage of growth opportunities in international and commercial markets; foreign currency exchange rates and fluctuations in those rates; the outcome of contingencies, including with respect to litigation and other proceedings relating to intellectual property, product liability, warranty liability, personal injury and environmental remediation; risks associated with cybersecurity and other industrial and physical security threats; capital market volatility and the availability of financing; changes to accounting standards or policies; and changes in tax rules or pronouncements. Vista Outdoor undertakes no obligation to update any forward-looking statements. For further information on factors that could impact Vista Outdoor, and statements contained herein, please refer to Vista Outdoor’s filings with the Securities and Exchange Commission, including the company’s annual report on Form 10-K and any subsequent quarterly reports on Form 10-Q and current reports on Form 8-K filed with the U.S. Securities and Exchange Commission. 2 Forward Looking Statements

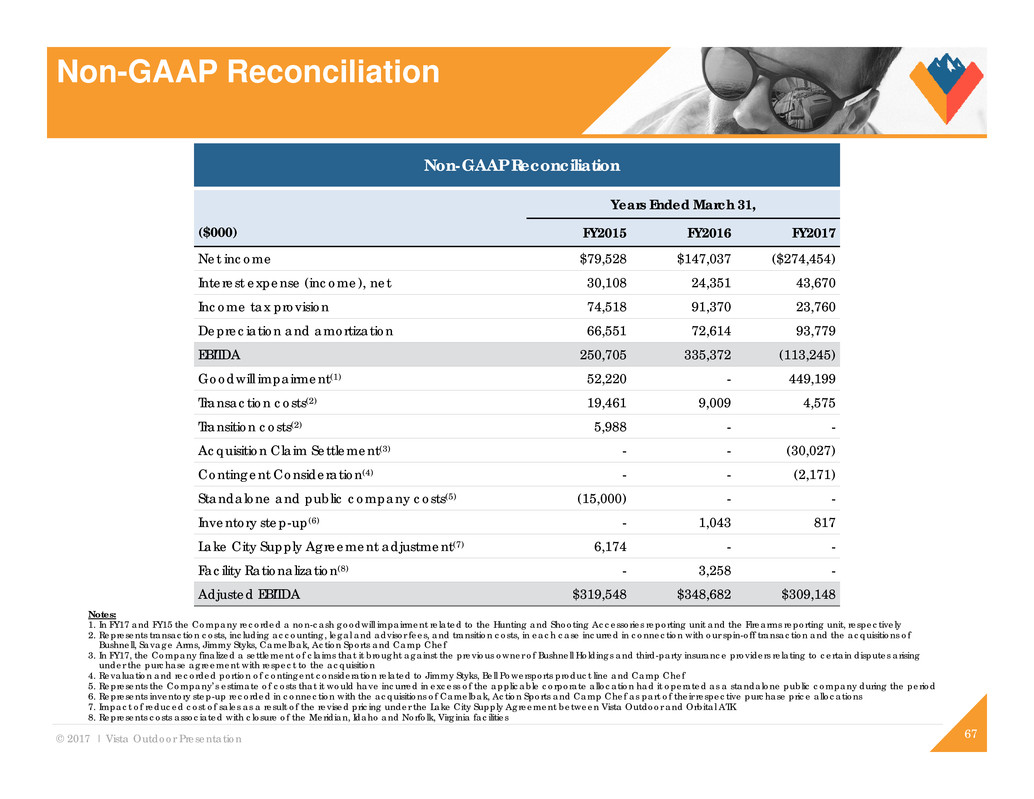

© 2017 | Vista Outdoor Presentation Non-GAAP financial measures such as earnings before interest, tax, depreciation and amortization (“EBITDA”), Adjusted EBITDA, EBITDA Margin and Free Cash Flow as included in this Presentation are supplemental measures that are not calculated in accordance with Generally Accepted Accounting Principles (“GAAP”). Please see the Appendix to this presentation for reconciliations of these Non-GAAP financial measures to their comparable GAAP financial measures. We define Adjusted EBITDA as EBITDA adjusted for the impact of asset impairments and for the impact of transaction costs, transition costs and certain other items related to our spin-off from Alliant Techsystems Inc. and acquisition transactions. We believe that the presentation of EBITDA and Adjusted EBITDA helps investors analyze underlying trends in our business, evaluate the performance of our business both on an absolute basis and relative to our peers and the broader market, provides useful information to both management and investors by excluding certain items that may not be indicative of the core operating results and operational strength of our business and helps investors evaluate our ability to service our debt. We define EBITDA margin as EBITDA divided by net sales. We believe EBITDA margin provides investors with an important perspective on the company's core profitability and helps investors analyze underlying trends in the company's business and evaluate its performance on an absolute basis and relative to its peers. EBITDA margin should be considered in addition to, and not as a substitute for, GAAP net profit margin. Our definition may differ from that used by other companies. Vista Outdoor has not reconciled EBITDA margin guidance to GAAP net profit margin guidance because Vista Outdoor does not provide guidance for net income, which is a reconciling item between GAAP net profit margin and non-GAAP EBITDA margin. Accordingly, a reconciliation to net profit margin is not available without unreasonable effort. We define Free Cash Flow as cash provided by operating activities less capital expenditures, allocated interest expense, and excluding transaction costs incurred to date. Vista Outdoor management uses Free Cash Flow internally to assess both business performance and overall liquidity and we believe that Free Cash Flow provides investors with an important perspective on the cash available for debt repayment, share repurchases and acquisitions after making the capital investments required to support ongoing business operations. These non-GAAP financial measures have limitations as analytical and comparative tools and you should consider EBITDA, Adjusted EBITDA, EBITDA Margin and Free Cash Flow in addition to, and not as a substitute for, operating income, cash from operating activities or any other measure of financial performance or liquidity reported in accordance with GAAP. Throughout the presentation, certain numbers will not sum to the total due to rounding. 3 Non-GAAP Financial Measures

© 2017 | Vista Outdoor Presentation Overview and Investment Highlights 4

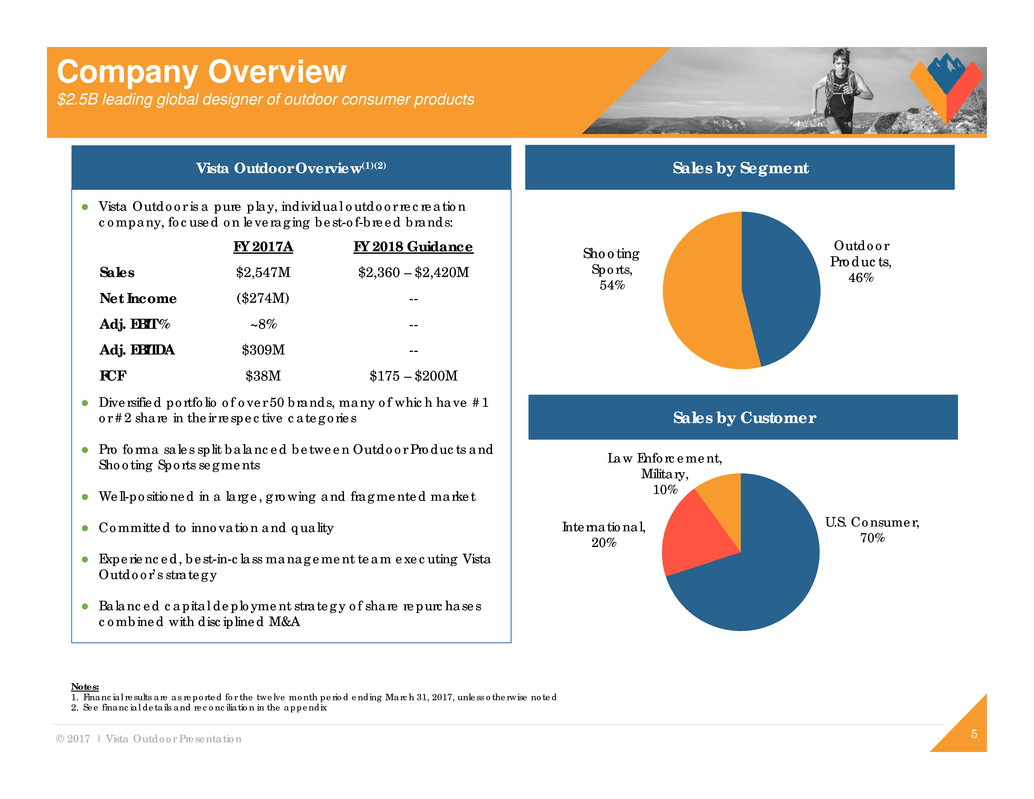

© 2017 | Vista Outdoor Presentation 5 Vista Outdoor is a pure play, individual outdoor recreation company, focused on leveraging best-of-breed brands: Diversified portfolio of over 50 brands, many of which have #1 or #2 share in their respective categories Pro forma sales split balanced between Outdoor Products and Shooting Sports segments Well-positioned in a large, growing and fragmented market Committed to innovation and quality Experienced, best-in-class management team executing Vista Outdoor’s strategy Balanced capital deployment strategy of share repurchases combined with disciplined M&A Vista Outdoor Overview(1)(2) Company Overview $2.5B leading global designer of outdoor consumer products Sales by Customer U.S. Consumer, 70% Law Enforcement, Military, 10% International, 20% Sales by Segment Shooting Sports, 54% Outdoor Products, 46% Notes: 1. Financial results are as reported for the twelve month period ending March 31, 2017, unless otherwise noted 2. See financial details and reconciliation in the appendix FY 2017A FY 2018 Guidance Sales $2,547M $2,360 – $2,420M Net Income ($274M) -- Adj. EBIT % ~8% -- Adj. EBITDA $309M -- FCF $38M $175 – $200M

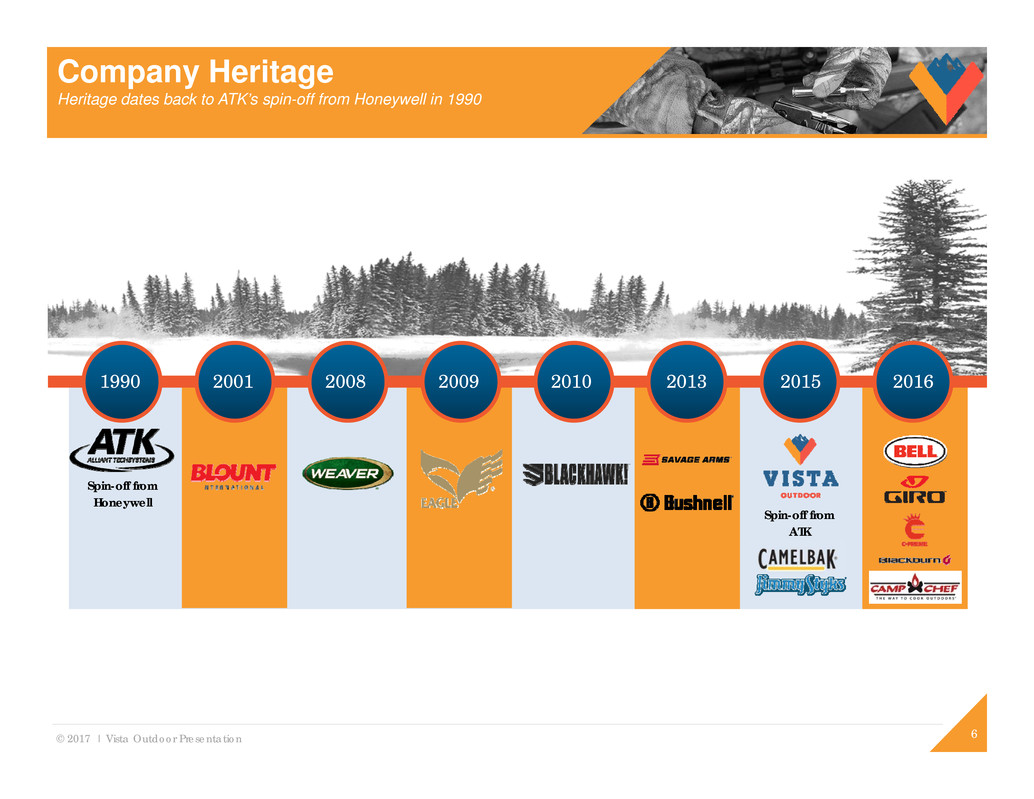

© 2017 | Vista Outdoor Presentation 6 2001 20102008 2013 20151990 2009 Spin-off from ATK Spin-off from Honeywell 2016 Company Heritage Heritage dates back to ATK’s spin-off from Honeywell in 1990

© 2017 | Vista Outdoor Presentation 7 Bringing the World Outside At Vista Outdoor, we are passionate about the outdoors Our Vision Be a leading provider of quality products for the outdoor enthusiast, while delivering superior long-term returns to our shareholders, value for our customers, and rewarding careers for our employees Our Mission To bring the world outside, leverage our capabilities and experience and instill passion into products that help outdoor enthusiasts achieve independence and success in the activity of their choice

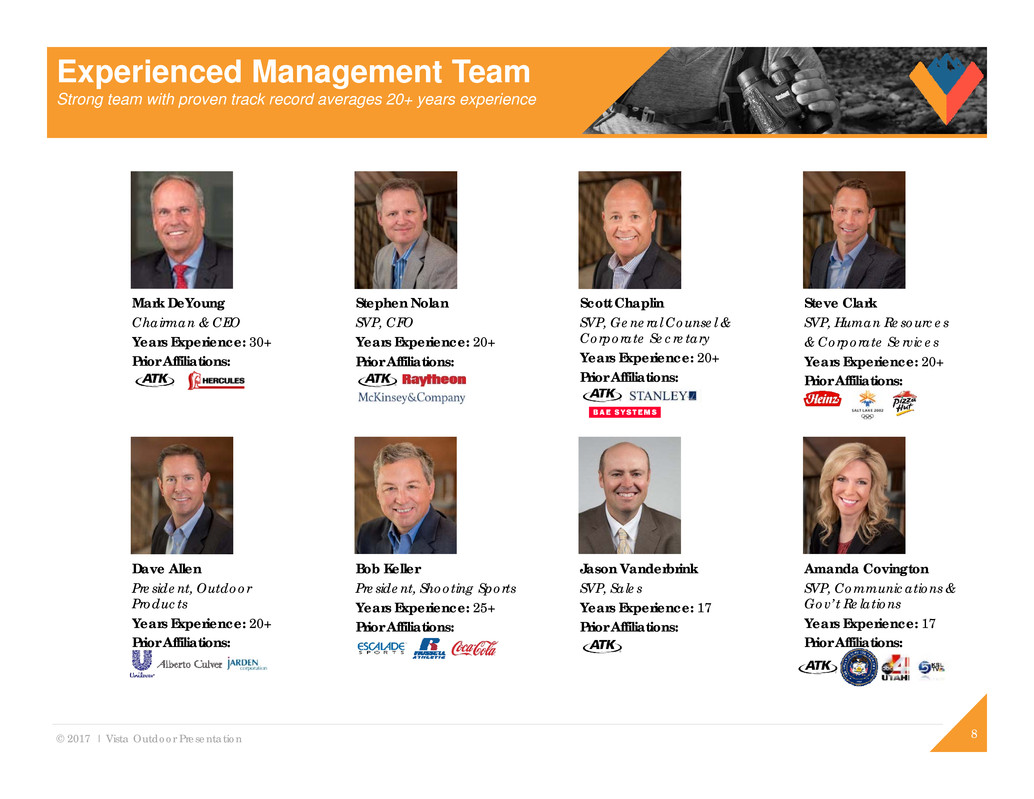

© 2017 | Vista Outdoor Presentation 8 Steve Clark SVP, Human Resources & Corporate Services Years Experience: 20+ Prior Affiliations: Scott Chaplin SVP, General Counsel & Corporate Secretary Years Experience: 20+ Prior Affiliations: Stephen Nolan SVP, CFO Years Experience: 20+ Prior Affiliations: Amanda Covington SVP, Communications & Gov’t Relations Years Experience: 17 Prior Affiliations: Mark DeYoung Chairman & CEO Years Experience: 30+ Prior Affiliations: Jason Vanderbrink SVP, Sales Years Experience: 17 Prior Affiliations: Bob Keller President, Shooting Sports Years Experience: 25+ Prior Affiliations: Experienced Management Team Strong team with proven track record averages 20+ years experience Dave Allen President, Outdoor Products Years Experience: 20+ Prior Affiliations:

© 2017 | Vista Outdoor Presentation 9 Key Investment Highlights Vista Outdoor is positioned as outdoor rec’s premier investment opportunity Multiple Growth Avenues to Deploy Capital 7 Strong Customer Relationships 5 Portfolio of Authentic Brands Focused on Outdoor Sports and Recreation 1 Large, Addressable and Growing Outdoor Recreation and Shooting Sports Market 2 Commitment to Leading Innovation and Product Development Capabilities 3 Proven M&A Capabilities 6 Established Manufacturing, Global Sourcing and Distribution Platform 4

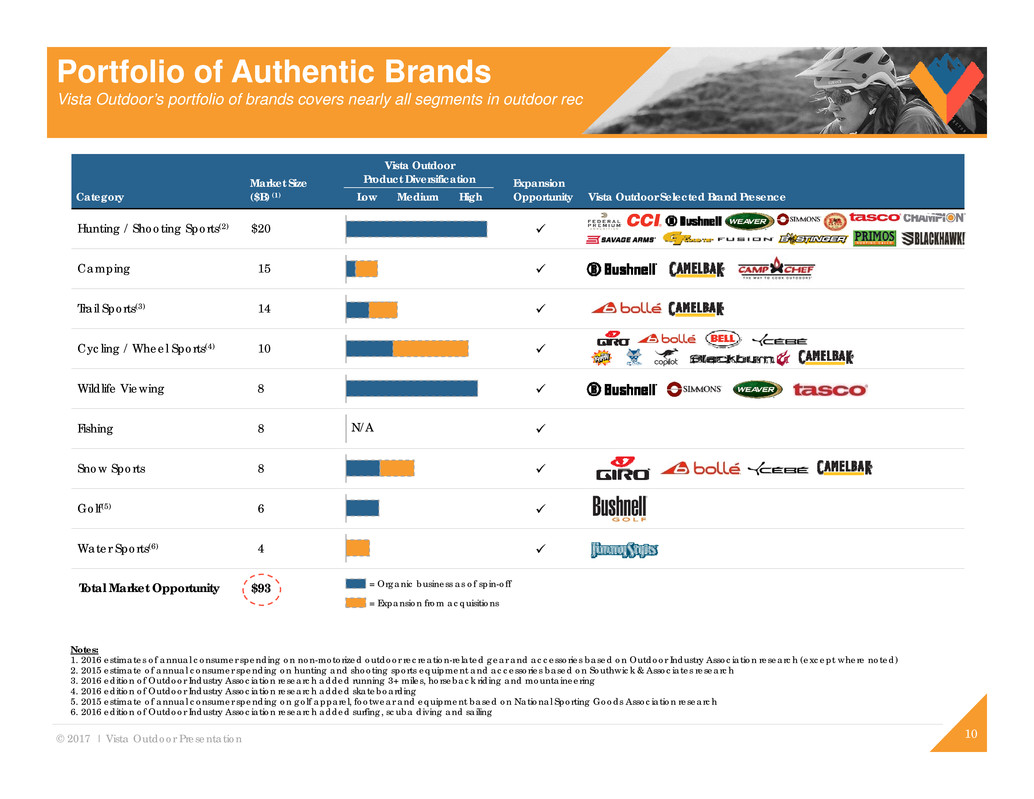

© 2017 | Vista Outdoor Presentation Category Market Size ($B) (1) Vista Outdoor Product Diversification Low Medium High Expansion Opportunity Vista Outdoor Selected Brand Presence Hunting / Shooting Sports(2) $20 Camping 15 Trail Sports(3) 14 Cycling / Wheel Sports(4) 10 Wildlife Viewing 8 Fishing 8 Snow Sports 8 Golf(5) 6 Water Sports(6) 4 $93 Notes: 1. 2016 estimates of annual consumer spending on non-motorized outdoor recreation-related gear and accessories based on Outdoor Industry Association research (except where noted) 2. 2015 estimate of annual consumer spending on hunting and shooting sports equipment and accessories based on Southwick & Associates research 3. 2016 edition of Outdoor Industry Association research added running 3+ miles, horseback riding and mountaineering 4. 2016 edition of Outdoor Industry Association research added skateboarding 5. 2015 estimate of annual consumer spending on golf apparel, footwear and equipment based on National Sporting Goods Association research 6. 2016 edition of Outdoor Industry Association research added surfing, scuba diving and sailing = Expansion from acquisitions Portfolio of Authentic Brands Vista Outdoor’s portfolio of brands covers nearly all segments in outdoor rec Total Market Opportunity 10 N/A = Organic business as of spin-off

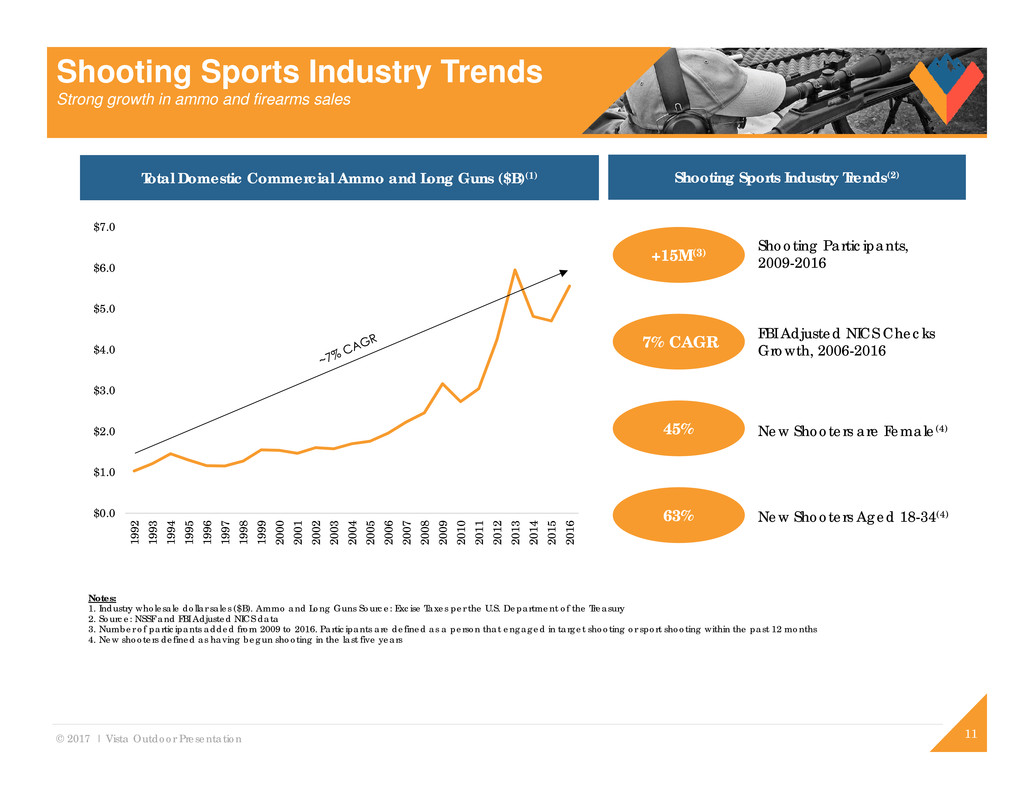

© 2017 | Vista Outdoor Presentation $0.0 $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 1 9 9 2 1 9 9 3 1 9 9 4 1 9 9 5 1 9 9 6 1 9 9 7 1 9 9 8 1 9 9 9 2 0 0 0 2 0 0 1 2 0 0 2 2 0 0 3 2 0 0 4 2 0 0 5 2 0 0 6 2 0 0 7 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5 2 0 1 6 11 Shooting Sports Industry Trends Strong growth in ammo and firearms sales Total Domestic Commercial Ammo and Long Guns ($B)(1) Shooting Sports Industry Trends(2) +15M(3) 45% 7% CAGR 63% Shooting Participants, 2009-2016 FBI Adjusted NICS Checks Growth, 2006-2016 New Shooters are Female(4) New Shooters Aged 18-34(4) Notes: 1. Industry wholesale dollar sales ($B). Ammo and Long Guns Source: Excise Taxes per the U.S. Department of the Treasury 2. Source: NSSF and FBI Adjusted NICS data 3. Number of participants added from 2009 to 2016. Participants are defined as a person that engaged in target shooting or sport shooting within the past 12 months 4. New shooters defined as having begun shooting in the last five years

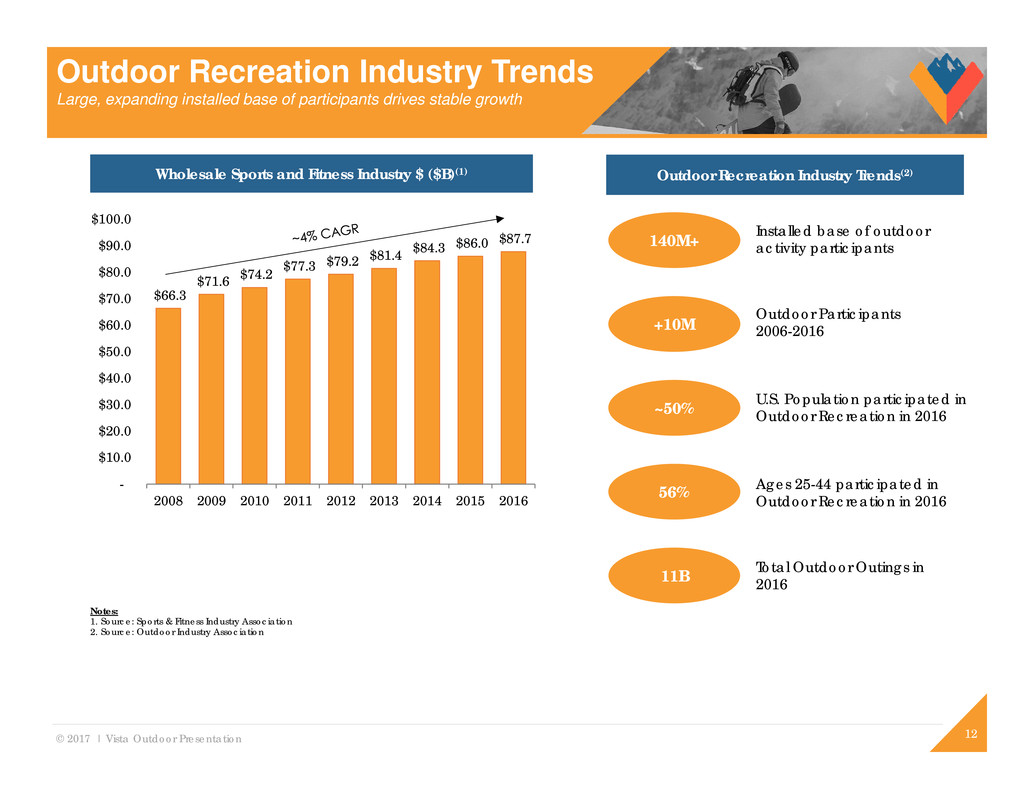

© 2017 | Vista Outdoor Presentation $66.3 $71.6 $74.2 $77.3 $79.2 $81.4 $84.3 $86.0 $87.7 - $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 $70.0 $80.0 $90.0 $100.0 2008 2009 2010 2011 2012 2013 2014 2015 2016 12 Outdoor Recreation Industry Trends Large, expanding installed base of participants drives stable growth Outdoor Recreation Industry Trends(2) +10M Outdoor Participants 2006-2016 11B Total Outdoor Outings in 2016 ~50% U.S. Population participated in Outdoor Recreation in 2016 56% Ages 25-44 participated in Outdoor Recreation in 2016 140M+ Installed base of outdoor activity participants Notes: 1. Source: Sports & Fitness Industry Association 2. Source: Outdoor Industry Association Wholesale Sports and Fitness Industry $ ($B)(1)

© 2017 | Vista Outdoor Presentation Bushnell Trophy Cam HD 13 Commitment to Innovation Vista Outdoor’s culture of innovation drives organic growth CamelBak’s hydration pack testing device and 3D printer in Petaluma, CA …results in superior, innovative products… …that receive award recognition and create consumer pull Commitment to investing in R&D capabilities… - Best-in-class in-house R&D teams - Rapid prototyping and 3D printing capabilities - State-of-the-art computer-aided design - World-class design facilities such as Action Sports’ “The Dome” - Acquisitions bring new expertise into the Company and provide environment for cross-pollination of ideas across brands Bell’s and Giro’s product innovations come to fruition at “The Dome”, Action Sports’ state-of-the-art design and testing facility in Scotts Valley, CA CamelBak Quick Stow CamelBak Skyline 10 LR American Eagle Syntech Bushnell Elite 1-Mile Rangefinder Giro Factor Techlace Bell Super 2R CamelBak Quick Stow CamelBak Skyline 10 LR American Eagle Syntech Bushnell Elite 1-Mile Rangefinder Giro Factor Techlace Bushnell Trophy Cam HD People’s Upgrade Choice #1 Open Face Helmet to Buy Best Enduro Helmet Best Softwear Bell Super 2R Best of the Test Editor’s Choice Editor’s Choice

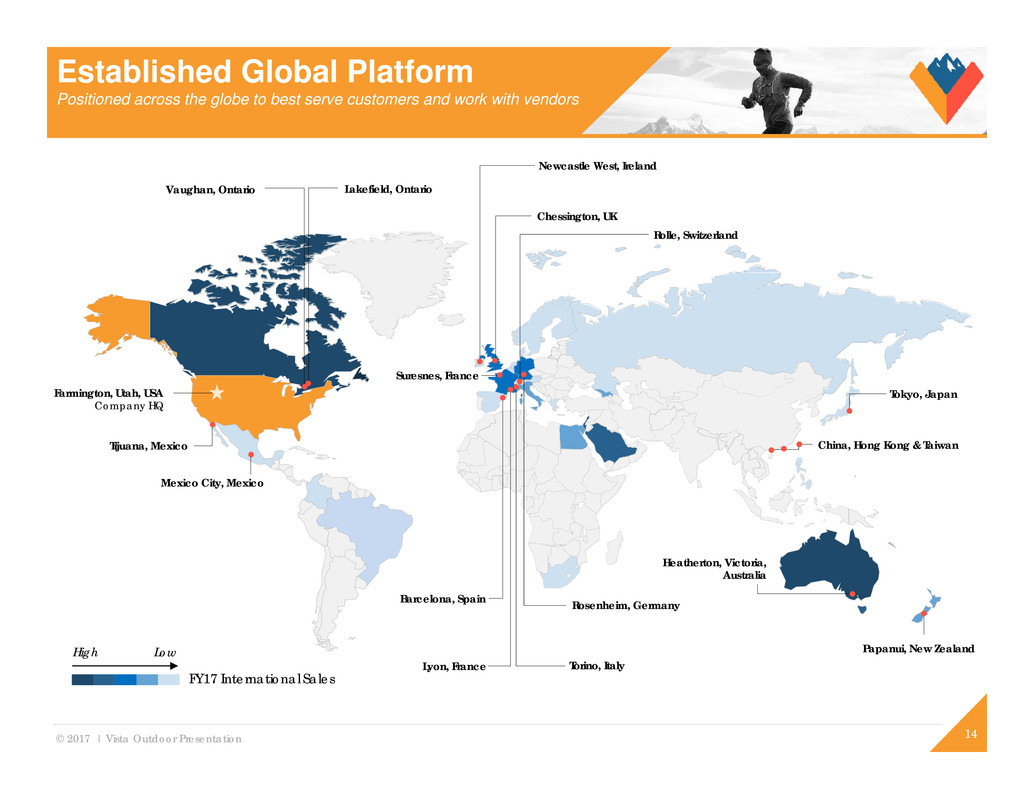

© 2017 | Vista Outdoor Presentation Lyon, France 14 Established Global Platform Positioned across the globe to best serve customers and work with vendors Farmington, Utah, USA Company HQ Vaughan, Ontario Lakefield, Ontario Chessington, UK Mexico City, Mexico Suresnes, France Barcelona, Spain Torino, Italy Rosenheim, Germany Tokyo, Japan China, Hong Kong & Taiwan Heatherton, Victoria, Australia Papanui, New Zealand FY17 International Sales Tijuana, Mexico Newcastle West, Ireland Rolle, Switzerland High Low

© 2017 | Vista Outdoor Presentation 15 Broad Presence Across the United States World class supply chain and distribution = Expansion from acquisitions State-of-the-Art Manufacturing and Distribution Facilities Across the United States(1) Notes: 1. Map includes facilities with significant operations

© 2017 | Vista Outdoor Presentation 16 Strong Customer Relationships Highly valued partner for diverse set of retailers across multiple channels Highly Diversified Customer Base… Customer-Centric Approach to Retailers Long-Tenured Retail and Distribution Relationships Award-Winning Portfolio of Products Dedicated Teams for Top Accounts Industry-Leading Customer Service Support … Supported by Customer-Focused, Dedicated Sales Teams

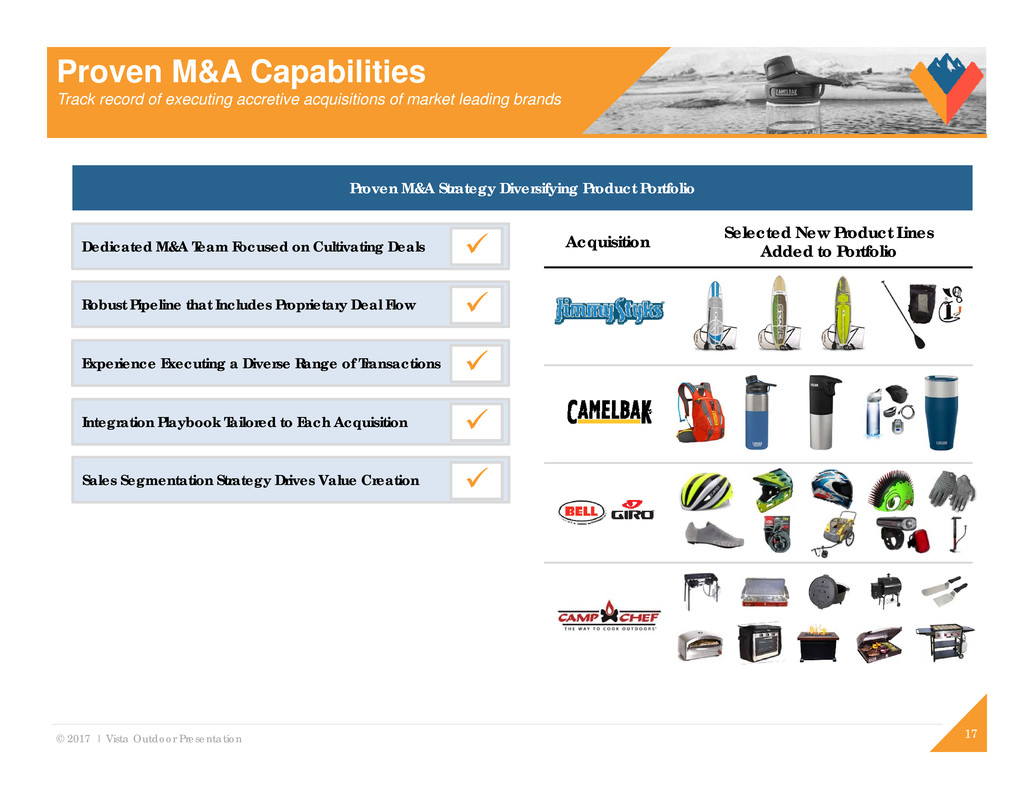

© 2017 | Vista Outdoor Presentation 17 Proven M&A Capabilities Track record of executing accretive acquisitions of market leading brands Dedicated M&A Team Focused on Cultivating Deals Robust Pipeline that Includes Proprietary Deal Flow Experience Executing a Diverse Range of Transactions Integration Playbook Tailored to Each Acquisition Sales Segmentation Strategy Drives Value Creation Proven M&A Strategy Diversifying Product Portfolio Acquisition Selected New Product LinesAdded to Portfolio

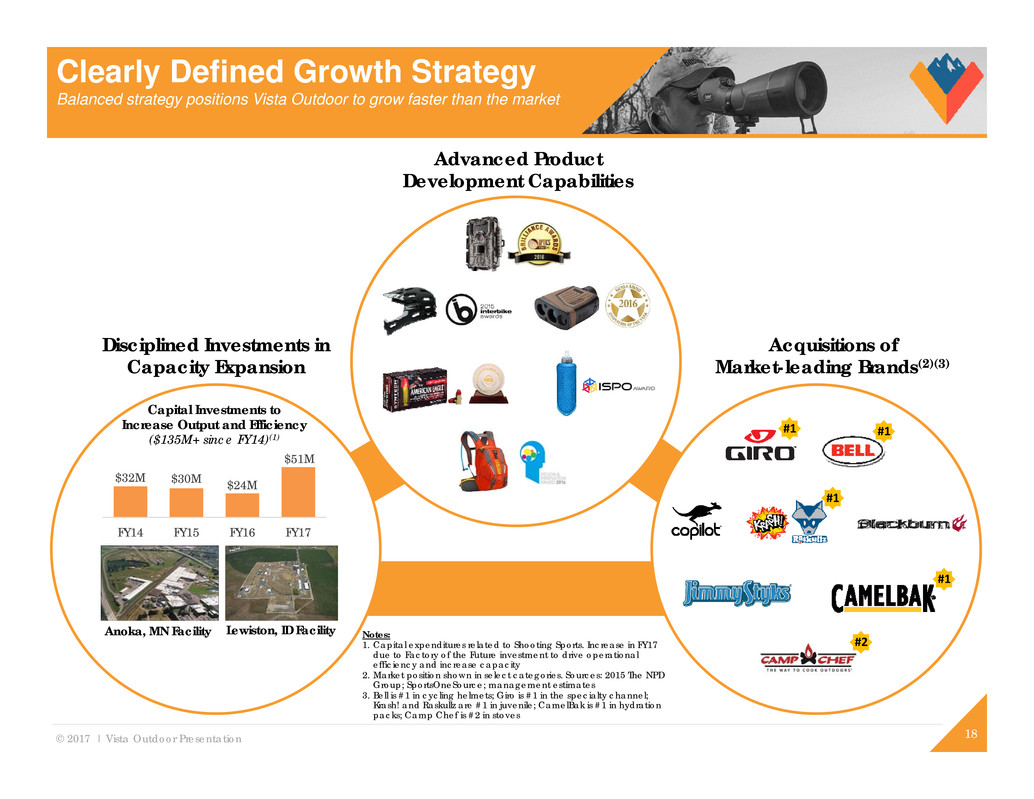

© 2017 | Vista Outdoor Presentation 18 Disciplined Investments in Capacity Expansion Advanced Product Development Capabilities Clearly Defined Growth Strategy Balanced strategy positions Vista Outdoor to grow faster than the market Acquisitions of Market-leading Brands(2)(3) $32M $30M $24M $51M FY14 FY15 FY16 FY17 Capital Investments to Increase Output and Efficiency ($135M+ since FY14)(1) Anoka, MN Facility Lewiston, ID Facility #1 #1 #1 #1 #2 Notes: 1. Capital expenditures related to Shooting Sports. Increase in FY17 due to Factory of the Future investment to drive operational efficiency and increase capacity 2. Market position shown in select categories. Sources: 2015 The NPD Group; SportsOneSource; management estimates 3. Bell is #1 in cycling helmets; Giro is #1 in the specialty channel; Krash! and Raskullz are #1 in juvenile; CamelBak is #1 in hydration packs; Camp Chef is #2 in stoves

© 2017 | Vista Outdoor Presentation Sales Growth Strategy 19

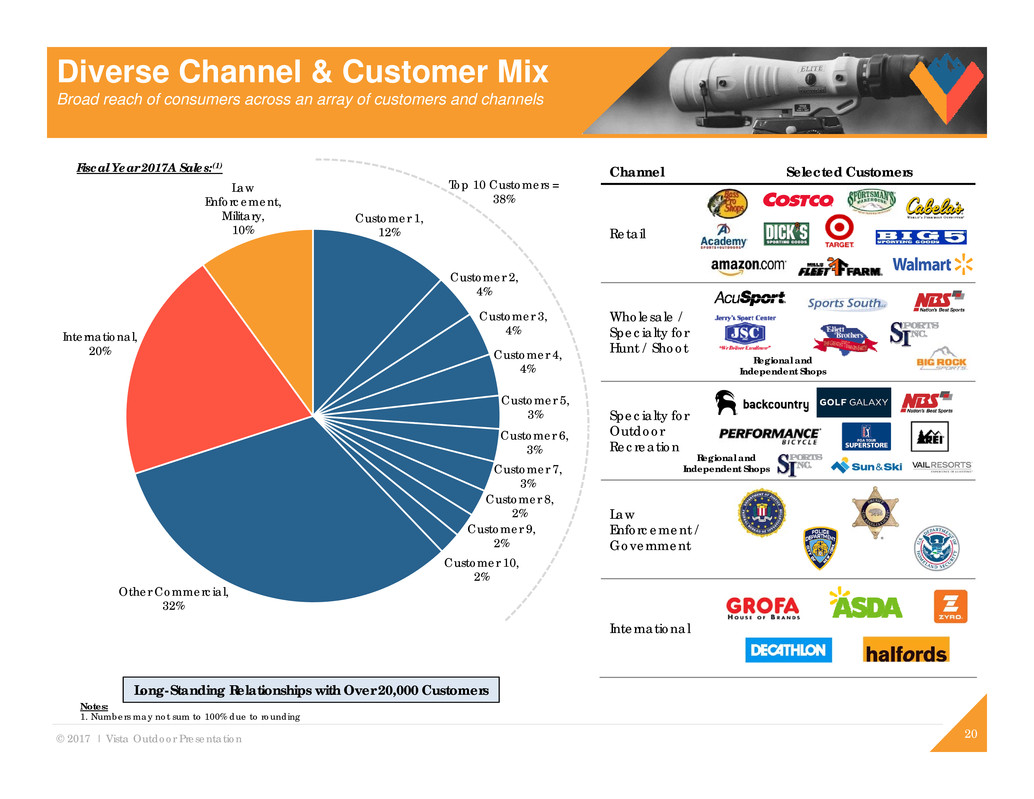

© 2017 | Vista Outdoor Presentation Channel Selected Customers Retail Wholesale / Specialty for Hunt / Shoot Specialty for Outdoor Recreation Law Enforcement / Government International 20 Diverse Channel & Customer Mix Broad reach of consumers across an array of customers and channels International, 20% Law Enforcement, Military, 10% Other Commercial, 32% Customer 10, 2% Customer 9, 2% Customer 8, 2% Customer 7, 3% Customer 6, 3% Customer 5, 3% Customer 4, 4% Customer 3, 4% Customer 2, 4% Customer 1, 12% Top 10 Customers = 38% Regional and Independent Shops Regional and Independent Shops Long-Standing Relationships with Over 20,000 Customers Fiscal Year 2017A Sales:(1) Notes: 1. Numbers may not sum to 100% due to rounding

© 2017 | Vista Outdoor Presentation Develop strategic customer teams with subject matter expertise at the buyer level 3 Create efficiencies and synergies through operating company model 5 21 Leverage the portfolio of brands across customers and channels 1 Align by channel and route to market 2 Maintain scalable structure for future acquisitions 4 Sales Objectives Scalable sales structure across customers and channels

© 2017 | Vista Outdoor Presentation 22 Segmentation Strategy Vista Outdoor’s platform leveraged by aligning channels and route to market Supported by a trade marketing & business development organization that increases communication and collaboration between Sales and Product/Marketing to ensure plan delivery Retail - Allows for a single point of contact at key customers, increases ability to leverage the portfolio, and maintains subject matter expertise at the buyer level Specialty for Outdoor Recreation - Enables product categories to retain their unique route-to- market structures - Provides new opportunities to expand distribution across channels Law Enforcement / Government - Integrated selling organization focused on delivering solutions to LE/Govt customers Wholesale / Specialty for Hunt / Shoot - Increases focus on independent retail - Also creates unique capabilities to integrate future acquisitions International - Integrated sales team that sells consumer portfolio across regions Regional and Independent Shops Regional and Independent Shops

© 2017 | Vista Outdoor Presentation 23 Good, Better, Best Approach Vista Outdoor positions its brands to satisfy the demands of broad end users Vista Outdoor implements a good, better, best marketing strategy across brands in a number of key product categories Offering consumers a breadth of features and price points allows the Company to serve more consumers and capture a greater portion of the demand curve Additionally, this strategy increases Vista Outdoor’s distribution channels by giving the Company access to both Mass and Specialty Optics Rifle Ammunition Protective Products Better Good Best Priced up to $2,150 Up to $320 Up to $225 Up to $2.50/round Up to $1.30/round Up to $550 Up to $100 Up to $200 (Mass) Up to $10.50/round

© 2017 | Vista Outdoor Presentation 24 Portfolio Growth Increased distribution and promotion across channel and customers Expansion of Vista’s Portfolio to New Customers and Markets 1 Collaboration Between Brands to Drive Innovation 2 Increased Promotion and Merchandising of Vista Outdoor’s Brands through Solution Selling 3 Leverage Relationships and Portfolio to Increase Distribution with Existing Customers 4 Keys to Driving Growth:

© 2017 | Vista Outdoor Presentation 25 Advertisement created specifically for the German market Photoshoot to create an image portfolio specific to the European market Ammunition catalogue created for France with updated imagery and full translation Drive distribution to new markets globally Drive distribution into new customers Portfolio Expansion Increasing distribution and market specific advertising 1 Market Specific Advertising Grow Domestic and International Distribution

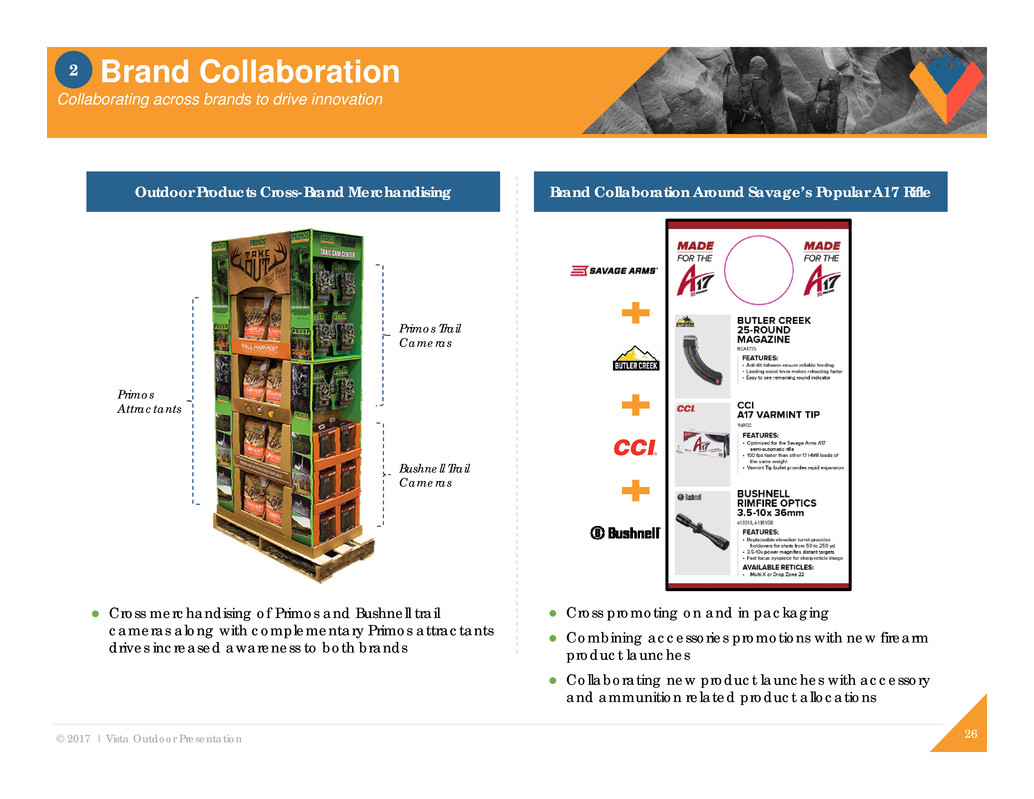

© 2017 | Vista Outdoor Presentation 26 Brand Collaboration Collaborating across brands to drive innovation 2 Cross promoting on and in packaging Combining accessories promotions with new firearm product launches Collaborating new product launches with accessory and ammunition related product allocations Brand Collaboration Around Savage’s Popular A17 RifleOutdoor Products Cross-Brand Merchandising Cross merchandising of Primos and Bushnell trail cameras along with complementary Primos attractants drives increased awareness to both brands Primos Trail Cameras Bushnell Trail Cameras Primos Attractants

© 2017 | Vista Outdoor Presentation 27 Promotion and Merchandising Driving Vista Outdoor’s brands through solution selling 3 Merchandising and Point-of-Purchase Advertising

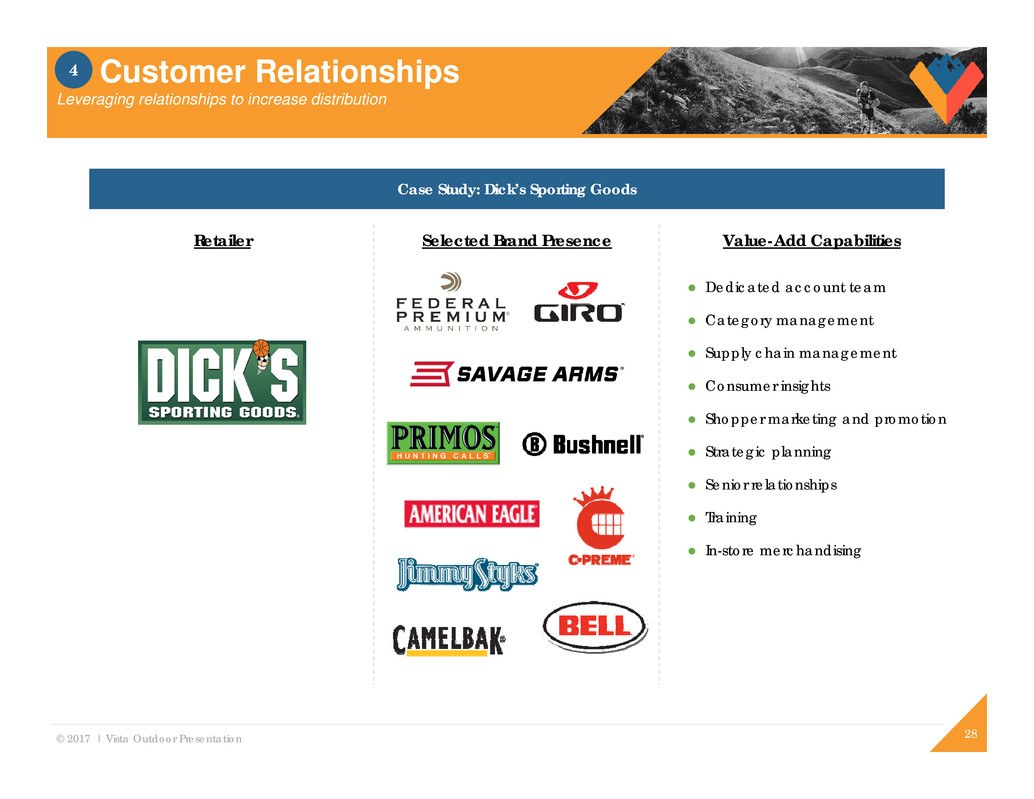

© 2017 | Vista Outdoor Presentation 28 Customer Relationships Leveraging relationships to increase distribution 4 Case Study: Dick’s Sporting Goods Retailer Selected Brand Presence Value-Add Capabilities Dedicated account team Category management Supply chain management Consumer insights Shopper marketing and promotion Strategic planning Senior relationships Training In-store merchandising

© 2017 | Vista Outdoor Presentation Outdoor Products 29

© 2017 | Vista Outdoor Presentation 30 - 35 brands with a diverse range of products across the $93B Outdoor Recreation market - Proven ability to add complementary brands to portfolio Outdoor Products Segment A portfolio of well-respected brands designed to bring the world outside Protective Performance Gear Performance Optics Capture & Measurement Products Tactical & Shooting Accessories Recreational Performance Products $730M $862M $1,171M FY 2015A FY 2016A FY 2017A $200M $243M $293M FY 2015A FY 2016A FY 2017A Outdoor Products Net Sales(1) Outdoor Products Gross Profit(1) Vista Outdoor’s Diverse Outdoor Products Portfolio YoY Growth 61.9% 18.0% 35.8% % of Net Sales 27.4% 28.2% 25.0% Notes: (1) Figures shown are as reported and are not Pro Forma for acquisitions Archery & Hunting Accessories

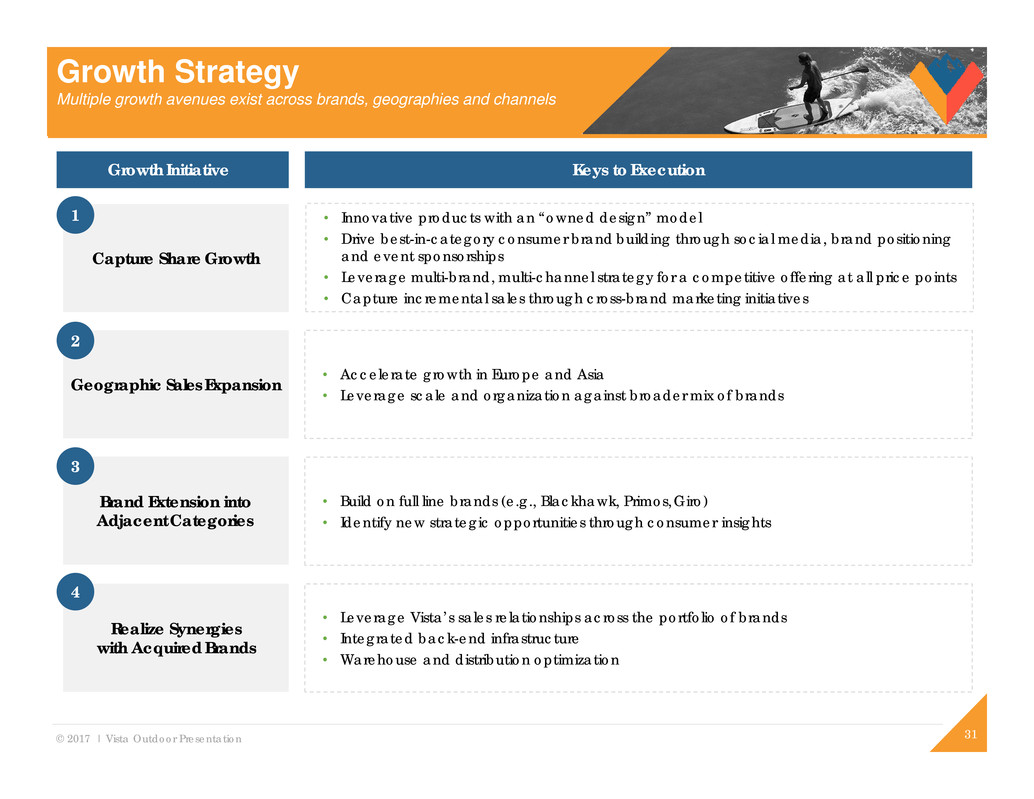

© 2017 | Vista Outdoor Presentation Capture Share Growth Geographic Sales Expansion Brand Extension into Adjacent Categories Realize Synergies with Acquired Brands Growth Initiative 31 Keys to Execution 1 2 3 4 Growth Strategy Multiple growth avenues exist across brands, geographies and channels • Innovative products with an “owned design” model • Drive best-in-category consumer brand building through social media, brand positioning and event sponsorships • Leverage multi-brand, multi-channel strategy for a competitive offering at all price points • Capture incremental sales through cross-brand marketing initiatives • Accelerate growth in Europe and Asia • Leverage scale and organization against broader mix of brands • Build on full line brands (e.g., Blackhawk, Primos,Giro) • Identify new strategic opportunities through consumer insights • Leverage Vista’s sales relationships across the portfolio of brands • Integrated back-end infrastructure • Warehouse and distribution optimization

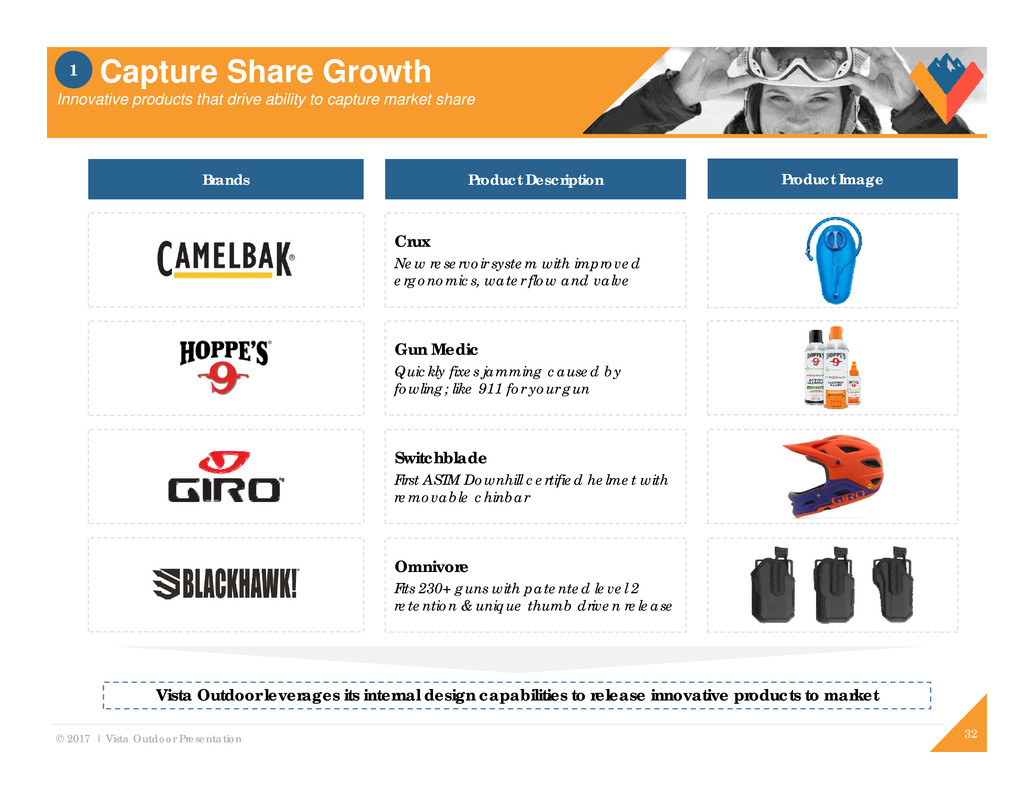

© 2017 | Vista Outdoor Presentation 32 Vista Outdoor leverages its internal design capabilities to release innovative products to market Crux New reservoir system with improved ergonomics, water flow and valve Gun Medic Quickly fixes jamming caused by fowling; like 911 for your gun Switchblade First ASTM Downhill certified helmet with removable chinbar Omnivore Fits 230+ guns with patented level 2 retention & unique thumb driven release Capture Share Growth Innovative products that drive ability to capture market share 1 Brands Product Description Product Image

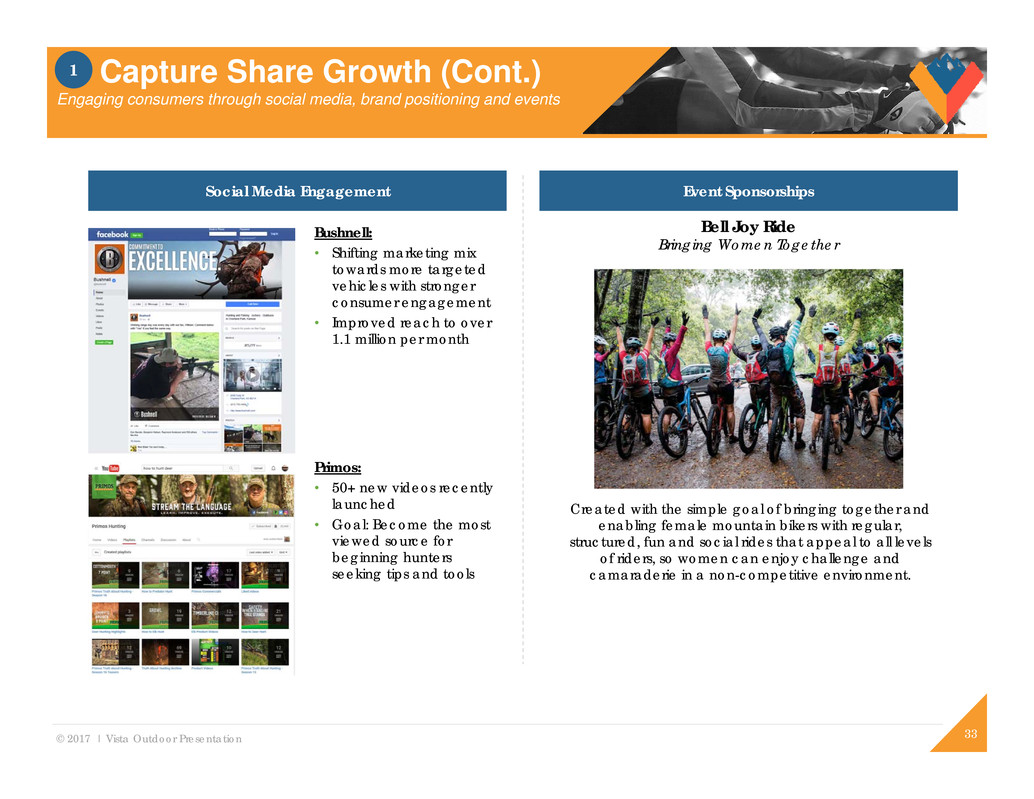

© 2017 | Vista Outdoor Presentation 33 Capture Share Growth (Cont.) Engaging consumers through social media, brand positioning and events 1 Bushnell: • Shifting marketing mix towards more targeted vehicles with stronger consumer engagement • Improved reach to over 1.1 million per month Primos: • 50+ new videos recently launched • Goal: Become the most viewed source for beginning hunters seeking tips and tools Event SponsorshipsSocial Media Engagement Bell Joy Ride Bringing Women Together Created with the simple goal of bringing together and enabling female mountain bikers with regular, structured, fun and social rides that appeal to all levels of riders, so women can enjoy challenge and camaraderie in a non-competitive environment.

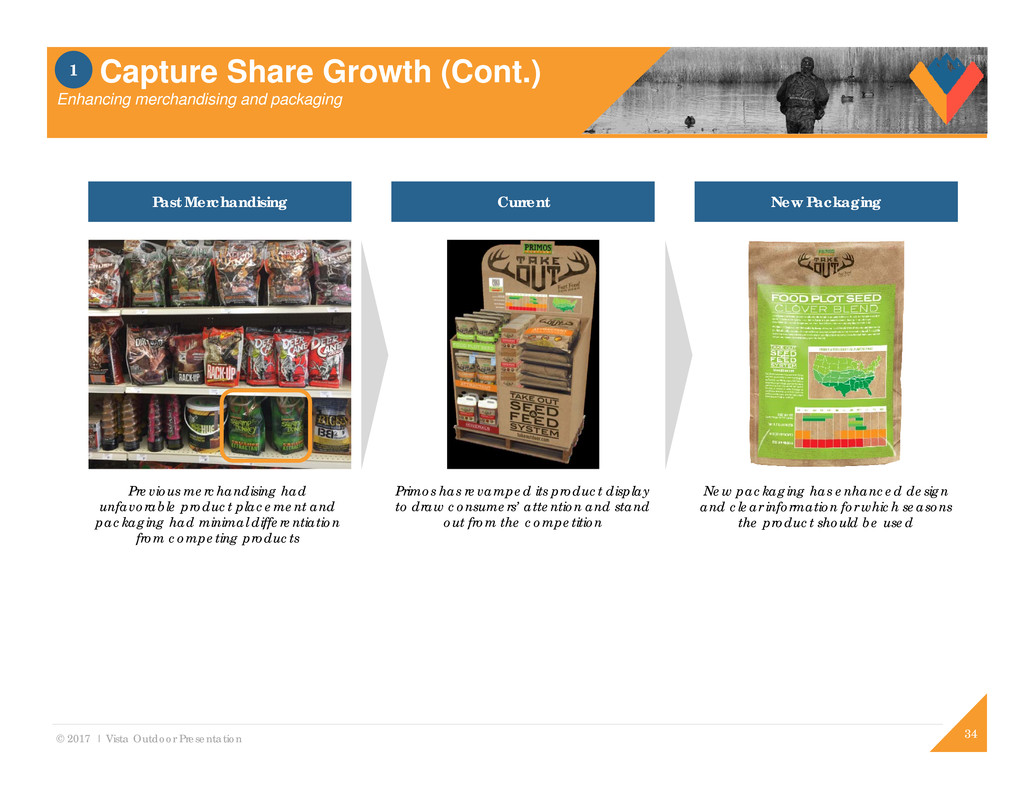

© 2017 | Vista Outdoor Presentation 34 Past Merchandising New PackagingCurrent Previous merchandising had unfavorable product placement and packaging had minimal differentiation from competing products Primos has revamped its product display to draw consumers’ attention and stand out from the competition New packaging has enhanced design and clear information for which seasons the product should be used Capture Share Growth (Cont.) Enhancing merchandising and packaging 1

© 2017 | Vista Outdoor Presentation Geography Opportunities Europe Australia / Asia 35 Powersports Bike / Snow Bike / Powersports Binoculars Trail Cams Binoculars / Trail Cams Geographic Sales Expansion Growing through geographic sales expansion in Europe, Australia and Asia 2

© 2017 | Vista Outdoor Presentation 36 Foundation in Polymer Holsters Leather Holsters • Leverage core • Expand to natural product lines • Stretch beyond core to offer full suite of specialized products Holster Iterations Firearm Accessories Lifestyle Products On-gun Accessories Suppressors MSR Optics & Aiming Devices Tactical Nylon Light Armor Technical Apparel Brand Extension Leveraging brands into adjacent markets and categories 3

© 2017 | Vista Outdoor Presentation 37 Leverage Acquisitions Methodically integrating acquisitions to drive success 4 Post-Acquisition Integration Strategy Sourcing Finance, HR, Legal, IT Manufacturing Marketing Research and Development Sales Warehousing and Distribution Customer Service • Leverage relationships with key retailers to add incremental brands to assortment (e.g., Jimmy Styks in Dick’s Sporting Goods or Cabela’s) • Ensure manufacturing, marketing, and research and development remain intact, maintaining company DNA and culture • Where applicable, leverage creative insights from acquisition management teams across entire Vista Outdoor portfolio • Enable Vista Outdoor’s sourcing, warehousing and distribution operations to drive cost synergies due to their leverage and scale • Optimize warehousing and distribution across portfolio to best serve customers • Outsource back-office functions such as Finance, HR, Legal and IT to Vista Outdoor corporate = Functions led by Vista Outdoor post-closing = Functions led by acquisition post-closing

© 2017 | Vista Outdoor Presentation Cycling Helmets Cycling Footwear Snow Helmets Eye Protection Softgoods Branded Accessories Powersports Helmets - ~$450M in FY17 Net Sales - Leader within $10B Cycling and $8B Snow Sports categories - Iconic brands with multi-channel distribution #1 Top 5 #1 Top 5 Top 5 Notes: (1) Source: SportsOneSource; 2015 NPD Group; management estimates 38 = Vista Outdoor market position(1) Protective Performance Gear Innovative safety products for gravity sports enthusiasts #2

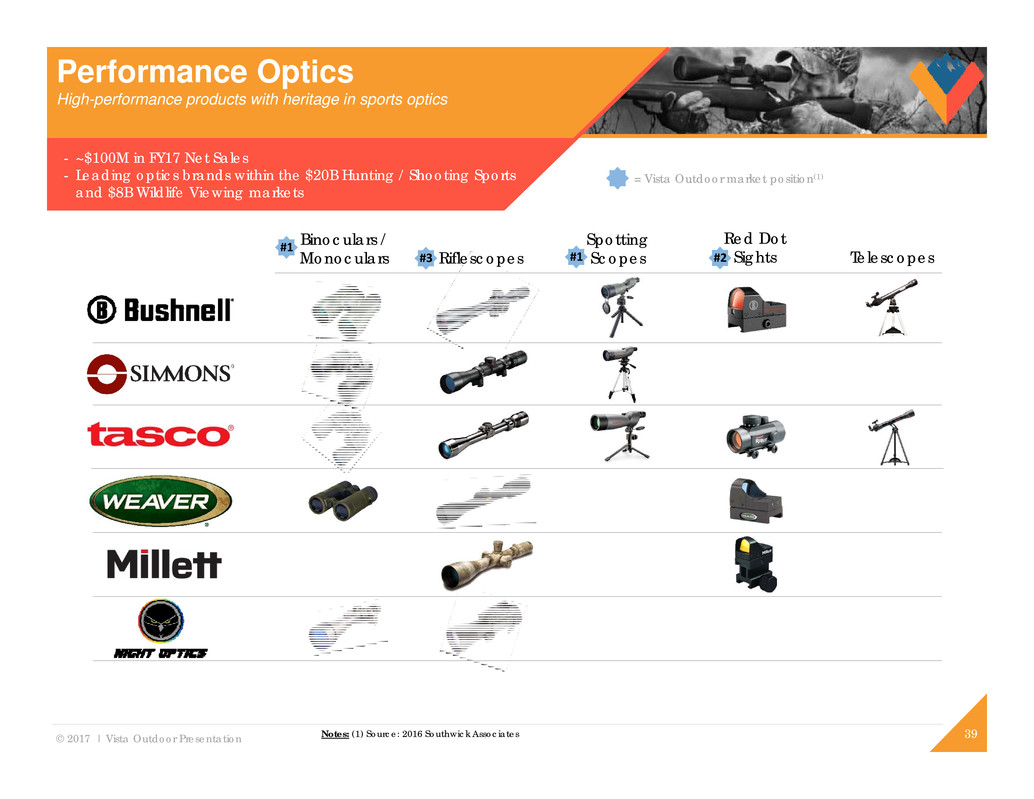

© 2017 | Vista Outdoor Presentation Binoculars / Monoculars Riflescopes Spotting Scopes Telescopes - ~$100M in FY17 Net Sales - Leading optics brands within the $20B Hunting / Shooting Sports and $8B Wildlife Viewing markets #1 #3 #1 Red Dot Sights#2 39Notes: (1) Source: 2016 Southwick Associates = Vista Outdoor market position(1) Performance Optics High-performance products with heritage in sports optics

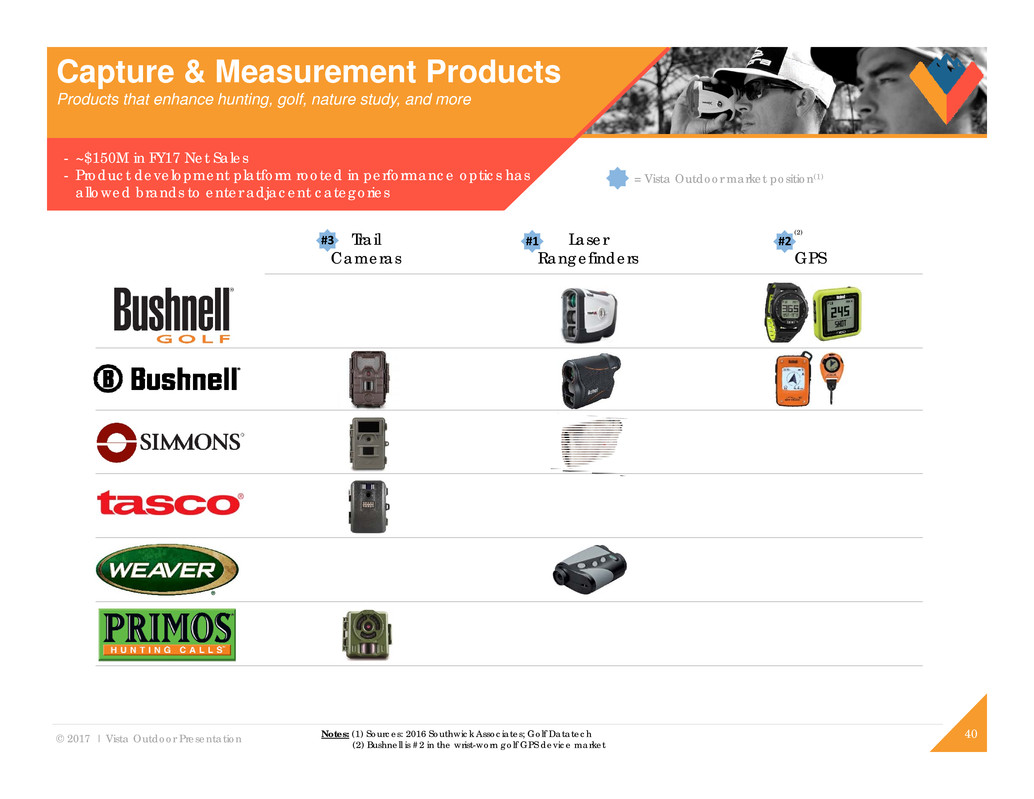

© 2017 | Vista Outdoor Presentation Trail Cameras Laser Rangefinders GPS - ~$150M in FY17 Net Sales - Product development platform rooted in performance optics has allowed brands to enter adjacent categories #1#3 40 = Vista Outdoor market position(1) Capture & Measurement Products Products that enhance hunting, golf, nature study, and more (2) Notes: (1) Sources: 2016 Southwick Associates; Golf Datatech (2) Bushnell is #2 in the wrist-worn golf GPS device market #2

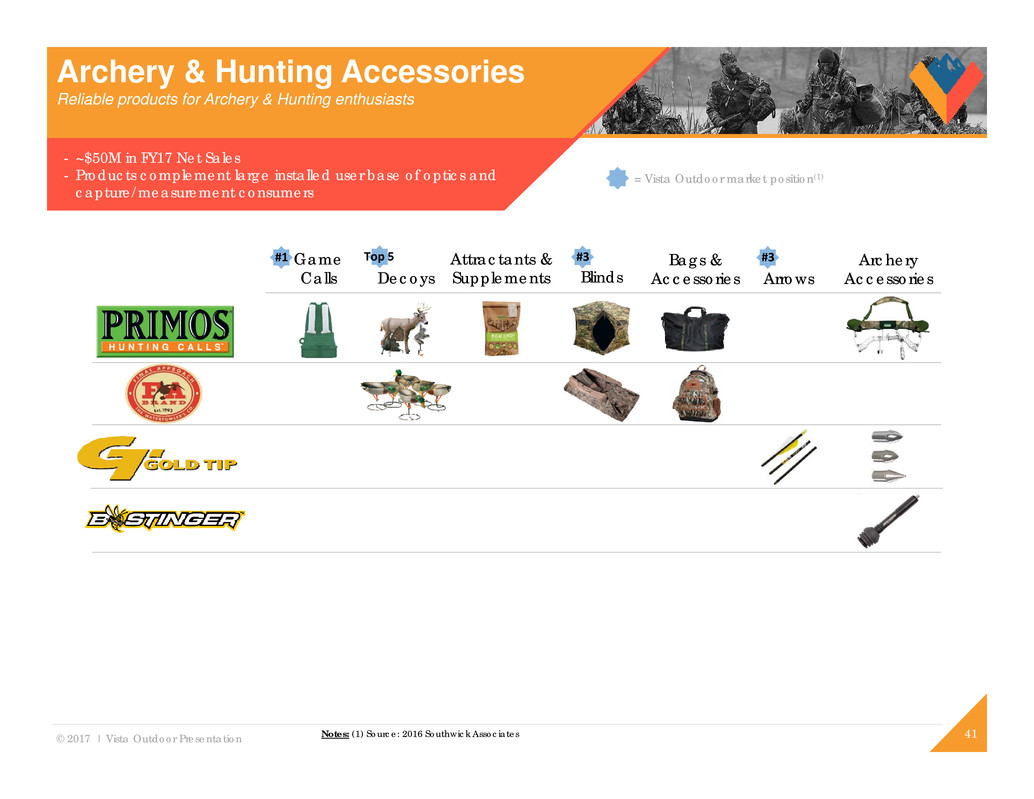

© 2017 | Vista Outdoor Presentation - ~$50M in FY17 Net Sales - Products complement large installed user base of optics and capture/measurement consumers Game Calls Decoys Attractants & Supplements Blinds Archery Accessories Bags & Accessories Arrows #1 #3 #3 41Notes: (1) Source: 2016 Southwick Associates = Vista Outdoor market position(1) Archery & Hunting Accessories Reliable products for Archery & Hunting enthusiasts Top 5

© 2017 | Vista Outdoor Presentation - ~$200M in FY17 Net Sales - Strong reputation for quality and reliability resonates with consumers and increases loyalty Holsters Targets Firearm Care Reloading Equipment Other Accessories Scope Mounts Bags, Packs, & Apparel #1#1 #1 #1#1 42 = Vista Outdoor market position(1) Notes: (1) Source: 2016 Southwick Associates (2) Champion #1 in traps and target-throwing devices; RCBS/Federal #1 in reloading tools and accessories (2) (2) Tactical & Shooting Accessories Field-proven quality for all shooters from hunting to self defense

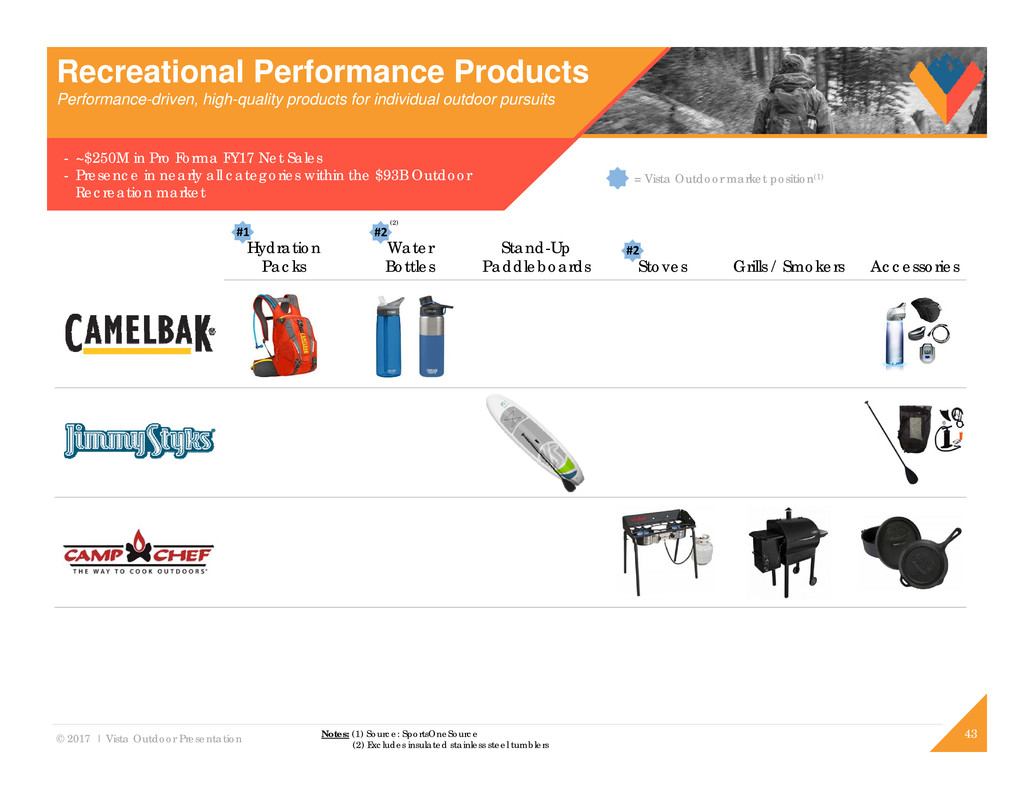

© 2017 | Vista Outdoor Presentation - ~$250M in Pro Forma FY17 Net Sales - Presence in nearly all categories within the $93B Outdoor Recreation market 43 Hydration Packs Water Bottles Stand-Up Paddleboards Stoves Grills / Smokers Accessories #1 #2 #2 Notes: (1) Source: SportsOneSource (2) Excludes insulated stainless steel tumblers = Vista Outdoor market position(1) Recreational Performance Products Performance-driven, high-quality products for individual outdoor pursuits (2)

© 2017 | Vista Outdoor Presentation Shooting Sports 44

© 2017 | Vista Outdoor Presentation 45 - 11 brands with a diverse range of products across the $20B Hunting / Shooting Sports market $1,353M $1,409M $1,376M FY 2015A FY 2016A FY 2017A $331M $377M $377M FY 2015A FY 2016A FY 2017A Shooting Sports Net Sales Shooting Sports Gross Profit YoY Growth (4.9%) 4.1% (2.3%) % of Net Sales 24.4% 26.8% 27.4% Premium Ammunition Value/Target Ammunition Firearms Vista Outdoor’s Premier Shooting Sports Product Portfolio Shooting Sports Segment Unmatched performance leader to shooting sports enthusiasts

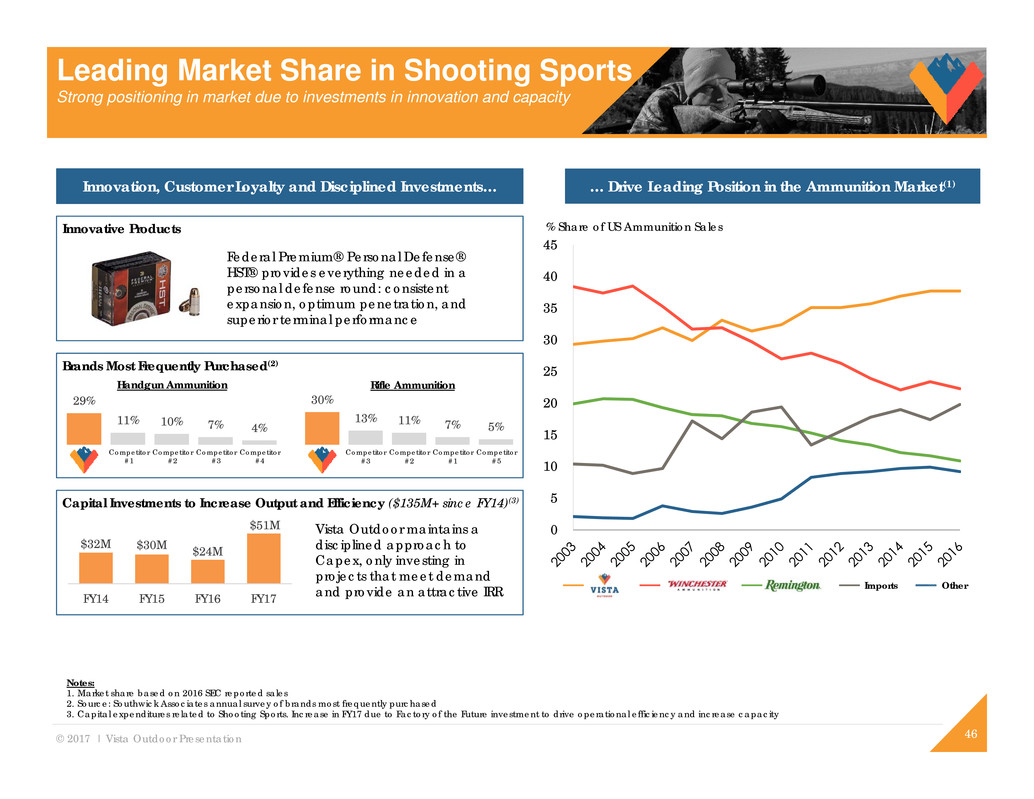

© 2017 | Vista Outdoor Presentation $32M $30M $24M $51M FY14 FY15 FY16 FY17 46 Innovation, Customer Loyalty and Disciplined Investments… Notes: 1. Market share based on 2016 SEC reported sales 2. Source: Southwick Associates annual survey of brands most frequently purchased 3. Capital expenditures related to Shooting Sports. Increase in FY17 due to Factory of the Future investment to drive operational efficiency and increase capacity Innovative Products Federal Premium® Personal Defense® HST® provides everything needed in a personal defense round: consistent expansion, optimum penetration, and superior terminal performance 29% 11% 10% 7% 4% 30% 13% 11% 7% 5% Brands Most Frequently Purchased(2) Handgun Ammunition Rifle Ammunition Capital Investments to Increase Output and Efficiency ($135M+ since FY14)(3) Vista Outdoor maintains a disciplined approach to Capex, only investing in projects that meet demand and provide an attractive IRR Competitor #1 Competitor #2 Competitor #3 Competitor #4 Competitor #3 Competitor #2 Competitor #1 Competitor #5 0 5 10 15 20 25 30 35 40 45 … Drive Leading Position in the Ammunition Market(1) % Share of US Ammunition Sales Imports Other Leading Market Share in Shooting Sports Strong positioning in market due to investments in innovation and capacity

© 2017 | Vista Outdoor Presentation 47 Capture Growth with Emerging Shooting Sports Consumers 1 Enhance Competitive Position in Marketplace 2 Expand Savage Brand to Broader Hunting and Shooting Markets 3 Keys to Driving Growth: Growth Strategy Capitalize on growing shooting sports market

© 2017 | Vista Outdoor Presentation 48 Engage New Consumers Gaining share by capitalizing on shifting demographics of shooters 1 • New product offerings designed with female consumers in mind • Brand ambassadors that relate well to the next generation of shooters • Support community events that encourage and foster newcomers to shooting sports Attract Female Participants • Social media engagement • Sleek and modern packaging • Sponsor brand advocates with broad reach to millennials Leverage Younger Demographic Cultivate Consumers for Life • Generate long-term brand loyalty through early consumer engagement • Sponsorship of youth programs – Boy Scouts, Scholastic Shooting Sports Foundation and National 4-H Shooting Programs • Support individual high school shooting programs • Diverse product offering catering to all user levels and interests Federal Premium: 2.8M views 253k likes 80.3k followers Savage Arms: 565k likes

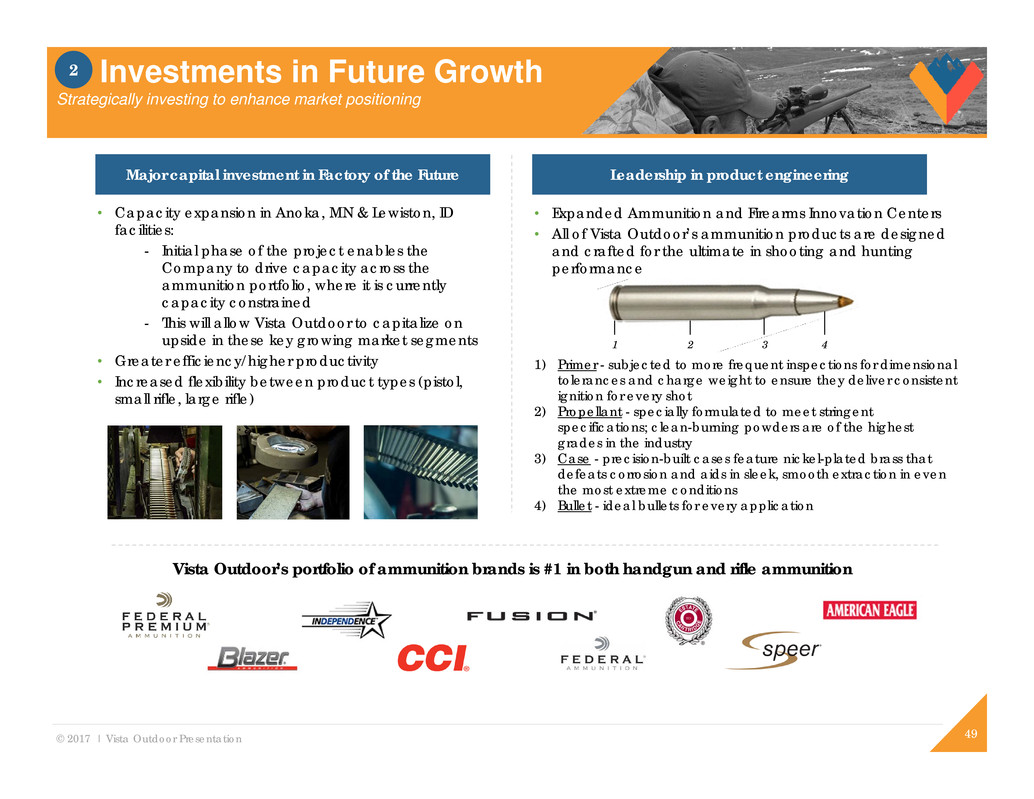

© 2017 | Vista Outdoor Presentation 1 2 3 4 49 Vista Outdoor’s portfolio of ammunition brands is #1 in both handgun and rifle ammunition Investments in Future Growth Strategically investing to enhance market positioning 2 Major capital investment in Factory of the Future Leadership in product engineering • Capacity expansion in Anoka, MN & Lewiston, ID facilities: - Initial phase of the project enables the Company to drive capacity across the ammunition portfolio, where it is currently capacity constrained - This will allow Vista Outdoor to capitalize on upside in these key growing market segments • Greater efficiency/higher productivity • Increased flexibility between product types (pistol, small rifle, large rifle) • Expanded Ammunition and Firearms Innovation Centers • All of Vista Outdoor’s ammunition products are designed and crafted for the ultimate in shooting and hunting performance 1) Primer - subjected to more frequent inspections for dimensional tolerances and charge weight to ensure they deliver consistent ignition for every shot 2) Propellant - specially formulated to meet stringent specifications; clean-burning powders are of the highest grades in the industry 3) Case - precision-built cases feature nickel-plated brass that defeats corrosion and aids in sleek, smooth extraction in even the most extreme conditions 4) Bullet - ideal bullets for every application

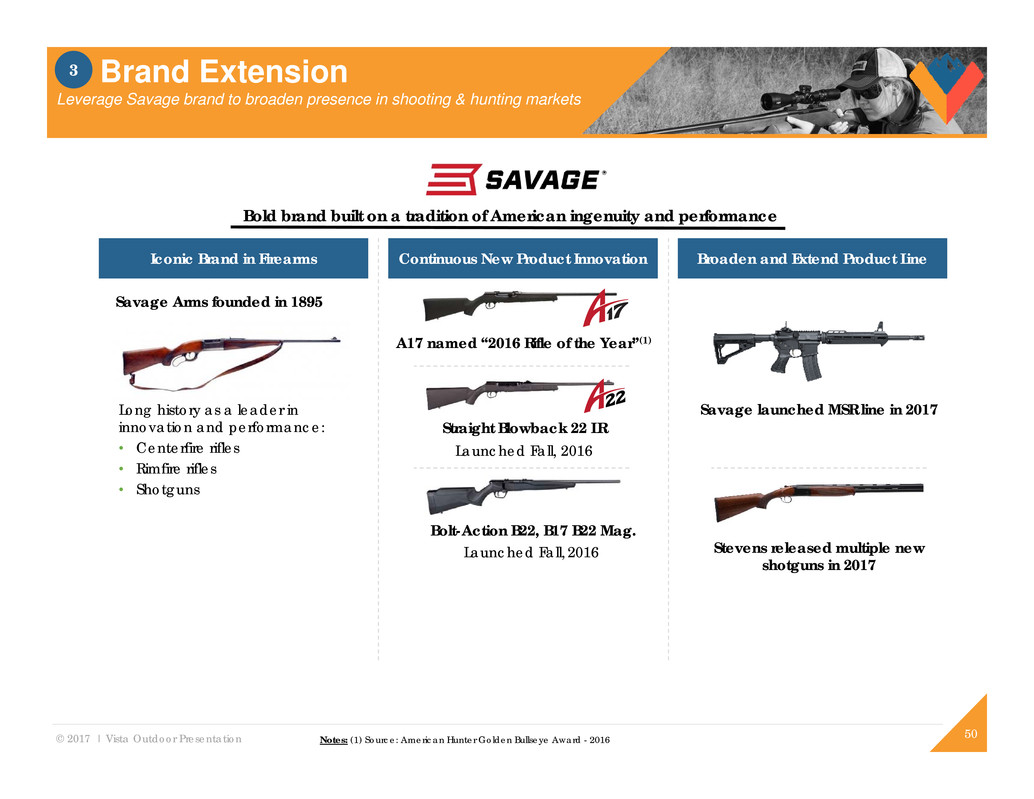

© 2017 | Vista Outdoor Presentation Stevens released multiple new shotguns in 2017 50Notes: (1) Source: American Hunter Golden Bullseye Award - 2016 Brand Extension Leverage Savage brand to broaden presence in shooting & hunting markets 3 Bold brand built on a tradition of American ingenuity and performance Savage launched MSR line in 2017 Straight Blowback 22 LR A17 named “2016 Rifle of the Year”(1) Launched Fall, 2016 Savage Arms founded in 1895 Long history as a leader in innovation and performance: • Centerfire rifles • Rimfire rifles • Shotguns Iconic Brand in Firearms Continuous New Product Innovation Broaden and Extend Product Line Bolt-Action B22, B17 B22 Mag. Launched Fall, 2016

© 2017 | Vista Outdoor Presentation - ~$350M in FY17 Net Sales - Preeminent brands in the ammunition segment of the Hunting / Shooting Sports category Shotshell Ammunition #1Rifle Ammunition #1 Handgun Ammunition #1 Rimfire Centerfire Rimfire Centerfire 51Notes: (1) Source: 2016 Southwick Associates (2) Represents market position for the combined premium and value/target markets = Vista Outdoor market position(1) (2) (2) (2) Premium Ammunition Highly engineered products designed for ultimate performance

© 2017 | Vista Outdoor Presentation Shotshell Ammunition - ~$800M in FY17 Net Sales - Value products reinforce “Good, Better, Best” strategy, allowing profits to be captured across the demand curve 52 #1 #1#1 Rifle AmmunitionHandgun Ammunition Rimfire Centerfire Rimfire Centerfire Notes: (1) Source: 2016 Southwick Associates (2) Represents market position for the combined premium and value/target markets = Vista Outdoor market position(1) (2) (2) (2) Value/Target Ammunition Reducing cost of practice allows users to shoot more, and more often

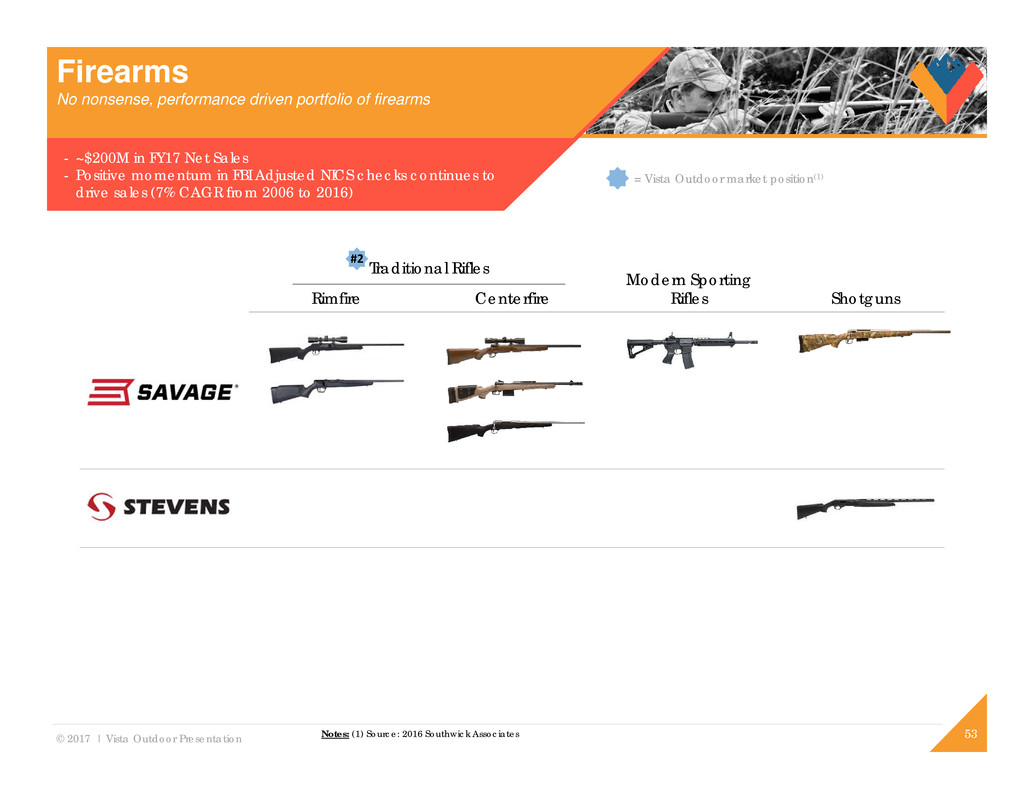

© 2017 | Vista Outdoor Presentation - ~$200M in FY17 Net Sales - Positive momentum in FBI Adjusted NICS checks continues to drive sales (7% CAGR from 2006 to 2016) 53 = Vista Outdoor market position(1) Notes: (1) Source: 2016 Southwick Associates Firearms No nonsense, performance driven portfolio of firearms Shotguns #2 Rimfire Centerfire Traditional Rifles Modern Sporting Rifles

© 2017 | Vista Outdoor Presentation M&A Strategy 54

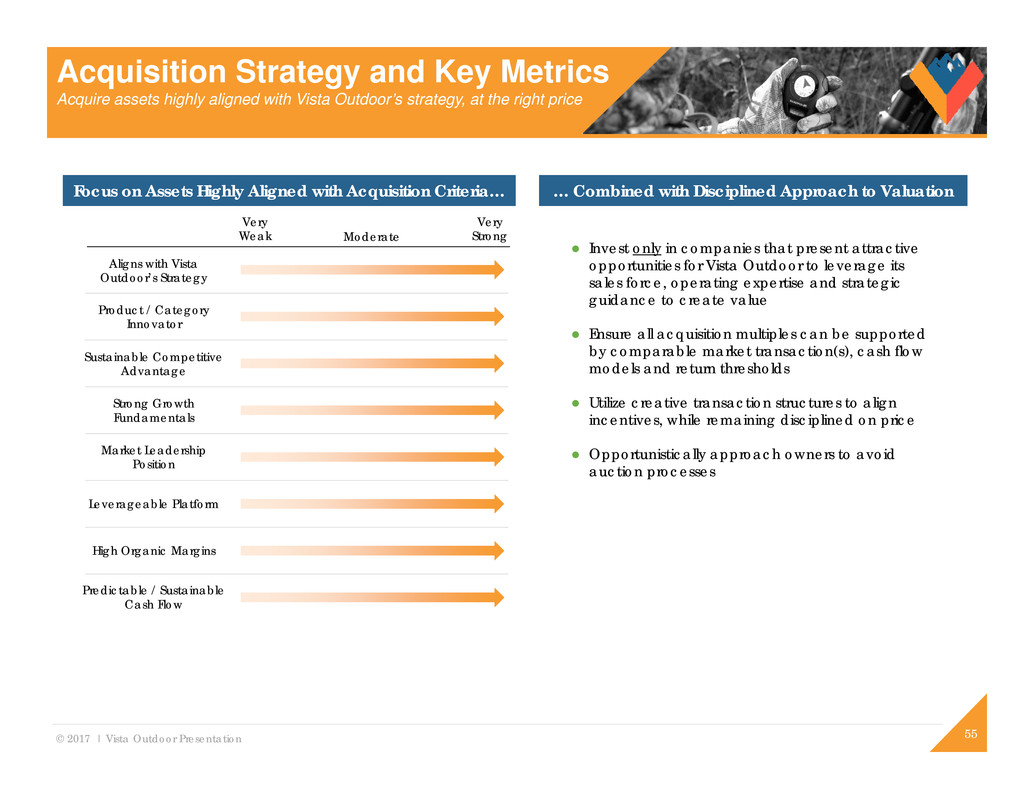

© 2017 | Vista Outdoor Presentation 55 Invest only in companies that present attractive opportunities for Vista Outdoor to leverage its sales force, operating expertise and strategic guidance to create value Ensure all acquisition multiples can be supported by comparable market transaction(s), cash flow models and return thresholds Utilize creative transaction structures to align incentives, while remaining disciplined on price Opportunistically approach owners to avoid auction processes Focus on Assets Highly Aligned with Acquisition Criteria… … Combined with Disciplined Approach to Valuation Aligns with Vista Outdoor’s Strategy Product / Category Innovator Sustainable Competitive Advantage Strong Growth Fundamentals Market Leadership Position Leverageable Platform High Organic Margins Predictable / Sustainable Cash Flow Very Weak Moderate Very Strong Acquisition Strategy and Key Metrics Acquire assets highly aligned with Vista Outdoor’s strategy, at the right price

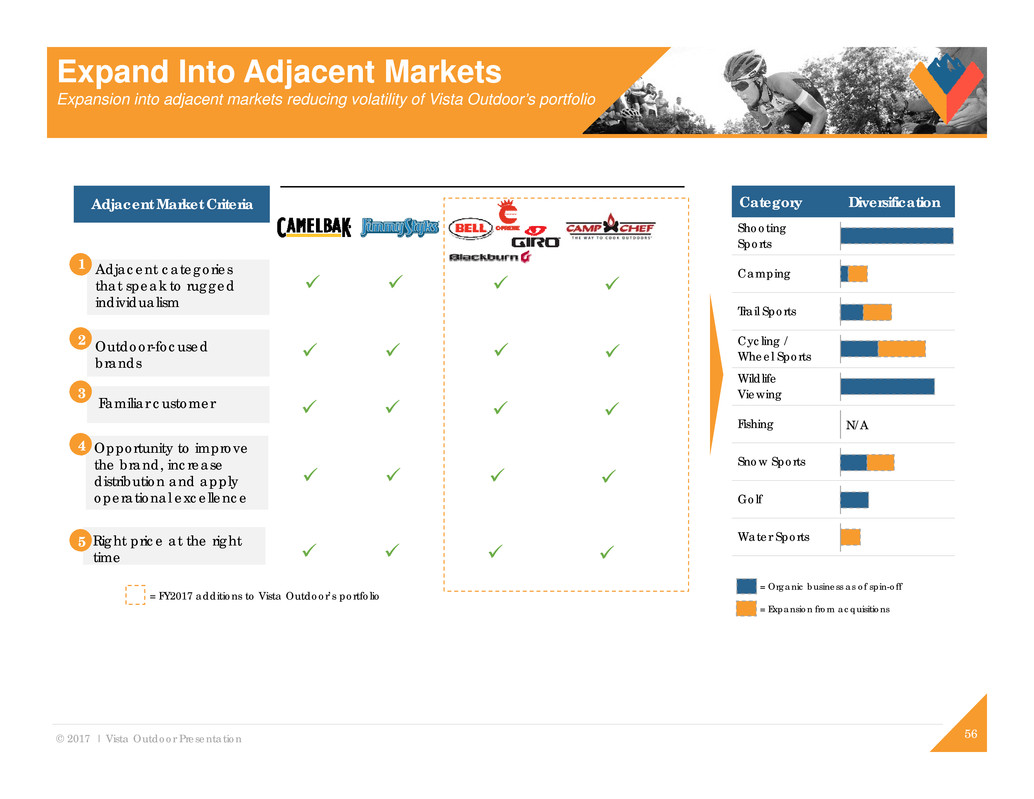

© 2017 | Vista Outdoor Presentation Adjacent categories that speak to rugged individualism 1 Outdoor-focused brands 2 Familiar customer 3 Opportunity to improve the brand, increase distribution and apply operational excellence 4 Right price at the right time 5 Adjacent Market Criteria Shooting Sports Camping Trail Sports Cycling / Wheel Sports Wildlife Viewing Fishing Snow Sports Golf Water Sports Category = FY2017 additions to Vista Outdoor’s portfolio 56 Diversification N/A Expand Into Adjacent Markets Expansion into adjacent markets reducing volatility of Vista Outdoor’s portfolio = Expansion from acquisitions = Organic business as of spin-off

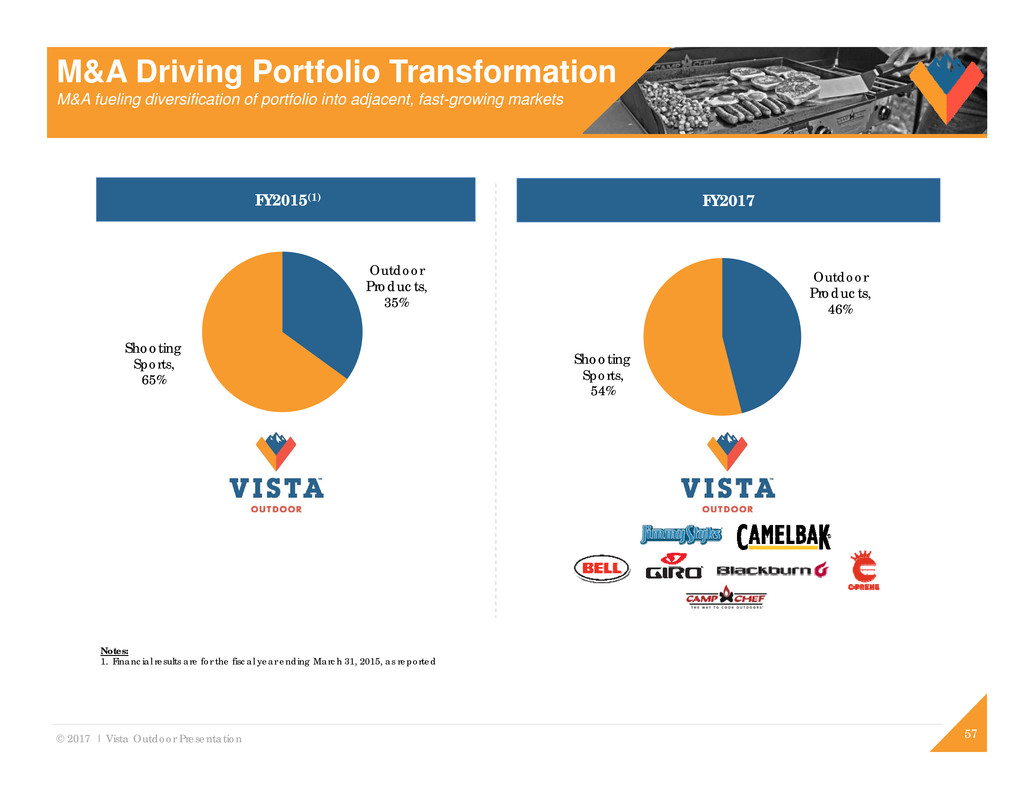

© 2017 | Vista Outdoor Presentation 57 FY2015(1) Notes: 1. Financial results are for the fiscal year ending March 31, 2015, as reported Shooting Sports, 65% Outdoor Products, 35% FY2017 Shooting Sports, 54% Outdoor Products, 46% M&A Driving Portfolio Transformation M&A fueling diversification of portfolio into adjacent, fast-growing markets

© 2017 | Vista Outdoor Presentation Financial Overview and Long-term Targets 58

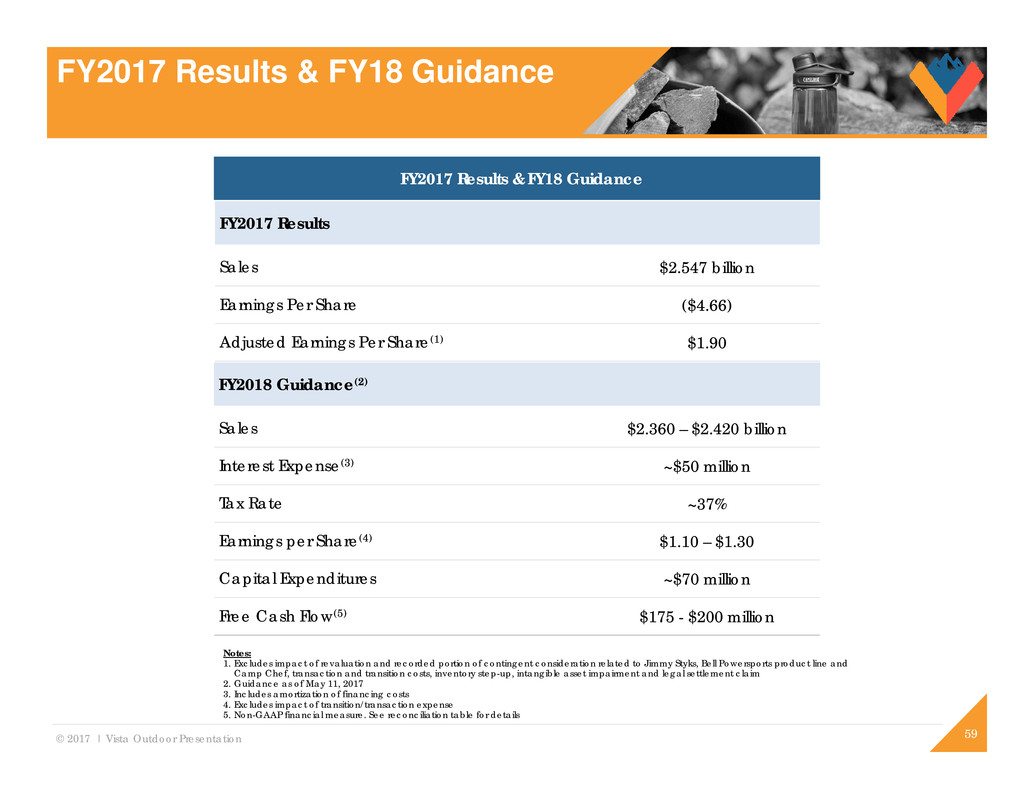

© 2017 | Vista Outdoor Presentation Sales $2.547 billion Earnings Per Share ($4.66) Adjusted Earnings Per Share(1) $1.90 59 Sales $2.360 – $2.420 billion Interest Expense(3) ~$50 million Tax Rate ~37% Earnings per Share(4) $1.10 – $1.30 Capital Expenditures ~$70 million Free Cash Flow(5) $175 - $200 million FY2018 Guidance(2) FY2017 Results & FY18 Guidance FY2017 Results Notes: 1. Excludes impact of revaluation and recorded portion of contingent consideration related to Jimmy Styks, Bell Powersports product line and Camp Chef, transaction and transition costs, inventory step-up, intangible asset impairment and legal settlement claim 2. Guidance as of May 11, 2017 3. Includes amortization of financing costs 4. Excludes impact of transition/transaction expense 5. Non-GAAP financial measure. See reconciliation table for details FY2017 Results & FY18 Guidance

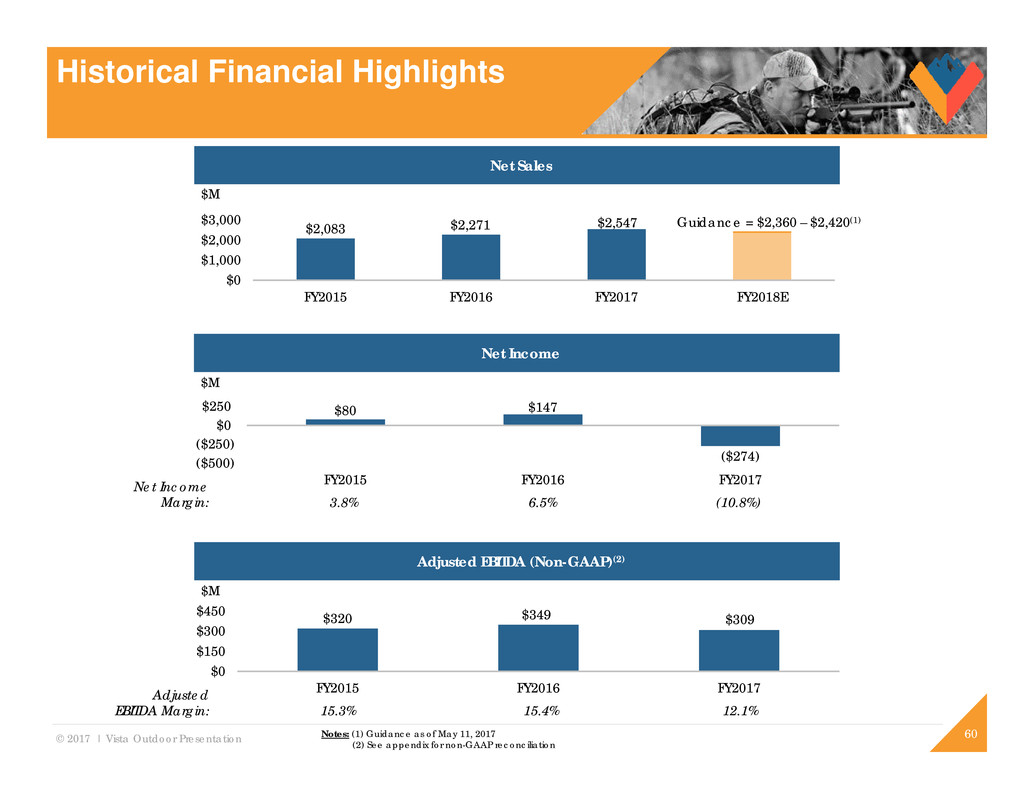

© 2017 | Vista Outdoor Presentation 60 $M Adjusted EBITDA (Non-GAAP)(2) Adjusted EBITDA Margin: 15.3% 15.4% 12.1% $320 $349 $309 $0 $150 $300 $450 FY2015 FY2016 FY2017 $M $2,083 $2,271 $2,547 $0 $1,000 $2,000 $3,000 FY2015 FY2016 FY2017 FY2018E Net Sales Guidance = $2,360 – $2,420(1) Historical Financial Highlights $M Net Income Net Income Margin: 3.8% 6.5% (10.8%) $80 $147 ($274)($500) ($250) $0 $250 FY2015 FY2016 FY2017 Notes: (1) Guidance as of May 11, 2017 (2) See appendix for non-GAAP reconciliation

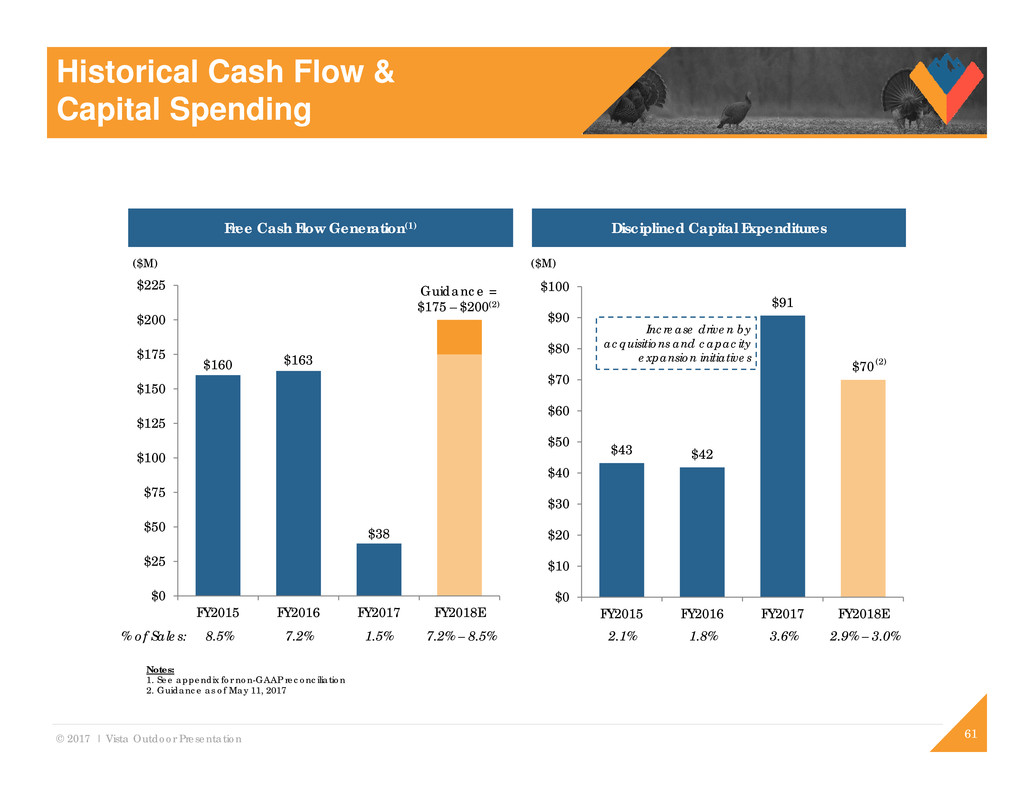

© 2017 | Vista Outdoor Presentation $160 $163 $38 $0 $25 $50 $75 $100 $125 $150 $175 $200 $225 FY2015 FY2016 FY2017 FY2018E Disciplined Capital ExpendituresFree Cash Flow Generation(1) $43 $42 $91 $70 $0 $10 $20 $30 $40 $50 $60 $70 $80 $90 $100 FY2015 FY2016 FY2017 FY2018E ($M) ($M) 2.1% 1.8% 3.6%% of Sales: 8.5% 7.2% 1.5% 61 Notes: 1. See appendix for non-GAAP reconciliation 2. Guidance as of May 11, 2017 Guidance = $175 – $200(2) 7.2% – 8.5% Increase driven by acquisitions and capacity expansion initiatives 2.9% – 3.0% (2) Historical Cash Flow & Capital Spending

© 2017 | Vista Outdoor Presentation 62 Long-term Financial Goals Metric 2-3 Year Goal Long-term Goal Organic Revenue Growth 2% – 4% 6% – 8% Adjusted EBITDA Margin 12% – 14% 16% – 18% Capital Expenditures (% of Sales) 2% – 3% 2% – 3% Long-term Financial Goals

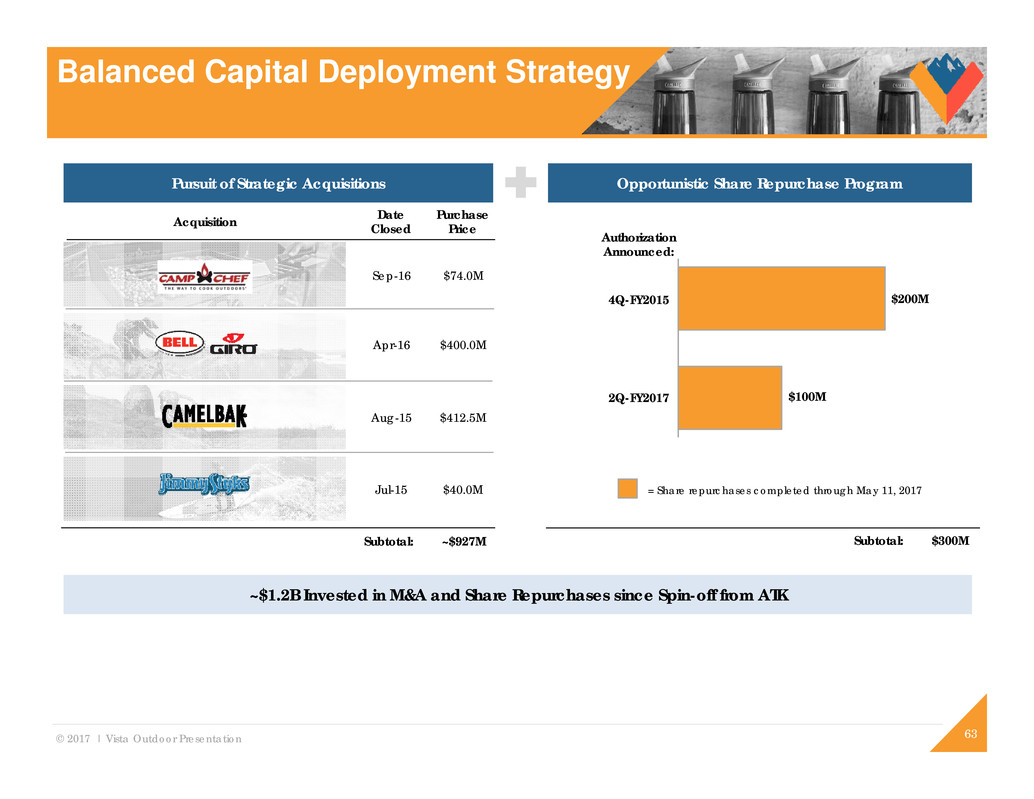

© 2017 | Vista Outdoor Presentation 63 $200M $100M Authorization Announced: 4Q-FY2015 2Q-FY2017 Opportunistic Share Repurchase ProgramPursuit of Strategic Acquisitions = Share repurchases completed through May 11, 2017 Date Closed Purchase Price ~$1.2B Invested in M&A and Share Repurchases since Spin-off from ATK Sep-16 $74.0M Apr-16 $400.0M Aug-15 $412.5M Jul-15 $40.0M Subtotal: ~$927M Subtotal: $300M Acquisition Balanced Capital Deployment Strategy

© 2017 | Vista Outdoor Presentation Strong Customer Relationships Vista Outdoor is the Vendor of Choice for Customers in the Shooting Sports and Outdoor Recreation Markets 5 64 Portfolio of Authentic Brands Focused on Outdoor Sports and Recreation #1 or #2 Market Share Across a Number of Outdoor Recreation Product Categories 1 Large, Addressable and Growing Outdoor Recreation and Shooting Sports Market Diverse, Growing Presence Across Outdoor Recreation’s $93B Market 2 Commitment to Leading Innovation and Product Development Capabilities State-of-the-Art Facilities and Cross-Pollination of Brands Drive Organic Growth 3 Proven M&A Capabilities Track Record of Strategic Acquisitions, Including Jimmy Styks, CamelBak, Action Sports and Camp Chef 6 Established Manufacturing, Global Sourcing and Distribution Platform Global Presence with Modernized Facilities and Efficient Operations 4 Multiple Growth Avenues to Deploy Capital Balanced Growth Strategy with Opportunities in Multiple Avenues 7 Key Investment Highlights Vista Outdoor is positioned as outdoor rec’s premier investment opportunity

© 2017 | Vista Outdoor Presentation Appendix 65

© 2017 | Vista Outdoor Presentation Years Ended March 31, ($M) FY2015 FY2016 FY2017 Net Sales $2,083 $2,271 $2,547 Gross Profit 529 619 669 % Margin 25.4% 27.3% 26.3% Operating Income 184(2) 263 (207)(3) % Margin 8.8% 11.6% (8.1%) D&A 67 73 94 EBITDA (Non-GAAP) 251 335 (113) % Margin 12.0% 14.8% (4.4%) Adjusted EBITDA (Non-GAAP) 320 349 309 % Margin 15.3% 15.4% 12.1% Select Financials(1) Notes: 1. Numbers may not sum due to rounding 2. Includes $52M goodwill/trade name impairment 3. Includes $449M goodwill/trade name impairment 66 Historical Financial Summary

© 2017 | Vista Outdoor Presentation Years Ended March 31, ($000) FY2015 FY2016 FY2017 Net income $79,528 $147,037 ($274,454) Interest expense (income), net 30,108 24,351 43,670 Income tax provision 74,518 91,370 23,760 Depreciation and amortization 66,551 72,614 93,779 EBITDA 250,705 335,372 (113,245) Goodwill impairment(1) 52,220 - 449,199 Transaction costs(2) 19,461 9,009 4,575 Transition costs(2) 5,988 - - Acquisition Claim Settlement(3) - - (30,027) Contingent Consideration(4) - - (2,171) Standalone and public company costs(5) (15,000) - - Inventory step-up(6) - 1,043 817 Lake City Supply Agreement adjustment(7) 6,174 - - Facility Rationalization(8) - 3,258 - Adjusted EBITDA $319,548 $348,682 $309,148 Notes: 1. In FY17 and FY15 the Company recorded a non-cash goodwill impairment related to the Hunting and Shooting Accessories reporting unit and the Firearms reporting unit, respectively 2. Represents transaction costs, including accounting, legal and advisor fees, and transition costs, in each case incurred in connection with our spin-off transaction and the acquisitions of Bushnell, Savage Arms, Jimmy Styks, Camelbak, Action Sports and Camp Chef 3. In FY17, the Company finalized a settlement of claims that it brought against the previous owner of Bushnell Holdings and third-party insurance providers relating to certain disputes arising under the purchase agreement with respect to the acquisition 4. Revaluation and recorded portion of contingent consideration related to Jimmy Styks, Bell Powersports product line and Camp Chef 5. Represents the Company’s estimate of costs that it would have incurred in excess of the applicable corporate allocation had it operated as a standalone public company during the period 6. Represents inventory step-up recorded in connection with the acquisitions of Camelbak, Action Sports and Camp Chef as part of their respective purchase price allocations 7. Impact of reduced cost of sales as a result of the revised pricing under the Lake City Supply Agreement between Vista Outdoor and Orbital ATK 8. Represents costs associated with closure of the Meridian, Idaho and Norfolk, Virginia facilities 67 Non-GAAP Reconciliation Non-GAAP Reconciliation

© 2017 | Vista Outdoor Presentation Free cash flow is defined as cash provided by operating activities less capital expenditures and excluding an acquisition claim settlement, and transaction and transition costs net of taxes incurred to date. Vista Outdoor management believes free cash flow provides investors with an important perspective on the cash available for debt repayment, share repurchases and acquisitions after making the capital investments required to support ongoing business operations. Vista Outdoor management uses free cash flow internally to assess both business performance and overall liquidity. Years Ended March 31, ($000) FY2015 FY2016 FY2017 FY2018 Guidance (1) Cash from Operating Activities $154,338 $198,002 $154,688 $245,000-$270,000 Capital Expenditures (43,189) (41,526) (90,665) ~(70,000) Allocated Interest expense 30,108 - - - Acquisition Claim Settlement - - (30,027) - Transaction costs paid to date, net of tax 18,547 6,485 3,720 - Free Cash Flow $159,804 $162,961 $37,716 $175,000-$200,000 Notes: 1. As of May 11, 2017 68 Non-GAAP Reconciliation: Free Cash Flow Non-GAAP Reconciliation: Free Cash Flow