As filed with the U.S. Securities and Exchange Commission on July 8, 2022

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23024

Pacer Funds Trust

(Exact name of registrant as specified in charter)

500 Chesterfield Parkway

Malvern, PA 19355

(Address of principal executive offices) (Zip code)

Joe M. Thomson, President

500 Chesterfield Parkway

Malvern, PA 19355

(Name and address of agent for service)

610-644-8100

Registrant's telephone number, including area code

Date of fiscal year end: October 31

Date of reporting period: November 01, 2021 through April 30, 2022

Item 1. Reports to Stockholders.

(a)

Pacer Funds

TABLE OF CONTENTS

Page | |

Portfolio Allocation | 1 |

Performance Summary | 4 |

Expense Example | 19 |

Schedules of Investments | 21 |

Statements of Assets & Liabilities | 36 |

Statements of Operations | 40 |

Statements of Changes in Net Assets | 46 |

Financial Highlights | 54 |

Notes to Financial Statements | 69 |

Additional Information | 88 |

Pacer Funds

PORTFOLIO ALLOCATION (Unaudited)

As of April 30, 2022

Pacer American Energy Independence ETF

Sector(a) | Percentage of | |||

Transportation and Warehousing | 52.9 | % | ||

Utilities | 20.2 | % | ||

Mining, Quarrying, and Oil and Gas Extraction | 9.0 | % | ||

Wholesale Trade | 7.5 | % | ||

Professional Scientific and Technical Services | 7.3 | % | ||

Real Estate and Rental and Leasing | 1.9 | % | ||

Retail Trade | 0.6 | % | ||

Short-Term Investments | 0.1 | % | ||

Investments Purchased With Proceeds From Securities Lending | 13.0 | % | ||

Liabilities in Excess of Other Assets | -12.5 | % | ||

| 100.0 | % | |||

(a) | The Fund may classify a company in a different category than the American Energy Independence Index. |

Pacer Swan SOS Conservative (January) ETF

Sector | Percentage of | |||

Purchased Options | 102.0 | % | ||

Short-Term Investments | 0.9 | % | ||

Liabilities in Excess of Other Assets | -2.9 | % | ||

| 100.0 | % | |||

Pacer Swan SOS Moderate (January) ETF

Sector | Percentage of | |||

Purchased Options | 105.6 | % | ||

Short-Term Investments | 0.6 | % | ||

Liabilities in Excess of Other Assets | -6.2 | % | ||

| 100.0 | % | |||

Pacer Swan SOS Flex (January) ETF

Sector | Percentage of | |||

Purchased Options | 107.9 | % | ||

Short-Term Investments | 0.9 | % | ||

Liabilities in Excess of Other Assets | -8.8 | % | ||

| 100.0 | % | |||

Pacer Swan SOS Fund of Funds ETF

Sector | Percentage of | |||

Affiliated Exchange-Traded Funds | 99.1 | % | ||

Short-Term Investments | 0.9 | % | ||

Liabilities in Excess of Other Assets | 0.0 | %(a) | ||

| 100.0 | % | |||

(a) | Less than 0.05%. |

1

Pacer Funds

PORTFOLIO ALLOCATION (Unaudited)

As of April 30, 2022 (Continued)

Pacer Swan SOS Conservative (April) ETF

Sector | Percentage of | |||

Purchased Options | 103.1 | % | ||

Short-Term Investments | 1.0 | % | ||

Liabilities in Excess of Other Assets | -4.1 | % | ||

| 100.0 | % | |||

Pacer Swan SOS Moderate (April) ETF

Sector | Percentage of | |||

Purchased Options | 106.3 | % | ||

Short-Term Investments | 1.1 | % | ||

Liabilities in Excess of Other Assets | -7.4 | % | ||

| 100.0 | % | |||

Pacer Swan SOS Flex (April) ETF

Sector | Percentage of | |||

Purchased Options | 109.3 | % | ||

Short-Term Investments | 1.1 | % | ||

Liabilities in Excess of Other Assets | -10.4 | % | ||

| 100.0 | % | |||

Pacer Swan SOS Conservative (July) ETF

Sector | Percentage of | |||

Purchased Options | 100.3 | % | ||

Short-Term Investments | 0.4 | % | ||

Liabilities in Excess of Other Assets | -0.7 | % | ||

| 100.0 | % | |||

Pacer Swan SOS Moderate (July) ETF

Sector | Percentage of | |||

Purchased Options | 101.2 | % | ||

Short-Term Investments | 0.4 | % | ||

Liabilities in Excess of Other Assets | -1.6 | % | ||

| 100.0 | % | |||

Pacer Swan SOS Flex (July) ETF

Sector | Percentage of | |||

Purchased Options | 101.3 | % | ||

Short-Term Investments | 0.5 | % | ||

Liabilities in Excess of Other Assets | -1.8 | % | ||

| 100.0 | % | |||

2

Pacer Funds

PORTFOLIO ALLOCATION (Unaudited)

As of April 30, 2022 (Continued)

Pacer Swan SOS Conservative (October) ETF

Sector | Percentage of | |||

Purchased Options | 102.0 | % | ||

Short-Term Investments | 0.5 | % | ||

Liabilities in Excess of Other Assets | -2.5 | % | ||

| 100.0 | % | |||

Pacer Swan SOS Moderate (October) ETF

Sector | Percentage of | |||

Purchased Options | 103.7 | % | ||

Short-Term Investments | 0.4 | % | ||

Liabilities in Excess of Other Assets | -4.1 | % | ||

| 100.0 | % | |||

Pacer Swan SOS Flex (October) ETF

Sector | Percentage of | |||

Purchased Options | 104.3 | % | ||

Short-Term Investments | 0.5 | % | ||

Liabilities in Excess of Other Assets | -4.8 | % | ||

| 100.0 | % | |||

Pacer BlueStar Digital Entertainment ETF

Sector(a) | Percentage of | |||

Consumer, Cyclical | 50.5 | % | ||

Technology | 36.5 | % | ||

Communications | 12.6 | % | ||

Short-Term Investments | 0.4 | % | ||

Liabilities in Excess of Other Assets | 0.0 | %(b) | ||

Total | 100.0 | % | ||

(a) | The Fund may classify a company in a different category than the BlueStar Global Online Gambling, Video Gaming, and eSports Index. |

(b) | Less than 0.05%. |

3

Pacer American Energy Independence ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on December 12, 2017, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The American Energy Independence Total Return (the “Index”) uses a proprietary, rules-based methodology to measure the performance of a portfolio of U.S. and Canadian exchange-listed equity securities of companies that generate a majority of their cash flow from certain qualifying “midstream” energy infrastructure activities. The companies in the Index are expected to benefit from regulatory policies favoring and industry trends toward American energy independence (i.e., a reduced or eliminated need for the United States to import fuels, such as coal, crude oil, or natural gas). Midstream energy infrastructure refers to the processing, storage, transportation, and distribution of crude oil, natural gas, refined products, and their related products, as well as the transmission or storage of renewable energy. The following activity segments are considered qualifying midstream energy infrastructure activities: gathering & processing, compression, fractionation, logistics, midstream services, pipeline transportation, storage and terminaling of oil, gas, natural gas liquids, and refined products, as well as operating liquid natural gas facilities. The following activity segments are not qualifying activities: refining, shipping, exploration, production, retail distribution, or oil services. The Index may include small-, mid-, and large-capitalization companies.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Annualized Returns(1)

(For the periods ended April 30, 2022)

Six Months | One Year | Three Year | Since Inception(2) | |

Pacer American Energy Independence ETF - NAV | 12.86% | 31.32% | 12.06% | 9.19% |

Pacer American Energy Independence ETF - Market | 13.26% | 30.95% | 12.12% | 9.25% |

American Energy Independence Total Return Index (3) | 13.45% | 32.81% | 13.50% | 10.53% |

S&P 500 Index (3) | -9.65% | 0.21% | 13.85% | 12.51% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated February 28, 2022, is 0.75%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is December 12, 2017. The Fund is the sucessor to the investment performance of the American Energy Independence ETF (the “Predecessor USAI”) as a result of the reorganization of the Predecessor USAI Fund into the Fund on December 16, 2019. Accordingly, the performance information shown in the chart and table above for periods prior to December 16, 2019 is that of the Predecessor USAI Fund’s Shares for the Fund. The Predecessor USAI Fund was advised by SL Advisors, LLC and sub-advised by Penserra Capital Management LLC and had substantially the same investment objectives, policies, and strategies as the Fund. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

4

Pacer Swan SOS Conservative (January) ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on December 22, 2020, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Conservative (January) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 8.60% (before fees and expenses of the Fund) and 7.85% (after fees and expenses of the Fund), while providing a buffer against Underlying ETF losses between 5% and 30% over the period from December 20, 2021 to December 31, 2022.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Annualized Returns (1)

(For the periods ended April 30, 2022)

Six Months | One Year | Since Inception(2) | |

Pacer Swan SOS Conservative (January) ETF - NAV | -4.62% | -1.93% | 2.17% |

Pacer Swan SOS Conservative (January) ETF - Market | -4.69% | -1.92% | 2.32% |

S&P 500 Index (3) | -9.65% | 0.21% | 10.31% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated February 28, 2022 as supplemented April 1, 2022, is 0.75%. For performance information current to the most recent month- end, please call 1-877-337-0500. |

(2) | Inception date is December 22, 2020. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

5

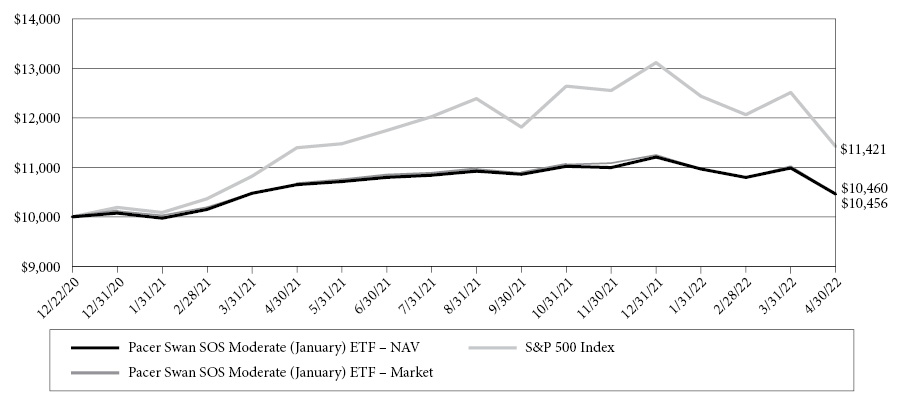

Pacer Swan SOS Moderate (January) ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on December 22, 2020, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Moderate (January) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (“the Underlying ETF”) up to a predetermined upside cap of 10.30% (before fees and expenses of the Fund) and 9.55% (after fees and expenses of the Fund), while providing a buffer against the first 15% of Underlying ETF losses, over the period from December 20, 2021 to December 31, 2022.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Annualized Returns (1)

(For the periods ended April 30, 2022)

Six Months | One Year | Since Inception(2) | |

Pacer Swan SOS Moderate (January) ETF - NAV | -5.08% | -1.78% | 3.38% |

Pacer Swan SOS Moderate (January) ETF - Market | -5.42% | -1.95% | 3.35% |

S&P 500 Index (3) | -9.65% | 0.21% | 10.31% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated February 28, 2022 as supplemented April 1, 2022, is 0.75%. For performance information current to the most recent month- end, please call 1-877-337-0500. |

(2) | Inception date is December 22, 2020. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

6

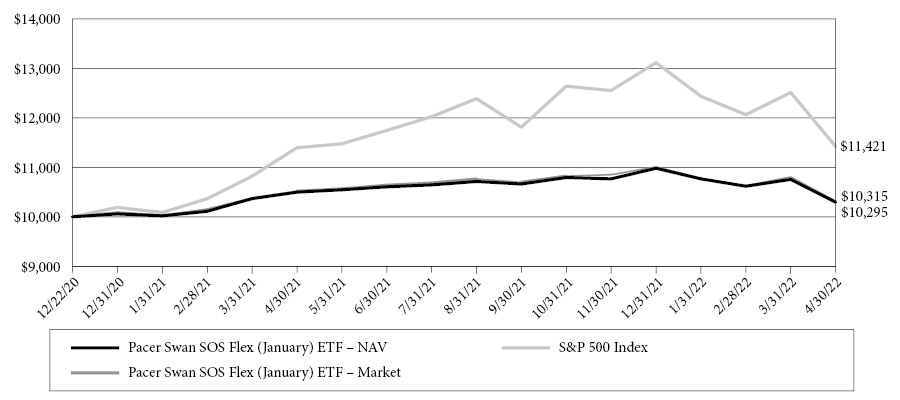

Pacer Swan SOS Flex (January) ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on December 22, 2020, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Flex (January) ETF (the “Fund”) seeks to provide investors with returns that match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 14.70% (before fees and expenses of the Fund) and 13.95% (after fees and expenses of the Fund), while providing a buffer against the first 20% of Underlying ETF losses with the benefits of such buffer declining from 20% to 0% for Underlying ETF losses between 20% and 40%, over the period from December 20, 2021 to December 31, 2022.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Annualized Returns (1)

(For the periods ended April 30, 2022)

Six Months | One Year | Since Inception(2) | |

Pacer Swan SOS Flex (January) ETF - NAV | -5.55% | -0.13% | 6.87% |

Pacer Swan SOS Flex (January) ETF - Market | -5.98% | -0.23% | 6.81% |

S&P 500 Index (3) | -9.65% | 0.21% | 10.31% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated February 28, 2022 as supplemented April 1, 2022, is 0.75%. For performance information current to the most recent month- end, please call 1-877-337-0500. |

(2) | Inception date is December 22, 2020. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

7

Pacer Swan SOS Fund of Funds ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on December 29, 2020, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Fund of Funds ETF (the “Fund”) seeks capital appreciation with downside protection.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Annualized Returns (1)

(For the periods ended April 30, 2022)

Six Months | One Year | Since Inception(2) | |

Pacer Swan SOS Fund of Funds ETF - NAV | -4.67% | -0.48% | 4.34% |

Pacer Swan SOS Fund of Funds ETF - Market | -4.70% | -0.59% | 4.41% |

S&P 500 Index (3) | -9.65% | 0.21% | 9.57% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated February 28, 2022 as supplemented April 1, 2022, is 0.93%. For performance information current to the most recent month- end, please call 1-877-337-0500. |

(2) | Inception date is December 29, 2020. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

8

Pacer Swan SOS Conservative (April) ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on March 31, 2021, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Conservative (April) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 9.10% (before fees and expenses of the Fund) and 8.35% (after fees and expenses of the Fund), while providing a buffer against Underlying ETF losses between 5% and 30% over the period from April 1, 2021 to March 31, 2022.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Annualized Returns (1)

(For the periods ended April 30, 2022)

Six Months | One Year | Since Inception(2) | |

Pacer Swan SOS Conservative (April) ETF - NAV | -2.36% | 1.09% | 2.73% |

Pacer Swan SOS Conservative (April) ETF - Market | -2.34% | 1.13% | 2.87% |

S&P 500 Index (3) | -9.65% | 0.21% | 5.13% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated February 28, 2022 as supplemented April 1, 2022, is 0.75%. For performance information current to the most recent month- end, please call 1-877-337-0500. |

(2) | Inception date is March 31, 2021. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

9

Pacer Swan SOS Moderate (April) ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on March 31, 2021, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Moderate (April) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (“the Underlying ETF”) up to a predetermined upside cap of 10.48% (before fees and expenses of the Fund) and 9.73% (after fees and expenses of the Fund), while providing a buffer against the first 15% of Underlying ETF losses, over the period from April 1, 2021 to March 31, 2022.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Annualized Returns (1)

(For the periods ended April 30, 2022)

Six Months | One Year | Since Inception(2) | |

Pacer Swan SOS Moderate (April) ETF - NAV | -2.83% | 1.41% | 3.37% |

Pacer Swan SOS Moderate (April) ETF - Market | -2.83% | 1.51% | 3.44% |

S&P 500 Index (3) | -9.65% | 0.21% | 5.13% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated February 28, 2022 as supplemented April 1, 2022, is 0.75%. For performance information current to the most recent month- end, please call 1-877-337-0500. |

(2) | Inception date is March 31, 2021. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

10

Pacer Swan SOS Flex (April) ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on March 31, 2021, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Flex (April) ETF (the “Fund”) seeks to provide investors with returns that match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 16.04% (before fees and expenses of the Fund) and 15.29% (after fees and expenses of the Fund), while providing a buffer against the first 20% of Underlying ETF losses with the benefits of such buffer declining from 20% to 0% for Underlying ETF losses between 20% and 40%, over the period from April 1, 2021 to March 31, 2022.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Annualized Returns (1)

(For the periods ended April 30, 2022)

Six Months | One Year | Since Inception(2) | |

Pacer Swan SOS Flex (April) ETF - NAV | -4.49% | 1.93% | 5.00% |

Pacer Swan SOS Flex (April) ETF - Market | -4.72% | 1.97% | 4.95% |

S&P 500 Index (3) | -9.65% | 0.21% | 5.13% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated February 28, 2022 as supplemented April 1, 2022, is 0.75%. For performance information current to the most recent month- end, please call 1-877-337-0500. |

(2) | Inception date is March 31, 2021. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

11

Pacer Swan SOS Conservative (July) ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000, investment made on June 30, 2021, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Conservative (July) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 7.15% (before fees and expenses of the Fund) and 6.40% (after fees and expenses of the Fund), while providing a buffer against Underlying ETF losses between 5% and 30% over the period from July 1, 2021 to June 30, 2022.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Cumulative Returns (1)

(For the periods ended April 30, 2022)

Six Months | Since Inception(2) | |

Pacer Swan SOS Conservative (July) ETF - NAV | -4.08% | -1.95% |

Pacer Swan SOS Conservative (July) ETF - Market | -4.20% | -1.80% |

S&P 500 Index (3) | -9.65% | -2.75% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated February 28, 2022 as supplemented April 1, 2022, is 0.75%. For performance information current to the most recent month- end, please call 1-877-337-0500. |

(2) | Inception date is June 30, 2021. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

12

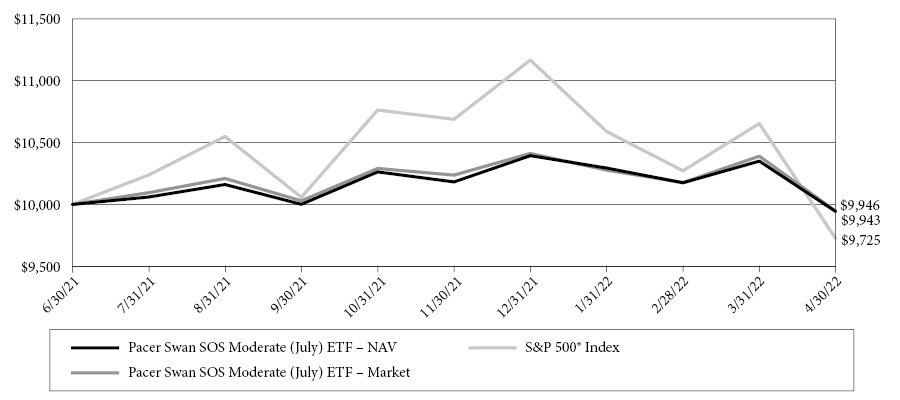

Pacer Swan SOS Moderate (July) ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000, investment made on June 30, 2021, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Moderate (July) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (“the Underlying ETF”) up to a predetermined upside cap of 7.95% (before fees and expenses of the Fund) and 7.20% (after fees and expenses of the Fund), while providing a buffer against the first 15% of Underlying ETF losses, over the period from July 1, 2021 to June 30, 2022.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Cumulative Returns (1)

(For the periods ended April 30, 2022)

Six Months | Since Inception(2) | |

Pacer Swan SOS Moderate (July) ETF - NAV | -3.12% | -0.57% |

Pacer Swan SOS Moderate (July) ETF - Market | -3.35% | -0.54% |

S&P 500 Index (3) | -9.65% | -2.75% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated February 28, 2022 as supplemented April 1, 2022, is 0.75%. For performance information current to the most recent month- end, please call 1-877-337-0500. |

(2) | Inception date is June 30, 2021 |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

13

Pacer Swan SOS Flex (July) ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000, investment made on June 30, 2021, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Flex (July) ETF (the “Fund”) seeks to provide investors with returns that match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 11.30% (before fees and expenses of the Fund) and 10.55% (after fees and expenses of the Fund), while providing a buffer against the first 20% of Underlying ETF losses with the benefits of such buffer declining from 20% to 0% for Underlying ETF losses between 20% and 40%, over the period from July 1, 2021 to June 30, 2022.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Cumulative Returns (1)

(For the periods ended April 30, 2022)

Six Months | Since Inception(2) | |

Pacer Swan SOS Flex (July) ETF - NAV | -4.37% | -0.49% |

Pacer Swan SOS Flex (July) ETF - Market | -4.51% | -0.43% |

S&P 500 Index (3) | -9.65% | -2.75% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated February 28, 2022 as supplemented April 1, 2022, is 0.75%. For performance information current to the most recent month- end, please call 1-877-337-0500. |

(2) | Inception date is June 30, 2021 |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

14

Pacer Swan SOS Conservative (October) ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on September 30, 2021, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Conservative (October) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 7.56% (before fees and expenses of the Fund) and 6.81% (after fees and expenses of the Fund), while providing a buffer against Underlying ETF losses between 5% and 30% over the period from October 1, 2021 to September 30, 2022.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Cumulative Returns (1)

(For the periods ended April 30, 2022)

Six Months | Since Inception(2) | |

Pacer Swan SOS Conservative (October) ETF - NAV | -3.64% | -2.00% |

Pacer Swan SOS Conservative (October) ETF - Market | -3.74% | -1.79% |

S&P 500 Index (3) | -9.65% | -3.32% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated February 28, 2022 as supplemented April 1, 2022, is 0.75%. For performance information current to the most recent month- end, please call 1-877-337-0500. |

(2) | Inception date is September 30, 2021 |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

15

Pacer Swan SOS Moderate (October) ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on September 30, 2021, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Moderate (October) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (“the Underlying ETF”) up to a predetermined upside cap of 9.07% (before fees and expenses of the Fund) and 8.32% (after fees and expenses of the Fund), while providing a buffer against the first 15% of Underlying ETF losses, over the period from October 1, 2021 to September 30, 2022.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Cumulative Returns (1)

(For the periods ended April 30, 2022)

Six Months | Since Inception(2) | |

Pacer Swan SOS Moderate (October) ETF - NAV | -3.69% | -1.54% |

Pacer Swan SOS Moderate (October) ETF - Market | -3.77% | -1.39% |

S&P 500 Index (3) | -9.65% | -3.32% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated February 28, 2022 as supplemented April 1, 2022, is 0.75%. For performance information current to the most recent month- end, please call 1-877-337-0500. |

(2) | Inception date is September 30, 2021 |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

16

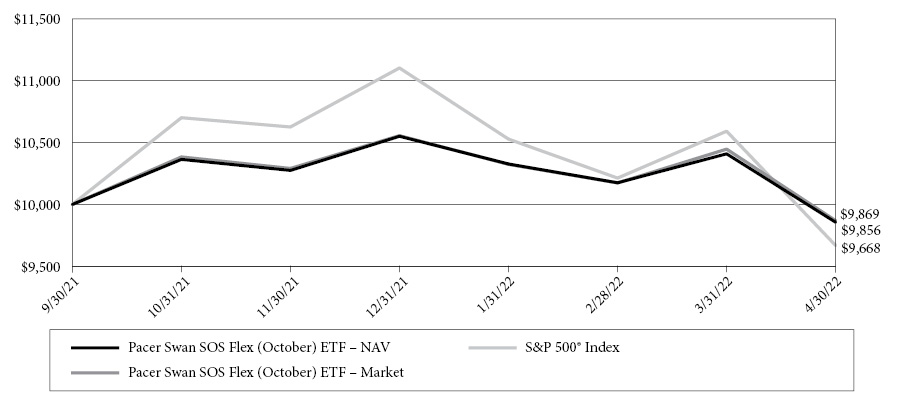

Pacer Swan SOS Flex (October) ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on September 30, 2021, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Flex (October) ETF (the “Fund”) seeks to provide investors with returns that match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 12.98% (before fees and expenses of the Fund) and 12.23% (after fees and expenses of the Fund), while providing a buffer against the first 20% of Underlying ETF losses with the benefits of such buffer declining from 20% to 0% for Underlying ETF losses between 20% and 40%, over the period from October 1, 2021 to September 30, 2022.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Cumulative Returns (1)

(For the periods ended April 30, 2022)

Six Months | Since Inception(2) | |

Pacer Swan SOS Flex (October) ETF - NAV | -4.90% | -1.44% |

Pacer Swan SOS Flex (October) ETF - Market | -4.96% | -1.31% |

S&P 500 Index (3) | -9.65% | -3.32% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated February 28, 2022 as supplemented April 1, 2022, is 0.75%. For performance information current to the most recent month- end, please call 1-877-337-0500. |

(2) | Inception date is September 30, 2021 |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

17

Pacer BlueStar Digital Entertainment ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on April 7, 2022, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The BlueStar Global Online Gambling, Video Gaming, and eSports Index is a rules-based index that consists of globally-listed stocks and depositary receipts of digital entertainment companies. Companies eligible to be added to the Index are those that derive at least 50% of their revenues from the following activities: online gambling platforms or software related to online gambling; video game development and software related to the development of video games or hardware such as computer processors and graphics cards used in video gaming systems, controllers, headsets, and gaming consoles; and streaming services or video games and/or hardware for use in eSports events or that are involved in eSports events such as league operators, teams, distributors and platforms, (collectively, “Digital Entertainment”) as determined by MV Index Solutions (the “Index Provider”).

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Cumulative Returns(1)

(For the periods ended April 30, 2022)

Since Inception(2) | |

Pacer BlueStar Digital Entertainment ETF - NAV | -8.92% |

Pacer BlueStar Digital Entertainment ETF - Market | -9.89% |

BlueStar Global Online Gambling, Video Gaming, and eSports Index | -9.33% |

S&P 500 Index (3) | -8.13% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated April 6, 2022 as supplemented April 27, 2022, is 0.60%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is April 7, 2022. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

18

Pacer Funds

EXPENSE EXAMPLE

For the Period Ended April 30, 2022 (Unaudited)

As a shareholder of a Fund, you pay ongoing expenses, such as advisory fees, and other Fund expenses. The following examples are intended to help you understand the ongoing cost (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other funds. Please note, the expenses shown in the tables are meant to highlight ongoing costs only and do not reflect any transactional costs. You may pay brokerage commissions on your purchase and sale of Fund shares, which are not reflected in the following examples. Each example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses

The columns under the heading entitled “Actual” help you estimate the actual expenses you paid over the period. The “Actual Ending Account Value” shown is derived from a Fund’s actual return and the “Actual Expenses Paid During Period” show the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. To estimate the expenses you paid on your account during this period, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000=8.6), then multiply the result by the number in the column under the heading untitled “Actual Expenses Paid During Period”.

Hypothetical Example for Comparison Purposes

The columns under the heading entitled “Hypothetical” provide information about hypothetical account value and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s return. The hypothetical account value and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs which may be applicable to your account. Therefore, the last column of the table (Hypothetical Expenses Paid During Period) is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Fund’s Annual | Beginning | Ending | Expenses Paid | |

Pacer American Energy Independence ETF | ||||

Actual | 0.75% | $ 1,000.00 | $ 1,128.60 | $ 3.96 |

Hypothetical(b) | 0.75% | $ 1,000.00 | $ 1,021.08 | $ 3.76 |

Pacer Swan SOS Conservative (January) ETF | ||||

Actual | 0.75% | $ 1,000.00 | $ 953.80 | $ 3.63 |

Hypothetical(b) | 0.75% | $ 1,000.00 | $ 1,021.08 | $ 3.76 |

Pacer Swan SOS Moderate (January) ETF | ||||

Actual | 0.75% | $ 1,000.00 | $ 949.20 | $ 3.62 |

Hypothetical(b) | 0.75% | $ 1,000.00 | $ 1,021.08 | $ 3.76 |

Pacer Swan SOS Flex (January) ETF | ||||

Actual | 0.75% | $ 1,000.00 | $ 944.50 | $ 3.62 |

Hypothetical(b) | 0.75% | $ 1,000.00 | $ 1,021.08 | $ 3.76 |

Pacer Swan SOS Fund of Funds ETF | ||||

Actual | 0.18% | $ 1,000.00 | $ 953.30 | $ 0.87 |

Hypothetical(b) | 0.18% | $ 1,000.00 | $ 1,023.90 | $ 0.90 |

Pacer Swan SOS Conservative (April) ETF | ||||

Actual | 0.75% | $ 1,000.00 | $ 976.40 | $ 3.68 |

Hypothetical(b) | 0.75% | $ 1,000.00 | $ 1,021.08 | $ 3.76 |

Pacer Swan SOS Moderate (April) ETF | ||||

Actual | 0.75% | $ 1,000.00 | $ 971.70 | $ 3.67 |

Hypothetical(b) | 0.75% | $ 1,000.00 | $ 1,021.08 | $ 3.76 |

Pacer Swan SOS Flex (April) ETF | ||||

Actual | 0.75% | $ 1,000.00 | $ 955.10 | $ 3.64 |

Hypothetical(b) | 0.75% | $ 1,000.00 | $ 1,021.08 | $ 3.76 |

19

Pacer Funds

EXPENSE EXAMPLE

For the Period Ended April 30, 2022 (Unaudited) (Continued)

Fund’s Annual | Beginning | Ending | Expenses Paid | |

Pacer Swan SOS Conservative (July) ETF | ||||

Actual | 0.75% | $ 1,000.00 | $ 959.20 | $ 3.64 |

Hypothetical(b) | 0.75% | $ 1,000.00 | $ 1,021.08 | $ 3.76 |

Pacer Swan SOS Moderate (July) ETF | ||||

Actual | 0.75% | $ 1,000.00 | $ 968.80 | $ 3.66 |

Hypothetical(b) | 0.75% | $ 1,000.00 | $ 1,021.08 | $ 3.76 |

Pacer Swan SOS Flex (July) ETF | ||||

Actual | 0.75% | $ 1,000.00 | $ 956.30 | $ 3.64 |

Hypothetical(b) | 0.75% | $ 1,000.00 | $ 1,021.08 | $ 3.76 |

Pacer Swan SOS Conservative (October) ETF | ||||

Actual | 0.75% | $ 1,000.00 | $ 963.60 | $ 3.65 |

Hypothetical(b) | 0.75% | $ 1,000.00 | $ 1,021.08 | $ 3.76 |

Pacer Swan SOS Moderate (October) ETF | ||||

Actual | 0.75% | $ 1,000.00 | $ 963.10 | $ 3.65 |

Hypothetical(b) | 0.75% | $ 1,000.00 | $ 1,021.08 | $ 3.76 |

Pacer Swan SOS Flex (October) ETF | ||||

Actual | 0.75% | $ 1,000.00 | $ 951.00 | $ 3.63 |

Hypothetical(b) | 0.75% | $ 1,000.00 | $ 1,021.08 | $ 3.76 |

(a) | The dollar amounts shown as expenses paid during the period are equal to the annualized six-month expense ratio multiplied by the average account value during the period, multiplied by the number of days (181) in the most recent six-month period and divided by the number of days in the most recent twelve-month period (365). |

(b) | Assumes 5% return before expenses. |

Fund’s Annual | Beginning | Ending | Expenses Paid | |

Pacer BlueStar Digital Entertainment ETF | ||||

Actual | 0.60% | $ 1,000.00 | $ 910.80 | $ 0.36(b) |

Hypothetical(d) | 0.60% | $ 1,000.00 | $ 1,021.82 | $ 3.01(c) |

(a) | Inception Date of the Fund. |

(b) | The dollar amounts shown as expenses paid during the period are equal to the annualized six-month expense ratio multiplied by the average account value during the period, multiplied by the number of days (23) in the most recent period and divided by the number of days in the most recent twelve-month period (365). |

(c) | The dollar amounts shown as expenses paid during the period are equal to the annualized six-month expense ratio multiplied by the average account value during the period, multiplied by the number of days (181) in the most recent six-month period and divided by the number of days in the most recent twelve-month period (365). |

(d) | Assumes 5% return before expenses. |

20

Pacer American Energy Independence ETF

SCHEDULES OF INVESTMENTS

April 30, 2022 (Unaudited)

Shares | Value | |||||||

COMMON STOCKS — 77.4% | ||||||||

Oil & Gas — 2.3% | ||||||||

Tellurian, Inc. (a) | 176,094 | $ | 876,948 | |||||

Oil & Gas Services — 1.9% | ||||||||

Archrock, Inc. | 81,557 | 710,361 | ||||||

Pipelines — 73.2% (b) | ||||||||

Antero Midstream Corp. | 86,736 | 890,779 | ||||||

Cheniere Energy, Inc. (c) | 19,296 | 2,620,590 | ||||||

DT Midstream, Inc. (c) | 20,001 | 1,075,054 | ||||||

Enbridge, Inc. | 59,835 | 2,611,100 | ||||||

EnLink Midstream LLC | 89,497 | 883,335 | ||||||

Equitrans Midstream Corp. | 112,748 | 886,199 | ||||||

Gibson Energy, Inc. | 43,600 | 830,153 | ||||||

Hess Midstream LP - Class A (c) | 23,251 | 683,812 | ||||||

Keyera Corp. | 44,315 | 1,099,380 | ||||||

Kinder Morgan, Inc. | 147,865 | 2,683,750 | ||||||

Kinetik Holdings, Inc. | 9,760 | 694,424 | ||||||

New Fortress Energy, Inc. (c) | 21,687 | 841,022 | ||||||

NextDecade Corp. (a) | 156,658 | 875,718 | ||||||

ONEOK, Inc. | 22,755 | 1,441,074 | ||||||

Pembina Pipeline Corp. | 42,017 | 1,589,886 | ||||||

Plains GP Holdings LP - Class A | 70,356 | 785,877 | ||||||

Targa Resources Corp. (c) | 21,727 | 1,594,979 | ||||||

TC Energy Corp. | 47,900 | 2,533,612 | ||||||

The Williams Cos., Inc. (c) | 81,958 | 2,810,340 | ||||||

| 27,431,084 | ||||||||

TOTAL COMMON STOCKS (Cost $21,873,847) | 29,018,393 | |||||||

MASTER LIMITED PARTNERSHIPS AND RELATED COMPANIES — 22.0% (b) | ||||||||

Pipelines — 22.0% (b) | ||||||||

Crestwood Equity Partners LP | 6,972 | 203,303 | ||||||

Energy Transfer LP | 155,565 | 1,723,660 | ||||||

Enterprise Products Partners LP | 107,260 | 2,779,107 | ||||||

Genesis Energy LP | 12,302 | 135,076 | ||||||

Holly Energy Partners LP | 6,304 | 107,987 | ||||||

Magellan Midstream Partners LP | 17,226 | 834,600 | ||||||

MPLX LP | 30,197 | 977,175 | ||||||

NuStar Energy LP | 10,564 | 161,312 | ||||||

PBF Logistics LP | 5,320 | 83,471 | ||||||

Rattler Midstream LP | 47,616 | 640,435 | ||||||

Shell Midstream Partners LP | 12,681 | 179,183 | ||||||

Shares | Value | |||||||

Pipelines — 22.0% (b) (Continued) | ||||||||

Western Midstream Partners LP | 16,858 | $ | 407,795 | |||||

TOTAL MASTER LIMITED PARTNERSHIPS AND RELATED COMPANIES (Cost $6,384,330) | 8,233,104 | |||||||

Principal | ||||||||

SHORT-TERM INVESTMENTS — 0.1% | ||||||||

Money Market Deposit Accounts — 0.1% | ||||||||

U.S. Bank Money Market Deposit Account, 0.130% (d) | $ | 53,914 | 53,914 | |||||

TOTAL SHORT-TERM INVESTMENTS (Cost $53,914) | 53,914 | |||||||

Shares | ||||||||

INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING — 13.0% | ||||||||

Mount Vernon Liquid Assets Portfolio, LLC, 0.450% (d) | 4,883,031 | 4,883,031 | ||||||

TOTAL INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING (Cost $4,883,031) | 4,883,031 | |||||||

Total Investments (Cost $33,195,122) — 112.5% | 42,188,442 | |||||||

Liabilities in Excess of Other Assets — (12.5)% | (4,691,969 | ) | ||||||

TOTAL NET ASSETS — 100.0% | $ | 37,496,473 | ||||||

Percentages are stated as a percent of net assets.

(a) | Non-income producing security. |

(b) | To the extent that the Fund invests more heavily in particular industry groups of the economy, its performance will be especially sensitive to developments that significantly affect those industry groups or strategies. |

(c) | All or a portion of this security is on loan as of April 30, 2022. The total value of securities on loan is $4,637,944 or 12.4% of net assets. |

(d) | The rate shown is as of April 30, 2022. |

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or they may be defined by Fund management. This definition does not apply for all purposes of this report, which may combine sub-classifications for reporting ease.

The accompanying notes are an integral part of the financial statements.

21

Pacer Swan SOS Conservative (January) ETF

SCHEDULES OF INVESTMENTS

April 30, 2022 (Unaudited)

Contracts | Notional Amount | Value | ||||||||||

PURCHASED OPTIONS — 102.0% (a) (b) | ||||||||||||

CALL OPTIONS — 92.1% | ||||||||||||

SPDR S&P 500 ETF Trust, Expires 12/30/2022, Strike Price $5.52 | 182 | $ | 7,498,400 | $ | 7,308,695 | |||||||

| 7,308,695 | ||||||||||||

PUT OPTIONS — 9.9% | ||||||||||||

SPDR S&P 500 ETF Trust, Expires 12/30/2022, Strike Price $436.88 | 182 | 7,498,400 | 784,584 | |||||||||

| 784,584 | ||||||||||||

TOTAL PURCHASED OPTIONS (Cost $8,782,333) | 8,093,279 | |||||||||||

Principal | ||||||||||||

SHORT-TERM INVESTMENTS — 0.9% | ||||||||||||

Money Market Deposit Accounts — 0.9% | ||||||||||||

U.S. Bank Money Market Deposit Account, 0.130% (c) | $ | 75,582 | 75,582 | |||||||||

TOTAL SHORT-TERM INVESTMENTS (Cost $75,582) | 75,582 | |||||||||||

Total Investments (Cost $8,857,915) — 102.9% | 8,168,861 | |||||||||||

Liabilities in Excess of Other Assets - (2.9%) | (231,078 | ) | ||||||||||

TOTAL NET ASSETS — 100.0% | $ | 7,937,783 | ||||||||||

Percentages are stated as a percent of net assets.

(a) | Exchange-Traded. |

(b) | Purchased option contracts are held in connection with corresponding written option contracts. |

(c) | The rate shown is as of April 30, 2022. |

SCHEDULE OF WRITTEN OPTIONS

April 30, 2022 (Unaudited)

Contracts | Notional Amount | Value | ||||||||||

WRITTEN OPTIONS — (2.9%) (a) | ||||||||||||

CALL OPTIONS — (0.6%) | ||||||||||||

SPDR S&P 500 ETF Trust, Expires 12/30/2022, Strike Price $499.42 | 182 | $ | (7,498,400 | ) | $ | (49,966 | ) | |||||

| (49,966 | ) | |||||||||||

PUT OPTIONS — (2.3%) | ||||||||||||

SPDR S&P 500 ETF Trust, Expires 12/30/2022, Strike Price $321.91 | 182 | (7,498,400 | ) | (178,960 | ) | |||||||

| (178,960 | ) | |||||||||||

TOTAL WRITTEN OPTIONS (Premiums Received $497,215) | $ | (228,926 | ) | |||||||||

Percentages are stated as a percent of net assets.

(a) | Exchange-Traded. |

The accompanying notes are an integral part of the financial statements.

22

Pacer Swan SOS Moderate (January) ETF

SCHEDULES OF INVESTMENTS

April 30, 2022 (Unaudited)

Contracts | Notional Amount | Value | ||||||||||

PURCHASED OPTIONS — 105.6% (a) (b) | ||||||||||||

CALL OPTIONS — 92.6% | ||||||||||||

SPDR S&P 500 ETF Trust, Expires 12/30/2022, Strike Price $5.56 | 506 | $ | 20,847,200 | $ | 20,317,785 | |||||||

| 20,317,785 | ||||||||||||

PUT OPTIONS — 13.0% | ||||||||||||

SPDR S&P 500 ETF Trust, Expires 12/30/2022, Strike Price $459.92 | 506 | 20,847,200 | 2,848,937 | |||||||||

| 2,848,937 | ||||||||||||

TOTAL PURCHASED OPTIONS (Cost $24,690,636) | 23,166,722 | |||||||||||

Principal | ||||||||||||

SHORT-TERM INVESTMENTS — 0.6% | ||||||||||||

Money Market Deposit Accounts — 0.6% | ||||||||||||

U.S. Bank Money Market Deposit Account, 0.130% (c) | $ | 130,508 | 130,508 | |||||||||

TOTAL SHORT-TERM INVESTMENTS (Cost $130,508) | 130,508 | |||||||||||

Total Investments (Cost $24,821,144) — 106.2% | 23,297,230 | |||||||||||

Liabilities in Excess of Other Assets — (6.2%) | (1,358,688 | ) | ||||||||||

TOTAL NET ASSETS — 100.0% | $ | 21,938,542 | ||||||||||

Percentages are stated as a percent of net assets.

(a) | Exchange-Traded. |

(b) | Purchased option contracts are held in connection with corresponding written option contracts. |

(c) | The rate shown is as of April 30, 2022. |

SCHEDULE OF WRITTEN OPTIONS

April 30, 2022 (Unaudited)

Contracts | Notional Amount | Value | ||||||||||

WRITTEN OPTIONS — (6.1%) (a) | ||||||||||||

CALL OPTIONS — (0.4%) | ||||||||||||

SPDR S&P 500 ETF Trust, Expires 12/30/2022, Strike Price $507.24 | 506 | $ | (20,847,200 | ) | $ | (100,248 | ) | |||||

| (100,248 | ) | |||||||||||

PUT OPTIONS — (5.7%) | ||||||||||||

SPDR S&P 500 ETF Trust, Expires 12/30/2022, Strike Price $390.89 | 506 | (20,847,200 | ) | (1,246,673 | ) | |||||||

| (1,246,673 | ) | |||||||||||

TOTAL WRITTEN OPTIONS (Premiums Received $1,703,154) | $ | (1,346,921 | ) | |||||||||

Percentages are stated as a percent of net assets.

(a) | Exchange-Traded. |

The accompanying notes are an integral part of the financial statements.

23

Pacer Swan SOS Flex (January) ETF

SCHEDULES OF INVESTMENTS

April 30, 2022 (Unaudited)

Contracts | Notional Amount | Value | ||||||||||

PURCHASED OPTIONS — 107.9% (a) (b) | ||||||||||||

CALL OPTIONS — 93.5% | ||||||||||||

SPDR S&P 500 ETF Trust, Expires 12/30/2022, Strike Price $5.61 | 773 | $ | 31,847,600 | $ | 31,035,023 | |||||||

| 31,035,023 | ||||||||||||

PUT OPTIONS — 14.4% | ||||||||||||

SPDR S&P 500 ETF Trust, Expires 12/30/2022, Strike Price $275.92 | 773 | 31,847,600 | 417,158 | |||||||||

SPDR S&P 500 ETF Trust, Expires 12/30/2022, Strike Price $459.87 | 773 | 31,847,600 | 4,349,707 | |||||||||

| 4,766,865 | ||||||||||||

TOTAL PURCHASED OPTIONS (Cost $37,617,180) | 35,801,888 | |||||||||||

Principal | ||||||||||||

SHORT-TERM INVESTMENTS — 0.9% | ||||||||||||

Money Market Deposit Accounts — 0.9% | ||||||||||||

U.S. Bank Money Market Deposit Account, 0.130% (c) | $ | 286,580 | 286,580 | |||||||||

TOTAL SHORT-TERM INVESTMENTS (Cost $286,580) | 286,580 | |||||||||||

Total Investments (Cost $37,903,760) — 108.8% | 36,088,468 | |||||||||||

Liabilities in Excess of Other Assets - (8.8%) | (2,908,117 | ) | ||||||||||

TOTAL NET ASSETS — 100.0% | $ | 33,180,351 | ||||||||||

Percentages are stated as a percent of net assets.

(a) | Exchange-Traded. |

(b) | Purchased option contracts are held in connection with corresponding written option contracts. |

(c) | The rate shown is as of April 30, 2022. |

SCHEDULE OF WRITTEN OPTIONS

April 30, 2022 (Unaudited)

Contracts | Notional Amount | Value | ||||||||||

WRITTEN OPTIONS — (8.7%) (a) | ||||||||||||

CALL OPTIONS — (0.2%) | ||||||||||||

SPDR S&P 500 ETF Trust, Expires 12/30/2022, Strike Price $527.47 | 773 | $ | (31,847,600 | ) | $ | (71,867 | ) | |||||

| (71,867 | ) | |||||||||||

PUT OPTIONS — (8.5%) | ||||||||||||

SPDR S&P 500 ETF Trust, Expires 12/30/2022, Strike Price $367.90 | 1,546 | (63,695,200 | ) | (2,817,897 | ) | |||||||

| (2,817,897 | ) | |||||||||||

TOTAL WRITTEN OPTIONS (Premiums Received $3,061,968) | $ | (2,889,764 | ) | |||||||||

Percentages are stated as a percent of net assets.

(a) | Exchange-Traded. |

The accompanying notes are an integral part of the financial statements.

24

Pacer Swan SOS Fund of Funds ETF

SCHEDULES OF INVESTMENTS

April 30, 2022 (Unaudited)

Shares | Value | |||||||

AFFILIATED EXCHANGE-TRADED FUNDS — 99.1% | ||||||||

Pacer Swan SOS Conservative (April) ETF (a) | 198,792 | $ | 4,224,608 | |||||

Pacer Swan SOS Conservative (January) ETF (a) | 257,890 | 5,469,202 | ||||||

Pacer Swan SOS Conservative (July) ETF (a) | 141,671 | 2,849,089 | ||||||

Pacer Swan SOS Conservative (October) ETF (a) | 125,361 | 2,525,021 | ||||||

Pacer Swan SOS Flex (April) ETF (a) | 318,778 | 6,922,487 | ||||||

Pacer Swan SOS Flex (January) ETF (a) | 363,305 | 8,165,789 | ||||||

Pacer Swan SOS Flex (July) ETF (a) | 257,232 | 5,245,372 | ||||||

Pacer Swan SOS Flex (October) ETF (a) | 229,374 | 4,642,851 | ||||||

Pacer Swan SOS Moderate (April) ETF (a) | 676,196 | 14,456,056 | ||||||

Pacer Swan SOS Moderate (January) ETF | 878,691 | 18,801,527 | ||||||

Pacer Swan SOS Moderate (July) ETF | 639,736 | 13,028,544 | ||||||

Pacer Swan SOS Moderate (October) ETF (a) | 645,142 | 13,048,255 | ||||||

TOTAL AFFILIATED EXCHANGE-TRADED FUNDS (Cost $103,592,225) | 99,378,801 | |||||||

Principal | ||||||||

SHORT-TERM INVESTMENTS — 0.9% | ||||||||

Money Market Deposit Accounts — 0.9% | ||||||||

U.S. Bank Money Market Deposit Account, 0.130% (b) | $ | 875,067 | 875,067 | |||||

TOTAL SHORT-TERM INVESTMENTS (Cost $875,067) | 875,067 | |||||||

Total Investments (Cost $104,467,292) — 100.0% | 100,253,868 | |||||||

Liabilities in Excess of Other Assets — 0.0% (c) | (14,355 | ) | ||||||

TOTAL NET ASSETS — 100.0% | $ | 100,239,513 | ||||||

Percentages are stated as a percent of net assets.

(a) | Non-income producing security. |

(b) | The rate shown is as of April 30, 2022. |

(c) | Less than 0.05%. |

The accompanying notes are an integral part of the financial statements.

25

Pacer Swan SOS Conservative (April) ETF

SCHEDULES OF INVESTMENTS

April 30, 2022 (Unaudited)

Contracts | Notional Amount | Value | ||||||||||

PURCHASED OPTIONS — 103.1% (a) (b) | ||||||||||||

CALL OPTIONS — 93.0% | ||||||||||||

SPDR S&P 500 ETF Trust, Expires 03/31/2023, Strike Price $5.42 | 148 | $ | 6,097,600 | $ | 5,923,104 | |||||||

| 5,923,104 | ||||||||||||

PUT OPTIONS — 10.1% | ||||||||||||

SPDR S&P 500 ETF Trust, Expires 03/31/2023, Strike Price $429.06 | 148 | 6,097,600 | 640,805 | |||||||||

| 640,805 | ||||||||||||

TOTAL PURCHASED OPTIONS (Cost $6,932,270) | 6,563,909 | |||||||||||

Principal | ||||||||||||

SHORT-TERM INVESTMENTS — 1.0% | ||||||||||||

Money Market Deposit Accounts — 1.0% | ||||||||||||

U.S. Bank Money Market Deposit Account, 0.130% (c) | $ | 60,802 | 60,802 | |||||||||

TOTAL SHORT-TERM INVESTMENTS (Cost $60,802) | 60,802 | |||||||||||

Total Investments (Cost $6,993,072) — 104.1% | 6,624,711 | |||||||||||

Liabilities in Excess of Other Assets — (4.1%) | (259,071 | ) | ||||||||||

TOTAL NET ASSETS — 100.0% | $ | 6,365,640 | ||||||||||

Percentages are stated as a percent of net assets.

(a) | Exchange-Traded. |

(b) | Purchased option contracts are held in connection with corresponding written option contracts. |

(c) | The rate shown is as of April 30, 2022. |

SCHEDULE OF WRITTEN OPTIONS

April 30, 2022 (Unaudited)

Contracts | Notional Amount | Value | ||||||||||

WRITTEN OPTIONS — (4.0%) (a) | ||||||||||||

CALL OPTIONS — (1.3%) | ||||||||||||

SPDR S&P 500 ETF Trust, Expires 03/31/2023, Strike Price $497.84 | 148 | $ | (6,097,600 | ) | $ | (85,097 | ) | |||||

| (85,097 | ) | |||||||||||

PUT OPTIONS — (2.7%) | ||||||||||||

SPDR S&P 500 ETF Trust, Expires 03/31/2023, Strike Price $316.15 | 148 | (6,097,600 | ) | (172,427 | ) | |||||||

| (172,427 | ) | |||||||||||

TOTAL WRITTEN OPTIONS (Premiums Received $335,570) | $ | (257,524 | ) | |||||||||

Percentages are stated as a percent of net assets.

(a) | Exchange-Traded. |

The accompanying notes are an integral part of the financial statements.

26

Pacer Swan SOS Moderate (April) ETF

SCHEDULES OF INVESTMENTS

April 30, 2022 (Unaudited)

Contracts | Notional Amount | Value | ||||||||||

PURCHASED OPTIONS — 106.3% (a) (b) | ||||||||||||

CALL OPTIONS — 93.6% | ||||||||||||

SPDR S&P 500 ETF Trust, Expires 03/31/2023, Strike Price $5.46 | 387 | $ | 15,944,400 | $ | 15,486,608 | |||||||

| 15,486,608 | ||||||||||||

PUT OPTIONS — 12.7% | ||||||||||||

SPDR S&P 500 ETF Trust, Expires 03/31/2023, Strike Price $451.69 | 387 | 15,944,400 | 2,109,024 | |||||||||

| 2,109,024 | ||||||||||||

TOTAL PURCHASED OPTIONS (Cost $18,435,732) | 17,595,632 | |||||||||||

Principal | ||||||||||||

SHORT-TERM INVESTMENTS — 1.1% | ||||||||||||

Money Market Deposit Accounts — 1.1% | ||||||||||||

U.S. Bank Money Market Deposit Account, 0.130% (c) | $ | 179,183 | 179,183 | |||||||||

TOTAL SHORT-TERM INVESTMENTS (Cost $179,183) | 179,183 | |||||||||||

Total Investments (Cost $18,614,915) — 107.4% | 17,774,815 | |||||||||||

Liabilities in Excess of Other Assets — (7.4%) | (1,219,222 | ) | ||||||||||

TOTAL NET ASSETS — 100.0% | $ | 16,555,593 | ||||||||||

Percentages are stated as a percent of net assets.

(a) | Exchange-Traded. |

(b) | Purchased option contracts are held in connection with corresponding written option contracts. |

(c) | The rate shown is as of April 30, 2022. |

SCHEDULE OF WRITTEN OPTIONS

April 30, 2022 (Unaudited)

Contracts | Notional Amount | Value | ||||||||||

WRITTEN OPTIONS — (7.3%) (a) | ||||||||||||

CALL OPTIONS — (1.2%) | ||||||||||||

SPDR S&P 500 ETF Trust, Expires 03/31/2023, Strike Price $502.72 | 387 | $ | (15,944,400 | ) | $ | (192,383 | ) | |||||

| (192,383 | ) | |||||||||||

PUT OPTIONS — (6.1%) | ||||||||||||

SPDR S&P 500 ETF Trust, Expires 03/31/2023, Strike Price $383.89 | 387 | (15,944,400 | ) | (1,019,337 | ) | |||||||

| (1,019,337 | ) | |||||||||||

TOTAL WRITTEN OPTIONS (Premiums Received $1,178,431) | $ | (1,211,720 | ) | |||||||||

Percentages are stated as a percent of net assets.

(a) | Exchange-Traded. |

The accompanying notes are an integral part of the financial statements.

27

Pacer Swan SOS Flex (April) ETF

SCHEDULES OF INVESTMENTS

April 30, 2022 (Unaudited)

Contracts | Notional Amount | Value | ||||||||||

PURCHASED OPTIONS — 109.3% (a) (b) | ||||||||||||

CALL OPTIONS — 94.8% | ||||||||||||

SPDR S&P 500 ETF Trust, Expires 03/31/2023, Strike Price $5.51 | 283 | $ | 11,659,600 | $ | 11,323,452 | |||||||

| 11,323,452 | ||||||||||||

PUT OPTIONS — 14.5% | ||||||||||||

SPDR S&P 500 ETF Trust, Expires 03/31/2023, Strike Price $270.98 | 283 | 11,659,600 | 187,562 | |||||||||

SPDR S&P 500 ETF Trust, Expires 03/31/2023, Strike Price $451.64 | 283 | 11,659,600 | 1,541,525 | |||||||||

| 1,729,087 | ||||||||||||

TOTAL PURCHASED OPTIONS (Cost $13,603,421) | 13,052,539 | |||||||||||

Principal | ||||||||||||

SHORT-TERM INVESTMENTS — 1.1% | ||||||||||||

Money Market Deposit Accounts — 1.1% | ||||||||||||

U.S. Bank Money Market Deposit Account, 0.130% (c) | $ | 133,952 | 133,952 | |||||||||

TOTAL SHORT-TERM INVESTMENTS (Cost $133,952) | 133,952 | |||||||||||

Total Investments (Cost $13,737,373) — 110.4% | 13,186,491 | |||||||||||

Liabilities in Excess of Other Assets — (10.4%) | (1,236,817 | ) | ||||||||||

TOTAL NET ASSETS — 100.0% | $ | 11,949,674 | ||||||||||

Percentages are stated as a percent of net assets.

(a) | Exchange-Traded. |

(b) | Purchased option contracts are held in connection with corresponding written option contracts. |

(c) | The rate shown is as of April 30, 2022. |

SCHEDULE OF WRITTEN OPTIONS

April 30, 2022 (Unaudited)

Contracts | Notional Amount | Value | ||||||||||

WRITTEN OPTIONS — (10.3%) (a) | ||||||||||||

CALL OPTIONS — (0.7%) | ||||||||||||

SPDR S&P 500 ETF Trust, Expires 03/31/2023, Strike Price $518.84 | 283 | $ | (11,659,600 | ) | $ | (85,538 | ) | |||||

| (85,538 | ) | |||||||||||

PUT OPTIONS — (9.6%) | ||||||||||||

SPDR S&P 500 ETF Trust, Expires 03/31/2023, Strike Price $361.31 | 566 | (23,319,200 | ) | (1,146,915 | ) | |||||||

| (1,146,915 | ) | |||||||||||

TOTAL WRITTEN OPTIONS (Premiums Received $985,373) | $ | (1,232,453 | ) | |||||||||

Percentages are stated as a percent of net assets.

(a) | Exchange-Traded. |

The accompanying notes are an integral part of the financial statements.

28

Pacer Swan SOS Conservative (July) ETF

SCHEDULES OF INVESTMENTS

April 30, 2022 (Unaudited)

Contracts | Notional Amount | Value | ||||||||||

PURCHASED OPTIONS — 100.3% (a) (b) | ||||||||||||

CALL OPTIONS — 96.6% | ||||||||||||

SPDR S&P 500 ETF Trust, Expires 06/30/2022, Strike Price $6.42 | 96 | $ | 3,955,200 | $ | 3,878,441 | |||||||

| 3,878,441 | ||||||||||||

PUT OPTIONS — 3.7% | ||||||||||||

SPDR S&P 500 ETF Trust, Expires 06/30/2022, Strike Price $406.66 | 96 | 3,955,200 | 150,289 | |||||||||

| 150,289 | ||||||||||||

TOTAL PURCHASED OPTIONS (Cost $4,245,732) | 4,028,730 | |||||||||||

Principal | ||||||||||||

SHORT-TERM INVESTMENTS — 0.4% | ||||||||||||

Money Market Deposit Accounts — 0.4% | ||||||||||||

U.S. Bank Money Market Deposit Account, 0.130% (c) | $ | 15,906 | 15,906 | |||||||||

TOTAL SHORT-TERM INVESTMENTS (Cost $15,906) | 15,906 | |||||||||||

Total Investments (Cost $4,261,638) — 100.7% | 4,044,636 | |||||||||||

Liabilities in Excess of Other Assets — (0.7%) | (28,543 | ) | ||||||||||

TOTAL NET ASSETS — 100.0% | $ | 4,016,093 | ||||||||||

Percentages are stated as a percent of net assets.

(a) | Exchange-Traded. |

(b) | Purchased option contracts are held in connection with corresponding written option contracts. |

(c) | The rate shown is as of April 30, 2022. |

SCHEDULE OF WRITTEN OPTIONS

April 30, 2022 (Unaudited)

Contracts | Notional Amount | Value | ||||||||||

WRITTEN OPTIONS — (0.7%) (a) | ||||||||||||

CALL OPTIONS — (0.3%) | ||||||||||||

SPDR S&P 500 ETF Trust, Expires 06/30/2022, Strike Price $458.67 | 96 | $ | (3,955,200 | ) | $ | (13,080 | ) | |||||

| (13,080 | ) | |||||||||||

PUT OPTIONS — (0.4%) | ||||||||||||

SPDR S&P 500 ETF Trust, Expires 06/30/2022, Strike Price $299.64 | 96 | (3,955,200 | ) | (15,461 | ) | |||||||

| (15,461 | ) | |||||||||||

TOTAL WRITTEN OPTIONS (Premiums Received $209,435) | $ | (28,541 | ) | |||||||||

Percentages are stated as a percent of net assets.

(a) | Exchange-Traded. |

The accompanying notes are an integral part of the financial statements.

29

Pacer Swan SOS Moderate (July) ETF

SCHEDULES OF INVESTMENTS

April 30, 2022 (Unaudited)

Contracts | Notional Amount | Value | ||||||||||

PURCHASED OPTIONS — 101.2% (a) (b) | ||||||||||||

CALL OPTIONS — 95.2% | ||||||||||||

SPDR S&P 500 ETF Trust, Expires 06/30/2022, Strike Price $6.46 | 360 | $ | 14,832,000 | $ | 14,542,714 | |||||||

| 14,542,714 | ||||||||||||

PUT OPTIONS — 6.0% | ||||||||||||

SPDR S&P 500 ETF Trust, Expires 06/30/2022, Strike Price $428.10 | 360 | 14,832,000 | 910,436 | |||||||||

| 910,436 | ||||||||||||

TOTAL PURCHASED OPTIONS (Cost $16,146,150) | 15,453,150 | |||||||||||

Principal | ||||||||||||

SHORT-TERM INVESTMENTS — 0.4% | ||||||||||||

Money Market Deposit Accounts — 0.4% | ||||||||||||

U.S. Bank Money Market Deposit Account, 0.130% (c) | $ | 61,518 | 61,518 | |||||||||

TOTAL SHORT-TERM INVESTMENTS (Cost $61,518) | 61,518 | |||||||||||

Total Investments (Cost $16,207,668) — 101.6% | 15,514,668 | |||||||||||

Liabilities in Excess of Other Assets — (1.6%) | (245,611 | ) | ||||||||||

TOTAL NET ASSETS — 100.0% | $ | 15,269,057 | ||||||||||

Percentages are stated as a percent of net assets.

(a) | Exchange-Traded. |

(b) | Purchased option contracts are held in connection with corresponding written option contracts. |

(c) | The rate shown is as of April 30, 2022. |

SCHEDULE OF WRITTEN OPTIONS

April 30, 2022 (Unaudited)

Contracts | Notional Amount | Value | ||||||||||

WRITTEN OPTIONS — (1.6%) (a) | ||||||||||||

CALL OPTIONS — (0.3%) | ||||||||||||

SPDR S&P 500 ETF Trust, Expires 06/30/2022, Strike Price $462.09 | 360 | $ | (14,832,000 | ) | $ | (37,066 | ) | |||||

| (37,066 | ) | |||||||||||

PUT OPTIONS — (1.3%) | ||||||||||||

SPDR S&P 500 ETF Trust, Expires 06/30/2022, Strike Price $363.85 | 360 | (14,832,000 | ) | (201,994 | ) | |||||||

| (201,994 | ) | |||||||||||

TOTAL WRITTEN OPTIONS (Premiums Received $1,013,560) | $ | (239,060 | ) | |||||||||

Percentages are stated as a percent of net assets.

(a) | Exchange-Traded. |

The accompanying notes are an integral part of the financial statements.

30

Pacer Swan SOS Flex (July) ETF

SCHEDULES OF INVESTMENTS

April 30, 2022 (Unaudited)

Contracts | Notional Amount | Value | ||||||||||

PURCHASED OPTIONS — 101.3% (a) (b) | ||||||||||||

CALL OPTIONS — 95.1% | ||||||||||||

SPDR S&P 500 ETF Trust, Expires 06/30/2022, Strike Price $6.51 | 144 | $ | 5,932,800 | $ | 5,816,367 | |||||||

| 5,816,367 | ||||||||||||

PUT OPTIONS — 6.2% | ||||||||||||

SPDR S&P 500 ETF Trust, Expires 06/30/2022, Strike Price $256.84 | 144 | 5,932,800 | 12,155 | |||||||||

SPDR S&P 500 ETF Trust, Expires 06/30/2022, Strike Price $428.06 | 144 | 5,932,800 | 363,888 | |||||||||

| 376,043 | ||||||||||||

TOTAL PURCHASED OPTIONS (Cost $6,481,440) | 6,192,410 | |||||||||||

Principal | ||||||||||||

SHORT-TERM INVESTMENTS — 0.5% | ||||||||||||

Money Market Deposit Accounts — 0.5% | ||||||||||||

U.S. Bank Money Market Deposit Account, 0.130% (c) | $ | 28,357 | 28,357 | |||||||||

TOTAL SHORT-TERM INVESTMENTS (Cost $28,357) | 28,357 | |||||||||||

Total Investments (Cost $6,509,797) — 101.8% | 6,220,767 | |||||||||||

Liabilities in Excess of Other Assets — (1.8%) | (107,163 | ) | ||||||||||

TOTAL NET ASSETS — 100.0% | $ | 6,113,604 | ||||||||||

Percentages are stated as a percent of net assets.

(a) | Exchange-Traded. |

(b) | Purchased option contracts are held in connection with corresponding written option contracts. |

(c) | The rate shown is as of April 30, 2022. |

SCHEDULE OF WRITTEN OPTIONS

April 30, 2022 (Unaudited)

Contracts | Notional Amount | Value | ||||||||||

WRITTEN OPTIONS — (1.7%) (a) | ||||||||||||

CALL OPTIONS — (0.1%) | ||||||||||||

SPDR S&P 500 ETF Trust, Expires 06/30/2022, Strike Price $476.43 | 144 | $ | (5,932,800 | ) | $ | (4,402 | ) | |||||

| (4,402 | ) | |||||||||||

PUT OPTIONS — (1.6%) | ||||||||||||

SPDR S&P 500 ETF Trust, Expires 06/30/2022, Strike Price $342.45 | 288 | (11,865,600 | ) | (100,876 | ) | |||||||

| (100,876 | ) | |||||||||||

TOTAL WRITTEN OPTIONS (Premiums Received $403,269) | $ | (105,278 | ) | |||||||||

Percentages are stated as a percent of net assets.

(a) | Exchange-Traded. |

The accompanying notes are an integral part of the financial statements.

31

Pacer Swan SOS Conservative (October) ETF

SCHEDULES OF INVESTMENTS

April 30, 2022 (Unaudited)

Contracts | Notional Amount | Value | ||||||||||

PURCHASED OPTIONS — 102.0% (a) (b) | ||||||||||||

CALL OPTIONS — 96.1% | ||||||||||||

SPDR S&P 500 ETF Trust, Expires 09/30/2022, Strike Price $6.44 | 108 | $ | 4,449,600 | $ | 4,346,039 | |||||||

| 4,346,039 | ||||||||||||

PUT OPTIONS — 5.9% | ||||||||||||

SPDR S&P 500 ETF Trust, Expires 09/30/2022, Strike Price $407.68 | 108 | 4,449,600 | 269,939 | |||||||||

| 269,939 | ||||||||||||

TOTAL PURCHASED OPTIONS (Cost $4,951,640) | 4,615,978 | |||||||||||

Principal | ||||||||||||

SHORT-TERM INVESTMENTS — 0.5% | ||||||||||||

Money Market Deposit Accounts — 0.5% | ||||||||||||

U.S. Bank Money Market Deposit Account, 0.130% (c) | $ | 21,237 | 21,237 | |||||||||