Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS

As filed with the Securities and Exchange Commission on August 21, 2014

Registration No. 333-[ • ]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

AbbVie Private Limited

(Exact Name of Registrant as Specified in Its Charter)

| | | | |

| Jersey | | | | |

(Channel Islands)

(State or Other Jurisdiction of

Incorporation or Organization) | | 2834

(Primary Standard Industrial

Classification Code Number) | | 98-1184846

(I.R.S. Employer

Identification Number) |

Abbott House, Vanwall Business Park

Vanwall Road, Maidenhead

Berkshire, SL6 4XE, United Kingdom

+ 44 (0)1628 561090

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Laura J. Schumacher

Executive Vice President, Business Development, External Affairs and General Counsel

AbbVie Inc.

1 North Waukegan Road

North Chicago, Illinois 60064-6400

(847) 932-7900

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| | |

| With copies to: |

Lara M. Levitan

AbbVie Inc.

1 North Waukegan Road

North Chicago, Illinois 60064-6400

(847) 932-7900 |

|

Matthew G. Hurd

Sullivan & Cromwell LLP

125 Broad Street

New York, New York 10004

(212) 558-4000

|

Approximate date of commencement of the proposed sale of the securities to the public: As soon as practicable after this Registration Statement becomes effective and upon completion of the Arrangement and the Merger described in the enclosed proxy statement/prospectus.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, as amended, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | |

| Large accelerated filer ý | | Accelerated filer o | | Non-accelerated filer o

(Do not check if a

smaller reporting company) | | Smaller reporting company o |

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) o

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) o

CALCULATION OF REGISTRATION FEE

| | | | | | | | |

| | | | | | | | |

| |

Title of each class of securities

to be registered

| | Amount to be

registered

| | Proposed maximum

offering price per

share

| | Proposed maximum

aggregate offering

price

| | Amount of

registration fee

|

|---|

| |

Ordinary Shares, nominal value $0.01 per share | | 1,621,414,851(1) | | Not Applicable | | $87,361,832,171.88(2) | | $11,252,203.98(3) |

|

- (1)

- Represents the maximum number of the registrant's ordinary shares estimated to be issuable upon the completion of the Merger described herein. Calculated as the product obtained by multiplying (x) the sum of (i) 1,592,332,053 shares of AbbVie Inc.'s common stock (the total number of shares of AbbVie Inc.'s common stock outstanding as of August 14, 2014), (ii) 28,866,377 shares of AbbVie Inc.'s common stock potentially issuable pursuant to stock options outstanding as of August 14, 2014 that are vested or that are expected to vest prior to completion of the Merger and (iii) 216,421 shares of AbbVie Inc.'s common stock issuable pursuant to restricted stock awards and restricted stock units outstanding as of August 14, 2014 that are expected to vest and/or be settled in shares of AbbVie Inc.'s common stock prior to completion of the Merger by (y) 1.00 (the number of ordinary shares of the registrant a holder will receive for each share of common stock of the registrant).

- (2)

- Estimated solely for the purpose of calculating the registration fee required by Section 6(b) of the Securities Act and computed pursuant to Rule 457(f)(1) and (f)(3) and 457(c) under the Securities Act. Calculated by multiplying (x) $53.88 (the average of the high and low prices of shares of AbbVie Inc.'s common stock on 14, 2014), by (y) 1,621,414,851 shares of AbbVie Inc.'s common stock (the total number of shares of AbbVie Inc.'s common stock outstanding as of August 14, 2014, the total number of shares of AbbVie Inc.'s common stock potentially issuable pursuant to stock options outstanding as of August 14, 2014 that are vested or that are expected to vest prior to completion of the Merger and the total number of shares of AbbVie Inc.'s common stock issuable pursuant to restricted stock awards and restricted stock units outstanding as of August 14, 2014 that are expected to vest and/or be settled in shares of AbbVie Inc.'s common stock prior to completion of the Merger).

- (3)

- Determined in accordance with Section 6(b) of the Securities Act at a rate equal to $128.80 per $1,000,000 of the proposed maximum aggregate offering price.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such dates as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

Information contained herein is subject to completion or amendment. A registration statement relating to these securities has been filed with the Securities and Exchange Commission. These securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes effective. This document shall not constitute an offer to sell or the solicitation of any offer to buy nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

SUBJECT TO COMPLETION, DATED AUGUST 21, 2014

PRELIMINARY COPY

Dear AbbVie Stockholder:

On July 18, 2014, the boards of AbbVie Inc. and Shire plc agreed to combine our two great companies in a transaction that represents a compelling opportunity to create a new, world class biopharmaceutical company. We are excited about this Combination and the opportunities that it presents, and we invite you to a Special Meeting of AbbVie stockholders on [ • ], 2014 at [ • ] a.m. local time, at [ • ] to vote on matters relating to it.

We believe the combined financial strength and R&D experience of the combined company will accelerate our ability to reach our full potential for shareholders and patients in need across the globe. We also believe that the Combination would result in incremental sustainable leadership positions within high value market segments of significant unmet need.

We believe the Combination is strategically compelling and would create a larger and more diversified biopharmaceutical company with multiple leading franchises and significant financial capacity for future acquisitions, investment and opportunity for enhanced shareholder distributions and value creation. We believe that Shire's platform has a strong complementary fit with AbbVie's existing specialty focus. We expect the new company to be able to leverage AbbVie's existing, well-established global infrastructure across more than 170 countries.

The combined company will also have an attractive financial profile and an enhanced R&D/pipeline that we believe will enhance a long-term value creation strategy that has already generated an approximately 60% increase in AbbVie's share price since AbbVie became an independent company on January 1, 2013.

Following completion of the Combination, AbbVie's and Shire's businesses will operate under a new holding company, referred to as New AbbVie. In the Combination, each AbbVie stockholder will receive one share of New AbbVie for each AbbVie share that they held, and each Shire shareholder will receive £24.44 in cash and 0.8960 shares of New AbbVie for each Shire share that they held. AbbVie's current board of directors will be joined by two Shire directors to make up the New AbbVie board of directors, and we intend to list the combined company's ordinary shares under the symbol "ABBV" on the New York Stock Exchange as well as on the Chicago Stock Exchange and the NYSE Euronext Paris Professional Segment. Upon completion of the Combination, AbbVie stockholders would own approximately 75% of New AbbVie and Shire shareholders would own approximately 25%.

You are being asked to consider and vote on the following proposals:

- •

- to adopt the Merger Agreement that will implement the Merger, and make the Combination possible;

- •

- to approve, on a non-binding advisory basis, the compensatory arrangements between AbbVie and certain AbbVie executive officers relating to the Combination that are disclosed in the section captioned "Stockholder Vote on Specified Compensatory Arrangements" beginning on page 102 of the enclosed proxy statement/prospectus; and

- •

- to approve any motion to adjourn the Special Meeting, or any postponement thereof, to another time or place if necessary or appropriate (i) to solicit additional proxies if there are insufficient votes at the time of the Special Meeting to adopt the Merger Agreement, (ii) to provide to AbbVie stockholders any supplement or amendment to the proxy statement/prospectus and (iii) to disseminate any other information which is material to AbbVie stockholders voting at the Special Meeting.

ABBVIE'S BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE "FOR" EACH OF THE PROPOSALS DESCRIBED ABOVE.

More information about the Combination and the proposals described above is contained in the accompanying proxy statement/prospectus. We urge you to read this document, including the Annexes and the documents incorporated by reference, carefully and in full. In particular, we urge you to read the section captioned "Risk Factors"beginning on page 25.

The close of business on [ • ], 2014 has been fixed as the record date for determining the AbbVie stockholders entitled to receive notice of and to vote at the Special Meeting.

We look forward to seeing you at the Special Meeting and appreciate your support at this key moment for our company.

| | |

| | | Best regards, |

|

|

/s/ RICHARD A. GONZALEZ |

| | | Richard A. Gonzalez

Chairman and Chief Executive Officer |

Table of Contents

Your vote is very important. Whether or not you plan to attend the Special Meeting, please vote as soon as possible by following the instructions in the accompanying proxy statement/prospectus.

We are not asking for a proxy from Shire shareholders and Shire shareholders are requested not to send us a proxy. Shire shareholders are not entitled to vote on the matters described above. Shire shareholders are expected to receive a separate circular and should read and respond to that document.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued in connection with the Combination or determined if the accompanying proxy statement/prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The accompanying draft proxy statement/prospectus is not intended to be and is not a prospectus for the purposes of the Companies (Jersey) Law 1991, as amended, or the Companies (General Provisions) (Jersey) Order 2002, as amended, and neither the Jersey Financial Services Commission nor the Registrar of Companies for Jersey has approved this draft document.

The accompanying proxy statement/prospectus is dated [ • ], 2014, and is first being mailed to AbbVie stockholders on or about [ • ], 2014.

Table of Contents

ADDITIONAL INFORMATION REGARDING ABBVIE

The accompanying proxy statement/prospectus incorporates by reference important business and financial information about AbbVie from documents that are not included in or delivered with the proxy statement/ prospectus. This information is available to you without charge upon your written or oral request. You can obtain the documents incorporated by reference in the accompanying proxy statement/prospectus by requesting them in writing or by telephone at the following address and telephone number.

AbbVie Inc.

1 North Waukegan Road

North Chicago, Illinois 60064

Attention: Investor Relations

(847) 932-7900

http://www.abbvieinvestor.com/

In addition, if you have questions about the Combination or the Special Meeting, or if you need to obtain copies of the accompanying proxy statement/prospectus, proxy card or other documents incorporated by reference in the proxy statement/prospectus, you may contact the company listed below. You will not be charged for any of the documents you request.

Georgeson Inc.

480 Washington Blvd., 26th Floor

Jersey City, New Jersey 07310

(877) 278-4775

If you would like to request documents, please do so by [ • ], 2014, in order to receive them before the Special Meeting.

For a more detailed description of the information incorporated by reference in the accompanying proxy statement/prospectus and how you may obtain it, see the section captioned "Where You Can Find More Information" beginning on page 168 of the accompanying proxy statement/prospectus.

3

Table of Contents

ADDITIONAL INFORMATION REGARDING SHIRE

The accompanying proxy statement/prospectus incorporates by reference important business and financial information about Shire from documents that are not included in or delivered with the proxy statement/ prospectus. This information is available to you without charge upon your written or oral request. You can obtain the documents incorporated by reference in the accompanying proxy statement/prospectus by requesting them in writing or by telephone at the following address and telephone number.

Shire plc

5 Riverwalk

Citywest Business Campus

Dublin 24, Ireland

Attention: Investor Relations

+353 1 429 7700

http://www.shire.com/shireplc/en/investors

For a more detailed description of the information incorporated by reference in the accompanying proxy statement/prospectus and how you may obtain it, see the section captioned "Where You Can Find More Information" beginning on page 168 of the accompanying proxy statement/prospectus.

4

Table of Contents

NOTICE OF SPECIAL MEETING

Important Notice Regarding the Special Meeting on[ • ], 2014

A Special Meeting of AbbVie Stockholders will be held on [ • ], 2014, at [ • ] a.m. local time at [ • ] for the following purposes:

- 1.

- To adopt the Agreement and Plan of Merger, dated as of July 18, 2014 (the "Merger Agreement"), among AbbVie Inc., AbbVie Private Limited and AbbVie Ventures LLC;

- 2.

- To approve, on a non-binding advisory basis, certain compensatory arrangements between AbbVie and certain named AbbVie executive officers relating to the Combination that are described in the section captioned "Stockholder Vote on Specified Compensatory Arrangements" beginning on page 102 of the enclosed proxy statement/prospectus; and

- 3.

- To approve any motion to adjourn the Special Meeting, or any postponement thereof, to another time or place if necessary or appropriate (i) to solicit additional proxies if there are insufficient votes at the time of the Special Meeting to adopt the Merger Agreement, (ii) to provide to AbbVie Stockholders any supplement or amendment to the proxy statement/prospectus and/or (iii) to disseminate any other information which is material to AbbVie Stockholders voting at the Special Meeting.

YOUR VOTE IS VERY IMPORTANT!

Please promptly vote your shares by telephone, using the Internet, or by signing and returning your proxy in the enclosed envelope if you received a printed version.

ABBVIE'S BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTEFOR ITEMS 1, 2 AND 3 ON THE PROXY CARD.

More information about the Combination and the proposals described above is contained in the accompanying proxy statement/prospectus. We urge all AbbVie stockholders to read this document, including the Annexes and the documents incorporated by reference, carefully and in full. In particular, we urge you to read the section captioned "Risk Factors" beginning on page 25.

The close of business on [ • ], 2014 has been fixed as the record date for determining the stockholders entitled to receive notice of and to vote at the Special Meeting.

AbbVie's proxy statement/prospectus is available at www.abbvieinvestor.com. If you are an AbbVie Stockholder of record, you may access your proxy card by either:

- •

- Going to the following website: www.proxyvote.com, entering the information requested on your computer screen and following the simple instructions, or

- •

- Calling (in the United States and Canada) toll free 1-800-690-0903 on a touch-tone telephone and following the simple instructions provided by the recorded message.

5

Table of Contents

Admission to the meeting will be by admission card only. If you plan to attend, please complete and return the reservation form in the back of these materials and an admission card will be sent to you. Due to space limitations, reservation forms must be received before [ • ], 2014. Each admission card, along with photo identification, admits one person. A stockholder may request two admission cards, but a guest must be accompanied by a stockholder.

| | |

| | | By Order of the Board of Directors, |

|

|

/s/ LAURA J. SCHUMACHER

Laura J. Schumacher

Secretary |

[ • ], 2014

6

Table of Contents

TABLE OF CONTENTS

| | |

QUESTIONS AND ANSWERS ABOUT THE COMBINATION | | 1 |

SUMMARY | | 12 |

RISK FACTORS | | 25 |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS | | 34 |

SELECTED HISTORICAL FINANCIAL DATA OF ABBVIE | | 35 |

SELECTED HISTORICAL FINANCIAL DATA OF SHIRE | | 37 |

SELECTED UNAUDITED PRO FORMA FINANCIAL DATA | | 40 |

THE SPECIAL MEETING | | 41 |

COMPANIES INVOLVED IN THE COMBINATION | | 46 |

BACKGROUND AND REASONS FOR THE COMBINATION | | 48 |

OVERVIEW OF THE COMBINATION | | 65 |

THE ARRANGEMENT AND THE CO-OPERATION AGREEMENT | | 67 |

THE MERGER AND THE MERGER AGREEMENT | | 78 |

REGULATORY APPROVALS | | 81 |

OWNERSHIP OF NEW ABBVIE AFTER COMPLETION OF THE COMBINATION | | 83 |

ABBVIE AND SHIRE UNAUDITED PROSPECTIVE FINANCIAL INFORMATION | | 84 |

LISTING OF NEW ABBVIE SHARES TO BE ISSUED IN CONNECTION WITH THE COMBINATION | | 87 |

FINANCING | | 88 |

CERTAIN US FEDERAL INCOME TAX CONSEQUENCES OF THE COMBINATION | | 92 |

CERTAIN UNITED KINGDOM TAX CONSIDERATIONS | | 98 |

CERTAIN JERSEY TAX CONSIDERATIONS | | 101 |

STOCKHOLDER VOTE ON SPECIFIED COMPENSATORY ARRANGEMENTS | | 102 |

INTERESTS OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON | | 105 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | | 108 |

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION | | 110 |

COMPARATIVE HISTORICAL AND UNAUDITED PRO FORMA PER SHARE DATA | | 124 |

COMPARATIVE PER SHARE MARKET PRICE DATA AND DIVIDEND INFORMATION | | 126 |

DESCRIPTION OF NEW ABBVIE SHARES | | 128 |

COMPARISON OF THE RIGHTS OF ABBVIE STOCKHOLDERS AND NEW ABBVIE SHAREHOLDERS | | 141 |

LEGAL MATTERS | | 160 |

EXPERTS | | 161 |

ENFORCEABILITY OF CIVIL LIABILITIES | | 162 |

DIRECTORS' RESPONSIBILITY STATEMENT REQUIRED BY THE UK TAKEOVER CODE | | 163 |

FUTURE SHAREHOLDER PROPOSALS | | 164 |

NO DELAWARE APPRAISAL RIGHTS | | 166 |

ACCOUNTING TREATMENT OF THE COMBINATION | | 167 |

WHERE YOU CAN FIND MORE INFORMATION | | 168 |

SCHEDULE I | | I-1 |

ANNEX A—AGREEMENT AND PLAN OF MERGER | | A-1 |

ANNEX B—OPINION OF J.P. MORGAN SECURITIES LLC | | B-1 |

ANNEX C—MEMORANDUM AND ARTICLES OF ASSOCIATION OF NEW ABBVIE | | C-1 |

ANNEX D—CO-OPERATION AGREEMENT | | D-1 |

ANNEX E—CONDITIONS TO AND CERTAIN FURTHER TERMS OF THE COMBINATION | | E-1 |

INFORMATION NOT REQUIRED IN THE PROSPECTUS | | II-1 |

i

Table of Contents

QUESTIONS AND ANSWERS ABOUT THE COMBINATION

The following questions and answers are intended to address briefly some commonly asked questions regarding the proposed Combination and the Special Meeting. These questions and answers only highlight some of the information contained in this proxy statement/prospectus. They may not contain all the information that is important to you. You should read carefully this entire proxy statement/prospectus, including the annexes and the documents incorporated by reference into this proxy statement/prospectus, to understand fully the proposed Combination and the voting procedures for the Special Meeting. See the section captioned"Where You Can Find More Information" beginning on page 168. Unless otherwise indicated or the context requires, all references in this proxy statement/prospectus to:

- •

- "AbbVie" refers to AbbVie Inc., a Delaware corporation.

- •

- "AbbVie Shares" refers to outstanding shares of common stock of AbbVie, par value $0.01 each.

- •

- "AbbVie Stockholders" refers to the holders of AbbVie Shares.

- •

- "Arrangement" means the scheme of arrangement proposed to be made under Article 125 of the Companies (Jersey) Law 1991 (as amended) between Shire and the Shire Shareholders, with or subject to any modification, addition or condition approved or imposed.

- •

- "Board" refers to AbbVie's board of directors, New AbbVie's board of directors or Shire's board of directors, as the context suggests.

- •

- "dollars" or "$" refers to US dollars.

- •

- "Foreign Holdco" refers to AbbVie Holdings Private Limited, a private limited company organized under the laws of Jersey.

- •

- "Merger" means the merger of Merger Sub with and into AbbVie, with AbbVie continuing as the surviving corporation, pursuant to the Agreement and Plan of Merger, dated as of July 18, 2014, among New AbbVie, AbbVie and Merger Sub.

- •

- "Merger Sub" refers to AbbVie Ventures LLC, a Delaware limited liability company.

- •

- "New AbbVie" refers to AbbVie Private Limited, currently a private limited company organized under the laws of Jersey and currently a wholly owned subsidiary of AbbVie, which will be re-registered as a public limited company and renamed AbbVie plc at or prior to the completion of the Arrangement (or, if the Arrangement is converted to a Takeover Offer, before the making of the Takeover Offer (as defined below)).

- •

- "New AbbVie Shares" refers to ordinary shares of New AbbVie.

- •

- "New AbbVie Shareholders" refers to the holders of New AbbVie Shares.

- •

- "our", "we" or "us" refers to AbbVie.

- •

- "pounds" or "£" refers to UK pounds sterling.

- •

- "Shire" refers to Shire plc, a public limited company organized under the laws of Jersey.

- •

- "Shire ADSs" refers to American Depositary Shares, each representing three Shire Ordinary Shares.

- •

- "Shire Ordinary Shares" refers to outstanding ordinary shares of Shire, par value 5 pence each.

- •

- "Shire Shares" refers to Shire Ordinary Shares and Shire ADSs collectively.

- •

- "Shire Shareholders" refers to the holders of Shire Shares.

- •

- "Takeover Offer" means a takeover offer as defined in Article 116 of the Jersey Companies Law.

- •

- "US Holdco" refers to AbbVie US Holdings LLC, a Delaware limited liability company and a direct wholly owned subsidiary of New AbbVie.

1

Table of Contents

- 1.

- Whose proxies are being solicited?

ONLY AbbVie Stockholders' proxies are being solicited. We are not soliciting any proxies or votes from Shire Shareholders, including holders of Shire ADSs, through this proxy statement/prospectus.

If you are a Shire Shareholder and not an AbbVie Stockholder, and you have received or gained access to this proxy statement/prospectus, you should disregard it completely and should not treat it as any solicitation of your proxy, vote or support on any matter. If you are both an AbbVie Stockholder and a Shire Shareholder, you should treat this proxy statement/prospectus as soliciting only your proxy with respect to the AbbVie Shares held by you and should not treat it as a solicitation of your proxy, vote or support on any matter with respect to your Shire Shares. Shire Shareholders are expected to receive a separate circular and should read and respond to such circular.

- 2.

- When and where is the Special Meeting?

AbbVie will hold a special meeting on [ • ], 2014, at [ • ] a.m. local time at [ • ].

- 3.

- What am I being asked to vote on at the Special Meeting?

You are being asked to consider and vote on the following proposals:

- •

- to adopt the Agreement and Plan of Merger, dated as of July 18, 2014 (the "Merger Agreement"), among AbbVie, New AbbVie and Merger Sub, which is attached asAnnex A to this proxy statement/prospectus and as described in the section captioned "The Merger and the Merger Agreement" beginning on page 78 (the "Merger Agreement Proposal");

- •

- to approve, on a non-binding advisory basis, specified compensatory arrangements between AbbVie and its named executive officers relating to the Combination as disclosed in the section captioned "Stockholder Vote on Specified Compensatory Arrangements" beginning on page 102 (the "Non-Binding Compensation Proposal"); and

- •

- to approve any motion to adjourn the Special Meeting, or any postponement thereof, to another time or place if necessary or appropriate (i) to solicit additional proxies if there are insufficient votes at the time of the Special Meeting to adopt the Merger Agreement, (ii) to provide to AbbVie Stockholders any supplement or amendment to the proxy statement/prospectus and/or (iii) to disseminate any other information which is material to AbbVie Stockholders voting at the Special Meeting (the "Adjournment Proposal").

Approval of the Non-Binding Compensation Proposal and approval of the Adjournment Proposal is not a condition to completion of the Combination or the Arrangement.

- 4.

- Does the AbbVie Board recommend approval of the proposals?

YES. ABBVIE'S BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE "FOR" EACH OF THE PROPOSALS DESCRIBED ABOVE.

- 5.

- Why am I being asked to vote on the Merger Agreement Proposal?

You are being asked to vote to adopt the Merger Agreement so that we can implement the combination (the "Combination") of AbbVie with Shire, another leading pharmaceutical company. The Combination will be implemented in two main steps, which we call the Arrangement and the Merger:

In the Arrangement:

- •

- the Shire Ordinary Shares, other than Shire Ordinary Shares held by Shire in treasury, will be cancelled;

2

Table of Contents

- •

- Shire Shareholders will receive £24.44 in cash and will be issued 0.8960 New AbbVie Share in consideration for each Shire Ordinary Share so cancelled (an amount in US dollars equal to £73.32 in cash and 2.6880 New AbbVie Shares for each Shire ADS); and

- •

- new ordinary shares of Shire will be issued to Foreign Holdco.

In the Merger:

- •

- Merger Sub will be merged with and into AbbVie; and

- •

- each AbbVie Share, other than AbbVie Shares held by AbbVie as treasury stock will be converted into the right to receive one New AbbVie Share.

As a result of the Combination, AbbVie and Shire will each become indirect wholly owned subsidiaries of New AbbVie, and AbbVie Stockholders and Shire Shareholders will become New AbbVie Shareholders. Upon completion of the Combination, we estimate that AbbVie Stockholders will own approximately 75% of the ordinary shares of New AbbVie, and Shire Shareholders will have received approximately £14.6 billion in cash in the aggregate and will own approximately 25% of the ordinary shares of New AbbVie. Two current members of the Shire Board are expected to join the New AbbVie Board following completion of the Combination. All of the current directors of the AbbVie Board are expected to serve on the board of New AbbVie.

The Arrangement is conditioned on, among other things, the approval of the Merger Agreement Proposal by the holders of a majority of the AbbVie Shares outstanding and entitled to vote. The consummation of the Merger is conditioned on the completion of the Arrangement. Therefore, we will be unable to complete the Combination unless the requisite votes for the Merger Agreement Proposal are obtained at the Special Meeting. However, neither the Arrangement nor the Merger is conditioned on the approval of Non-Binding Compensation Proposal or the Adjournment Proposal.

New AbbVie is incorporated in Jersey, which is Shire's current jurisdiction of incorporation. New AbbVie is and, following completion of the Combination is expected to continue to be, resident in the United Kingdom for UK tax purposes because the central management and control of New AbbVie (as determined for UK tax purposes) is exercised in the United Kingdom. It is expected that such central management and control will continue to be exercised in the United Kingdom.

- 6.

- What is Shire plc?

Shire is a leading global specialty biopharmaceutical company that focuses on developing and marketing innovative specialty medicines. Shire has four business units that focus exclusively on the commercial execution of its marketed products in the following specialist therapeutic areas: rare diseases, neuroscience, gastrointestinal and internal medicine. Shire's leading brands include Vyvanse®, Lialda®, Cinryze®, Elaprase® and Replagal®. You can find more information about Shire from various sources described in the section captioned "Where You Can Find More Information" on page 168.

As a result of the Combination, Shire will become an indirect wholly owned subsidiary of New AbbVie, and Shire Shareholders will become New AbbVie Shareholders.

- 7.

- What will AbbVie Stockholders receive as consideration in the Merger?

AbbVie Stockholders will receive one New AbbVie Share in consideration for each AbbVie Share they hold and will receive cash in lieu of any fractional New AbbVie Shares. We estimate that, upon the completion of the Combination, the former AbbVie Stockholders will own approximately 75% of the outstanding New AbbVie Shares.

3

Table of Contents

- 8.

- What will the Shire Shareholders receive as consideration in the Arrangement?

Shire Shareholders will receive in consideration for each Shire Ordinary Share (other than Shire Ordinary Shares held by Shire in treasury) £24.44 in cash and 0.8960 New AbbVie Share. Because each Shire ADS represents three Shire Ordinary Shares, holders of Shire ADSs will receive in consideration for each Shire ADS an amount equal to £73.32 in cash and 2.6880 New AbbVie Shares. We estimate that, upon the completion of the Combination, the former Shire Shareholders will own approximately 25% of the outstanding New AbbVie Shares.

- 9.

- What is a Scheme of Arrangement?

A "scheme of arrangement" is a statutory procedure under the Companies (Jersey) Law 1991, as amended (the "Jersey Companies Law"), pursuant to which the Royal Court of Jersey may approve an arrangement between a company and some or all of its shareholders. Upon such a scheme of arrangement becoming effective in accordance with the Jersey Companies Law, it will bind the company and such shareholders. When the Arrangement becomes effective in accordance with its terms and the Jersey Companies Law, New AbbVie will become the indirect owner of the entire issued and to be issued ordinary share capital of Shire and will issue New AbbVie Shares to existing Shire Shareholders in partial consideration for the cancellation of their Shire Ordinary Shares (other than Shire Ordinary Shares held by Shire in treasury).

- 10.

- Why is Jersey the place of incorporation of New AbbVie?

New AbbVie is incorporated in the Bailiwick of Jersey (in the Channel Islands) because Jersey has a modern and flexible body of corporate law, Jersey enjoys strong relationships with members of the European Union, the United States and other countries where both AbbVie and Shire have major operations, and Jersey is a beneficial location considering Shire's and AbbVie's presence in markets outside the United States, particularly in Europe. Jersey is also the current place of incorporation of Shire.

- 11.

- Why is New AbbVie resident in the United Kingdom for tax purposes?

AbbVie and Shire both already have a presence in the United Kingdom and each has substantial activities and presence in markets outside the United States. The United Kingdom offers access to the European Union and to an extensive network of comprehensive income tax treaties that reduce or eliminate double-taxation of certain cross-border business activities, including with the United States, other members of the European Union and many other countries. Maintaining New AbbVie's tax residence in the United Kingdom is also expected to result in enhanced global cash management and flexibility and associated financial benefits to the combined enterprise. These benefits may include increased global liquidity and global cash flow among the various entities of the combined enterprise. For the most part, subject to certain anti-avoidance rules, the United Kingdom generally taxes companies only on profits that arise to them if they are UK tax resident or if they carry on a trade in the United Kingdom through a permanent establishment in the United Kingdom. Recent revisions to the UK corporation tax legislation on the taxation of foreign profits (including in particular an exemption from corporation tax for most dividends from controlled subsidiaries and a modernized controlled foreign company regime) mean that New AbbVie and its affiliates expect to be in a position to undertake intercompany business operations and other transactions without material negative UK tax effect. This cash management flexibility may reduce the need for external financing and therefore reduce financing costs, resulting in associated financial benefits. All of the above make the United Kingdom an attractive location from which to establish a platform for further international expansion.

New AbbVie's ability to realize these benefits is subject to certain risks. See "Risk Factors" beginning on page 25.

4

Table of Contents

- 12.

- When is the Combination expected to be completed?

As of the date of this proxy statement/prospectus, the Combination is expected to be completed before the end of 2014, however, no assurance can be provided as to when or if the Combination will be completed. The required vote of Shire Shareholders and AbbVie Stockholders to approve the relevant shareholder proposals at their respective meetings, as well as the sanction and confirmation of the Royal Court of Jersey and the necessary regulatory consents and approvals, must be obtained and other conditions specified inAnnex Eto this proxy statement/prospectus must be satisfied or, to the extent applicable, waived.

- 13.

- Why am I being asked to vote on the Non-Binding Compensation Proposal?

Under the Dodd-Frank Wall Street Reform and Consumer Protection Act and Section 14A of the Securities Exchange Act of 1934, as amended, AbbVie Stockholders are entitled to an advisory vote on the compensation of the AbbVie named executive officers that is based on or otherwise relates to the merger as disclosed in this registration statement. See "Stockholder Vote on Specified Compensatory Arrangements—Advisory Vote on Specified Compensatory Arrangements" beginning on page 103.

Approval by the AbbVie Stockholders of AbbVie named executive officer compensation related to the Combination is not a condition to completion of the Merger, and the advisory vote is not binding on AbbVie. Regardless of the outcome of this advisory vote, such compensation may be payable, subject to the AbbVie Board's discretion and the conditions applicable thereto, if the Merger is approved. The terms of the compensation related to the Combination are described under "Stockholder Vote on Specified Compensatory Arrangements—Specified Compensatory Arrangements" beginning on page 102 and "Stockholder Vote on Specified Compensatory Arrangements—Advisory Vote on Specified Compensatory Arrangements" beginning on page 103.

- 14.

- How are AbbVie stock options and other equity-based awards treated in the Merger?

Upon the effective time of the Merger:

- •

- Each option to acquire AbbVie Shares granted or outstanding under the AbbVie 2013 Incentive Stock Program, the AbbVie 2013 Employee Stock Purchase Plan for Non-US Employees and the AbbVie Non-Employee Directors' Fee Plan (collectively, the "AbbVie Stock Plans") (each, an "AbbVie Option") shall be converted into an option to acquire the same number of New AbbVie Shares (each, a "New AbbVie Option") at a price per share equal to the per share exercise price of the AbbVie Option immediately prior to the effective time. Subject to applicable law, the New AbbVie Options shall be subject to material terms (including vesting conditions) substantially similar to those applied to the pre-conversion AbbVie Options immediately prior to such effective time. Holders of options under the AbbVie United Kingdom Share Option Plan (a sub-plan of the AbbVie 2013 Incentive Stock Program) will be offered the opportunity to accept New AbbVie Options as described above.

- •

- Each restricted AbbVie Share granted or outstanding under the AbbVie Stock Plans (each, an "AbbVie Restricted Share") shall be converted into a restricted New AbbVie Share (each, a "New AbbVie Restricted Share"). Subject to applicable law, the New AbbVie Restricted Shares shall be subject to material terms (including vesting conditions) substantially similar to those applied to the pre-conversion AbbVie Restricted Shares immediately prior to such effective time.

- •

- Each restricted stock unit granted or outstanding under the AbbVie Stock Plans (each, an "AbbVie RSU") shall be converted into an award based on the same number of New AbbVie Shares (each, a "New AbbVie RSU"). Subject to applicable law, the New AbbVie RSUs shall be subject to material terms (including vesting conditions) substantially similar to those applied to the pre-conversion AbbVie RSUs immediately prior to such effective time.

5

Table of Contents

- •

- Each award (other than AbbVie Options, AbbVie Restricted Shares and AbbVie RSUs) based on AbbVie Shares and granted or outstanding under the AbbVie Stock Plans (each, an "AbbVie Share-Based Award") shall be converted into an award based on the same number of New AbbVie Shares (each, a "New AbbVie Share-Based Award"). Subject to applicable law, the New AbbVie Share-Based Awards shall be subject to material terms (including vesting conditions) substantially similar to those applied to the pre-conversion AbbVie Share-Based Awards immediately prior to such effective time.

- 15.

- Has the Shire Board recommended the Combination?

The Shire Board has recommended the Combination. All of the members of the Shire Board (acting solely in their capacity as Shire Shareholders) have irrevocably undertaken to vote in favor of the Arrangement and in favor of the resolutions to be proposed in connection with the Combination at the applicable meetings of Shire Shareholders.

- 16.

- Who is entitled to vote at the Special Meeting?

The close of business on [ • ], 2014 has been fixed as the record date for determining the AbbVie Stockholders entitled to receive notice of and to vote at the Special Meeting (the "Record Date"). Each AbbVie Share is entitled to one vote on each matter to be voted upon at the Special Meeting, and both stockholders of record and non-record (beneficial) stockholders will be entitled to vote. If you are a non-record (beneficial) holder of AbbVie Shares, to vote you must instruct your broker or other intermediary how to vote.

- 17.

- What if I sell my AbbVie Shares before the Special Meeting?

The Record Date is earlier than the date of Special Meeting and the date that the Combination is expected to be completed. If you transfer your AbbVie Shares after the Record Date but before the Special Meeting and unless you make arrangements to the contrary with your transferee, you will retain your right to vote at the Special Meeting, but will have transferred the right to receive New AbbVie Shares pursuant to the Merger. In order to receive the New AbbVie Shares, you must hold your shares through the completion of the Combination.

- 18.

- What constitutes a quorum at the Special Meeting?

A quorum of AbbVie Stockholders is necessary to validly hold the Special Meeting. A quorum will be present if a majority of the outstanding shares of our common stock on the Record Date are represented at the Special Meeting, either in person or by proxy. Your shares will be counted for purposes of determining a quorum if you vote:

- •

- via the Internet;

- •

- by telephone;

- •

- by submitting a properly executed proxy card or voting instruction form by mail; or

- •

- in person at the Special Meeting.

Abstentions will be counted for determining whether a quorum is present for the Special Meeting.

AbbVie's by-laws provide that the chairman of the AbbVie Board or the president may adjourn the meeting from time to time, whether or not there is a quorum.

6

Table of Contents

- 19.

- What vote is needed to approve each of the proposals?

Approval of the Merger Agreement Proposal requires an affirmative vote of the holders of a majority of the AbbVie Shares outstanding and entitled to vote on this proposal.

Approval of the Non-Binding Compensation Proposal requires the affirmative vote of the holders of a majority of the AbbVie Shares represented in person or by proxy, if a quorum is present; however, this vote is non-binding.

If the chairman of the AbbVie Board or the president does not adjourn the Special Meeting, the Adjournment Proposal requires the affirmative vote of the holders of a majority of the AbbVie Shares present in person or represented by proxy and entitled to vote thereon, whether or not a quorum is present.

ABBVIE'S BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE "FOR" EACH OF THE PROPOSALS.

- 20.

- What is the effect if I do not cast my vote?

If a stockholder of record does not cast its vote by proxy or in any other permitted fashion, no votes will be cast on behalf of such stockholder of record on any of the items of business at the Special Meeting. If a non-record (beneficial) stockholder does not instruct its broker or other intermediary on how to vote on any of the proposals at the Special Meeting, no votes will be cast on behalf of such non-record (beneficial) stockholder with respect to such items of business.

If you fail to submit a proxy or vote in person at the Special Meeting, or you vote to abstain, or you do not provide your bank, brokerage firm or other nominee or intermediary with instructions, as applicable, this will have the same effect as a vote "against" the adoption of the Merger Agreement. This will have no effect on the outcome of the proposal for specified compensatory arrangements between AbbVie and its named executive officers or the proposal to adjourn or postpone the Special Meeting.

Your vote is very important. Whether or not you plan to attend the Special Meeting, please vote as soon as possible by following the instructions in this proxy statement/prospectus.

- 21.

- What is the difference between holding AbbVie Shares as a stockholder of record and holding AbbVie Shares as a non-record (beneficial) holder?

If your AbbVie Shares are owned directly in your name with our transfer agent, Computershare Trust Company, N.A., you are considered a "stockholder of record" of those shares.

If your AbbVie Shares are held in a brokerage account or by a bank or other nominee, you hold those shares in "street name" and are considered a "non-record (beneficial) stockholder."

- 22.

- How do I vote my shares?

The voting process differs depending on whether you are a stockholder of record or a non-record (beneficial) stockholder:

If you are a stockholder of record, a proxy card is enclosed with this proxy statement/prospectus to enable you to vote, or to appoint a proxyholder to vote on your behalf, at the Special Meeting.

7

Table of Contents

Whether or not you plan to attend the Special Meeting, you may vote your AbbVie Shares by proxy by any one of the following methods:

- •

- by mail: Mark, sign and date your proxy card and return it in the postage paid envelope enclosed to Broadridge Financial Solutions ("Broadridge"). Broadridge must receive your proxy card not later than 11:59 p.m. (Eastern Time) on [ • ], 2014 in order for your vote to be counted;

- •

- by telephone: Call toll free 1-800-690-6903. You will be prompted to provide your control number printed on the proxy card below your preprinted name and address. The telephone voting service is available until 11:59 p.m. (Eastern Time) on [ • ], 2014; and

- •

- via the Internet: Go to www.proxyvote.com and follow the instructions on the website and complete your proxy voting prior to 11:59 p.m. (Eastern Time) on [ • ], 2014. We provide Internet proxy voting to allow you to vote your AbbVie Shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions.

If the Special Meeting is adjourned or postponed, Broadridge must receive your proxy card or your vote via telephone or Internet not later than 11:59 p.m. (Eastern Time) on the business day immediately preceding the date of any rescheduled meeting.

Voting your AbbVie Shares by proxy does not prevent you from attending the Special Meeting in person.

Non-record (beneficial) stockholders

If you are a non-record (beneficial) stockholder, your intermediary (or its agent) will send you a voting instruction form or proxy form with this proxy statement/prospectus. Properly completing such form and returning it to your intermediary (or its agent) will instruct your intermediary how to vote your AbbVie Shares at the Special Meeting on your behalf. You should carefully follow the instructions provided by your intermediary (or its agent) and contact your intermediary (or its agent) promptly if you need help.

If you do not intend to attend the Special Meeting and vote in person, mark your voting instructions on the voting instruction form or proxy form, sign it, and return it as instructed by your intermediary (or its agent). Your intermediary (or its agent) may have also provided you with the option of voting by telephone or Internet similar to those applicable to stockholders of record set forth above.

If you wish to vote in person at the Special Meeting, follow the instructions provided by your intermediary (or its agent).

In addition, your intermediary (or its agent) may need to receive your voting instructions in sufficient time in advance for your intermediary to act on them prior to the deadline for the deposit of proxies of 11:59 p.m. (Eastern Time) on [ • ], 2014, or, in the case of any adjournment or postponement of the Special Meeting, 11:59 p.m. (Eastern Time) on the business day immediately preceding the date of any rescheduled meeting.

- 23.

- If my AbbVie Shares are held in a brokerage account or in "street name" will my broker or other intermediary vote them for me?

If you own your AbbVie Shares through a bank, trust company, securities broker or other intermediary, you will receive instructions from your intermediary on how to instruct them to vote your AbbVie Shares, including by completing a voting instruction form, or providing instructions by telephone or fax or through the Internet. If you do not receive such instructions, you may contact your intermediary to request them. In accordance with rules issued by the New York Stock Exchange (the

8

Table of Contents

"NYSE"), intermediaries who hold AbbVie Shares in "street name" for customers may not exercise their voting discretion with respect to the proposals.

Accordingly, if you do not provide your intermediary with instructions on how to vote your street name shares, your intermediary will not be permitted to vote them at the Special Meeting.

- 24.

- How do I appoint a proxyholder?

Your proxyholder is the person you appoint to cast your votes on your behalf. You can choose anyone you want to be your proxyholder; it does not have to be either of the persons we have designated in the proxy card. To designate a different person to be your proxyholder, write in the name of the person you would like to appoint in the blank space provided in the proxy card. Please ensure that the person you have appointed will be attending the Special Meeting and is aware that he or she will be voting your AbbVie Shares.

If you sign the proxy card without naming your own proxyholder, you appoint Richard A. Gonzalez (AbbVie's Chairman and Chief Executive Officer) and Laura J. Schumacher (AbbVie's Executive Vice President, Business Development, External Affairs and General Counsel) as your proxyholders, either of whom will be authorized to vote and otherwise act for you at the Special Meeting (including any postponements or adjournments of the Special Meeting).

- 25.

- How will my shares be voted if I give my proxy?

On the proxy card, you can indicate how you want your proxyholder to vote your AbbVie Shares, or you can let your proxyholder decide for you by signing and returning the proxy card without indicating a voting preference for one or both proposals. If you have specified on the proxy card how you want to vote on a particular proposal (by marking, as applicable, "for" or "against"), then your proxyholder must vote your AbbVie Shares accordingly.

- 26.

- What if I return a proxy card or otherwise vote but do not make specific choices?

If you are a stockholder of record and you submit your proxy through the Internet or by telephone without indicating your vote, or if you sign and return an AbbVie proxy card without giving specific voting instructions, then the proxyholders will vote your shares in the manner recommended by the AbbVie Board on all matters presented in this proxy statement/prospectus and as the proxyholders may determine in their discretion with respect to any other matters properly presented for a vote at the Special Meeting.

If you are a non-record (beneficial) stockholder and you do not provide the organization that holds your AbbVie Shares with specific instructions, under the rules of various national and regional securities exchanges, the organization that holds your AbbVie Shares may generally vote on routine matters but cannot vote on non-routine matters. If the organization that holds your AbbVie Shares does not receive instructions from you on how to vote your AbbVie Shares on a non-routine matter, the organization that holds your AbbVie Shares will inform the inspector for the Special Meeting that it does not have the authority to vote on this matter with respect to your AbbVie Shares. This is generally referred to as a "broker non-vote." When AbbVie's inspector of elections tabulates the votes for any particular matter, broker non-votes will be counted for purposes of determining whether a quorum is present, but will have the same effect as a vote "against" the Merger Agreement Proposal. Broker non-votes will not have an effect on the Non-Binding Compensation Proposal and the

9

Table of Contents

Adjournment Proposal. AbbVie encourages you to provide voting instructions to the organization that holds your AbbVie Shares to ensure that your vote is counted on all three proposals.

- 27.

- I am a participant in the AbbVie Savings Plan. Can I vote? If so, how do I vote?

Yes. Participants in the AbbVie Savings Plan will receive a voting instruction card for their AbbVie Shares held in the AbbVie Savings Plan Trust (the "Trust"). The Trust is administered by both a trustee and an investment committee. The trustee is Mercer Trust Company. The members of the investment committee are Amarendra Duvvur, William H.S. Preece and Michael J. Thomas, employees of AbbVie. The voting power with respect to the shares is held by and shared between the investment committee and the participants. The investment committee must solicit voting instructions from the participants and follow the voting instructions it receives. The investment committee may use its own discretion with respect to those AbbVie Shares for which no voting instructions are received.

- 28.

- What is "householding"?

The SEC has adopted rules that permit companies and intermediaries (such as brokers or banks) to satisfy the delivery requirements for proxy statements with respect to two or more security holders sharing the same address by delivering a single notice or proxy statement addressed to those security holders. This process, which is commonly referred to as "householding," potentially provides extra convenience for security holders and cost savings for companies.

Several brokers and banks with accountholders who are AbbVie Stockholders will be "householding" our proxy materials. As indicated in the notice provided by these brokers to AbbVie Stockholders, a single proxy statement will be delivered to multiple stockholders sharing an address unless contrary instructions have been received from an affected stockholder. Once you have received notice from your broker that it will be "householding" communications to your address, "householding" will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in "householding" and you prefer to receive a separate proxy statement, please notify your broker or contact our proxy solicitor, Georgeson Inc. ("Georgeson") at (877) 278-4775, or write us at Investor Relations, AbbVie Inc., 1 North Waukegan Road, North Chicago, Illinois 60064. AbbVie Stockholders who currently receive multiple copies of the proxy statement at their address and would like to request "householding" of their communications should contact their broker or bank.

- 29.

- If I change my mind, can I change my vote or revoke my proxy once I have given it?

Yes. If you are a non-record (beneficial) stockholder, you can revoke your prior voting instructions by providing new instructions on a voting instruction form or proxy form with a later date, or at a later time in the case of voting by telephone or through the Internet. Otherwise, contact your intermediary (or its agent) if you want to revoke your proxy or change your voting instructions, or if you change your mind and want to vote in person. Any new voting instructions given to an intermediary (or its agent) in connection with the revocation of proxies may need be received in sufficient time in advance to allow the intermediary to act on such instructions prior to the deadline for the deposit of proxies of 11:59 p.m. (Eastern Time), on [ • ], 2014, or, in the case of any adjournment or postponement of the Special Meeting, 11:59 p.m. (Eastern Time) on the business day immediately preceding the date of any rescheduled meeting.

If you are a stockholder of record, you may revoke any proxy that you have given until the time of the Special Meeting by voting again by telephone or through the Internet as instructed above, by signing and dating a new proxy card and submitting it as instructed above, by giving written notice of such revocation to AbbVie's Corporate Secretary at our address, by revoking it in person at the Special Meeting, or by voting by ballot at the Special Meeting. If you choose to submit a proxy multiple times

10

Table of Contents

whether by telephone, through the Internet or by mail, or a combination thereof, only your latest vote, not revoked and received prior to 11:59 p.m. (Eastern Time), on [ • ], 2014 (or, in the case of any adjournment or postponement of the Special Meeting, 11:59 p.m. (Eastern Time) on the business day immediately preceding the date of any rescheduled meeting) will be counted. A stockholder of record participating in person, in a vote by ballot at the Special Meeting, will automatically revoke any proxy previously given by that stockholder regarding business considered by that vote. However, attendance at the Special Meeting by a registered stockholder who has voted by proxy does not alone revoke such proxy.

- 30.

- Who will count the votes?

Representatives from Hagberg & Associates and the inspector of elections (scrutineer) will count the votes.

- 31.

- Who is soliciting my proxy?

The AbbVie Board is soliciting your proxy for use at the Special Meeting to be held on [ • ], 2014 at [ • ] a.m. local time at [ • ] or any adjournments or postponements of that meeting). It is expected that the solicitation will be primarily by mail, but proxies may also be solicited personally, by advertisement or by telephone, by directors, officers or employees of AbbVie without special compensation or by AbbVie's proxy solicitor, Georgeson. This proxy statement/prospectus describes the voting procedures and the proposals to be voted on at the Special Meeting.

- 32.

- Are AbbVie Stockholders able to exercise dissenters' or appraisal rights with respect to the matters being voted upon at the Special Meeting?

No, AbbVie Stockholders will not be entitled to dissenters' or appraisal rights.

- 33.

- Where can I find more information on AbbVie and Shire?

You can find more information about AbbVie and Shire from various sources described in the section captioned "Where You Can Find More Information" on page 168.

- 34.

- Who should I contact if I have additional questions concerning the proxy statement/prospectus or the proxy card?

If you have any questions concerning the information contained in this proxy statement/prospectus or require assistance completing the proxy card, you may contact Georgeson as follows:

Georgeson Inc.

480 Washington Blvd., 26th Floor

Jersey City, New Jersey 07310

Banks, Brokers and Stockholders

Call Toll-Free (877) 278-4775

11

Table of Contents

SUMMARY

This summary highlights selected information contained in this proxy statement/prospectus and may not contain all of the information that may be important to you. We urge you to read this document, including the Annexes and the documents incorporated by reference, carefully and in full. In particular, we urge you to read the section captioned"Risk Factors" beginning on page 25. The page references have been included in this summary to direct you to a more complete description of the topics presented below. See also the section entitled"Where You Can Find More Information" beginning on page 168.

Companies Involved in the Combination (Page 46)

In the Combination, AbbVie and Shire will each become indirect wholly owned subsidiaries of New AbbVie, and AbbVie Stockholders and Shire Shareholders will become New AbbVie Shareholders.

AbbVie is a global, research-based biopharmaceutical company that was launched as an independent company in January 2013 following separation from Abbott Laboratories. Since January 2013, AbbVie has grown to become an approximately $86 billion market capitalization company with approximately 25,000 employees worldwide across over 170 countries and sales of nearly $19 billion in 2013.

AbbVie's key products include Humira® (the world's top selling medicine globally in 2013), Duodopa®, Synagis®, Kaletra®, Synthroid®, AndroGel®, Creon® and Lupron®, among others. In addition to its key products, AbbVie has a strong pipeline within several therapeutic categories, including assets in oncology, immunology, liver disease, neuroscience, renal, ophthalmology and women's health. AbbVie's pipeline also includes a broad range of attractive late-stage development and/or registration programs, as well as programs in earlier phases of clinical development and multiple promising assets currently in Phase III such as ABT-199 for chronic lymphocytic leukemia, veliparib for breast and non-small cell lung cancer, daclizumab for multiple sclerosis, elagolix for endometriosis, atrasentan for diabetic nephropathy, Humira® for uveitis and hidradenitis suppurativa, Duopa® for advanced Parkinson's disease and elotuzumab for multiple myeloma. AbbVie currently expects to launch its hepatitis C (HCV) therapy in the United States in 2014 and in Europe in early 2015.

AbbVie Shares are listed on the NYSE under the symbol "ABBV" and the Chicago Stock Exchange. Outside the United States, AbbVie Shares are listed on the NYSE Euronext Paris professional segment and the SIX Swiss Exchange. AbbVie's principal executive office is located at 1 North Waukegan Road, North Chicago, Illinois 60064-6400 and its telephone number is (847) 932-7900.

Shire is a leading global specialty biopharmaceutical company that focuses on developing and marketing innovative specialty medicines. Shire has grown through acquisition, completing a series of major transactions that have brought therapeutic, geographic and pipeline growth and diversification. Shire has four business units that focus exclusively on the commercial execution of its marketed products in the following specialist therapeutic areas: rare diseases, neuroscience, gastrointestinal and internal medicine. Its leading brands include Vyvanse®, Lialda®, Cinryze®, Elaprase® and Replagal®.

Shire Ordinary Shares are listed on the UK Listing Authority Official List and traded on the London Stock Exchange ("LSE") under the symbol "SHP" and Shire ADSs are listed and traded on the Nasdaq Global Select Market ("Nasdaq") under the symbol "SHPG". Shire's principal executive office is located at 5 Riverwalk, Citywest Business Campus, Dublin 24, Republic of Ireland and its telephone number is +353 1 429 7700.

12

Table of Contents

New AbbVie is a private limited company incorporated in Jersey, Shire's current place of incorporation. New AbbVie was formed solely for the purpose of effecting the Combination and is currently a wholly owned subsidiary of AbbVie. Prior to the completion of the Combination, New AbbVie will be converted, pursuant to the Jersey Companies Law, to a public limited company. To date, New AbbVie has not conducted any activities other than those incidental to its formation, the execution of the Merger Agreement and certain documents relating to the financing arrangements entered into in connection with the Combination and the preparation of applicable filings under applicable securities laws and regulatory filings made in connection with the Combination. Following completion of the Combination, New AbbVie will become the holding company of Shire and AbbVie. New AbbVie's principal executive office and registered UK address is located at Abbott House, Vanwall Business Park, Vanwall Road, Maidenhead, Berkshire, SL6 4XE, United Kingdom and its telephone number is + 44 (0)1628 561090.

Other participants in the Combination will include US Holdco, Foreign Holdco and Merger Sub, and they are described in the section captioned "Companies Involved in the Combination" beginning on page 46.

Overview of the Combination (Page 65)

The Combination will be implemented in two main steps: the Arrangement and the Merger. The Arrangement is a Jersey statutory procedure pursuant to which the Royal Court of Jersey may approve an arrangement between a company and some or all of its shareholders, which is binding once effective in accordance with its terms and the Jersey Companies Law. Pursuant to the Arrangement, the Shire Ordinary Shares, other than Shire Ordinary Shares held by Shire in treasury, will be cancelled and Shire Shareholders will receive £24.44 in cash and will be issued 0.8960 New AbbVie Share in consideration for each Shire Ordinary Share so cancelled (an amount in US dollars equal to £73.32 in cash and 2.6880 New AbbVie Shares for each Shire ADS). In the Merger, Merger Sub will be merged with and into AbbVie, and each AbbVie Share, other than AbbVie Shares held by AbbVie as treasury stock, will be converted into the right to receive one New AbbVie Share. As a result of the Combination, AbbVie and Shire will each become indirect wholly owned subsidiaries of New AbbVie, and AbbVie Stockholders and Shire Shareholders will become New AbbVie Shareholders. We estimate that AbbVie Stockholders will own approximately 75% of the ordinary shares of New AbbVie, and Shire Shareholders will receive approximately £14.6 billion in cash in the aggregate and will own approximately 25% of the ordinary shares of New AbbVie.

Based on the number of Shire Shares outstanding as of [ • ], 2014 and the number of AbbVie Shares outstanding as of the Record Date, New AbbVie is expected to issue approximately [ • ] New AbbVie Shares to the Shire Shareholders upon completion of the Arrangement and approximately [ • ] New AbbVie Shares to the AbbVie Shareholders upon completion of the Merger.

The Arrangement is conditioned on, among other things, the approval of the Merger Agreement Proposal by the holders of a majority of the AbbVie Shares outstanding and entitled to vote. The consummation of the Merger is conditioned on the completion of the Arrangement.

13

Table of Contents

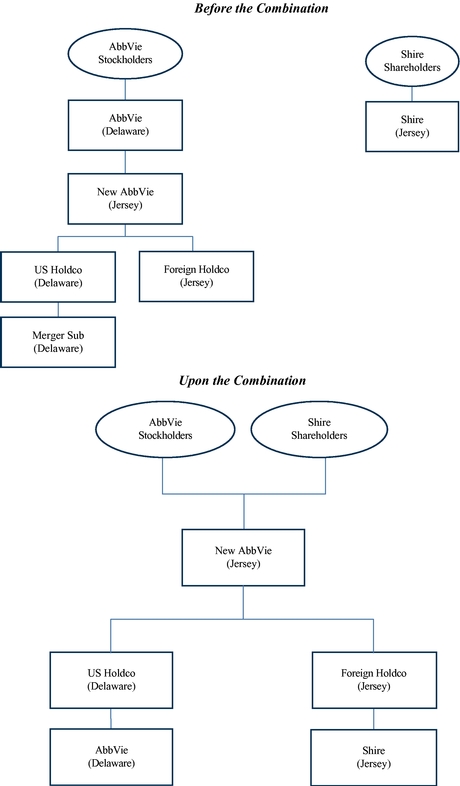

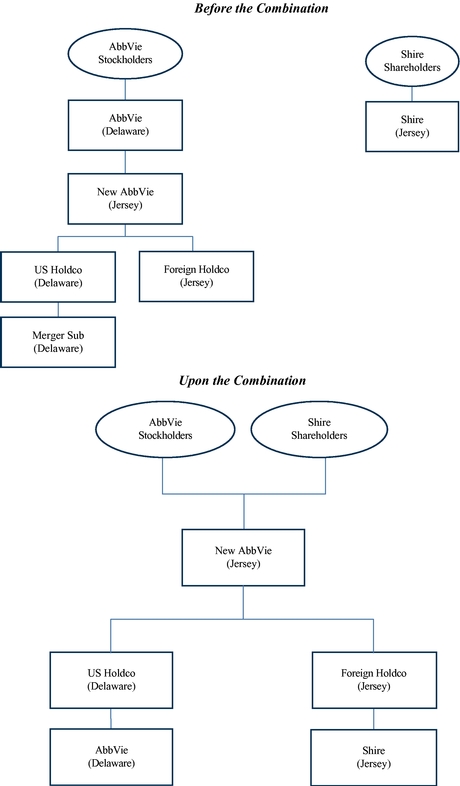

The diagram below illustrates in a simplified manner New AbbVie's corporate structure before and after the completion of the Combination.

For further information, including diagrams explaining the Combination, please see the section captioned "Overview of the Combination" beginning on page 65.

14

Table of Contents

The Arrangement and the Co-operation Agreement (Page 67)

In the Arrangement, the Shire Ordinary Shares, other than Shire Ordinary Shares held by Shire in treasury, will be cancelled and Shire Shareholders will receive £24.44 in cash and will be issued 0.8960 New AbbVie Share in consideration for each Shire Ordinary Share so cancelled (an amount in US dollars equal to £73.32 in cash and 2.6880 New AbbVie Shares for each Shire ADS). As a result of the Arrangement, Shire will become an indirect wholly owned subsidiary of New AbbVie, and Shire Shareholders will become New AbbVie Shareholders. Upon the completion of the Combination, we estimate that Shire Shareholders will receive approximately £14.6 billion in cash in the aggregate and will own approximately 25% of the ordinary shares of New AbbVie. The Arrangement is conditioned on the approval of the Merger Agreement Proposal by the holders of a majority of the AbbVie Shares outstanding and entitled to vote, as well as the conditions summarized below. The consummation of the Merger is conditioned on the completion of the Arrangement.

The Arrangement is conditioned on receipt of the following approvals:

- •

- the approval of a resolution proposing the Arrangement at a meeting or meetings of Shire Shareholders convened by an order of the Royal Court of Jersey (the "Shire Court Meeting") by a majority in number of the Shire Shareholders present and voting, either in person or by proxy at the Shire Court Meeting or any adjournment thereof, representing 3/4ths or more of the voting rights of those Shire Shareholders (the "Shire Court Meeting Approval");

- •

- the approval of resolutions by the requisite majority of Shire Shareholders necessary to approve and implement the Arrangement (including an associated reduction of capital (the "Reduction of Capital") at a general meeting of Shire Shareholders (the "Shire General Meeting") to be convened in connection with the Arrangement and to be held immediately after the Shire Court Meeting (the "Shire General Meeting Approval");

- •

- the sanction (with or without modification) of the Arrangement and confirmation of the Reduction of Capital at a hearing (the "Shire Court Hearing") of the Royal Court of Jersey (the "Shire Court Hearing Approval"); and

- •

- the delivery by Shire of the Act of Court sanctioning the Arrangement for registration to the Registrar of Companies for Jersey (the "Registrar") and (in relation to the Reduction of Capital) registration of the Act of Court relating thereto by the Registrar.

In addition, the Arrangement is conditioned on, among other things:

- •

- except as provided in the Co-operation Agreement, the Shire Court Meeting being convened on or before [ • ], 2014, or such later date (if any) as AbbVie and Shire may agree (the "Shire Court Meeting Date");

- •

- except as provided in the Co-operation Agreement, the Shire General Meeting being convened on or before [ • ], 2014, or such later date (if any) as AbbVie and Shire may agree (the "Shire General Meeting Date");

- •

- except as provided in the Co-operation Agreement, the Shire Court Hearing being held on or before [ • ], 2014 or such later date (if any) as AbbVie and Shire may agree (the "Shire Court Hearing Date");

- •

- the Arrangement becoming effective by April 30, 2015, or such later date as may be agreed by AbbVie and Shire and (if required) the Royal Court of Jersey allows (the "Final Long Stop Date", and together with the Shire Court Meeting Date, the Shire General Meeting Date and the Shire Court Hearing Date, the "Long Stop Dates");

15

Table of Contents

- •

- approval of the Merger Agreement Proposal by the affirmative vote of the holders of a majority of outstanding AbbVie Shares entitled to vote;

- •

- the Registration Statement on Form S-4 of which this proxy statement/prospectus is a part (the "Form S-4") having become effective under the Securities Act of 1933, as amended (the "Securities Act") and not having been the subject of any stop order suspending its effectiveness, and no proceedings seeking any such stop order having been initiated or threatened by the SEC; and

- •

- the NYSE having authorized the listing of all of the New AbbVie Shares upon official notice of issuance and not having withdrawn such authorization.

The consummation of the Arrangement is also subject to clearance by antitrust and competition authorities in the European Union, the United States, Canada, Ukraine, Israel, Russia, Turkey, Brazil, Japan, Jersey and other jurisdictions where merger control filings are required or appropriate (the "Regulatory Approvals"). See the section captioned "Regulatory Approvals" beginning on page 81. Further terms of the Combination are set out inAnnex E entitled "Conditions to and Certain Further Terms of the Combination" beginning on page E-1.

To the extent permitted by law and subject to the requirements of the UK Takeover Panel, AbbVie has reserved the right to waive all or any of the conditions (other than the conditions relating to the approval of the Arrangement by Shire Shareholders and the Royal Court of Jersey, the condition relating to the effectiveness of the Form S-4, the condition relating to approval of the Merger Agreement Proposal and the condition relating to the listing of the New AbbVie Shares on the NYSE).

The City Code on Takeovers and Mergers (the "UK Takeover Code") only permits AbbVie to invoke a condition to the offer (other than certain conditions relating to the approval of the Arrangement by Shire Shareholders and the Royal Court of Jersey, the effectiveness of Form S-4, approval under Council Regulation (EC) No. 139/2004 (as amended) (the "EU Merger Regulation"), approval of the Merger Agreement Proposal and the listing of New AbbVie Shares on the NYSE) where the circumstances underlying the failure of the condition are of material significance to AbbVie in the context of the Combination. Because of this requirement, the conditions may provide AbbVie with less protection than the customary conditions in a comparable combination with a US corporation. Please see the section captioned "Risk Factors—Risks Relating to the Combination" beginning on page 25.

On July 18, 2014, Shire and AbbVie entered into a Co-operation Agreement (the "Co-operation Agreement") in connection with the proposed Combination. Pursuant to the Co-operation Agreement, Shire has agreed to provide AbbVie with such information and assistance as AbbVie may reasonably require for the purpose of obtaining all regulatory clearances and making any submission, filing or notification to any regulatory authority. AbbVie has also given certain undertakings regarding the implementation of the Combination and the conduct of its business from the date of the Co-operation Agreement until the effective date of the Combination (the "Combination Effective Date"). Additionally, AbbVie has agreed to certain limitations on the ability of the AbbVie Board to change its recommendation to approve the Merger Agreement Proposal, subject to exceptions relating to the AbbVie Board's fiduciary duties. Please see the sections captioned "The Arrangement and the Co-operation Agreement—Co-operation Agreement—Undertakings to Implement the Combination" beginning on page 69 and "The Arrangement and the Co-operation Agreement—Co-operation Agreement—Change in Recommendation" beginning on page 71.

The Co-operation Agreement also provides that, on the occurrence of a Break Fee Payment Event (as explained below), AbbVie will pay to Shire an amount in cash in US Dollars equal to 3% of the aggregate of the product of the indicative value of the cash and shares to be delivered per Shire Ordinary Share of £53.20 disclosed on July 14, 2014 in Shire's announcement pursuant to Rule 2.4 of the UK Takeover Code (the "Rule 2.4 Announcement") multiplied by the number of issued Shire Ordinary Shares (set at 598,420,949 shares) (the "Break Fee"), using an exchange rate of $1 = £0.5840.

16

Table of Contents

A "Break Fee Payment Event" will occur in the event that at or prior to the termination of the Co-operation Agreement the AbbVie Board withdraws or modifies its recommendation in a manner adverse to the consummation of the Combination or fails to include its recommendation in this proxy statement/prospectus and:

- •

- A vote on the Merger Agreement is taken at the Special Meeting and the Merger Agreement Proposal is not approved (an "Adverse AbbVie Stockholder Vote");

- •

- The Special Meeting is not held within 60 days of the withdrawal or the adverse modification of the recommendation; or

- •

- The Arrangement is withdrawn or lapses and the Co-operation Agreement is terminated without the Merger Agreement Proposal having been approved.

A Break Fee Payment Event will also occur in circumstances where either (i) Regulatory Approval is not obtained or (ii) the European Commission initiates Phase 2 European Commission proceedings under the EU Merger Regulation or has referred (or has been deemed to have referred) any part of the Combination to the merger control authority of one or more Member States of the European Union under Article 9 of the EU Merger Regulation and, as a result, the Arrangement is withdrawn or lapses. For more information about what constitutes a Break Fee Payment Event, see the section captioned "The Arrangement and the Co-operation Agreement—Co-operation Agreement" beginning on page 69.

If an Adverse AbbVie Stockholder Vote occurs in circumstances in which the Break Fee is not payable, the Co-operation Agreement also obligates AbbVie to make a payment to Shire for its reasonable out-of-pocket expenses and losses incurred directly or indirectly in connection with the consideration, negotiation and implementation of the Co-operation Agreement and the transactions and other actions contemplated thereby (the "Costs"), up to a maximum amount of 1% of the aggregate indicative value of cash and shares to be delivered in respect of each Shire Ordinary Share, to be determined using the same methodology used for purposes of the calculation of the Break Fee. AbbVie and Shire have also agreed that this payment will be no less than $500 million.

In the event that a Break Fee Payment Event or a Cost Reimbursement Event (as defined below) has occurred, Shire's right to receive the Break Fee or Costs, as the case may be, will be the sole and exclusive remedy of Shire against AbbVie for any and all losses and damages suffered in connection with the Co-operation Agreement and the transactions and other actions contemplated by the Co-operation Agreement. In no event will AbbVie be required to pay the Break Fee or Costs more than once. In the event the Break Fee is paid or payable, the Costs will not be payable, and in the event the Costs are paid or payable, the Break Fee will not be payable.

The Merger and the Merger Agreement (Page 78)